The Daily Shot: 09-Apr-21

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

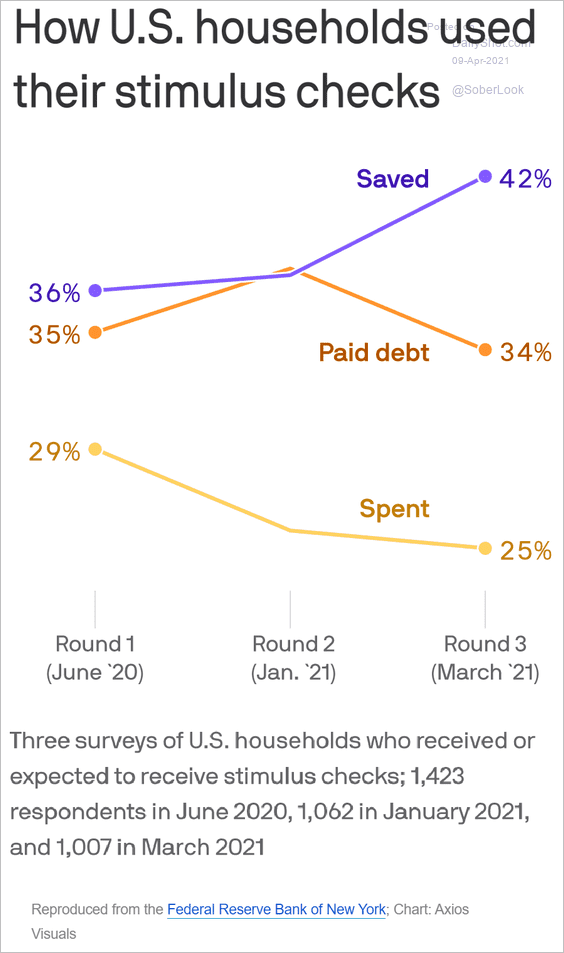

1. Americans are saving/investing more of their stimulus cash.

Source: @axios Read full article

Source: @axios Read full article

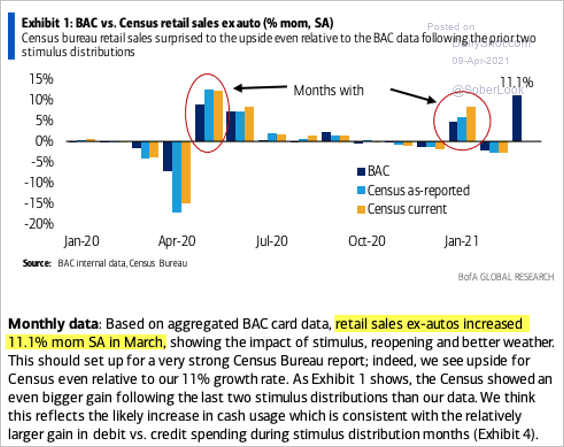

Nonetheless, Bank of America is predicting an 11% jump in retail sales for March.

Source: BofA Global Research, @LONGCONVEXITY

Source: BofA Global Research, @LONGCONVEXITY

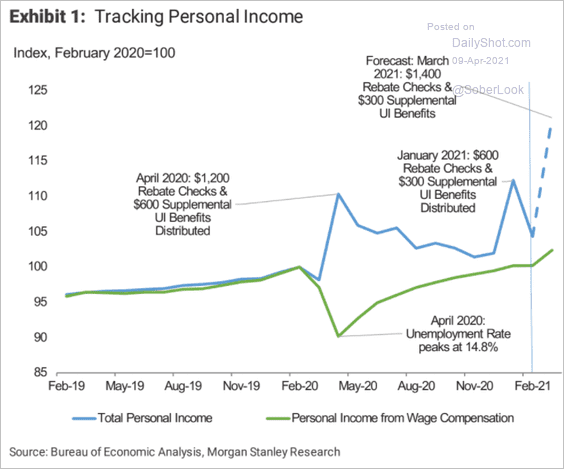

And here is a forecast for personal incomes from Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

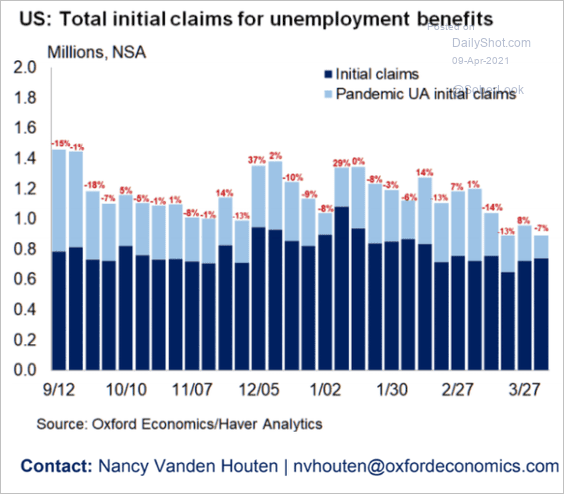

2. Initial unemployment claims continue to drift lower and are now below one million per week.

Source: Oxford Economics

Source: Oxford Economics

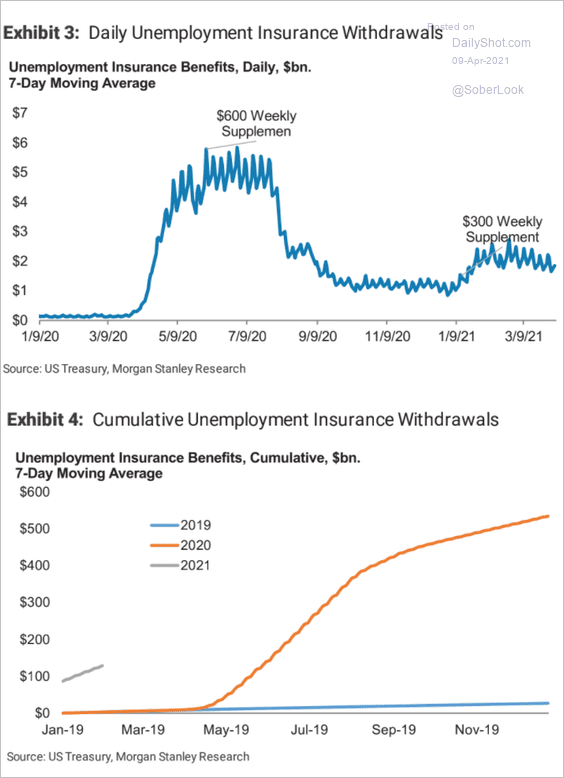

The following two charts show US unemployment insurance withdrawals over time.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

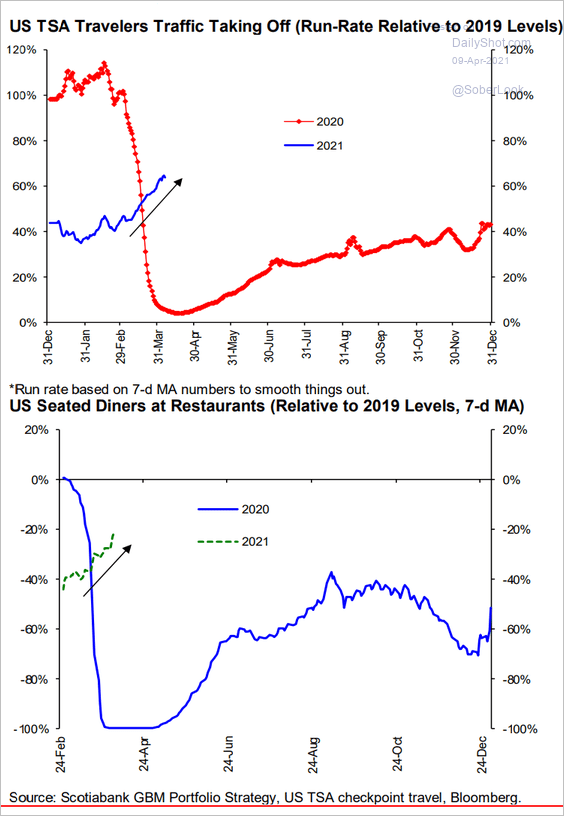

3. High-frequency indicators continue to show rapid improvement.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

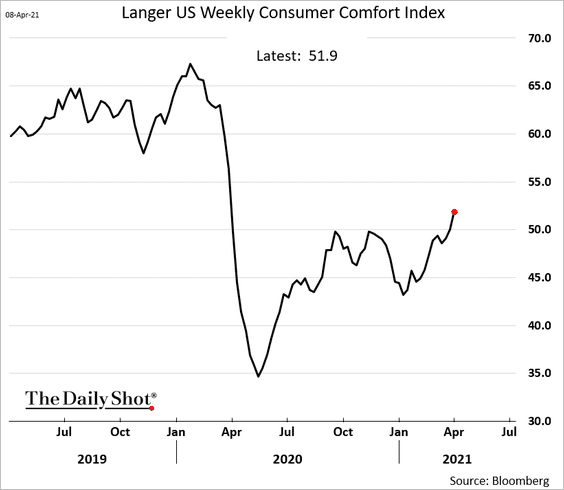

Consumer confidence is recovering.

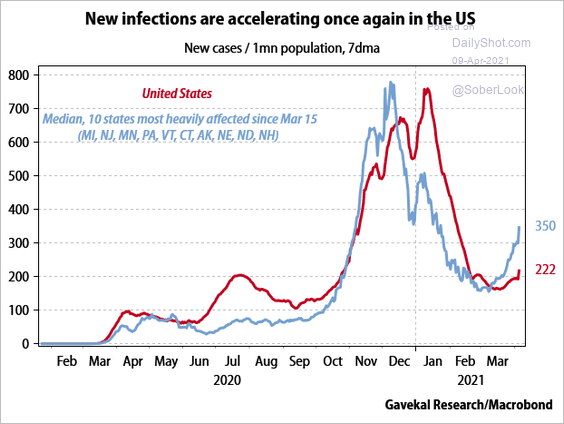

But new infections are rising again.

Source: Gavekal Research

Source: Gavekal Research

——————–

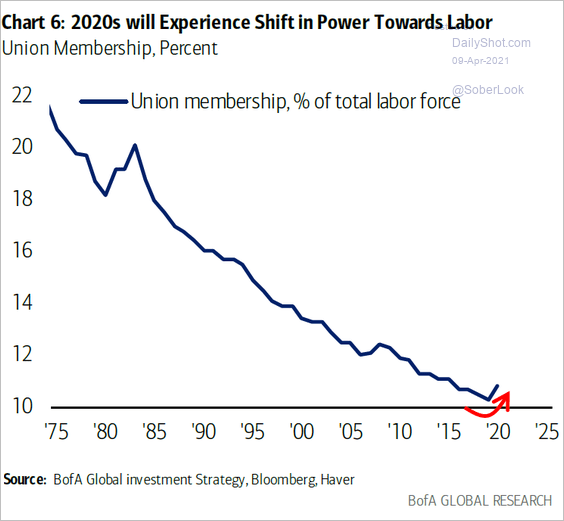

4. Returning to the topic of wage inflation (here), will we see a shift in power toward labor?

Source: BofA Global Research

Source: BofA Global Research

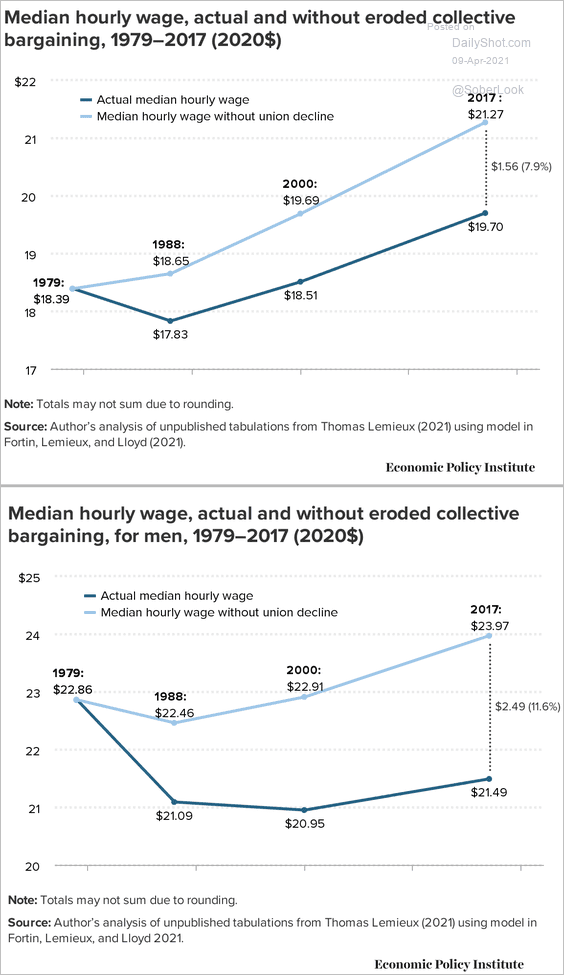

Increased collective bargaining could boost wage growth substantially.

Source: EPI Read full article

Source: EPI Read full article

——————–

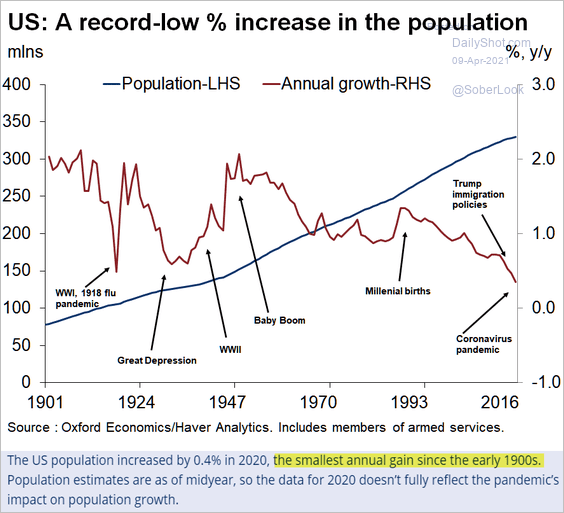

5. US population growth hit a record low.

Source: Oxford Economics

Source: Oxford Economics

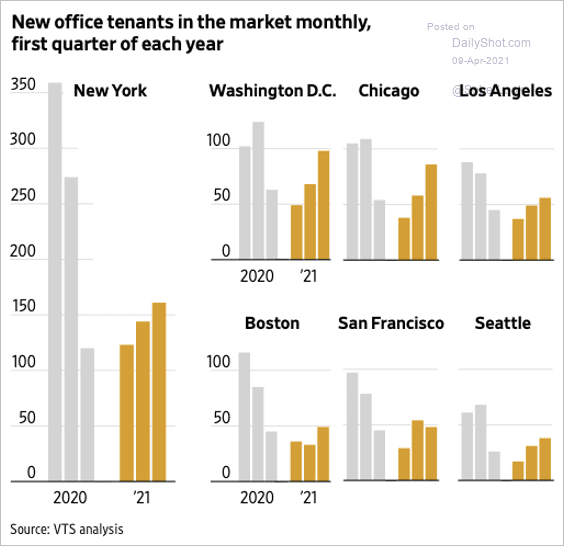

6. Office leases are rebounding, driven by bargain rates.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJGraphics Read full article

Source: @WSJGraphics Read full article

——————–

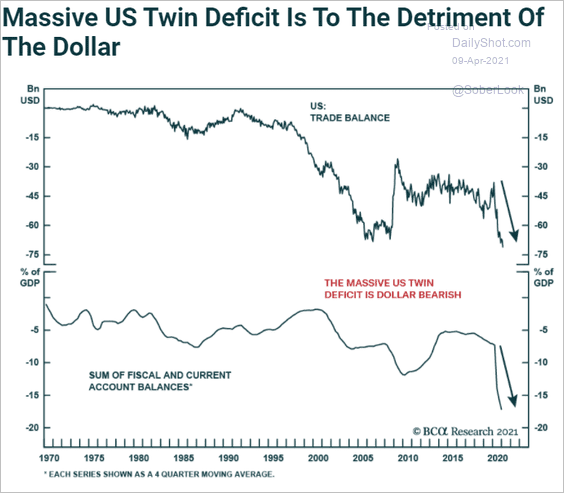

7. Will the massive US twin deficit put downward pressure on the dollar?

Source: BCA Research

Source: BCA Research

Back to Index

The United Kingdom

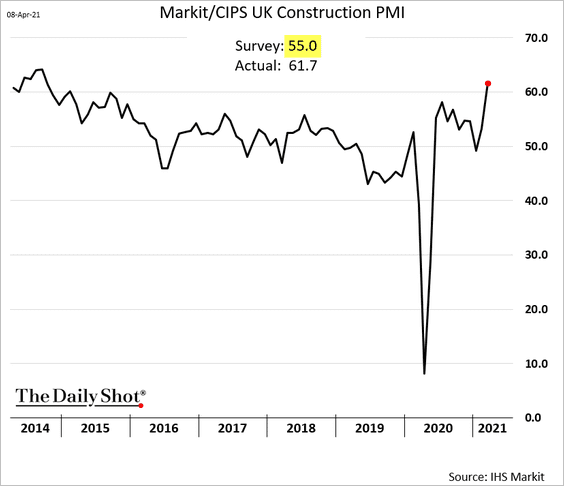

1. Construction activity surged last month.

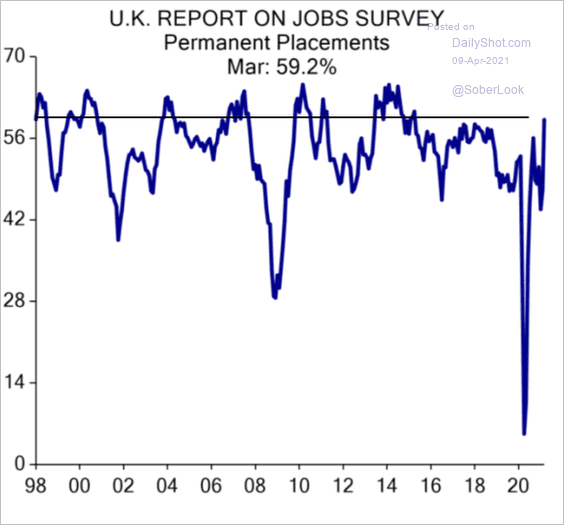

2. The nation’s labor market is recovering quickly.

Source: Evercore ISI

Source: Evercore ISI

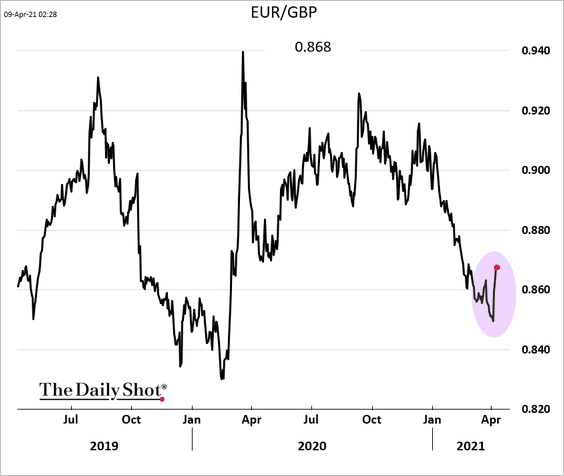

3. Is the vaccine euphoria over? The pound softened vs. the euro.

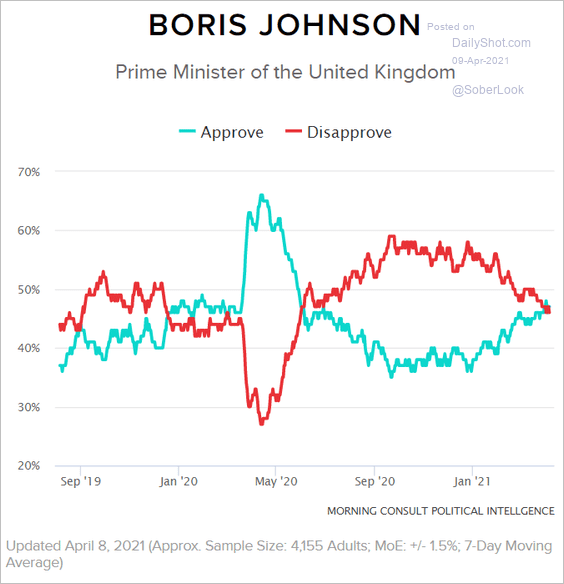

4. Here is the prime minister’s approval rating.

Source: Morning Consult

Source: Morning Consult

Back to Index

The Eurozone

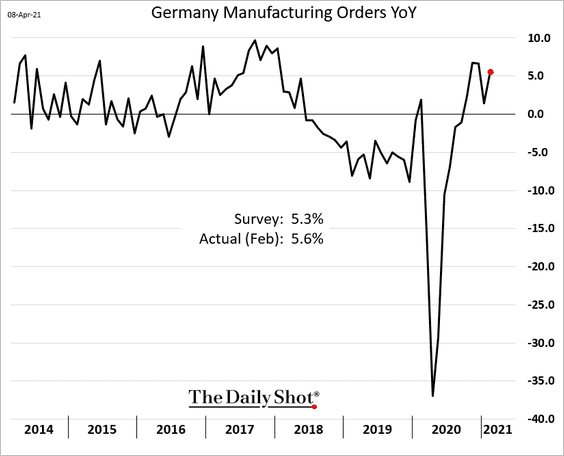

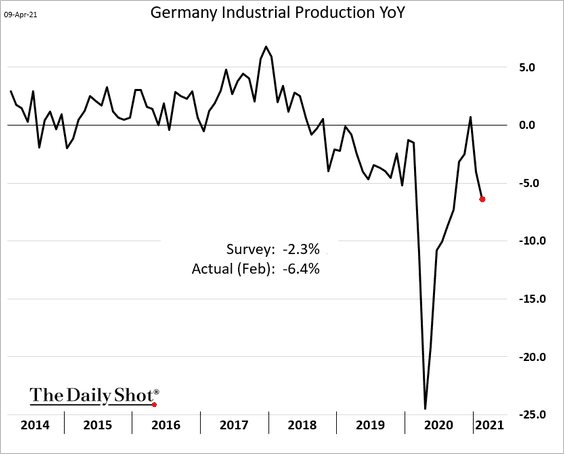

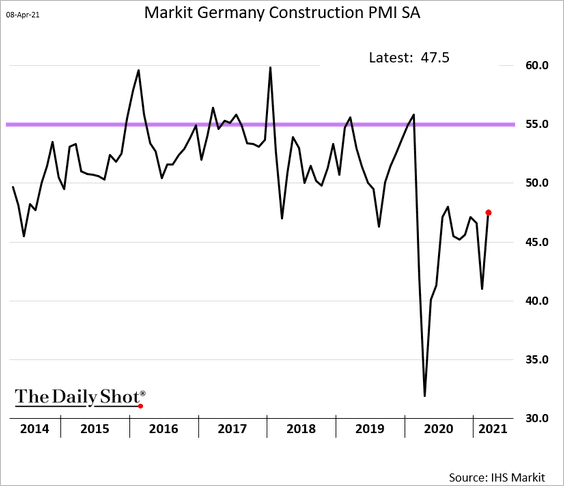

1. Let’s begin with Germany.

• Factory orders strengthened in February.

But the industrial production report was terrible – well below consensus.

• Construction activity remains soft.

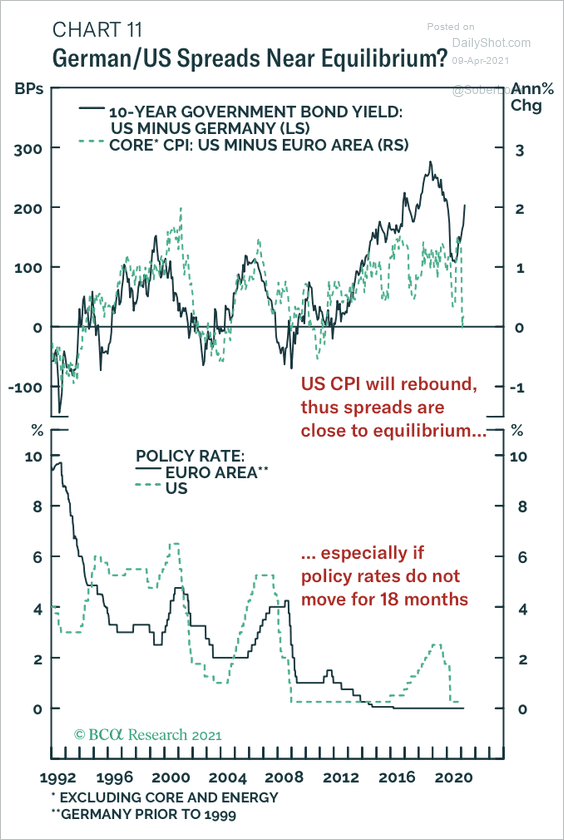

• Have US yields reached a temporary equilibrium relative to German yields?

Source: BCA Research

Source: BCA Research

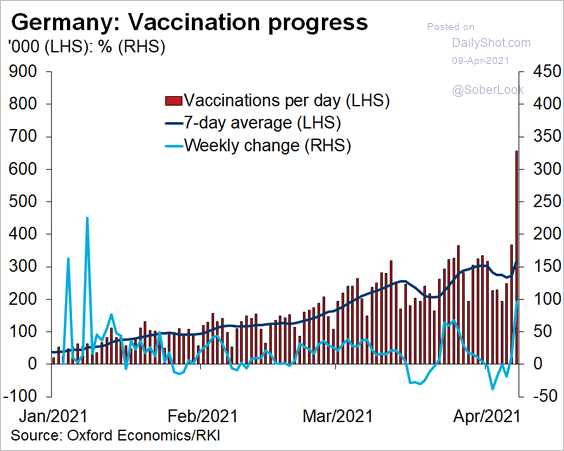

• Vaccinations are gaining momentum.

Source: @OliverRakau

Source: @OliverRakau

——————–

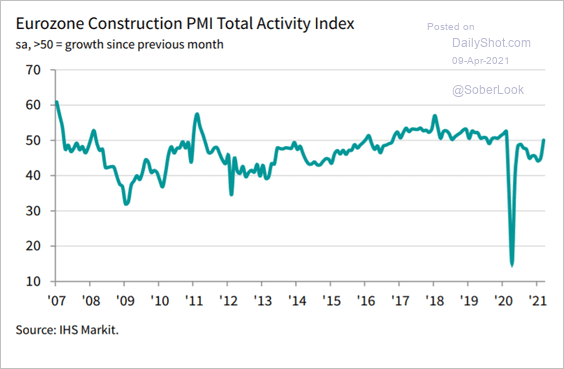

2. Construction activity at the Eurozone level has stabilized.

Source: IHS Markit

Source: IHS Markit

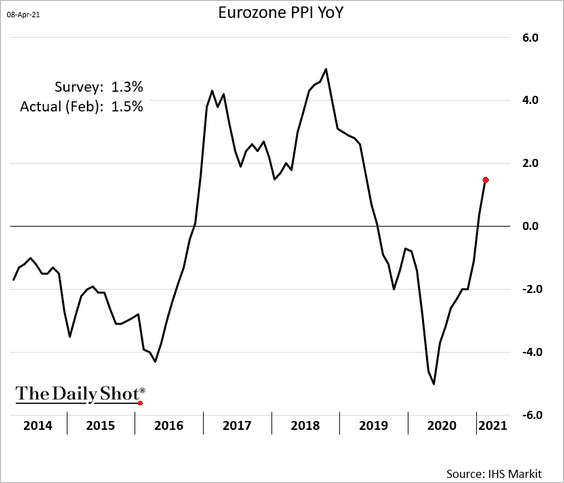

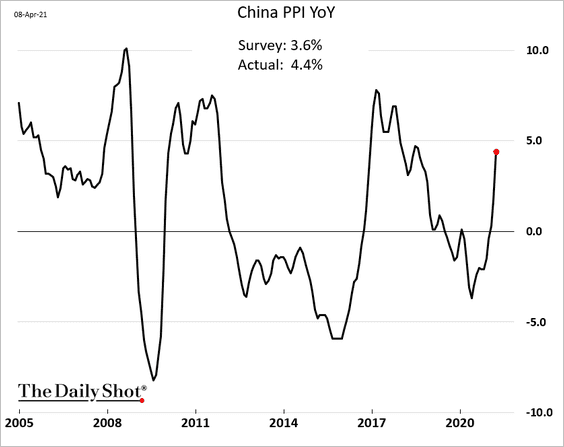

3. Eurozone’s producer price gains are accelerating. A similar PPI pattern appears throughout the world (see the China section).

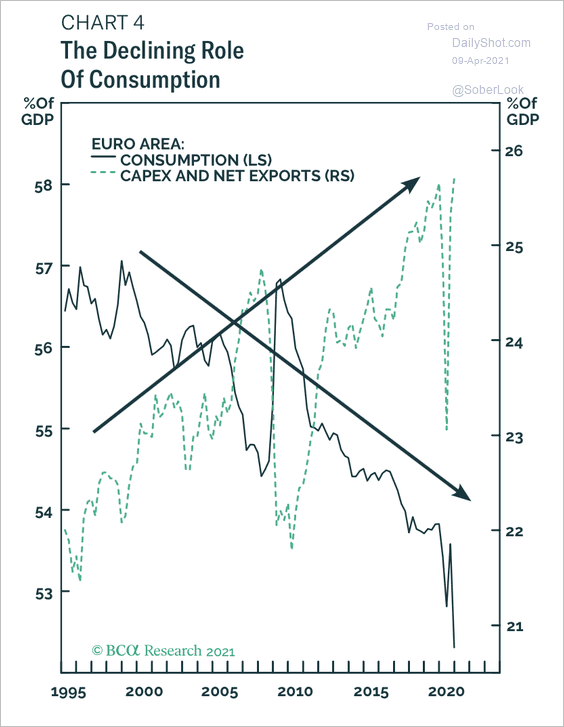

4. Over the past 11 years, consumption has accounted for a lower share of GDP while capital expenditures and exports have risen.

Source: BCA Research

Source: BCA Research

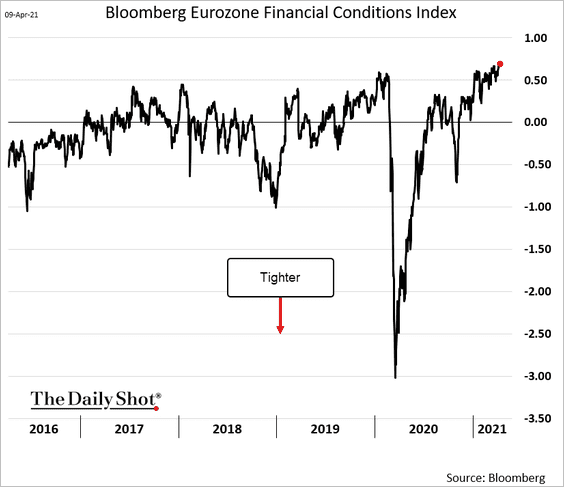

5. Euro-area financial conditions are the most accommodative in years.

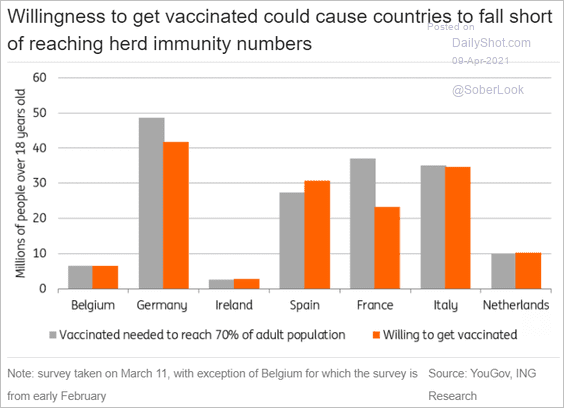

6. How willing is the population to get vaccinated?

Source: ING

Source: ING

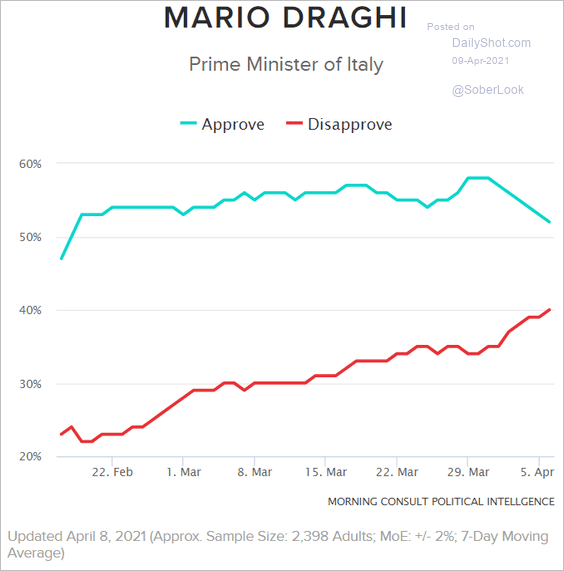

7. This chart shows Mario Draghi’s approval rating.

Source: Morning Consult

Source: Morning Consult

Back to Index

Europe

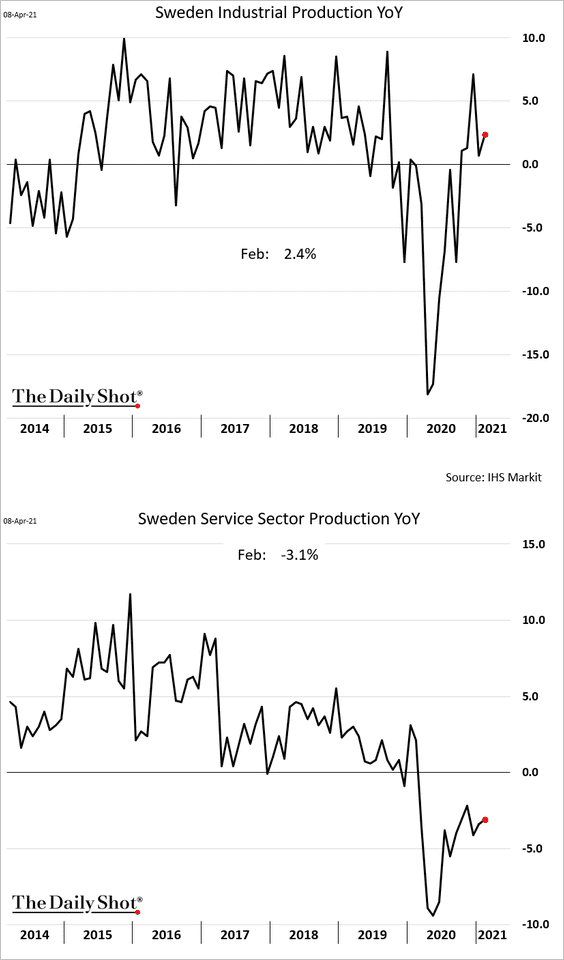

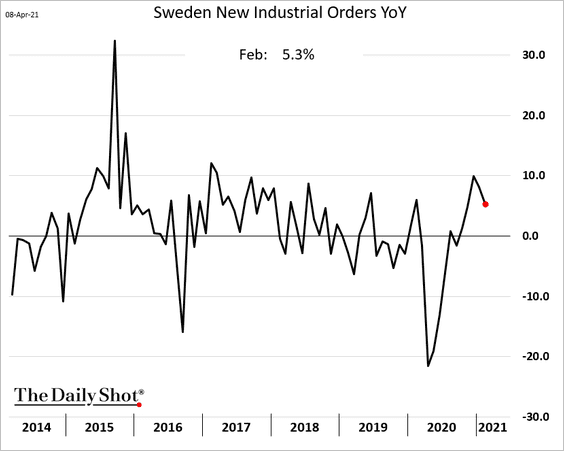

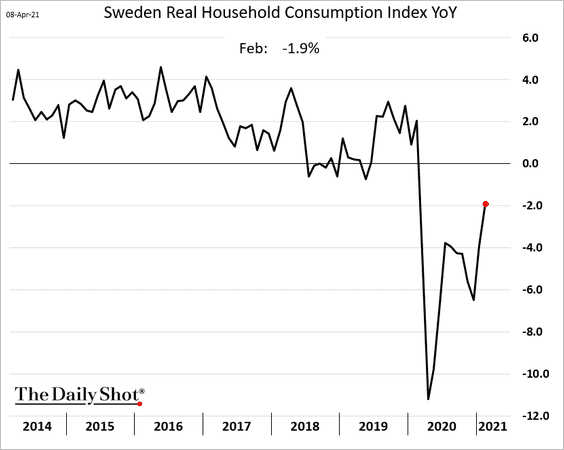

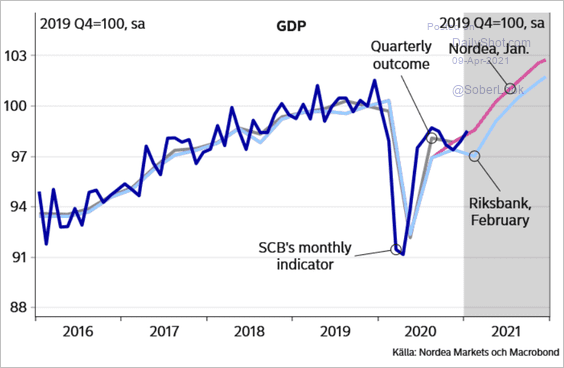

1. Let’s begin with Sweden.

• Business output improved in February, but services continue to lag.

Industrial orders remain robust.

• Household consumption is rebounding.

• Here is the GDP forecast from Nordea Markets.

Source: Nordea Markets

Source: Nordea Markets

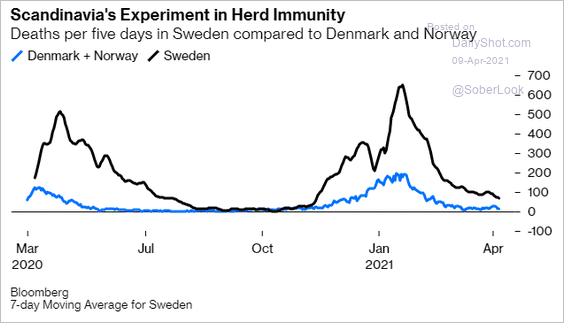

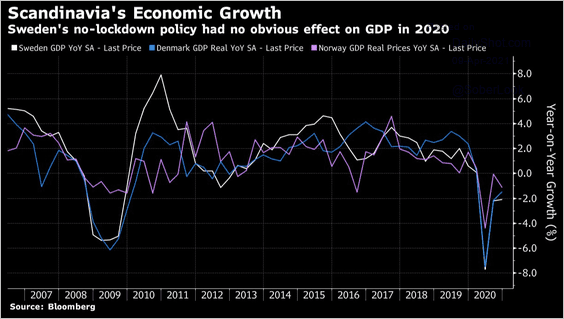

• Was avoiding strict lockdowns worth it for Sweden?

– Deaths:

Source: @johnauthers Read full article

Source: @johnauthers Read full article

– GDP growth:

Source: @johnauthers Read full article

Source: @johnauthers Read full article

——————–

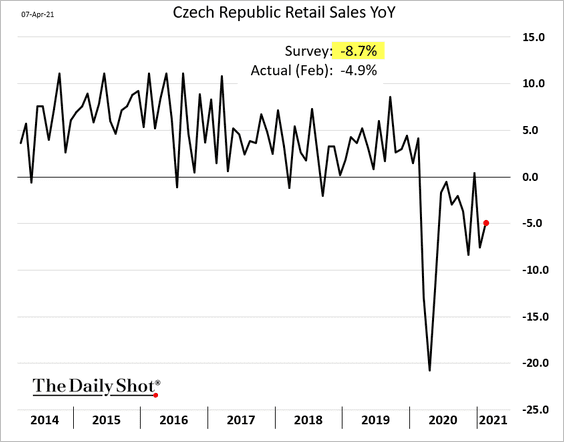

2. Czech retail sales were stronger than expected in February.

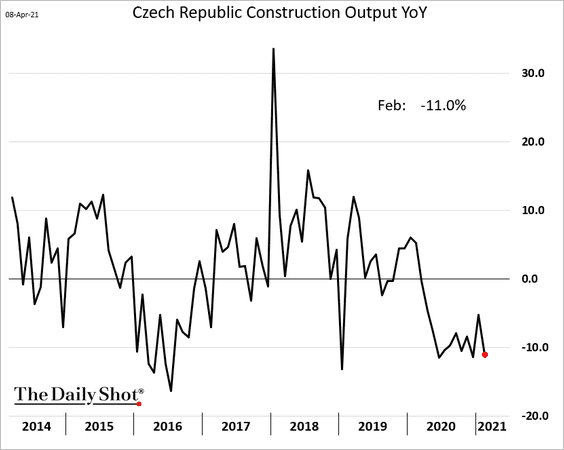

But construction output remained soft.

——————–

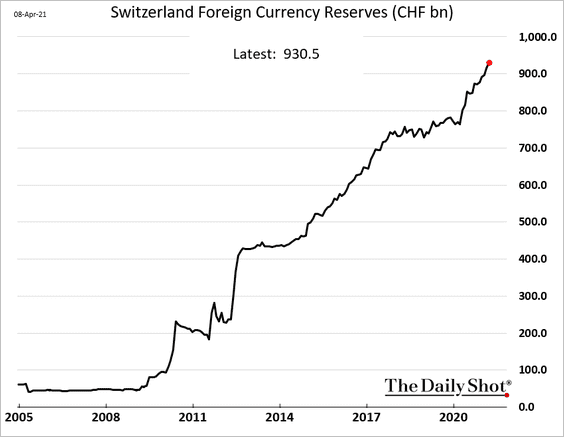

3. Swiss F/X reserves continue to climb (now well above the annual economic output).

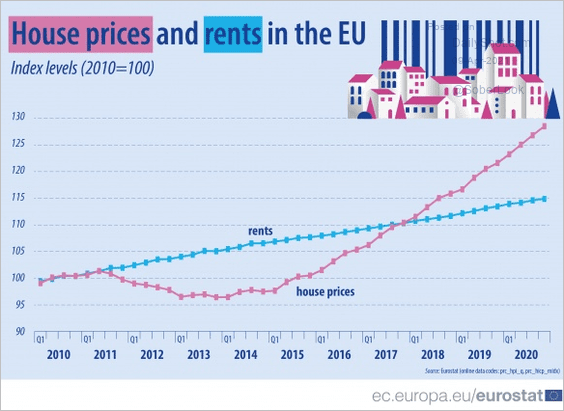

4. This chart shows home prices vs. rents in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

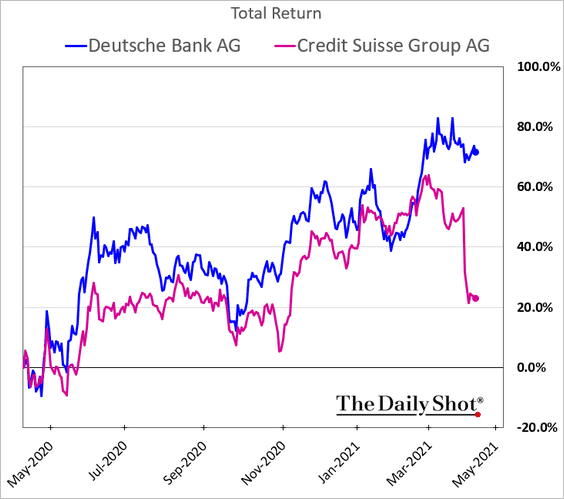

5. Here are the share prices of Deutsche Bank vs. Credit Suisse.

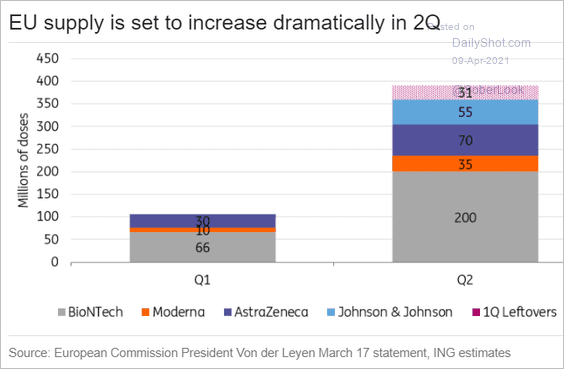

6. EU’s vaccine supply will increase dramatically this quarter.

Source: ING

Source: ING

Back to Index

Asia – Pacific

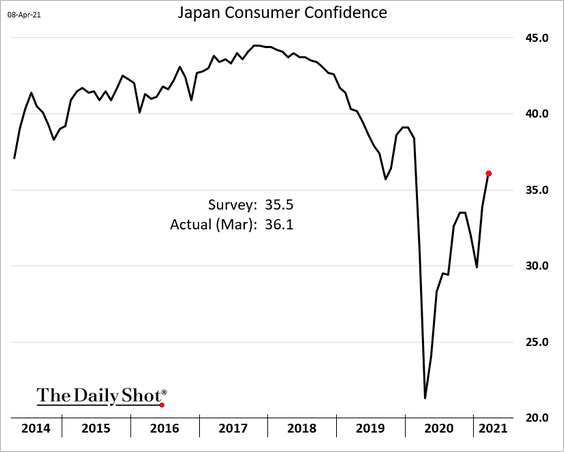

1. Japan’s consumer confidence is recovering.

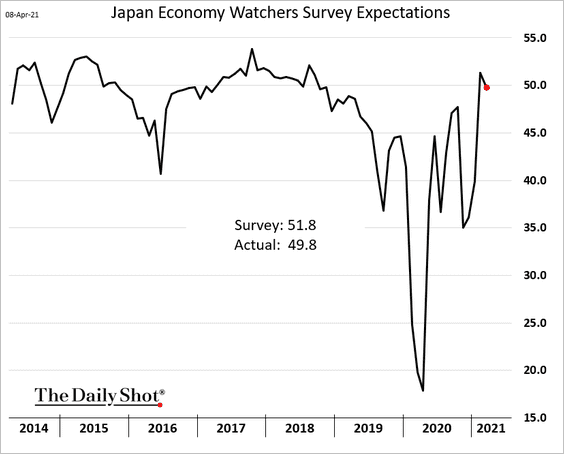

Here is the Economy Watchers Survey Expectations index.

——————–

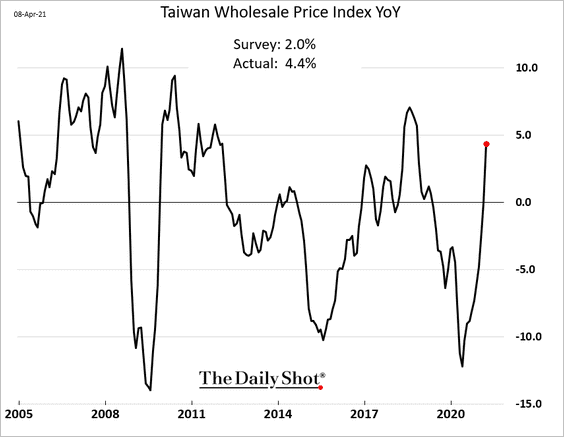

2. Taiwan’s wholesale prices are surging (once again, it’s a global trend).

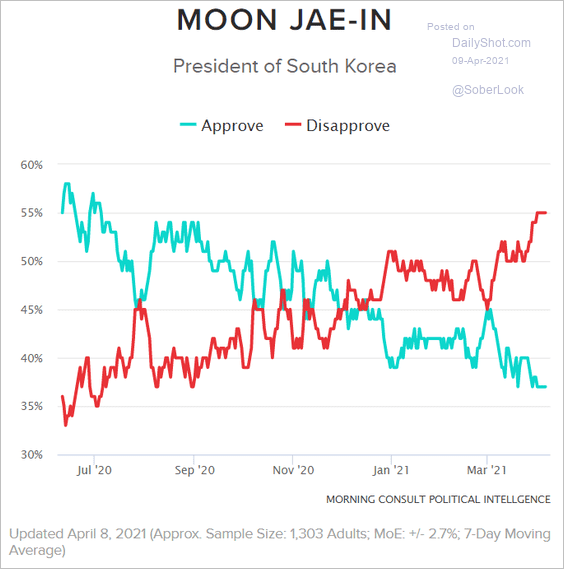

3. Here is Moon Jae-in’s approval rating.

Source: Morning Consult

Source: Morning Consult

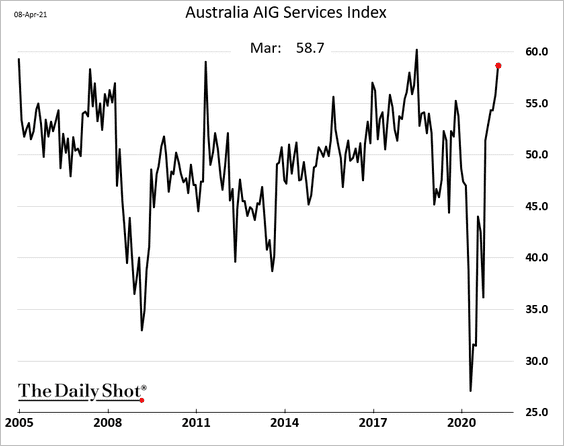

4. Australia’s service sector activity is surging.

Back to Index

China

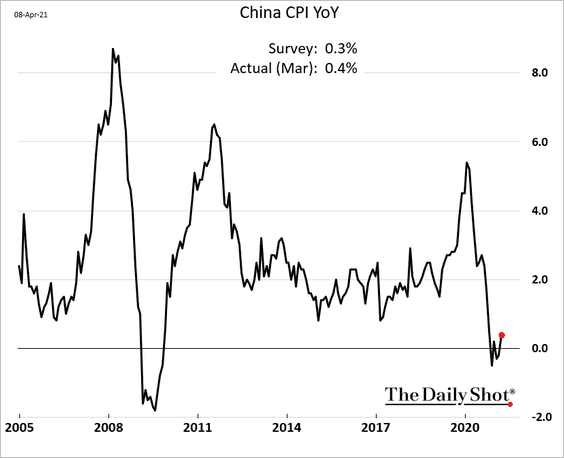

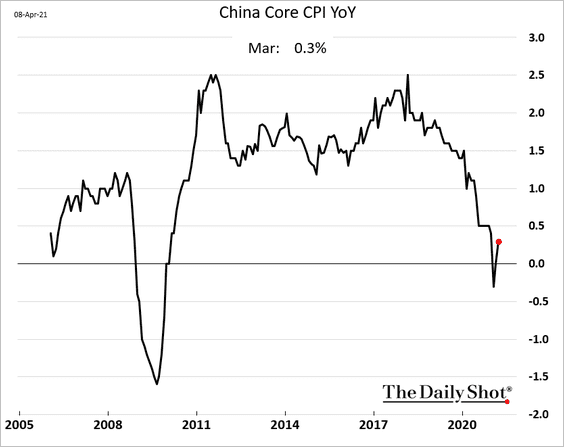

1. China’s CPI is back in positive territory.

——————–

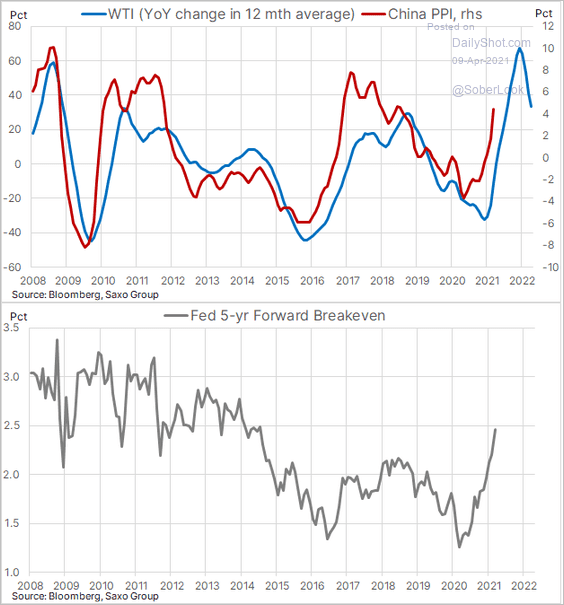

2. A bigger story, however, is China’s PPI, which surprised to the upside.

The above chart looks similar in many economies around the world, driven primarily by energy.

Source: @Ole_S_Hansen

Source: @Ole_S_Hansen

——————–

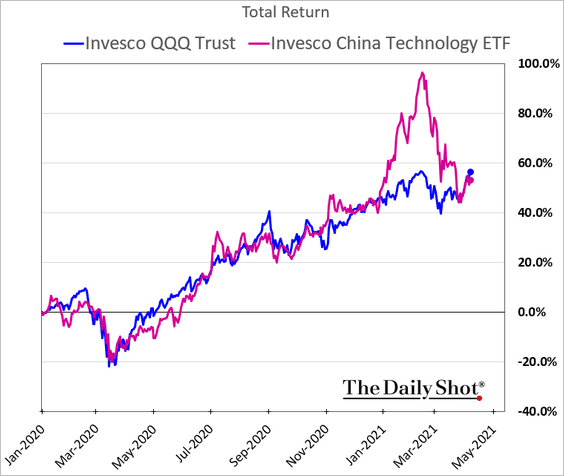

3. China’s tech firms have given up their outperformance vs. the Nasdaq 100 (in dollar terms).

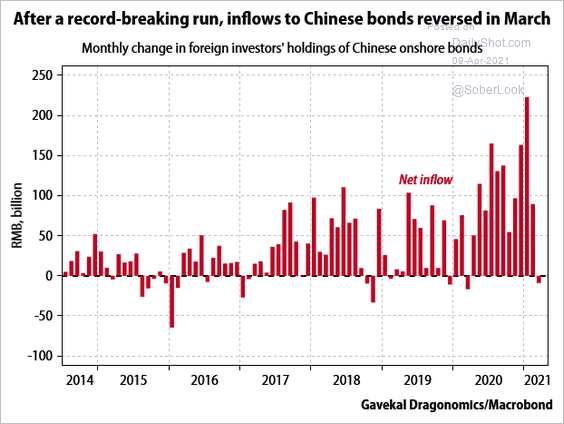

4. Bond inflows paused in March.

Source: Gavekal Research

Source: Gavekal Research

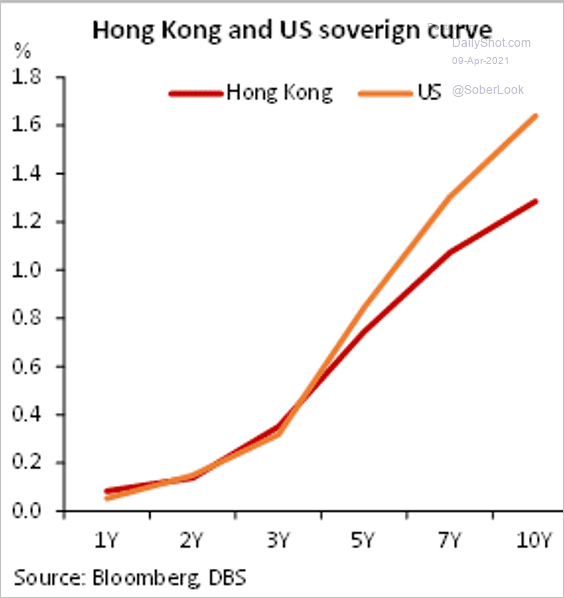

5. Will Hong Kong’s bond yields rise further to align more with the US?

Source: DBS

Source: DBS

Back to Index

Emerging Markets

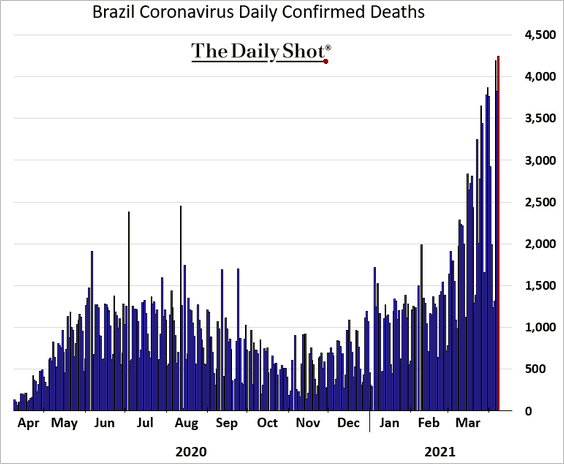

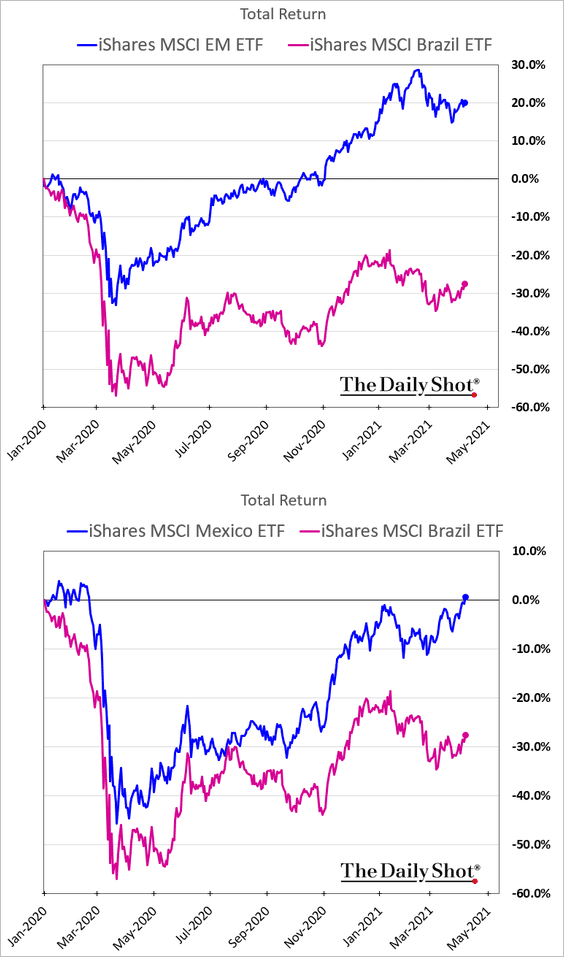

1. Brazil’s COVID-related deaths hit a record high.

Brazilian stocks have underperformed substantially since the start of 2020 (in dollar terms). Will the gap narrow going forward?

——————–

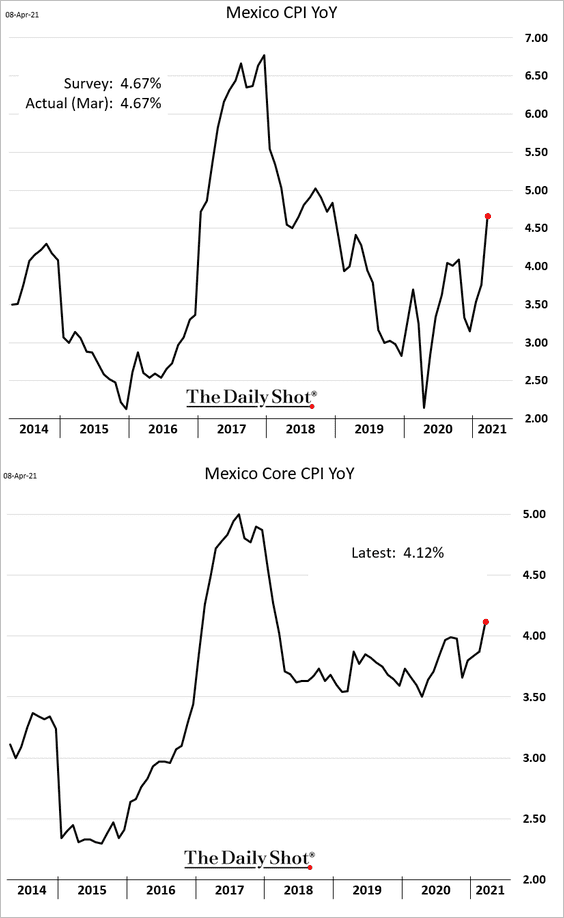

2. Mexico’s CPI is climbing.

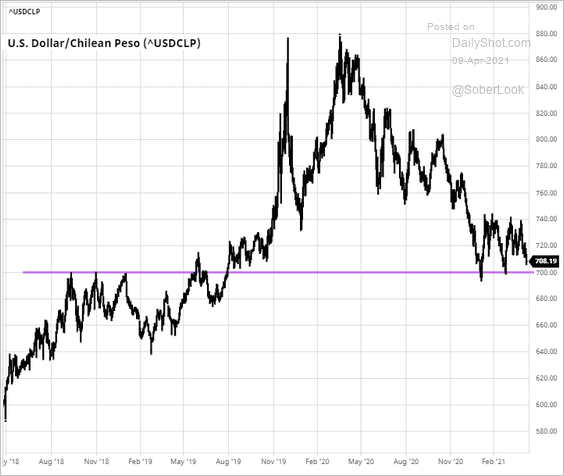

3. The Chilean peso is making another run at the 700 level.

Source: barchart.com

Source: barchart.com

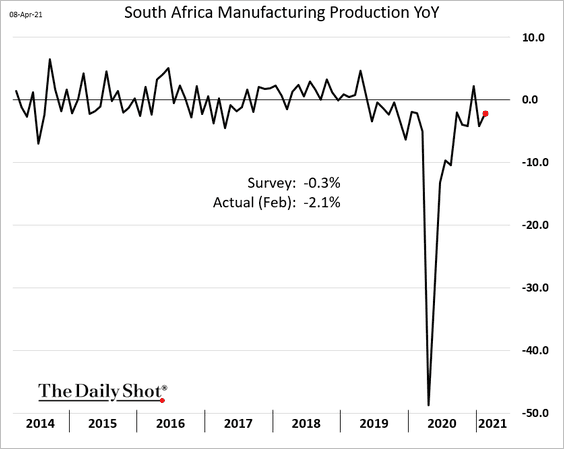

4. South Africa’s February industrial production was below expectations.

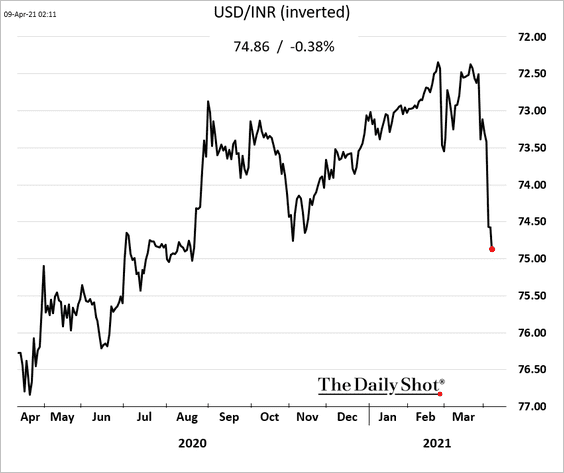

5. The Indian rupee continues to slump.

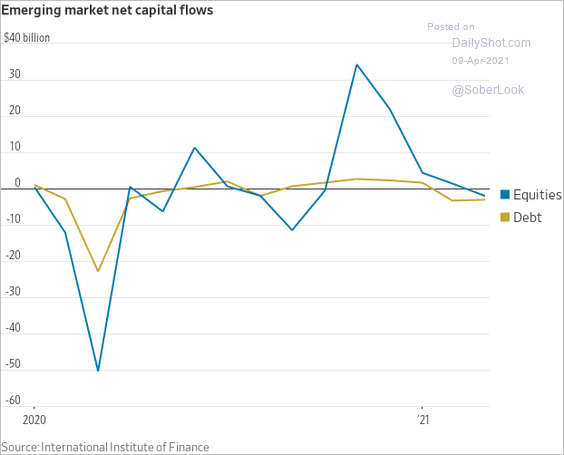

5. EM fund flows have turned negative.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Cryptocurrency

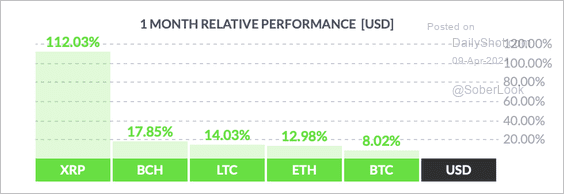

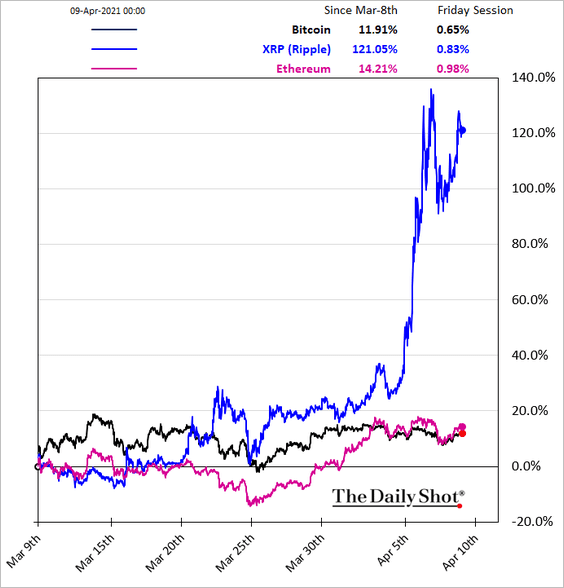

1. XRP has significantly outperformed large cryptocurrencies over the past month.

Source: FinViz

Source: FinViz

——————–

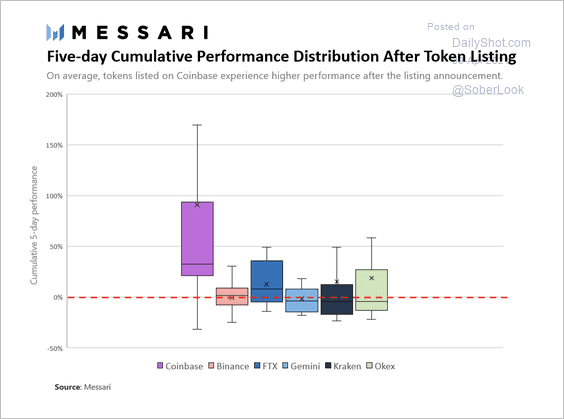

2. Cryptocurrencies tend to rise by an average of 91% within 5-days from being listed on Coinbase, more so than other crypto exchanges.

Source: Messari Read full article

Source: Messari Read full article

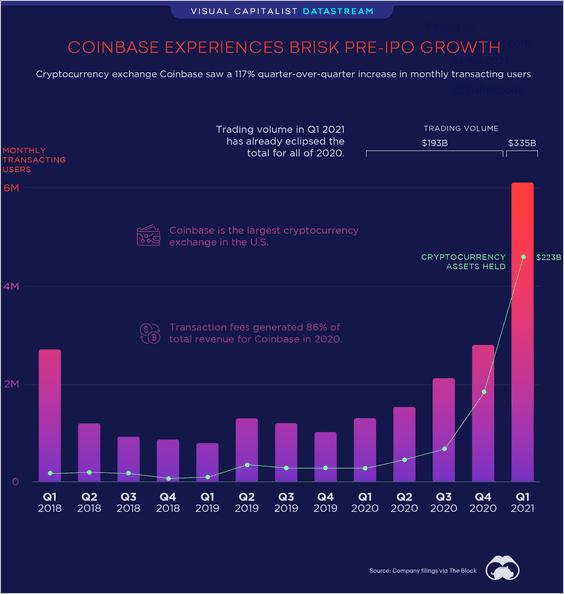

Coinbase’s growth has been impressive.

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

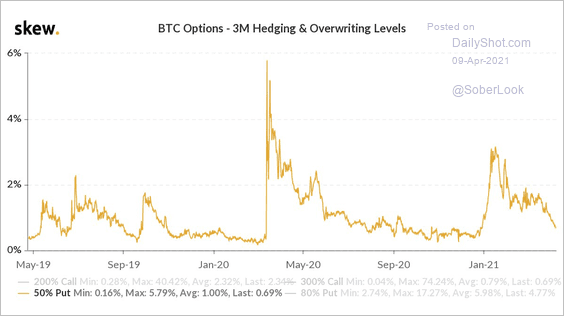

3. The cost of hedging against a bitcoin crash using options is collapsing.

Source: @skewdotcom

Source: @skewdotcom

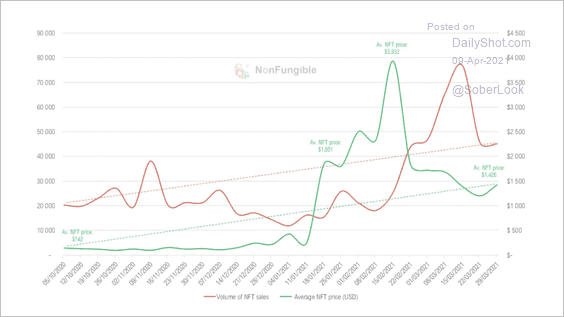

4. The average price of NFTs is falling after peaking at around $4,000 in mid-February.

Source: Nonfungible.com

Source: Nonfungible.com

Back to Index

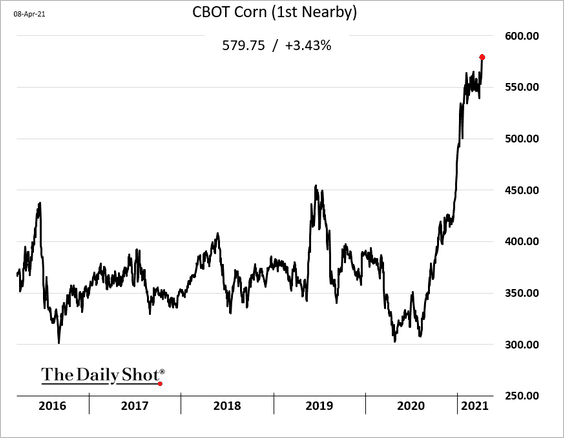

Commodities

1. US corn futures are surging.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

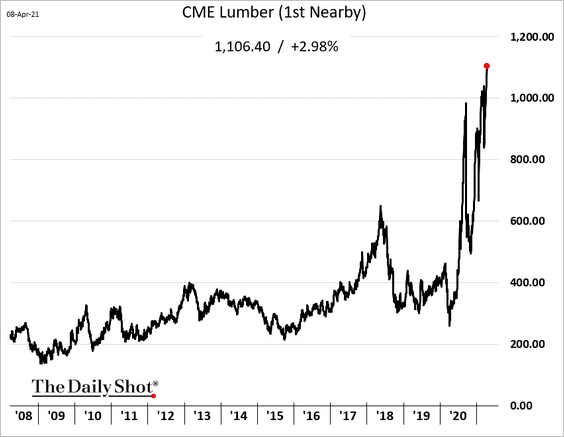

2. Chicago lumber futures continue to hit record highs.

Back to Index

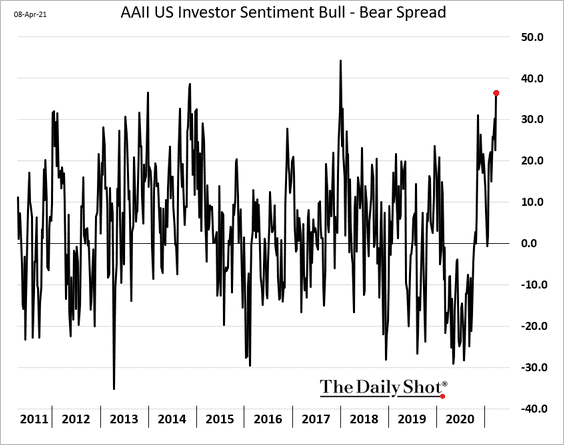

Equities

1. Sentiment is increasingly bullish as bears capitulate.

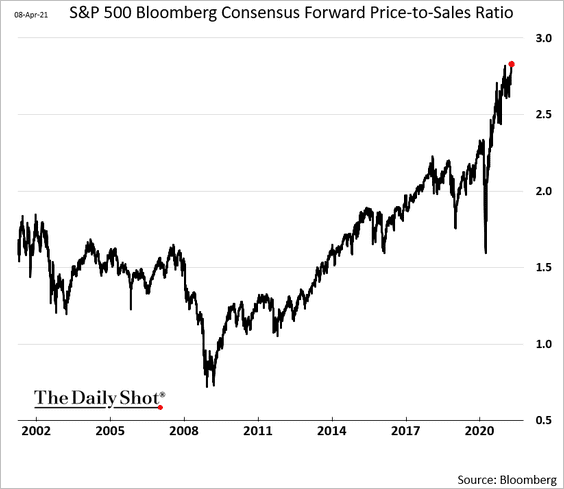

2. The S&P 500 forward price-to-sales ratio hit another post-dot-com high.

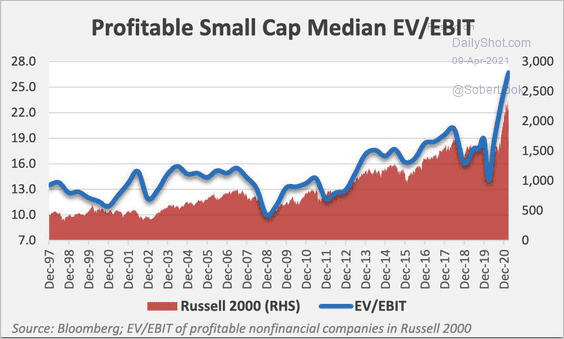

3. Valuations are extreme for the Russell 2000 companies that are profitable.

Source: @jessefelder Read full article

Source: @jessefelder Read full article

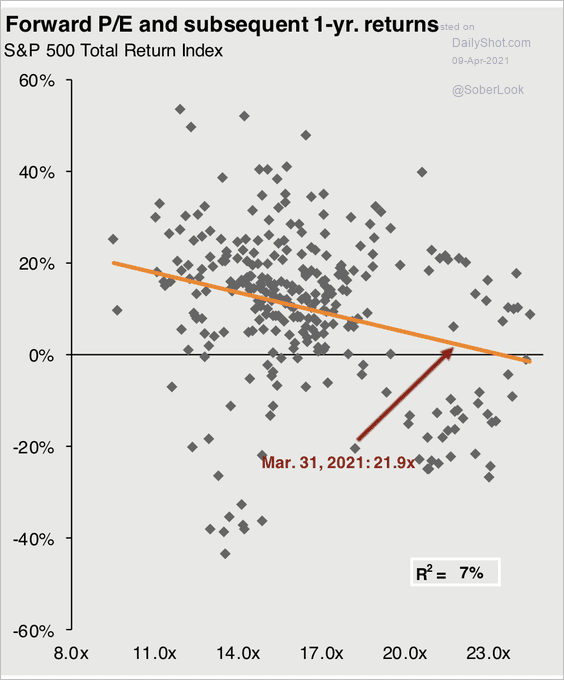

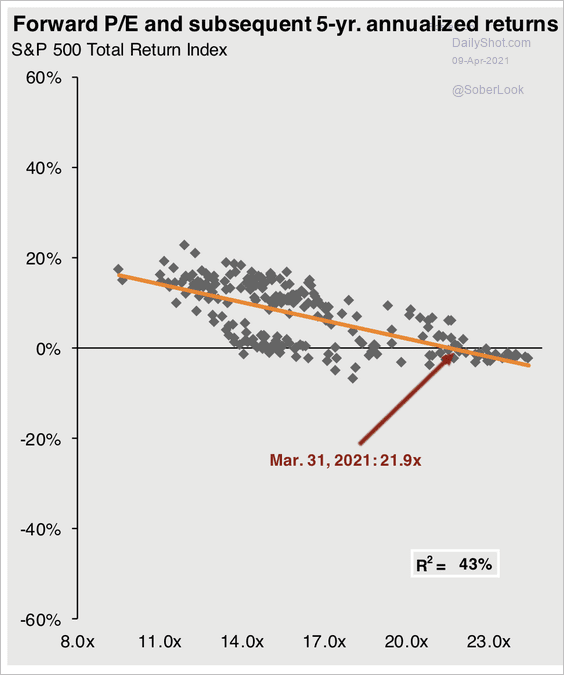

4. S&P 500 valuations imply low to negative returns over the next 1-5 years (2 charts).

Source: JP Morgan Asset Management

Source: JP Morgan Asset Management

Source: JP Morgan Asset Management

Source: JP Morgan Asset Management

——————–

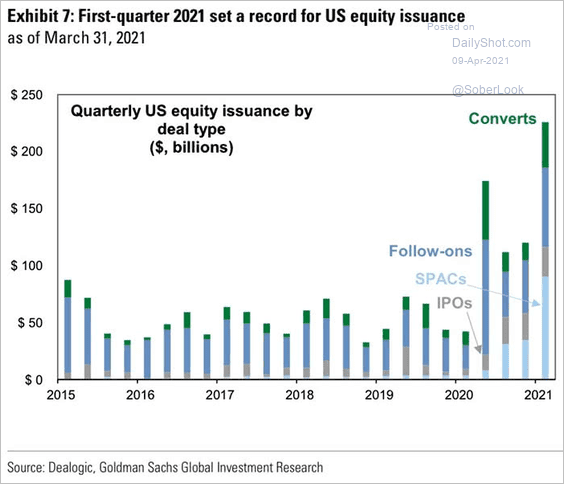

5. Here is the breakdown of US equity issuance.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

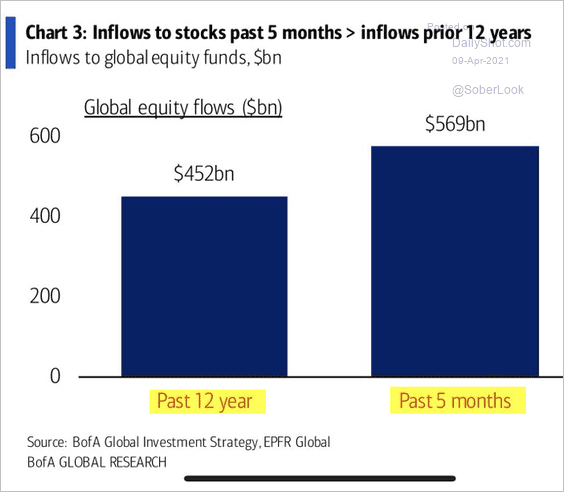

6. Global equity fund inflows over the past five months have been spectacular.

Source: @DiMartinoBooth, @BankofAmerica

Source: @DiMartinoBooth, @BankofAmerica

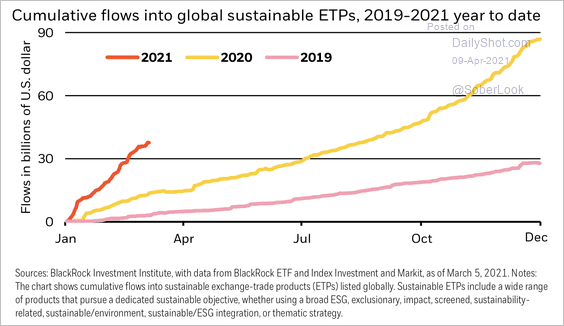

Inflows to sustainable ETPs are on track to outpace the previous two years.

Source: BlackRock

Source: BlackRock

——————–

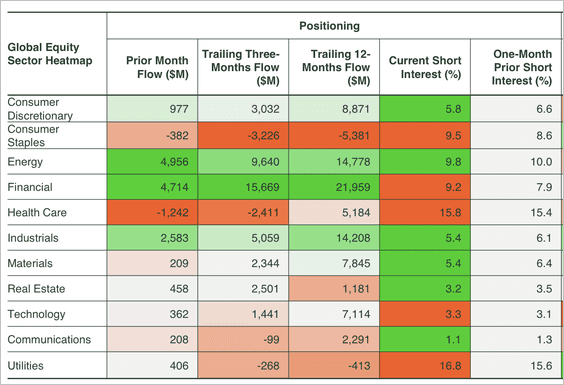

7. Investors rotated out of healthcare and consumer staples stocks last month.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

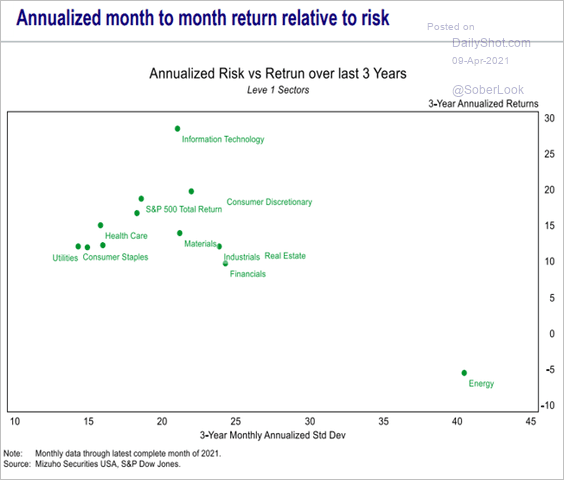

8. This chart shows equity risk/return profile by sector.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

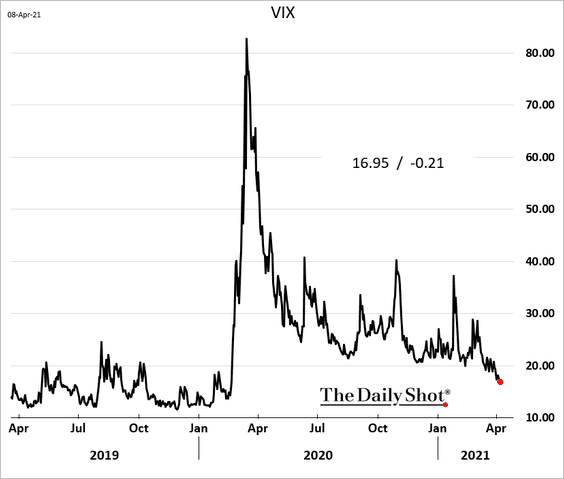

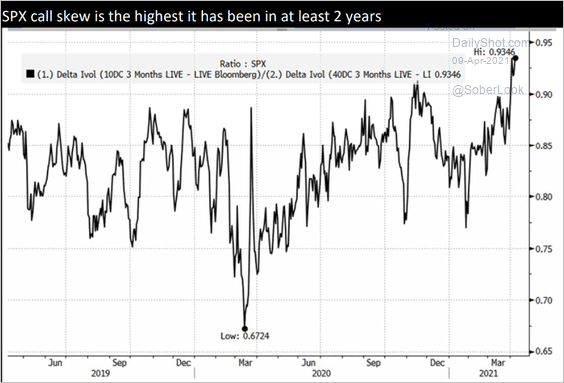

9. VIX is below 17.

The S&P 500 call skew is the highest in years.

Source: Chris Murphy, Susquehanna Derivative Strategy

Source: Chris Murphy, Susquehanna Derivative Strategy

——————–

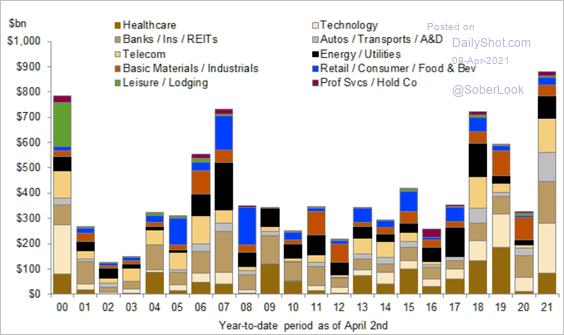

10. Finally, here is the M&A activity by sector.

Source: Dealogic, @themarketear

Source: Dealogic, @themarketear

Back to Index

Credit

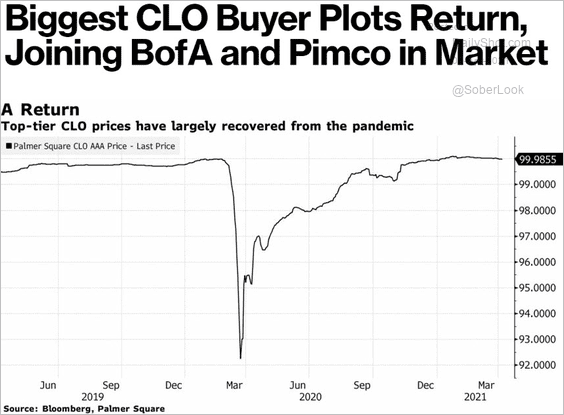

1. AAA CLO paper is in demand once more as Nochu returns. The CLO market is chasing leverage loan allocations again. Just don’t upset your leveraged finance banker.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

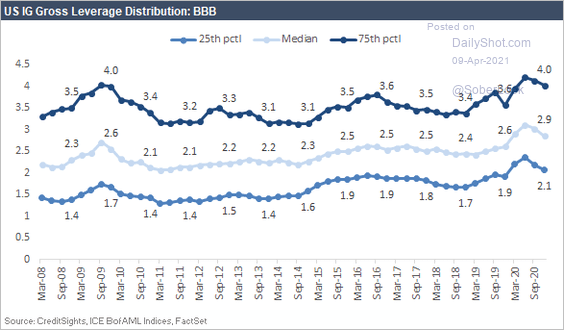

2. This chart shows BBB bond leverage distribution.

Source: CreditSights

Source: CreditSights

Back to Index

Rates

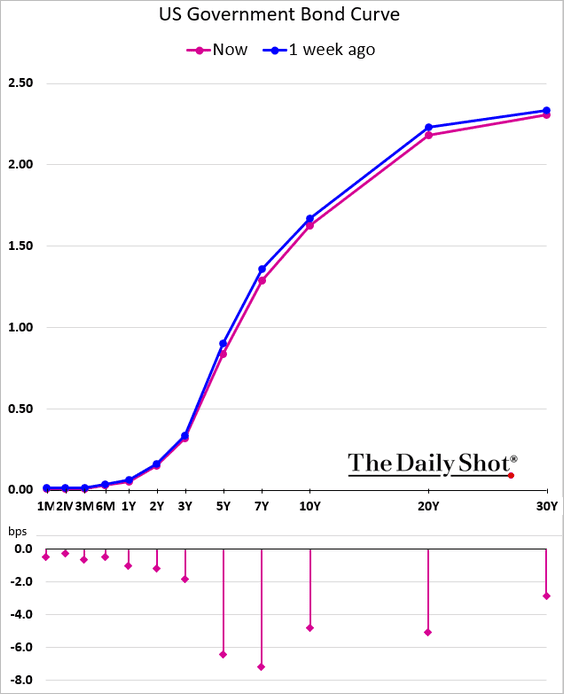

1. Here is the one-week change in the Treasury curve.

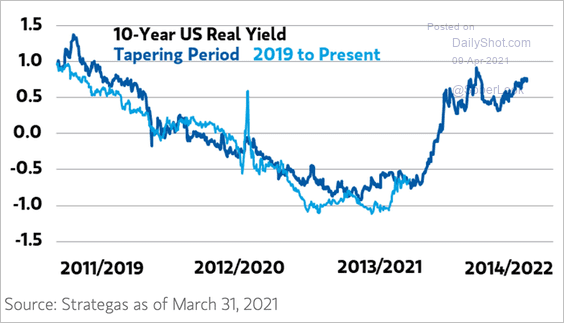

2. Should investors be concerned about taper-tantrum 2.0?

Source: @ISABELNET_SA, @MorganStanley

Source: @ISABELNET_SA, @MorganStanley

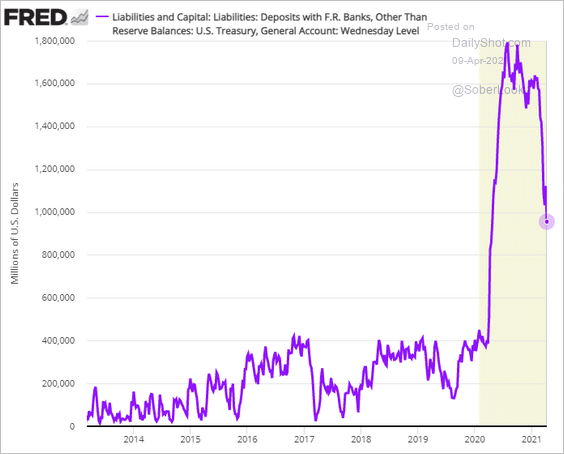

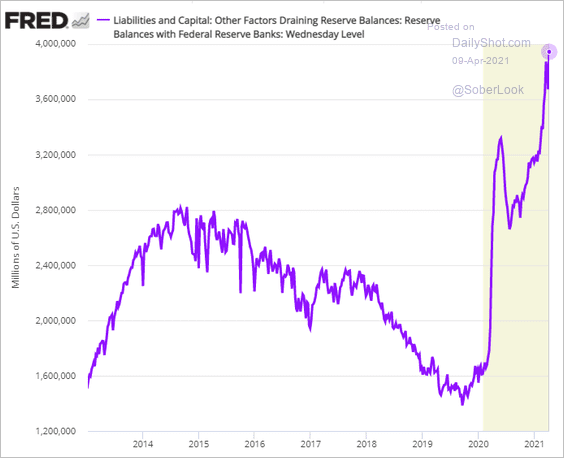

3. The US Treasury cash balances at the Fed continue to drop as stimulus checks go out.

As a result, bank reserves hit a record high (the market is flooded with liquidity).

Back to Index

Global Developments

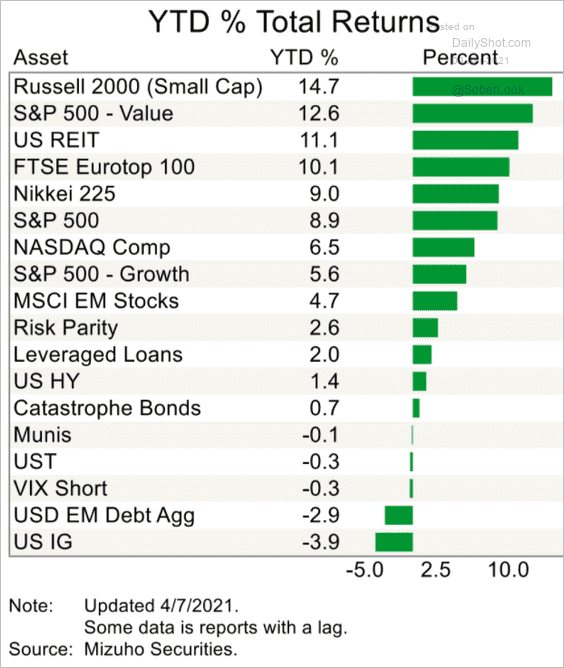

1. Below are the year-to-date returns by asset class.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

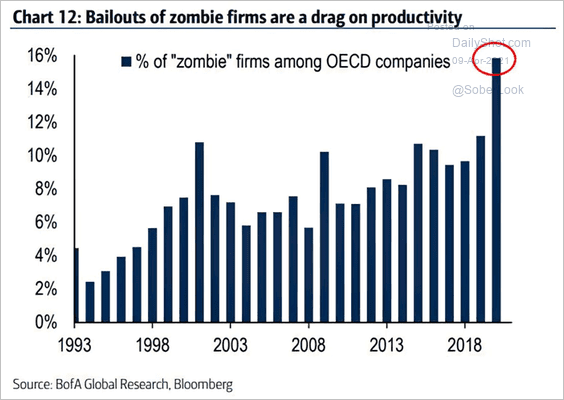

2. Global zombie firms (held up by government programs) will be a drag on productivity.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

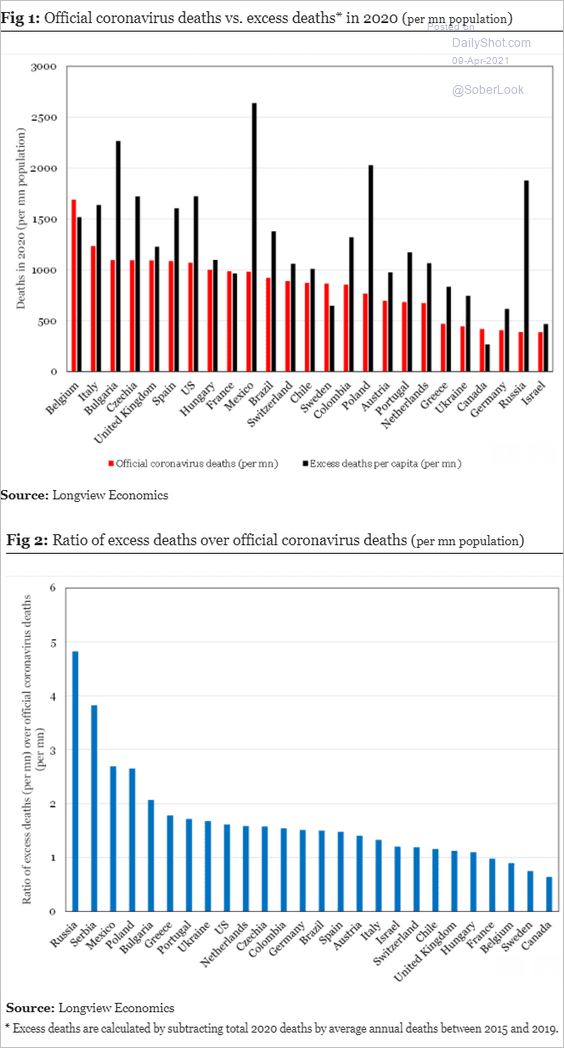

3. High excess deaths point to underreporting of COVID cases.

Source: Longview Economics

Source: Longview Economics

——————–

Food for Thought

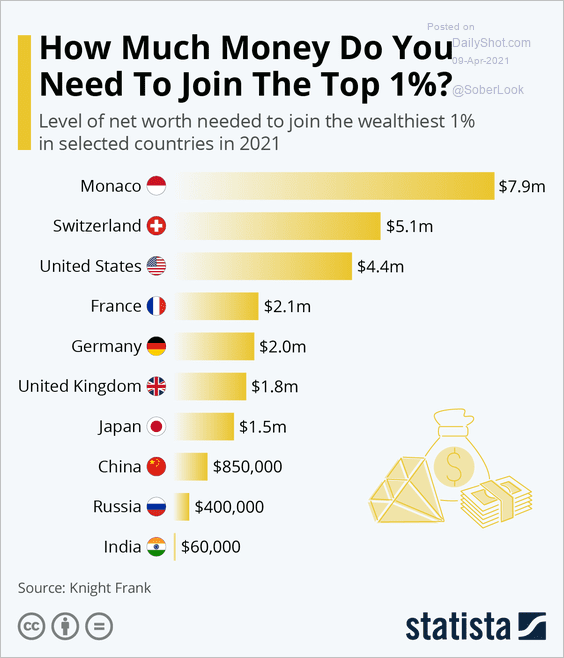

1. What would it take to join the 1%?

Source: Statista

Source: Statista

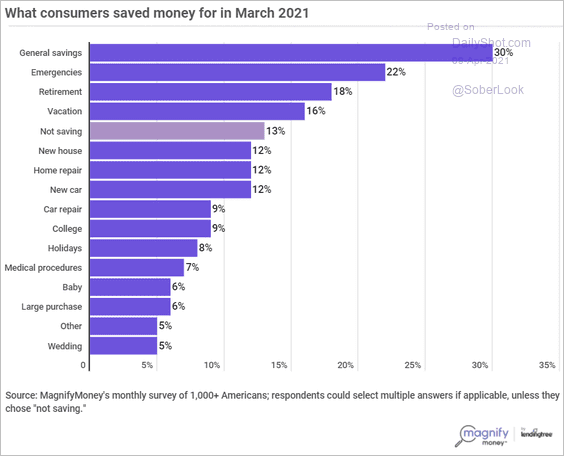

2. Reasons for saving money:

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

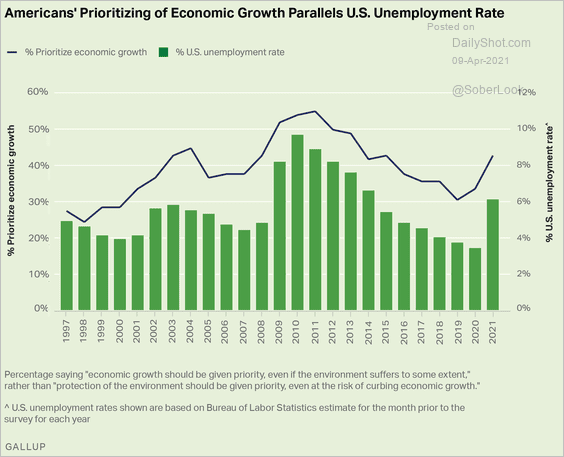

3. Americans prioritizing economic growth compared to the unemployment rate:

Source: Gallup Read full article

Source: Gallup Read full article

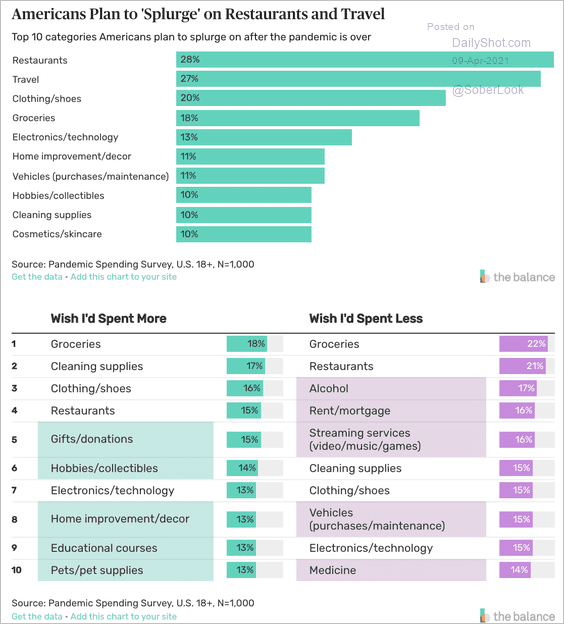

4. Splurging after the pandemic:

Source: The Balance Read full article

Source: The Balance Read full article

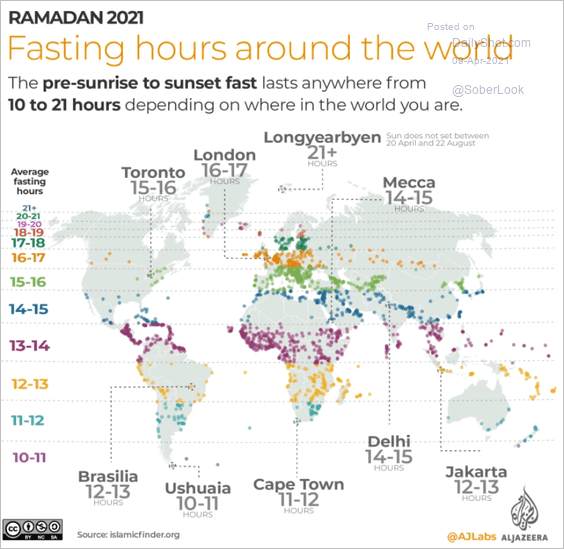

5. Ramadan Mubarak. Ramadan 2021 fasting hours:

Source: Al Jazeera Read full article

Source: Al Jazeera Read full article

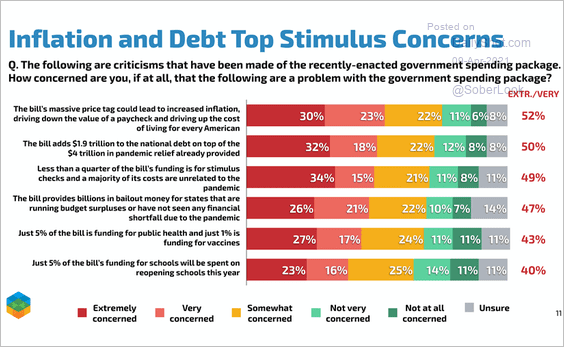

6. Concerns about US stimulus:

Source: Echelon Insights

Source: Echelon Insights

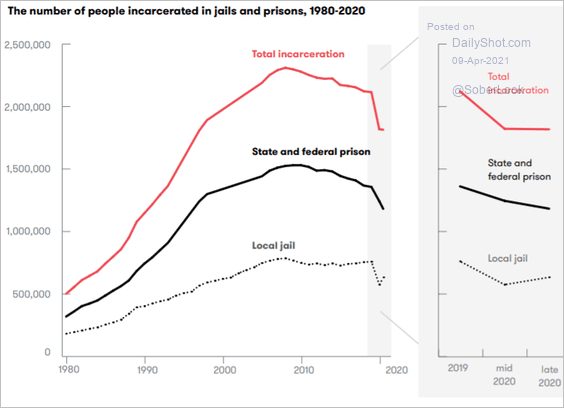

7. US incarcerations:

Source: Vera Institute of Justice Read full article

Source: Vera Institute of Justice Read full article

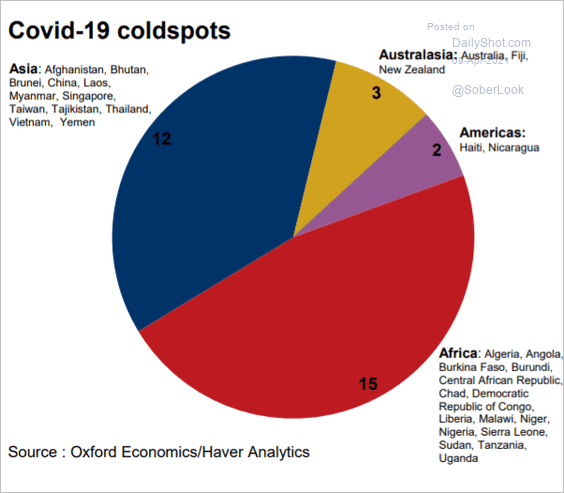

8. Economies with fewer than five new COVID cases per million people over the past month:

Source: Oxford Economics

Source: Oxford Economics

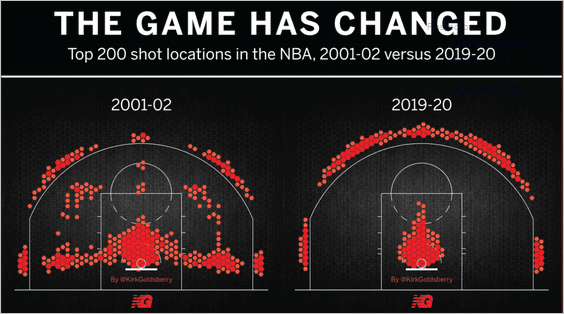

9. Top 200 shot locations in the NBA:

Source: @kirkgoldsberry

Source: @kirkgoldsberry

——————–

Have a great weekend!

Back to Index