The Daily Shot: 21-Jan-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Global Developments

• Food for Thought

The United States

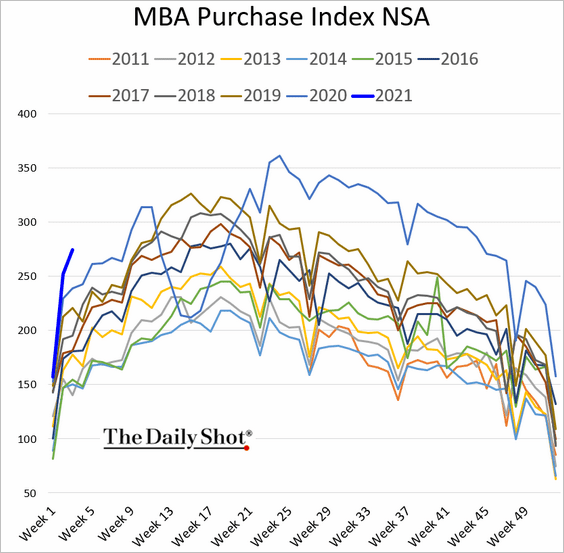

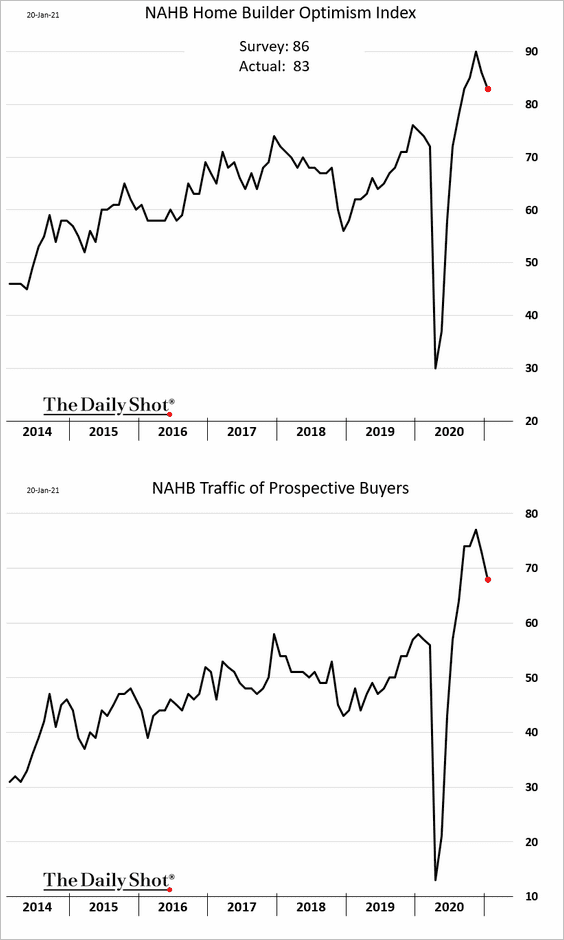

1. Let’s begin with the housing market.

• Mortgage applications to buy a house remain robust.

• The NAHB homebuilder optimism surprised to the downside, declining for the third month in a row. Nonetheless, the sentiment level is still elevated.

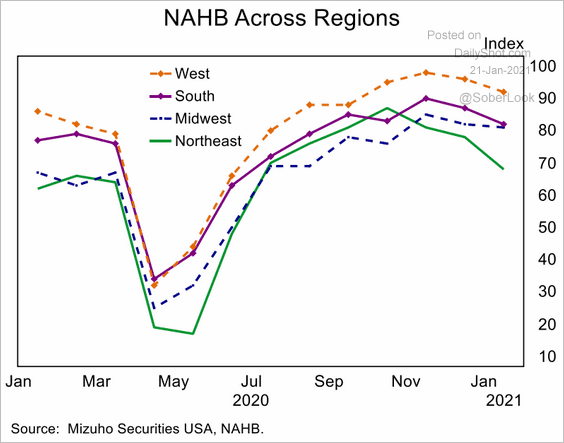

Here is the trend by region.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

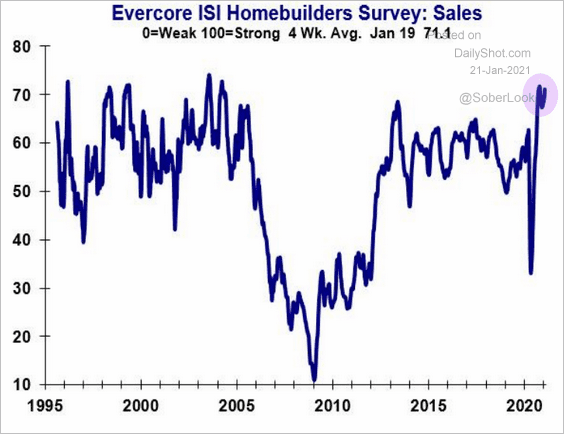

• A separate survey by Evercore ISI shows homebuilder sentiment holing near the highs.

Source: Evercore ISI

Source: Evercore ISI

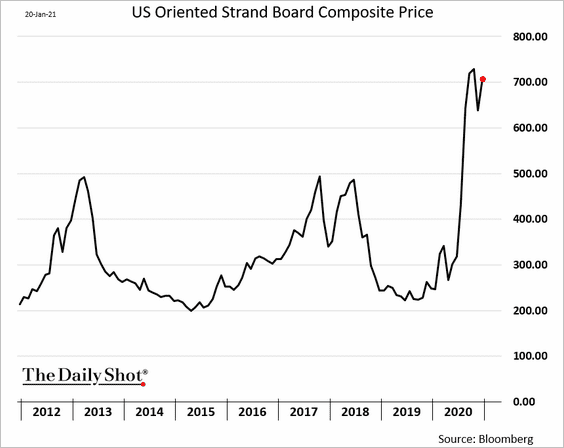

• Rising costs of construction materials have been an issue for many homebuilders.

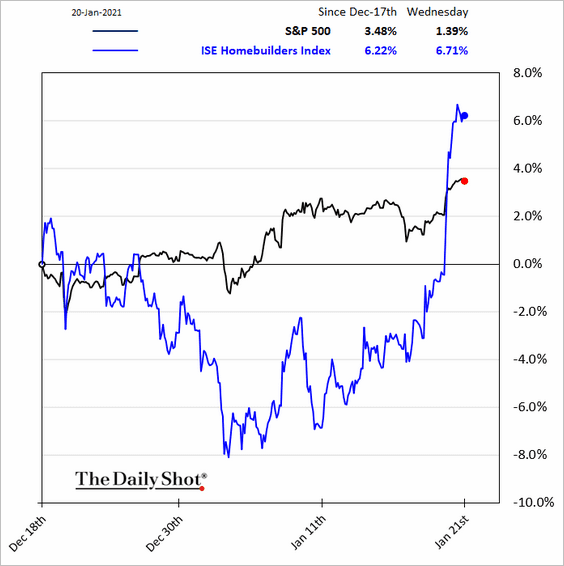

• Homebuilder shares rose sharply on Wednesday.

——————–

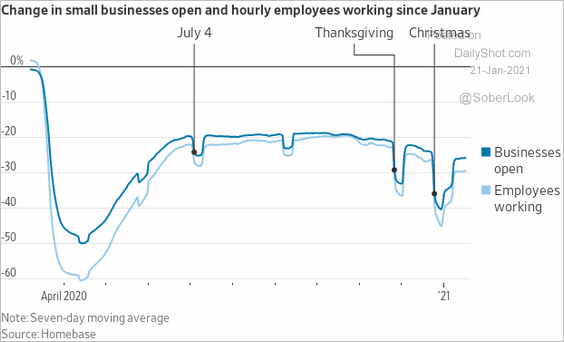

2. According to Homebase, small business employment remains soft.

Source: @WSJ Read full article

Source: @WSJ Read full article

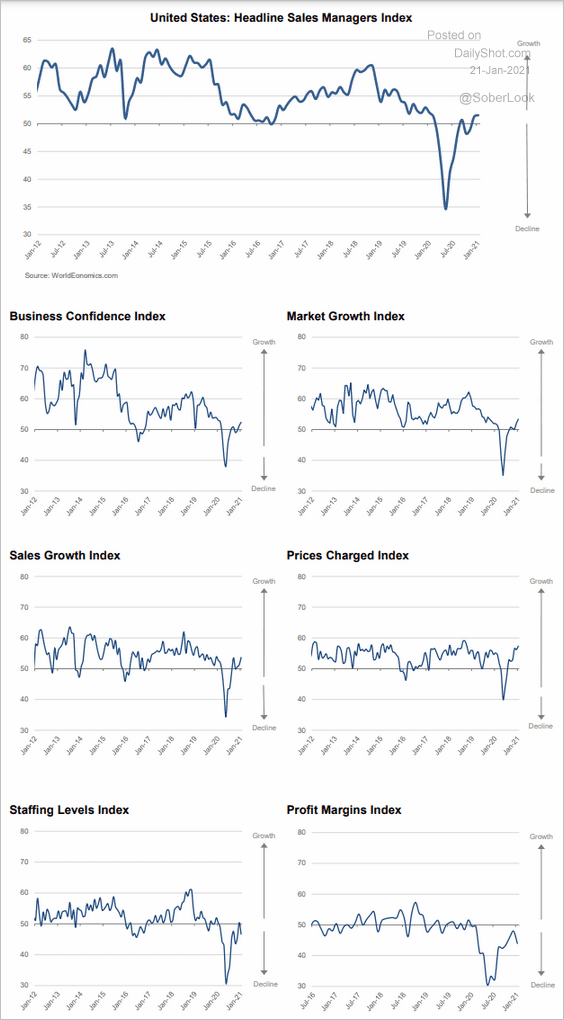

3. The January World Economics SMI report shows ongoing, albeit modest, expansion in business activity.

Source: World Economics

Source: World Economics

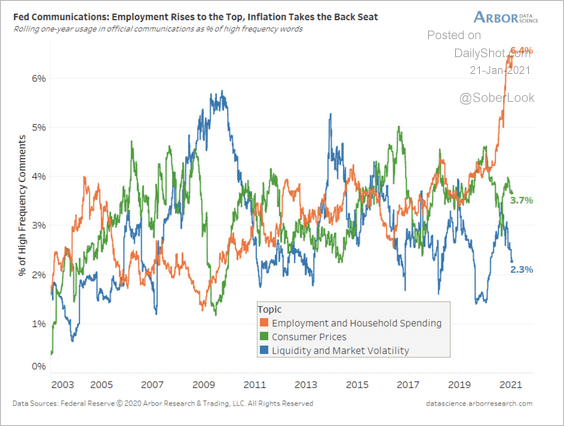

4. Fed communications remain highly focused on employment and household spending instead of inflation.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

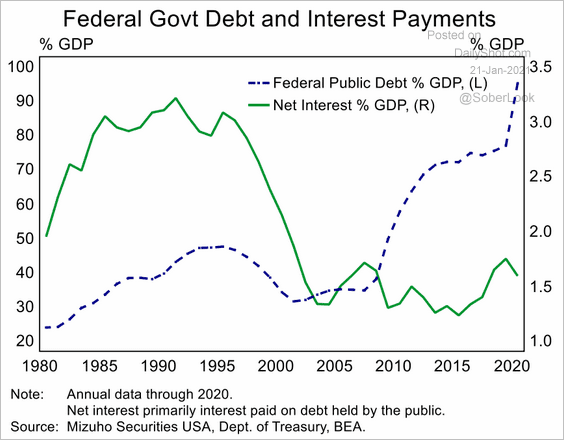

5. By holding down rates, the US central bank has allowed the federal government to massively increase its debt without incurring higher interest expenses. Will the Fed sustain this trend as the US implements another fiscal stimulus package?

Source: Mizuho Securities USA

Source: Mizuho Securities USA

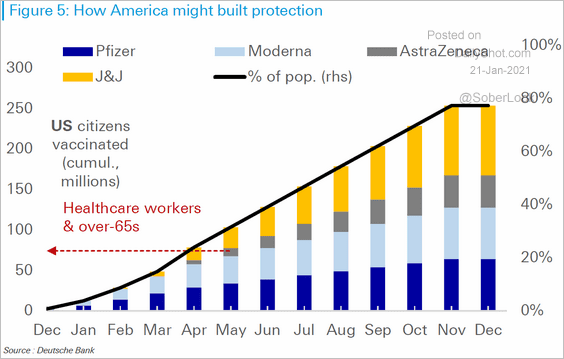

6. Here is a possible vaccination scenario for the US.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Canada

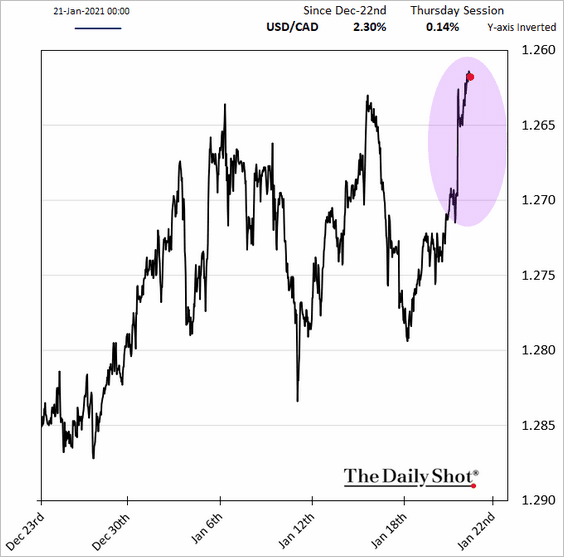

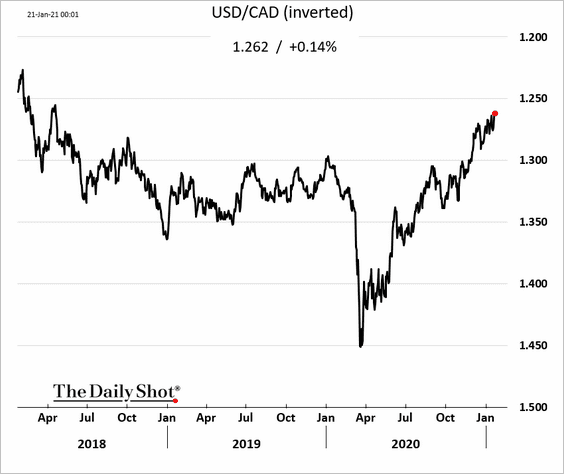

1. The BoC left policy unchanged but surprised the markets with a comment on adjusting “net purchases.” Below is a quote from Desjardins.

The tapering signal came in earlier than we envisioned, and taken with comments made on vaccines and fiscal stimulus, it is abundantly clear that the BoC does not see itself as having the main role, as opposed to a supportive role, in the fight on the pandemic. This need not mean that the BoC is sending a hawkish signal at this stage, but at a bare minimum, the bar for further accommodation seems to be higher than markets expected.

The loonie rose sharply in response.

The Canadian dollar is now at the highest level vs. USD since early 2018.

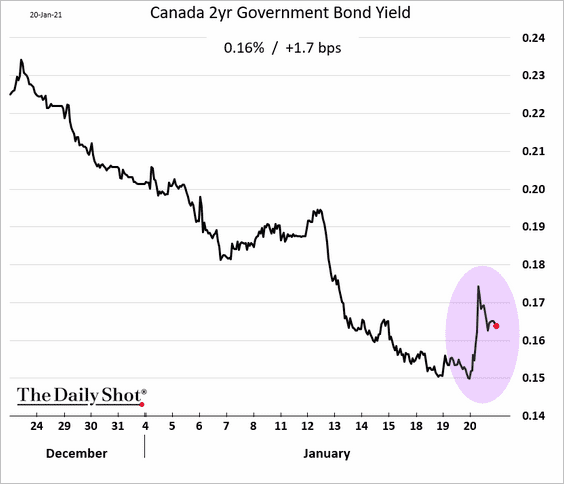

Short-term bond yields rose as well.

——————–

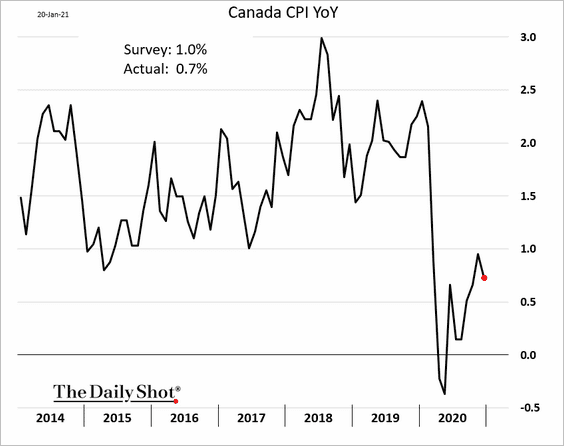

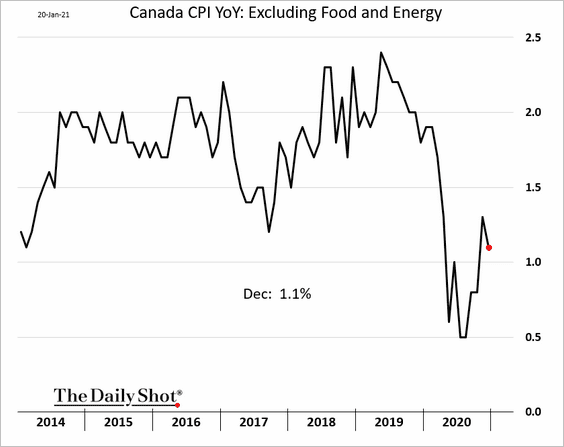

2. The CPI ticked lower in December.

——————–

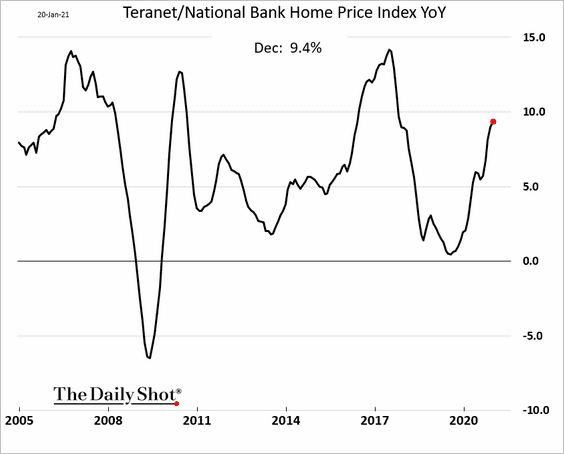

3. Home price appreciation continues to climb.

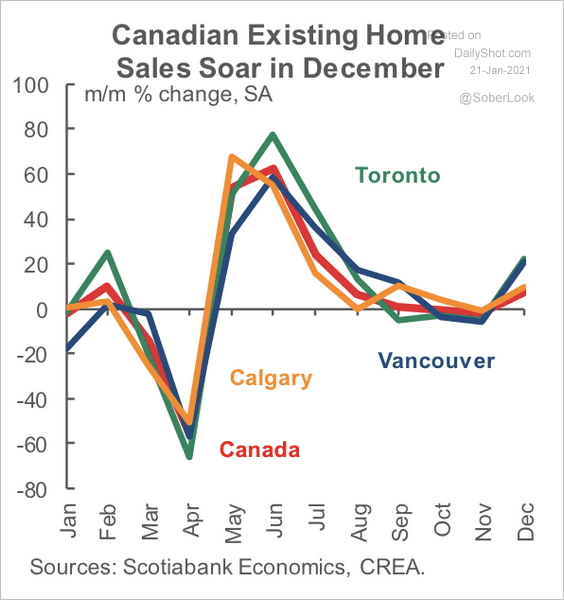

4. Existing home sales climbed further last month, especially in Toronto and Vancouver.

Source: Scotiabank Economics

Source: Scotiabank Economics

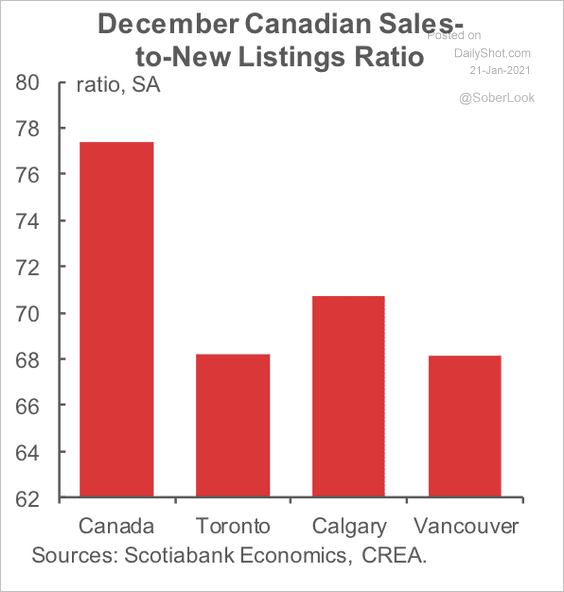

However, the tightest housing markets are not in the biggest cities.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

The United Kingdom

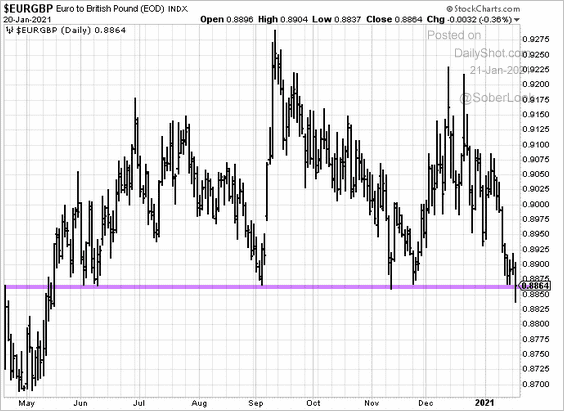

1. EUR/GBP is testing support.

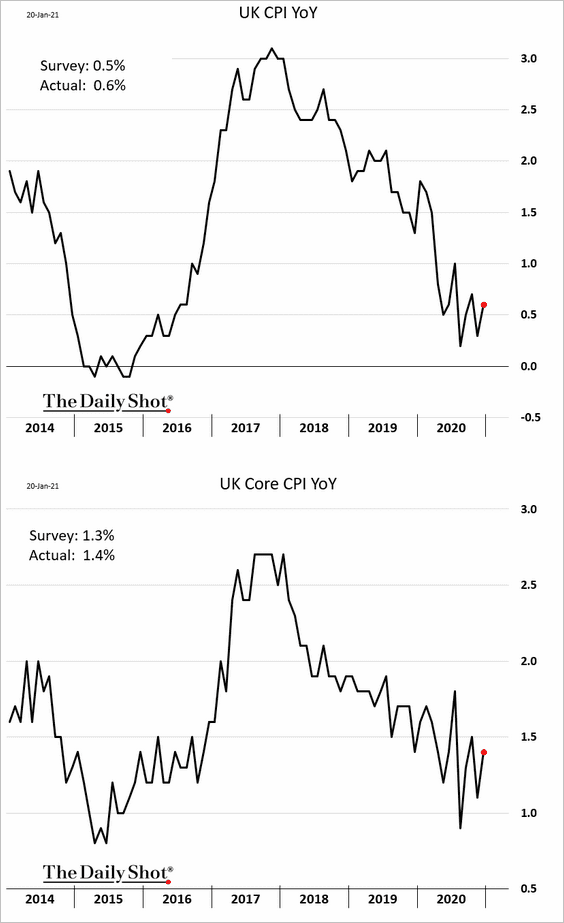

2. Inflation ticked higher in December.

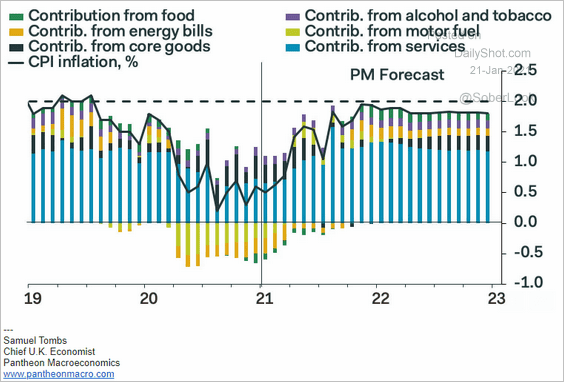

Here is a forecast for the UK CPI from Pantheon Macroeconomics.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

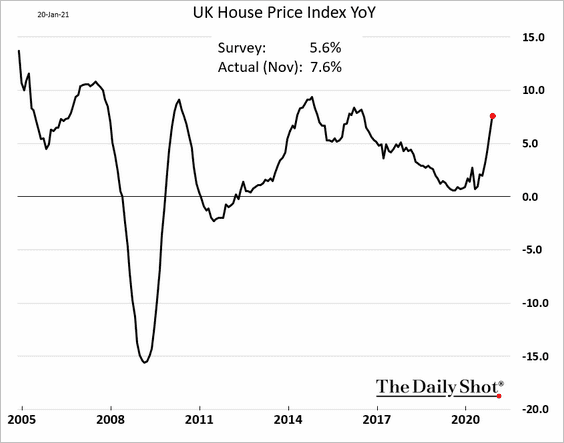

3. The November home price (official) index surprised to the upside as the housing market heats up.

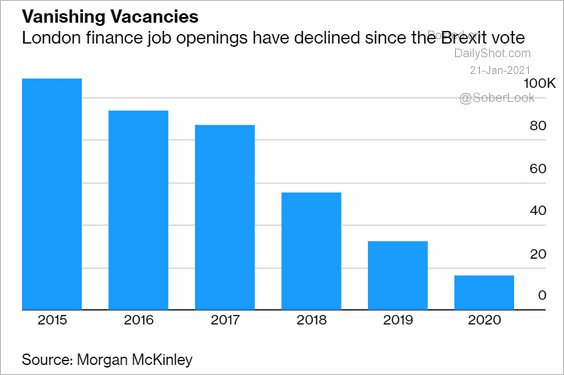

4. Finance job openings in London have been declining for years.

Source: @business Read full article

Source: @business Read full article

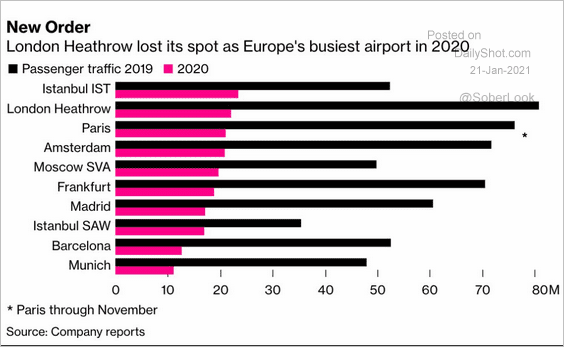

5. Heathrow is no longer Europe’s busiest airport.

Source: @Quicktake Read full article

Source: @Quicktake Read full article

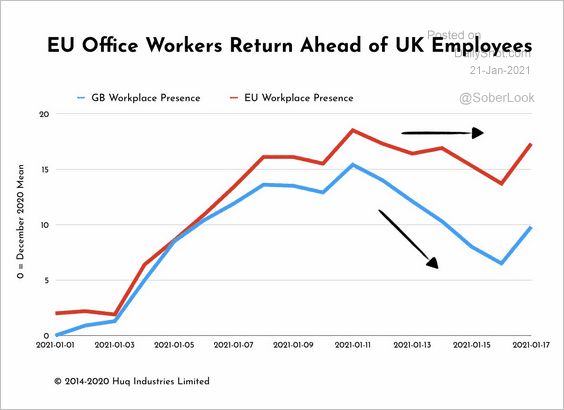

6. Fewer UK workers have returned to the office than their peers in the EU.

Source: Huq Read full article

Source: Huq Read full article

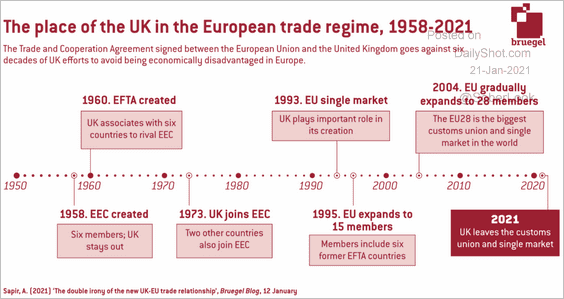

7. Here is the timeline of the UK trade regime in Europe.

Source: @Bruegel_org Read full article

Source: @Bruegel_org Read full article

Back to Index

The Eurozone

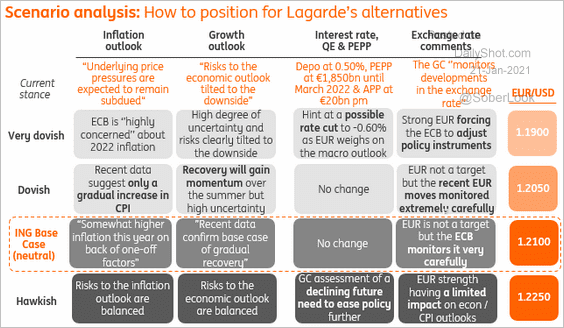

1. What should we expect from the ECB? Below are some scenarios from ING.

Source: ING

Source: ING

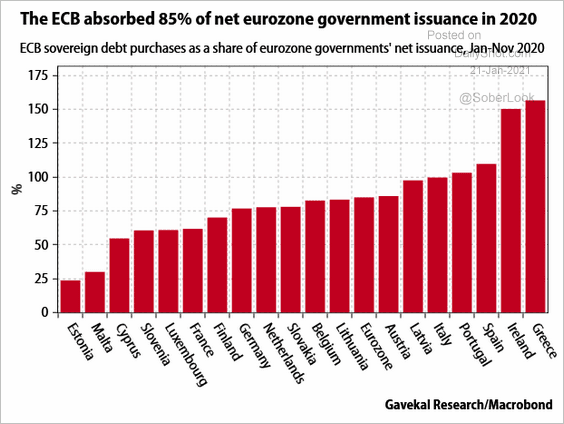

2. The ECB absorbed 85% of net government bond issuance last year.

Source: Gavekal Research

Source: Gavekal Research

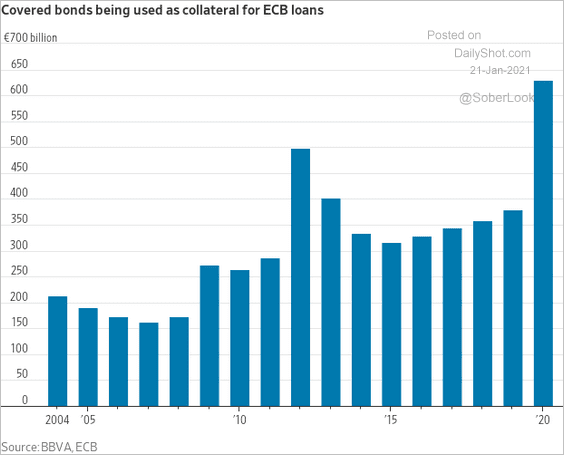

3. The value of covered bonds used as collateral for ECB loans hit a record in 2020.

Source: @jimwillhite, @WSJ Read full article

Source: @jimwillhite, @WSJ Read full article

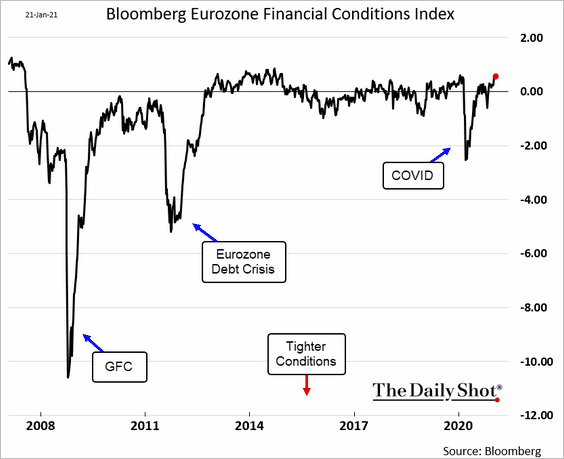

4. Eurozone financial conditions have fully recovered.

Back to Index

Asia – Pacific

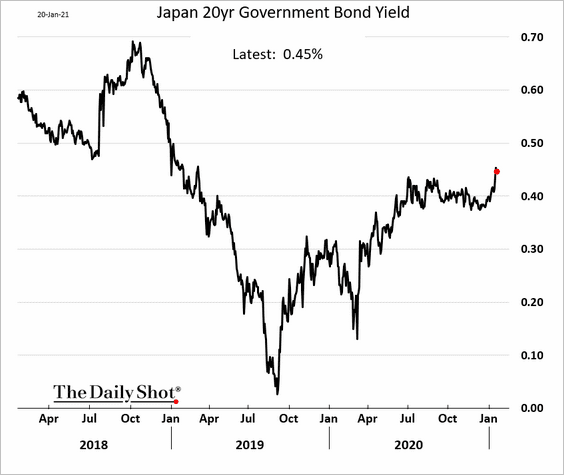

1. Longer-dated JGB yields have been rising.

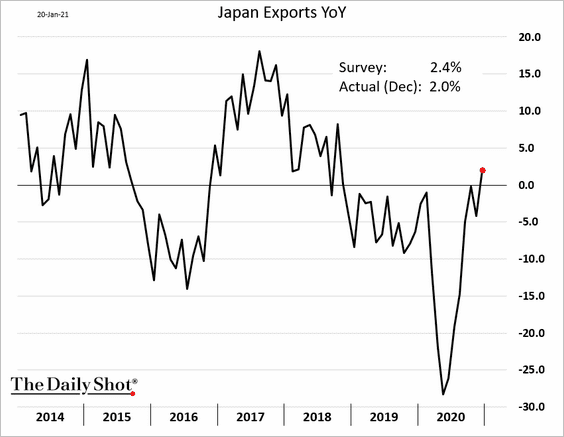

2. Japan’s exports have rebounded, but last month’s figures were below market expectations.

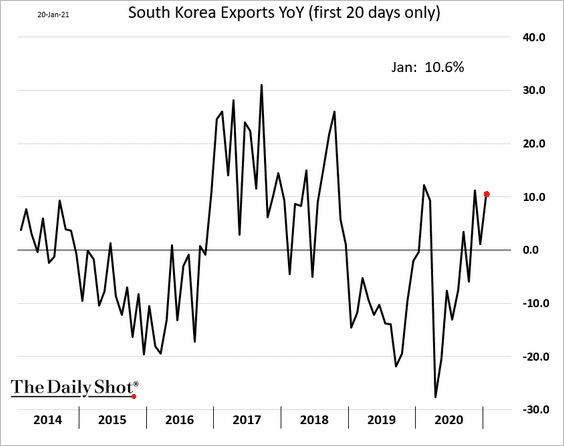

3. South Korea’s exports were robust this month.

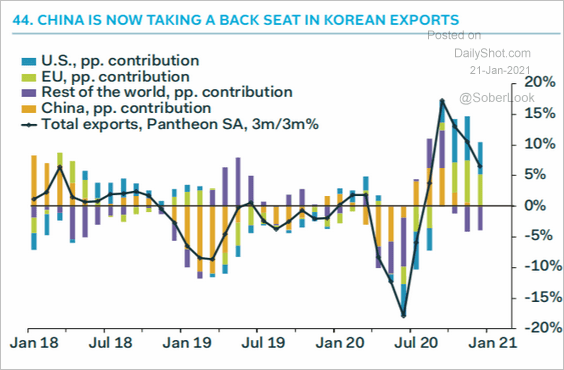

Exports to China haven’t been growing lately.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

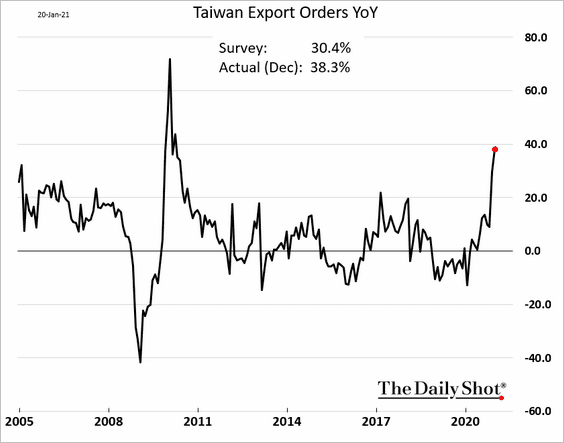

4. Taiwan’s export orders are soaring.

Source: @markets Read full article

Source: @markets Read full article

——————–

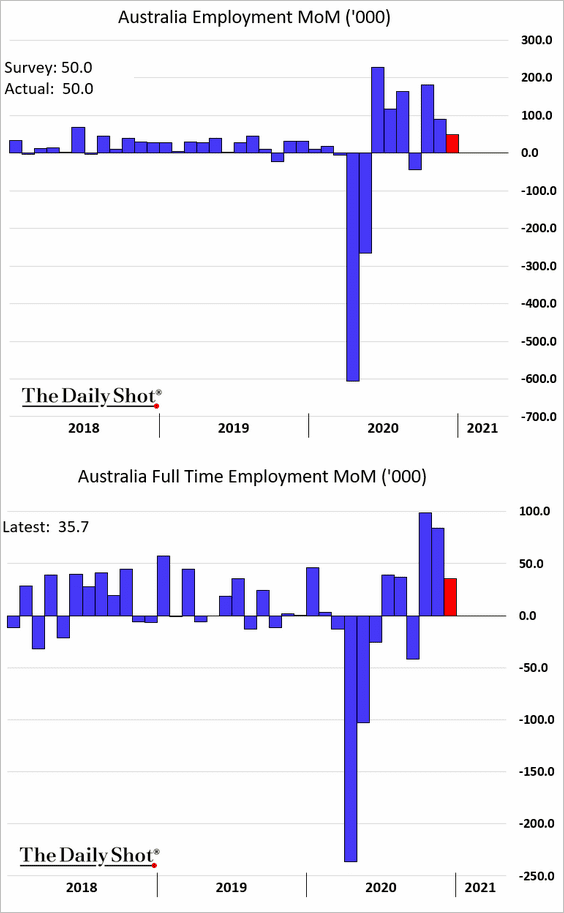

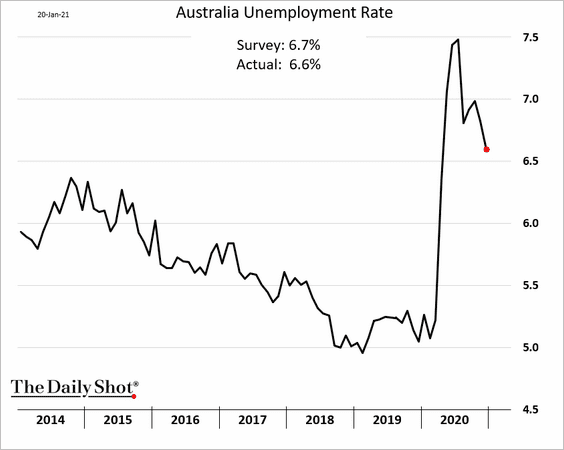

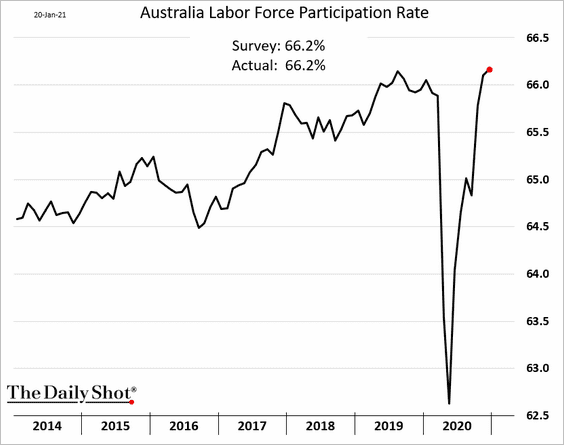

5. Australia’s employment report was solid (in line with expectations).

• Job gains:

• Unemployment rate:

• Participation rate:

——————–

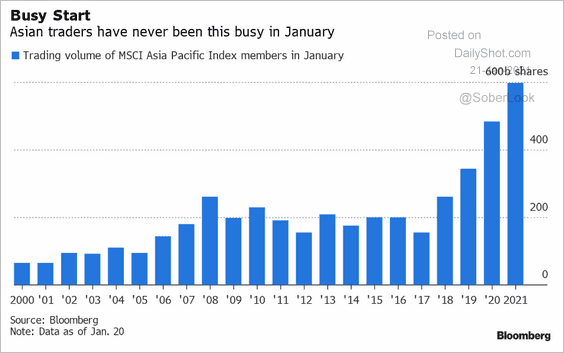

6. Asia’s stock trading volumes hit a record this month.

Source: Moxy Ying, @TheTerminal, Bloomberg Finance L.P.

Source: Moxy Ying, @TheTerminal, Bloomberg Finance L.P.

Back to Index

China

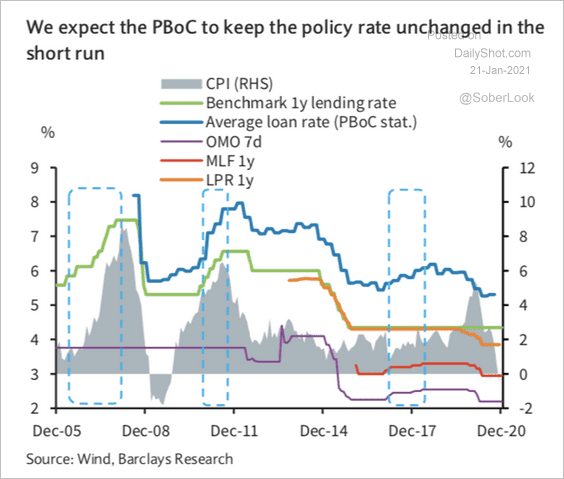

1. Barclays expects the PBoC to keep the policy rate stable in the near-term.

Source: Barclays Research

Source: Barclays Research

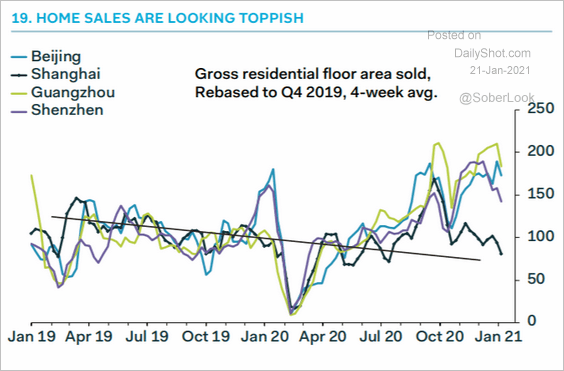

2. Home sales appear to be peaking.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

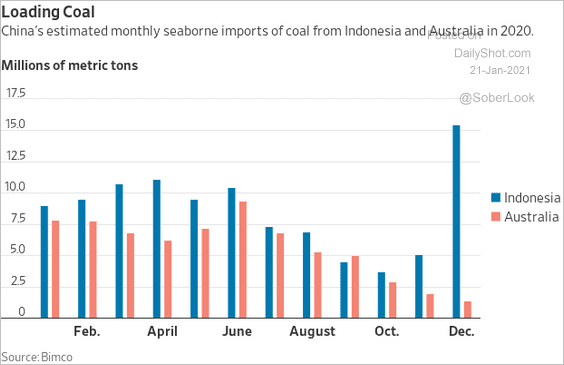

3. China shifted to Indonesia’s coal exporters to punish Australia.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Emerging Markets

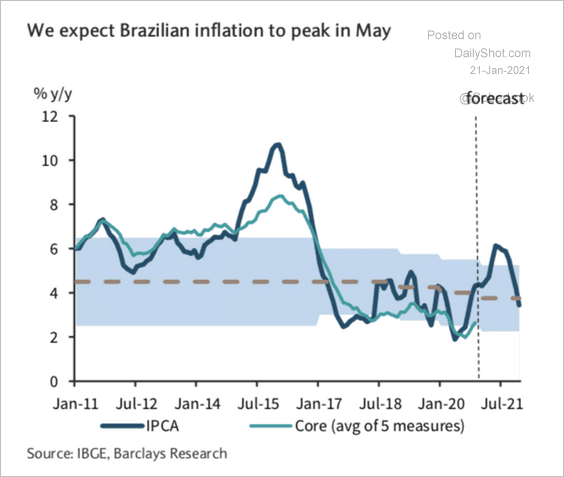

1. Brazil’s inflation is expected to peak at around 6% in May.

Source: Barclays Research

Source: Barclays Research

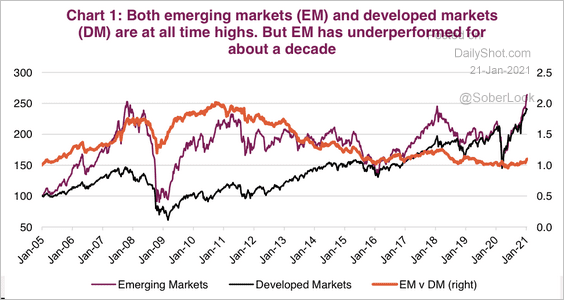

2. EM equities have underperformed DM for about a decade.

Source: Market Ethos, Richardson GMP

Source: Market Ethos, Richardson GMP

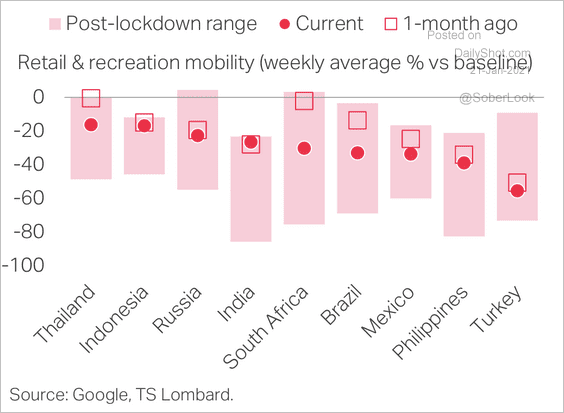

3. EM mobility is well above pandemic lows.

Source: TS Lombard

Source: TS Lombard

Back to Index

Cryptocurrency

1. Bitcoin is testing support.

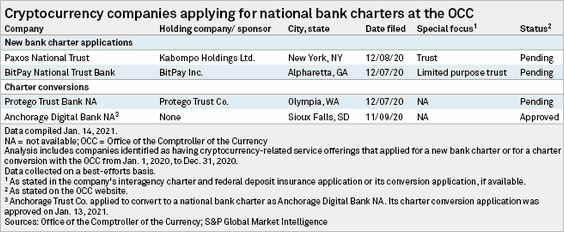

2. A number of crypto companies have been applying for bank charters in the US.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

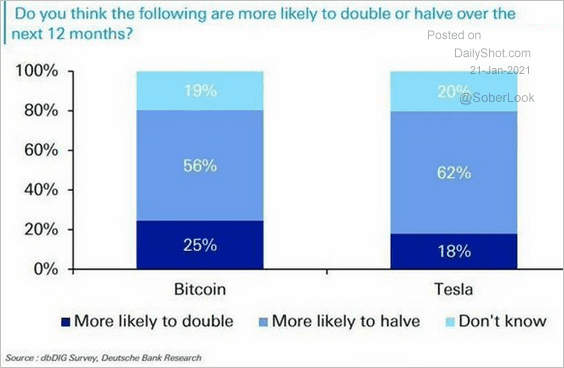

3. Which asset is more likely to double/halve?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

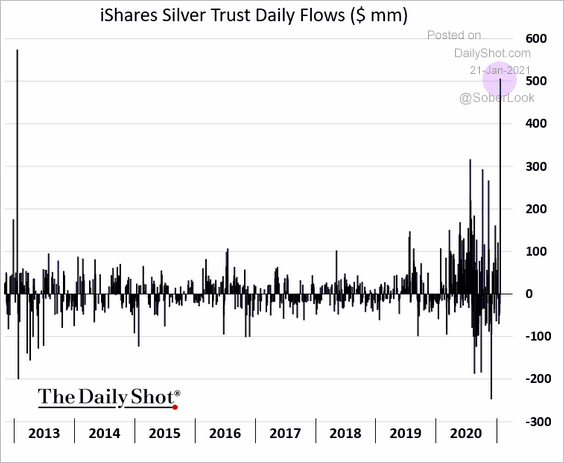

Commodities

1. The largest silver ETF got a sizeable inflow.

h/t @Edspencive

h/t @Edspencive

2. Industrial metals have been on a tear over the past year.

Source: BCA Research

Source: BCA Research

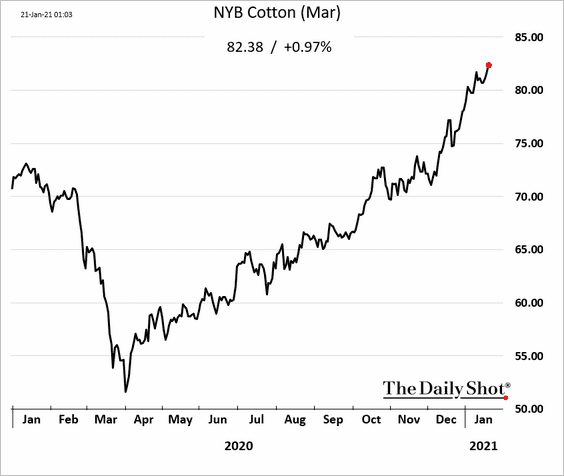

3. US cotton futures continue to climb.

Back to Index

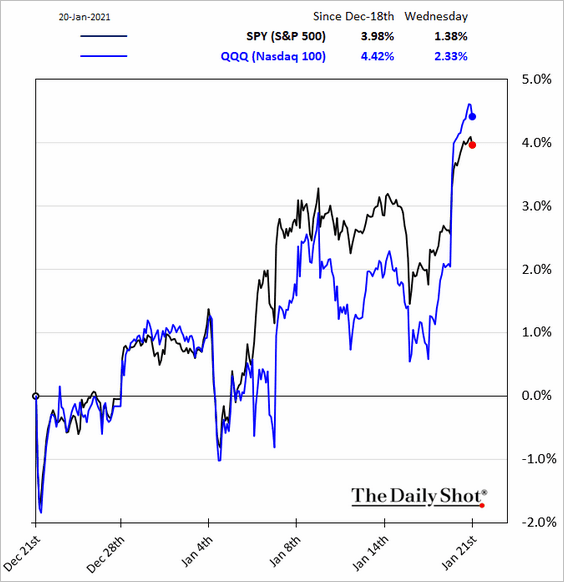

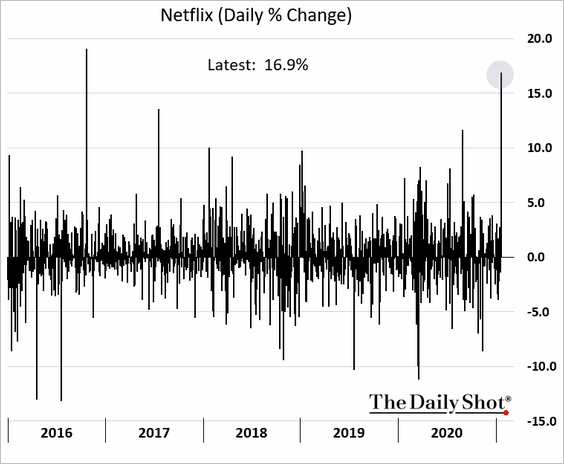

Equities

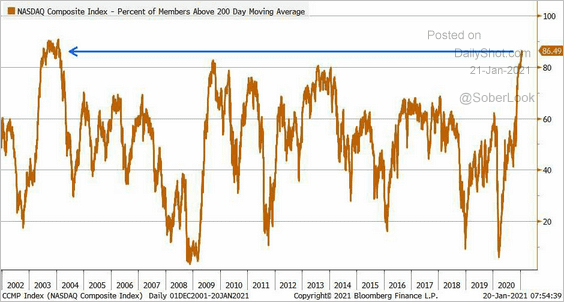

1. Stock indices hit another record high, with tech back in the driver’s seat.

The Nasdaq Composite breadth has been exceptionally strong.

Source: @LizAnnSonders

Source: @LizAnnSonders

——————–

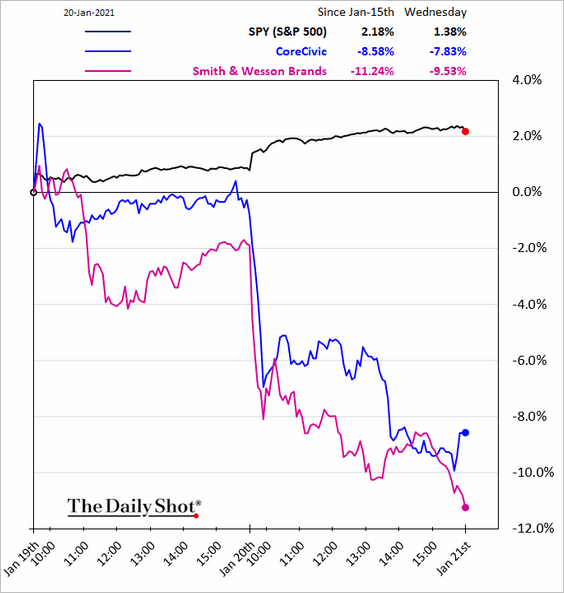

2. Private prisons and gun stocks sold off as Democrats took control.

h/t @tracyalloway

h/t @tracyalloway

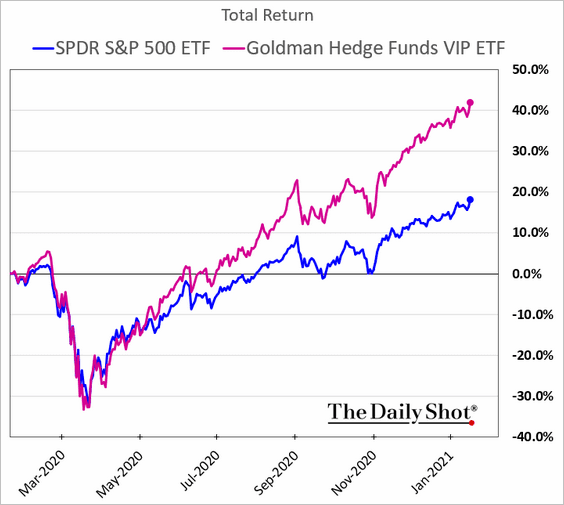

3. Hedge funds’ favorite stocks continue to outperform.

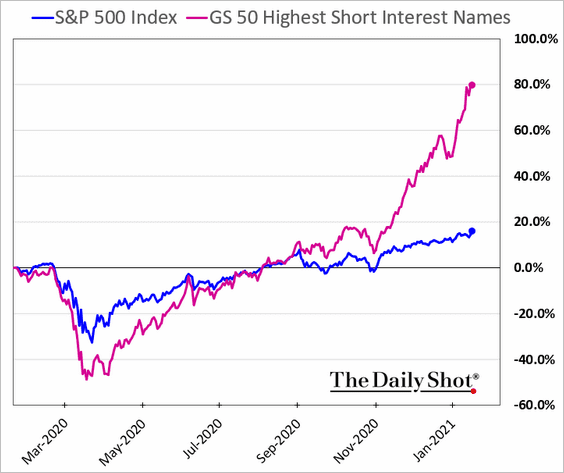

4. The most heavily shorted stocks are soaring.

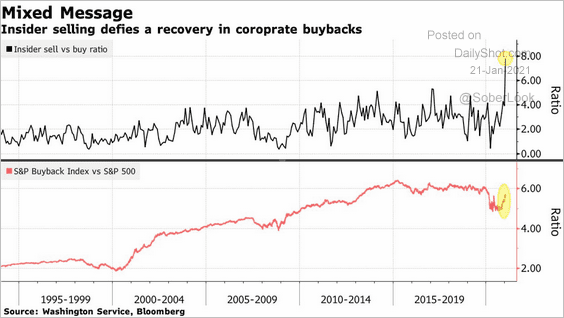

5. Despite the improvement in corporate share buybacks, insiders have been selling.

Source: @jessefelder, @markets Read full article

Source: @jessefelder, @markets Read full article

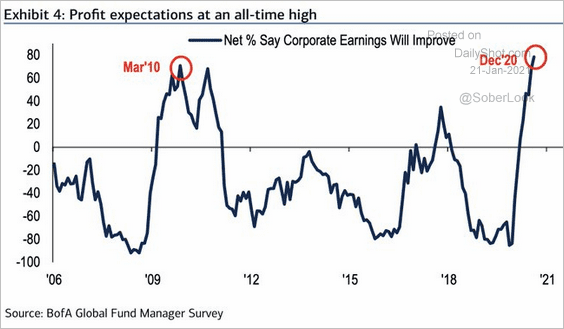

6. Fund managers are upbeat about corporate earnings.

Source: BofA Global Research

Source: BofA Global Research

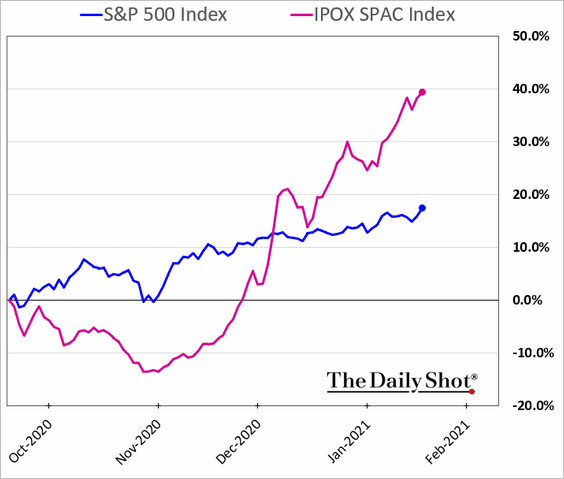

7. SPACs have sharply outperformed the broader market since the vaccine news.

h/t @LizAnnSonders

h/t @LizAnnSonders

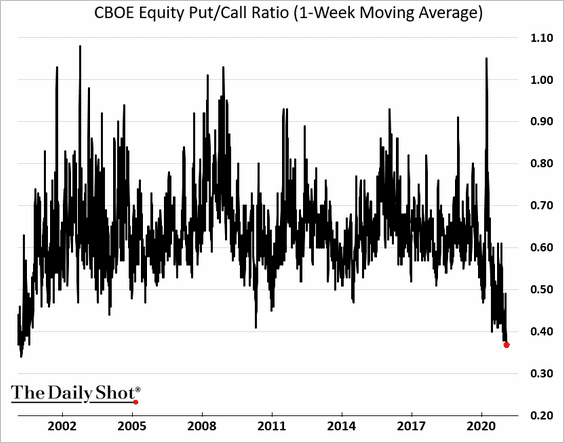

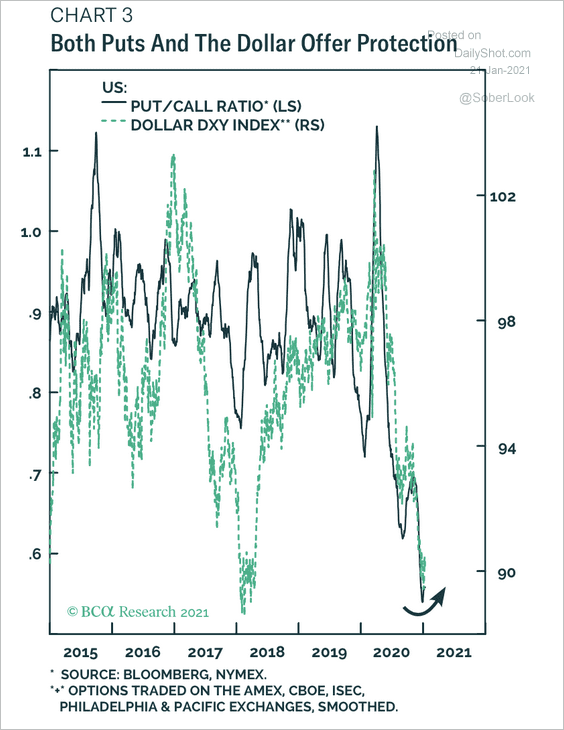

8. The put-call ratio continues to hit multi-year lows amid rising retail demand for call options.

h/t @LizAnnSonders

h/t @LizAnnSonders

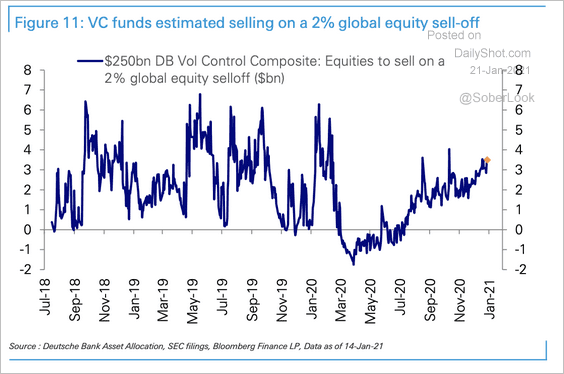

9. The value of stocks that volatility-controlled funds will have to sell on a 2% selloff is rising (which may exacerbate the selloff).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

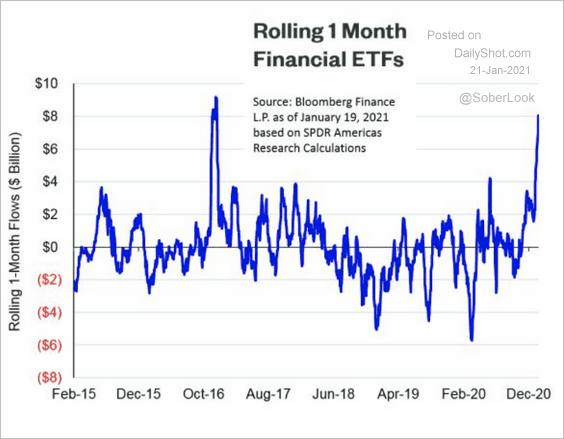

10. Financial ETFs have taken in $6 billion of inflows in just 11 trading days, according to State Street.

Source: SPDR Americas Research, @mattbartolini Read full article

Source: SPDR Americas Research, @mattbartolini Read full article

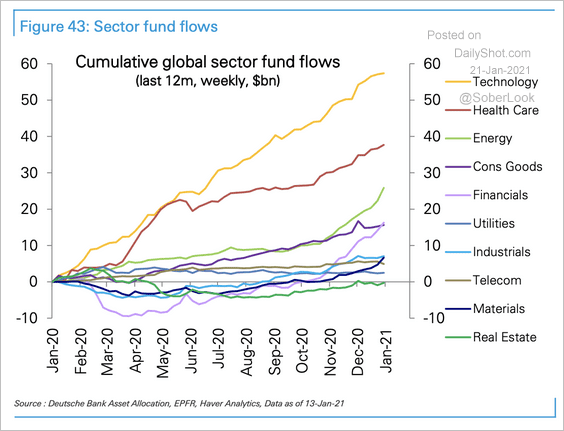

11. Here is a look at global sector fund flows over the past 12 months.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

1. Will an equity correction lead to a dollar bounce?

Source: BCA Research

Source: BCA Research

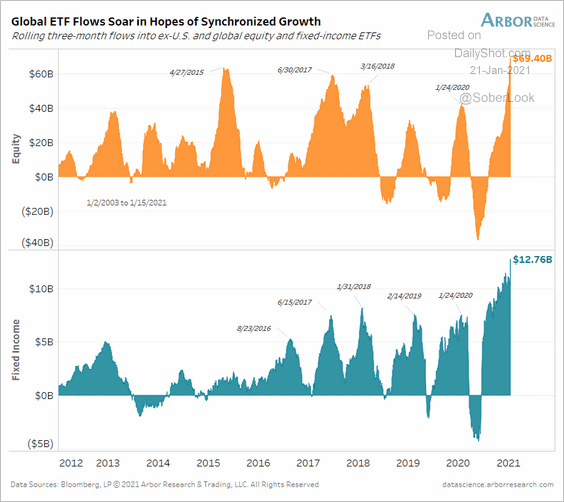

2. Flows into non-US equity and fixed-income ETFs accelerated in recent weeks.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

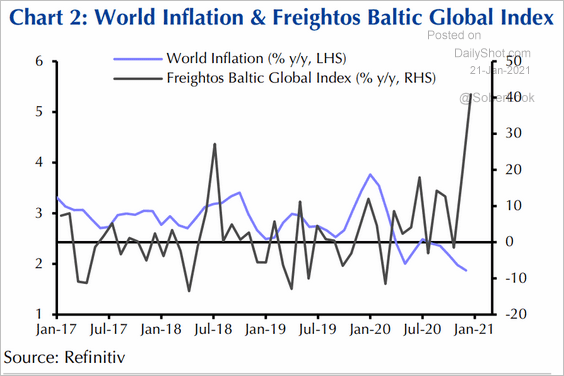

3. Will freight bottlenecks push inflation higher?

Source: Capital Economics

Source: Capital Economics

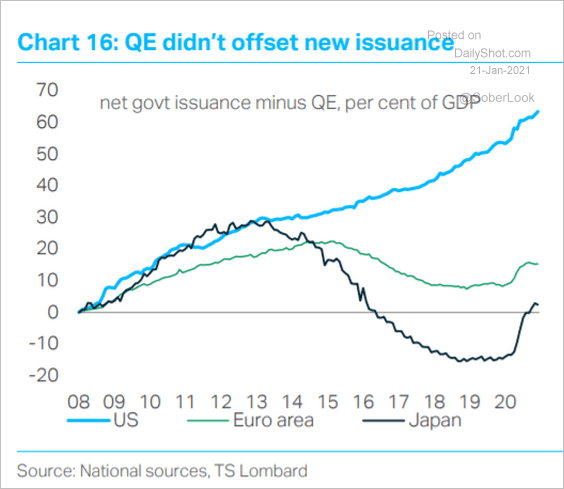

4. This chart shows government bond issuance less QE.

Source: TS Lombard

Source: TS Lombard

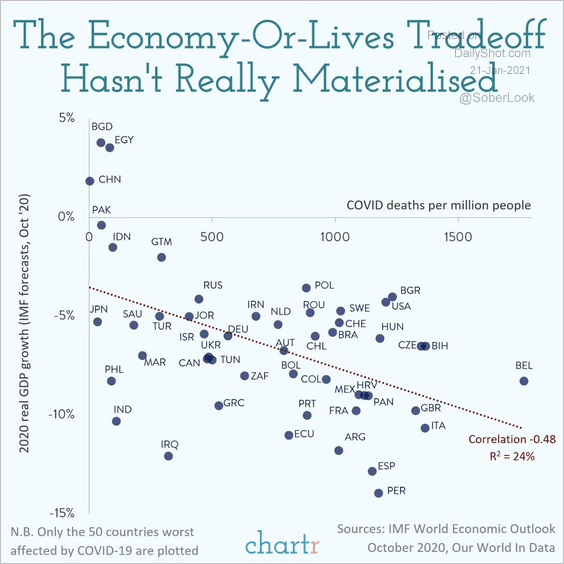

5. The argument around saving the economy vs. saving lives is invalid.

Source: @chartrdaily

Source: @chartrdaily

——————–

Food for Thought

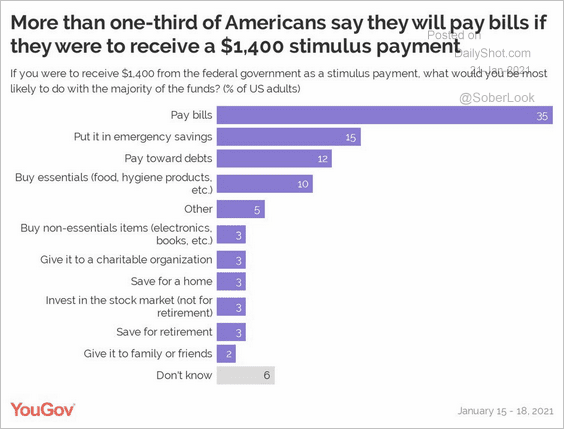

1. How would Americans use the $1,400 stimulus checks?

Source: @YouGovAmerica

Source: @YouGovAmerica

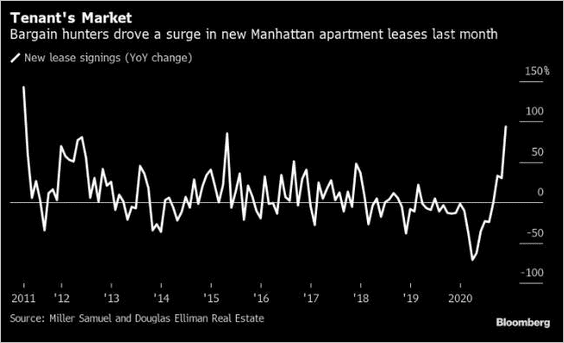

2. New Manhattan apartment leases:

Source: @LizAnnSonders, @jonathanmiller, @DouglasElliman

Source: @LizAnnSonders, @jonathanmiller, @DouglasElliman

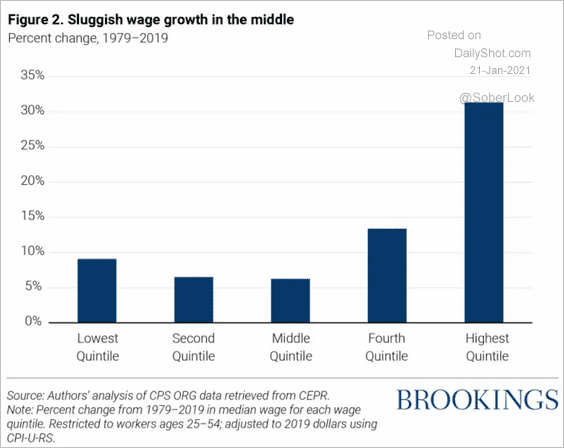

3. US wage growth:

Source: Brookings

Source: Brookings

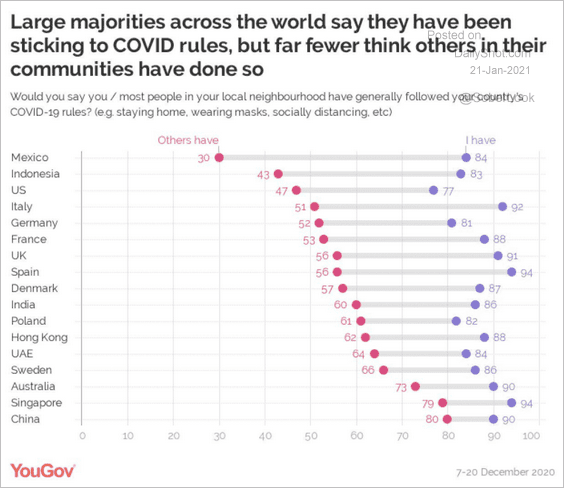

4. Sticking to COVID rules:

Source: @YouGovAmerica Read full article

Source: @YouGovAmerica Read full article

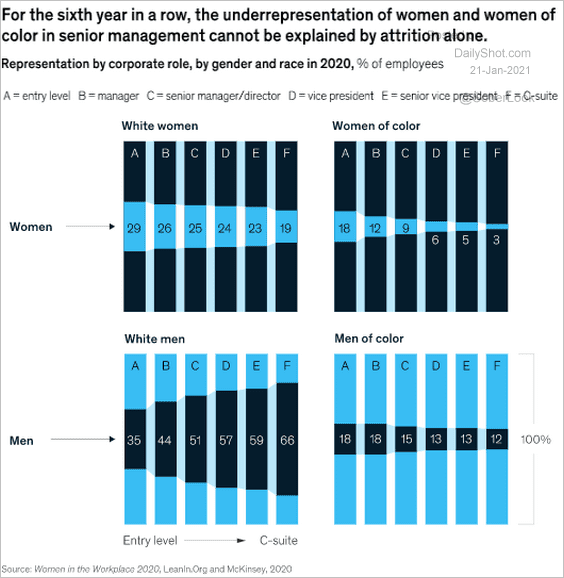

5. Representation of women in various corporate roles:

Source: McKinsey Read full article

Source: McKinsey Read full article

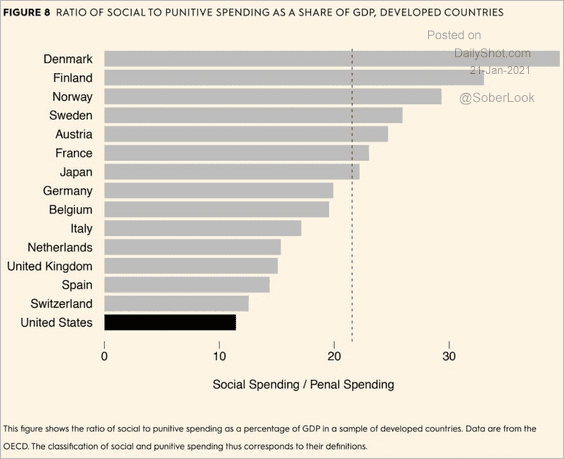

6. Social-to-punitive spending ratio:

Source: @adam_tooze, @EricLevitz, @intelligencer Read full article

Source: @adam_tooze, @EricLevitz, @intelligencer Read full article

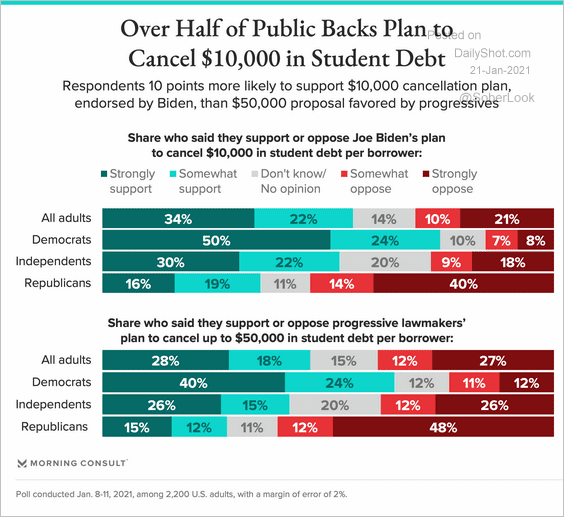

7. Canceling student debt:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

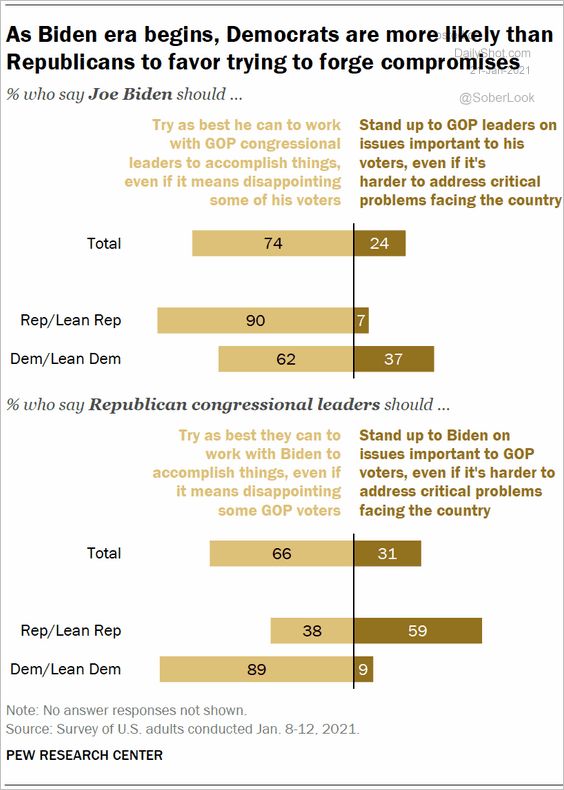

8. Forging compromises:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

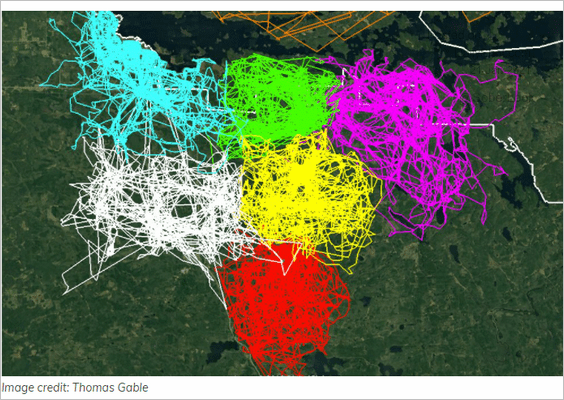

9. Wolf packs sticking to their territory:

Source: Earthly Mission Read full article

Source: Earthly Mission Read full article

——————–

Back to Index