The Daily Shot: 11-Feb-21

• The United States

• The Eurozone

• Europe

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

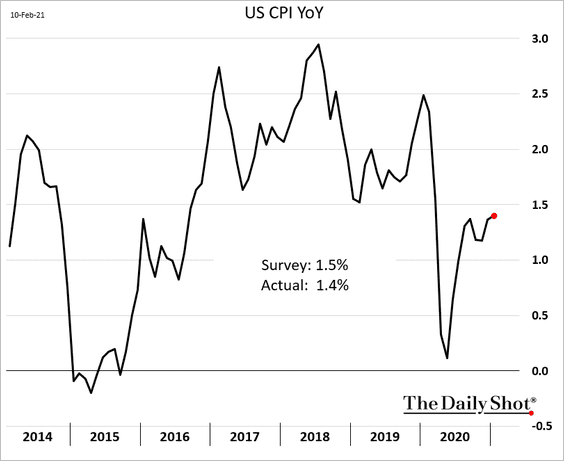

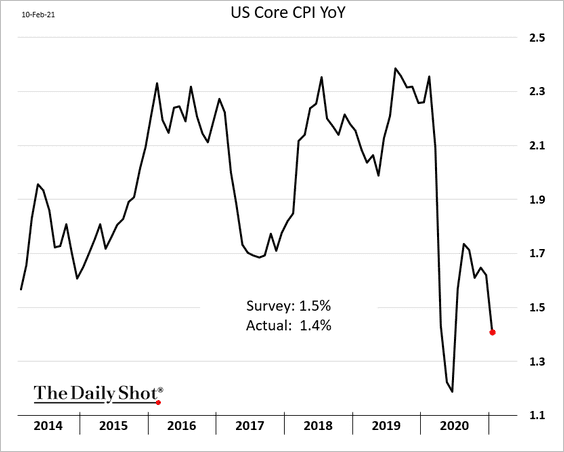

1. The January CPI report was a bit weaker than the markets were expecting.

• Headline CPI:

• Core CPI:

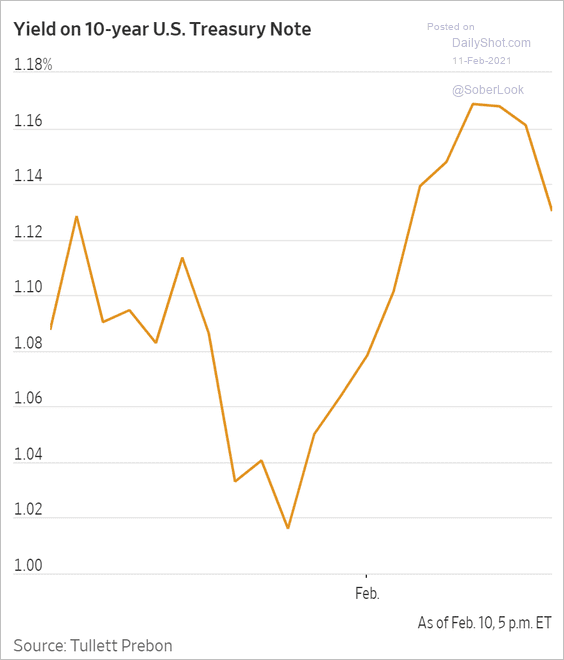

Treasury yields pulled back.

Source: @WSJ Read full article

Source: @WSJ Read full article

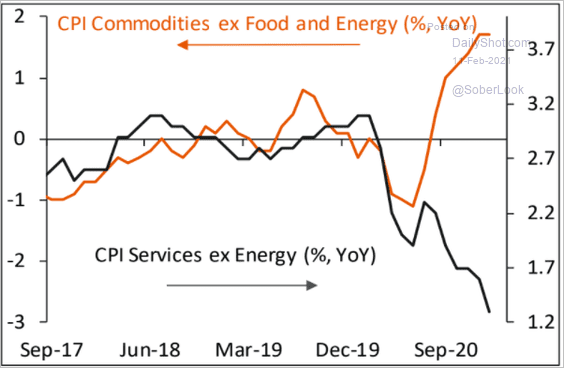

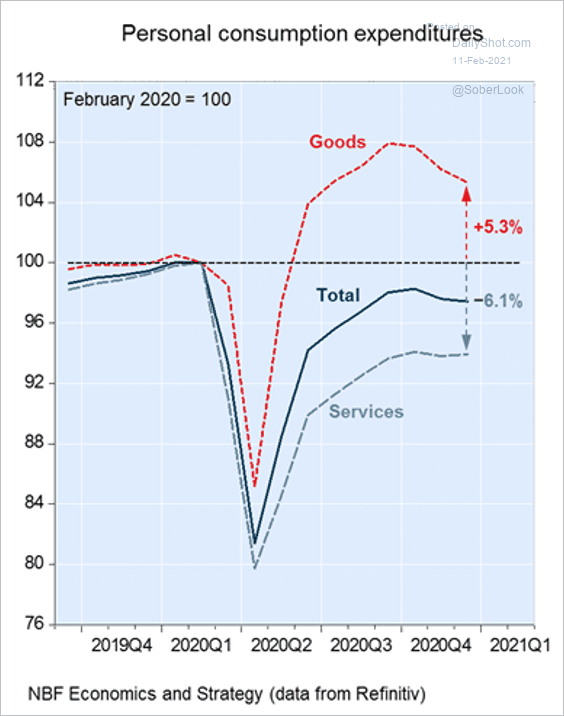

Services remain a drag on the core CPI. The pandemic-related divergence below …

Source: Piper Sandler

Source: Piper Sandler

… is the result of consumer spending pattern changes.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

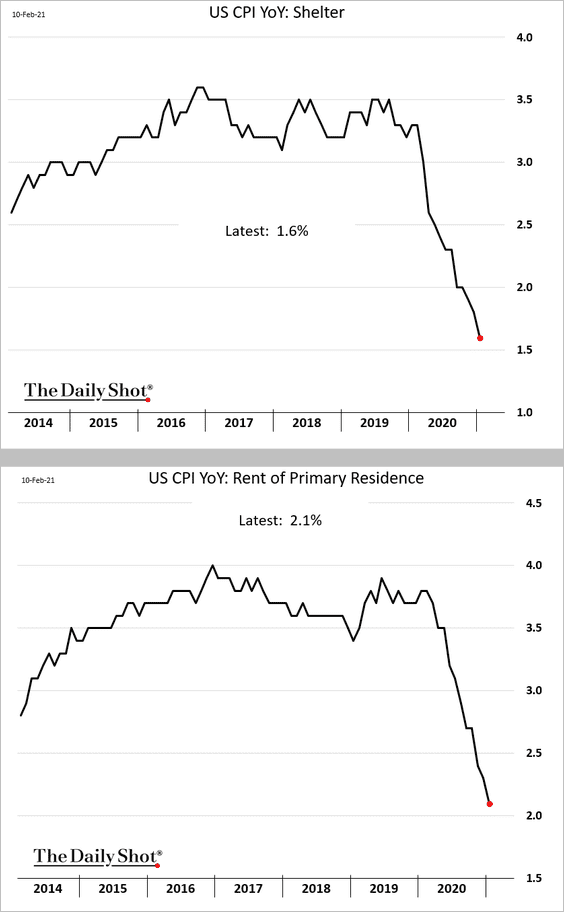

• Shelter inflation keeps moderating.

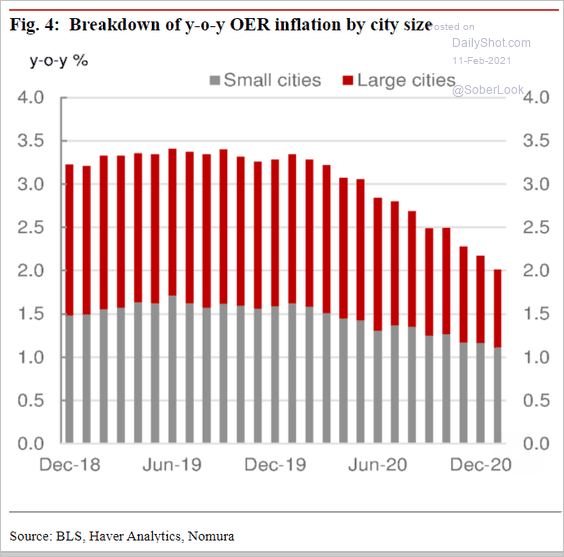

Owners’ equivalent rent CPI has been under pressure, especially in large cities.

Source: Nomura Securities

Source: Nomura Securities

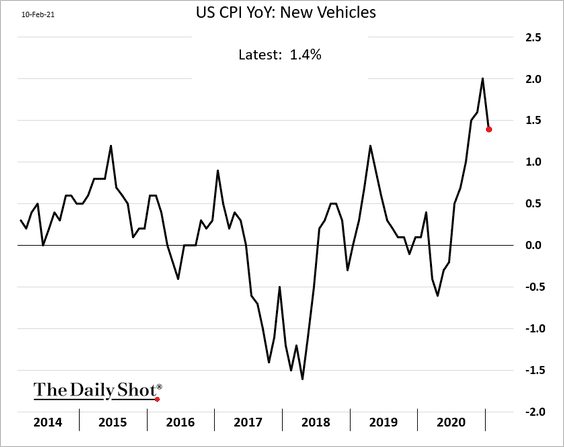

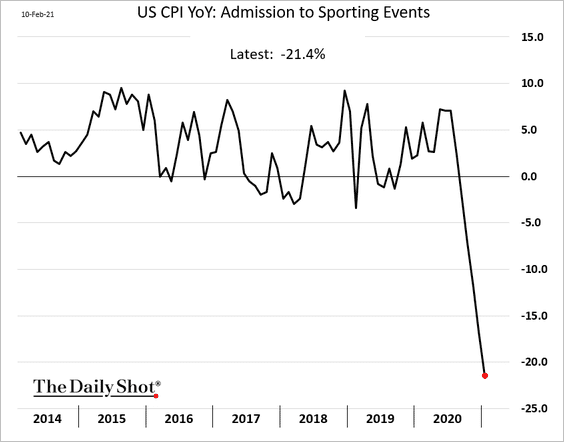

• A couple of other items contributed to core CPI weakness in January.

– New cars:

– A massive decline in admission prices for sports events:

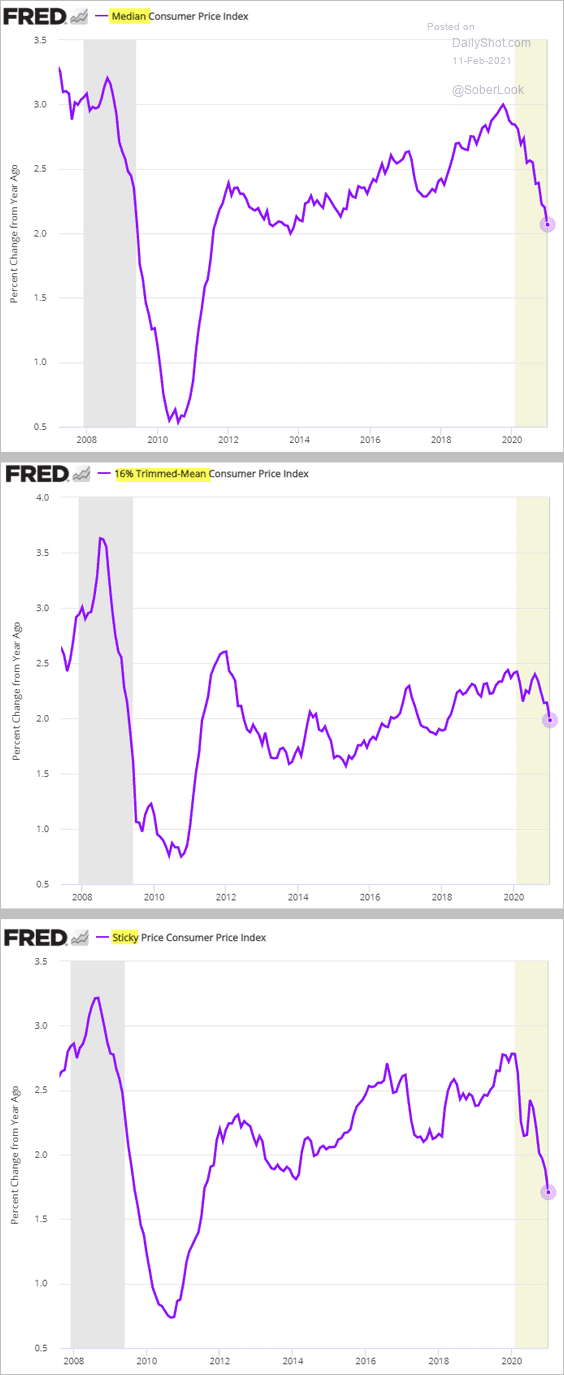

• Alternative measures of inflation continue to trend lower.

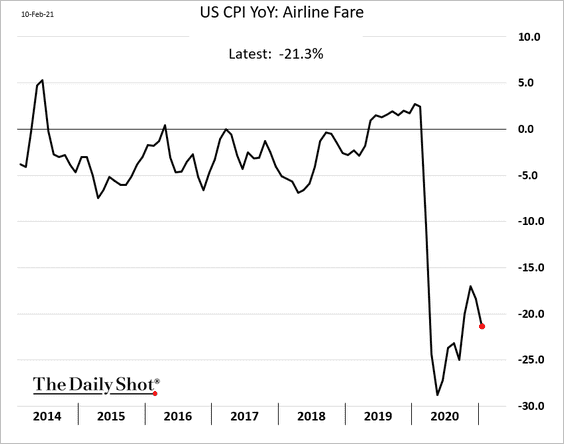

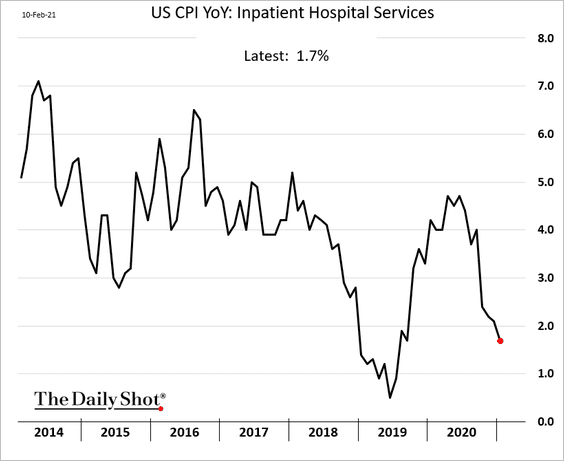

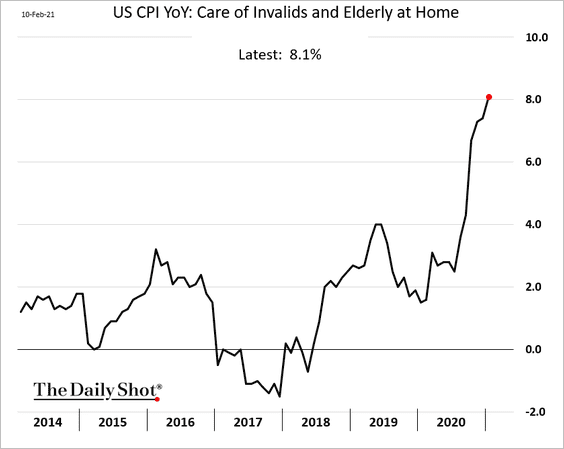

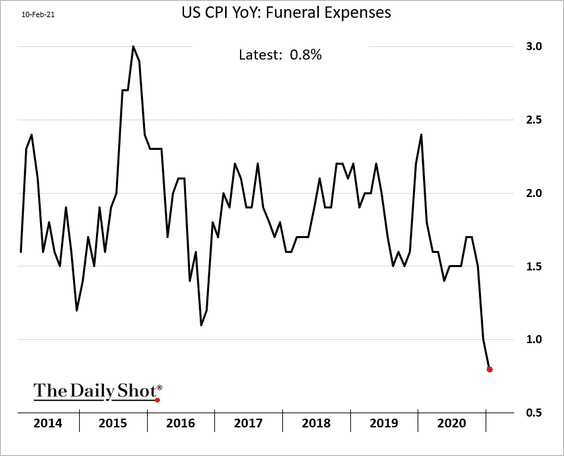

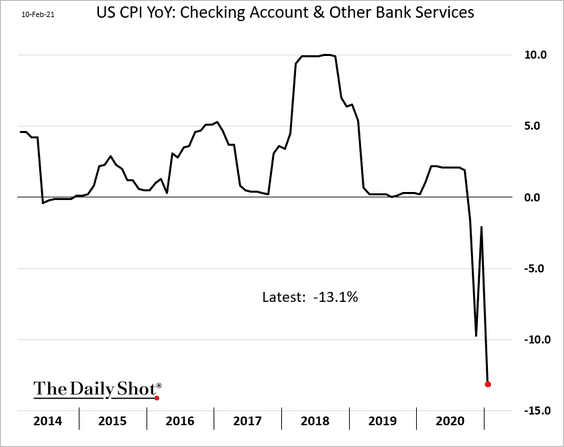

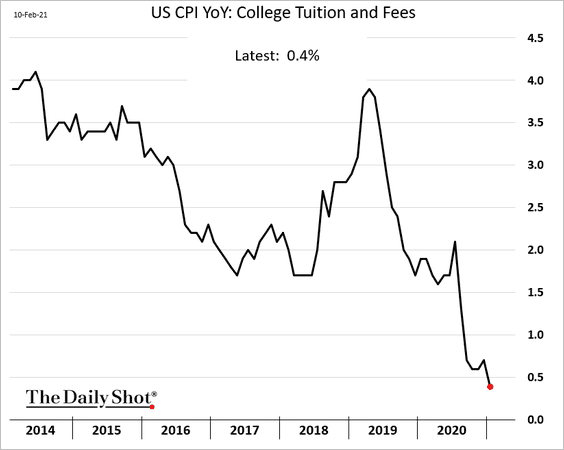

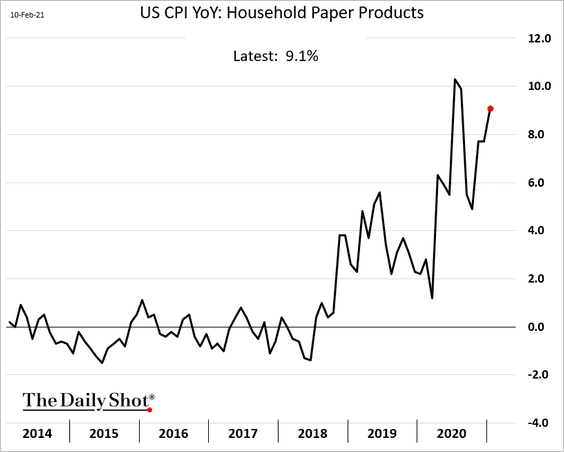

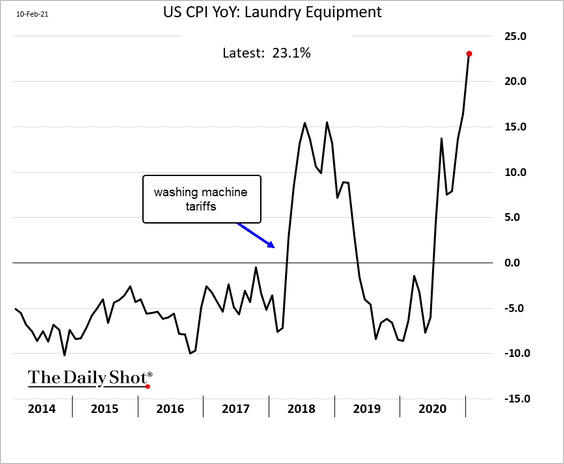

• Next, we have a select set of CPI components.

– Airline fare:

– Inpatient hospital services:

– Elderly care at home:

– Funeral expenses:

– Bank services:

– College tuition:

– Household paper products:

– Laundry equipment:

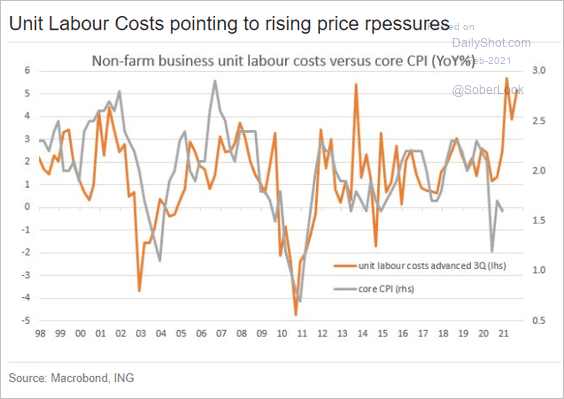

• Economists expect a rebound in inflation shortly. It’s unclear, however, just how sustainable the rebound will be.

Source: ING

Source: ING

——————–

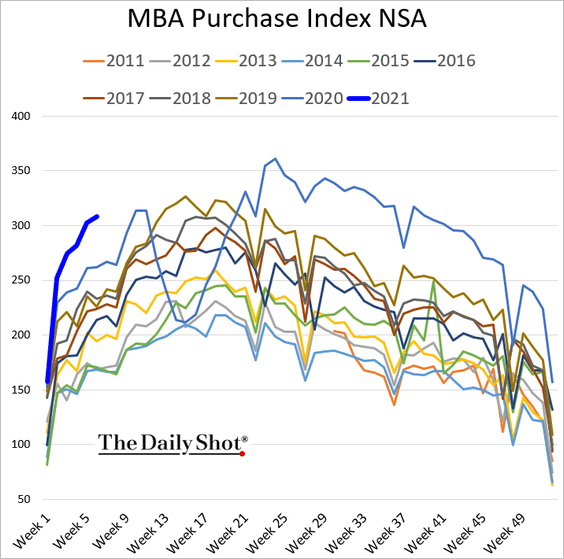

2. Mortgage applications for house purchase are holding up.

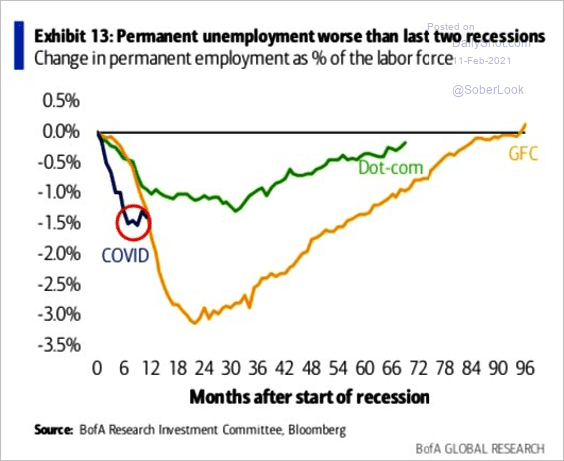

3. Here are a couple of updates on the labor market.

• Permanent employment drop relative to the previous two recessions:

Source: BofA Global Research, @WallStJesus

Source: BofA Global Research, @WallStJesus

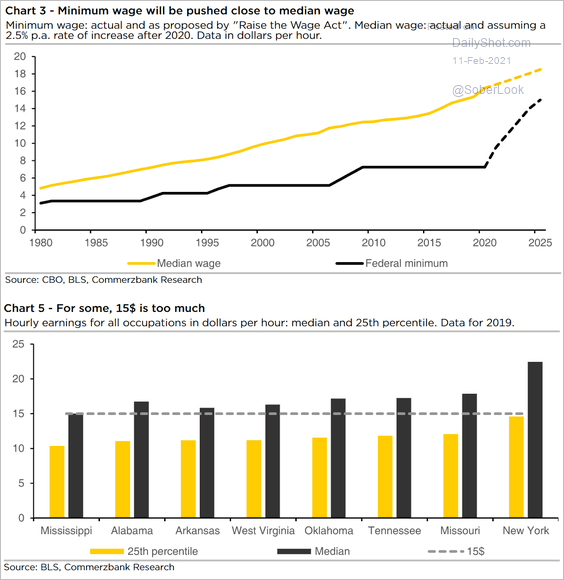

• Is the proposed minimum wage increase to $15/hr too much?

Source: Commerzbank Research

Source: Commerzbank Research

——————–

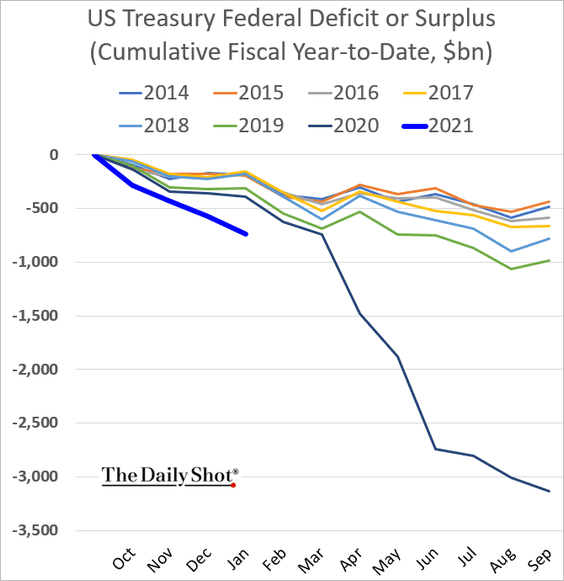

4. Here is the cumulative (fiscal year-to-date) federal budget deficit.

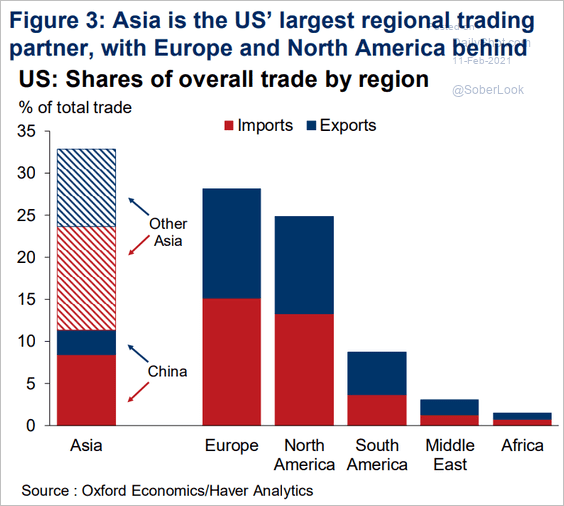

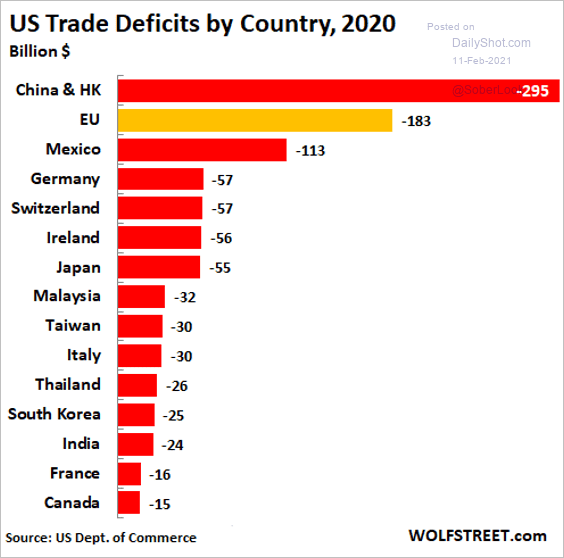

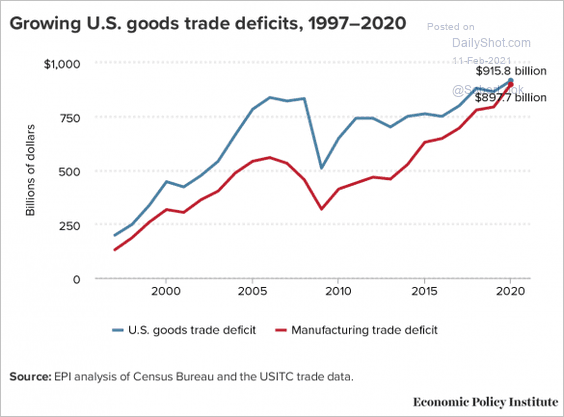

5. Finally, we have some updates on international trade.

• Major trading partners:

Source: Oxford Economics

Source: Oxford Economics

• The 2020 trade deficit by country:

Source: @wolfofwolfst Read full article

Source: @wolfofwolfst Read full article

• Manufacturing trade deficit:

Source: @EconomicPolicy

Source: @EconomicPolicy

Back to Index

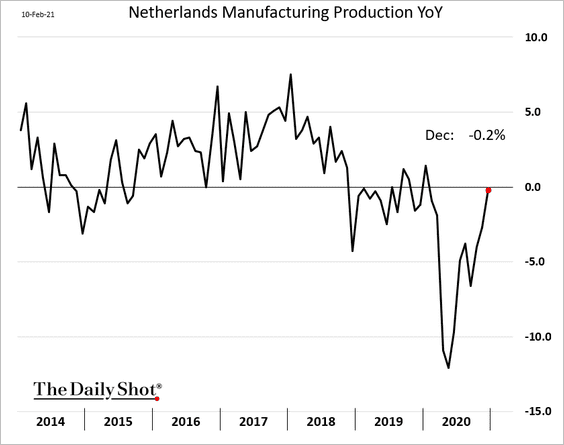

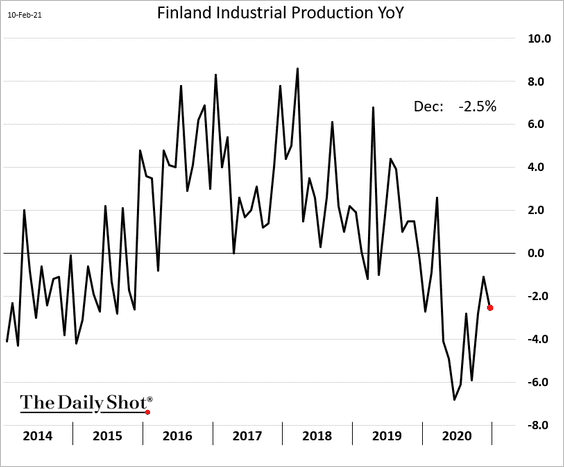

The Eurozone

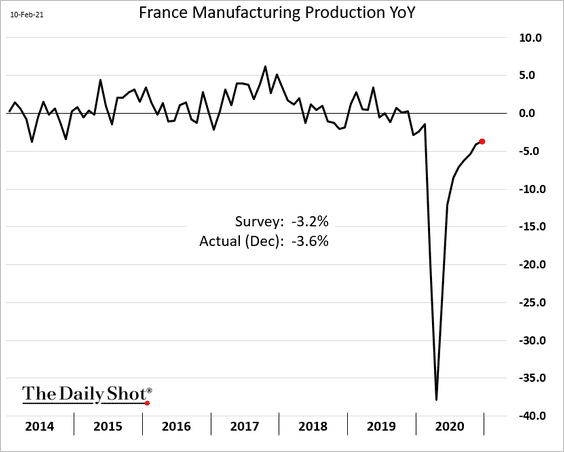

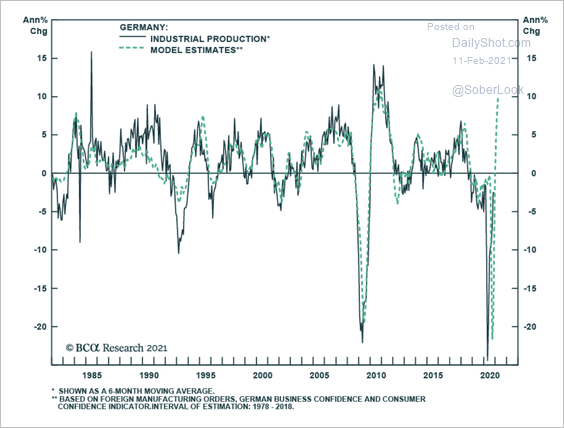

1. The euro-area manufacturing output recovery has been uneven.

• The Netherlands:

• Finland:

• France:

• BCA Research expects a sharp recovery in Germany’s industrial production.

Source: BCA Research

Source: BCA Research

——————–

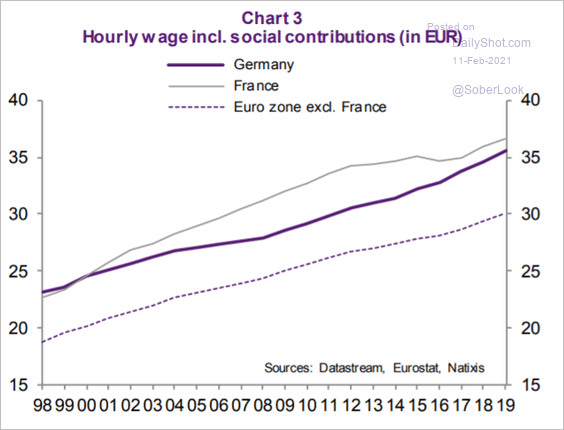

2. French wage growth has outpaced the rest of the Eurozone over the past couple of decades.

Source: Natixis

Source: Natixis

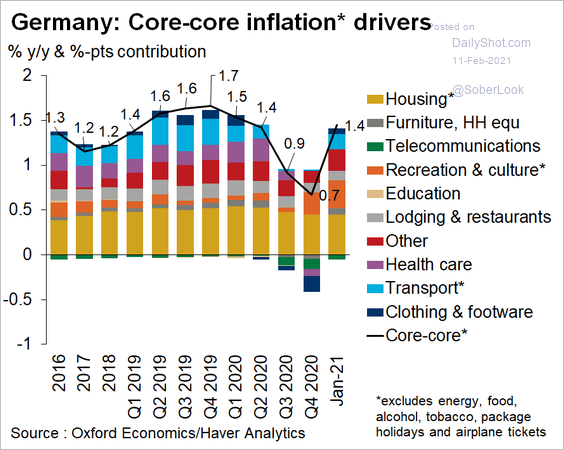

3. This chart shows Germany’s month-over-month core CPI components.

Source: @OliverRakau

Source: @OliverRakau

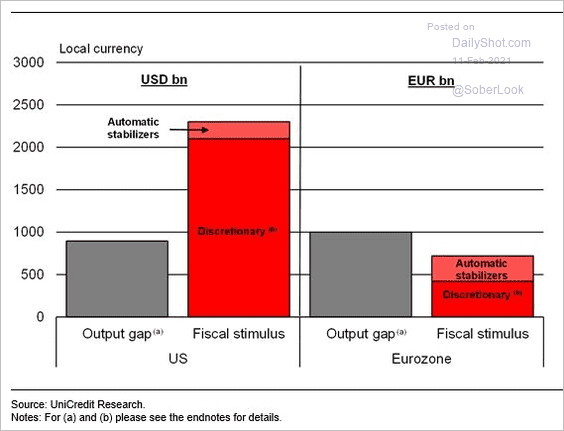

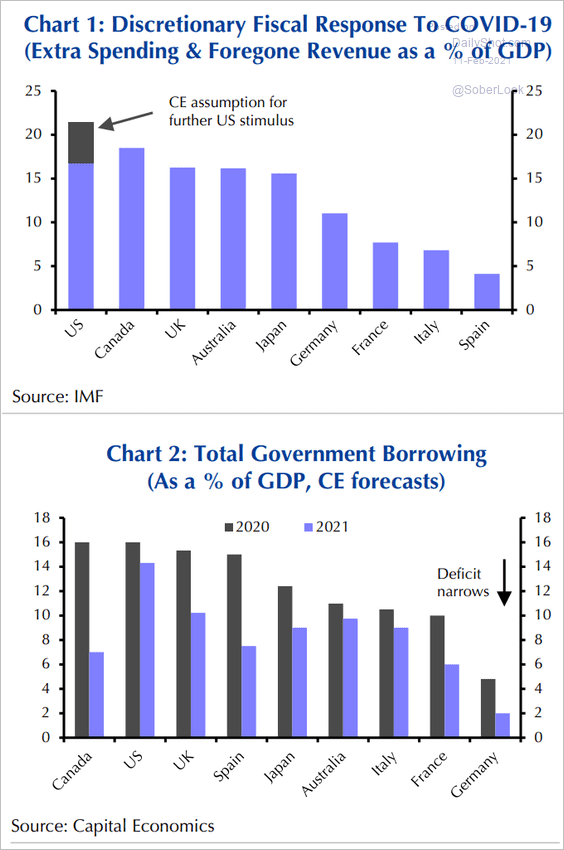

4. The US – Eurozone gap in COVID-related fiscal stimulus levels has been remarkable.

Source: UniCredit, Octavian Adrian Tanase

Source: UniCredit, Octavian Adrian Tanase

Back to Index

Europe

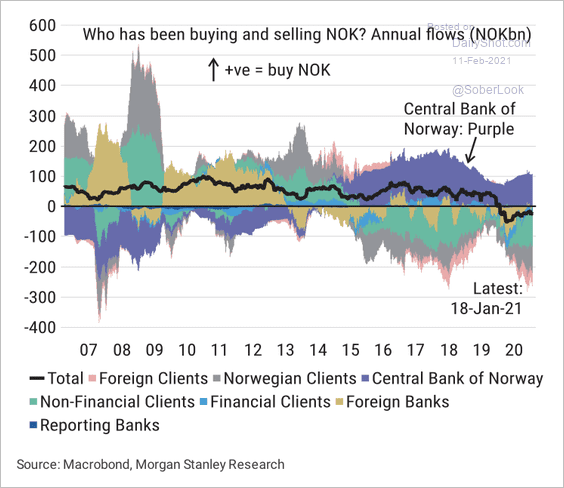

1. The Norges bank has been the largest buyer of the Norwegian krone since 2014 (on behalf of the government).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

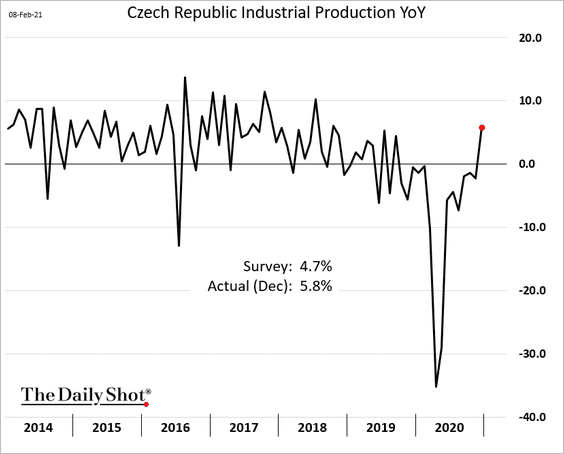

2. Czech industrial production surged in December.

3. Iceland’s unemployment rate continues to climb as the tourism sector remains depressed.

Back to Index

China

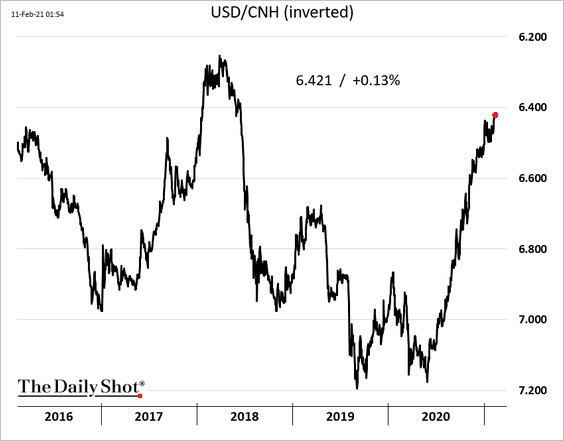

1. The renminbi keeps grinding higher (the offshore yuan shown below).

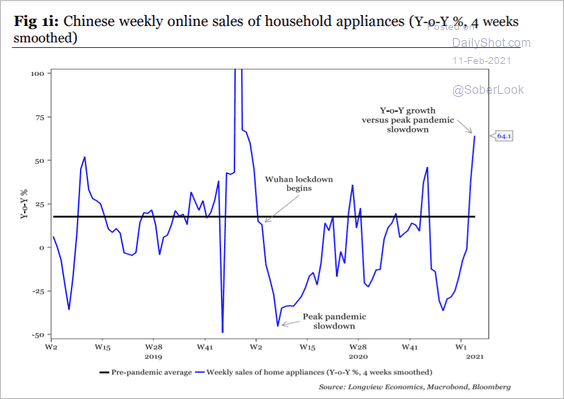

2. Sales of household appliances have accelerated.

Source: Longview Economics

Source: Longview Economics

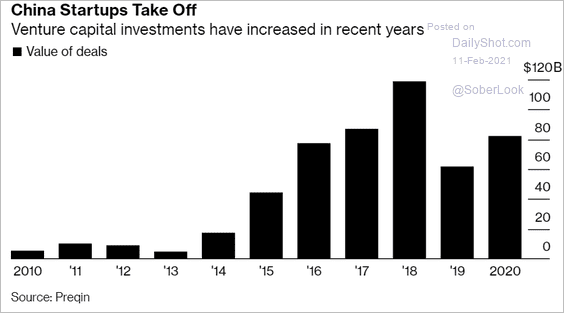

3. VC activity remains robust.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Emerging Markets

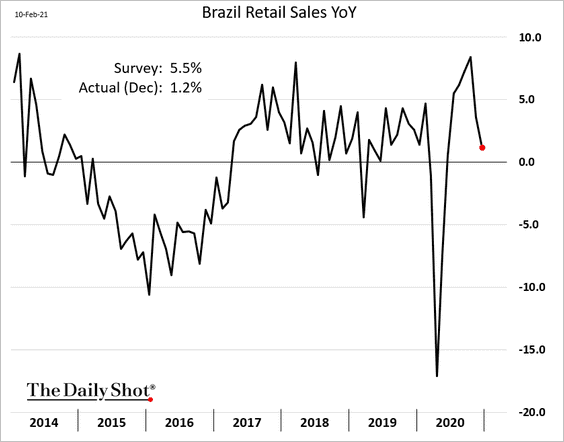

1. Brazil’s retail sales tumbled in December.

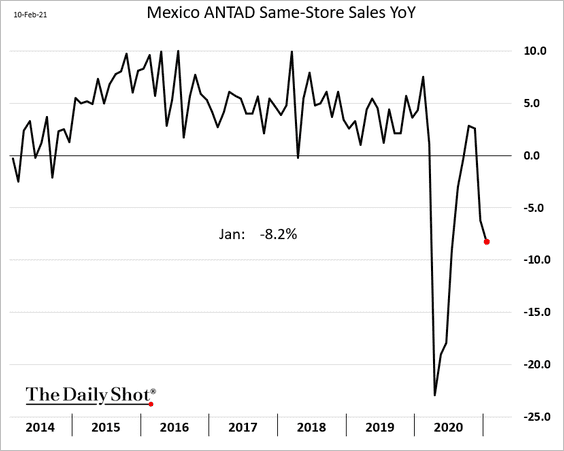

2. Mexico’s same-store sales continue to shrink.

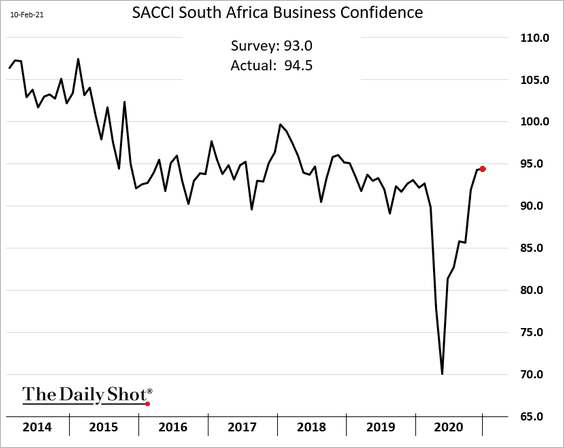

3. South Africa’s business confidence is holding up well.

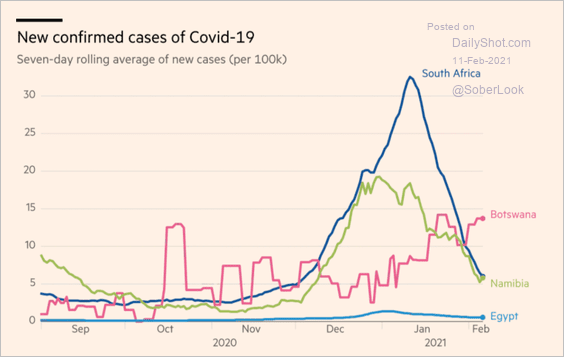

4. This chart shows new COVID cases in select African nations.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

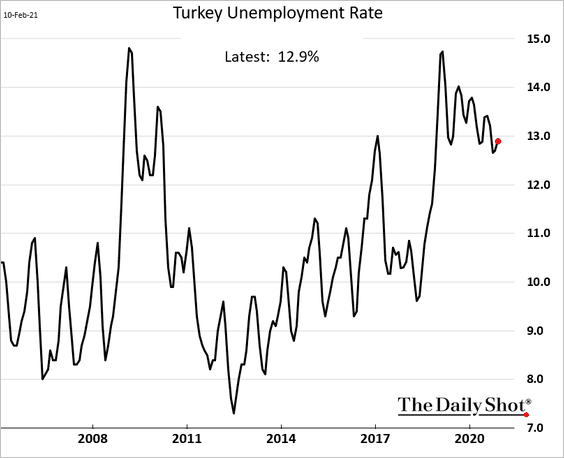

5. Turkey’s unemployment rate remains elevated.

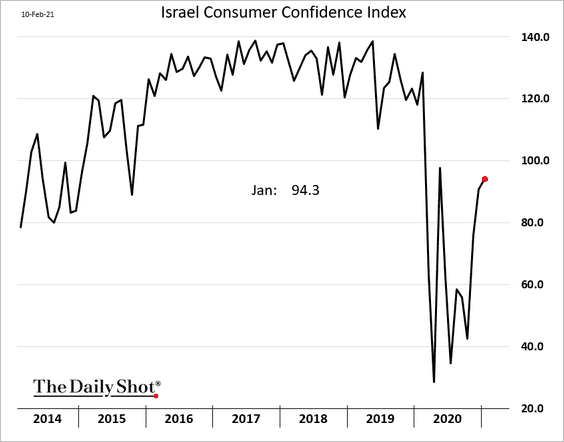

6. Israel’s consumer confidence is recovering amid vaccination progress.

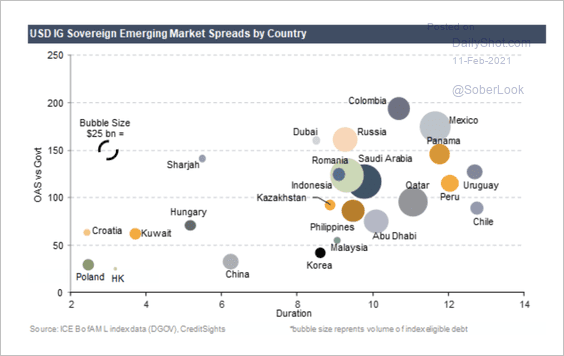

7. This scatterplot shows investment-grade EM sovereign debt spreads vs. duration, …

Source: CreditSights

Source: CreditSights

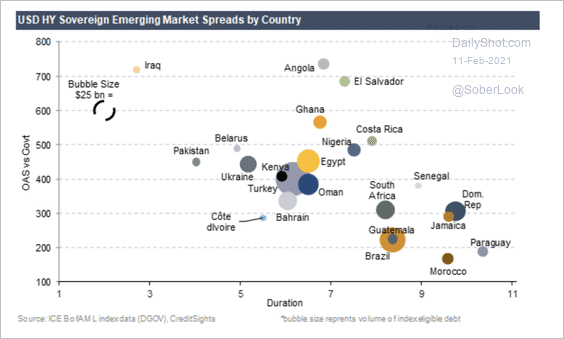

…and here are EM high-yield sovereign debt spreads.

Source: CreditSights

Source: CreditSights

Back to Index

Commodities

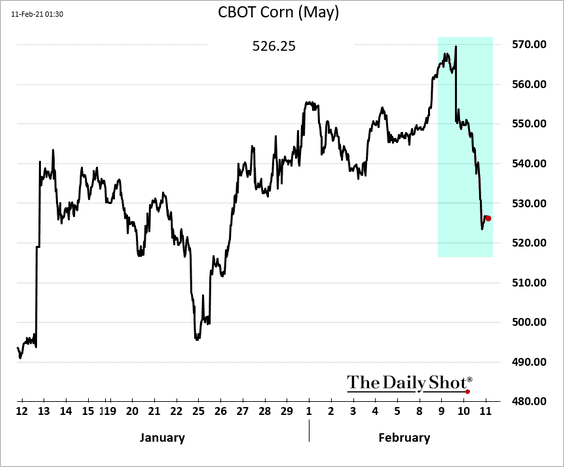

1. US corn futures tumbled after the key government report (WASDE) showed a smaller than expected drop in domestic stockpile estimates. Soy futures declined as well.

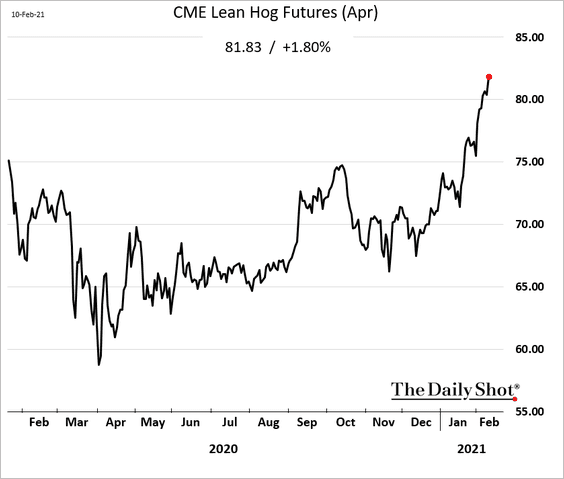

2. Chicago hog futures keep climbing.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

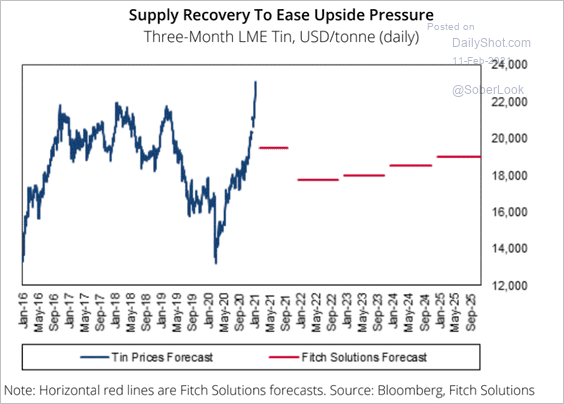

3. Tin prices have shot up, but Fitch Solutions expects a correction.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

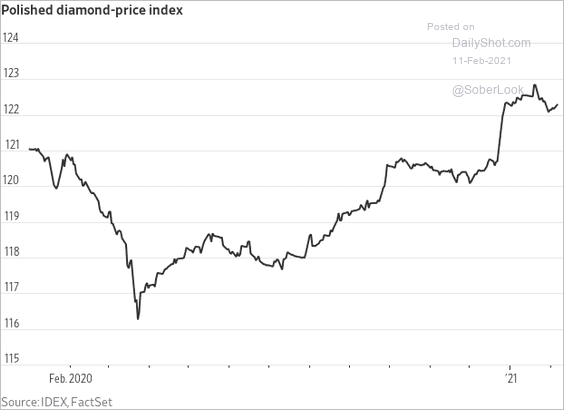

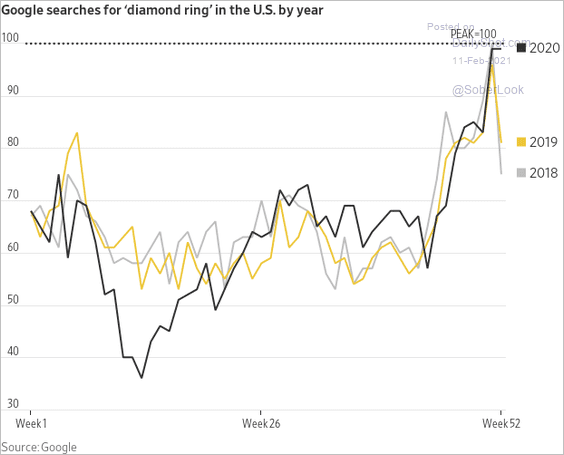

4. Diamond prices have been rising since the COVID selloff.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Energy

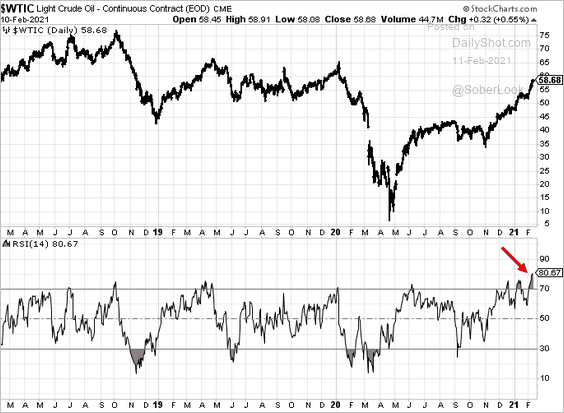

1. Technicals point to downside risk for WTI crude.

h/t Sophie Caronello

h/t Sophie Caronello

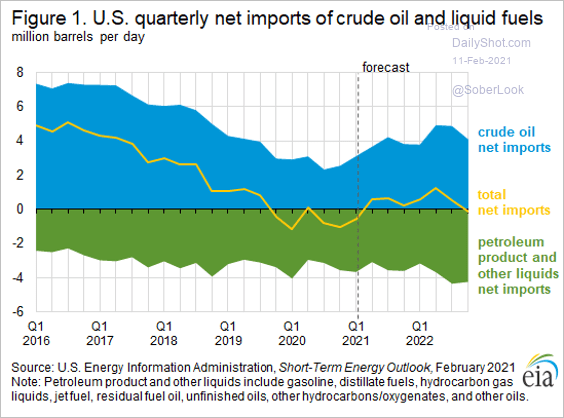

2. The US is expected to remain “energy independent.”

Source: @EIAgov

Source: @EIAgov

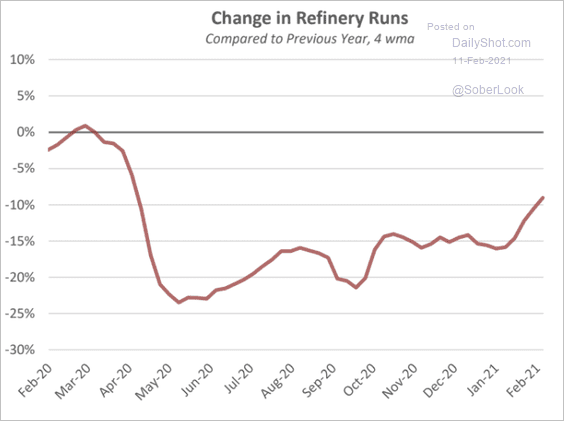

3. US refinery inputs are recovering.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

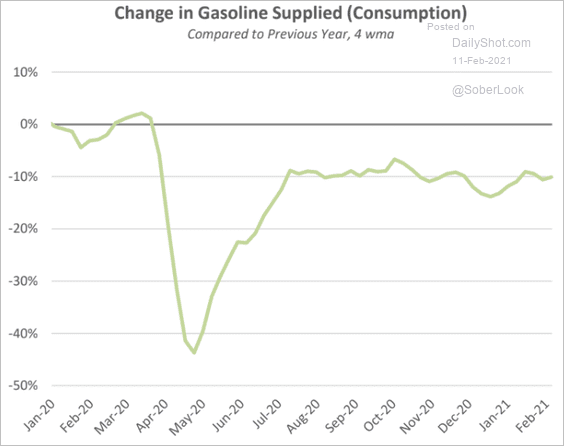

But gasoline demand remains about 10% below pre-pandemic levels.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

——————–

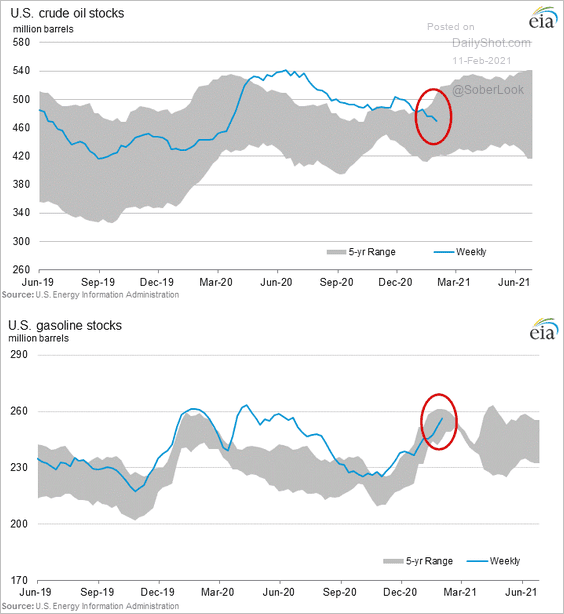

4. Crude oil and gasoline inventories remain inside the 5-year range.

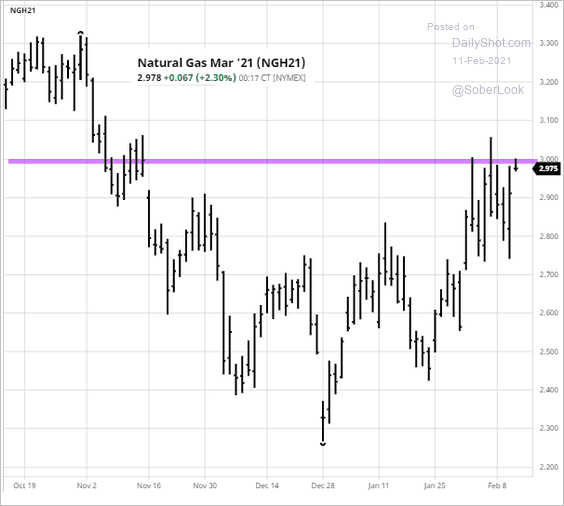

5. US natural gas futures are testing resistance at $3/mmbtu.

Source: barchart.com

Source: barchart.com

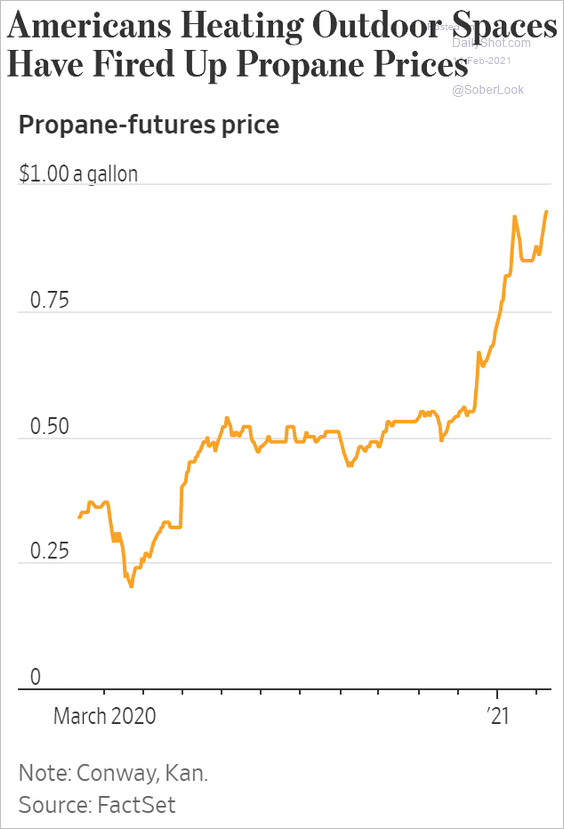

6. Propane prices have risen sharply this year.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Equities

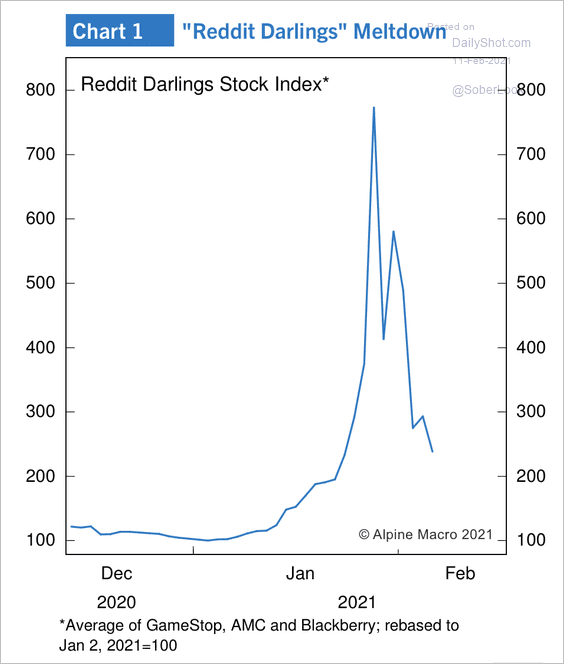

1. Popular short-squeeze stocks have almost fully reversed their Reddit-fueled surge.

Source: Alpine Macro

Source: Alpine Macro

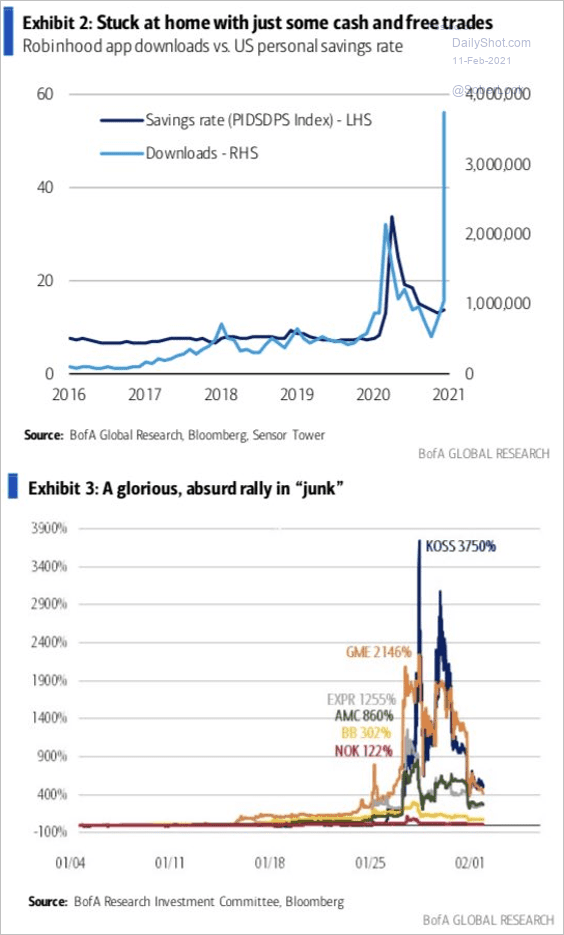

2. “Stuck at home with just some cash and free trades …”

Source: BofA Global Research, @WallStJesus

Source: BofA Global Research, @WallStJesus

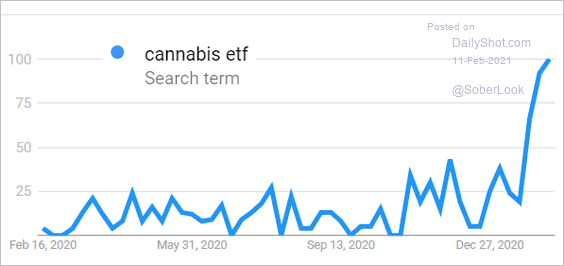

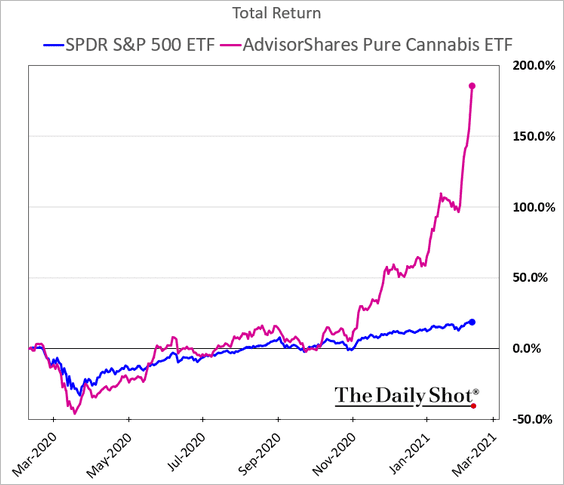

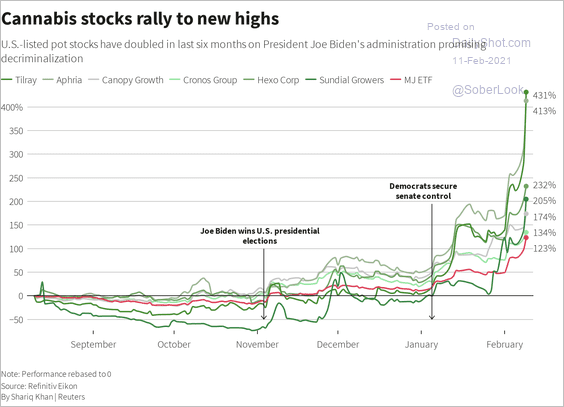

3. The Reddit crowd has set its sights on cannabis stocks.

• Online search activity:

Source: Google Trends

Source: Google Trends

• Stock prices:

Source: Reuters Read full article

Source: Reuters Read full article

——————–

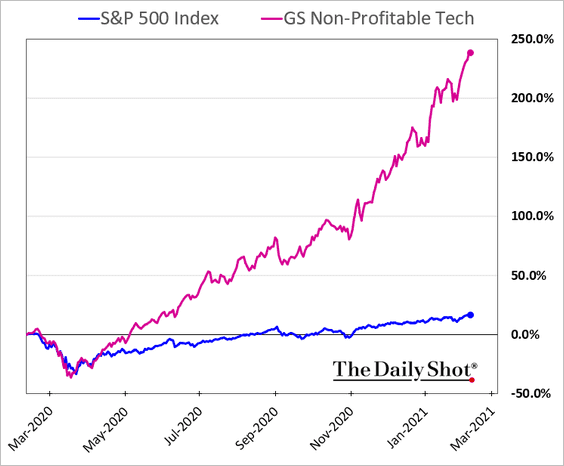

4. Goldman’s non-profitable tech index is approaching 250% year-over-year performance.

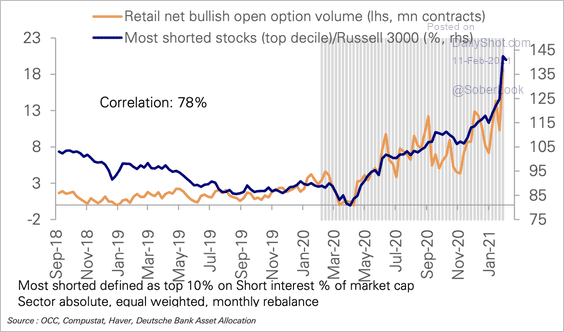

5. Outperformance of the most shorted stocks has coincided with a surge in call option volume.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

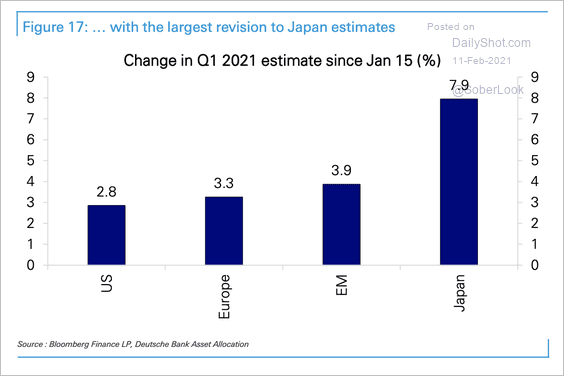

6. Japan has seen the largest forward earnings estimate revision so far this year.

Source: SunTrust Private Wealth Management

Source: SunTrust Private Wealth Management

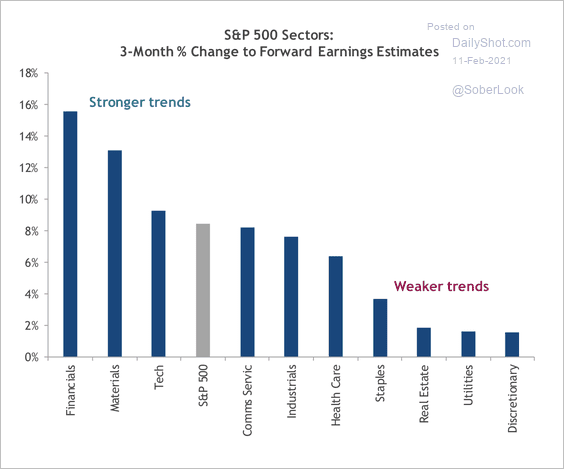

7. Cyclical sectors have seen the strongest upward earnings revisions.

Source: SunTrust Private Wealth Management

Source: SunTrust Private Wealth Management

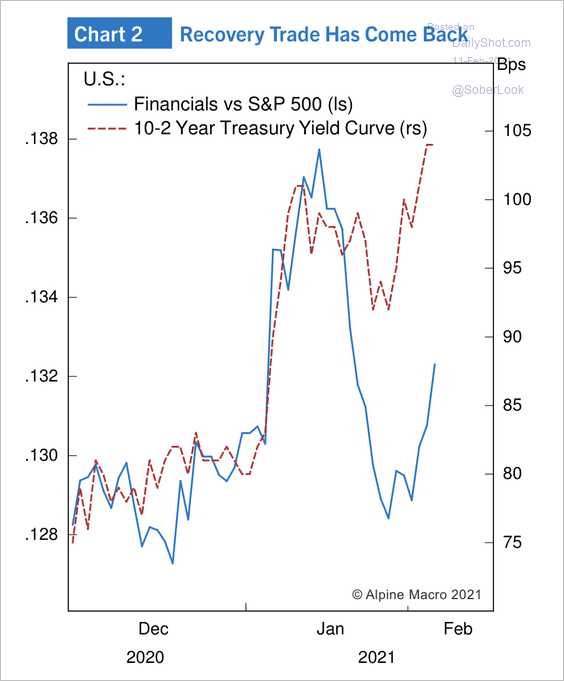

8. Based on the yield curve steepening, S&P 500 financials could have further room to run.

Source: Alpine Macro

Source: Alpine Macro

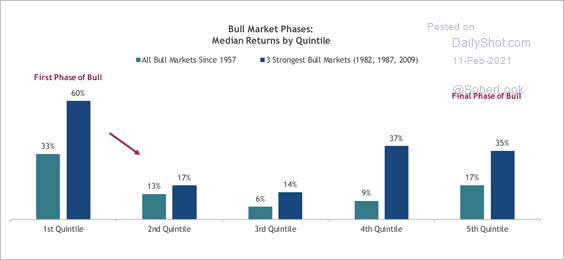

9. The first phase of this bull market, which should be the strongest from a return standpoint, is likely over, according to SunTrust.

Source: SunTrust Private Wealth Management

Source: SunTrust Private Wealth Management

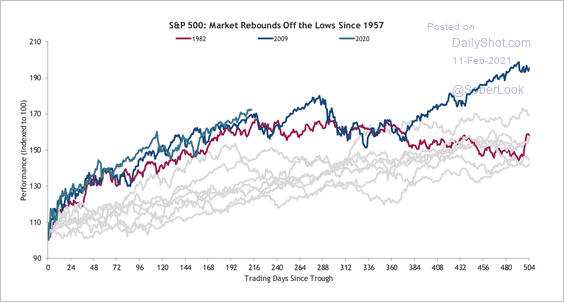

The current bull market continues to track the 1982 and 2009 paths (nearing a pause).

Source: SunTrust Private Wealth Management

Source: SunTrust Private Wealth Management

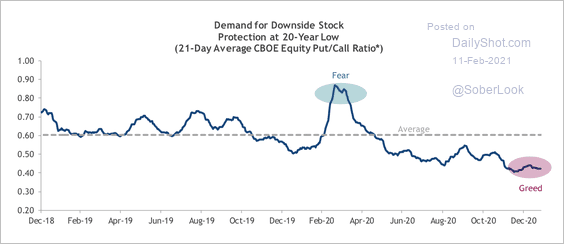

Investor complacency remains a near-term market risk.

Source: SunTrust Private Wealth Management

Source: SunTrust Private Wealth Management

Back to Index

Credit

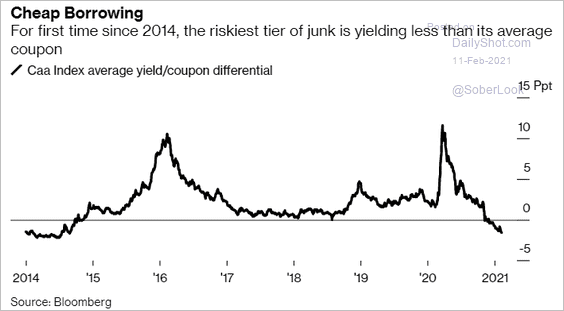

1. Some of the most leveraged companies will be refinancing their debt as yields decline below coupon levels.

Source: @markets Read full article

Source: @markets Read full article

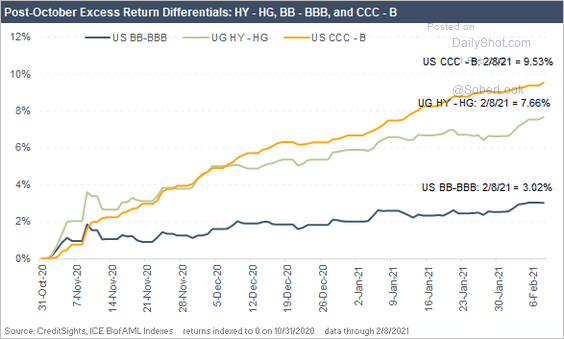

2. Here is the relative performance (total return) of BB vs. BBB bonds, high-yield vs. investment-grade, and CCC vs. B-rated debt.

Source: CreditSights

Source: CreditSights

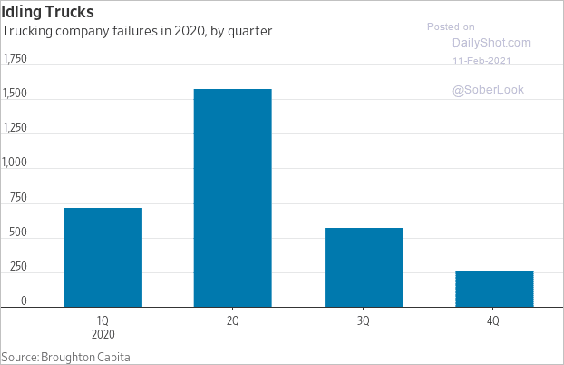

3. Many US trucking companies failed last year.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Rates

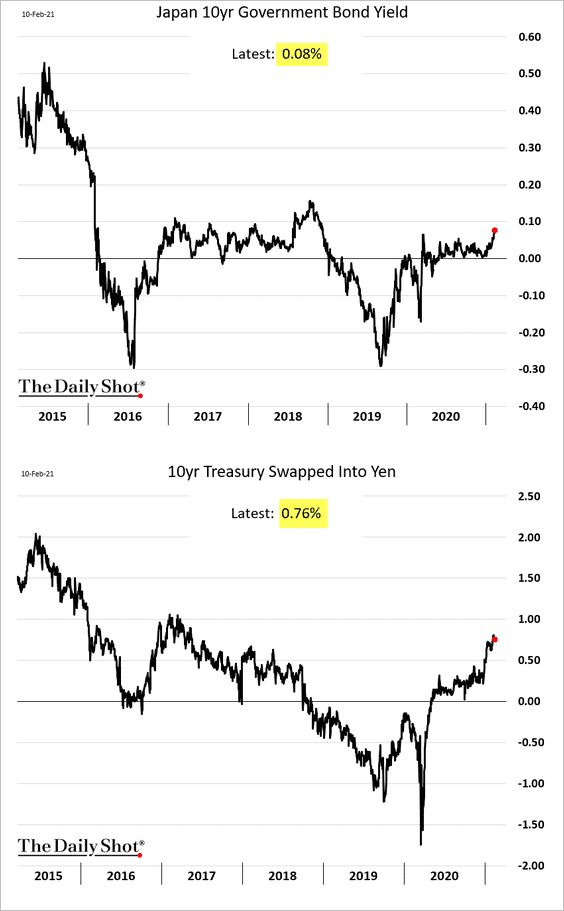

1. The 10yr Treasury swapped into yen (via cross-currency swaps) looks attractive relative to JGBs.

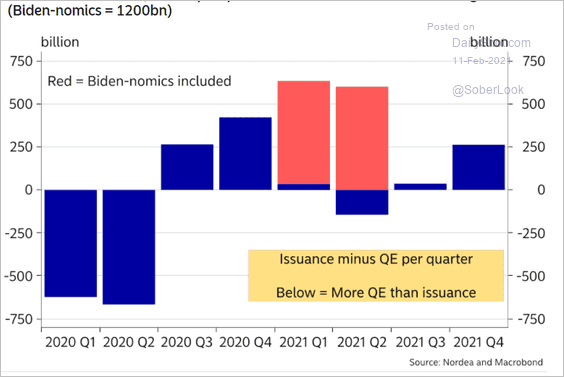

2. At the current QE pace, the Fed won’t absorb much of the additional Treasury debt coming to market.

Source: Nordea Markets

Source: Nordea Markets

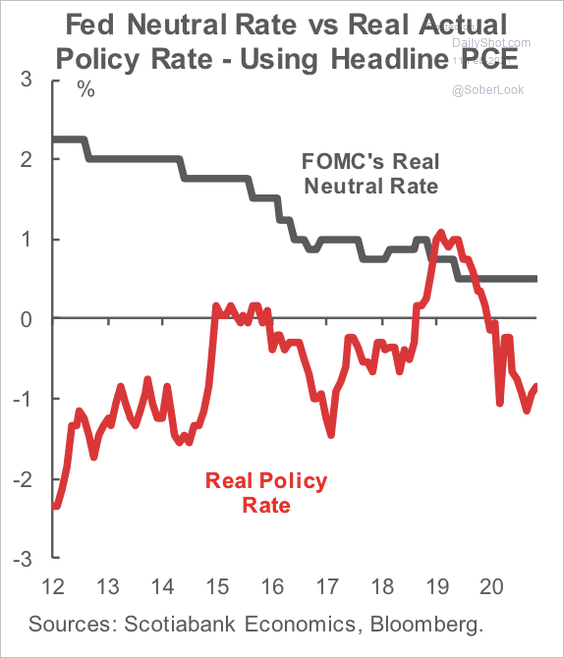

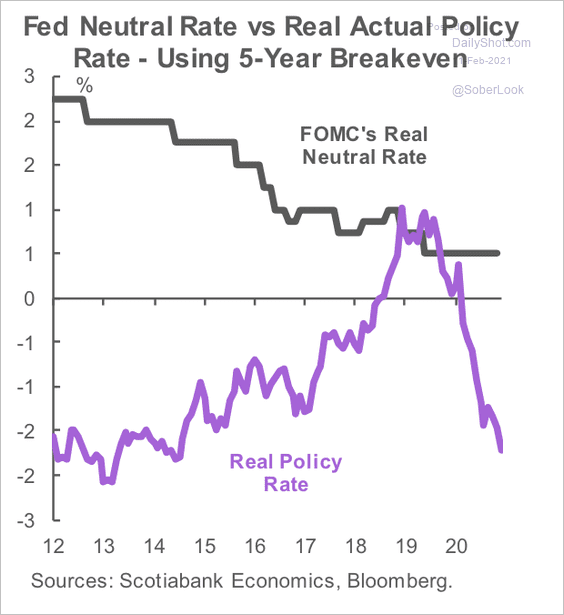

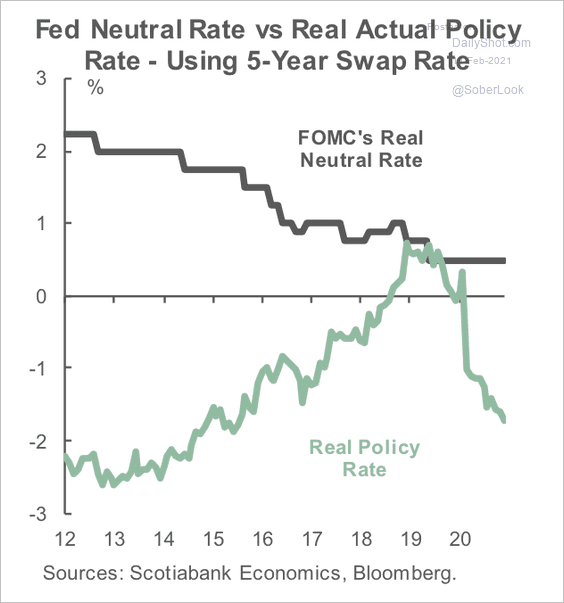

3. The following charts show the real Fed’s policy rate in relation to the neutral rate of interest.

• Using headline PCE:

Source: Scotiabank Economics

Source: Scotiabank Economics

• 5-year breakeven rate:

Source: Scotiabank Economics

Source: Scotiabank Economics

• 5-year inflation swap rate:

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

Global Developments

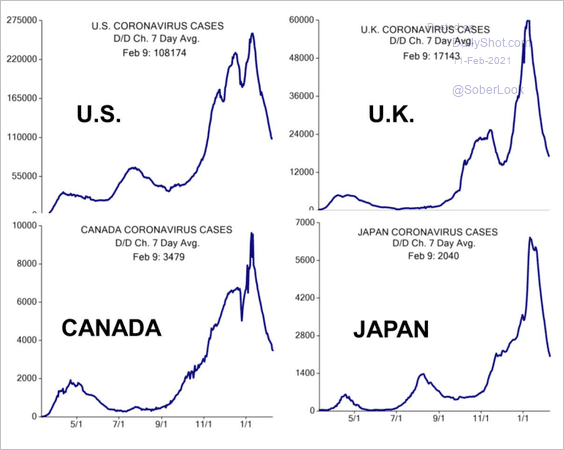

1. New COVID cases are declining in most countries.

Source: Evercore ISI

Source: Evercore ISI

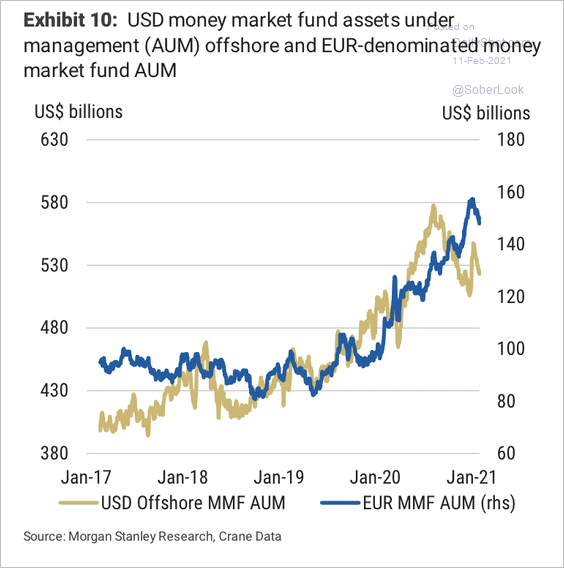

2. Money market fund assets under management have surged over the past two years. This could mean risk-taking in markets has further room to run, according to Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

3. Here is a summary of the fiscal response to COVID in advanced economies.

Source: Capital Economics

Source: Capital Economics

——————–

Food for Thought

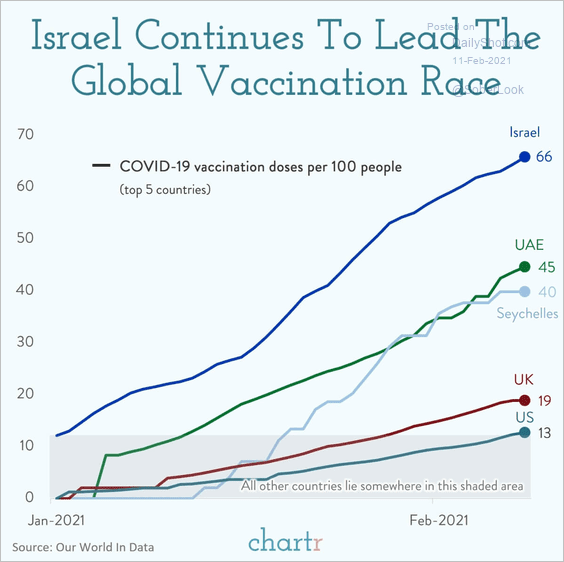

1. The global vaccination race:

Source: @chartrdaily

Source: @chartrdaily

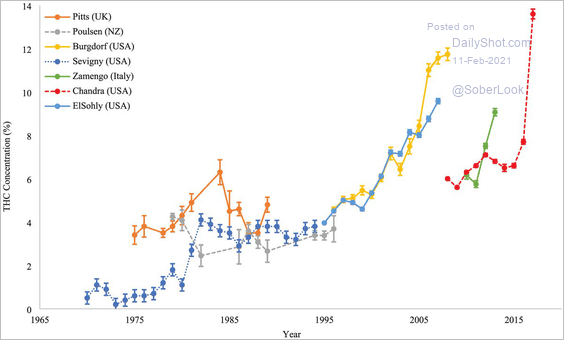

2. THC concentration in cannabis over time (getting more potent):

Source: @PotResearch, @KeithNHumphreys, @AddictionJrnl

Source: @PotResearch, @KeithNHumphreys, @AddictionJrnl

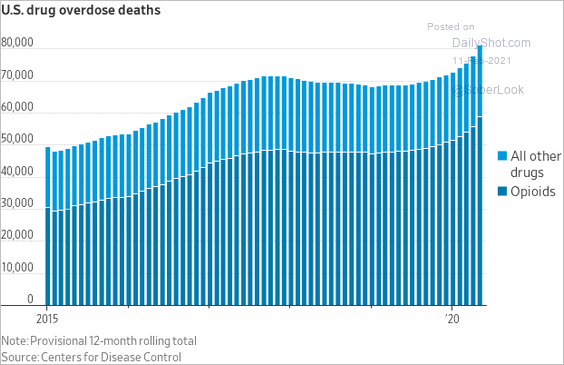

3. US drug overdoses:

Source: @WSJ Read full article

Source: @WSJ Read full article

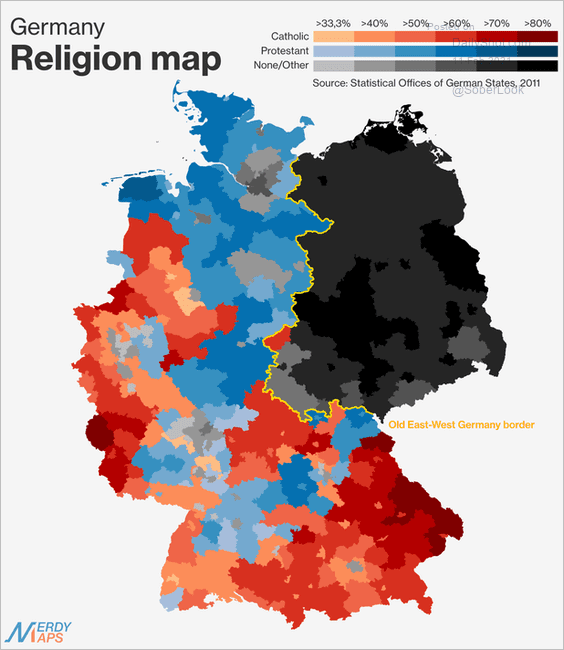

4. Germany’s religion map:

Source: @nerdy_maps

Source: @nerdy_maps

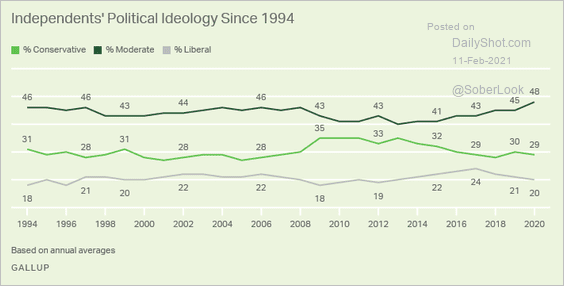

5. US independents’ political ideology:

Source: Gallup Read full article

Source: Gallup Read full article

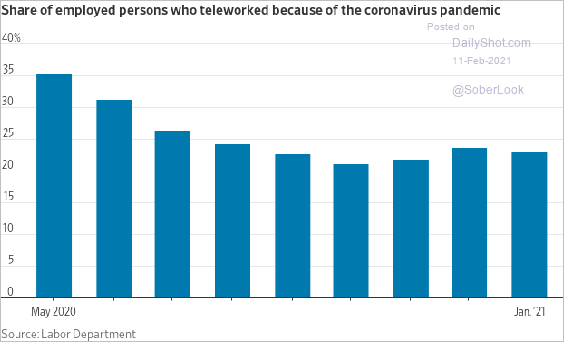

6. Teleworking due to the pandemic:

Source: @WSJ Read full article

Source: @WSJ Read full article

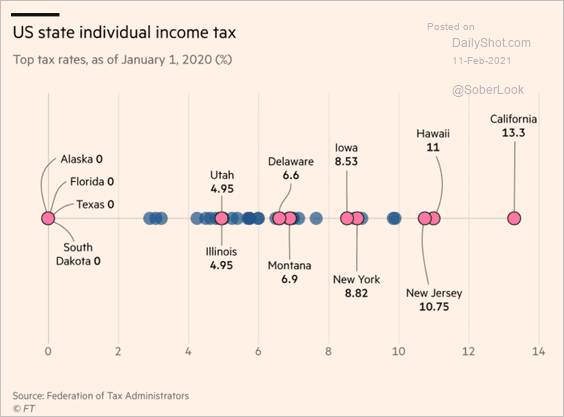

7. US state income taxes:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

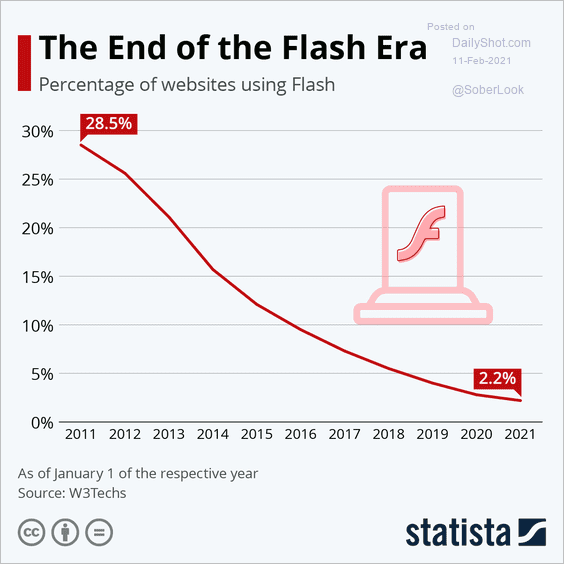

8. Websites using Flash:

Source: Statista

Source: Statista

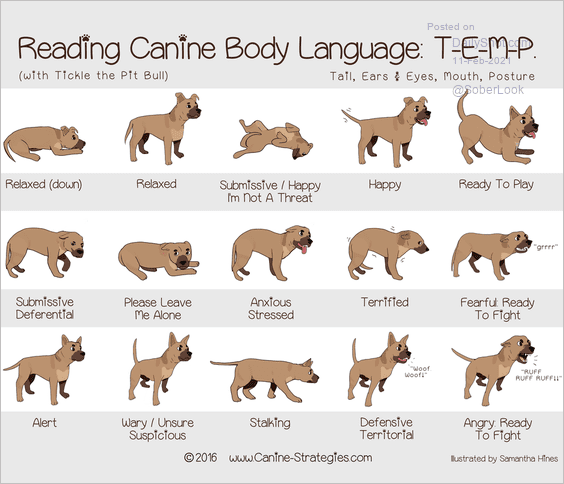

9. Canine body language:

Source: Canine Strategies

Source: Canine Strategies

——————–

Back to Index