The Daily Shot: 11-Mar-21

• The United States

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

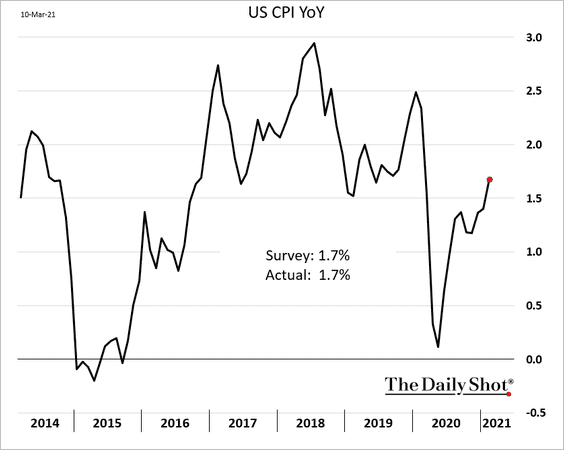

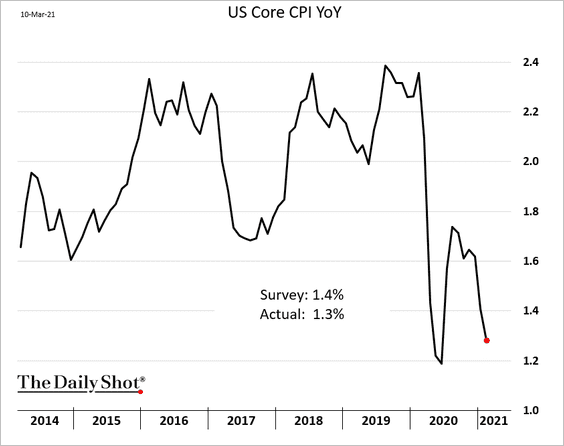

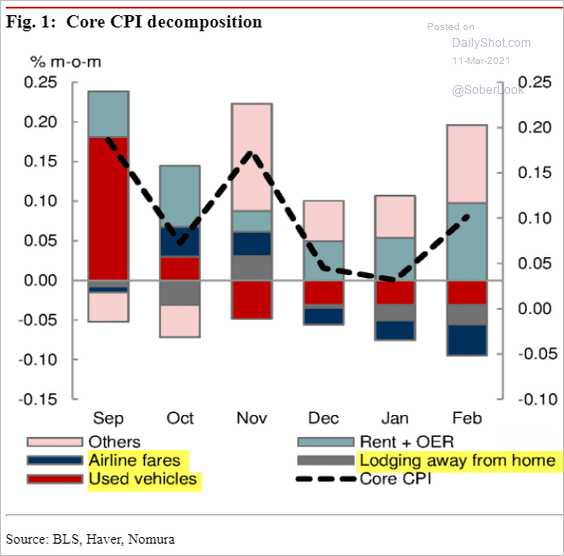

1. The CPI report was a bit softer than expected as the core inflation (2nd chart) continues to drift lower.

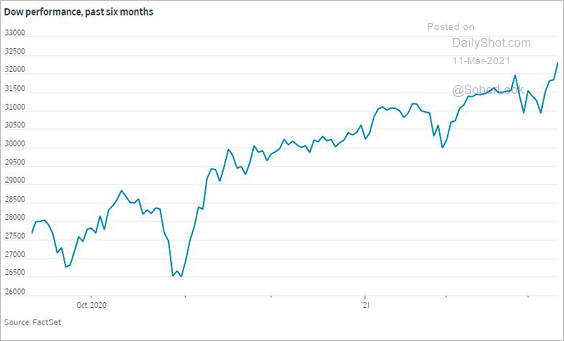

• The Dow hit a new record in response to the tepid inflation data.

Source: @WSJmarkets Read full article

Source: @WSJmarkets Read full article

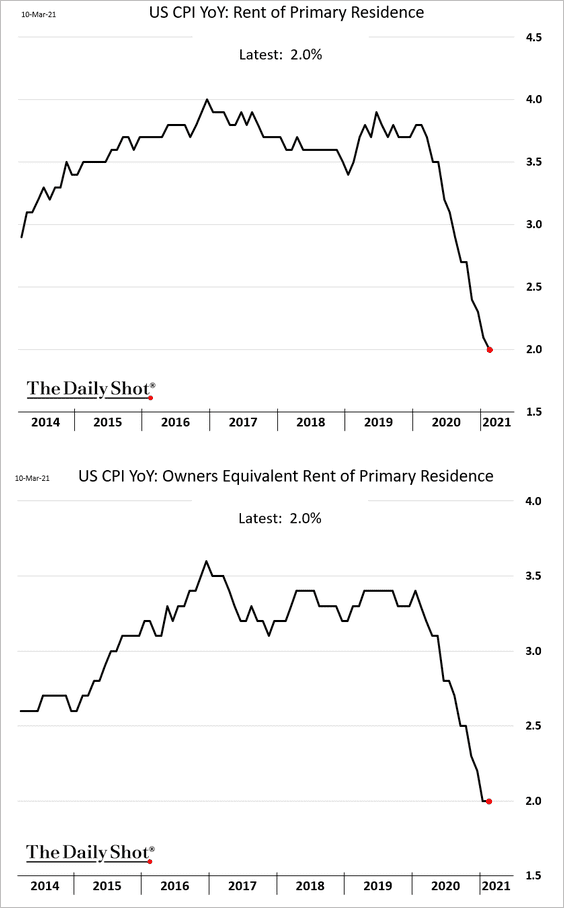

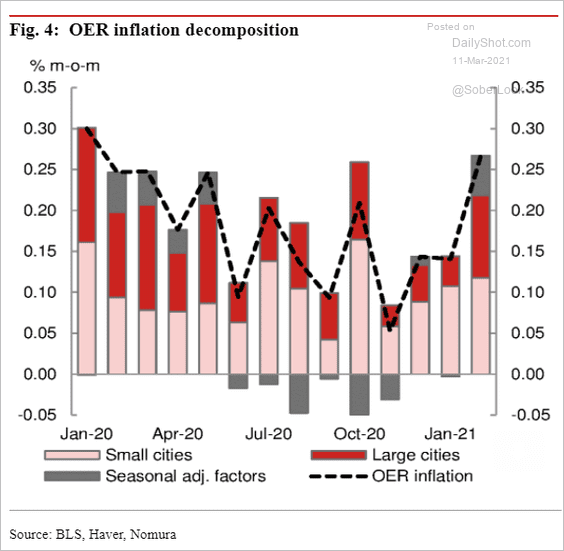

• On a year-over-year basis, rent CPI continues to trend lower, while the owners’ equivalent rent (OER) stabilized last month.

On a monthly basis, however, these measures ticked higher. Here is the OER breakdown.

Source: Nomura Securities

Source: Nomura Securities

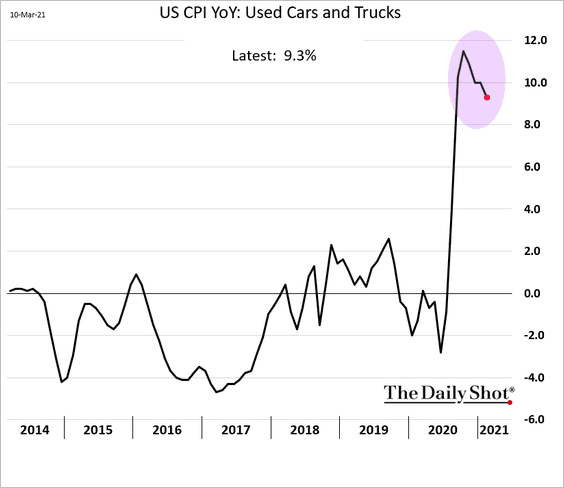

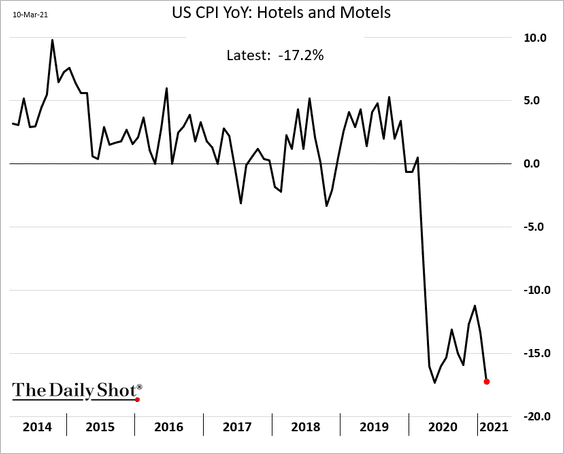

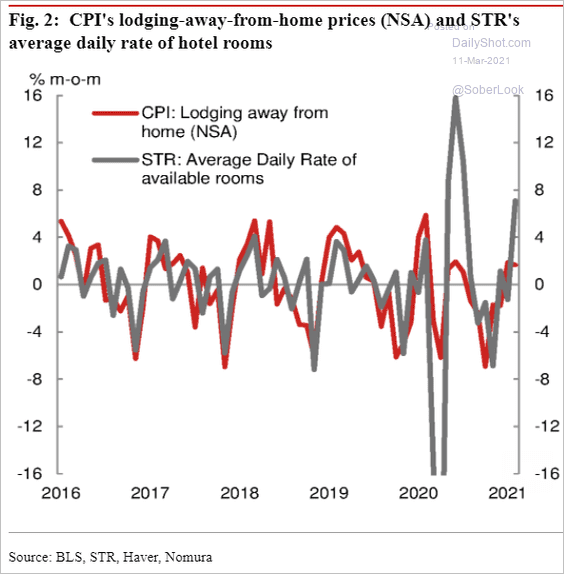

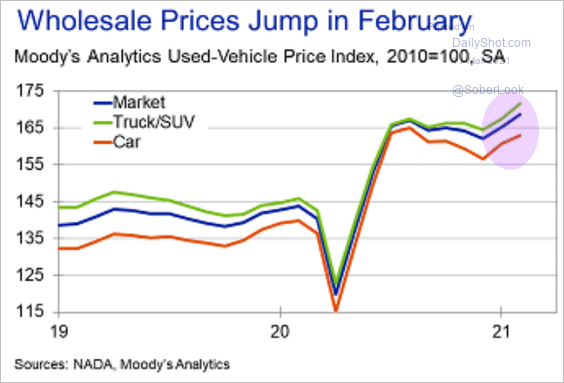

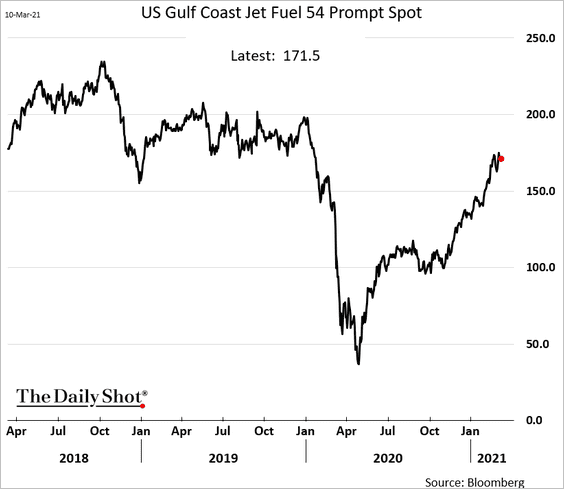

A substantial portion of the drag on core inflation in February came from three sectors: airline fares, used cars, and hotels.

Source: Nomura Securities

Source: Nomura Securities

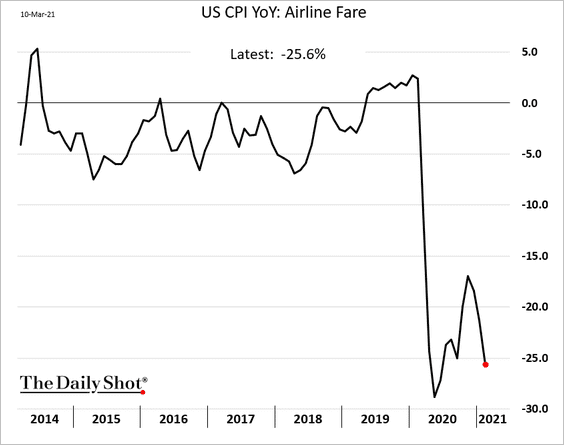

Here are the three trends.

But as we saw yesterday (#2 here), these trends are reversing.

– Hotels:

Source: Nomura Securities

Source: Nomura Securities

– Used cars:

Source: Moody’s Analytics

Source: Moody’s Analytics

– Higher jet fuel costs will force airlines to boost prices this spring.

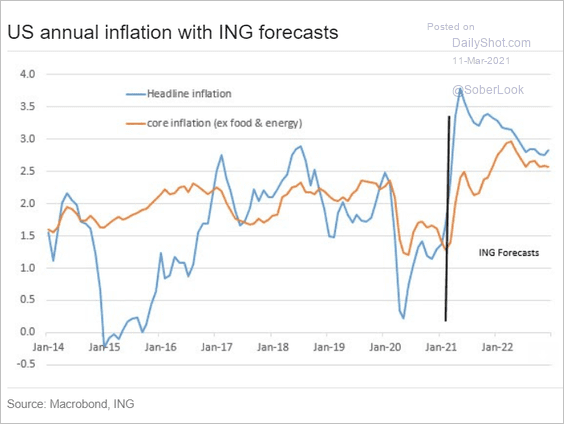

• Here are some inflation forecasts.

– ING:

Source: ING

Source: ING

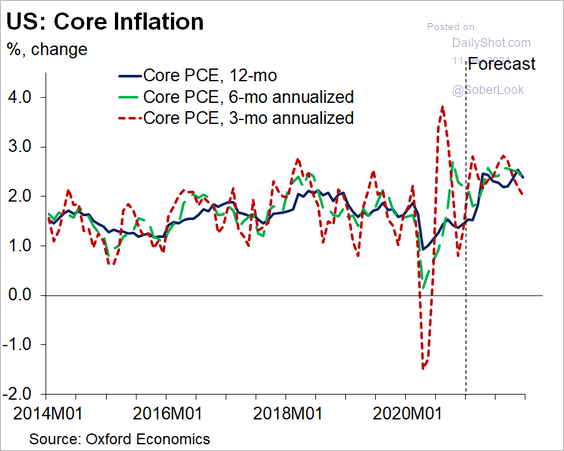

– Oxford Economics:

Source: @GregDaco

Source: @GregDaco

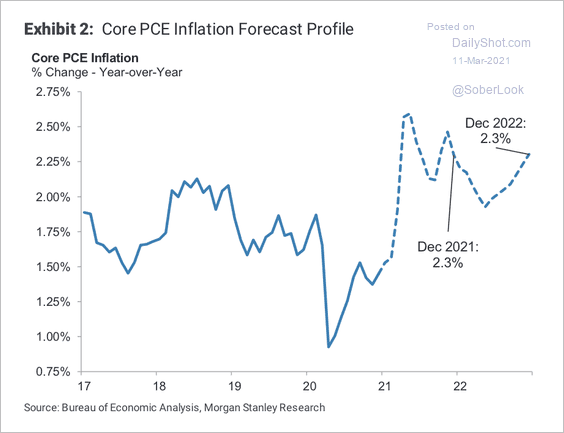

– Morgan Stanley (core PCE):

Source: Morgan Stanley Research

Source: Morgan Stanley Research

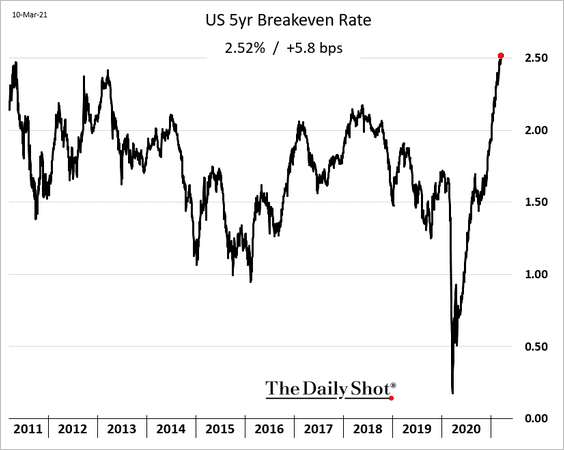

The five-year breakeven rate (market-based inflation expectations) keeps climbing.

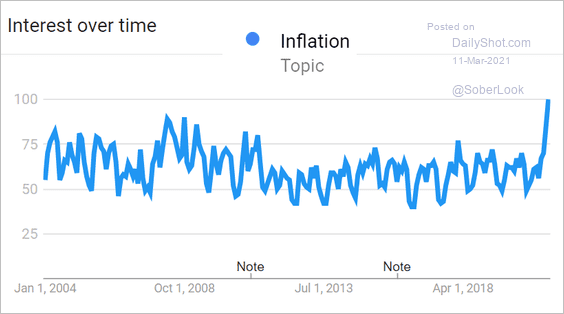

• The public’s interest in inflation has spiked this year. Here is inflation-related Google search activity since 2004.

Source: Google Trends

Source: Google Trends

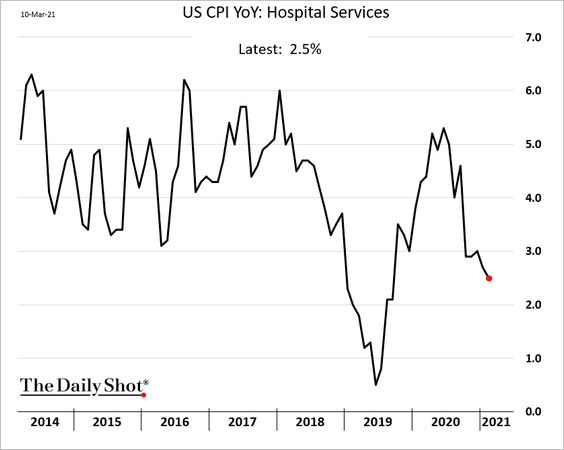

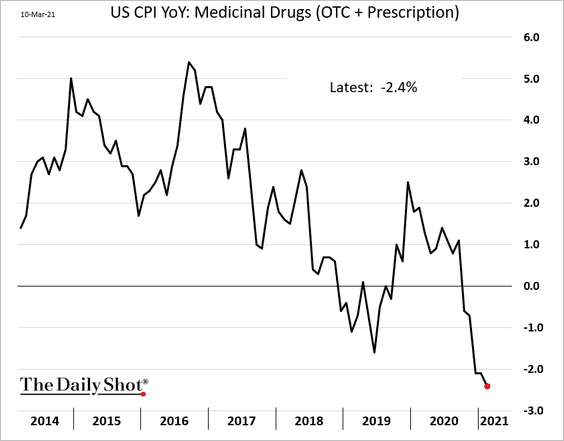

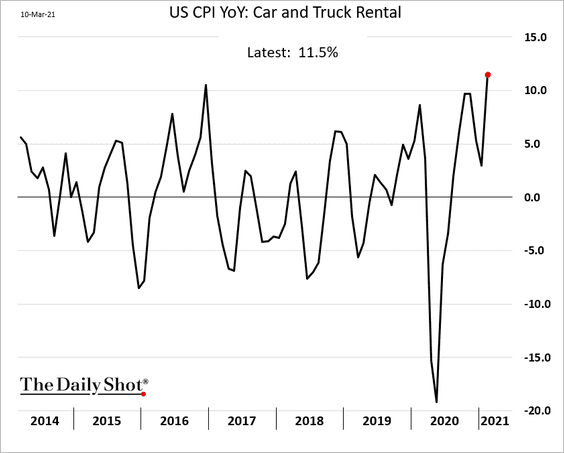

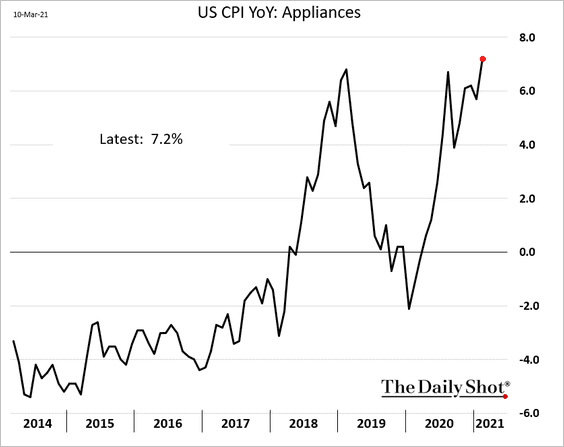

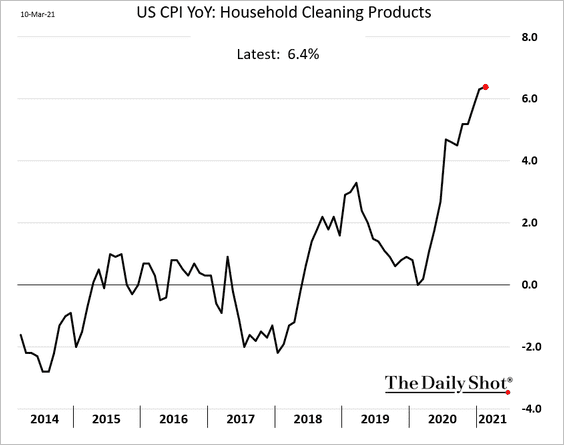

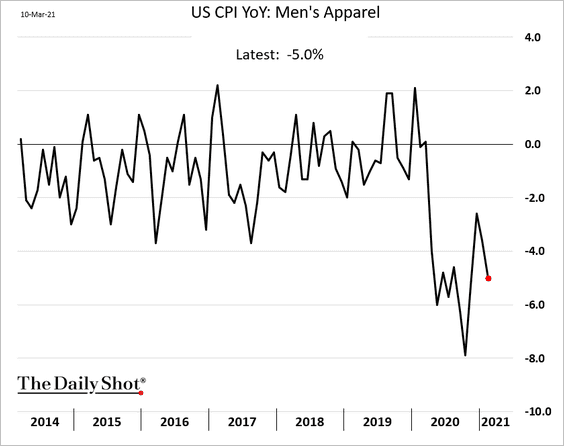

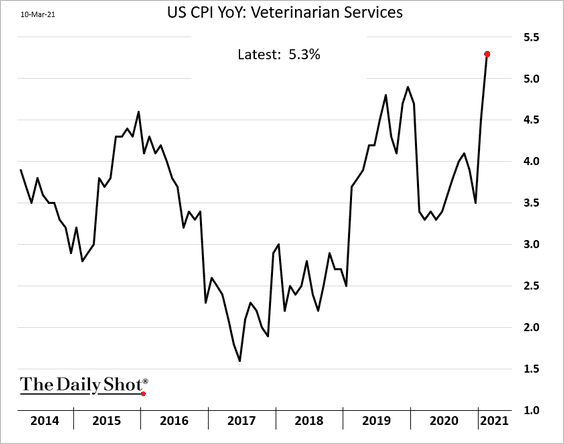

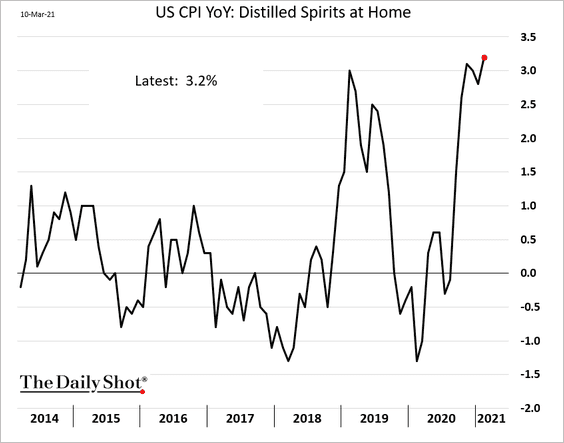

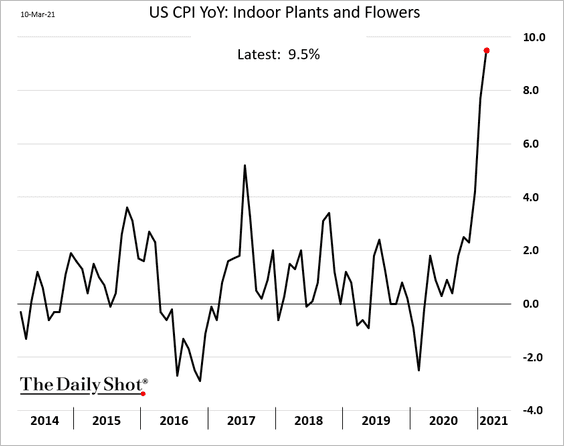

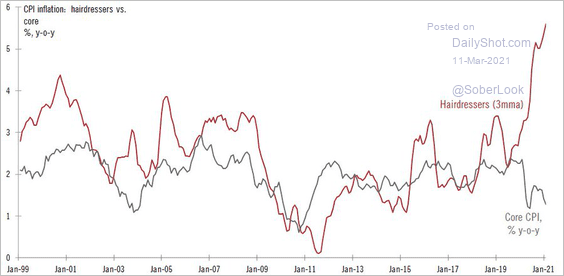

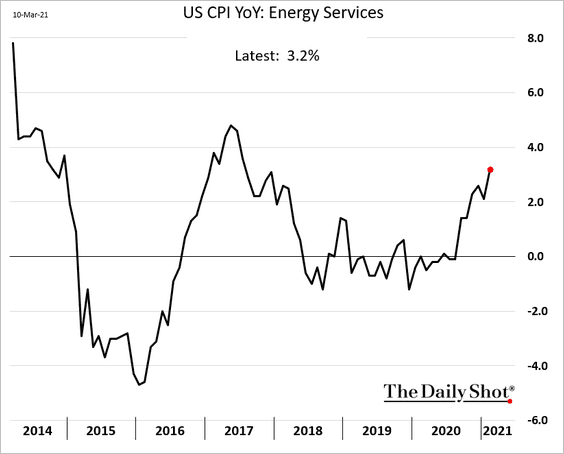

• Staying with our tradition, here are a few other CPI components. Most of the latest trends are due to pandemic-related sector changes and spending patterns.

– Hospital services and medications:

– Car rentals:

– Appliances:

– Cleaning products:

– Men’s apparel:

– Veterinary services:

– Booze:

– Indoor plants:

– Haircuts (a leading indicator for inflation?):

Source: @TCosterg

Source: @TCosterg

– Energy services popped due to the Texas deep freeze.

——————–

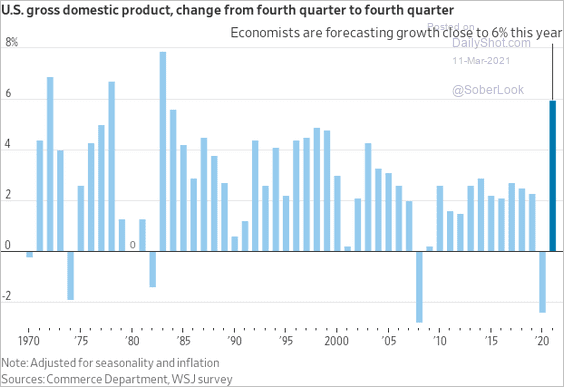

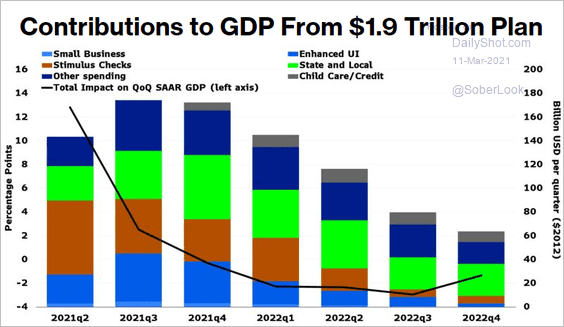

2. Government stimulus is expected to generate the fastest annual growth in nearly four decades.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @bpolitics Read full article

Source: @bpolitics Read full article

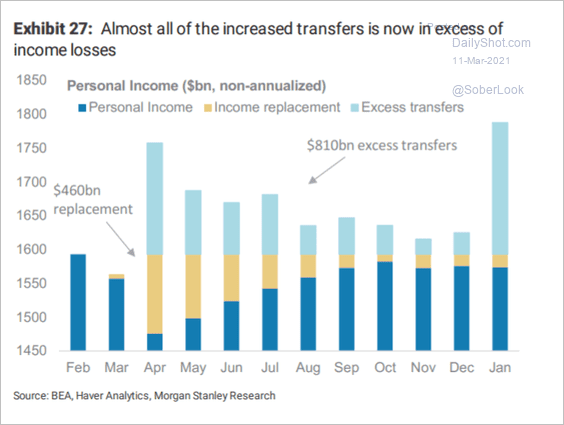

Almost all new government payments are now boosting incomes (as wage loss slows).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

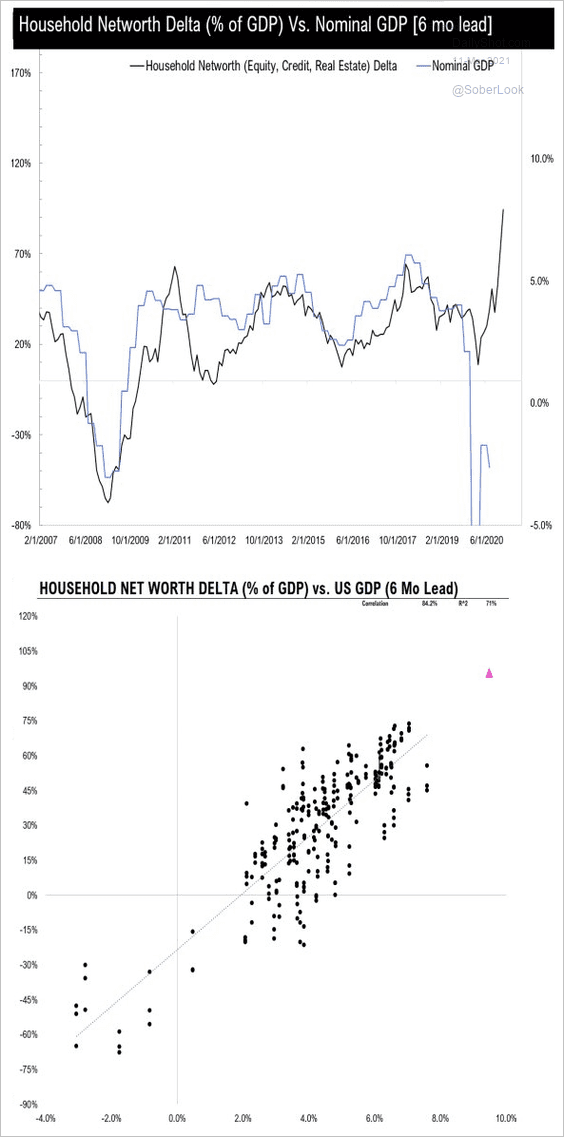

Savings have risen sharply. Houses and stocks have seen massive price gains. Can the ongoing increase in household wealth catapult the GDP to double-digit growth this year? What are the implications for inflation and bond yields? Here is a chart from Pervalle Global.

Source: @TeddyVallee

Source: @TeddyVallee

——————–

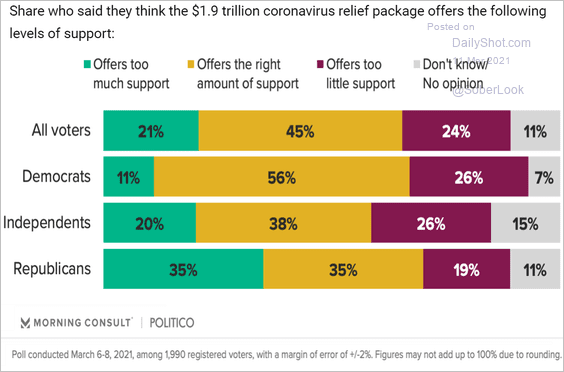

3. Overall, Americans don’t think that the $1.9 trillion package is too much stimulus.

Source: Morning Consult Read full article

Source: Morning Consult Read full article

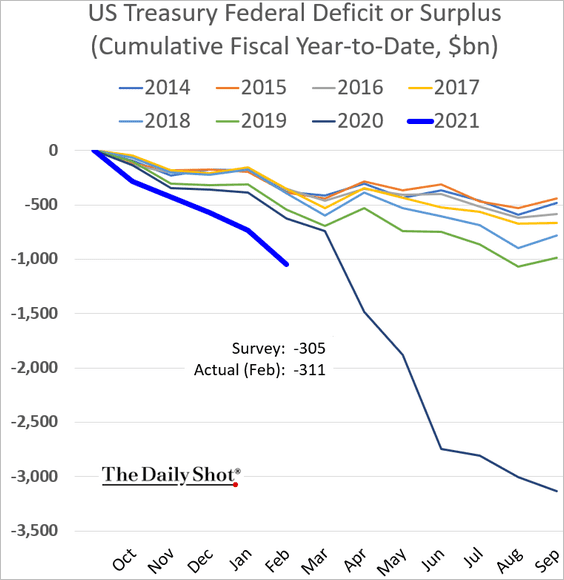

4. The budget deficit continues to widen. We will have more on the topic shortly.

Back to Index

The Eurozone

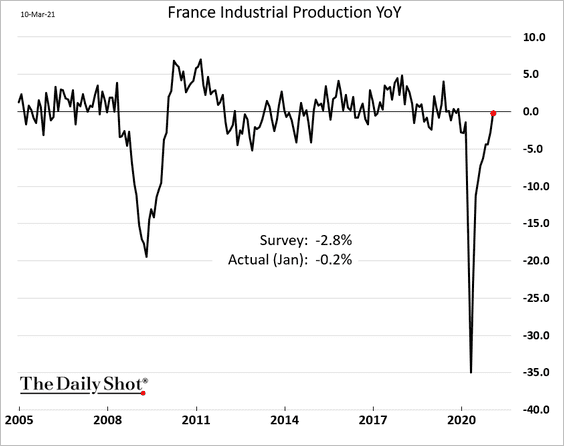

1. French industrial production topped economists’ forecasts.

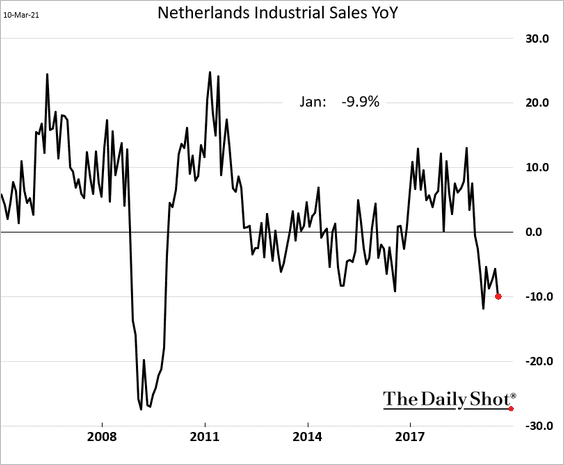

2. Dutch industrial sales are still down 10% from a year ago.

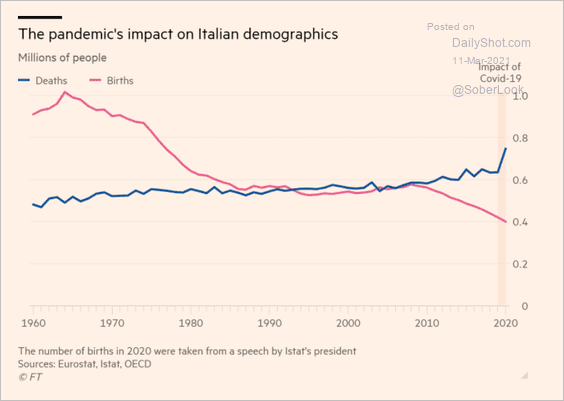

3. Italy’s demographic trends continue to worsen.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Europe

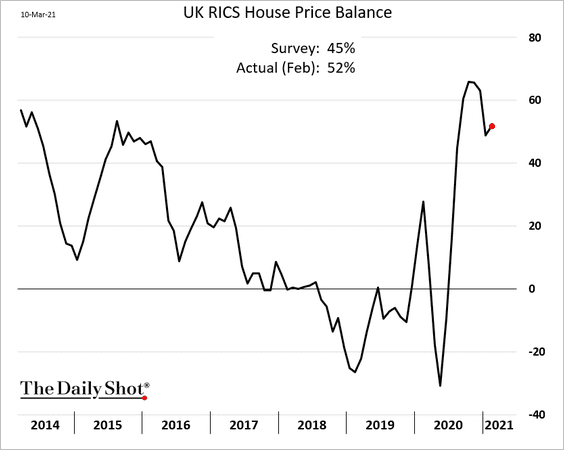

1. The UK’s housing market is holding up well.

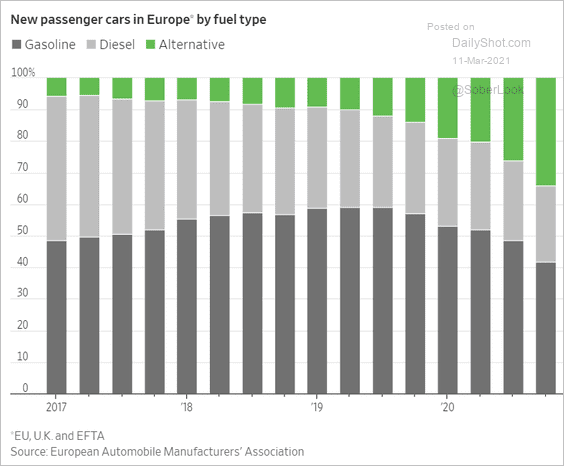

2. Here is the distribution of new car sales in Europe (by fuel type).

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Asia – Pacific

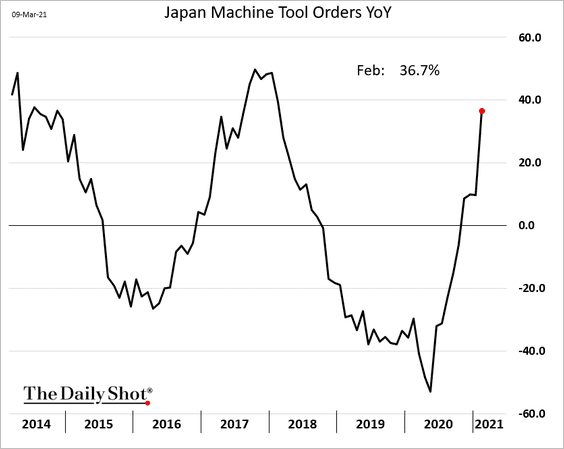

1. Japan’s machine tool orders have accelerated.

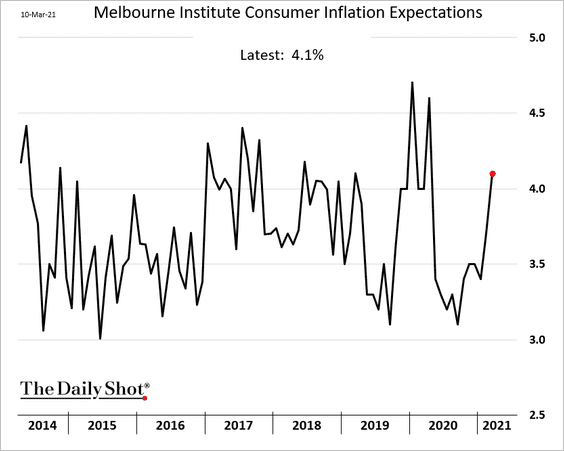

2. Consumer inflation expectations in Australia are rebounding.

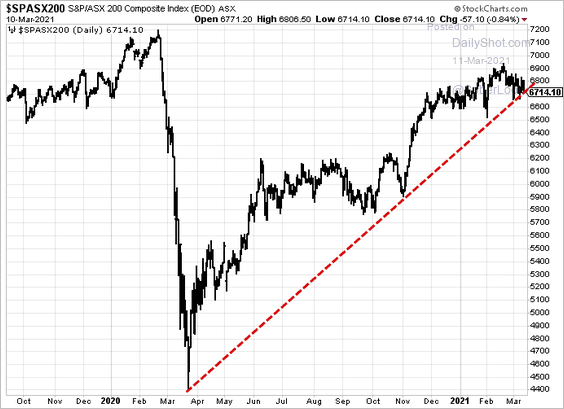

Separately, Australia’s benchmark stock index is at support.

h/t @ThuyOng

h/t @ThuyOng

——————–

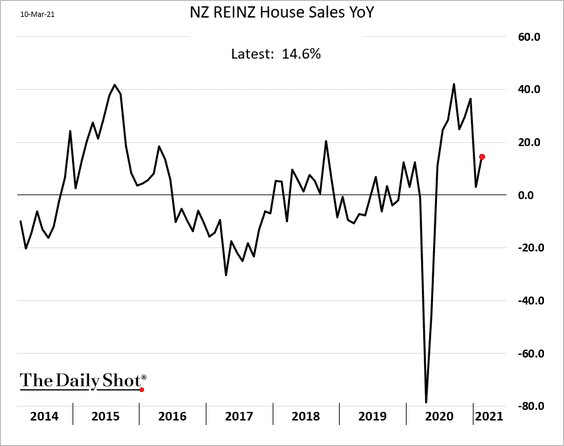

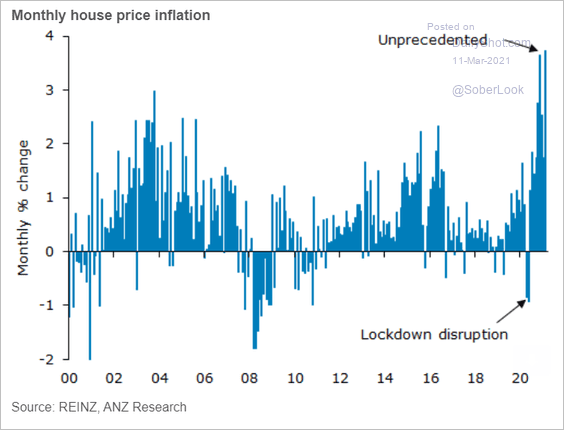

3. New Zealand’s housing market remains hot.

• Sales:

• Prices:

Source: ANZ Research

Source: ANZ Research

Back to Index

China

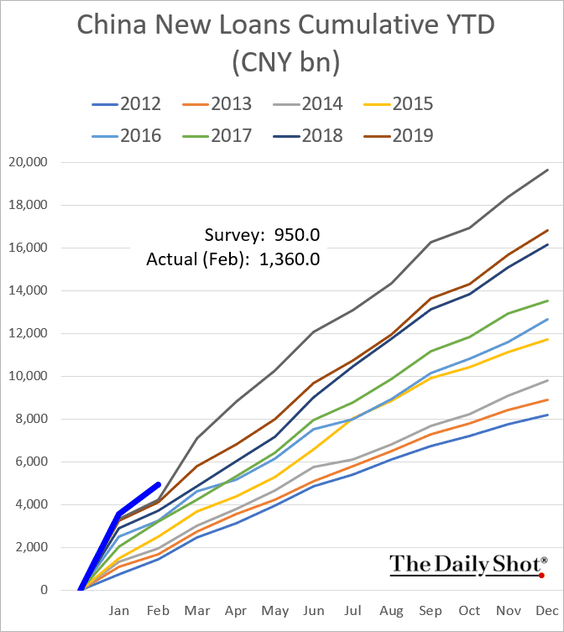

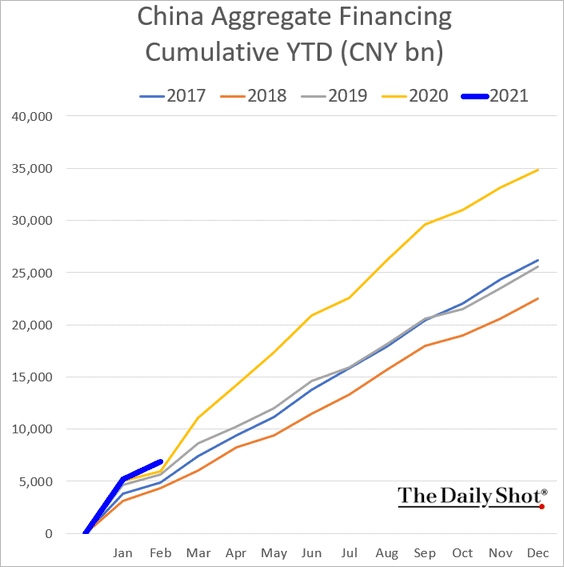

1. Last month’s credit expansion topped forecasts. Here is the year-to-date bank loan growth.

This chart shows the “aggregate” financing, which includes bonds.

——————–

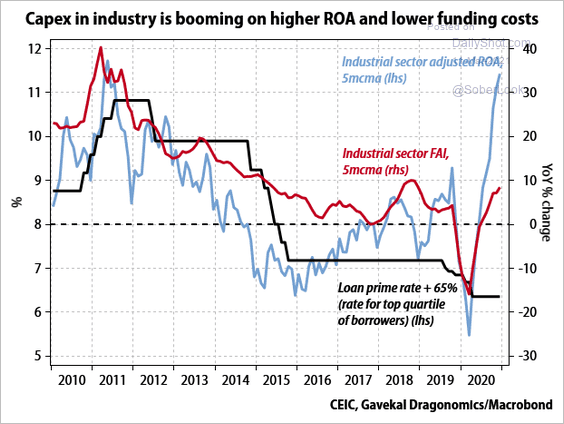

2. Will we see a spike in CapEx this year?

Source: Gavekal Research

Source: Gavekal Research

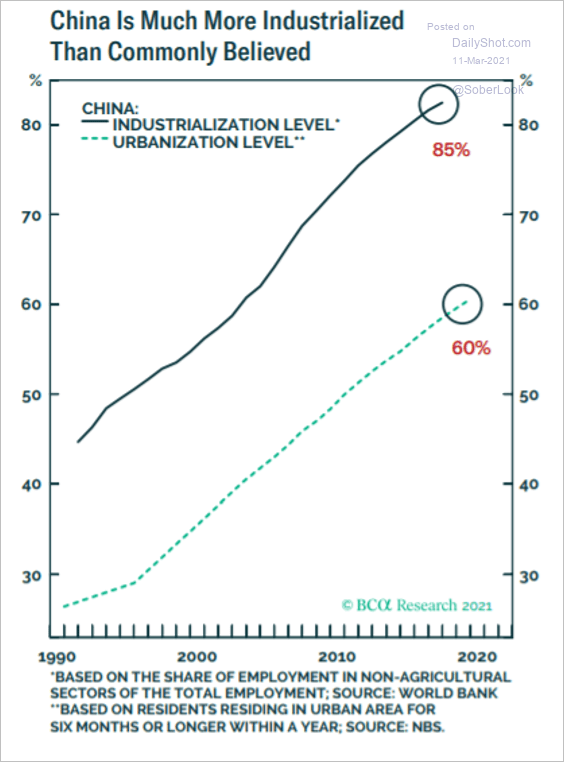

3. Here are the urbanization and industrialization trends for China.

Source: BCA Research

Source: BCA Research

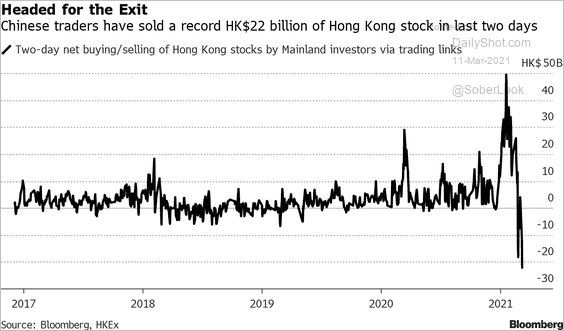

4. Mainland investors have been pulling out of Hong Kong stocks.

Source: @JeannyYu, @TheTerminal

Source: @JeannyYu, @TheTerminal

Back to Index

Emerging Markets

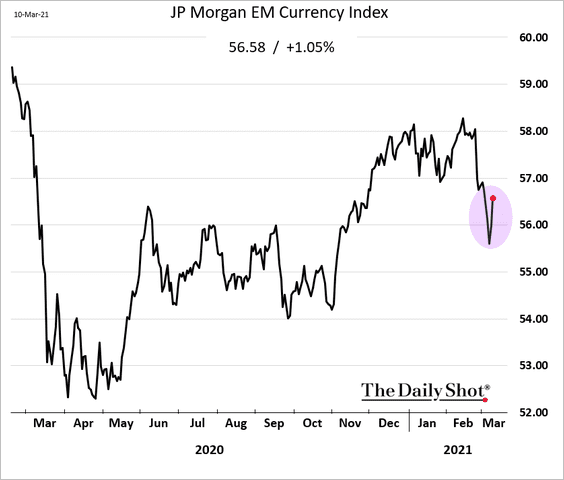

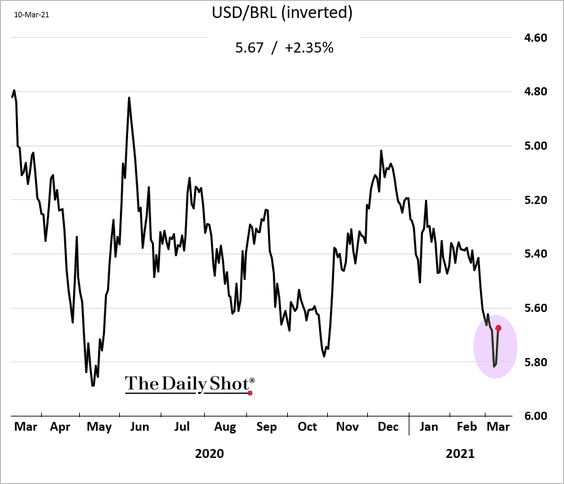

1. EM currencies bounced on improved risk appetite.

The Brazilian real was up over 2%.

——————–

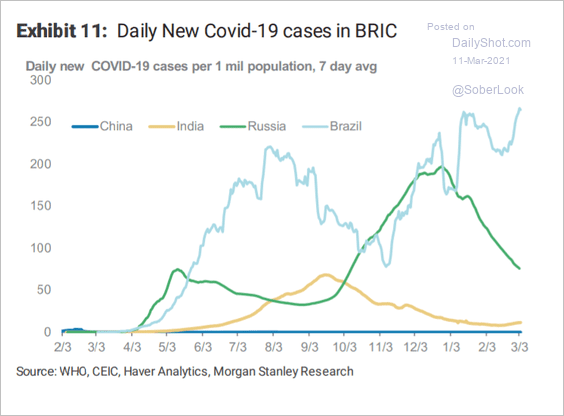

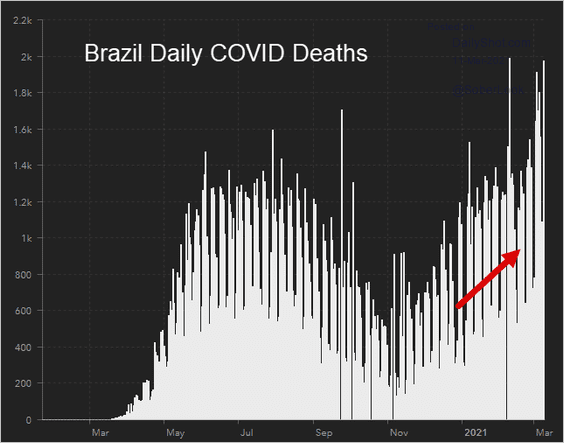

2. Brazil is struggling to contain the pandemic.

Source: @axios Read full article

Source: @axios Read full article

• New cases:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

• Deaths:

Source: Johns Hopkins University & Medicine

Source: Johns Hopkins University & Medicine

——————–

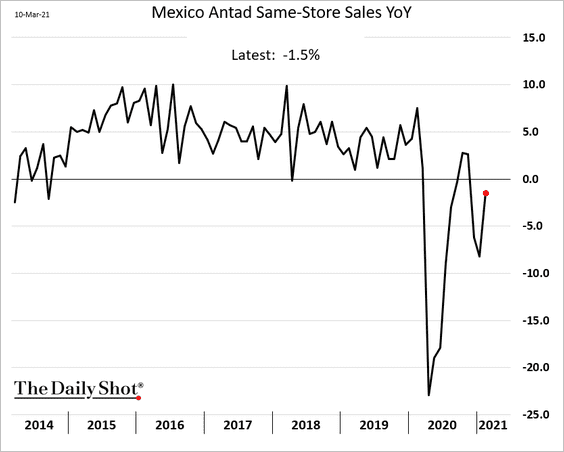

3. Mexico’s same-store sales rebounded last month.

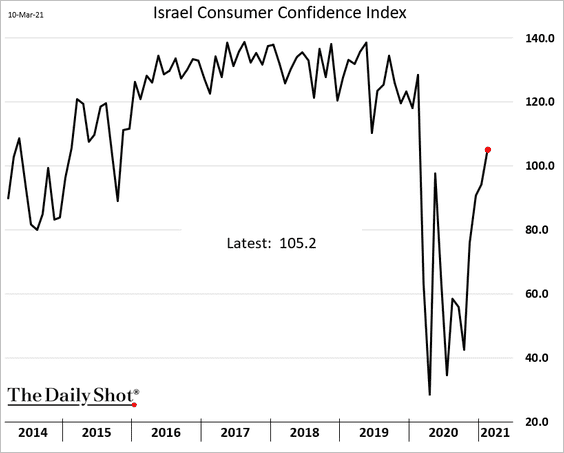

4. Israel’s consumer confidence is recovering in response to the vaccination success.

Back to Index

Cryptocurrency

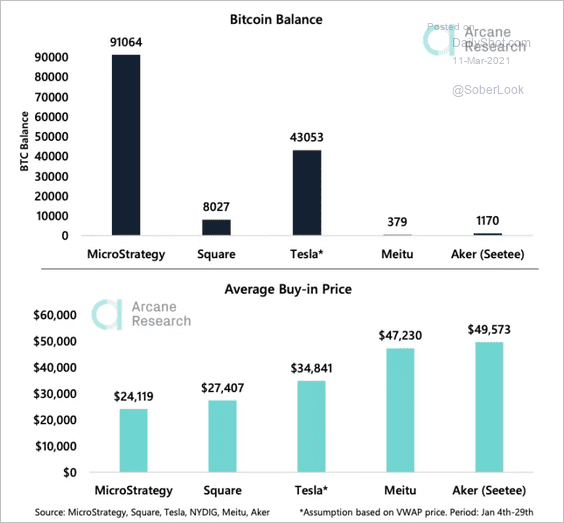

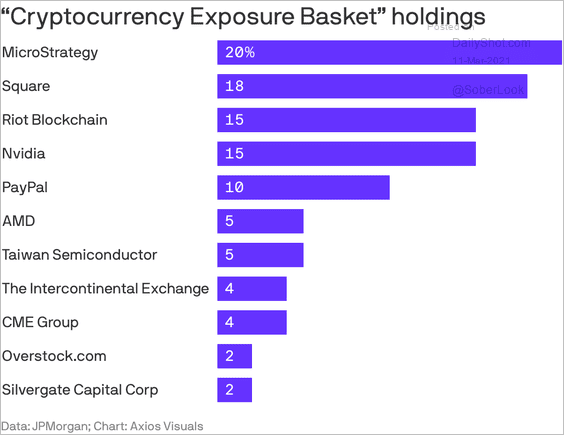

1. This chart shows corporate treasury Bitcoin balances and average buy-in prices. The corporate Bitcoin buying trend has spread from the US to Hong Kong and Scandinavia.

Source: Arcane Crypto Read full article

Source: Arcane Crypto Read full article

Source: @axios Read full article

Source: @axios Read full article

——————–

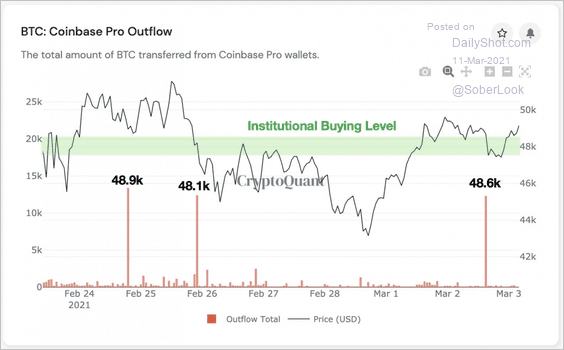

2. Bitcoin has strong support from the $48,000 level, which coincided with unusually large withdrawals from Coinbase Pro wallets (movement from wallet to storage could signal intention to hold instead of trade).

Source: CryptoQuant Read full article

Source: CryptoQuant Read full article

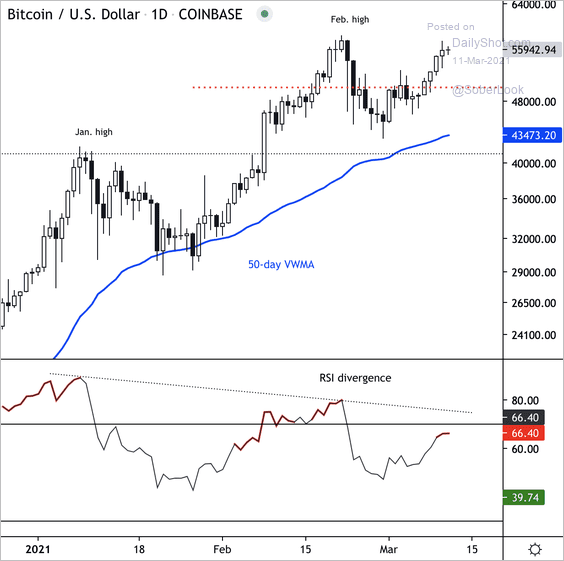

Bitcoin is holding support, but the uptrend from January is slowing as seen by the RSI divergence.

Source: Dantes Outlook

Source: Dantes Outlook

——————–

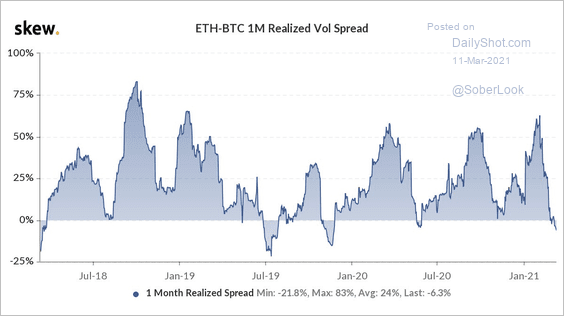

3. Bitcoin is now more volatile than ether, based on the 1-month realized vol spread.

Source: @skewdotcom

Source: @skewdotcom

Back to Index

Commodities

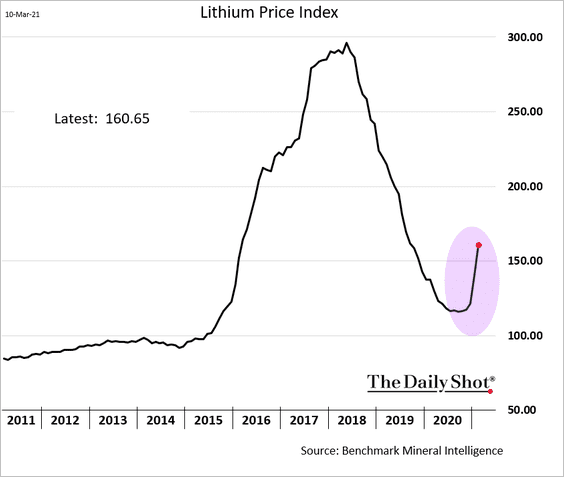

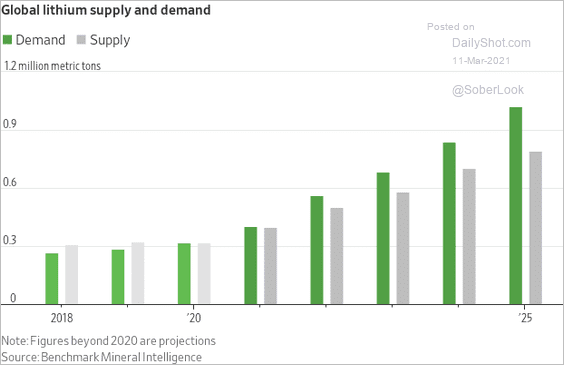

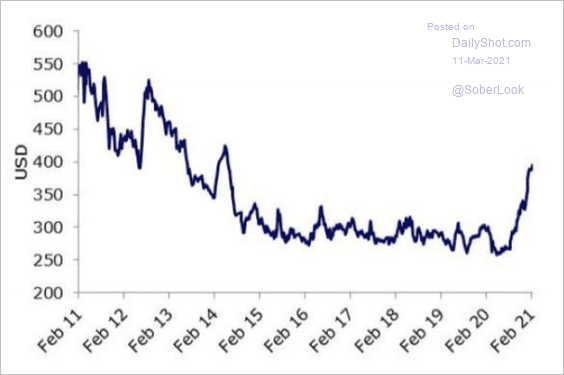

1. Lithium prices are rebounding as the market tightens (2nd chart).

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

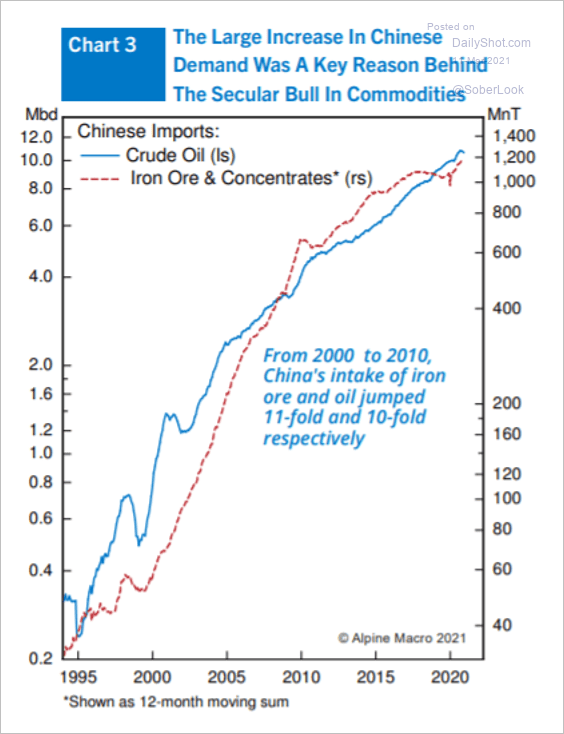

2. This chart shows China’s imports of crude oil and iron ore.

Source: Alpine Macro

Source: Alpine Macro

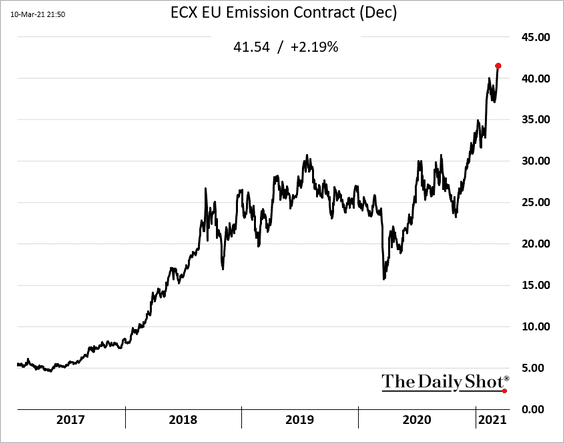

3. European emissions futures are rallying amid stronger environmental regulations in the EU.

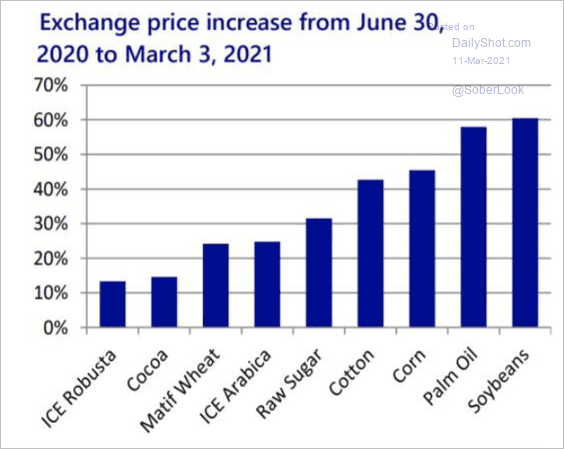

4. The S&P GSCI Agriculture Index soared to the highest level since 2014.

Source: Rabobank

Source: Rabobank

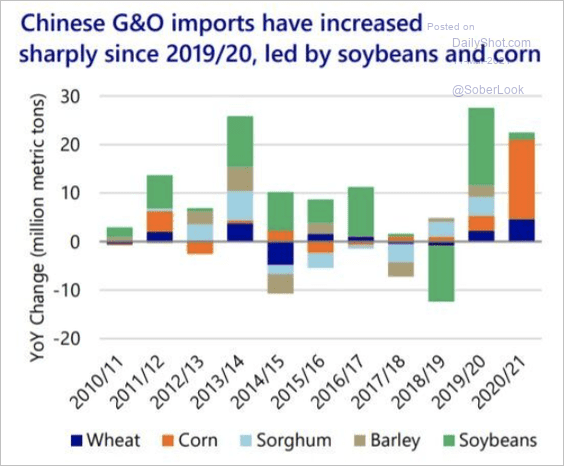

Most of the rise in agriculture performance over the past year has been driven by soybeans, palm oil, and corn, …

Source: Rabobank

Source: Rabobank

… boosted by strong Chinese demand.

Source: Rabobank

Source: Rabobank

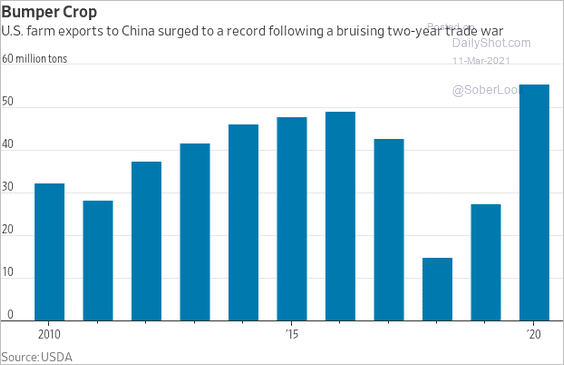

• That demand sent US farm exports to China to a new record.

Source: @WSJ Read full article

Source: @WSJ Read full article

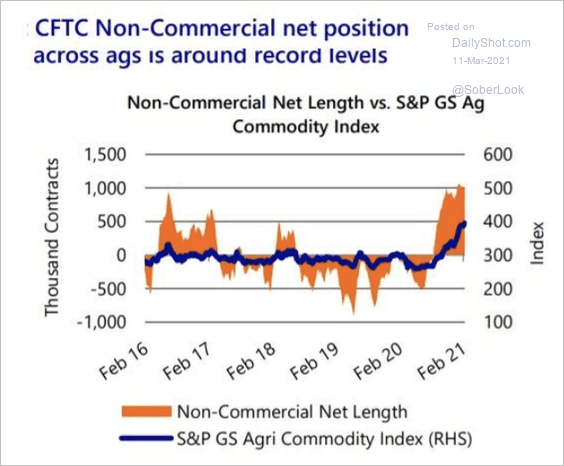

• Speculative long positioning in agriculture futures appears stretched.

Source: Rabobank

Source: Rabobank

——————–

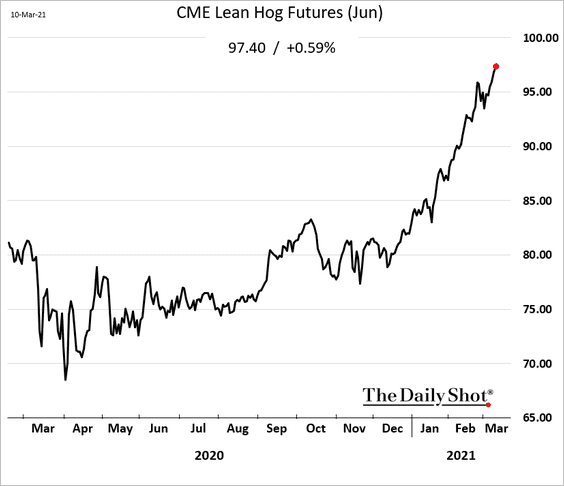

5. Related to the trends above, US hog futures continue to climb.

Back to Index

Energy

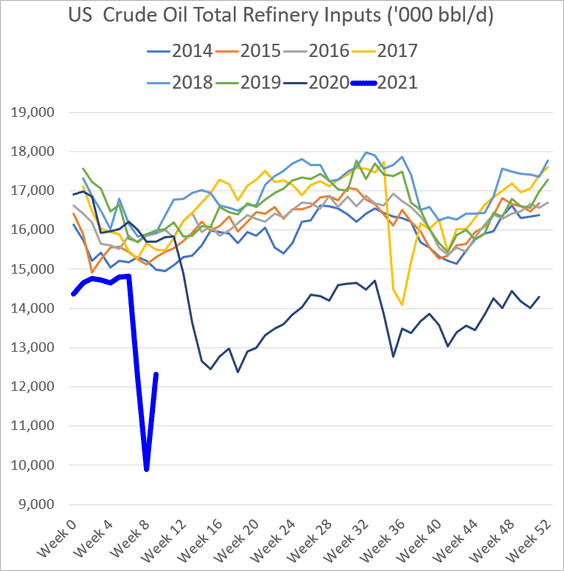

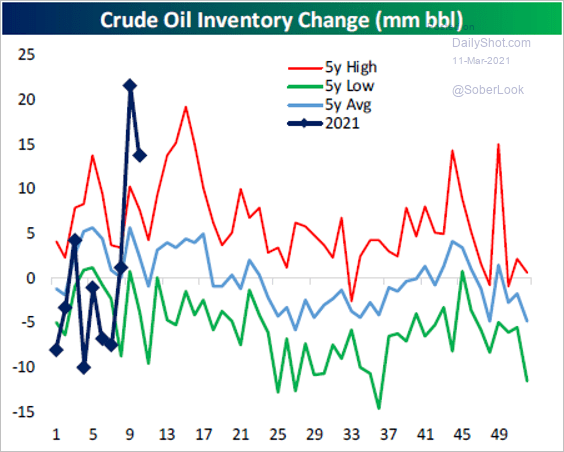

1. The Texas “deep freeze” impact is still visible in the US energy markets. Refinery inputs have not yet recovered.

Crede oil inventories are still elevated.

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

——————–

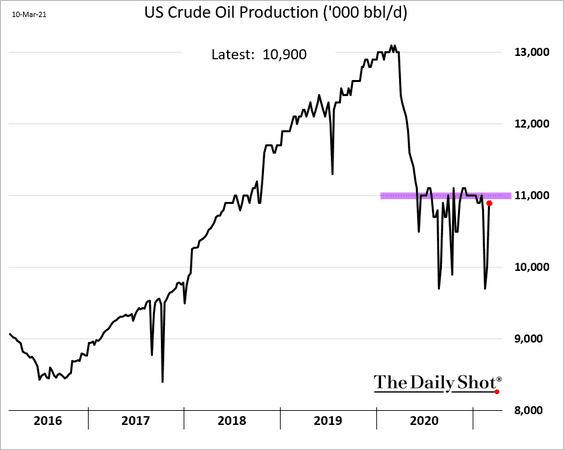

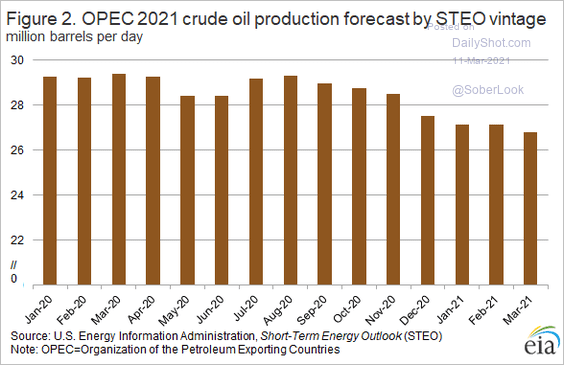

2. US crude oil production is back to 11 million barrels per day.

Will we see US output rise further as OPEC holds back and prices keep rising?

Source: @EIAgov

Source: @EIAgov

——————–

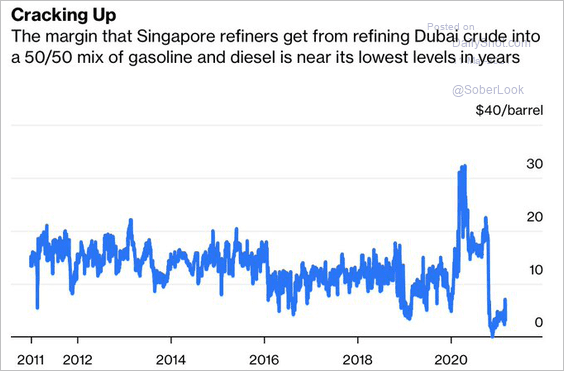

3. Will weak refinery margins cap crude oil price gains?

Source: @aeberman12 Read full article

Source: @aeberman12 Read full article

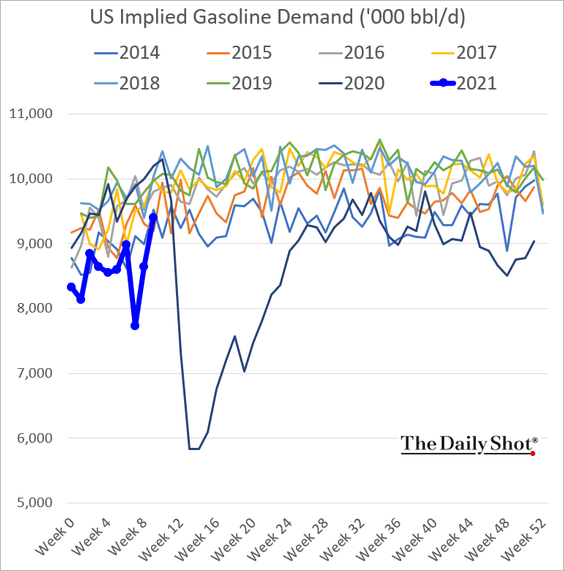

4. US gasoline demand has rebounded.

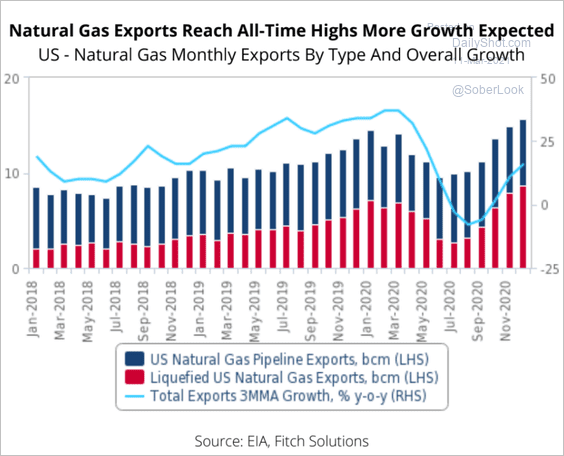

5. This chart shows US natural gas exports.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Back to Index

Equities

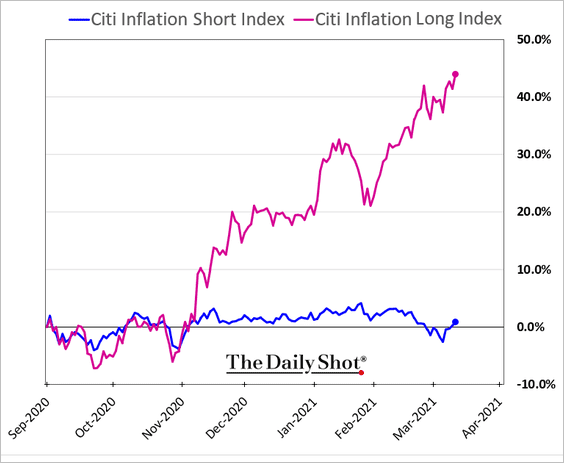

1. The market is increasingly pricing in higher inflation ahead. Stocks sensitive to rising prices have outperformed sharply since the vaccine announcement.

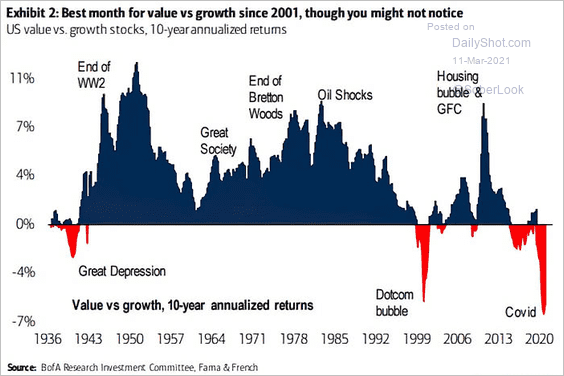

2. It’s been a good month for value stocks.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

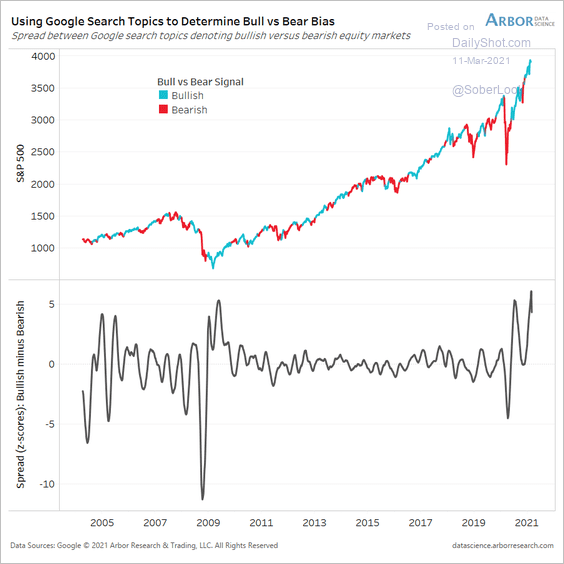

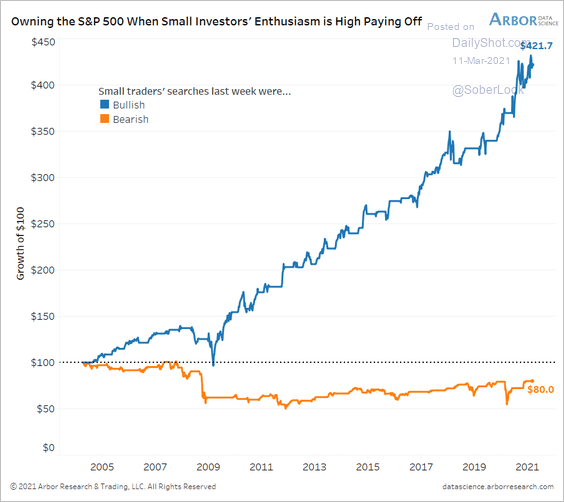

3. Retail investor sentiment is extremely bullish.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

And retail investors have been right.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Back to Index

Rates

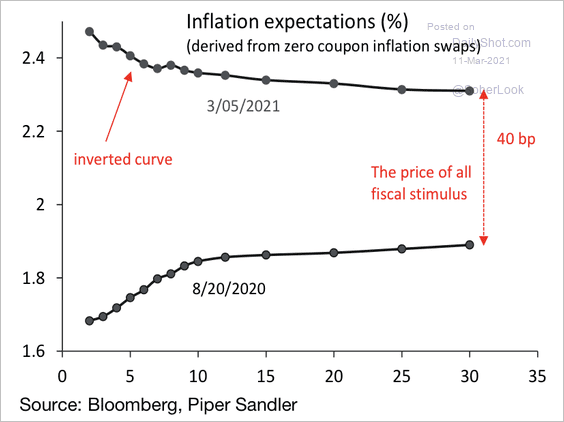

1. Long-term inflation expectations have increased by only 40 basis points since August when the breakeven yield curve inverted. The market is expecting a temporary boost to inflation. By the way, some have suggested that the curve inversion is driven by a steeper backwardation in the crude oil curve.

Source: Piper Sandler

Source: Piper Sandler

——————–

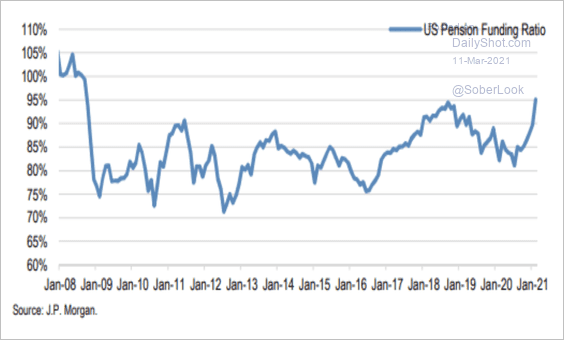

2. The rise in bond yields (and higher equity prices) has led to an increase in the US pension funding ratio (around 95%), according to III Capital Management.

Source: III Capital Management

Source: III Capital Management

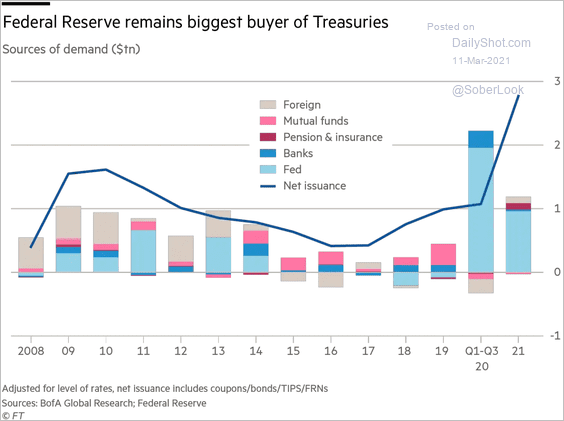

3. The Fed remains the biggest buyer of Treasuries.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

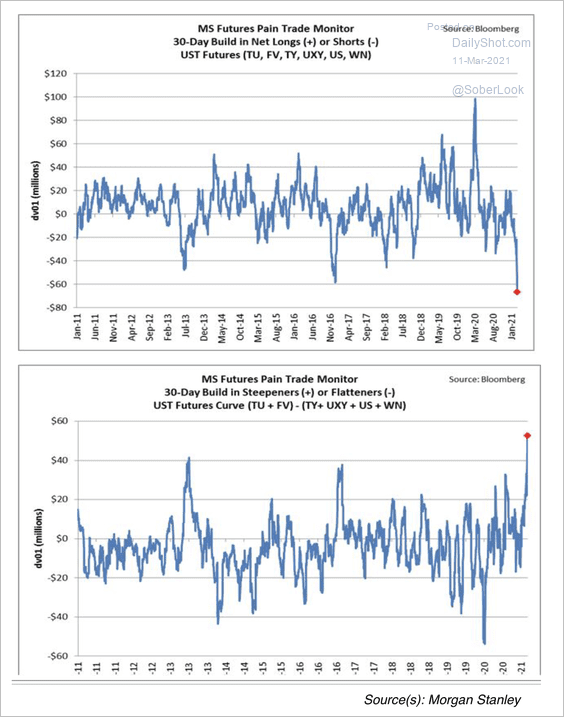

4. Trades betting on higher rates and a steeper yield curve appear crowded.

Source: III Capital Management

Source: III Capital Management

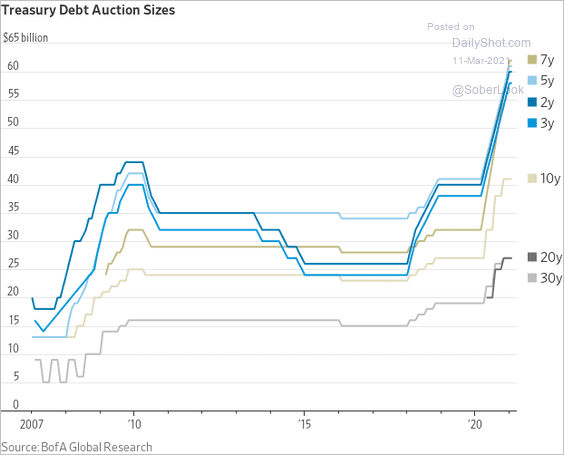

5. This chart shows Treasury debt auction sizes.

Source: @WSJ Read full article

Source: @WSJ Read full article

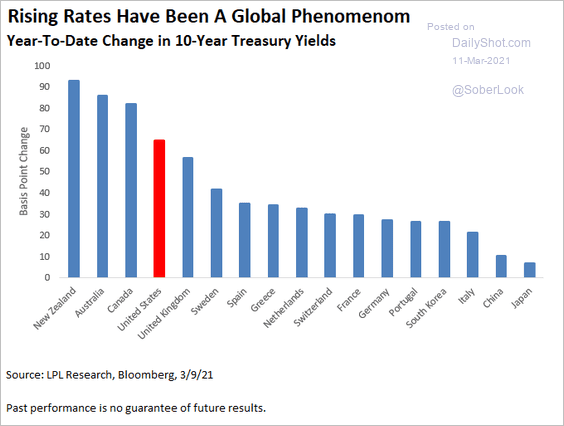

6. Yields have risen globally.

Source: LPL Research

Source: LPL Research

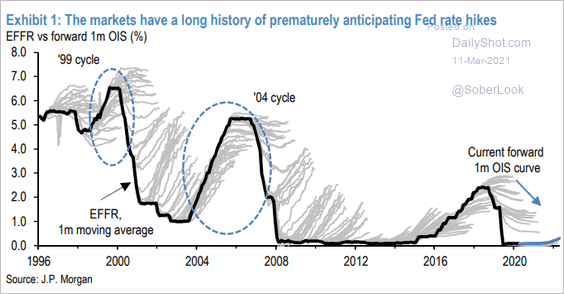

7. Finally, we have the fed funds rate vs. market expectations.

Source: JP Morgan; @tracyalloway

Source: JP Morgan; @tracyalloway

Back to Index

Global Developments

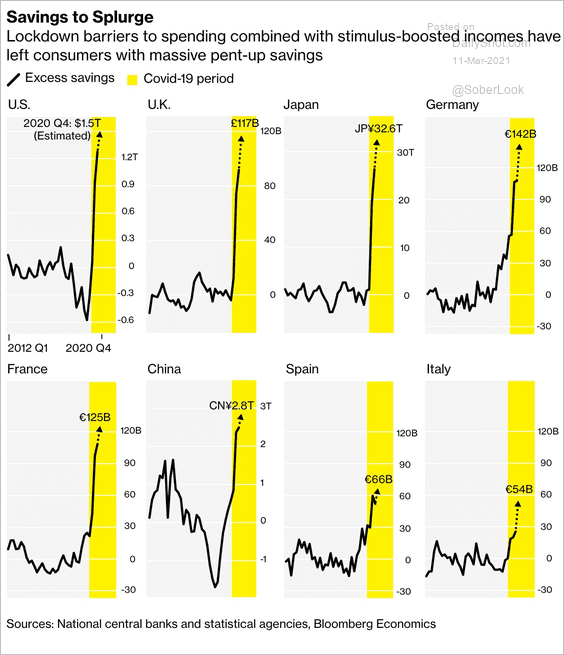

1. Household savings have surged during the pandemic.

Source: @BBGVisualData Read full article

Source: @BBGVisualData Read full article

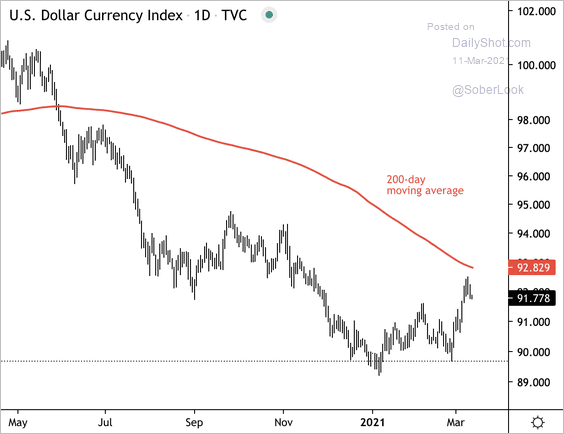

2. The dollar is testing resistance at its 200-day moving average.

Source: Dantes Outlook

Source: Dantes Outlook

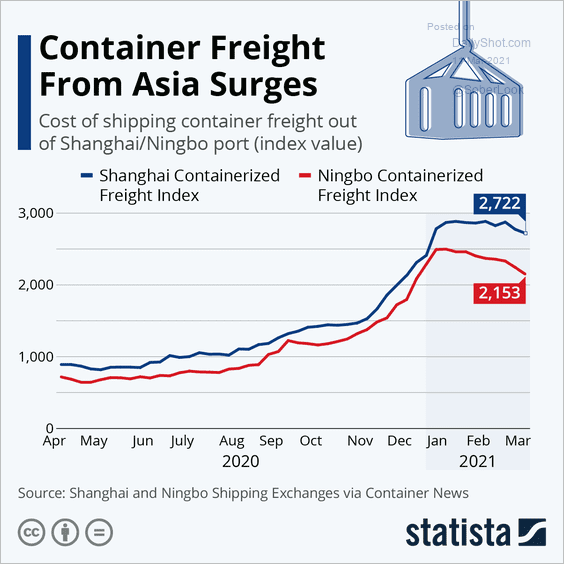

3. Have freight costs peaked?

Source: Statista

Source: Statista

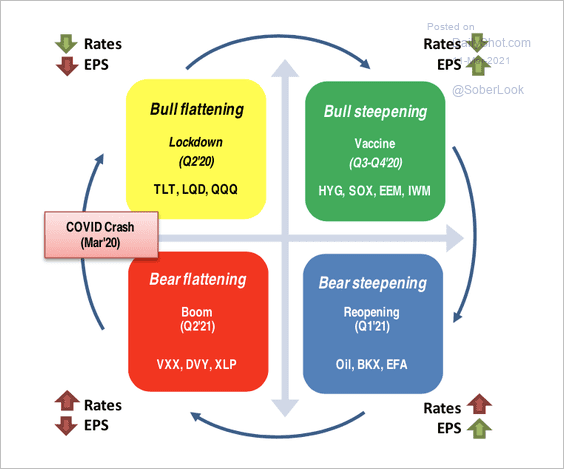

4. Here is a look at market phases since the March 2020 crash, according to BofA.

Source: BofA Global Research

Source: BofA Global Research

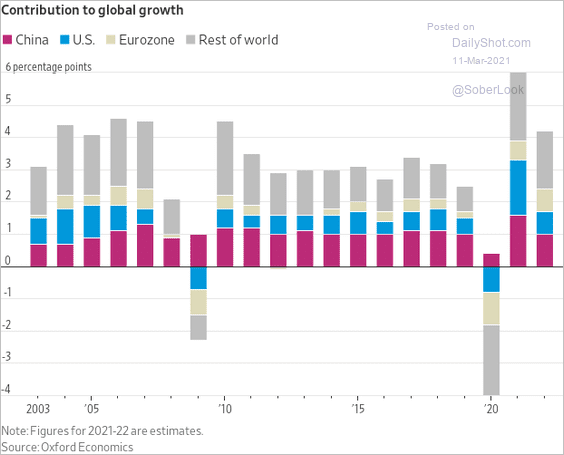

5. This chart shows the contributions to global growth.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Food for Thought

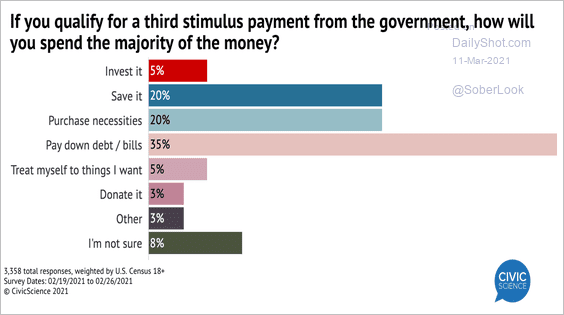

1. Spending intentions for the third stimulus check:

Source: CivicScienc Read full article

Source: CivicScienc Read full article

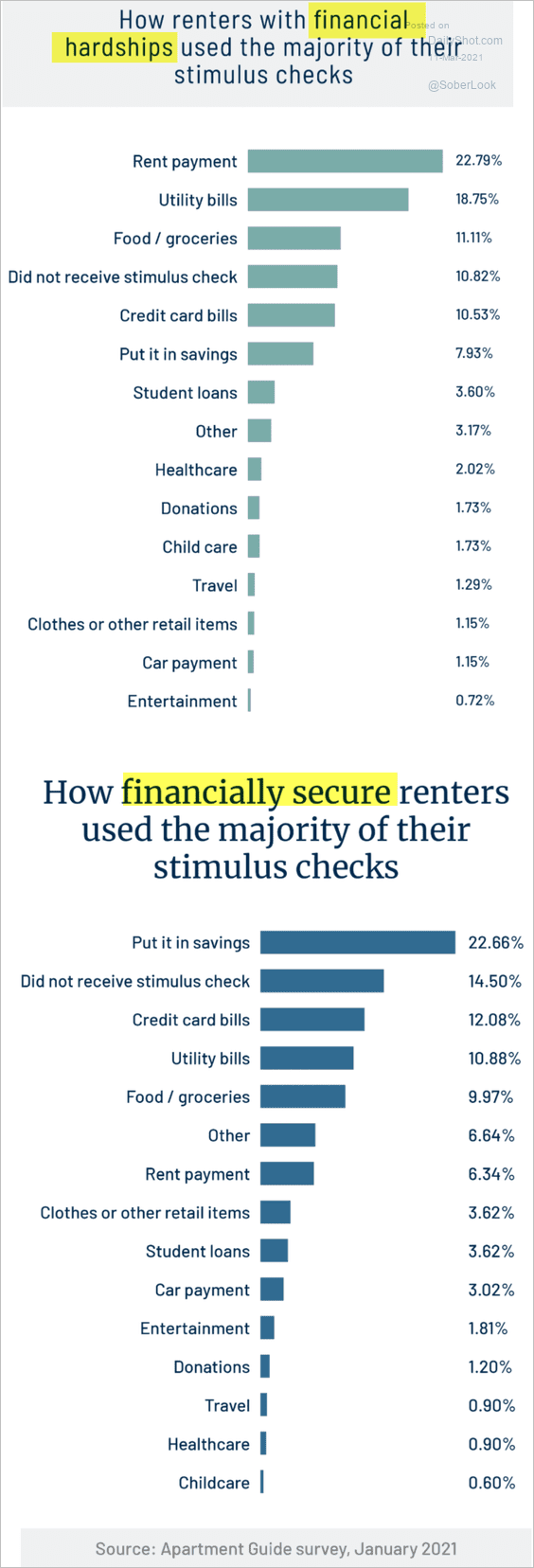

Renters with financial hardships:

Source: Apartment Guide

Source: Apartment Guide

——————–

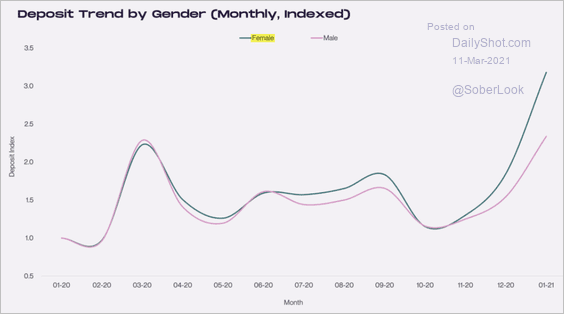

2. US deposit trends by gender:

Source: cardify Read full article

Source: cardify Read full article

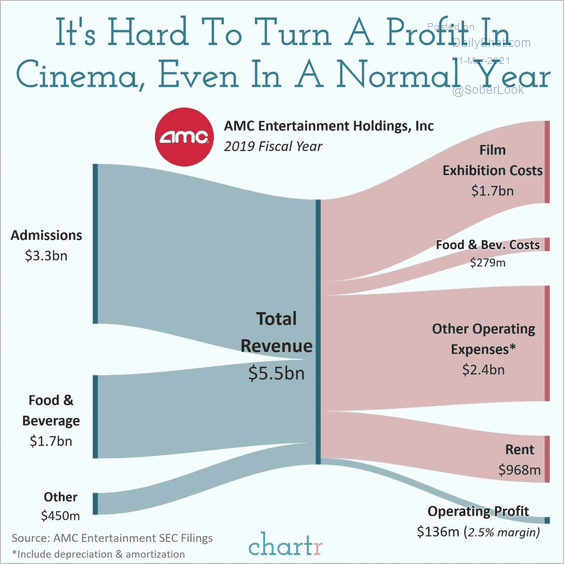

3. AMC’s pre-COVID revenues and expenses (thin margins):

Source: @chartrdaily

Source: @chartrdaily

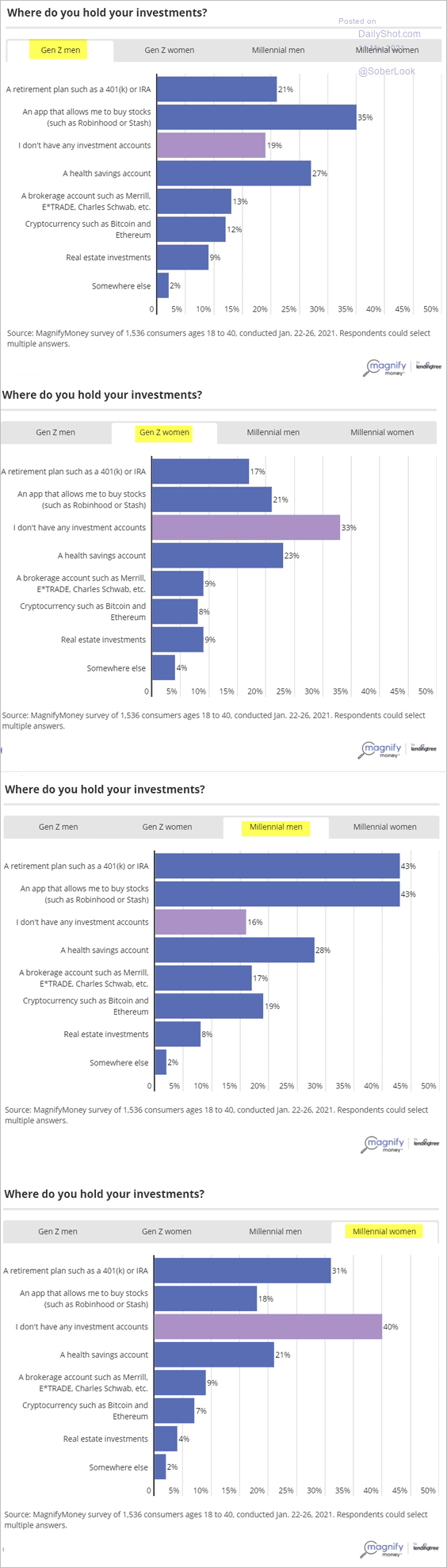

4. Where do young investors hold their investments?

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

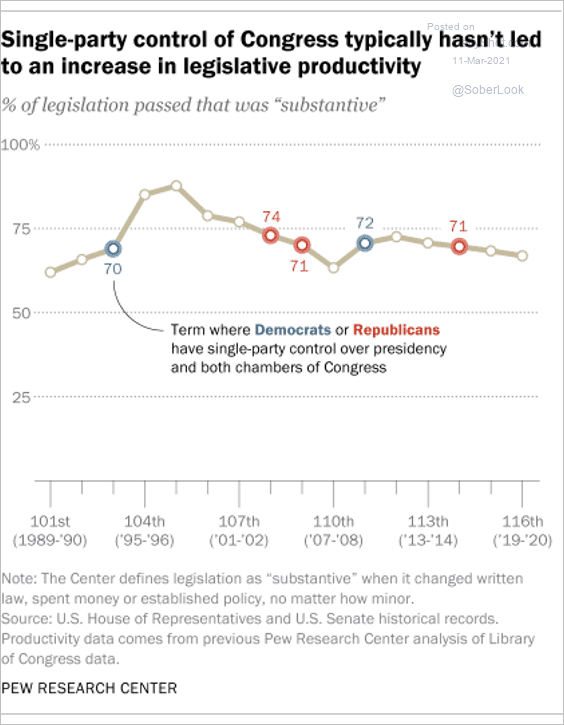

5. US federal legislation trend:

Source: @FactTank Read full article

Source: @FactTank Read full article

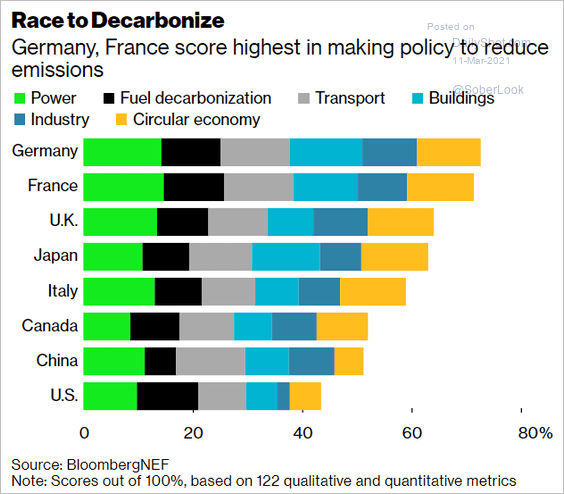

6. Strongest carbon emission policies:

Source: @business Read full article

Source: @business Read full article

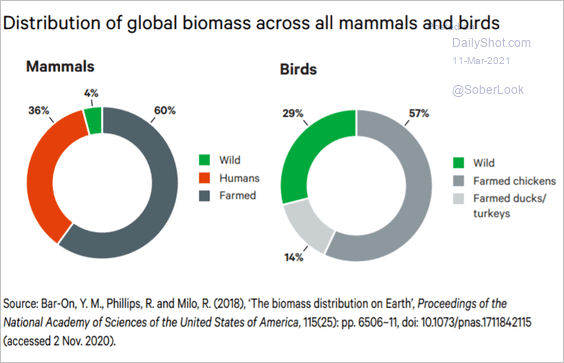

7. The distribution of global biomass:

Source: Chatham House Read full article

Source: Chatham House Read full article

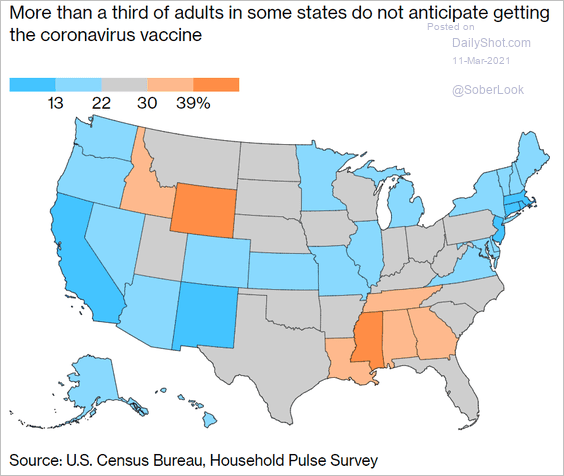

8. No vaccine intentions:

Source: @business Read full article

Source: @business Read full article

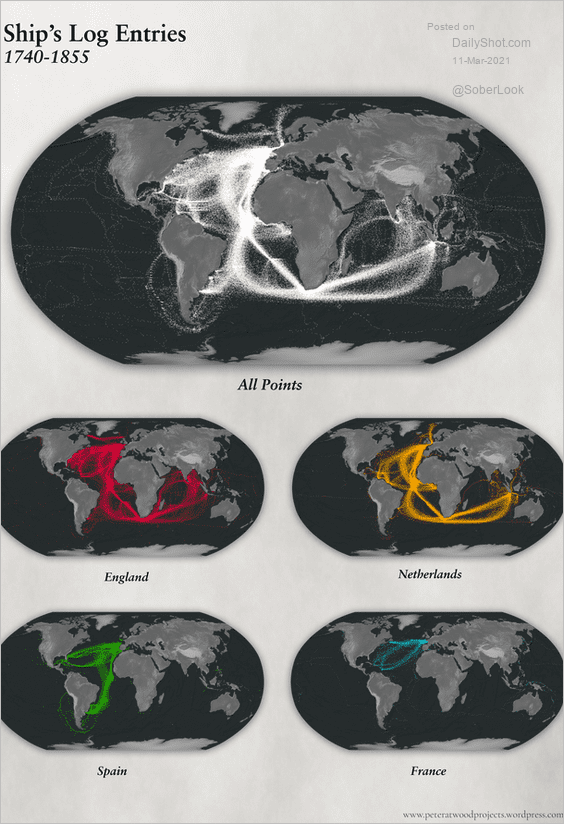

9. Ship log entries from 1740 to 1855:

Source: Peter Atwood

Source: Peter Atwood

——————–

Back to Index