The Daily Shot: 31-Mar-21

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Alternatives

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

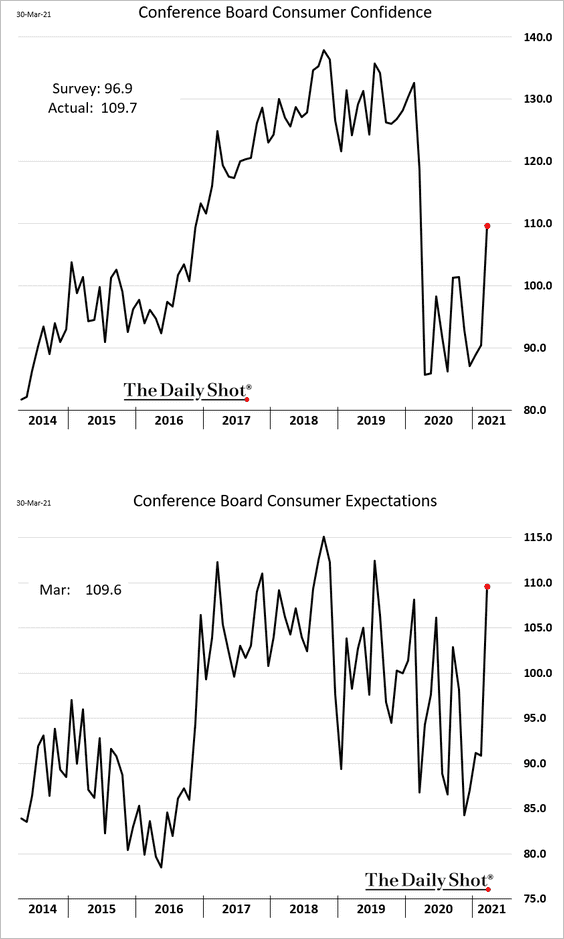

1. The Conference Board’s consumer confidence index surged in March, topping forecasts.

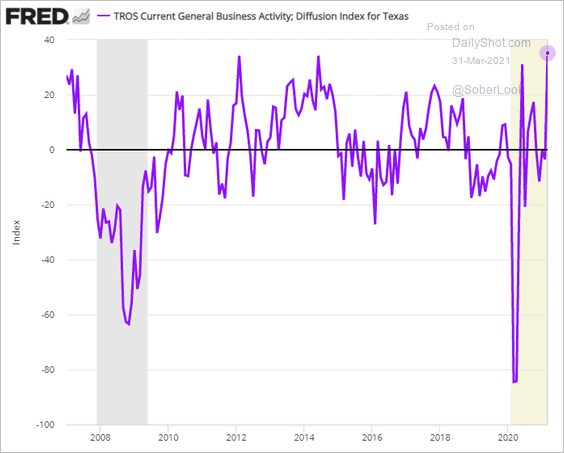

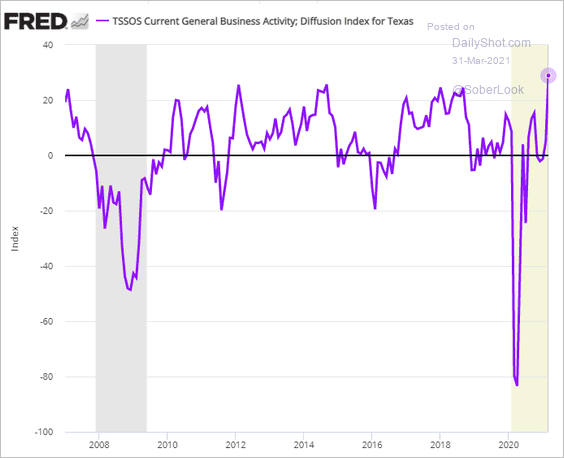

2. The Dallas Fed’s regional nonmanufacturing reports (see map) showed accelerating growth.

• Retail:

• Services:

——————–

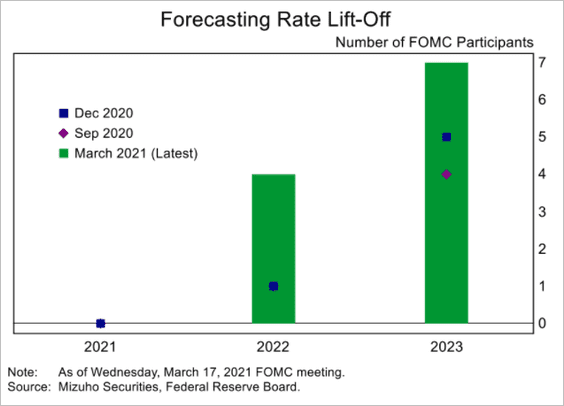

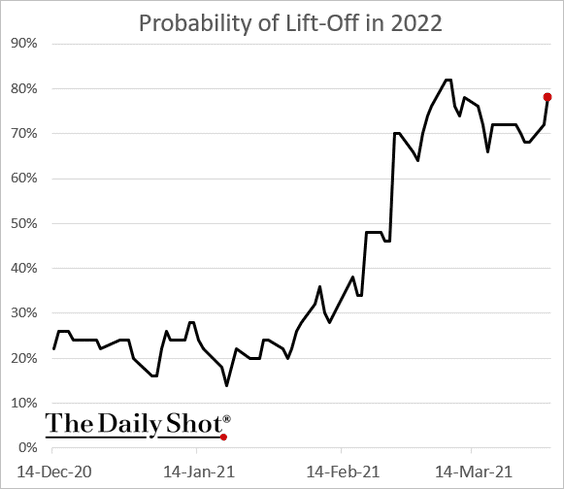

3. As discussed previously, only four FOMC members expect a rate hike (liftoff) next year.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

However, the market continues to assign close to an 80% probability of liftoff in 2022. It’s important to note that the Fed will not raise rates while conducting QE. It means that the central bank will need to announce tapering as soon as late this year to gradually reduce securities purchases. Given the Fed officials’ statements, that seems unlikely. There is a clear disconnect between the markets and the Fed’s communications.

——————–

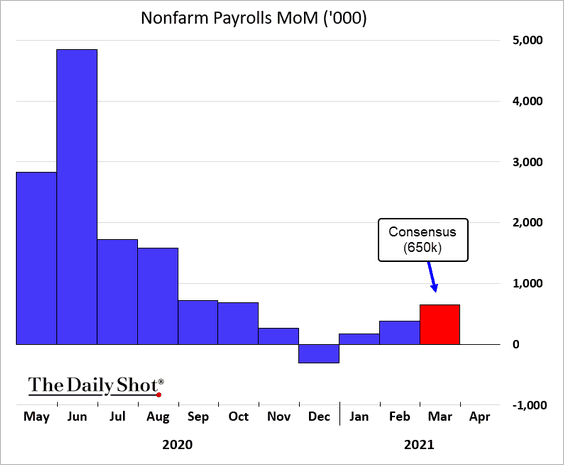

4. How many jobs were created in March? The consensus estimate is 650k.

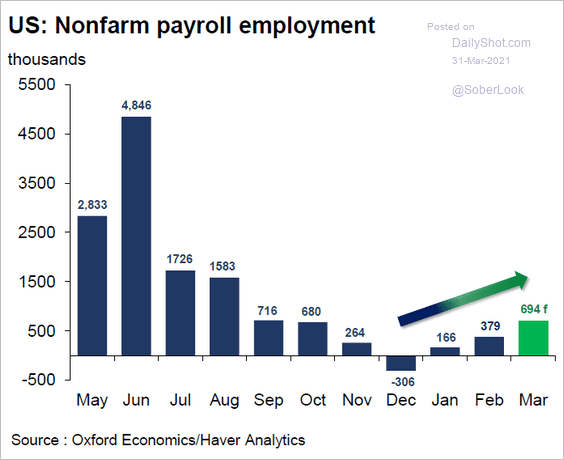

Here is a forecast from Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

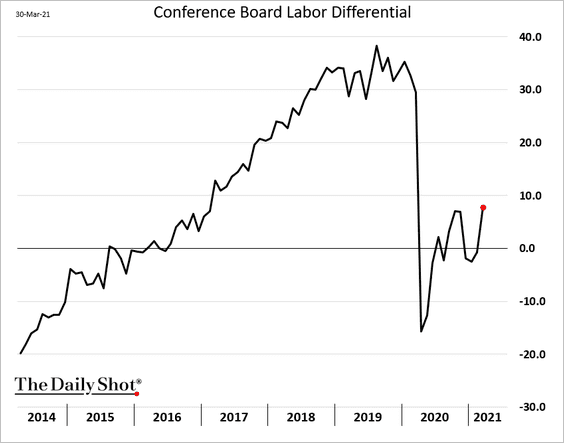

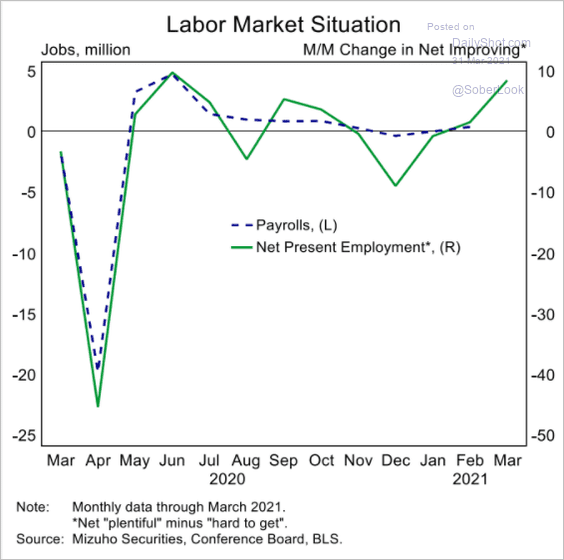

• The Conference Board’s labor differential (“jobs plentiful” – “jobs hard to get”) is rebounding.

Here is the same index (month-over-month) plotted against the payrolls data.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

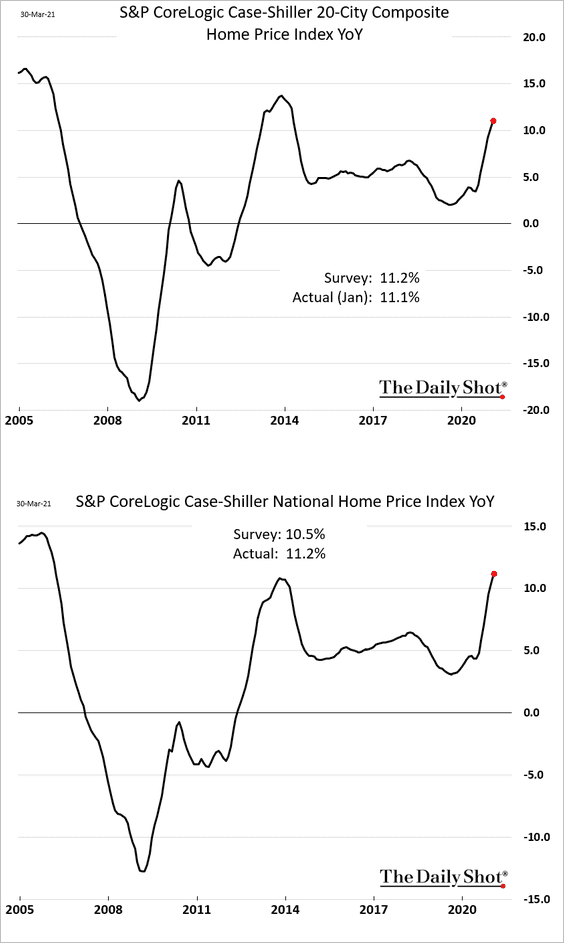

5. Next, we have some updates on the housing market.

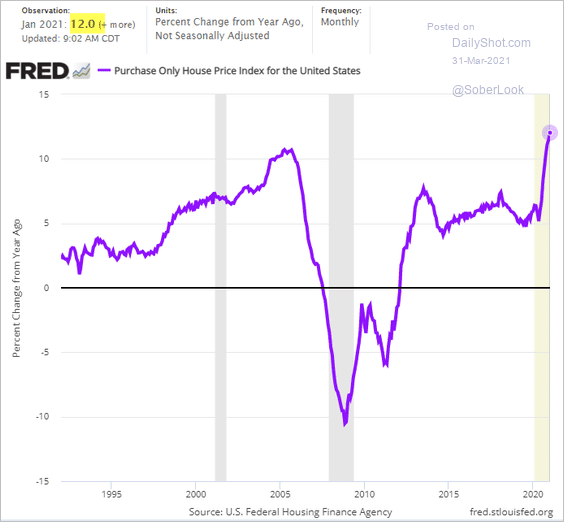

• Home price appreciation continues to climb.

– The Case-Shiller index:

– FHFA’s index:

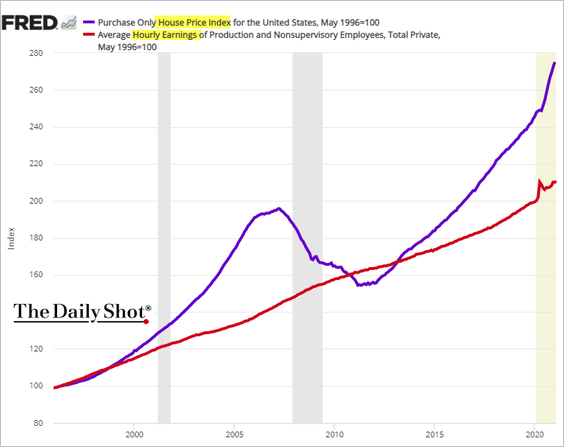

• Home price gains are increasingly outpacing wages.

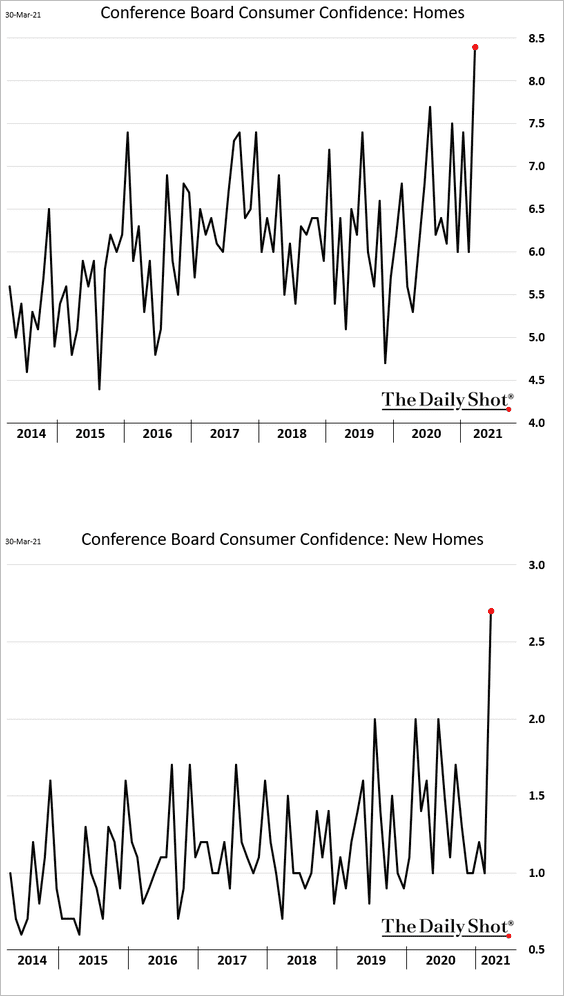

• According to the Conference Board, consumers are upbeat about the housing market.

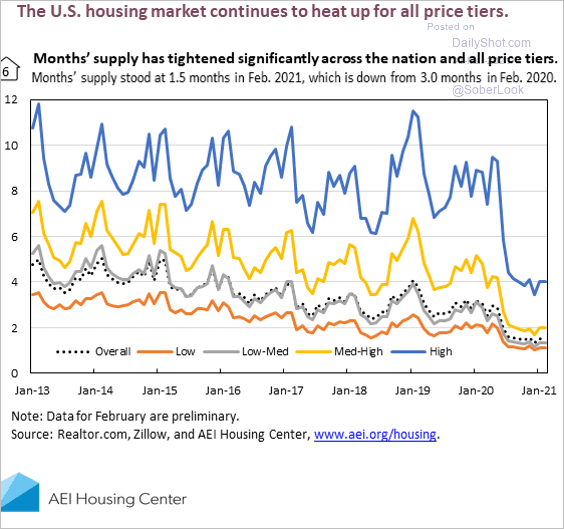

• This chart shows the supply of homes by price tier.

Source: AEI Housing Center

Source: AEI Housing Center

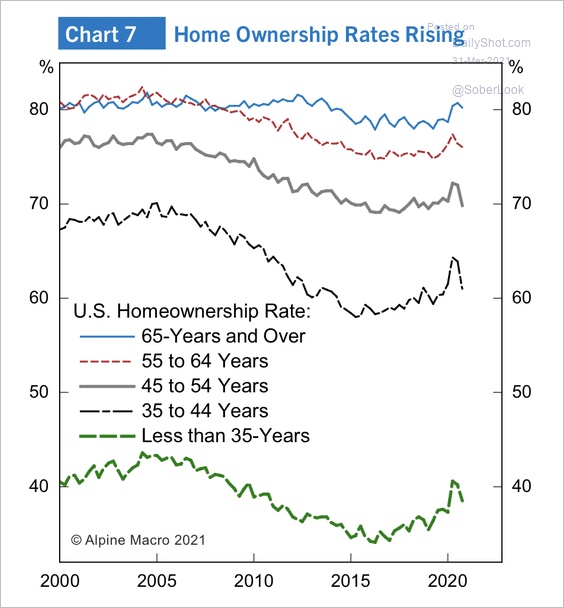

• Homeownership rates for all age cohorts bottomed between 2015 and 2018.

Source: Alpine Macro

Source: Alpine Macro

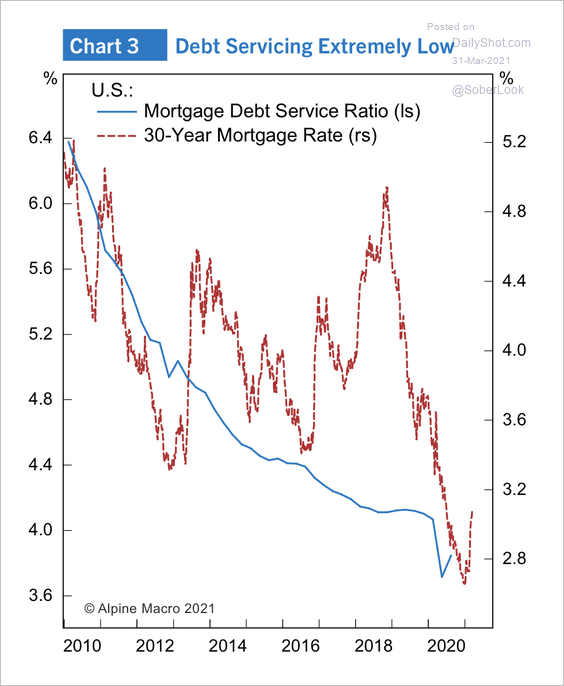

• The mortgage debt-service ratio is still near historic lows.

Source: Alpine Macro

Source: Alpine Macro

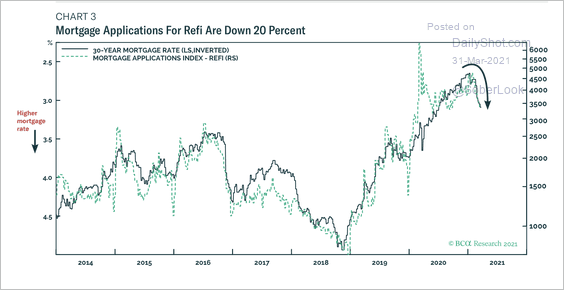

• Refi mortgage applications are down as rates climb.

Source: BCA Research

Source: BCA Research

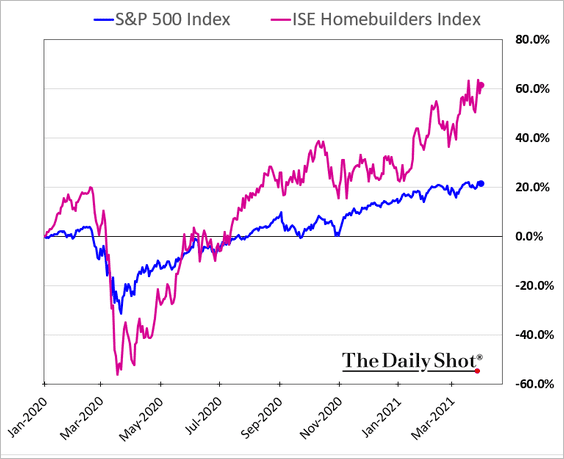

• Homebuilders’ shares continue to outperform.

——————–

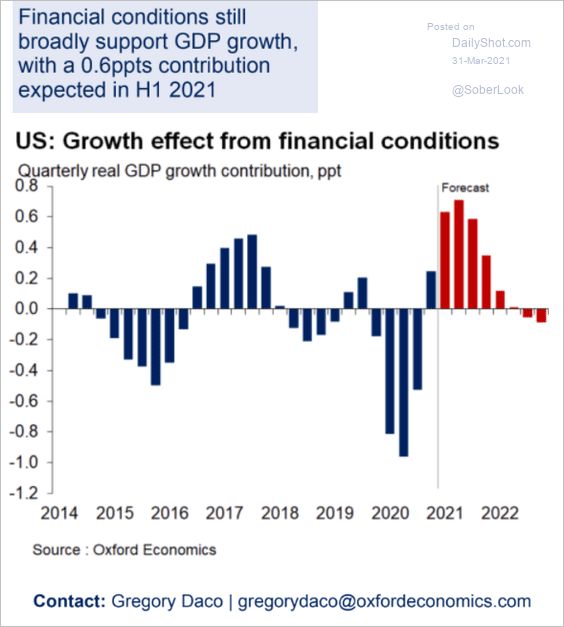

6. Accommodative financial conditions should boost GDP growth over the next few quarters.

Source: Oxford Economics

Source: Oxford Economics

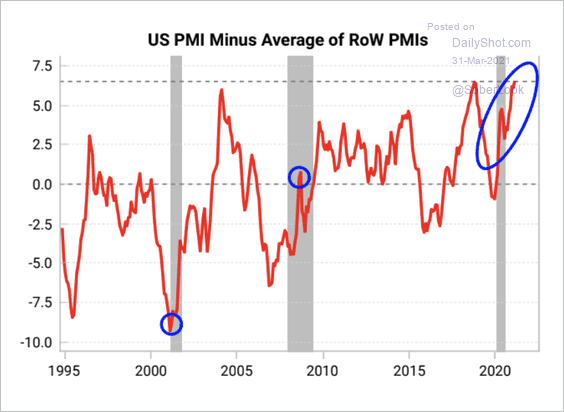

7. US business activity (measured by PMIs) is outperforming the rest of the world.

Source: Variant Perception

Source: Variant Perception

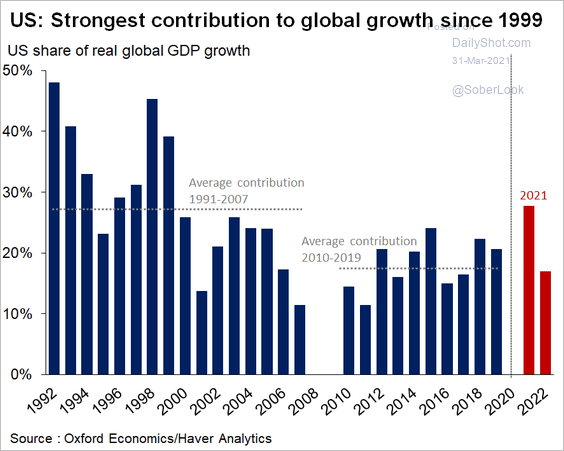

The US contribution to the world’s GDP is expected to be the highest since 1999.

Source: @GregDaco, @OxfordEconomics

Source: @GregDaco, @OxfordEconomics

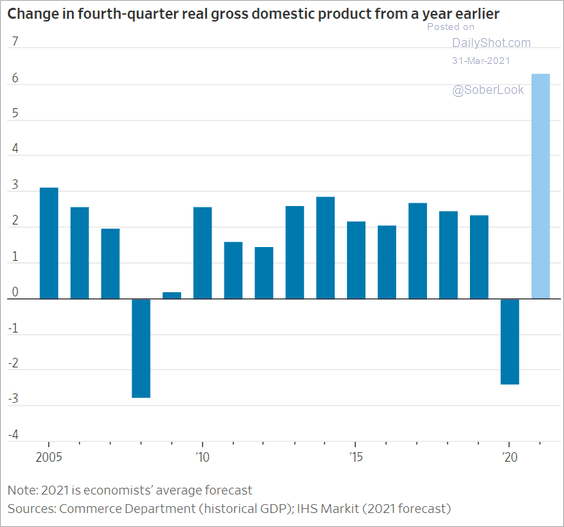

Source: @WSJ Read full article

Source: @WSJ Read full article

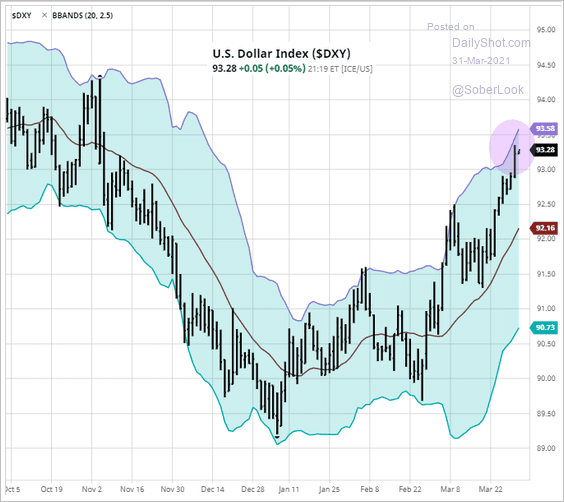

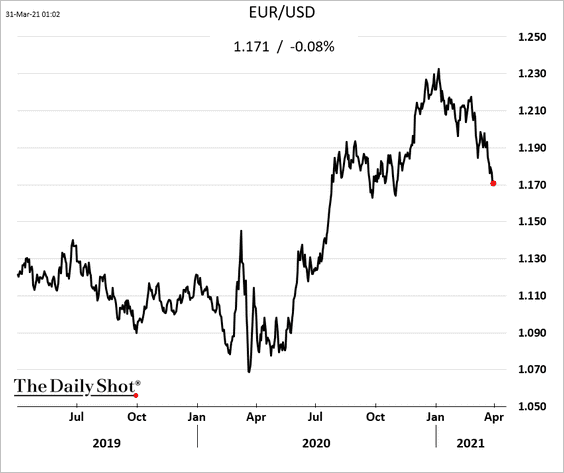

Combined with the vaccine progress, the nation’s economic outperformance is boosting the US dollar.

Source: barchart.com, h/t @Tobin_Tweets

Source: barchart.com, h/t @Tobin_Tweets

Back to Index

The United Kingdom

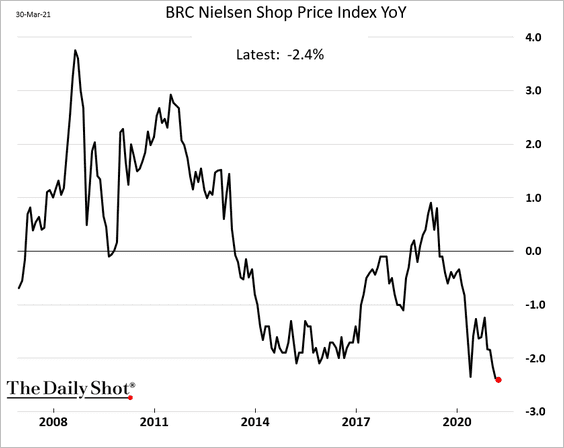

1. The BRC Shop Price index is still in deflation amid heavy discounting.

Source: Yahoo! Finance Read full article

Source: Yahoo! Finance Read full article

——————–

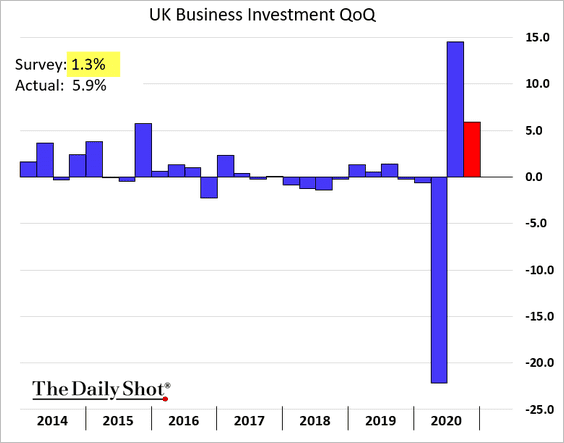

2. Last quarter’s business investment was stronger than initially reported.

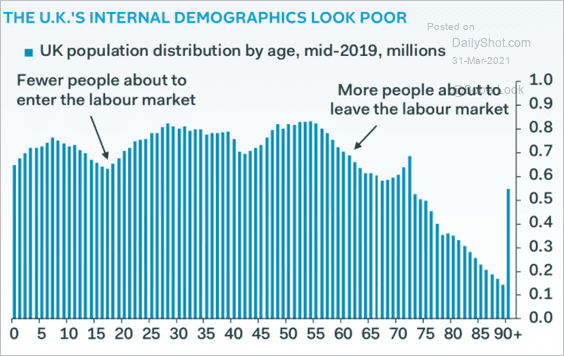

3. UK demographics don’t look promising for growth.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

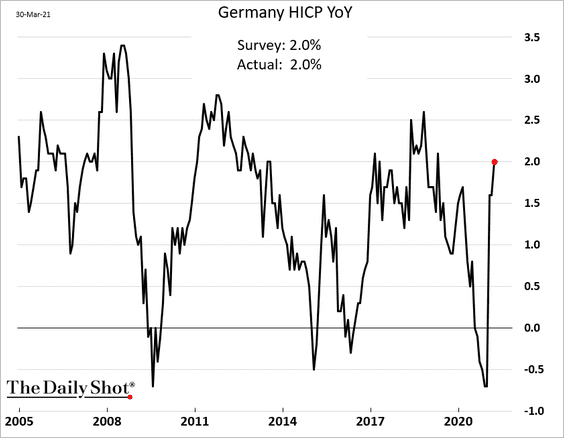

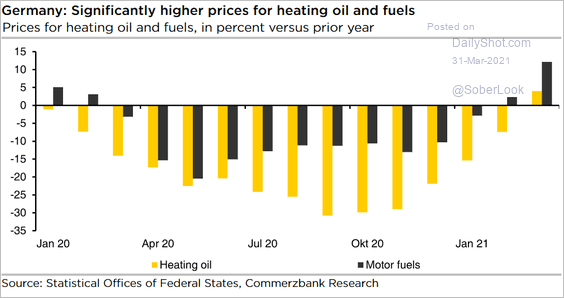

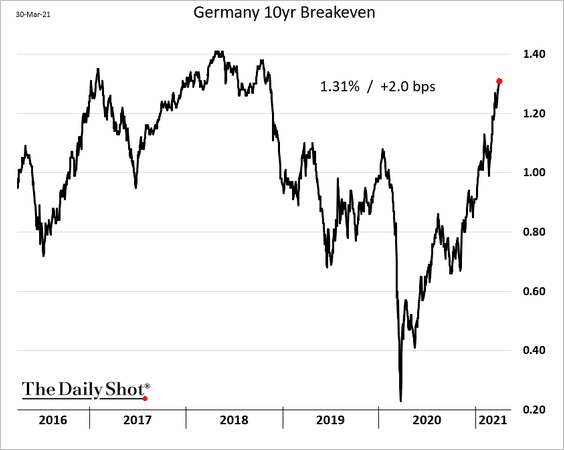

1. Germany’s inflation climbed further, in line with expectations.

Energy was a significant factor in the latest increase.

Source: Commerzbank Research

Source: Commerzbank Research

Market-based inflation expectations continue to rise.

——————–

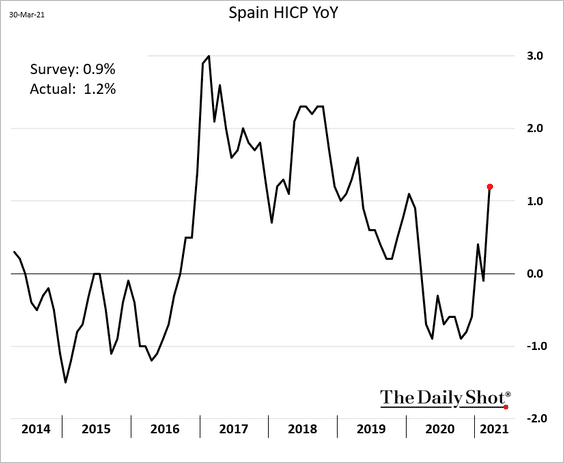

2. Spain’s CPI jumped as well.

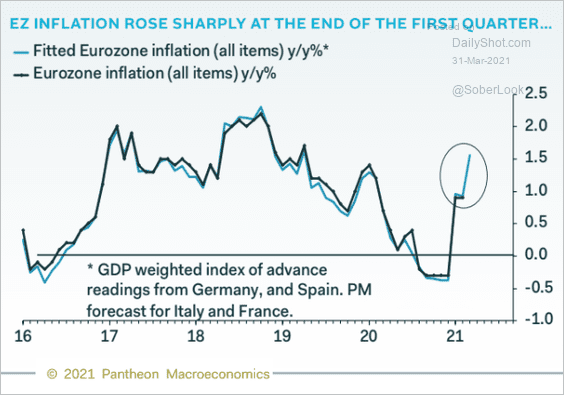

The combination of German and Spanish CPI reports points to inflation gains at the Eurozone level.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

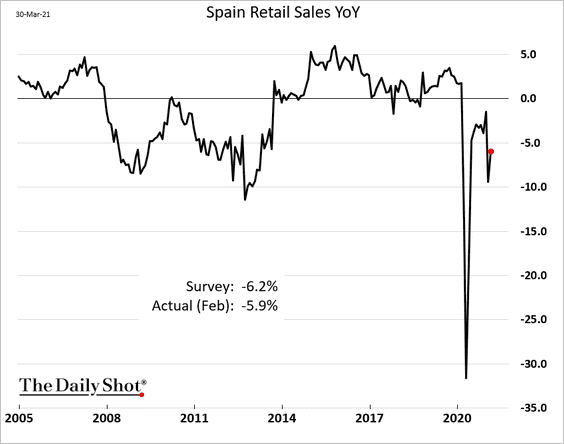

3. Spain’s retail sales rose in February.

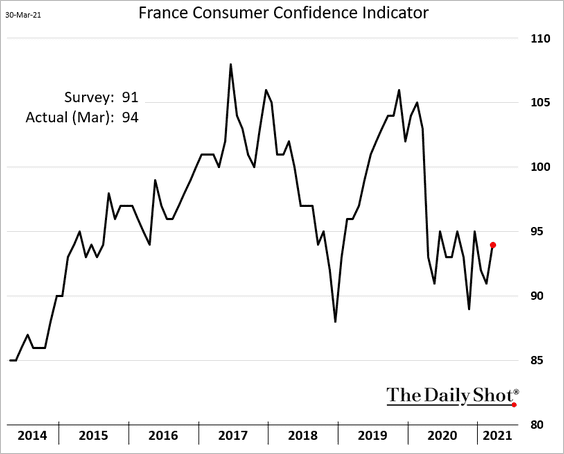

4. French consumer confidence ticked higher.

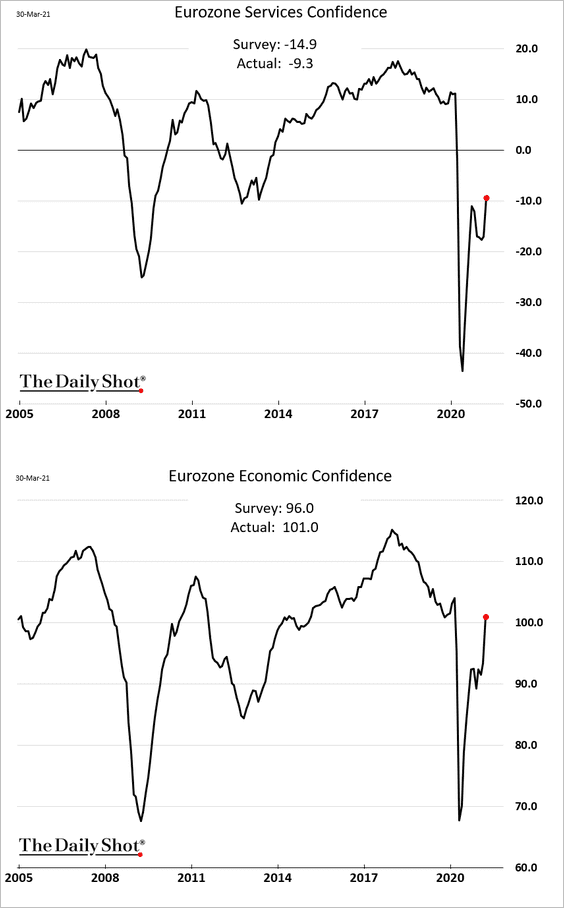

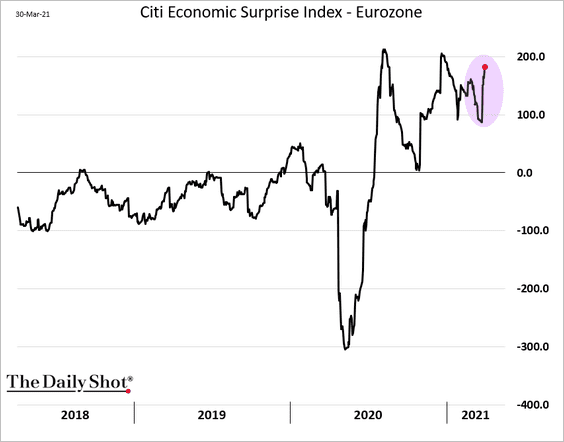

5. Confidence indicators at the Eurozone level surprised to the upside.

The combination of strong PMI reports and sentiment measures boosted the Citi Economic Surprise Index.

——————–

6. The euro has been weakening.

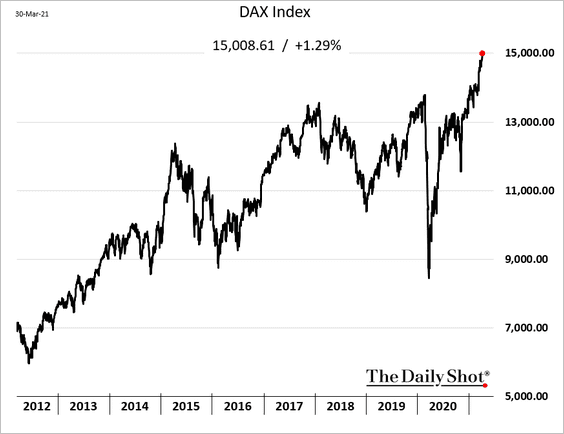

7. Germany’s DAX index hit a record high.

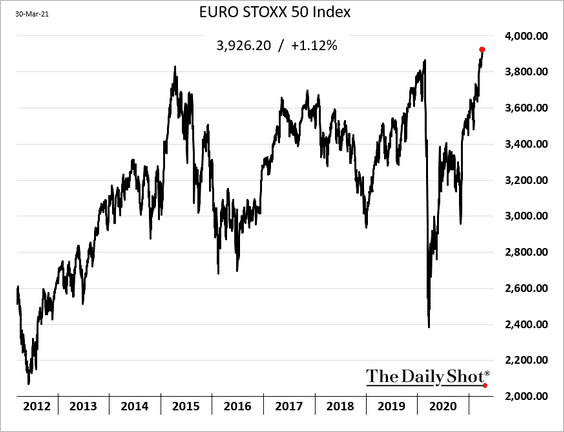

Here is the Stoxx 50 Index.

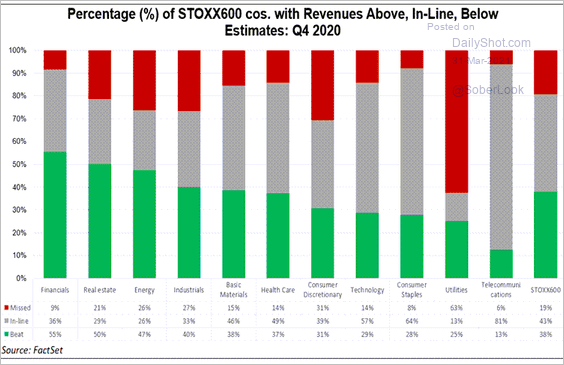

This chart shows the percentage of STOXX 600 companies reporting revenues that are above or below estimates.

Source: @FactSet Read full article

Source: @FactSet Read full article

Back to Index

Europe

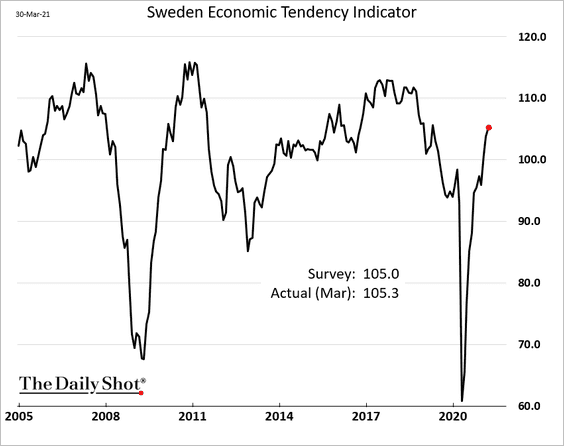

1. Sweden’s economic confidence (business + consumer) continues to rebound.

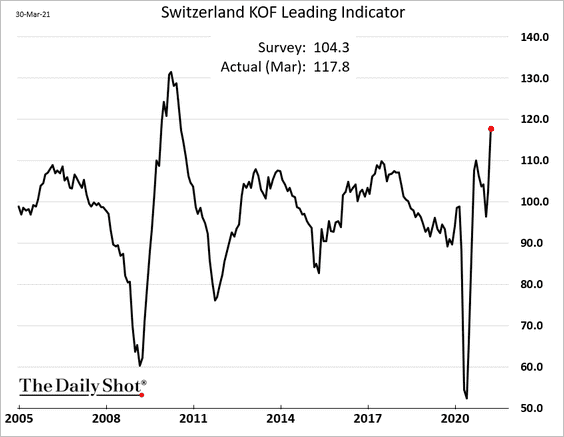

2. Switzerland’s KOF leading indicator hit the highest level in a decade.

Back to Index

Asia – Pacific

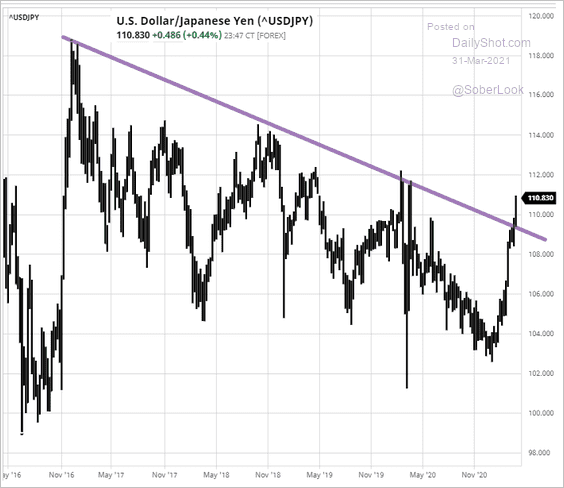

1. The yen continues to weaken vs. the dollar.

Source: barchart.com

Source: barchart.com

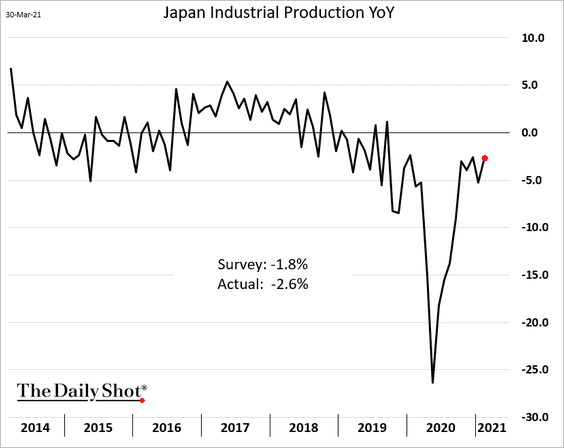

2. Japan’s industrial production report was disappointing.

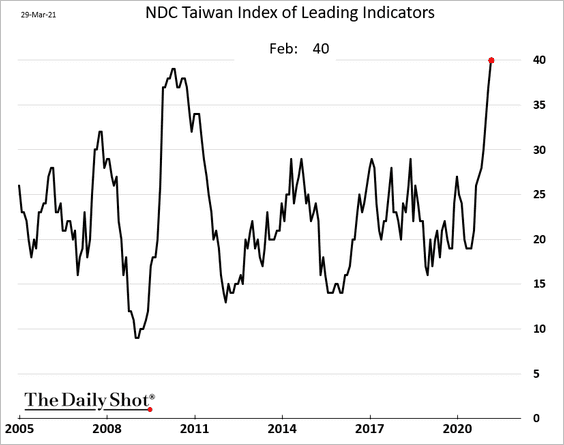

3. Taiwan’s index of leading indicators hit a multi-year high.

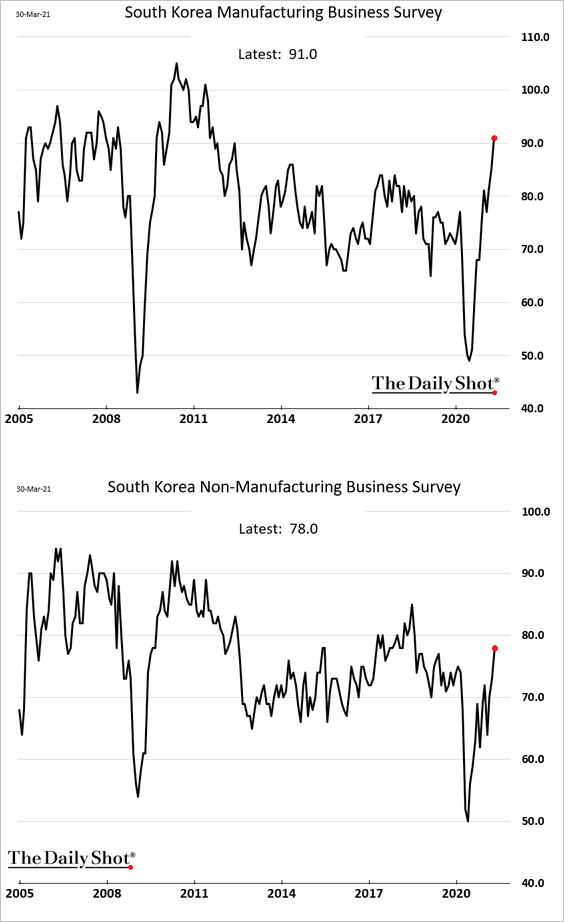

4. South Korea’s business surveys showed further improvements this month.

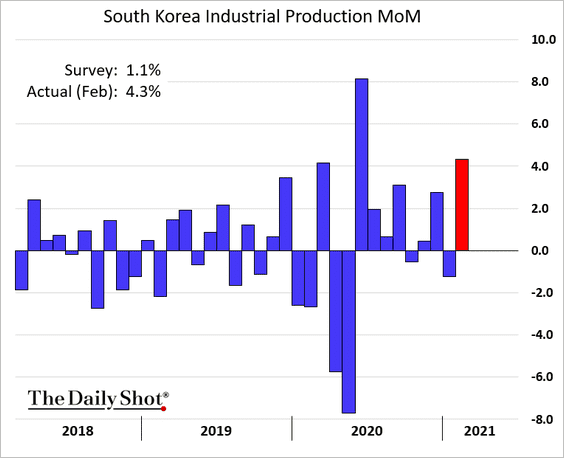

Industrial production surprised to the upside.

——————–

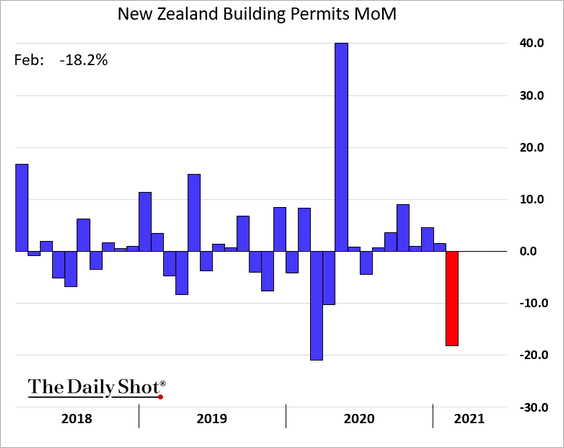

5. New Zealand’s building permits tumbled in February.

6. Next, we have some updates on Australia.

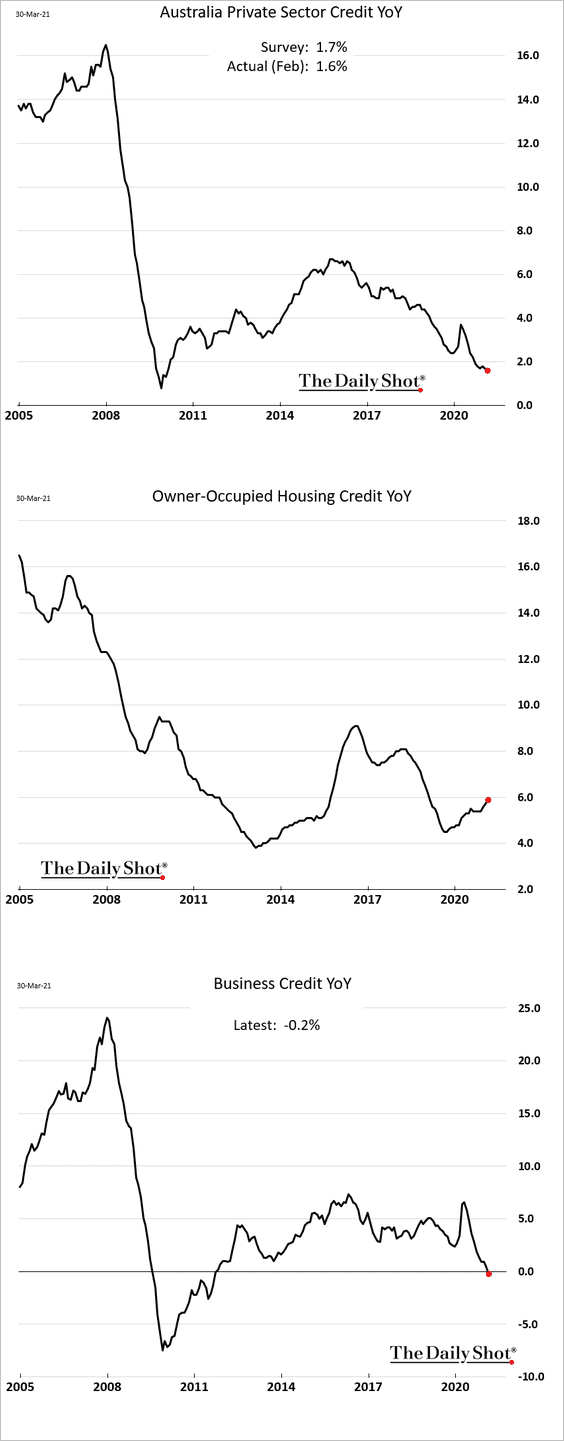

• Private credit growth continues to moderate, driven by business lending. Housing credit has been strengthening.

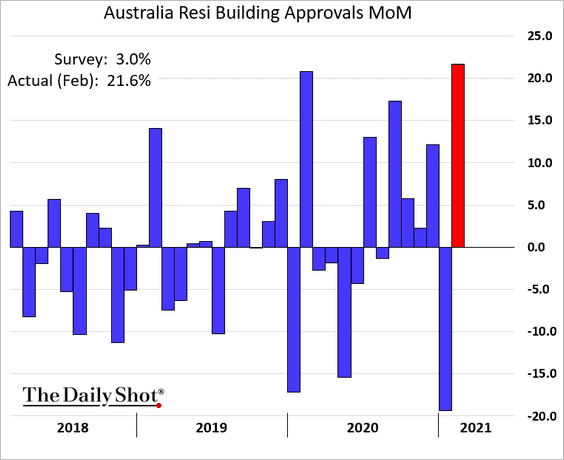

• Building approvals rebounded last month.

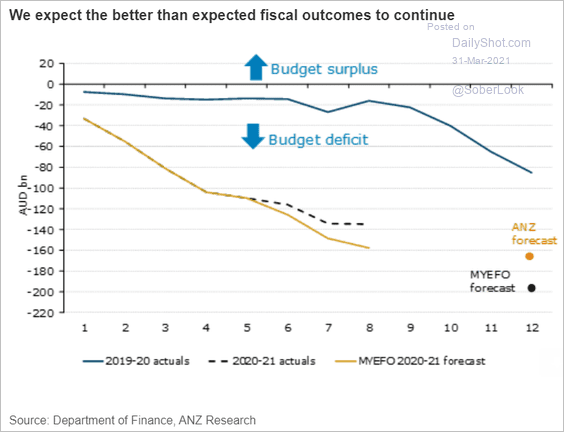

• The nation’s budget deficit has been less severe than expected.

Source: ANZ Research

Source: ANZ Research

Back to Index

China

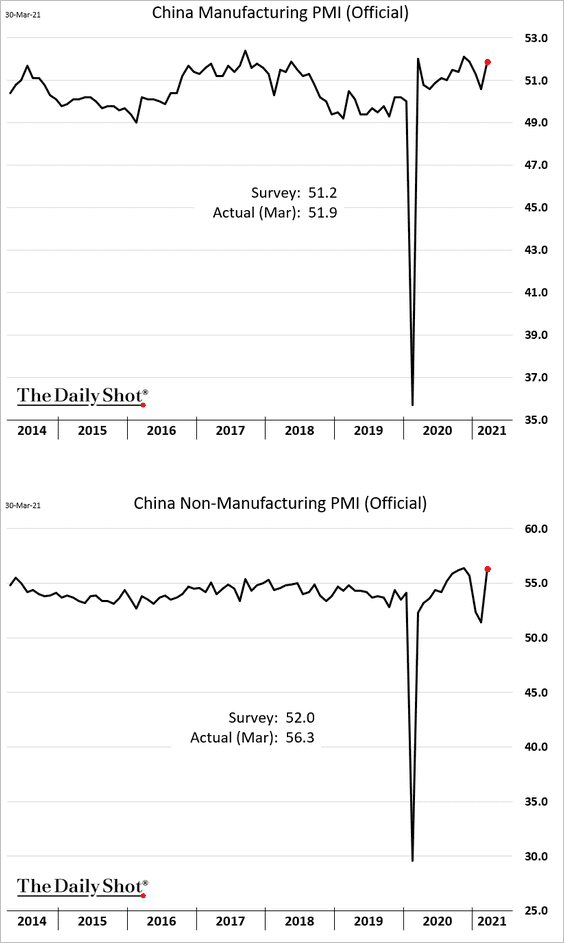

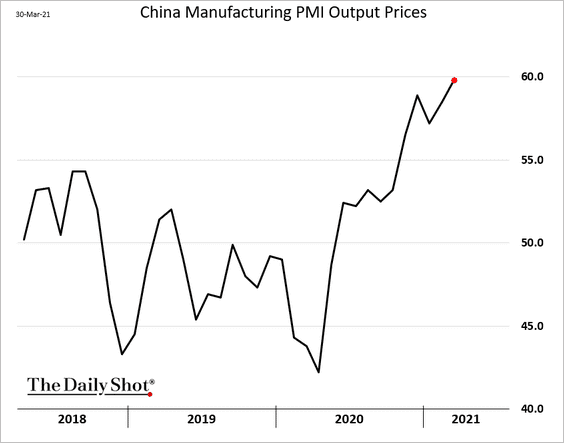

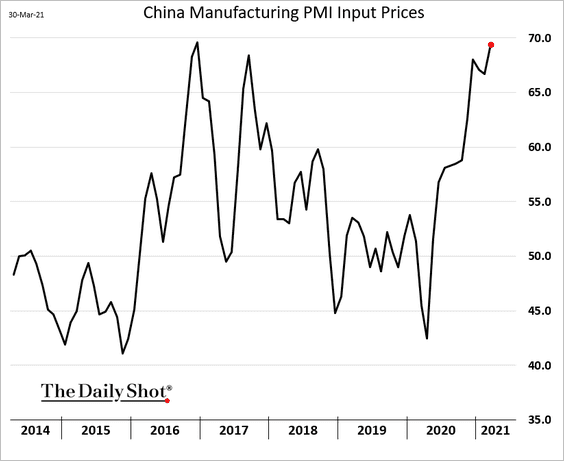

1. The official PMI report showed a rebound in business activity in March.

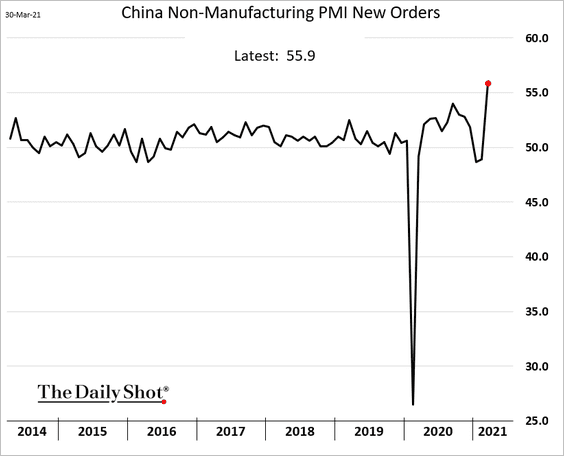

Non-manufacturing growth improved sharply.

Input and output prices are surging.

——————–

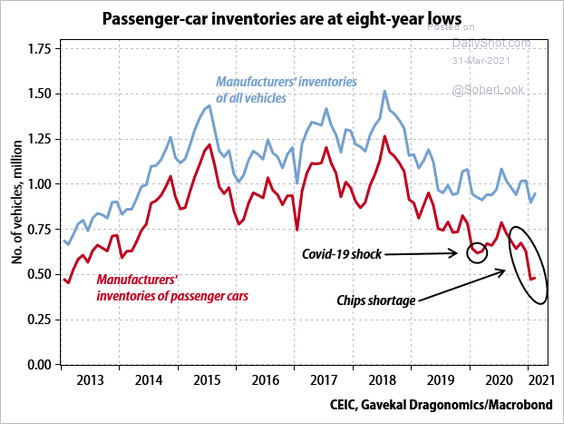

2. Passenger-car inventories have been declining.

Source: Gavekal Research

Source: Gavekal Research

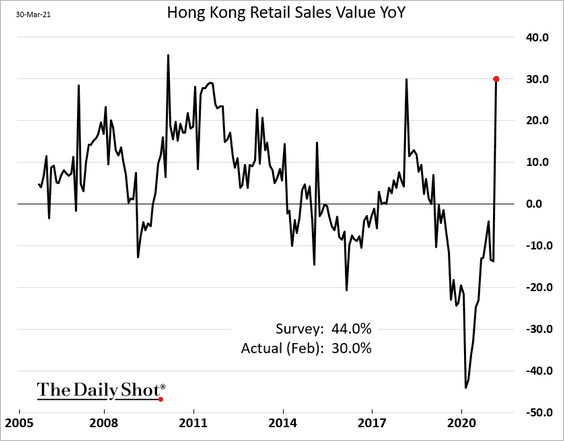

3. Hong Kong’s retail sales were up 30% vs. last year due to base effects (there wasn’t much shopping in February of 2020). Otherwise, the report was disappointing.

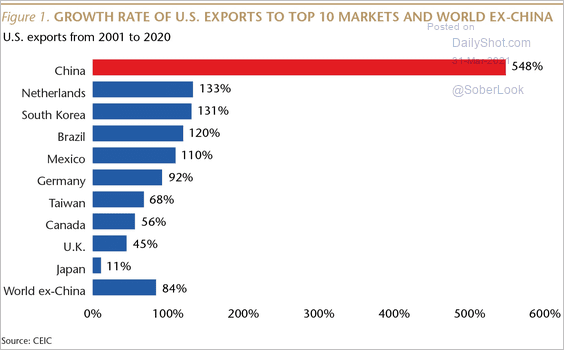

4. This chart shows the changes in US exports to China relative to other economies over the past couple of decades.

Source: Matthews Asia Read full article

Source: Matthews Asia Read full article

Back to Index

Emerging Markets

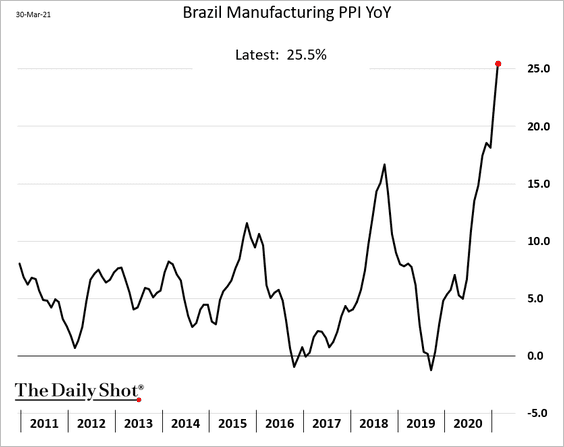

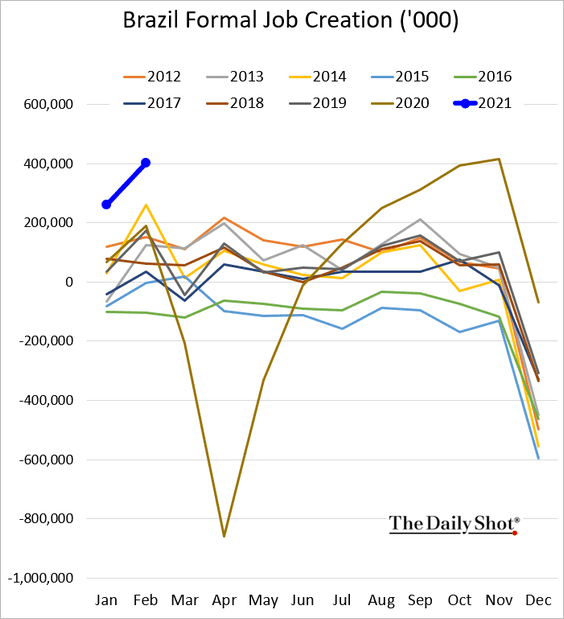

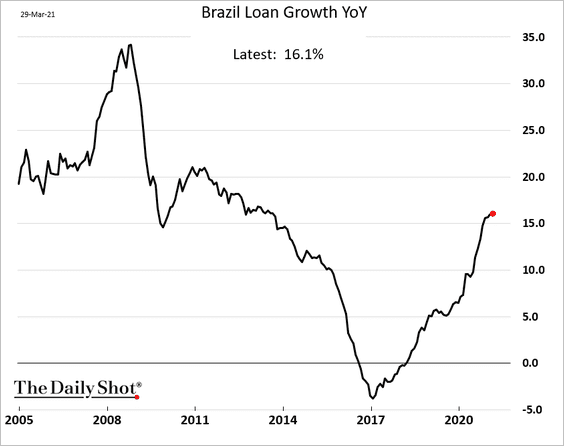

1. Let’s begin with Brazil.

• Manufacturing producer price inflation is surging.

• Formal job creation remains strong.

• Loan growth is at multi-year highs.

——————–

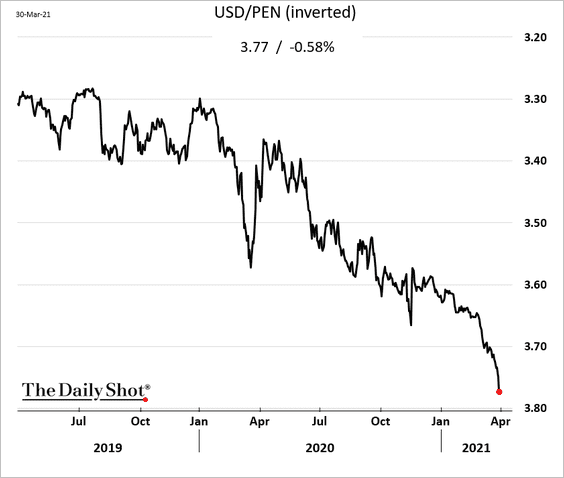

2. The Peruvian sol hit a record low. Traders have been using it as the short leg of EM relative value currency trades.

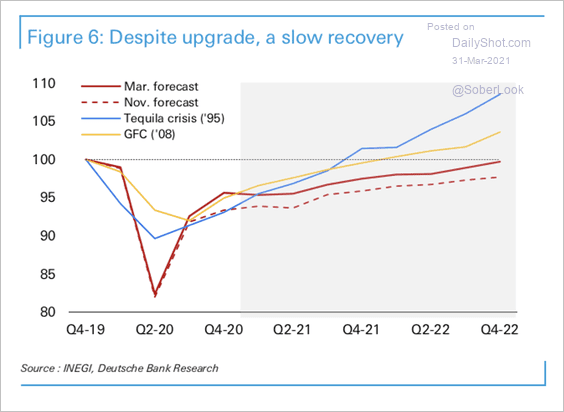

3. Deutsche Bank expects a slow recovery for Mexico.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

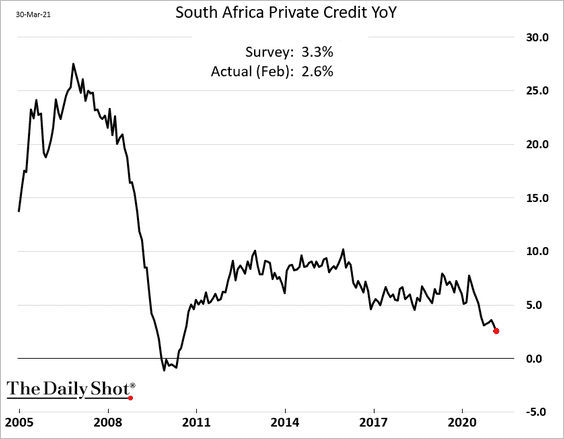

4. South Africa’s credit growth keeps slowing.

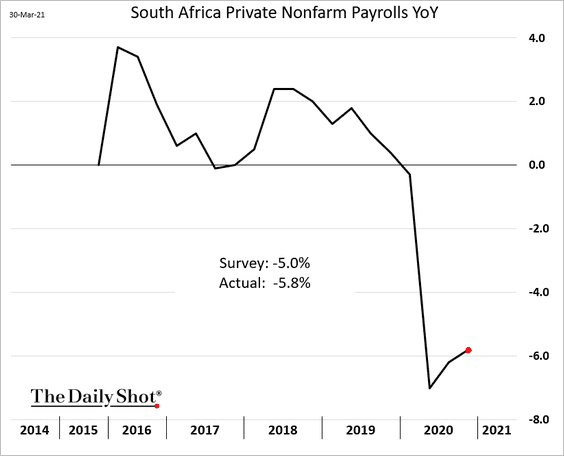

The nation’s labor force declined by almost 6% last year.

——————–

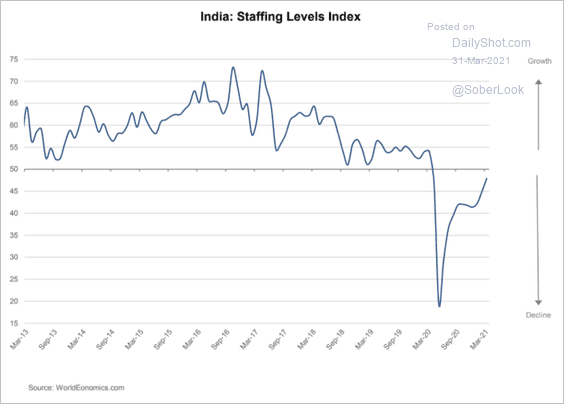

5. India’s staffing levels have stabilized, according to the latest World Economics SMI report.

Source: World Economics

Source: World Economics

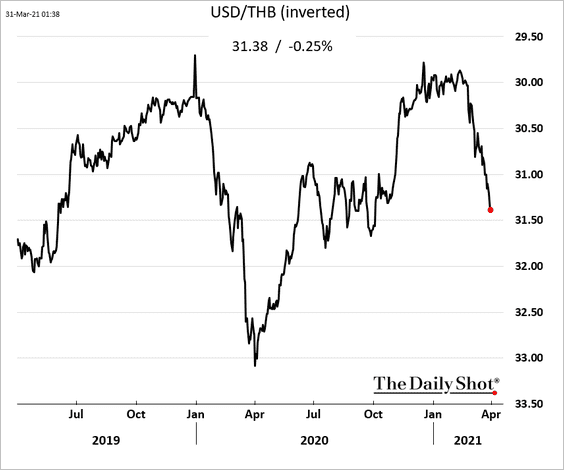

6. The Thai baht is rolling over.

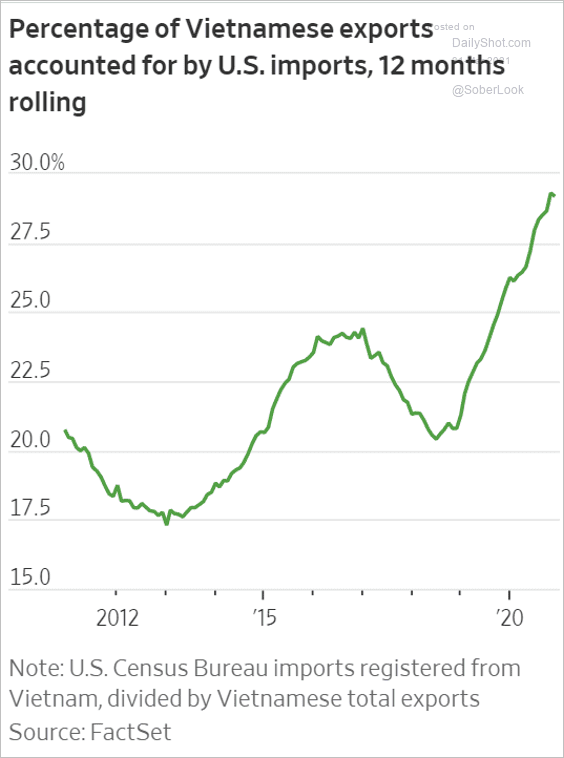

7. Vietnam’s exports are increasingly focused on the US.

Source: @WSJ Read full article

Source: @WSJ Read full article

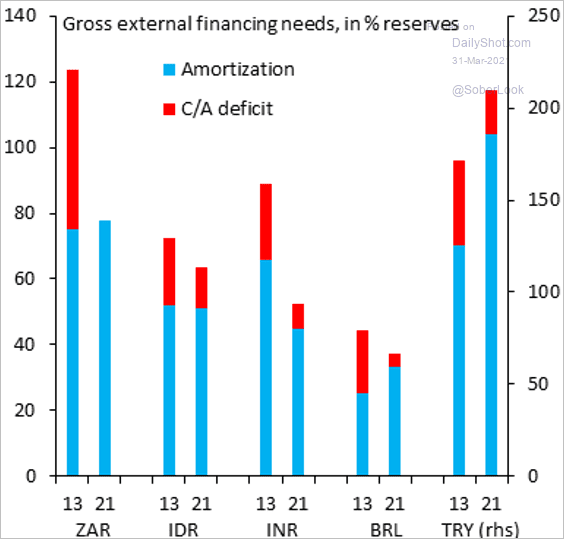

8. This chart shows external financing needs as a percentage of FX reserves for select economies.

Source: @SergiLanauIIF

Source: @SergiLanauIIF

Back to Index

Cryptocurrency

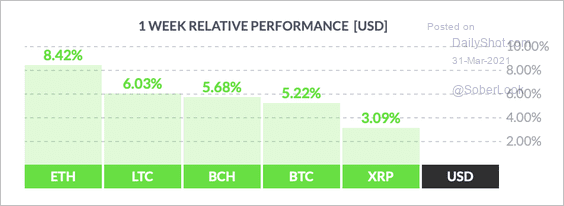

1. Ether (ETH) has been outperforming other major cryptocurrencies over the past week.

Source: FinViz

Source: FinViz

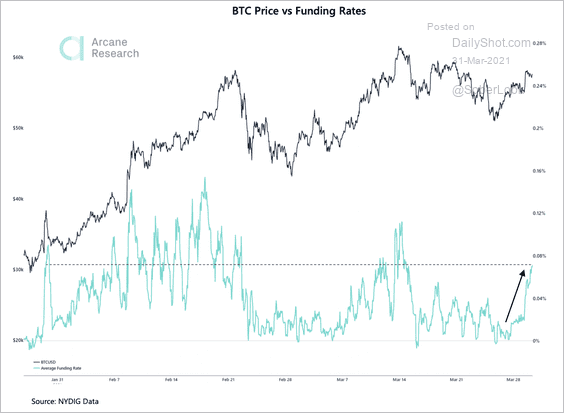

2. The cost to fund long positions in the market for bitcoin perpetual swaps has broken above neutral levels for the first time since mid-March. This suggests renewed appetite for risk-taking.

Source: Arcane Crypto Read full article

Source: Arcane Crypto Read full article

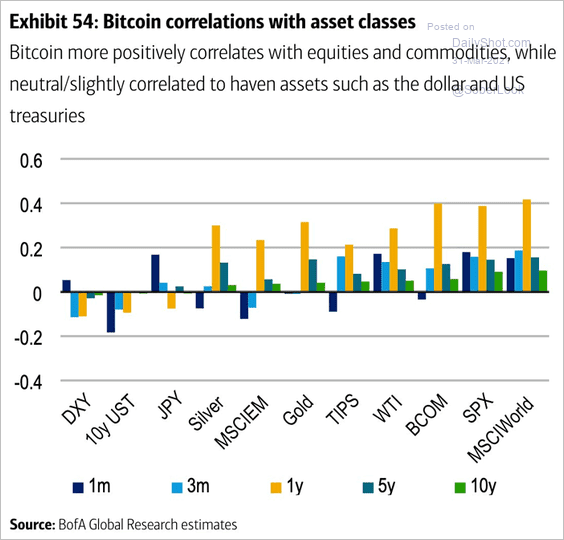

3. The next chart shows bitcoin’s correlation with different asset classes.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

Back to Index

Commodities

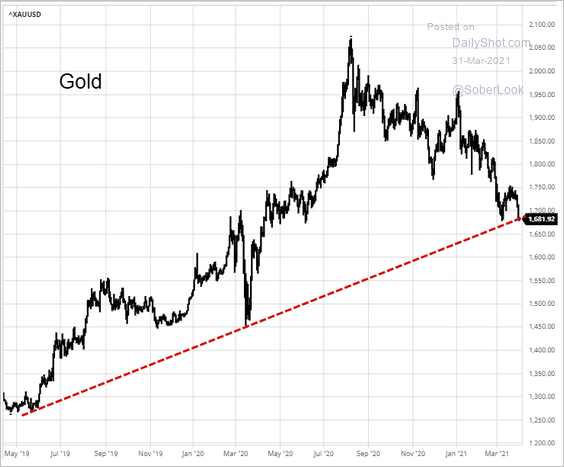

1. Gold is at support.

Source: barchart.com

Source: barchart.com

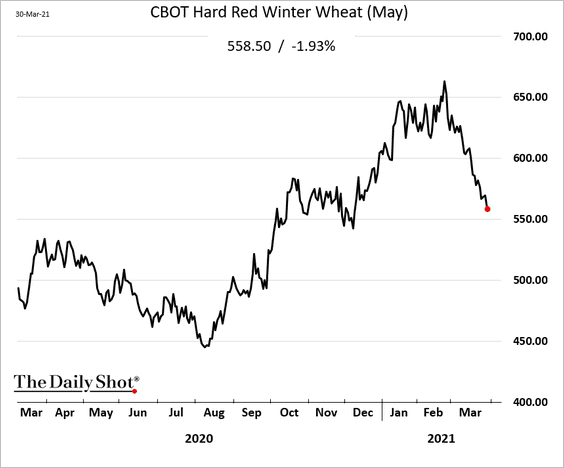

2. US wheat futures continue to retreat.

Back to Index

Equities

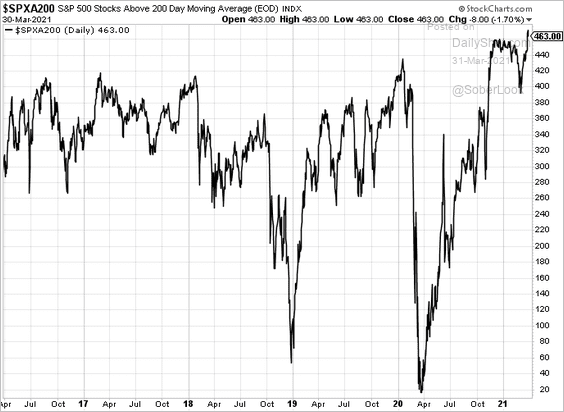

1. The percentage of S&P 500 stocks above their 200-day moving average is near multi-year highs.

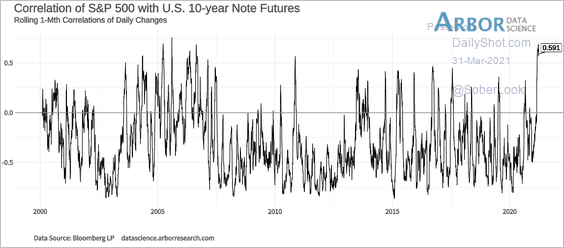

2. Stock-bond correlations remain elevated.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

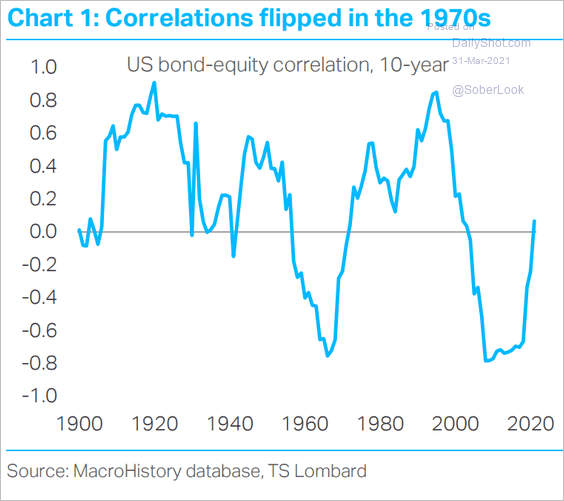

This chart shows stock-bond 10-year correlations going back to 1900.

Source: TS Lombard

Source: TS Lombard

——————–

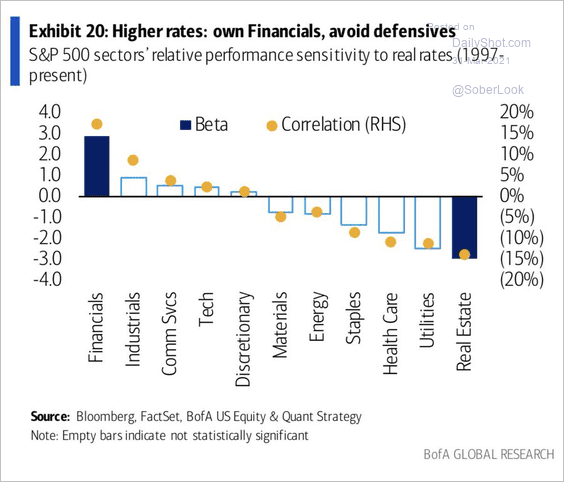

3. How sensitive are different sectors to real rates?

Source: BofA Global Research, @WallStJesus

Source: BofA Global Research, @WallStJesus

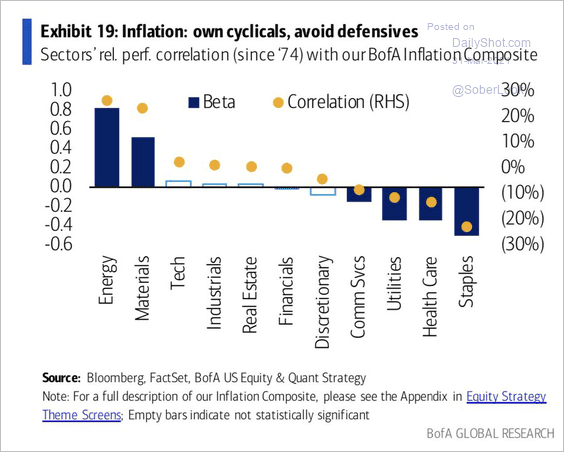

How about inflation?

Source: BofA Global Research, @WallStJesus

Source: BofA Global Research, @WallStJesus

——————–

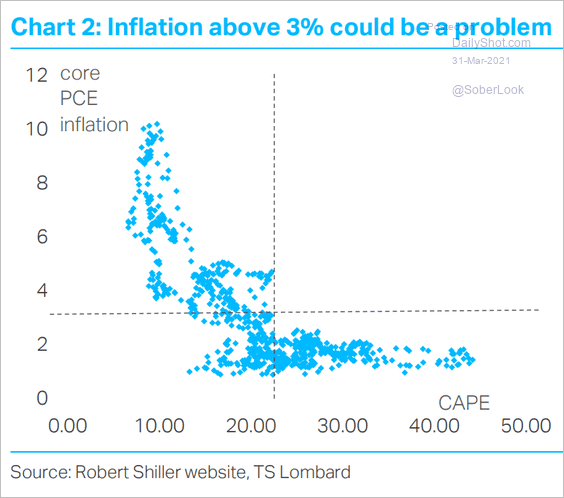

4. When does inflation become a problem for stocks? This chart shows the core PCE inflation vs. the CAPE ratio (valuation).

Source: TS Lombard

Source: TS Lombard

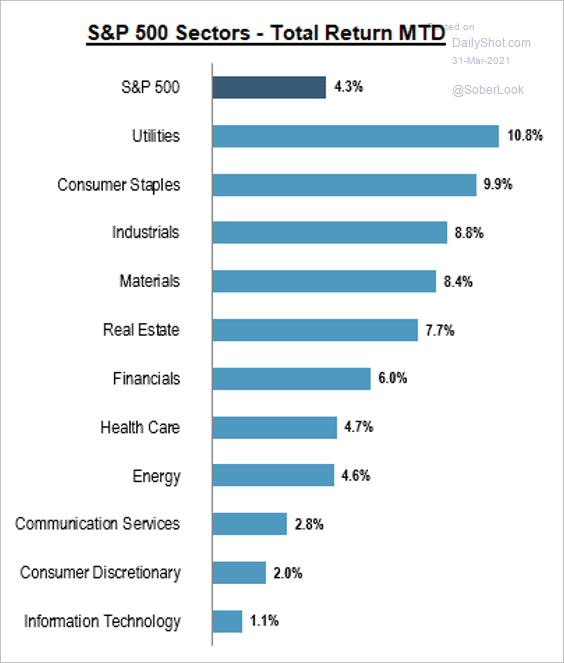

5. Here are the month-to-date returns by sector.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

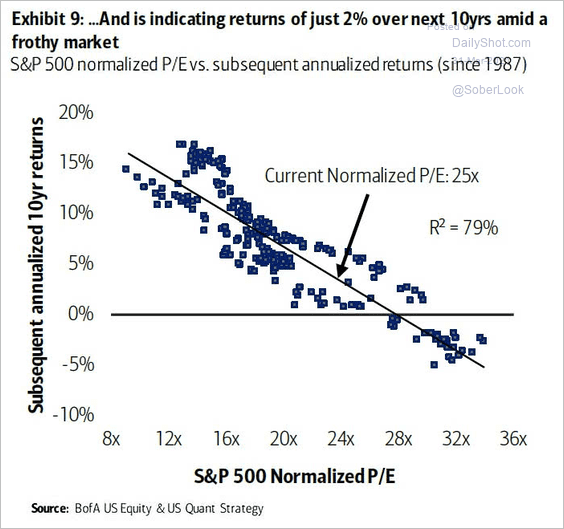

6. Current valuations suggest that we should expect a 2% annualized return for the S&P 500 over the next decade.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

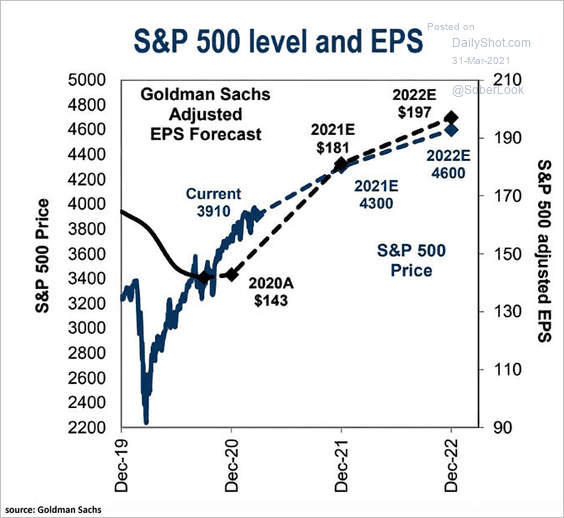

7. Goldman remains bullish on the equity market.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

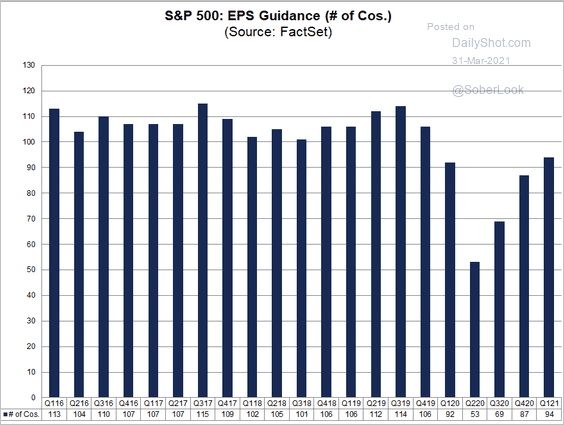

8. The number of companies issuing EPS guidance is rebounding.

Source: @FactSet

Source: @FactSet

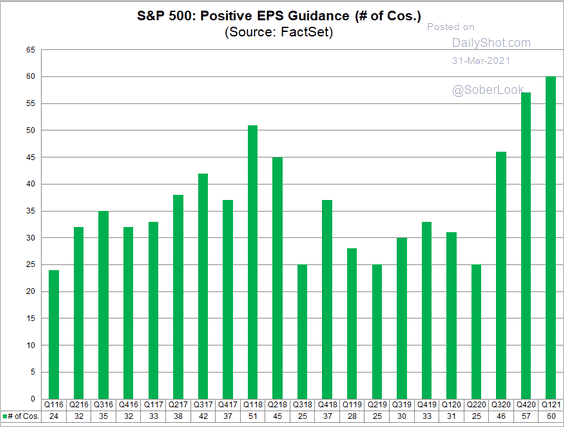

Here is the percentage of S&P 500 companies issuing positive guidance.

Source: @FactSet

Source: @FactSet

——————–

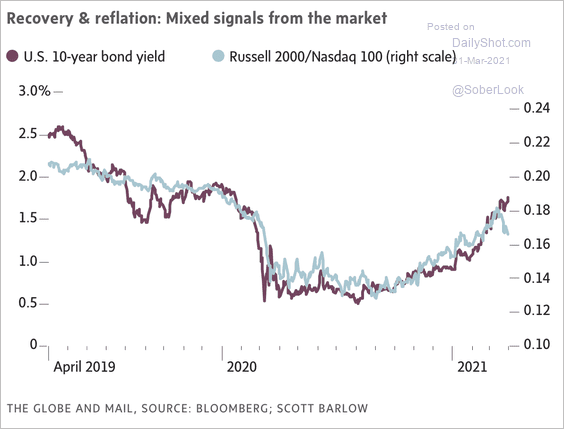

9. Higher Treasury yields point to further outperformance for small-cap stocks.

Source: @SBarlow_ROB Read full article

Source: @SBarlow_ROB Read full article

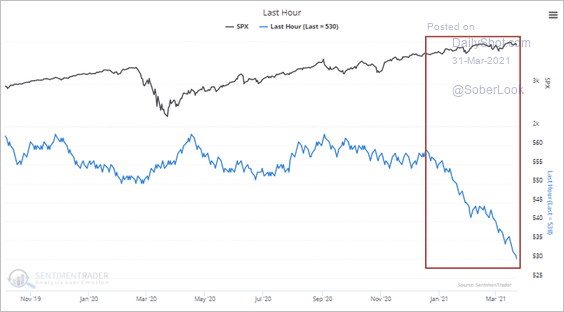

10. Stocks haven’t performed well in the last hour of trading this year.

Source: @sentimentrader, @DeanChristians

Source: @sentimentrader, @DeanChristians

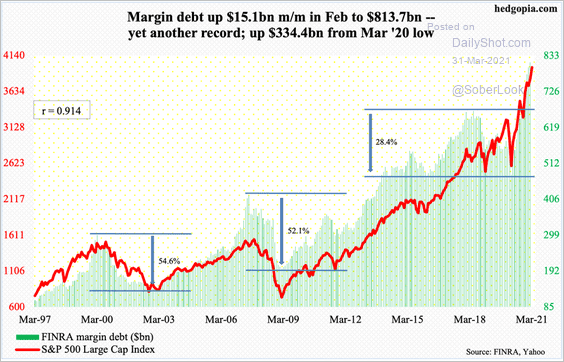

11. Margin debt continues to climb.

Source: @hedgopia

Source: @hedgopia

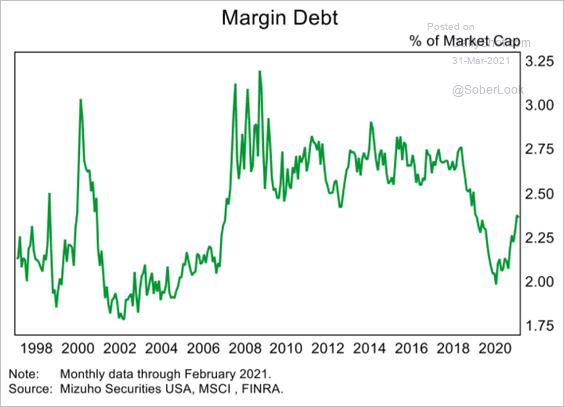

But the level is not extreme relative to the overall market capitalization.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

Back to Index

Alternatives

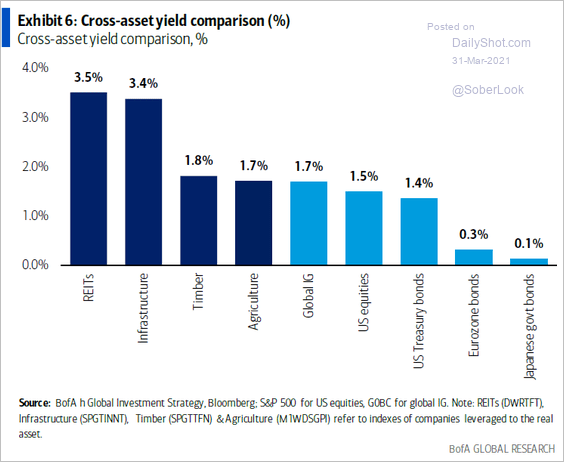

1. Some real asset classes have (relatively) attractive yields.

Source: BofA Global Research

Source: BofA Global Research

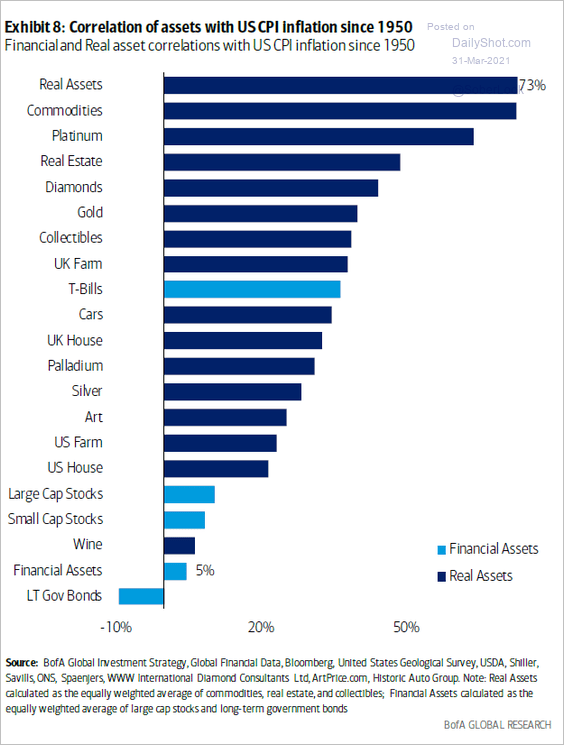

2. Real assets are more correlated with inflation.

Source: BofA Global Research

Source: BofA Global Research

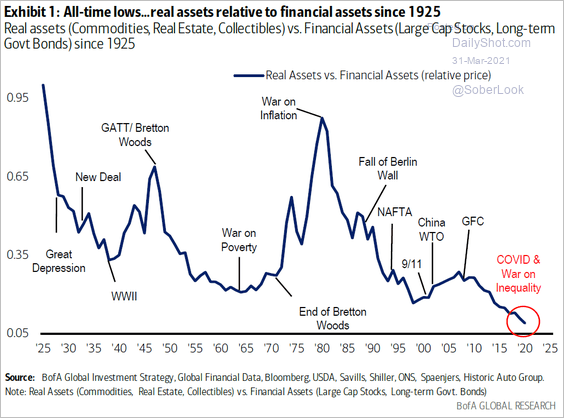

3. This chart shows real assets relative to financial assets over the past century.

Source: BofA Global Research

Source: BofA Global Research

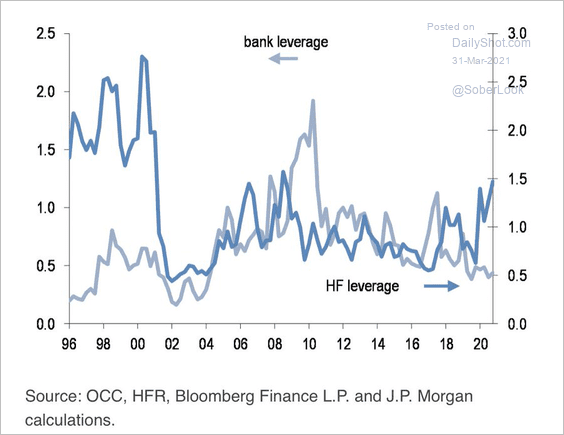

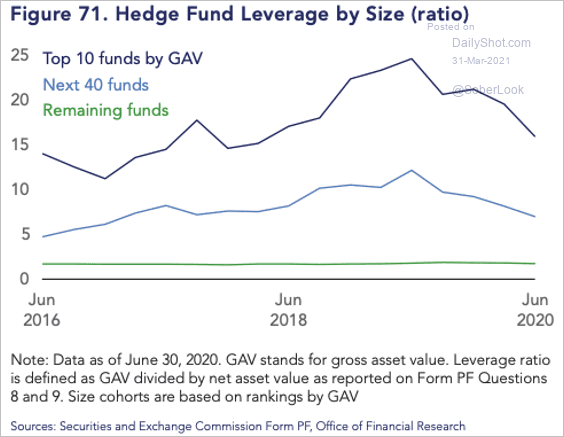

4. Hedge fund leverage increased over the past year but is not extreme.

Source: JP Morgan, @carlquintanilla

Source: JP Morgan, @carlquintanilla

The largest funds tend to be more leveraged.

Source: @apark_

Source: @apark_

——————–

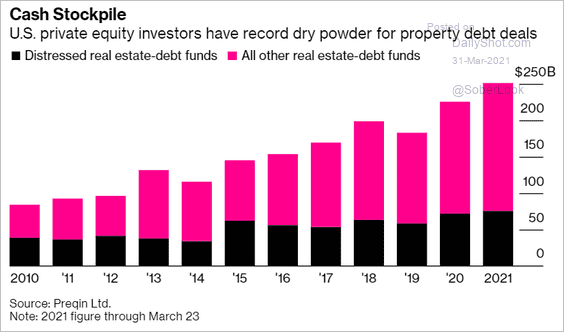

5. A great deal of capital is chasing distressed real estate assets.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

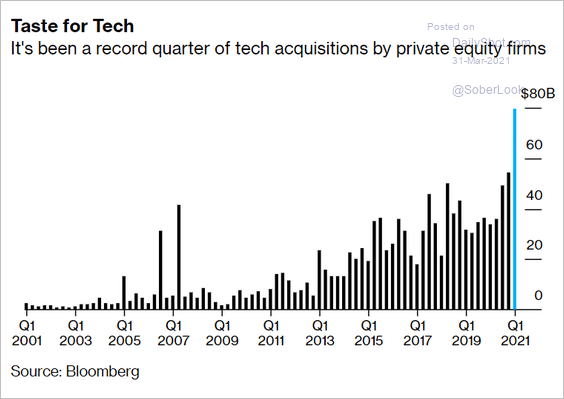

6. Private equity tech acquisitions hit a record high.

Source: @business Read full article

Source: @business Read full article

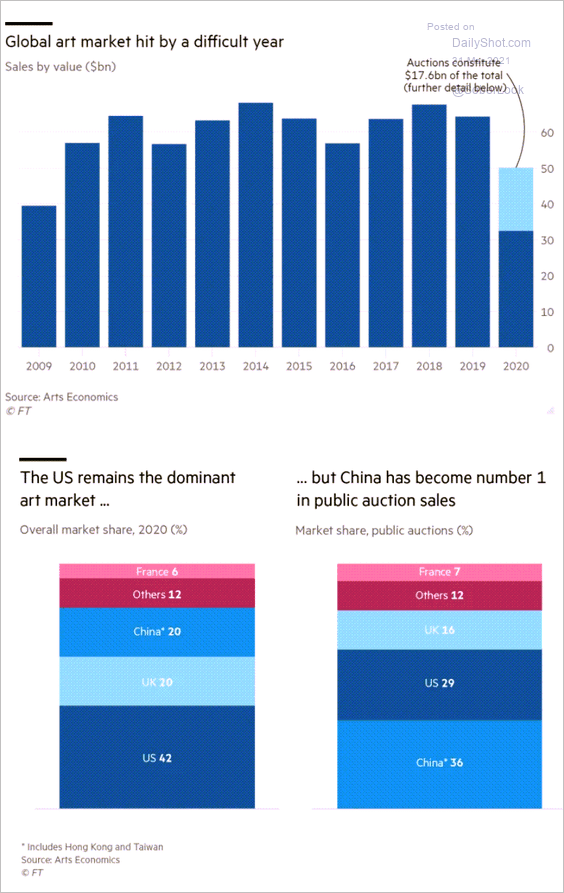

7. 2020 was a challenging year for the art market.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Credit

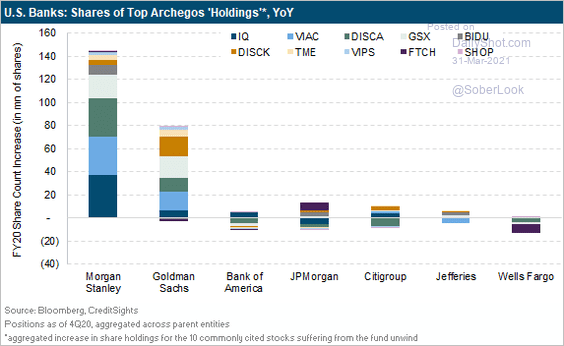

1. How much exposure did US banks have to Archegos’ largest stock holdings?

Source: CreditSights

Source: CreditSights

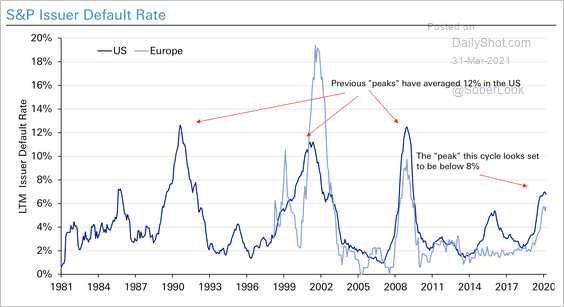

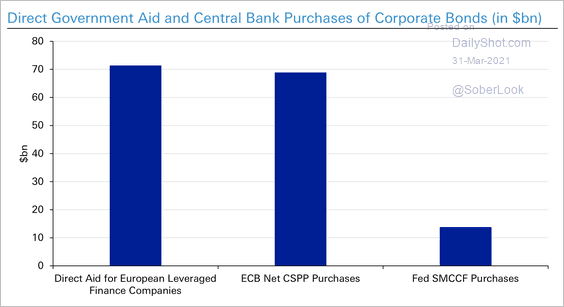

2. Default rates in the US and Europe remain below 2008 levels, partly due to government support (2 charts).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

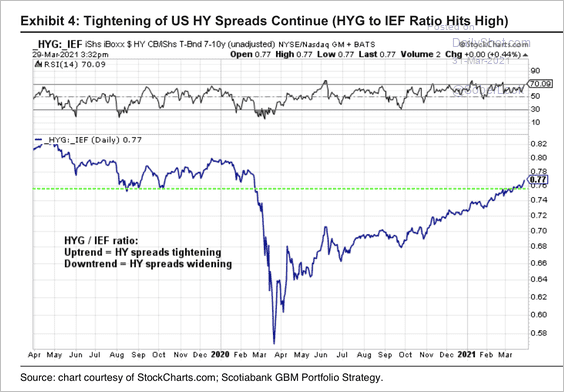

3. The iShares US corporate high-yield bond ETF (HYG) has been outperforming the iShares 7-10-year Treasury bond ETF (IEF) since the pandemic low.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

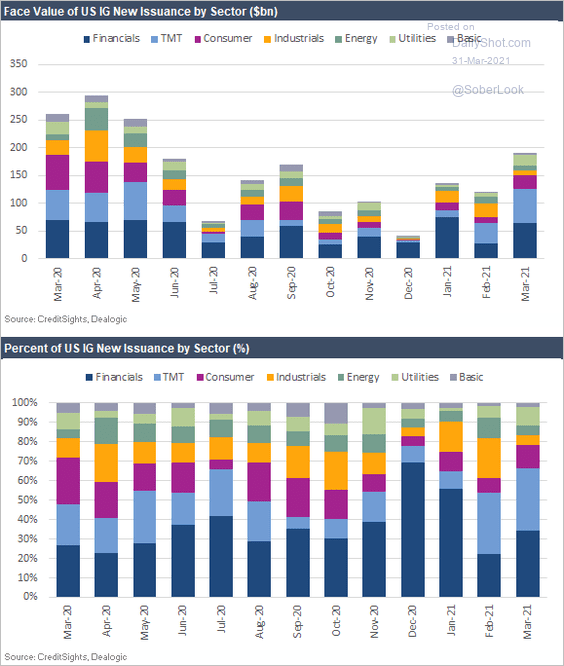

4. Here is the monthly distribution of US investment-grade bond issuance by sector.

Source: CreditSights

Source: CreditSights

Back to Index

Rates

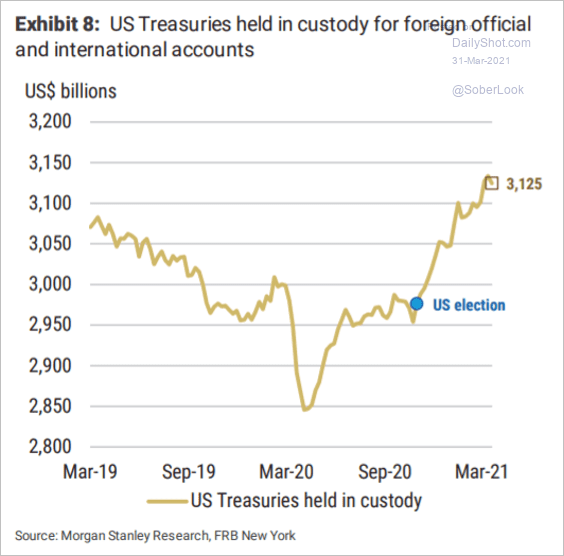

1. The amount of Treasuries held in custody (at the Fed) by foreign accounts has been rising over the past few months.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

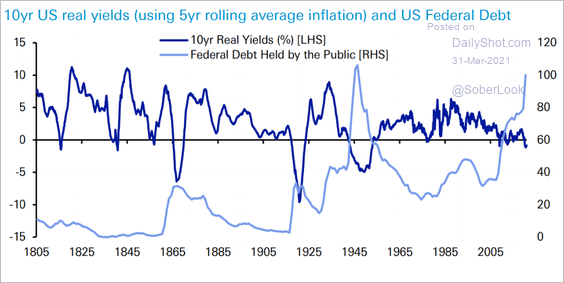

2. This chart shows US real yields vs. the federal debt (as % of GDP) going back to 1805.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

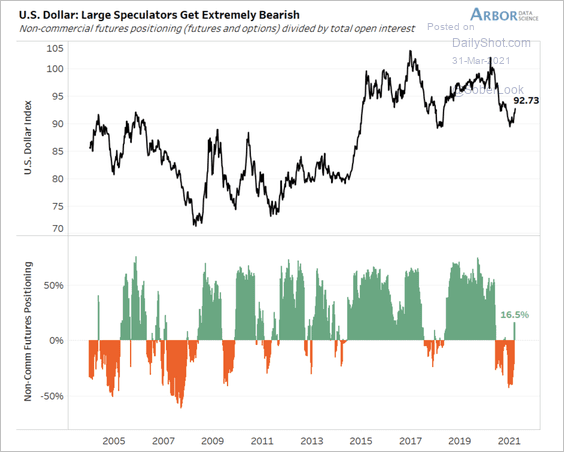

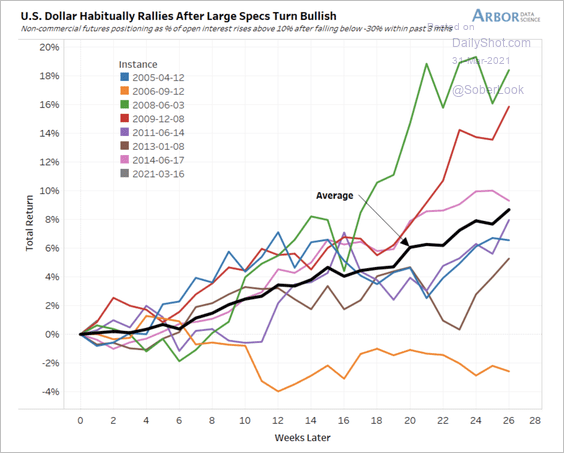

1. Speculators reversed their US dollar short positions last week, which typically precedes further upside for the greenback (2 charts).

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

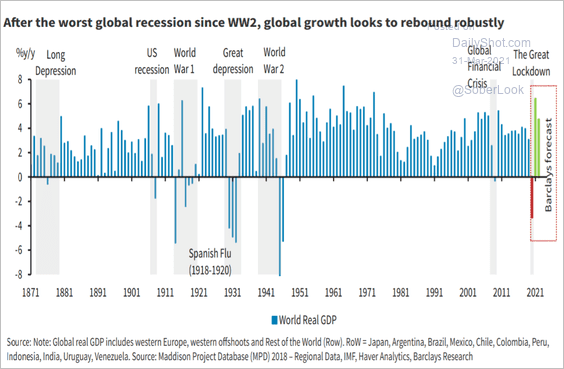

2. Global growth is expected to rebound sharply.

Source: Barclays Research

Source: Barclays Research

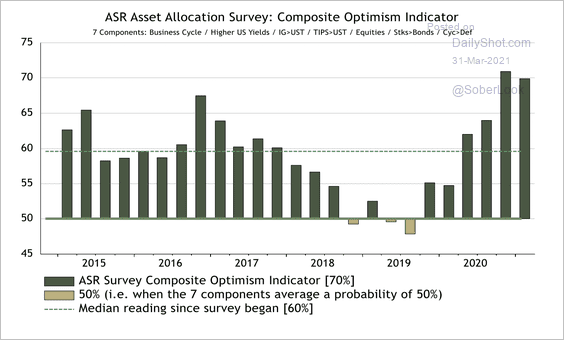

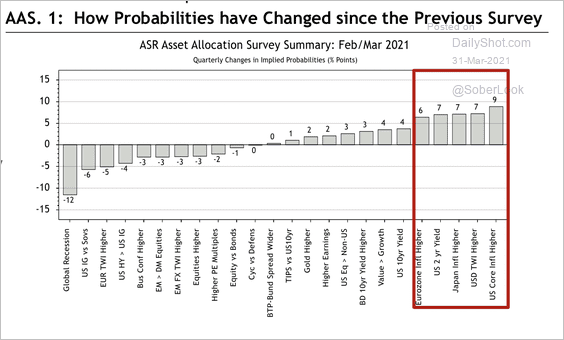

3. Investors remain optimistic and anticipate a full-on global reflation over the coming 12-months, according to an Absolute Strategy survey (2 charts).

Source: Absolute Strategy Research

Source: Absolute Strategy Research

Source: Absolute Strategy Research

Source: Absolute Strategy Research

——————–

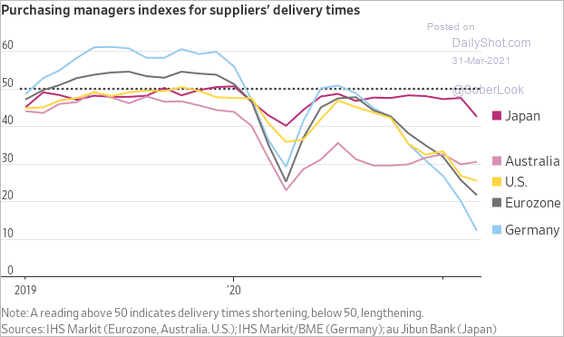

4. Supply-chain bottlenecks have worsened.

Source: @jeffsparshott

Source: @jeffsparshott

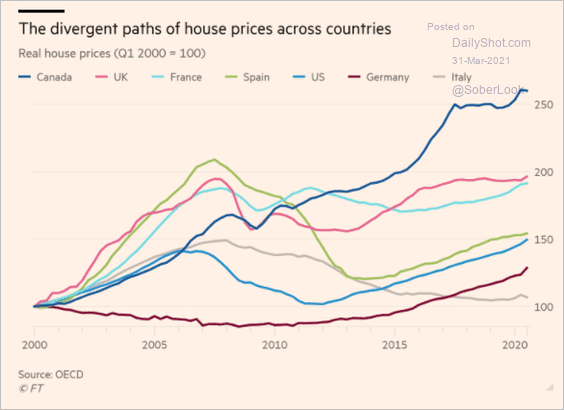

5. This chart shows inflation-adjusted home price appreciation in Western Europe, the US, and Canada.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

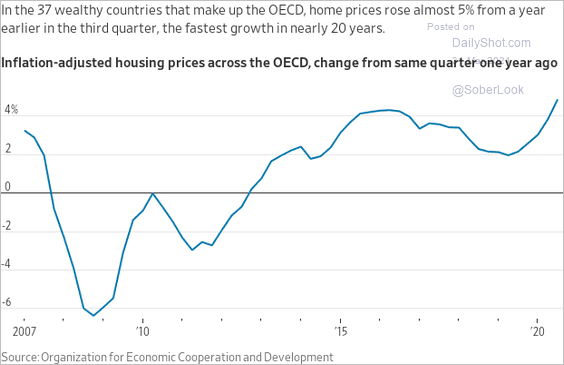

And here is real home price appreciation across OECD economies.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Food for Thought

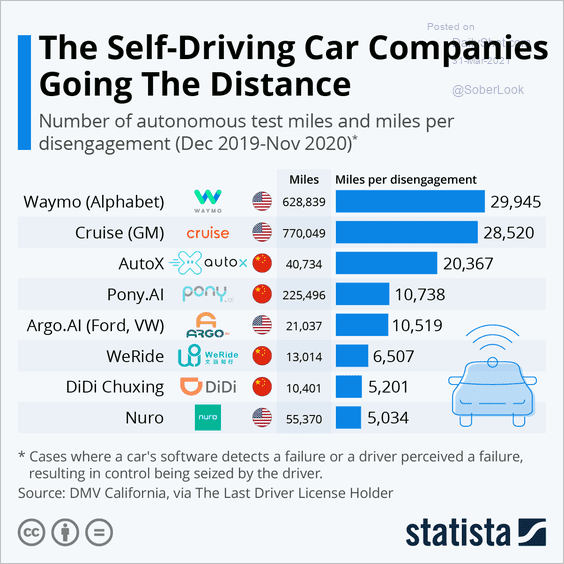

1. Self-driving car companies’ test miles:

Source: Statista

Source: Statista

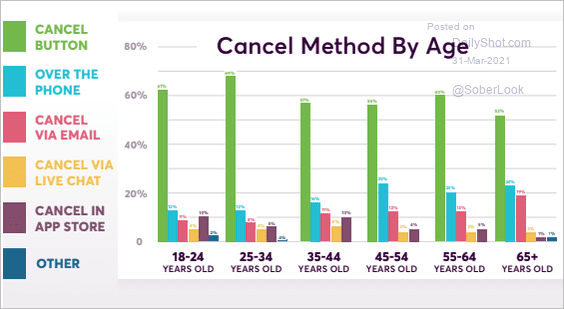

2. Online subscription cancellation by method and age:

Source: Brightback

Source: Brightback

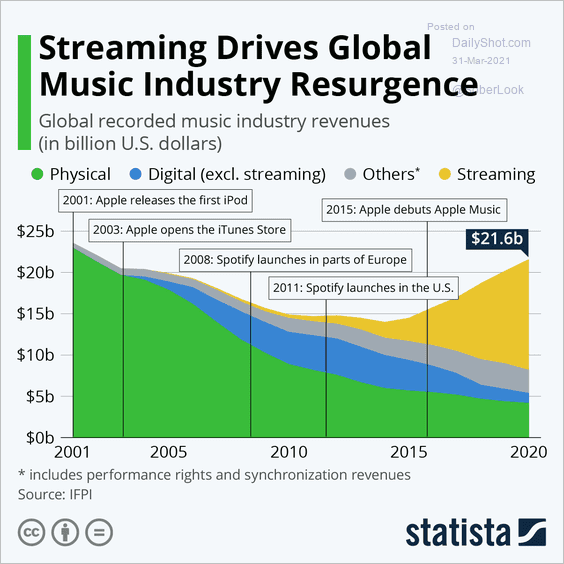

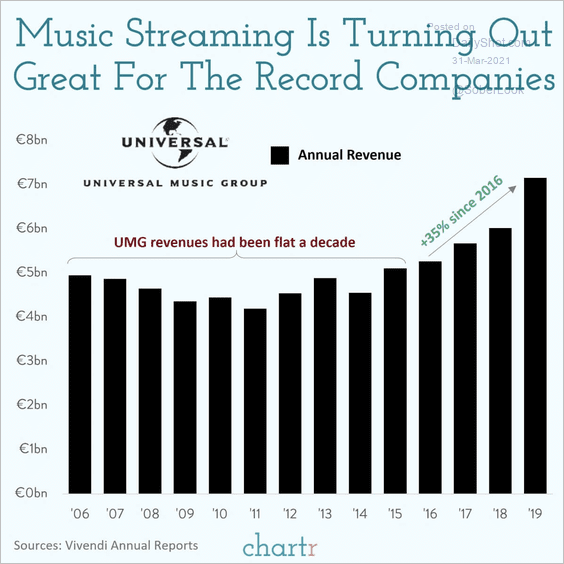

3. Music industry revenues:

Source: Statista

Source: Statista

Source: @chartrdaily

Source: @chartrdaily

——————–

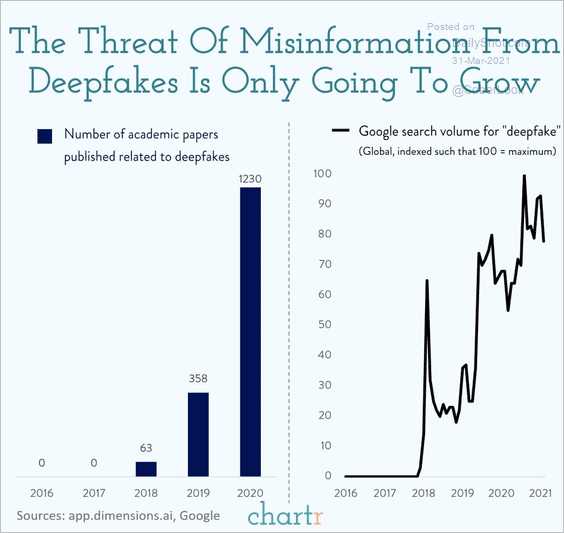

4. Misinformation from deepfakes:

Source: @chartrdaily

Source: @chartrdaily

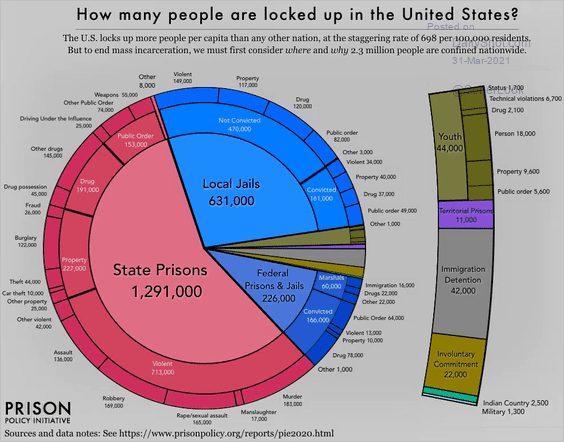

5. People locked up in the US:

Source: Prison Policy Initiative Read full article

Source: Prison Policy Initiative Read full article

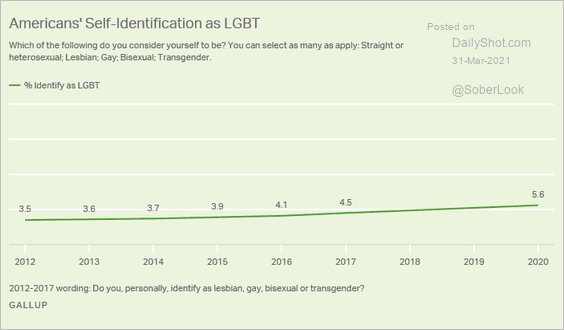

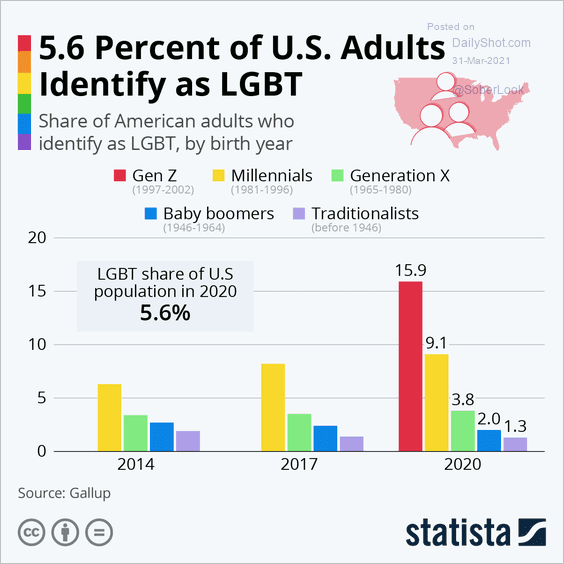

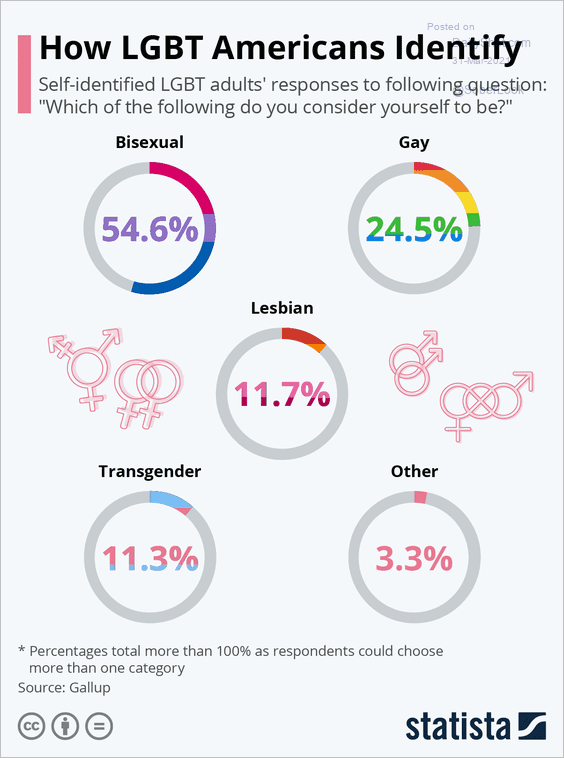

6. Americans identifying as LGBT (3 charts):

Source: Gallup Read full article

Source: Gallup Read full article

Source: Statista

Source: Statista

Source: Statista

Source: Statista

——————–

7. Vaccine refusal:

Source: Echelon Insights

Source: Echelon Insights

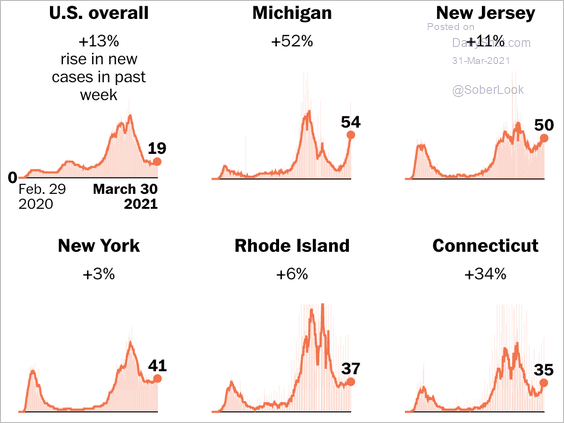

8. COVID cases in select states:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

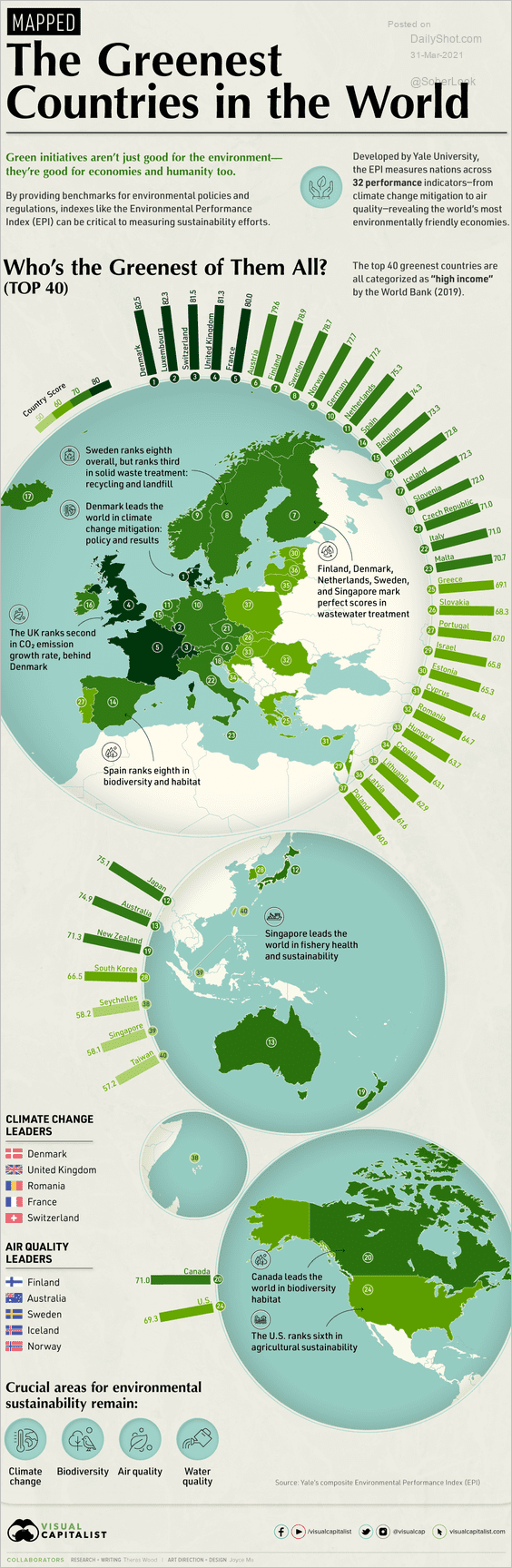

9. The greenest countries in the world:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

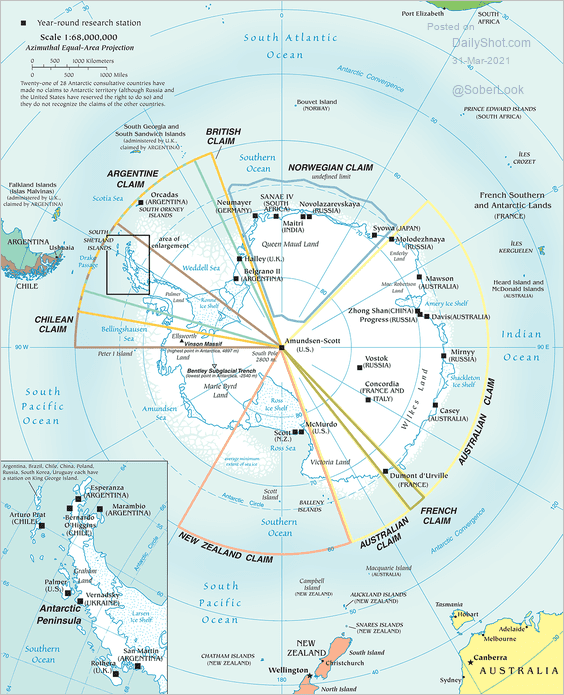

10. Who controls Antarctica?

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

Back to Index