The Daily Shot: 08-Jan-21

• The United States

• Canada

• The Eurozone

• Asia – Pacific

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

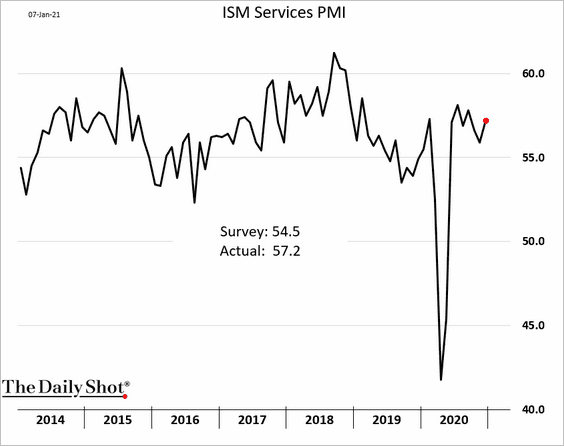

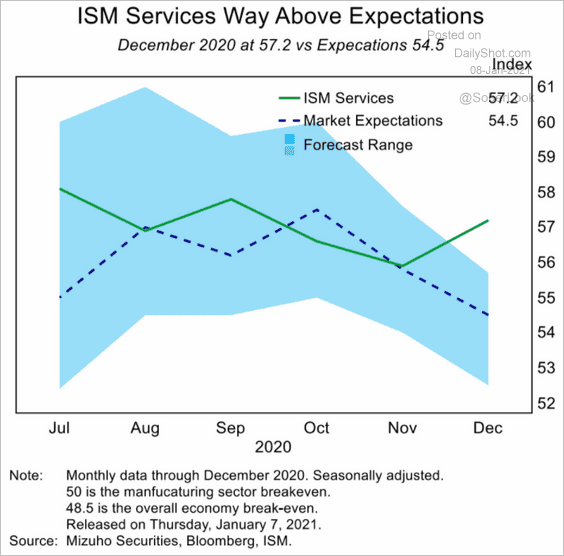

1. The ISM Services PMI surprised to the upside.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

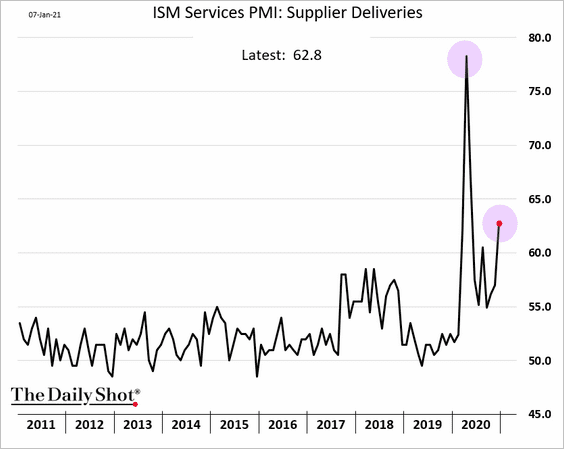

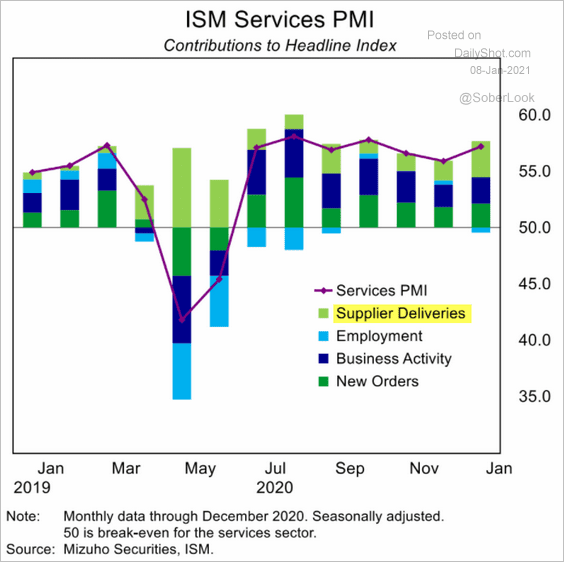

While service-sector growth remained stable in December (despite the pandemic ramping up), the headline ISM figure is distorted by supplier bottlenecks. It’s the same issue we saw in the manufacturing PMI reports.

Here are the contributions to the ISM PMI.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

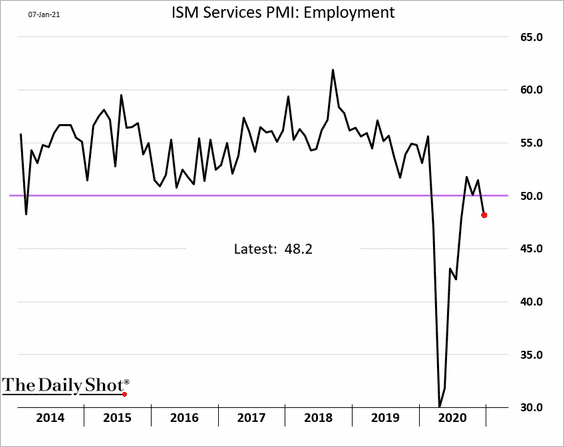

The pandemic spike did show up in the employment component.

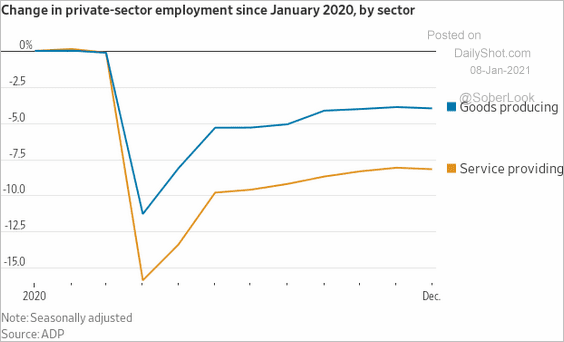

By the way, service-sector employment continues to lag.

Source: @jeffsparshott

Source: @jeffsparshott

——————–

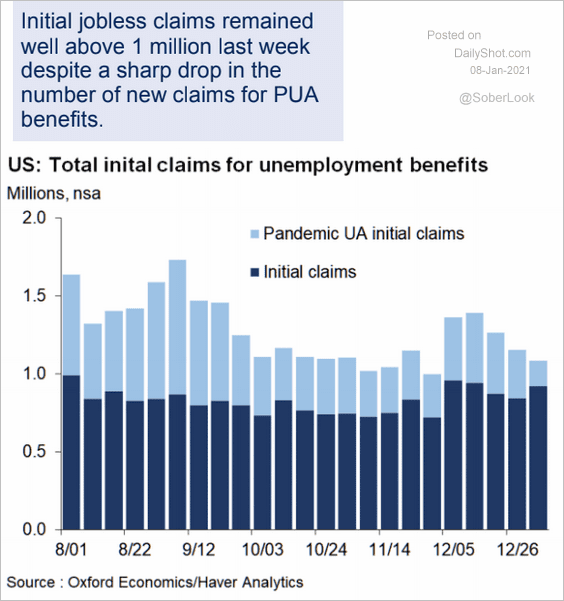

2. Applications for emergency unemployment benefit programs declined last week, but the overall number of new claims remained above a million.

Source: Oxford Economics

Source: Oxford Economics

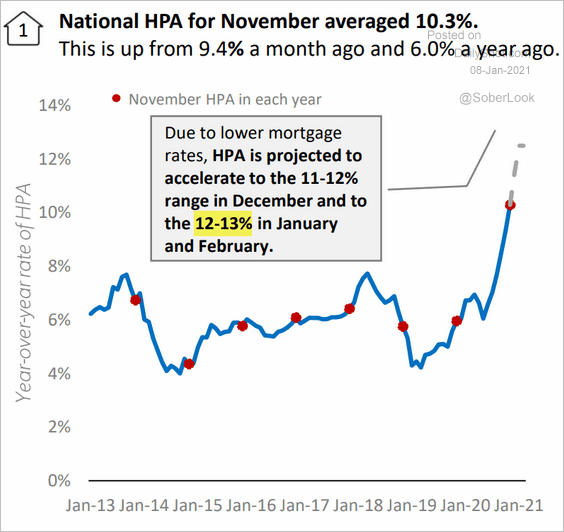

3. The AEI Housing Center expects home prices to rise 12-13% on a year-over-year basis.

Source: AEI Housing Center

Source: AEI Housing Center

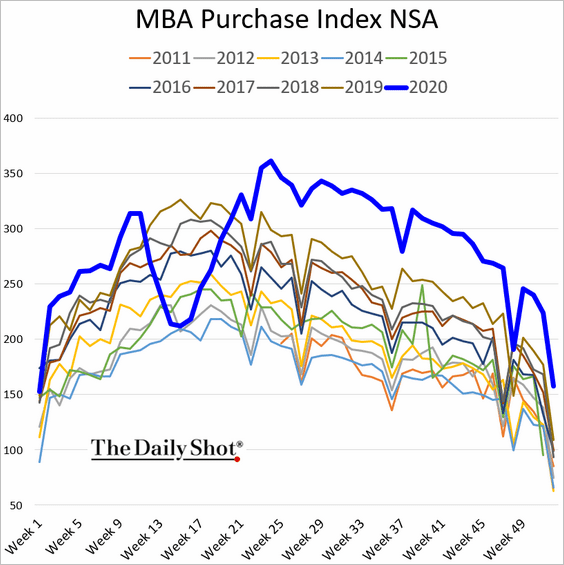

Mortgage applications were well above 2019 levels in the last week of 2020.

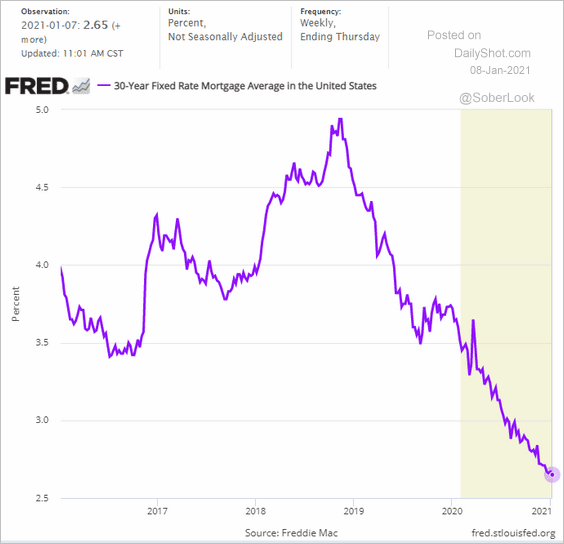

And mortgage rates hit another record low.

——————–

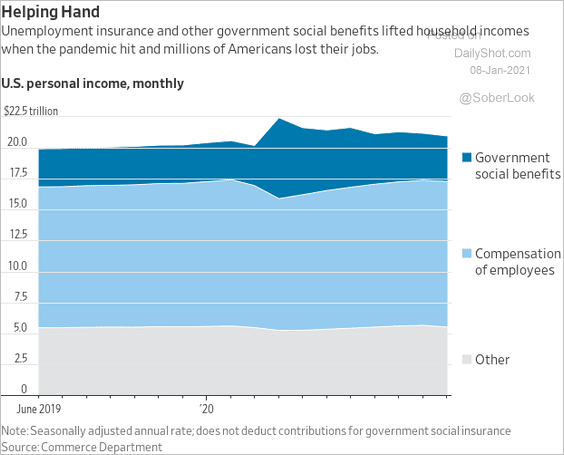

4. Government support kept incomes elevated last year.

Source: @WSJ Read full article

Source: @WSJ Read full article

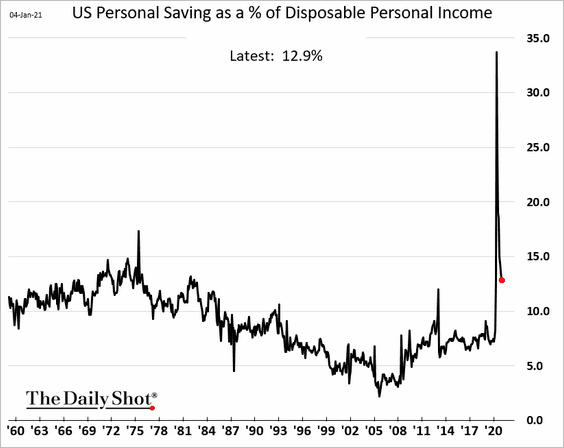

Savings spiked and remain elevated. And there is more money on the way from the federal government.

Further reading

Further reading

——————–

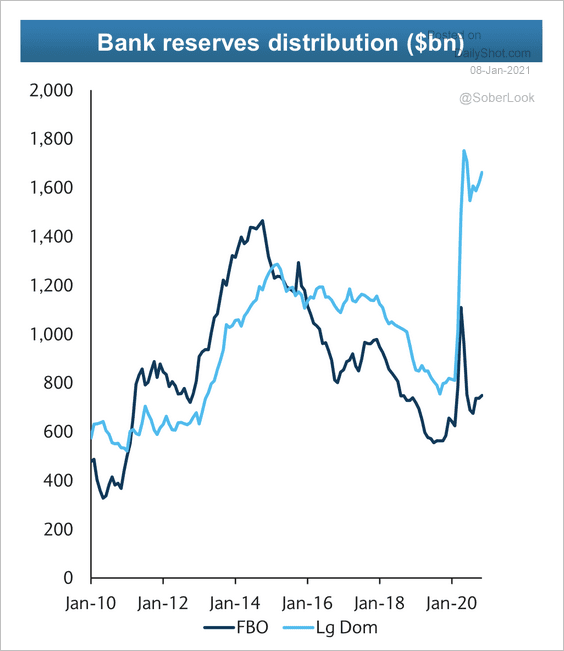

5. The 2020 surge in reserves has been concentrated at large banks.

Source: Barclays Research

Source: Barclays Research

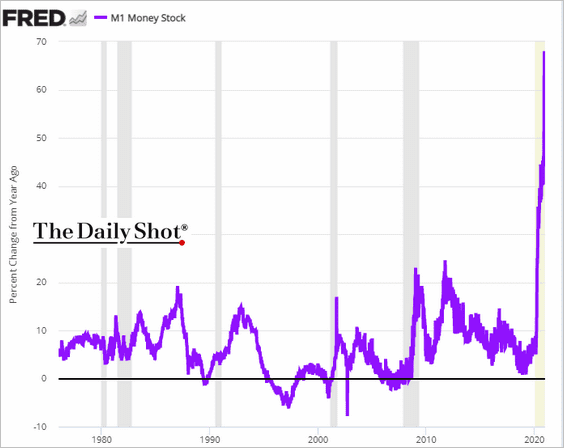

6. The QE-driven spike in US deposits has been unprecedented, with the narrow money supply (M1) rising by more than 65% (year-over-year).

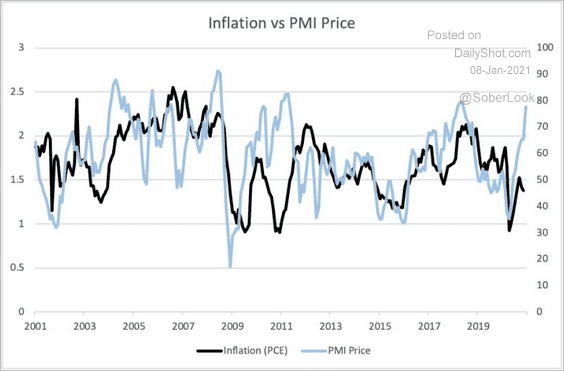

7. Some analysts are increasingly concerned about higher inflation ahead. As we saw earlier (chart), factory input prices have been climbing rapidly.

Source: Benjamin Verschuere

Source: Benjamin Verschuere

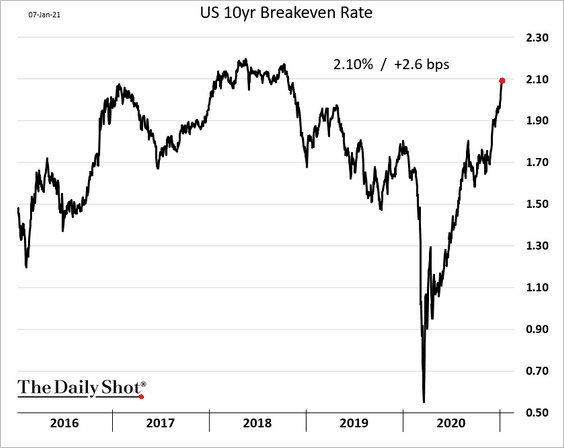

And market-based inflation expectations keep rising – boosted by higher oil prices and forecasts for more fiscal stimulus.

——————–

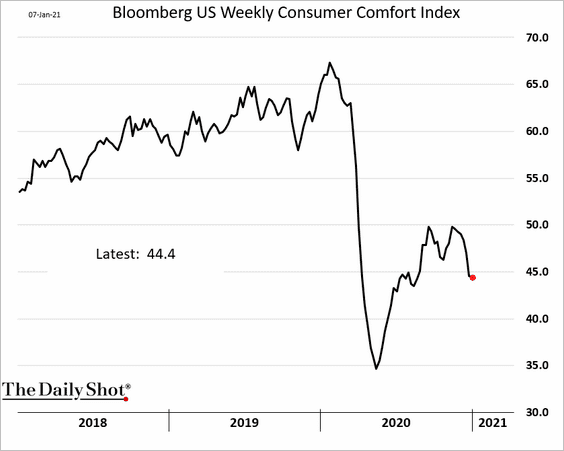

8. Bloomberg’s consumer sentiment index remains depressed.

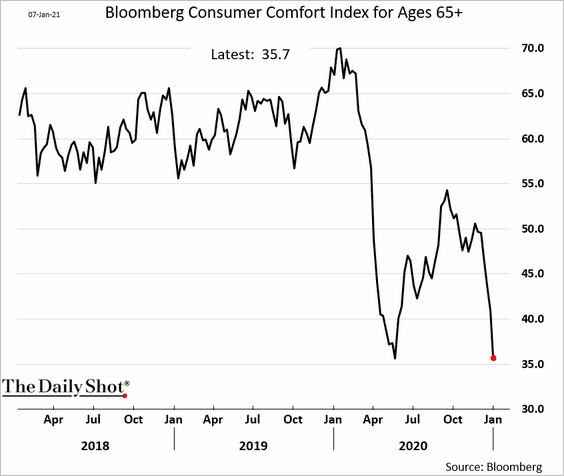

Older Americans are especially pessimistic.

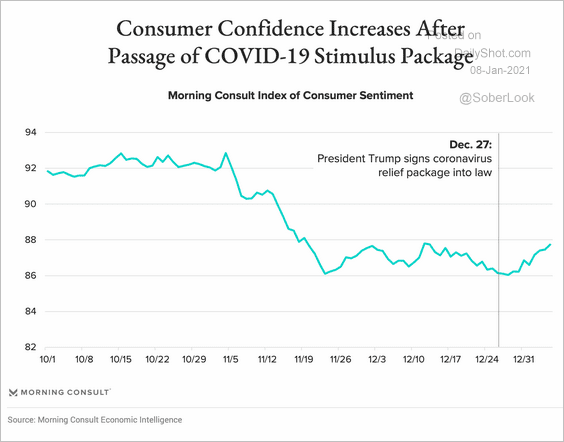

The above results contradict the sentiment index from Morning Consult. Whatever the case, Wednesday’s events in Washington, DC will probably put further downward pressure on consumer confidence.

Source: Morning Consult Read full article

Source: Morning Consult Read full article

——————–

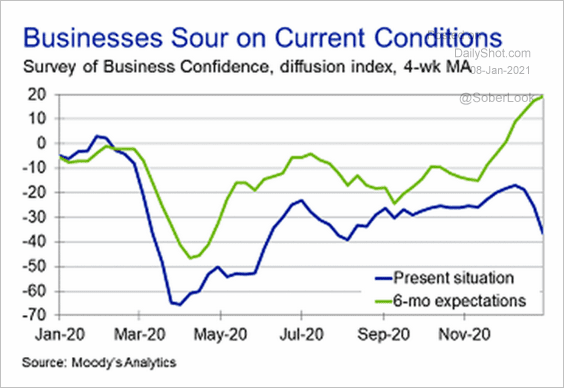

9. The spread between business expectations and current conditions has blown out.

Source: Moody’s Analytics

Source: Moody’s Analytics

——————–

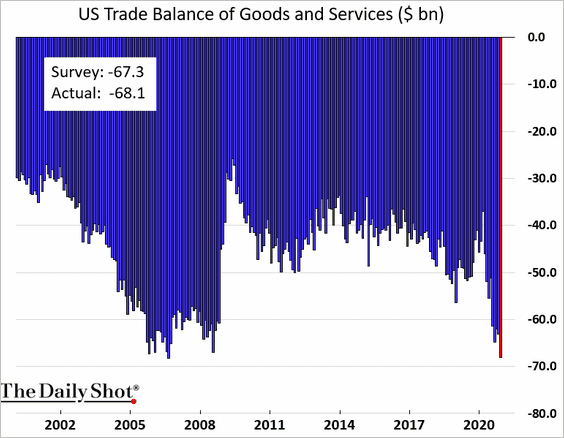

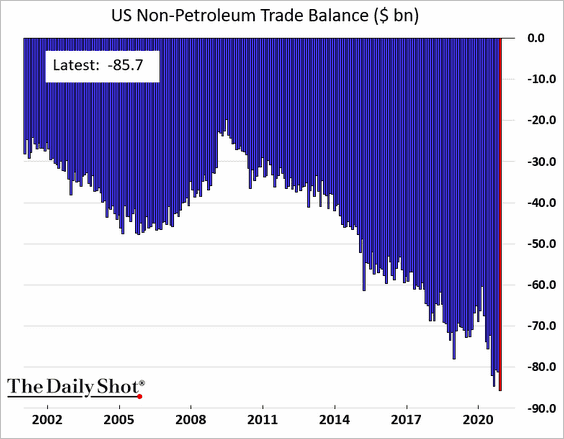

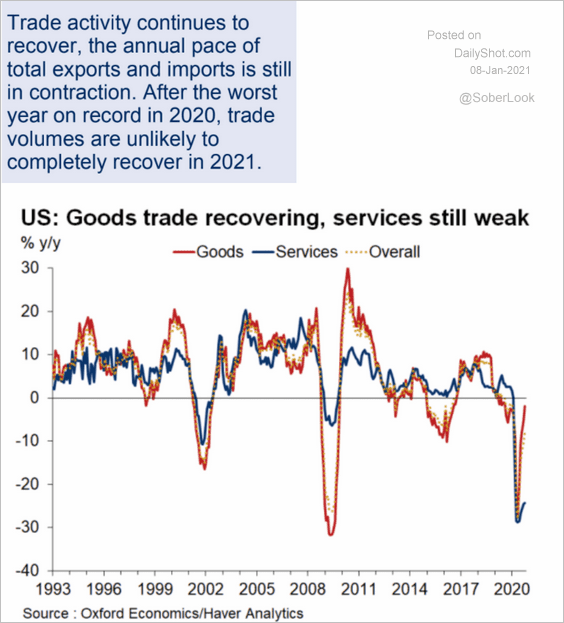

10. Next, we have some updates on trade.

• The trade deficit is approaching record levels.

• Excluding petroleum products, the deficit is already at record highs.

• Trade in services continues to lag.

Source: Oxford Economics

Source: Oxford Economics

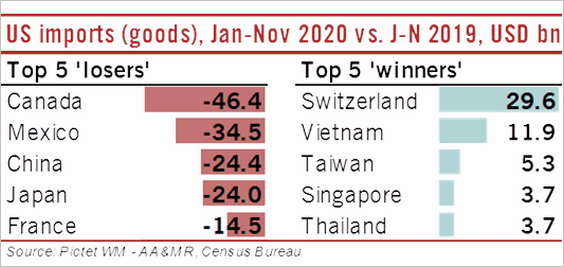

• US imports from Canada, Mexico, China, Japan, and France declined last year. On the other hand, Switzerland and Vietnam sold more to the US.

Source: @TCosterg

Source: @TCosterg

Back to Index

Canada

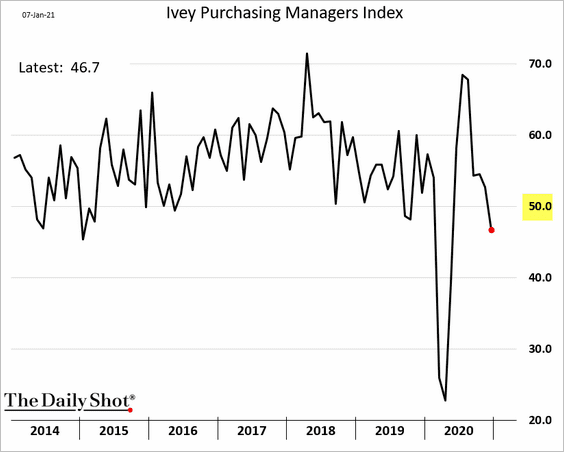

1. The Ivey PMI showed a contraction in business activity last month. This index completely contradicts the report we saw from Markit.

Whatever the case, the pandemic continues to pressure the recovery. Here is the Oxford Economics Recovery Tracker.

![]() Source: Oxford Economics

Source: Oxford Economics

——————–

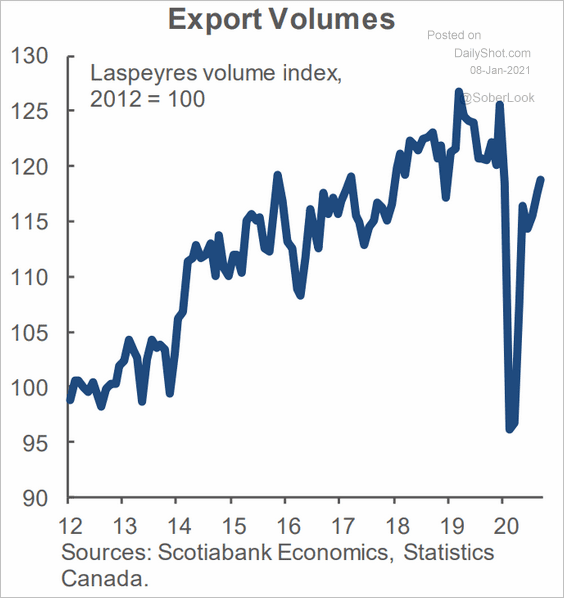

2. Exports are rebounding.

Source: Scotiabank Economics

Source: Scotiabank Economics

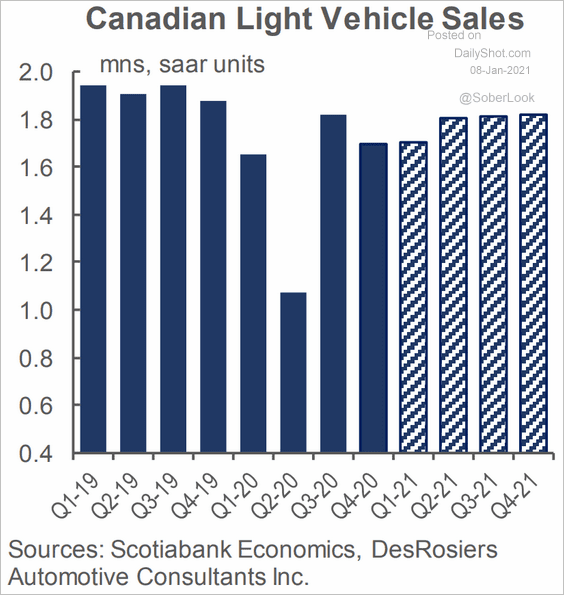

3. Vehicle sales have been robust.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

The Eurozone

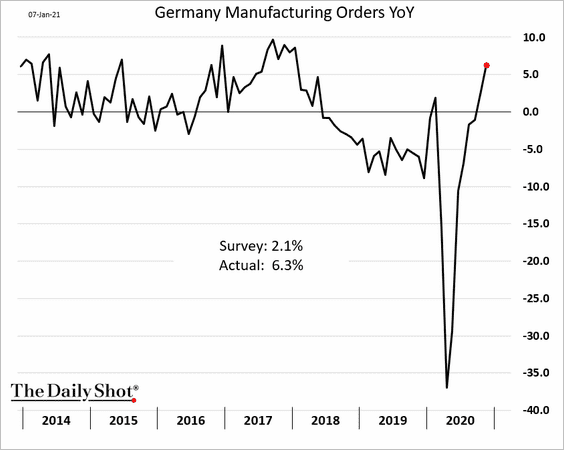

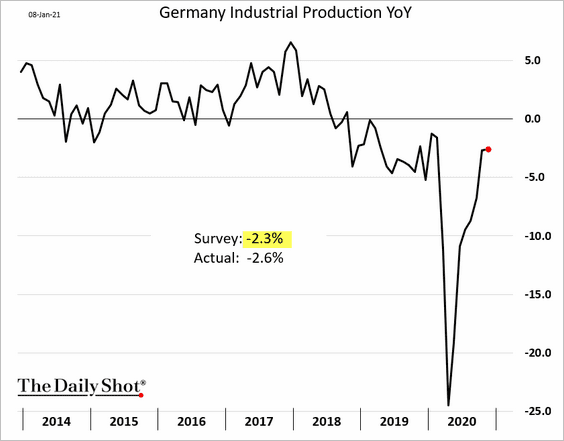

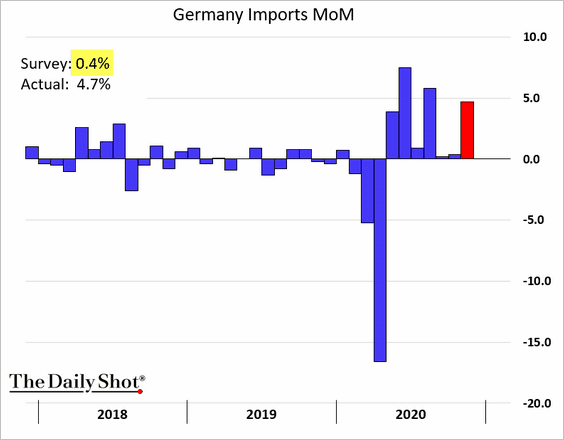

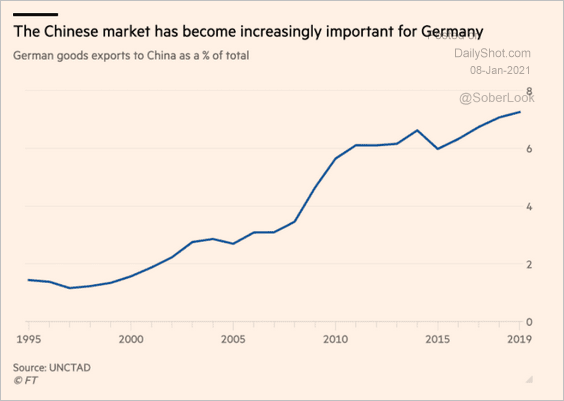

1. Let’s begin with Germany.

• November factory orders were exceptionally strong.

However, that strength did not show up in industrial production.

• Imports spiked last month.

• China is increasingly important for German exporters.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

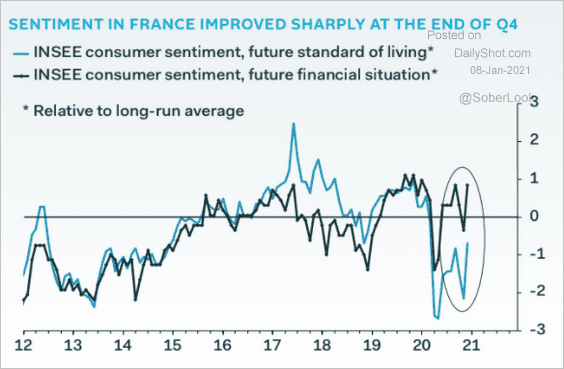

2. French sentiment improved at the end of last year.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

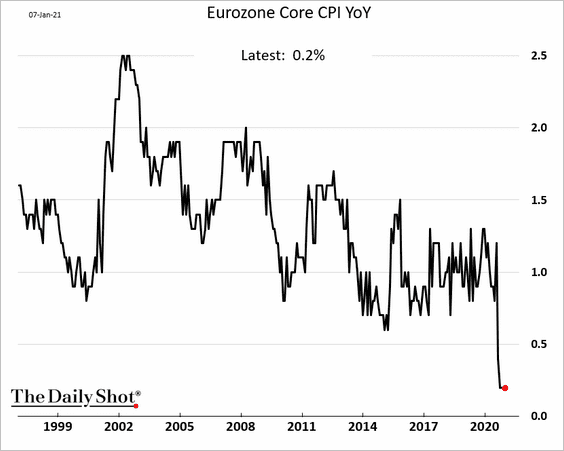

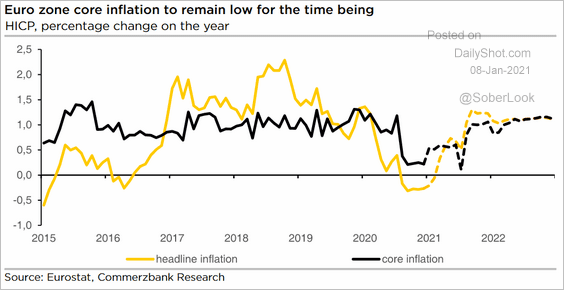

3. The Eurozone core CPI remains at record lows (going back to the formation of the euro).

But forecasts show that inflation has bottomed.

Source: Commerzbank Research

Source: Commerzbank Research

——————–

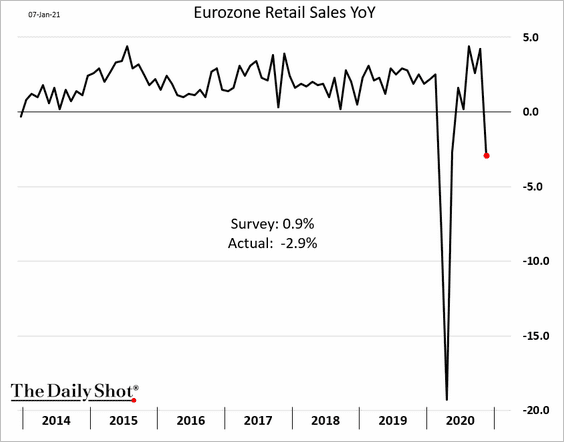

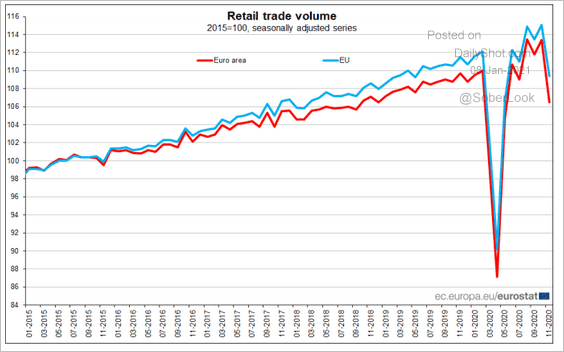

4. Eurozone retail sales tumbled in November (2 charts).

Source: Eurostat Read full article

Source: Eurostat Read full article

——————–

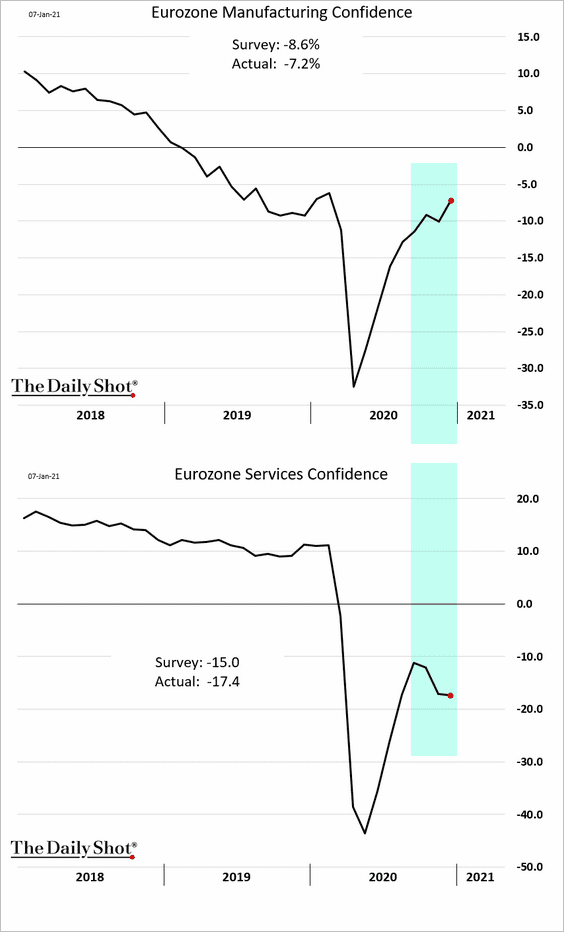

5. Manufacturing and service-sector confidence indicators have diverged.

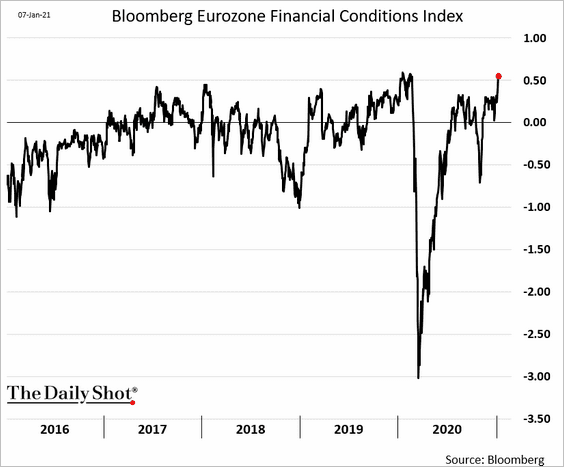

6. Bloomberg’s Eurozone financial conditions index has fully recovered.

7. The savings rate is likely to stay elevated.

Source: @markets Read full article

Source: @markets Read full article

Here is the Bank of France prediction.

Source: @markets Read full article

Source: @markets Read full article

——————–

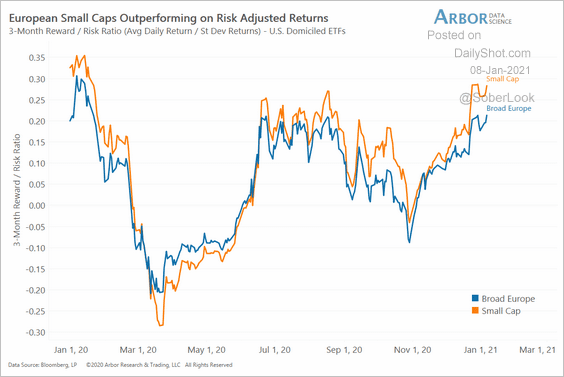

8. European small-caps have been outperforming.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Back to Index

Asia – Pacific

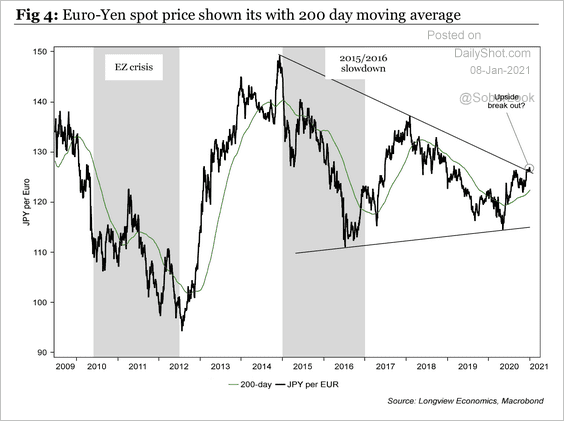

1. EUR/JPY is on the verge of a breakout.

Source: Longview Economics

Source: Longview Economics

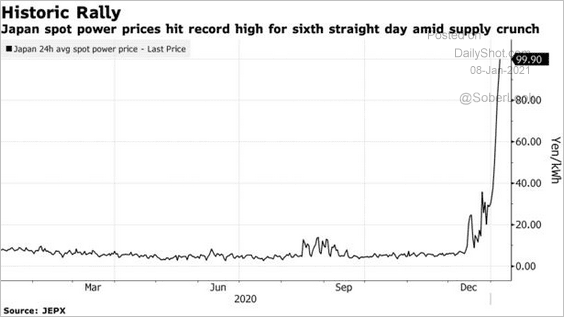

2. Japan’s electricity prices spiked due to cold weather and LNG shortages.

Source: @business Read full article

Source: @business Read full article

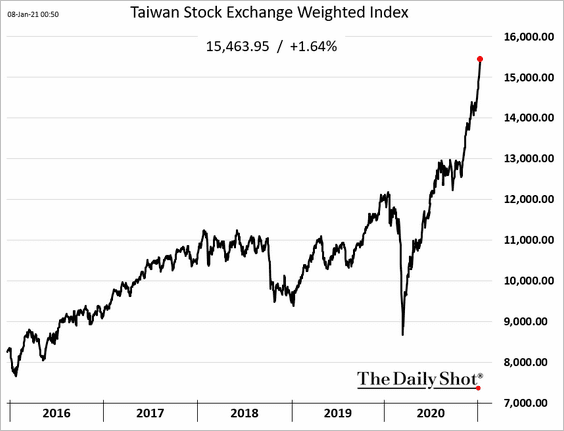

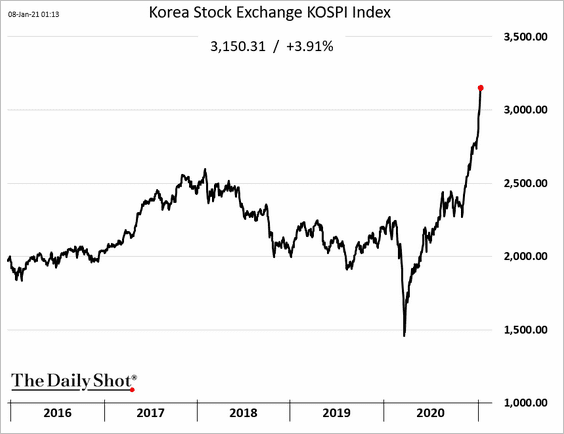

3. Taiwan’s and South Korea’s stocks are soaring.

Back to Index

Emerging Markets

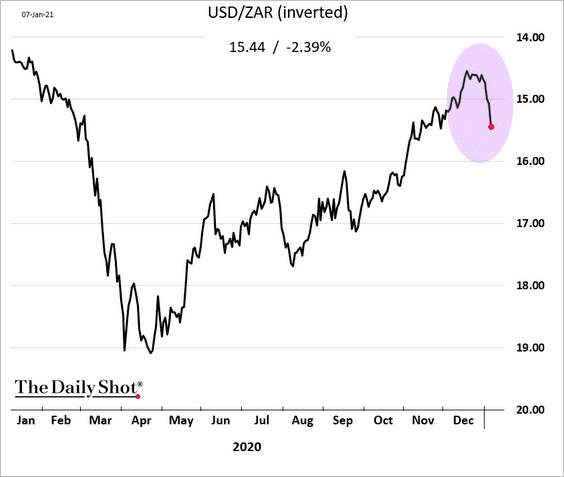

1. The pandemic is starting to pressure the South African rand (the new COVID strain has been devastating).

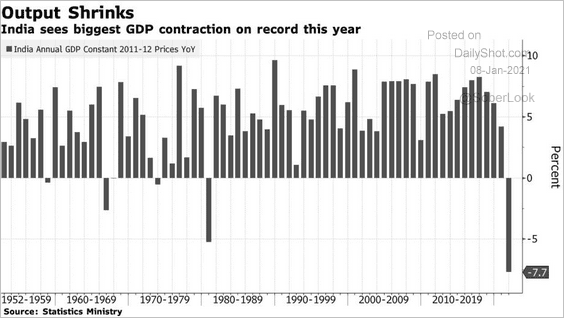

2. India’s annual GDP contraction was the largest in decades.

Source: @markets Read full article

Source: @markets Read full article

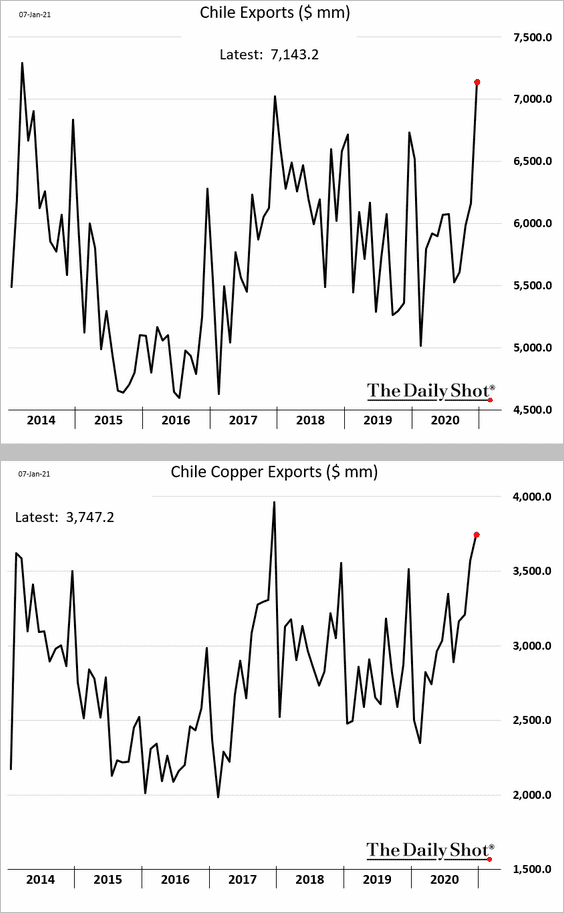

3. Chilean exports are surging.

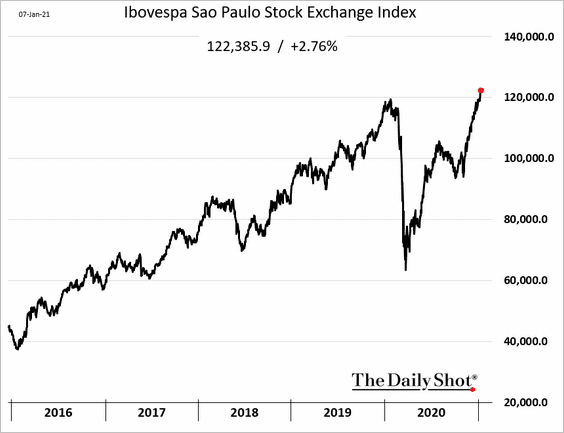

4. Brazil’s stock market index hit a new high.

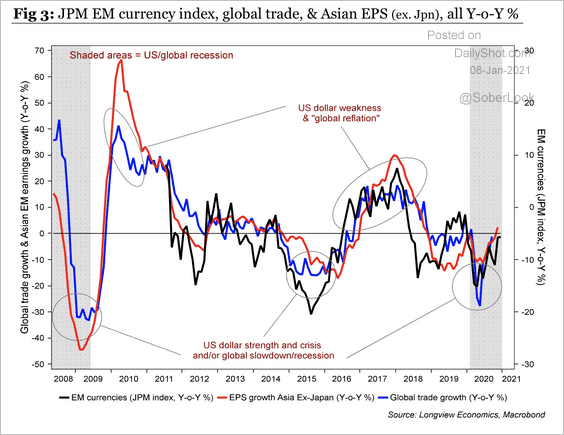

5. EM currencies are rising along with company earnings and global trade growth.

Source: Longview Economics

Source: Longview Economics

Back to Index

Cryptocurrency

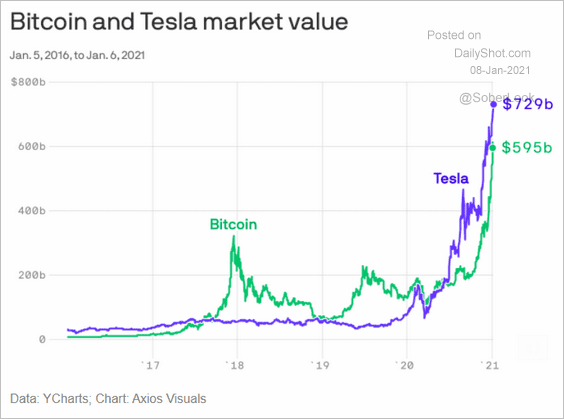

1. Bitcoin hit $40k!

A speculative frenzy has gripped the crypto markets – similar to what we see with stocks like Tesla.

Source: @axios

Source: @axios

——————–

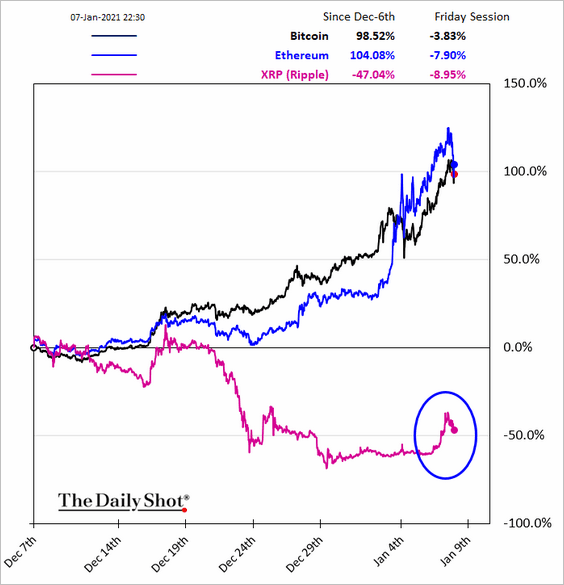

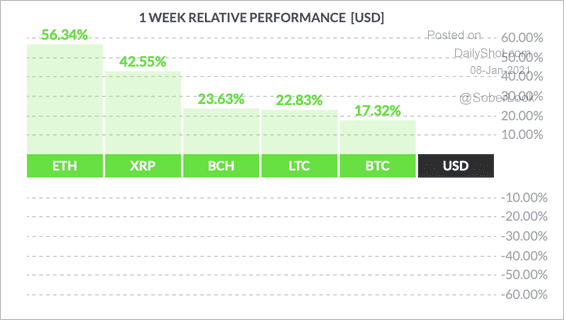

2. Here is the relative performance.

ETH has outperformed over the past week. Also, XRP experienced a short-squeeze with a near 50% rise in one day.

Source: FinViz

Source: FinViz

——————–

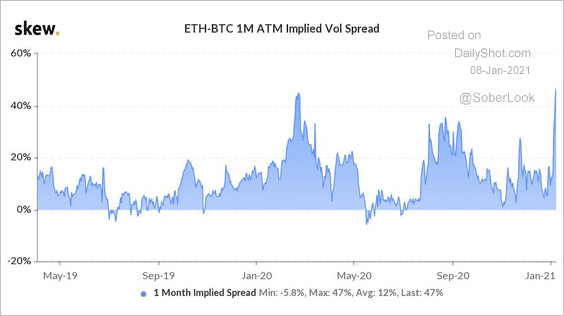

3. The Ether-Bitcoin one-month implied volatility spread spiked over the past week.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

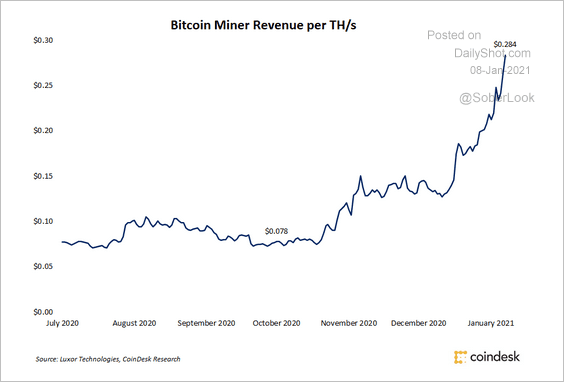

4. Bitcoin mining revenue is accelerating.

Source: CoinDesk

Source: CoinDesk

Back to Index

Commodities

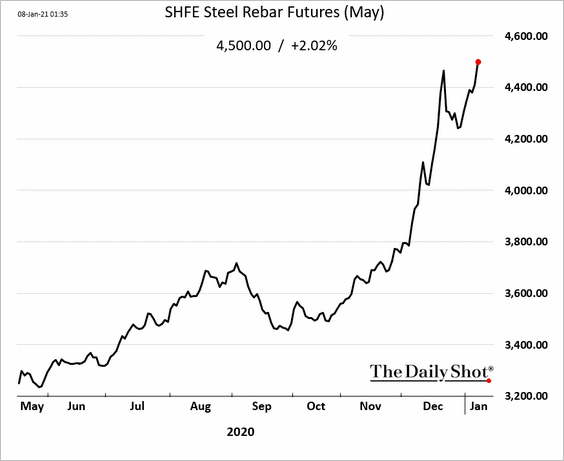

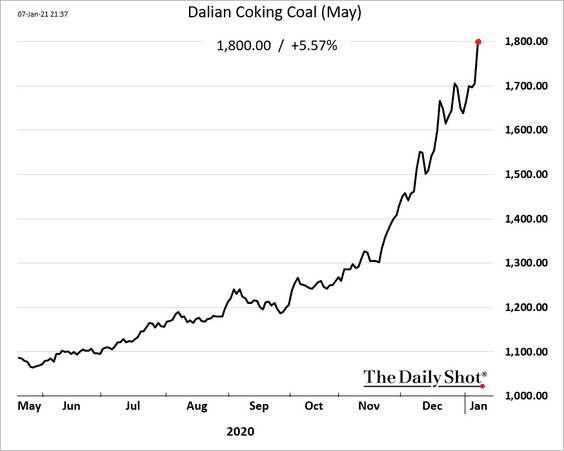

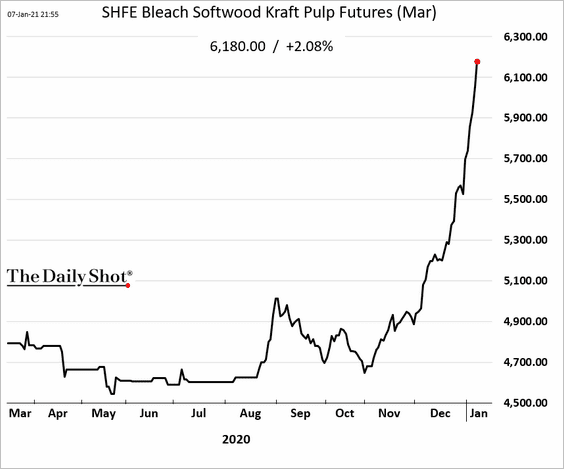

1. Industrial commodities in China are soaring.

• Steel and metallurgical coal:

• Pulp futures:

——————–

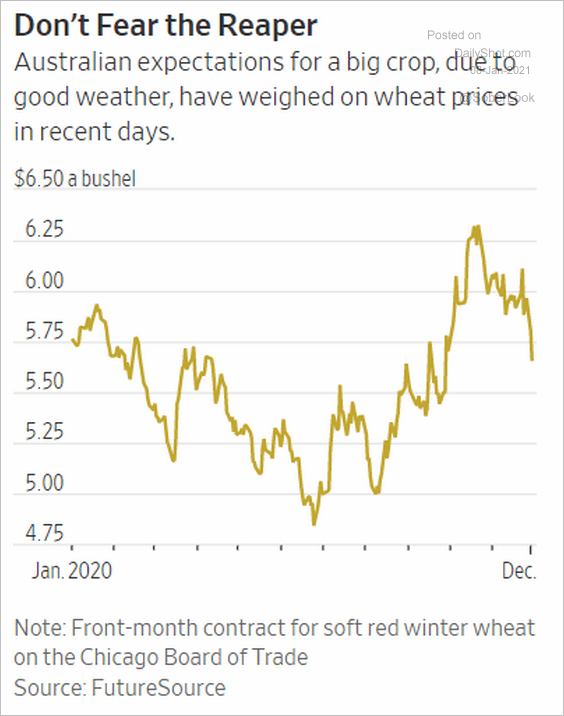

2. The wheat rally has stalled.

Source: @jeffsparshott, @Lucy_Craymer Read full article

Source: @jeffsparshott, @Lucy_Craymer Read full article

3. Here is Bloomberg’s broad commodity index.

Back to Index

Equities

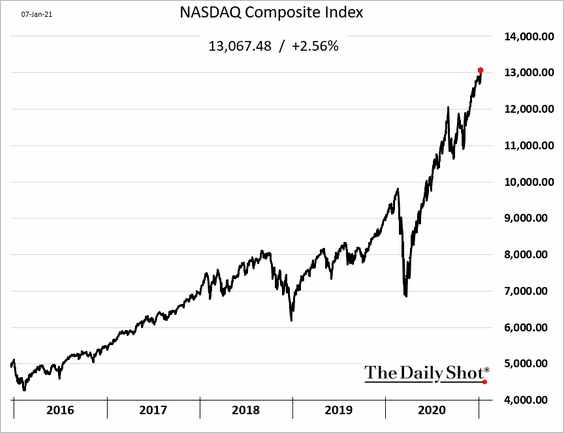

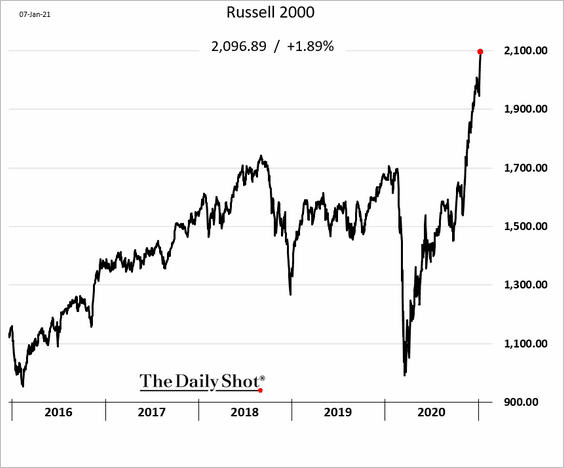

1. US indices are hitting new records

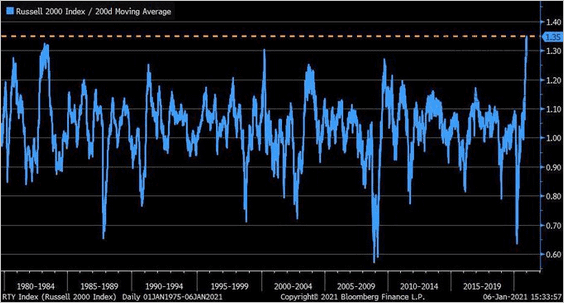

2. The Russell 2000 (small-caps) index saw unprecedented gains in recent weeks.

• Here is the index relative to its 200-day moving average.

Source: @LizAnnSonders

Source: @LizAnnSonders

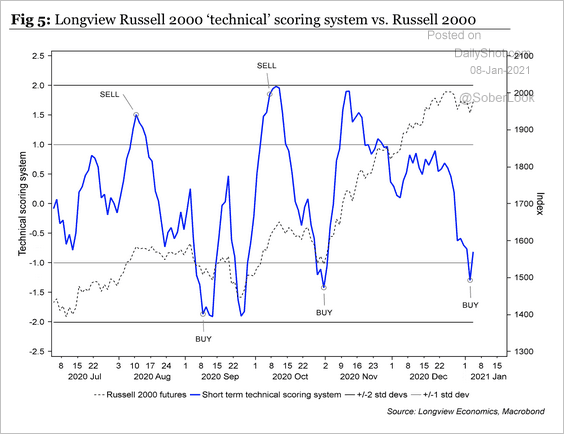

• Technicals suggest further upside for the index.

Source: Longview Economics

Source: Longview Economics

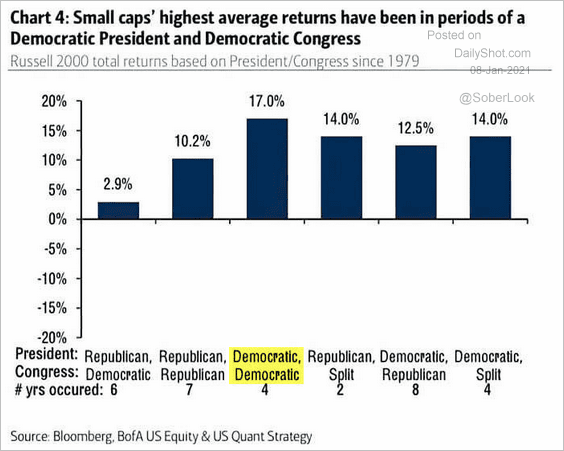

• The political shift in Washington also bodes well for small caps.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

——————–

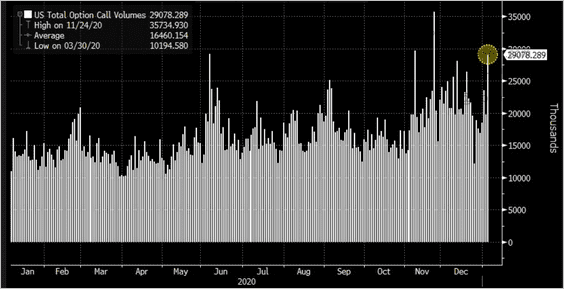

3. Despite this Wednesday’s ugly mess in DC, speculators were buying up call options.

Source: @SarahPonczek

Source: @SarahPonczek

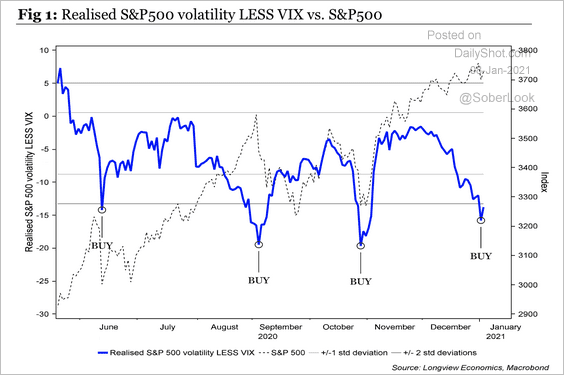

4. The spread between S&P 500 realized volatility and implied volatility (VIX) is at the lowest level since October.

Source: Longview Economics

Source: Longview Economics

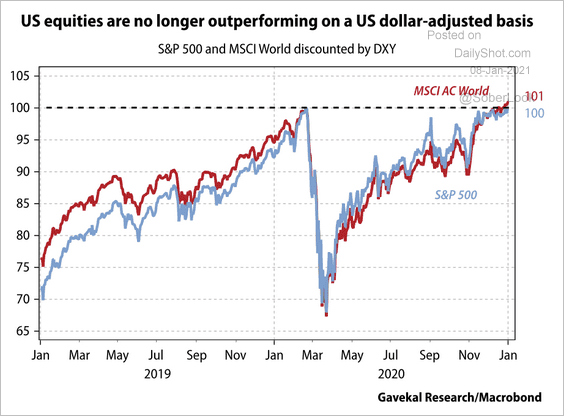

5. The US equity rally has been stalling in foreign-currency terms (due to a weak dollar).

Source: Gavekal Research

Source: Gavekal Research

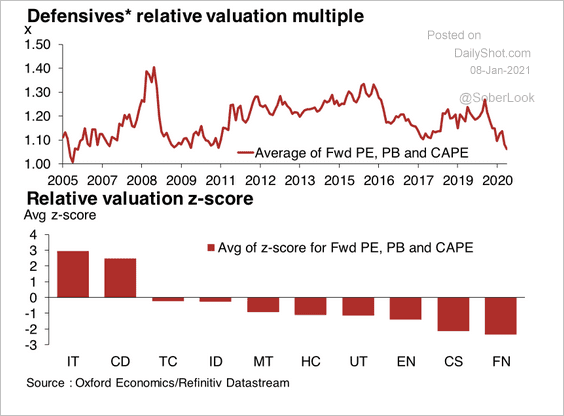

6. Defensive sectors appear cheap relative to the broader market.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Credit

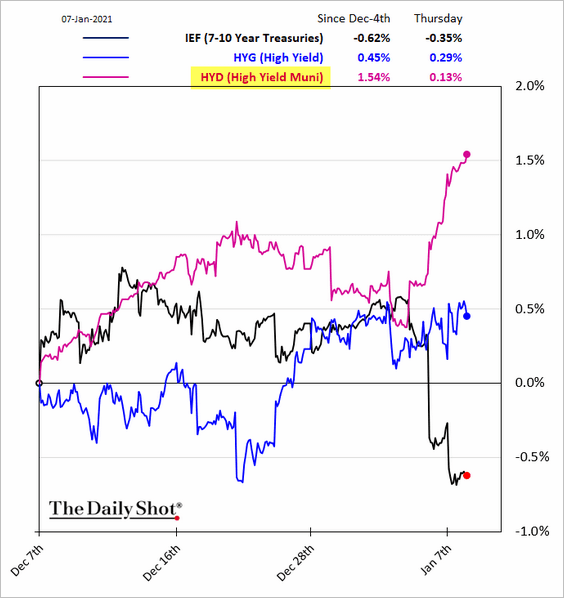

1. High-yield munis rallied in response to Democrats taking control of the US Senate.

Source: @markets Read full article

Source: @markets Read full article

——————–

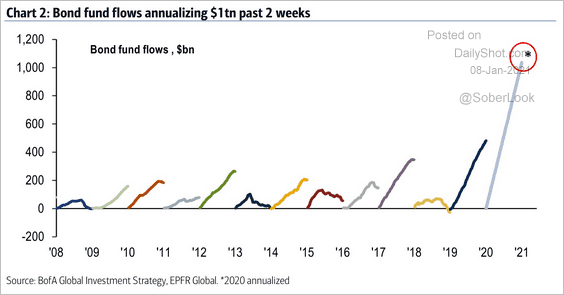

2. Bond fund flows have been impressive.

Source: BofA Global Research, @TayTayLLP

Source: BofA Global Research, @TayTayLLP

Back to Index

Rates

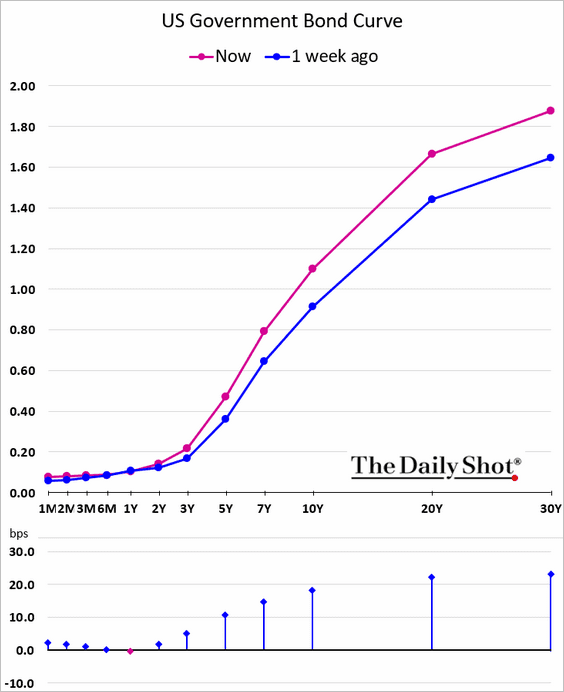

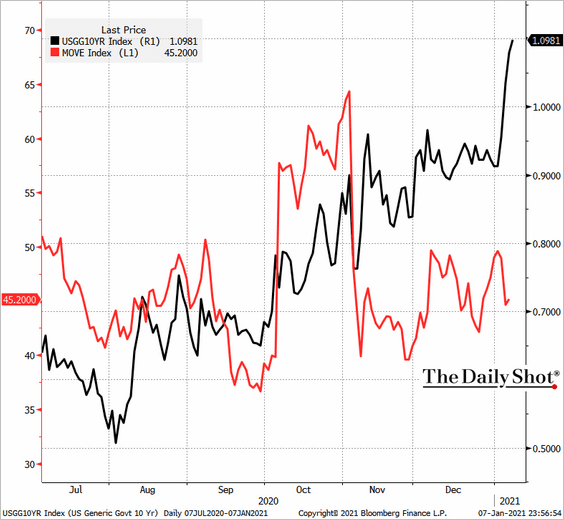

1. The US yield curve has steepened substantially over the past few days.

2. Treasury market implied volatility (MOVE) remains subdued despite the recent spike in yields.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

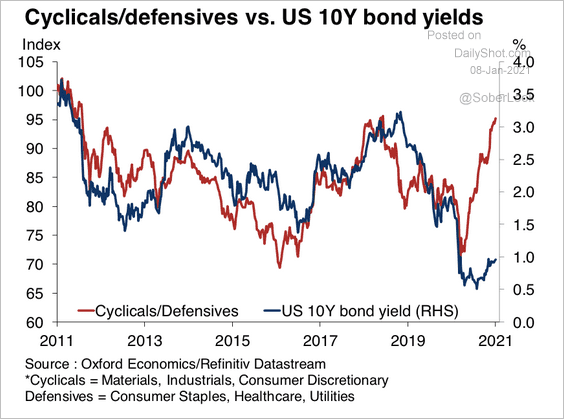

3. The rise in cyclical versus defensive stocks reflects expectations of higher Treasury yields.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Global Developments

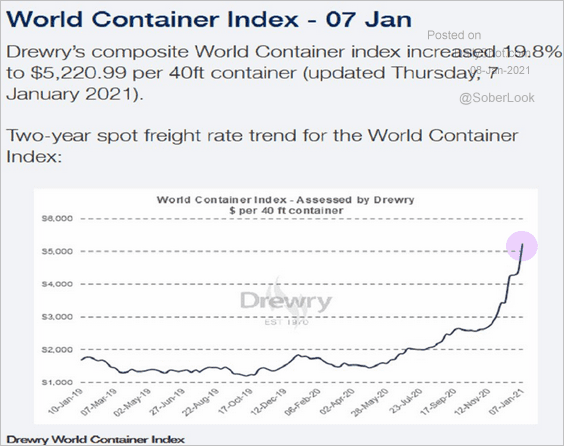

1. Shipping costs are soaring.

Source: @JeffWeniger, Drewry

Source: @JeffWeniger, Drewry

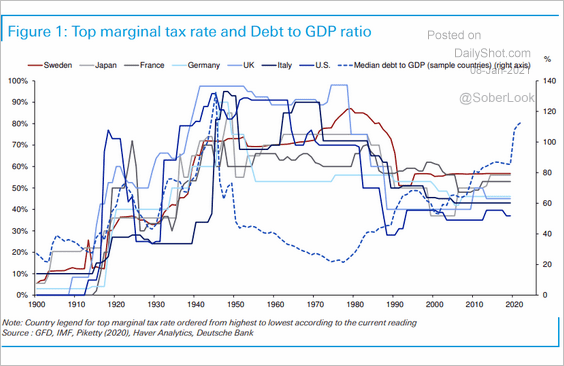

2. Are taxes going up?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

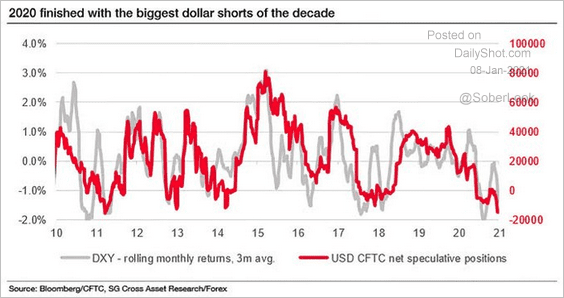

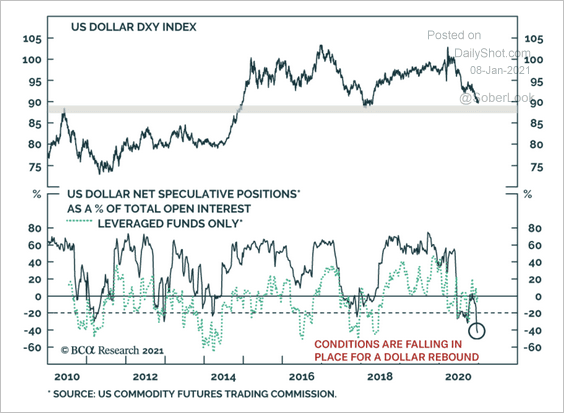

3. Speculative bets against the US dollar are stretched (2 charts).

Source: @ISABELNET_SA, @SocGen_US

Source: @ISABELNET_SA, @SocGen_US

Source: BCA Research

Source: BCA Research

——————–

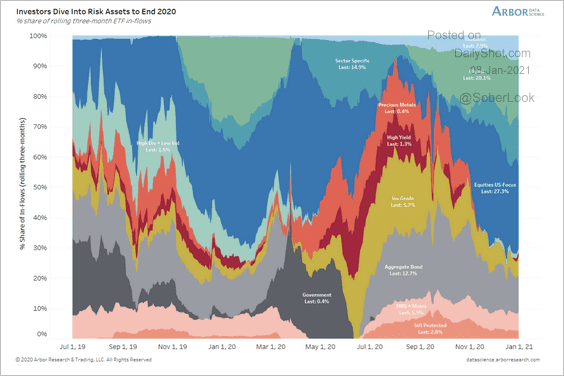

4. Investors shifted into risk assets and away from US Treasuries over the past quarter.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

Food for Thought

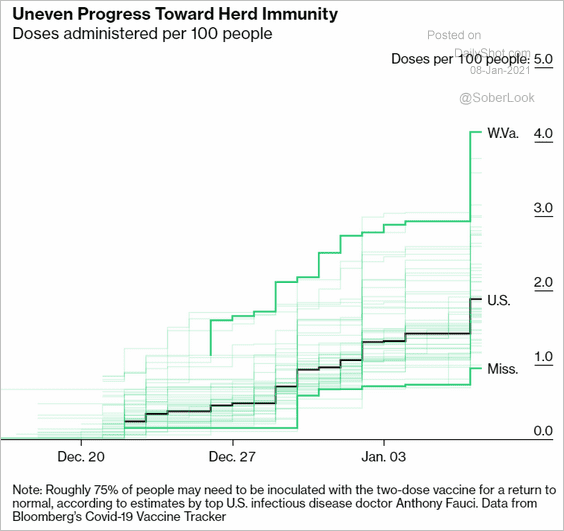

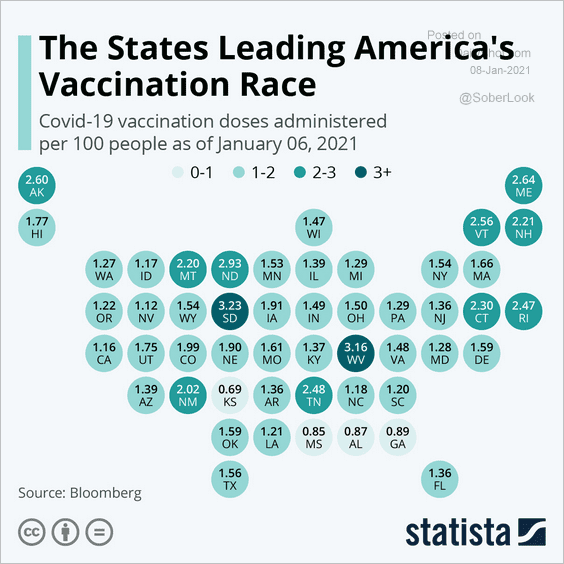

1. Uneven pace of US vaccinations:

Source: @bbgvisualdata Read full article

Source: @bbgvisualdata Read full article

Source: Statista

Source: Statista

——————–

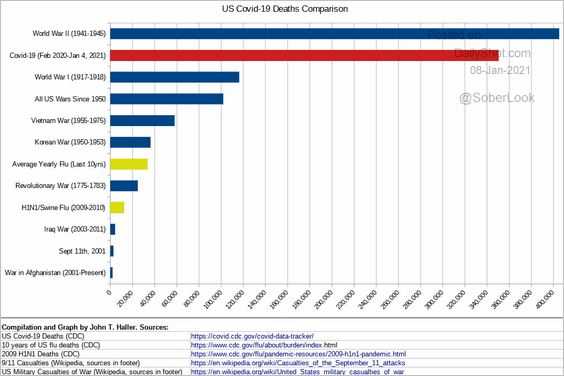

2. COVID deaths in perspective:

Source: Data Is Beautiful

Source: Data Is Beautiful

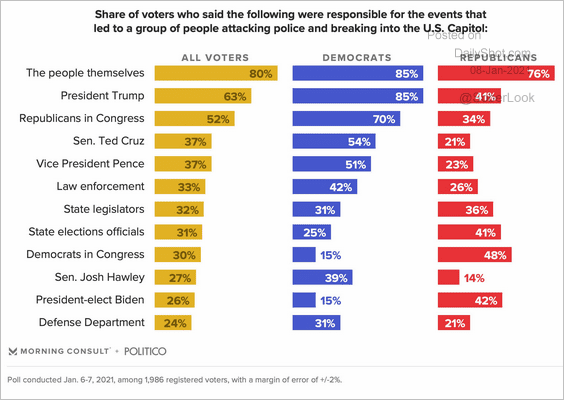

3. Who is to blame for the attack on the US Capitol?

Source: @crampell Read full article

Source: @crampell Read full article

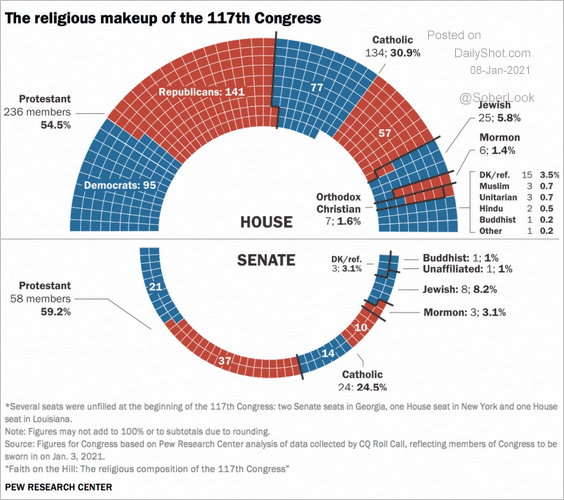

4. Religious makeup of the 117th Congress:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

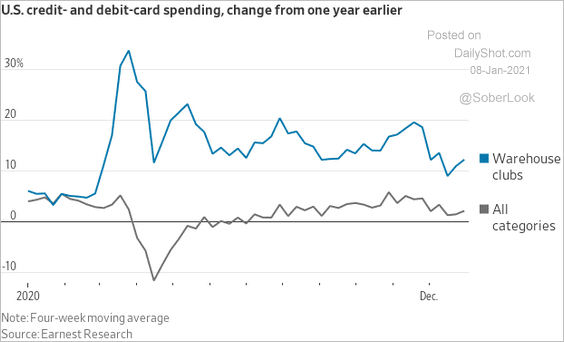

5. Spending at warehouse clubs:

Source: @WSJ Read full article

Source: @WSJ Read full article

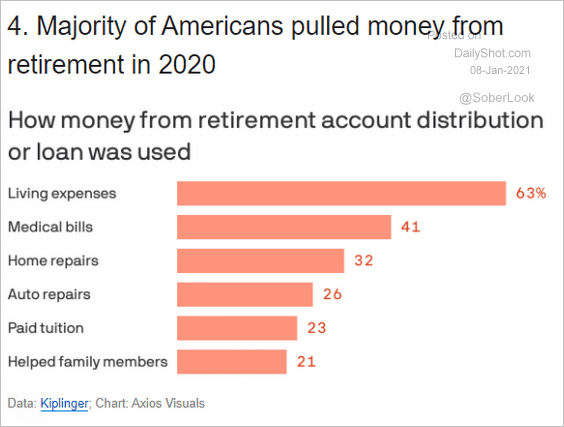

6. Pulling money from retirement:

Source: @axios Read full article

Source: @axios Read full article

7. Manhattan office vacancies:

Source: @business Read full article

Source: @business Read full article

8. Conspiracy theories:

Source: The Brussels Times Read full article

Source: The Brussels Times Read full article

——————–

Back to Index