The Daily Shot: 20-Jan-21

• The United States

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

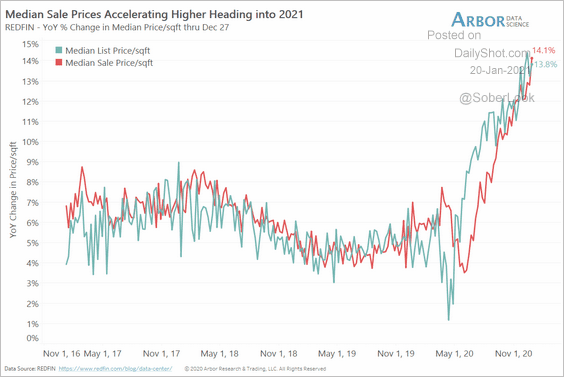

1. US housing price gains accelerated going into 2021, …

Source: Arbor Research & Trading

Source: Arbor Research & Trading

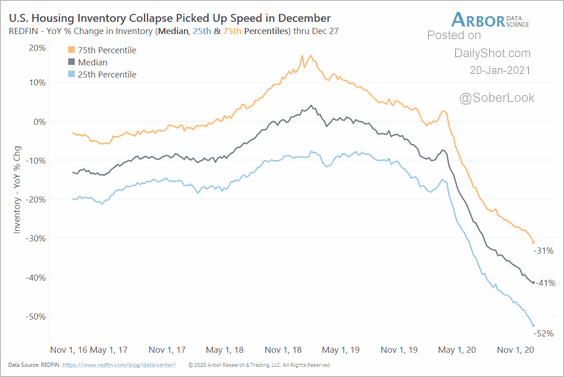

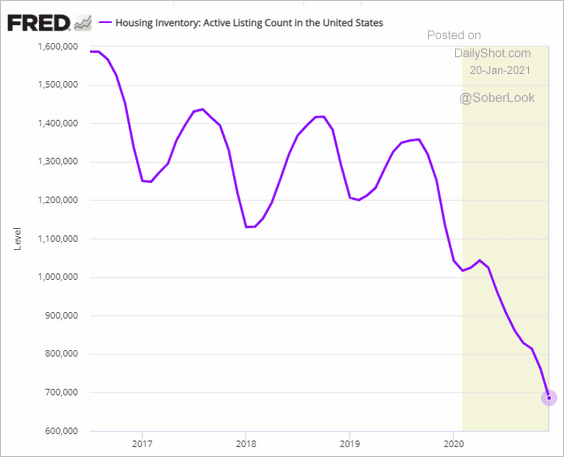

… as inventories tightened further (2 charts).

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

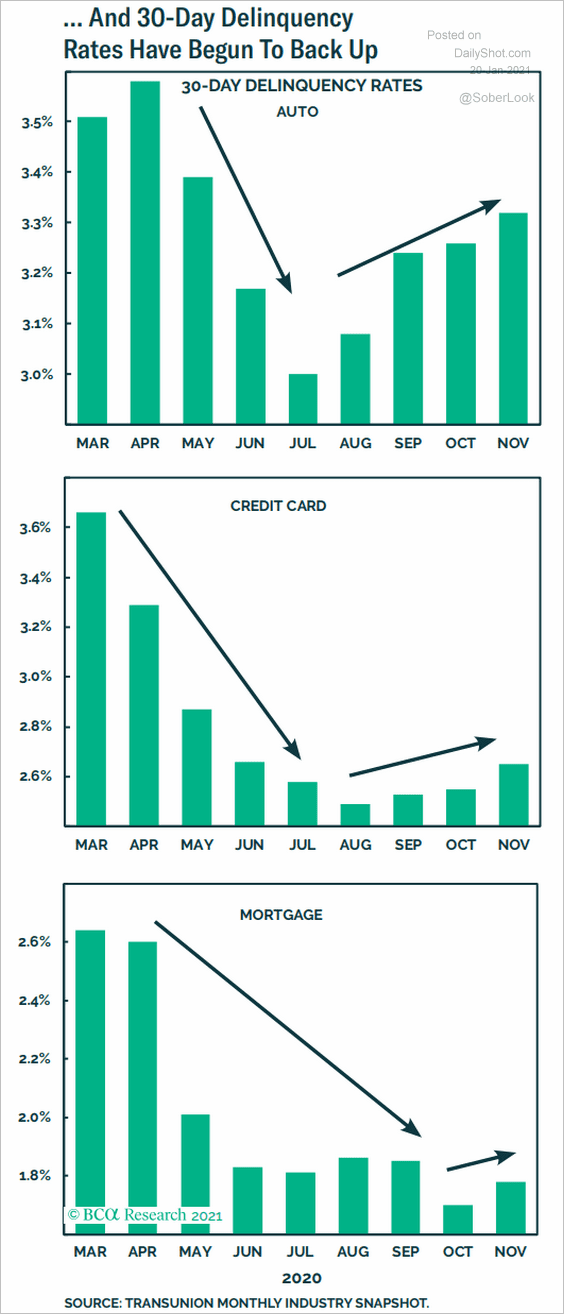

2. Consumer delinquency rates have been creeping higher in recent months.

Source: BCA Research

Source: BCA Research

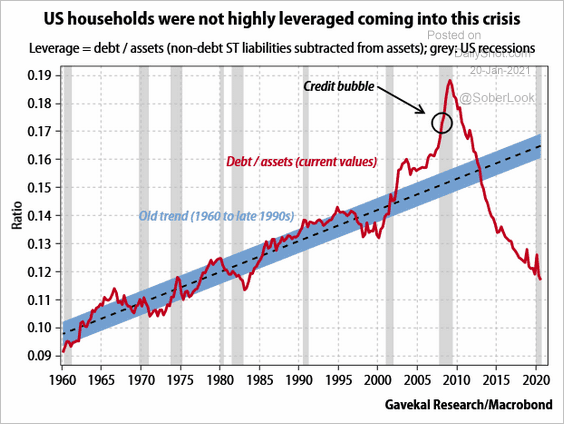

However, US household leverage hit a multi-decade low last year.

Source: Gavekal Research

Source: Gavekal Research

——————–

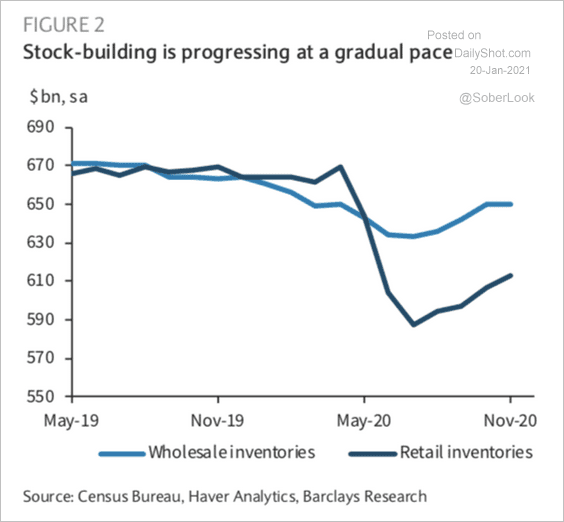

3. Business inventories continue to recover.

Source: Barclays Research

Source: Barclays Research

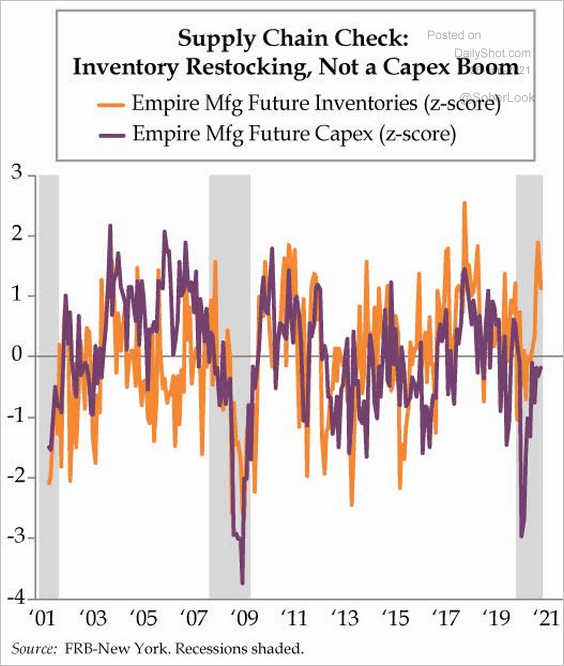

Business spending has been focused on inventories rather than CapEx.

Source: The Daily Feather

Source: The Daily Feather

——————–

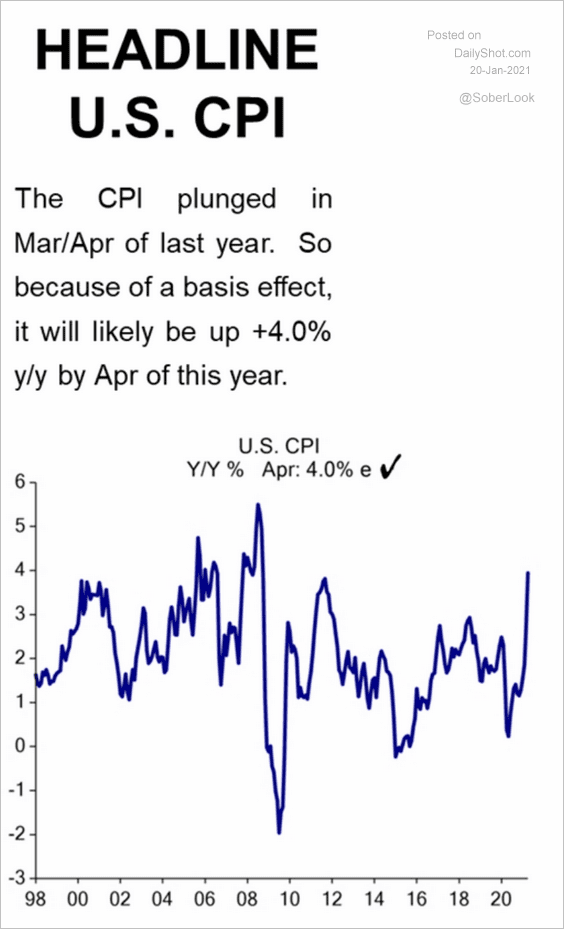

4. Next, we have some updates on inflation.

• According to Evercore ISI, the headline CPI will hit 4% (year-over-year) in April due to base effects.

Source: Evercore ISI

Source: Evercore ISI

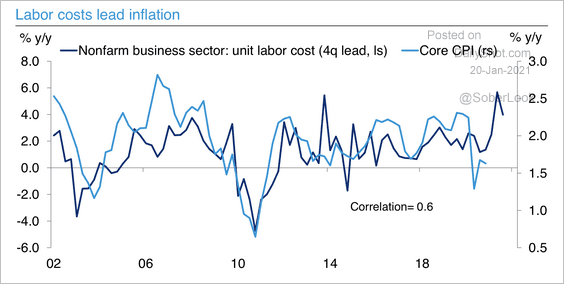

• Will steady growth in labor costs push the core CPI higher?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

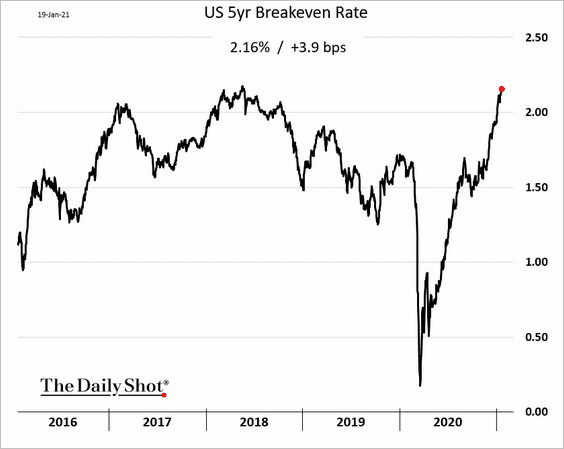

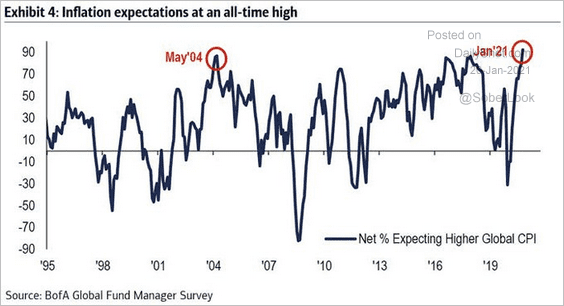

• Inflation expectations keep climbing.

– Market-based:

– Fund managers:

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

——————–

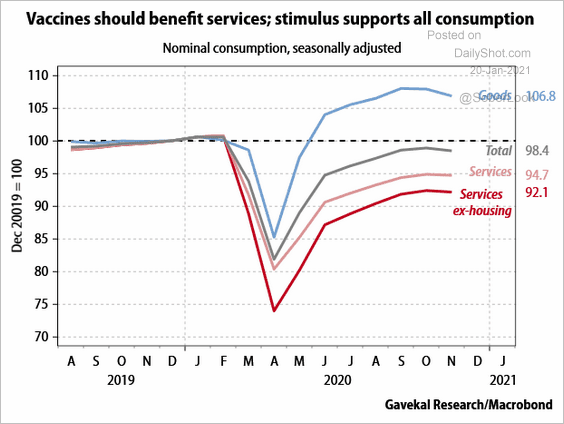

5. US vaccination efforts should benefit service sectors the most.

Source: Gavekal Research

Source: Gavekal Research

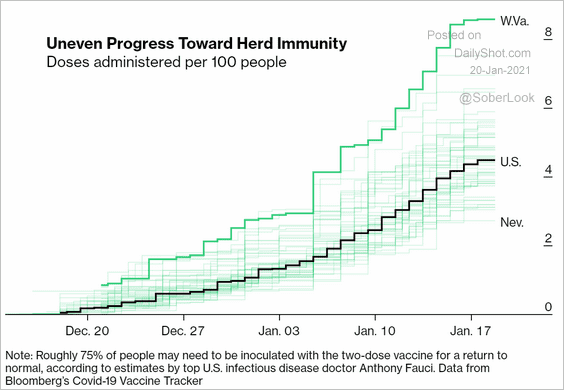

The pace of vaccinations remains uneven across the country.

Source: @bbgvisualdata Read full article

Source: @bbgvisualdata Read full article

Back to Index

The Eurozone

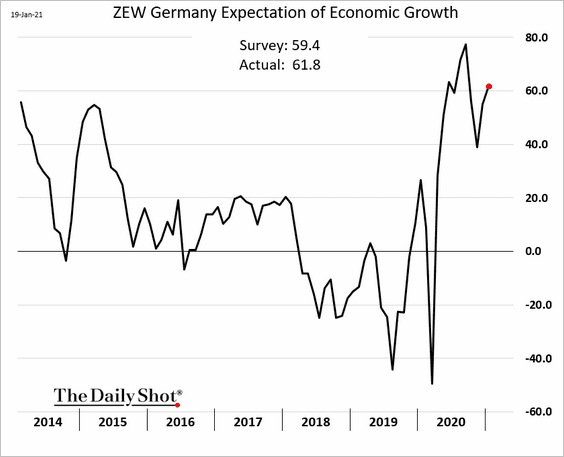

1. Germany’s ZEW expectations index (survey of financial market experts) surprised to the upside this month.

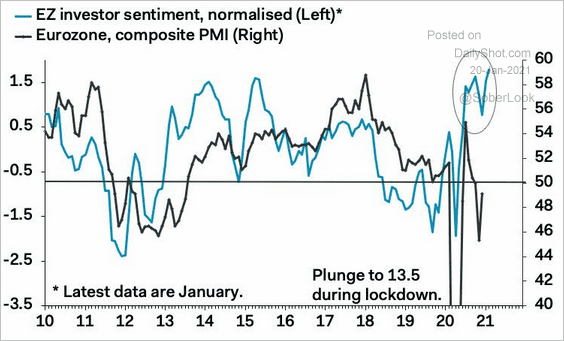

At the Eurozone level, sentiment has diverged from business activity.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

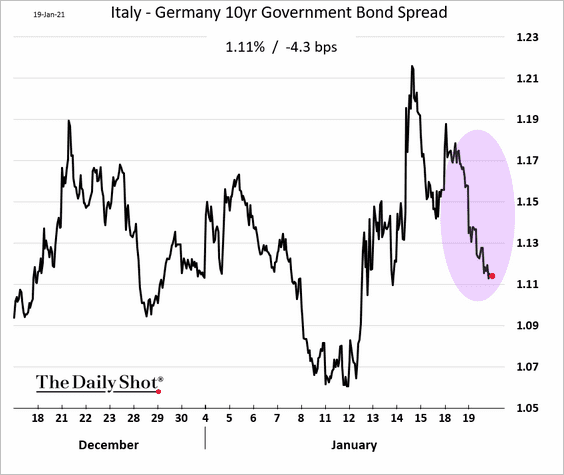

2. Italian spreads tightened, …

… as Conte won the confidence vote.

Source: The Guardian Read full article

Source: The Guardian Read full article

——————–

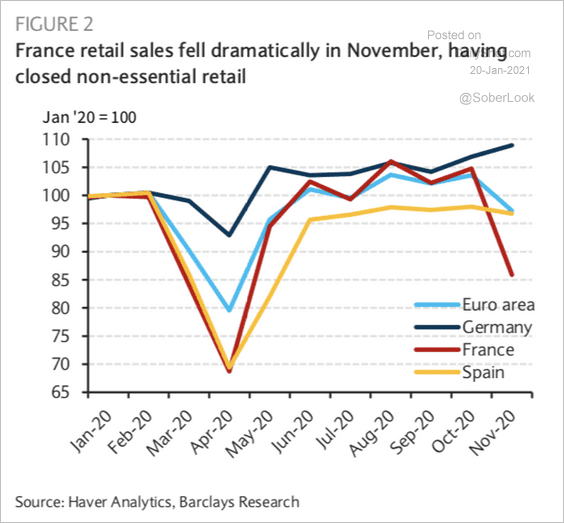

3. France’s retail sector has taken a massive hit due to renewed lockdown measures.

Source: Barclays Research

Source: Barclays Research

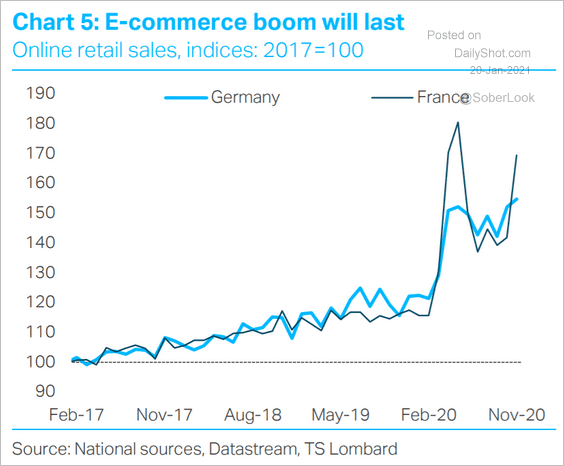

4. The e-commerce boom continues.

Source: TS Lombard

Source: TS Lombard

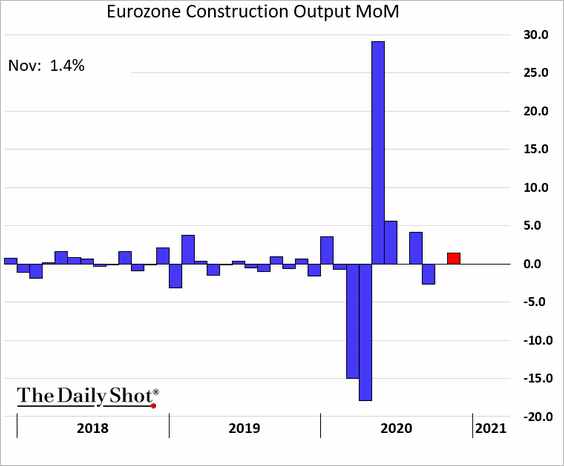

5. Euro-area construction output improved in November.

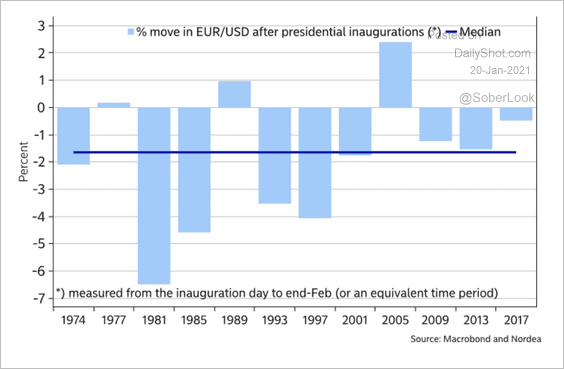

6. EUR/USD tends to drop after US presidential inaugurations.

Source: Nordea Markets

Source: Nordea Markets

Back to Index

Europe

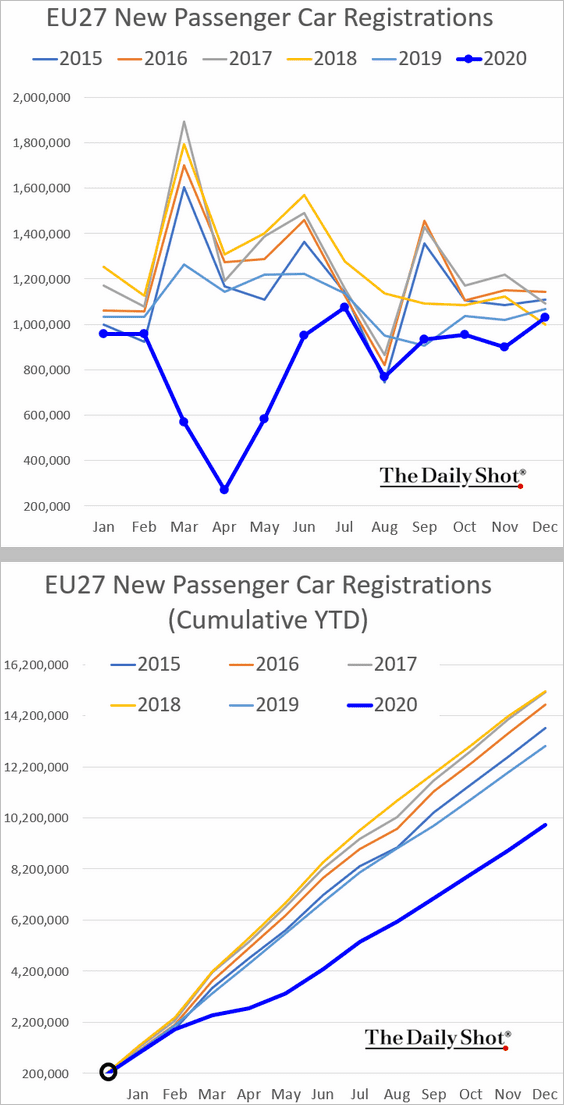

1. EU’s new car registrations improved in December but were at multi-year lows on a year-to-date basis.

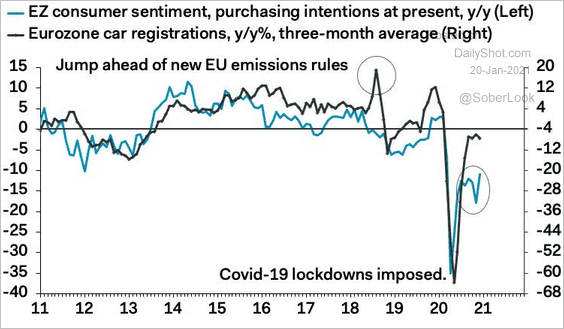

Sentiment in the Eurozone points to downside risks for automobile purchases.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

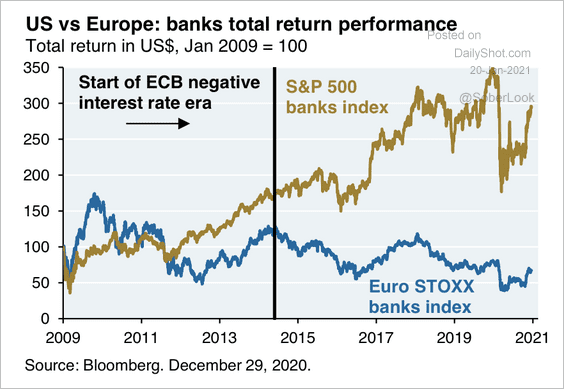

2. European bank equity returns have trailed the US since negative policy rates began in 2014.

Source: JP Morgan Asset Management

Source: JP Morgan Asset Management

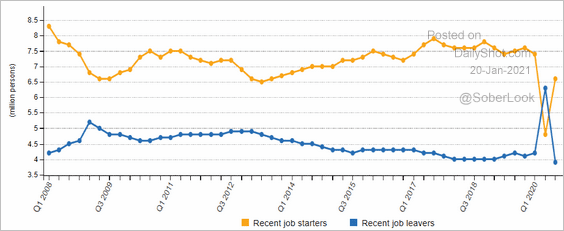

3. This chart shows the trends for recent job starters vs. leavers.

Source: Eurostat Read full article

Source: Eurostat Read full article

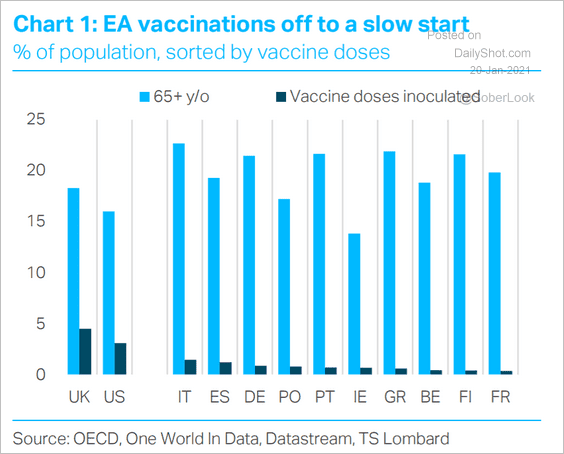

4. The vaccination effort is off to a slow start.

Source: TS Lombard

Source: TS Lombard

Back to Index

Asia – Pacific

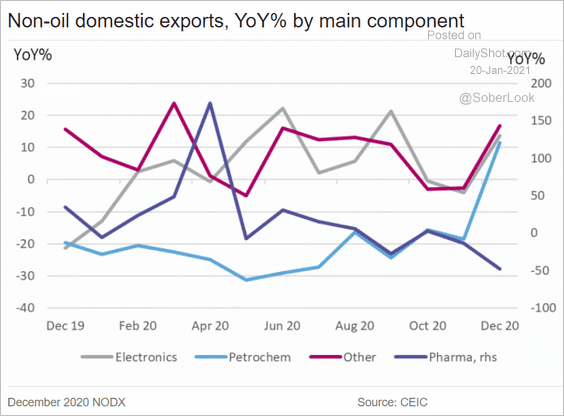

1. Outside of pharma, Singapore’s exports have been strong.

Source: ING

Source: ING

2. Taiwan’s stock market benefitted from the US-China trade spat.

Source: @markets Read full article

Source: @markets Read full article

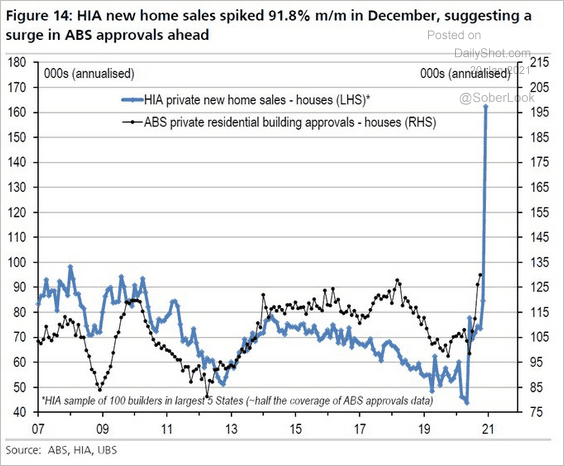

3. Home sales point to further gains in Australia’s residential construction.

Source: UBS, @Scutty

Source: UBS, @Scutty

Back to Index

China

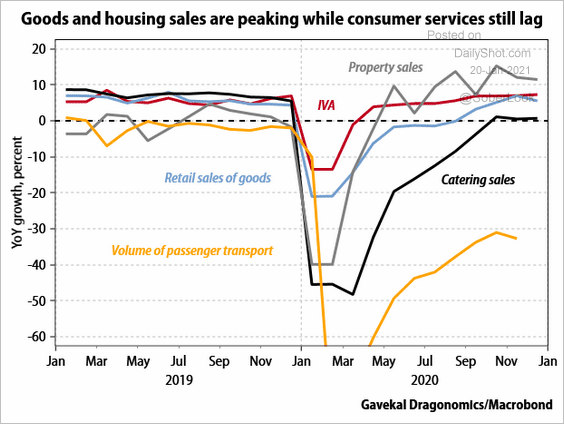

1. Passenger transport volumes continue to lag other sectors.

Source: Gavekal Research

Source: Gavekal Research

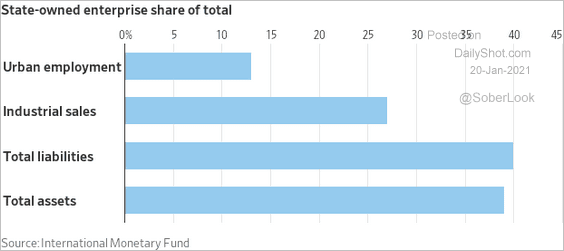

2. State-owned enterprises dominate large swaths of the economy.

Source: @WSJ Read full article

Source: @WSJ Read full article

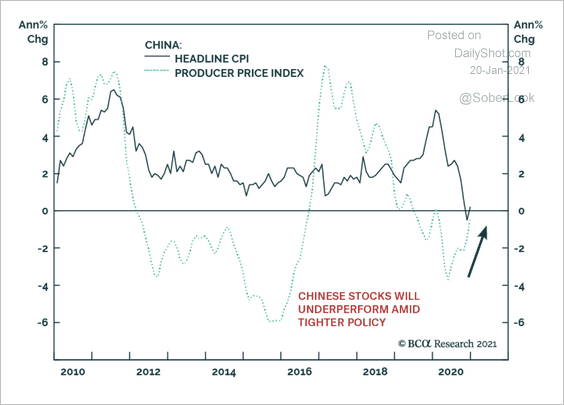

3. Could China’s moderating deflation support a hawkish tone at the PBoC?

Source: BCA Research

Source: BCA Research

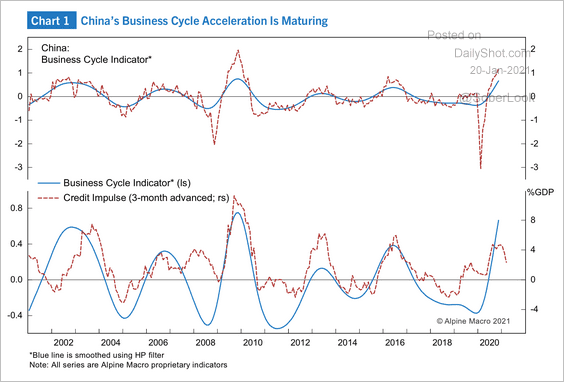

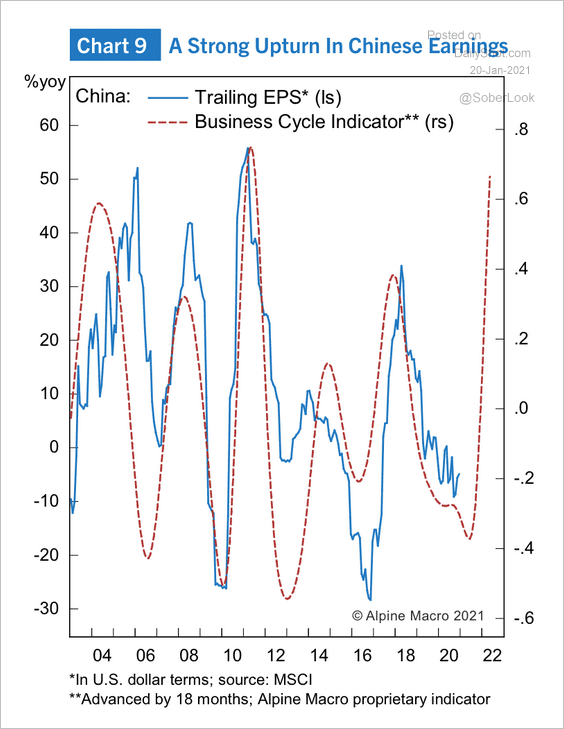

4. China’s credit impulse is slowing, which could mark a turn in the business cycle.

Source: Alpine Macro

Source: Alpine Macro

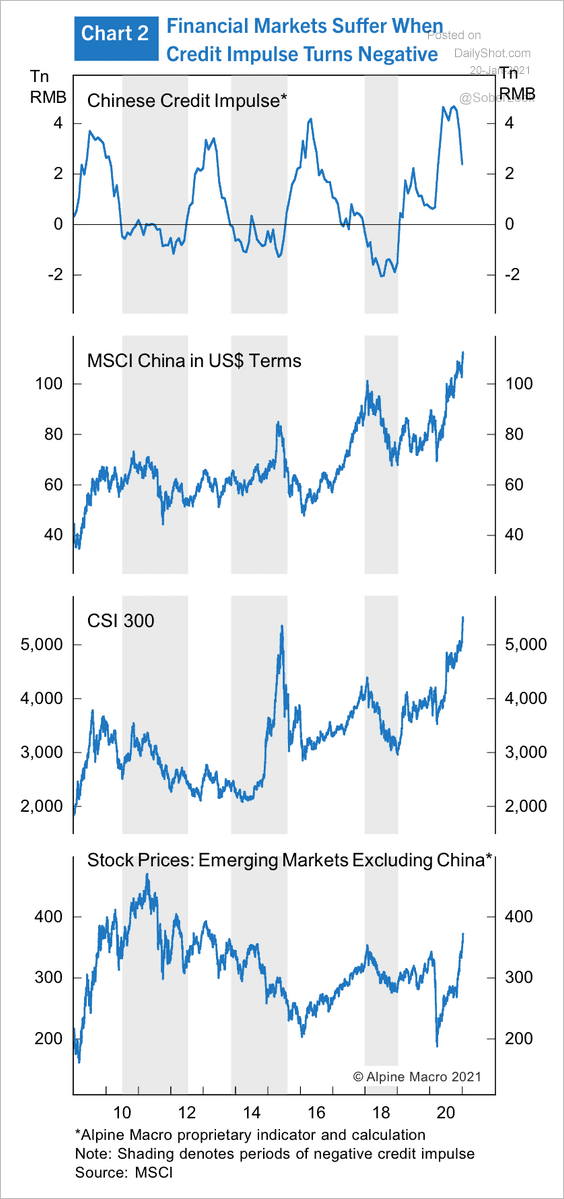

Credit tightening could pressure Chinese equities.

Source: Alpine Macro

Source: Alpine Macro

But earnings have not yet caught up with the economic recovery.

Source: Alpine Macro

Source: Alpine Macro

——————–

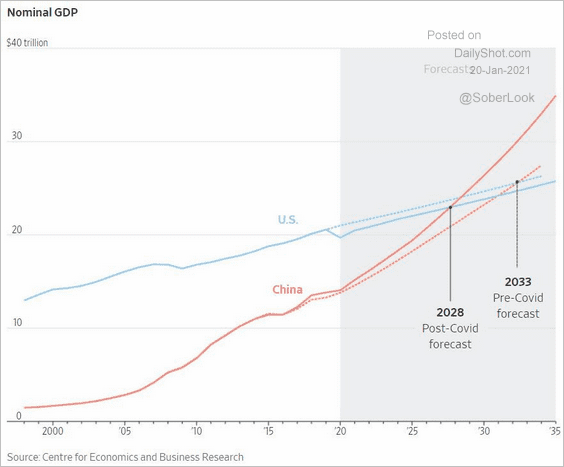

5. COVID brought forward the timing of China overtaking the US as the world’s largest economy.

Source: @WSJ Read full article

Source: @WSJ Read full article

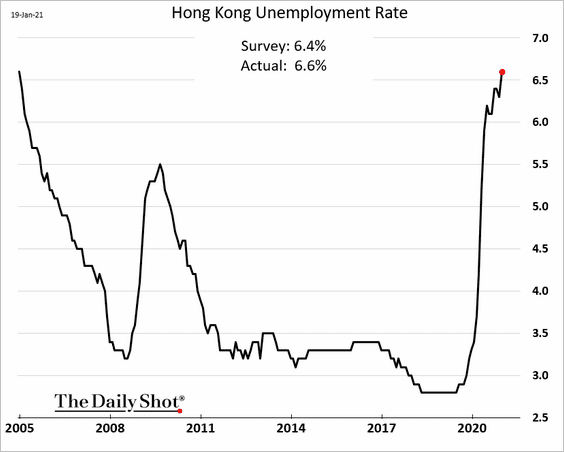

6. Hong Kong’s unemployment rate continues to climb.

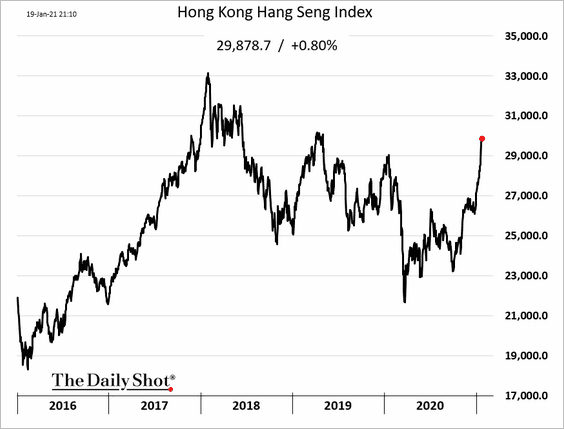

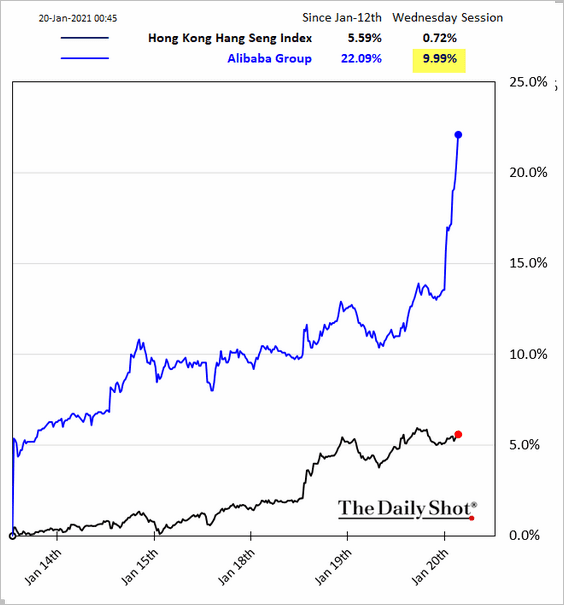

7. Hong Kong’s stock market is heating up.

8. Jack Ma is back.

Source: CNBC Read full article

Source: CNBC Read full article

Back to Index

Emerging Markets

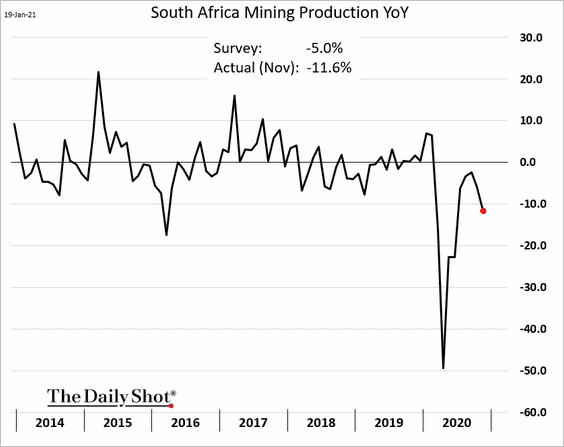

1. South Africa’s mining output tumbled in November, with the weakness driven primarily by iron-ore production.

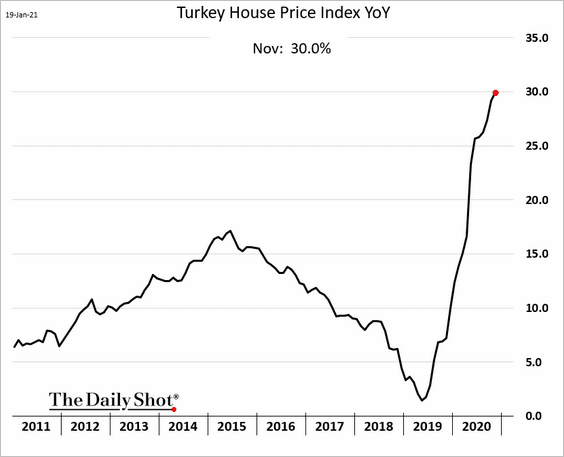

2. Turkey’s home prices were up 30% in November vs. 2019.

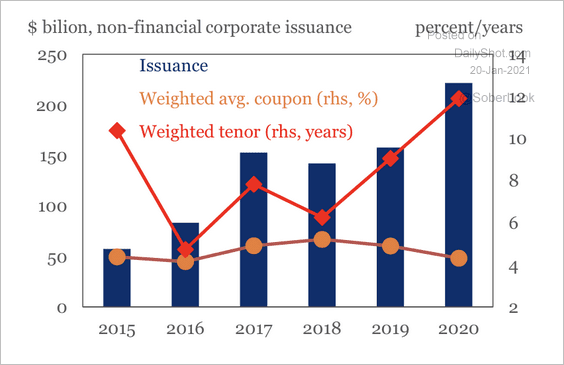

3. EM corporates are borrowing at longer maturities.

Source: IIF

Source: IIF

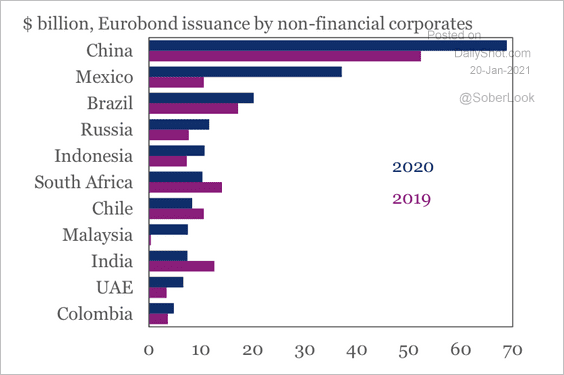

Here are the top 10 non-financial corporate issuers by country.

Source: IIF

Source: IIF

Back to Index

Cryptocurrency

1. Bitcoin continues to consolidate.

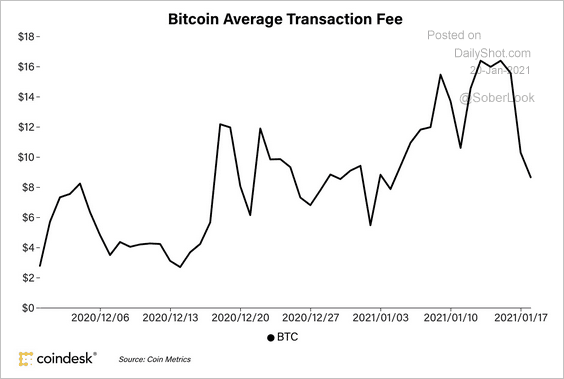

2. Bitcoin’s average transaction fee declined over the past few days, indicating lower network congestion. For now, this could ease concerns about price volatility as BTC/USD consolidates.

Source: @CoinDeskData

Source: @CoinDeskData

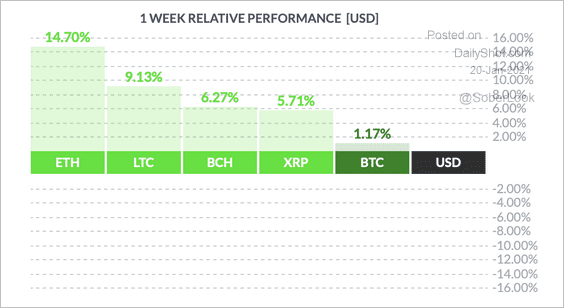

3. Ethereum continued to outperform this week, reaching an all-time-high near $1,440.

Source: FinViz

Source: FinViz

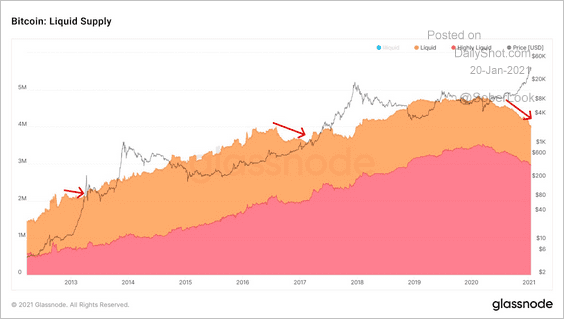

4. The “liquid supply” of Bitcoin is decreasing, which typically precedes price rallies.

Source: Glassnode Read full article

Source: Glassnode Read full article

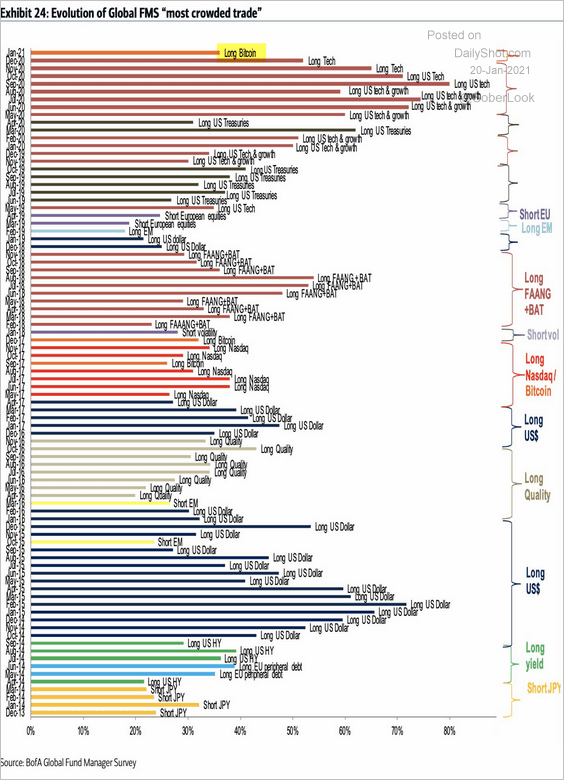

5. Fund managers surveyed by BofA now see Bitcoin as the most crowded trade.

Source: BofA Global Research

Source: BofA Global Research

6. Bitcoin mining computers can make good heaters for your chicken coop.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Commodities

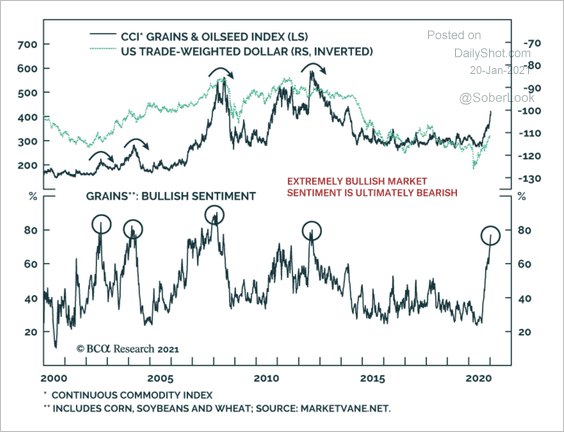

1. Bullish sentiment in agricultural commodities is at an extreme.

Source: BCA Research

Source: BCA Research

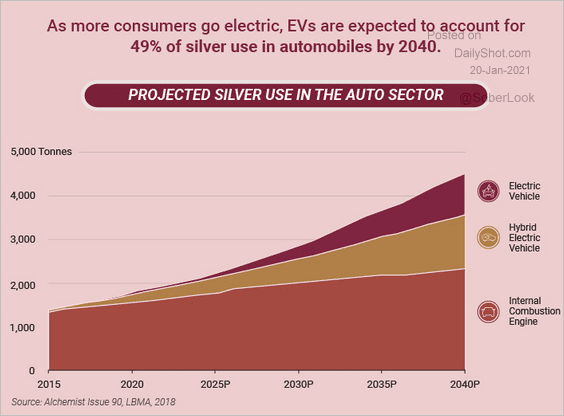

2. This chart shows the use of silver in the automobile industry.

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

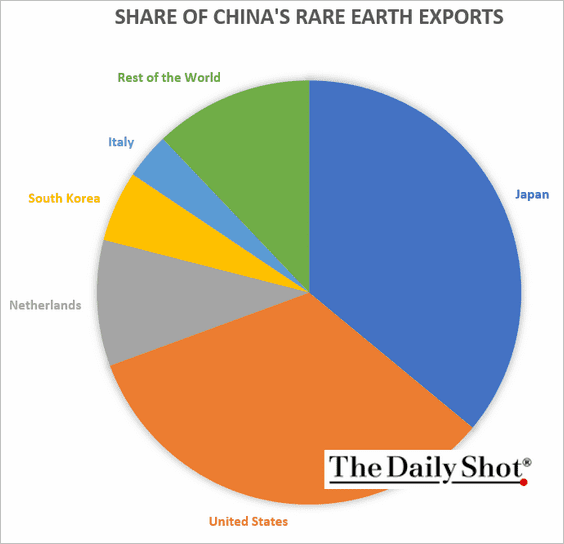

3. Who buys rare earths from China?

Further reading

Further reading

Back to Index

Equities

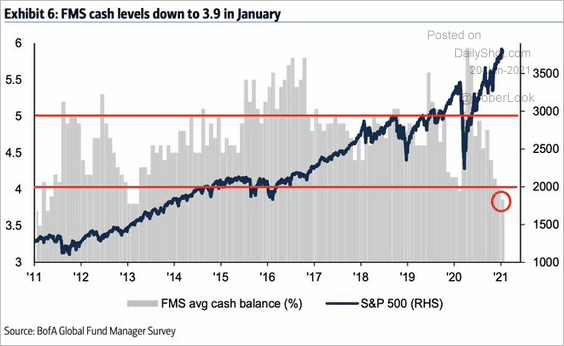

1. Fund managers’ cash holdings continue to hit multi-year lows, …

Source: BofA Global Research

Source: BofA Global Research

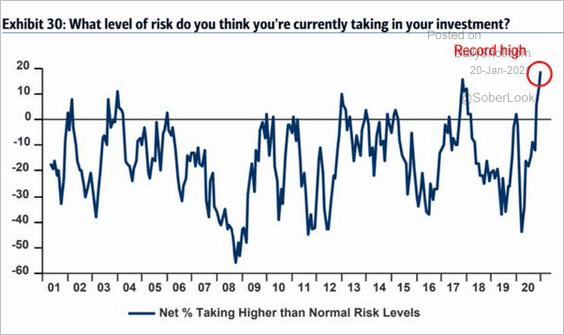

… as their risk appetite climbs.

Source: BofA Global Research

Source: BofA Global Research

——————–

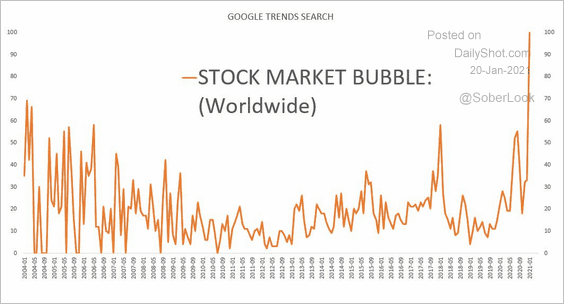

2. Google search activity for “stock market bubble” is off the charts.

Source: Anastasios Avgeriou

Source: Anastasios Avgeriou

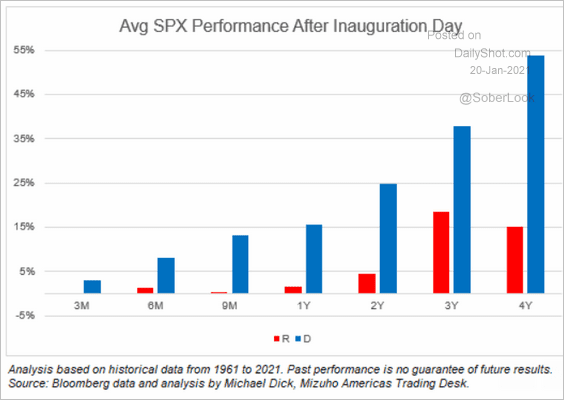

3. How does the S&P 500 perform after presidential inauguration day?

Source: Michael Dick, Mizuho Americas Trading Desk

Source: Michael Dick, Mizuho Americas Trading Desk

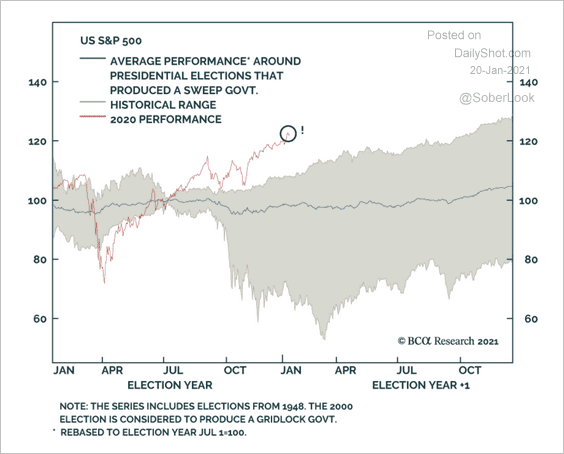

4. The S&P 500 is now far above its average performance range during similar election sweeps.

Source: BCA Research

Source: BCA Research

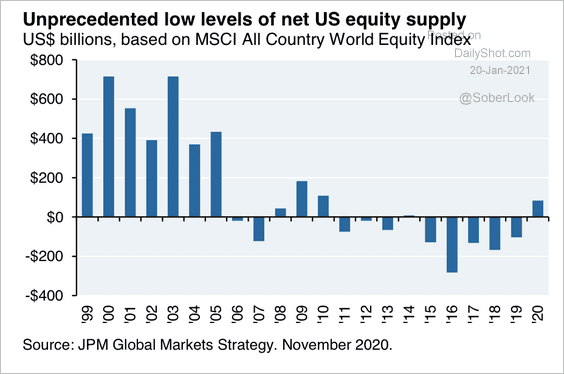

5. The total stock of investible public equity in the US has not grown over the past decade.

Source: JP Morgan Asset Management

Source: JP Morgan Asset Management

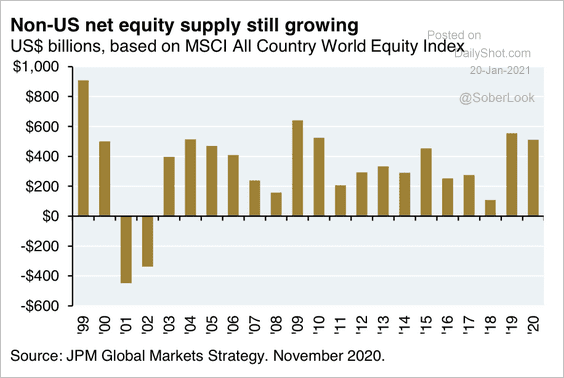

But net equity supply outside of the US continues to rise.

Source: JP Morgan Asset Management

Source: JP Morgan Asset Management

——————–

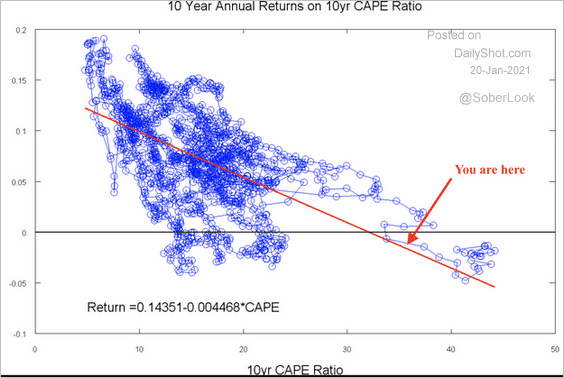

6. Based on current valuations (CAPE ratio), investors should expect negative returns over the next decade.

Source: @NoProb_XXX

Source: @NoProb_XXX

——————–

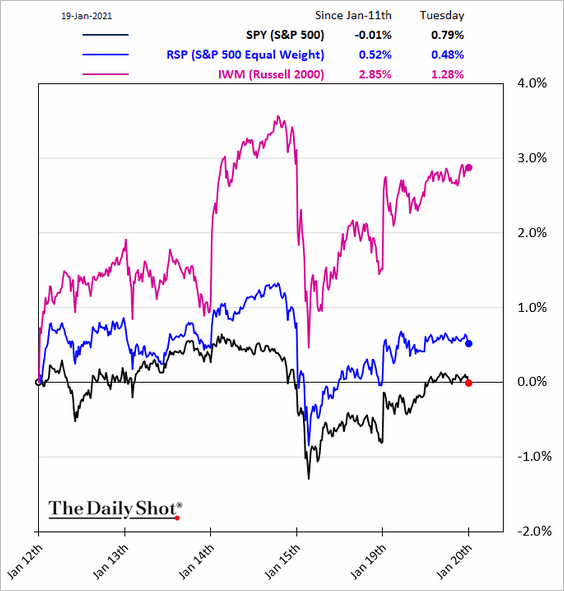

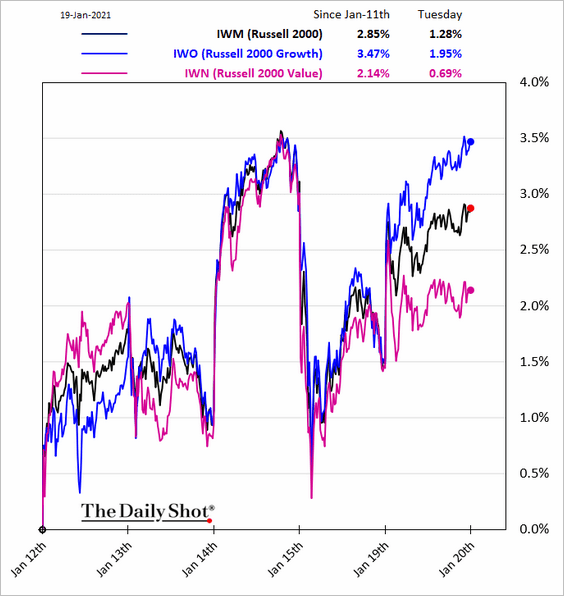

7. Small-cap shares continue to outperform.

Small-cap growth stocks did particularly well on Tuesday.

——————–

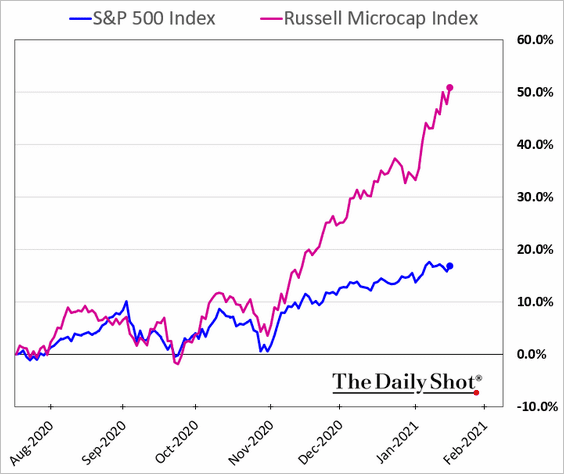

8. Microcaps have been on fire since the vaccine announcement.

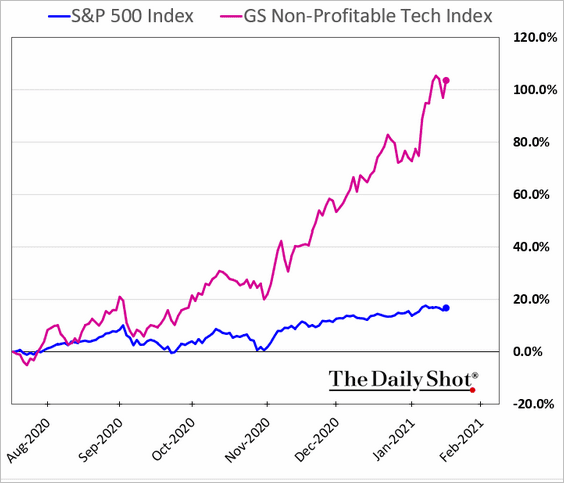

9. Shares of non-profitable tech firms are soaring.

h/t @LizAnnSonders

h/t @LizAnnSonders

10. Next, we have some sector updates.

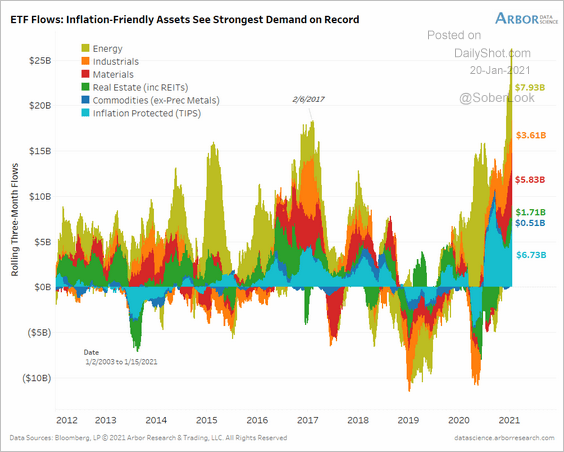

• ETF flows into inflation-friendly sectors hit a record high.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

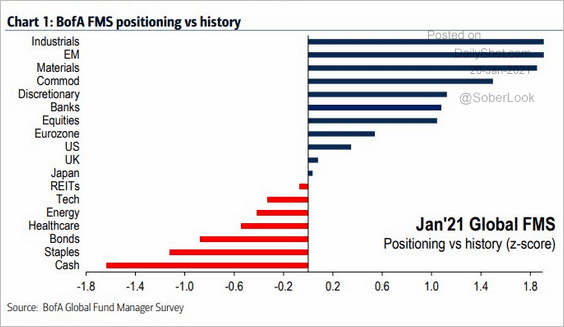

• This chart shows how fund managers are positioned vs. historical averages.

Source: BofA Global Research

Source: BofA Global Research

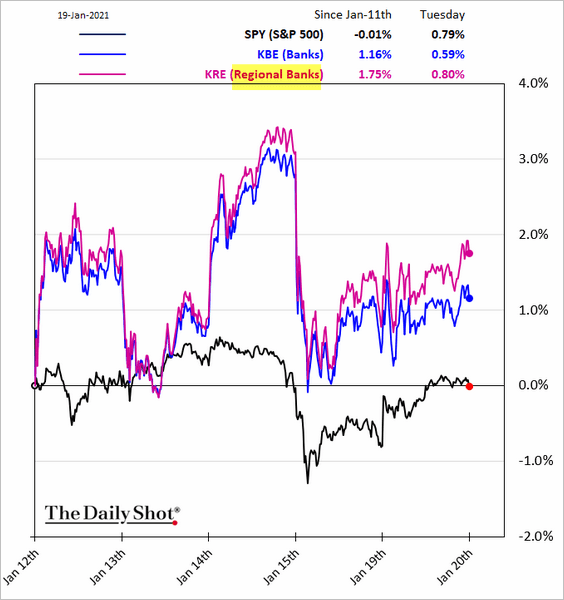

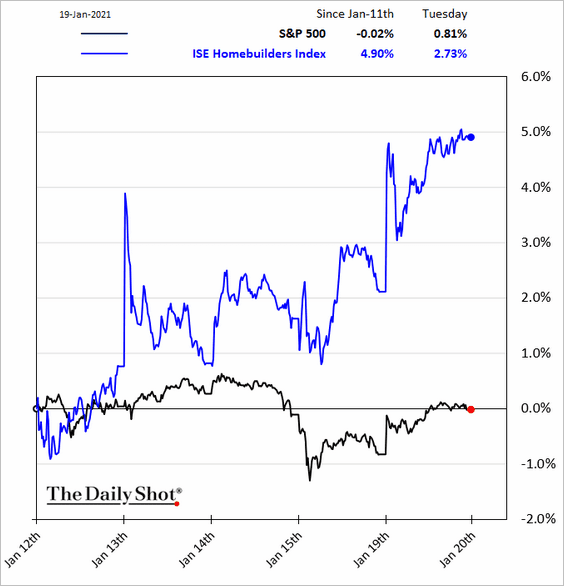

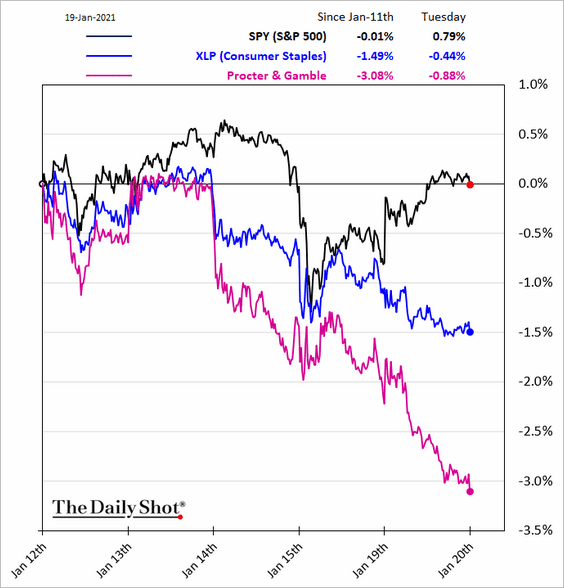

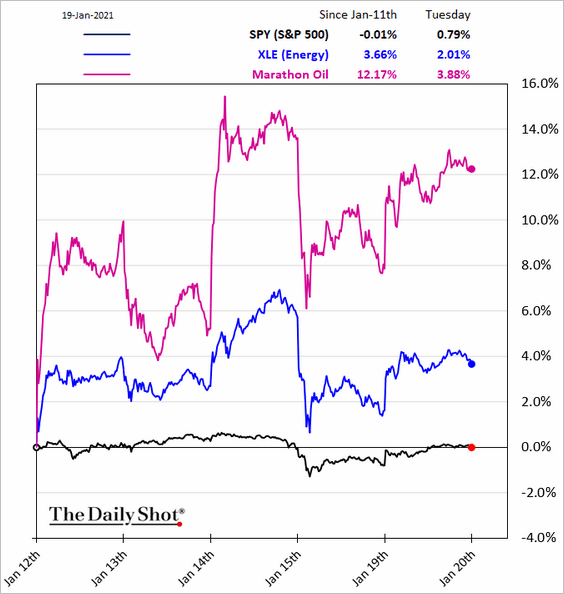

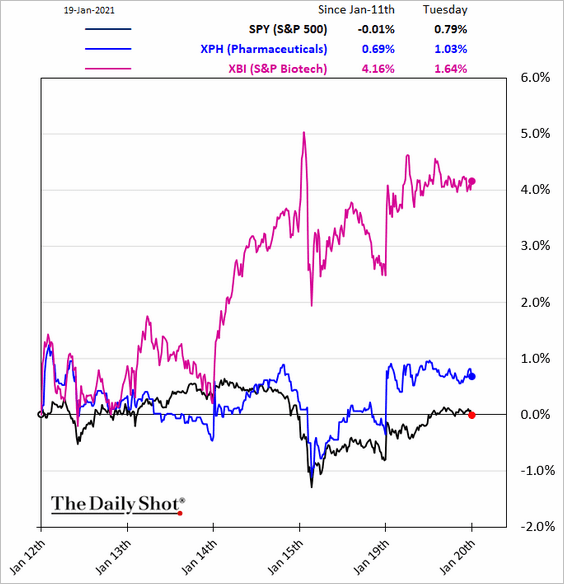

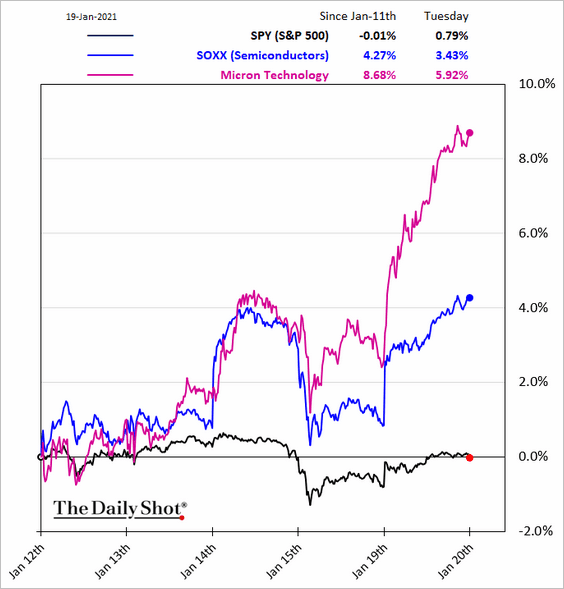

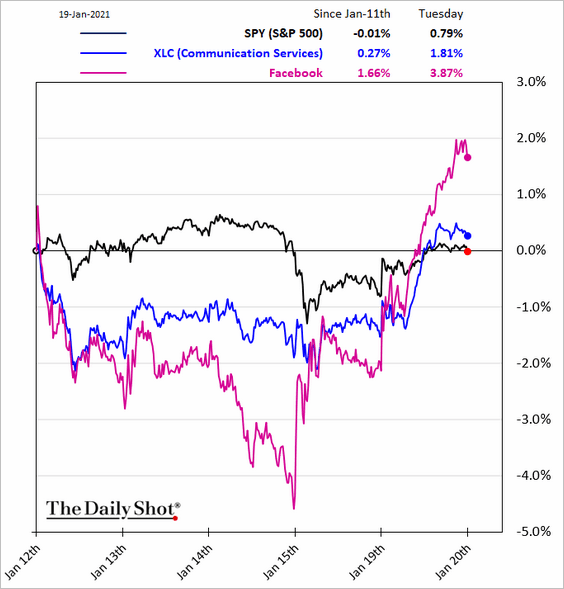

• Here are some sector/sub-sector performance charts over the past five business days.

– Banks:

– Homebuilders:

– Consumer staples:

– Energy:

– Pharma and biotech:

– Semiconductors:

– Communication services:

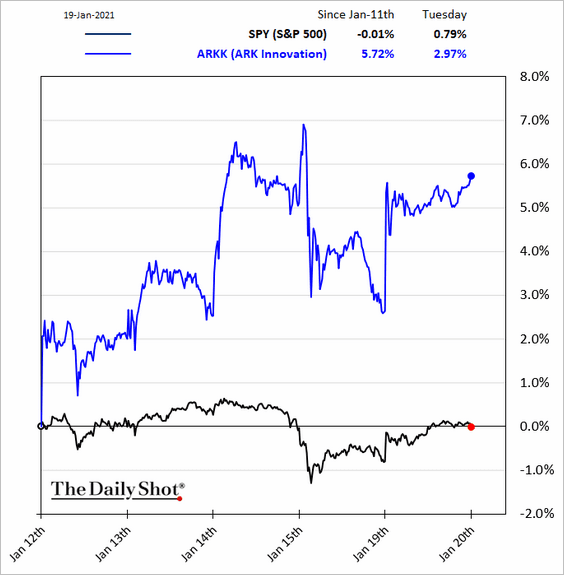

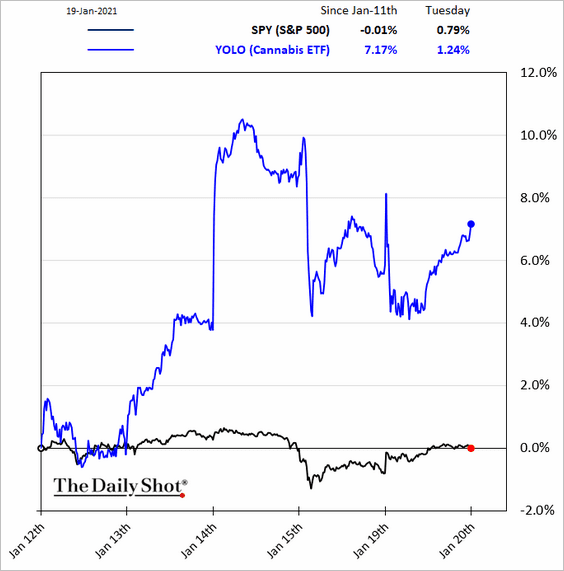

Some of the specialty funds favored by retail investors continue to climb.

– ARK Innovation:

– Cannabis:

Back to Index

Credit

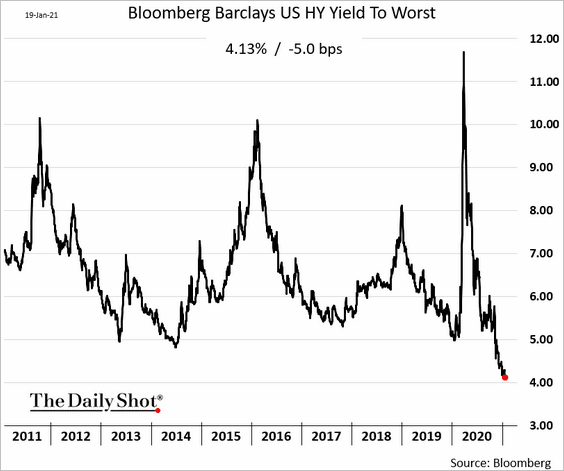

1. Yields on US junk bonds (HY) are hitting record lows.

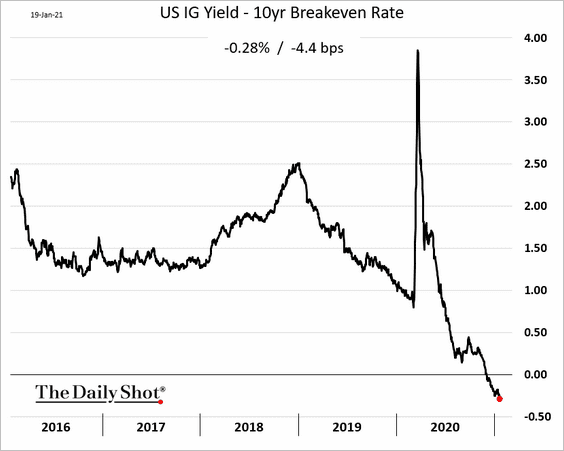

2. Real investment-grade (IG) yields are deep in negative territory.

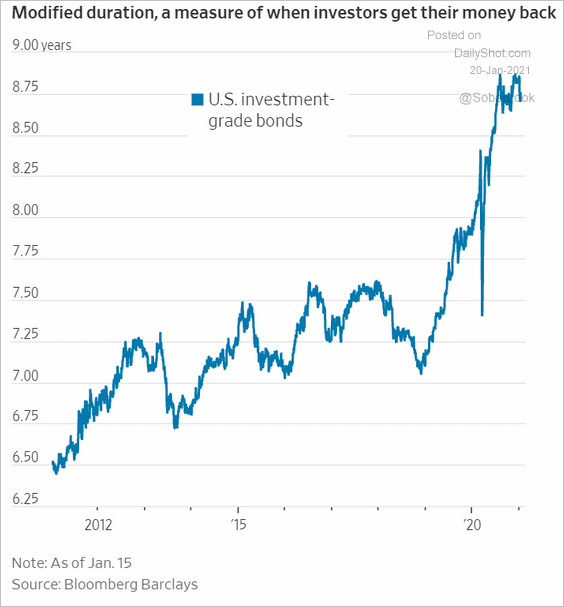

3. Investment-grade market duration keeps climbing.

Source: @WSJ Read full article

Source: @WSJ Read full article

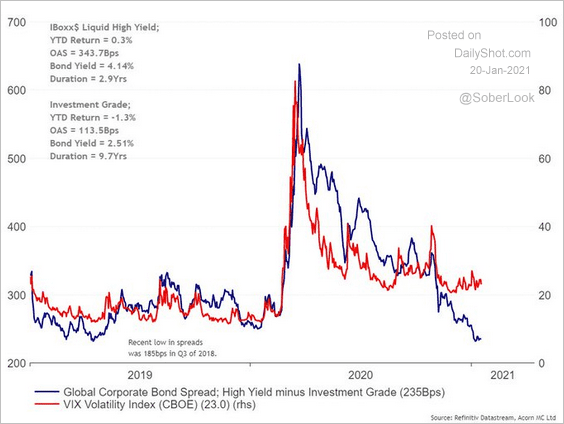

4. Global HY-IG spreads have diverged from VIX (credit is pricing less risk than equities).

Source: @RichardDias_CFA

Source: @RichardDias_CFA

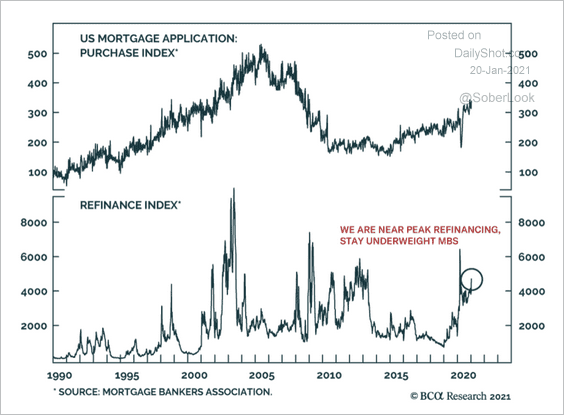

5. Elevated US mortgage refinancing is a near-term risk for mortgage-backed securities (MBS).

Source: BCA Research

Source: BCA Research

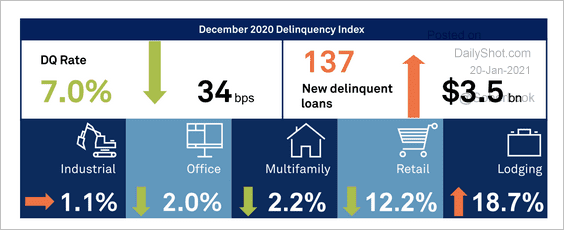

6. The overall US commercial mortgage-backed securities (CMBS) delinquency rate declined to 7% at the end of 2020, driven by improvements in retail and multi-family segments. Lodging remains a weak spot.

Source: S&P Global Ratings

Source: S&P Global Ratings

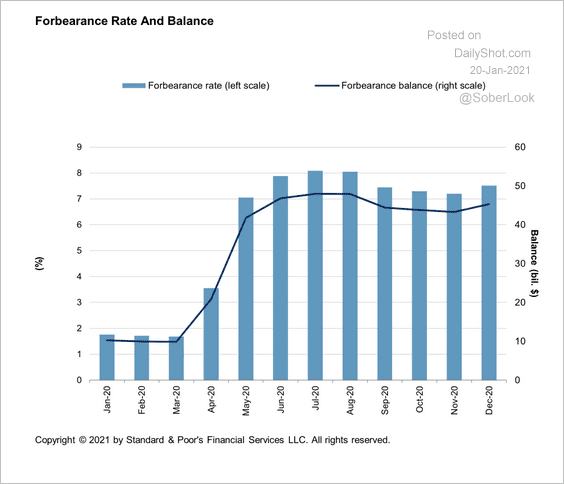

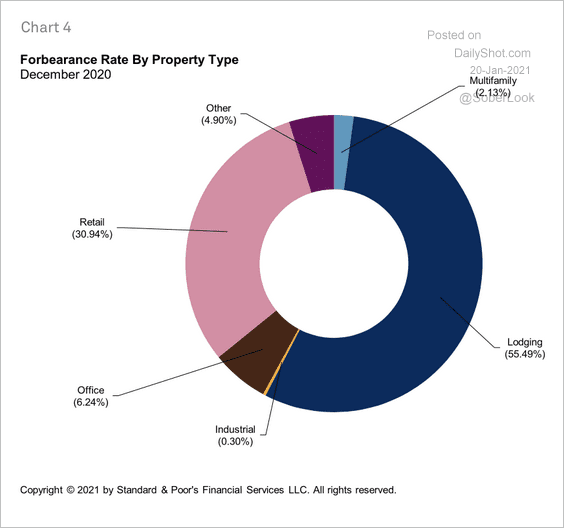

The CMBS forbearance rate remains elevated, mostly in lodging and retail (2 charts).

Source: S&P Global Ratings

Source: S&P Global Ratings

Source: S&P Global Ratings

Source: S&P Global Ratings

Back to Index

Rates

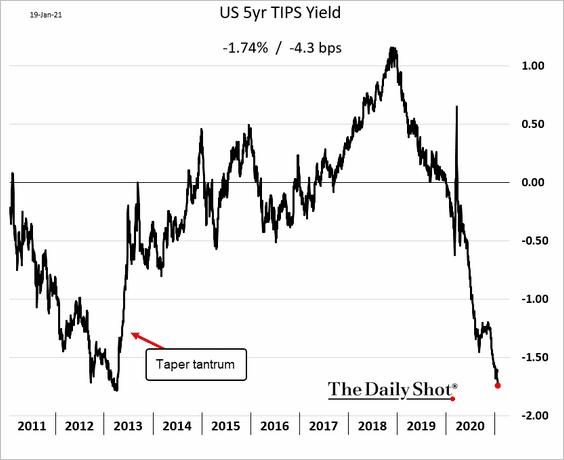

1. The 5-year TIPS yield (implied real rate) is approaching record lows.

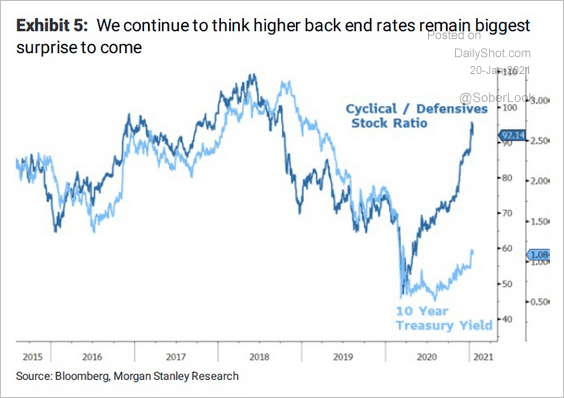

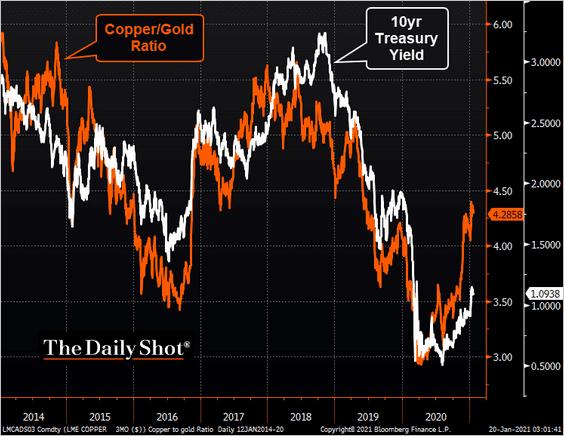

2. The cyclicals/defensives equity ratio and the copper/gold ratio point to higher Treasury yields (2 charts).

Source: Morgan Stanley Research, @Scutty

Source: Morgan Stanley Research, @Scutty

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

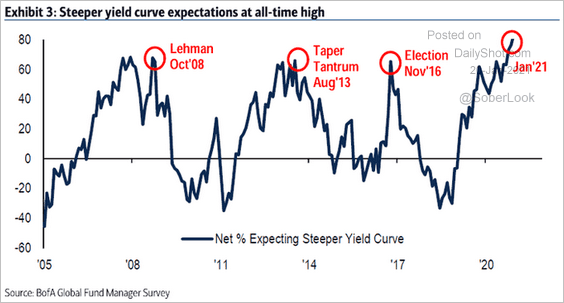

3. Fund managers see a steeper yield curve ahead.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

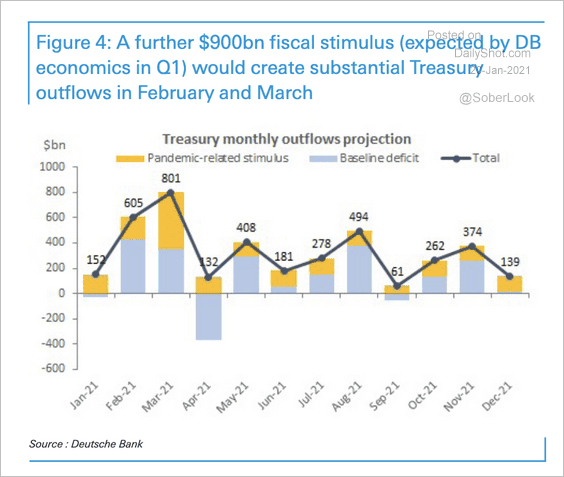

4. Fiscal stimulus could trigger substantial Treasury outflows over the next couple of months.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

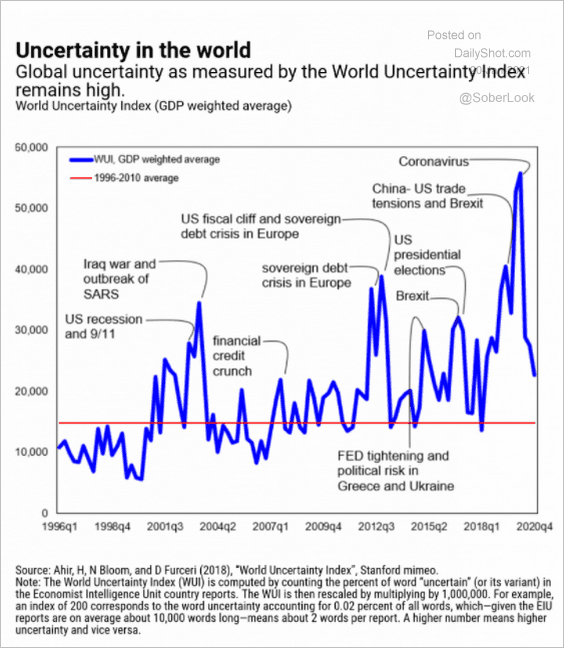

1. Let’s start with the global uncertainty index.

Source: IMF Read full article

Source: IMF Read full article

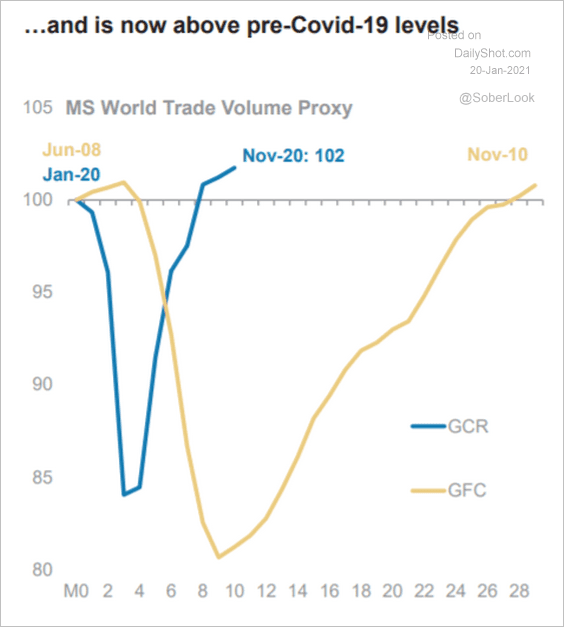

2. According to Morgan Stanley, world trade is now above pre-COVID levels.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

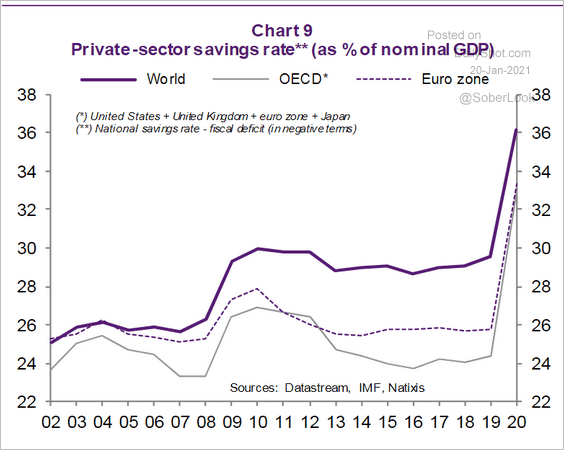

3. Private-sector savings spiked last year.

Source: Natixis

Source: Natixis

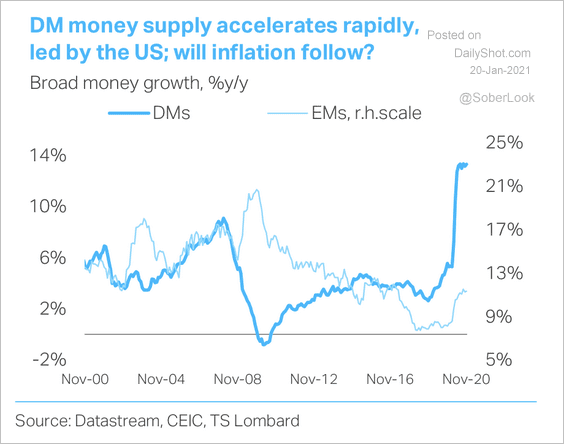

4. The growth in money supply in developed markets has far outpaced emerging markets last year.

Source: TS Lombard

Source: TS Lombard

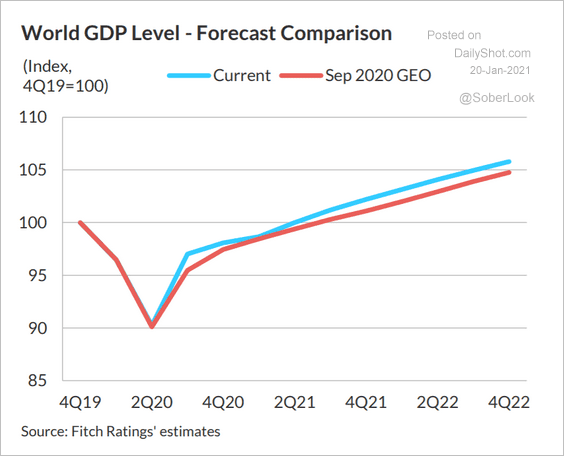

5. Fitch upgraded its forecast for the global GDP trajectory.

Source: Fitch Ratings

Source: Fitch Ratings

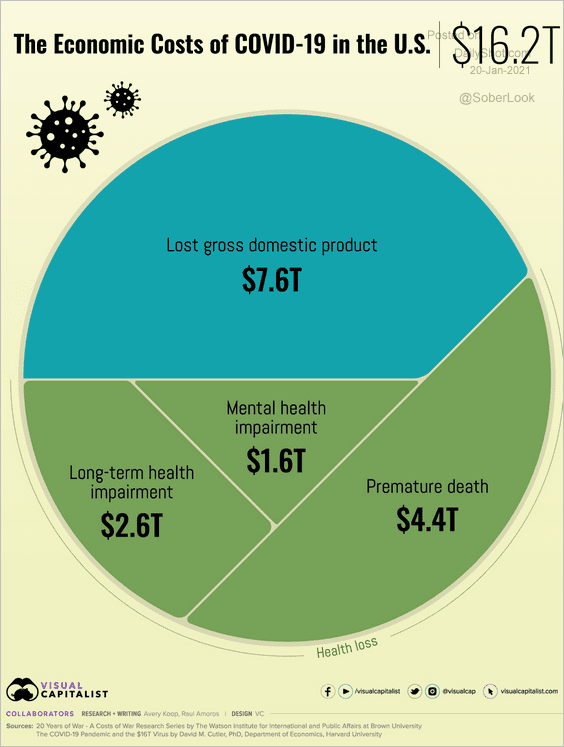

6. What is the total cost of the pandemic?

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

Back to Index

Food for Thought

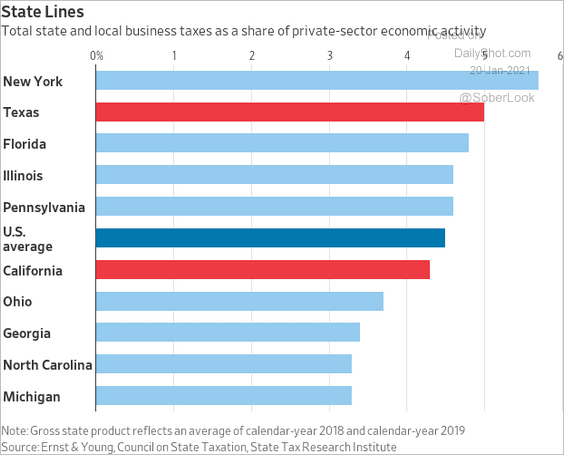

1. Business taxes by state:

Source: @WSJ Read full article

Source: @WSJ Read full article

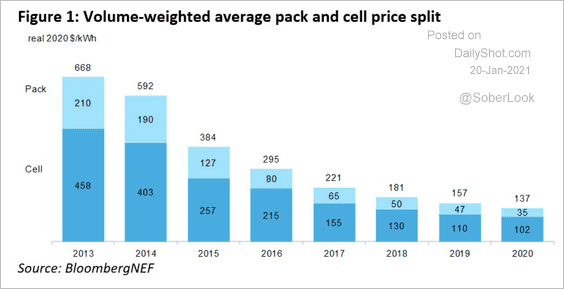

2. Battery prices:

Source: BloombergNEF’ Read full article

Source: BloombergNEF’ Read full article

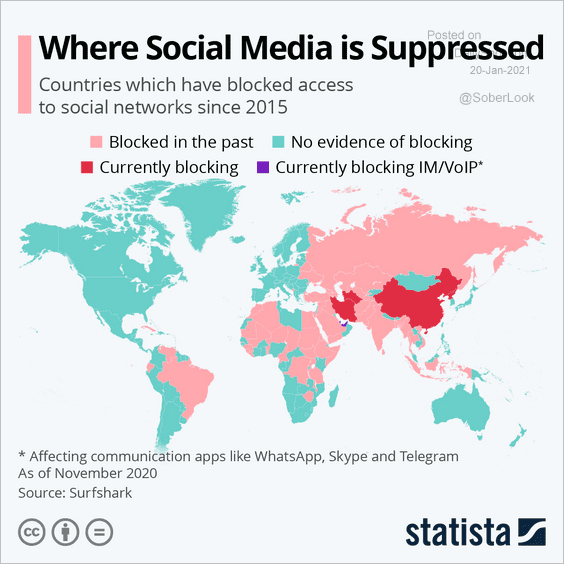

3. Governments suppressing social media:

Source: Statista

Source: Statista

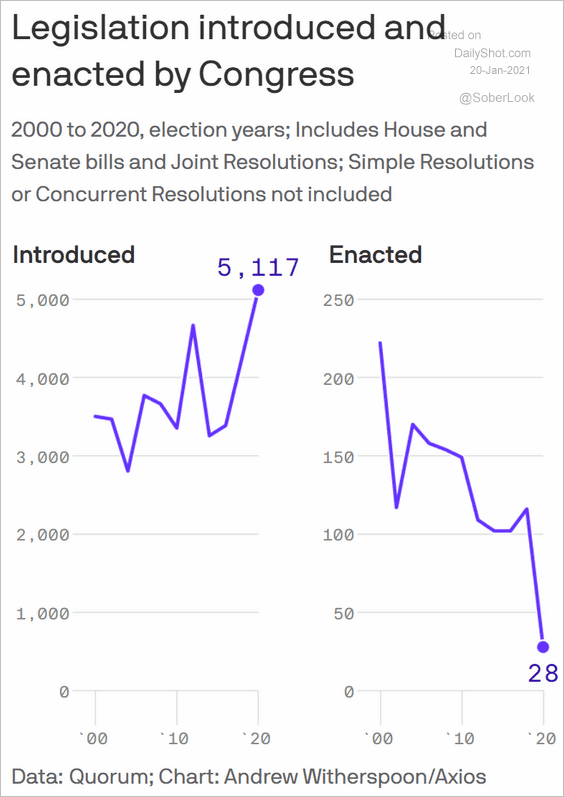

4. US legislation introduced and enacted:

Source: @axios Read full article

Source: @axios Read full article

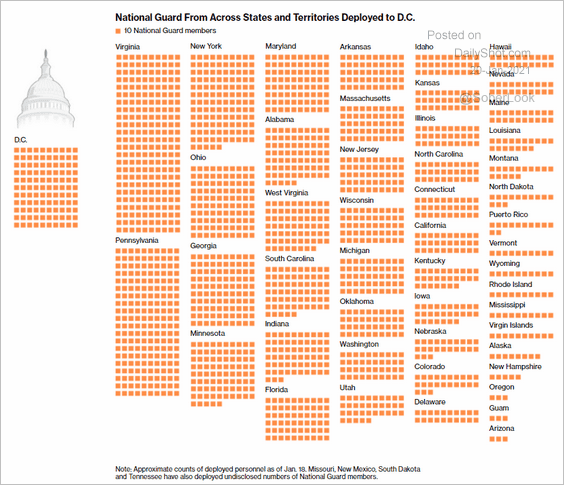

5. The National Guard in DC:

Source: @bbgvisualdata Read full article

Source: @bbgvisualdata Read full article

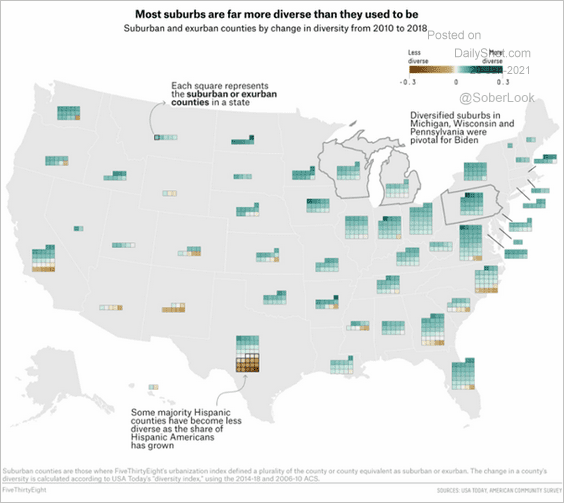

6. Increasing diversity in US suburbs:

Source: FiveThirtyEight Read full article

Source: FiveThirtyEight Read full article

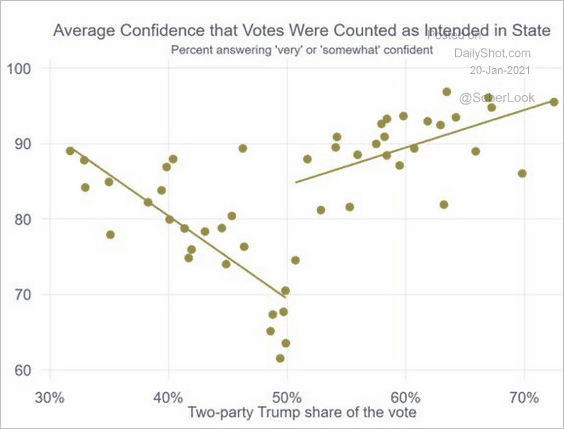

7. Confidence in the 2020 presidential election vote count:

Source: @jon_m_rob

Source: @jon_m_rob

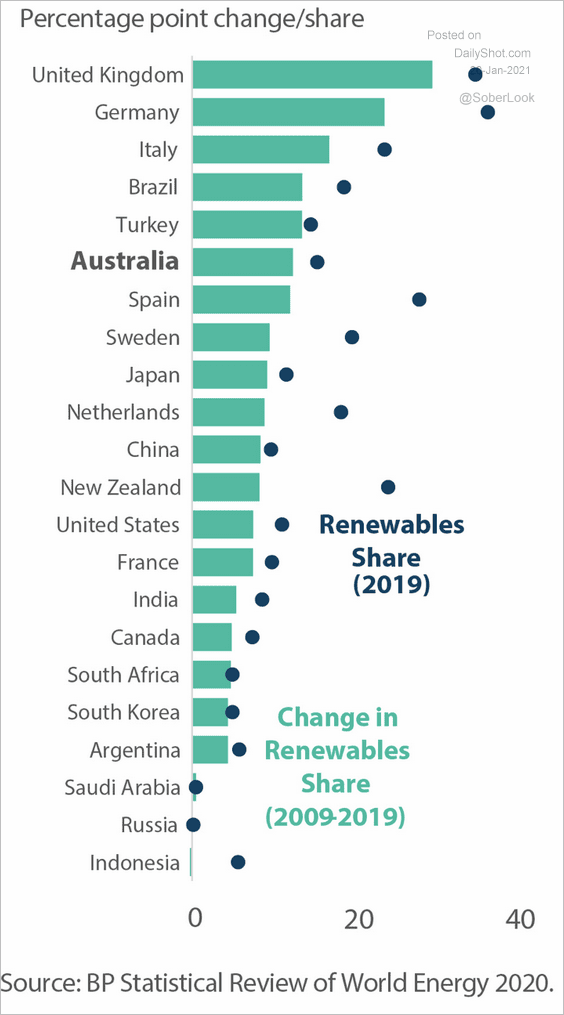

8. Renewables usage by country:

Source: CSIS Read full article

Source: CSIS Read full article

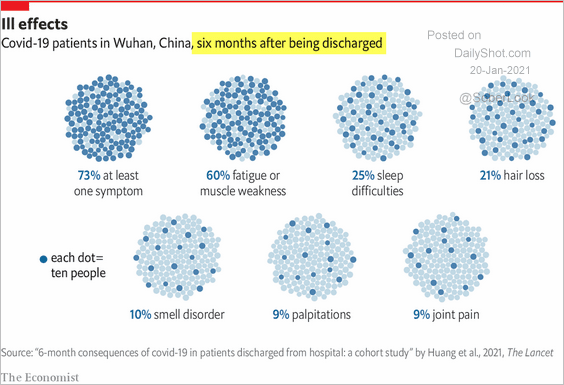

9. COVID symptoms six months after being discharged:

Source: The Economist Read full article

Source: The Economist Read full article

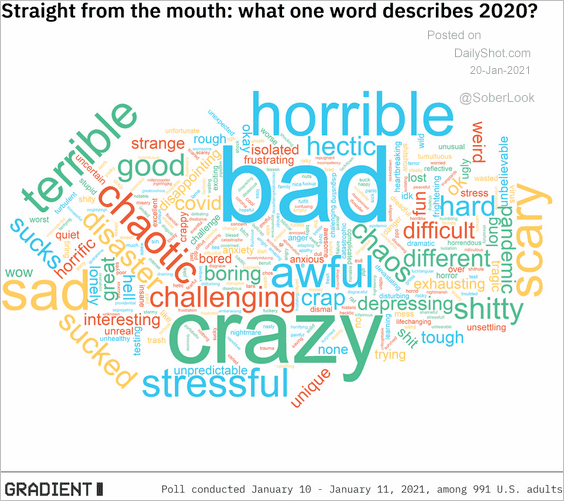

10. Describing 2020:

Source: Gradient Metrics

Source: Gradient Metrics

11. Missions to the moon over the past 20 years:

Source: Statista

Source: Statista

——————–

Back to Index