The Daily Shot: 02-Feb-21

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

US online job search activity deteriorated again

The United States

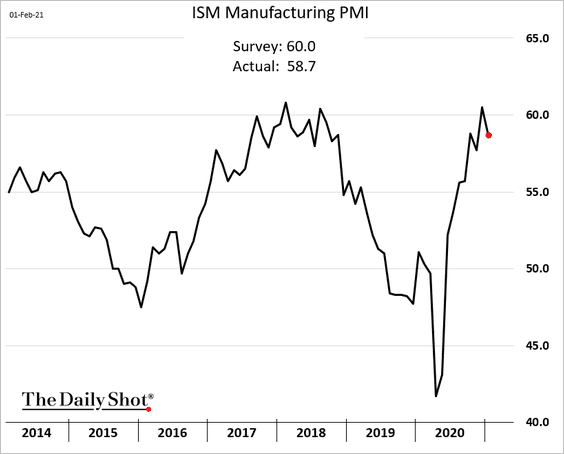

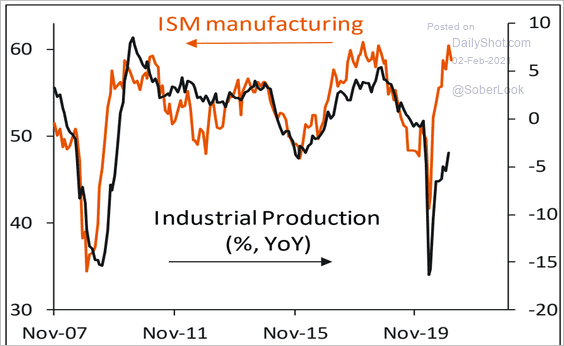

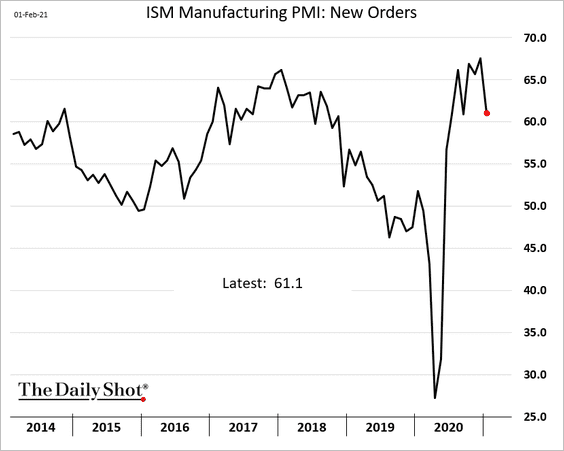

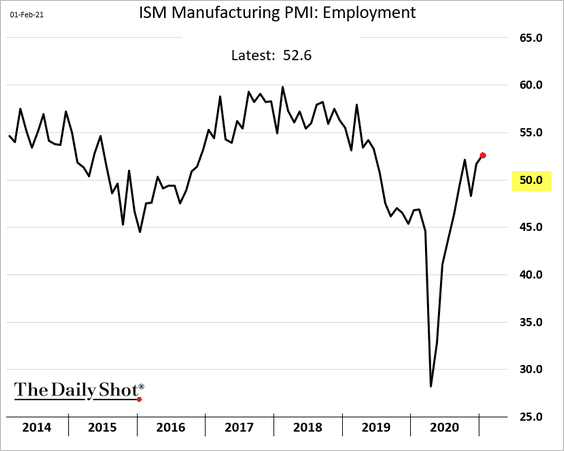

1. The ISM Manufacturing PMI index came in a bit below consensus, but factory activity remains solid.

• The report bodes well for the nation’s industrial production recovery.

Source: Piper Sandler

Source: Piper Sandler

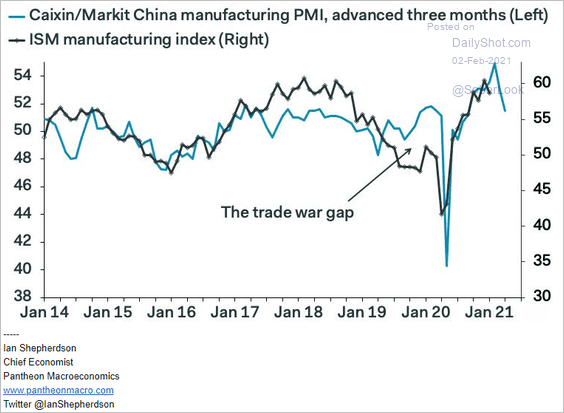

• The ISM index has been tracking China’s Markit PMI (with a lag).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

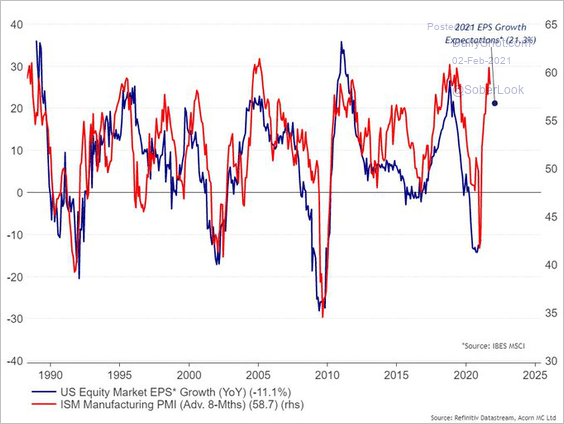

• The index points to corporate earnings improvements.

Source: @RichardDias_CFA

Source: @RichardDias_CFA

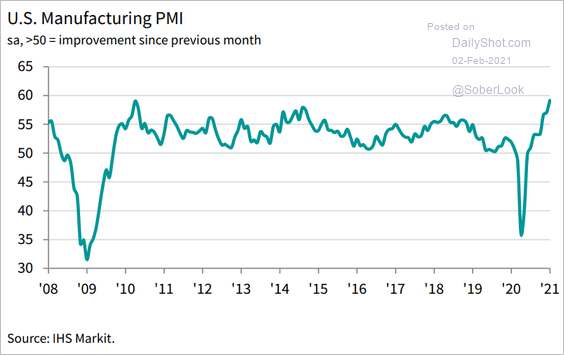

• An alternative measure of US manufacturing activity from Markit is at the highest level in years.

Source: IHS Markit

Source: IHS Markit

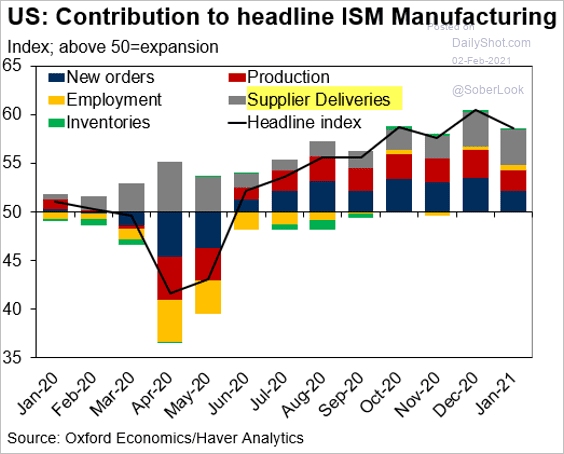

• Growth in ISM new orders has been strong.

• Hiring continues to improve, although some manufacturers complain about labor shortages.

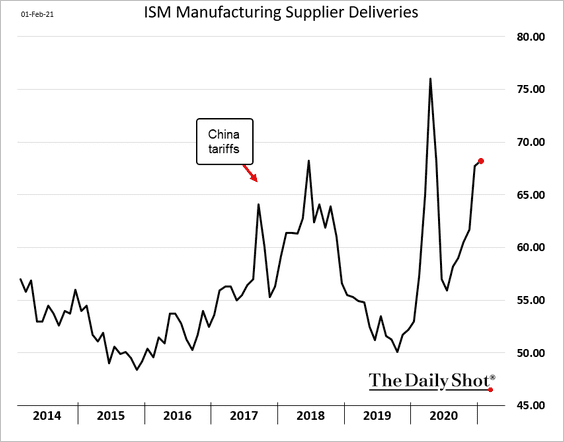

• Supplier bottlenecks persist, …

… which has been pushing the headline ISM index higher.

Source: @OrenKlachkin

Source: @OrenKlachkin

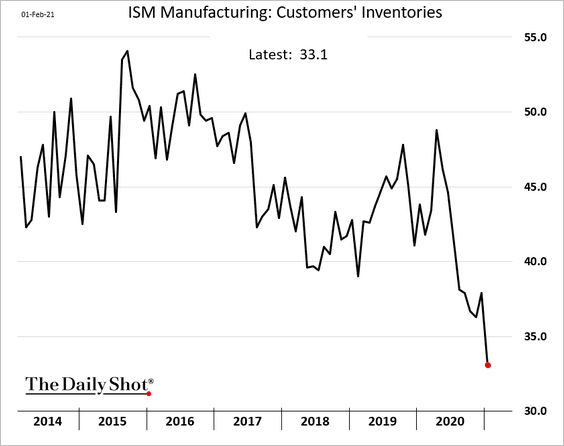

Strong orders and delivery delays have resulted in tight inventories, …

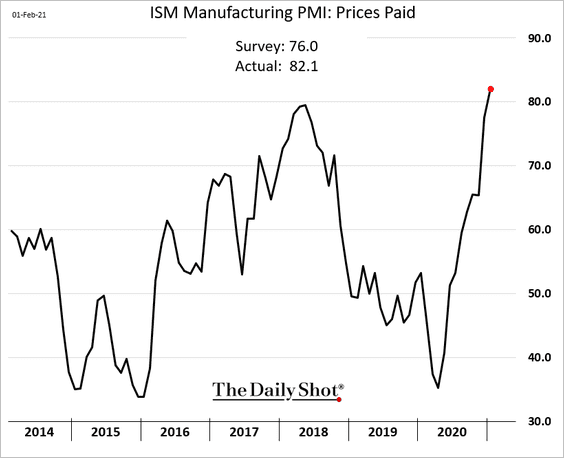

… sending prices higher.

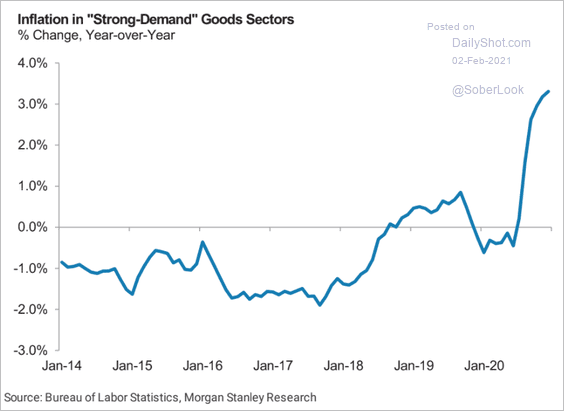

As a result, consumer prices on certain “strong-demand” goods have been climbing.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

2. Here are some additional updates on inflation.

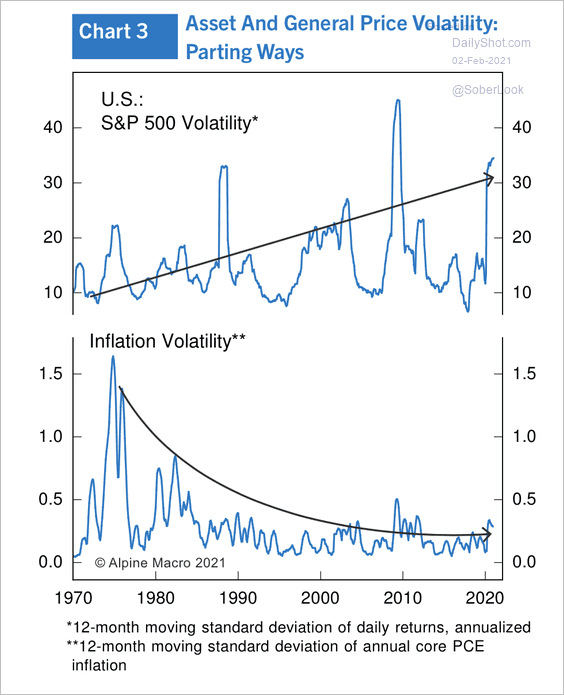

• Inflation volatility remains very low, diverging from volatility in risk assets.

Source: Alpine Macro

Source: Alpine Macro

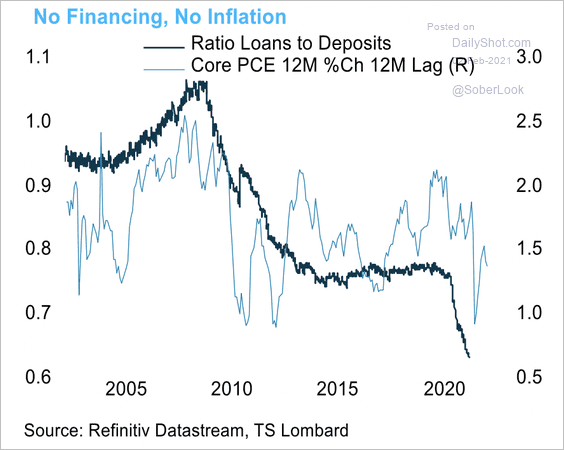

• The declining ratio of loans to deposits suggests lower inflation.

Source: TS Lombard

Source: TS Lombard

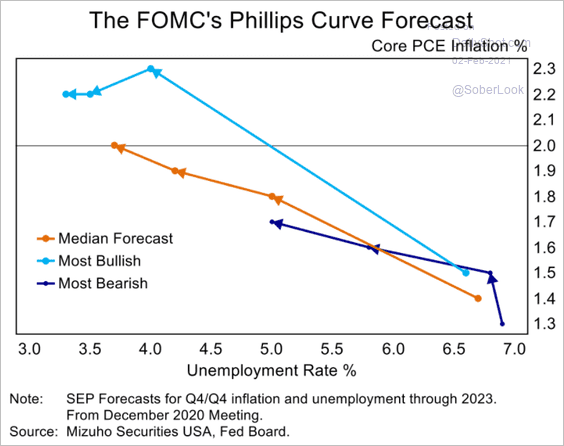

• This chart shows the FOMC’s projection of the Phillips Curve.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

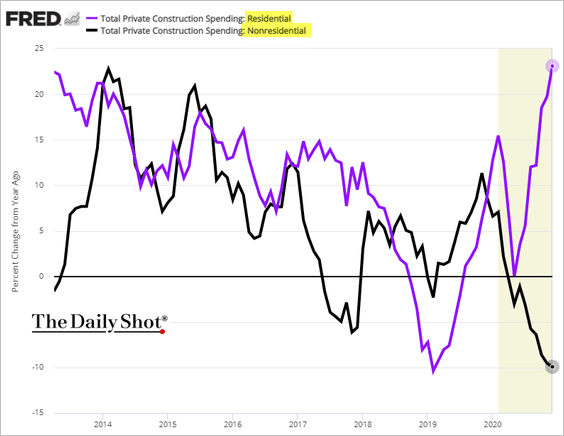

3. The spending gap between residential and nonresidential construction continues to widen.

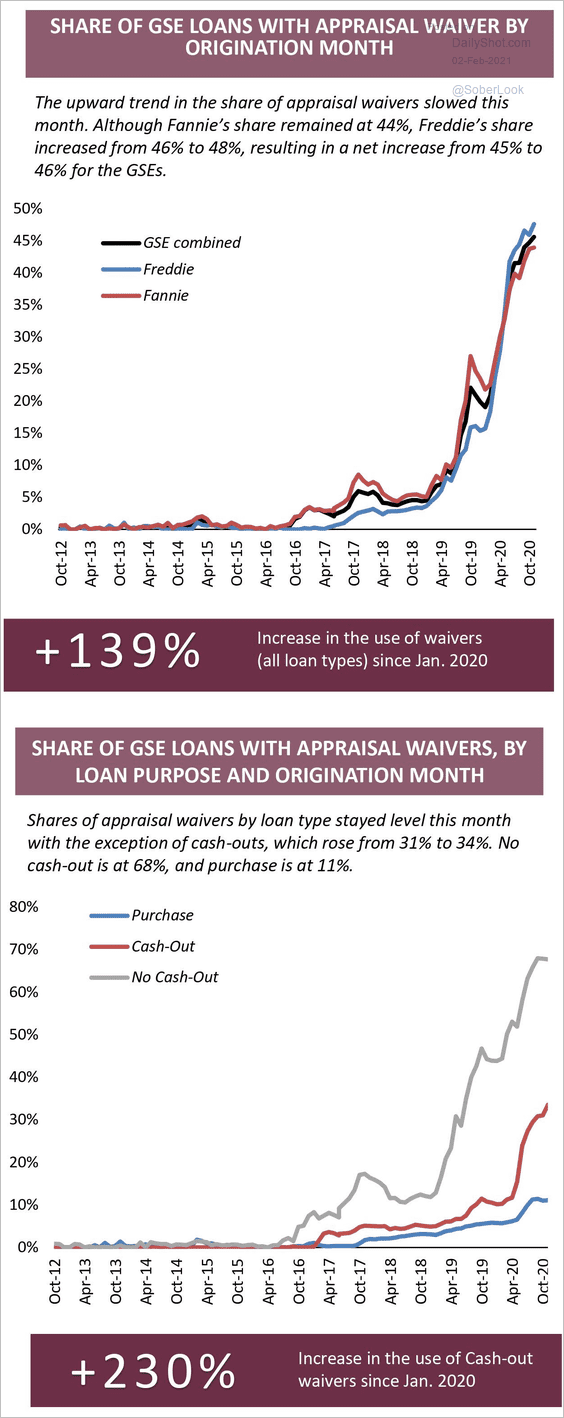

4. Pandemic-driven housing appraisal waivers keep climbing.

Source: AEI Housing Center

Source: AEI Housing Center

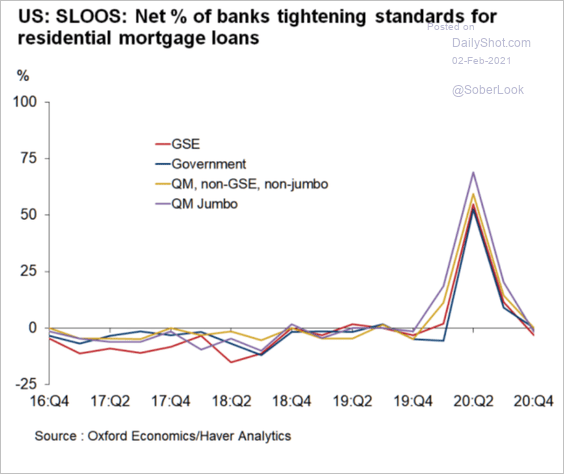

Mortgage lending standards eased slightly last quarter.

Source: Oxford Economics

Source: Oxford Economics

——————–

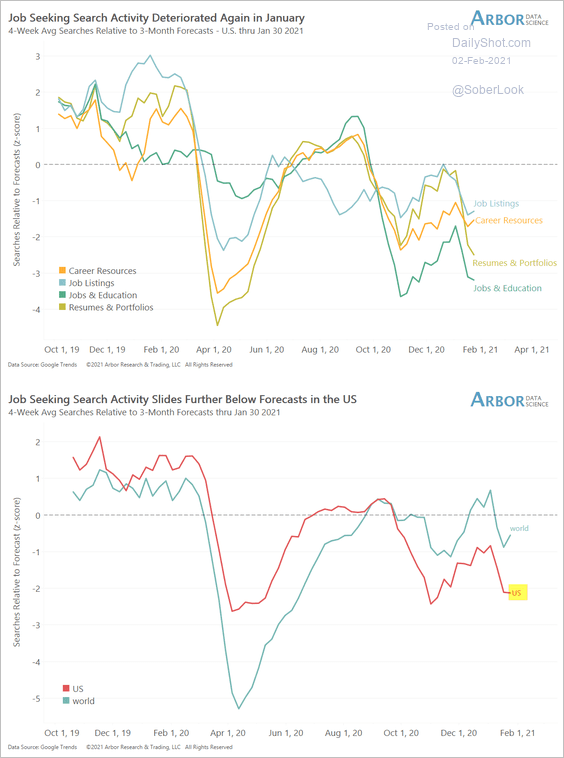

5. Next, we have a couple of updates on the labor market.

• Online job search activity deteriorated again last month, with the US lagging other countries. Some have suggested that the extra $400/week in unemployment benefits (COVID bill) has contributed to this trend.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

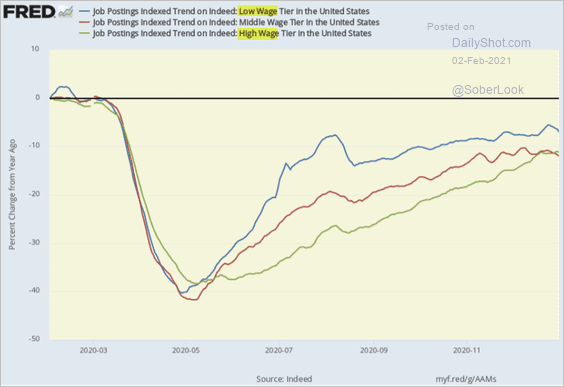

• Online job postings for lower-wage openings have been outpacing higher-wage jobs.

Source: Thomas Michel, Robins School of Business, University of Richmond

Source: Thomas Michel, Robins School of Business, University of Richmond

——————–

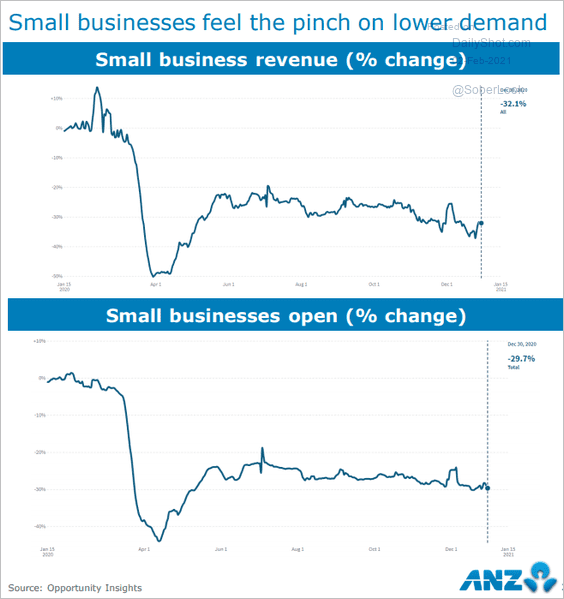

6. Small businesses continue to struggle.

Source: ANZ Research

Source: ANZ Research

Back to Index

The United Kingdom

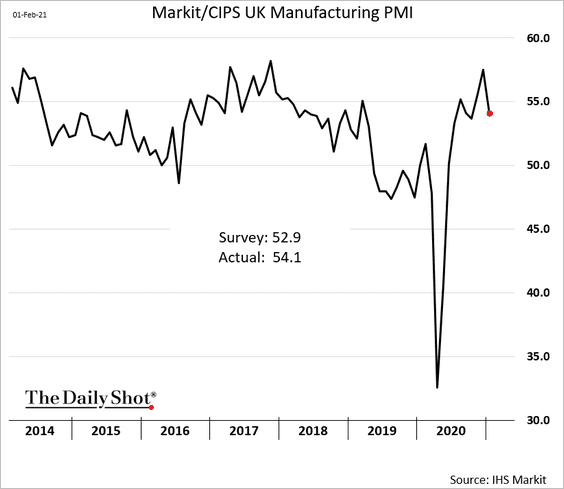

1. The January manufacturing PMI index was revised higher.

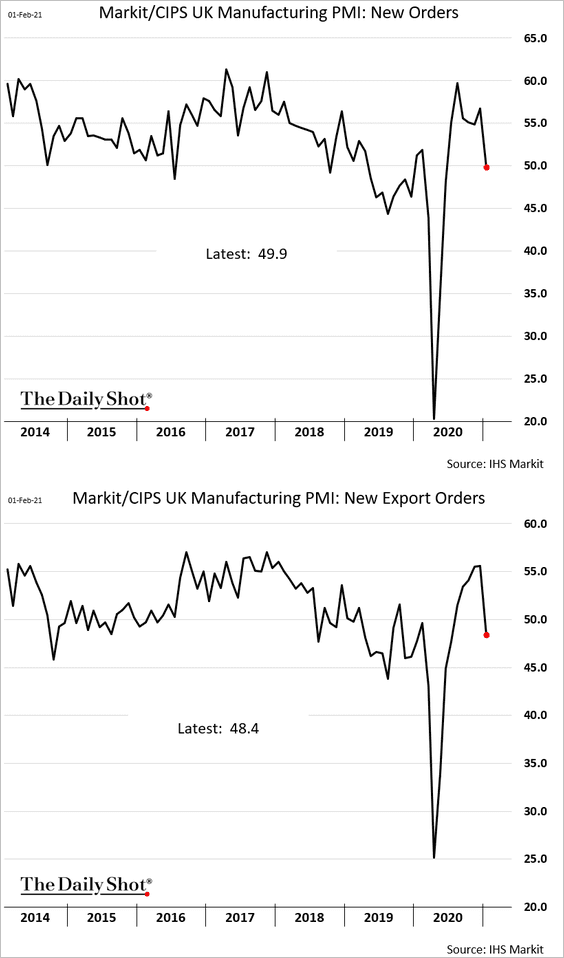

However, growth in new orders has stalled …

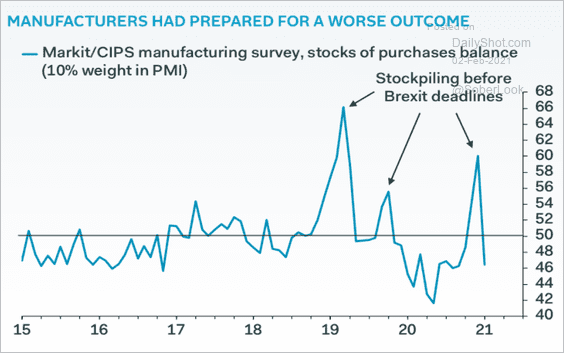

… partially due to pre-Brexit inventory building in Q4.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

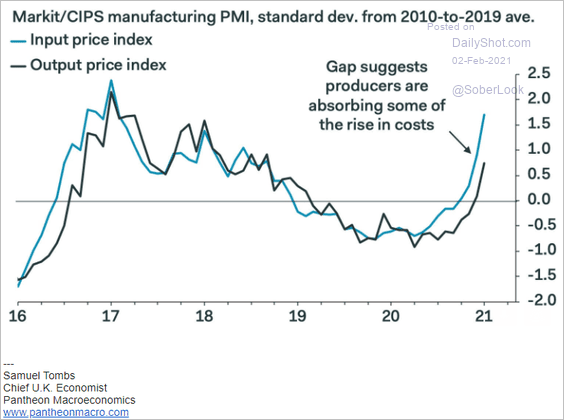

Input prices are rising faster than output prices, which points to margin pressures.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

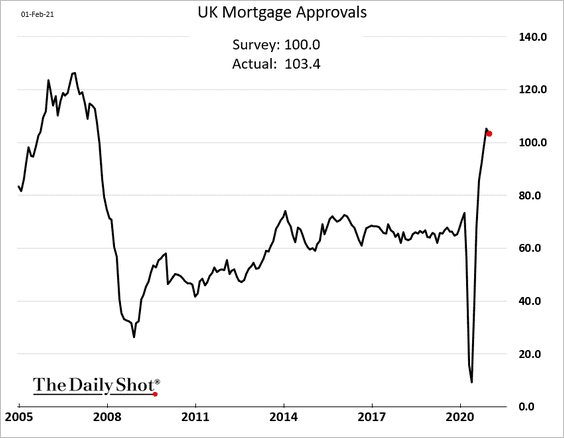

2. While mortgage approvals are near multi-year highs, …

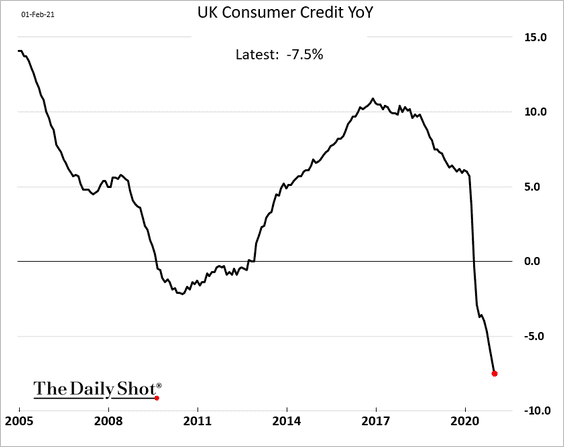

… consumer credit continues to shrink.

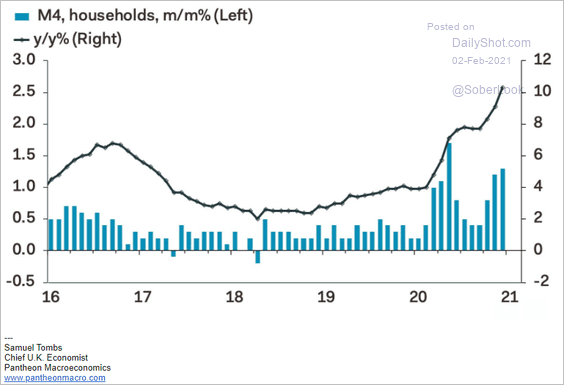

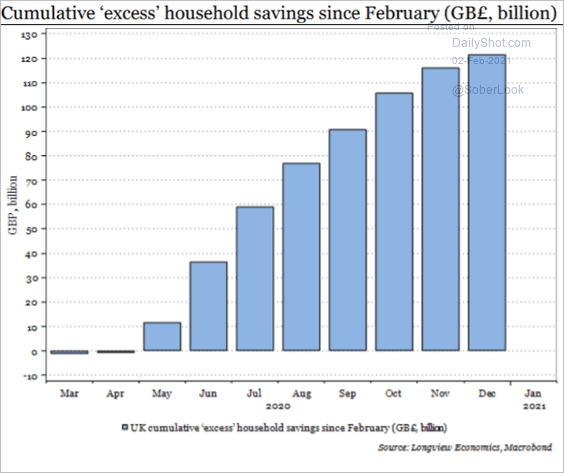

UK households are sitting on quite a bit of cash (2 charts).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Longview Economics

Source: Longview Economics

——————–

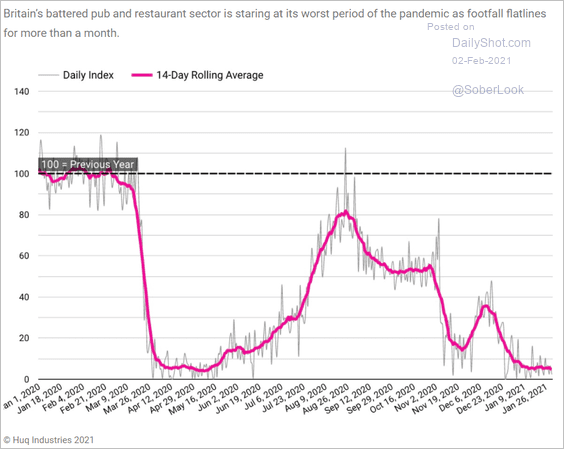

3. UK pubs and restaurants are struggling.

Source: Huq

Source: Huq

Back to Index

The Eurozone

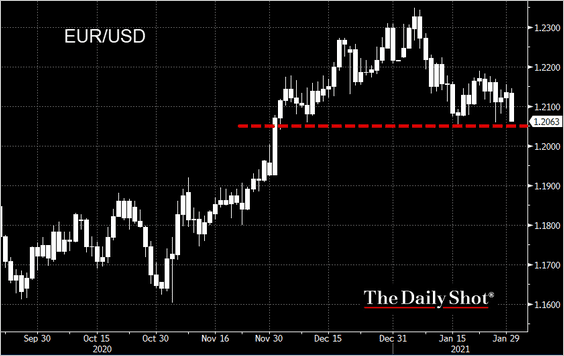

1. The euro is testing support against the dollar.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

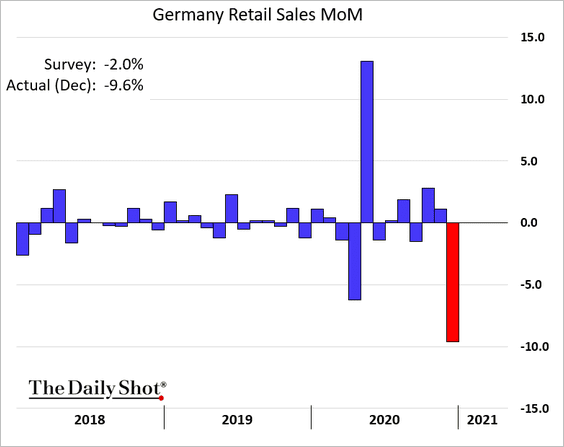

2. German retail sales dropped by almost 10% in December.

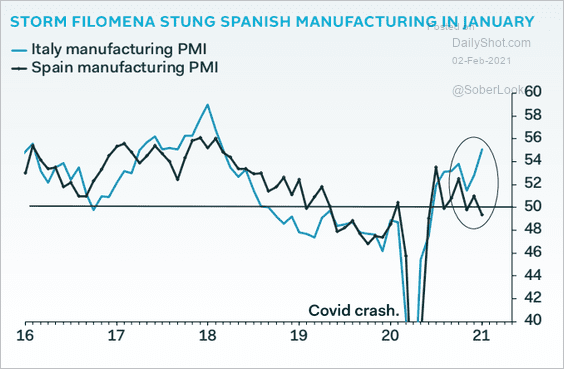

3. Italy’s factory activity has been outperforming Spain.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

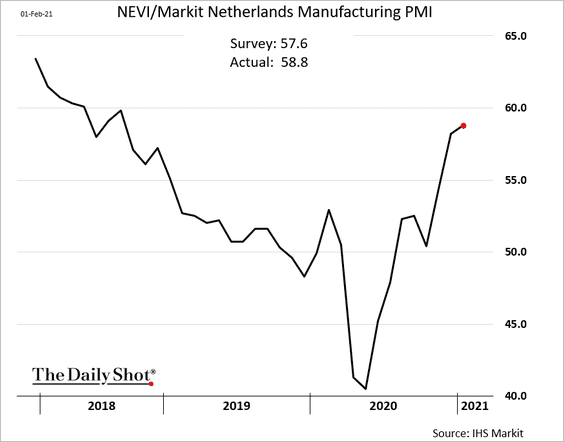

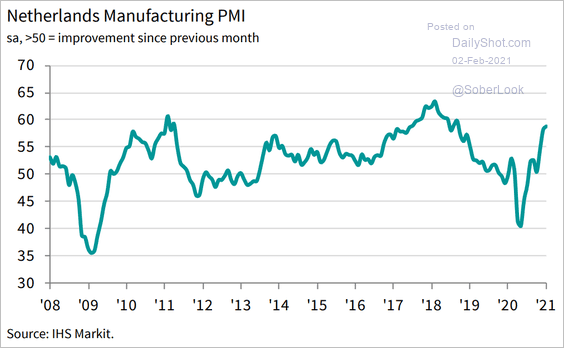

The manufacturing rebound in the Netherlands strengthened further last month.

Back to Index

Europe

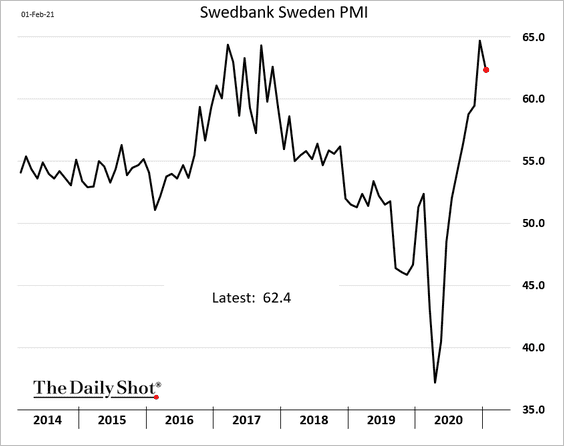

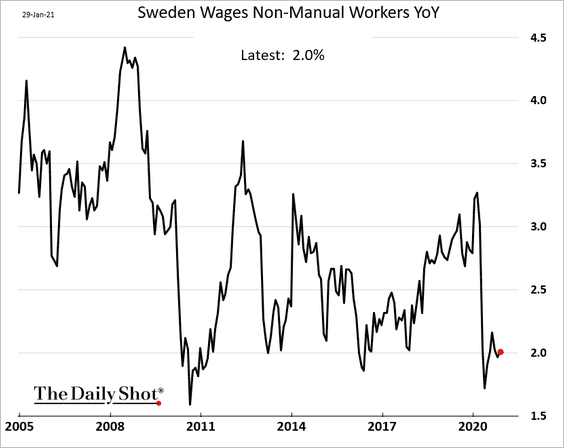

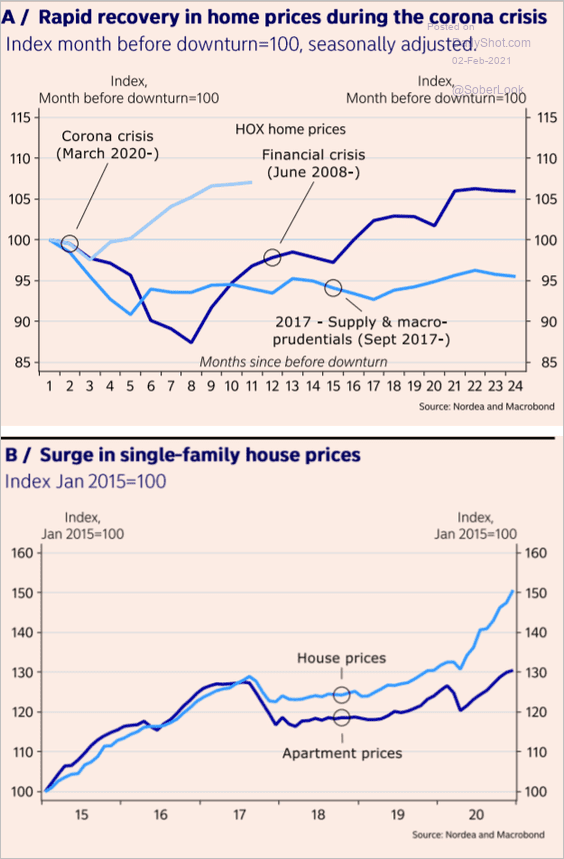

1. Let’s begin with Sweden.

• Factory activity remains exceptionally strong.

• Wage growth has been slow.

• The rebound in home prices has outpaced previous downturns.

Source: Nordea Markets

Source: Nordea Markets

——————–

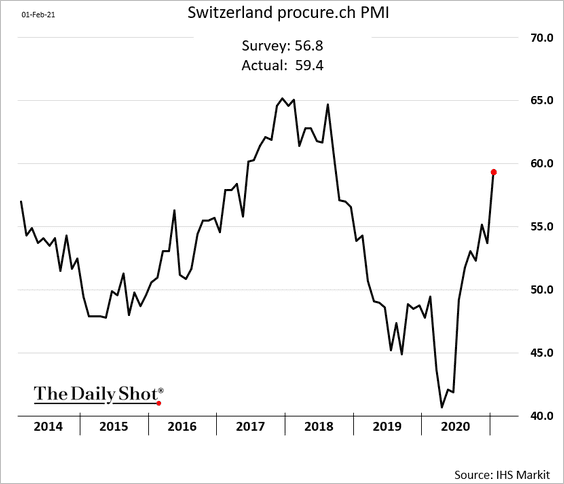

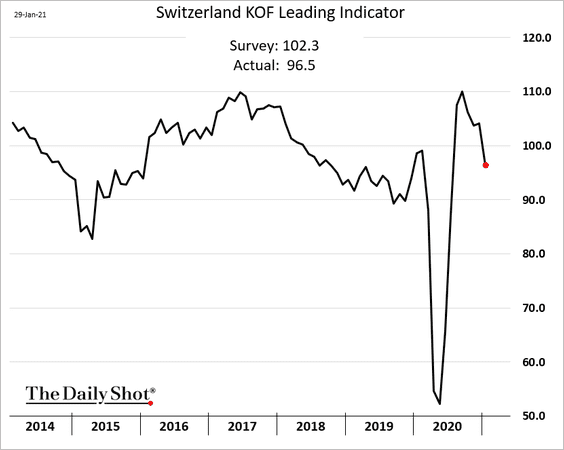

2. Swiss factory activity is accelerating.

But the leading indicator shows loss of momentum.

——————–

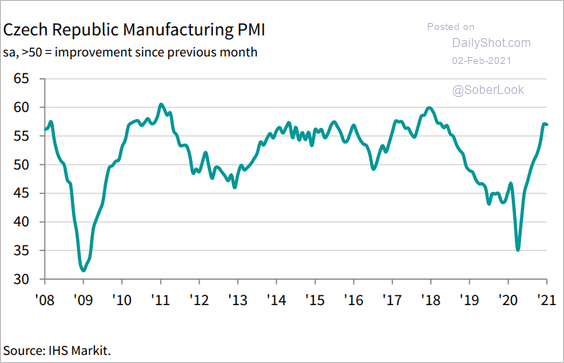

3. Central Europe is experiencing a rebound in manufacturing.

• The Czech Republic:

Source: IHS Markit

Source: IHS Markit

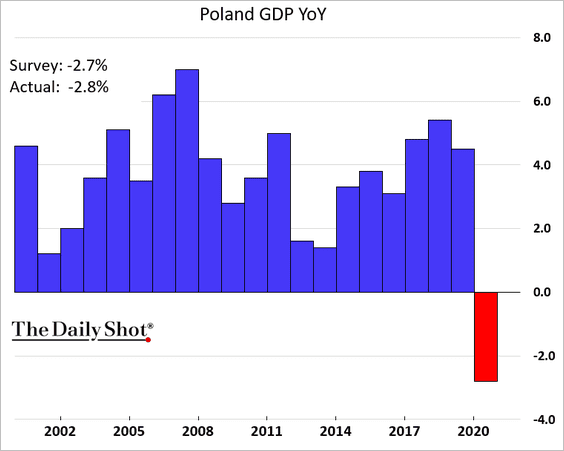

• Poland:

Source: IHS Markit

Source: IHS Markit

Poland’s 2020 GDP decline was a bit worse than expected.

——————–

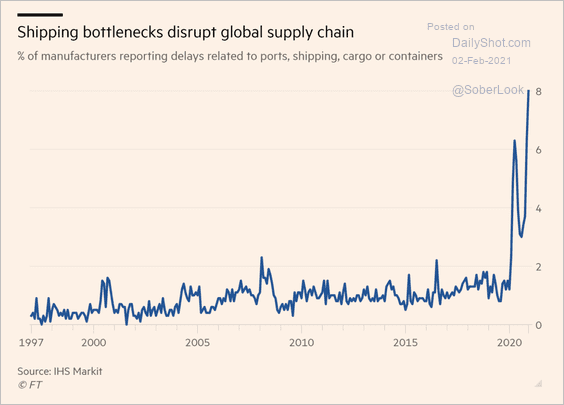

4. Logistics bottlenecks have been a problem for European manufacturers.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Asia – Pacific

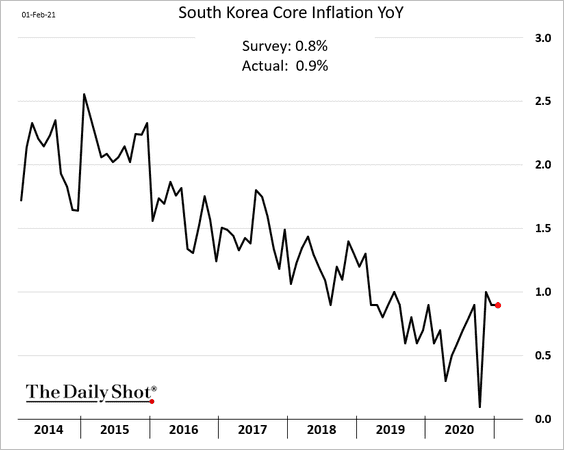

1. South Korea’s CPI was a bit firmer than expected last month, but it’s unlikely to have an impact on monetary policy.

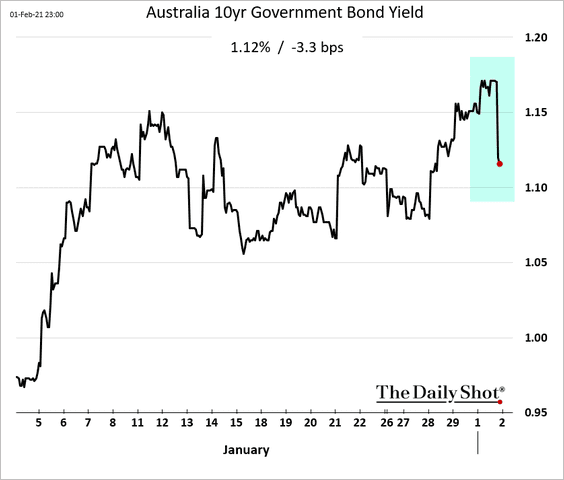

2. Australia’s bond yields declined after the RBA announced a A$100bn extension of its QE program.

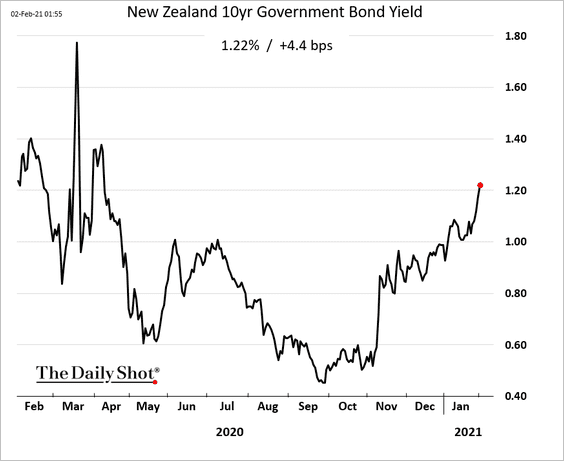

3. New Zealand’s bond yields keep climbing, with the 10-year topping 1.2%.

Back to Index

Emerging Markets

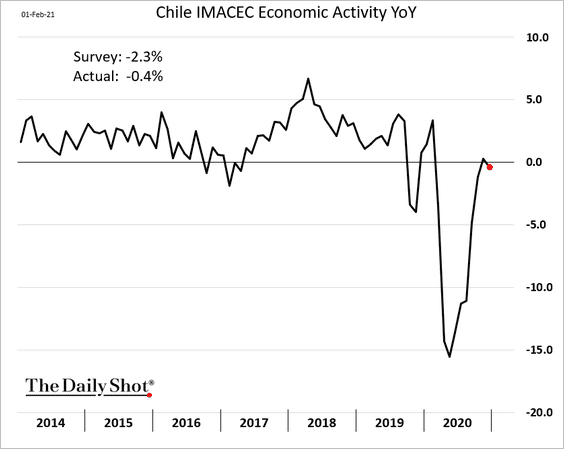

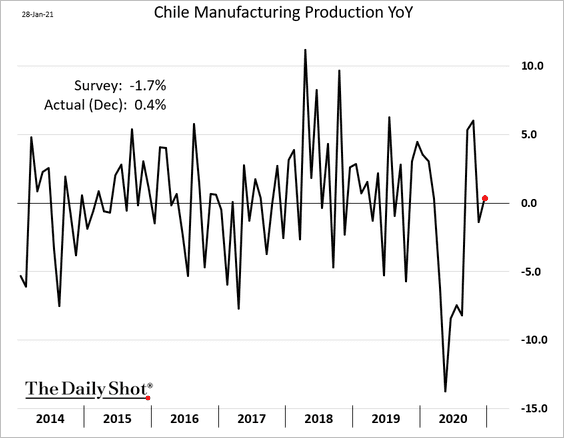

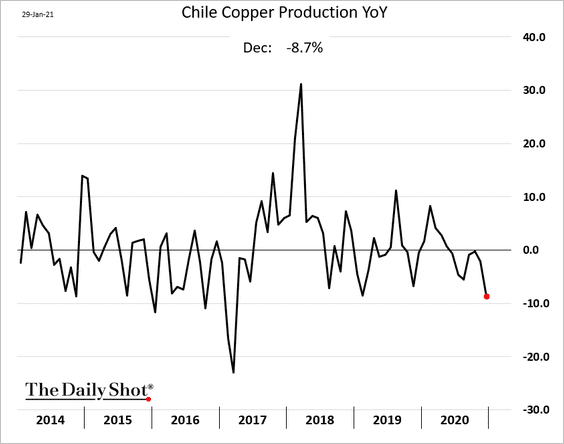

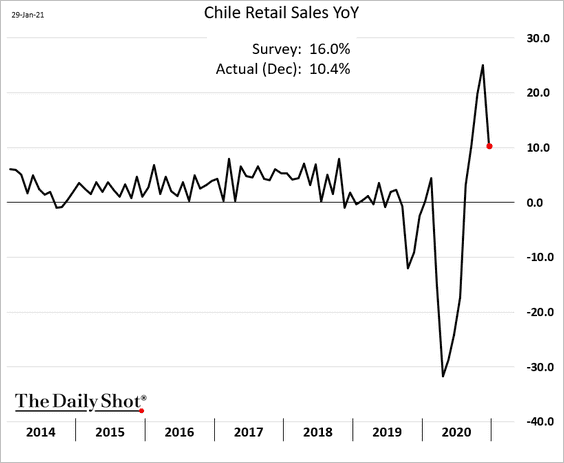

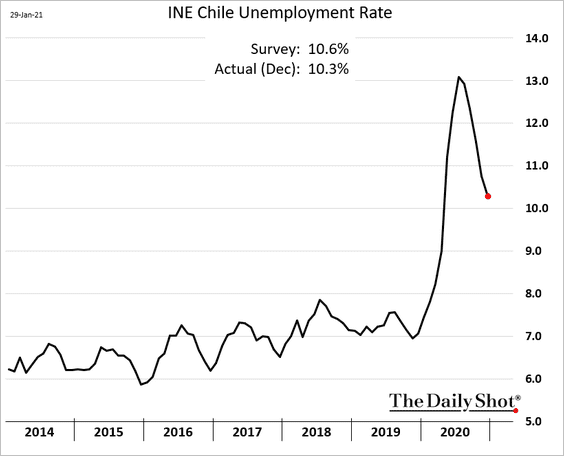

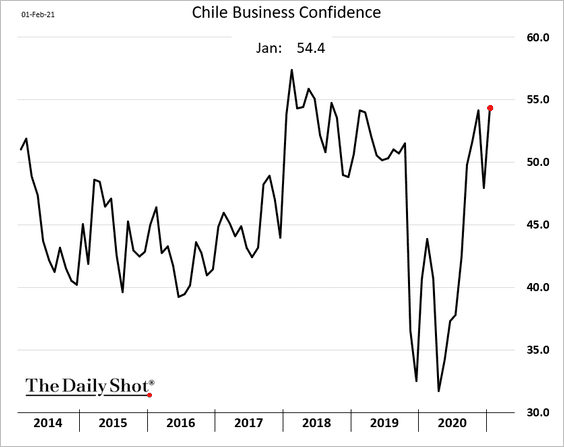

1. Let’s begin with Chile.

• December economic activity surprised to the upside.

Here are several additional indicators (most were better than expected).

– Industrial production:

– Copper production:

– Retail sales:

– The unemployment rate:

– Business confidence:

——————–

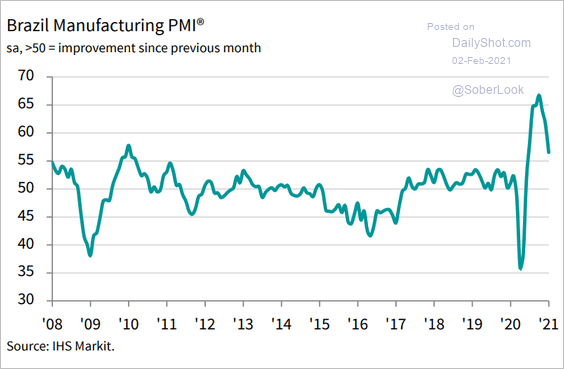

2. Next, we have some updates on Brazil.

• Factory activity is losing momentum.

Source: IHS Markit

Source: IHS Markit

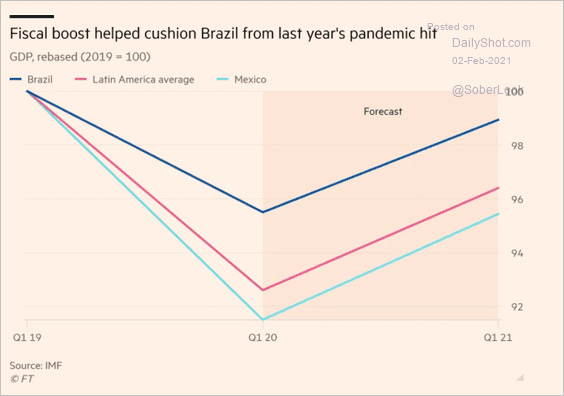

• Government spending allowed Brazil’s economy to outperform.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

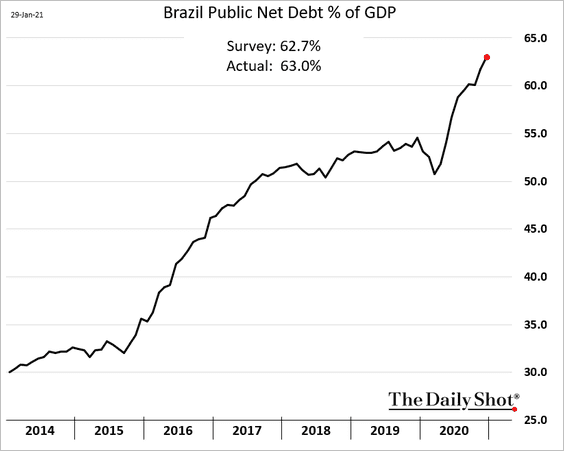

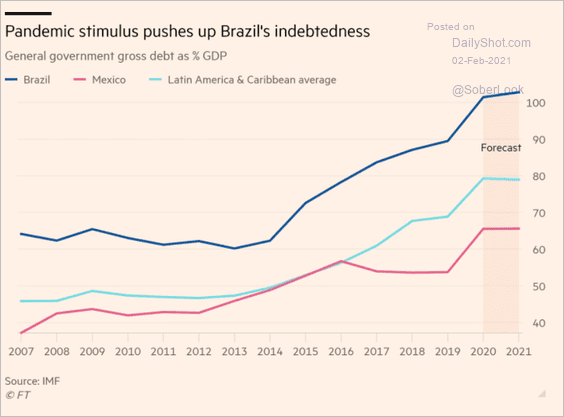

As a result, the nation’s fiscal situation continues to deteriorate (2 charts).

Source: @financialtimes Read full article

Source: @financialtimes Read full article

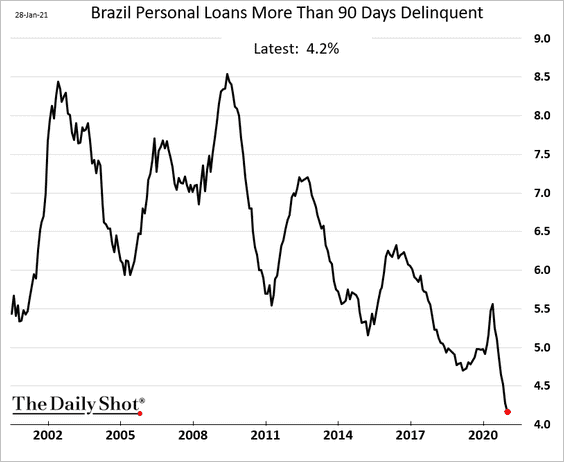

• Government spending reduced consumer loan delinquencies.

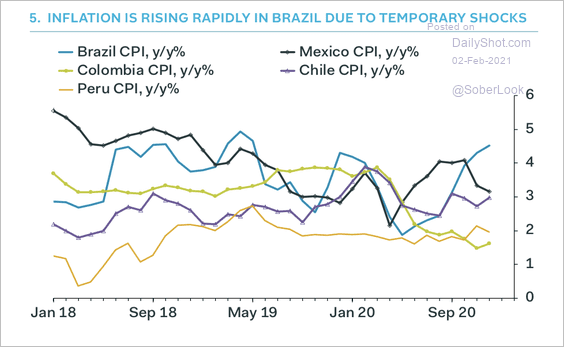

• Inflation in Brazil has been rising faster than its peers.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

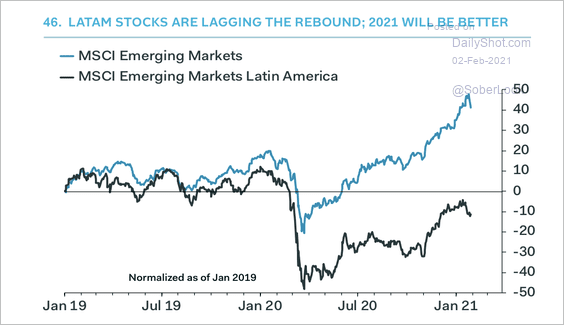

3. Latin American stocks have lagged the broader emerging market rebound.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

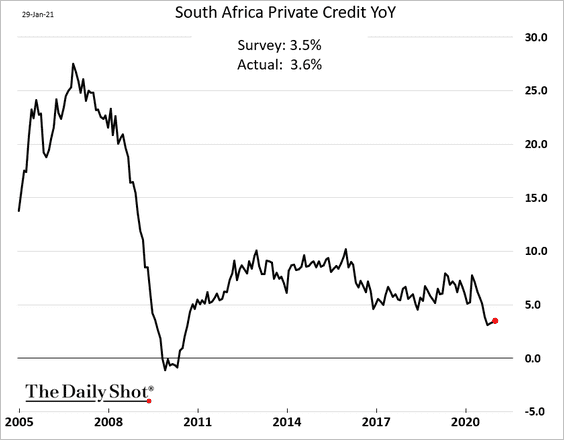

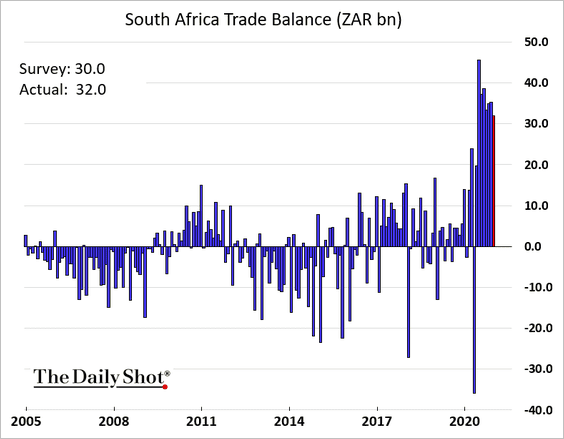

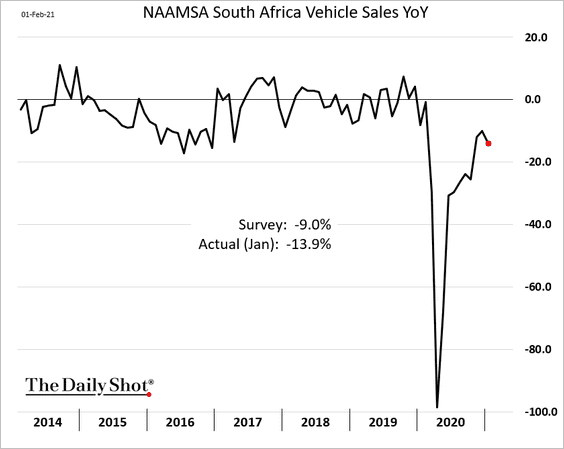

4. Here are some updates on South Africa.

• Private credit growth:

• Trade balance:

• Vehicle sales:

——————–

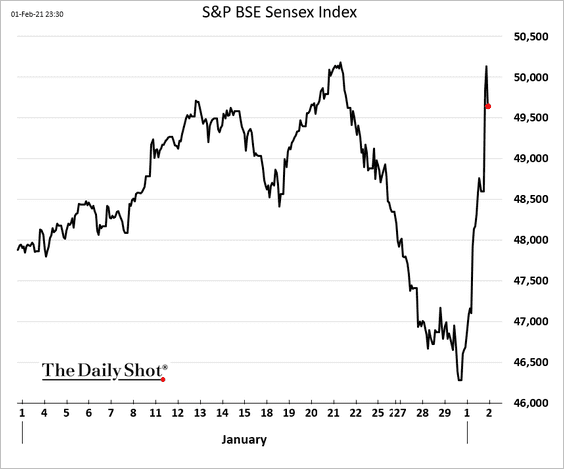

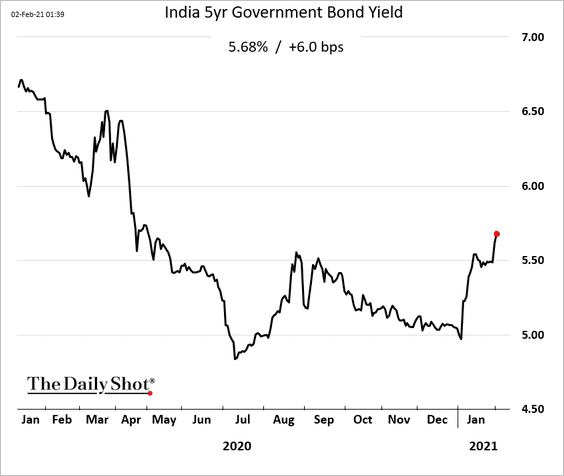

5. India is gearing up to finance a massive budget.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

The stock market liked the news, …

… but bonds sold off.

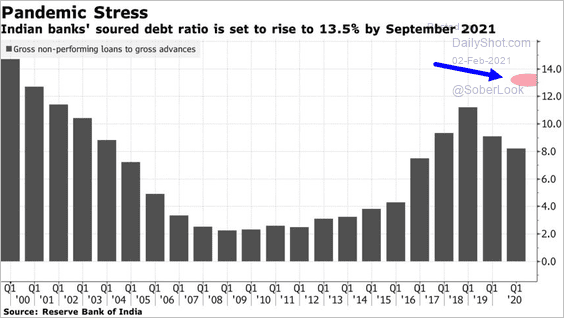

Separately, nonperforming loans are expected to spike this year.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Commodities

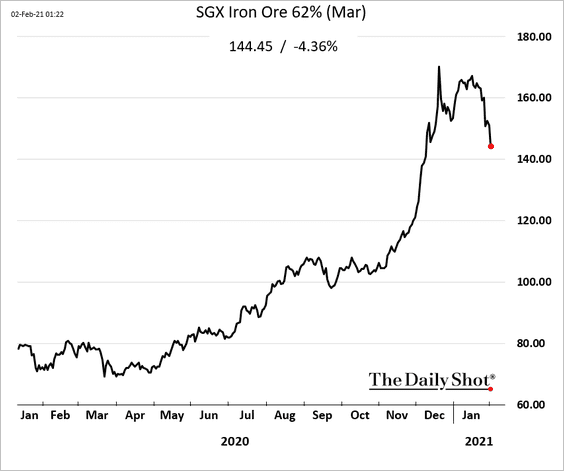

1. Iron ore is selling off as supply bottlenecks ease.

China’s steel prices are following iron ore lower.

——————–

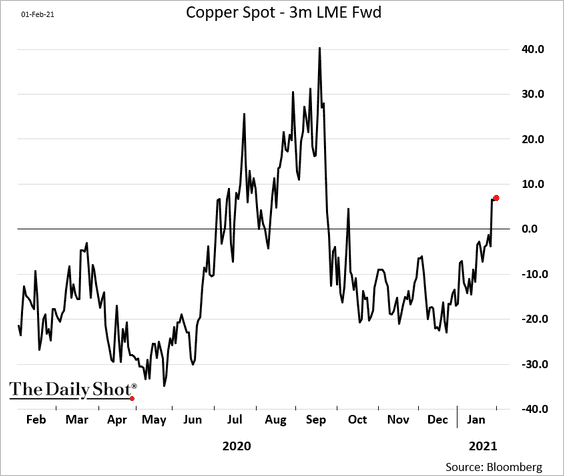

2. Copper is in backwardation.

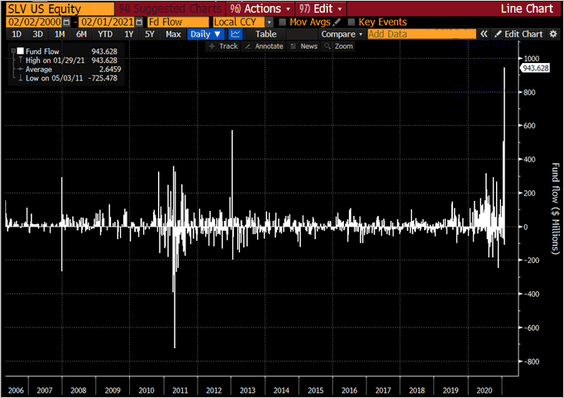

3. The largest silver ETF (SLV) saw massive inflows.

Source: @SarahPonczek Read full article

Source: @SarahPonczek Read full article

Prices spiked but held resistance.

——————–

4. Gold demand declined last year.

Source: Statista

Source: Statista

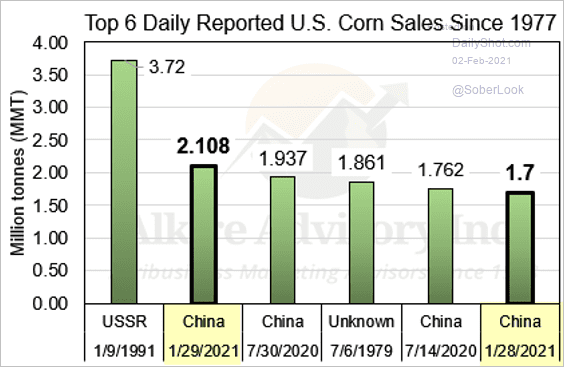

5. Two of China’s largest single-day corn purchases from the US occurred last week, driving prices higher.

Source: Alkire Advisory

Source: Alkire Advisory

Back to Index

Energy

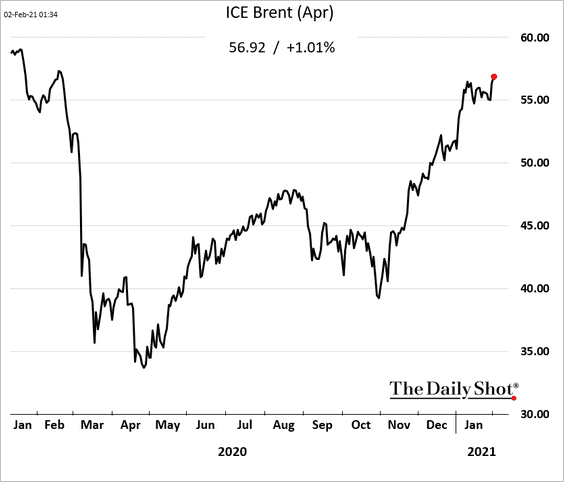

1. Brent crude is trading near $57/bbl.

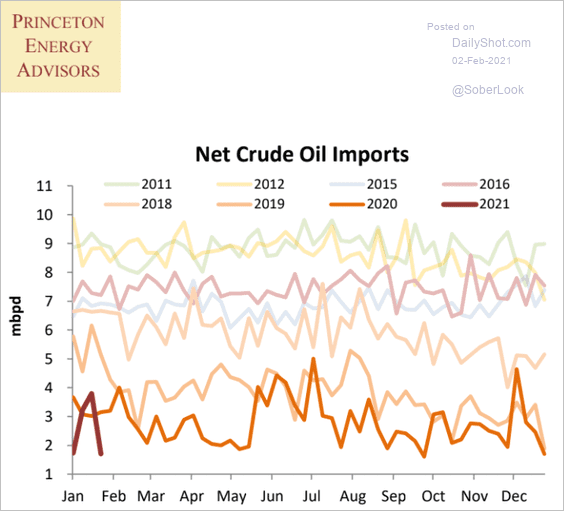

2. US net crude oil imports are at the lowest level in years (for this time of the year).

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

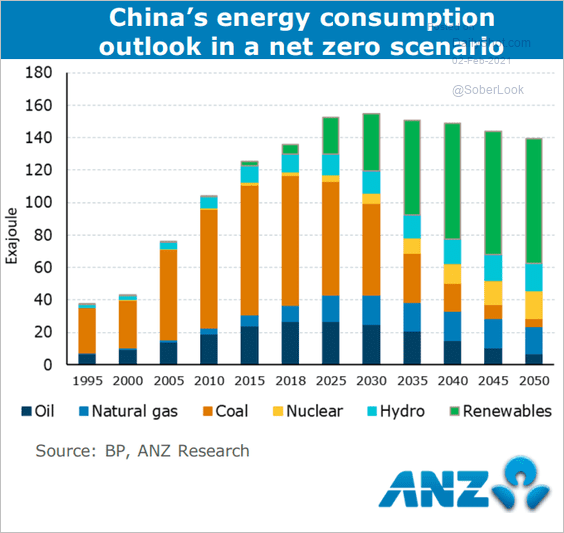

3. This chart shows a potential scenario for China’s energy consumption.

Source: ANZ Research

Source: ANZ Research

Back to Index

Equities

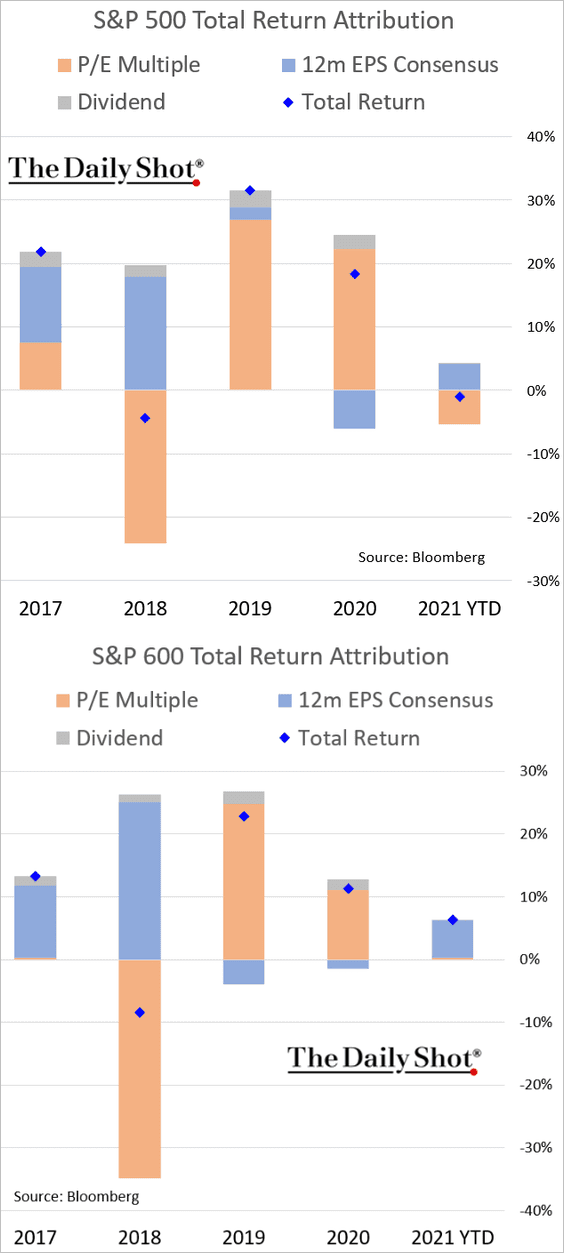

1. Let’s begin with the January return attribution for the S&P 500 and the S&P 600 (small caps).

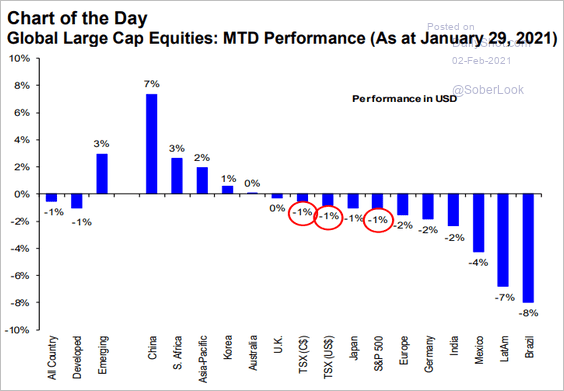

2. Here is the January equity performance globally.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

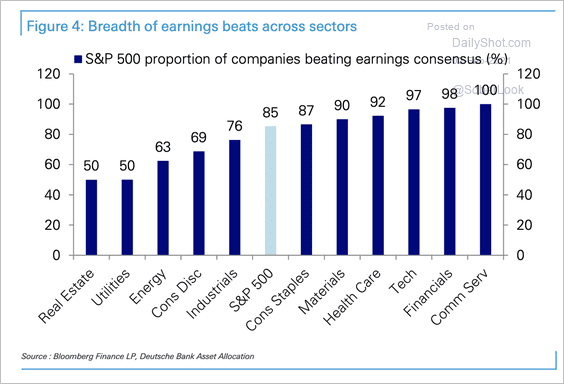

3. Most S&P 500 companies have been beating Q4 earnings forecasts.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

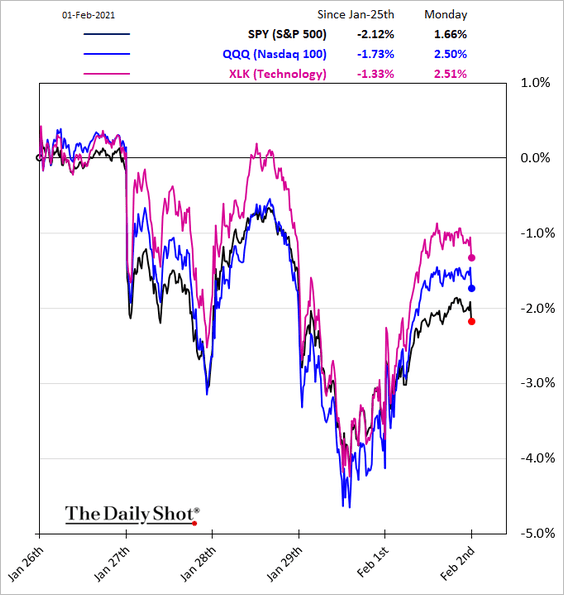

4. Tech stocks are outperforming again.

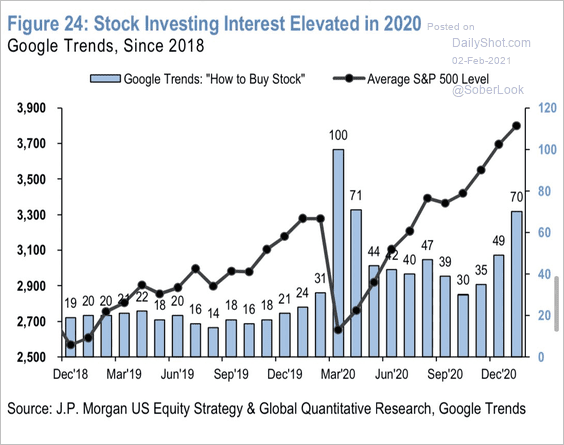

5. Stock investing interest remains elevated.

Source: JP Morgan, @carlquintanilla

Source: JP Morgan, @carlquintanilla

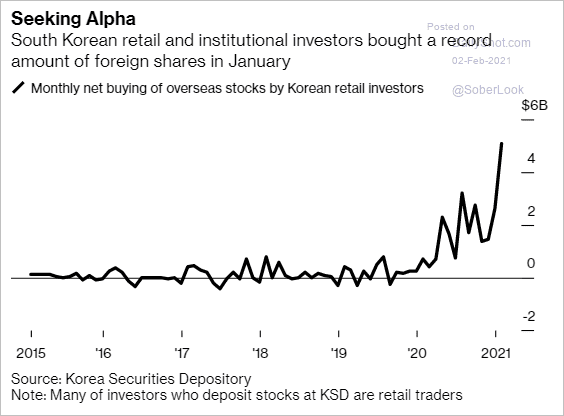

6. Foreign retail investors have been buying up US shares.

Source: @markets Read full article

Source: @markets Read full article

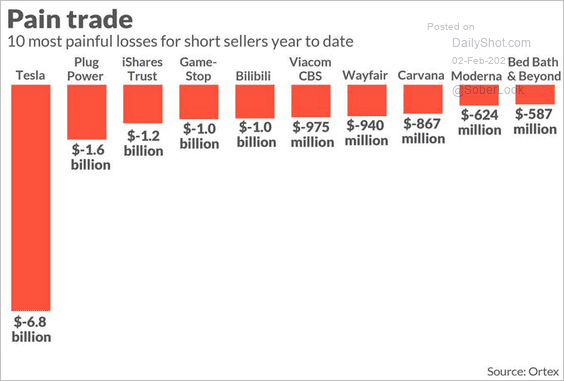

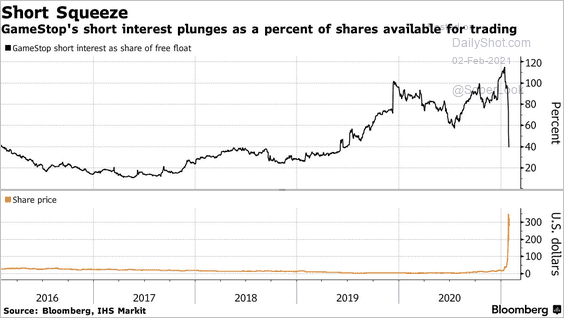

7. Here is an estimate of how much money short sellers lost this year.

Source: @LizAnnSonders, @OrtexEquity

Source: @LizAnnSonders, @OrtexEquity

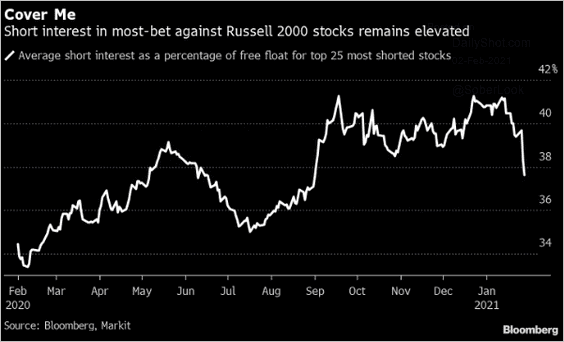

Short interest has been declining, which makes the market vulnerable to downside corrections.

Source: @TheOneDave

Source: @TheOneDave

Source: @BloombergQuint Read full article

Source: @BloombergQuint Read full article

——————–

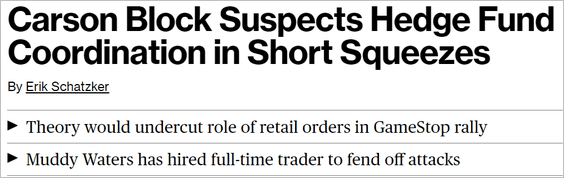

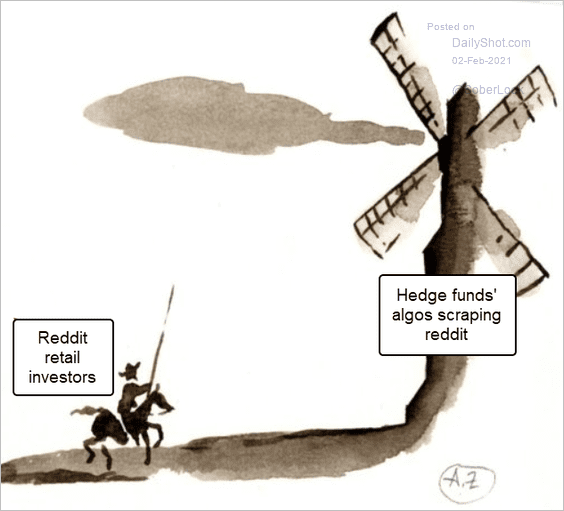

8. Carson Block suggested that hedge funds have been involved in short squeezes (against other funds).

Source: @markets Read full article

Source: @markets Read full article

While there is no “coordination,” he is not wrong about funds buying up stocks touted on Reddit. Our sources tell us that funds have been using algos to scrape data (posts) on these discussion boards, which has been going on for months. By the time retail investors locate the ticker symbol (assuming they get the correct one), algos are already searching for the next target. When there are no new buyers, somebody will be “holding the bag,” and it won’t be the fast-moving hedge funds.

Source: Favpng

Source: Favpng

——————–

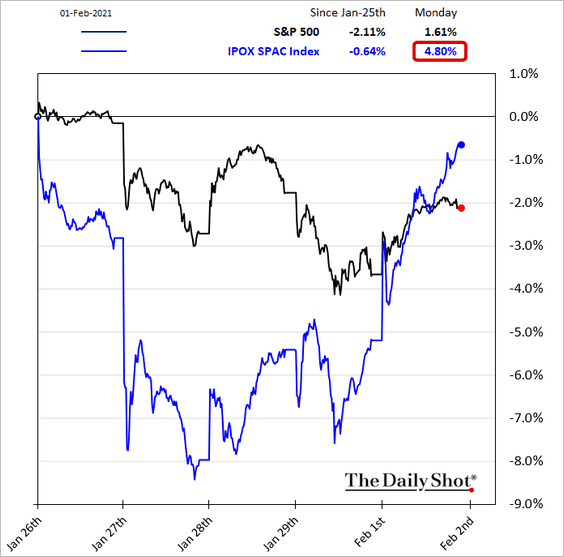

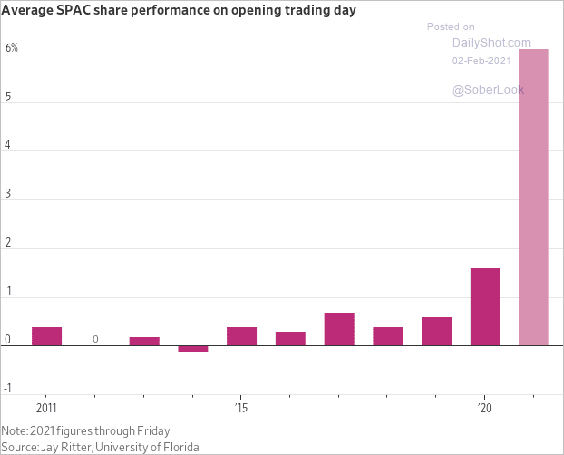

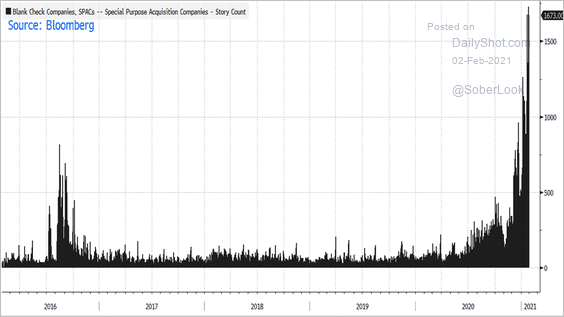

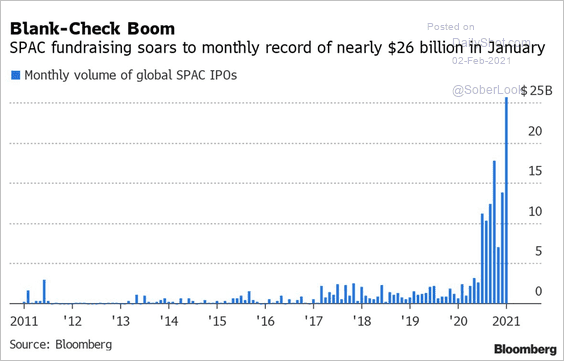

9. Next, we have some updates on SPACs.

• Guess who is buying?

Source: @WSJ Read full article

Source: @WSJ Read full article

• SPAC performance:

Source: @WSJ Read full article

Source: @WSJ Read full article

• SPAC stories on Bloomberg:

Source: @Clay1016, @LizAnnSonders, @Bloomberg

Source: @Clay1016, @LizAnnSonders, @Bloomberg

• SPAC fundraising:

Source: @technology, h/t @LizAnnSonders Read full article

Source: @technology, h/t @LizAnnSonders Read full article

——————–

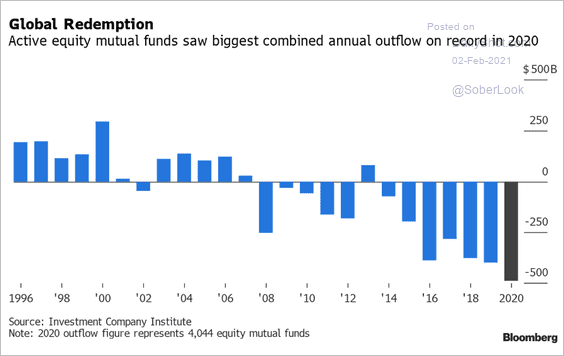

10. Active mutual funds continue to see outflows.

Source: Nancy Moran, @TheTerminal, Bloomberg Finance L.P.

Source: Nancy Moran, @TheTerminal, Bloomberg Finance L.P.

Back to Index

Credit

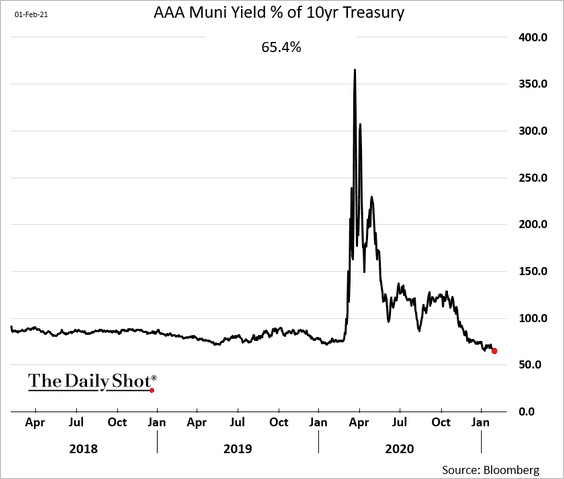

1. High-rated muni yields hit a new low relative to Treasuries.

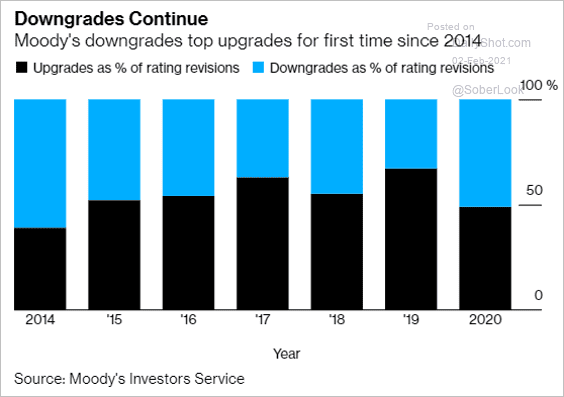

2. Muni downgrades topped upgrades last year.

Source: @markets Read full article

Source: @markets Read full article

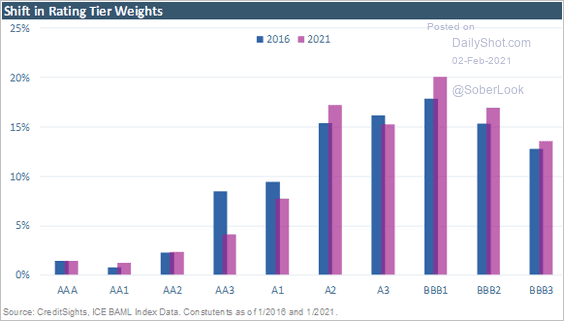

3. The credit quality of the corporate investment-grade market has deteriorated in recent years.

Source: CreditSights

Source: CreditSights

Back to Index

Rates

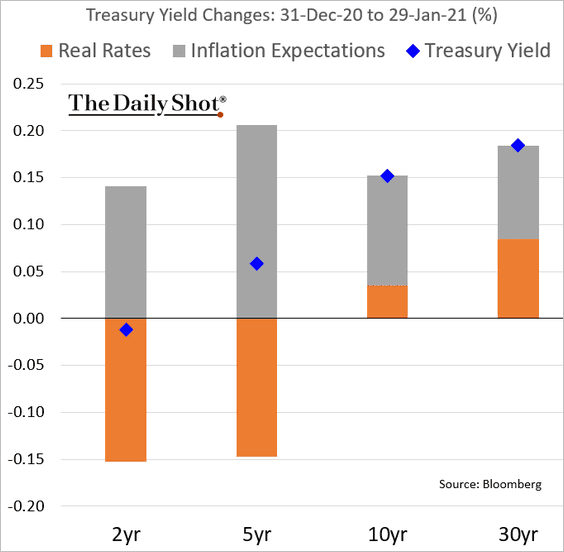

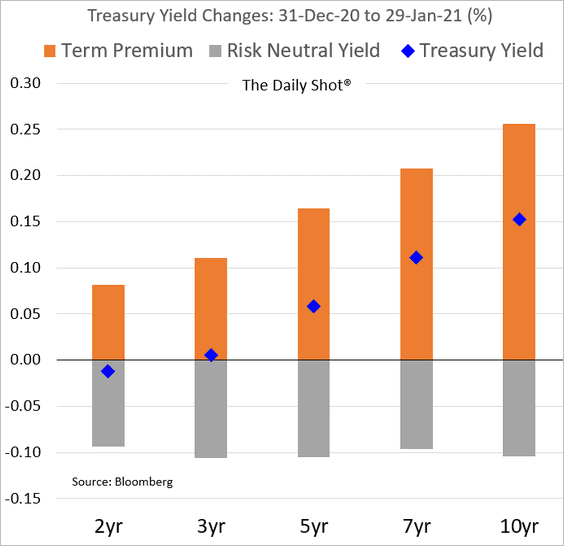

1. Here is the attribution of Treasury yield changes in January.

• Inflation expectations vs. real rates:

• Term premium vs. risk-neutral yield:

——————–

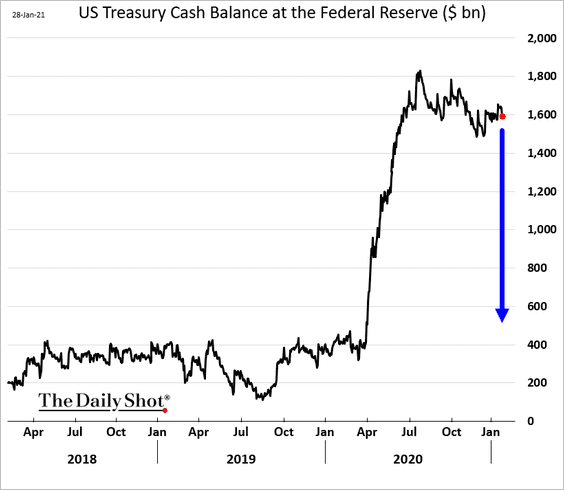

2. The Treasury will be taking out some two-thirds of its balances at the Fed, which will significantly boost reserves and pour more liquidity into money markets.

——————–

Food for Thought

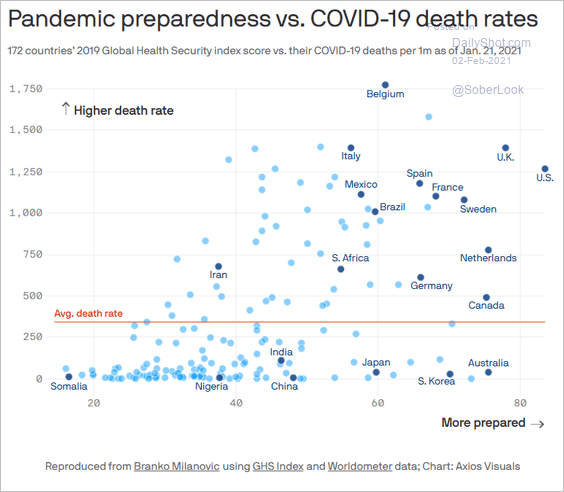

1. COVID death rates vs. the level of preparedness:

Source: @axios Read full article

Source: @axios Read full article

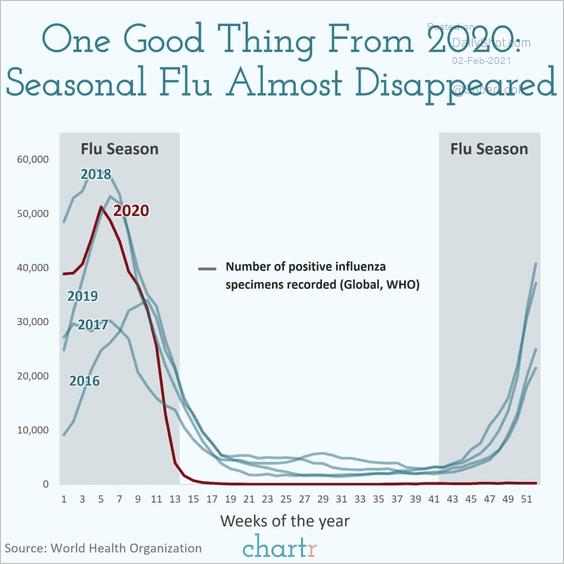

2. Seasonal flu cases:

Source: @chartrdaily

Source: @chartrdaily

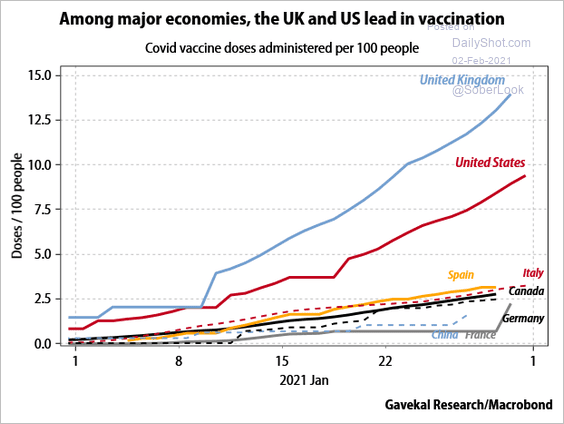

3. Vaccinations administered:

Source: Gavekal Research

Source: Gavekal Research

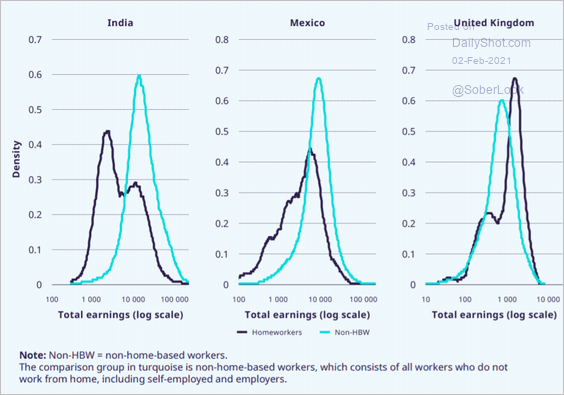

4. Home-workers’s pay vs. those who are not working from home:

Source: ILO Read full article

Source: ILO Read full article

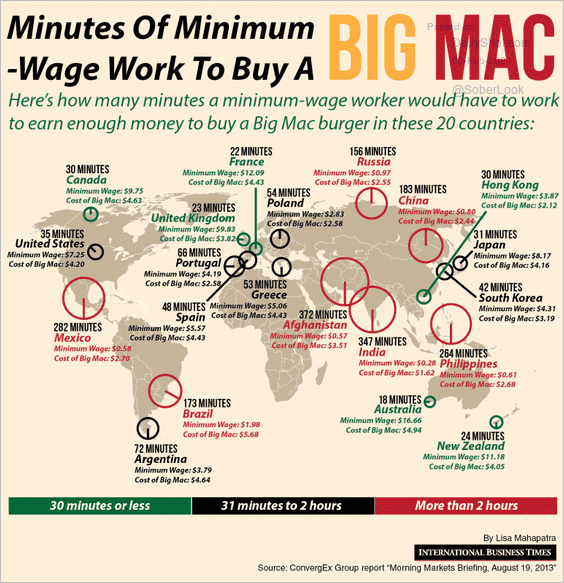

5. Minutes a minimum-wage worker needs to work to buy a Big Mac:

Source: Reddit

Source: Reddit

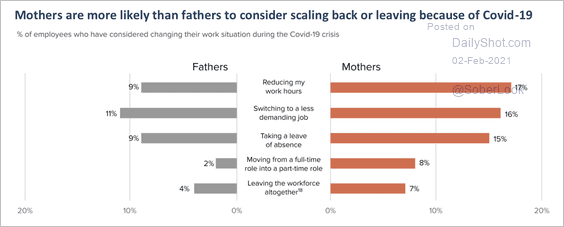

6. Scaling back on work due to the pandemic:

Source: McKinsey & Company

Source: McKinsey & Company

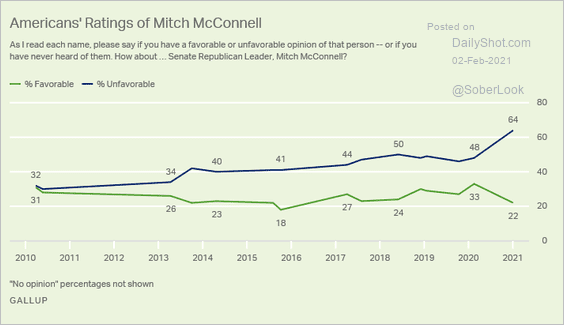

7. Mitch McConnell’s approval ratings:

Source: Gallup Read full article

Source: Gallup Read full article

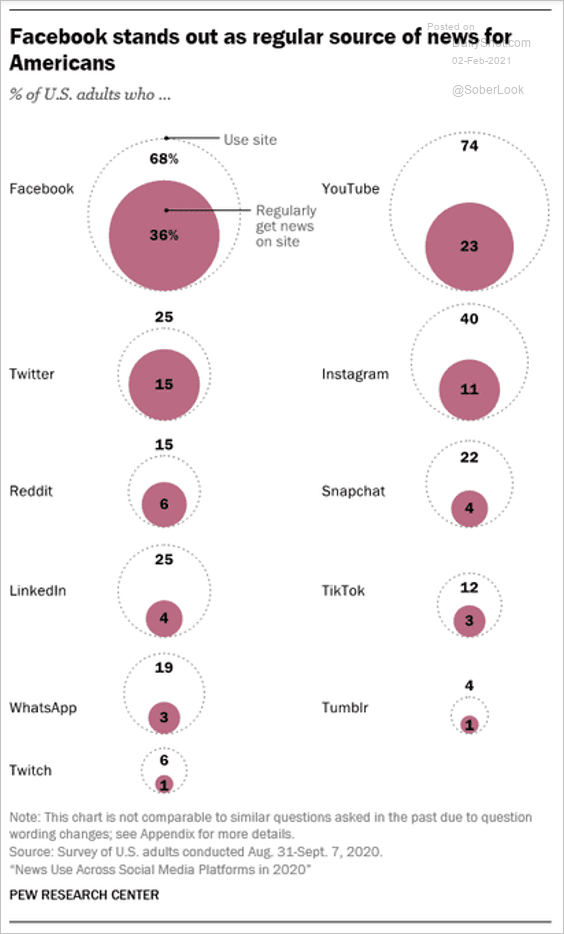

8. Getting the news on social media:

Source: @pewjournalism Read full article

Source: @pewjournalism Read full article

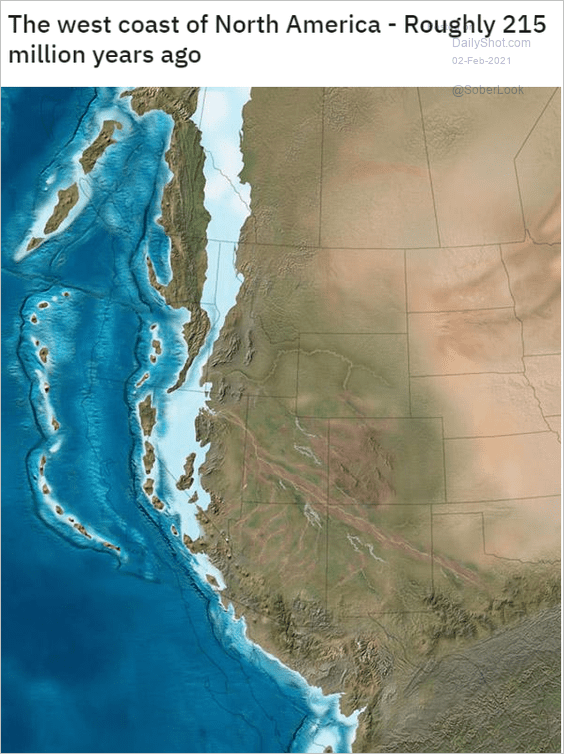

9. The west coast of North America 215 million years ago:

Source: Reddit

Source: Reddit

——————–

Back to Index