The Daily Shot: 07-Jan-21

• Equities

• Credit

• Rates

• Energy

• Cryptocurrency

• Emerging Markets

• Asia – Pacific

• Japan

• The Eurozone

• The United States

• Food for Thought

Equities

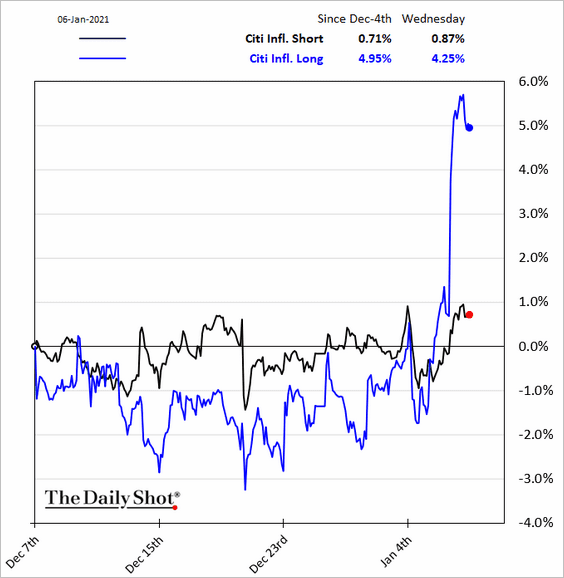

1. The news of Democrats taking control of the US Senate reignited the reflation trade. The market is betting on the federal government unleashing further fiscal stimulus, boosting consumption, economic growth, and inflation. Here is the relative performance of stocks that benefit from higher prices (Citi inflation long index) vs. those that do well in a deflationary environment.

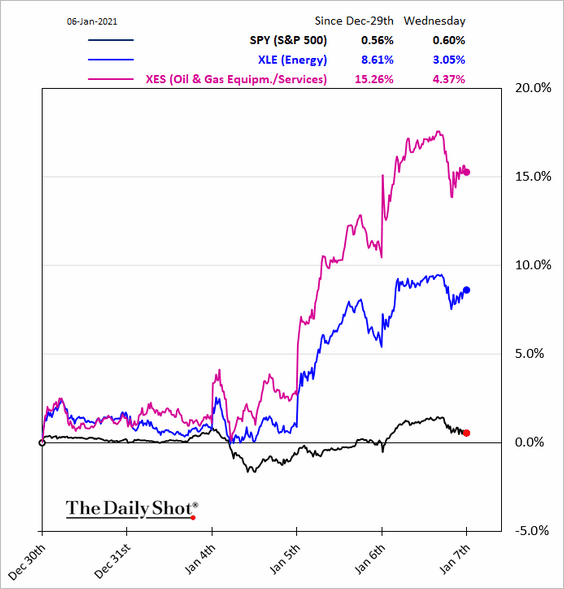

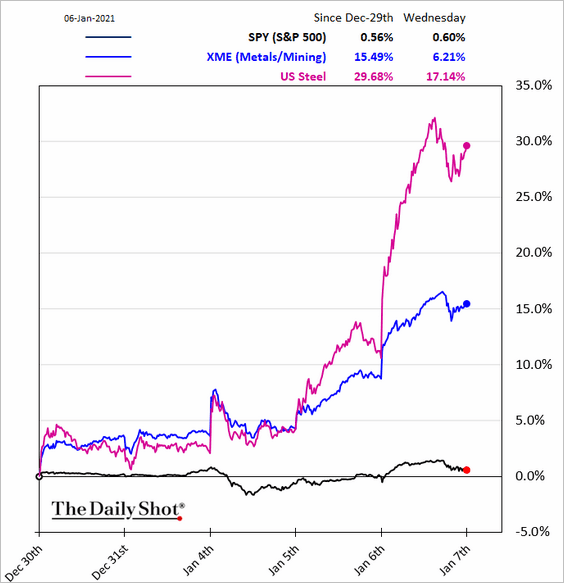

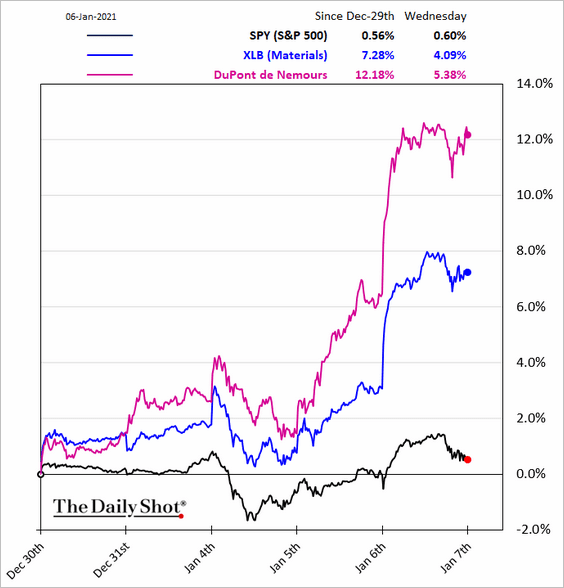

Below are the “reflation” sectors.

• Energy:

• Metals & Mining:

• Materials:

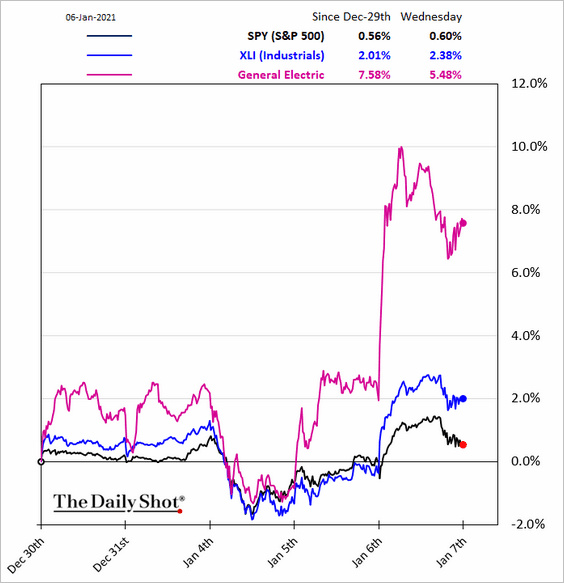

• Industrials:

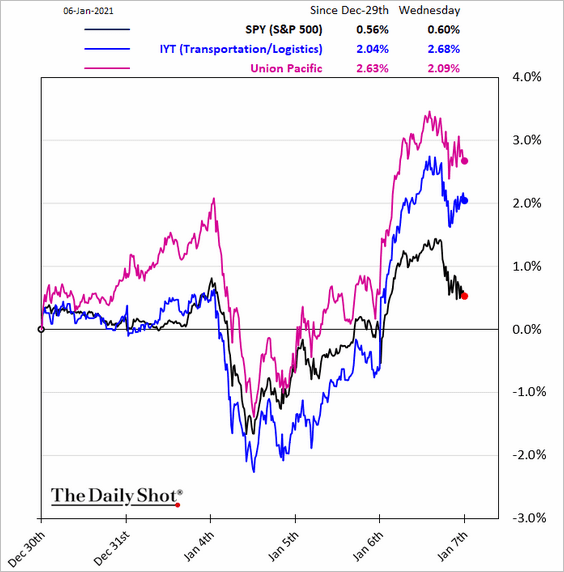

• Transportation:

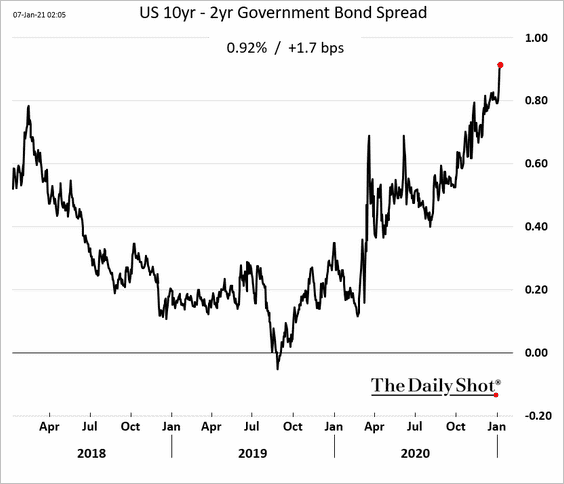

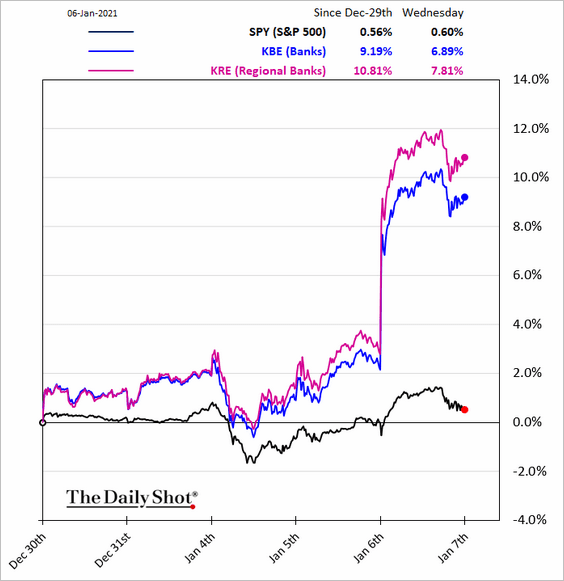

Banks also tend to benefit from reflation, especially from a steepening yield curve.

Bank shares rose sharply. Notice the spread between the regional and total banking indices. Democrats are likely to tighten the regulatory environment, which may have a greater impact on larger banks.

——————–

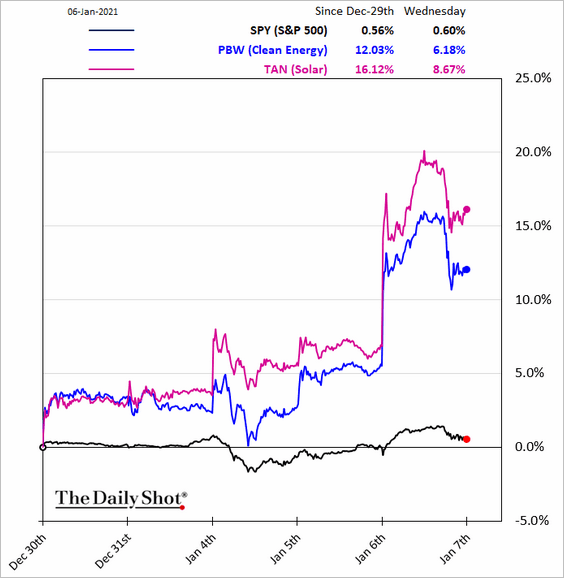

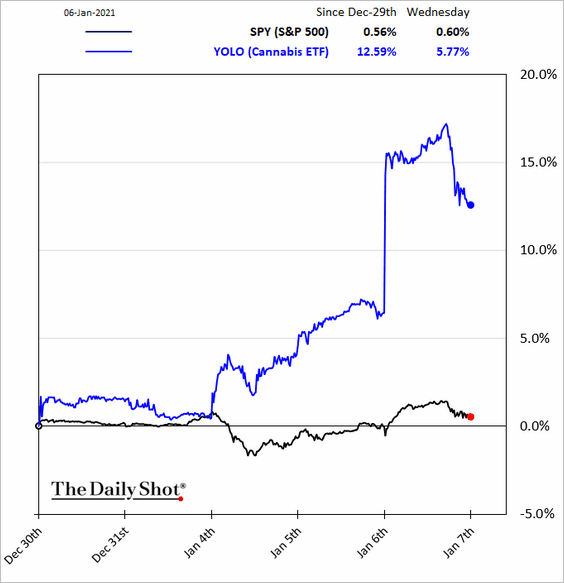

2. The political shift in Washington is expected to benefit other sectors/sub-sectors as well.

• Clean energy:

• Cannabis:

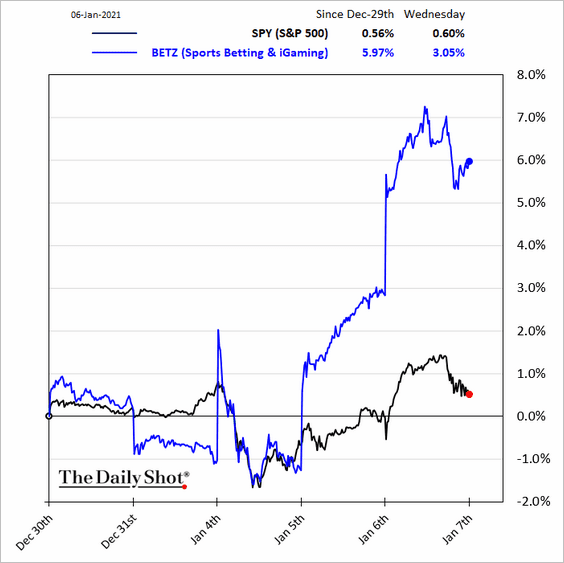

Sports betting shares also rallied.

——————–

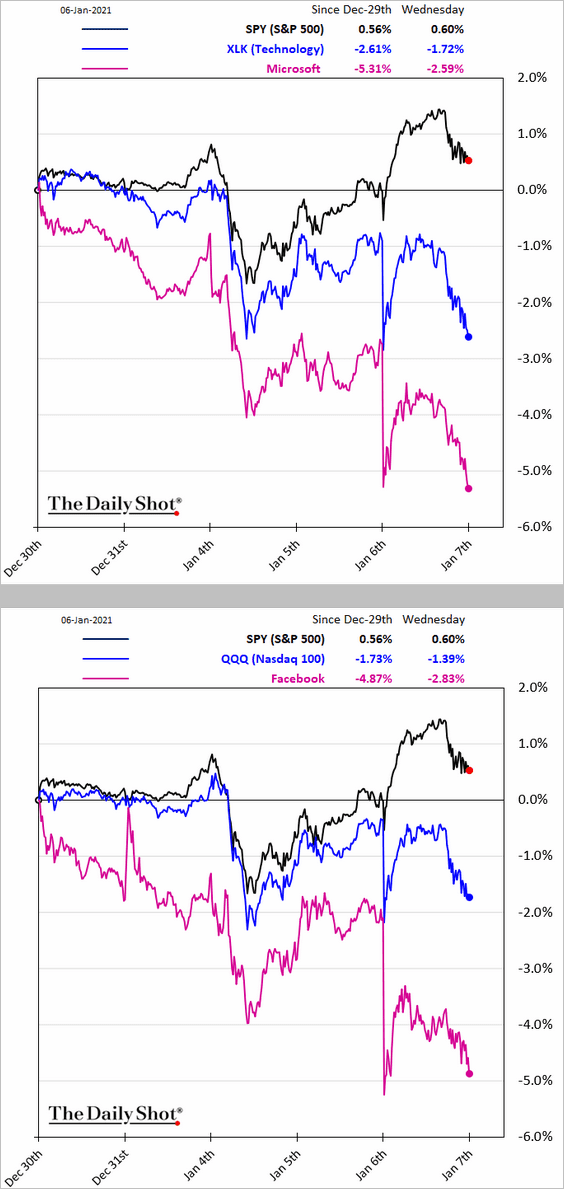

3. On the other hand, large tech companies could face increased regulatory pressures.

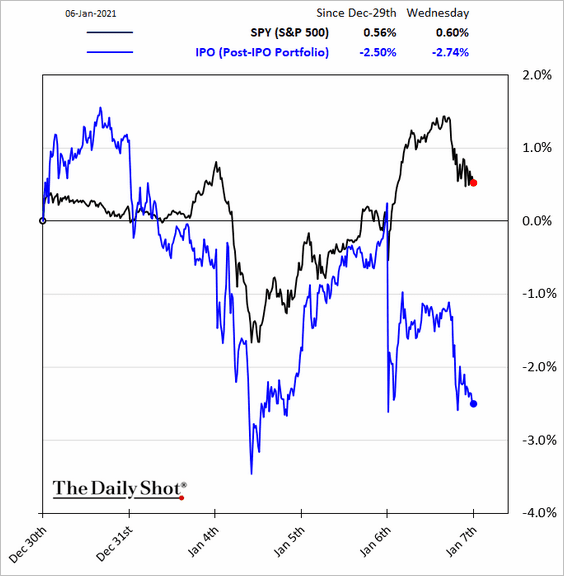

Here is the ETF tracking post-IPO stocks.

——————–

4. Below are some other sector trends.

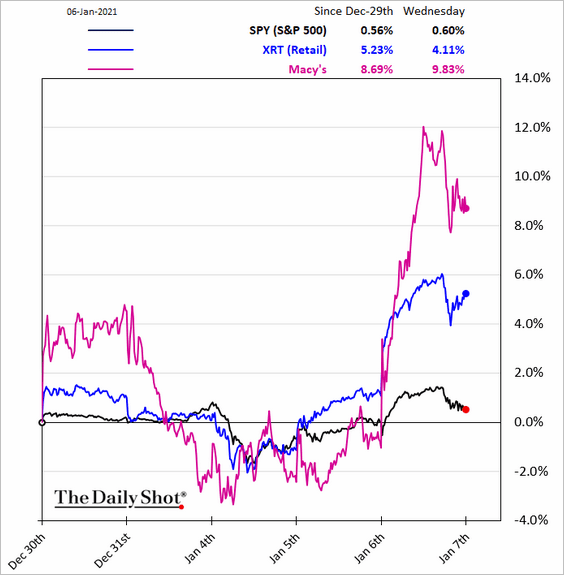

• Retail:

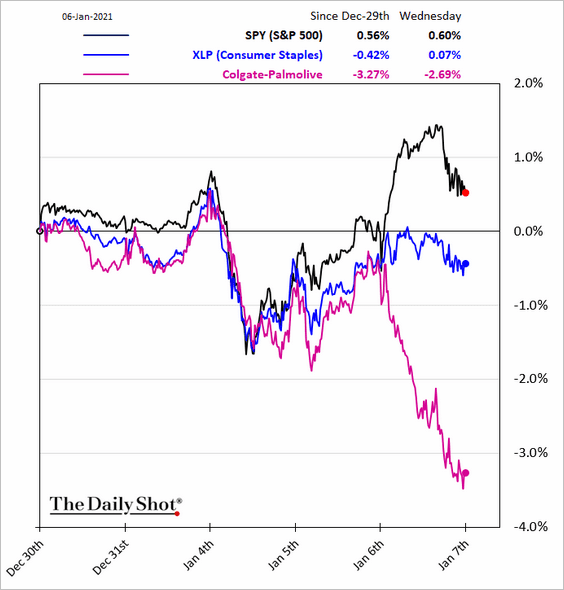

• Consumer staples:

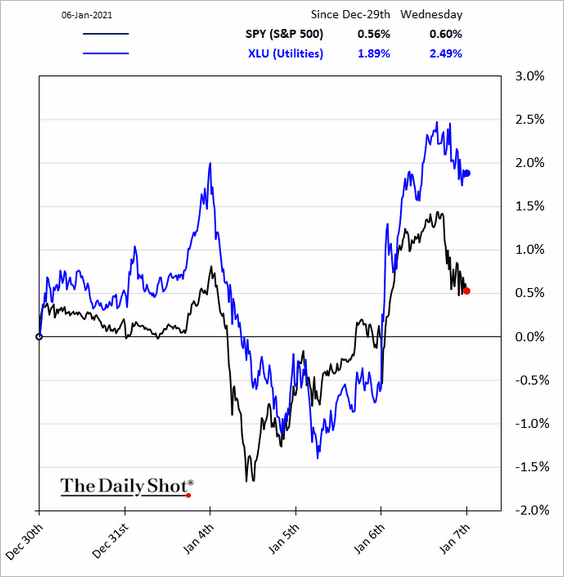

• Utilities (surprising outperformance, given higher Treasury yields):

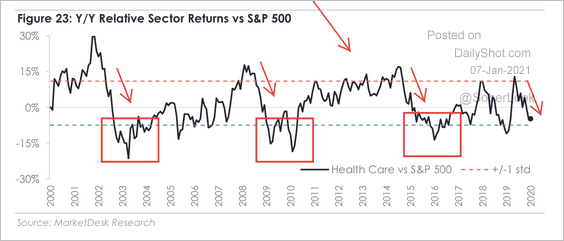

• Healthcare sector returns continue to trail the S&P 500.

Source: MarketDesk Research

Source: MarketDesk Research

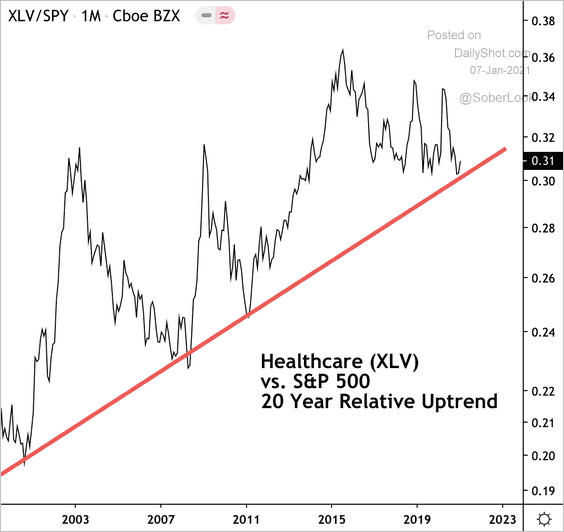

However, healthcare is at long-term support relative to the S&P 500.

Source: @DantesOutlook

Source: @DantesOutlook

——————–

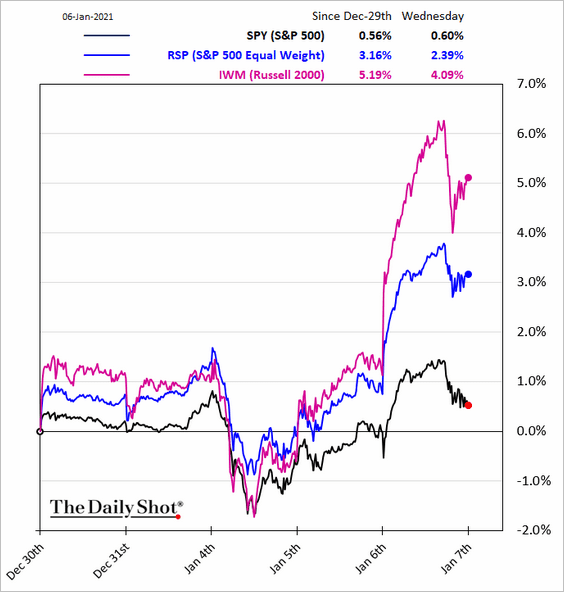

5. Reflation also benefits small caps.

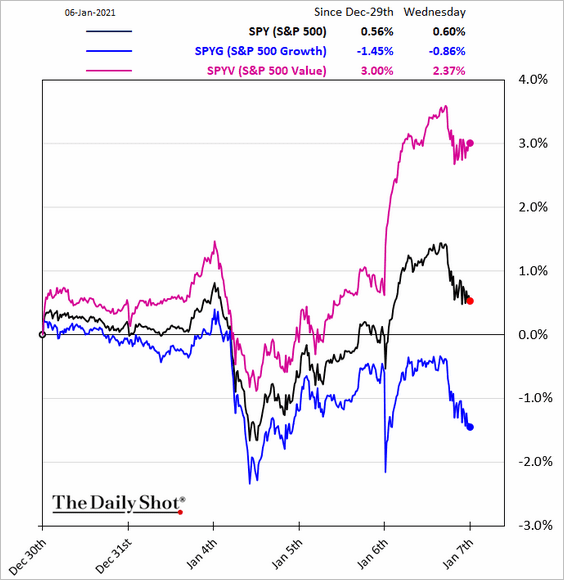

6. Value stocks surged relative to growth.

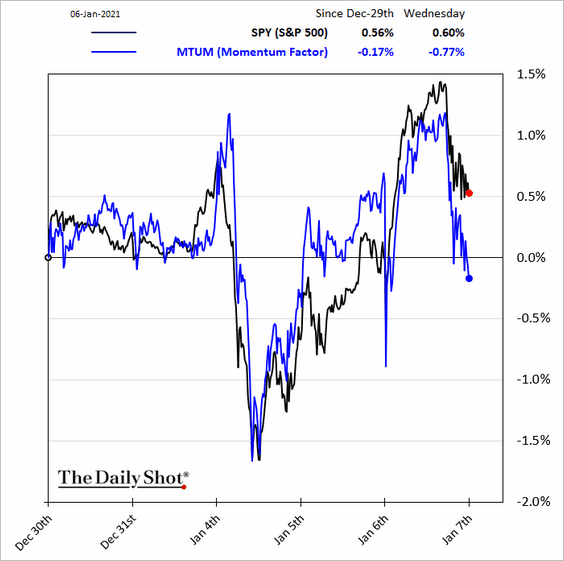

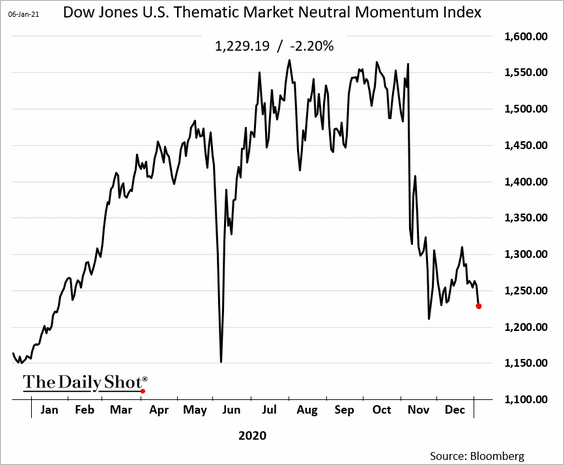

• Momentum underperformed.

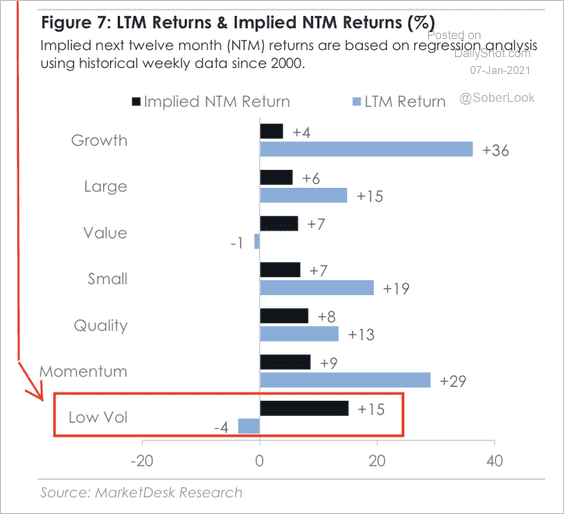

• Separately, the low volatility factor has the highest implied forward return versus other factors, according to MarketDesk Research.

Source: MarketDesk Research

Source: MarketDesk Research

——————–

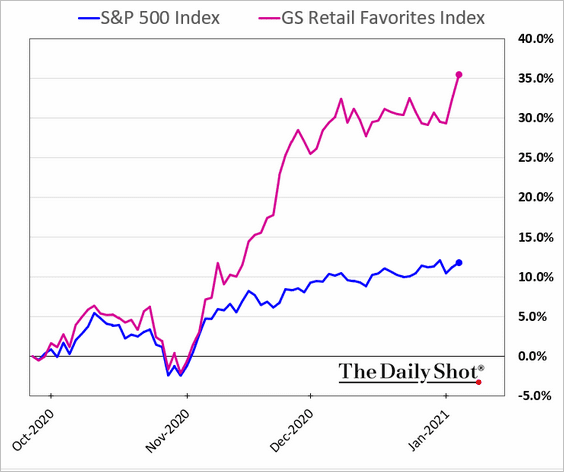

7. Shares favored by retail investors are soaring.

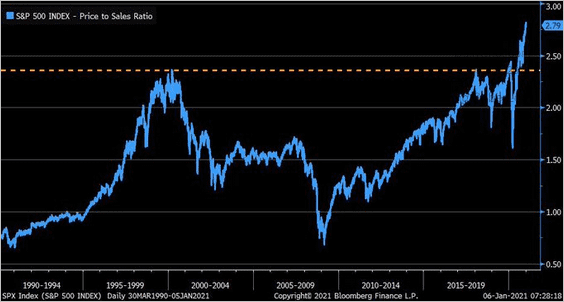

8. The S&P 500 price-to-sales ratio continues to hit record highs.

Source: @LizAnnSonders, @Bloomberg

Source: @LizAnnSonders, @Bloomberg

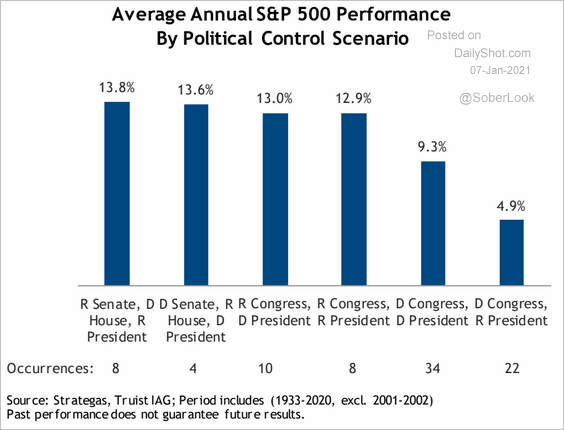

9. Democrats controlling both Congress and the White House is not the best scenario for stocks historically.

Source: SunTrust Private Wealth Management

Source: SunTrust Private Wealth Management

Back to Index

Credit

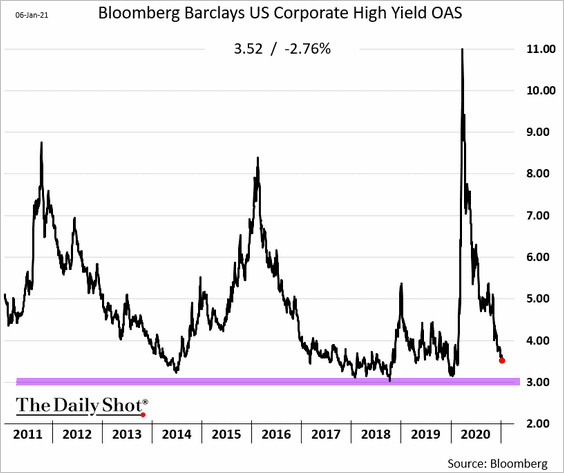

1. High-yield bond spreads are approaching pre-crisis lows.

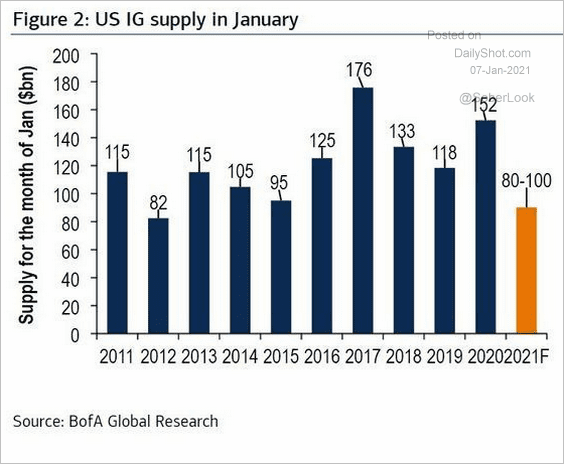

2. Investment-grade supply is expected to slow this year.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

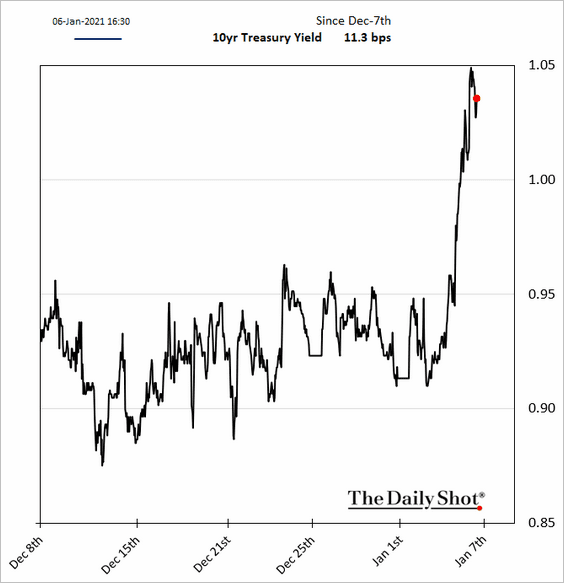

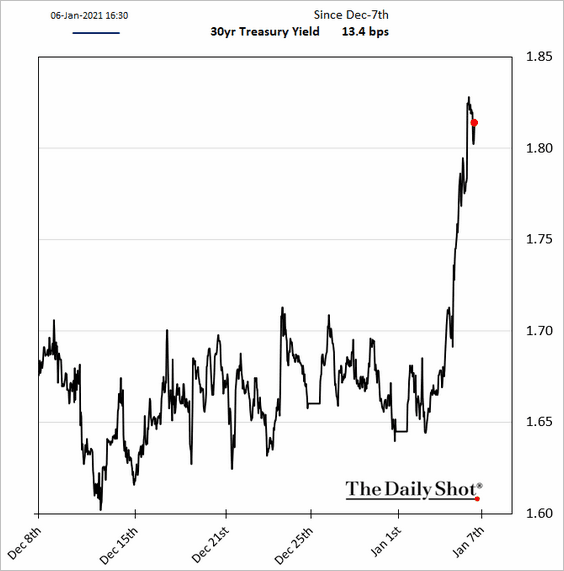

Rates

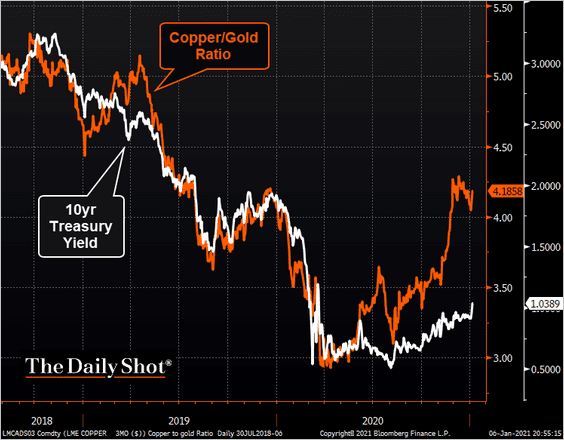

1. Treasury yields rose further, with the 10-year breaching 1%.

The copper-to-gold ratio points to more gains for bond yields.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

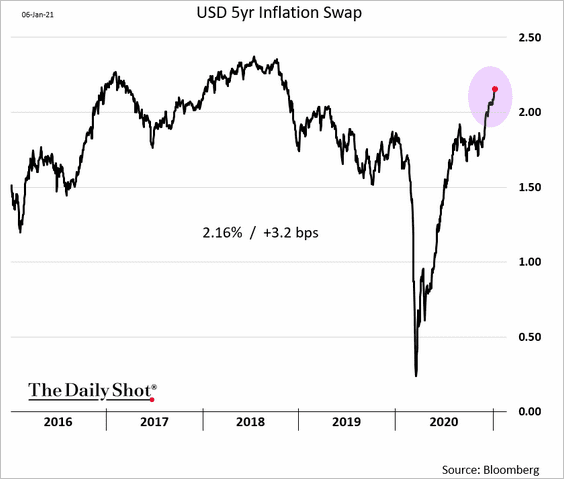

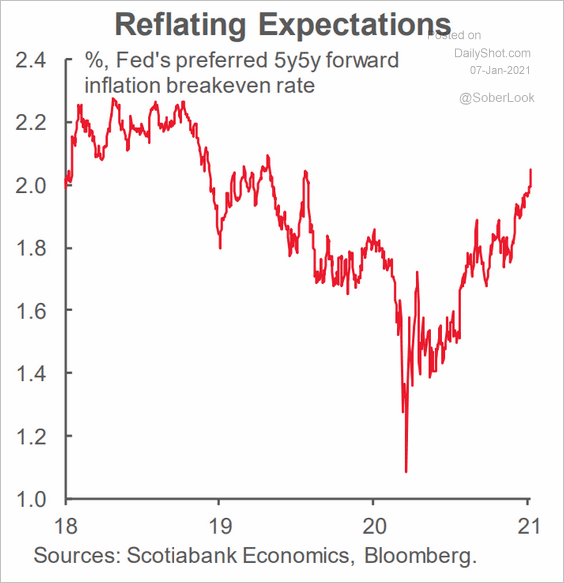

2. Market-based inflation expectations are climbing.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

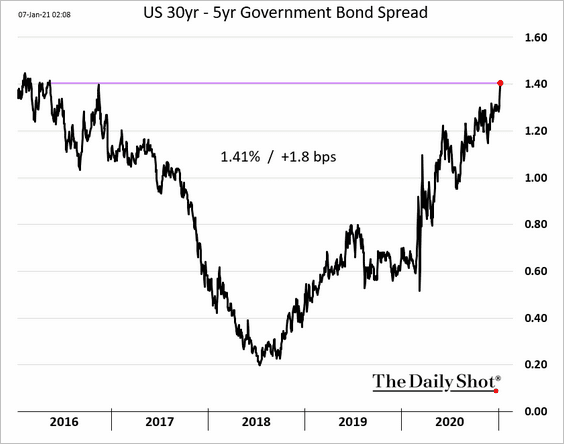

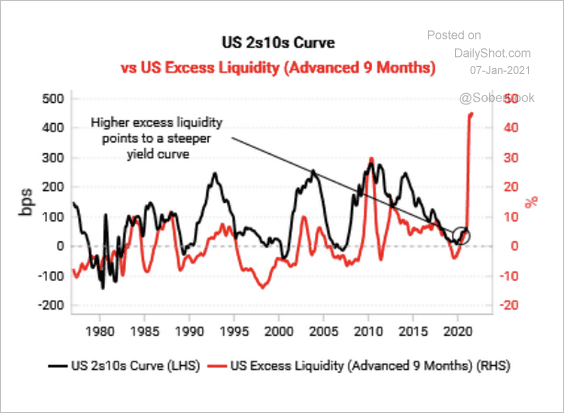

3. The long end of the Treasury curve continues to steepen.

The surge in excess liquidity points to the Treasury curve steepening further. Will the Fed step in with “Operation Twist” (shifting purchases to longer-term Treasuries) to cap the steepening trend.

Source: Variant Perception

Source: Variant Perception

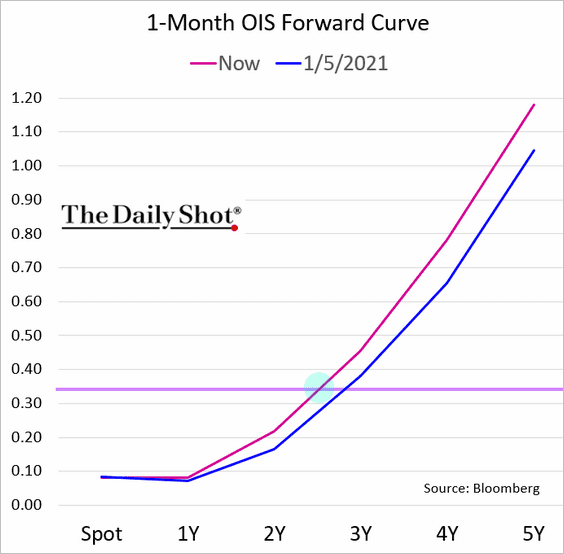

4. The election surprise brought forward the expected Fed liftoff timing (purple line shows the first hike).

Back to Index

Energy

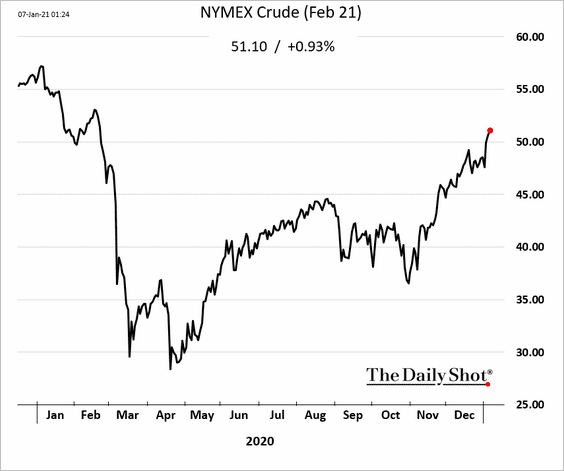

1. WTI crude oil climbed past $51/bbl.

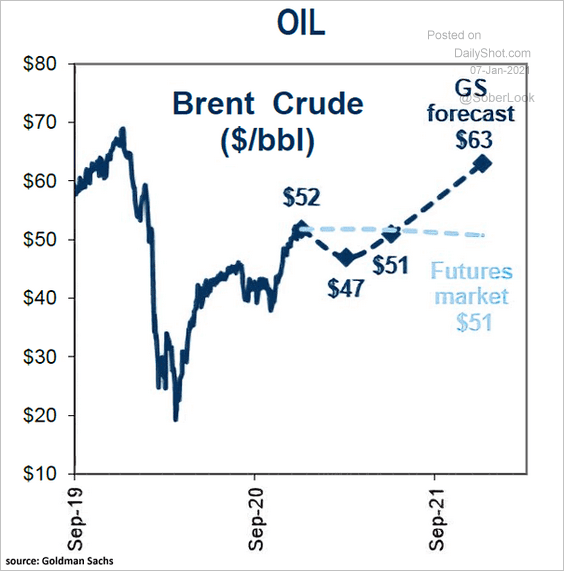

Goldman expects Brent crude to reach $63/bbl by the end of the year.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

——————–

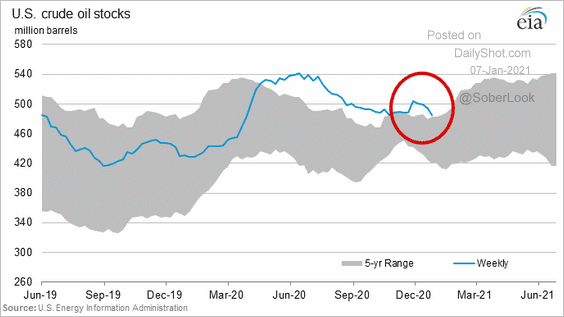

2. US crude oil inventories declined in recent weeks.

Back to Index

Cryptocurrency

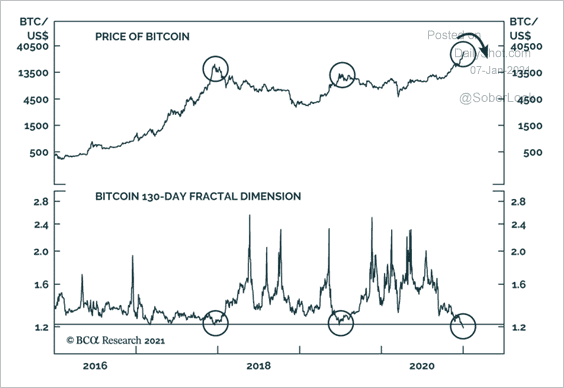

1. Bitcoin topped $37k.

Technicals suggest Bitcoin is due for a pull-back.

Source: BCA Research

Source: BCA Research

——————–

2. The total cryptocurrency market value hit $1 trillion.

Source: @DantesOutlook

Source: @DantesOutlook

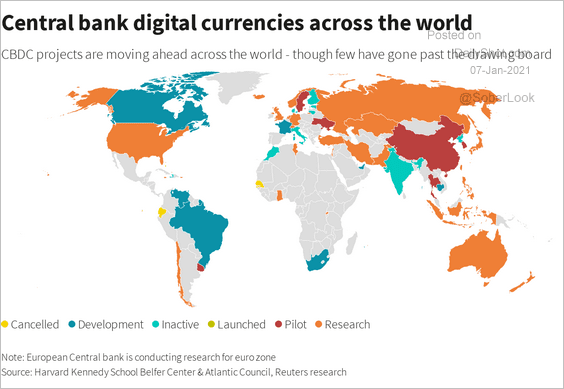

3. This map shows the status of central bank digital currencies around the world. These instruments are not substantially different from “fiat” currencies because central banks control the supply.

Source: Reuters Read full article

Source: Reuters Read full article

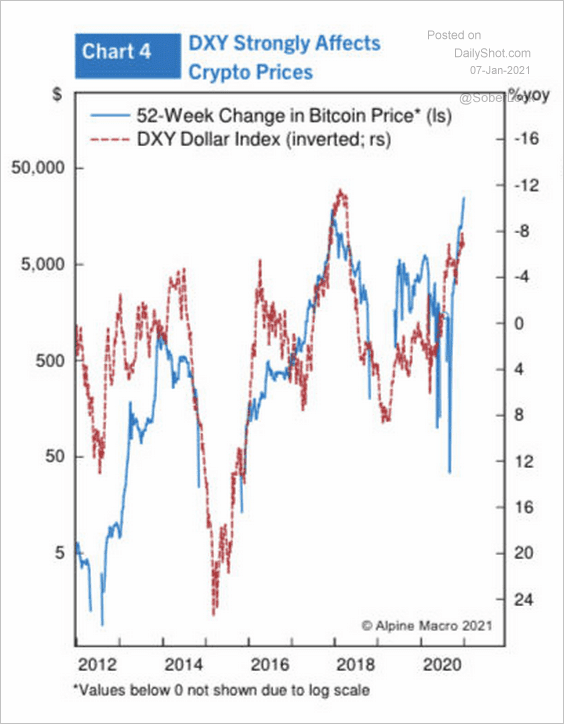

4. The US dollar has a significant impact on Bitcoin’s performance.

Source: Alpine Macro

Source: Alpine Macro

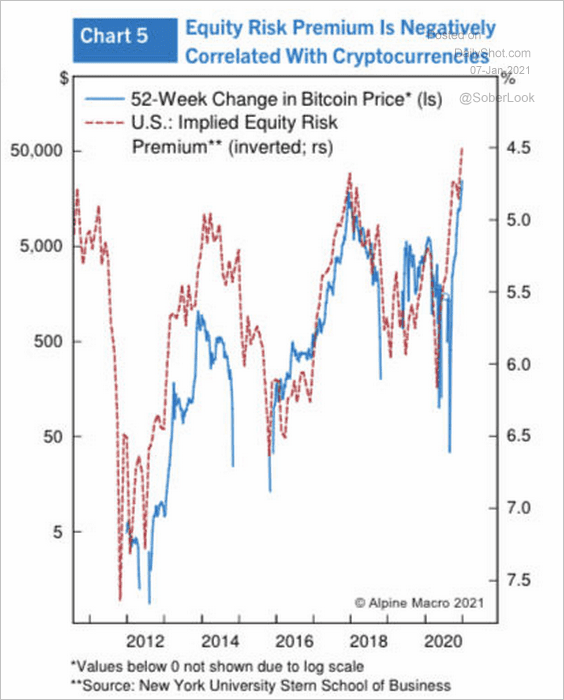

5. Bitcoin is correlated with equity risk premium.

Source: Alpine Macro

Source: Alpine Macro

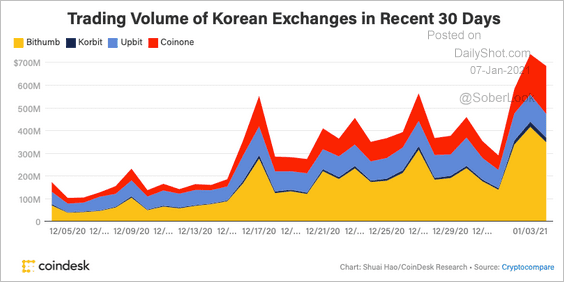

6. Trading volume in South Korean cryptocurrency exchanges spiked over the past few days.

Source: CoinDes Read full article

Source: CoinDes Read full article

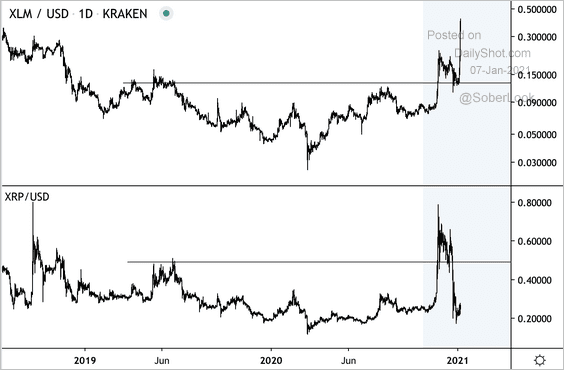

7. Stellar’s XLM surged to a two-year high yesterday as traders continued to sell XRP. Stellar, a protocol for digital currency transfers, also announced that it is helping Ukraine develop a central bank digital currency.

Source: @DantesOutlook

Source: @DantesOutlook

Back to Index

Emerging Markets

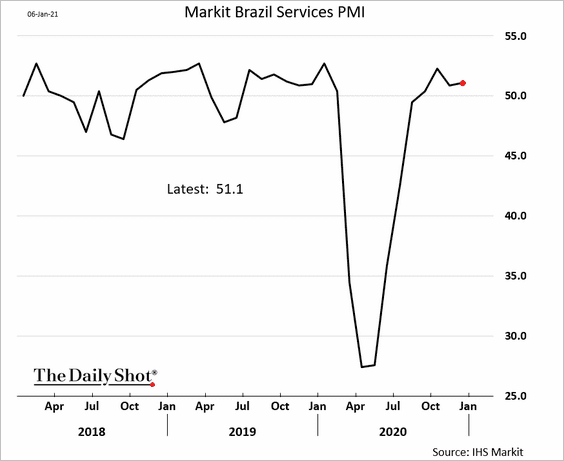

1. Brazil’s service sector PMI remains in growth mode.

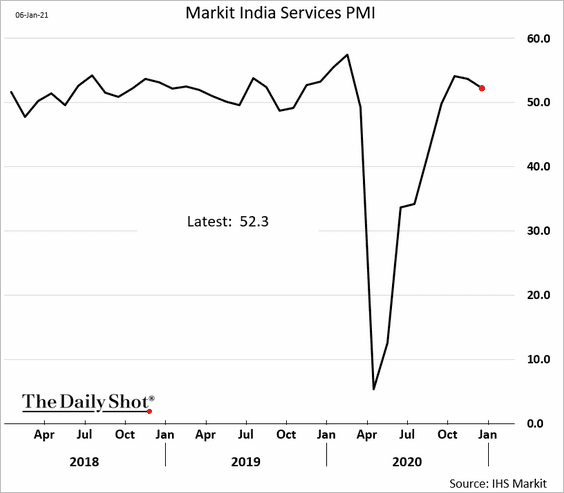

India’s service sector is expanding as well.

——————–

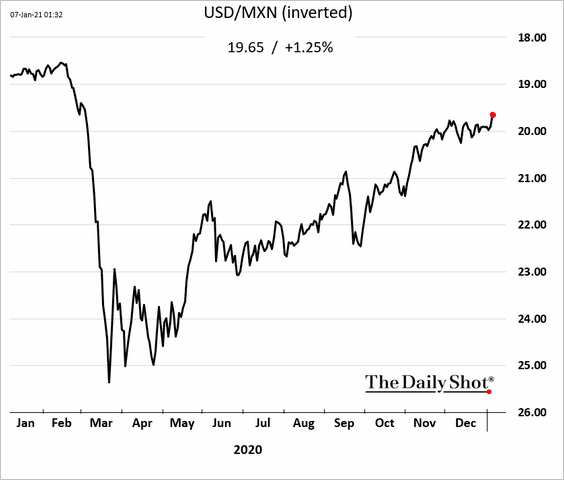

2. The Mexican peso rallied on Wednesday (part of the reflation trade).

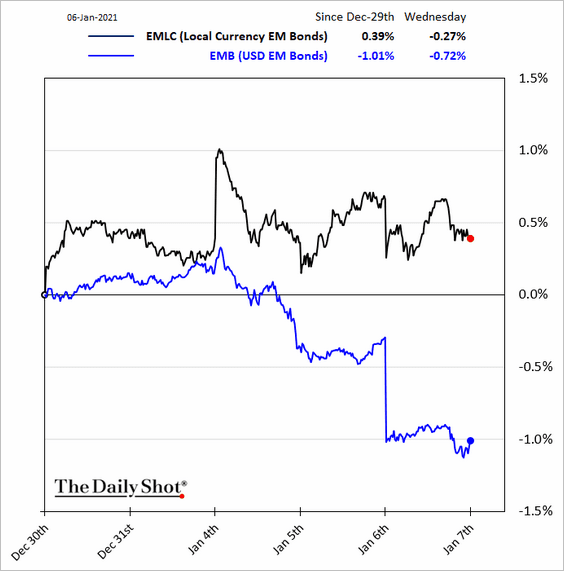

3. Dollar-denominated EM debt underperformed as Treasury yields climbed.

Back to Index

Asia – Pacific

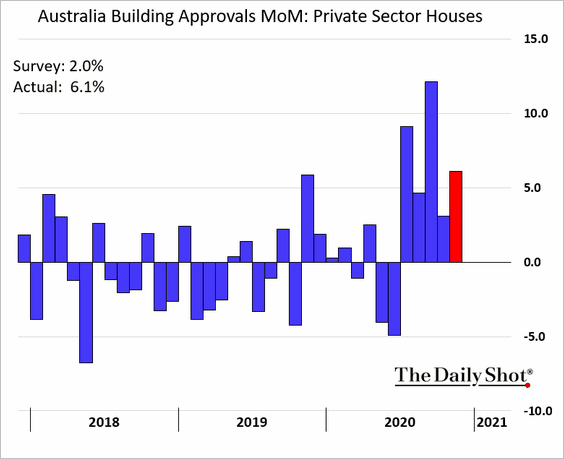

1. Australia’s building approvals remain robust, topping economists’ expectations.

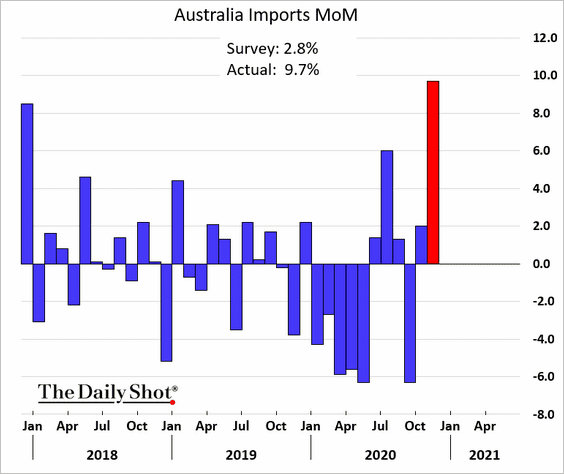

Separately, Australian imports surged last month (driven by capital purchases).

——————–

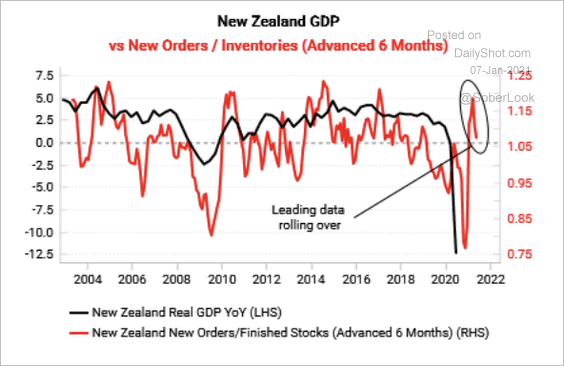

2. New Zealand’s leading economic data are starting to moderate.

Source: Variant Perception

Source: Variant Perception

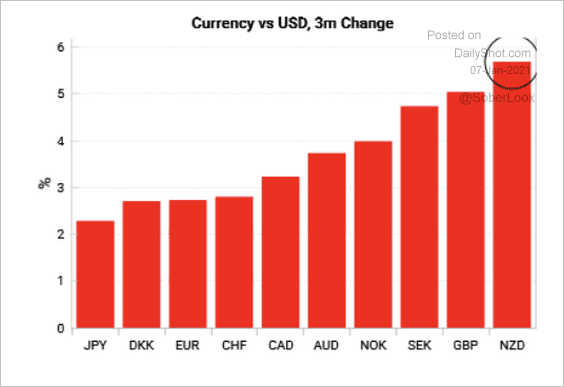

The New Zealand dollar has been one of the best performing G10 currencies against the greenback over the past three months.

Source: Variant Perception

Source: Variant Perception

Back to Index

Japan

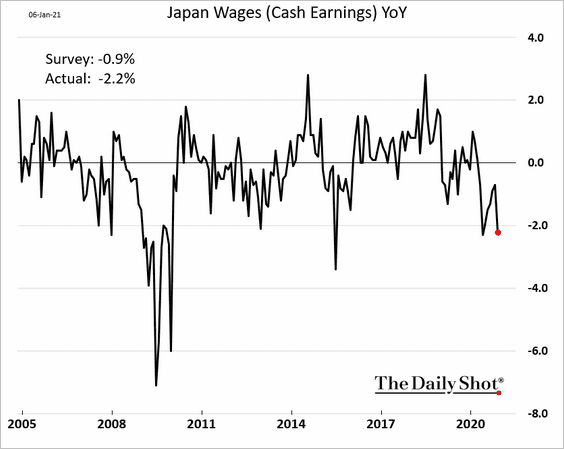

1. Wages continue to shrink.

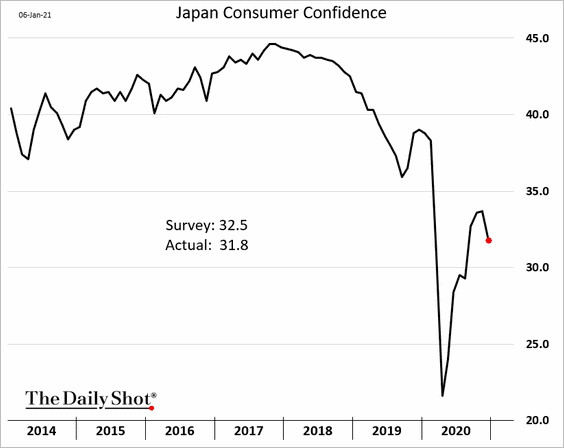

2. Consumer confidence weakened last month.

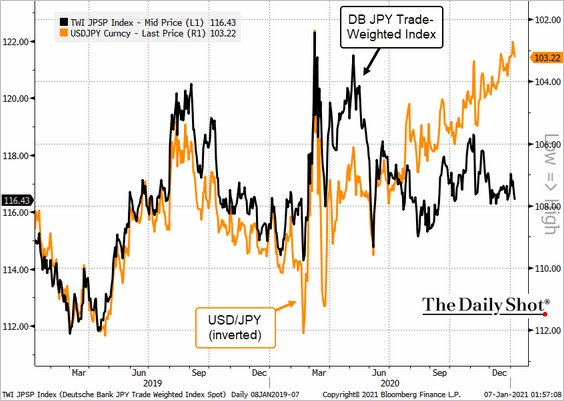

3. The yen has been rallying against the US dollar. However, the yen trade-weighted index has been flat over the past year.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

The Eurozone

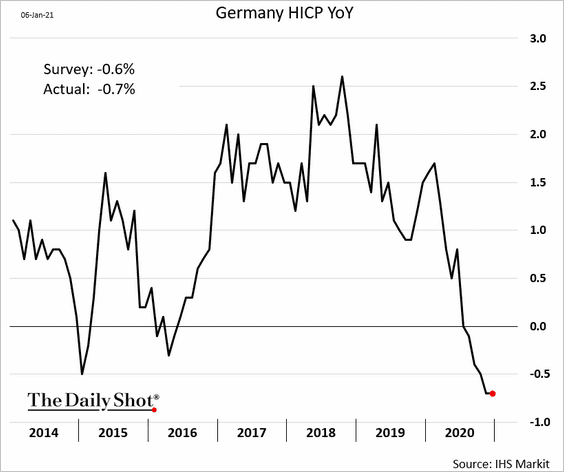

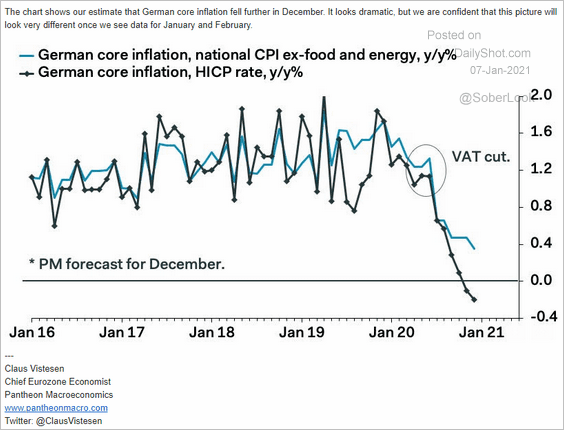

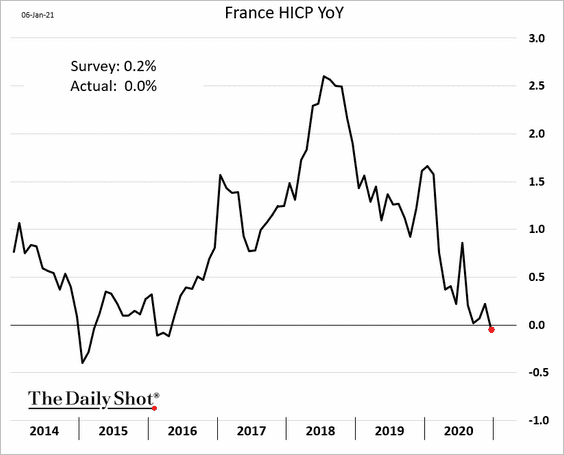

1. Inflation remains soft.

• German headline CPI:

• German core CPI:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• French CPI:

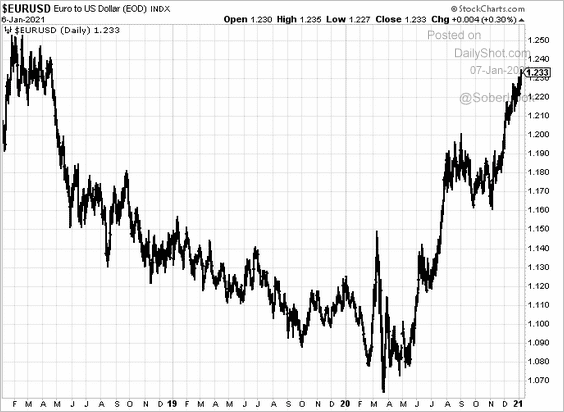

The euro continues to climb, which is exacerbating disinflationary pressures.

——————–

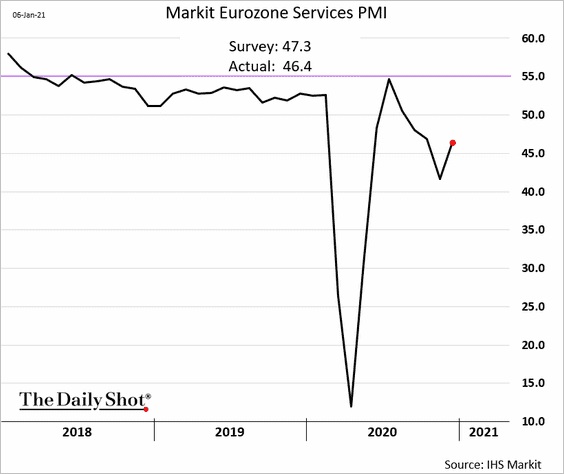

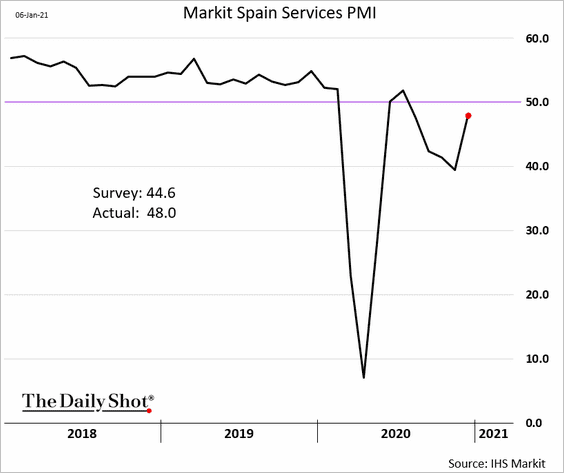

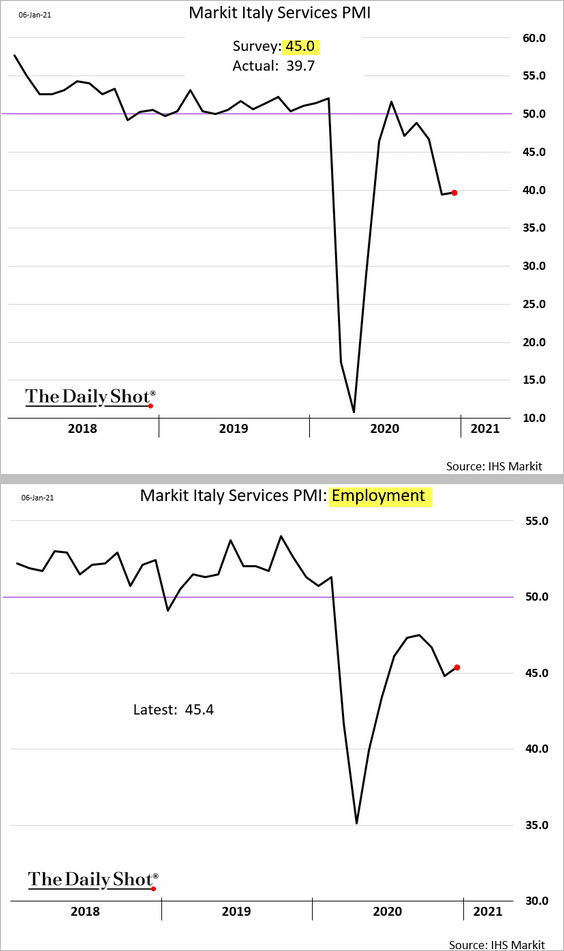

2. Service-sector PMI reports continue to show ongoing contraction.

• The Eurozone:

• Spain:

• Italy (awful):

——————–

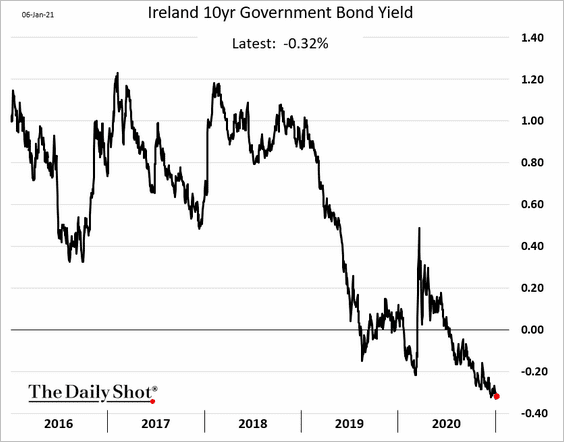

3. Irish bond yields hit a record low.

Back to Index

The United States

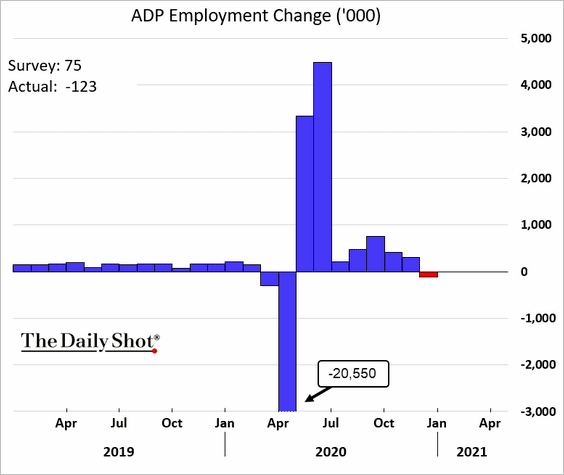

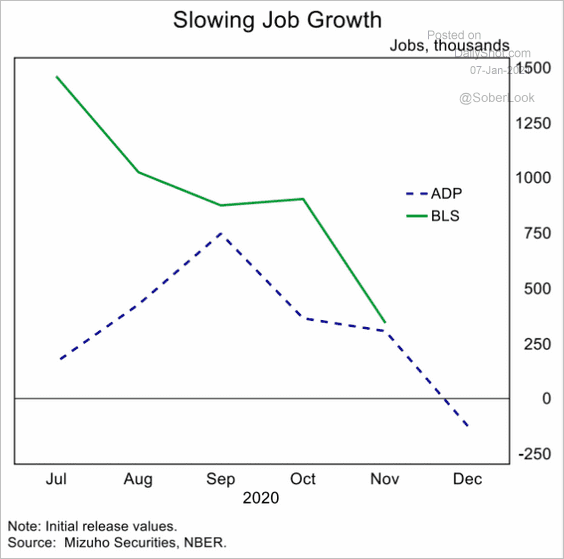

1. The ADP report showed a contraction in private payrolls last month.

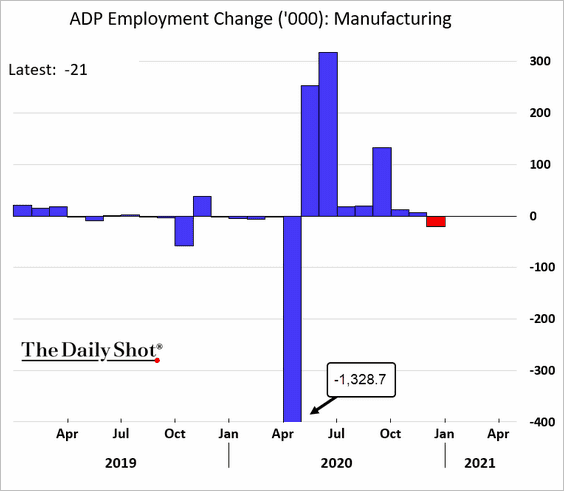

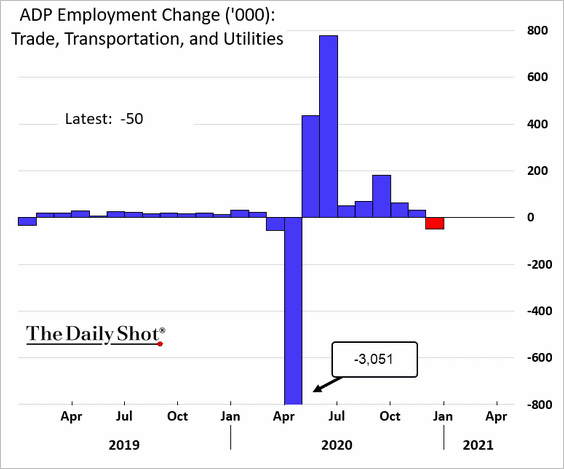

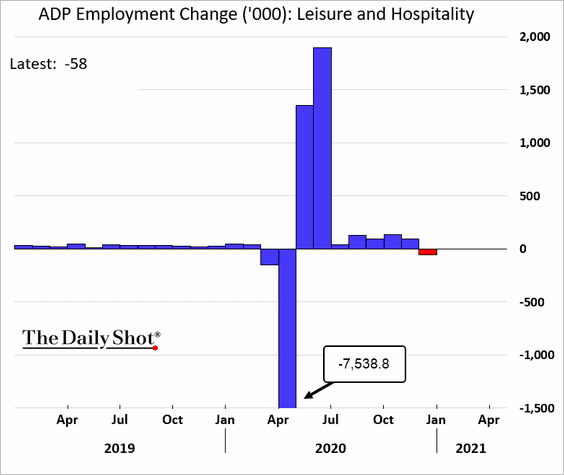

Here are the key drivers of employment weakness.

• Manufacturing:

• Trade & transportation:

• Leisure and hospitality:

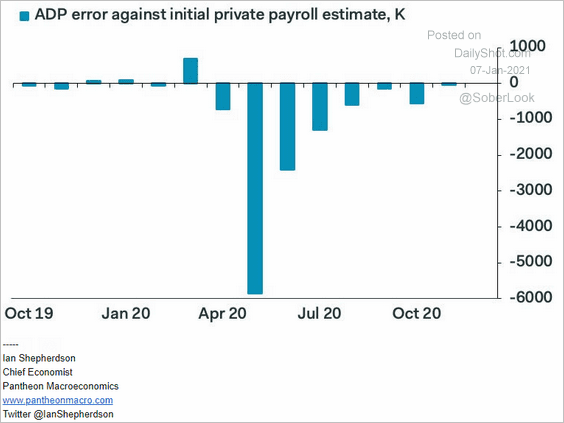

Does this mean we will see a decline in payrolls in the government report (BLS) on Friday? It’s unclear. ADP has been consistently below the official data (2 charts).

Source: Mizuho Securities USA

Source: Mizuho Securities USA

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

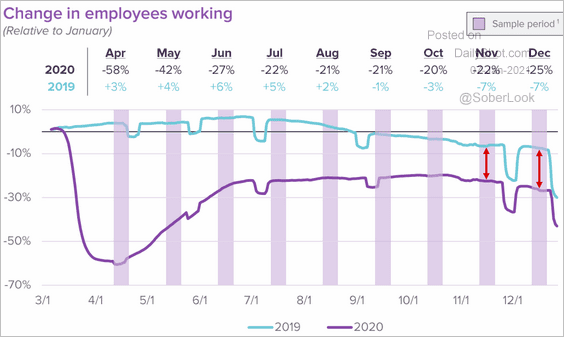

However, small business employment data from Homebase points to a decline.

Source: Homebase

Source: Homebase

——————–

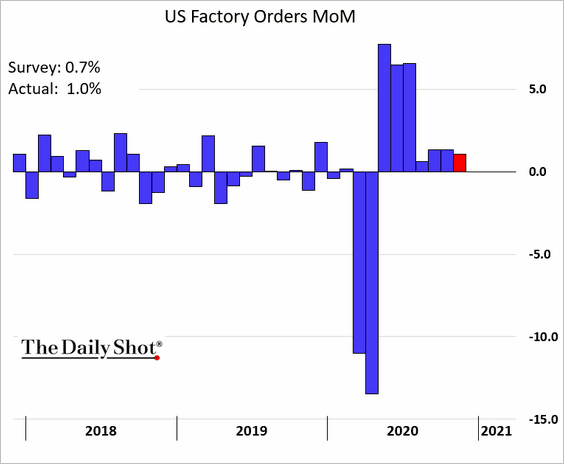

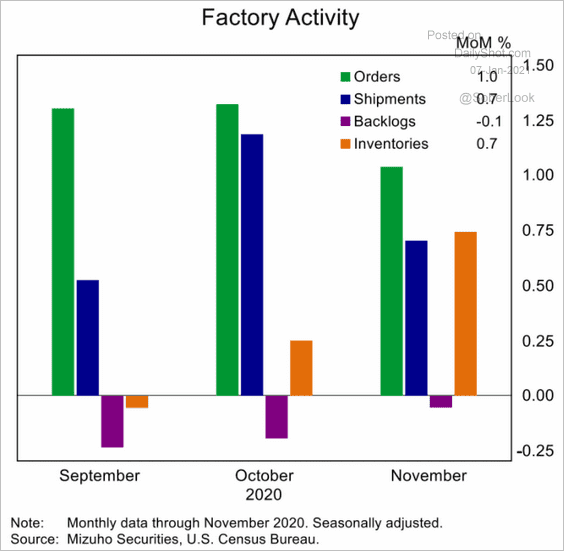

2. Factory orders remained robust in November.

Here are the changes in factory activity for September, October, and November.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

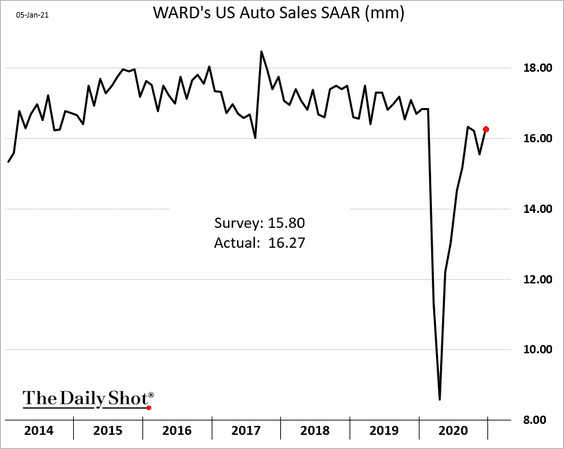

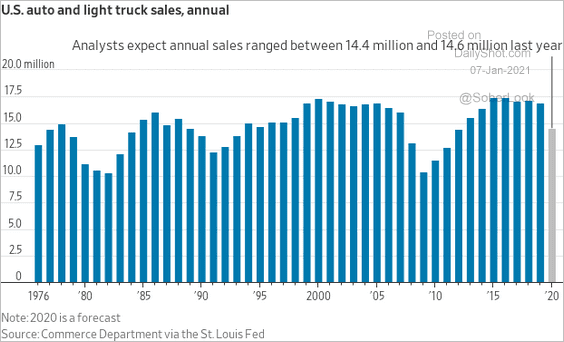

3. US vehicle sales finished the year on a strong note.

But sales were lower for the full year.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

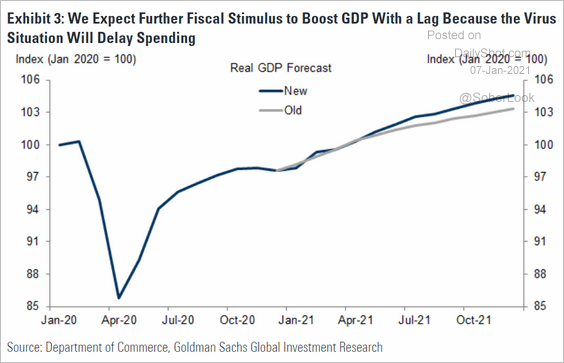

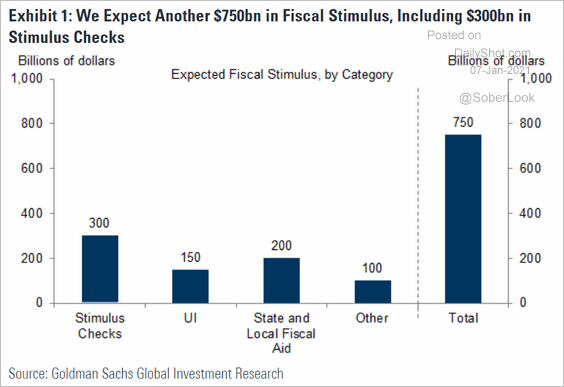

4. Goldman boosted the US GDP forecast in response to the election outcome.

Source: Goldman Sachs

Source: Goldman Sachs

The bank expects another $750bn of fiscal stimulus.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

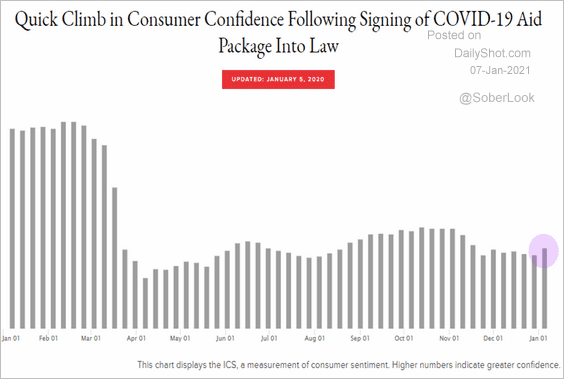

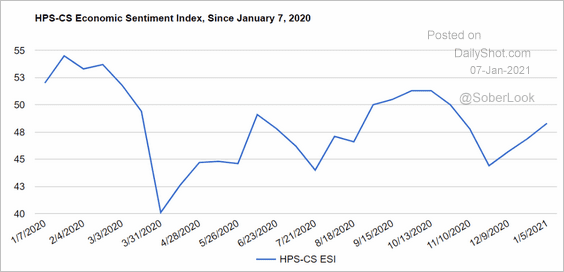

5. Two indicators point to an improvement in consumer sentiment in recent weeks.

• Morning Consult:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

• HPS-CS:

Source: @HPSInsight, @CivicScience

Source: @HPSInsight, @CivicScience

Back to Index

Food for Thought

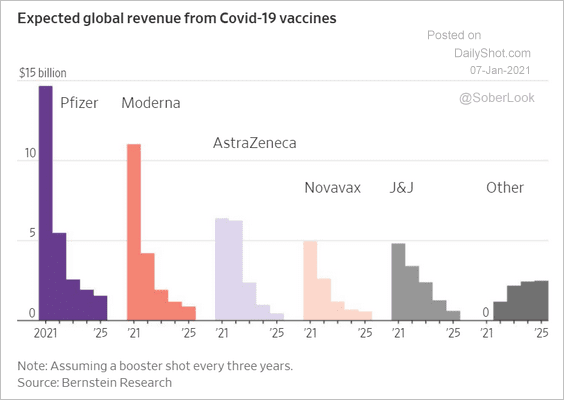

1. Vaccine revenue stream:

Source: @WSJ Read full article

Source: @WSJ Read full article

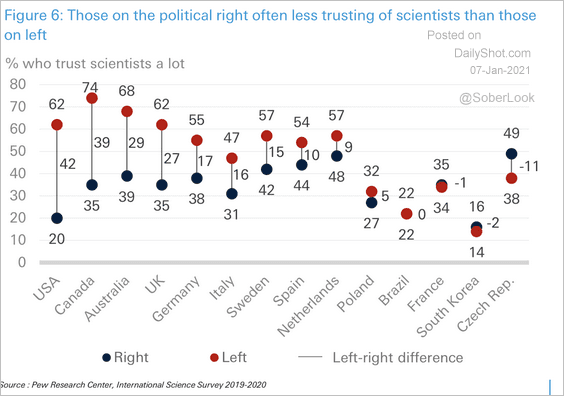

2. Trust in scientists:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

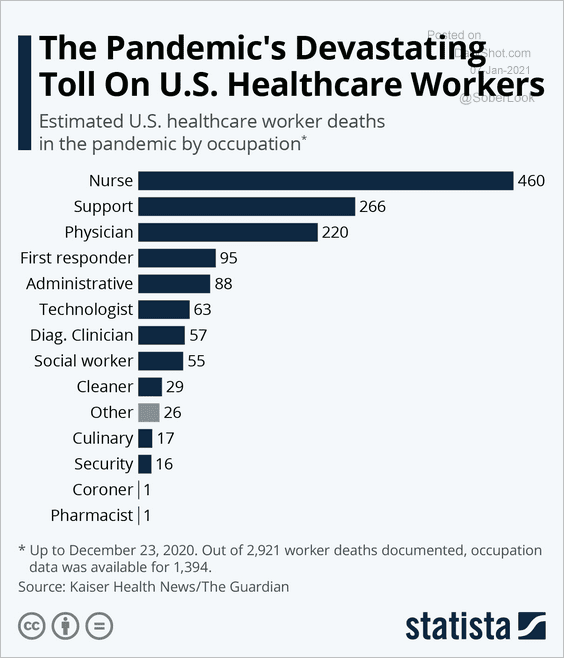

3. US healthcare worker deaths from COVID:

Source: Statista

Source: Statista

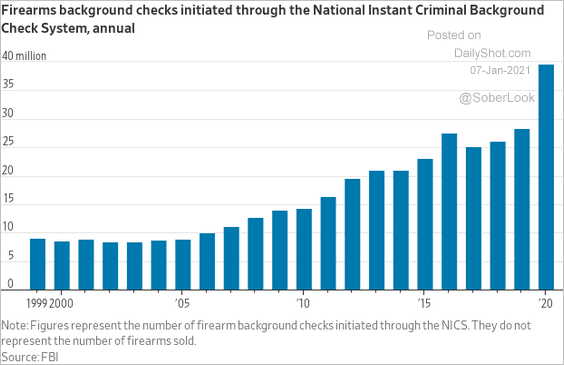

4. US background checks to purchase firearms:

Source: @jeffsparshott

Source: @jeffsparshott

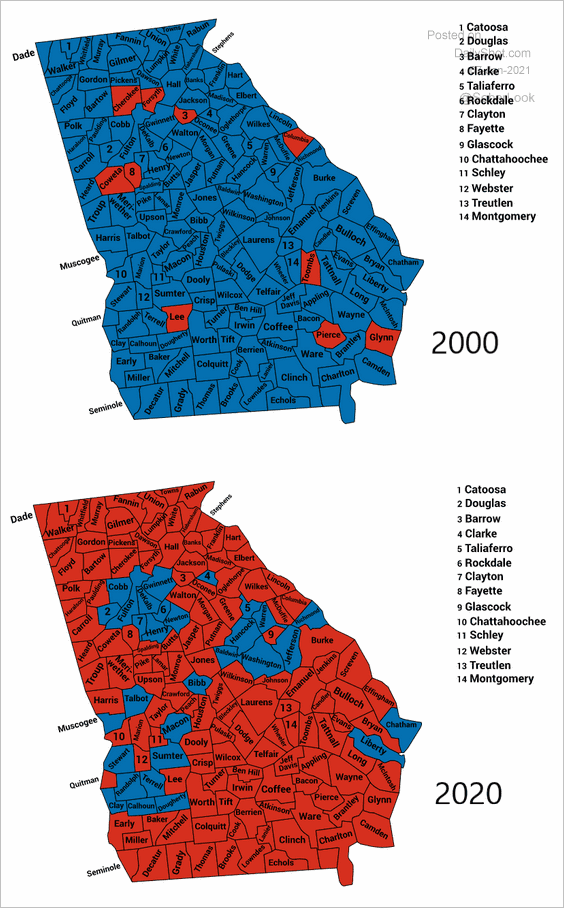

5. Comparison between the last time a Democrat was elected to a Senate seat in Georgia (2000) and the 2020 Democratic victory:

Source: Reddit

Source: Reddit

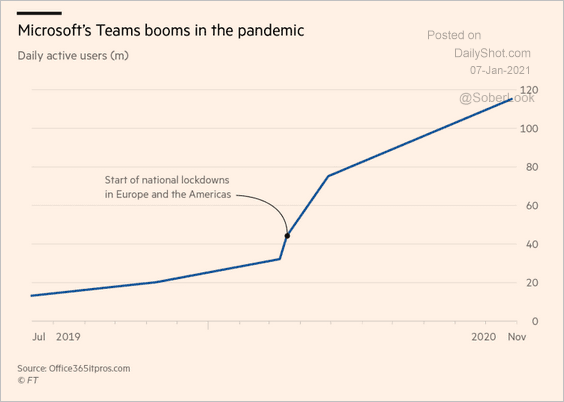

6. Microsoft Teams (online collaboration software) users:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

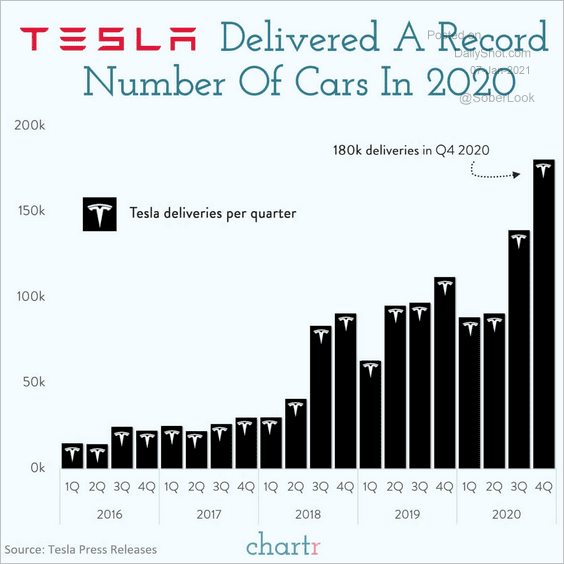

7. Tesla deliveries:

Source: @chartrdaily

Source: @chartrdaily

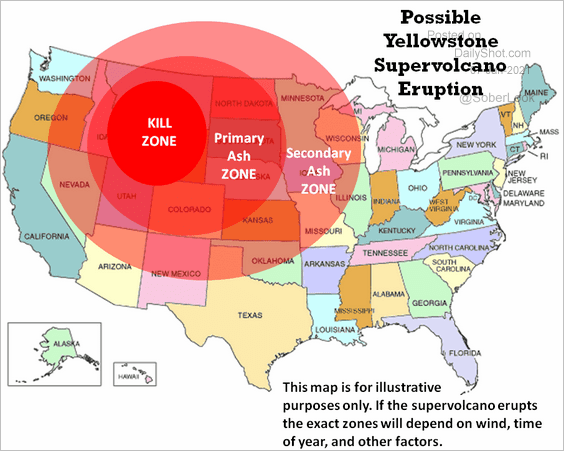

8. Yellowstone supervolcano eruption potential impact:

Source: @onlmaps

Source: @onlmaps

——————–

Back to Index