The Daily Shot: 12-Mar-21

• Rates

• Credit

• Equities

• Emerging Markets

• China

• Asia – Pacific

• The Eurozone

• Canada

• The United States

• Global Developments

• Food for Thought

• Have a great weekend!

Rates

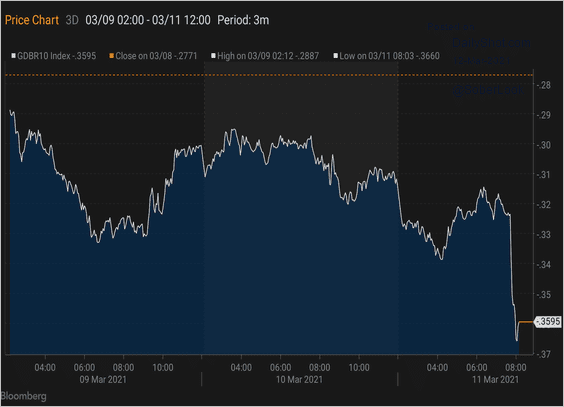

1. The ECB has had enough of rising bond yields as it announced a faster pace of QE.

The Governing Council: – First, the Governing Council will continue to conduct net asset purchases under the pandemic emergency purchase programme (PEPP) with a total envelope of €1,850 billion until at least the end of March 2022 and, in any case, until it judges that the coronavirus crisis phase is over. Based on a joint assessment of financing conditions and the inflation outlook, the Governing Council expects purchases under the PEPP over the next quarter to be conducted at a significantly higher pace than during the first months of this year.

(more on the topic in the Eurozone section)

The announcement sent Bund yields lower.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

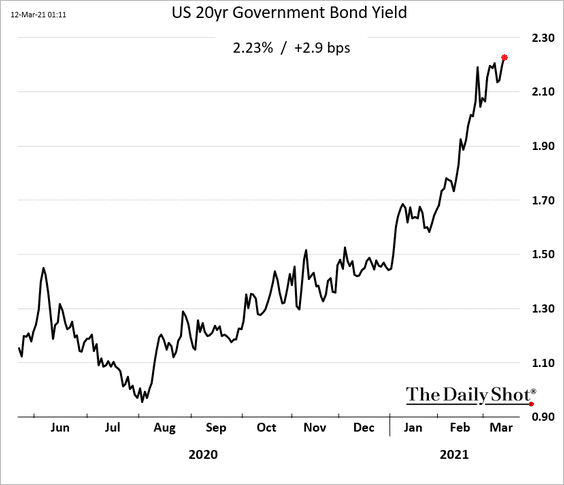

However, longer-dated Treasury yields resumed their ascent.

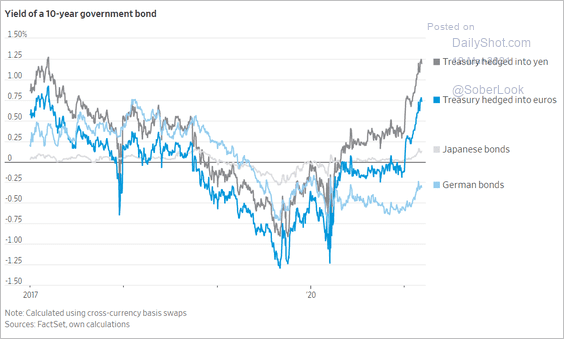

With the ECB (and the BoJ) capping yield gains, Treasuries are becoming increasingly attractive for foreign investors. This chart shows the 10yr note swapped into euros or yen.

Source: @WSJ Read full article

Source: @WSJ Read full article

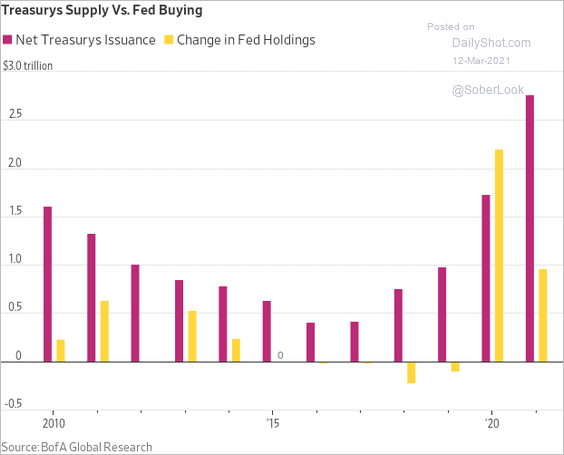

Will we see significant inflows into Treasuries from abroad, or are investors too concerned about the rapid growth US debt supply (as the $1.9 trillion stimulus package becomes law)?

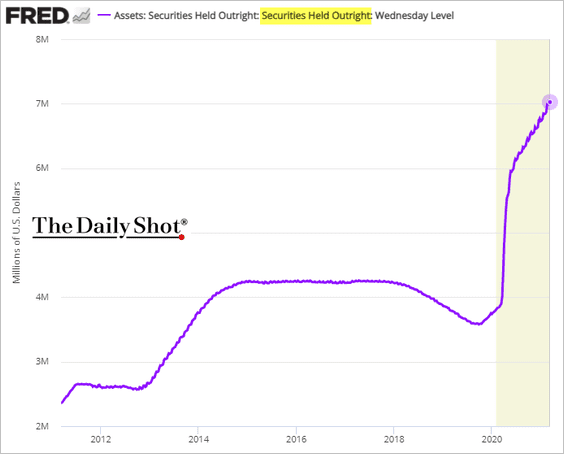

Of course, the Fed continues to purchase Treasuries and agency MBS debt, with the total securities balance now exceeding $7 trillion.

But that won’t be enough to offset the stimulus-related debt issuance bump.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

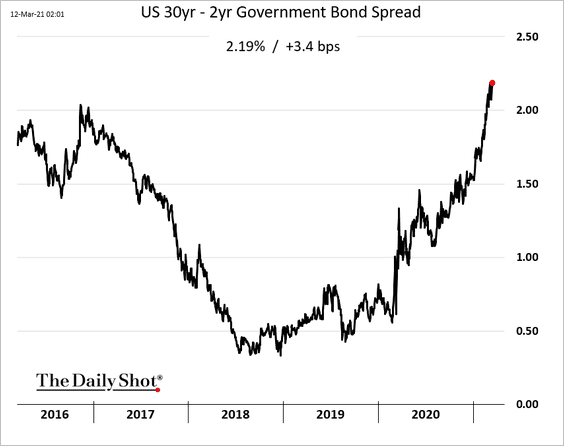

2. The US yield curve steepened on Thursday as the stock market hit new highs.

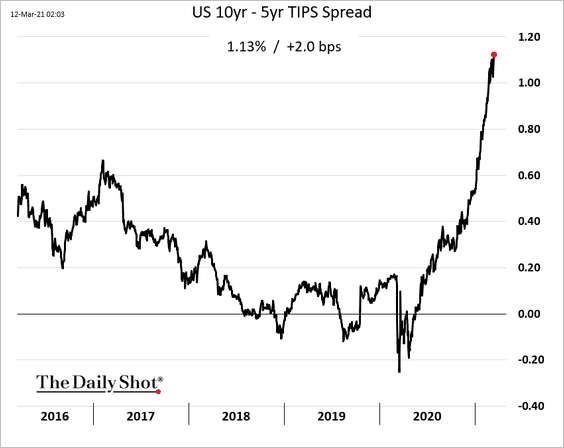

Steepening in real yields has been particularly sharp.

——————–

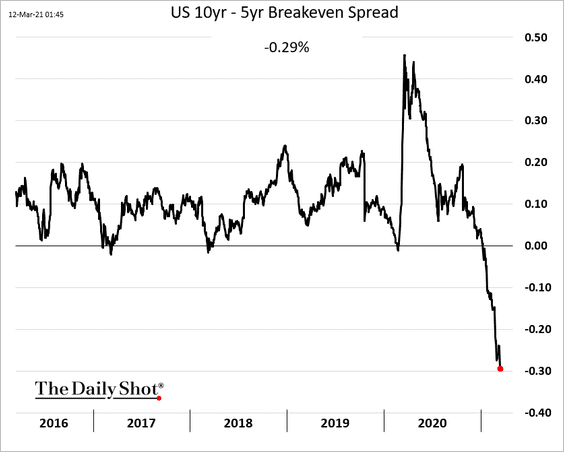

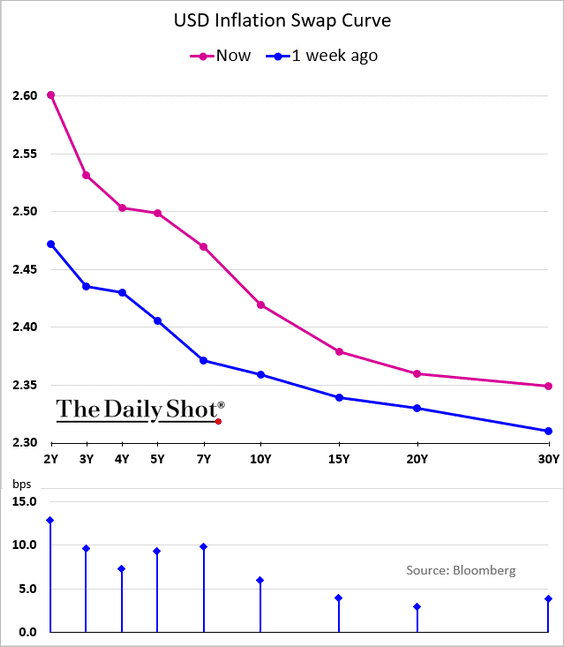

3. Inflation expectations curves are becoming more inverted.

• The 10yr – 5yr breakeven spread:

• Inflation swaps:

——————–

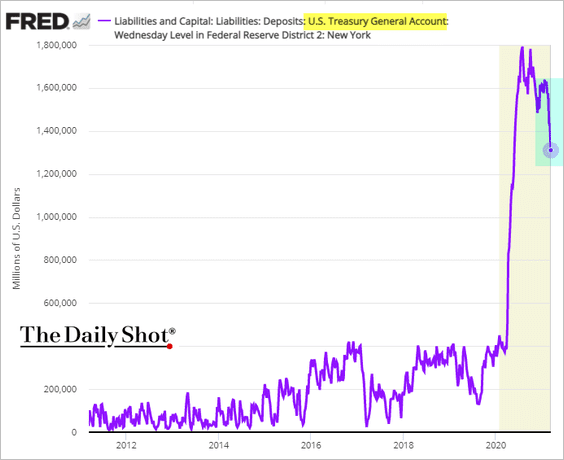

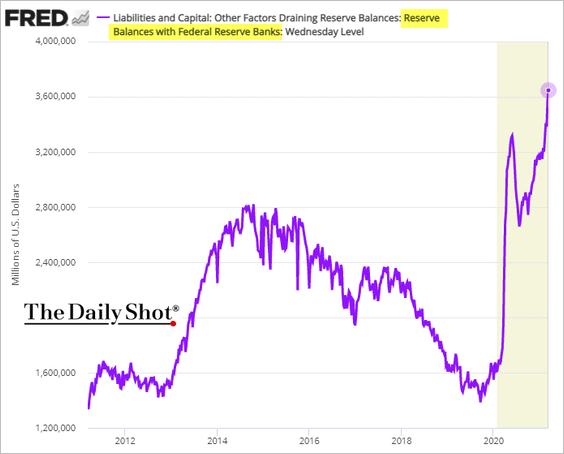

4. The combination of the Fed’s securities purchases and the US Treasury reducing its cash holdings at the central bank (chart below) sent bank reserves to a record high (2nd chart).

——————–

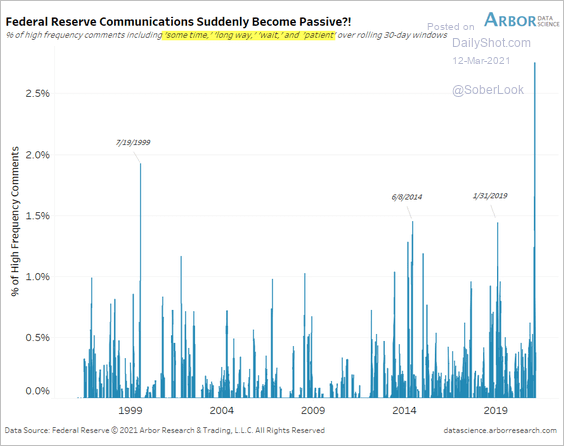

5. Fed officials’ messaging in recent weeks shows caution.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

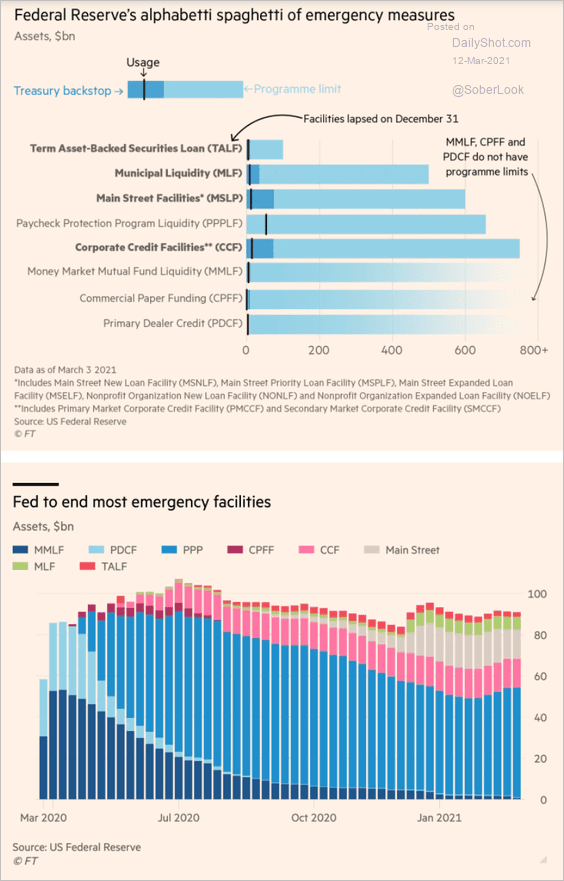

6. Here is an update on the Fed’s emergency programs.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

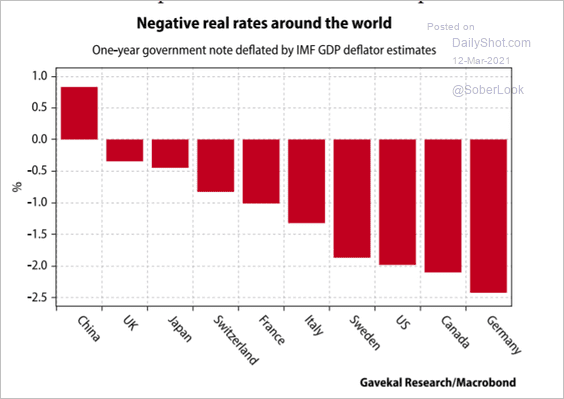

7. Finally, this chart shows real short-term rates globally.

Source: Gavekal Research

Source: Gavekal Research

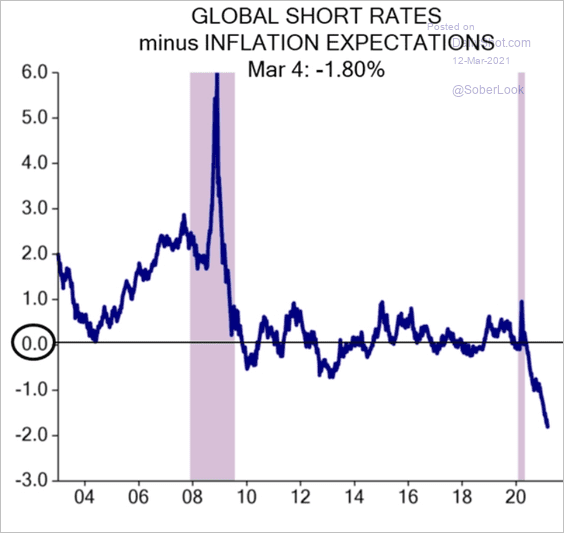

And here is a blended real rate based on inflation expectations.

Source: Evercore ISI

Source: Evercore ISI

Back to Index

Credit

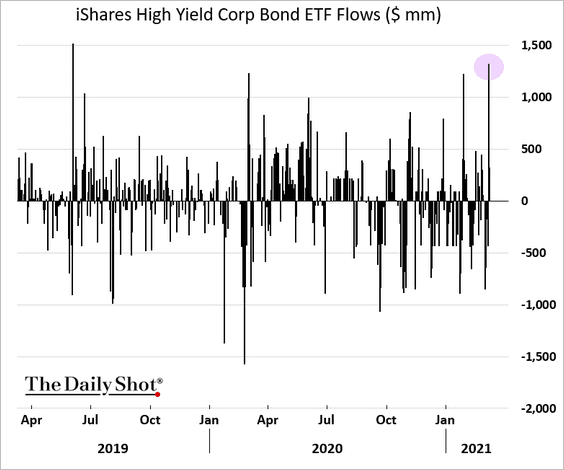

1. Investors pumped some money into high-yield ETFs this week.

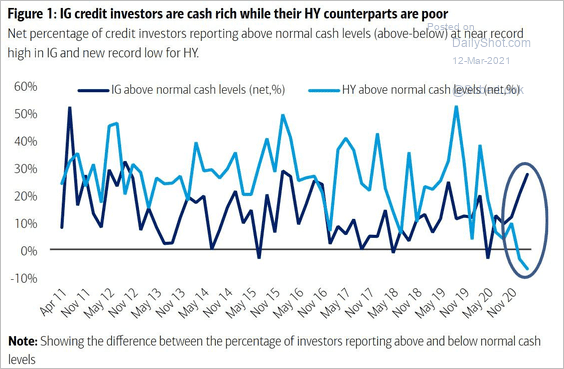

Based on portfolio cash levels, high-yield investors are all in, while investment-grade debt investors are more cautious.

Source: BofA Global Research, James W.

Source: BofA Global Research, James W.

——————–

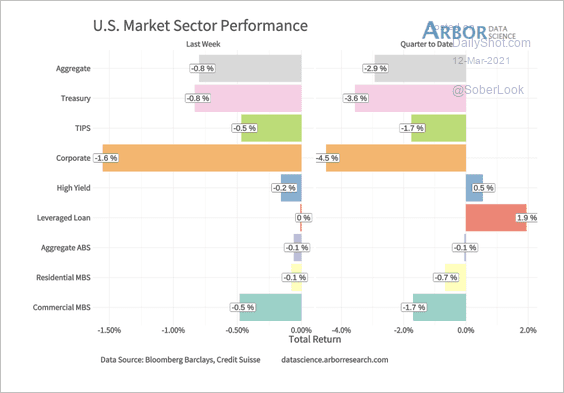

2. US corporate bonds continued to underperform other fixed-income assets last week.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

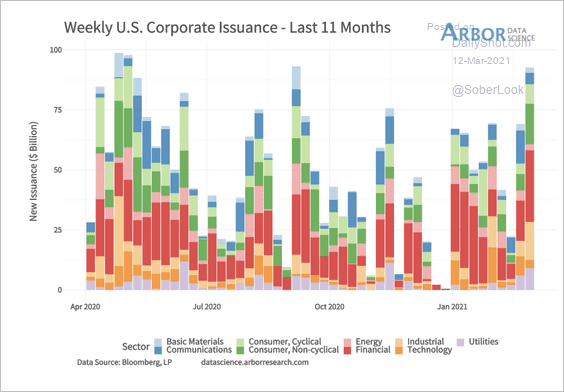

3. US corporate debt issuance picked up in recent days as yields marched higher.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

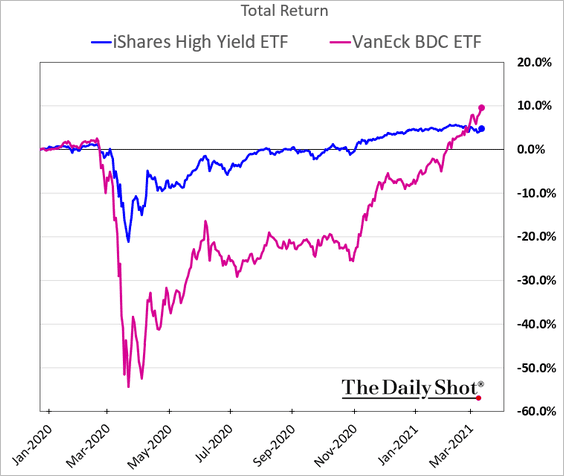

4. The recovery in BDCs has been remarkable.

Back to Index

Equities

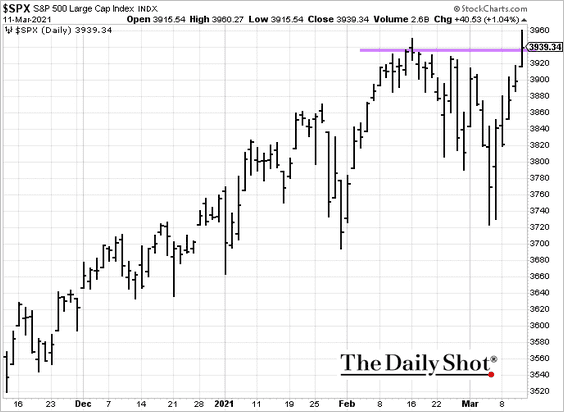

1. The S&P 500 hit a record high but is now at resistance. Elevated Treasury yields will remain a drag on the market.

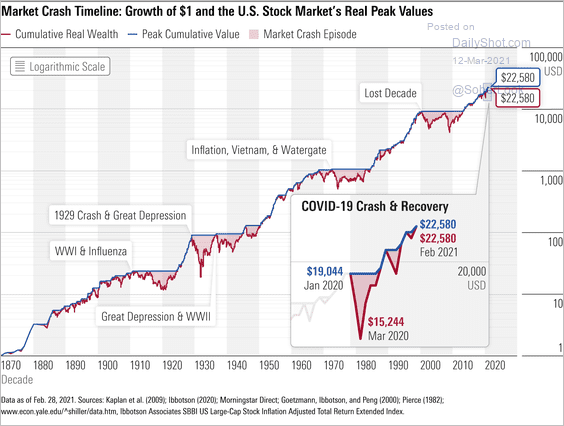

2. The depth of the COVID-19 market crash was a mere blip compared to previous market crashes.

Source: Morningstar Read full article

Source: Morningstar Read full article

3. Where’s my check, bro?

Source: CNBC Read full article

Source: CNBC Read full article

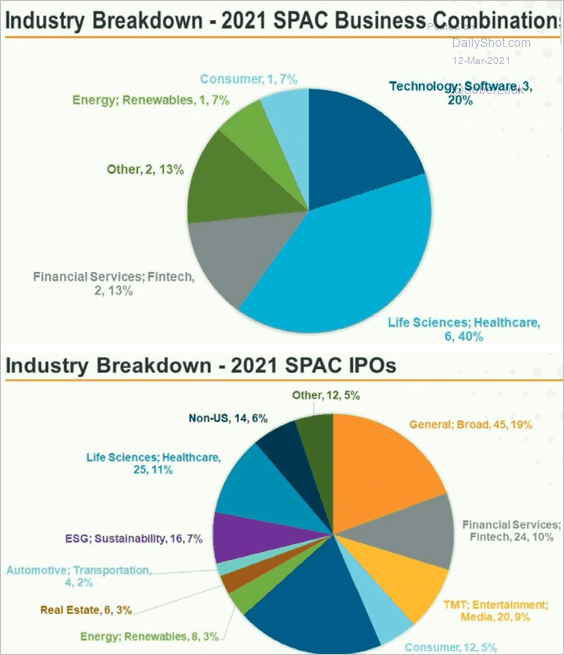

4. Next, we have some sector data on SPAC IPOs and mergers (combinations).

Source: Goodwin Proctor, @apark_

Source: Goodwin Proctor, @apark_

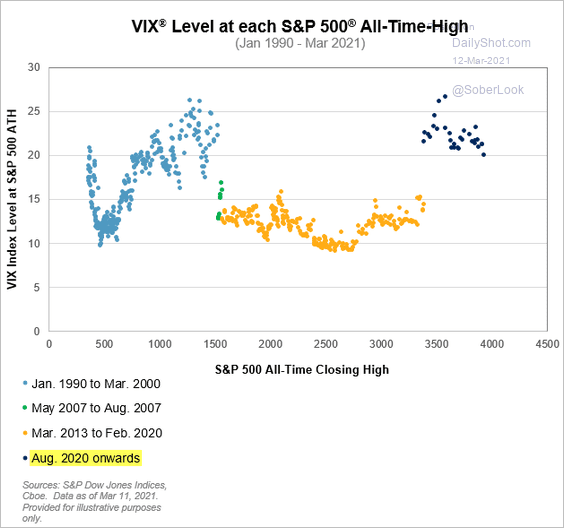

5. Finally, this scatterplot shows VIX levels when the S&P 500 hit all-time highs.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Emerging Markets

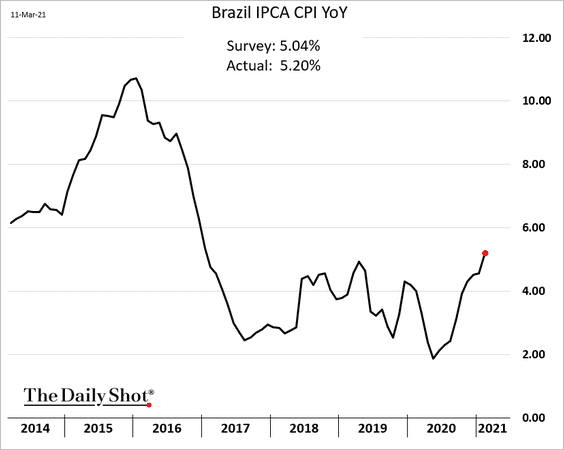

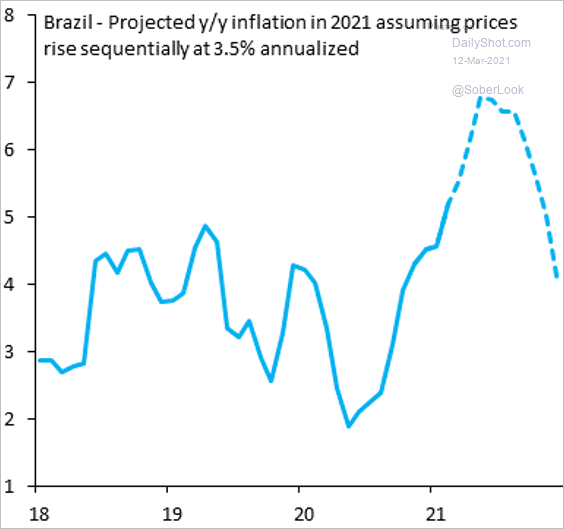

1. Brazil’s inflation rose more than expected, boosted by energy prices.

Here is the CPI forecast from IIF.

Source: @SergiLanauIIF

Source: @SergiLanauIIF

——————–

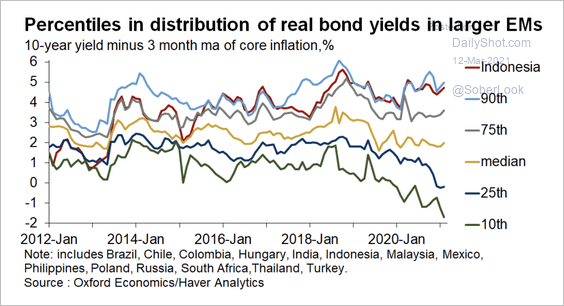

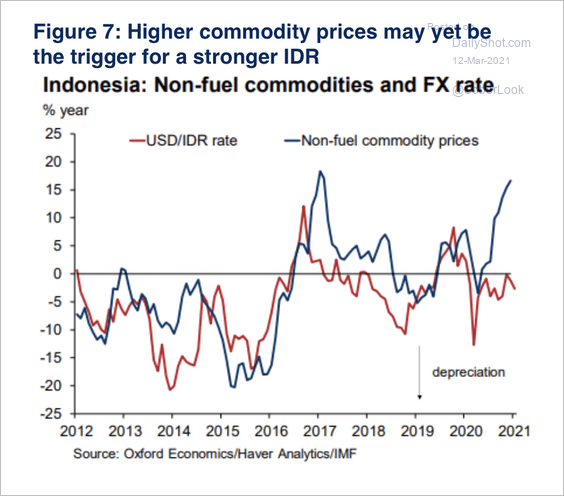

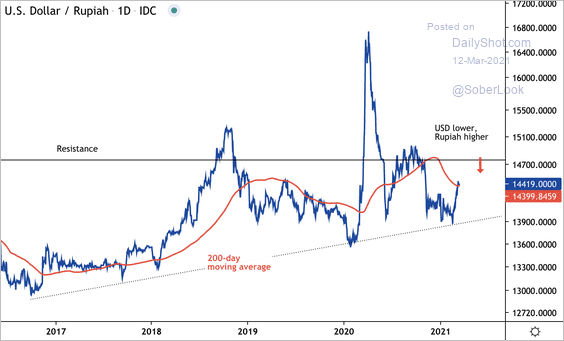

2. Next, we have some updates on Indonesia.

• Real yields are around the 90th percentile among EMs.

Source: Oxford Economics

Source: Oxford Economics

• The recovery in commodity prices could support a higher rupiah (IDR).

Source: Oxford Economics

Source: Oxford Economics

USD/IDR is testing initial resistance at its 200-day moving average.

Source: Dantes Outlook

Source: Dantes Outlook

——————–

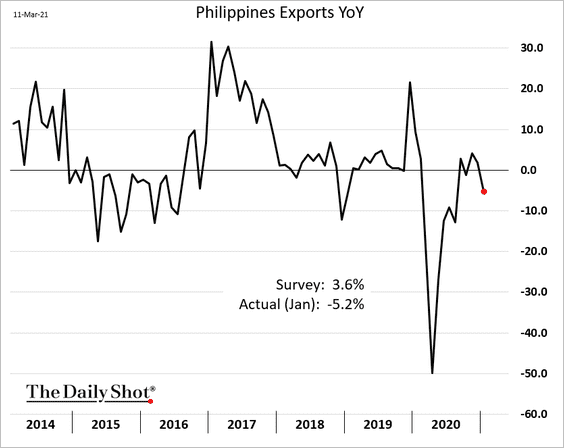

3. Philippine exports rolled over in January as the nation remains in recession.

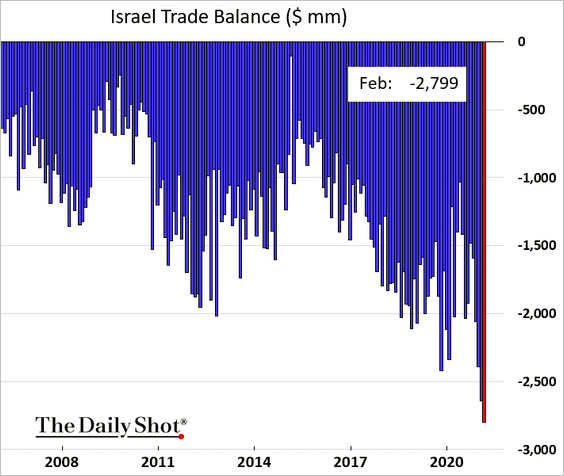

4. Israel’s trade deficit hit a new record.

Back to Index

China

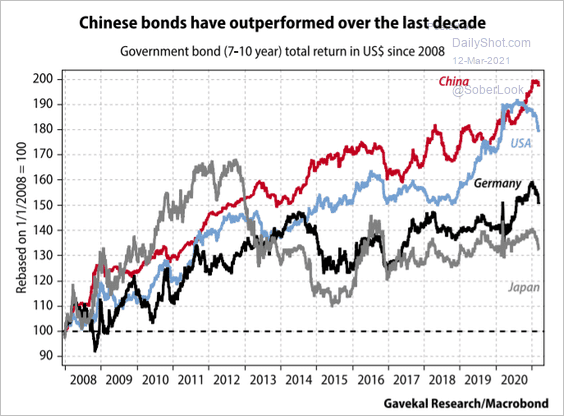

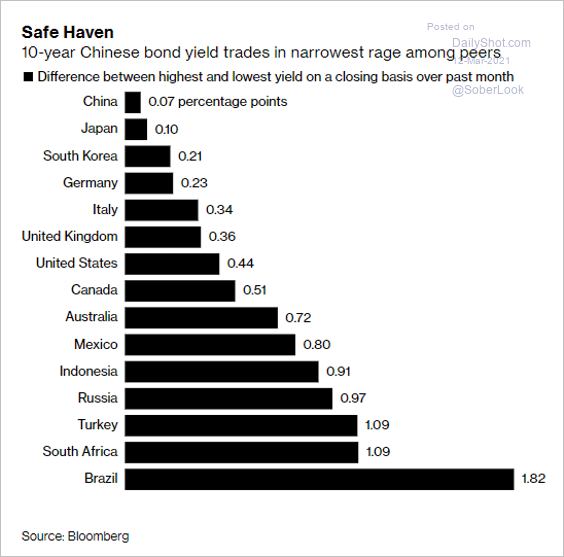

1. China’s bonds have outperformed over the past decade.

Source: Gavekal Research

Source: Gavekal Research

Recently, the 10-year yield trading range has been remarkably tight.

Source: @tracyalloway Read full article

Source: @tracyalloway Read full article

——————–

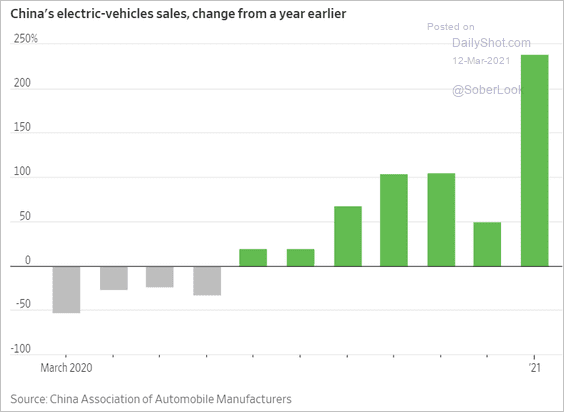

2. EV sales spiked this year.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Asia – Pacific

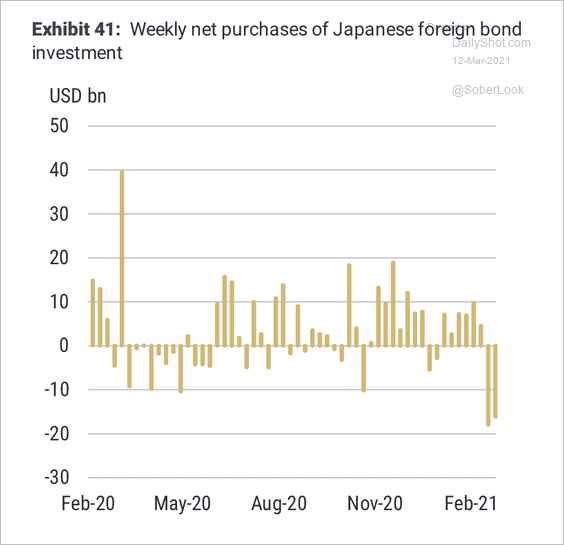

1. Japanese investors were big net sellers of foreign bonds in late February.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

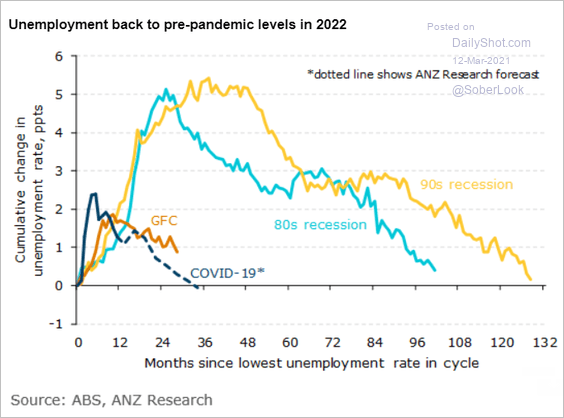

2. Here is a forecast for the Australian unemployment rate from ANZ Research.

Source: ANZ Research

Source: ANZ Research

Back to Index

The Eurozone

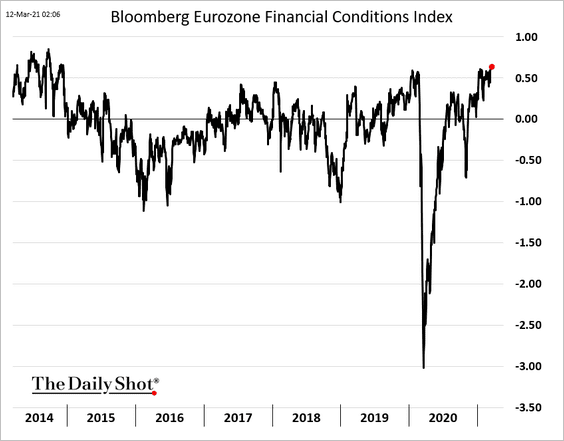

1. It’s not clear just how aggressive the ECB will get in holding down bond yields in the future (see the rates section). After all, the Eurozone financial conditions remain highly accommodative.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

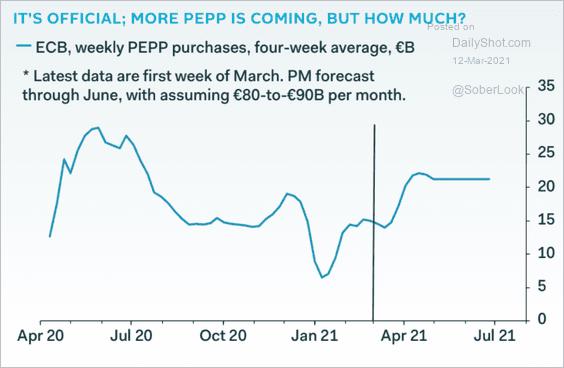

Here is a forecast for the ECB’s securities purchases from Pantheon Macroeconomics.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

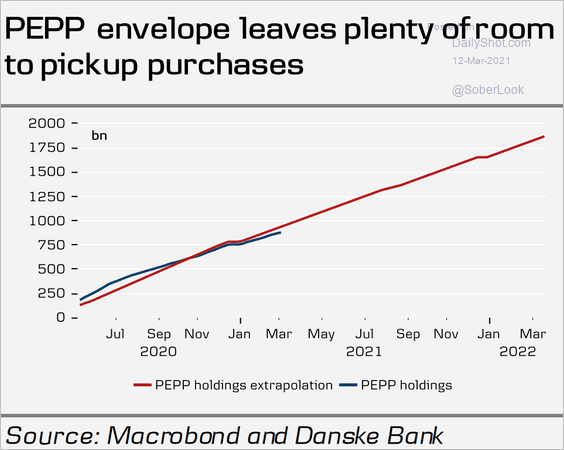

There is certainly room to do more.

Source: Danske Bank

Source: Danske Bank

——————–

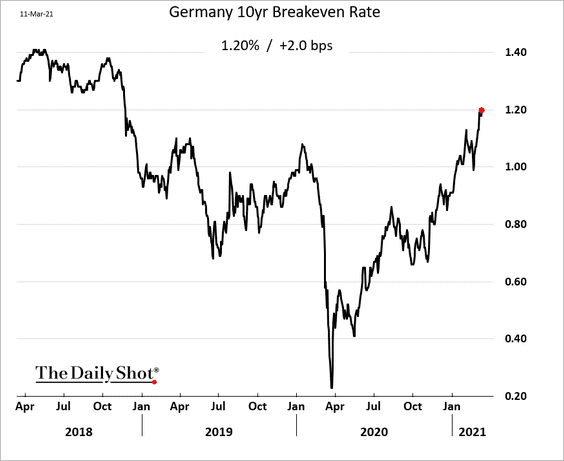

2. The ECB’s announcement further boosted market-based inflation expectations.

——————–

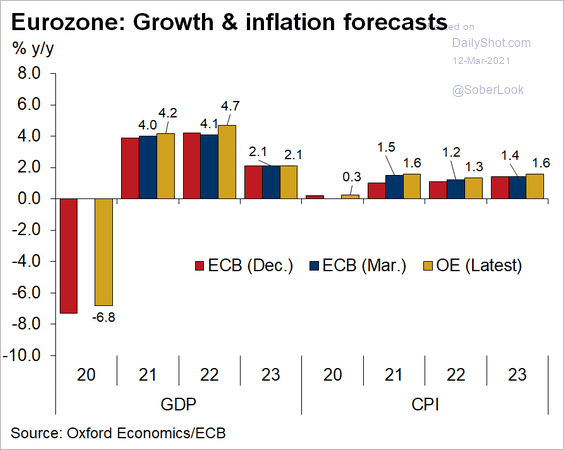

3. Growth and inflation forecasts were little changed in the latest ECB release. Here is a comparison with the projections from Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

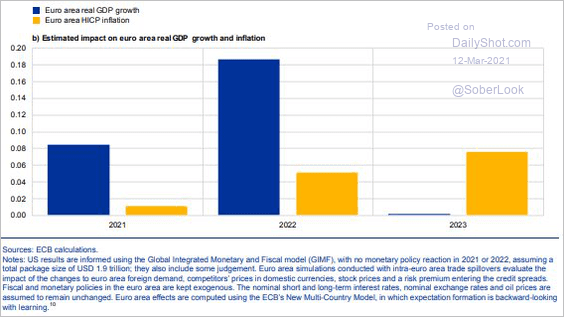

4. The US fiscal stimulus is expected to have a visible impact on the euro-area growth and inflation.

Source: @nghrbi

Source: @nghrbi

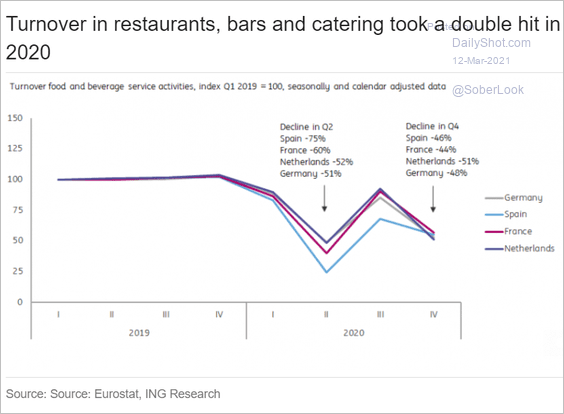

5. The recovery in hours worked has stalled, …

Source: ANZ Research

Source: ANZ Research

… as turnover at restaurants and bars took a double hit last year.

Source: ING

Source: ING

Back to Index

Canada

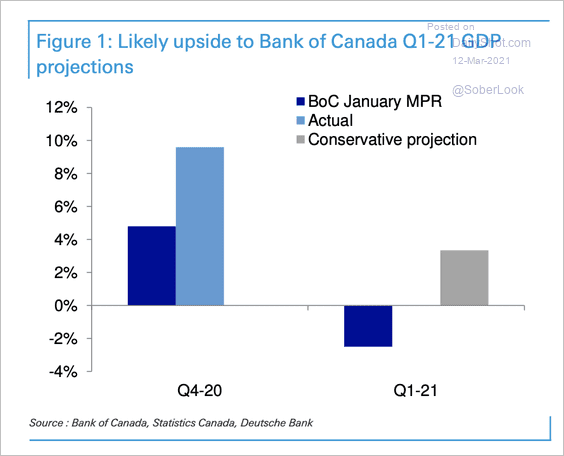

Deutsche Bank sees limited upside to the Bank of Canada’s Q1-Q2 GDP projections.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

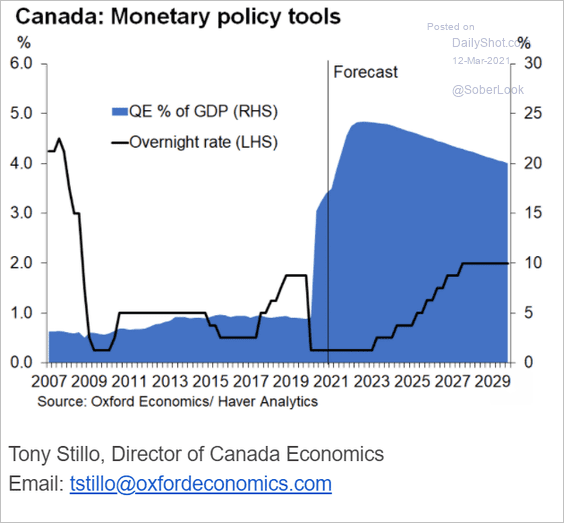

Here is a forecast for the BoC balance sheet (% of GDP) and the policy rate from Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

The United States

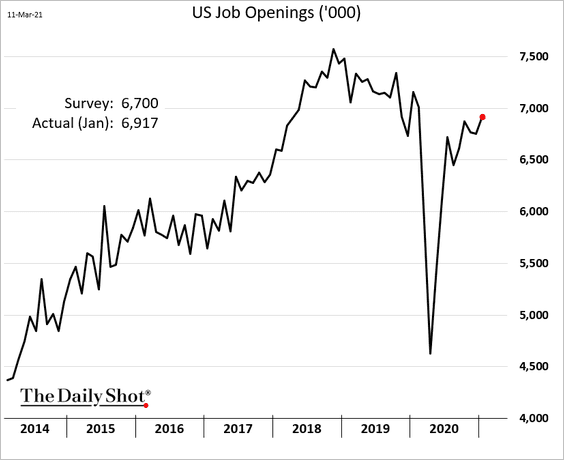

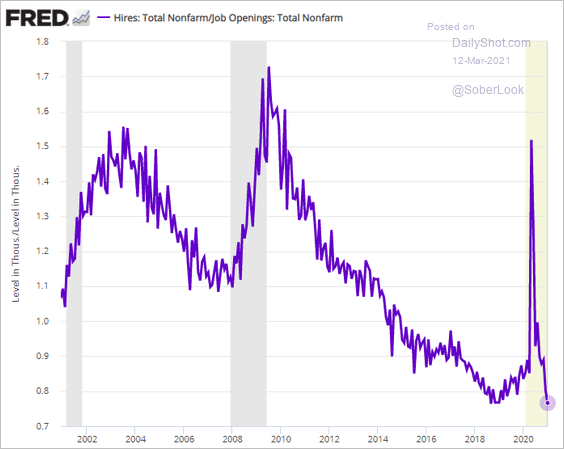

1. January job openings were stronger than expected.

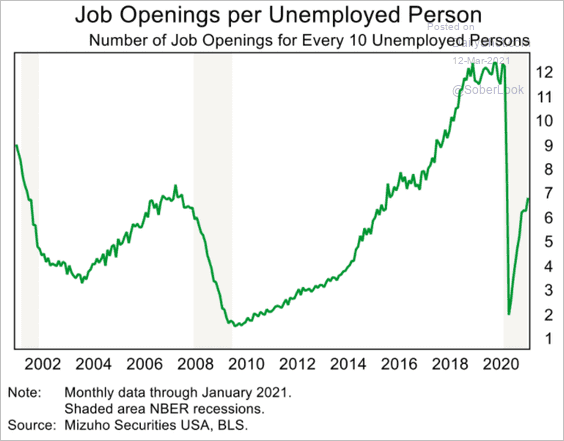

• Here is the number of vacancies per ten unemployed workers.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

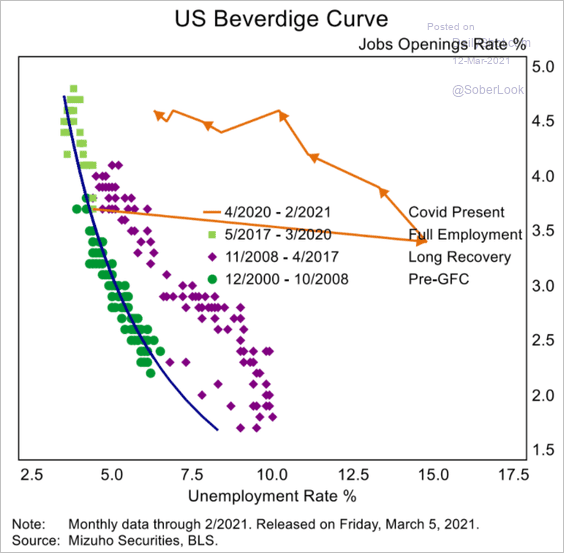

The Beveridge curve shows that the labor market recovery has ways to go.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

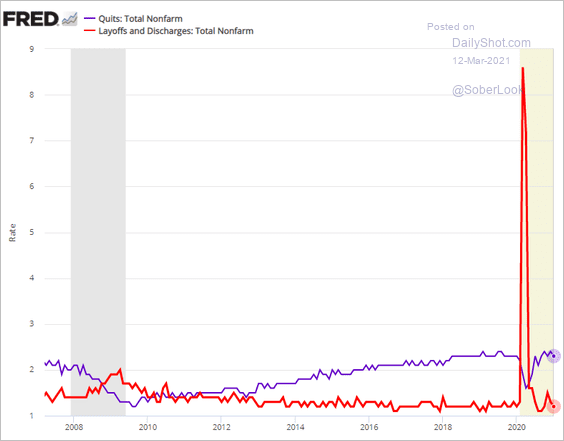

• Layoffs eased, while voluntary resignations (quits rate) are back at pre-COVID levels.

• But hiring was slow in January. The hires-to-openings ratio hit a record low, pointing to potential labor shortages in some sectors.

——————–

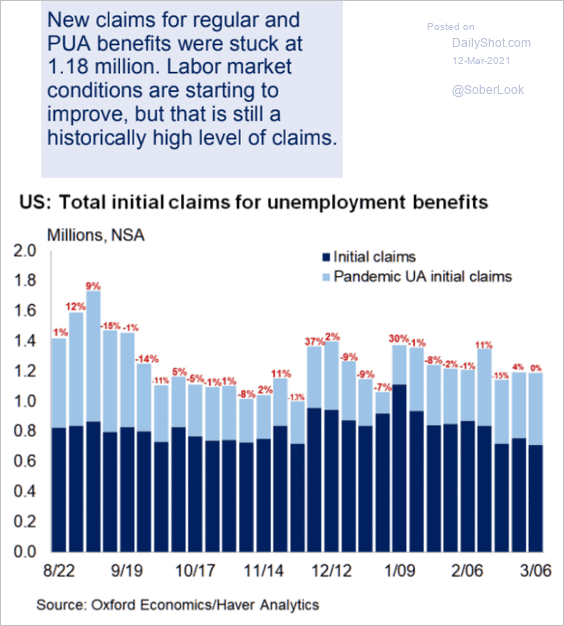

2. New unemployment claims remain well above 1 million per week.

Source: Oxford Economics

Source: Oxford Economics

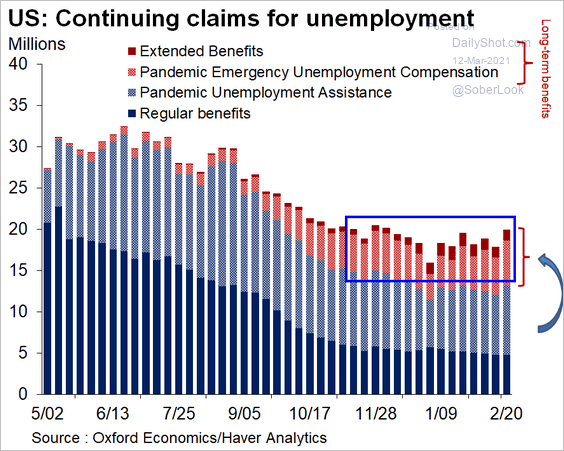

And there hasn’t been much progress on continuing claims.

Source: @GregDaco

Source: @GregDaco

——————–

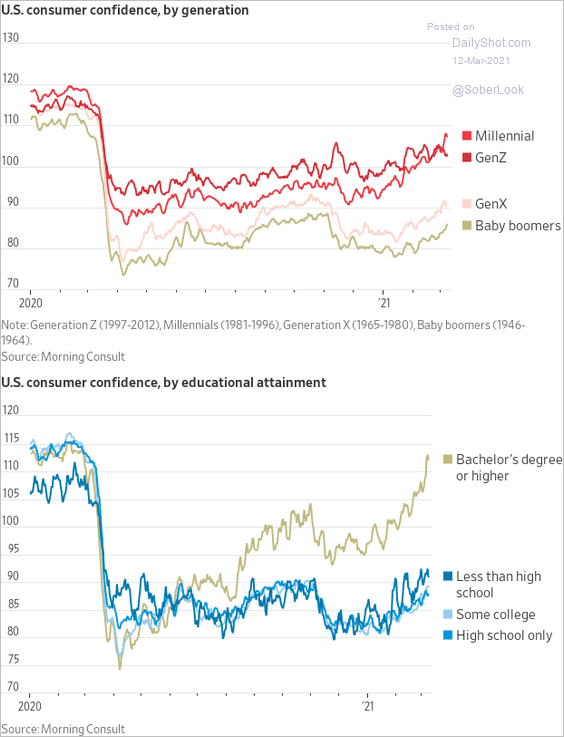

3. The next two charts show the evolution of consumer confidence by generation and educational attainment.

Source: @jeffsparshott

Source: @jeffsparshott

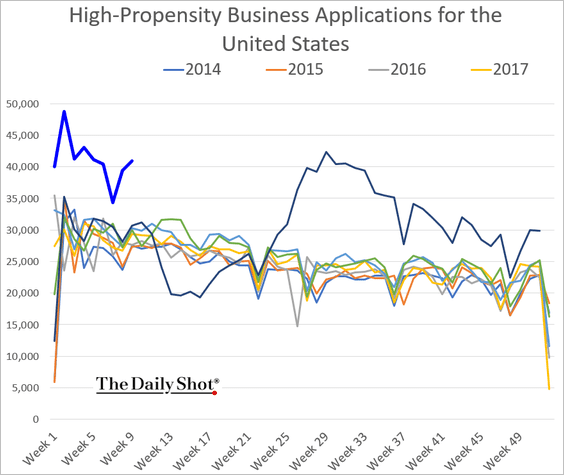

4. Business applications remain elevated.

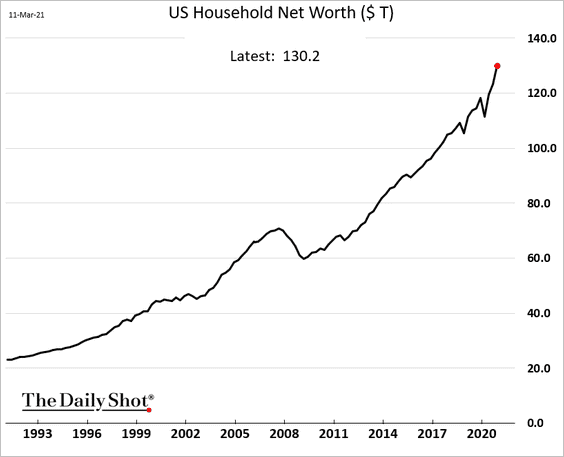

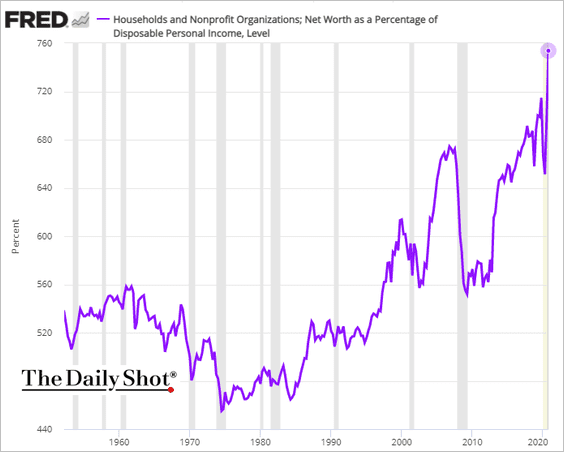

5. US household net worth hit a new record last quarter. And there will likely be substantial gains in the current quarter, adding fuel to economic expansion.

The increase in household net worth as a percentage of disposable income has been remarkable (outpacing the gains during the housing bubble).

——————–

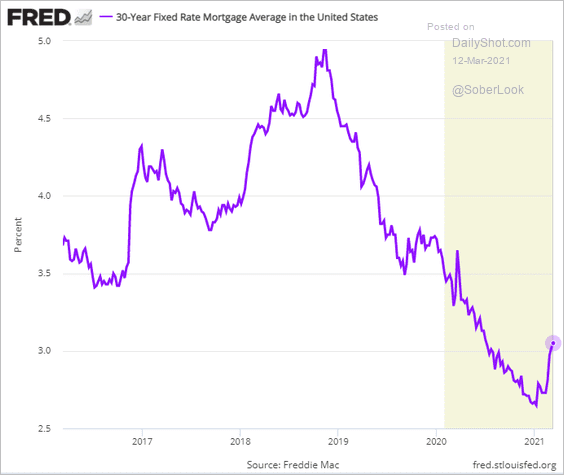

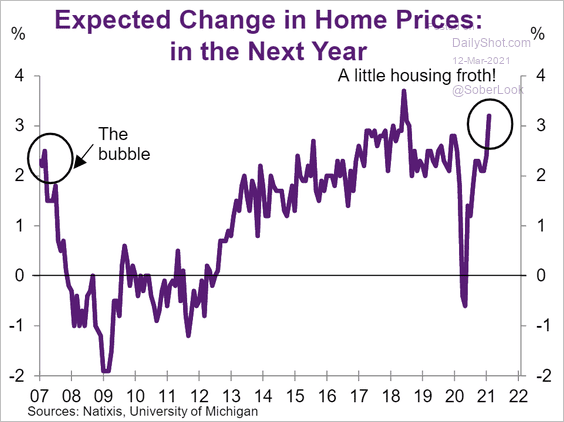

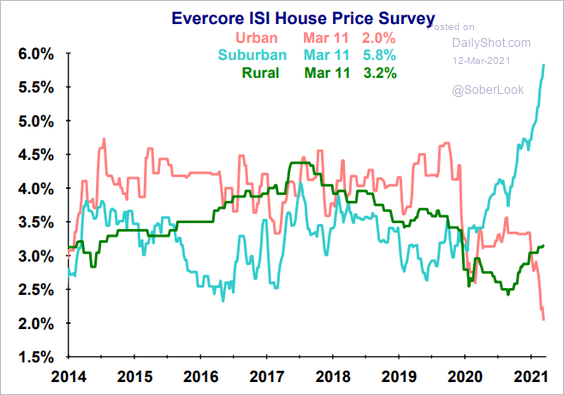

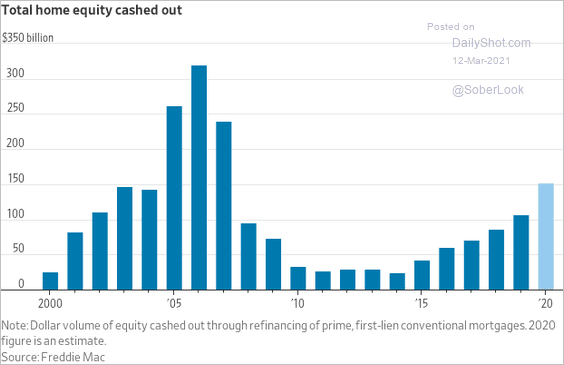

6. Finally, we have some updates on the housing market.

• Mortgage rates rose further in recent days.

• Consumers expect strong gains in home prices.

Source: Natixis

Source: Natixis

• Here is the Evercore ISI house price survey for urban, suburban, and rural communities.

Source: Evercore ISI

Source: Evercore ISI

• Americans are increasingly taking cash out of home equity as house prices rise.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Global Developments

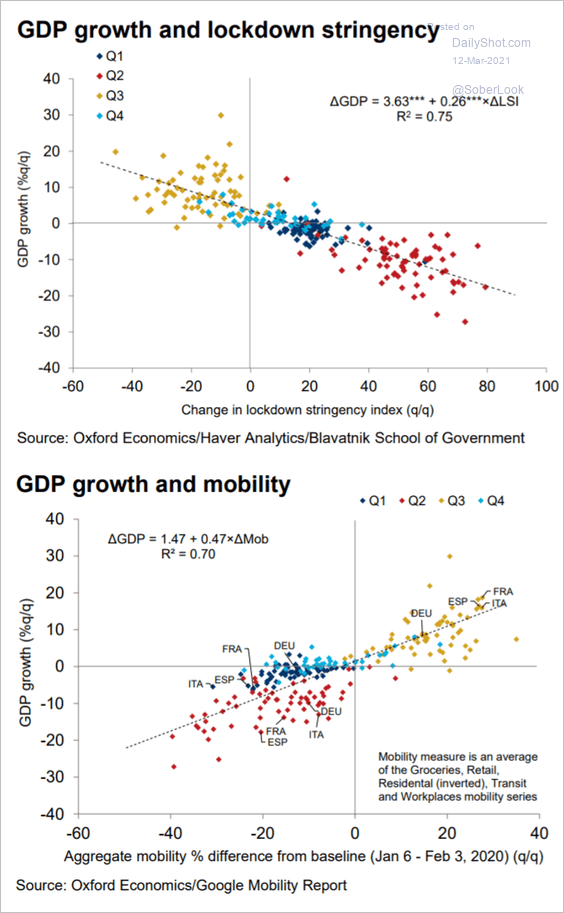

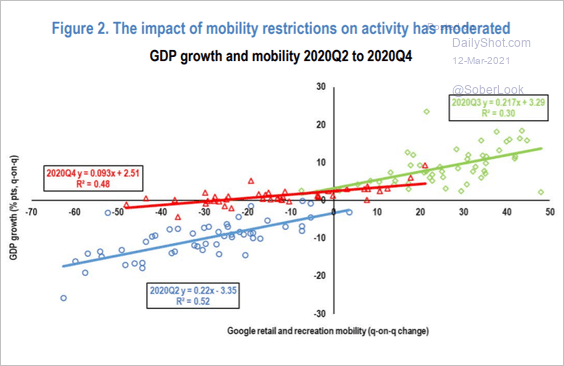

1. How did lockdown stringency and mobility impact GDP growth?

Source: Oxford Economics

Source: Oxford Economics

Source: OECD Read full article

Source: OECD Read full article

——————–

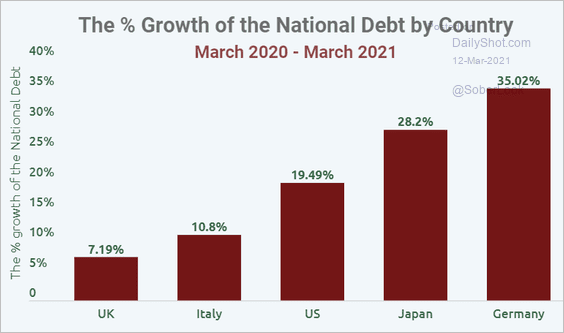

2. Here is the percent growth in national debt by country.

Source: Finbold.com Read full article

Source: Finbold.com Read full article

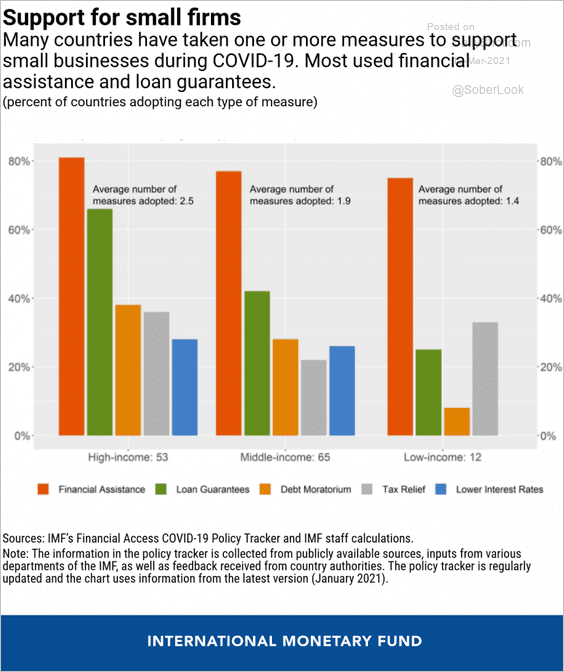

3. What kind of assistance did governments provide for small firms during the pandemic?

Source: IMF Read full article

Source: IMF Read full article

——————–

Food for Thought

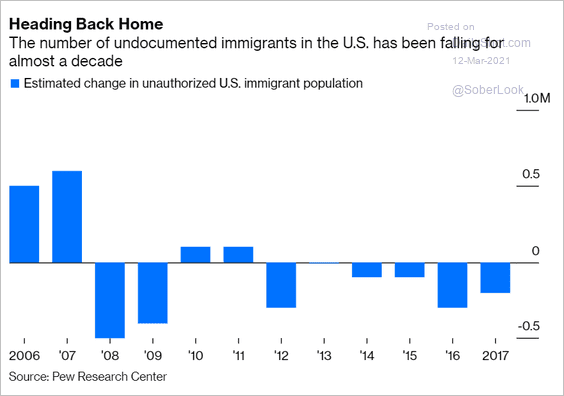

1. Undocumented immigrants in the US:

Source: @Noahpinion, @bopinion Read full article

Source: @Noahpinion, @bopinion Read full article

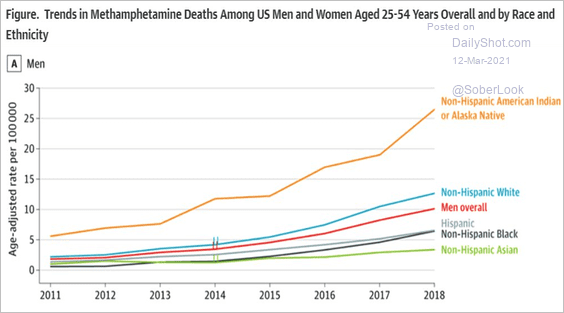

2. Meth-related deaths:

Source: @PotResearch Read full article

Source: @PotResearch Read full article

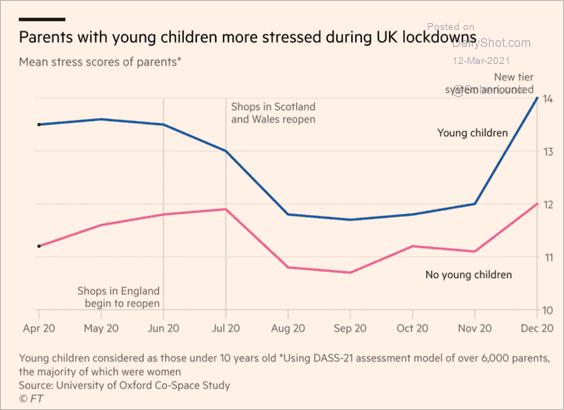

3. Stress on parents with young children during lockdowns:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

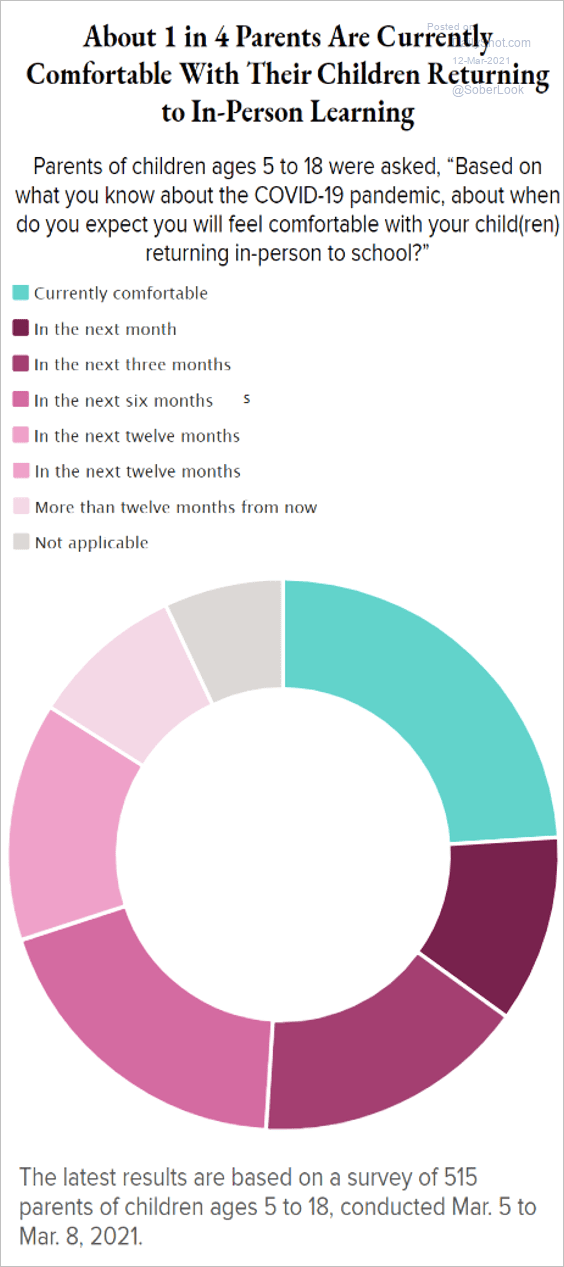

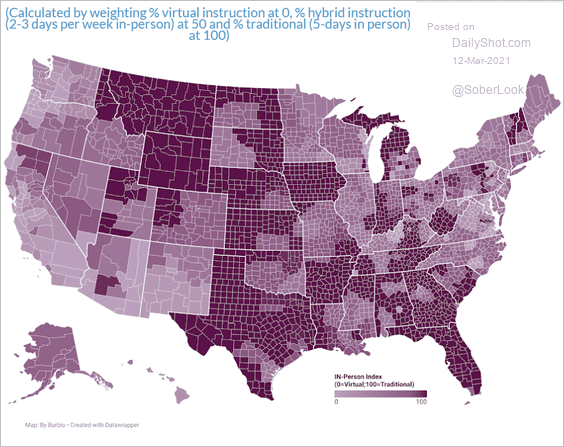

4. Returning to in-person learning:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

The in-person schooling index by county:

Source: Burbio

Source: Burbio

——————–

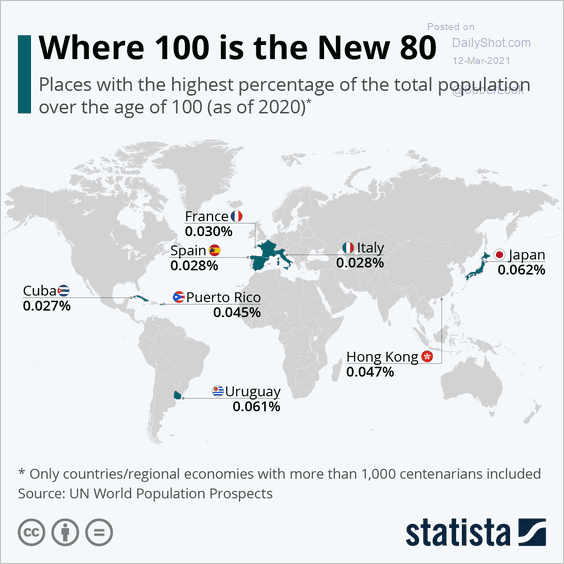

5. Population over the age of 100:

Source: Statista

Source: Statista

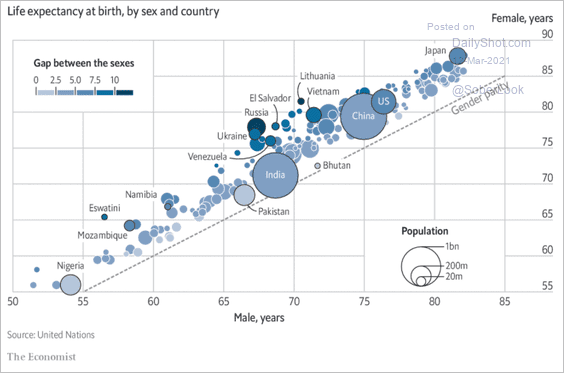

6. Life expectancy:

Source: The Economist Read full article

Source: The Economist Read full article

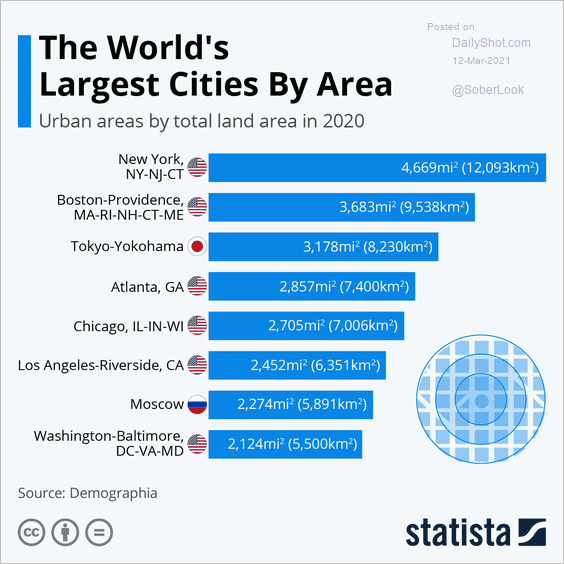

7. World’s largest cities by area:

Source: Statista

Source: Statista

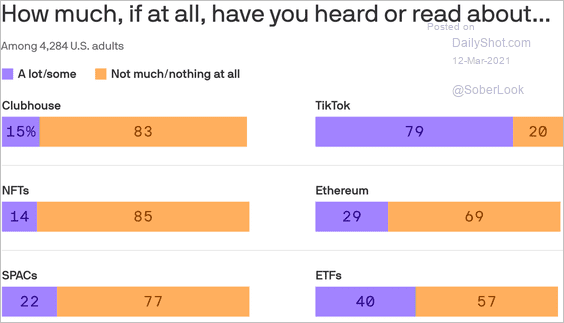

8. How much have you heard about the following?

Source: @axios Read full article

Source: @axios Read full article

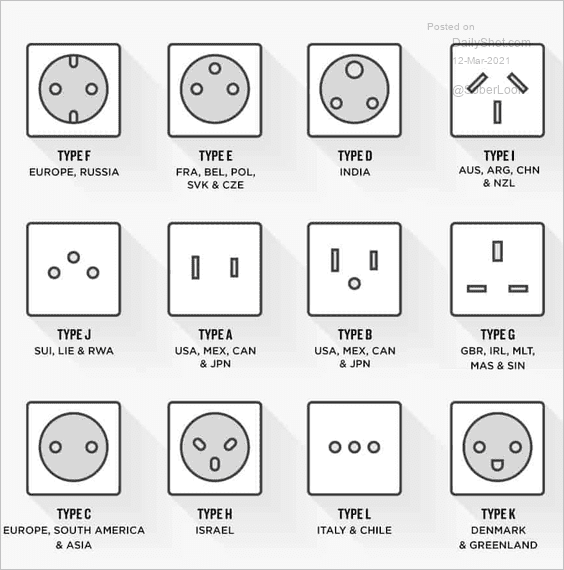

9. Socket types:

Source: South East Asia Backpacker Read full article

Source: South East Asia Backpacker Read full article

——————–

Have a great weekend!

Back to Index