The Daily Shot: 21-Dec-20

• Administrative Update

• The United Kingdom

• The United States

• The Eurozone

• Emerging Markets

• Commodities

• Energy

• Equities

• Alternatives

• Credit

• Rates

• Global Developments

• Food for Thought

Administrative Update

Please note that The Daily Shot will not be published from Thursday, December 24 through Friday, January 1. However, in keeping with our annual tradition, we will send out a special edition of Food for Thought next week.

As a reminder, scheduling updates are available online at https://thedailyshot.com/administrative-updates/

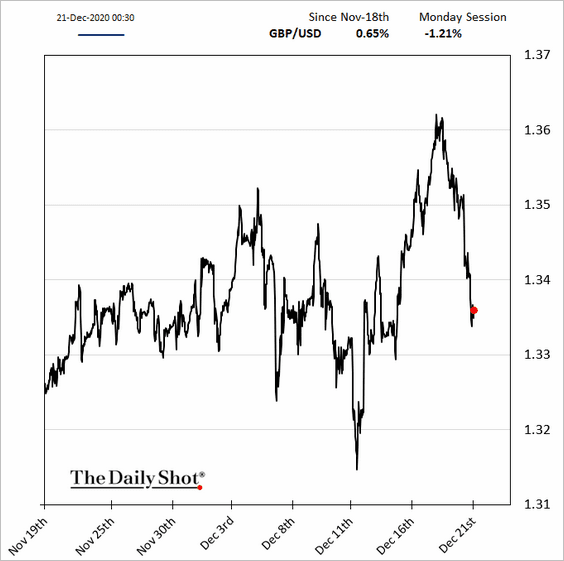

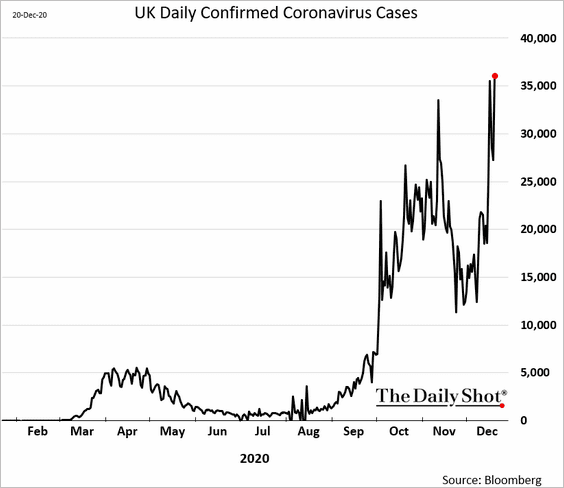

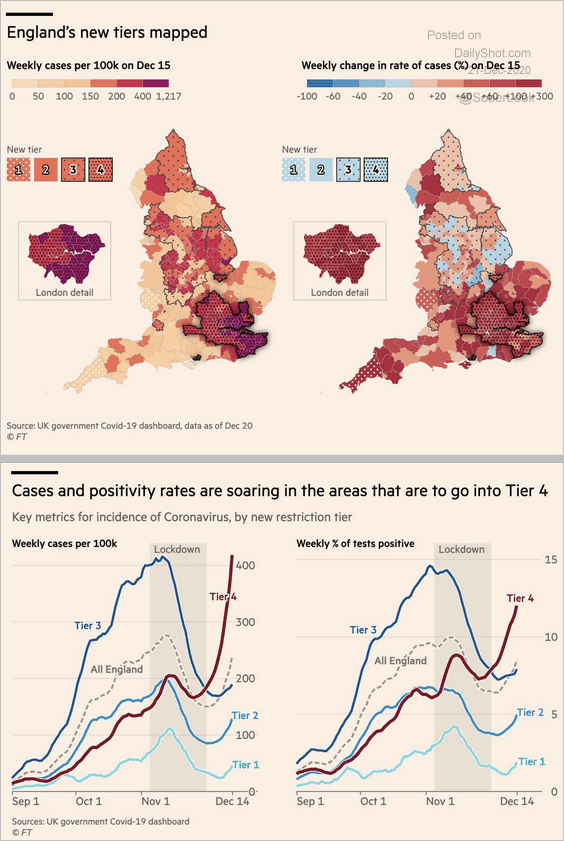

The United Kingdom

1. A more contagious strain of the COVID virus halted many international flights and sent London into an emergency lockdown.

Source: South China Morning Post Read full article

Source: South China Morning Post Read full article

Source: @bpolitics Read full article

Source: @bpolitics Read full article

• The pound reversed its “Brexit optimism” gains.

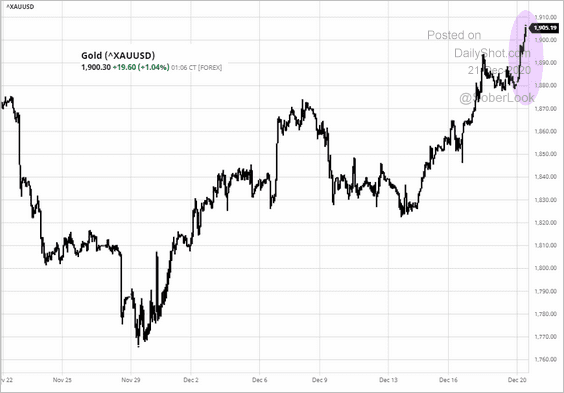

Gold moved higher.

Source: barchart.com

Source: barchart.com

• The number of new daily infections hit a record.

The charts below show some regional statistics.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

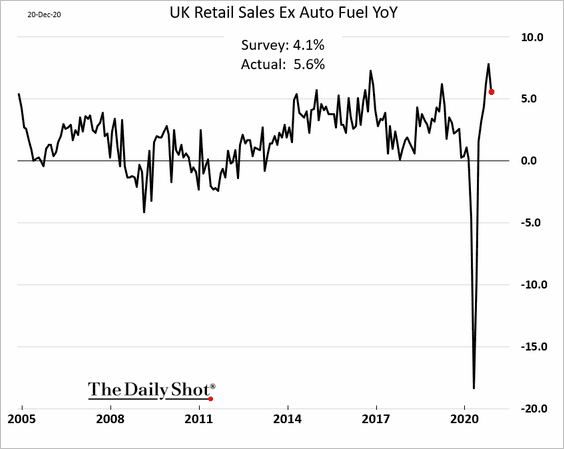

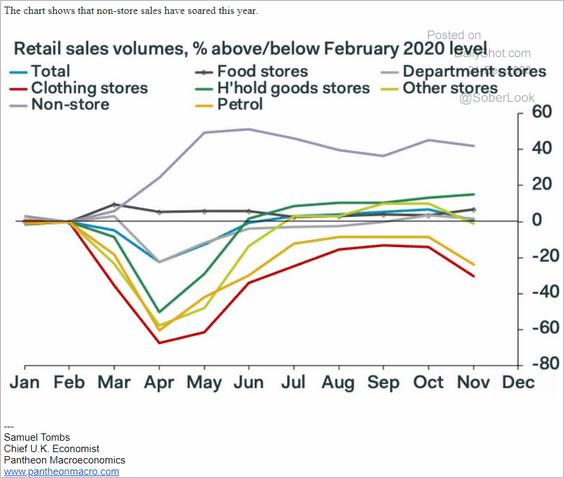

2. Retail sales pulled back from the highs in November but topped economists’ expectations.

Here are the trends for select groupings.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

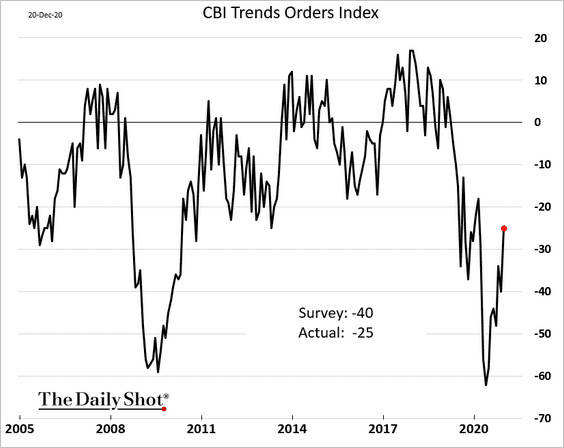

3. The December CBI business orders index also surprised to the upside (boosted by precautionary Brexit-related inventory building).

——————–

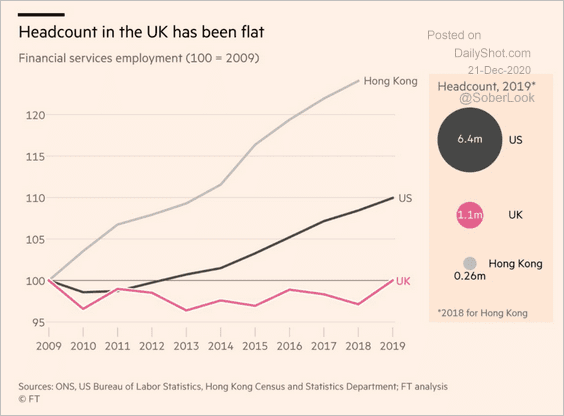

4. Financial services jobs in the UK have lagged Hong Kong and the US.

Source: @adam_tooze, @financialtimes Read full article

Source: @adam_tooze, @financialtimes Read full article

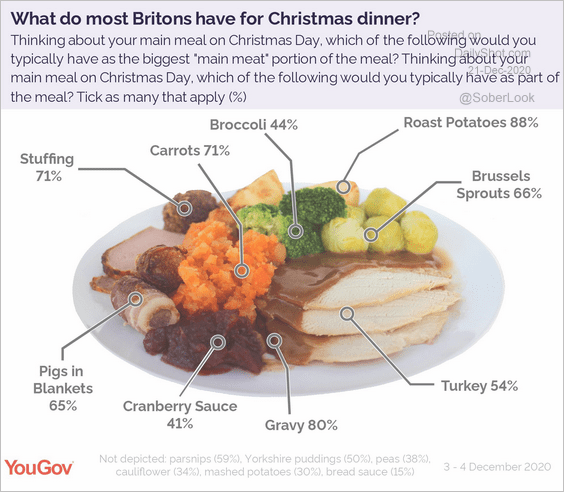

5. Switching topics, what will most Britons have for Christmas dinner?

Source: @YouGov Read full article

Source: @YouGov Read full article

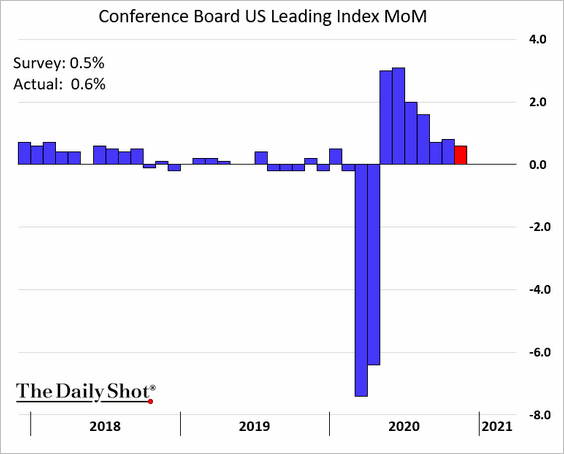

The United States

1. The index of leading indicators held up well in November.

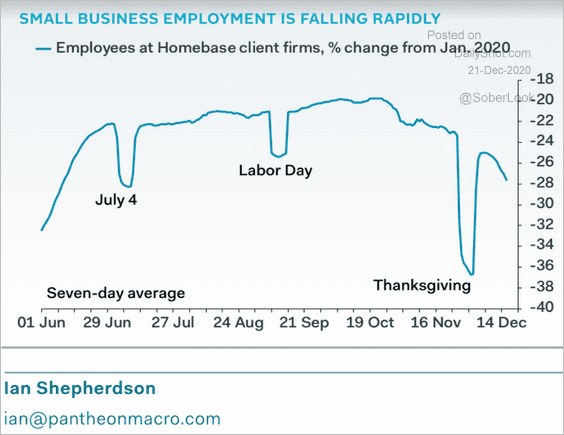

2. Next, we have some updates on the labor market.

• Small business employment (published by Homebase) continues to deteriorate.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

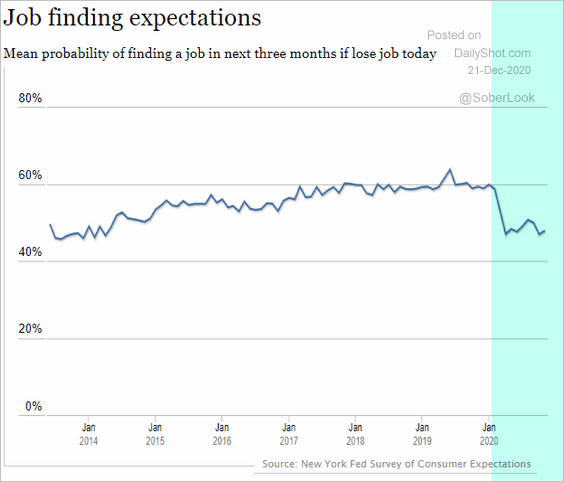

• The NY Fed’s consumer survey shows that job finding expectations remain depressed nationally.

Source: NY Fed

Source: NY Fed

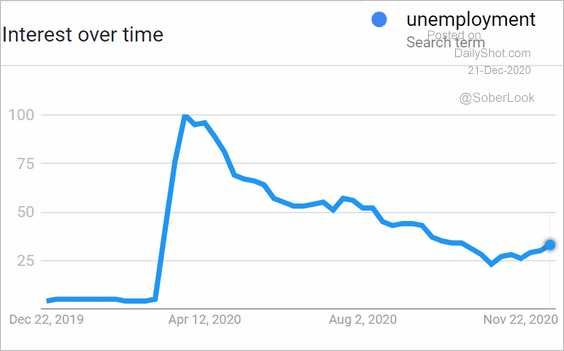

• Unemployment-related Google search activity is climbing again.

Source: Google Trends, h/t The Daily Feather

Source: Google Trends, h/t The Daily Feather

——————–

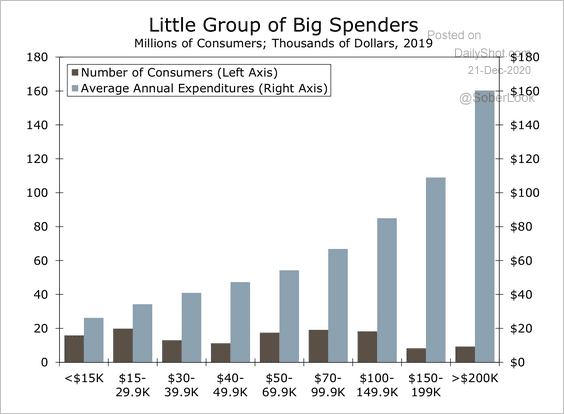

3. Consumption across lower-income households represents a relatively small share of aggregate spending in the economy.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

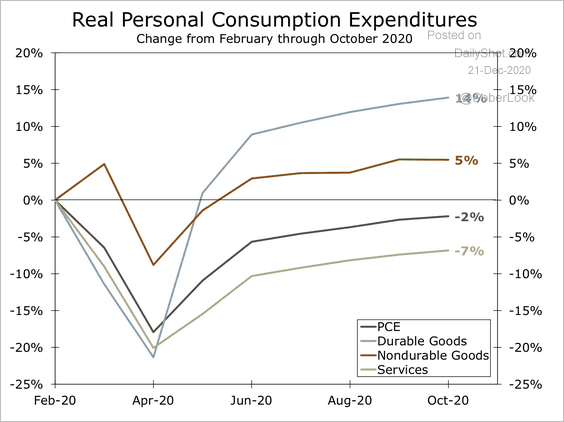

Separately, spending on durable goods held up this year, while service consumption has been weak.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

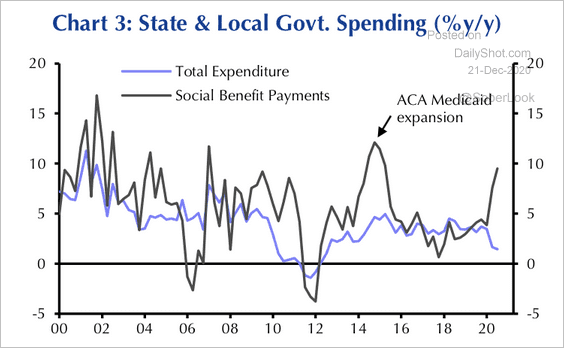

4. State and local governments are spending more on social benefits such as Medicaid this year.

Source: Capital Economics

Source: Capital Economics

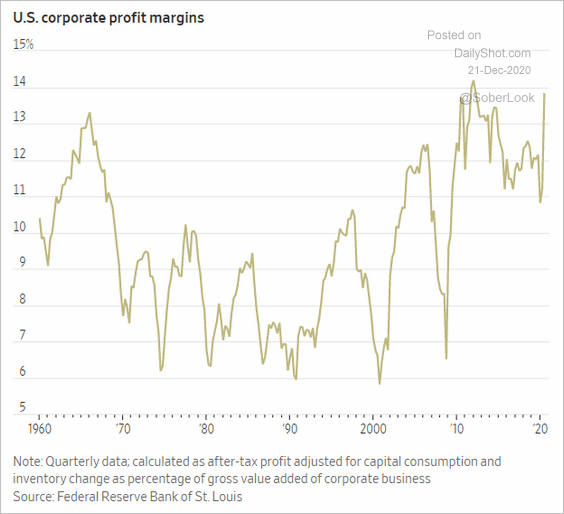

5. Corporate profit margins have rebounded.

Source: @WSJ Read full article

Source: @WSJ Read full article

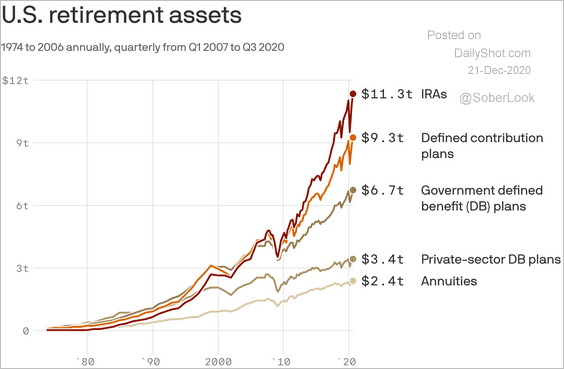

6. Here is the growth trajectory of US retirement assets.

Source: @axios

Source: @axios

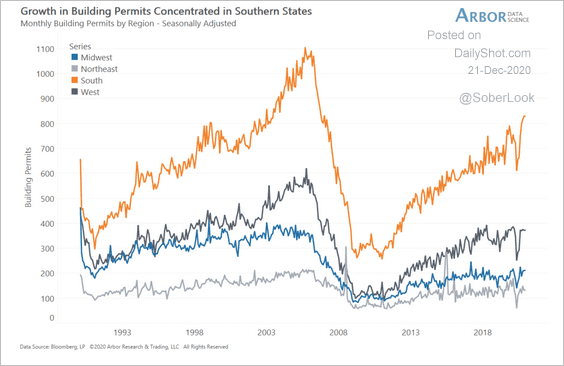

7. Finally, we have some updates on housing.

• Southern states have been the focal point of new home construction over the past decade.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

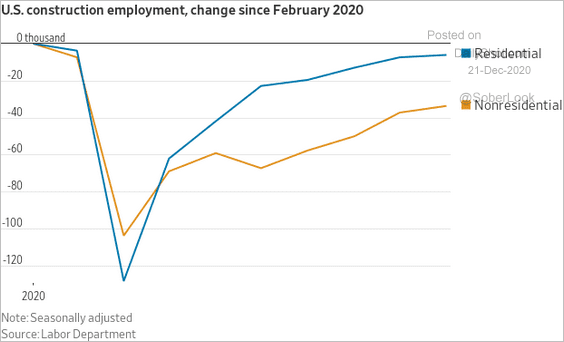

• Residential construction employment has almost recovered to pre-pandemic levels. That’s not the case for nonresidential construction.

Source: @jeffsparshott

Source: @jeffsparshott

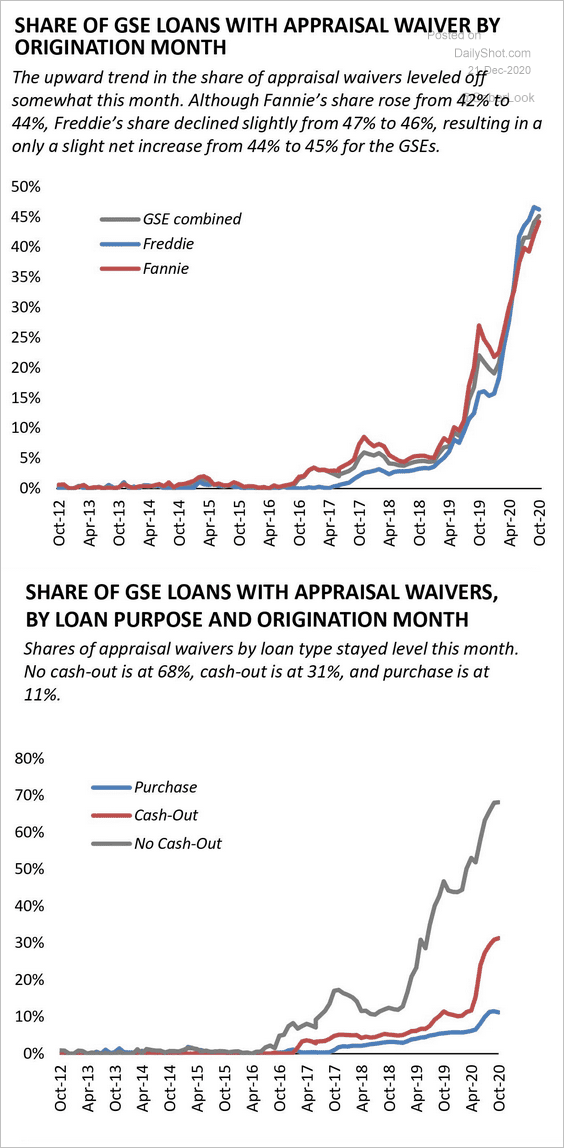

• Due to the pandemic, Freddie and Fannie have been waiving home appraisals on a significant proportion of mortgages.

Source: AEI Housing Center

Source: AEI Housing Center

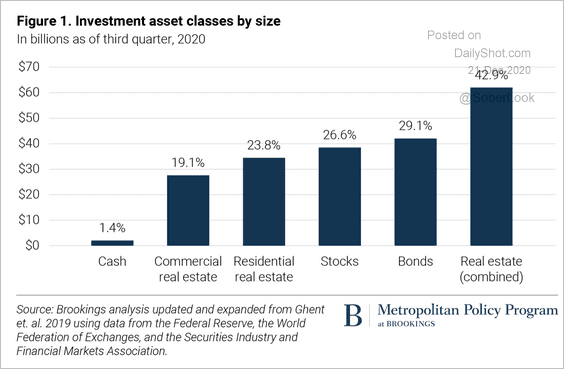

• Real estate is the largest asset class in the US.

Source: Brookings-LOCUS Initiative Read full article

Source: Brookings-LOCUS Initiative Read full article

The Eurozone

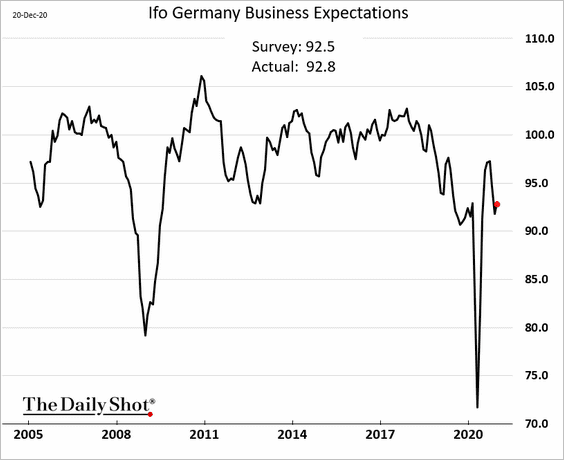

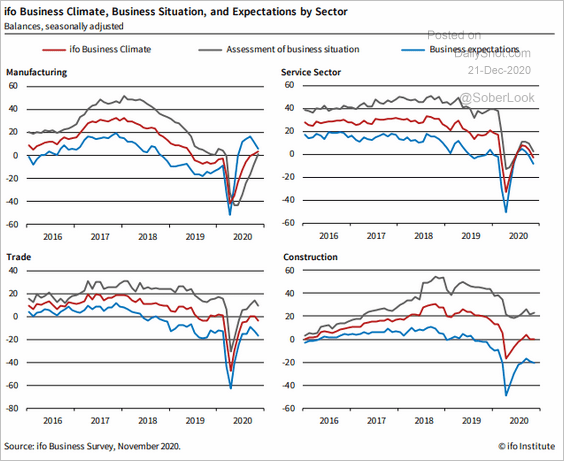

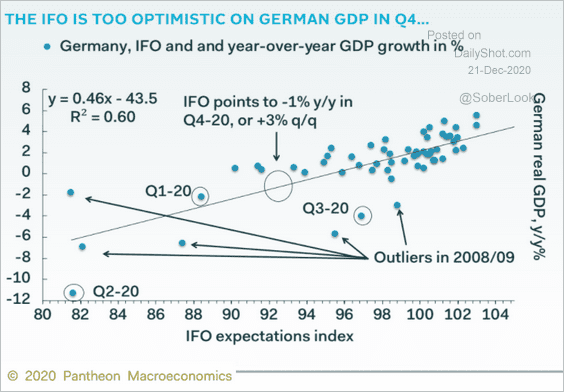

1. Germany’s Ifo expectations index ticked higher this month.

Here is the breakdown by sector.

Source: ifo Institute

Source: ifo Institute

Has the Ifo indicator been too upbeat?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

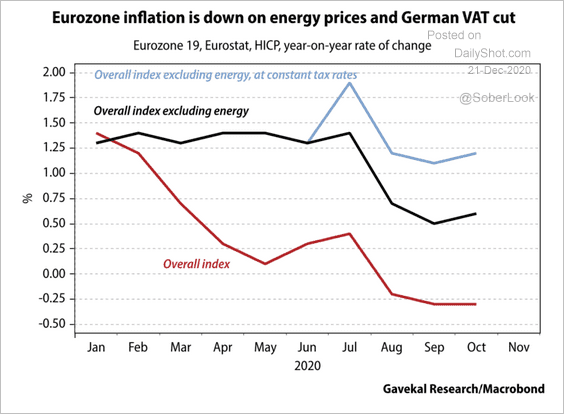

2. How much did energy and Germany’s VAT reduction impact the euro-area CPI?

Source: Gavekal Research

Source: Gavekal Research

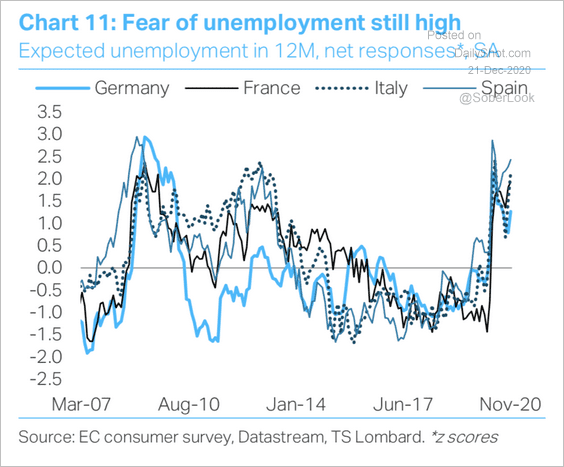

3. Employment uncertainty remains elevated.

Source: TS Lombard

Source: TS Lombard

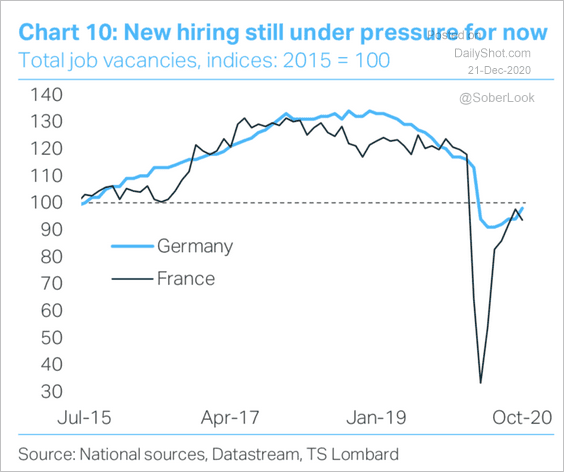

And job vacancies haven’t fully rebounded.

Source: TS Lombard

Source: TS Lombard

Emerging Markets

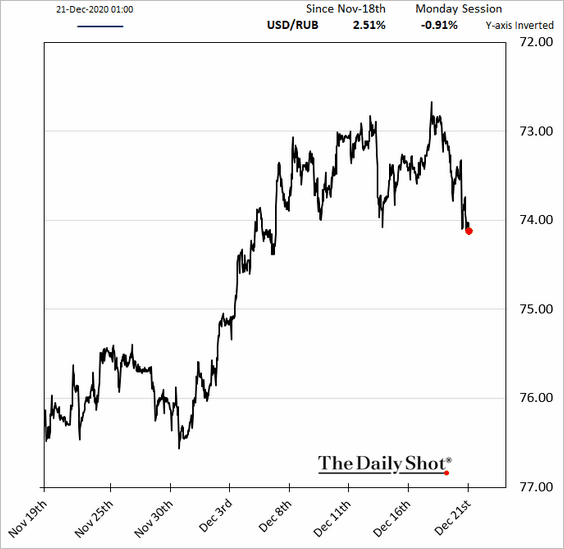

1. The ruble is softer, partially in response to the massive hacking attack uncovered in the US.

Source: WIRED Read full article

Source: WIRED Read full article

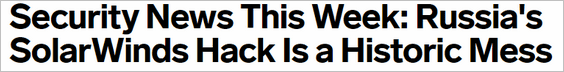

Nonetheless, Goldman expects the ruble to keep strengthening (despite potential US sanctions).

Source: Goldman Sachs

Source: Goldman Sachs

——————–

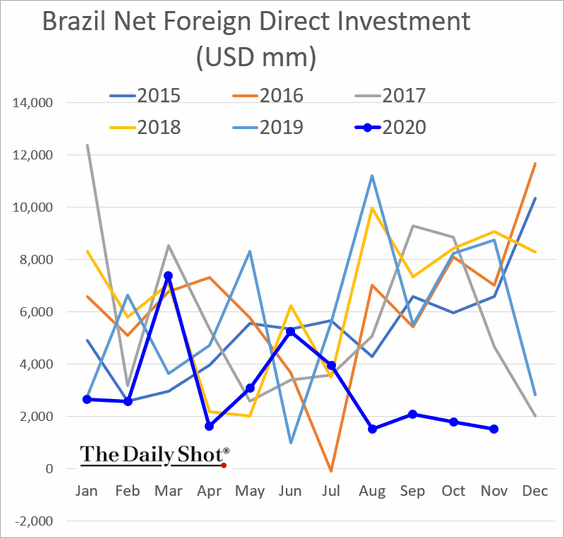

2. Brazil’s foreign direct investment remains depressed.

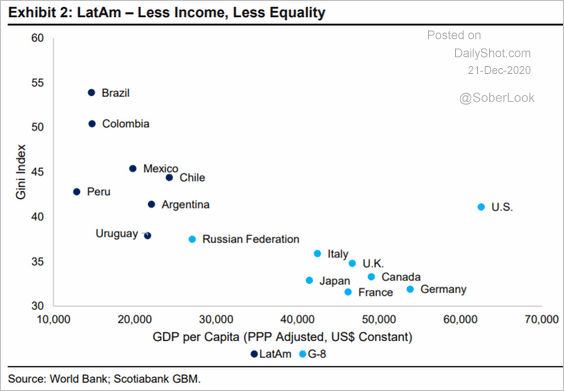

3. Income inequality in Latin America stands out.

Source: Scotiabank Economics

Source: Scotiabank Economics

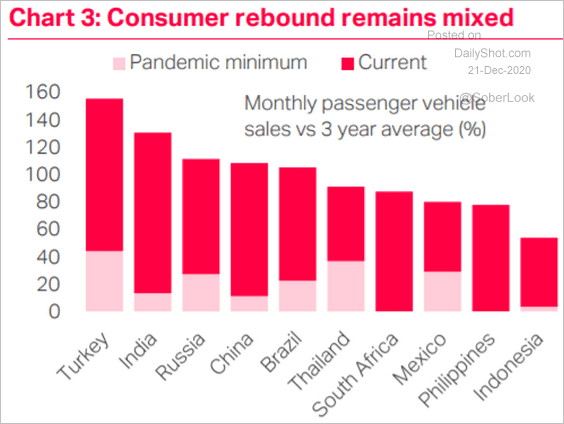

4. EM consumer rebound is uneven.

Source: TS Lombard

Source: TS Lombard

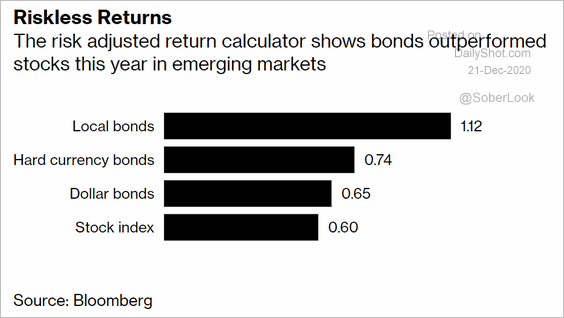

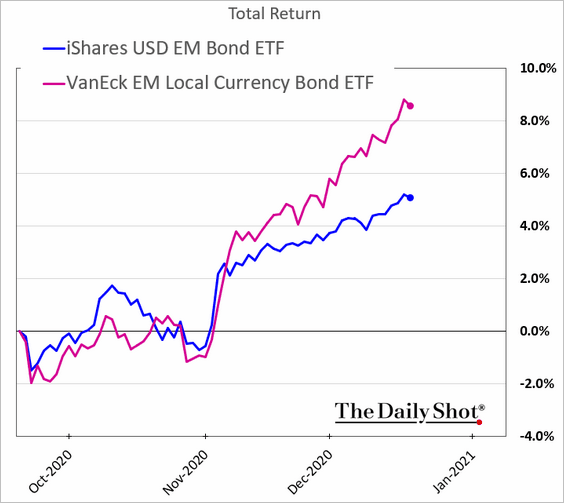

5. Local-currency bonds have been outperforming.

Source: @markets Read full article

Source: @markets Read full article

——————–

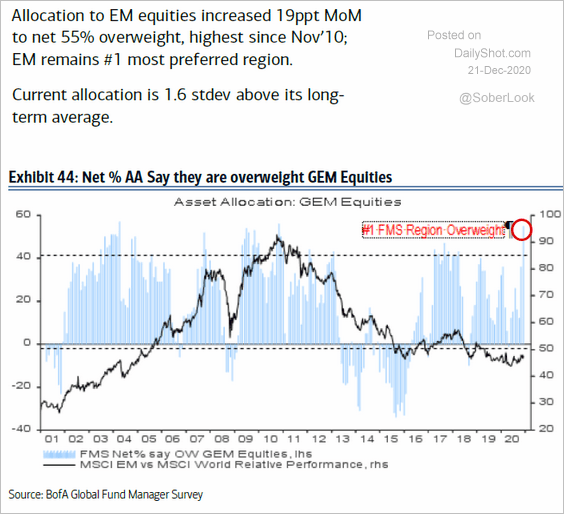

6. Fund managers are overweight EM stocks.

Source: BofA Global Research

Source: BofA Global Research

Commodities

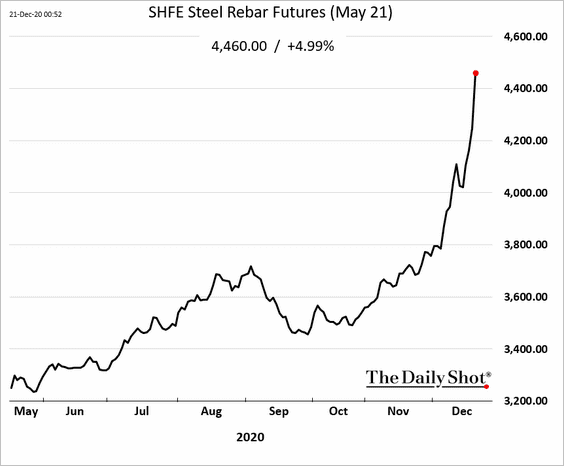

1. A Vale mine accident sent iron ore markets into a frenzy.

Source: Reuters Read full article

Source: Reuters Read full article

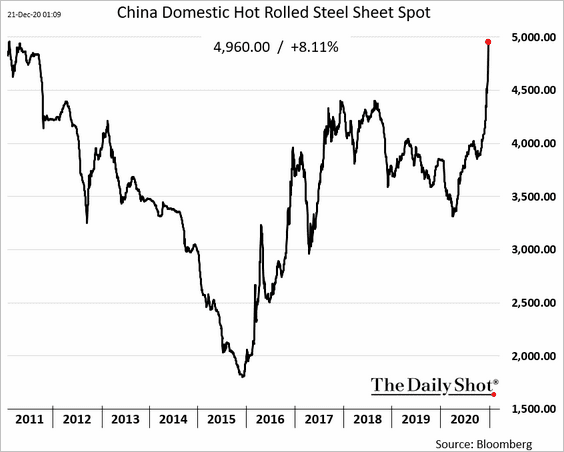

This event is further fueling the industrial commodities rally in China. Steel prices are following iron ore sharply higher.

Here is the spot price index for China’s hot-rolled steel.

——————–

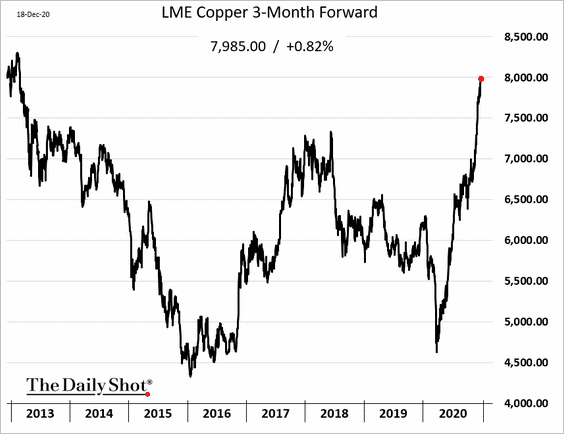

2. LME copper is trading near $8,000 a ton.

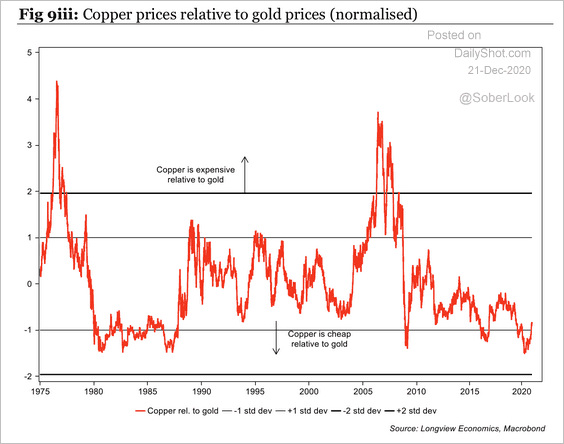

Copper is still oversold relative to gold, …

Source: Longview Economics

Source: Longview Economics

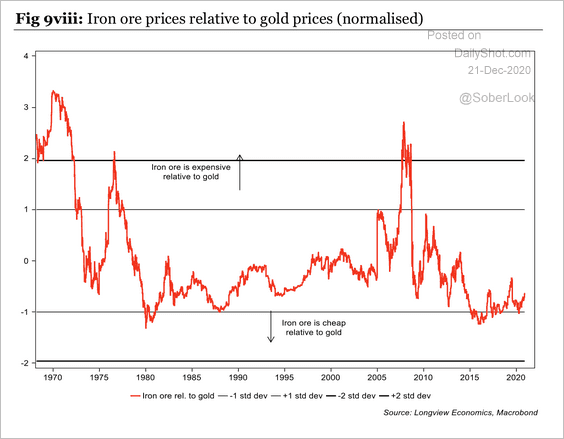

… and so is iron ore.

Source: Longview Economics

Source: Longview Economics

——————–

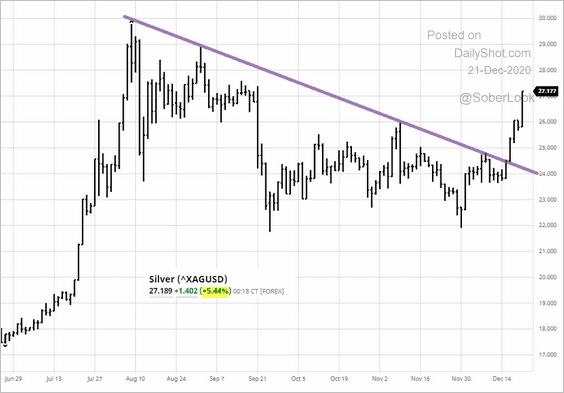

3. Silver broke resistance and just kept going.

Source: barchart.com

Source: barchart.com

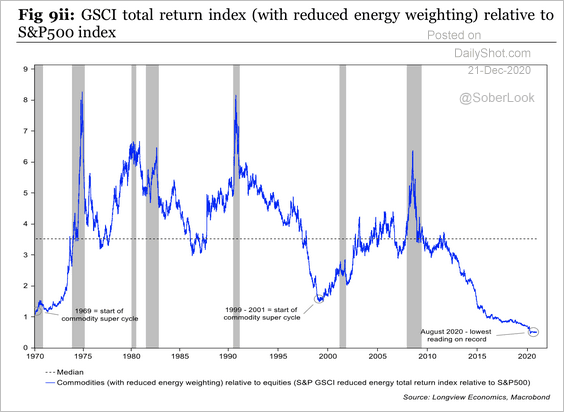

4. Commodities are at the cheapest level relative to equities since the 1970s.

Source: Longview Economics

Source: Longview Economics

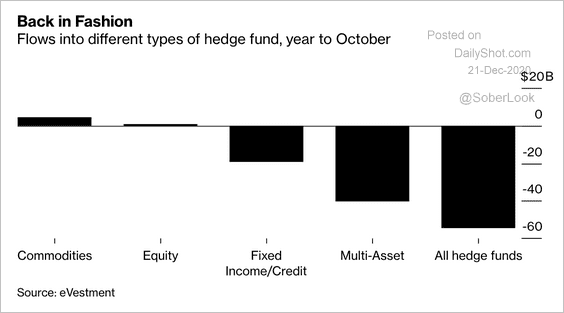

5. Hedge funds focused on commodities have managed to raise money this year, compared to about $55 billion in outflows from the industry overall.

Source: @markets Read full article

Source: @markets Read full article

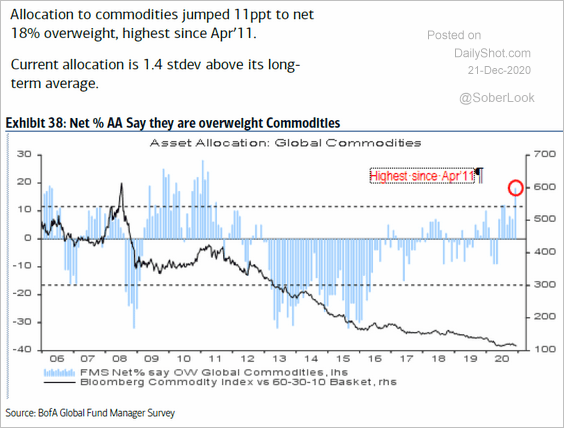

6. Fund managers have boosted their allocations to commodities.

Source: BofA Global Research

Source: BofA Global Research

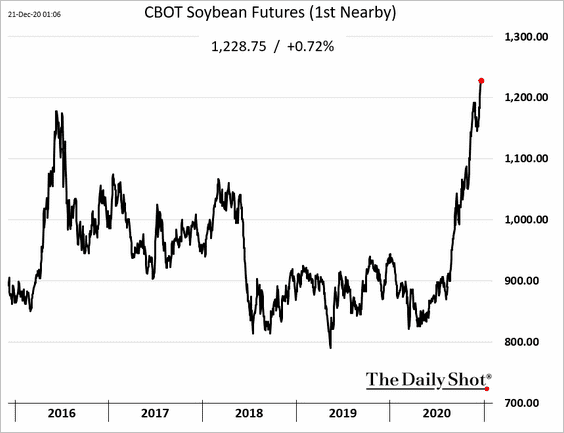

7. US soy futures keep climbing.

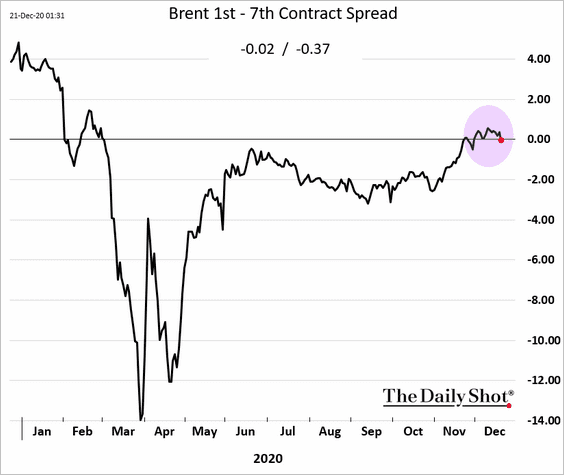

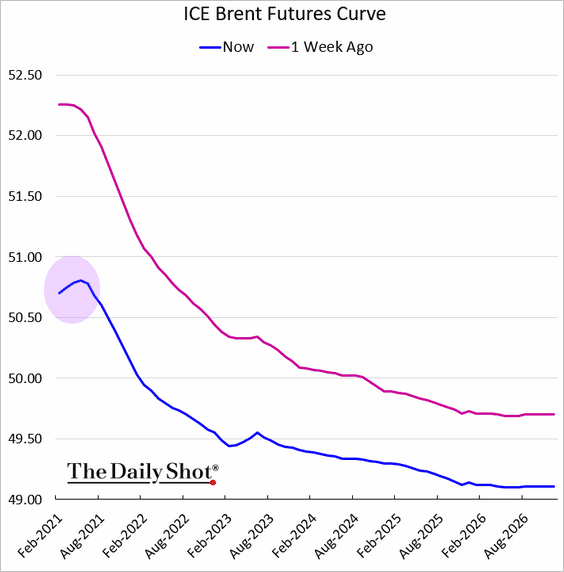

Energy

The front end of the Brent curve is back in contango.

——————–

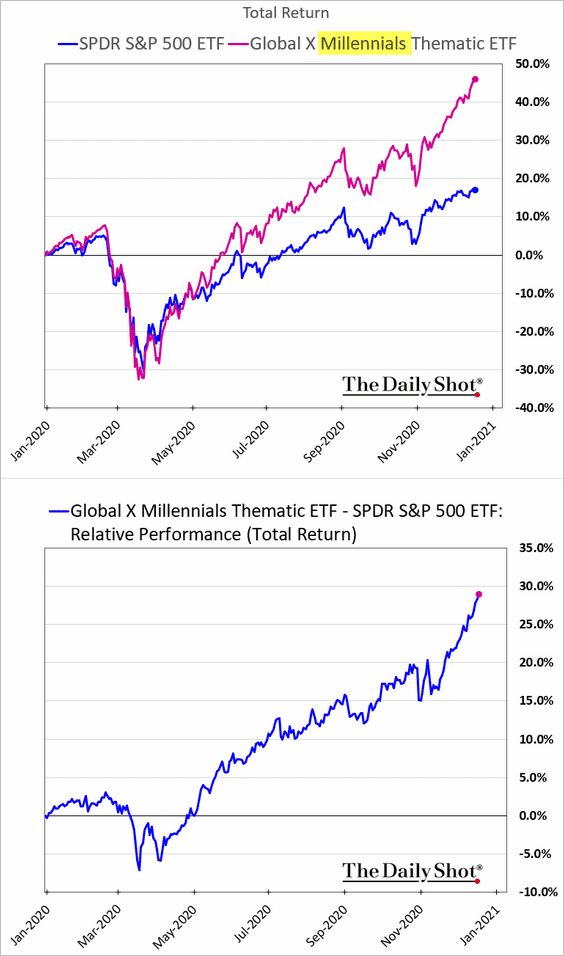

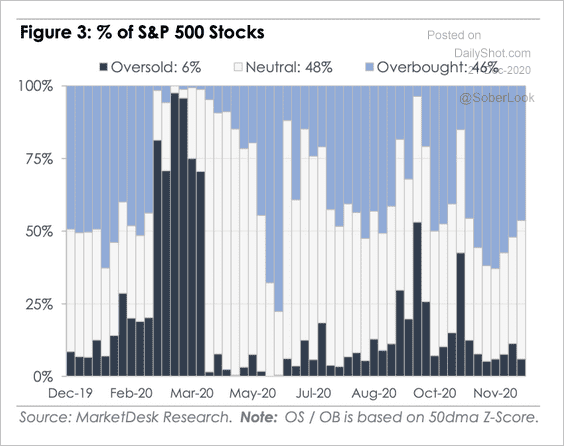

Equities

1. Shares of companies with products and services preferred by Millenials have outperformed substantially this year.

2. The percent of S&P 500 stocks that are overbought is still below prior extremes.

Source: MarketDesk Research

Source: MarketDesk Research

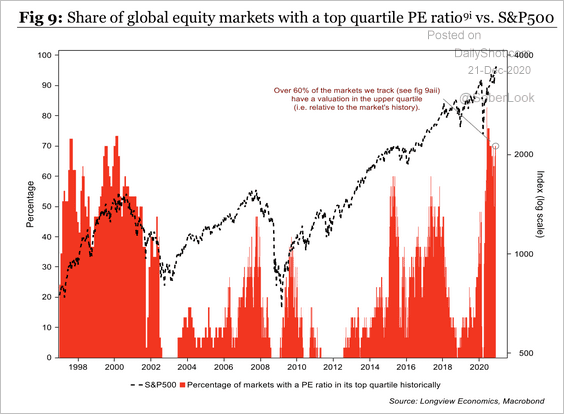

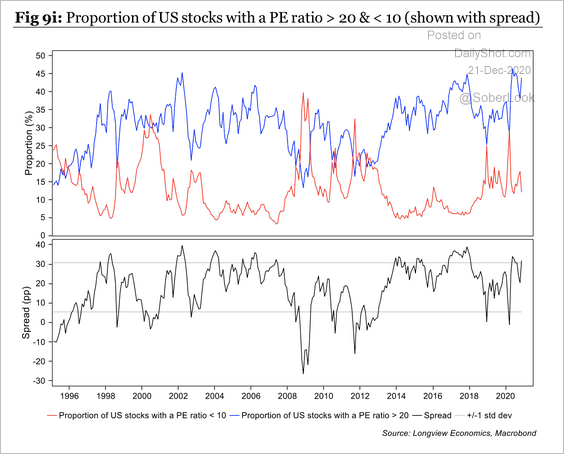

However, global and US valuations are nearing extremes (two charts).

Source: Longview Economics

Source: Longview Economics

Source: Longview Economics

Source: Longview Economics

——————–

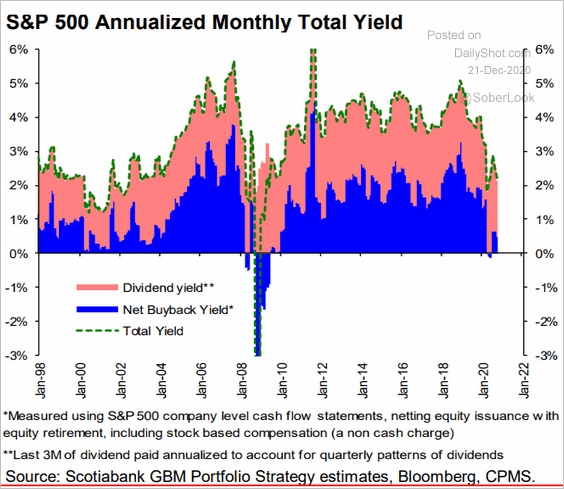

3. This chart shows the S&P 500 total cash yield.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

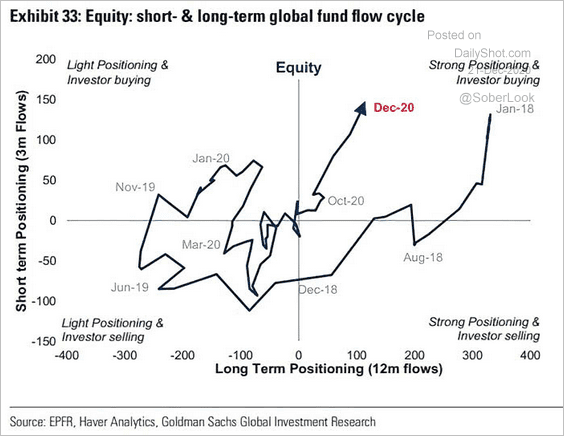

4. Here is the trajectory of equity short- and long-term positioning.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

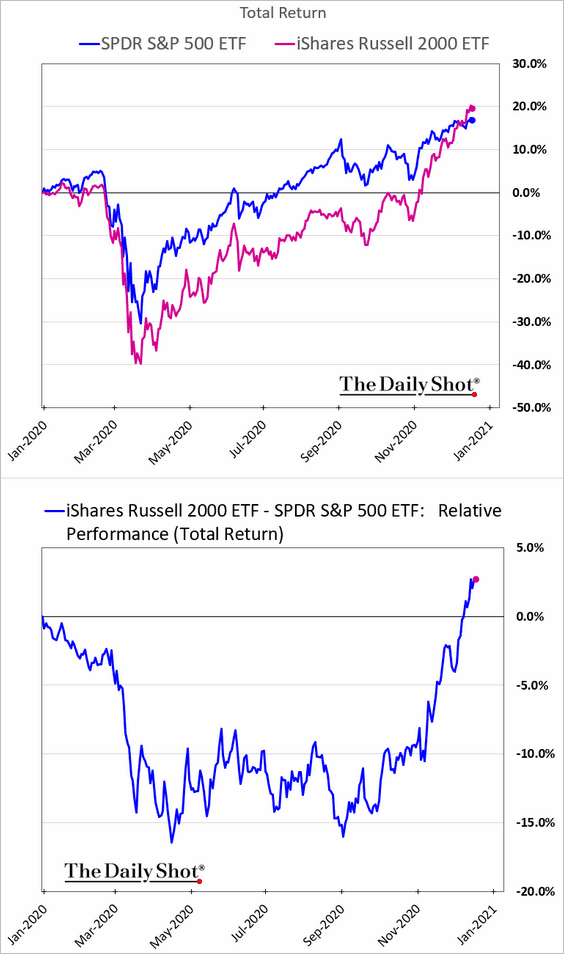

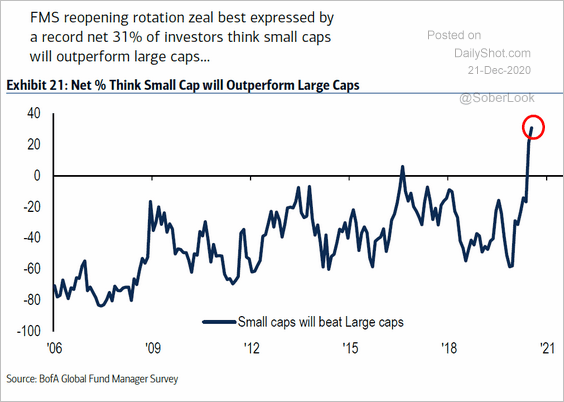

5. The Russell 2000 index is now outperforming the S&P 500 year-to-date.

Fund managers have not been this bullish on small caps in years.

Source: BofA Global Research

Source: BofA Global Research

——————–

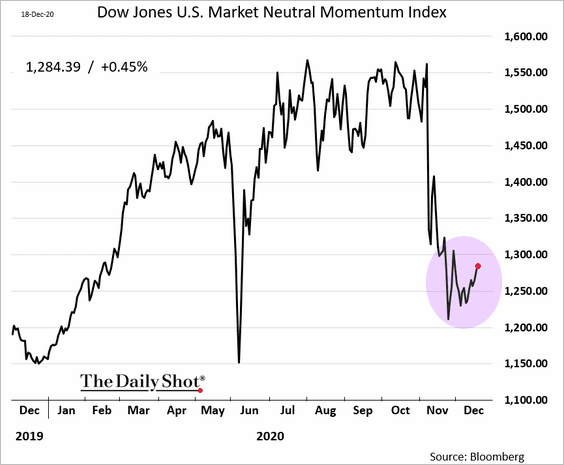

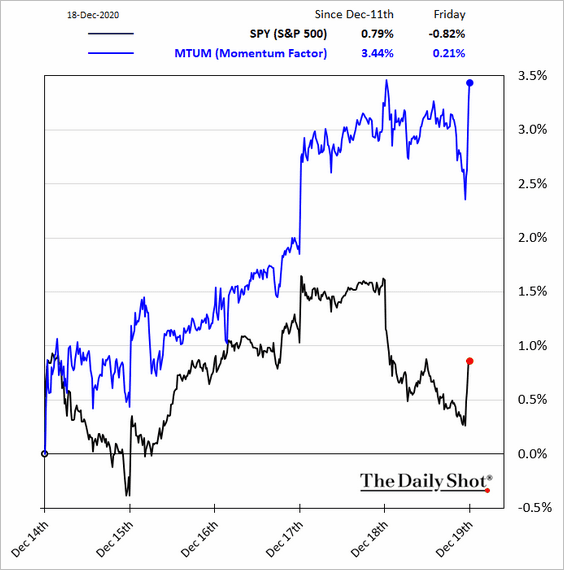

6. The momentum factor is starting to recover.

——————–

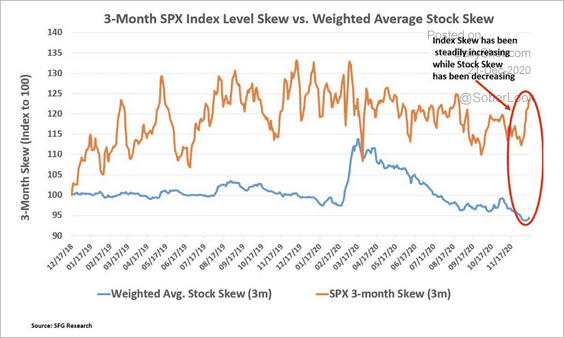

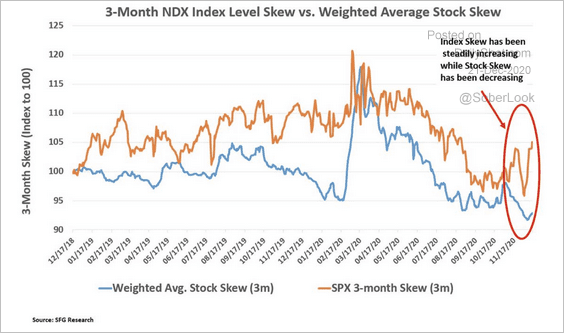

7. The S&P 500 and Nasdaq 100 index skew remains elevated versus individual stock skew. The trend suggests that investors expect markets to grind higher next year, albeit with larger anticipated moves on the individual stock level (two charts).

Source: Chris Murphy; Susquehanna

Source: Chris Murphy; Susquehanna

Source: Chris Murphy; Susquehanna

Source: Chris Murphy; Susquehanna

——————–

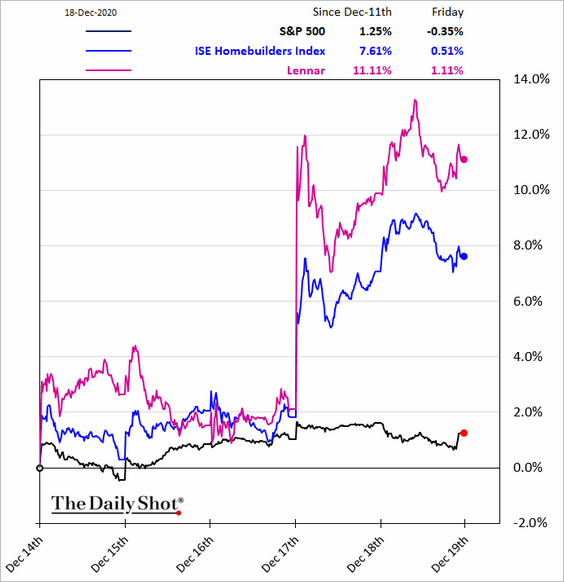

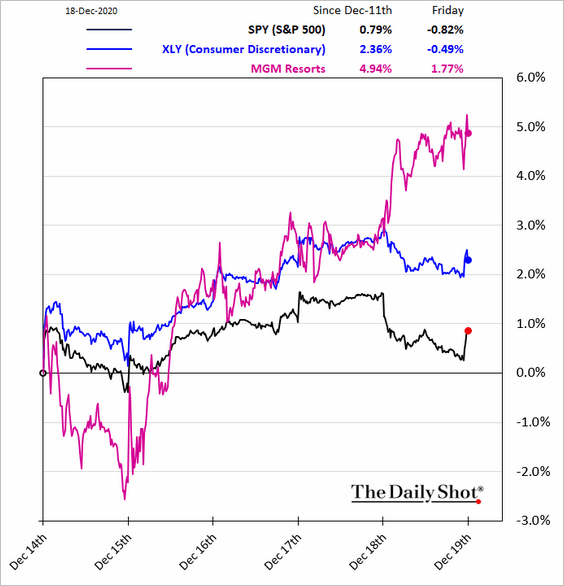

8. Finally, we have some sector/subsector updates.

• Homebuilders:

• Consumer Discretionary:

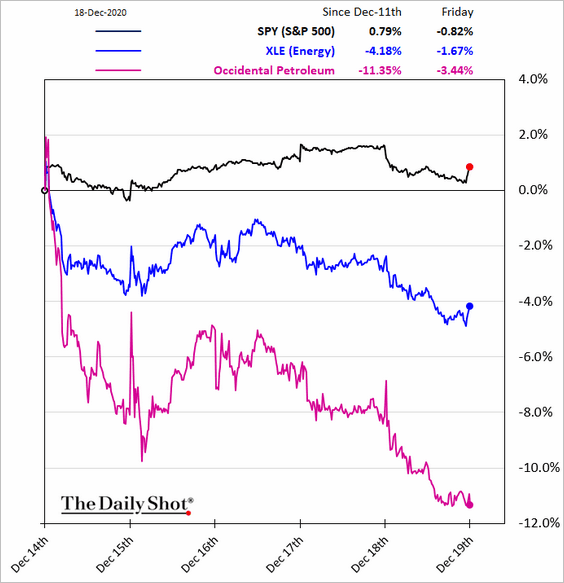

• Energy:

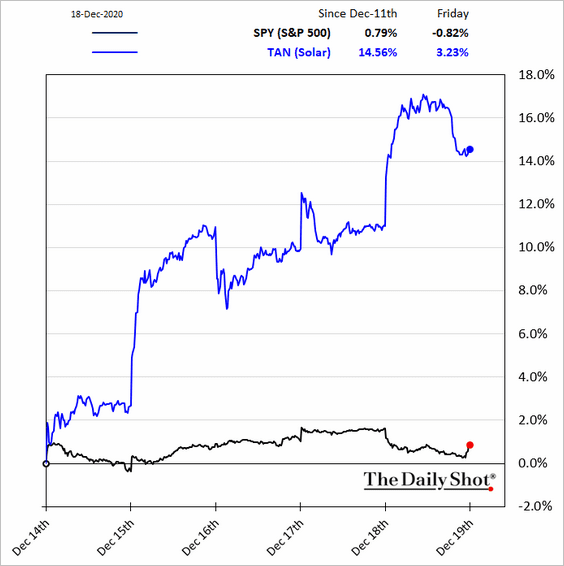

• Solar:

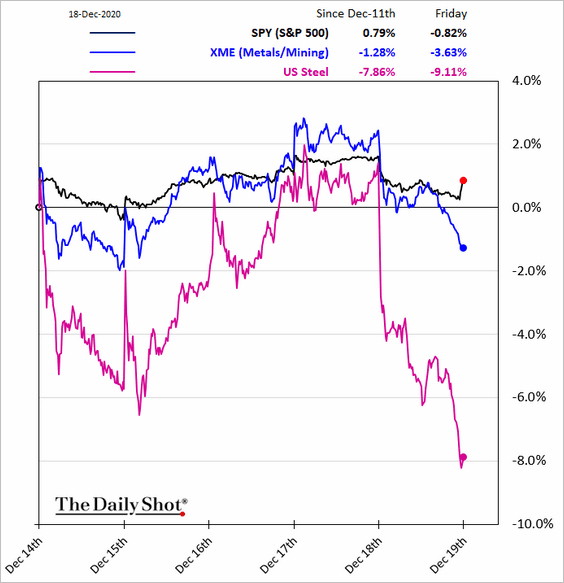

• Metals & Mining:

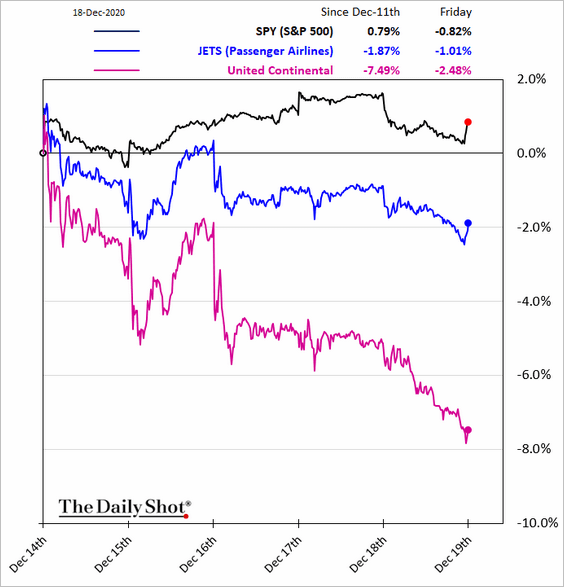

• Airlines:

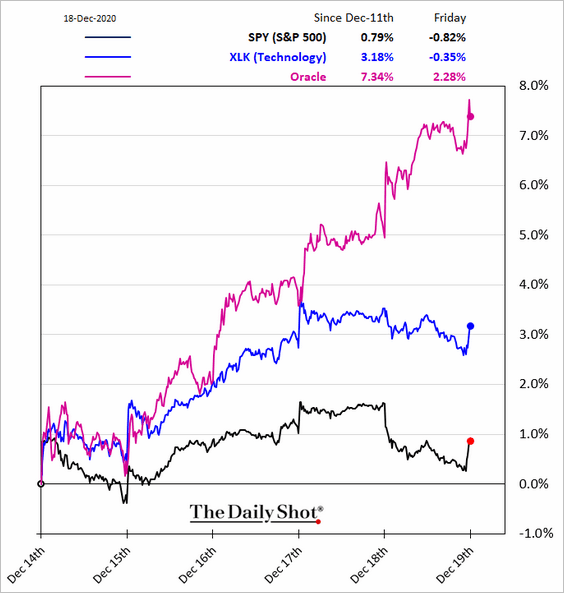

• Tech:

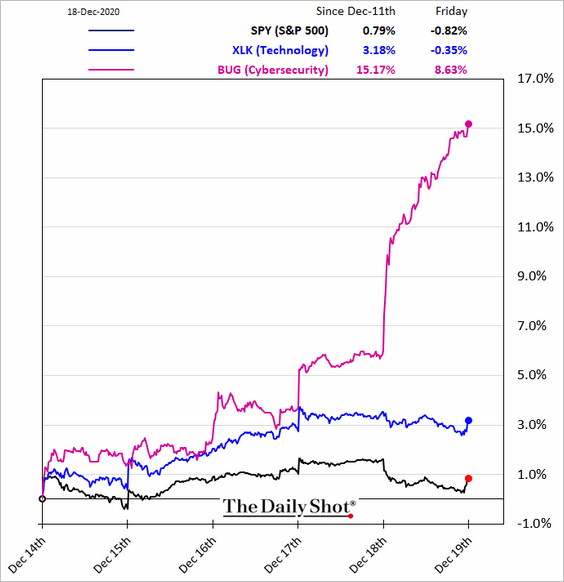

• Cybersecurity:

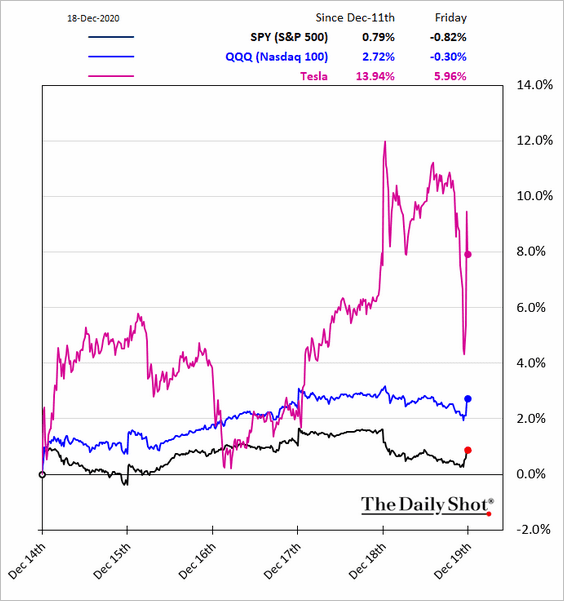

• The Nasdaq 100:

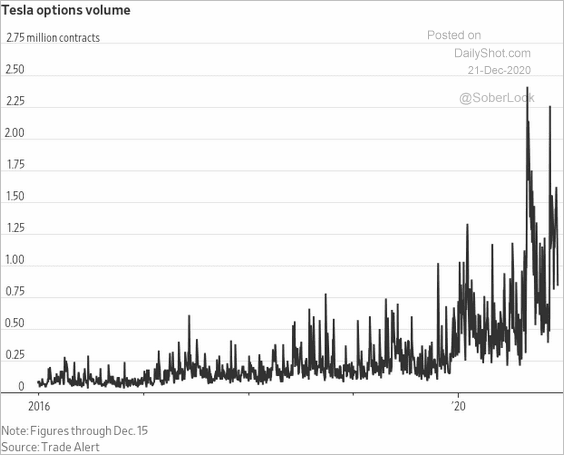

Related to the above, here are a couple of updates on Tesla.

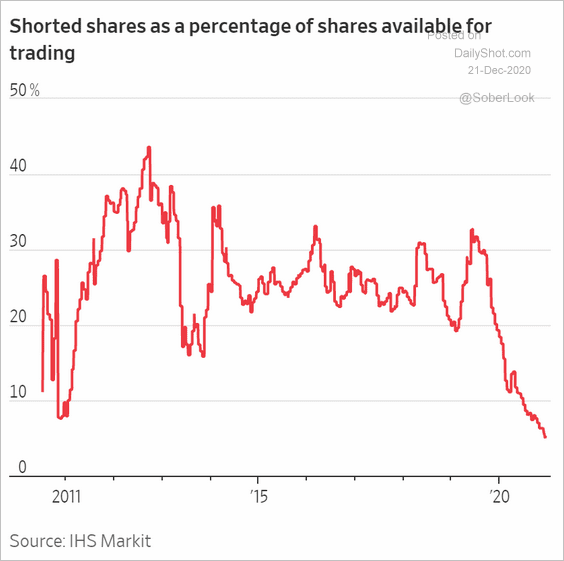

– Shorted shares (capitulation):

Source: @WSJ Read full article

Source: @WSJ Read full article

– Tesla options volume:

Source: @WSJ Read full article

Source: @WSJ Read full article

Alternatives

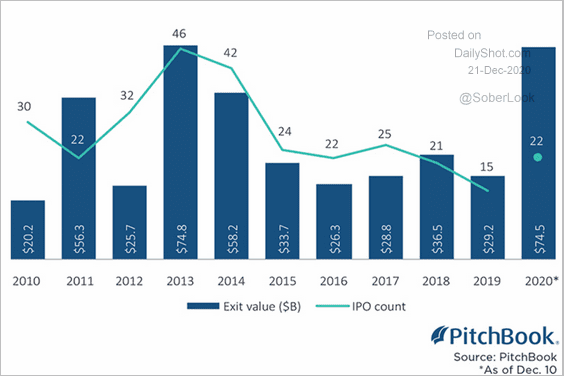

1. US private equity firms had a surge in exits this year across 22 IPOs of portfolio companies. This is the highest annual value in at least a decade, according to PitchBook.

Source: PitchBook Read full article

Source: PitchBook Read full article

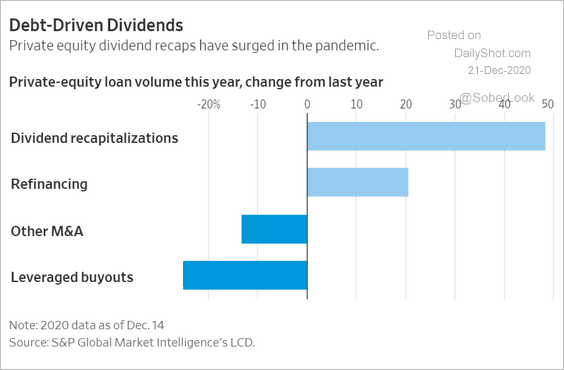

2. Private equity dividend recaps have been popular this year.

Source: @WSJ Read full article

Source: @WSJ Read full article

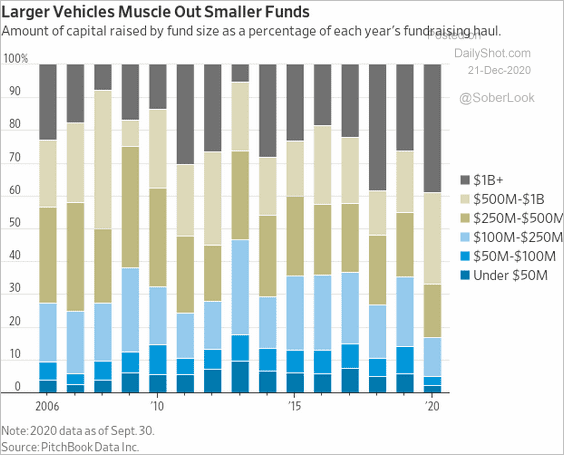

3. Mega-funds increasingly dominate the VC fundraising market.

Source: @WSJ Read full article

Source: @WSJ Read full article

Credit

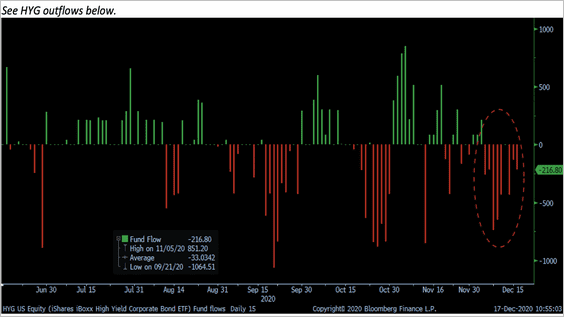

1. The largest US high-yield corporate bond ETF (HYG) has been experiencing outflows over the past month.

Source: Chris Murphy; Susquehanna

Source: Chris Murphy; Susquehanna

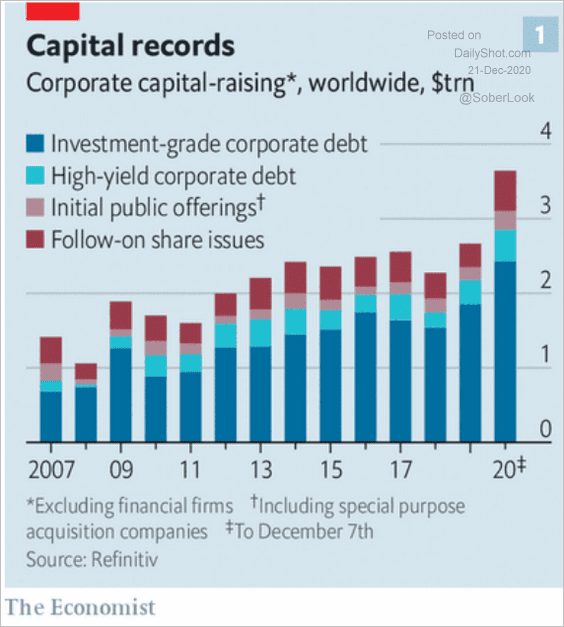

2. Global corporate capital-raising has been unprecedented.

Source: @adam_tooze, The Economist Read full article

Source: @adam_tooze, The Economist Read full article

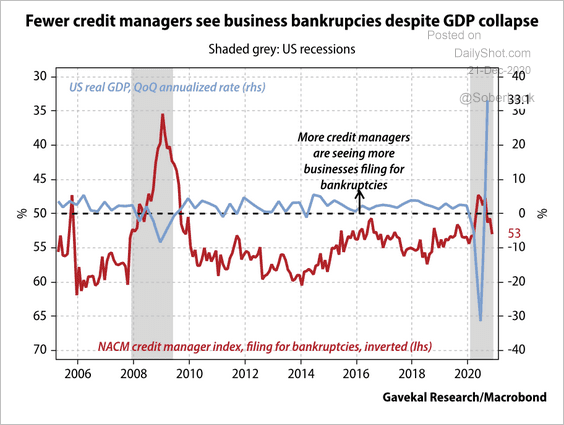

3. US credit managers have not seen a substantial rise in business bankruptcies.

Source: Gavekal Research

Source: Gavekal Research

Rates

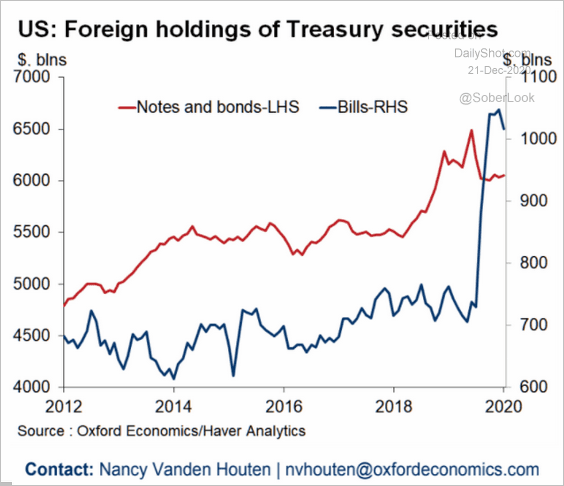

1. Foreigners bought a substantial amount of Treasury bills.

Source: Oxford Economics

Source: Oxford Economics

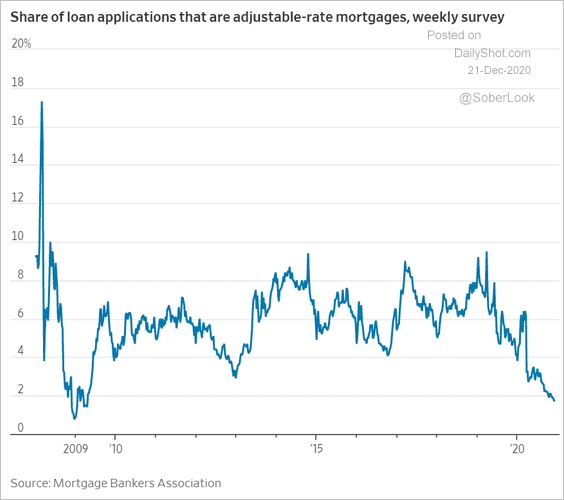

2. US adjustable-rate mortgage activity is at the lowest level since 2009 (relative to fixed-rate loans).

Source: @WSJ Read full article

Source: @WSJ Read full article

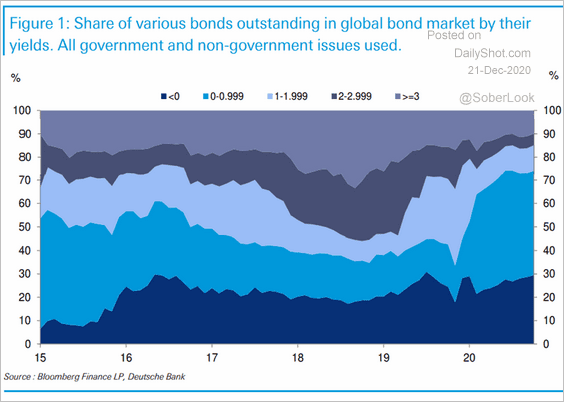

3. This chart shows the distribution of yields across global bond markets.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Global Developments

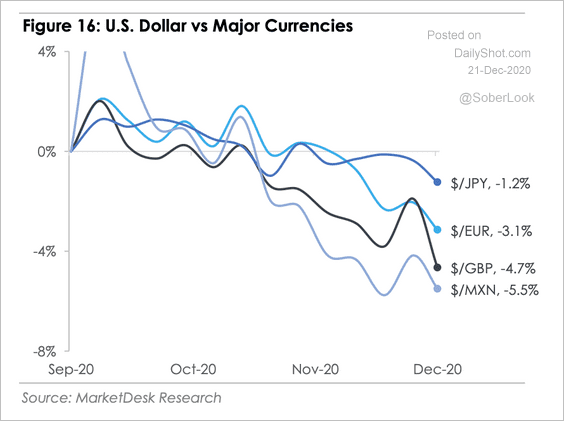

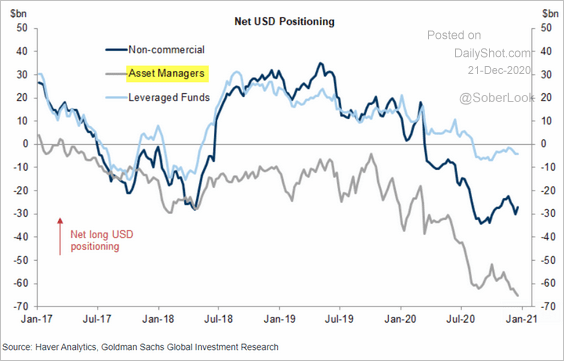

1. Here is the recent US dollar performance vs. select currencies.

Source: MarketDesk Research

Source: MarketDesk Research

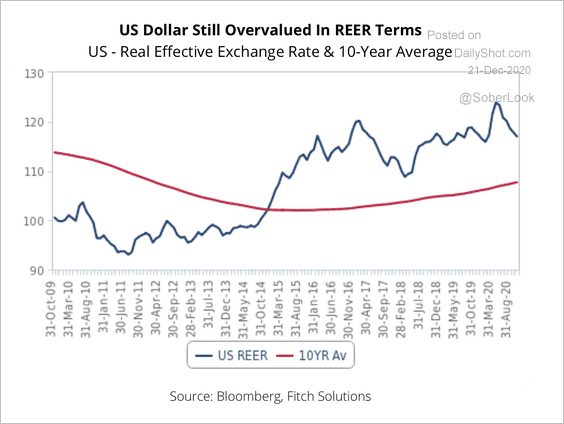

The dollar remains overvalued in real exchange rate terms.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Asset managers expect the dollar to keep declining.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

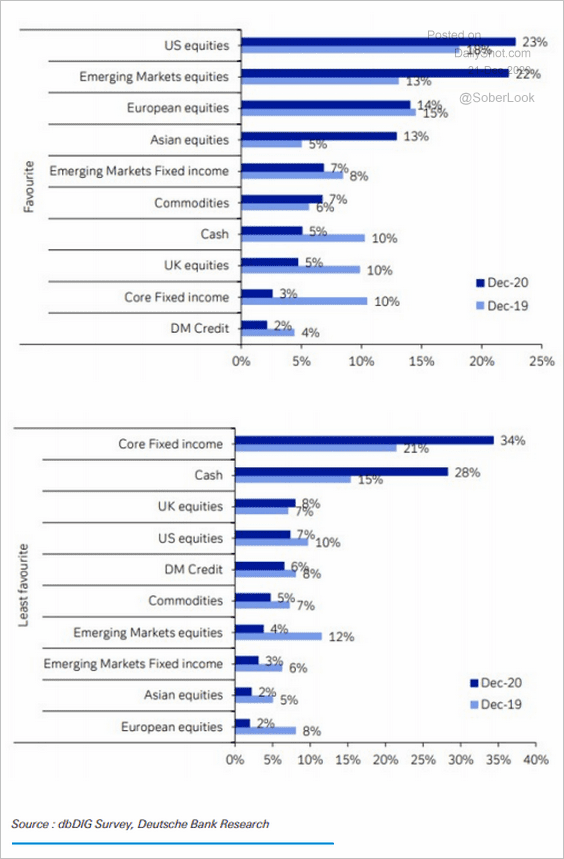

2. What are investors’ most- and least-favorite asset classes?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

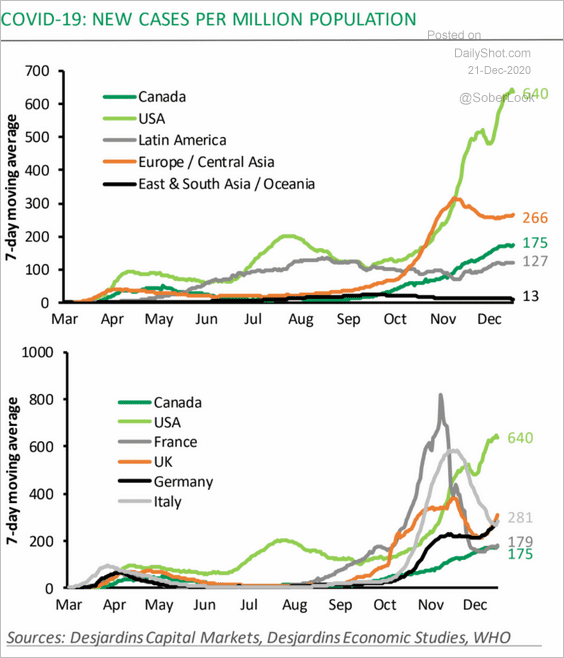

3. This chart shows new COVID cases per million.

Source: Desjardins

Source: Desjardins

——————–

Food for Thought

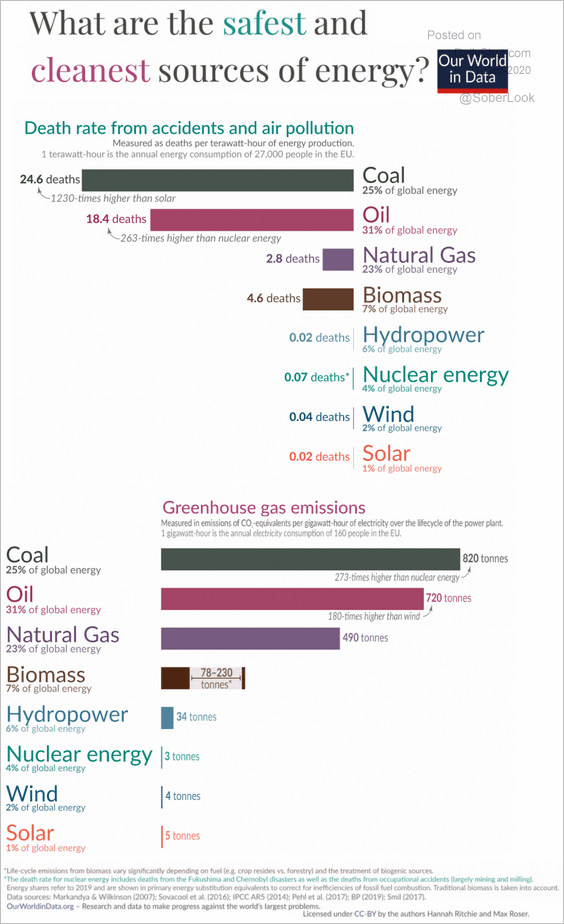

1. Safest and cleanest sources of energy:

Source: @OurWorldInData, @_HannahRitchie, @MaxCRoser Read full article

Source: @OurWorldInData, @_HannahRitchie, @MaxCRoser Read full article

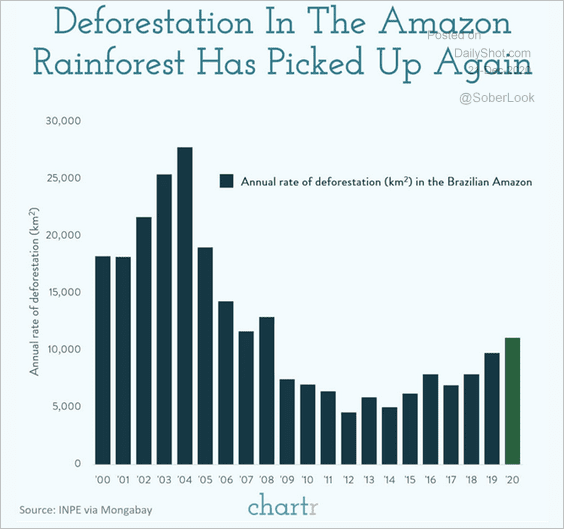

2. Amazon deforestation:

Source: @chartrdaily

Source: @chartrdaily

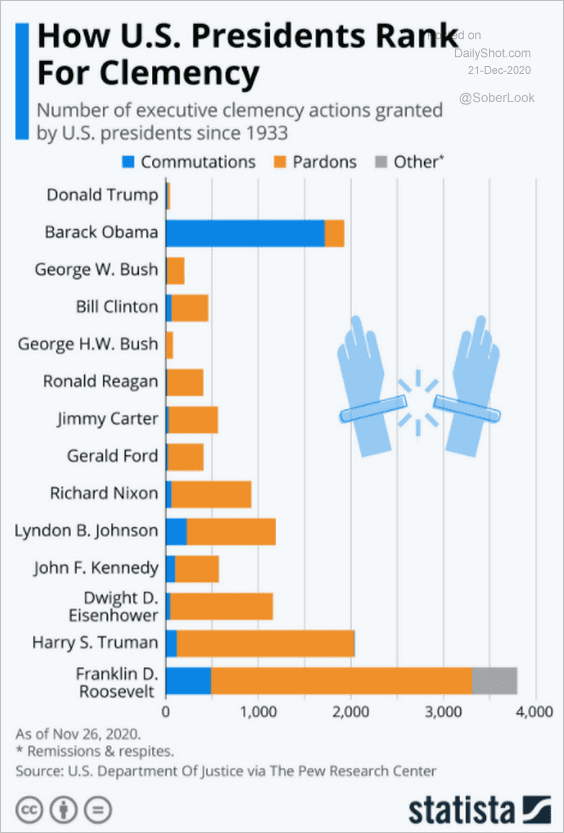

3. US executive clemency actions:

Source: Statista

Source: Statista

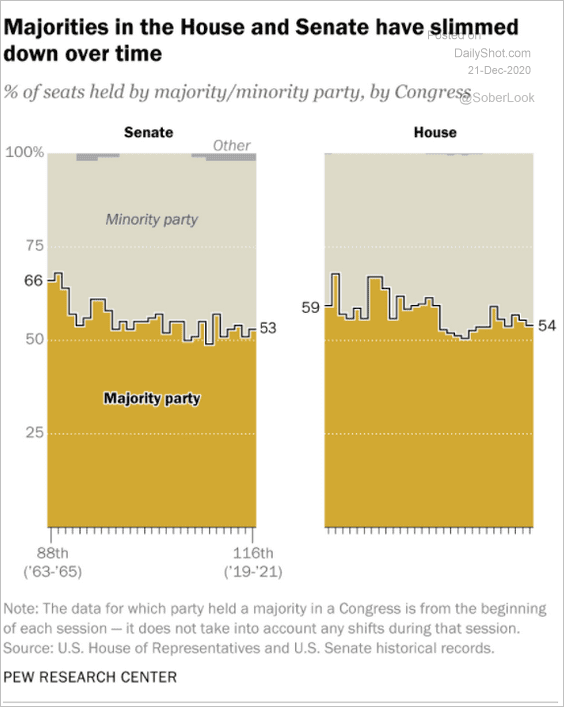

4. US Senate and House majorities:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

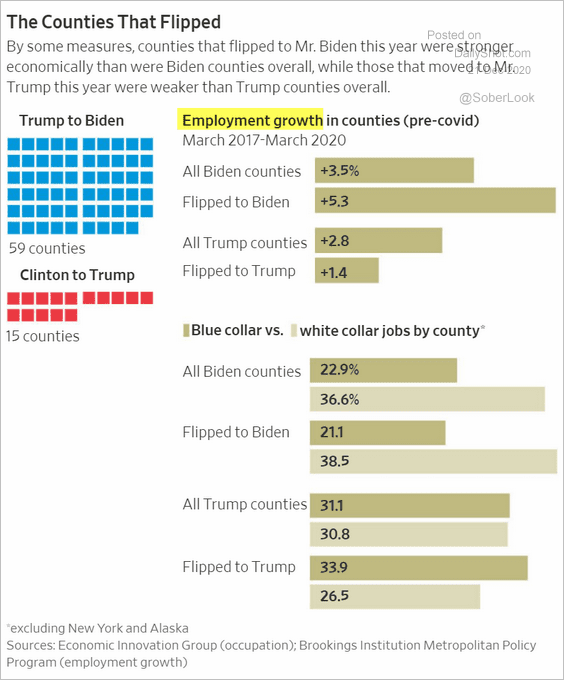

5. Employment growth vs. presidential vote:

Source: @WSJGraphics Read full article

Source: @WSJGraphics Read full article

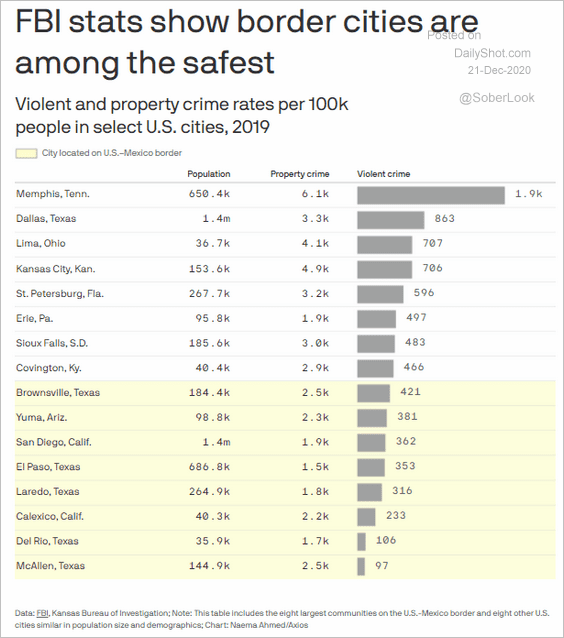

6. The safety of US border cities:

Source: @axios Read full article

Source: @axios Read full article

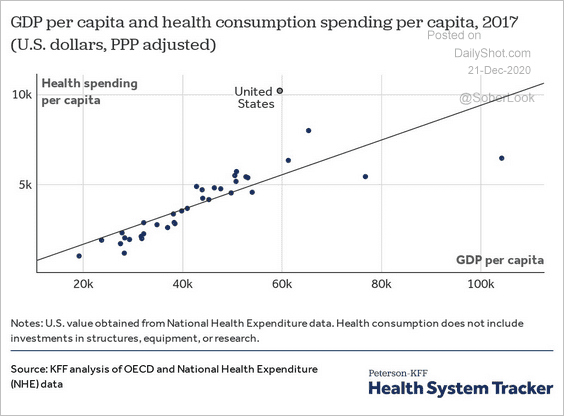

7. Healthcare spending vs. GDP per capita:

Source: Peterson-KFF Health System Tracker

Source: Peterson-KFF Health System Tracker

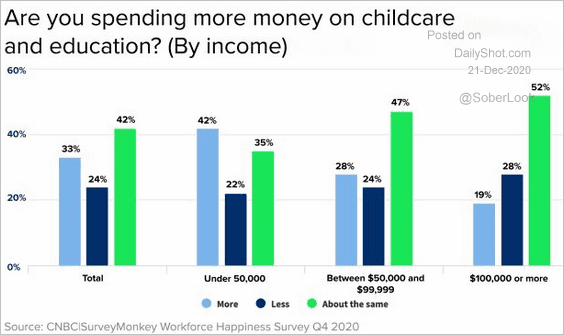

8. Spending on childcare and education, by income:

Source: CNBC, @DiMartinoBooth Read full article

Source: CNBC, @DiMartinoBooth Read full article

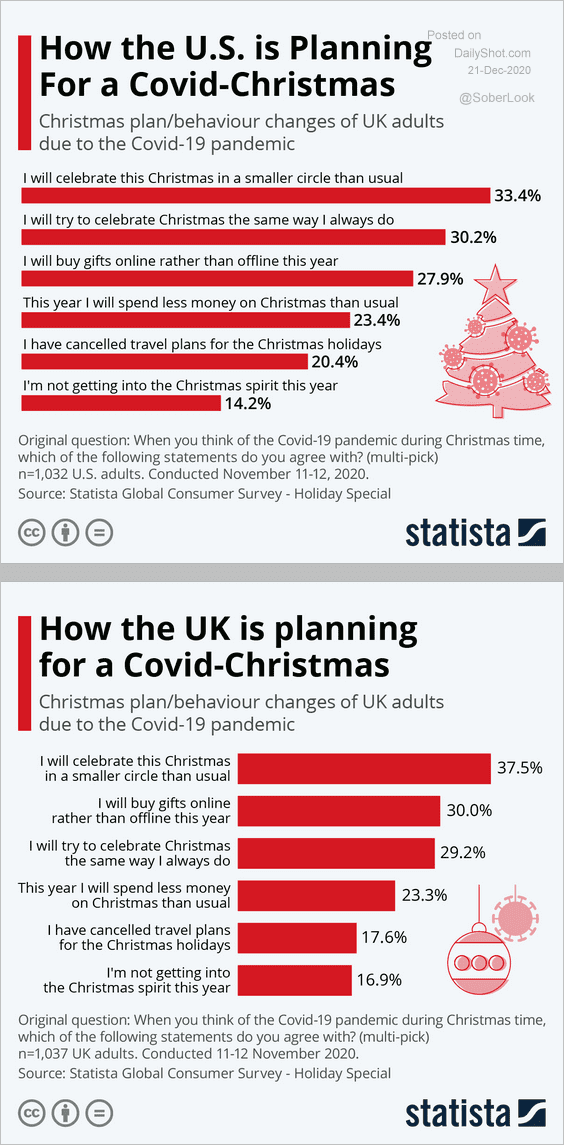

9. The US vs. UK Christmas planning:

Source: Statista

Source: Statista

——————–