The Daily Shot: 28-Jan-21

• Equities

• Credit

• Rates

• Commodities

• Energy

• Emerging Markets

• China

• Asia – Pacific

• The Eurozone

• The United States

• Food for Thought

Equities

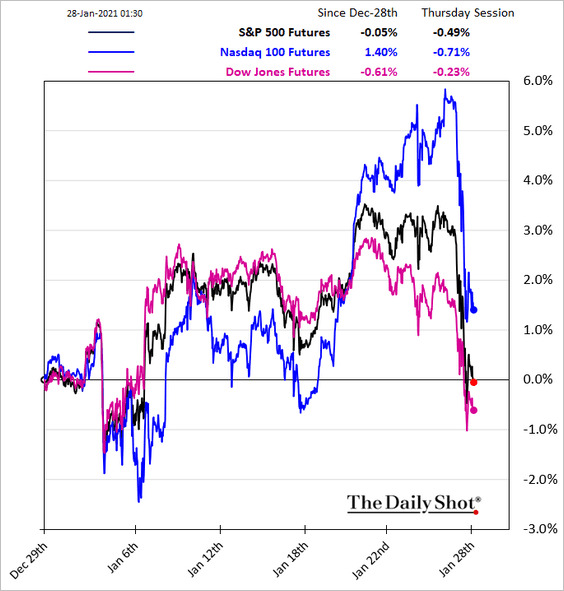

1. The market blew off some steam on Wednesday, with US indices ending sharply lower. Futures are heavy again this morning.

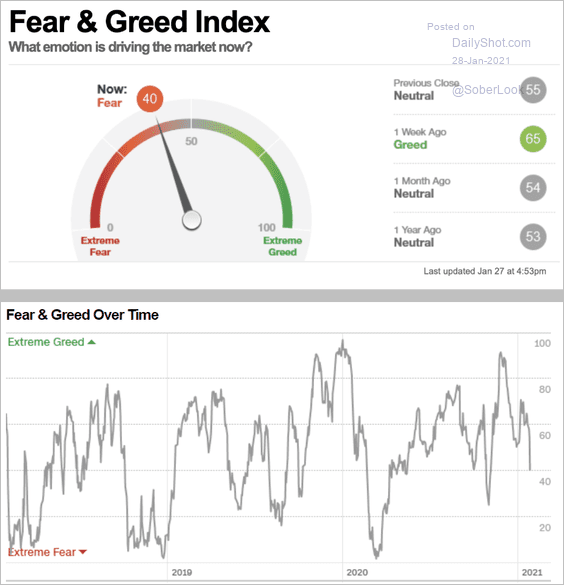

• While the overall sentiment has shifted to risk-off, …

Source: CNN Business

Source: CNN Business

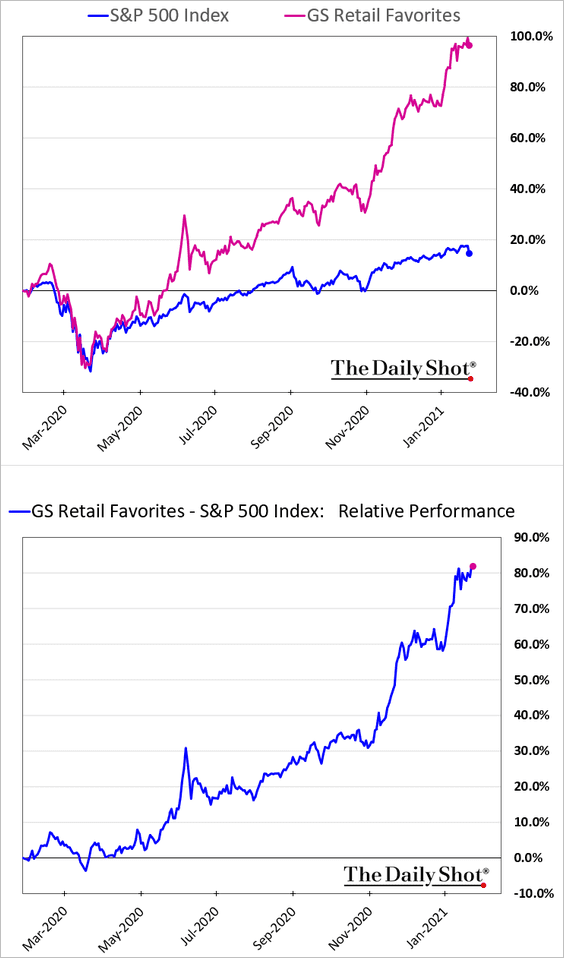

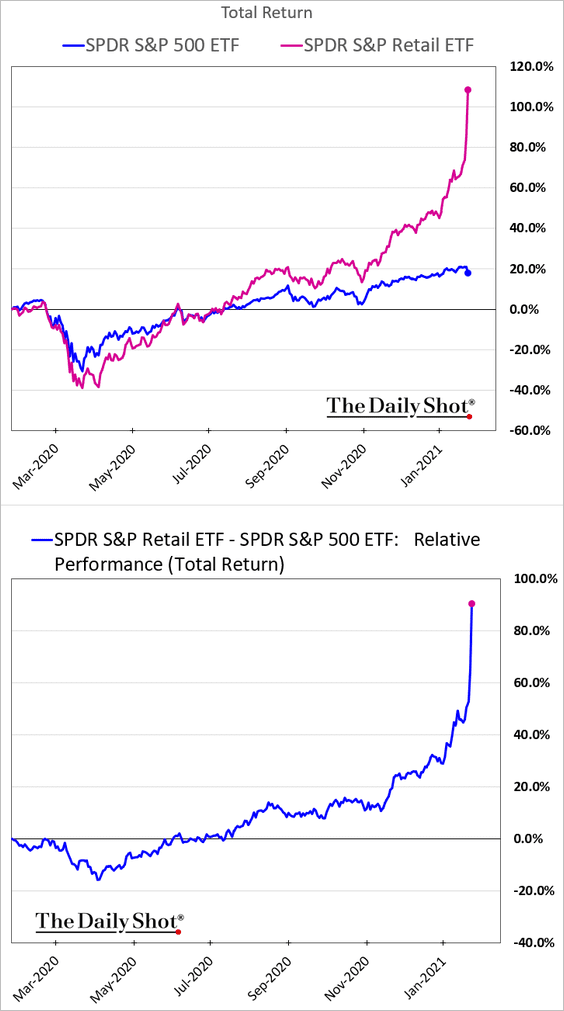

… the Reddit crowd didn’t get the memo. There are no significant signs of capitulation amid retail traders as their favorite shares’ performance hit a new high vs. the S&P 500.

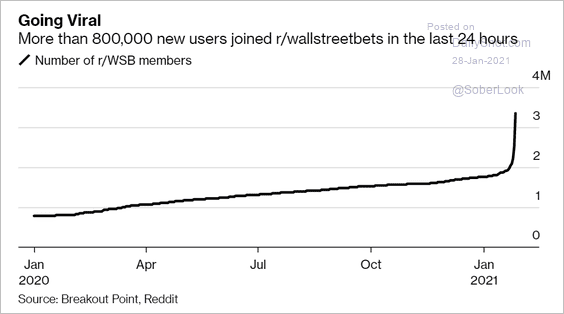

• Retail investors continued to flood to the r/WallStreetBets discussion board, shutting it down for a short period.

Source: Business Insider Read full article

Source: Business Insider Read full article

Source: @markets Read full article

Source: @markets Read full article

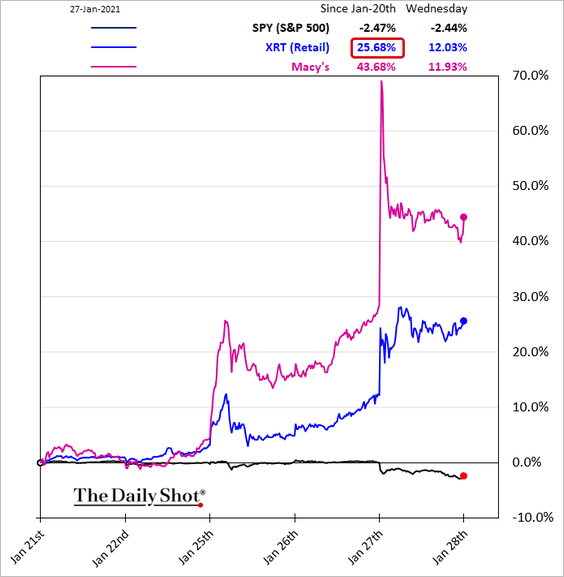

• The SPDR retail sector ETF continued to soar (now up 26% over the past five business days).

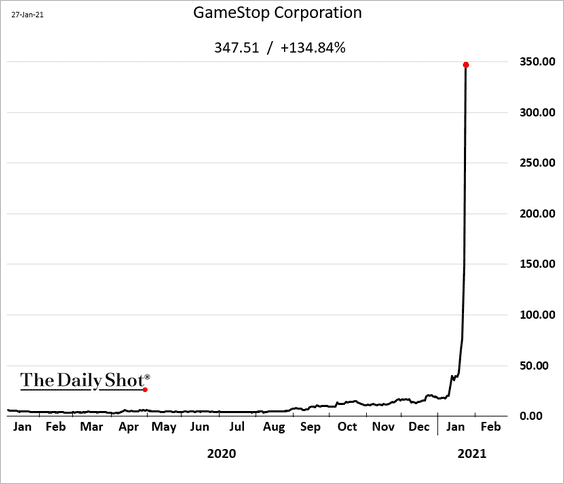

• GameStop’s market value hit $24 billion.

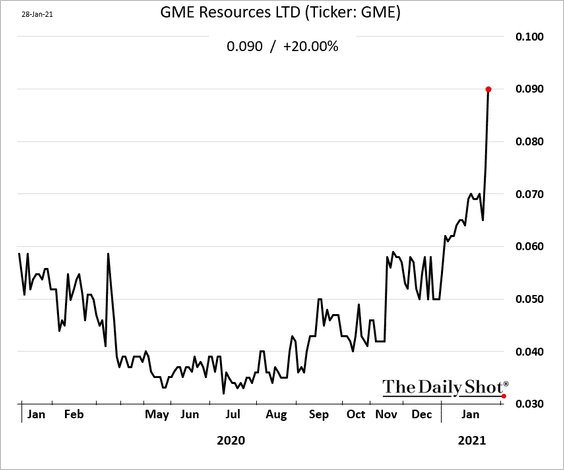

As a demonstration of just how distorted the market has become, here is the share price of a relatively small Australian mining company called GME Resources. The good news for the miner is that it has the same ticker symbol as GameStop (but in Australia), and the retail crowd mistakenly rewarded it with a 20% up day.

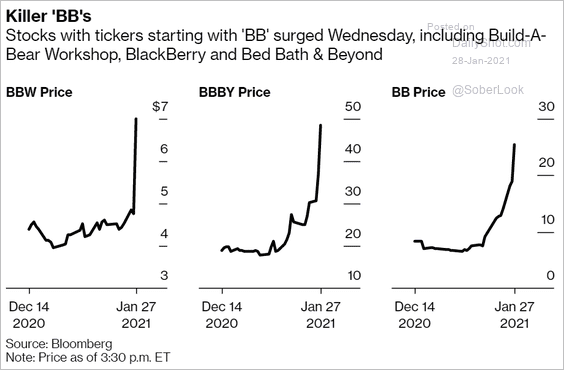

A similar development was this massive rally in stocks whose ticker symbols start with “BB.”

Source: @markets Read full article

Source: @markets Read full article

——————–

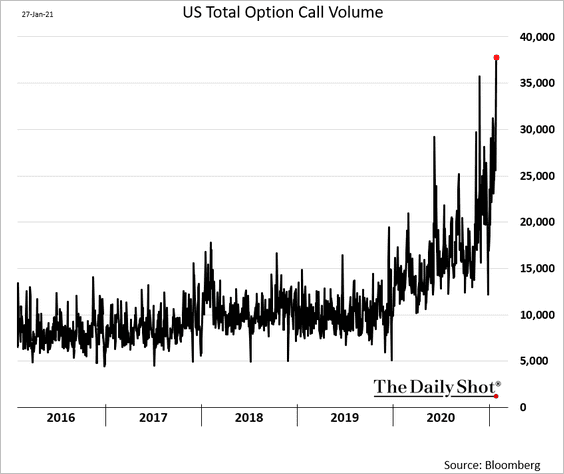

2. Call option volume hit a new record, …

… with many retail investors buying the dip.

Source: @jessefelder, @financialtimes Read full article

Source: @jessefelder, @financialtimes Read full article

——————–

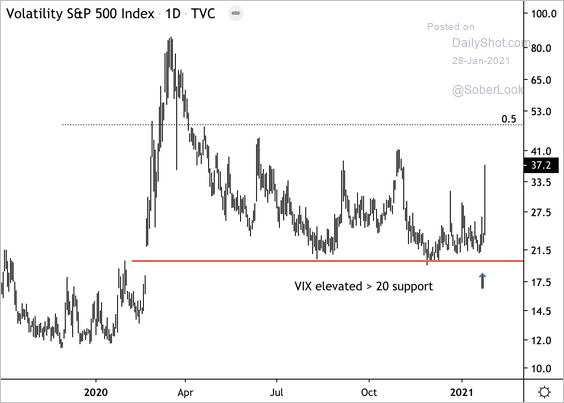

3. VIX spiked yesterday after holding support above 20 over the past year.

Source: Dantes Outlook

Source: Dantes Outlook

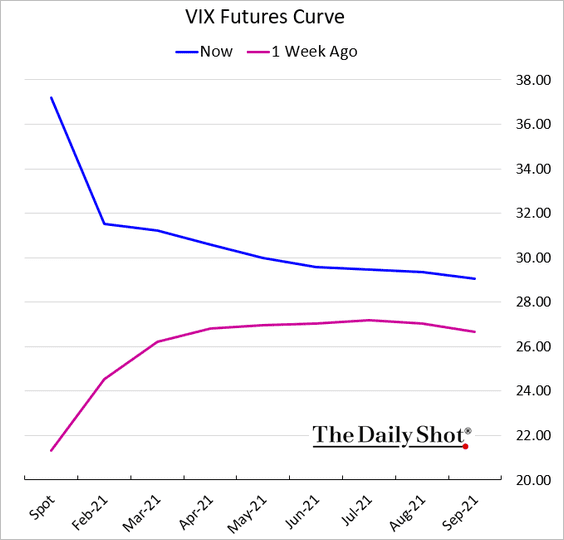

The VIX futures curve inverted.

——————–

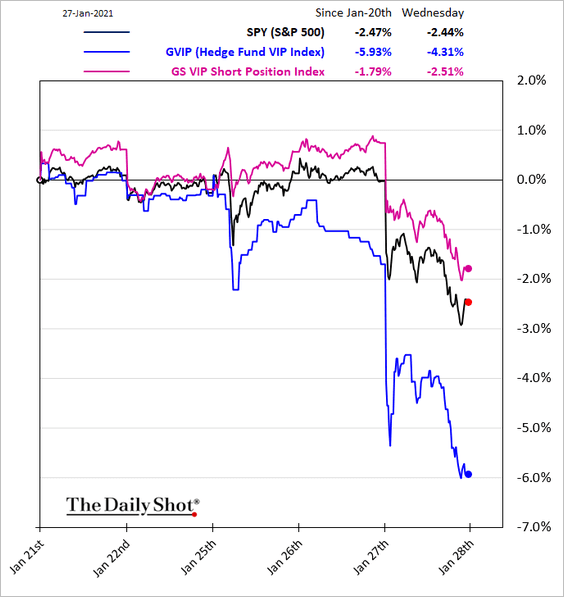

4. Equity hedge funds have been struggling in recent days as their short positions (pressured by the Reddit crowd) sharply outperform their longs.

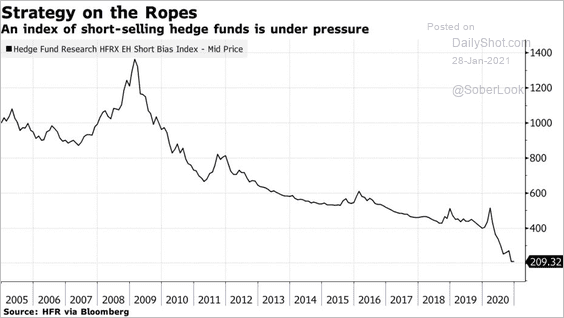

By the way, funds with a short bias had a rough year.

Source: @markets Read full article

Source: @markets Read full article

——————–

5. The PHLX Semiconductor Index held resistance (with a sharp selloff this week).

![]() Source: Dantes Outlook

Source: Dantes Outlook

![]()

——————–

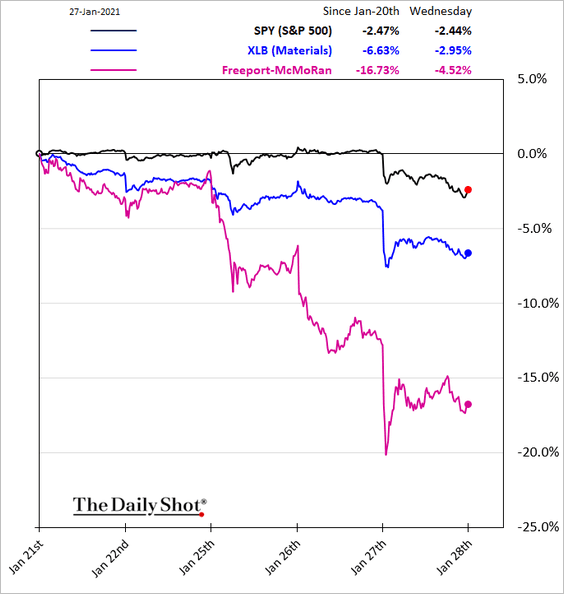

6. The cyclical trade unwind continued.

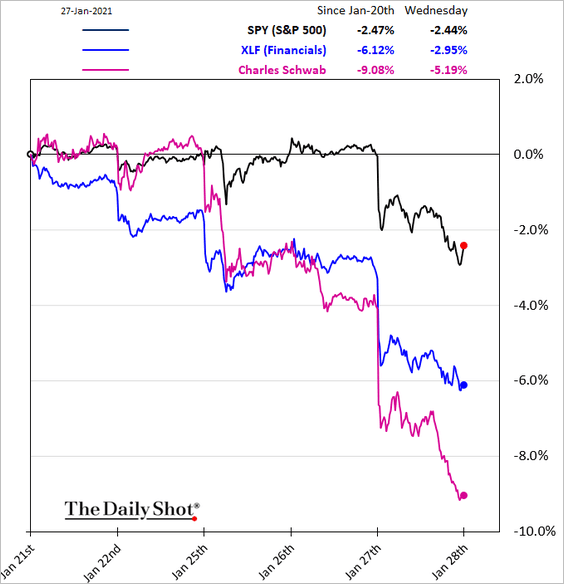

7. Extreme trading volumes created some challenges for online brokers.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

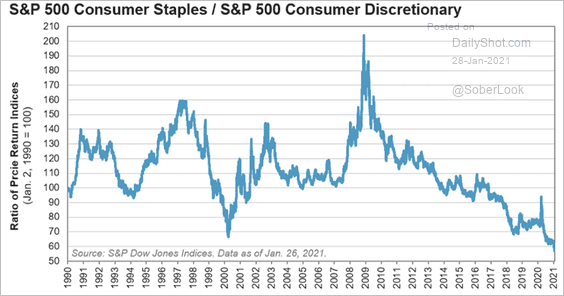

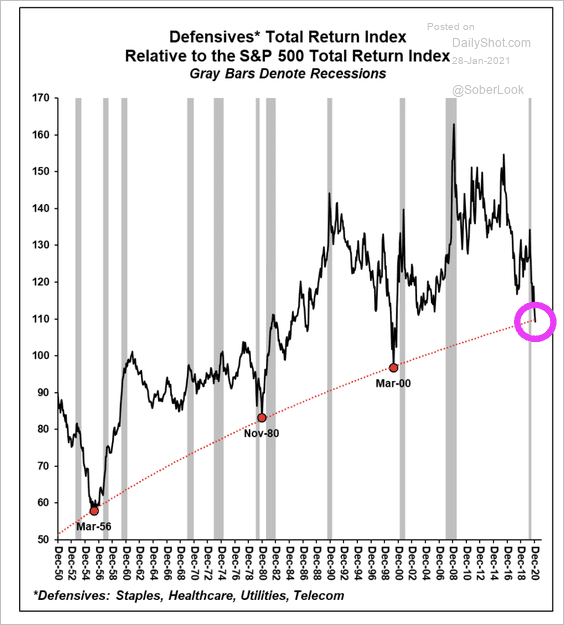

8. Consumer staples continue to underperform consumer discretionary stocks.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Defensive stocks are at long-term support relative to the S&P 500.

Source: Stifel

Source: Stifel

——————–

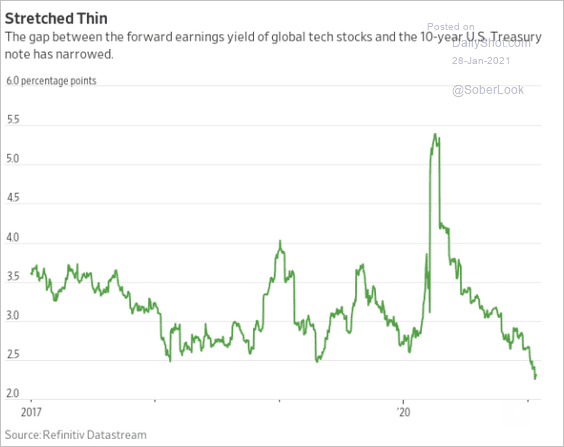

9. The spread between the S&P 500 expected earnings yield and the 10-year Treasury continues to tighten.

Source: @WSJ Read full article

Source: @WSJ Read full article

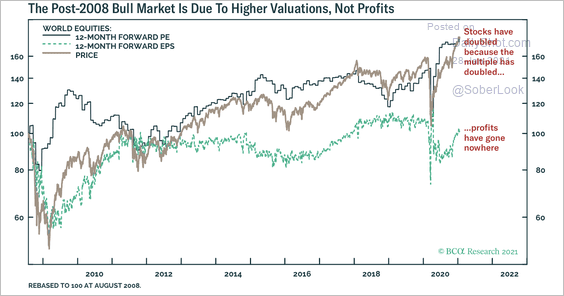

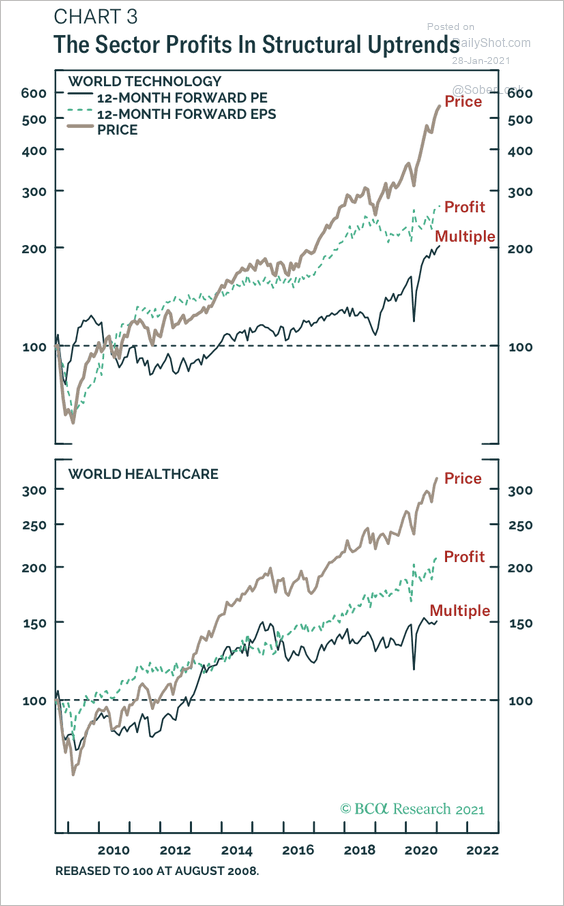

10. The global equity bull market has not been driven by profit growth over the past decade.

Source: BCA Research

Source: BCA Research

However, profits in IT and healthcare sectors have been in structural uptrends.

Source: BCA Research

Source: BCA Research

Back to Index

Credit

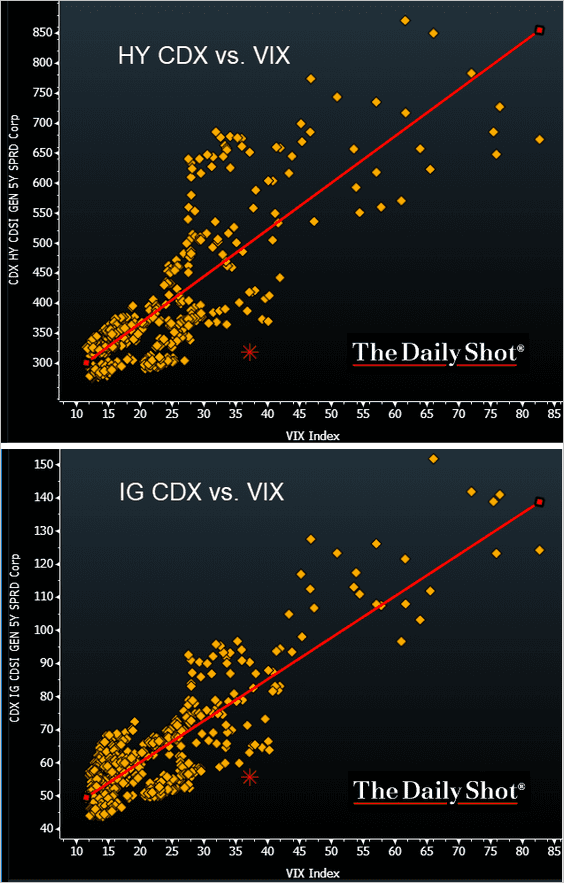

1. Corporate credit default swap spreads (both high-yield and investment-grade) are much too tight relative to VIX. There is a similar divergence between bond spreads and VIX.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

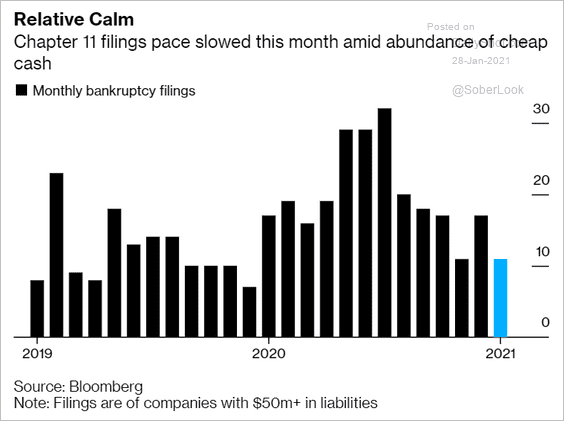

2. Chapter 11 filings slowed this month.

Source: @markets Read full article

Source: @markets Read full article

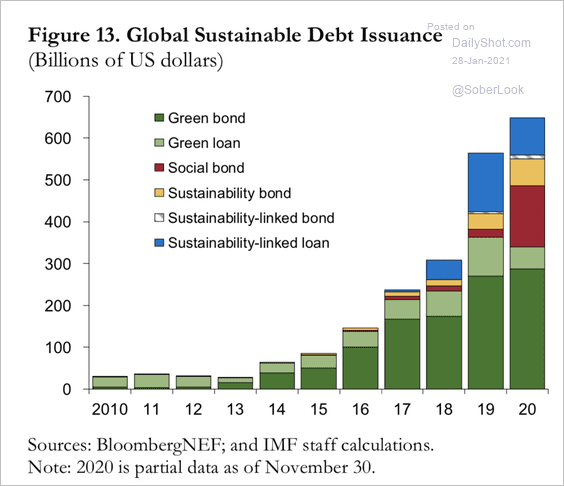

3. Sustainable debt issuance hit a record last year.

Source: IMF Read full article

Source: IMF Read full article

Back to Index

Rates

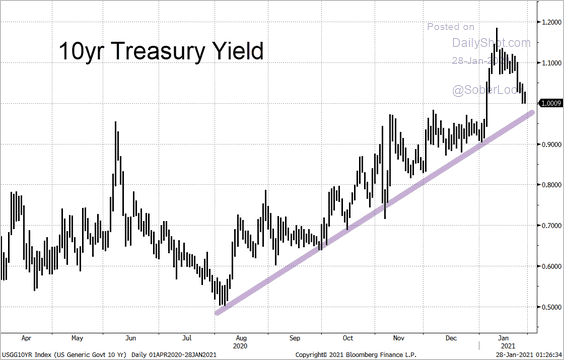

1. The 10yr Treasury yield declined, but the upward trend remains intact for now.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

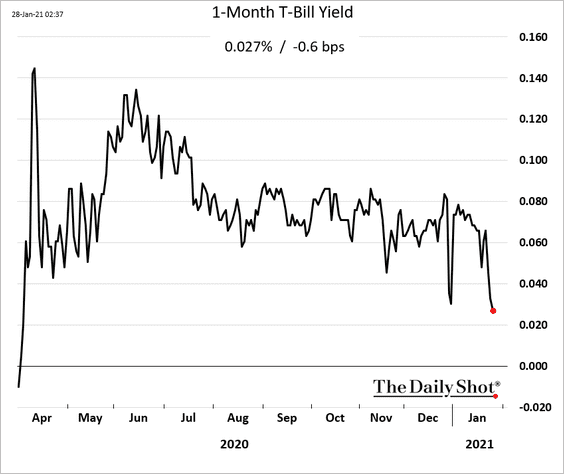

2. With money markets flooded with liquidity, the 1-month T-Bill yield hit the lowest level since the pandemic crash.

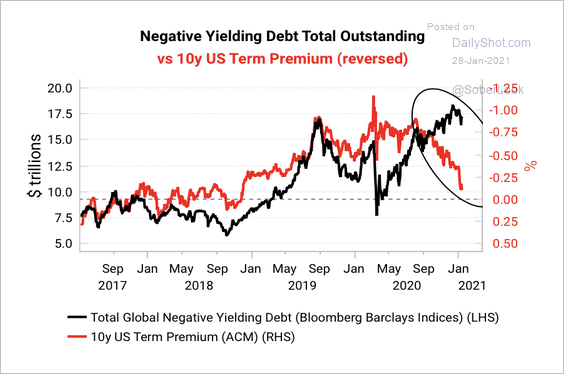

3. This chart shows the divergence between the negative-yielding debt and the Treasury term premium.

Source: Variant Perception

Source: Variant Perception

Back to Index

Commodities

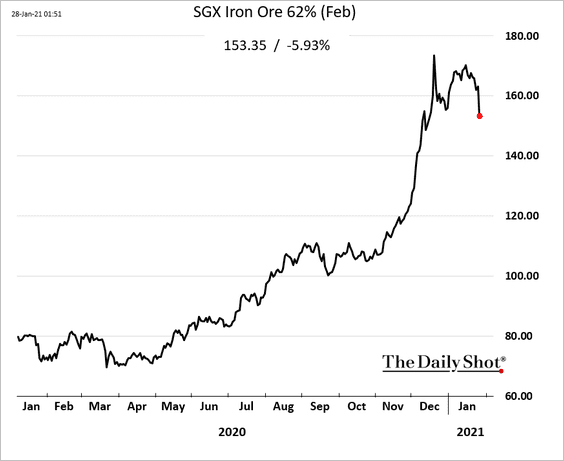

Iron ore is rolling over.

Back to Index

Energy

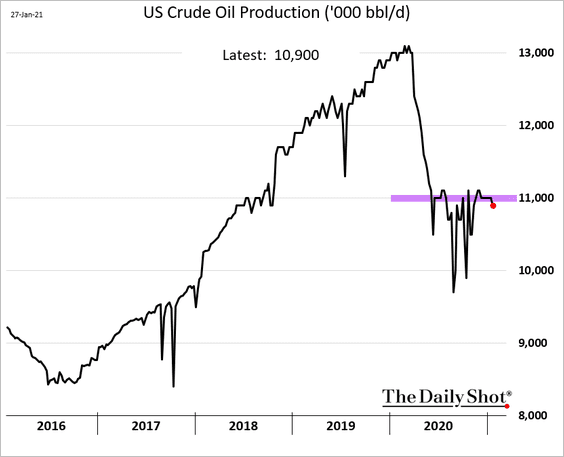

1. US crude oil production is stuck at around 11 million barrels per day.

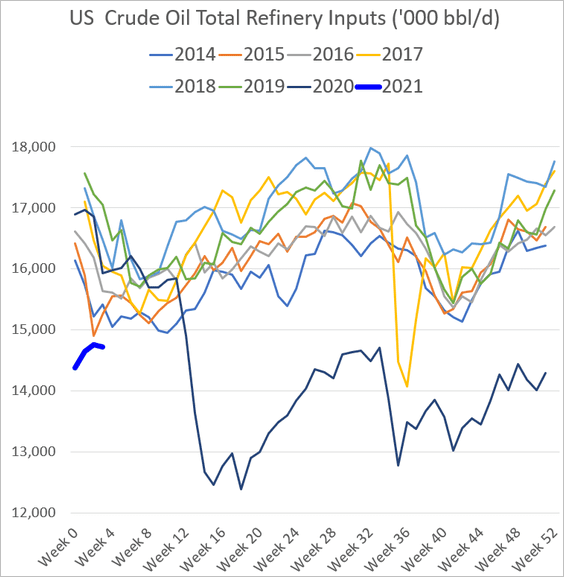

2. US refinery inputs are holding below the 7-year range.

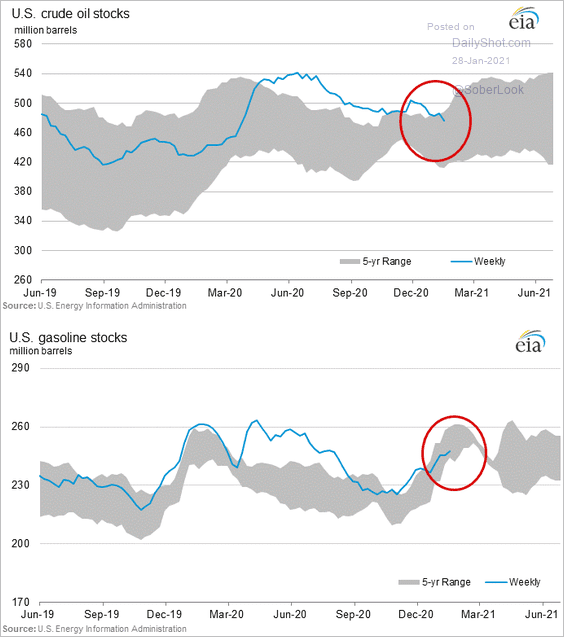

3. Crude oil and gasoline inventories are now within the five-year range.

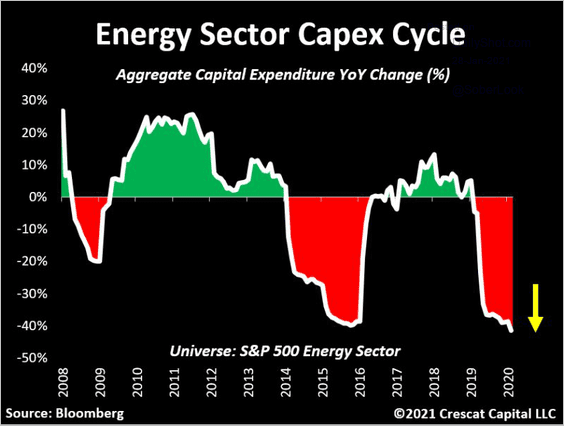

4. As discussed previously, energy-sector CapEx tumbled last year.

Source: @TaviCosta

Source: @TaviCosta

Back to Index

Emerging Markets

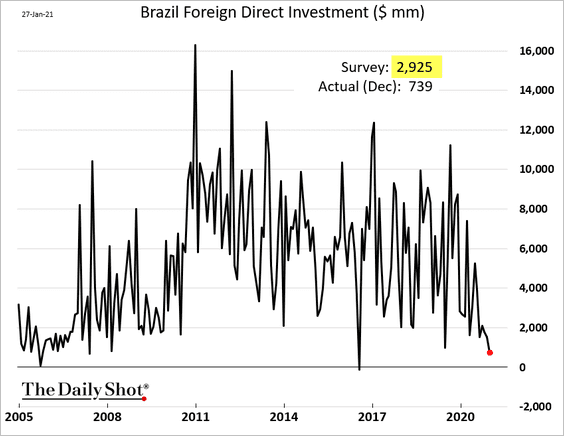

1. Foreign direct investment into Brazil slumped last year.

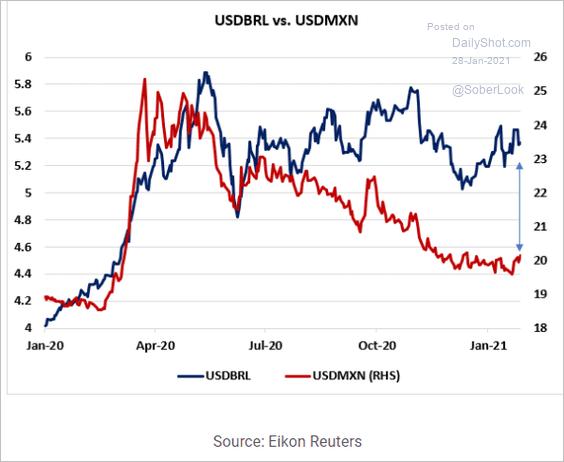

2. The Mexican peso and the Brazilian real have diverged (the peso massively outperformed post-crisis).

Source: Rothko Research

Source: Rothko Research

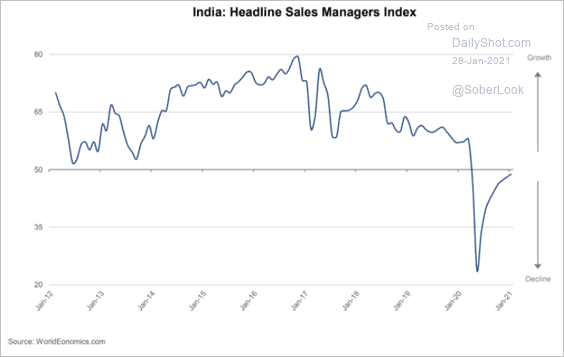

3. India’s business activity has almost stabilized (SMI approaching 50).

Source: World Economics

Source: World Economics

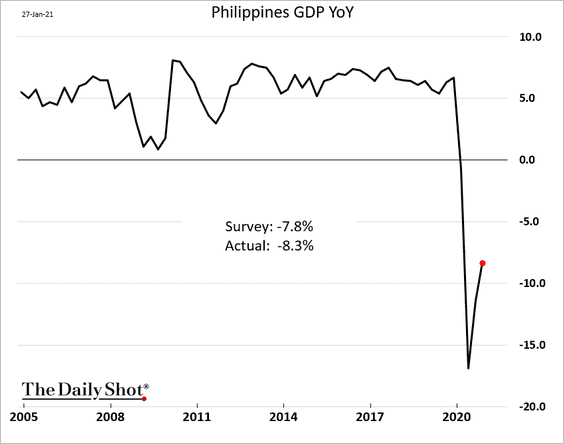

4. The Philippines’ Q4 GDP was below expectations. The recovery will take time.

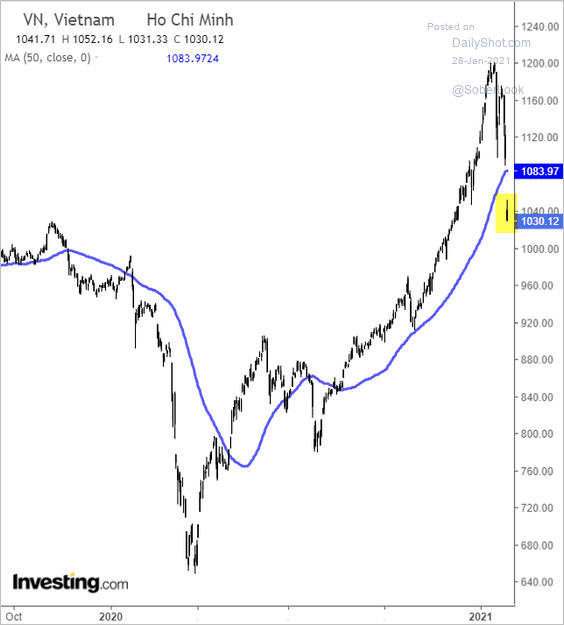

5. Vietnam’s stock index broke below the 50-day moving average and kept going.

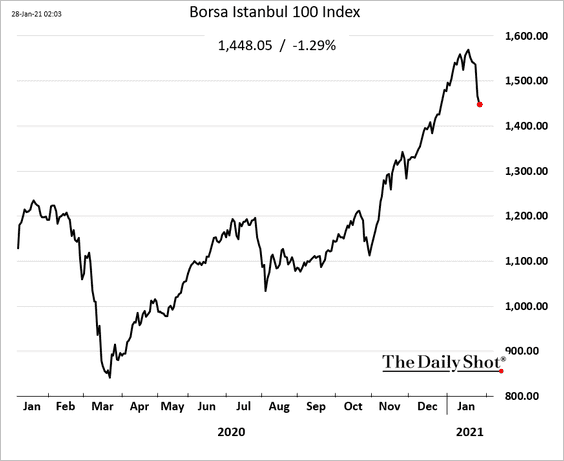

6. Turkey’s stock market is rolling over.

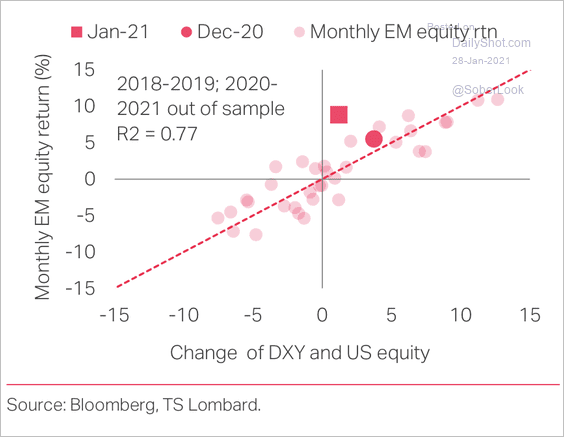

7. EM stocks have been driven by changes in US equities and the dollar.

Source: TS Lombard

Source: TS Lombard

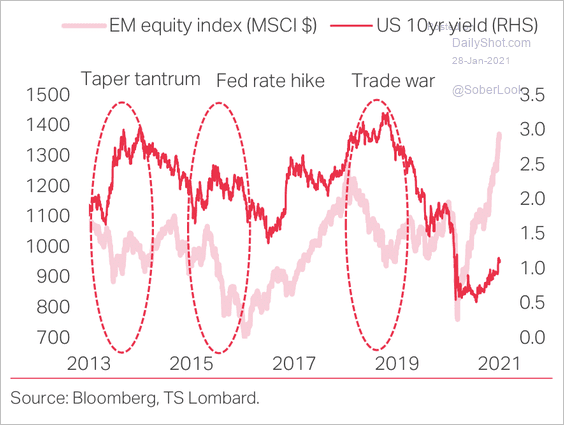

8. Rising US yields could trigger a decline in EM equities.

Source: TS Lombard

Source: TS Lombard

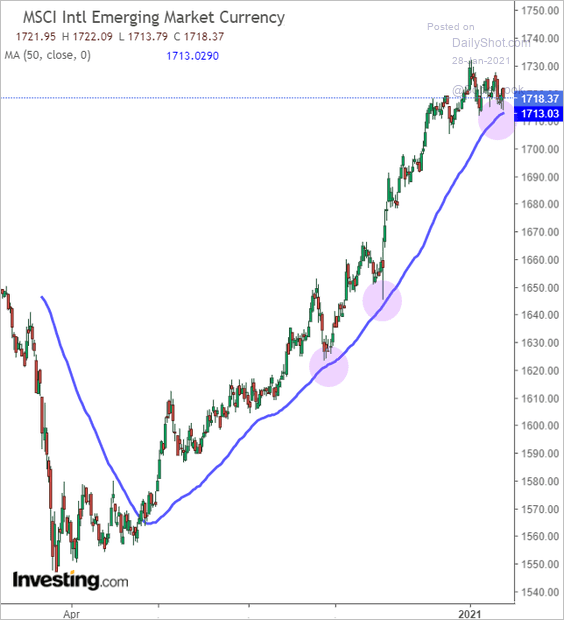

9. The MSCI EM Currency Index is at support.

Back to Index

China

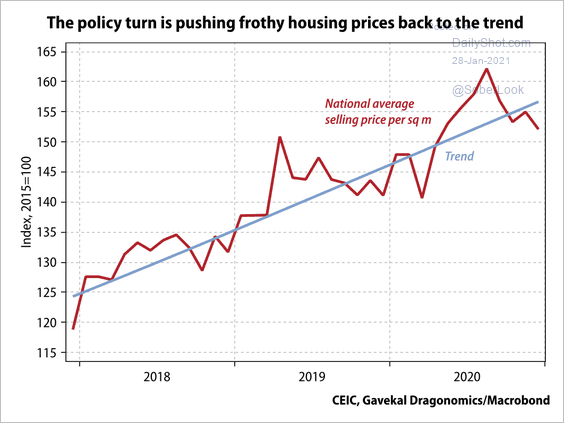

1. Tighter policies have been effective in cooling down housing prices …

Source: Gavekal Research

Source: Gavekal Research

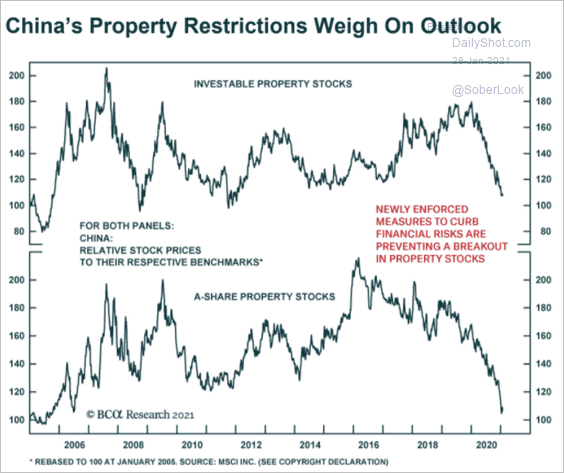

… and pressuring property stocks.

Source: BCA Research

Source: BCA Research

——————–

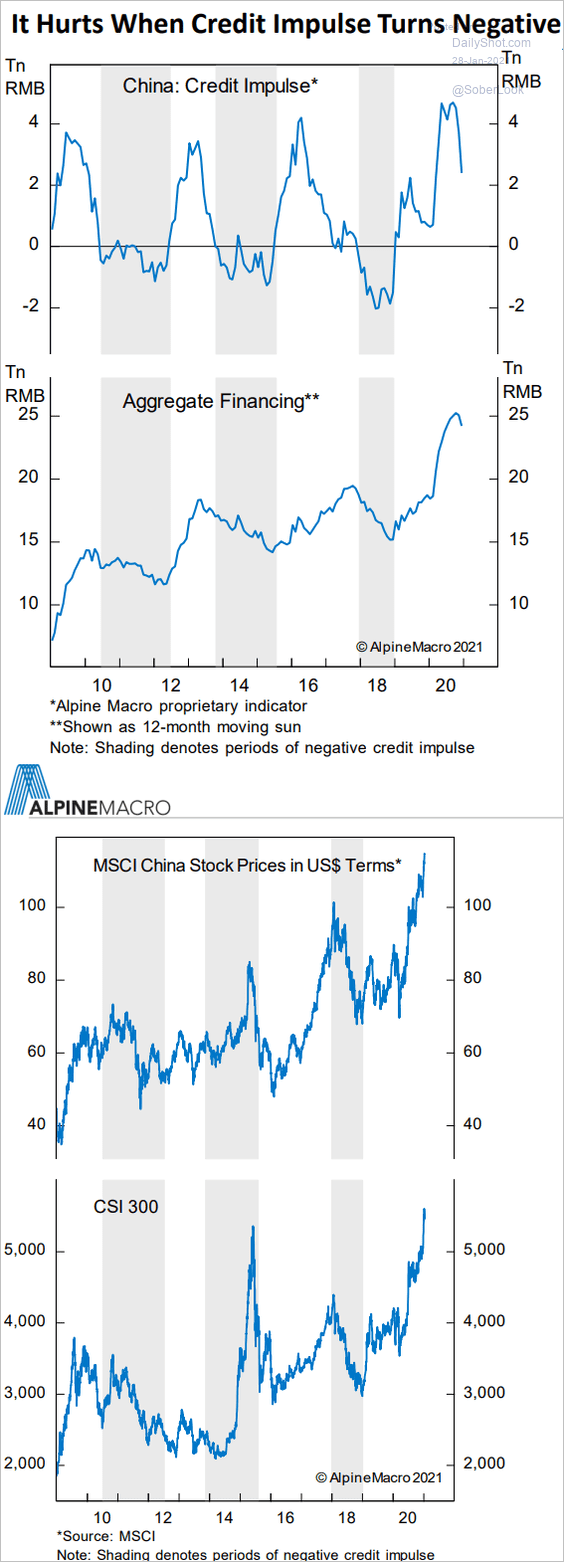

2. The decline in China’s credit impulse could slow growth and halt the stock market rally.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Asia – Pacific

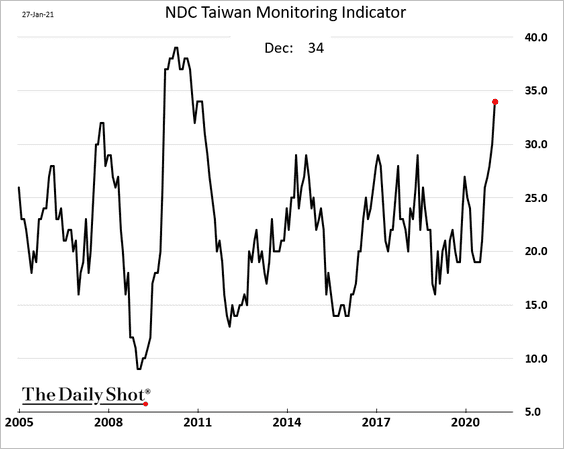

1. Taiwan’s economic index soared going into the year-end.

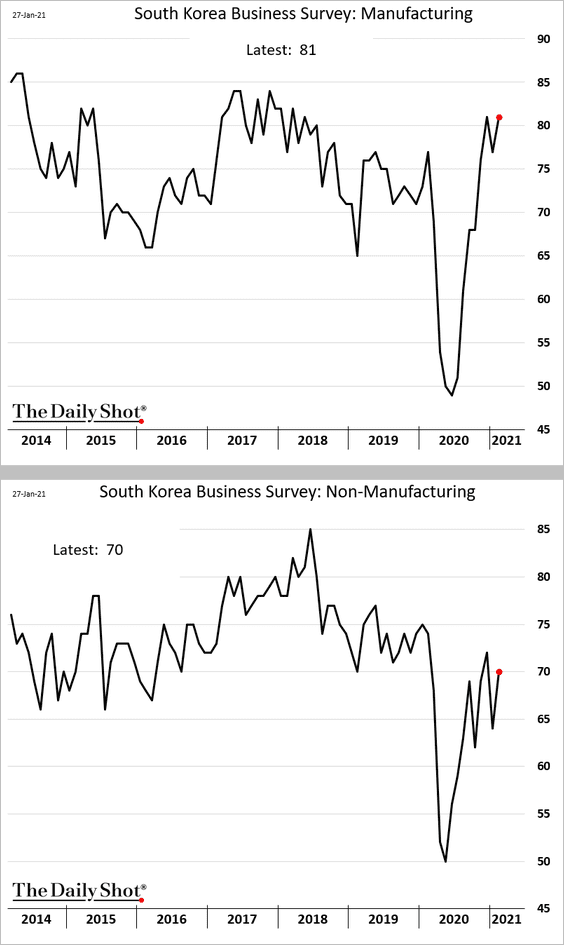

2. South Korea’s business surveys improved this month.

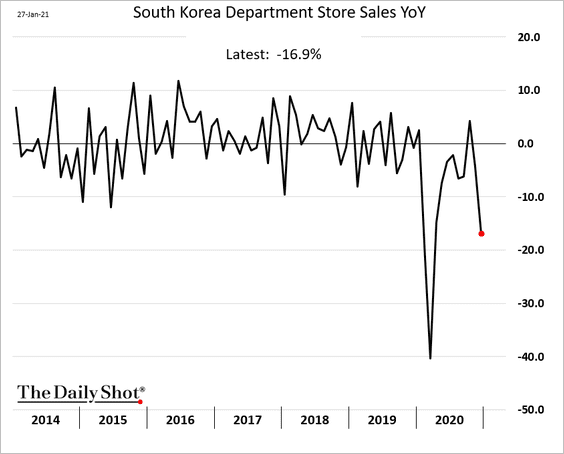

Department store sales tumbled in December.

——————–

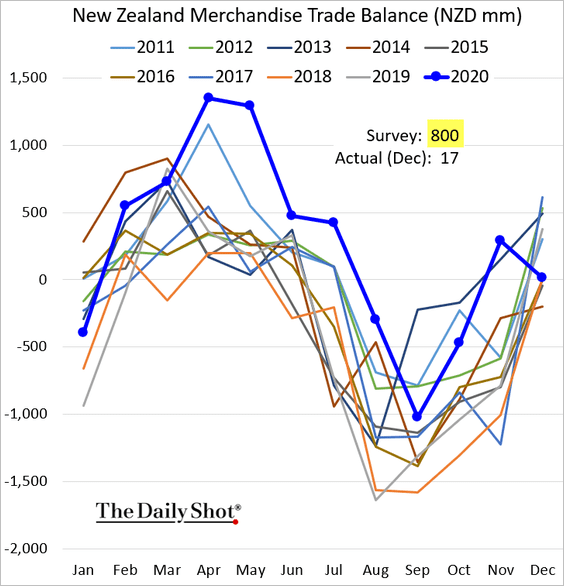

3. New Zealand’s trade surplus unexpectedly declined last month.

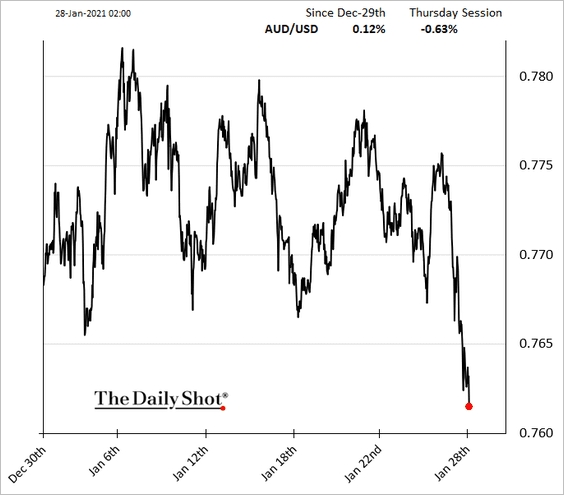

4. The Aussie dollar is heavy amid global risk-off sentiment.

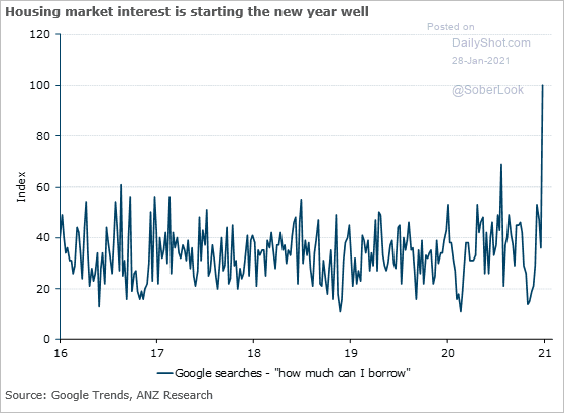

5. Australians’ interest in the housing market soared last year.

Source: @ANZ_Research, @DimesHayden, @DavidPlank12

Source: @ANZ_Research, @DimesHayden, @DavidPlank12

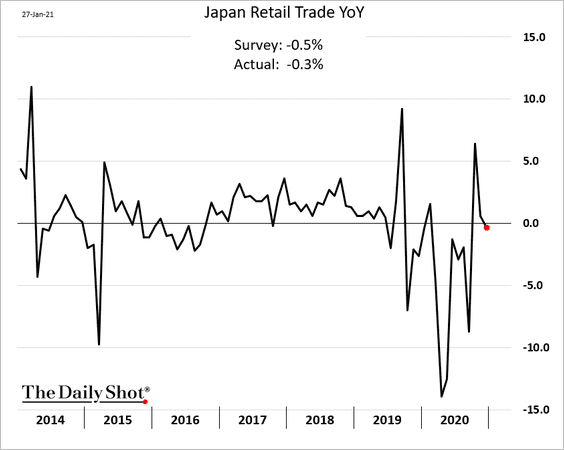

6. Japanese retail sales declined less than expected.

Back to Index

The Eurozone

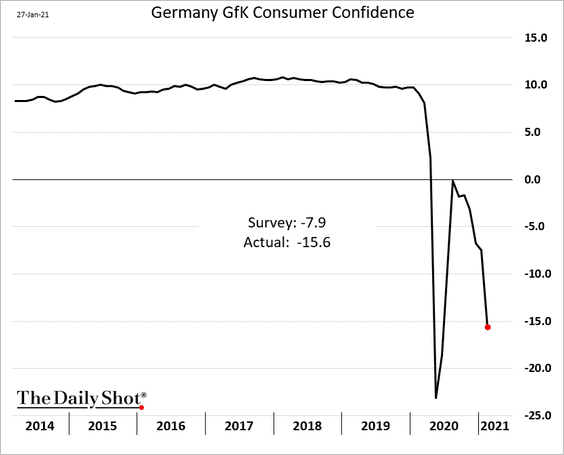

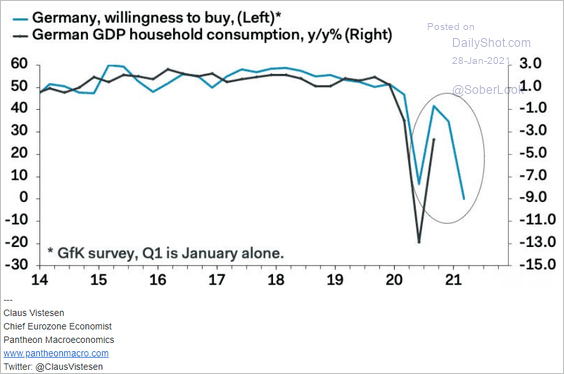

1. German consumer sentiment tumbled this month.

This trend is likely to pressure the nation’s economic growth in Q1.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

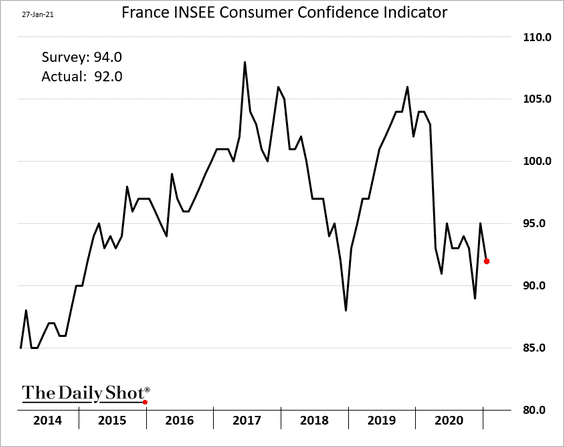

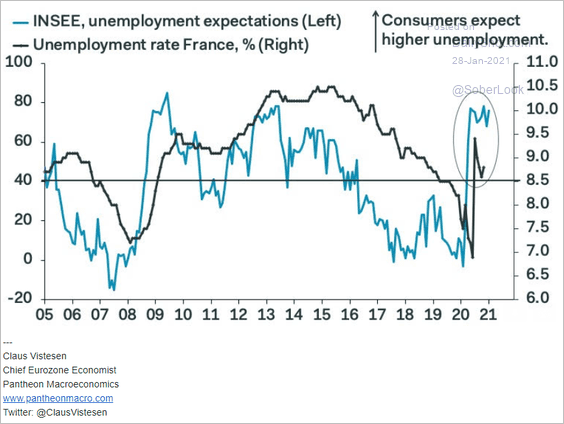

2. French consumer confidence also softened.

The unease with the labor market remains elevated.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

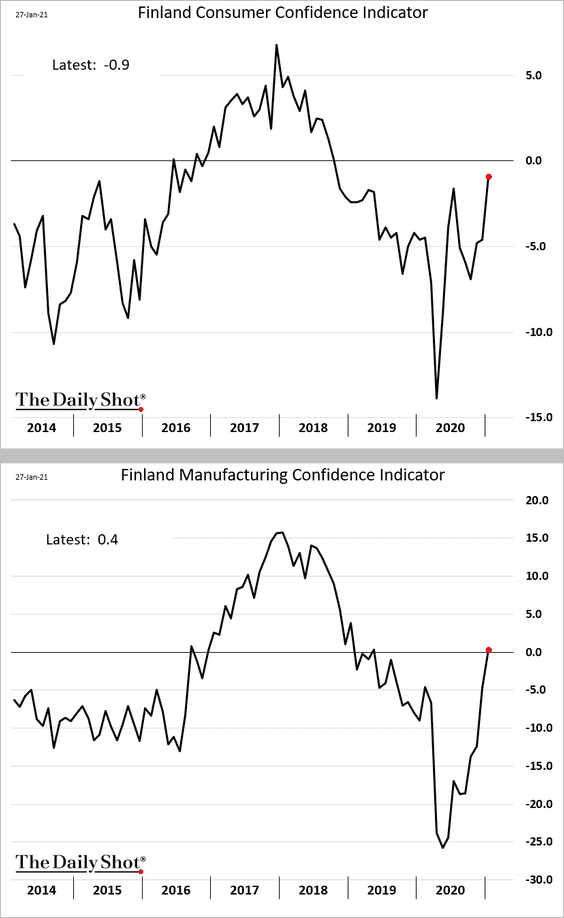

3. Finland’s sentiment indicators continue to recover.

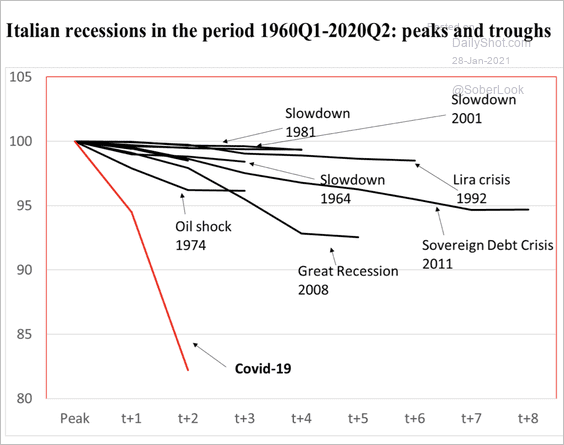

4. Italy’s economic contraction has been devastating.

Source: Banca D’Italia Read full article

Source: Banca D’Italia Read full article

Back to Index

The United States

1. As was widely expected, the Fed left policy unchanged. But Chairman Powell appeared annoyed with all the talk about QE tapering.

In terms of tapering, it’s just premature. We just created the guidance. We said we wanted to see substantial further progress toward our goals before we modify our asset purchase guidance. … It’s just too early to be talking about dates. We should be focused on progress that we need to see.

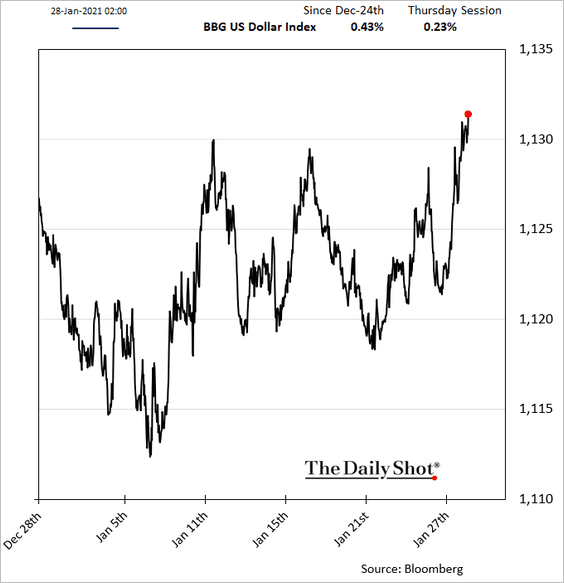

2. The dollar rose amid global risk-off sentiment.

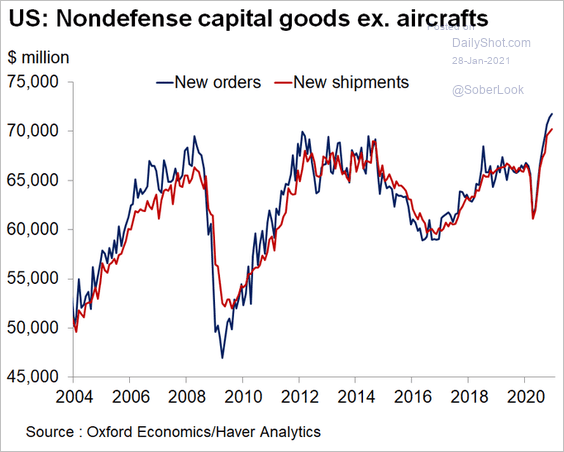

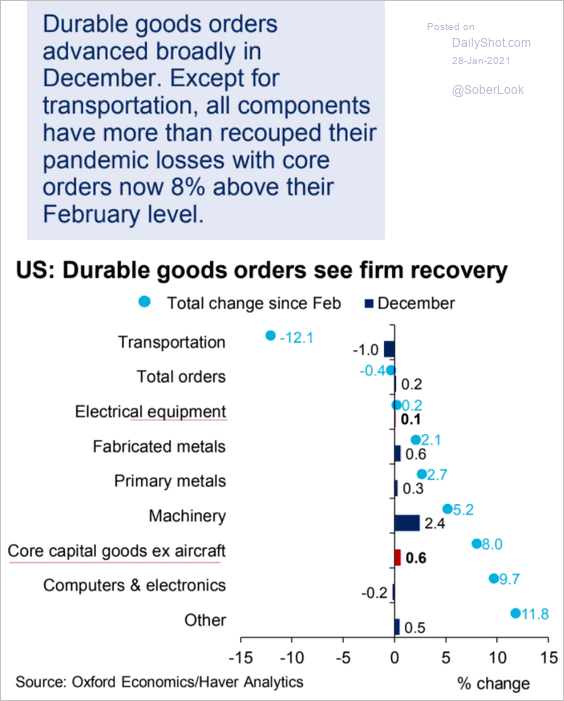

3. The durable goods orders report showed robust factory activity going into the year-end.

Source: @GregDaco

Source: @GregDaco

Outside of the aircraft sector, orders were strong.

Source: Oxford Economics

Source: Oxford Economics

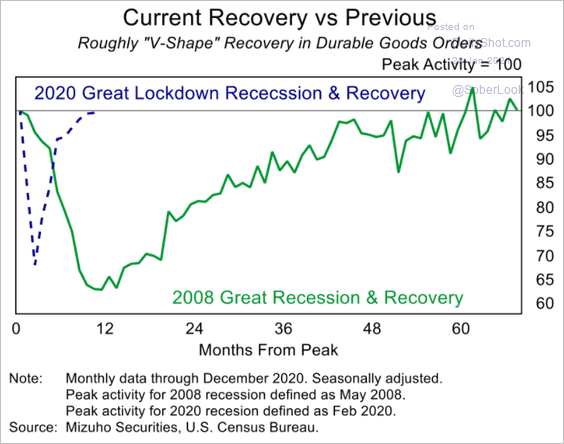

Here is a comparison with the 2008 downturn.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

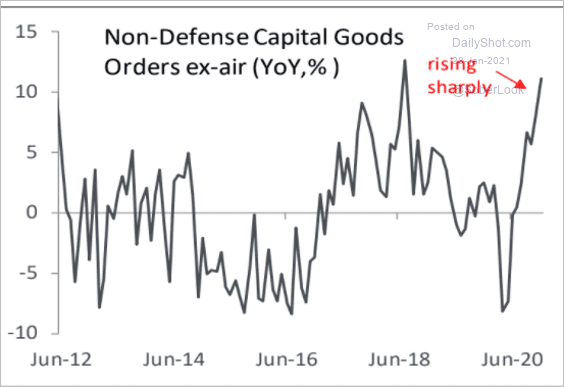

Capital goods orders continued to rise sharply, pointing to a robust CapEx recovery.

Source: Piper Sandler

Source: Piper Sandler

——————–

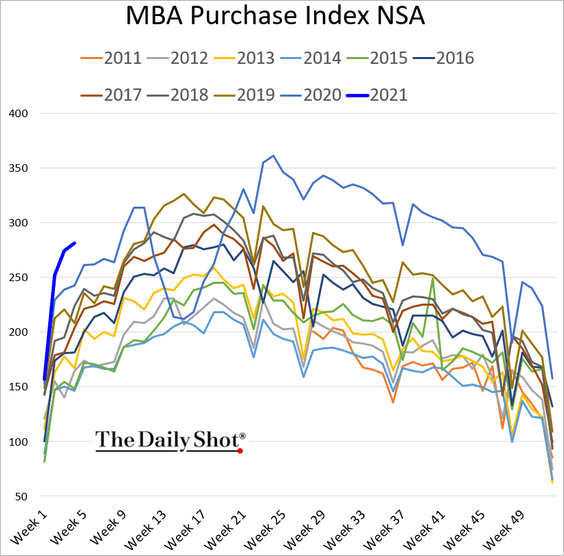

4. Mortgage applications to purchase a house are holding up.

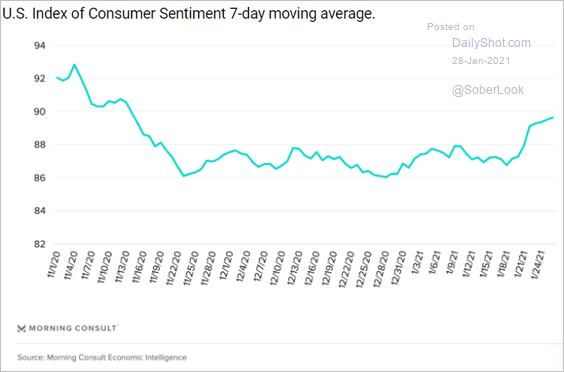

5. According to Morning Consult, US consumer sentiment is recovering.

Source: Morning Consult Read full article

Source: Morning Consult Read full article

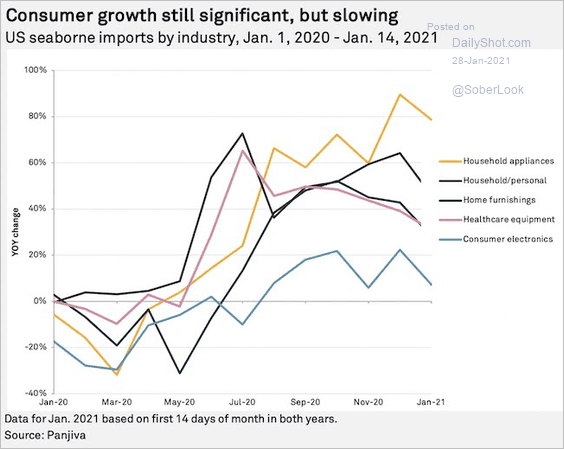

6. Consumer demand for imported goods remains strong, but it may be losing momentum.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

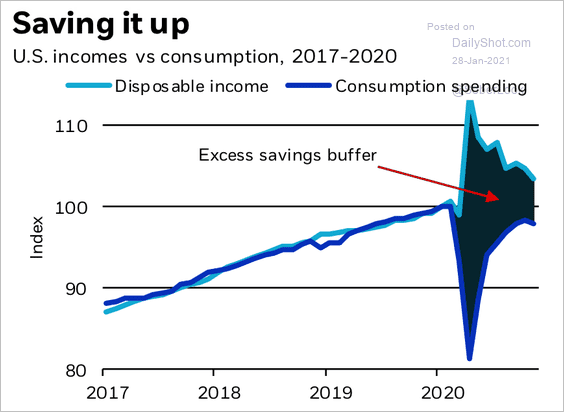

However, there is plenty of pent-up demand that could be unleashed later this year.

Source: BlackRock

Source: BlackRock

——————–

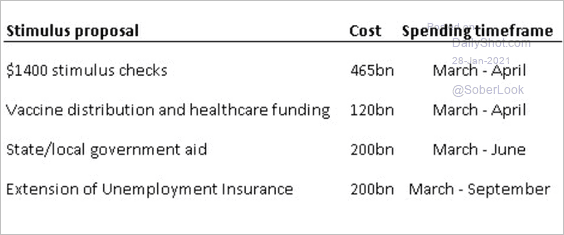

7. Here is a sample fiscal package that could pass in Q1, according to Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Food for Thought

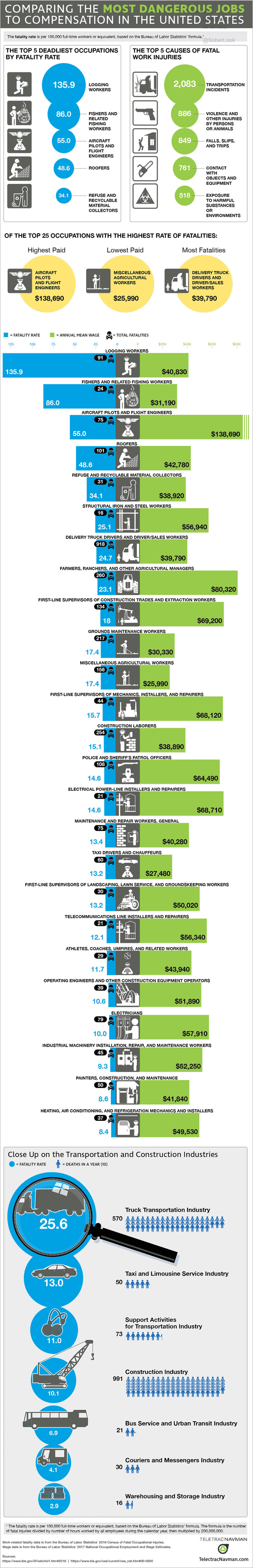

1. Most dangerous jobs:

Source: Teletrac Navman

Source: Teletrac Navman

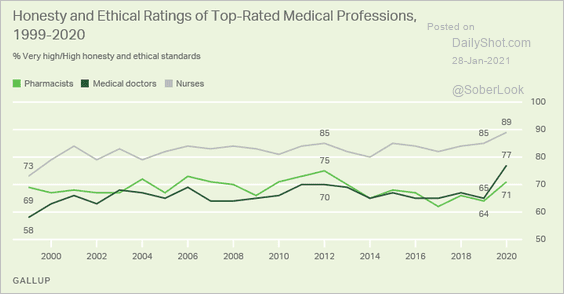

2. Ethical ratings of medical professionals:

Source: Gallup Read full article

Source: Gallup Read full article

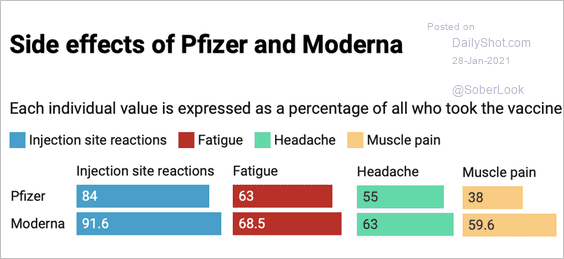

3. Vaccine side effects:

Source: r/dataisbeautiful

Source: r/dataisbeautiful

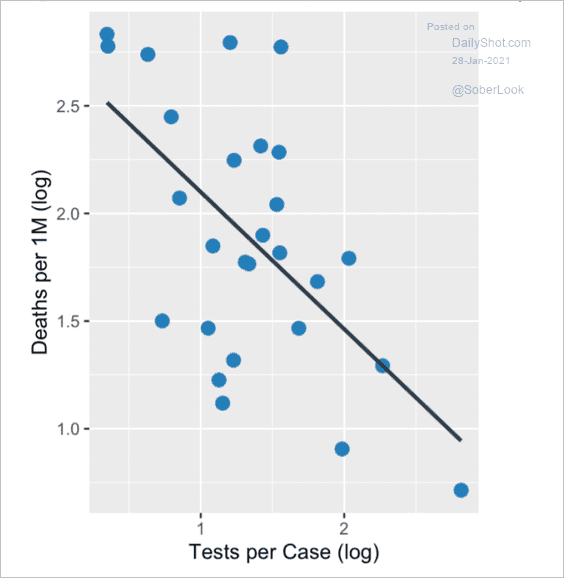

4. COVID deaths vs. testing (each dot represents a country):

Source: Kannoth, Kandula, Shaman Read full article

Source: Kannoth, Kandula, Shaman Read full article

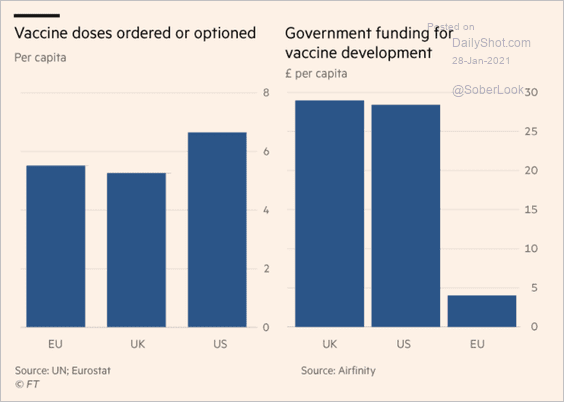

5. Vaccine financing:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

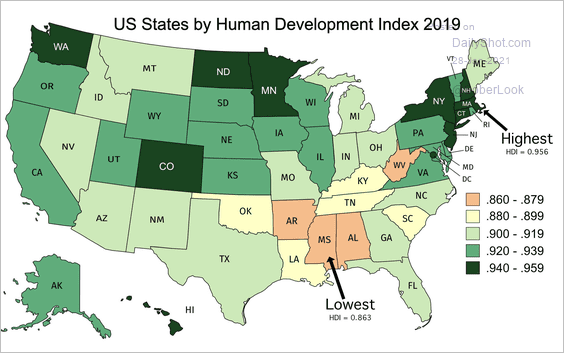

6. The Human Development Index in the US:

Source: Reddit

Source: Reddit

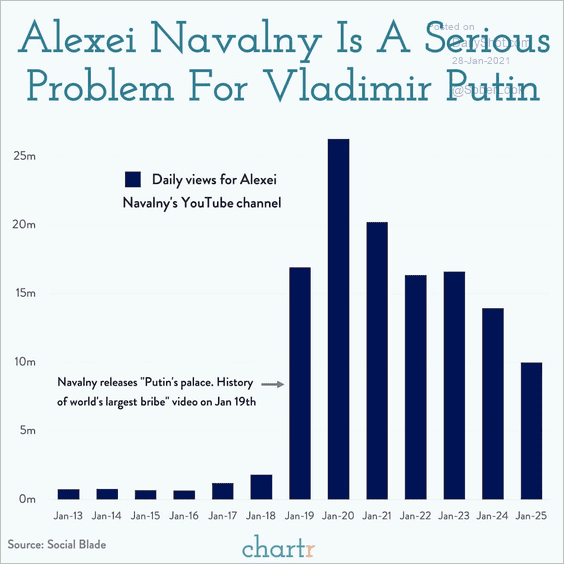

7. Interest in Navalny’s YouTube channel:

Source: @chartrdaily

Source: @chartrdaily

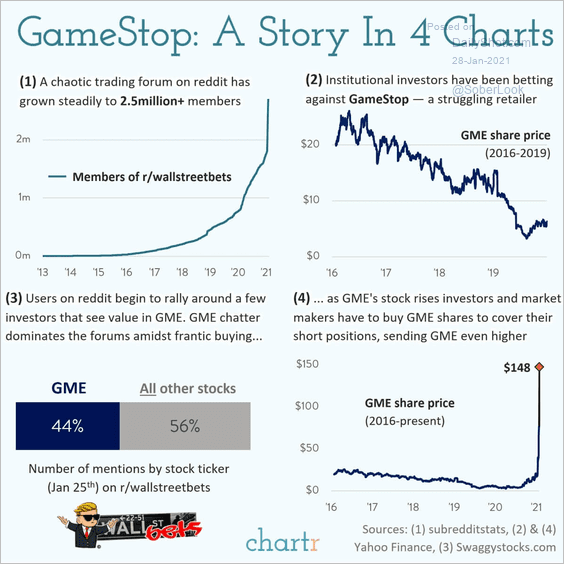

8. What has been going on with GameStop?

Source: @chartrdaily

Source: @chartrdaily

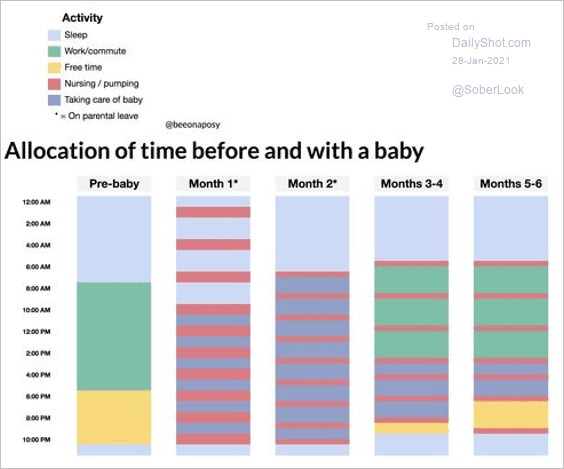

9. Time allocation before and after having a baby:

Source: Workingmother.com Read full article

Source: Workingmother.com Read full article

——————–

Back to Index