The Daily Shot: 04-Dec-20

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

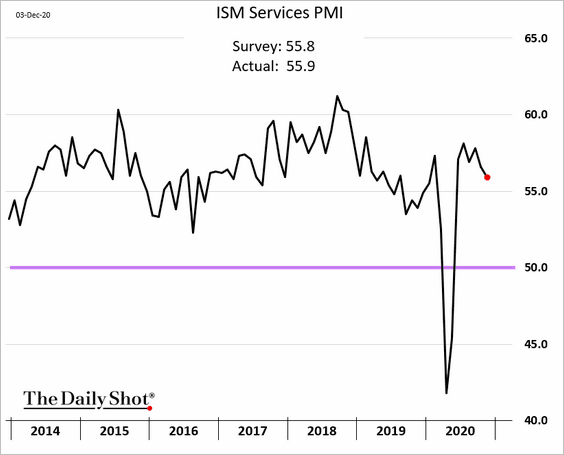

1. The ISM Services PMI index declined in November, but service-sector activity remains well into growth territory (PMI > 50).

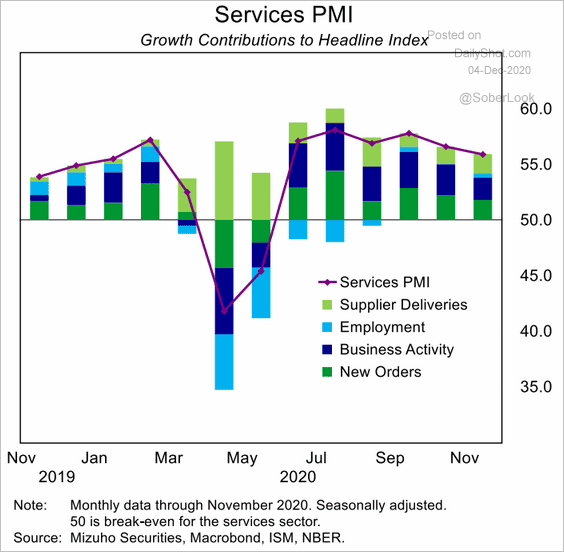

Here are the components of the ISM index.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

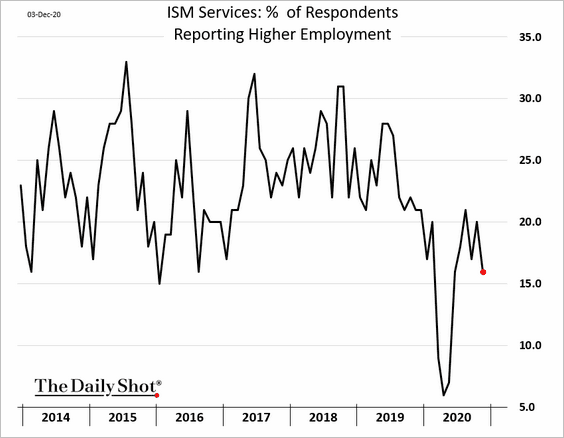

Hiring has slowed.

——————–

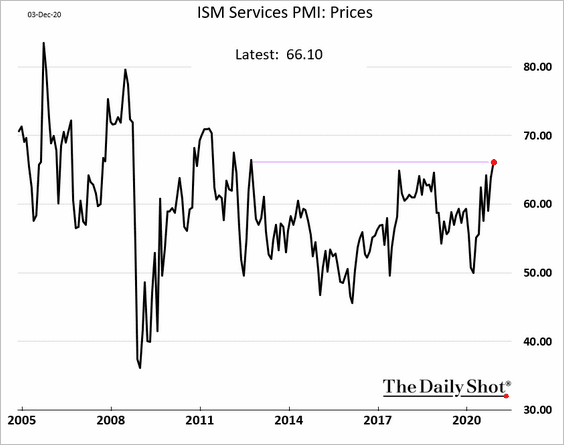

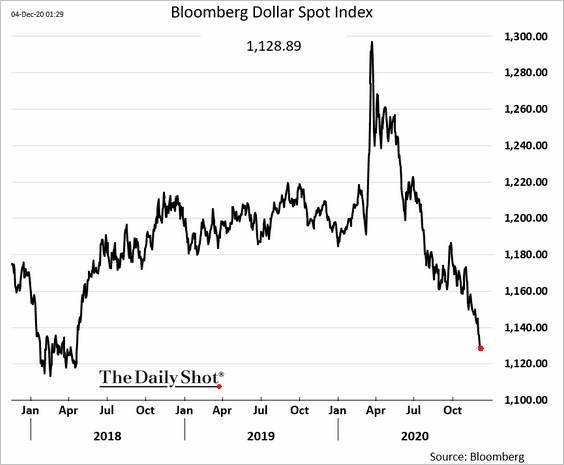

2. Next, we have some updates on inflation.

• An increasing share of service-sector companies have been boosting prices, according to the ISM report (above).

• The dollar continues to weaken, putting upward pressure on commodities and import prices. By the way, this is a positive development for domestic manufacturers who will have an easier time competing with foreign firms.

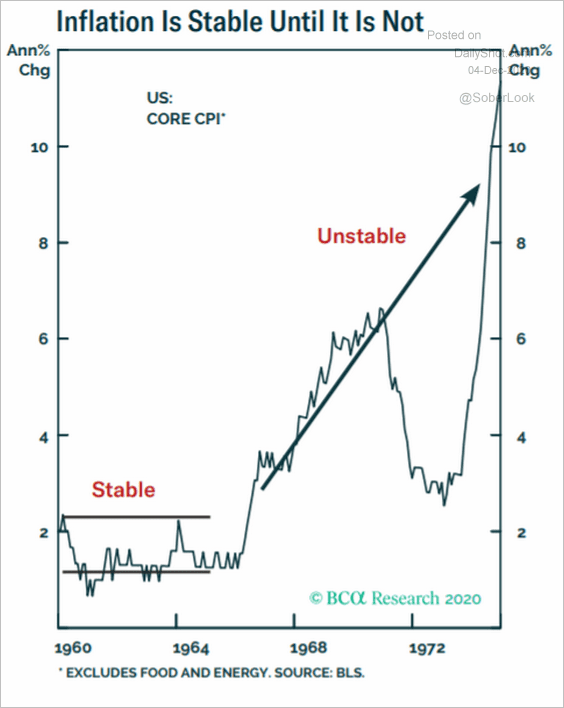

• Can consumer inflation suddenly accelerate as it did in the late 1960s/early 1970s?

Source: BCA Research

Source: BCA Research

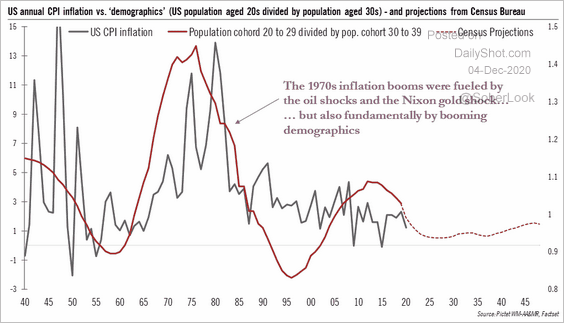

• Many economists doubt that we could get a repeat of the inflation spike shown above because of the US demographics. Young people now represent a much smaller proportion of the population relative to the Boomer wave.

Source: @TCosterg

Source: @TCosterg

——————–

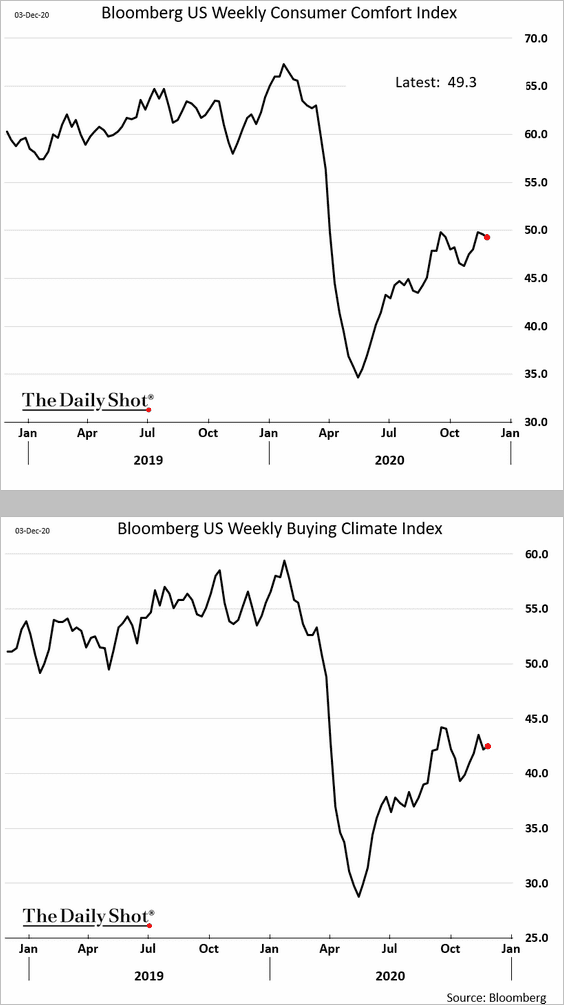

3. Bloomberg’s consumer sentiment index has not improved since the summer.

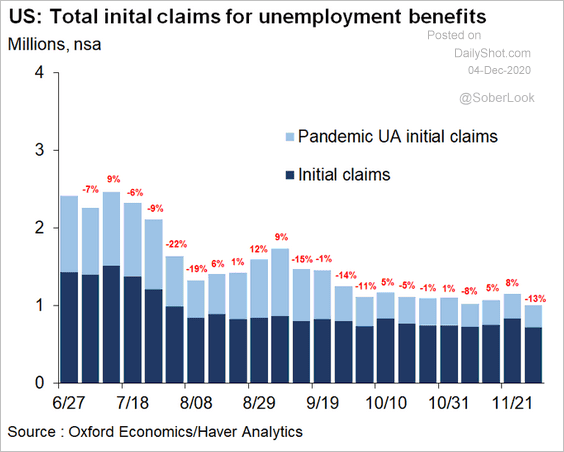

4. Initial jobless claims declined last week, but we still saw a million Americans file for unemployment benefits (assuming the government figures are correct).

Source: @GregDaco

Source: @GregDaco

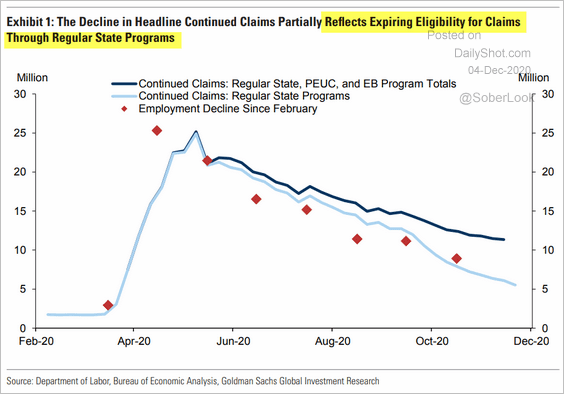

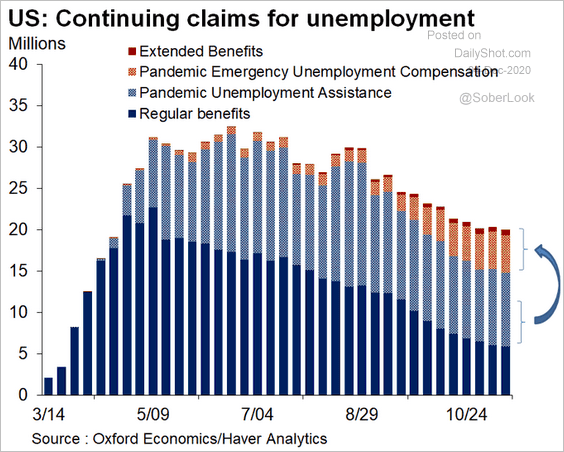

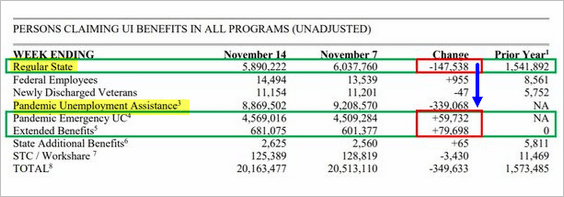

There is an ongoing shift into the emergency programs as regular benefits expire (3 charts).

Source: Goldman Sachs

Source: Goldman Sachs

Source: @GregDaco

Source: @GregDaco

Source: @GregDaco

Source: @GregDaco

——————–

5. Will the government extend these emergency programs? The new bipartisan bill contemplates adding a few months. Here is a comparison to the GOP’s bill introduced a few months back.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

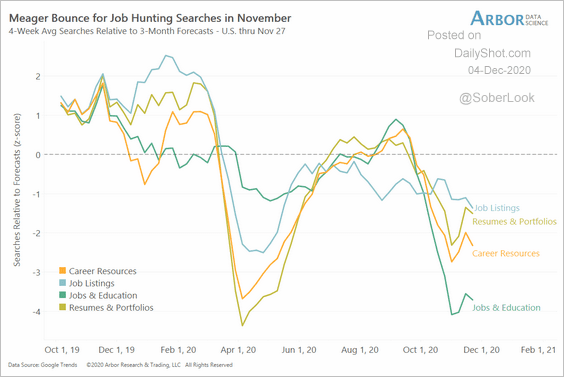

6. Online activity related to searching for a job has deteriorated.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

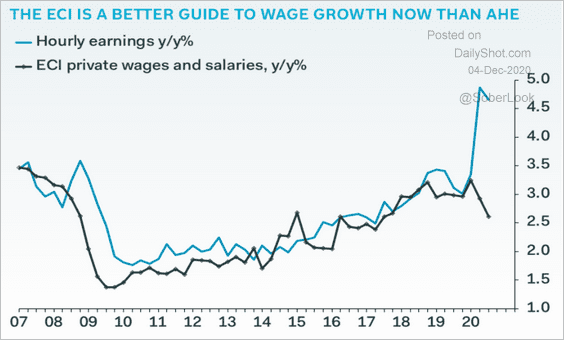

7. The unemployment report has been showing a spike in wages. That’s a distortion due to disproportionally high layoffs among low-wage workers, making the average salary artificially high. The employment cost index provides a more accurate picture.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

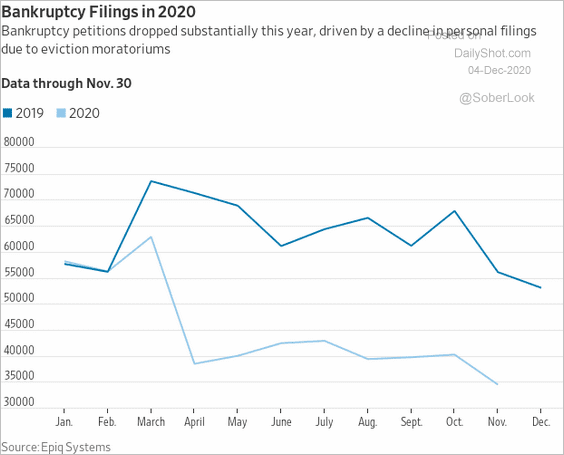

8. Eviction moratoriums have reduced US bankruptcy petitions.

Source: @WSJ Read full article

Source: @WSJ Read full article

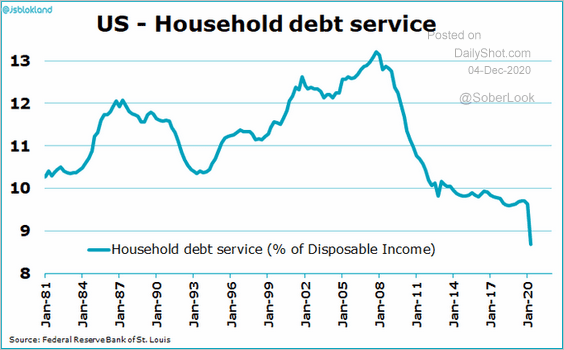

Also, the US household debt service ratio is at a record low. That’s due to lower interest rates and a massive cash injection from the government.

Source: @jsblokland

Source: @jsblokland

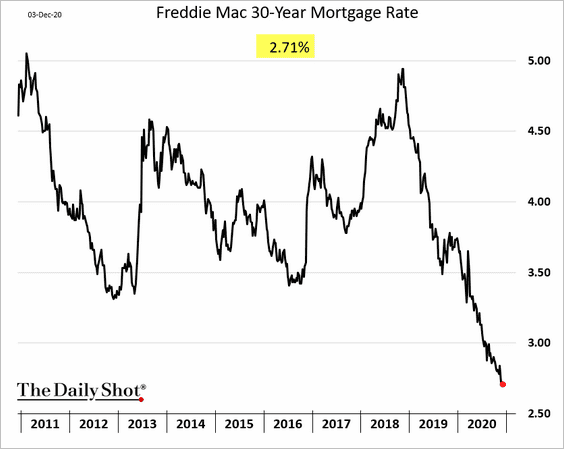

By the way, mortgage rates continue to hit new lows.

The United Kingdom

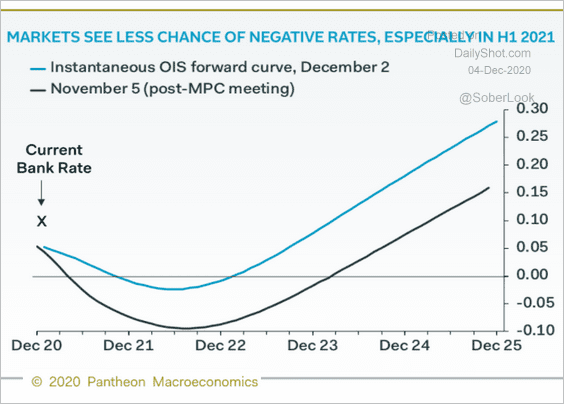

1. The probability of the BoE taking rates into negative territory has diminished.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

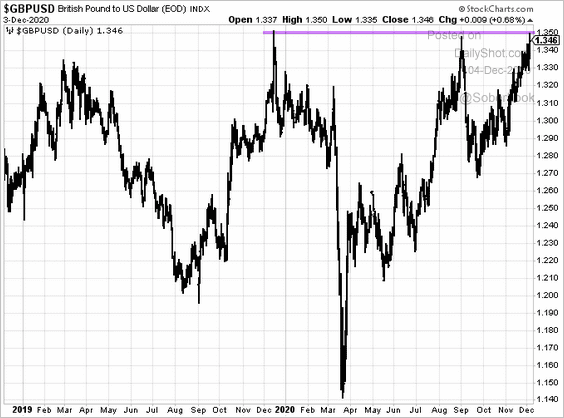

2. GBP/USD is testing resistance at $1.35.

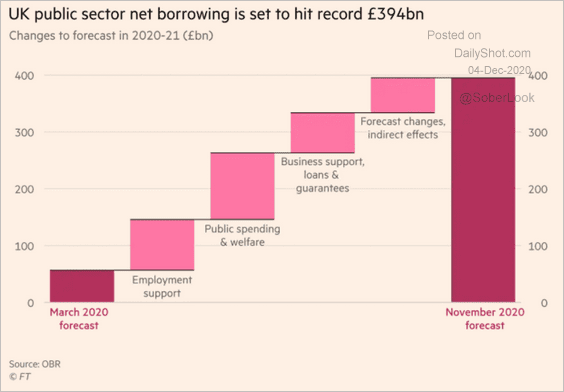

3. How do we get from the March 2020 public-sector borrowing forecast to the one last month?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

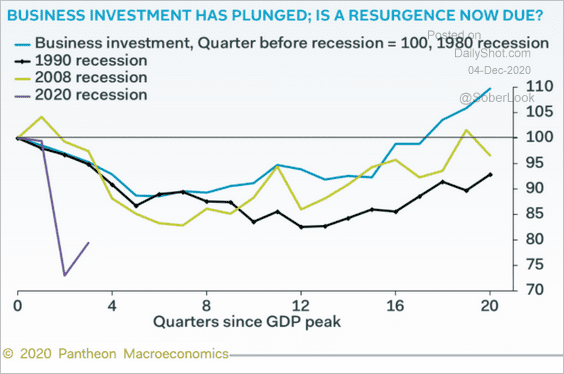

4. Business investment has declined much more than during previous downturns.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

The Eurozone

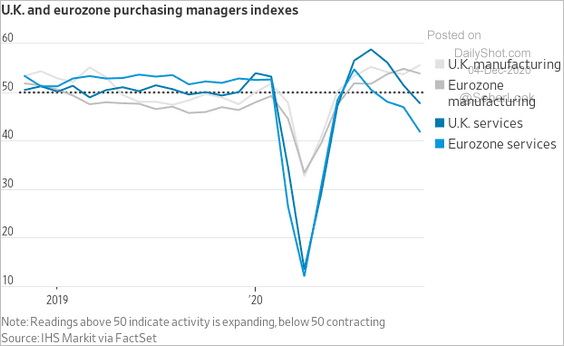

1. The updated service-sector PMI data from Markit confirmed the deterioration in November. The chart below shows the divergence between manufacturing and services in the Eurozone and the UK.

Source: @jeffsparshott

Source: @jeffsparshott

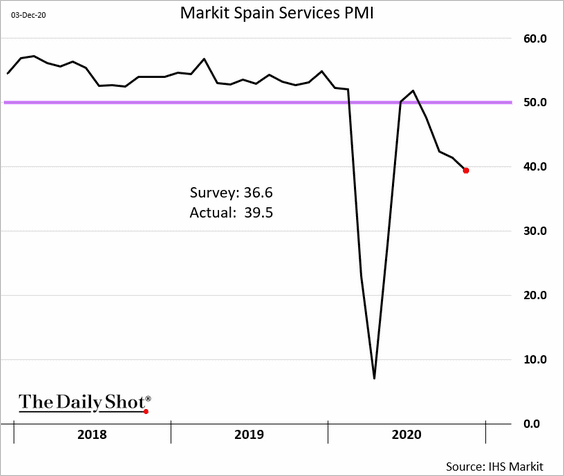

• Spain:

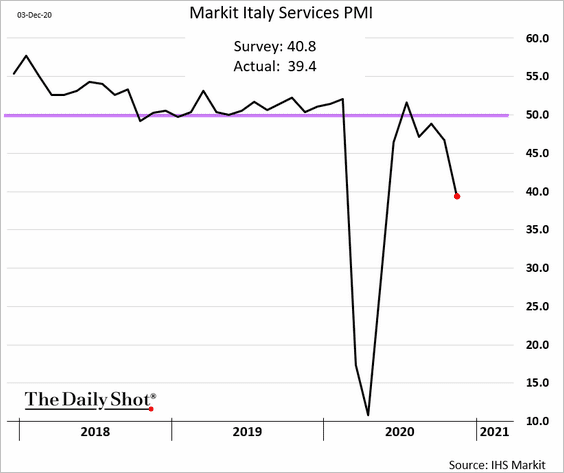

• Italy:

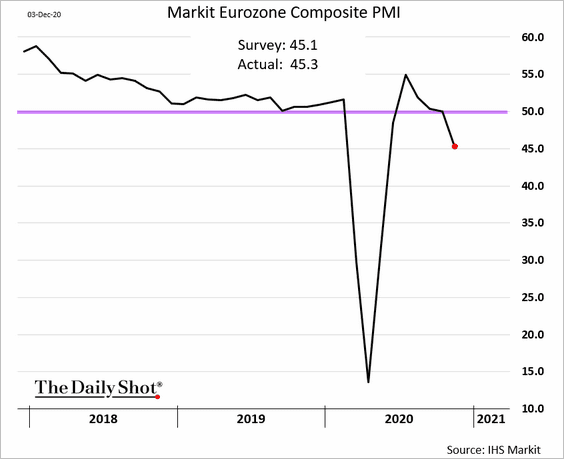

Here is the composite PMI at the Eurozone level.

——————–

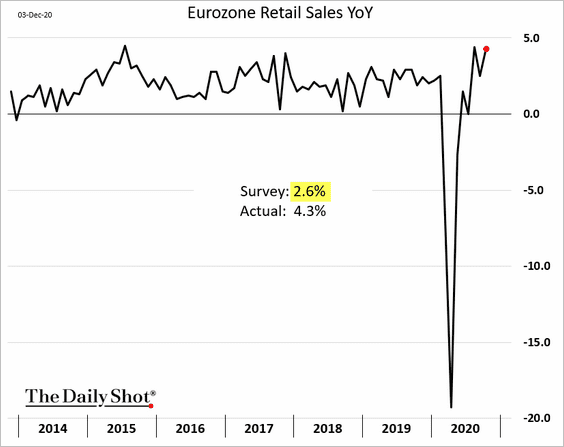

2. Retail sales accelerated in October, topping economists’ estimates.

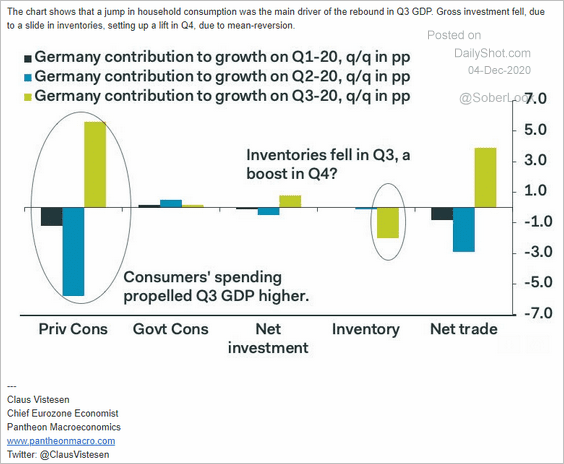

3. Below are some updates on Germany.

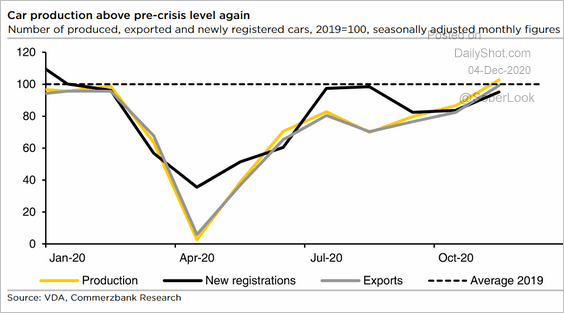

• Car production has recovered.

Source: Commerzbank Research

Source: Commerzbank Research

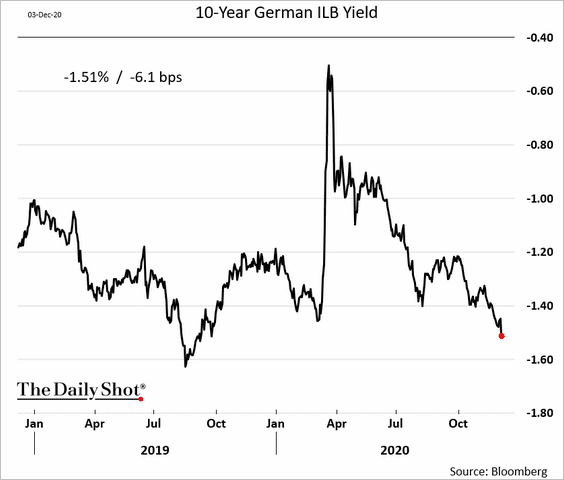

• Inflation-linked bond yields, a proxy for real rates, continue to fall.

h/t Tradeweb

h/t Tradeweb

• Here is the GDP breakdown.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

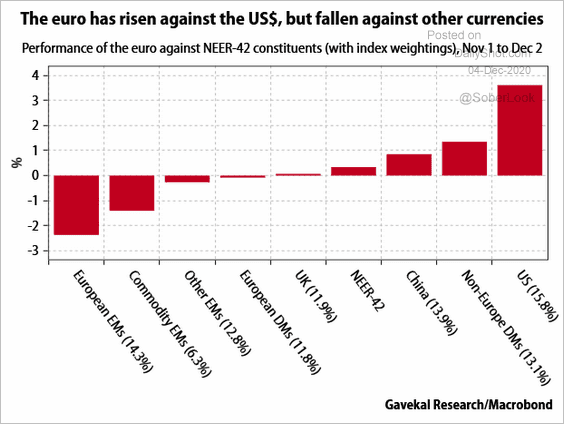

4. This chart shows how the euro performed vs. other currencies over the past month.

Source: Gavekal

Source: Gavekal

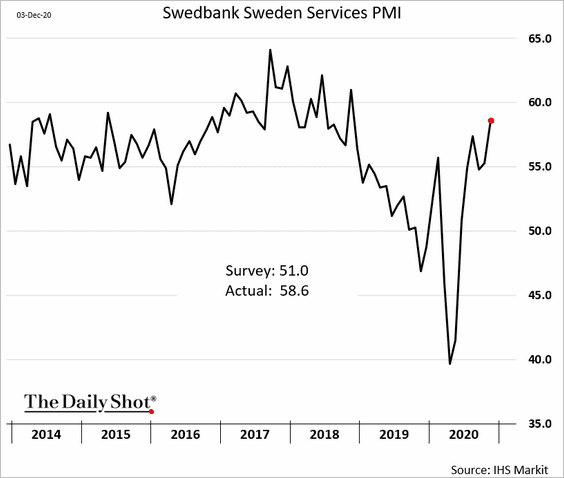

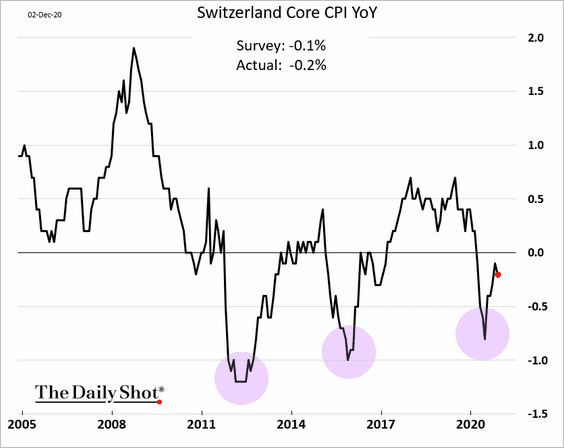

Europe

1. Sweden’s service sector strengthened further last month, exceeding forecasts.

2. Switzerland’s core CPI is still in negative territory – a third bout with deflation over the past decade.

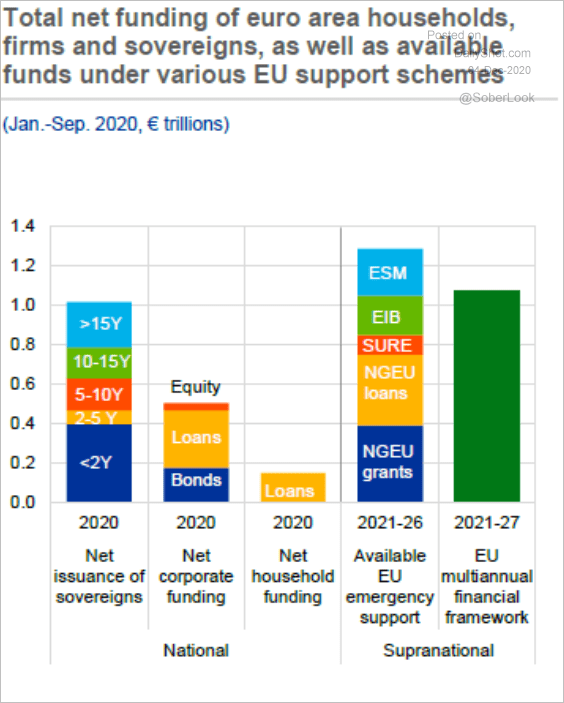

3. Here are the various emergency support programs in the EU.

Source: ECB Read full article

Source: ECB Read full article

Asia – Pacific

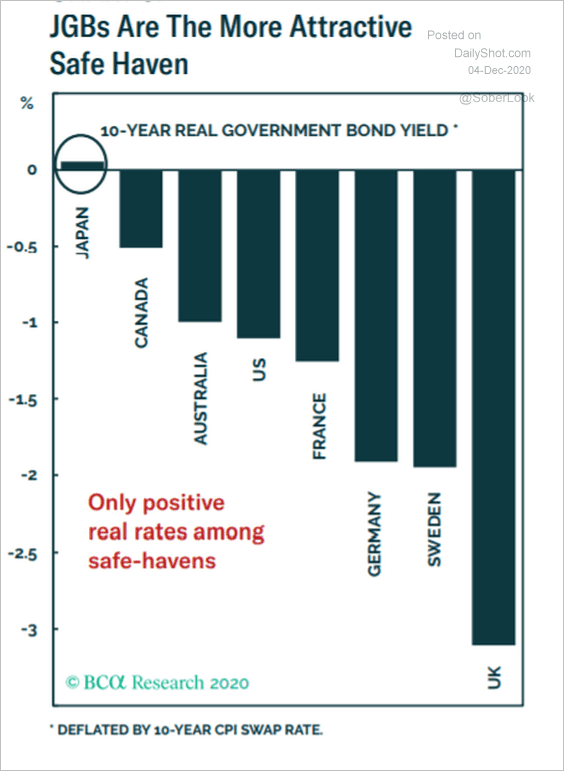

1. The 10yr JGB yield adjusted for inflation is positive, which is unusual.

Source: BCA Research

Source: BCA Research

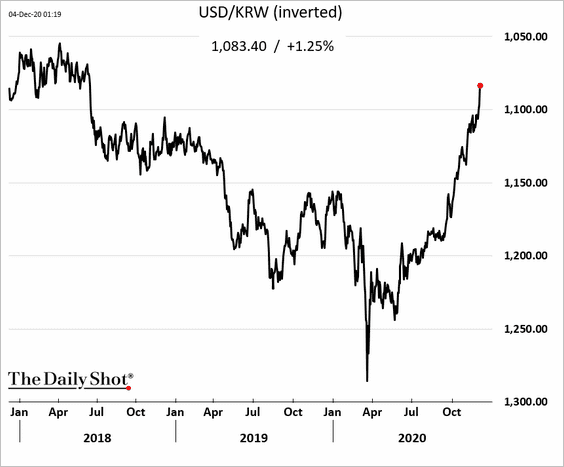

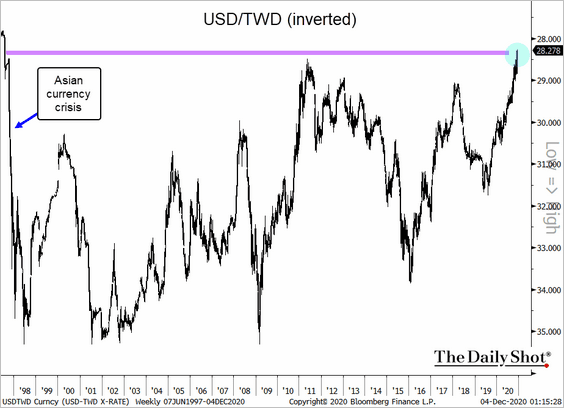

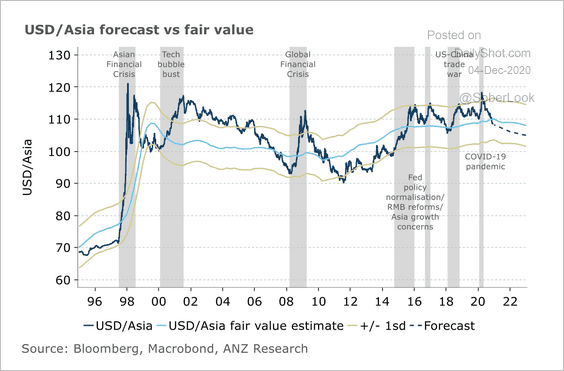

2. Asian currencies are soaring.

• The South Korean won:

• The Taiwan dollar (highest since 1997):

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

ANZ expects further upside for Asian currencies versus the dollar next year. This is mainly due to improved growth prospects, which bodes well for exports and investor risk sentiment (chart shows the dollar weakening against Asian currencies).

Source: ANZ Research

Source: ANZ Research

——————–

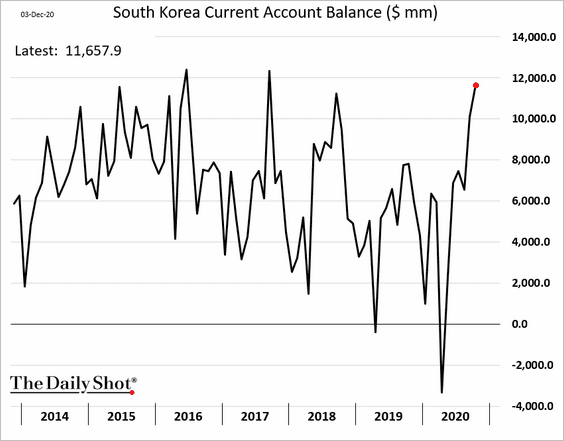

3. South Korea’s current account surplus hit a multi-year high as exports recover.

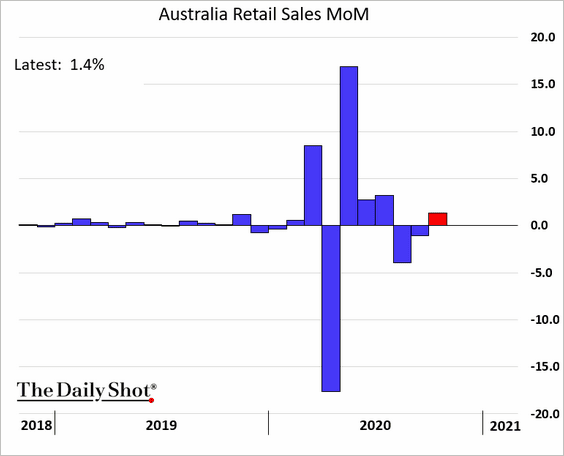

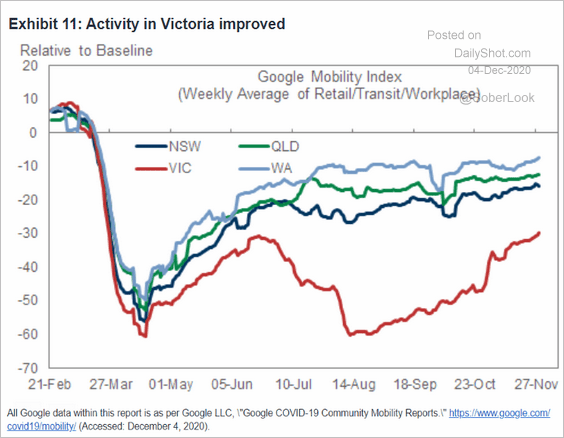

4. Here are some updates on Australia.

• Retail sales (through October):

• Mobility trends:

Source: Goldman Sachs

Source: Goldman Sachs

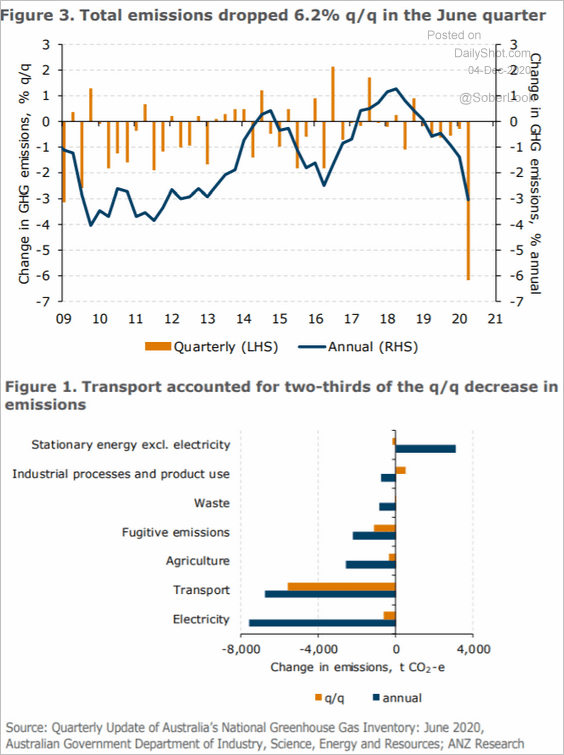

• The decline in emissions:

Source: ANZ Research

Source: ANZ Research

China

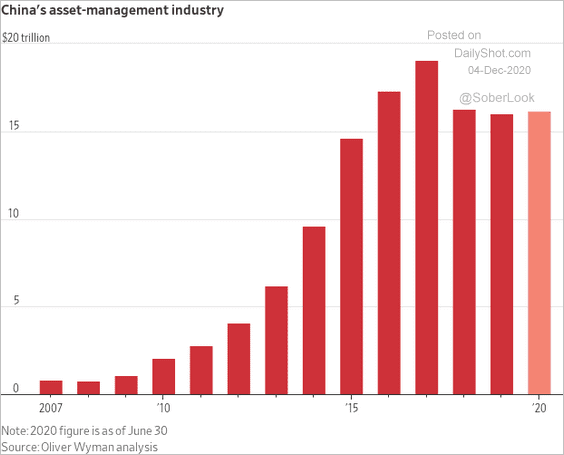

1. This chart shows Chana’s asset management industry trend.

Source: @WSJ Read full article

Source: @WSJ Read full article

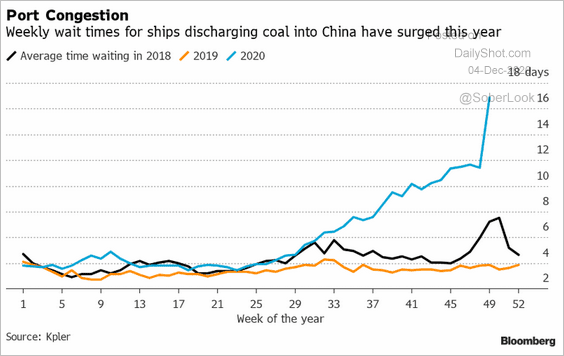

2. The China-Australia dispute created a bottleneck for ships discharging coal.

Source: @aaronaclark1, @TheTerminal, Bloomberg Finance L.P.

Source: @aaronaclark1, @TheTerminal, Bloomberg Finance L.P.

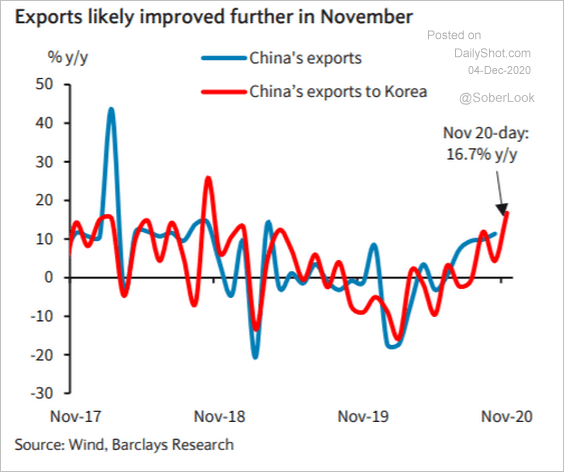

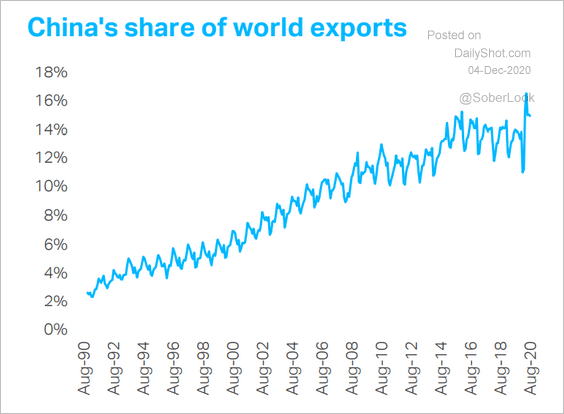

3. Exports continue to grow.

Source: Barclays Research

Source: Barclays Research

Source: TS Lombard

Source: TS Lombard

Emerging Markets

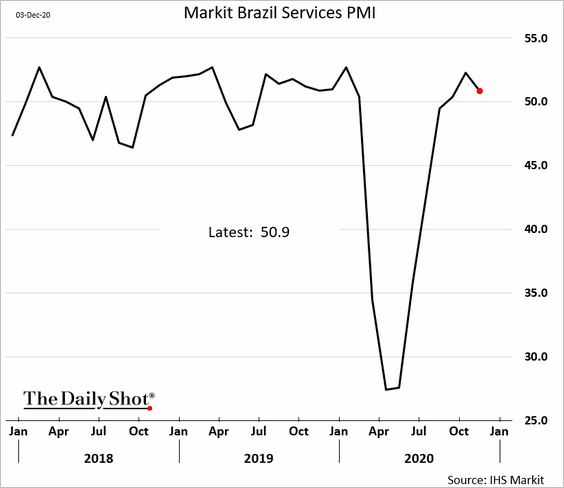

1. Brazil’s service sector growth slowed last month.

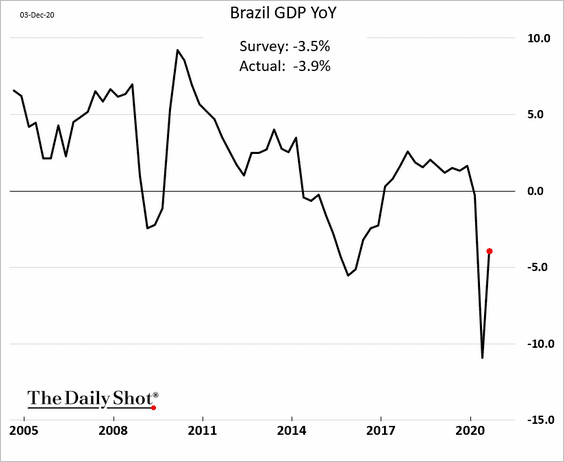

The Q3 GDP rebound was a bit softer than expected.

——————–

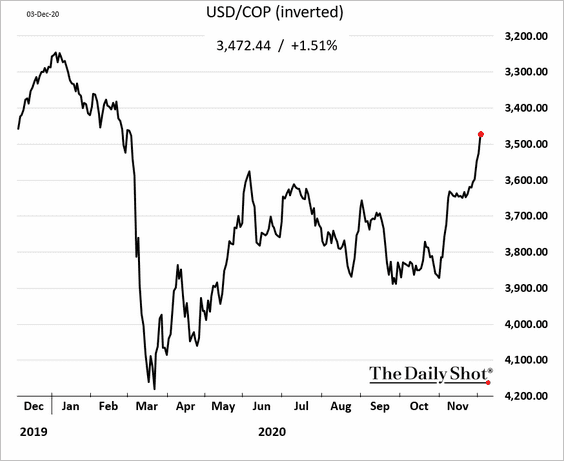

2. The Colombian peso is soaring.

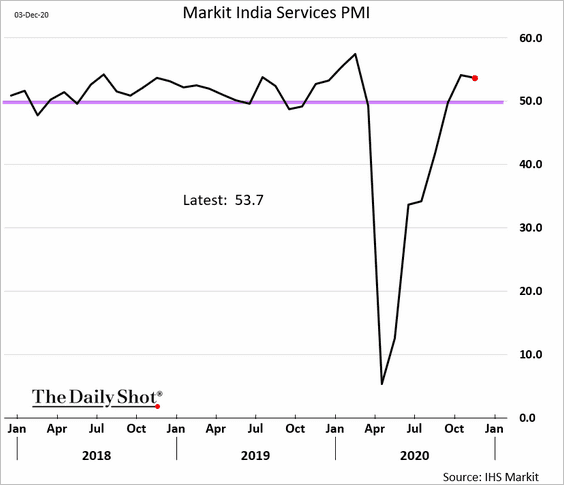

3. India’s service-sector growth was stable in November.

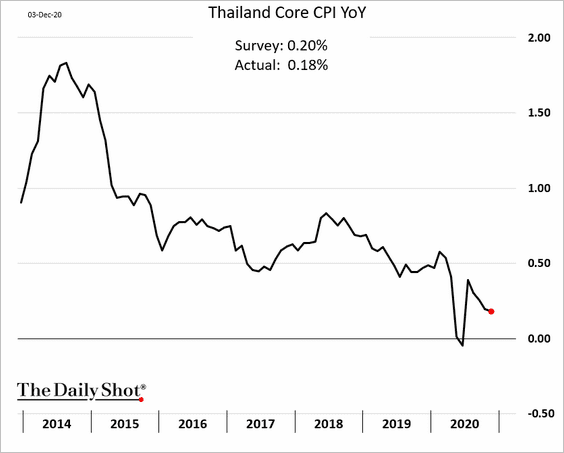

4. Thailand’s CPI continues to trend lower.

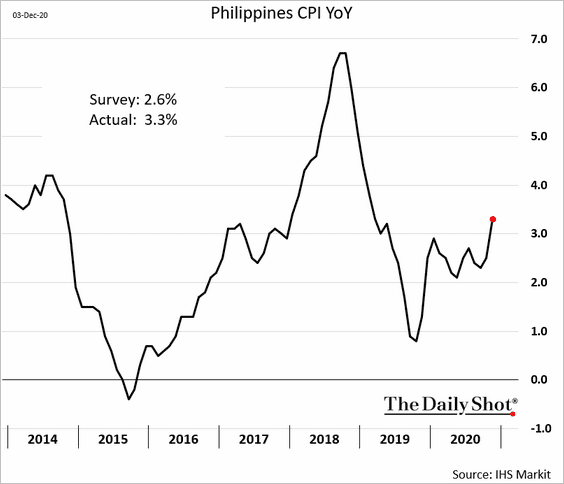

5. But inflation in the Philippines jumped last month (after the typhoons).

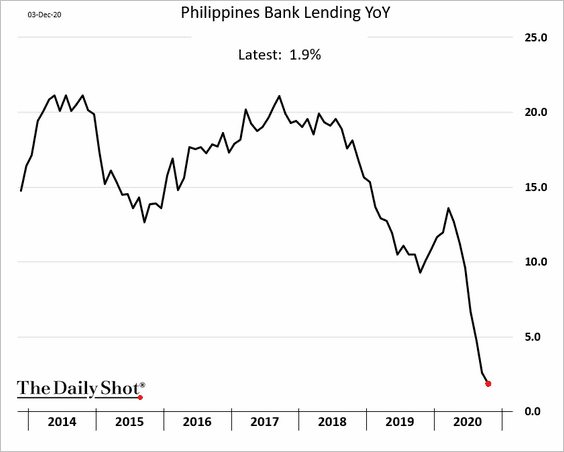

Credit growth in the Philippines continues to slow.

——————–

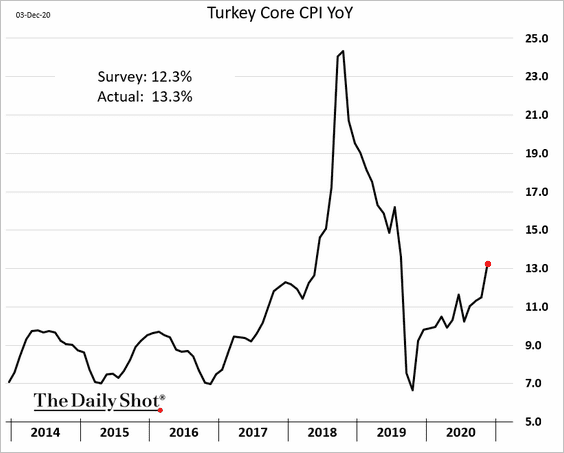

6. Turkey’s inflation is accelerating after the massive currency devaluation.

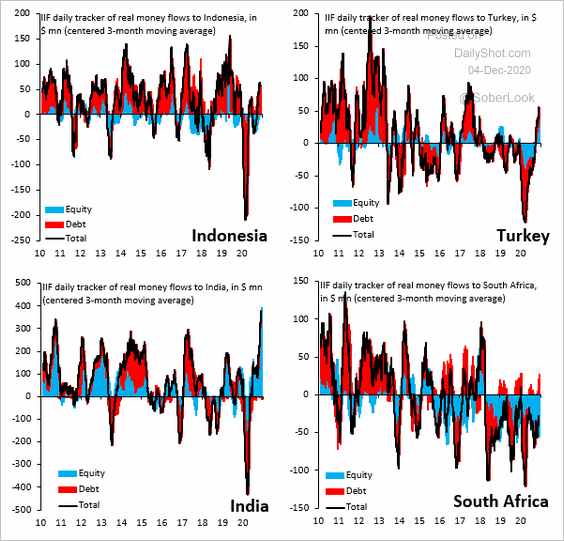

7. Here are some fund flow trends.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

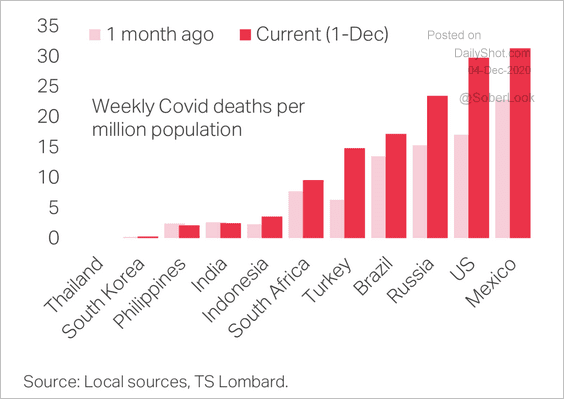

8. This chart shows the changes in COVID-related deaths.

Source: TS Lombard

Source: TS Lombard

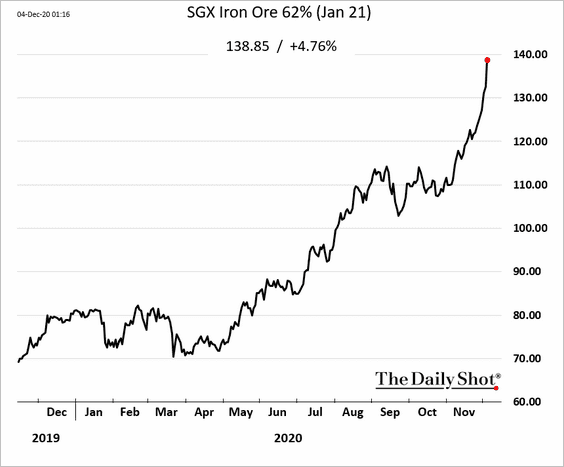

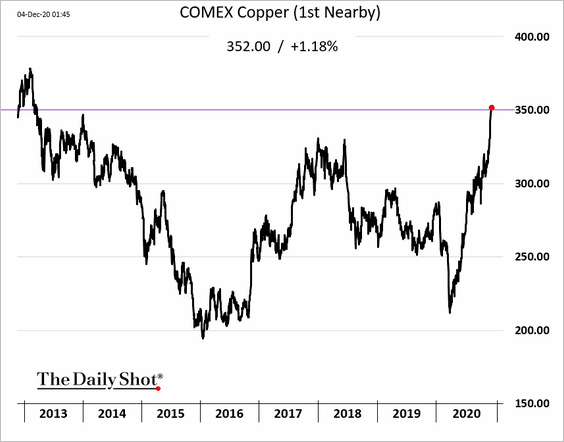

Commodities

1. Industrial commodities are flying high.

• Iron ore:

• Copper:

——————–

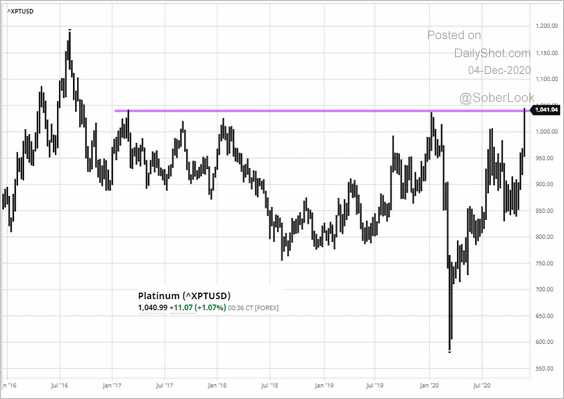

2. Platinum is at resistance.

Source: barchart.com

Source: barchart.com

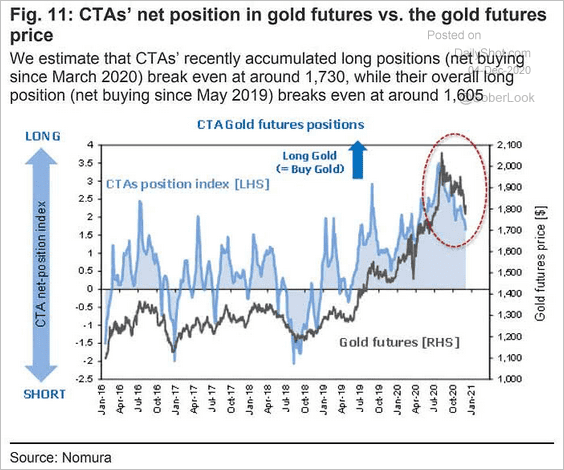

3. Here is Goldman’s estimate of CTA’s gold positioning.

Source: @ISABELNET_SA, @Nomura

Source: @ISABELNET_SA, @Nomura

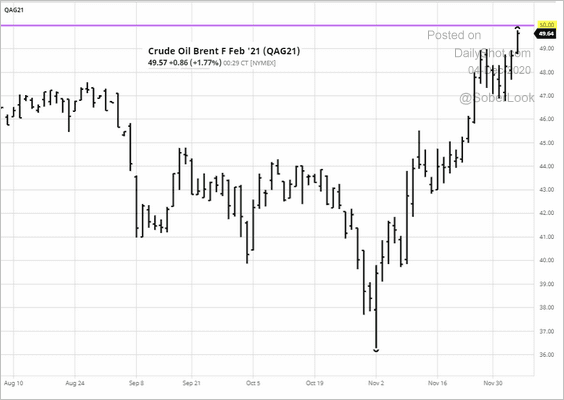

Energy

1. Brent is testing $50/bbl.

Source: barchart.com

Source: barchart.com

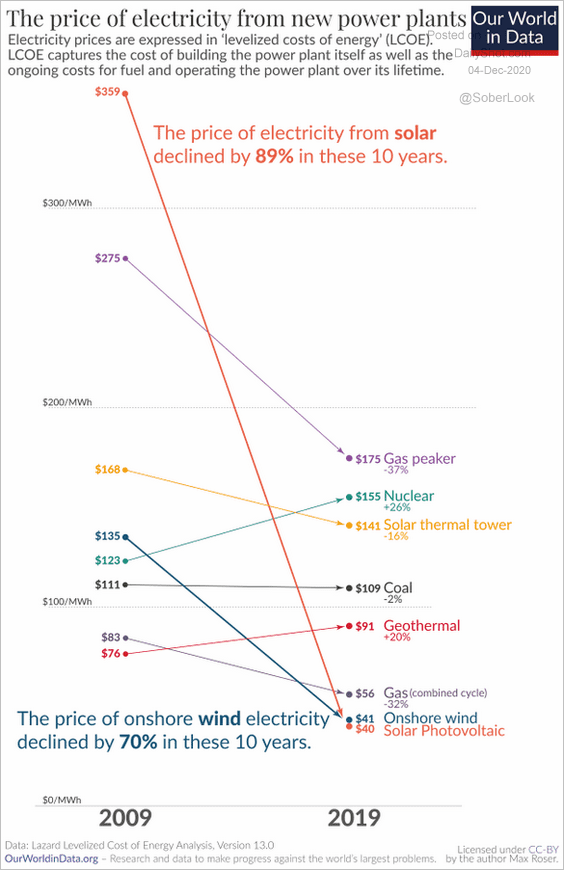

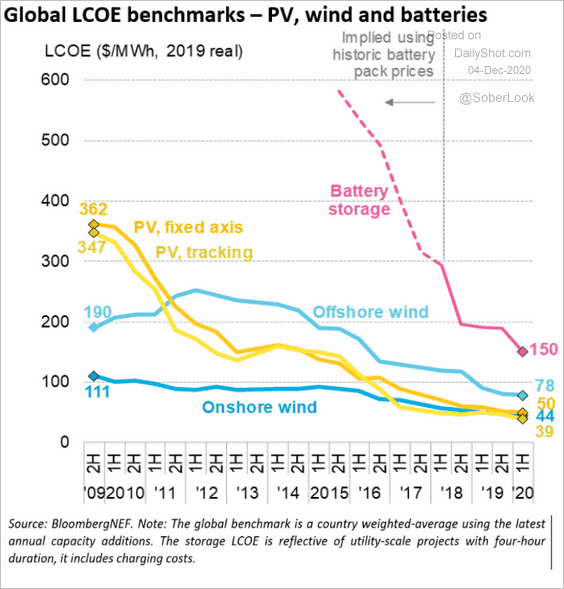

2. The next couple of charts show cost trends for renewables.

Source: @MaxCRoser Read full article

Source: @MaxCRoser Read full article

Source: @bopinion Read full article

Source: @bopinion Read full article

Equities

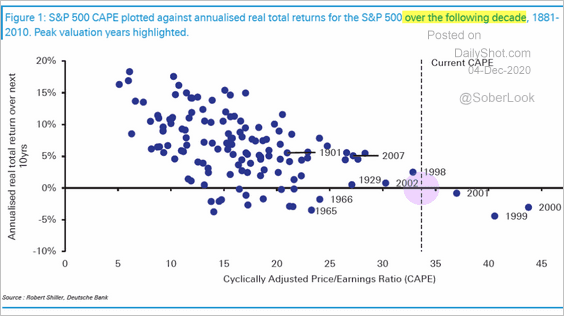

1. Given the current S&P 500 valuations, what returns should we expect over the next decade?

Source: Jim Reid, Deutsche Bank Research

Source: Jim Reid, Deutsche Bank Research

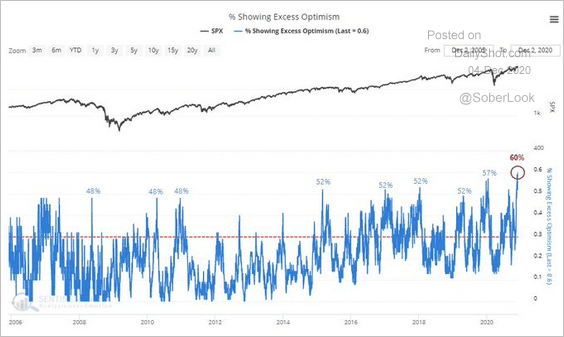

2. Sentiment indicators are flashing excessive optimism.

Source: @sentimentrader

Source: @sentimentrader

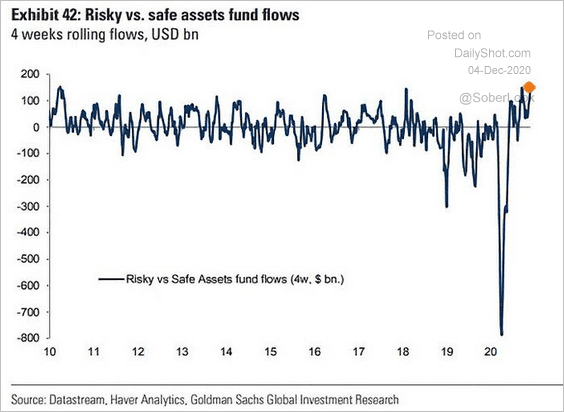

As we saw earlier (chart), fund flows point to high levels of risk appetite.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

——————–

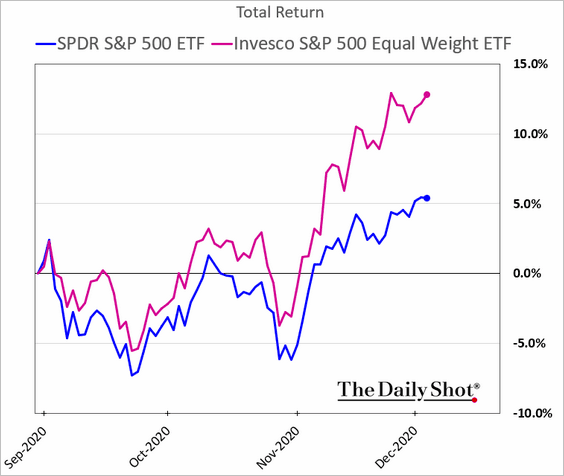

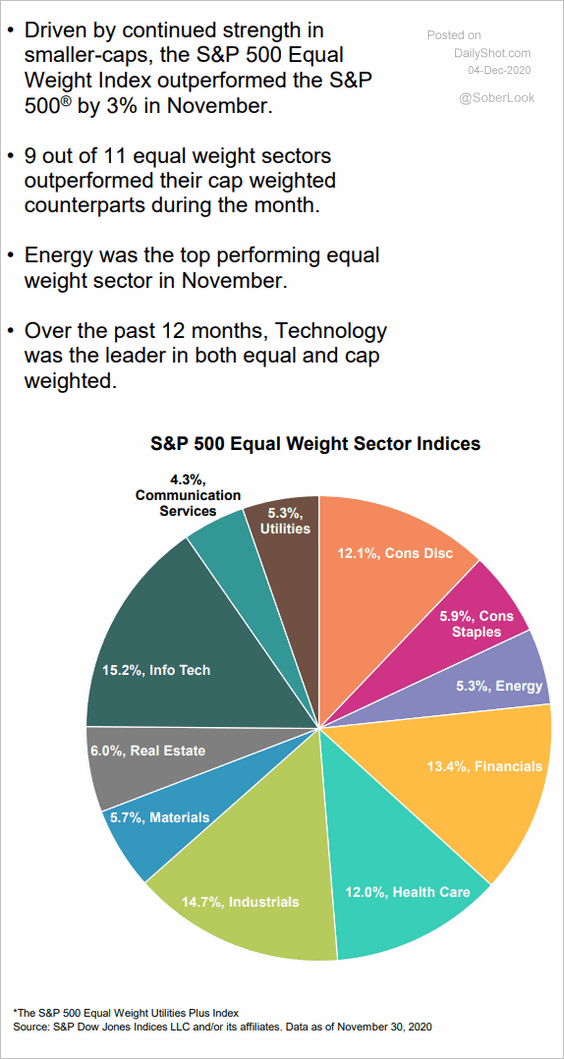

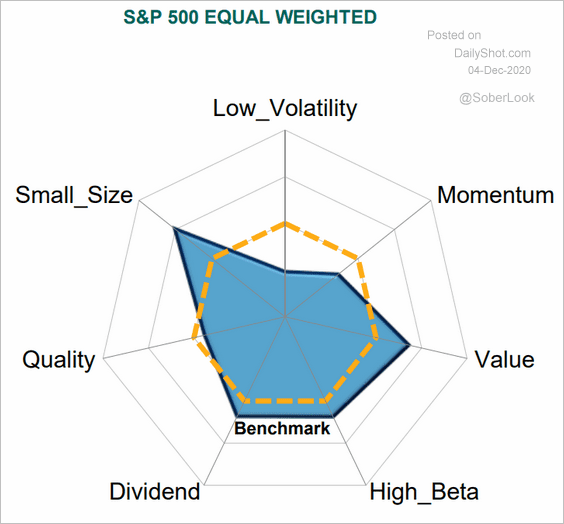

3. Next, let’s take a look at the equal-weight S&P 500 index.

• Relative performance over the past three months:

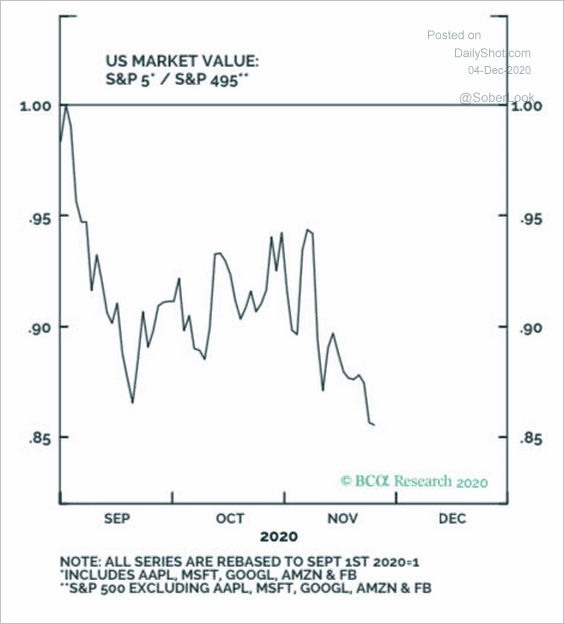

By the way, the above trend resulted in the “S&P 5” underperforming “S&P 495”.

Source: Anastasios Avgeriou, BCA Research

Source: Anastasios Avgeriou, BCA Research

• Sector distribution of the equal-weight index:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

• Equity factor “weights”:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

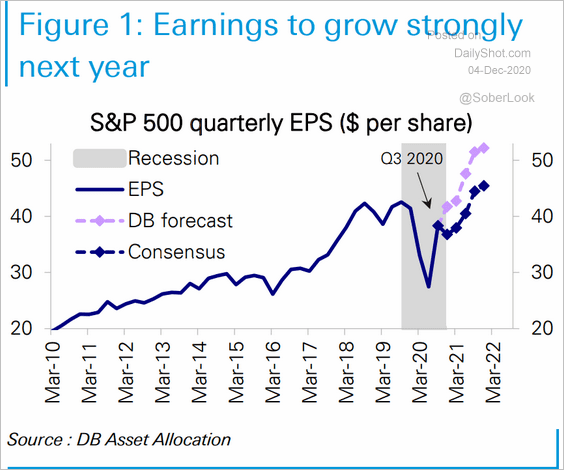

4. Analysts expect earnings growth to accelerate next year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

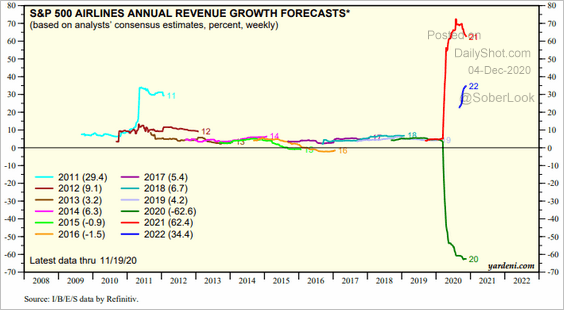

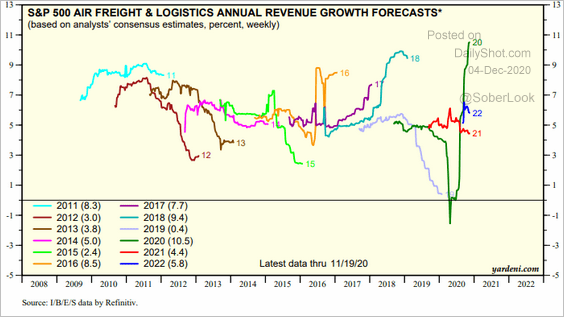

5. Here are a couple of revenue trends (consensus expectations).

• Airlines:

Source: Yardeni Research

Source: Yardeni Research

• Air freight (limited global capacity this year):

Source: Yardeni Research

Source: Yardeni Research

Credit

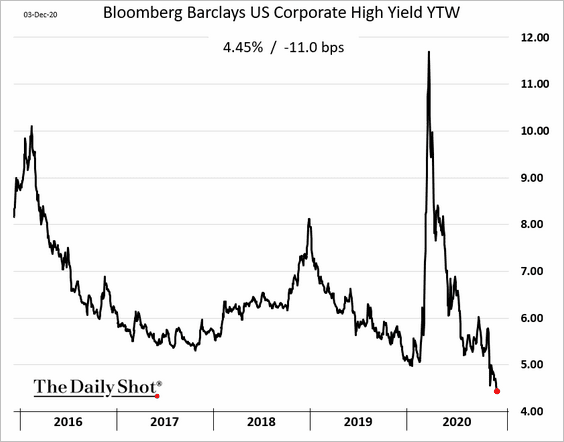

1. The yield on US high-yield bonds hit a record low.

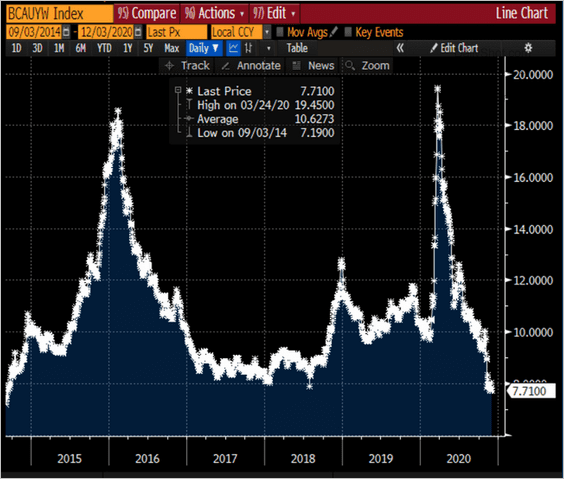

Even CCC yields are at multi-year lows.

Source: @lisaabramowicz1

Source: @lisaabramowicz1

——————–

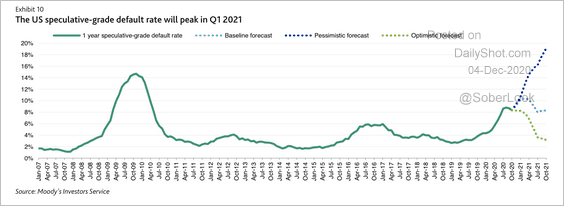

2. Moody’s expects the US speculative-grade default rate to peak in Q1 next year.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

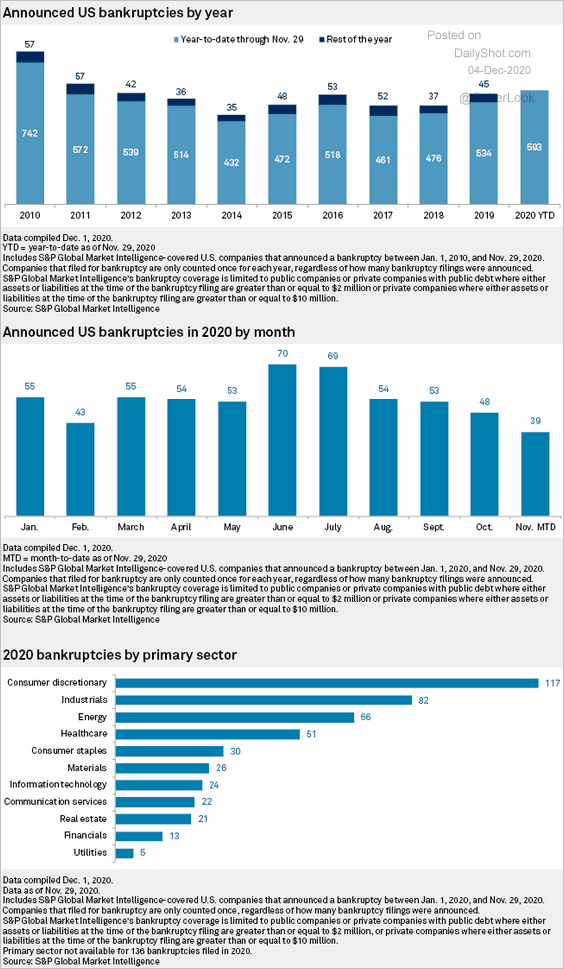

3. Here is an updated chart on corporate bankruptcies from S&P Global.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

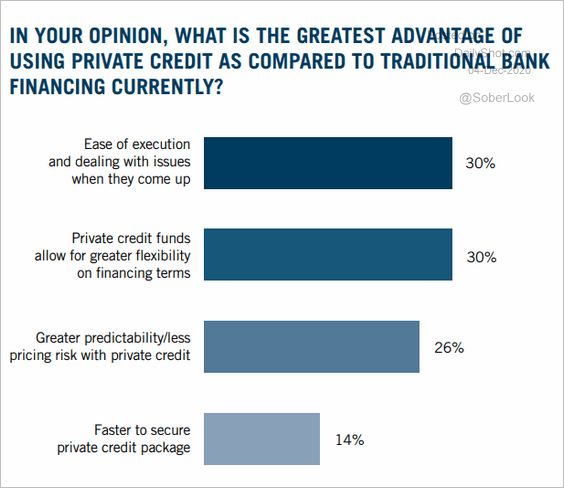

4. What are the advantages for borrowers of using private credit?

Source: Dechert

Source: Dechert

Rates

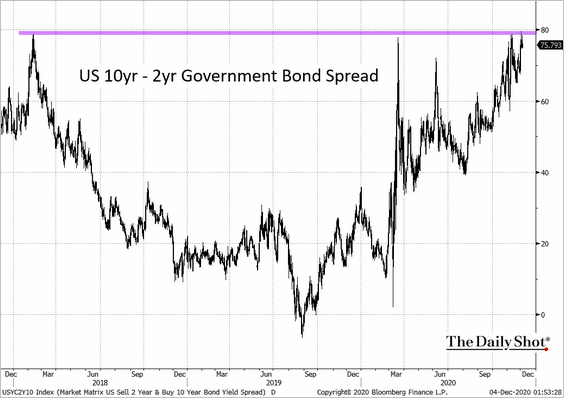

1. The 10yr-2yr Treasury spread is at resistance as the curve steepens.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

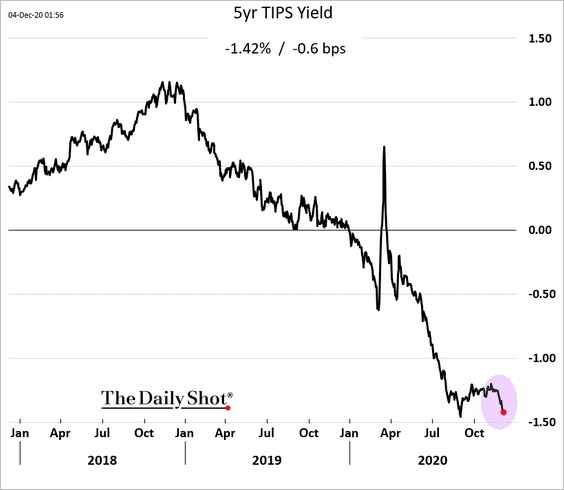

2. TIPS yields (real rates) are falling again as inflation expectations climb. We see the same trend in Germany (the Eurozone section).

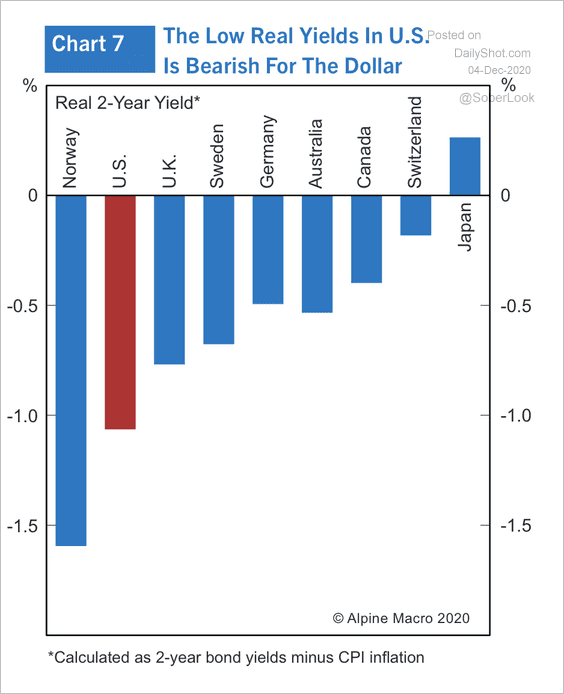

US real yields are some of the lowest among developed economies.

Source: Alpine Macro

Source: Alpine Macro

——————–

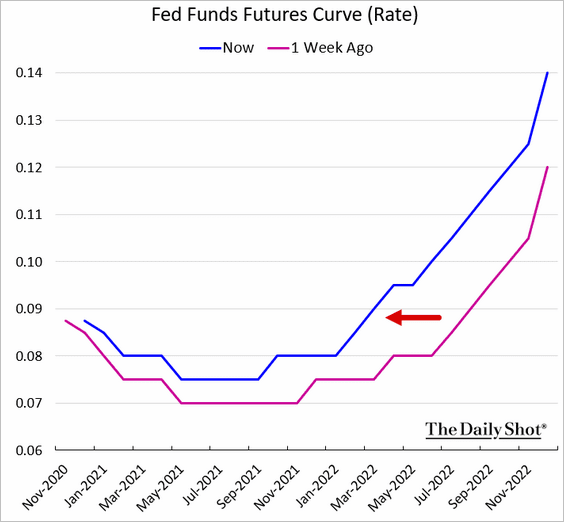

3. The market is bringing forward expectations of the first Fed rate hike.

Global Developments

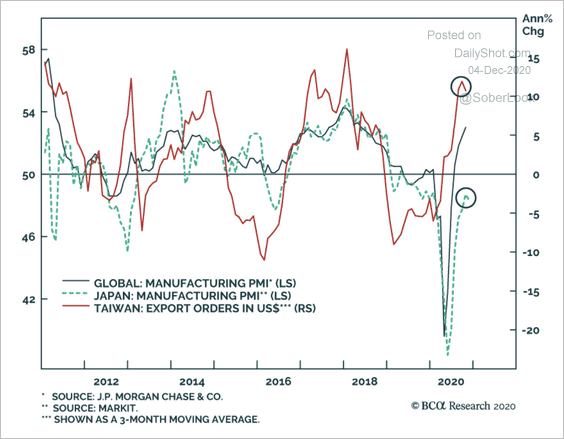

1. The recovery in Taiwan’s export orders bodes well for global manufacturing PMIs.

Source: BCA Research

Source: BCA Research

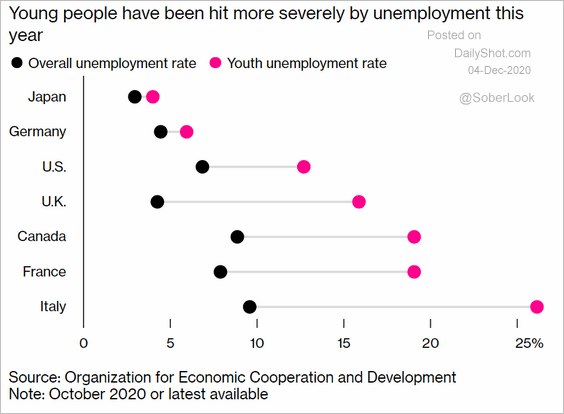

2. This chart shows youth unemployment in advanced economies.

Source: @markets Read full article

Source: @markets Read full article

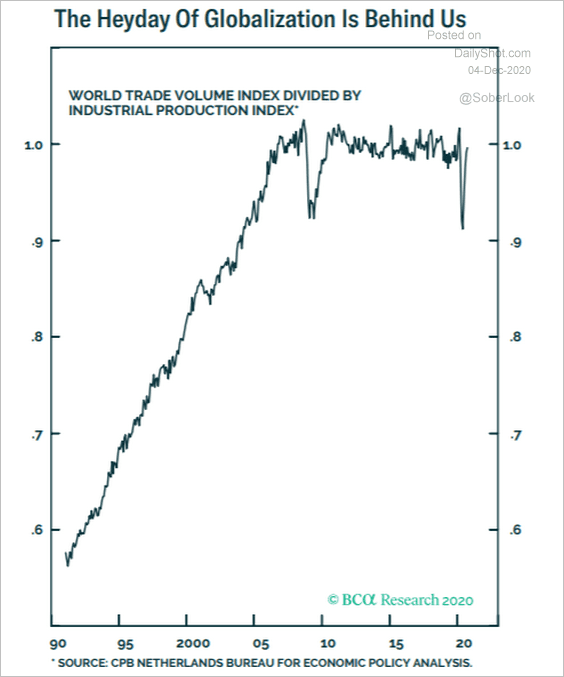

3. Peak globalization?

Source: BCA Research

Source: BCA Research

——————–

Food for Thought

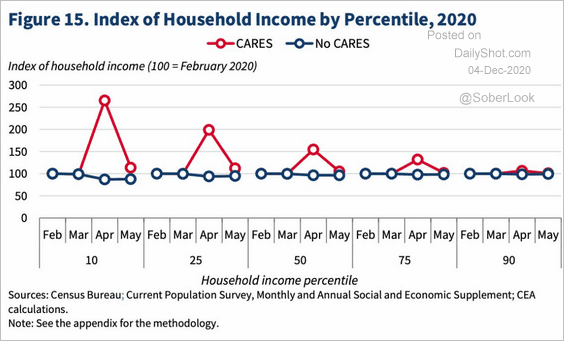

1. US household incomes with and without government stimulus:

Source: @adam_tooze, @LondonReview Read full article

Source: @adam_tooze, @LondonReview Read full article

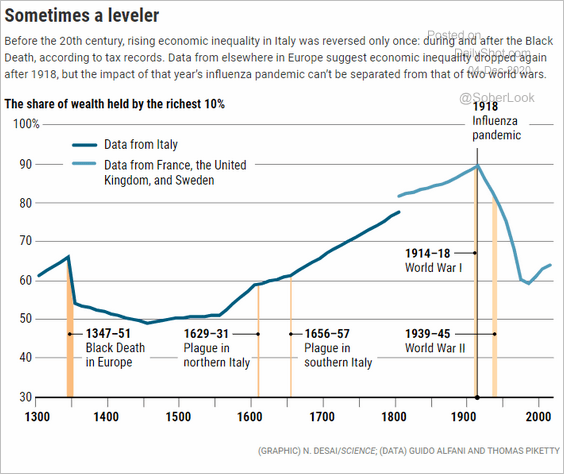

2. Pandemics can sometimes reduce inequality.

Source: Science Read full article

Source: Science Read full article

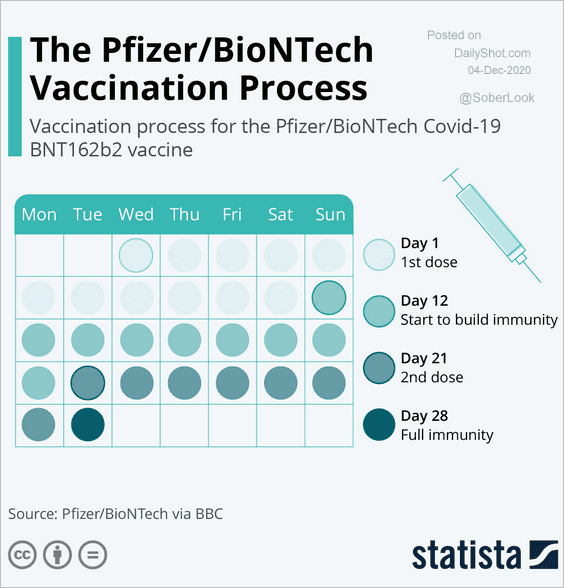

3. Pfizer’s vaccine is not a “one-shot” procedure.

Source: Statista

Source: Statista

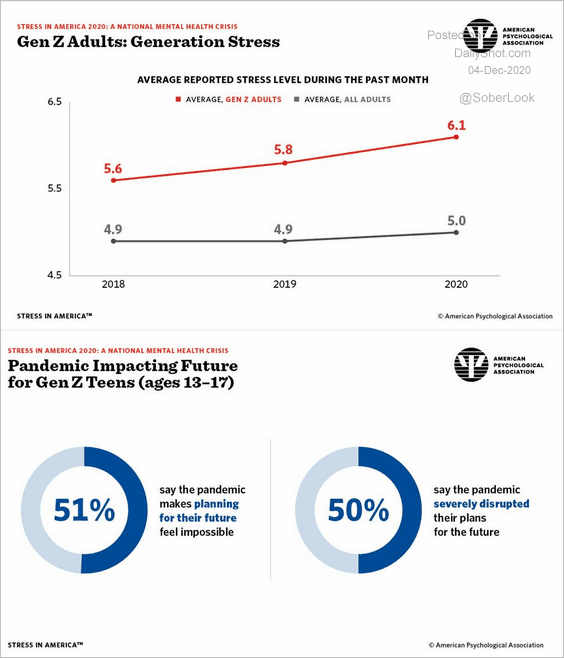

4. Gen-Z under stress:

Source: APA Read full article

Source: APA Read full article

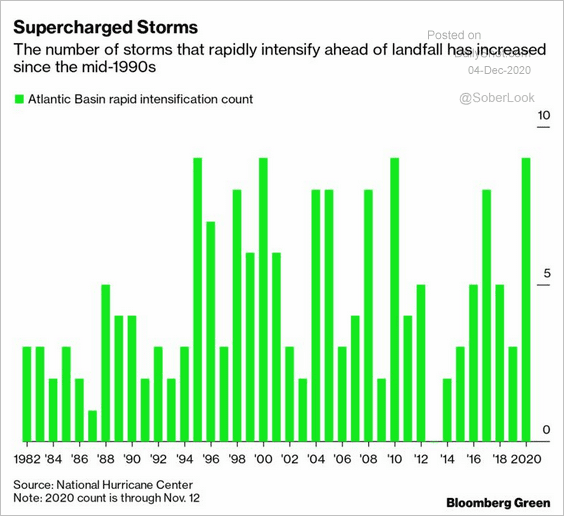

5. The number of storms that rapidly intensify:

Source: @business Read full article

Source: @business Read full article

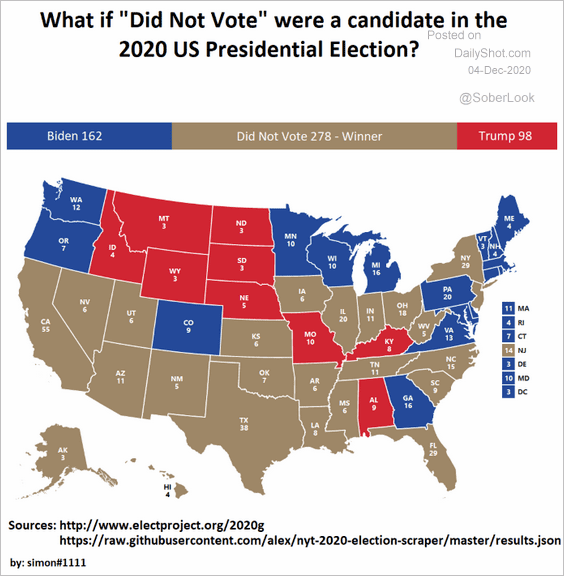

6. “Did not vote” is the winner:

Source: @BrilliantMaps

Source: @BrilliantMaps

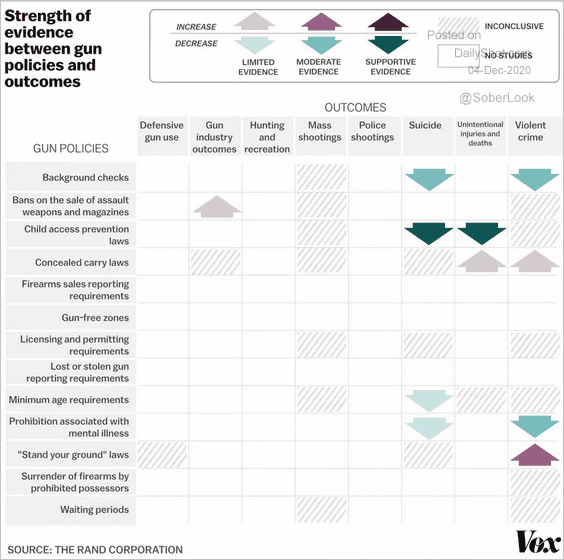

7. Gun policy outcomes:

Source: VOX Read full article

Source: VOX Read full article

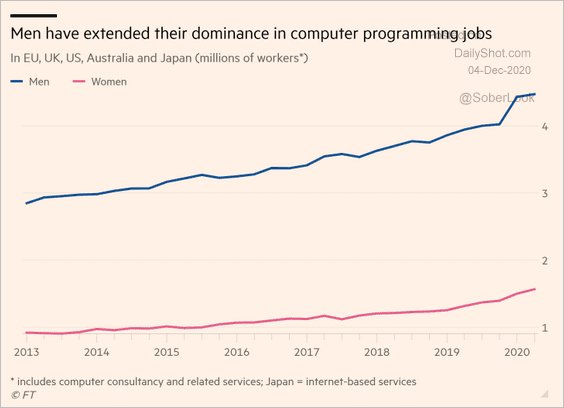

8. Computer programming jobs:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

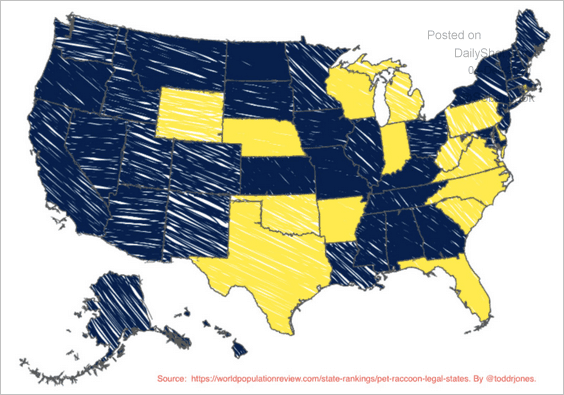

9. Where it is legal to own a raccoon:

Source: @toddrjones

Source: @toddrjones

——————–

Have a great weekend!