The Daily Shot: 06-Apr-21

• The United States

• Canada

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

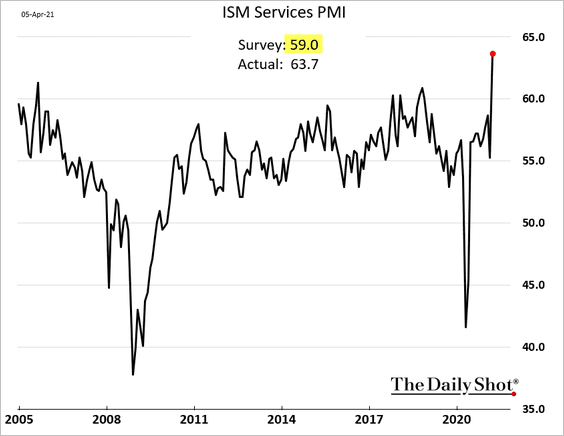

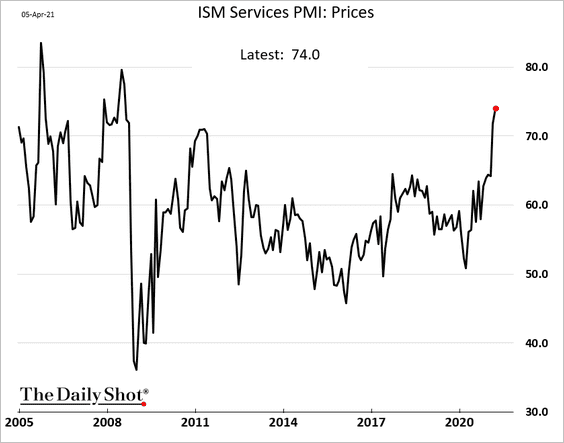

1. The ISM Services PMI surged in March, hitting a record high.

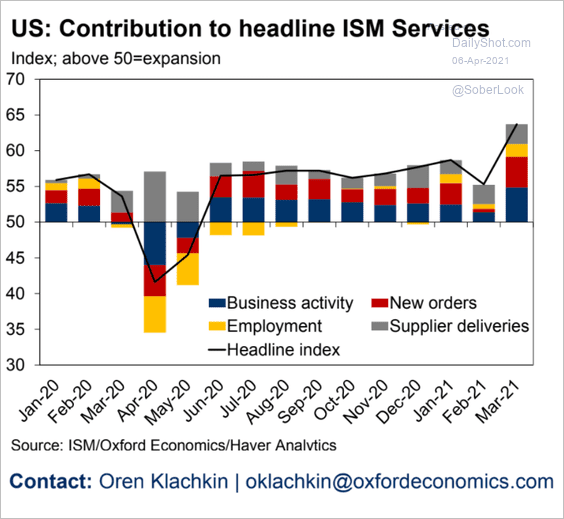

• Here is the attribution.

Source: Oxford Economics

Source: Oxford Economics

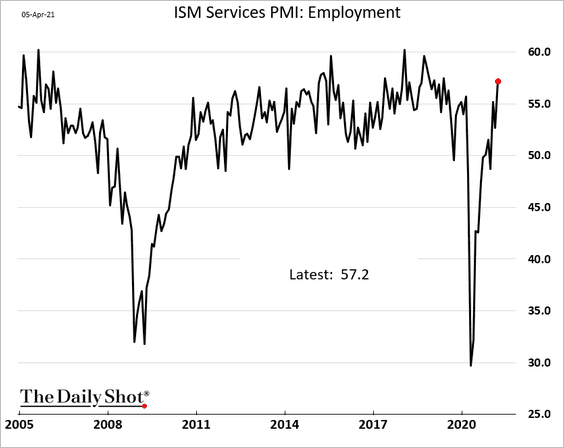

• Service firms increased hiring, a trend we saw in March the employment report.

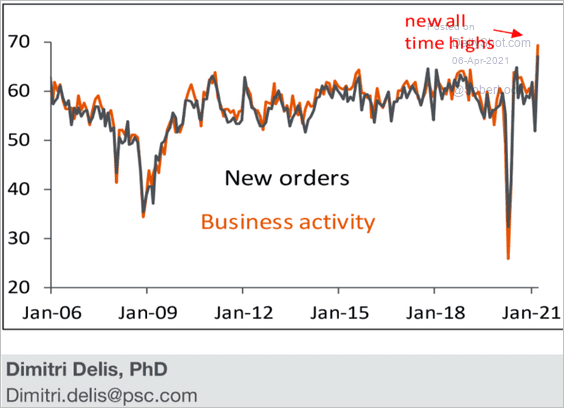

• New orders jumped.

Source: Piper Sandler

Source: Piper Sandler

• The index measuring prices paid hit the highest level since 2008.

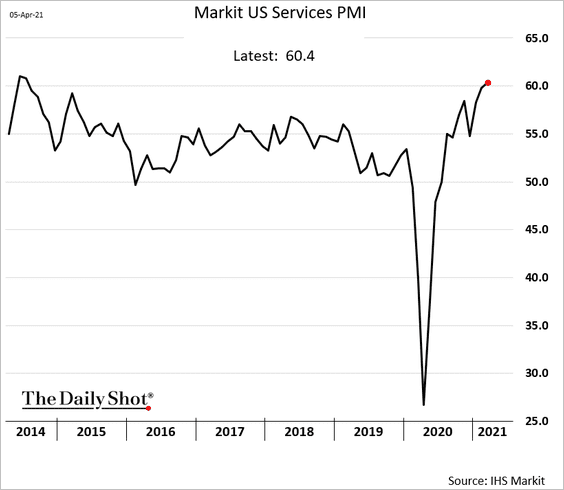

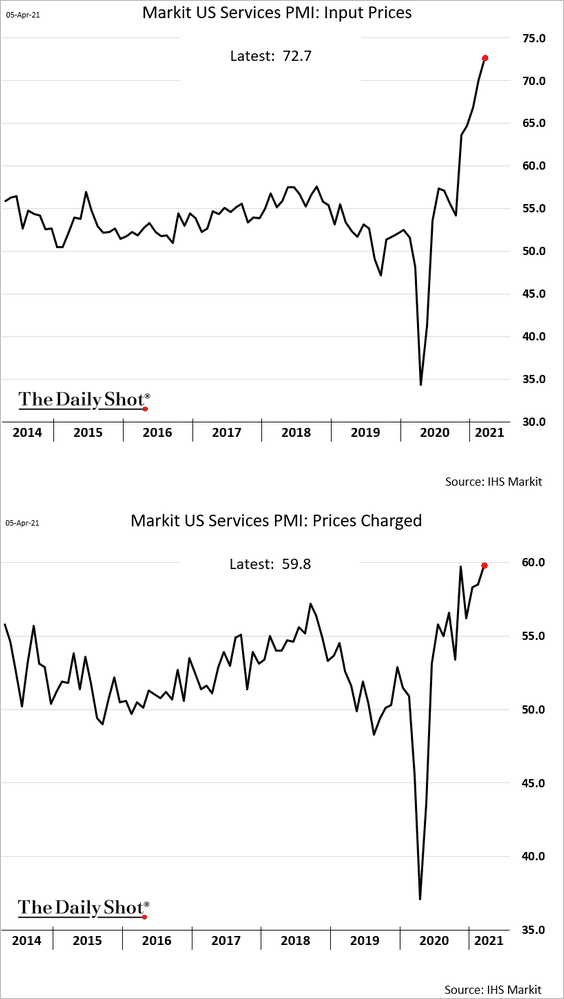

A similar indicator from IHS Markit also showed strength in service-sector activity and …

… increasing price pressures.

——————–

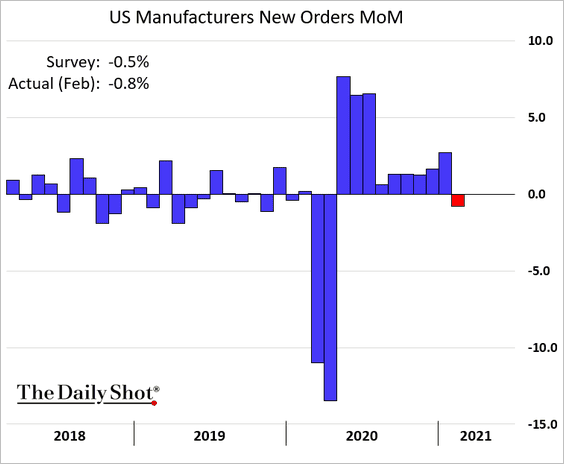

2. Factory orders declined in February for the first time in ten months. Based on the PMI reports, we should see a rebound in March.

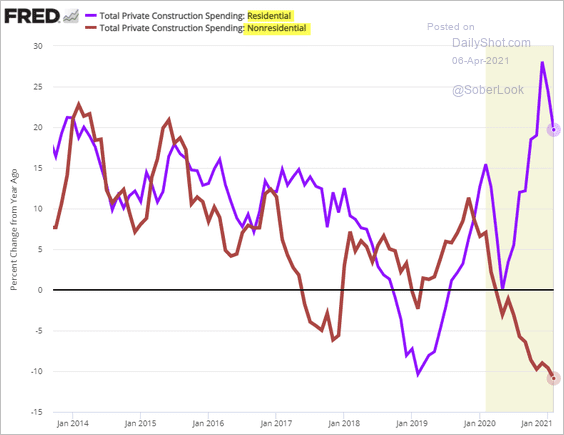

3. Residential construction spending pulled back from the highs in February. Nonresidential expenditures have been shrinking.

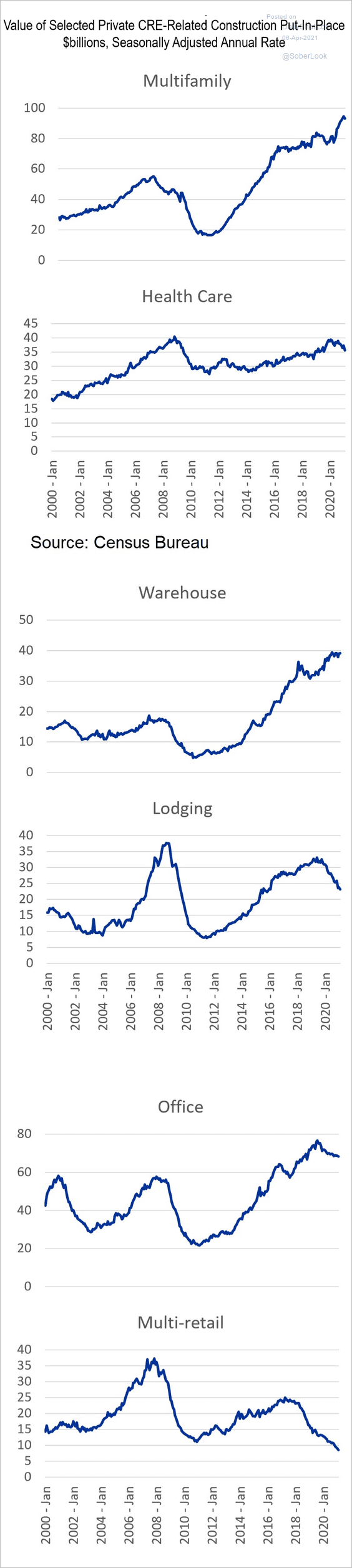

These charts show commercial real estate construction trends over the past couple of decades.

Source: Mortgage Bankers Association

Source: Mortgage Bankers Association

——————–

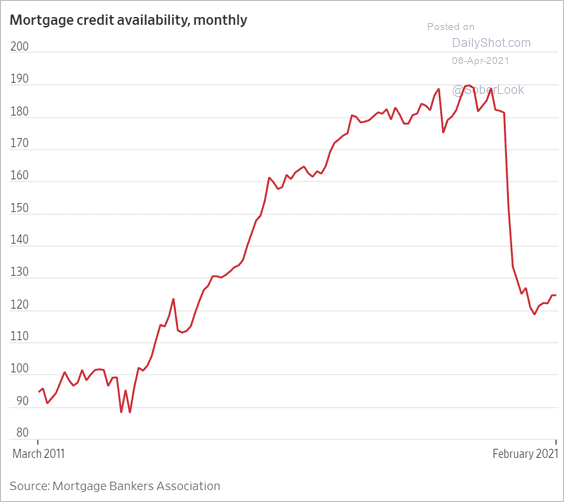

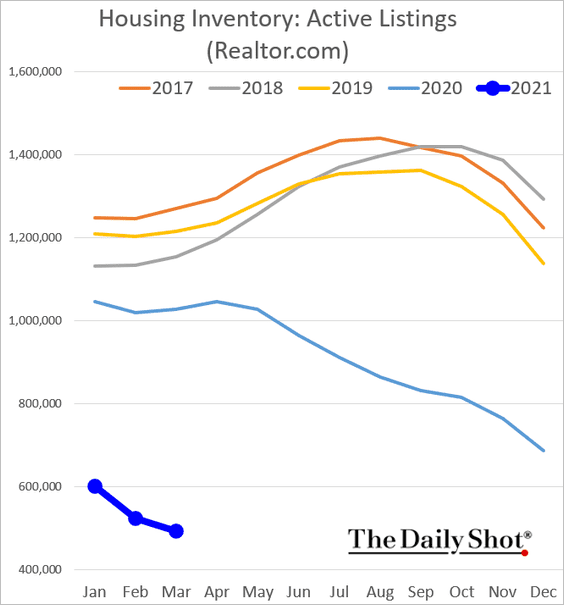

4. Next, we have a couple of updates on the housing market.

• Tightening mortgage credit:

Source: @WSJ Read full article

Source: @WSJ Read full article

• Housing inventories:

——————–

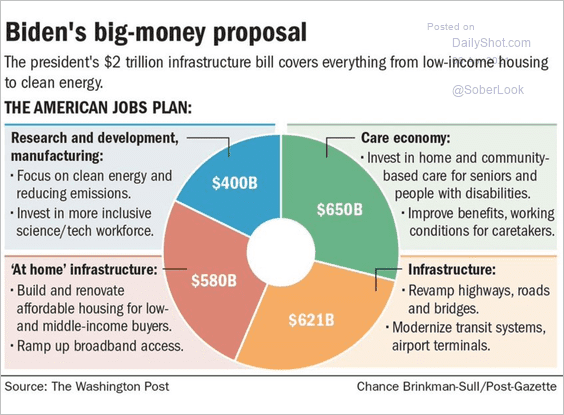

5. Here is a summary of the proposed infrastructure bill.

Source: @adam_tooze, Pittsburgh Post-Gazette Read full article

Source: @adam_tooze, Pittsburgh Post-Gazette Read full article

• Government investment in structures has been trending lower for decades.

Source: Moody’s Analytics

Source: Moody’s Analytics

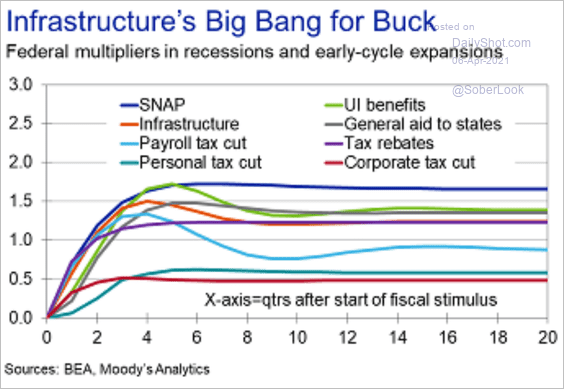

• This chart shows the economic multipliers of different types of government programs.

Source: Moody’s Analytics

Source: Moody’s Analytics

——————–

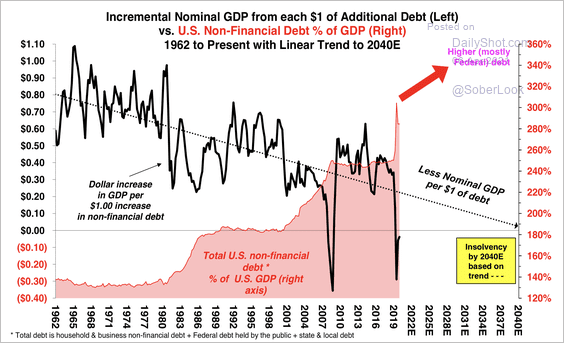

6. Historically, nominal GDP growth has declined as government debt increased.

Source: Stifel

Source: Stifel

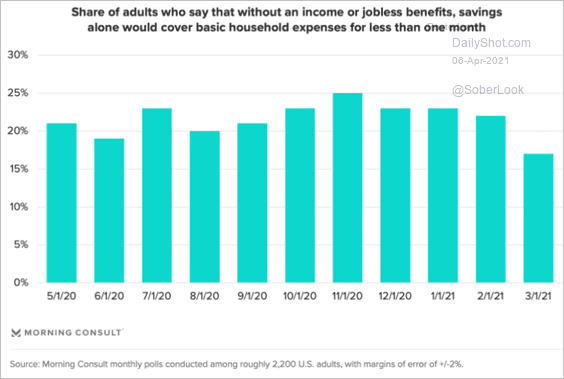

7. Households’ financial vulnerabilities have eased.

Source: Morning Consult Read full article

Source: Morning Consult Read full article

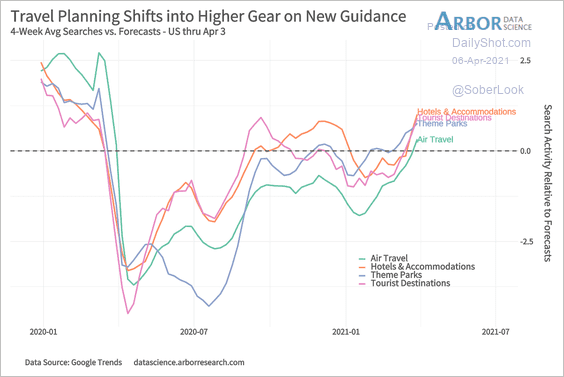

8. Travel-related online search activity is rebounding.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

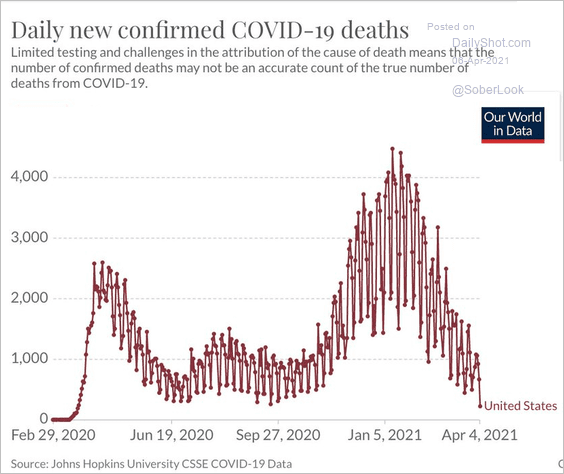

9. US COVID-related deaths are at the lowest level since the start of the pandemic.

Source: @NateSilver538 Read full article

Source: @NateSilver538 Read full article

Back to Index

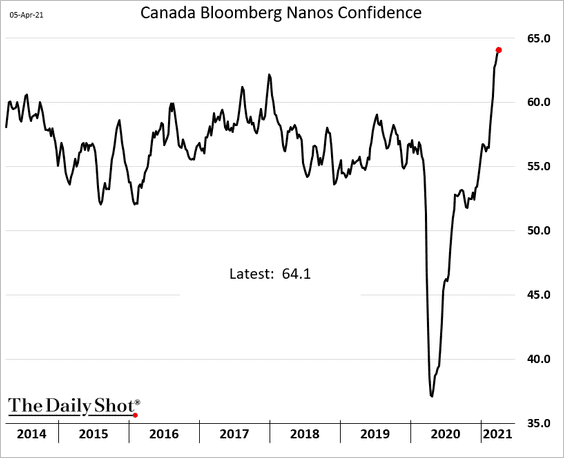

Canada

1. Consumer confidence keeps rising.

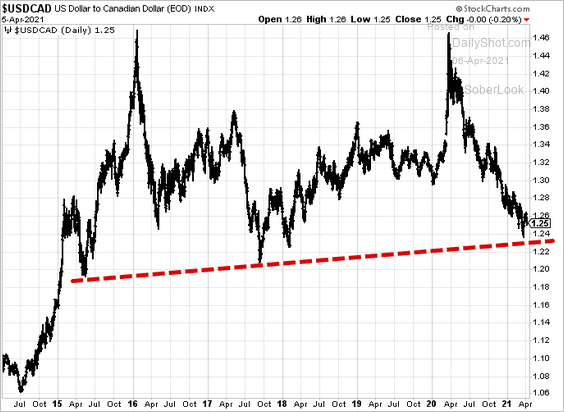

2. USD/CAD held long-term support as the US economic expansion accelerates.

h/t Robert Fullem

h/t Robert Fullem

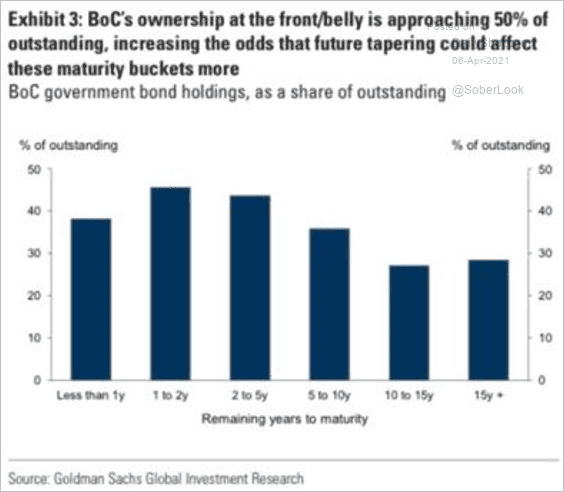

3. The BOC’s ownership of shorter-maturity bonds is approaching 50% of outstanding.

Source: J B, Goldman Sachs

Source: J B, Goldman Sachs

Back to Index

Europe

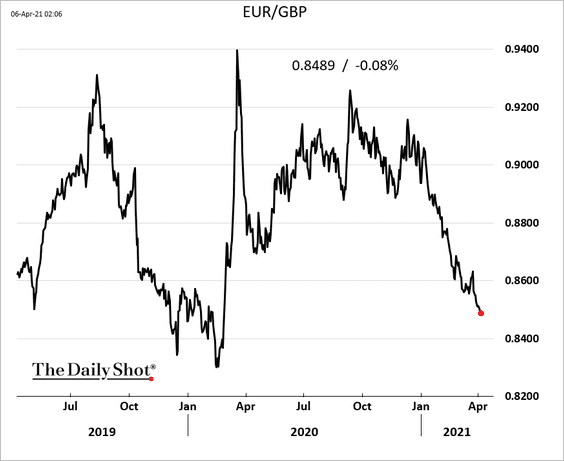

1. EUR/GBP dipped below 0.85, with traders betting on the UK’s strong vaccination program translating into economic outperformance vs. the Eurozone.

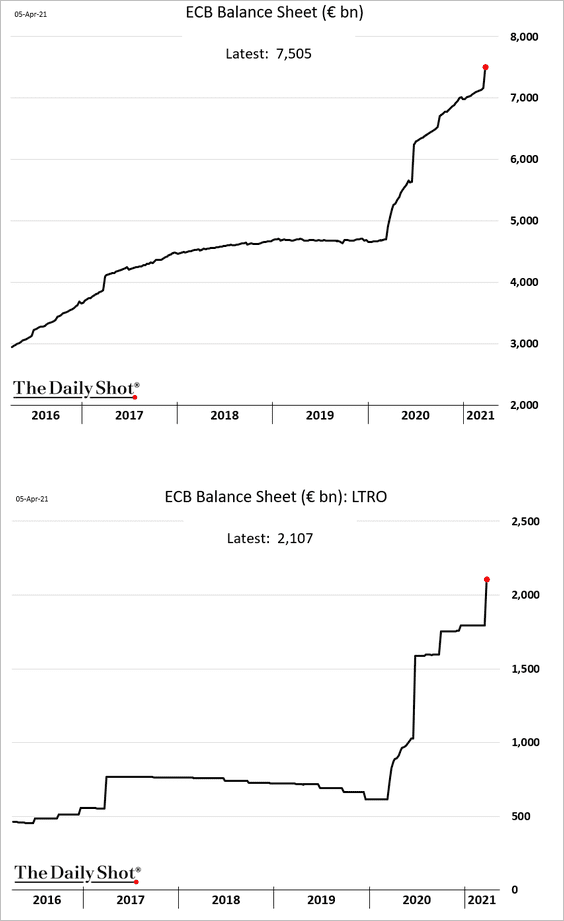

2. The latest TLTRO tranche saw substantial uptake from banks, sharply boosting the ECB’s (Eurosystem) balance sheet.

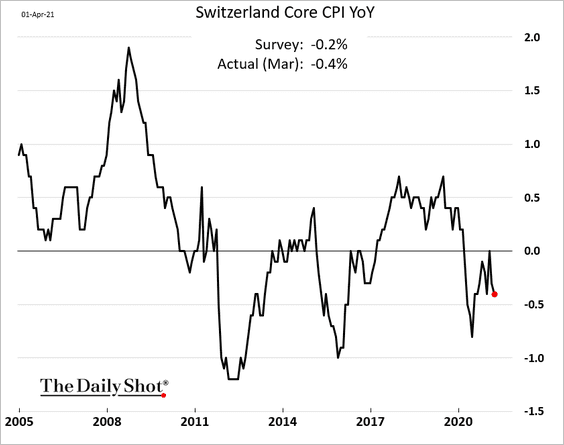

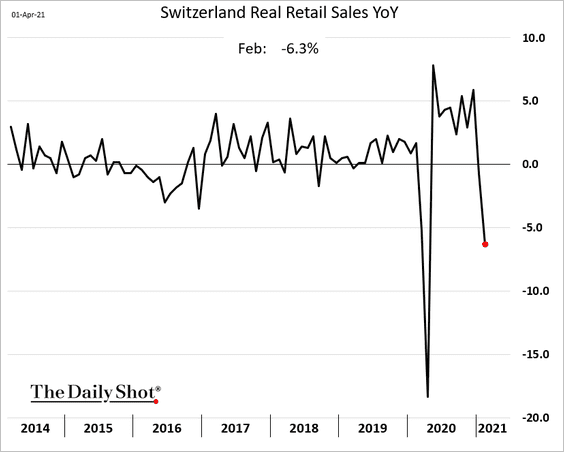

3. Switzerland remains in deflation.

Swiss retail sales tumbled in February.

——————–

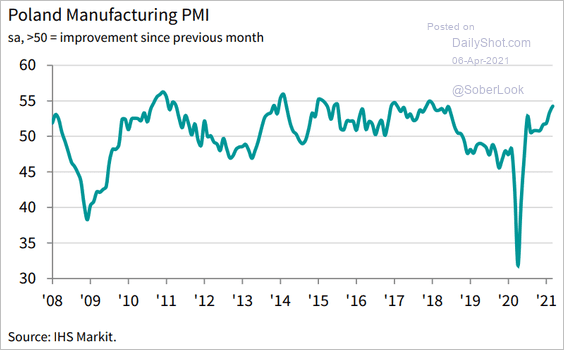

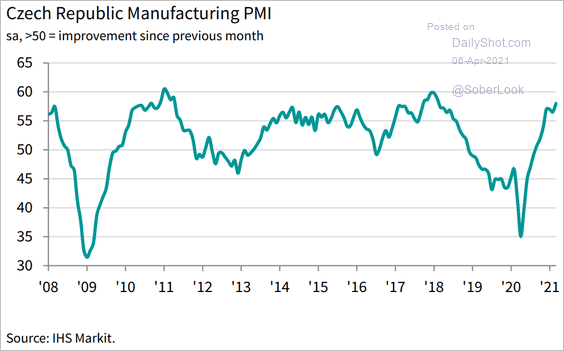

4. Central European manufacturing activity continues to strengthen.

• Poland:

Source: IHS Markit

Source: IHS Markit

• The Czech Republic:

Source: IHS Markit

Source: IHS Markit

——————–

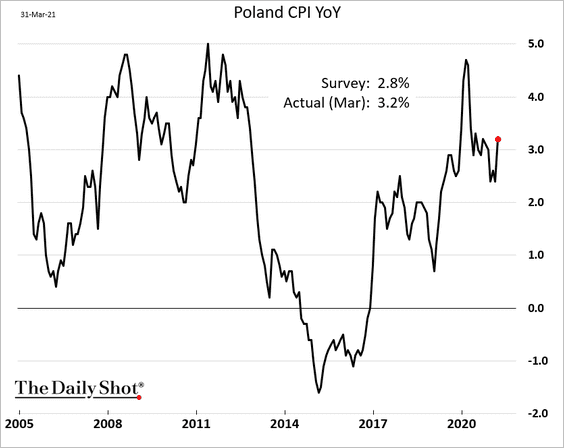

5. Poland’s inflation surprised to the upside.

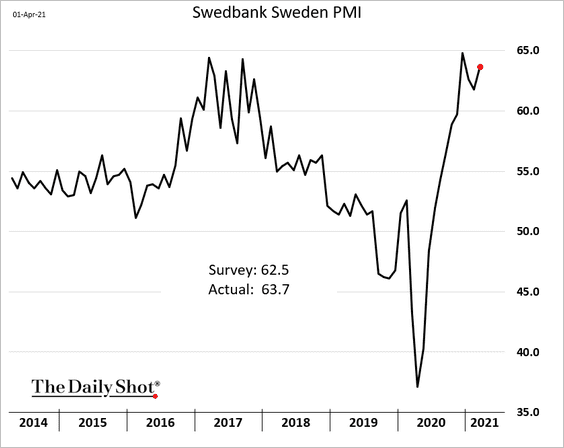

6. Sweden’s factory activity accelerated last month.

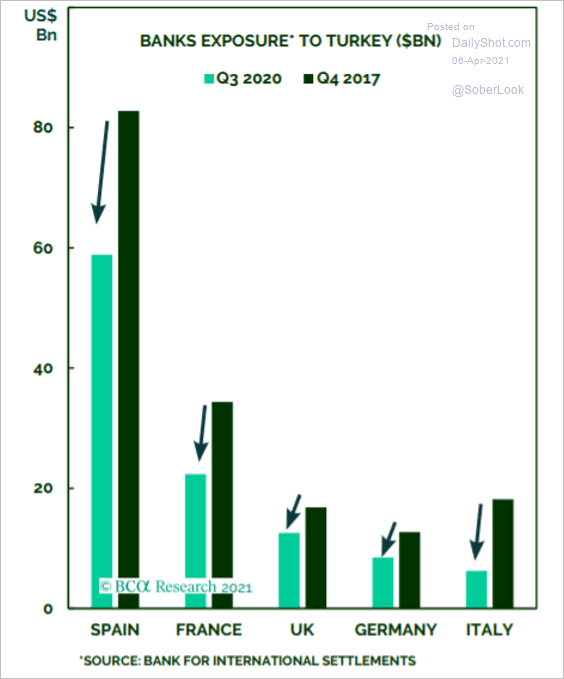

7. European banks are less exposed to Turkey than they were a few years ago.

Source: BCA Research

Source: BCA Research

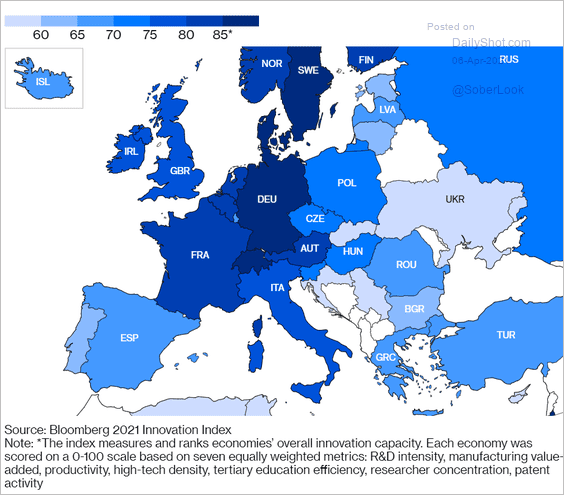

8. Here is Bloomberg’s innovation index.

Source: @business Read full article

Source: @business Read full article

Back to Index

Asia – Pacific

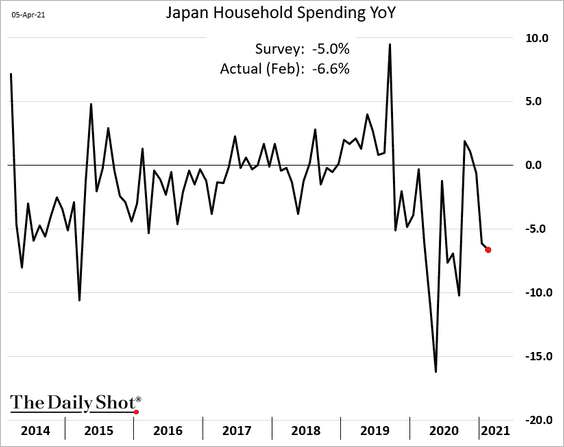

1. Japan’s household spending remained tepid in February.

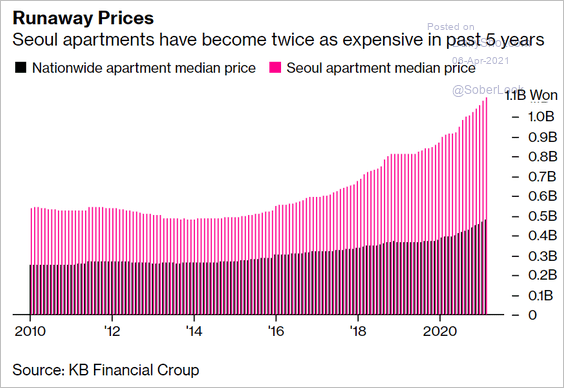

2. Seoul housing prices have surged in recent years.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

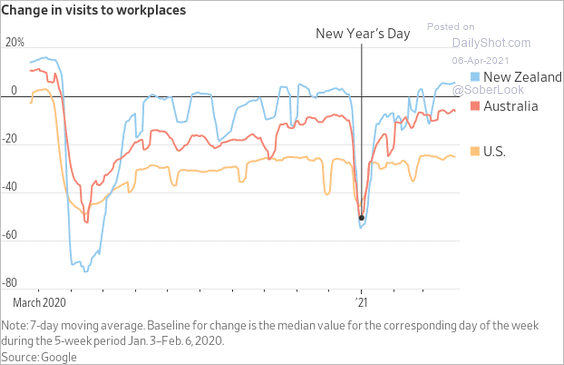

3. New Zealand’s visits to workplaces have almost fully recovered.

Source: @WSJ Read full article

Source: @WSJ Read full article

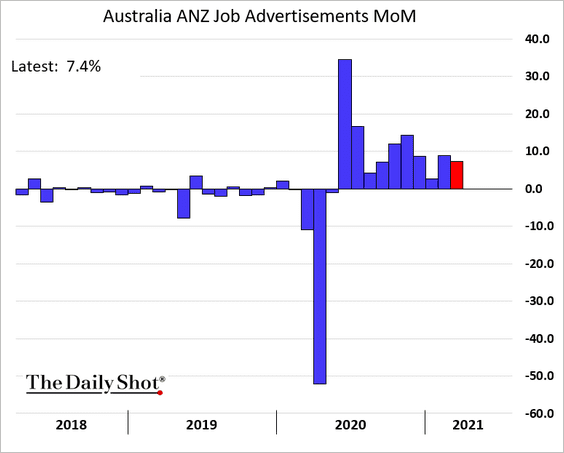

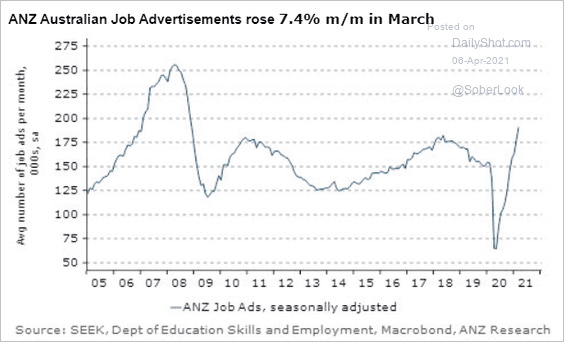

4. Australia’s job ads continue to rise, pointing to a strengthening labor market.

Source: ANZ Research

Source: ANZ Research

Back to Index

China

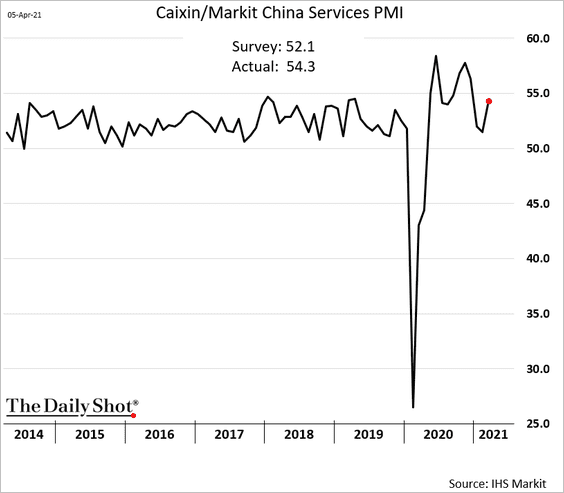

1. The service-sector PMI report from Markit was better than expected.

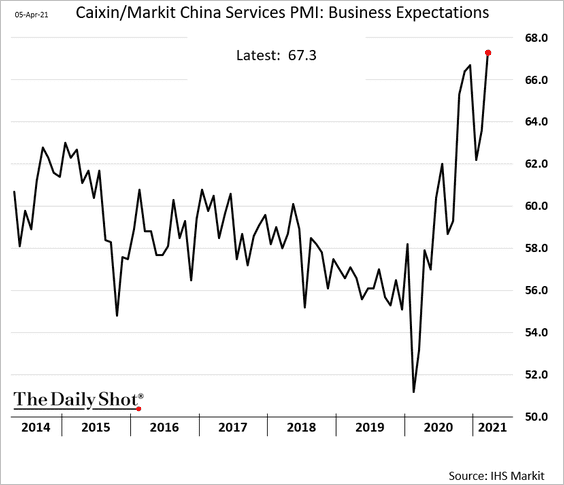

Businesses are increasingly upbeat.

——————–

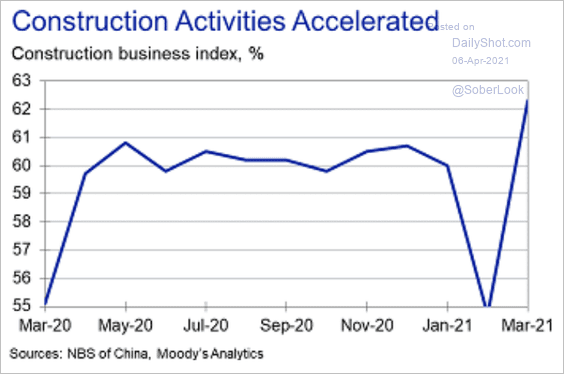

2. Construction activity rebounded last month.

Source: Moody’s Analytics

Source: Moody’s Analytics

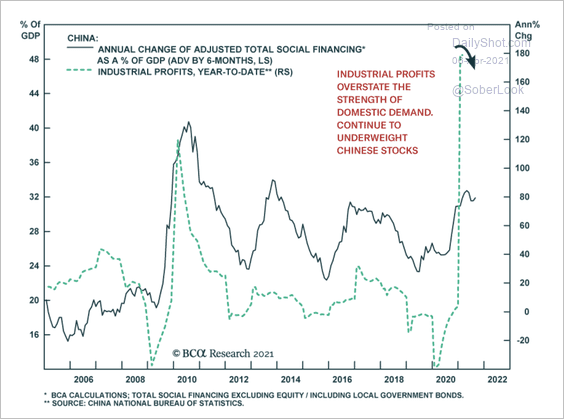

3. The surge in industrial prices has not coincided with a spike in social financing.

Source: BCA Research

Source: BCA Research

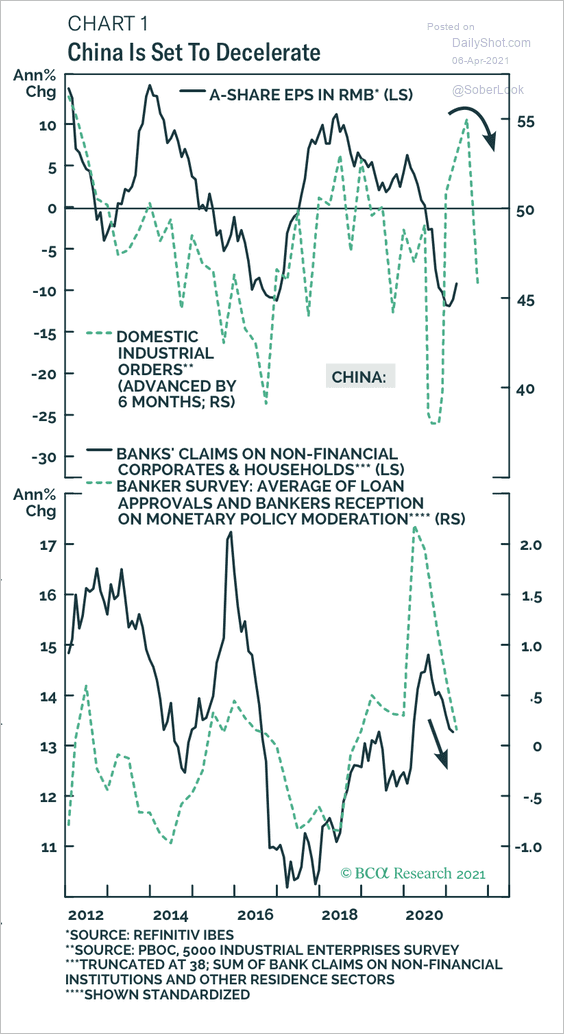

4. The slowdown in domestic industrial orders could lead A-shares lower.

Source: BCA Research

Source: BCA Research

Back to Index

Emerging Markets

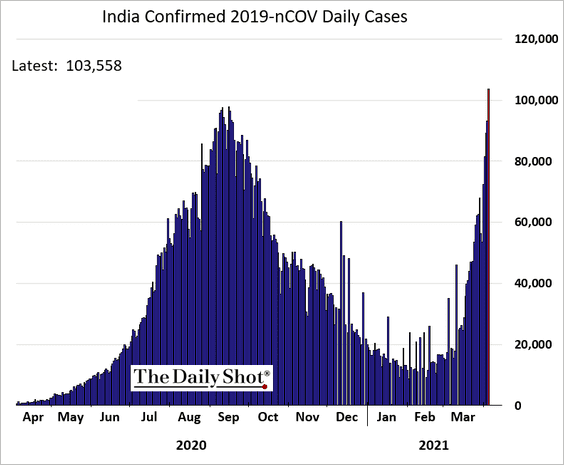

1. New COVID cases in India hit a record high.

Source: @axios Read full article

Source: @axios Read full article

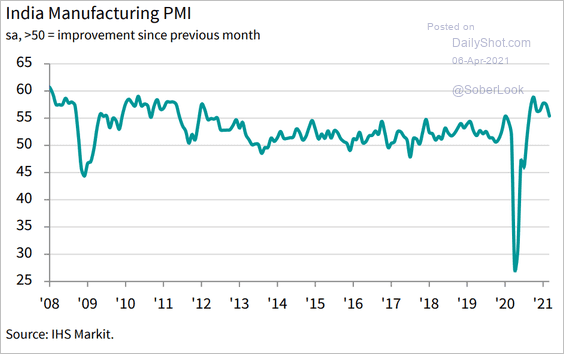

Nonetheless, factory growth held up well last month.

Source: IHS Markit

Source: IHS Markit

——————–

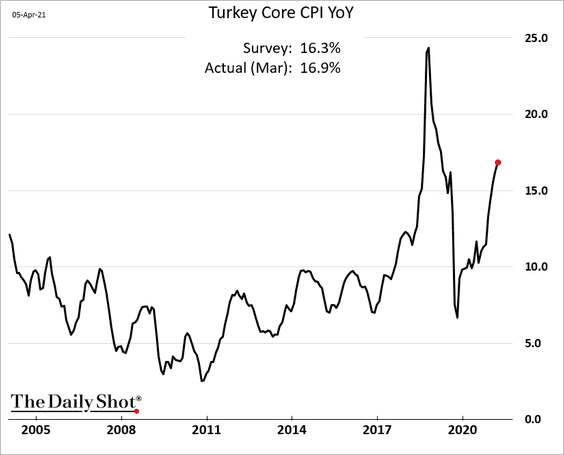

2. Turkey’s inflation keeps climbing, with the core CPI approaching 17%.

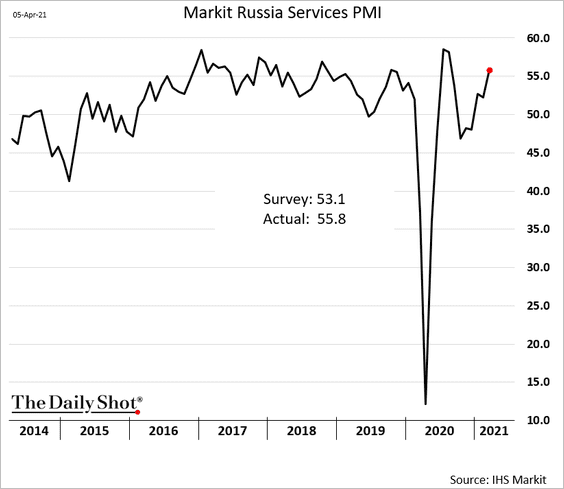

3. Russia’s service companies performed better than expected last month.

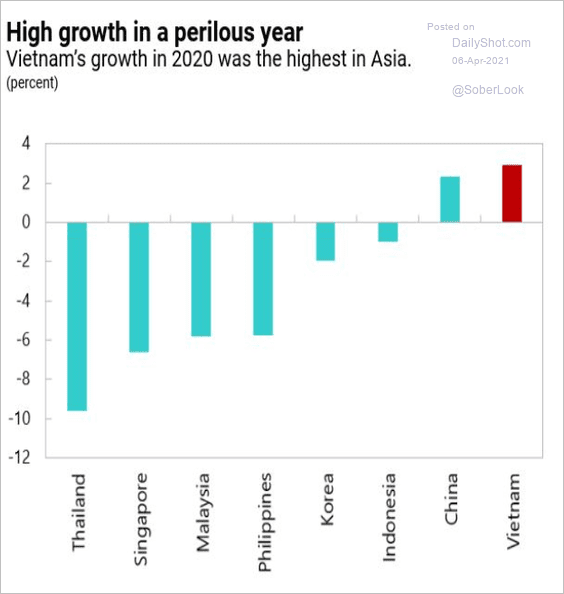

4. Vietnam’s economy outperformed other Asian countries last year.

Source: IMF Read full article

Source: IMF Read full article

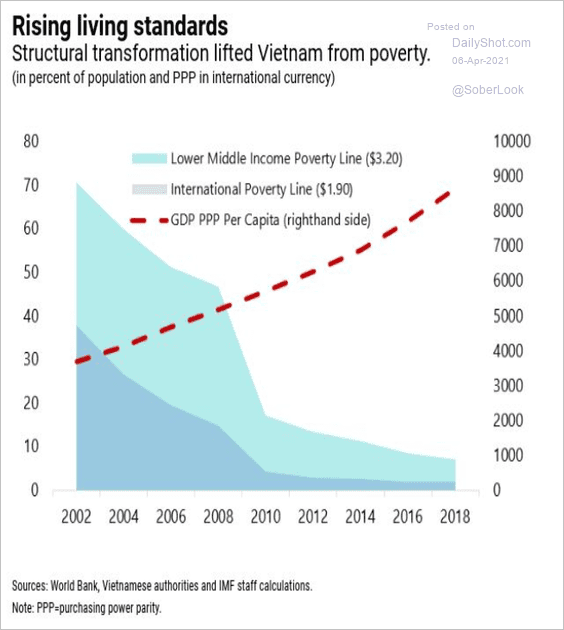

Standards of living are improving.

Source: IMF Read full article

Source: IMF Read full article

——————–

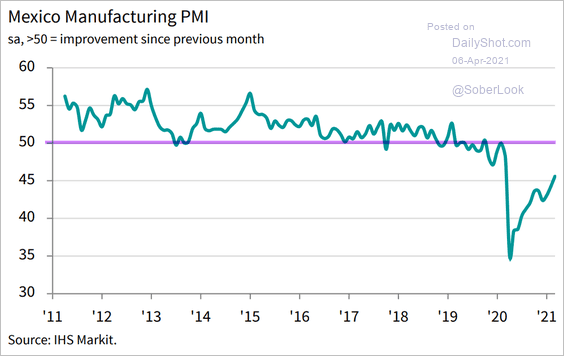

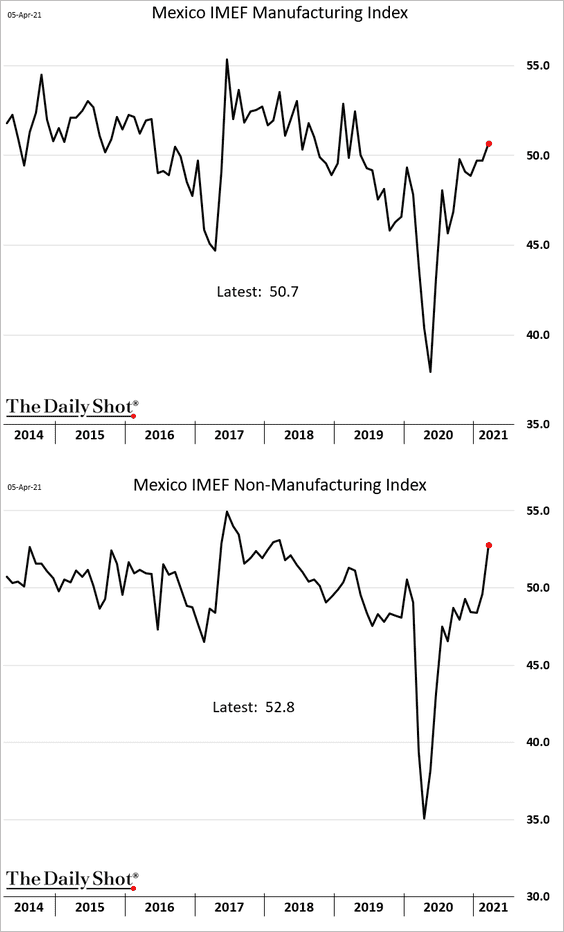

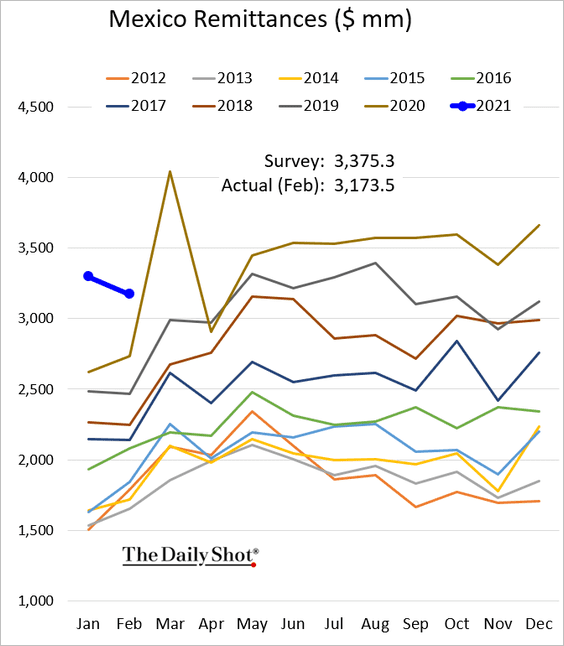

5. Next, we have some updates on Mexico.

• The Markit PMI report continues to show persistent weakness in Mexico’s manufacturing.

Source: IHS Markit

Source: IHS Markit

• However, the IMEF indices have been more upbeat.

• Remittances weakened in February but remain elevated.

——————–

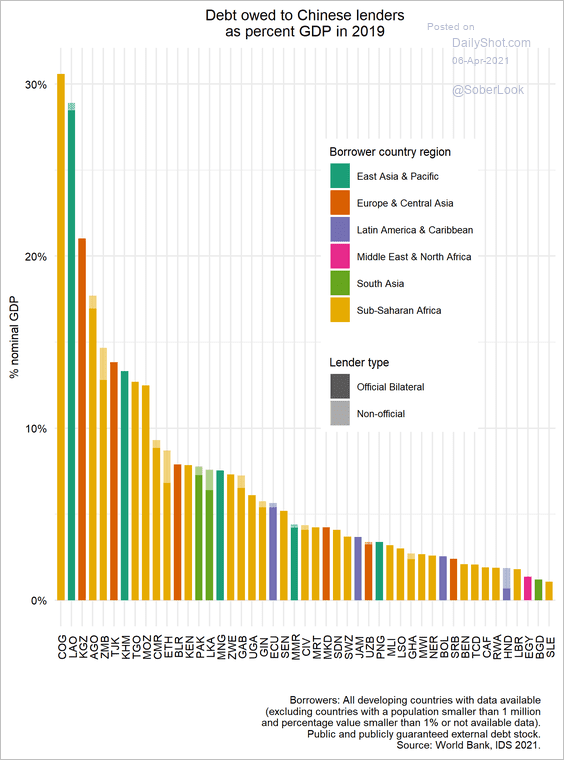

6. Some EM nations owe China quite a bit of money.

Source: @davidmihalyi, @WorldBank

Source: @davidmihalyi, @WorldBank

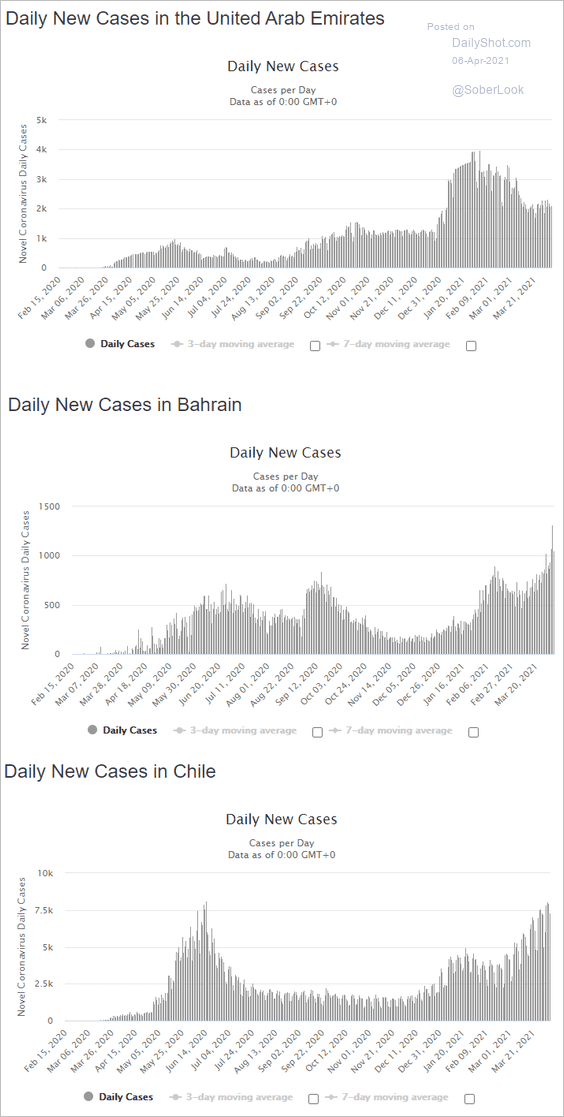

7. UAE, Bahrain, and Chile have strong vaccination programs (outpacing the US), but they rely heavily on Chinese vaccines. Is it possible that these vaccines are ineffective against COVID variants?

Source: @Noahpinion

Source: @Noahpinion

Back to Index

Commodities

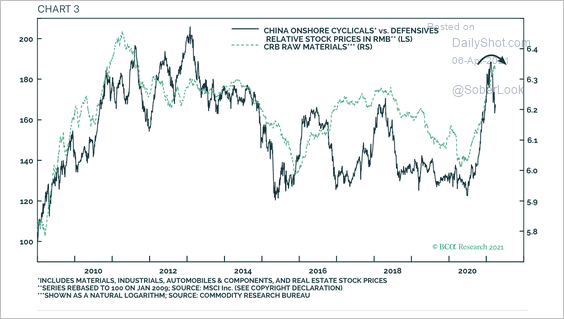

1. The decline in Chinese cyclical versus defensive stocks points to a top in commodity prices …

Source: BCA Research

Source: BCA Research

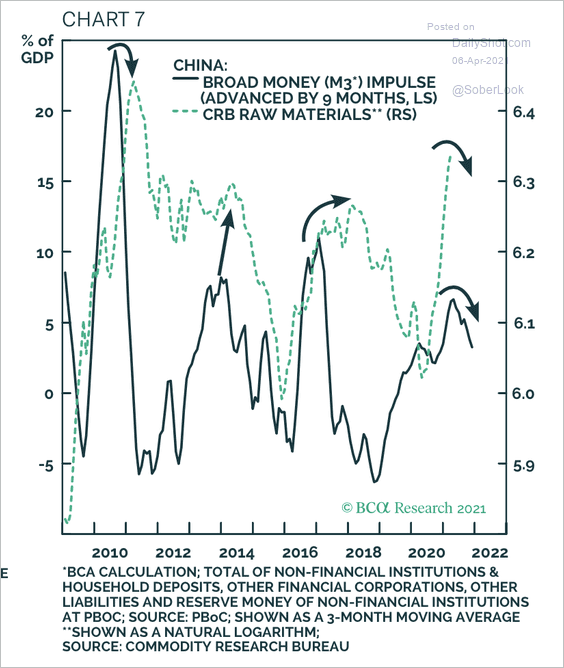

… and a declining broad money impulse doesn’t help.

Source: BCA Research

Source: BCA Research

——————–

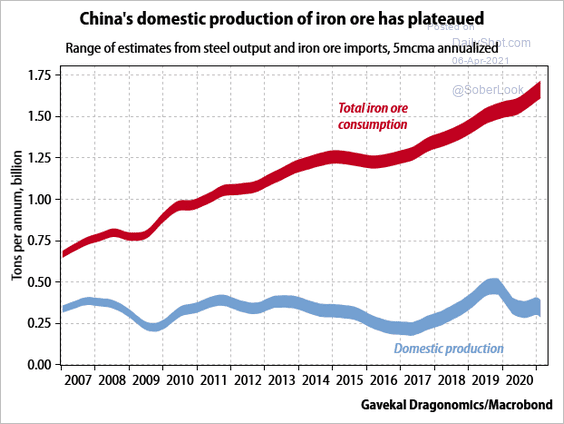

2. China increasingly relies on imported iron ore.

Source: Gavekal Research

Source: Gavekal Research

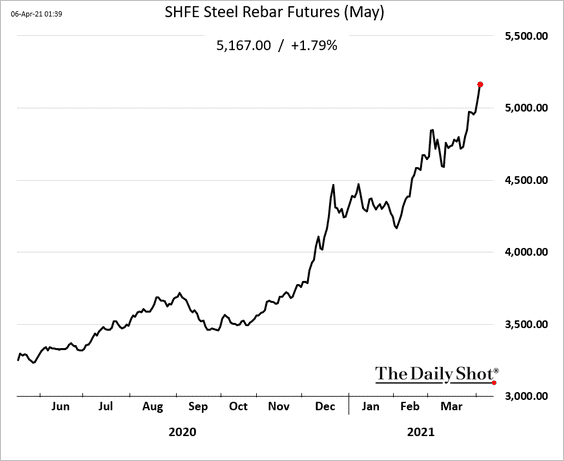

3. China’s steel rebar futures keep climbing.

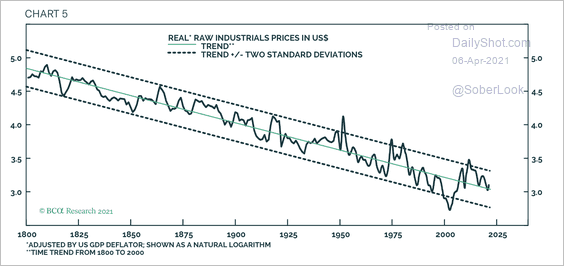

4. In real terms, raw industrial prices remain in a long-term downtrend.

Source: BCA Research

Source: BCA Research

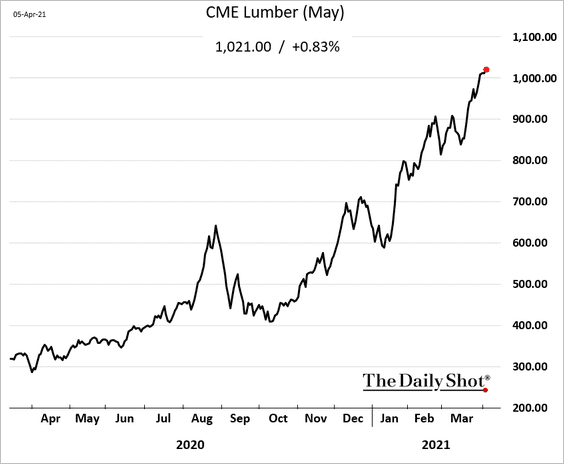

5. US lumber futures continue to rise.

Back to Index

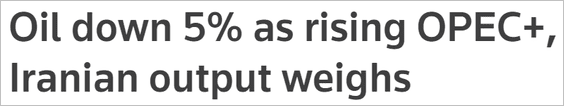

Energy

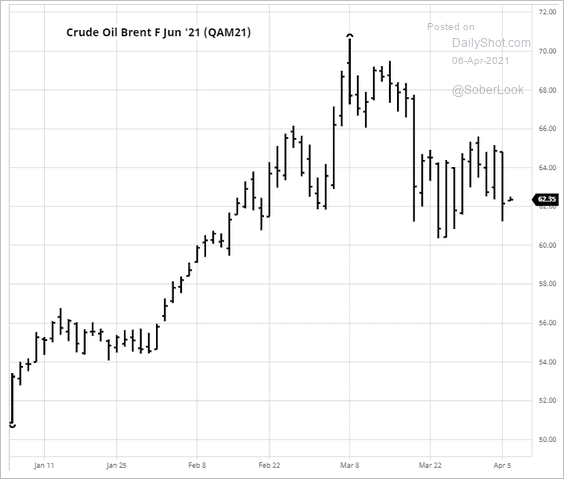

Crude oil sold off on Monday amid rising OPEC+ production.

Source: barchart.com

Source: barchart.com

Source: Reuters Read full article

Source: Reuters Read full article

Here is Iran’s oil output.

Back to Index

Equities

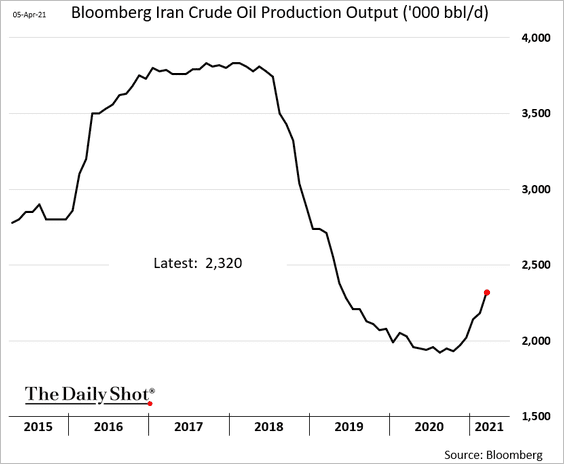

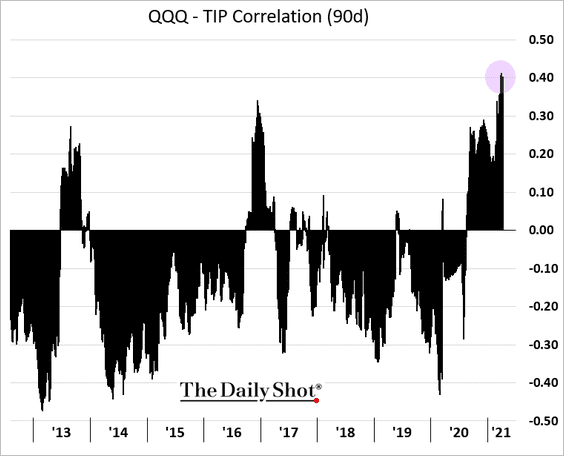

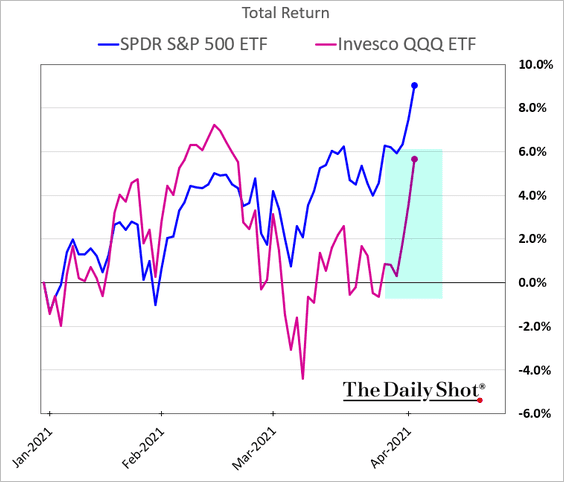

1. The inverse correlation between tech stocks and bond yields remains intact. The relationship has been particularly strong with real rates. Here is the Nasdaq 100 correlation with TIPS prices.

As real rates stabilized, …

… the Nasdaq 100 rebounded.

——————–

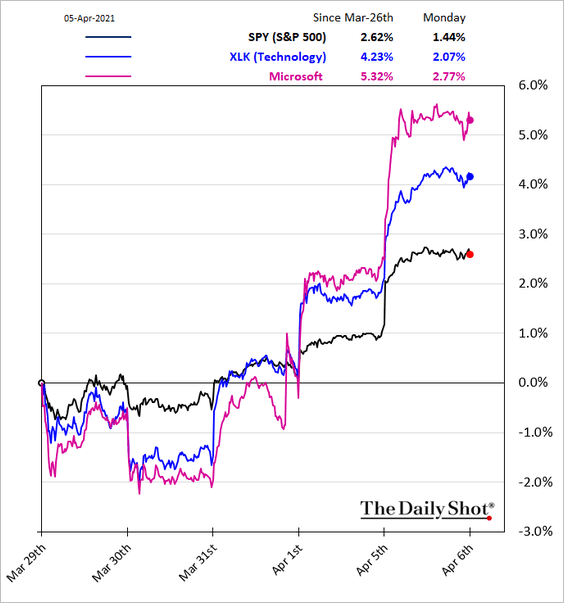

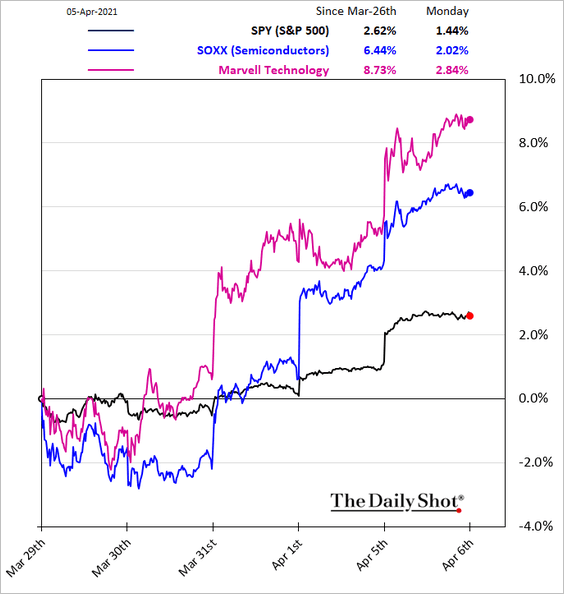

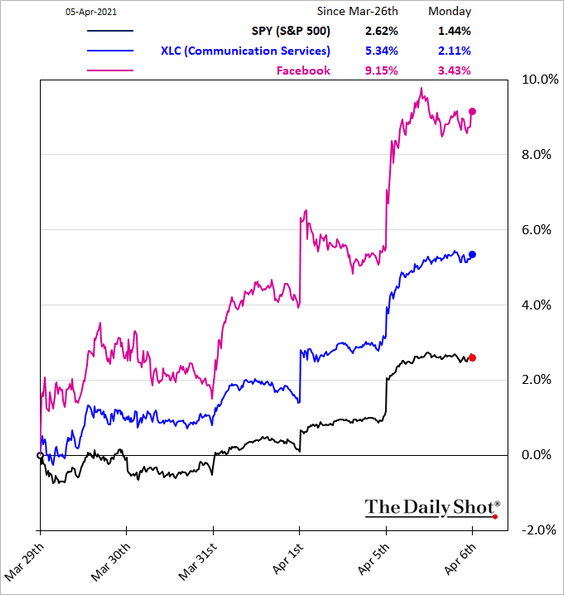

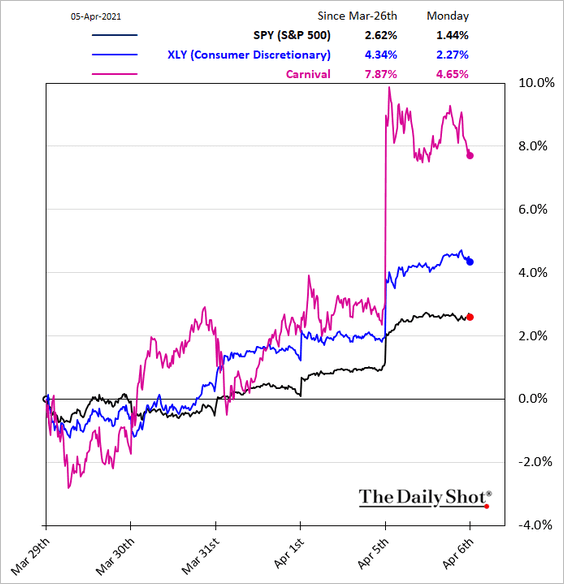

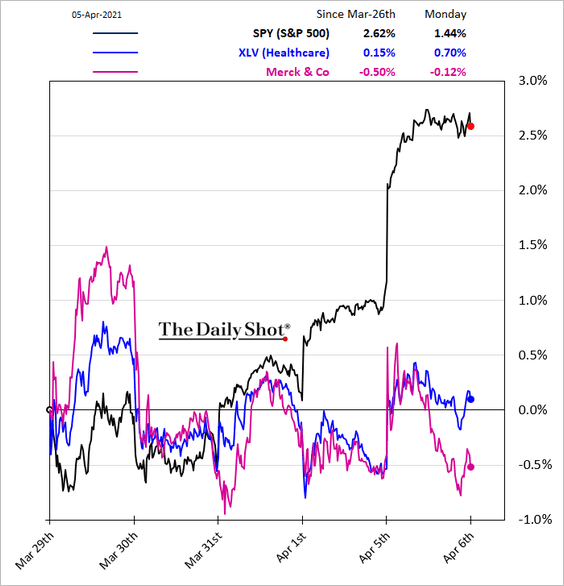

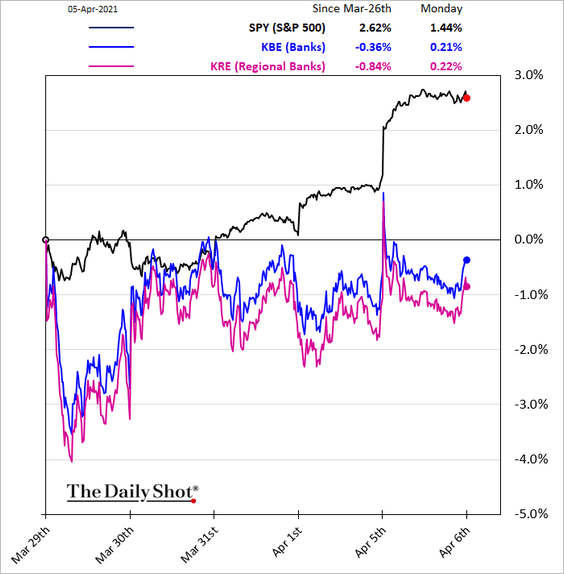

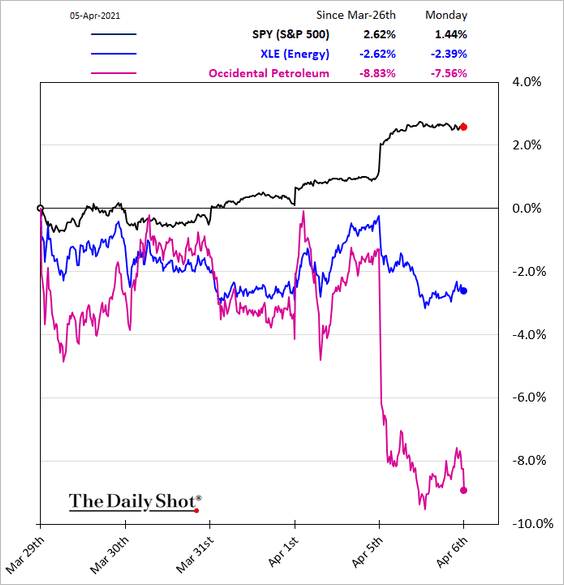

2. Next, we have some sector performance charts.

• Tech and semicondutors:

• Communication Services:

• Consumer Discretionary:

• Healthcare:

• Banks:

• Energy:

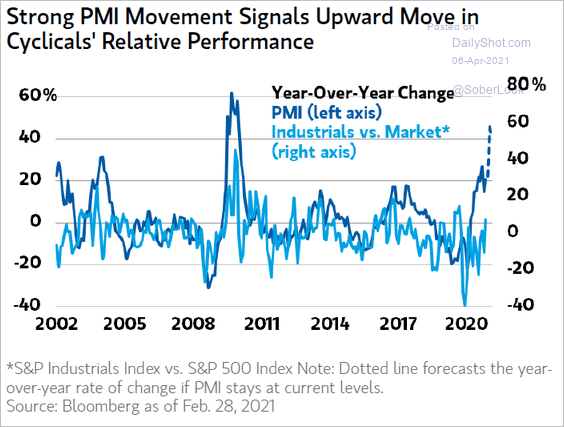

Strong PMI indicators point to further outperformance for industrials.

Source: @ISABELNET_SA, @MorganStanley

Source: @ISABELNET_SA, @MorganStanley

——————–

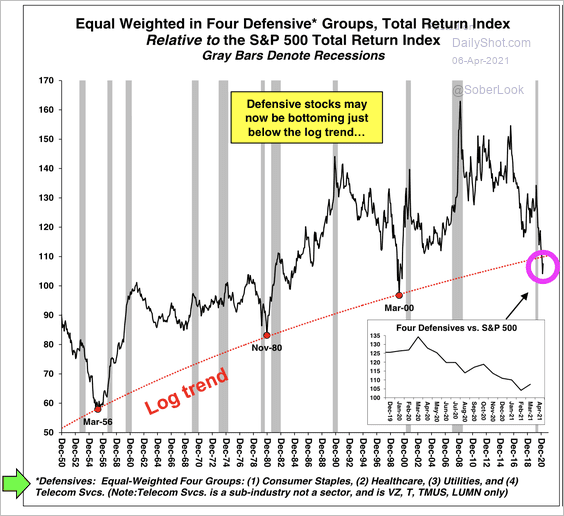

3. On an equal-weighted basis, S&P 500 defensive stocks have significantly underperformed the broader market over the past decade.

Source: Stifel

Source: Stifel

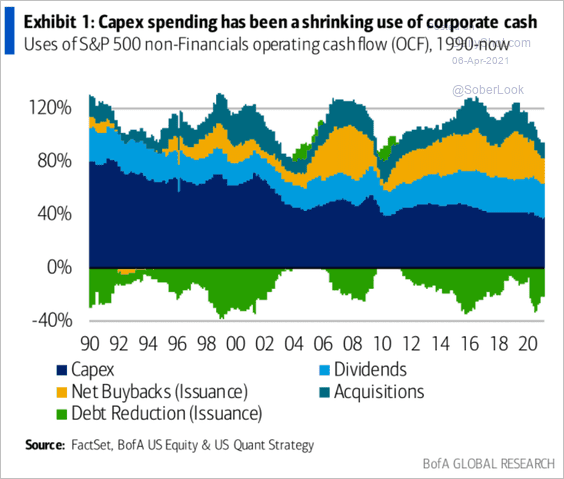

4. Capital expenditures have been a shrinking use of US corporate cash over the past 30 years.

Source: BofA Global Research

Source: BofA Global Research

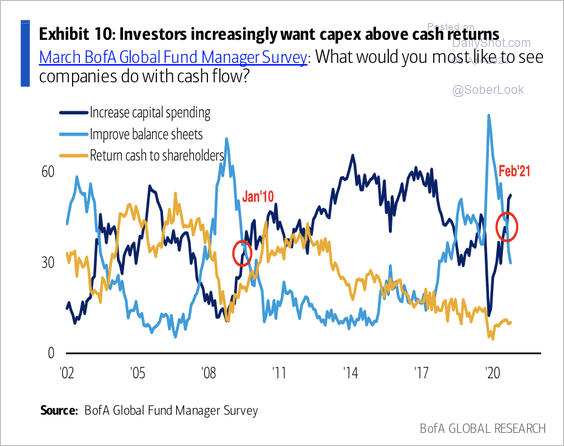

Investors want companies to increase CapEx, according to a BofA survey.

Source: BofA Global Research

Source: BofA Global Research

——————–

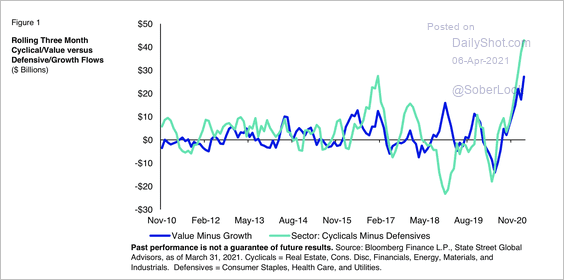

5. Flows into cyclical ETFs continue to rise relative to defensive ETFs.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

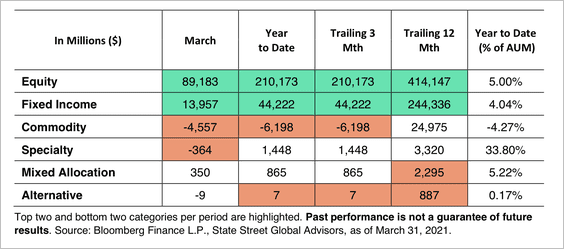

Equity ETF flows remain strong this year (in contrast to commodity ETFs).

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

——————–

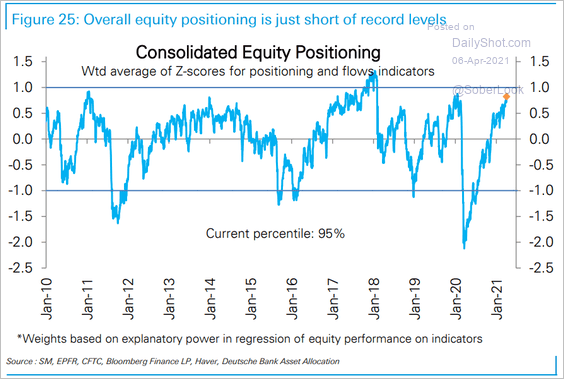

6. Equity positioning is approaching extreme levels.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

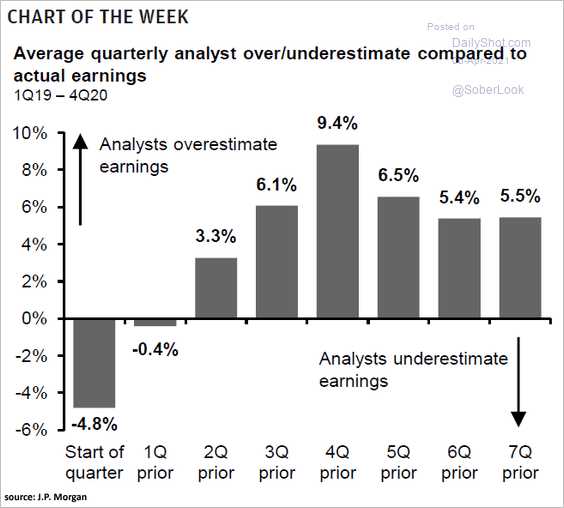

7. Analysts’ longer-term projections tend to overestimate corporate earnings.

Source: @ISABELNET_SA, @JPMorganAM

Source: @ISABELNET_SA, @JPMorganAM

8. “Artificial” share price gains become real for GameStop.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Credit

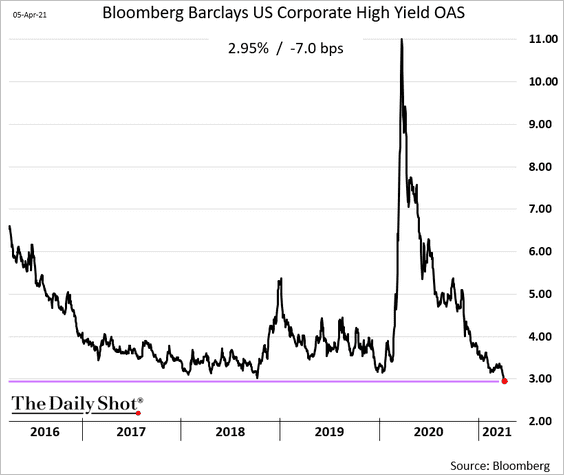

1. US high-yield spreads hit a multi-year low.

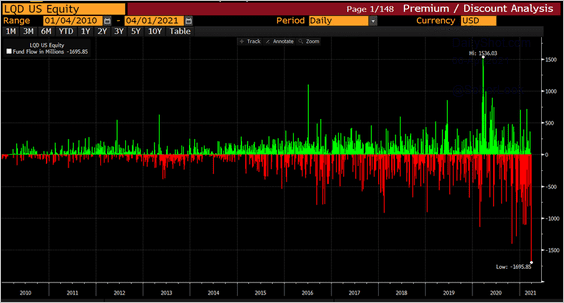

2. The largest investment-grade ETF saw substantial outflows last week.

Source: @lisaabramowicz1

Source: @lisaabramowicz1

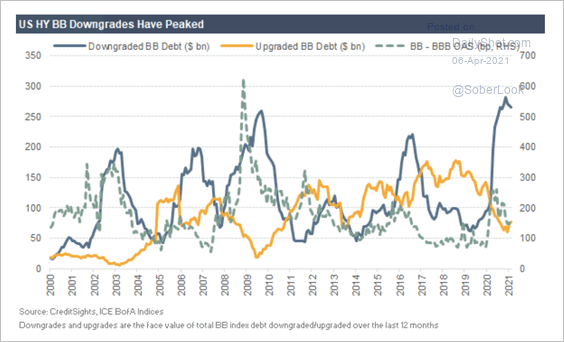

3. The record number of US BB-rated high-yield downgrades appears to have peaked.

Source: CreditSights

Source: CreditSights

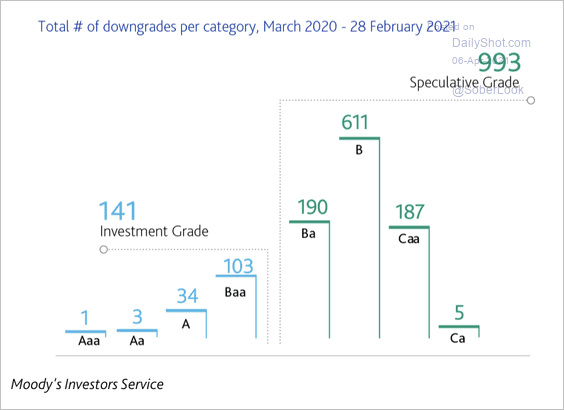

The majority of global corporate downgrades over the past year were in speculative-grade debt.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

——————–

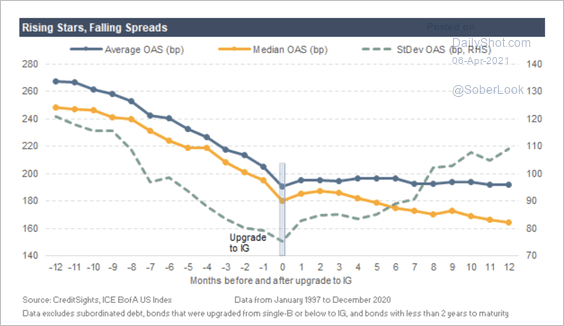

4. Spreads tend to tighten significantly during the year before a downgrade.

Source: CreditSights

Source: CreditSights

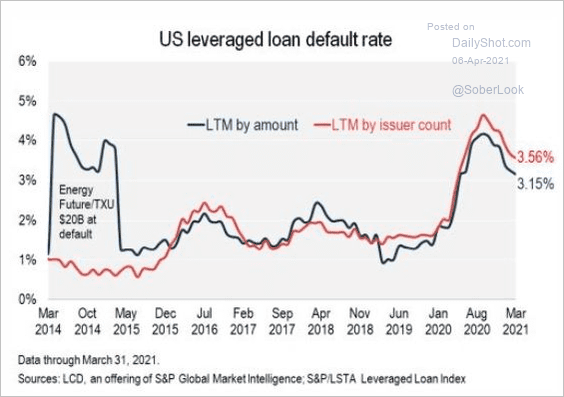

5. Leveraged loan defaults have peaked.

Source: @lcdnews, @Kakourisr Read full article

Source: @lcdnews, @Kakourisr Read full article

Back to Index

Global Developments

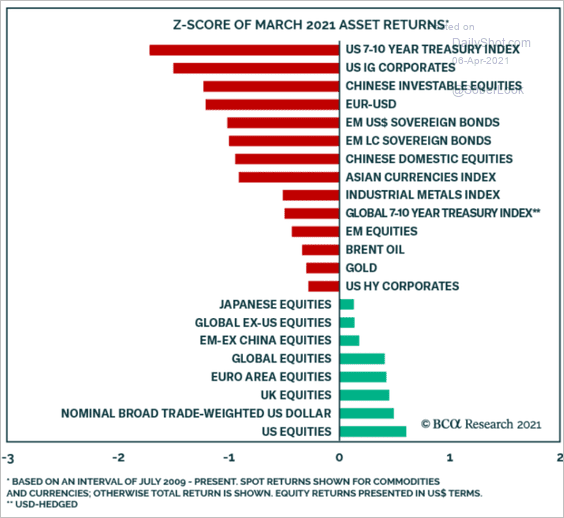

1. Here is a look at last month’s asset class returns in terms of z-scores (number of standard deviations).

Source: BCA Research

Source: BCA Research

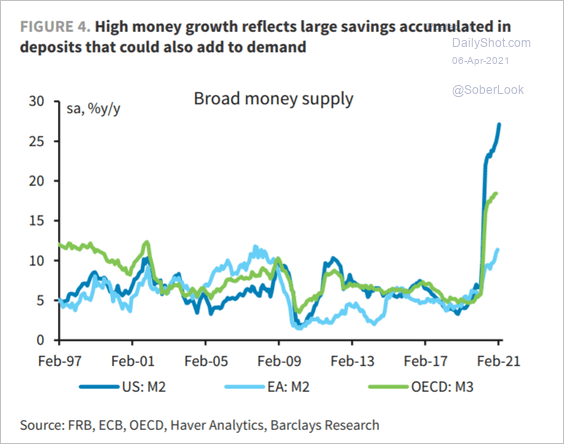

2. The spike in money supply was a global phenomenon.

Source: Barclays Research

Source: Barclays Research

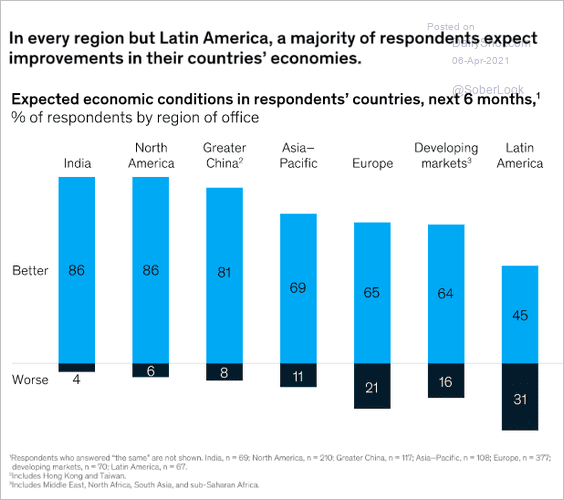

3. Business surveys point to economic optimism.

Source: McKinsey Global Survey Read full article

Source: McKinsey Global Survey Read full article

——————–

Food for Thought

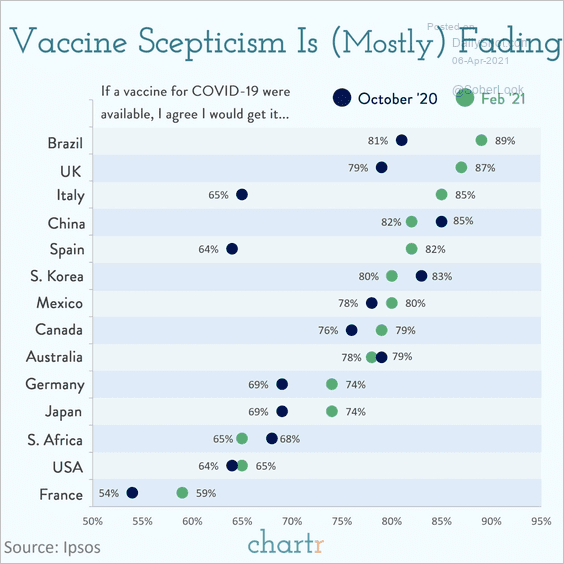

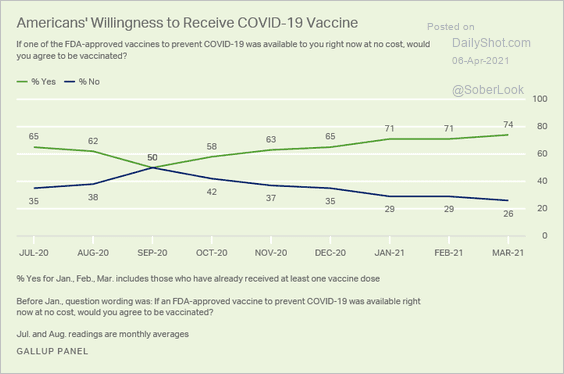

1. Fading vaccine skepticism:

Source: @chartrdaily

Source: @chartrdaily

Source: Gallup Read full article

Source: Gallup Read full article

——————–

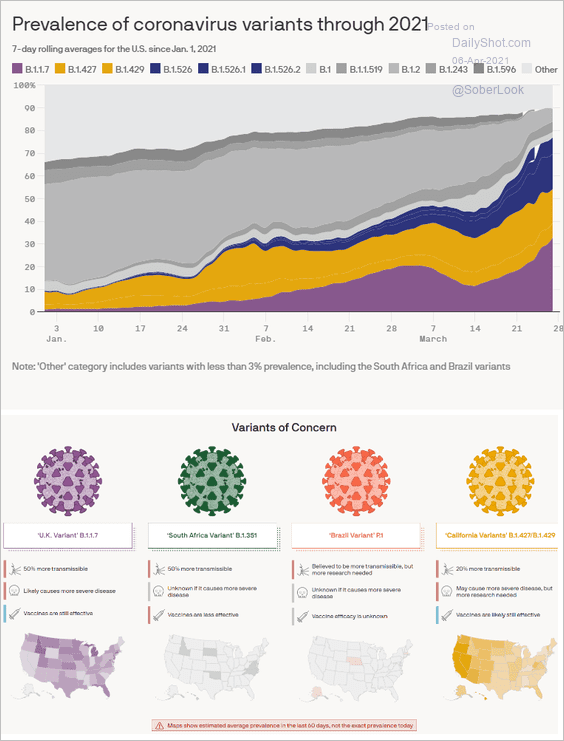

2. Data on coronavirus variants:

Source: @axios Read full article

Source: @axios Read full article

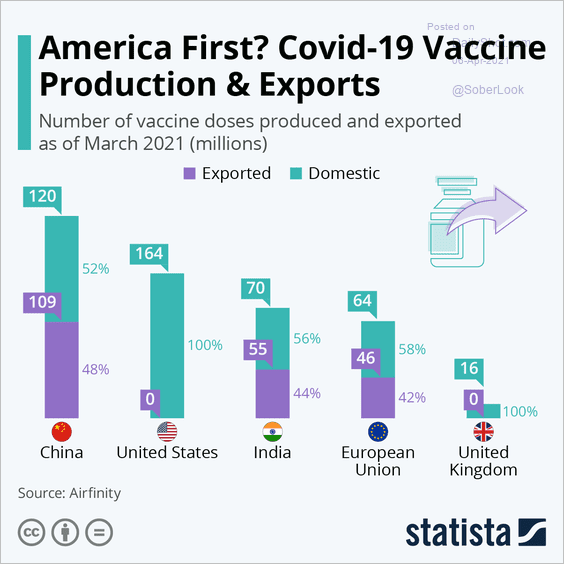

3. Vaccine exports:

Source: Statista

Source: Statista

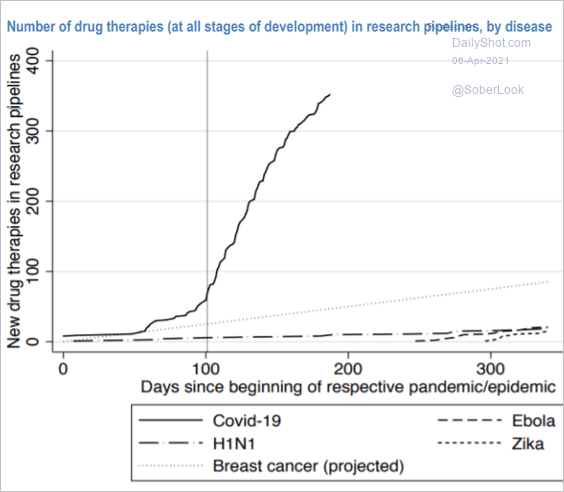

4. The number of drug therapies in research pipelines:

Source: OECD Read full article

Source: OECD Read full article

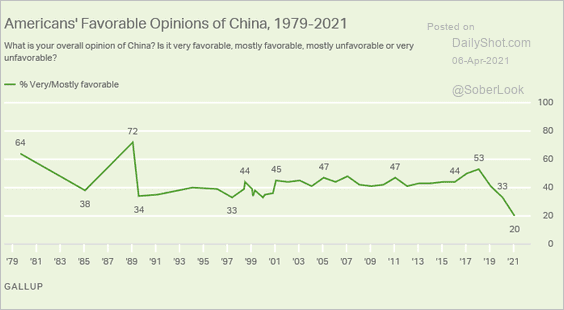

5. US views on China:

Source: Gallup Read full article

Source: Gallup Read full article

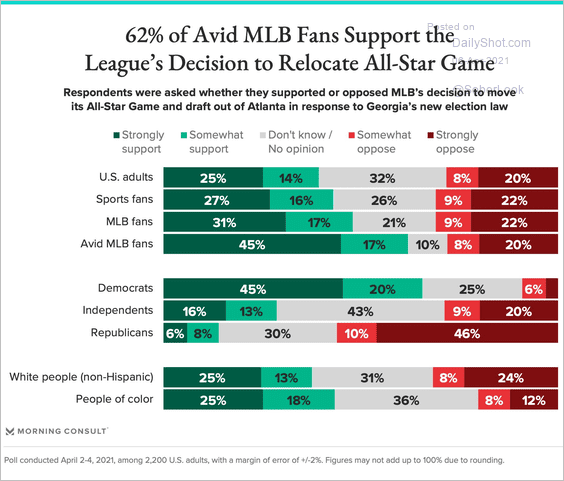

6. Views on MLB’s decision to relocate the All-Star game:

Source: @MorningConsult, @AlexMSilverman Read full article

Source: @MorningConsult, @AlexMSilverman Read full article

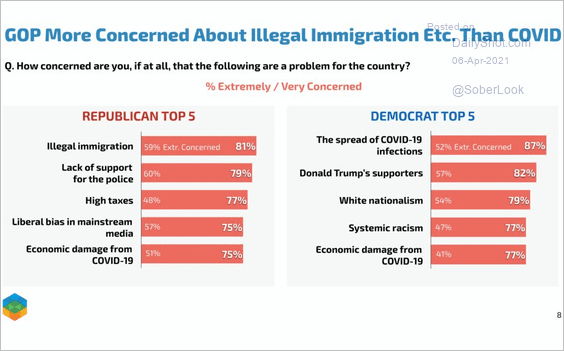

7. Top concerns by party affiliation:

Source: @EchelonInsights Read full article

Source: @EchelonInsights Read full article

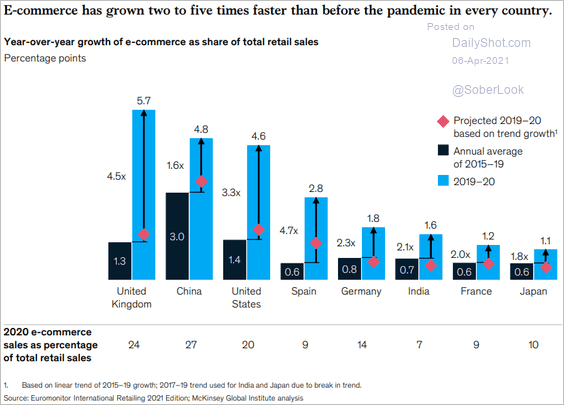

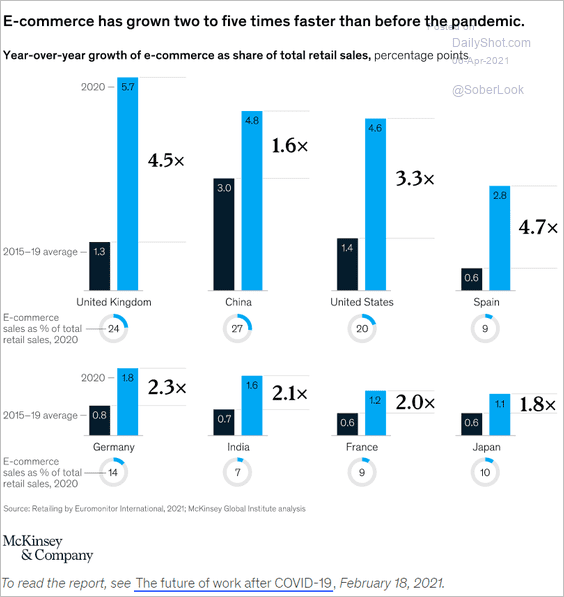

8. E-commerce growth:

Source: McKinsey Read full article

Source: McKinsey Read full article

Source: McKinsey & Company Read full article

Source: McKinsey & Company Read full article

——————–

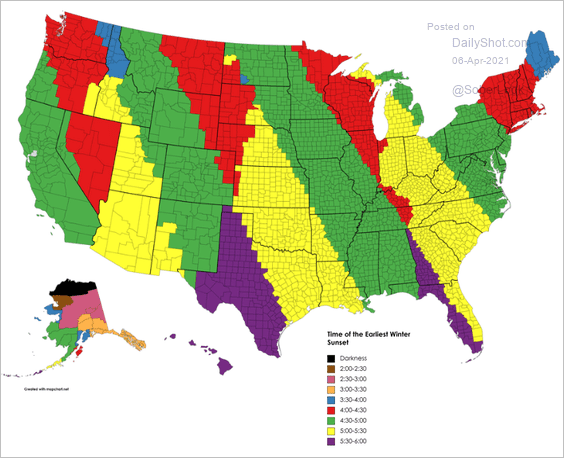

9. The time of the earliest winter sunset in each county in the US:

Source: r/dataisbeautiful

Source: r/dataisbeautiful

——————–

Back to Index