The Daily Shot: 23-Feb-21

• Equities

• Credit

• Rates

• Commodities

• Energy

• Cryptocurrency

• Emerging Markets

• China

• Asia – Pacific

• The Eurozone

• The United Kingdom

• Canada

• The United States

• Global Developments

• Food for Thought

Equities

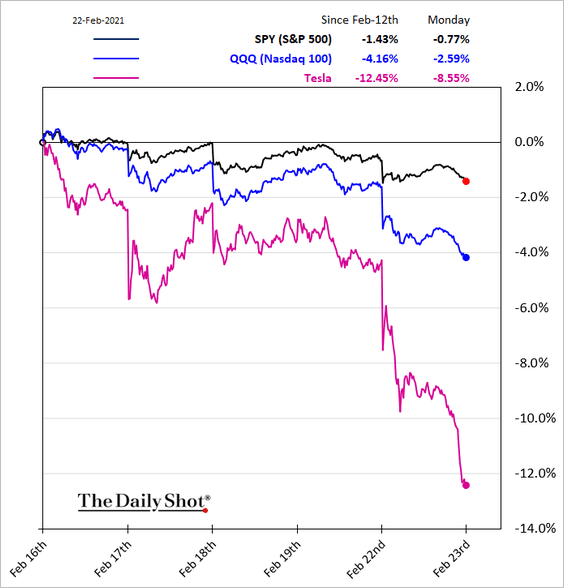

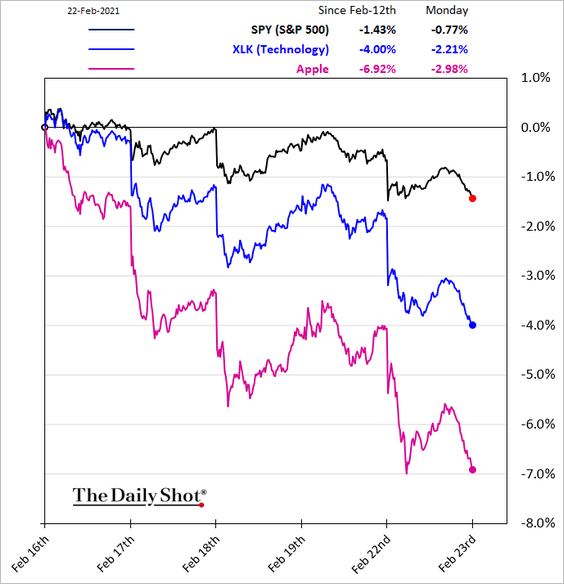

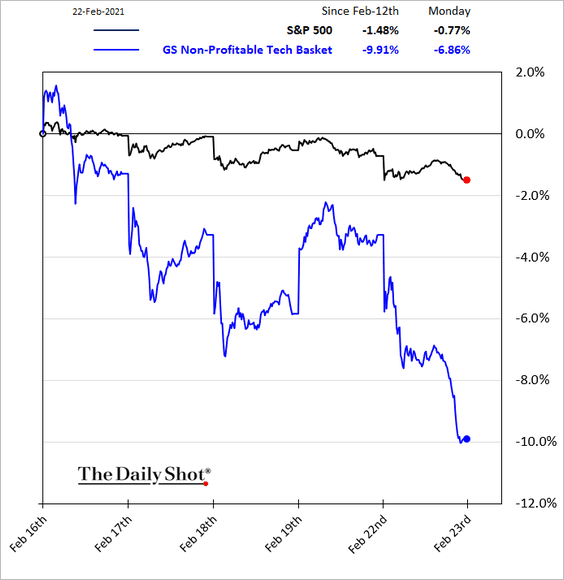

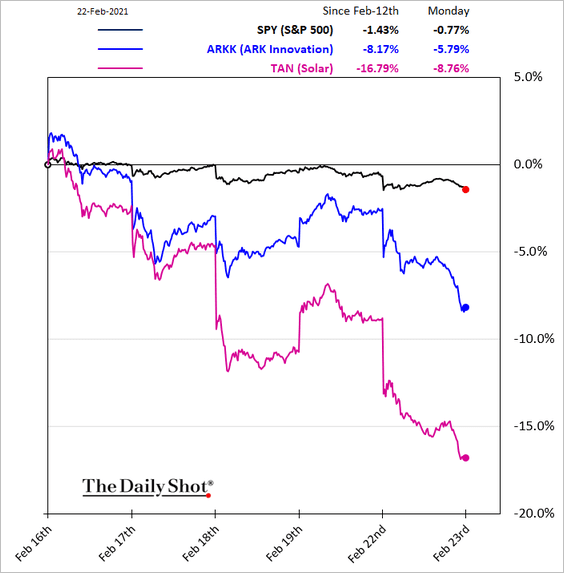

1. The recent increase in Treasury yields has been putting a bit of pressure on some high-flying stocks.

– Nasdaq 100:

– Tech:

– Goldman’s non-profitable tech basket:

– Popular thematic ETFs:

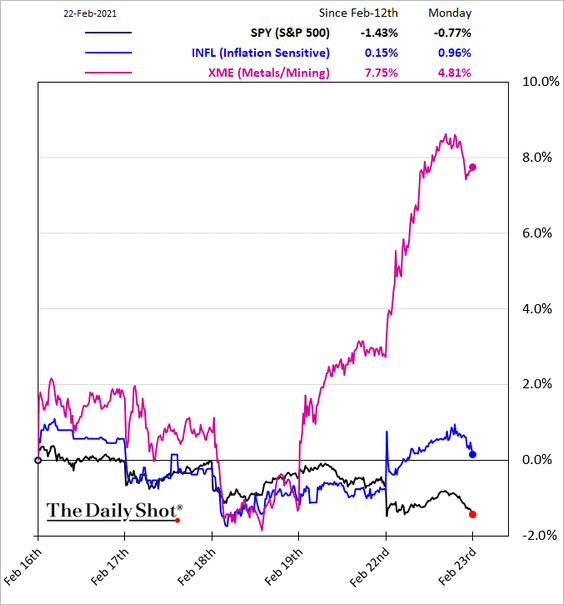

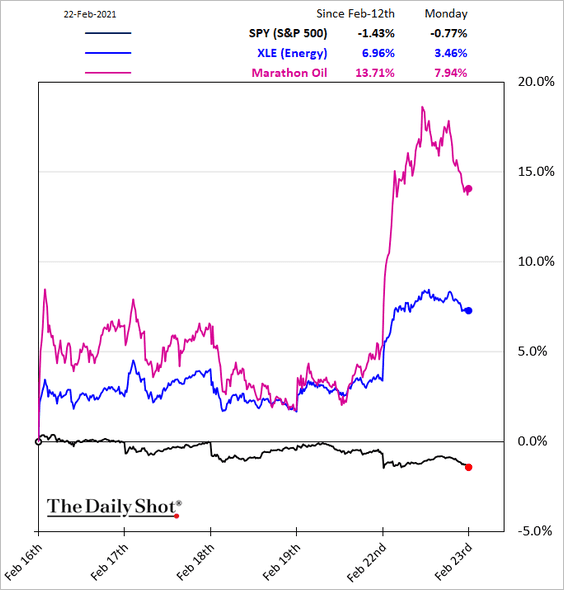

At the same time, the reflation trade has accelerated (2 charts).

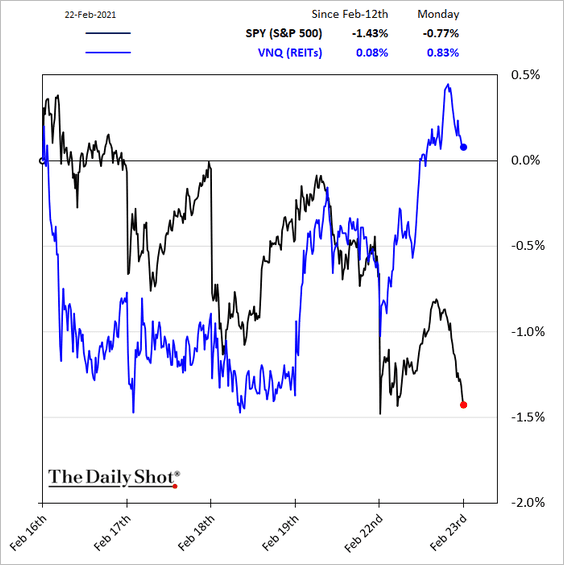

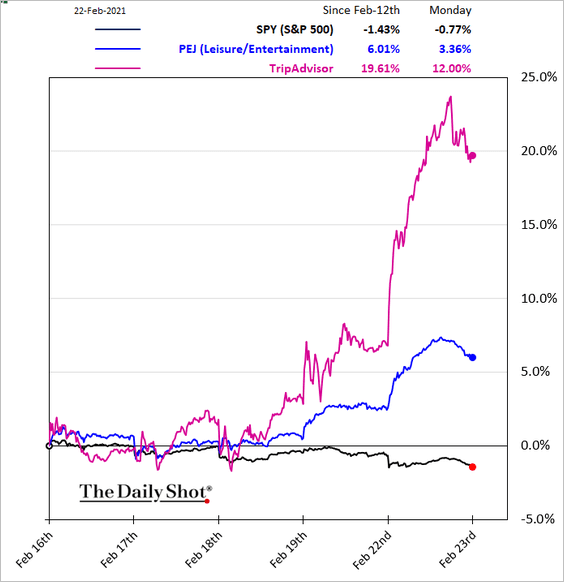

The vaccine progress is boosting some of the beaten-down sectors.

– Property operators (REITs):

– Travel/Leisure:

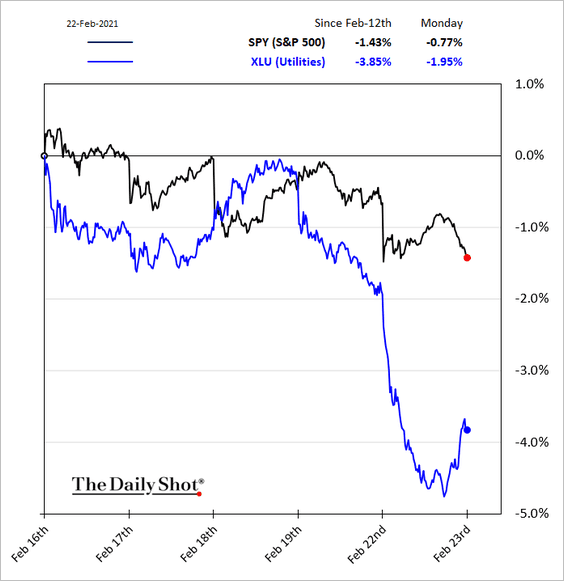

Higher yields are pressuring utility stocks, …

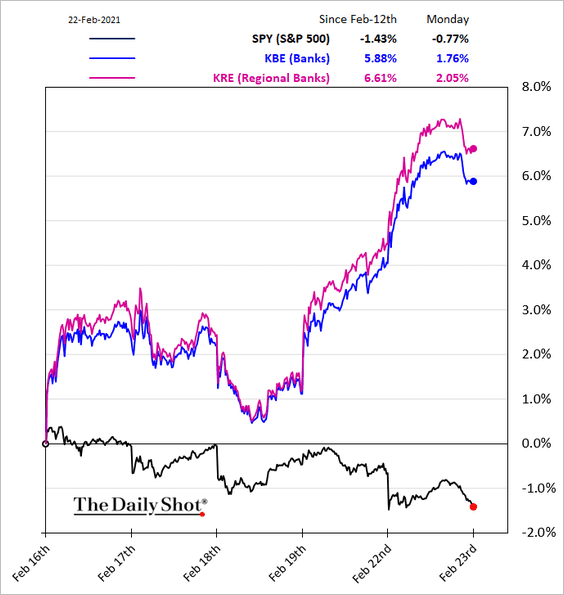

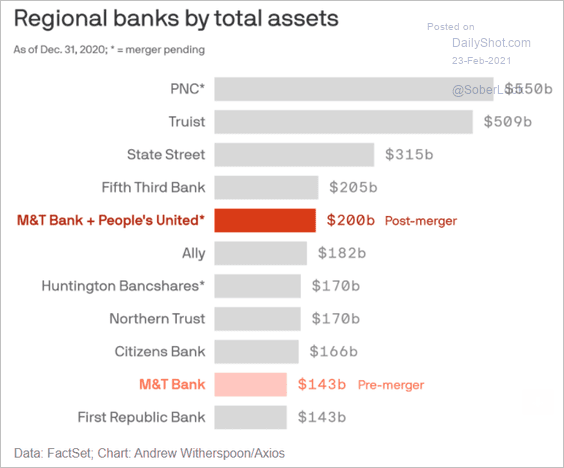

… while helping banks. The banking sector also got a boost from some M&A developments (2nd chart).

Source: @axios Read full article

Source: @axios Read full article

——————–

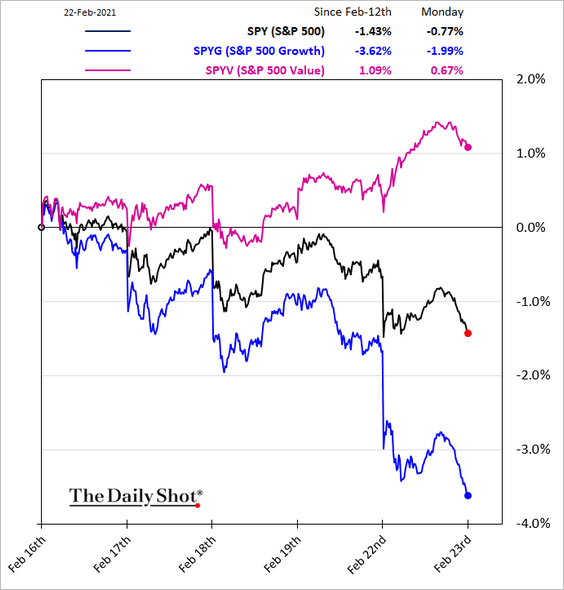

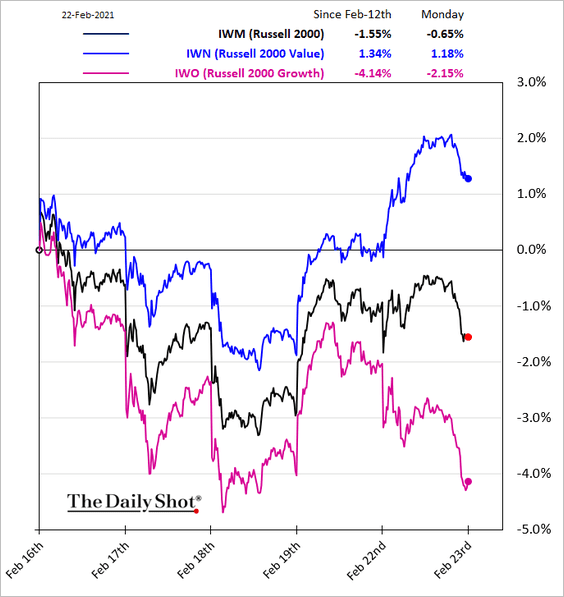

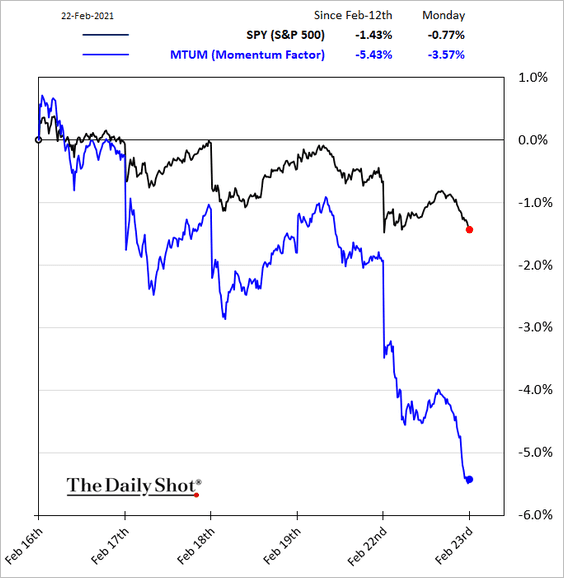

2. The sector moves shown above resulted in a sharp divergence between value and growth factors (2 charts).

Momentum stocks underperformed.

——————–

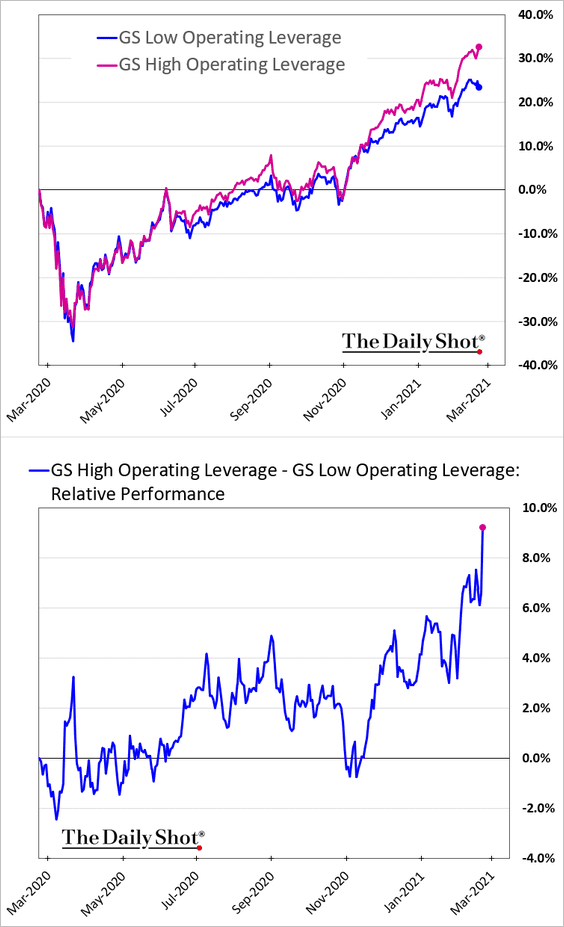

3. Firms with higher operating leverage have outperformed recently.

h/t @luwangnyc

h/t @luwangnyc

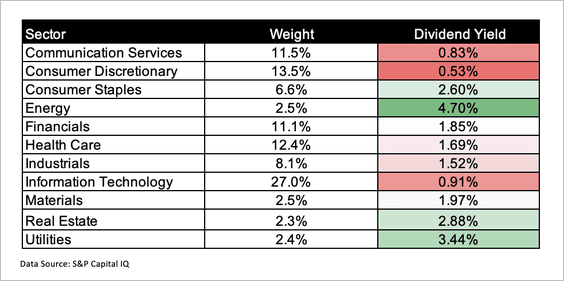

4. Here is a look at S&P 500 sector weights and corresponding dividend yields.

Source: Daniel Moskovits

Source: Daniel Moskovits

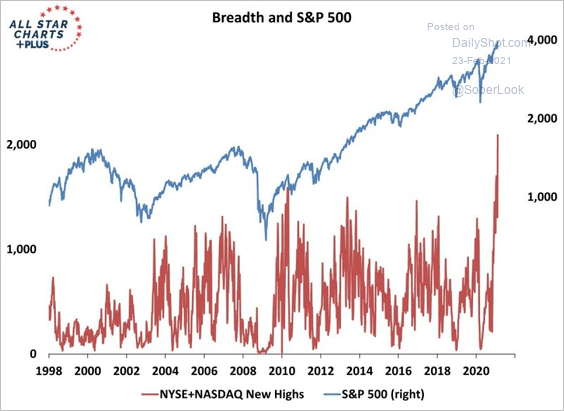

5. This chart shows the number of US shares making new highs.

Source: Tilo Marotz, William Delwiche, Callum Thomas Topdown Charts

Source: Tilo Marotz, William Delwiche, Callum Thomas Topdown Charts

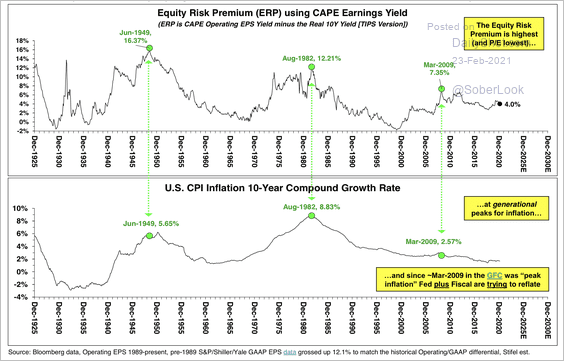

6. Higher inflation typically results in a rising equity risk premium.

Source: Stifel

Source: Stifel

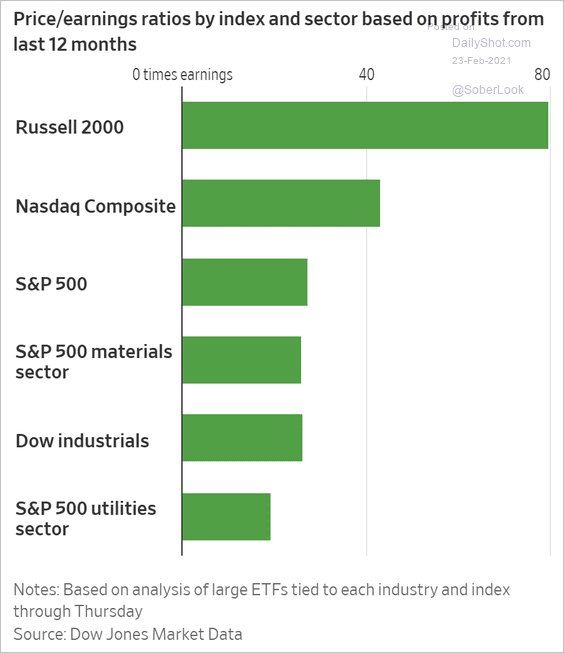

7. Below is an overview of P/E ratios based on trailing earnings.

Source: @WSJ Read full article

Source: @WSJ Read full article

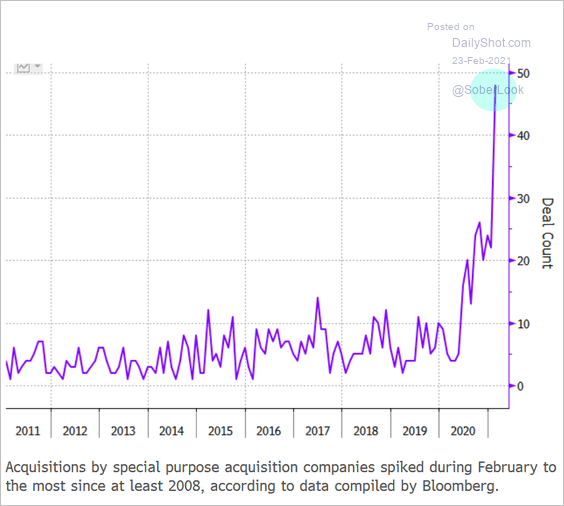

8. SPAC acquisitions hit a record this year.

Source: @Drew_Singer, Bloomberg Finance L.P.

Source: @Drew_Singer, Bloomberg Finance L.P.

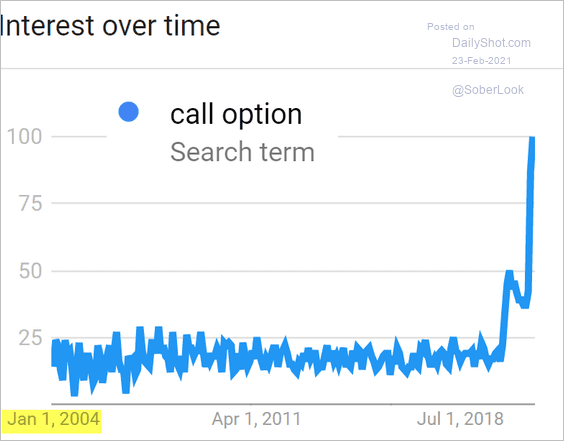

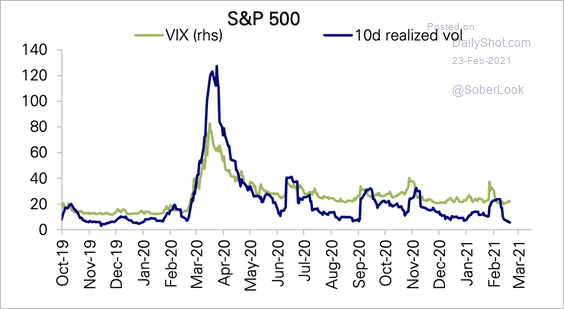

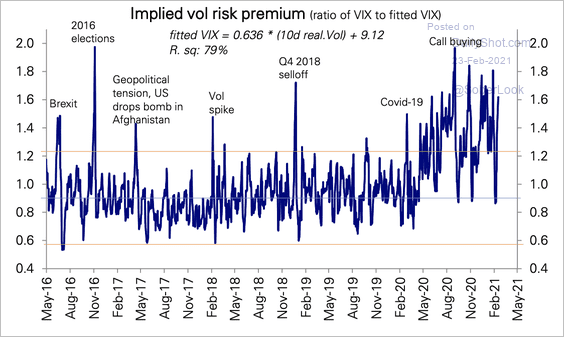

9. Next, we have some updates on volatility.

• The public is very interested in call options.

Source: Google Trends, h/t Tilo Marotz

Source: Google Trends, h/t Tilo Marotz

• Realized and implied volatility measures have diverged (partially related to the trend above).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• The implied vol “premium” (VIX vs. modeled VIX) remains elevated.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Credit

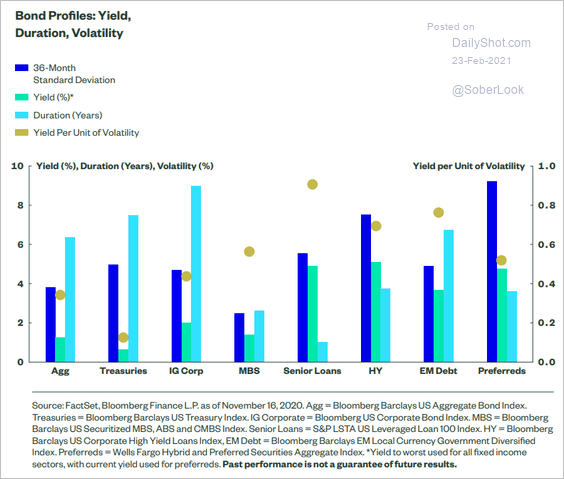

1. Here is an overview of fixed-income asset volatility, yield, duration, and yield per unit of volatility.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

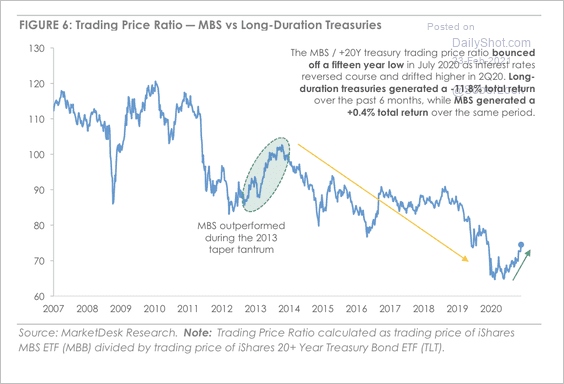

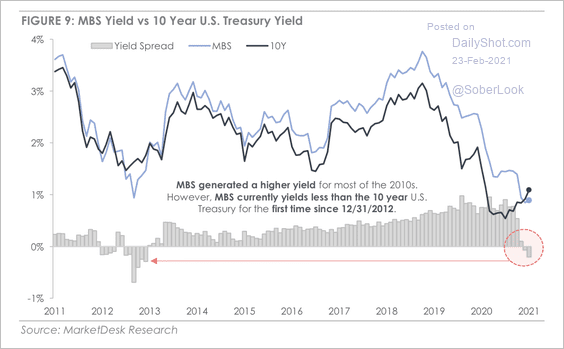

2. US mortgage-backed securities (MBS) are starting to outperform long-duration Treasuries, similar to the 2013 taper tantrum.

Source: MarketDesk Research

Source: MarketDesk Research

Source: MarketDesk Research

Source: MarketDesk Research

Back to Index

Rates

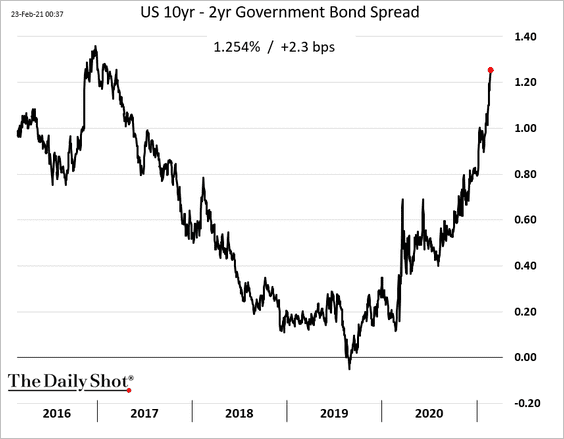

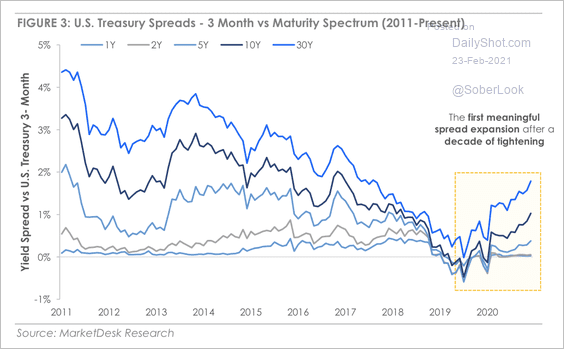

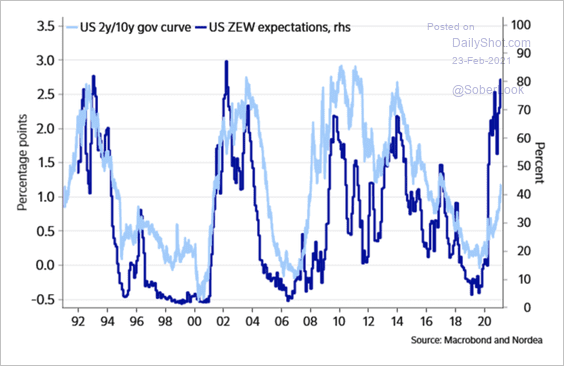

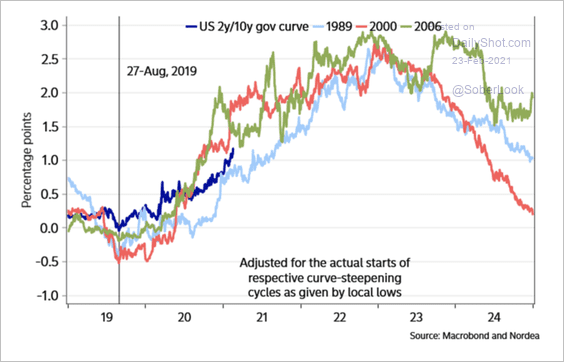

1. While the Treasury curve keeps steepening (2 charts), …

Source: MarketDesk Research

Source: MarketDesk Research

… it is not as steep as growth indicators would imply.

Source: Nordea Markets

Source: Nordea Markets

The yield curve has further room to steepen based on previous cycles.

Source: Nordea Markets

Source: Nordea Markets

——————–

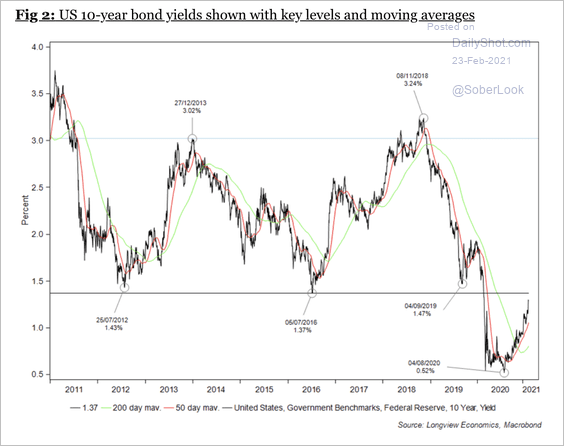

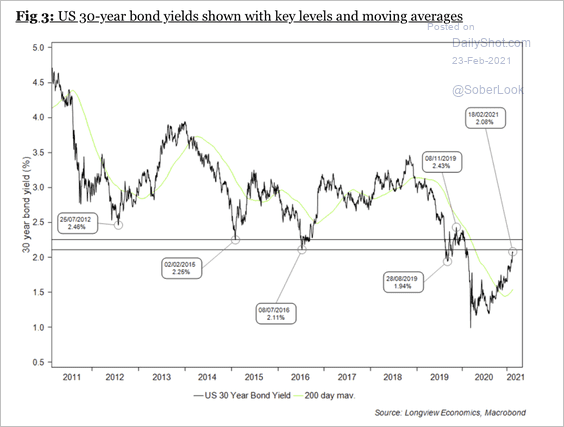

2. 10-year and 30-year Treasury yields are approaching resistance (2 charts).

Source: Longview Economics

Source: Longview Economics

Source: Longview Economics

Source: Longview Economics

——————–

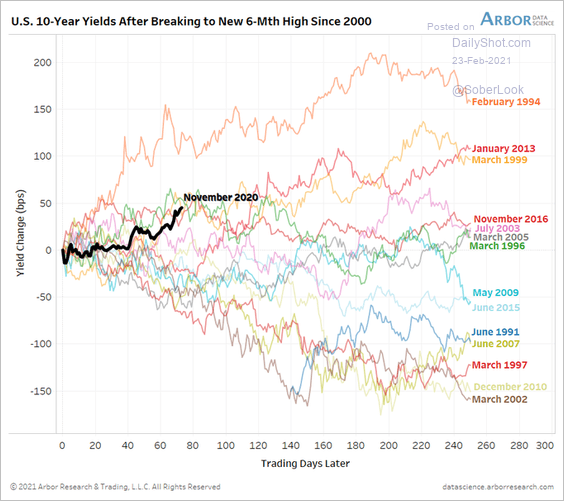

3. How does the current yield increase compare to previous cycles?

Source: @benbreitholtz

Source: @benbreitholtz

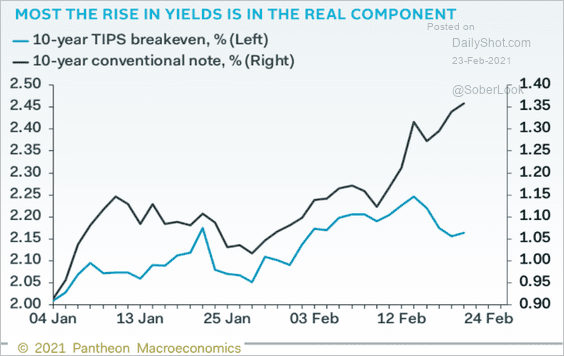

4. Real rates rather than inflation expectations drove the most recent jump in yields.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

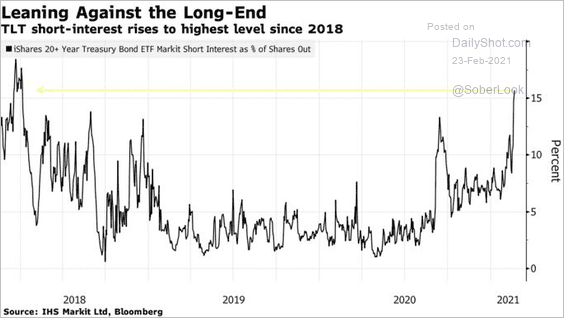

5. Is the Treasury selloff overdone?

Source: @markets Read full article

Source: @markets Read full article

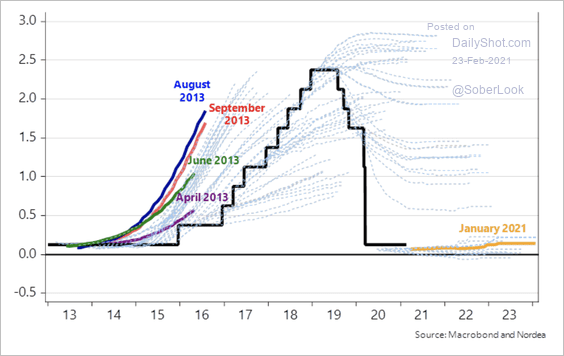

6. Current fed funds futures pricing is nowhere near the levels seen during the 2013 taper tantrum.

Source: Nordea Markets

Source: Nordea Markets

Back to Index

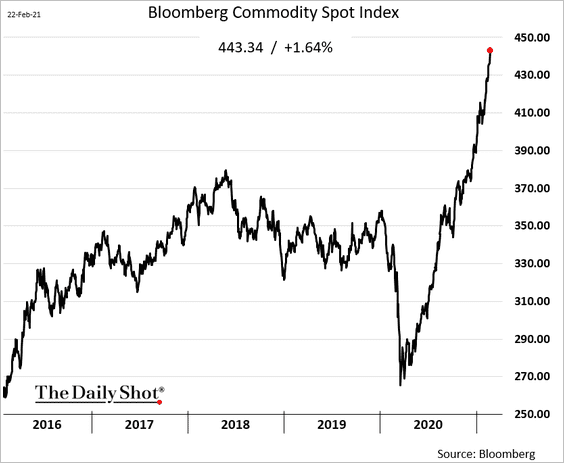

Commodities

1. Bloomberg’s spot commodity index hit a multi-year high.

Further reading

Further reading

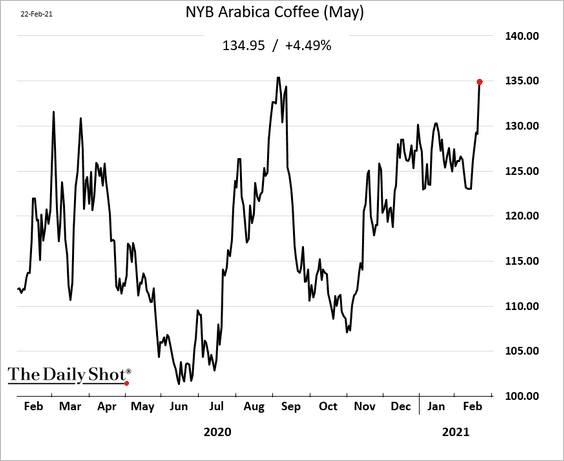

2. Coffee futures are sharply higher in New York as some parts of Brazil get hit with damaging rainfalls (after the drought damage).

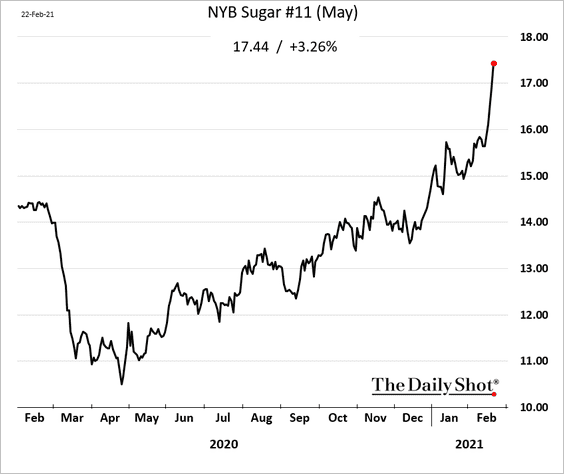

3. Sugar futures are higher due to Brazil’s shipping bottlenecks (which also impacted soybeans).

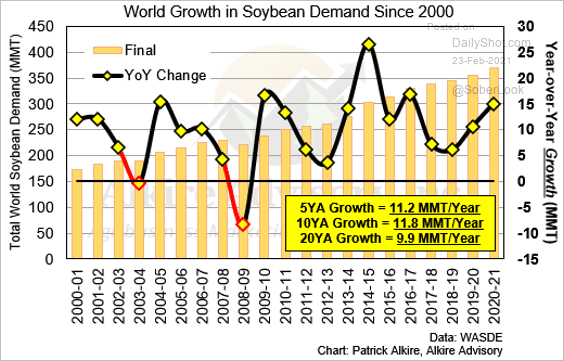

4. Global soybean demand keeps climbing.

Source: Alkire Advisory

Source: Alkire Advisory

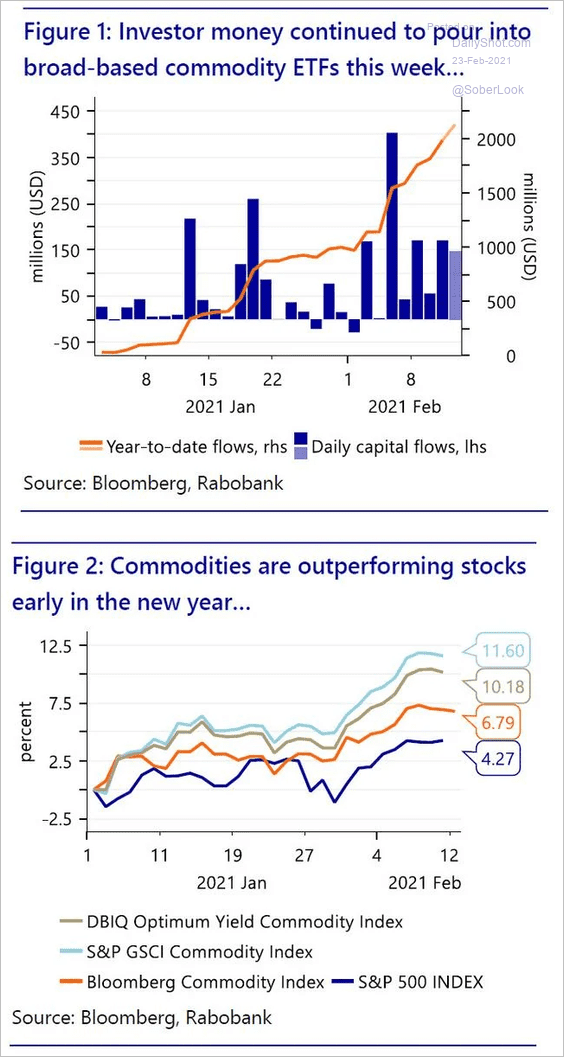

5. Commodity fund inflows remain robust.

Source: Rabobank, Charles-Henry Monchau

Source: Rabobank, Charles-Henry Monchau

Back to Index

Energy

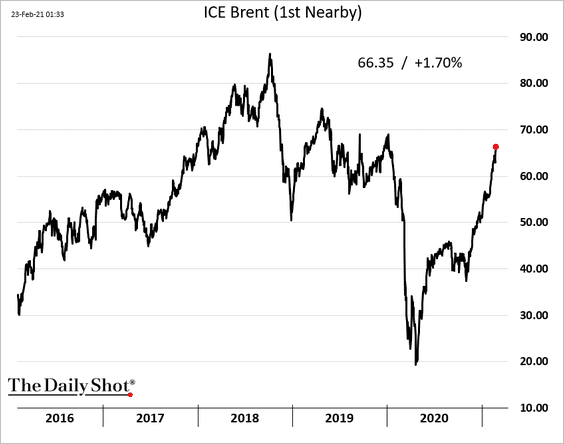

1. Brent is making its way toward $70/bbl.

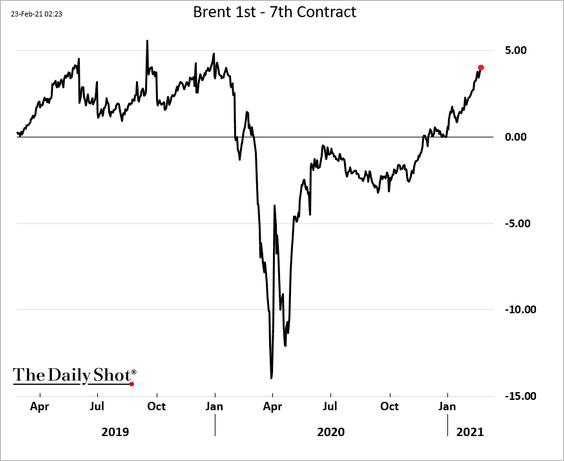

The curve is moving deeper into backwardation.

——————–

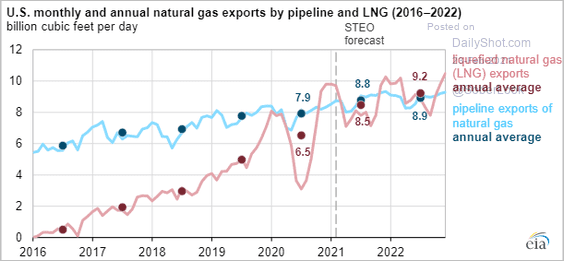

2. US LNG exports are exceeding pipeline natural gas exports.

Source: @EIAgov

Source: @EIAgov

Back to Index

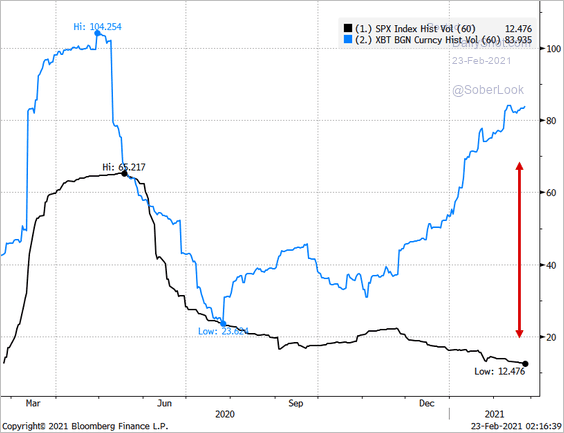

Cryptocurrency

Bitcoin tumbled below $50k.

Bitcoin realized volatility continues to climb, widening the gap with stocks.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Emerging Markets

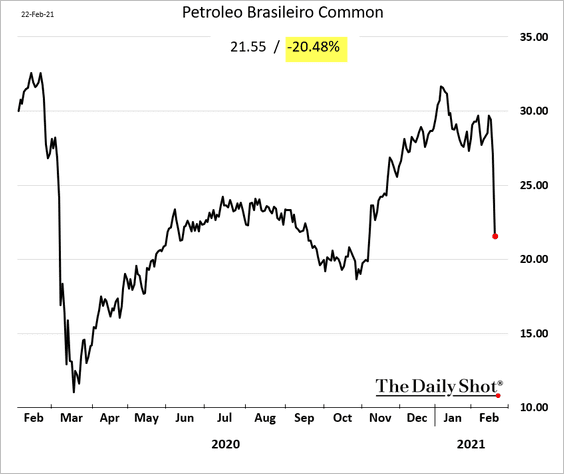

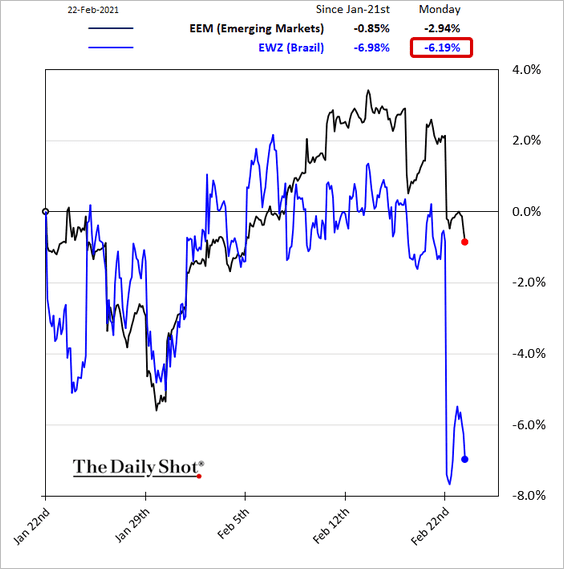

1. The Petrobras mess (#4 here) has been putting pressure on Brazil’s markets.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

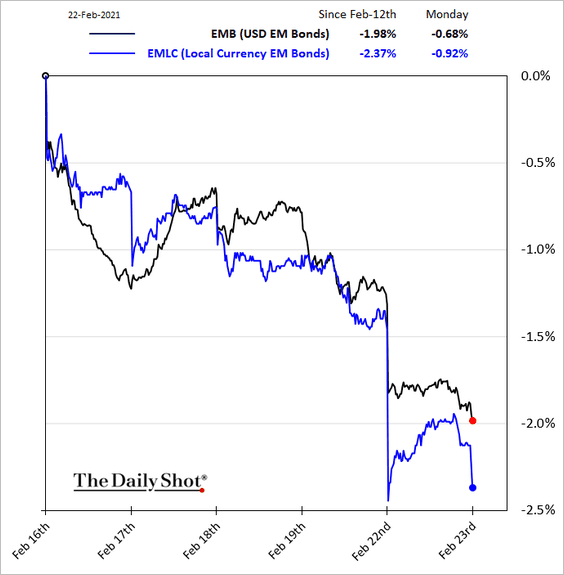

2. EM bonds continue to move lower.

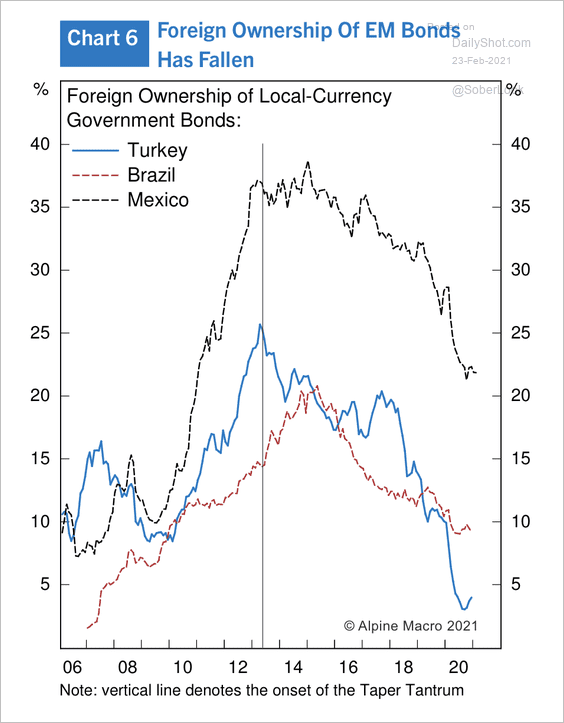

3. Foreign ownership of “fragile” EM bonds has fallen since the taper tantrum.

Source: Alpine Macro

Source: Alpine Macro

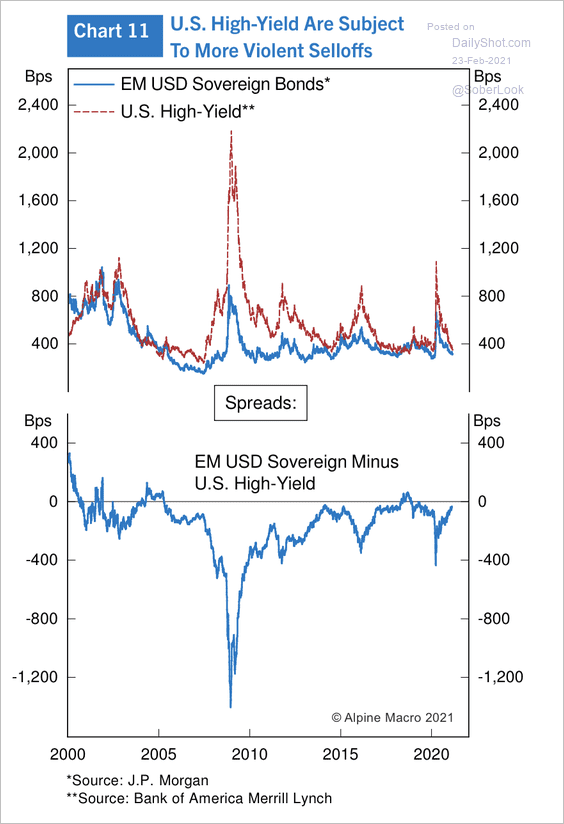

4. Sell-offs in US junk bonds have been more violent than EM USD sovereign bonds over the past decade.

Source: Alpine Macro

Source: Alpine Macro

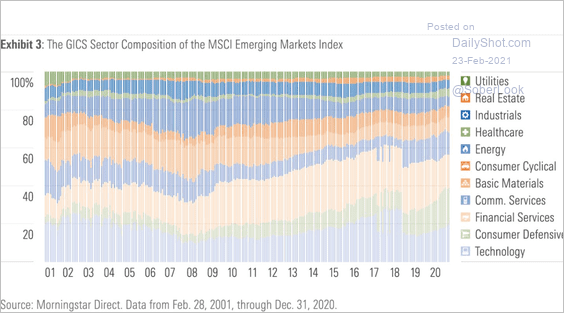

5. This chart shows the MSCI EM equity index sector breakdown.

Source: Morningstar, Steven Desmyter

Source: Morningstar, Steven Desmyter

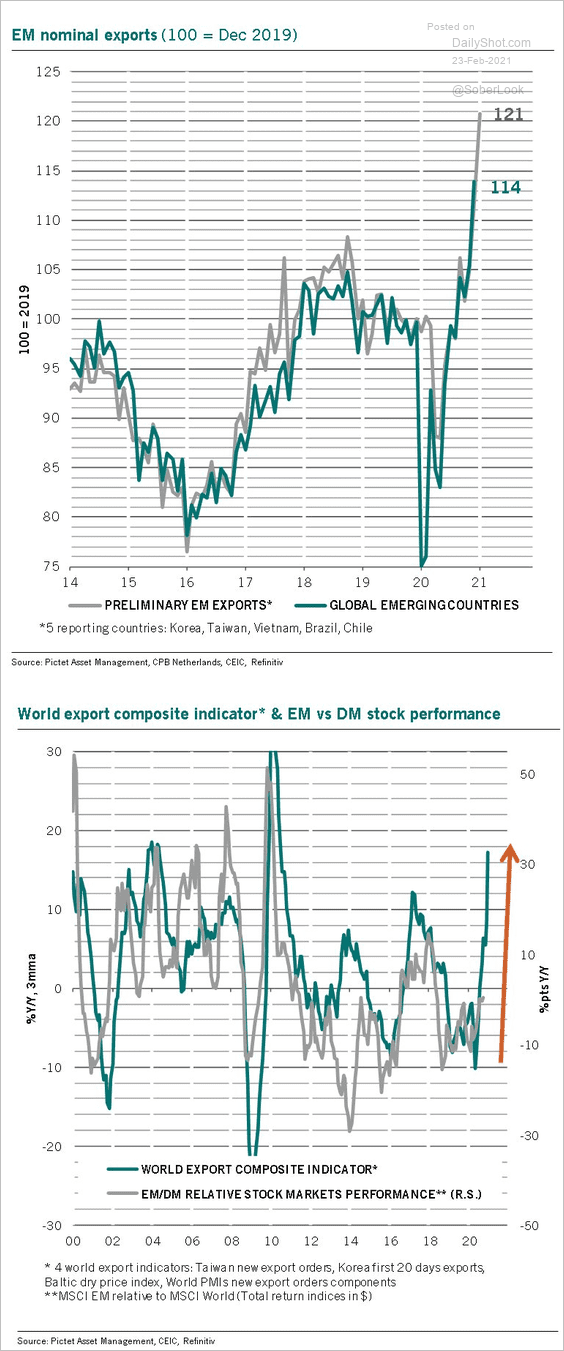

6. Will improving exports usher EM outperformance over DM?

Source: @PkZweifel

Source: @PkZweifel

Back to Index

China

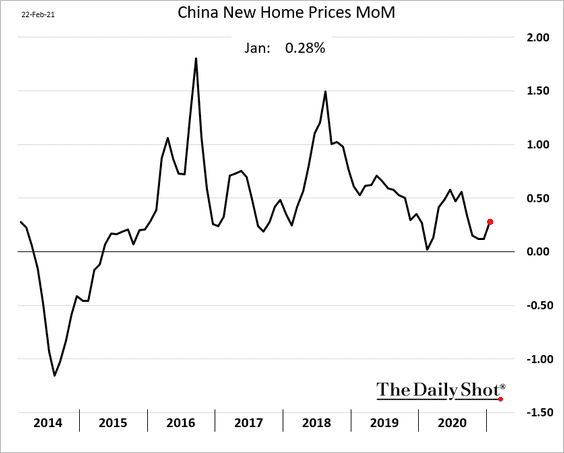

1. New home prices continue to grind higher.

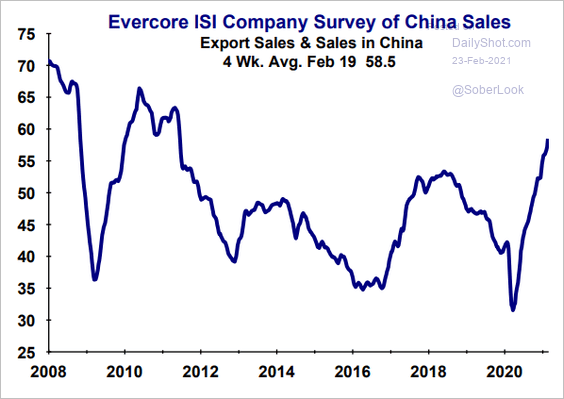

2. Companies with sales in China are increasingly upbeat, according to Evercore ISI.

Source: Evercore ISI

Source: Evercore ISI

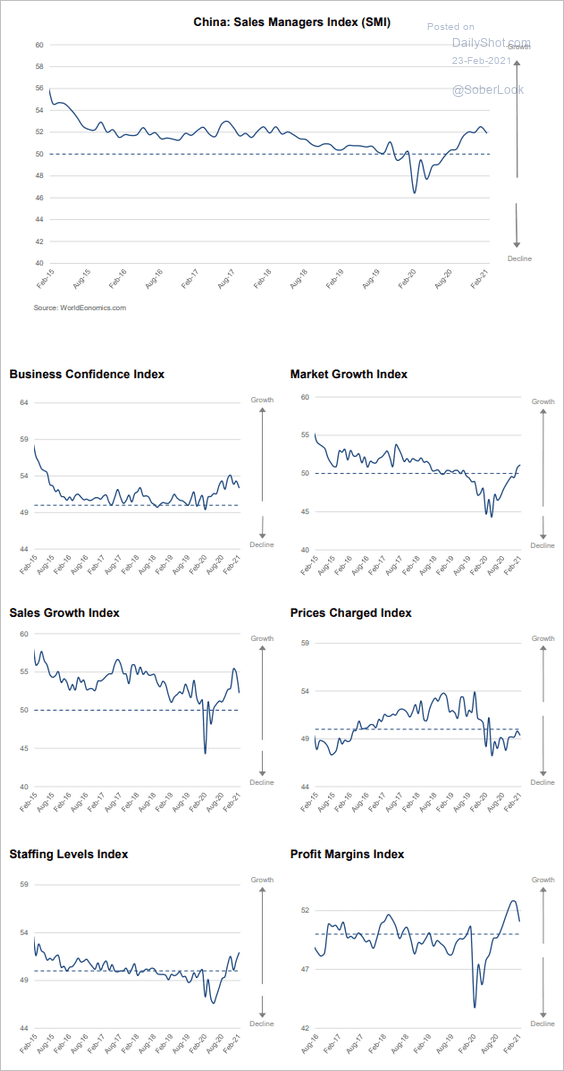

3. According to the World Economics SMI report, China’s business activity continued to expand this month.

Source: World Economics

Source: World Economics

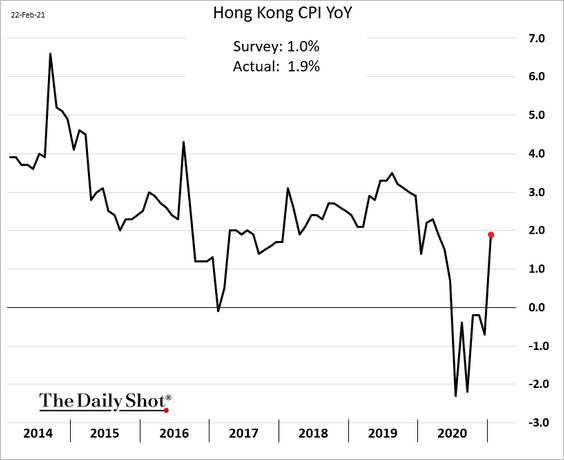

4. Hong Kong’s CPI surprised to the upside (some of which is housing-related).

Back to Index

Asia – Pacific

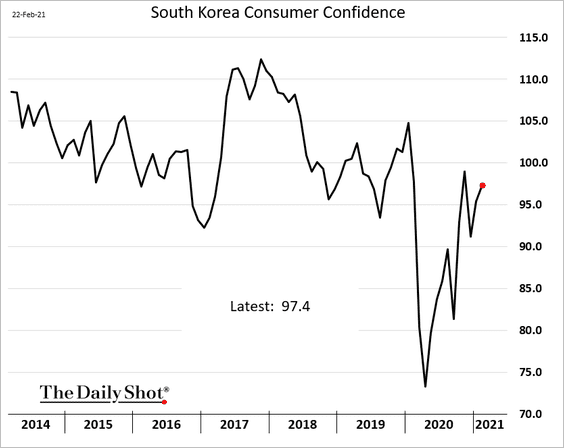

1. South Korea’s consumer confidence is trending higher.

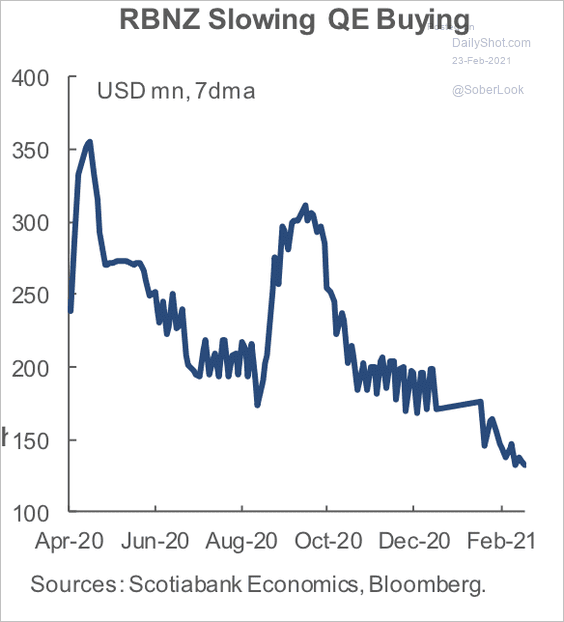

2. The Reserve Bank of New Zealand’s government bond purchase program is slowing.

Source: Scotiabank Economics

Source: Scotiabank Economics

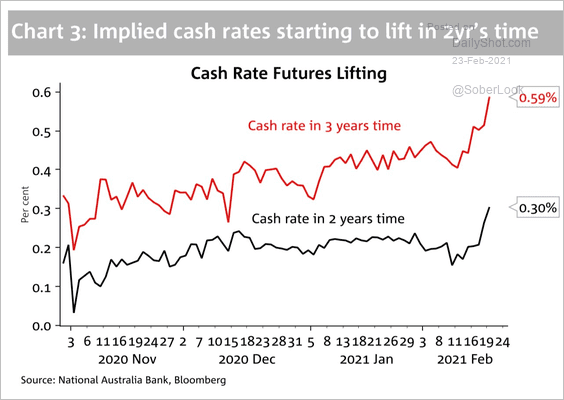

3. The market is increasingly pricing in a higher RBA policy rate in the next couple of years.

Source: @Scutty

Source: @Scutty

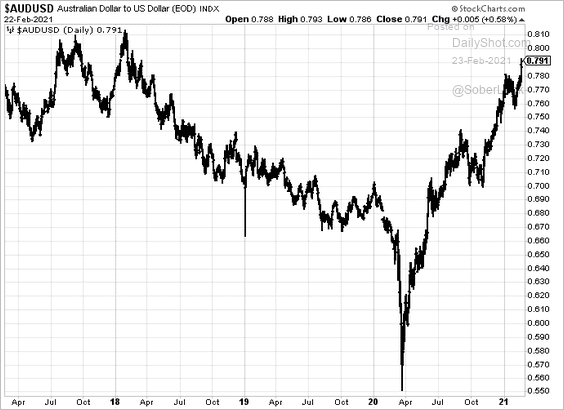

4. The Aussie dollar is headed for USD 0.8.

Back to Index

The Eurozone

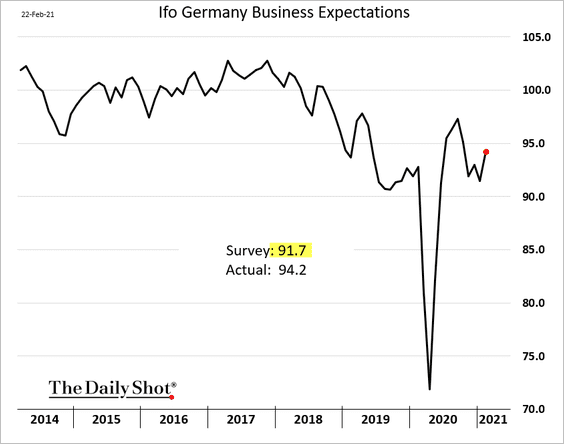

1. The Ifo report surprised to the upside, showing Germany’s business expectations rebounding.

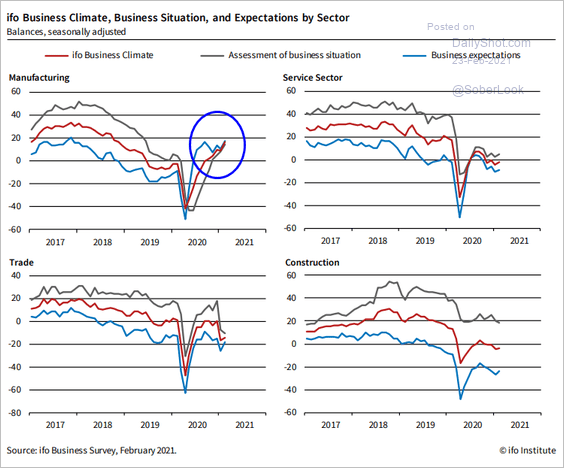

The improvement was mostly driven by manufacturing.

Source: ifo Institute

Source: ifo Institute

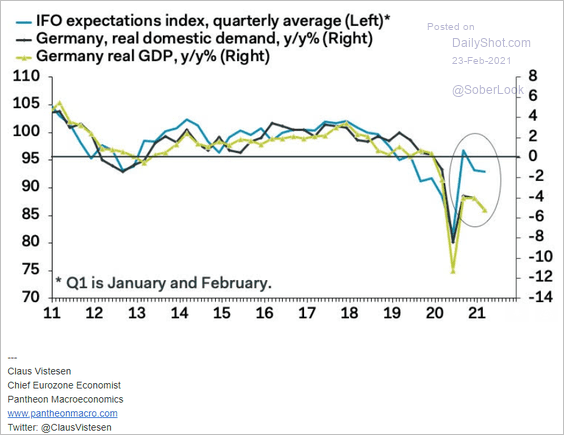

Will we see a commensurate improvement in economic growth?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

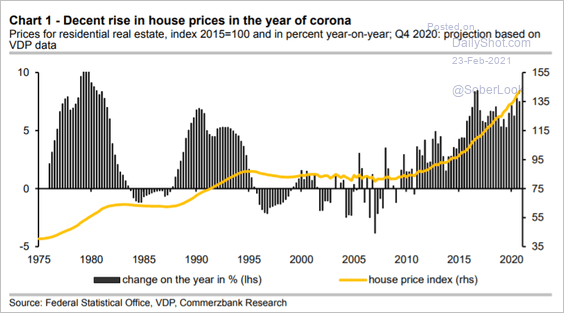

2. Germany’s housing prices continue to climb.

Source: Commerzbank Research

Source: Commerzbank Research

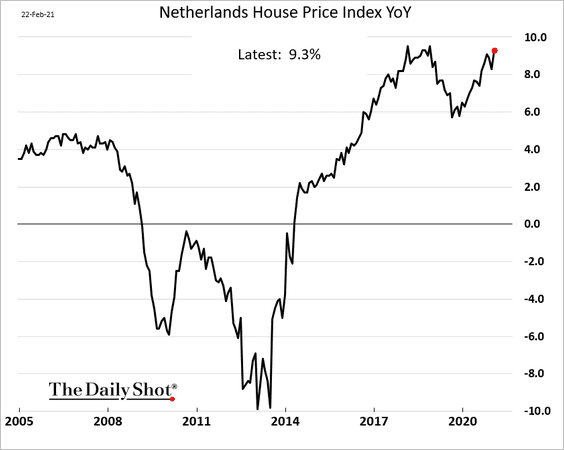

Property price gains also accelerated in the Netherlands.

——————–

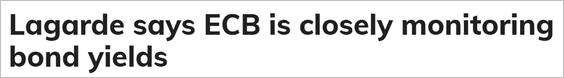

3. Will the ECB allow higher bond yields?

Source: MarketWatch Read full article

Source: MarketWatch Read full article

Back to Index

The United Kingdom

1. Gilt yields and the pound continue to climb.

——————–

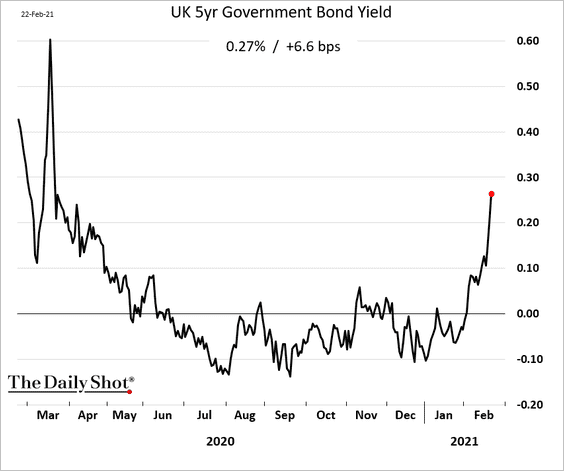

2. Government borrowing has been below forecasts.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

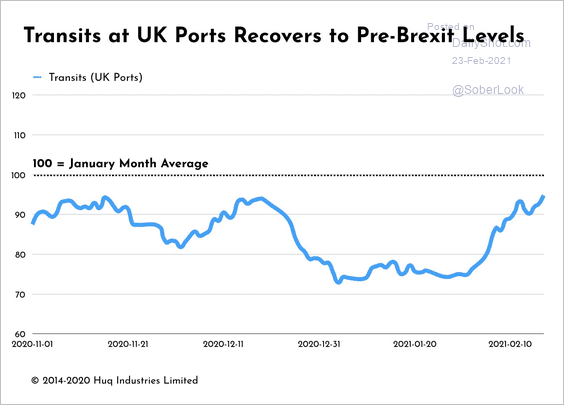

3. Port activity is recovering.

Source: Huq Read full article

Source: Huq Read full article

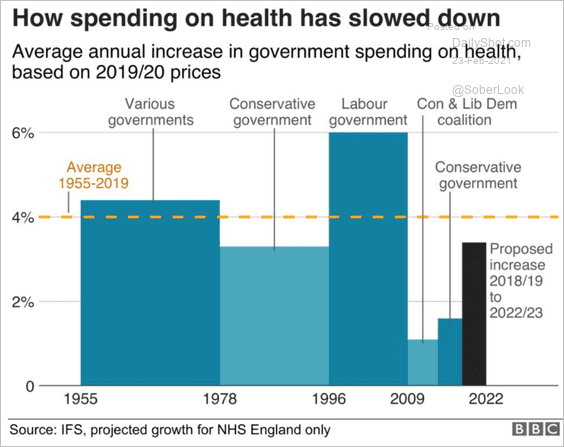

4. Here is an overview of government spending on health.

Source: BBC Read full article

Source: BBC Read full article

Back to Index

Canada

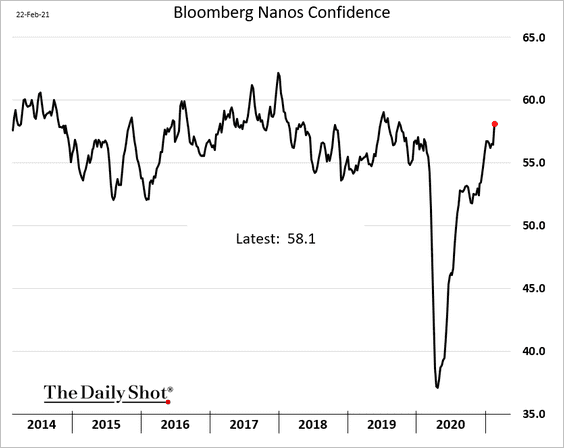

1. Consumer confidence is improving.

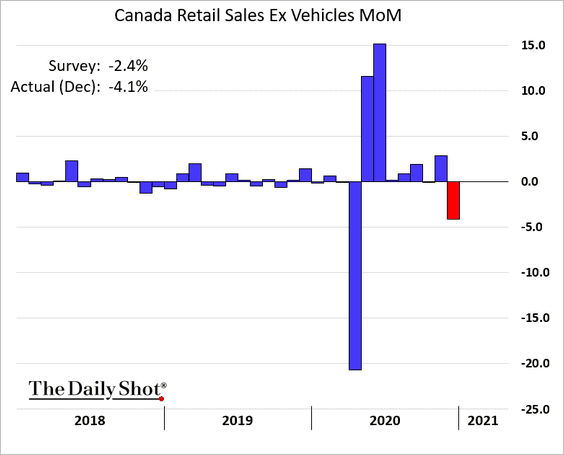

2. Retail sales tumbled in December.

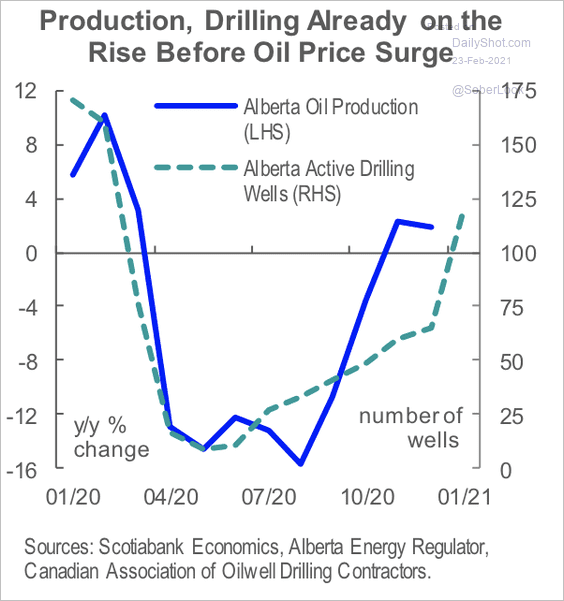

3. Oil drilling and production have risen over the past few months.

Source: Scotiabank Economics

Source: Scotiabank Economics

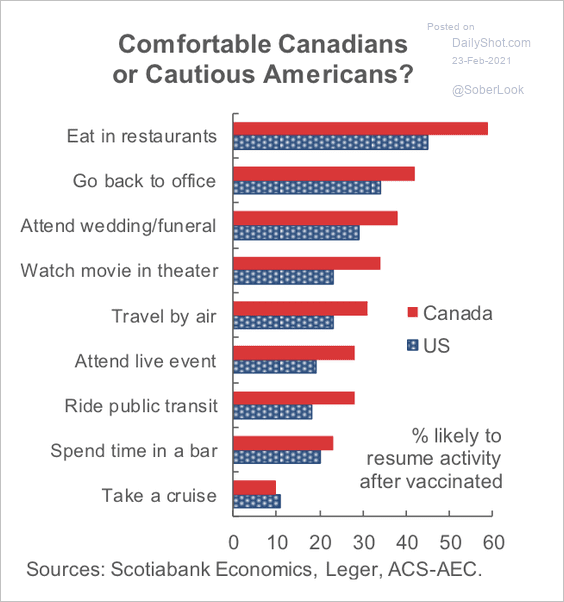

4. Canadians are more eager to return to pre-COVID activity than their US counterparts.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

The United States

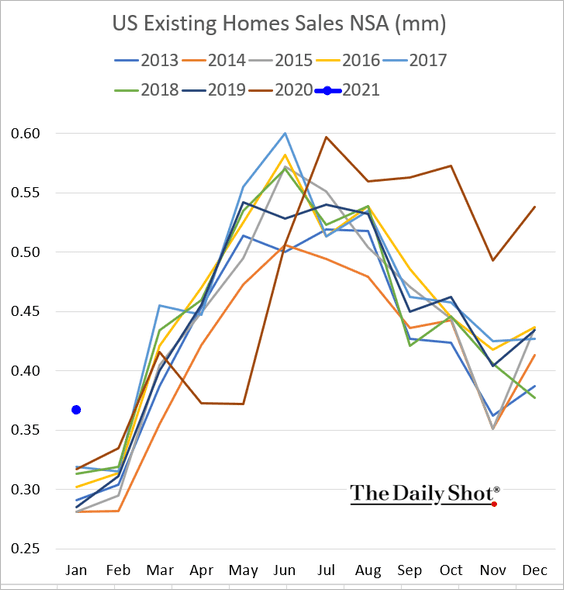

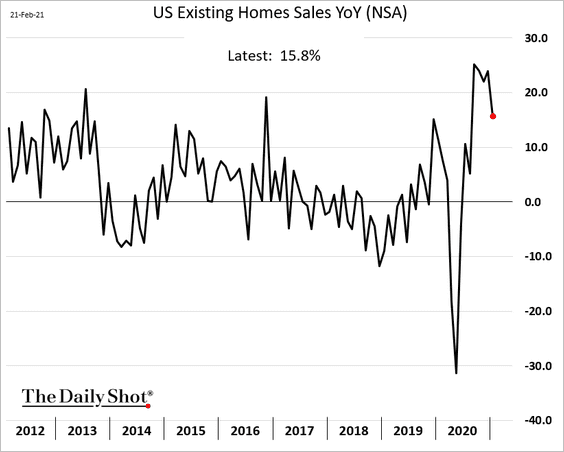

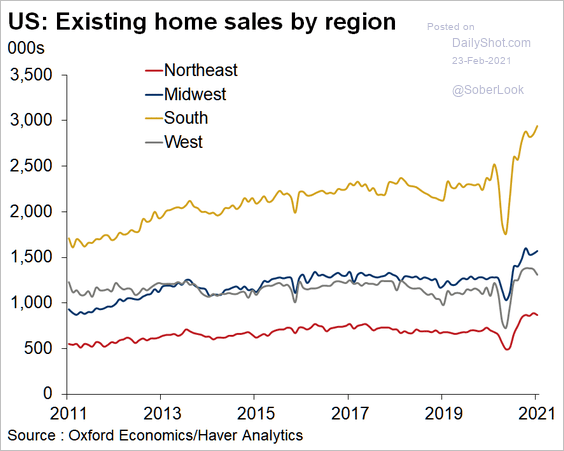

1. Existing home sales were quite strong in January (almost 16% above Jan 2020 levels).

• Here is the regional breakdown.

Source: Oxford Economics

Source: Oxford Economics

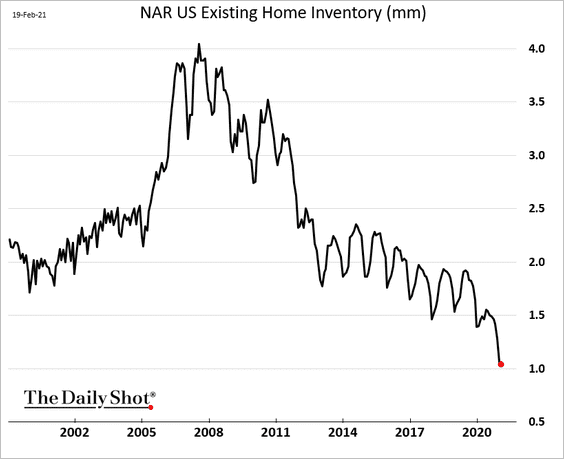

• The inventory of homes for sale hit a multi-decade low.

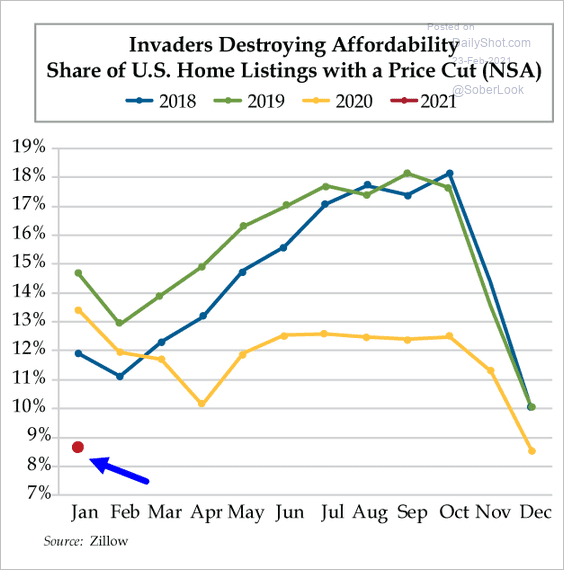

Very few listings have a price cut these days.

Source: The Daily Feather

Source: The Daily Feather

——————–

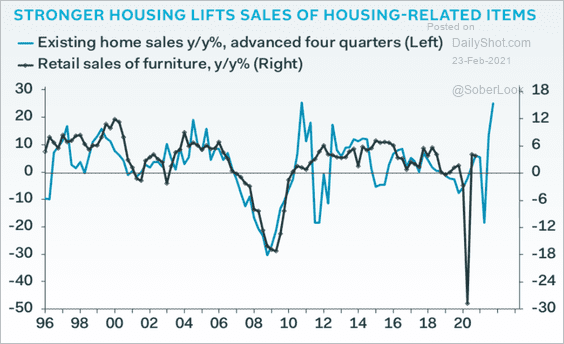

2. The housing market strength is making its way into retail sales.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

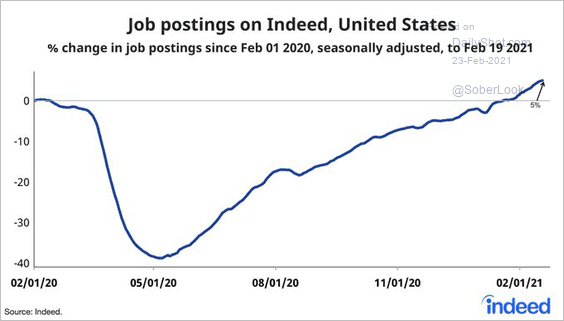

3. Job openings continue to climb.

Source: @JedKolko, @indeed

Source: @JedKolko, @indeed

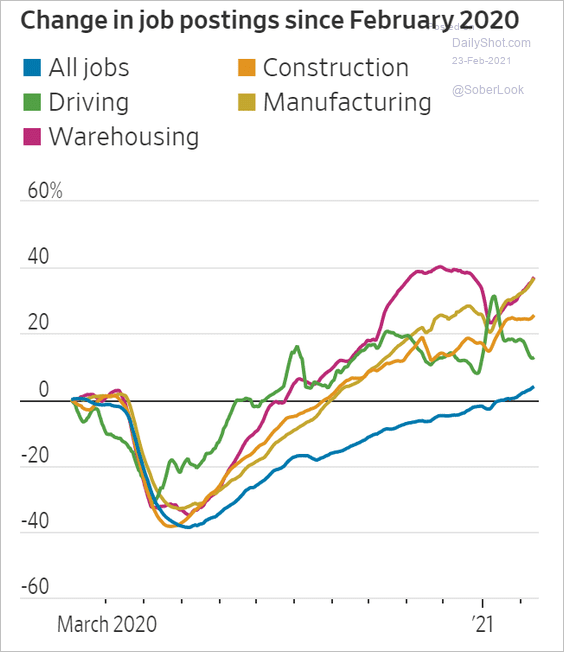

Some blue-collar workers are in high demand.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

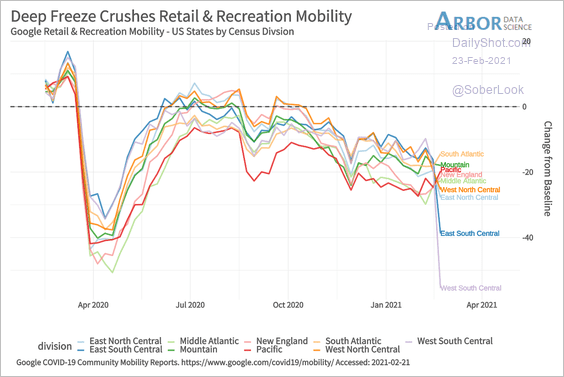

4. The deep freeze put downward pressure on mobility indicators in parts of the US.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

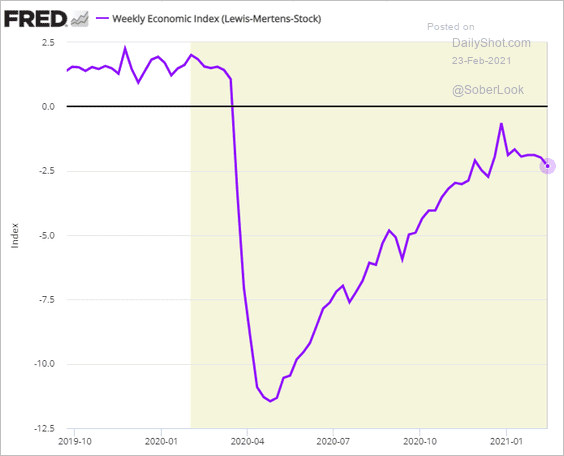

5. Here is the NY Fed’s national economic activity index (WEI).

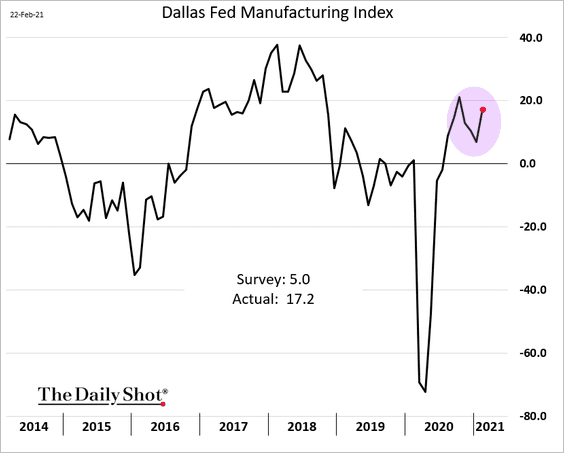

6. The Dallas Fed’s manufacturing index rebounded this month, exceeding forecasts.

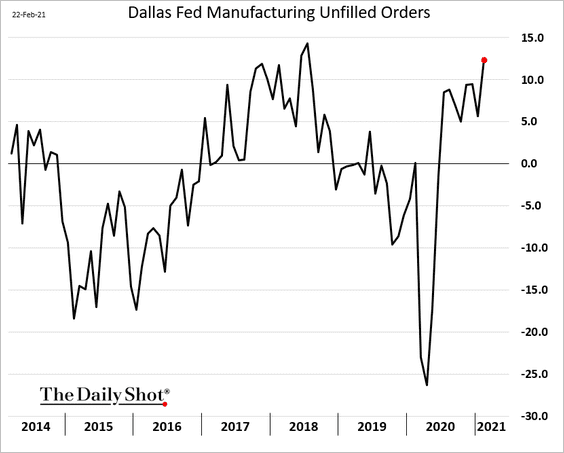

• Unfilled orders spiked.

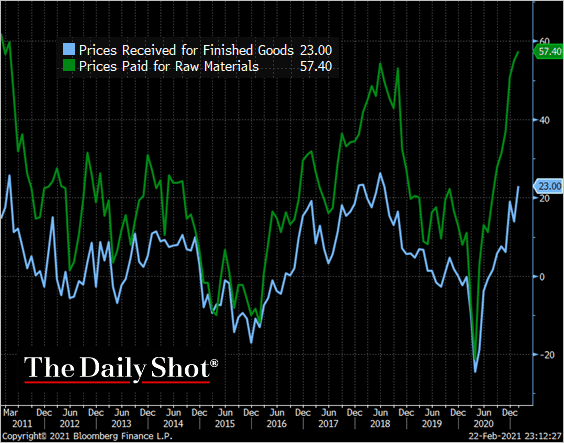

• Gains in input costs are accelerating, forcing some manufacturers to boost prices for finished goods.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

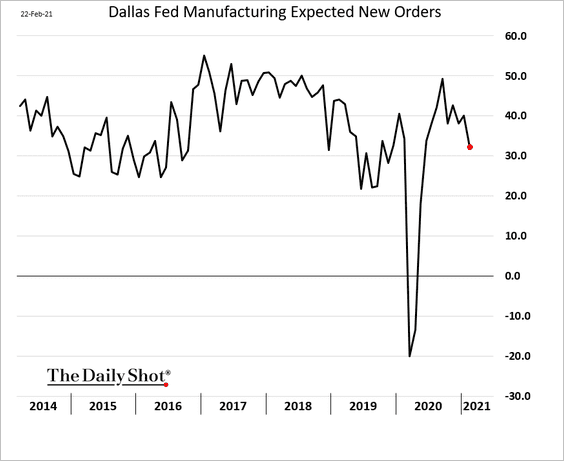

• Forward-looking indicators pulled back.

Back to Index

Global Developments

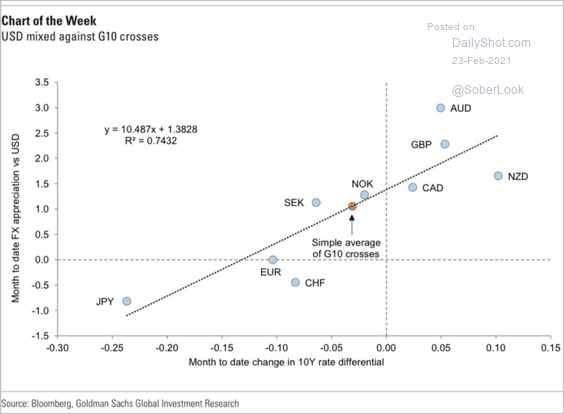

1. Currency moves relative to USD have been tracking rate differentials.

Source: Goldman Sachs, Jalák B

Source: Goldman Sachs, Jalák B

2. Will the dollar repeat the 1985 and 2002 downtrends (implying 1.60 in EUR/USD by 2030)?

Source: Nordea Markets

Source: Nordea Markets

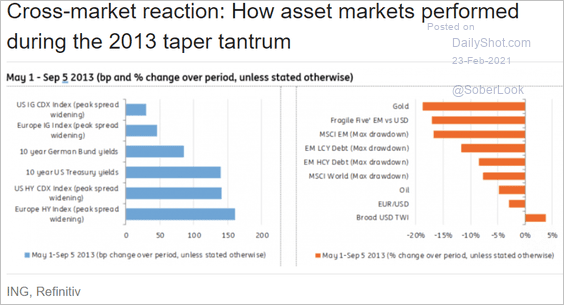

3. How did different asset classes perform during taper tantrum?

Source: ING

Source: ING

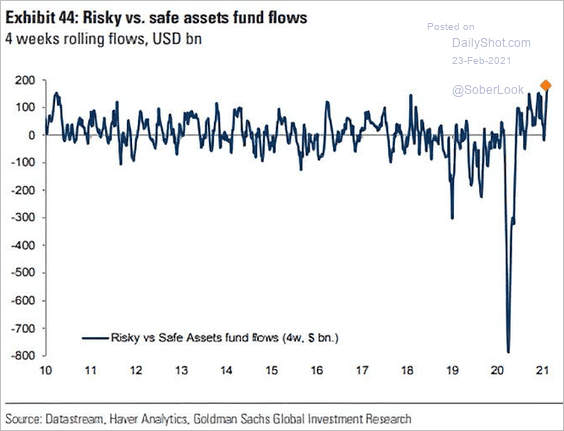

4. The differential between risky vs. safe fund flows hit a new high.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

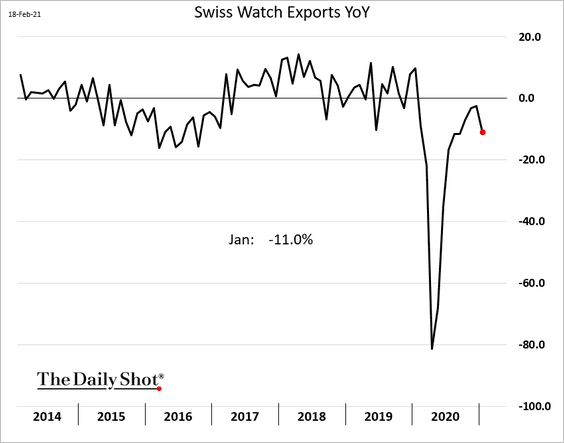

5. Swiss watch exports, an indicator of luxury demand, pulled back last month amid lockdowns.

——————–

Food for Thought

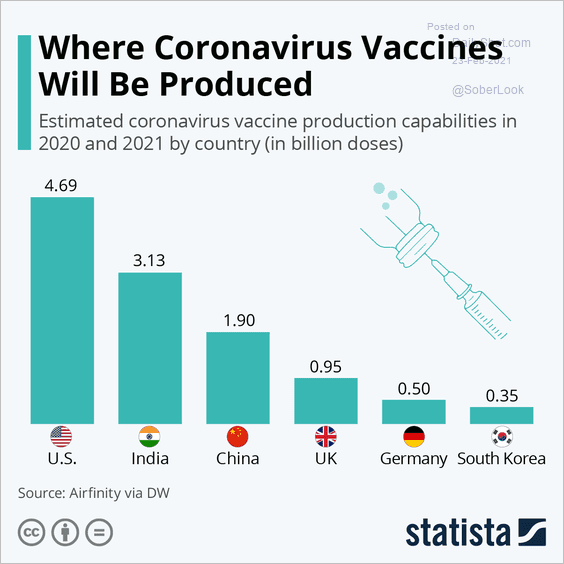

1. Vaccine production capability by country:

Source: Statista

Source: Statista

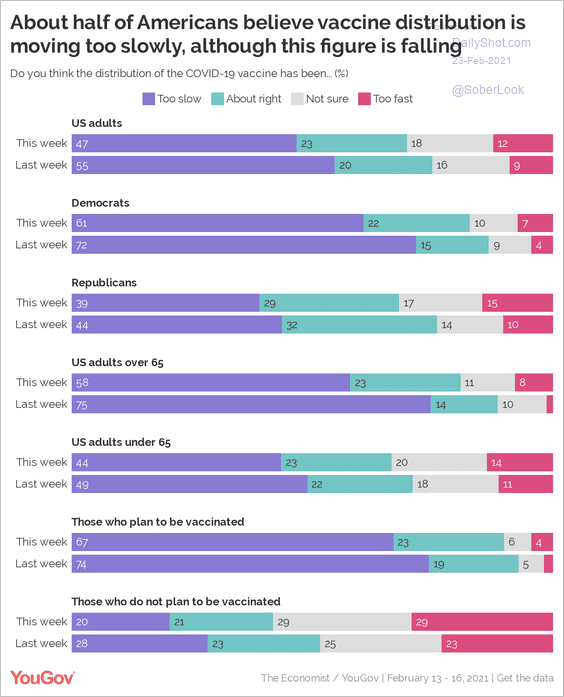

2. Is vaccine distribution moving too slowly?

Source: @YouGovAmerica Read full article

Source: @YouGovAmerica Read full article

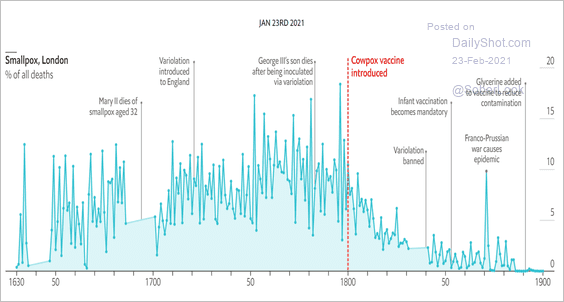

3. Smallpox deaths in London:

Source: The Economist Read full article

Source: The Economist Read full article

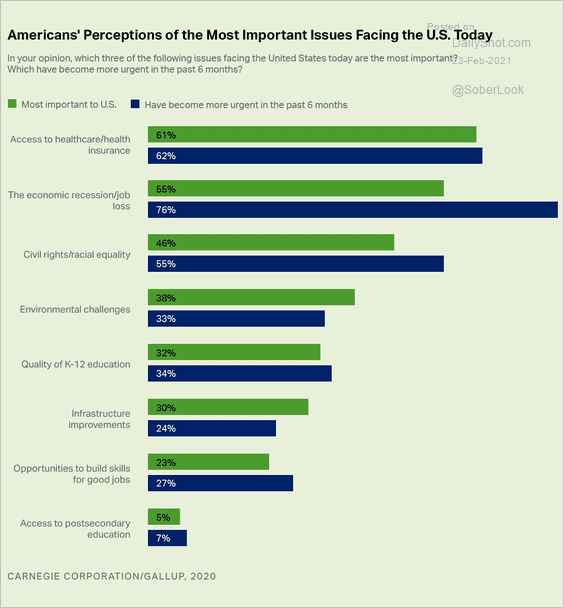

4. Most important issues facing the US:

Source: Gallup Read full article

Source: Gallup Read full article

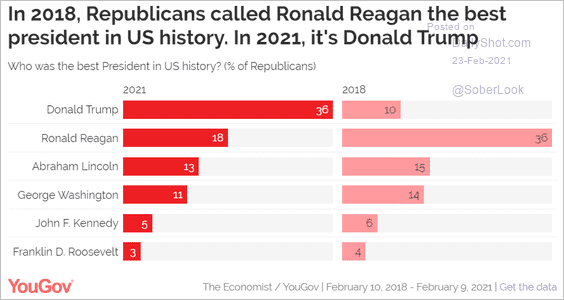

5 Who was the best US president according to GOP voters?

Source: YouGov America

Source: YouGov America

6. Racial income inequality by state:

Source: @howmuch_net Read full article

Source: @howmuch_net Read full article

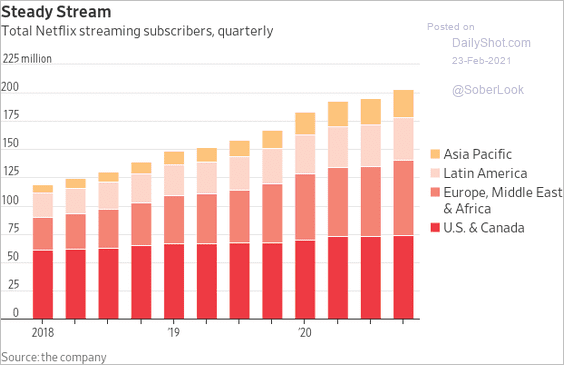

7. Netflix subscribers by region:

Source: @WSJ Read full article

Source: @WSJ Read full article

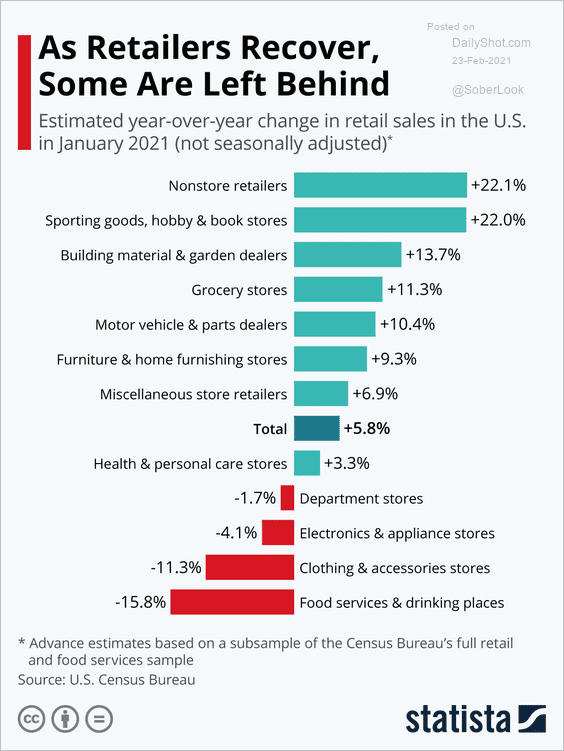

8. Changes in US January retail sales, by sector:

Source: Statista

Source: Statista

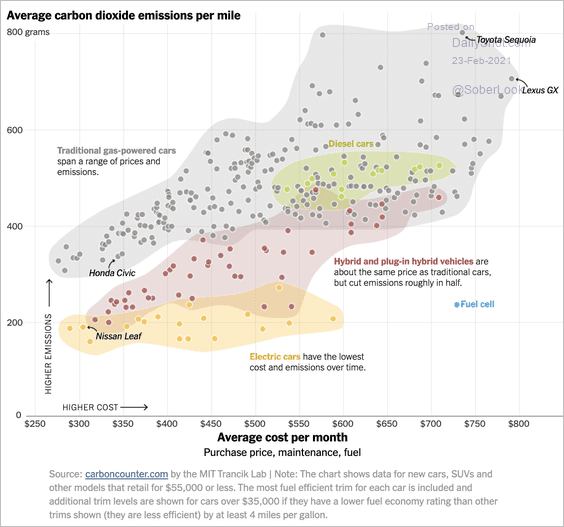

9. Car emissions per mile vs. cost per month:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

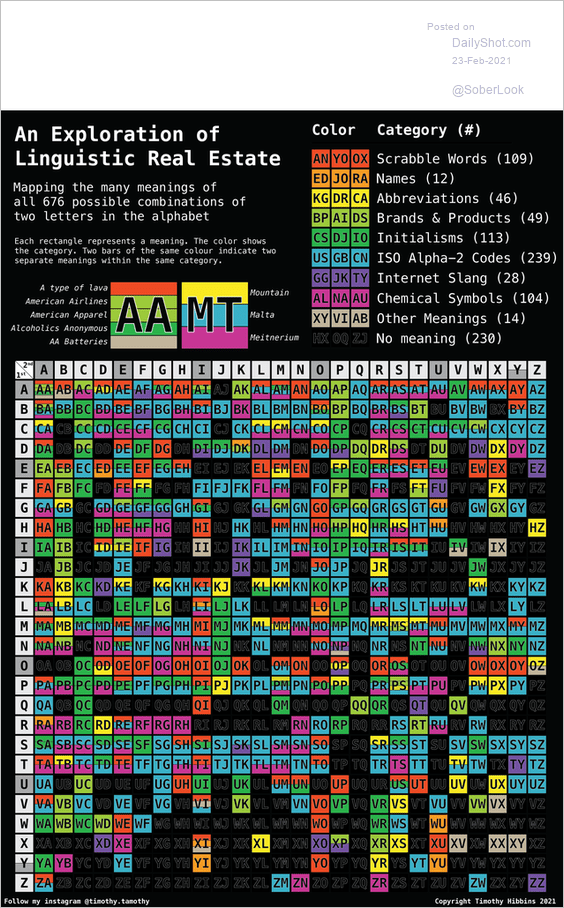

10. Two-letter combinations that have a meaning:

Source: Timothy Hibbins

Source: Timothy Hibbins

——————–

Back to Index