The Daily Shot: 23-Dec-20

• Administrative Update

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Equities

• Rates

• Global Developments

• Food for Thought

Administrative Update

Please note that The Daily Shot will not be published from Thursday, December 24th through Friday, January 1st.

As a reminder, scheduling updates are available online at https://thedailyshot.com/administrative-updates/

The United States

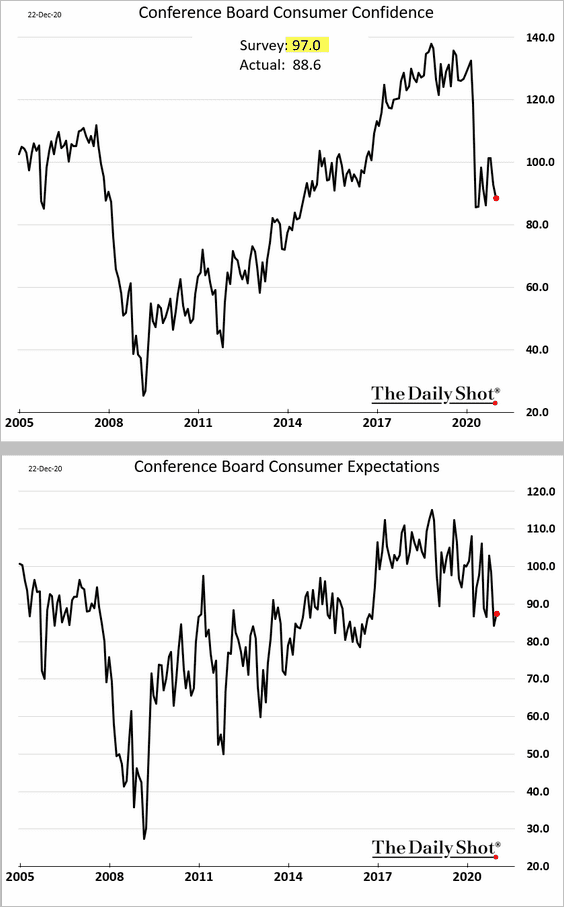

1. The Conference Board’s consumer confidence index is back near pandemic lows this month.

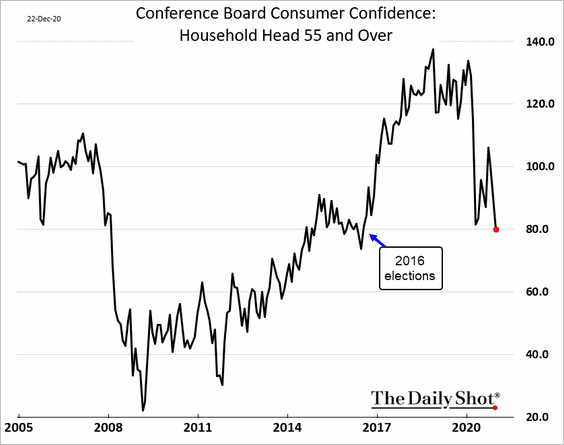

Consumer confidence among Americans 55 and older hit the lowest level since 2016.

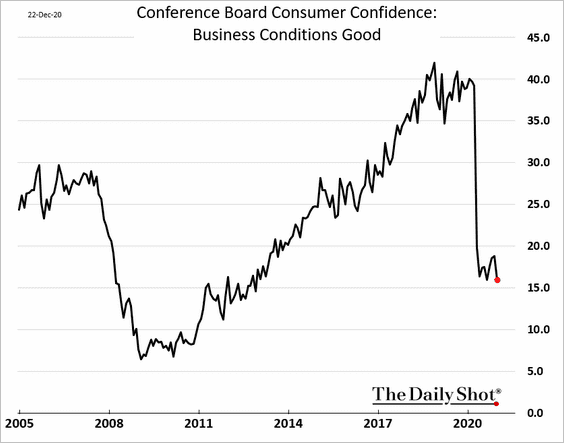

Households are pessimistic about business conditions.

Some economists expect the vaccine progress and the new stimulus bill to boost sentiment next month – assuming the relief package is not delayed.

Source: Reuters Read full article

Source: Reuters Read full article

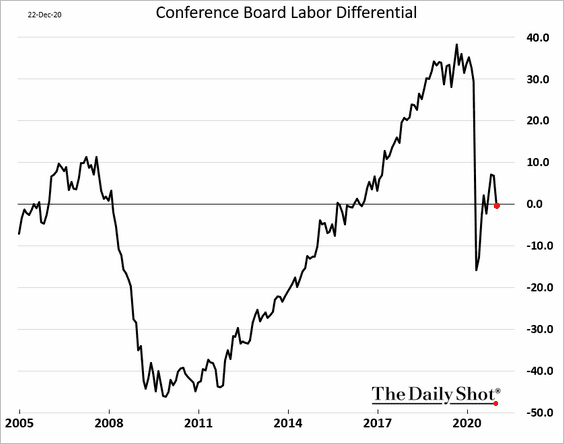

The labor differential (the spread between “jobs plentiful” and “jobs hard to get” indices) deteriorated in December.

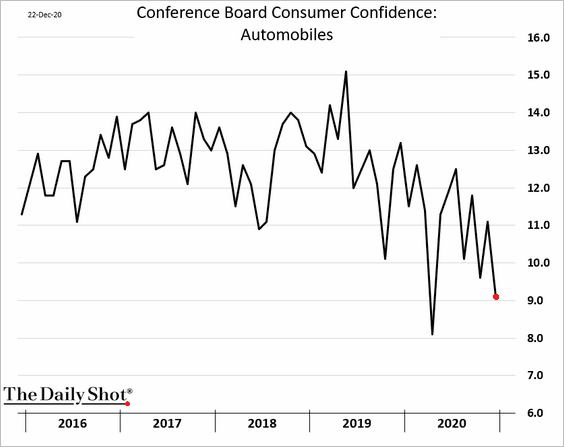

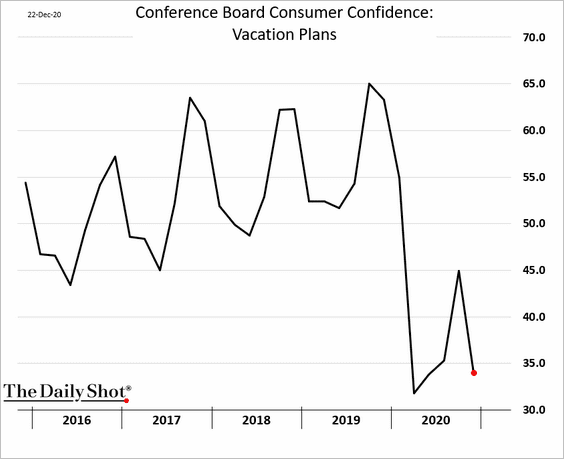

Americans seem to be less interested in buying a car, and fewer are making vacation plans.

——————–

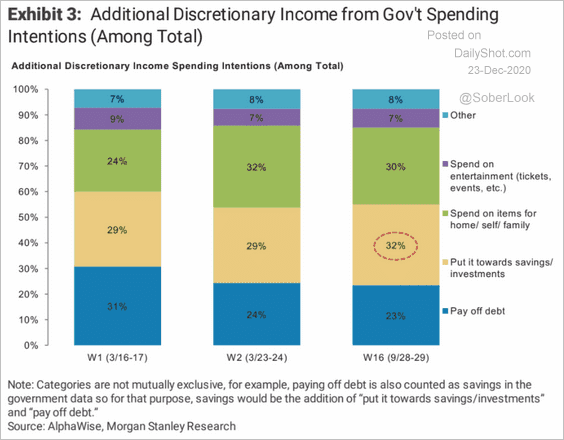

2. Here is an indication of how Americans may spend their stimulus checks.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

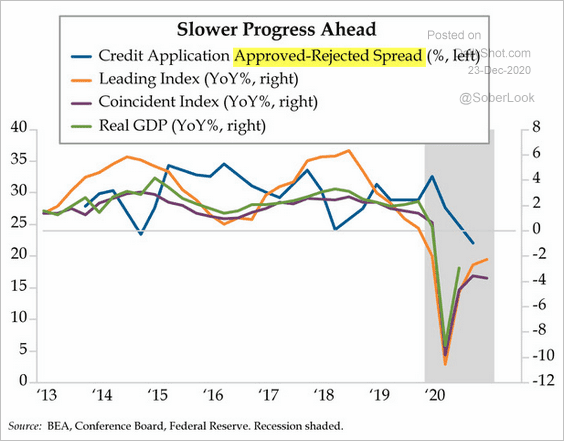

3. Fewer credit applications were approved this year.

Source: The Daily Feather

Source: The Daily Feather

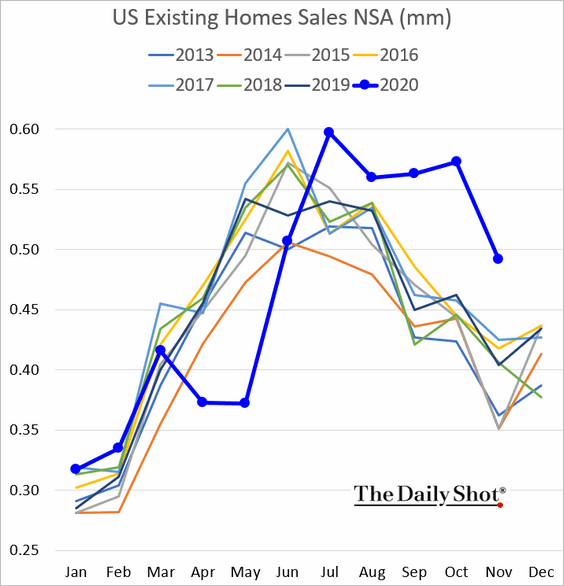

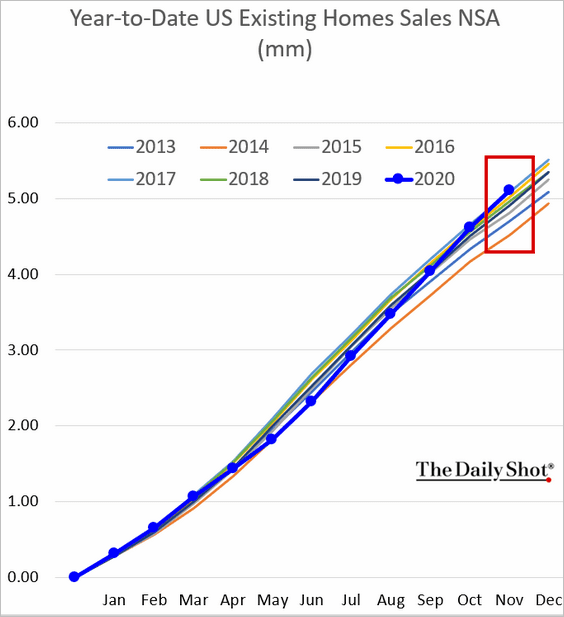

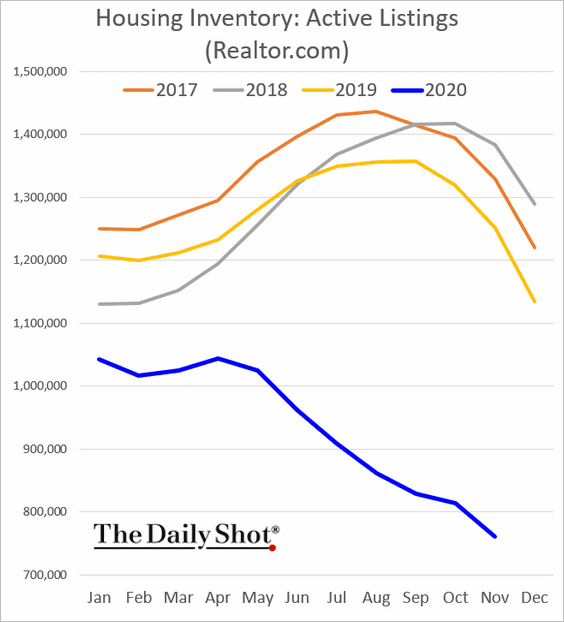

4. Home sales eased last month but remained well above 2019 levels.

Year-to-date sales are also higher than last year.

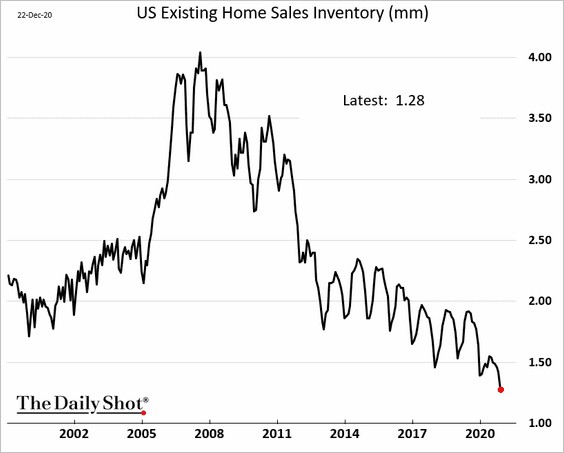

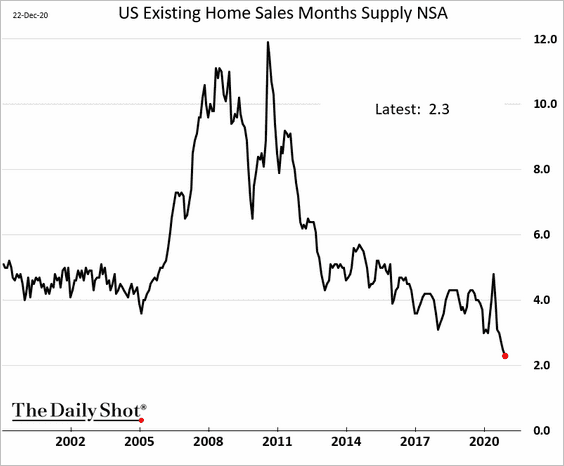

The inventory of homes for sale is now the lowest in decades.

• Total inventory:

• Months of supply:

• Realtor.com active listings:

——————–

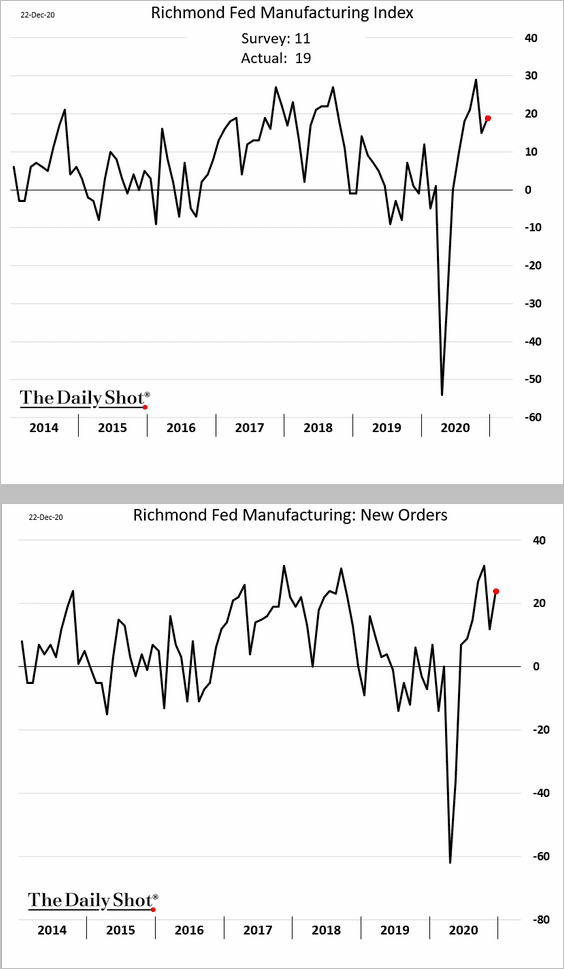

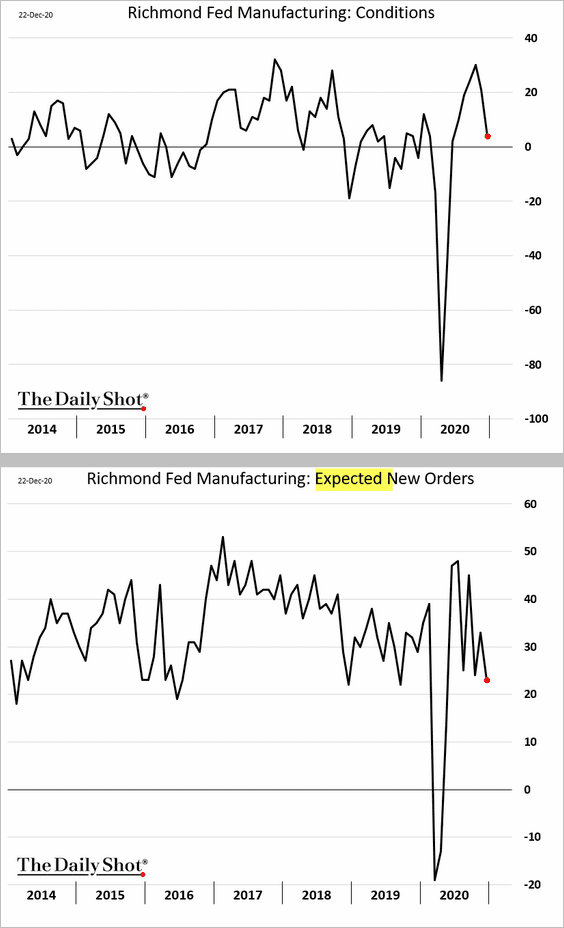

5. The Richmond Fed’s regional manufacturing index strengthened this month.

However, the assessment of business conditions and expectations were softer.

——————–

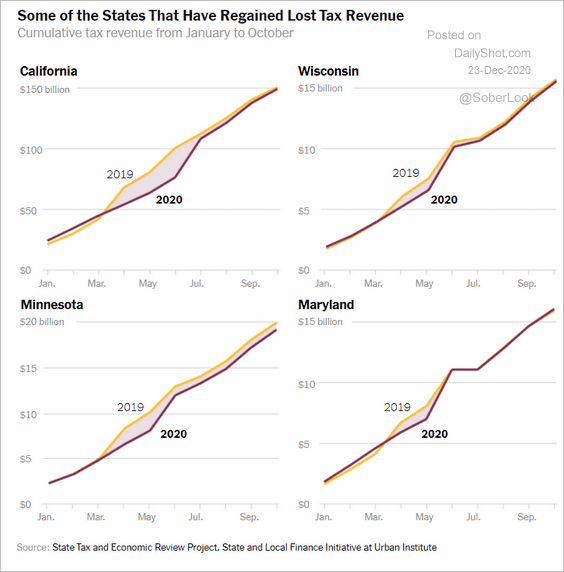

6. State revenues have surprised to the upside in a number of cases this year.

Source: @UpshotNYT Read full article

Source: @UpshotNYT Read full article

It appears to be a consequence of the K-shaped recovery.

The New York Times: – This recession, distinct from many before it, has piled its worst effects on low-wage workers. That means that state budgets that rely the most on wealthier residents to fund government haven’t been hurt as much by an economic crisis that left the well-off largely unscathed.

——————–

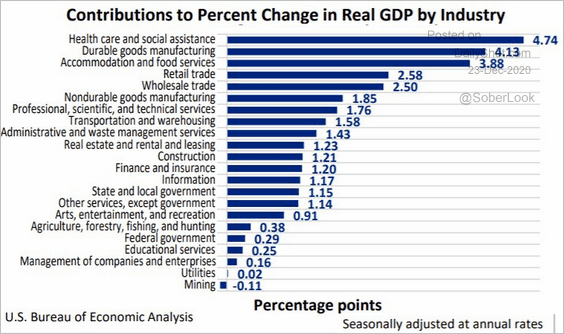

7. Finally, this chart shows the contribution of different sectors to the third-quarter GDP rebound.

Source: BEA, @GregDaco

Source: BEA, @GregDaco

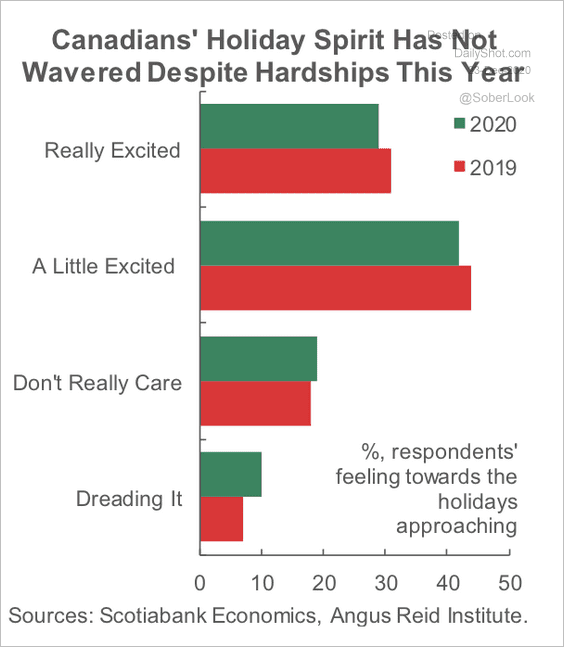

Canada

1. Consumers remain in good spirits during this holiday season.

Source: Scotiabank Economics

Source: Scotiabank Economics

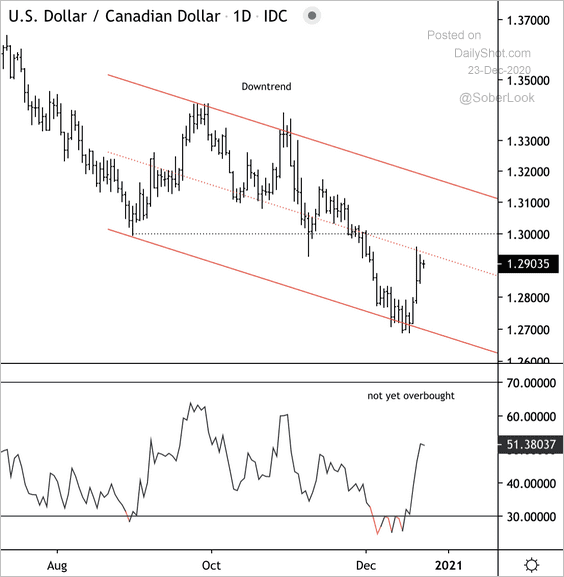

2. USD/CAD is at short-term support.

Source: @DantesOutlook

Source: @DantesOutlook

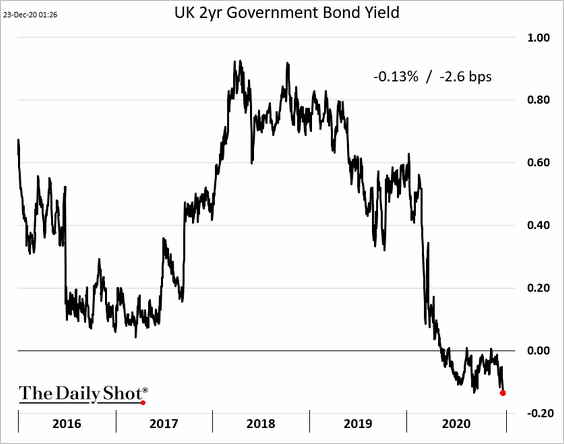

The United Kingdom

1. The 2-year gilt yield hit a record low.

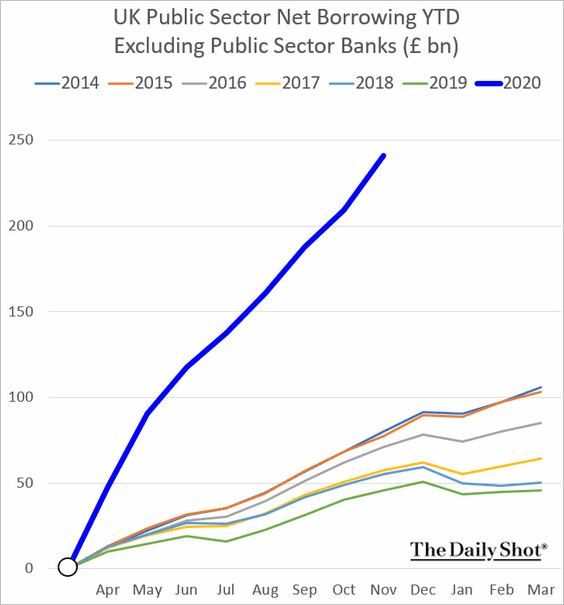

2. The government’s pace of borrowing remains unprecedented, although it has been below official forecasts.

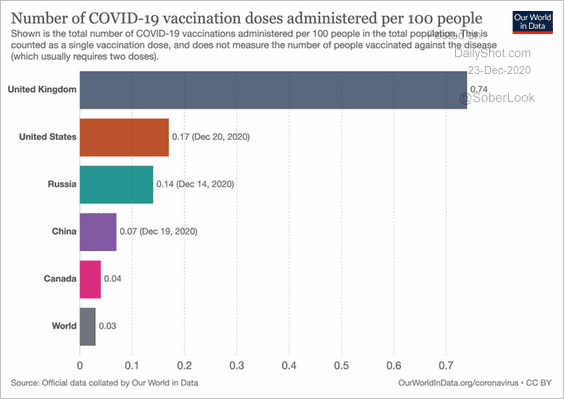

3. The UK is still ahead in vaccinations.

Source: @redouad Read full article

Source: @redouad Read full article

The Eurozone

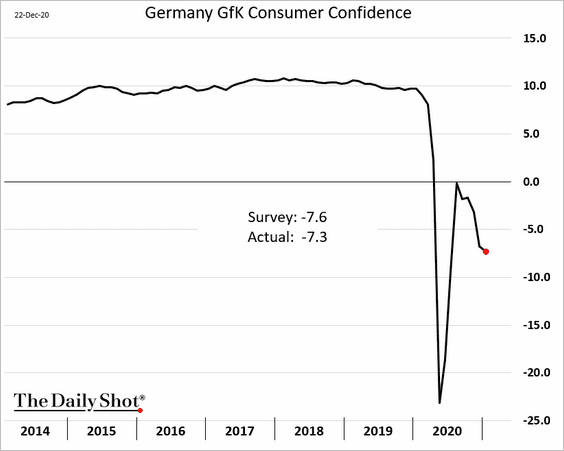

1. German consumer confidence declined further.

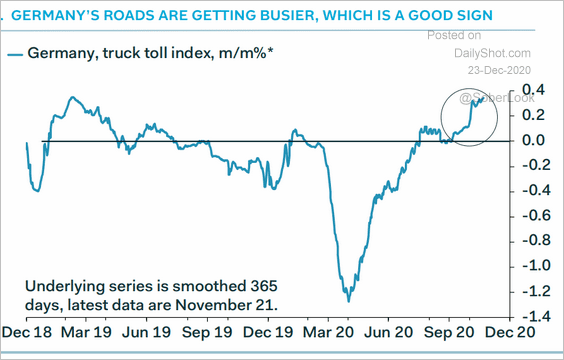

German trucking activity remains elevated.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

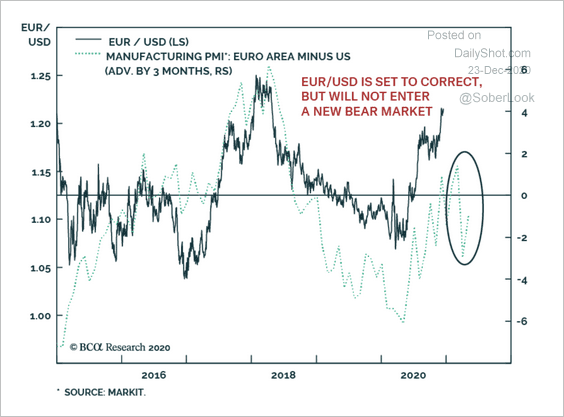

2. The euro-area manufacturing PMI is underperforming the US, which is a negative for EUR/USD over the short-term.

Source: BCA Research

Source: BCA Research

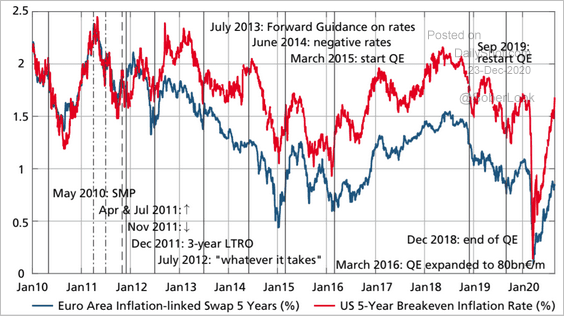

3. The gap between the euro-area and US inflation expectations remains wide.

Source: IMFS Read full article

Source: IMFS Read full article

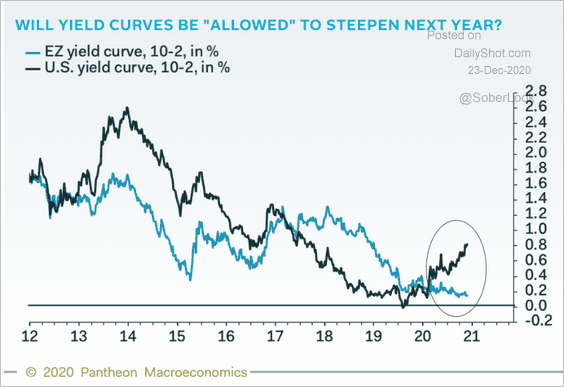

4. The Eurozone yield curve (aggregate) has not been steepening as it has in the US.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

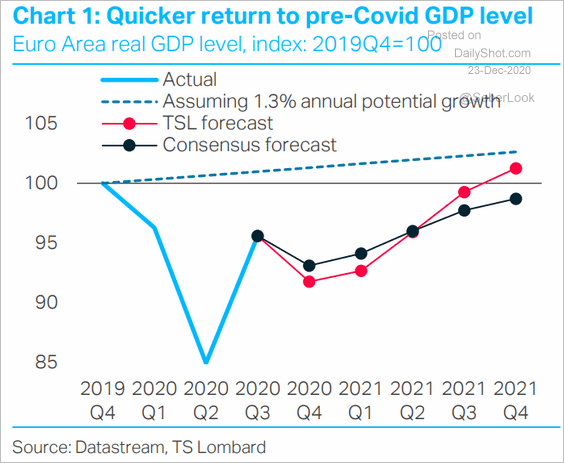

5. How soon will the GDP return to pre-pandemic levels?

Source: TS Lombard

Source: TS Lombard

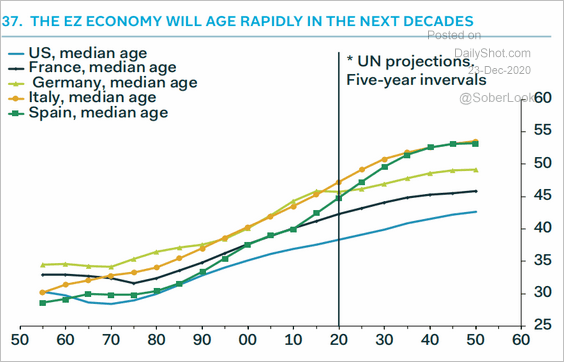

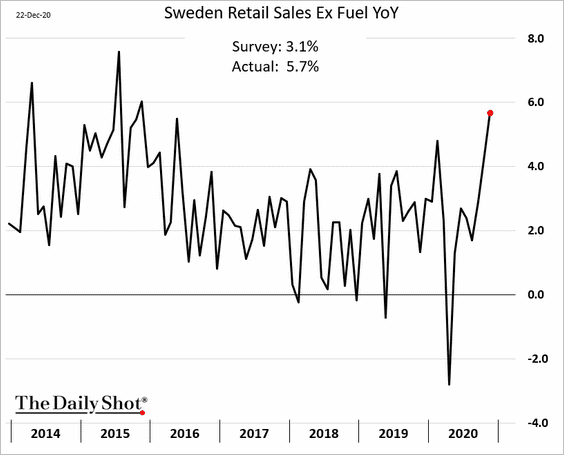

6. Euro-area’s aging population will be a drag on growth.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Europe

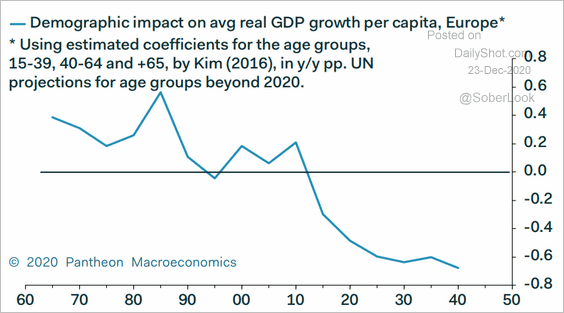

1. The SNB’s equity holdings (as % of Swiss GDP) spiked this year and are well above other central banks.

Source: Natixis

Source: Natixis

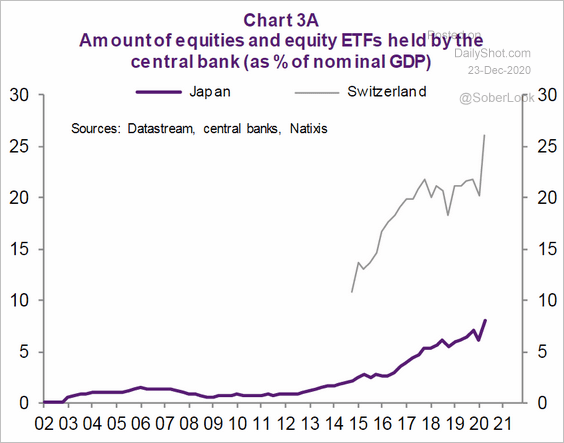

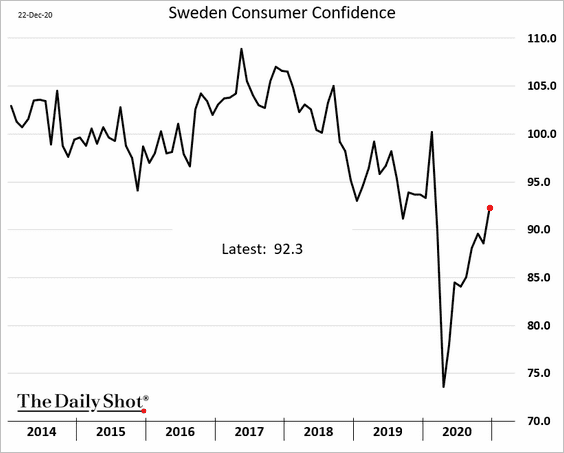

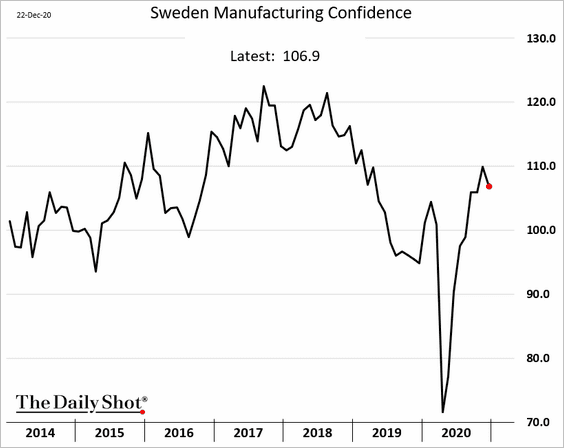

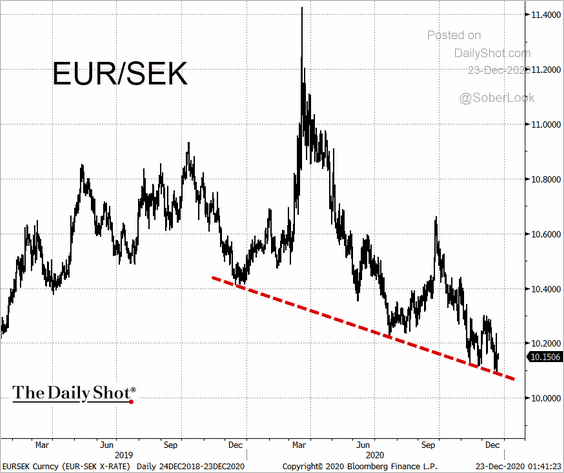

2. Next, we have some updates on Sweden.

• Retail sales (through November):

• Consumer and manufacturing sentiment (through December):

• EUR/SEK is at support:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

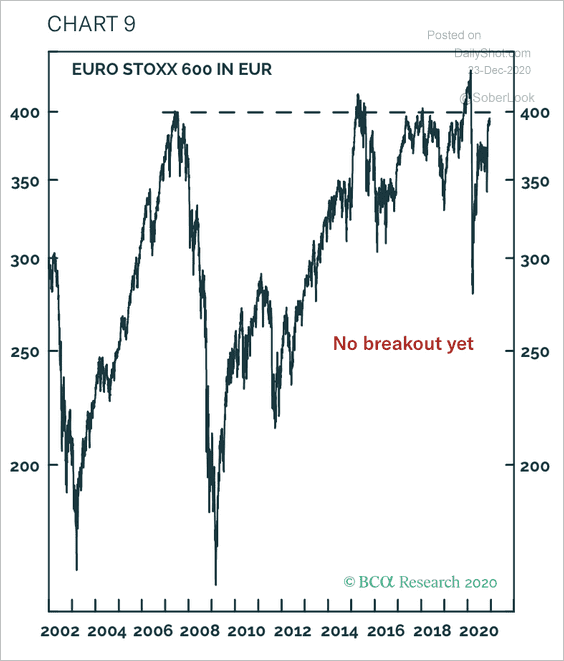

3. The Euro Stoxx 600 index is at resistance.

Source: BCA Research

Source: BCA Research

Asia – Pacific

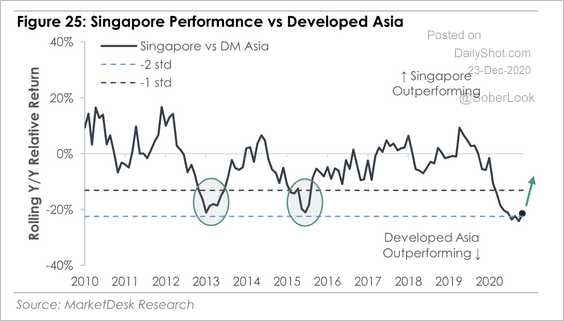

1. The relative return of Singapore equities versus developed Asia is at an extreme low.

Source: MarketDesk Research

Source: MarketDesk Research

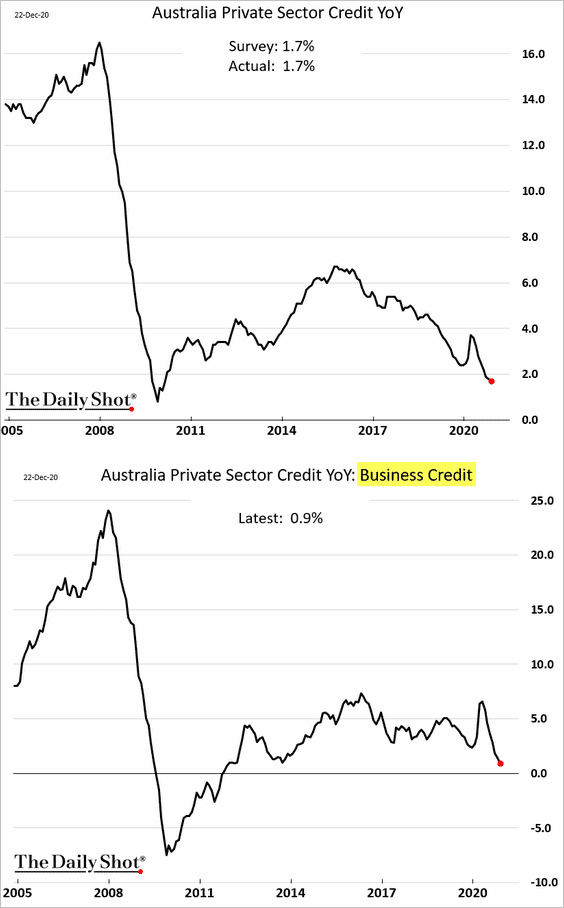

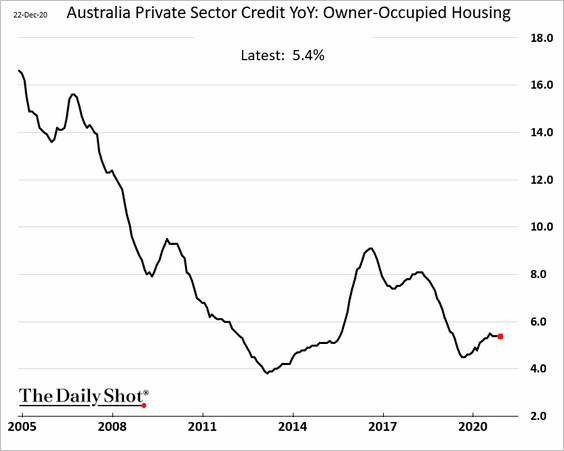

2. Australia’s private credit growth continues to slow, driven by softer business lending.

Housing credit expansion remains stable.

China

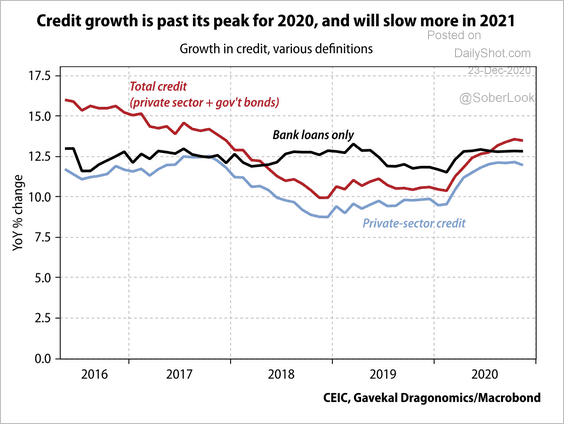

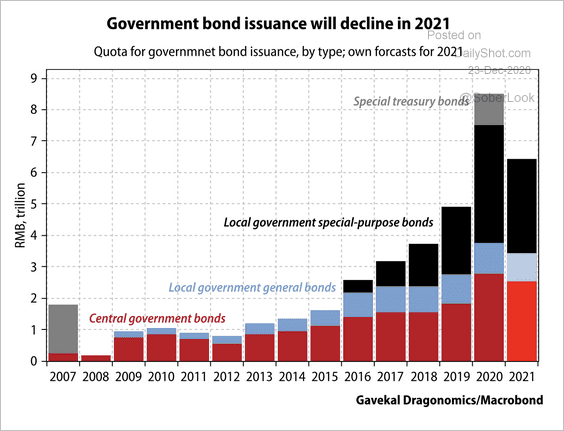

1. Credit growth likely peaked in October, marking the first phase of policy normalization, according to Gavekal Research.

Source: Gavekal Research

Source: Gavekal Research

Reduced government bond issuance will lower total debt growth next year.

Source: Gavekal Research

Source: Gavekal Research

——————–

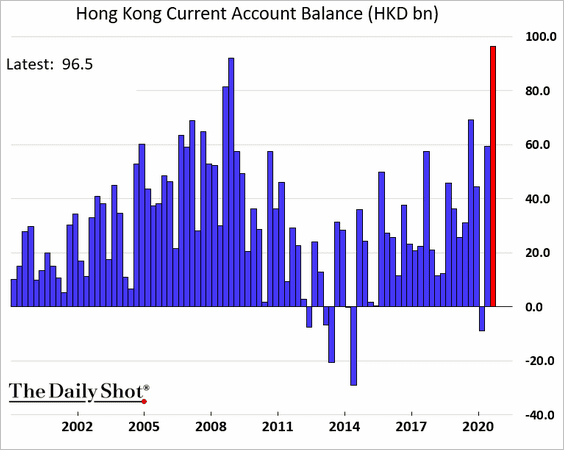

2. Hong Kong’s current account balance hit a new high.

Emerging Markets

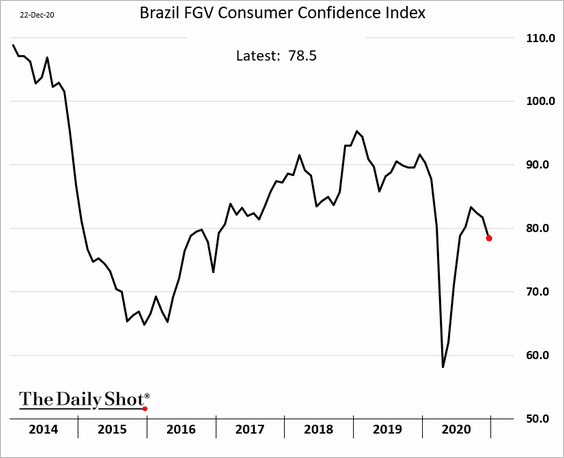

1. Brazil’s consumer confidence is weakening.

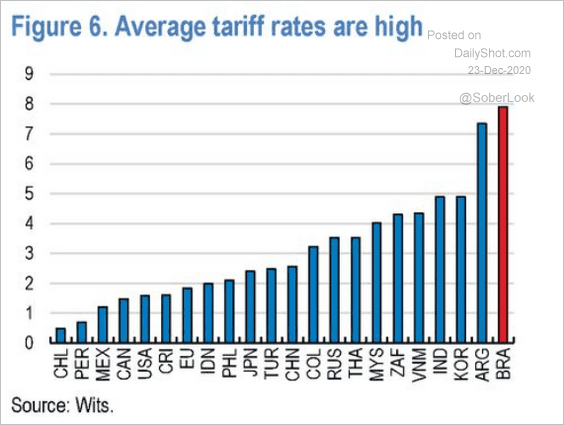

Separately, Brazil has some of the highest tariffs in the world.

Source: @adam_tooze, @OECDeconomy Read full article

Source: @adam_tooze, @OECDeconomy Read full article

——————–

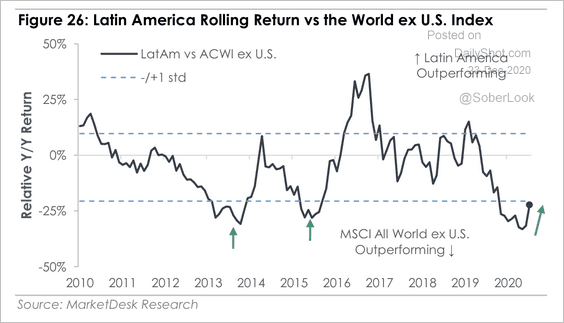

2. Latin American equities have underperformed the MSCI All World ex-US index over the past few years. Is it time for a reversal?

Source: MarketDesk Research

Source: MarketDesk Research

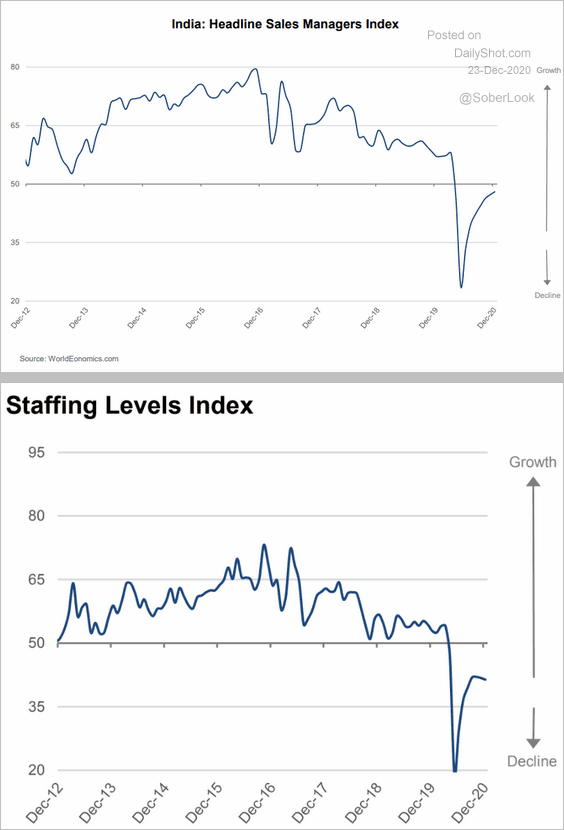

3. The December World Economics SMI report shows that India’s business activity is not yet in growth mode. This contradicts the trends we see from Markit PMI (here and here). Employment has been particularly soft.

Source: World Economics

Source: World Economics

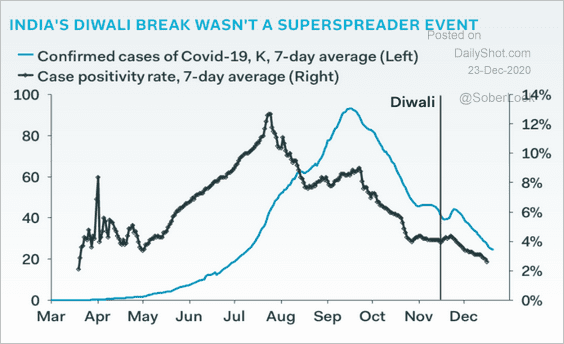

Separately, the Diwali celebrations did not create a meaningful spike in COVID cases.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

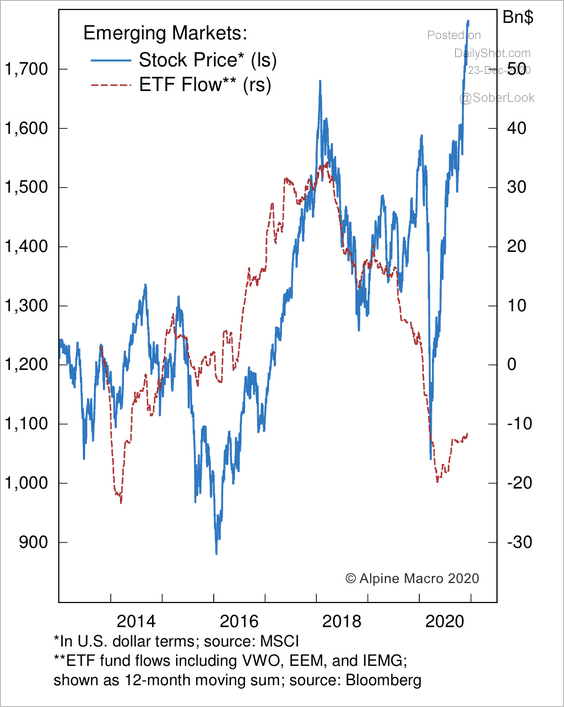

4. Fund flows to EM stocks have been weak this year.

Source: Alpine Macro

Source: Alpine Macro

Commodities

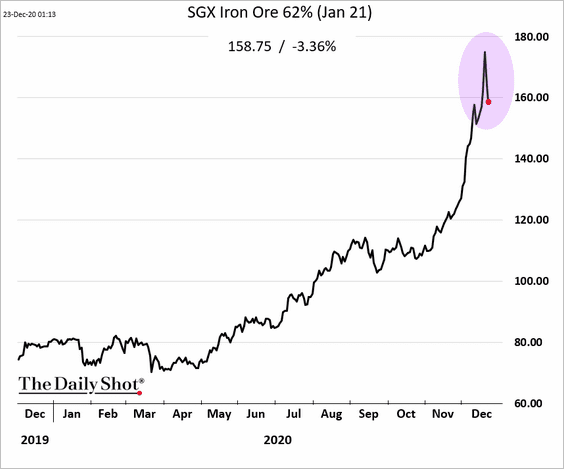

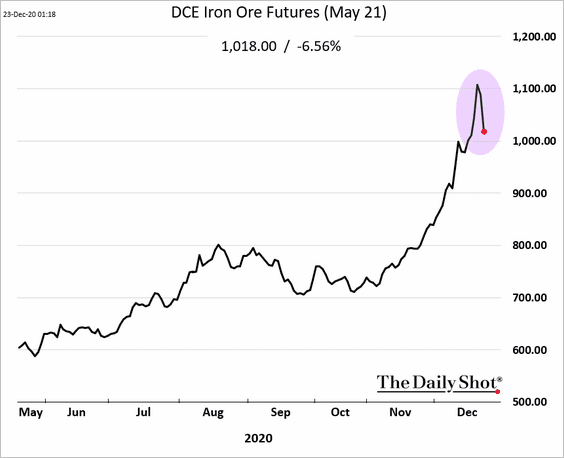

1. Iron ore has pulled back from the highs.

• Singapore:

• China:

——————–

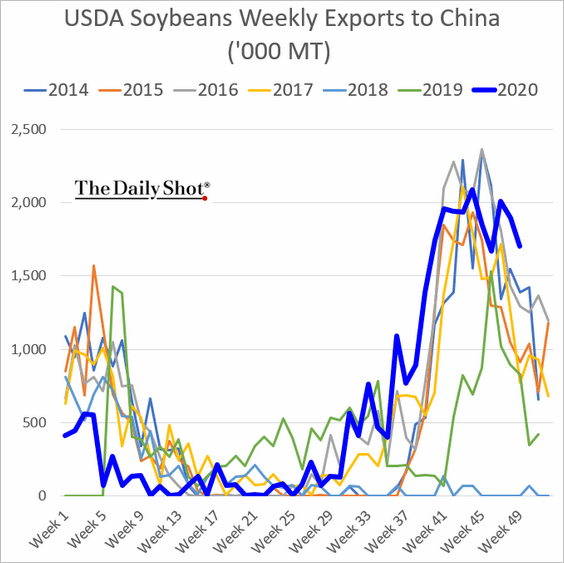

2. US soybean exports to China remain elevated.

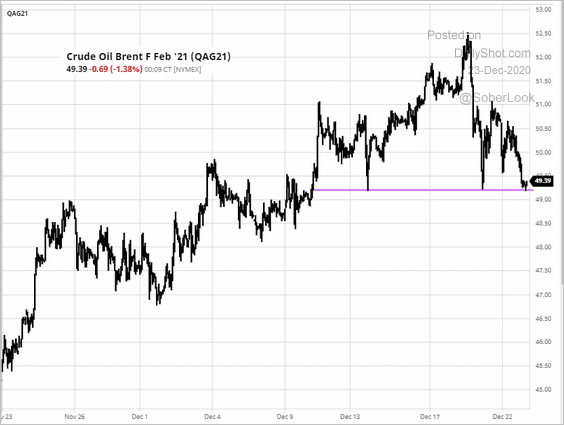

3. Brent crude is trading below $50/bbl (current support is $49.20).

Source: barchart.com

Source: barchart.com

Equities

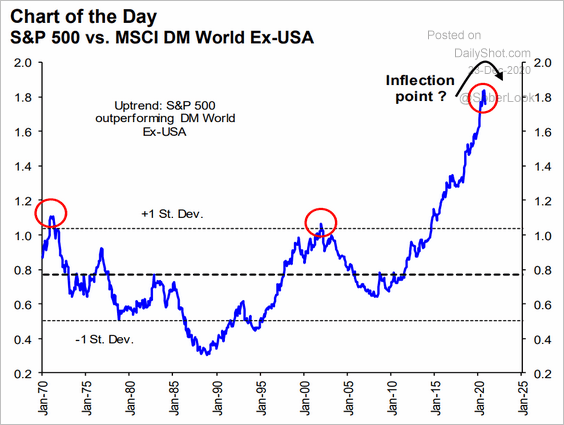

1. Has the S&P 500 peaked relative to stocks in other advanced economies?

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

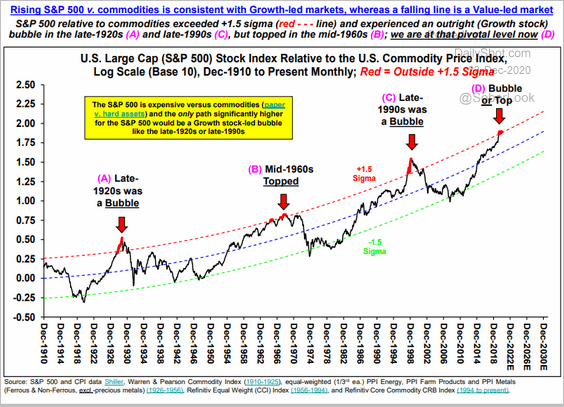

2. Have US stocks peaked vs. commodity prices?

Source: Stifel

Source: Stifel

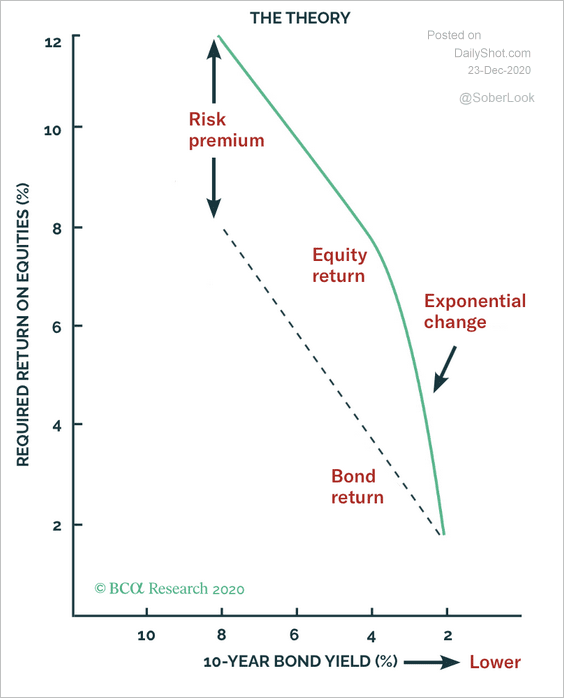

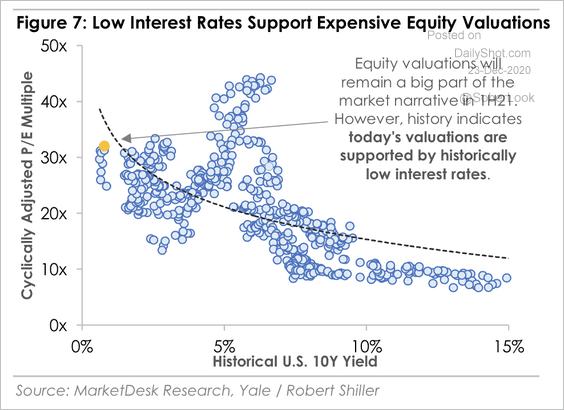

3. Ultra-low bond yields have contributed to rising equity valuations (two charts).

Source: BCA Research

Source: BCA Research

Source: MarketDesk Research

Source: MarketDesk Research

——————–

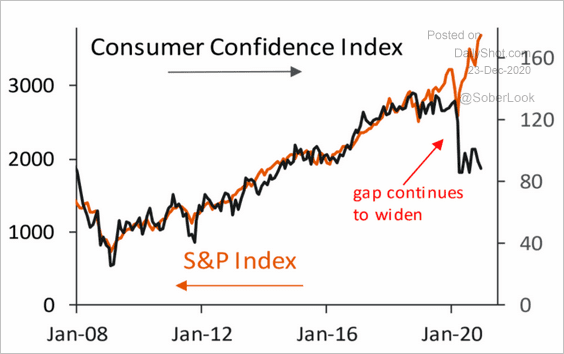

4. The gap between stocks and consumer confidence keeps widening.

Source: Piper Sandler

Source: Piper Sandler

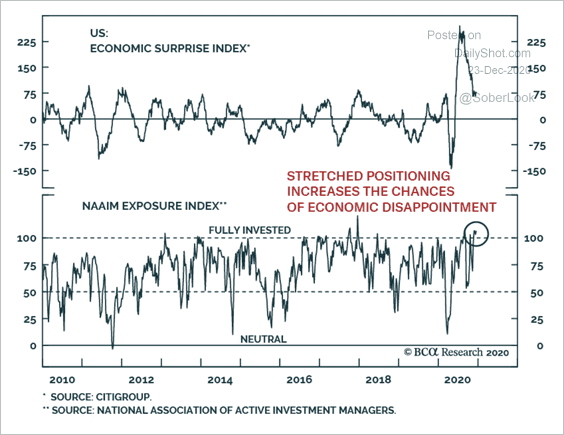

5. Will investors reduce risk exposure, given near-term weakness in the US economy?

Source: BCA Research

Source: BCA Research

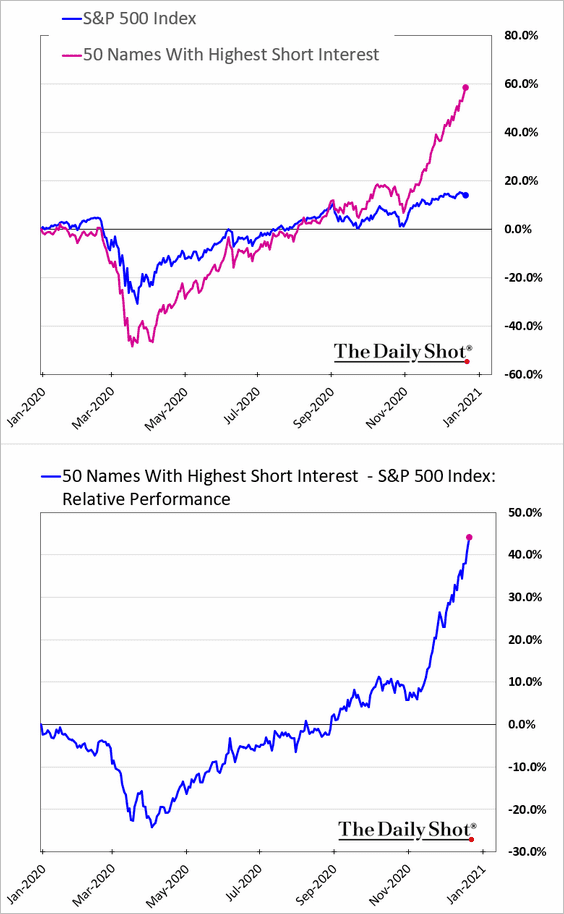

6. The most shorted stocks in the Russell 3000 (broad) index continue to widen their outperformance vs. the S&P 500, punishing short-sellers.

Source: Goldman Sachs, Bloomberg

Source: Goldman Sachs, Bloomberg

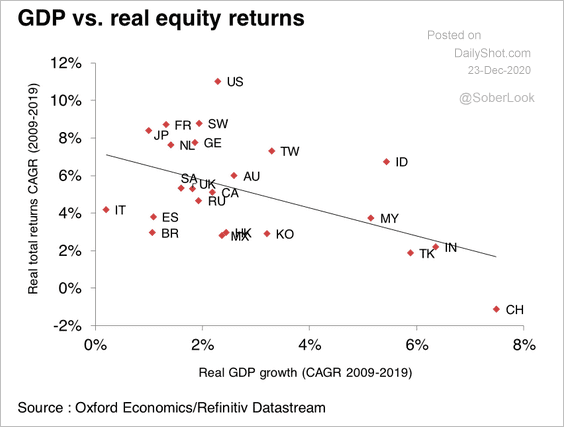

7. The correlation between GDP growth and equity market returns has been negative.

Source: Oxford Economics

Source: Oxford Economics

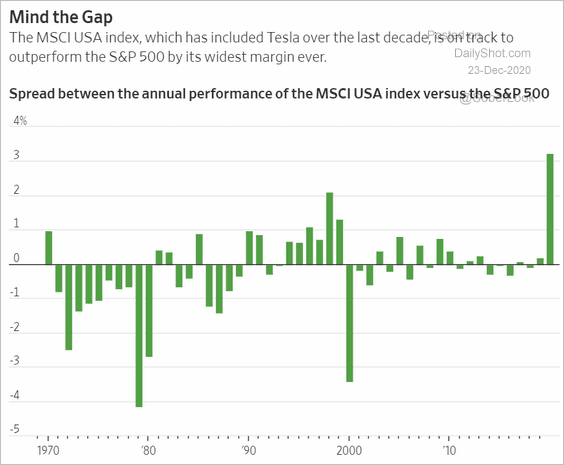

8. Tesla helped the MSCI USA index outperform the S&P 500.

Source: @WSJ Read full article

Source: @WSJ Read full article

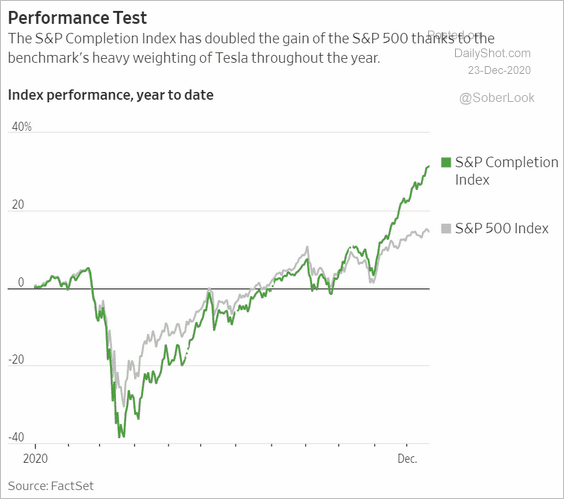

Here is the S&P Completion Index, which includes all US shares except those in the S&P 500.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

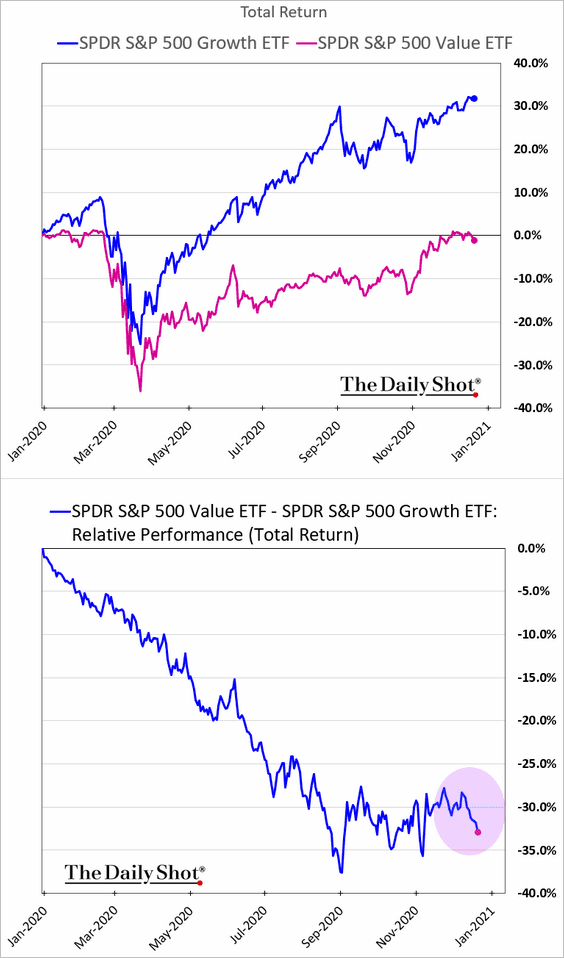

9. The bounce in value vs. growth (relative performance) has been short-lived.

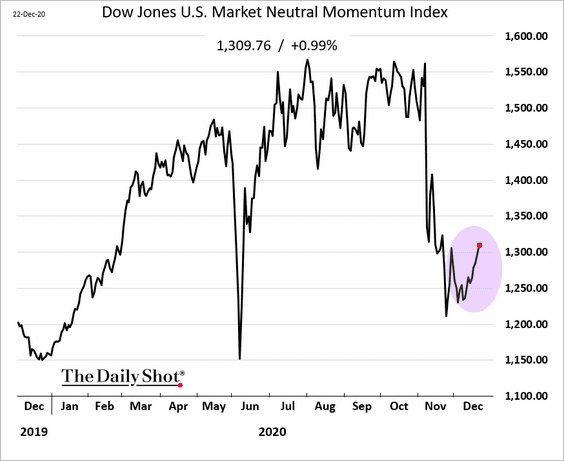

Momentum shares are rebounding.

——————–

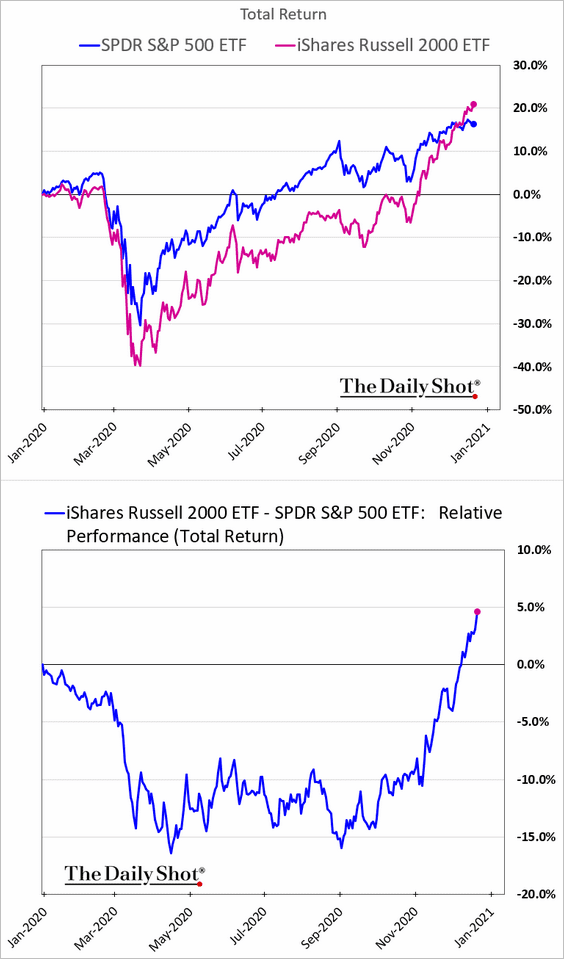

10. Small caps keep widening their outperformance.

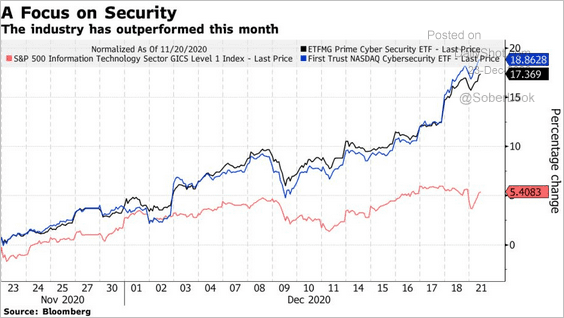

11. Cybersecurity shares continue to rally.

Source: @markets Read full article

Source: @markets Read full article

Rates

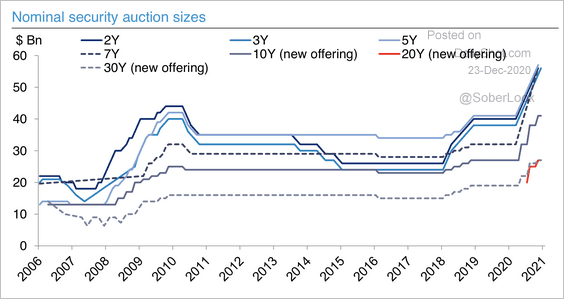

1. Coupon Treasury auctions (notes and bonds) have risen to records this year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

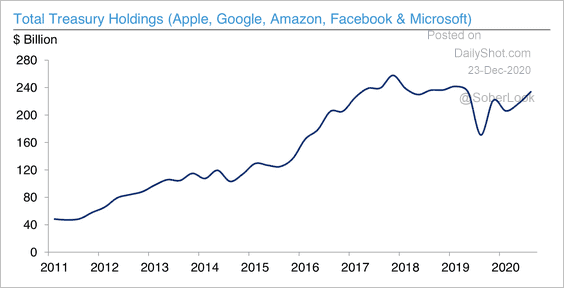

2. Large tech companies own a considerable amount of Treasuries.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

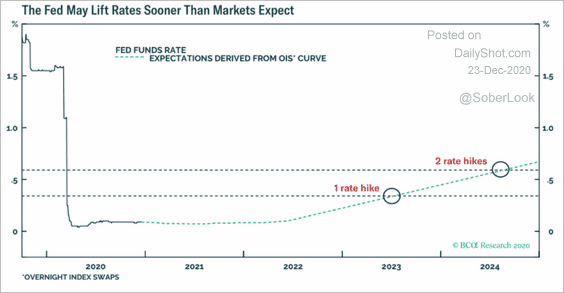

3. Here is the market-implied path for the fed funds rate.

Source: BCA Research

Source: BCA Research

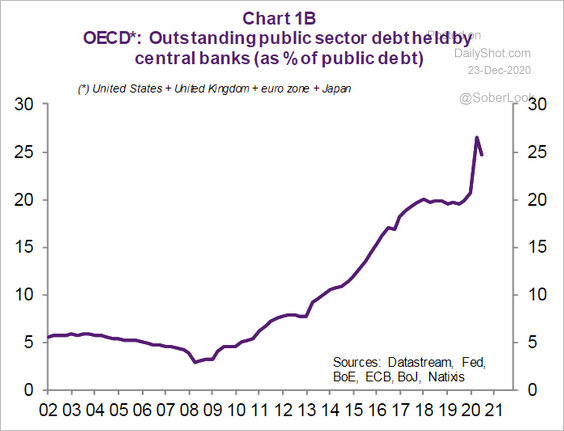

4. This chart shows the percentage of outstanding public debt held by central banks (US, UK, Eurozone, and Japan).

Source: Natixis

Source: Natixis

Global Developments

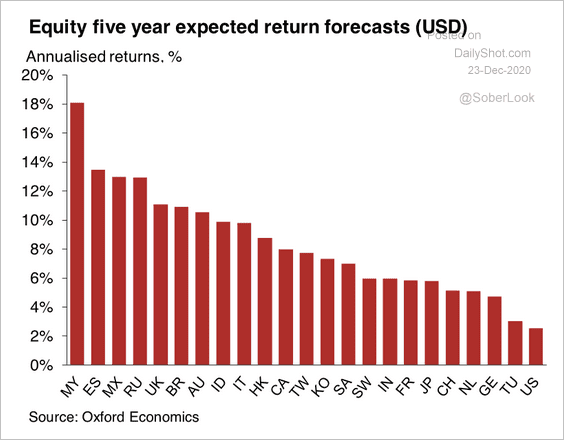

1. Oxford Economics expects non-US equities to outperform over the next five years.

Source: Oxford Economics

Source: Oxford Economics

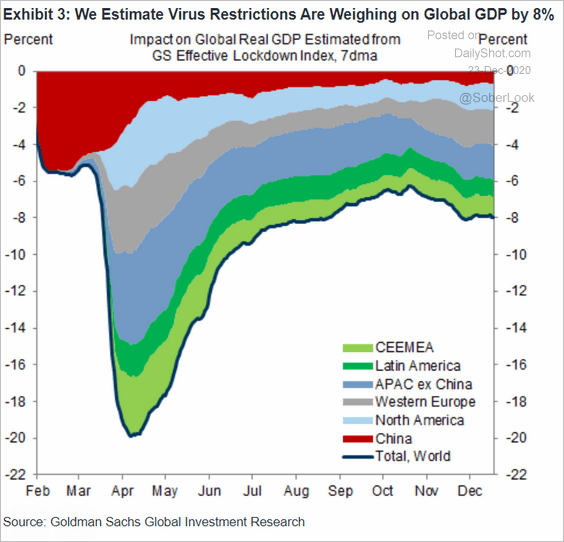

2. What is the expected impact of current pandemic restrictions on the GDP?

Source: Goldman Sachs

Source: Goldman Sachs

——————–

Food for Thought

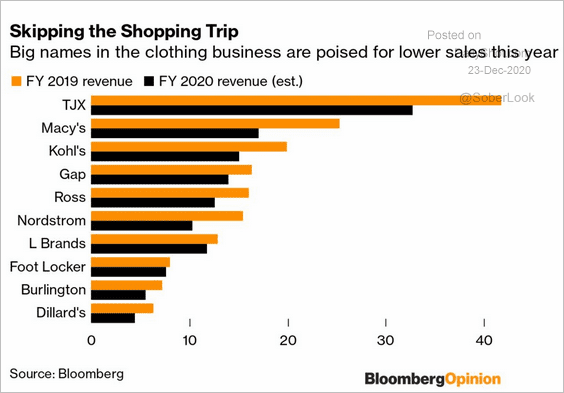

1. Large US clothing retailers’ sales relative to 2019:

Source: @BloombergQuint Read full article

Source: @BloombergQuint Read full article

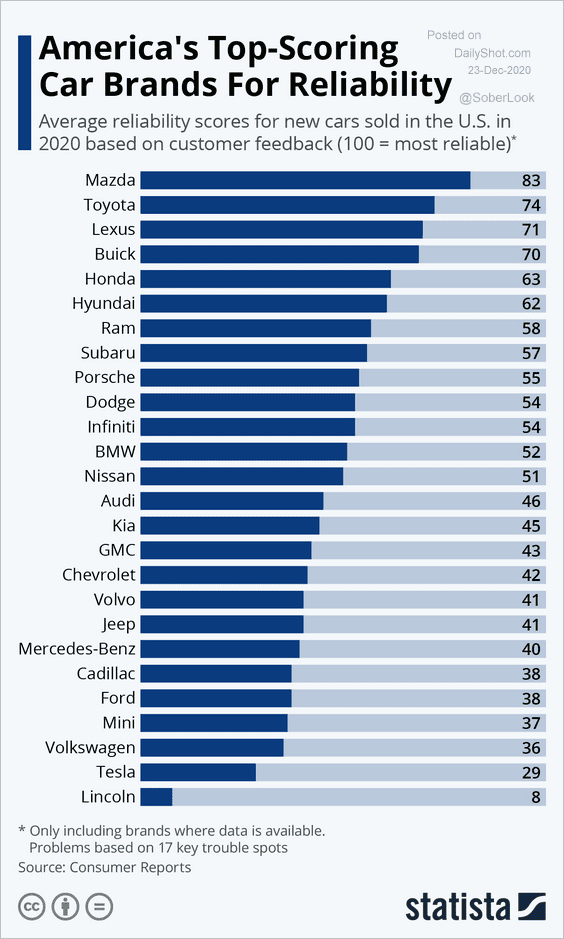

2. US car reliability scores:

Source: Statista

Source: Statista

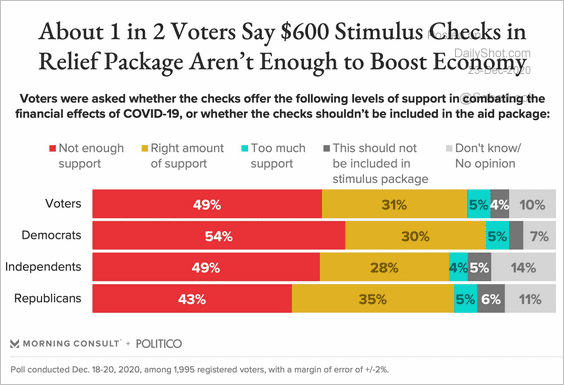

3. More money …

Source: @MorningConsult, @politico Read full article

Source: @MorningConsult, @politico Read full article

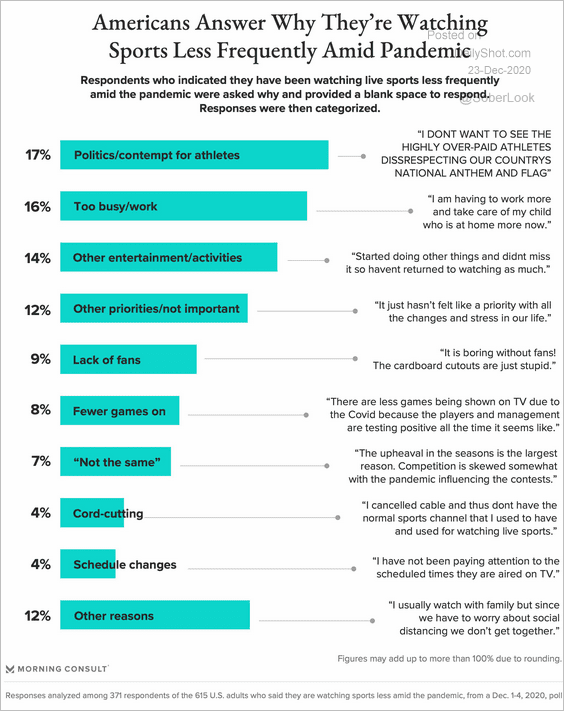

4. Watching sports less frequently:

Source: @AlexMSilverman, @MorningConsult Read full article

Source: @AlexMSilverman, @MorningConsult Read full article

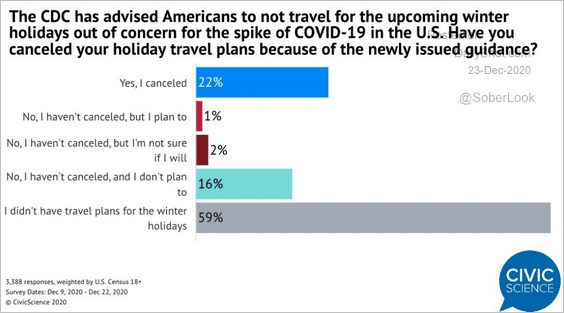

5. Cancelling travel plans:

Source: @CivicScience, @CDCgov

Source: @CivicScience, @CDCgov

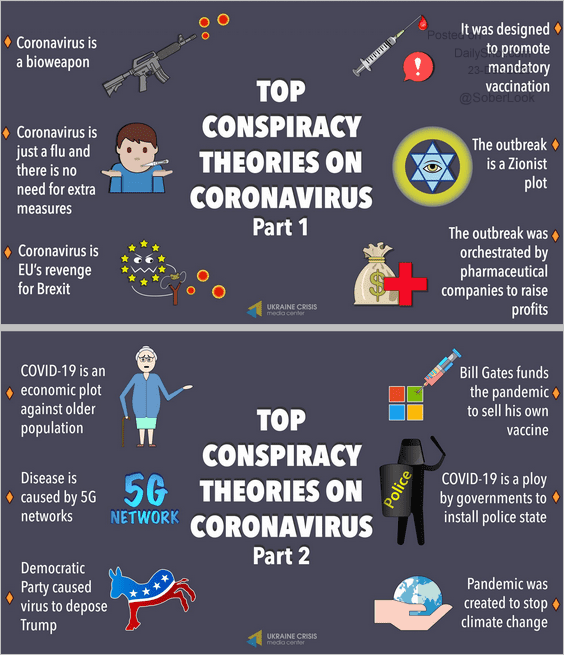

6. Coronavirus conspiracy theories:

Source: UCMC

Source: UCMC

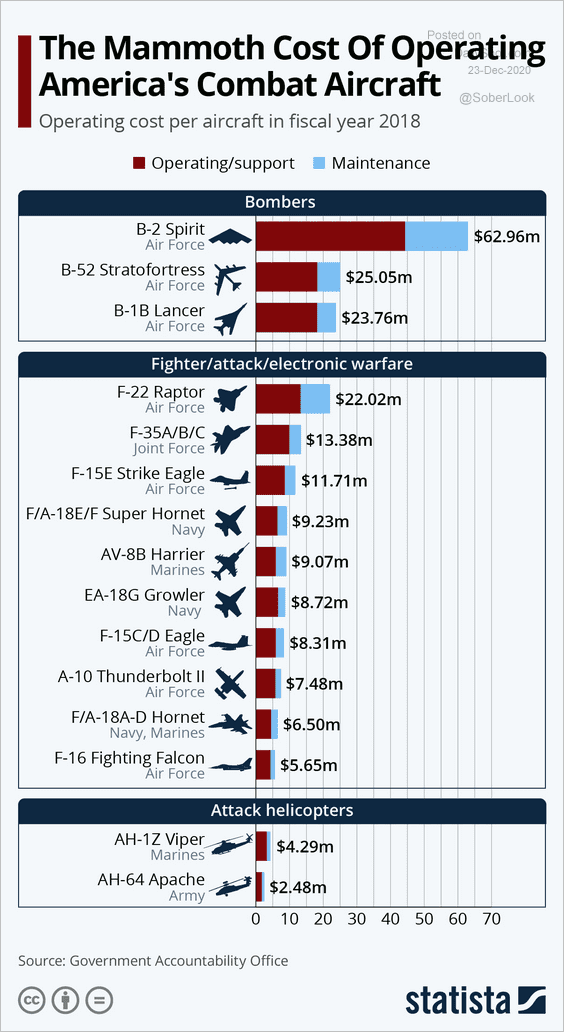

7. US combat aircraft maintenance costs:

Source: Statista

Source: Statista

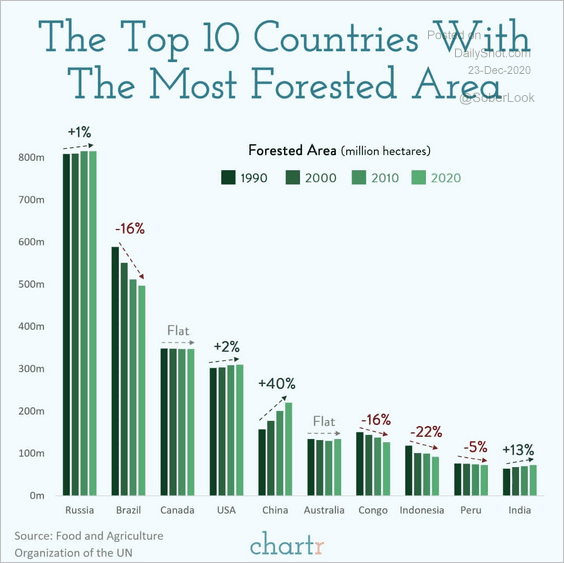

8. Trends in forested areas around the world:

Source: @chartrdaily

Source: @chartrdaily

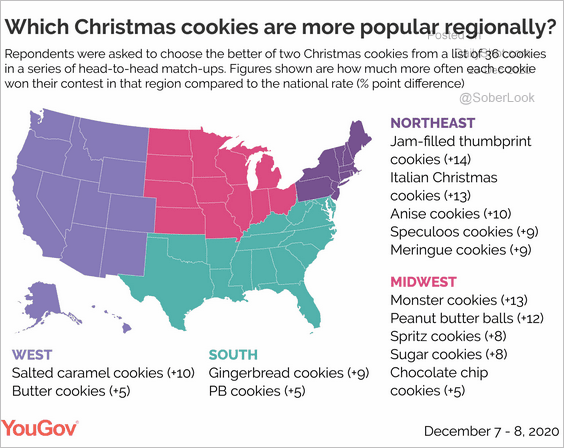

9. Christmas cookies:

Source: @YouGovAmerica Read full article

Source: @YouGovAmerica Read full article

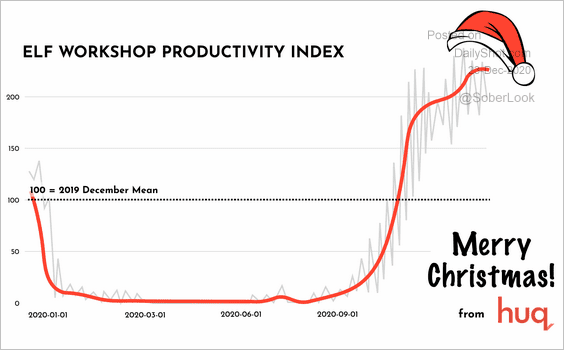

10. The elf workshop productivity index:

Source: Huq Read full article

Source: Huq Read full article

——————–

The next Daily Shot will be out on Monday, January 4th.

Happy holidays!