The Daily Shot: 19-Jan-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

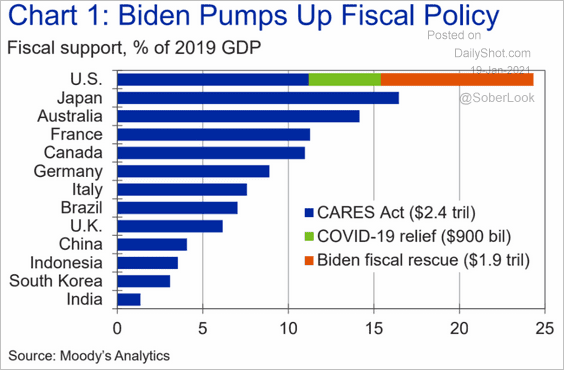

1. The fiscal package proposed by President-elect Biden is almost as big as the CARES Act.

Source: Moody’s Analytics

Source: Moody’s Analytics

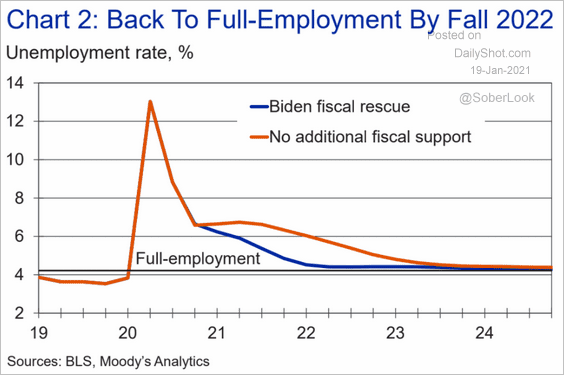

A new stimulus program of this size will turbo-charge economic growth and take the US to “full employment” by the fall of 2022, according to Moody’s Analytics.

Source: Moody’s Analytics

Source: Moody’s Analytics

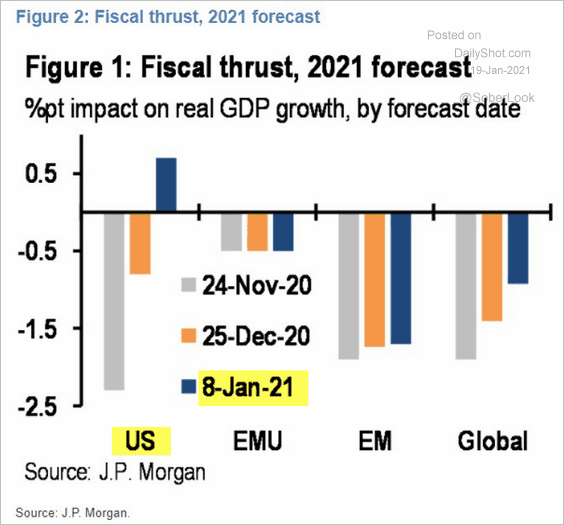

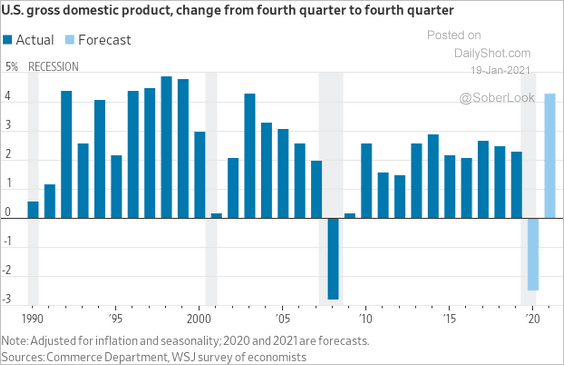

Given the expectations of a much higher “fiscal thrust,” economists are rapidly upgrading their 2021 GDP growth forecasts.

Source: JP Morgan, @jsblokland

Source: JP Morgan, @jsblokland

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

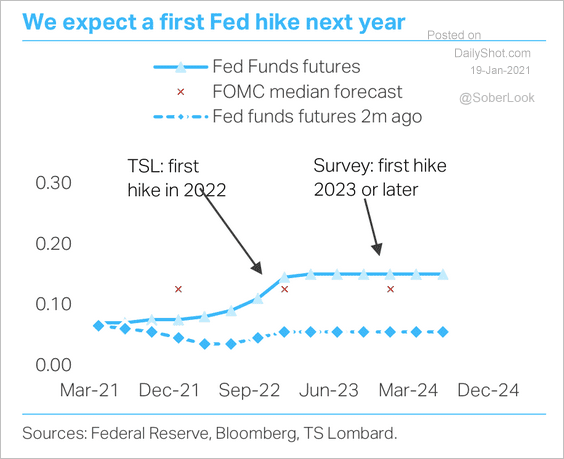

2. TS Lombard expects a Fed rate hike next year.

Source: TS Lombard

Source: TS Lombard

Presumably, the central bank would need to begin tapering its securities purchases before liftoff, risking “taper tantrum.” At the same time, the Fed will need to support another round of massive government borrowing to pay for Biden’s package. Without that support (faster QE), Treasury yields will spike, potentially choking off the recovery.

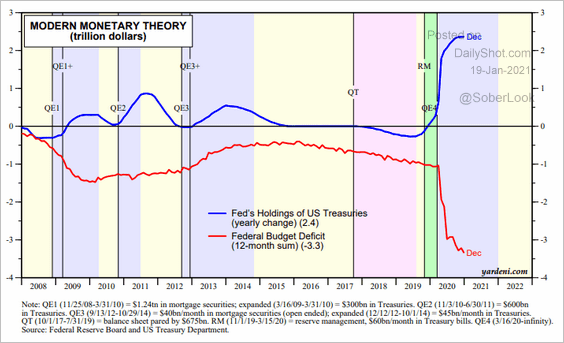

Source: Yardeni Research

Source: Yardeni Research

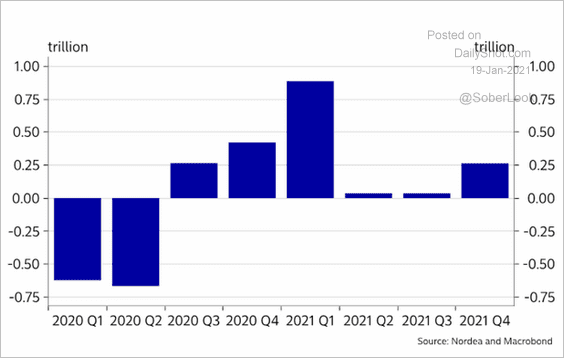

This chart shows Nordea’s forecast for Treasury issuance net of the Fed’s QE purchases.

Source: @AndreasSteno

Source: @AndreasSteno

——————–

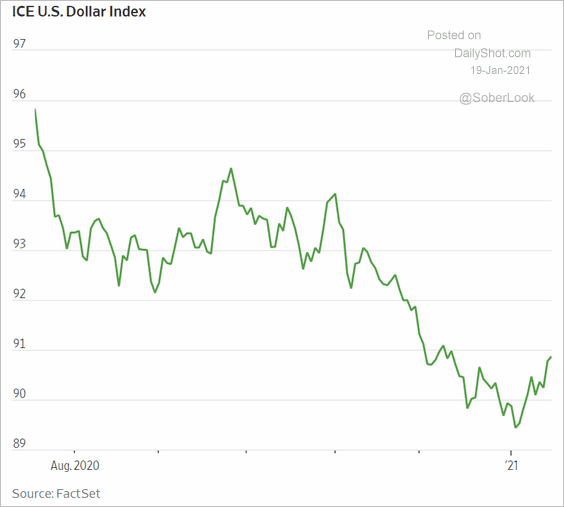

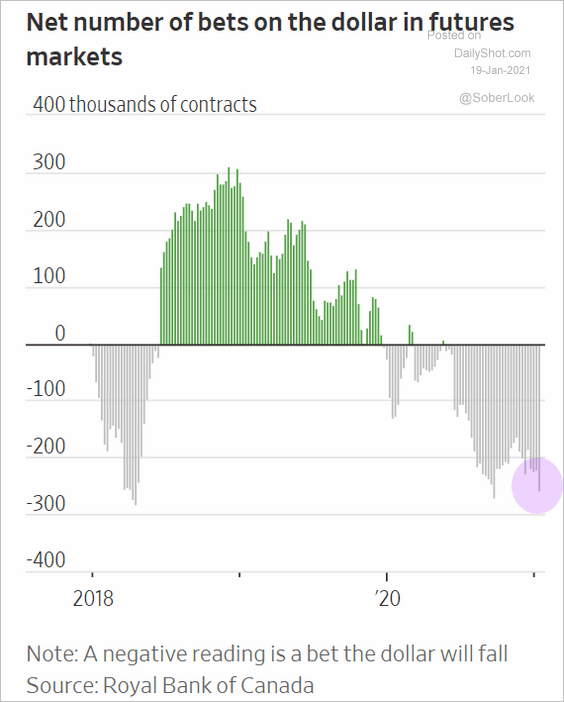

3. The dollar has been moving higher this year. But given all the stimulus talk, the rally is unlikely to continue.

Source: @WSJ Read full article

Source: @WSJ Read full article

Money managers are betting heavily against the dollar.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

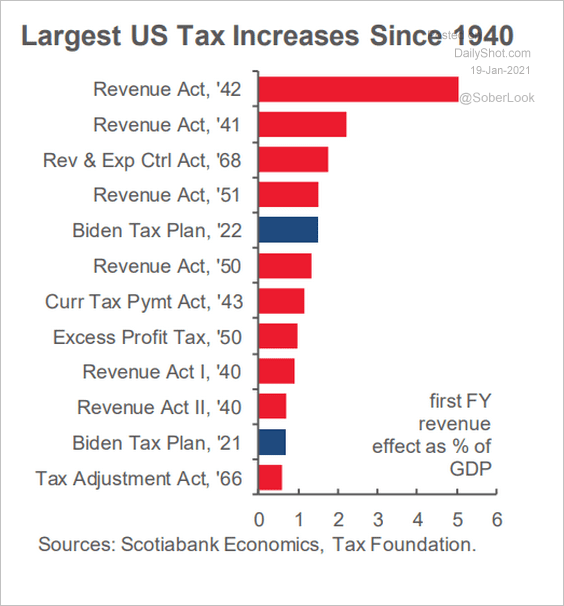

4. Will we see a tax hike this year? Below are some of the largest US tax increases since 1940.

Source: Scotiabank Economics

Source: Scotiabank Economics

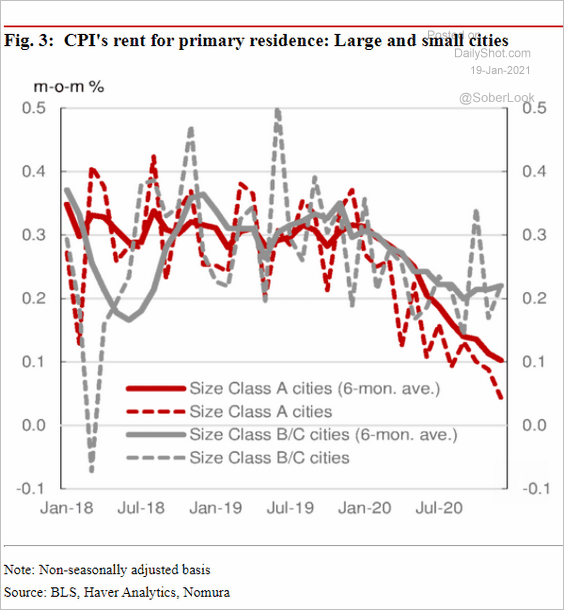

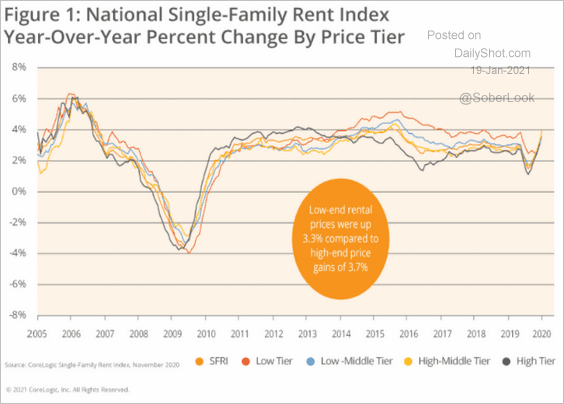

5. Next, we have some updates on housing.

• Rent inflation weakened more in larger cities.

Source: Nomura Securities

Source: Nomura Securities

• Single-family (house) rent inflation is rebounding.

Source: CoreLogic

Source: CoreLogic

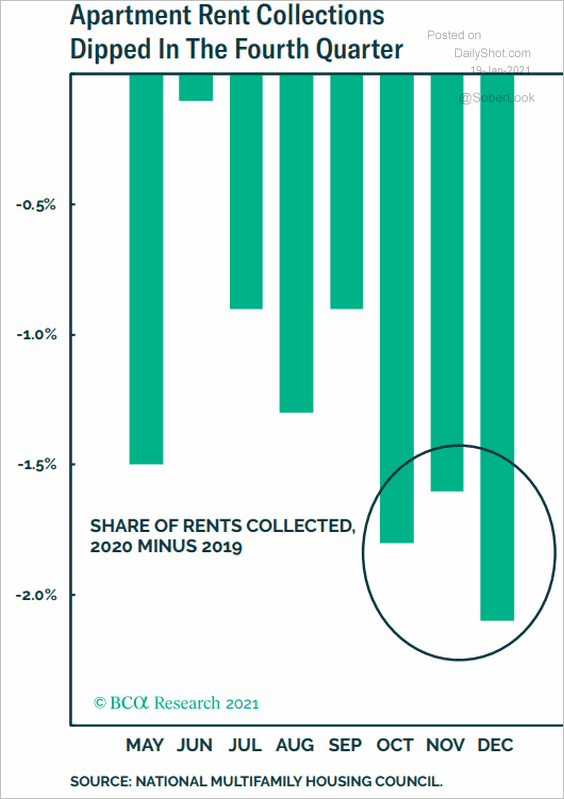

• Apartment rent collections dipped last quarter.

Source: BCA Research

Source: BCA Research

Back to Index

Canada

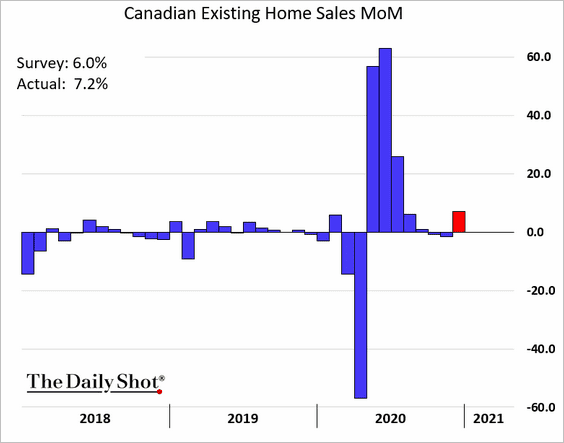

1. Existing home sales jumped last month.

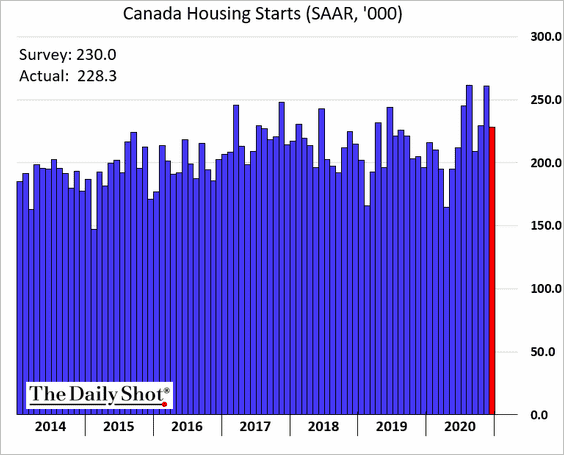

2. Residential construction is off the highs but remains robust.

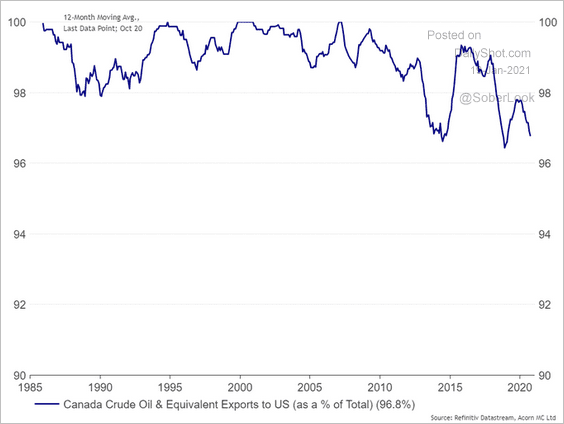

3. Canada exports most of its petroleum products to the US. The Keystone pipeline project cancellation could be painful.

Source: @RichardDias_CFA

Source: @RichardDias_CFA

Back to Index

The United Kingdom

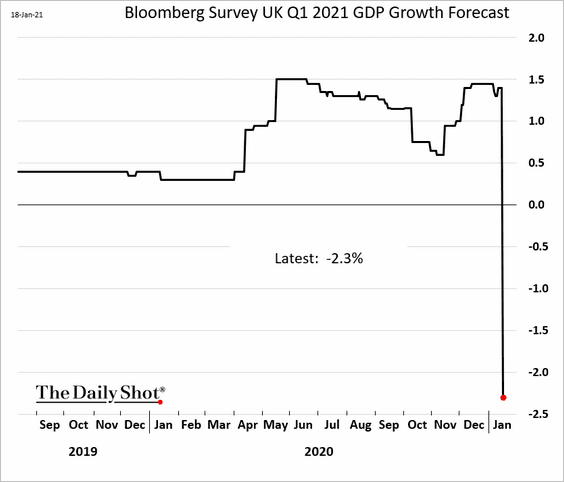

1. Bloomberg’s latest survey shows economists expecting a sharp GDP contraction this quarter.

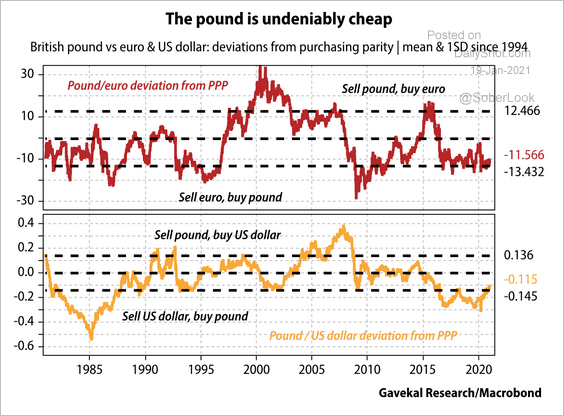

2. The pound has been undervalued against the dollar and euro for more than four years, according to Gavekal.

Source: Gavekal Research

Source: Gavekal Research

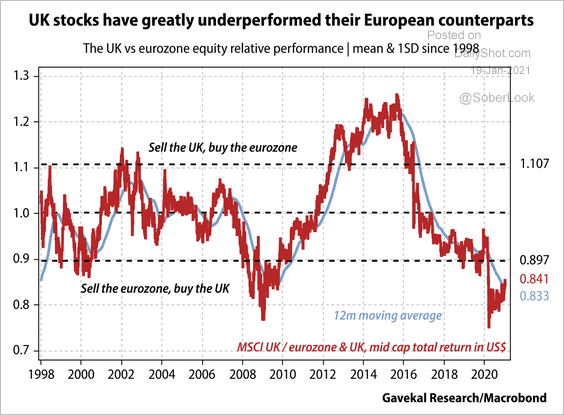

UK stocks are at long-term support relative to eurozone equities.

Source: Gavekal Research

Source: Gavekal Research

——————–

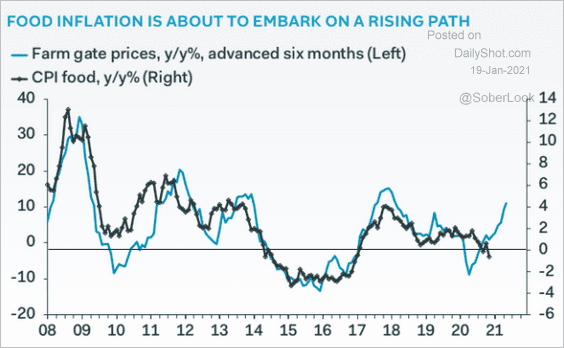

3. Food inflation is set to climb.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

The Eurozone

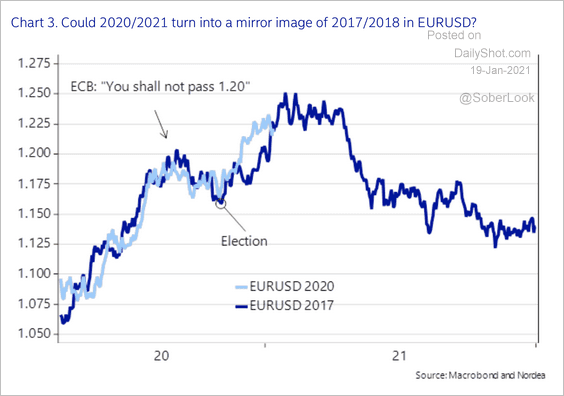

1. Will the euro follow the 2017/18 trajectory, with support at 1.15?

Source: Nordea Markets

Source: Nordea Markets

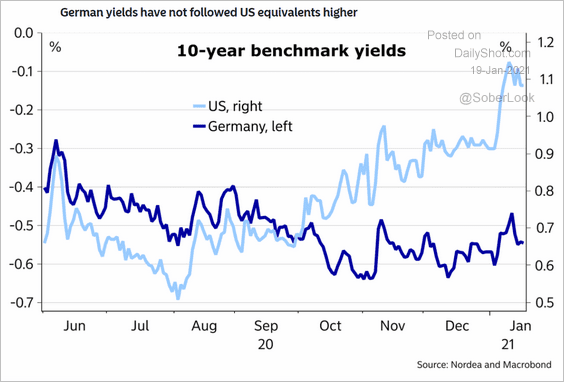

2. The spread between Bunds and Treasuries has blown out.

Source: Nordea Markets

Source: Nordea Markets

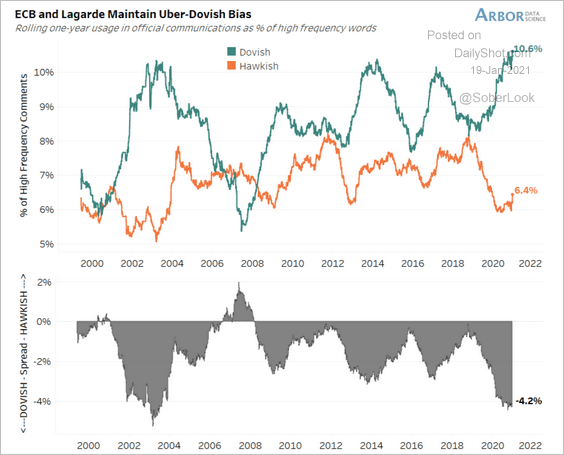

3. Based on the ECB’s communications, the central bank has been extremely dovish over the past year.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

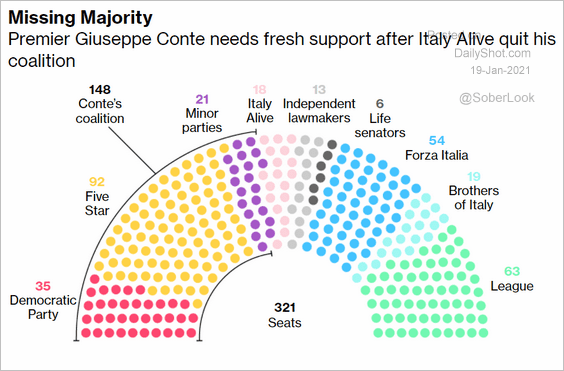

4. Italy’s Conte is trying to hold on to power without a majority.

Source: Politico Read full article

Source: Politico Read full article

Source: @bpolitics Read full article

Source: @bpolitics Read full article

——————–

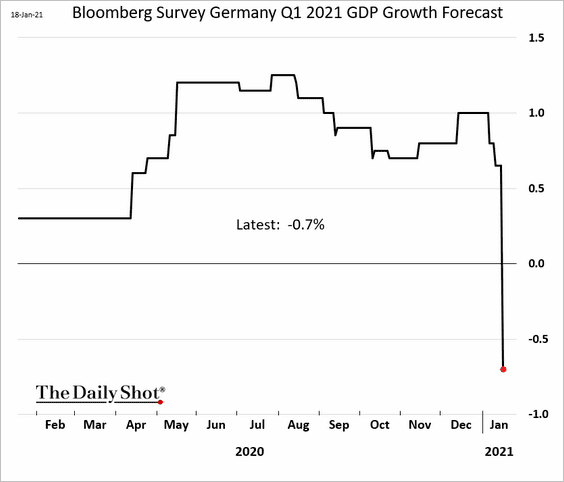

5. Bloomberg’s latest survey shows economists expecting a GDP contraction in Germany this quarter.

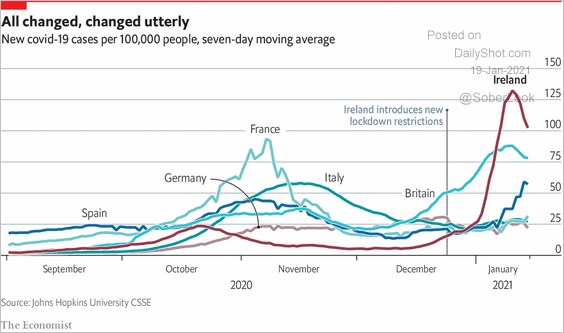

6. Ireland’s new COVID cases appear to be peaking.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Japan

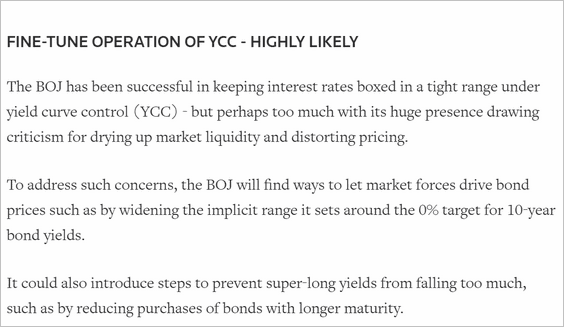

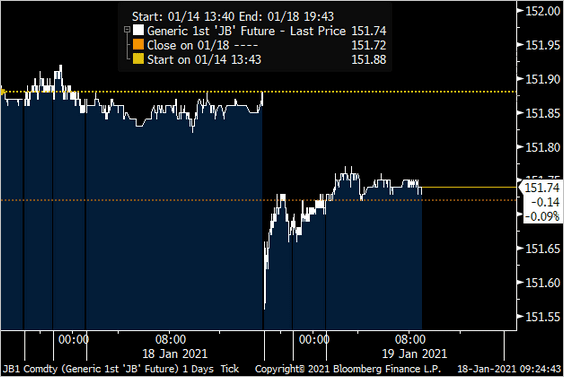

1. JGBs dropped on a Reuters story suggesting the BoJ may let yields rise a bit.

Source: Reuters Read full article

Source: Reuters Read full article

Source: @djr8519

Source: @djr8519

——————–

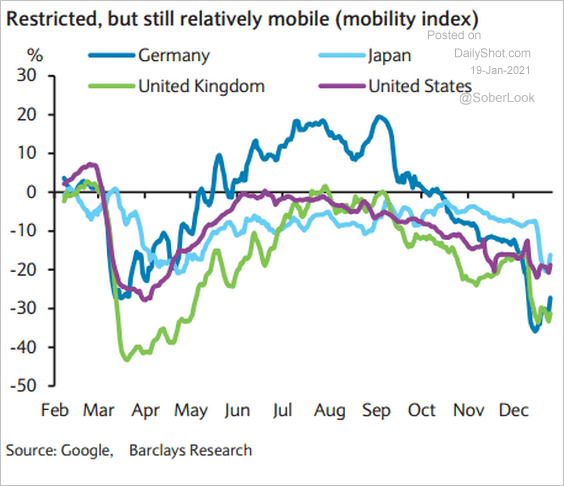

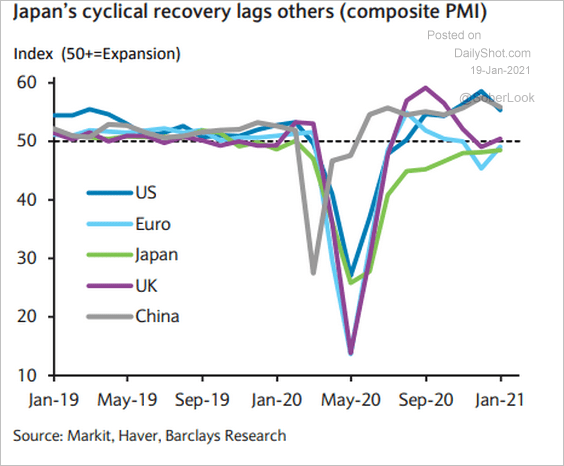

2. Japan’s mobility has been outperforming other developed economies.

Source: Barclays Research

Source: Barclays Research

But the recovery in business activity has been lagging.

Source: Barclays Research

Source: Barclays Research

Back to Index

China

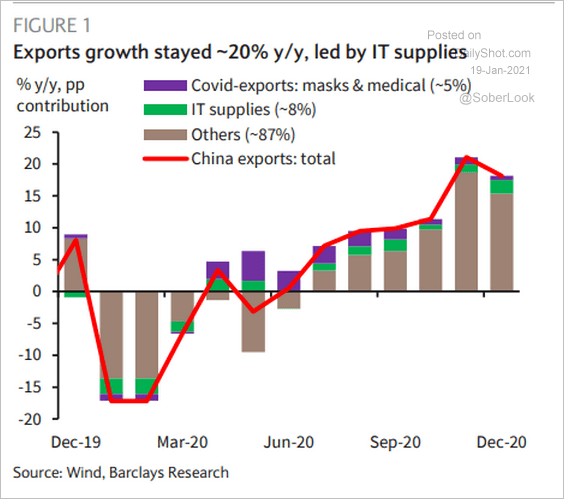

1. Exports have been robust.

Source: Barclays Research

Source: Barclays Research

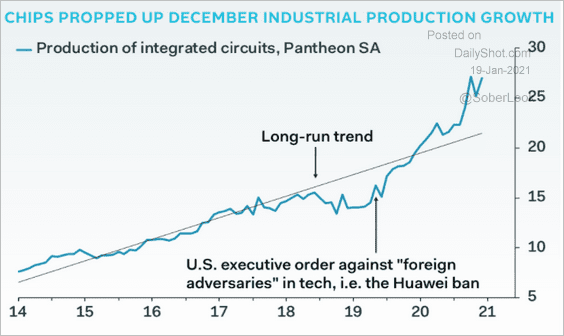

2. China has boosted its chip production.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

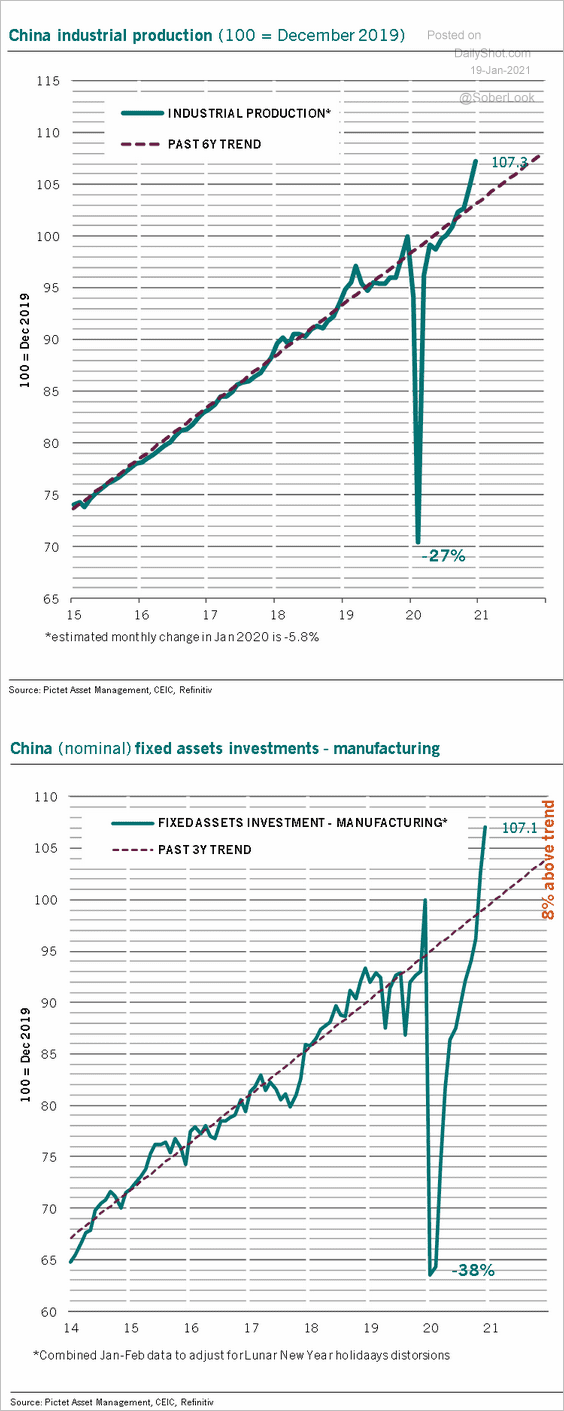

3. Industrial production and fixed asset investments into manufacturing facilities have been running well above trend.

Source: @PkZweifel

Source: @PkZweifel

Back to Index

Emerging Markets

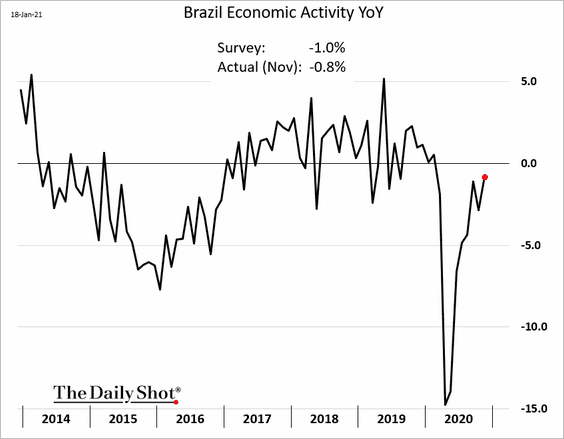

1. Brazil’s economic activity has almost fully recovered (as of November).

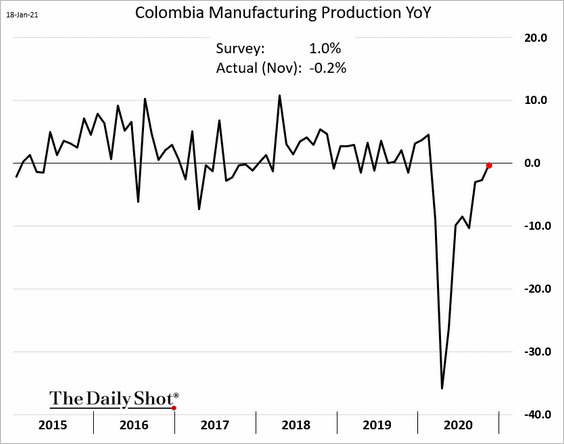

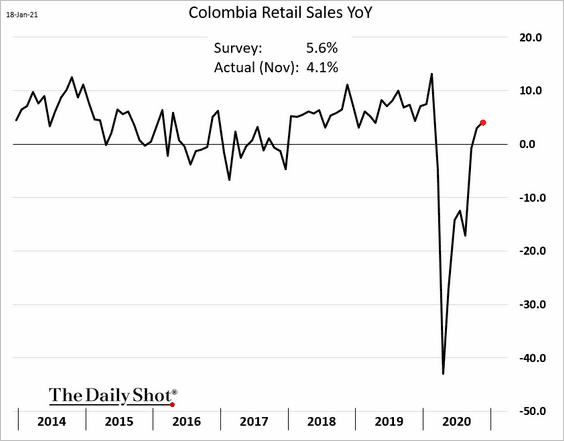

2. Colombia’s November manufacturing output and retail sales were below market expectations.

——————–

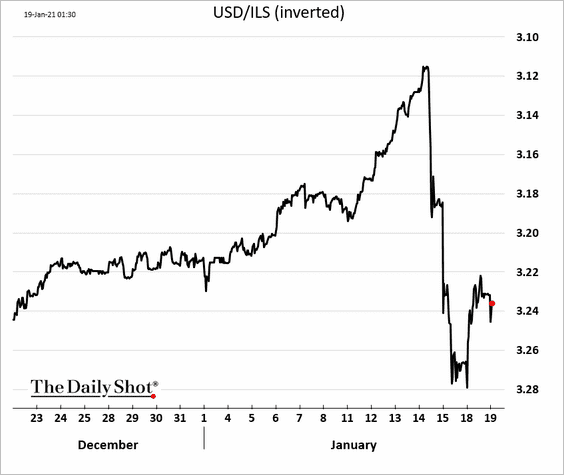

3. The Israeli shekel took a hit in response to a warning from the central bank.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

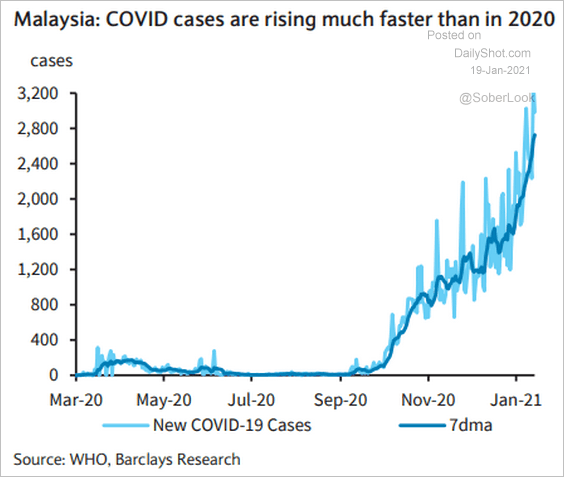

4. Malaysia’s COVID cases have spiked.

Source: Barclays Research

Source: Barclays Research

5. Vietnam’s benchmark stock index tumbled after hitting resistance.

Back to Index

Commodities

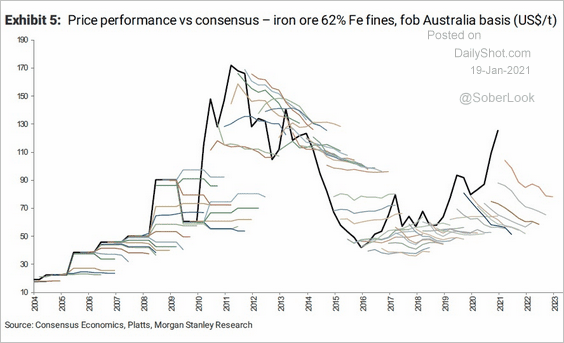

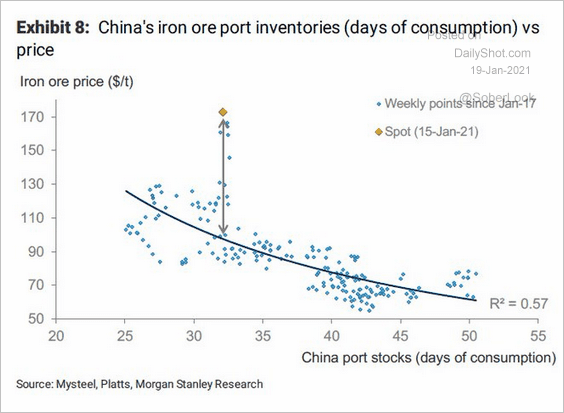

1. Iron ore has been rallying despite continuing calls for a correction.

Source: Morgan Stanley Research, @Scutty

Source: Morgan Stanley Research, @Scutty

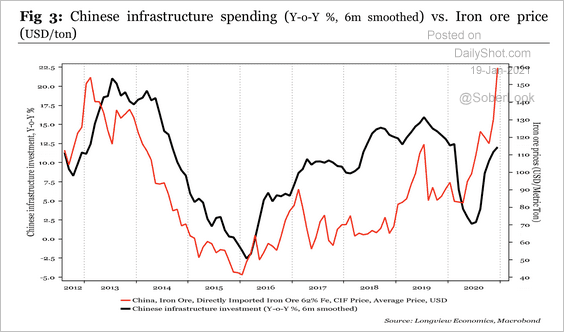

The recovery in Chinese infrastructure spending has been supporting the rise in iron ore prices.

Source: Longview Economics

Source: Longview Economics

At this point, prices are inconsistent with inventories at China’s ports.

Source: Morgan Stanley Research, @Scutty

Source: Morgan Stanley Research, @Scutty

——————–

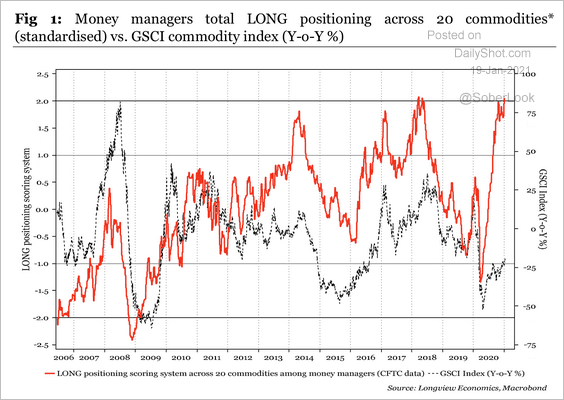

2. Bullish positioning in commodity futures is at its highest in at least a decade.

Source: Longview Economics

Source: Longview Economics

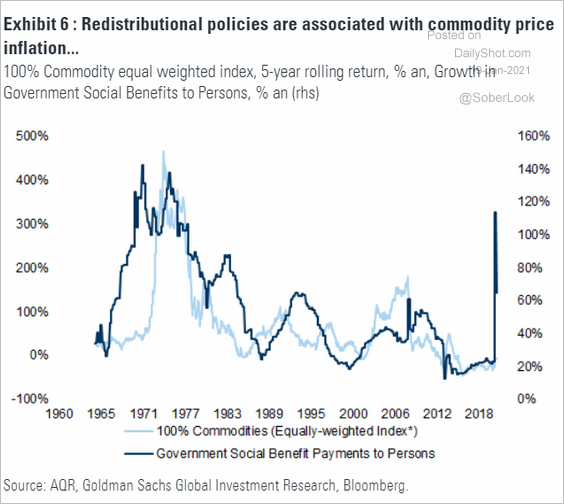

According to Goldman, “redistributional” government policies point to further gains in commodity prices.

Source: Goldman Sachs, @jsblokland

Source: Goldman Sachs, @jsblokland

——————–

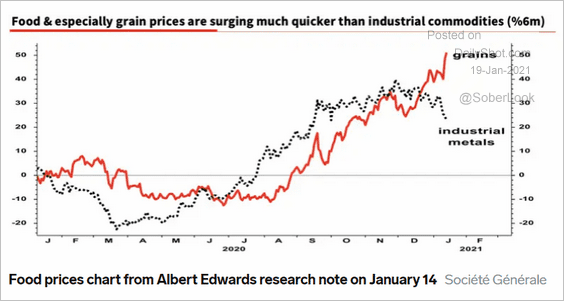

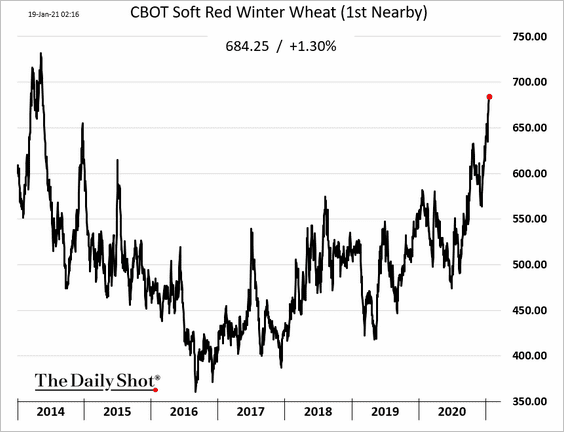

3. Grains have been outperforming industrial metals.

Source: Société Générale, @jessefelder, @albertedwards99 Read full article

Source: Société Générale, @jessefelder, @albertedwards99 Read full article

US wheat futures continue to rally (nearing $7 per bushel).

Back to Index

Energy

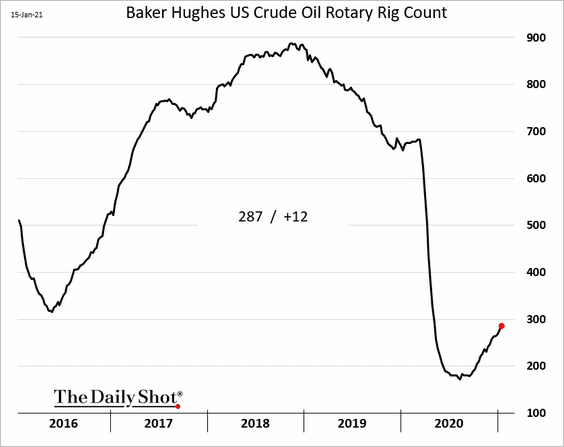

1. US oil rig count is recovering.

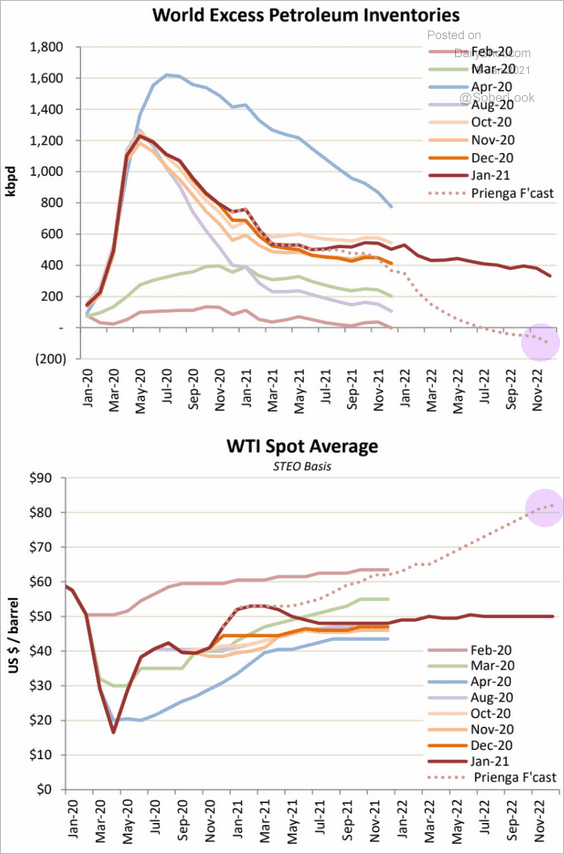

2. Princeton Energy Advisors is forecasting tight petroleum inventories and sharply higher oil prices next year.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

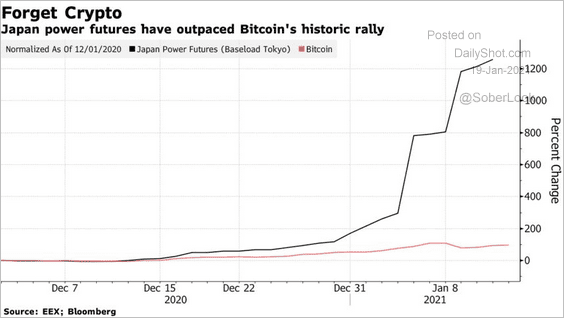

3. Japan’s electricity futures experienced a dramatic rally (cold weather and tight LNG supplies).

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Equities

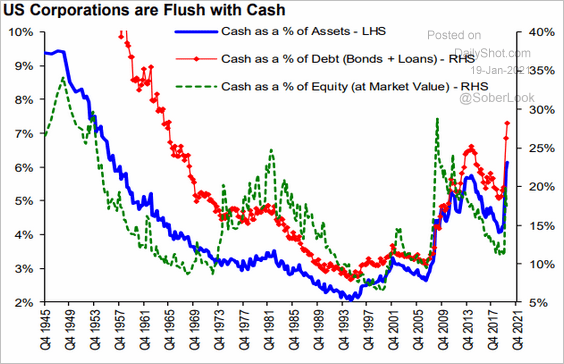

1. US companies are sitting on a great deal of cash.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

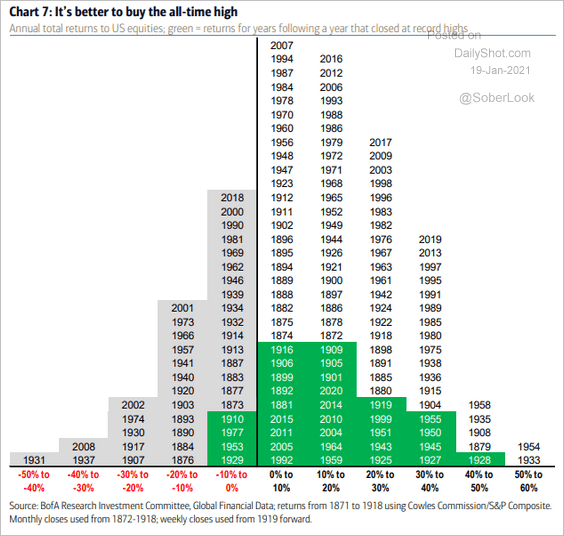

2. Here is a comment from BofA on buying stocks at the highs.

… since 1871, buying the market when it closed the year at an all-time high offered a better-than-average return (15% vs. 10% for other years), with the distribution of returns skewed visibly to the upside.

Source: BofA Global Research

Source: BofA Global Research

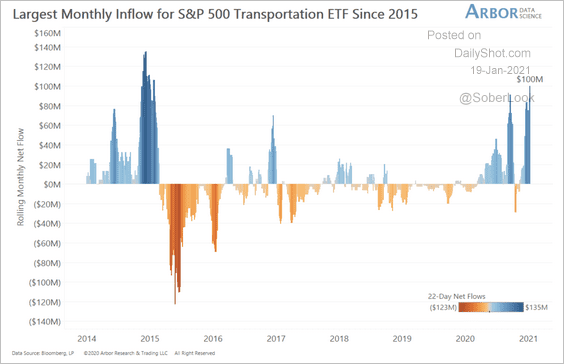

3. The S&P 500 Transportation ETF posted its largest monthly net-inflow since 2015 (reflation bet).

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Back to Index

Rates

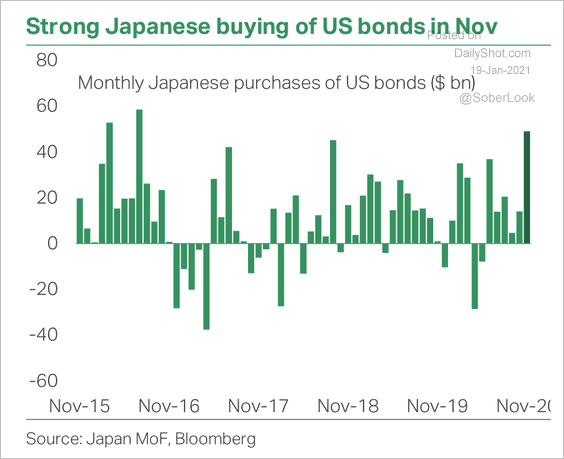

1. Rising Treasury yields are becoming more attractive for global buyers, especially in Japan.

Source: TS Lombard

Source: TS Lombard

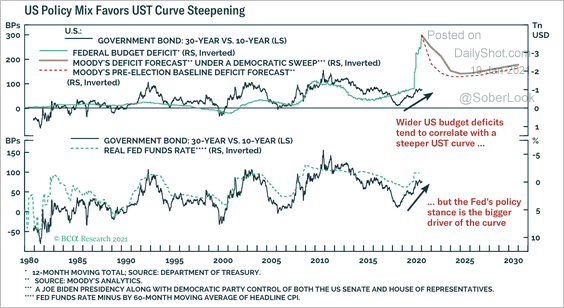

2. BCA Research expects the Fed to maintain rates well below US realized inflation over the next few years. This should keep real rates negative and prevent a flattening of the yield curve.

Source: BCA Research

Source: BCA Research

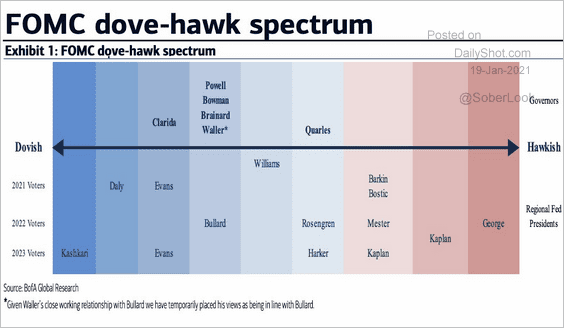

3. Here is the FOMC dove-hawk spectrum.

Source: BofA Global Research, @SamRo

Source: BofA Global Research, @SamRo

Back to Index

Global Developments

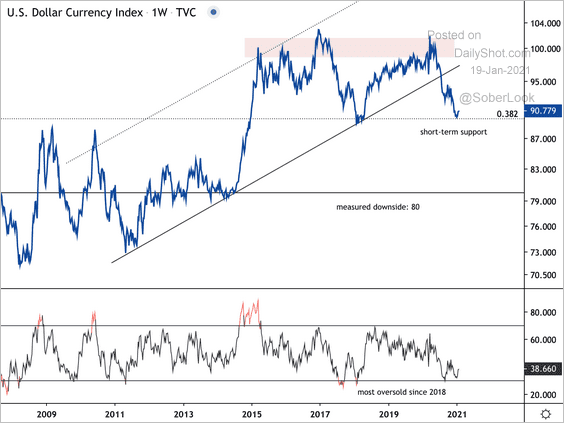

1. The dollar is at short-term support, but the long-term trend is no longer bullish.

Source: Dantes Outlook

Source: Dantes Outlook

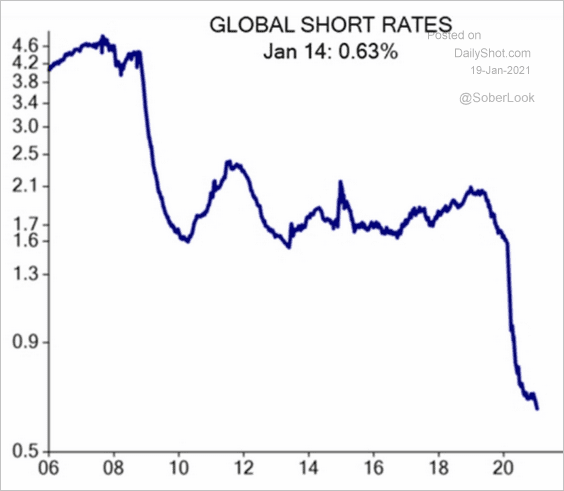

2. This chart shows the average of global short-term rates.

Source: Evercore ISI

Source: Evercore ISI

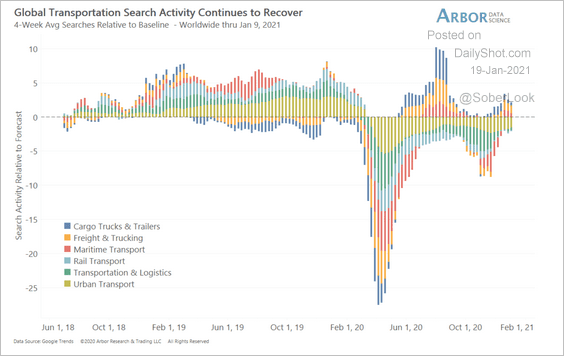

3. Google search activity for transports, including cargo trucks, freight and trucking is recovering.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

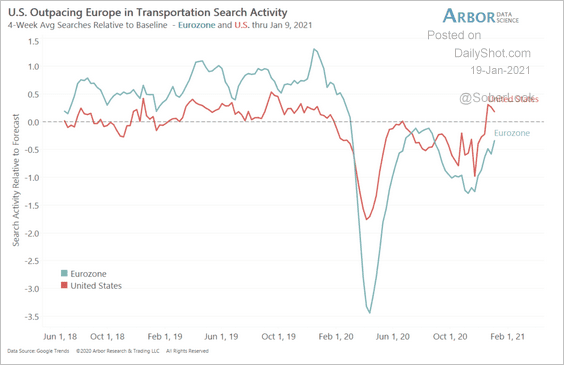

Transport search activity is higher in the US versus Europe.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

Food for Thought

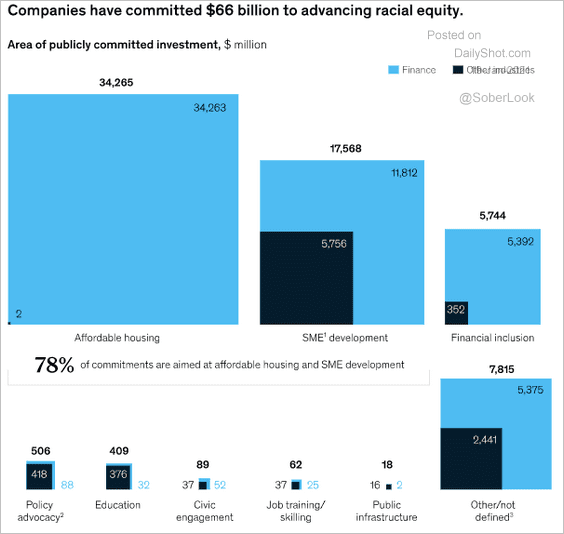

1. Companies advancing racial equality:

Source: @wef Read full article

Source: @wef Read full article

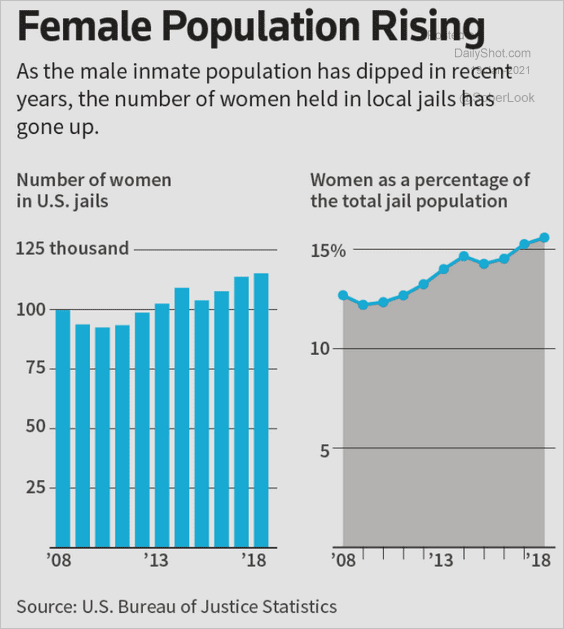

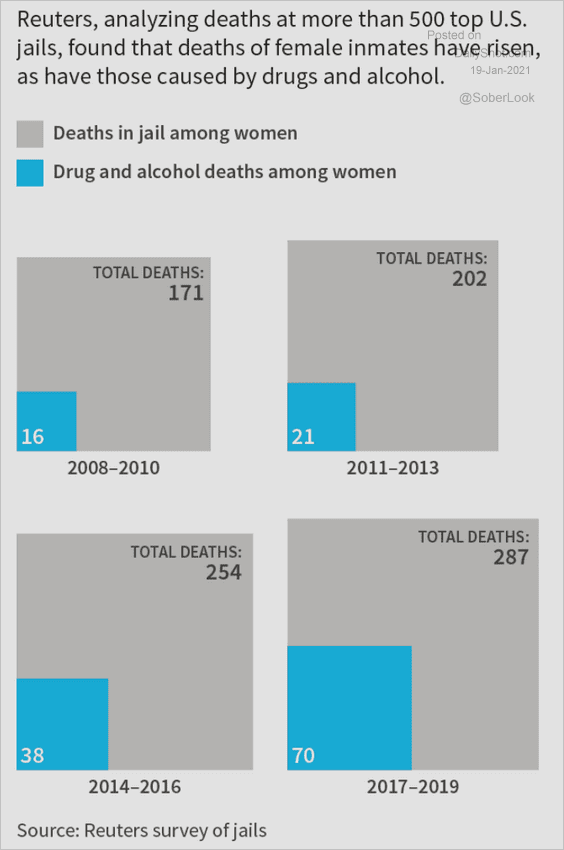

2. Female population in US prisons:

Source: Reuters Read full article

Source: Reuters Read full article

Deaths of female inmates in US prisons:

Source: Reuters Read full article

Source: Reuters Read full article

——————–

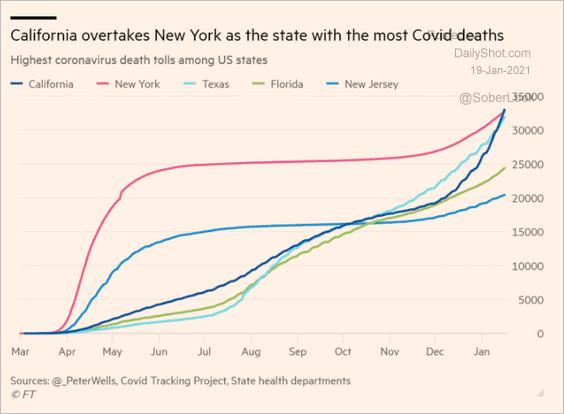

3. COVID deaths by state:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

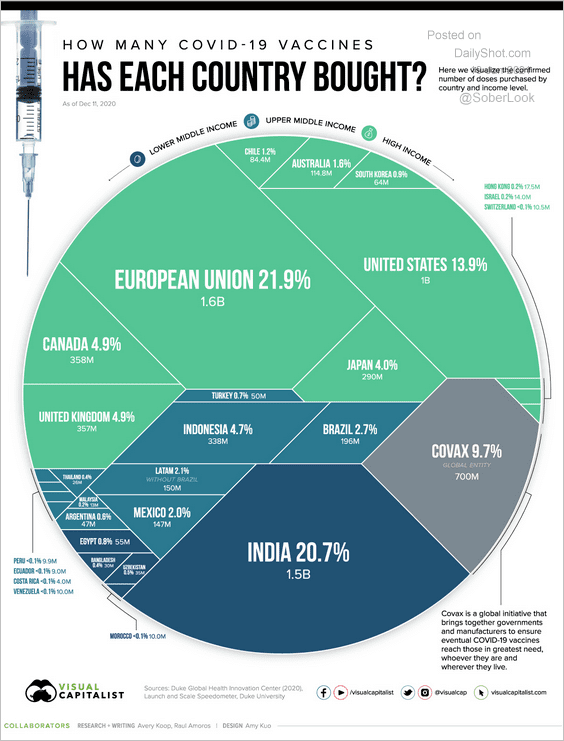

4. Vaccine purchases:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

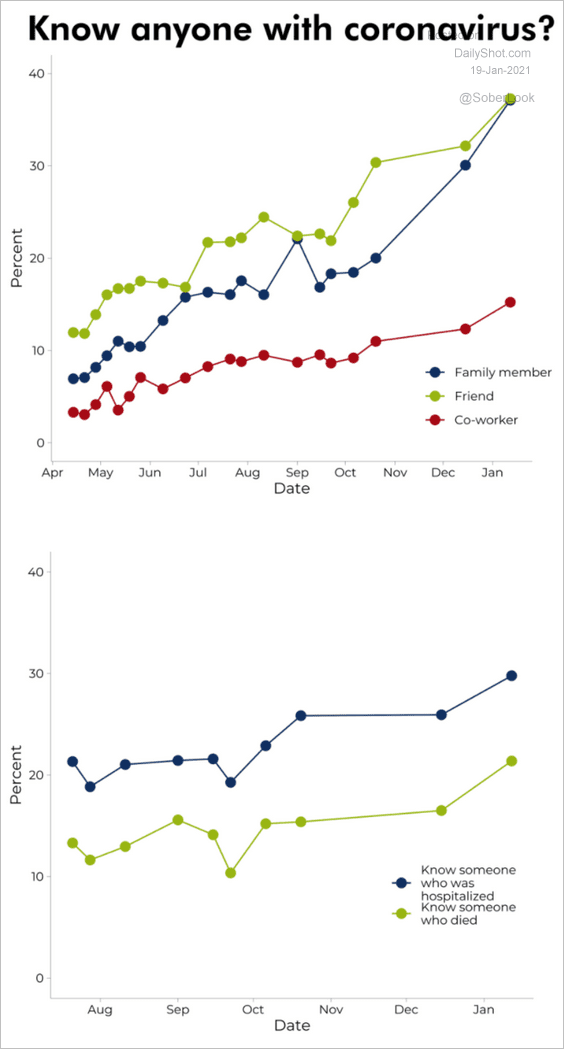

5. Know anyone with coronavirus?

Source: DFP Read full article

Source: DFP Read full article

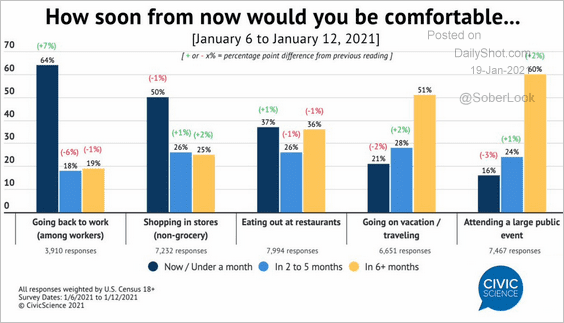

6. How soon would you be comfortable …

Source: @CivicScience

Source: @CivicScience

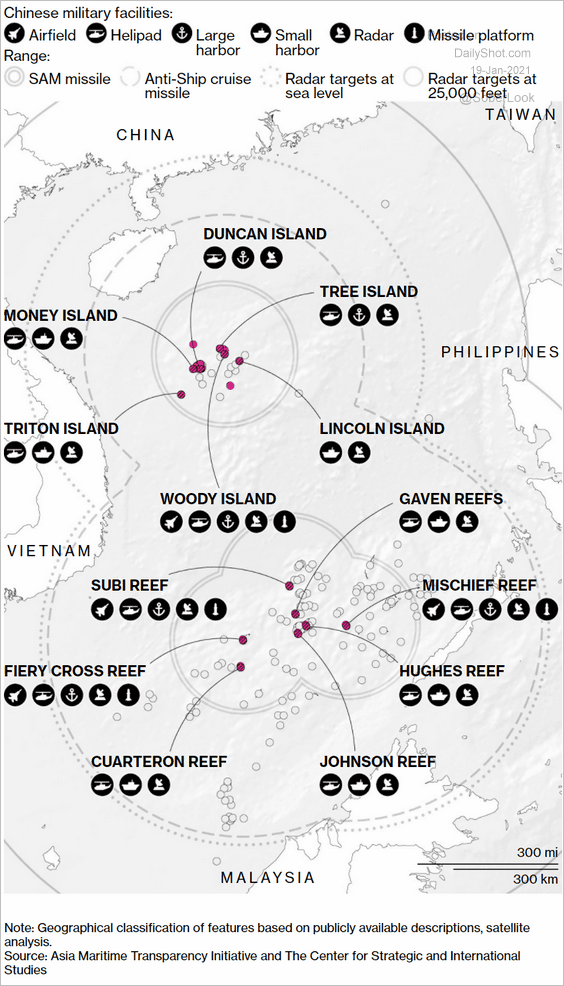

7. China’s military facilities in the South China Sea:

Source: @BBGVisualData Read full article

Source: @BBGVisualData Read full article

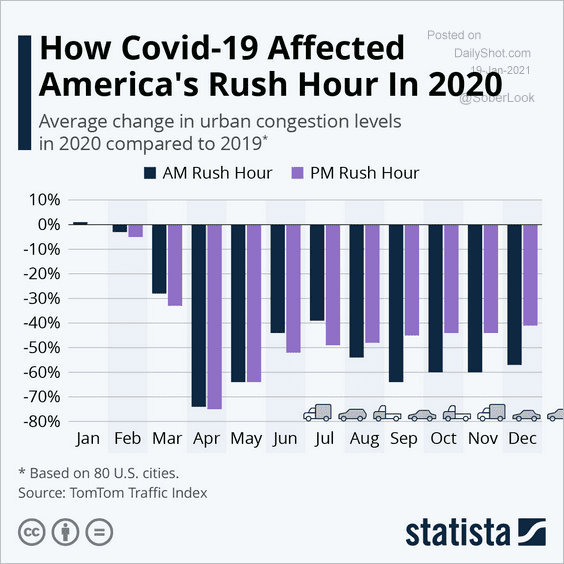

8. US rush hour congestion (vs. 2019):

Source: Statista

Source: Statista

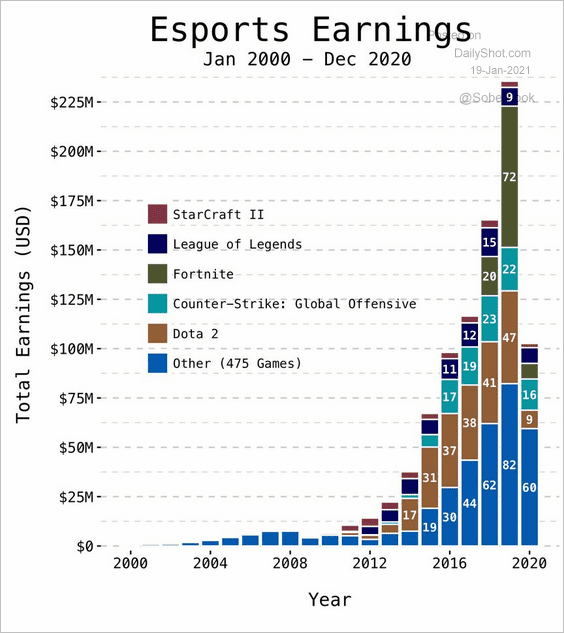

9. Esports earnings:

Source: @simongerman600 Read full article

Source: @simongerman600 Read full article

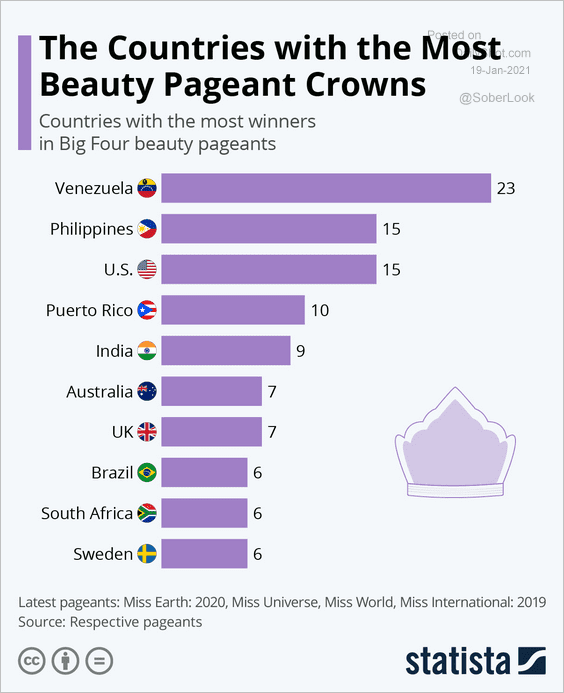

10. Countries with the most beauty pageant winners:

Source: Statista

Source: Statista

——————–

Back to Index