The Daily Shot: 04-Mar-21

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

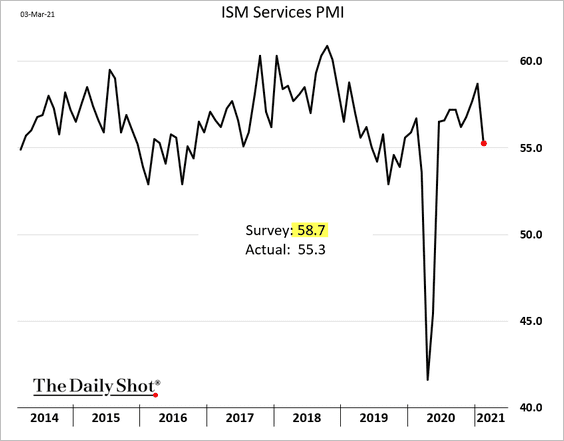

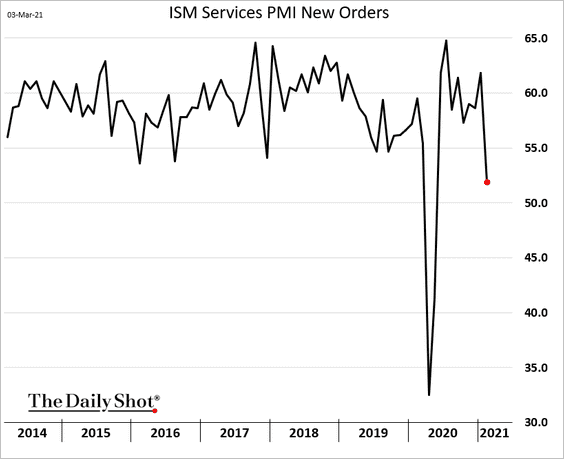

1. The ISM Services PMI report showed some loss of momentum last month as growth in new orders slowed sharply (2nd chart).

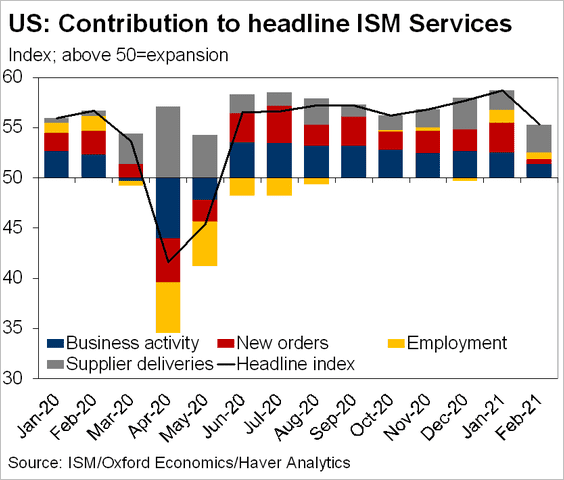

Here are the contributions to the services PMI over time. Supplier delivery bottlenecks kept the index from deteriorating further.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

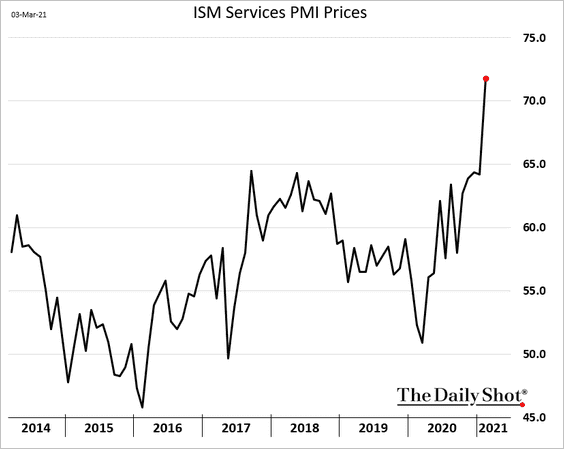

Rising input prices are becoming problematic.

——————–

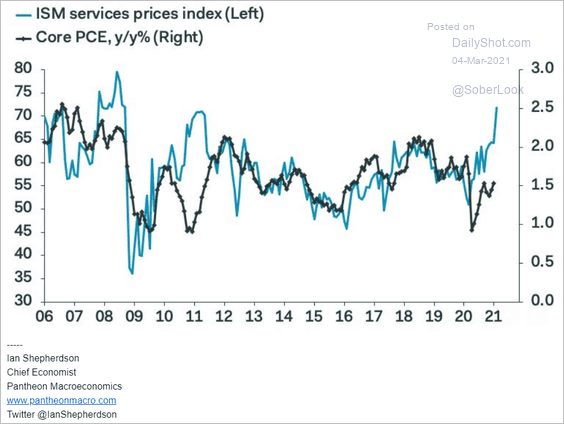

2. Here is the ISM price index (shown above) vs. the core PCE inflation.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

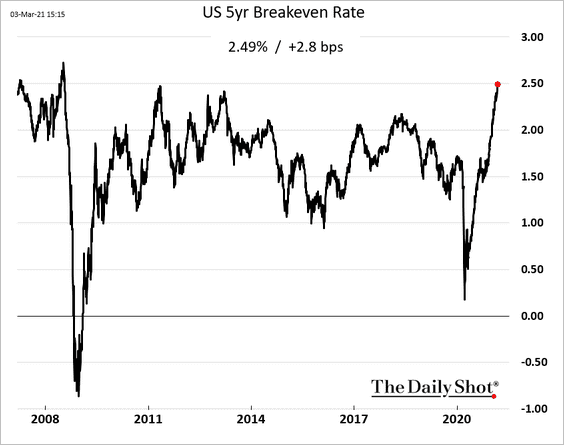

The 5-year breakeven rate (market-based inflation expectations) hit the highest level in over a decade.

——————–

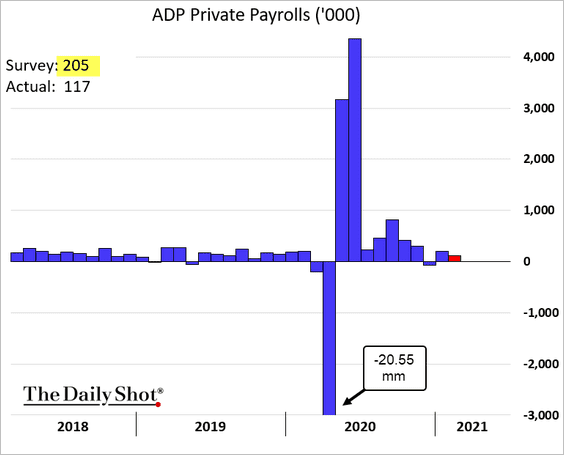

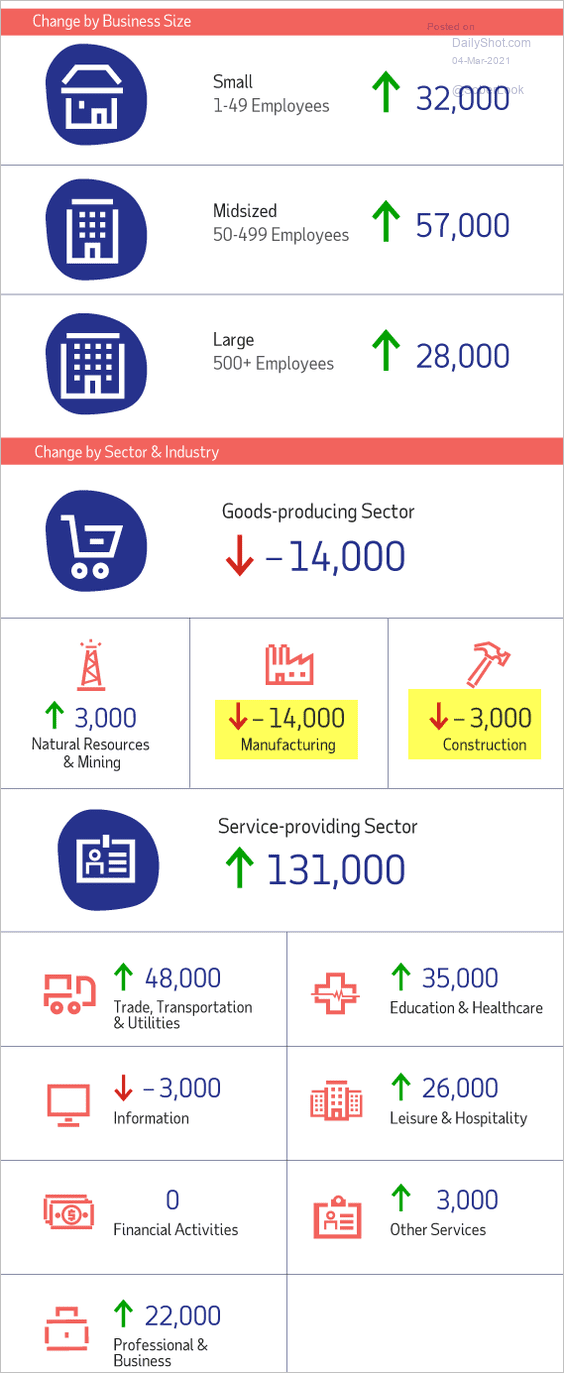

3. The ADP private payrolls report was disappointing, suggesting that the job market recovery remains tepid.

• Despite persistently strong survey data in the manufacturing sector, factory hiring appears to have stalled.

• Here is the ADP report summary.

Source: ADP

Source: ADP

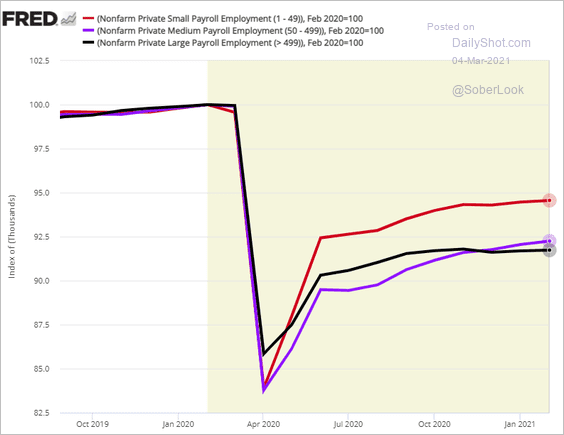

• This chart shows the relative employment recovery paths for businesses of different sizes.

——————–

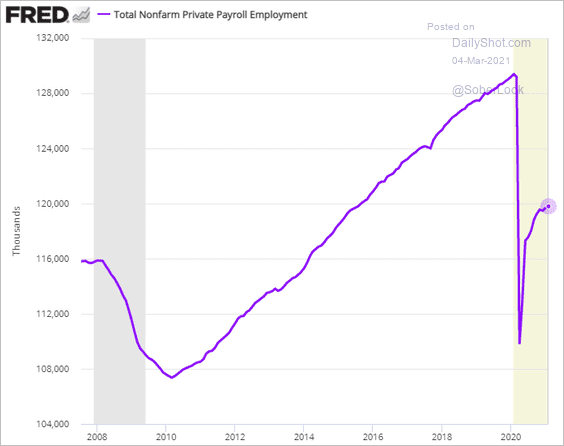

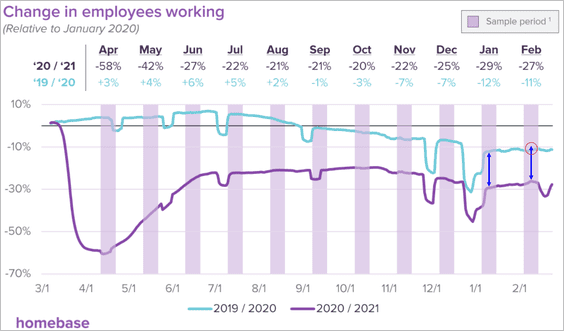

4. Here are a couple of additional updates on the labor market.

• The Homebase small business data point to a modest uptick in the official employment report for February.

Source: Homebase

Source: Homebase

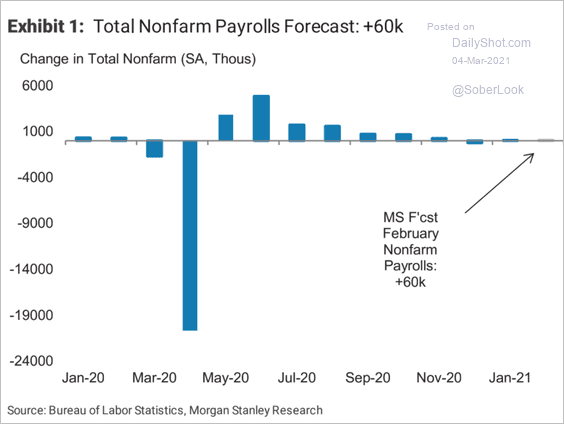

• Morgan Stanley expects a 60k increase in payrolls.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

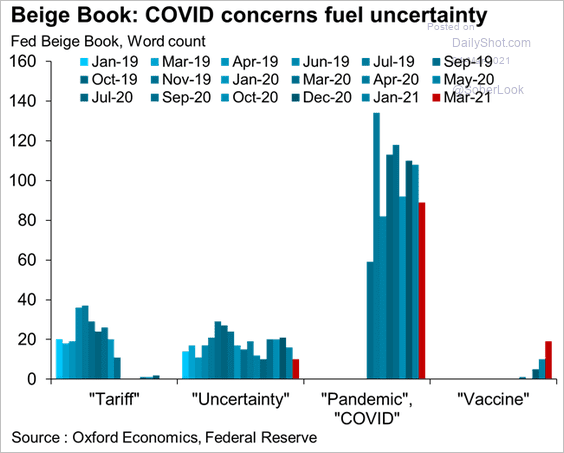

5. The Fed’s Beige Book report shows less uncertainty as businesses place their hopes on vaccination.

Source: @GregDaco, @OxfordEconomics

Source: @GregDaco, @OxfordEconomics

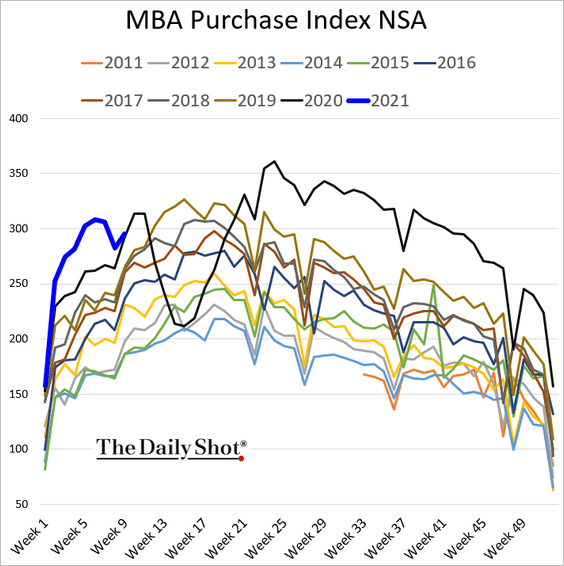

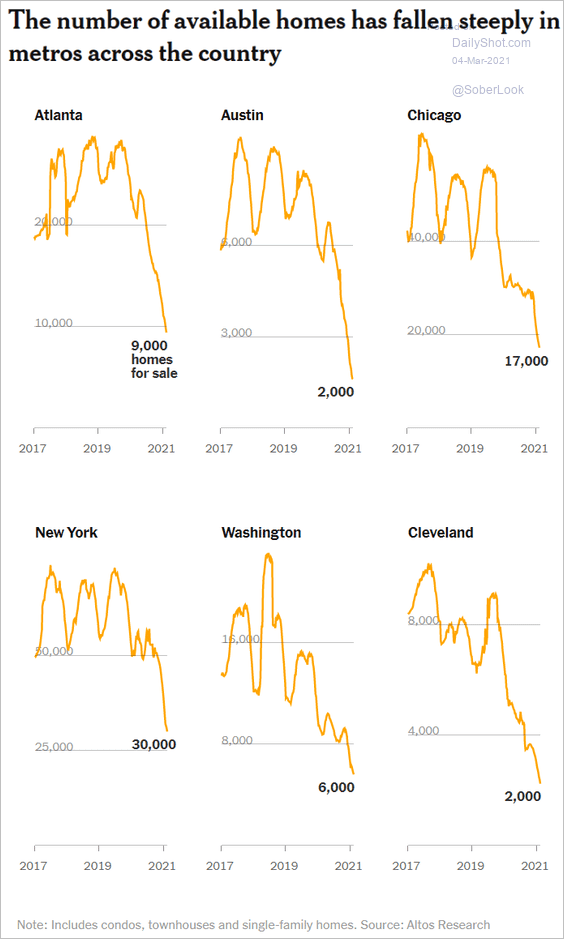

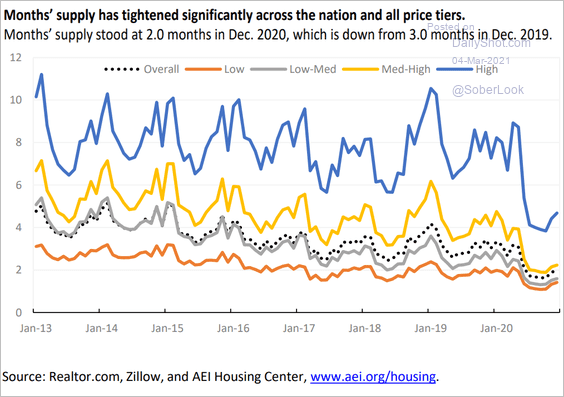

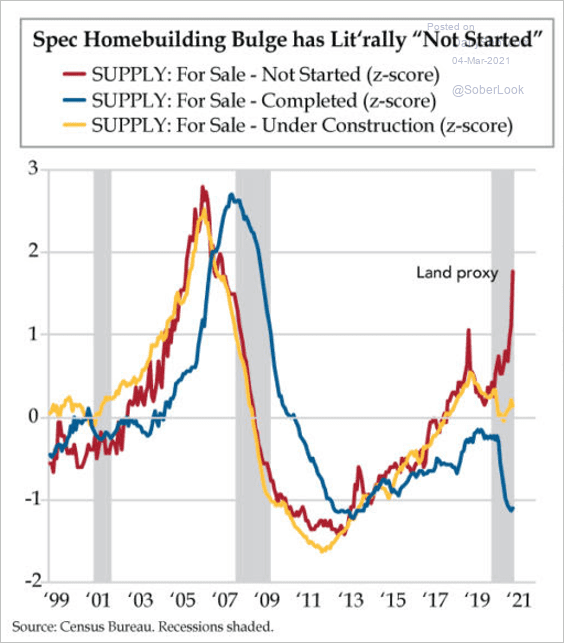

6. Finally, we have some updates on the housing market.

• Mortgage applications ticked higher but are now in line with last year’s level.

• Housing shortages are severe across most metro areas.

Source: @UpshotNYT Read full article

Source: @UpshotNYT Read full article

• This chart shows housing inventories by price tier.

Source: AEI Housing Center

Source: AEI Housing Center

• Homebuilders are increasingly “pre-selling” housing amid robust demand.

Source: The Daily Feather

Source: The Daily Feather

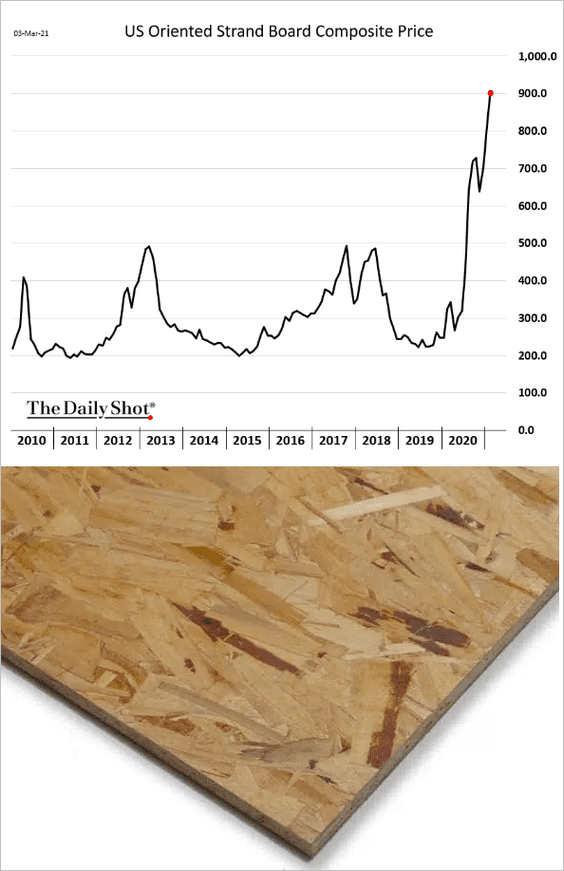

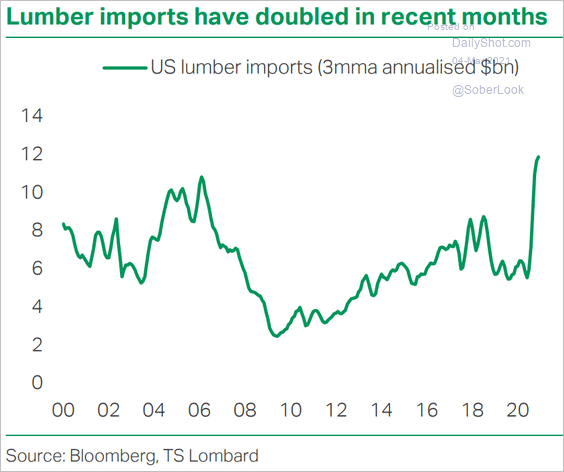

• Rising costs and supplier bottlenecks for building materials have been a challenge for homebuilders.

Source: The Inquirer Read full article

Source: The Inquirer Read full article

– Oriented strand board price:

Source: The Home Depot

Source: The Home Depot

– US lumber imports (showing tight domestic supplies):

Source: TS Lombard

Source: TS Lombard

Back to Index

The United Kingdom

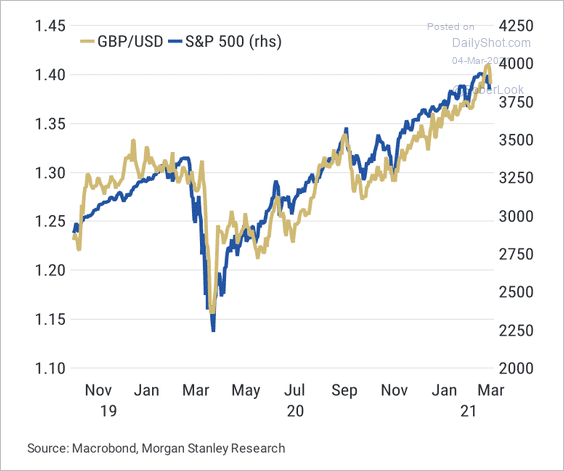

1. GBP/USD generally tracked the S&P 500 over the past year.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

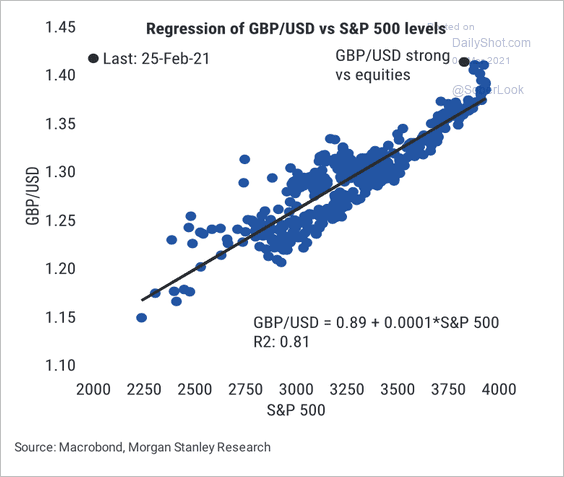

But recently, GBP/USD has traded stronger than the S&P 500 would suggest.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

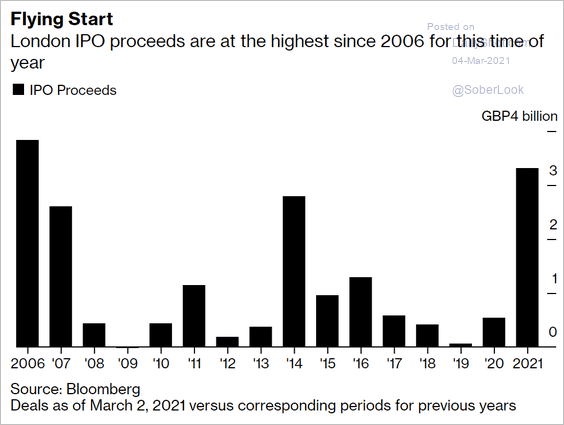

2. London IPO proceeds have taken off this year.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

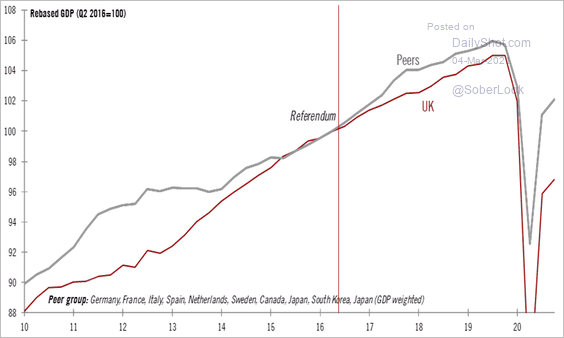

3. The UK GDP continues to lag peers.

Source: @TCosterg

Source: @TCosterg

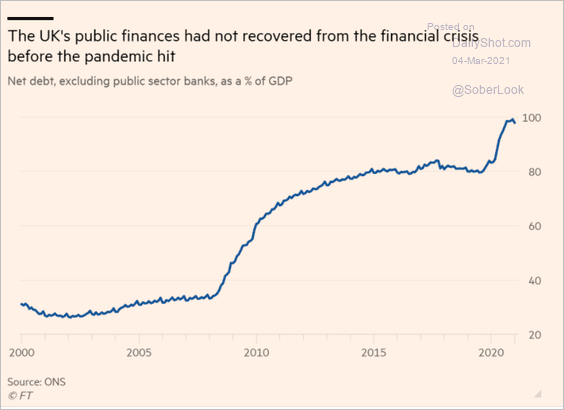

4. The debt-to-GDP ratio rose sharply last year.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

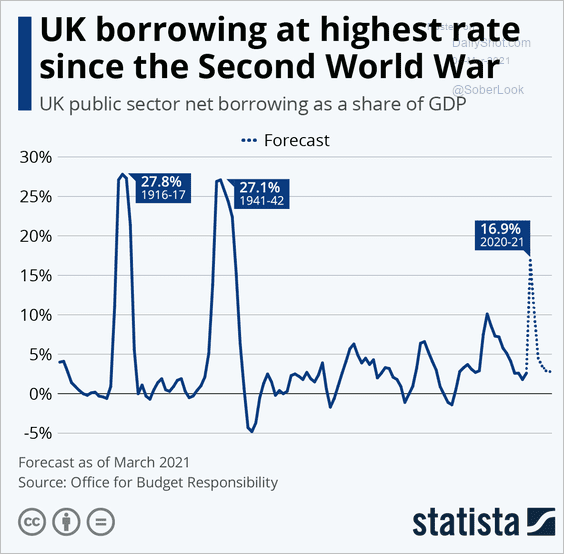

Borrowing as a share of GDP is expected to hit the highest level since WW-II.

Source: Statista

Source: Statista

Back to Index

The Eurozone

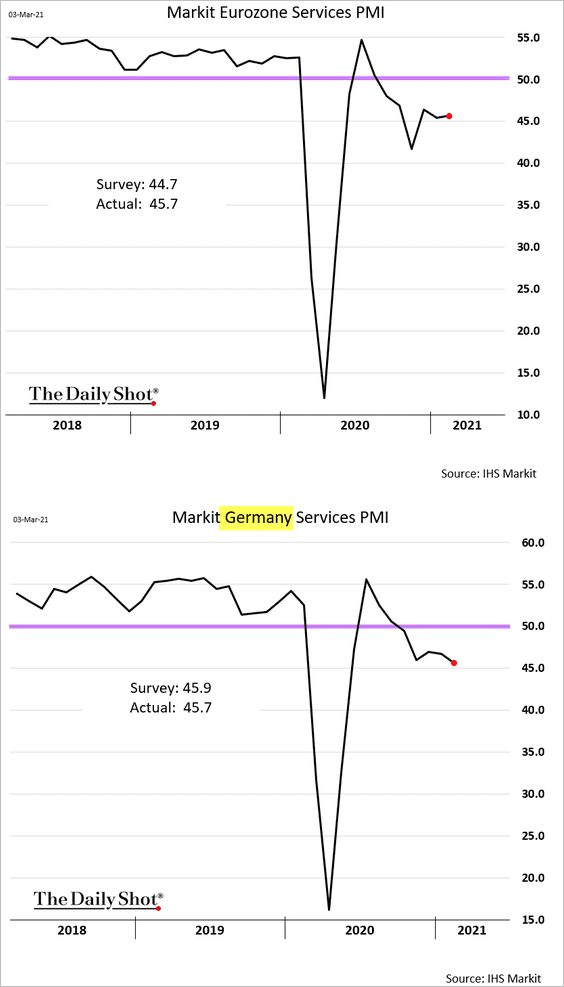

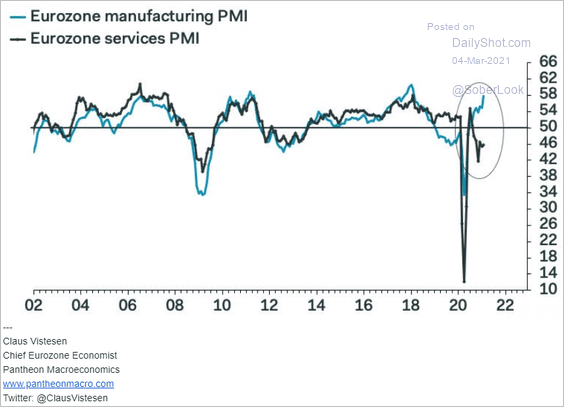

1. Service-sector activity remains in contraction territory, according to Markit PMI.

The divergence between services and manufacturing has widened.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

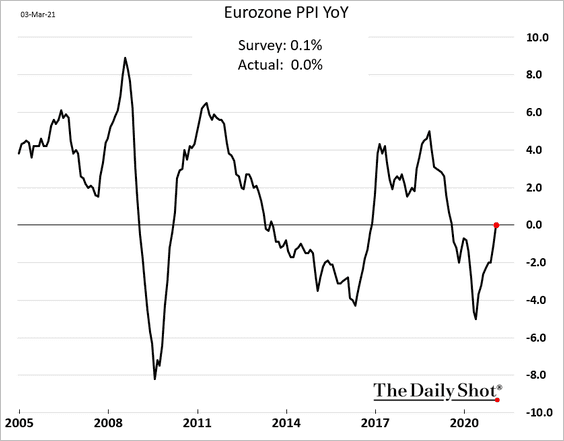

2. Producer prices are rebounding.

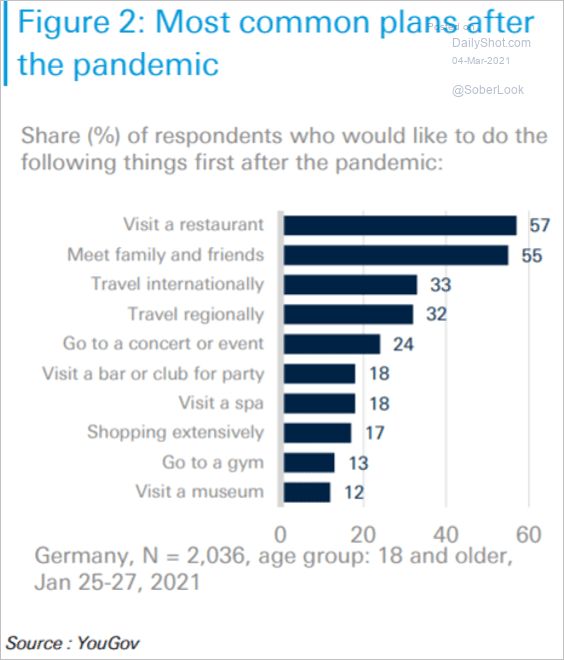

3. Here is what Germans want to do after the pandemic.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Europe

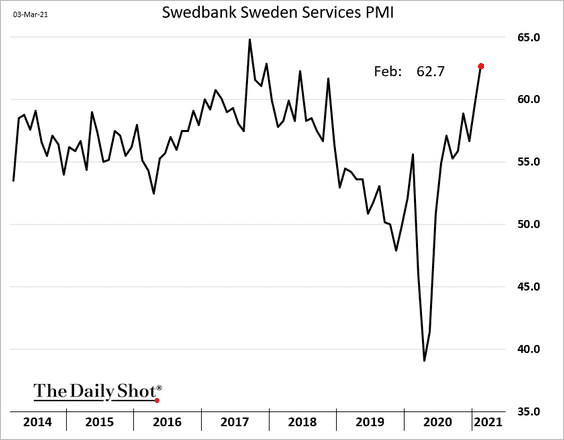

1. Sweden’s service sector is heating up.

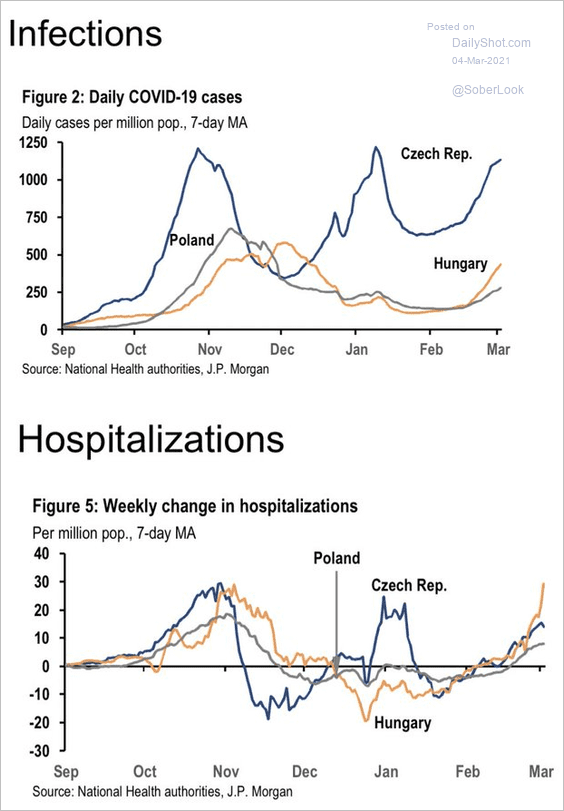

2. Central Europe is facing another wave of infections.

Source: JP Morgan; @carlquintanilla, @CNBC

Source: JP Morgan; @carlquintanilla, @CNBC

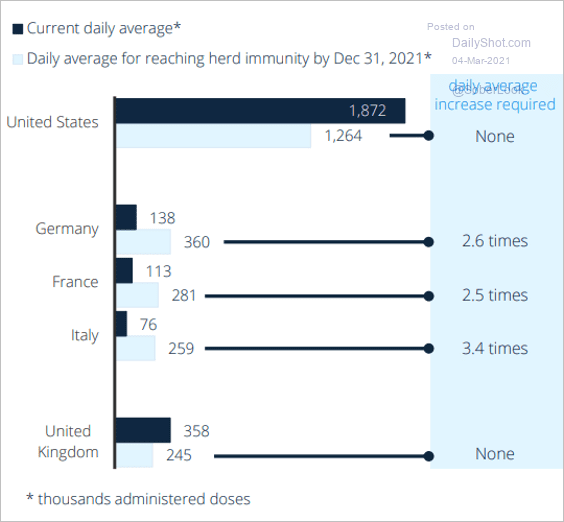

3. The EU needs to accelerate vaccinations.

Source: Statista Read full article

Source: Statista Read full article

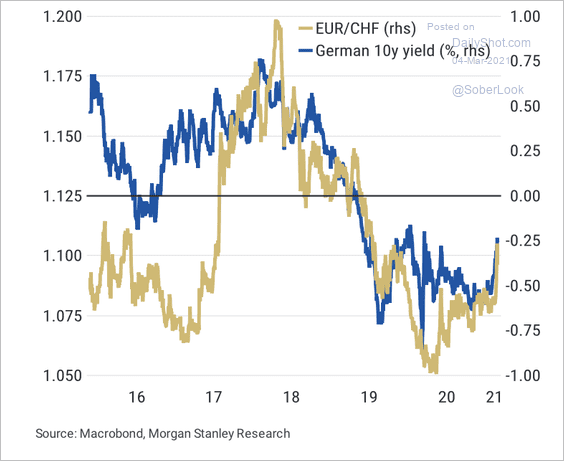

4. EUR/CHF is rising along with the 10-year Bund yield.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

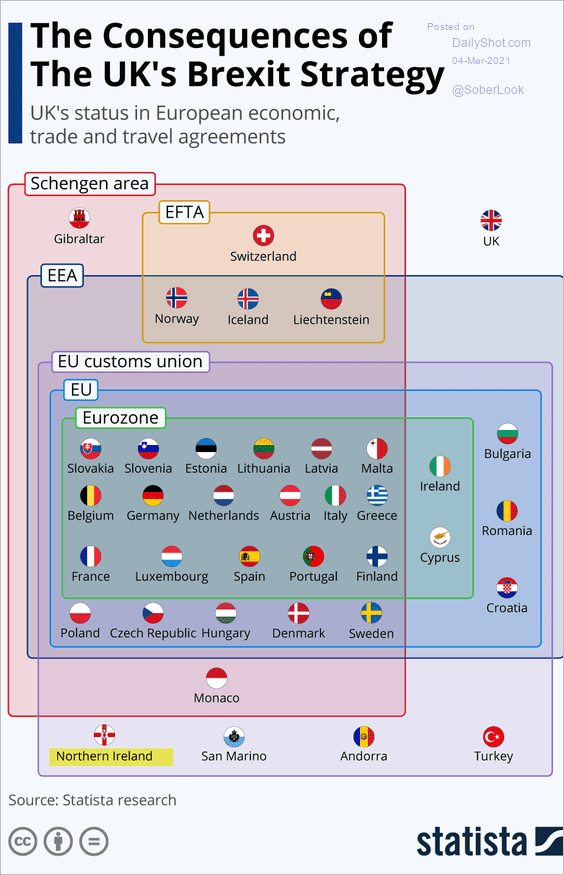

5. Here is an overview of the post-Brexit economic, trade, and travel agreements.

Source: Statista

Source: Statista

Back to Index

Asia – Pacific

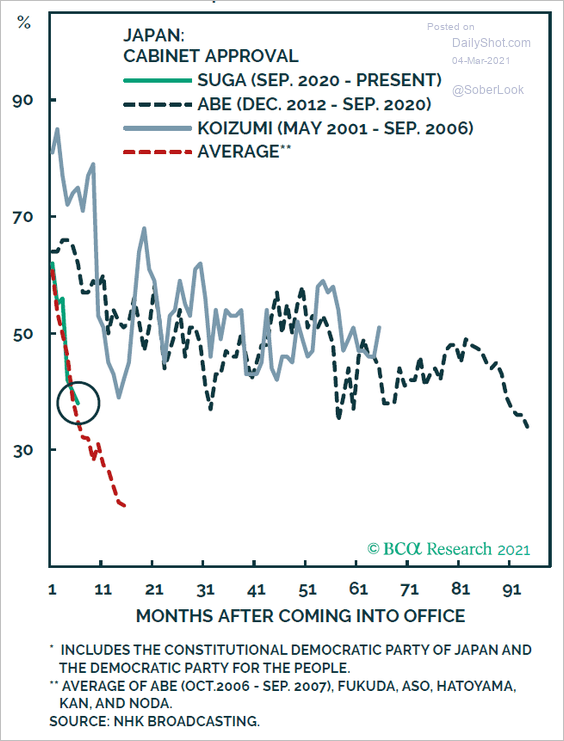

1. Yoshihide Suga’s cabinet approval has been falling.

Source: BCA Research

Source: BCA Research

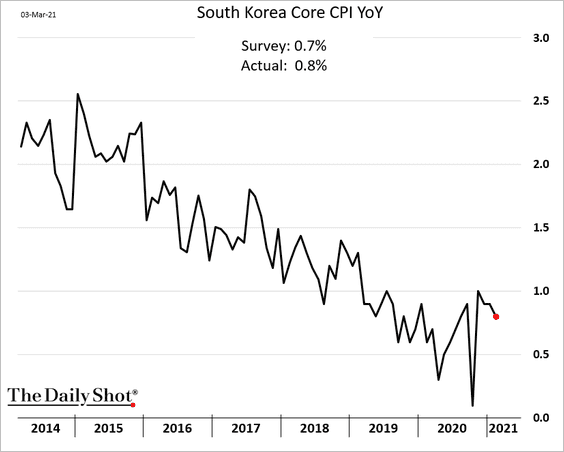

2. Here is South Korea’s core CPI.

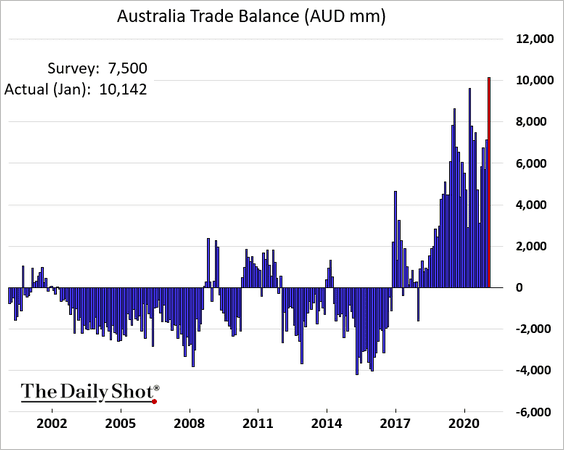

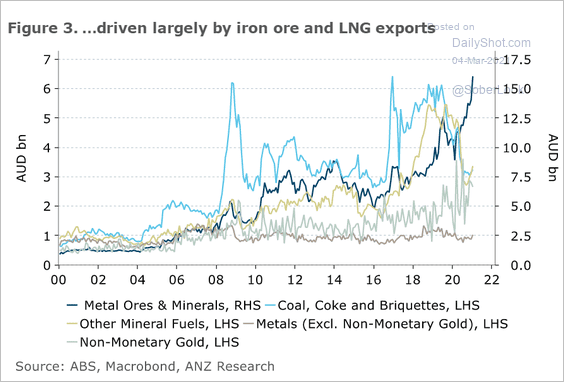

3. Australia’s trade surplus hit a record high, boosted by iron ore and LNG exports.

Source: ANZ Research

Source: ANZ Research

Back to Index

China

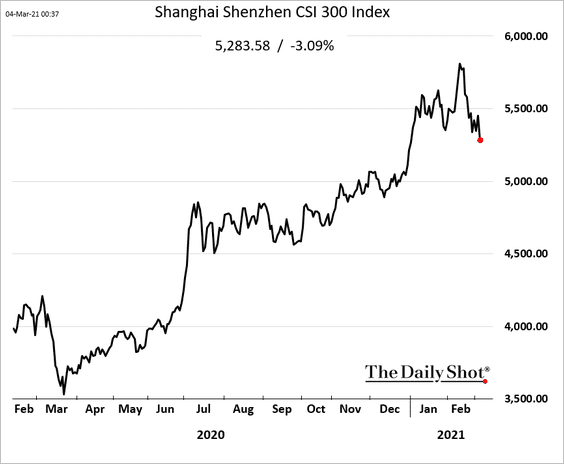

1. The stock market is under a bit of pressure.

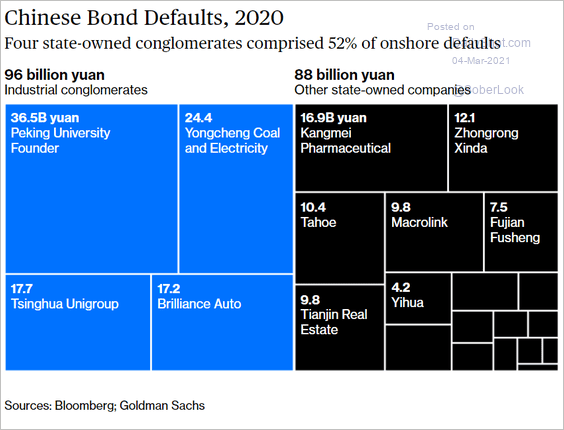

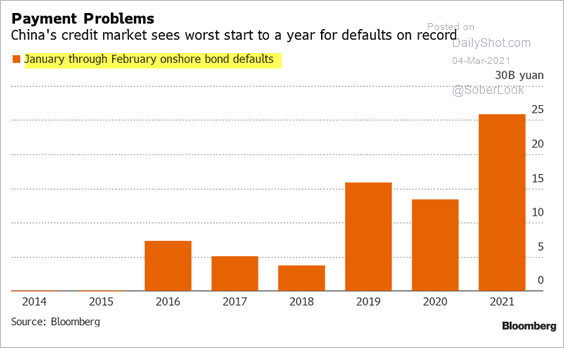

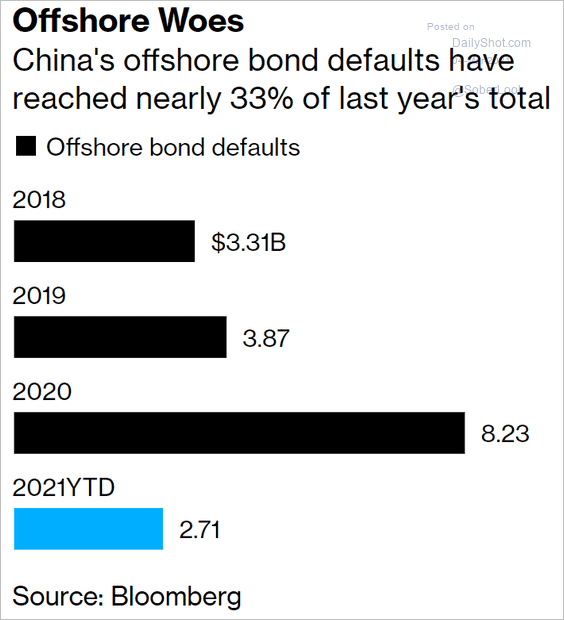

2. Next, we have some charts on bond defaults (from Bloomberg).

• 2020 defaults:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

• Onshore debt default (Jan-Feb by year):

Source: @MollyDai Further reading

Source: @MollyDai Further reading

• Offshore debt defaults:

Source: @markets Read full article

Source: @markets Read full article

——————–

3. China will attempt to become less dependent on semiconductor imports.

![]() Source: Gavekal Research

Source: Gavekal Research

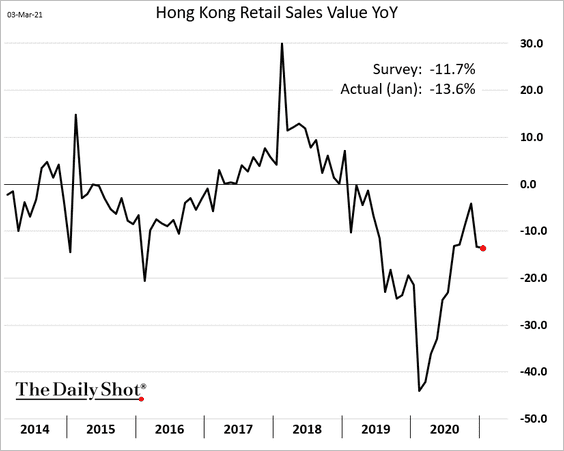

4. Hong Kong’s retail sales remain soft.

Back to Index

Commodities

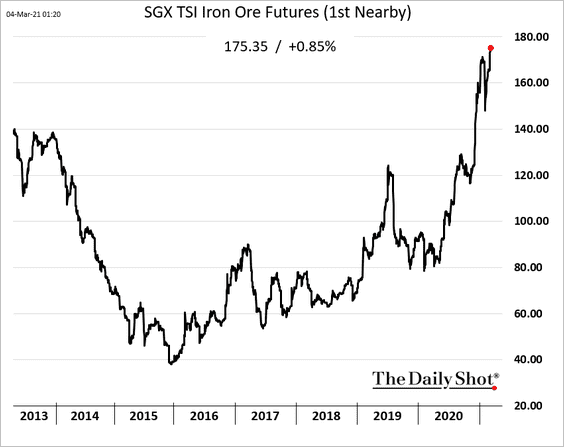

1. Singapore iron ore futures hit a multi-year high.

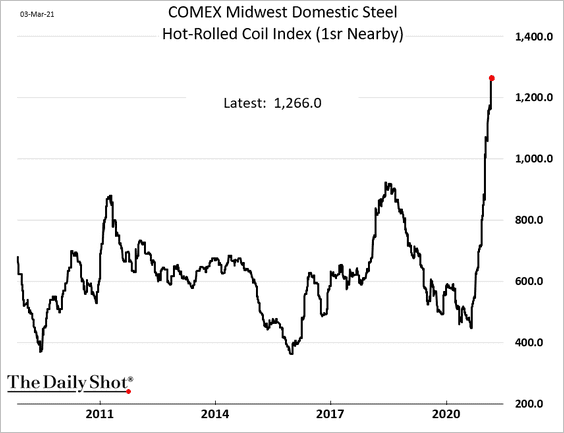

2. US steel prices keep climbing.

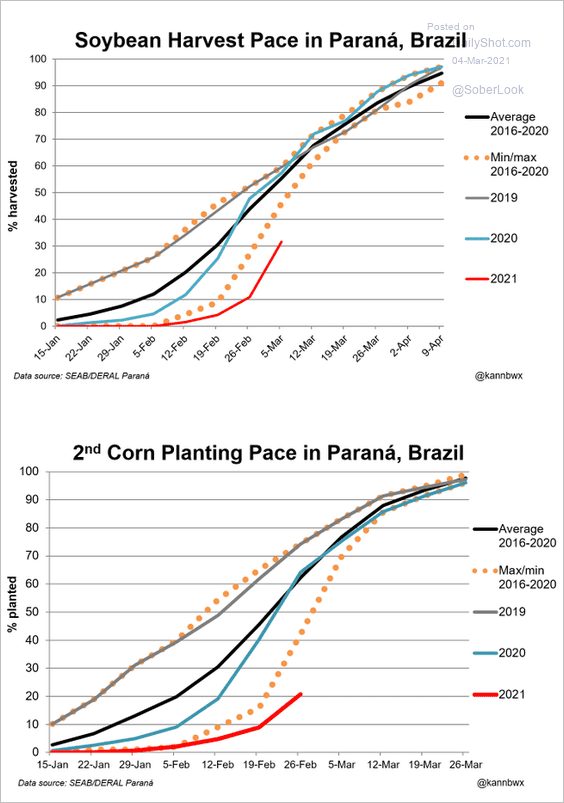

3. Brazil’s soybean harvest is running well behind schedule. Corn planting is lagging as well.

Source: @kannbwx

Source: @kannbwx

Back to Index

Energy

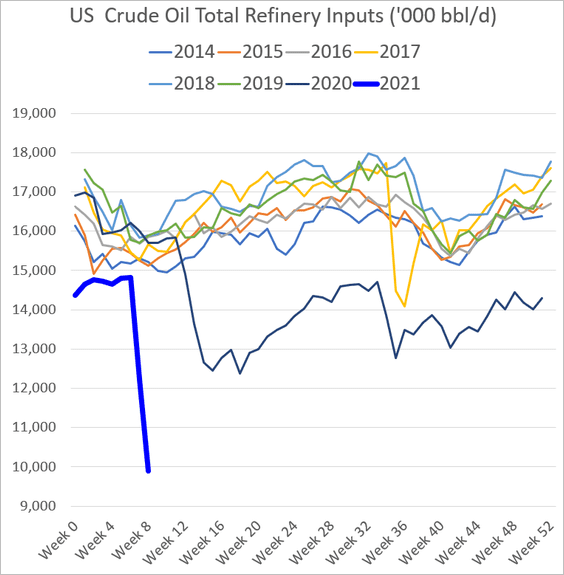

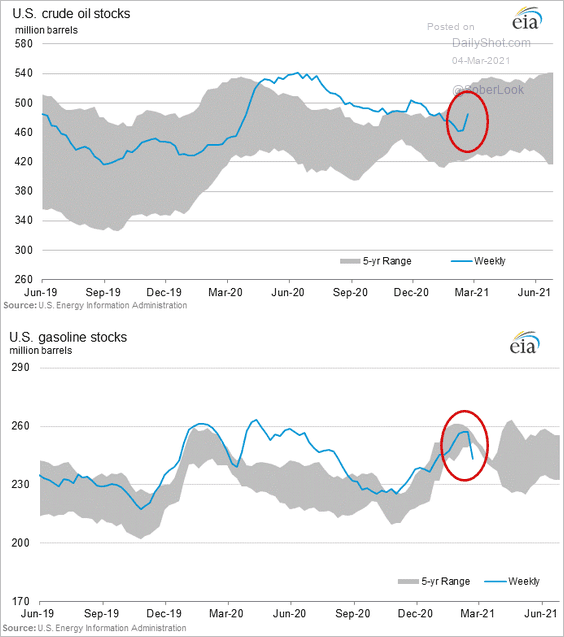

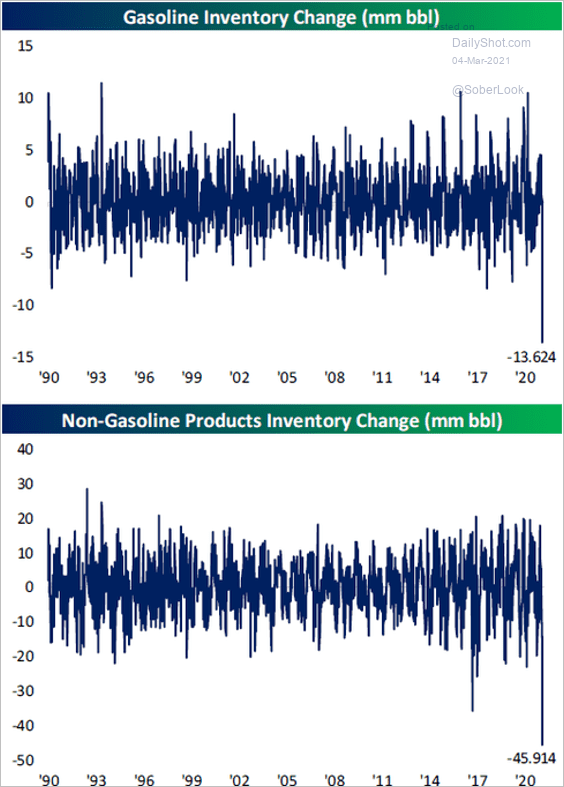

1. US energy markets are still recovering from the Texas deep freeze. With refinery capacity temporarily impaired, …

… crude oil inventories shot up while gasoline and other refined product stockpiles tumbled.

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

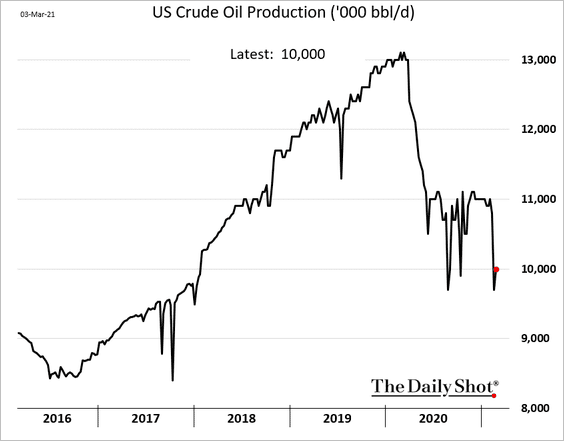

Oil production remained depressed.

——————–

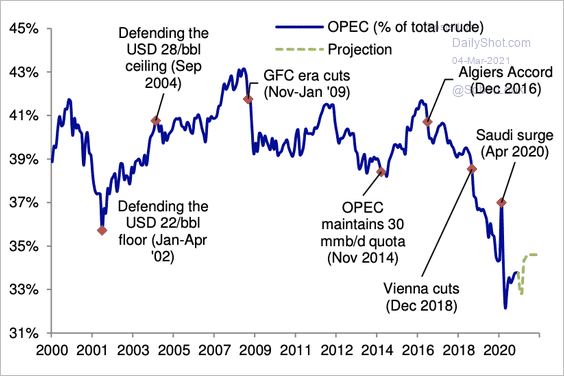

2. Deutsche Bank expects OPEC to moderately increase its market share of crude oil production.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

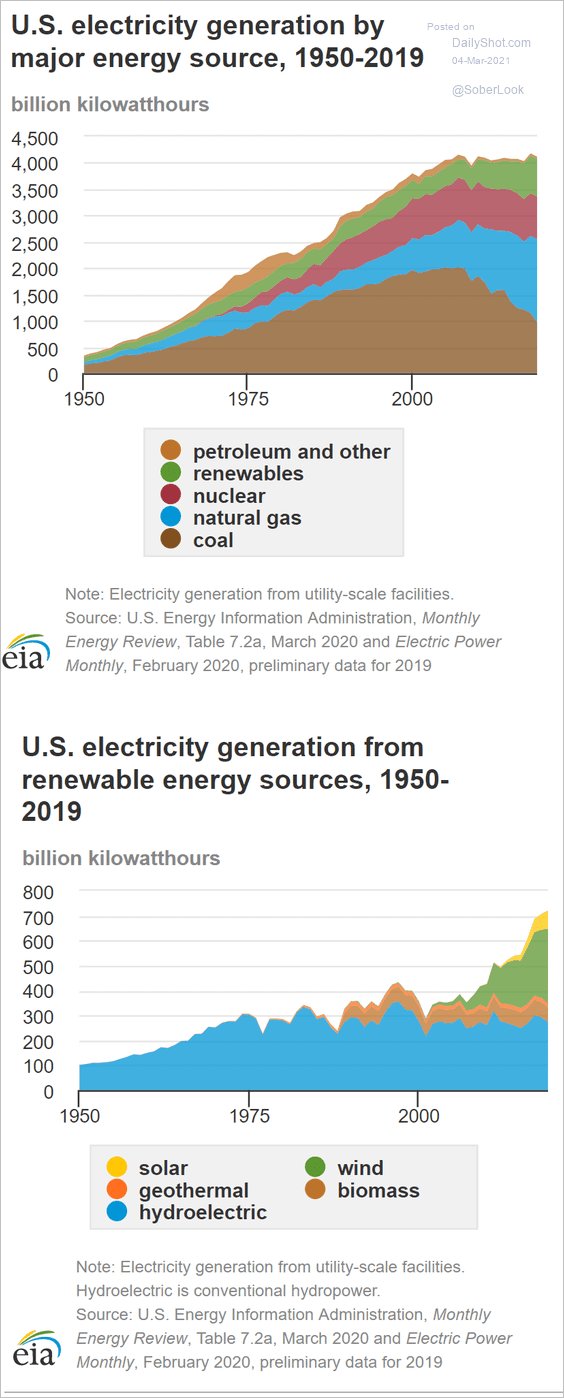

3. Here is US electricity generation by energy source.

Source: @EIAgov Read full article

Source: @EIAgov Read full article

Back to Index

Equities

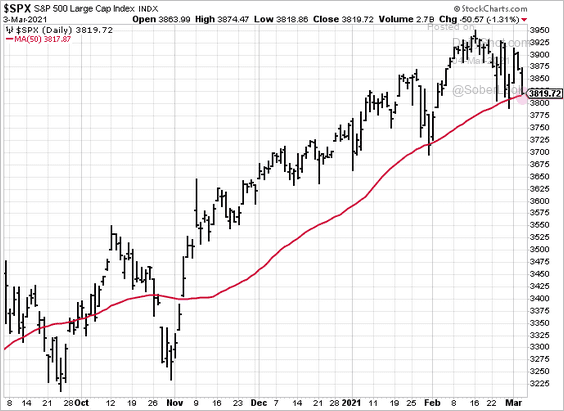

1. Once again, the S&P 500 is testing support at the 50-day moving average.

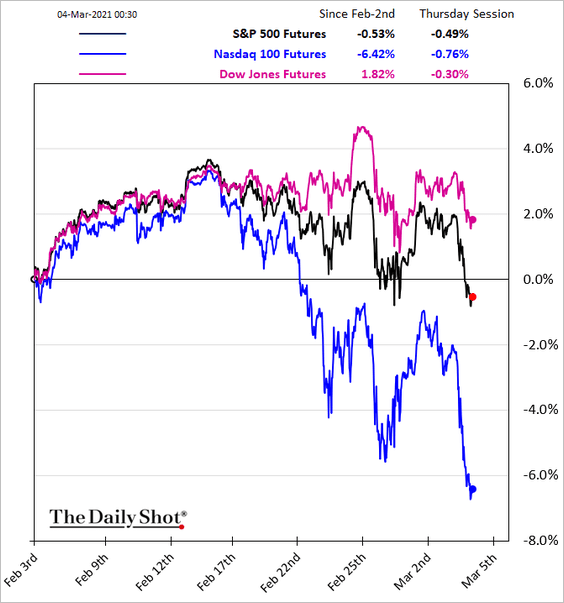

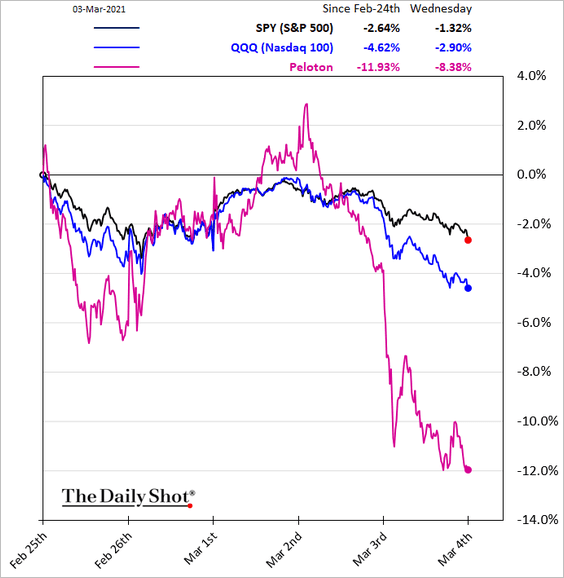

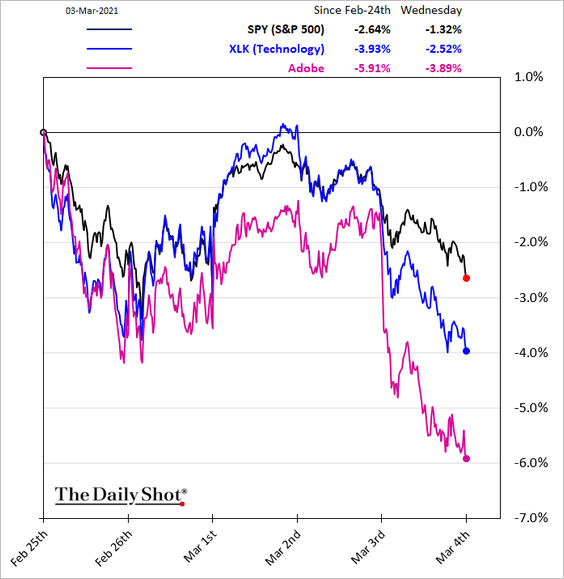

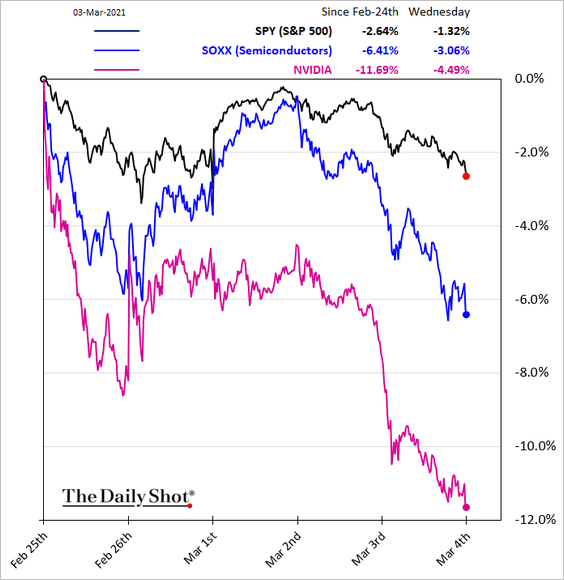

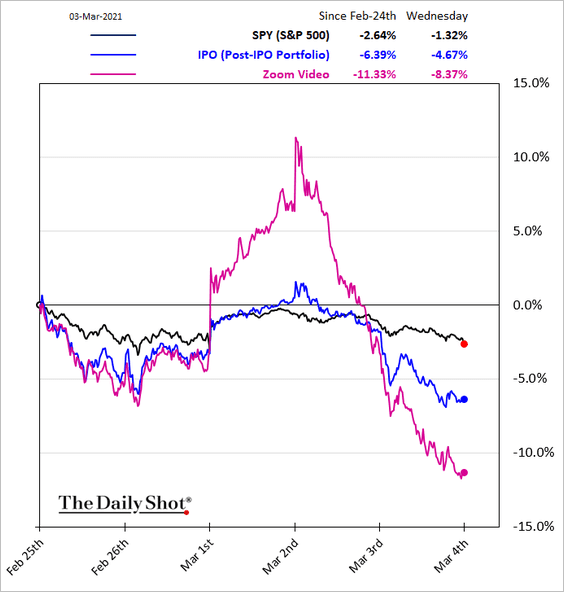

2. Tech stocks continue to be a drag on the US equity market.

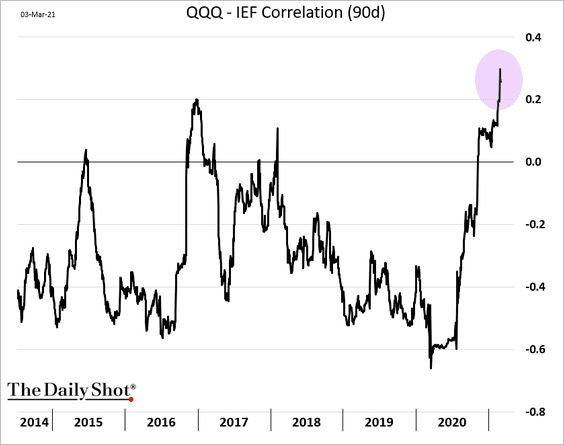

The Nasdaq 100 has been correlated with Treasury prices lately (QQQ = Nasdaq 100; IEF = 7-10yr Treasury ETF).

Below is the relative performance over the past five business days.

• Tech:

• Semiconductors:

• Post-IPO stocks:

——————–

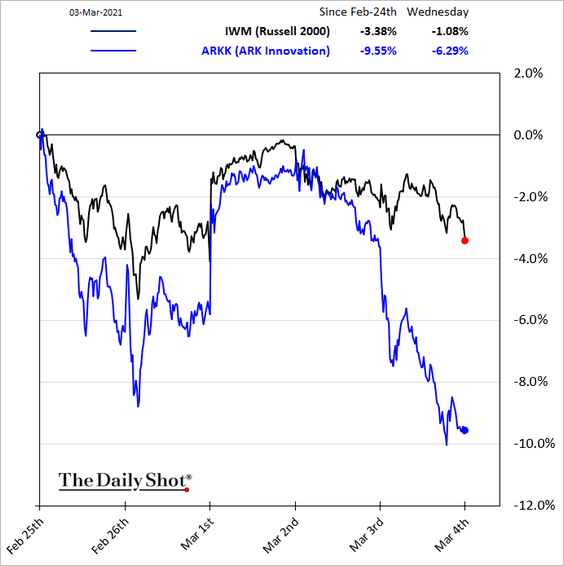

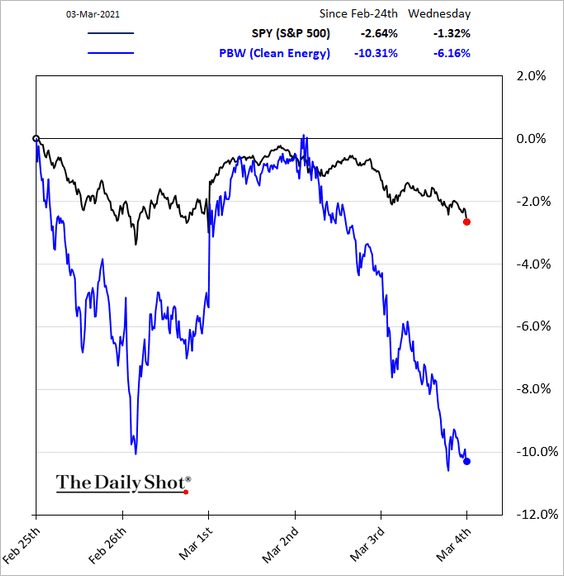

3. Some of the popular thematic ETFs took a hit.

• ARK Innovation:

• Clean energy:

——————–

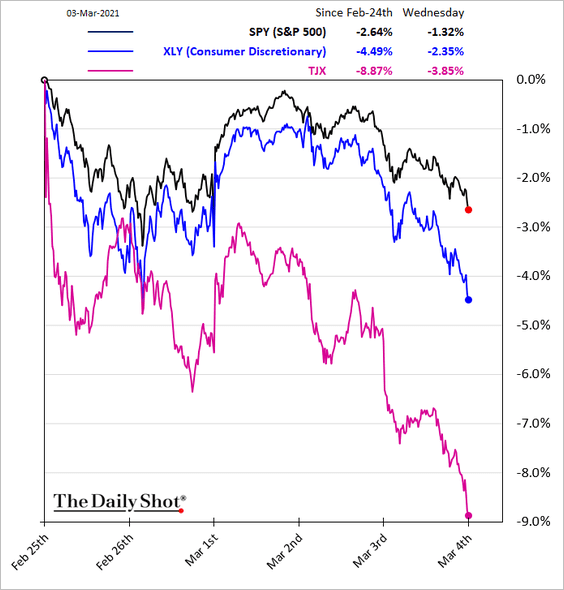

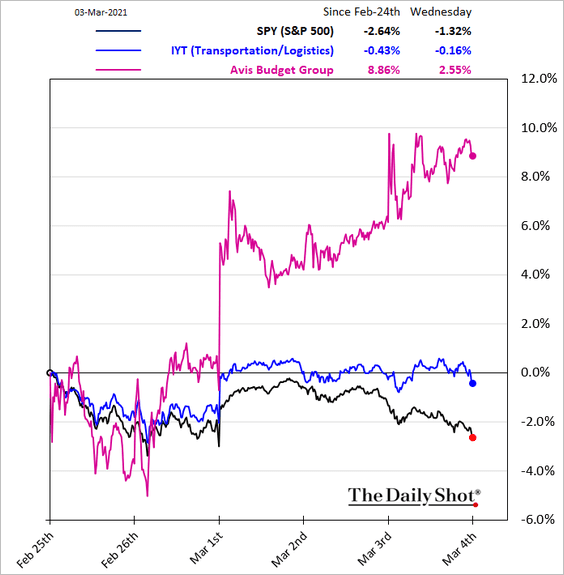

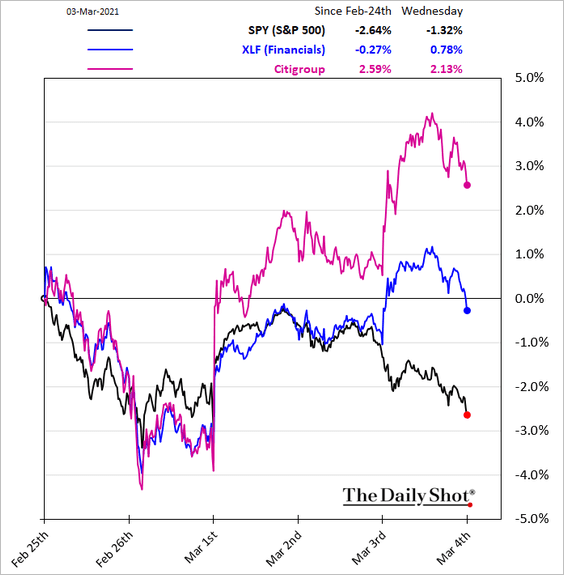

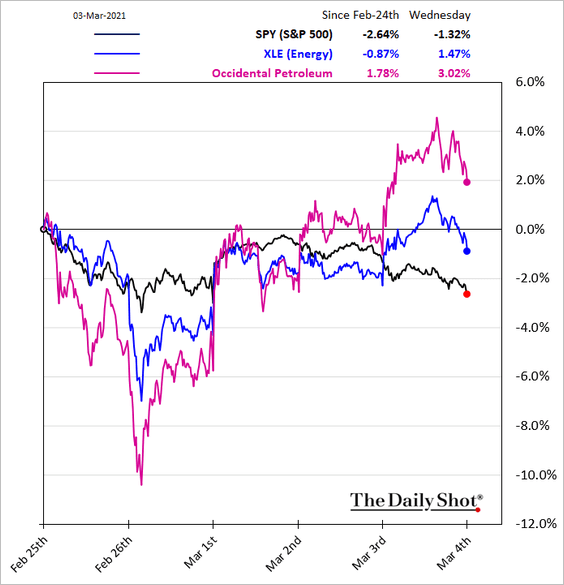

4. Here are a few additional sector trends.

• Consumer discretionary:

• Transportation:

• Financials:

• Energy:

——————–

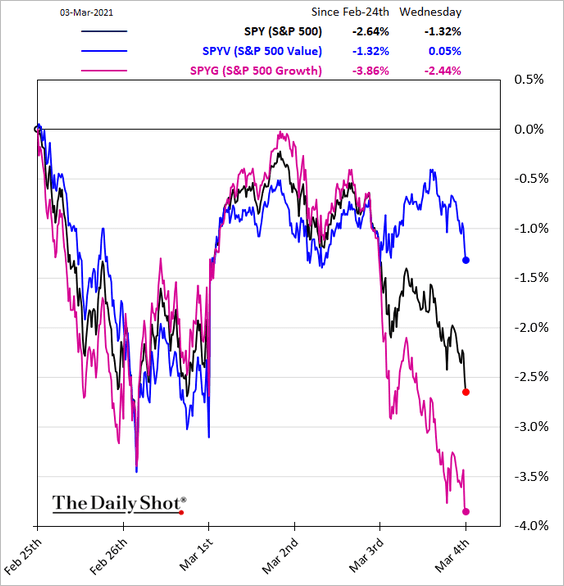

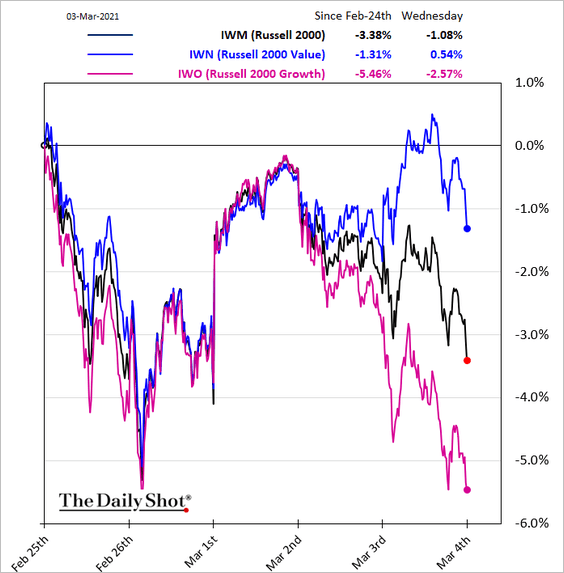

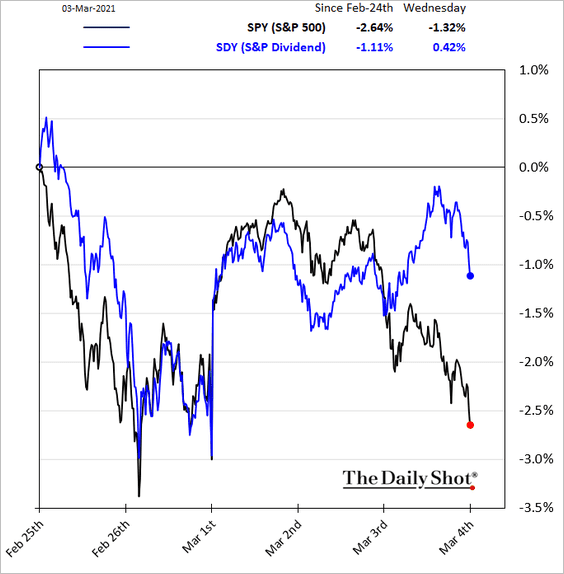

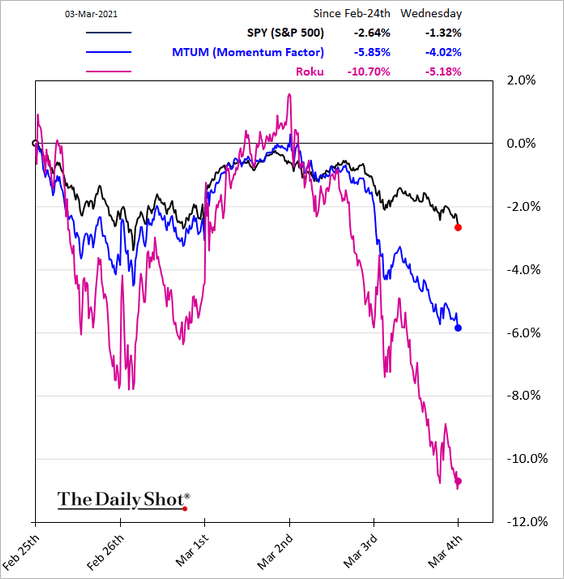

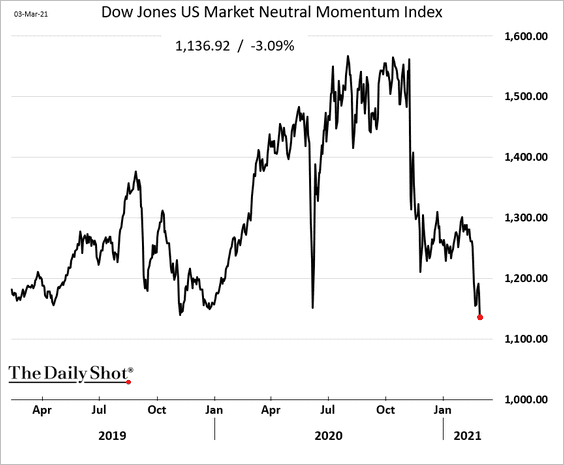

5. Next, we have some equity factor performance charts.

• Value vs. growth:

• Small-cap value vs. growth:

• High-dividend shares:

• Momentum (2 charts):

——————–

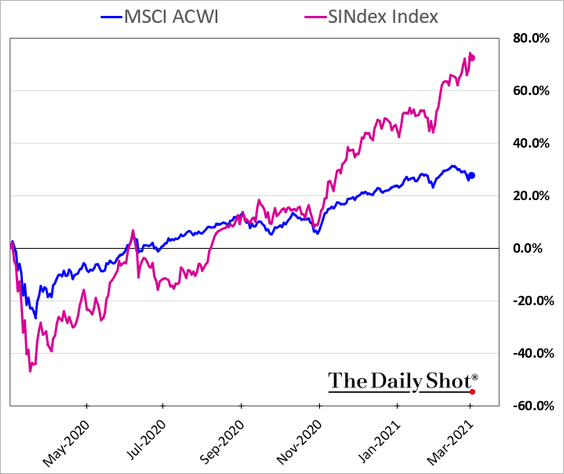

6. The global “sin index” (gambling, booze, and cigarettes) has been outperforming the broader market.

h/t Cormac Mullen

h/t Cormac Mullen

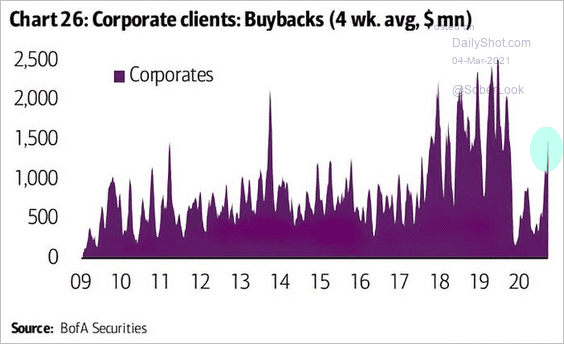

7. Share buybacks are coming back.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

——————–

Rates

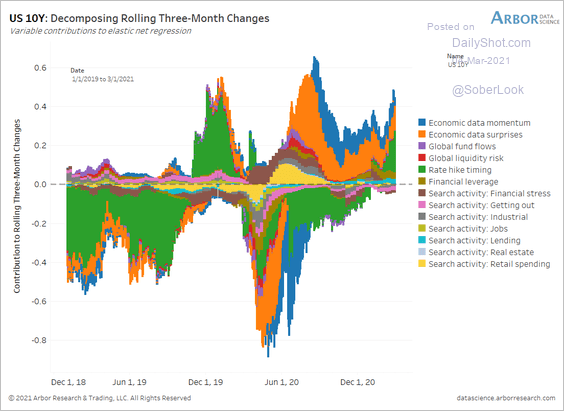

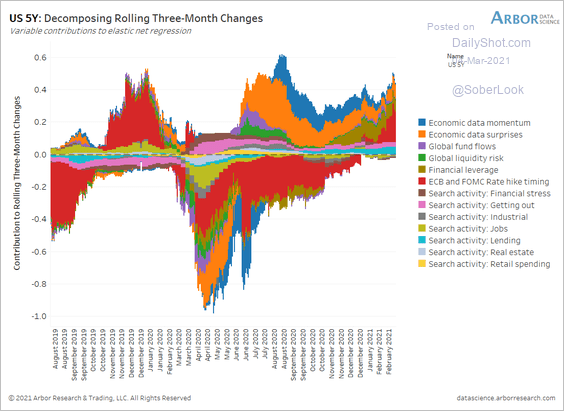

1. The charts below from Arbor Data Science show an estimated decomposition of Treasury yield changes.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

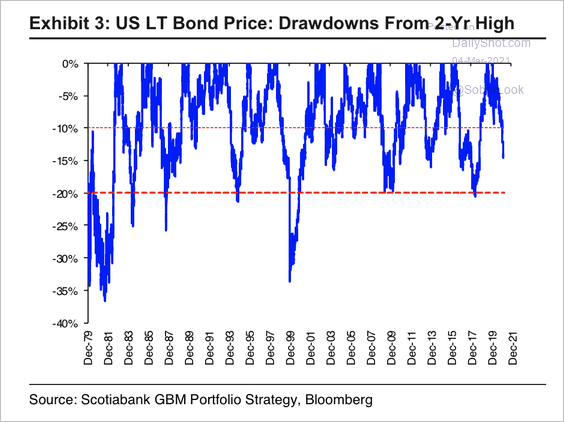

2. The recent drawdown in long-term US Treasury bonds is still below prior extremes.

Source: Scotiabank Economics

Source: Scotiabank Economics

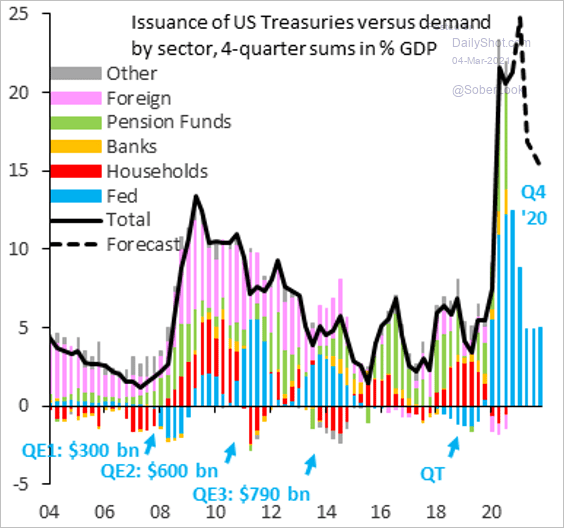

3. Demand for Treasury securities is not expected to keep up with the issuance.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

——————–

Food for Thought

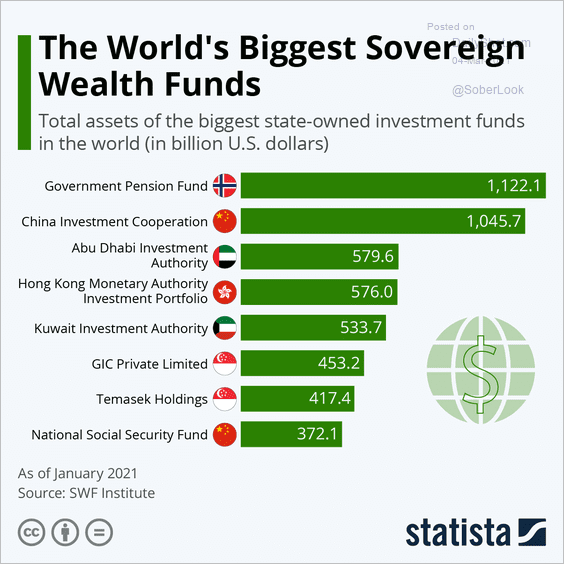

1. The biggest sovereign wealth funds:

Source: Statista

Source: Statista

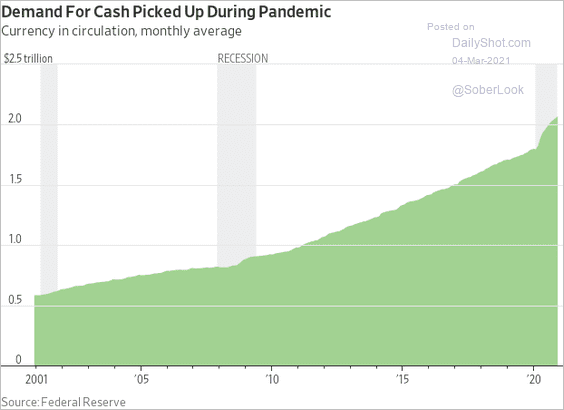

2. US banknotes (paper money) in circulation:

Source: @WSJ Read full article

Source: @WSJ Read full article

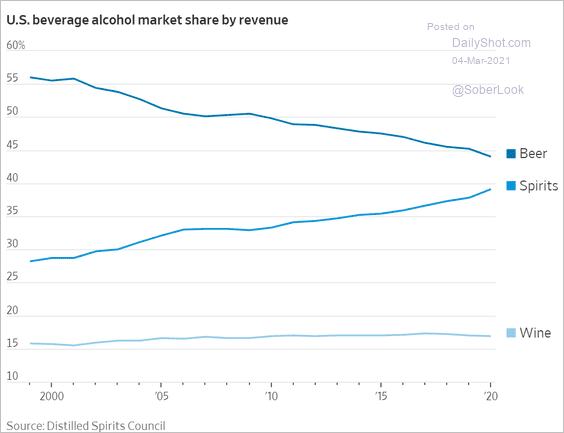

3. Sales of alcohol:

Source: @WSJ Read full article

Source: @WSJ Read full article

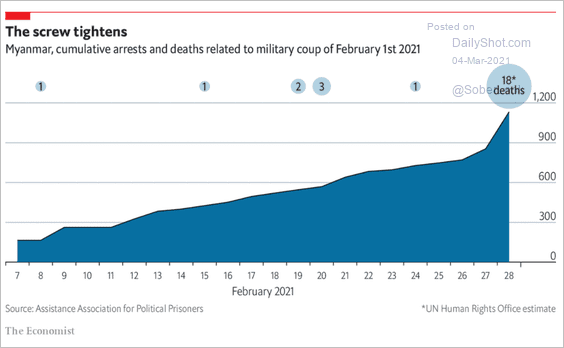

4. Myanmar arrests and deaths:

Source: The Economist Read full article

Source: The Economist Read full article

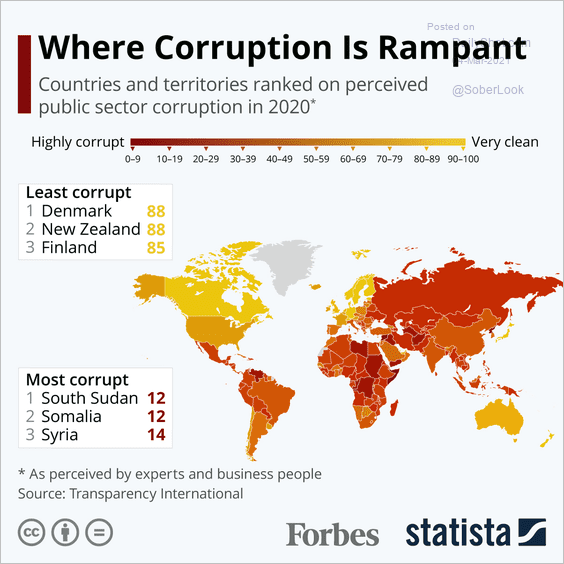

5. Corruption rankings:

Source: Statista

Source: Statista

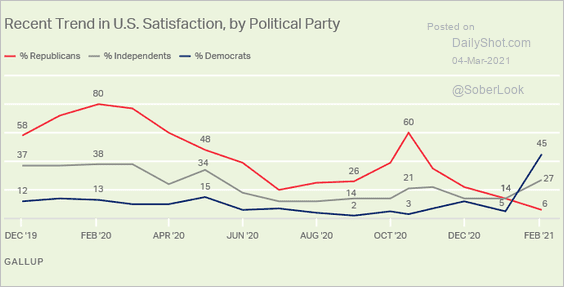

6. Satisfaction with the way things are going in the US:

Source: Gallup Read full article

Source: Gallup Read full article

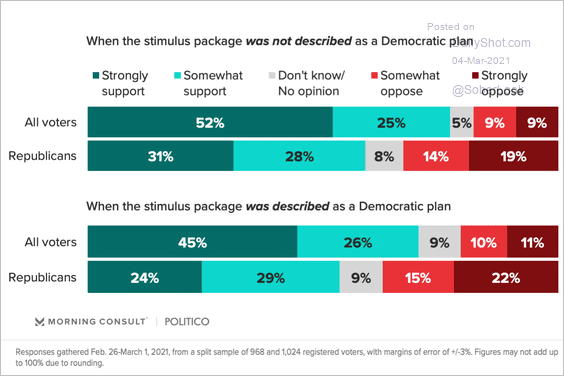

7. Support for the $1.9 trillion stimulus bill:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

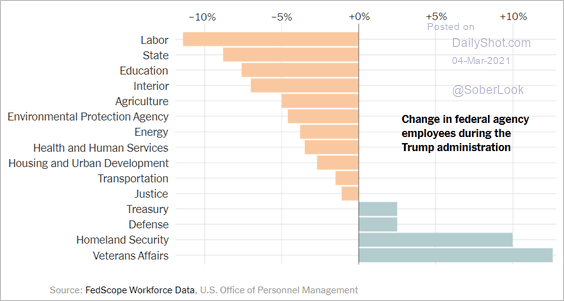

8. Changes in US federal agency employment:

Source: The New York Times Read full article

Source: The New York Times Read full article

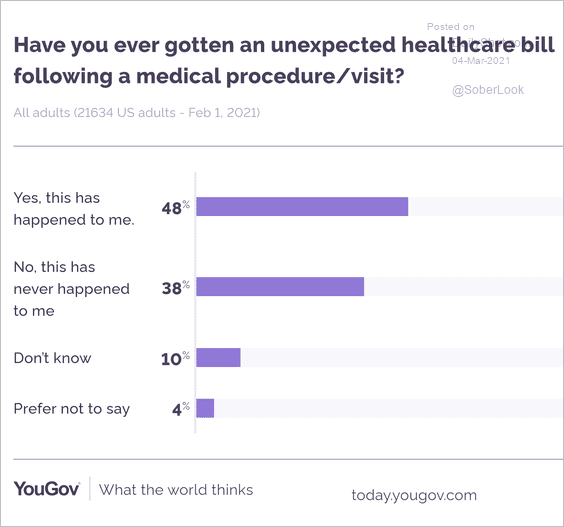

9. Unexpected medical bills:

Source: YouGov

Source: YouGov

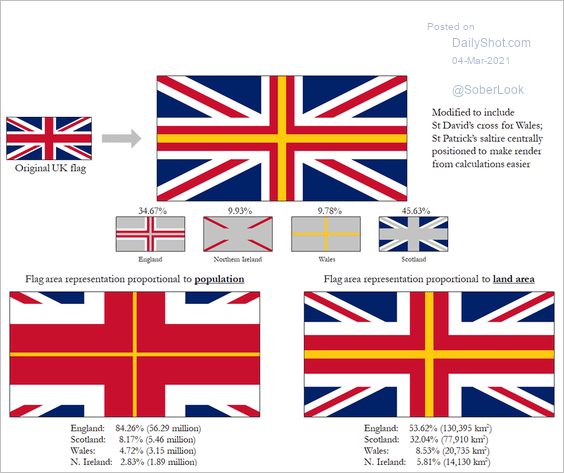

10. Different representations of the Union Jack:

Source: Reddit

Source: Reddit

——————–

Back to Index