The Daily Shot: 16-Dec-20

• The United States

• Canada

• The United Kingdom

• Europe

• Japan

• Asia – Pacific

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

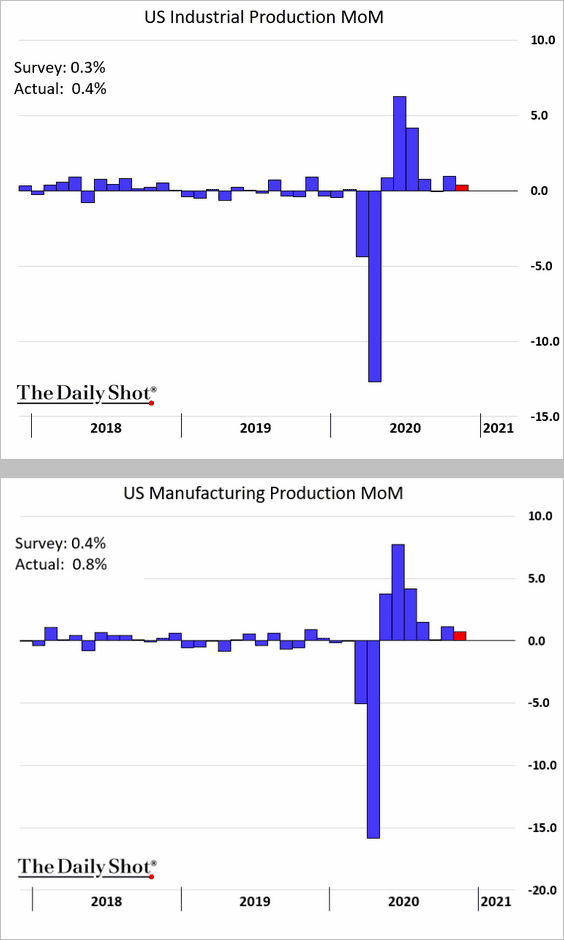

1. US industrial production continues to recover, with the November factory output exceeding market expectations.

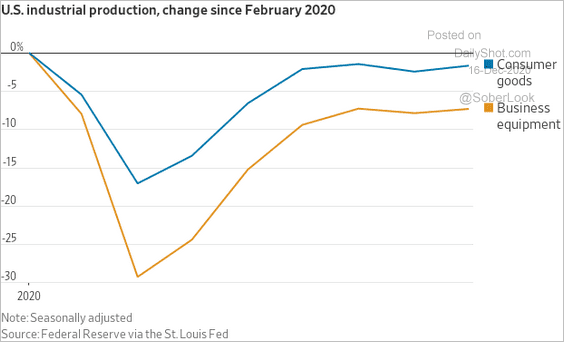

• The rebound in consumer goods production has outpaced business equipment.

Source: @jeffsparshott

Source: @jeffsparshott

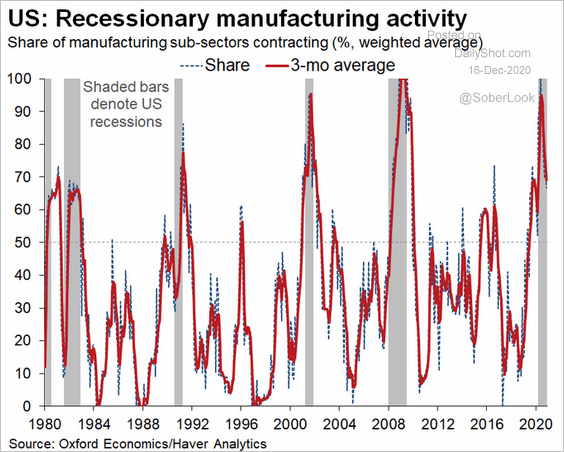

• Many industrial sectors are still operating below last year’s levels.

Source: @GregDaco, @OxfordEconomics

Source: @GregDaco, @OxfordEconomics

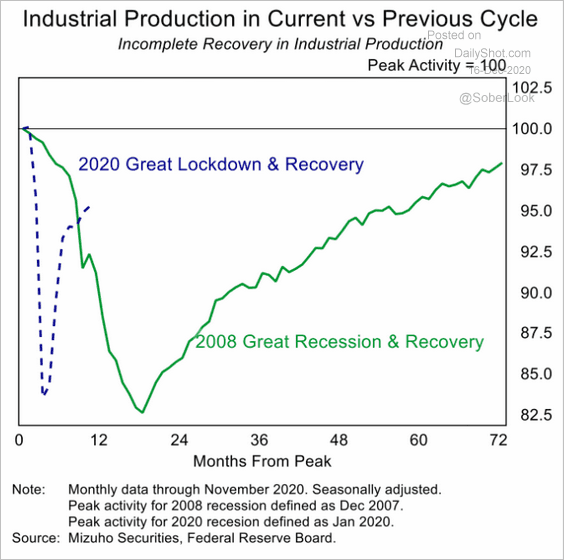

• Here is a comparison to the 2008 recession.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

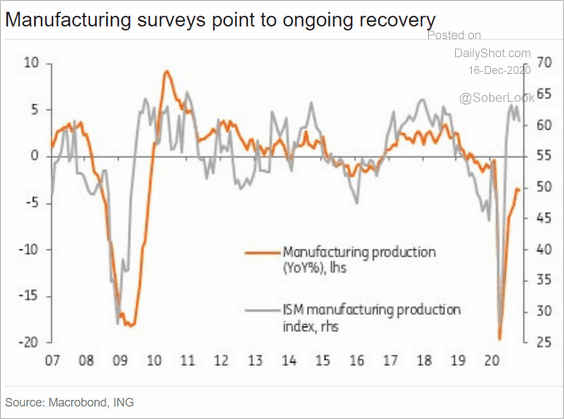

• Survey data point to further upside for industrial production.

Source: ING

Source: ING

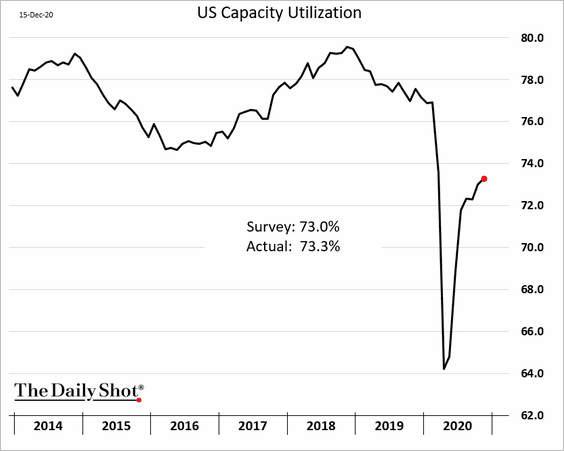

• Capacity utilization is still well below pre-COVID levels.

——————–

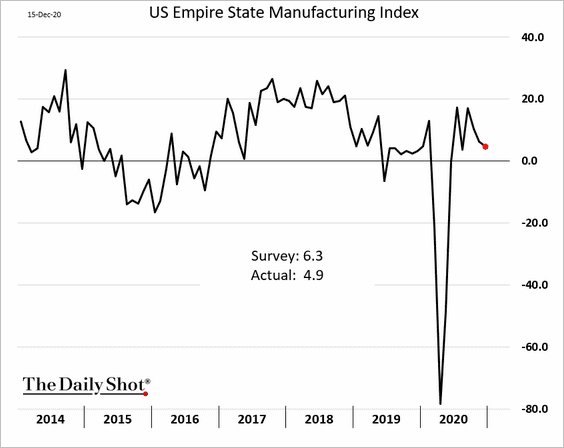

2. The NY Fed’s regional manufacturing activity index showed further moderation.

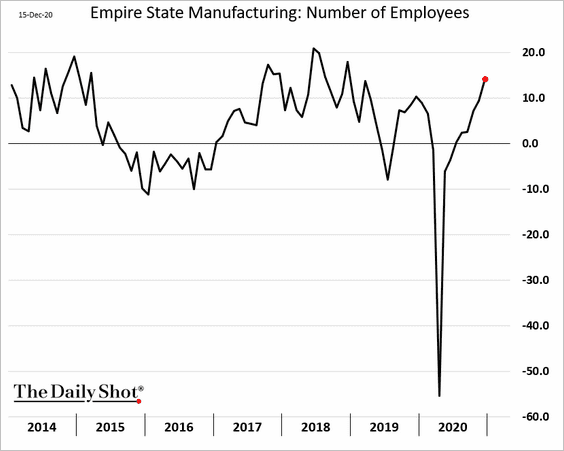

But factory employment continues to improve.

——————–

3. Households increasingly expect to boost their spending in the next 12 months.

Source: @WSJ Read full article

Source: @WSJ Read full article

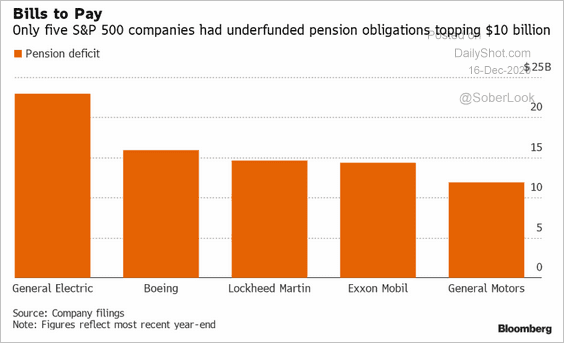

4. This chart shows the most underfunded corporate pensions (in dollar terms).

Source: Tom Contiliano, Ryan Beene, Rick Clough, @business Read full article

Source: Tom Contiliano, Ryan Beene, Rick Clough, @business Read full article

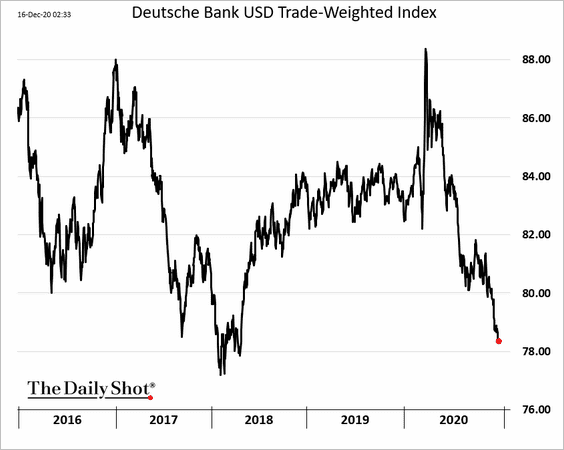

5. US financial conditions are now the most accommodative in decades, which typically signals stronger economic growth ahead. The stock market rally, low rates, tightening credit spreads, and a weakening US dollar have been the drivers of this trend.

Source: @markets Read full article

Source: @markets Read full article

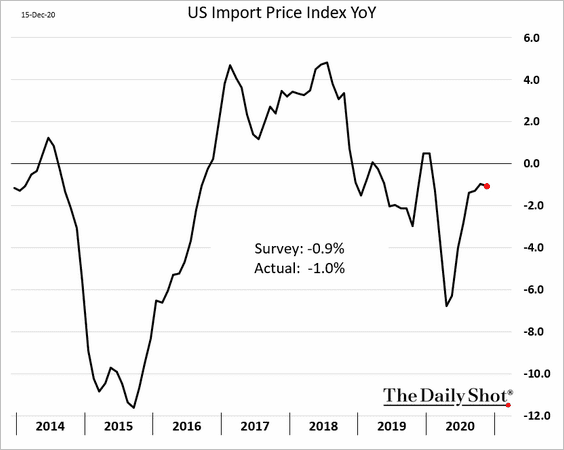

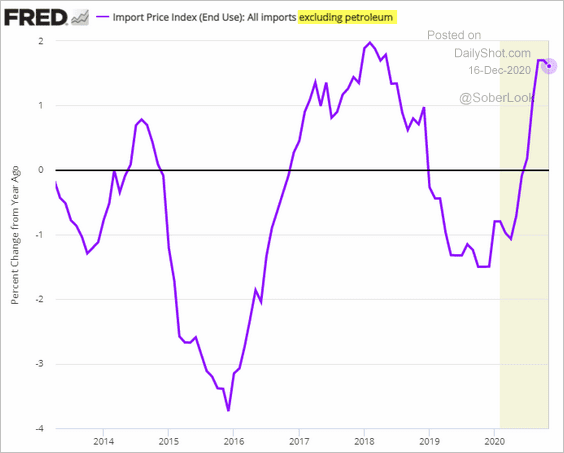

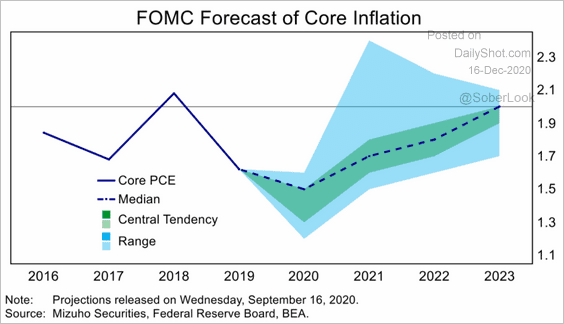

6. Next, we have some updates on inflation.

• Gains in import prices slowed last month despite the US dollar’s persistent downward trend (3rd chart).

• Here is the FOMC’s forecast for core inflation.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

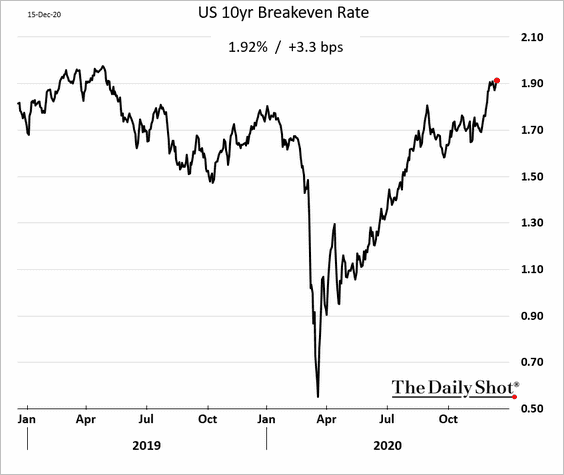

• Long-term market-based inflation expectations continue to grind higher.

Canada

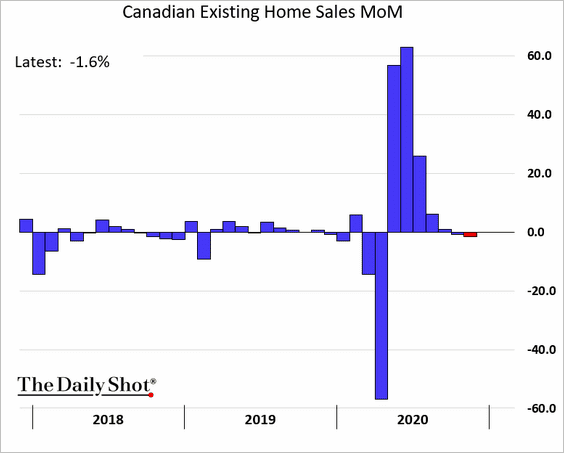

1. Existing home sales declined last month.

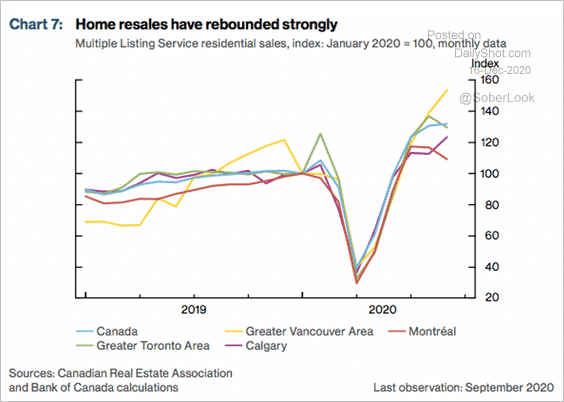

Home sales have rebounded strongly since the Q1 lows, especially in Vancouver.

Source: Bank of Canada

Source: Bank of Canada

——————–

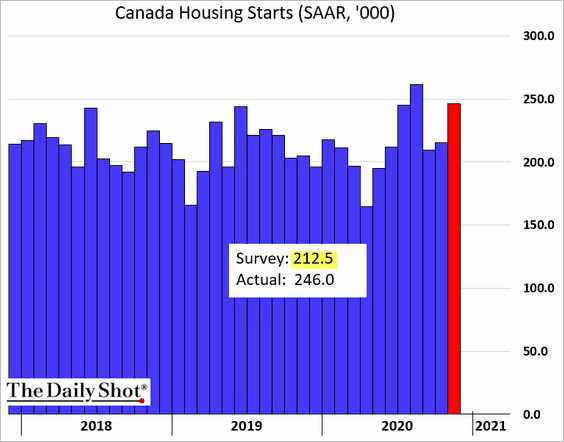

2. November housing starts surprised to the upside.

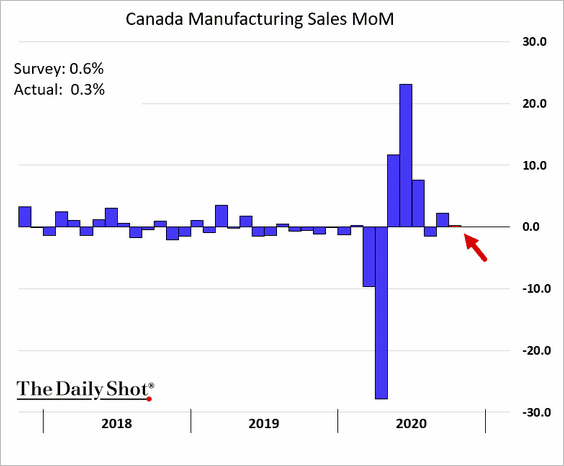

3. Manufacturing sales were softer than expected in October.

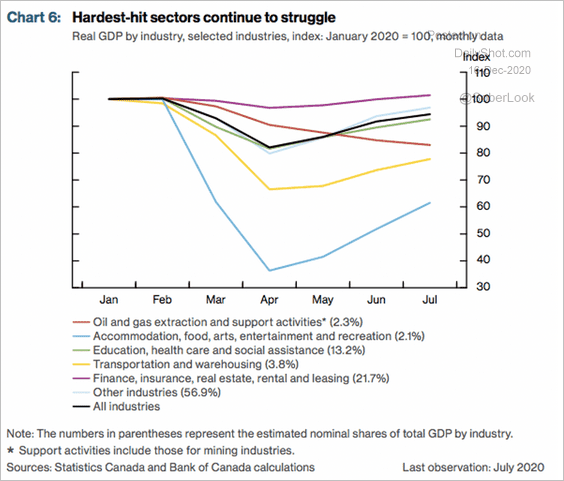

4. The recovery in oil and gas continues to lag other industries.

Source: Bank of Canada

Source: Bank of Canada

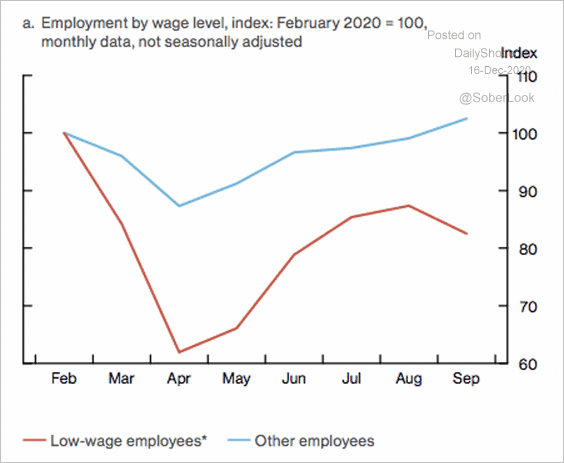

5. Low-wage workers have suffered far worse than the average employee this year.

Source: Bank of Canada

Source: Bank of Canada

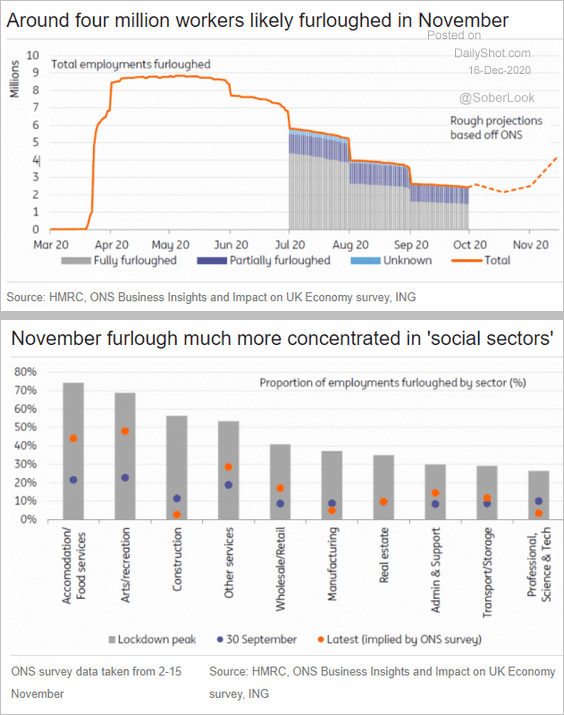

The United Kingdom

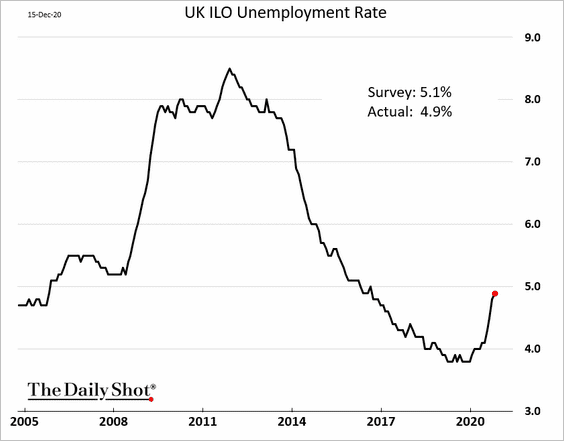

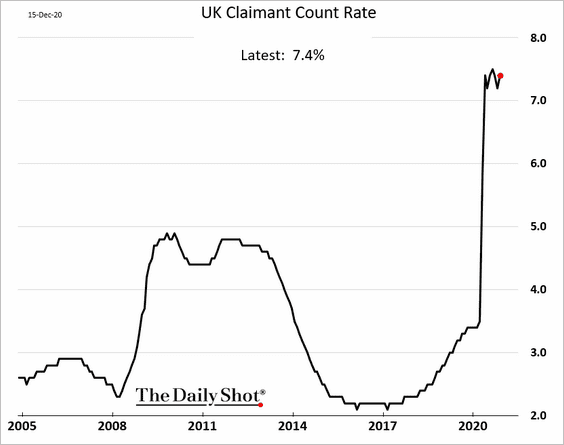

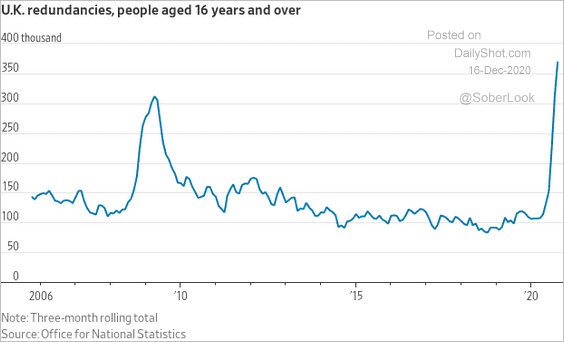

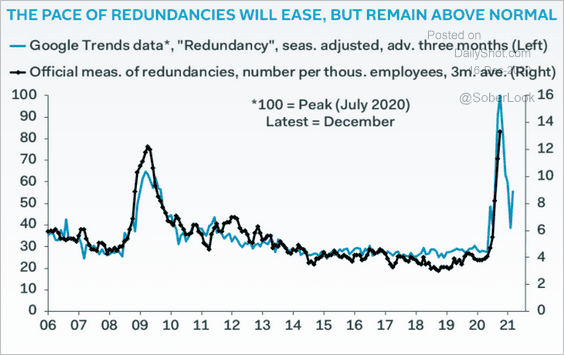

1. Let’s begin with the labor market.

• The unemployment rate increased less than expected.

• The claimant rate (the number of people seeking jobless benefits) remains elevated.

• Layoffs hit the highest level in years.

Source: @jeffsparshott

Source: @jeffsparshott

But Google search activity points to layoffs peaking.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Below are some data of furloughs from ING.

Source: ING

Source: ING

——————–

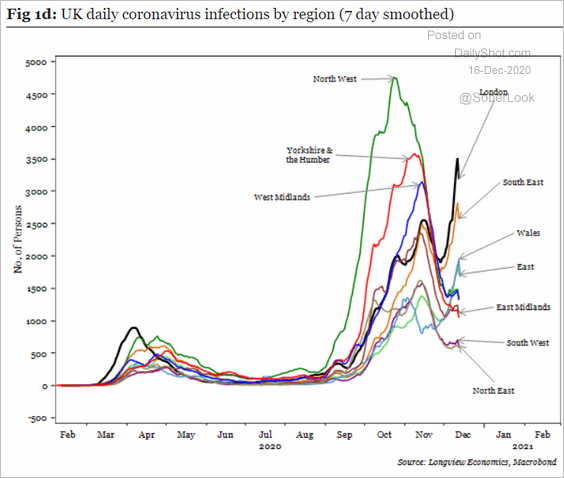

2. Here is the COVID situation by region.

Source: Longview Economics

Source: Longview Economics

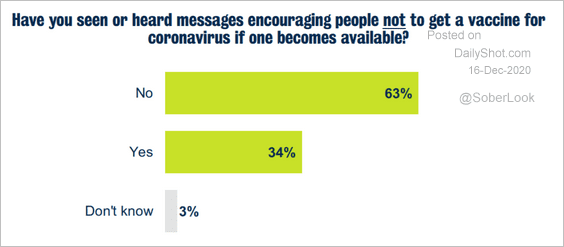

There is no shortage of misinformation out there.

Source: @policyatkings, @kingscollegelon

Source: @policyatkings, @kingscollegelon

——————–

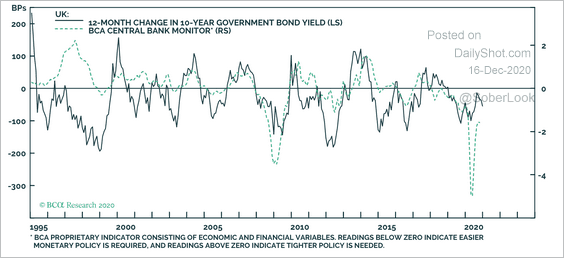

3. BCA Research expects gilts to lag as global bond yields rise.

Source: BCA Research

Source: BCA Research

Europe

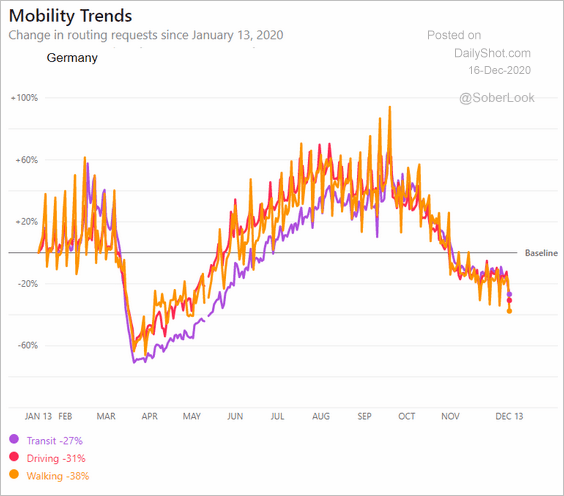

1. This chart shows Germany’s mobility trends.

Source: Apple

Source: Apple

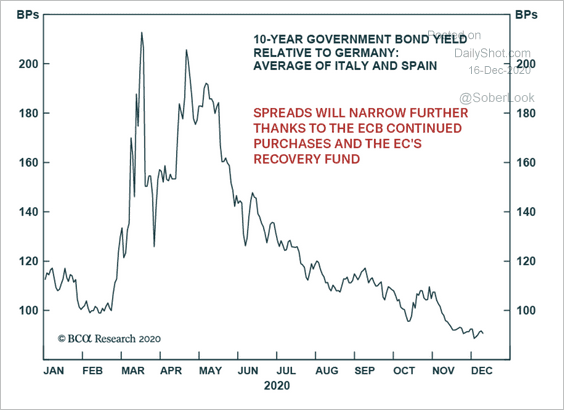

2. BCA Research expects tighter government bond spreads given additional easing from the ECB.

Source: BCA Research

Source: BCA Research

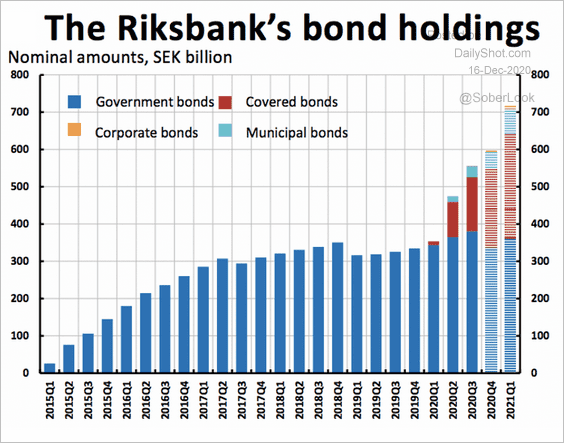

3. Bond holdings at Sweden’s Riksbank are expected to exceed SEK 700 billion next year.

Source: Riksbank

Source: Riksbank

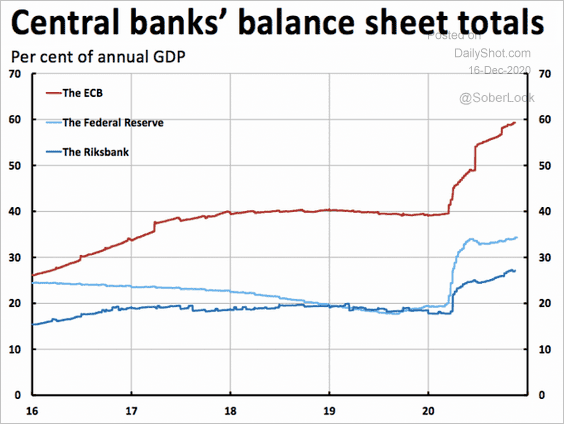

Riksbank’s balance sheet as a percent of GDP remains below that of the ECB and the Fed.

Source: Riksbank

Source: Riksbank

——————–

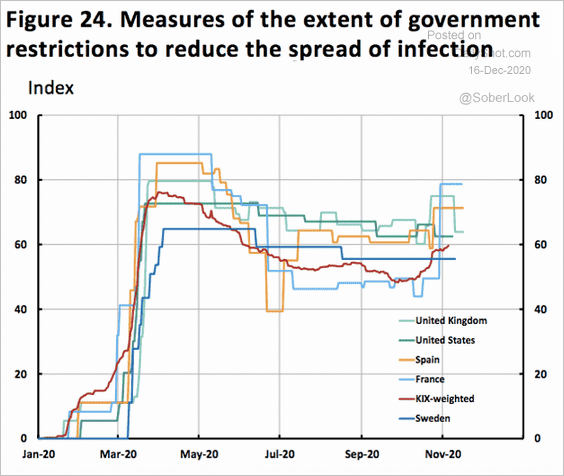

4. This chart shows the extent of measures to reduce the spread of COVID-19 by country.

Source: Riksbank

Source: Riksbank

Japan

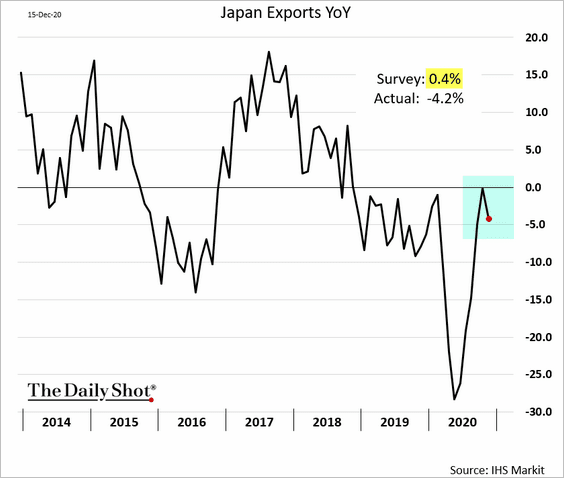

1. Exports unexpectedly pulled back in November.

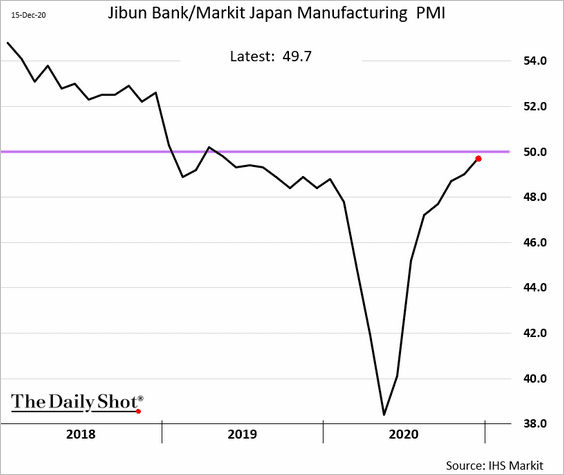

2. Manufacturing activity has almost stabilized in December (PMI close to 50).

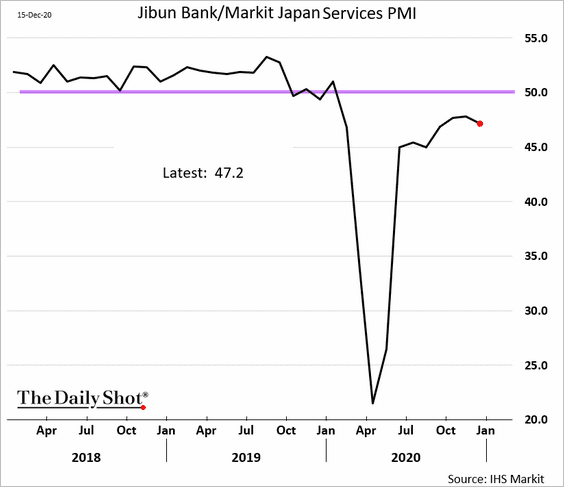

But service activity weakened at a faster pace amid the third wave of COVID infections.

——————–

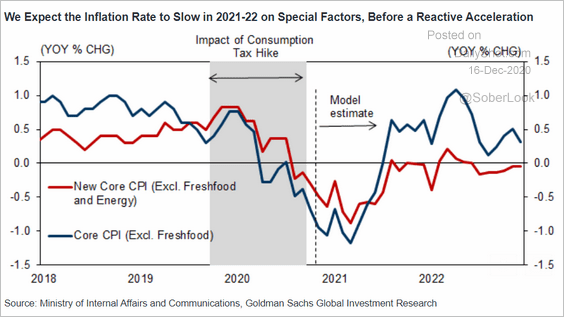

3. According to Goldman, deflation will continue to worsen over the next few months.

Source: Goldman Sachs

Source: Goldman Sachs

Asia – Pacific

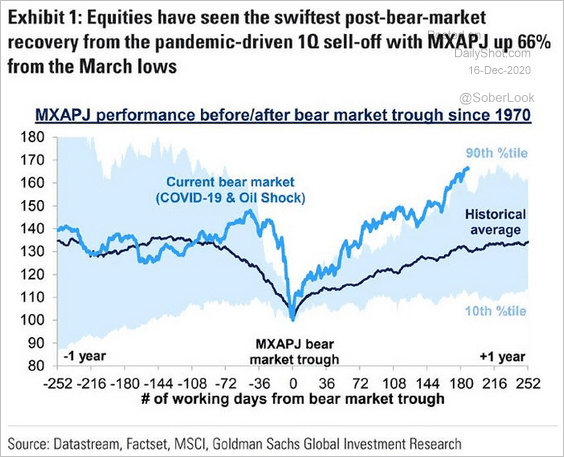

1. Stocks have rebounded faster than in any recovery since 1970.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

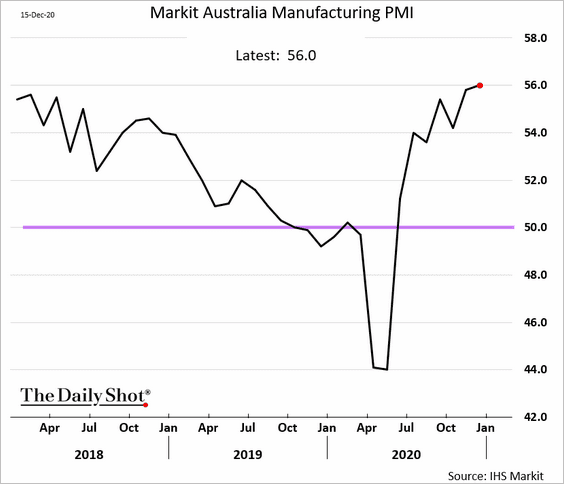

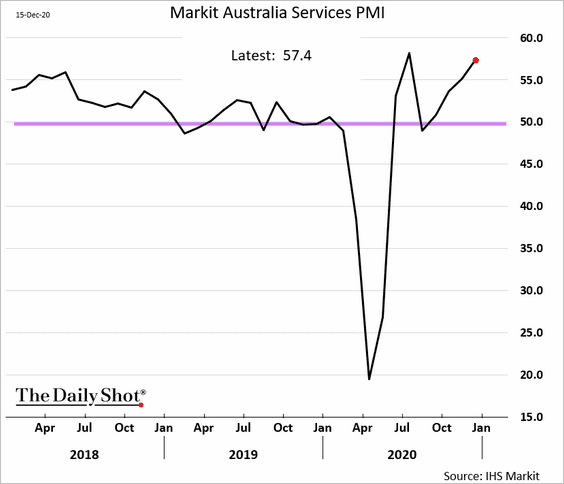

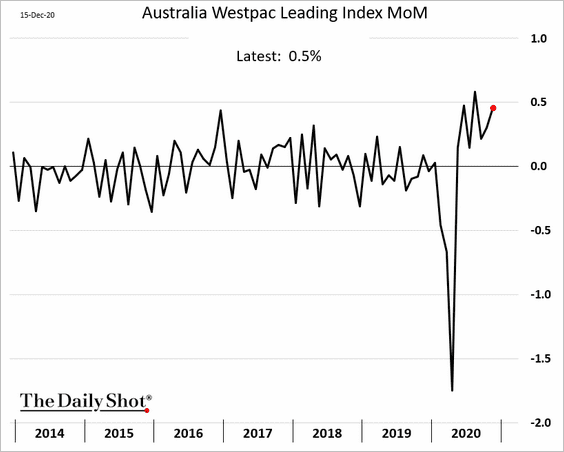

2. Here are some updates on Australia.

• Both manufacturing and service activity accelerated in December.

• The Westpac leading index growth remains elevated.

Emerging Markets

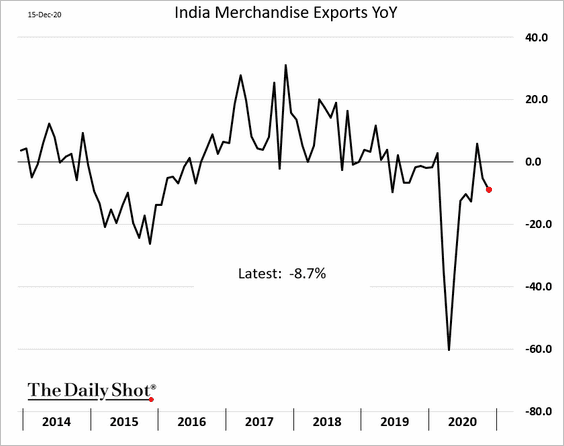

1. India’s exports declined last month.

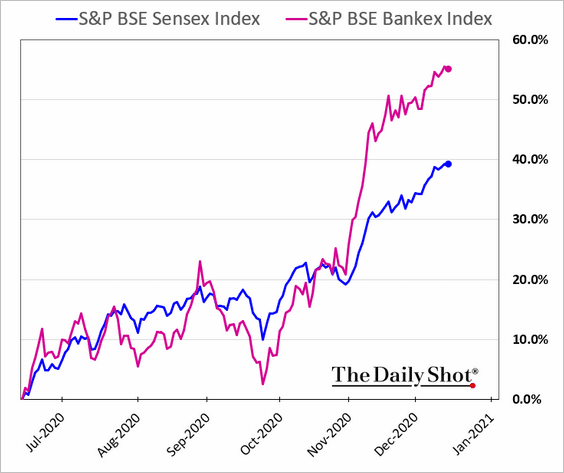

Separately, Indian banks have been outperforming amid recovery optimism.

h/t @nupuracharya

h/t @nupuracharya

——————–

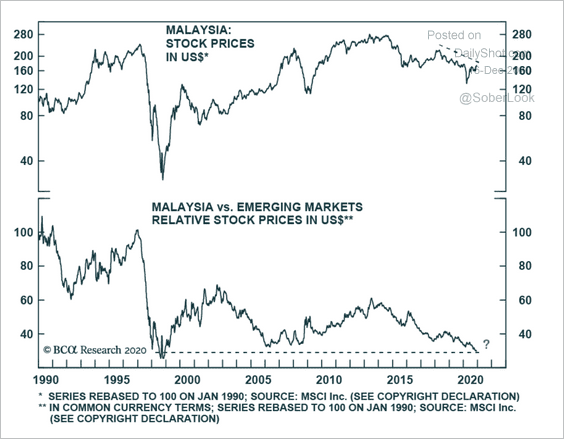

2. Malaysian equities are at support relative to the broader EM index.

Source: BCA Research

Source: BCA Research

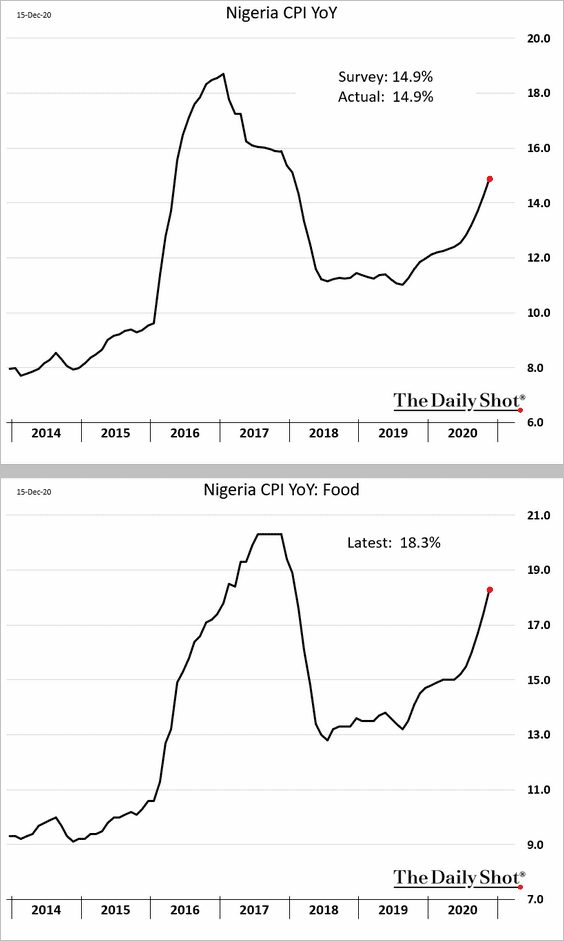

3. Nigeria’s inflation is accelerating (driven by food prices).

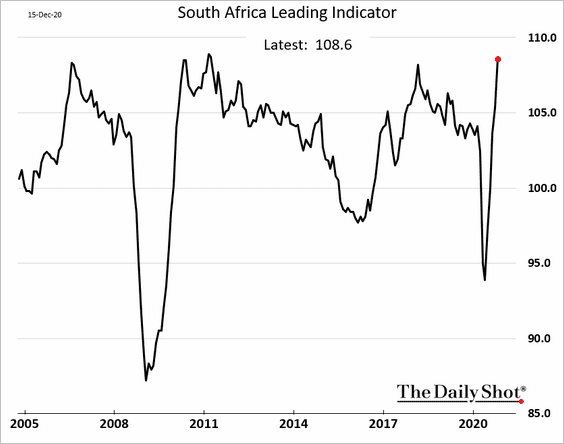

4. South Africa’s leading index hit a multi-year high in October.

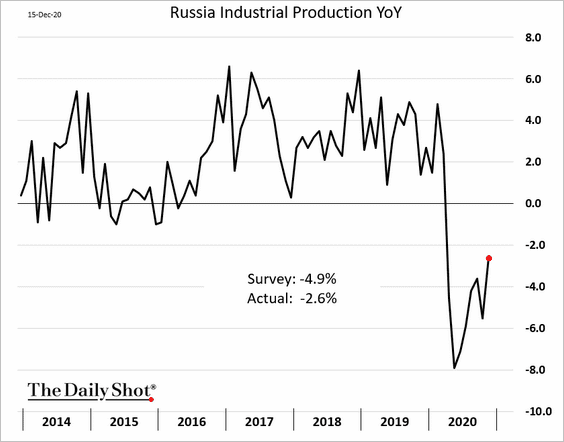

5. Russia’s industrial output is finally rebounding.

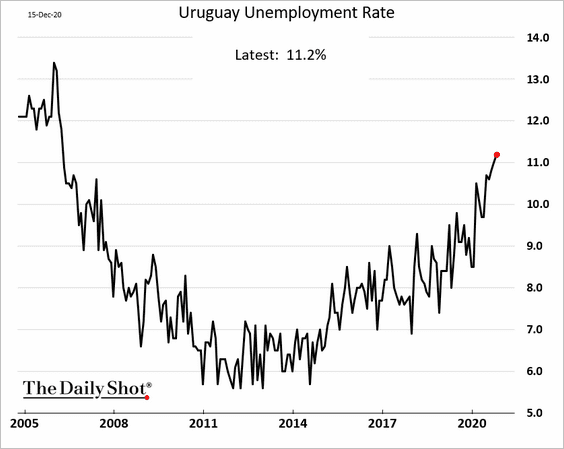

6. Here is Uruguay’s unemployment rate.

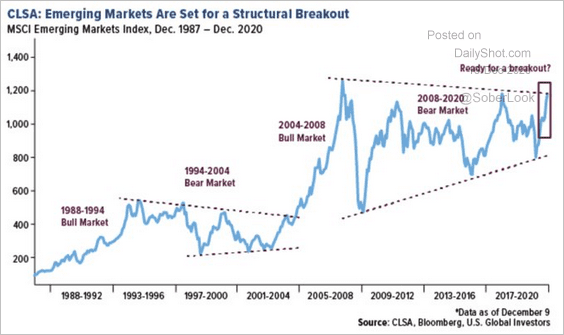

7. EM equities are at long-term resistance.

Source: @Callum_Thomas

Source: @Callum_Thomas

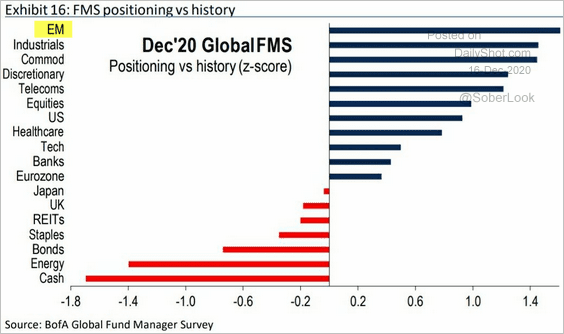

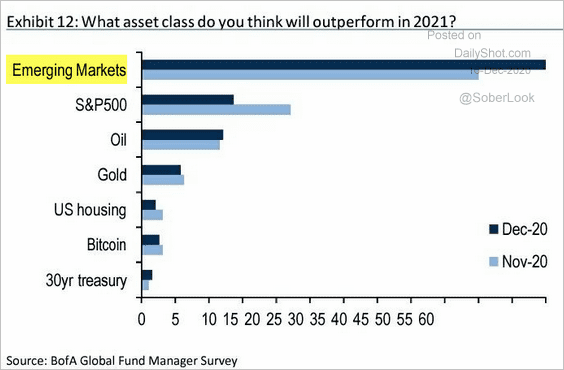

8. Fund managers are upbeat on EM stocks (2 charts).

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

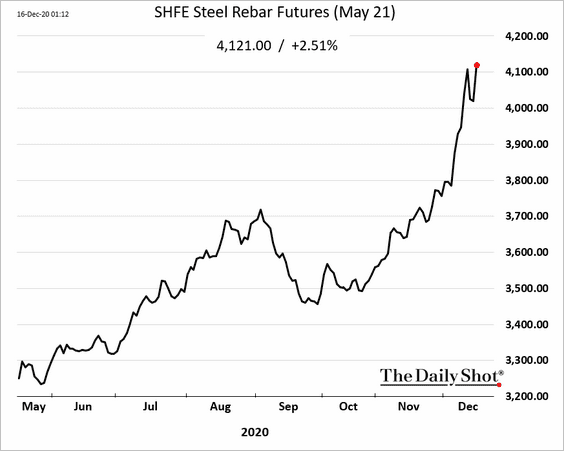

Commodities

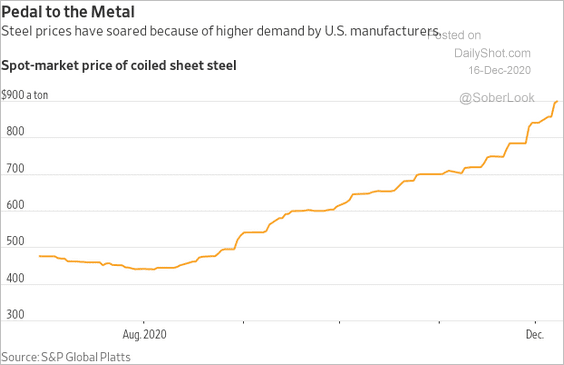

1. Steel prices continue to climb.

• US:

Source: @WSJ Read full article

Source: @WSJ Read full article

• China:

——————–

2. Silver is at resistance.

Source: @Ole_S_Hansen

Source: @Ole_S_Hansen

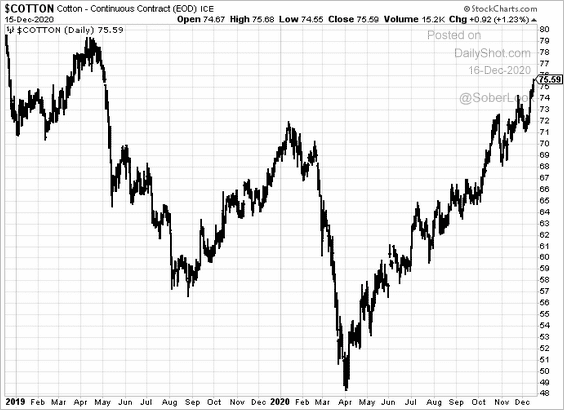

3. US cotton futures keep rising. According to Bloomberg, “US cotton output this year will be 15.95 million bales, down 20% from a year earlier following adverse weather …”

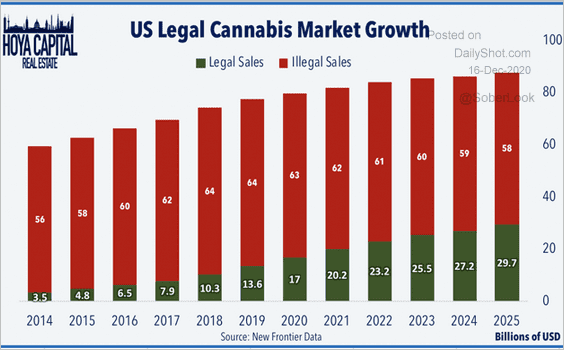

4. This chart shows the latest projections for legal and illegal cannabis sales in the US.

Source: Hoya Capital Real Estate

Source: Hoya Capital Real Estate

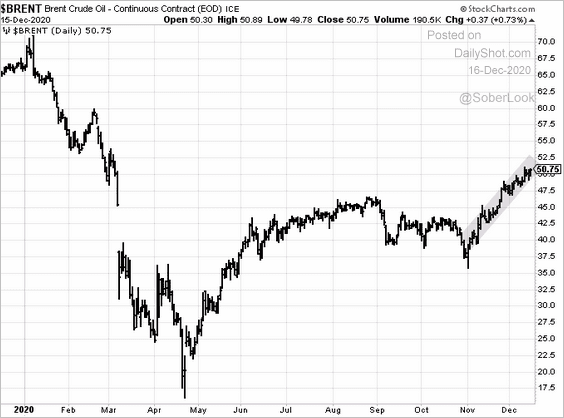

Energy

1. Crude oil continues to trend higher amid rising Middle East tensions.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

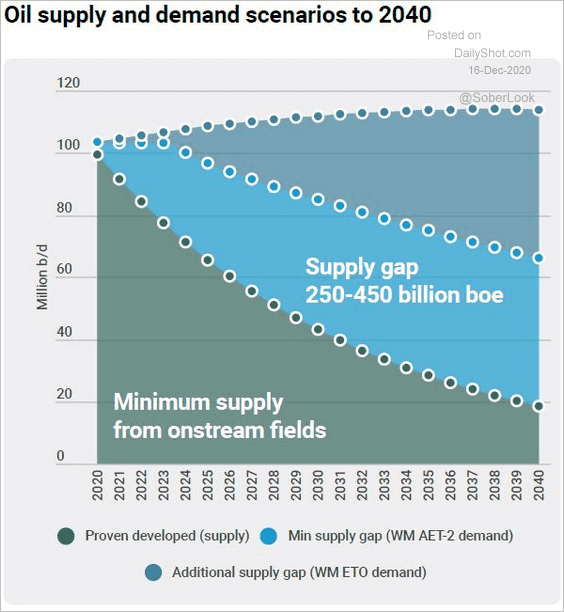

2. Despite “peak oil demand,” insufficient investment will create a massive supply gap over the next couple of decades.

Source: @jessefelder, Reuters Read full article

Source: @jessefelder, Reuters Read full article

Equities

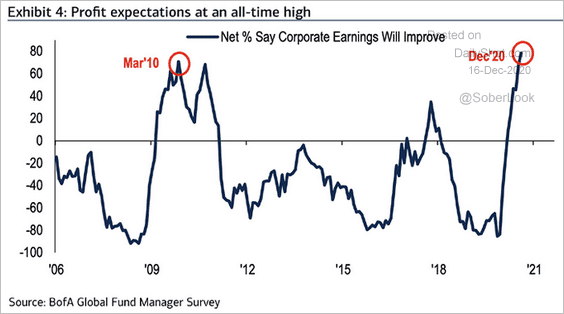

1. A record percentage of fund managers expect corporate earnings to improve.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

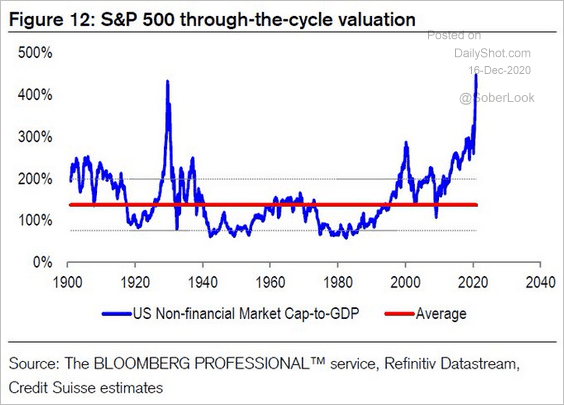

Is next year’s earnings jump sufficient to justify lofty valuations such as this market cap-to-GDP ratio?

Source: Credit Suisse, @Scutty

Source: Credit Suisse, @Scutty

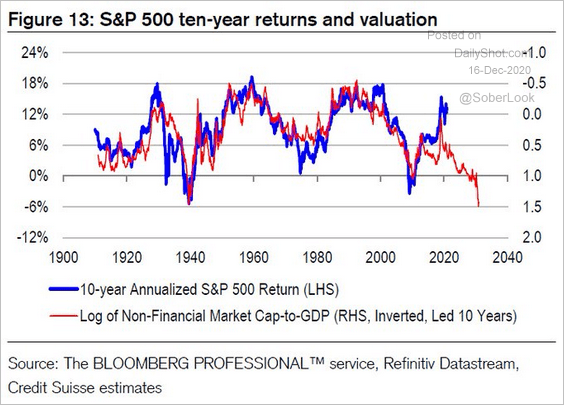

What returns should we expect over the next decade, given current valuations?

Source: Credit Suisse, @Scutty

Source: Credit Suisse, @Scutty

——————–

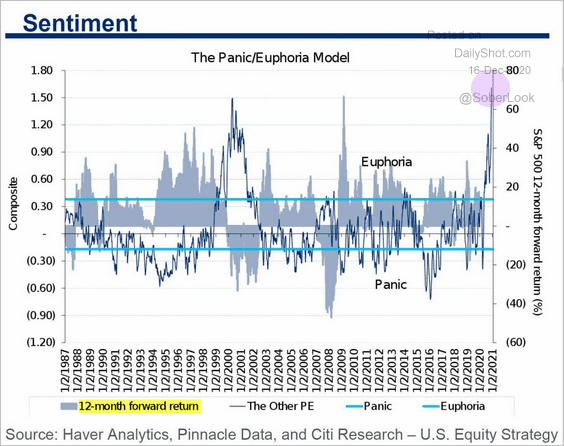

2. Sentiment indicators continue to point to investor euphoria.

• The Citi Panic/Euphoria index (and the returns over the next 12 months):

Source: Citi Research, Tilo Marotz

Source: Citi Research, Tilo Marotz

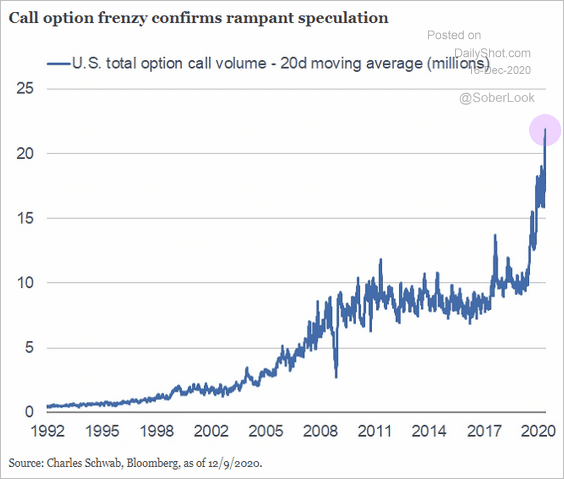

• The call option frenzy:

Source: Charles Schwab Read full article

Source: Charles Schwab Read full article

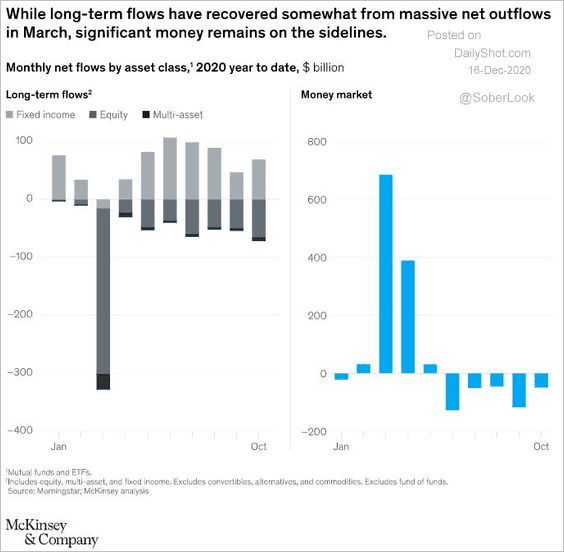

However, there is still a great deal of cash sitting on the sidelines.

Source: McKinsey & Company, Garrett Roche

Source: McKinsey & Company, Garrett Roche

——————–

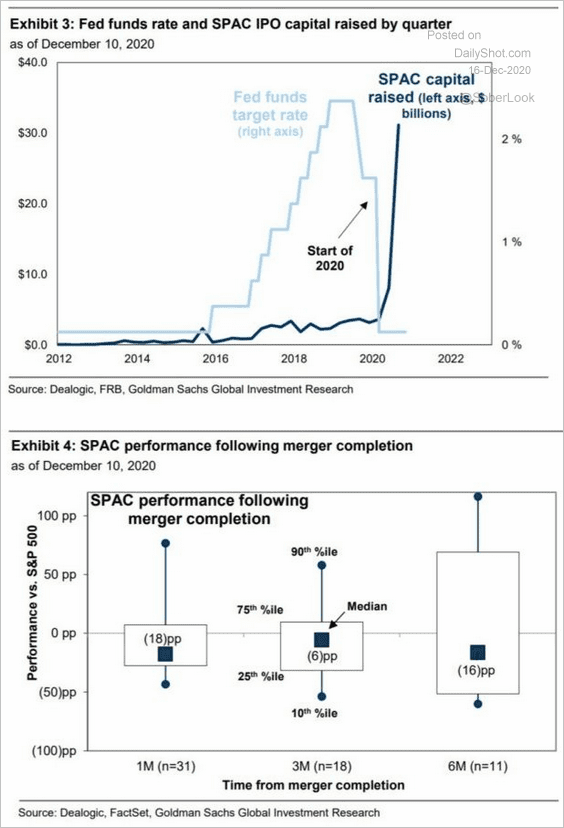

3. How have SPACs performed following merger completions?

Source: Goldman Sachs

Source: Goldman Sachs

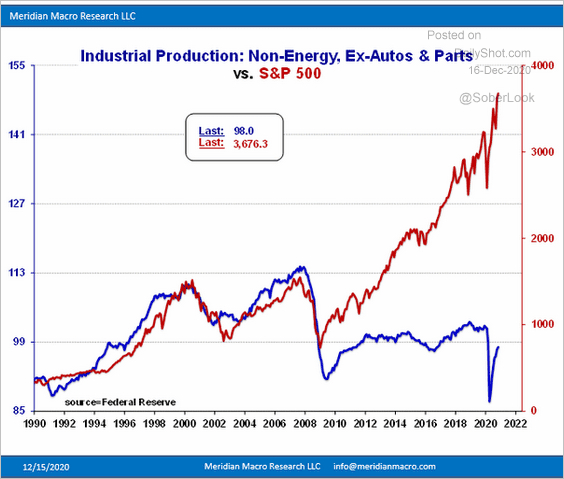

4. Given the US shift toward services in recent decades, is it still appropriate to compare stock performance with industrial production?

Source: @epomboy

Source: @epomboy

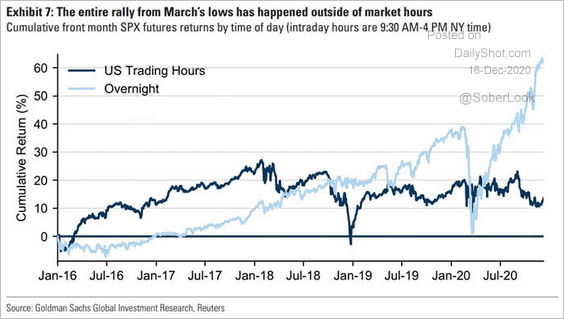

5. The entire rally since the March lows took place outside market working hours.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

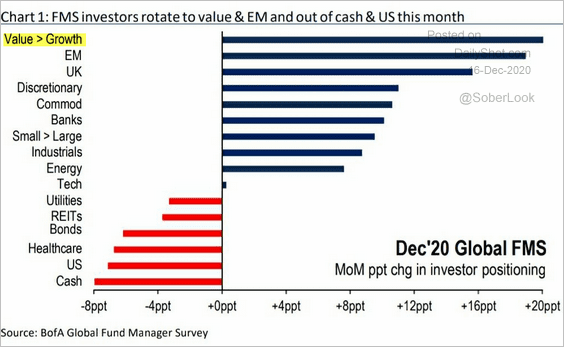

6. Fund managers have been rotating from growth to value.

Source: BofA Global Research

Source: BofA Global Research

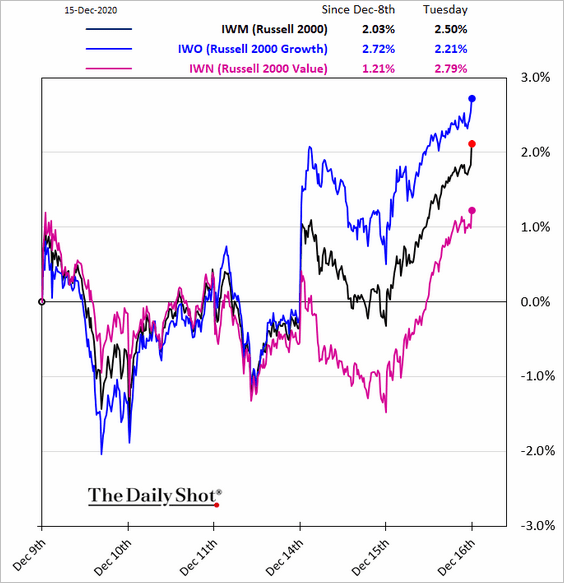

Here is the relative performance of small-cap value vs. growth over the past five business days.

——————–

7. Finally, we have some sector/sub-sector updates.

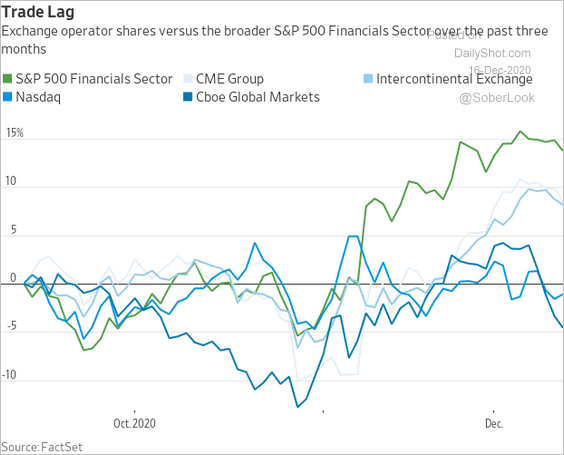

• Exchange operators (pressured by new SEC data rules):

Source: @WSJ Read full article

Source: @WSJ Read full article

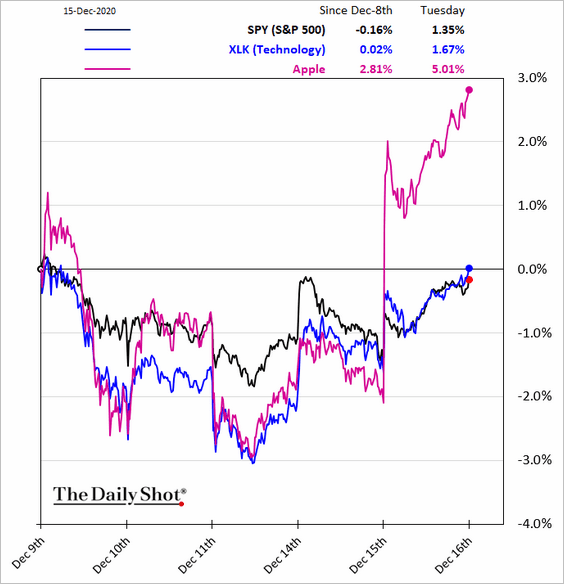

• Tech:

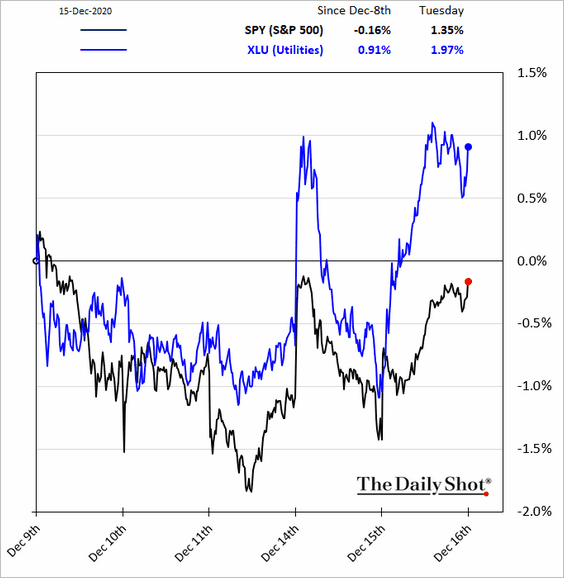

• Utilities:

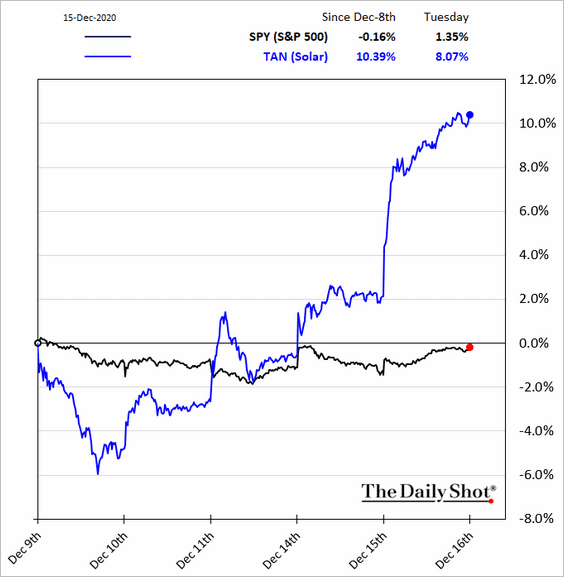

• Solar:

h/t Walter

h/t Walter

Credit

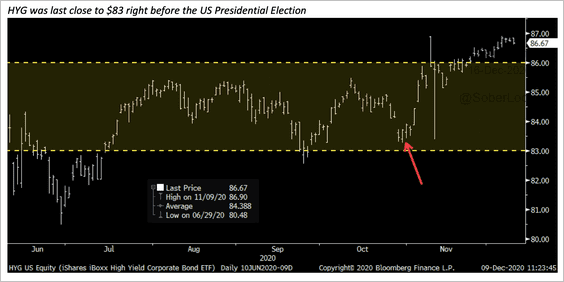

1. The iShares US high-yield corporate bond ETF (HYG) has broken above a five-month range.

Source: Christopher Murphy; Susquehanna

Source: Christopher Murphy; Susquehanna

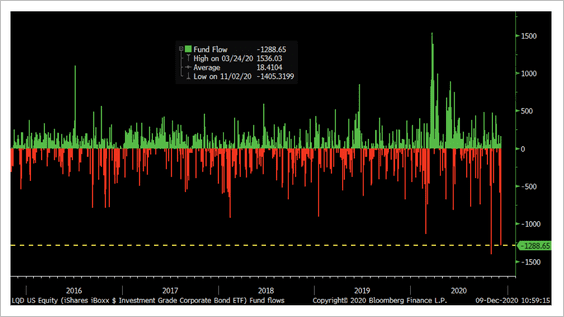

2. The iShares investment-grade corporate bond ETF (LQD) posted the second-highest outflow in at least five years.

Source: Christopher Murphy; Susquehanna

Source: Christopher Murphy; Susquehanna

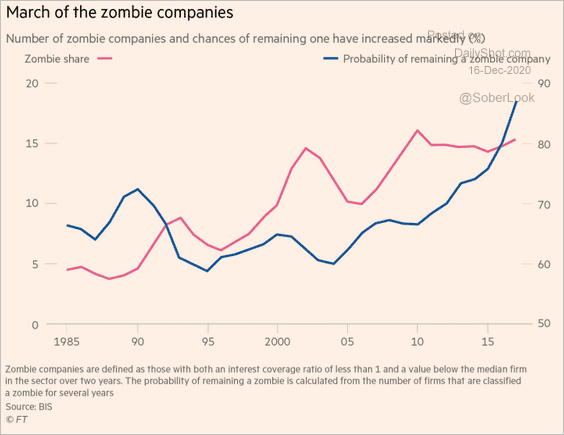

3. Demand for yield (driven by extraordinarily low rates) has produced a large number of zombie companies.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Rates

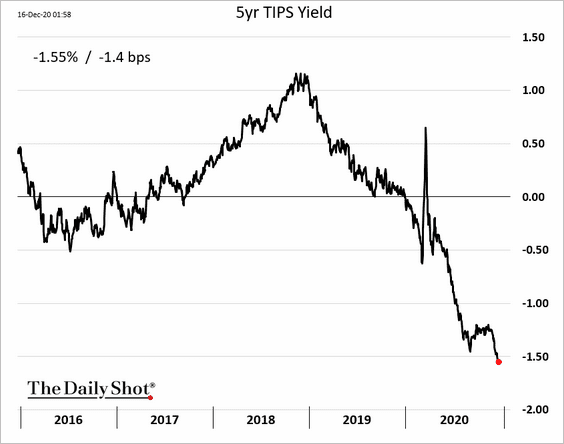

1. TIPS-implied US real rates continue to move deeper into negative territory as inflation expectations climb.

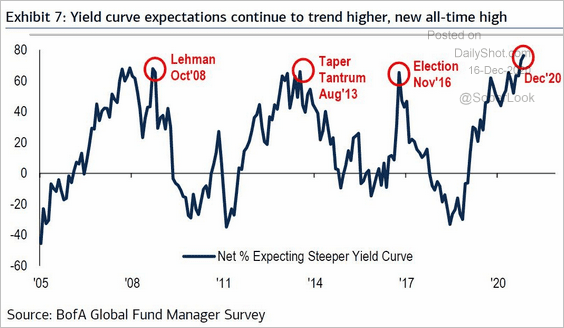

2. Fund managers increasingly expect a steeper yield curve ahead.

Source: BofA Global Research

Source: BofA Global Research

Global Developments

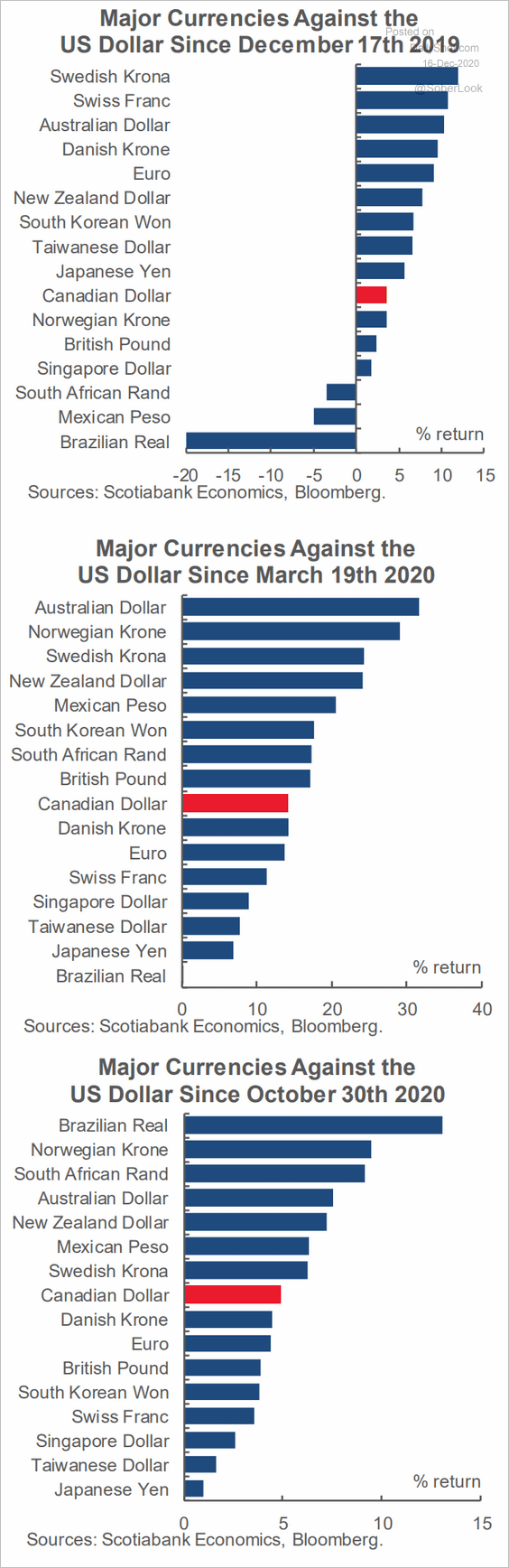

1. How have different currencies performed against the dollar?

Source: Scotiabank Economics

Source: Scotiabank Economics

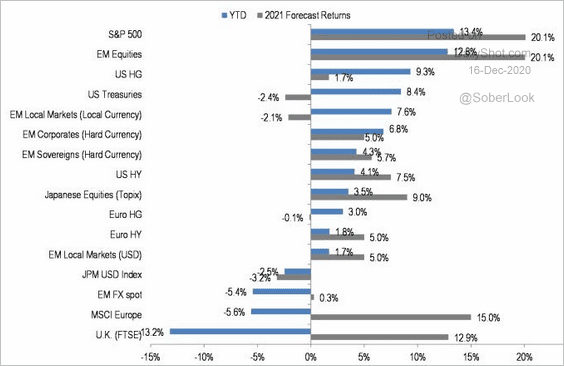

2. Here is JP Morgan’s 2021 performance forecast for different asset classes.

Source: JP Morgan

Source: JP Morgan

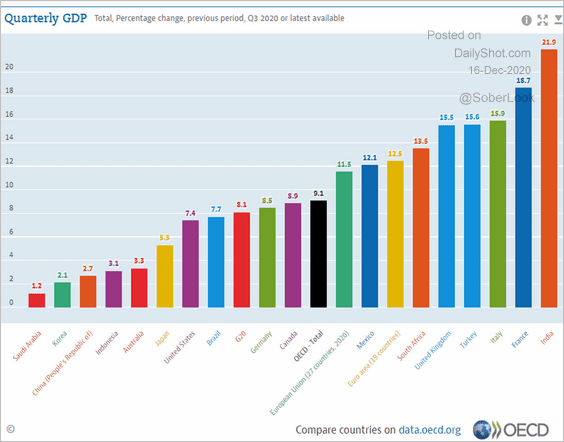

3. Below is the Q3 GDP growth by country.

Source: OECD Read full article

Source: OECD Read full article

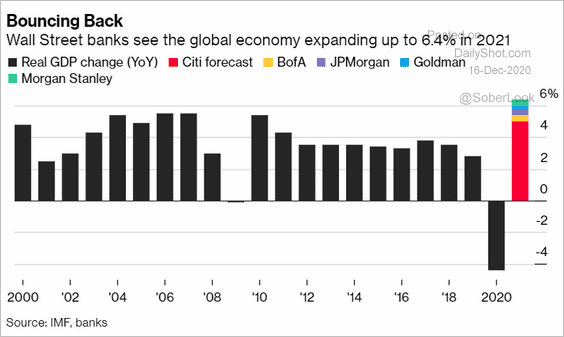

4. Economists expect a sharp rebound in the global GDP next year.

Source: @markets Read full article

Source: @markets Read full article

——————–

Food for Thought

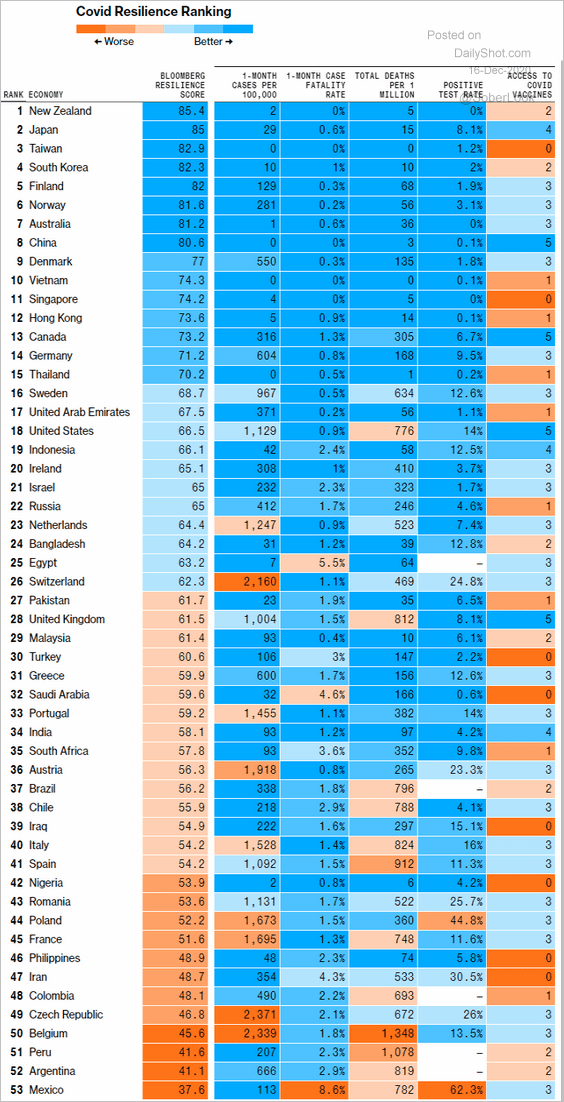

1. COVID resilience rankings:

Source: @bbgvisualdata Read full article

Source: @bbgvisualdata Read full article

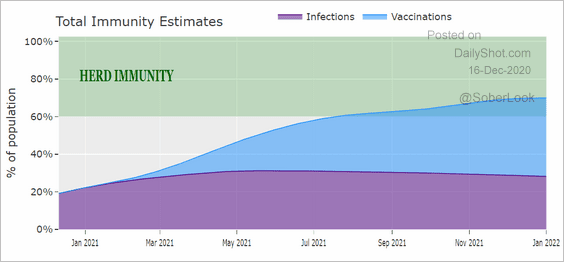

2. Reaching herd immunity in the US:

Source: @youyanggu

Source: @youyanggu

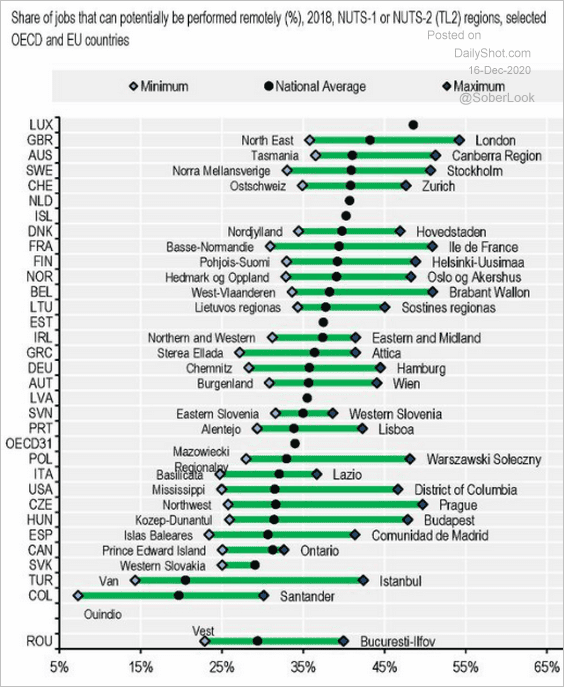

3. Remote work by country (lowest and highest):

Source: OECD Read full article

Source: OECD Read full article

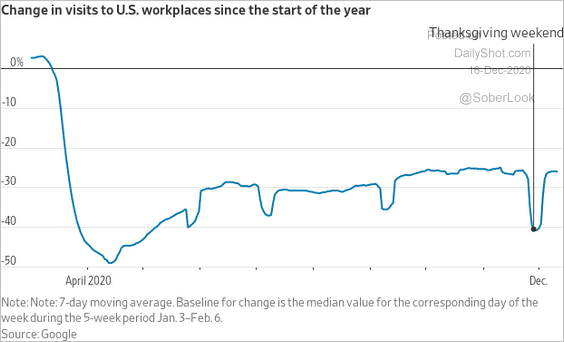

4. Workplace visits:

Source: @WSJ Read full article

Source: @WSJ Read full article

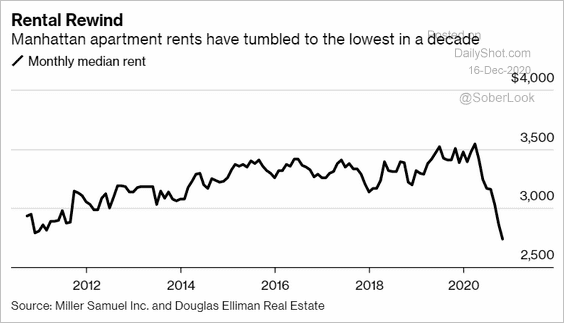

5. Manhattan apartment rents:

Source: @markets Read full article

Source: @markets Read full article

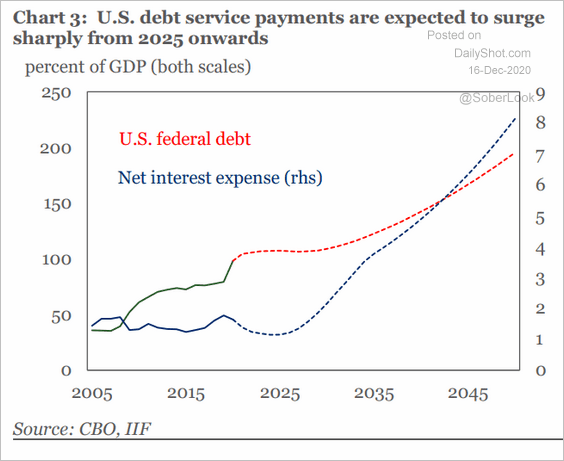

6. US federal debt and interest expense:

Source: IIF

Source: IIF

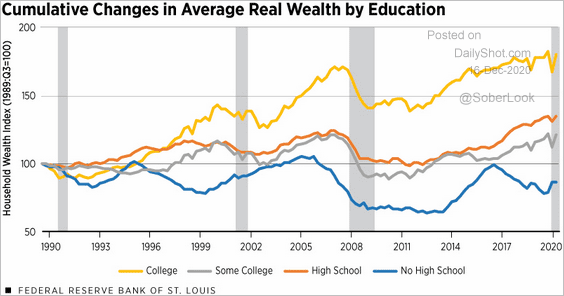

7. Wealth changes, by education:

Source: St. Louis Fed Read full article

Source: St. Louis Fed Read full article

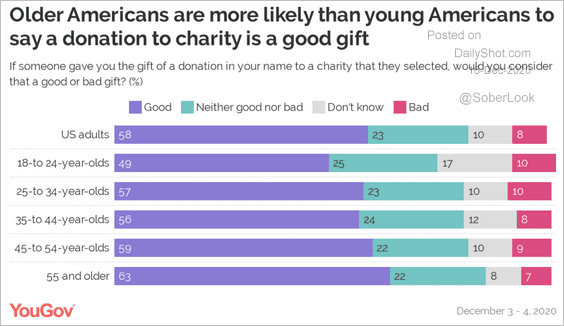

8. Donation to charity as a gift:

Source: YouGov Read full article

Source: YouGov Read full article

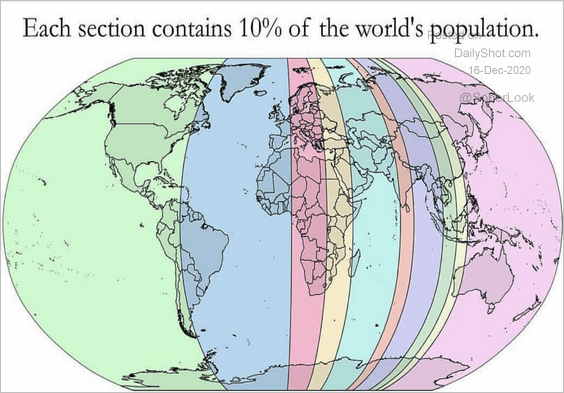

9. The world’s population in ten equal sections:

Source: reddit

Source: reddit

——————–