The Daily Shot: 22-Jan-21

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

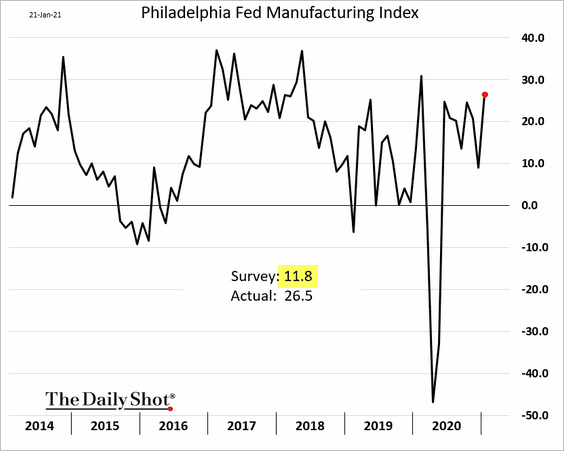

1. The Philly Fed’s manufacturing report showed solid factory activity in the region, exceeding market expectations.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

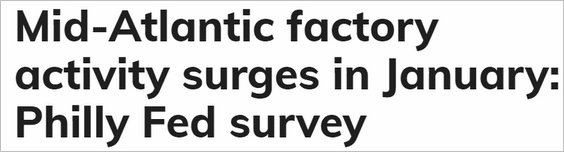

• New orders and employment indicators jumped.

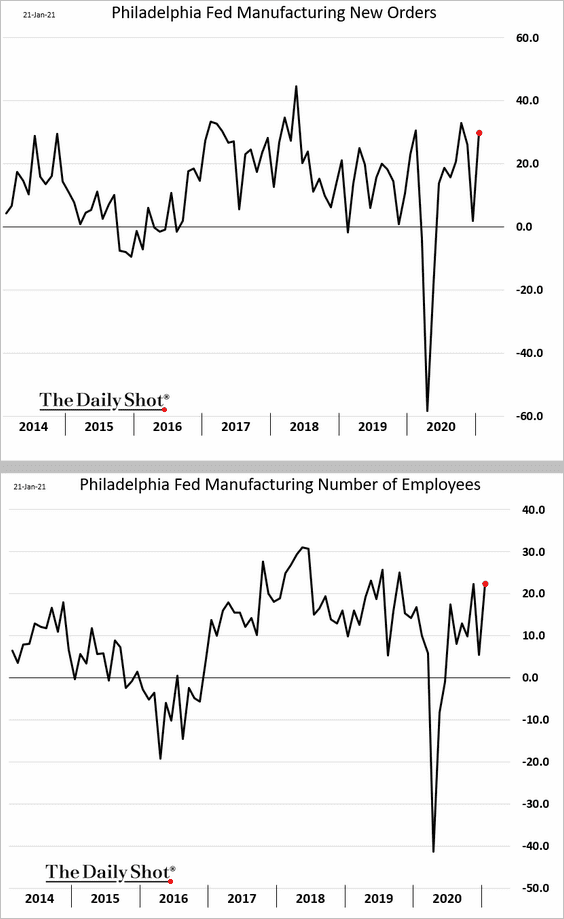

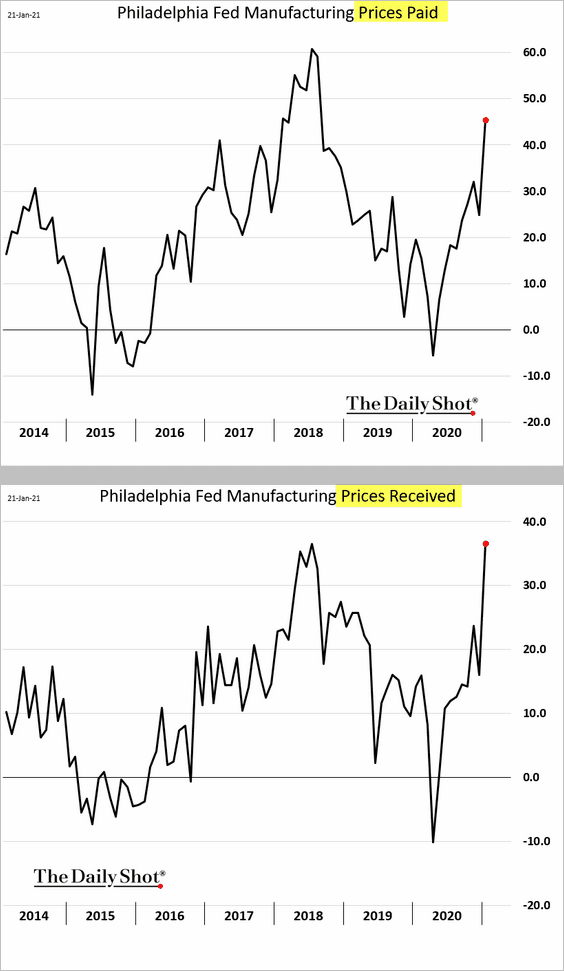

• The report also showed manufacturers facing some price pressures, which they are passing on to their customers.

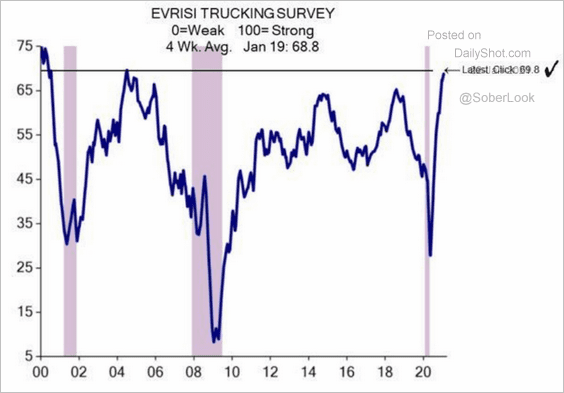

One reason for higher prices is tight inventories and logistics bottlenecks. For example, here is the ISI Trucking Survey.

Source: Evercore ISI

Source: Evercore ISI

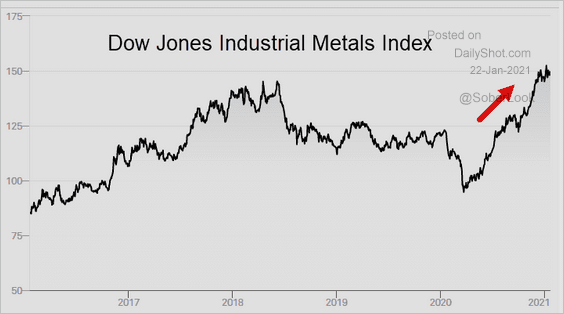

Another reason is rising industrial commodity prices.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

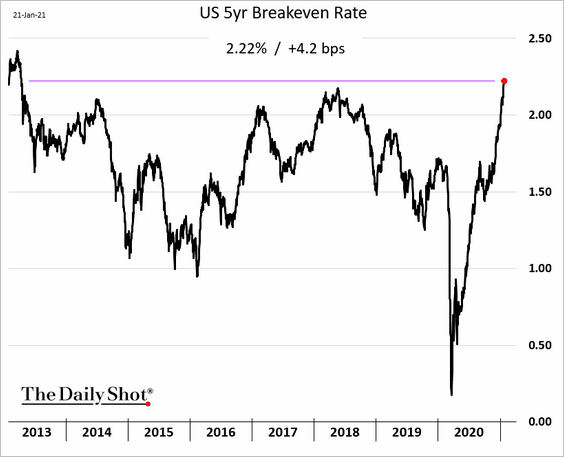

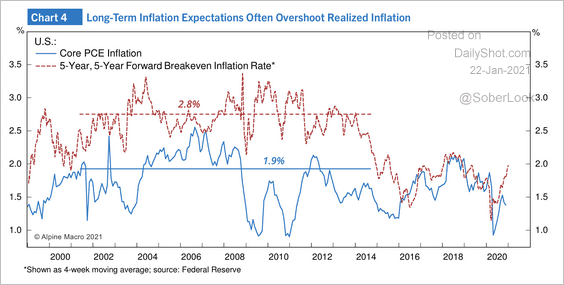

By the way, the 5-year breakeven rate (market-based inflation expectations) hit the highest level since 2013.

——————–

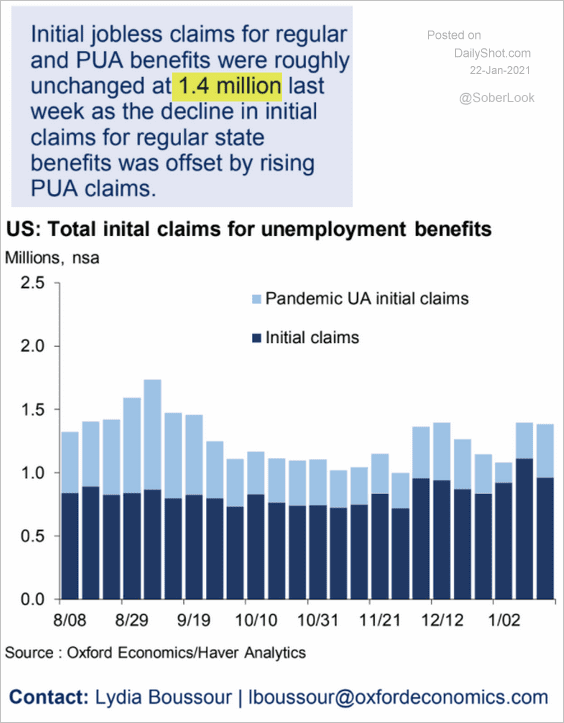

2. US initial unemployment claims remain elevated.

Source: Oxford Economics

Source: Oxford Economics

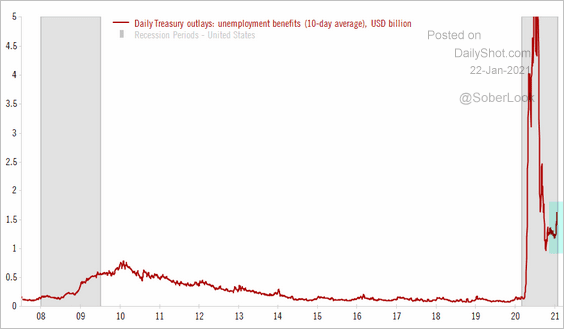

Separately, the US Treasury outlays are already showing an increase in unemployment payouts from the $900 billion COVID relief bill.

Source: @TCosterg

Source: @TCosterg

——————–

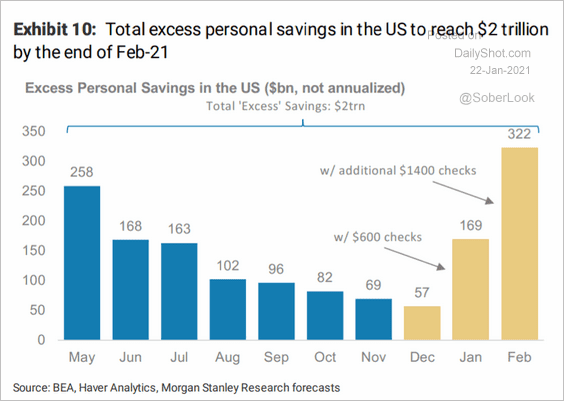

3. With more stimulus coming, personal savings are expected to exceed the levels we saw after the CARES package payouts.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

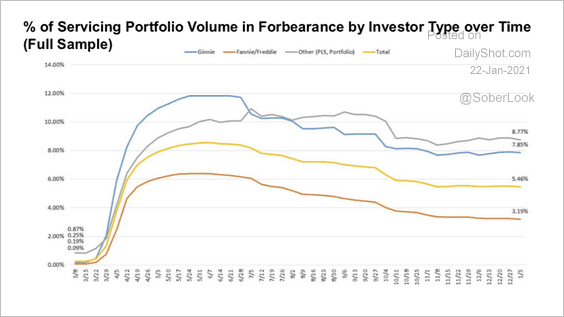

4. The percentage of US residential mortgages in forbearance has steadily declined since the May-June peak.

Source: Mortgage Bankers Association

Source: Mortgage Bankers Association

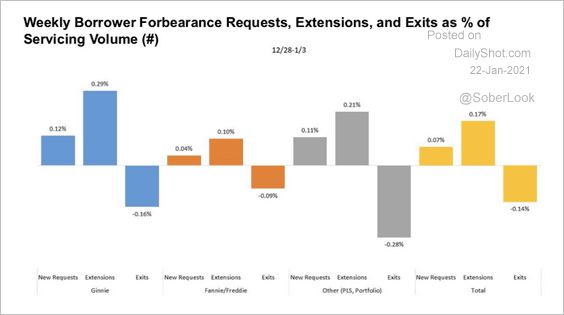

Forbearance exits are outpacing new applications, but many borrowers are still requesting extensions.

Source: Mortgage Bankers Association

Source: Mortgage Bankers Association

——————–

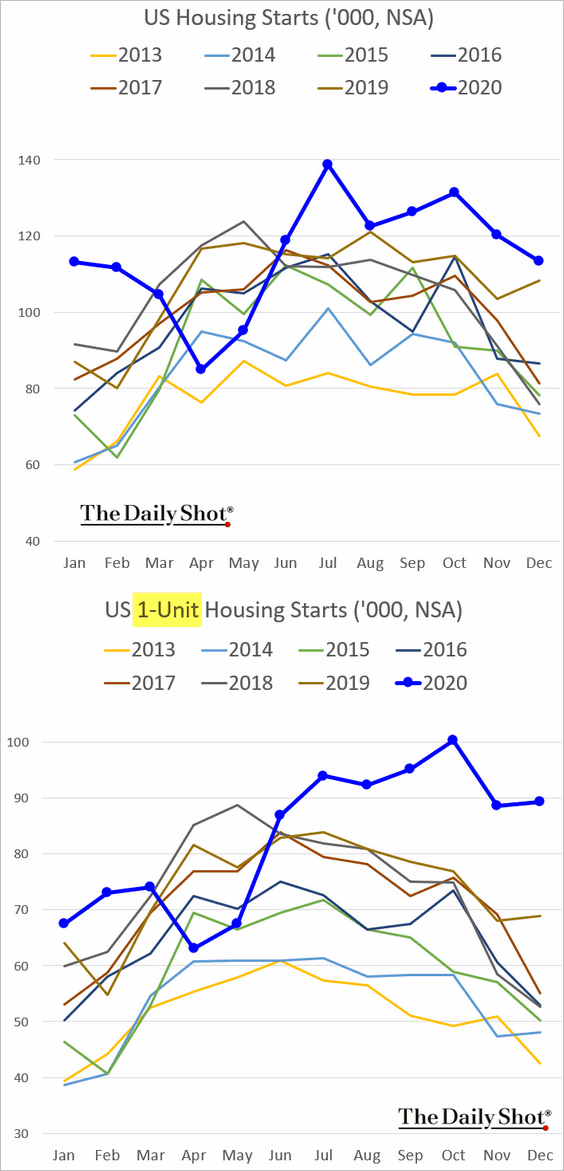

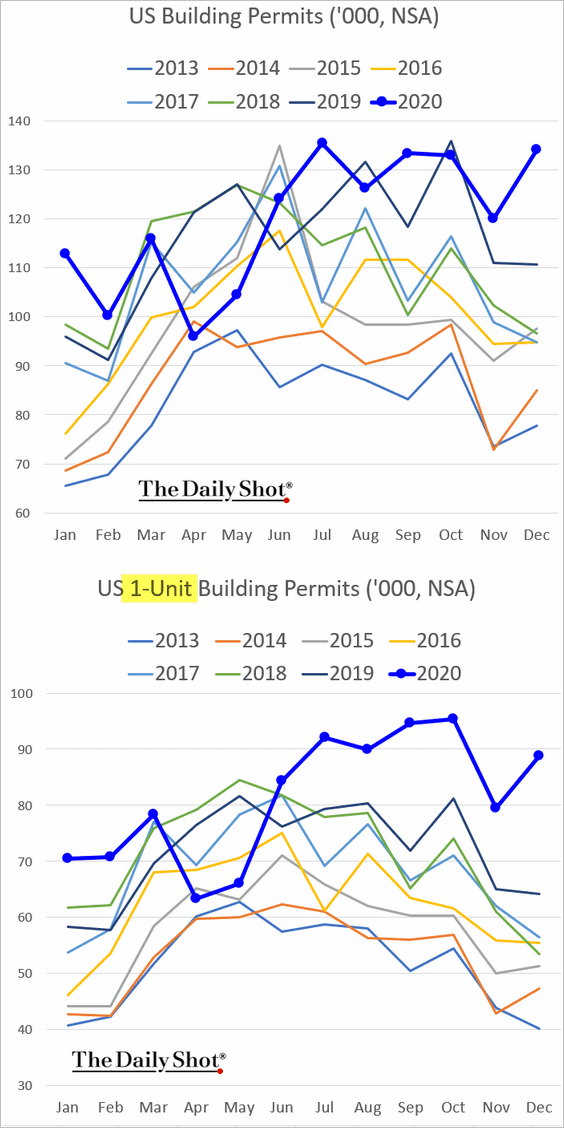

5. Residential construction activity was robust in December, driven by single-family units.

– Housing starts:

– Building permits:

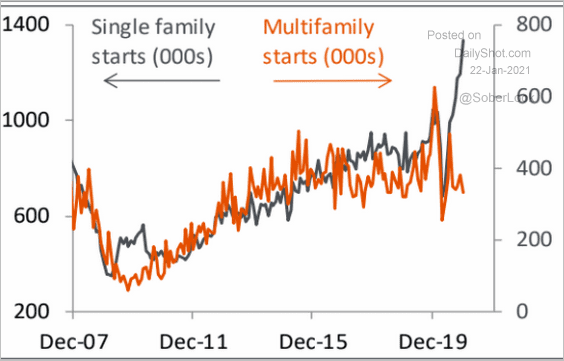

• The pandemic-driven demand divergence between houses and apartments continues (trends below are seasonally adjusted).

Source: Piper Sandler

Source: Piper Sandler

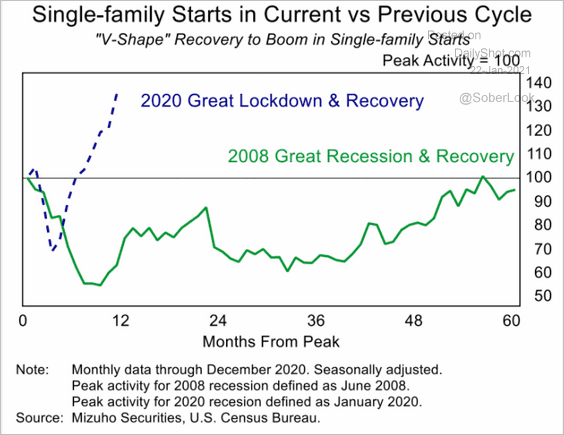

• Here is a comparison to the 2008 downturn.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

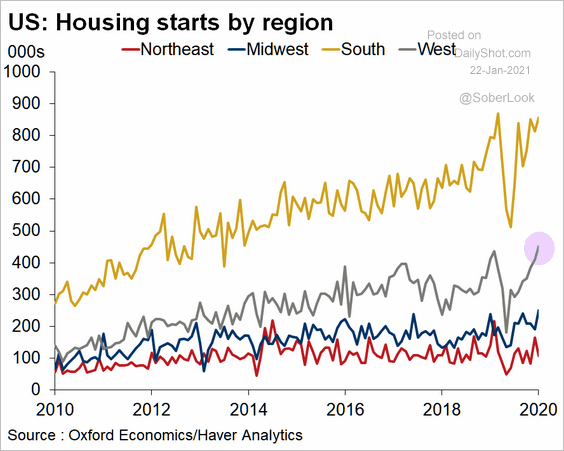

• There was a strong rebound in housing starts in the Western US.

Source: Oxford Economics

Source: Oxford Economics

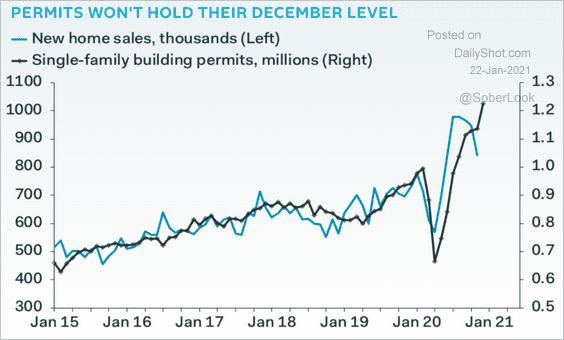

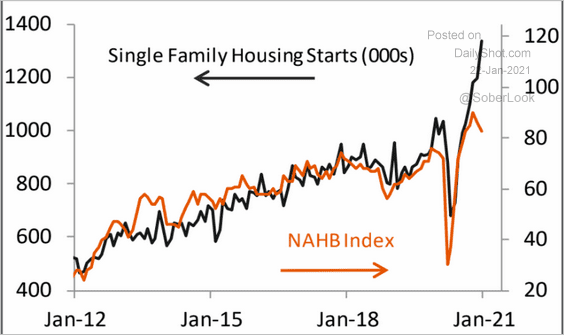

• However, single-family construction has probably peaked for now.

– Single-family building permits vs. new home sales:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

– Single-family housing starts vs. the NAHB homebuilder optimism index:

Source: Piper Sandler

Source: Piper Sandler

——————–

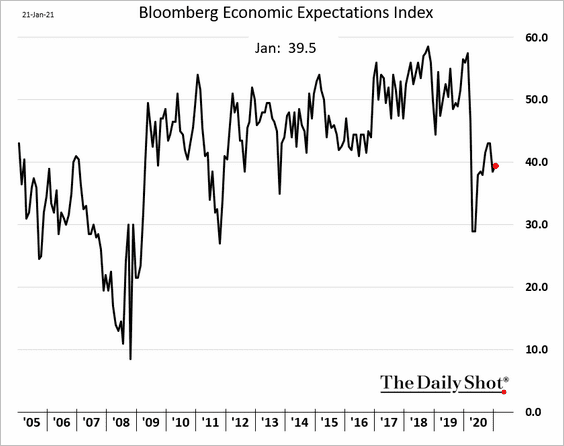

6. Bloomberg’s economic expectations index remains soft.

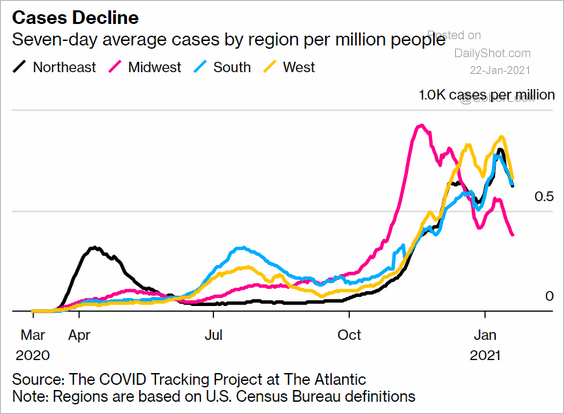

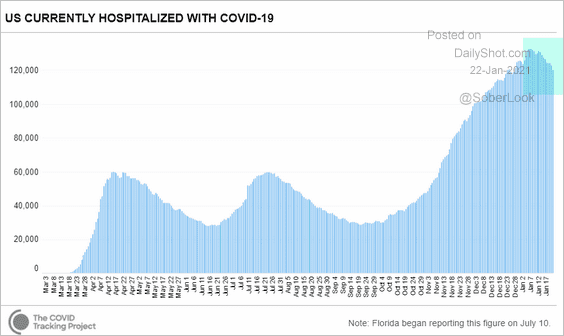

7. The COVID situation shows signs of improvement.

• New COVID cases:

Source: @bpolitics Read full article

Source: @bpolitics Read full article

• Hospitalizations:

Source: CovidTracking.com

Source: CovidTracking.com

Back to Index

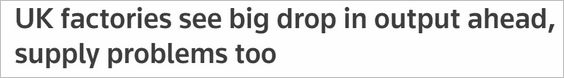

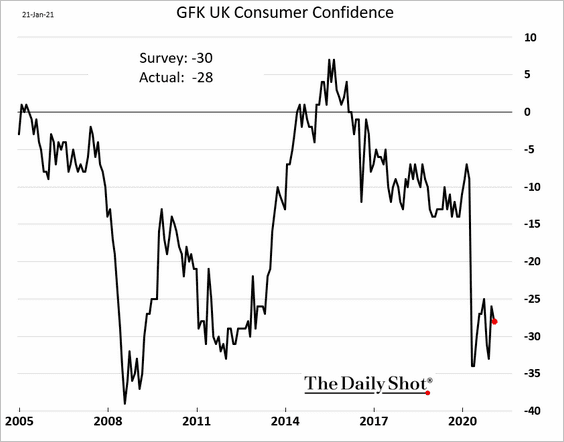

The United Kingdom

1. The CBI report showed UK manufacturers struggling with the confluence of the pandemic and Brexit.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

2. Consumer confidence remains weak.

Back to Index

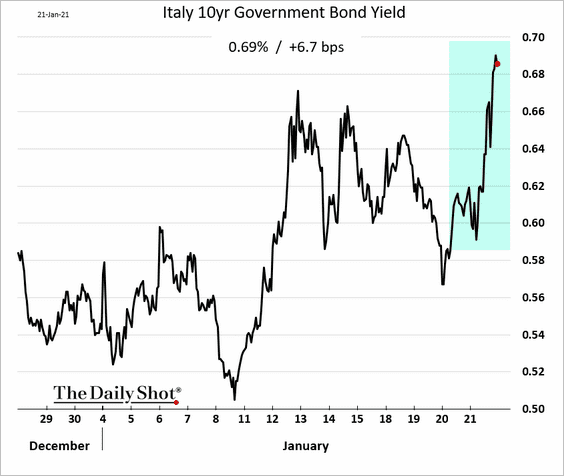

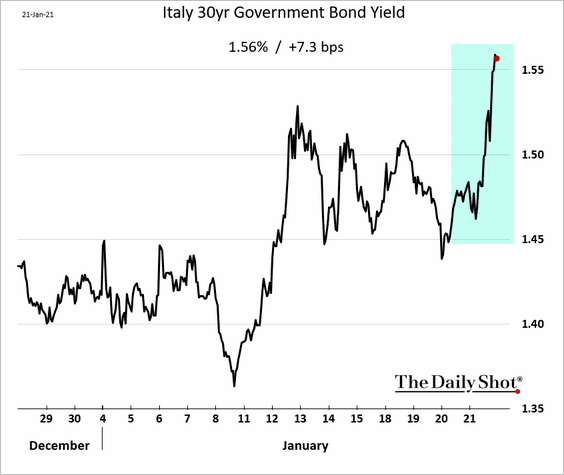

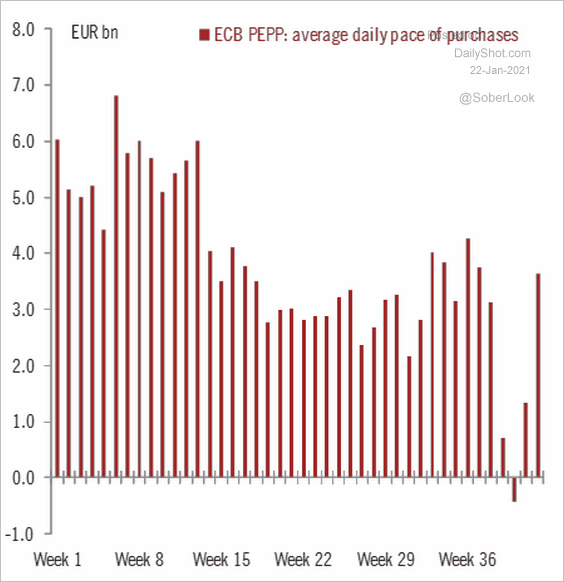

The Eurozone

1. The ECB hinted at the possibility that it may not end up using the full amount allocated to the emergency QE program.

ECB: – … the Governing Council will continue the purchases under the pandemic emergency purchase programme (PEPP) with a total envelope of €1,850 billion. The Governing Council will conduct net asset purchases under the PEPP until at least the end of March 2022 and, in any case, until it judges that the coronavirus crisis phase is over. The purchases under the PEPP will be conducted to preserve favourable financing conditions over the pandemic period. If favourable financing conditions can be maintained with asset purchase flows that do not exhaust the envelope over the net purchase horizon of the PEPP, the envelope need not be used in full. Equally, the envelope can be recalibrated if required to maintain favourable financing conditions to help counter the negative pandemic shock to the path of inflation.

Bond yields (especially Italian yields) rose in response.

This chart shows the ECB’s purchases under the emergency program.

Source: Frederik Ducrozet, Pictet Wealth Management

Source: Frederik Ducrozet, Pictet Wealth Management

——————–

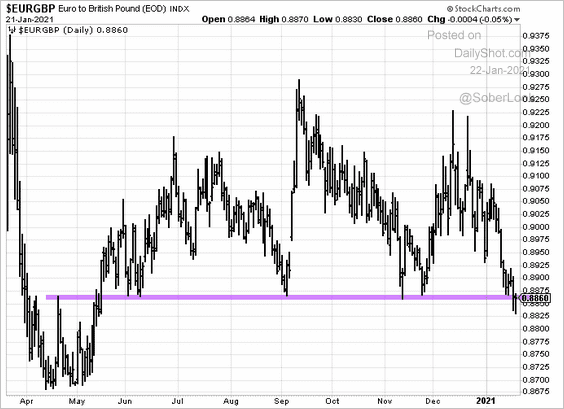

2. EUR/GBP held support.

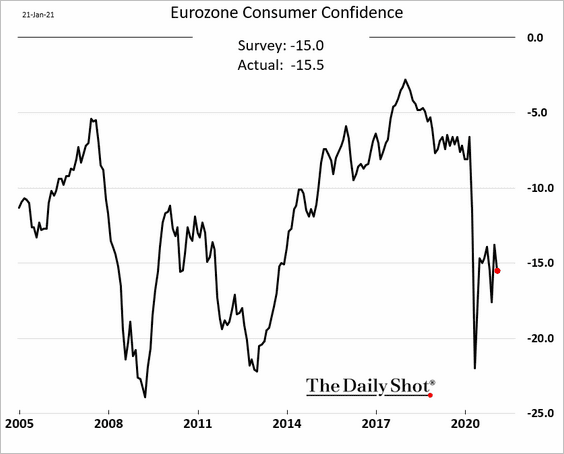

3. Consumer confidence at the Eurozone level ticked lower.

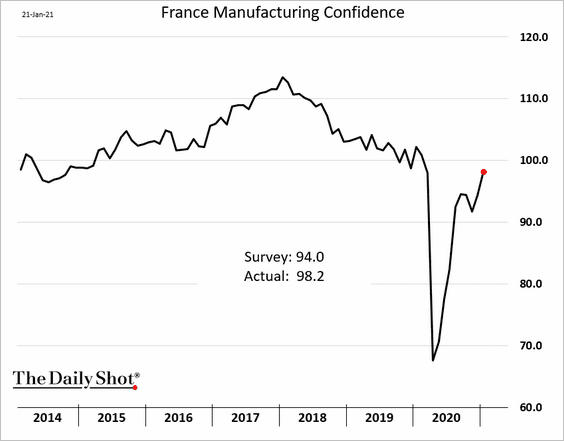

4. French manufacturing confidence has almost fully recovered, topping forecasts.

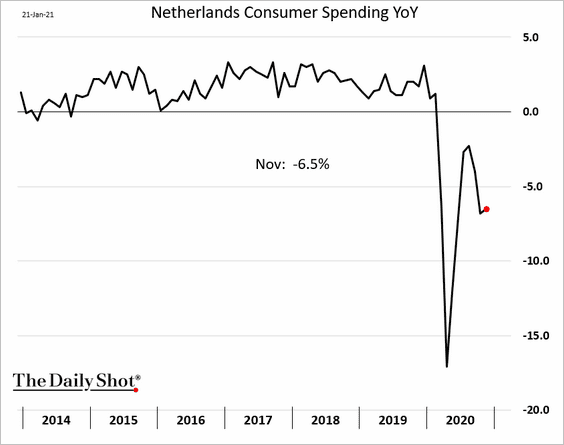

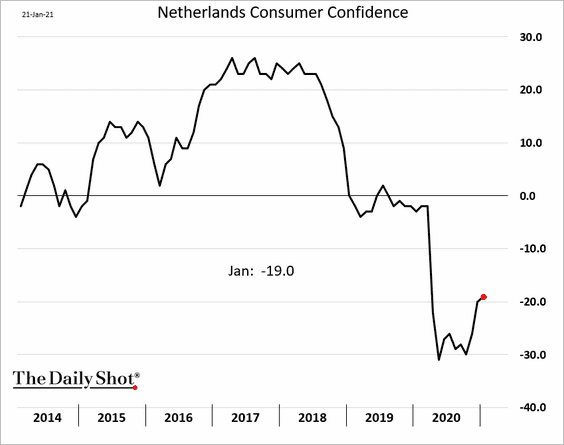

5. Consumer spending in the Netherlands remained soft in November.

Since then, consumer confidence has rebounded somewhat but remains depressed.

——————–

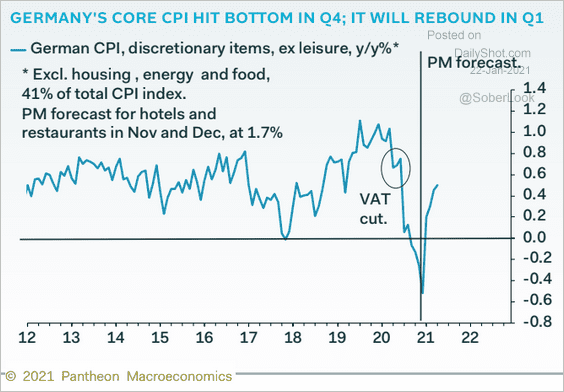

6. Next, we have some updates on inflation.

• Germany’s core CPI forecast from Pantheon Macroeconomics:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

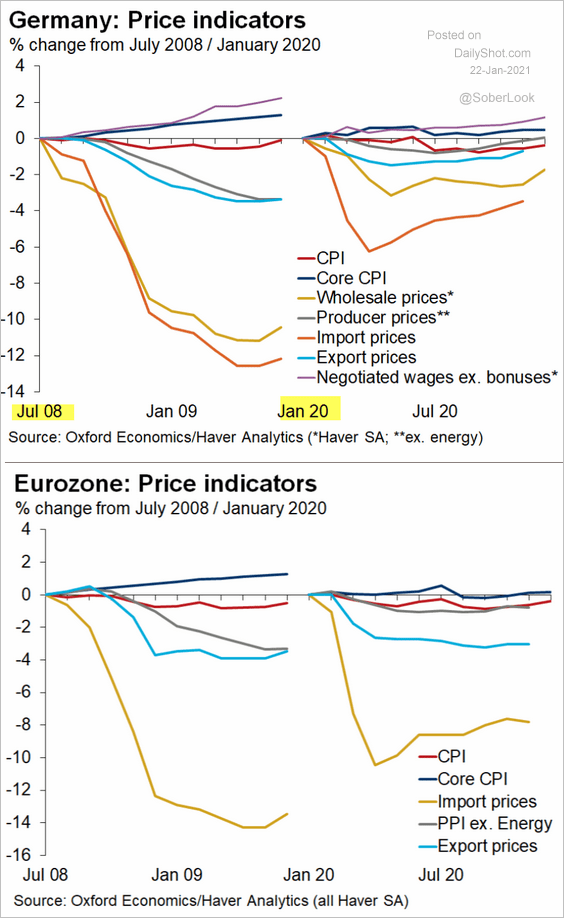

• Germany and the Eurozone price indicators (since 2008 and last year):

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Europe

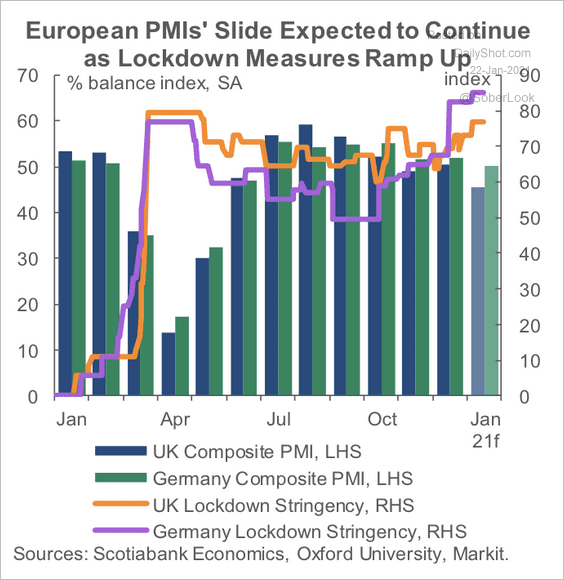

1. According to Scotiabank, European PMIs will continue to decline as lockdown measures become more stringent.

Source: Scotiabank Economics

Source: Scotiabank Economics

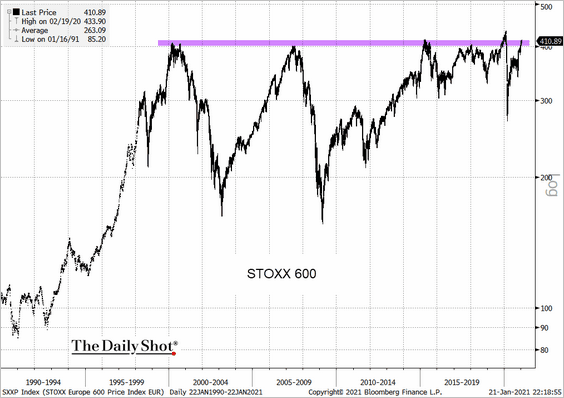

2. The STOXX 600 index has been testing long-term resistance.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

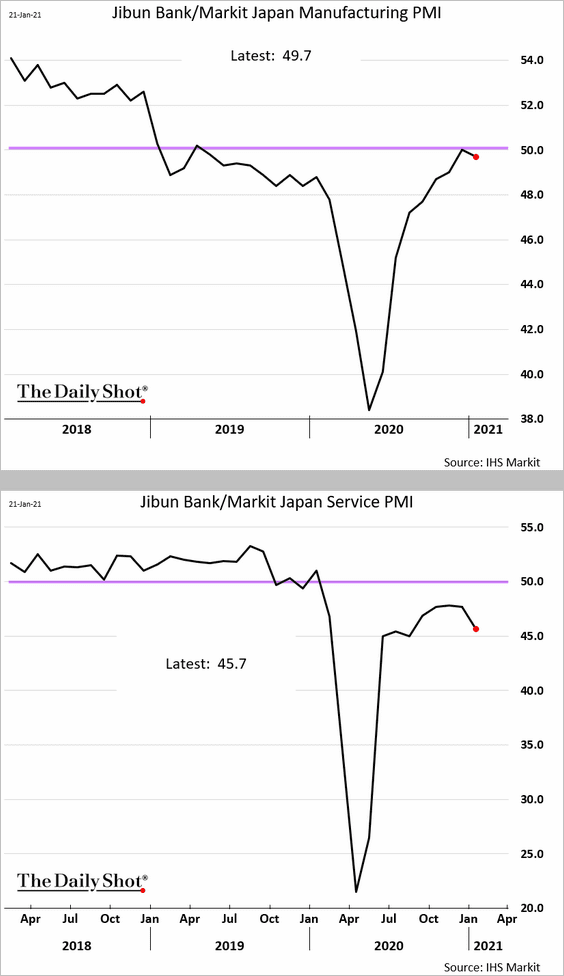

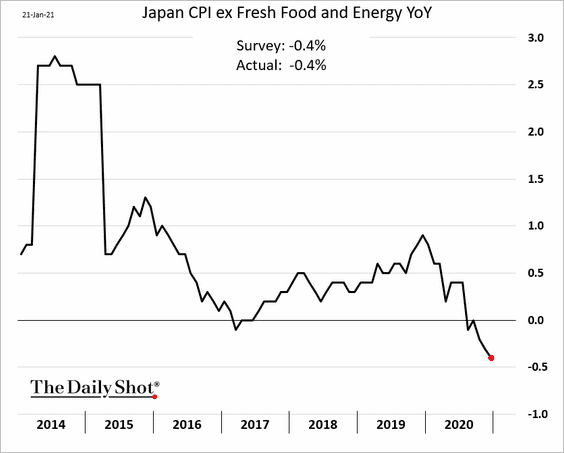

Japan

1. The January PMI measures were disappointing. Service sectors are especially weak.

2. Japan remains in deflation.

Back to Index

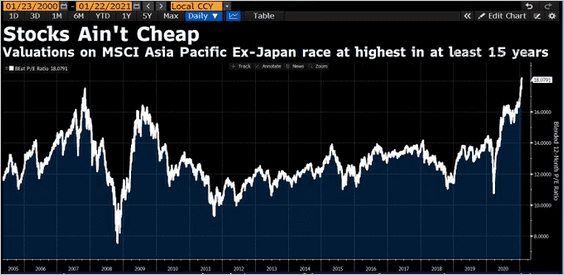

Asia – Pacific

1. Stock valuations look frothy.

Source: @DavidInglesTV

Source: @DavidInglesTV

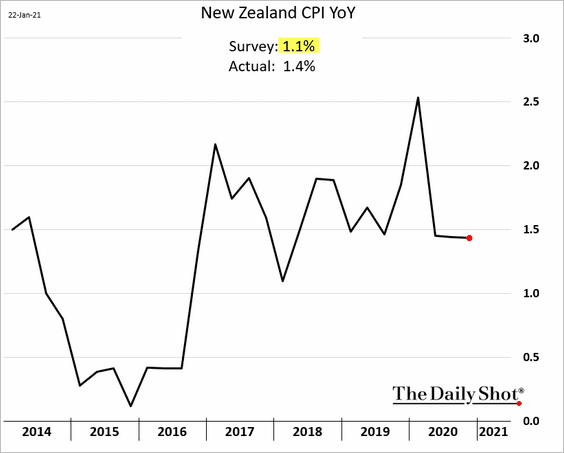

2. New Zealand’s fourth-quarter CPI surprised to the upside.

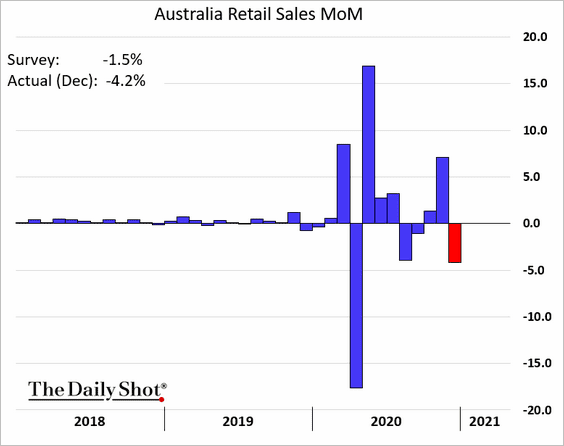

3. Australian retail sales declined in December. Will we see a rebound this month?

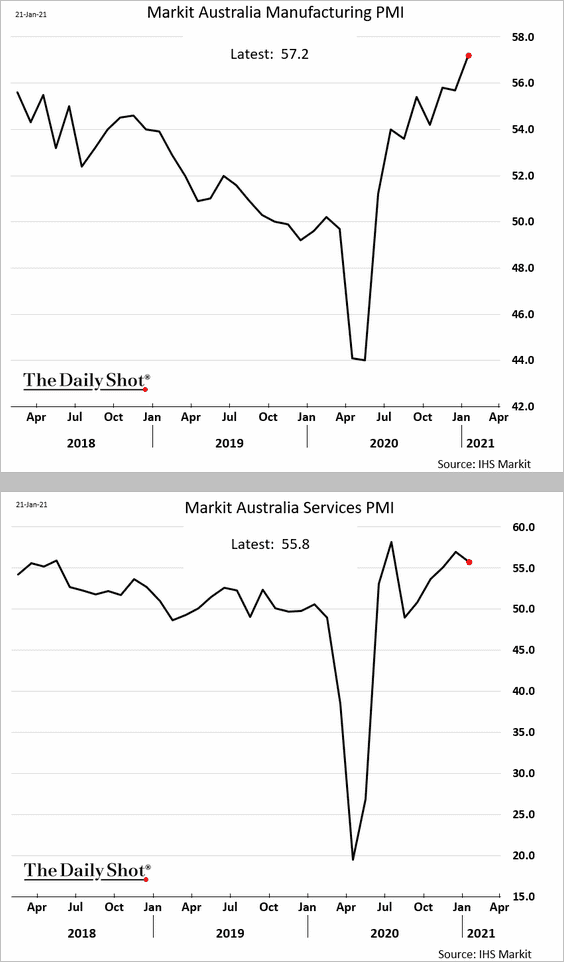

Australian factory activity accelerated this month, and services remain in growth mode.

Back to Index

China

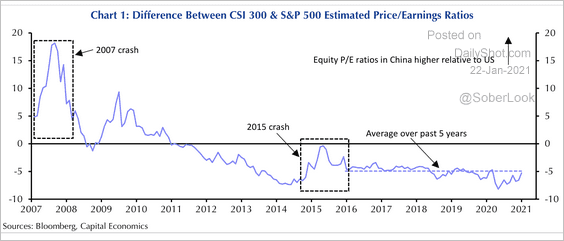

1. Chinese equities remain undervalued versus the S&P 500.

Source: Capital Economics

Source: Capital Economics

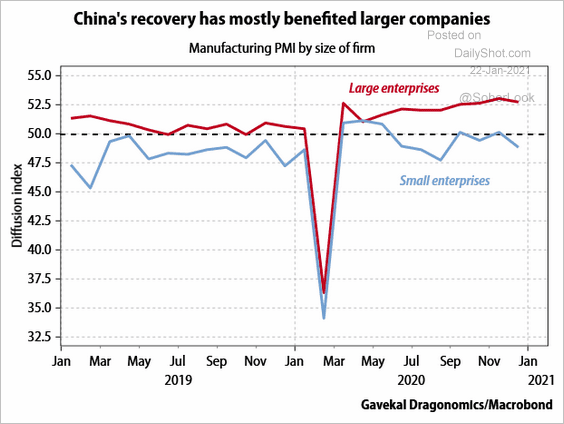

2. The recovery has mostly benefitted large firms.

Source: Gavekal Research

Source: Gavekal Research

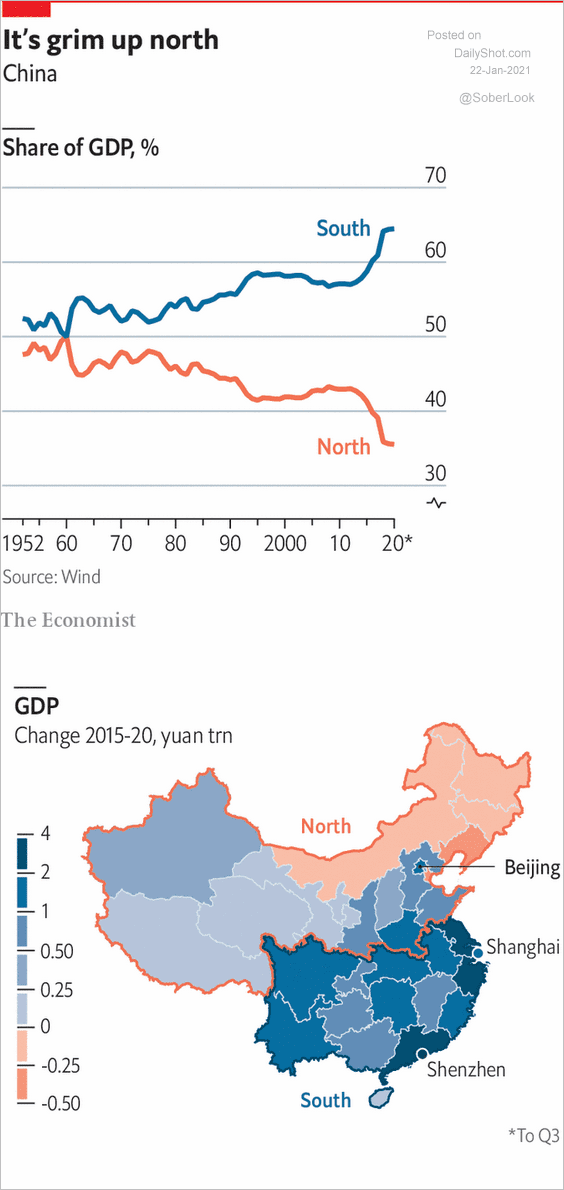

3. The North-South economic gap has widened.

Source: The Economist Read full article

Source: The Economist Read full article

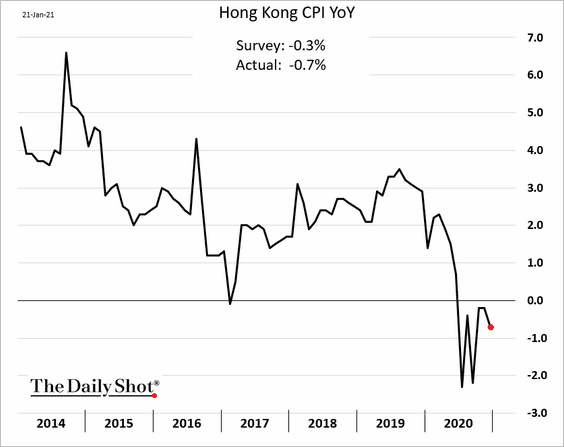

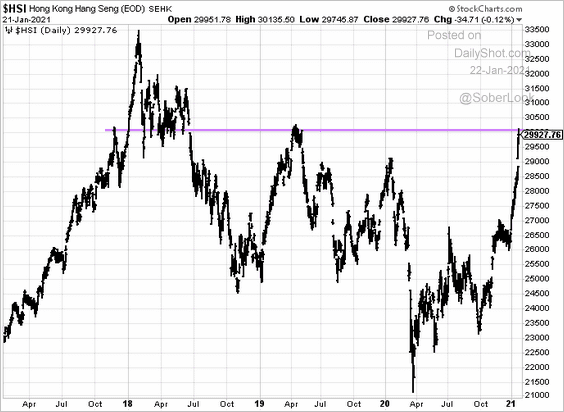

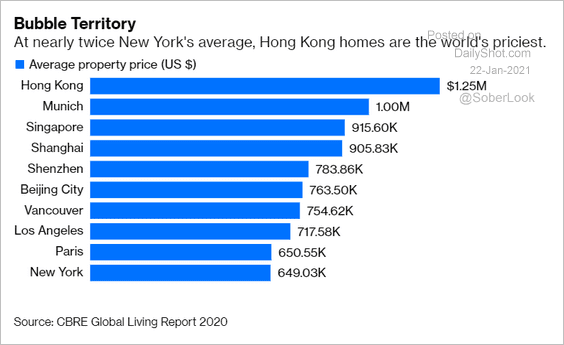

4. Next, we have some updates on Hong Kong.

• Still in deflation:

• The Hang Seng Index hitting resistance at 30k:

• Housing prices vs. other cities:

Source: @claraDFMarques, @mbrookerHK, @bopinion Read full article

Source: @claraDFMarques, @mbrookerHK, @bopinion Read full article

Back to Index

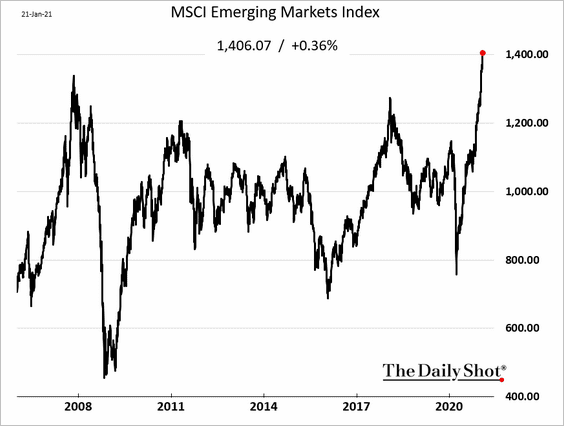

Emerging Markets

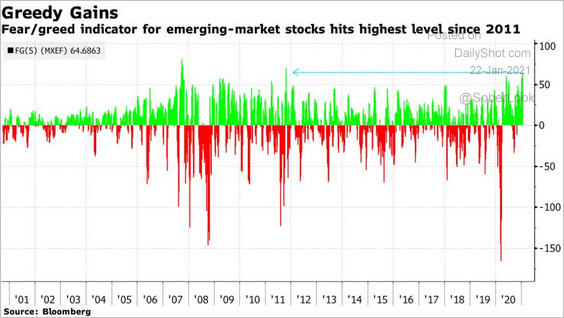

1. EM equity rally has been impressive.

• Bloomberg’s fear/greed indicator is deep in greed territory.

Source: @markets Read full article

Source: @markets Read full article

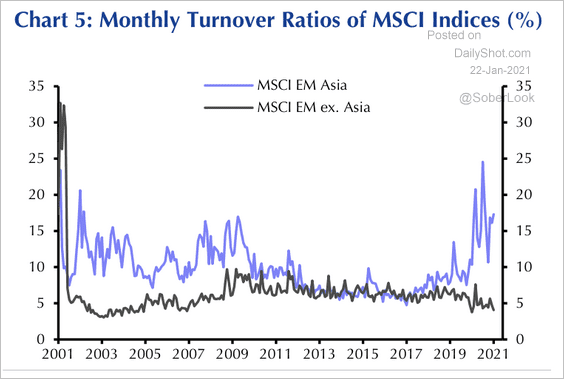

• Equity market turnover surged in Asia, while the rest of EM remains subdued.

Source: Capital Economics

Source: Capital Economics

——————–

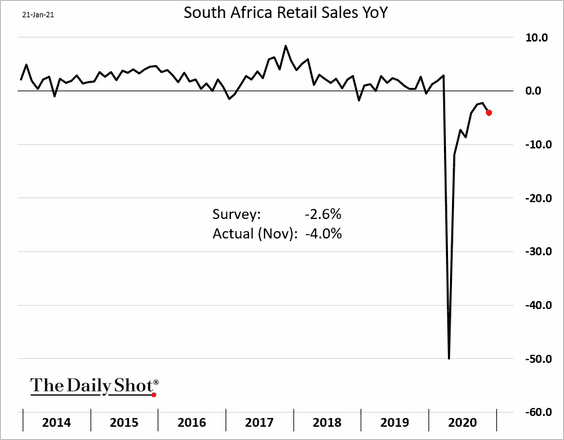

2. South African retail sales deteriorated in November.

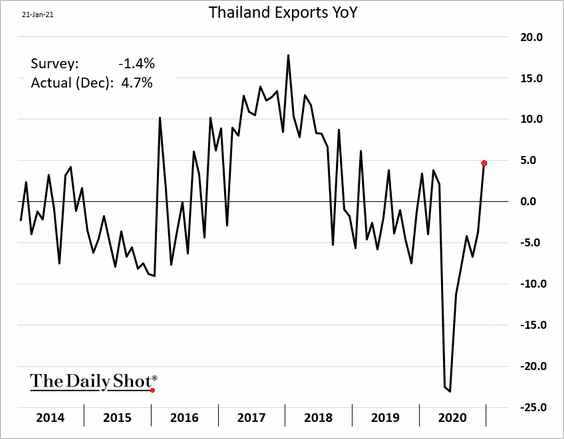

3. Thai exports are surging.

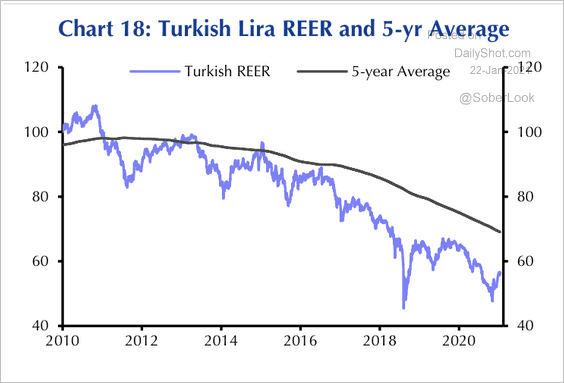

4. The Turkish lira’s real effective exchange rate remains well below its 5-year average. Will it break higher?

Source: Capital Economics

Source: Capital Economics

Back to Index

Cryptocurrency

Bitcoin took a hit but appears to have stabilized at $30k.

Back to Index

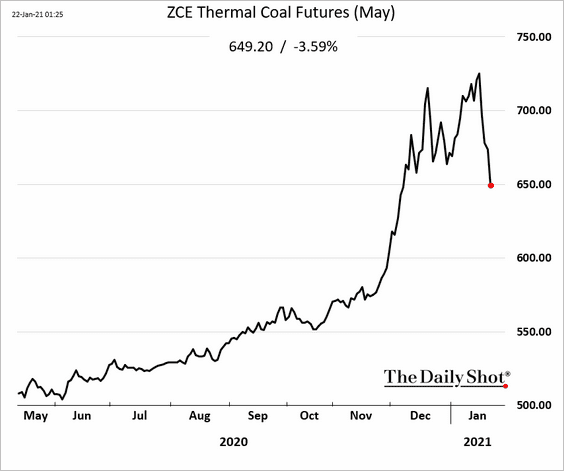

Commodities

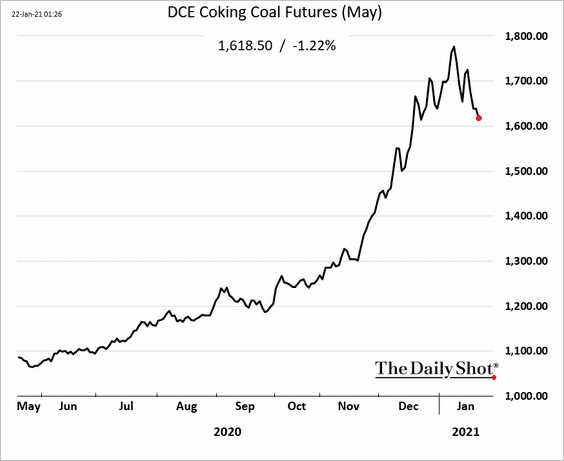

1. China’s coal rally has stalled.

——————–

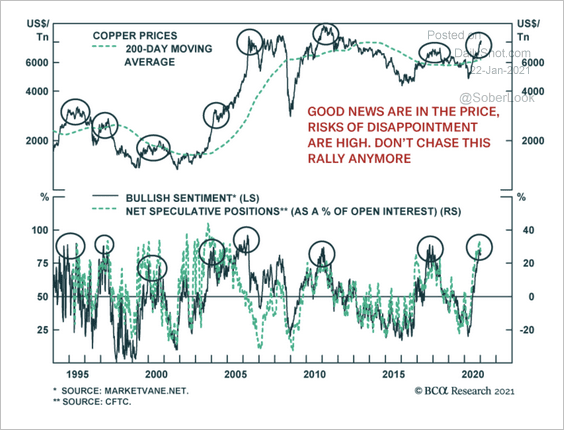

2. Long positioning in copper futures is at an extreme.

Source: BCA Research

Source: BCA Research

Back to Index

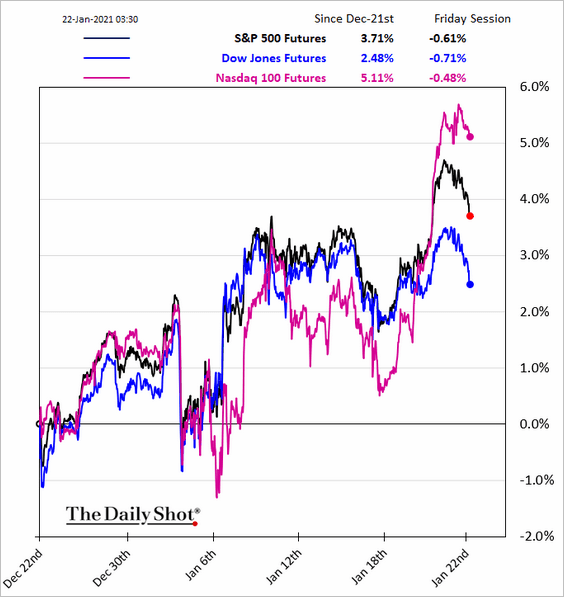

Equities

1. Stock futures are off the highs this morning as the US indices hit another record.

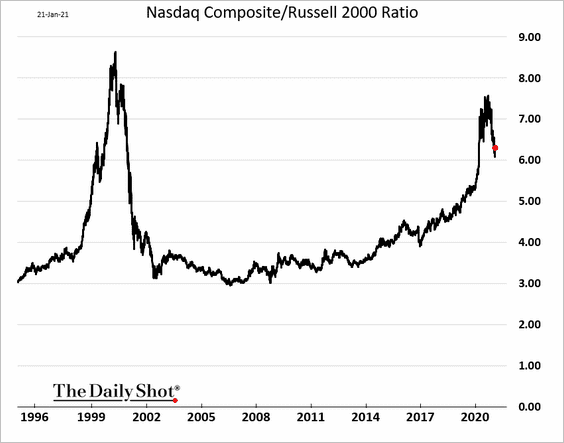

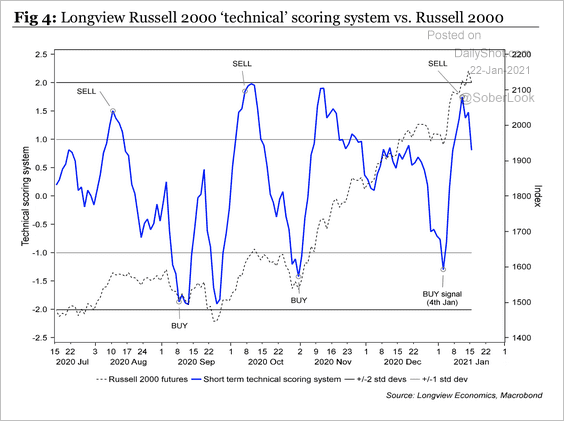

2. The Nasdaq/Russell 2000 ratio appears to have peaked.

But technicals suggest that the Russell 2000 is overbought.

Source: Longview Economics

Source: Longview Economics

——————–

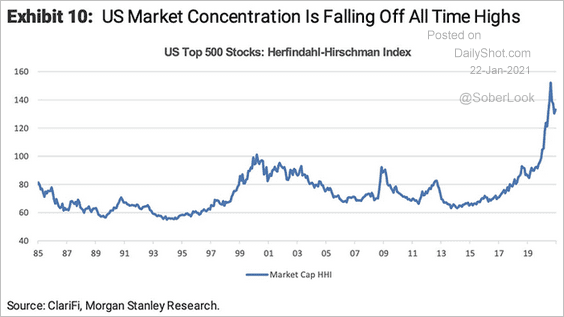

3. Market concentration is off the highs.

Source: @ISABELNET_SA, @MorganStanley

Source: @ISABELNET_SA, @MorganStanley

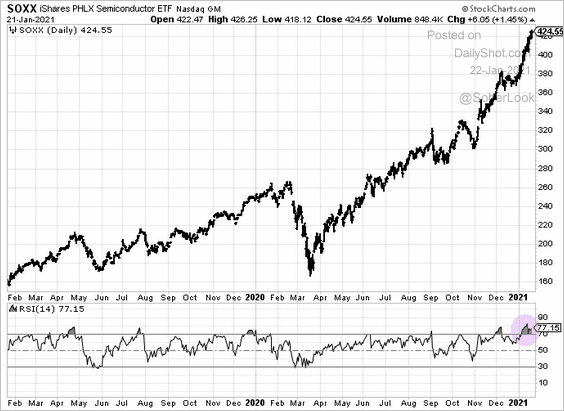

4. The semiconductor stock rally looks stretched.

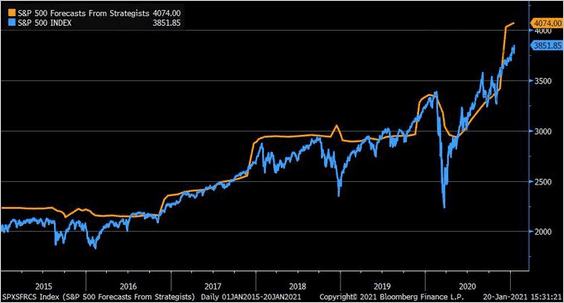

5. Strategists remain upbeat on stocks.

Source: @LizAnnSonders, @Bloomberg

Source: @LizAnnSonders, @Bloomberg

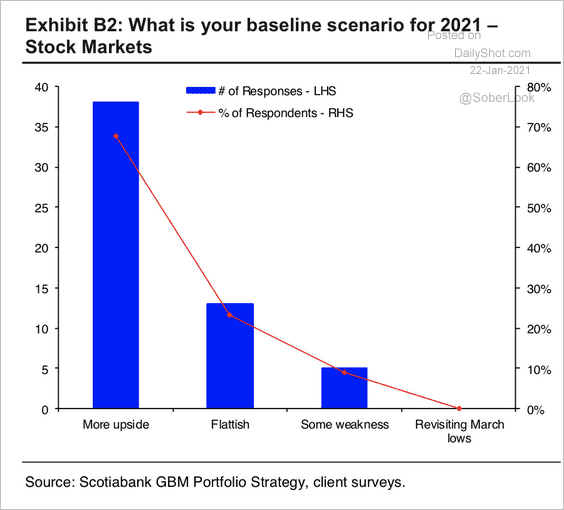

6. A majority of institutional investors expect more upside in equities this year, according to a Scotiabank survey.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

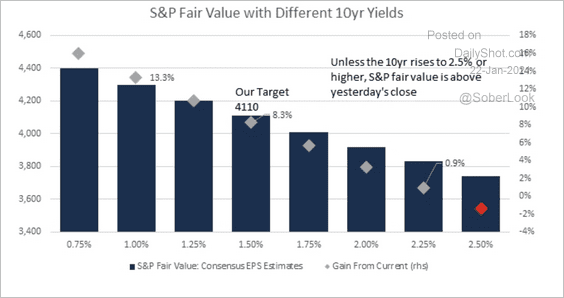

7. According to Evercore ISI, there is upside for the S&P 500 until the 10-year Treasury yield crosses above 2.25%.

Source: Evercore ISI

Source: Evercore ISI

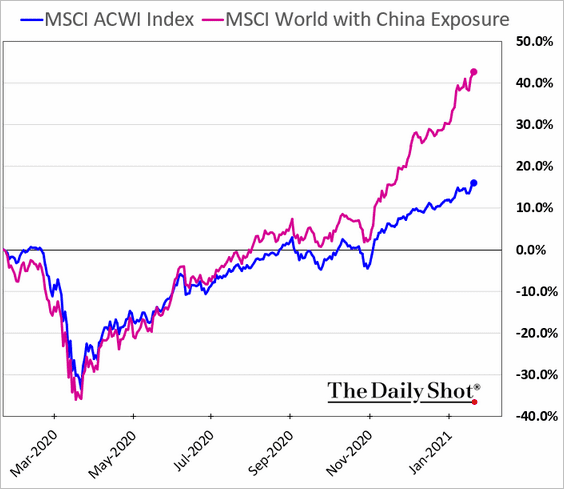

8. Global companies with sales in China continue to widen their outperformance.

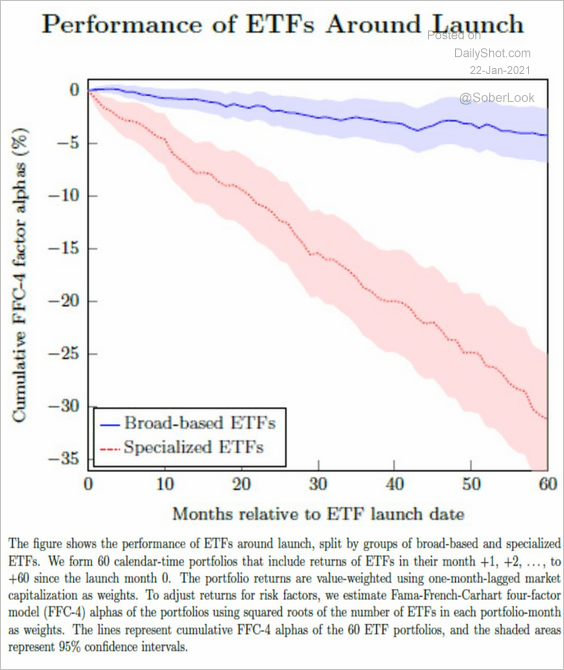

9. While many thematic ETFs saw spectacular rallies in recent months, they typically underperform the market.

Source: @jessefelder, @markets Read full article

Source: @jessefelder, @markets Read full article

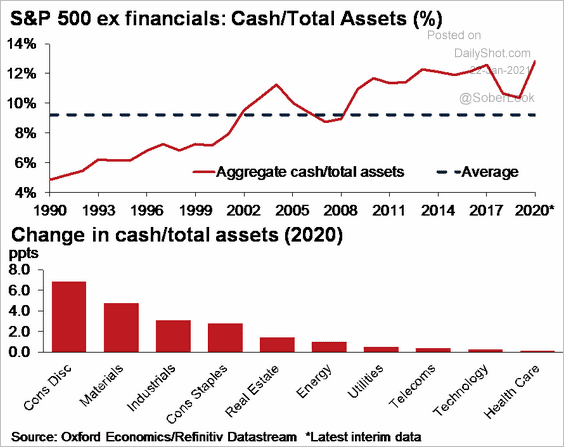

10. Which sectors are holding the most cash?

Source: Oxford Economics

Source: Oxford Economics

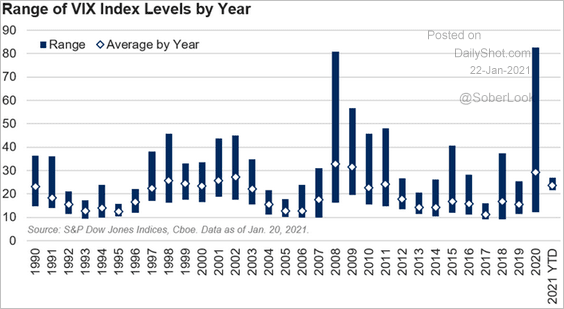

11. Here is the history of VIX yearly averages and ranges.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Credit

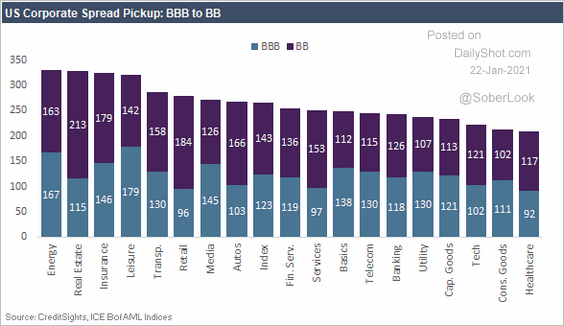

1. This chart shows the current investment-grade bond spreads by sector.

Source: CreditSights

Source: CreditSights

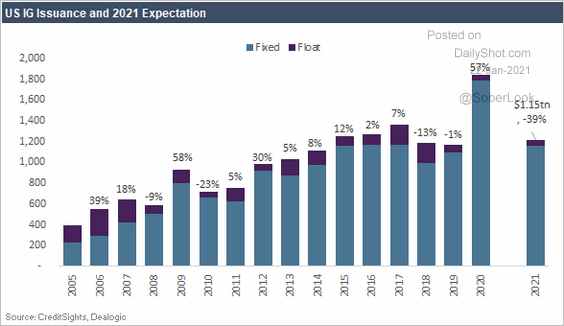

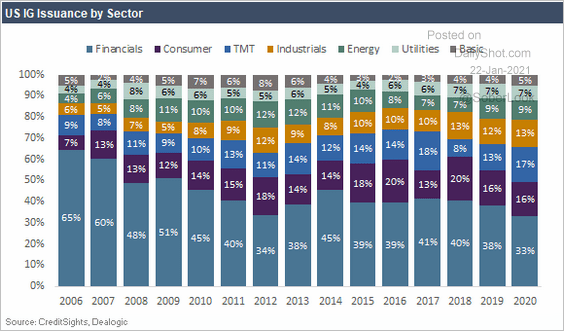

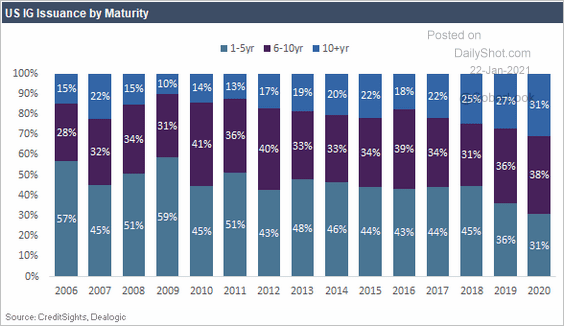

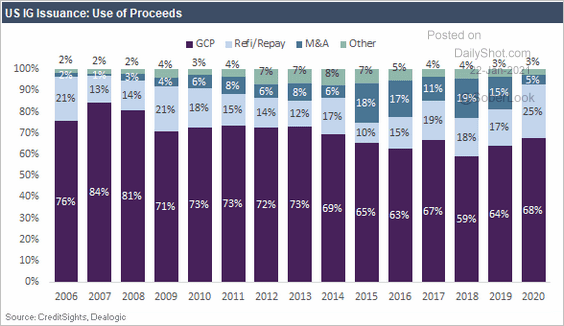

2. Next, let’s take a look at investment-grade issuance (from CreditSights).

• Fixed vs. floating coupon:

Source: CreditSights

Source: CreditSights

• By sector:

Source: CreditSights

Source: CreditSights

• By maturity:

Source: CreditSights

Source: CreditSights

• Use of proceeds:

Source: CreditSights

Source: CreditSights

Back to Index

Rates

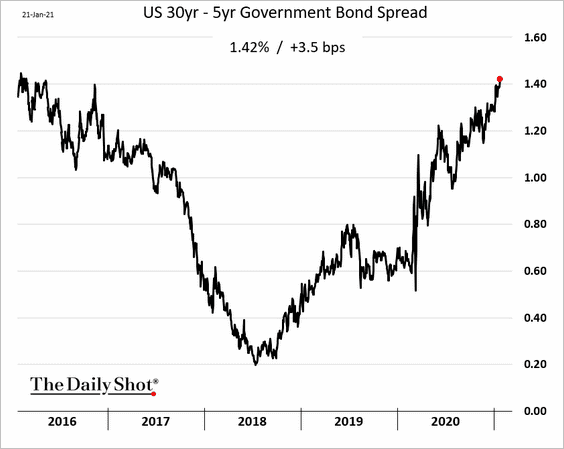

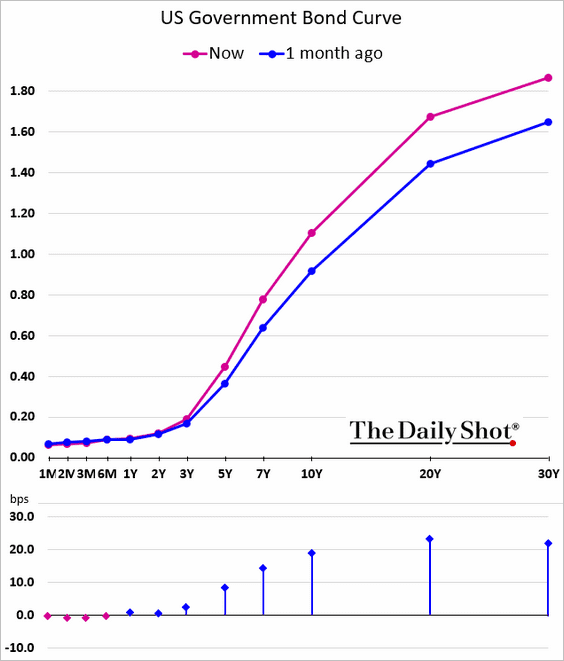

1. The Treasury curve has been steepening, especially in the 5-30yr range.

——————–

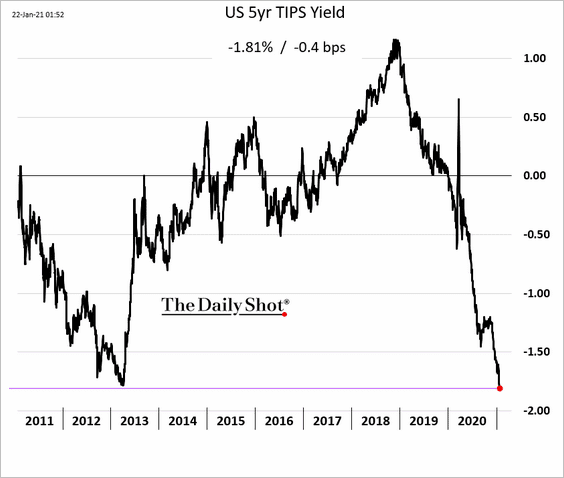

2. The 5-year TIPS yield (implied real rate) hit a record low as inflation expectations spike (see the US section)

3. The US 5-year, 5-year forward breakeven rate (inflation expectations) typically overshoots realized inflation.

Source: Alpine Macro

Source: Alpine Macro

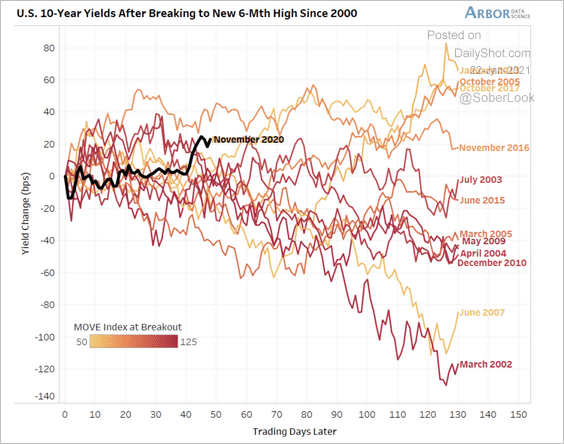

4. The 10-year Treasury yield tends to decline after breaking to a new 6-month high.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

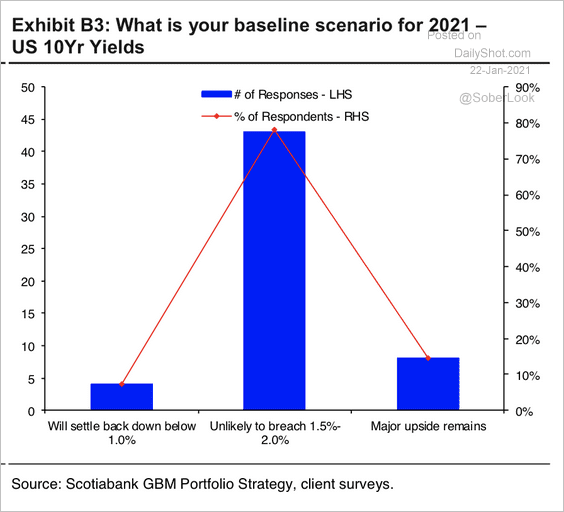

5. Most institutional investors do not expect the 10-year Treasury yield to break above 2% this year, according to a Scotiabank survey.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Back to Index

Global Developments

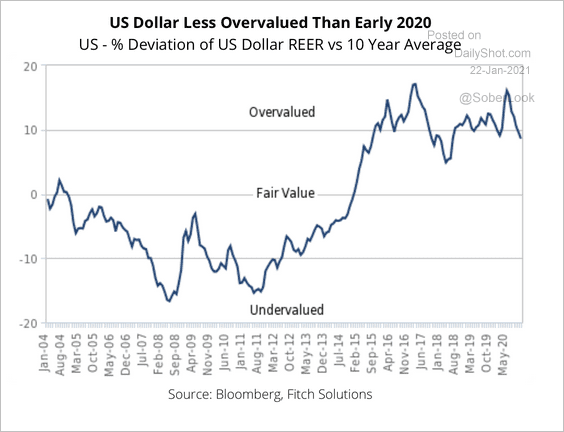

1. Fitch maintains a bearish outlook on the dollar despite the potential for a short-term bounce.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

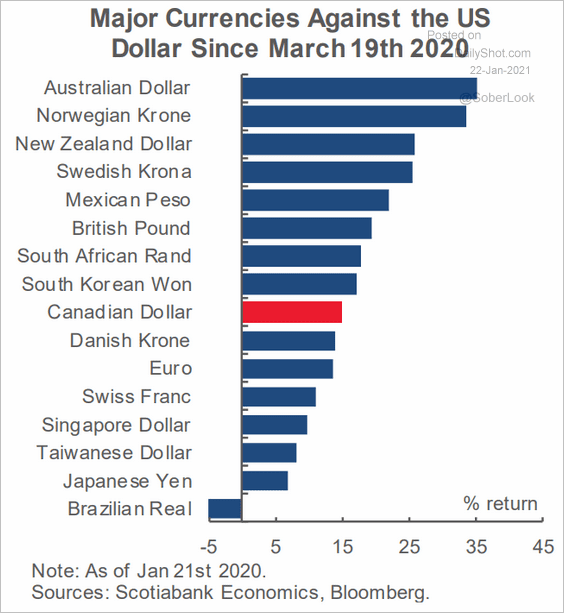

Which currencies had the biggest gains vs. the dollar since March of 2020?

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

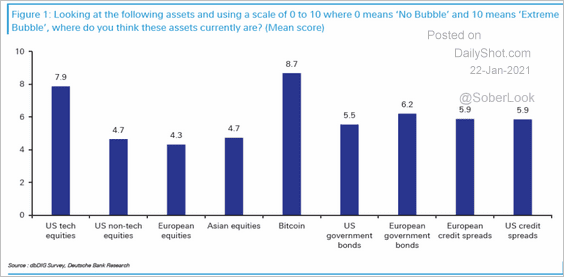

2. How close to a bubble are we (across different assets)?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

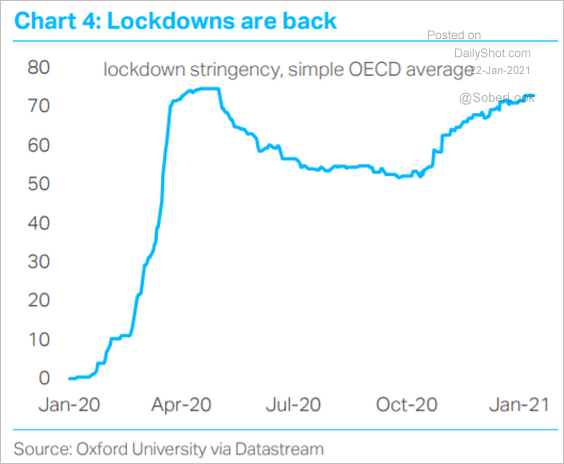

3. Lockdowns continue to pressure growth.

Source: TS Lombard

Source: TS Lombard

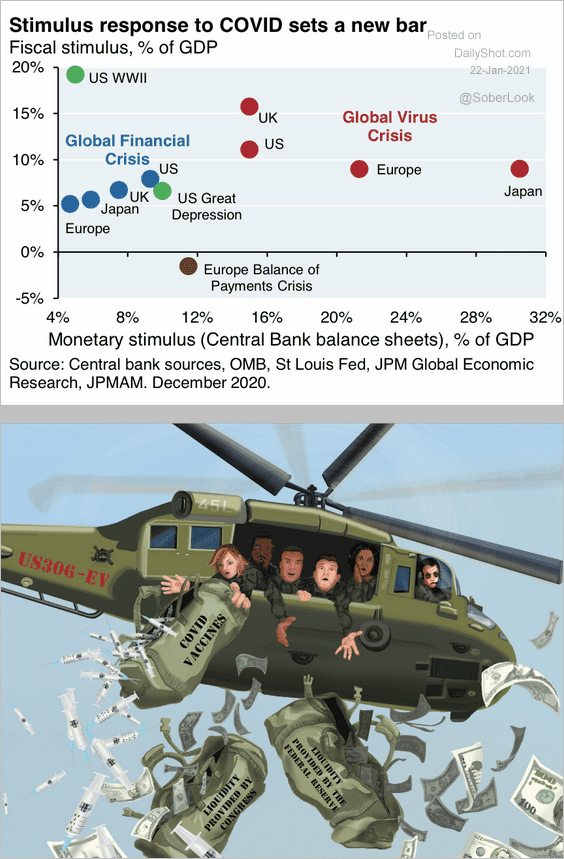

4. The fiscal response to the pandemic has been unprecedented.

Source: JP Morgan Asset Management

Source: JP Morgan Asset Management

——————–

Food for Thought

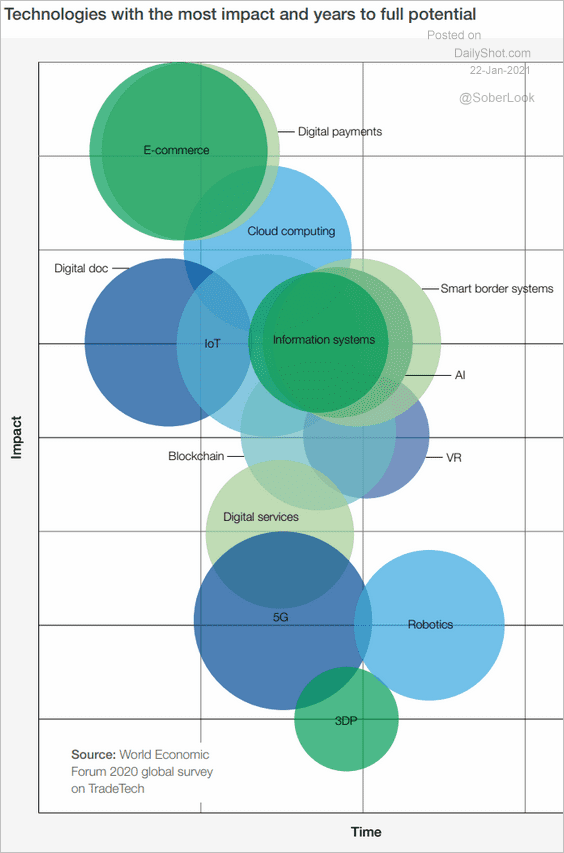

1. Technologies’ impact vs. time to full potential:

Source: WEF Read full article

Source: WEF Read full article

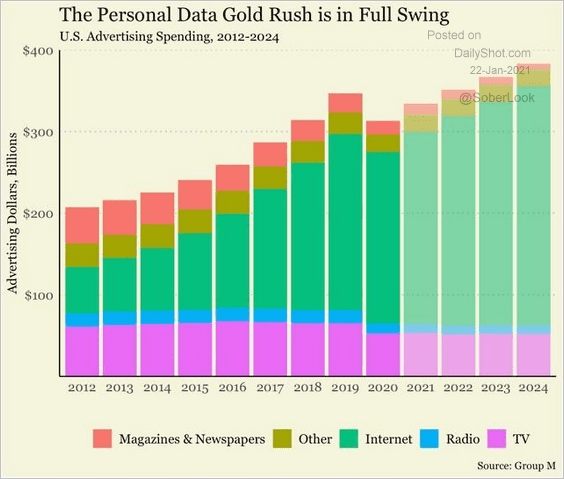

2. The personal data gold rush:

Source: @simongerman600 Read full article

Source: @simongerman600 Read full article

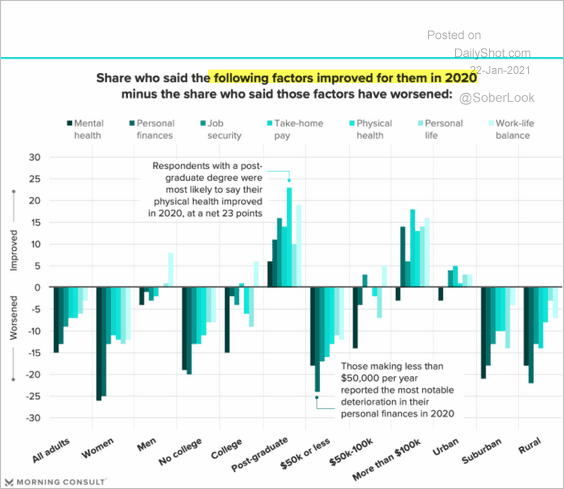

3. The demographics of COVID’s impact:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

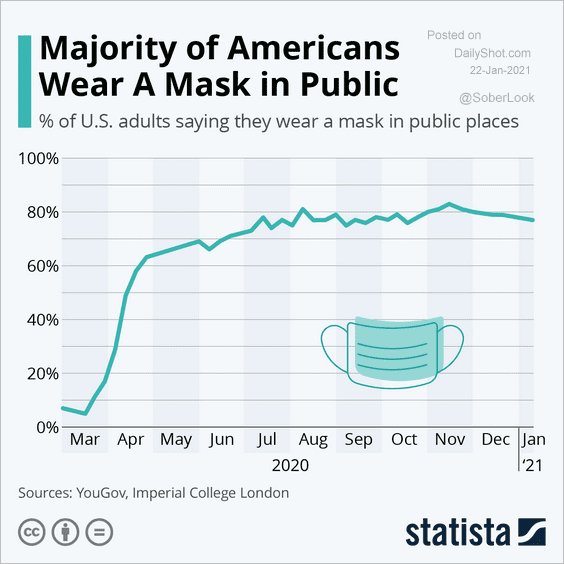

4. Wearing a mask in public:

Source: Statista

Source: Statista

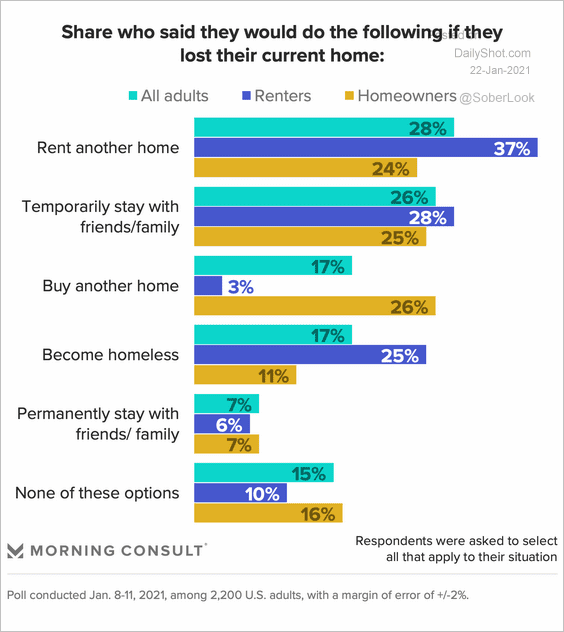

5. What would you do if you lost your current home?

Source: Morning Consult Read full article

Source: Morning Consult Read full article

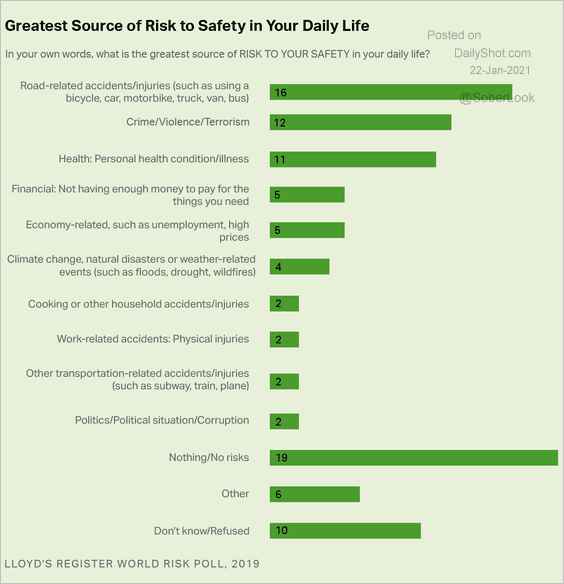

6. The greatest source of risk:

Source: Gallup Read full article

Source: Gallup Read full article

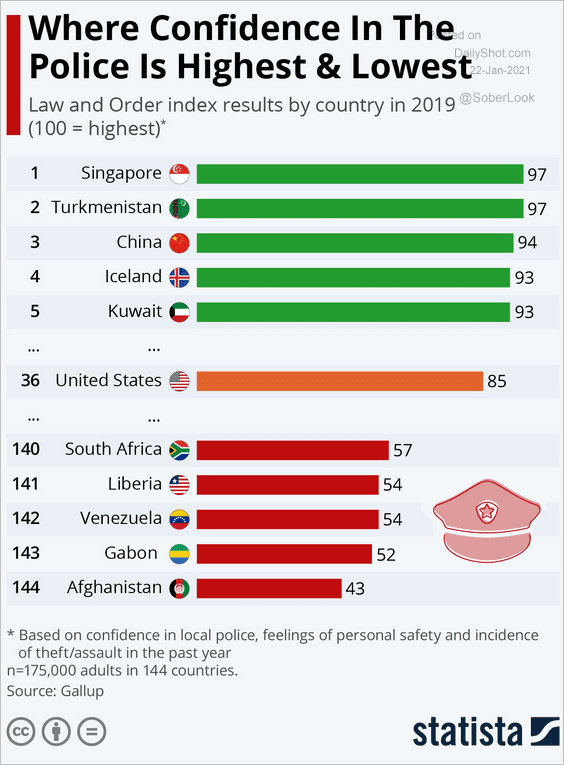

7. Confidence in the police:

Source: Statista

Source: Statista

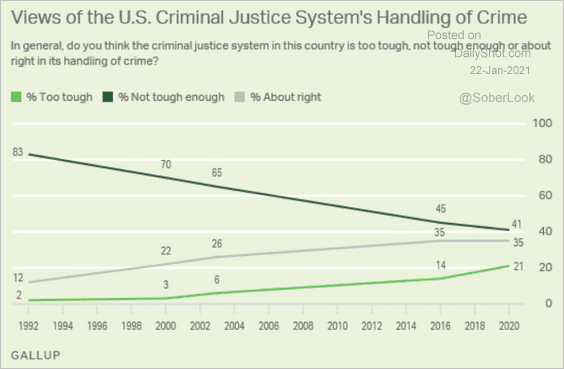

8. Views of the US criminal justice system:

Source: Gallup Read full article

Source: Gallup Read full article

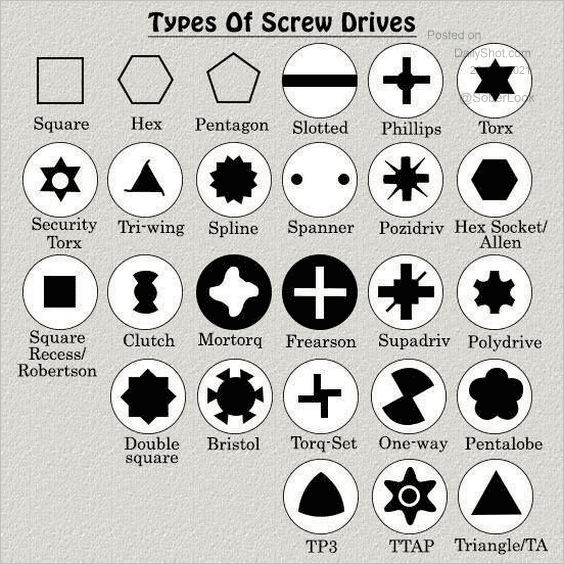

9. Types of screwdrivers:

Source: @simongerman600

Source: @simongerman600

——————–

Have a great weekend!

Back to Index