The Daily Shot: 02-Mar-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• Emerging Markets

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

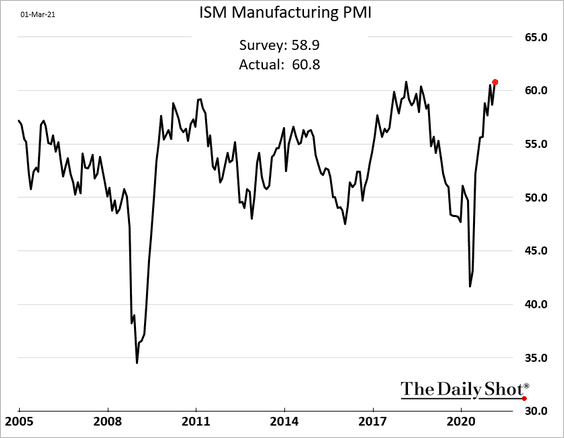

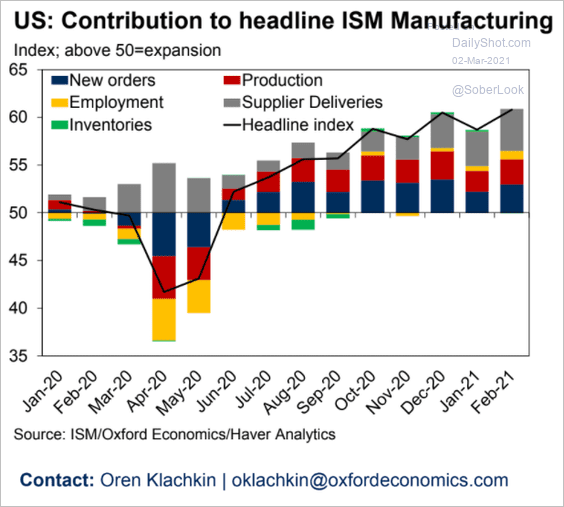

1. The ISM Manufacturing PMI report topped market forecasts, showing US factory activity accelerating in February.

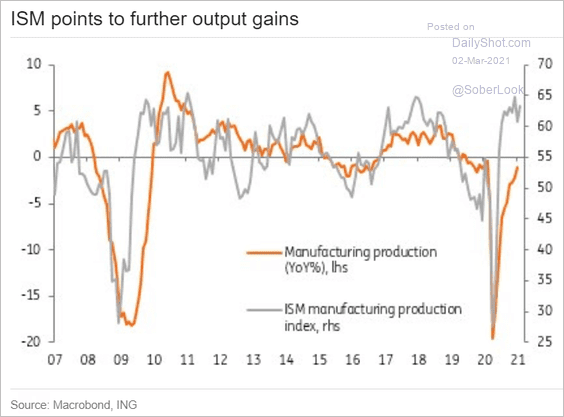

The report points to further gains in the nation’s industrial production.

Source: ING

Source: ING

However, slower factory activity in China suggests that US manufacturing will moderate in the months ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

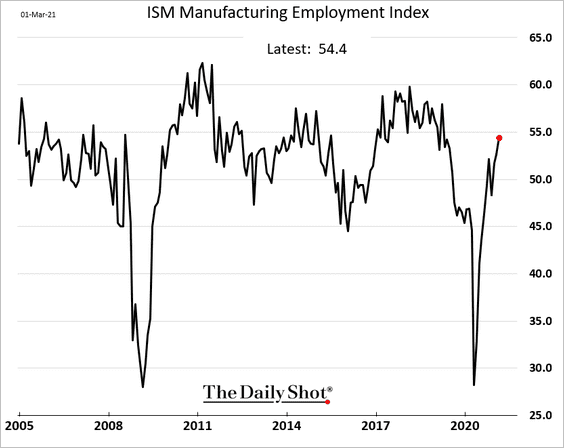

• Hiring improved, but many factories have trouble finding qualified workers.

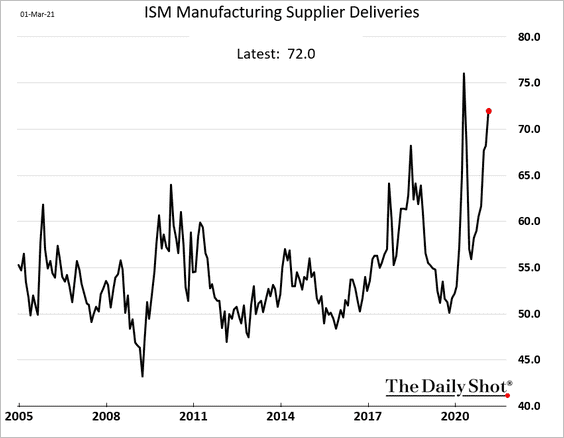

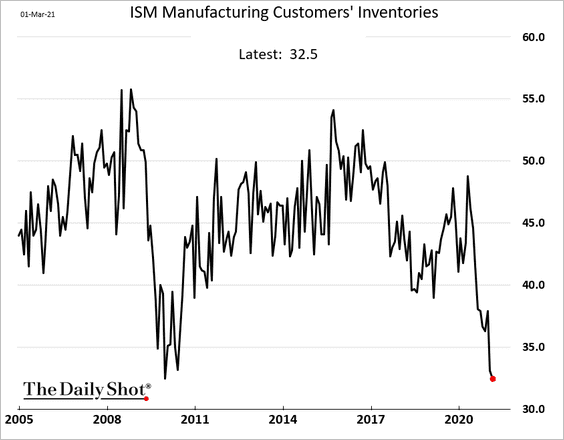

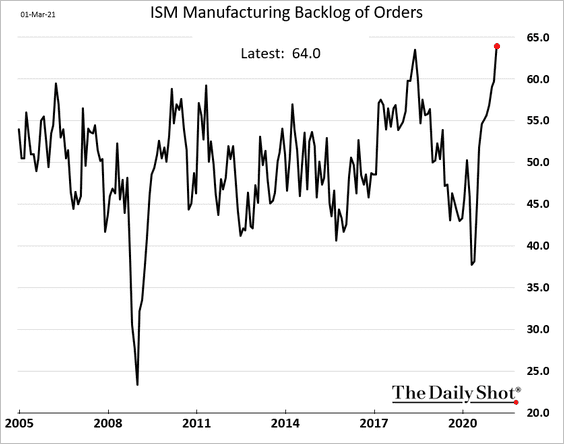

• Manufacturers report increased lead times, rising backlogs, supply chain bottlenecks, and tight customer inventories.

– Supplier deliveries (higher number indicates longer delivery times):

– Customer inventories:

– Order backlogs:

• Here are the contributions to the headline index.

Source: Oxford Economics

Source: Oxford Economics

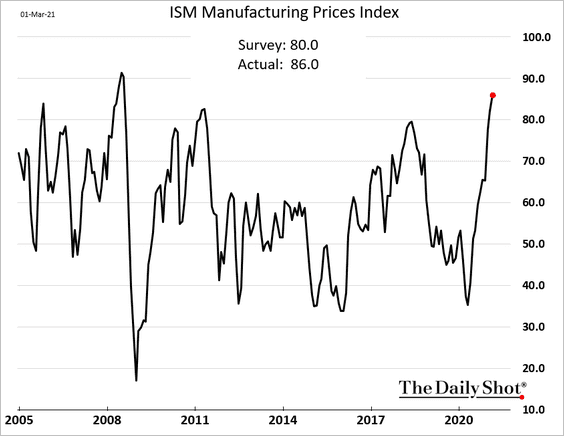

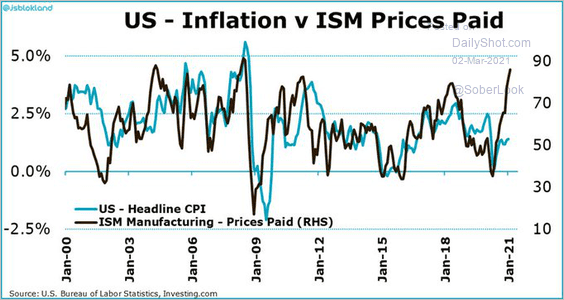

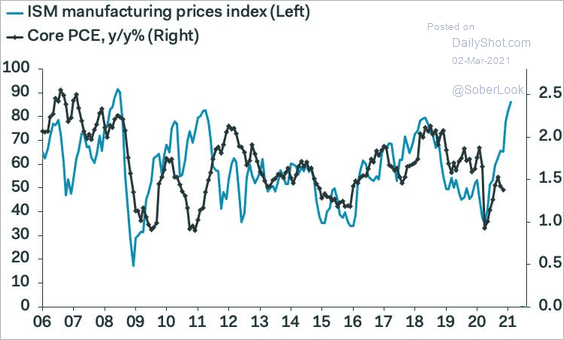

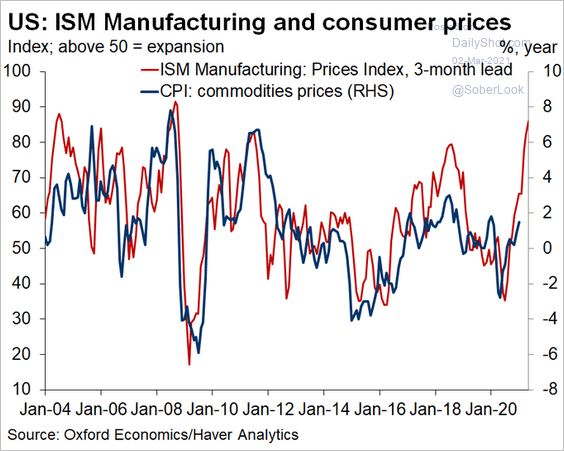

• As we’ve seen in other reports, manufacturers increasingly face cost pressures. This trend is driven by higher commodity prices as well as supply bottlenecks.

• US consumer inflation tends to be correlated with the ISM “prices paid” index.

– Headline CPI:

Source: @jsblokland

Source: @jsblokland

– Core PCE:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

– Commodities CPI:

Source: @GregDaco

Source: @GregDaco

——————–

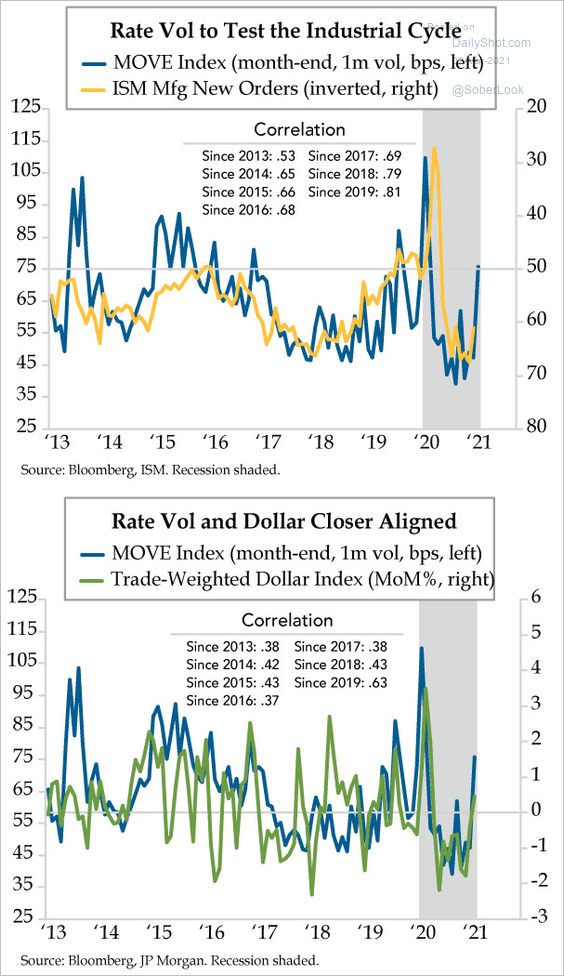

2. The recent increase in bond volatility (MOVE) points to a stronger US dollar and slower factory orders ahead.

Source: The Daily Feather

Source: The Daily Feather

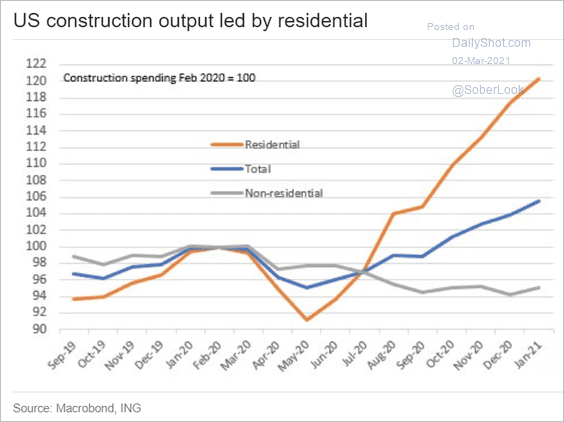

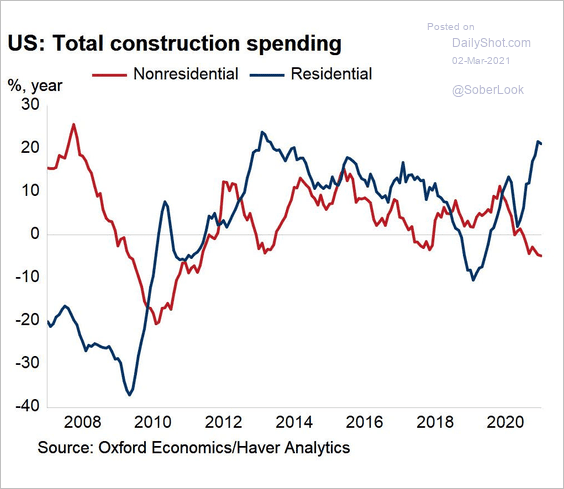

3. The residential – nonresidential construction spending divergence continues (2 charts).

Source: ING

Source: ING

Source: Oxford Economics

Source: Oxford Economics

——————–

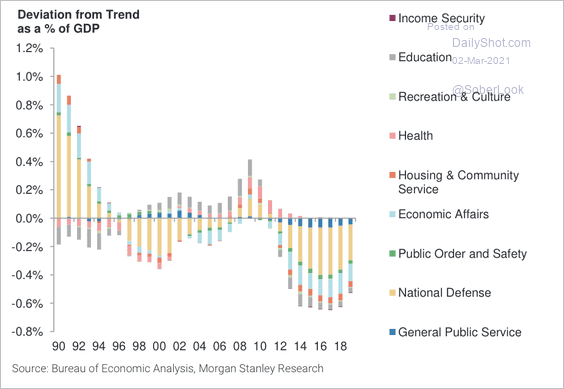

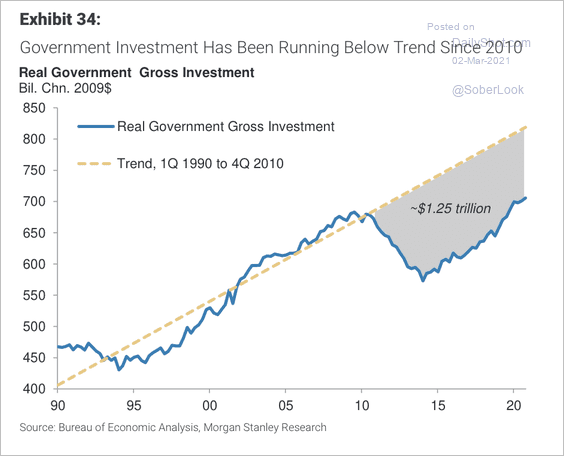

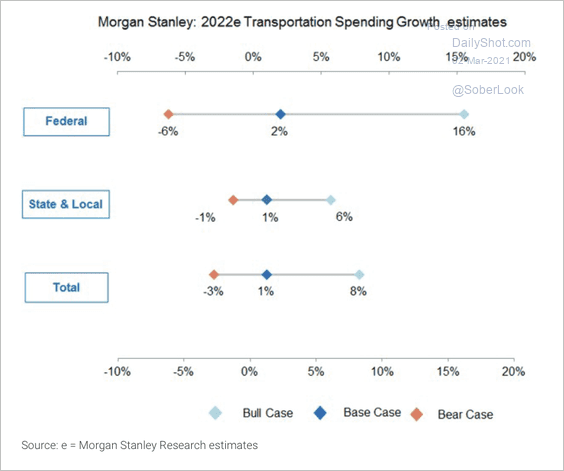

4. There has been significant underspending in infrastructure over the past few years (2 charts).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Here are Morgan Stanley’s estimates of transportation spending growth.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

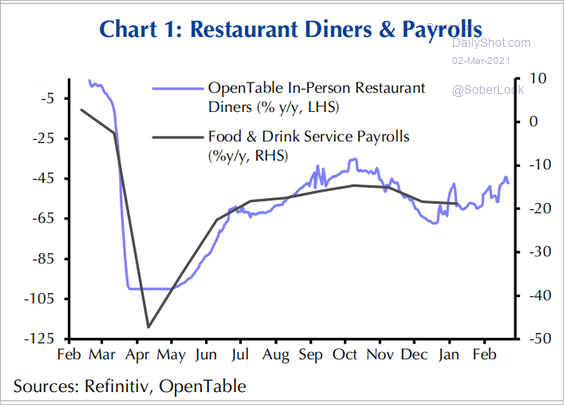

5. Restaurant activity shows signs of improvement, which should boost payrolls.

Source: Capital Economics

Source: Capital Economics

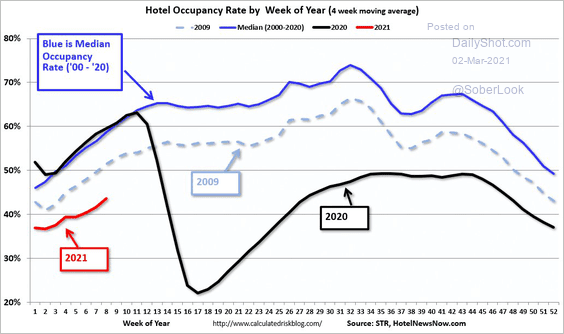

6. Hotel occupancy remains depressed for this time of the year.

Source: @calculatedrisk Read full article

Source: @calculatedrisk Read full article

Back to Index

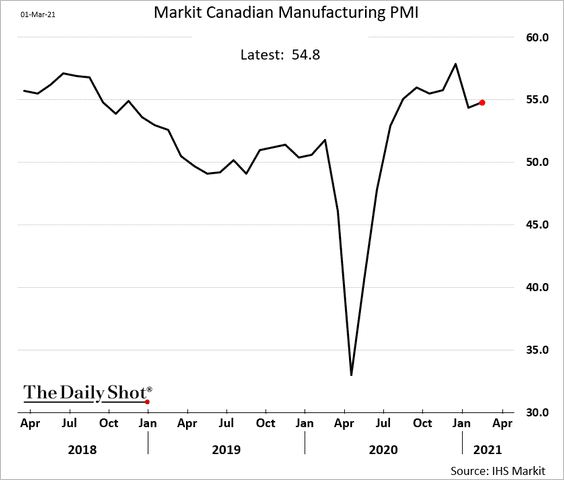

Canada

1. Manufacturing expansion held steady last month.

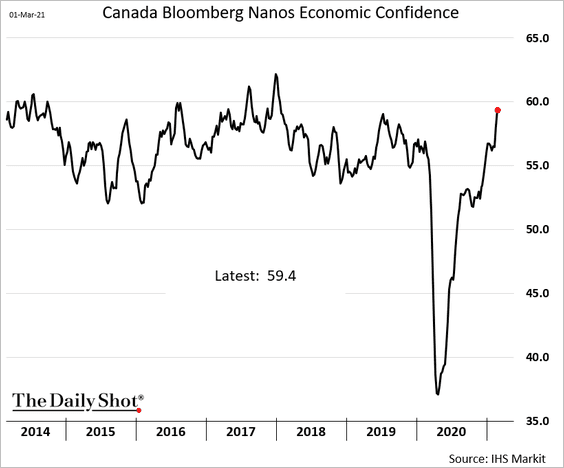

2. Economic confidence continues to climb.

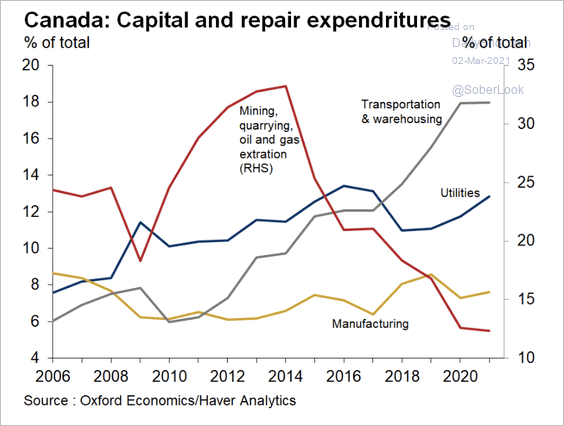

3. Transportation and warehouse sectors represent a growing share of total capital expenditures.

Source: Oxford Economics

Source: Oxford Economics

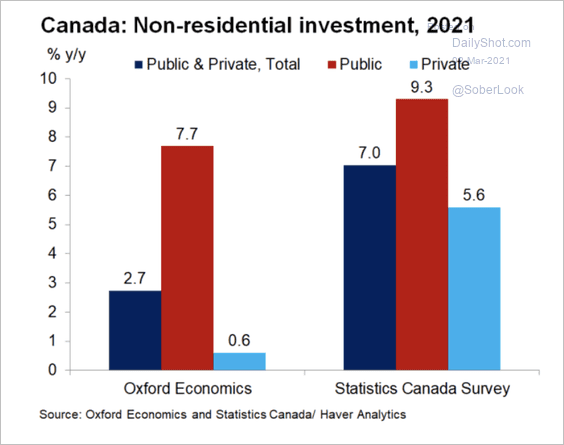

Public and private capital spending is expected to increase this year.

Source: Oxford Economics

Source: Oxford Economics

——————–

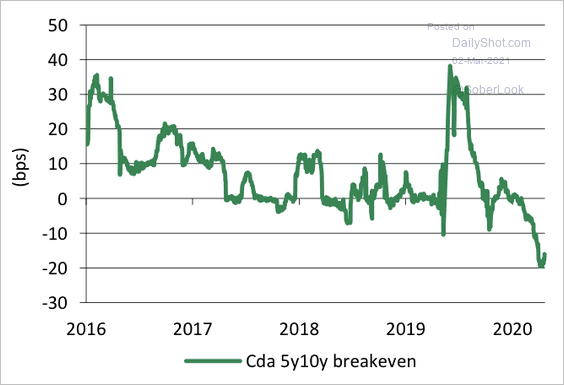

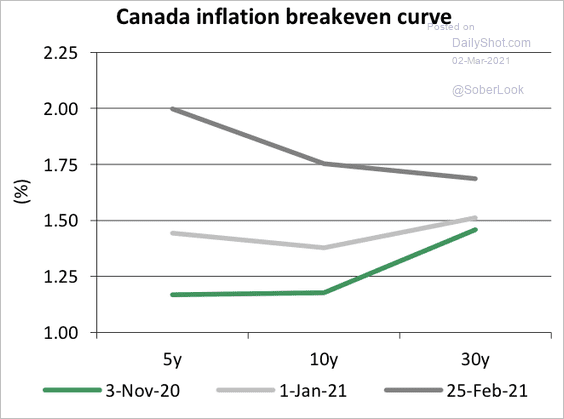

3. The 5-year 10-year breakeven curve is deeply inverted.

Source: Desjardins

Source: Desjardins

Source: Desjardins

Source: Desjardins

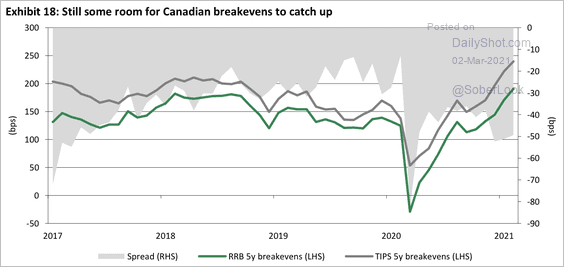

Canadian inflation expectations have room to catch up to the US.

Source: Desjardins

Source: Desjardins

Back to Index

The United Kingdom

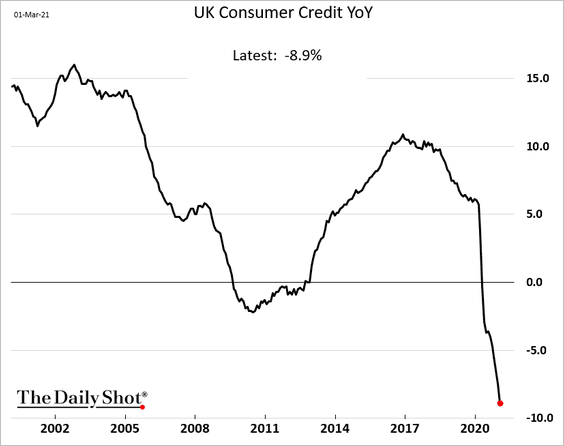

1. Consumer credit continues to shrink as households hold back on borrowing.

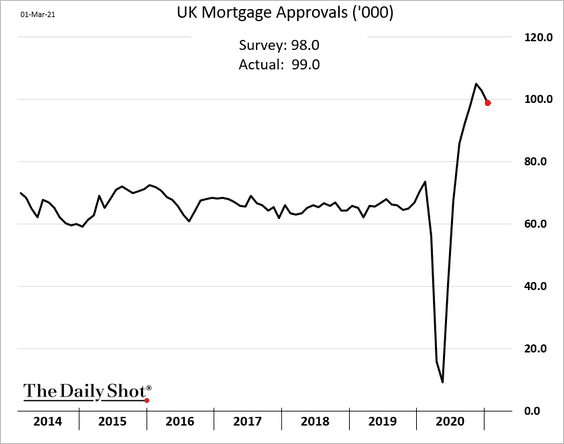

Mortgage approvals remain elevated (although off the highs).

——————–

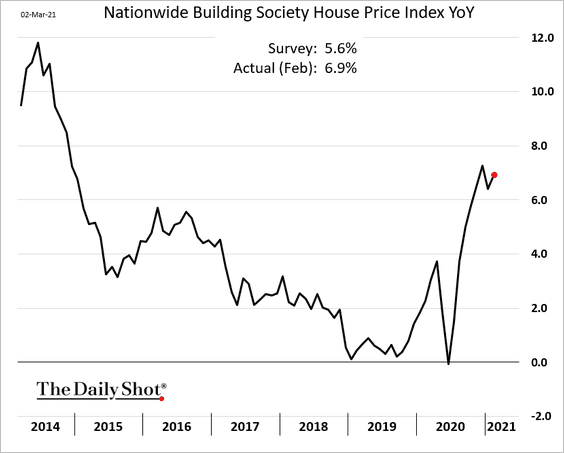

2. Home price appreciation picked up last month.

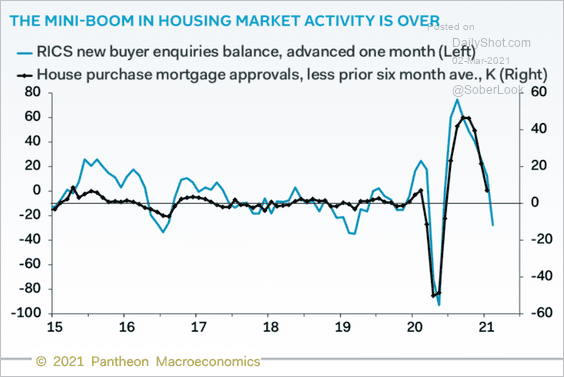

But new homebuyer activity appears to be tapering.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

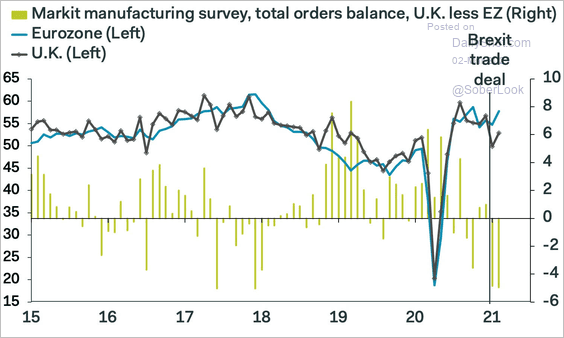

3. Growth in UK factory orders is lagging the Eurozone.

Source: @samueltombs, Pantheon Macroeconomics

Source: @samueltombs, Pantheon Macroeconomics

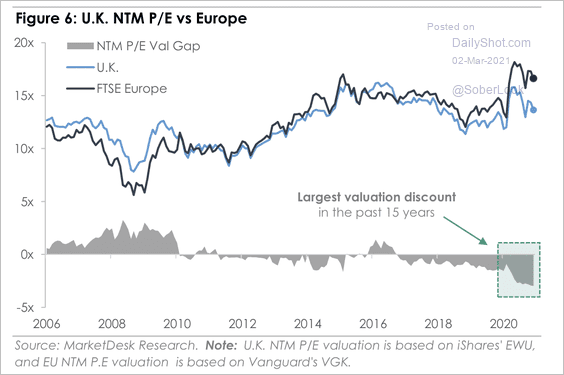

4. UK equities are trading at the largest forward price-to-earnings valuation gap versus developed Europe in years.

Source: MarketDesk Research

Source: MarketDesk Research

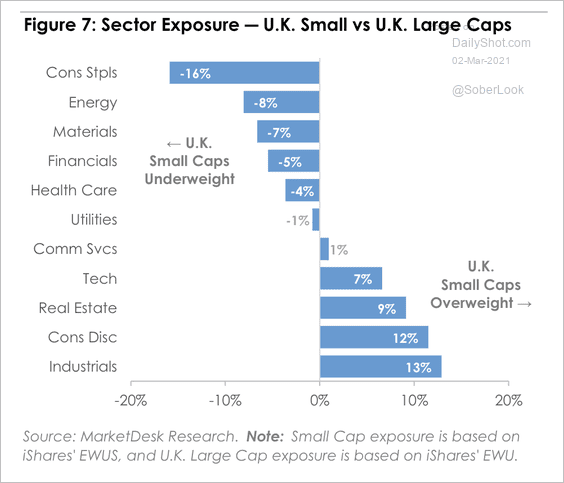

5. This chart shows the sector weightings of the iShares UK small-cap ETF (EWUS) versus the iShares UK large-cap ETF (EWU).

Source: MarketDesk Research

Source: MarketDesk Research

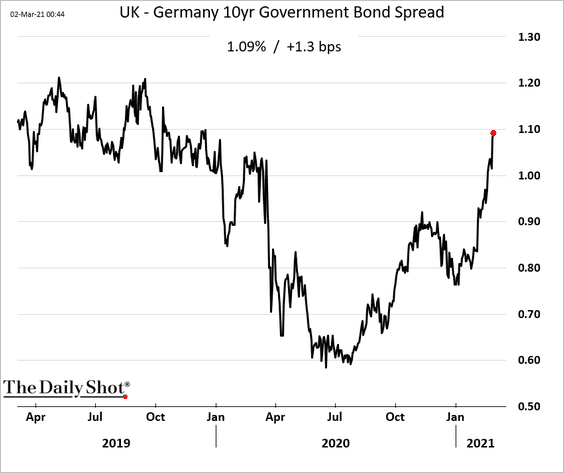

6. The spread between gilts and Bunds keeps widening.

Back to Index

The Eurozone

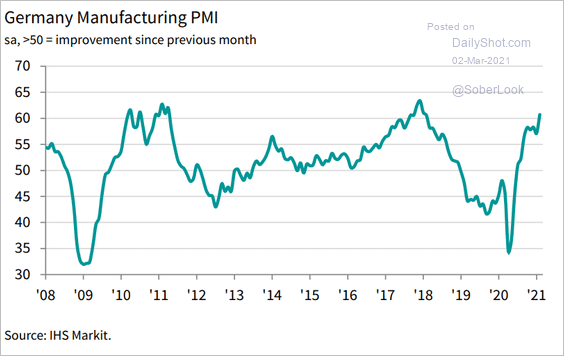

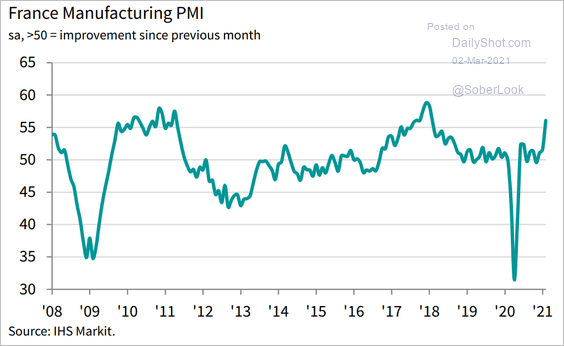

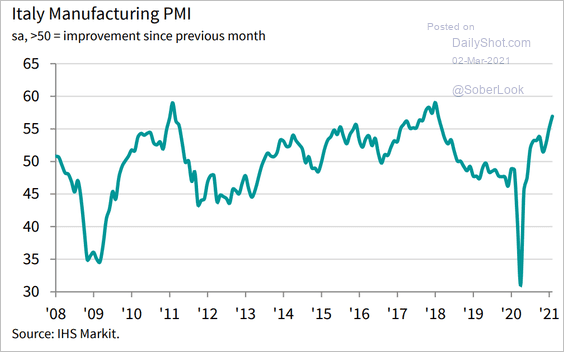

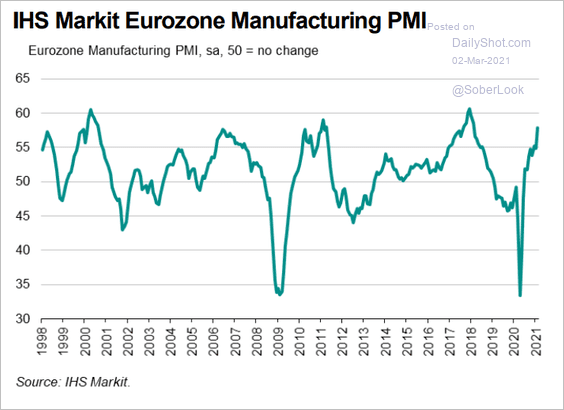

1. Manufacturing activity strengthened across Europe last month. Here are some PMI trends.

• Germany:

Source: IHS Markit

Source: IHS Markit

• France:

Source: IHS Markit

Source: IHS Markit

• Italy:

Source: IHS Markit

Source: IHS Markit

• The Eurozone:

Source: IHS Markit

Source: IHS Markit

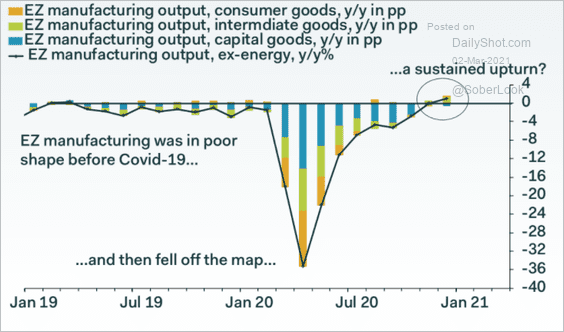

Will we continue to see sustained improvements in factory output?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

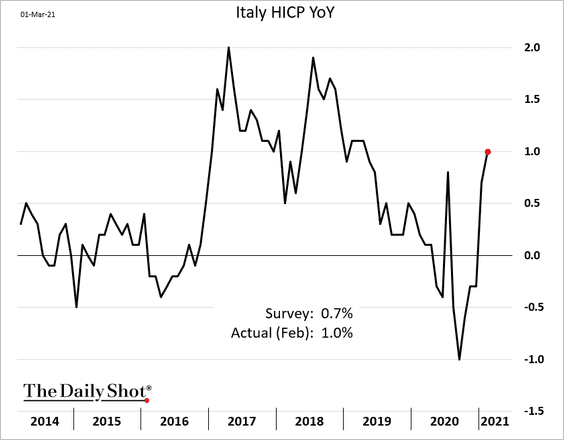

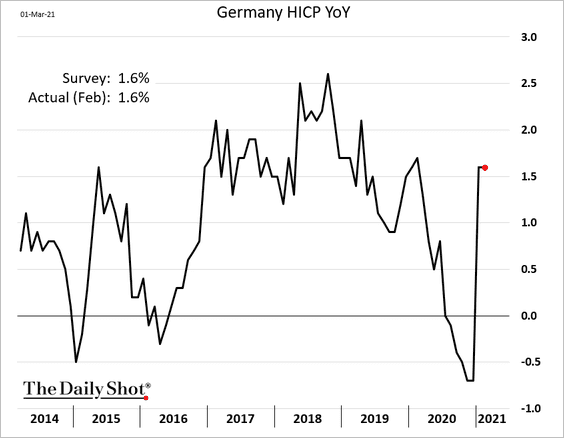

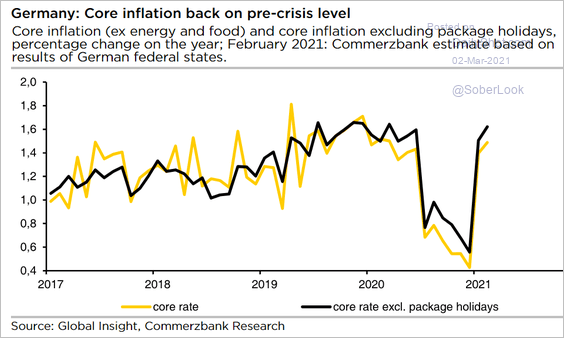

2. Inflation picked up this year.

• Italy:

• Germany:

• Germany core CPI:

Source: Commerzbank Research

Source: Commerzbank Research

——————–

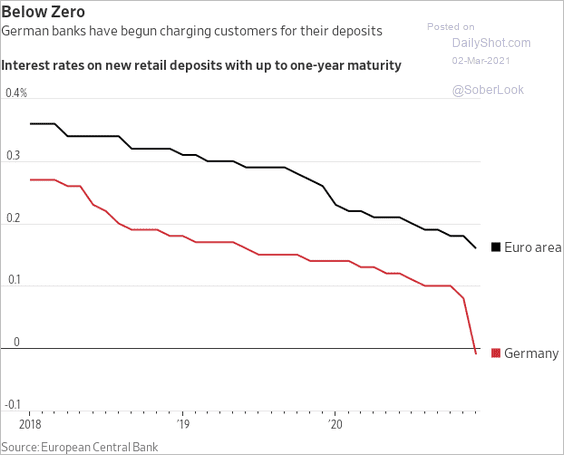

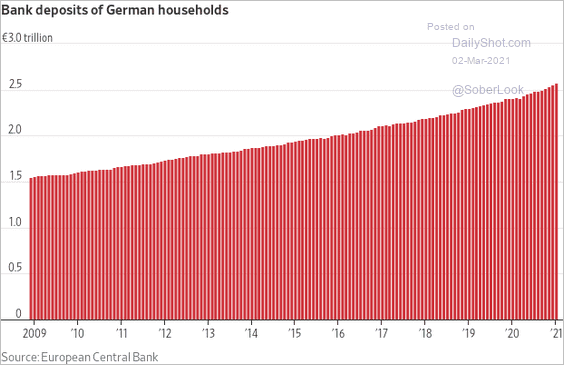

3. As deposits swell, German lenders are starting to charge customers for holding money at the bank.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

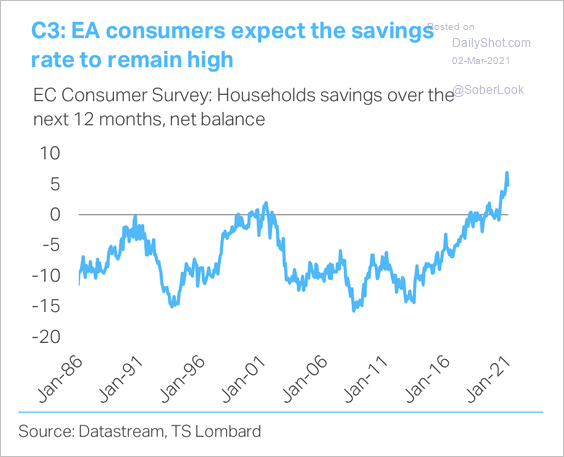

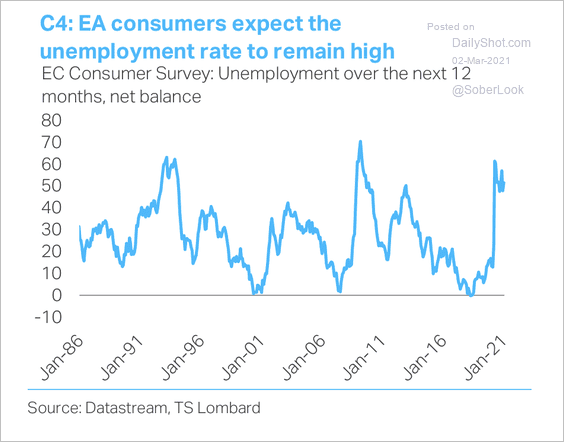

And consumers across the euro area expect to save more as the employment outlook remains uncertain (two charts).

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

——————–

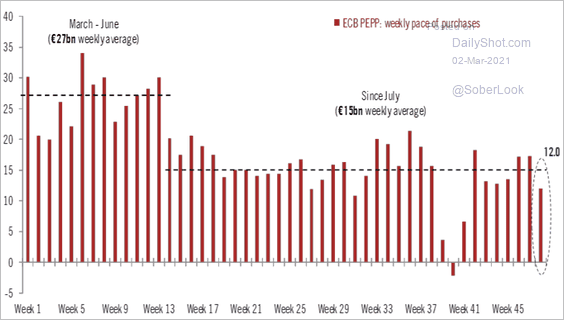

4. The ECB’s latest weekly securities purchases were weaker than expected. It’s surprising, given the pickup in yields.

Source: @fwred

Source: @fwred

Back to Index

Europe

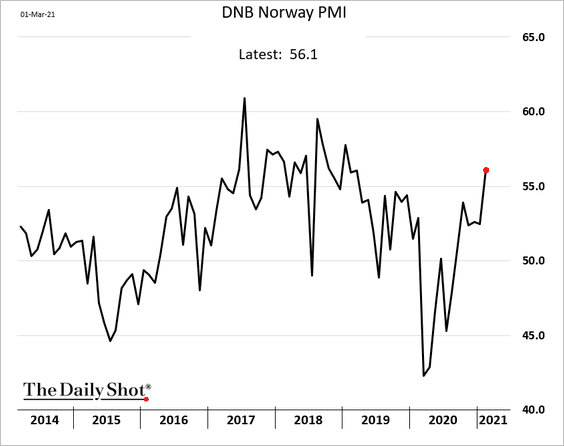

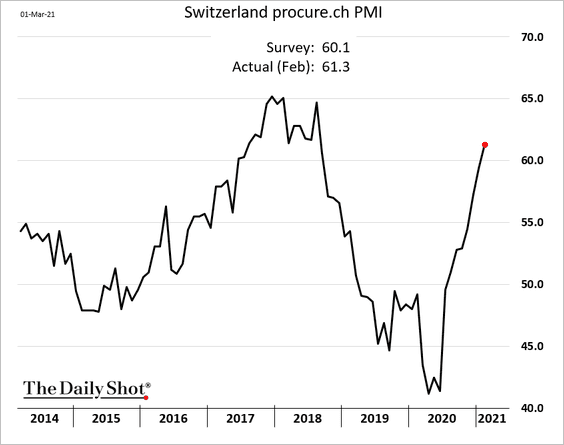

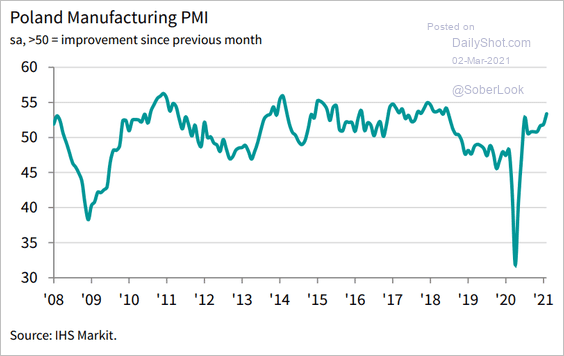

1. Just as we saw across the Eurozone, factories boosted production elsewhere in Europe.

• Norway:

• Switzerland:

• Poland:

Source: IHS Markit

Source: IHS Markit

——————–

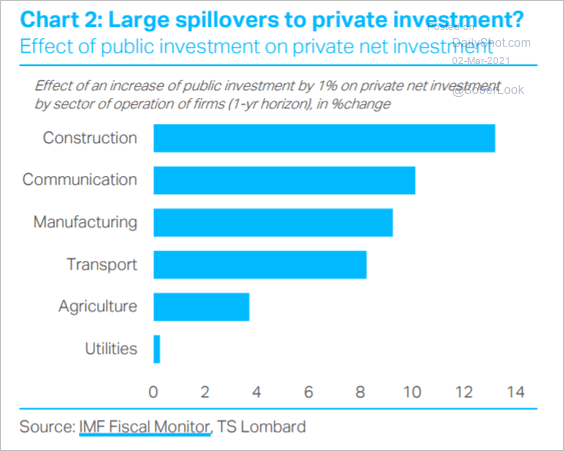

2. What is the effect of a 1% public investment increase on private investment?

Source: TS Lombard

Source: TS Lombard

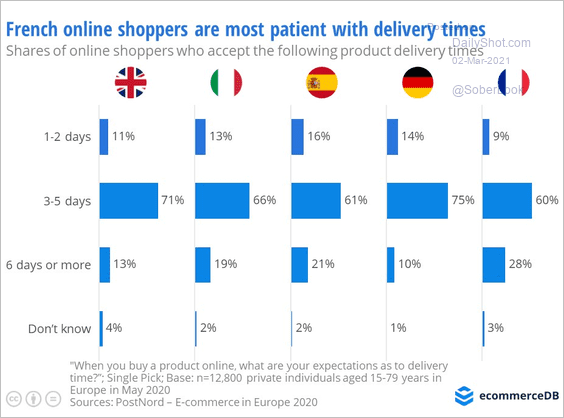

3. How patient are European buyers with online deliveries?

Source: ecommerceDB Read full article

Source: ecommerceDB Read full article

Back to Index

Japan

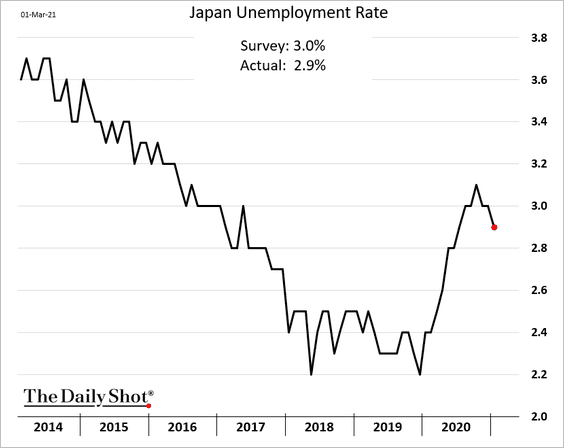

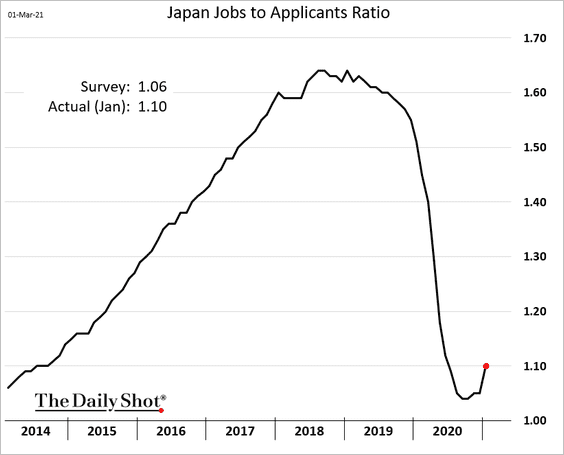

1. The labor market is recovering.

• The unemployment rate:

• Jobs-to-applicants ratio:

——————–

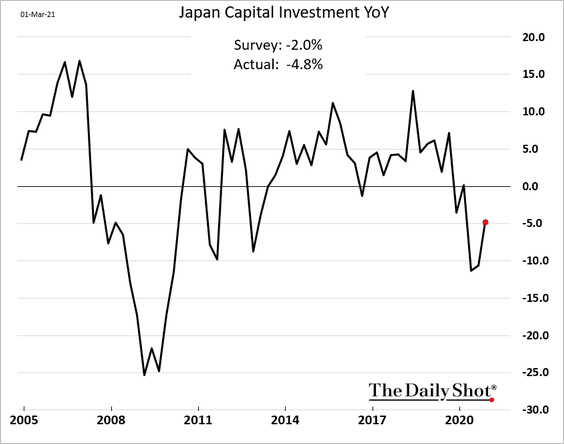

2. Japan’s recovery in capital investment will take some time.

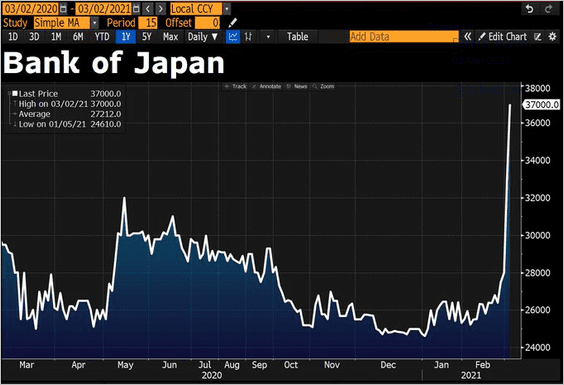

3. Japan’s central bank (BoJ) is a publicly listed entity, trading on the Jasdaq (Belgium, Greece, and Switzerland also have publicly listed central banks). BoJ shares soared on Monday.

Source: @DavidInglesTV

Source: @DavidInglesTV

Back to Index

Asia – Pacific

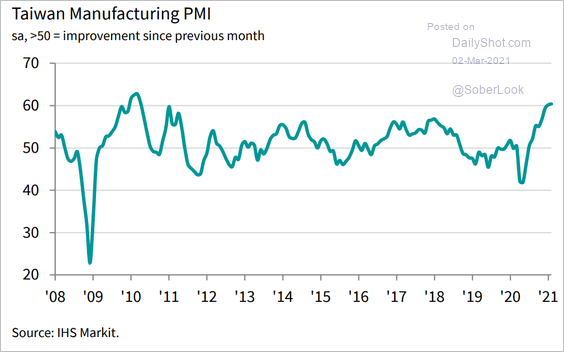

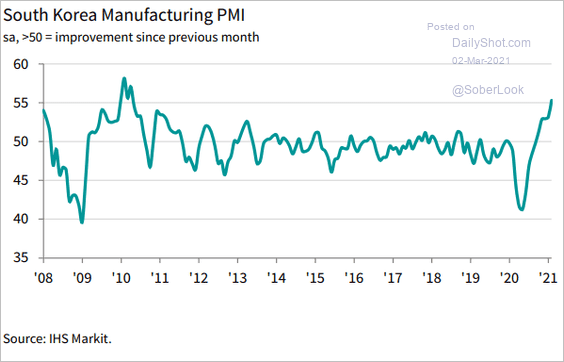

1. Manufacturing PMIs point to faster expansion last month.

• Taiwan:

Source: IHS Markit

Source: IHS Markit

• South Korea:

Source: IHS Markit

Source: IHS Markit

——————–

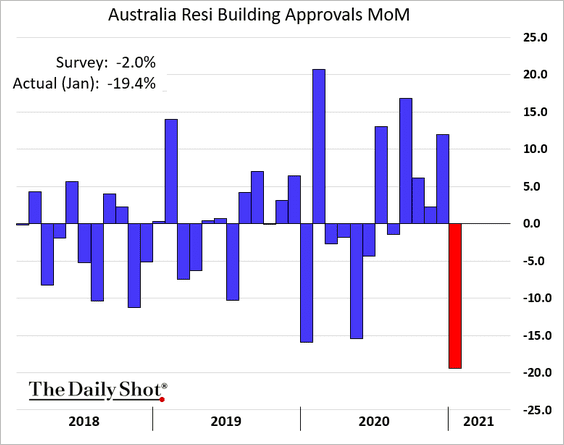

2. Australia’s building approvals declined sharply in January.

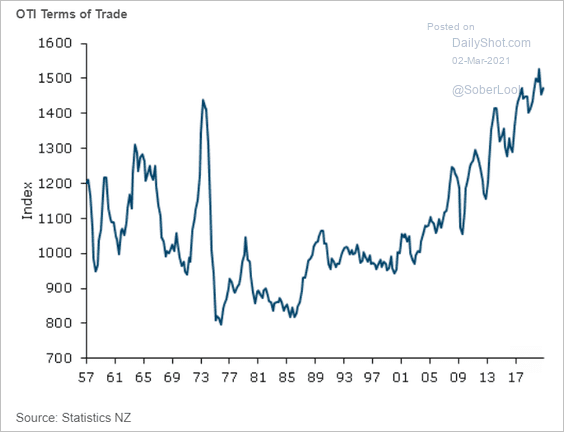

3. This chart shows New Zealand’s terms of trade index.

Source: ANZ Research

Source: ANZ Research

Back to Index

Emerging Markets

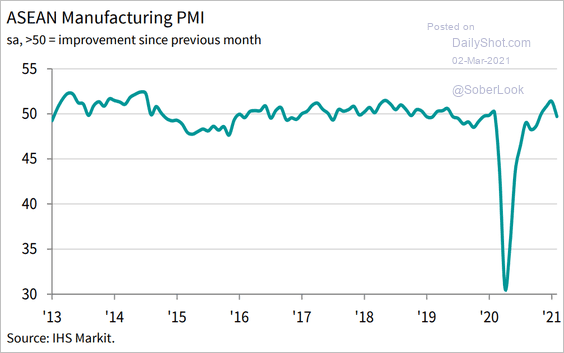

1. ASEAN manufacturing activity stalled last month.

Source: IHS Markit

Source: IHS Markit

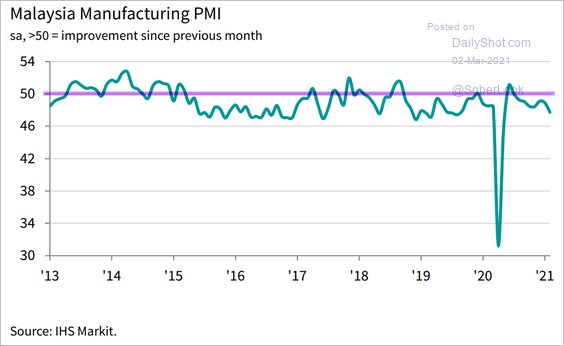

• Malaysia:

Source: IHS Markit

Source: IHS Markit

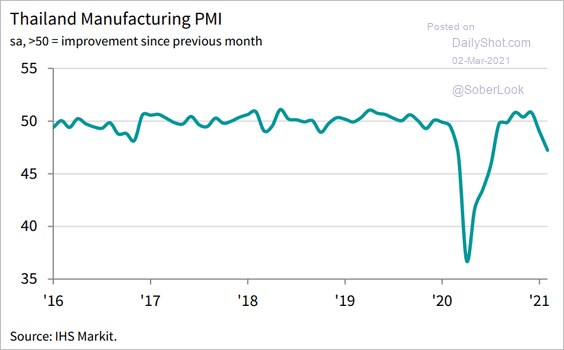

• Thailand:

Source: IHS Markit

Source: IHS Markit

——————–

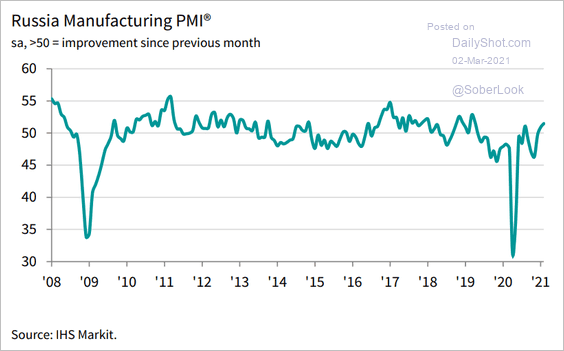

2. Here are a few other manufacturing PMI trends.

• Russia (back in growth mode):

Source: IHS Markit

Source: IHS Markit

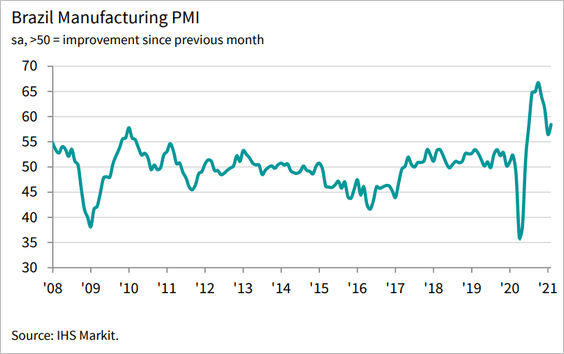

• Brazil (still quite strong):

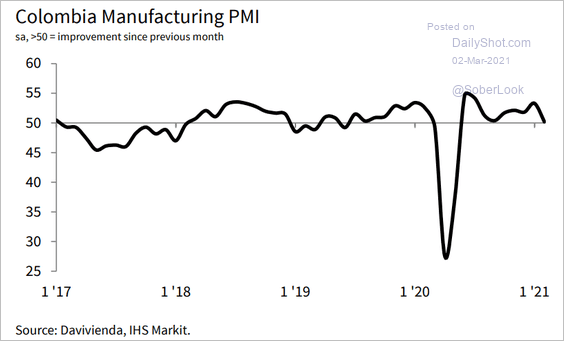

• Colombia (stalling):

Source: IHS Markit

Source: IHS Markit

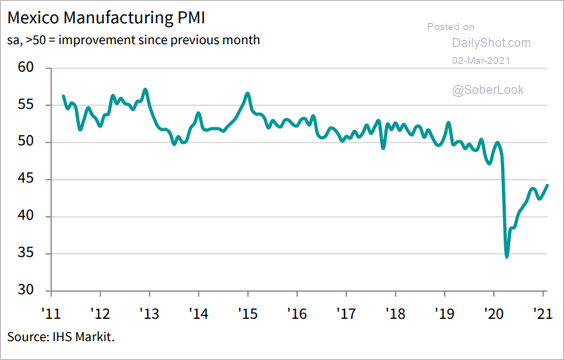

• Mexico (still struggling):

Source: IHS Markit

Source: IHS Markit

——————–

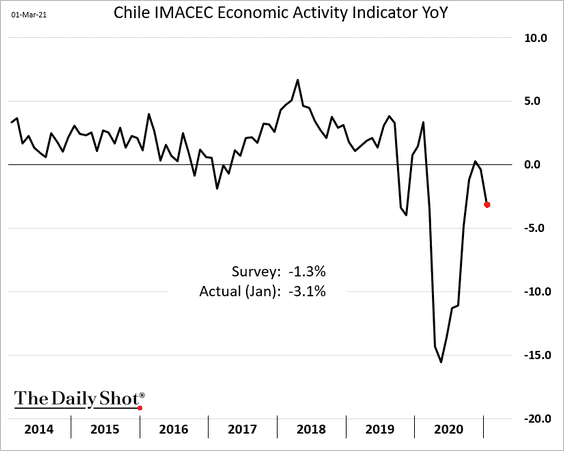

3. As we saw previously, Chile’s economy lost some momentum in January.

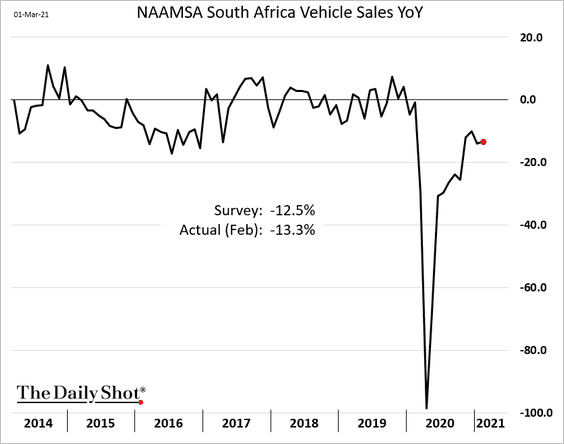

4. South Africa’s vehicle sales are yet to recover.

Back to Index

Commodities

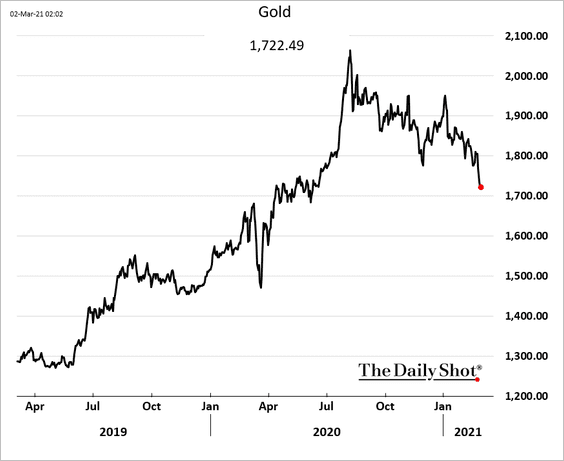

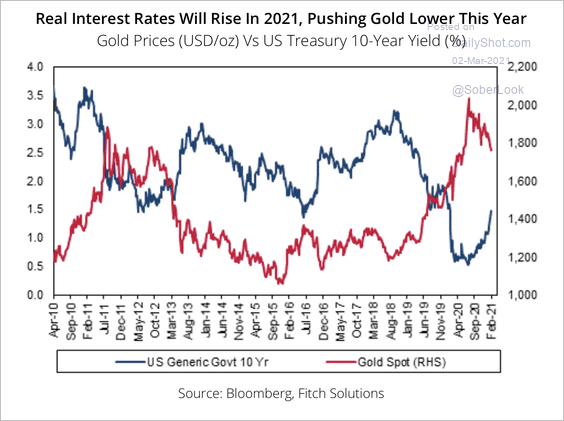

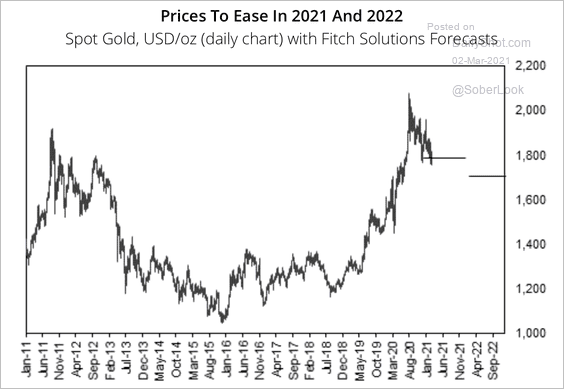

1. Gold has been drifting lower as US real rates bounce while the dollar’s decline appears to be over.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Fitch lowered its 2021 gold price forecast to $1,708 from $1,850 previously.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

——————–

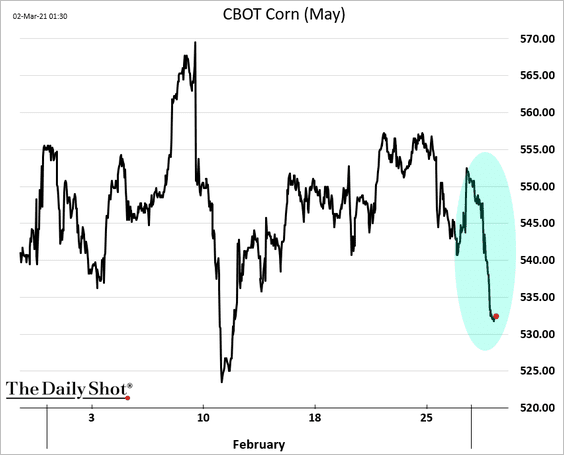

2. US corn futures fell, driven by fund selling.

Source: @WSJ Read full article

Source: @WSJ Read full article

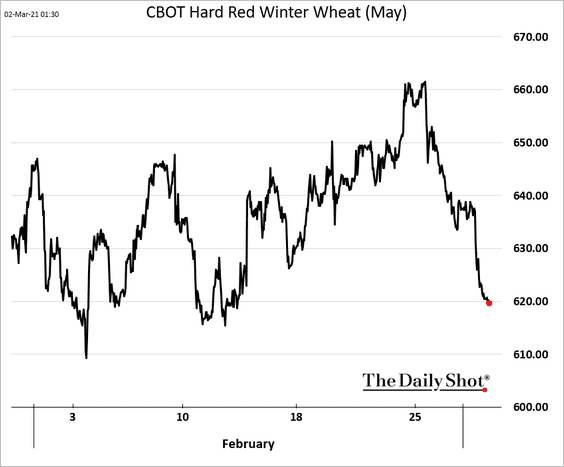

Wheat futures are softer as well amid increasing global supplies.

——————–

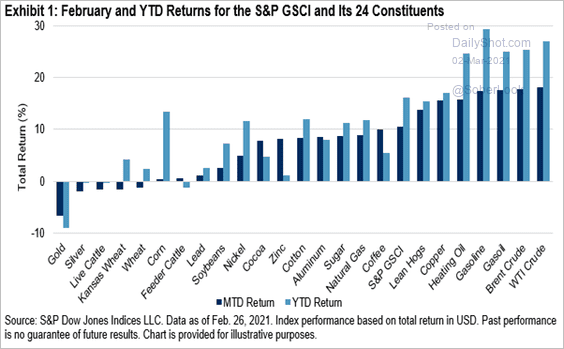

3. Here are the February and year-to-date returns across 24 commodities.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Energy

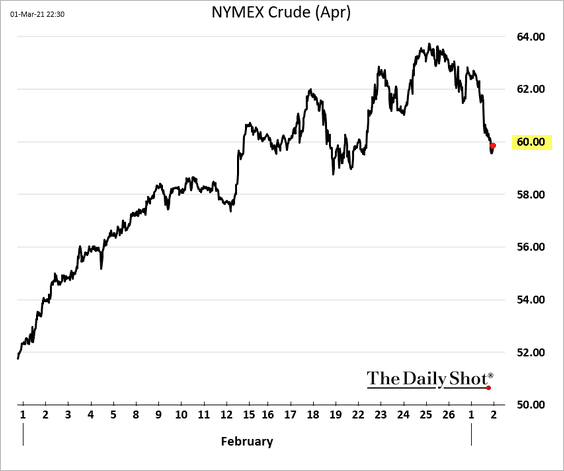

1. US crude oil futures are back below $60/bbl.

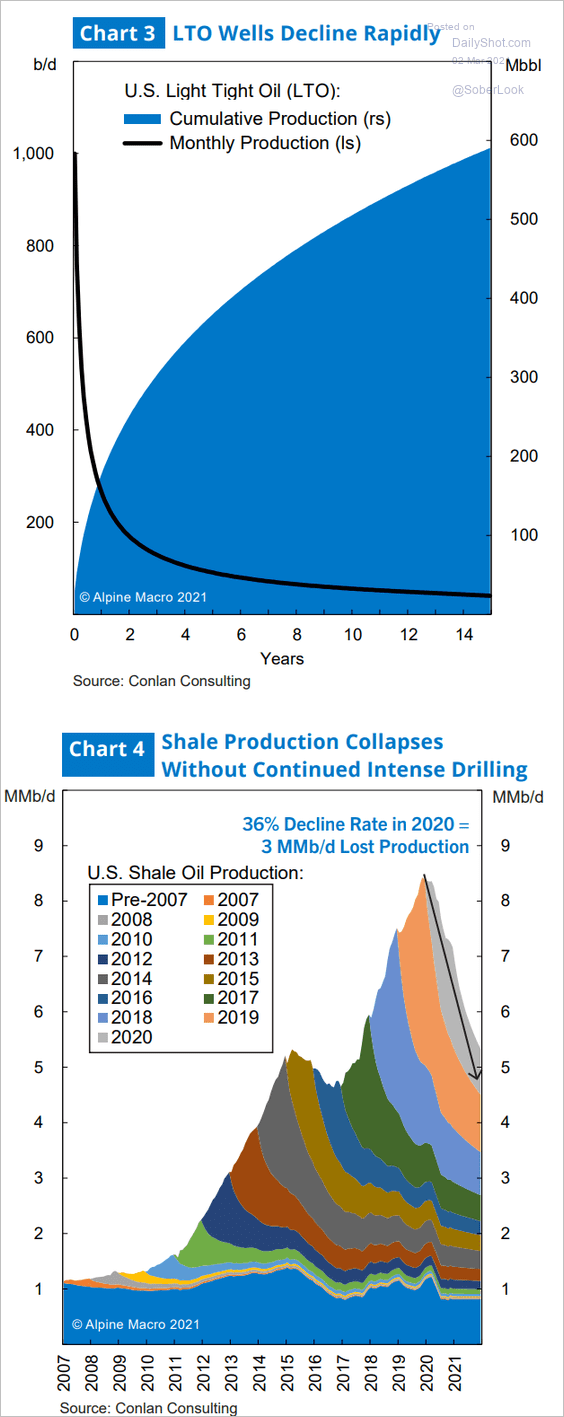

2. Without significant new drilling, US shale output will decline sharply.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Equities

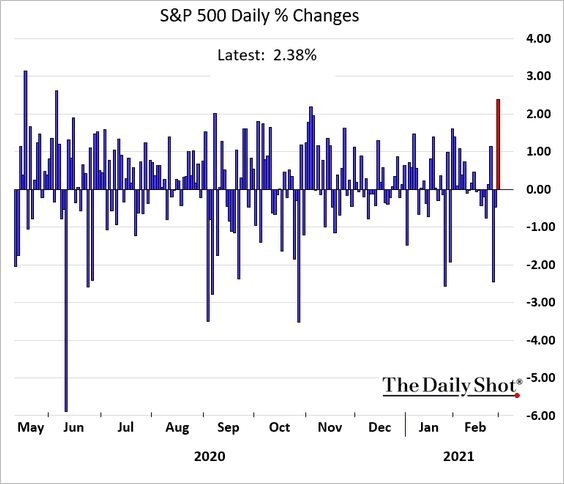

1. Stocks rose sharply as global bond yields stabilized.

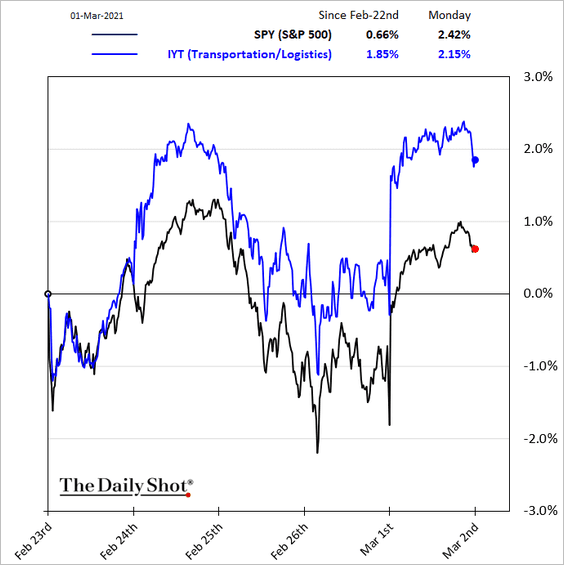

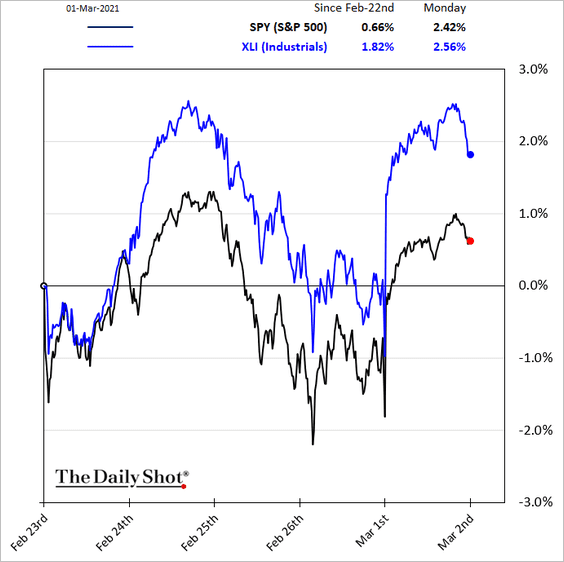

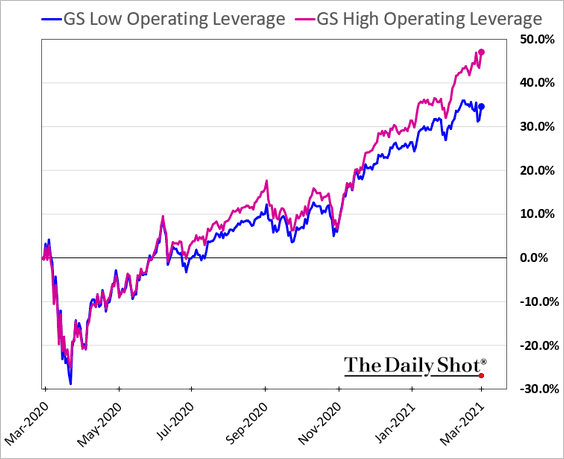

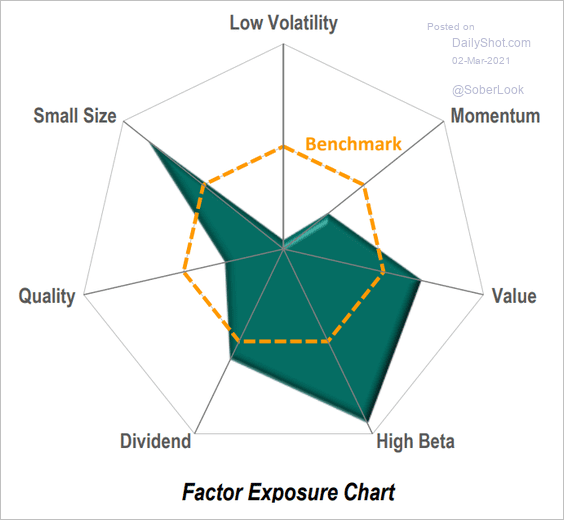

2. Driven by vaccine success and expected stimulus, the market is betting on acceleration in economic expansion. That’s why sectors like transportation and industrials are outperforming.

Faster economic growth will benefit companies with higher operating leverage.

——————–

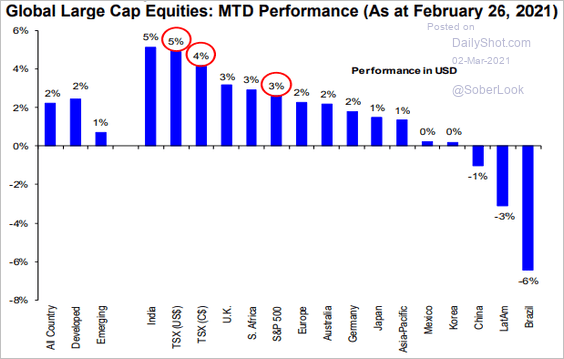

3. How did stocks around the world perform in February?

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

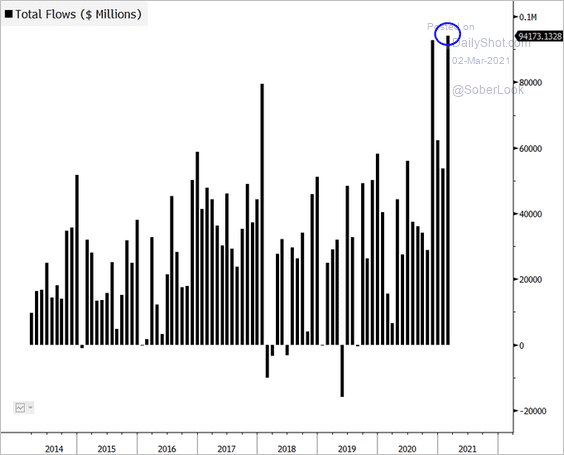

4. ETF inflows hit a record last month.

Source: @EricBalchunas, @cfb_18 Read full article

Source: @EricBalchunas, @cfb_18 Read full article

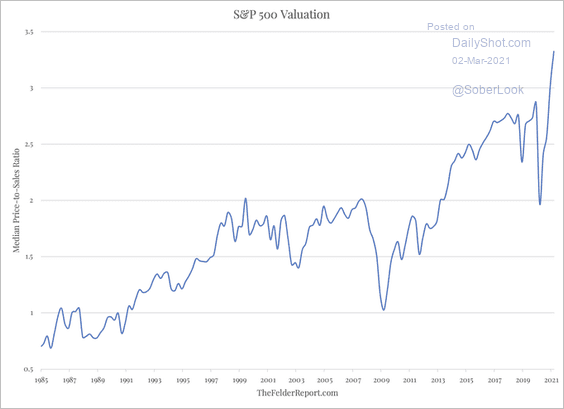

5. US stocks look extremely expensive on a price-to-sales basis.

Source: @jessefelder

Source: @jessefelder

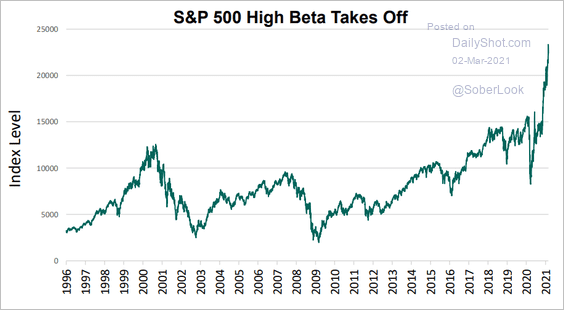

6. High-beta shares took off this year.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Many high-beta stocks are smaller firms – the small-cap rally helped.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

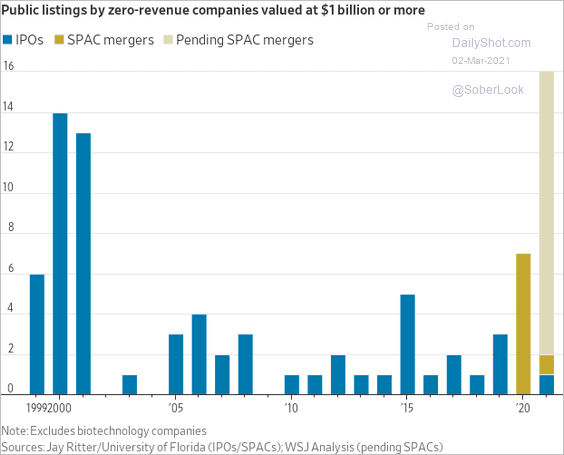

7. SPACs drove the recent sharp increase in public listings of zero-revenue companies.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Rates

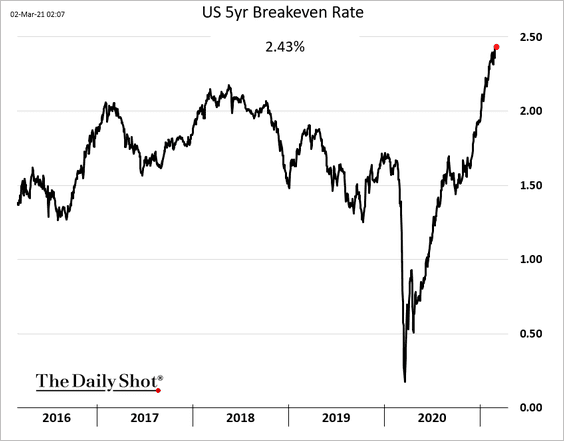

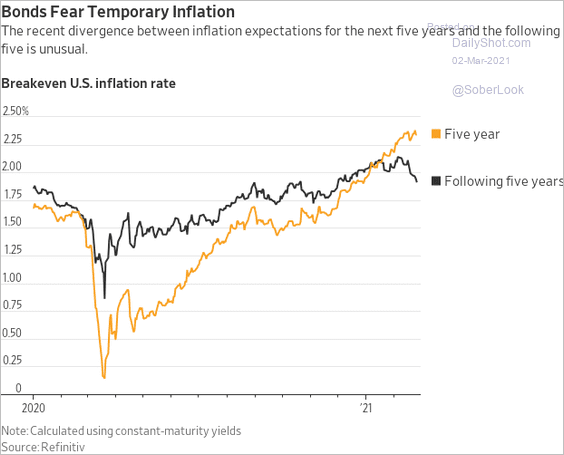

1. The five-year breakeven rate continues to climb.

However, as we saw yesterday, the market is pricing in lower inflation in the following five years.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

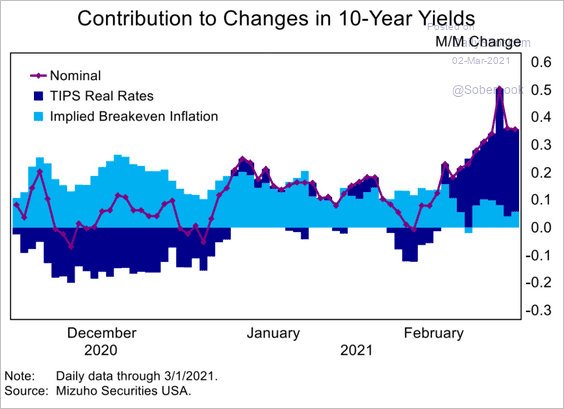

2. Here is the attribution of the 10yr Treasury yield changes over time.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

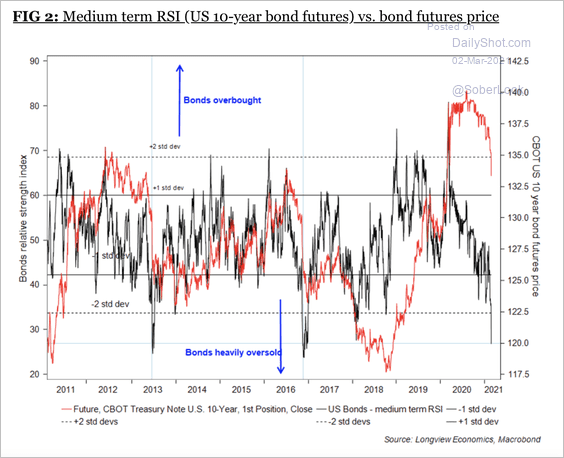

3. The 10-year Treasury note is oversold, while net-long futures positioning is starting to decline.

Source: Longview Economics

Source: Longview Economics

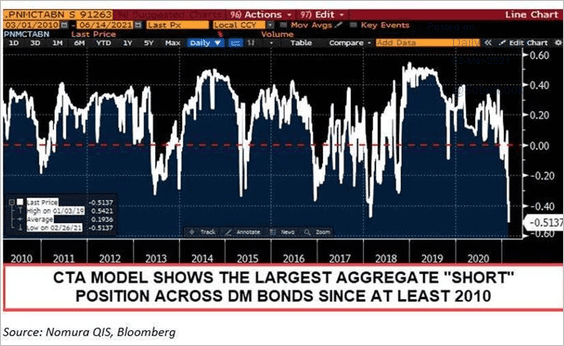

Moreover, Nomura’s model shows extreme short positions across global bond markets.

Source: @DriehausCapital

Source: @DriehausCapital

——————–

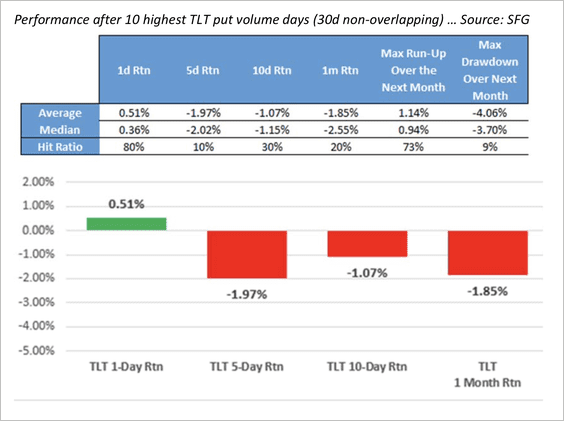

4. Historically, high put option volume in the iShares 20+ Treasury bond ETF (TLT) has preceded more weakness.

Source: Chris Murphy; Susquehanna Derivative Strategy

Source: Chris Murphy; Susquehanna Derivative Strategy

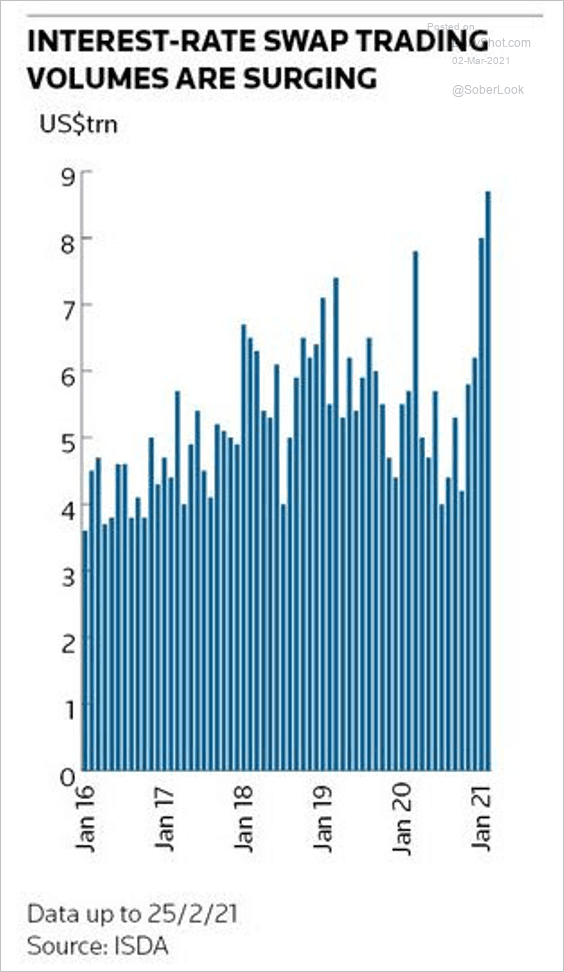

5. Mortgage hedging caused a sharp increase in swap trading volumes.

Source: IFR Read full article

Source: IFR Read full article

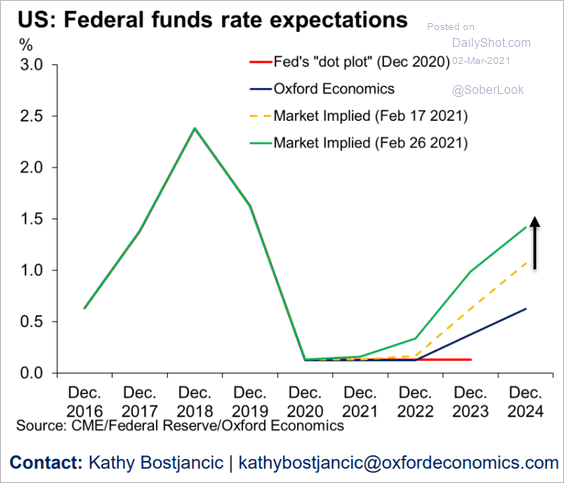

6. Is the market too hawkish on the timing and the pace of Fed rate hikes?

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Global Developments

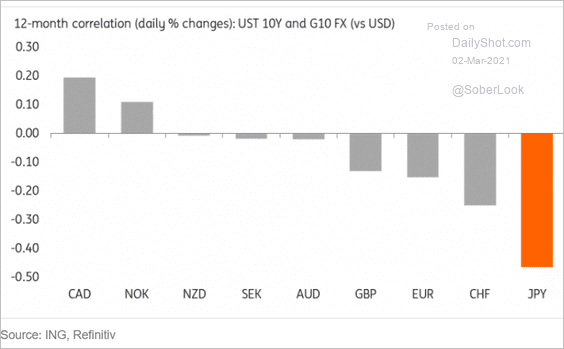

1. Here is the correlation between the 10yr Treasury yield and currencies of advanced economies (vs. USD).

Source: ING

Source: ING

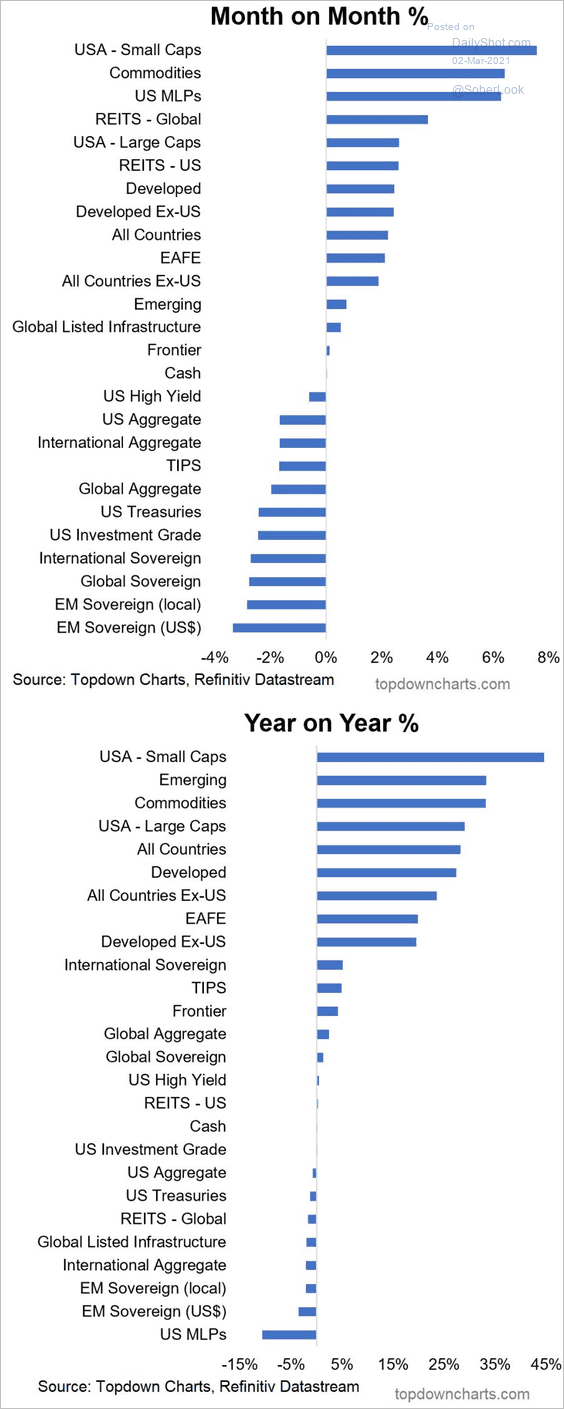

2. This chart shows February and year-over-year returns across asset classes.

Source: @topdowncharts

Source: @topdowncharts

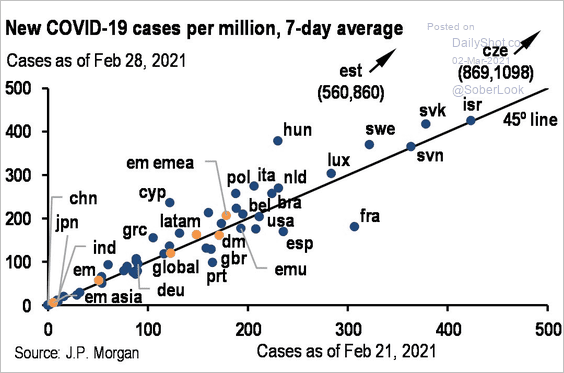

3. Some countries saw increases in new COVID infections last week.

Source: JP Morgan; @carlquintanilla

Source: JP Morgan; @carlquintanilla

——————–

Food for Thought

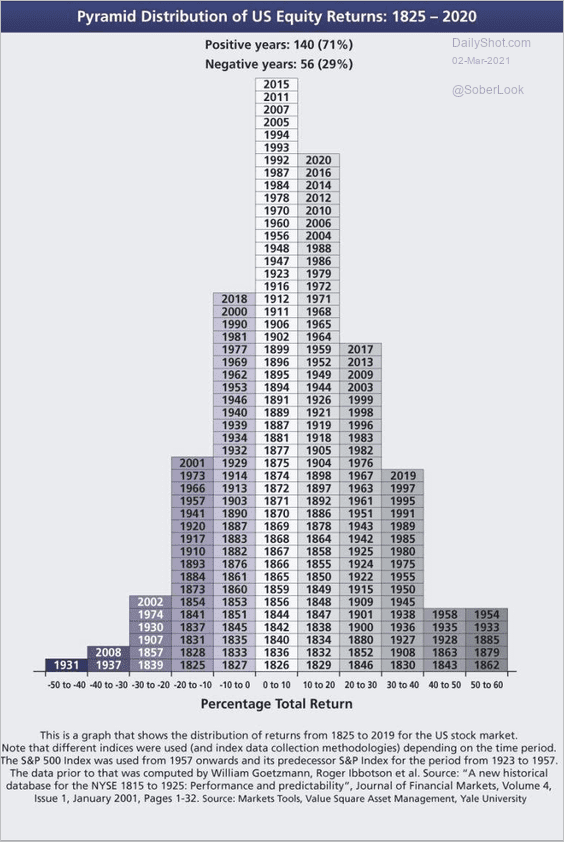

1. Pyramid distribution of US equity returns since 1825:

Source: @jsblokland

Source: @jsblokland

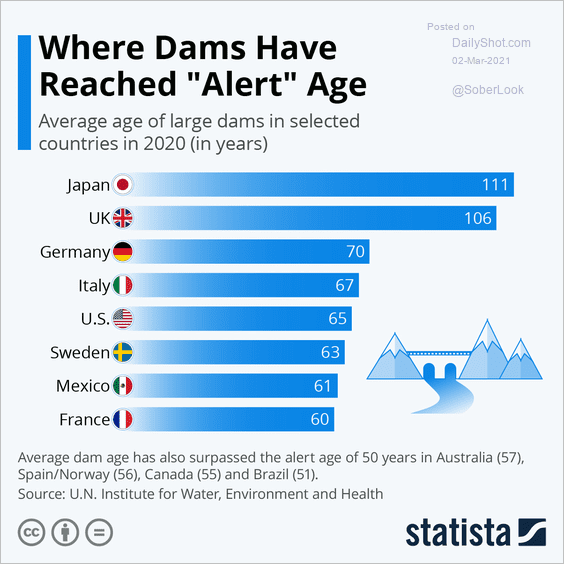

2. Average age of large dams:

Source: Statista

Source: Statista

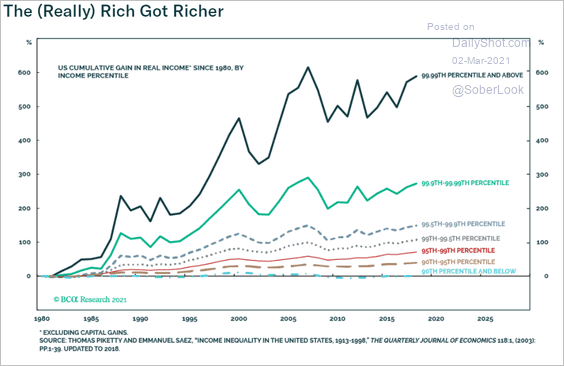

3. US gains in inflation-adjusted incomes by income percentile:

Source: BCA Research

Source: BCA Research

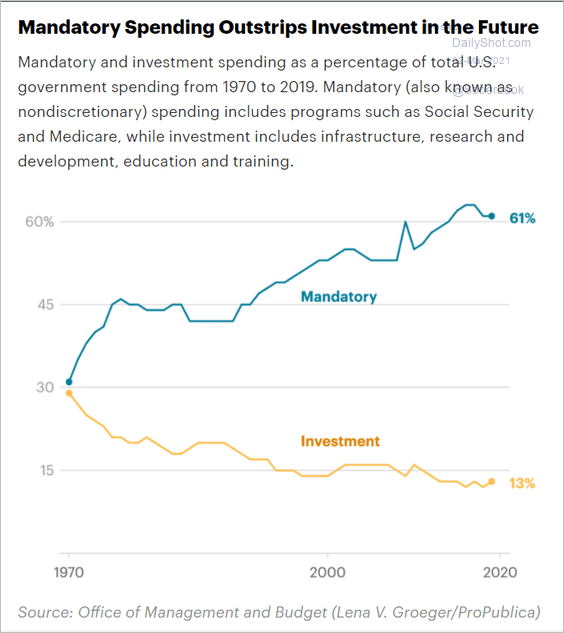

4. US mandatory spending vs. investment:

Source: ProPublica Read full article

Source: ProPublica Read full article

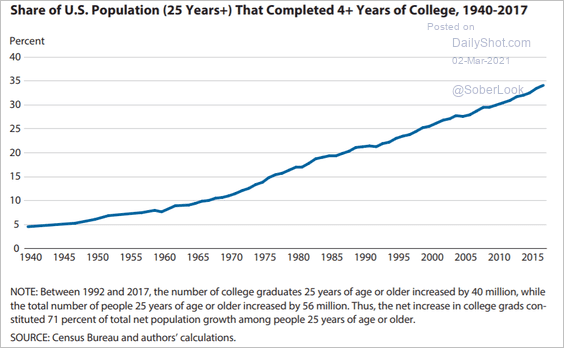

5. College graduates’ share of the population:

Source: @stlouisfed Read full article

Source: @stlouisfed Read full article

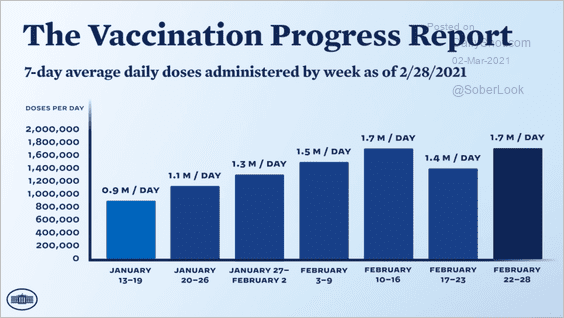

6. US vaccination progress:

Source: @WHCOVIDResponse

Source: @WHCOVIDResponse

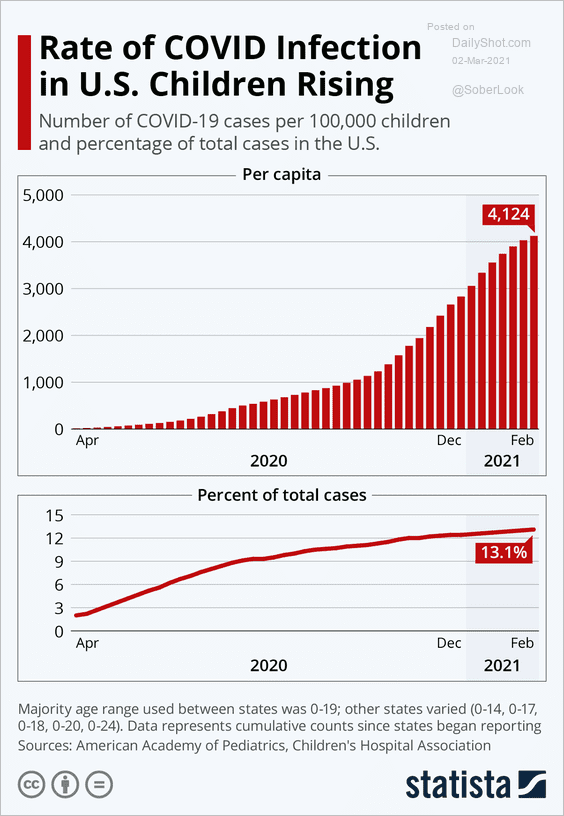

7. COVID infection rates in children:

Source: Statista

Source: Statista

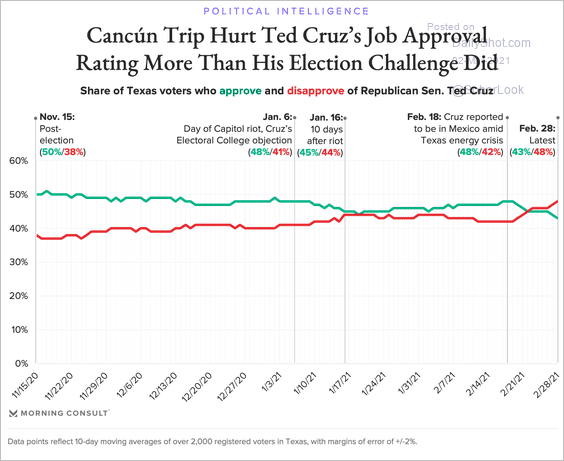

8. Ted Cruz’s approval ratings:

Source: @eyokley Read full article

Source: @eyokley Read full article

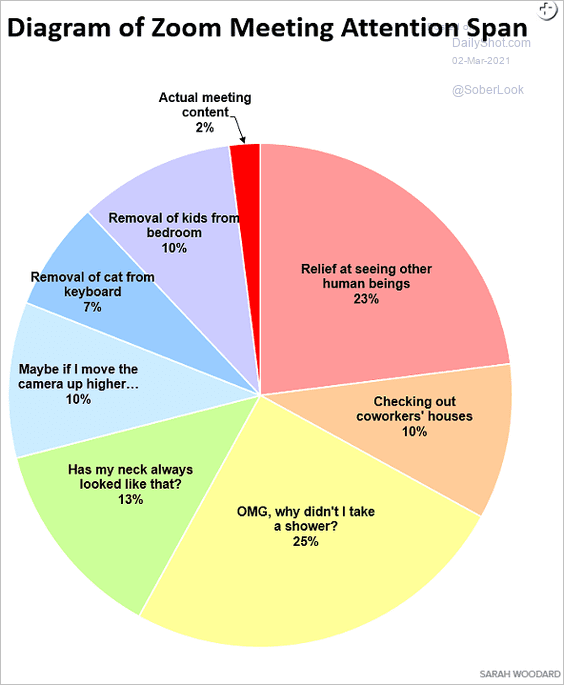

9. Zoom meeting attention span:

Source: Seven Days

Source: Seven Days

——————–

Back to Index