The Daily Shot: 23-Mar-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

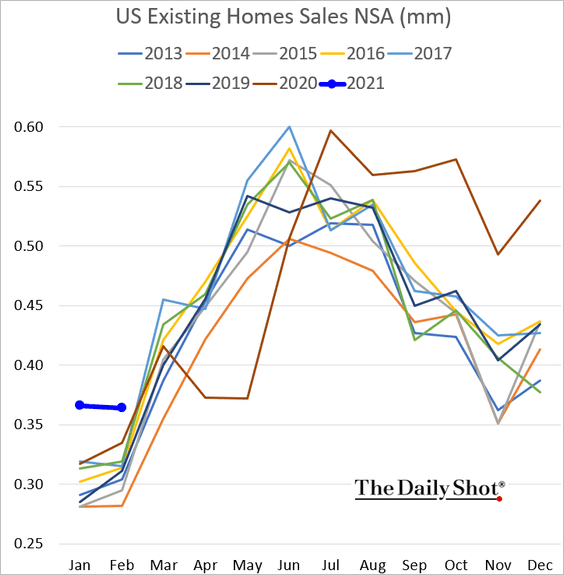

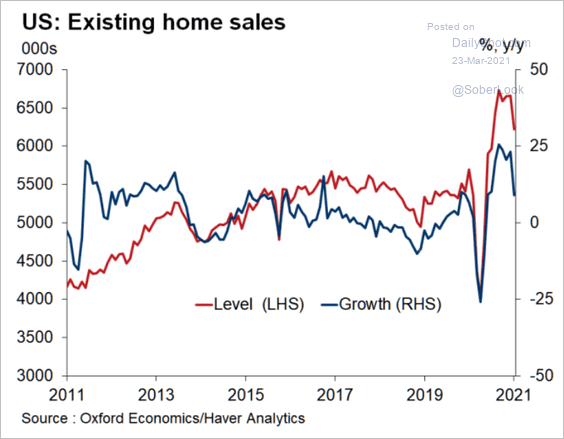

1. Existing home sales declined last month due to the deep freeze in parts of the country as well as collapsing housing inventories.

Source: @WSJ Read full article

Source: @WSJ Read full article

The housing market weakness in February is expected to be temporary. Here is a comment from Moody’s Analytics.

It took severe winter storms across many parts of the U.S. to cool the housing market. This should prove temporary, as sales and construction that would have occurred in February will be pushed into March and April.

– Sales level (not seasonally adjusted):

– Seasonally-adjusted and year-over-year:

Source: @GregDaco

Source: @GregDaco

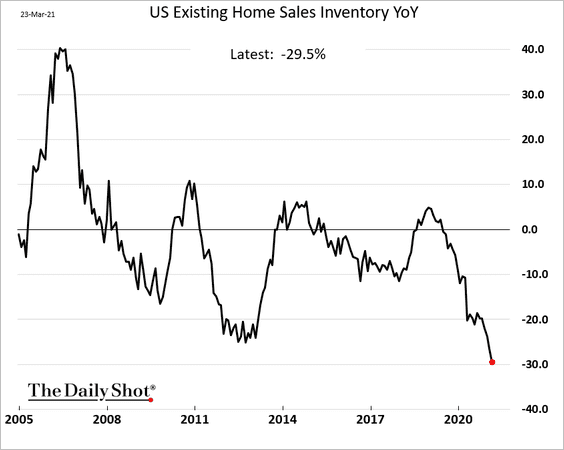

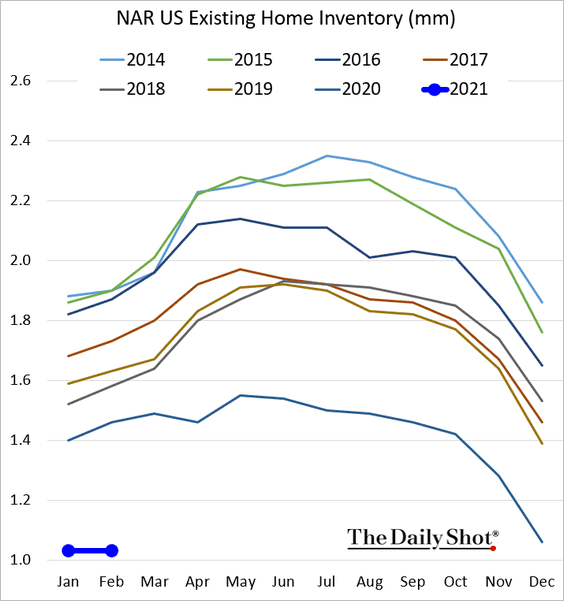

The inventory of homes for sale is down nearly 30% from February of 2020.

Here is the inventory level.

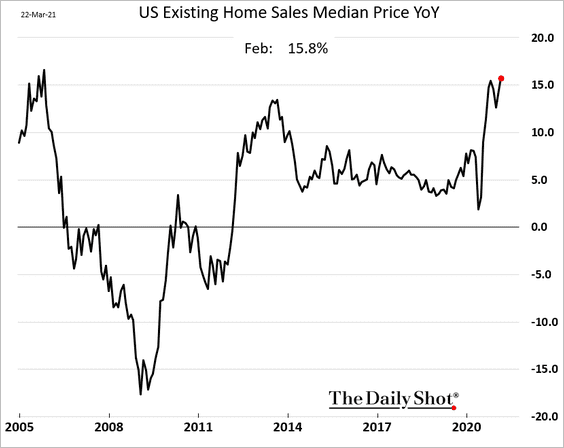

The median price of homes sold is up almost 16% from a year ago.

——————–

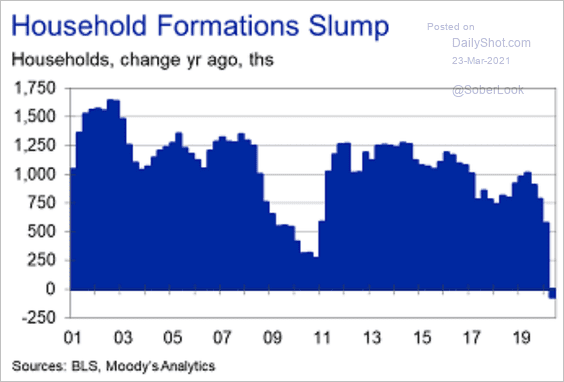

2. Household formation slumped last year.

Source: Moody’s Analytics

Source: Moody’s Analytics

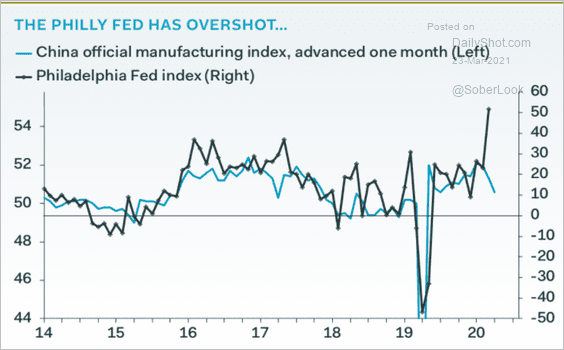

3. Was the Philly Fed’s remarkably strong manufacturing report an aberration? This chart compares it with China’s manufacturing activity.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

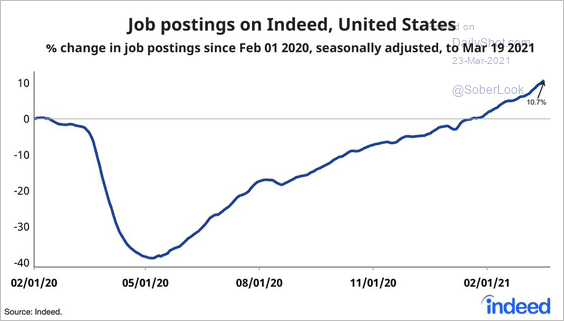

4. Job postings on Indeed keep climbing.

Source: @JedKolko, @indeed

Source: @JedKolko, @indeed

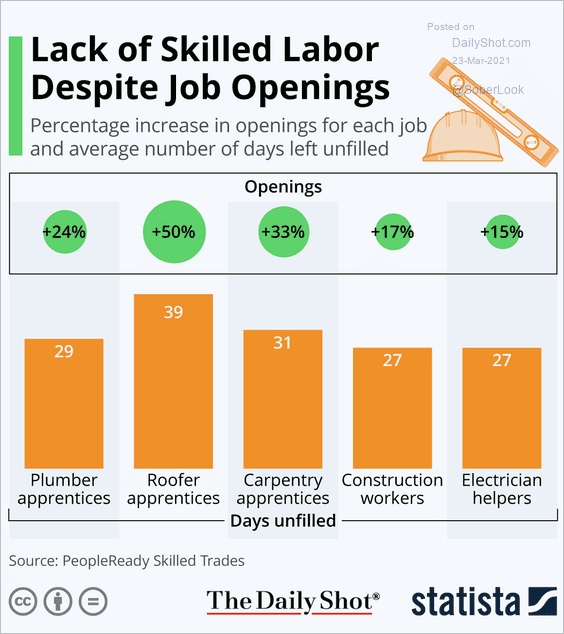

US demand for skilled blue-collar workers is surging. No skills? No problem – get an apprenticeship. (h/t PeopleReady.)

Source: Statista

Source: Statista

——————–

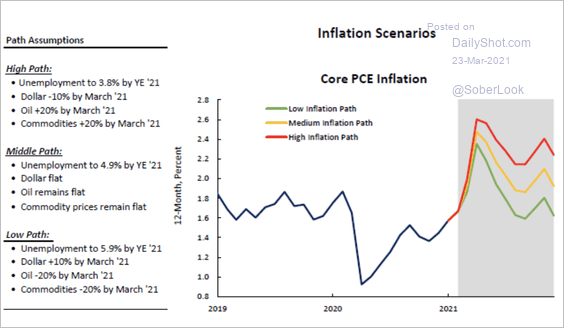

5. Finally, here are some potential core inflation scenarios through the end of the year (assumptions in the left column).

Source: PGIM Fixed Income

Source: PGIM Fixed Income

Back to Index

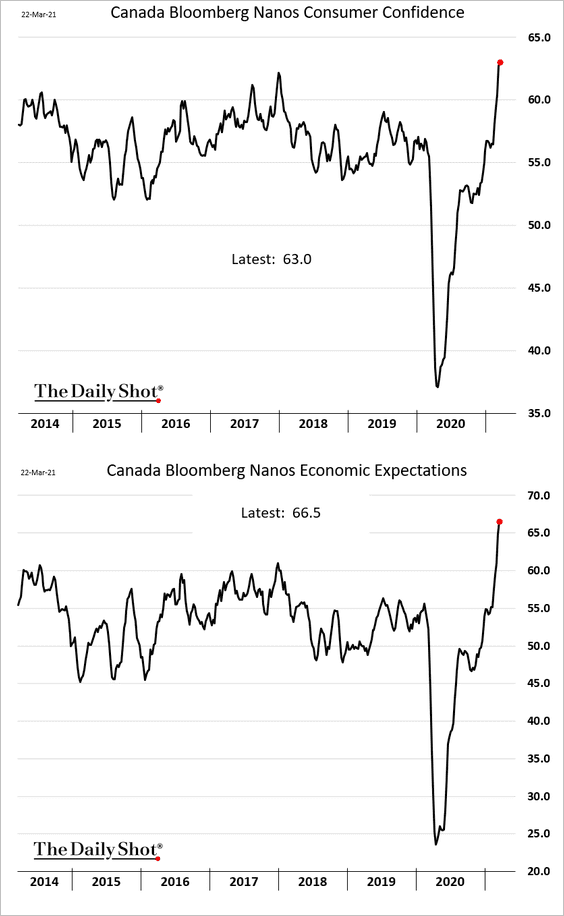

Canada

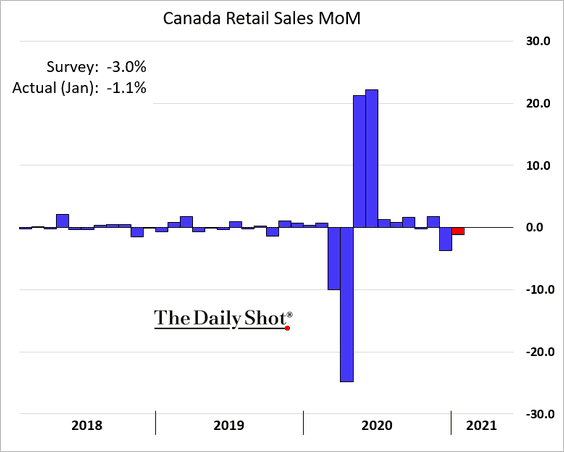

1. Retail sales held up better than expected in January.

2. Consumer sentiment is soaring.

Back to Index

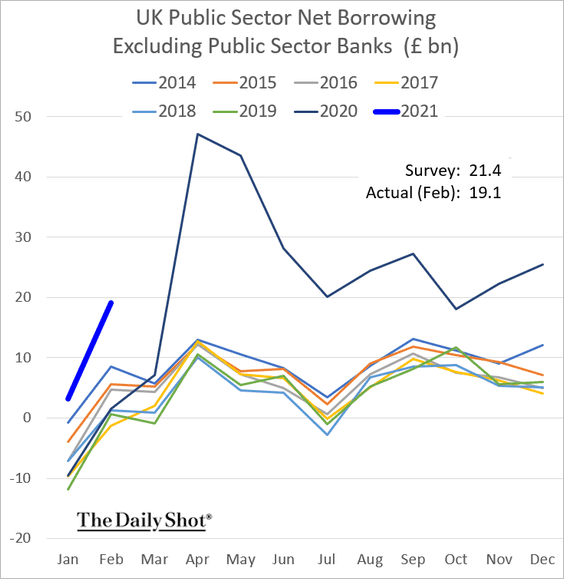

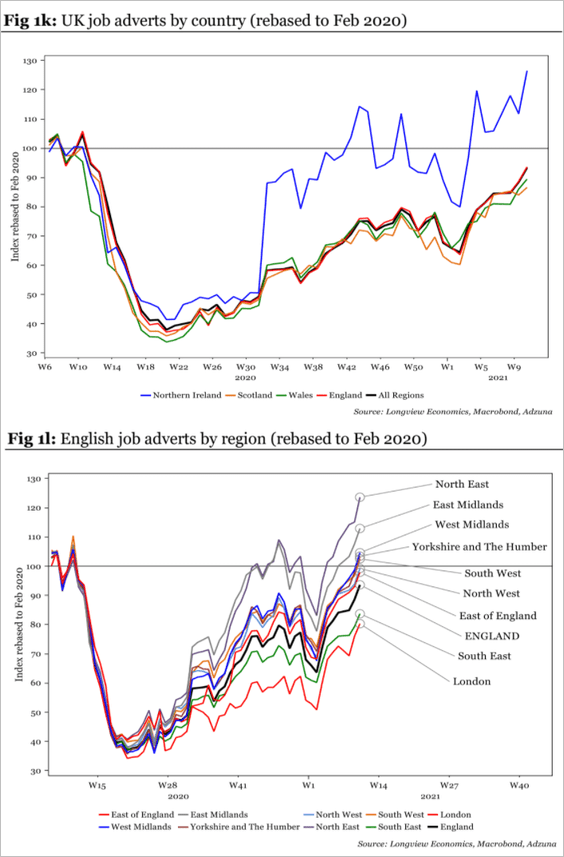

The United Kingdom

1. Public-sector borrowing has been unprecedented in the post-WW-II era, but the trend has been below forecasts.

2. The recovery in job postings has been uneven, but we continue to see improvements.

Back to Index

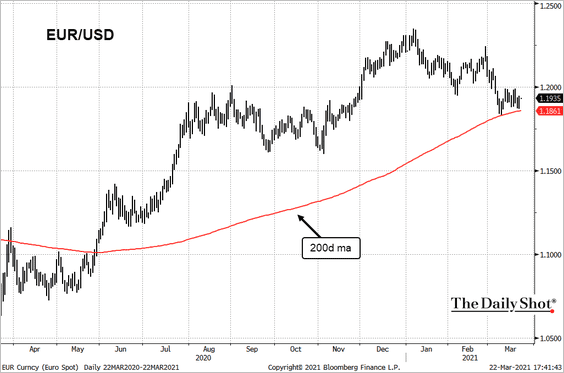

The Eurozone

1. The euro is testing support at the 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

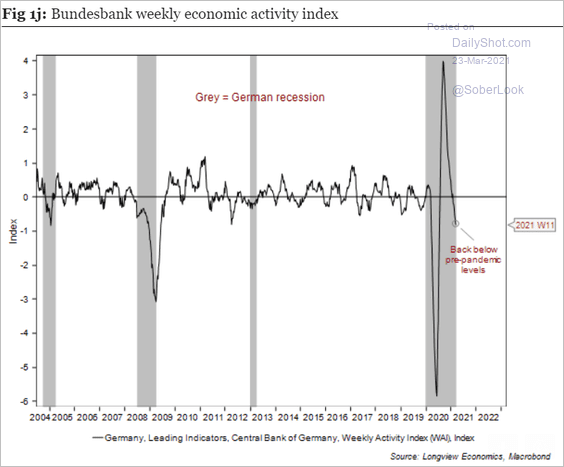

2. German economic activity has moderated after the post-lockdown rebound.

Source: Longview Economics

Source: Longview Economics

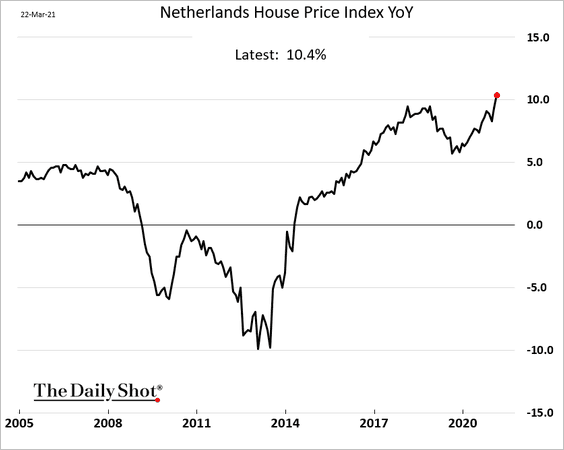

3. Dutch home prices are now climbing at 10% per year.

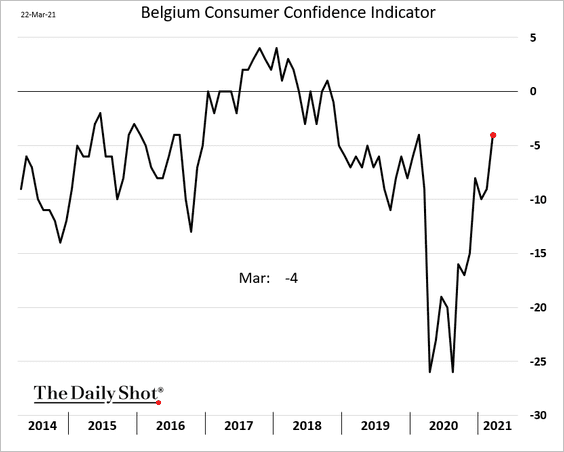

4. Belgian consumer sentiment is at pre-COVID levels.

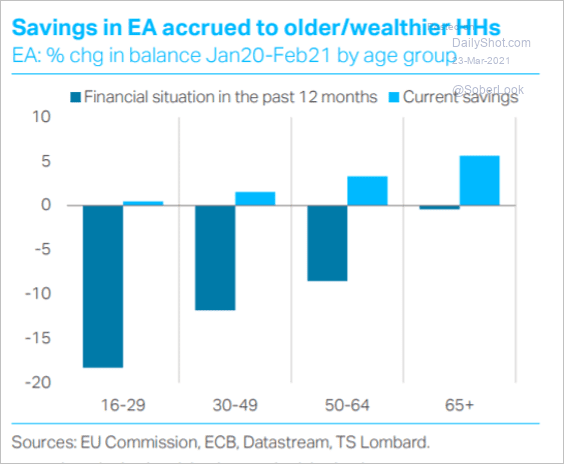

5. This chart shows the euro-area savings increase by age.

Source: TS Lombard

Source: TS Lombard

Back to Index

Europe

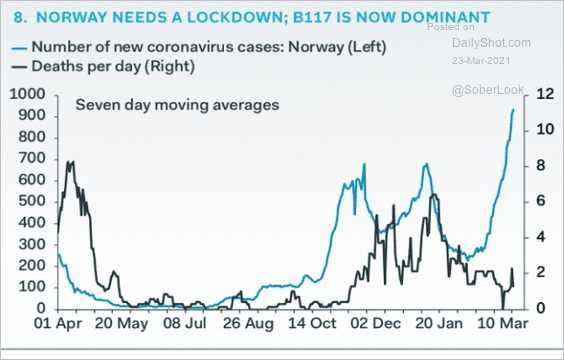

1. Norway may need a lockdown.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

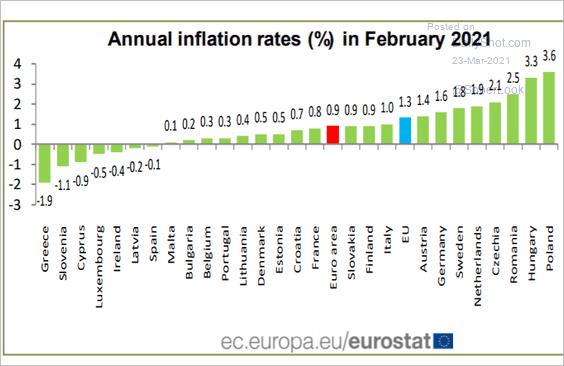

2. Next, we have inflation rates across the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

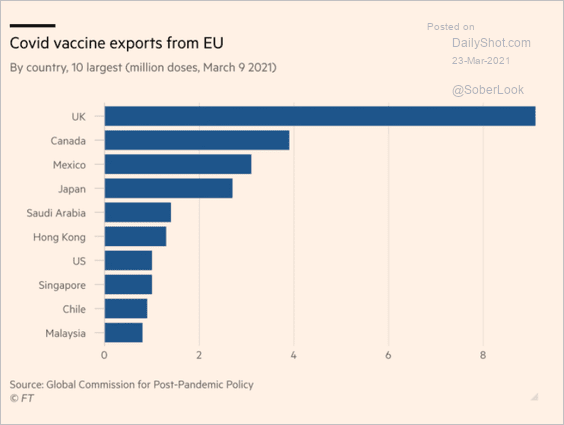

3. Here is a look at vaccine exports from the EU.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

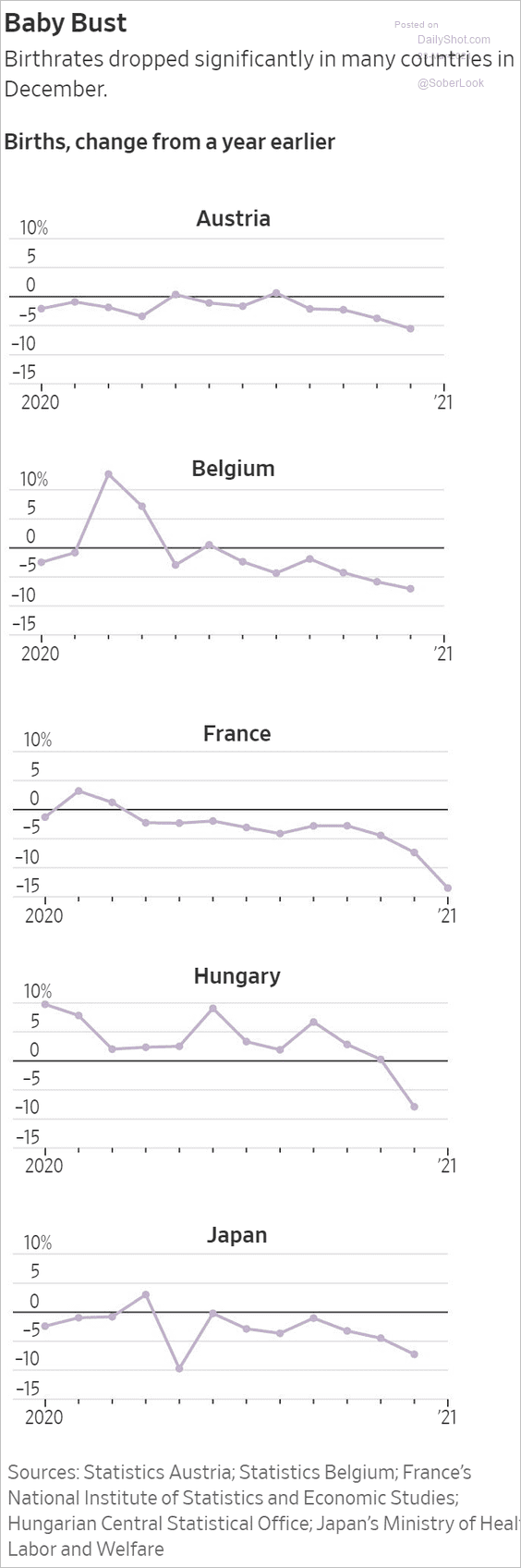

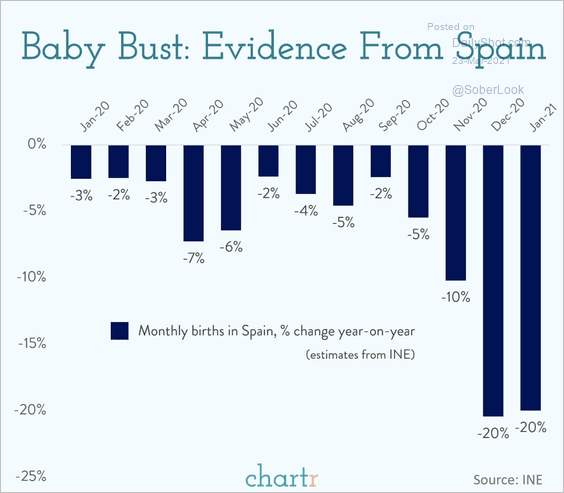

4. Birth rates declined in many European countries last year.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @chartrdaily

Source: @chartrdaily

——————–

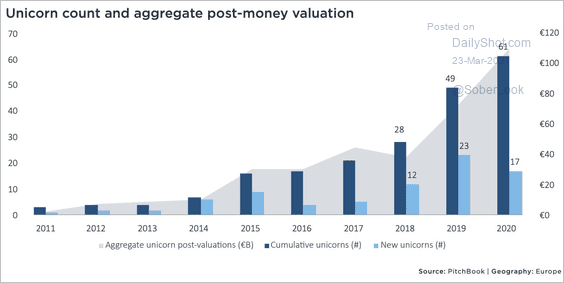

5. Finally, we have some data on European unicorns.

Source: @WorkMJ

Source: @WorkMJ

Back to Index

Asia – Pacific

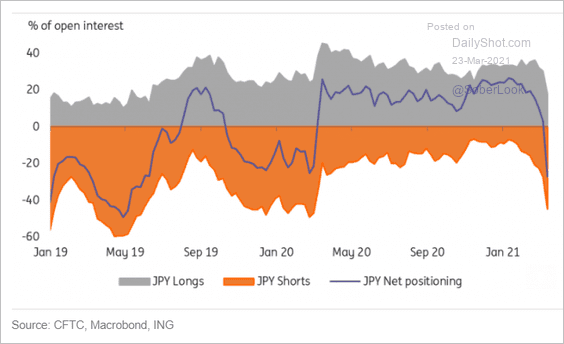

1. Speculative accounts have turned bearish on the yen (vs. USD).

Source: ING

Source: ING

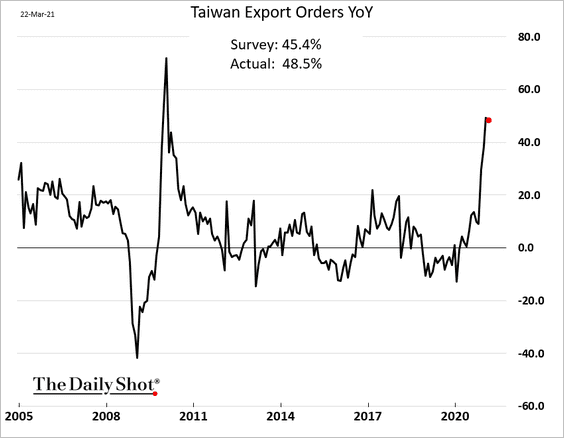

2. Taiwan’s export orders continue to surprise to the upside.

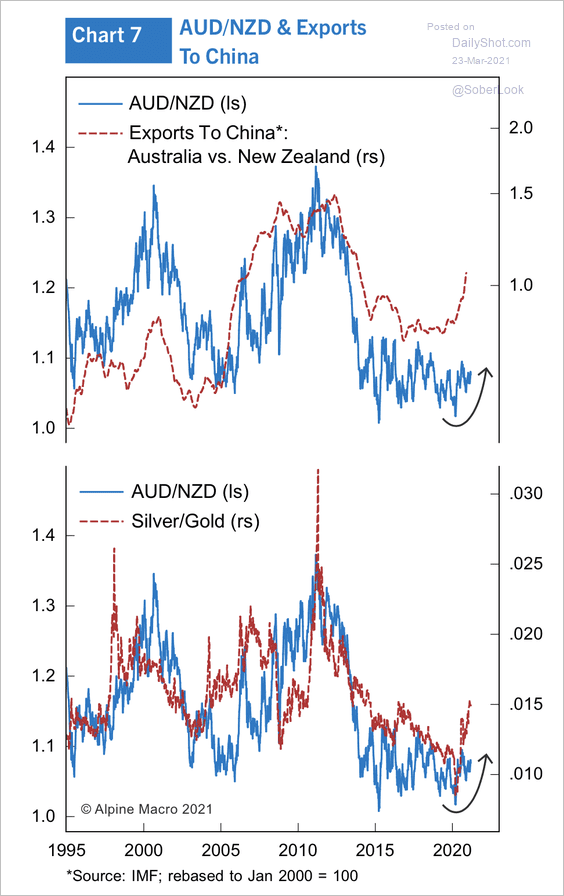

3. Australia’s exports to China and a rise in silver relative to gold could support a higher AUD/NZD.

Source: Alpine Macro

Source: Alpine Macro

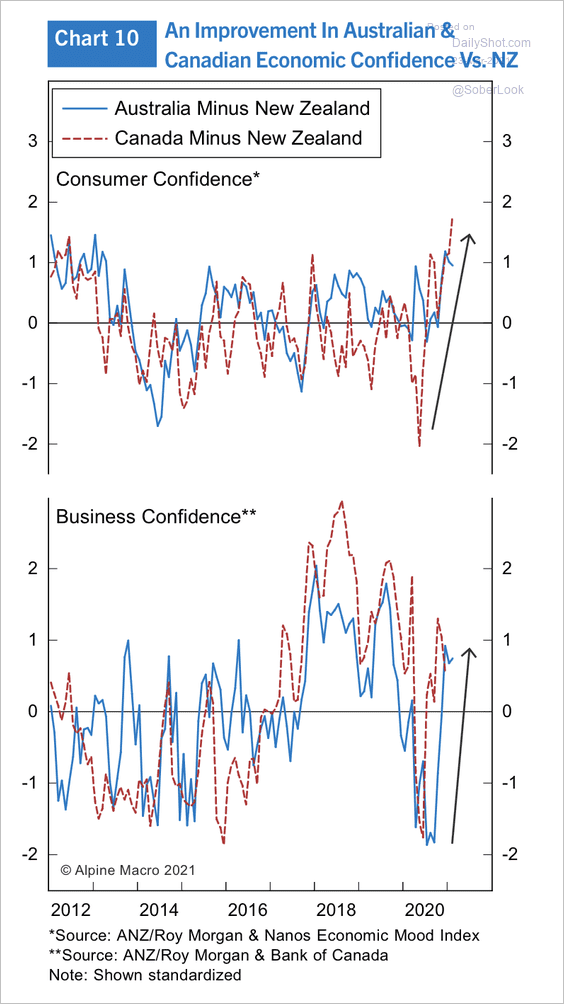

Economic confidence is rising in Australia and Canada relative to New Zealand, which could impact cross-rates.

Source: Alpine Macro

Source: Alpine Macro

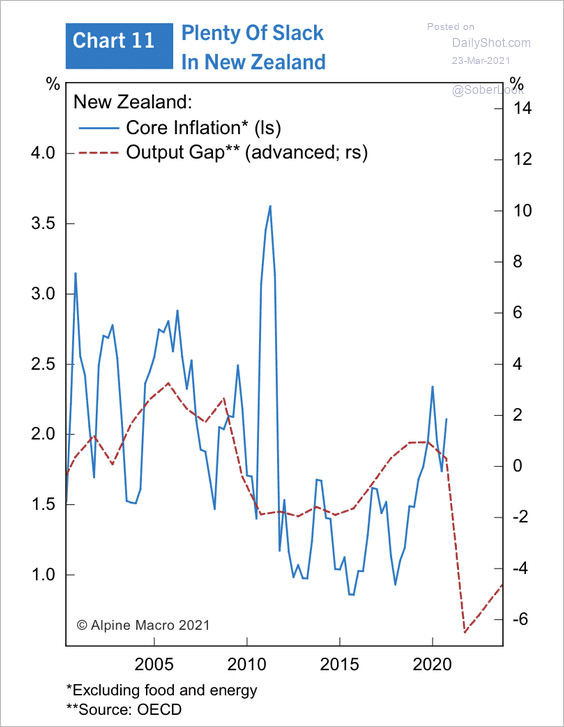

4. Inflation could continue lower in New Zealand until the output gap closes.

Source: Alpine Macro

Source: Alpine Macro

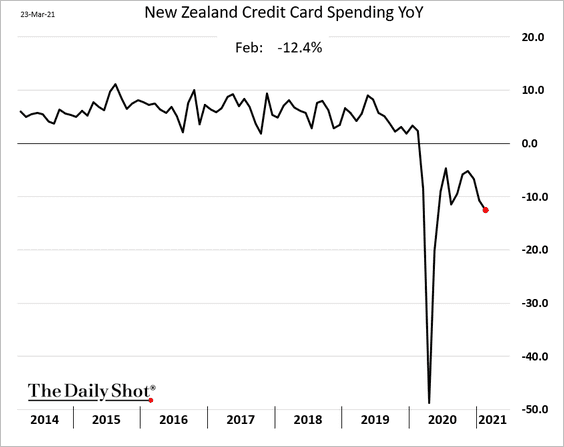

Separately, New Zealand’s credit card spending weakened this year.

Back to Index

China

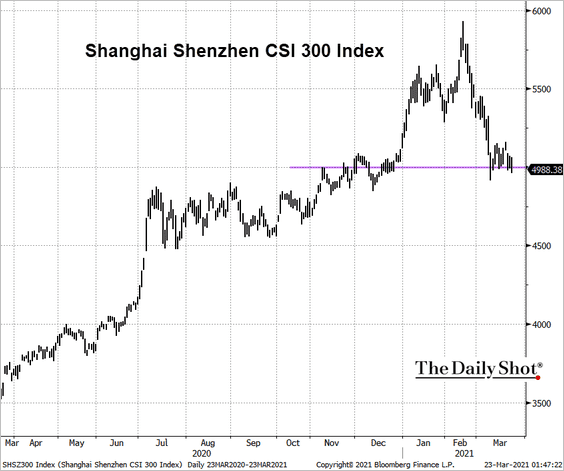

1. The Shanghai Shenzhen CSI 300 Index continues to test support at 5k.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

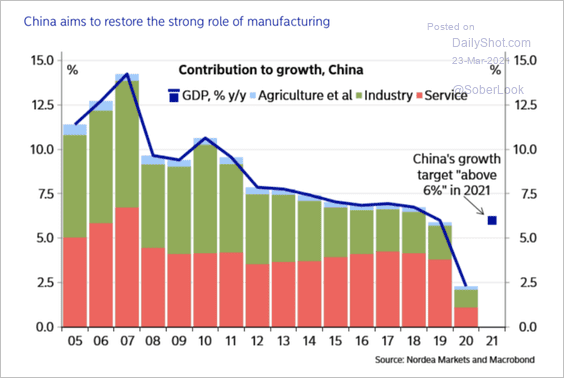

2. A boost in manufacturing is needed to reach a 6% GDP growth target this year.

Source: Nordea Markets

Source: Nordea Markets

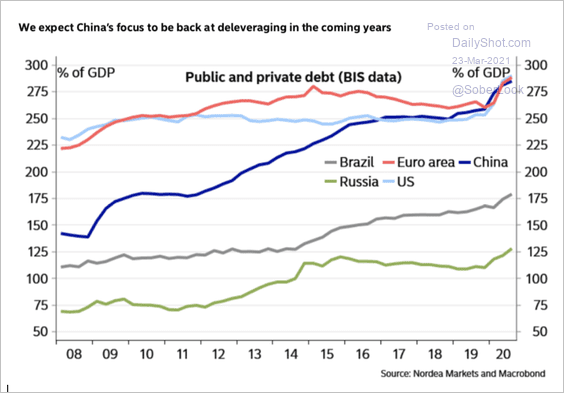

3. Nordea expects a period of deleveraging as China’s public and private debt/GDP reaches 300%.

Source: Nordea Markets

Source: Nordea Markets

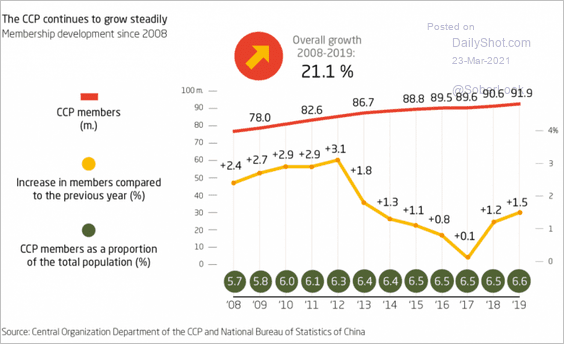

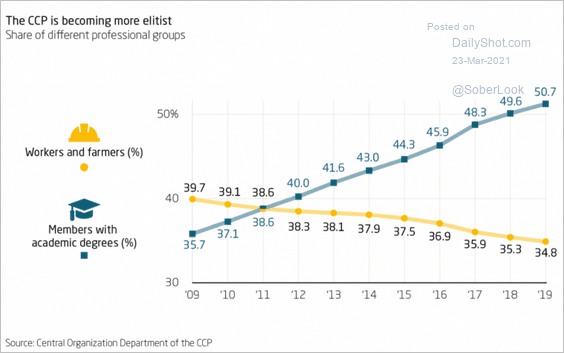

4. Next, we have some data on China’s Communist Party.

• Growth:

Source: MERICS Read full article

Source: MERICS Read full article

• Demographics:

Source: MERICS Read full article

Source: MERICS Read full article

——————–

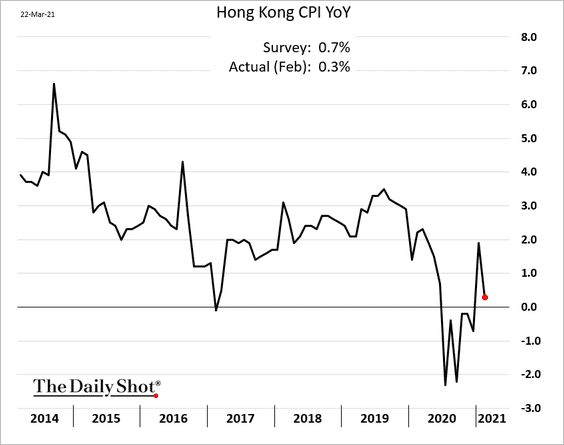

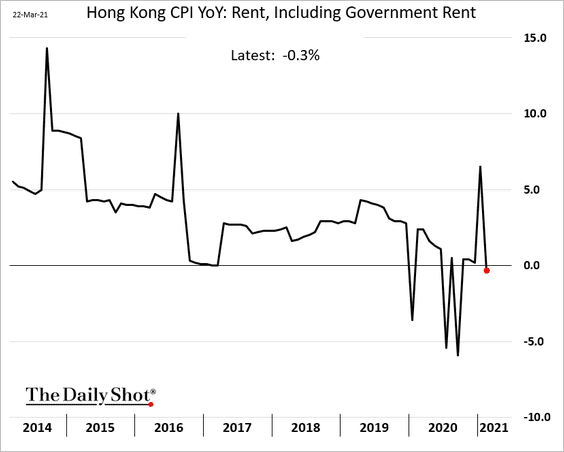

5. Hong Kong’s CPI is back near zero.

But much of the recent volatility in the index is related to government housing.

Back to Index

Emerging Markets

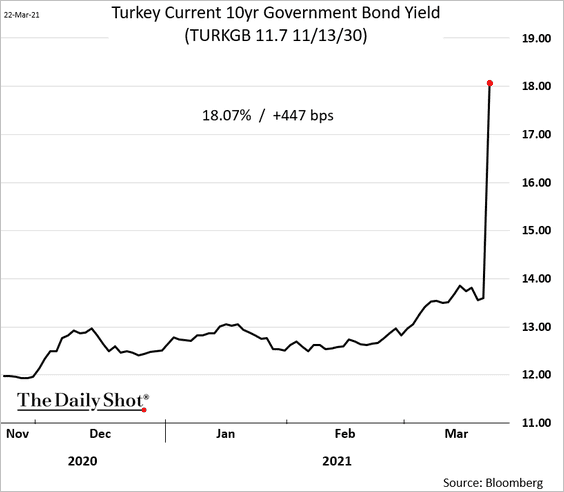

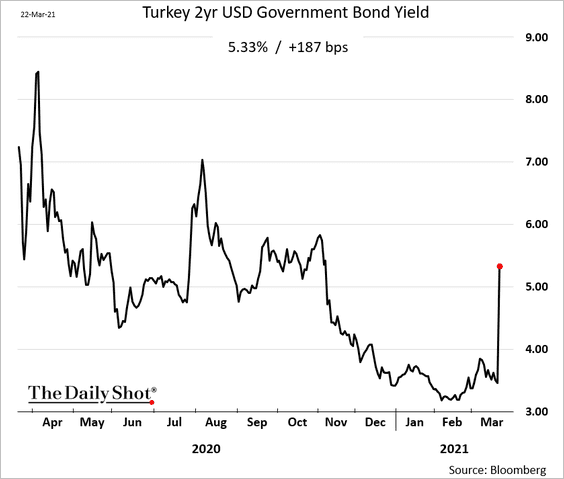

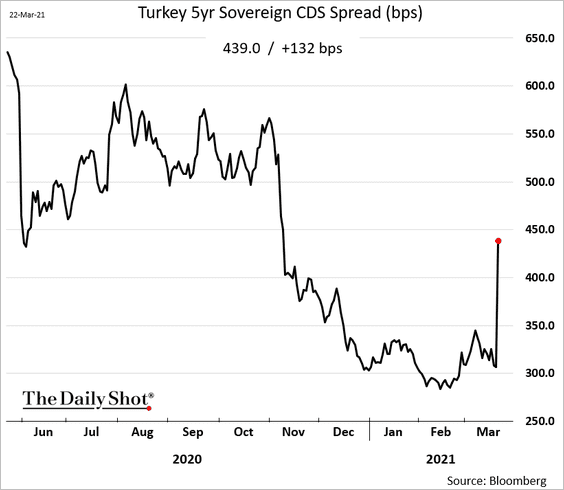

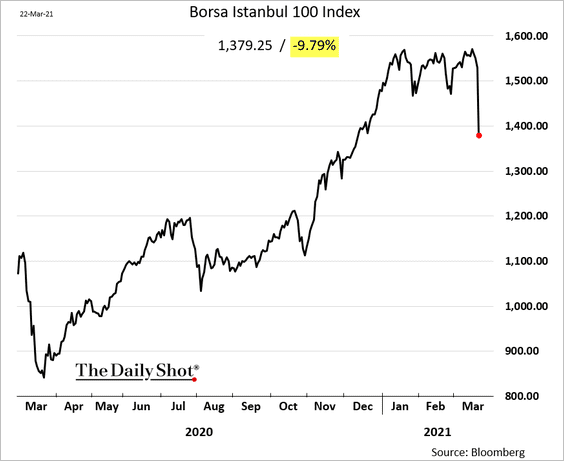

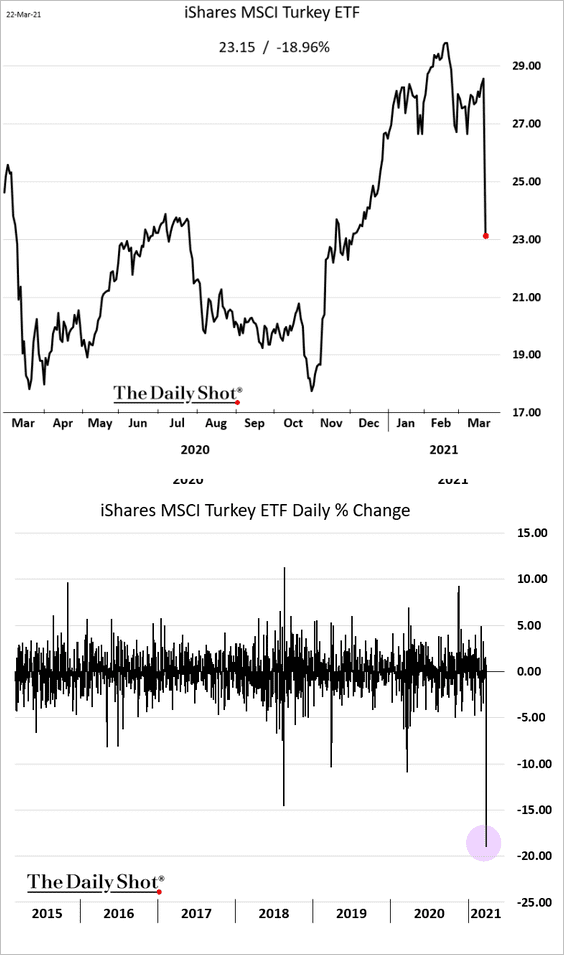

1. The markets have been punishing Turkey after Erdogan fired the hawkish central bank head (here).

• Domestic bonds:

• USD-denominated bonds:

• The sovereign CDS spread:

• The stock market:

Below are a couple of economic trends.

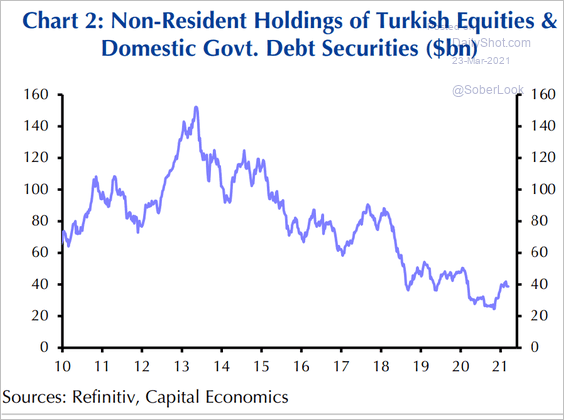

• Non-resident holdings of stocks and bonds:

Source: Capital Economics

Source: Capital Economics

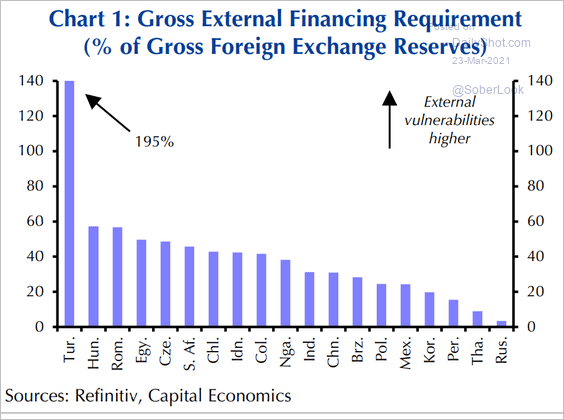

• External financing requirements:

Source: Capital Economics

Source: Capital Economics

——————–

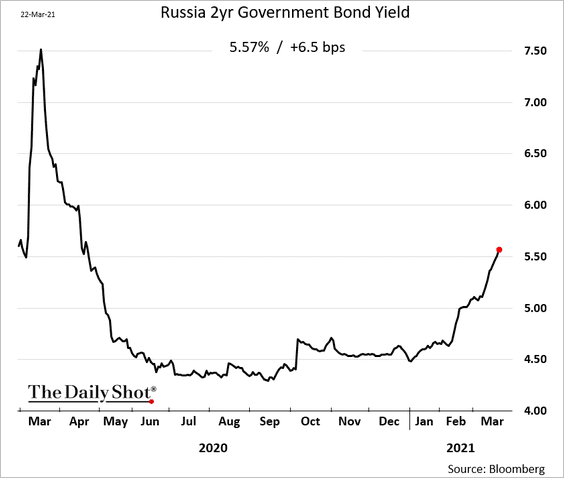

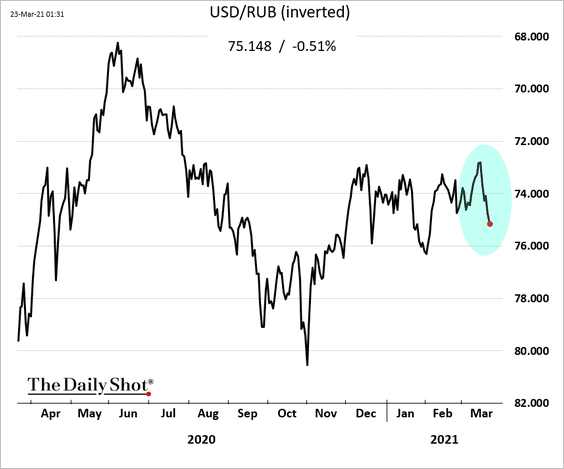

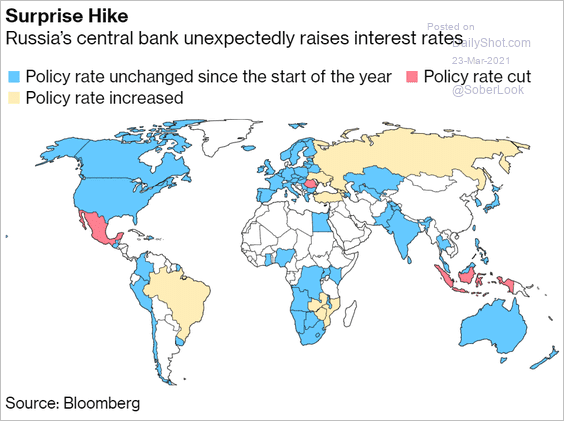

2. The markets weren’t happy with Russia’s unexpected rate hike.

• Bonds sold off further.

• The ruble dropped.

——————–

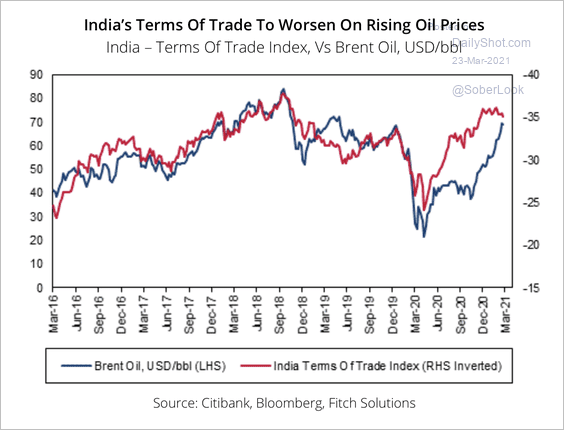

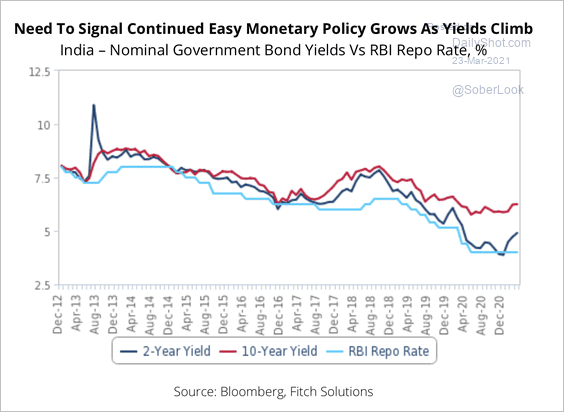

3. Higher oil prices have weighed on India’s terms of trade.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Fitch expects another 25 basis points worth of rate cuts, which could place downward pressure on the rupee.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

——————–

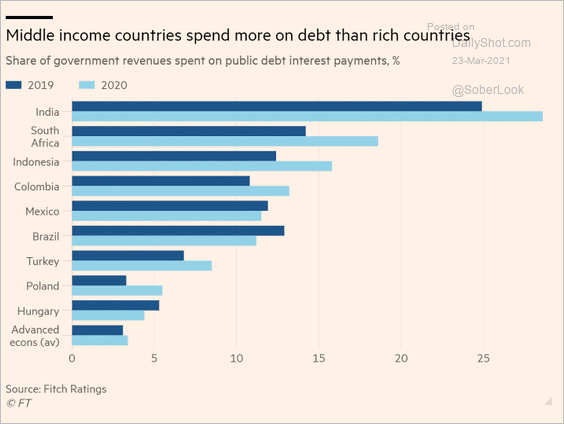

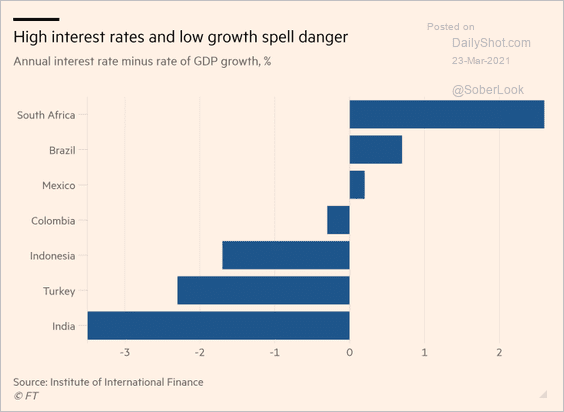

4. Here is a look at EM interest expenses.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

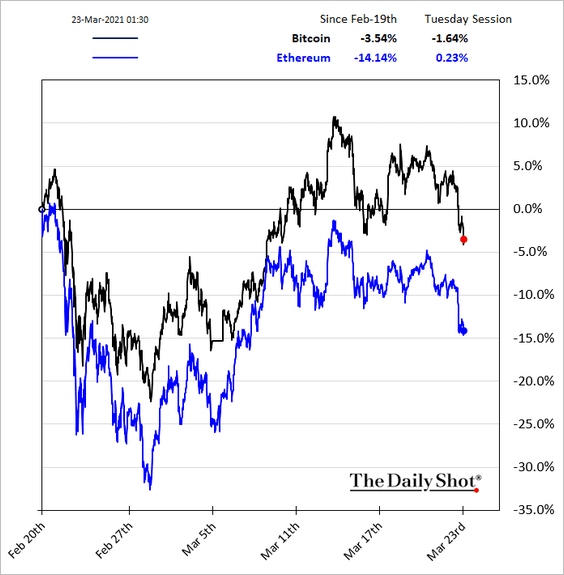

Cryptocurrency

1. Cryptos are under a bit of pressure, …

… as Bitcoin tests uptrend support.

——————–

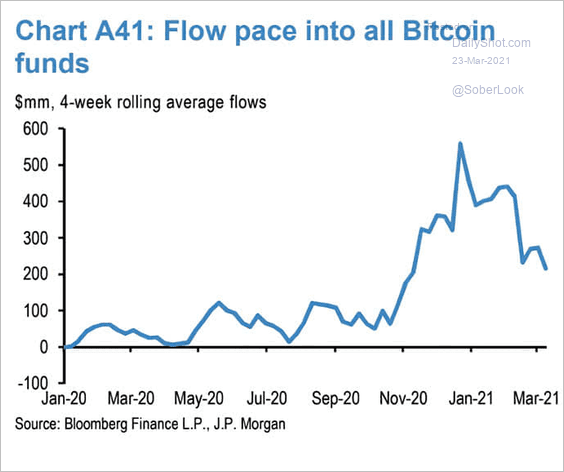

2. Bitcoin funds have been experiencing some outflows.

Source: @ISABELNET_SA, @jpmorgan

Source: @ISABELNET_SA, @jpmorgan

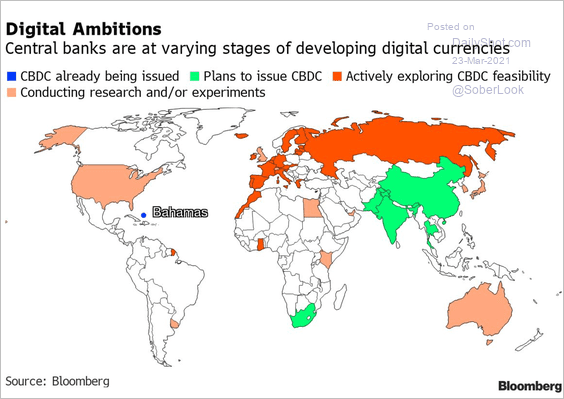

3. Which countries are considering central-bank-backed digital currencies?

Source: @markets Read full article

Source: @markets Read full article

Back to Index

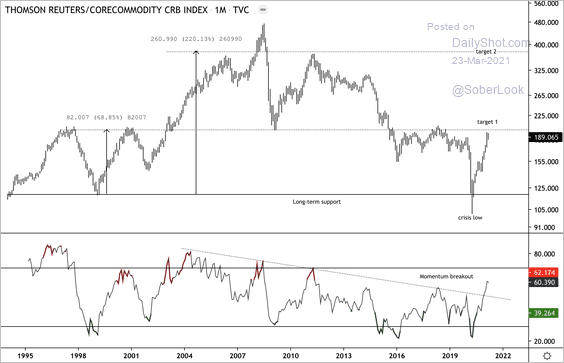

Commodities

1. The Dow Jones Commodity Index has been testing resistance.

Source: Dantes Outlook

Source: Dantes Outlook

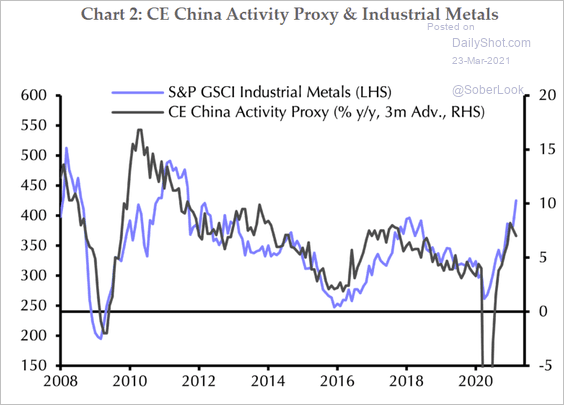

2. This chart shows industrial metals vs. China’s economic activity.

Source: Capital Economics

Source: Capital Economics

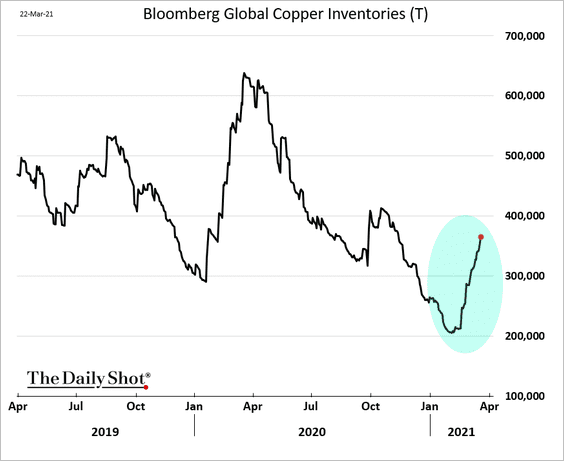

3. Copper inventories are rebounding.

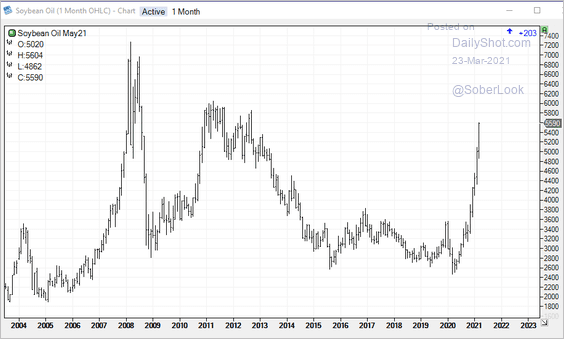

4. The spike in US soybean oil futures has been impressive.

h/t Tom

h/t Tom

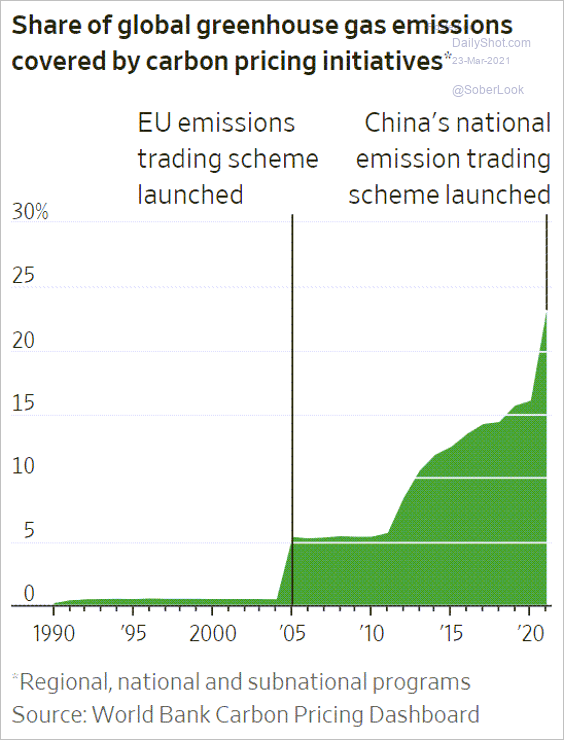

5. Here is the share of global greenhouse gas emissions covered by carbon pricing.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

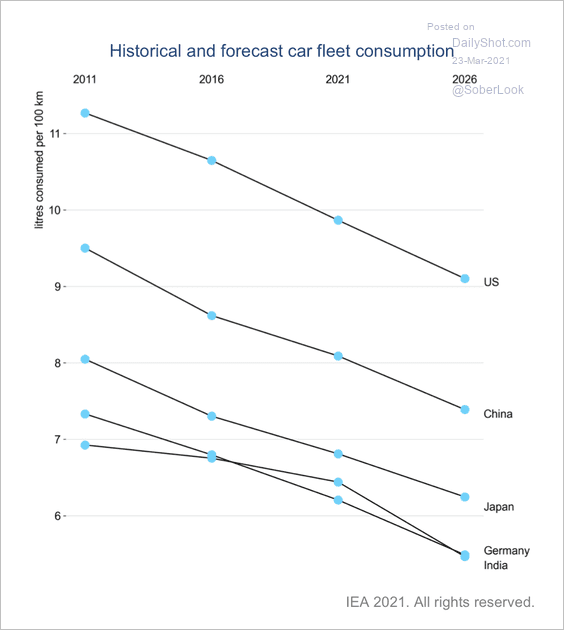

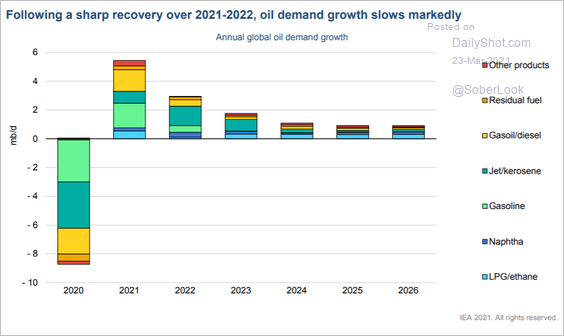

Energy

1. Global gasoline demand has peaked, according to the IEA.

Source: IEA

Source: IEA

The IEA expects oil demand to slow over the next few years.

Source: IEA

Source: IEA

——————–

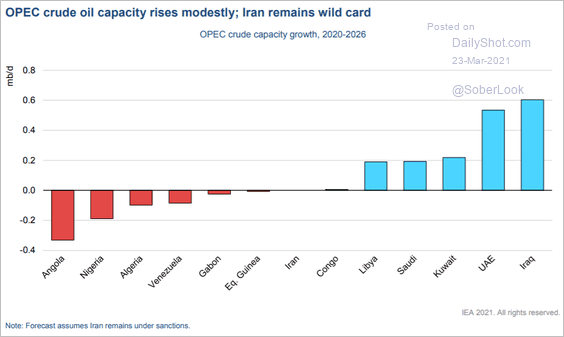

2. Here are the changes in OPEC’s crude oil capacity.

Source: IEA

Source: IEA

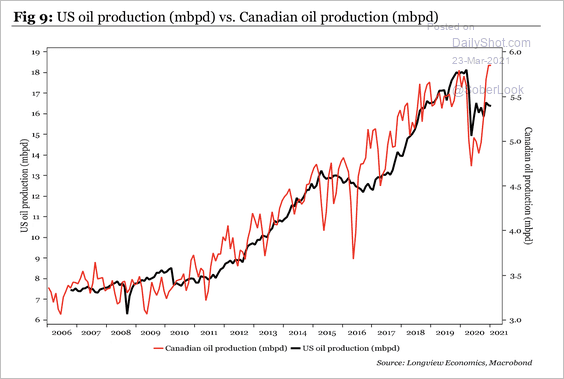

3. Canadian oil production has broken above pre-pandemic levels while the US lags.

Source: Longview Economics

Source: Longview Economics

Back to Index

Equities

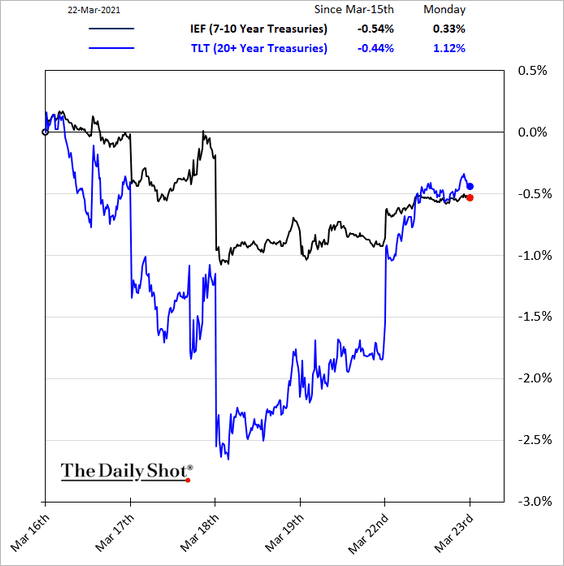

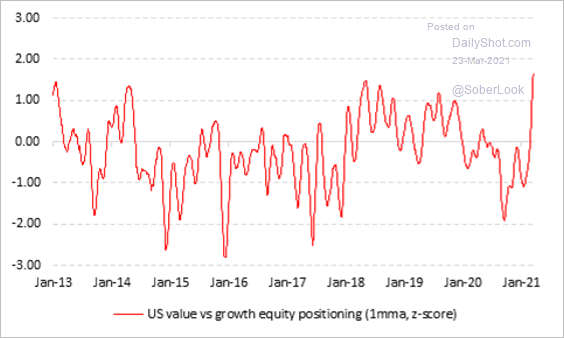

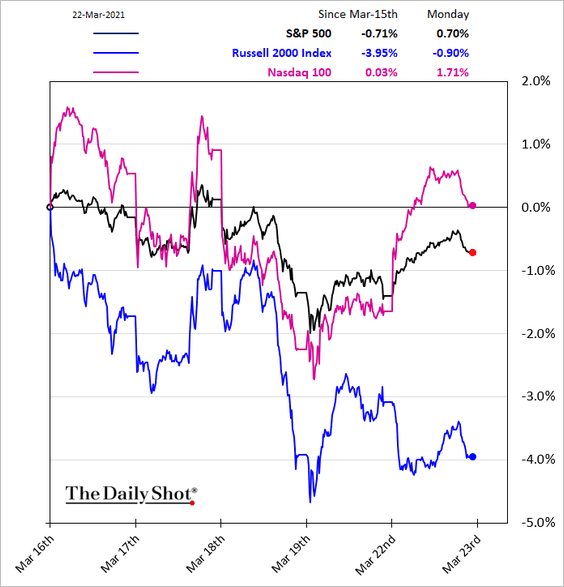

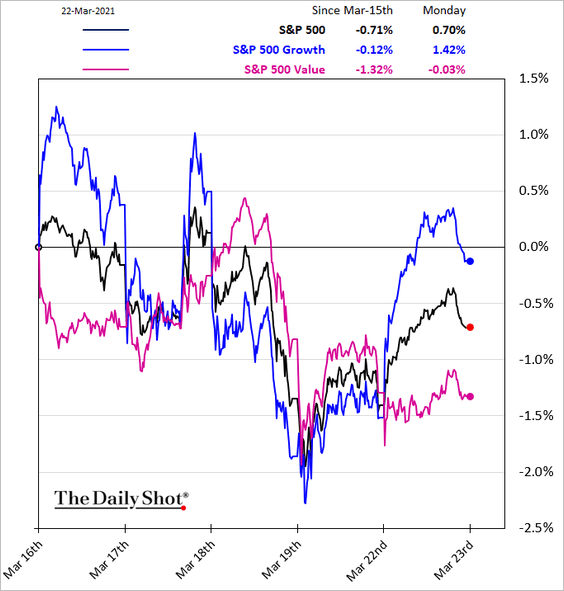

1. The recent rotation trends have been reversing a bit over the past few days as bonds rebound.

Positioning has been at extremes, and we are seeing some pullback.

Source: BofA Global Research; @MadThunderdome

Source: BofA Global Research; @MadThunderdome

• The Nasdaq 100 vs. the Russell 2000:

• Growth vs. Value:

——————–

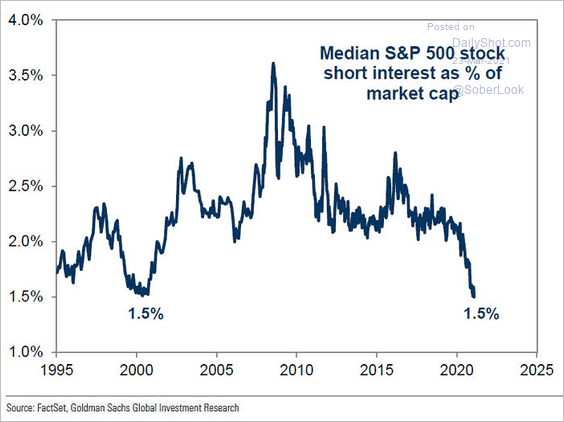

2. Short interest in S&P 500 stocks continues to drift lower.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

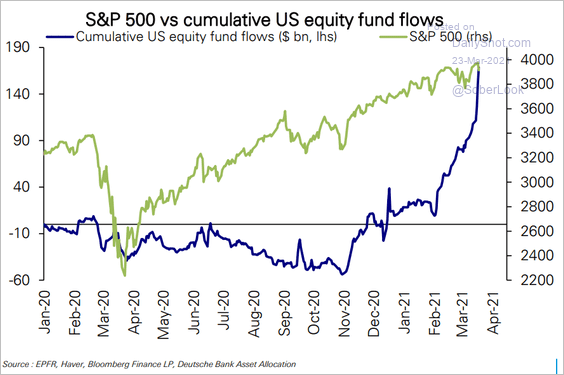

3. Flows into US equity funds have been impressive.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

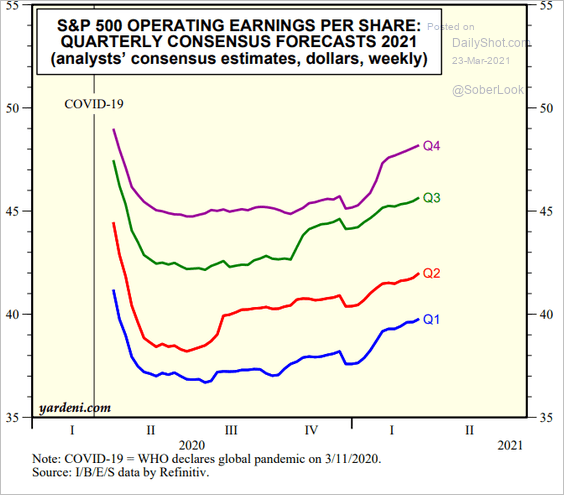

4. Analysts continue to upgrade their 2021 earnings forecasts.

Source: Yardeni Research

Source: Yardeni Research

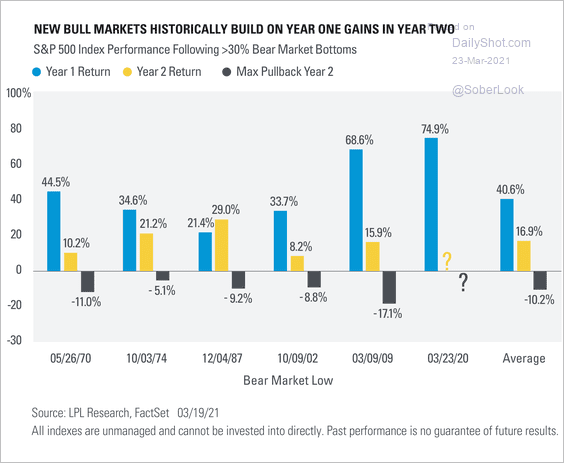

5. How do stocks perform in the second year after a 30%+ rebound from market bottoms?

Source: LPL Research

Source: LPL Research

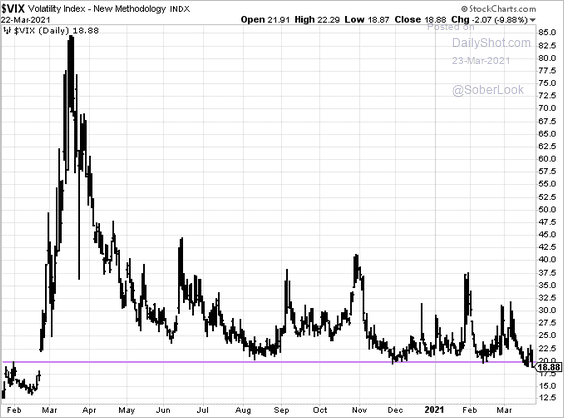

6. VIX is back below 20.

Back to Index

Credit

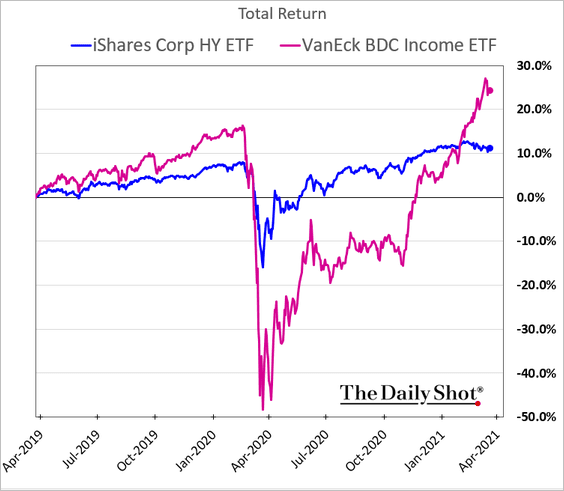

1. BDCs continue to outperform.

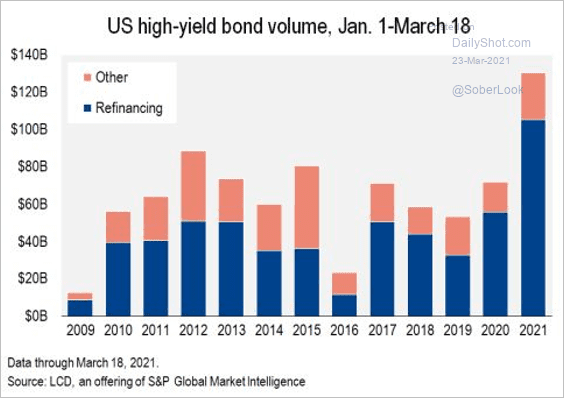

2. It’s been a good quarter for US high-yield bond issuance.

Source: @lcdnews Read full article

Source: @lcdnews Read full article

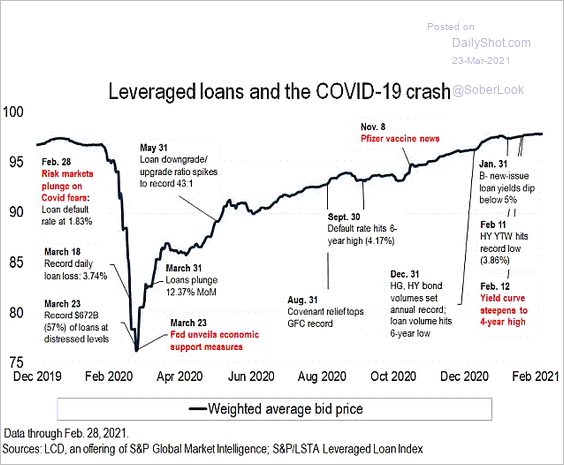

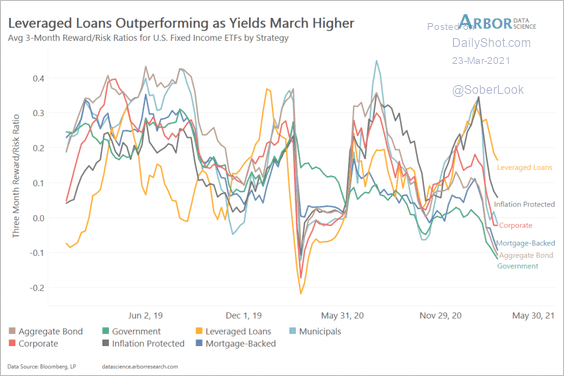

3. Leveraged loans have fully recovered the pandemic-driven losses …

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

… and have outperformed on a risk-adjusted basis.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Back to Index

Rates

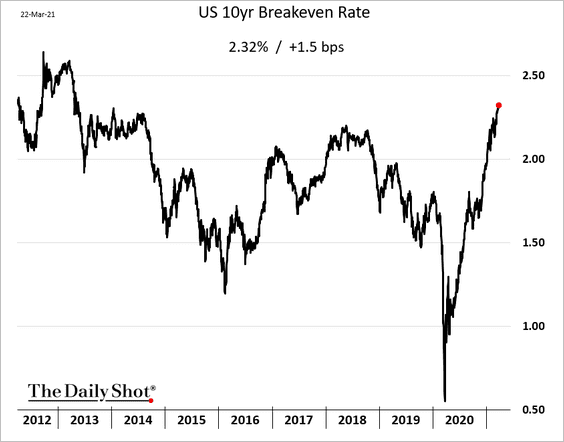

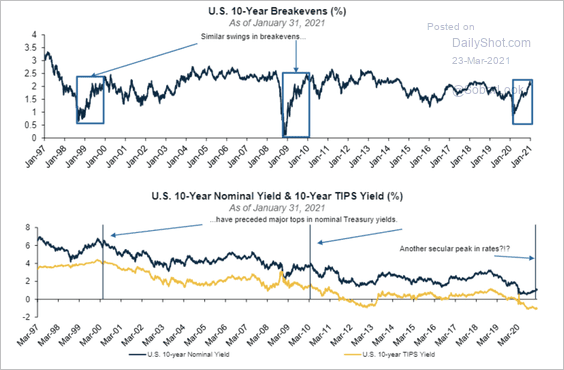

1. Longer-term inflation expectations keep grinding higher.

Similar rises in inflation expectations have coincided with peaks in long-term rates.

Source: PGIM Fixed Income

Source: PGIM Fixed Income

——————–

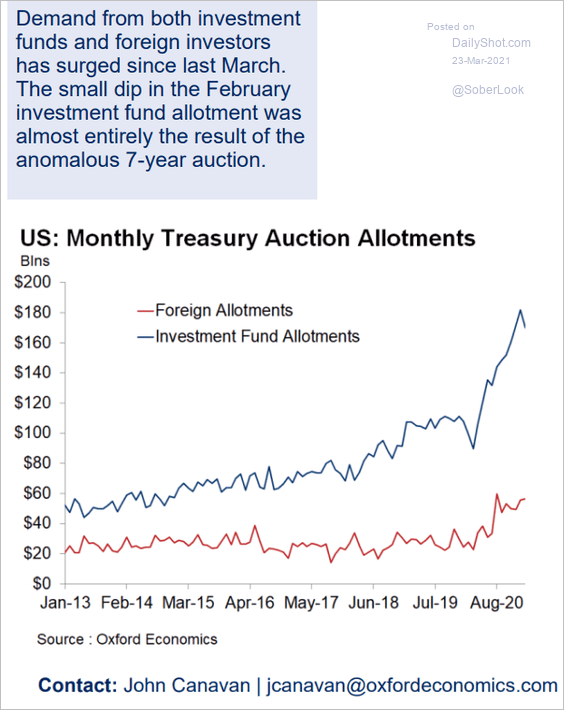

2. Demand for Treasuries has been robust.

Source: Oxford Economics

Source: Oxford Economics

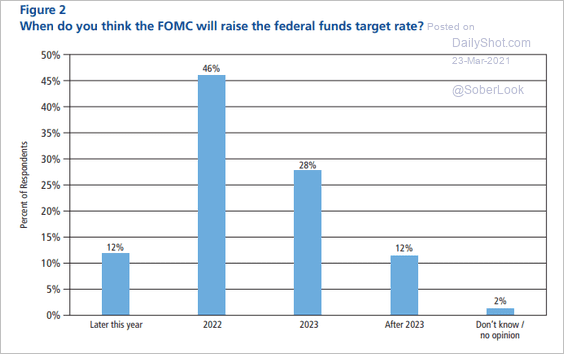

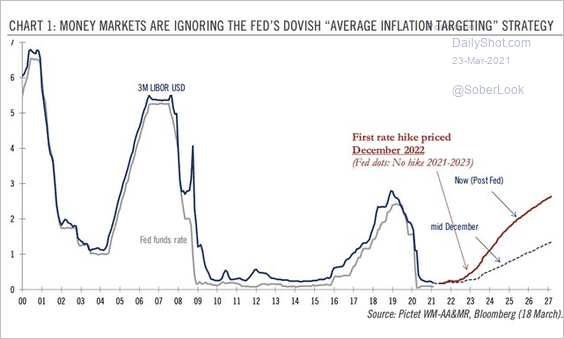

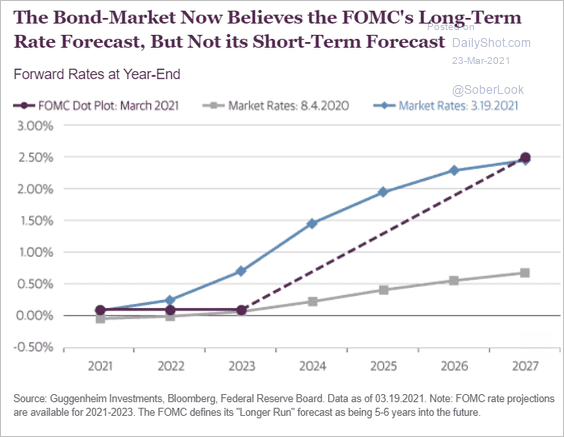

3. Is the market too “hawkish” on rate hikes in the US?

• Survey (almost half expect a hike next year):

Source: @GregDaco, @business_econ Read full article

Source: @GregDaco, @business_econ Read full article

• US market expectations (2 charts):

Source: @PictetWM

Source: @PictetWM

Source: Guggenheim Partners

Source: Guggenheim Partners

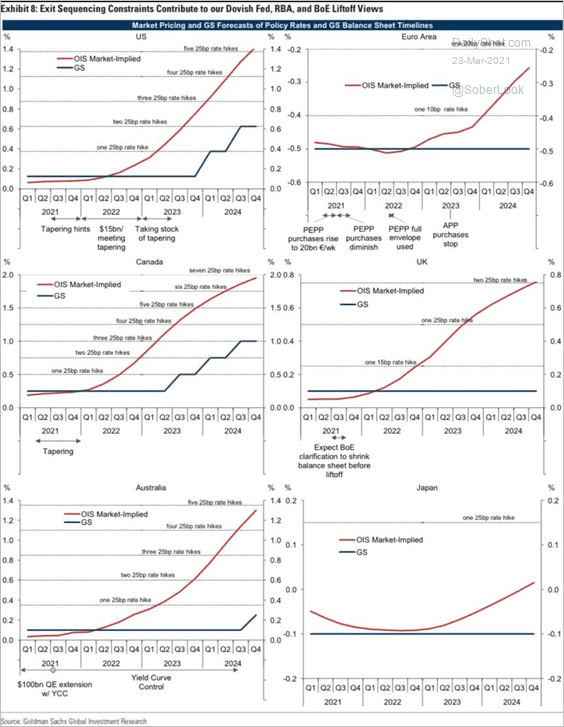

• Global market expectations vs. Goldman’s forecasts:

Source: J B; Goldman Sachs

Source: J B; Goldman Sachs

——————–

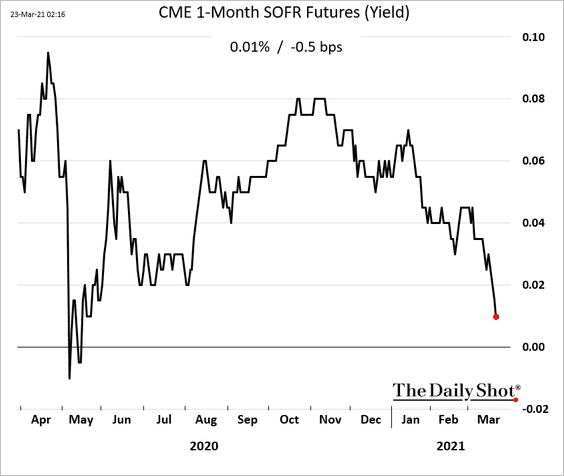

4. The Fed does not want SOFR to go to zero. It would be bad news for all the efforts to switch from LIBOR.

Back to Index

Global Developments

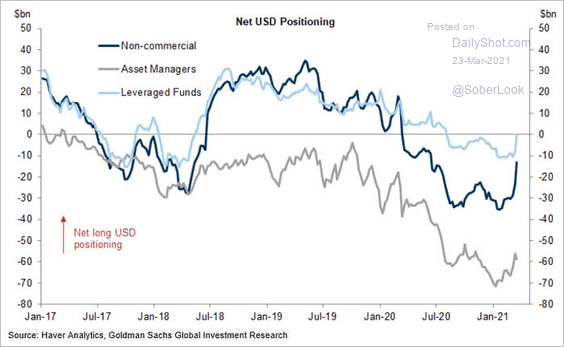

1. We are seeing some covering of short-dollar positions.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

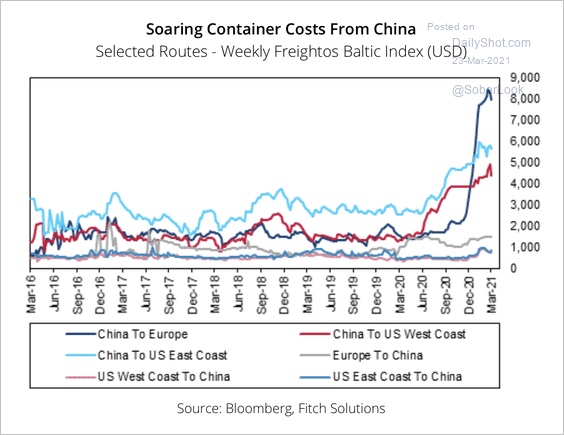

2. Costs for containers exporting goods from China have soared.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

3. Which central banks hiked rates this year?

Source: @markets Read full article

Source: @markets Read full article

——————–

Food for Thought

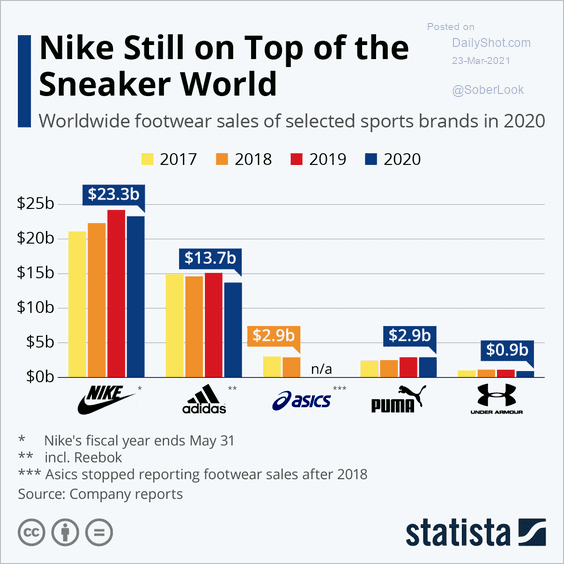

1. Sports footwear sales:

Source: Statista

Source: Statista

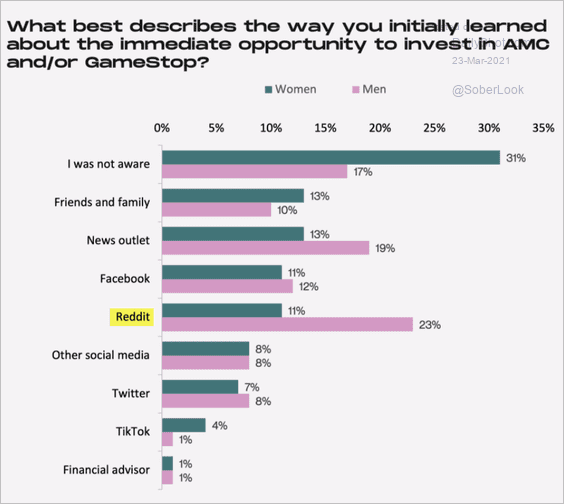

2. How did you learn about Gamestop?

Source: cardify Read full article

Source: cardify Read full article

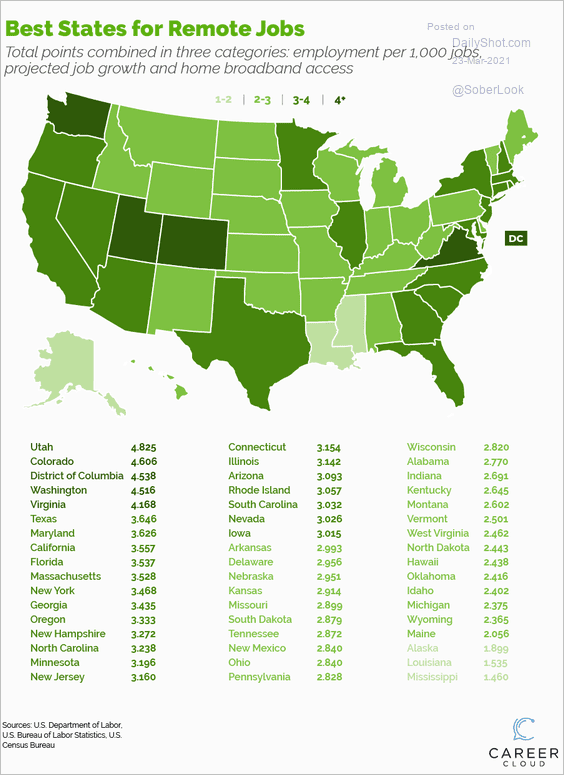

3. Best states for remote work:

Source: CareerCloud Read full article

Source: CareerCloud Read full article

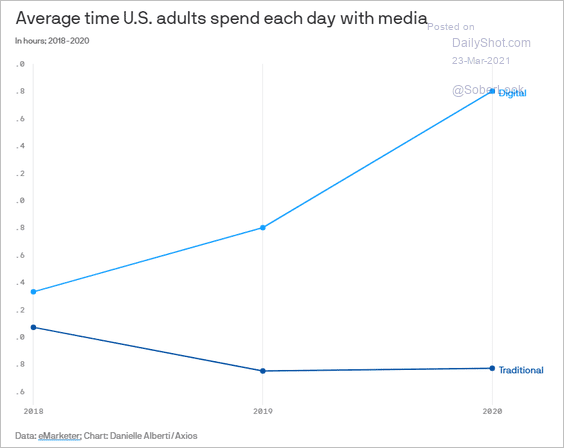

4. Time spent with media:

Source: @axios Read full article

Source: @axios Read full article

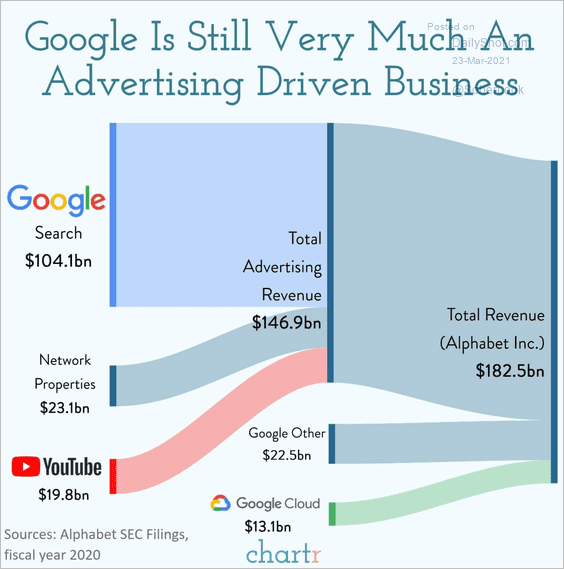

5. Google revenue sources:

Source: @chartrdaily

Source: @chartrdaily

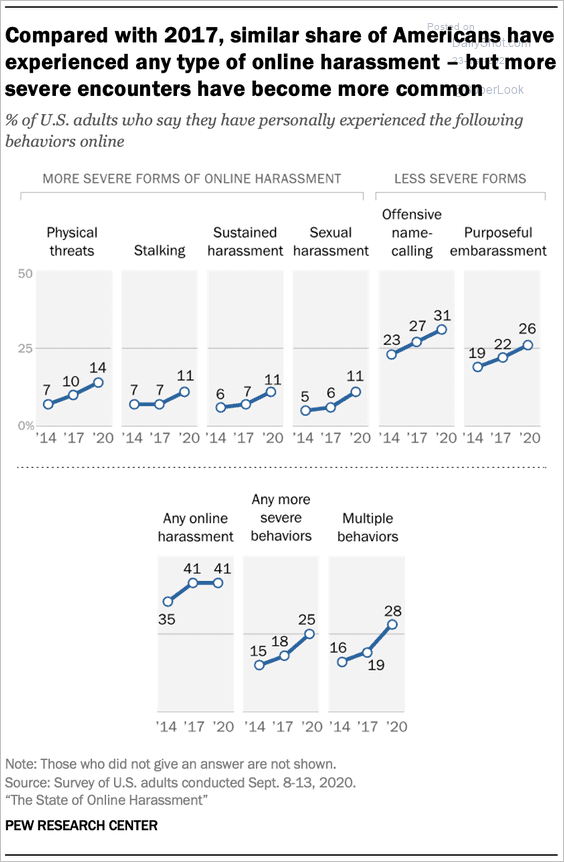

6. Online harassment:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

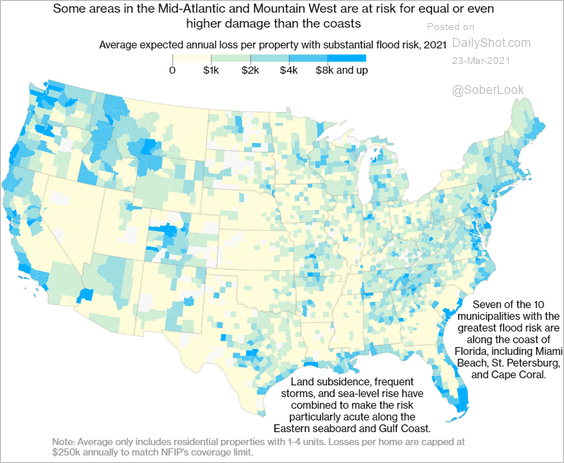

7. US flood risk:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

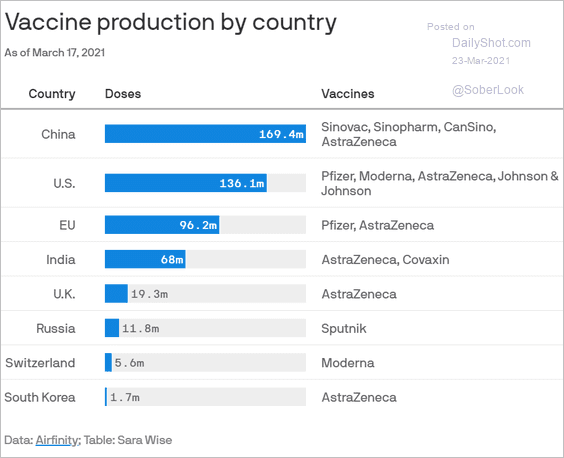

8. Vaccine production by country:

Source: @axios Read full article

Source: @axios Read full article

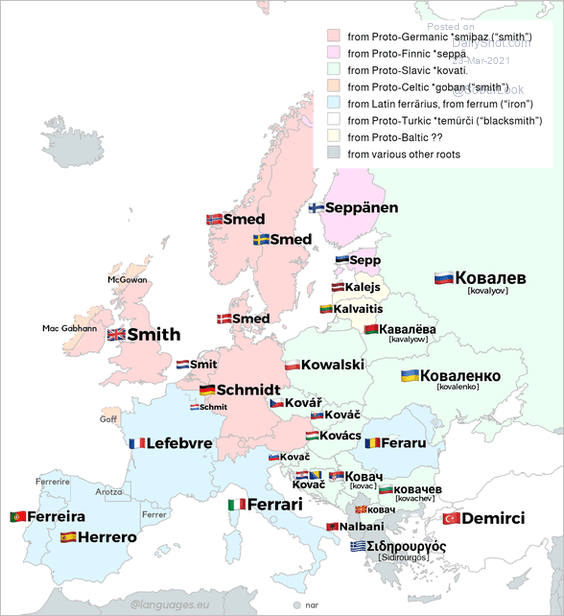

9. The surname “Smith” in several European languages:

Source: reddit

Source: reddit

——————–

Back to Index