The Daily Shot: 14-Apr-21

• The United States

• The United Kingdom

• The Eurozone

• Switzerland

• Asia- Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Alternatives

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

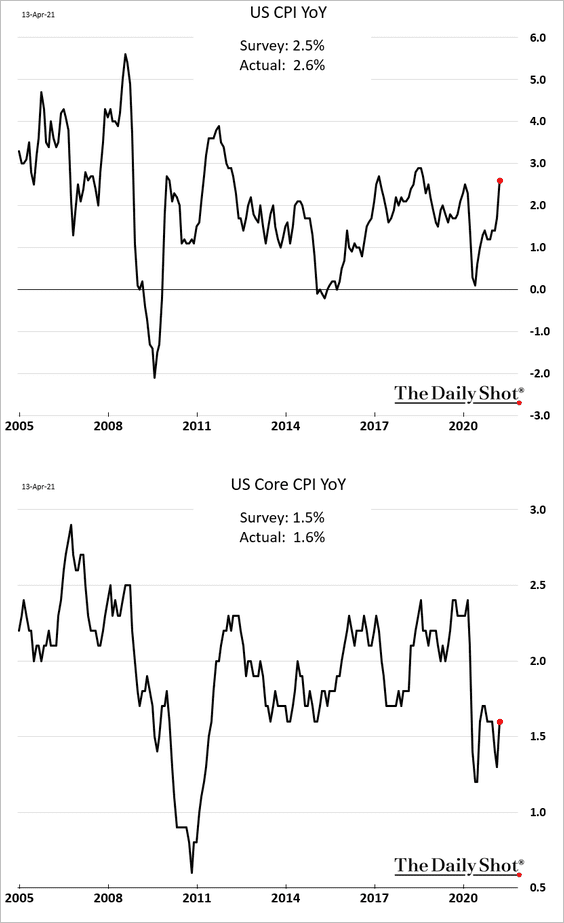

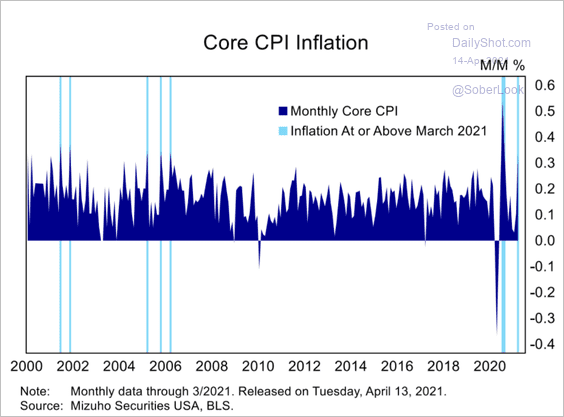

1. The March CPI figures were a bit stronger than expected, but there was little in the report to indicate that inflation is gapping higher. The core CPI remains relatively benign, suggesting that the Fed will stay the course.

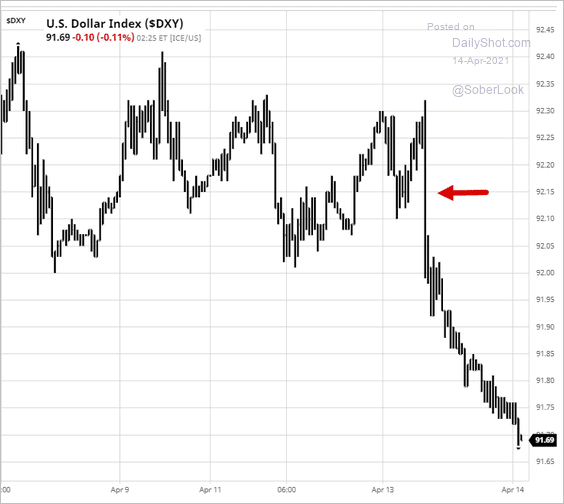

Markets breathed a sigh of relief. The US dollar tumbled – a green light for risk assets (such as equities, commodities, etc.).

Source: barchart.com

Source: barchart.com

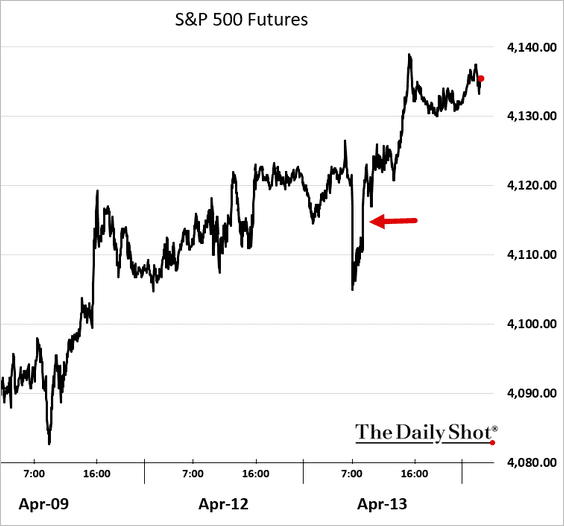

Stocks climbed further.

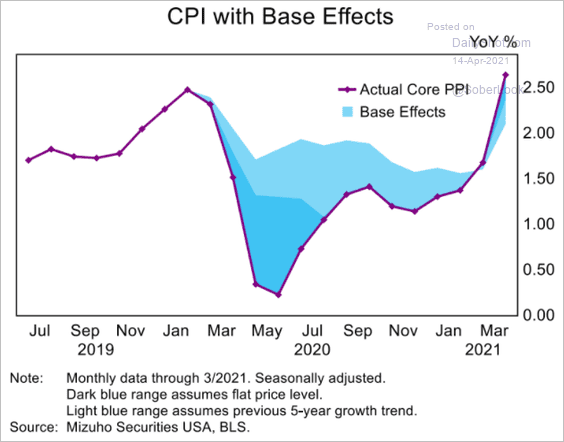

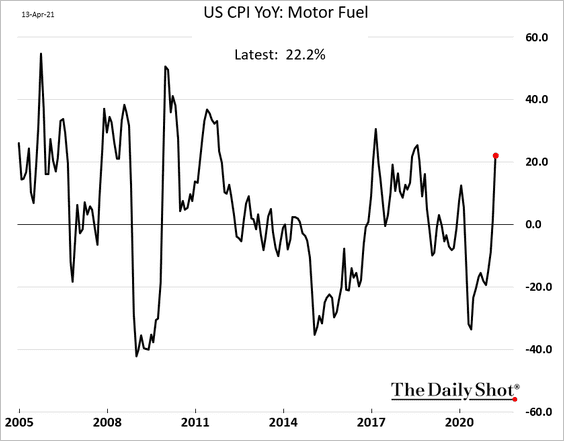

• Base effects drove part of the year-over-year gains in the headline CPI.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

Gasoline is a good example of that.

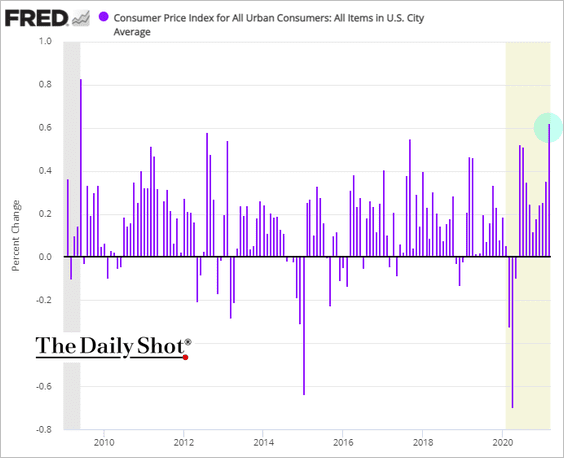

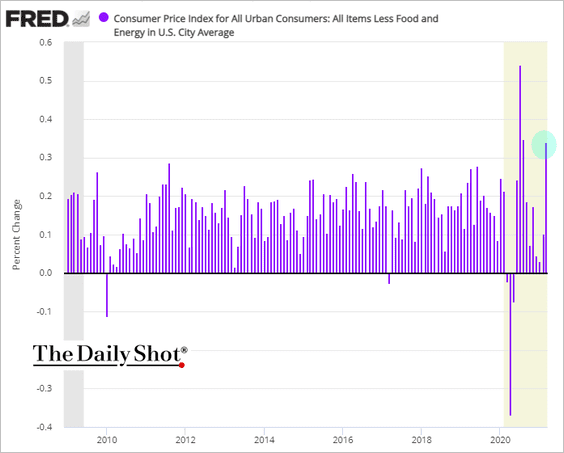

But there was also a solid pop in the month-over-month figures as well.

– Headline:

– Core:

Source: Mizuho Securities USA

Source: Mizuho Securities USA

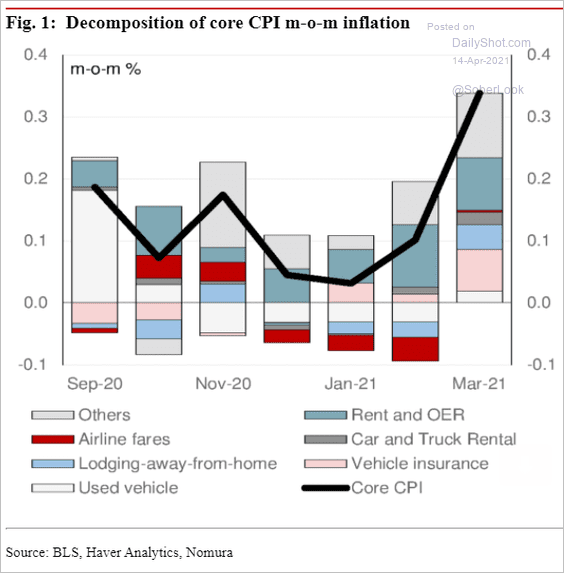

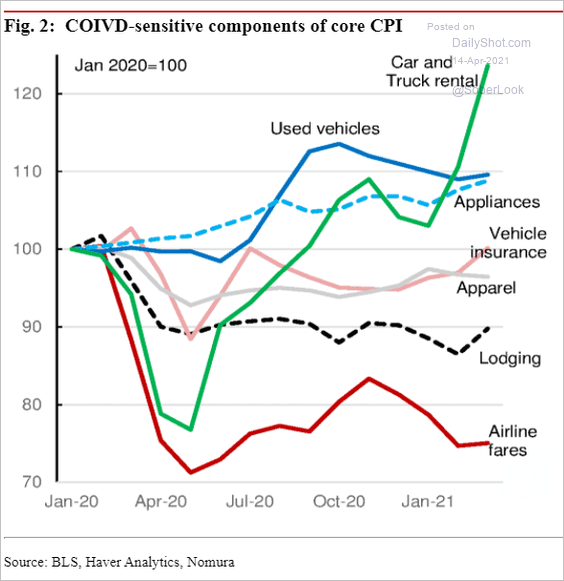

– Core inflation decomposition:

Source: Nomura Securities

Source: Nomura Securities

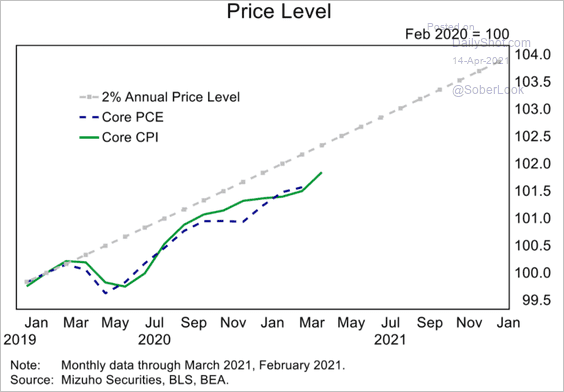

• On a price basis, inflation is still running well below the Fed’s 2% target.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

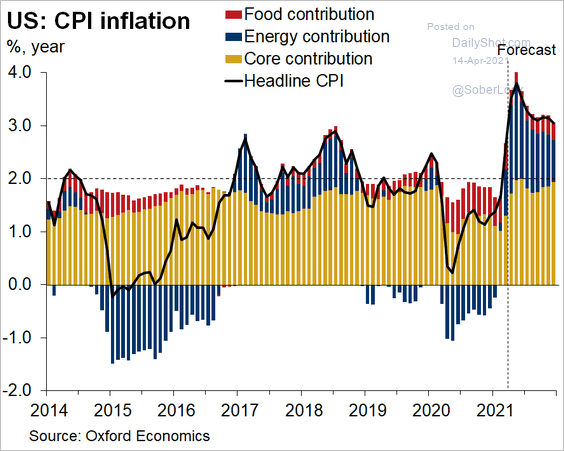

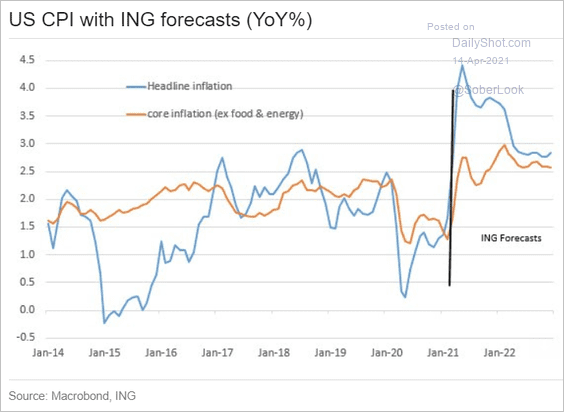

• Economists expect further gains in inflation.

– Oxford Economics:

Source: @GregDaco, @OxfordEconomics

Source: @GregDaco, @OxfordEconomics

– ING:

Source: ING

Source: ING

– Piper Sandler :

Source: Piper Sandler

Source: Piper Sandler

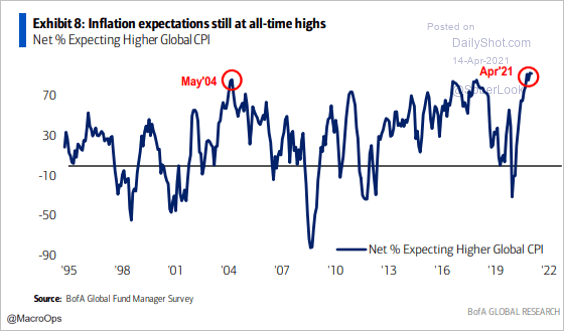

– Fund managers (BofA survey):

Source: BofA Global Research; @MacroOps

Source: BofA Global Research; @MacroOps

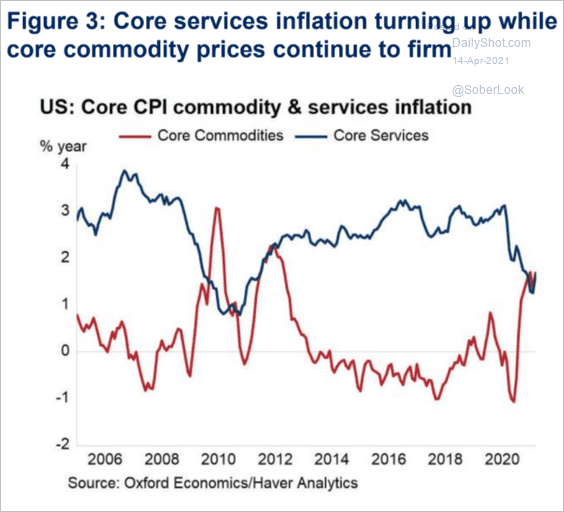

• Here are the trends for commodities and services components of the core CPI.

Source: Oxford Economics

Source: Oxford Economics

And the chart below shows some sector trends.

Source: Nomura Securities

Source: Nomura Securities

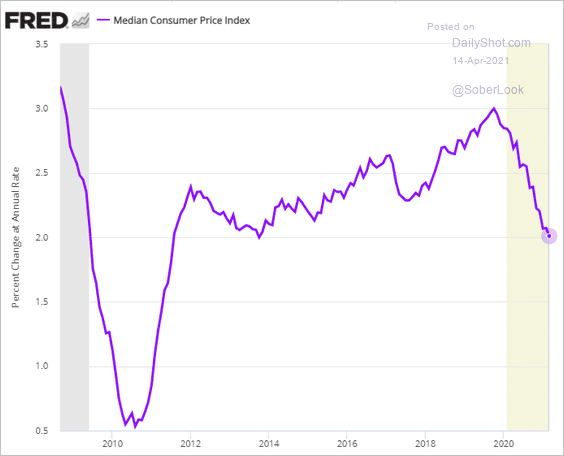

• The median CPI continues to drift lower.

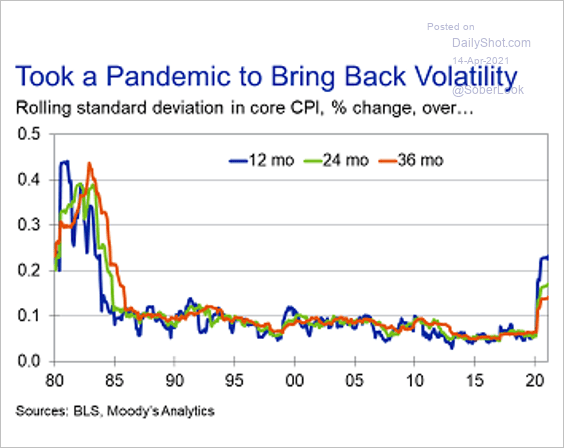

• Inflation volatility is back.

Source: Moody’s Analytics

Source: Moody’s Analytics

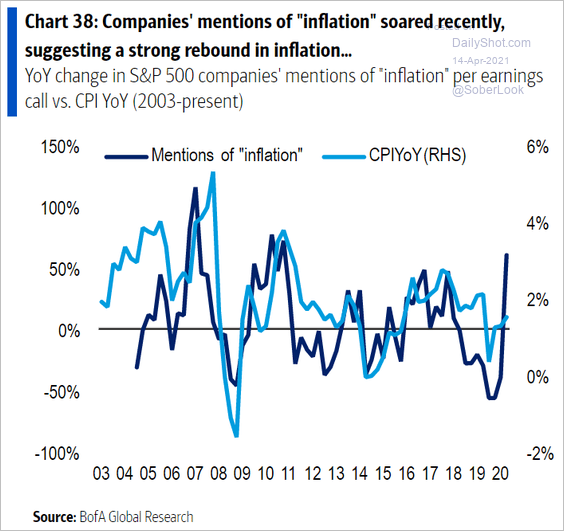

• More firms have been mentioning inflation on earnings calls.

Source: BofA Global Research

Source: BofA Global Research

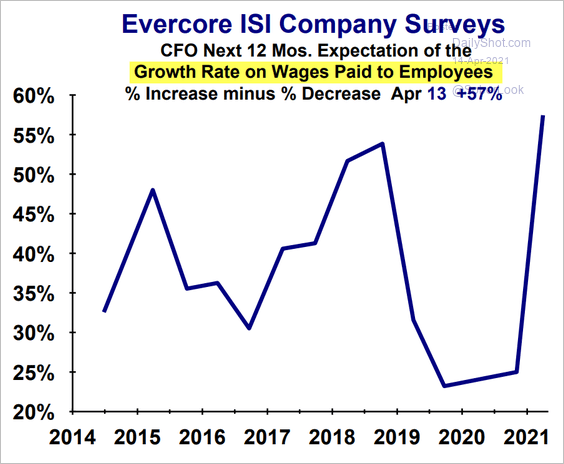

• As discussed previously, sustained inflation gains will require stronger wage growth. The latest Evercore ISI survey suggests that it’s a possibility.

Source: Evercore ISI

Source: Evercore ISI

——————–

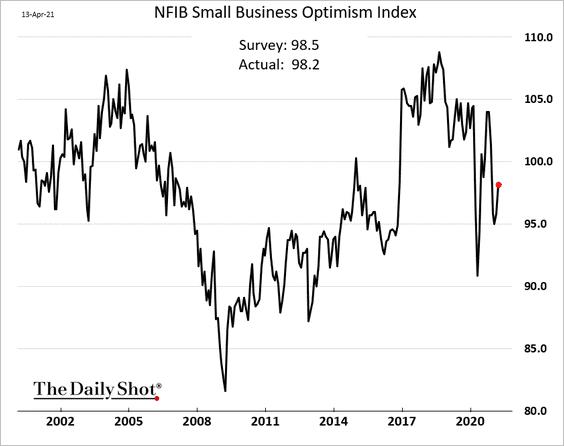

2. The NFIB small business optimism index was roughly in line with forecasts.

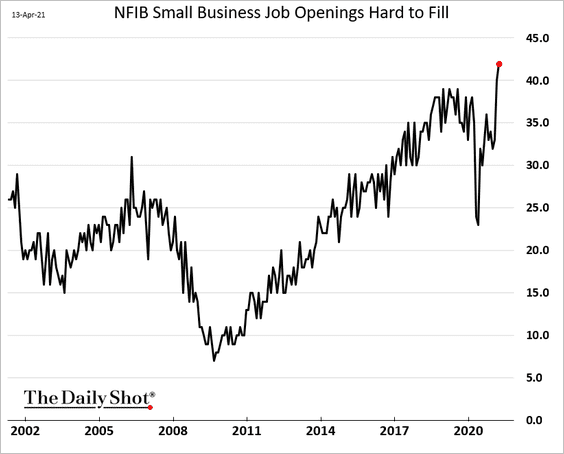

• The “job openings hard to fill” indicator hit another record high, pointing to labor shortages.

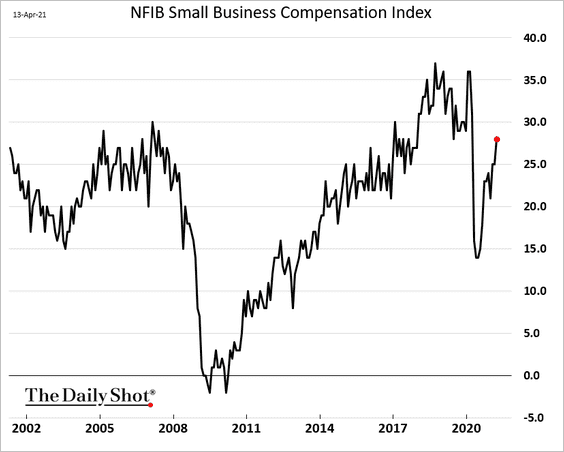

• The compensation index is rebounding but remains well below pre-COVID levels.

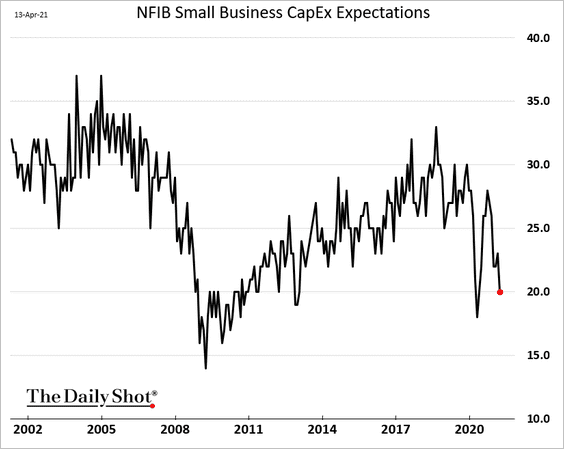

• CapEx intentions deteriorated further.

——————–

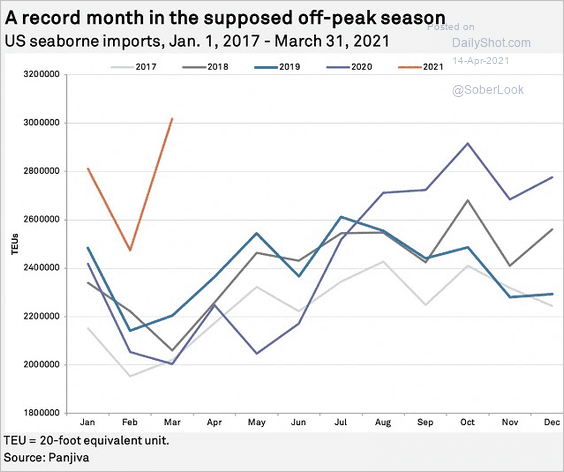

3. US seaborne imports soared last month as consumer spending accelerated while inventories remained tight.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

The United Kingdom

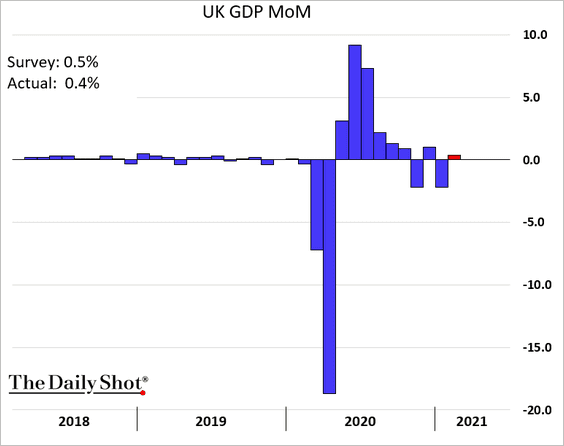

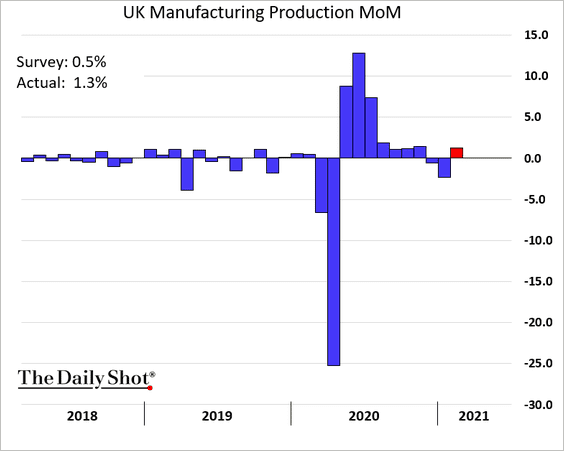

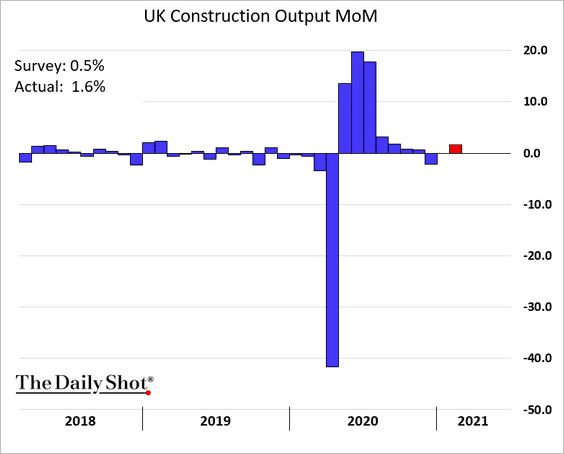

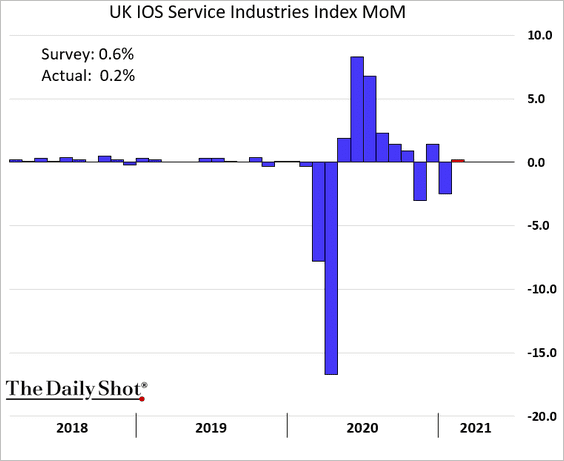

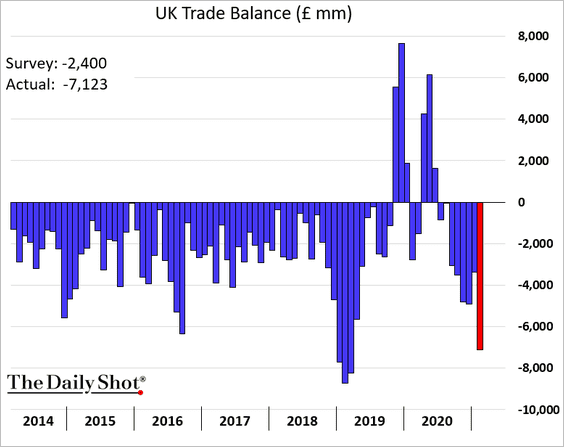

1. The economy expanded in February.

Here are the key metrics.

• Manufacturing output (above consensus):

• Construction (above consensus):

• Services (below expectations):

• Trade deficit (wider than expected):

——————–

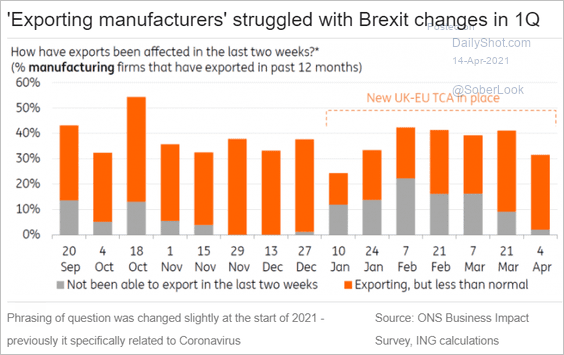

2. UK manufacturers are still exporting less than normal.

Source: ING

Source: ING

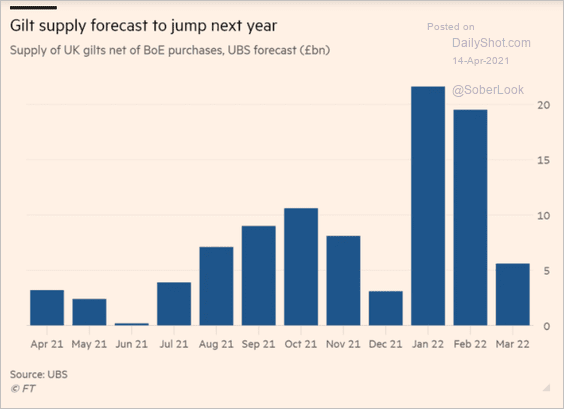

3. Gilt supply is expected to jump next year.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

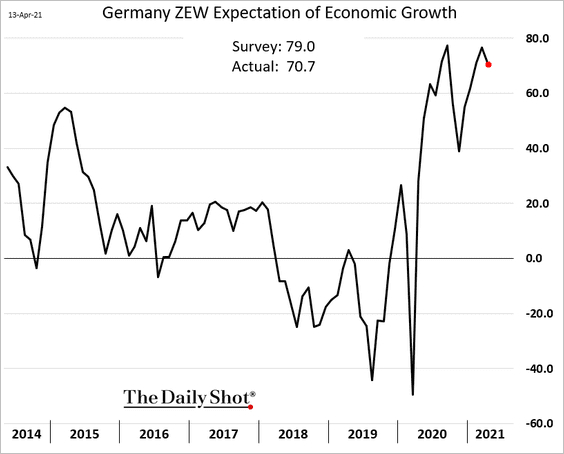

1. Germany’s ZEW Expectations indicator is off the highs but remains elevated.

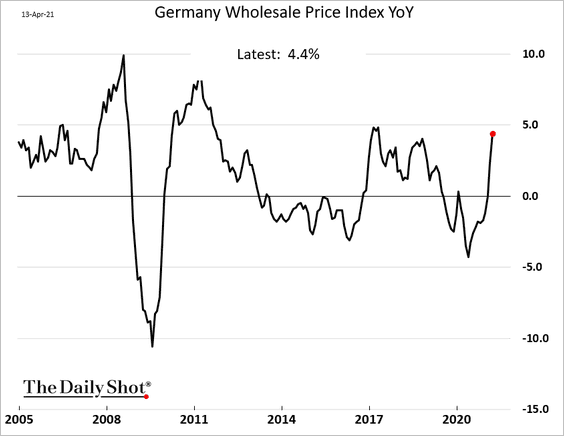

2. German wholesale prices are rebounding.

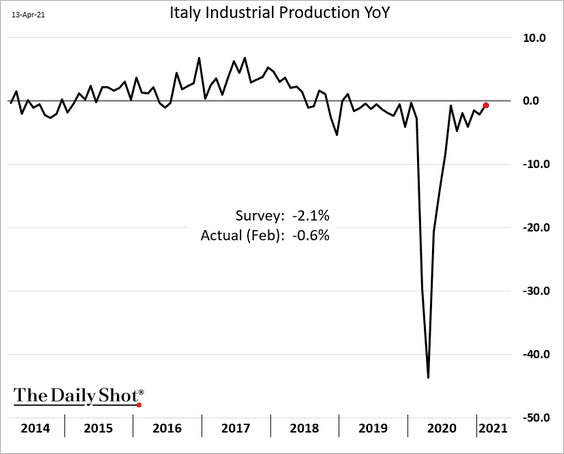

3. Italy’s industrial production continued to recover in February.

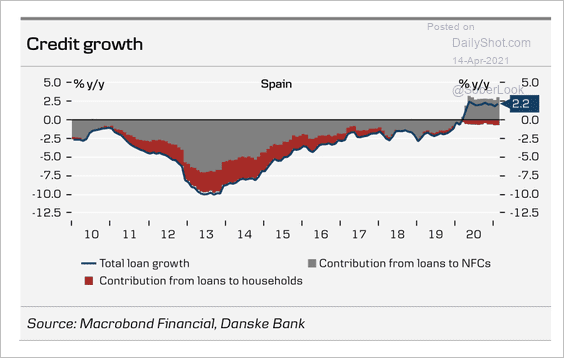

4. Credit growth in Spain is gradually recovering, driven by loans to nonfinancial corporations.

Source: Danske Bank

Source: Danske Bank

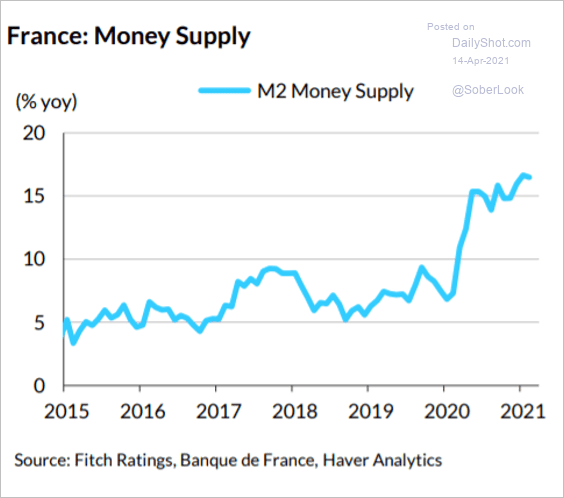

5. The broad money supply growth has been strong across the Eurozone, particularly in France.

Source: Fitch Ratings

Source: Fitch Ratings

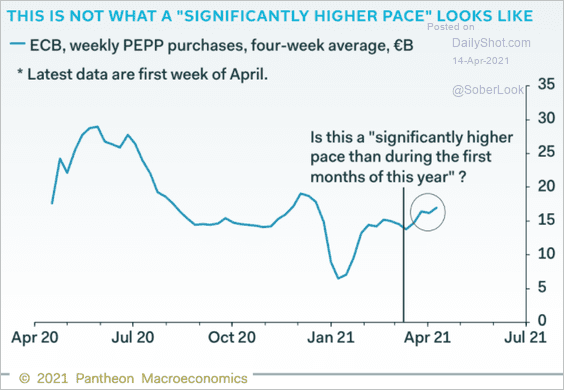

6. The ECB’s increase in securities purchases hasn’t been as aggressive as “promised.” Will the market test the central bank with higher yields?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

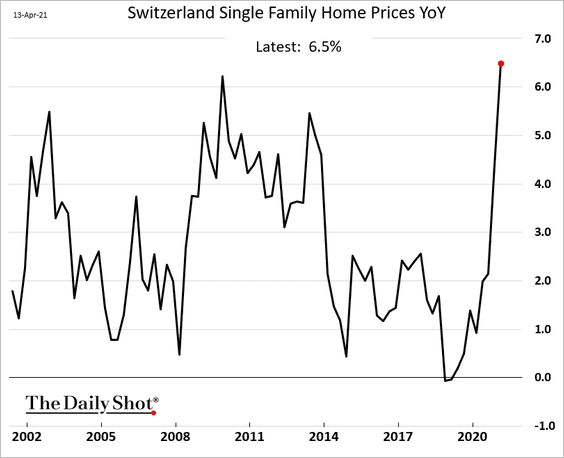

Switzerland

1. Housing price appreciation has accelerated.

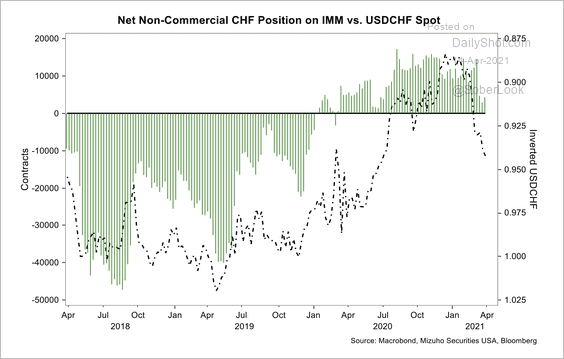

2. Speculators have reduced their net long Swiss franc positions over the past few months.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

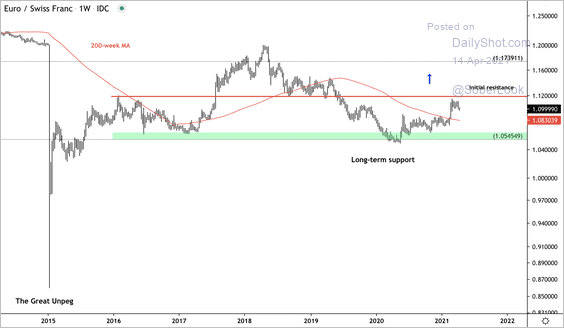

3. EUR/CHF is declining from initial resistance but remains supported above 1.08.

Source: Dantes Outlook

Source: Dantes Outlook

Back to Index

Asia- Pacific

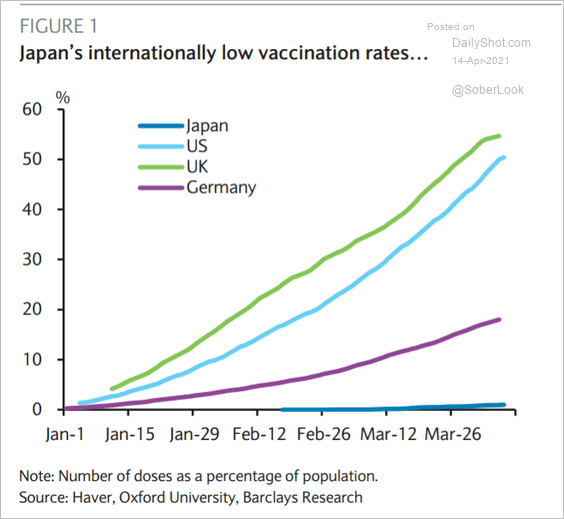

1. Japan’s vaccinations are lagging.

Source: Barclays Research

Source: Barclays Research

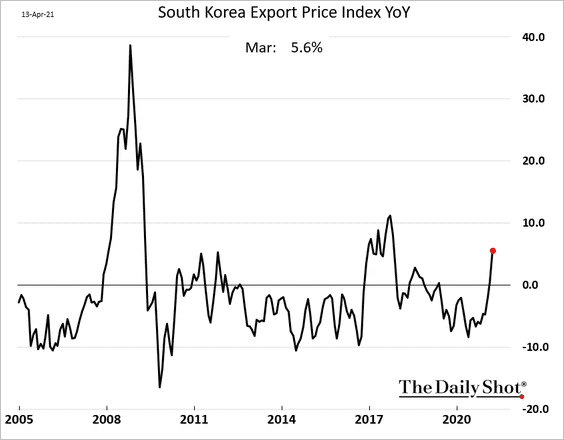

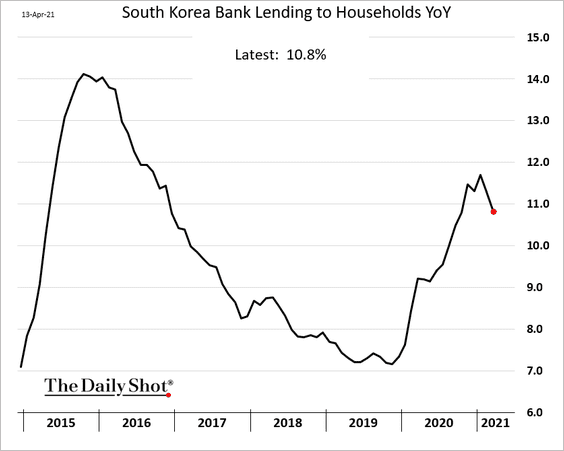

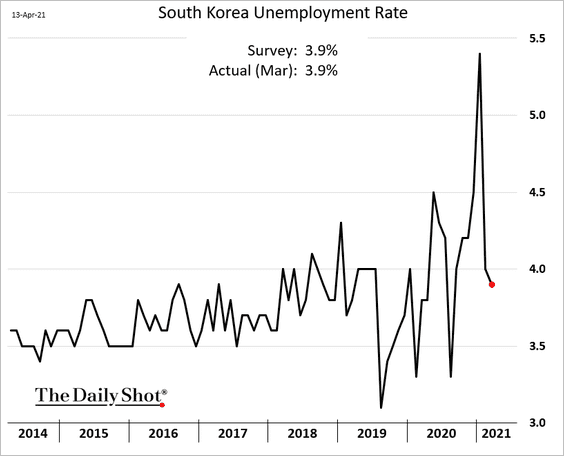

2. Next, we have some updates on South Korea.

• Export prices are recovering (gains partially due to base effects).

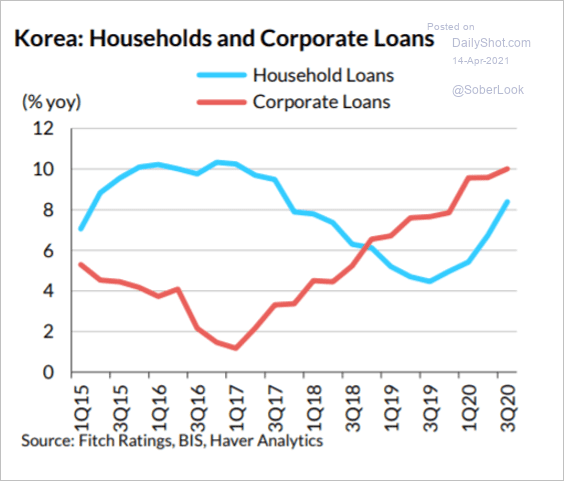

• Loan growth has been robust.

Source: Fitch Ratings

Source: Fitch Ratings

But household credit expansion appears to have peaked.

• The unemployment rate ticked lower last month.

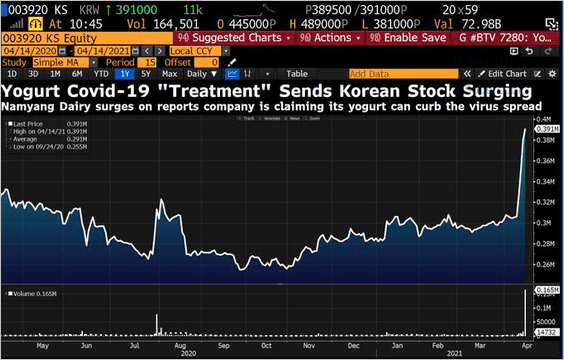

• How do you boost your stock price? Claim that your yogurt product curbs the coronavirus spread.

Source: @DavidInglesTV

Source: @DavidInglesTV

——————–

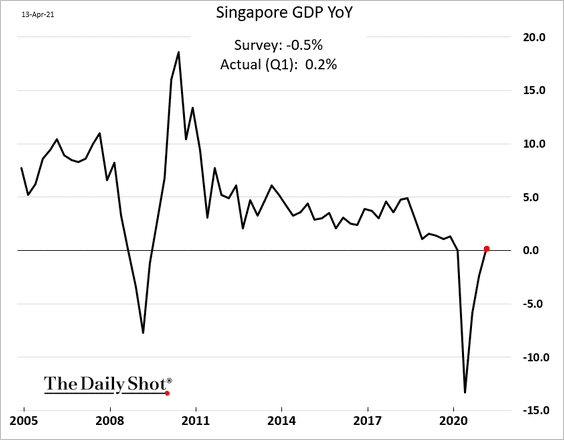

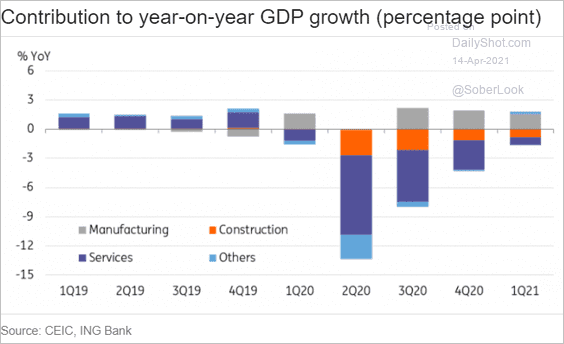

3. Singapore is out of recession.

Source: ING

Source: ING

——————–

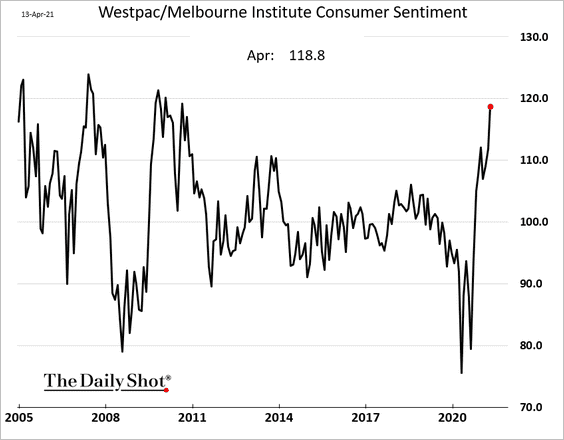

4. Australia’s consumer confidence is at multi-year highs, according to the Westpac index.

Back to Index

China

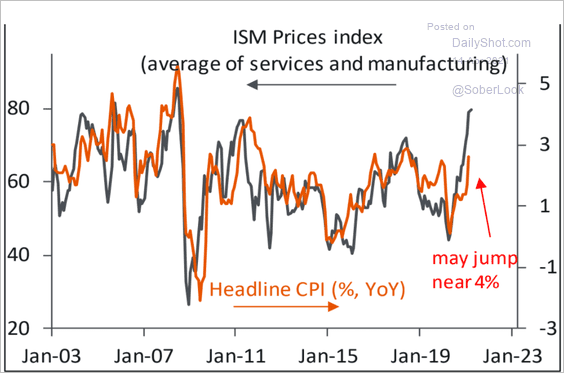

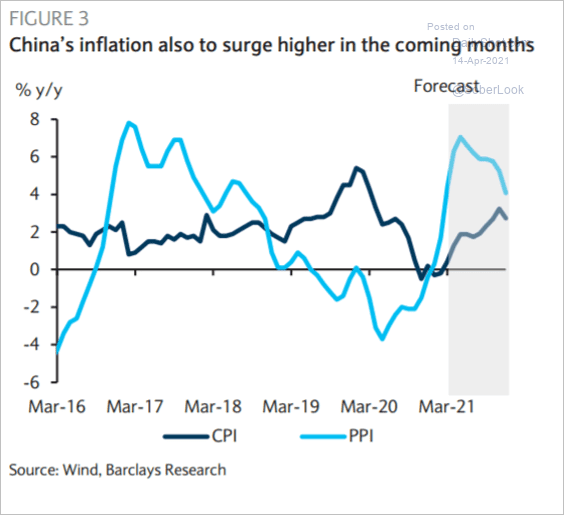

1. Inflation is about to accelerate.

Source: Barclays Research

Source: Barclays Research

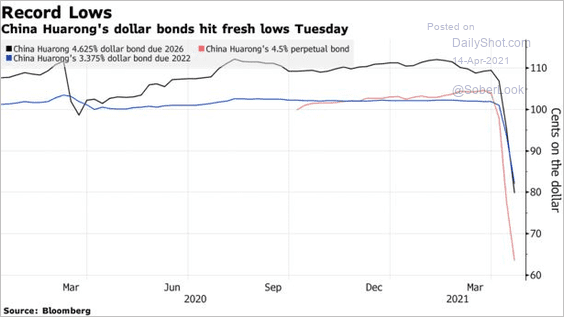

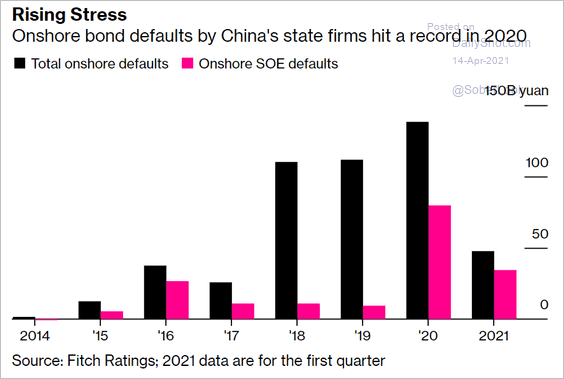

2. Will we see another state-owned company default? The bond market thinks so.

Source: @markets Read full article

Source: @markets Read full article

Onshore debt defaults have been hitting records.

Source: @markets Read full article

Source: @markets Read full article

——————–

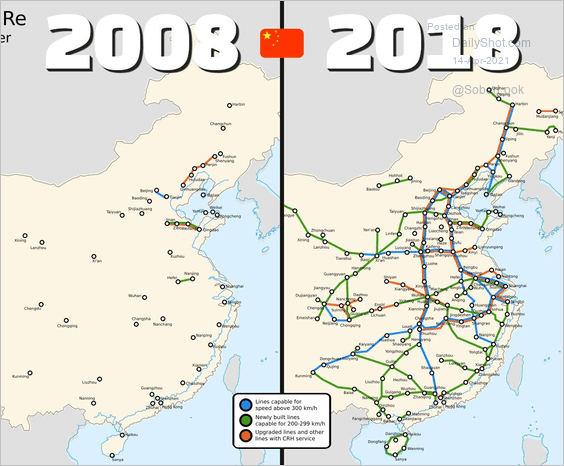

3. The development of China’s high-speed rail network has been impressive.

Source: @cesifoti, @gaojian08 Read full article

Source: @cesifoti, @gaojian08 Read full article

Back to Index

Emerging Markets

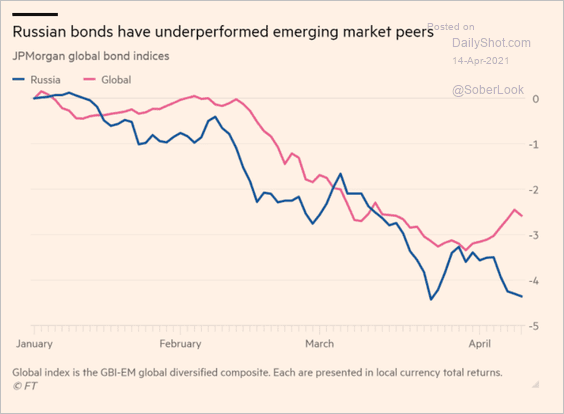

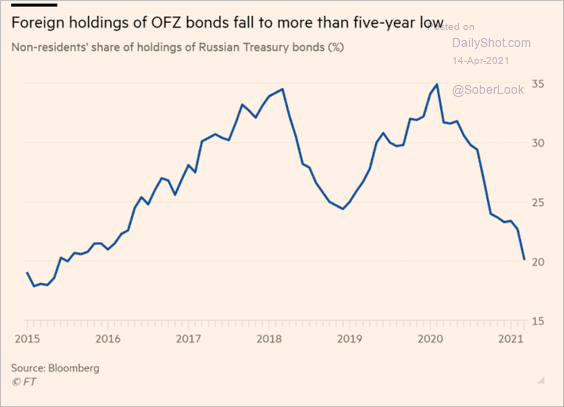

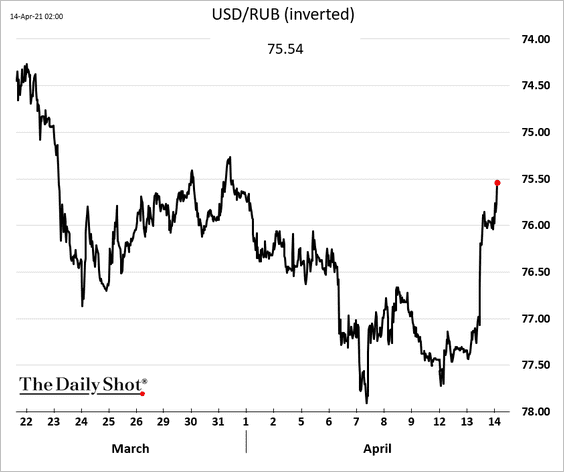

1. Let’s begin with Russia.

• The nation’s bonds have underperformed recently, …

Source: @financialtimes Read full article

Source: @financialtimes Read full article

… as foreign investors pulled out.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

• The possibility of a summit with the US sent the ruble sharply higher.

Source: ABC News Read full article

Source: ABC News Read full article

——————–

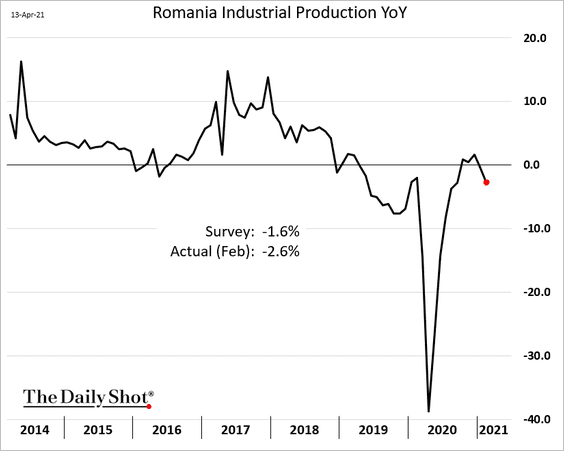

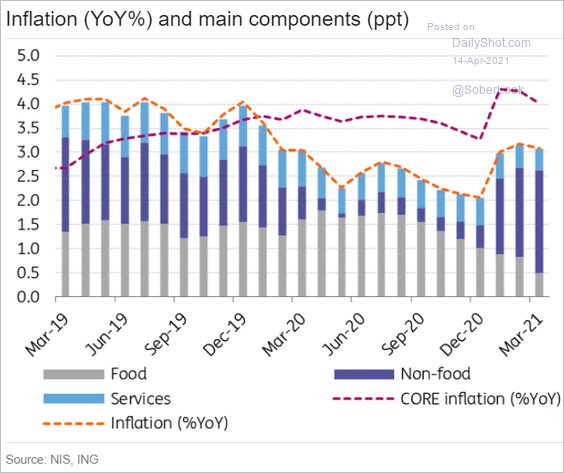

2. Romania’s industrial production weakened in February.

The nation’s core inflation remains above 4%.

Source: ING

Source: ING

——————–

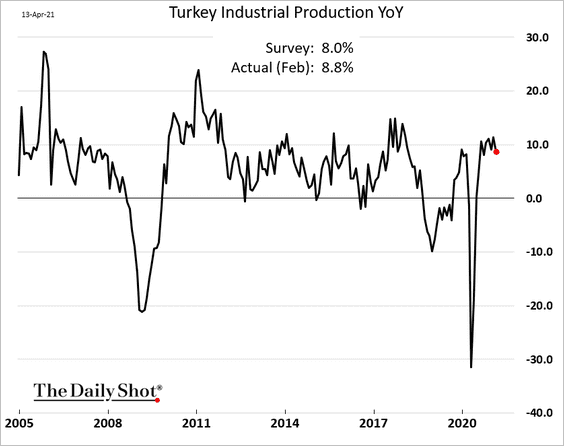

3. Turkey’s industrial output has been strong.

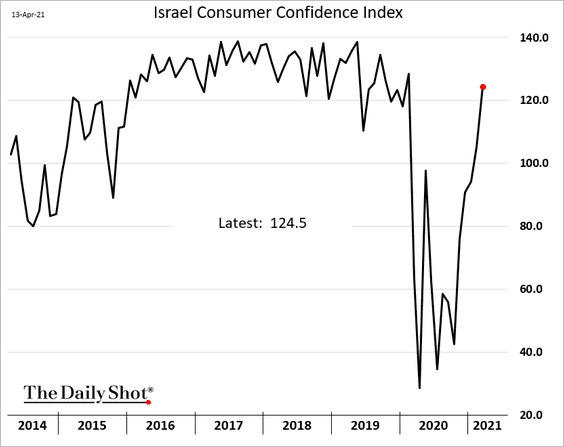

4. Israel’s consumer confidence has almost fully recovered.

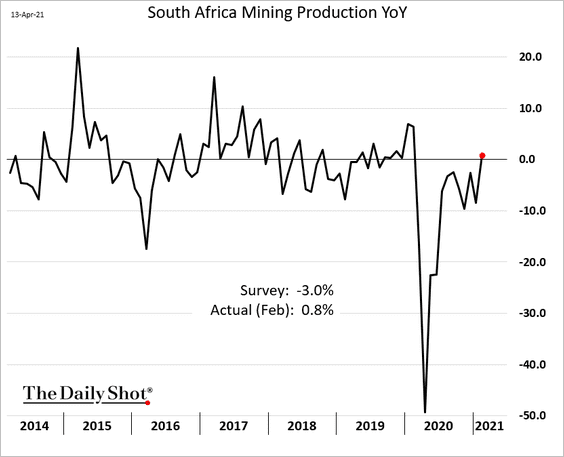

5. South Africa’s mining production was up on a year-over-year basis in February.

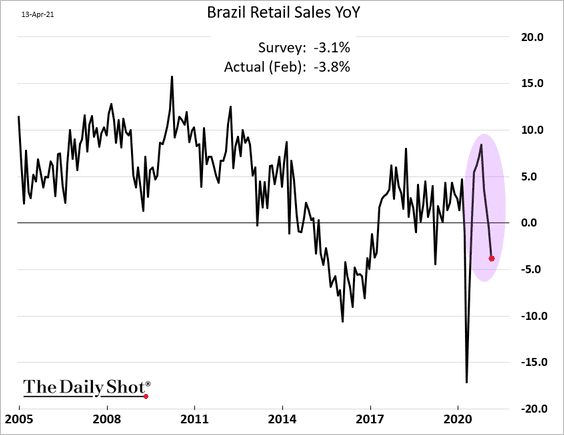

6. Brazil’s retail sales deteriorated in February.

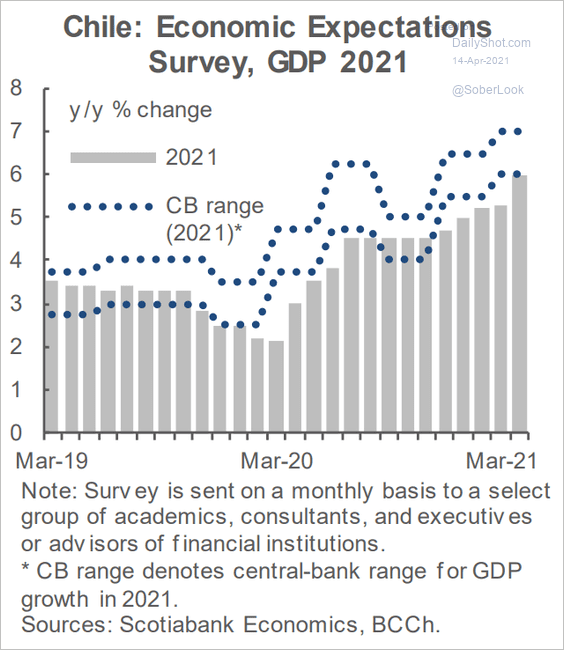

7. Chile’s economic expectations continue to improve.

Source: Scotiabank Economics

Source: Scotiabank Economics

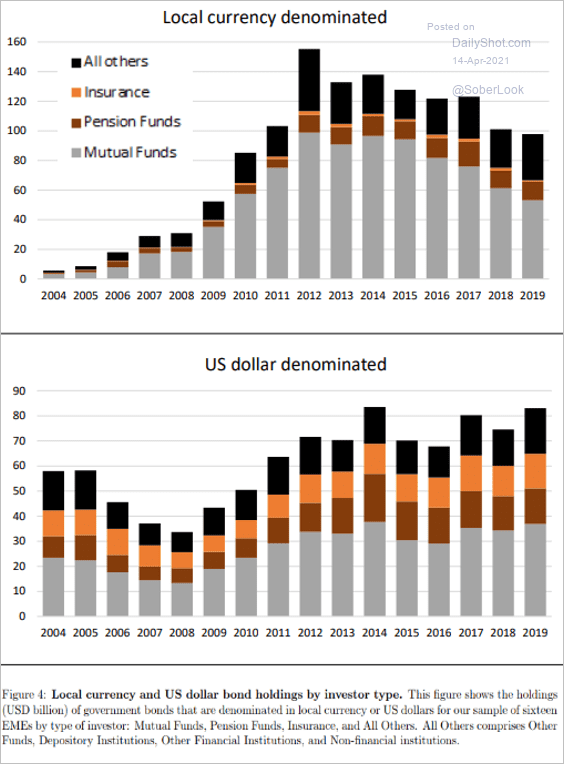

8. Who holds EM local-currency and USD sovereign debt?

Source: Bertaut, Bruno, Shin Read full article

Source: Bertaut, Bruno, Shin Read full article

Back to Index

Cryptocurrency

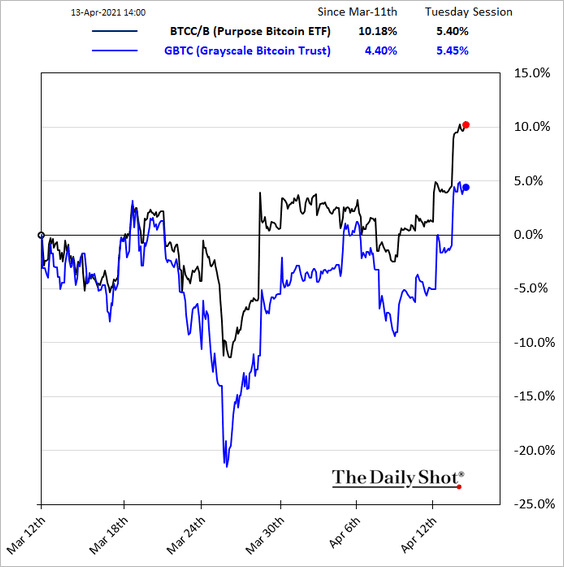

1. Bitcoin hit a new record, trading near $65k.

2. Grayscale Bitcoin Trust shares continue to lag.

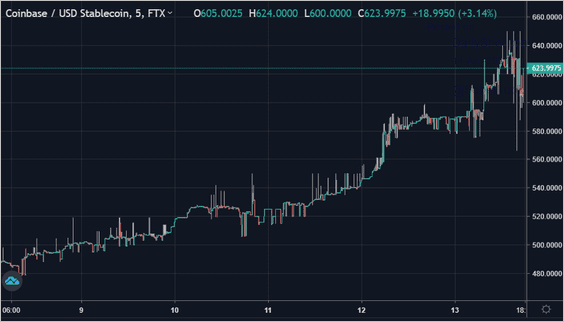

3. There is a substantial gap between Nasdaq’s reference price for Coinbase …

Source: @WSJ Read full article

Source: @WSJ Read full article

… and the FTX futures contract (which is more than double the reference price). Will we see a massive price pop?

Source: FTX

Source: FTX

Back to Index

Commodities

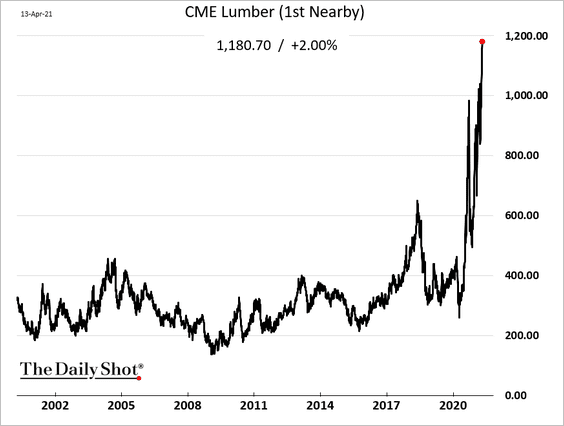

1. US lumber futures are hitting new records.

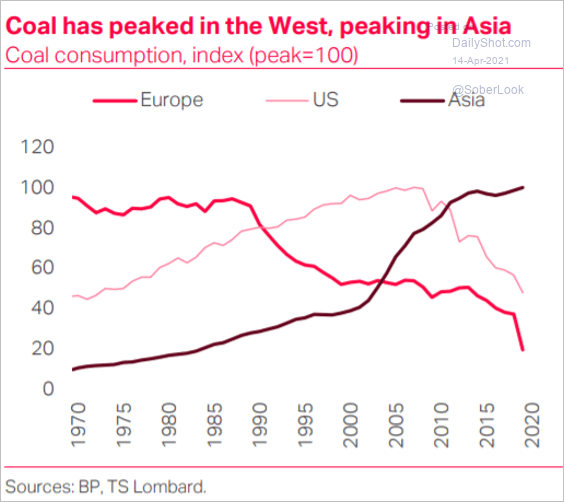

2. This chart shows coal consumption in Europe, the US, and Asia.

Source: TS Lombard

Source: TS Lombard

Back to Index

Equities

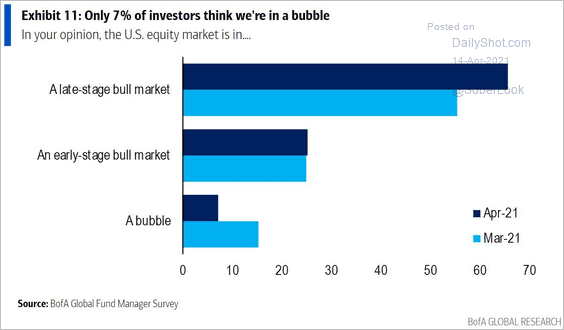

1. Fund managers don’t see a bubble.

Source: BofA Global Research

Source: BofA Global Research

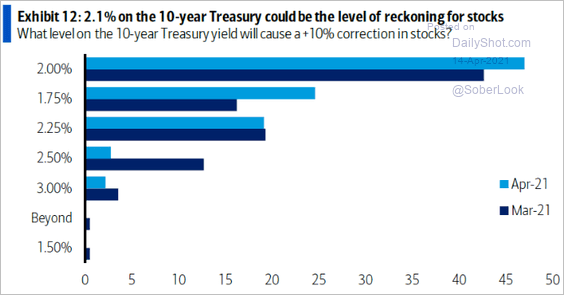

2. How high should the 10yr Treasury yield get to cause a correction in stocks?

Source: BofA Global Research

Source: BofA Global Research

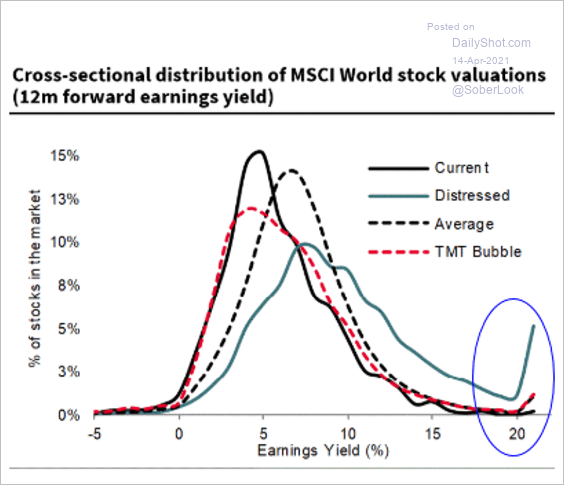

3. The distribution of forward earnings yields suggests that there are very few “cheap” stocks left (no tail at higher yields).

Source: Societe Generale Cross Asset Research; @johnauthers, @bopinion Read full article

Source: Societe Generale Cross Asset Research; @johnauthers, @bopinion Read full article

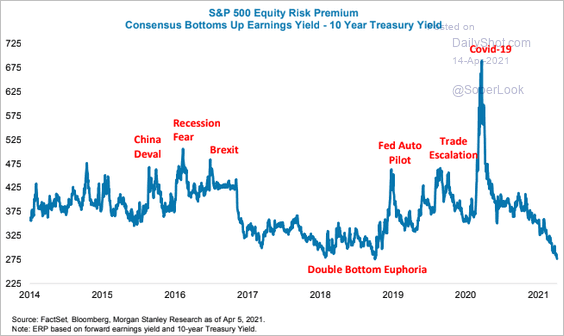

4. Here is the S&P 500 risk premium.

Source: @ISABELNET_SA, @MorganStanley

Source: @ISABELNET_SA, @MorganStanley

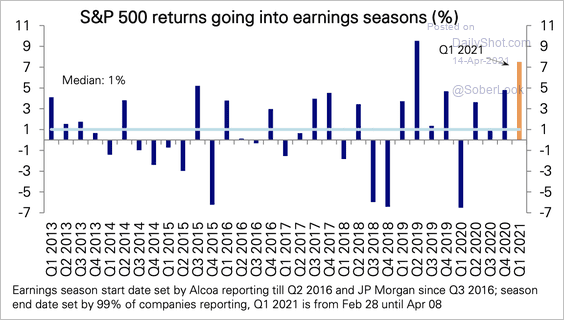

5. This has been one of the largest pre-earnings season rallies on record.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

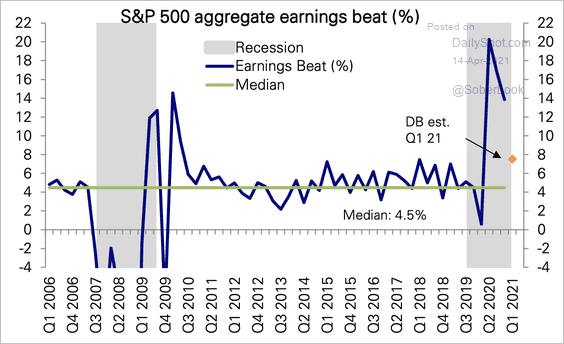

6. Deutsche Bank expects another strong season for earnings beats.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

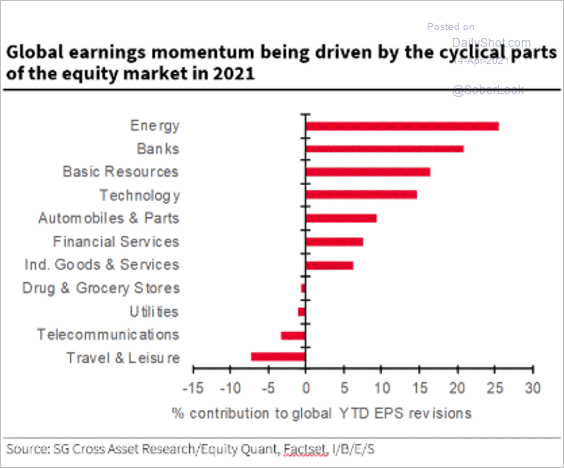

7. Analysts have been boosting earnings expectations in cyclical sectors.

Source: Societe Generale Cross Asset Research; @johnauthers, @bopinion Read full article

Source: Societe Generale Cross Asset Research; @johnauthers, @bopinion Read full article

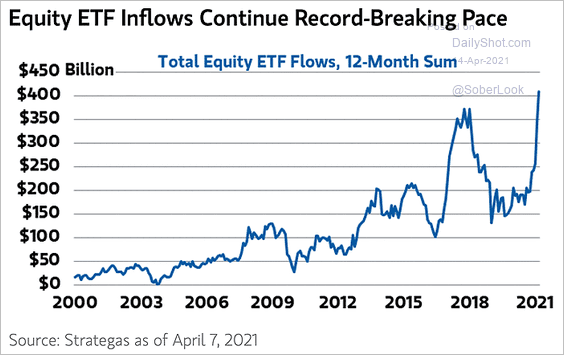

8. Equity ETF inflows continue to hit records.

Source: @ISABELNET_SA, @MorganStanley

Source: @ISABELNET_SA, @MorganStanley

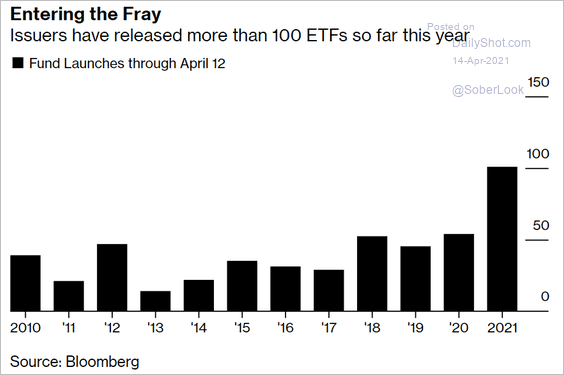

And the market is meeting the demand with more ETF offerings.

Source: @markets Read full article

Source: @markets Read full article

——————–

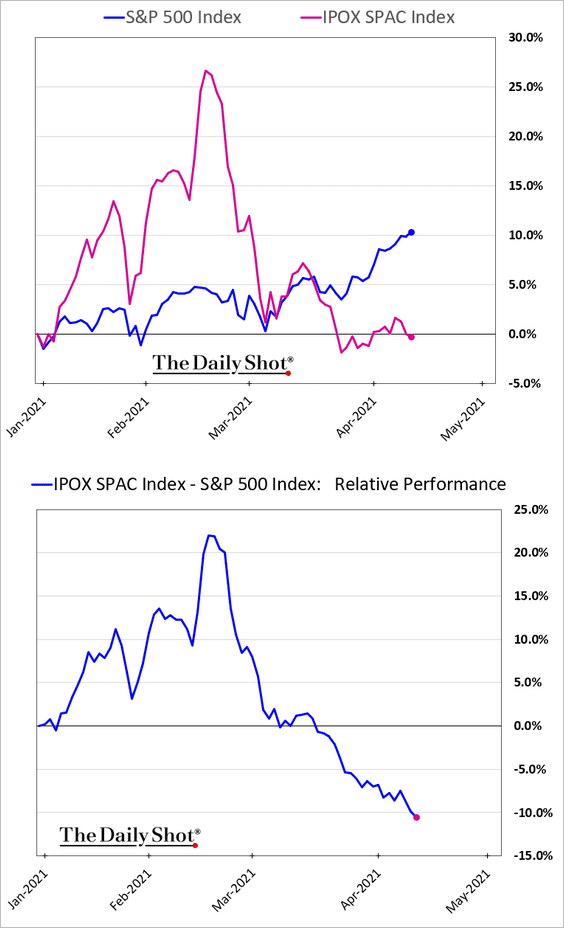

9. SPACs are widening their underperformance.

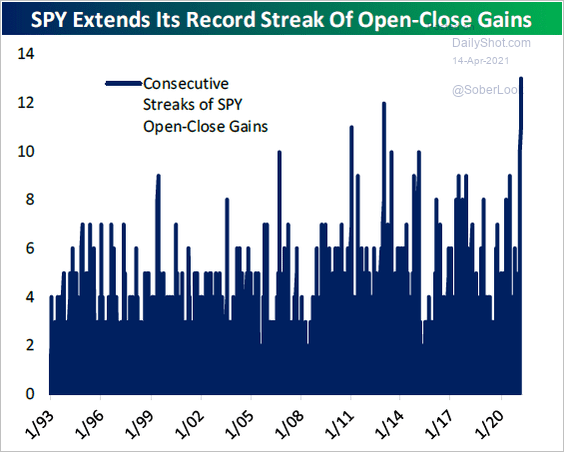

10. SPY (S&P 500 ETF) continues its streak of open-to-close gains.

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

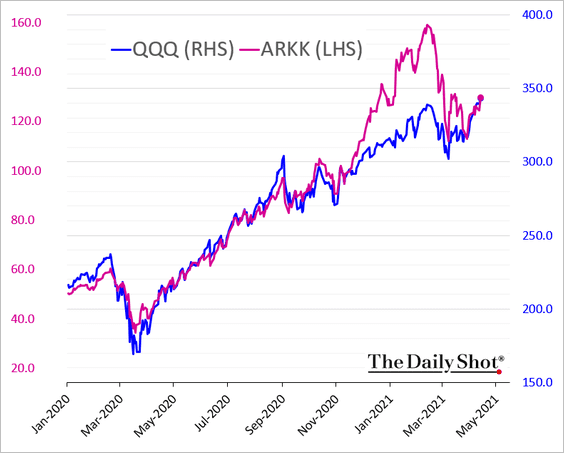

11. The ARK Innovation ETF is now trading more in line with the Nasdaq 100.

Back to Index

Alternatives

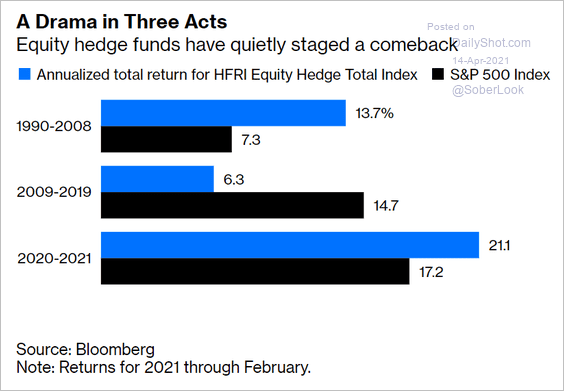

1. Equity hedge funds have outperformed since the start of 2020.

Source: @bopinion Read full article

Source: @bopinion Read full article

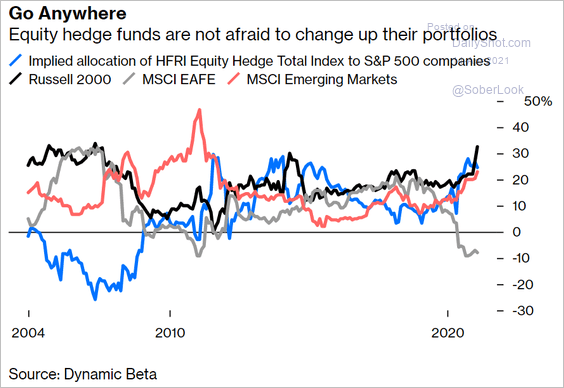

2. Equity hedge funds are not shy about rapidly adjusting their broad allocations.

Source: @bopinion Read full article

Source: @bopinion Read full article

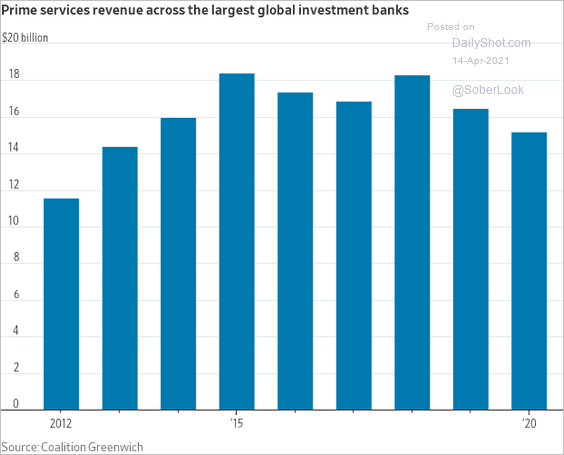

3. Will we see further declines in prime brokerage revenues after the Archegos fiasco?

Source: @WSJ Read full article

Source: @WSJ Read full article

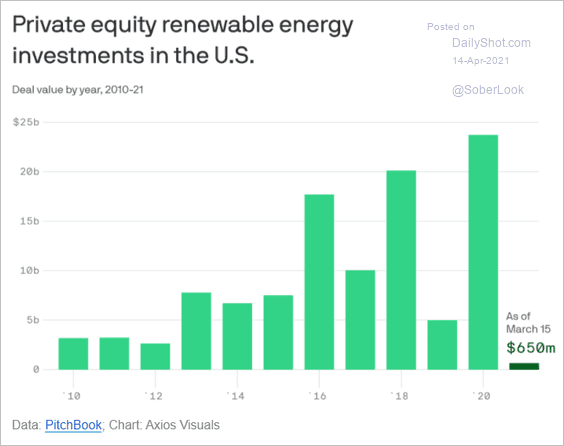

4. Private equity investors have been showing more interest in renewables.

Source: @axios Read full article

Source: @axios Read full article

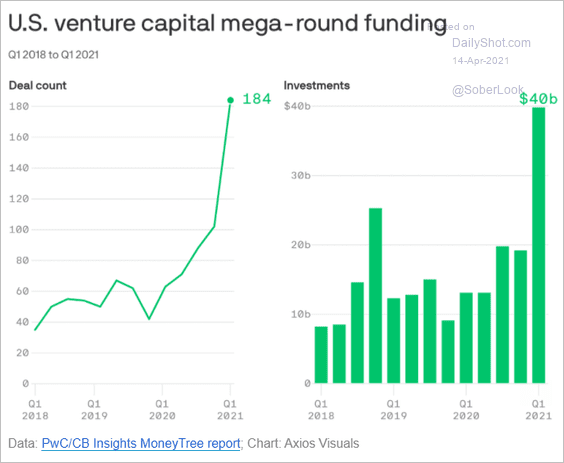

5. US VC mega-round funding activity spiked last quarter.

Source: @axios Read full article

Source: @axios Read full article

Back to Index

Credit

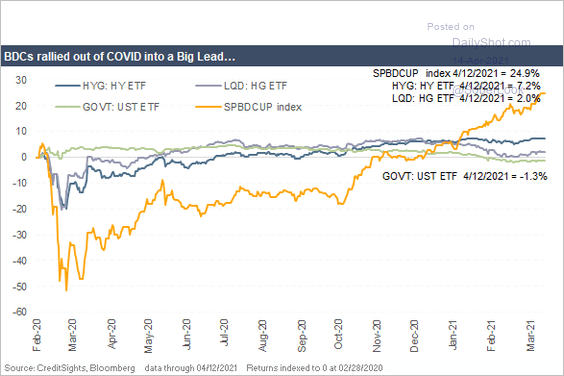

1. BDCs are widening their outperformance.

Source: CreditSights

Source: CreditSights

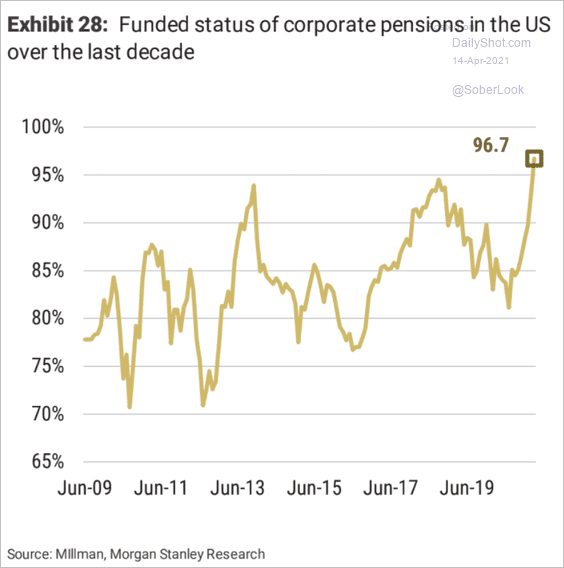

2. US corporate pensions are almost 97% funded.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

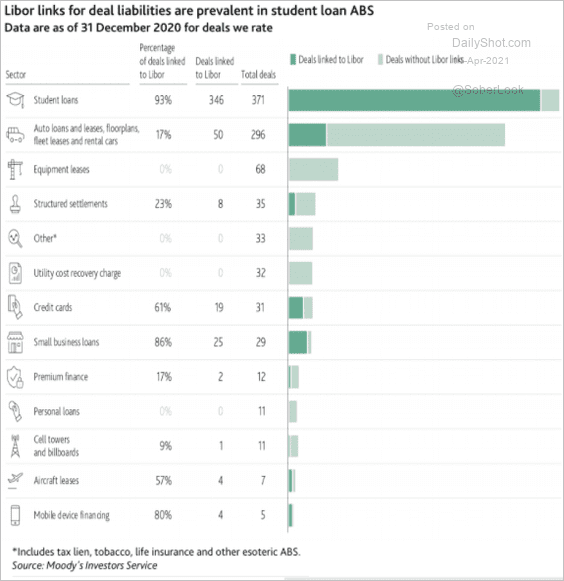

3. What types of ABS deals are linked to LIBOR?

Source: Moody’s Investors Service

Source: Moody’s Investors Service

Back to Index

Rates

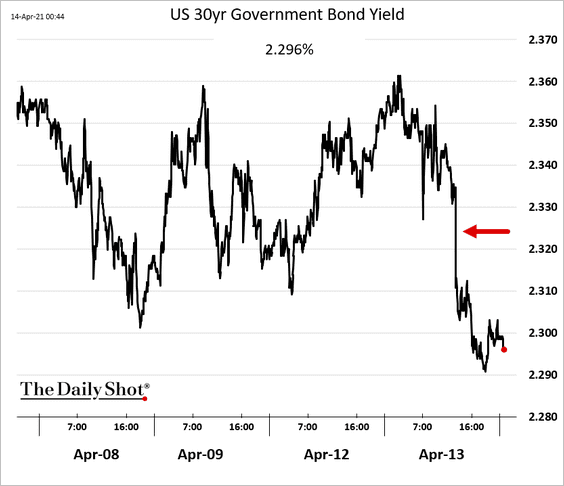

1. The 30yr Treasury auction was surprisingly strong.

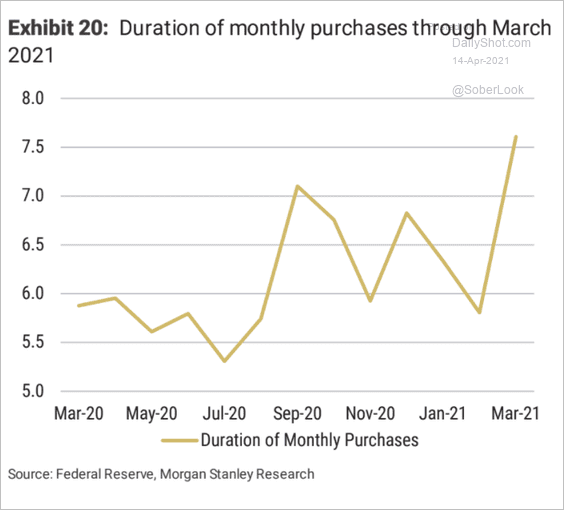

2. Here is the duration of the Fed’s monthly Treasury purchases.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

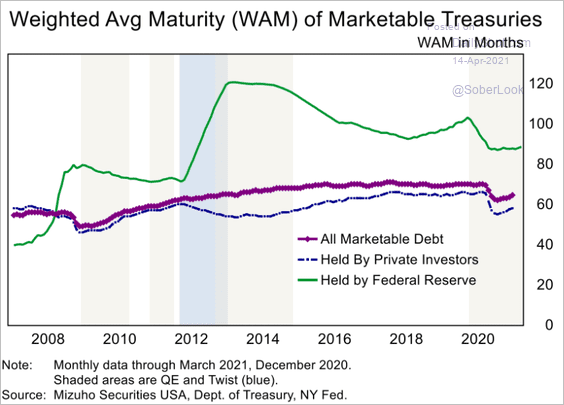

And this chart shows the weighted average maturity of Treasuries held by the central bank (vs. the market).

Source: Mizuho Securities USA

Source: Mizuho Securities USA

Back to Index

Global Developments

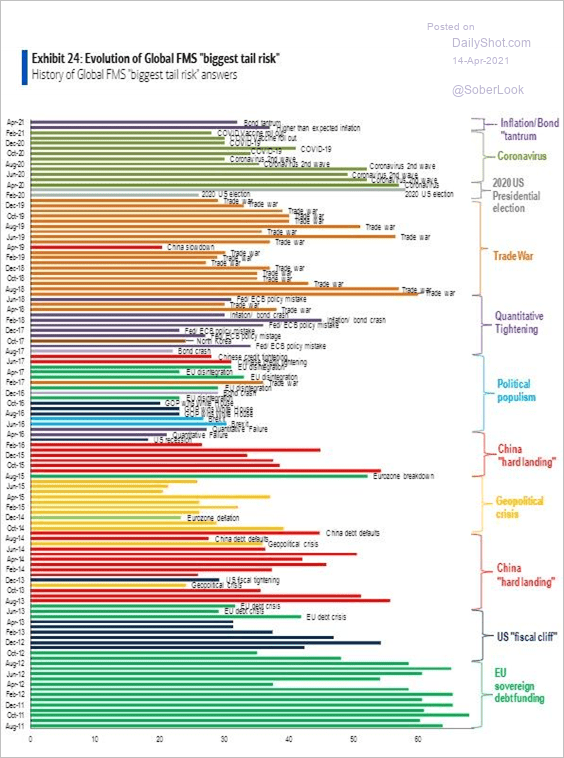

1. Inflation/taper-tantrum reamins the biggest tail risk, according to the BofA fund manager survey.

Source: BofA Global Research

Source: BofA Global Research

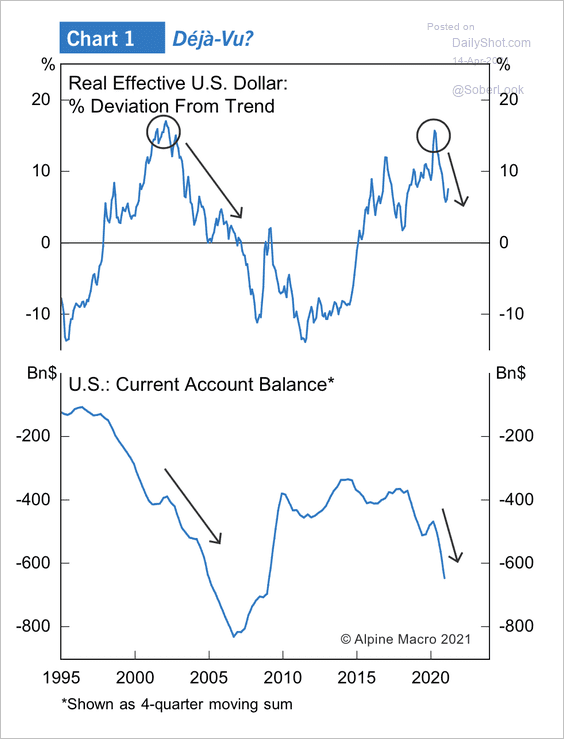

2. The dollar has deviated above its long-term trend as the US current account deficit widens (similar to the late 1990s).

Source: Alpine Macro

Source: Alpine Macro

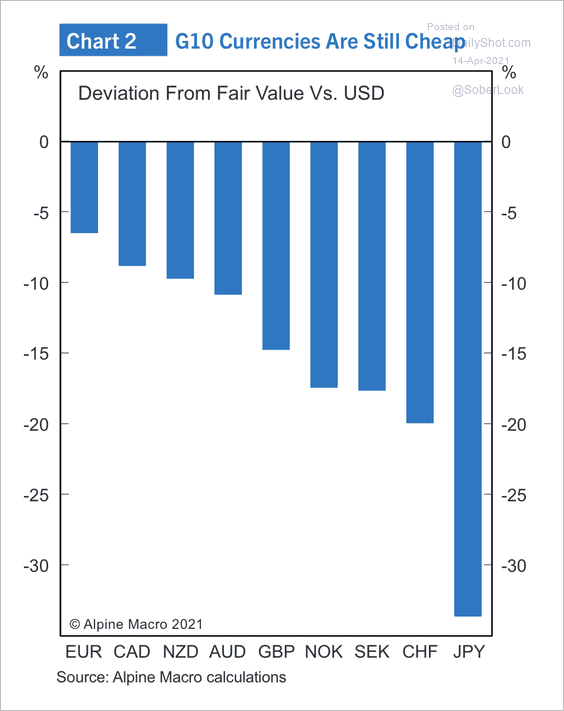

3. G10 currencies are still undervalued versus the dollar.

Source: Alpine Macro

Source: Alpine Macro

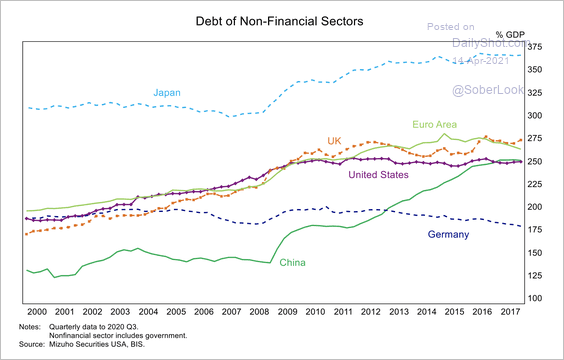

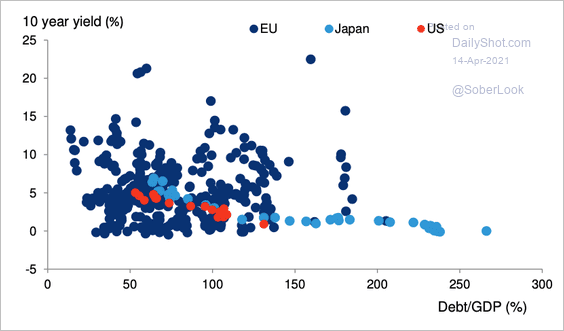

4. Here is a look at total debt/GDP ratios across major economies.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

5. The responsiveness of yields to government debt-to-GDP ratios tends to decline beyond the 100% threshold. Also, there are very few observations of debt/GDP above 200% outside of Japan.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

Food for Thought

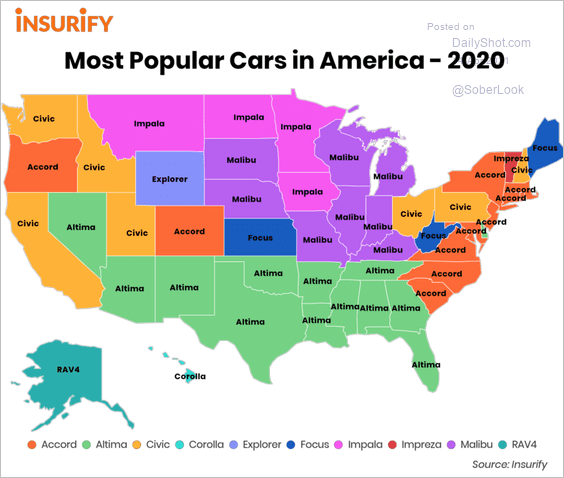

1. Most popular cars in the US:

Source: Insurify Read full article

Source: Insurify Read full article

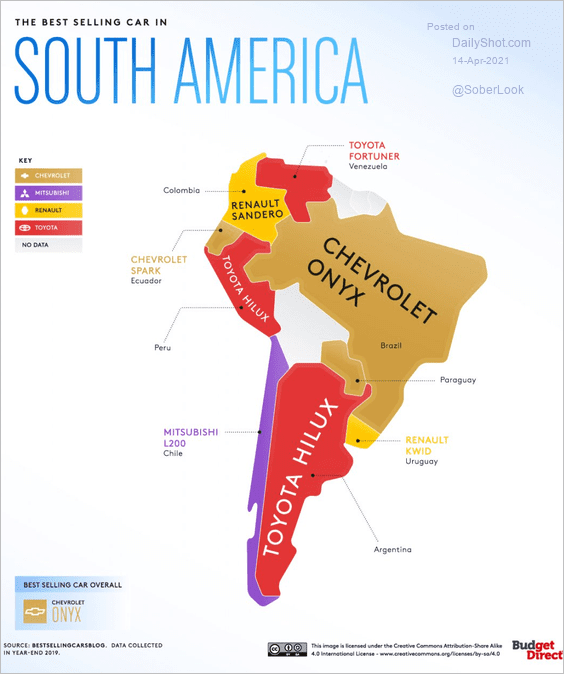

2. Best-selling cars in …

• South America:

Source: ClassicCars.Com Read full article

Source: ClassicCars.Com Read full article

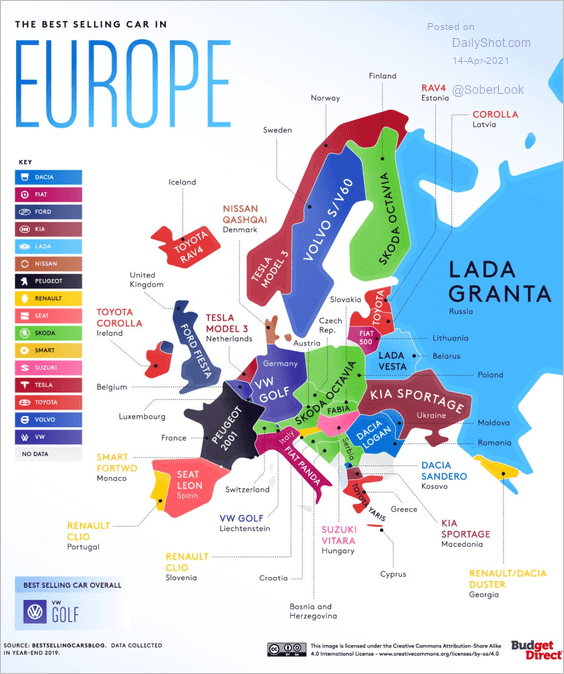

• Europe:

Source: ClassicCars.Com Read full article

Source: ClassicCars.Com Read full article

——————–

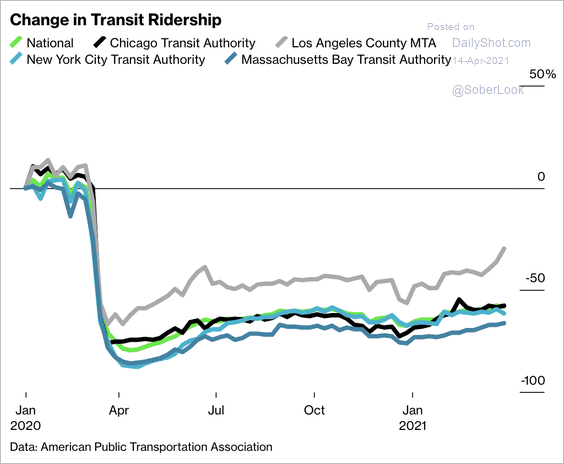

3. US public transit ridership:

Source: @business Read full article

Source: @business Read full article

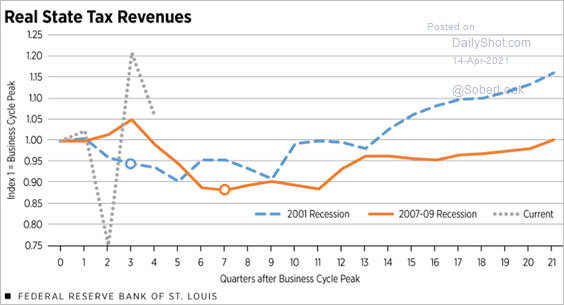

4. State tax revenues:

Source: @stlouisfed Read full article

Source: @stlouisfed Read full article

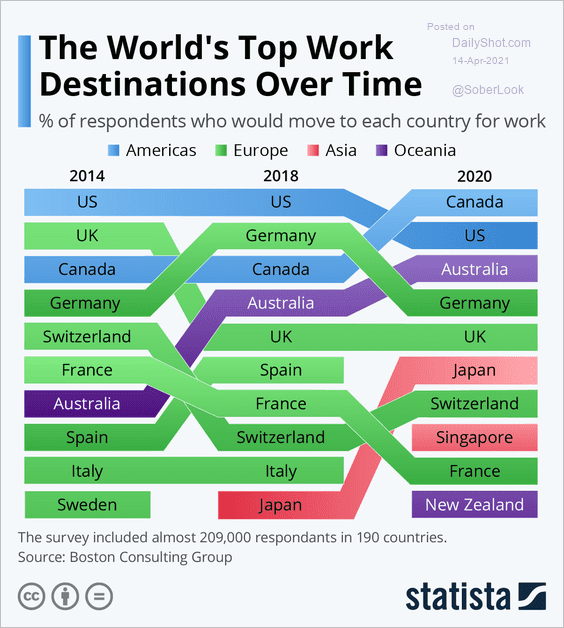

5. Top work destinations:

Source: Statista

Source: Statista

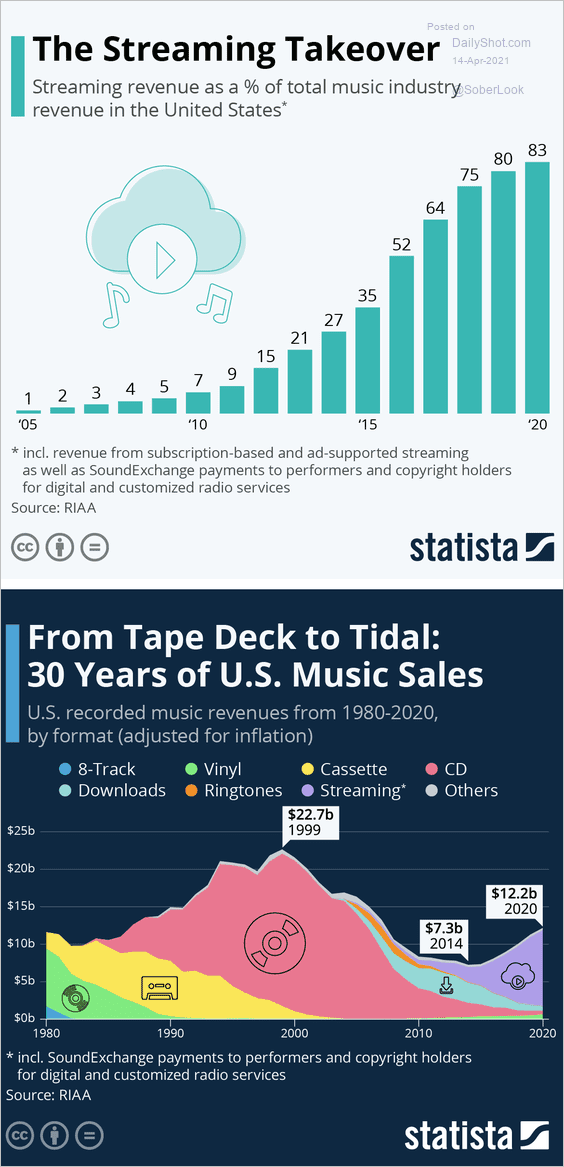

6. Streaming music revenues:

Source: Statista

Source: Statista

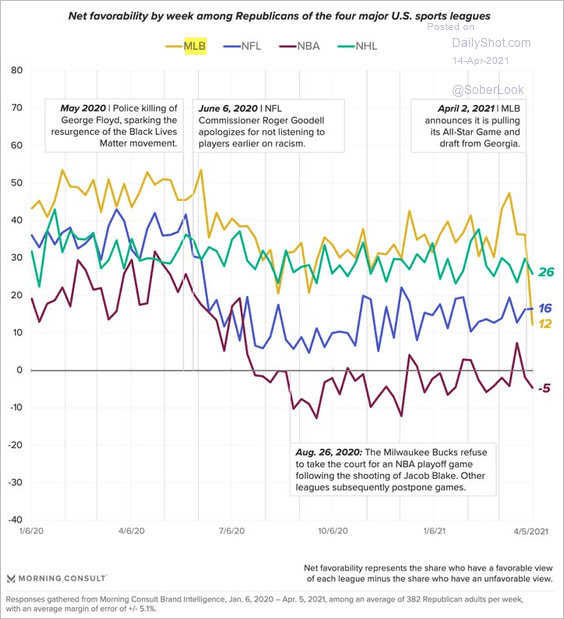

7. Republicans’ favorability of major US sports leagues:

Source: @MorningConsult, @AlexMSilverman Read full article

Source: @MorningConsult, @AlexMSilverman Read full article

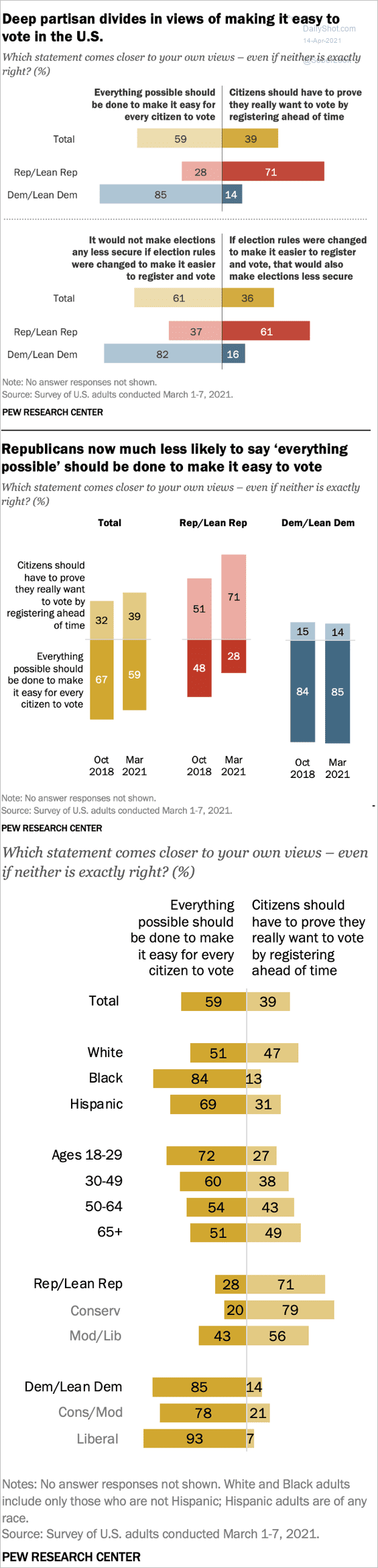

8. Views on making it easier for Americans to vote:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

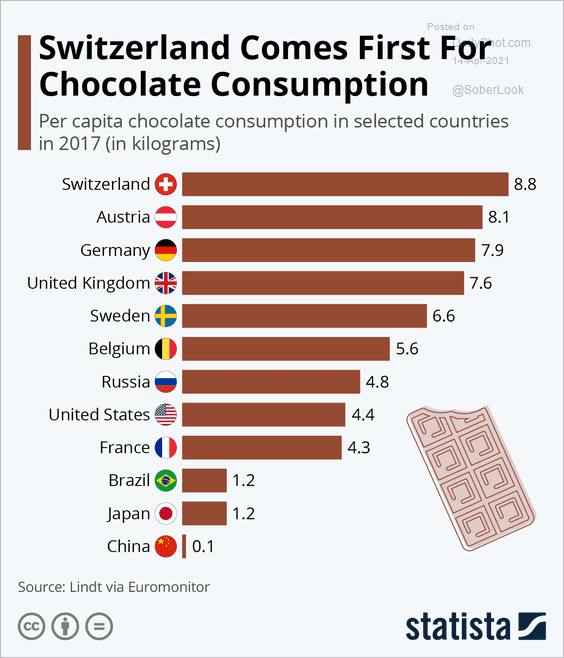

9. Chocolate consumption:

Source: Statista

Source: Statista

——————–

Back to Index