The Daily Shot: 25-Feb-21

• The United States

• Canada

• The Eurozone

• Asia – Pacific

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

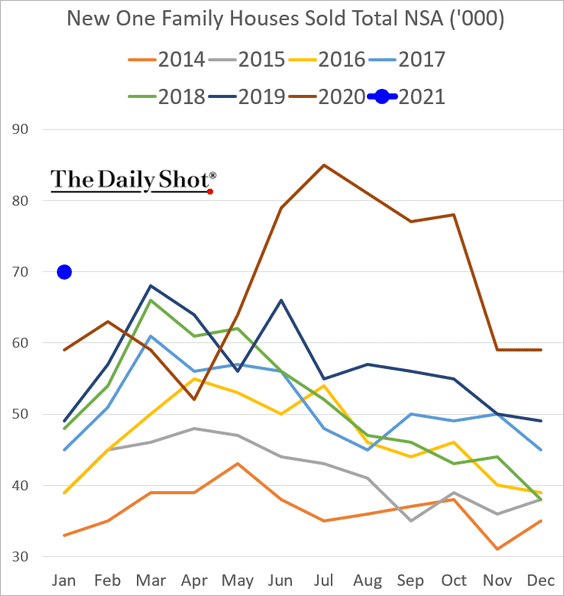

1. Let’s begin with the housing market.

• New home sales started the year on a strong note (well above Jan 2020 levels).

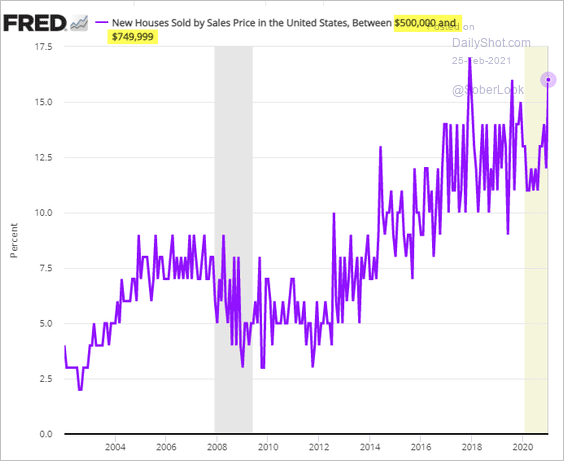

– Sales of higher-end homes picked up last month.

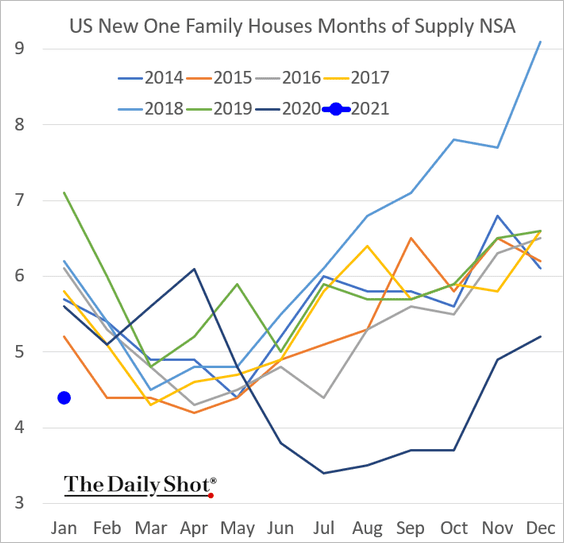

– Measured in months of supply, inventories of new homes are at multi-year lows.

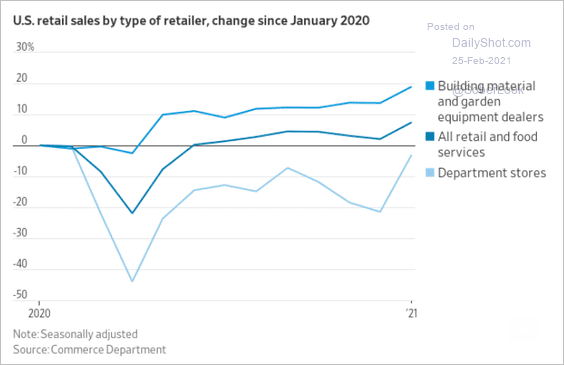

• Will housing continue to boost retail sales?

Source: @WSJ Read full article

Source: @WSJ Read full article

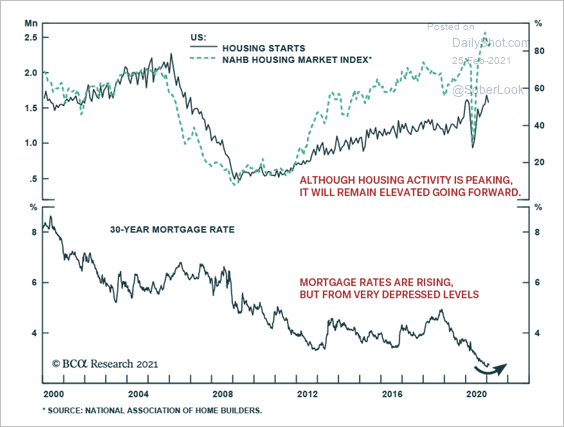

• As Treasury yields climb (see the rates section), a rise in the 30-year mortgage rate could weigh on housing activity.

Source: BCA Research

Source: BCA Research

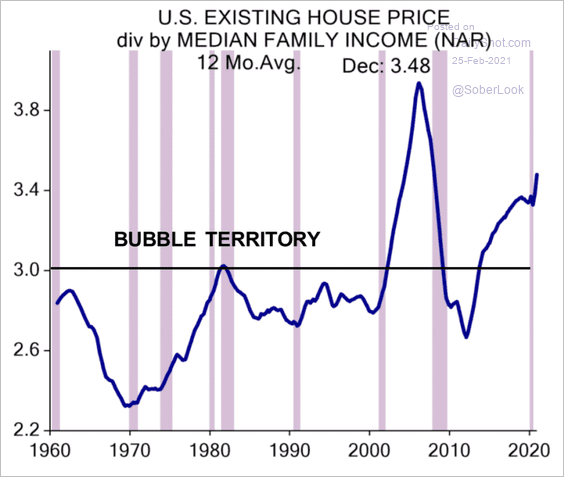

• The chart below shows the ratio of home prices to family incomes (similar to this trend).

Source: Evercore ISI

Source: Evercore ISI

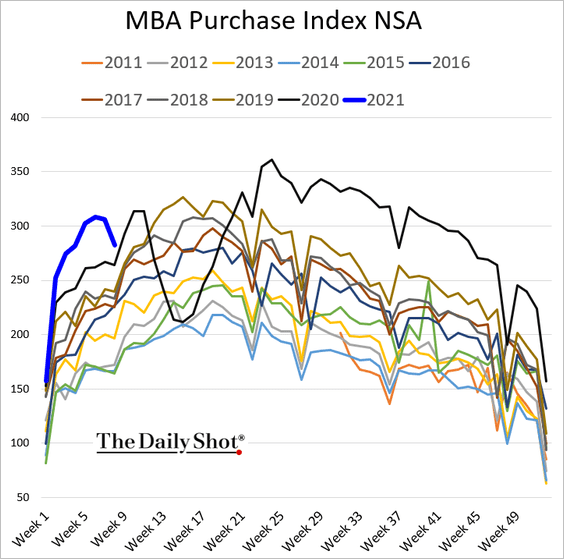

• Loan applications to purchase a home declined last week.

——————–

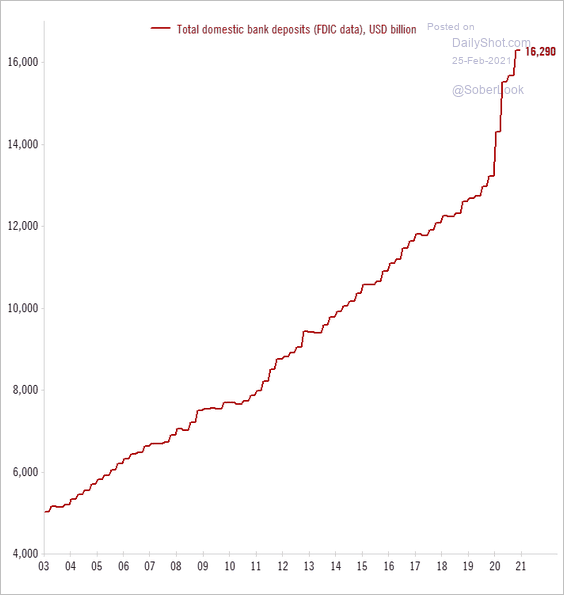

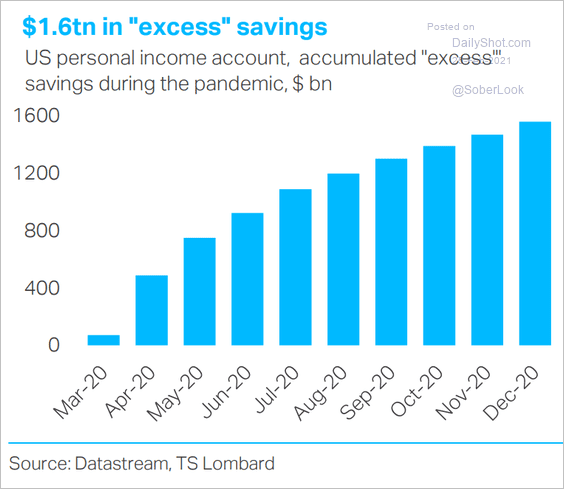

2. Will last year’s spike in savings convert into substantially stronger consumer spending this year? Will it boost inflation?

Source: @TCosterg

Source: @TCosterg

Here is an estimate of “excess” savings from TS Lombard.

Source: TS Lombard

Source: TS Lombard

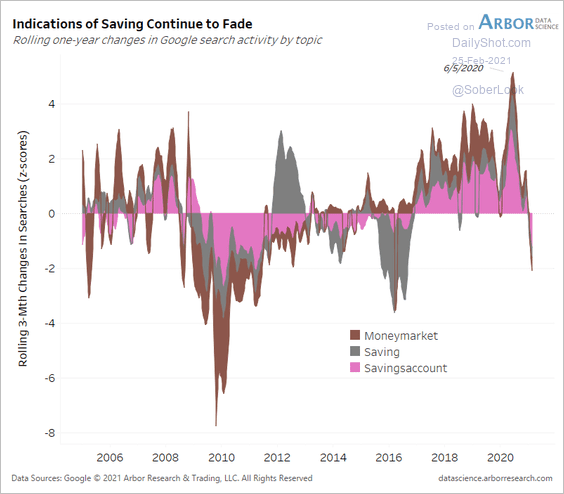

Online search activity suggests that consumers are losing interest in saving, which points to increased spending ahead. It could also indicate more flows into the stock market.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

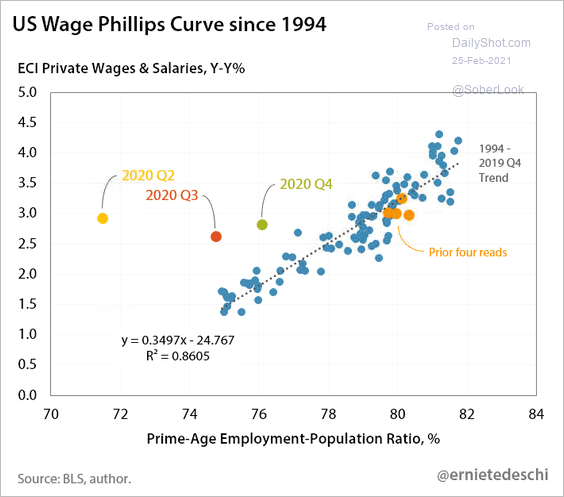

3. Here is the Wage Phillips Curve for the US. Can you spot government checks?

Source: @ernietedeschi

Source: @ernietedeschi

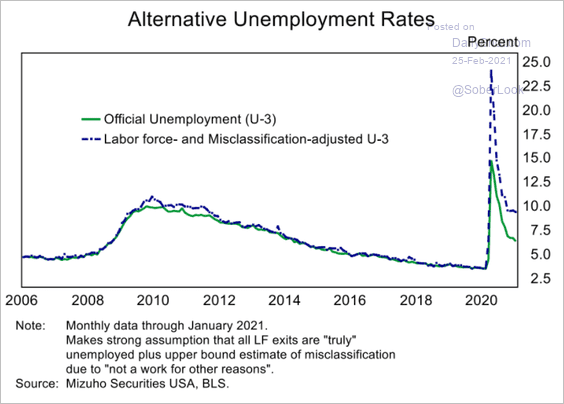

4. Next, we have some updates on the labor market.

• An alternative measure of the unemployment rate:

Source: Mizuho Securities USA

Source: Mizuho Securities USA

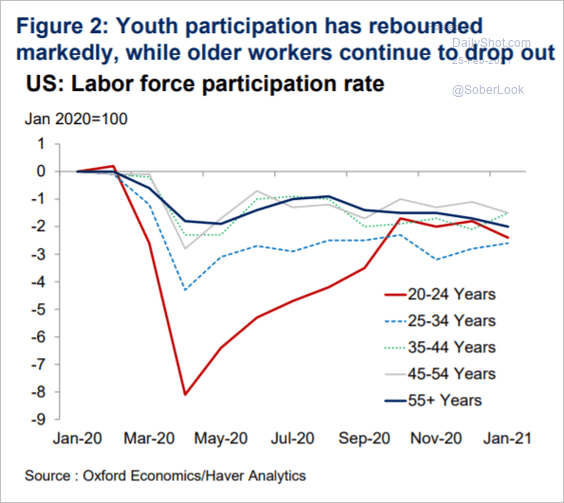

• Labor force participation by age:

Source: Oxford Economics

Source: Oxford Economics

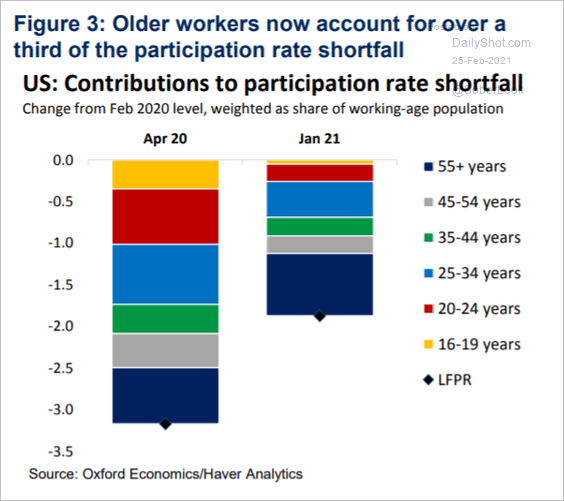

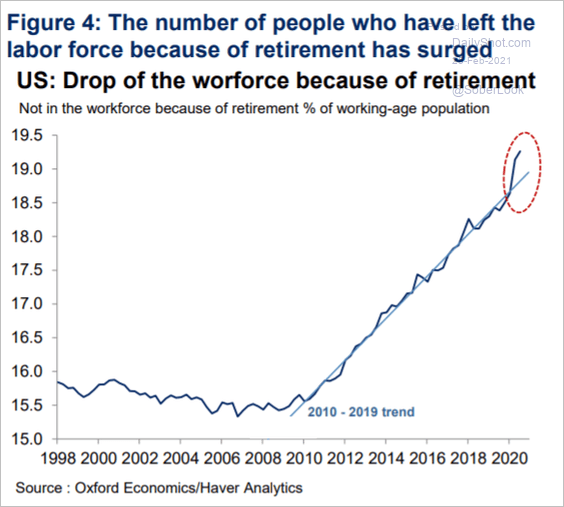

• The participation “shortfall” is increasingly driven by older Americans (retirement).

Source: Oxford Economics

Source: Oxford Economics

Source: Oxford Economics

Source: Oxford Economics

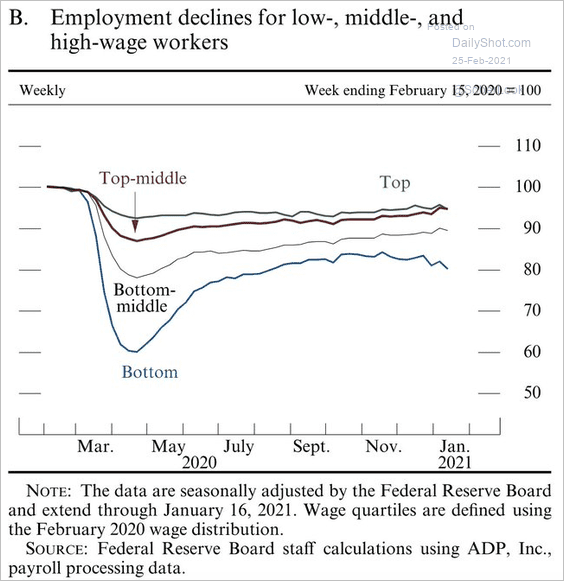

• Pandemic-driven changes in employment by wage category:

Source: @bcheungz Read full article

Source: @bcheungz Read full article

Back to Index

Canada

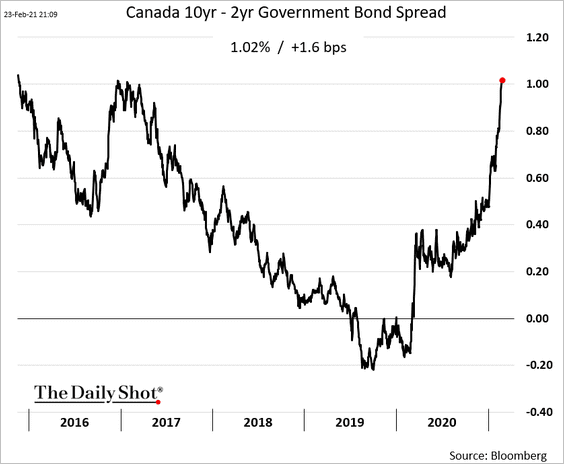

1. The yield curve continues to steepen.

h/t Robert Fullem

h/t Robert Fullem

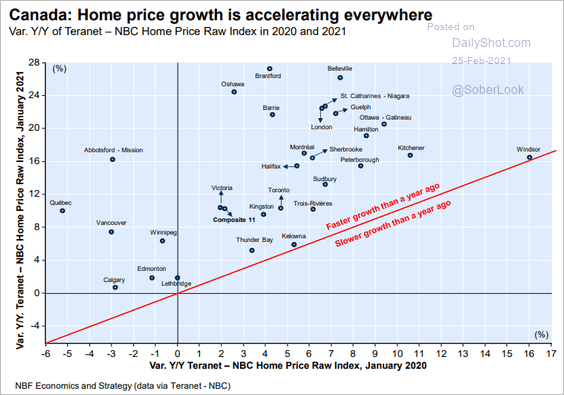

2. Home price appreciation has been broad.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

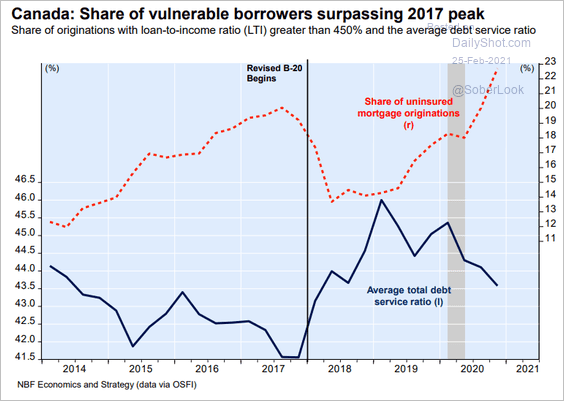

3. Uninsured mortgage originations keep climbing.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

Back to Index

The Eurozone

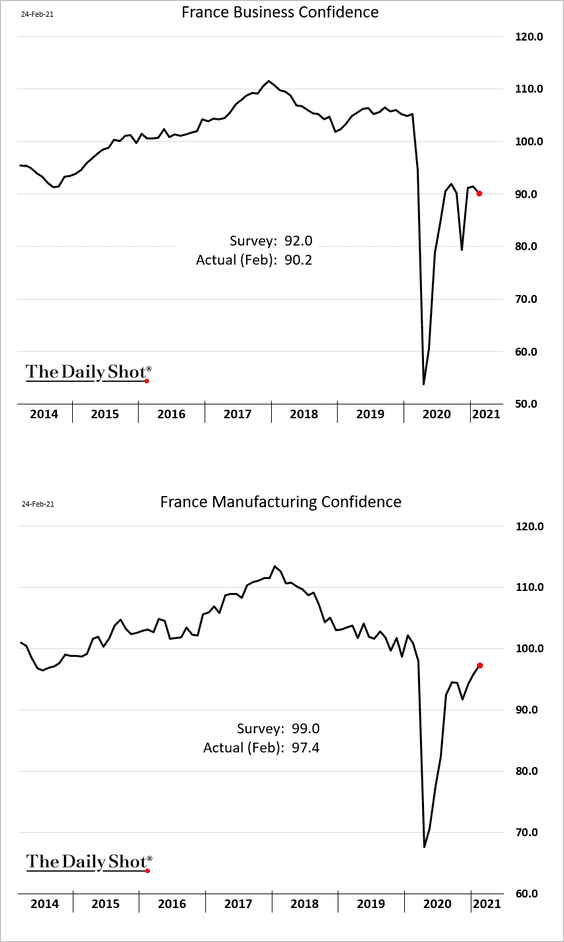

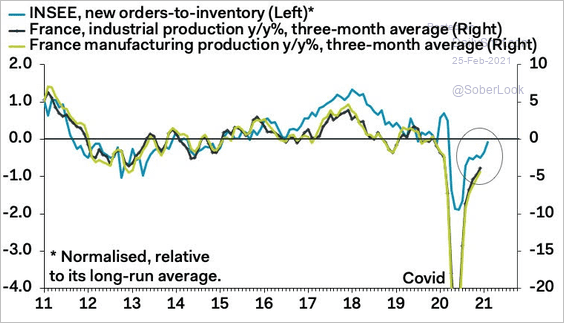

1. French business confidence was a bit softer than expected this month.

However, new orders-to-inventory estimates point to further gains in industrial output.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

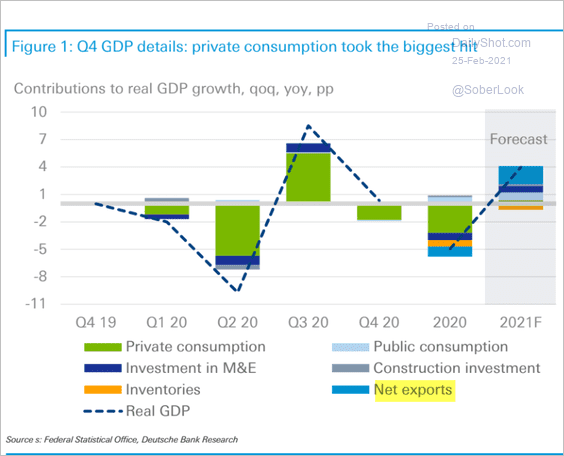

2. According to Deutsche Bank, Germany’s economic recovery this year will be primarily driven by exports.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

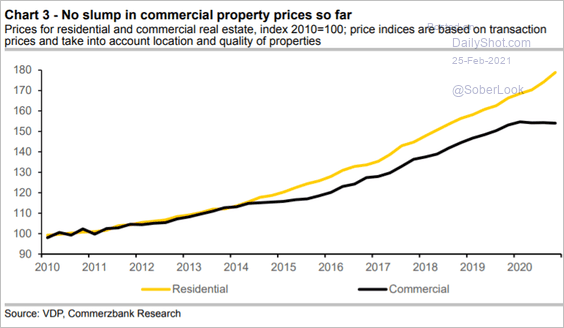

Separately, this chart shows the divergence between Germany’s commercial and residential property prices.

Source: Commerzbank Research

Source: Commerzbank Research

——————–

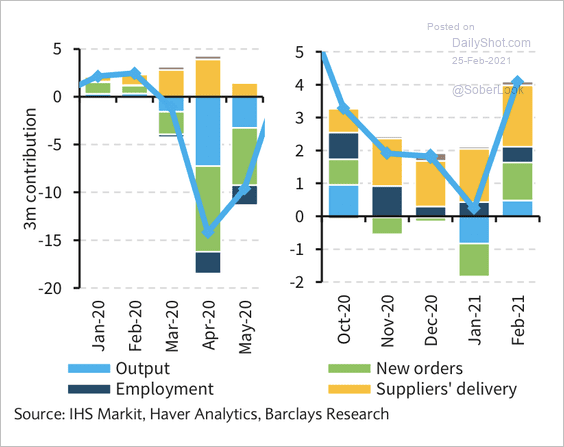

3. Global supply chain disruptions are distorting euro-area manufacturing PMI data. Will we see further increases in pricing pressure?

Source: Barclays Research

Source: Barclays Research

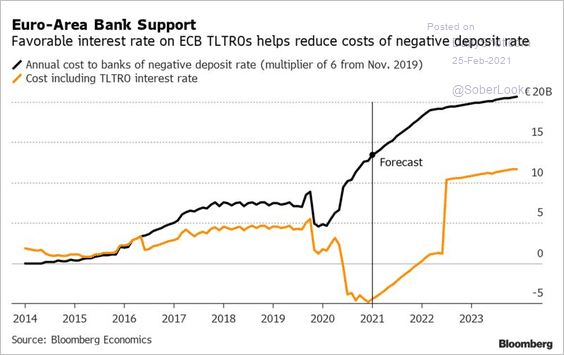

4. This chart shows the banking sector’s cost of negative rates with and without the TLTRO program.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

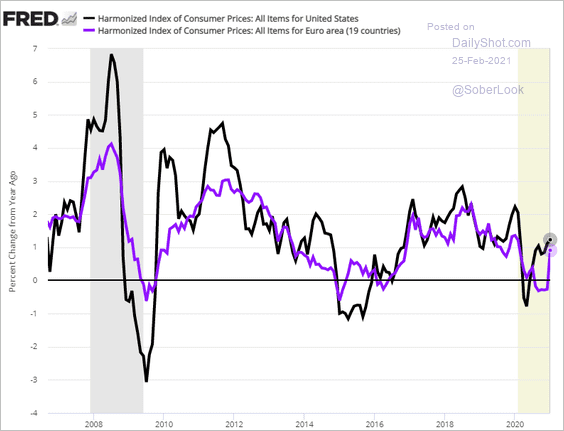

5. Over longer periods, the US and Eurozone inflation indices (apples-to-apples comparison) tend to track each other quite well. The US CPI is just more volatile.

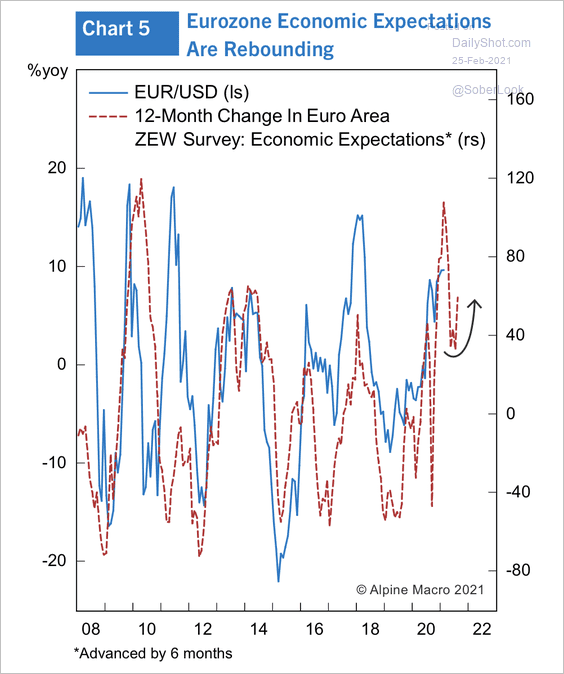

6. Economic expectations are rebounding, which could benefit EUR/USD.

Source: Alpine Macro

Source: Alpine Macro

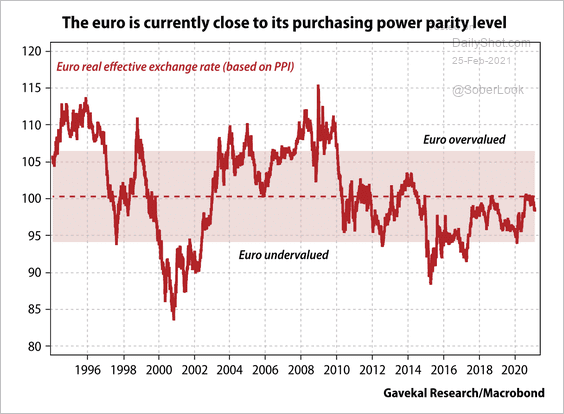

The euro is broadly at purchasing power parity.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Asia – Pacific

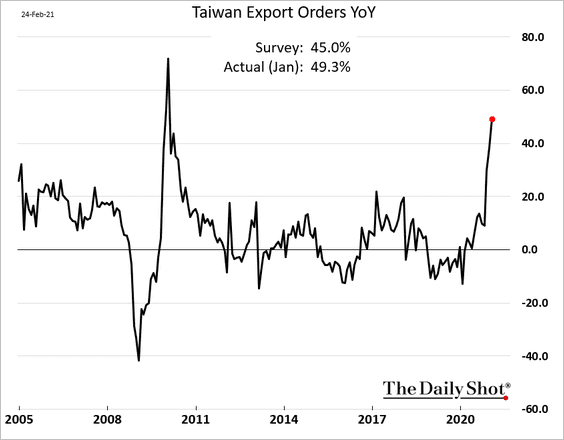

1. Taiwan’s export orders are nearly 50% above last year’s levels amid semiconductor shortages.

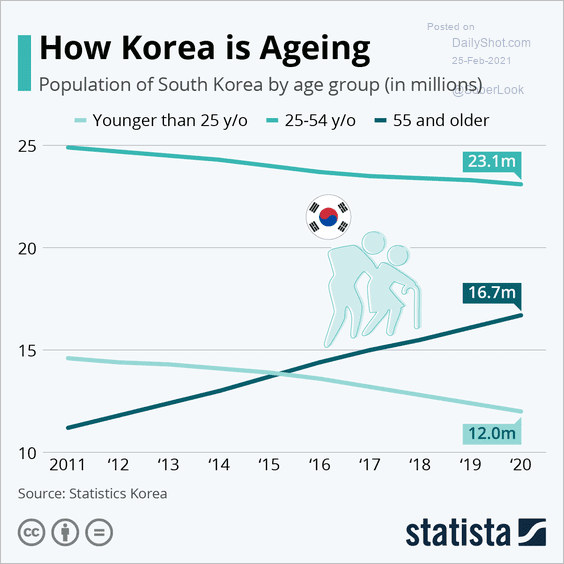

2. South Korea’s demographics don’t look promising.

Source: Statista

Source: Statista

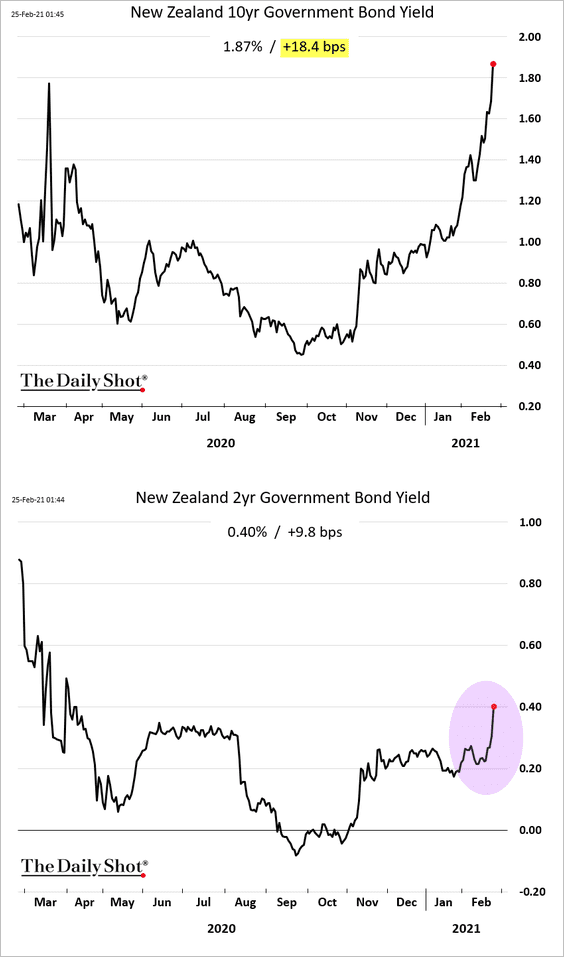

3. New Zealand’s bond yields are soaring. The market is now pricing in a possibility of a rate hike later this year.

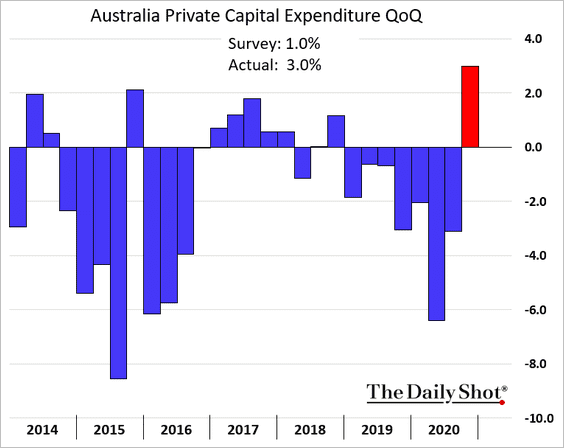

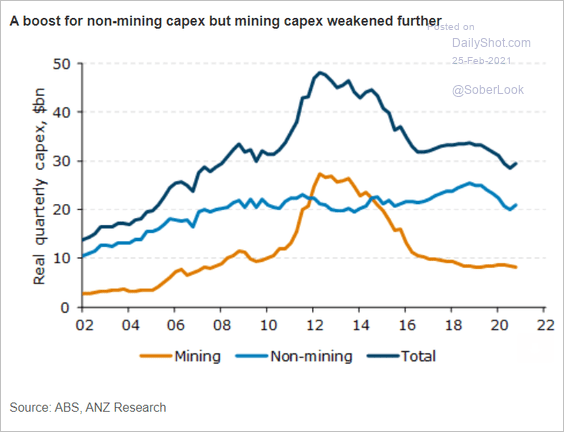

4. Australia’s CapEx jumped in Q4, driven by non-mining sectors.

Source: ANZ Research

Source: ANZ Research

Back to Index

Emerging Markets

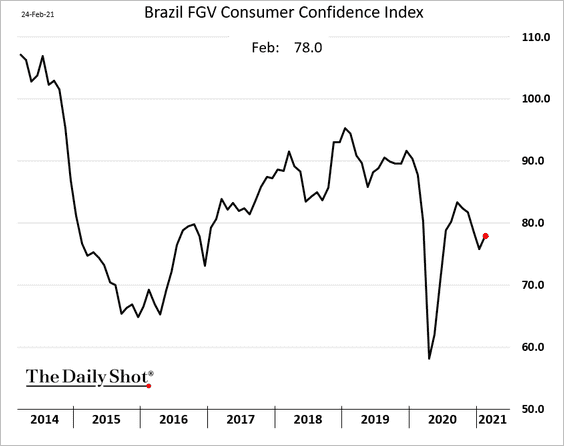

1. Brazil’s consumer confidence ticked up this month.

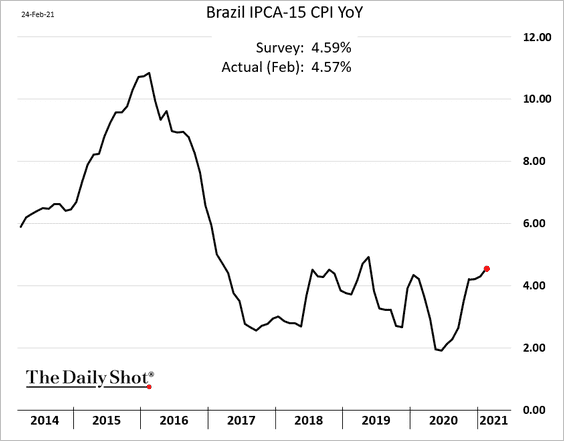

Inflation is grinding higher, but the pace has been a bit slower than expected.

——————–

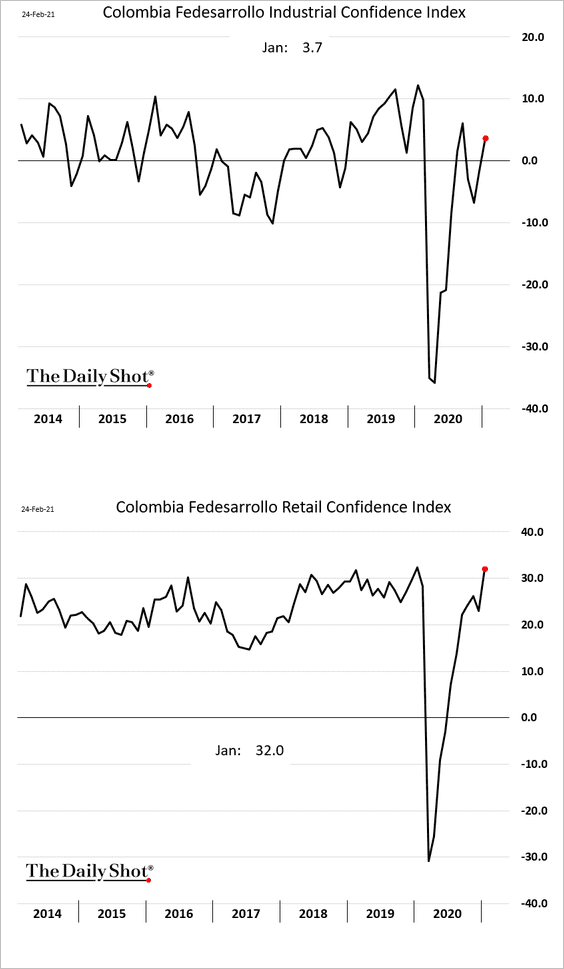

2. Unlike other countries, Colombia’s retail confidence has been outpacing sentiment at industrial firms.

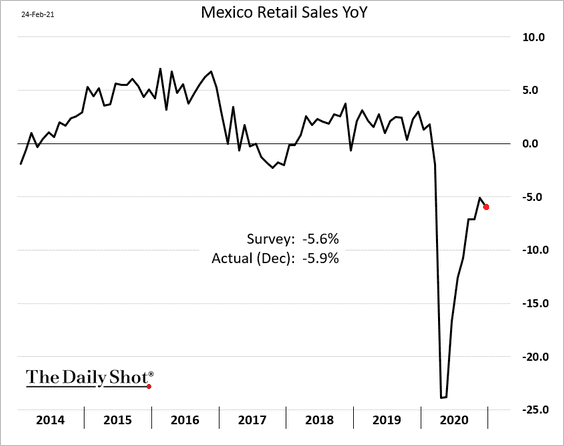

3. Mexico’s retail sales weakened in December. This is going to be a long recovery.

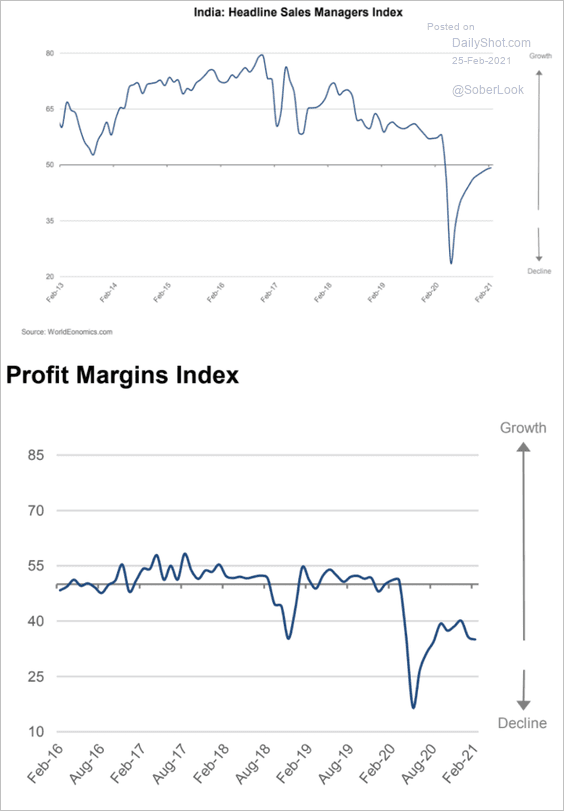

4. The World Economics SMI report on India points to persistent weakness in business activity as margins deteriorate.

Source: World Economics

Source: World Economics

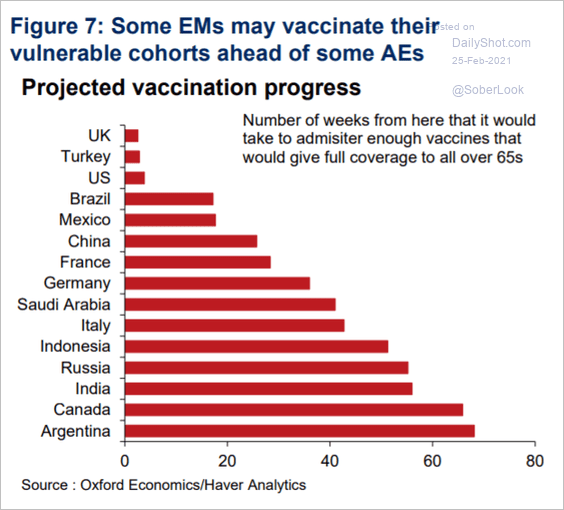

5. Some EM countries are outpacing developed nations in their vaccination progress.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Cryptocurrency

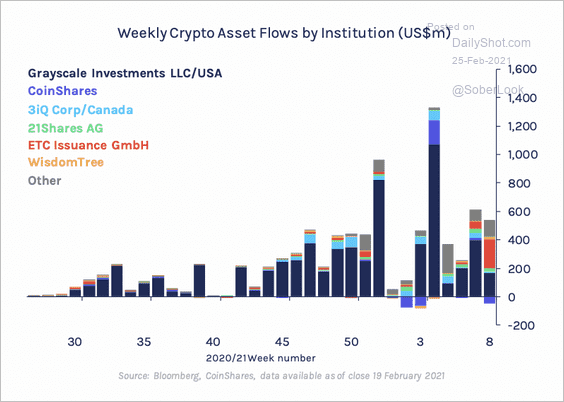

1. Digital asset investment products saw inflows totaling $492 million last week, with Bitcoin (BTC) products accounting for $412 million.

Source: CoinShares Read full article

Source: CoinShares Read full article

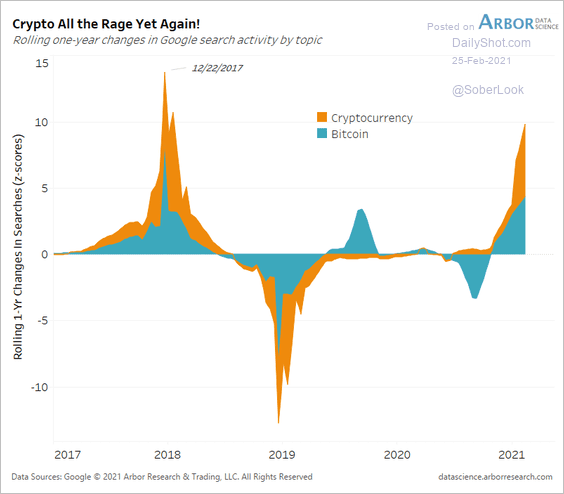

2. Online search activity for cryptos has accelerated.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

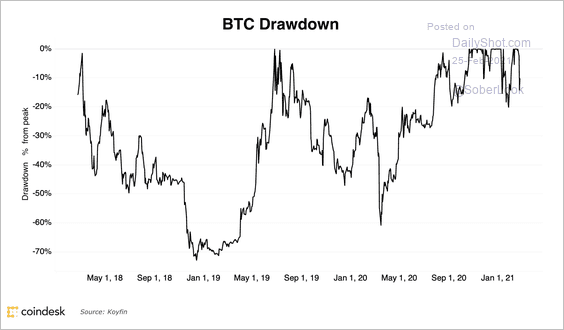

3. The current BTC drawdown is the largest since January.

Source: @CoinDeskData

Source: @CoinDeskData

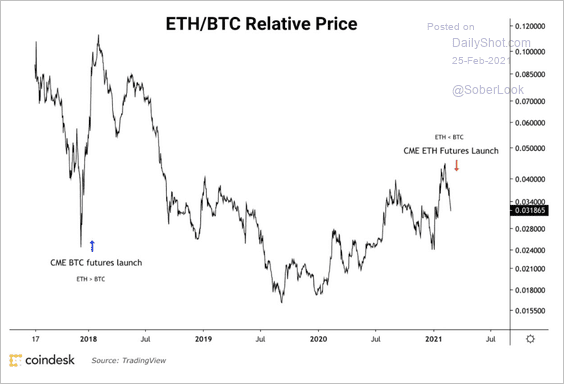

4. Ethereum (ETH) has underperformed BTC since its CME futures launch, accelerating during the recent crypto selloff.

Source: @CoinDeskData

Source: @CoinDeskData

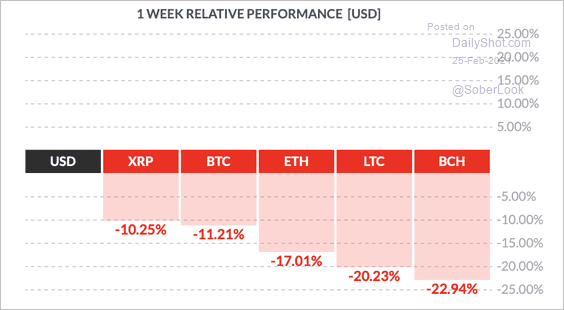

5. It’s been a tough week for cryptocurrencies so far.

Source: FinViz

Source: FinViz

Back to Index

Commodities

1. Industrial metals keep climbing.

• US copper (highest since 2011):

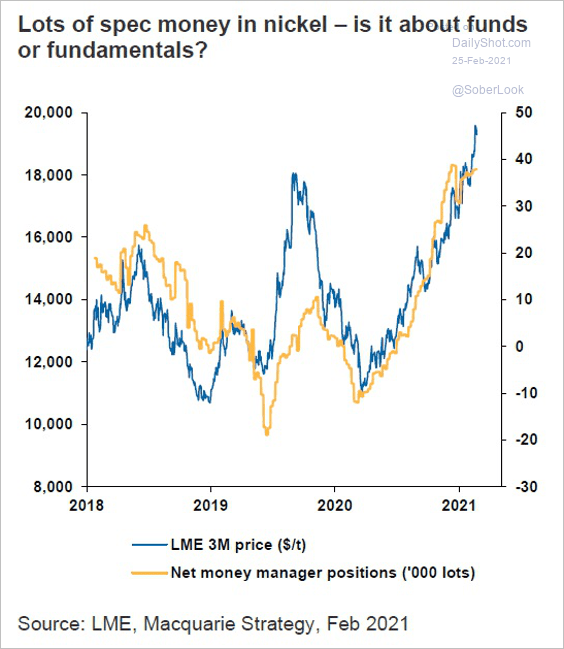

• Nickel (boosted by hedge funds):

Source: Macquarie Strategy, @Scutty

Source: Macquarie Strategy, @Scutty

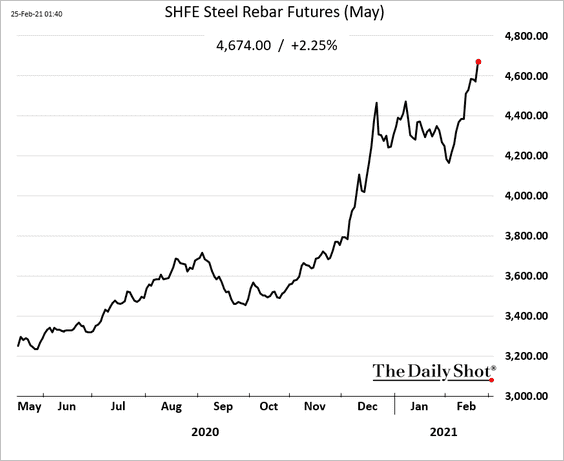

• Steel futures in China:

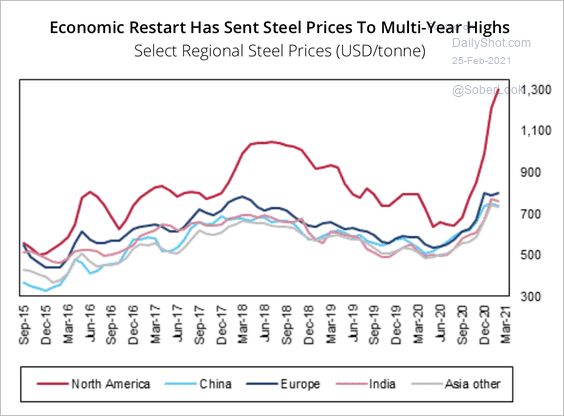

Steel prices in North America have risen sharply.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

——————–

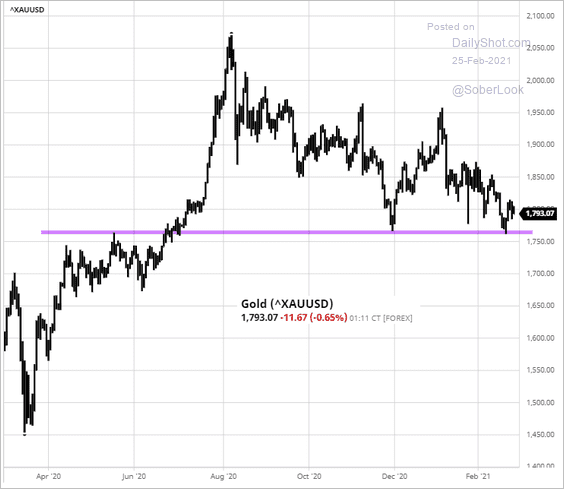

2. Gold held support, but higher bond yields will remain a drag on the precious metal.

Source: barchart.com

Source: barchart.com

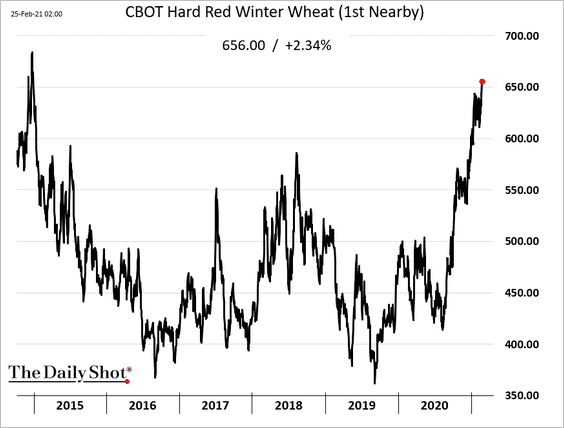

3. US wheat futures have been soaring.

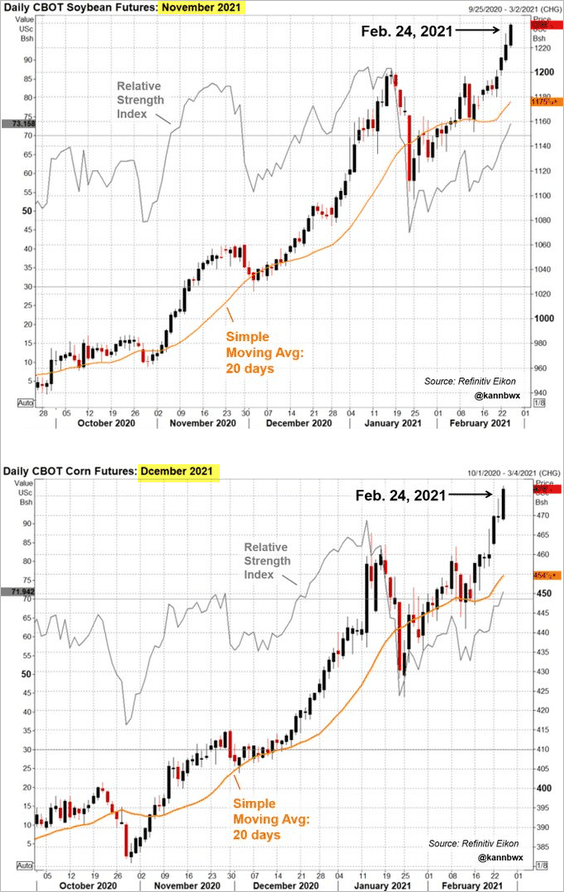

The charts below show “new crop” soybeans and corn futures (maturing this fall).

——————–

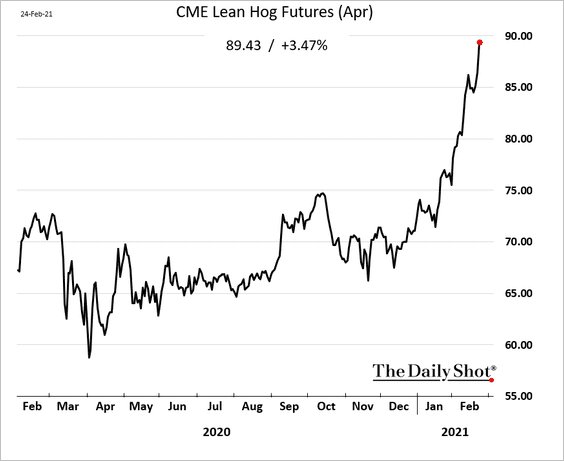

4. The Agriculture Department’s cold storage report showed declining pork belly and trim stocks, sending hog futures sharply higher.

5. It’s been a good month for commodities.

Source: @DavidInglesTV

Source: @DavidInglesTV

Back to Index

Energy

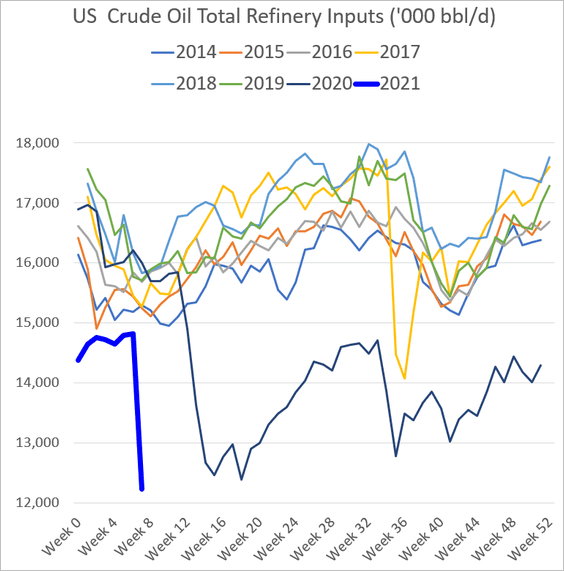

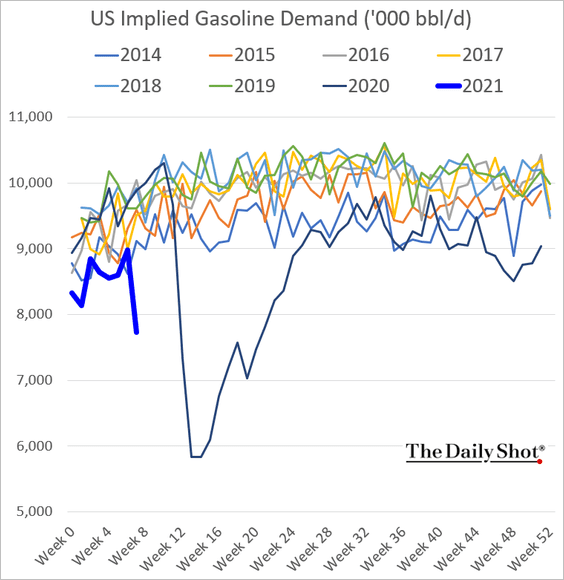

1. Last week’s freezing weather in Texas sent refinery runs to multi-year lows.

• Gasoline deliveries tumbled as well.

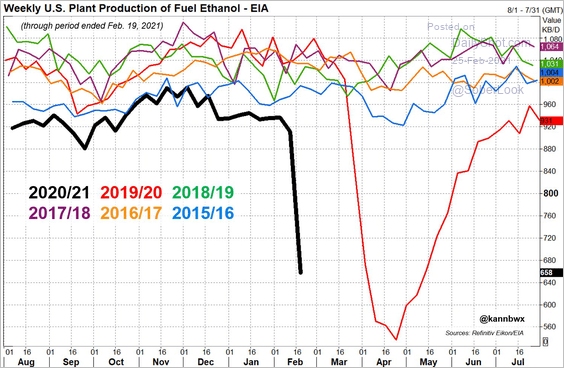

• And here is fuel ethanol production.

Source: @kannbwx

Source: @kannbwx

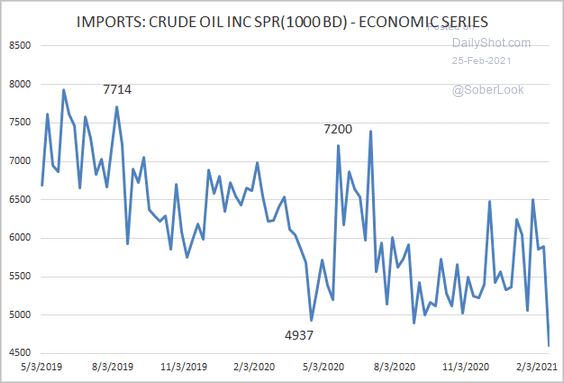

• Crude oil imports tumbled.

Source: @JeoffHall

Source: @JeoffHall

——————–

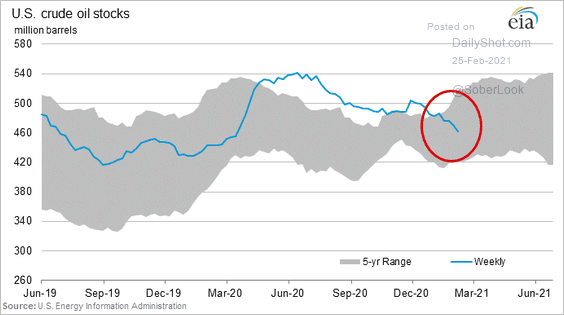

2. US crude oil inventories continue to decline.

Back to Index

Equities

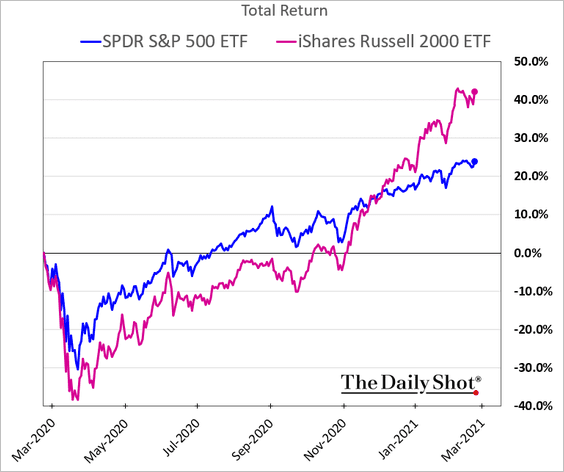

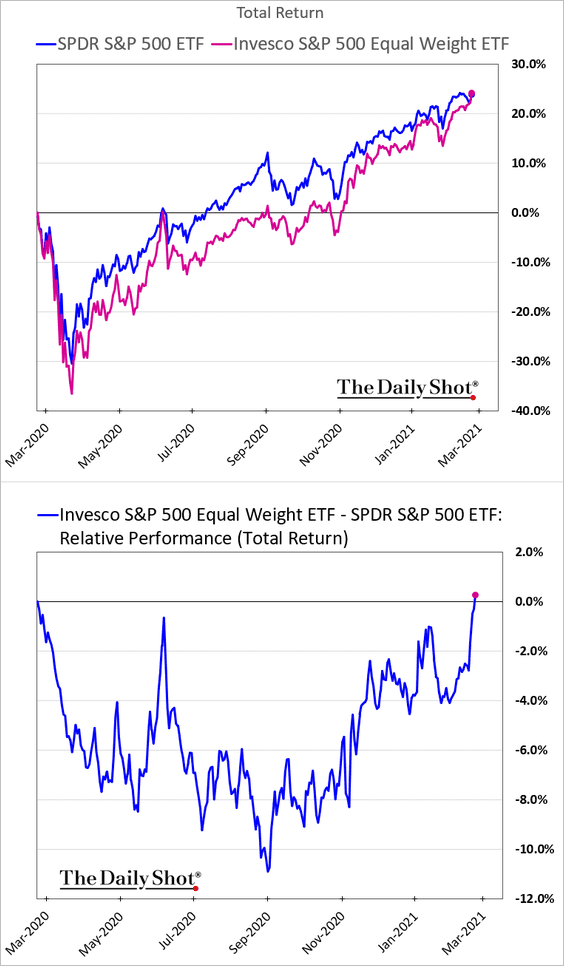

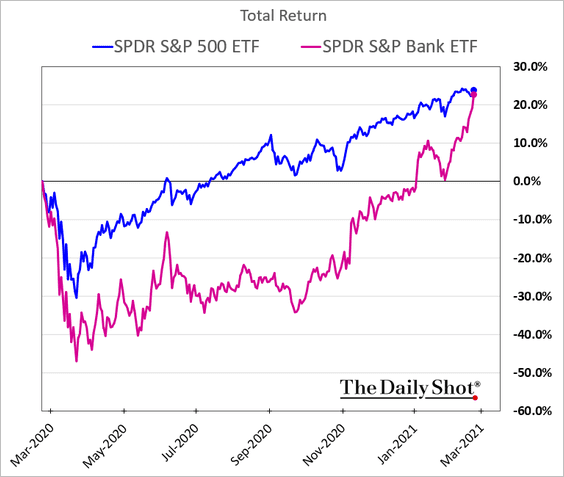

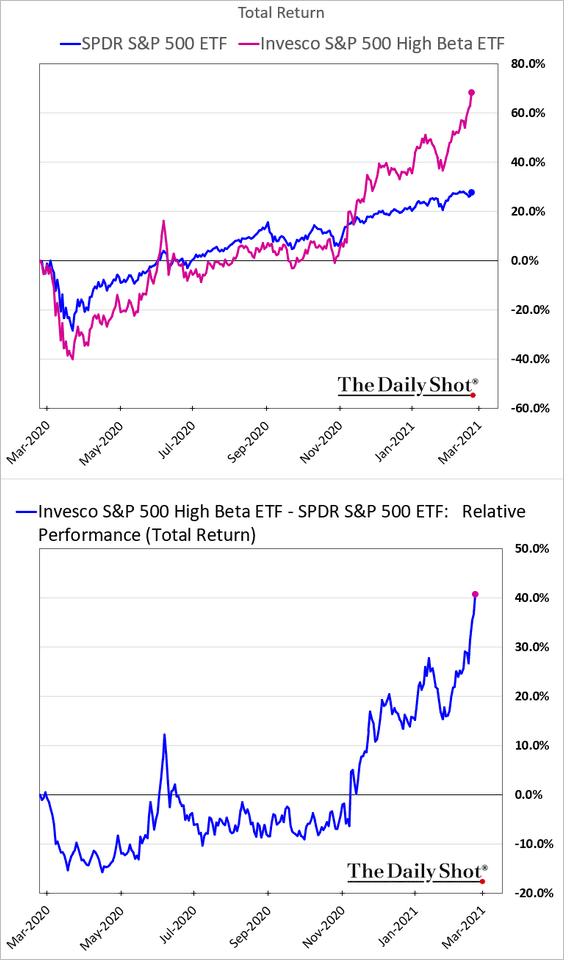

1. Let’s start with some relative performance trends over the past year.

• Small caps:

• Equal-weight S&P 500 (closing the gap):

h/t Nancy Moran

h/t Nancy Moran

• Banks (closing the gap):

• High-beta stocks:

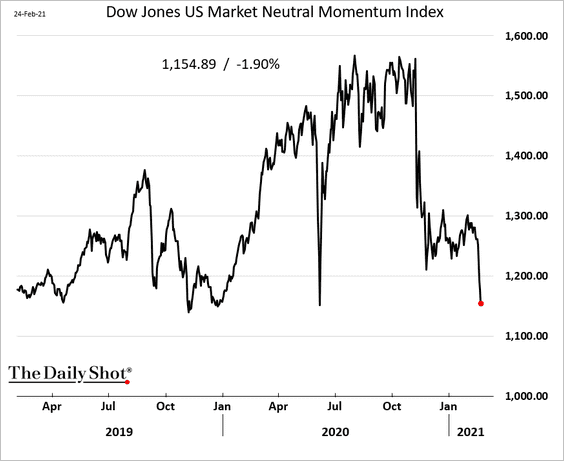

• Momentum factor:

——————–

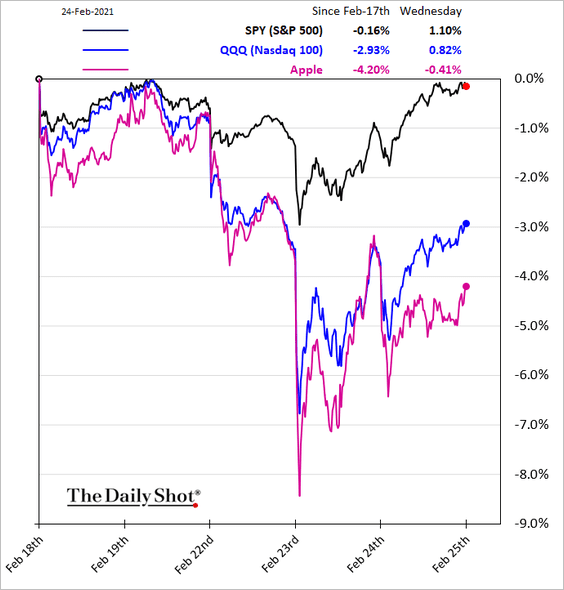

2. Mega-cap companies continue to underperform.

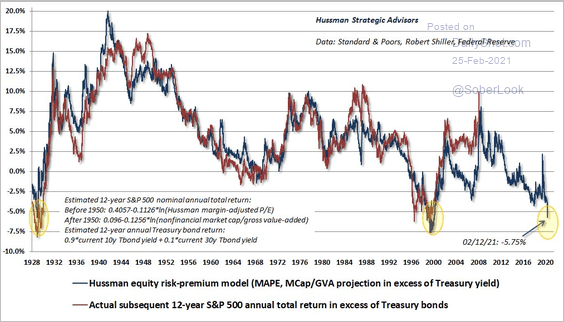

3. Some models suggest that given current valuations, long-term S&P 500 performance will be negative.

Source: @hussmanjp

Source: @hussmanjp

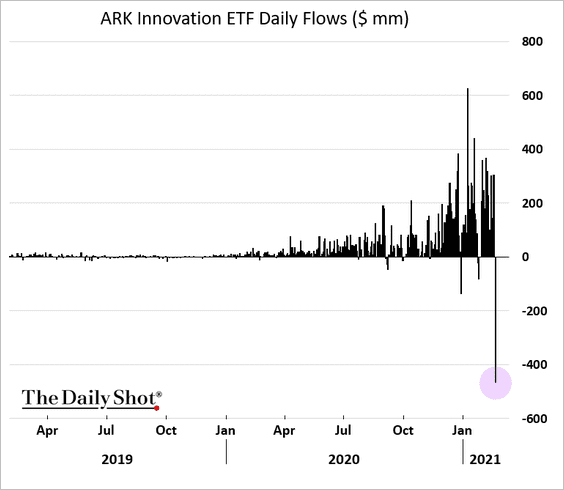

4. The popular ARK Innovation ETF saw some outflows.

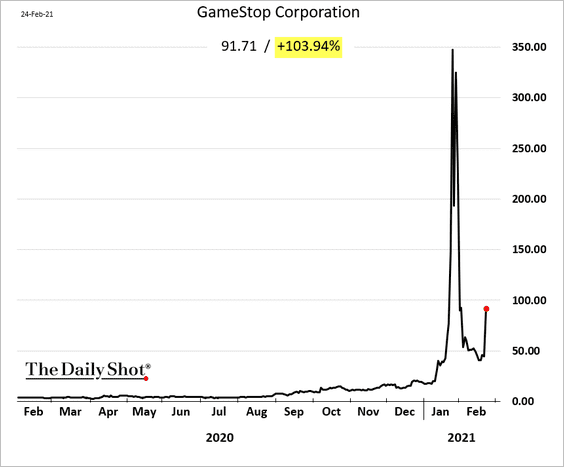

5. Here we go again.

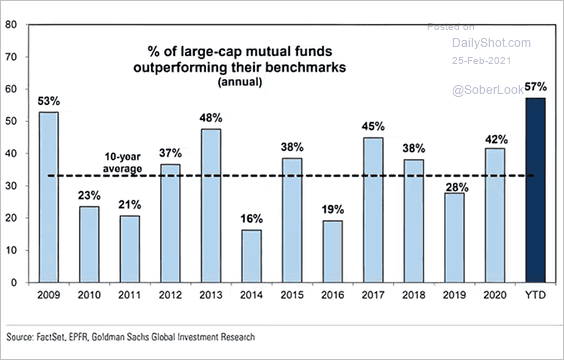

6. An unusually high percentage of large-cap mutual funds have outperformed their benchmark this year.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

Back to Index

Rates

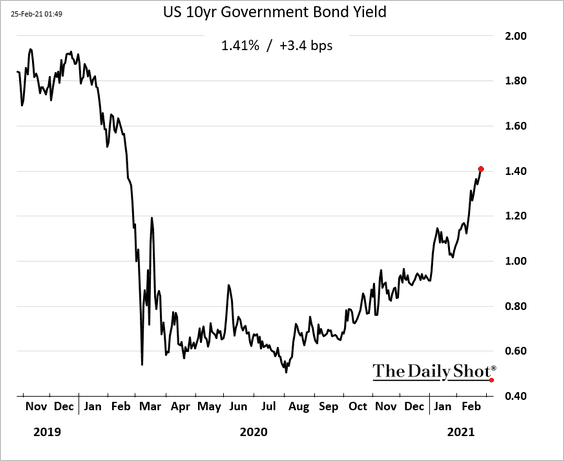

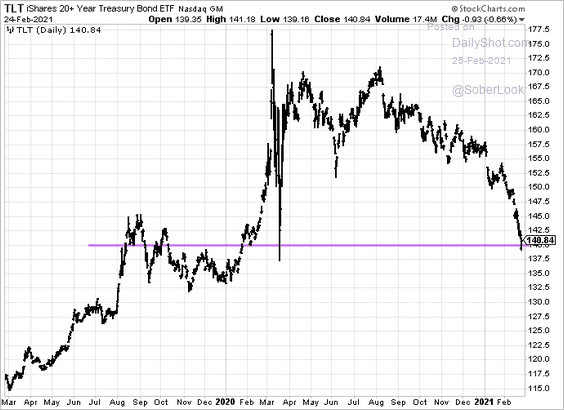

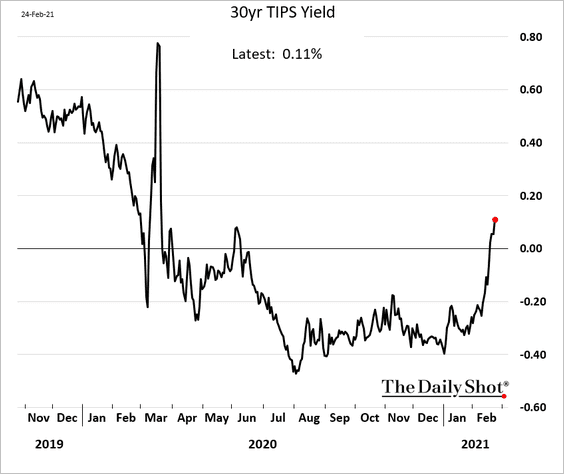

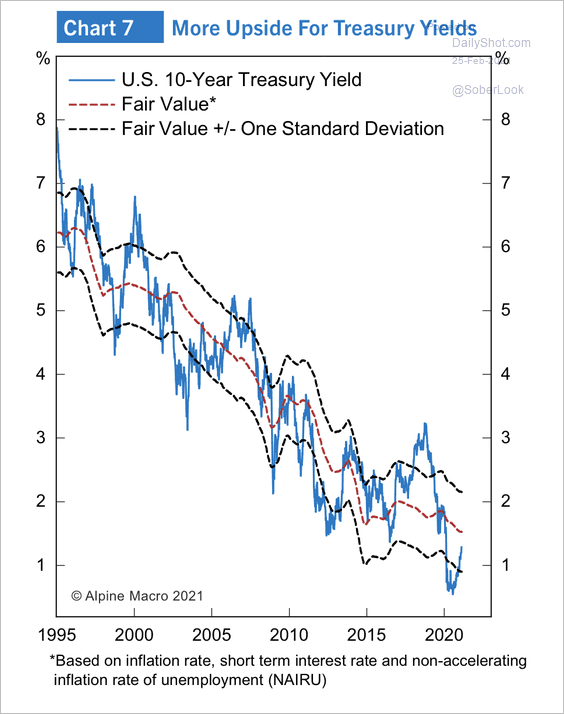

1. Treasury yields keep climbing, with the 10yr breaching 1.4%.

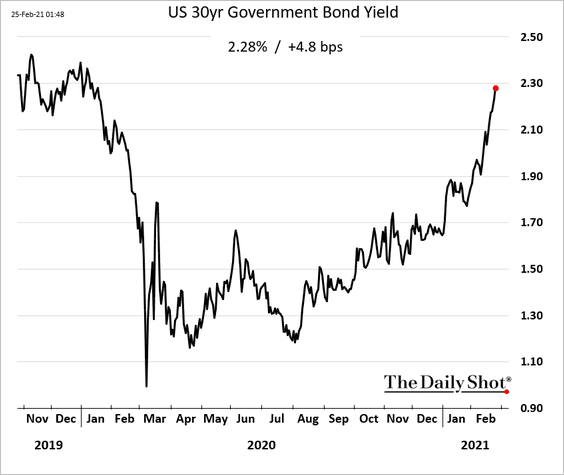

• Here is the 30yr yield.

And this chart shows the iShares 20+ Year Treasury ETF.

• The recent yield gains have been driven by real rates (TIPS yields) rather than inflation expectations.

• According to Alpine Macro, the 10yr Treasury yield has yet to return to “fair value.”

Source: Alpine Macro

Source: Alpine Macro

——————–

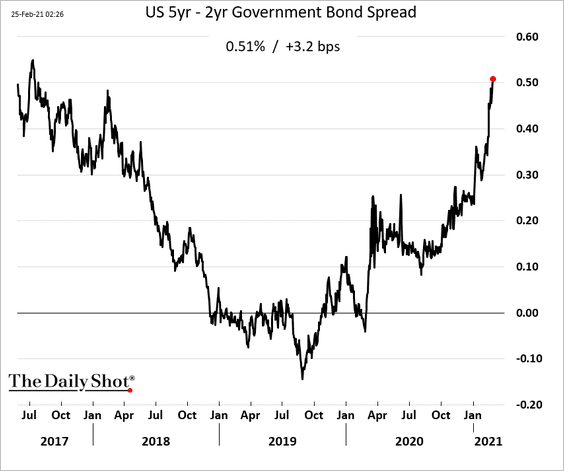

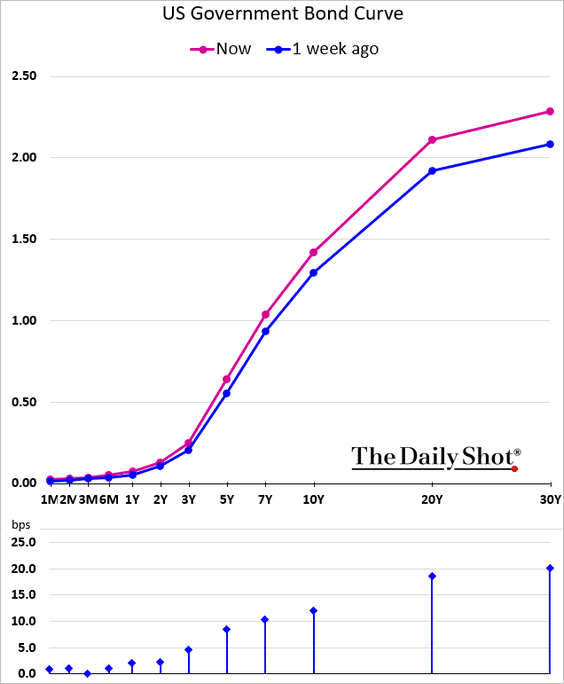

2. The yield curve is steepening across maturities, including at the short end.

——————–

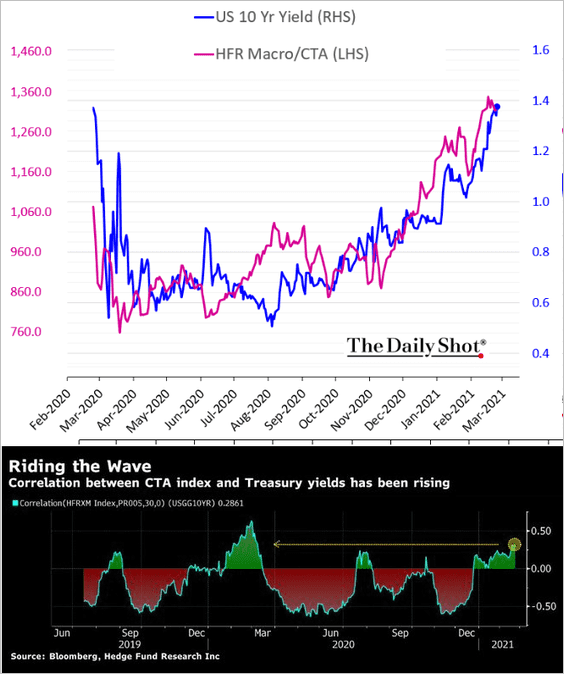

3. CTAs/macro hedge funds have been shorting Treasuries and got rewarded for it.

Source: @StephenSpratt Read full article

Source: @StephenSpratt Read full article

Back to Index

Global Developments

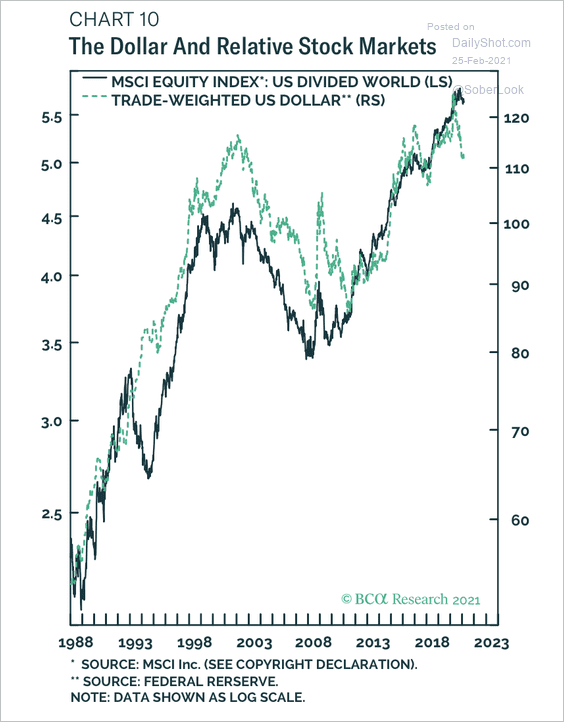

1. The dollar’s decline typically occurs during times of US equity market underperformance relative to the world.

Source: BCA Research

Source: BCA Research

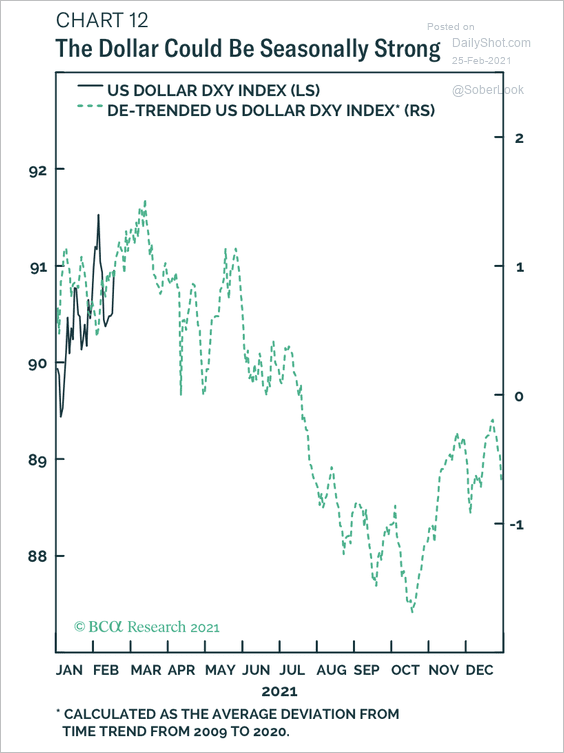

Here is the US dollar’s seasonal trend.

Source: BCA Research

Source: BCA Research

——————–

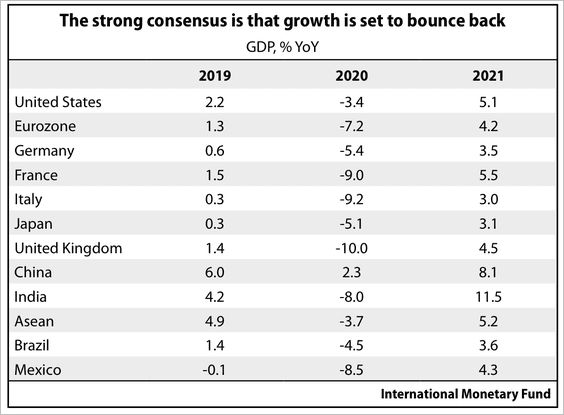

2. The IMF expects global growth to bounce back this year.

Source: Gavekal Research

Source: Gavekal Research

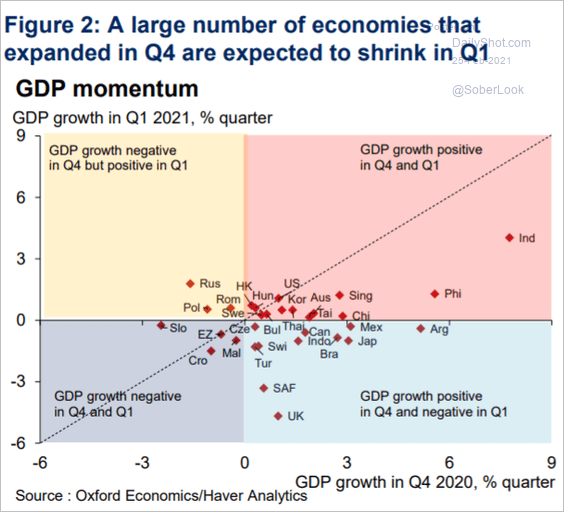

However, many economies that had a strong Q4 are expected to shrink this quarter.

Source: Oxford Economics

Source: Oxford Economics

——————–

Food for Thought

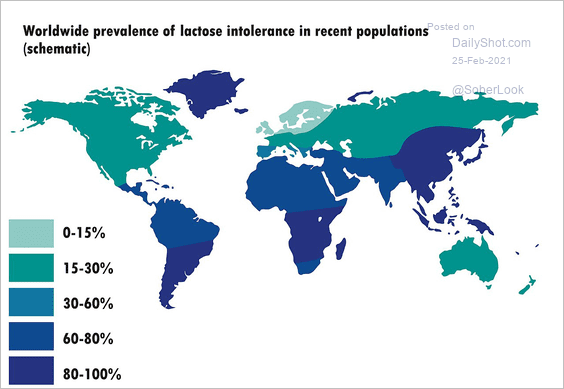

1. Prevalence of lactose intolerance globally:

Source: Wikipedia Read full article

Source: Wikipedia Read full article

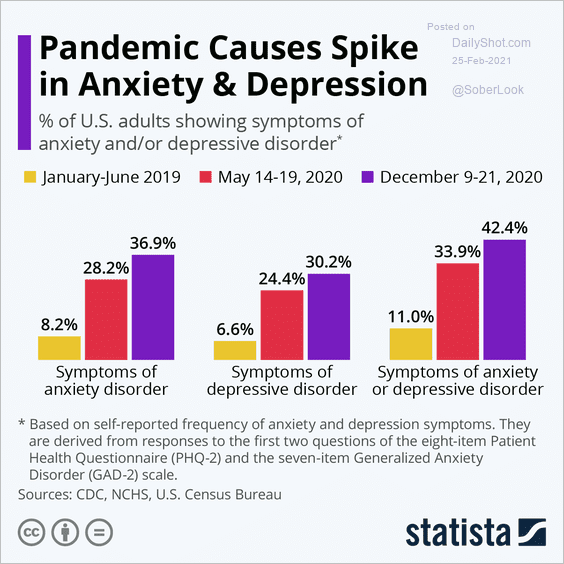

2. Pandemic-induced anxiety and depression:

Source: Statista

Source: Statista

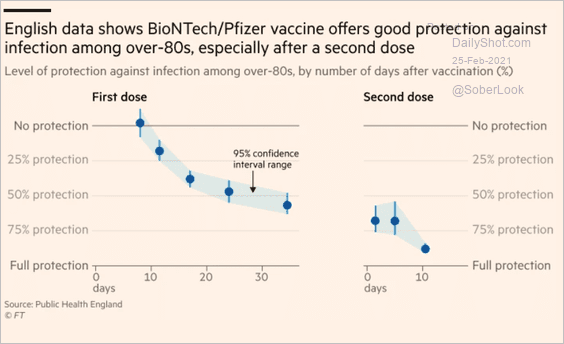

3. Encouraging vaccine data from the UK:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

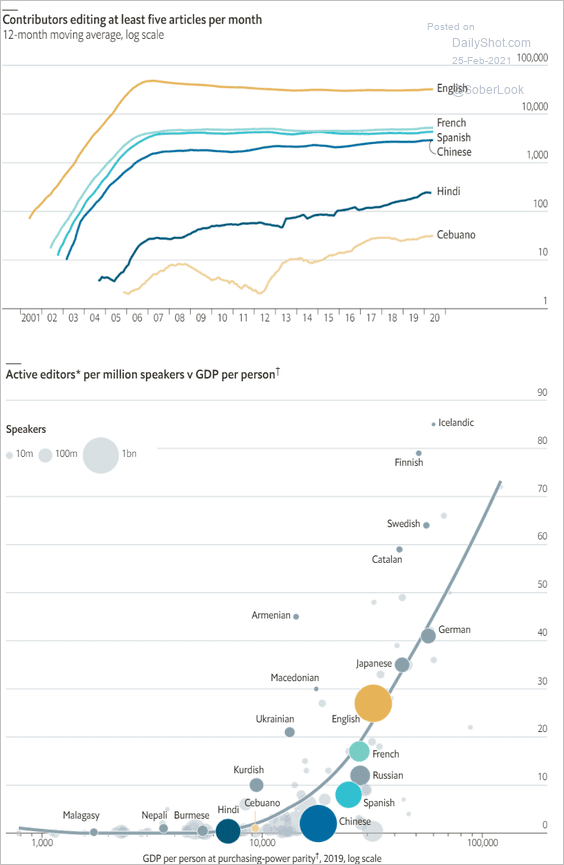

4. Wikipedia editors in different languages:

Source: The Economist Read full article

Source: The Economist Read full article

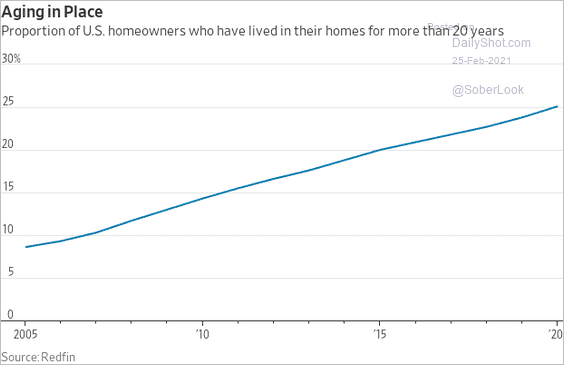

5. US homeowners who lived in their homes for more than twenty years:

Source: @WSJ Read full article

Source: @WSJ Read full article

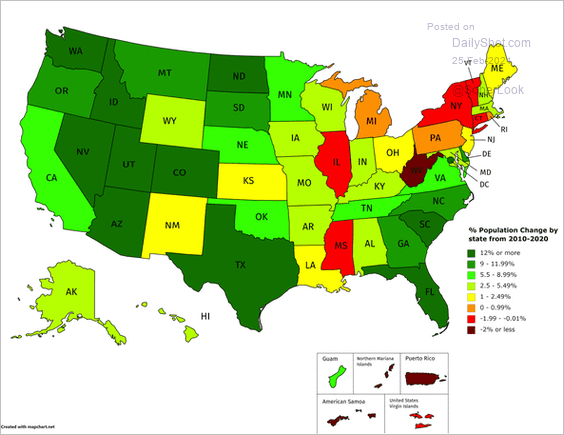

6. US states’ population change over the past decade:

Source: reddit

Source: reddit

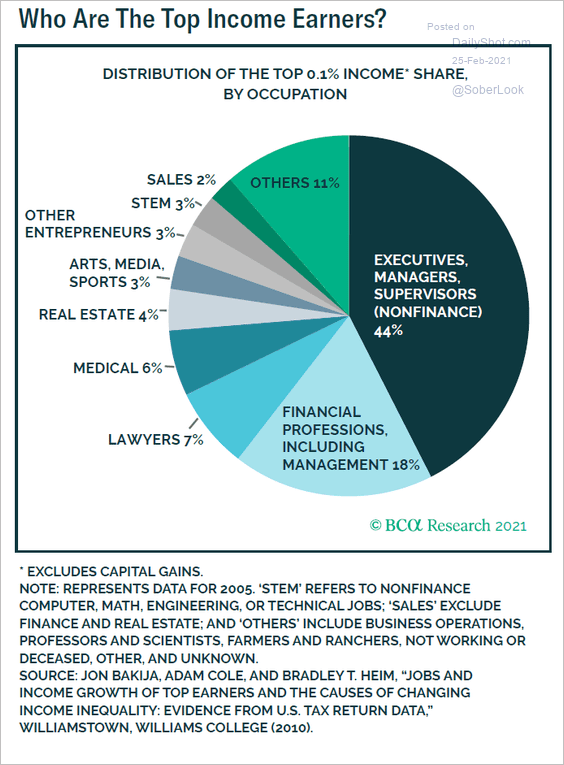

7. Who are the top income earners in the US?

Source: BCA Research

Source: BCA Research

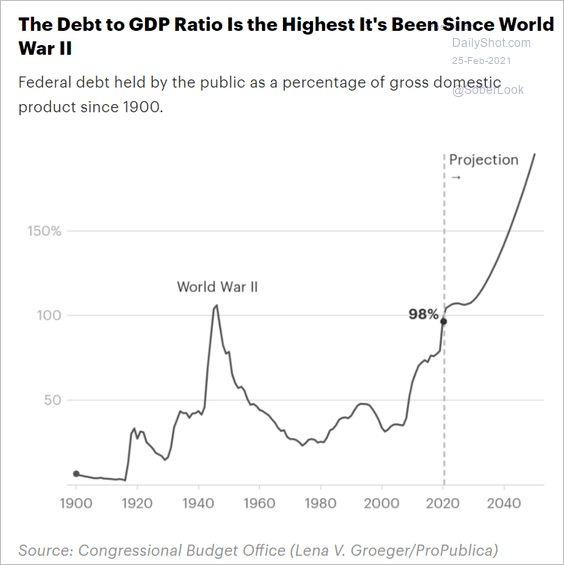

8. Projected US debt-to-GDP ratio:

Source: ProPublica Read full article

Source: ProPublica Read full article

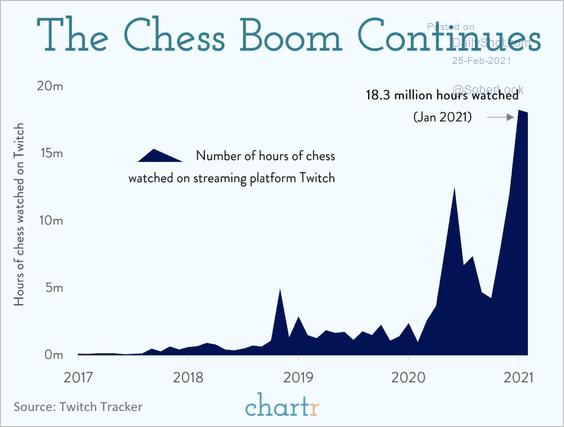

9. The chess boom:

Source: @chartrdaily

Source: @chartrdaily

——————–

Back to Index