The Daily Shot: 17-Dec-20

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

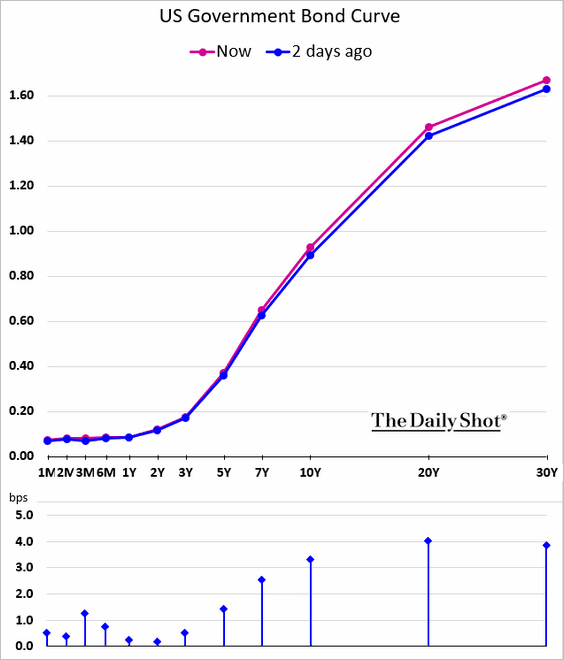

1. The Fed provided guidance for its asset purchases on Wednesday, with language suggesting that QE could continue for some time.

FOMC: … the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee’s maximum employment and price stability goals.

The market was a bit disappointed, with some expecting the central bank to boost the average maturity of bonds purchased. The yield curve steepened slightly in response.

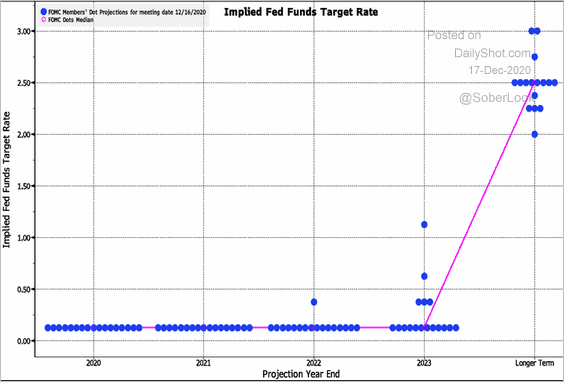

• According to the FOMC’s dot plot, the fed funds rate will remain near zero through the end of 2023.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

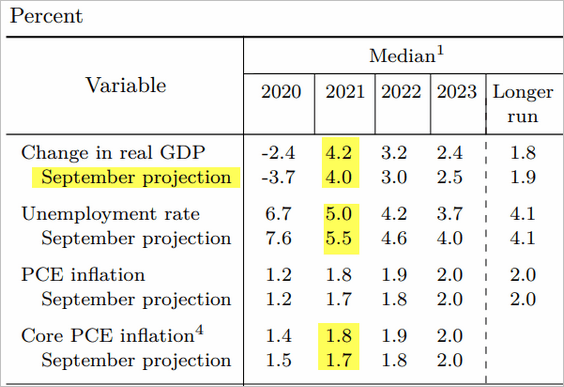

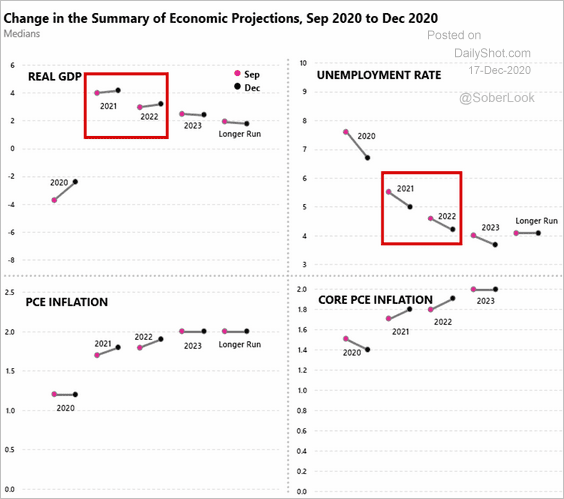

• The Fed boosted its projections for next year’s GDP growth and inflation while reducing the expected unemployment rate.

Source: FOMC Read full article

Source: FOMC Read full article

Source: @ernietedeschi

Source: @ernietedeschi

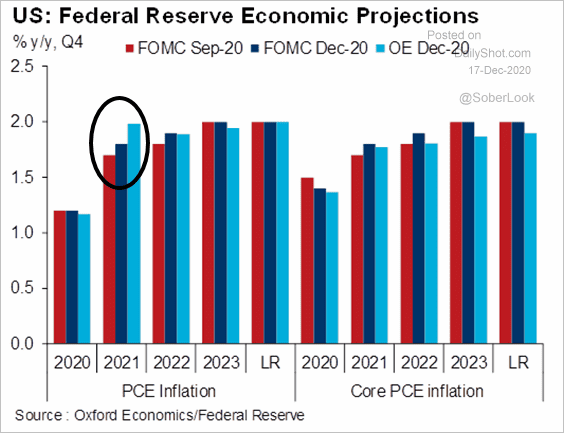

• With the lofty projection of 4.2% GDP growth next year, could the Fed get an inflation surprise? Here is a forecast from Oxford Economics (“OE”).

Source: @GregDaco

Source: @GregDaco

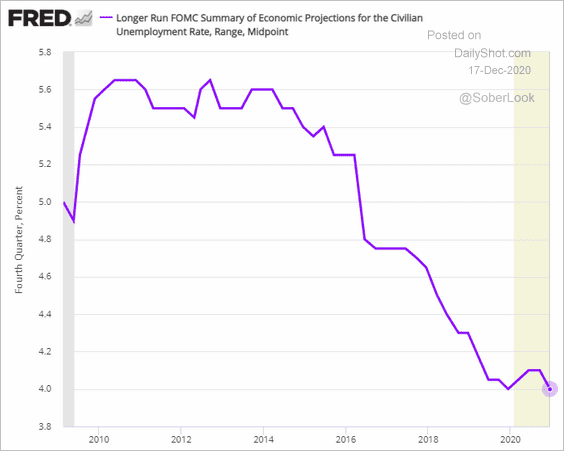

• The FOMC still sees the “long-run” unemployment rate at 4%.

——————–

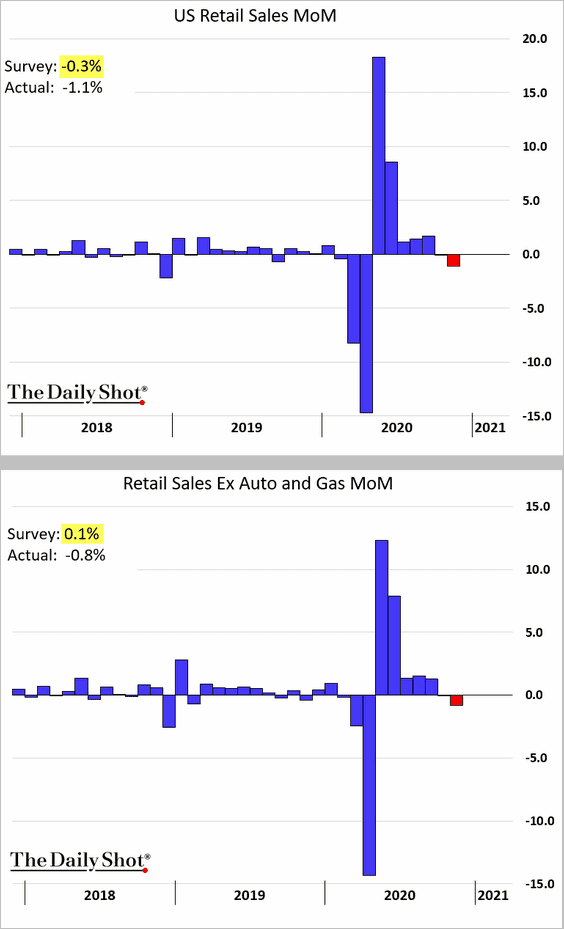

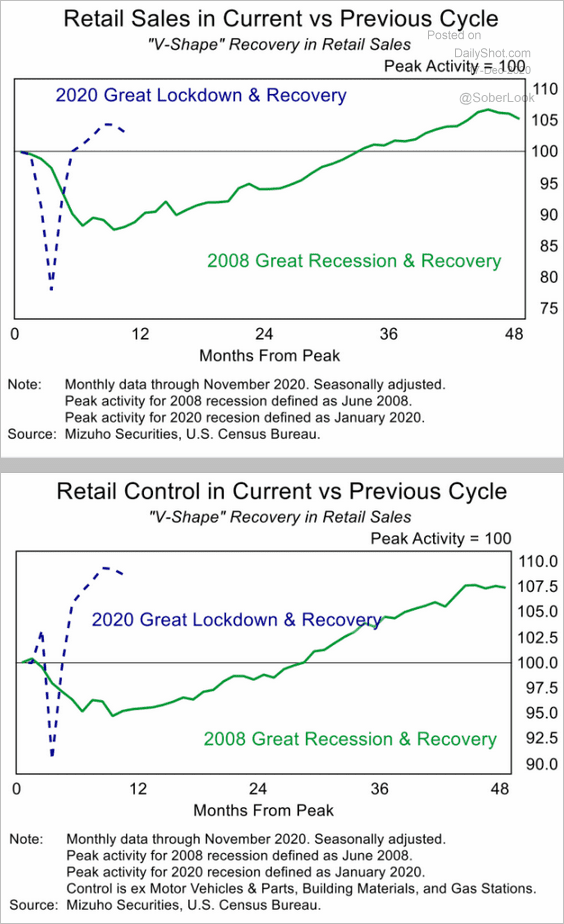

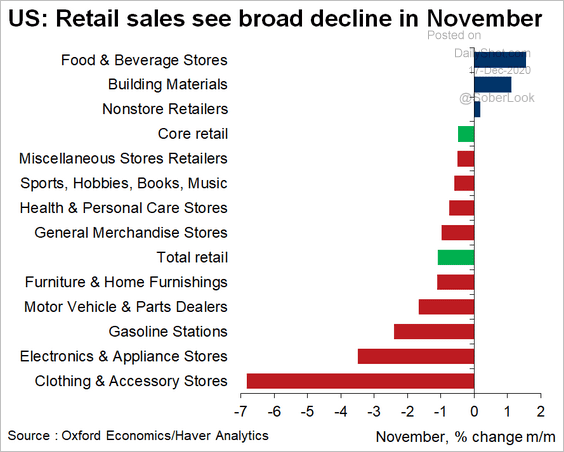

2. After a massive post-lockdown rebound, retail sales pulled back last month. The report came in well below market expectations.

• Here is the trajectory vs. the 2008 recession (the “control group” excludes autos, gasoline, and construction materials).

Source: Mizuho Securities USA

Source: Mizuho Securities USA

• The November decline in retail sales was broad.

Source: Oxford Economics

Source: Oxford Economics

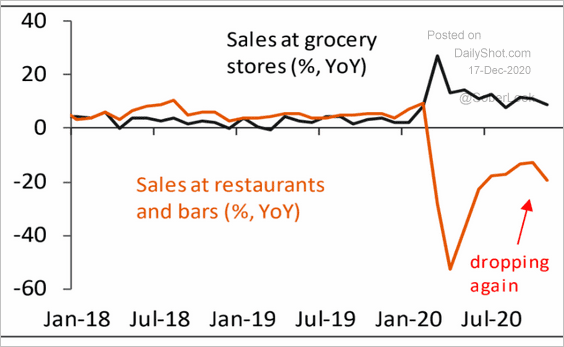

• Restaurants took a hit.

Source: Piper Sandler

Source: Piper Sandler

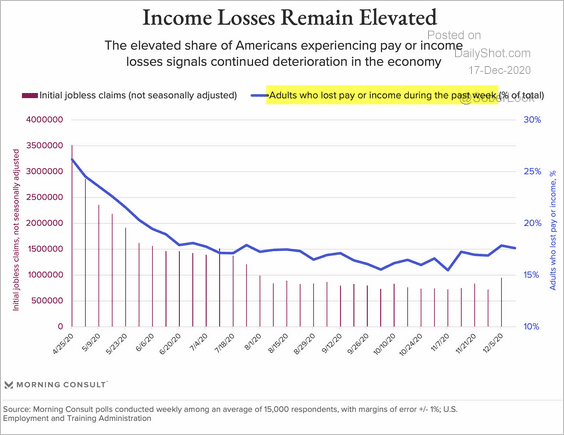

• Retail sales were pressured by lost income …

Source: Morning Consult

Source: Morning Consult

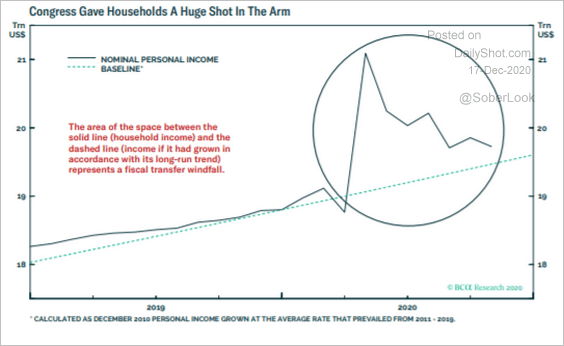

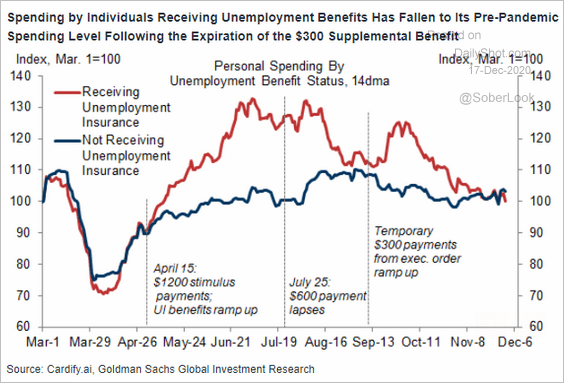

… and declining government support.

BCA Research: – It is perfectly reasonable to be concerned about the fading household income windfall. … the fiscal thrust is unequivocally fading. Oftentimes in markets, the direction of a variable is more impactful than its level.

Source: BCA Research

Source: BCA Research

This chart shows personal spending by Americans with and without unemployment benefits.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

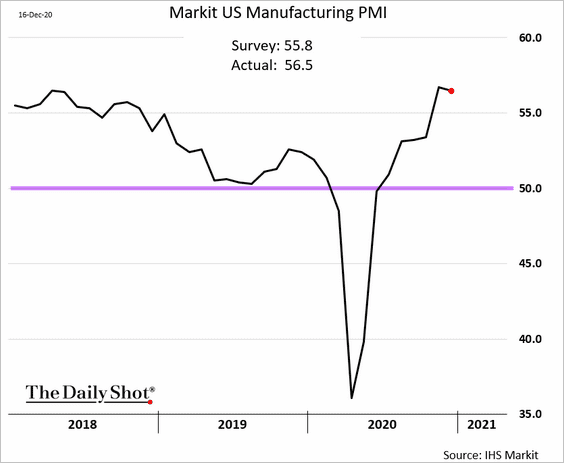

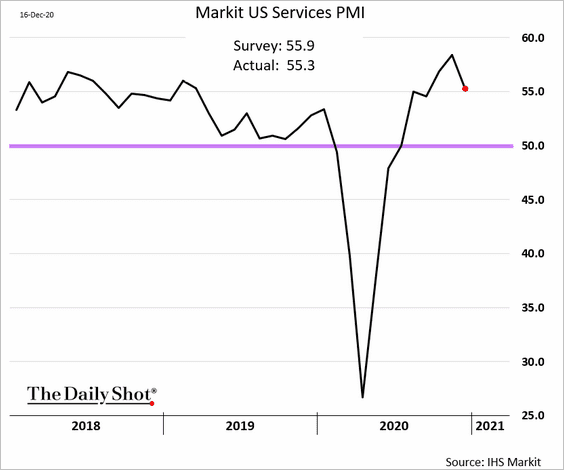

3. Business activity remained resilient in December. Here are the Markit PMI trends (PMI has been well above 50, which indicates growth).

• Manufacturing:

• Services:

——————–

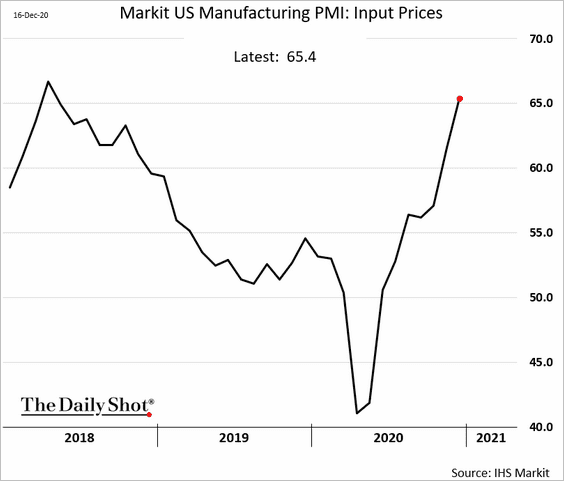

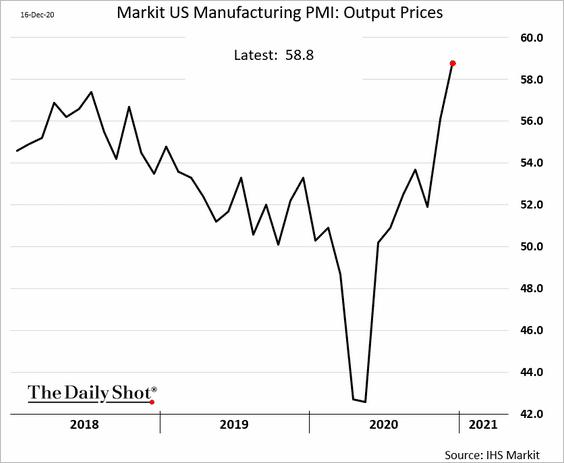

4. Manufacturers are increasingly feeling price pressures, and they seem to be passing those higher costs on to their customers.

• Input prices PMI:

• Output prices PMI:

——————–

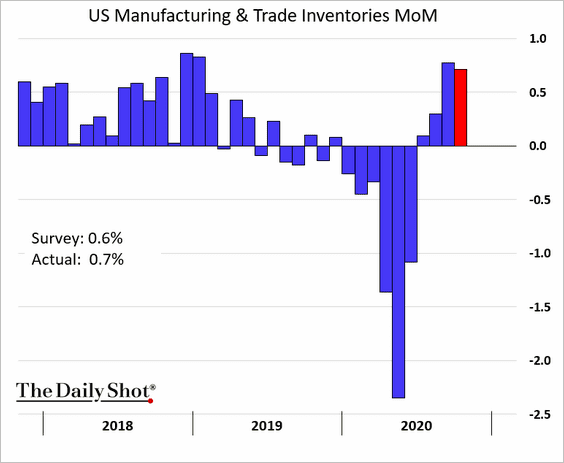

5. Inventory rebuilding continues.

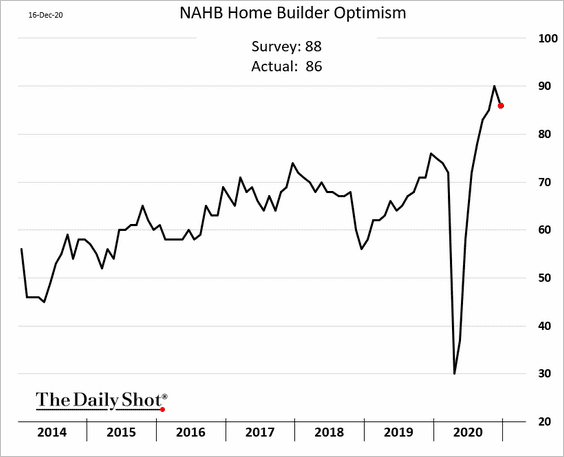

6. The NAHB homebuilder optimism index came off its record high but is still elevated.

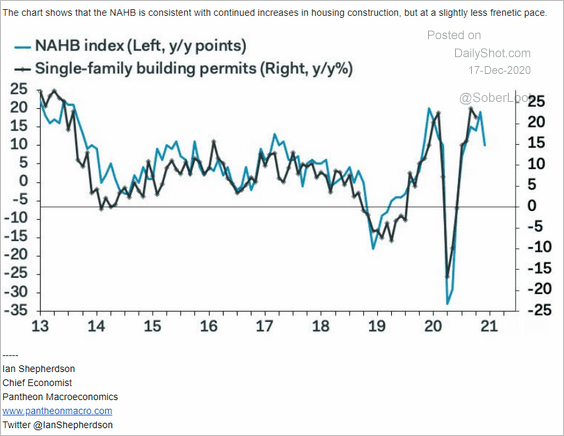

Residential construction growth is expected to stay robust.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

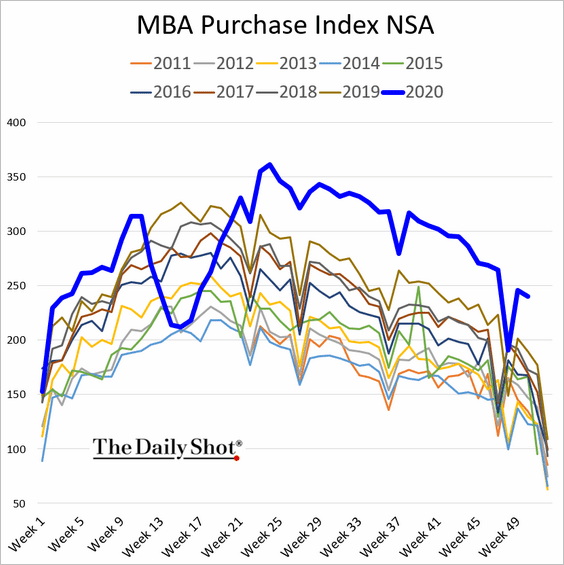

Mortgage applications remain strong for this time of the year.

The United Kingdom

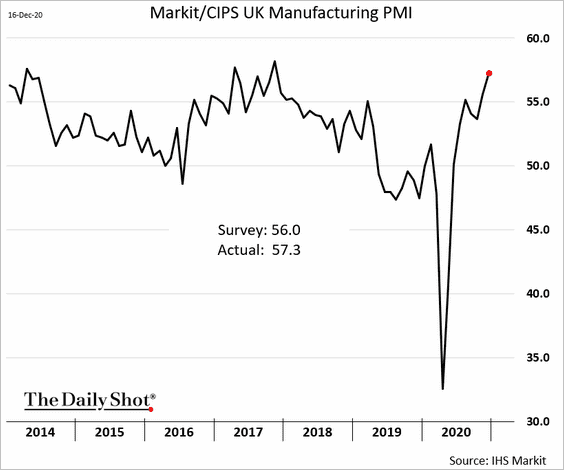

1. The December flash manufacturing PMI report was impressive.

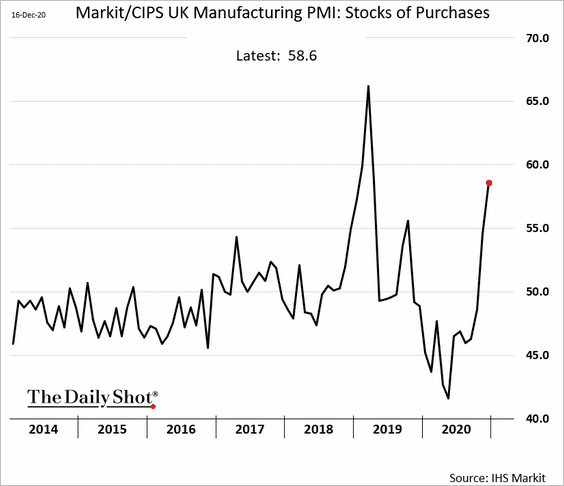

However, a great deal of this improved activity has been due to pre-Brexit inventory accumulation.

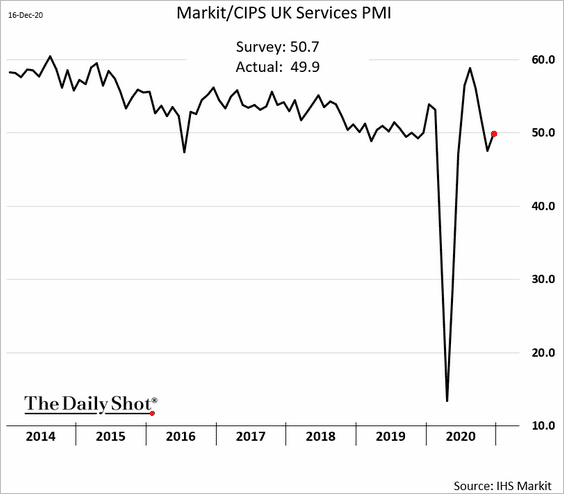

Here is the Markit services PMI.

——————–

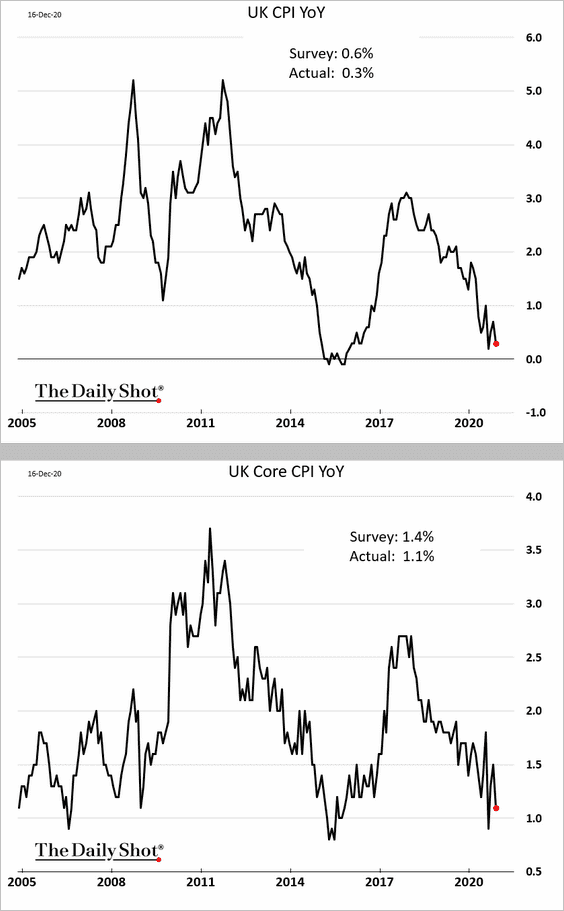

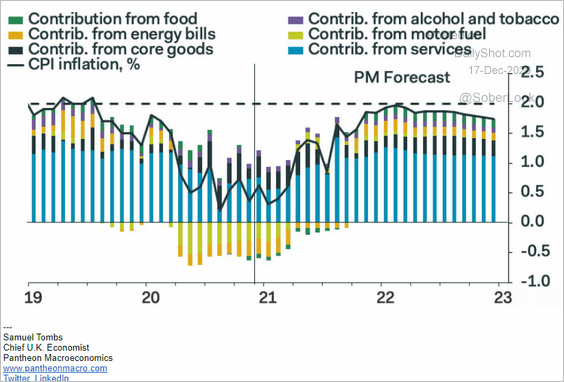

2. The CPI surprised to the downside.

Source: Reuters Read full article

Source: Reuters Read full article

Source: The Guardian Read full article

Source: The Guardian Read full article

Below is a forecast from Pantheon Macroeconomics.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

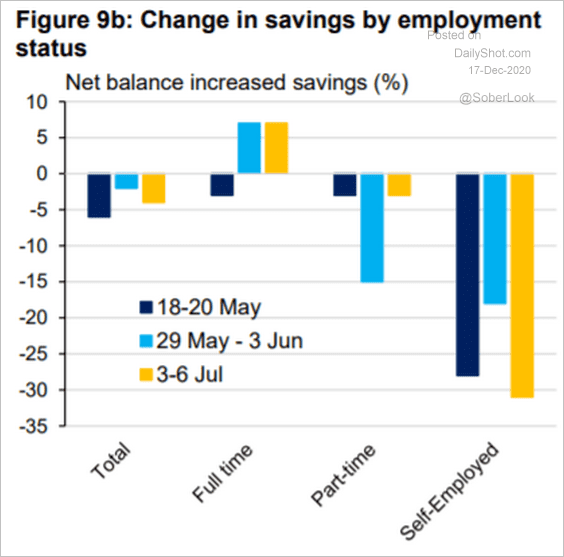

3. Savings declined the most among self-employed workers.

Source: BOE Read full article

Source: BOE Read full article

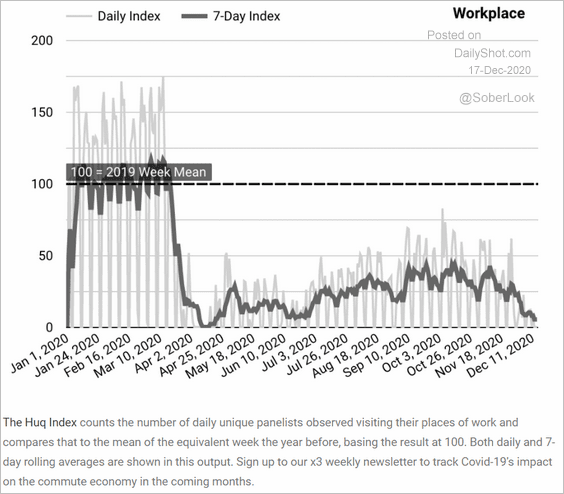

4. UK offices are nearly empty.

Source: Huq

Source: Huq

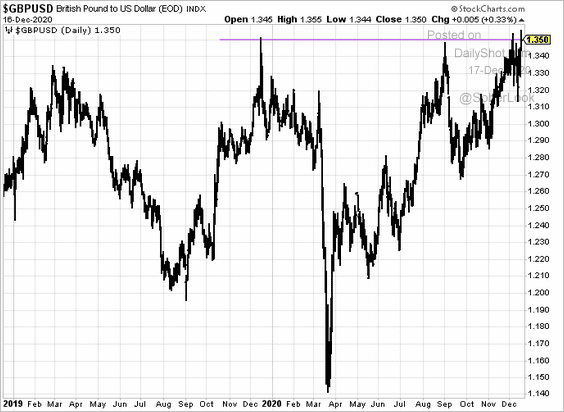

5. The pound continues to probe the $1.35 level.

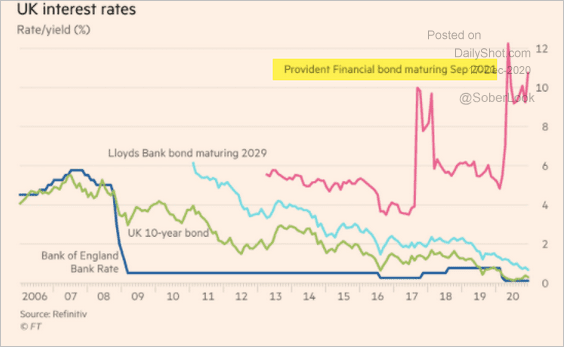

6. Subprime lenders face funding pressures as they try to meet the rising demand for mortgages.

Source: Reuters Read full article

Source: Reuters Read full article

For example, Provident Financial’s Sep 2021 bond yield has been elevated.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

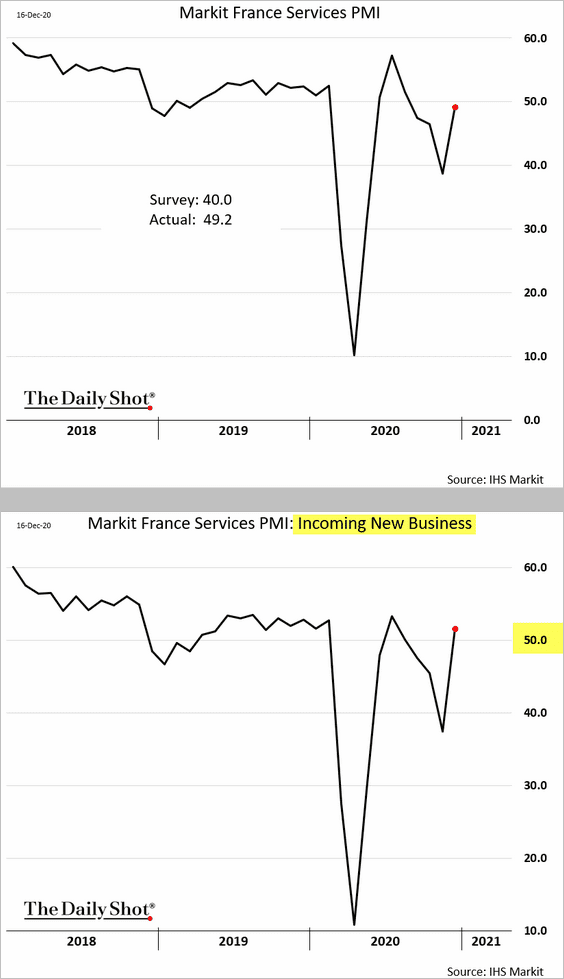

The Eurozone

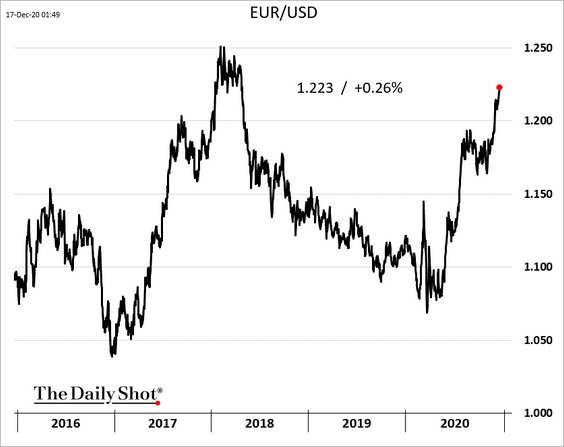

1. The euro is soaring vs. USD.

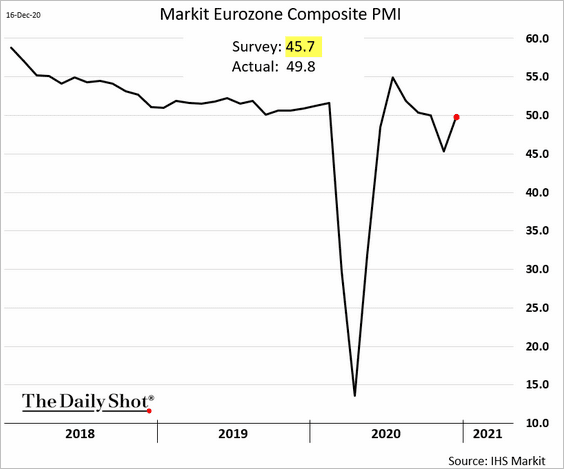

2. Next, let’s take a look at the preliminary PMI report, which showed that the Eurozone business activity has been resilient this month.

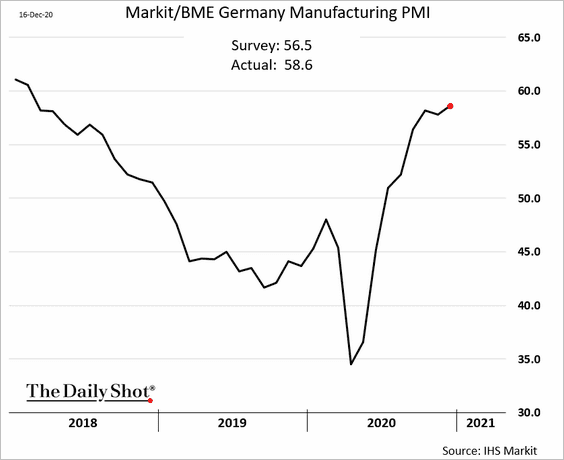

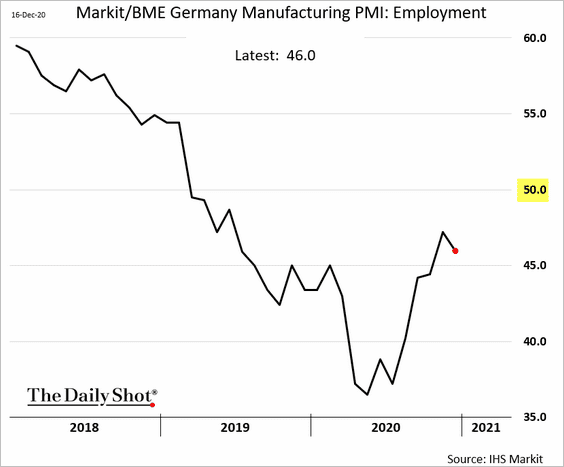

• German manufacturing PMI:

Manufacturing employment remains soft.

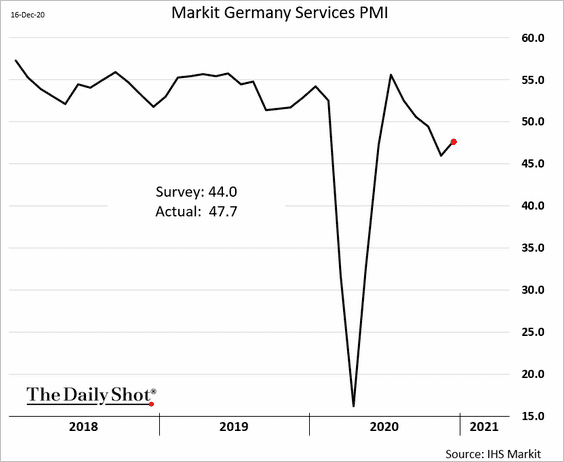

• German services PMI (still in contraction but better than expected):

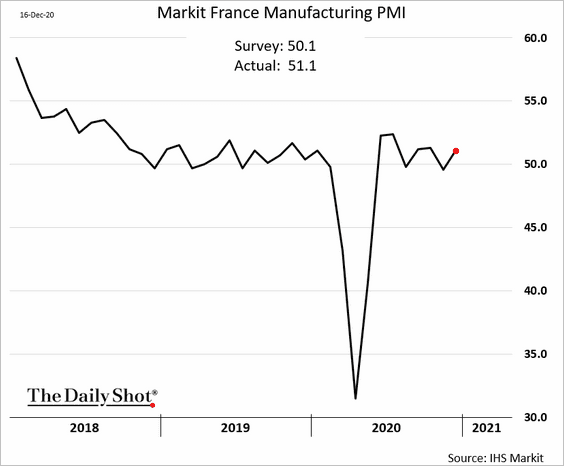

• French manufacturing PMI:

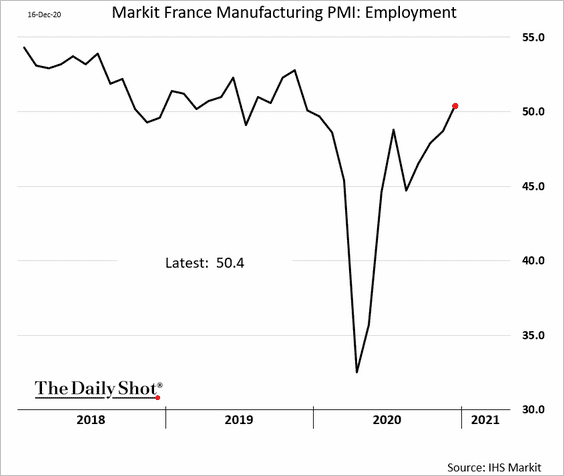

Manufacturing employment has stabilized.

• French services PMI (a massive upside surprise):

• Eurozone composite PMI:

——————–

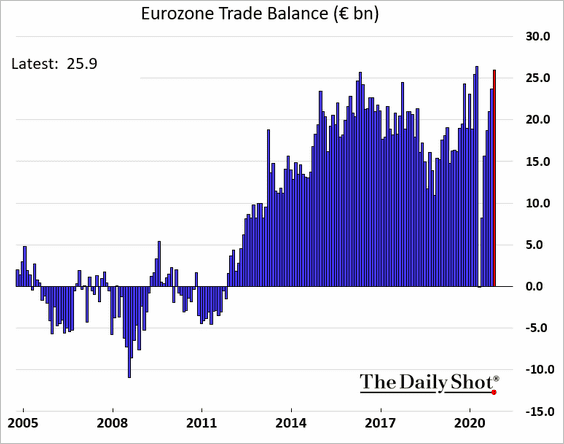

3. The euro-area trade surplus is back near record highs.

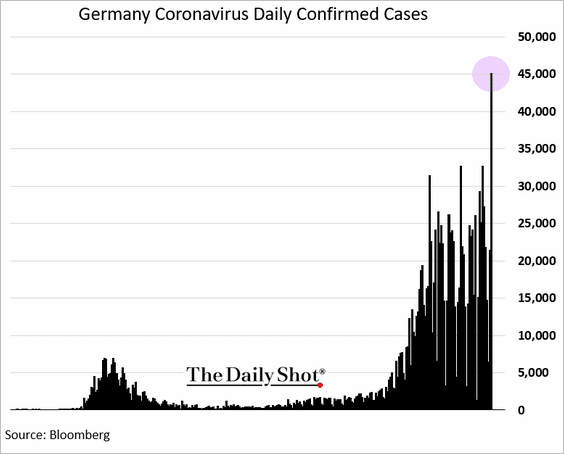

4. Germany’s COVID cases are exploding.

Asia – Pacific

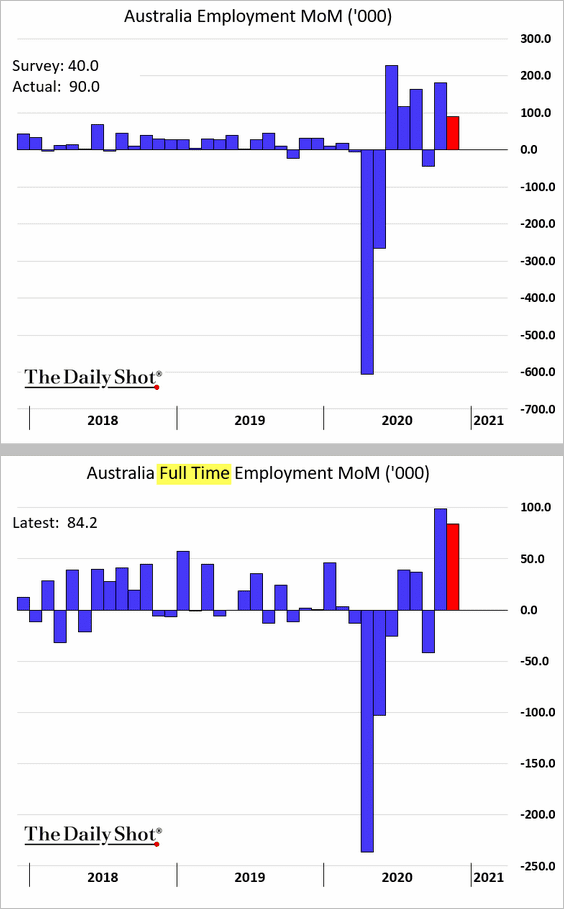

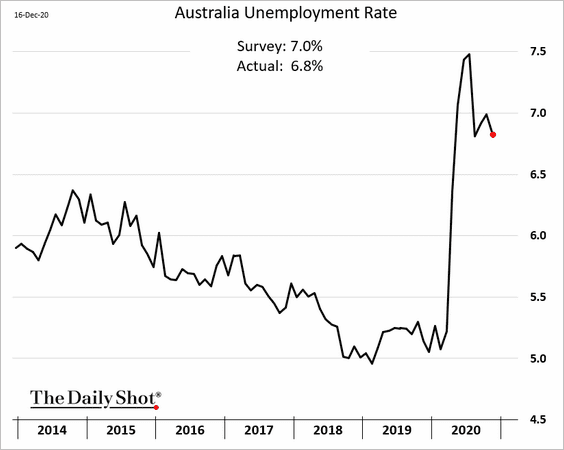

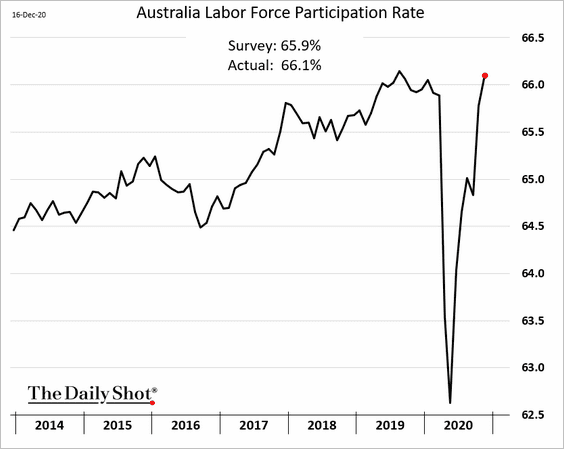

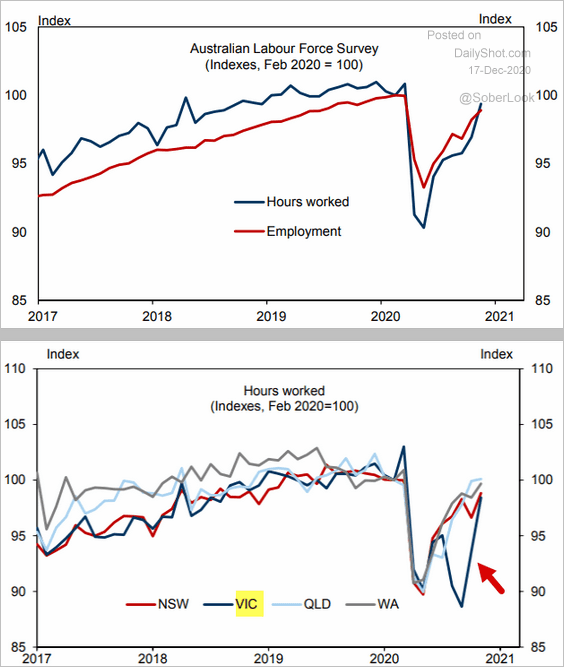

1. Australia’s employment report surprised to the upside.

• New payrolls (driven by full-time jobs):

• The unemployment rate:

• The participation rate:

• Hours worked (take a look at Victoria):

Source: Goldman Sachs

Source: Goldman Sachs

——————–

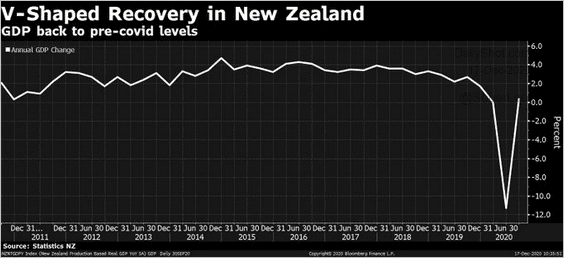

2. New Zealand’s GDP is now back at last year’s levels – a V-shaped recovery.

Source: @tracyalloway, @tracywwithers Read full article

Source: @tracyalloway, @tracywwithers Read full article

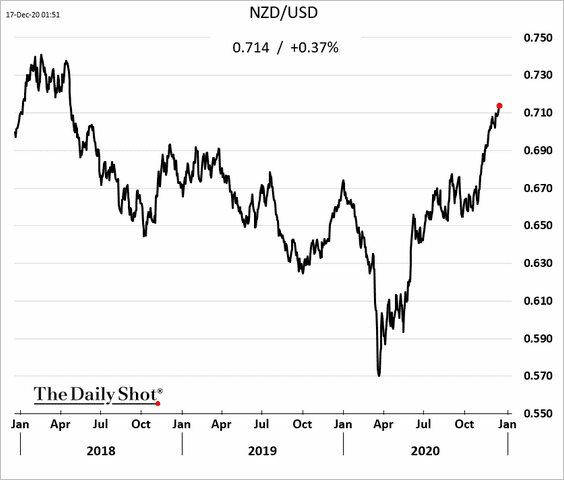

The Kiwi dollar continues to climb.

——————–

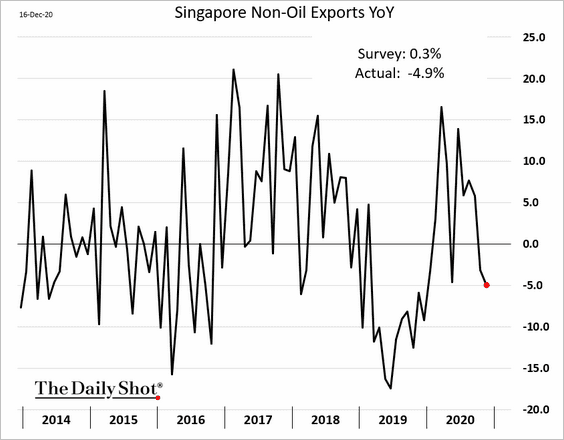

3. Singapore’s exports deteriorated last month.

Emerging Markets

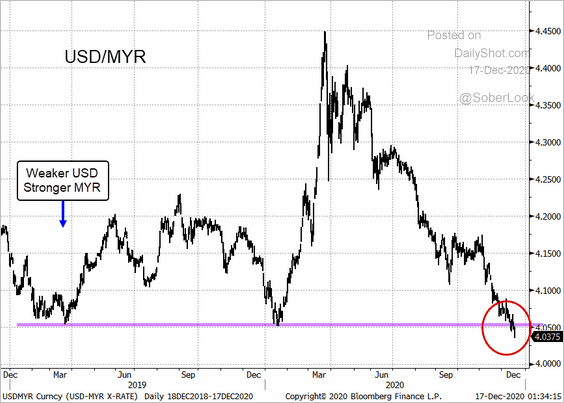

1. Asian currencies continue to rally.

• The Malaysian ringgit (USD/MYR breached support):

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

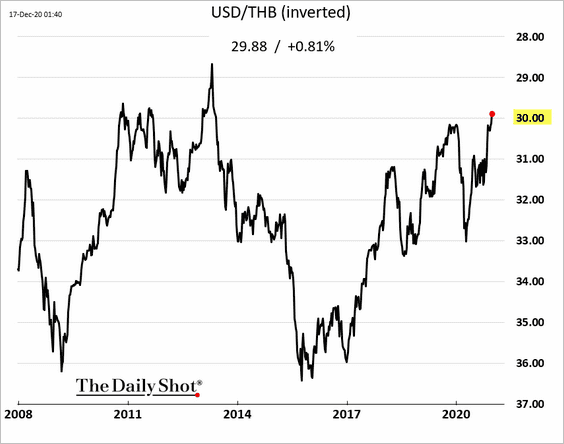

• The Thai baht (longer-term chart):

——————–

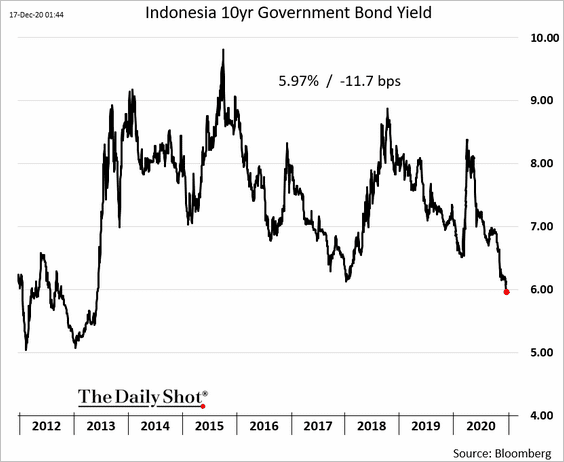

2. The Indonesian 10yr local-currency bond yield dipped below 6% for the first time since 2013 (taper tantrum).

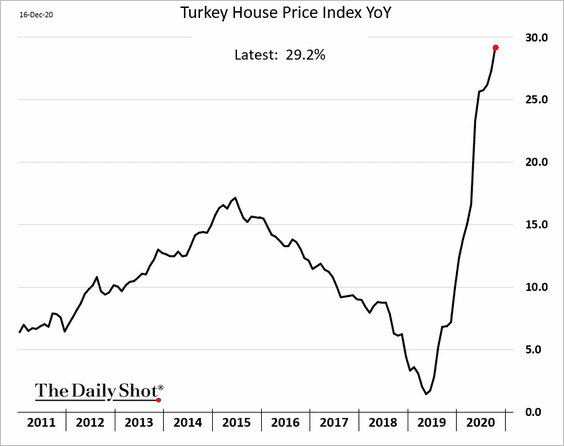

3. Turkish home prices are 29% above last year’s levels.

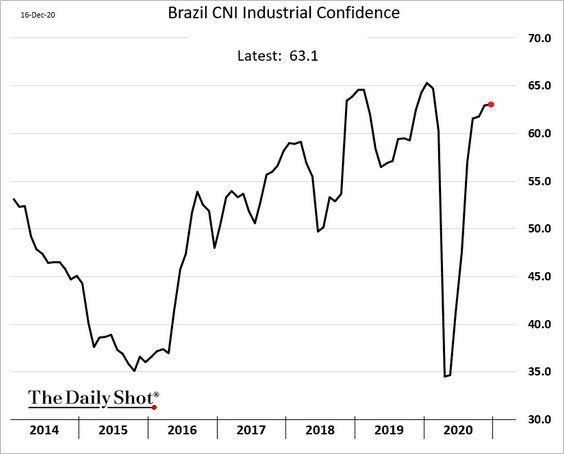

4. Brazil’s industrial confidence remains elevated.

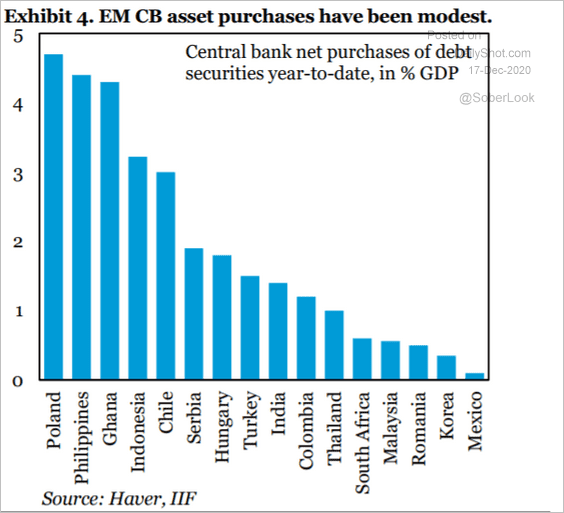

5. EM central banks’ asset purchases have been modest relative to advanced economies.

Source: IIF

Source: IIF

Cryptocurrency

1. Bitcoin breached $20k and just kept going. This print shows Bitcoin above $22k.

• How far will it go? There is no shortage of wild forecasts.

Source: @jessefelder, @Stocktwits

Source: @jessefelder, @Stocktwits

Source: @markets Read full article

Source: @markets Read full article

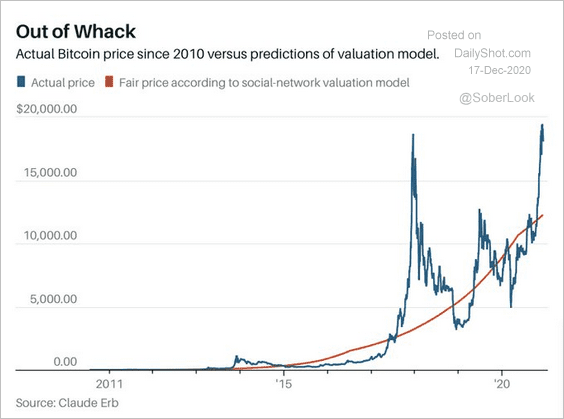

• But what is Bitcoin’s fair value? Here is an estimate.

Source: @jessefelder, @MktwHulbert Read full article

Source: @jessefelder, @MktwHulbert Read full article

——————–

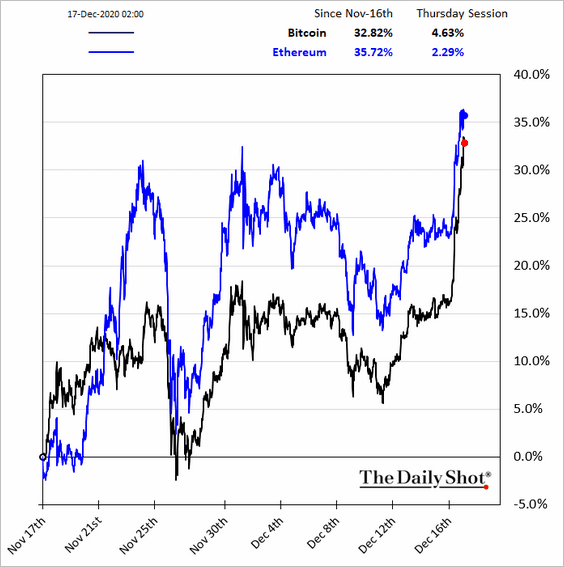

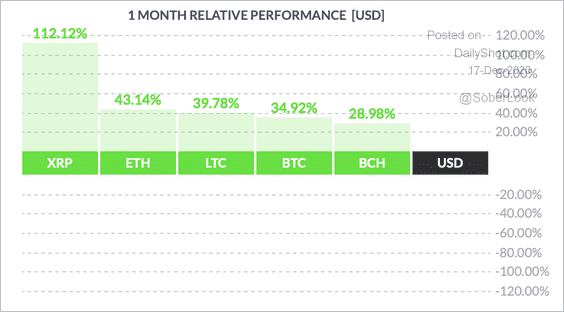

2. Below is the relative performance.

Ripple’s XRP massively outperformed other major cryptocurrencies over the past month.

Source: FinViz

Source: FinViz

——————–

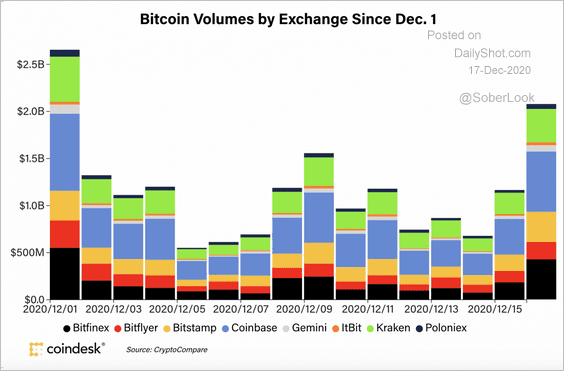

3. Bitcoin’s volume across major exchanges is the strongest since December 1.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Commodities

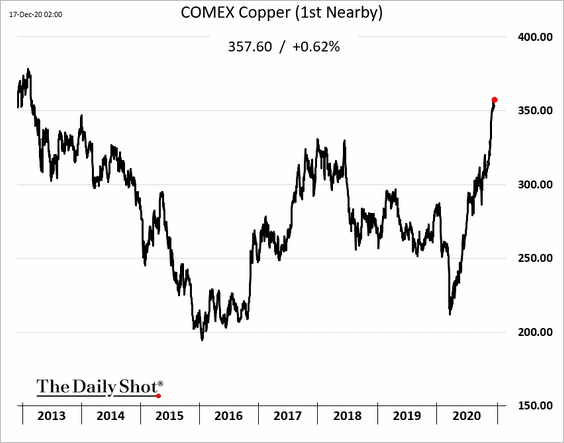

1. Copper continues to grind higher.

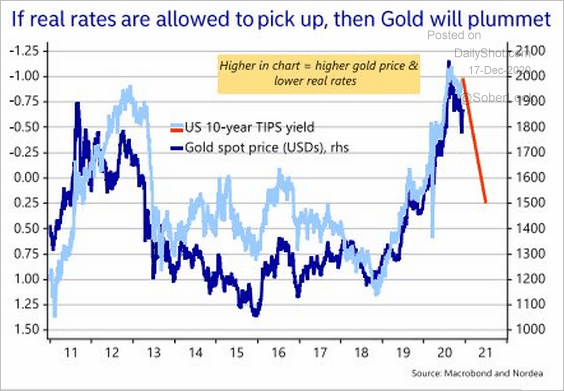

2. Will gold come under pressure if real rates climb next year?

Source: @AndreasSteno

Source: @AndreasSteno

Energy

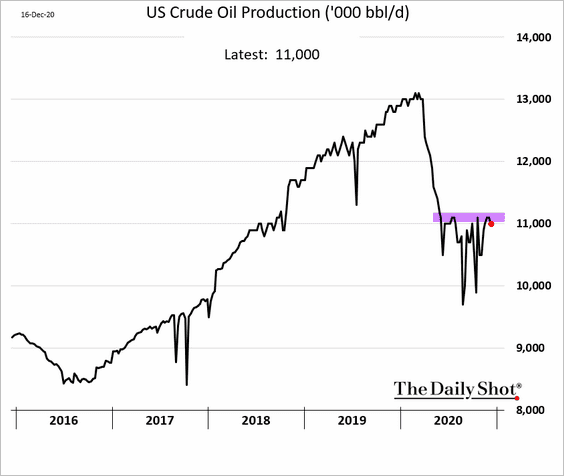

1. US oil production has been stuck around 11 million barrels per day.

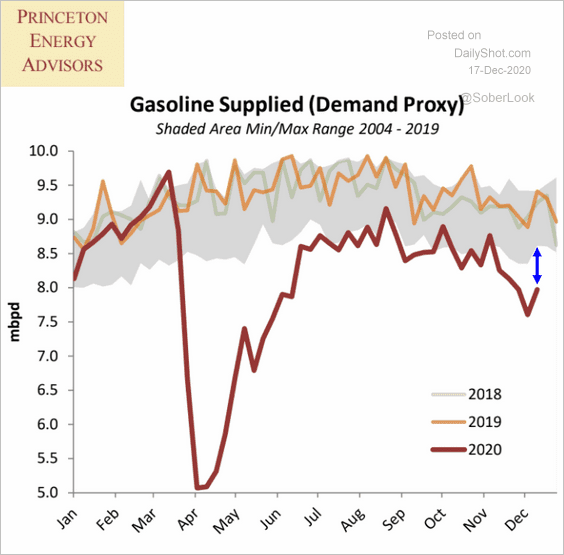

2. US gasoline demand remains soft.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

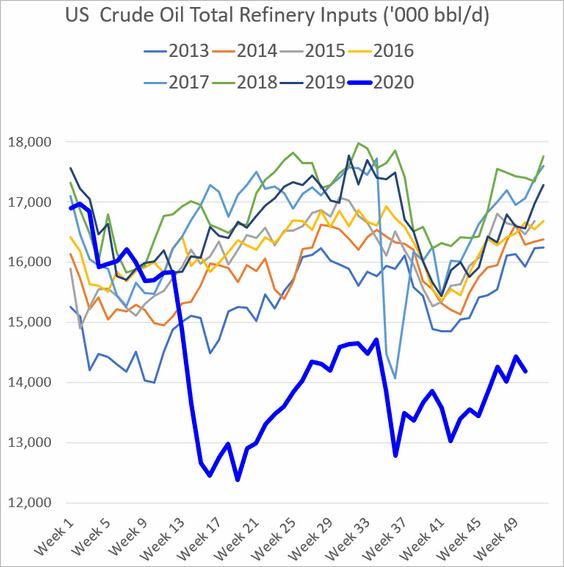

Refinery runs are also relatively weak.

——————–

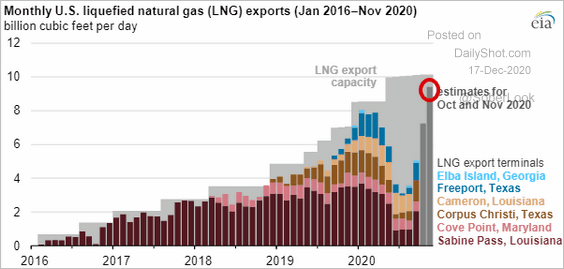

3. US LNG exports hit a record high and are expected to stay robust as prices in Asia rebound.

Source: EIA

Source: EIA

Equities

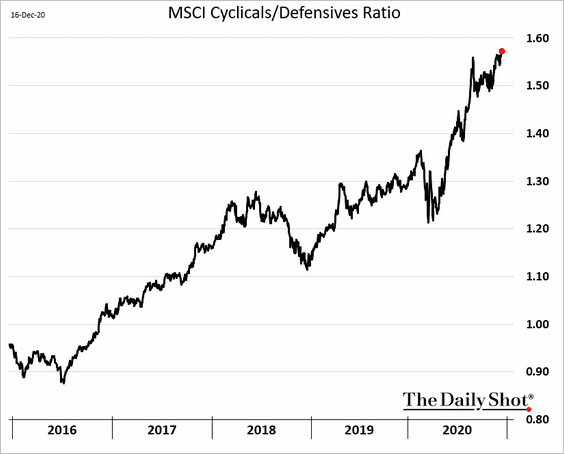

1. Cyclical shares have resumed their outperformance over defensives. The market is pricing in strong global economic growth ahead.

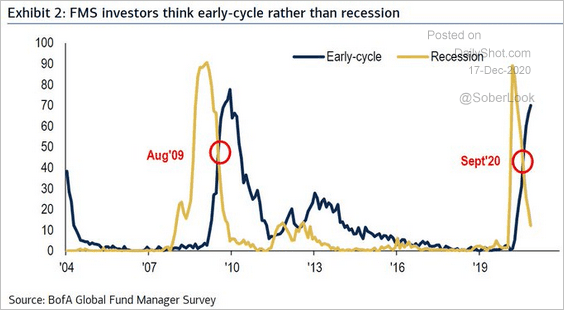

2. Fund managers now see “early-cycle” (the rebound phase of the economic cycle) rather than recession.

Source: BofA Global Research, @jsblokland

Source: BofA Global Research, @jsblokland

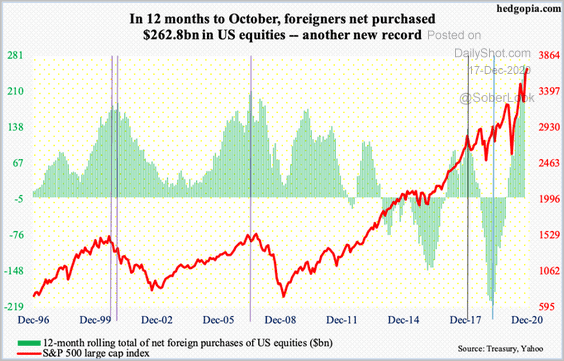

3. Foreigners have accelerated their purchases of US equities.

Source: @hedgopia Read full article

Source: @hedgopia Read full article

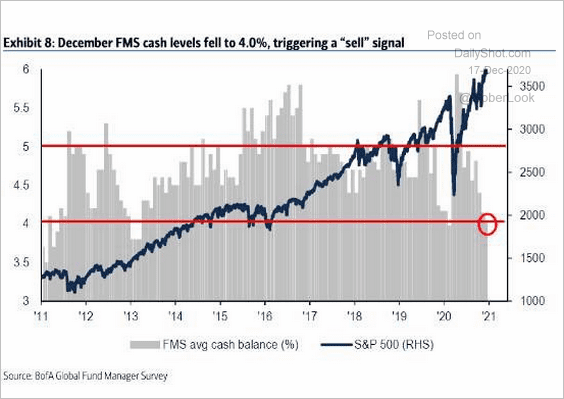

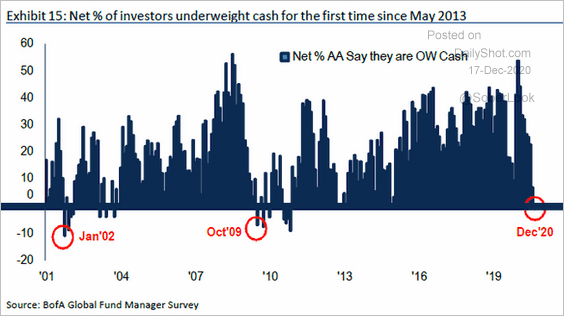

4. Fund managers are all-in, with cash levels at multi-year lows (2 charts).

Source: @LizAnnSonders, @BankofAmerica

Source: @LizAnnSonders, @BankofAmerica

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

——————–

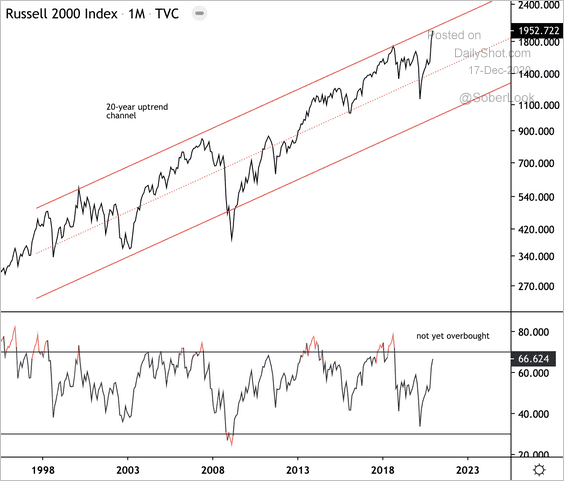

5. The Russell 2,000 index is at long-term resistance. Will we see a breakout?

Source: @DantesOutlook

Source: @DantesOutlook

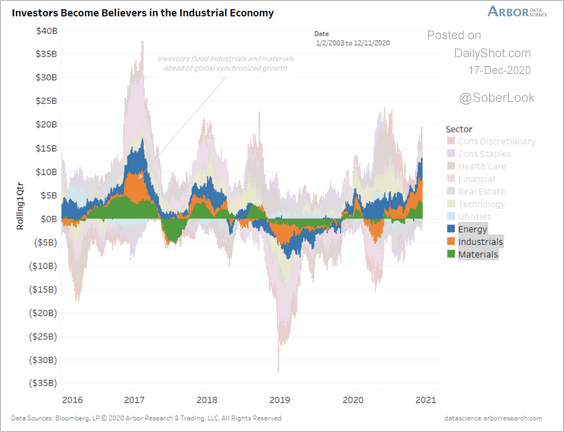

6. Flows into US equities have been heavily focused on energy, industrials, and materials.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

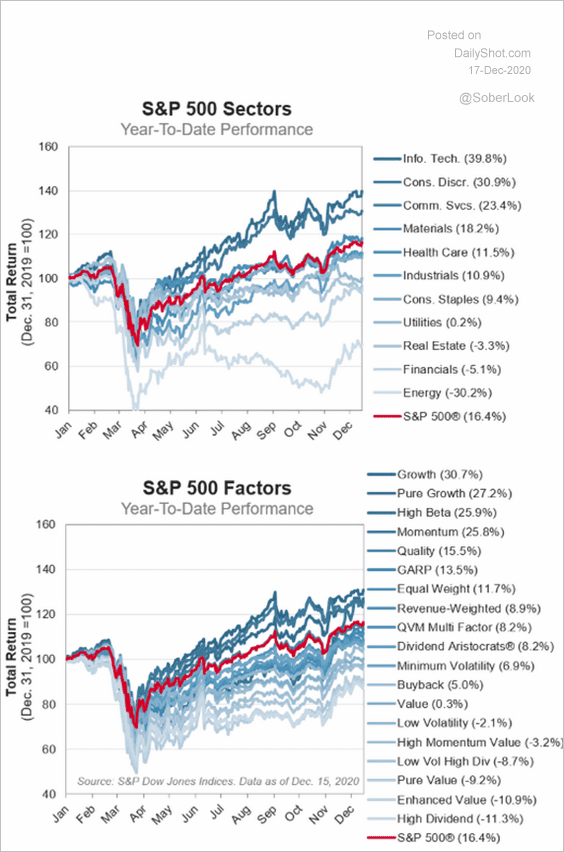

7. Here is the year-to-date relative performance of US sectors and equity factors.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

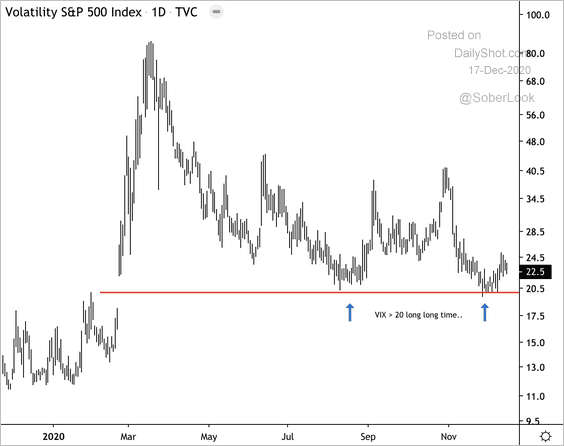

8. VIX has remained above 20 for most of the year.

Source: @DantesOutlook

Source: @DantesOutlook

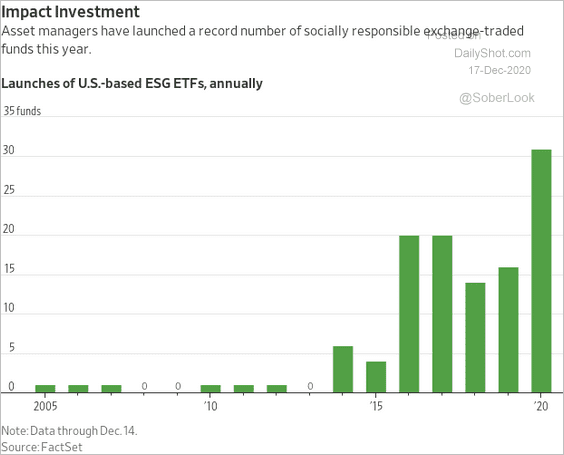

9. ESG ETFs are hot.

Source: @WSJ Read full article

Source: @WSJ Read full article

Credit

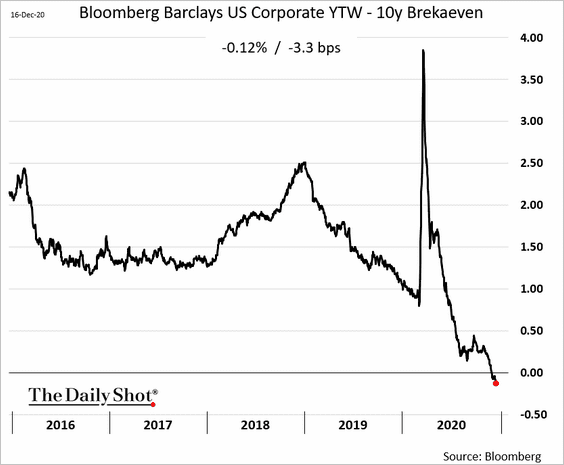

1. US real investment-grade yields are negative based on market-implied inflation expectations.

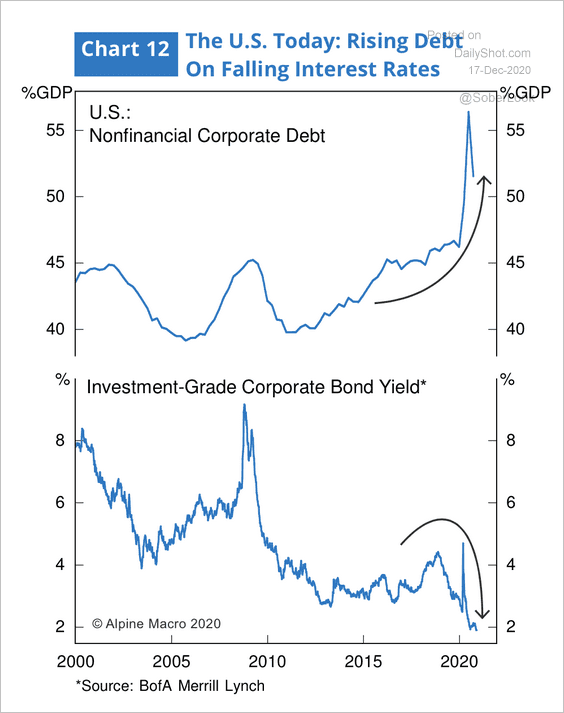

2. Is US investment-grade credit priced for perfection?

Source: Alpine Macro

Source: Alpine Macro

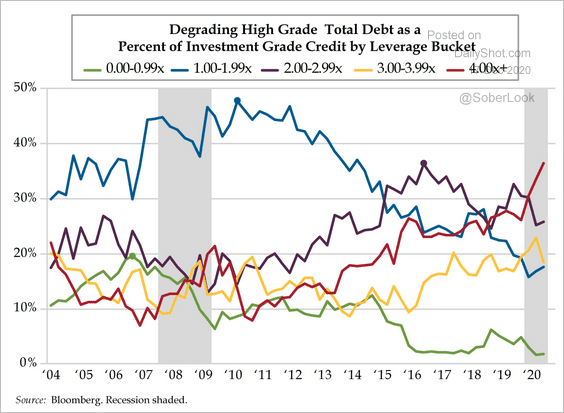

3. Corporate debt with more than 4x leverage makes up 36% of the US investment-grade market, which is almost double 2004 levels.

Source: The Daily Feather

Source: The Daily Feather

Global Developments

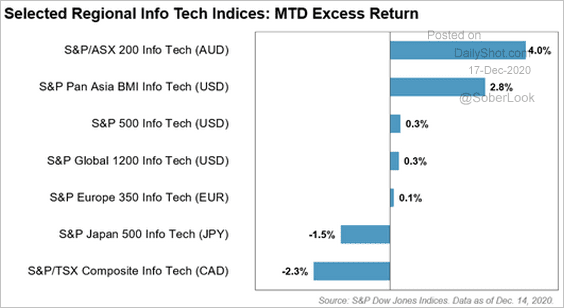

1. The tech sector has slowed its ascent in the US but has continued to climb in Australia. Here is a breakdown by select regions.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

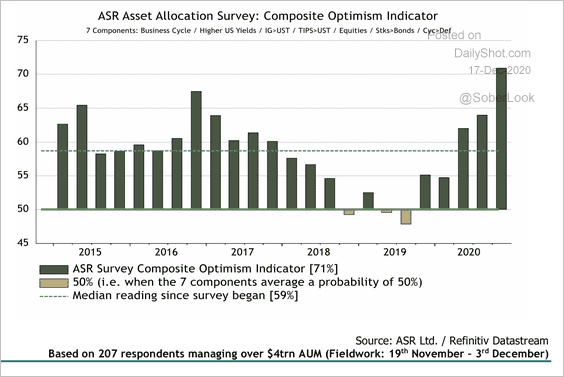

2. Investor optimism is at the highest level in four years, according to a survey by Absolute Strategy Research.

Source: Absolute Strategy Research

Source: Absolute Strategy Research

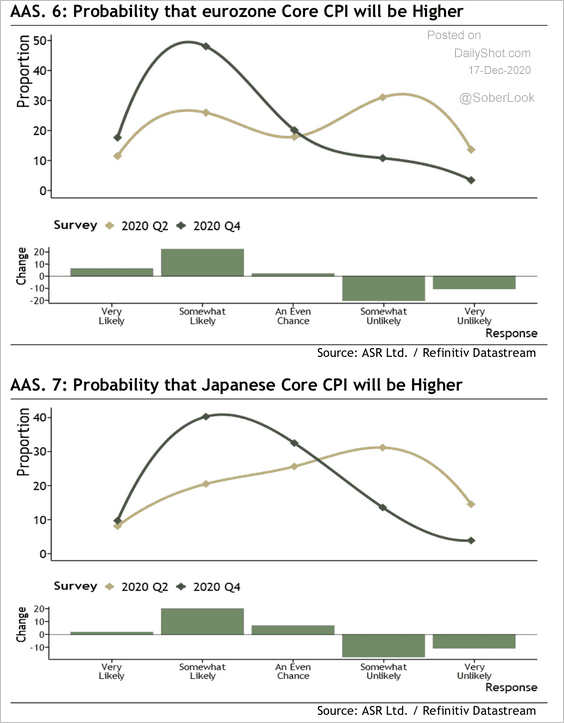

Expectations of a full-on global reflation are evident throughout the survey, especially in Europe and Japan.

Source: Absolute Strategy Research

Source: Absolute Strategy Research

——————–

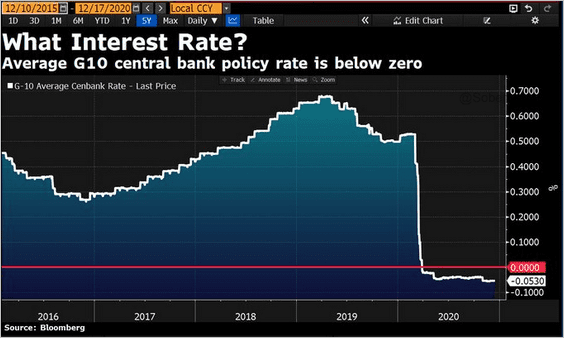

3. Here is the average G10 policy rate.

Source: @DavidInglesTV

Source: @DavidInglesTV

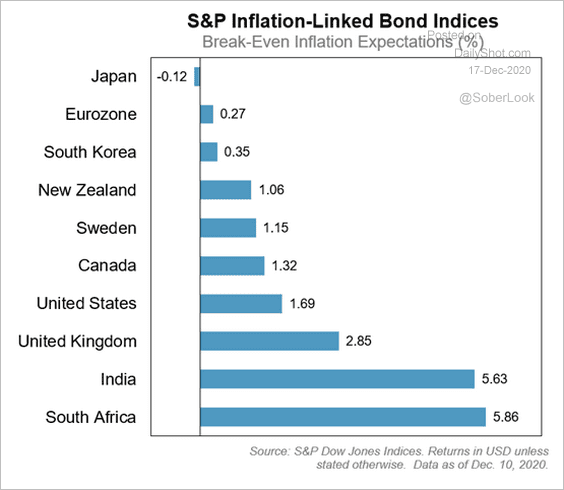

4. The chart below provides a proxy for inflation expectations (breakeven = the spread between sovereign inflation-linked bond indices and the equivalent duration-weighted sovereign yields).

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

Food for Thought

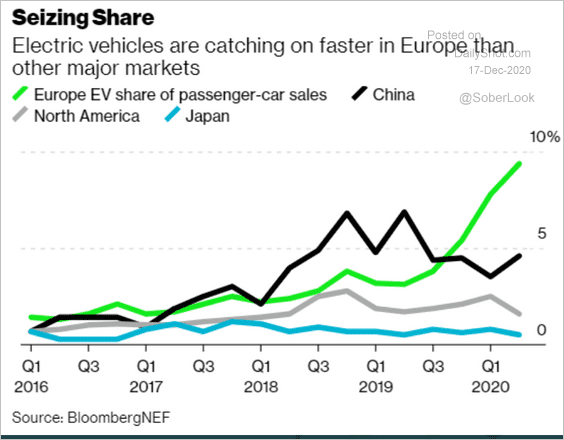

1. Electric vehicle sales (market share):

Source: @business Read full article

Source: @business Read full article

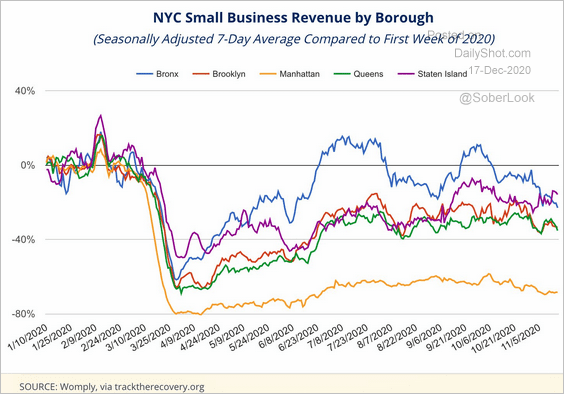

2. Small business revenues by NYC borough:

Source: Office of the New York City Comptroller, @adam_tooze Read full article

Source: Office of the New York City Comptroller, @adam_tooze Read full article

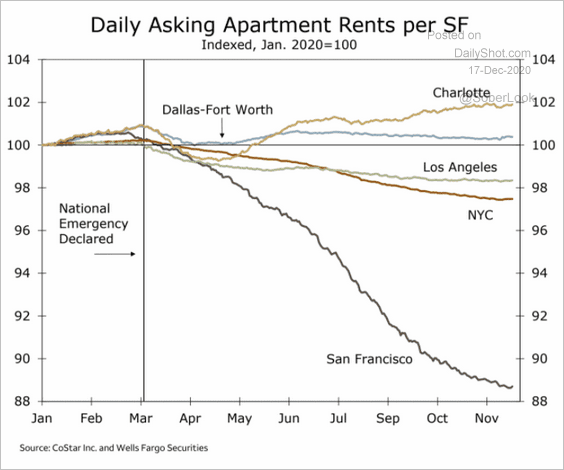

3. Apartment rents in select cities:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

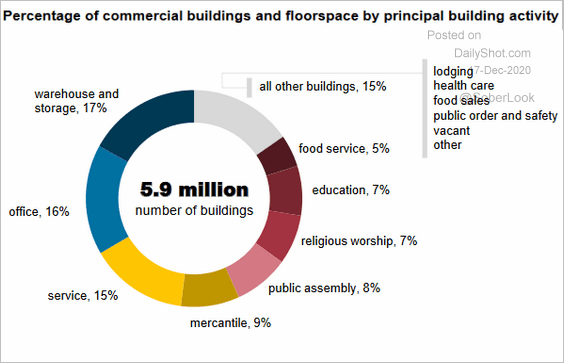

4. Commercial buildings floorspace by principal activity:

Source: @EIAgov Read full article

Source: @EIAgov Read full article

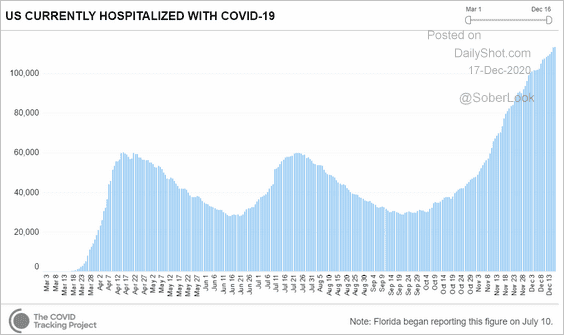

5. US COVID-related hospitalizations.

Source: CovidTracking.com

Source: CovidTracking.com

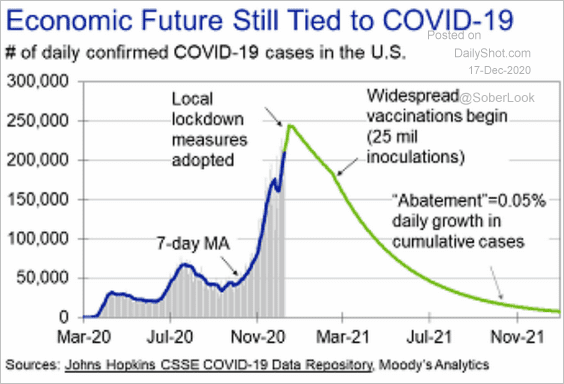

6. US COVID case projections:

Source: Moody’s Analytics

Source: Moody’s Analytics

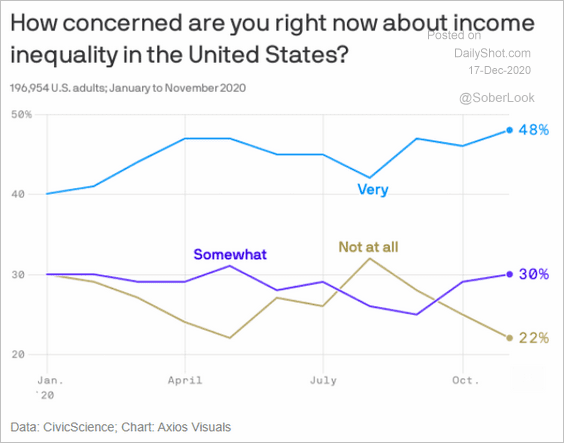

7. Views on income inequality:

Source: @axios Read full article

Source: @axios Read full article

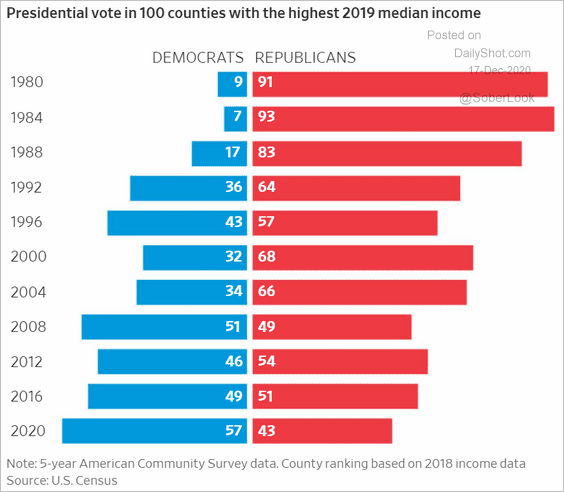

8. Presidential vote in US counties with the highest median income:

Source: @WSJGraphics Read full article

Source: @WSJGraphics Read full article

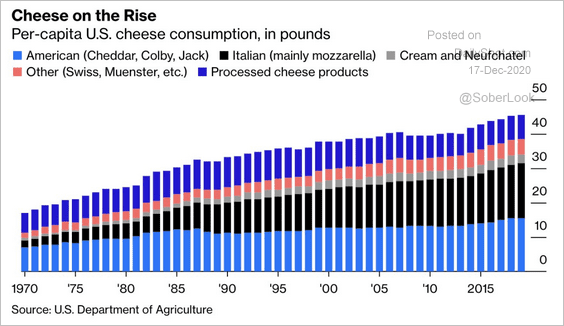

9. US cheese consumption:

Source: @bopinion Read full article

Source: @bopinion Read full article

——————–