The Daily Shot: 05-Mar-21

• Rates

• Equities

• Credit

• Commodities

• Energy

• Emerging Markets

• China

• Australia

• Japan

• The Eurozone

• The United Kingdom

• Canada

• The United States

• Food for Thought

Rates

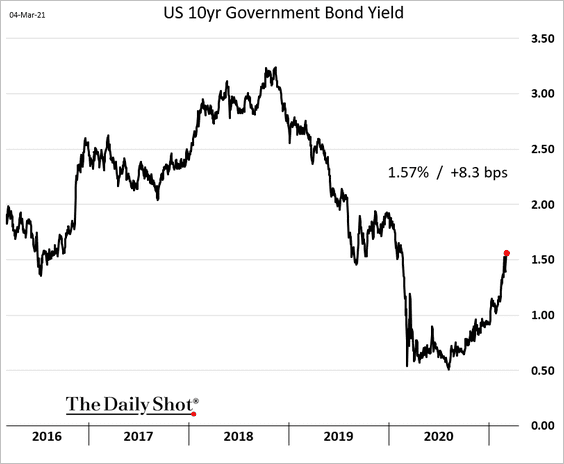

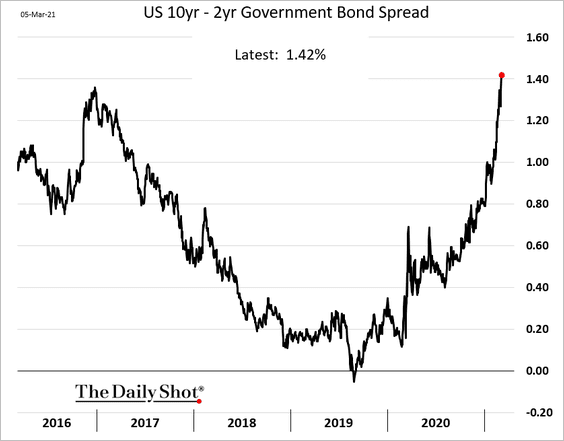

1. Jerome Powell’s comments on Thursday were dovish as usual. However, traders wanted to hear about how the Fed may address rising bond yields. In particular, there has been talk about the central bank shifting its bond purchases to longer maturities. The market didn’t get its wish, sending bond yields higher.

Source: @lisaabramowicz1

Source: @lisaabramowicz1

• The 10yr yield is now at pre-pandemic levels.

• The Treasury curve steepened further.

——————–

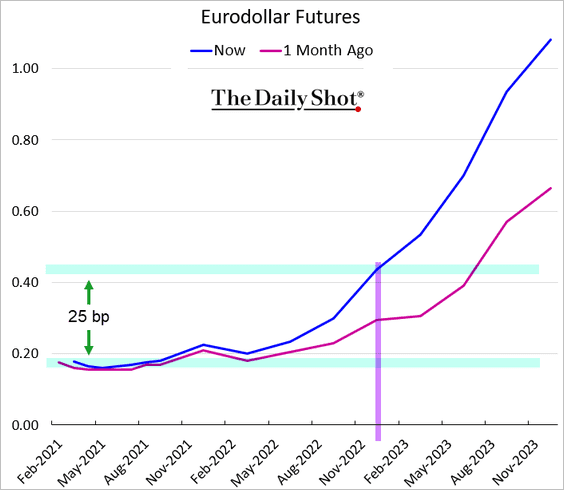

2. The market is now pricing in a full 25 bps hike by early 2023, with a substantial probability of liftoff next year.

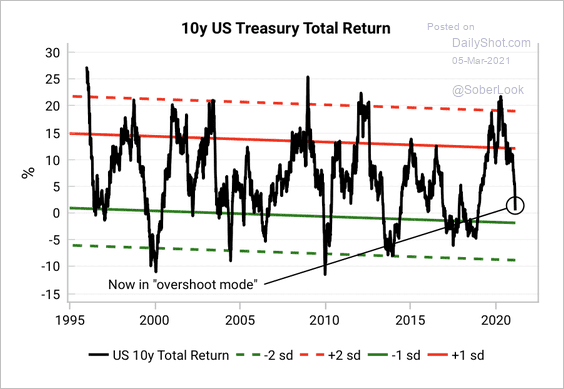

3. The 10-year Treasury note is approaching oversold territory.

Source: Variant Perception

Source: Variant Perception

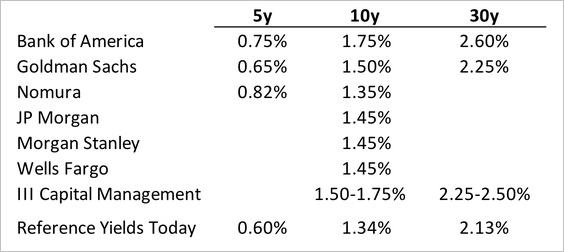

4. Here are some Treasury yield estimates for this year.

Source: III Capital Management

Source: III Capital Management

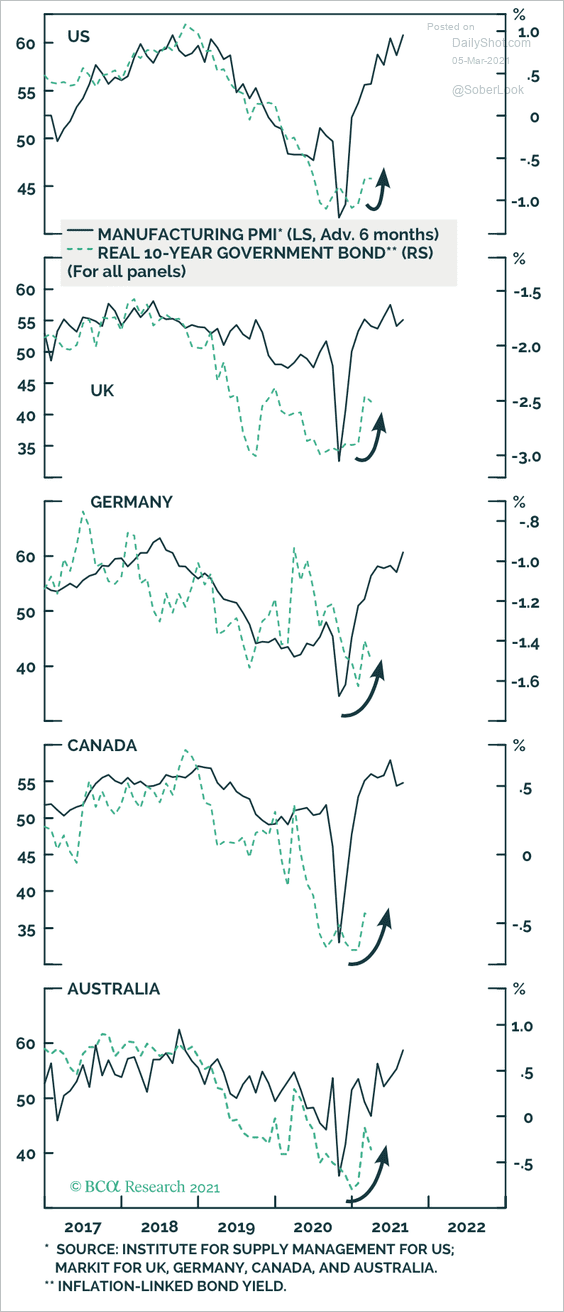

5. Real yields worldwide have plenty of room to catch up with the recovery in manufacturing PMIs.

Source: BCA Research

Source: BCA Research

Back to Index

Equities

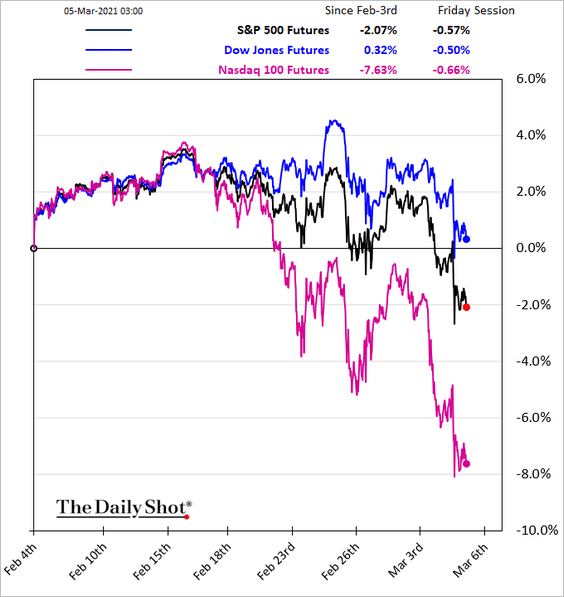

1. The Nasdaq 100 underperformance keeps widening.

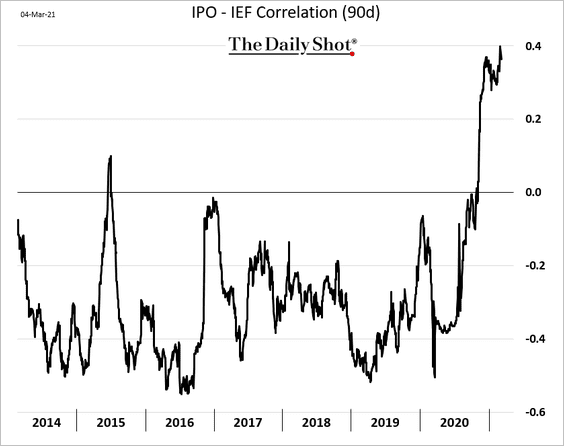

2. High valuation multiples imply rapid earnings growth in the future. But the present value of those earnings depends on the discount rate. That realization has been pushing the stock-bond correlation higher, especially for companies with profits (supposedly) occurring well in the future. Here is the correlation between post-IPO stocks and 7-10yr Treasuries (IEF).

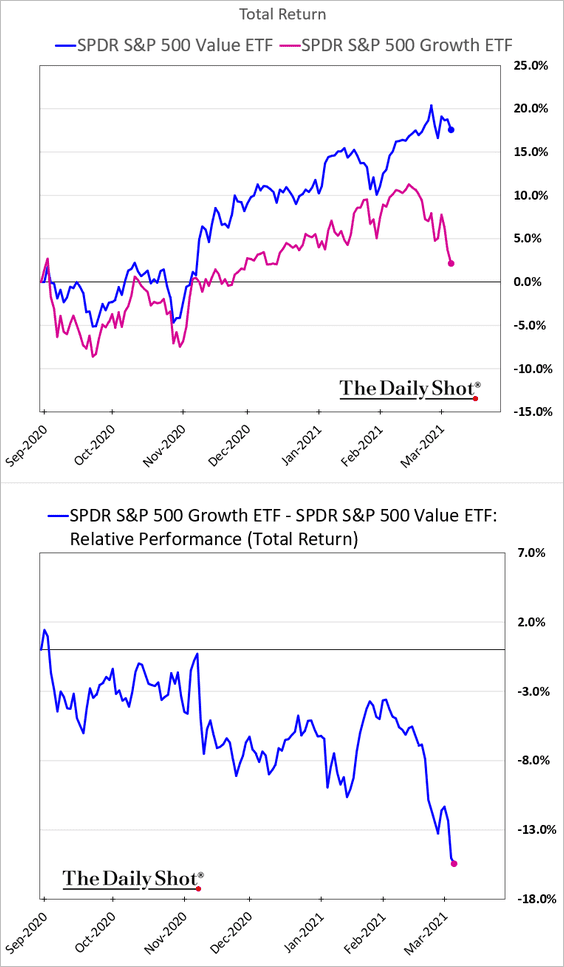

3. The growth-value rotation continues, …

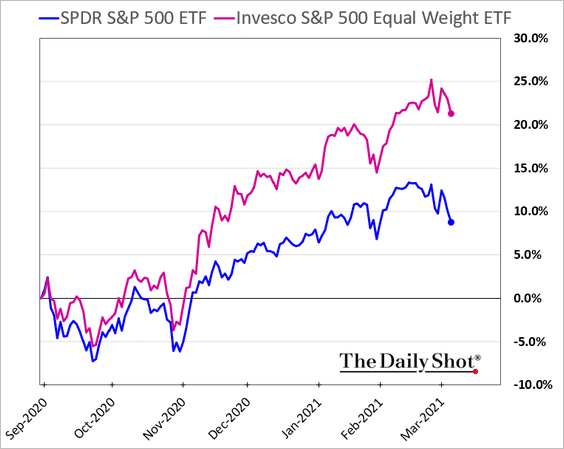

… which has been helping smaller firms.

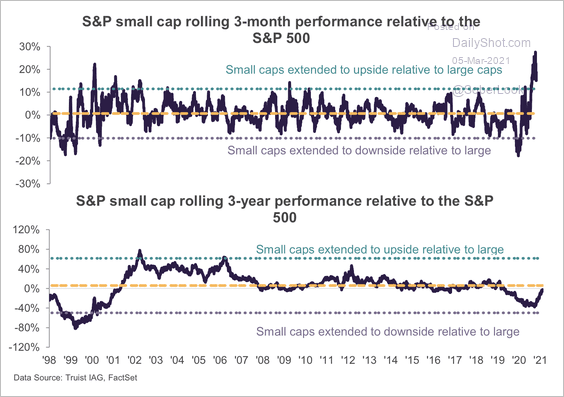

Small-caps now appear extended relative to large-caps over the short-term, but less so over the long-term.

Source: Truist Advisory Services

Source: Truist Advisory Services

——————–

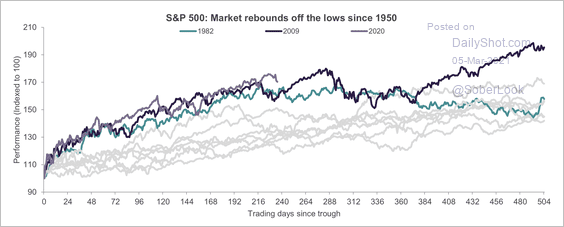

4. The S&P 500 could be entering a choppy phase similar to previous cycles.

Source: Truist Advisory Services

Source: Truist Advisory Services

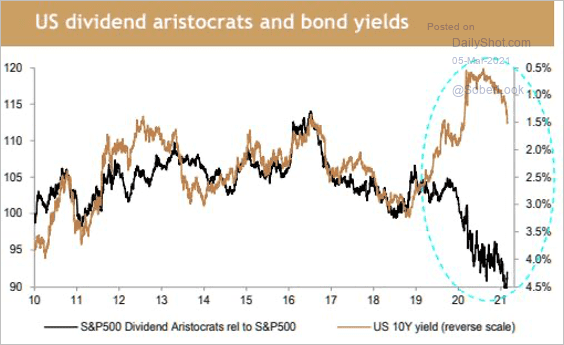

5. The relative performance of “dividend aristocrats” versus the S&P 500 has decoupled from the 10-year Treasury yield.

Source: JP Morgan, @TheMarketEar

Source: JP Morgan, @TheMarketEar

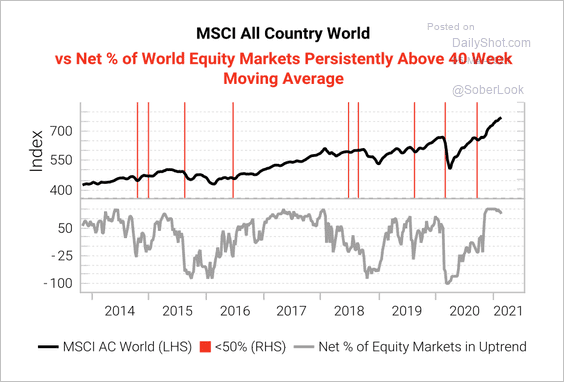

6. The net percent of global equity markets above their 40-week moving average has been at an extreme.

Source: Variant Perception

Source: Variant Perception

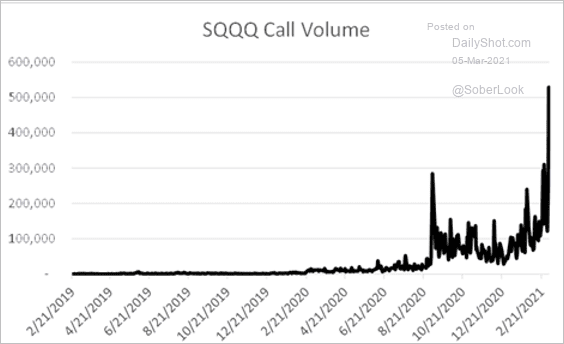

7. The SQQQ call option volume spiked. SQQQ is 3x short QQQ (Nasdaq 100) – so this is a bearish bet.

Source: @danny_kirsch

Source: @danny_kirsch

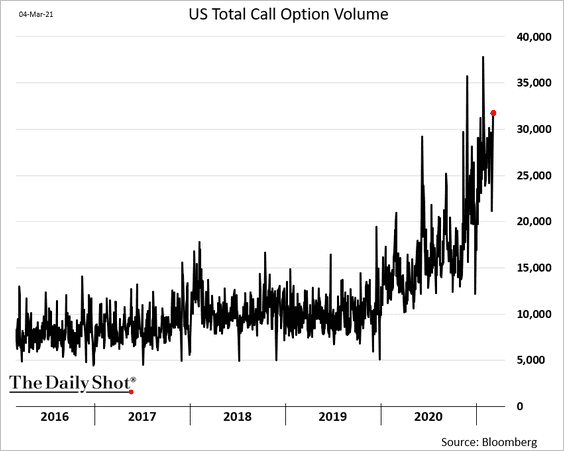

8. The total call option volume keeps climbing.

Back to Index

Credit

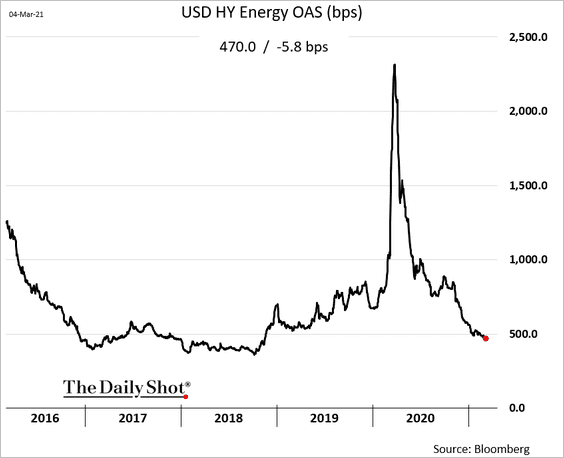

1. Energy-sector high-yield spreads hit the lowest level since 2018 as oil prices climb.

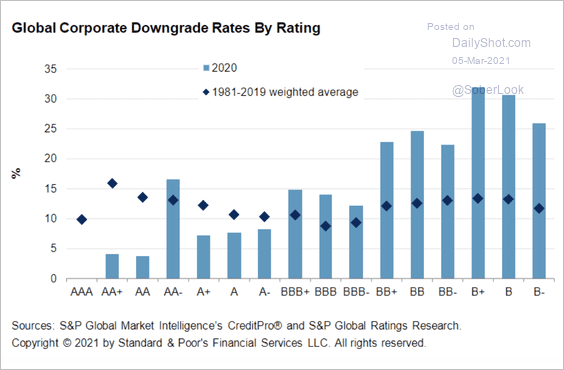

2. Last year’s corporate downgrades were concentrated in the lower ratings categories.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

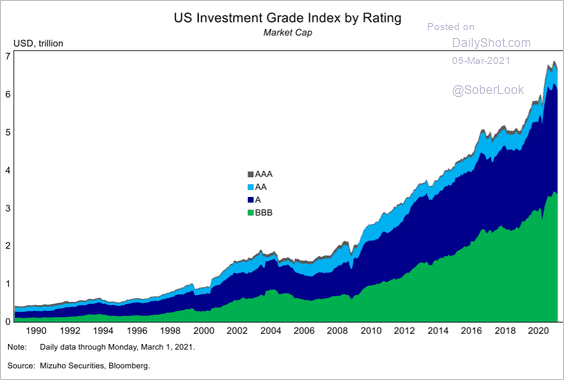

3. Here is the composition of the US investment-grade bond index.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

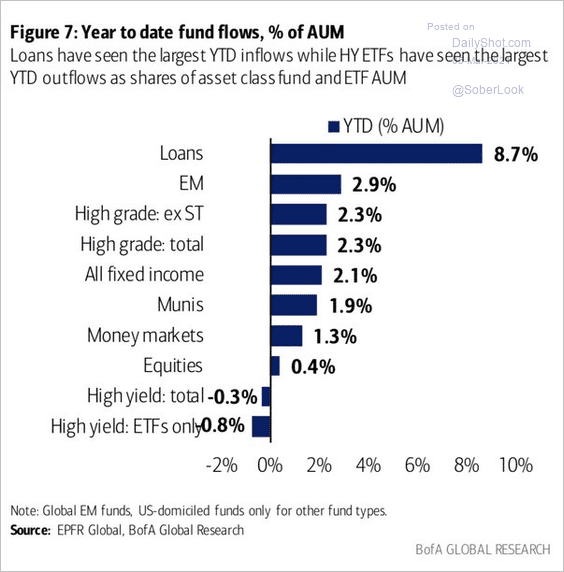

3. Loan funds are getting the most inflows this year as Treasury yields climb (leveraged loans have a floating coupon that will rise when the Fed hikes).

Source: BofA Global Research; @WallStJesus

Source: BofA Global Research; @WallStJesus

Back to Index

Commodities

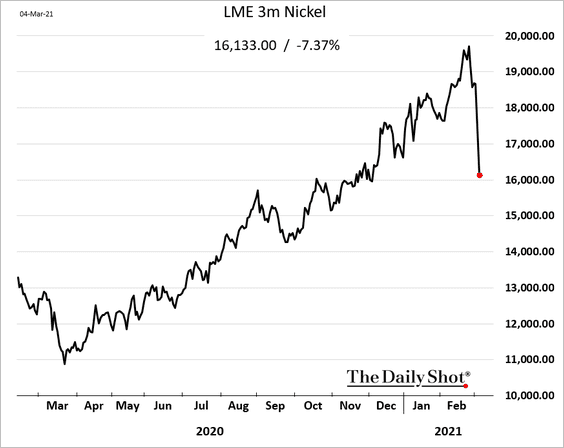

1. Nickel tumbled in response to higher supply expectations.

Source: @markets Read full article

Source: @markets Read full article

——————–

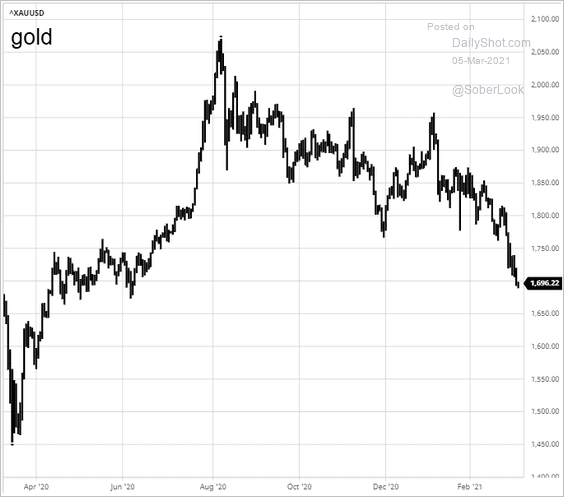

2. Gold remains under pressure as yields and the dollar move higher.

Source: barchart.com

Source: barchart.com

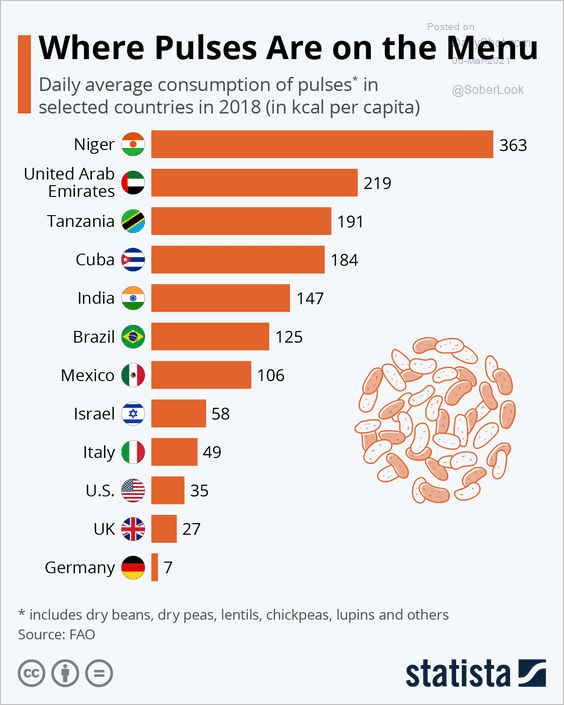

3. This chart shows pulses consumption per capita.

Source: Statista

Source: Statista

Back to Index

Energy

1. OPEC extended its production cuts, sending crude oil prices sharply higher.

Source: CNN Business Read full article

Source: CNN Business Read full article

——————–

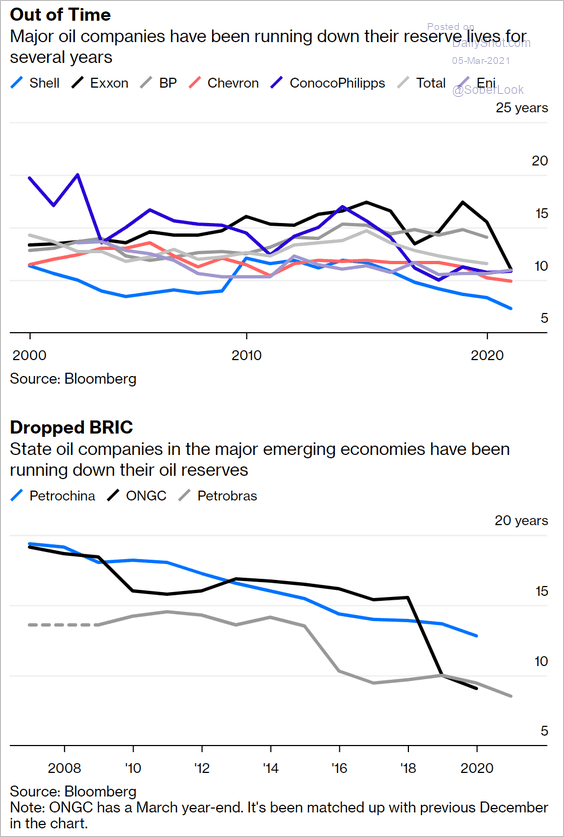

2. Oil reserves at major energy companies have been moving lower.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

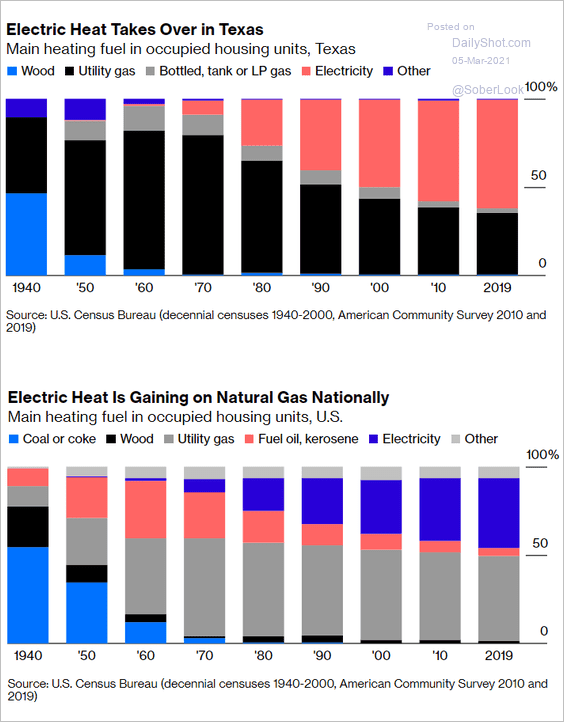

3. Texas has been shifting to electric heat.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

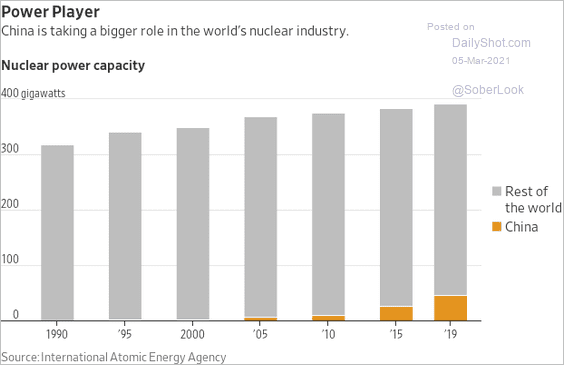

4. China’s nuclear power capacity is growing.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Emerging Markets

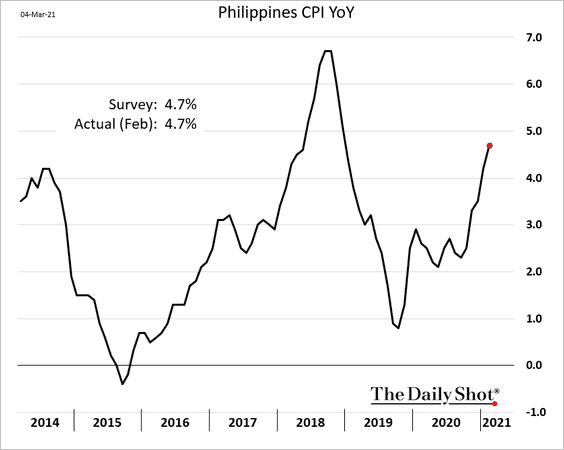

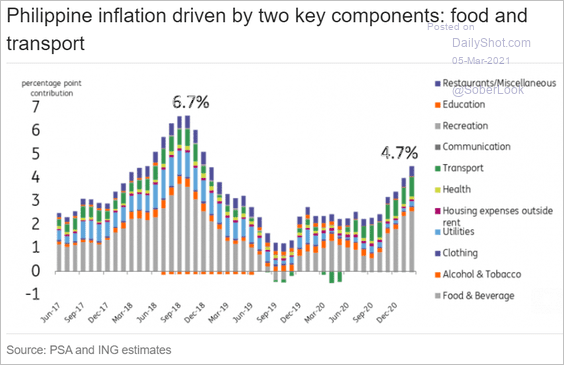

1. Let’s begin with a couple of inflation reports.

• The Philippines (2 charts):

Source: ING

Source: ING

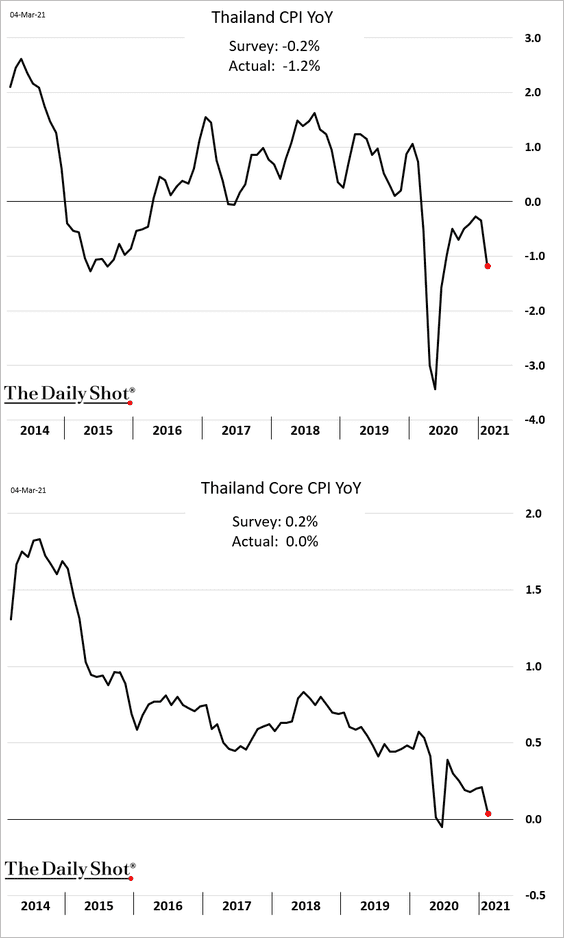

• Thailand (disinflationary pressures):

——————–

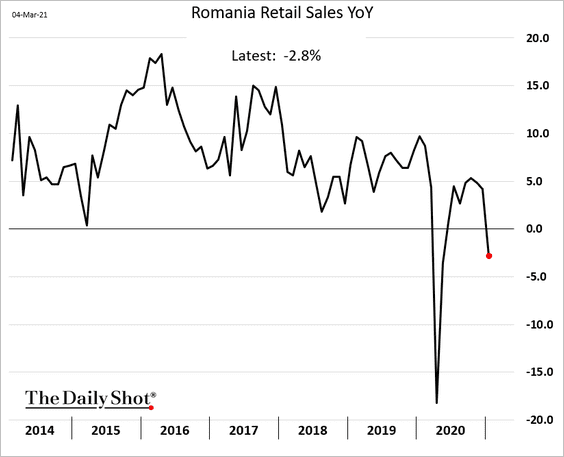

2. Romania’s retail sales tumbled in January (similar to the Eurozone).

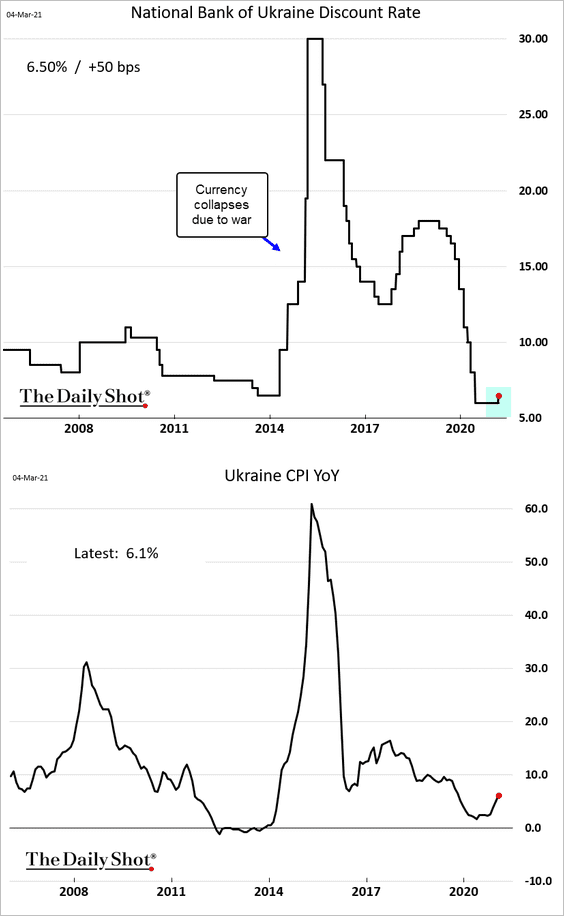

3. Ukraine’s central bank unexpectedly hiked rates.

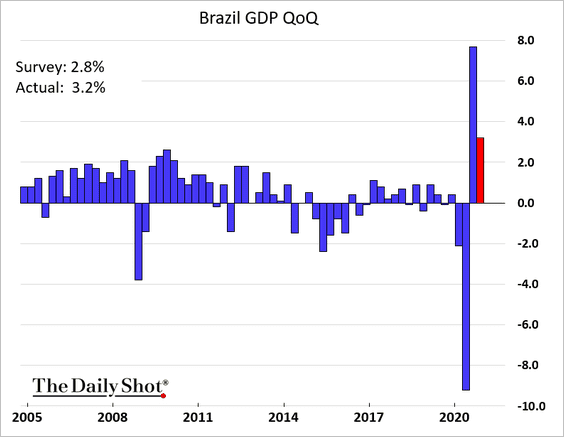

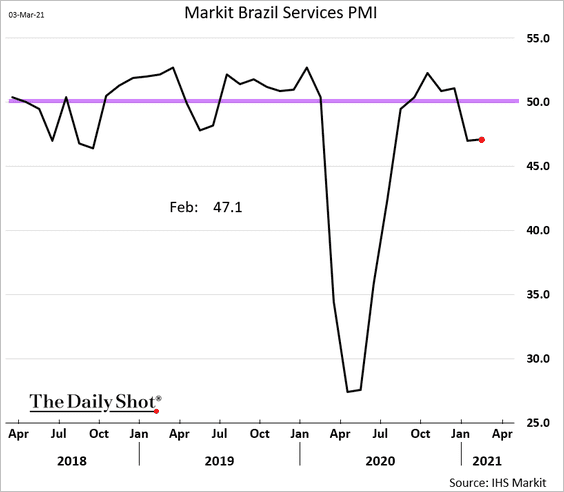

4. Brazil’s Q4 GDP growth was stronger than expected.

The nation’s service firms continue to struggle.

——————–

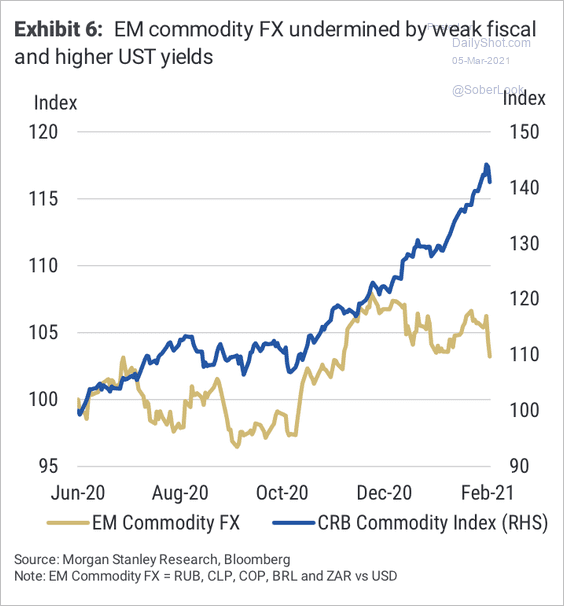

5. EM commodity currencies have lagged the rally in commodity prices over the past year. Morgan Stanley expects this divergence to continue, especially as Treasury yields rise.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

China

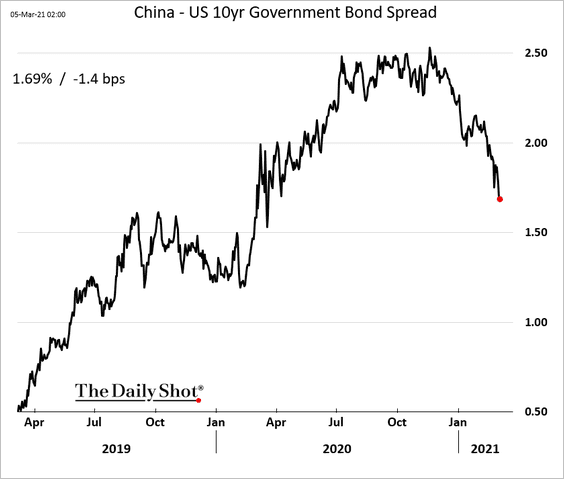

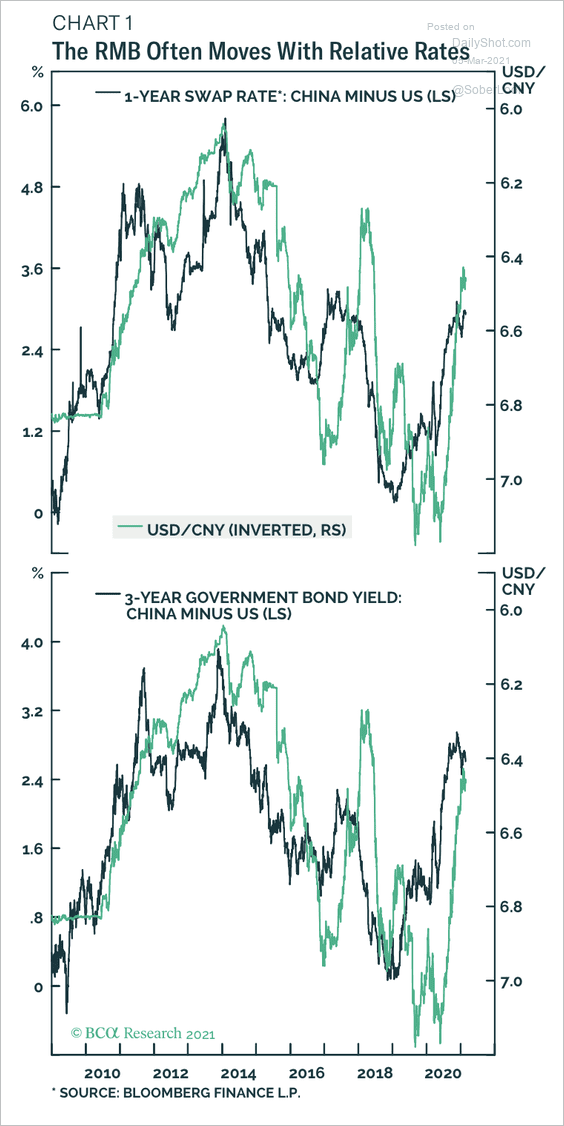

1. The China-US 10yr bond spread has rolled over.

The interest rate gap has been one of the key drivers behind the yuan’s performance.

Source: BCA Research

Source: BCA Research

——————–

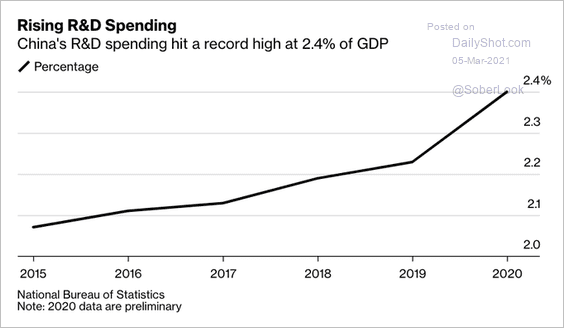

2. R&D spending keeps climbing.

Source: @markets Read full article

Source: @markets Read full article

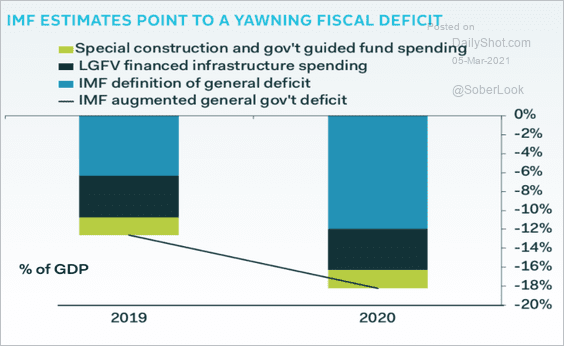

3. Last year’s fiscal deficit was massive.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Australia

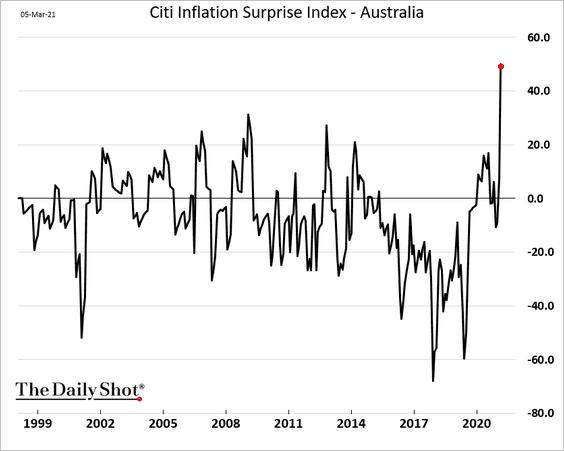

1. The Citi inflation surprise index hit a record high.

h/t @Callum_Thomas

h/t @Callum_Thomas

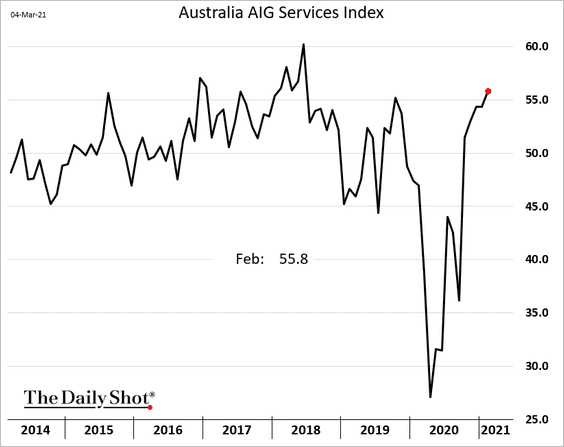

2. Service sector growth is strengthening.

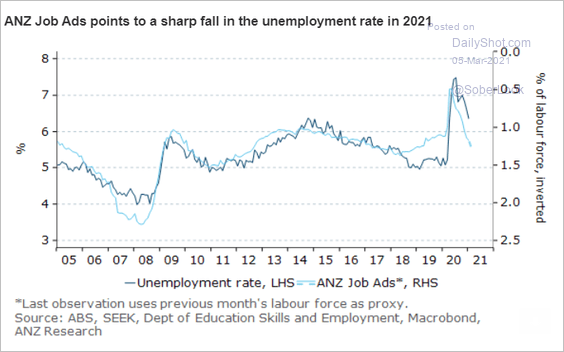

3. Job ads point to a lower unemployment rate ahead.

Source: ANZ Research

Source: ANZ Research

Back to Index

Japan

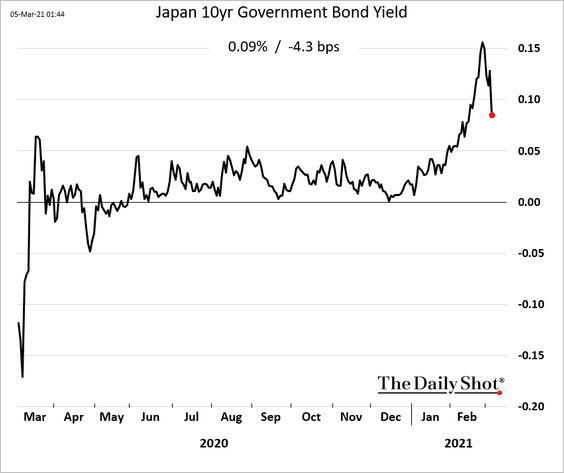

1. Kuroda won’t allow a wider yield band for JGBs in the near-term.

Source: Reuters Read full article

Source: Reuters Read full article

Yields dropped.

——————–

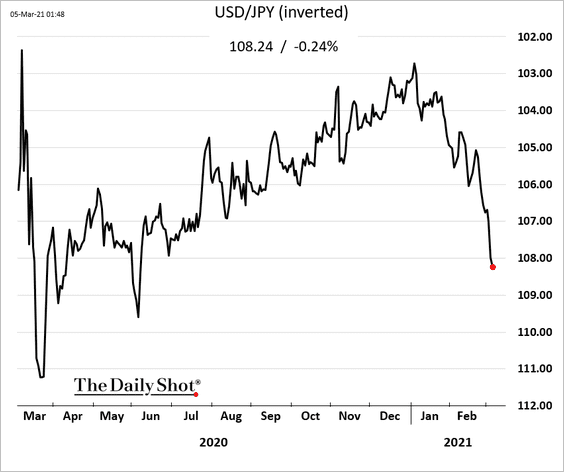

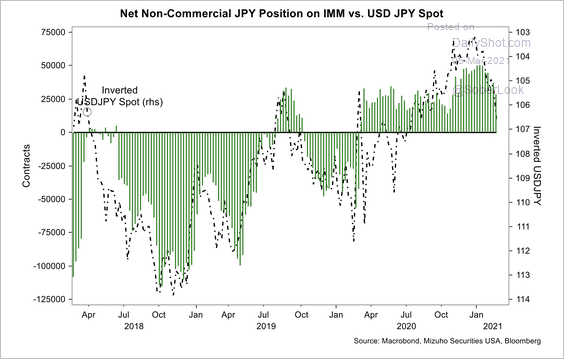

2. The yen has been weakening vs. USD.

Speculators have trimmed their net-long yen positions over the past few months.

Source: Longview Economics

Source: Longview Economics

——————–

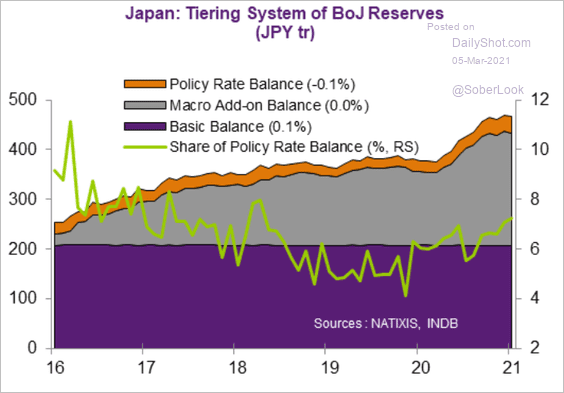

3. Only a sliver of bank reserves is subject to negative rates.

Source: Natixis

Source: Natixis

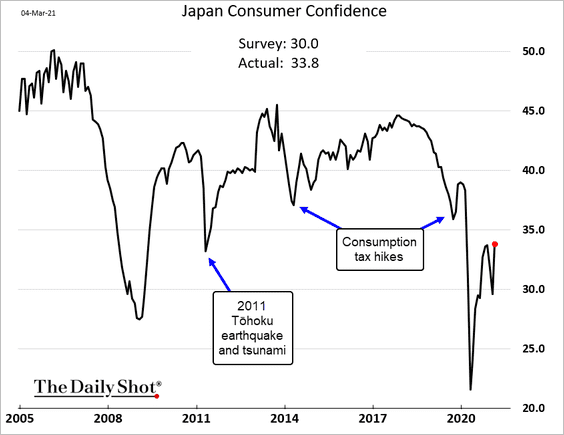

4. Consumer confidence is recovering.

Back to Index

The Eurozone

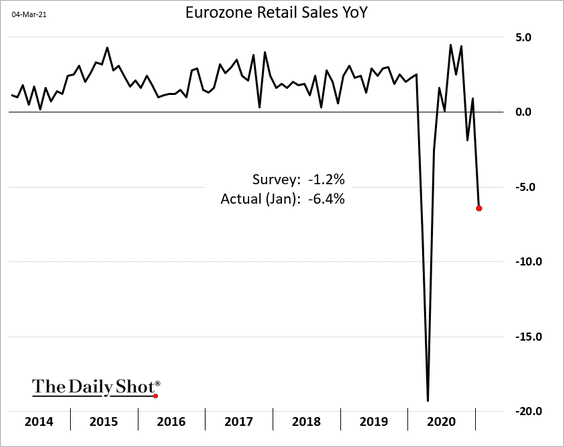

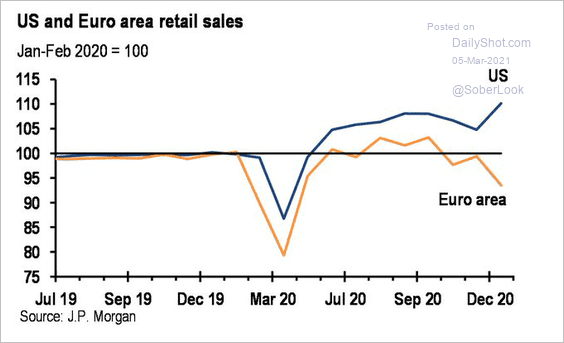

1. January was a tough month for retailers.

Source: JP Morgan, @carlquintanilla

Source: JP Morgan, @carlquintanilla

——————–

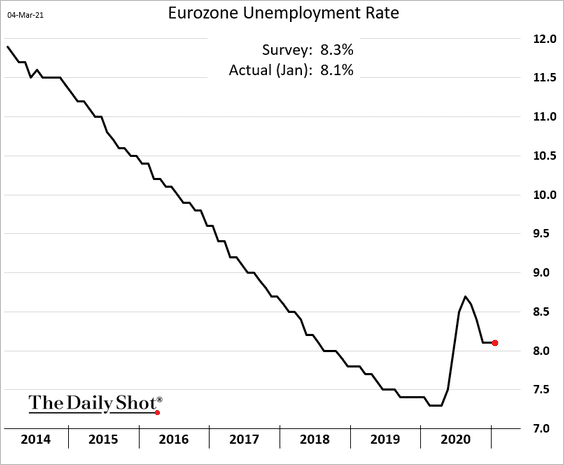

2. The unemployment rate held steady in January.

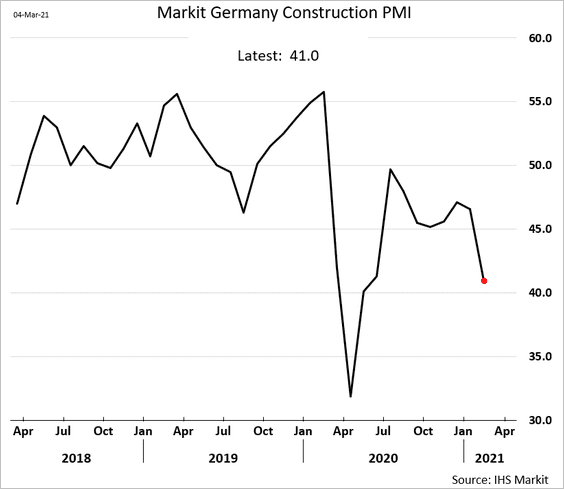

3. German construction activity deteriorated last month.

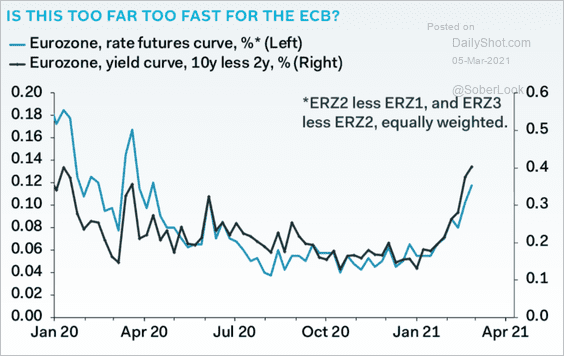

4. The market is starting to price in a rate hike over the next three years.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The United Kingdom

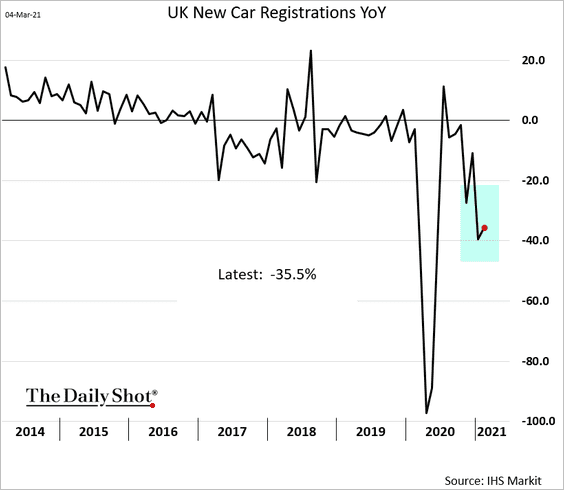

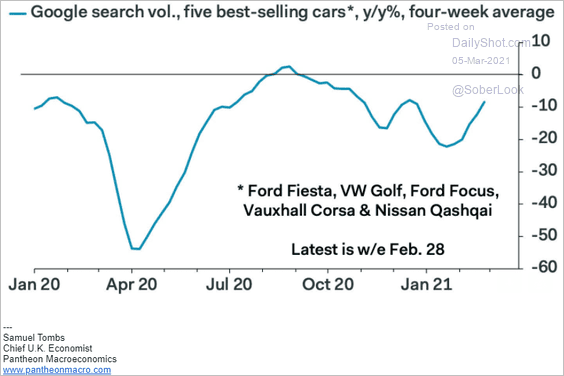

1. New car registrations remain depressed.

But Google search data point to an improvement ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

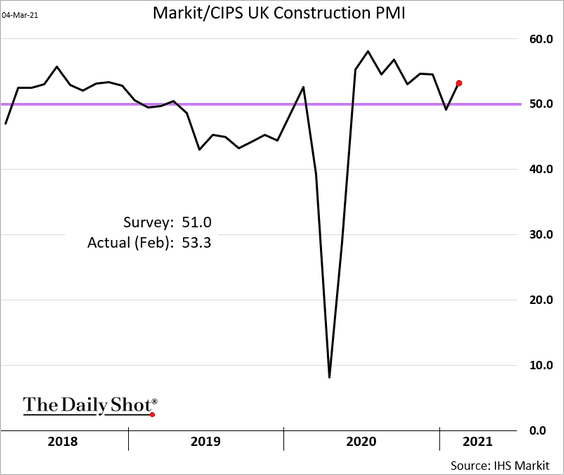

2. Construction activity is back in growth mode.

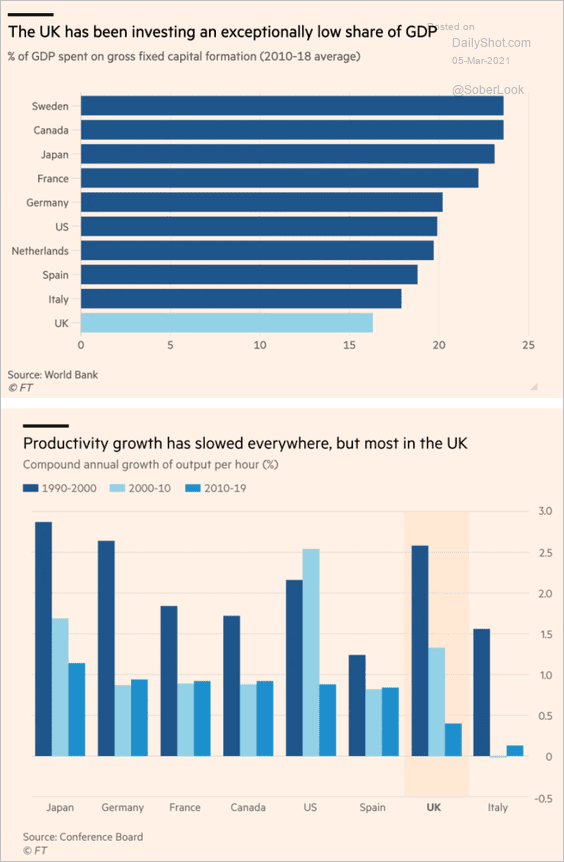

3. Low CapEx has been a drag on productivity growth.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Canada

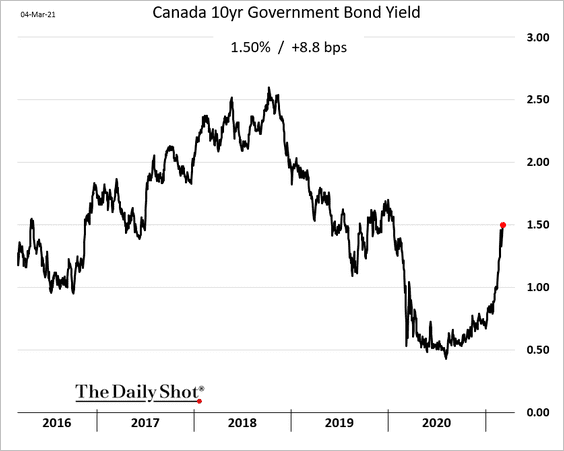

1. The 10-year bond yield is now at pre-pandemic levels.

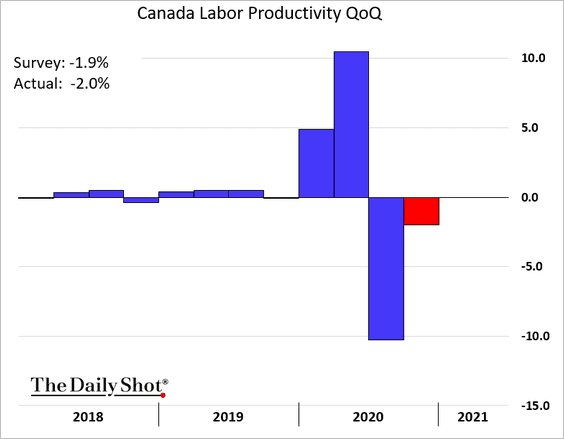

2. Labor productivity declined again in Q4 as workers’ hours increased (more people returned to work).

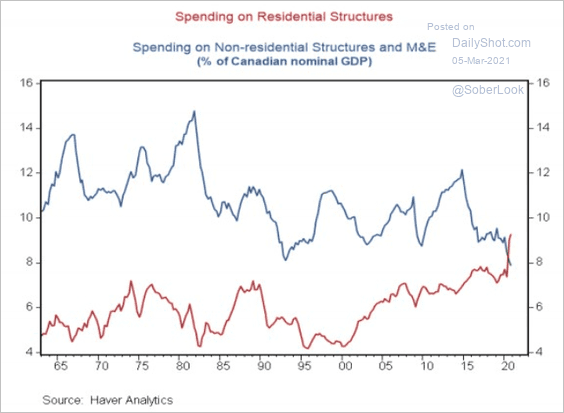

3. Investment has been increasingly dominated by residential structures.

Source: BMO; @SBarlow_ROB

Source: BMO; @SBarlow_ROB

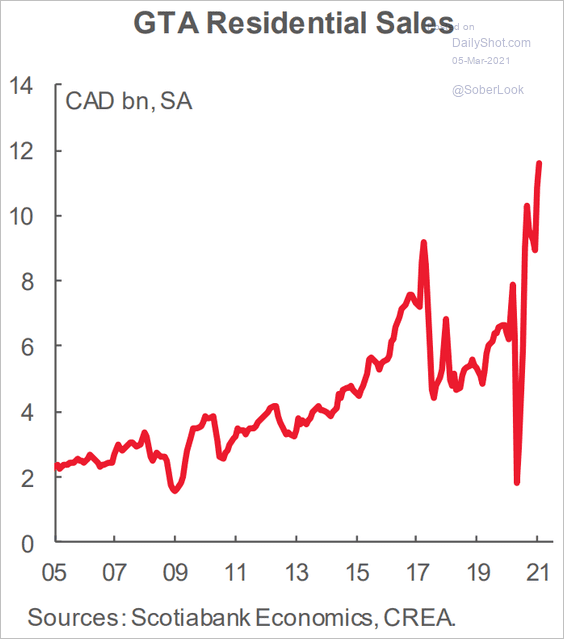

4. The Greater Toronto Area home sales hit a record.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

The United States

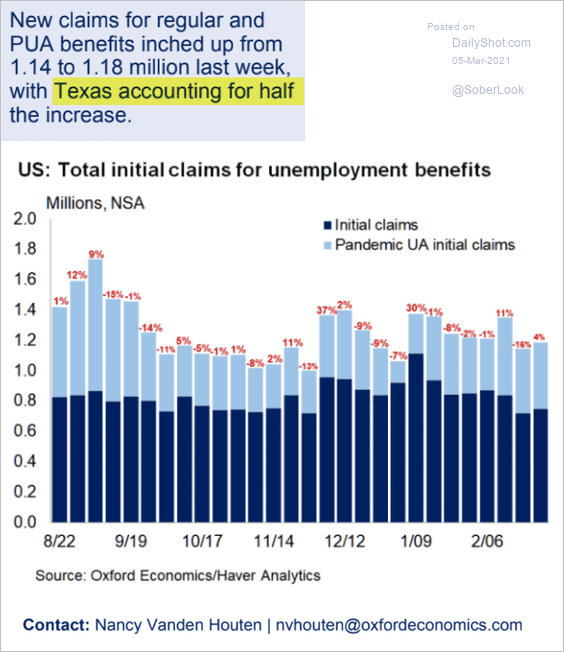

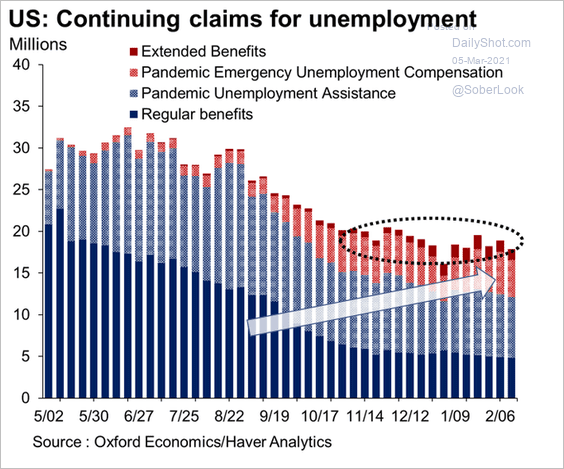

1. Initial jobless claims rose last week, with Texas accounting for over half the increase (due to the deep freeze).

Source: Oxford Economics

Source: Oxford Economics

According to Oxford Economics, there hasn’t been much progress on continuing unemployment claims since Thanksgiving.

Source: @GregDaco

Source: @GregDaco

——————–

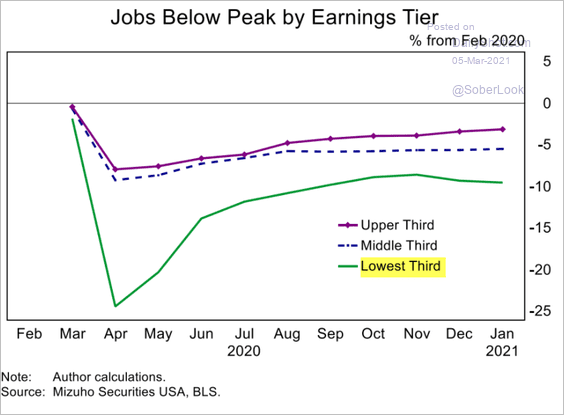

2. The job recovery has stalled for workers in the lower-earnings tiers.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

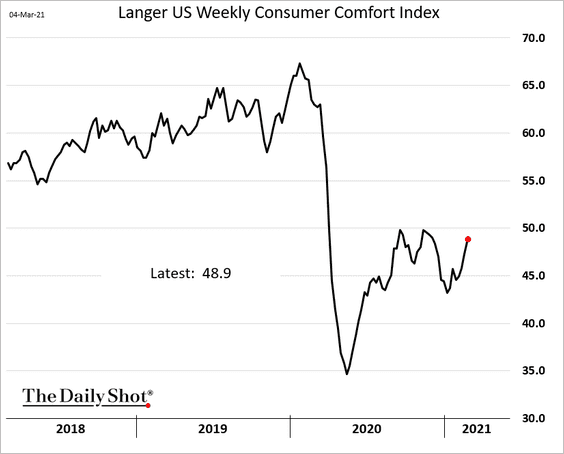

3. The Langer (formerly Bloomberg) Consumer Comfort Index is rebounding.

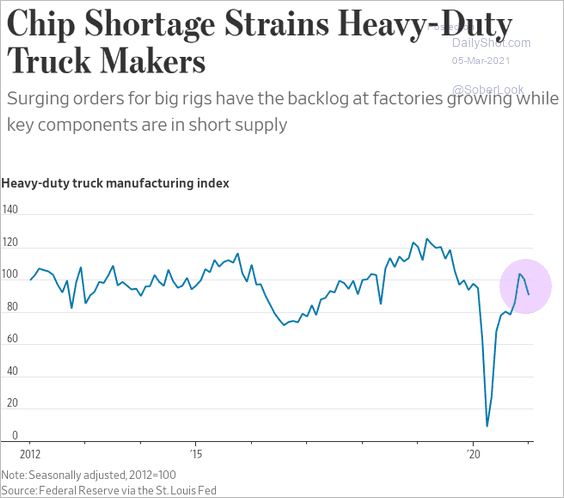

4. Chip shortages have been a drag on heavy-duty truck manufacturing.

Source: @WSJ Read full article

Source: @WSJ Read full article

5. Semiconductor CapEx is expected to climb in the years ahead.

![]() Source: @WSJ Read full article

Source: @WSJ Read full article

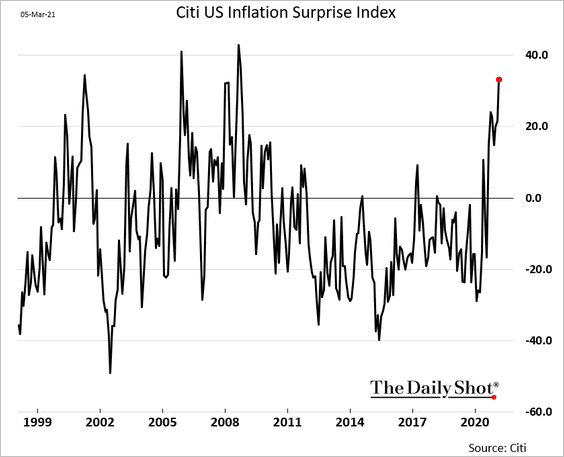

6. The Citi inflation surprise index has been rising.

h/t @Callum_Thomas

h/t @Callum_Thomas

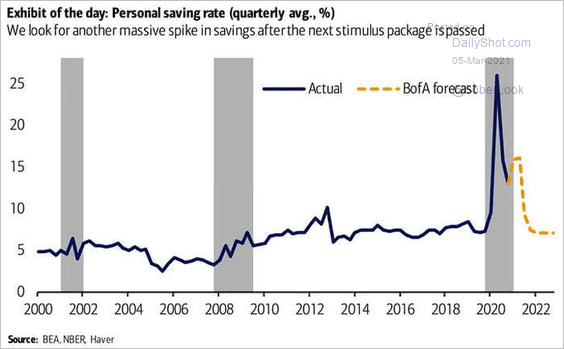

7. When will the saving rate return to more typical levels?

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

——————–

Food for Thought

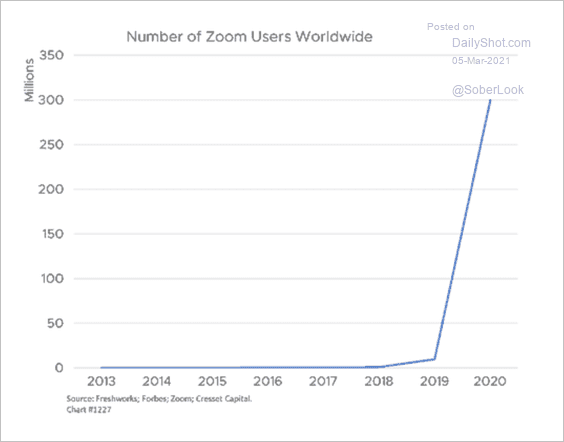

1. Zoom users:

Source: Jack Ablin, Cresset Wealth Advisors

Source: Jack Ablin, Cresset Wealth Advisors

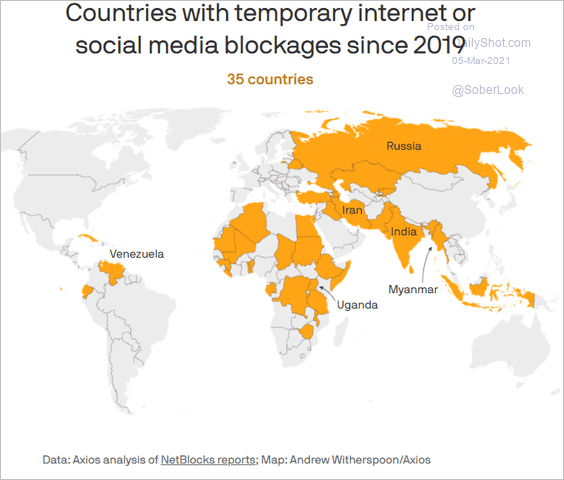

2. Temporary internet or social media blockages:

Source: @axios Read full article

Source: @axios Read full article

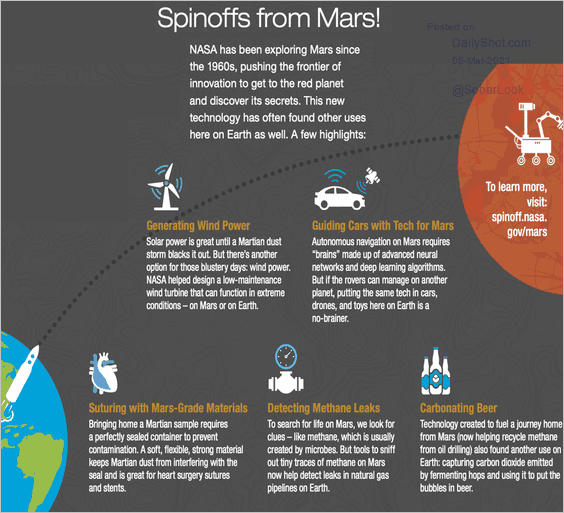

3. Technology spinoffs from Mars missions:

Source: NASA/JPL Read full article

Source: NASA/JPL Read full article

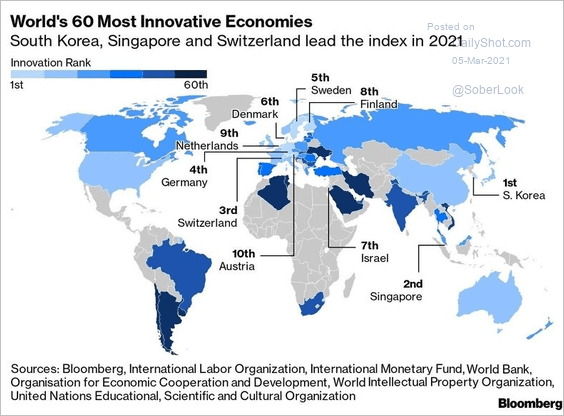

4. Most innovative economies:

Source: @business Read full article

Source: @business Read full article

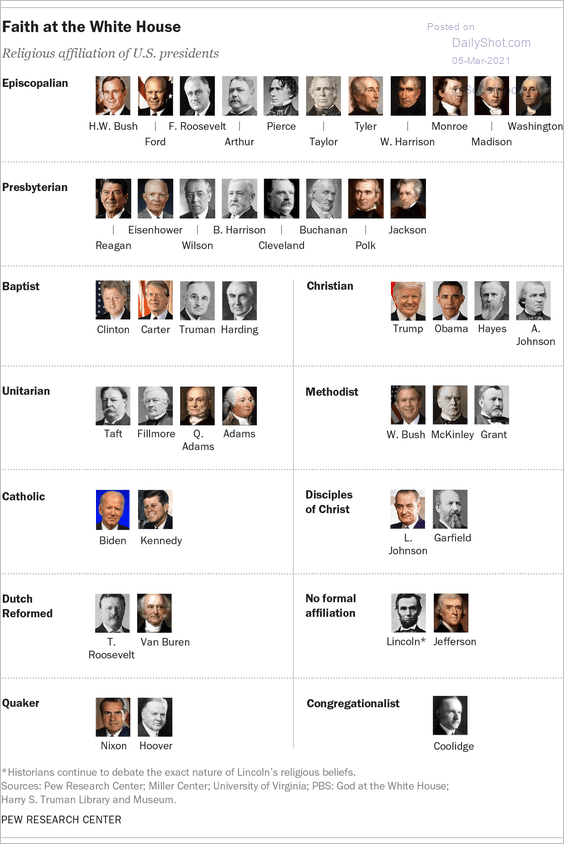

5. US presidents’ religious affiliation:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

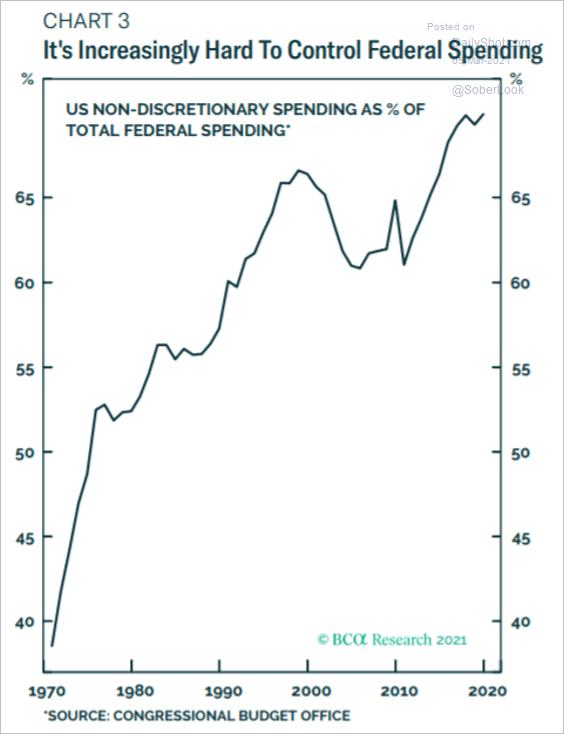

6. US federal government’s non-discretionary spending:

Source: BCA Research

Source: BCA Research

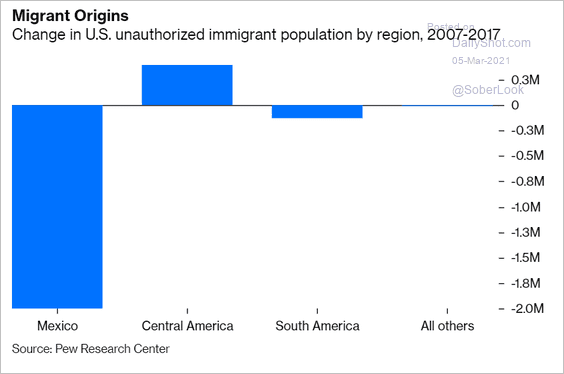

7. Changes in unauthorized immigrant population by origin:

Source: @Noahpinion, @bopinion Read full article

Source: @Noahpinion, @bopinion Read full article

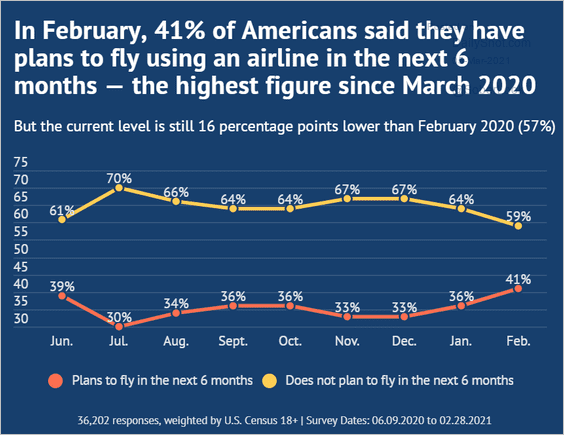

8. More Americans are ready to fly:

Source: CivicScience Read full article

Source: CivicScience Read full article

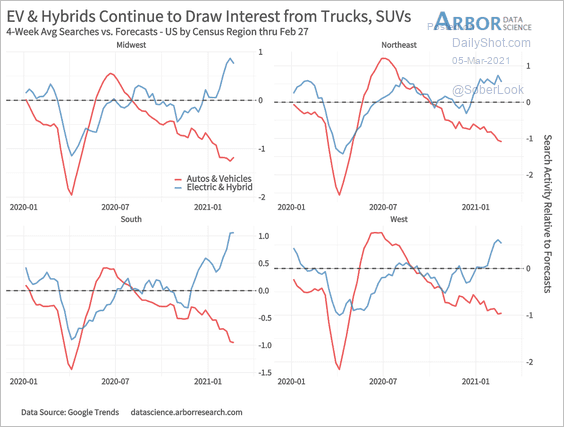

9. Online search activity for EVs and hybrids in the US:

Source: Arbor Research & Trading

Source: Arbor Research & Trading

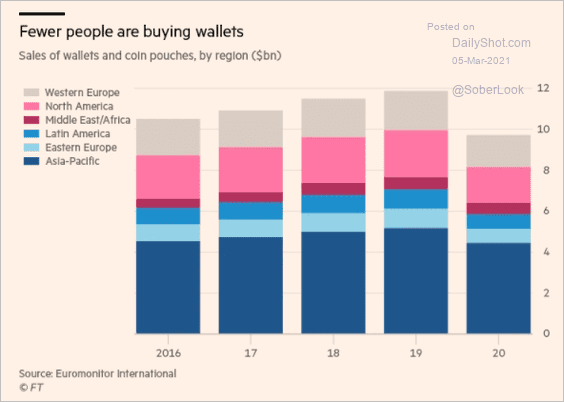

10. Wallet sales worldwide:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

Have a great weekend!

Back to Index