The Daily Shot: 01-Feb-21

• The United States

• Canada

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

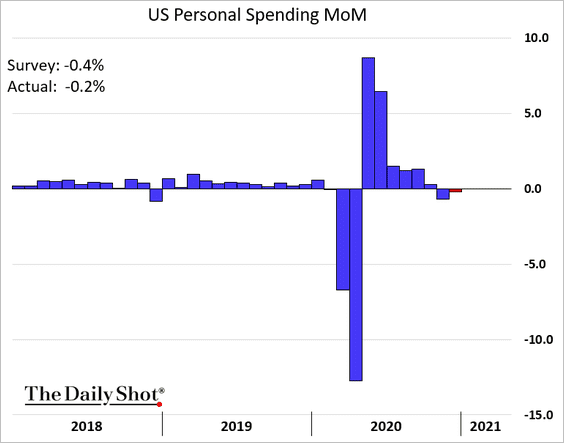

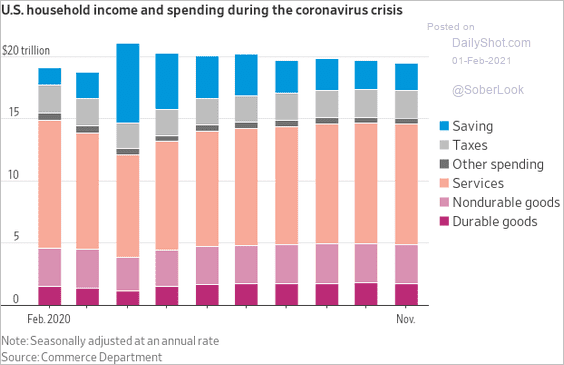

1. Consumer spending held up well in December, …

… as incomes climbed more than expected.

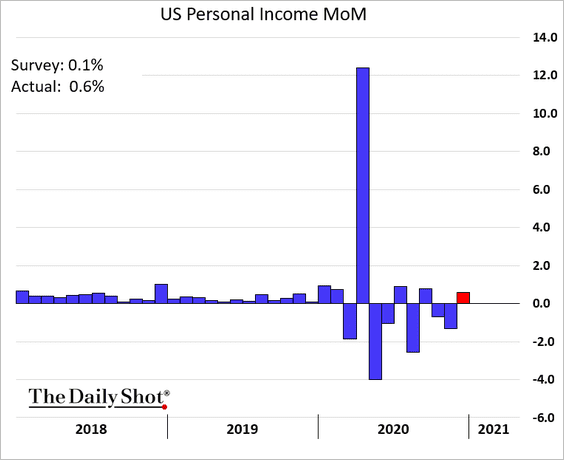

• These charts show consumer spending in dollar terms.

Source: Wolf Richter Read full article

Source: Wolf Richter Read full article

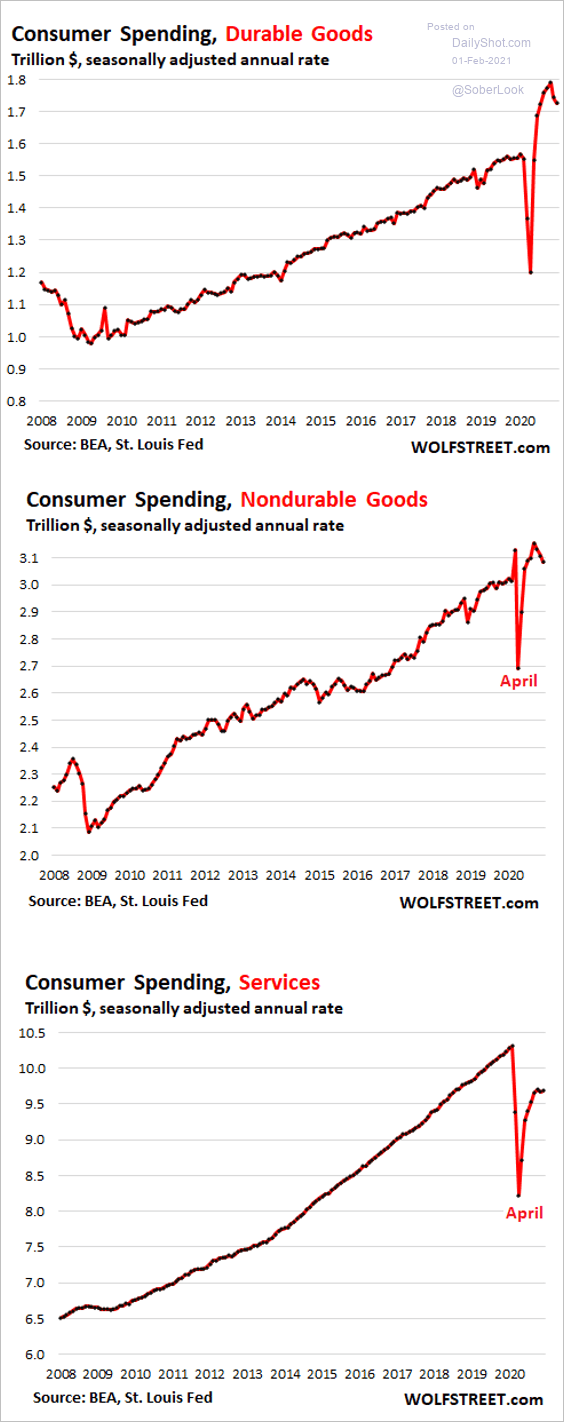

• Below is the breakdown of household income, spending, and saving.

Source: @WSJ Read full article

Source: @WSJ Read full article

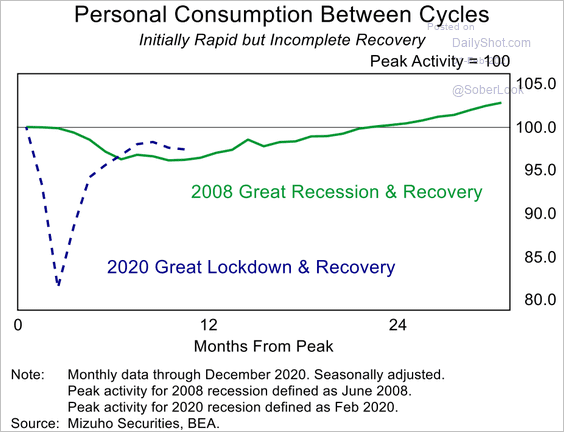

• And here are some comparisons to the 2008 downturn.

– Spending:

Source: Mizuho Securities USA

Source: Mizuho Securities USA

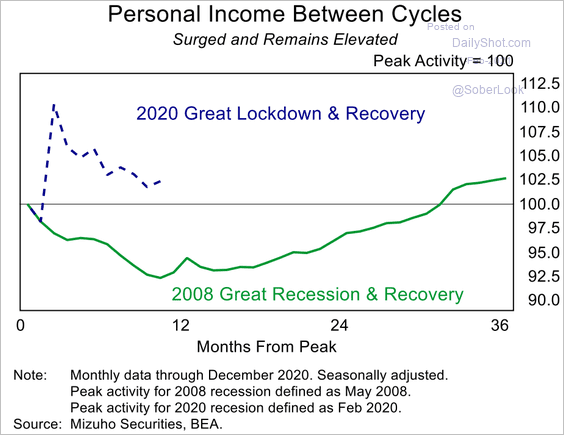

– Income:

Source: Mizuho Securities USA

Source: Mizuho Securities USA

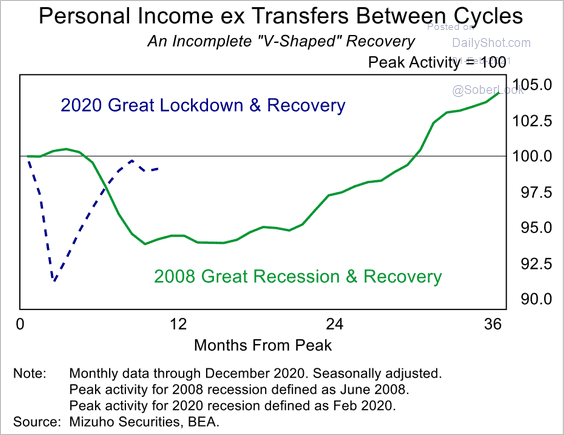

– Income excluding stimulus checks:

Source: Mizuho Securities USA

Source: Mizuho Securities USA

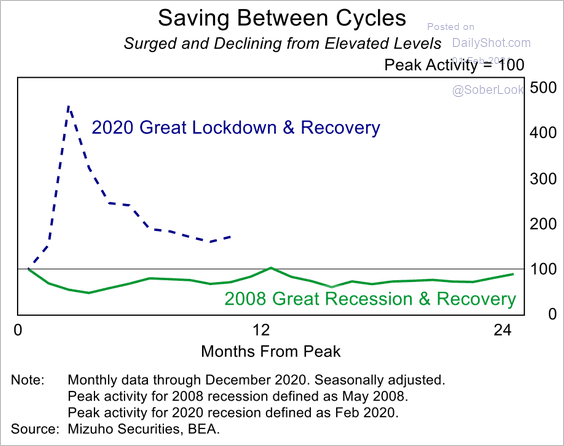

– Savings:

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

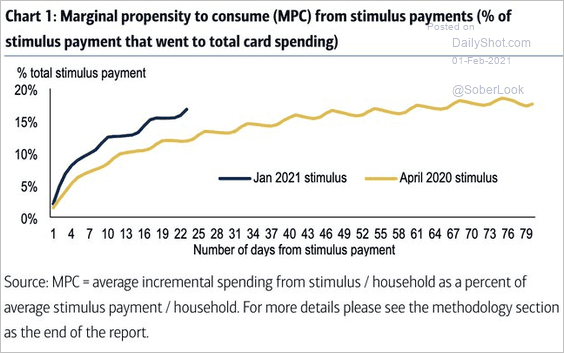

2. Consumers are more apt to spend the new stimulus checks than the CARES Act payments last year.

Source: @MylesUdland, @BofA_Business

Source: @MylesUdland, @BofA_Business

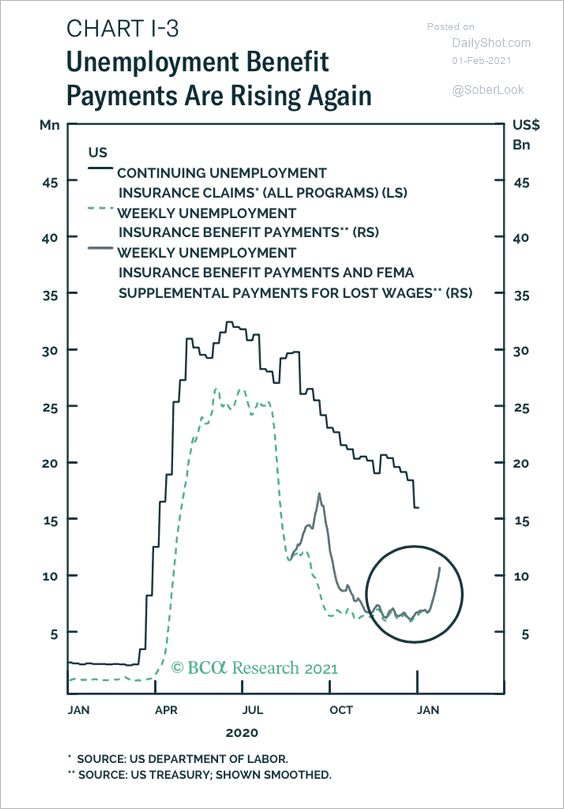

3. Increased unemployment benefit payments are flowing to households again.

Source: BCA Research

Source: BCA Research

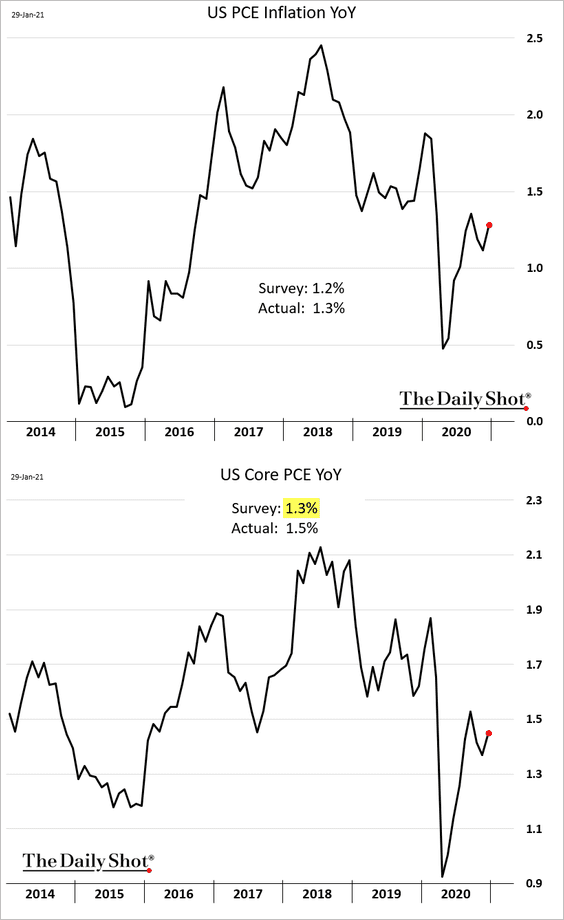

4. PCE inflation surprised to the upside.

However, there wasn’t much movement in the trimmed-mean PCE measure from the Dallas Fed (this indicator is closely followed by some Fed officials).

——————–

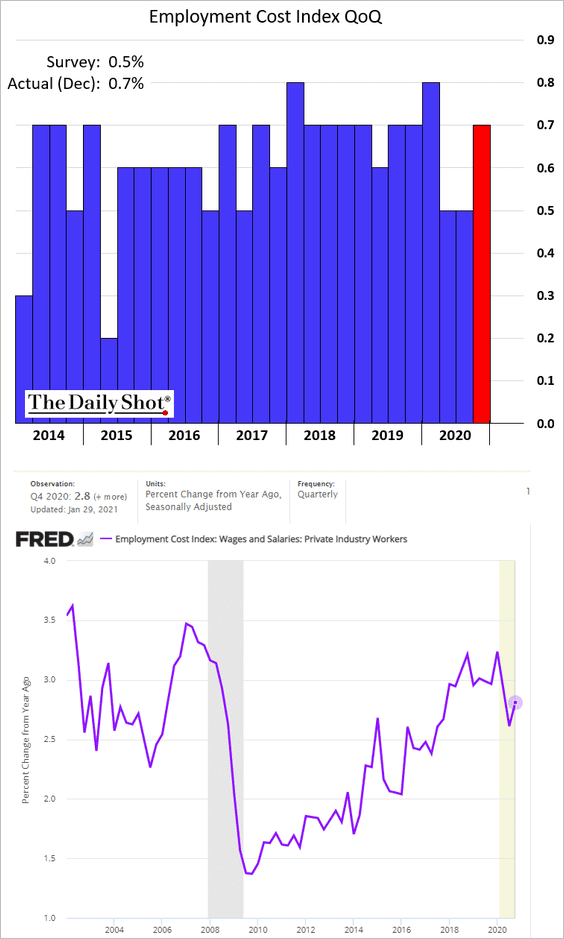

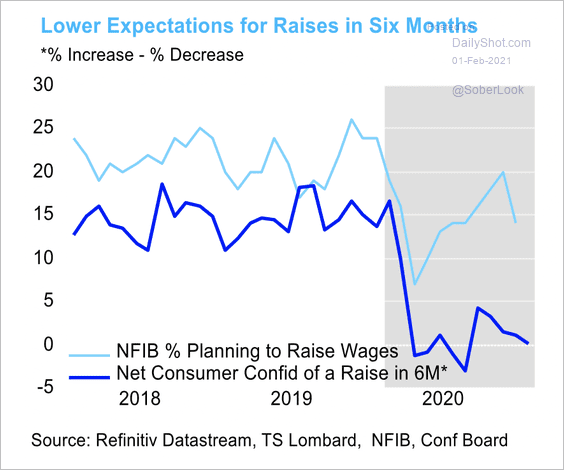

5. The Q4 employment cost index surprised to the upside.

However, small businesses and consumers are less optimistic about wage growth ahead.

Source: TS Lombard

Source: TS Lombard

——————–

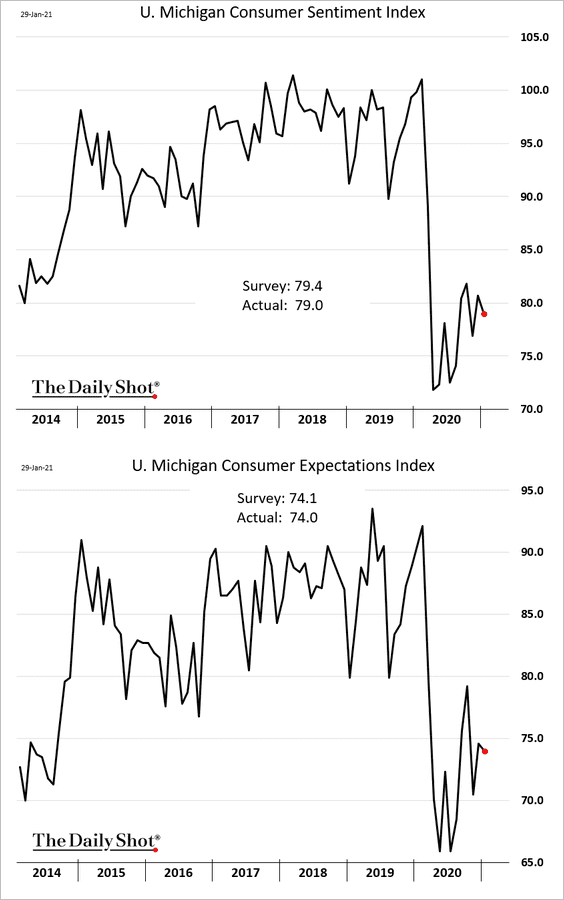

6. The U. Michigan consumer sentiment index showed no improvement in the second half of the month.

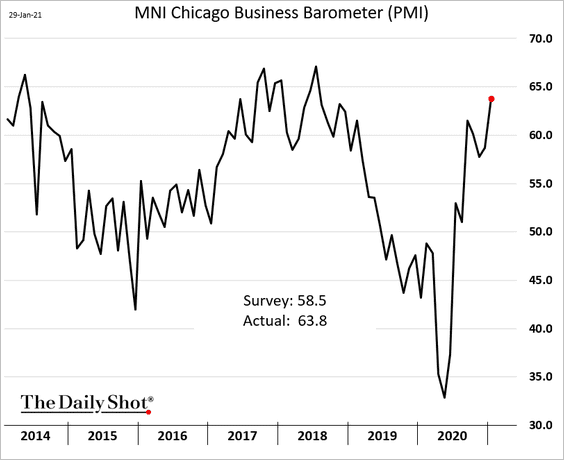

7. The Chicago PMI indicator showed rapid expansion in the region’s business activity. This result bodes well for manufacturing activity at the national level (ISM).

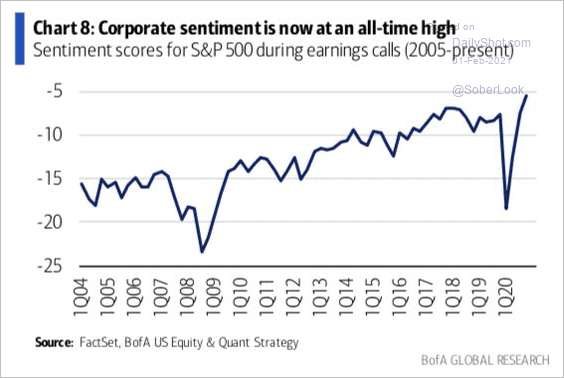

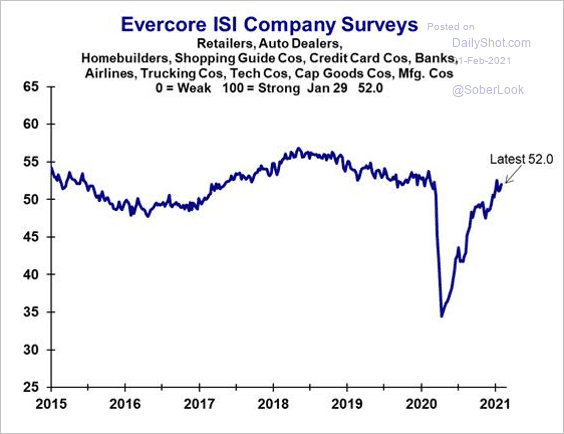

8. US corporate sentiment is increasingly upbeat.

Source: BofA Global Research, @WallStJesus

Source: BofA Global Research, @WallStJesus

Here is the Evercore ISI Company Survey indicator.

Source: Evercore ISI

Source: Evercore ISI

——————–

9. The ANZ US Activity Tracker shows that the recovery has stalled.

![]() Source: ANZ Research

Source: ANZ Research

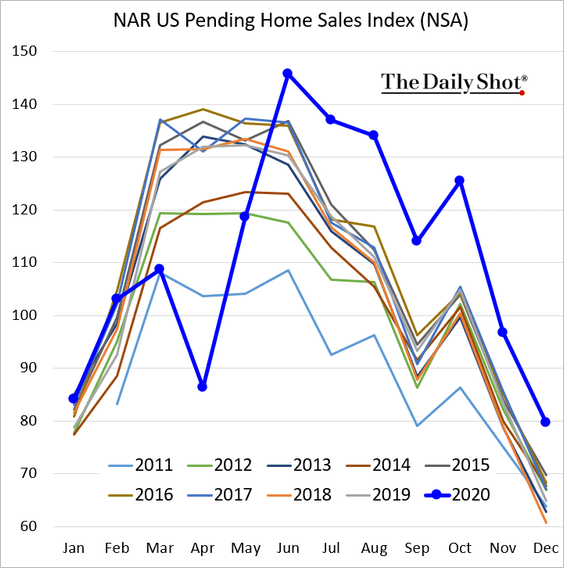

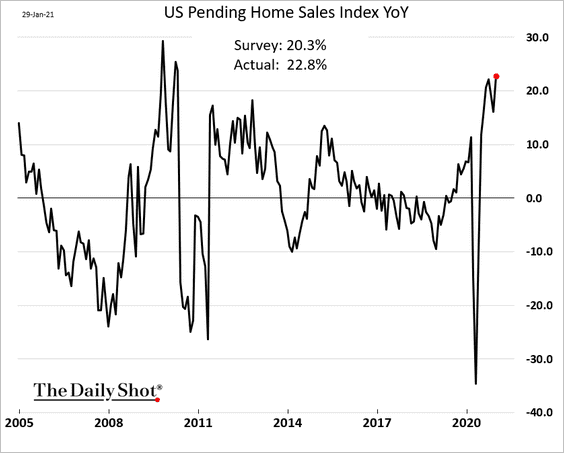

10. Pending home sales remained at multi-year highs in December.

Here is the year-over-year chart.

Back to Index

Canada

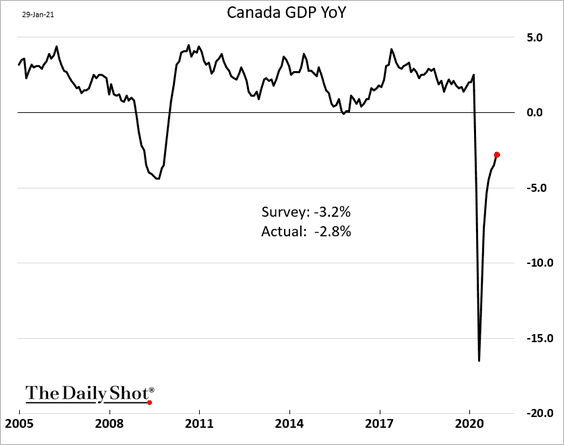

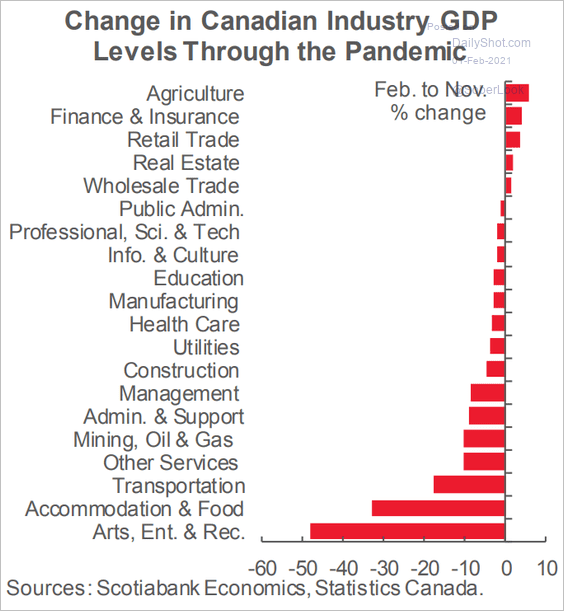

The November GDP report surprised to the upside.

Below are the changes in Canada’s output by sector since February.

Source: Scotiabank Economics

Source: Scotiabank Economics

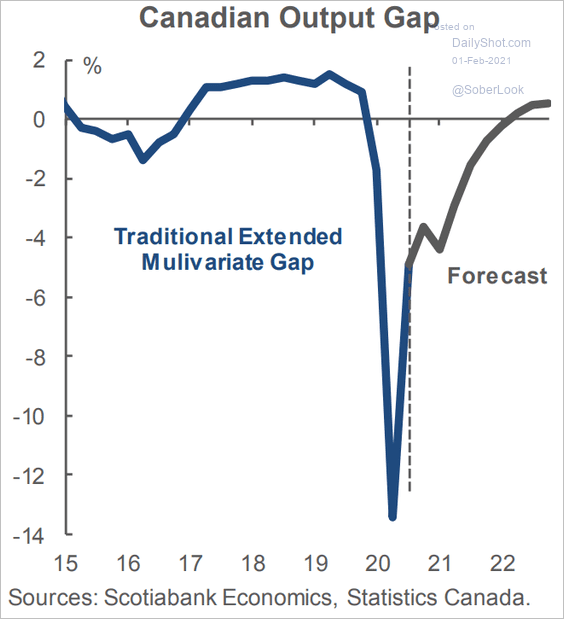

And this chart shows the output gap forecast from Scotiabank.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

The Eurozone

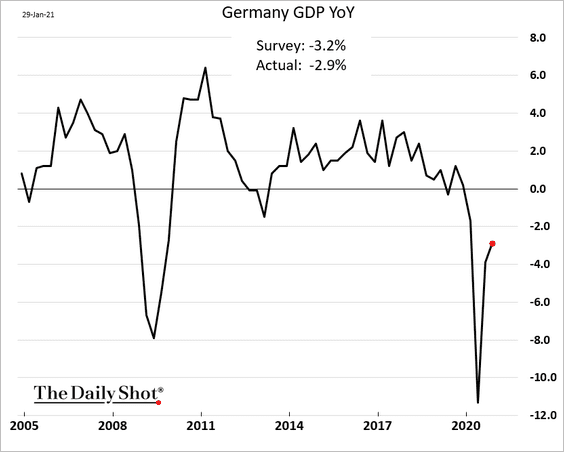

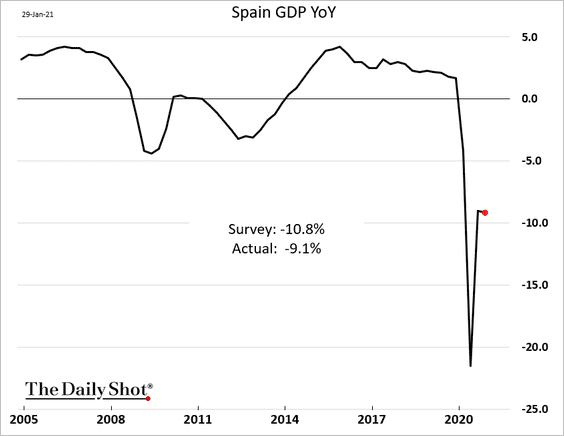

1. The Q4 GDP results topped economists’ forecasts.

• Germany:

• France (the “double-dip” was less severe than expected):

• Spain:

——————–

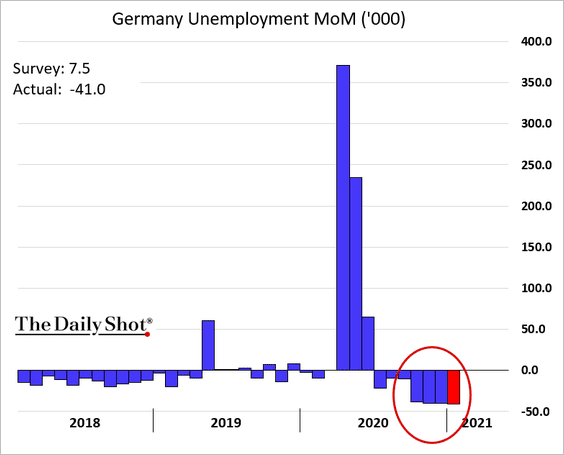

2. Germany’s labor market continues to recover. Here are the monthly changes in the number of unemployed workers.

The unemployment rate should keep drifting lower.

——————–

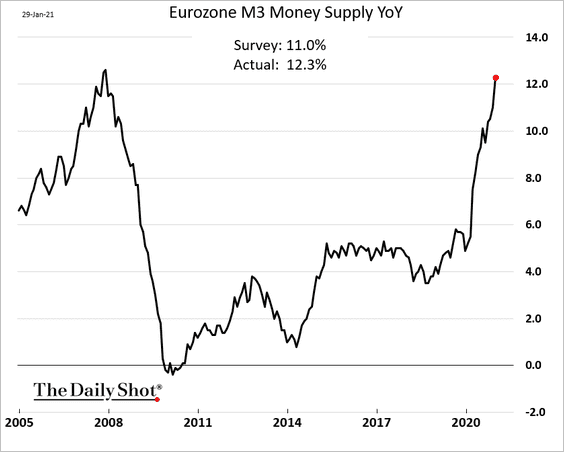

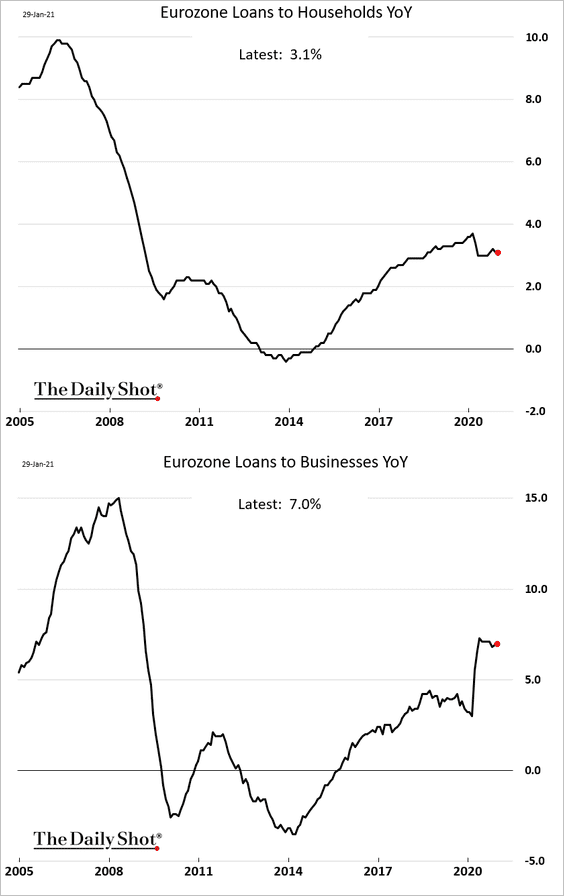

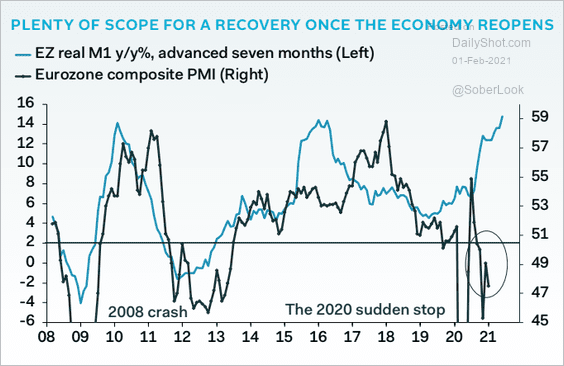

3. The euro-area broad money supply expansion accelerated further in December.

Loan growth has been relatively stable.

The rapid money supply expansion points to a potential rebound in economic activity once the pandemic is under control.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

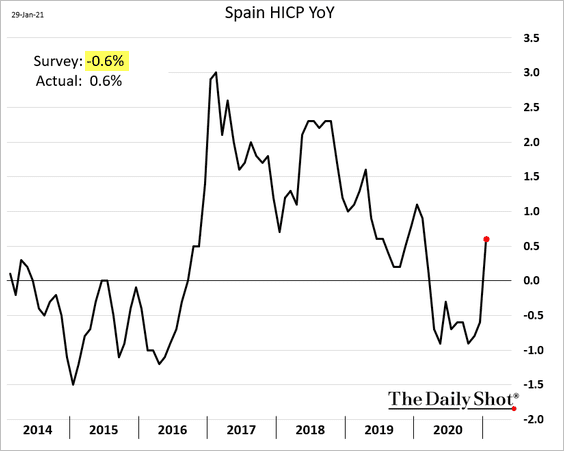

4. Spain’s CPI rebounded sharply in January (similar to Germany).

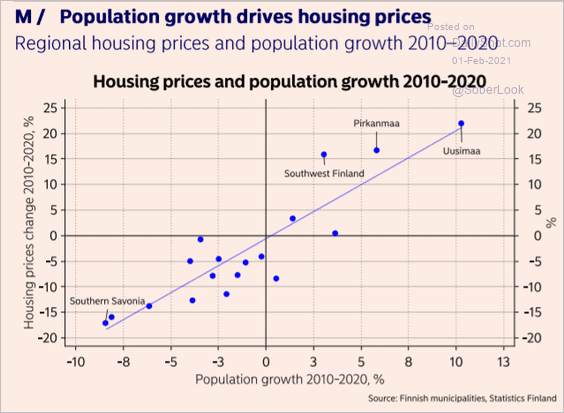

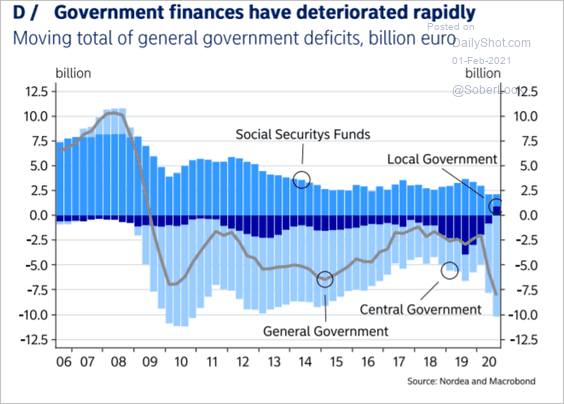

5. Finally, here are a couple of updates on Finland.

• Housing prices vs. population growth:

Source: Nordea Markets

Source: Nordea Markets

• Government deficit:

Source: Nordea Markets

Source: Nordea Markets

Back to Index

Japan

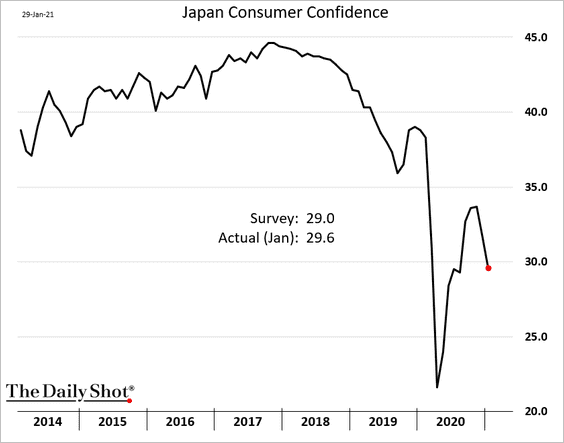

1. Consumer confidence tumbled in January.

2. Housing starts continue to weaken.

Back to Index

Asia – Pacific

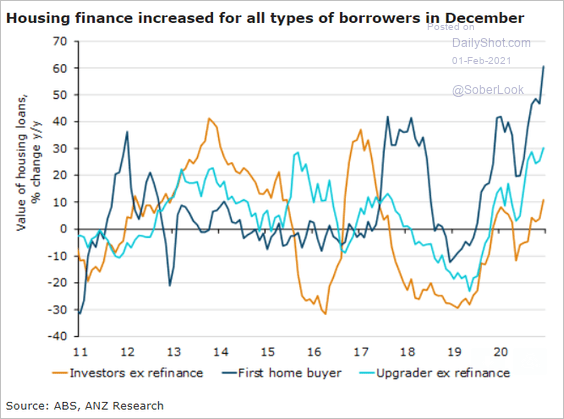

1. Australia’s housing finance growth has exploded to the upside.

Source: ANZ Research

Source: ANZ Research

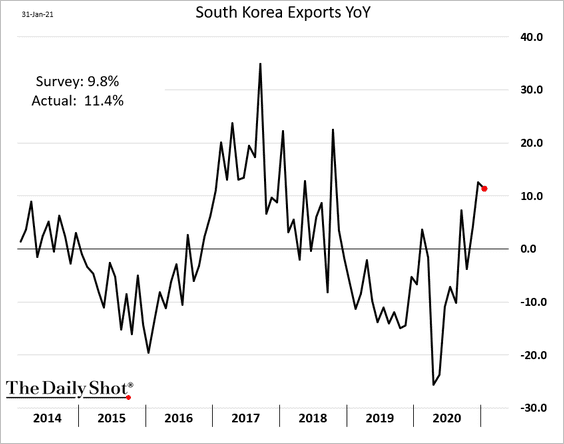

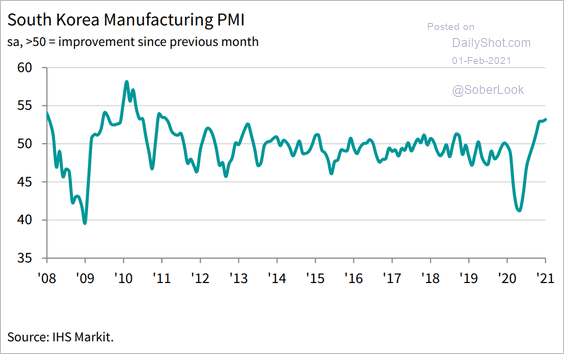

2. South Korea’s exports were up 11.4% vs. January of 2020, topping forecasts.

Manufacturing sector activity is expanding at the fastest pace in a decade.

Source: IHS Markit

Source: IHS Markit

——————–

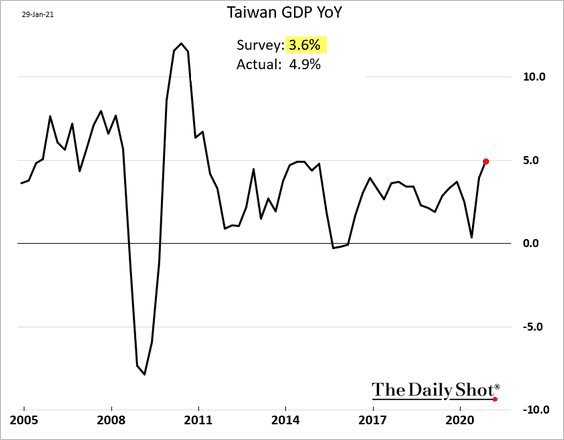

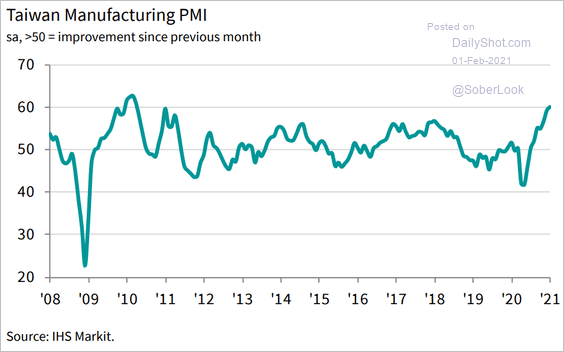

3. The pandemic’s impact on Taiwan’s economy is barely visible. The GDP surprised to the upside again.

Factory activity is growing at the fastest pace since 2010.

Source: IHS Markit

Source: IHS Markit

Back to Index

China

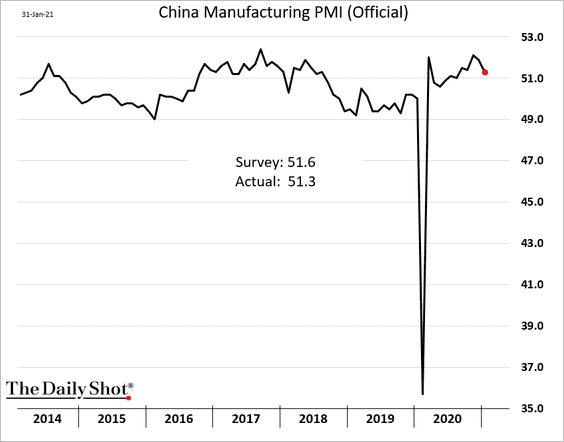

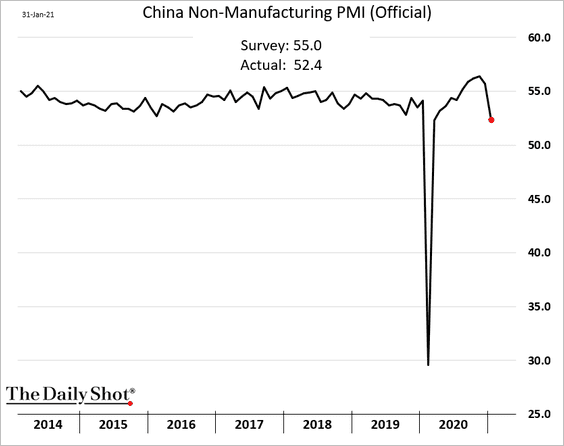

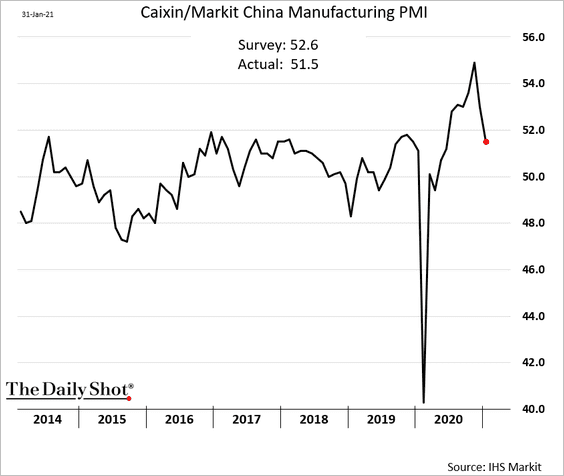

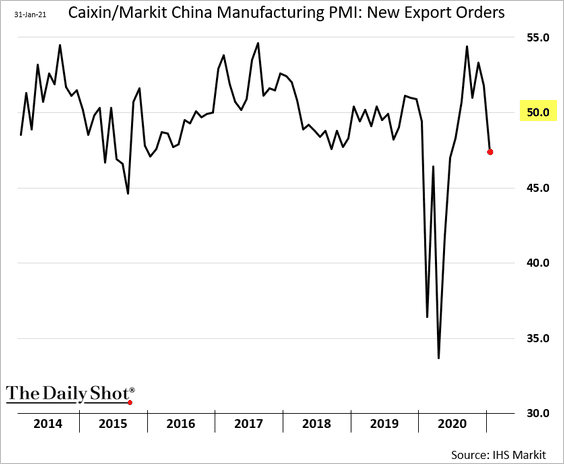

1. The nation’s economic momentum shows signs of fatigue as the January PMI reports surprise to the downside.

• Manufacturing PMI (official):

• Non-Manufacturing PMI:

• Markit Manufacturing PMI:

• Export orders are now contracting (PMI < 50).

——————–

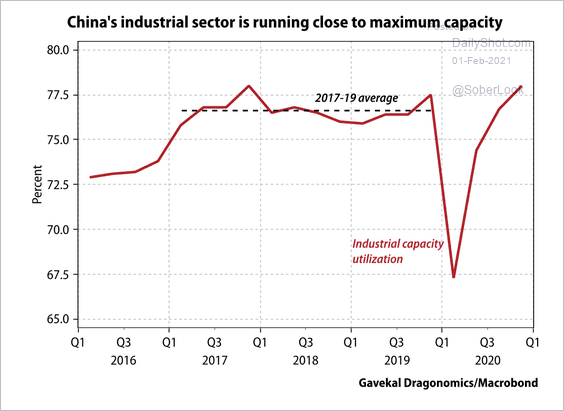

3. Capacity utilization in the industrial sector hit historic highs. This is partly due to high export demand (which has peaked – see above) and domestic construction activity.

Source: Gavekal Research

Source: Gavekal Research

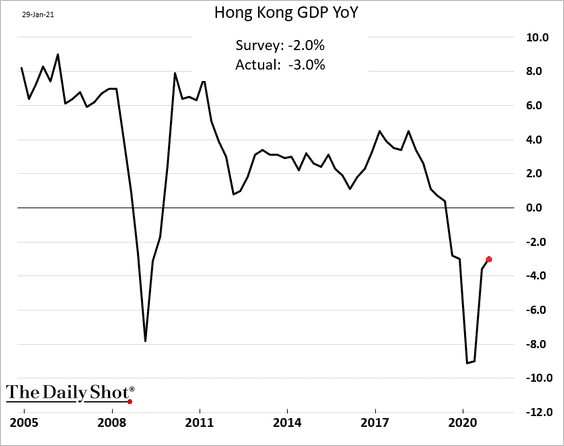

4. Hong Kong’s Q4 GDP report was softer than expected.

Back to Index

Emerging Markets

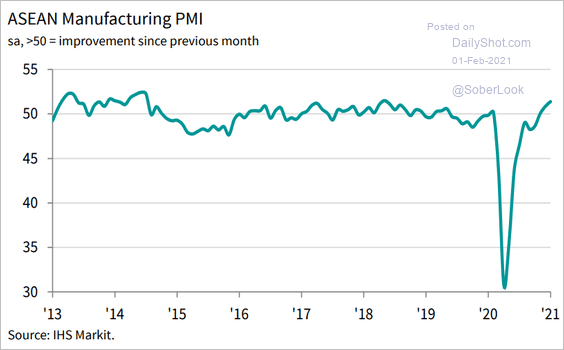

1. Let’s run through Asian PMI reports for January.

• ASEAN:

Source: IHS Markit

Source: IHS Markit

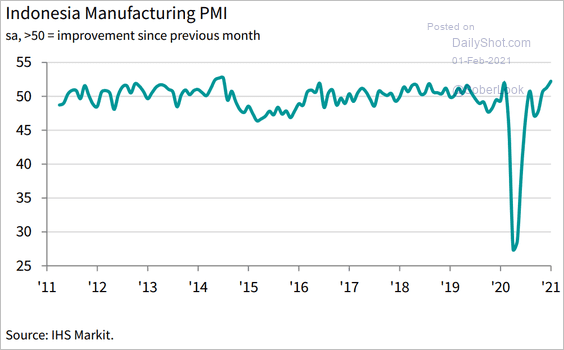

• Indonesia (strong):

Source: IHS Markit

Source: IHS Markit

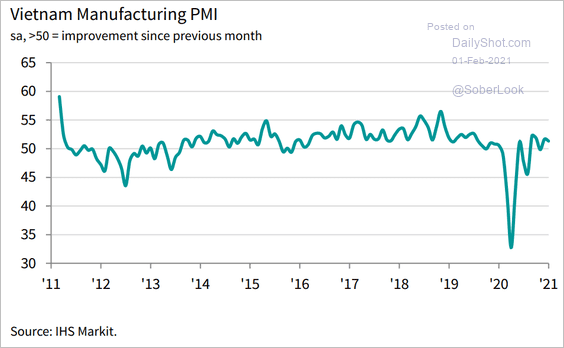

• Vietnam (stable):

Source: IHS Markit

Source: IHS Markit

• The Philippines (strong):

Source: IHS Markit

Source: IHS Markit

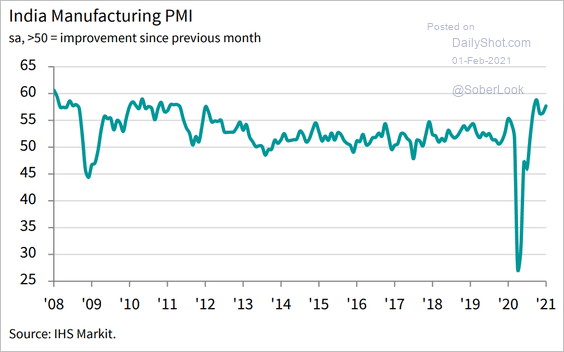

• India (very strong):

Source: IHS Markit

Source: IHS Markit

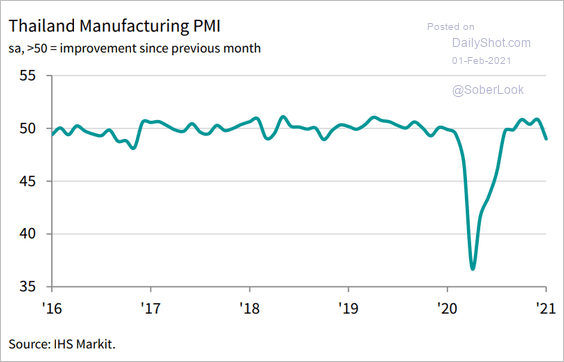

• Thailand (deteriorating):

Source: IHS Markit

Source: IHS Markit

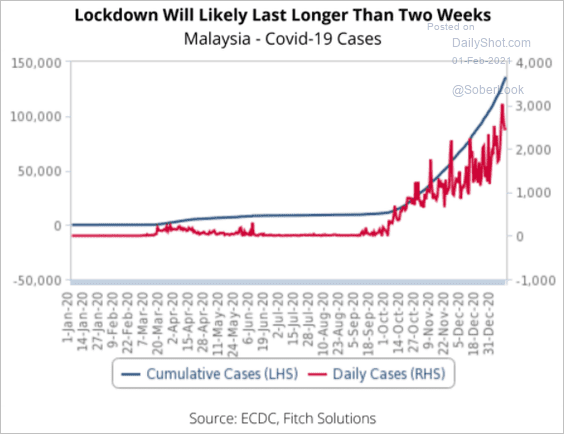

• Malaysia (still soft – see the second chart):

Source: IHS Markit

Source: IHS Markit

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

——————–

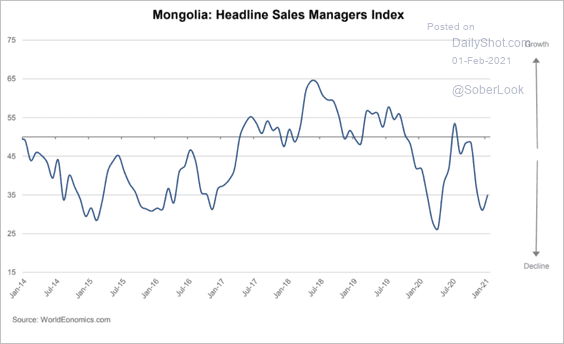

• Mongolia’s SMI report shows ongoing weakness in business activity amid lockdowns.

Source: World Economics

Source: World Economics

——————–

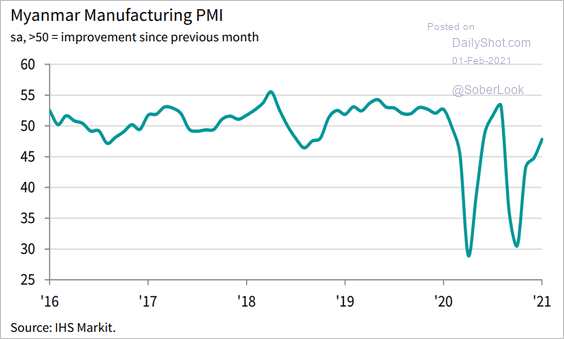

2. There was a coup in Myanmar.

Source: @WSJ Read full article

Source: @WSJ Read full article

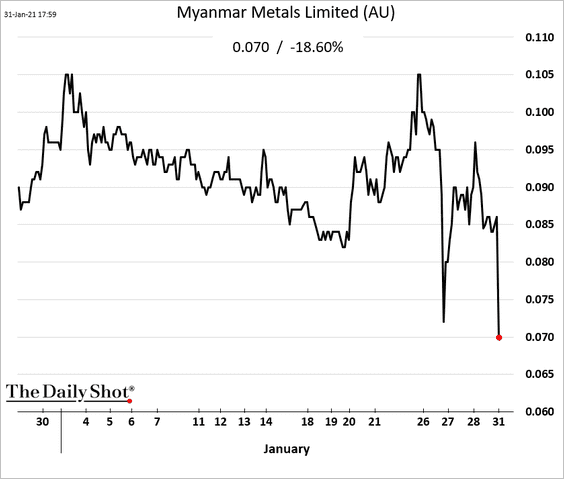

Trading in Myanmar Metals was halted in Australia as the share price gapped down.

By the way, Myanmar’s factory activity was starting to stabilize.

Source: IHS Markit

Source: IHS Markit

Back to Index

Cryptocurrency

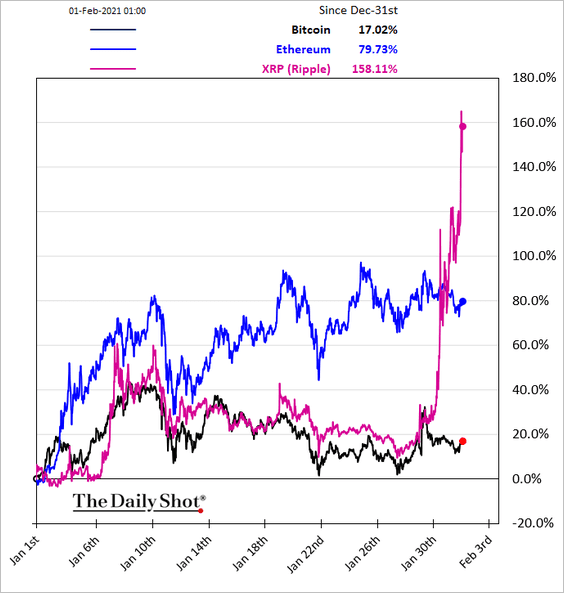

1. XRP went vertical in a coordinated “buying attack.”

Source: CoinDesk

Source: CoinDesk

Source: FinViz

Source: FinViz

——————–

2. Google searches for “defi” (short for decentralized finance) rose last week.

Source: Google Trends

Source: Google Trends

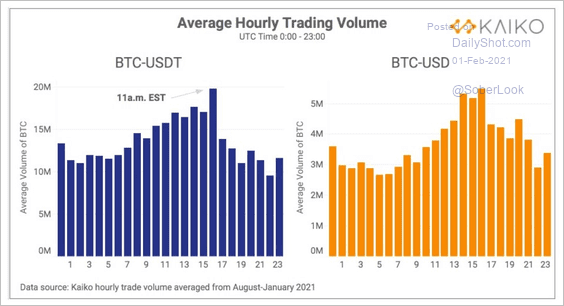

3. The bulk of Bitcoin trading occurs during North American hours (peaking at 11 am ET).

Source: @KaikoData

Source: @KaikoData

Back to Index

Commodities

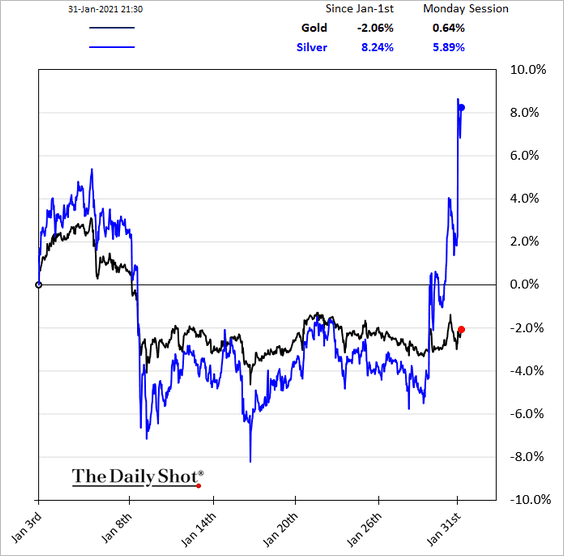

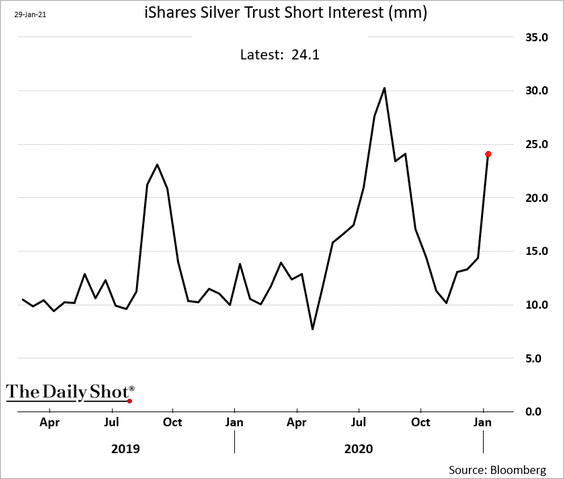

1. The Reddit crowd is going after silver, …

… generating a short-squeeze in silver ETFs.

Here is the gold-to-silver ratio.

Source: @DavidInglesTV

Source: @DavidInglesTV

——————–

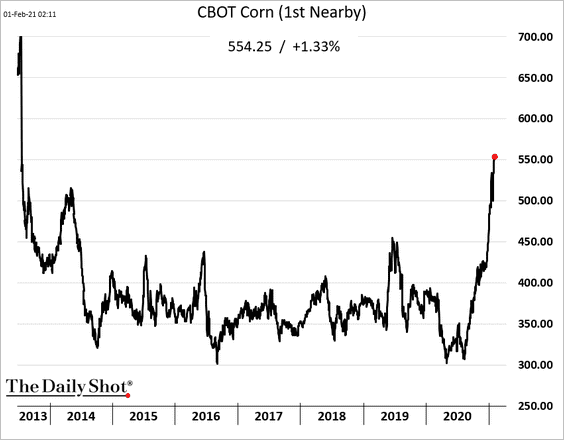

2. US corn futures continue to rally.

Back to Index

Energy

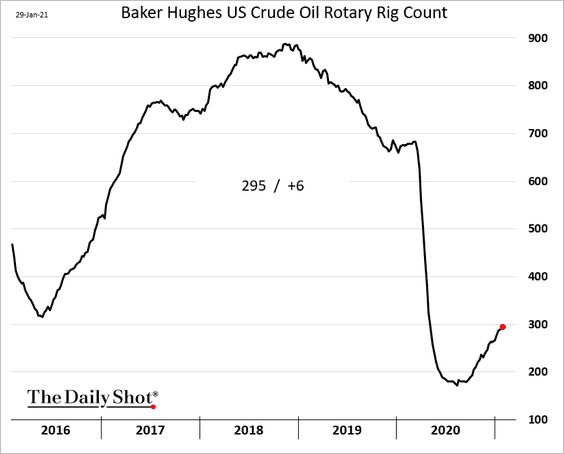

1. The number of active US oil rigs is nearing 300.

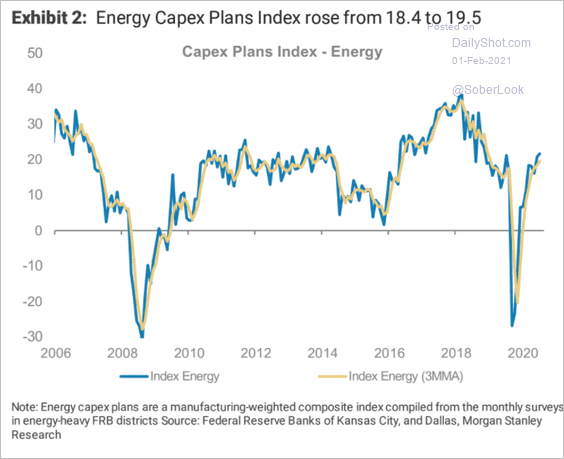

2. Energy CapEx plans have recovered to pre-COVID levels, according to Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

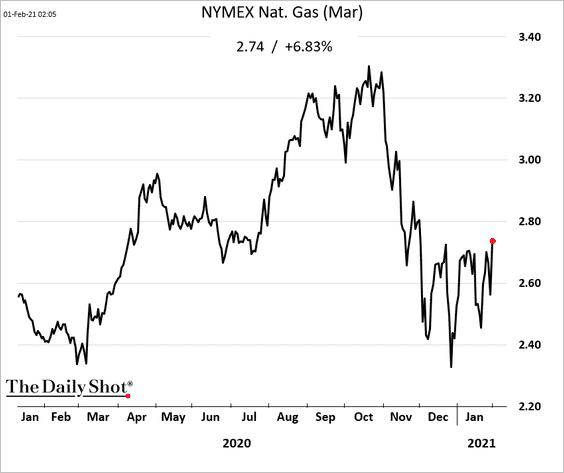

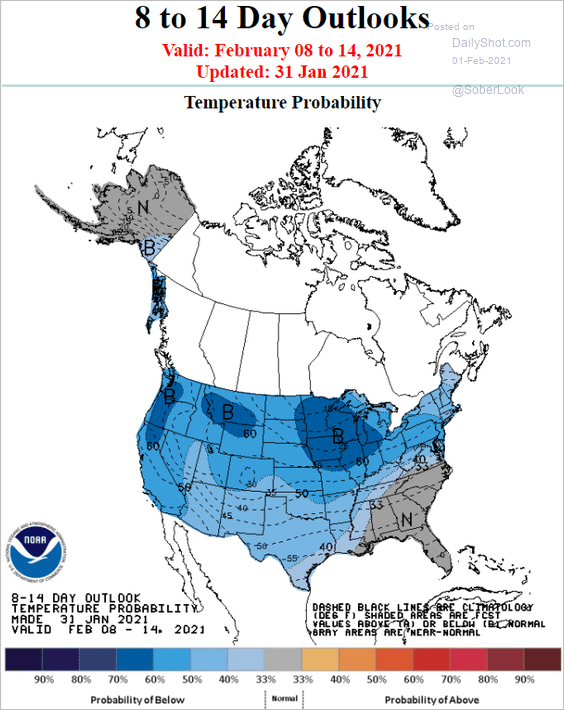

3. US natural gas prices are firmer as a massive snowstorm hits parts of the US.

Source: NOAA

Source: NOAA

Back to Index

Equities

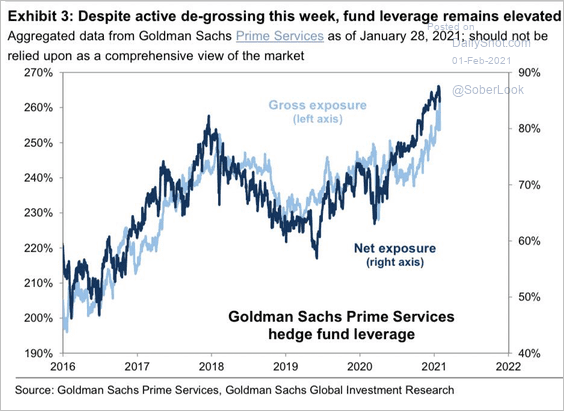

1. Hedge funds are cutting back on gross leverage to reduce short-squeeze risk.

Source: Morgan Stanley Research, @markets Read full article

Source: Morgan Stanley Research, @markets Read full article

However, hedge fund leverage remains elevated.

Source: Goldman Sachs, @carlquintanilla

Source: Goldman Sachs, @carlquintanilla

——————–

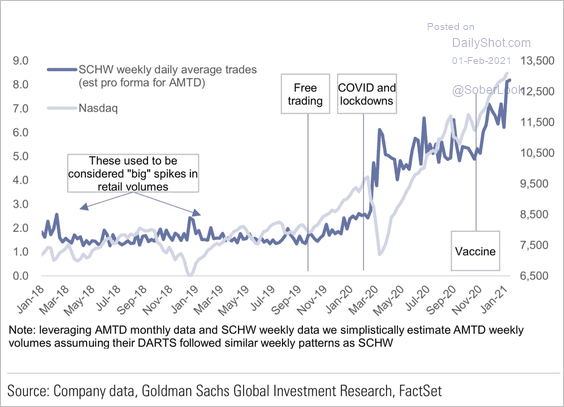

2. Free trading, work/school from home, and government checks drove the sharp increase in retail trading activity last year.

Source: Goldman Sachs, h/t Octavian Adrian Tanase

Source: Goldman Sachs, h/t Octavian Adrian Tanase

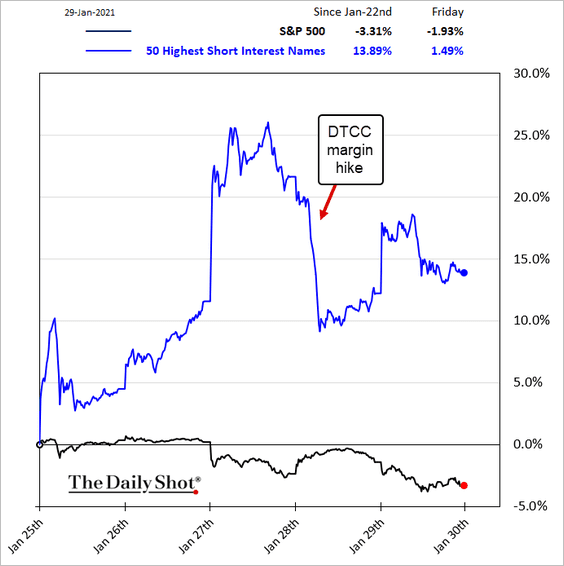

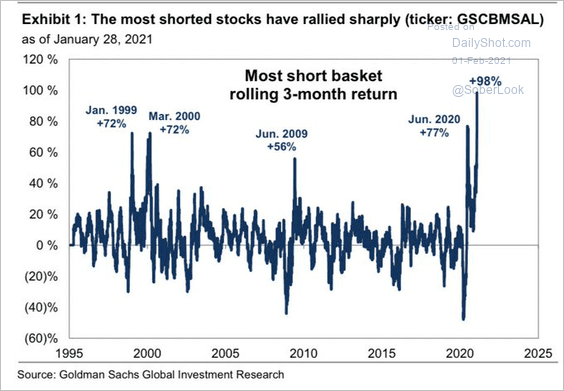

3. Most shorted names continued to outperform on Friday.

Source: Goldman Sachs, @carlquintanilla

Source: Goldman Sachs, @carlquintanilla

——————–

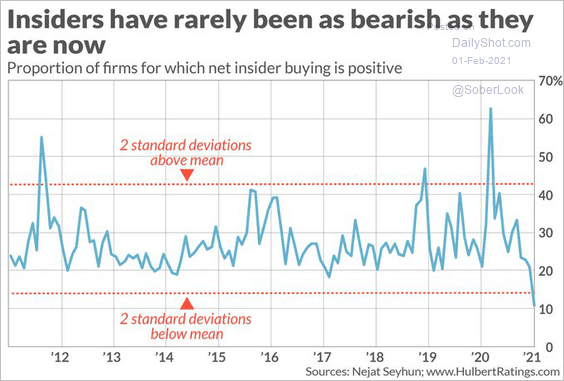

4. Corporate insiders are extremely bearish.

Source: Market Watch, @Callum_Thomas Read full article

Source: Market Watch, @Callum_Thomas Read full article

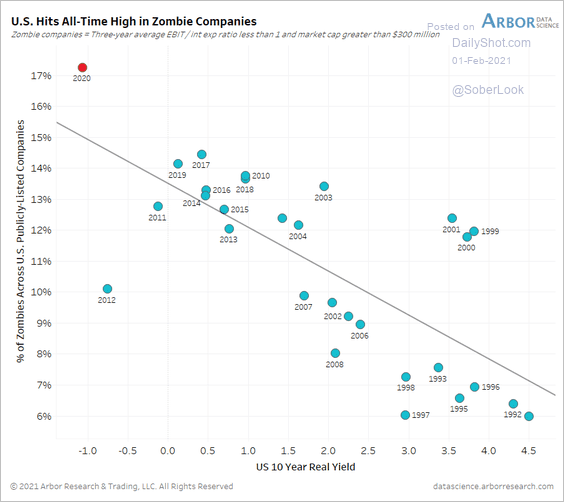

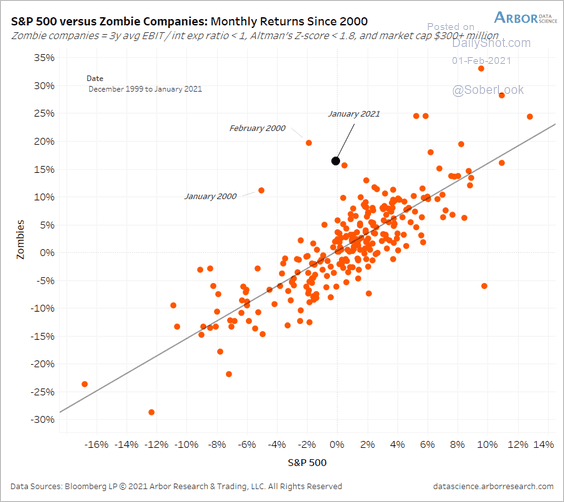

5. The number of zombie firms in the US hit a record high.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Zombie companies have been outperforming the S&P 500, …

Source: Arbor Research & Trading

Source: Arbor Research & Trading

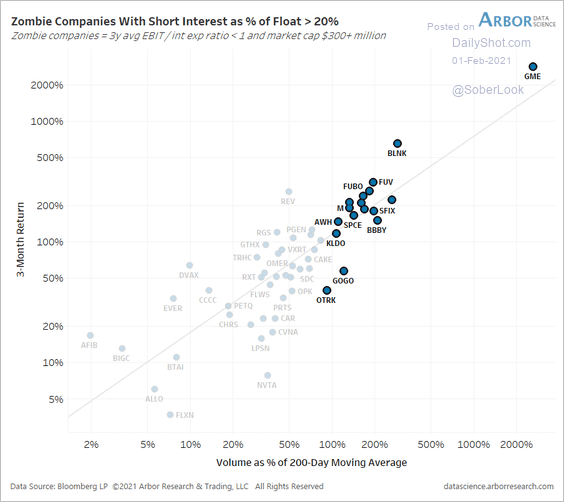

… with many of these stocks caught in a short squeeze.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

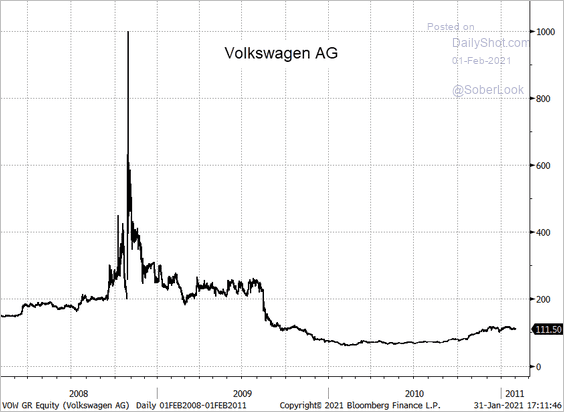

6. By the way, massive short-squeeze rallies are not a new phenomenon. Here is Volkswagen, for example.

Source: @TheTerminal, Bloomberg Finance L.P. Further reading

Source: @TheTerminal, Bloomberg Finance L.P. Further reading

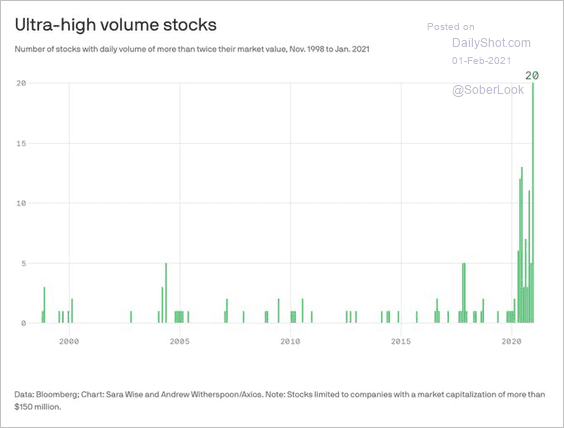

7. The number of ultra-high volume stocks hit a new record.

Source: @jessefelder, @axios Read full article

Source: @jessefelder, @axios Read full article

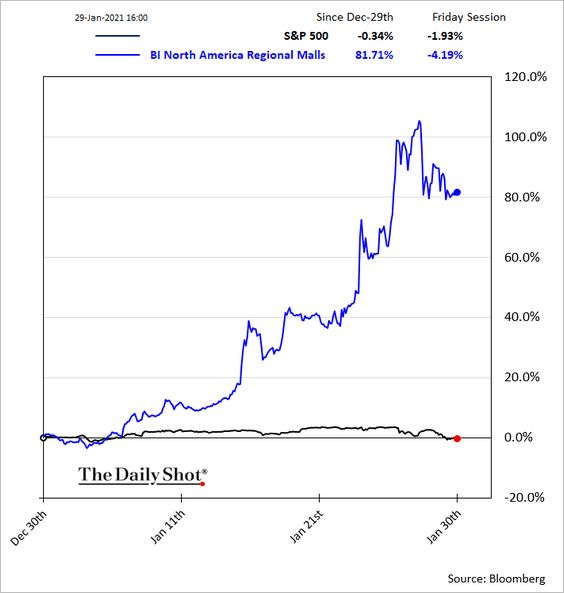

8. Some mall operators got caught in a short squeeze.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

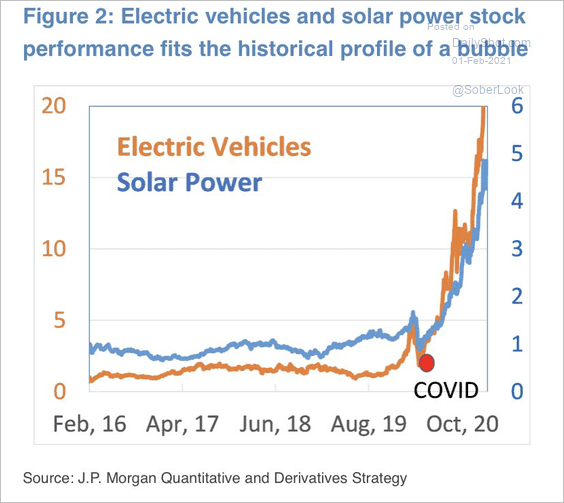

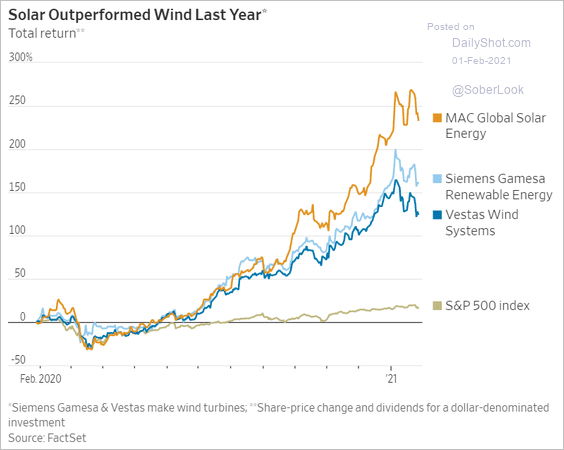

9. Solar and EV stocks are in bubble territory.

Source: JP Morgan, @Schuldensuehner

Source: JP Morgan, @Schuldensuehner

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

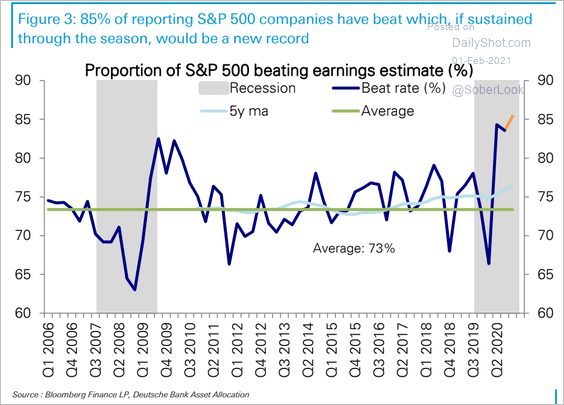

10. A record percentage of firms have been exceeding Q4 earnings estimates.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

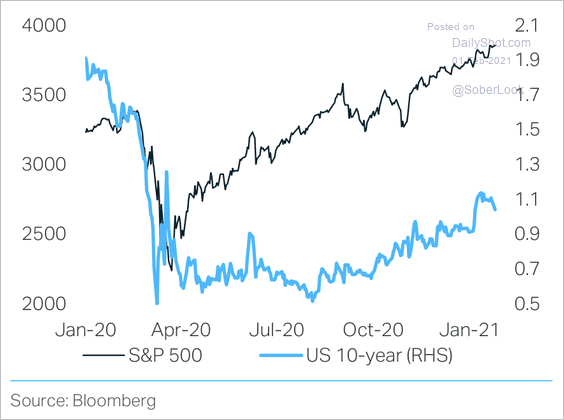

11. So far, stocks have been unmoved by rising yields.

Source: TS Lombard

Source: TS Lombard

Back to Index

Rates

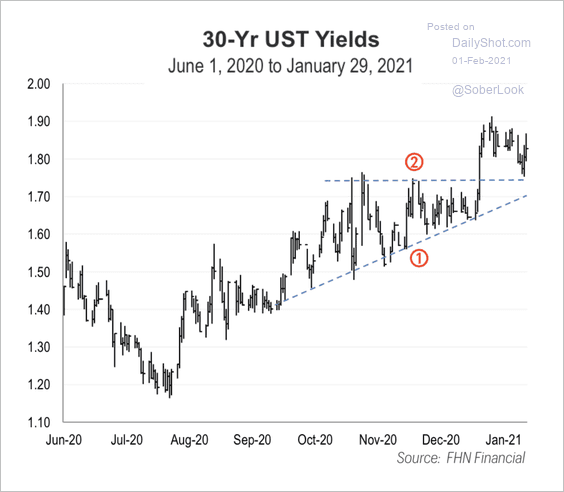

1. The 30-year Treasury yield is testing support.

Source: FHN Financial

Source: FHN Financial

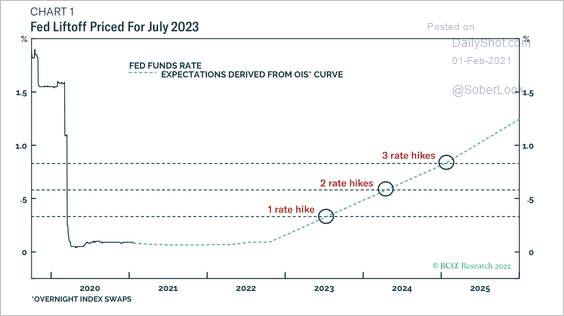

2. BCA Research expects a Fed rate hike in late-2022 or the first half of 2023.

Source: BCA Research

Source: BCA Research

Back to Index

Global Developments

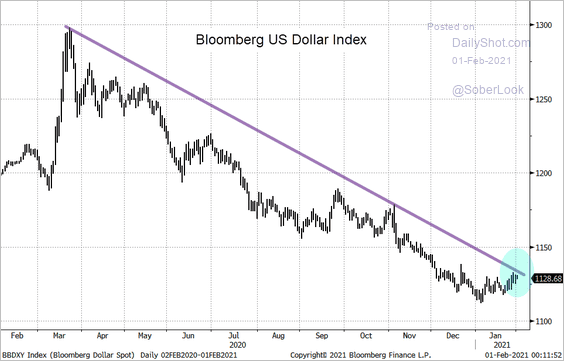

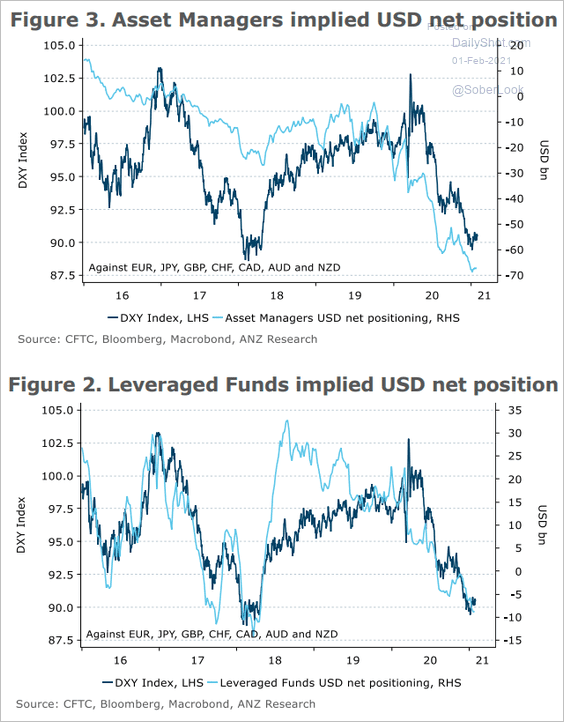

1. Looking for a potential short-squeeze opportunity? How about the US dollar?

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: ANZ Research

Source: ANZ Research

——————–

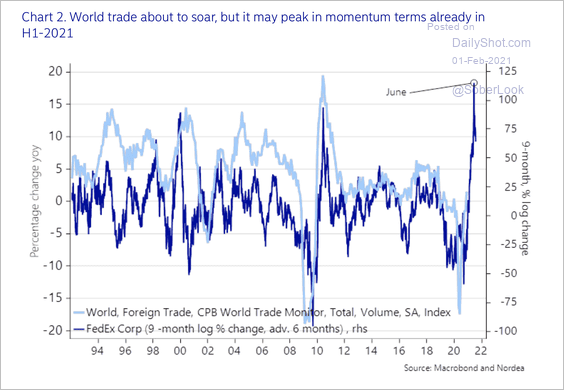

2. The rise in FedEx’s stock could signal further upside in world trade.

Source: Nordea Markets

Source: Nordea Markets

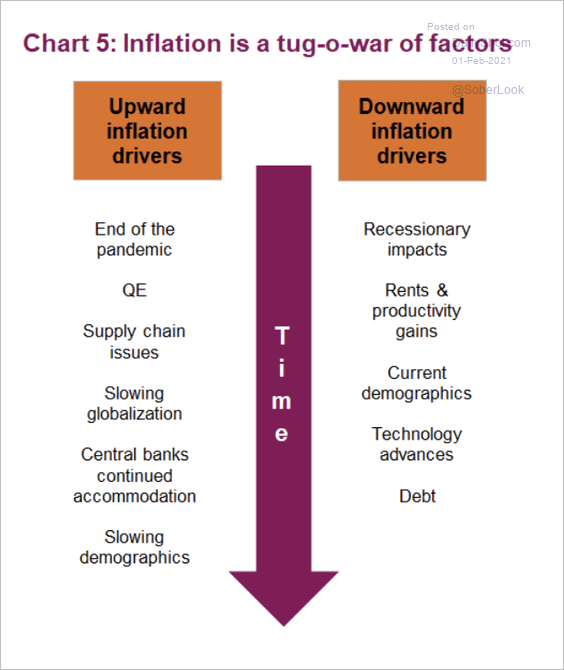

3. What are the upward/downward drivers of inflation?

Source: Market Ethos, Richardson GMP

Source: Market Ethos, Richardson GMP

——————–

Food for Thought

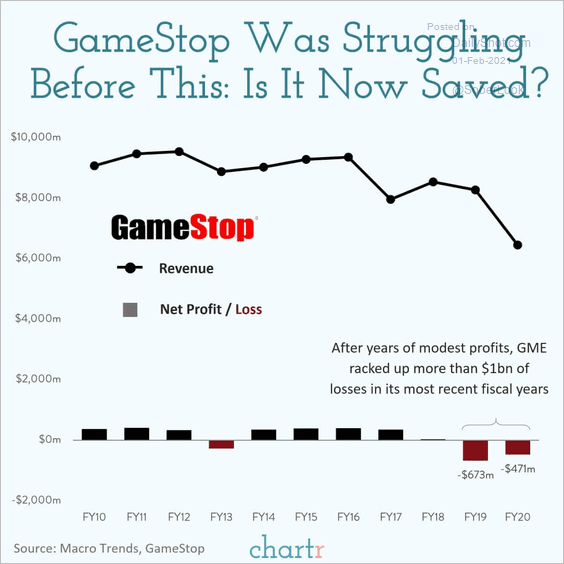

1. GameStop revenue and net profit/loss:

Source: @chartrdaily

Source: @chartrdaily

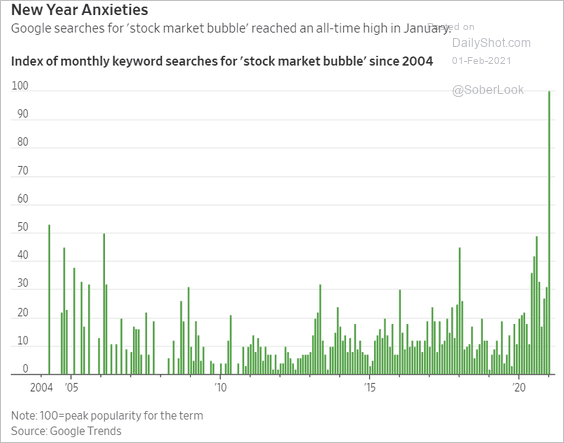

2. Online search for “stock market bubble”:

Source: @WSJ Read full article

Source: @WSJ Read full article

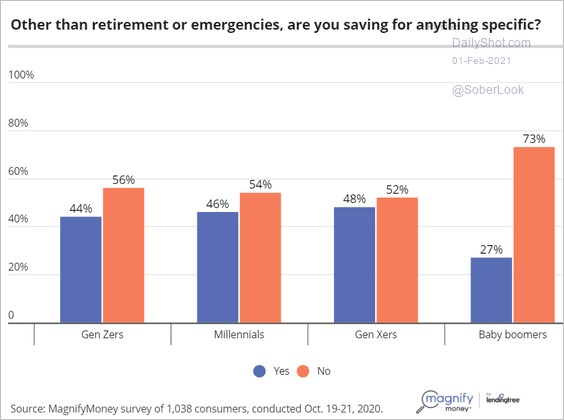

3. Americans saving for something specific:

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

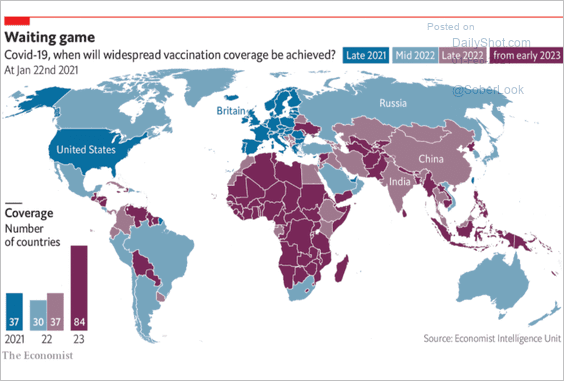

4. The timing of widespread vaccination coverage:

Source: The Economist Read full article

Source: The Economist Read full article

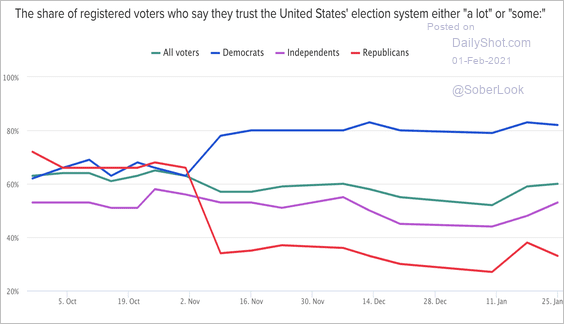

5. Trust in the US election system:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

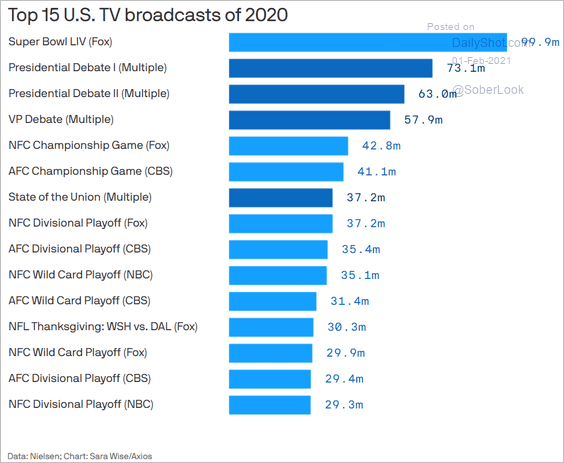

6. Top TV broadcasts of 2020:

Source: @axios Read full article

Source: @axios Read full article

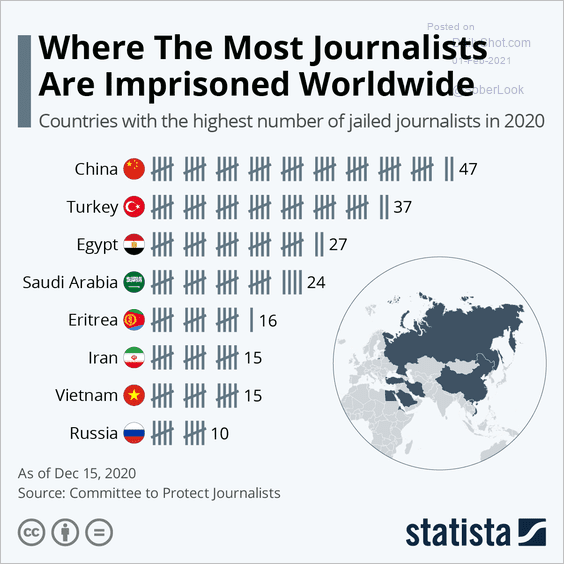

7. Countries with the highest number of jailed journalists:

Source: Statista

Source: Statista

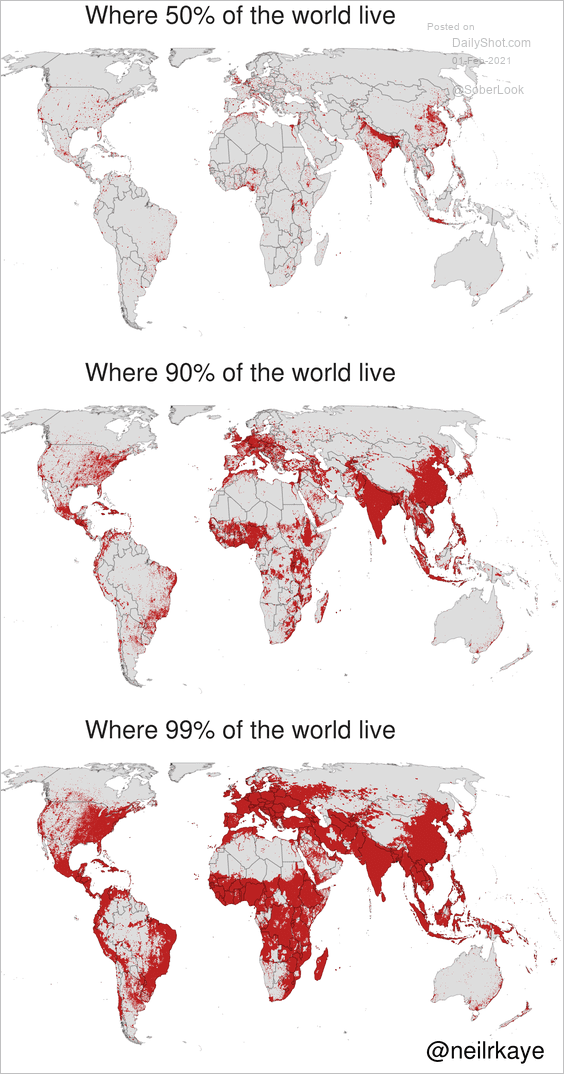

8. 50%, 90%, and 99% of the world’s population:

Source: @neilrkaye

Source: @neilrkaye

——————–

Back to Index