The Daily Shot: 15-Mar-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equity

• Rates

• Food for Thought

The United States

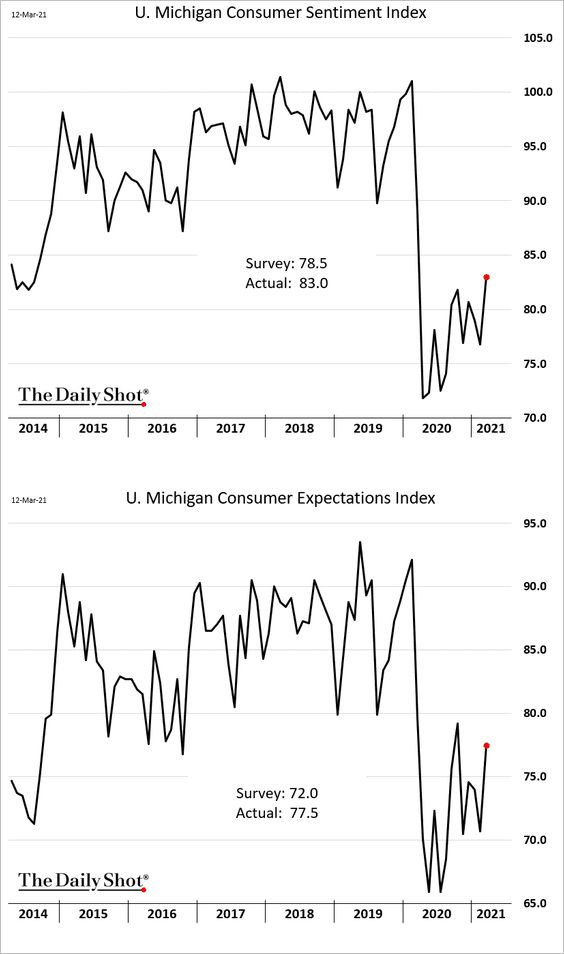

1. Consumer sentiment bounced this month amid soaring stock market, vaccine progress, and falling COVID cases. The improvement topped economists’ forecasts.

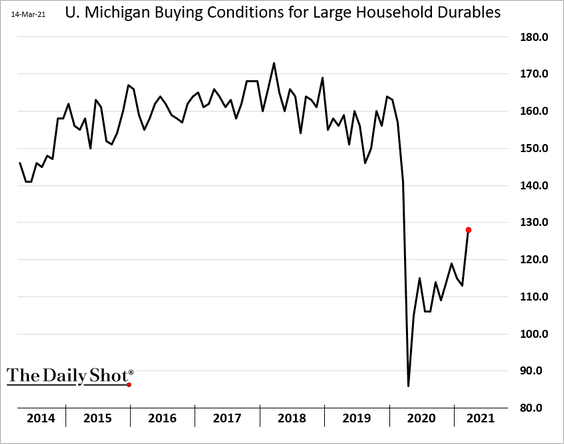

• Households showed interest in purchasing large durables.

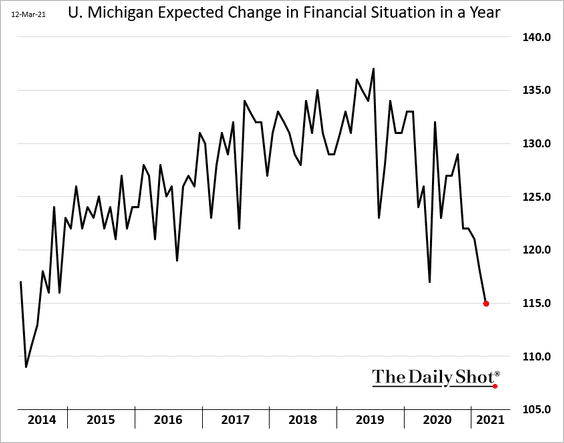

• But consumers seem to be concerned about their financial situation in a year (presumably when government support ends).

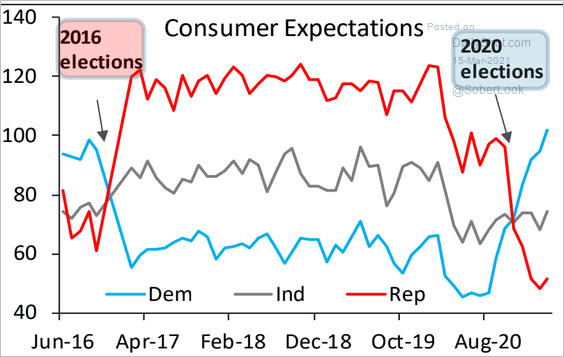

• The political gap remains wide.

Source: Piper Sandler

Source: Piper Sandler

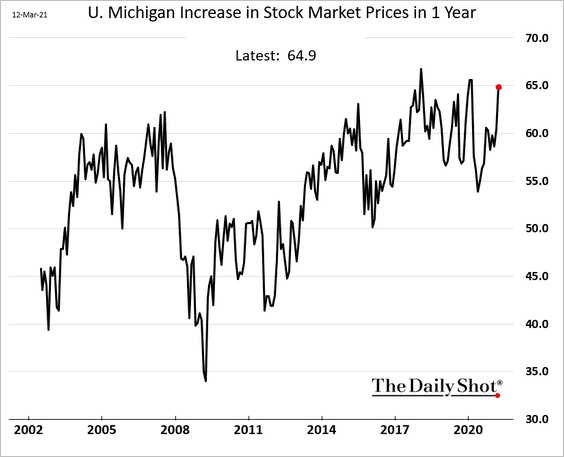

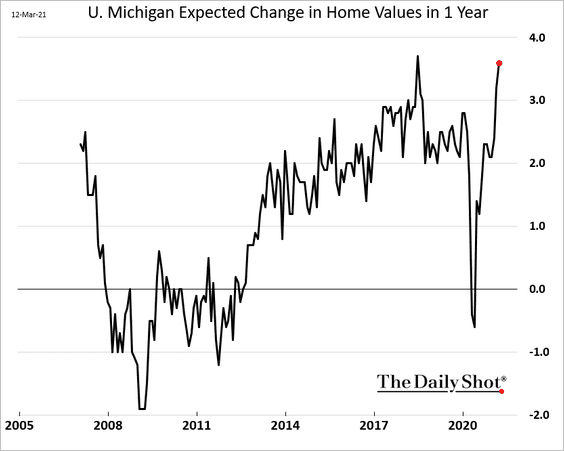

• Consumers are increasingly bullish on stocks and housing.

——————–

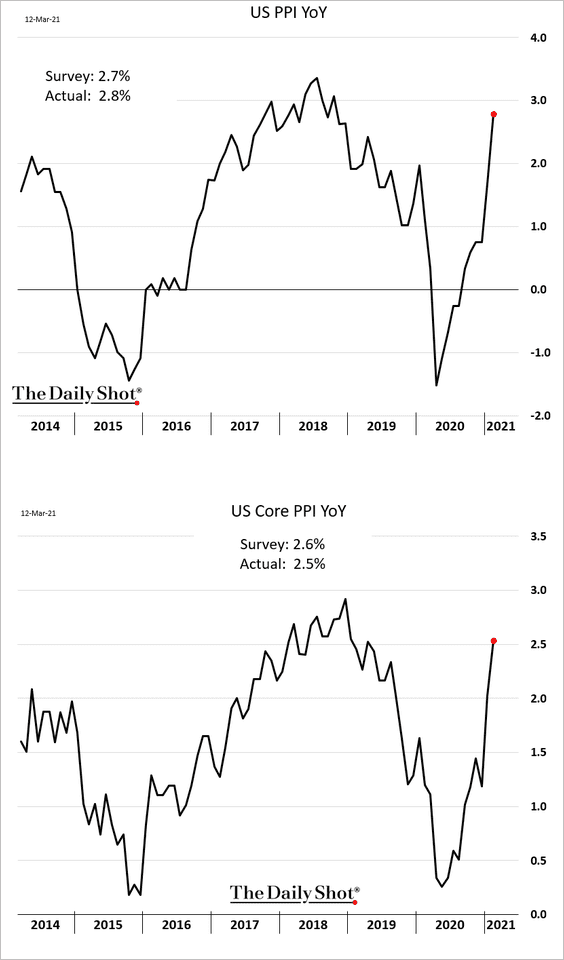

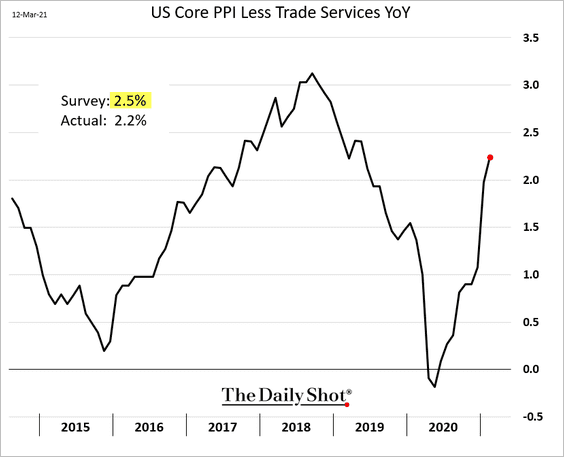

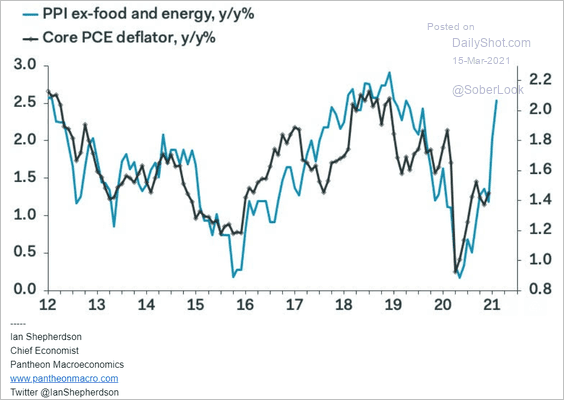

2. Producer price gains accelerated in February.

The core PPI ex. trade services (business markups) rose less than expected.

The PPI increase points to higher core PCE inflation (the Fed’s preferred measure).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

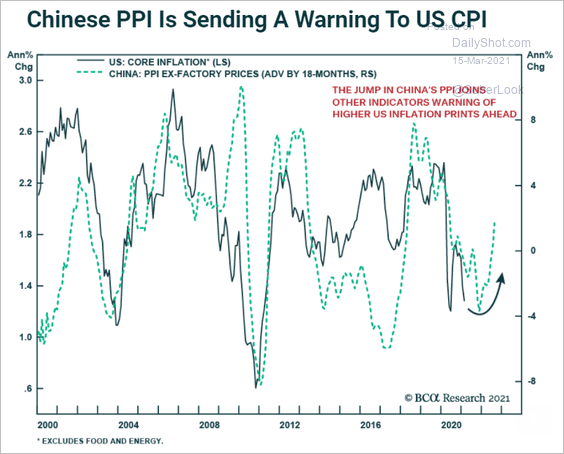

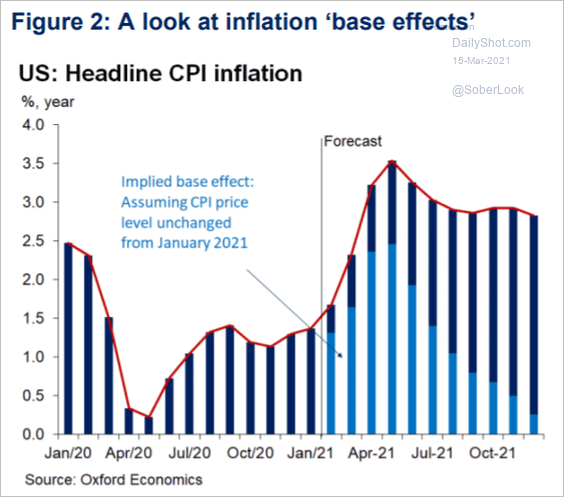

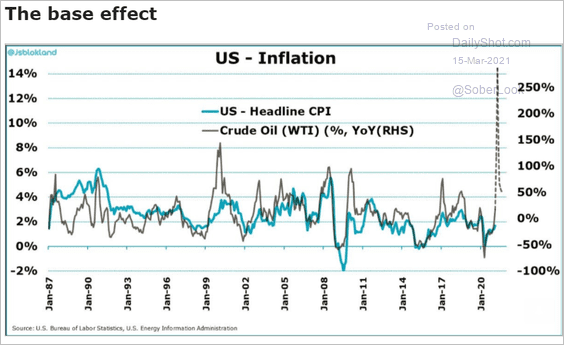

3. Here are some additional updates on inflation.

• China’s PPI vs. US CPI:

Source: BCA Research

Source: BCA Research

• Base effects (2 charts):

Source: @GregDaco

Source: @GregDaco

Source: @jsblokland

Source: @jsblokland

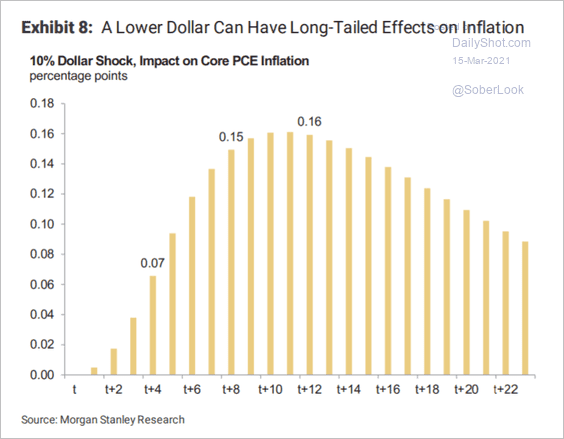

• What is the impact of a weaker dollar on inflation?

Source: Morgan Stanley Research

Source: Morgan Stanley Research

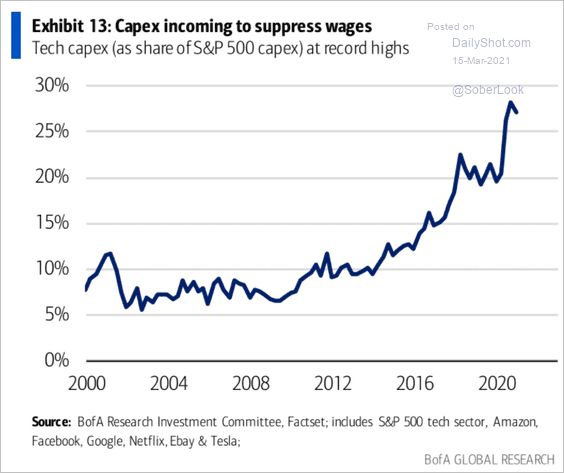

• Will increased CapEx boost productivity sufficiently to cap wage growth?

Source: BofA Global Research

Source: BofA Global Research

• The economy growing significantly above potential over the next few quarters could be inflationary.

Source: Moody’s Analytics

Source: Moody’s Analytics

——————–

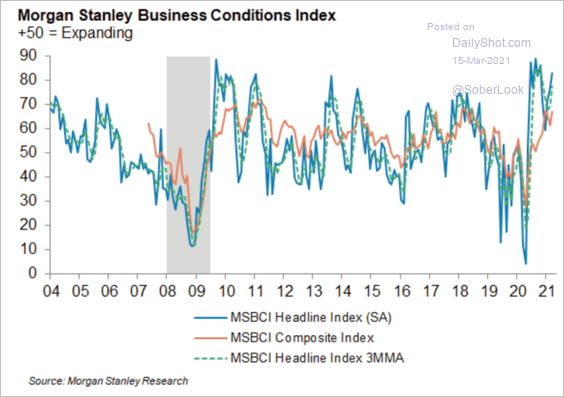

4. According to Morgan Stanley, business conditions have improved markedly in recent months.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

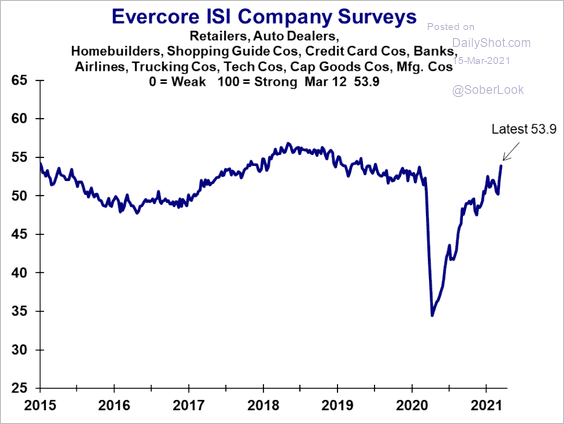

The Evercore ISI business survey index is above pre-COVID levels.

Source: Evercore ISI

Source: Evercore ISI

——————–

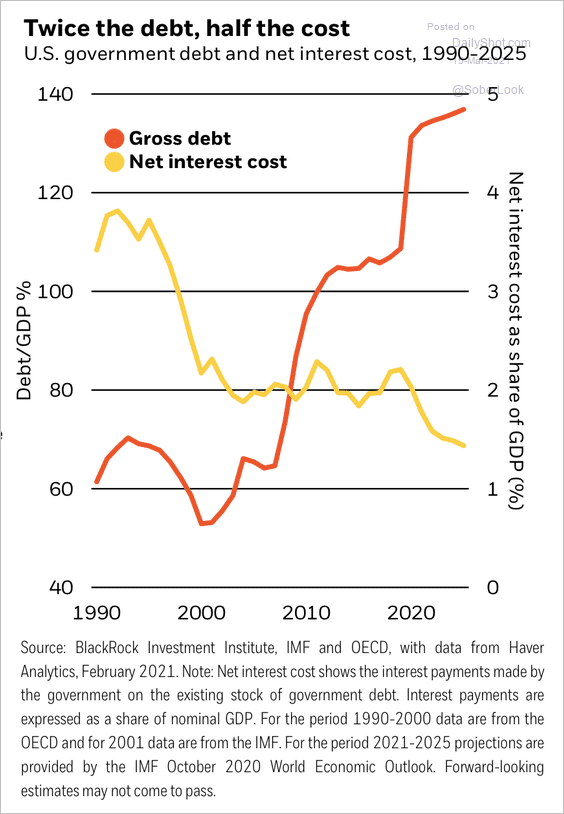

5. Finally, we have some updates on the US fiscal situation.

• In the next few years, government debt is poised to reach a record level of 135% of GDP based on IMF forecasts – twice as high as in the 1990s. But financing costs are about 50% lower as a share of GDP.

Source: BlackRock

Source: BlackRock

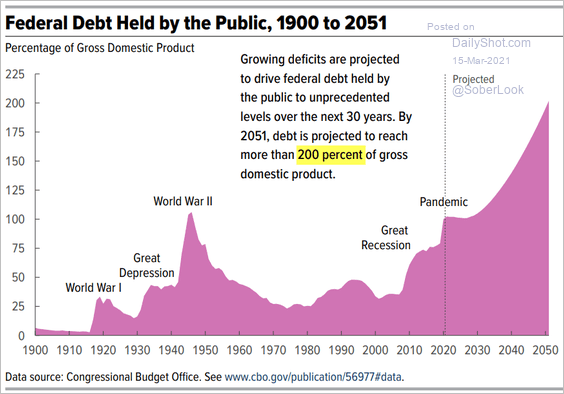

• By 2050, the nation’s federal debt is projected to reach 200% of the GDP.

Source: CBO

Source: CBO

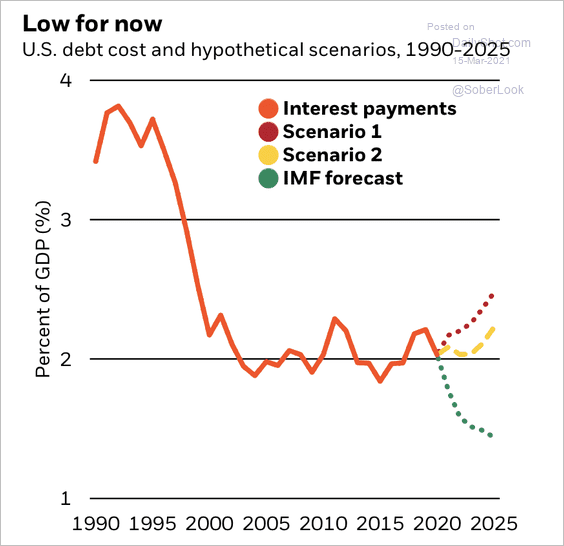

• Here are some estimates of future debt costs.

Source: BlackRock

Source: BlackRock

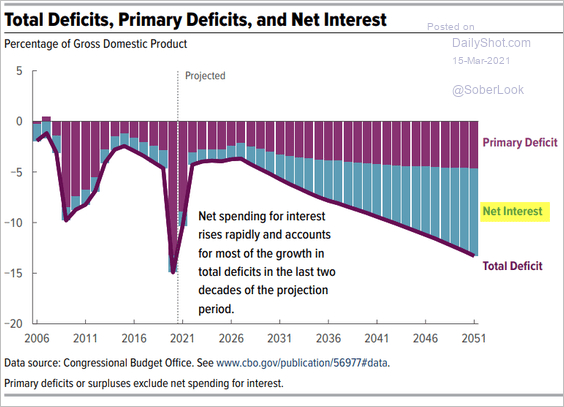

• Over the long run, the deficit will be increasingly dominated by interest expenses.

Source: CBO

Source: CBO

Back to Index

Canada

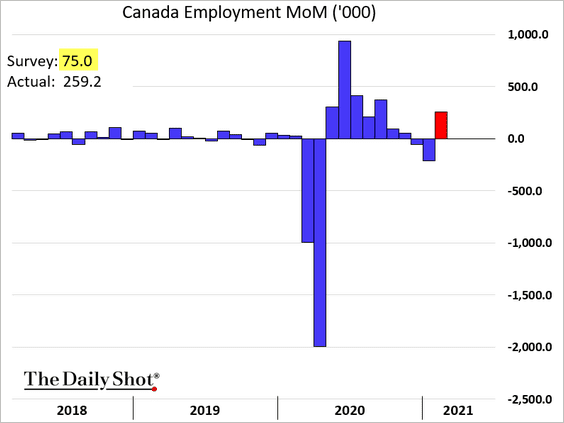

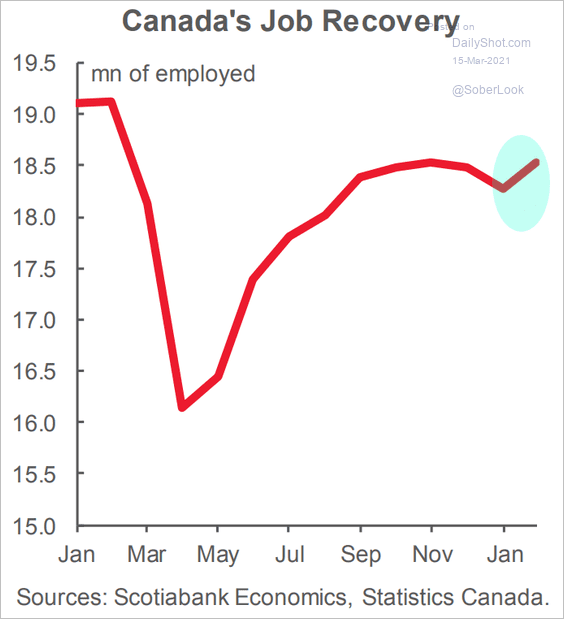

1. The February employment report was much stronger than markets were expecting.

Source: Scotiabank Economics

Source: Scotiabank Economics

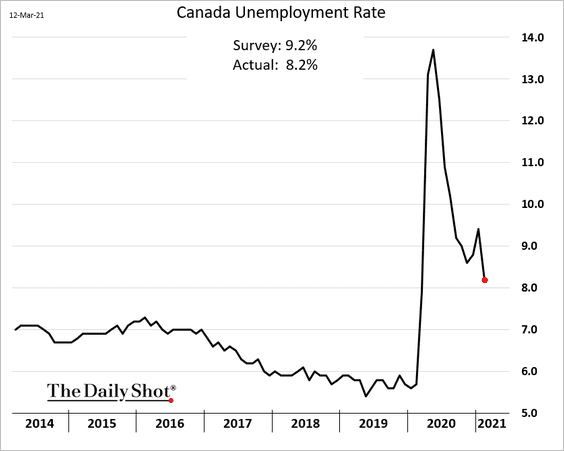

The unemployment rate dropped sharply.

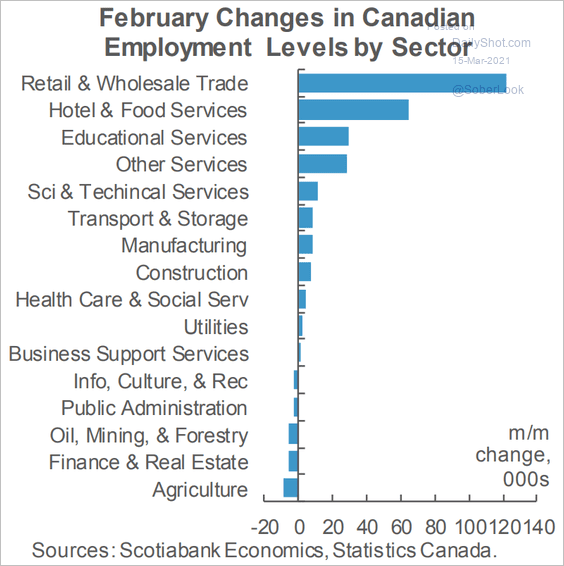

Here is the breakdown by sector.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

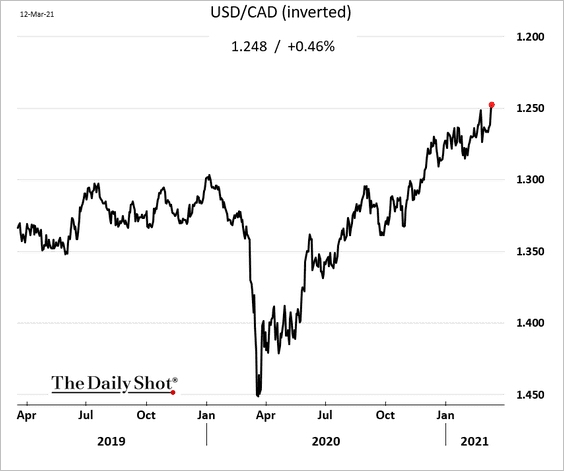

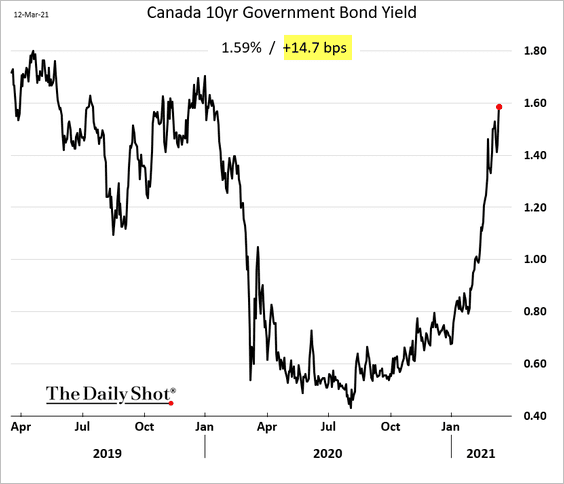

2. The loonie and bond yields jumped in response to the employment surprise.

——————–

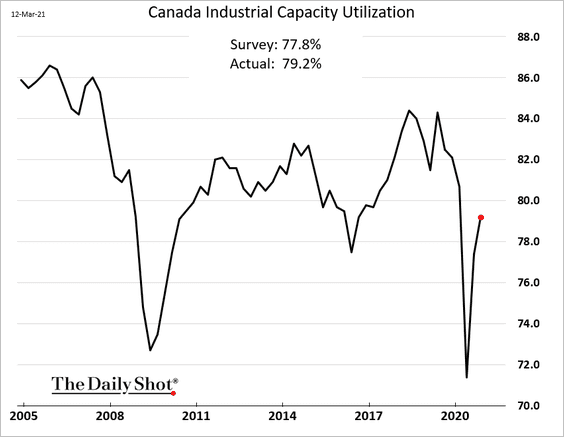

3. Industrial capacity utilization improved further in Q4.

Back to Index

The United Kingdom

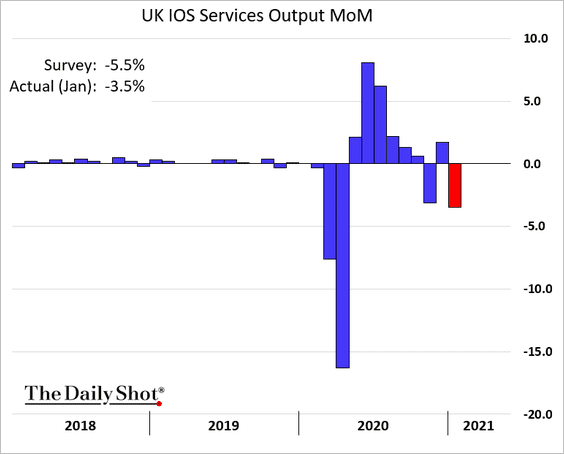

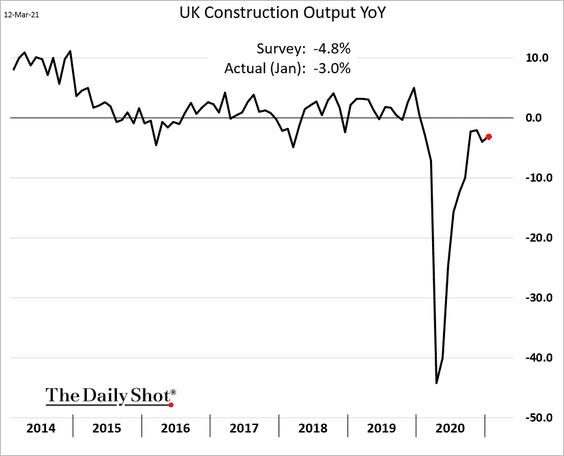

1. The January GDP decline was less severe than expected (-2.9% vs. -4.9% forecast). Here is the service sector.

Construction held up well.

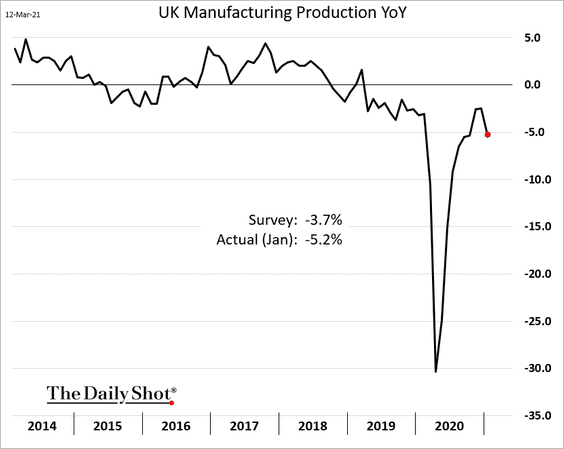

However, manufacturing production weakened sharply.

——————–

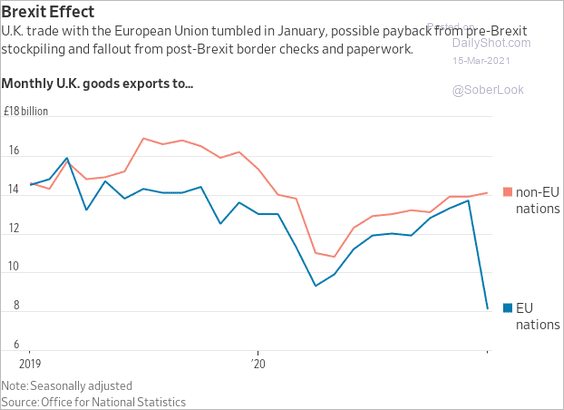

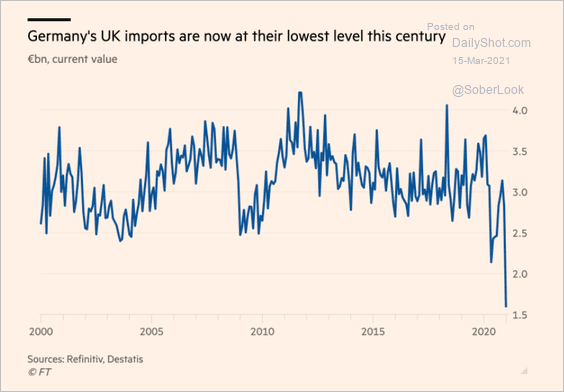

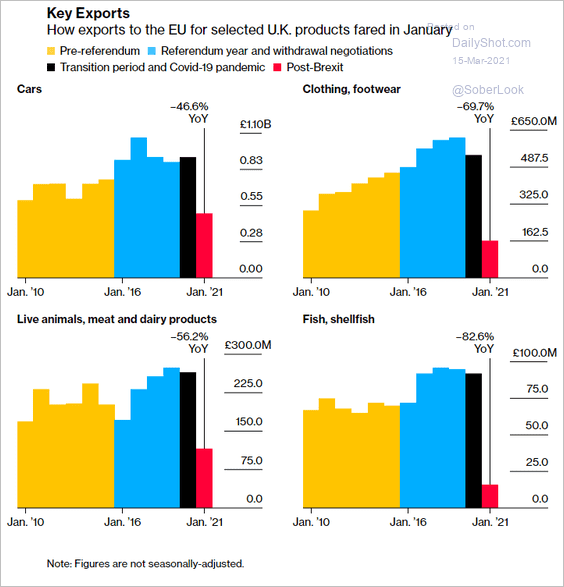

2. Exports to the EU tumbled.

Source: @jeffsparshott

Source: @jeffsparshott

Source: @adam_tooze, @valentinaromei Read full article

Source: @adam_tooze, @valentinaromei Read full article

This chart shows exports in select sectors.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

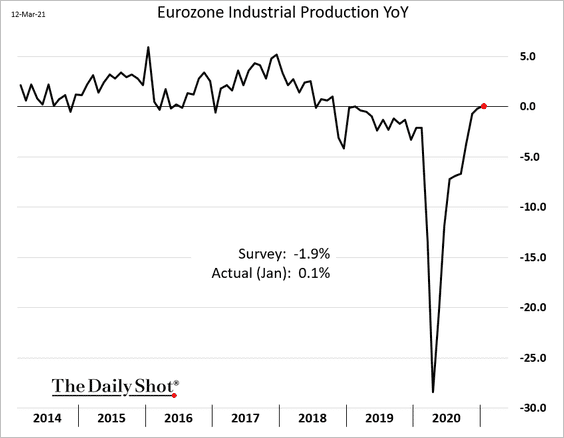

The Eurozone

1. January industrial production surprised to the upside and is now positive on a year-over-year basis.

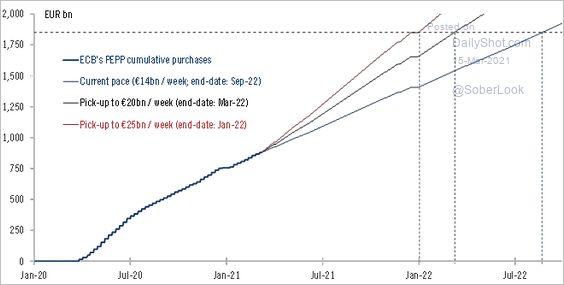

2. How much will the ECB accelerate its securities purchases?

Source: @fwred

Source: @fwred

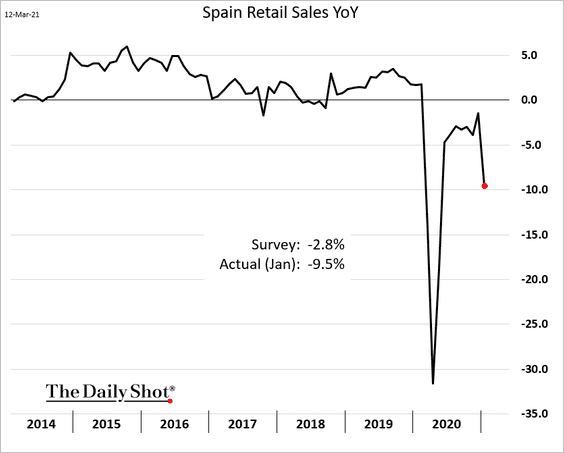

3. Spain’s retail sales tumbled at the beginning of the year.

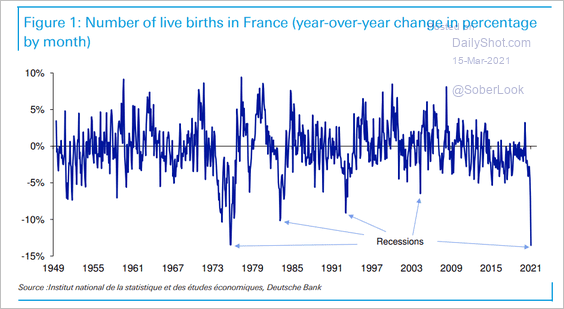

4. The number of births in France plummeted over the past year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

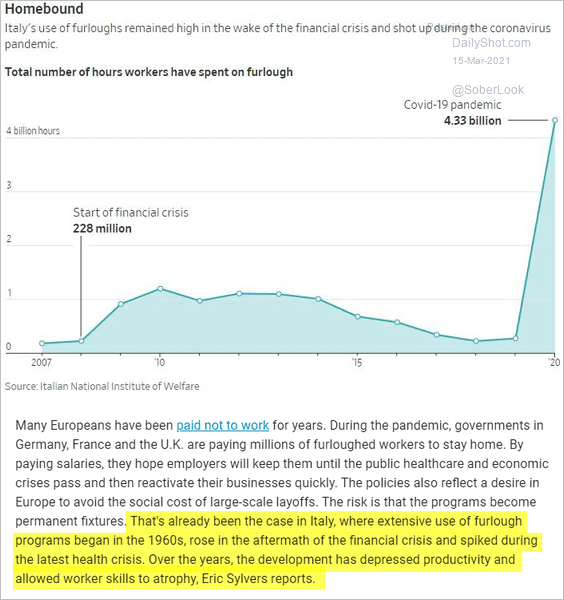

5. This chart illustrates Italy’s use of furloughs (see comment below from the Wall Street Journal).

Source: @WSJ Read full article

Source: @WSJ Read full article

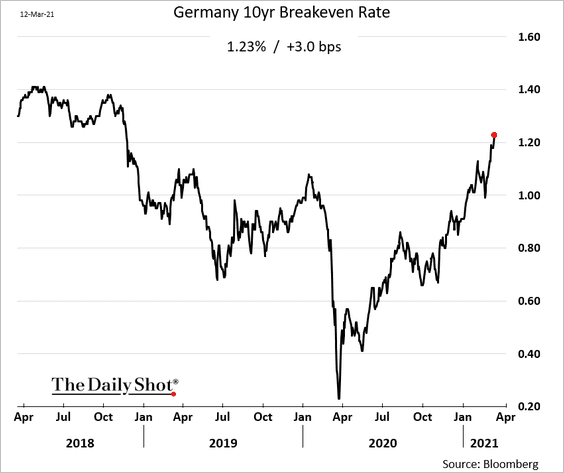

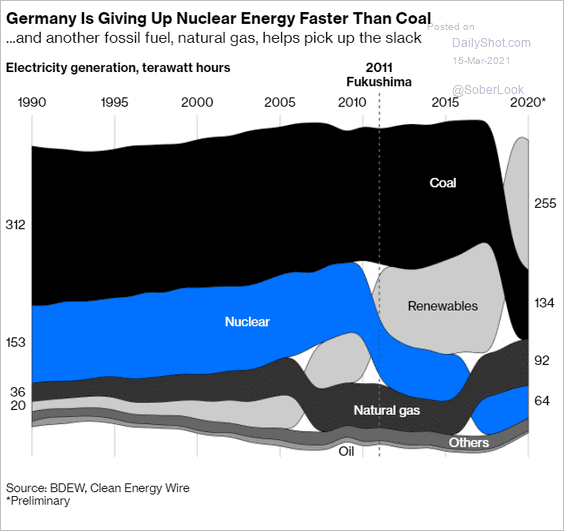

6. Next, we have some updates on Germany.

• Market-based inflation expectations:

• Electricity generation sources:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

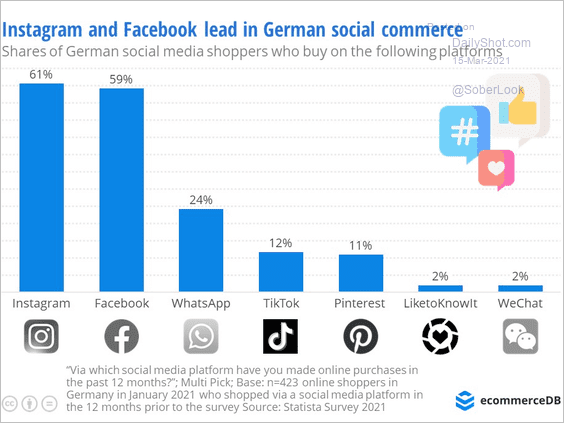

• Social commerce:

Source: ecommerceDB Read full article

Source: ecommerceDB Read full article

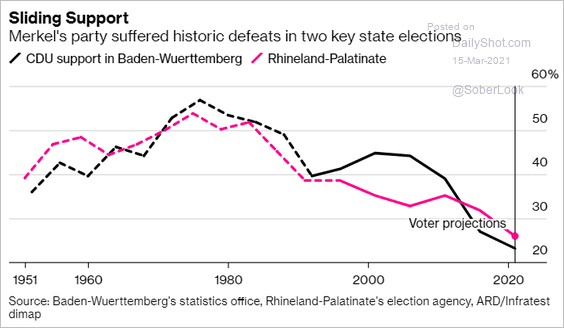

• CDU’s performance in regional elections:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

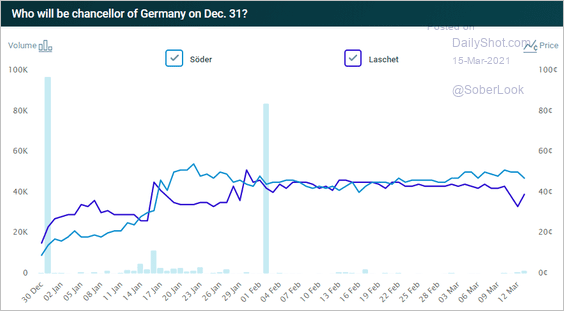

• Betting markets’ odds for chancellor:

Source: @PredictIt

Source: @PredictIt

Back to Index

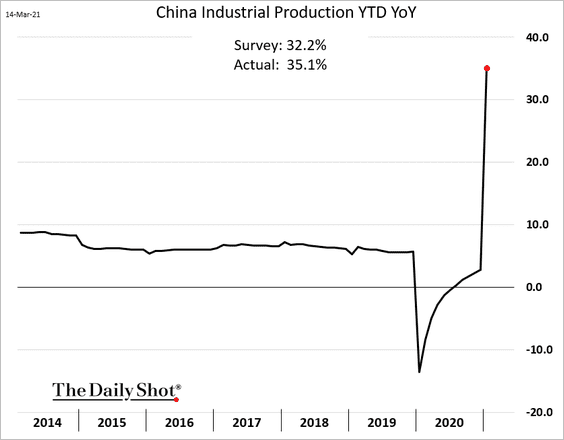

China

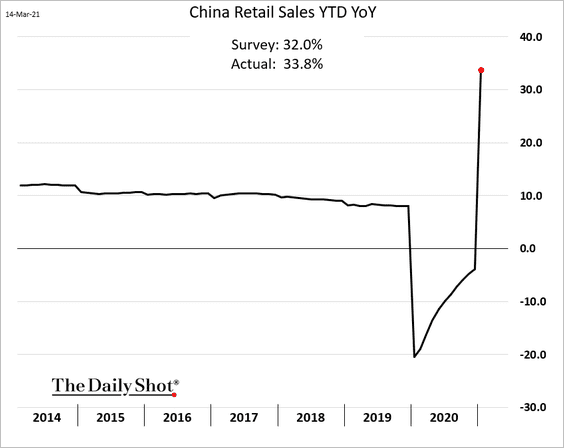

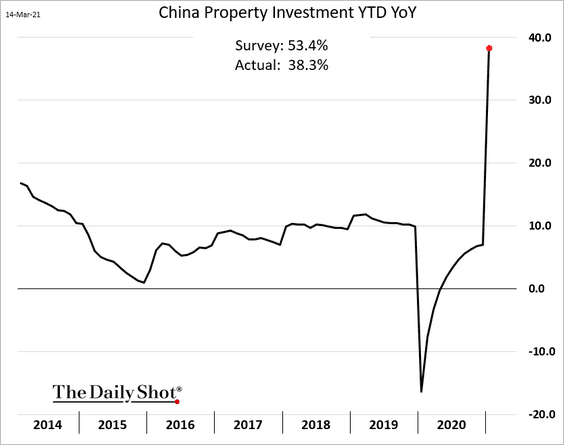

1. February economic data exceeded forecasts. Note that a large portion of the increases below are base effects (China was shut down in Feb 2020). But aside from the base effects, the economy performed well last month.

• Industrial production:

• Retail sales:

——————–

2. Property investment was softer than expected.

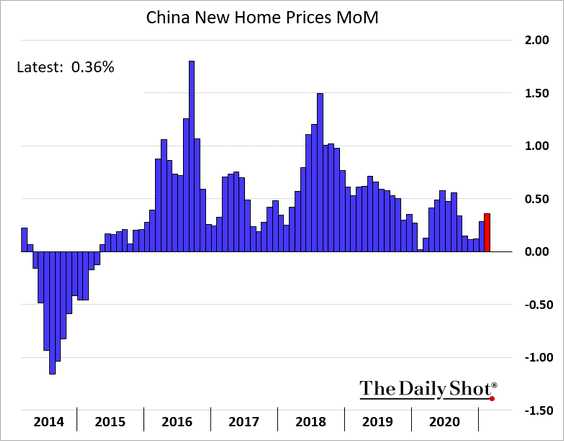

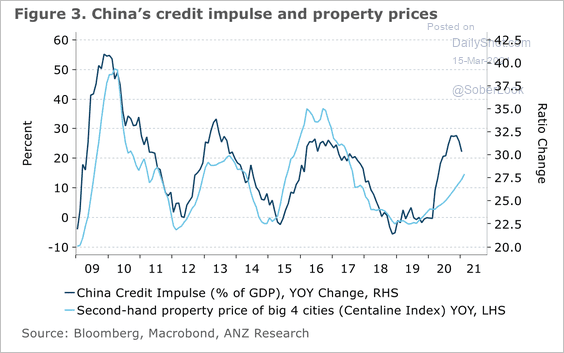

3. Home price appreciation is strengthening.

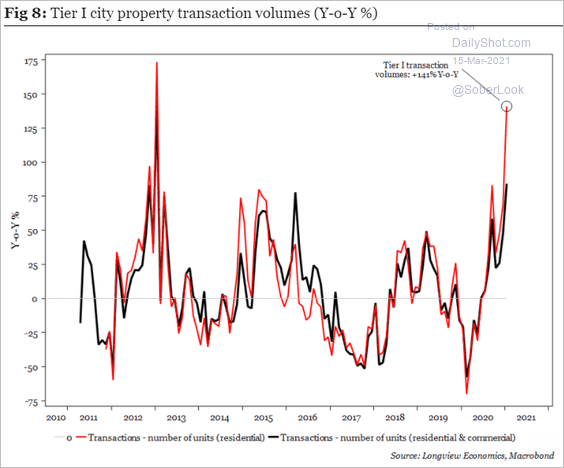

Sales activity in tier-I cities has accelerated.

Source: Longview Economics

Source: Longview Economics

The recent decline in China’s credit impulse suggests a slowdown in property price gains ahead.

Source: ANZ Research

Source: ANZ Research

——————–

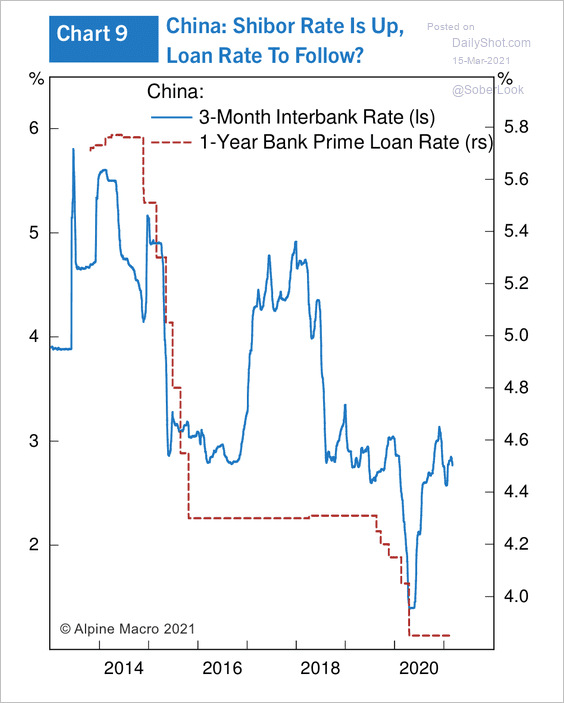

4. The Shibor rate has increased over the past year, while the benchmark lending rate remains at pandemic lows.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Emerging Markets

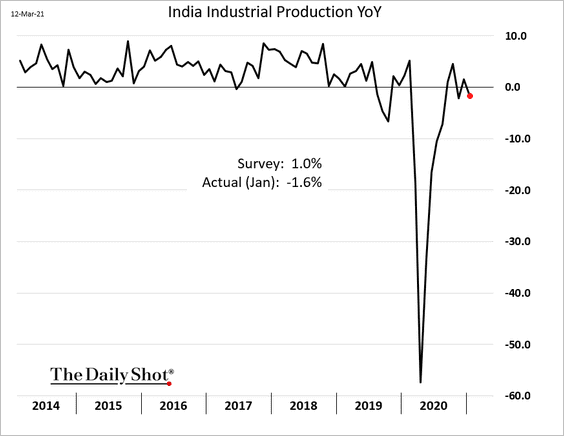

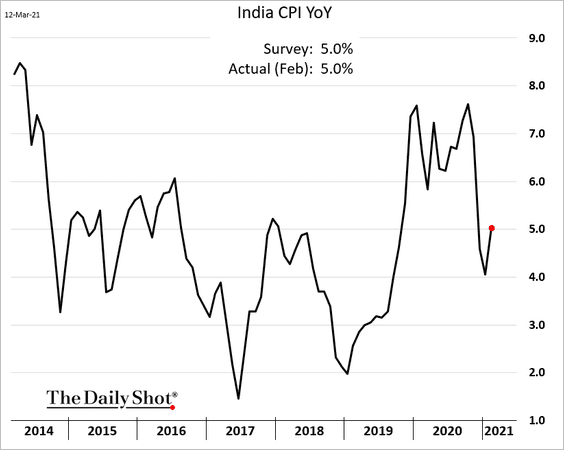

1. India’s industrial production unexpectedly declined in January.

Separately, consumer inflation is back at 5%.

——————–

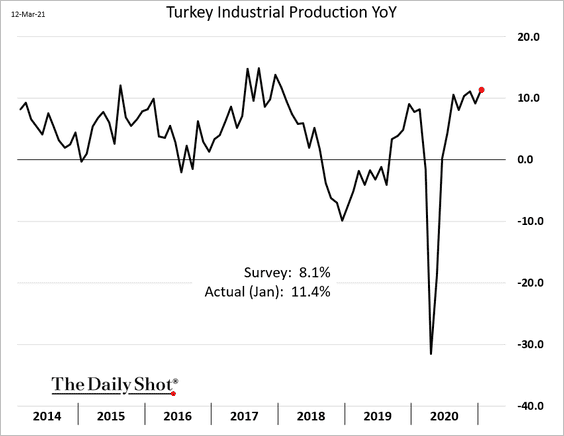

2. Turkey’s industrial production was up 11.4% on a year-over-year basis.

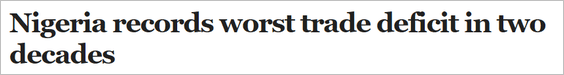

3. Nigeria’s trade deficit hit a new high.

Source: Premium Times Read full article

Source: Premium Times Read full article

——————–

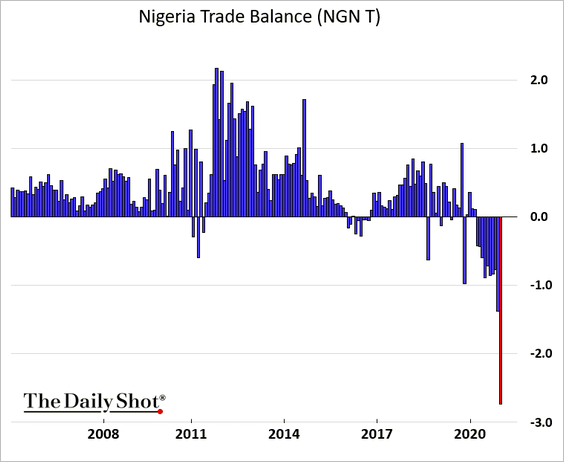

4. Mexico’s industrial production weakened in January.

5. Next, we have some updates on Brazil.

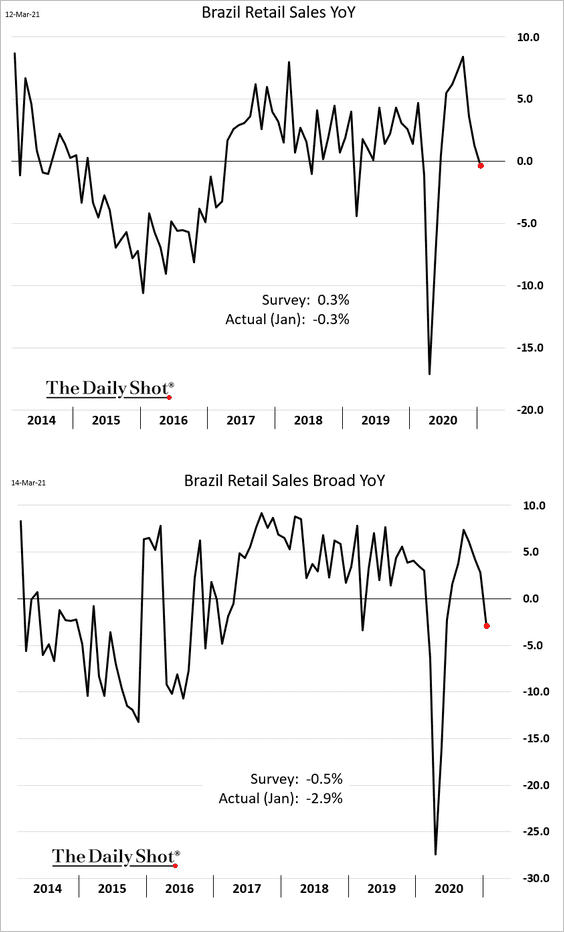

• Retail sales fell again in January (now down on a year-over-year basis).

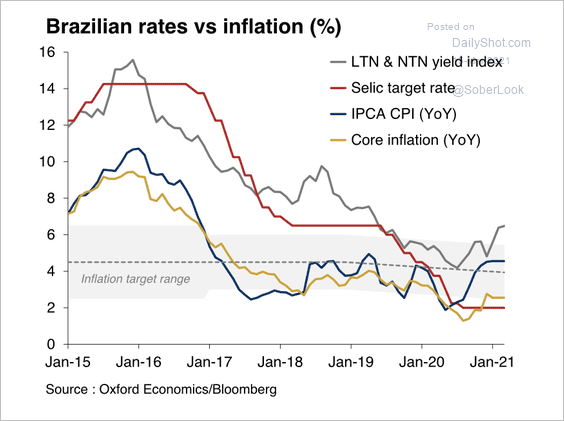

• Brazil’s policy rates have become largely negative in real terms. Will the central bank start a series of rate hikes?

Source: Oxford Economics

Source: Oxford Economics

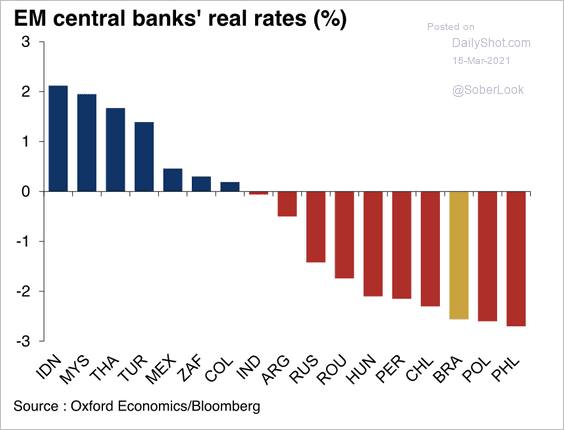

Brazil has one of the most negative real policy rates in EM.

Source: Oxford Economics

Source: Oxford Economics

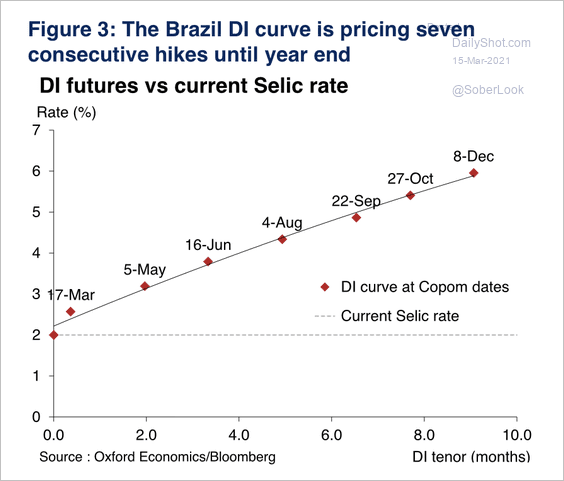

The market is expecting higher rates ahead.

Source: Oxford Economics

Source: Oxford Economics

——————–

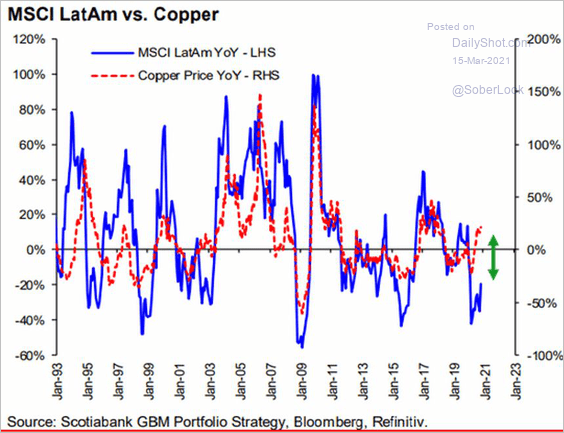

6. LatAm stocks have diverged from copper.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

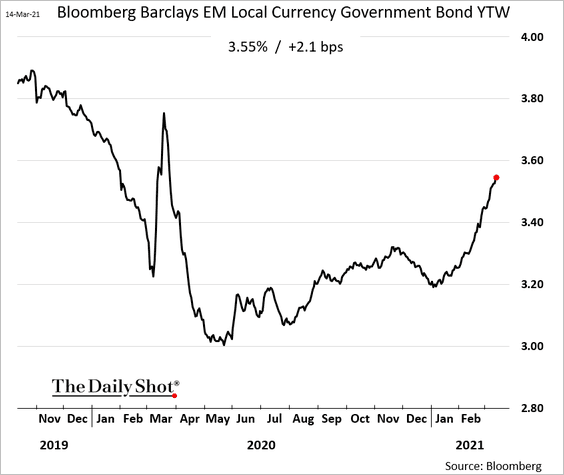

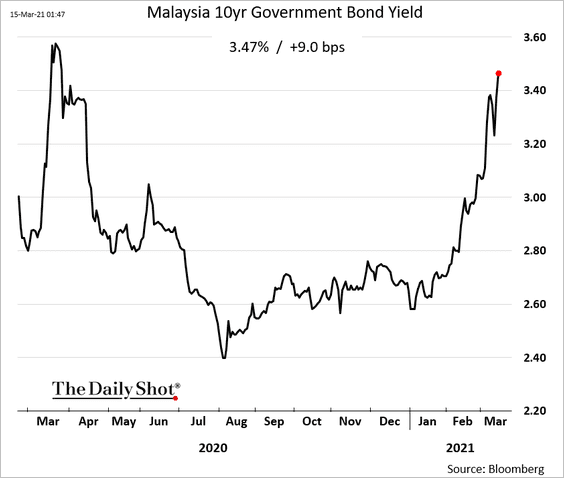

7. Local-currency government bond yields keep climbing.

Back to Index

Cryptocurrency

1. Bitcoin rose above $60k.

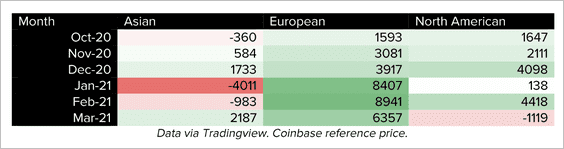

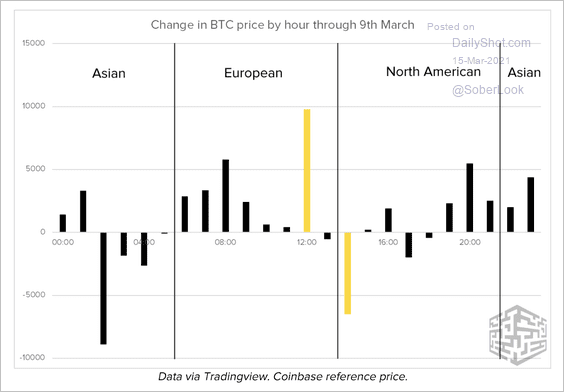

2. Bitcoin buying has been concentrated during European hours, with North America lagging far behind. Asian hours typically invite more sellers (2 charts).

Source: Enigma Securities

Source: Enigma Securities

Source: Enigma Securities

Source: Enigma Securities

——————–

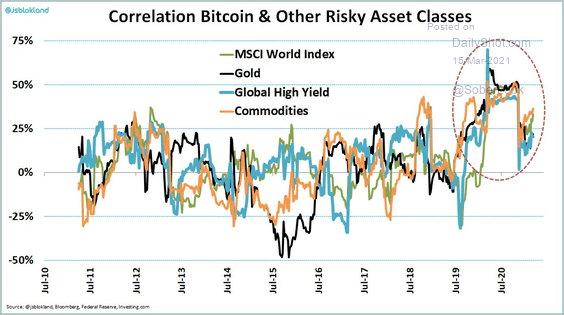

3. The days of Bitcoin being viewed as an uncorrelated asset are over.

Source: @jsblokland

Source: @jsblokland

Back to Index

Commodities

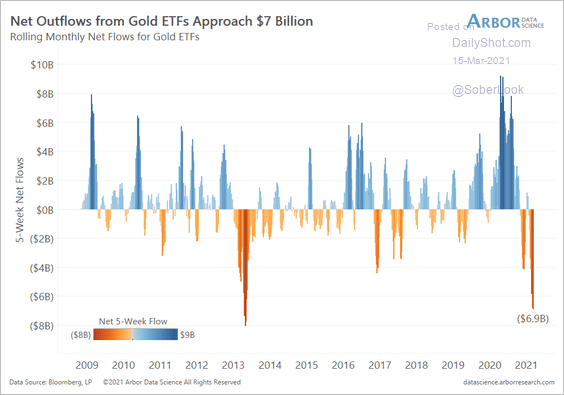

1. Gold ETF outflows accelerated in recent weeks.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

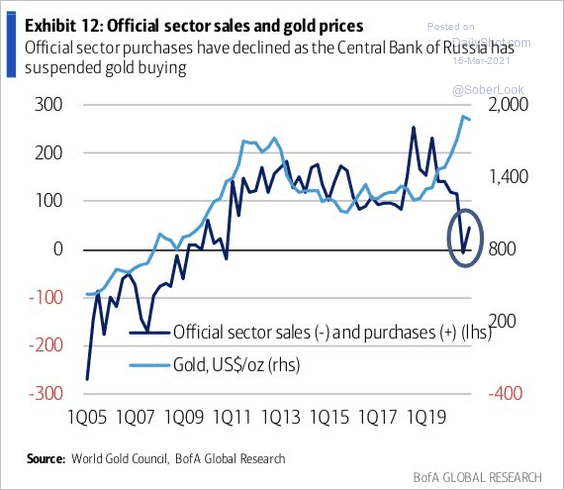

Official-sector gold purchases have declined.

Source: BofA Global Research, @WallStJesus

Source: BofA Global Research, @WallStJesus

——————–

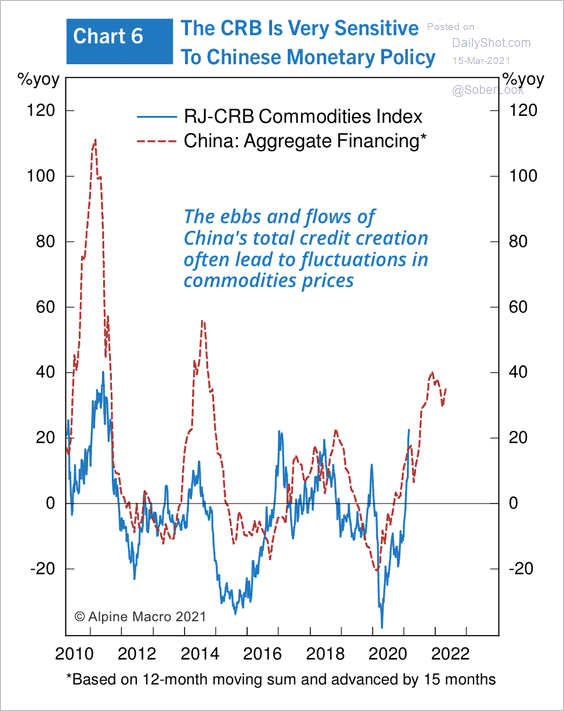

2. So far, Chinese policy easing has been a positive for commodity prices. But there may be signs of policy tightening.

Source: Alpine Macro

Source: Alpine Macro

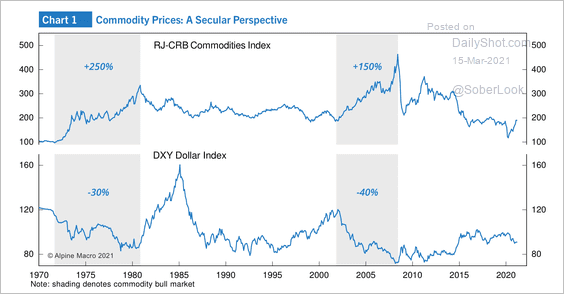

3. The previous two secular bull markets in commodities lasted for about a decade.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Energy

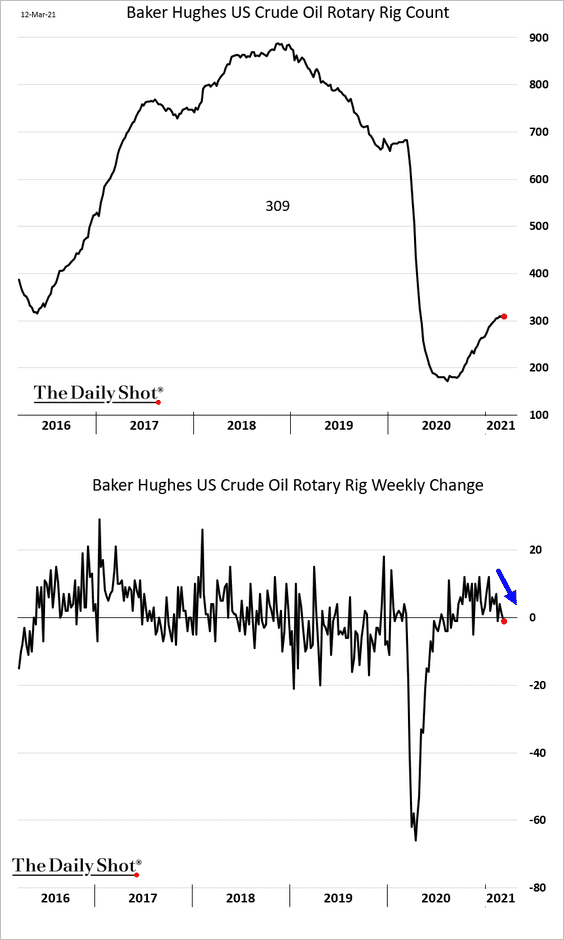

1. US oil rig count recovery has stalled.

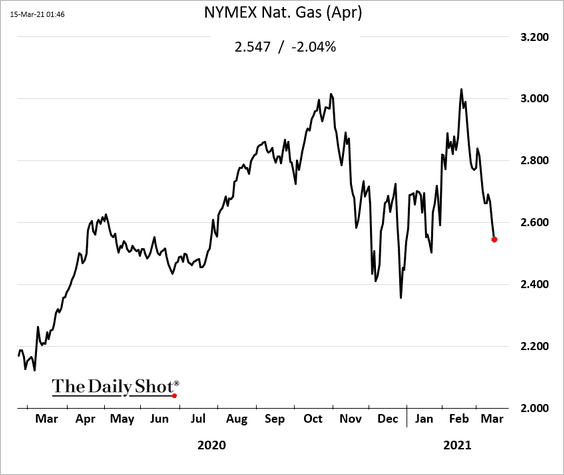

2. US natural gas futures are lower amid forecasts for warmer weather ahead.

Back to Index

Equity

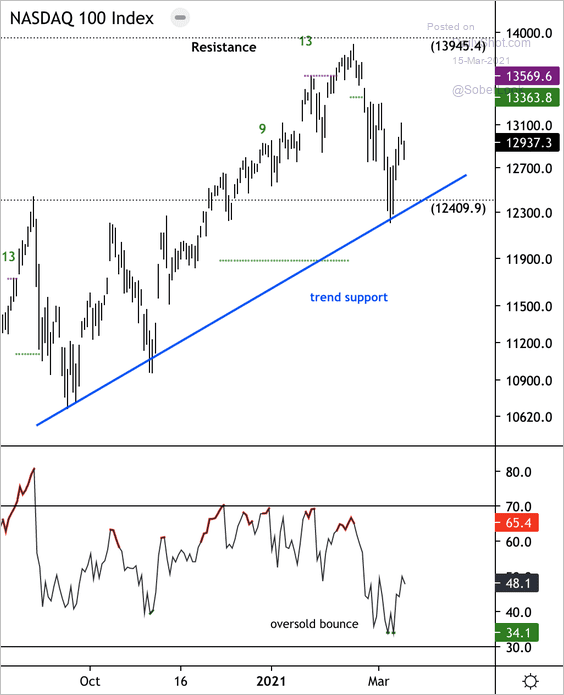

1. The Nasdaq 100 Index is holding short-term support.

Source: Dantes Outlook

Source: Dantes Outlook

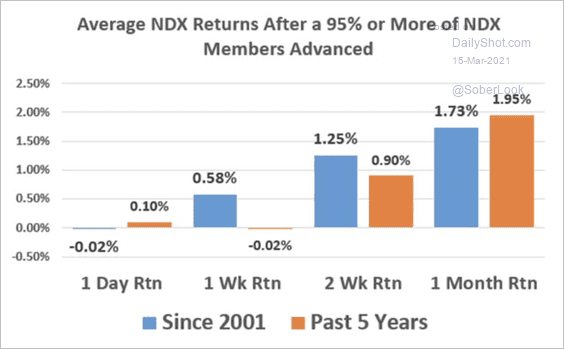

The index tends to do well after 95% or more of its members advance.

Source: Chris Murphy; Susquehanna Derivatives Strategy

Source: Chris Murphy; Susquehanna Derivatives Strategy

——————–

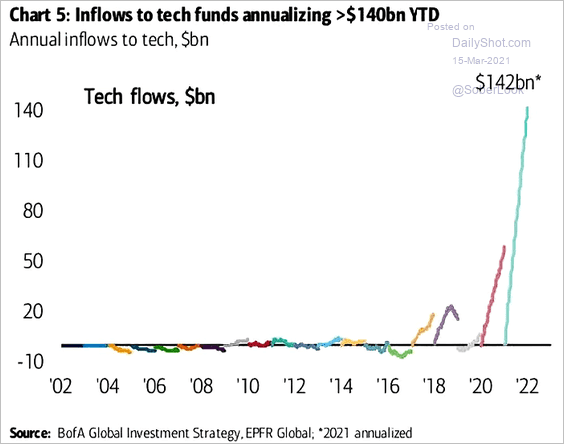

2. Tech inflows have been strong.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

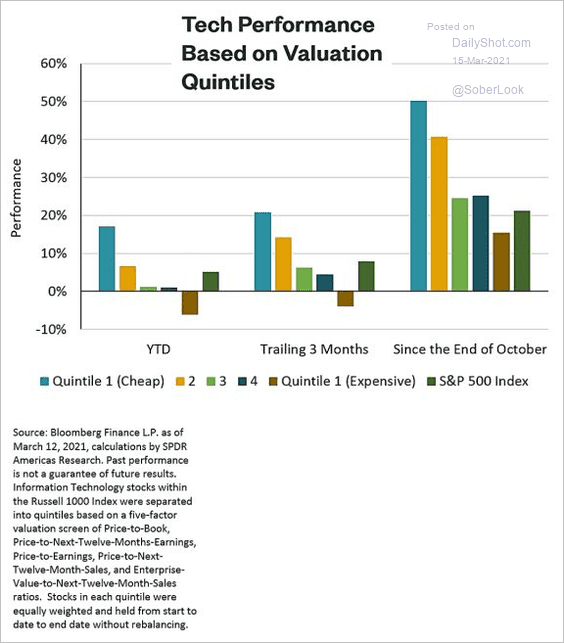

3. Cheap tech stocks have outperformed expensive tech stocks and the overall market over the past few months.

Source: SPDR Americas Research, Matthew Bartolini, @mattbartolini

Source: SPDR Americas Research, Matthew Bartolini, @mattbartolini

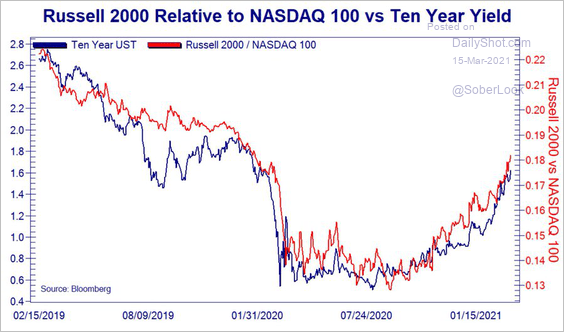

4. Higher Treasury yields have been driving the Russell 2000 outperformance vs. the Nasdaq 100.

Source: @Not_Jim_Cramer

Source: @Not_Jim_Cramer

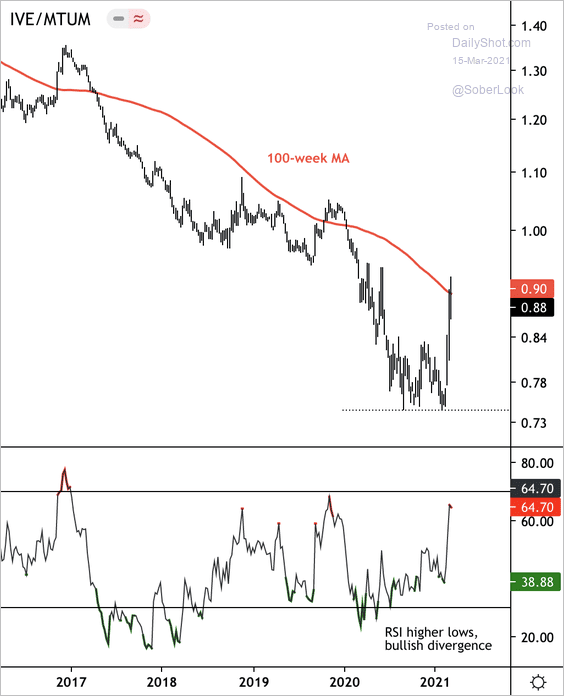

5. The iShares S&P 500 Value ETF (IVE) is testing resistance at its 100-week moving average relative to the iShares US Momentum ETF (MTUM).

Source: Dantes Outlook

Source: Dantes Outlook

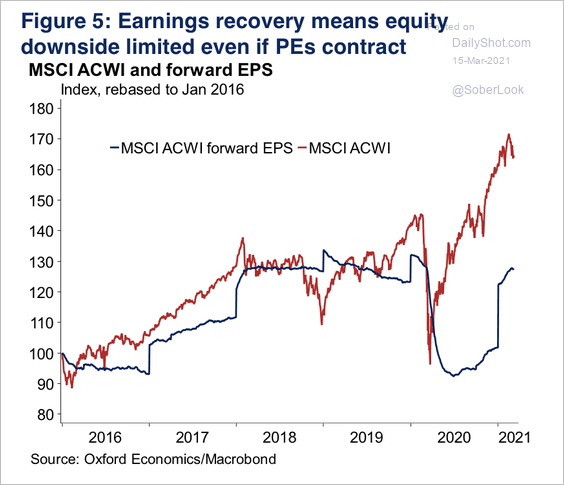

6. Will the earnings recovery limit potential downside in stocks?

Source: Oxford Economics

Source: Oxford Economics

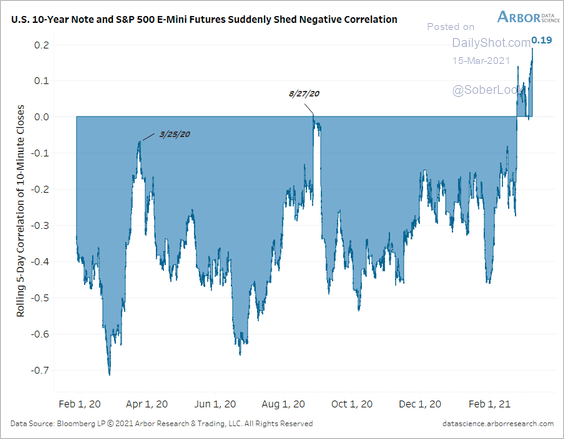

7. Stocks and bonds are now positively correlated.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

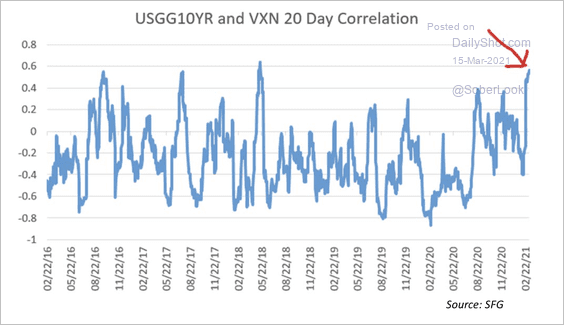

8. The 20-day correlation between the 10-year Treasury yield and the CBOE Nasdaq Volatility Index (VXN) is around a 5-year high.

Source: Chris Murphy; Susquehanna Derivatives Strategy

Source: Chris Murphy; Susquehanna Derivatives Strategy

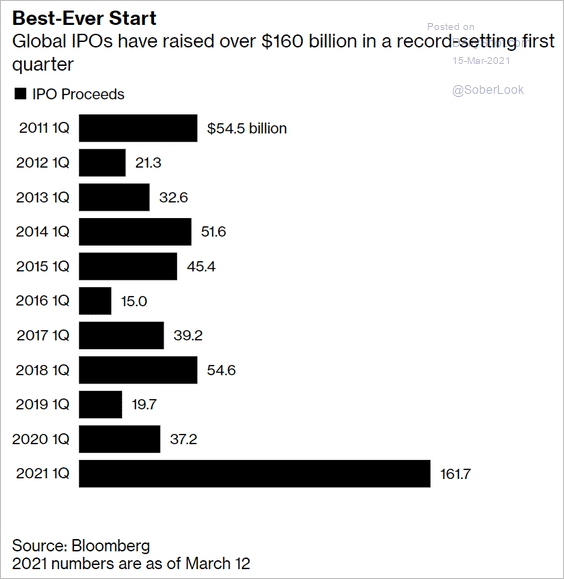

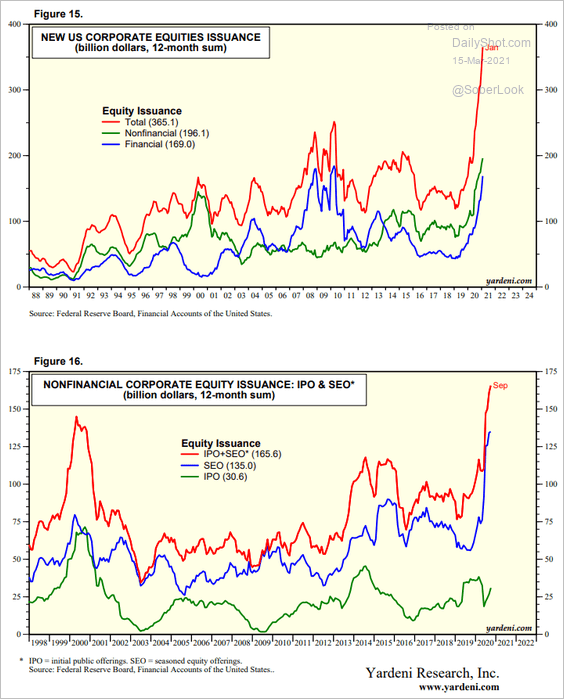

9. It’s been a good quarter for equity issuance (2 charts).

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Source: Yardeni Research

Source: Yardeni Research

Back to Index

Rates

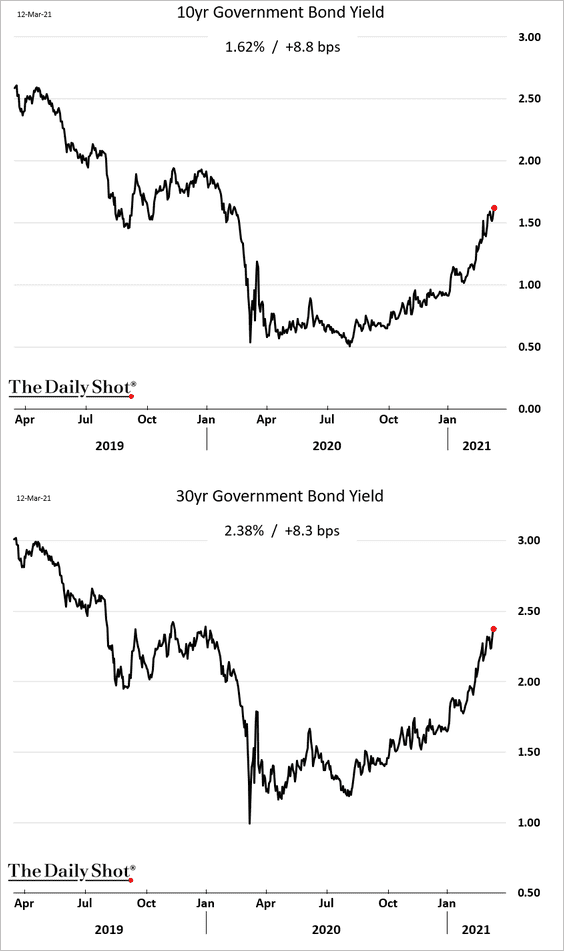

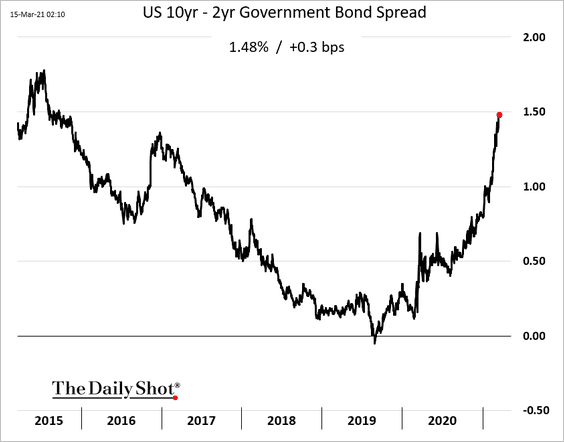

1. Treasury yields keep climbing.

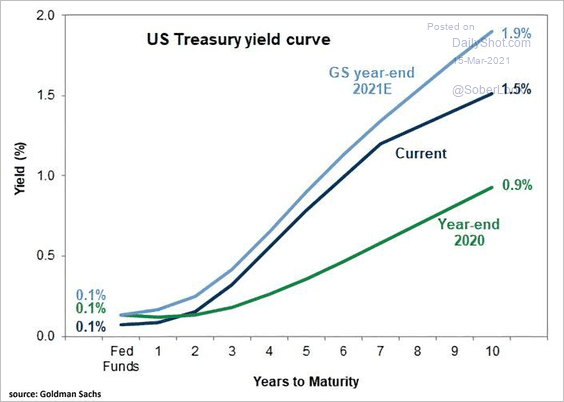

And the curve continues to steepen.

Here is Goldman’s forecast for the yield curve.

Source: Goldman Sachs; Heiko Hormel

Source: Goldman Sachs; Heiko Hormel

——————–

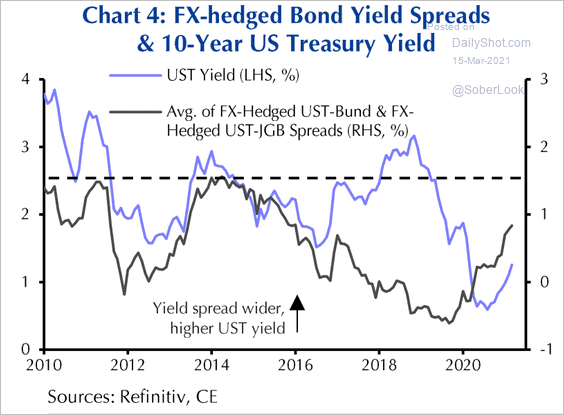

2. When will Treasuries become sufficiently attractive for foreigners to cap US yield increases?

Source: Capital Economics

Source: Capital Economics

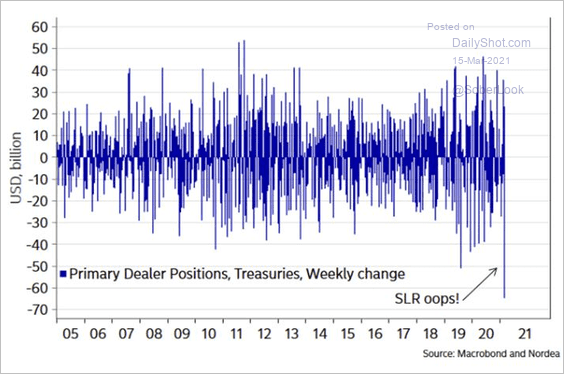

3. Primary dealers sharply reduced Treasury holdings ahead of the supplementary leverage ratio reprieve expiration (at the end of the month).

Source: Nordea Markets

Source: Nordea Markets

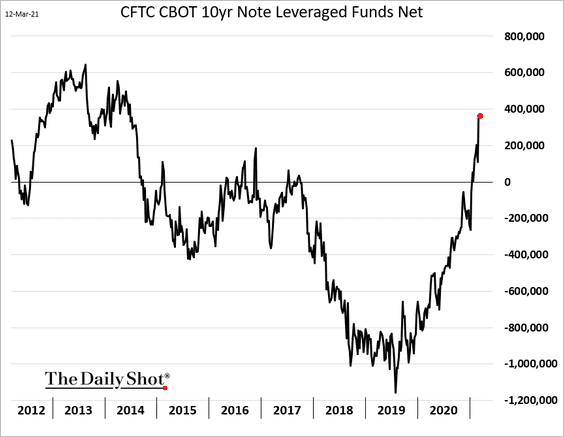

4. Leveraged funds are now long the 10yr note futures.

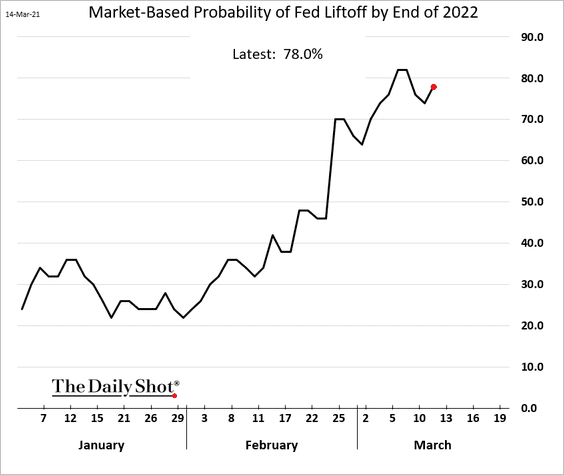

5. Economists expect liftoff in 2023. But the market has assigned a substantial probability of a rate hike by the end of next year.

Back to Index

Food for Thought

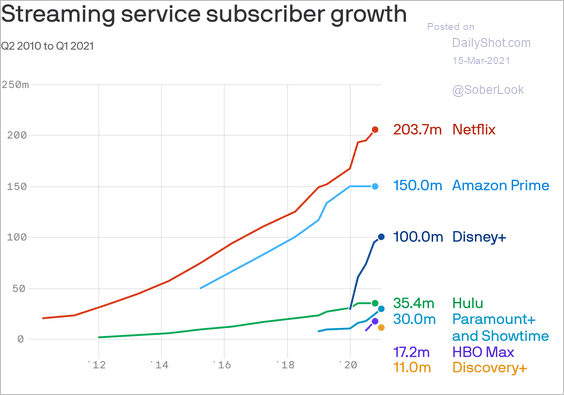

1. Streaming services subscriber growth:

Source: @axios Read full article

Source: @axios Read full article

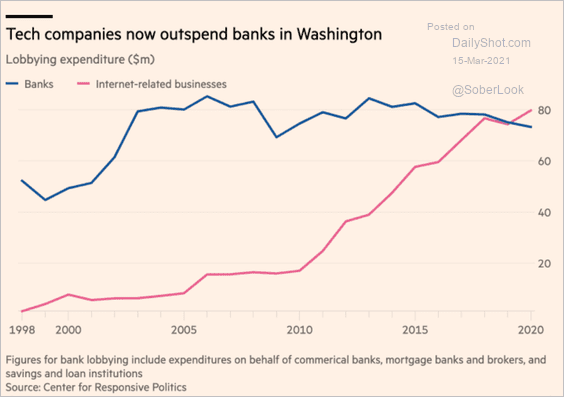

2. Tech lobbying:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

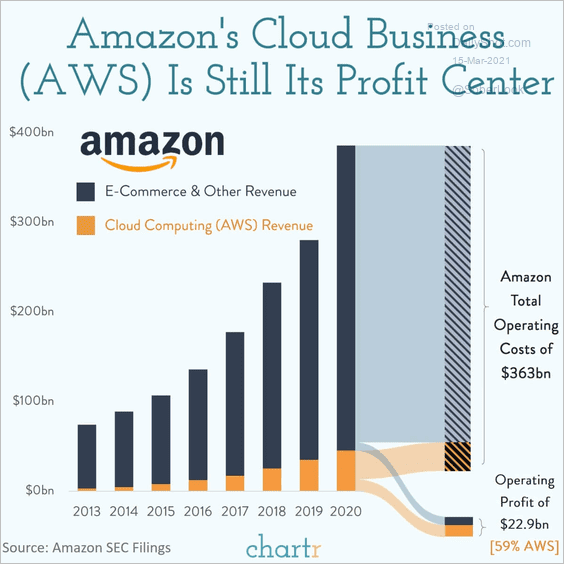

3. Amazon’s cloud business:

Source: @chartrdaily

Source: @chartrdaily

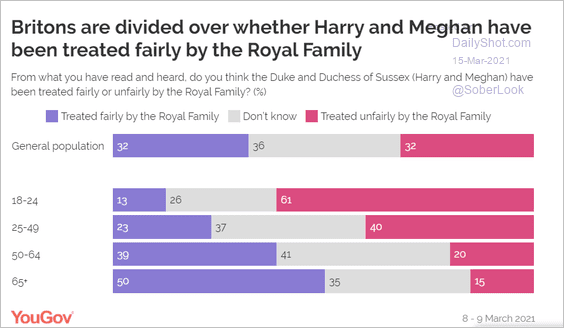

4. Britons’ views on the Harry and Meghan situation.

Source: YouGov Read full article

Source: YouGov Read full article

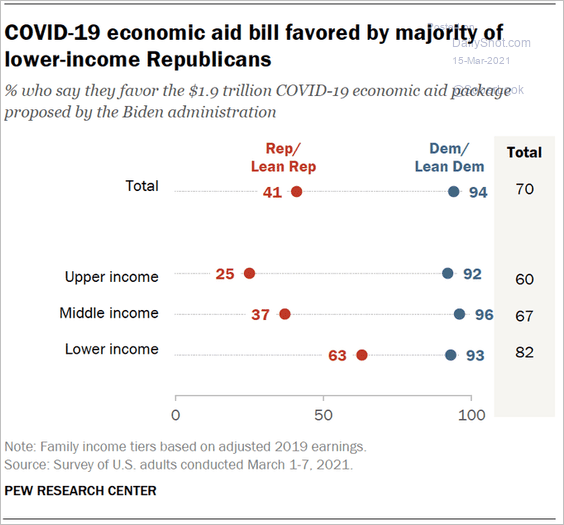

5. US support for the $1.9 trillion stimulus package:

Source: @pewresearch Read full article

Source: @pewresearch Read full article

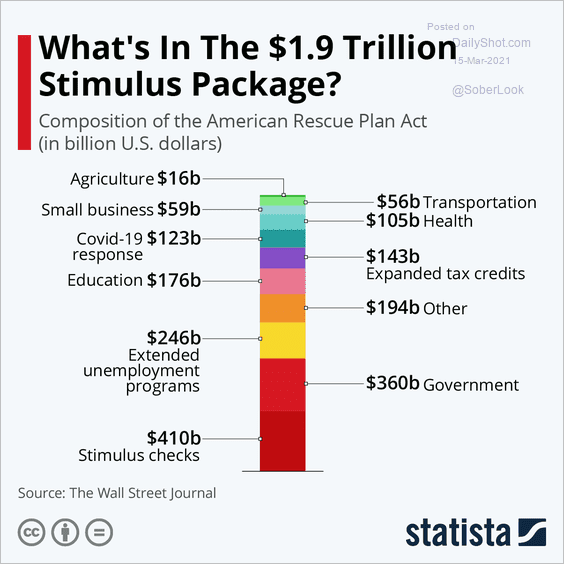

What’s in that bill?

Source: Statista

Source: Statista

——————–

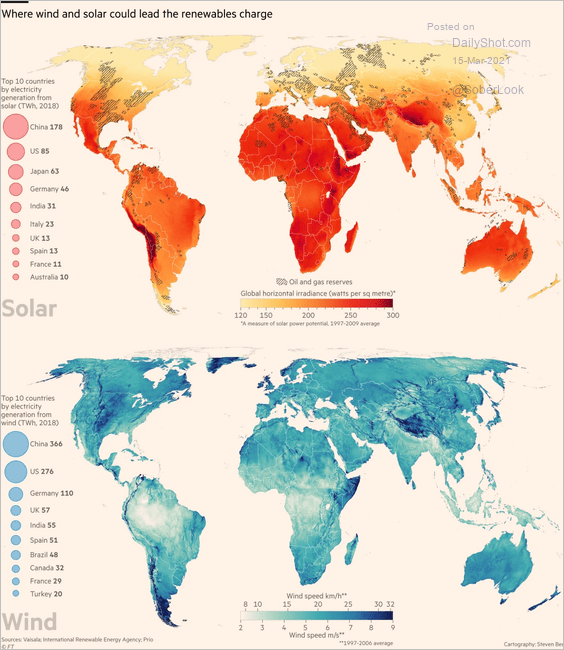

6. Solar and wind energy potential impact globally:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

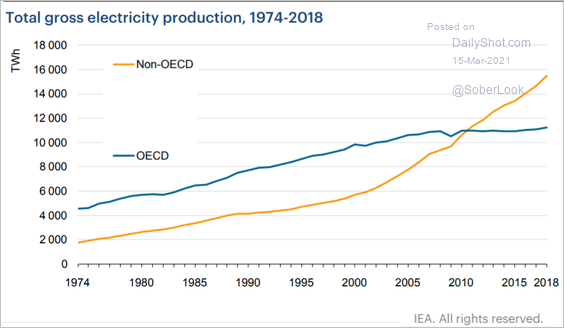

7. Electricity production in OECD and non-OECD countries:

Source: IEA

Source: IEA

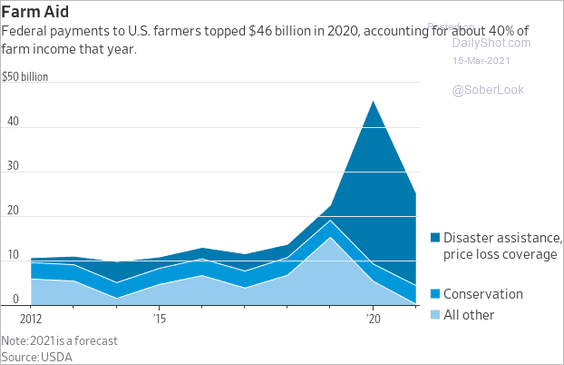

8. US federal payments to farmers:

Source: @WSJ Read full article

Source: @WSJ Read full article

9. Top searched “flights to …”:

Source: Google Trends, @carlquintanilla, @pkedrosky

Source: Google Trends, @carlquintanilla, @pkedrosky

——————–

Back to Index