The Daily Shot: 17-Feb-21

• The United States

• The United Kingdom

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

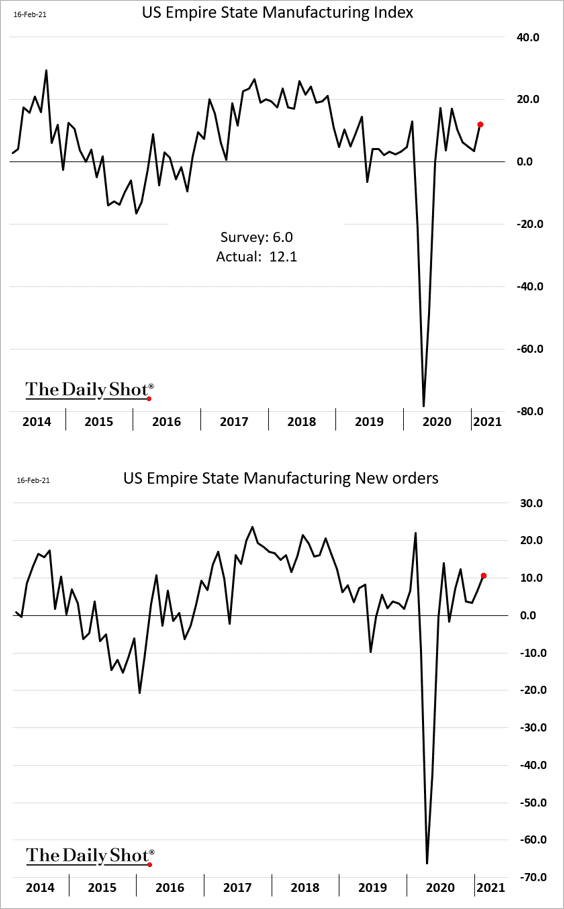

1. The New York Fed’s manufacturing index (Empire) showed robust factory activity in the region this month.

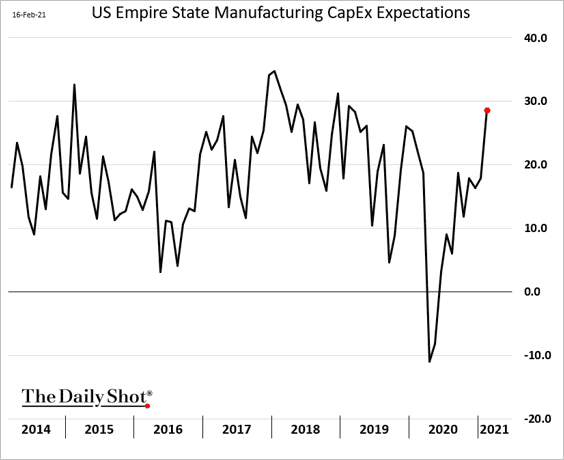

Manufacturers are upbeat on future business spending.

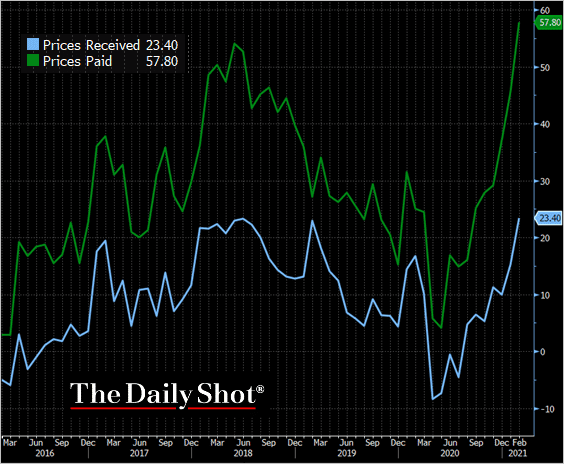

Input costs are rising quickly, and businesses are boosting sales prices. But the spread between input and output price indices keeps widening. Will we see some margin pressures?

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

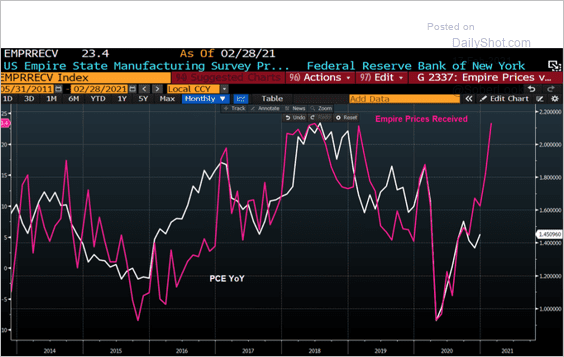

Empire prices paid point to a stronger US goods PPI, …

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

… while output prices indicate higher consumer inflation.

Source: @JulianMI2, @TheTerminal

Source: @JulianMI2, @TheTerminal

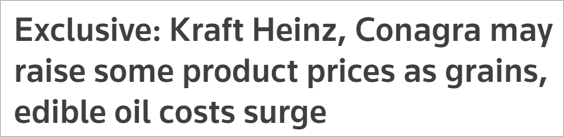

We are starting to see some of these trends showing up in the news.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

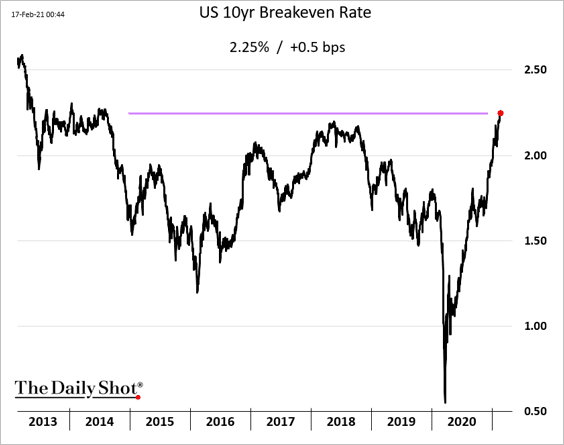

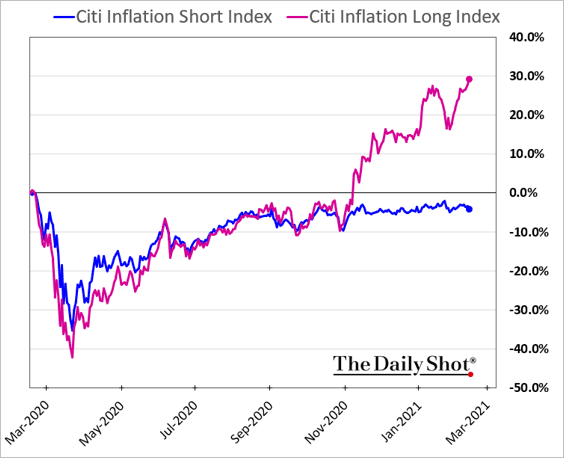

2. For the first time in years, the market is bullish on inflation.

• Breakeven rate:

• The stock market (2 charts):

– Inflation-sensitive stocks:

– ETF flows:

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

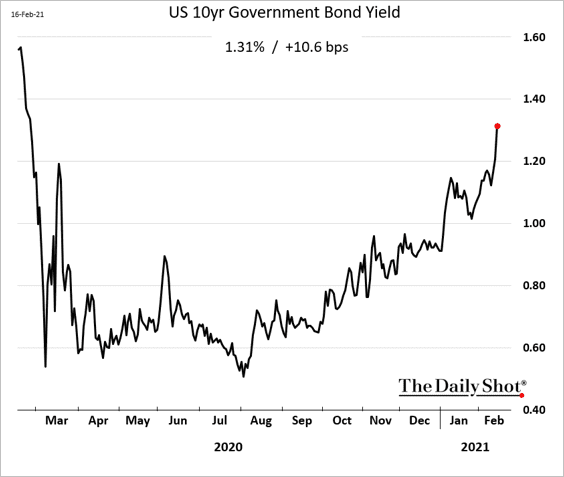

3. Treasury yields continue to climb. The bond rout is not limited to the US, with the selloff hitting major government debt markets worldwide.

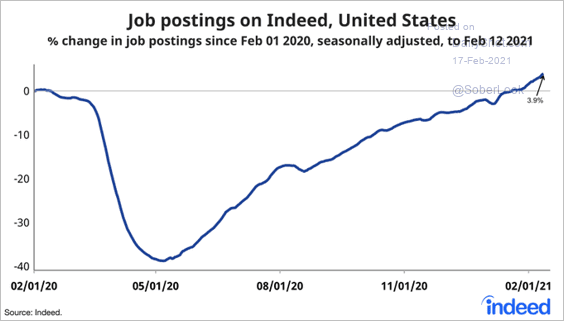

4. US job postings continue to climb.

Source: @JedKolko

Source: @JedKolko

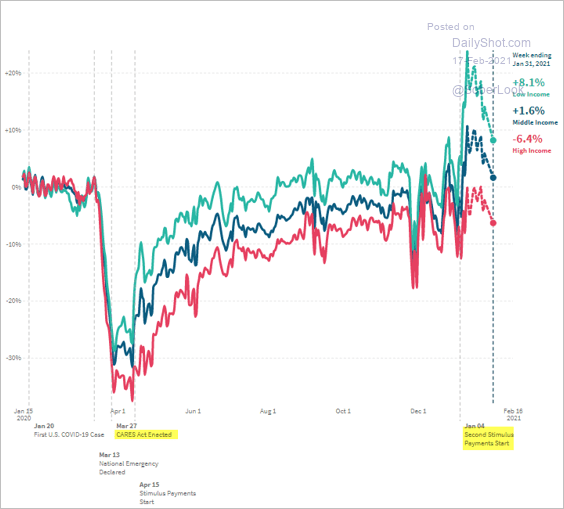

5. The latest round of stimulus checks boosted credit/debit card spending.

Source: Opportunity Insights

Source: Opportunity Insights

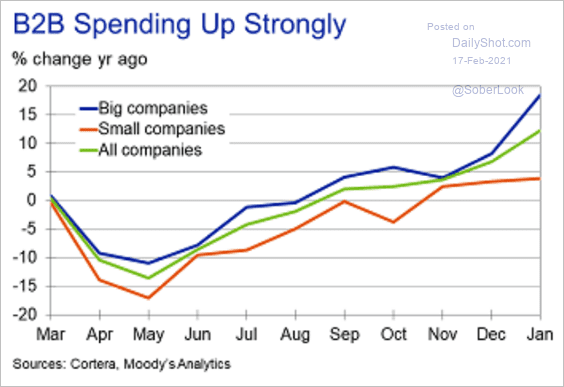

6. B2B spending is also up strongly.

Source: Moody’s Analytics

Source: Moody’s Analytics

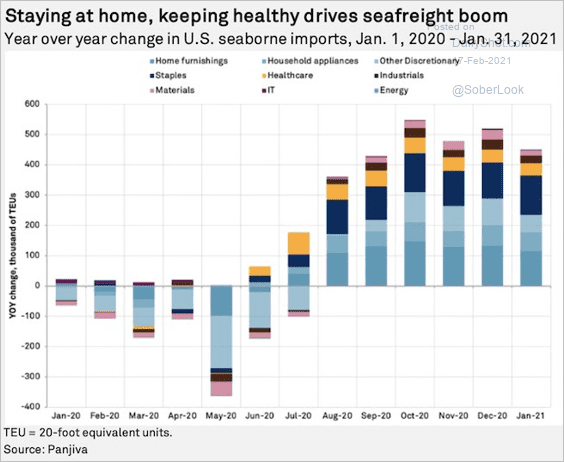

7. Here is the breakdown of the recent burst in imports.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

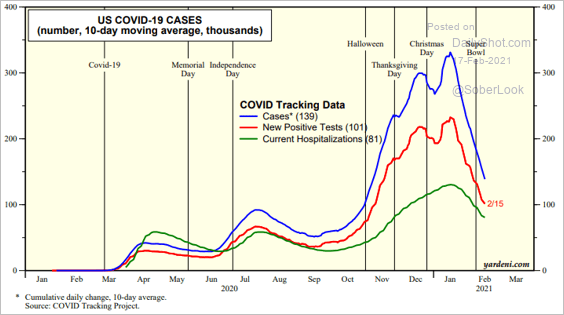

8. The COVID situation continues to improve.

Source: Yardeni Research

Source: Yardeni Research

Back to Index

The United Kingdom

1. Longer-term rates are rising rapidly, which is a global trend now.

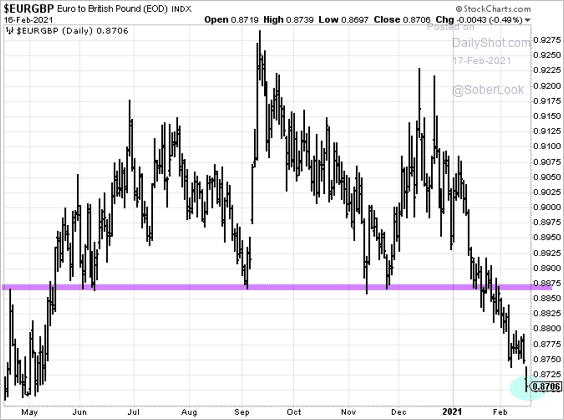

2. The pound continues to climb. EUR/GBP broke support and just kept going.

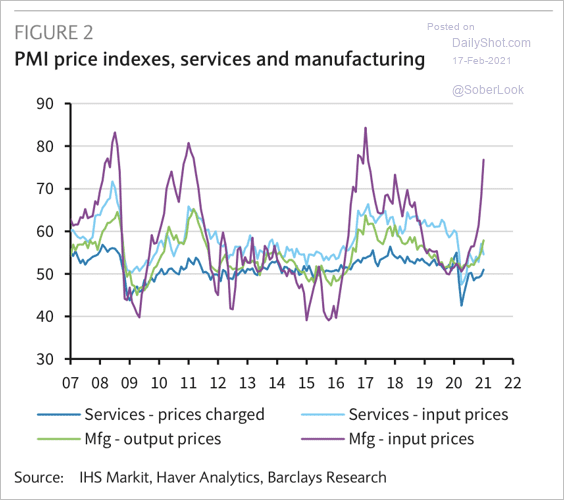

3. As we see in the US, manufacturers’ input prices are climbing, potentially putting pressure on margins.

Source: Barclays Research

Source: Barclays Research

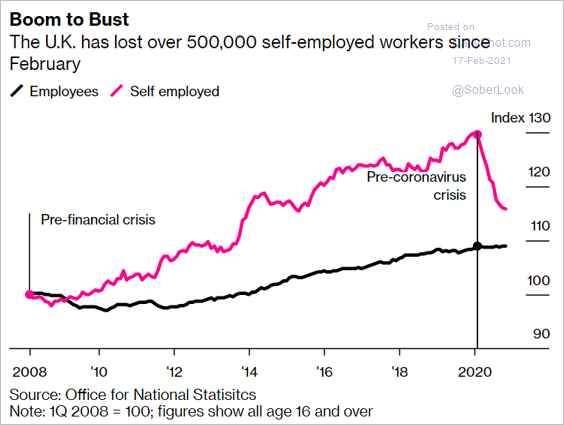

4. The number of self-employed workers has dropped off sharply.

Source: @markets Read full article

Source: @markets Read full article

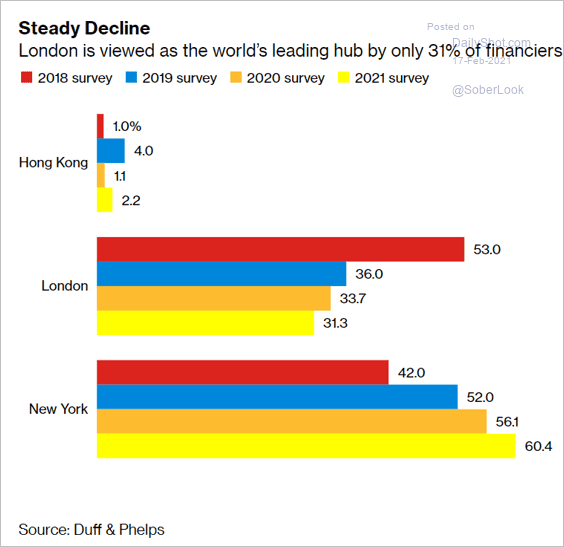

5. London is losing its status as the leading financial hub.

Source: @markets Read full article

Source: @markets Read full article

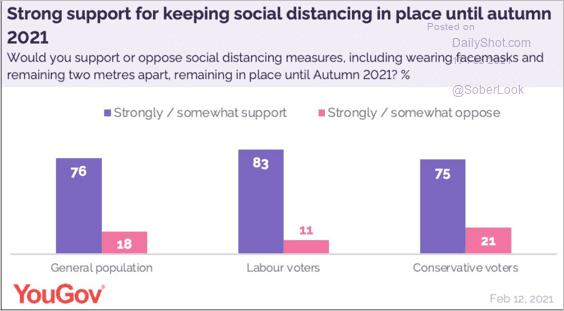

6. Britons support keeping social distancing in place until autumn.

Source: @YouGov Read full article

Source: @YouGov Read full article

Back to Index

The Eurozone

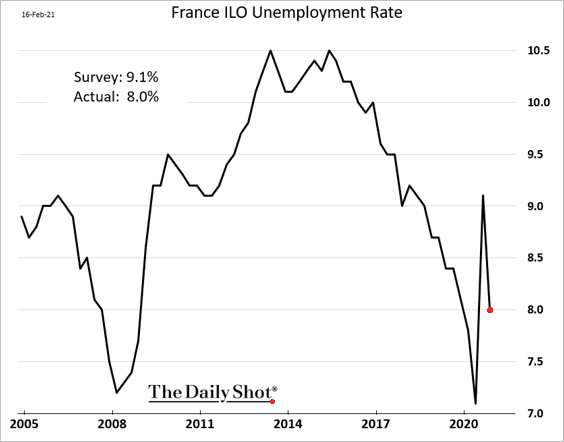

1. The French unemployment rate unexpectedly declined last quarter.

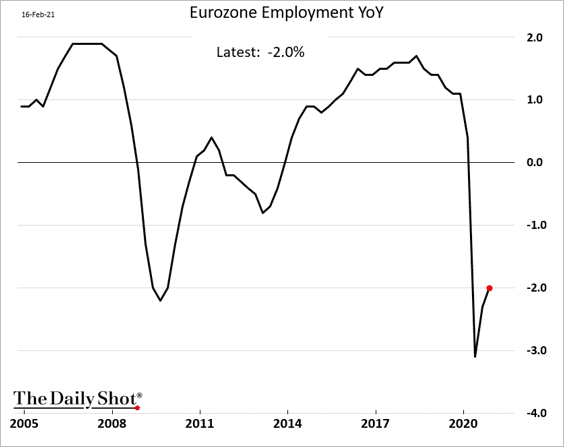

Here are the year-over-year changes in the euro-area total employment.

——————–

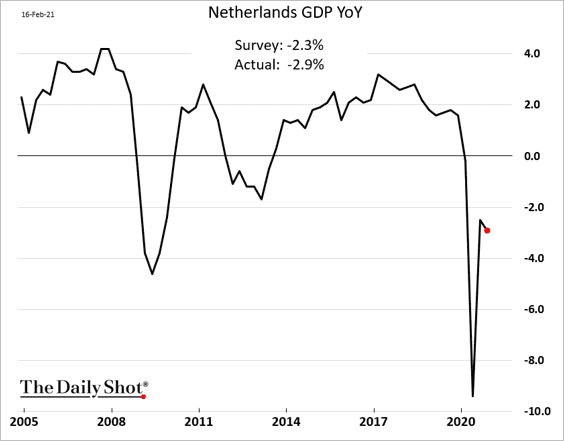

2. The Netherlands’ GDP declined last quarter (“double-dip”), pressured by weak consumer spending (2nd chart).

——————–

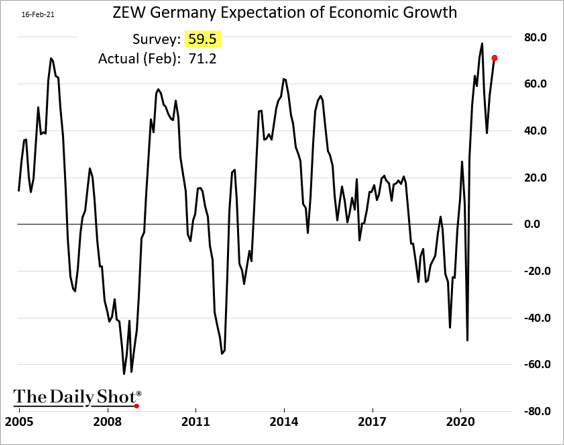

3. Germany’s ZEW expectations indicator jumped this month, exceeding estimates. Financial market experts are confident about the nation’s economic rebound.

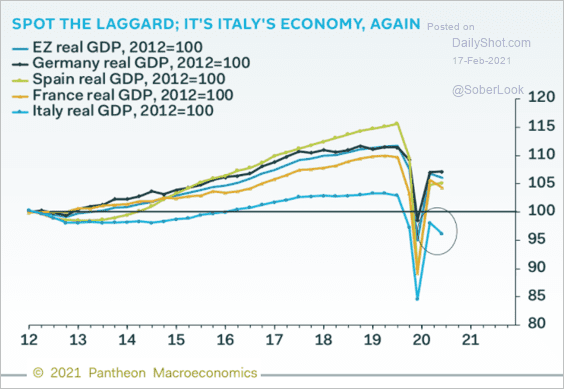

4. Italian GDP continues to lag the rest of the Eurozone.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

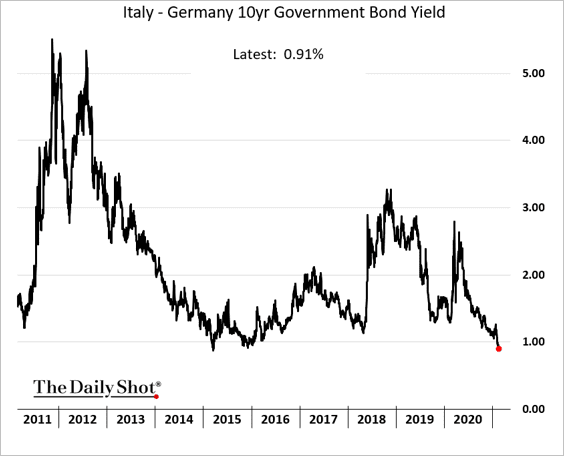

Italian bond spreads are at multi-year lows.

——————–

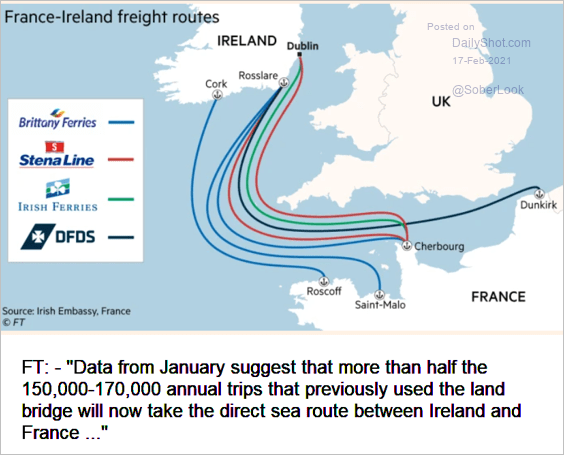

5. Brexit has forced a rerouting of trade routes between Ireland and the continent (see comment from the FT).

Source: @financialtimes Read full article

Source: @financialtimes Read full article

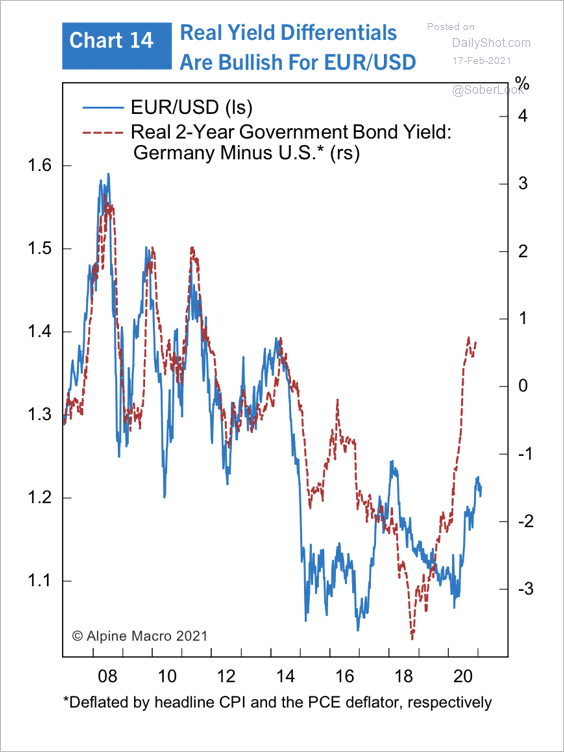

6. Real yield differentials suggest continued upside for EUR/USD.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Japan

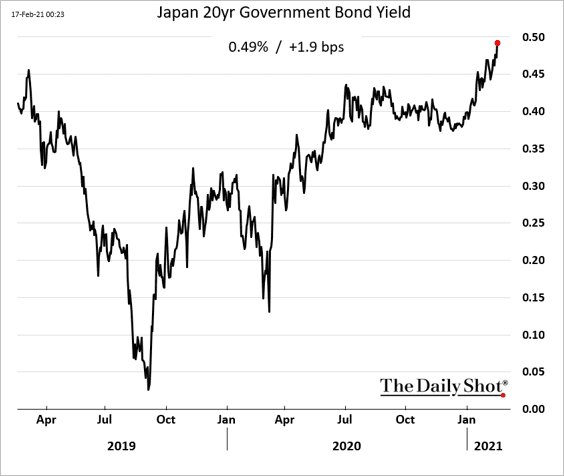

1. Japanese bond yields are climbing amid global debt selloff.

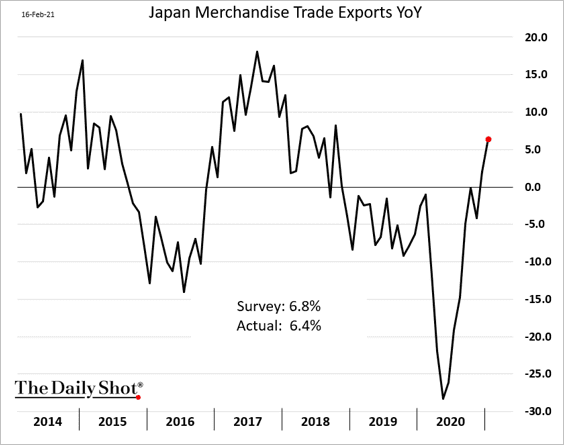

2. Exports accelerated, helped by demand from China.

Source: @BLaw Read full article

Source: @BLaw Read full article

——————–

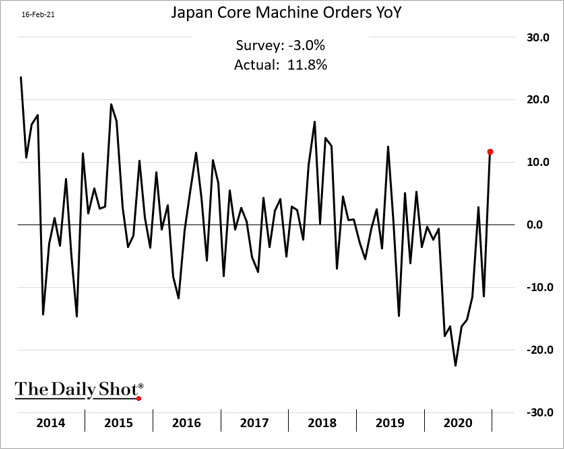

3. Machine orders surprised to the upside.

Back to Index

Asia – Pacific

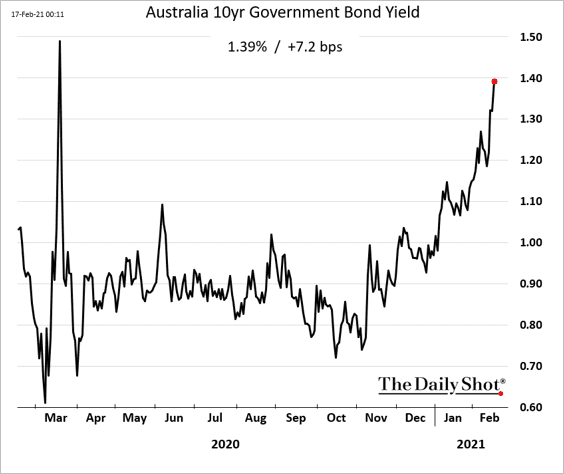

1. Australian bond yields are moving higher.

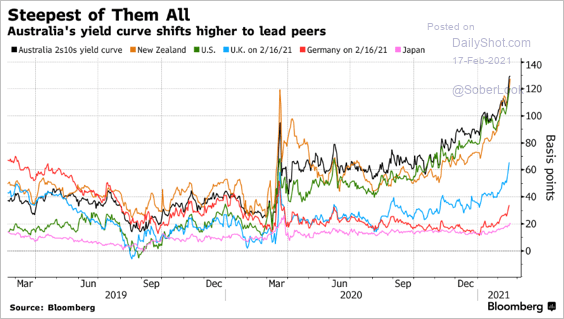

Australia’s yield curve steepening is outpacing other bond markets.

Source: Cormac Mullen, @TheTerminal, Bloomberg Finance L.P.

Source: Cormac Mullen, @TheTerminal, Bloomberg Finance L.P.

——————–

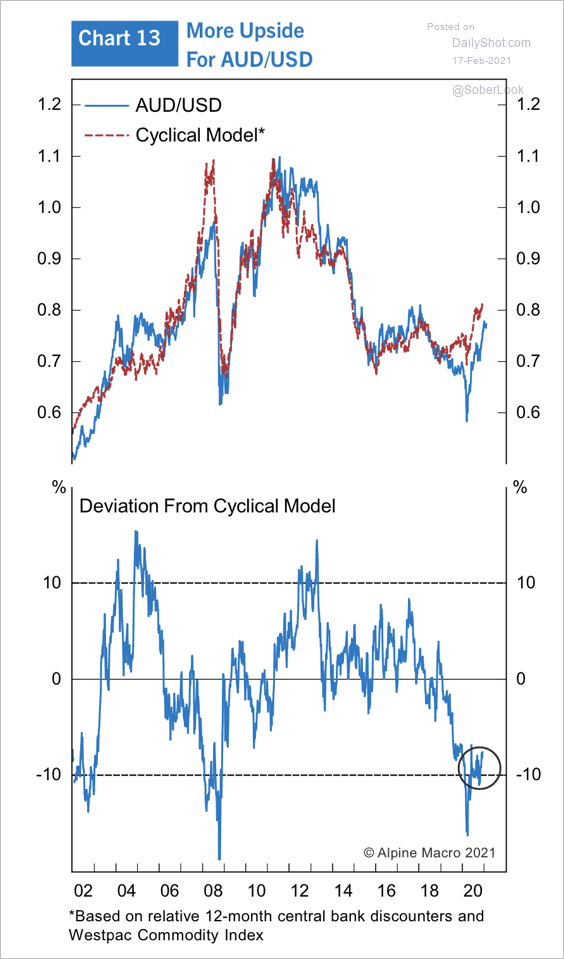

2. Alpine Macro expects further upside for AUD/USD.

Source: Alpine Macro

Source: Alpine Macro

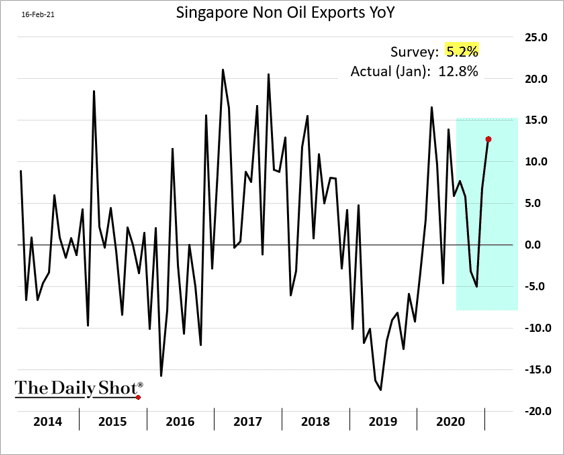

3. Singapore’s exports accelerated again last month.

Back to Index

China

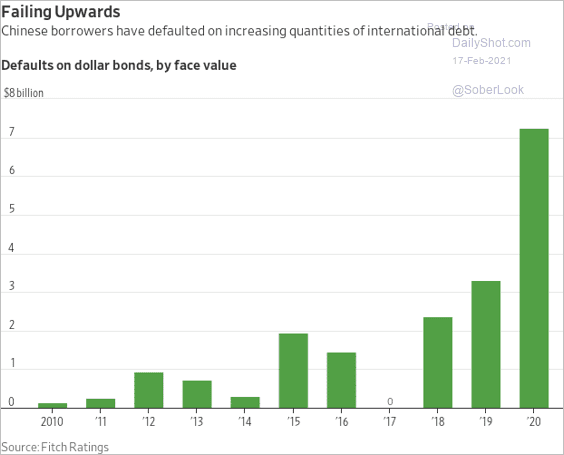

1. Due, in part, to some high-profile defaults, …

Source: @WSJ Read full article

Source: @WSJ Read full article

… China’s corporate high-yield debt has not rallied with the US peers.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

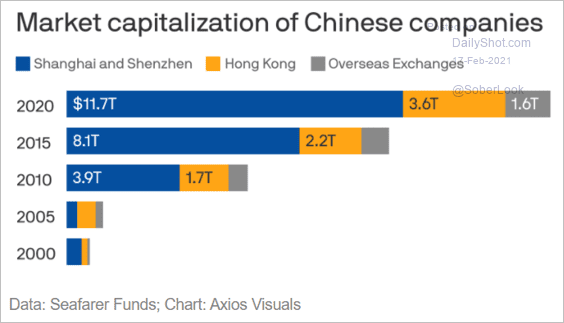

2. Here is the evolution of China’s equity market capitalization.

Source: @axios Read full article

Source: @axios Read full article

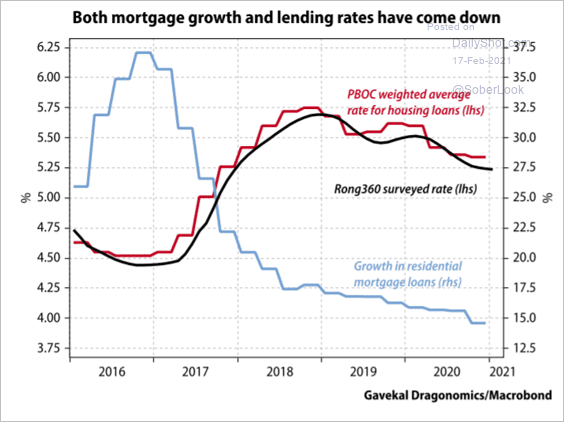

3. Mortgage rates have been drifting lower, and the overall mortgage market expansion has been slowing

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

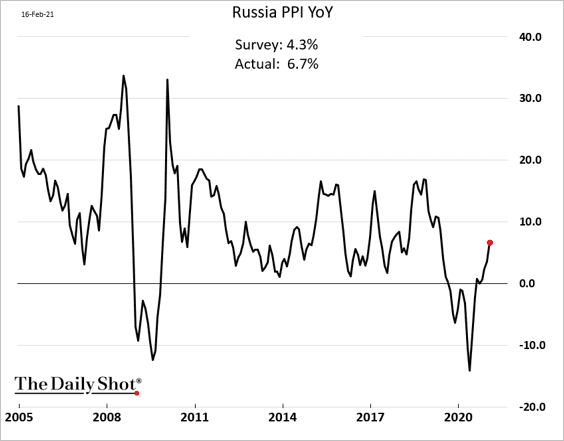

1. Russia’s producer prices are rising quickly. The central bank has become a bit hawkish lately amid signs of firmer inflation.

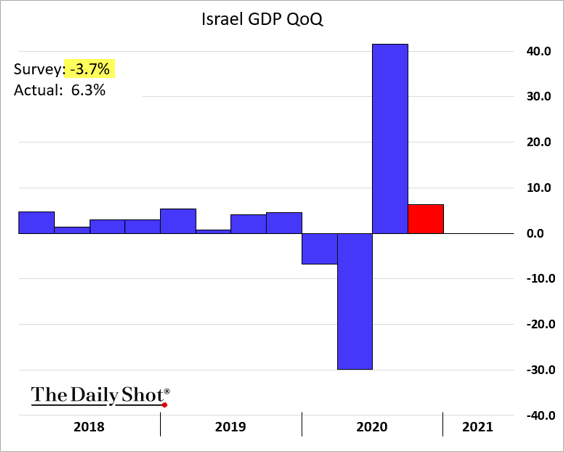

2. Israel’s Q4 GDP surprised to the upside.

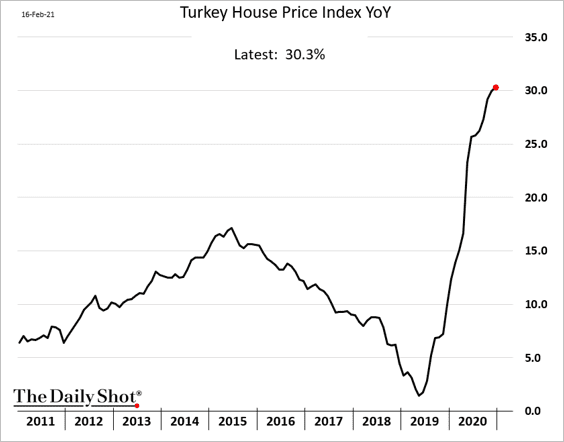

3. Turkish home prices are up 30% vs. a year ago (in lira terms).

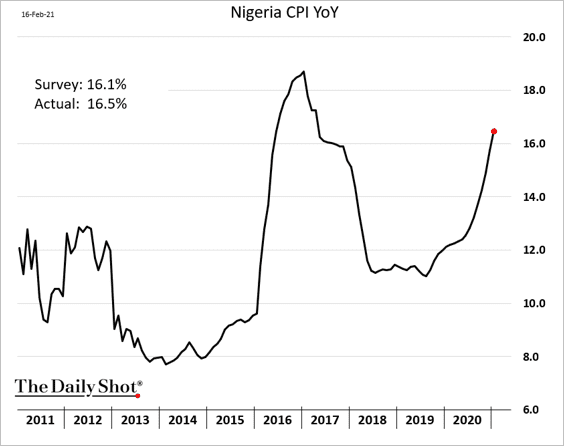

4. Nigeria’s consumer inflation is accelerating.

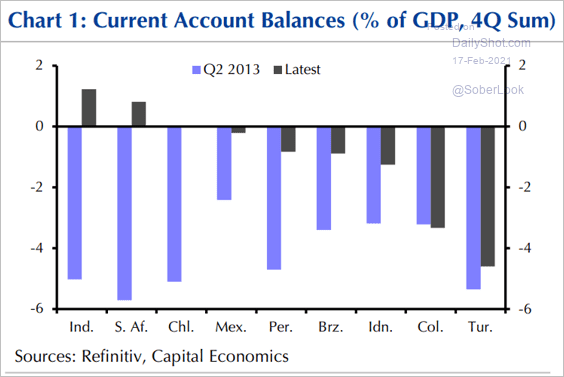

5. Current account balances are in much better shape than they were during taper-tantrum in 2013. Perhaps the selloff won’t be as severe after the next pullback in the Fed’s QE.

Source: Capital Economics

Source: Capital Economics

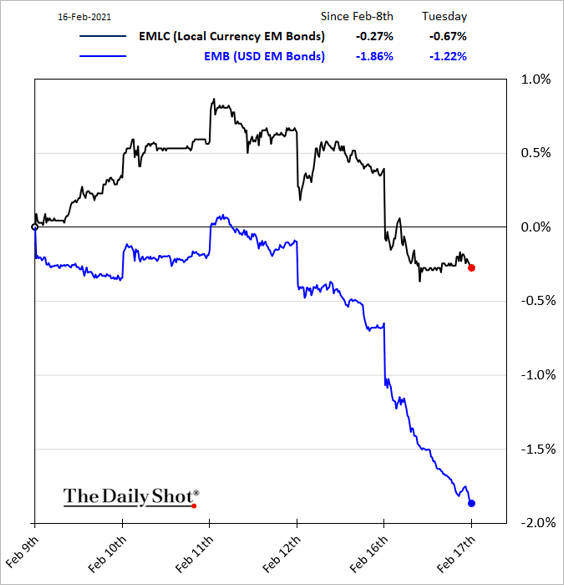

6. Dollar-denominated EM bonds are selling off with Treasuries.

Back to Index

Cryptocurrency

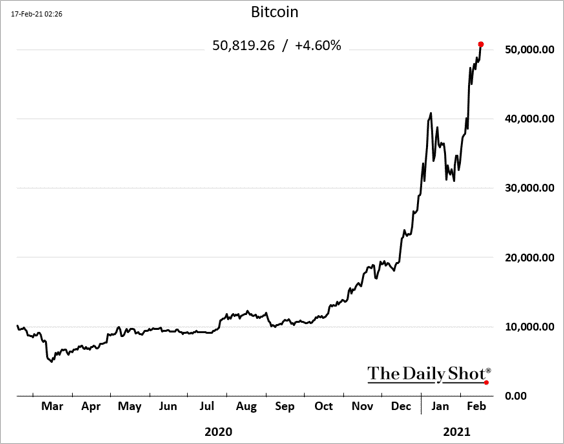

1. Bitcoin broke through resistance at $50k.

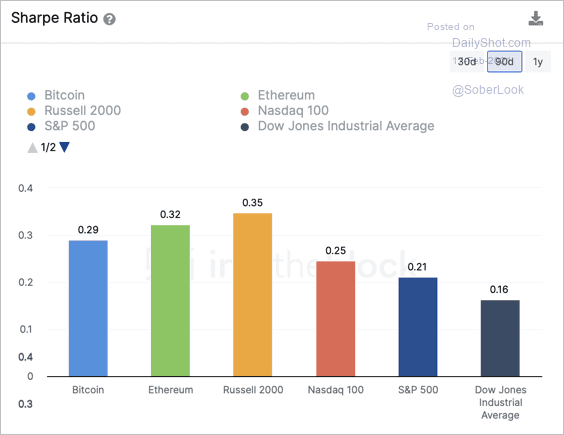

2. This chart shows the 90-day Sharpe ratio of Bitcoin and Ethereum versus traditional stock indices.

Source: IntoTheBlock

Source: IntoTheBlock

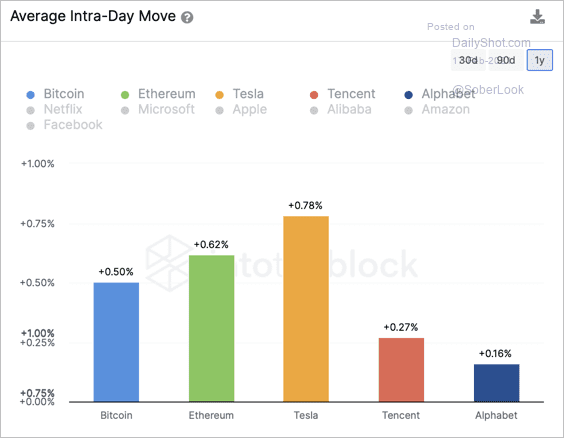

3. Here is the average intra-day move over one year for Bitcoin and Ethereum compared to popular stocks.

Source: IntoTheBlock

Source: IntoTheBlock

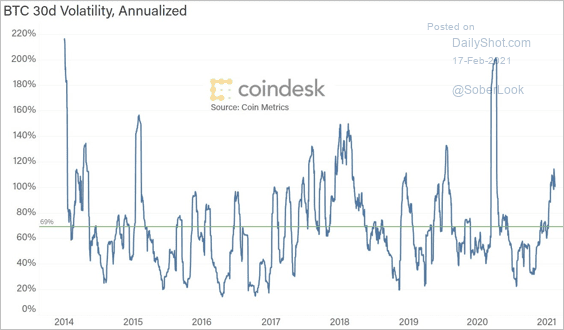

4. Bitcoin’s 30-day annualized volatility is at the highest level since the March 2020 crash.

Source: @CoinDeskData

Source: @CoinDeskData

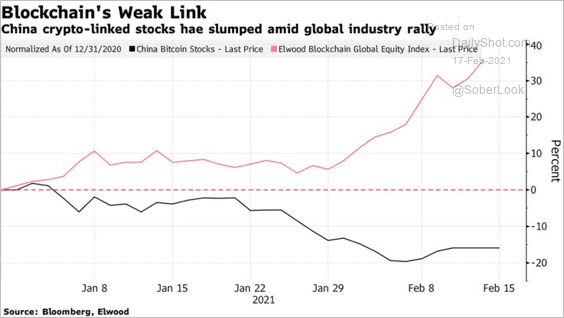

5. China’s crypto stocks have underperformed global peers.

Source: @markets Read full article

Source: @markets Read full article

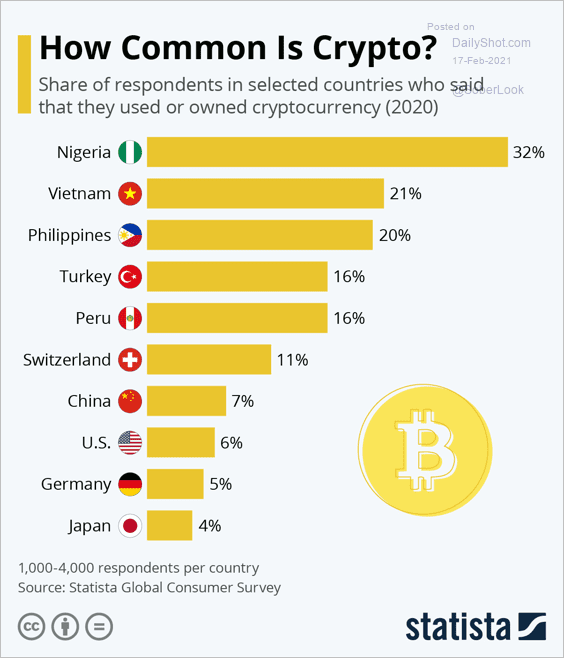

6. Bitcoin is popular in many emerging-market countries.

Source: Statista

Source: Statista

Back to Index

Commodities

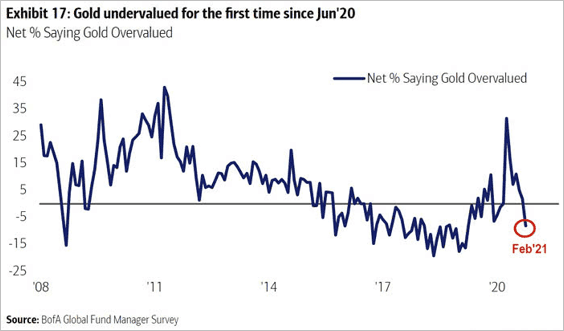

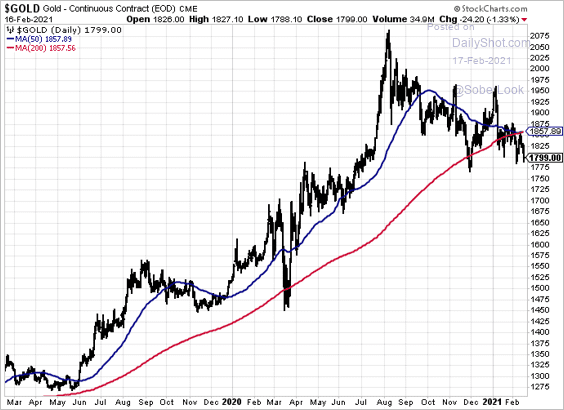

1. Fund managers no longer see gold as overvalued.

Gold has formed a death cross – a bearish signal, especially when combined with higher bond yields.

——————–

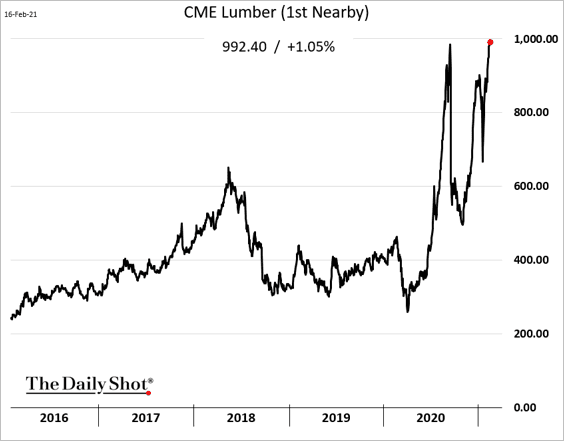

2. US lumber futures are at multi-year highs.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

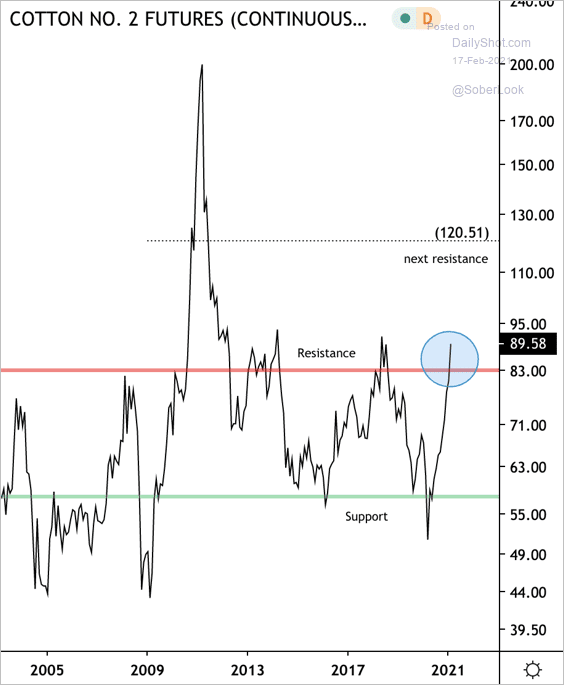

3. US cotton futures are breaking above long-term resistance.

Source: Dantes Outlook

Source: Dantes Outlook

Back to Index

Energy

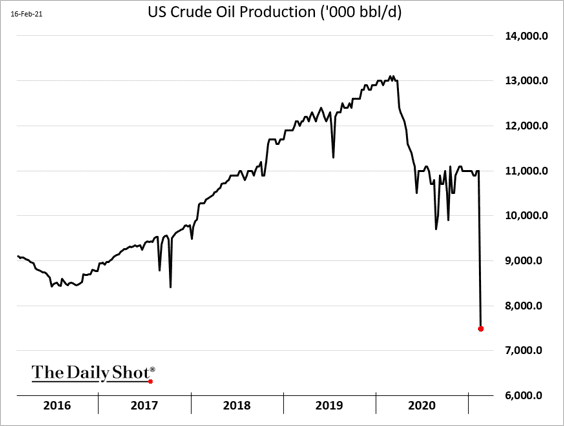

1. US oil output tumbled as a result of the frigid weather.

Source: @markets Read full article

Source: @markets Read full article

Here is an estimate of the decline.

——————–

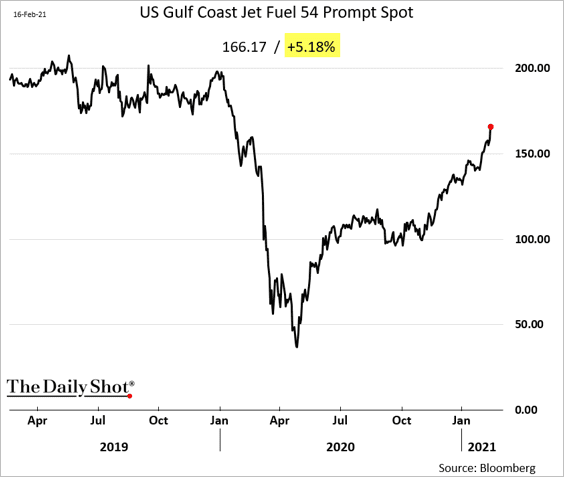

2. US refinery outages sent jet fuel prices sharply higher.

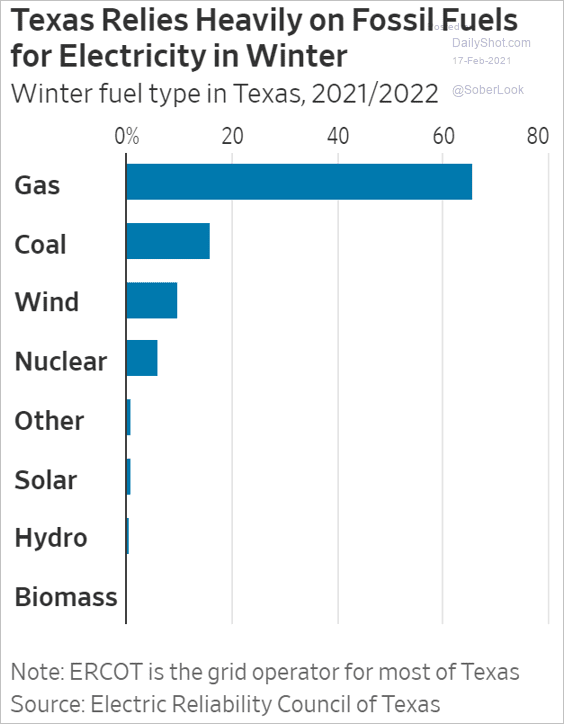

3. Natural gas output tumbled amid outages.

Source: @markets Read full article

Source: @markets Read full article

It’s by far the largest source of electricity production in Texas.

Source: @WSJ Read full article

Source: @WSJ Read full article

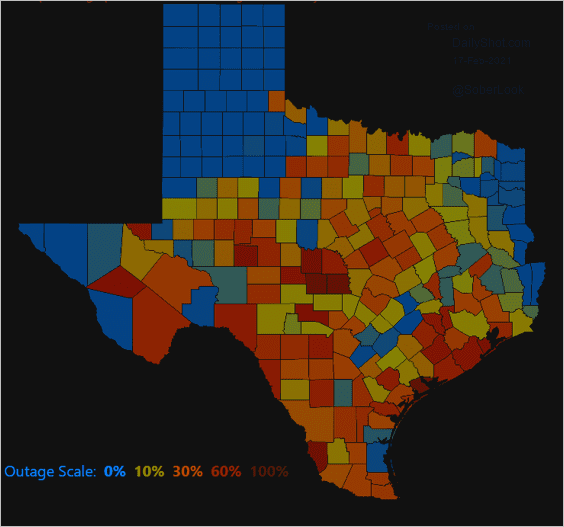

Many counties are still without power.

Source: PowerOutage.US

Source: PowerOutage.US

——————–

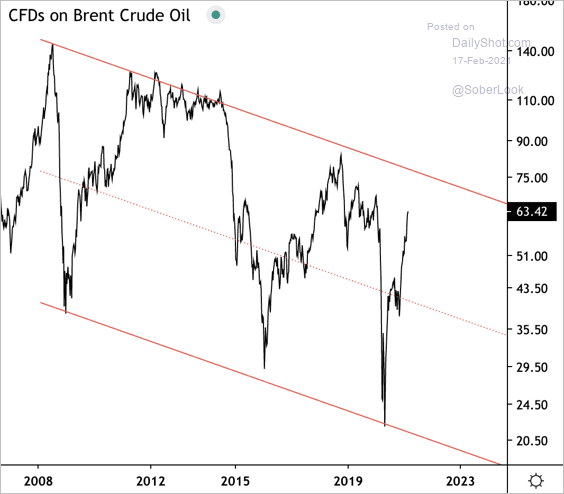

4. Will Brent crude oil break above its long-term downtrend?

Source: Dantes Outlook

Source: Dantes Outlook

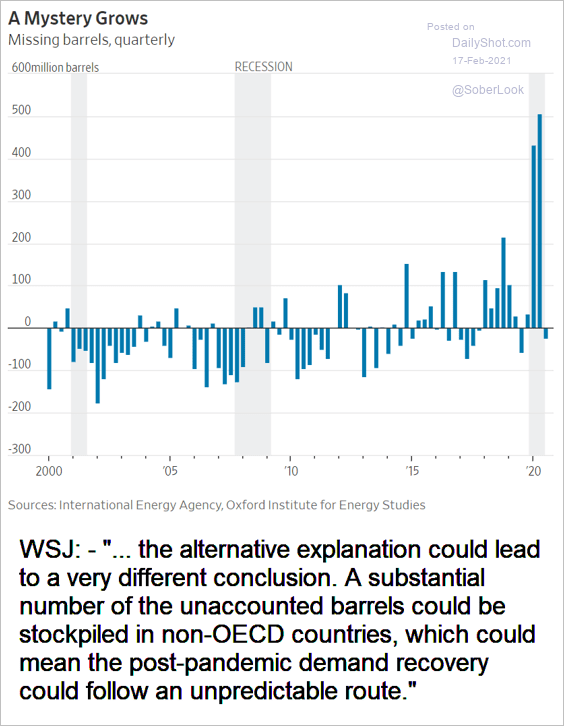

5. The International Energy Agency (IEA) can’t account for a few barrels of oil (see WSJ comment below):

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Equities

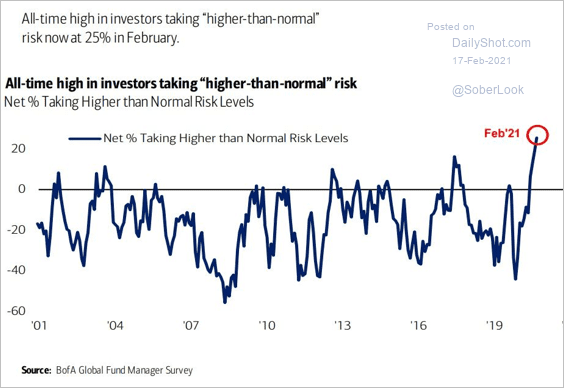

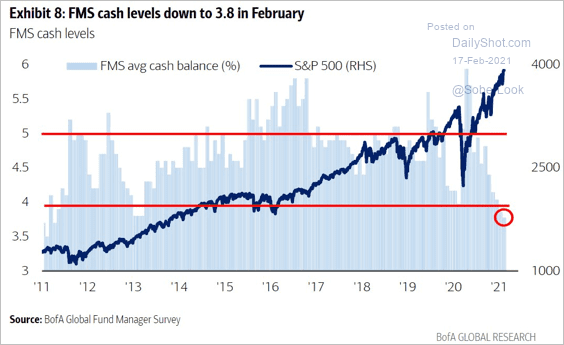

1. Fund managers surveyed by BofA are running record levels of risk.

Source: BofA Global Research

Source: BofA Global Research

• Cash balances keep shrinking.

Source: BofA Global Research

Source: BofA Global Research

• Here is Goldman’s risk appetite index.

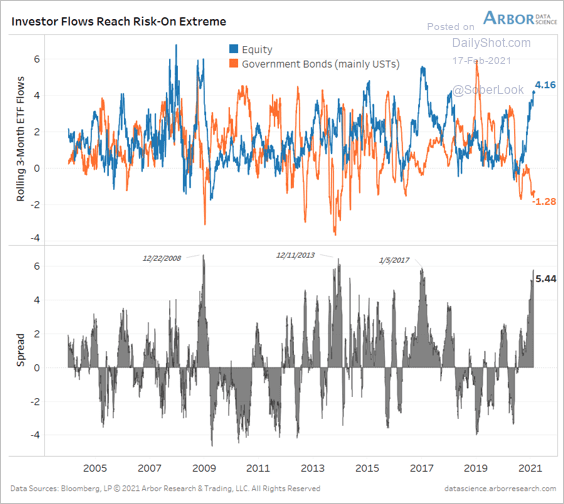

• The risk-on sentiment also shows up in the divergence between equity and government bond fund flows.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

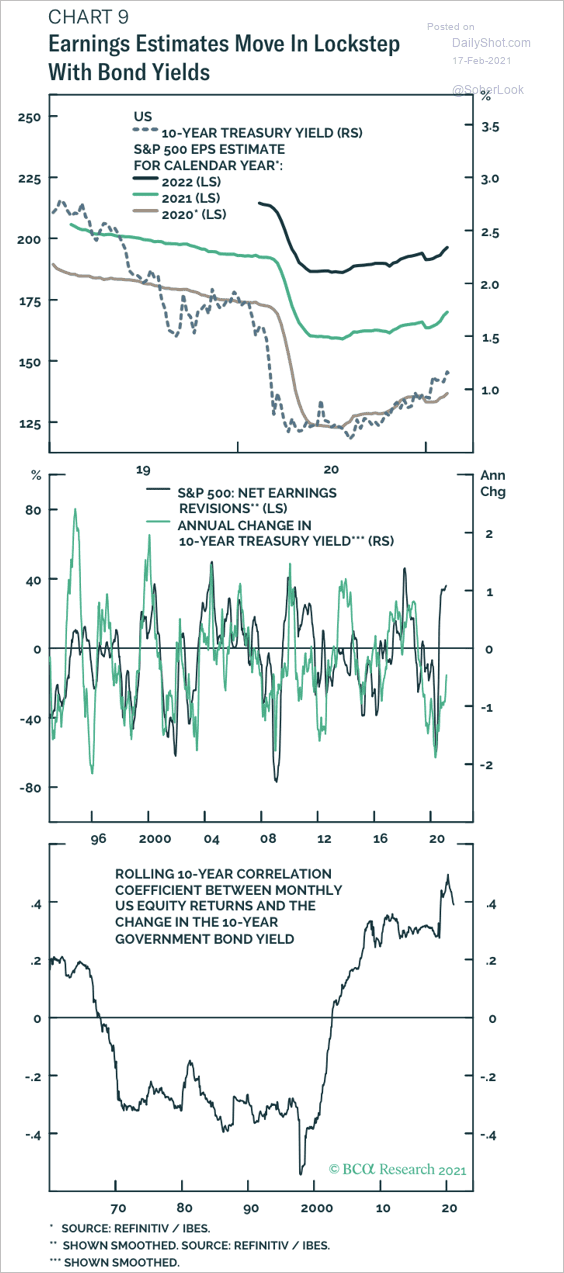

2. Increases in Treasury yields have generally been accompanied by stronger growth expectations and higher earnings estimates.

Source: BCA Research

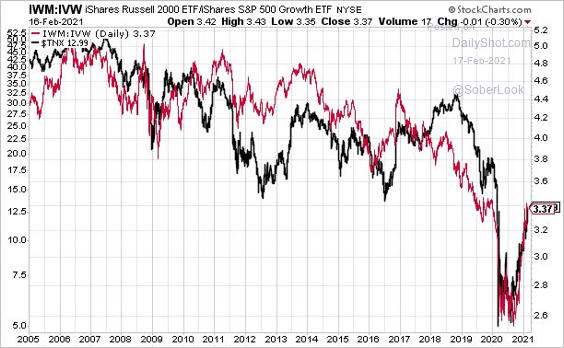

Source: BCA Research

3. Companies with substantial sales in China continue to outperform global peers.

4. Small-cap outperformance tends to be correlated with Treasury yields.

Source: Anastasios Avgeriou

Source: Anastasios Avgeriou

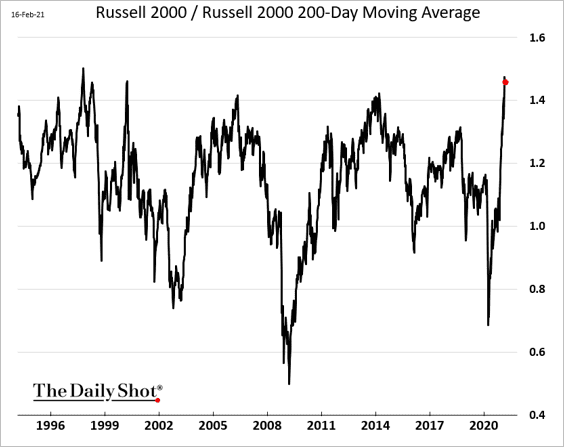

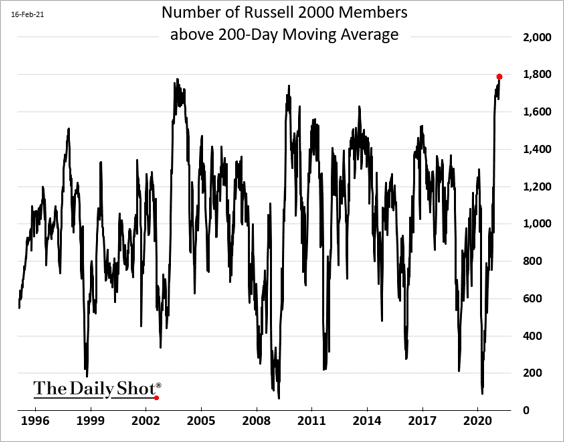

The rally in small caps has been impressive.

• The Russell 2000 index divided by its 200-day moving average:

• The number of Russell 2000 firms above their 200-day moving average:

——————–

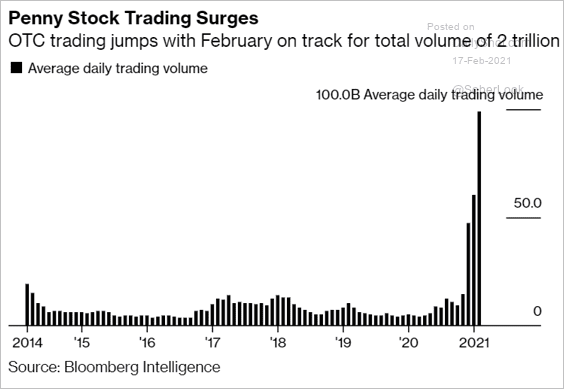

5. Penny stock activity has been extraordinary.

Source: @markets Read full article

Source: @markets Read full article

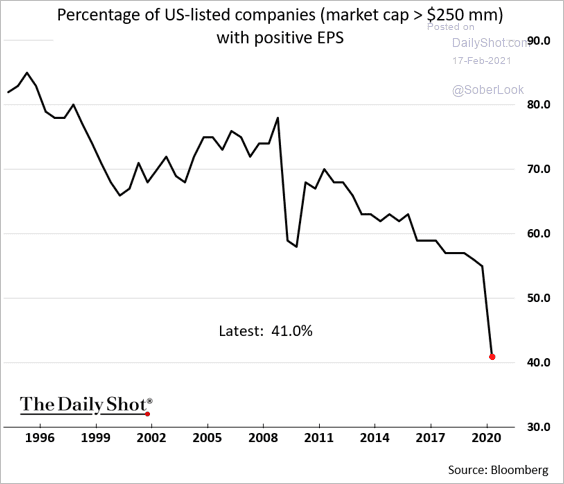

6. A smaller percentage of listed companies with a $250mm market cap or higher are profitable.

h/t @LizAnnSonders, @Bloomberg

h/t @LizAnnSonders, @Bloomberg

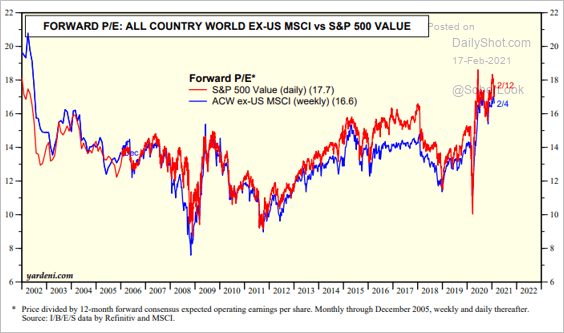

7. US value stocks trade at similar valuations to international shares.

Source: Yardeni Research

Source: Yardeni Research

Back to Index

Credit

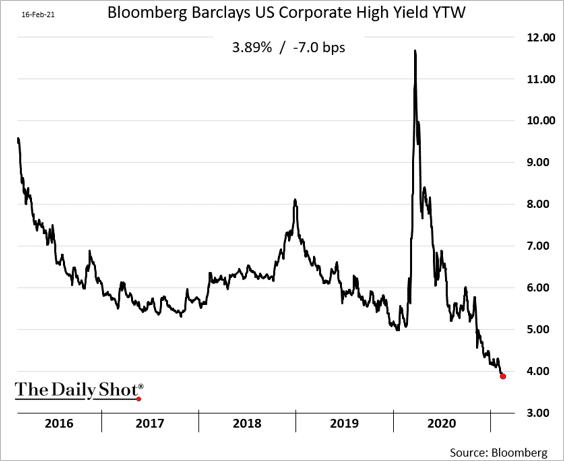

1. Junk bond yields continue to hit record lows.

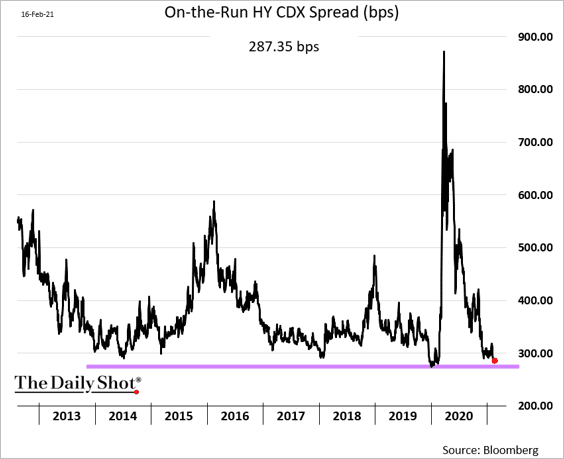

Here is the high-yield CDX spread (“index” of credit default swaps).

——————–

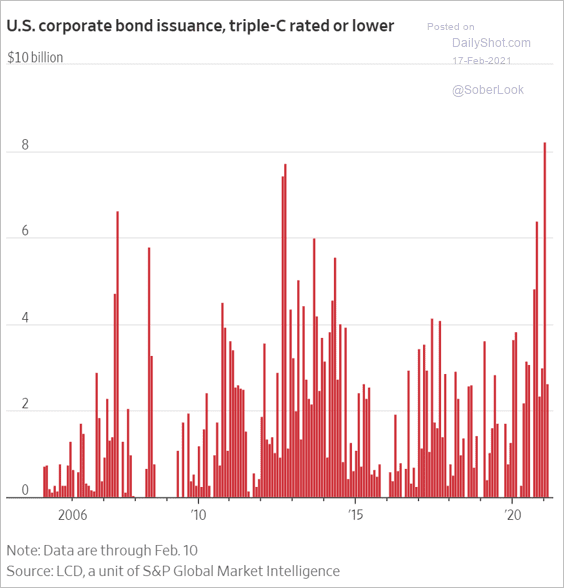

2. The most leveraged companies have been quite successful in tapping capital markets recently.

Source: @WSJ Read full article

Source: @WSJ Read full article

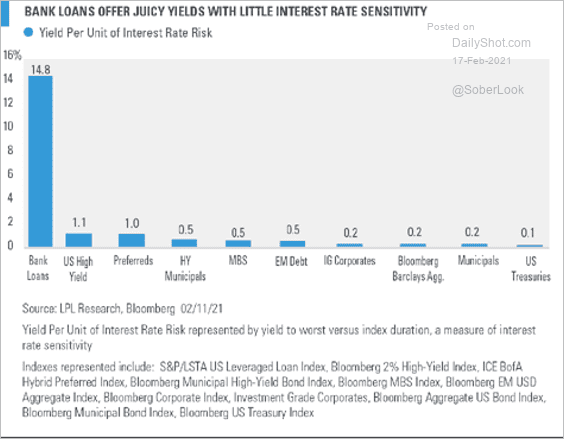

3. According to LPL Research, leveraged loans offer the best return per unit of interest rate risk (because these are floating rate instruments).

Source: LPL Research

Source: LPL Research

Back to Index

Rates

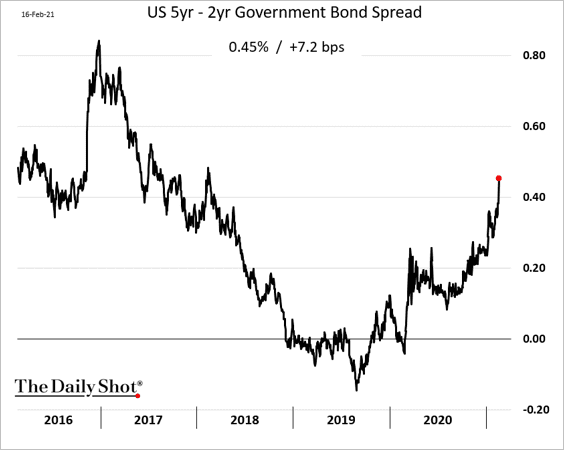

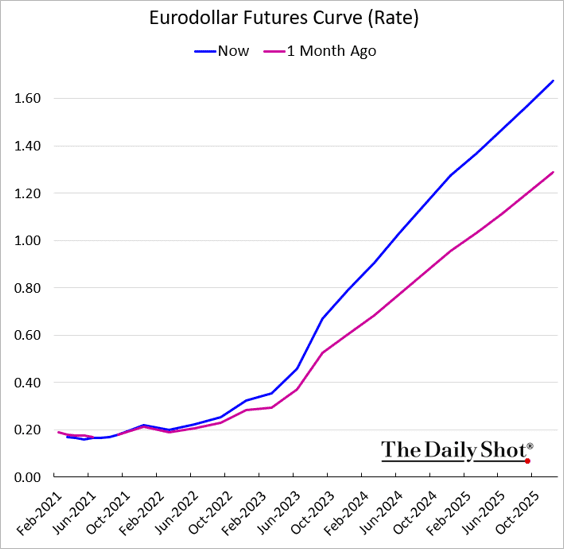

1. The short end of the Treasury curve has been steepening, …

… as the market recalibrates the timing and the pace of the Fed’s rate hikes (chart below shows rates implied by 3-month LIBOR futures).

——————–

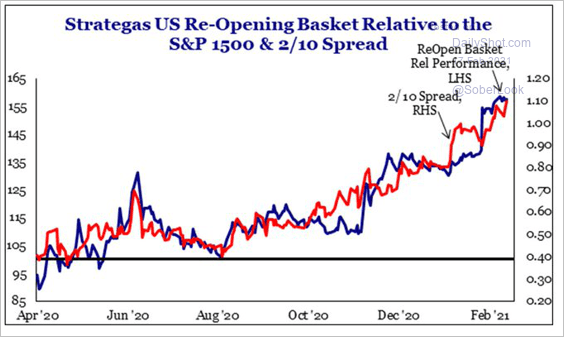

2. The yield curve slope has been correlated with the “reopen” basket of stocks’ relative performance.

Source: @StrategasRP

Source: @StrategasRP

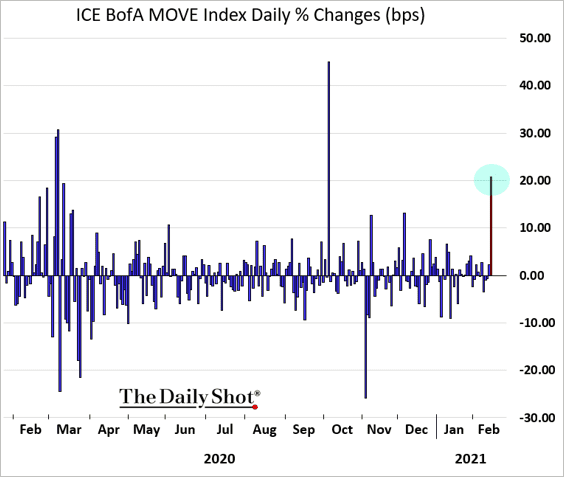

3. Treasury implied volatility jumped as bonds come under pressure.

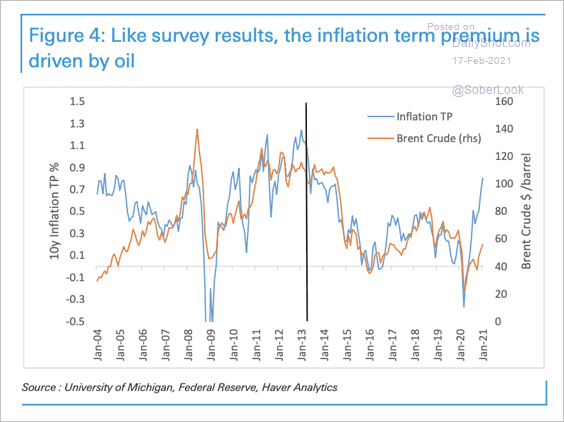

4. The recent recovery in breakevens (inflation expectations) have outpaced the increase in oil prices

Source: Deutsche Bank Research

Source: Deutsche Bank Research

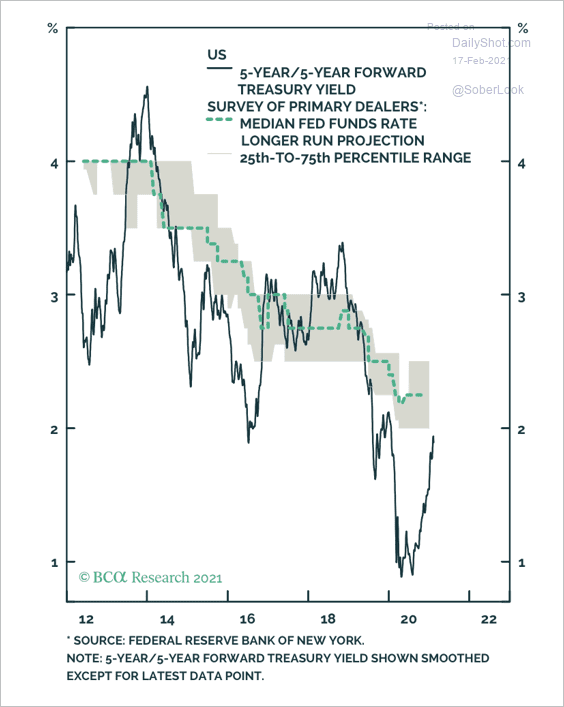

5. Forward Treasury yields are still below primary dealers’ projections.

Source: BCA Research

Source: BCA Research

Back to Index

Global Developments

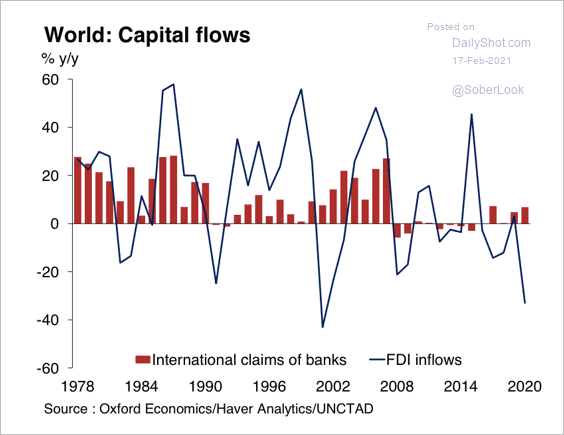

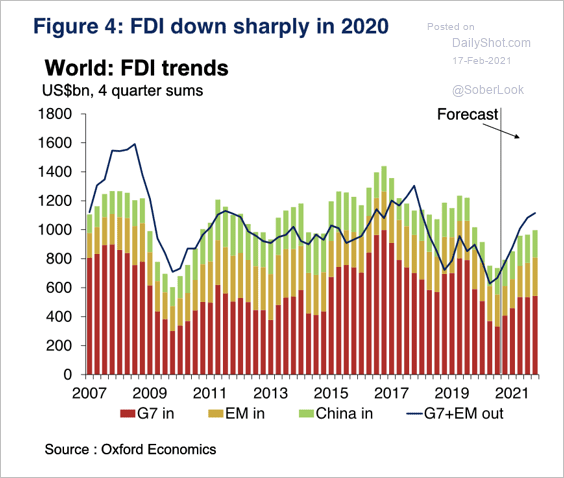

1. Global financial flows held up well last year, but foreign direct investment (FDI) slumped.

Source: Oxford Economics

Source: Oxford Economics

Oxford Economics expects a recovery in FDI, especially given recent strength in China.

Source: Oxford Economics

Source: Oxford Economics

——————–

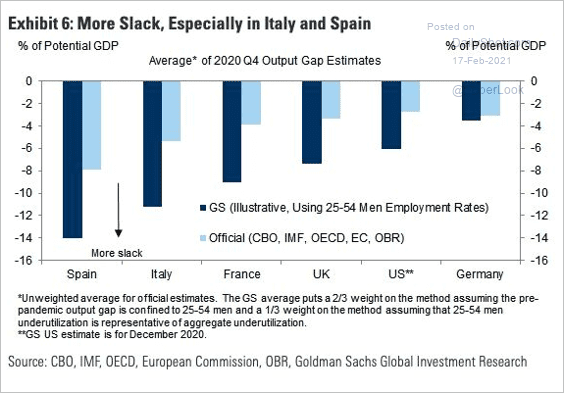

2. Analysts continue to question the official estimates of slack in the economy. If the amount of slack has been significantly underestimated, additional stimulus is less likely to fuel inflation.

Source: Goldman Sachs, Octavian Adrian Tanase

Source: Goldman Sachs, Octavian Adrian Tanase

Back to Index

Food for Thought

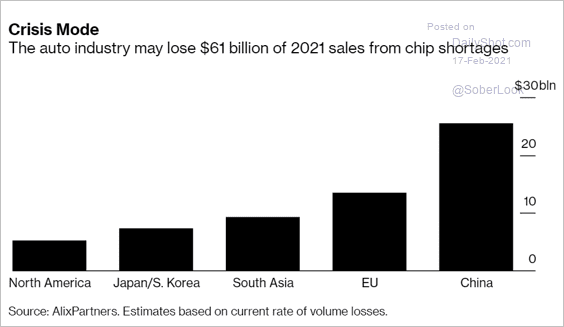

1. The impact of chip shortage on the auto industry (see overview):

Source: @technology Read full article

Source: @technology Read full article

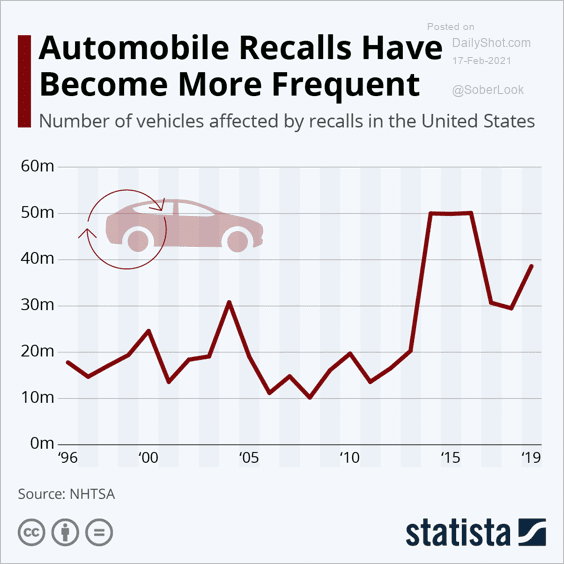

2. Auto recalls:

Source: Statista

Source: Statista

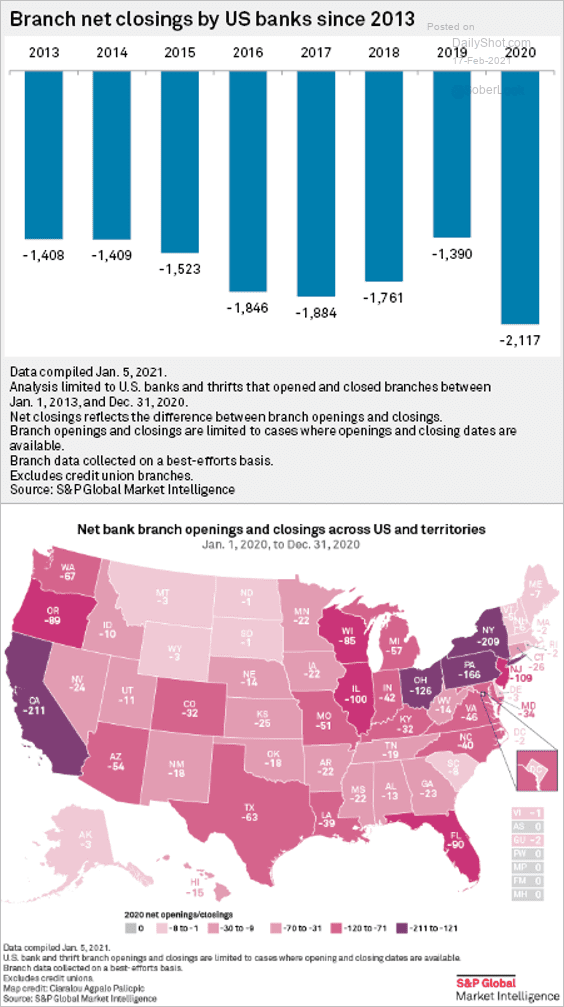

3. US bank branch closings:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

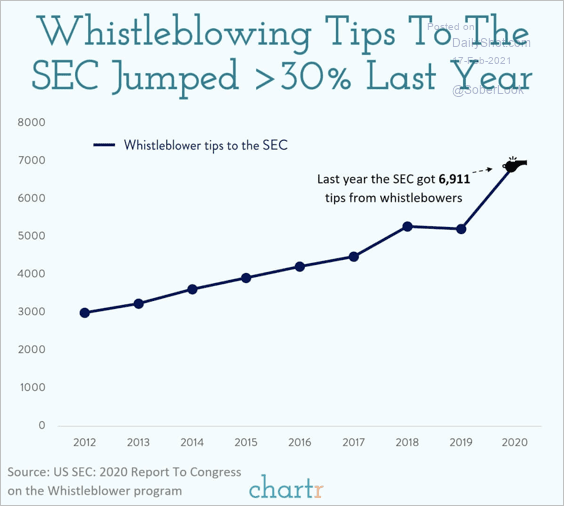

4. Whistleblowing tips to the SEC:

Source: @chartrdaily

Source: @chartrdaily

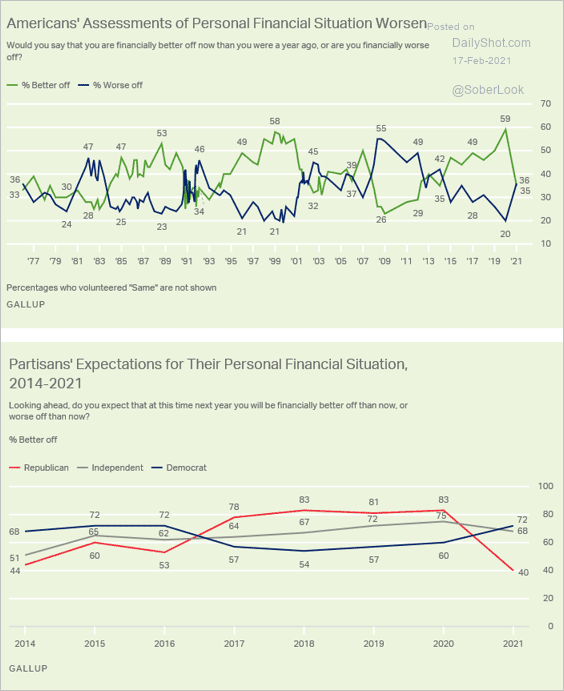

5. Americans’ assessment of their financial situation:

Source: Gallup Read full article

Source: Gallup Read full article

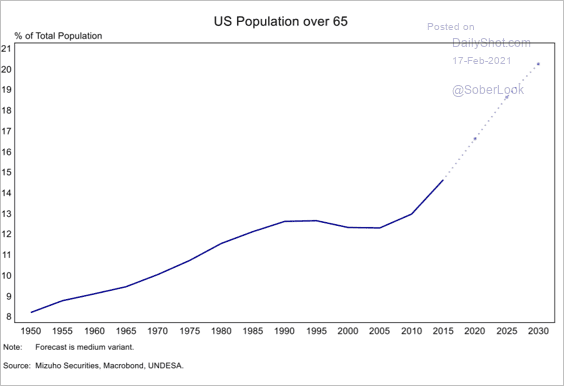

6. US population over 65:

Source: Mizuho Securities USA

Source: Mizuho Securities USA

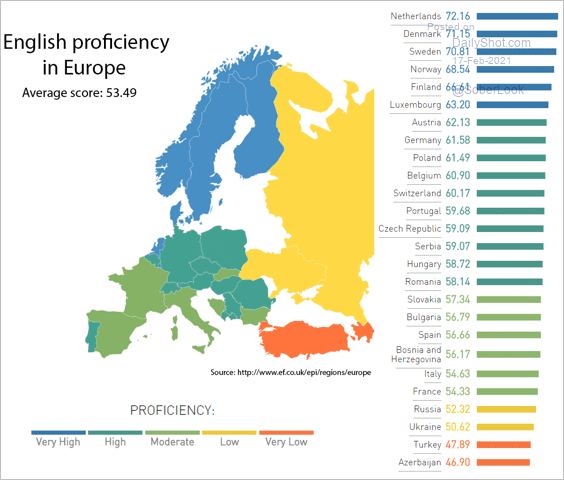

7. English proficiency in Europe:

Source: EF Education First

Source: EF Education First

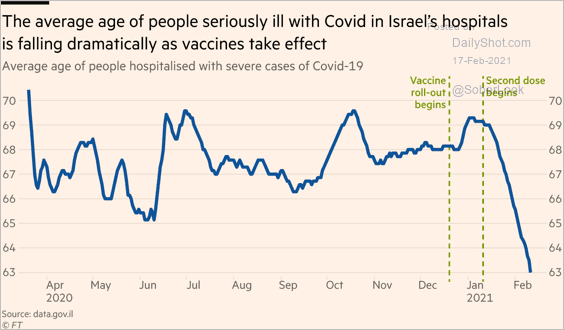

8. The average age of COVID hospitalizations in Israel:

Source: @financialtimes

Source: @financialtimes

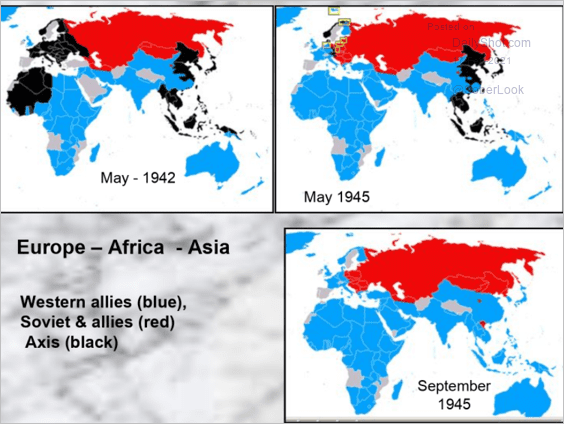

9. WW-II territory control over time:

Source: 5KNA

Source: 5KNA

——————–

Back to Index