The Daily Shot: 21-Apr-21

• The United States

• The United Kingdom

• Europe

• Asia – Pacific

• China

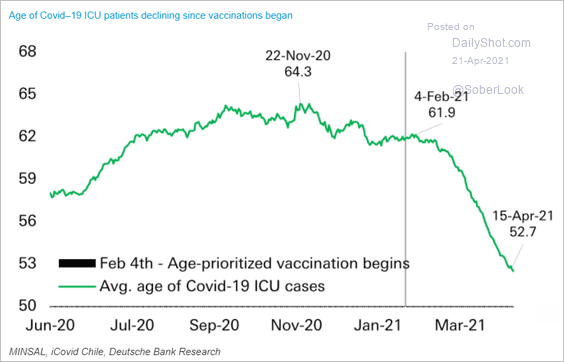

• Emerging Markets

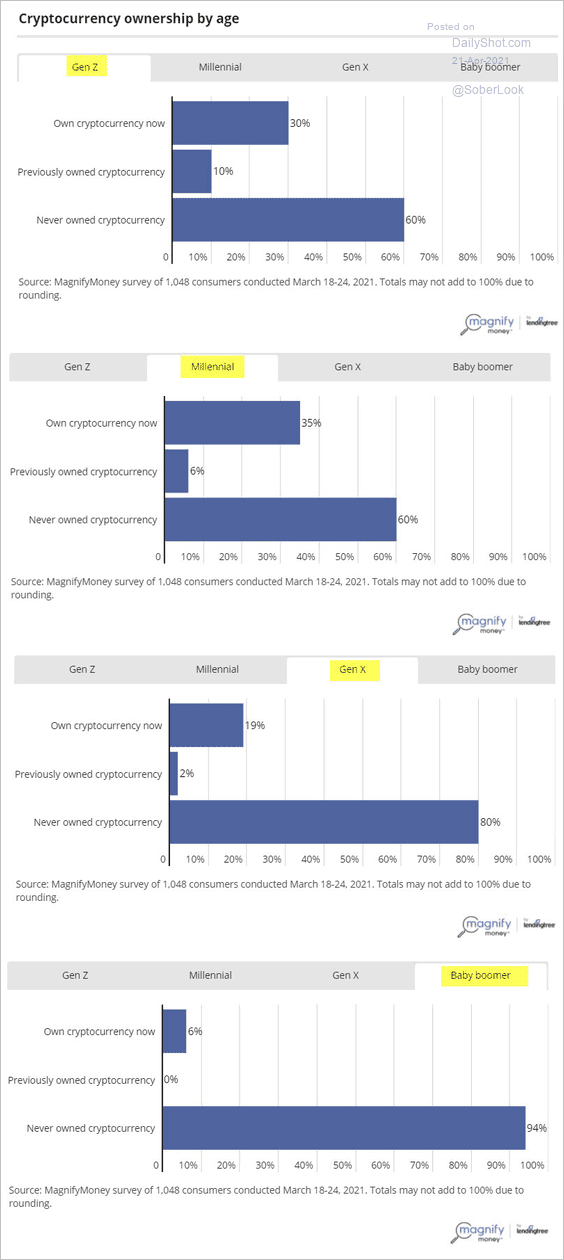

• Cryptocurrency

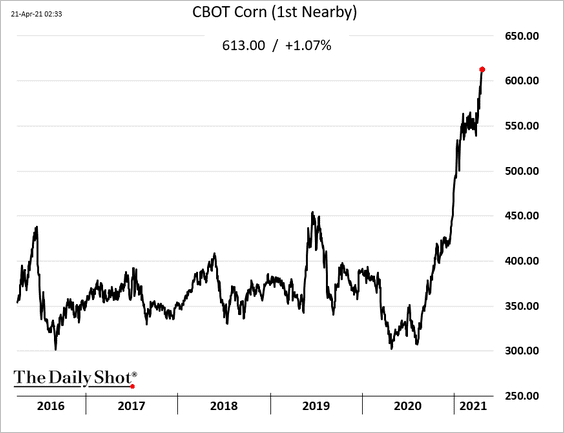

• Commodities

• Energy

• Equities

• Credit

• Food for Thought

The United States

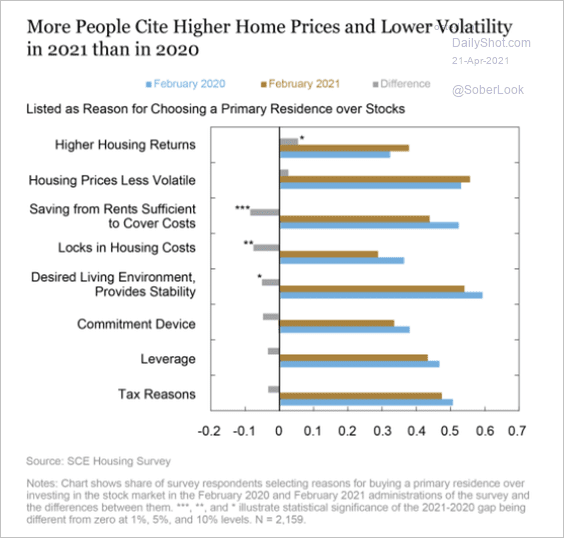

1. Let’s begin with some trends in housing.

• Homebuyers emphasize housing returns and stability as reasons for buying a home vs. stocks (compared to 2020).

Source: NY Fed Read full article

Source: NY Fed Read full article

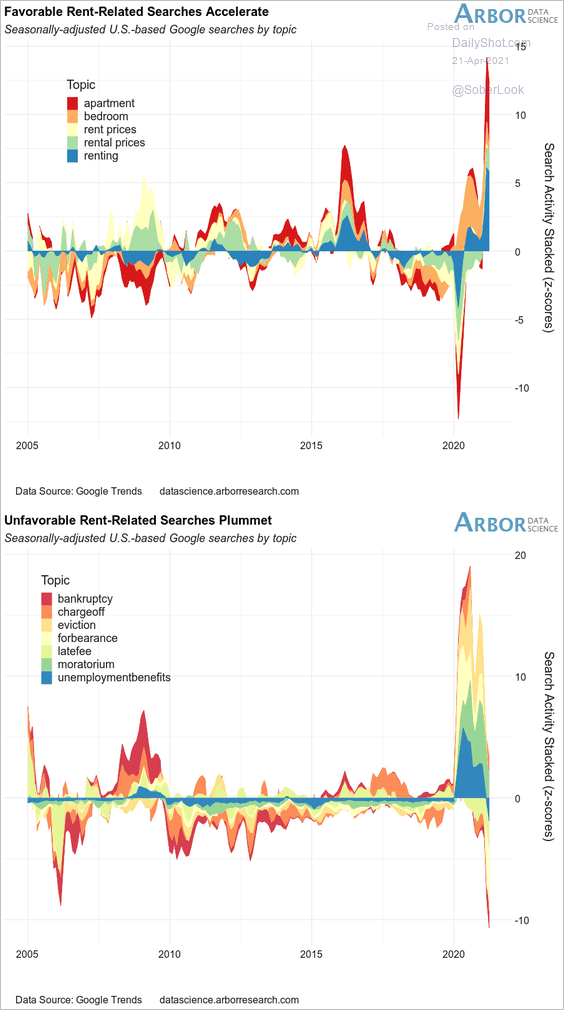

• Rent-related search activity has been more positive in recent weeks.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

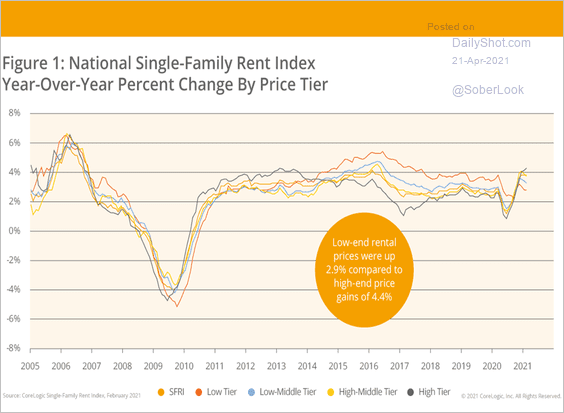

• Single-family housing rents on higher-tier properties are rising at the fastest pace in years (wealthier households moving out of urban areas). But lower-tier properties are lagging.

Source: CoreLogic

Source: CoreLogic

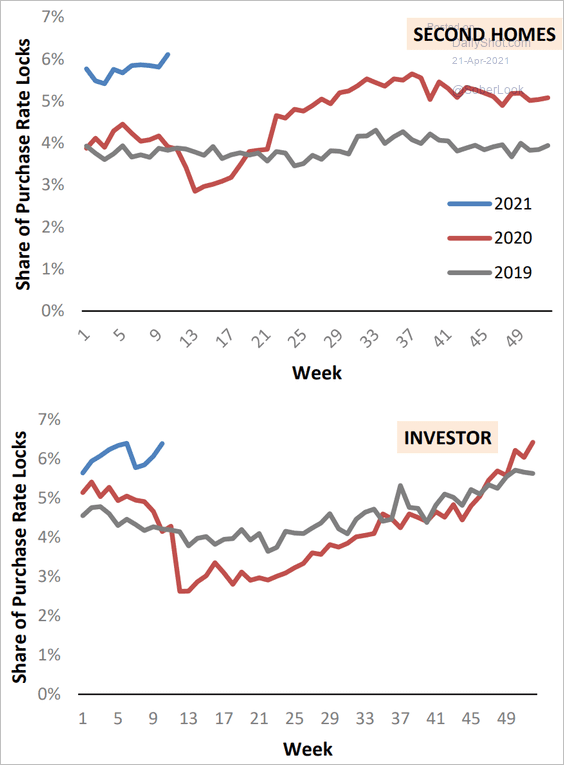

• Loan applications to purchase a second home or an investment property are well above the levels we’ve seen in recent years.

Source: AEI Housing Center

Source: AEI Housing Center

——————–

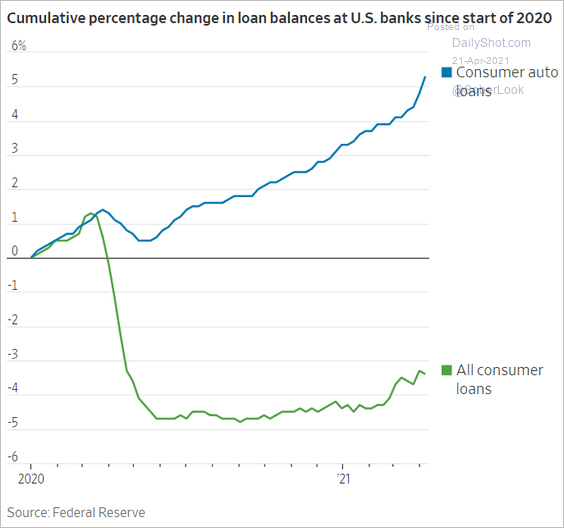

2. The nation’s automobile market is heating up.

Source: @WSJ Read full article

Source: @WSJ Read full article

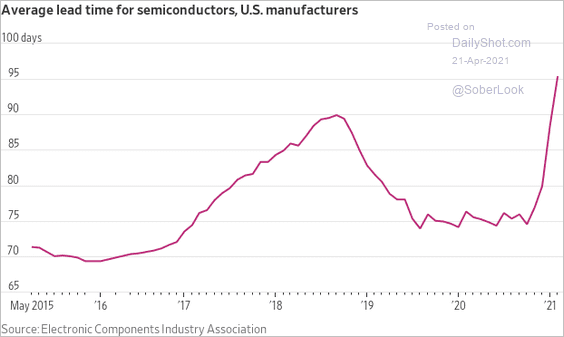

Shortages of new vehicles due to semiconductor supply issues …

Source: @WSJ Read full article

Source: @WSJ Read full article

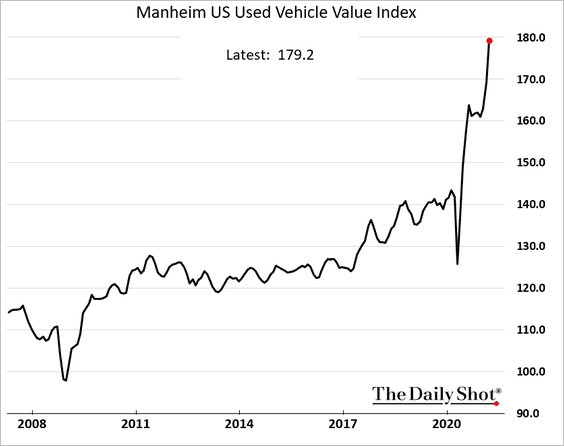

… helped boost prices on used cars.

——————–

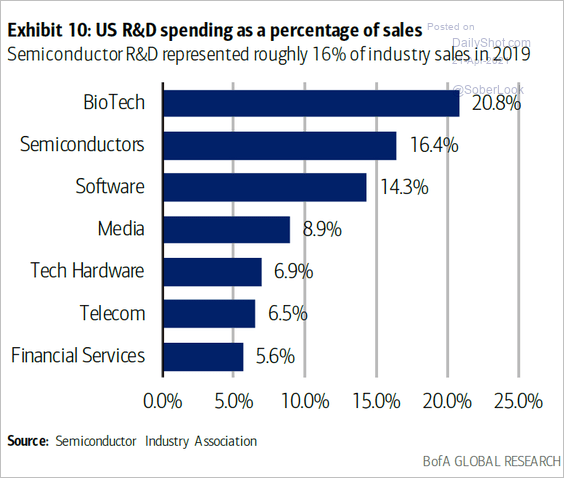

3. The semiconductor industry requires significant R&D spending.

Source: BofA Global Research

Source: BofA Global Research

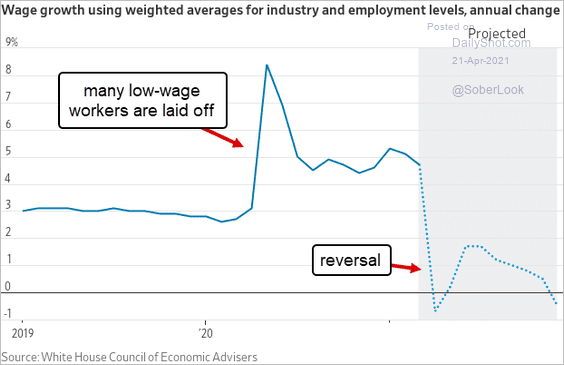

4. Last year’s upside distortion in wage growth will now show up on the downside.

Source: @jeffsparshott

Source: @jeffsparshott

Back to Index

The United Kingdom

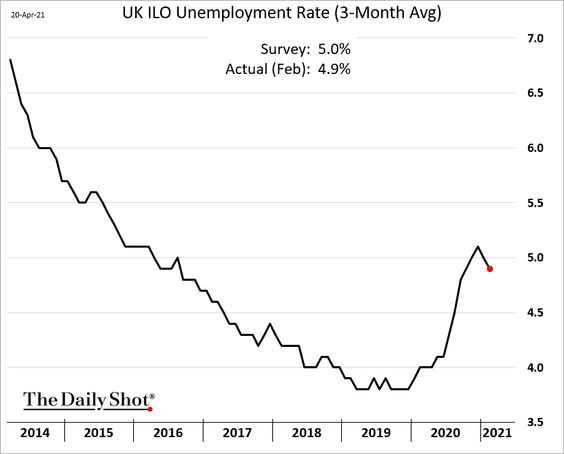

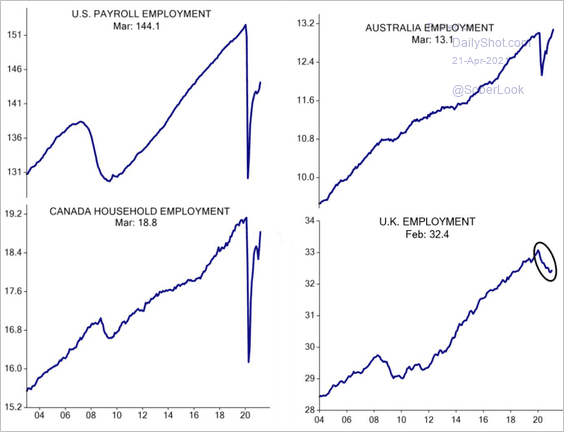

1. The unemployment rate ticked lower.

But the UK’s employment recovery has been in limbo.

Source: Evercore ISI

Source: Evercore ISI

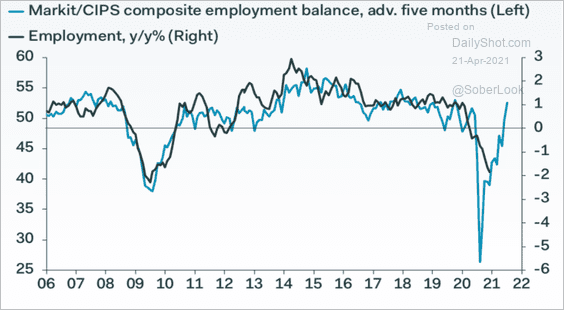

High-frequency indicators point to a rebound in the jobs market ahead.

• PMI employment:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

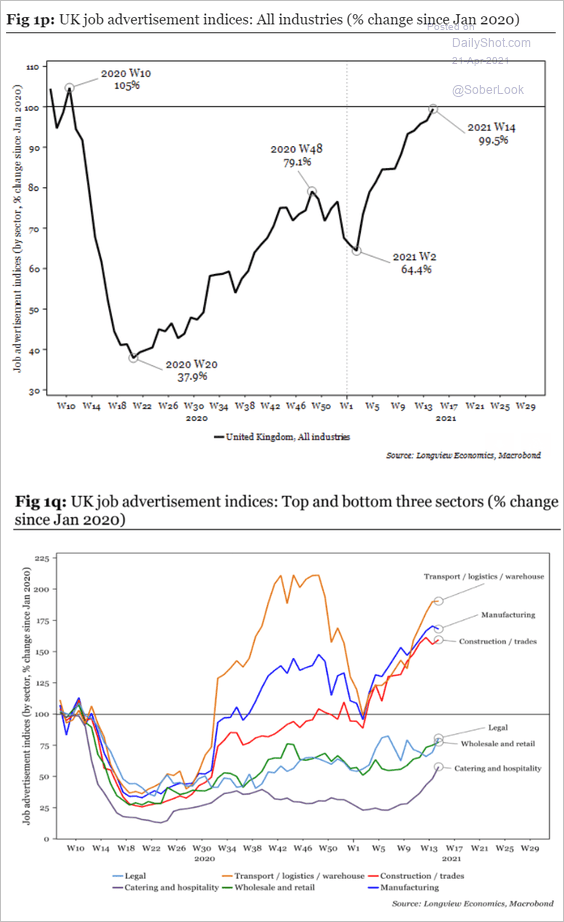

• Job ads:

Source: Longview Economics

Source: Longview Economics

——————–

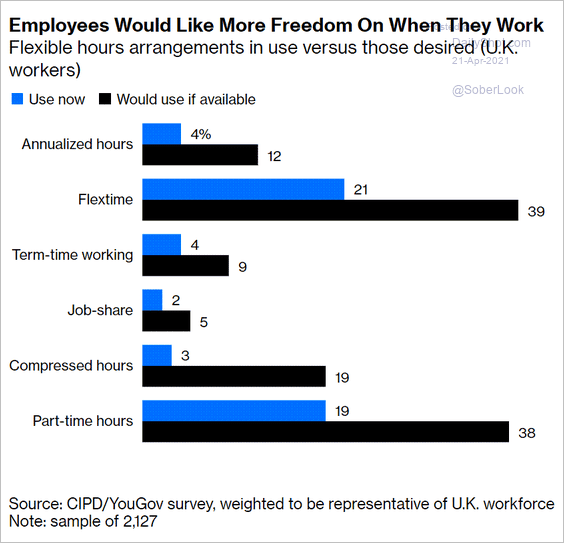

2. UK employees are looking for more flexible working arrangements.

Source: Chris Hughes, Bloomberg Read full article

Source: Chris Hughes, Bloomberg Read full article

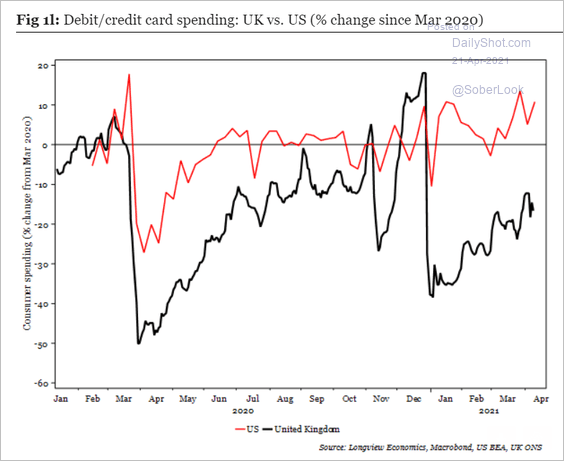

3. Debit/credit card spending recovery has been lagging the same indicator in the US.

Source: Longview Economics

Source: Longview Economics

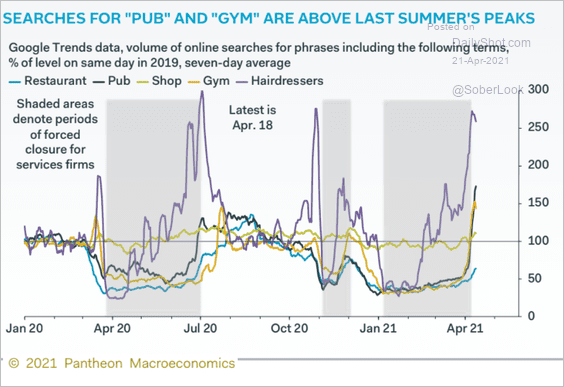

4. Online search activity for “going out” is rebounding.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

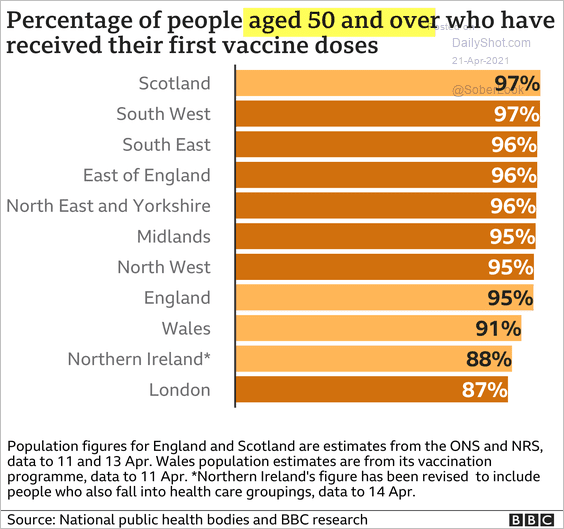

5. The UK has done an impressive job in reducing COVID-related pressures on the healthcare system.

Source: BBC Read full article

Source: BBC Read full article

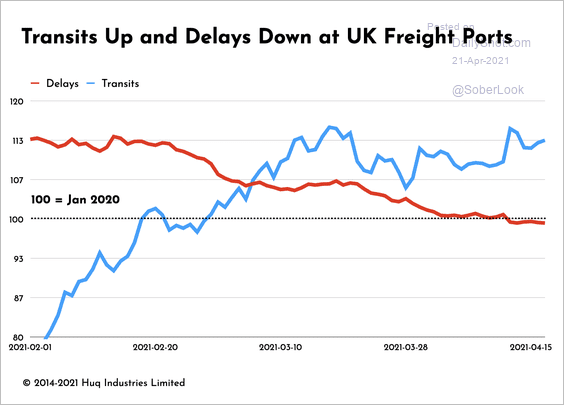

6. Port delays continue to ease.

Source: Huq Read full article

Source: Huq Read full article

Back to Index

Europe

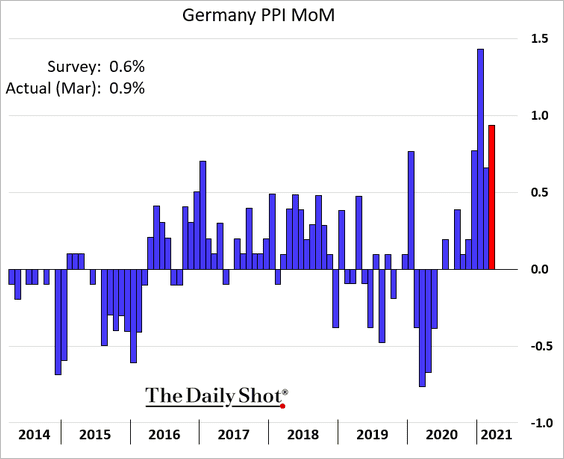

1. German producer prices are rising.

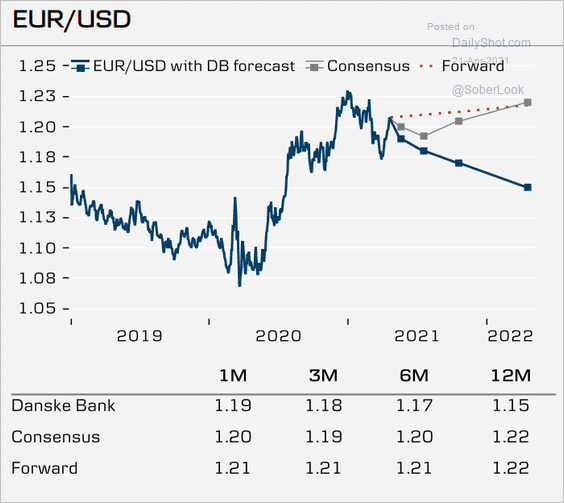

2. Danske Bank sees further downside for the euro.

Source: Danske Bank

Source: Danske Bank

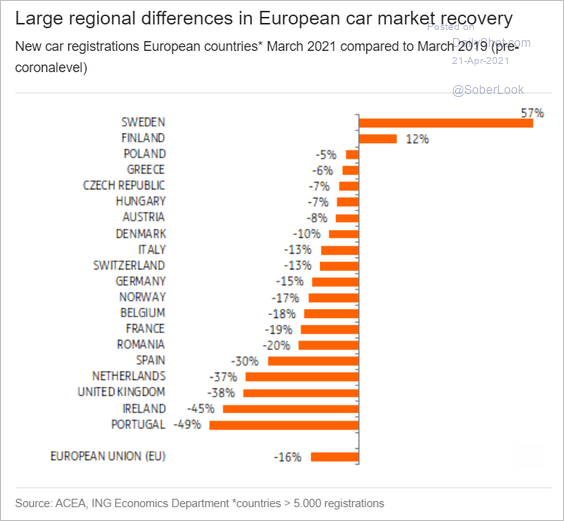

3. Next, we have some updates on Sweden.

• Car sales have outperformed other European economies.

Source: ING

Source: ING

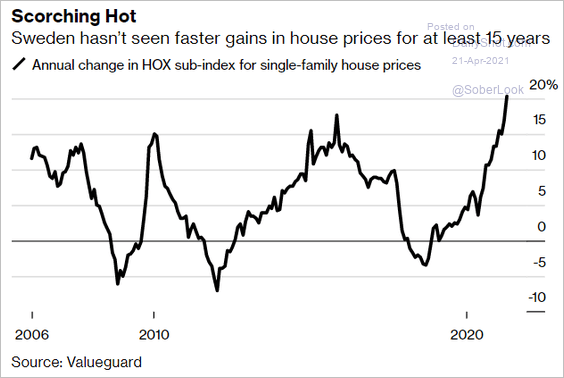

• Home prices are surging.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

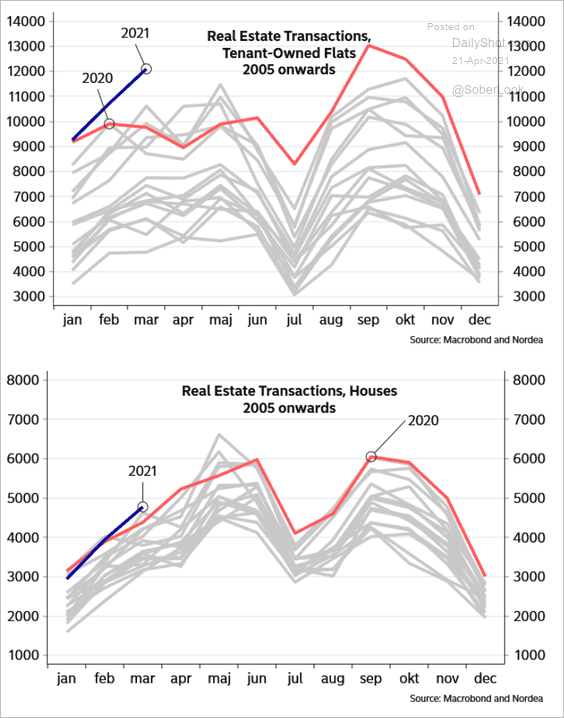

– Property transaction volumes are at multi-year highs.

Source: Nordea Markets

Source: Nordea Markets

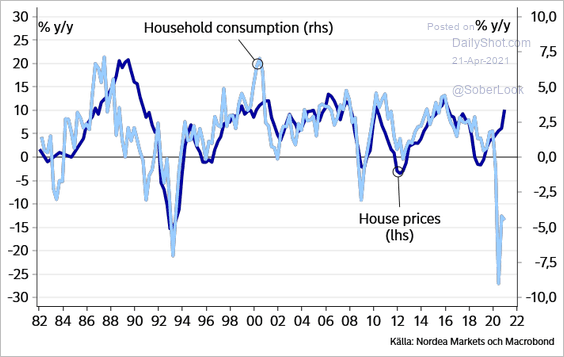

– Home prices have diverged from consumer spending.

Source: Nordea Markets

Source: Nordea Markets

——————–

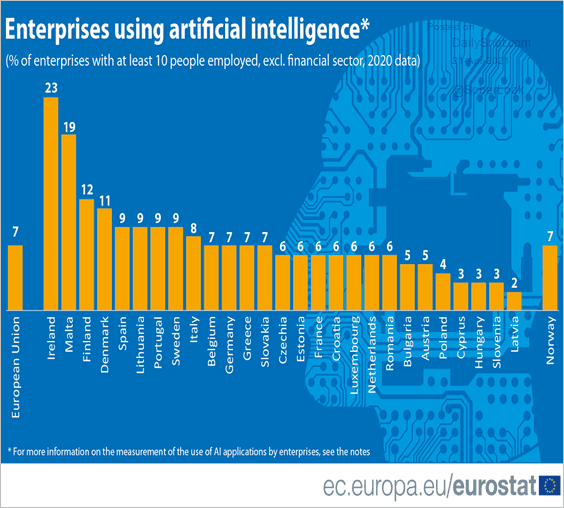

4. Which European countries use most AI in business?

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia – Pacific

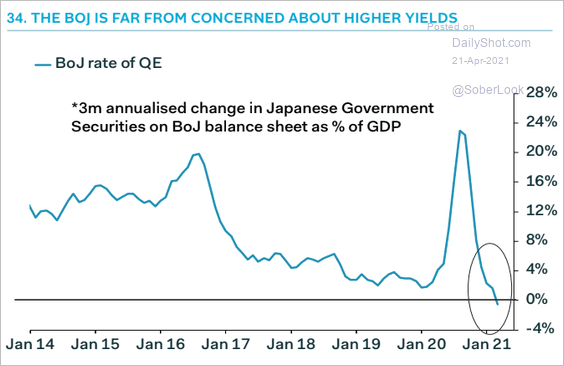

1. The BoJ has been cautious about JGB purchases.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

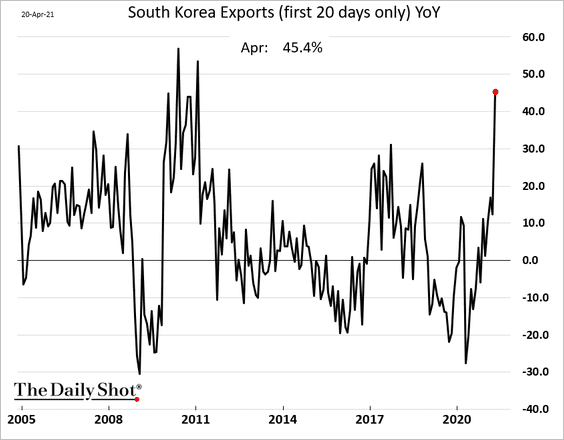

2. South Korea’s exports remain robust. Much of the 45% year-over-year spike was due to base effects – but not all.

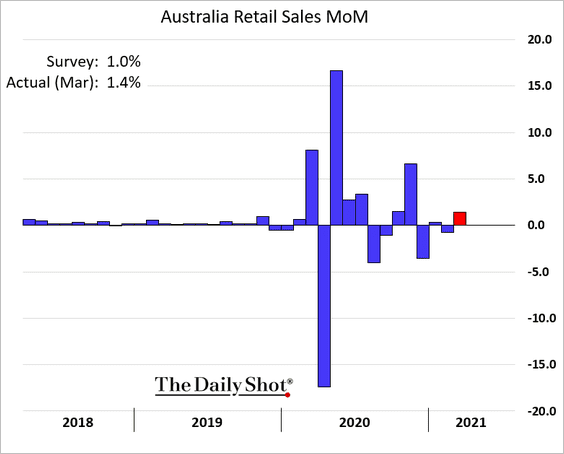

3. Australia’s retail sales firmed up in March.

Back to Index

China

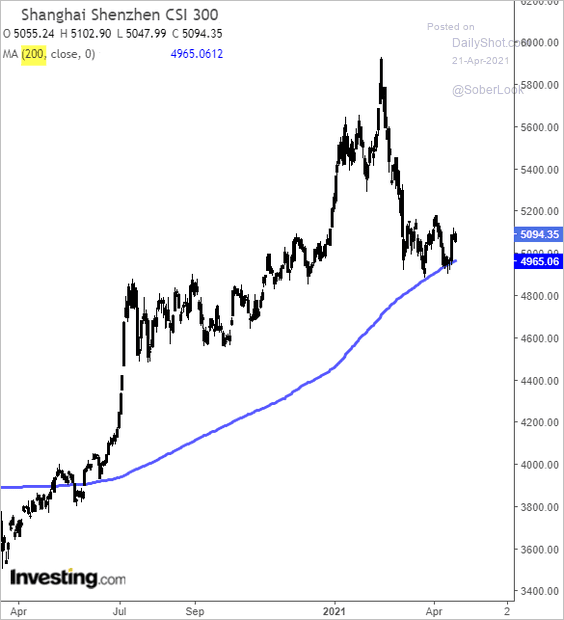

1. The stock market benchmark is holding support at the 200-day moving average.

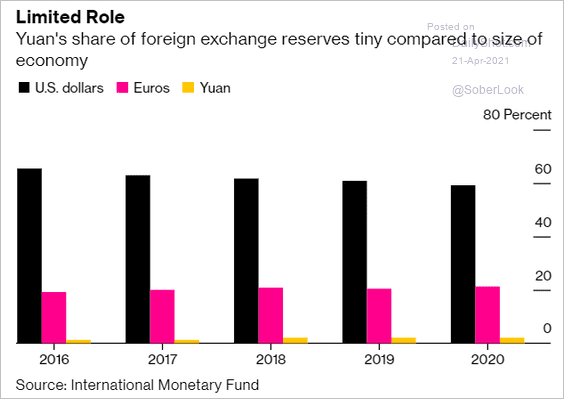

2. The yuan remains a minor component of global F/X reserves.

Source: @DiMartinoBooth, @bpolitics Read full article

Source: @DiMartinoBooth, @bpolitics Read full article

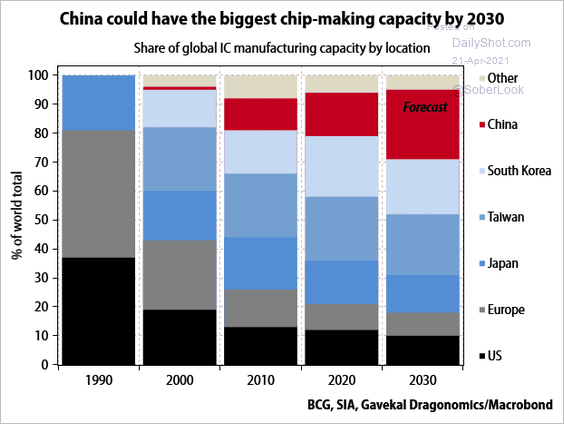

3. China’s semiconductor capacity is expected to surge over the next decade.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

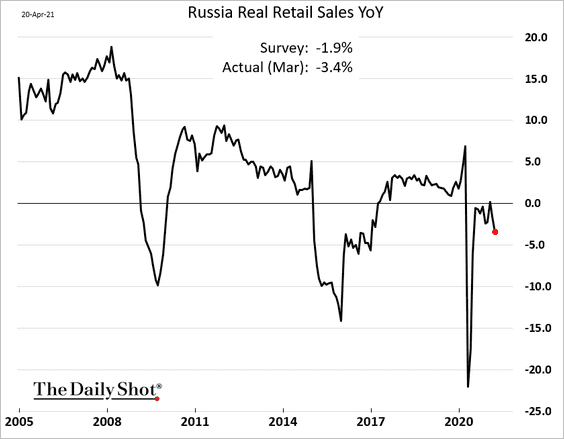

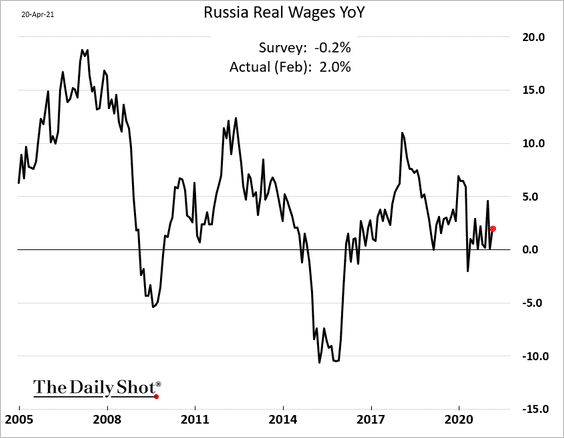

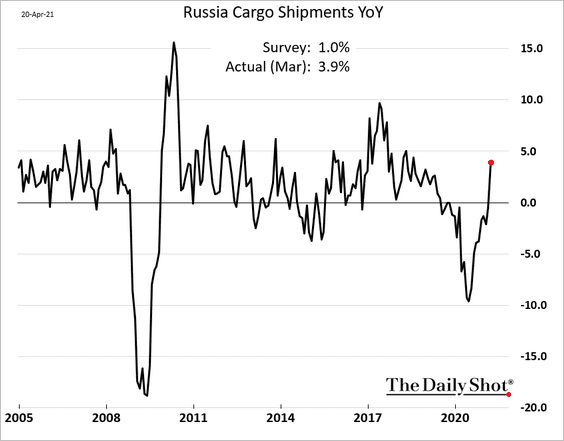

1. Let’s begin with Russia.

• The unemployment rate (lower than expected):

• Retail sales (very weak):

• Wage growth (better):

• Cargo shipments (strong):

——————–

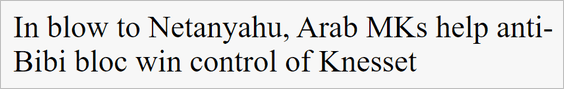

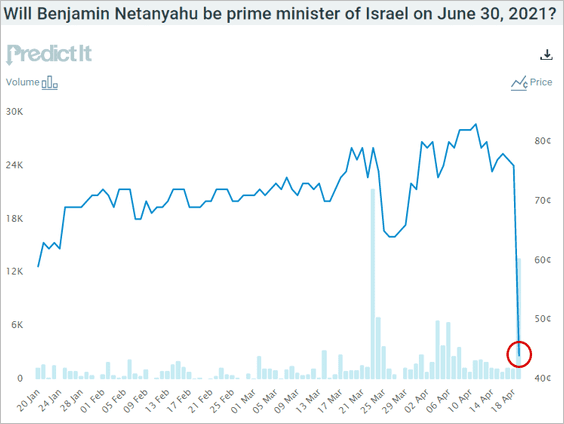

2. Benjamin Netanyahu’s odds of holding on to power have diminished.

Source: The Jerusalem Post Read full article

Source: The Jerusalem Post Read full article

——————–

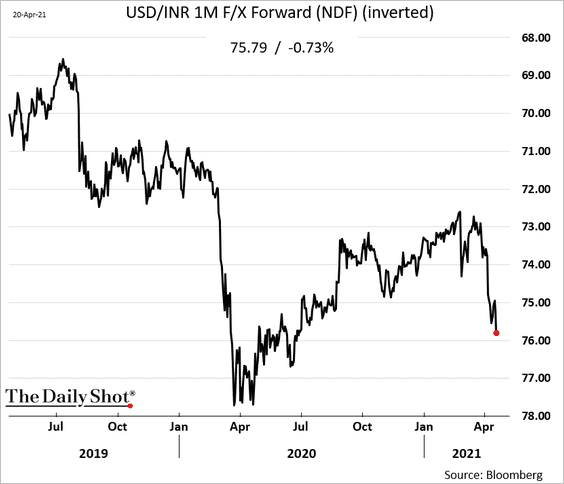

3. The rupee remains under pressure. Here is the 1-month F/X forward.

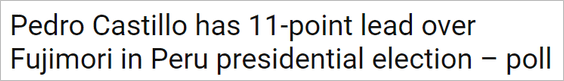

4. Peru’s far-left candidate is leading in the polls, which is spooking investors.

Source: The Rio Times Read full article

Source: The Rio Times Read full article

——————–

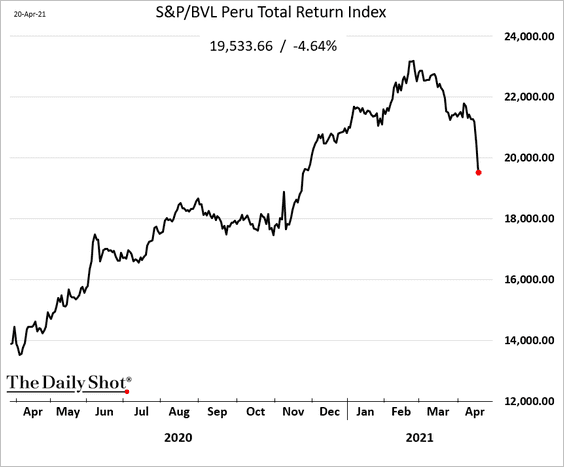

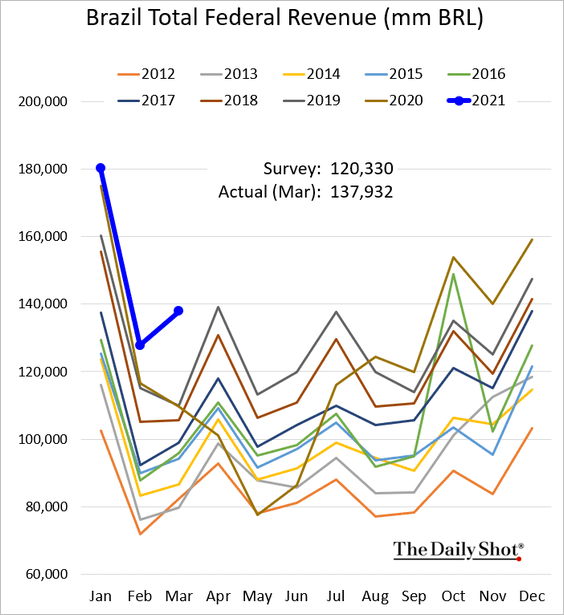

5. Brazil’s tax revenue surprised to the upside.

6. Chile’s vaccination program appears to be working, as the average age of ICU patients declines.

Source: Sebastian Brown, Deutsche Bank Research

Source: Sebastian Brown, Deutsche Bank Research

Back to Index

Cryptocurrency

1. Here is cryptocurrency ownership by age.

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

2. The massive Dogecoin rally has paused.

Source: FTX

Source: FTX

Source: Reuters Read full article

Source: Reuters Read full article

——————–

3. The Binance token is approaching record highs.

Source: FTX

Source: FTX

Back to Index

Commodities

1. US corn futures are trading above $6 bushel for the first time in years. Unfavorable weather forecasts increased concerns about the pace of planting.

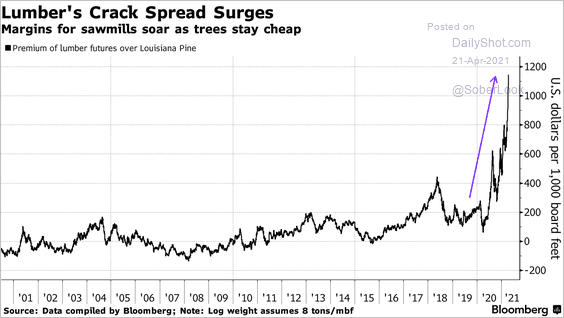

2. US lumber futures are trading at a massive premium to pine logs.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

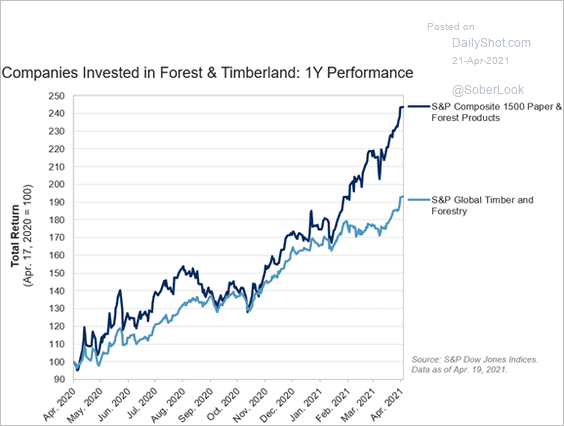

Forest and timberland properties have performed well over the past year.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Energy

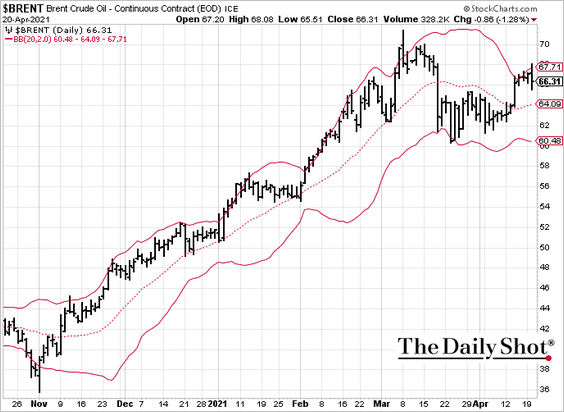

1. Brent held resistance at the upper Bollinger band.

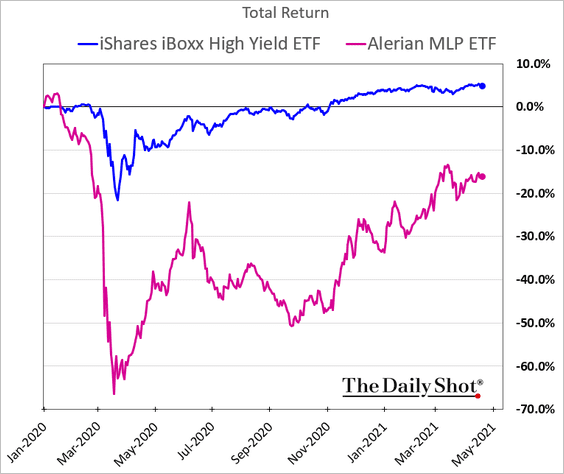

2. MLPs (pipeline companies) are yet to recover from the massive COVID crash.

Back to Index

Equities

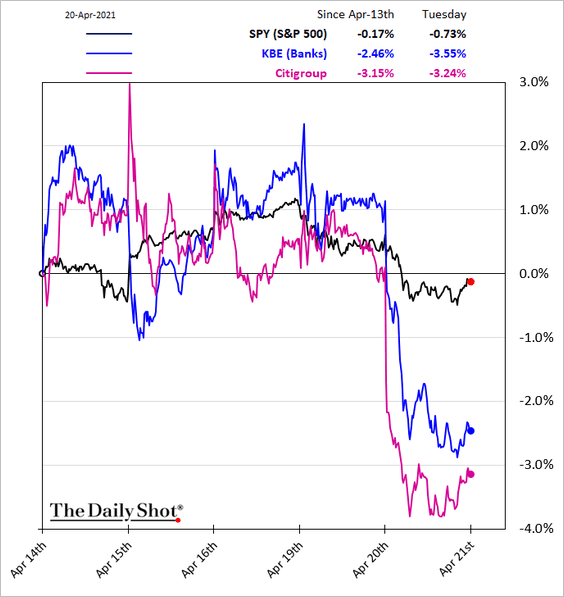

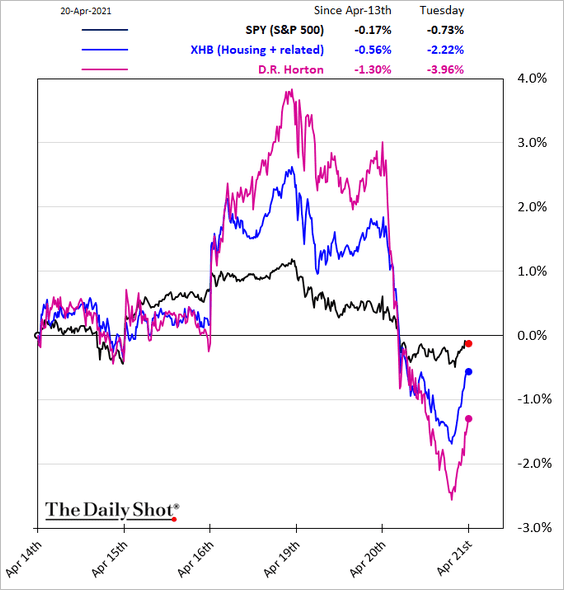

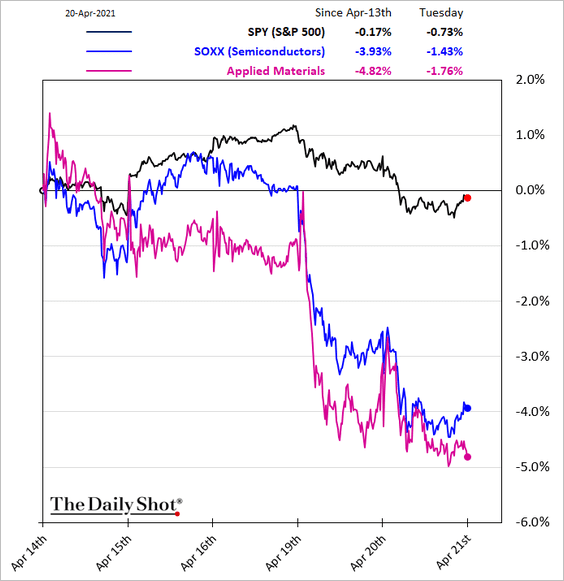

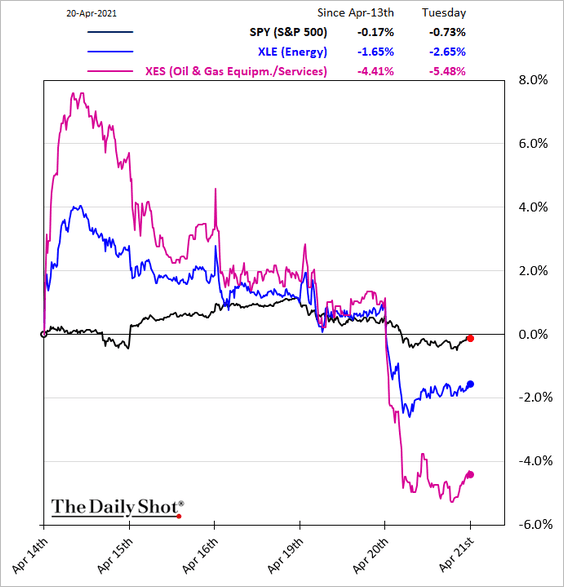

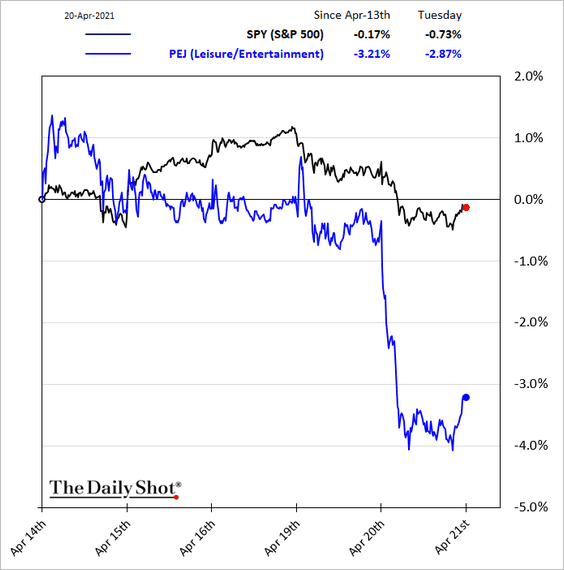

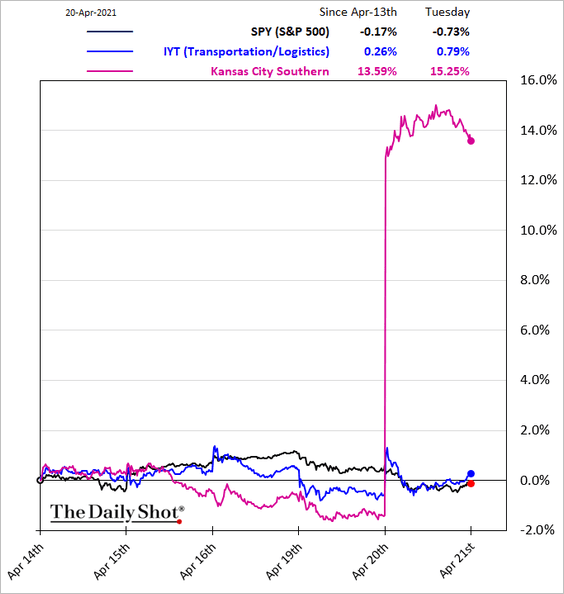

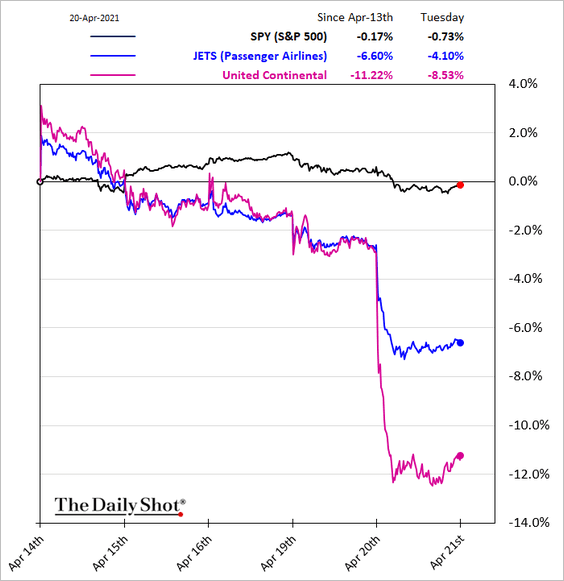

1. The stock market rally took a long-overdue pause. Cyclical sectors underperformed.

• Banks:

• Housing:

• Semiconductors:

• Energy:

• Leisure/entertainment:

• The transportation index climbed due to M&A activity.

Source: @WSJ Read full article

Source: @WSJ Read full article

But airlines slumped.

——————–

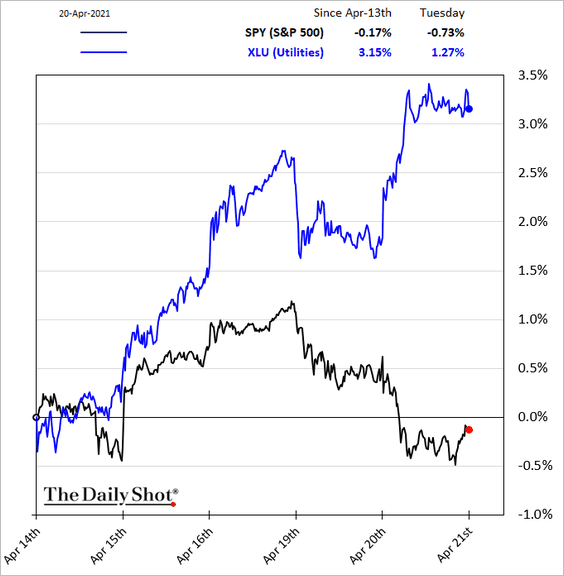

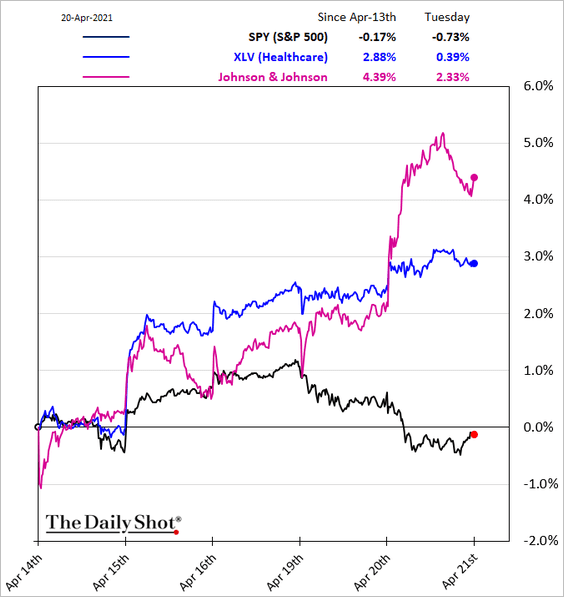

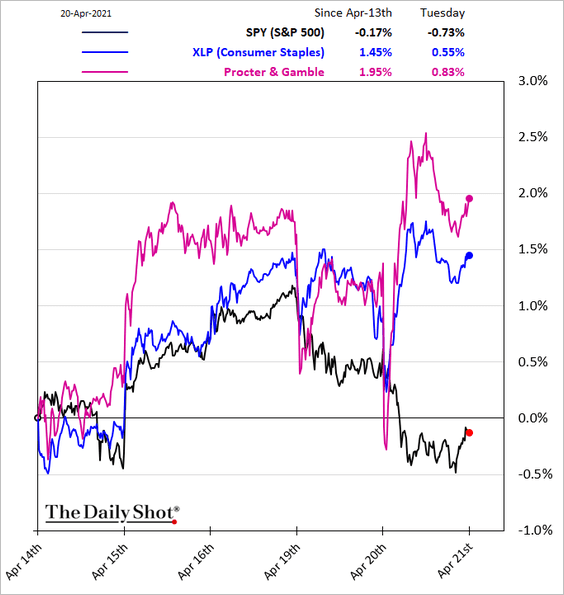

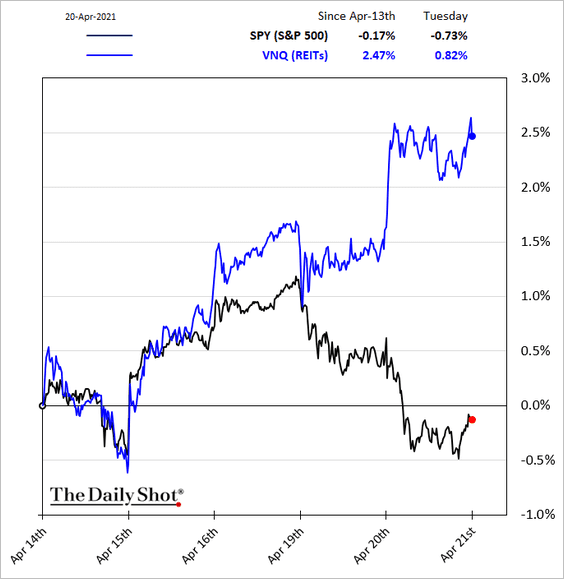

Defensive sectors gained.

• Utilities:

• Healthcare:

• Consumer staples:

• REITs:

——————–

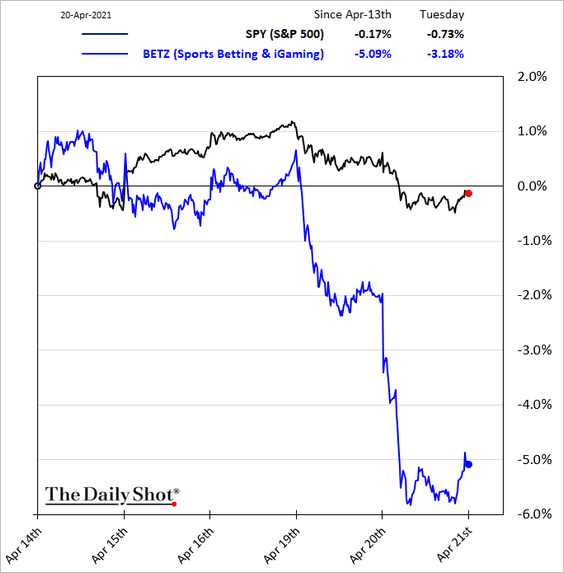

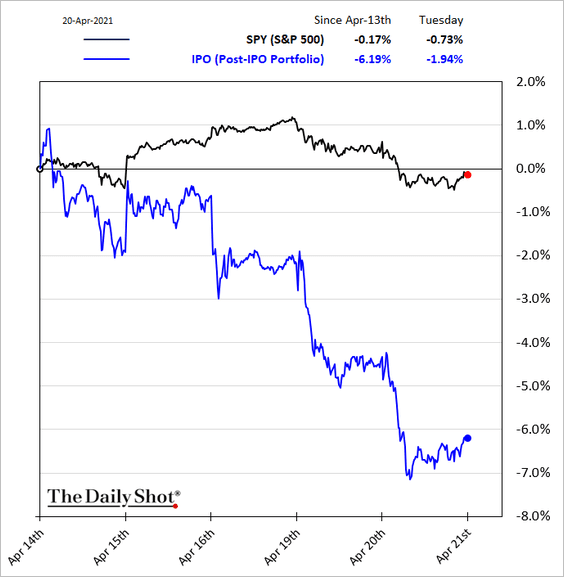

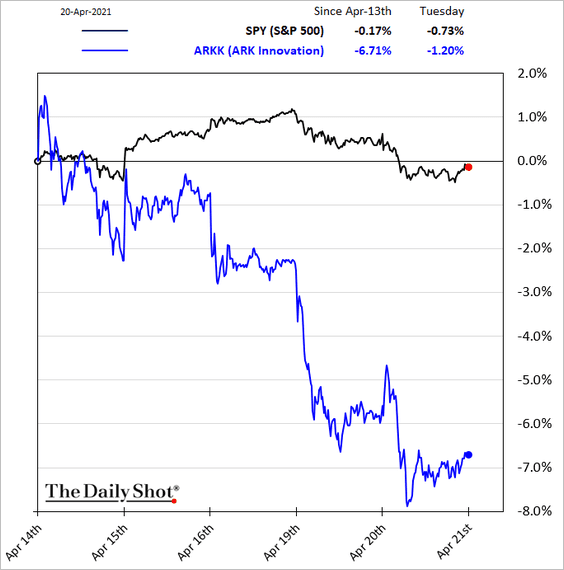

2. Here are some popular thematic ETFs.

• Sports betting:

• The post-IPO basket:

• Ark Innovation:

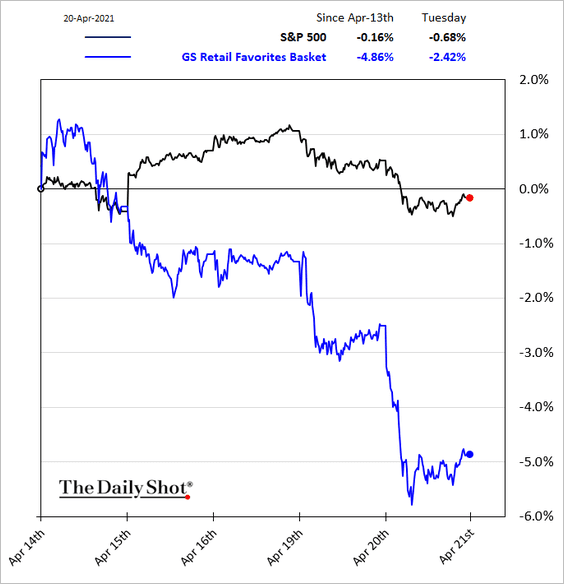

Retail favorites have been underperforming.

——————–

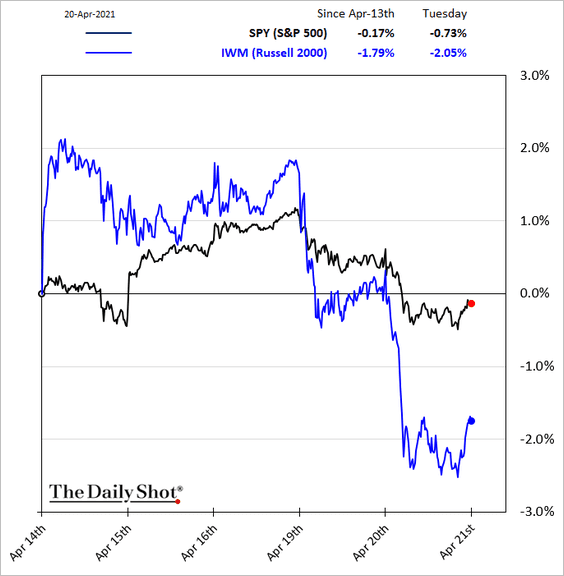

3. Small caps took a hit.

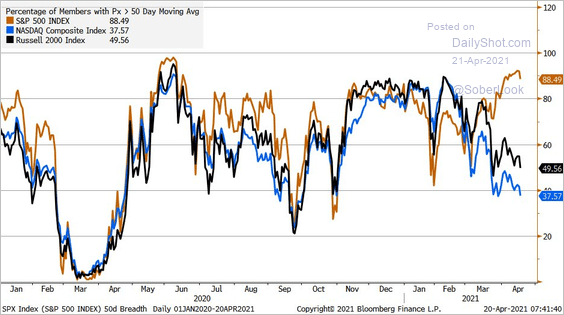

4. The S&P 500 breadth has diverged from that of the Nasdaq Composite and the Russell 2000.

Source: @LizAnnSonders

Source: @LizAnnSonders

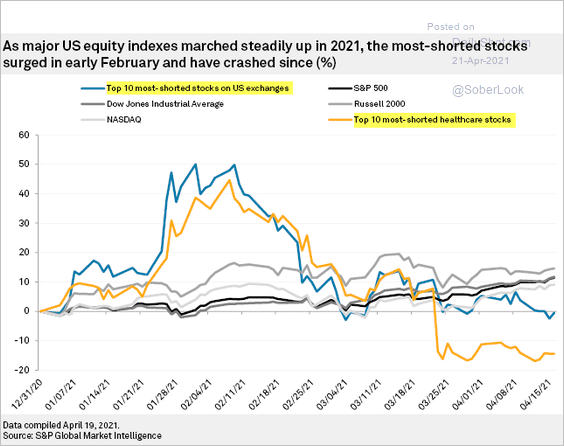

5. The most-shorted stocks are lagging again.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

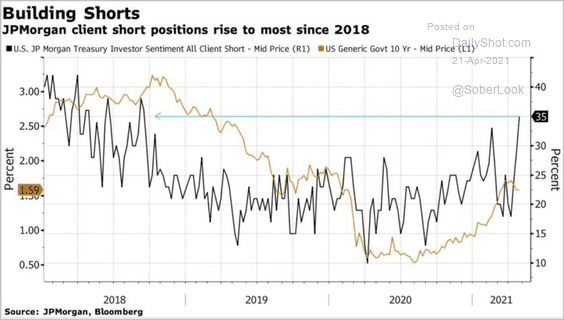

JP Morgan’s clients have boosted their short positions.

Source: @DiMartinoBooth, @jpmorgan, @business

Source: @DiMartinoBooth, @jpmorgan, @business

——————–

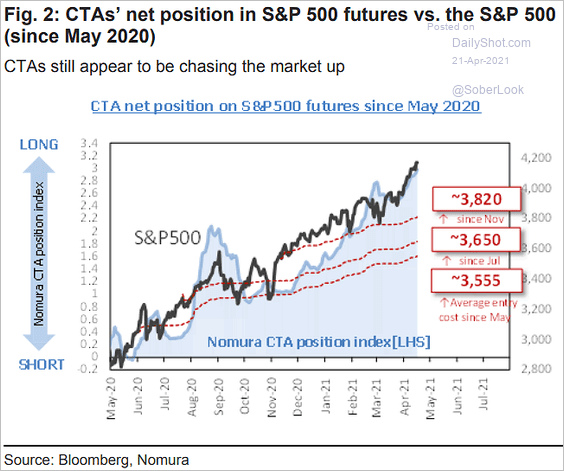

6. CTAs continue to raise their exposure to the S&P 500.

Source: @ISABELNET_SA, @Nomura

Source: @ISABELNET_SA, @Nomura

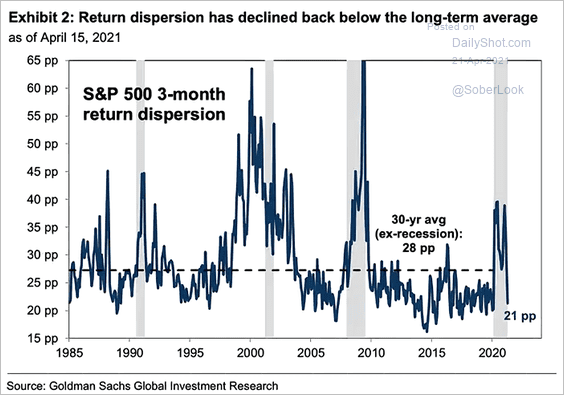

7. Returns dispersion is back below the long-term average.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

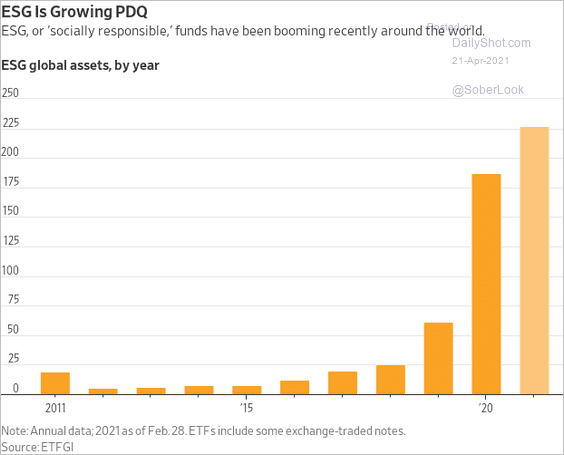

8. ESG funds have been booming.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Credit

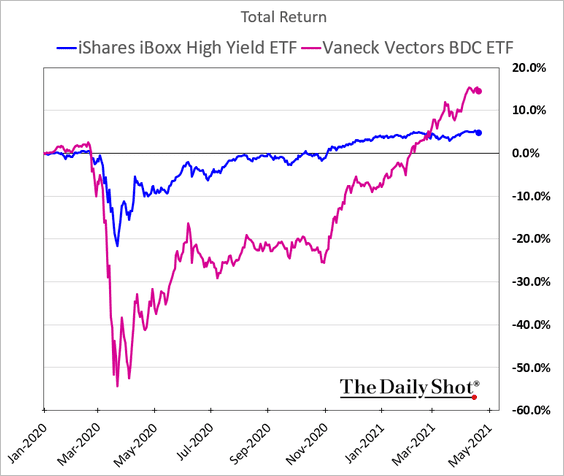

1. The recovery in BDC prices has been impressive.

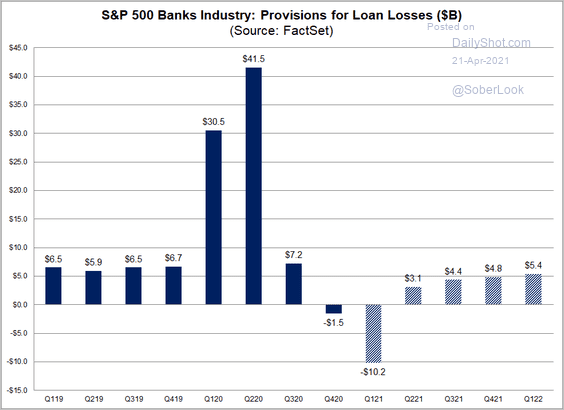

2. Banks have recouped some of their 2020 loan-loss provisions.

Source: @FactSet Read full article

Source: @FactSet Read full article

Back to Index

Food for Thought

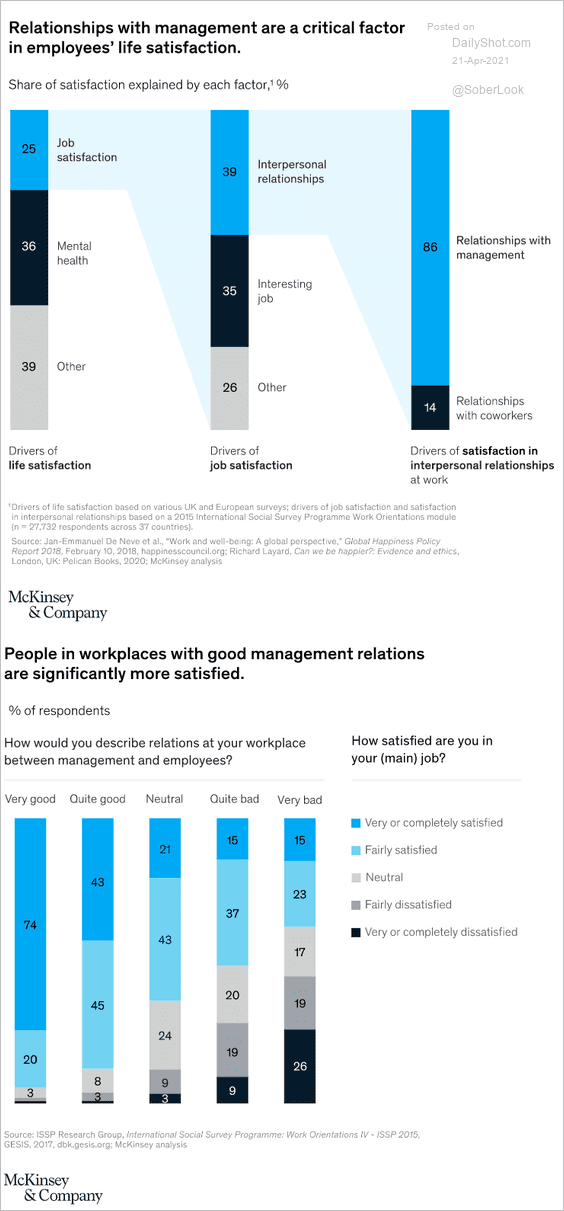

1. The importance of employees’ relationship with management:

Source: McKinsey Read full article

Source: McKinsey Read full article

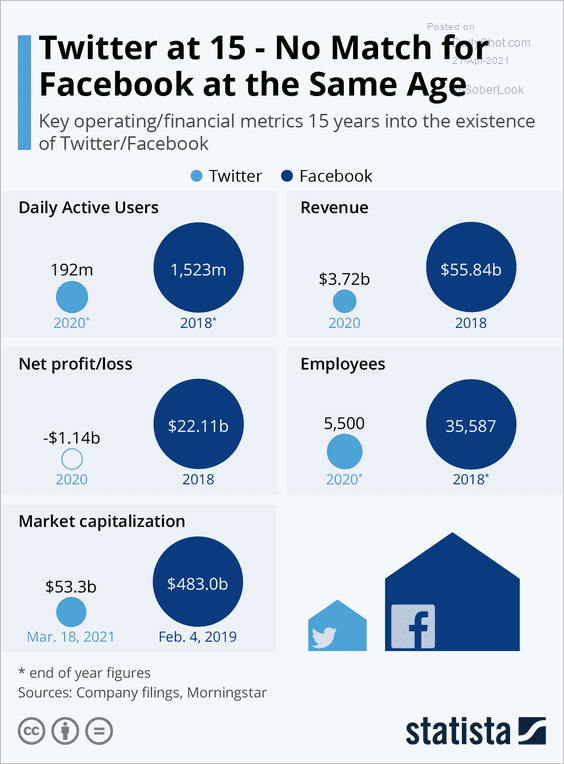

2. Twitter vs. Facebook:

Source: Statista

Source: Statista

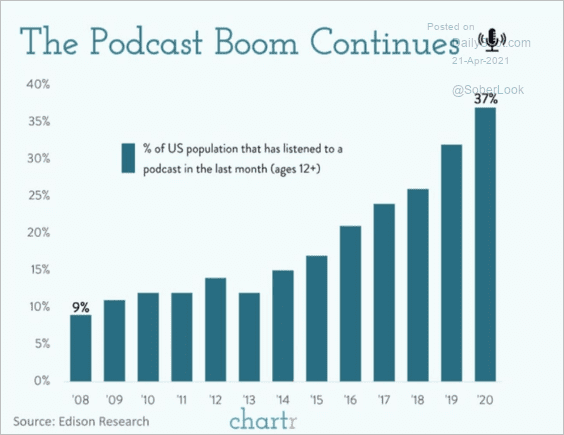

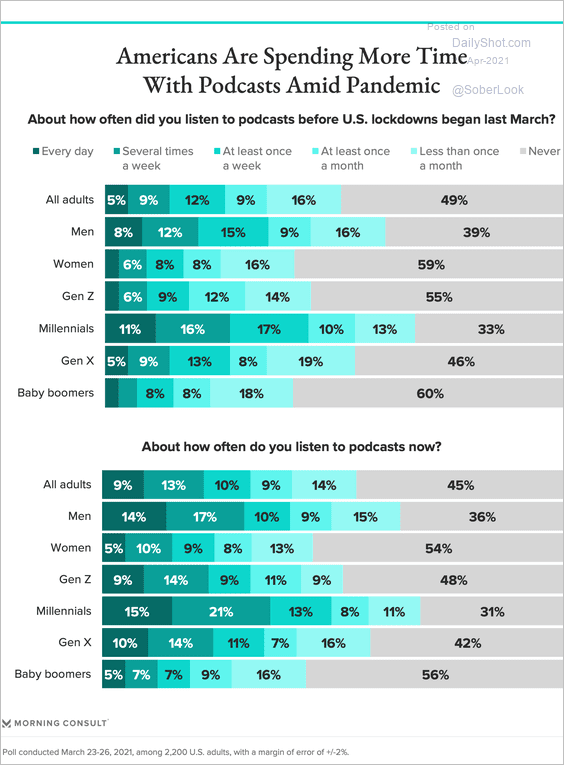

3. The podcast boom (2 charts):

Source: @chartrdaily Read full article

Source: @chartrdaily Read full article

Source: Morning Consult Read full article

Source: Morning Consult Read full article

——————–

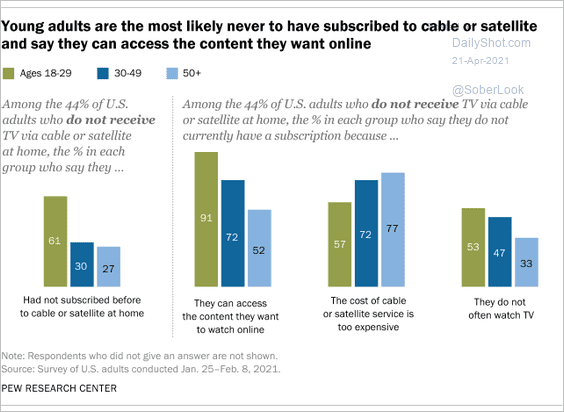

4. Reasons for not subscribing to cable or satellite TV:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

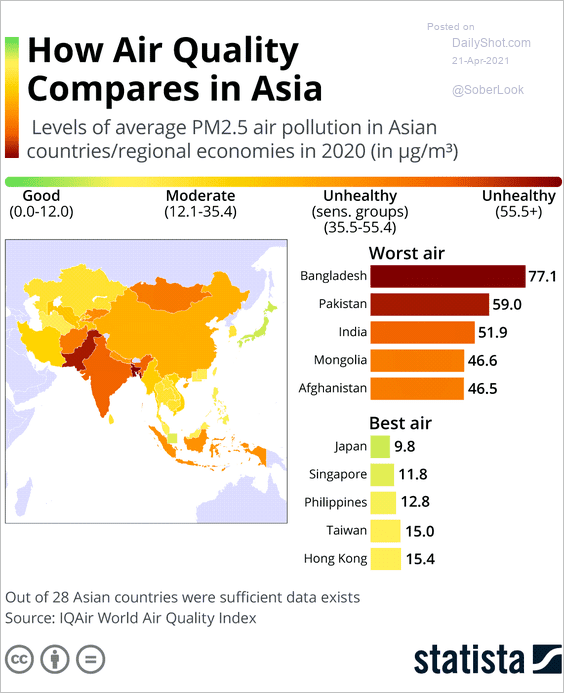

5. Air quality across Asia:

Source: Statista

Source: Statista

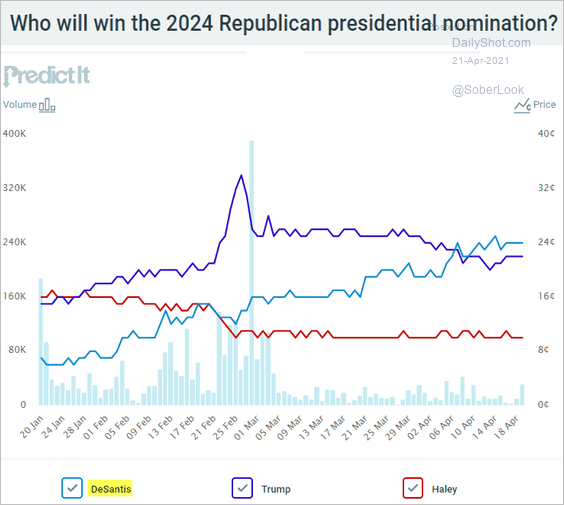

6. GOP 2024 presidential nomination betting market odds:

Source: PredictIt

Source: PredictIt

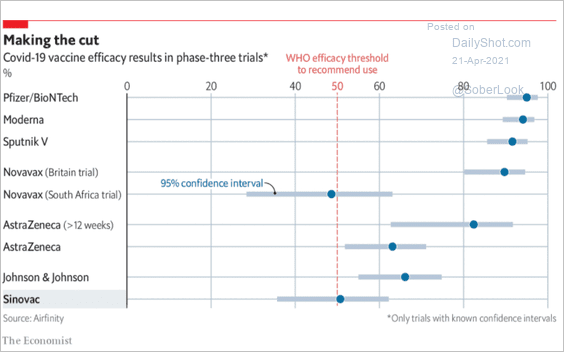

7. Vaccine efficacy:

Source: The Economist Read full article

Source: The Economist Read full article

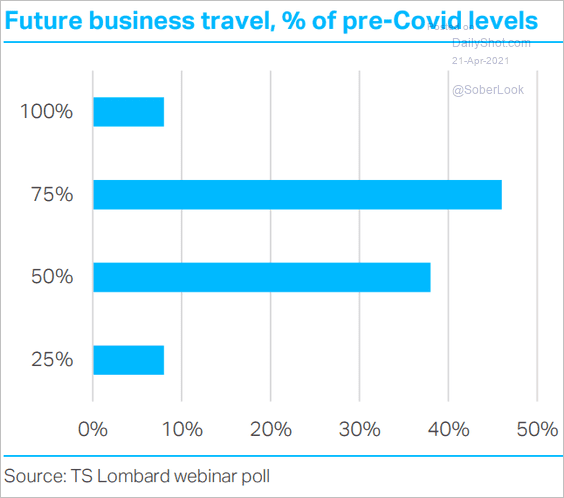

8. Future of business travel:

Source: TS Lombard

Source: TS Lombard

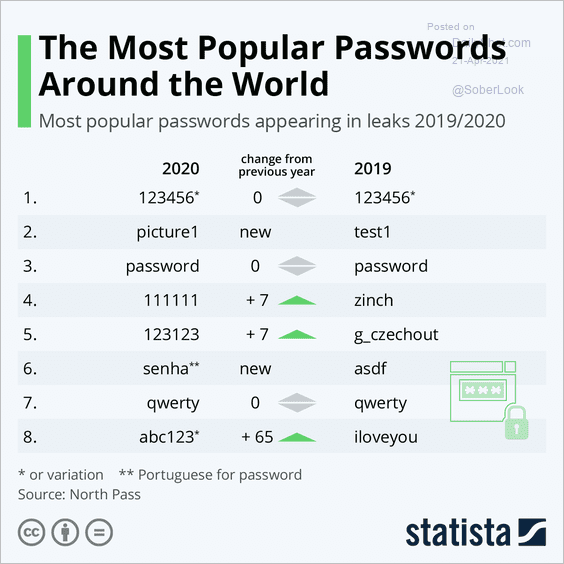

9. Bad passwords:

Source: Statista

Source: Statista

——————–

Back to Index