The Daily Shot: 22-Mar-21

• The United States

• The Eurozone

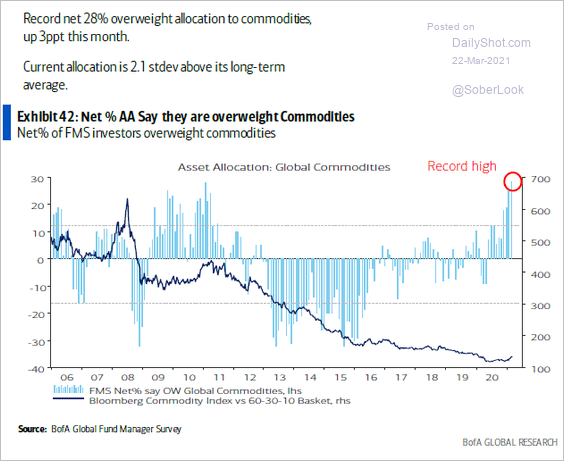

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

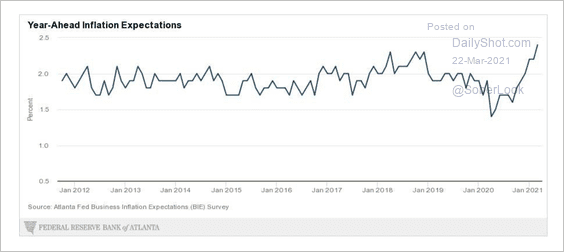

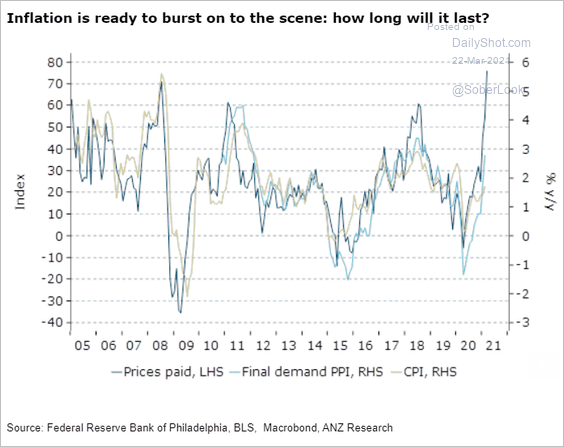

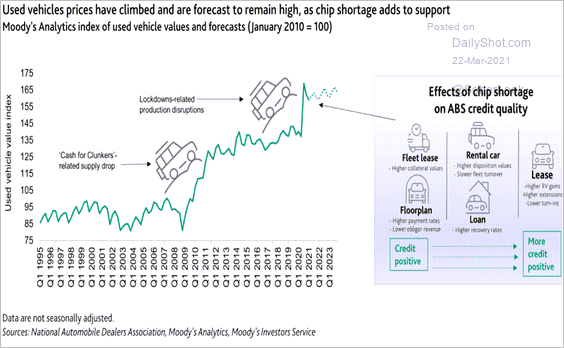

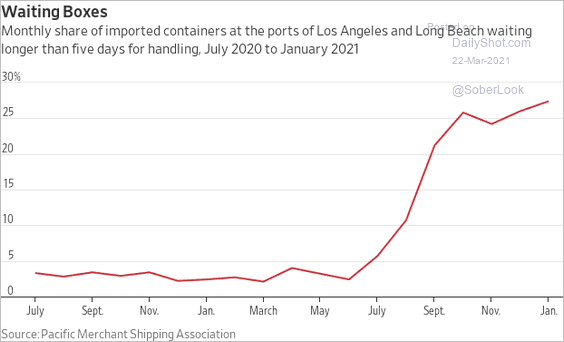

1. Let’s begin with some updates on inflation.

• Business inflation expectations are at a decade high.

Source: III Capital Management

Source: III Capital Management

• Manuacturers’ rising costs (here) continue to signal higher consumer inflation ahead.

Source: ANZ Research

Source: ANZ Research

• Supply chain disruptions have been boosting input prices. In addition to chip shortages …

Source: Moody’s Investors Service

Source: Moody’s Investors Service

… and bottlenecks at California ports, …

Source: @WSJ Read full article

Source: @WSJ Read full article

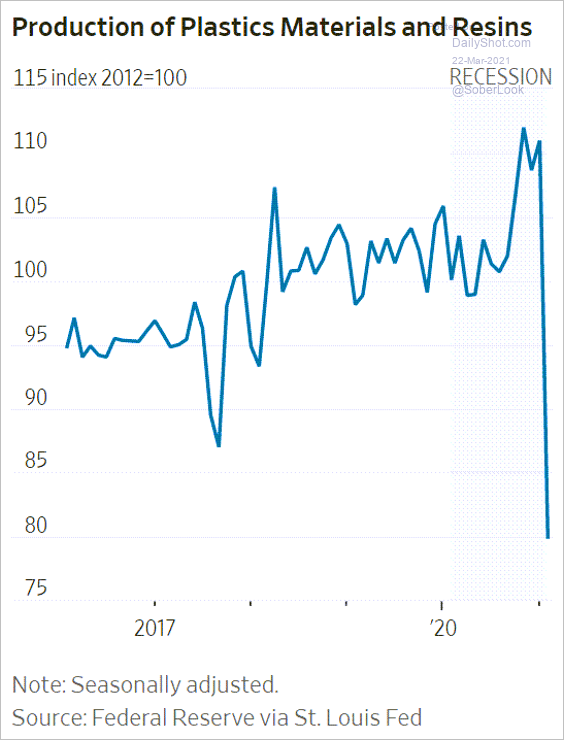

… the Texas deep freeze created a shortage of plastics.

Source: @WSJ Read full article

Source: @WSJ Read full article

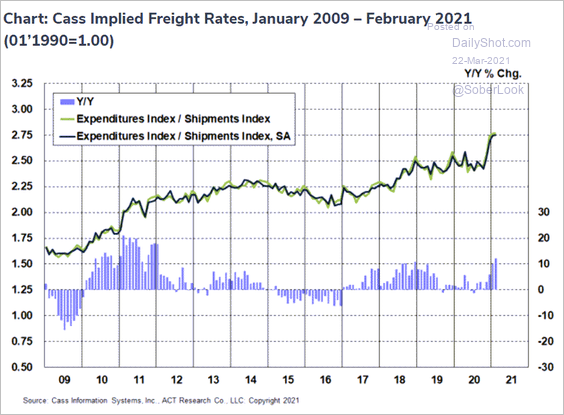

And freight rates are climbing.

Source: Cass Information Systems

Source: Cass Information Systems

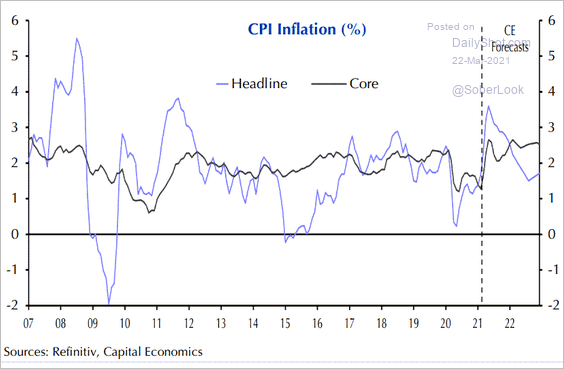

• The key question is whether the CPI increase will be sustained. Here is a forecast from Capital Economics.

Source: Capital Economics

Source: Capital Economics

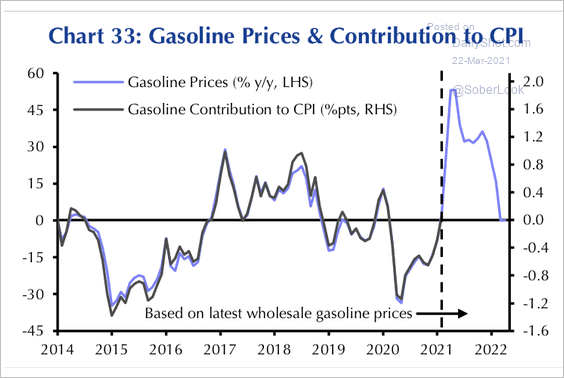

• The rise in gasoline prices will add close to 2 percentage points to headline CPI by April, according to Capital Economics (base effects). But the sharp rise will be short-lived.

Source: Capital Economics

Source: Capital Economics

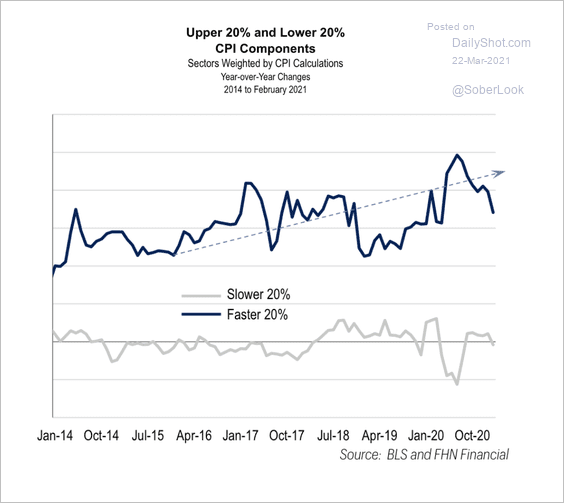

• The fastest 20% of CPI components have risen for several years, while the slower 20% have remained centered on zero. Here is a comment from Jim Vogel, FHN Financial.

Bottom Line: The time to start considering a real shift to sustained inflation is when the lowest 20th percentile of prices – with those prices weighted evenly – begins to rise along with the upper 20th percentile.

Source: FHN Financial

Source: FHN Financial

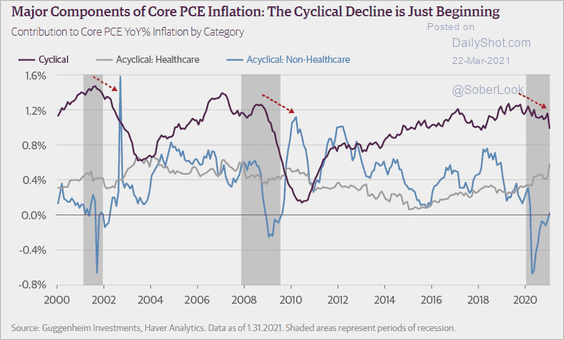

• The cyclical components of the core PCE inflation have been trending lower.

Source: @ScottMinerd

Source: @ScottMinerd

——————–

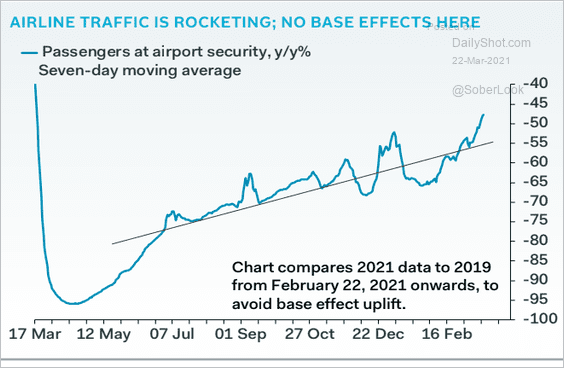

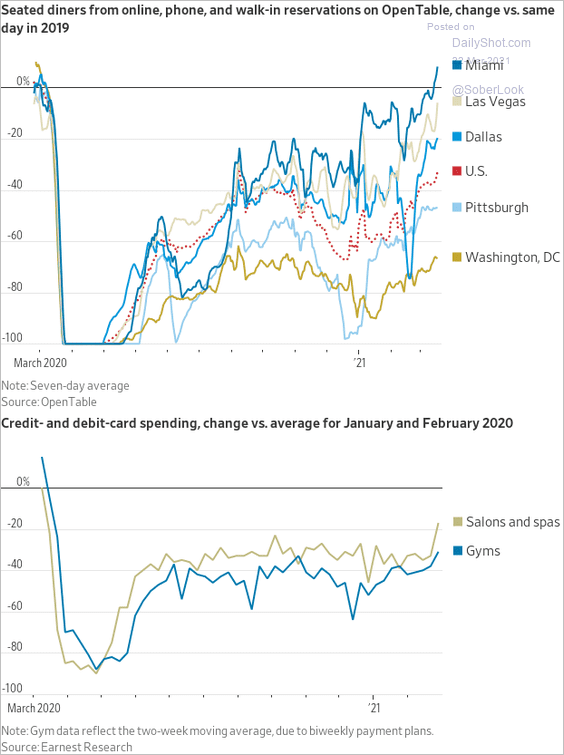

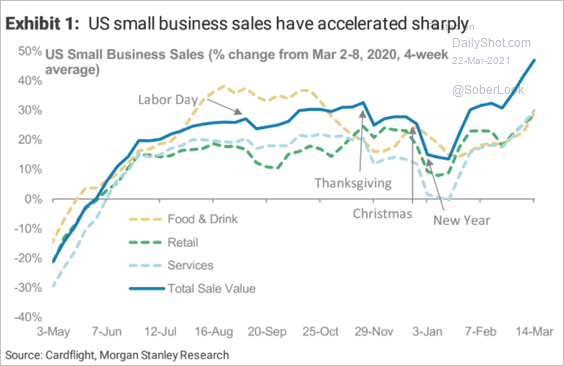

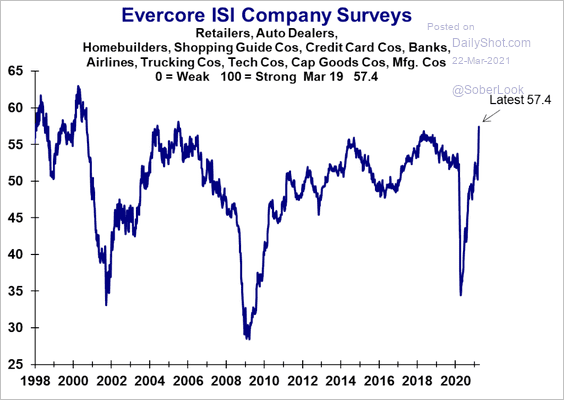

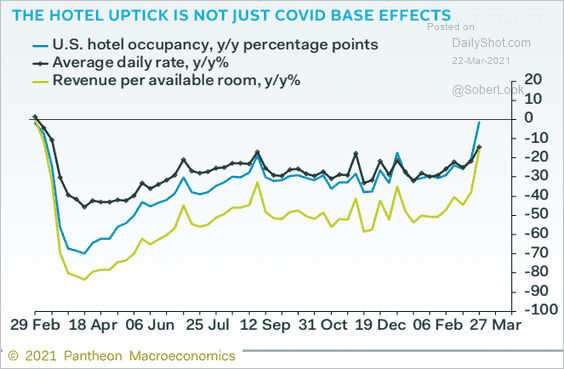

2. High-frequency indicators point to accelerating economic growth.

• Airline traffic:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Restaurant activity as well as spending on salons and spas:

Source: @WSJ Read full article

Source: @WSJ Read full article

• Small business sales:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

• Evercore ISI business survey:

Source: Evercore ISI

Source: Evercore ISI

Evercore ISI business survey of retailers:

Source: Evercore ISI

Source: Evercore ISI

• Hotel occupancy:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

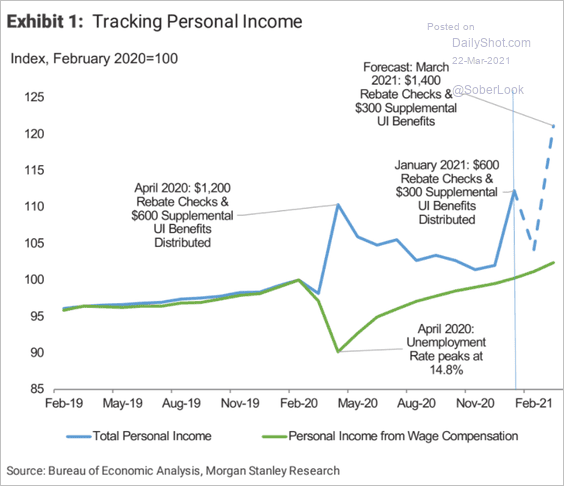

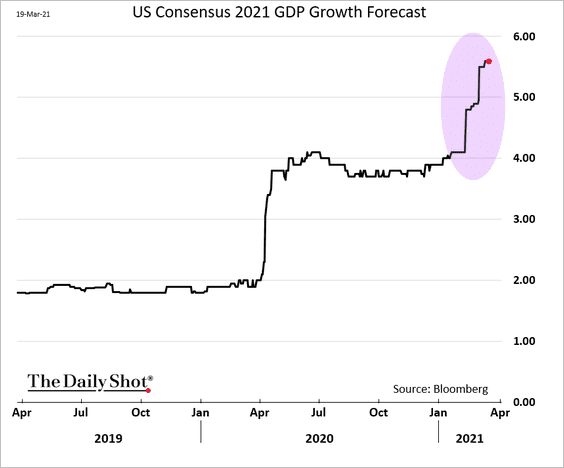

3. As a result of the above trends and the massive stimulus injection, …

Source: Morgan Stanley Research

Source: Morgan Stanley Research

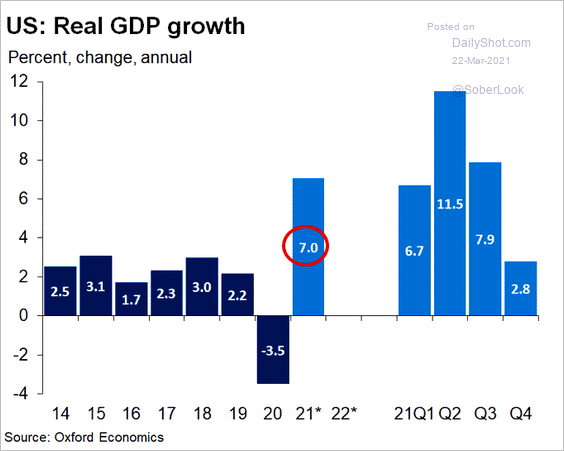

… economists increasingly expect China-like GDP growth this year.

Here is a forecast from Oxford Economics.

Source: @GregDaco, @OxfordEconomics

Source: @GregDaco, @OxfordEconomics

——————–

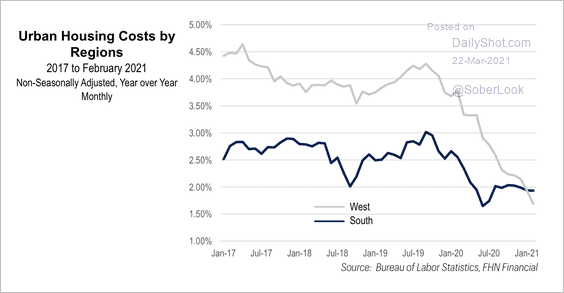

4. Urban housing costs have declined sharply in western states. Prices in southern cities held up better.

Source: FHN Financial

Source: FHN Financial

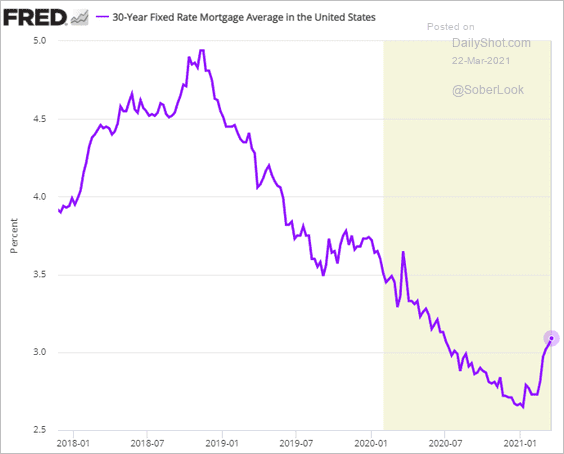

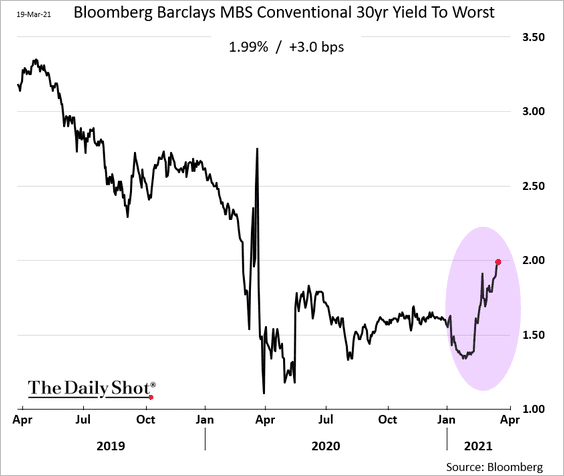

5. Mortgage rates are grinding higher, …

… boosted by rising MBS yields.

Back to Index

The Eurozone

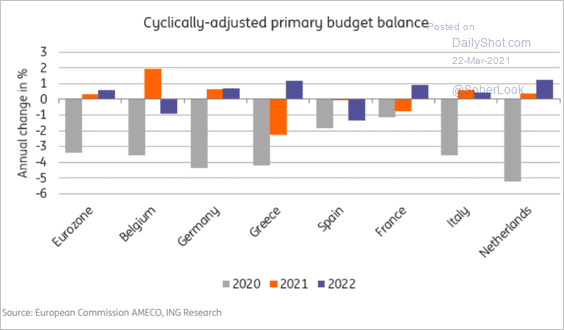

1. Let’s start with the latest budget balance forecasts by country (from ING).

Source: ING

Source: ING

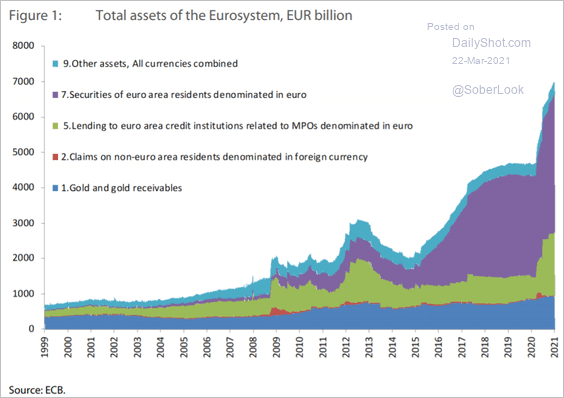

2. Here is the composition of the ECB’s balance sheet growth, …

Source: ECB Read full article

Source: ECB Read full article

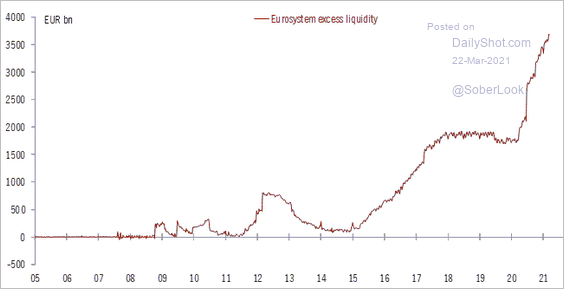

… which is pushing excess reserves to new records.

Source: @fwred

Source: @fwred

——————–

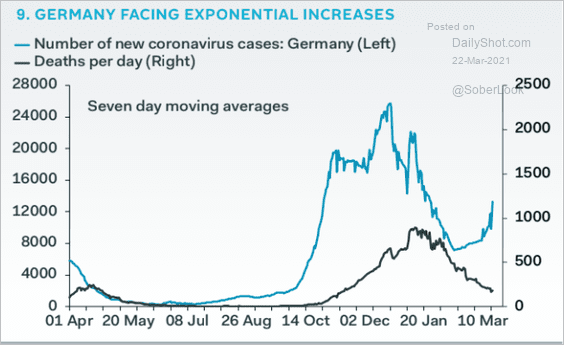

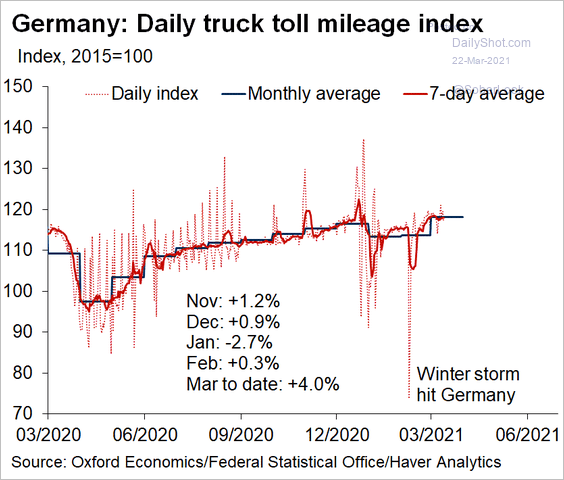

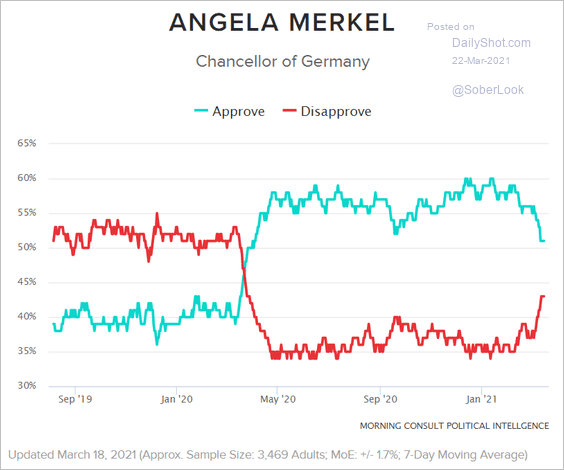

3. Next, we have some updates on Germany.

• New COVID cases:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Truck toll milage:

Source: @OliverRakau

Source: @OliverRakau

• Angela Merkel’s approval ratings:

Source: Morning Consult

Source: Morning Consult

——————–

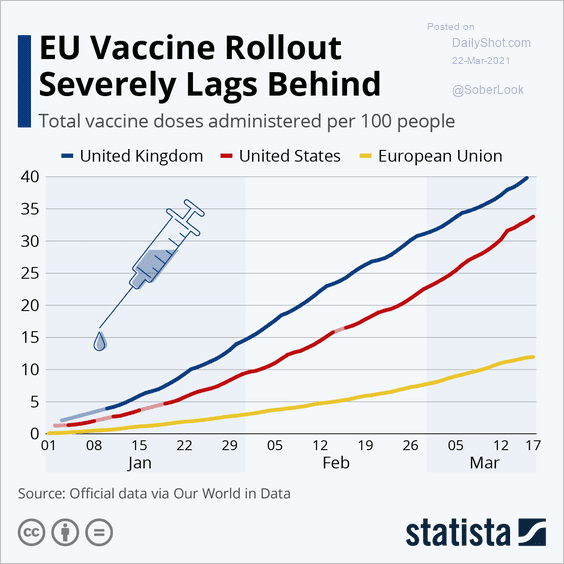

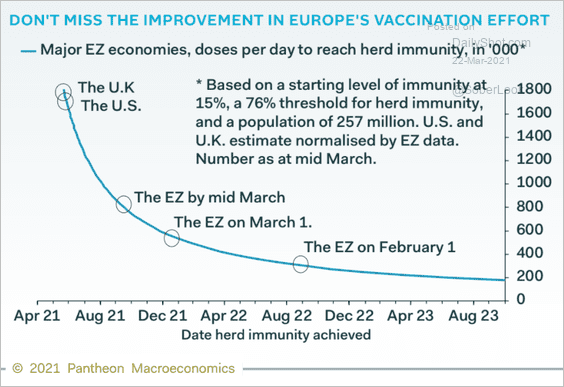

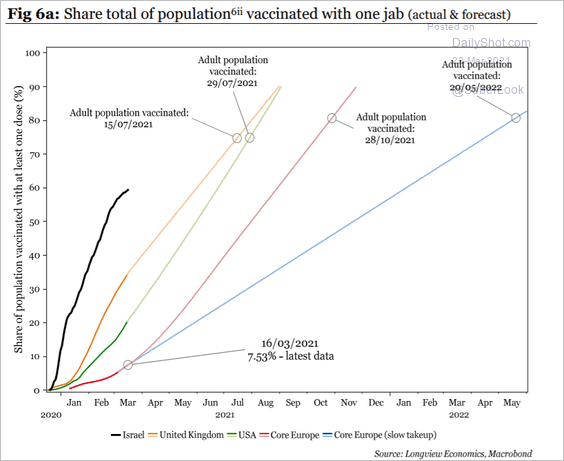

4. EU vaccination cases have been lagging, …

Source: Statista

Source: Statista

… but the pace has picked up in the Eurozone.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Here are a couple of scenarios.

Source: Longview Economics

Source: Longview Economics

Back to Index

Asia – Pacific

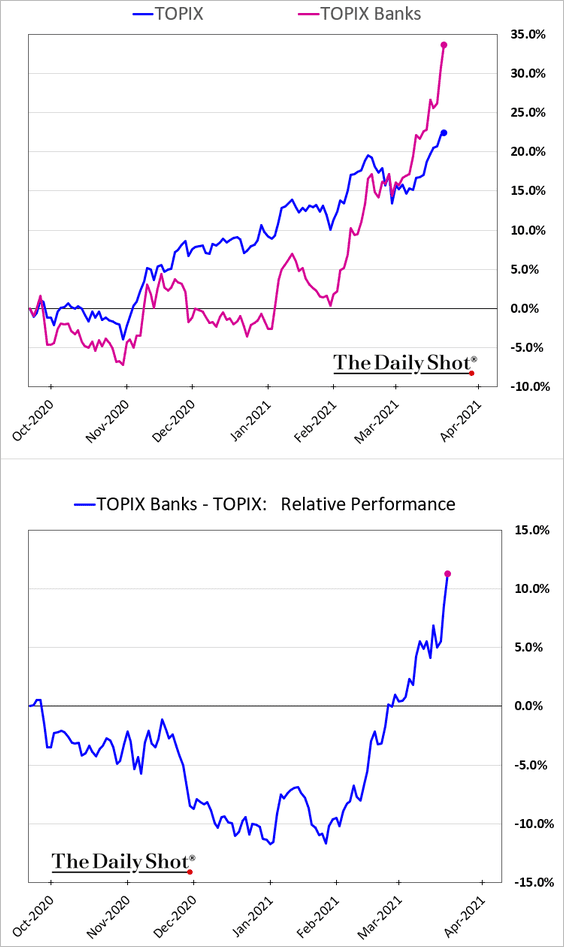

1. Japanese bank shares have outperformed sharply in recent weeks.

h/t @shoko_oda

h/t @shoko_oda

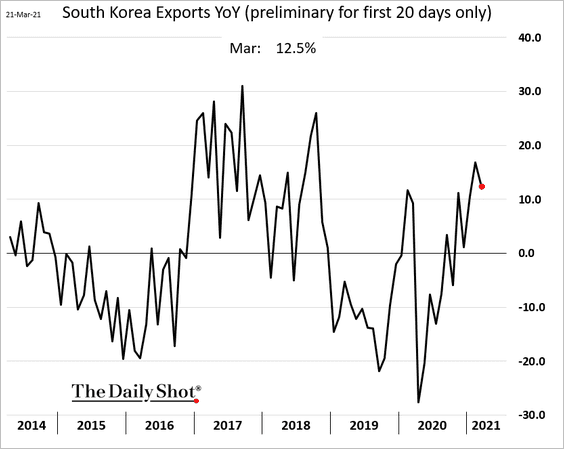

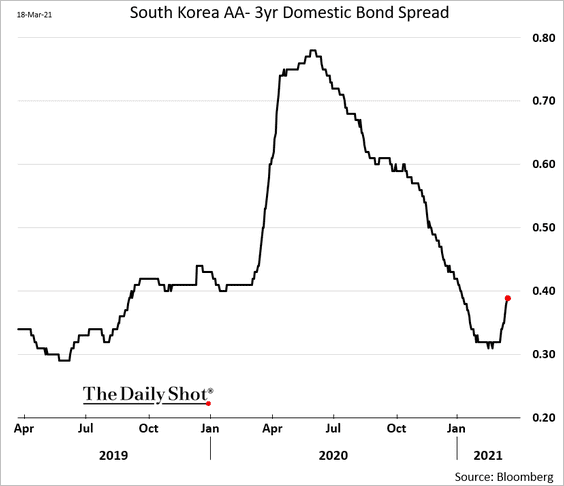

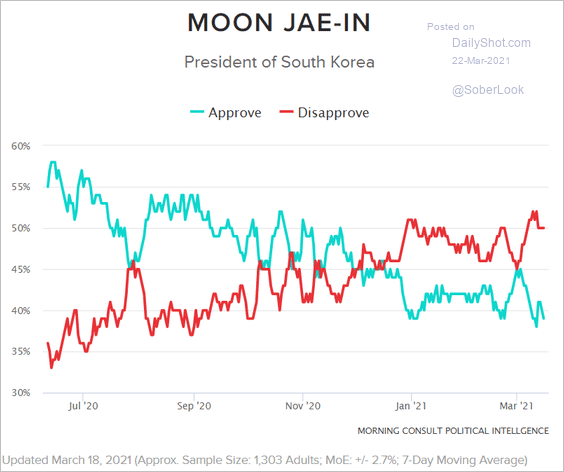

2. Here are some updates on South Korea.

• Exports are holding up well.

• Corporate bond spreads are widening.

Source: Kyungji Cho

Source: Kyungji Cho

• President Moon’s approval ratings have deteriorated.

Source: Morning Consult

Source: Morning Consult

Back to Index

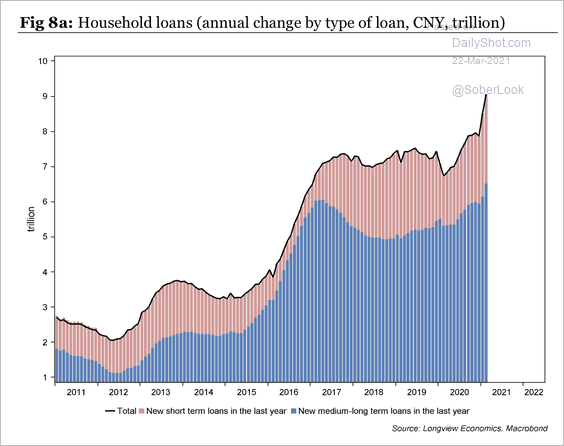

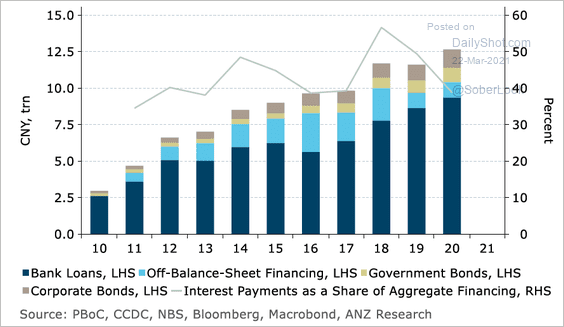

China

1. Households have been leveraging up.

Source: Longview Economics

Source: Longview Economics

2. This chart shows the total interest payments.

Source: ANZ Research

Source: ANZ Research

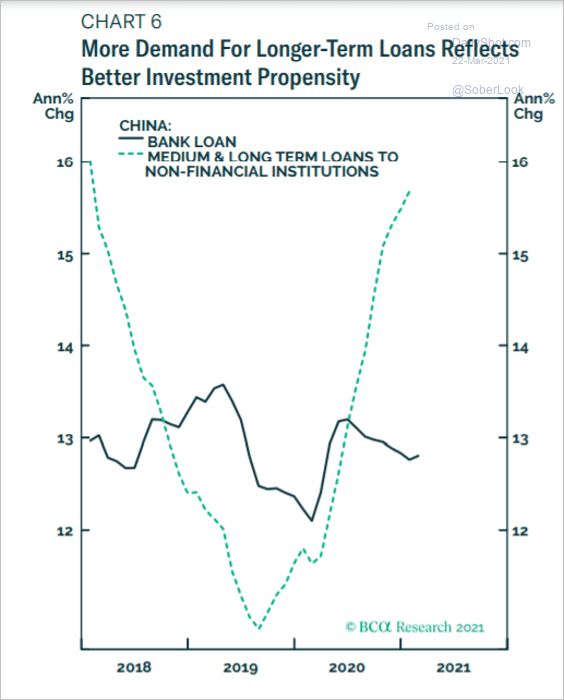

3. Demand for long-term loans has risen significantly.

Source: BCA Research

Source: BCA Research

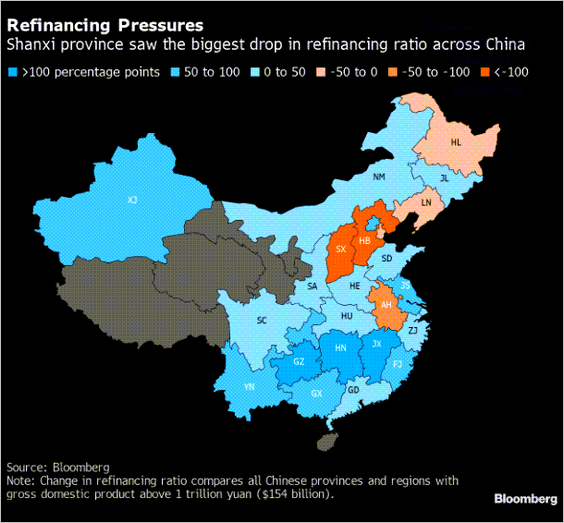

4. Some coal companies may have trouble rolling their debt.

Source: Molly Dai, @markets Read full article

Source: Molly Dai, @markets Read full article

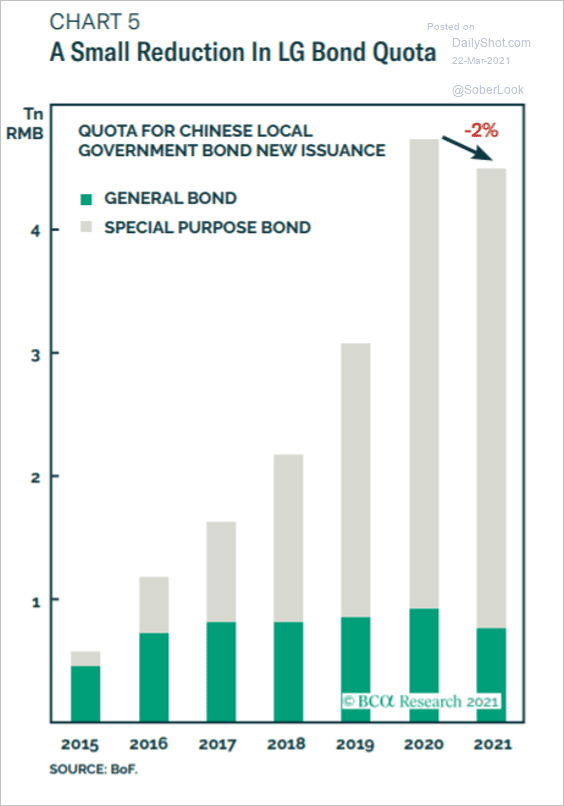

5. The 2021 reduction in the local government bond issuance quota was relatively small.

Source: BCA Research

Source: BCA Research

Back to Index

Emerging Markets

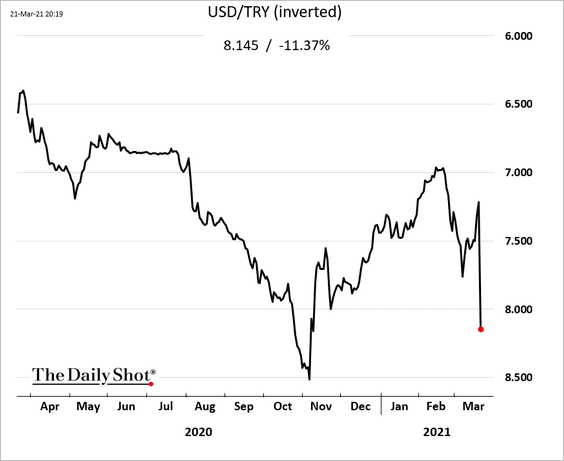

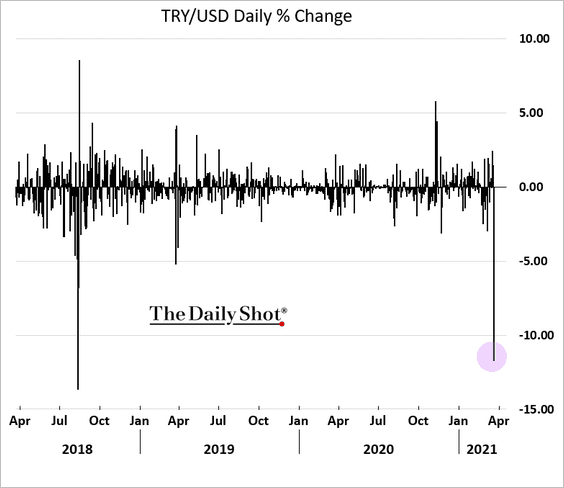

1. Turkey’s aggressive rate hike last week (here) cost the central bank chief his job.

Source: @WSJ Read full article

Source: @WSJ Read full article

The lira tumbled in response.

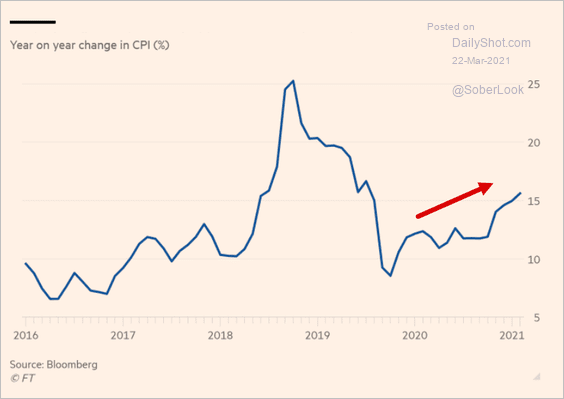

By the way, here is why the central bank hiked rates.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

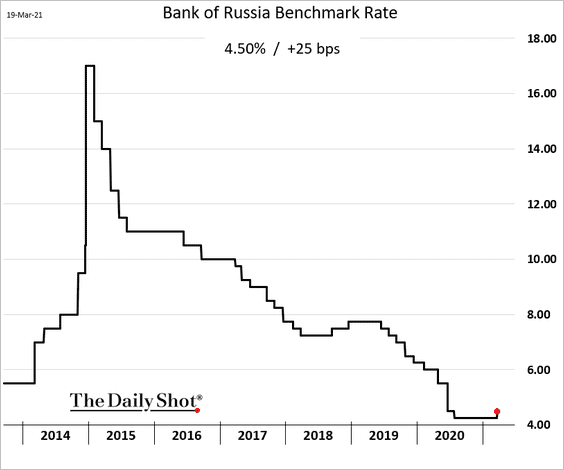

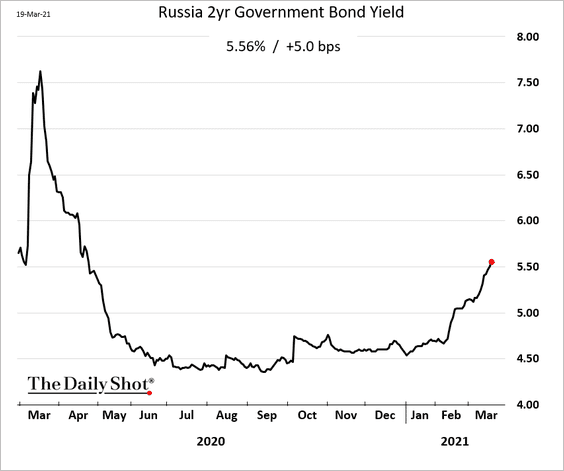

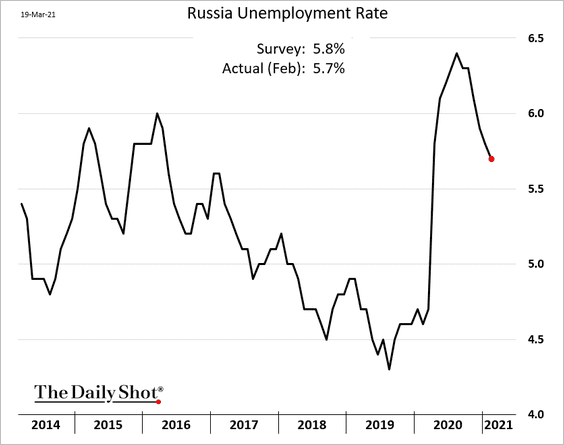

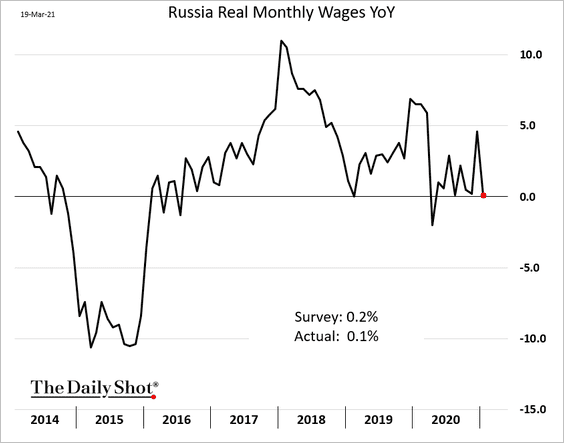

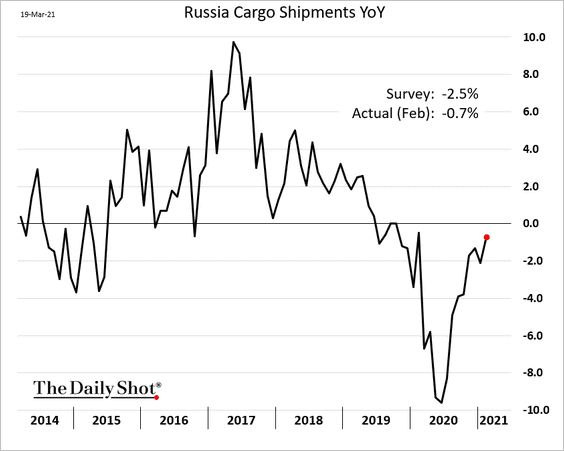

2. Next, we have some updates on Russia.

• The central bank surprised the market with a rate hike.

Source: @markets Read full article

Source: @markets Read full article

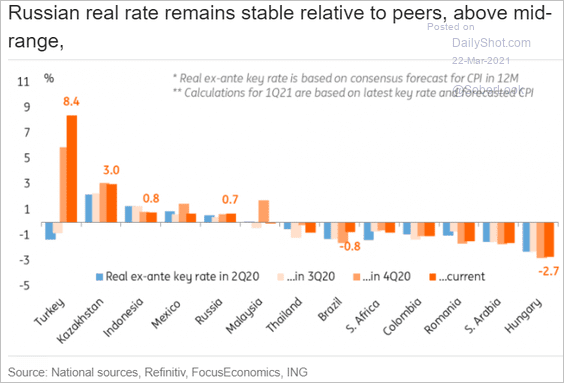

• Real rates have been stable.

Source: ING

Source: ING

• Domestic bond yields are climbing.

• Here are some economic indicators.

– The unemployment rate:

– Retail sales:

• Wage growth:

• Cargo shipments:

——————–

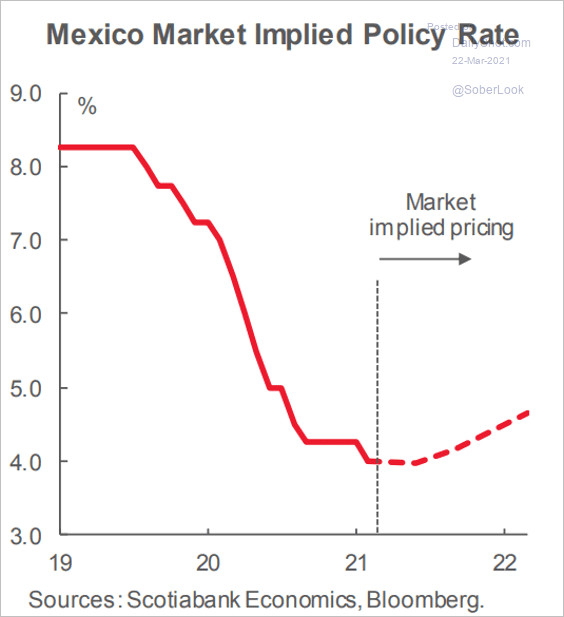

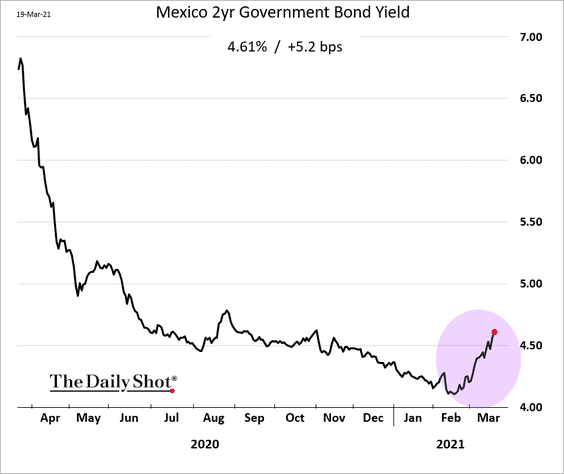

3. The market expects a rate hike in Mexico later this year.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

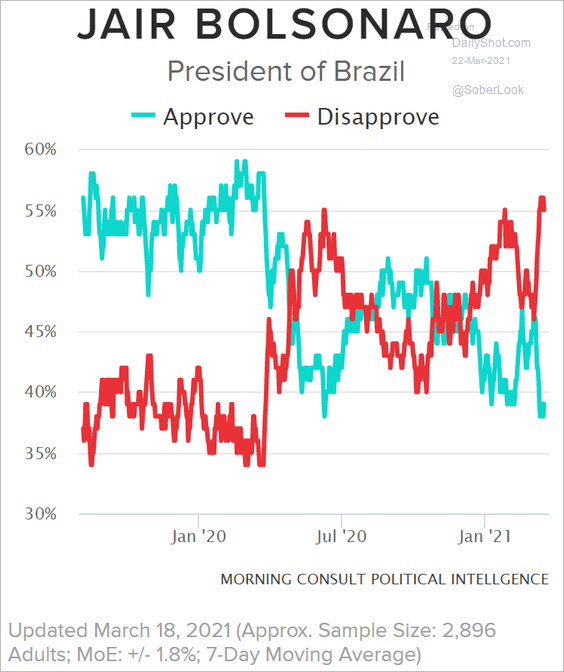

4. Bolsonaro’s approval ratings have deteriorated.

Source: Morning Consult

Source: Morning Consult

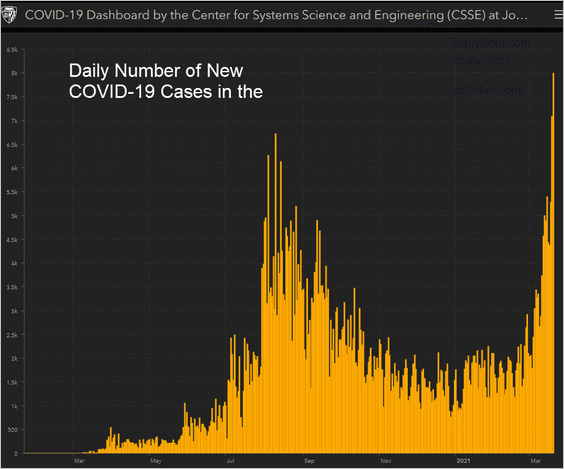

5. COVID cases in the Philippines are accelerating.

Source: JHU CSSE

Source: JHU CSSE

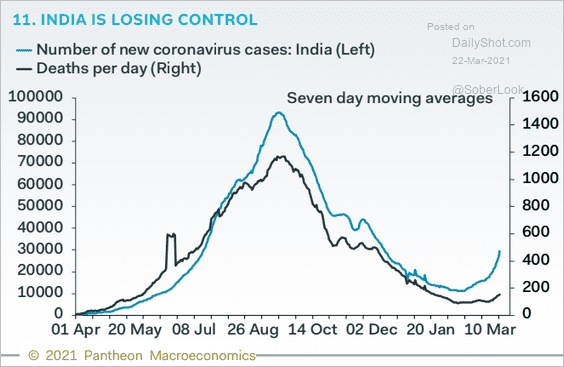

6. Here are some updates on India.

• New cases are rising again.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

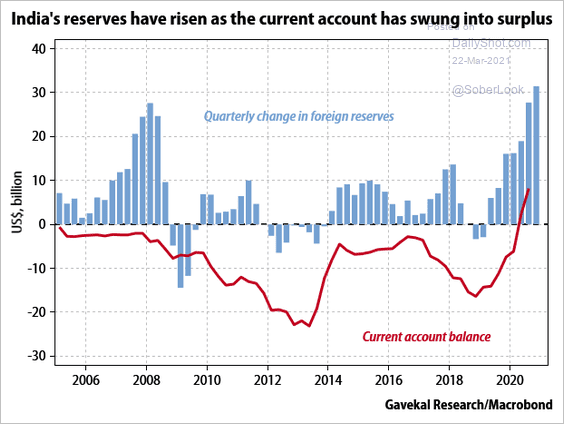

• F/X reserves rose sharply.

Source: Gavekal Research

Source: Gavekal Research

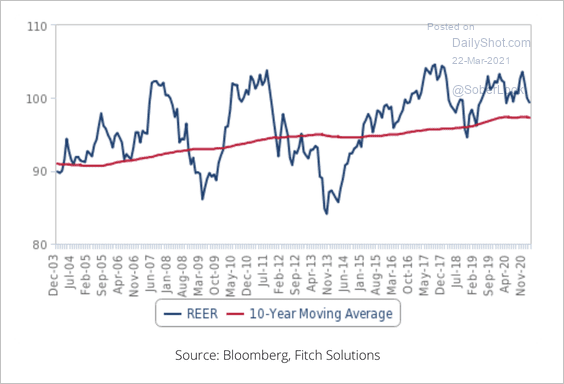

• The rupee is slightly overvalued relative to its 10-year average.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

——————–

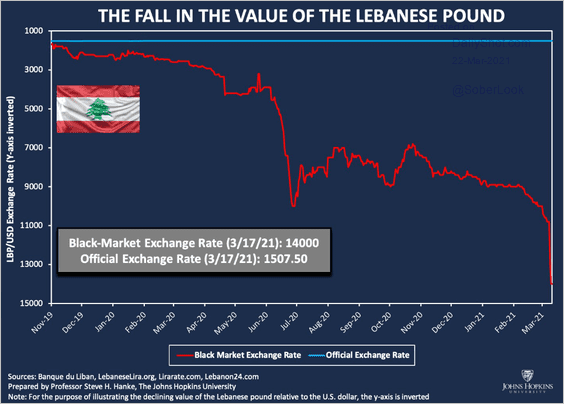

7. The Lebanese pound tumbled in the black market.

Source: @steve_hanke

Source: @steve_hanke

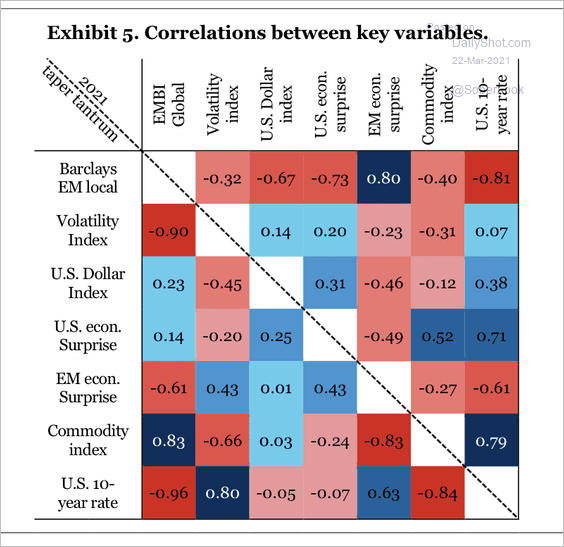

8. This chart shows key correlations with EM sovereign risk.

Source: IIF

Source: IIF

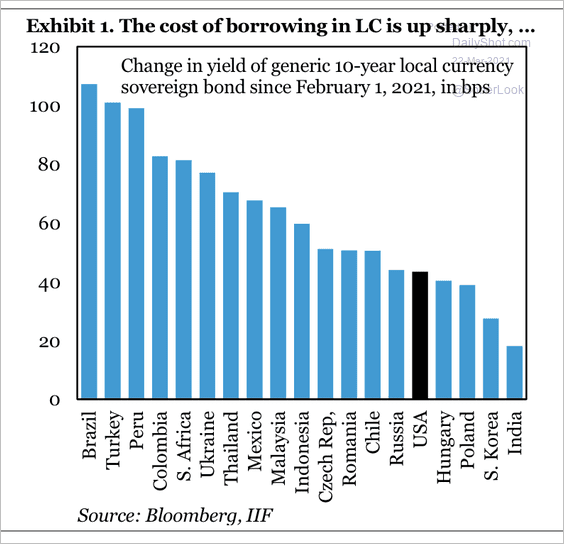

9. The cost of borrowing in local currency has increased sharply over the past month, …

Source: IIF

Source: IIF

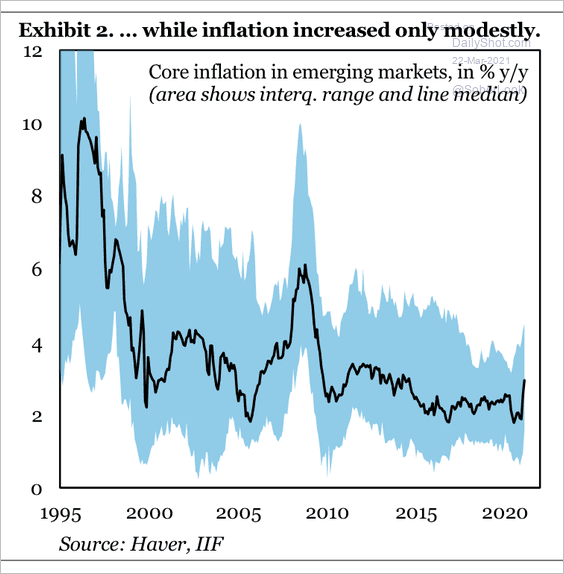

… despite relatively low inflation.

Source: IIF

Source: IIF

Back to Index

Commodities

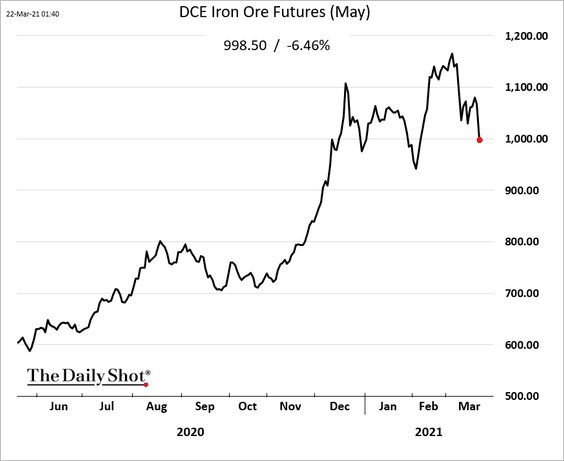

1. Iron ore is down 6.5% in China today.

2. Dry bulk shipping costs keep climbing.

3. Fund investors are very bullish on commodities. Too much enthusiasm, perhaps?

Source: BofA Global Research

Source: BofA Global Research

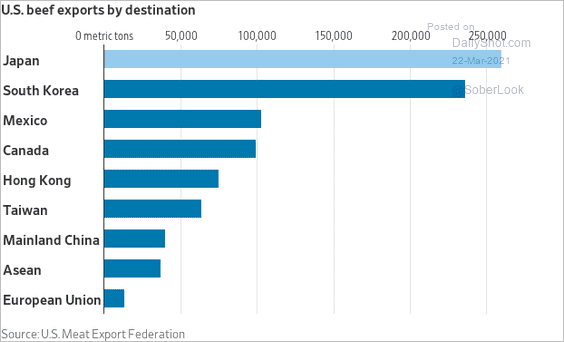

4. This chart shows US beef exports by country. Not being part of TPP puts the US at a disadvantage in Japan.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Energy

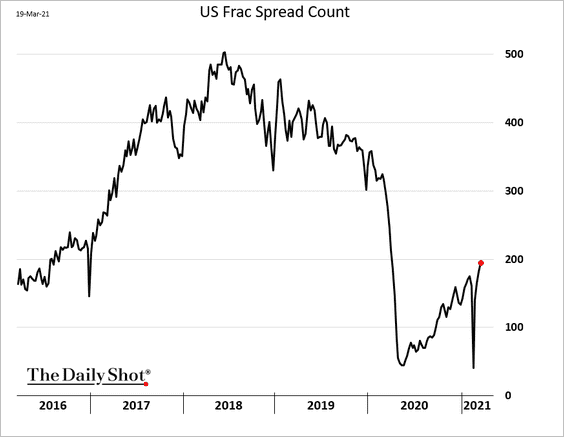

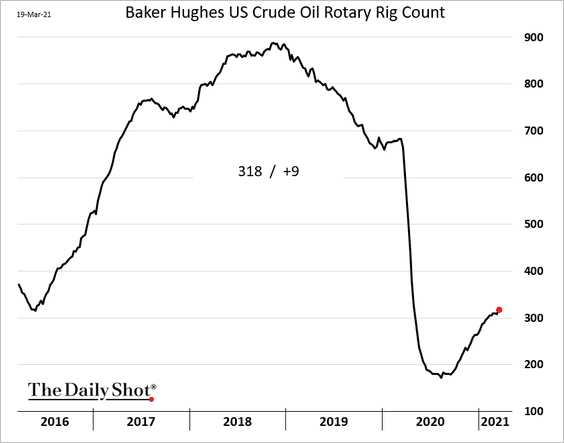

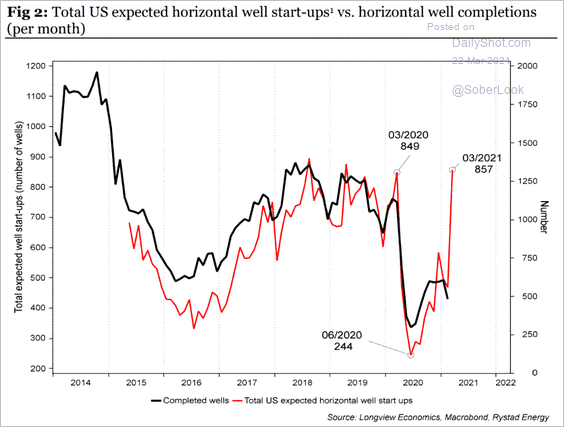

1. US fracking activity continues to improve.

• Nine rigs were added last week.

• Well start-ups have rebounded.

Source: Longview Economics

Source: Longview Economics

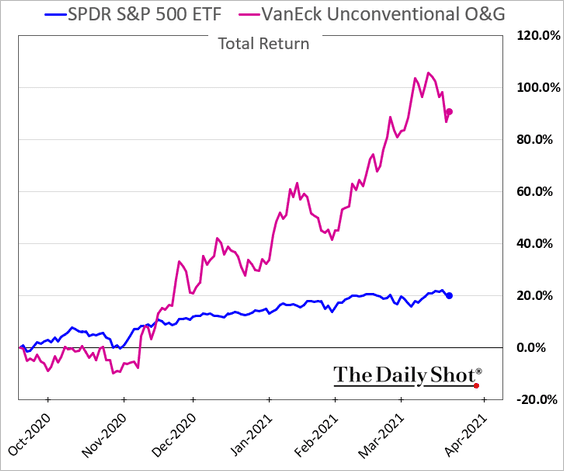

• Shares of fracking companies have been outperforming.

——————–

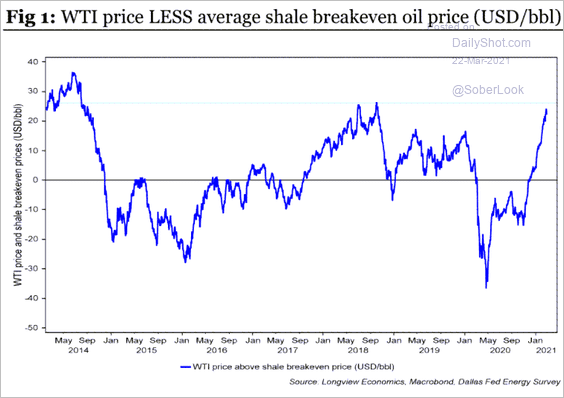

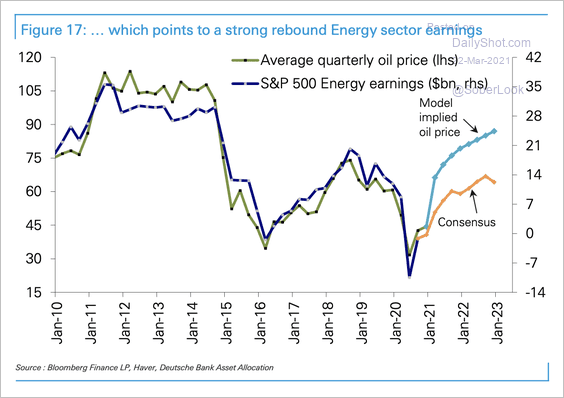

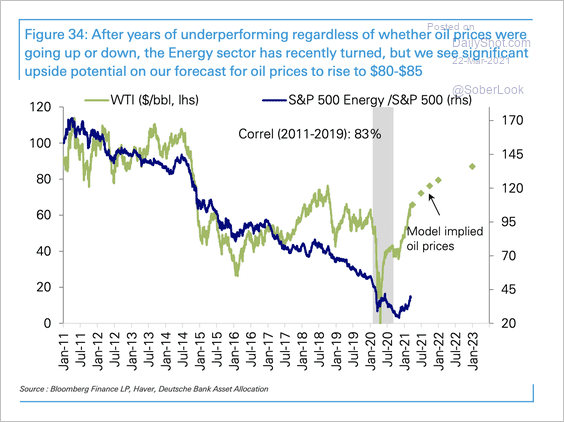

2. Higher oil prices would boost energy sector earnings (3 charts).

Source: Longview Economics

Source: Longview Economics

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

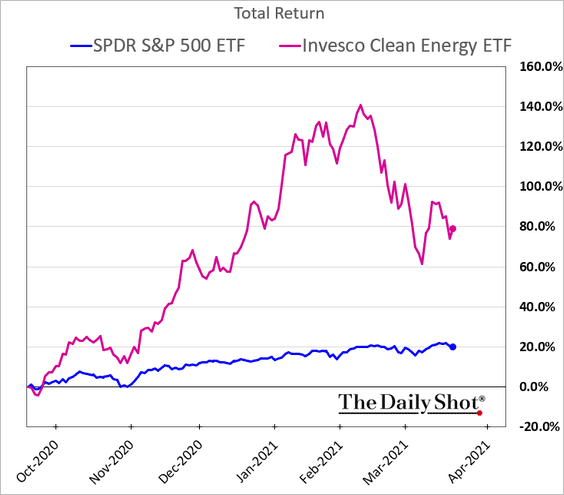

3. “Clean energy” stocks have given up some of the recent gains.

Back to Index

Equities

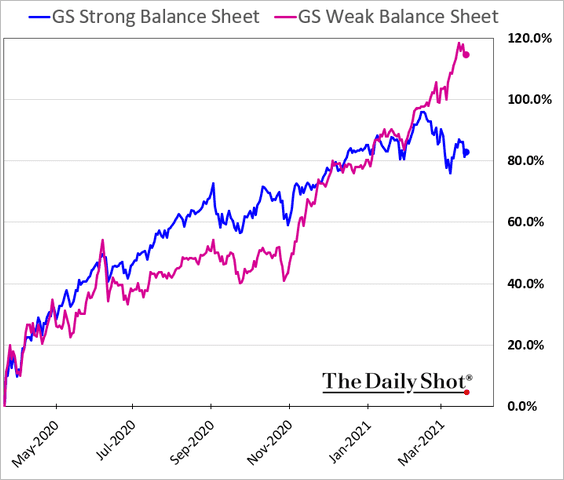

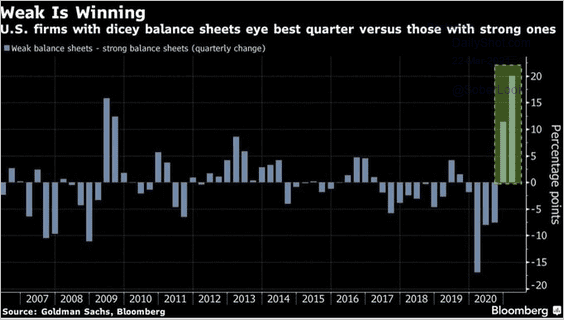

1. Companies with weak balance sheets have outperformed sharply (2 charts).

Source: @kgreifeld, @markets, @VildanaHajric Read full article

Source: @kgreifeld, @markets, @VildanaHajric Read full article

——————–

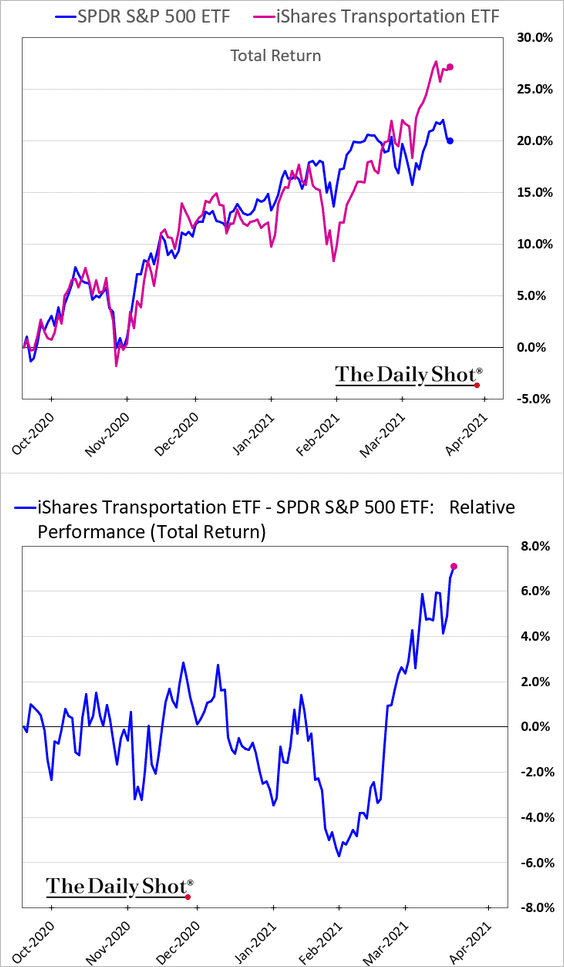

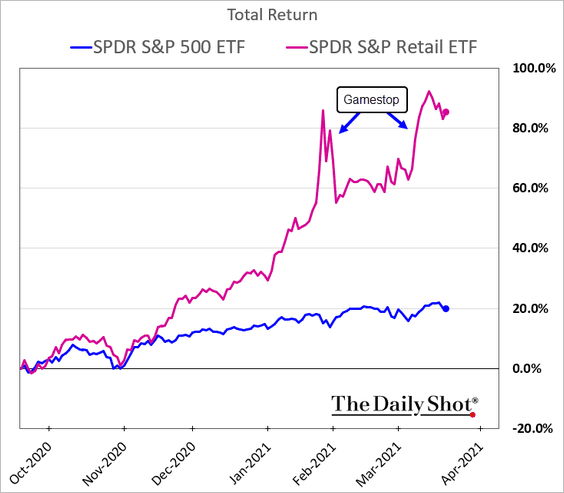

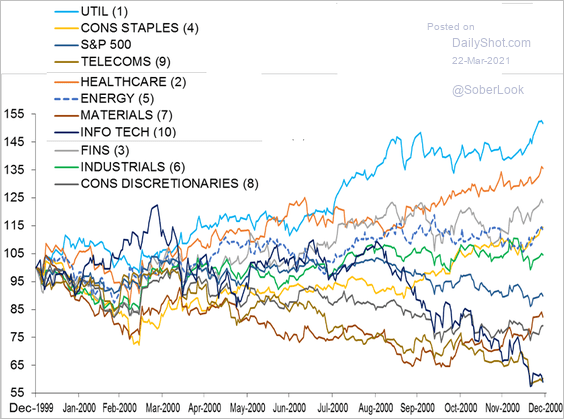

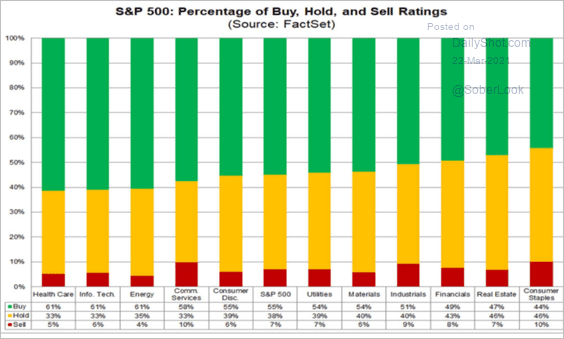

2. Next, we have some sector updates.

• Transportation:

• Retail:

• Sector performance around the dot-com bubble:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Analysts’ recommendations:

Source: @FactSet

Source: @FactSet

——————–

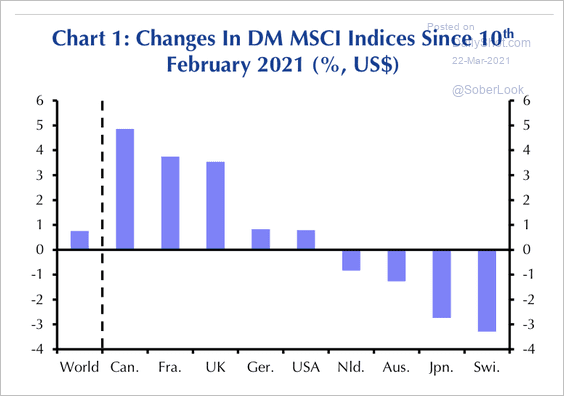

3. Canada, France, and UK equities have held up well relative to their developed-market peers over the past month.

Source: Capital Economics

Source: Capital Economics

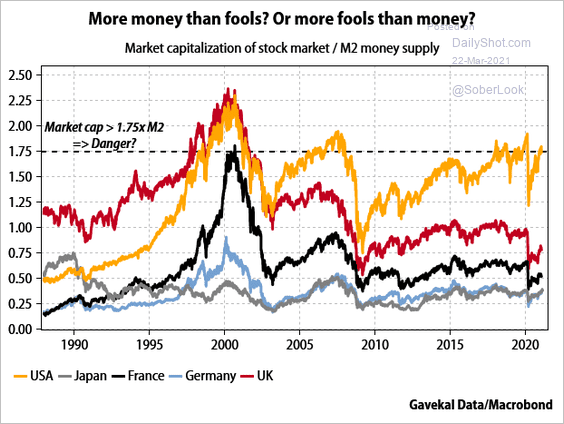

4. This chart shows market capitalizations as a share of the M2 money supply.

Source: Gavekal Research

Source: Gavekal Research

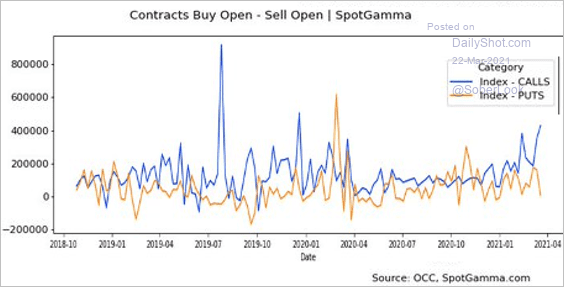

5. Traders have been buying call options at the open.

Source: @spotgamma

Source: @spotgamma

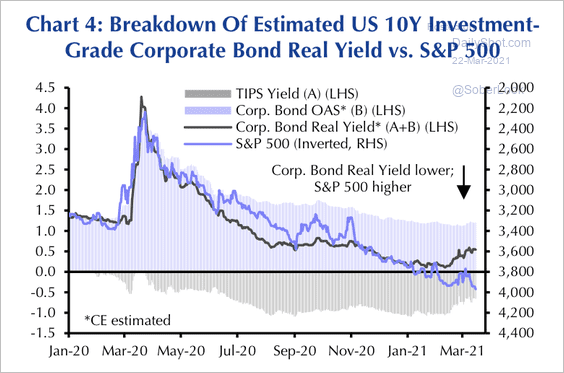

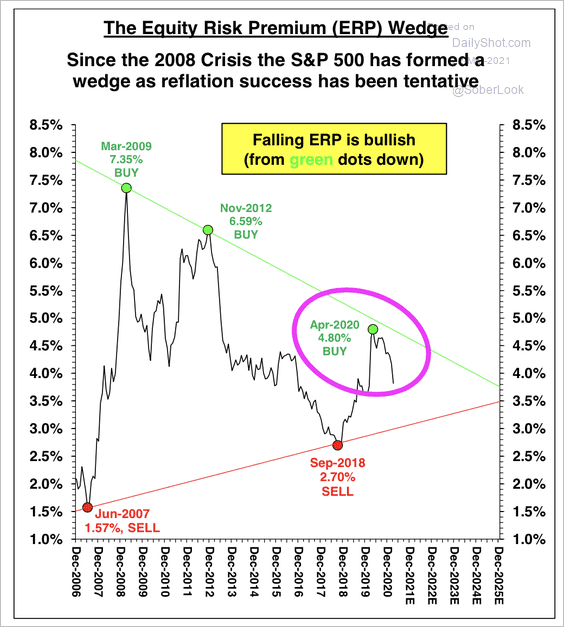

6. The low level of US corporate bond spreads is essentially a proxy for equity risk premia, according to Capital Economics (2 charts).

Source: Capital Economics

Source: Capital Economics

Source: Stifel

Source: Stifel

——————–

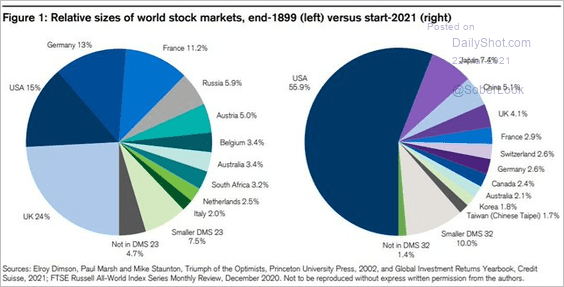

7. Finally, we have the relative sizes of equity markets in 1899 and 2021.

Source: @RyanDetrick, @CreditSuisse

Source: @RyanDetrick, @CreditSuisse

Back to Index

Rates

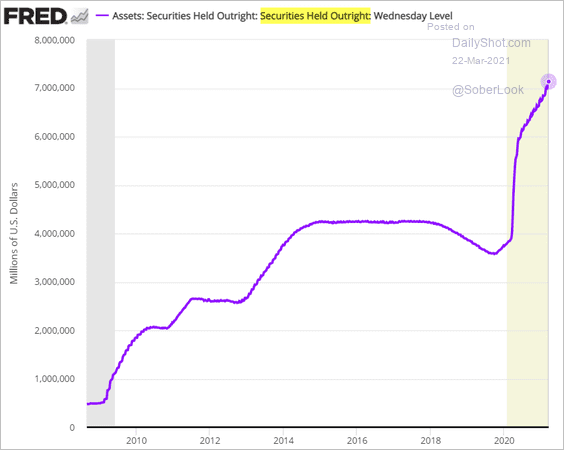

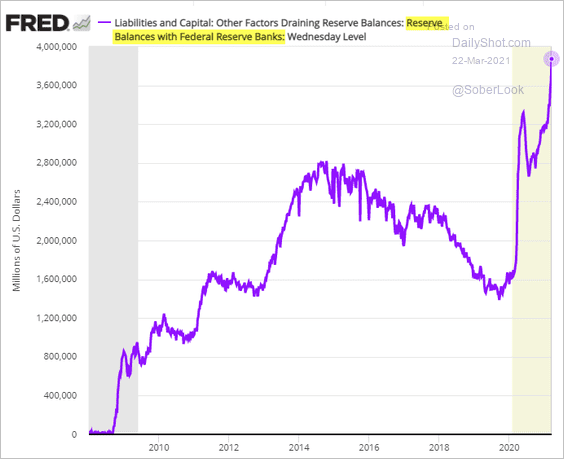

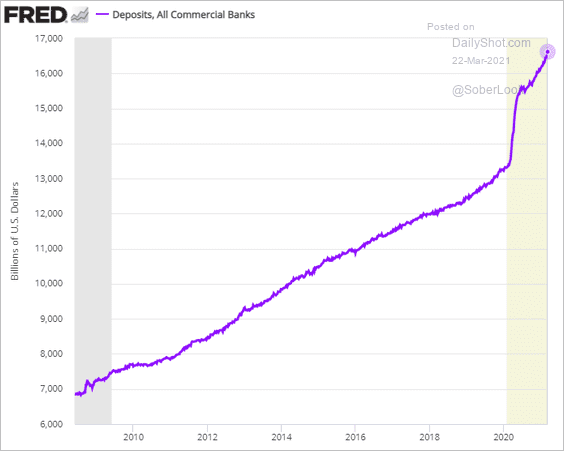

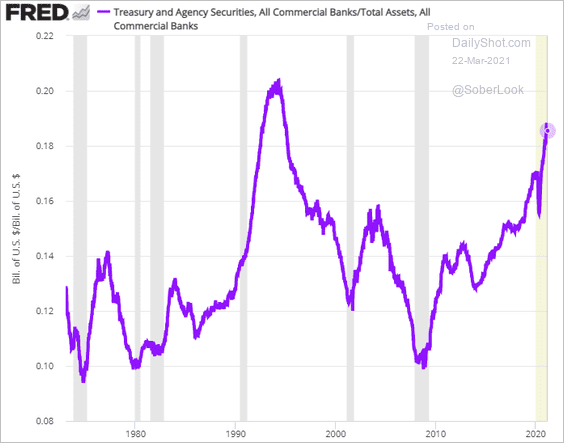

1. The combination of the US Treasury pulling liquidity from its account at the Fed (here) and the Fed’s ongoing QE program …

… sent reserve balances to record levels.

At the same time, private-sector deposits are surging.

In response to the above developments, the Fed boosted counterparty limits on its reverse repo program to create a floor on short-term rates. The central bank does not want to see negative rates.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

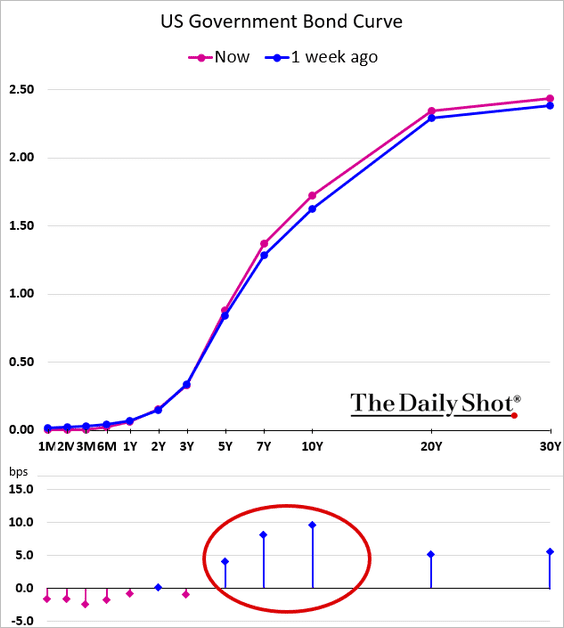

2. Yields climbed the most in the intermediate maturities last week.

3. The Fed is letting the bank leverage-ratio exemption expire.

Source: Reuters Read full article

Source: Reuters Read full article

Will it result in lower Treasury holdings at banks? It’s unlikely because the largest banks can get around these limitations.

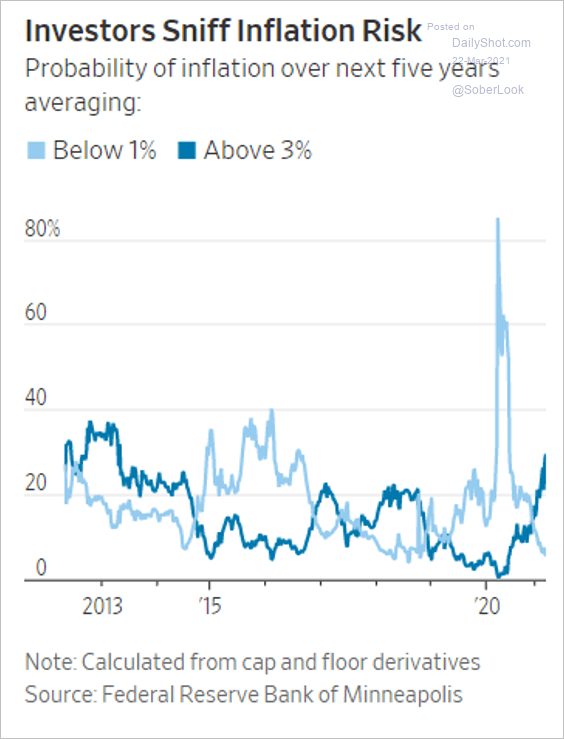

4. Inflation expectations based on inflation caps keep rising.

Source: @WSJ Read full article

Source: @WSJ Read full article

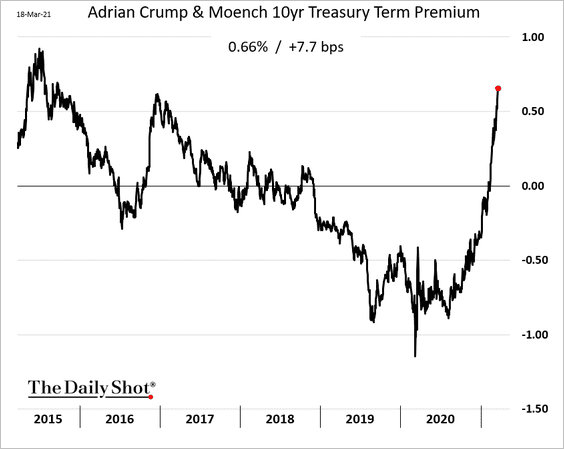

5. Treasury term premium keeps climbing.

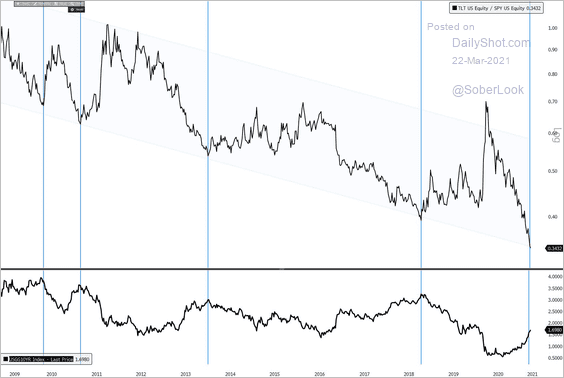

6. Here is the ratio of TLT (long-term Treasuries ETF) to SPY (S&P 500). Is the selloff in Treasuries over for now?

Source: @TeddyVallee

Source: @TeddyVallee

——————–

Food for Thought

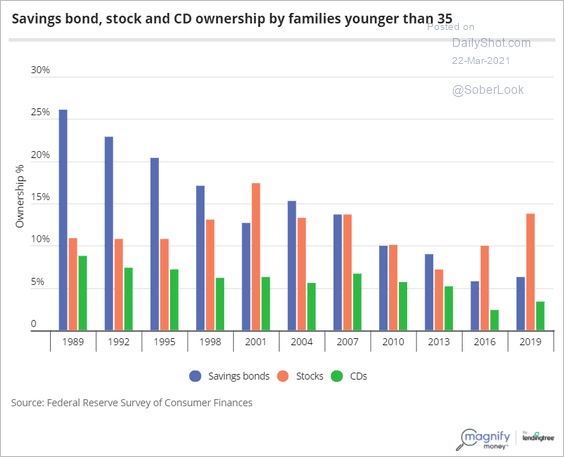

1. Abandoning savings bonds:

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

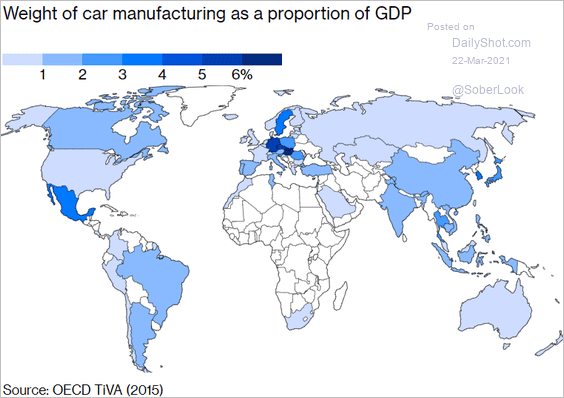

2. Automobile manufacturing as % of GDP:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

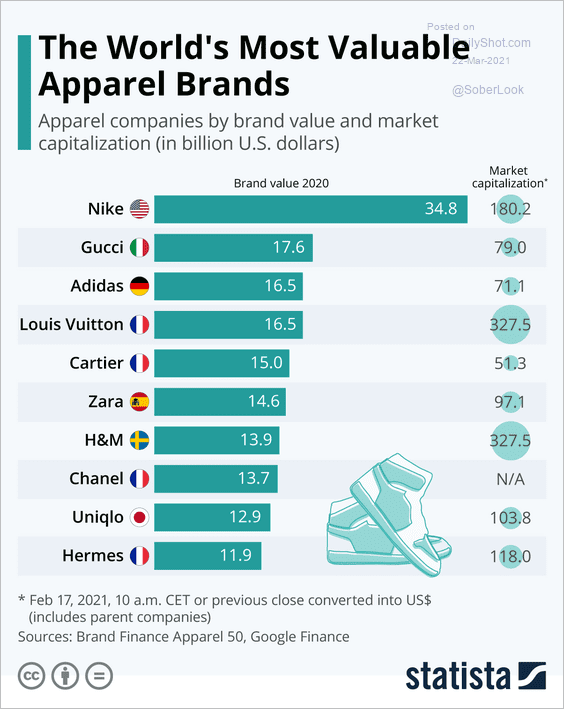

3. Most valuable apparel brands:

Source: Statista

Source: Statista

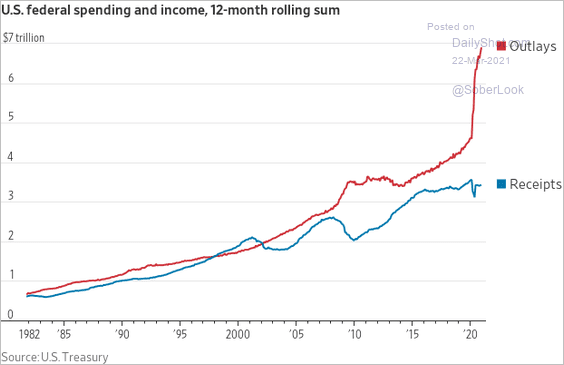

4. US federal spending and revenues:

Source: @WSJ Read full article

Source: @WSJ Read full article

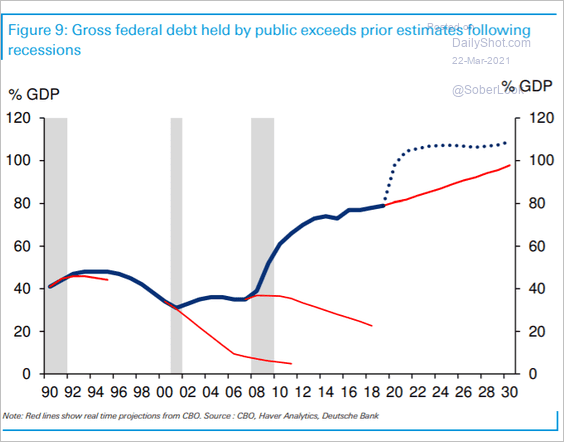

5. Federal debt vs. prior estimates:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

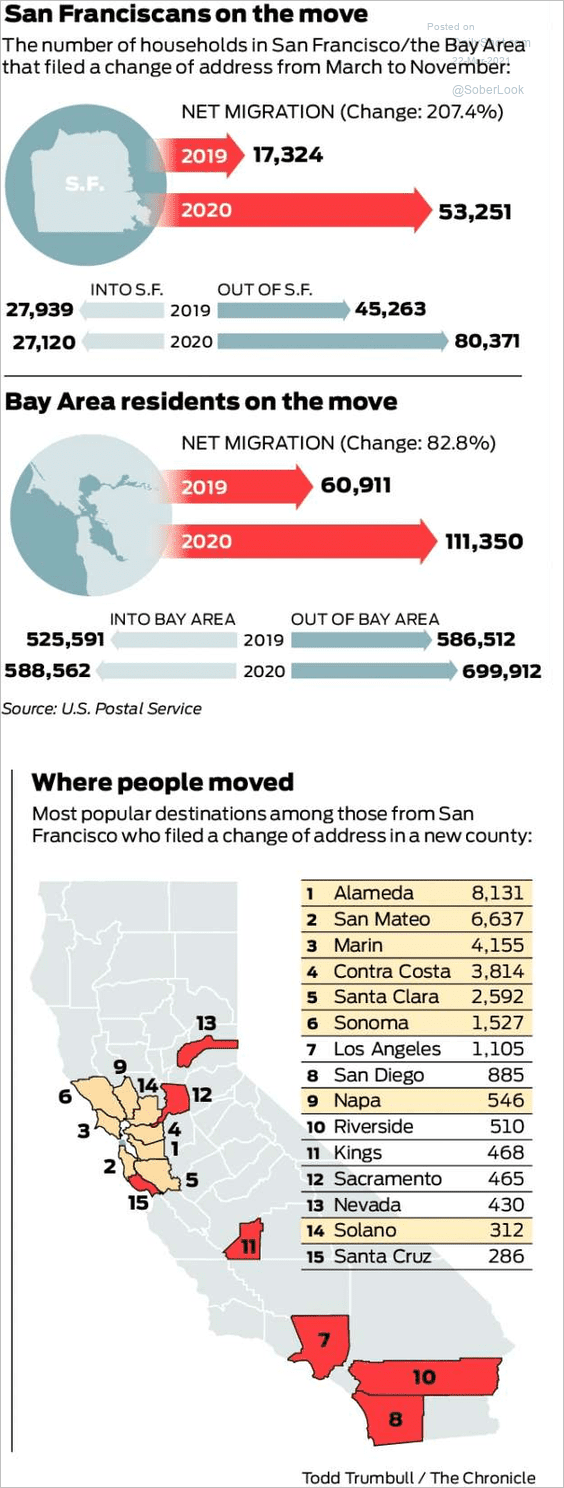

6. Leaving San Francisco:

Source: San Francisco Chronicle Read full article

Source: San Francisco Chronicle Read full article

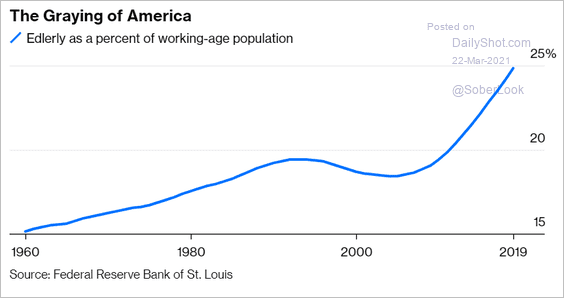

7. Older workers in the US:

Source: @GregDaco, @Noahpinion, @bopinion Read full article

Source: @GregDaco, @Noahpinion, @bopinion Read full article

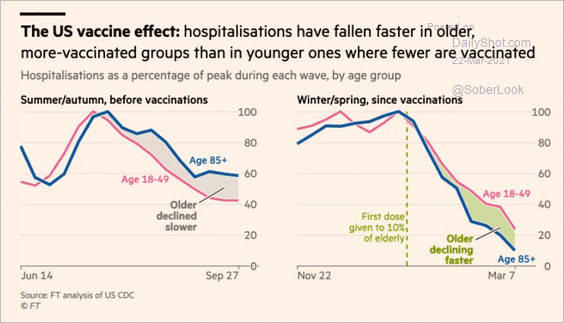

8. Vaccine effects on hospitalizations:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

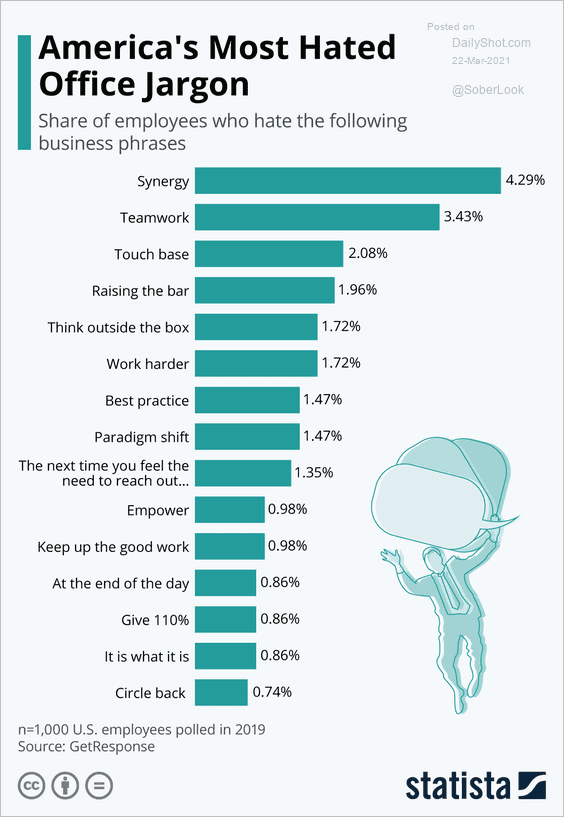

9. Most hated office jargon:

Source: Statista

Source: Statista

——————–

Back to Index