The Daily Shot: 26-Mar-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Financial Quant Survey – Part 1

• Food for Thought

The United States

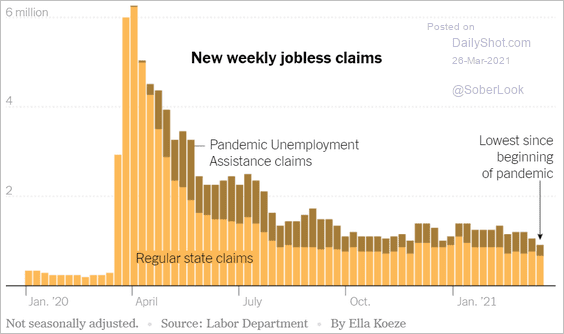

1. Let’s begin with the labor market.

• Initial jobless applications dropped to a post-pandemic low.

Source: The New York Times Read full article

Source: The New York Times Read full article

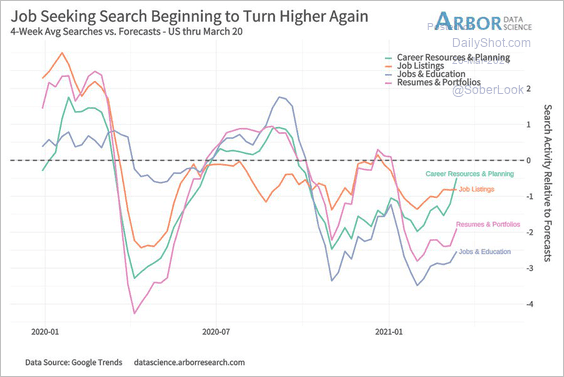

• Online job search activity shows some improvement.

Source: @DataArbor, @PeterSForbes

Source: @DataArbor, @PeterSForbes

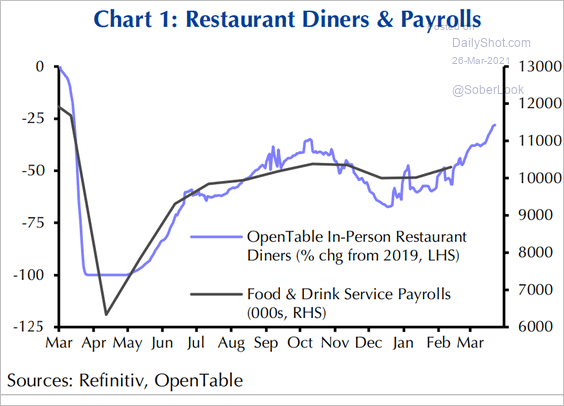

• Restaurant jobs should be rebounding.

Source: Capital Economics

Source: Capital Economics

——————–

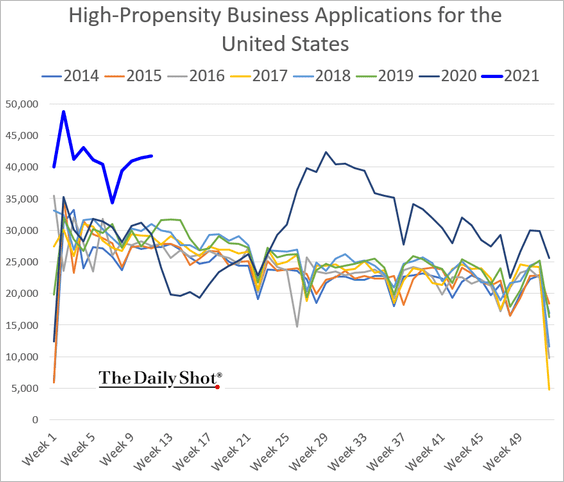

2. Business applications remain elevated.

3. Next, we have some updates on the housing market.

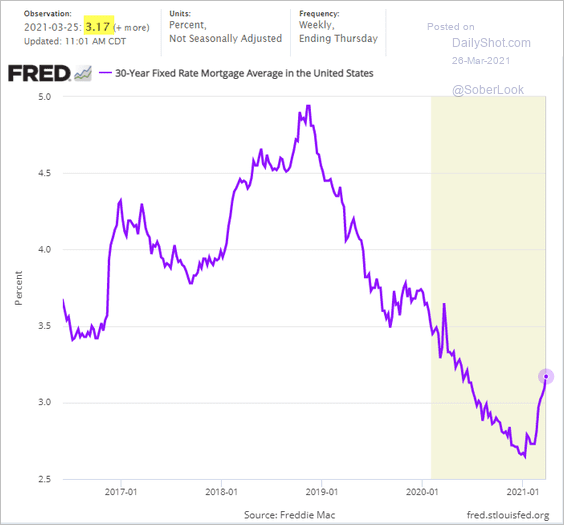

• Mortgage rates are grinding higher.

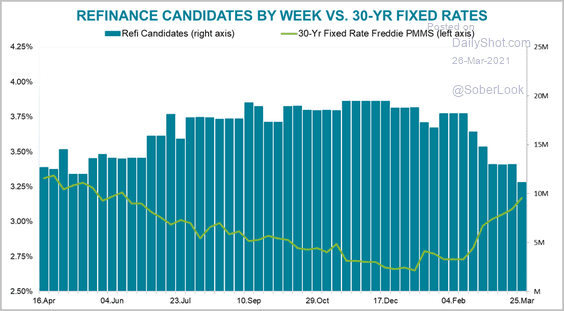

• The number of refi candidates (borrowers who would benefit from refinancing their loans at current rates) has declined.

Source: Black Knight

Source: Black Knight

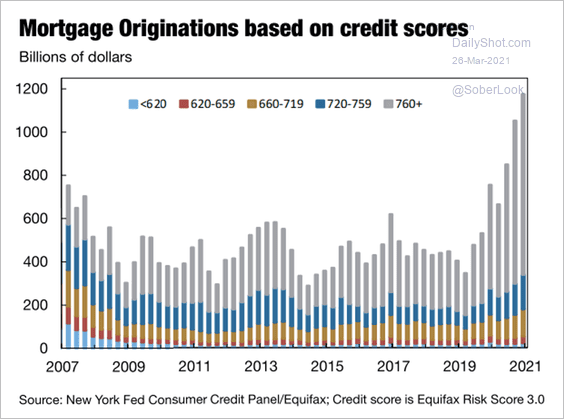

• Mortgage originations are dominated by borrowers with the highest credit scores.

Source: NY Fed Read full article

Source: NY Fed Read full article

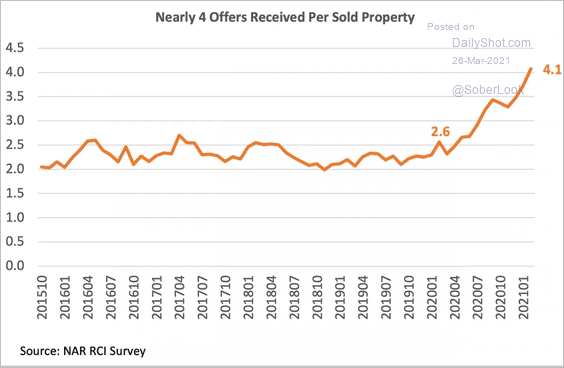

• On average, there are now four offers received for each residential property sold in the US.

Source: Scholastica Gay Cororaton, National Association of REALTORS

Source: Scholastica Gay Cororaton, National Association of REALTORS

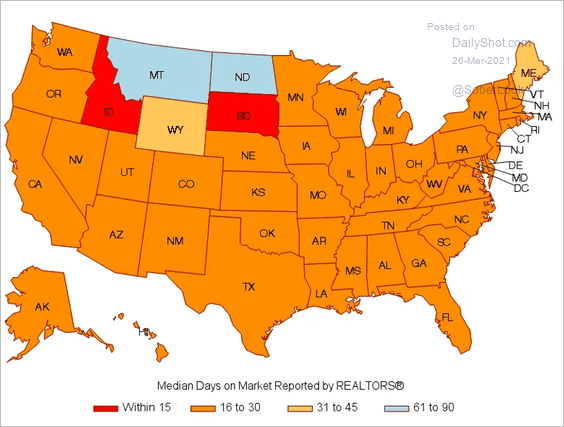

• This map shows the median time it takes to sell a house.

Source: Scholastica Gay Cororaton, National Association of REALTORS

Source: Scholastica Gay Cororaton, National Association of REALTORS

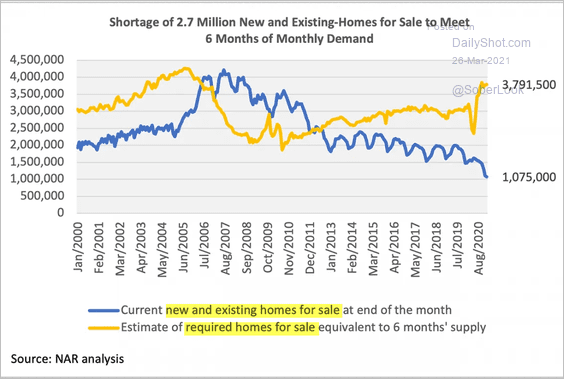

• The US needs an additional 2.7 million homes to meet near-term demand.

Source: Scholastica Gay Cororaton, National Association of REALTORS

Source: Scholastica Gay Cororaton, National Association of REALTORS

——————–

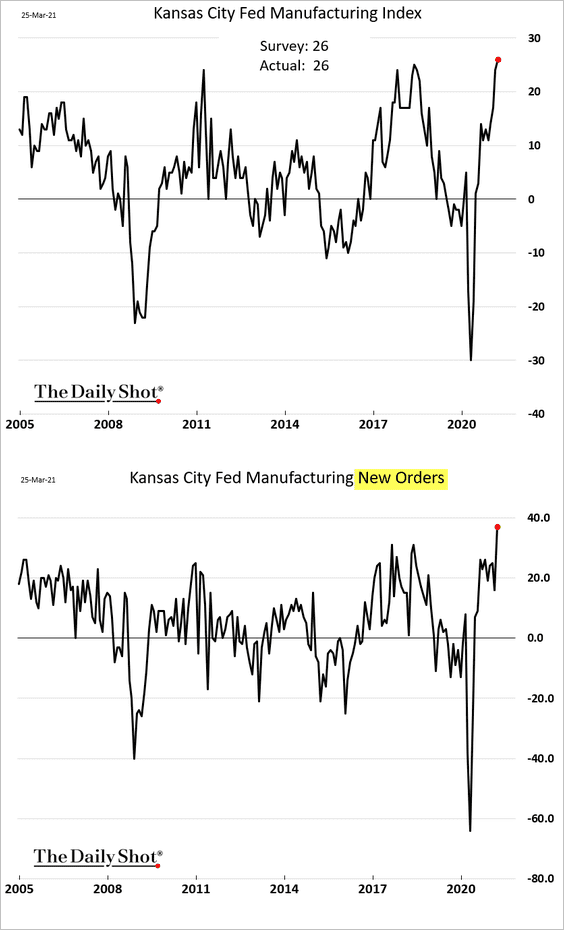

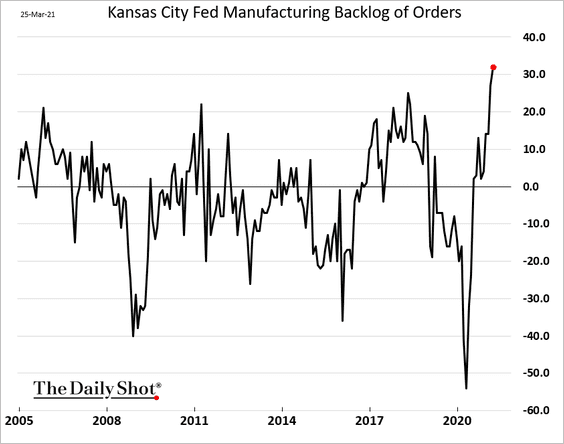

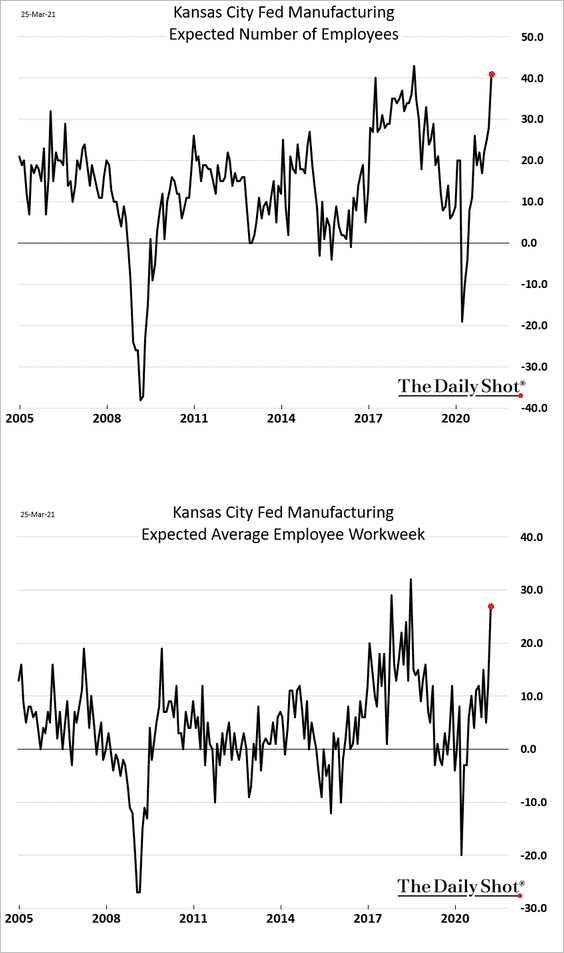

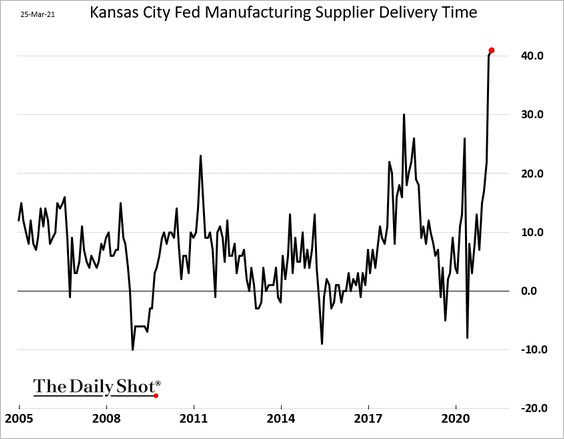

4. The Kansas City Fed’s regional manufacturing report points to rapid growth in factory activity.

• Backlog of work:

• Expected employment:

As we see in other surveys, supply chains remain strained.

——————–

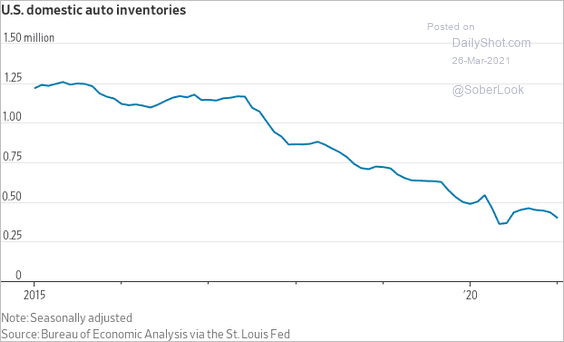

5. Automobile inventories are near multi-year lows.

Source: @WSJ Read full article

Source: @WSJ Read full article

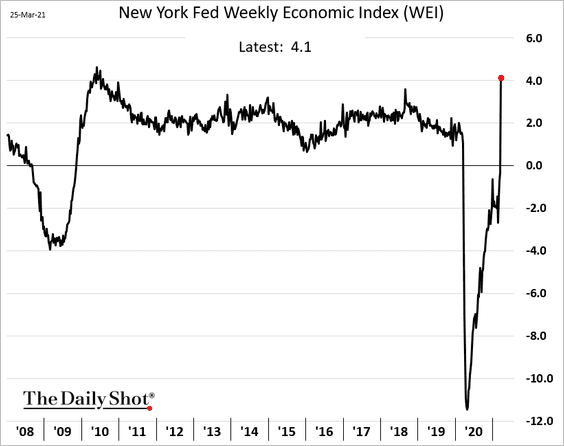

6. The New York Fed’s national economic activity index (WEI) shows acceleration in growth.

7. The Oxford Economics Recovery Tracker is trending higher.

![]() Source: Oxford Economics

Source: Oxford Economics

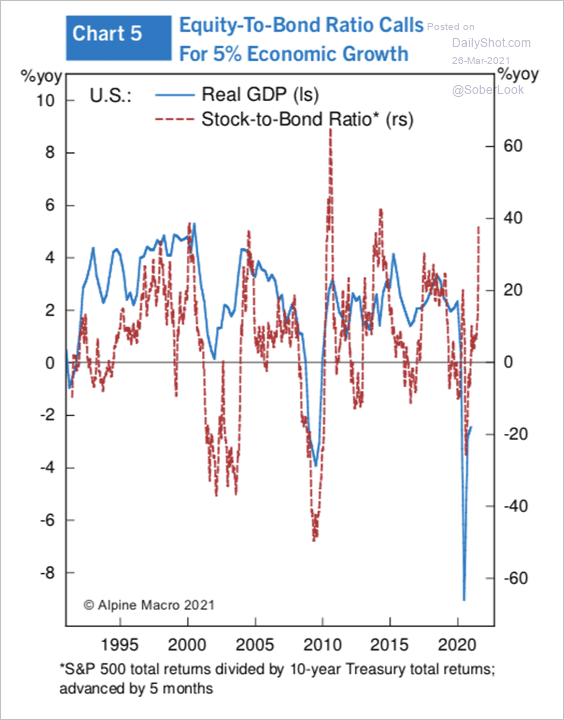

8. The equity-to-bond ratio points to a strengthening economy.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Canada

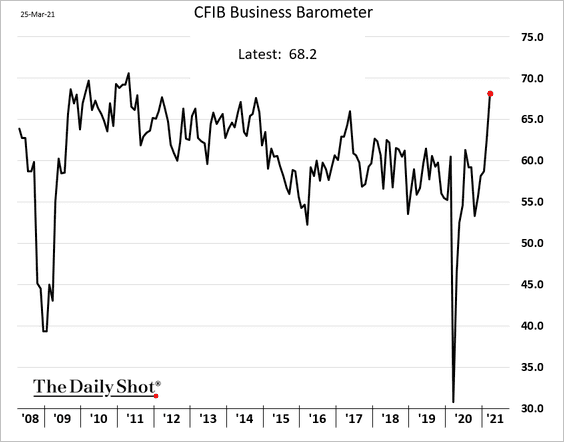

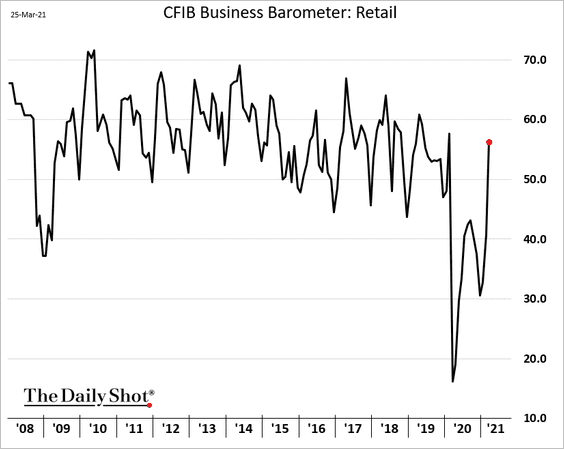

1. The CFIB small/medium-size business index hit the highest level in a decade.

Retail activity is rebounding.

——————–

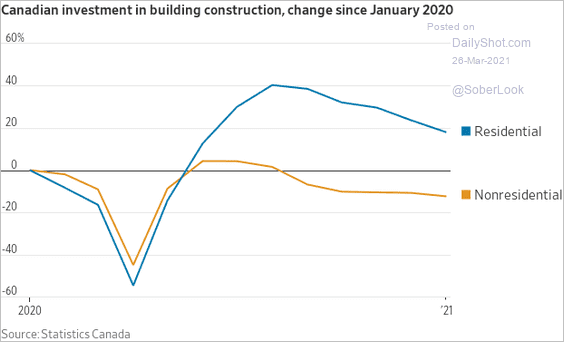

2. Just like in the US, residential investment surged last year.

Source: @WSJ Read full article

Source: @WSJ Read full article

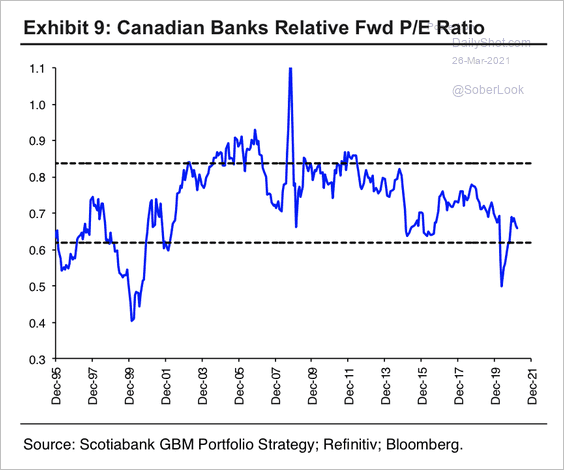

3. Canadian banks appear cheap based on the relative price-to-earnings ratio.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Back to Index

The United Kingdom

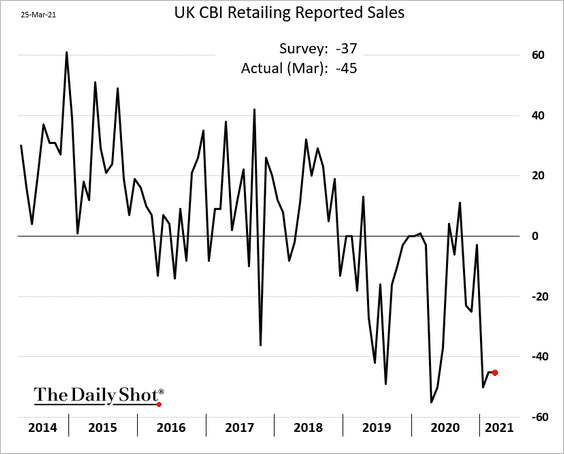

1. The CBI index suggests that retail sales remain subdued.

But retailers are hopeful.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

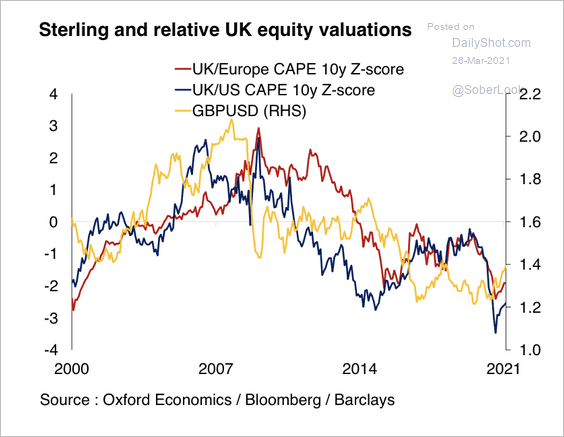

2. UK relative equity valuations are near decade lows.

Source: Oxford Economics

Source: Oxford Economics

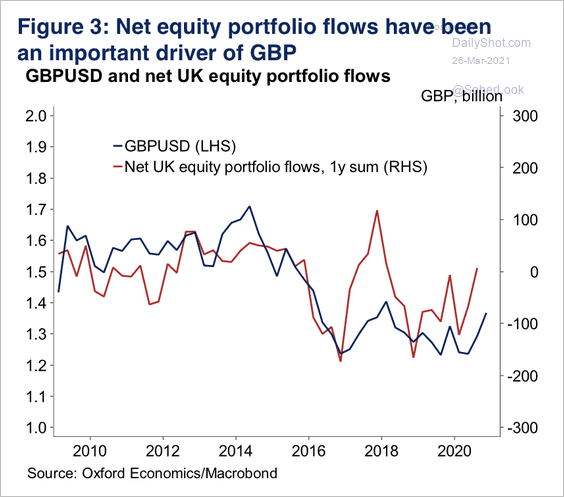

Separately, UK equity inflows could bode well for GBP/USD.

Source: Oxford Economics

Source: Oxford Economics

——————–

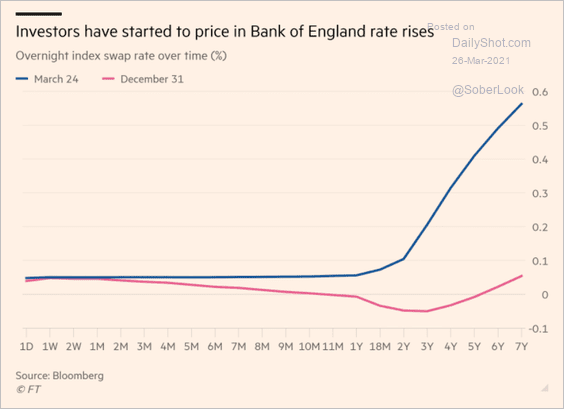

3. The market expects rate hikes in a couple of years.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

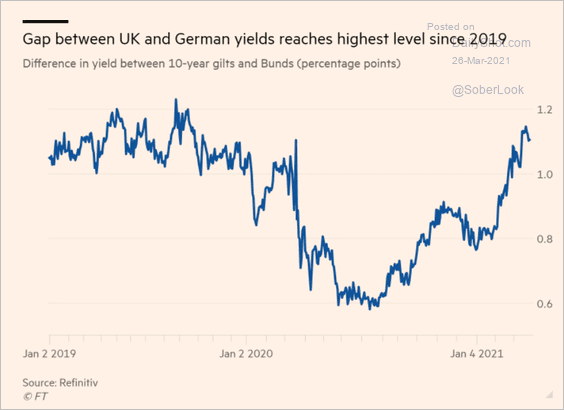

4. The gilt-Bund yield spread has widened substantially this year.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

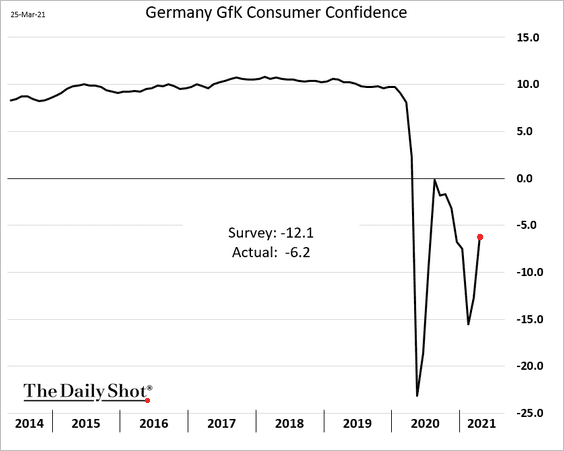

1. German consumer confidence is rebounding.

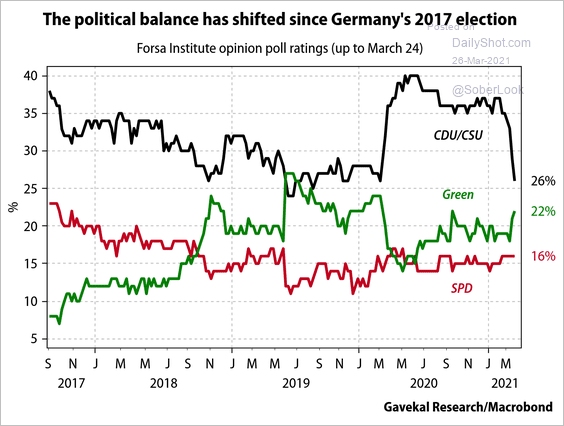

Separately, here are the latest polls.

Source: Gavekal Research

Source: Gavekal Research

——————–

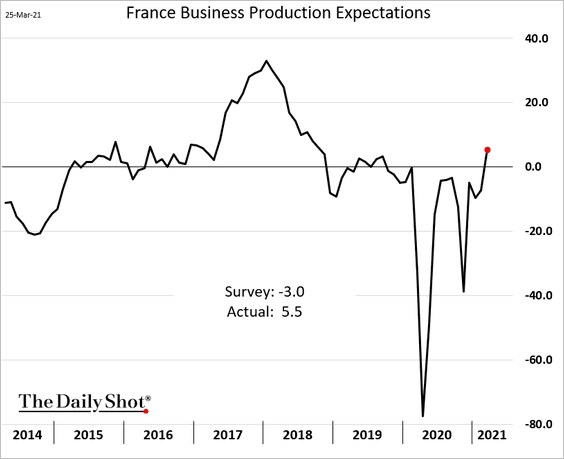

2. French business expectations have fully recovered.

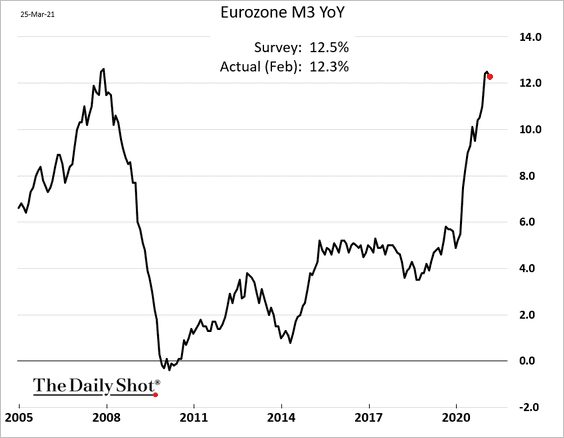

3. The broad money supply expansion ticked lower last month.

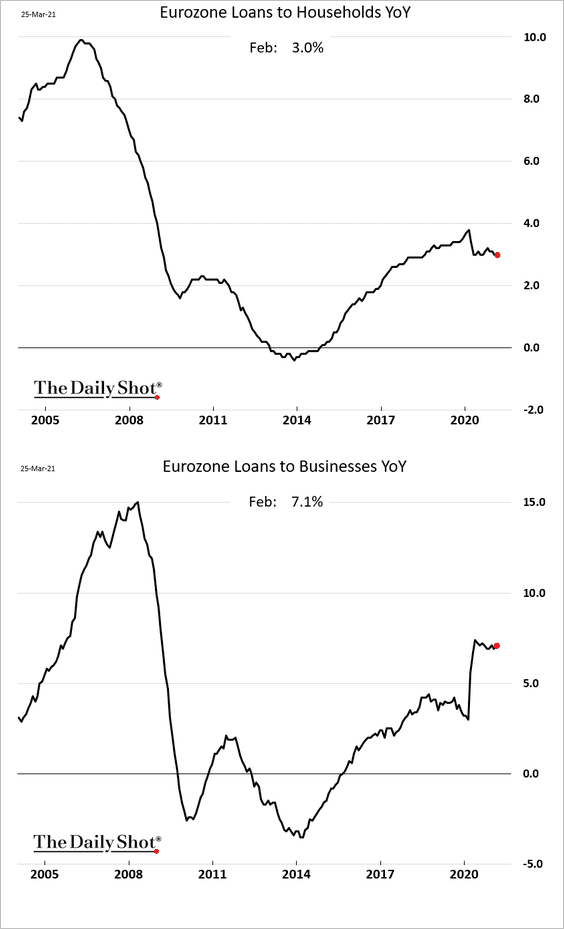

Here is loan growth across the euro area.

——————–

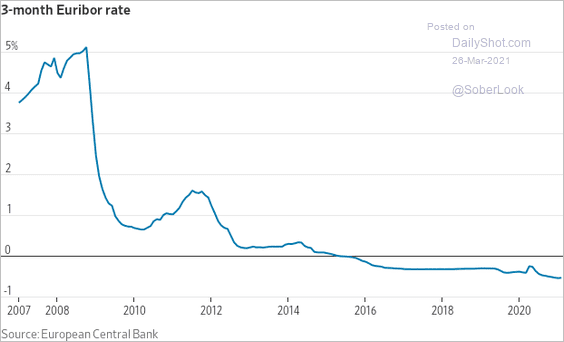

4. The 3-month Euribor rate is deep in negative territory.

Source: @WSJ Read full article

Source: @WSJ Read full article

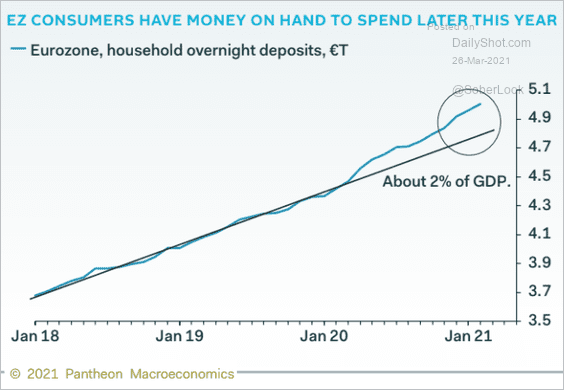

5. Households are sitting on massive savings.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

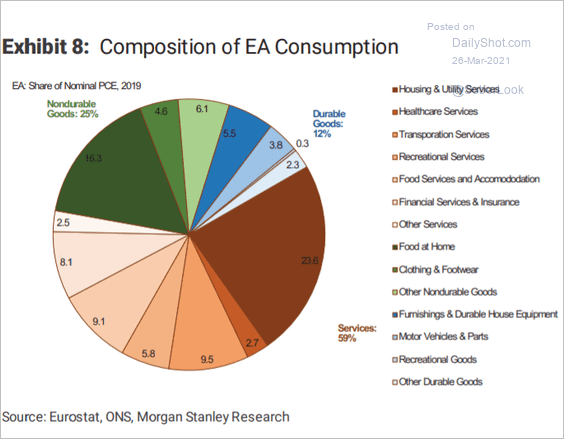

6. Here is the composition of consumer spending.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

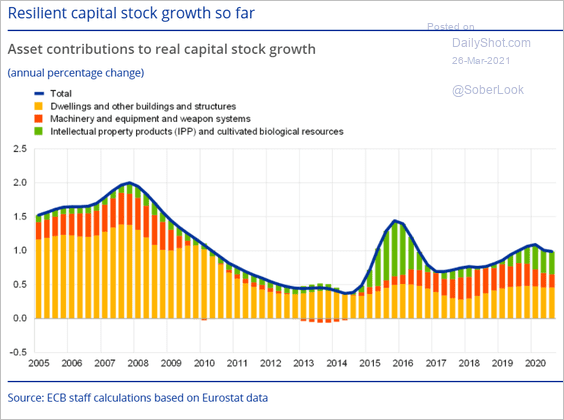

7. This chart shows the contributions to investment since 2005.

Source: ECB Read full article

Source: ECB Read full article

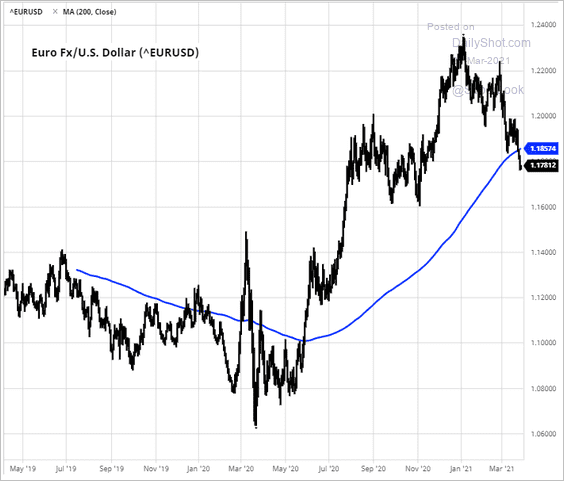

8. EUR/USD is below the 200-day moving average.

Source: barchart.com

Source: barchart.com

Back to Index

Europe

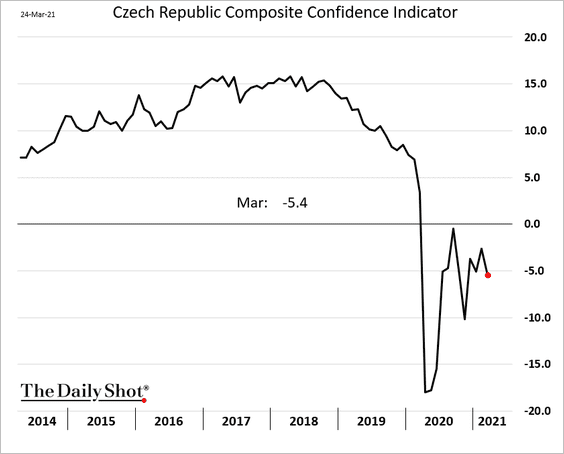

1. Czech consumer and business confidence remains depressed.

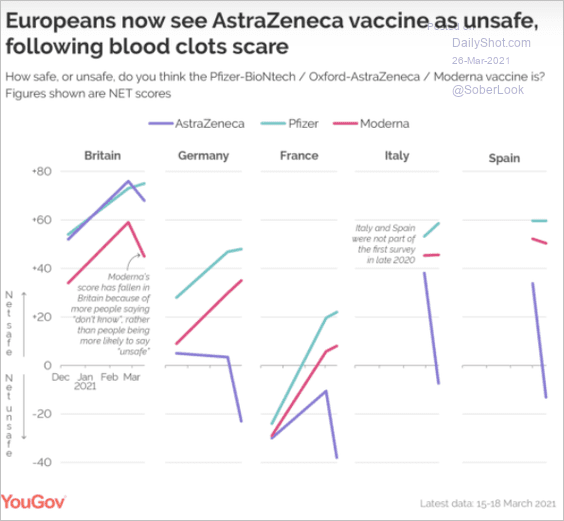

2. How do Europeans view different vaccines?

Source: YouGov Read full article

Source: YouGov Read full article

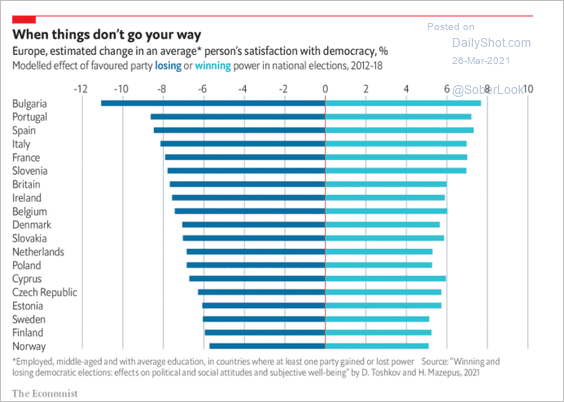

3. This chart shows satisfaction with democracy across Europe.

Source: The Economist Read full article

Source: The Economist Read full article

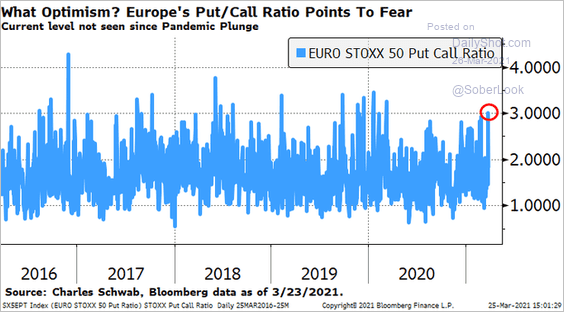

4. European stock investors remain cautious (see definition of put/call ratio).

Source: @JeffreyKleintop

Source: @JeffreyKleintop

Back to Index

Asia – Pacific

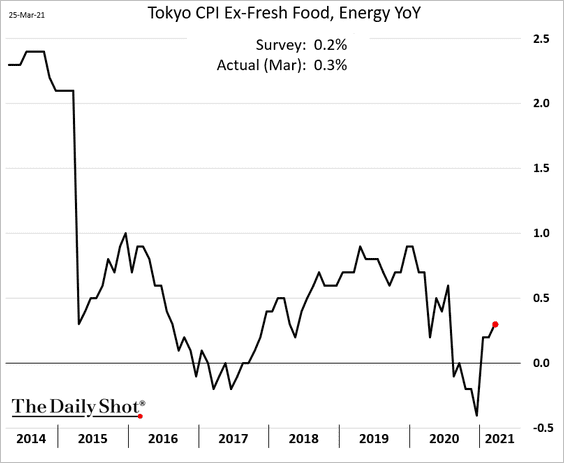

1. The Tokyo core CPI ticked higher this month.

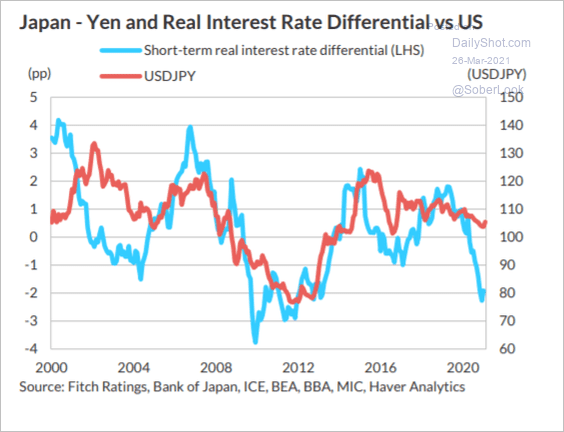

2. The yen has diverged for the US-Japan short-term rate differential.

Source: Fitch Ratings

Source: Fitch Ratings

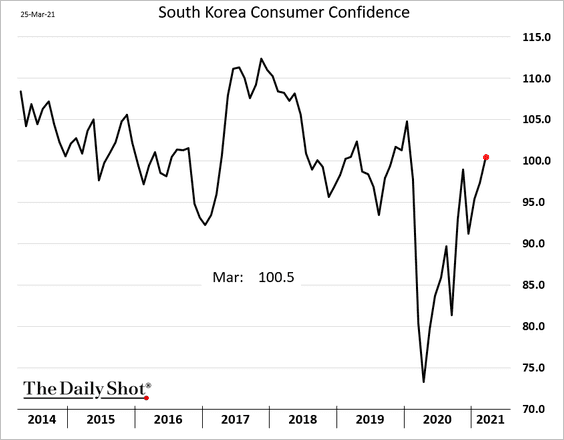

3. South Korea’s consumer confidence is rebounding.

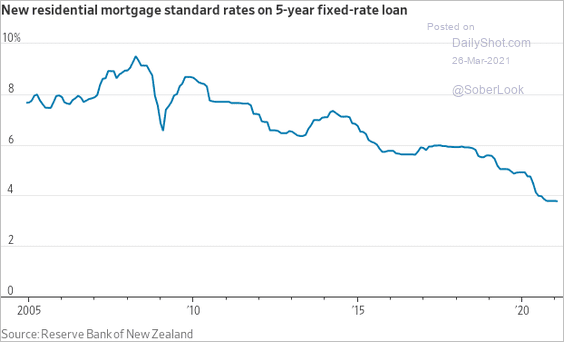

4. Exceptionally low rates contributed to New Zealand’s housing bubble.

Source: @WSJ Read full article

Source: @WSJ Read full article

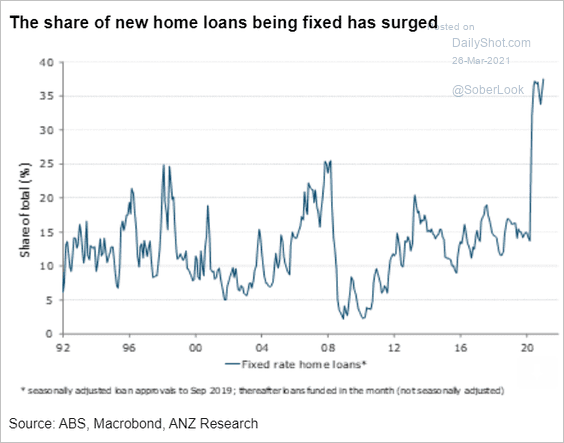

5. A higher percentage of Australia’s mortgages now have fixed rates.

Source: ANZ Research

Source: ANZ Research

Back to Index

China

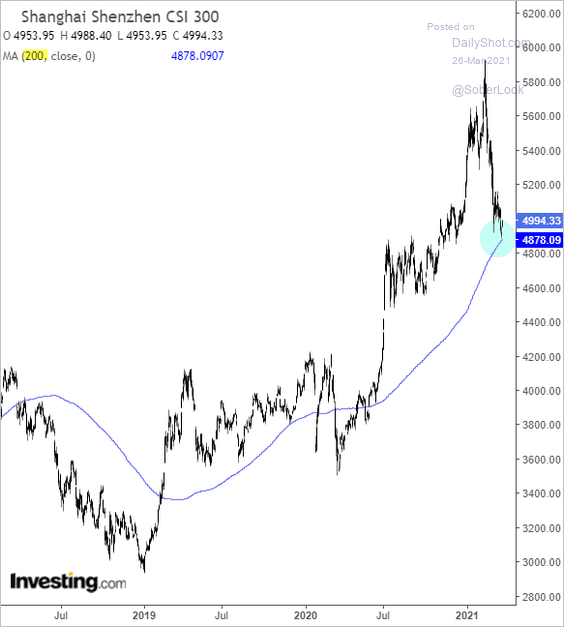

1. The Shanghai Shenzhen CSI 300 Index held support at the 200-day moving average.

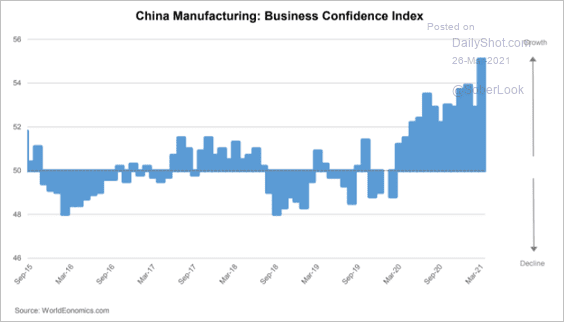

2. Manufacturing business confidence is at multi-year highs.

Source: World Economics

Source: World Economics

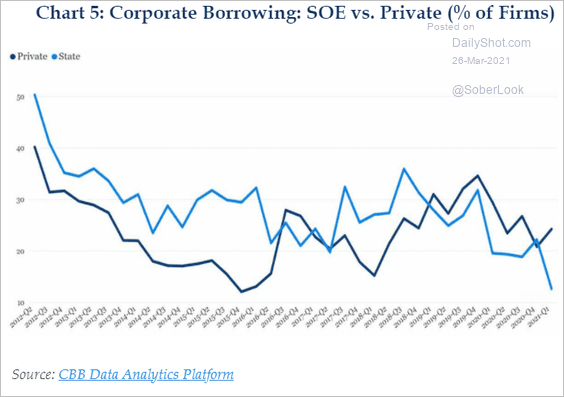

3. State-owned firms have cut back their borrowing.

Source: China Beige Book

Source: China Beige Book

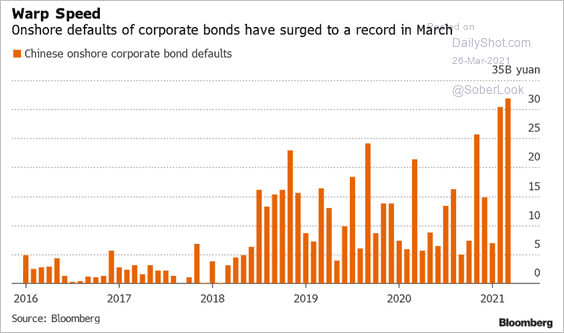

4. Onshore corporate bond defaults surged this year.

Source: @MollyDai, @TheTerminal, Bloomberg Finance L.P.

Source: @MollyDai, @TheTerminal, Bloomberg Finance L.P.

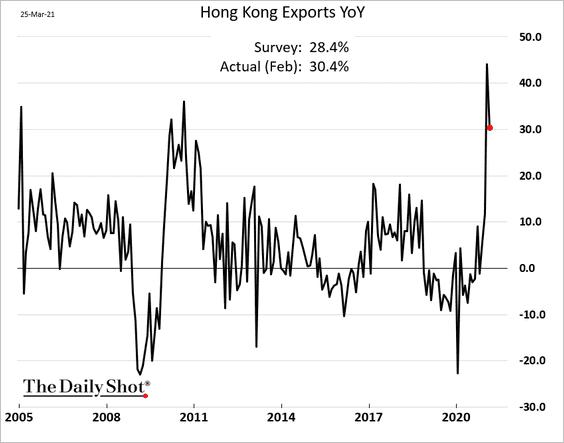

5. Hong Kong’s exports remain strong.

Back to Index

Emerging Markets

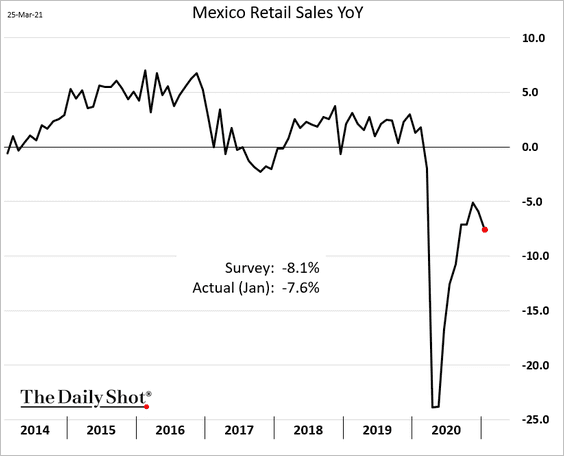

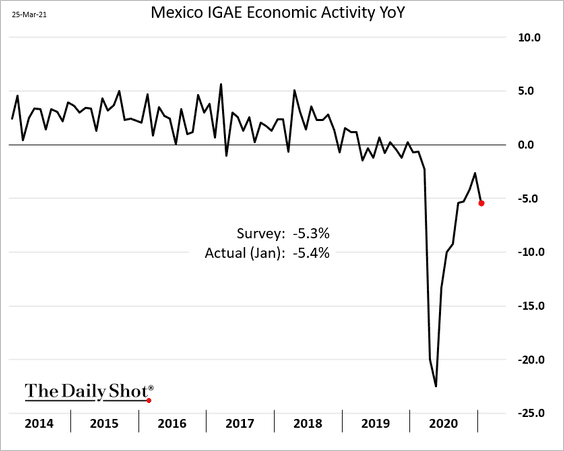

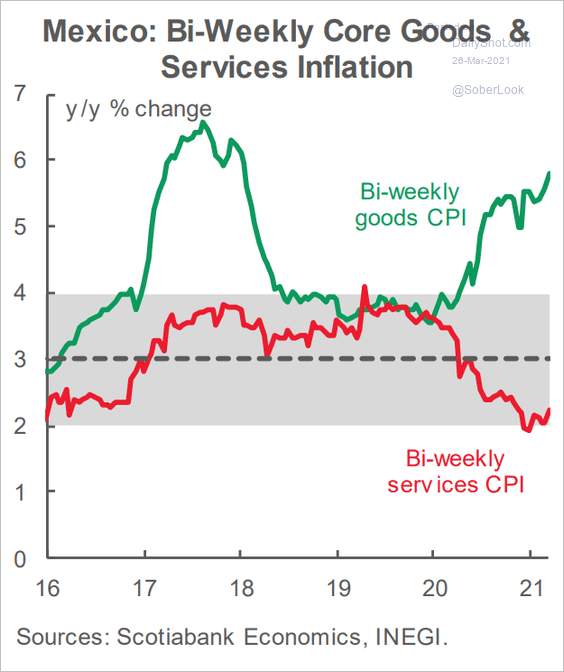

1. Let’s begin with Mexico.

• January was a rough month for the nation’s economy.

– Retail sales:

– Economic activity:

• Just like in the US, goods and services inflation trends have diverged.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

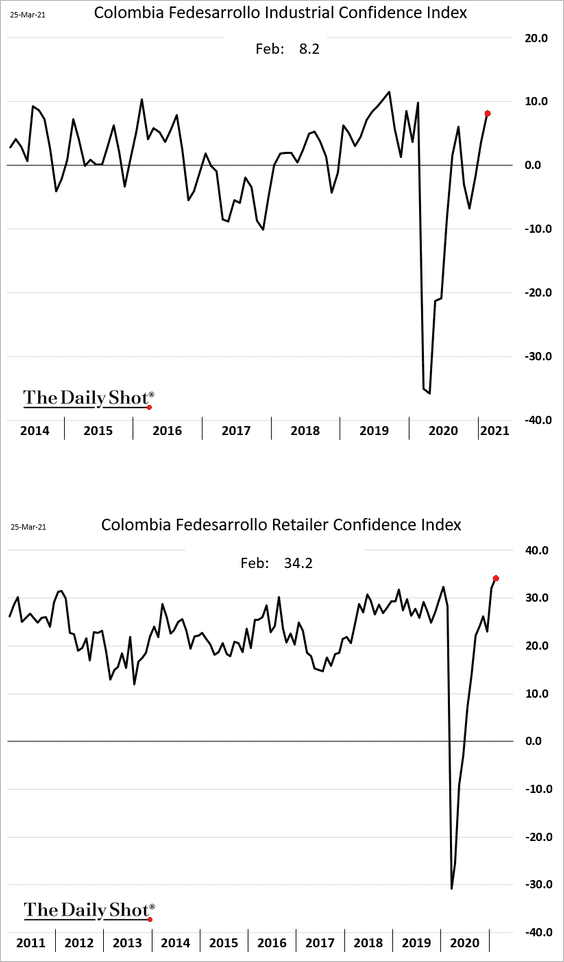

2. Colombia’s business confidence has fully recovered.

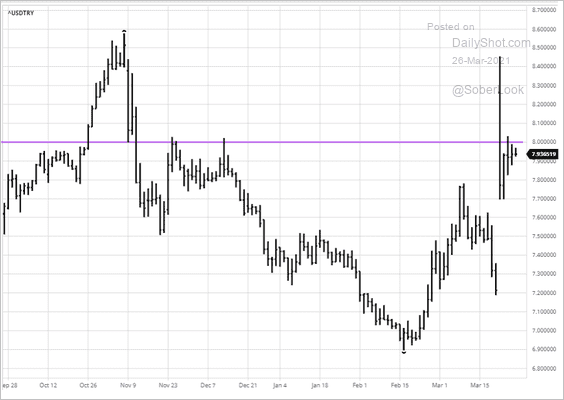

3. USD/TRY (Turkish lira per one dollar) held resistance at 8.0.

Source: barchart.com

Source: barchart.com

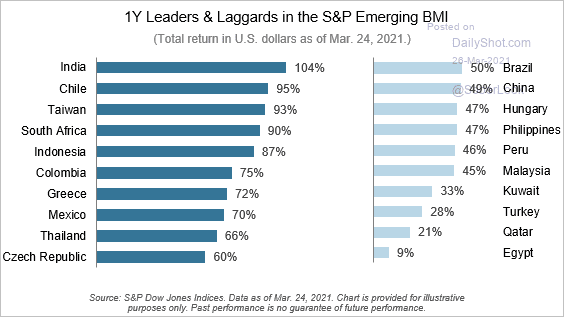

4. Here are the equity leaders and laggers over the past year.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Cryptocurrency

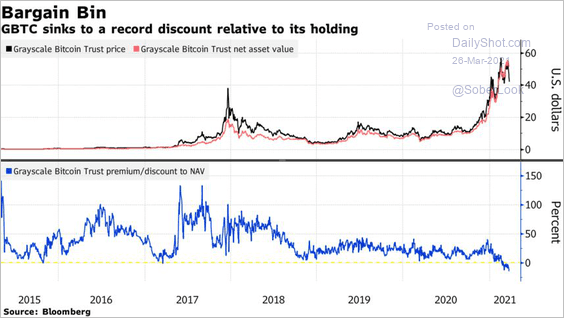

1. The largest Bitcoin fund is trading at a substantial discount to NAV.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

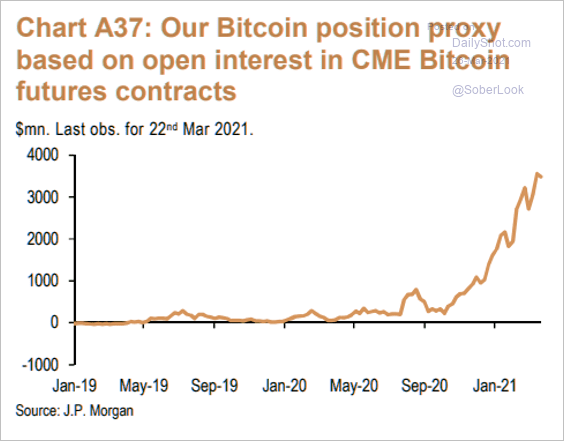

2. Here is JP Morgan’s Bitcoin positioning proxy.

Source: JP Morgan; @themarketear

Source: JP Morgan; @themarketear

Back to Index

Commodities

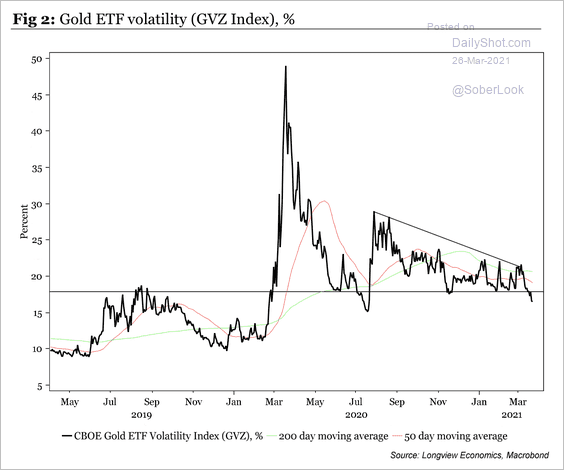

1. Gold ETF volatility is breaking down.

Source: Longview Economics

Source: Longview Economics

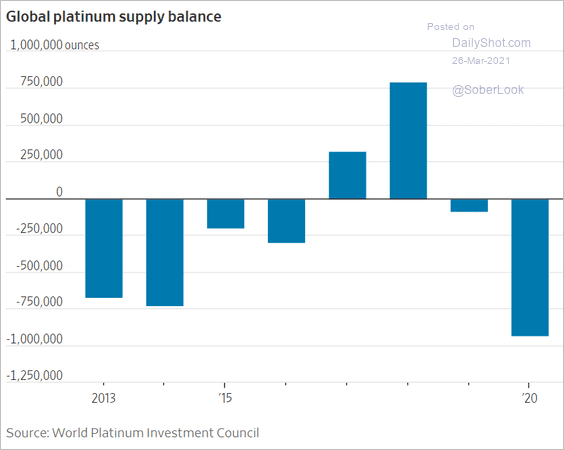

2. The platinum market has been in deficit.

Source: @WSJ Read full article

Source: @WSJ Read full article

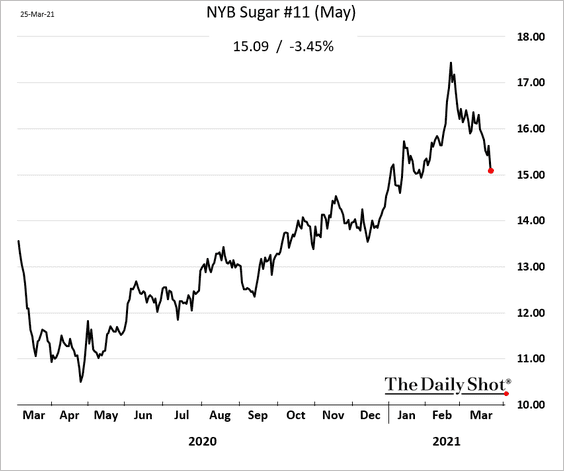

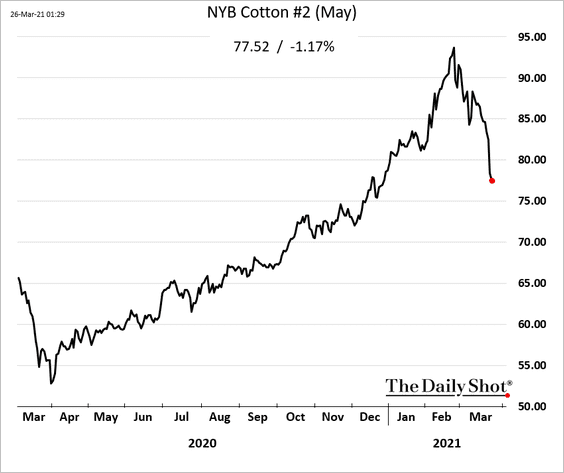

3. US softs have been rolling over.

• Sugar:

• Cotton:

——————–

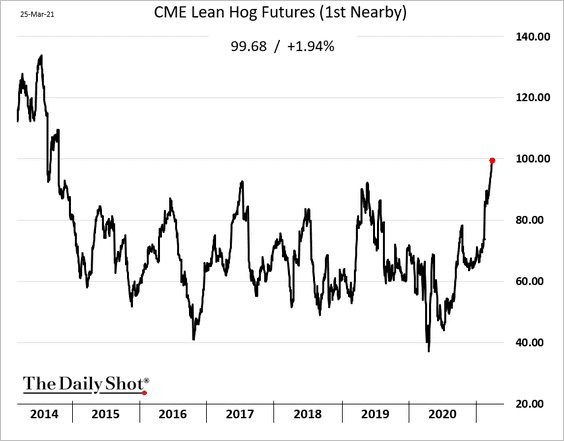

4. Chicago lean hog futures are at the highest level since 2014.

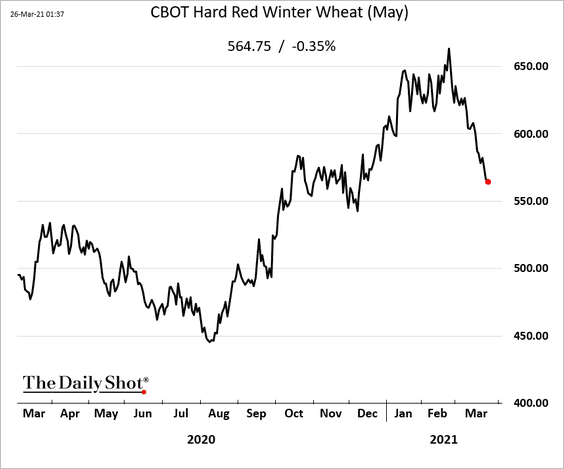

5. Wheat remains under pressure.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Energy

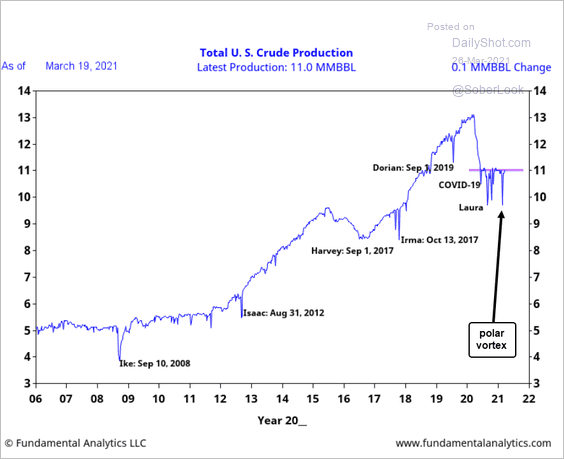

1. US crude oil production is back at pre-polar-vortex levels.

Source: Joel Fingerman

Source: Joel Fingerman

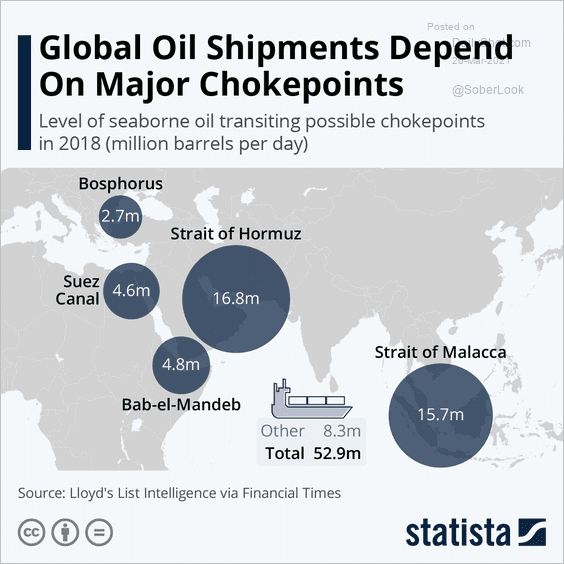

2. Here is an illustration of global oil chokepoints. By the way, the Suez situation is not expected to have a substantial impact on prices.

Source: Statista

Source: Statista

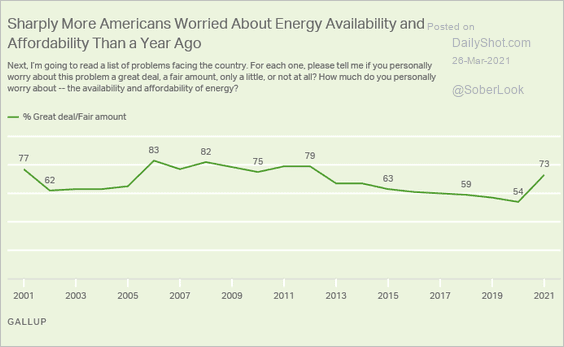

3. More Americans are concerned about energy availability and affordability (driven by the massive power outages in Texas).

Source: Gallup Read full article

Source: Gallup Read full article

Back to Index

Equities

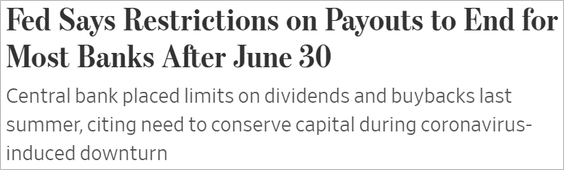

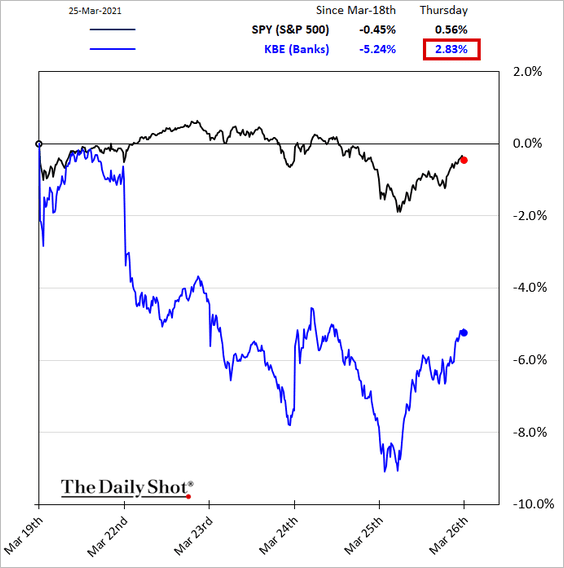

1. The Fed’s announcement on bank dividends and share buybacks boosted financials.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

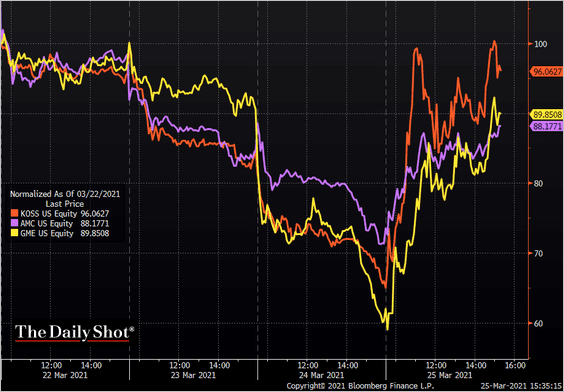

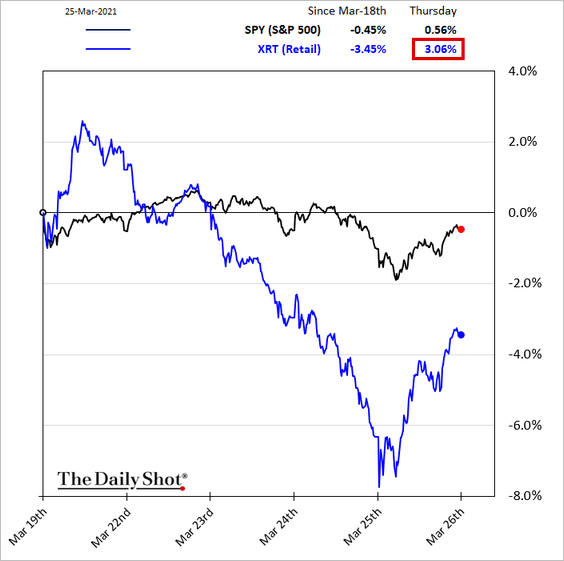

2. The Reddit crowd’s favorite stocks soared on Thursday.

Here is the SPDR retail ETF, which has been whipsawed by these stocks.

——————–

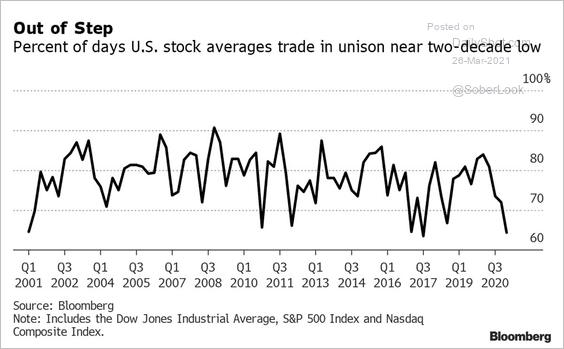

3. Major US indices are not trading in unison.

Source: BloombergQuint Read full article

Source: BloombergQuint Read full article

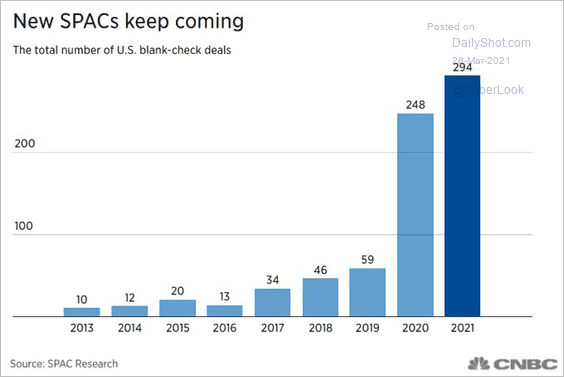

4. Next, we have some updates on SPACs.

• It’s been a good quarter for SPAC deals.

Source: @WallStJesus; CNBC Read full article

Source: @WallStJesus; CNBC Read full article

• Regulators are taking a look at SPAC-related practices.

Source: Reuters Read full article

Source: Reuters Read full article

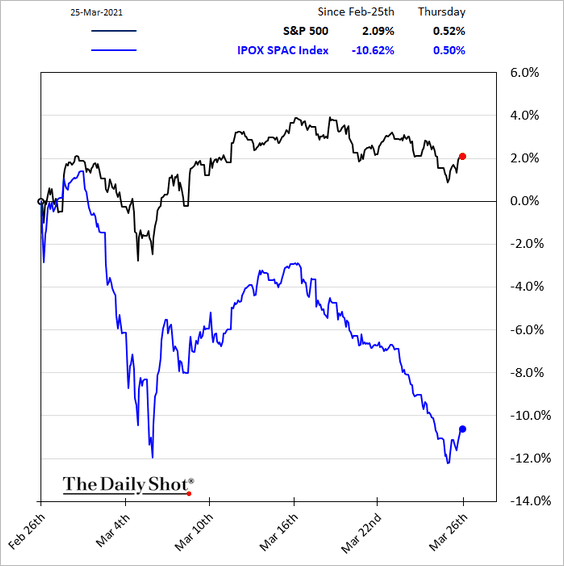

• It’s been a tough month for SPAC prices.

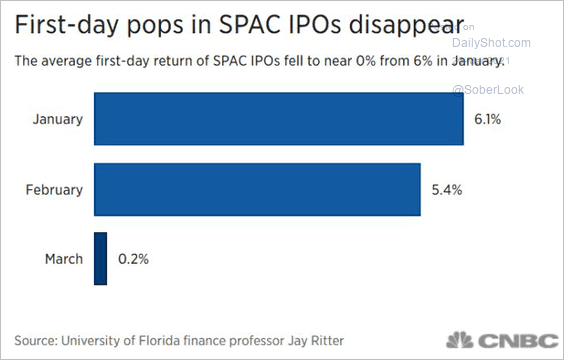

• SPACs are no longer popping immediately after their IPOs.

Source: @WallStJesus; CNBC Read full article

Source: @WallStJesus; CNBC Read full article

——————–

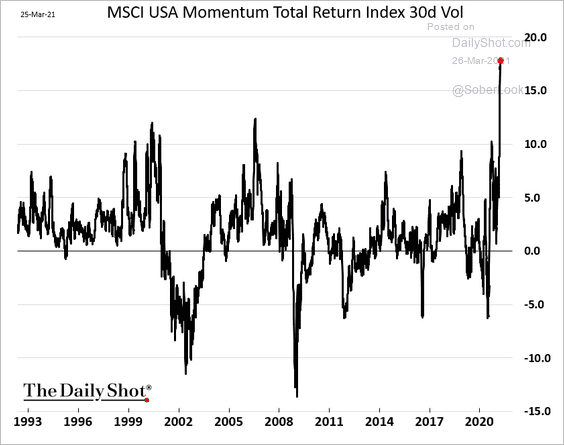

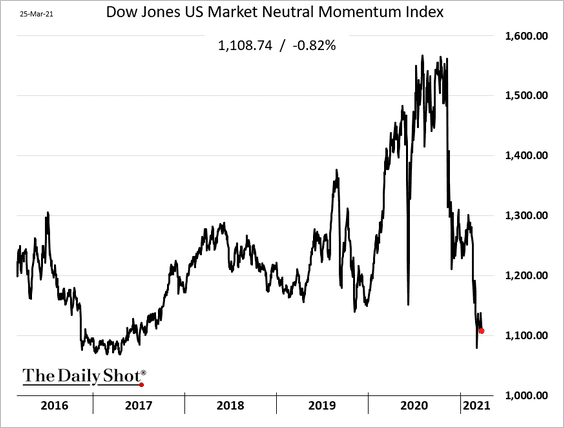

5. The momentum factor has experienced substantial volatility.

h/t @xieyebloomberg

h/t @xieyebloomberg

——————–

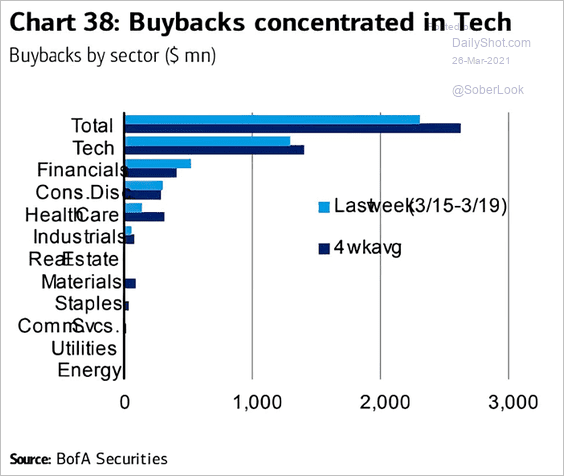

6. This chart shows share buybacks by sector.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

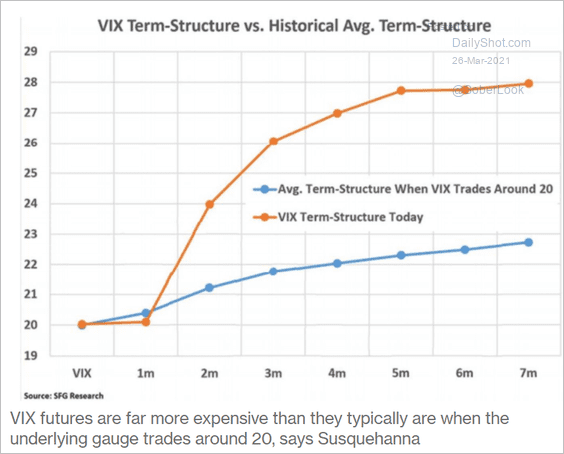

7. The VIX curve is quite steep relative to history.

Source: @markets Read full article

Source: @markets Read full article

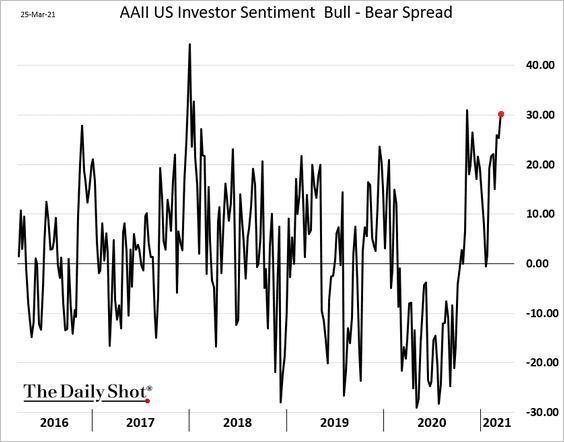

8. The AAII sentiment index shows increasing bullishness.

Back to Index

Credit

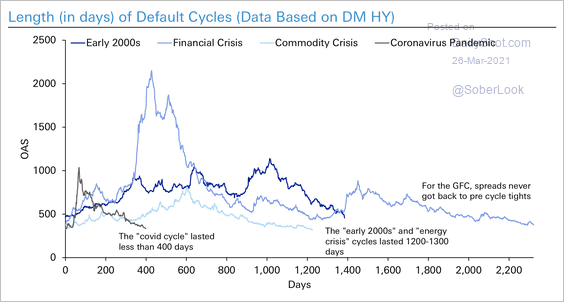

1. US high-yield spreads widened at the fastest rate during the pandemic, with the full cycle lasting a little more than a year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

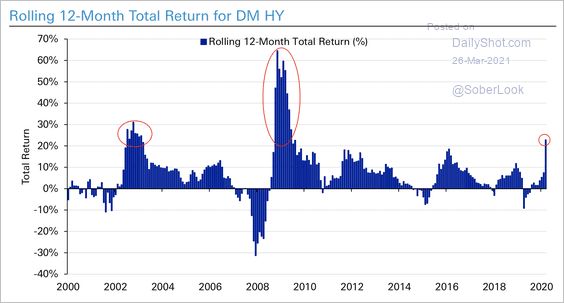

This is only the third time in history that rolling 12-month returns for US HY have been greater than 20%.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

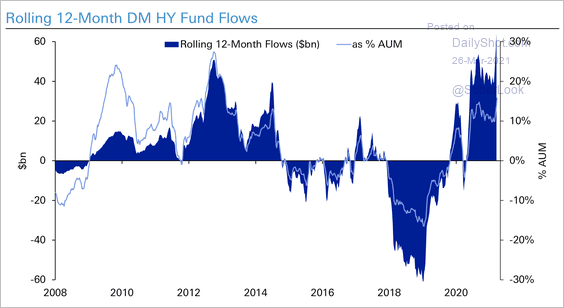

Developed market HY funds have seen record inflows at about 15% of assets under management over the past year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

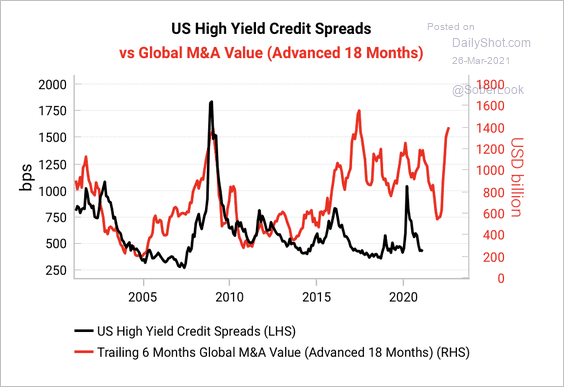

2. Typically, the rise in mergers and acquisitions has led to wider credit spreads.

Source: Variant Perception

Source: Variant Perception

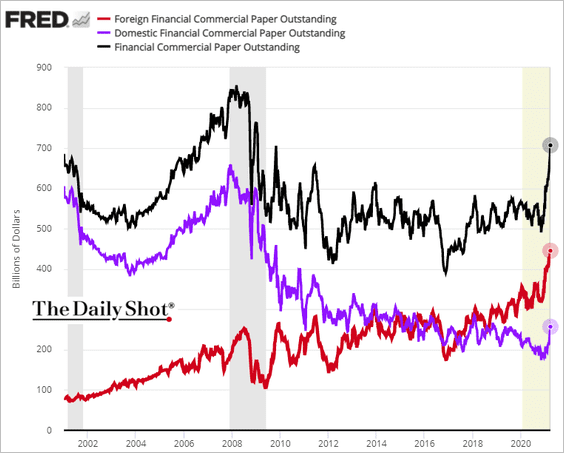

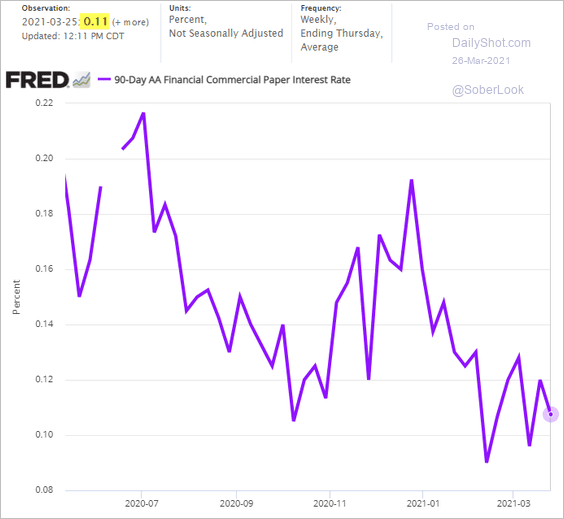

3. Banks continue to boost their issuance of USD commercial paper (driven by foreign banks).

It’s hard to resist borrowing at these rates, especially for banks that don’t have access to US deposits.

Back to Index

Rates

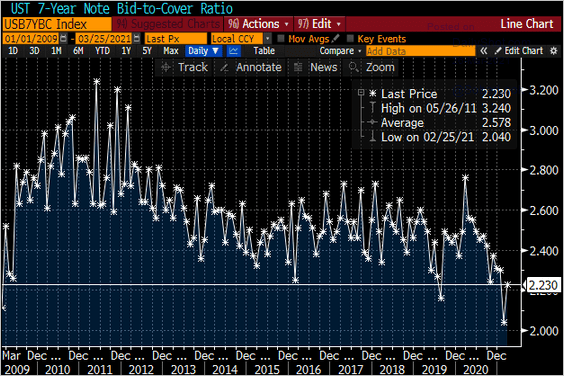

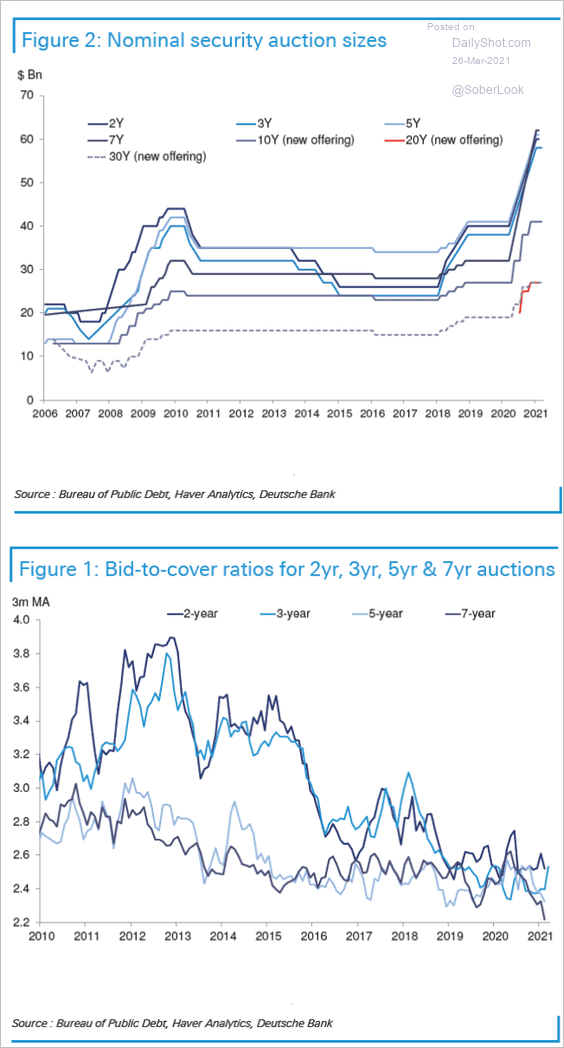

1. The latest 7-year Treasury note auction was better than the previous one.

Source: @BChappatta

Source: @BChappatta

But investors remain nervous given the massive supply hitting the market.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

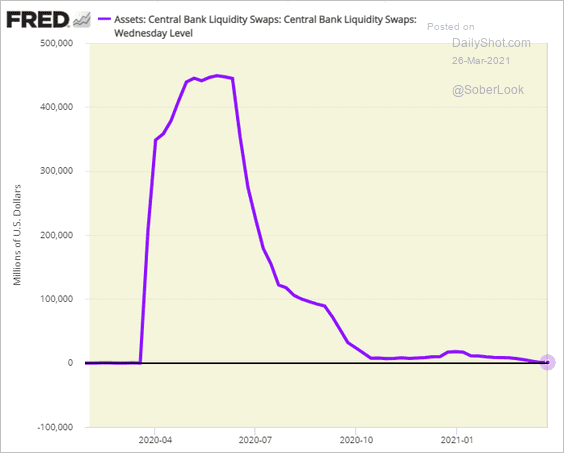

2. The Fed’s central bank liquidity swaps outstanding are now near zero (no shortage of dollars globally).

Back to Index

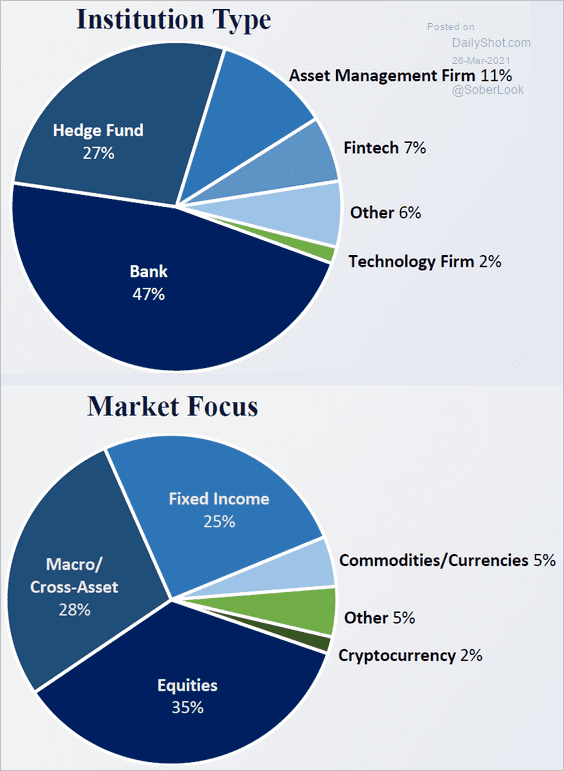

Financial Quant Survey – Part 1

Below we have some data on financial quants, based on a survey of Baruch MFE program graduates.

1. Where do financial quants work, and which markets are they involved with?

Source: Baruch MFE Program and The Daily Shot

Source: Baruch MFE Program and The Daily Shot

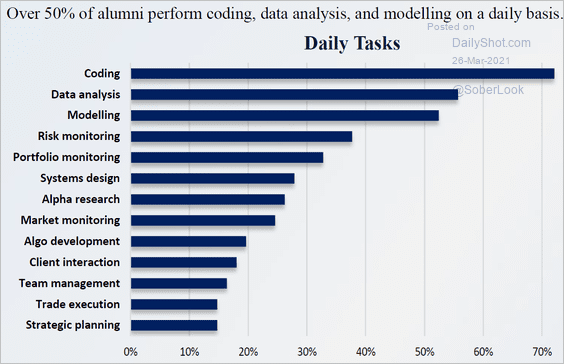

2. What type of work do quants do on a daily basis?

Source: Baruch MFE Program and The Daily Shot

Source: Baruch MFE Program and The Daily Shot

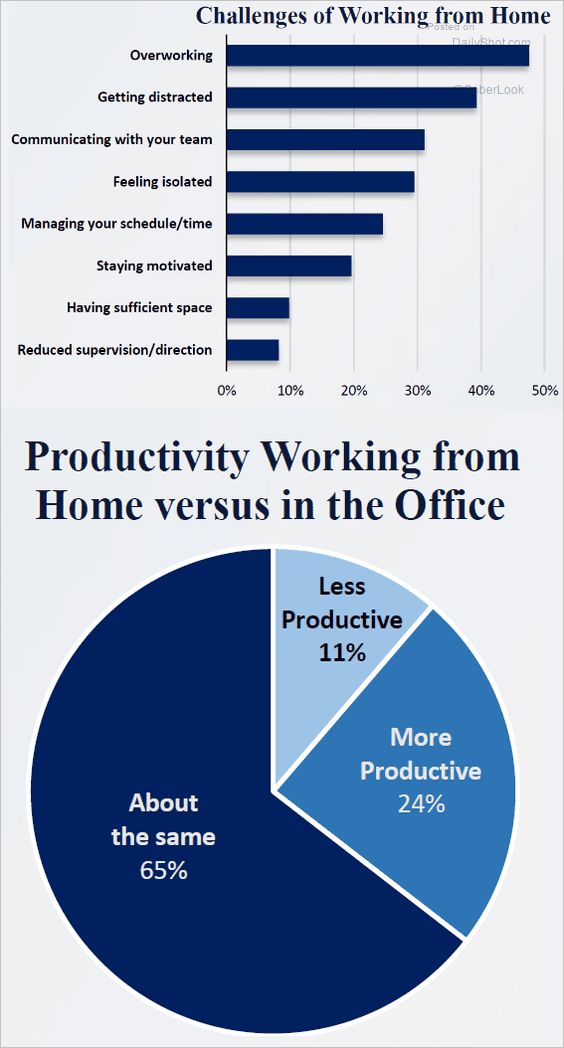

3. How did they handle the pandemic?

Source: Baruch MFE Program and The Daily Shot

Source: Baruch MFE Program and The Daily Shot

Next week, we will take a look at compensation.

——————–

Food for Thought

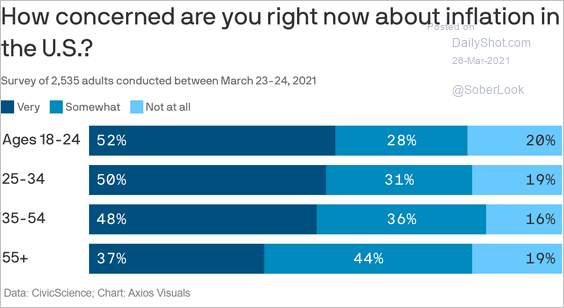

1. How concerned are you about inflation?

Source: @axios Read full article

Source: @axios Read full article

2. The Suez Canal situation:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: @markets Read full article

Source: @markets Read full article

——————–

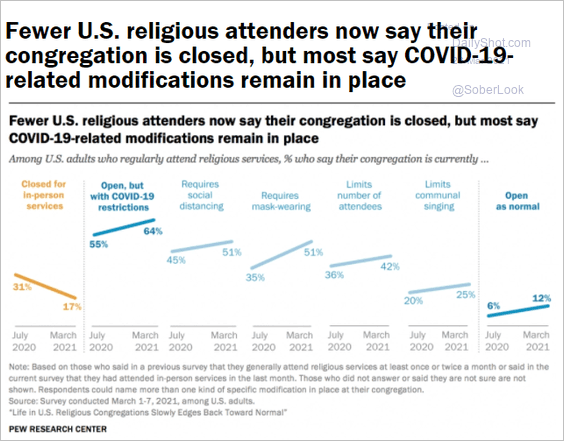

3. COVID-related modifications to religious services:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

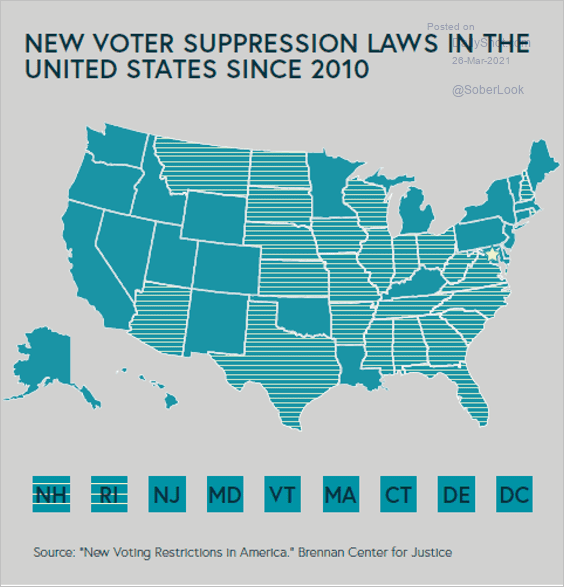

4. Voter restriction laws:

Source: NLIHC Read full article

Source: NLIHC Read full article

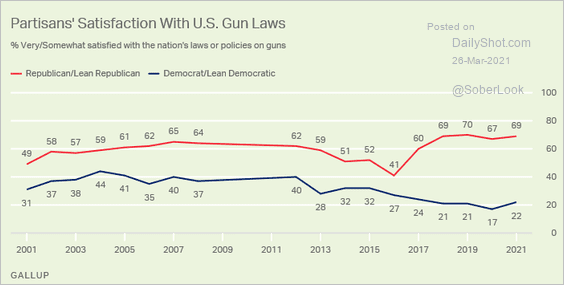

5. Satisfaction with US gun laws:

Source: Gallup Read full article

Source: Gallup Read full article

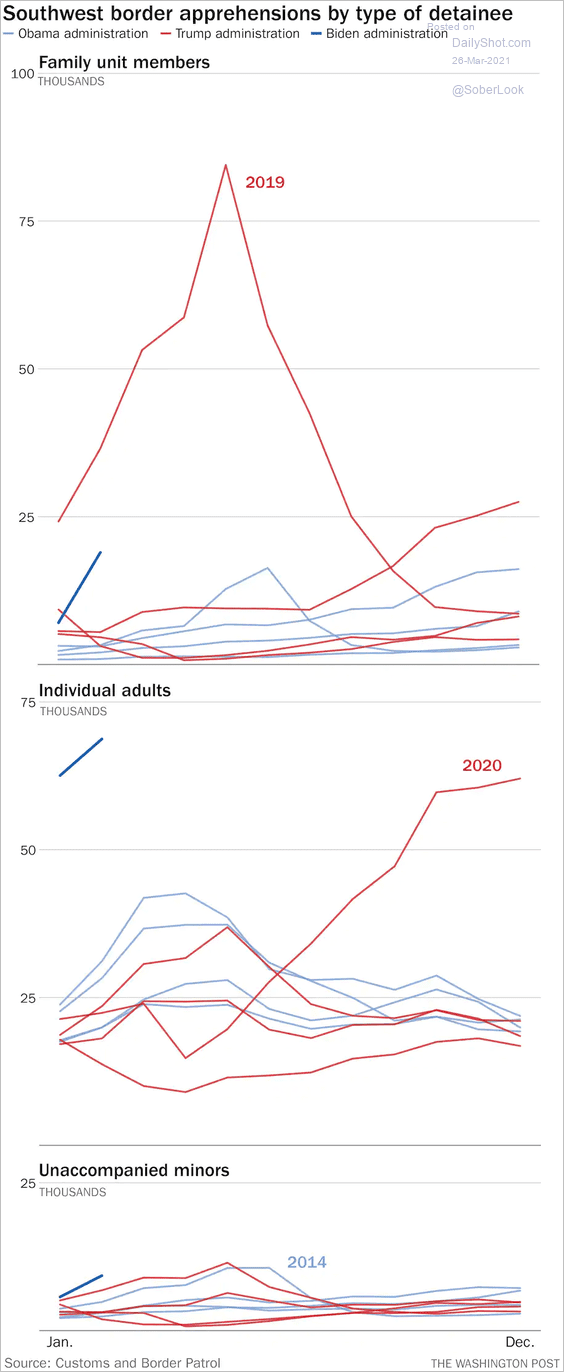

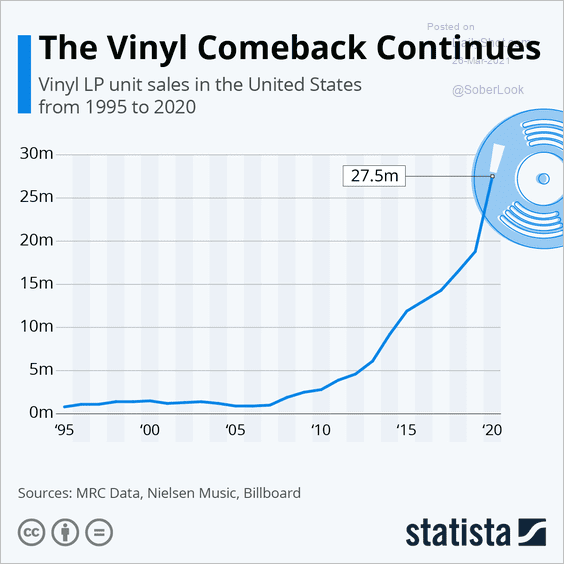

6. Southwest border apprehensions:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

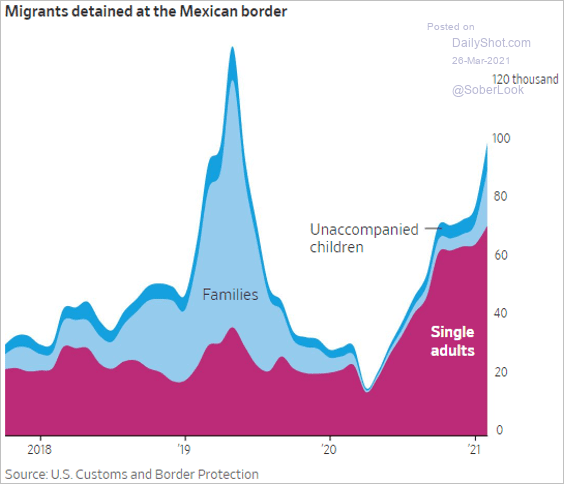

7. Vaccine eligibility:

Source: @bhrenton, @VermontDFR, @ariadnelabs

Source: @bhrenton, @VermontDFR, @ariadnelabs

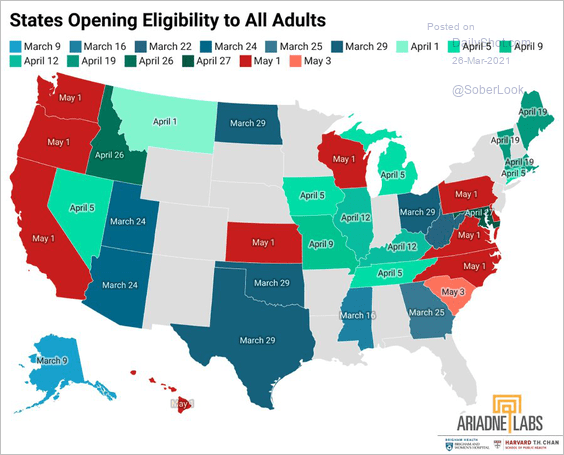

8. The comeback of vinyl records:

Source: Statista

Source: Statista

——————–

Have a great weekend!

Back to Index