The Daily Shot: 27-Apr-21

• The United States

• Canada

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives.

• Rates

• Global Developments

• Food for Thought

The United States

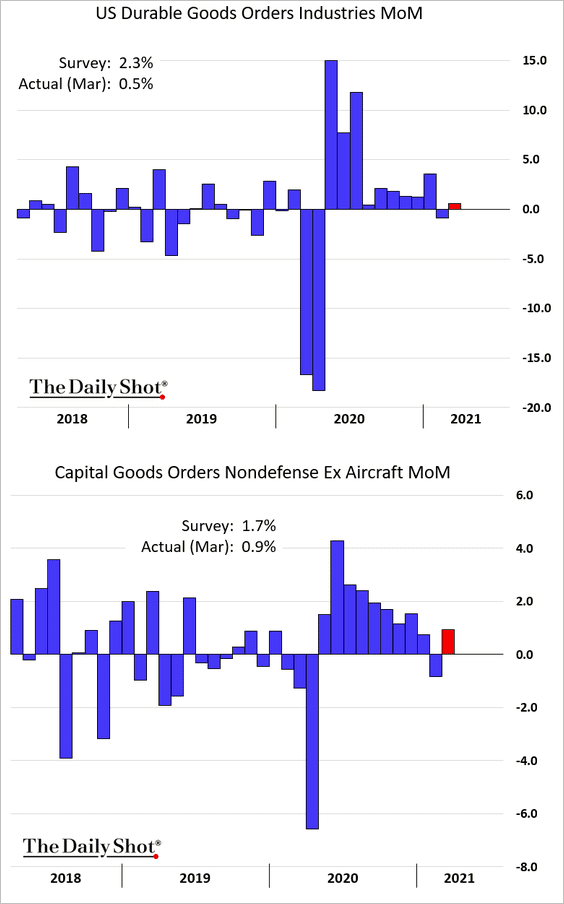

1. The March durable goods orders report was weaker than expected.

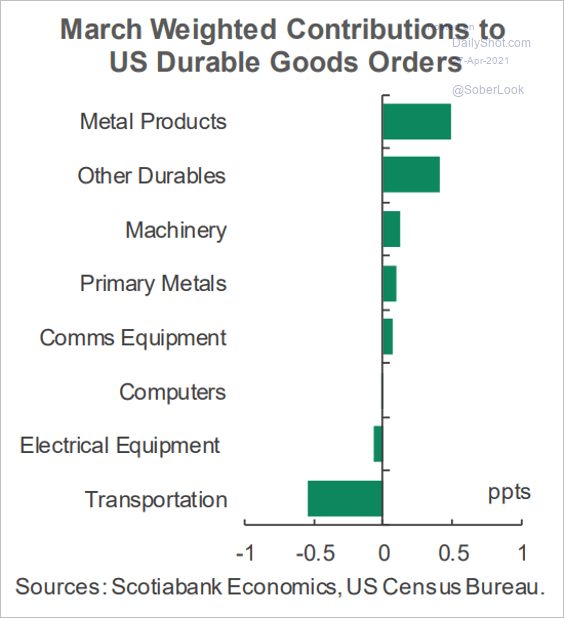

The transportation sector was a drag on orders. An early Easter holiday also had a negative impact.

Source: Scotiabank Economics

Source: Scotiabank Economics

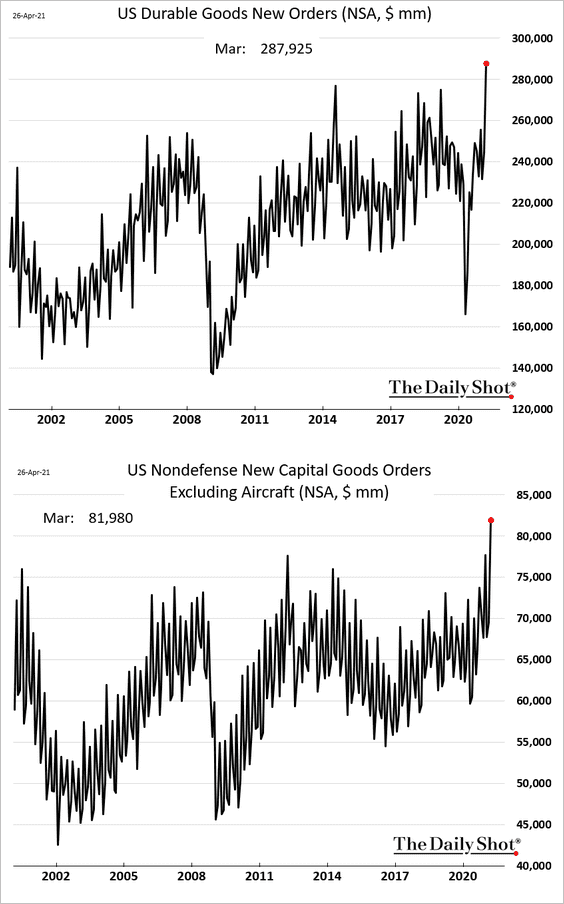

But to put this report into perspective, let’s look at the absolute dollar amount of orders without seasonal adjustments. The trend remains strong.

——————–

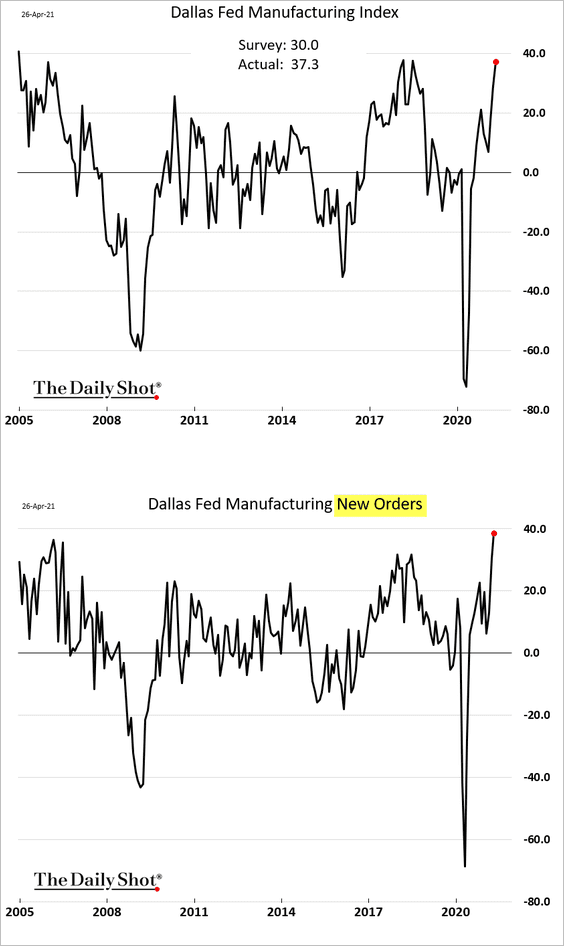

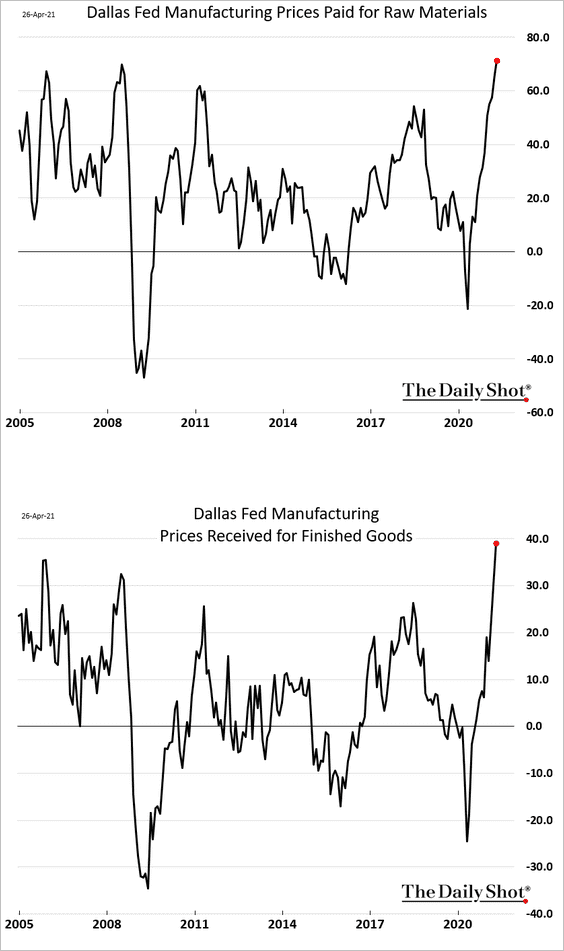

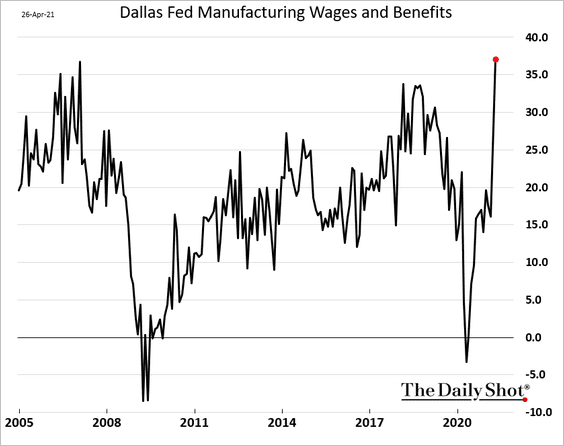

2. The Dallas Fed’s manufacturing report confirmed the exceptionally robust manufacturing activity we see across the country.

And we continue to see increasing price pressures.

• Input and output prices:

• Wages:

——————–

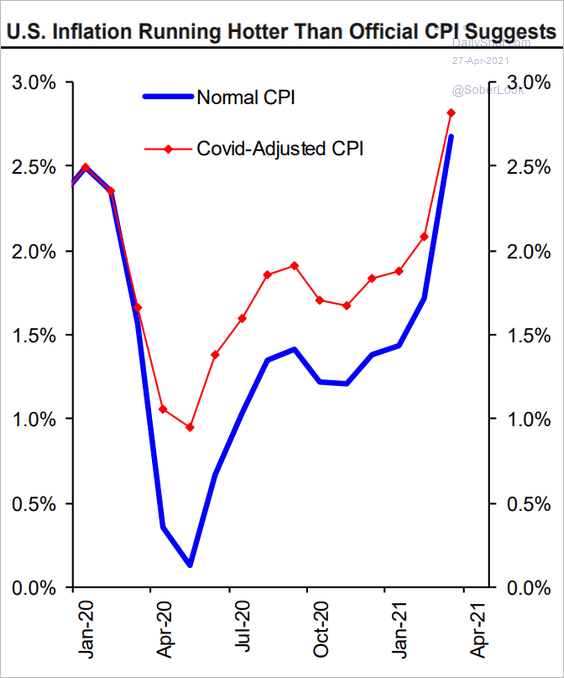

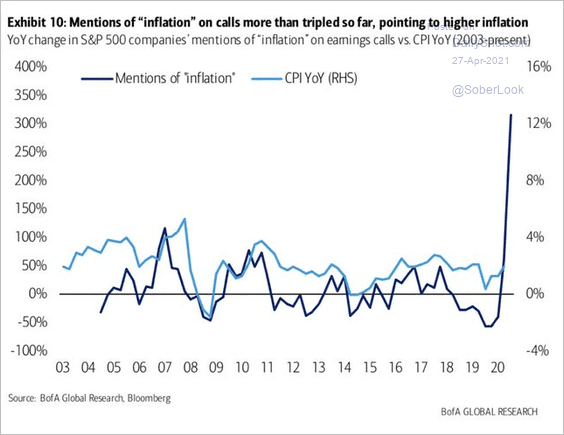

3. Next, we have some additional updates on inflation.

• What happens to the CPI when the pandemic-related changes in spending patterns are taken into account?

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

• Companies increasingly mention inflation on earnings calls.

Source: BofA Global Research; @carlquintanilla

Source: BofA Global Research; @carlquintanilla

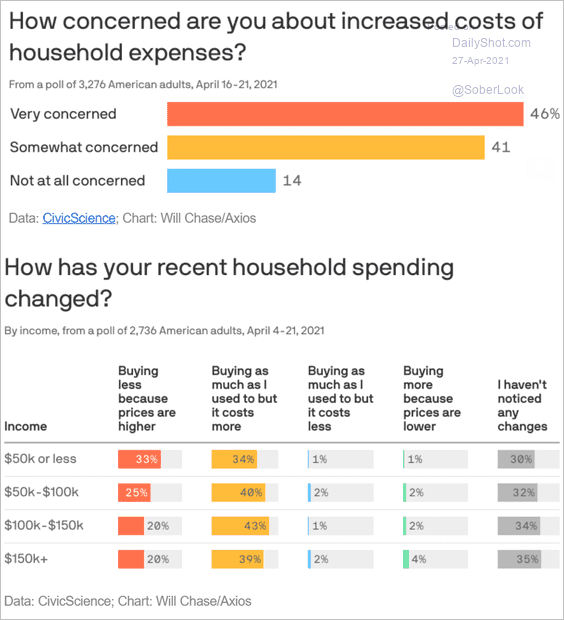

• Consumers are concerned about inflation. Will it impact spending?

Source: @axios Read full article

Source: @axios Read full article

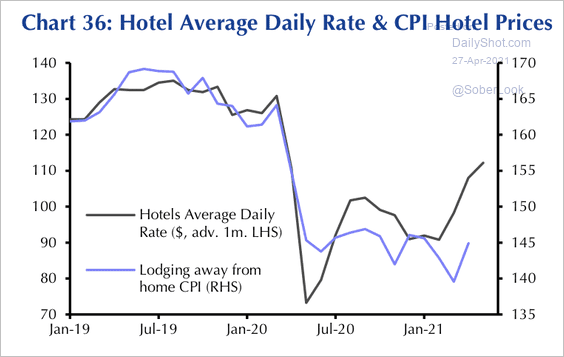

• Hotel rates are rising, …

Source: Capital Economics

Source: Capital Economics

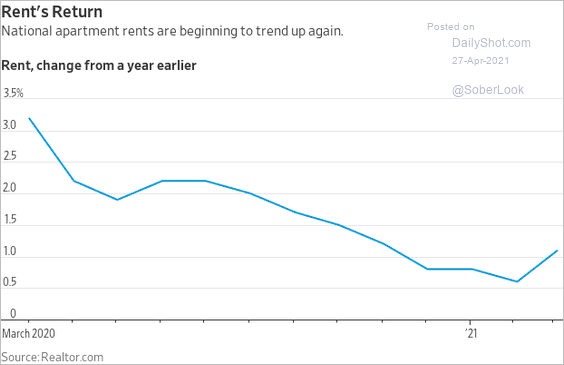

… and rent inflation has bottomed. These trends could boost service inflation.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

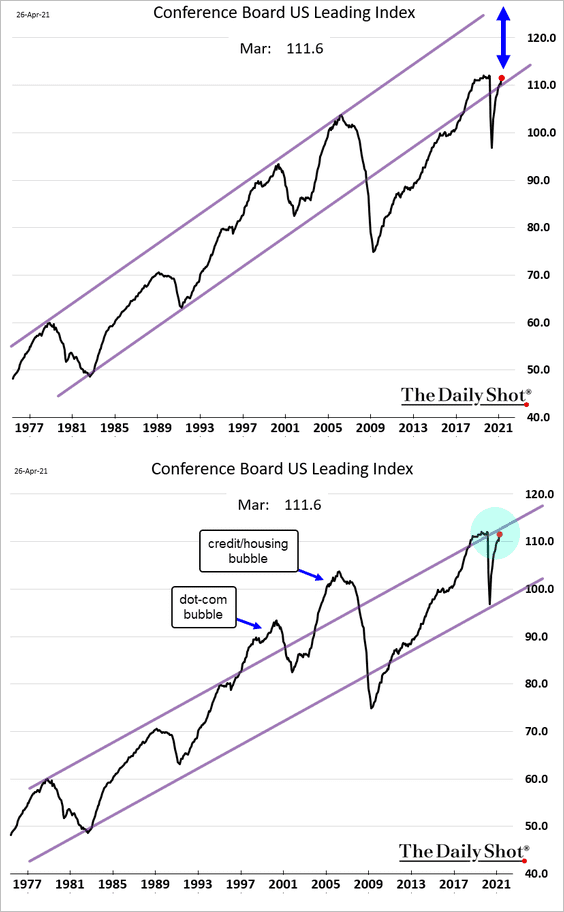

4. How much growth room does the economy have without accelerating inflation or creating bubbles in capital markets? Changing the trend slope tells different stories.

h/t Evercore ISI

h/t Evercore ISI

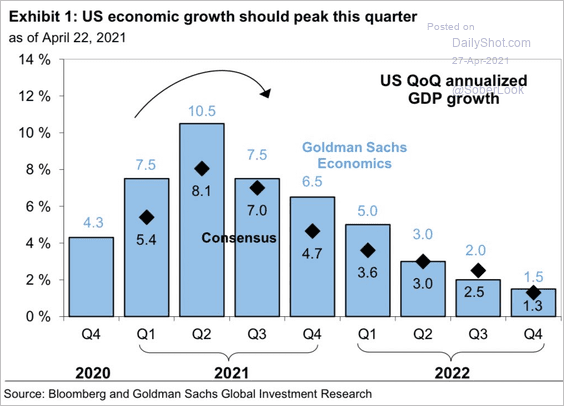

5. According to Goldman, the GDP growth will peak this quarter.

Source: Goldman Sachs, @carlquintanilla

Source: Goldman Sachs, @carlquintanilla

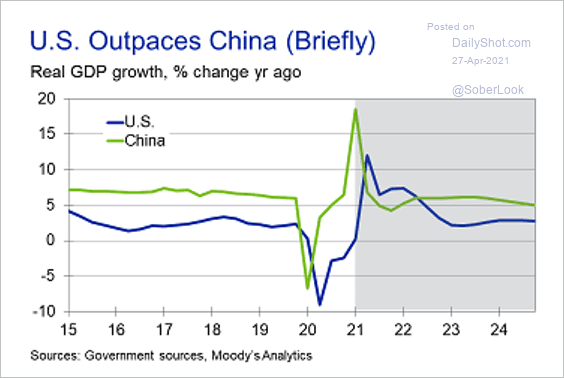

• Over the next few quarters, US growth will outpace that of China.

Source: Moody’s Analytics

Source: Moody’s Analytics

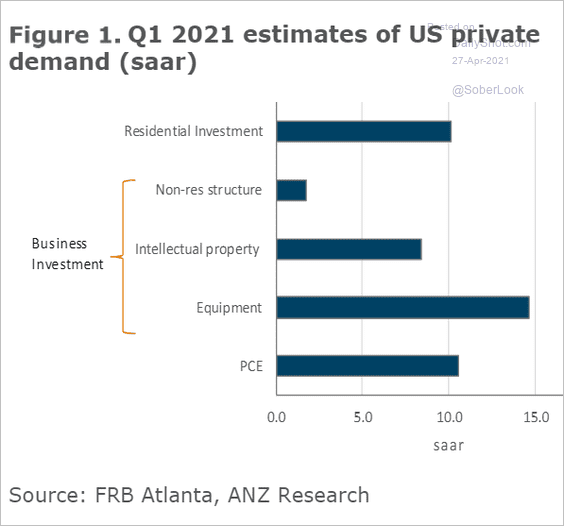

• Last quarter’s growth in private demand was massive.

Source: ANZ Research

Source: ANZ Research

——————–

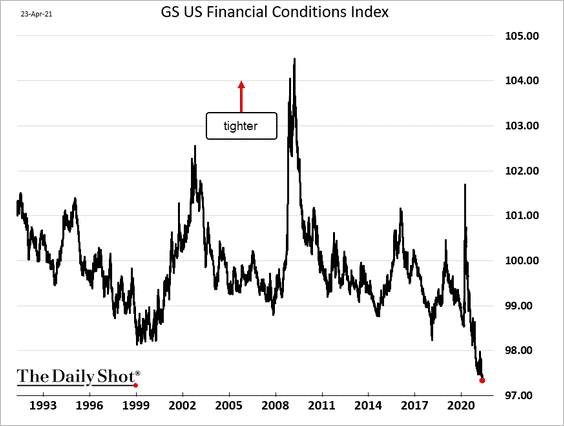

6. US financial conditions are extraordinarily accommodative.

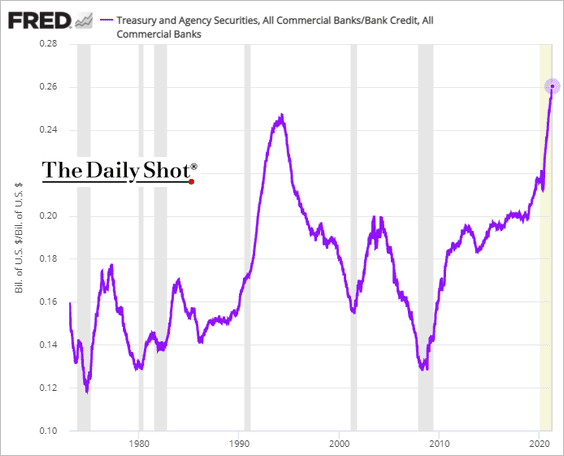

7. Over 26% of US bank credit is to the federal government and GSEs.

Back to Index

Canada

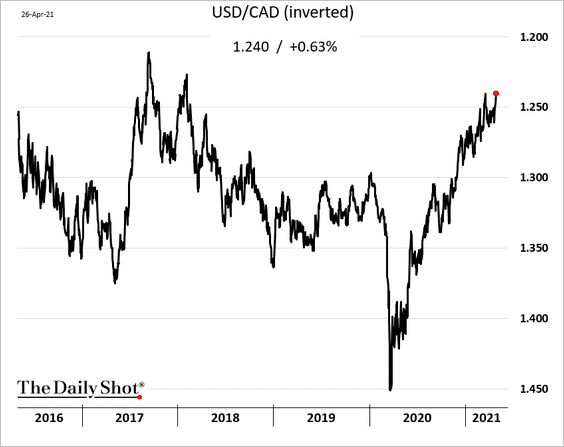

1. The loonie is near the highest level (vs. USD) since 2018.

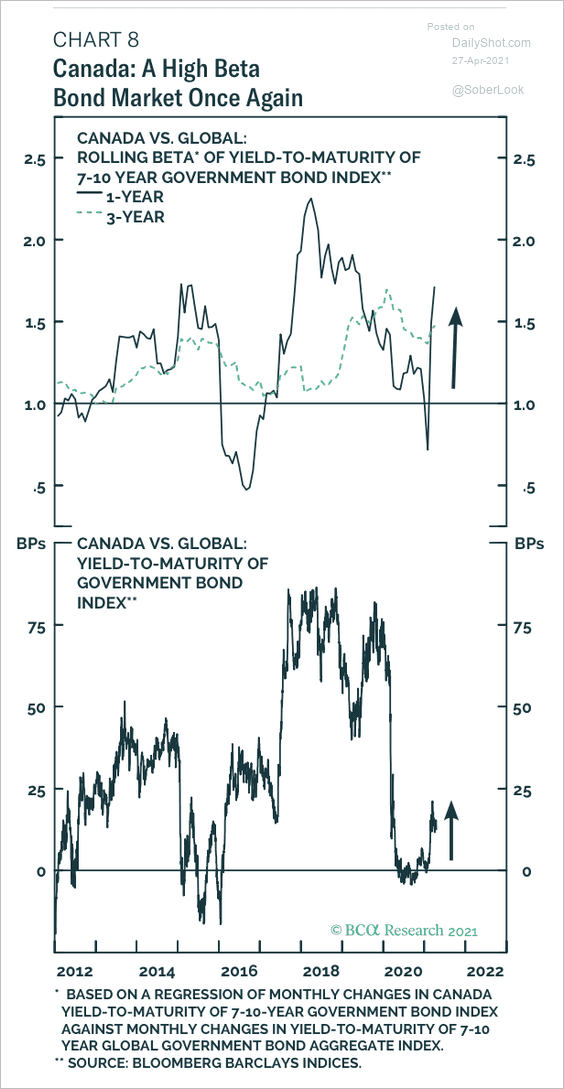

2. Government bonds are once again more sensitive to global interest rate moves.

Source: BCA Research

Source: BCA Research

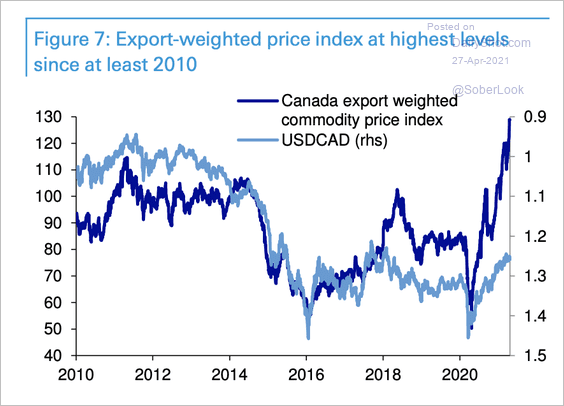

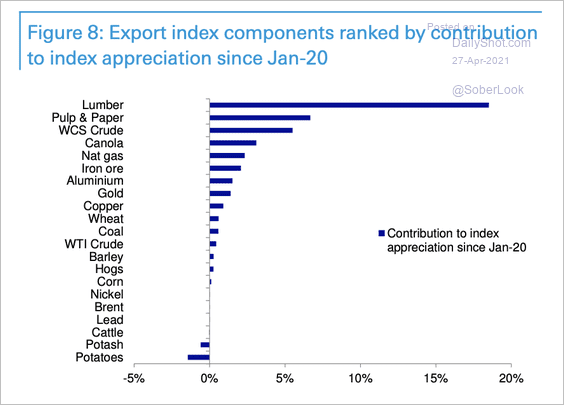

3. Export prices have rebounded strongly over the past year, mainly due to the rally in lumber prices (2 charts).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

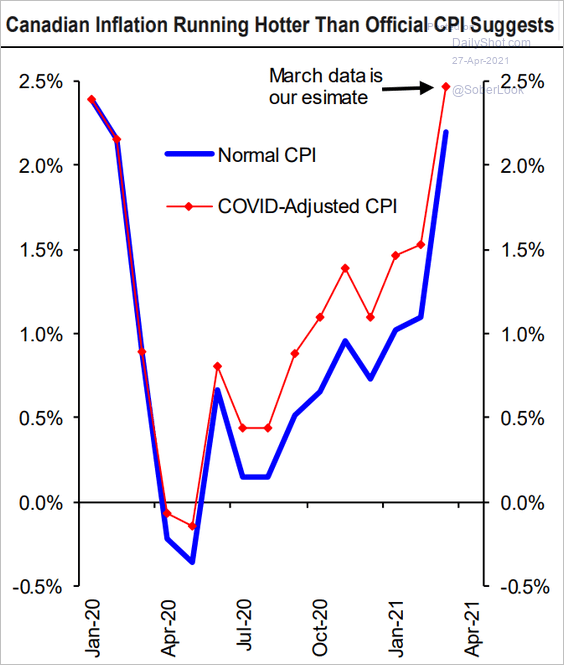

4. What happens to the CPI when the pandemic-related changes in spending patterns are taken into account?

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

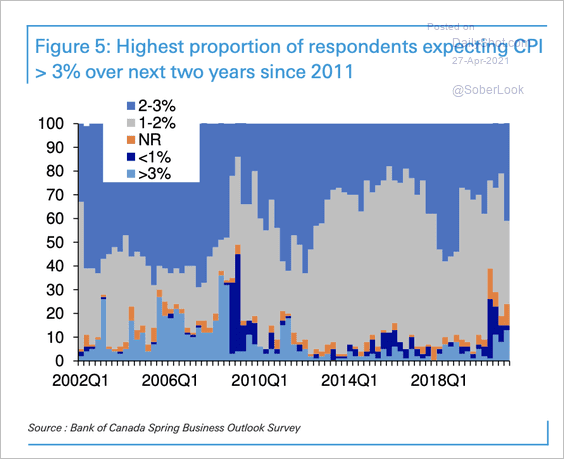

5. More firms expect higher inflation over the next two years, according to a Bank of Canada survey.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

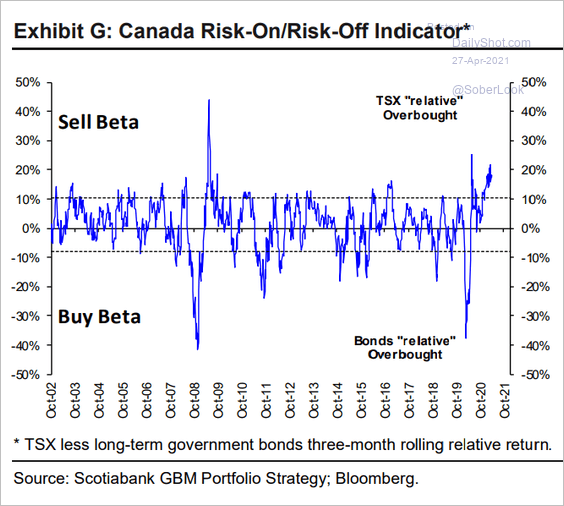

6. Stocks look overbought relative to bonds.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Back to Index

Europe

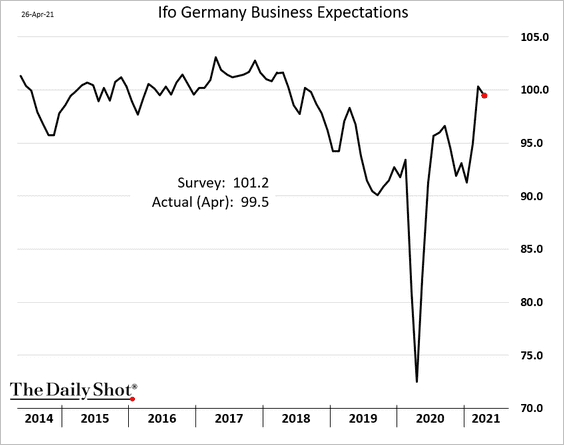

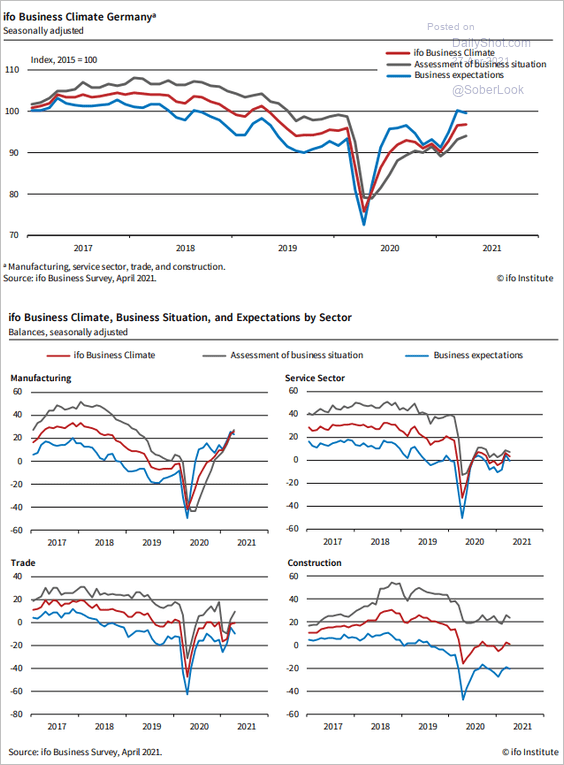

1. Germany’s Ifo expectations index pulled back from the highs.

Source: ifo Institute

Source: ifo Institute

——————–

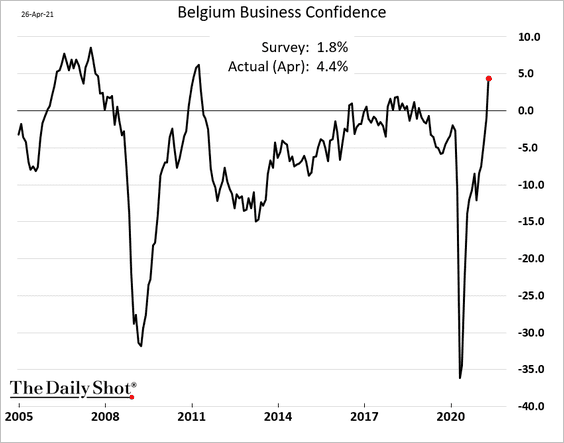

2. Belgian consumer confidence is soaring.

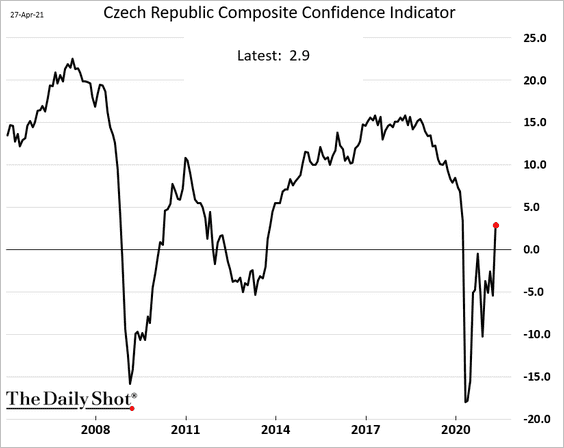

3. Czech business and consumer confidence is rebounding.

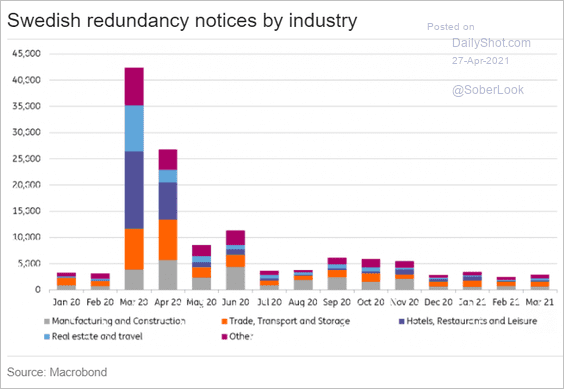

4. Sweden’s redundancy notices have been relatively subdued since last summer.

Source: ING

Source: ING

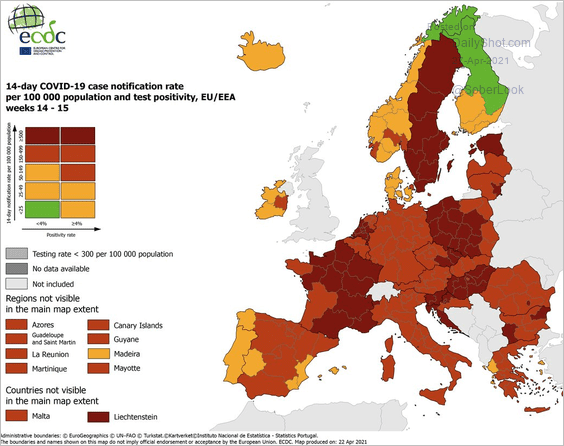

5. Here is the COVID cases map.

Source: @EU_Commission, @ECDC_EU Read full article

Source: @EU_Commission, @ECDC_EU Read full article

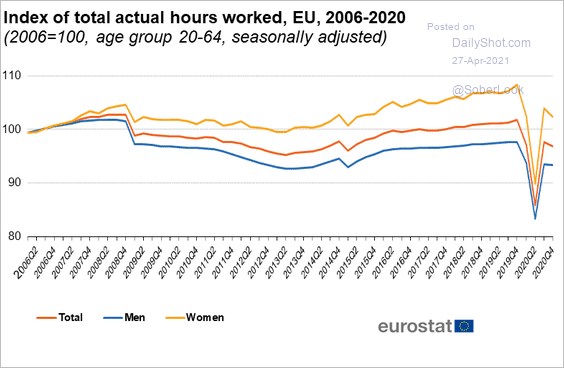

6. This chart shows the total hours worked in the EU.

Source: Eurostat

Source: Eurostat

Back to Index

Asia – Pacific

1. The BoJ downgraded its inflation forecasts, suggesting that the accommodation will stay in place for some time to come.

Source: Nikkei Asia Read full article

Source: Nikkei Asia Read full article

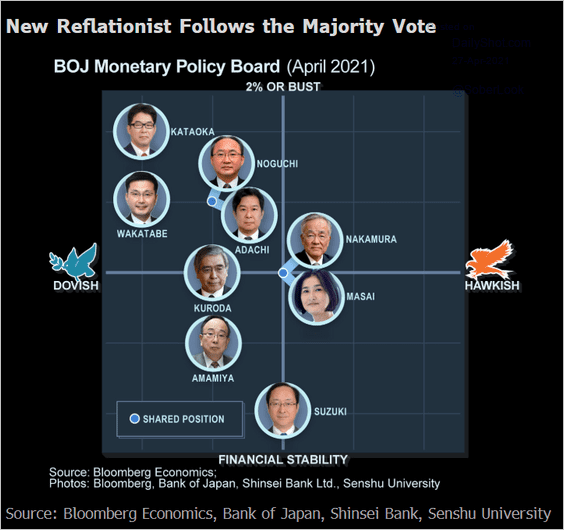

Here is Bloomberg’s take on the BoJ Monetary Policy Board.

Source: Yuki Masujima Read full article

Source: Yuki Masujima Read full article

——————–

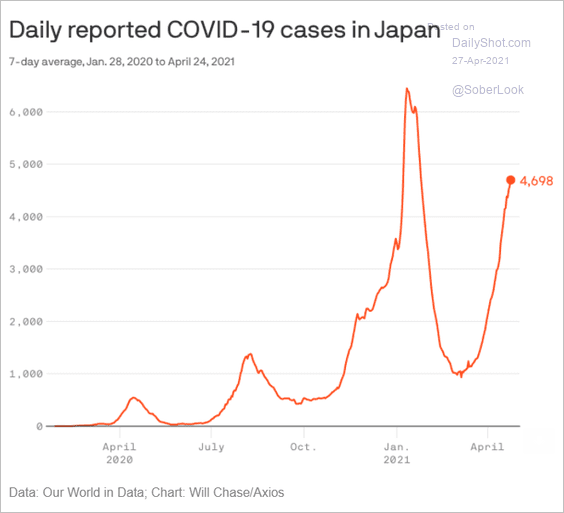

2. COVID cases in Japan are accelerating again.

Source: @axios Read full article

Source: @axios Read full article

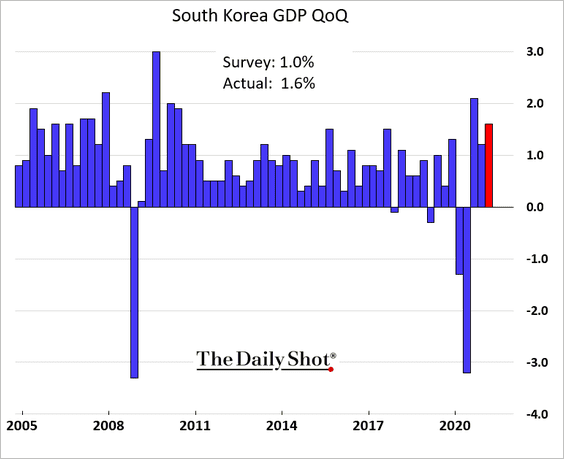

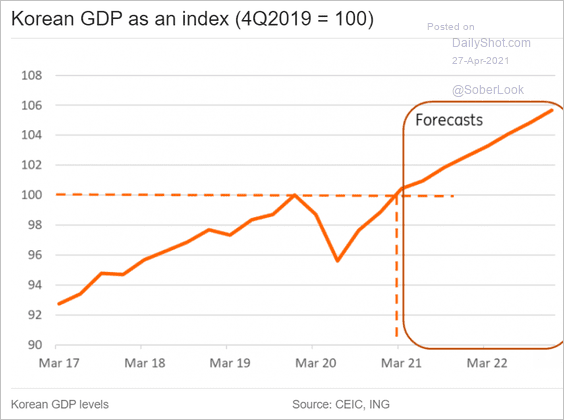

3. South Korea’s Q1 GDP topped forecasts.

Here is a projection from ING.

Source: ING

Source: ING

——————–

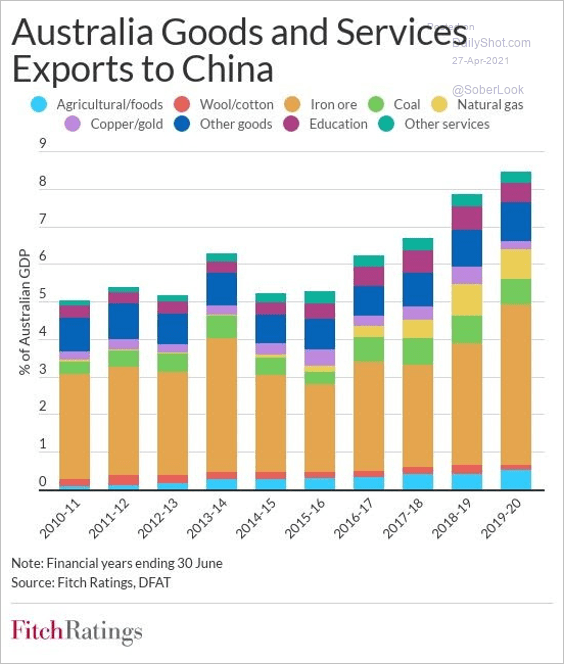

4. This chart shows the composition of Australia’s exports to China.

Source: Fitch Ratings

Source: Fitch Ratings

Back to Index

China

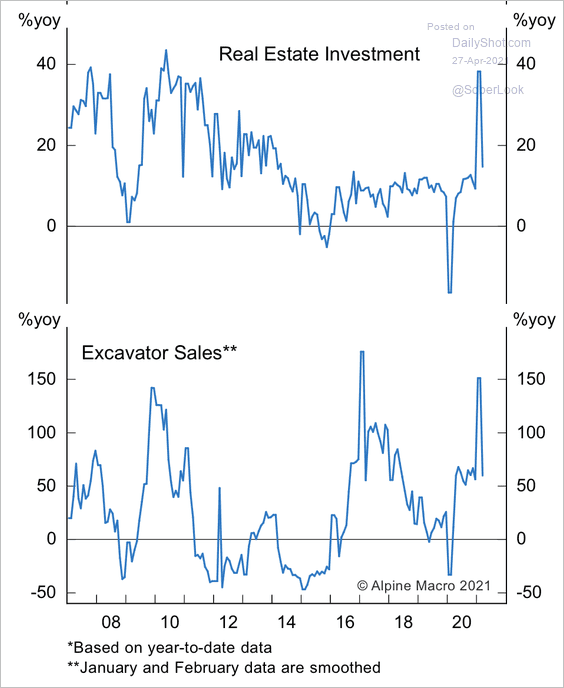

1. Real estate investment is starting to slow.

Source: Alpine Macro

Source: Alpine Macro

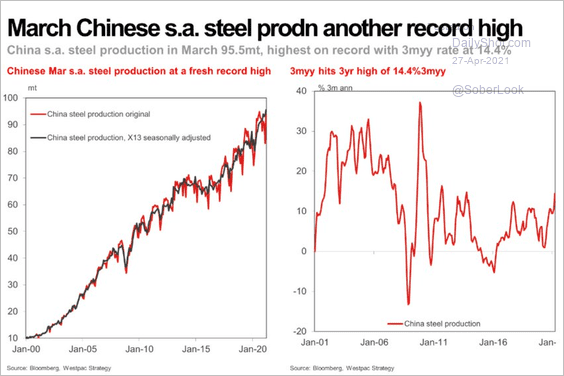

2. China’s steel production hit a record high.

Source: Westpac; @AvidCommentator

Source: Westpac; @AvidCommentator

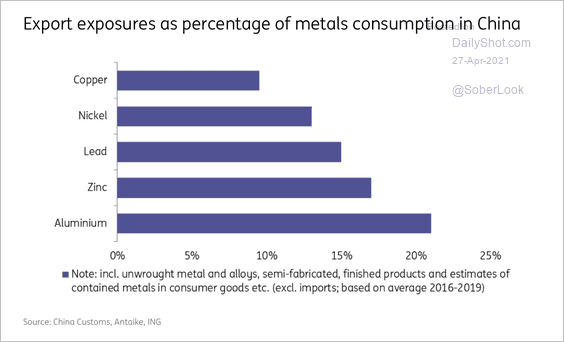

4. Total aluminum finished product exports grew 3% year-over-year in 2020 despite the collapse in economic activity during lockdowns, according to ING.

Source: ING

Source: ING

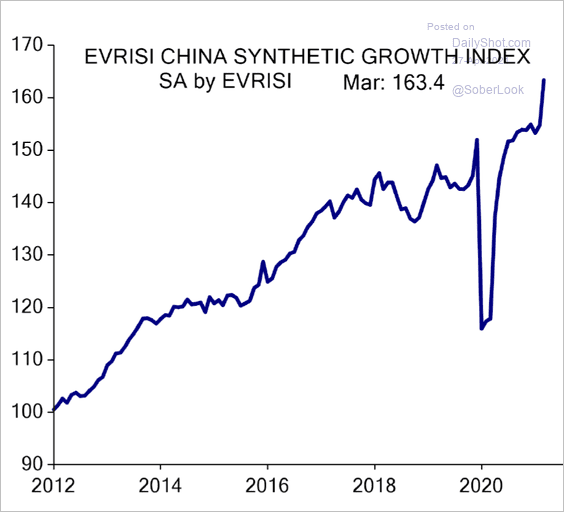

5. This is the Evercore ISI China Growth Index.

Source: Evercore ISI

Source: Evercore ISI

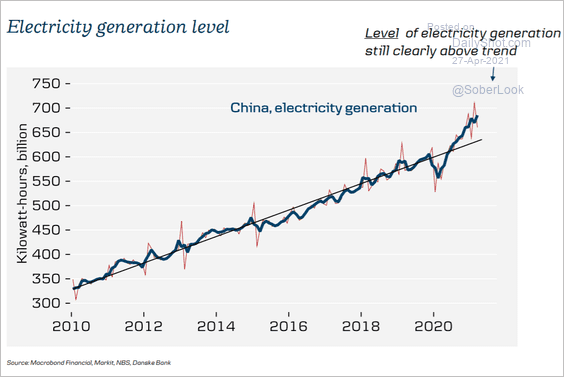

Electricity generation has been running above trend.

Source: Danske Bank

Source: Danske Bank

——————–

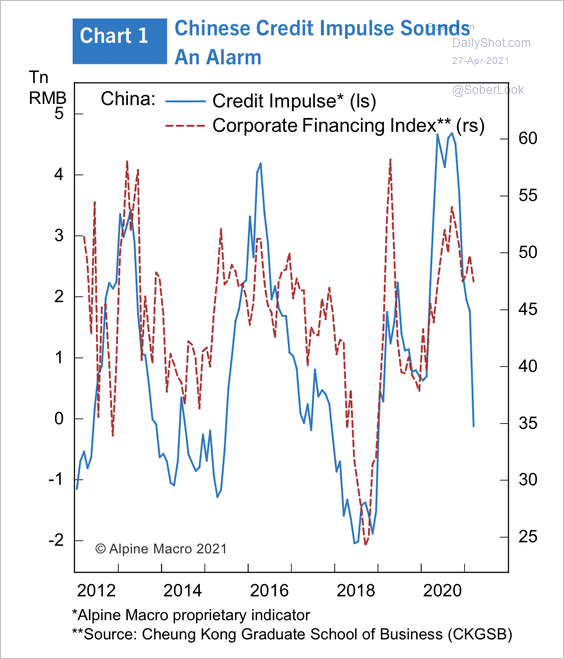

6. The credit impulse indicator has turned negative, which suggests slower economic growth ahead.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Emerging Markets

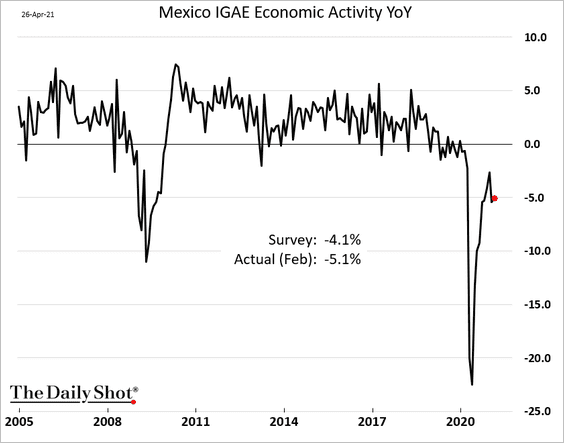

1. Mexico’s economic activity remained stagnant in February.

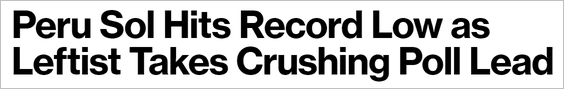

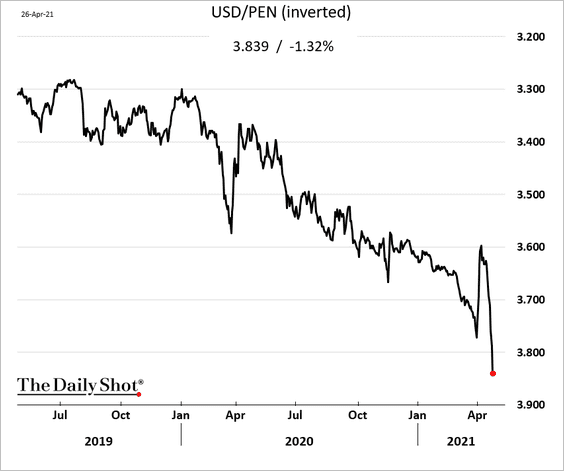

2. Peru’s assets are under pressure.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

• The Peruvian sol:

• The 5yr bond yield:

——————–

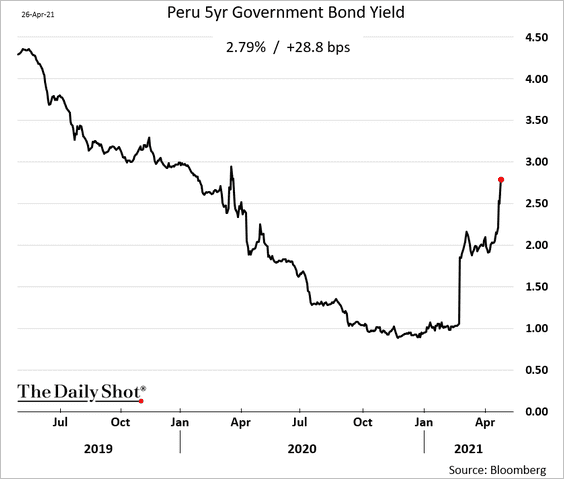

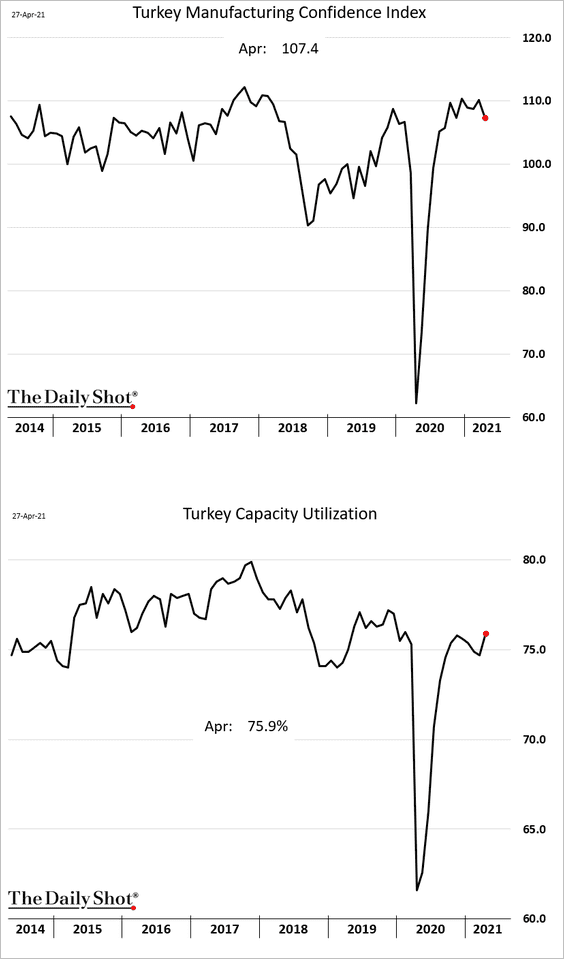

3. Turkey’s manufacturing confidence weakened this month even as capacity utilization improved.

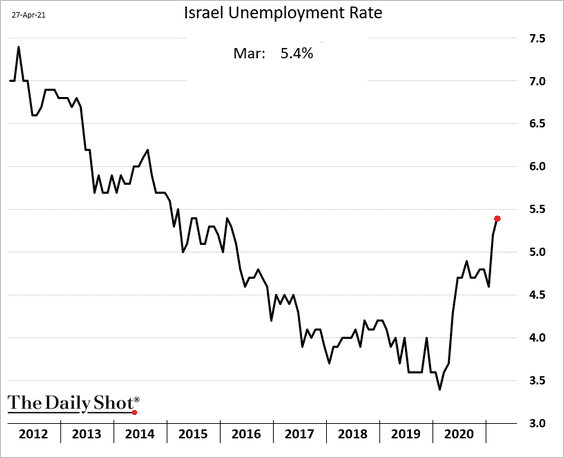

4. Israel’s unemployment rate keeps grinding higher.

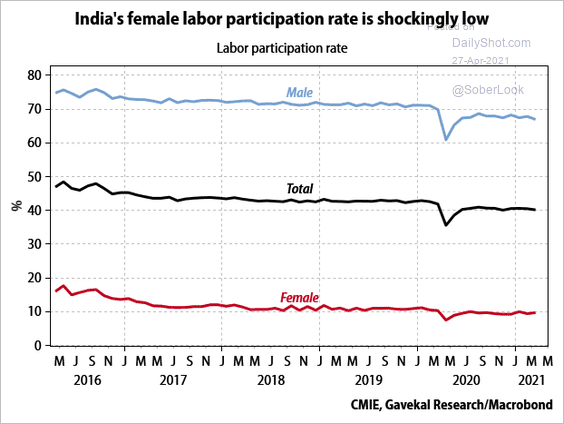

5. This chart shows India’s labor force participation rates.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Cryptocurrency

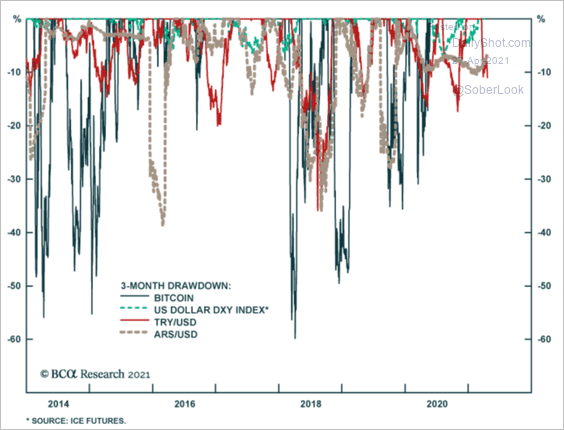

1. Bitcoin continues to recover.

2. Here is a comparison of bitcoin drawdowns vs. other currencies.

Source: BCA Research

Source: BCA Research

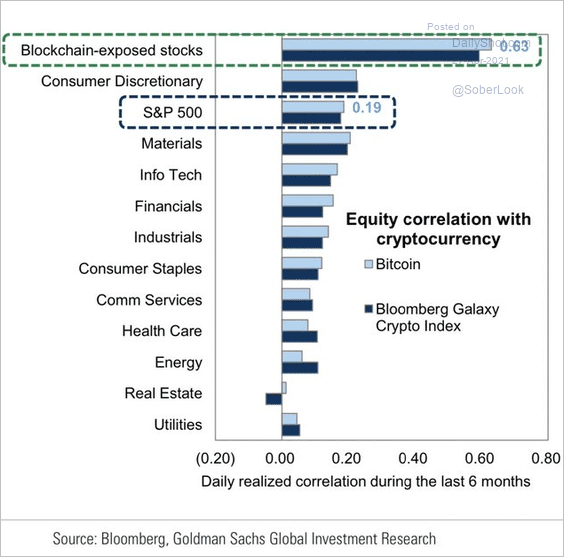

3. How correlated are US stocks with cryptocurrencies?

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

Back to Index

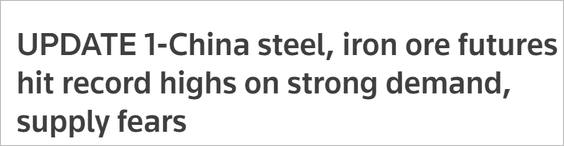

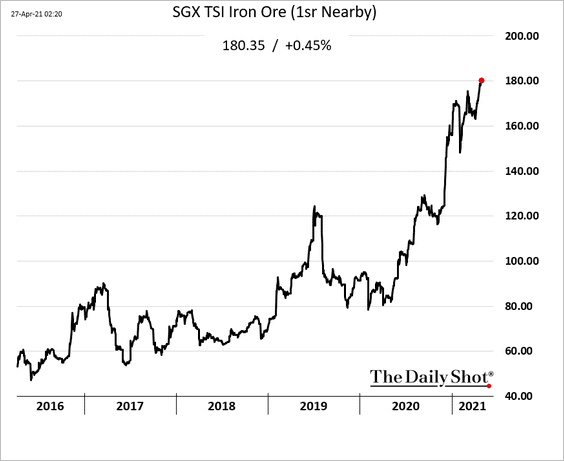

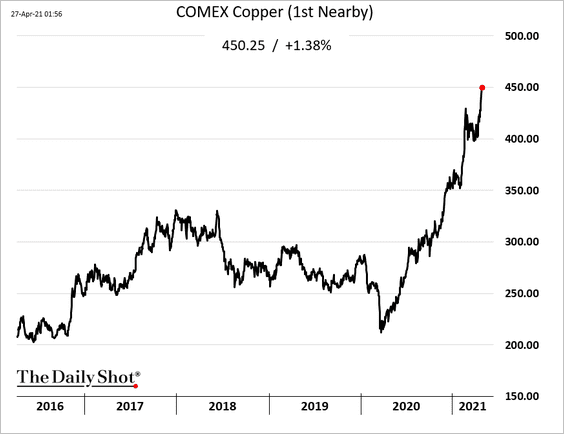

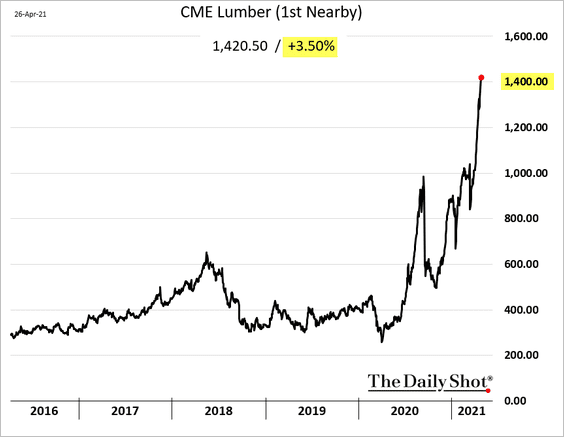

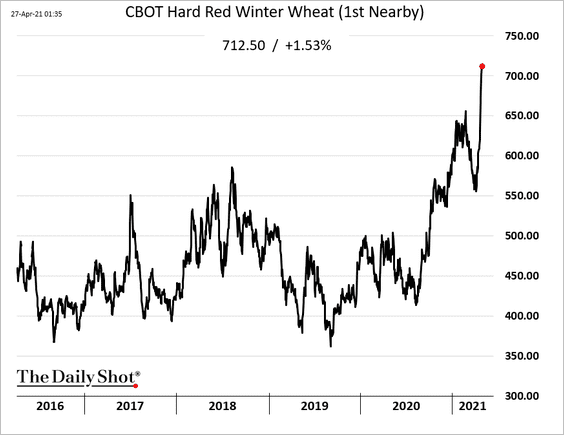

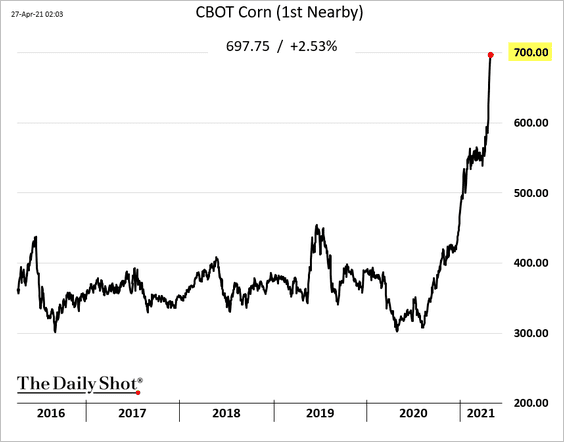

Commodities

The trends we highlighted yesterday are accelerating.

• Industrial commodities:

– Iron ore:

Source: Reuters Read full article

Source: Reuters Read full article

– Copper:

– Bloomberg’s industrial metals index:

——————–

• US lumber:

• US grains (boosted by concerns about dry weather conditions):

– Wheat:

– Corn:

Source: @WSJ Read full article

Source: @WSJ Read full article

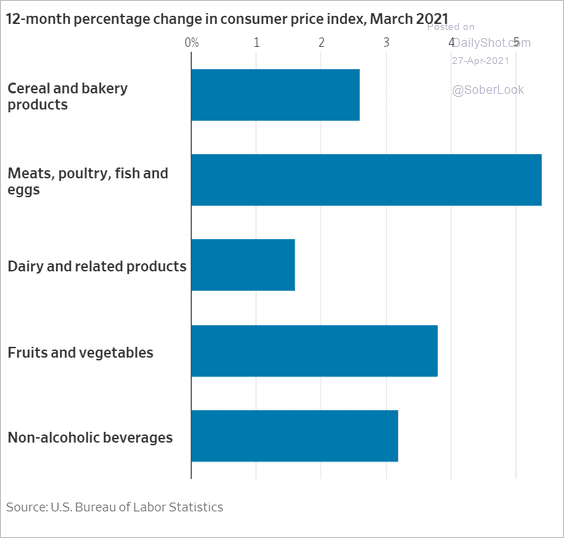

We are going to see further gains in food prices.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Energy

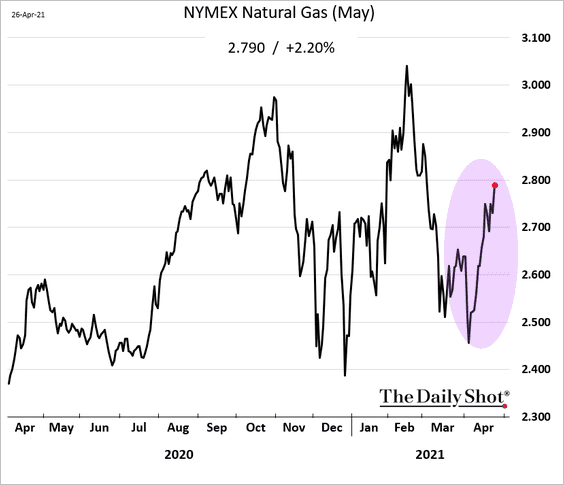

1. US natural gas is gaining amid rising LNG demand.

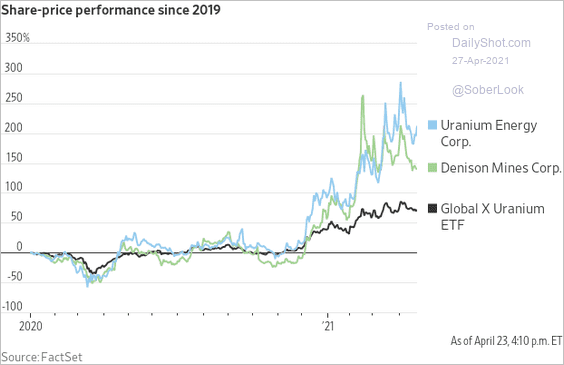

2. Uranium miners have been rallying. Nuclear energy may be the only viable way of meeting the aggressive emission reduction targets that are now in place.

Source: @WSJ Read full article

Source: @WSJ Read full article

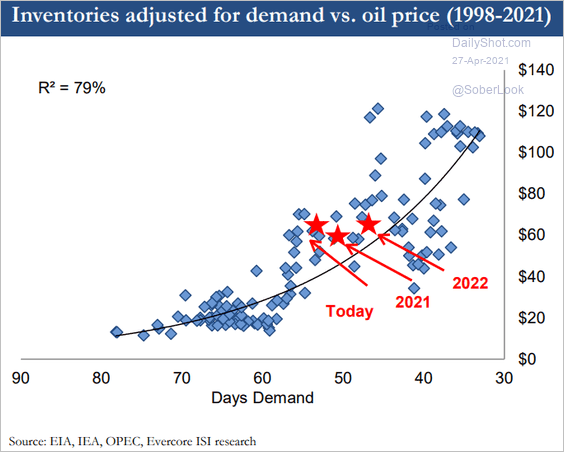

3. This chart shows the oil price vs. days of demand.

h/t Evercore ISI

h/t Evercore ISI

Back to Index

Equities

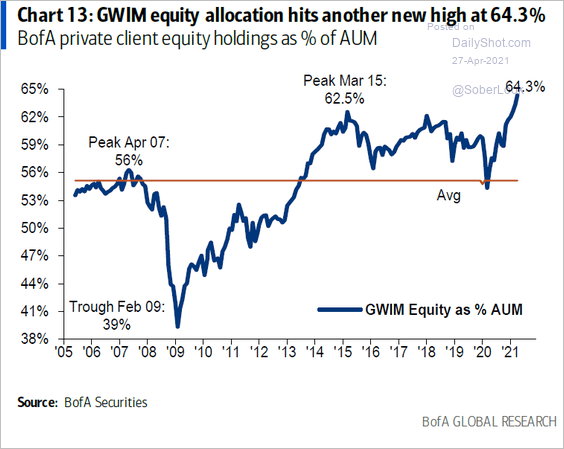

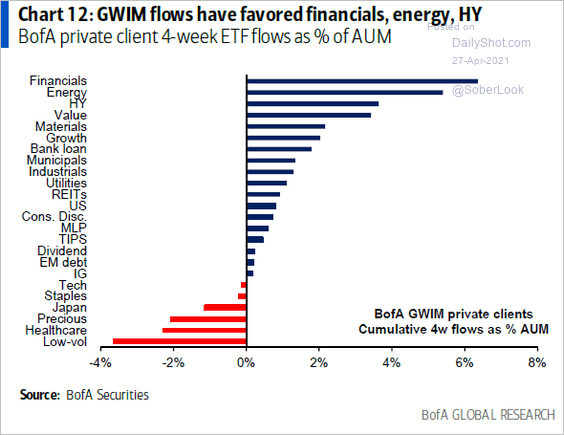

1. BofA’s private client equity allocations hit a record high.

Source: BofA Global Research

Source: BofA Global Research

Here are the private clients’ ETF flows over the past four weeks.

Source: BofA Global Research

Source: BofA Global Research

——————–

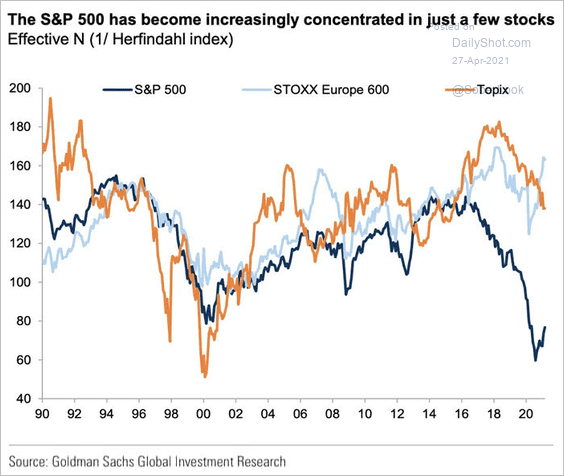

2. The S&P 500 remains highly concentrated.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

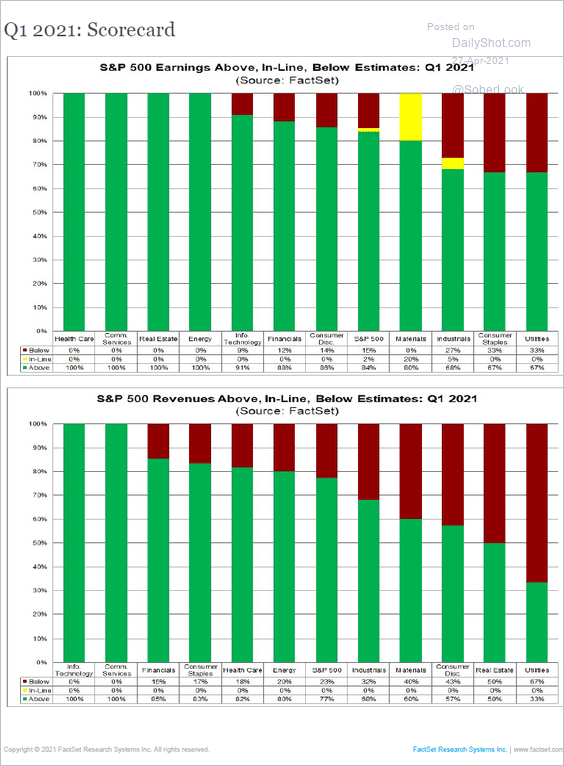

3. This chart shows how companies have been performing vs. estimates (by sector).

Source: @FactSet

Source: @FactSet

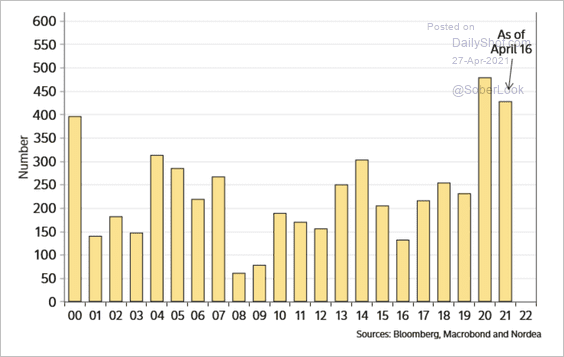

4. This year’s surge in IPOs is on track to outpace 2020.

Source: Nordea Markets

Source: Nordea Markets

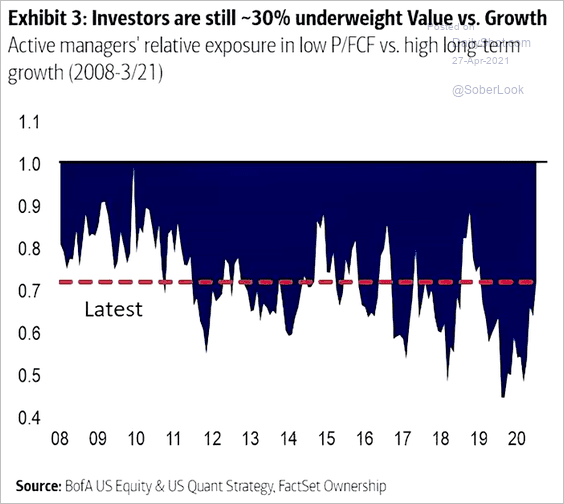

5. Investors are still underweight value stocks.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

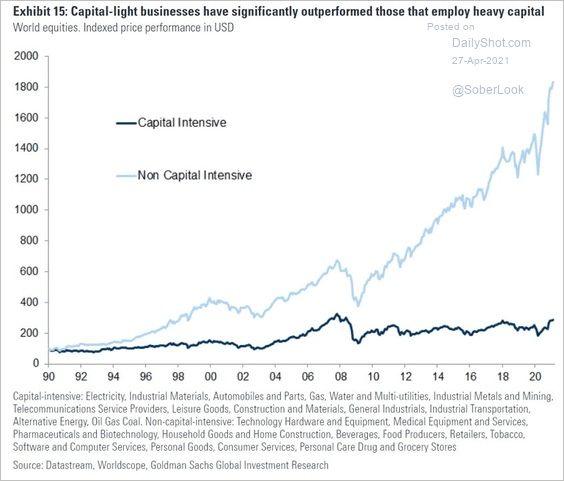

6. Capital-light businesses continue to outperform.

Source: Goldman Sachs; @jsblokland

Source: Goldman Sachs; @jsblokland

Back to Index

Alternatives.

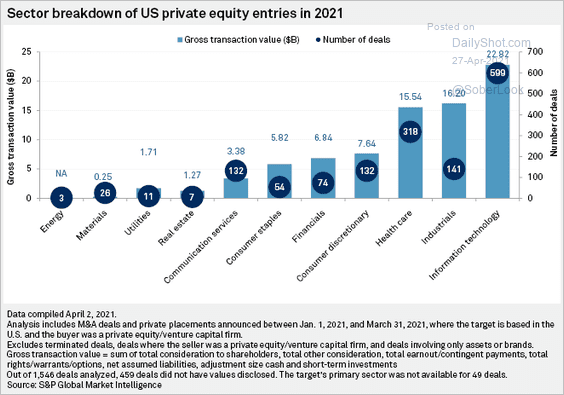

1. The tech sector is dominating private equity activity this year.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

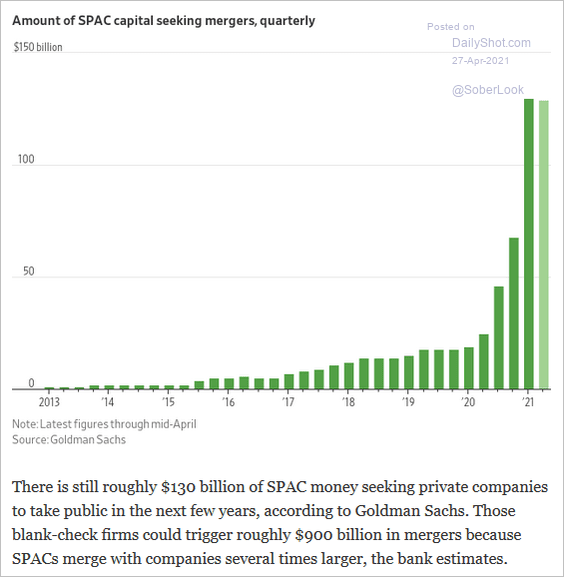

2. There is $130 billion of SPAC capital chasing private deals.

Source: @AmrithRamkumar, @WSJ

Source: @AmrithRamkumar, @WSJ

Back to Index

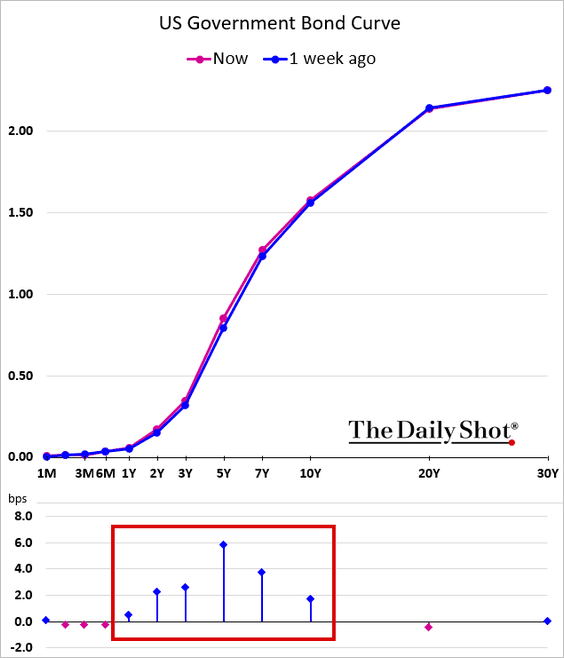

Rates

1. Short and intermediate-maturity Treasuries sold off in recent days.

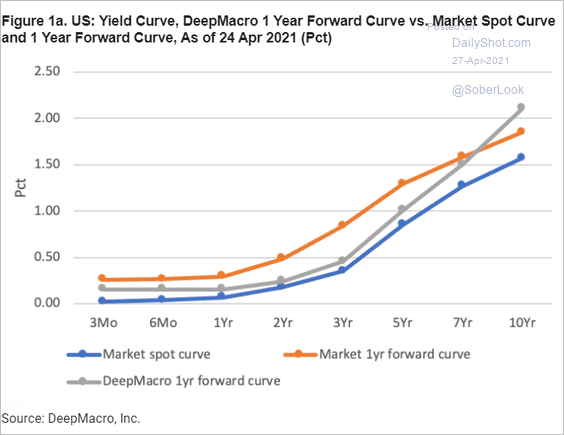

2. How steep will the yield curve be a year from now?

Source: @DeepMacro

Source: @DeepMacro

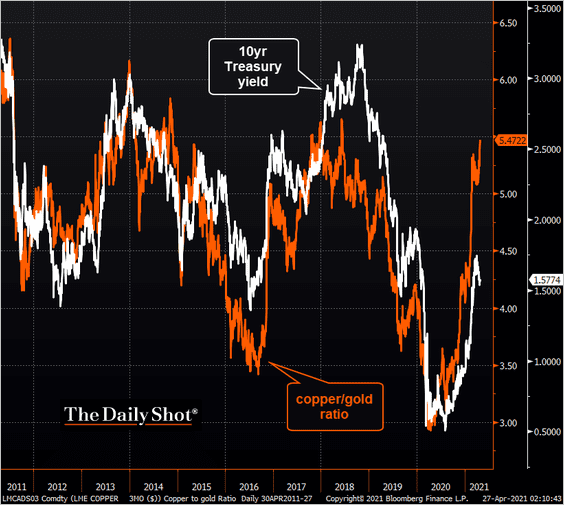

3. The copper-to-gold ratio points to significantly higher Treasury yields.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

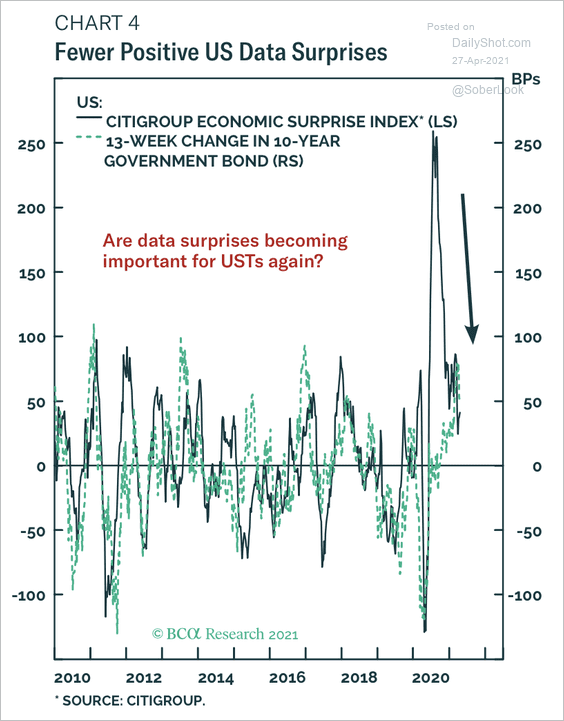

4. The 10-year Treasury yield is finally catching up to the decline in the US economic surprise index, which peaked in July 2020.

Source: BCA Research

Source: BCA Research

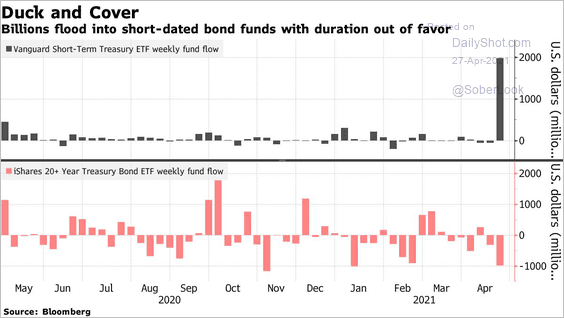

5. Flows into short-term Treasury funds have spiked.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

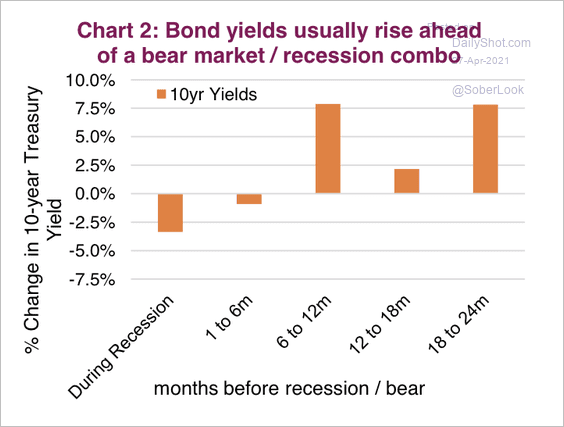

6. Yields typically rise materially 6-12 months before a recession/equity bear-market phase.

Source: Market Ethos, Richardson GMP

Source: Market Ethos, Richardson GMP

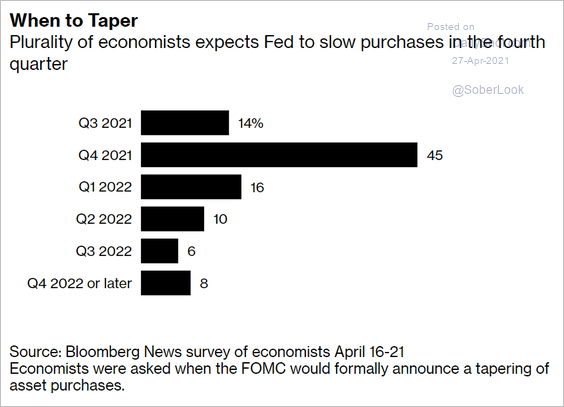

7. When will the Fed begin tapering?

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Global Developments

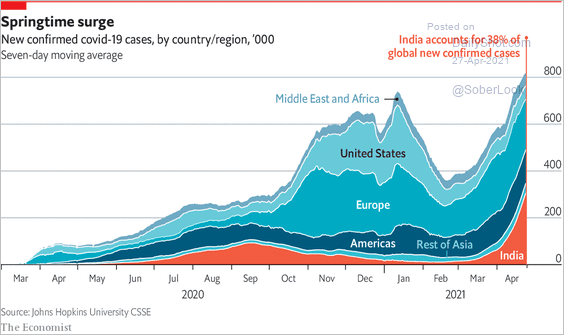

1. The latest global COVID surge has been driven by India.

Source: The Economist Read full article

Source: The Economist Read full article

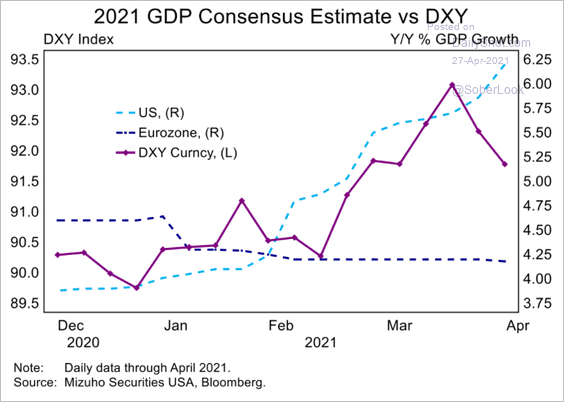

2. The outperformance of US GDP growth bodes well for the dollar.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

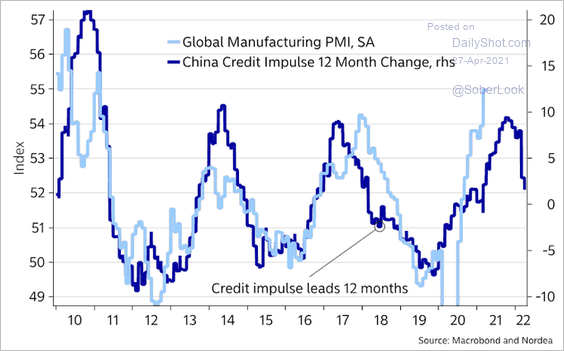

3. China’s slowing credit impulse points to a peak in manufacturing PMIs later this year.

Source: @NordeaMacroLab, @AndreasSteno Read full article

Source: @NordeaMacroLab, @AndreasSteno Read full article

Back to Index

Food for Thought

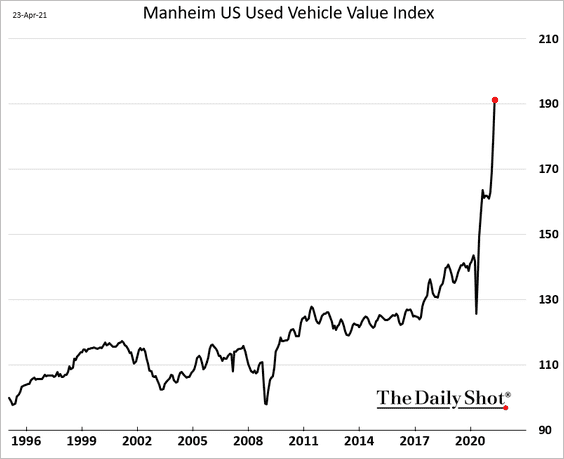

1. Used vehicle prices in the US:

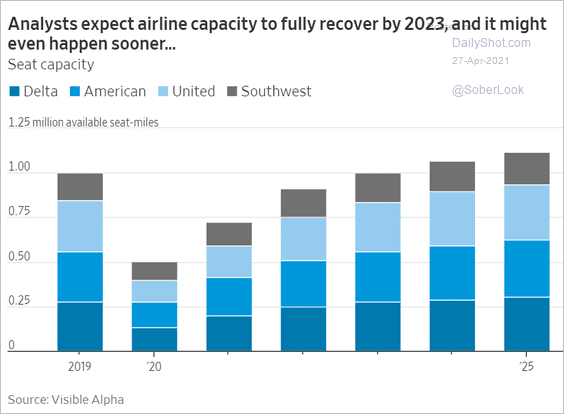

2. Projected airline seat capacity:

Source: @WSJ Read full article

Source: @WSJ Read full article

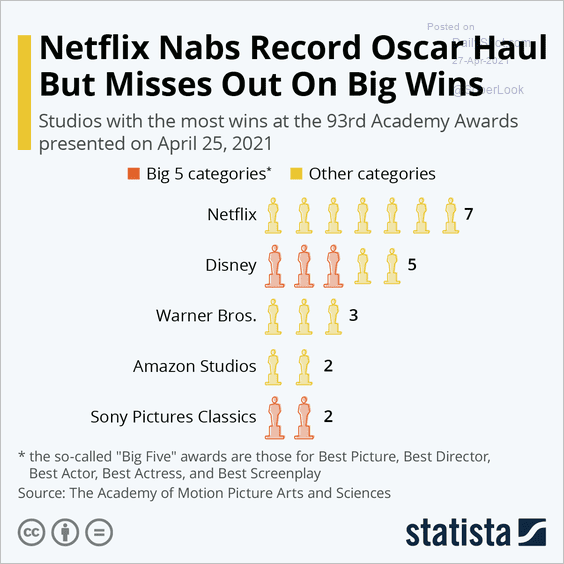

3. Academy Awards:

Source: Statista

Source: Statista

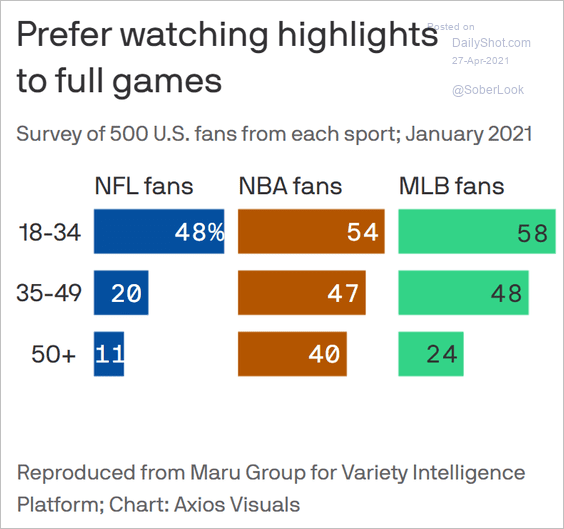

4. Watching sports:

Source: @axios Read full article

Source: @axios Read full article

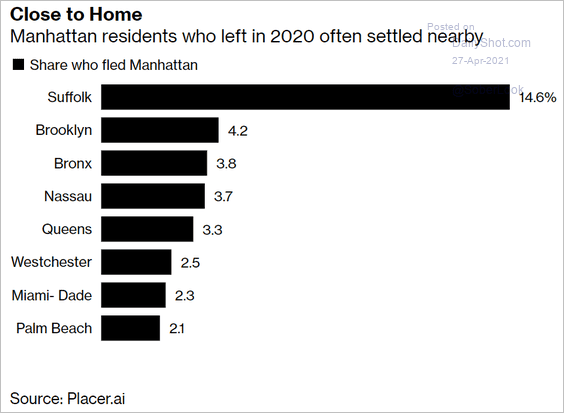

5. Leaving Manhattan, but not moving too far:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

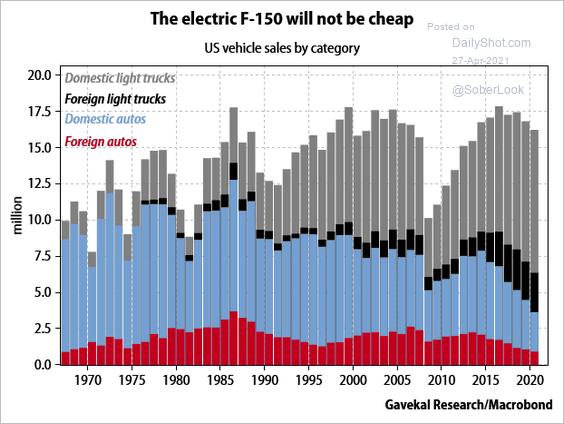

6. Vehicle sales by category:

Source: Gavekal Research

Source: Gavekal Research

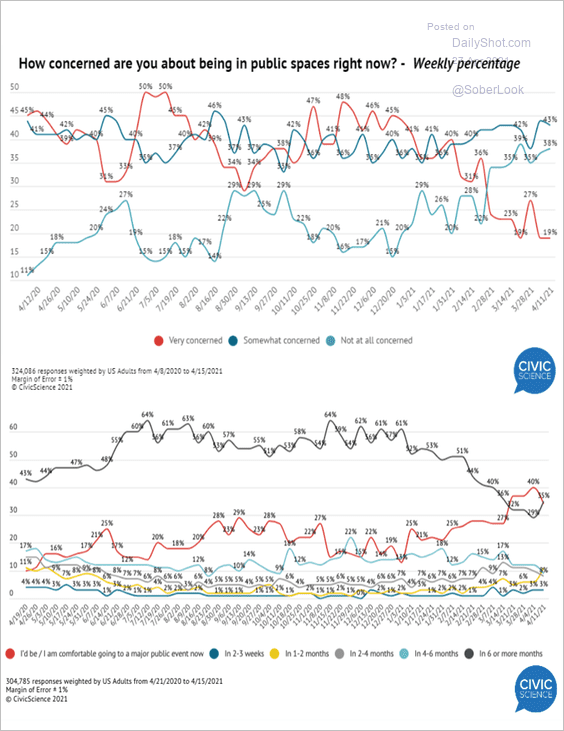

7. Visiting public spaces:

Source: CivicScience Read full article

Source: CivicScience Read full article

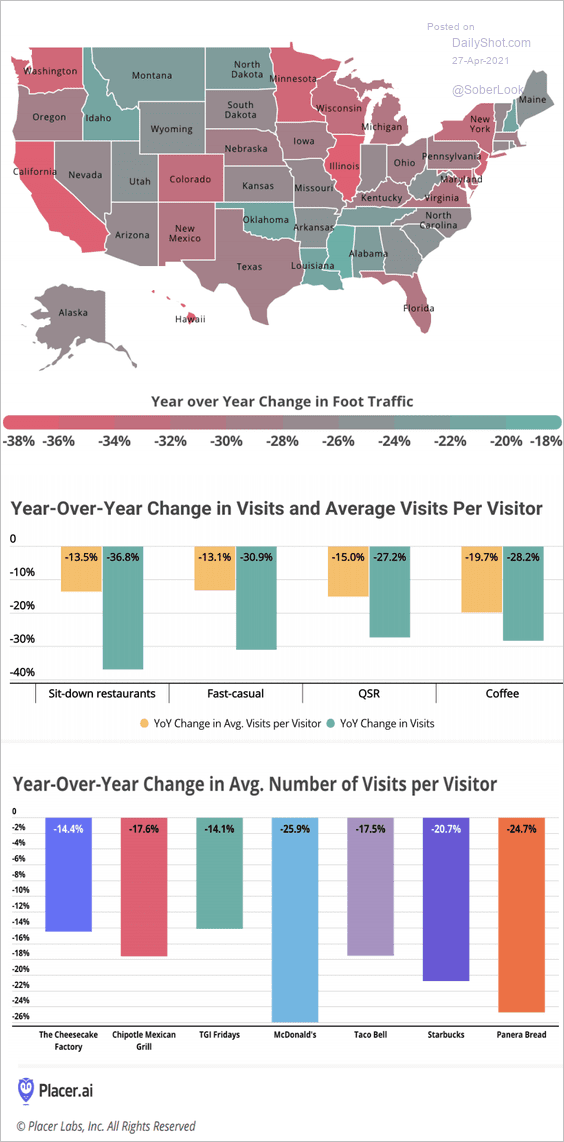

8. Restaurant foot traffic:

Source: Placer Labs Read full article

Source: Placer Labs Read full article

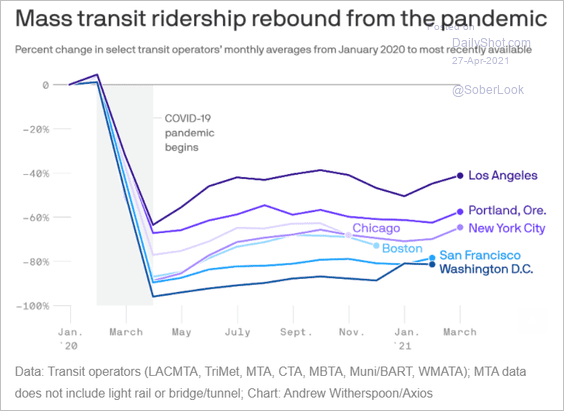

9. US public transit ridership:

Source: @axios Read full article

Source: @axios Read full article

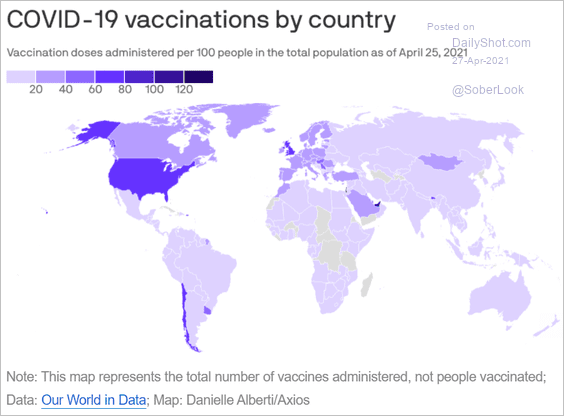

10. Vaccinations by country:

Source: @axios Read full article

Source: @axios Read full article

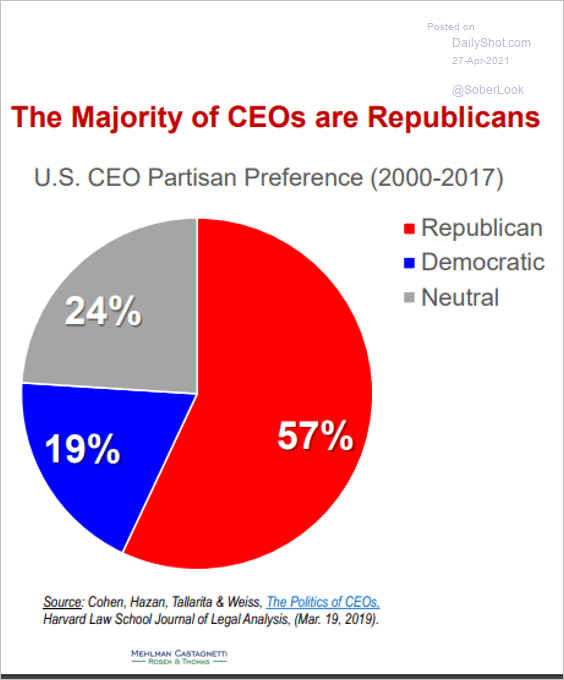

11. US CEOs’ political affiliation:

Source: MEHLMAN CASTAGNETTI ROSEN & THOMAS Read full article

Source: MEHLMAN CASTAGNETTI ROSEN & THOMAS Read full article

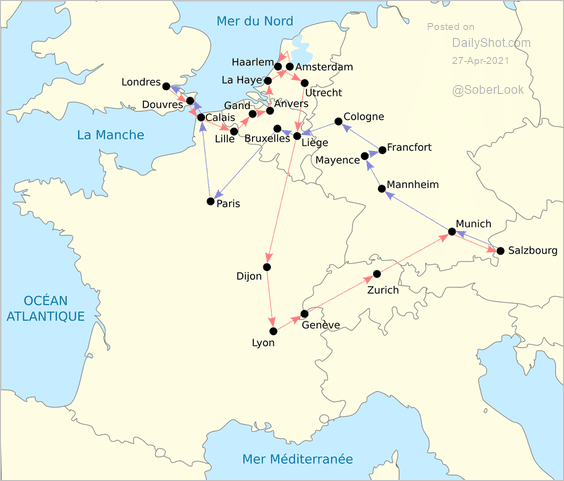

12. Mozart’s grand tour of Europe (1763-1766):

Source: Wikimedia Commons

Source: Wikimedia Commons

——————–

Back to Index