The Daily Shot: 19-Mar-21

• Rates

• Equities

• Energy

• Emerging Markets

• China

• Asia – Pacific

• The Eurozone

• Europe

• The United Kingdom

• The United States

• Food for Thought

Rates

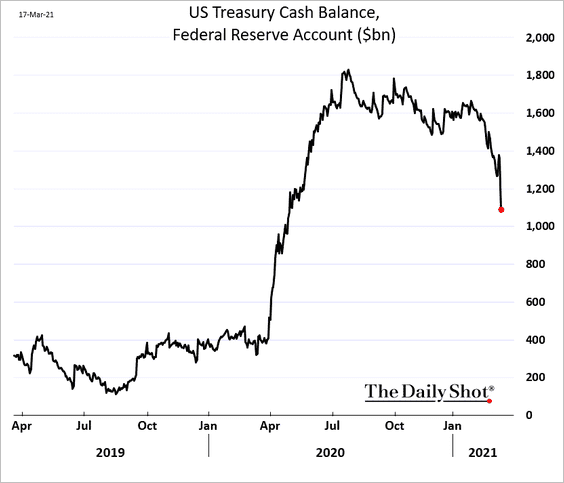

1. Stimulus checks are on their way. As the US Treasury withdraws cash from its account at the Fed, it moves liquidity into the private sector.

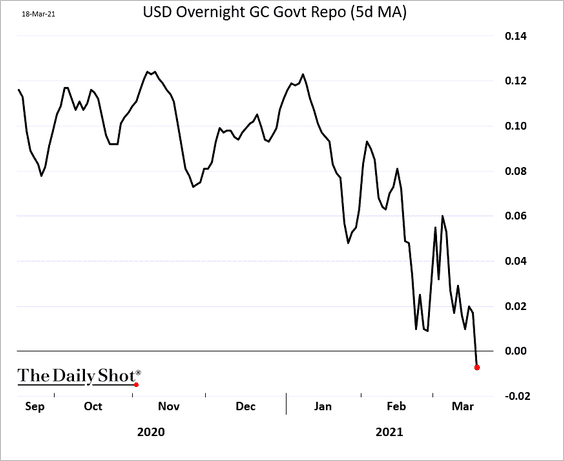

As a result, short-term rates have drifted into negative territory.

• Overnight GC repo rate (5-day moving average):

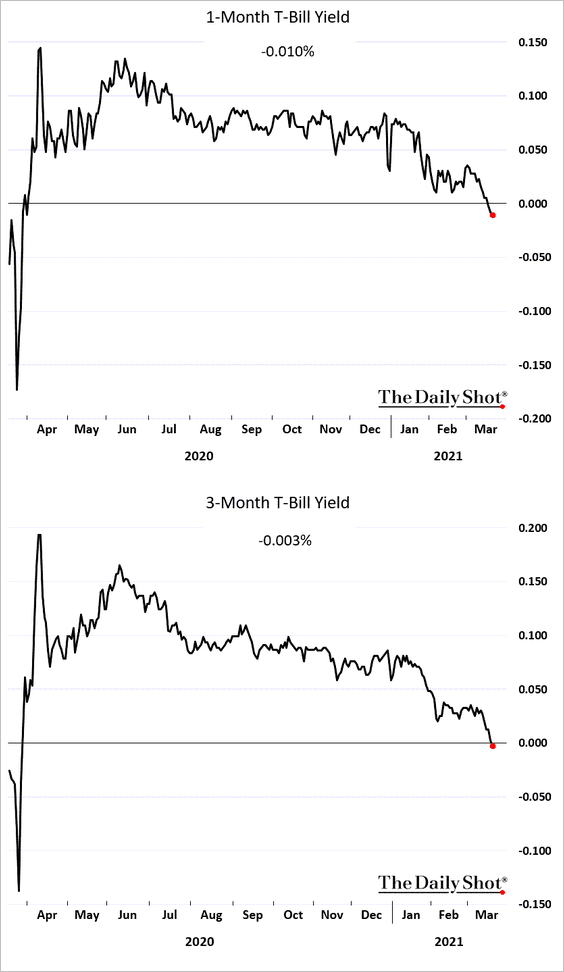

• Treasury bill yields (the 3-month bill is now negative):

——————–

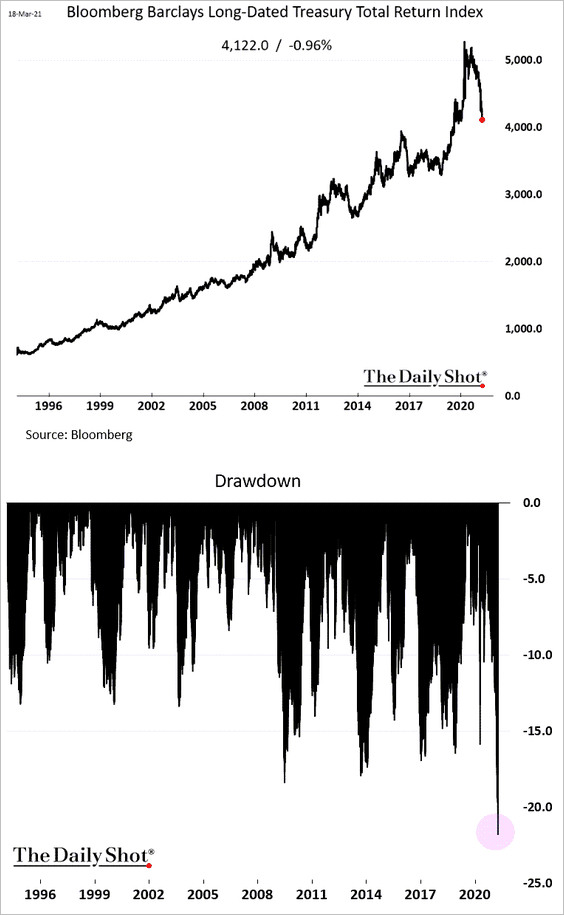

2. Bloomberg’s long-term Treasury total return index is experiencing the steepest drawdown in decades.

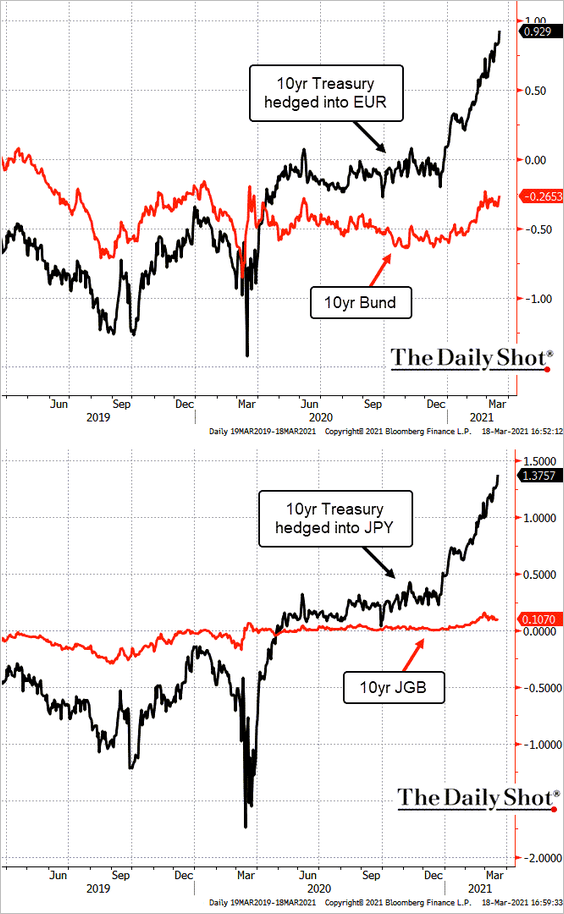

3. Treasury yields hedged into euro or yen are becoming increasingly attractive relative to Bunds and JGBs.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

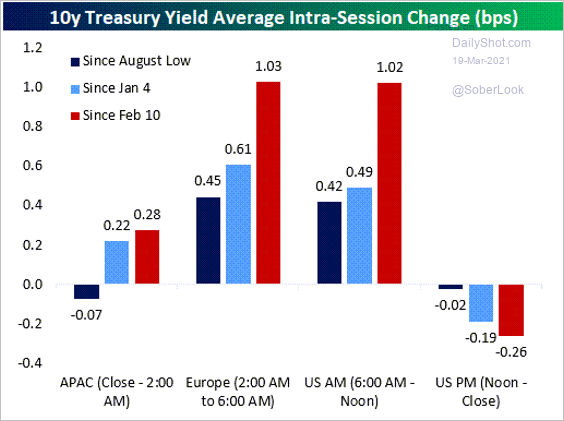

4. Here is a look at the 10yr Treasury yield changes during the four periods of the trading session.

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

Back to Index

Equities

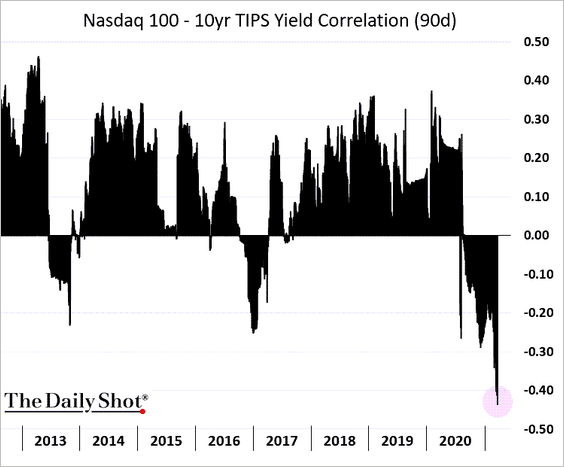

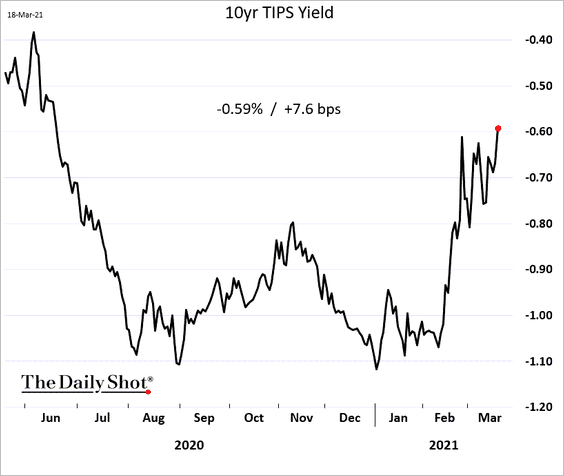

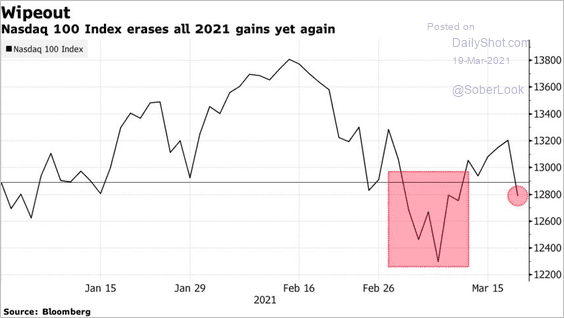

1. We’ve seen high-multiple stocks becoming increasingly correlated to Treasuries (inversely correlated with yields). The inverse correlation with real (TIPS) yields has been even stronger.

As TIPS yields climbed on Thursday, …

… the Nasdaq 100 erased its 2021 gains.

Source: @markets Read full article

Source: @markets Read full article

——————–

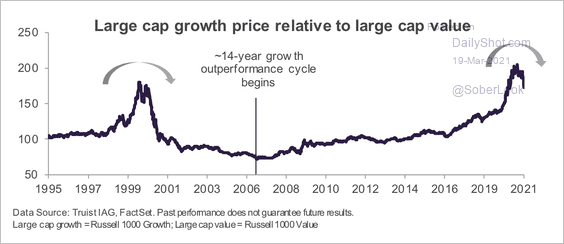

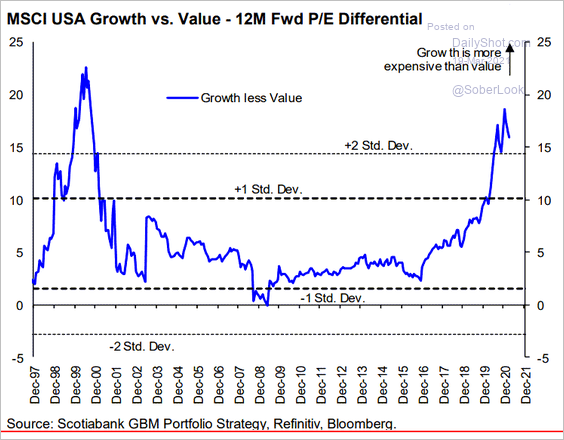

2. Similar to the late 1990s, the rotation from growth to value may just be getting started.

Source: Truist Advisory Services

Source: Truist Advisory Services

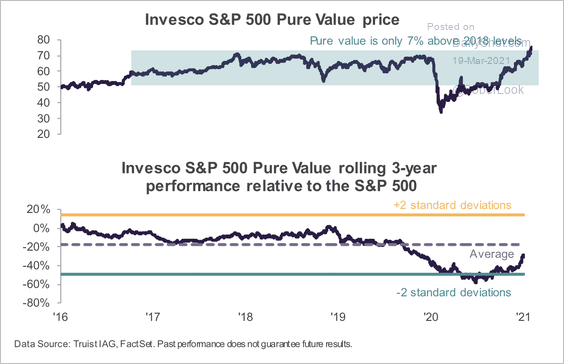

The S&P 500 Pure Value Index (PVI) is only slightly above its 2018 high and has lagged the broader market on a 3-year basis.

Source: Truist Advisory Services

Source: Truist Advisory Services

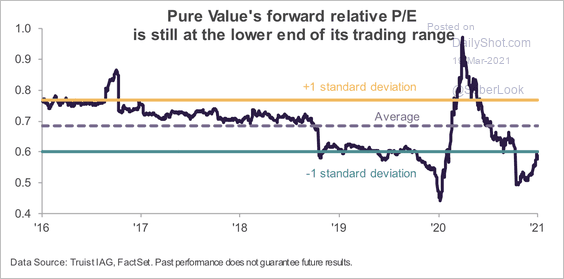

Value also appears cheap based on its forward price-to-earnings ratio (2 charts).

Source: Truist Advisory Services

Source: Truist Advisory Services

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

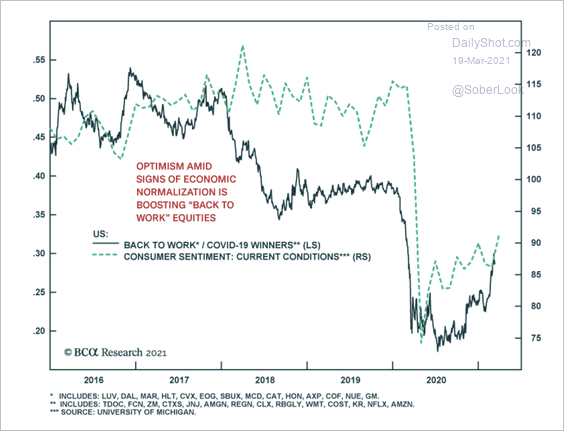

3. “Back to work” stocks have benefited from a rise in consumer sentiment.

Source: BCA Research

Source: BCA Research

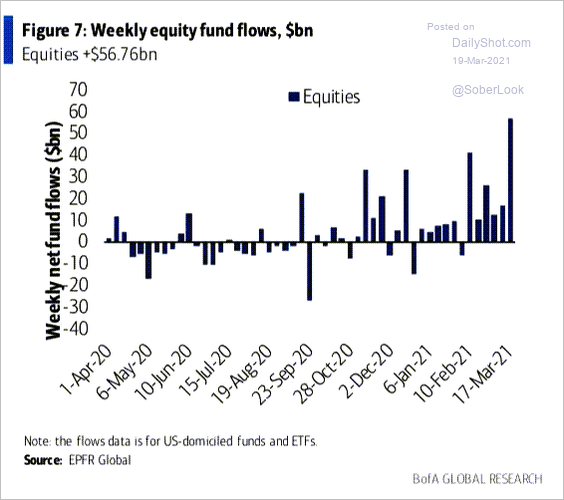

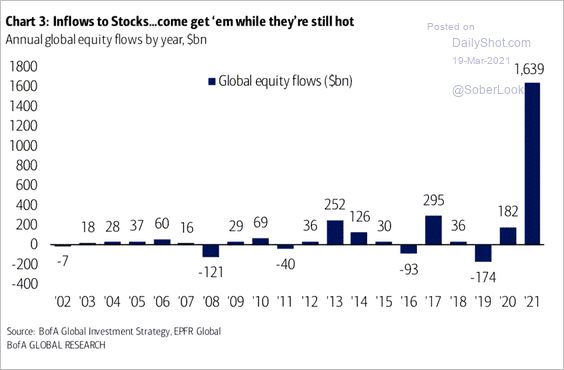

4. Equity fund inflows have been remarkable.

Source: BofA Global Research; @WallStJesus

Source: BofA Global Research; @WallStJesus

Source: BofA Global Research; @WallStJesus

Source: BofA Global Research; @WallStJesus

——————–

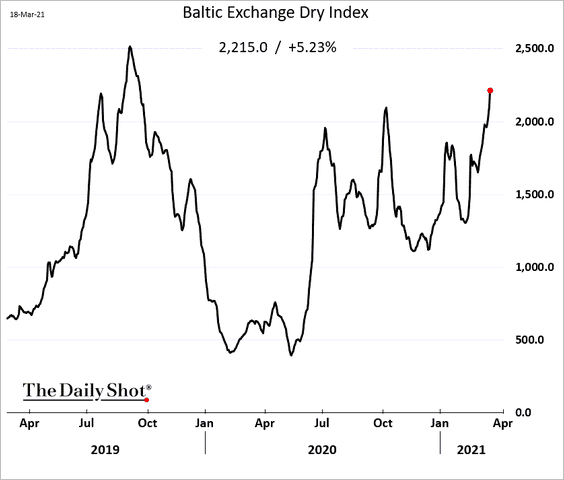

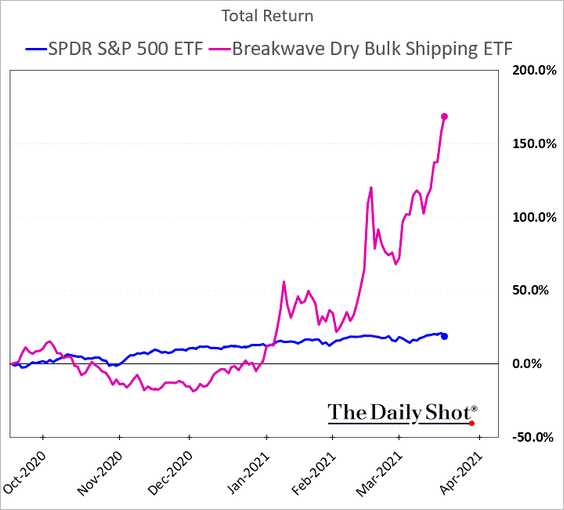

5. Global bulk shipping demand has risen sharply, …

… dramatically boosting shipping companies’ shares.

h/t Walter

h/t Walter

——————–

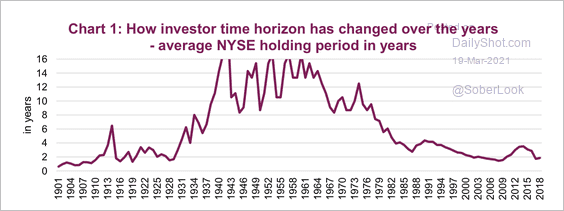

6. The average amount of time that US investors hold onto a given position is approaching an all-time low.

Source: Market Ethos, Richardson GMP

Source: Market Ethos, Richardson GMP

Back to Index

Energy

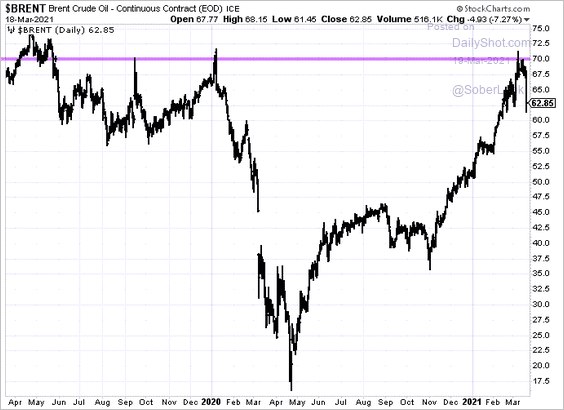

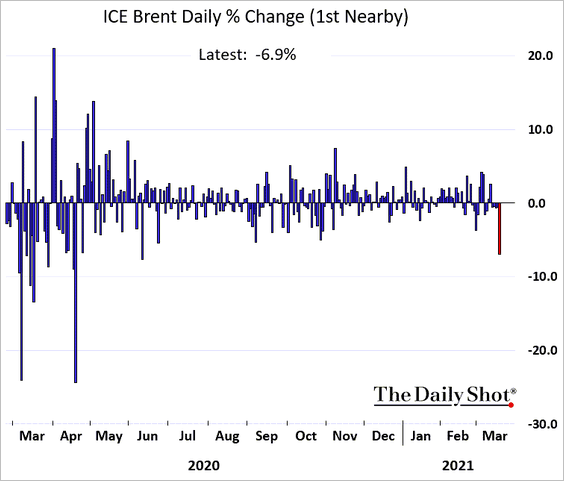

1. Crude oil took a hit on Thursday.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

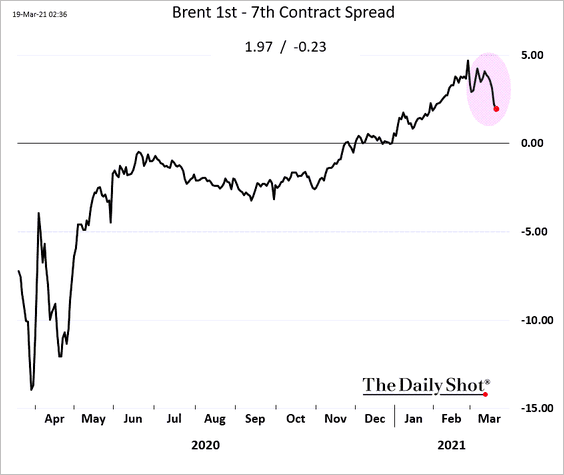

2. Brent crude backwardation declined sharply.

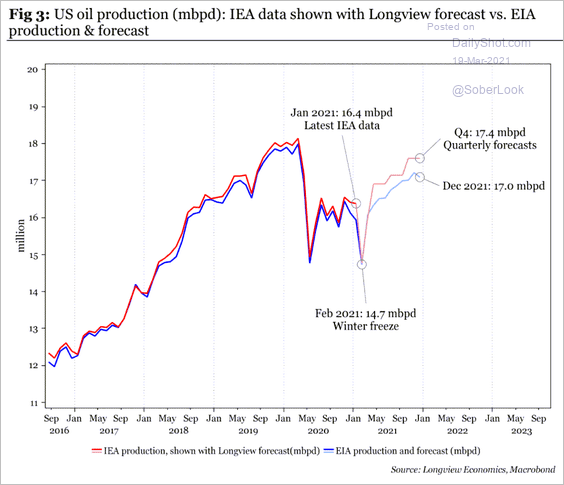

3. US oil production is expected to recover significantly by the end of the year.

Source: Longview Economics

Source: Longview Economics

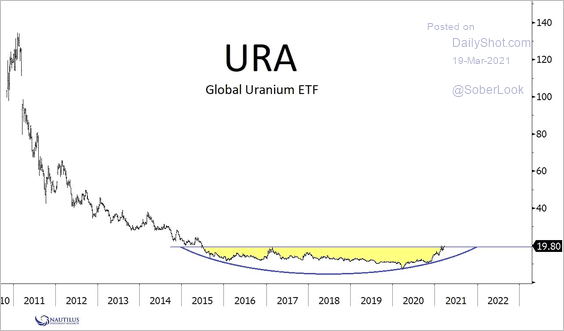

4. Is the Global X Uranium ETF (URA) bottoming?

Source: @NautilusCap

Source: @NautilusCap

Back to Index

Emerging Markets

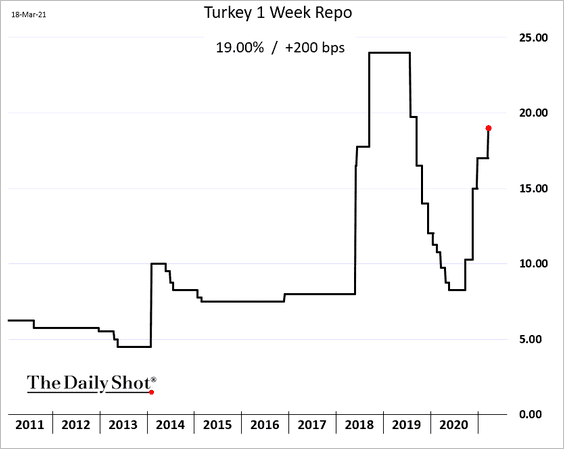

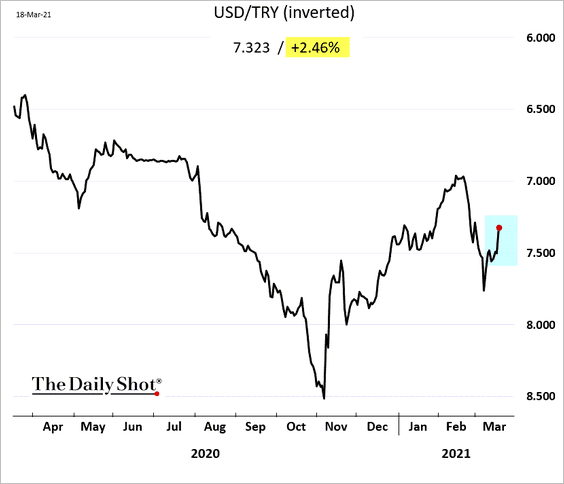

1. Turkey’s central bank hiked rates by 200 bps (the market expected 100 bps).

The lira surged.

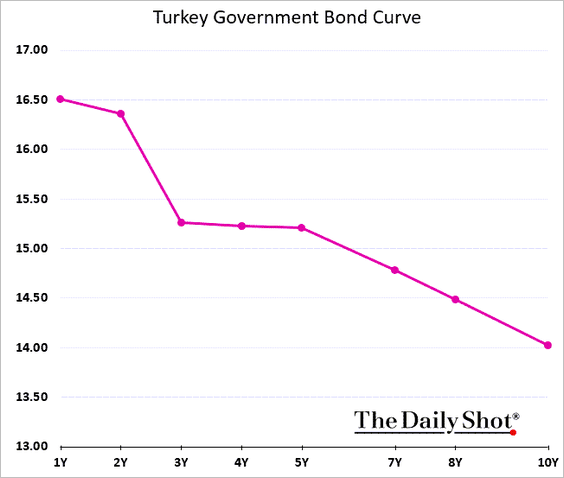

Separately, Turkey’s local-currency government yield curve is inverted.

——————–

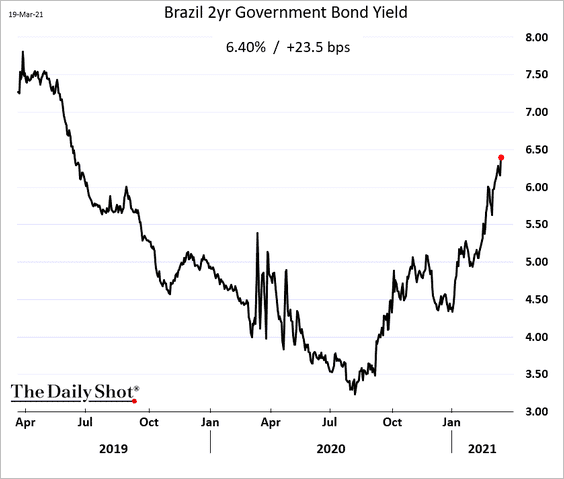

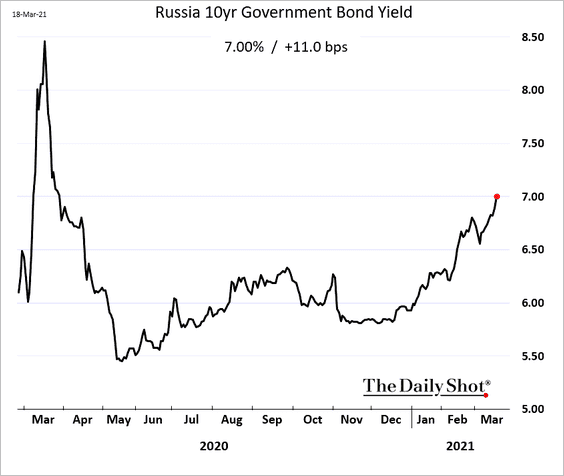

2. Brazil’s yields climbed further after a larger than expected rate hike on Wednesday.

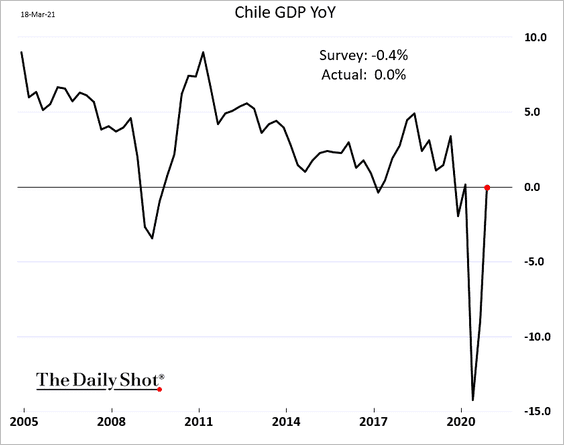

3. Chile pulled out of recession in Q4.

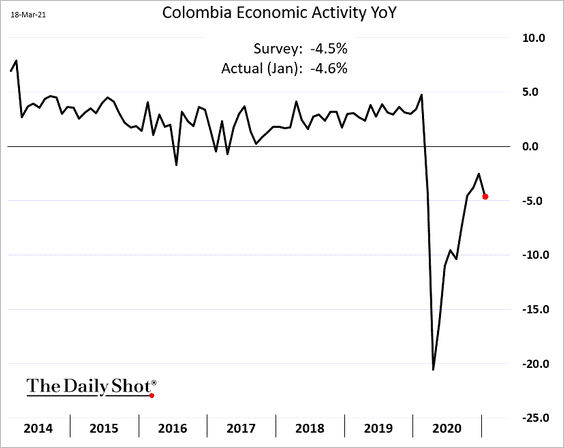

4. Colombia’s growth weakened in January.

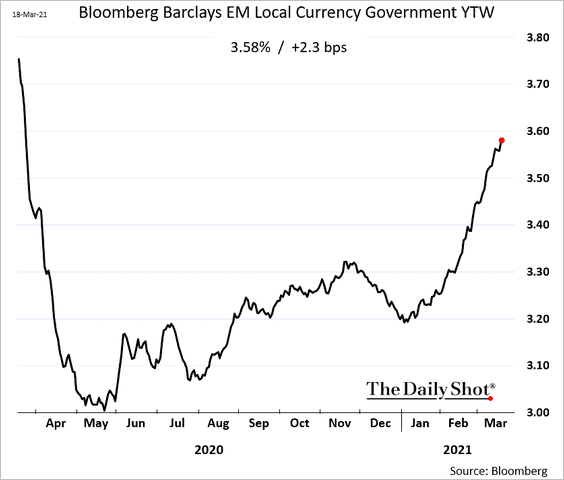

5. Local-currency EM bond yields keep climbing.

——————–

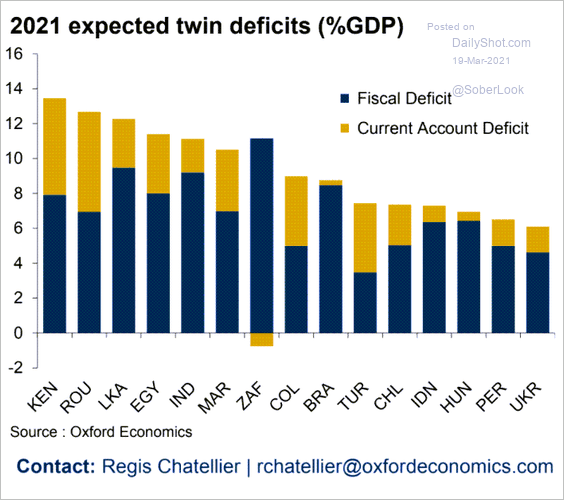

6. Twin deficits are expected for many EM economies this year.

Source: Oxford Economics

Source: Oxford Economics

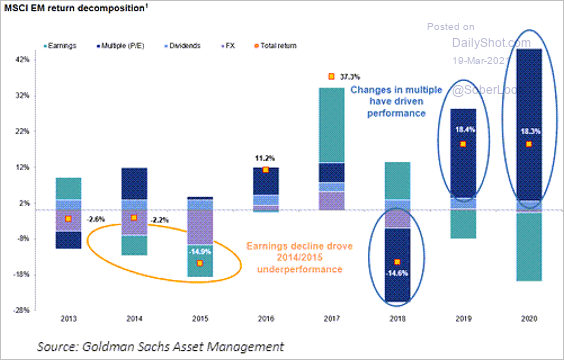

7. Here is the MSCI EM equity index returns attribution.

Source: LPL Research

Source: LPL Research

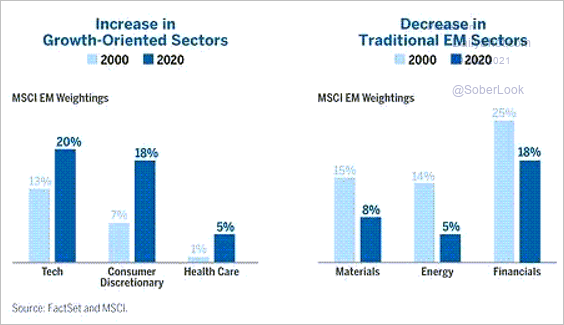

The index weights have shifted to more growth-oriented sectors.

Source: LPL Research

Source: LPL Research

Back to Index

China

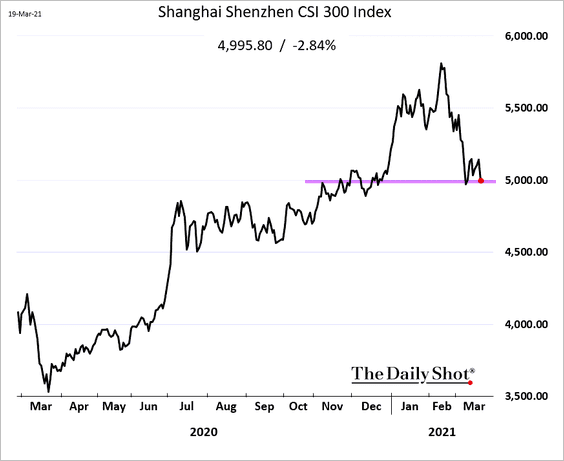

1. The stock market is lower today, with the CSI 300 index at support.

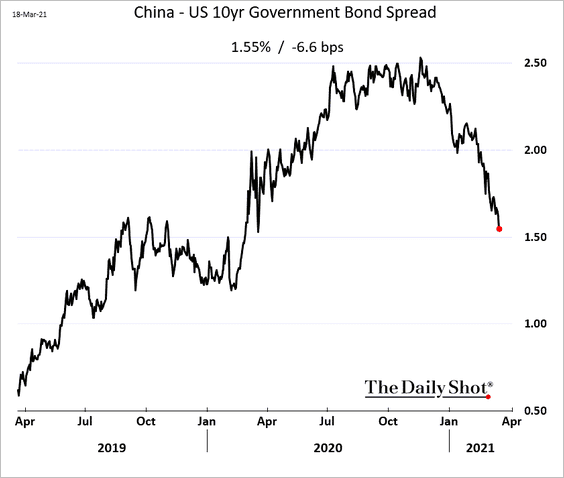

3. The 10yr government bond spread to Treasuries continues to tighten.

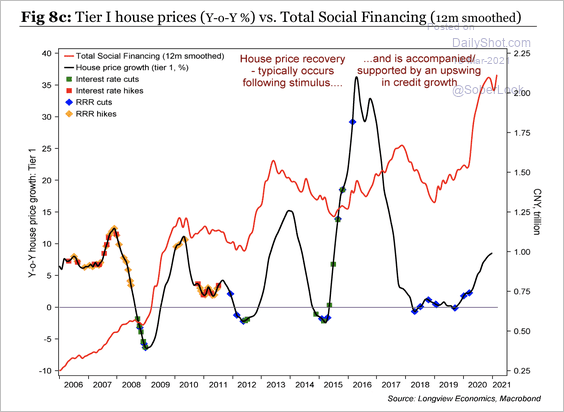

4. The house price recovery has been supported by an upswing in credit growth over the past two years.

Source: Longview Economics

Source: Longview Economics

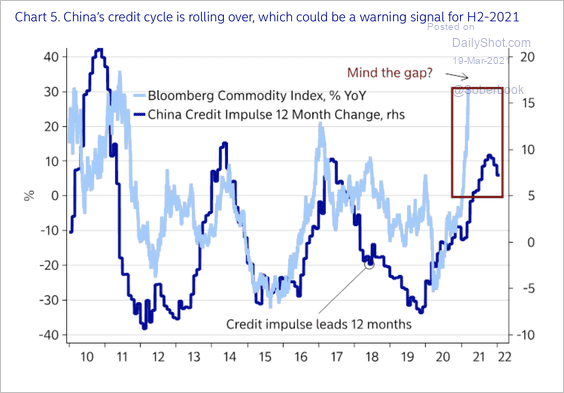

But the credit cycle is weakening.

Source: Nordea Markets

Source: Nordea Markets

——————–

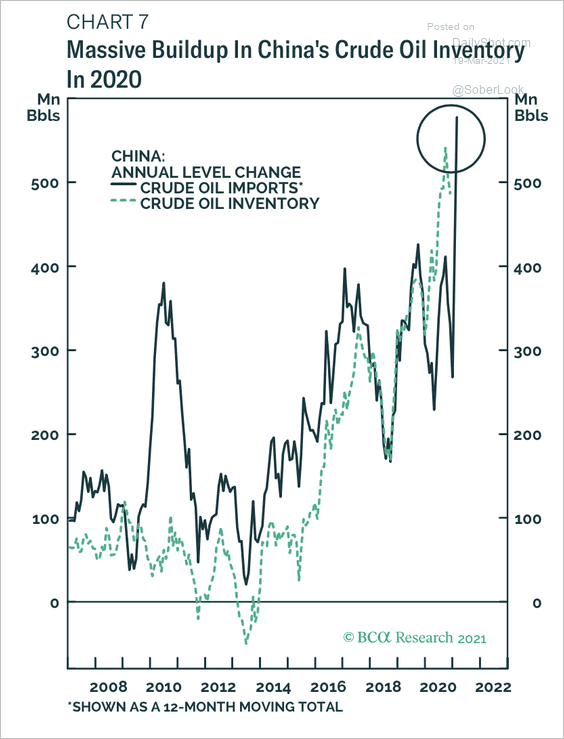

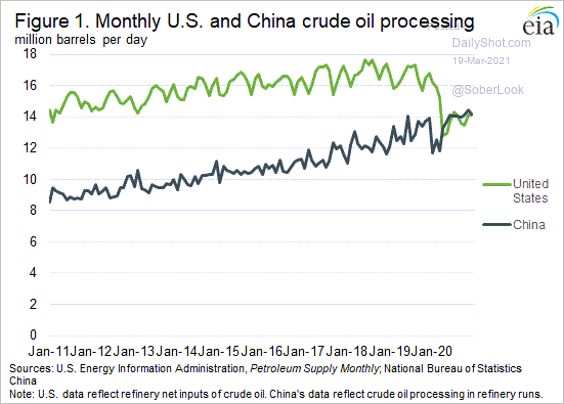

5. Finally, here are a couple of updates on China’s energy sector.

• Crude oil inventories:

Source: BCA Research

Source: BCA Research

• Refinery inputs relative to the US:

Source: EIA

Source: EIA

Back to Index

Asia – Pacific

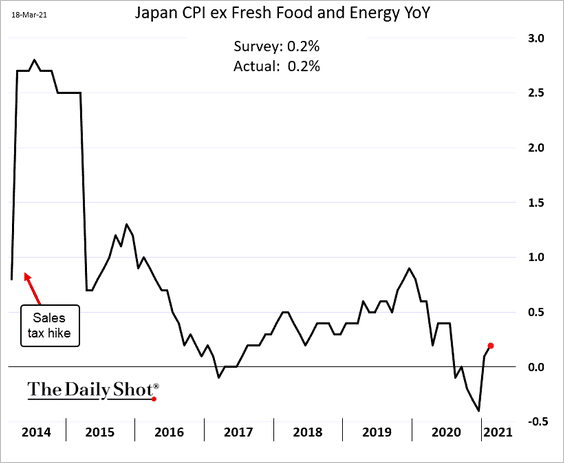

1. Japan’s CPI is back in positive territory.

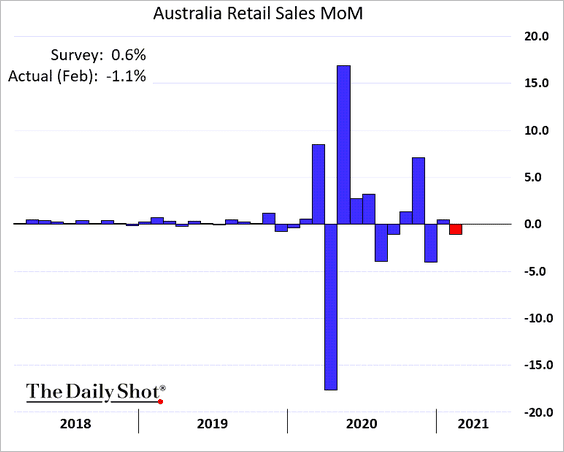

2. Australia’s retail sales were weaker than expected last month.

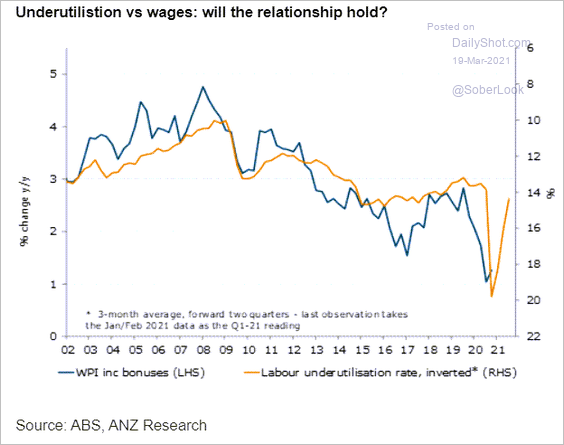

Separately, will Australian wages follow improvements in labor utilization?

Source: ANZ Research

Source: ANZ Research

Back to Index

The Eurozone

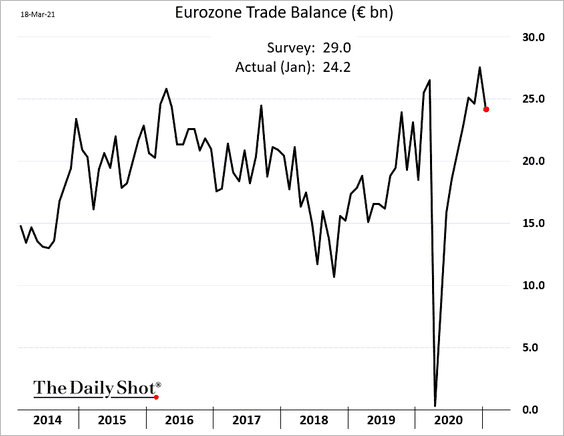

1. Trade surplus was below market expectations in January.

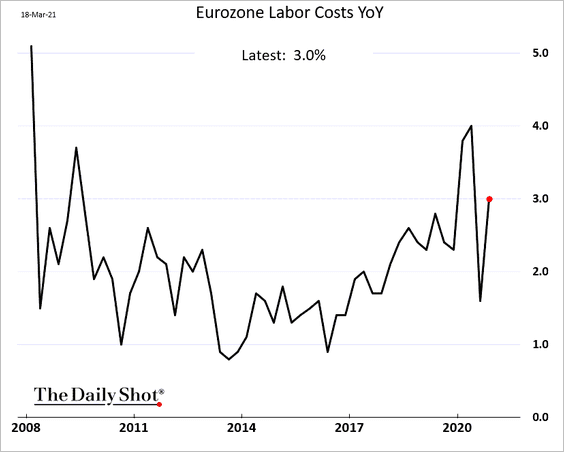

2. Labor costs rebounded in Q4.

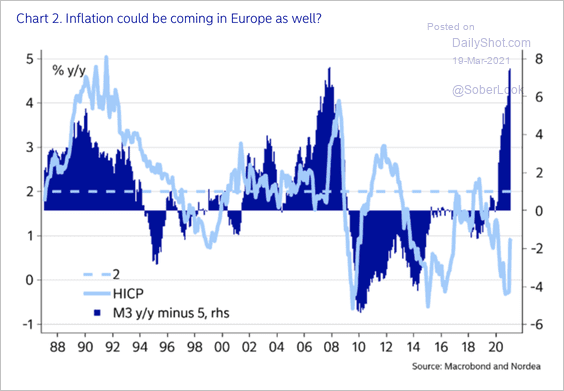

3. Will the rising money supply boost inflation?

Source: Nordea Markets

Source: Nordea Markets

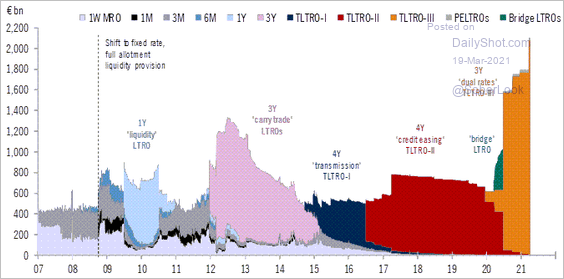

4. The latest round of TLTRO financing generated more demand than expected.

Source: @fwred

Source: @fwred

Back to Index

Europe

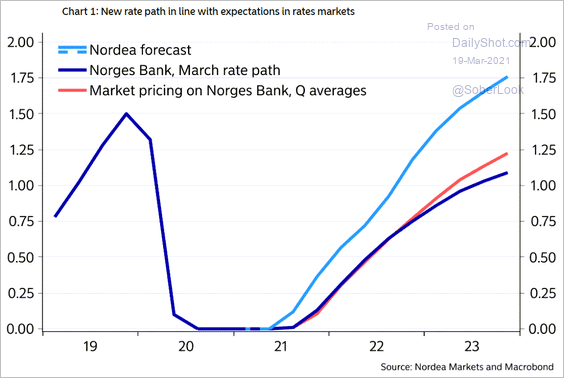

1. Norges Bank could lift rates as soon as September.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

Source: Nordea Markets

Source: Nordea Markets

——————–

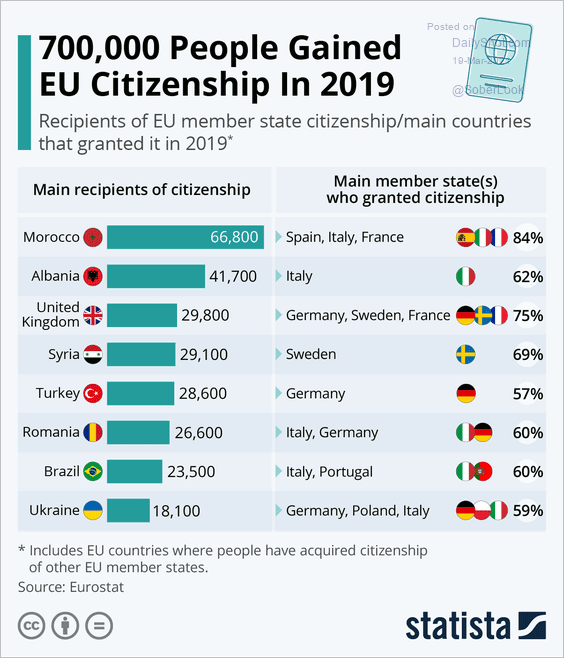

2. 700,000 people became EU citizens in 2019.

Source: Statista

Source: Statista

Back to Index

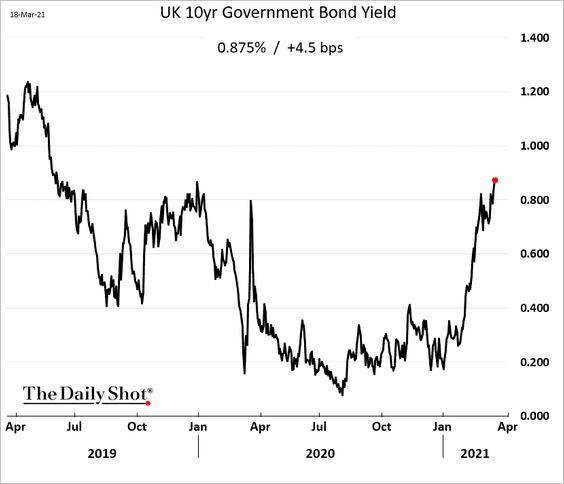

The United Kingdom

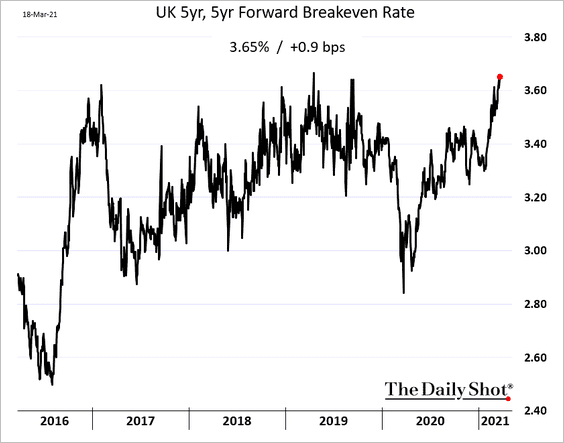

1. The Bank of England expects a strong rebound in the nation’s GDP growth.

Source: Reuters Read full article

Source: Reuters Read full article

The central bank doesn’t appear to be concerned about rising inflation expectations …

… and bond yields.

——————–

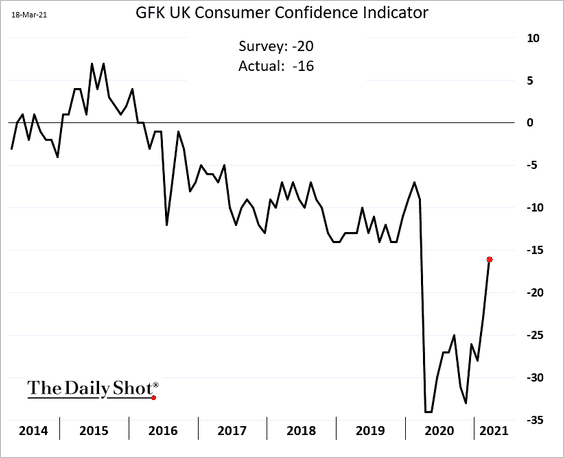

2. Consumer confidence is rebounding.

Back to Index

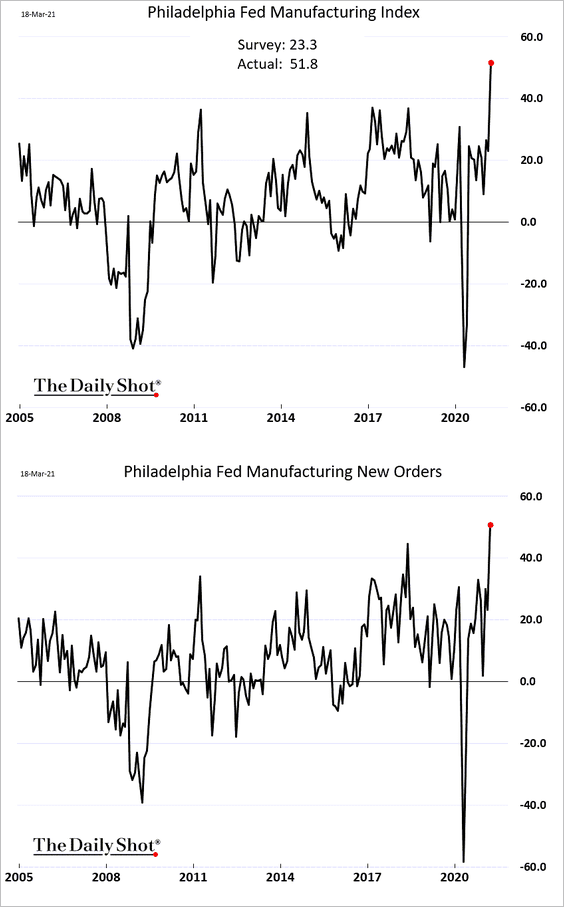

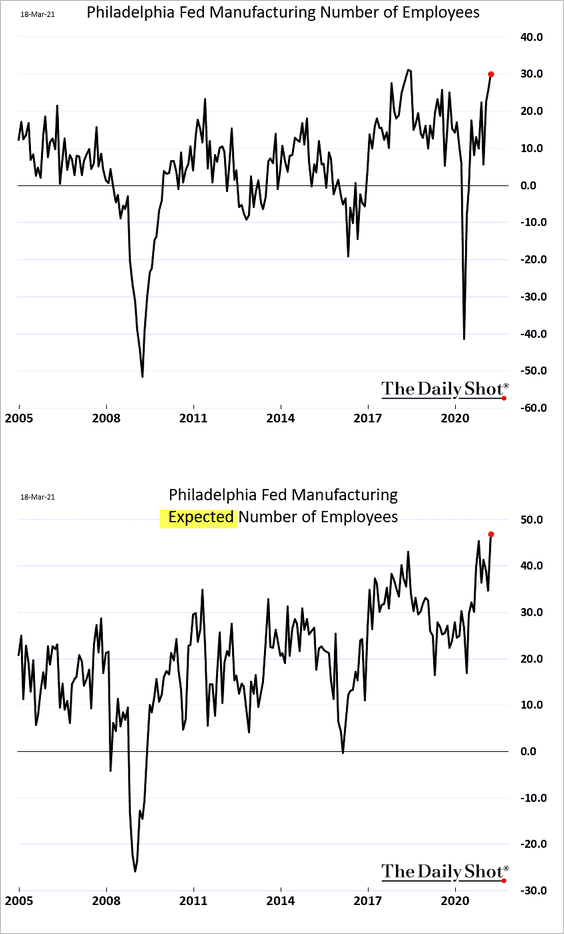

The United States

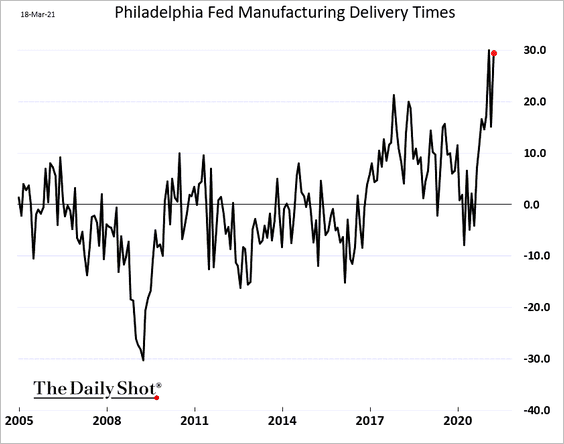

1. The Philly Fed’s manufacturing index soared to multi-decade highs.

Employment and hiring expectations indices surged.

Supply chain bottlenecks remain a problem.

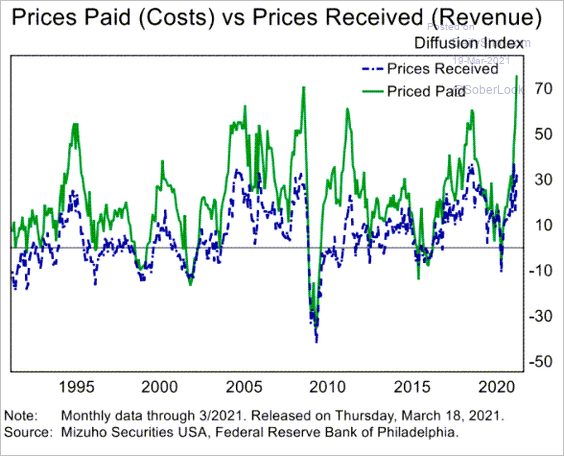

Gains in input prices accelerated. This does not look like an economy that needs zero rates.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

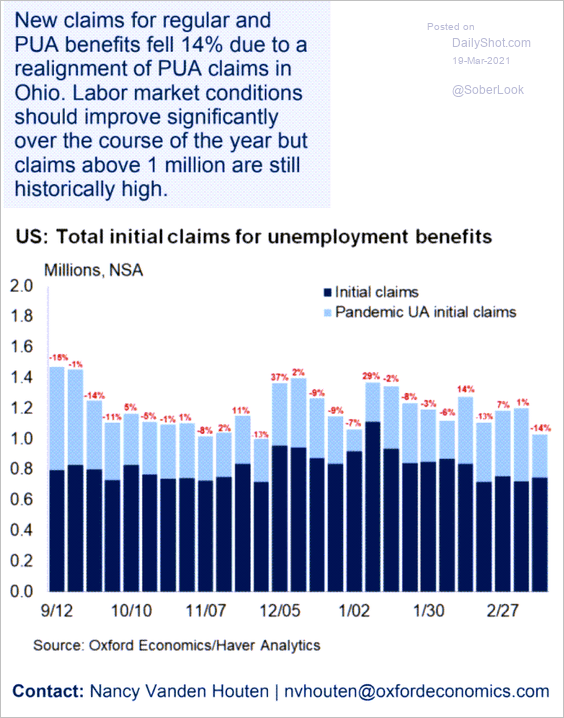

2. Next, we have some updates on the labor market.

• Initial jobless claims:

Source: Oxford Economics

Source: Oxford Economics

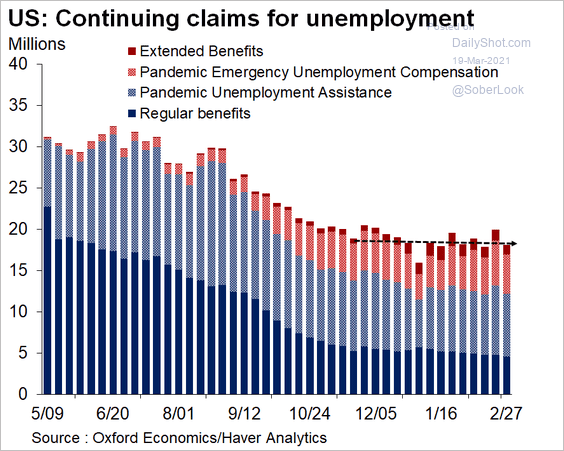

• Continuing claims:

Source: @GregDaco

Source: @GregDaco

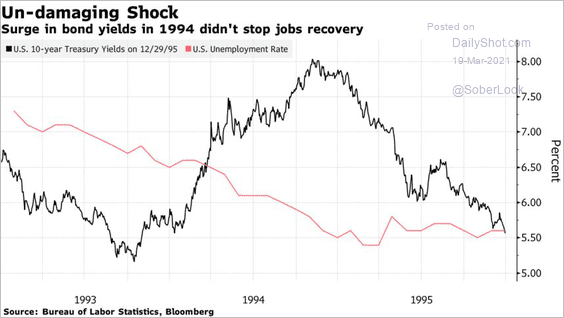

• Treasury yields vs. the unemployment rate in the 1990s:

Source: @markets Read full article

Source: @markets Read full article

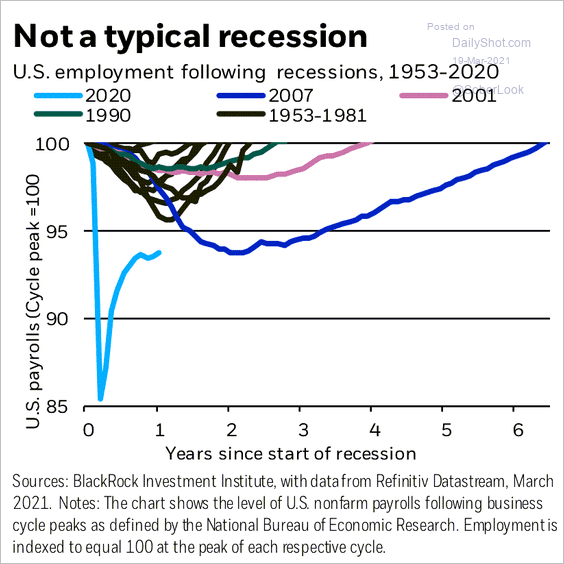

• Employment recovery vs. previous recessions:

Source: BlackRock

Source: BlackRock

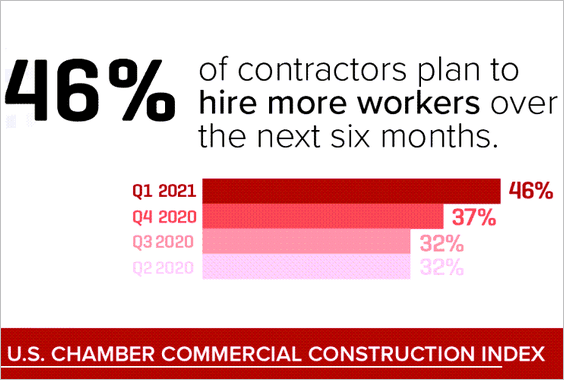

• Commercial construction hiring expectations:

——————–

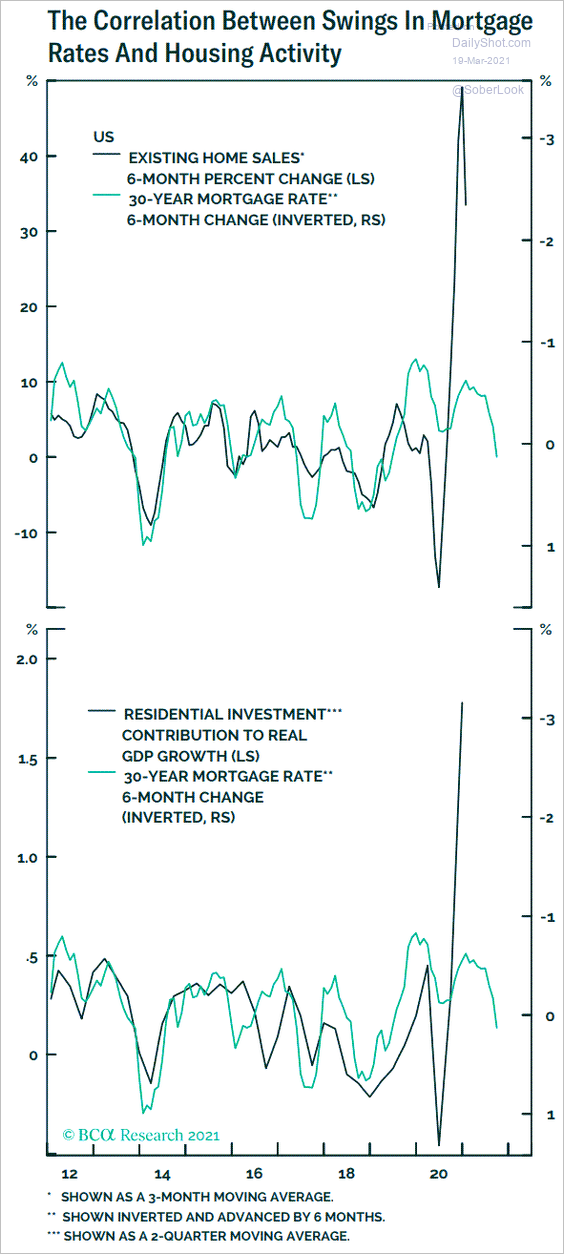

3. Higher mortgage rates are expected to cool US housing activity.

Source: BCA Research

Source: BCA Research

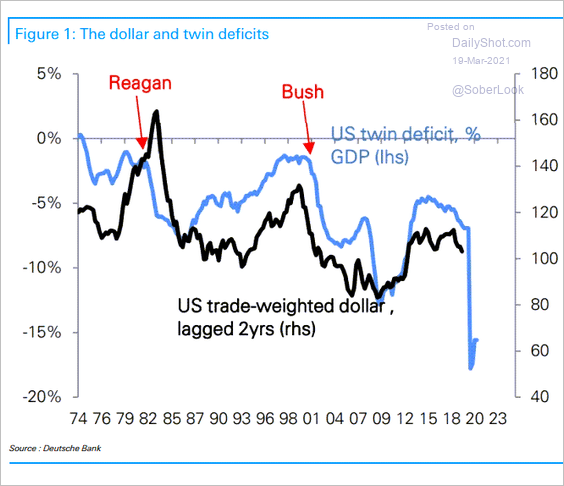

4. Here is a bearish case for the US dollar.

Source: Deutsche Bank Research; @DriehausCapital

Source: Deutsche Bank Research; @DriehausCapital

——————–

Food for Thought

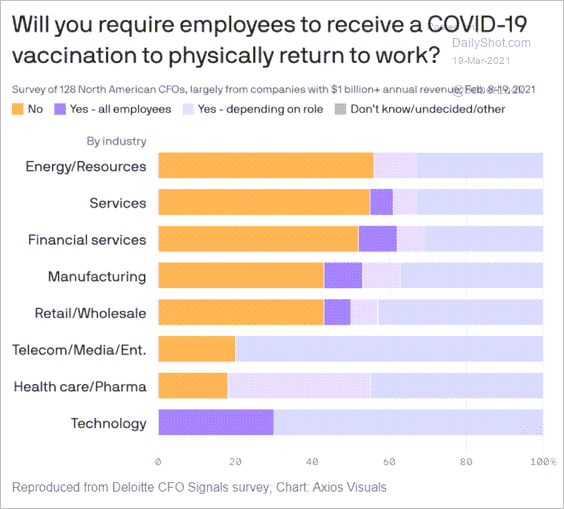

1. Will vaccinations be required before employees physically return to work?

Source: @axios Read full article

Source: @axios Read full article

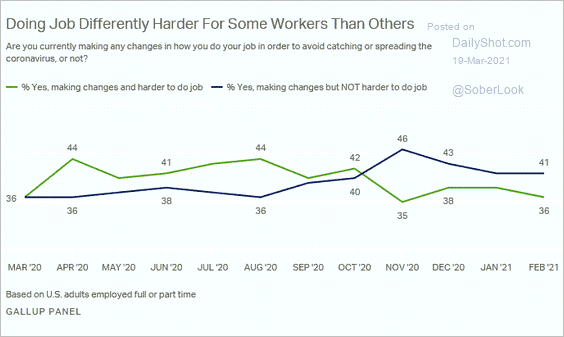

2. COVID-related work changes:

Source: Gallup Read full article

Source: Gallup Read full article

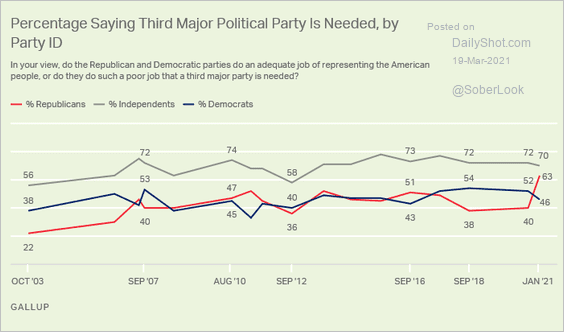

3. Is a third political party needed in the US?

Source: Gallup Read full article

Source: Gallup Read full article

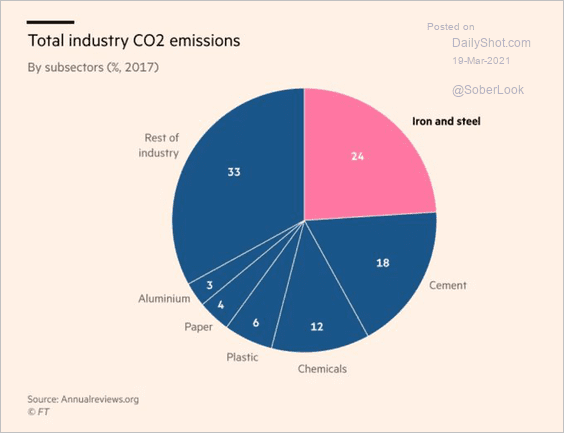

4. CO2 emissions by industry:

Source: @adam_tooze Read full article

Source: @adam_tooze Read full article

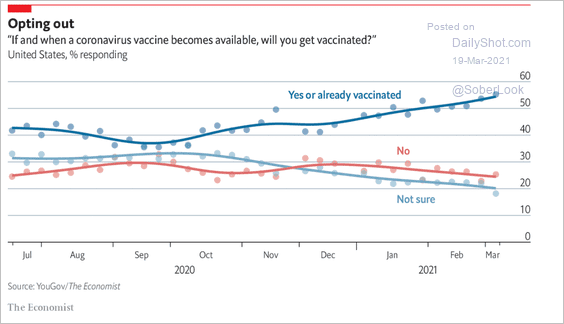

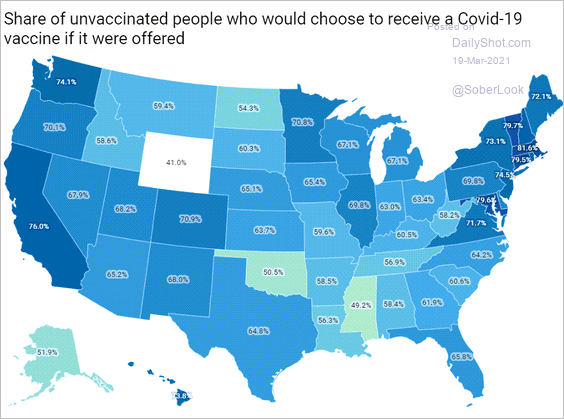

5. Opting out (2 charts):

Source: The Economist Read full article

Source: The Economist Read full article

Source: VOX Read full article

Source: VOX Read full article

——————–

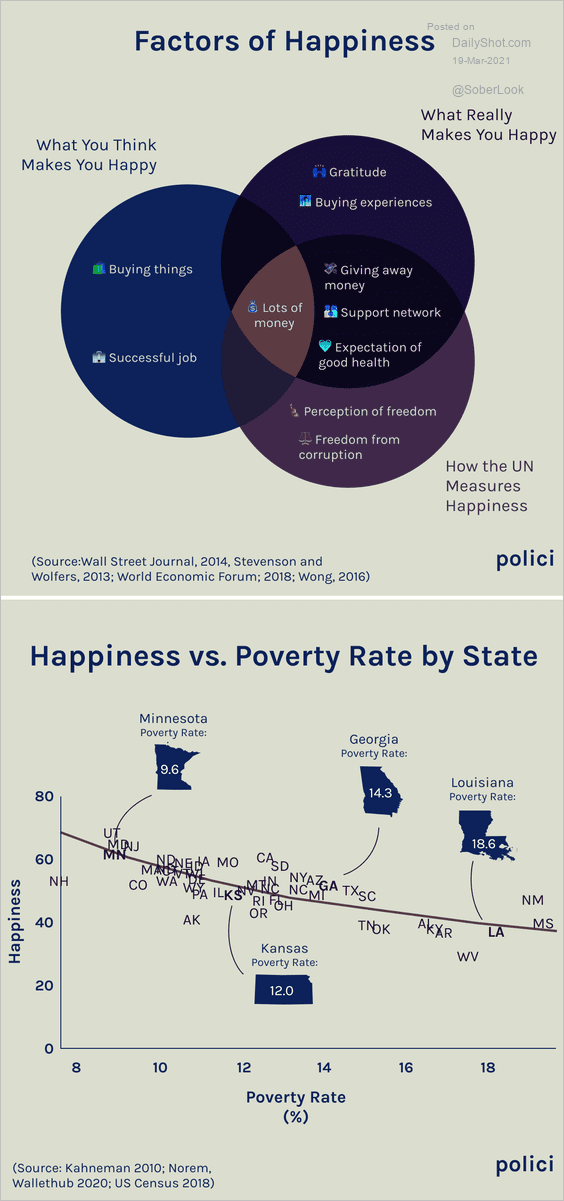

6. Factors of happiness:

Source: polici

Source: polici

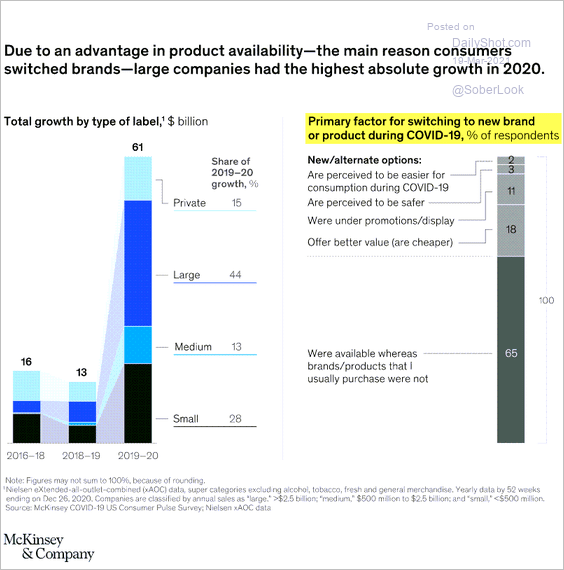

7. Reasons for switching brands last year:

Source: McKinsey Read full article

Source: McKinsey Read full article

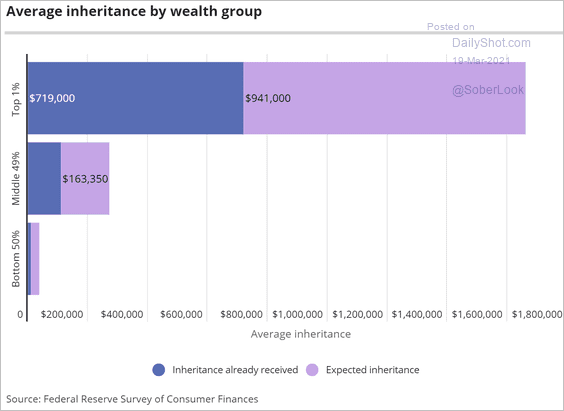

8. Average inheritance by wealth group:

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

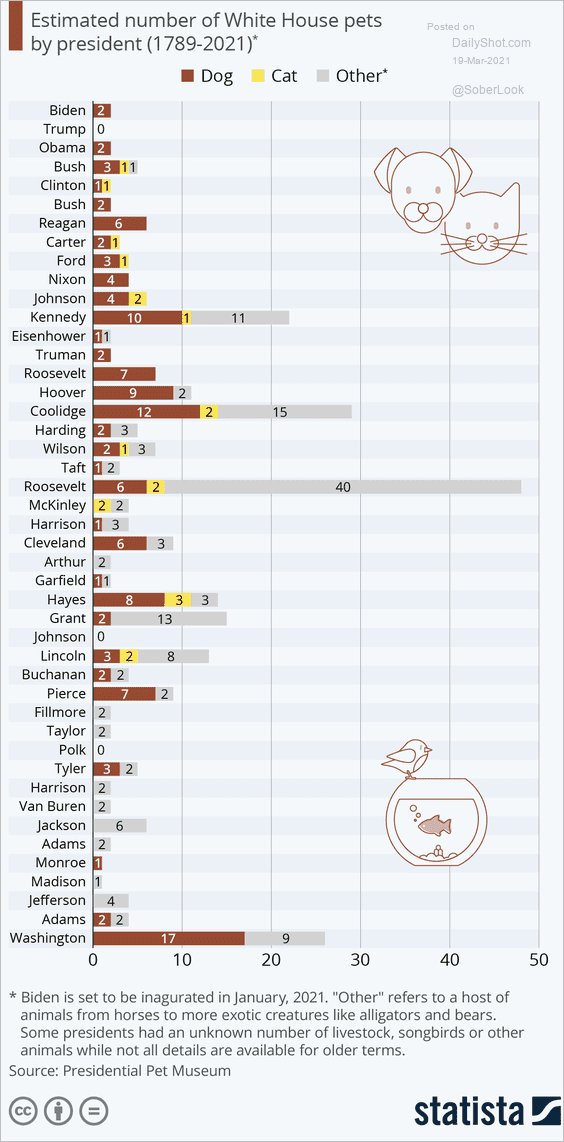

9. White House pets:

Source: Statista

Source: Statista

——————–

Have a great weekend!

Back to Index