The Daily Shot: 28-Apr-21

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

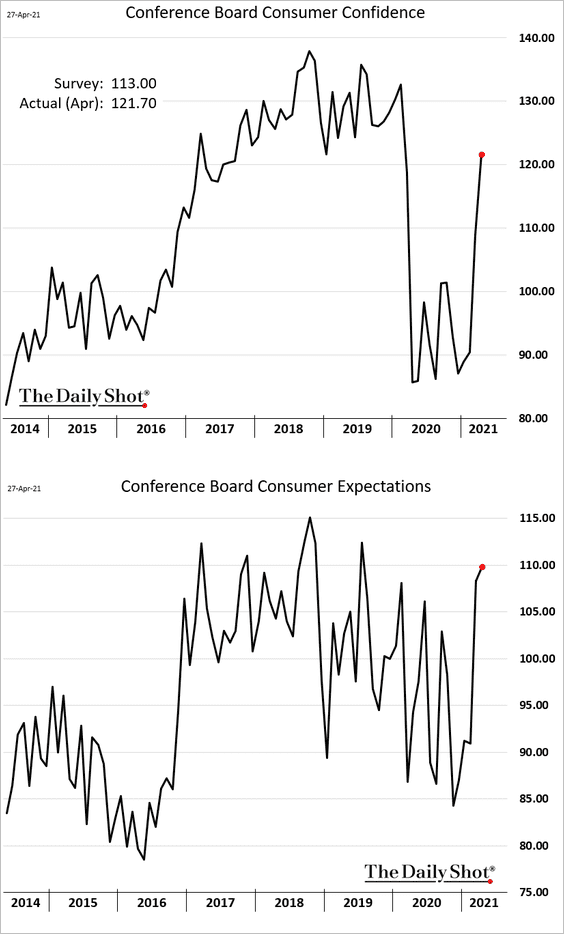

1. Consumer confidence surged in April, topping forecasts.

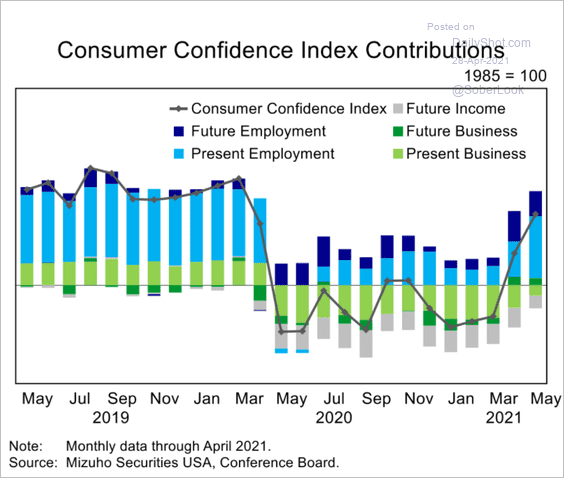

Here are the contributions to the Conference Board’s index.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

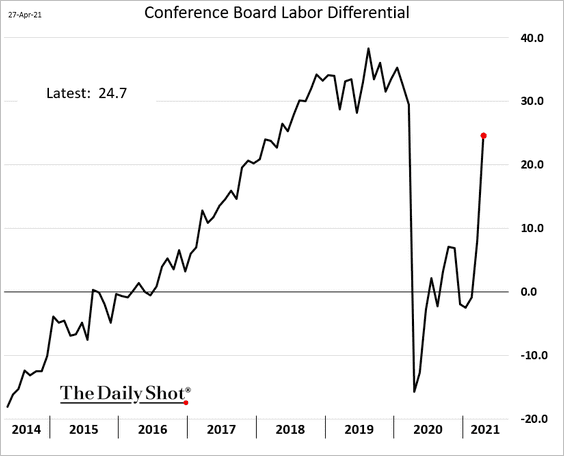

The labor differential (spread between ‘jobs plentiful’ and ‘jobs hard to get’ indices) rose sharply, pointing to a rapid recovery in the jobs market.

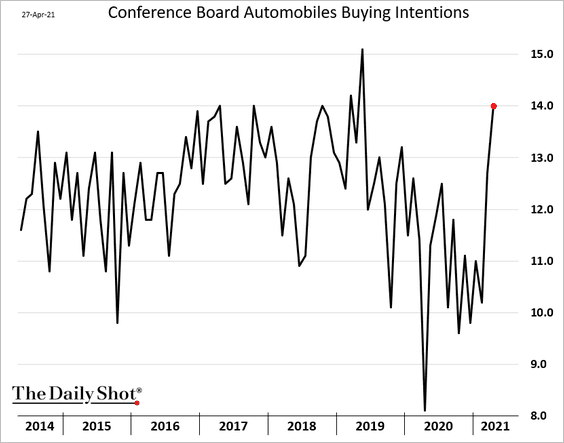

Automobile buying intentions increased again.

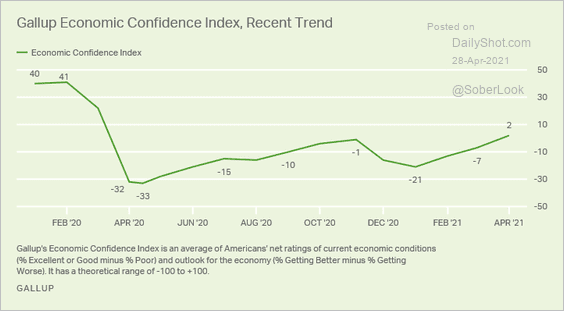

Separately, here is Gallup’s economic confidence index.

Source: Gallup Read full article

Source: Gallup Read full article

——————–

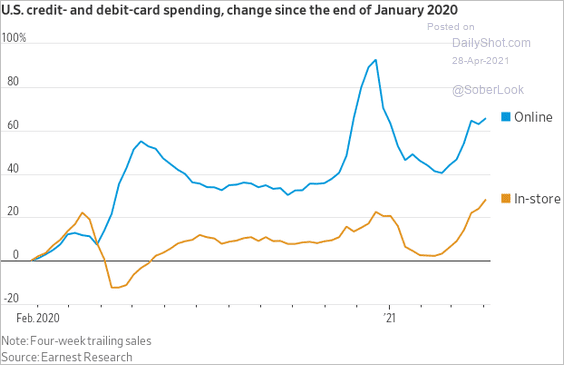

2. In-store credit card spending continues to recover.

Source: @WSJ Read full article

Source: @WSJ Read full article

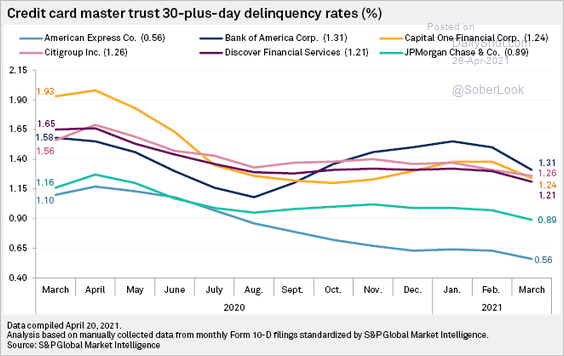

Credit card delinquencies have been trending lower.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

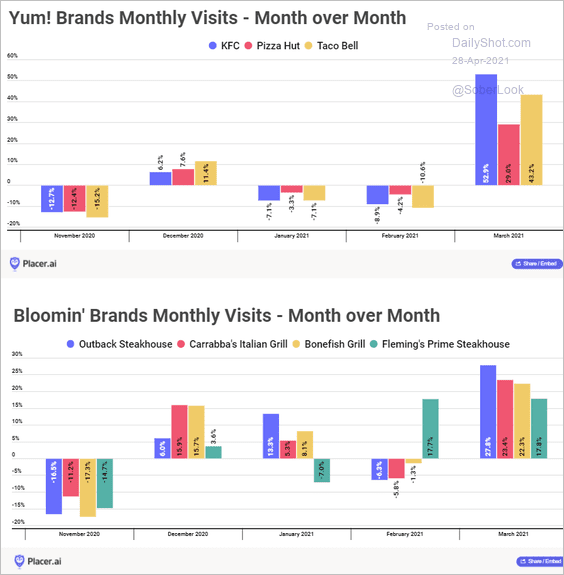

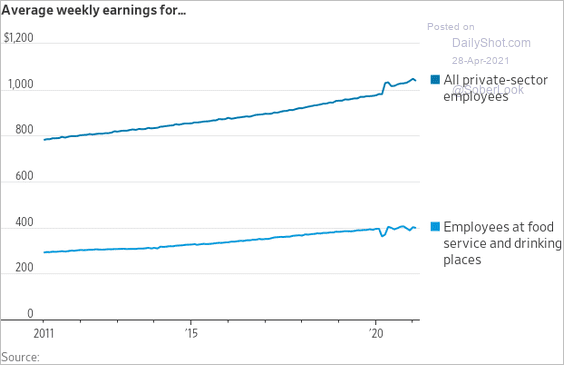

3. Restaurants are struggling to find workers as visits rebound.

Source: Placer Labs

Source: Placer Labs

Restaurant wages are going up.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

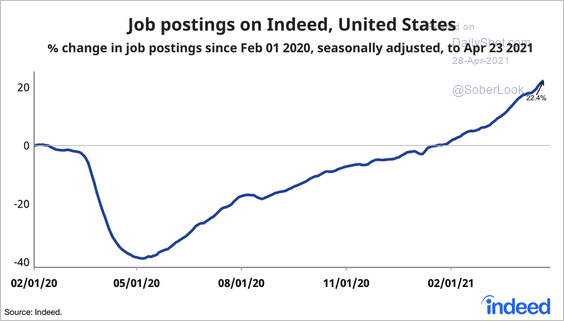

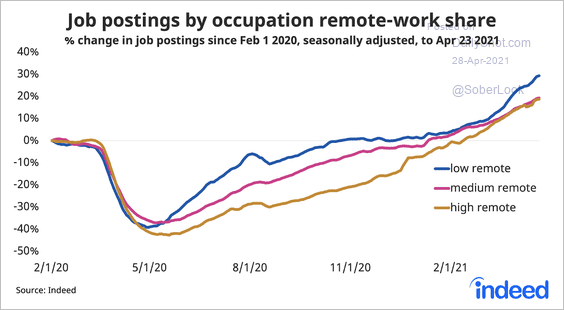

4. Job openings continue to recover.

Source: @JedKolko, @indeed

Source: @JedKolko, @indeed

Source: @JedKolko, @indeed

Source: @JedKolko, @indeed

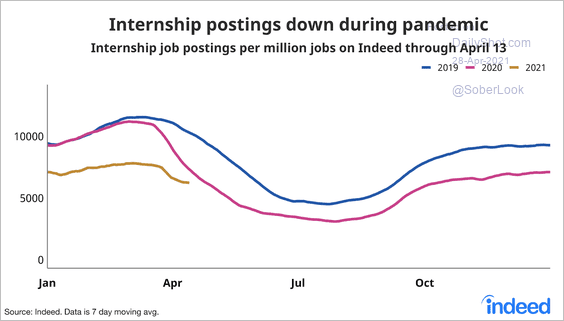

Openings for internships are still lagging the 2019 levels.

Source: @JedKolko, @indeed Read full article

Source: @JedKolko, @indeed Read full article

——————–

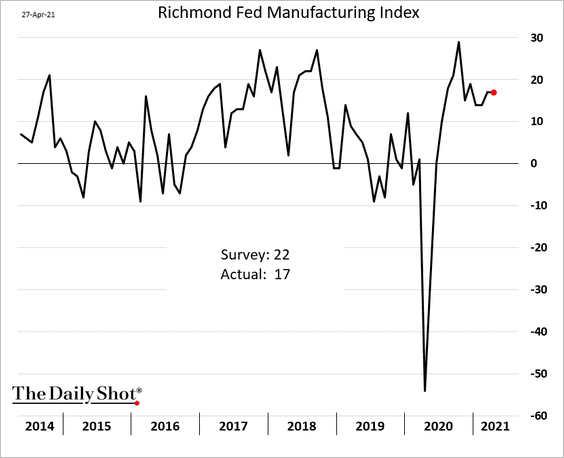

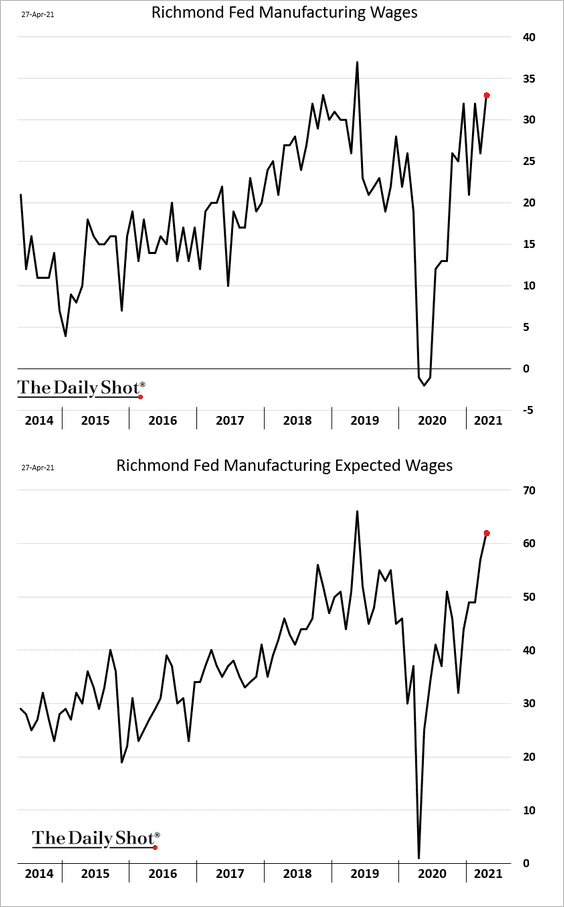

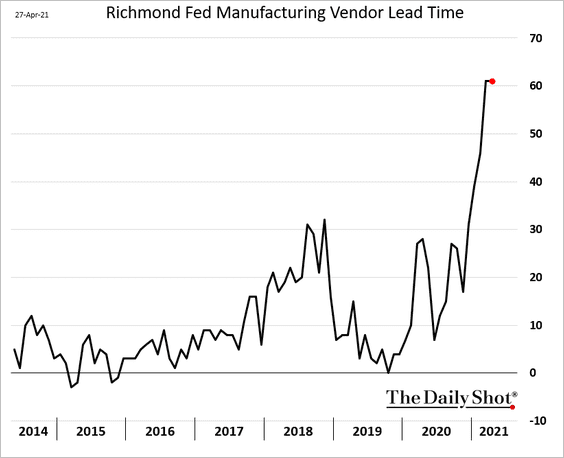

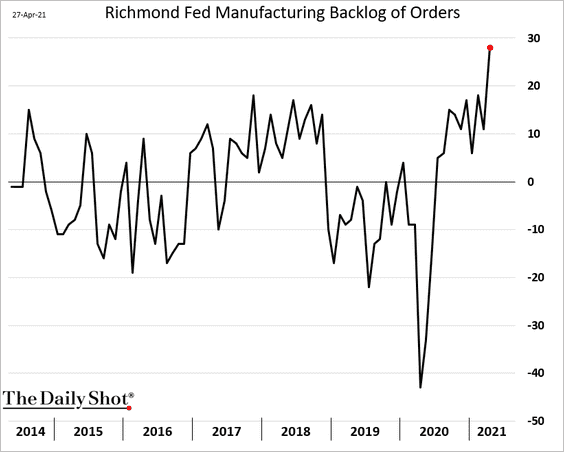

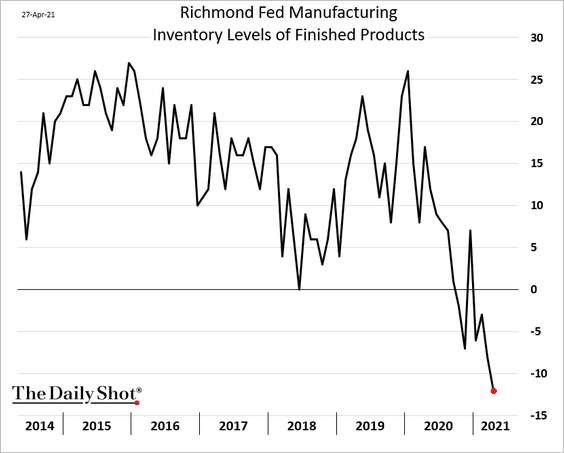

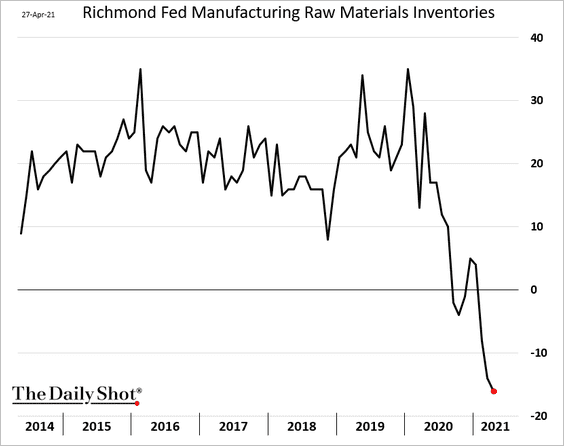

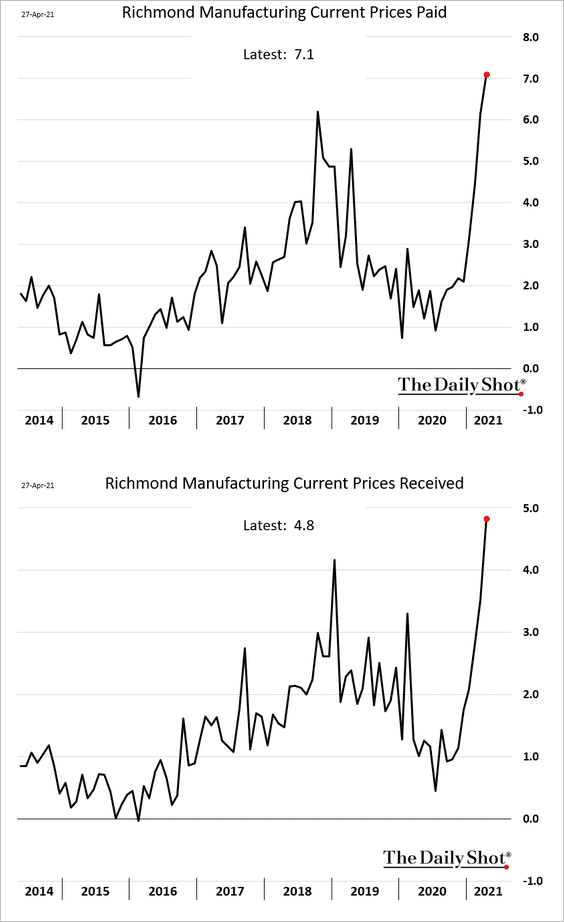

5. The Richmond Fed’s regional manufacturing index was softer than expected.

• Wage growth has rebounded.

• Supply-chain problems have become a drag on growth.

– Vendor lead times:

– Order backlog:

– Inventories:

– Price pressures:

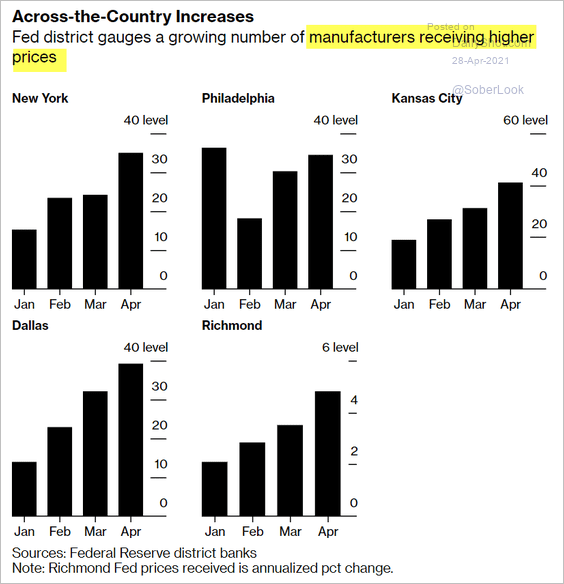

Manufacturers around the country are passing on higher prices to their customers.

Source: @markets Read full article

Source: @markets Read full article

——————–

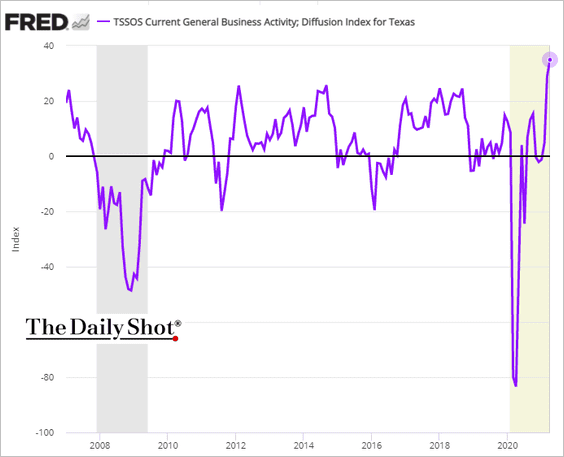

6. The Dallas Fed’s service-sector report shows rapid expansion in business activity.

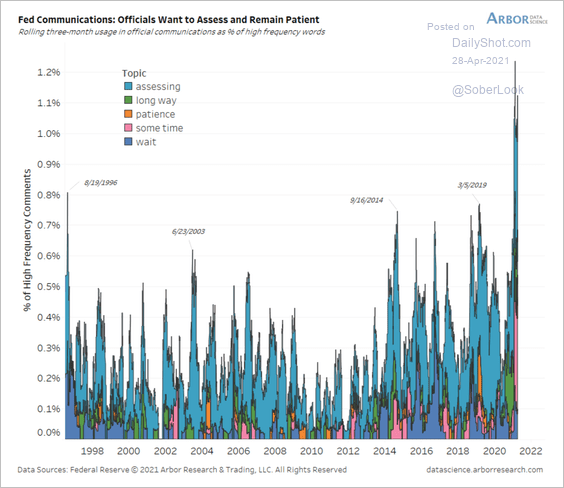

7. Based on recent communications, the Fed wants to “assess” and “give some time” before adjusting monetary policy.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

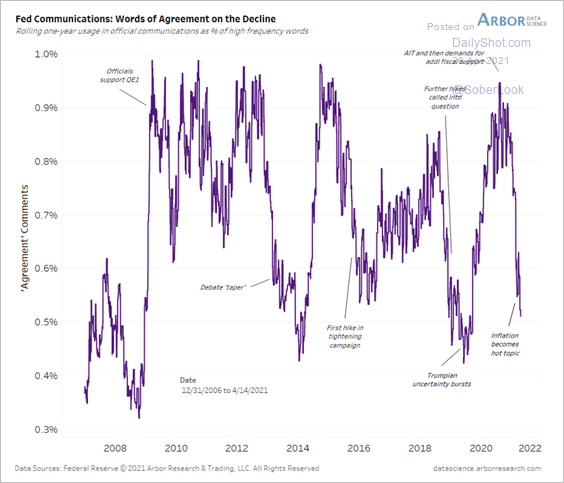

But agreement among Fed officials has fallen recently.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

8. The 10-year breakeven rate (market-based inflation expectations) hit the highest level since 2013.

Back to Index

The United Kingdom

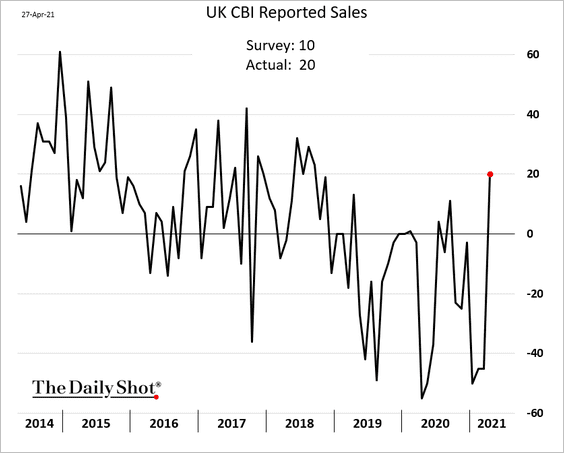

1. Retail sales jumped this month, according to CBI.

Source: The Guardian Read full article

Source: The Guardian Read full article

——————–

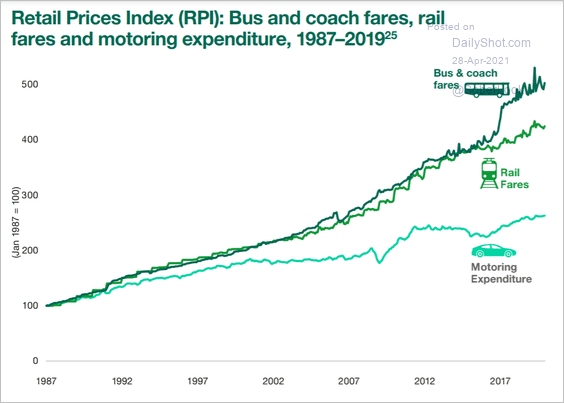

2. This chart shows UK ground transportation costs over time.

Source: GOV.UK Read full article

Source: GOV.UK Read full article

Back to Index

The Eurozone

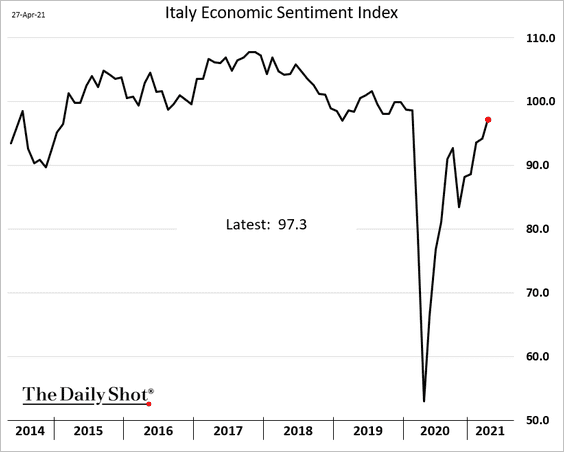

1. Italy’s economic sentiment has almost fully recovered.

The government is upbeat about growth in the next few years.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

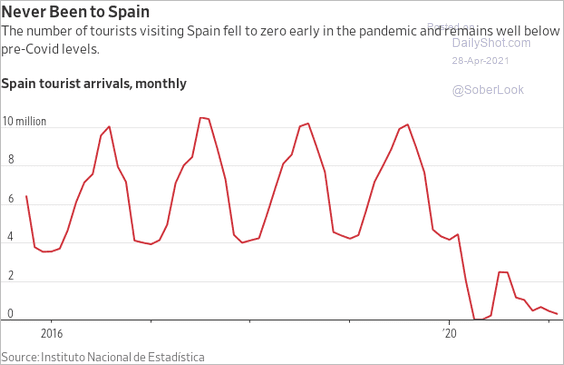

2. Spain’s tourism remains depressed.

Source: @WSJ Read full article

Source: @WSJ Read full article

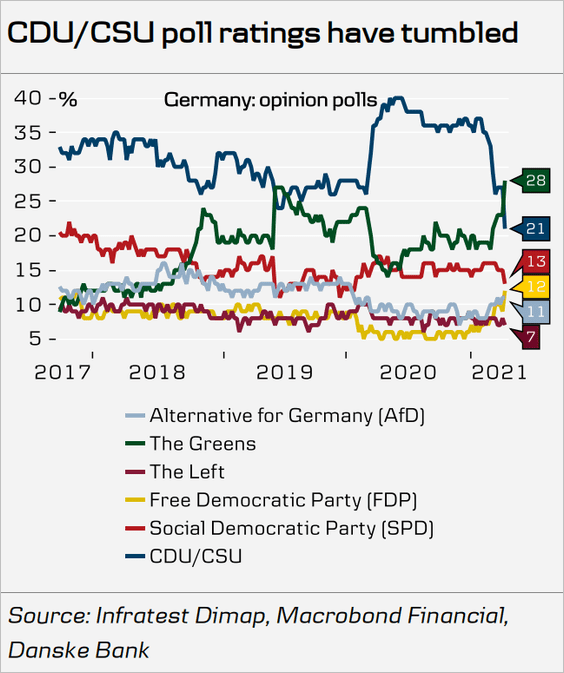

3. Here are the latest polls from Germany.

Source: Danske Bank

Source: Danske Bank

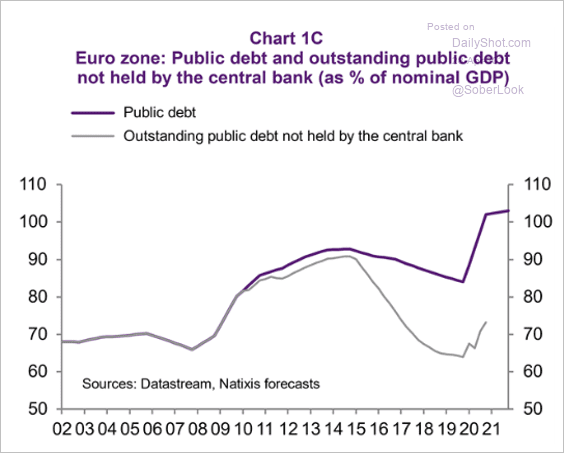

4. This chart shows the amount of public debt not held by the central bank.

Source: Natixis

Source: Natixis

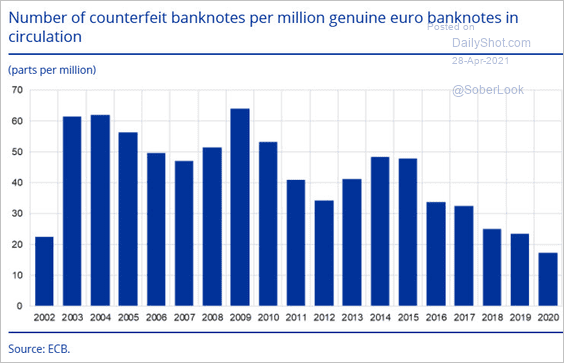

5. The percentage of counterfeit euros continues to decline.

Source: ECB Read full article

Source: ECB Read full article

Back to Index

Asia – Pacific

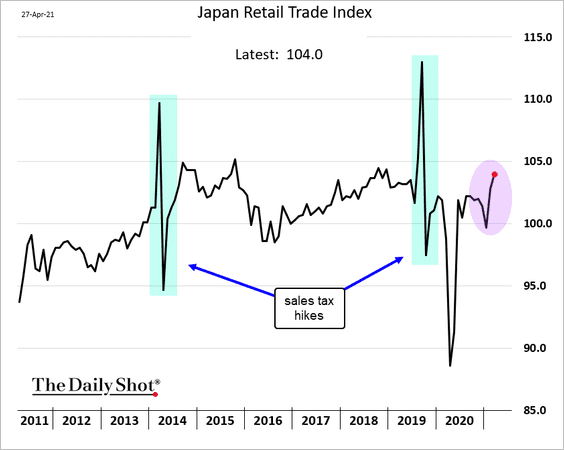

1. Japan’s retail sales are recovering.

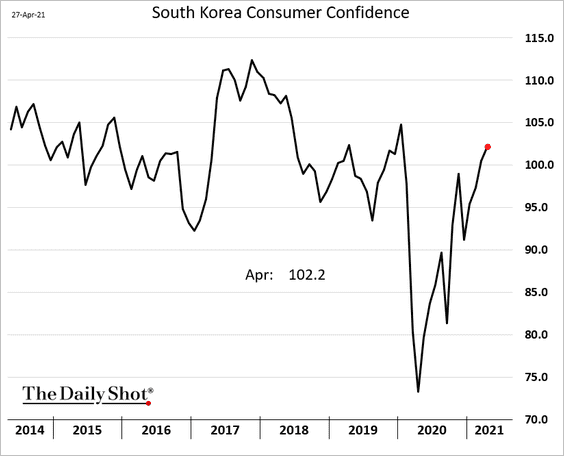

2. South Korea’s consumer confidence keeps strengthening.

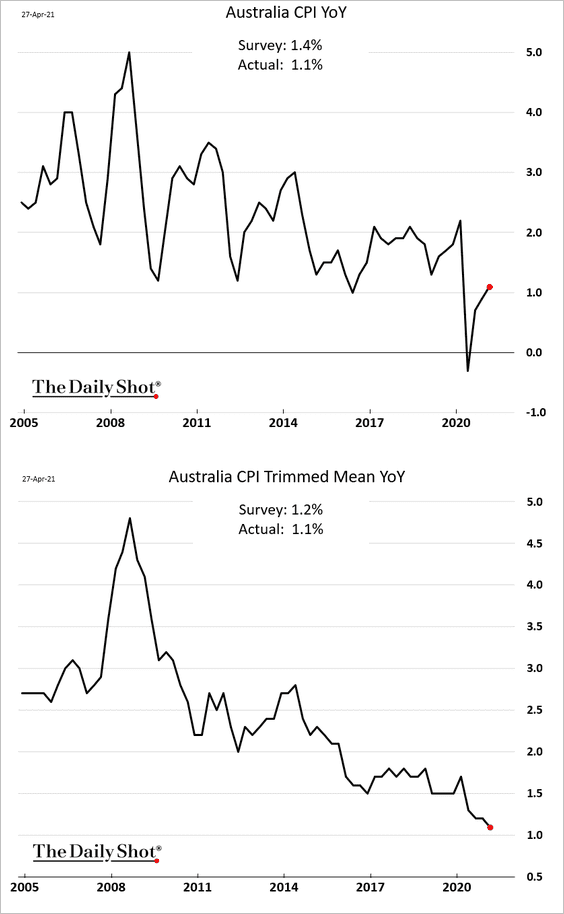

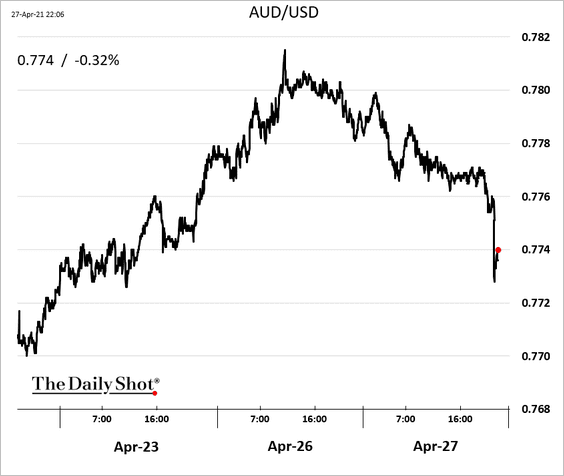

3. Australia’s first-quarter CPI surprised to the downside.

The Aussie dollar slumped in response.

——————–

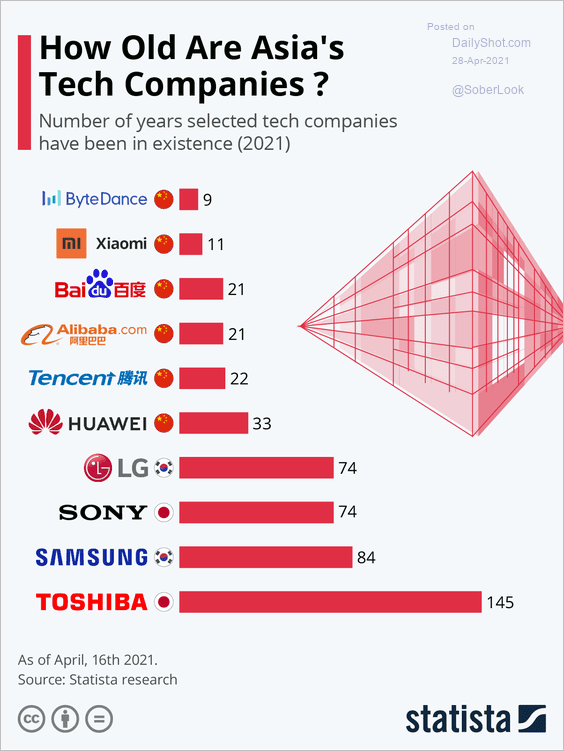

4. How old are Asia’s tech companies?

Source: Statista

Source: Statista

Back to Index

China

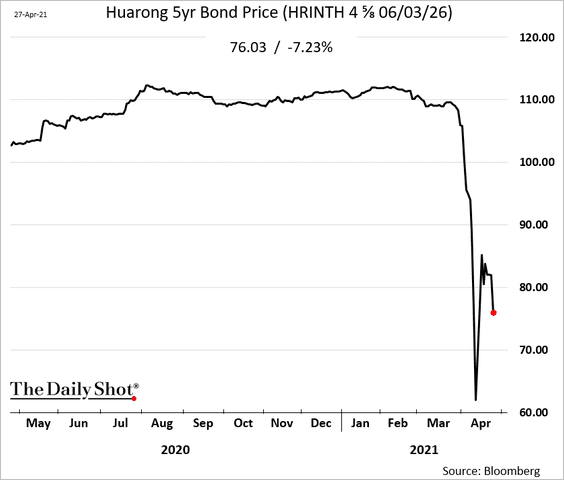

1. Investors remain concerned about Huarong’s debt.

Source: Fitch Ratings Read full article

Source: Fitch Ratings Read full article

——————–

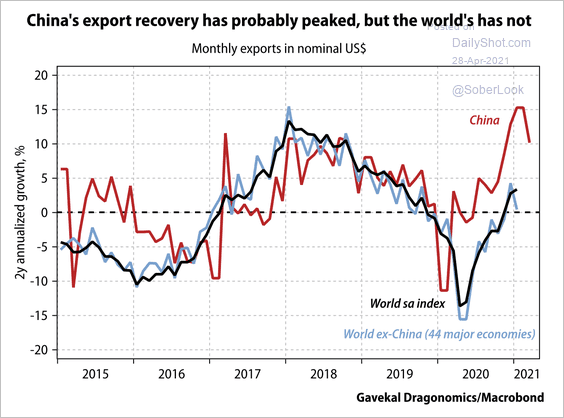

2. Exports are likely at their peak.

Source: Gavekal Research

Source: Gavekal Research

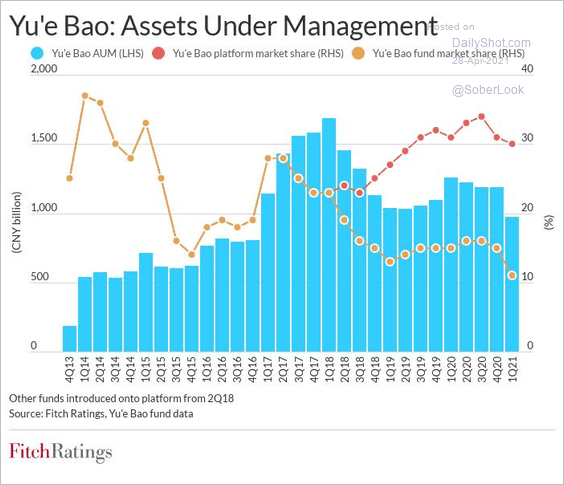

3. Will other funds benefit from a regulatory cap on Yu’e Bao (the largest money market fund)?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: Fitch Ratings

Source: Fitch Ratings

——————–

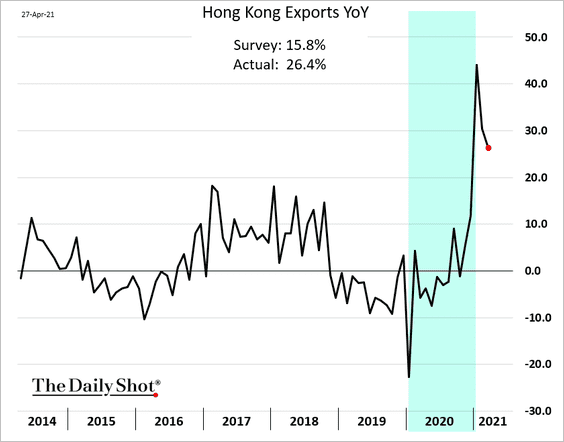

4. Hong Kong’s exports remain robust.

Back to Index

Emerging Markets

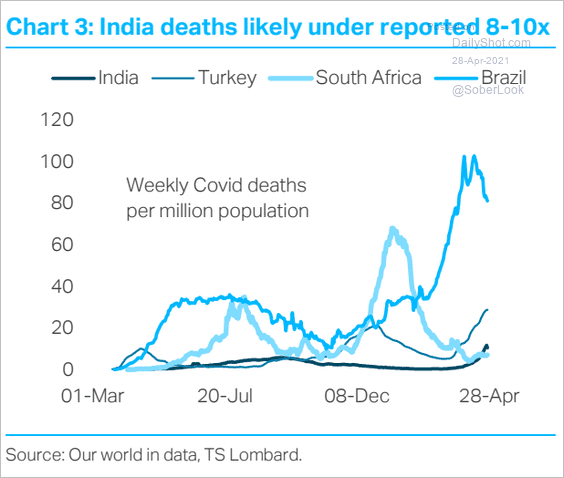

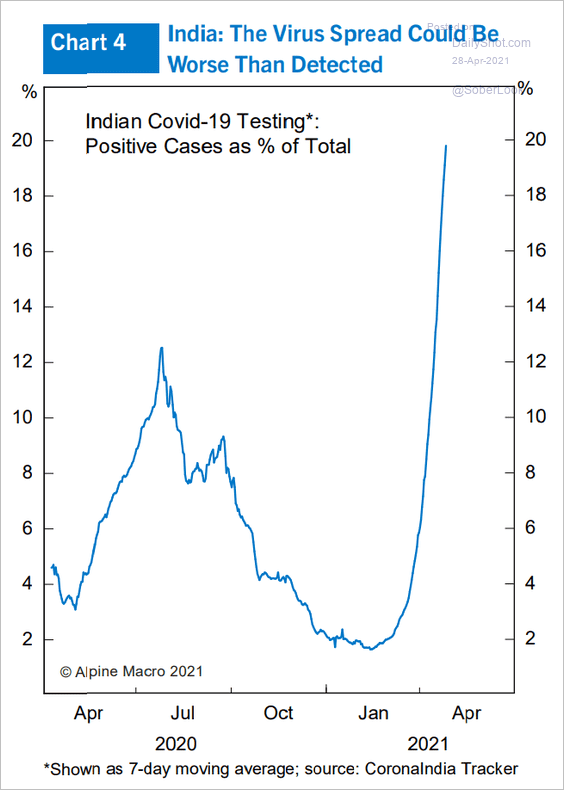

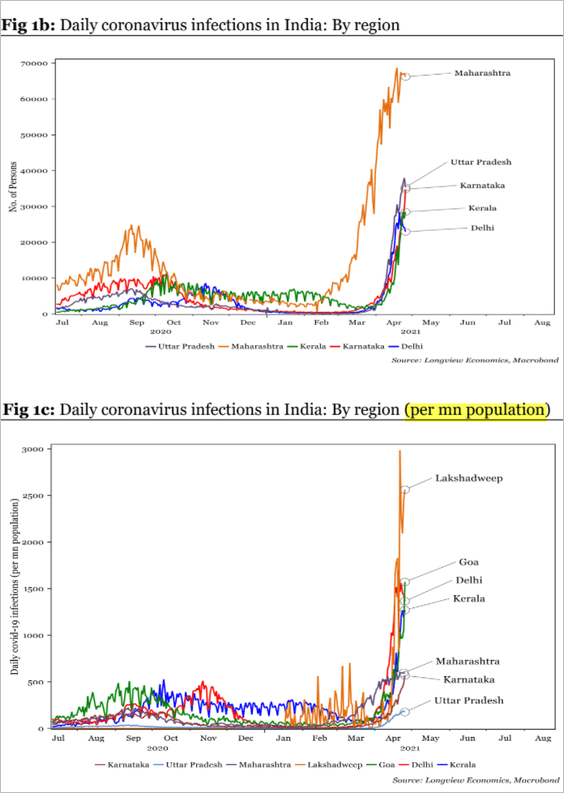

1. Let’s begin with India.

• COVID-related deaths are massively under-reported.

Source: TS Lombard

Source: TS Lombard

• Positivity rates are soaring.

Source: Alpine Macro

Source: Alpine Macro

• Below are the regional COVID trends.

Source: Longview Economics

Source: Longview Economics

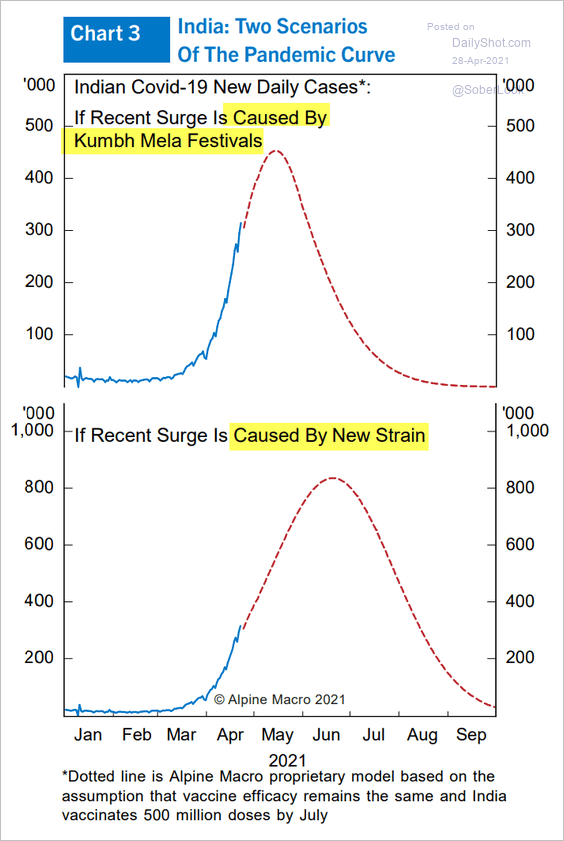

• And this chart shows two potential scenarios.

Source: Alpine Macro

Source: Alpine Macro

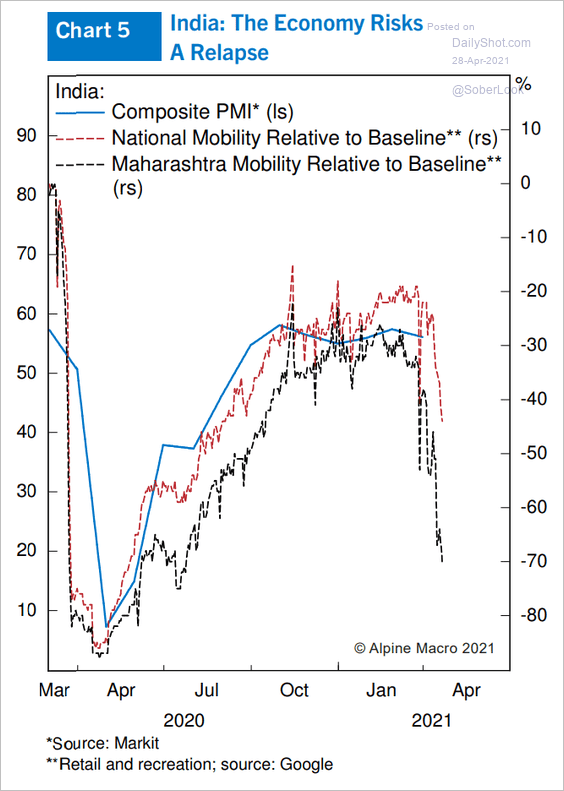

• Mobility indicators have tumbled, pointing to weakening business activity.

Source: Alpine Macro

Source: Alpine Macro

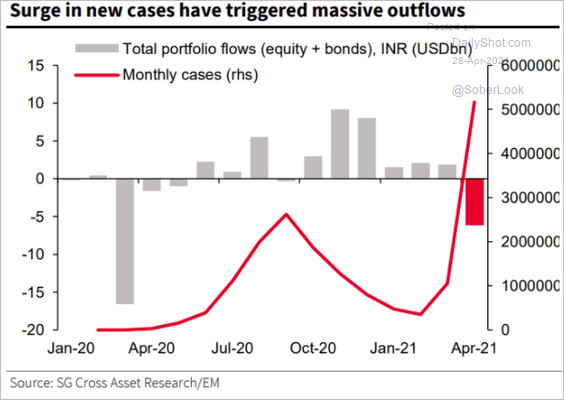

• The pandemic caused massive capital outflows.

Source: @johnauthers, @SocieteGenerale Read full article

Source: @johnauthers, @SocieteGenerale Read full article

——————–

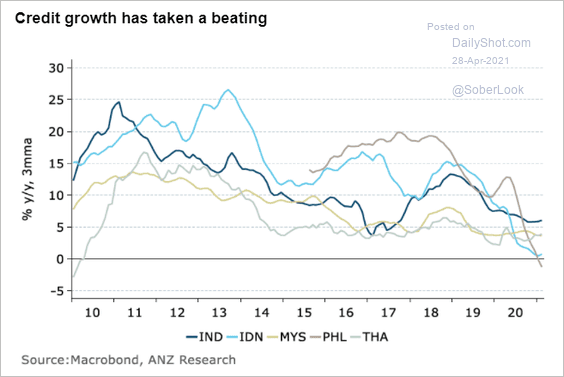

2. Credit growth has been slowing across EM Asia economies.

Source: ANZ Research

Source: ANZ Research

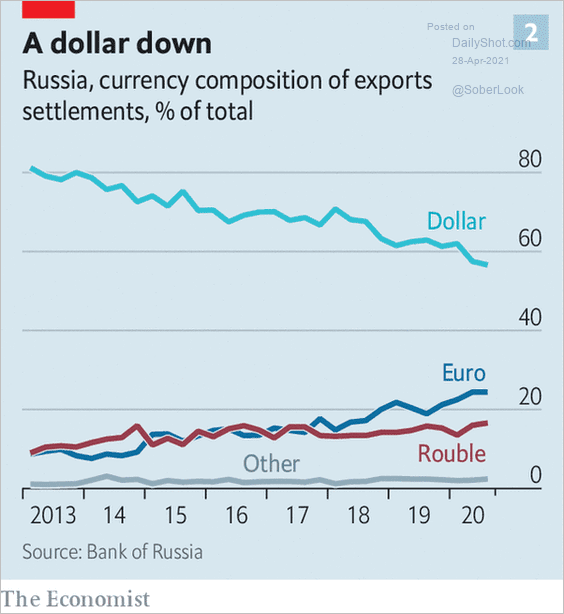

3. This chart shows Russia’s currency composition of exports.

Source: @adam_tooze; The Economist Read full article

Source: @adam_tooze; The Economist Read full article

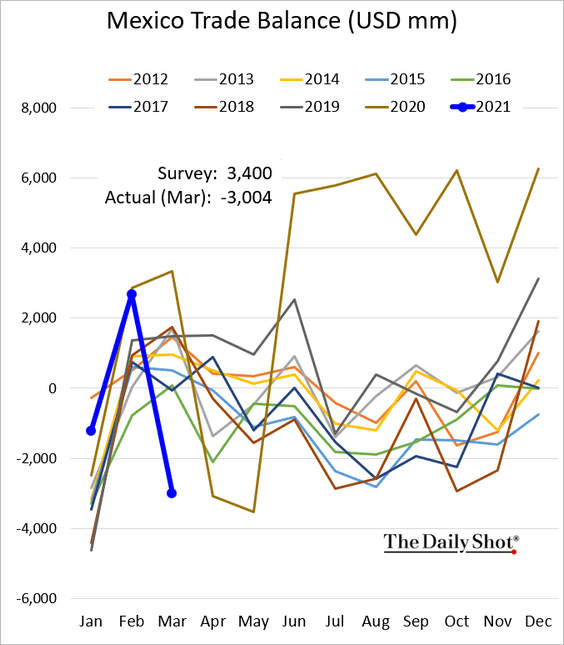

4. Mexico’s March exports surprised to the downside.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Commodities

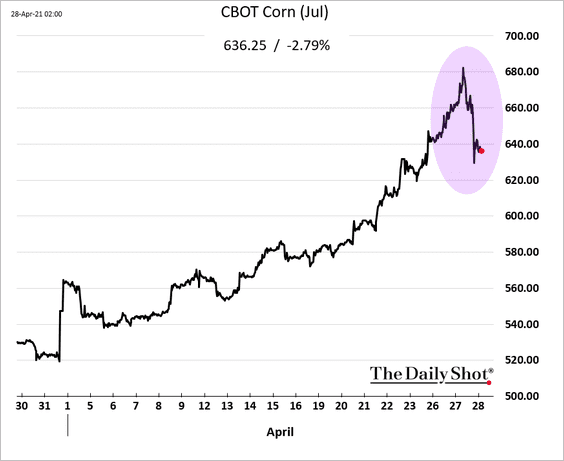

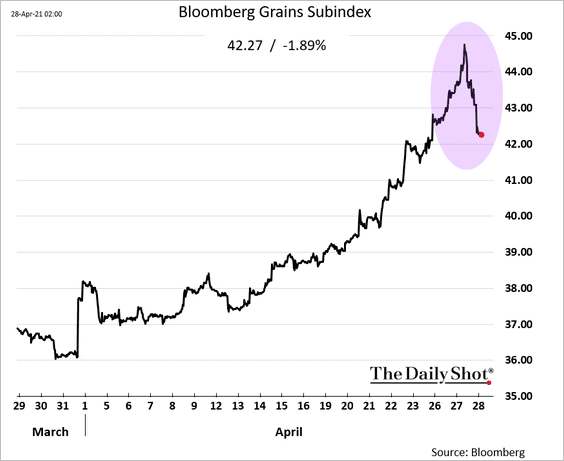

1. The rally in US grains is fading.

• Corn:

• Bloomberg’s grains index:

——————–

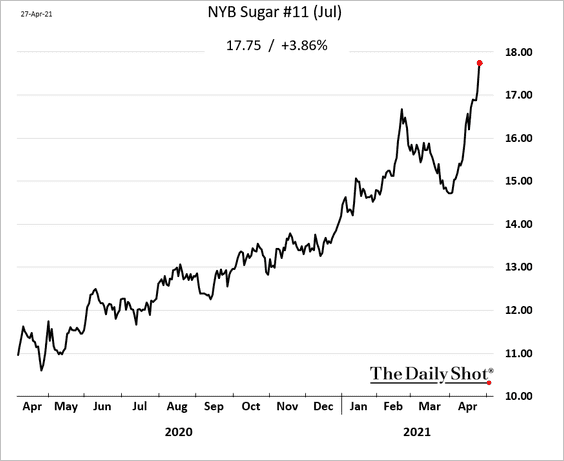

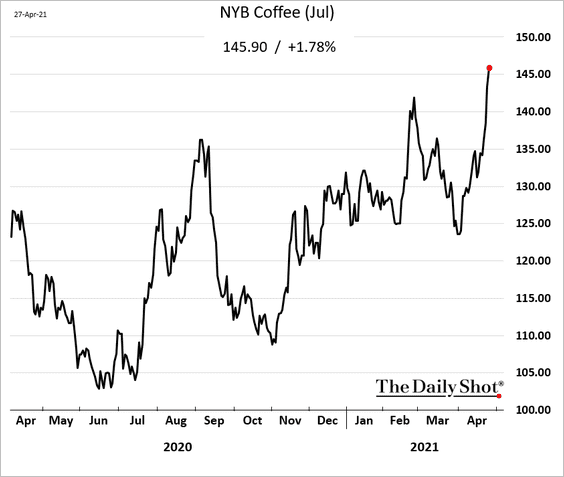

2. Softs are rallying in response to adverse weather conditions in Brazil (persistent dryness in parts of the country).

• Sugar:

• Arabica coffee:

——————–

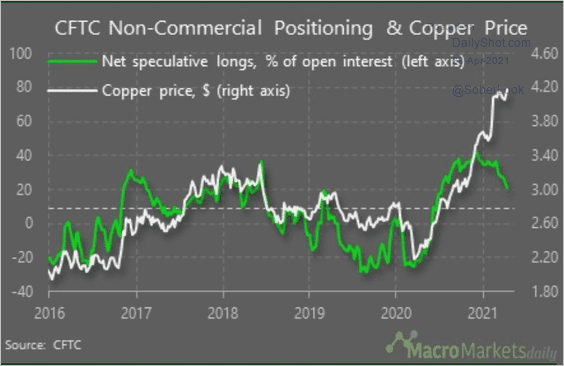

3. Copper prices have diverged from net speculative positions.

Source: MacroMarketsDaily

Source: MacroMarketsDaily

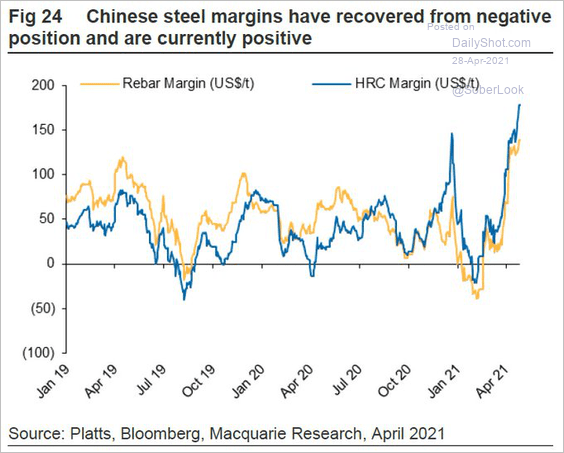

4. Global steel prices are surging.

Source: @jessefelder, @markets Read full article

Source: @jessefelder, @markets Read full article

China’s steel margins have rebounded.

Source: Macquarie, @Scutty

Source: Macquarie, @Scutty

Back to Index

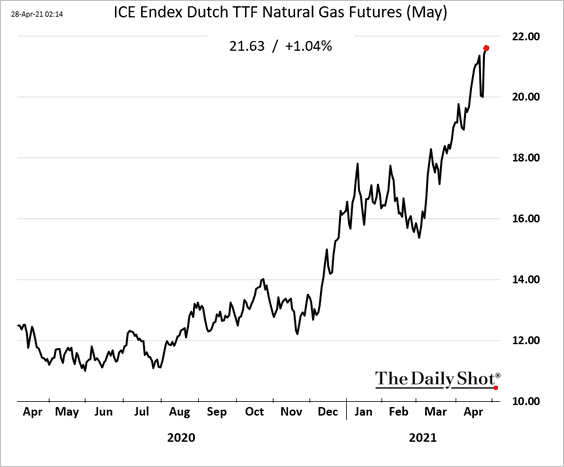

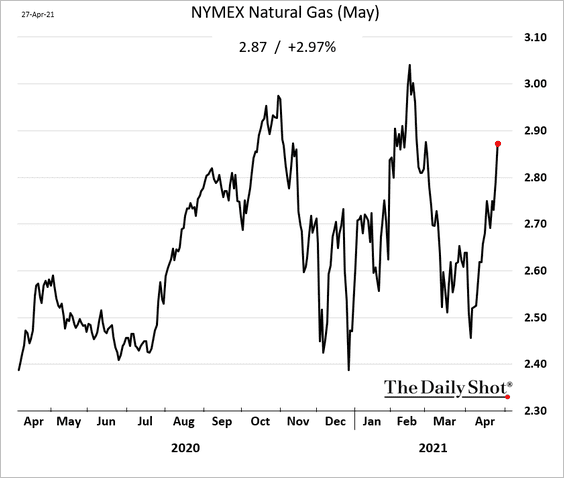

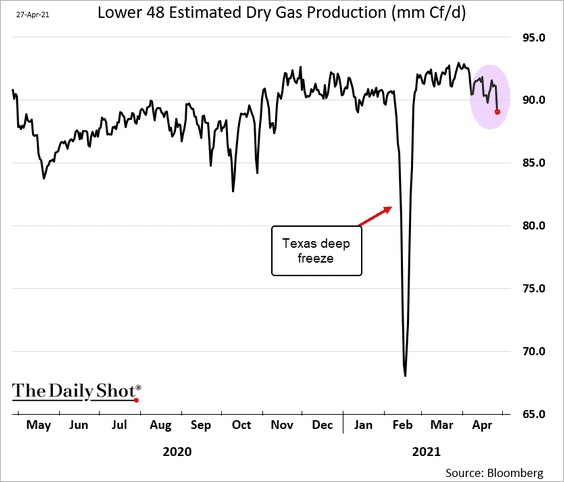

Energy

1. European natural gas prices are soaring.

Demand for LNG globally and weaker output have been boosting US natural gas futures.

——————–

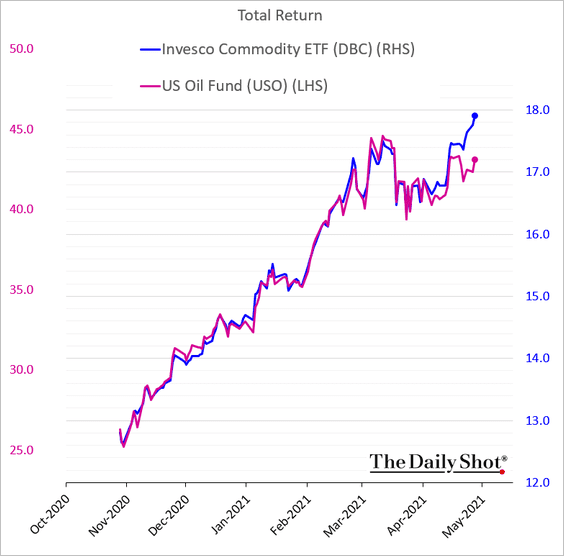

2. Crude oil has been underperforming other commodities.

h/t @themarketear

h/t @themarketear

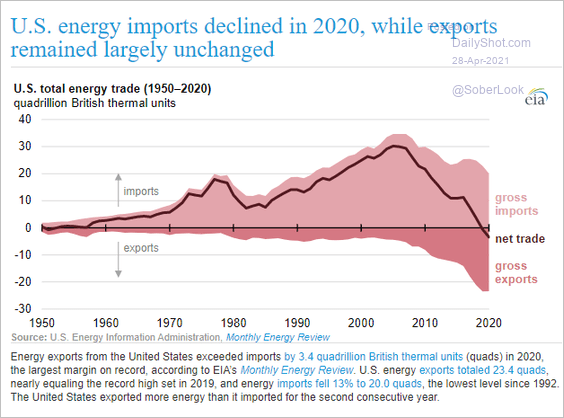

3. US energy trade has been in surplus.

Source: @EIAgov

Source: @EIAgov

Back to Index

Equities

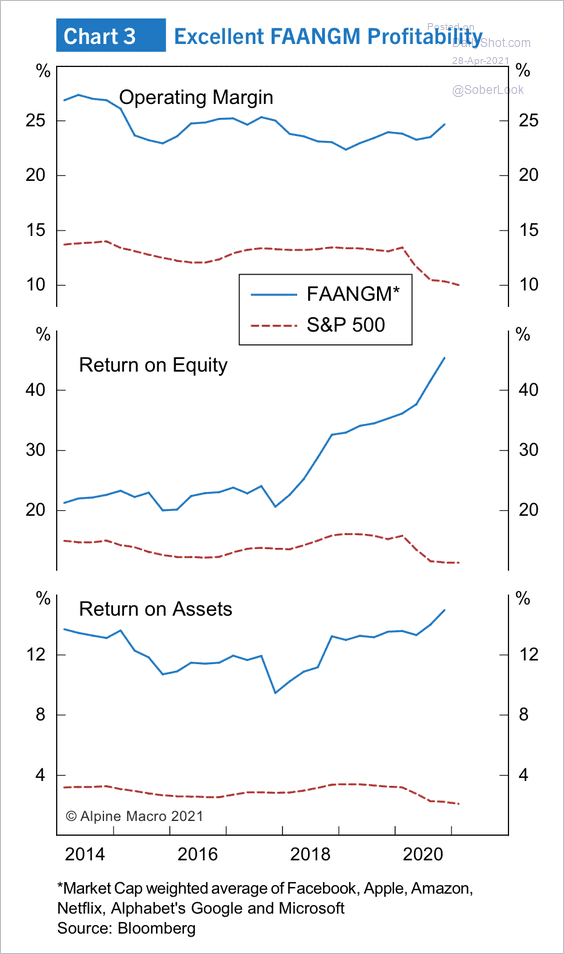

1. US tech mega-caps have had much better profitability than the broader market over the past few years.

Source: Alpine Macro

Source: Alpine Macro

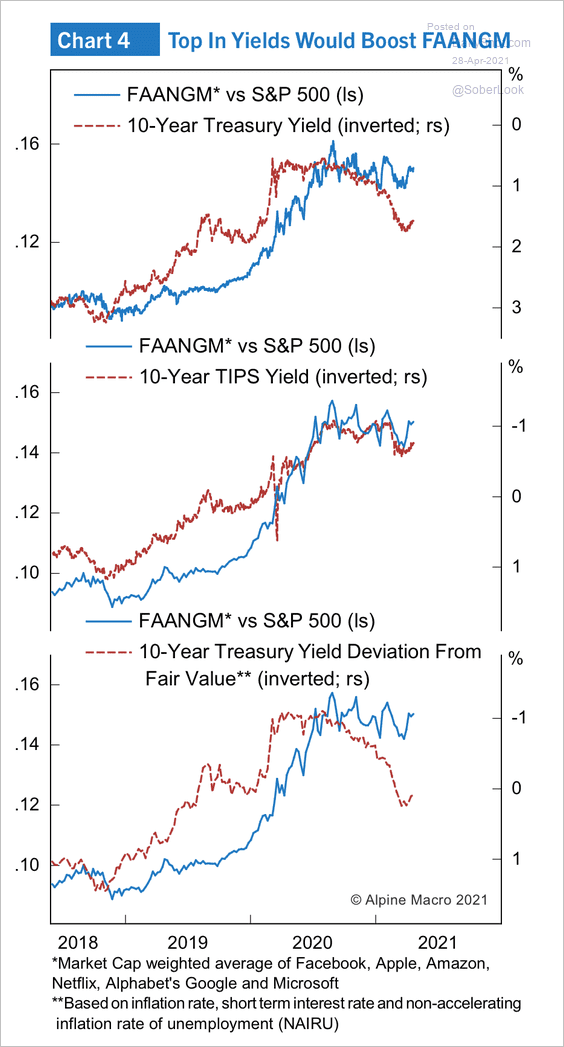

Alpine Macro expects FAANGM stocks to regain market leadership beyond the near term as Treasury yields peak.

Source: Alpine Macro

Source: Alpine Macro

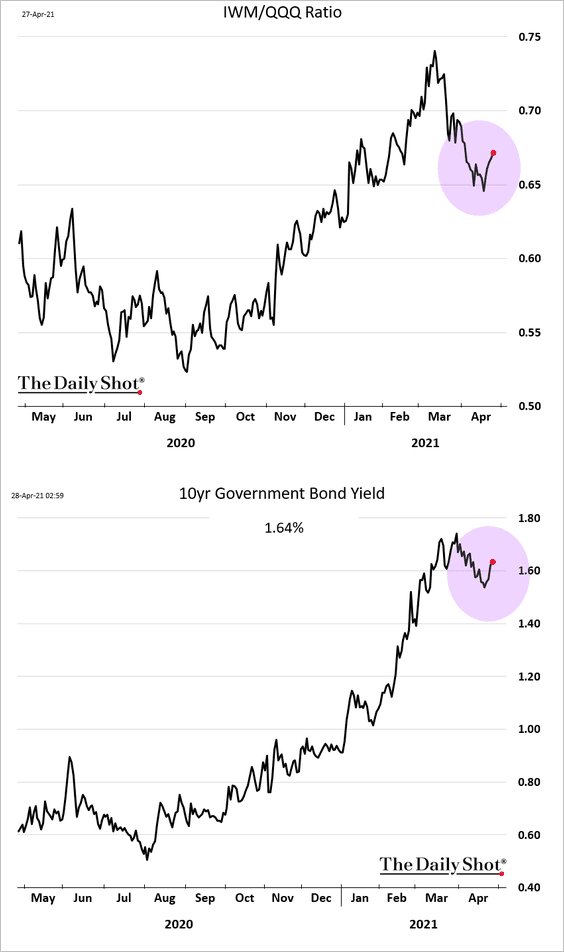

However, a rebound in Treasury yields this week is helping the Russell 2000 index outperform the Nasdaq 100.

——————–

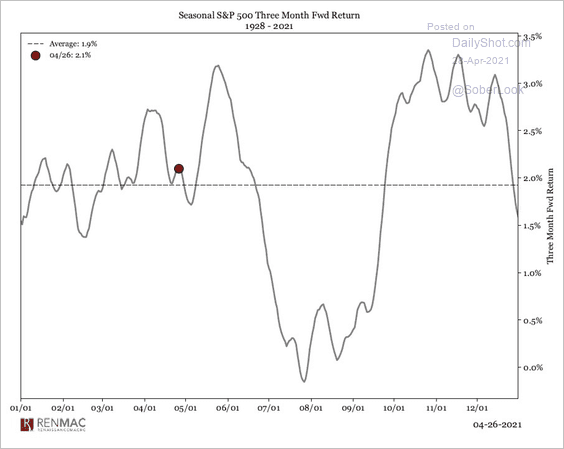

2. Is “sell in May and go away” a good idea?

Source: @RenMacLLC

Source: @RenMacLLC

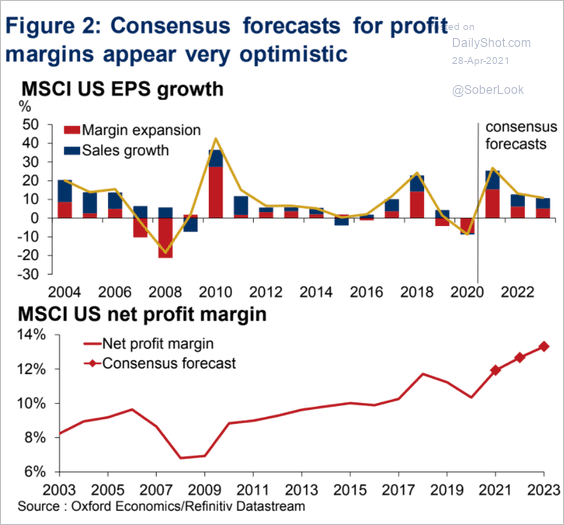

3. Are margin growth forecasts too optimistic?

Source: Daniel Grosvenor, Oxford Economics

Source: Daniel Grosvenor, Oxford Economics

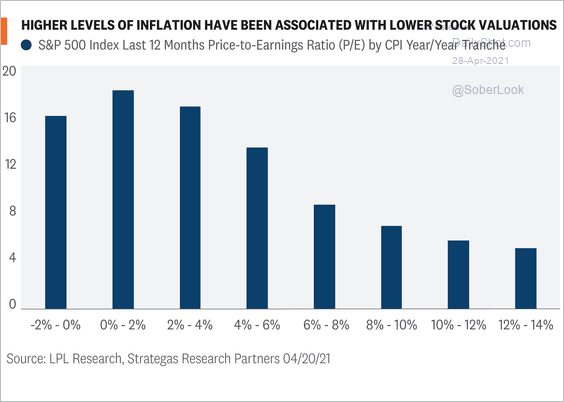

4. Higher inflation will require much stronger earnings to keep stock prices from declining.

Source: LPL Research

Source: LPL Research

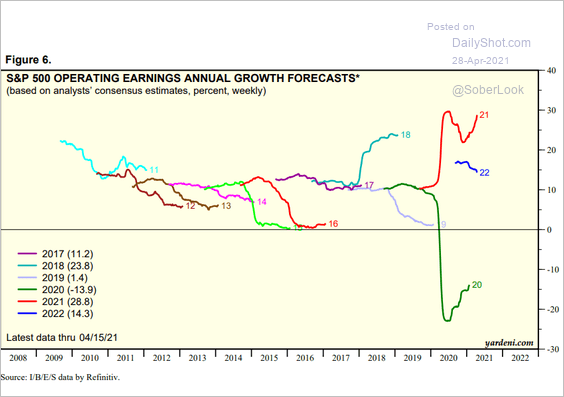

5. This chart shows S&P 500 earnings growth consensus forecasts over time.

Source: Yardeni Research

Source: Yardeni Research

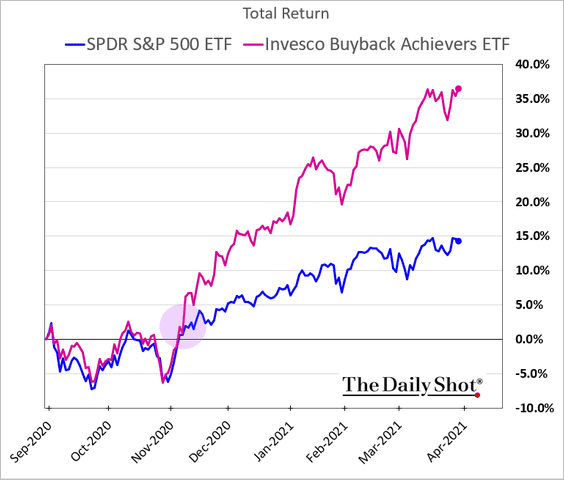

6. Companies known for share buybacks have been outperforming since the vaccine news last year.

7. Here is the Reddit crowd’s latest ‘pump & dump’ target

Source: @WSJ Read full article

Source: @WSJ Read full article

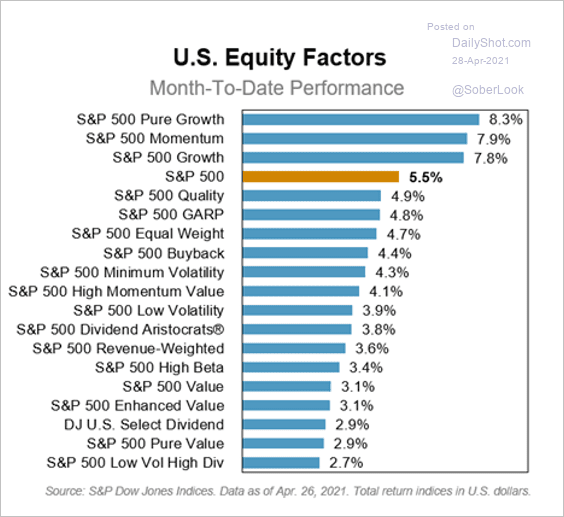

8. How have different equity factors performed this month?

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Credit

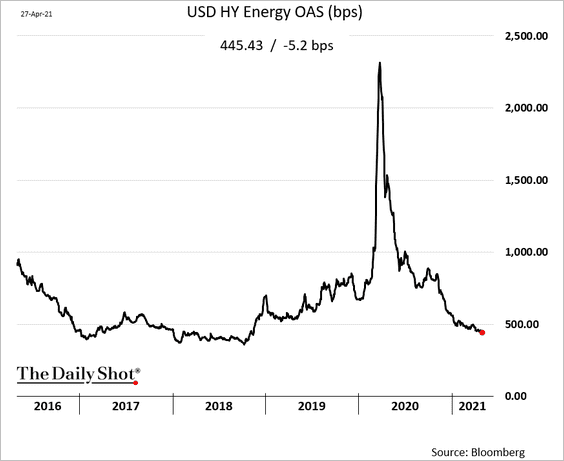

1. High-yield energy bond spreads continue to tighten.

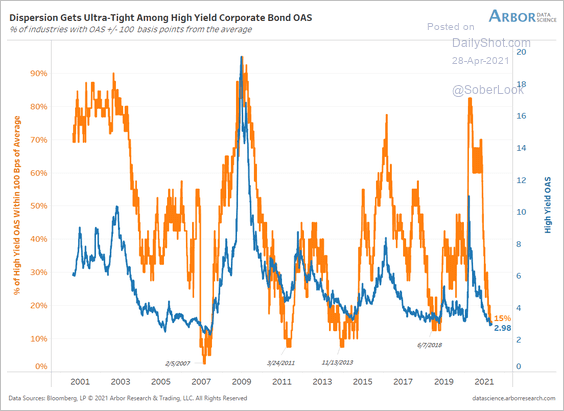

2. The overall US high-yield spread dispersion has tumbled in recent weeks.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

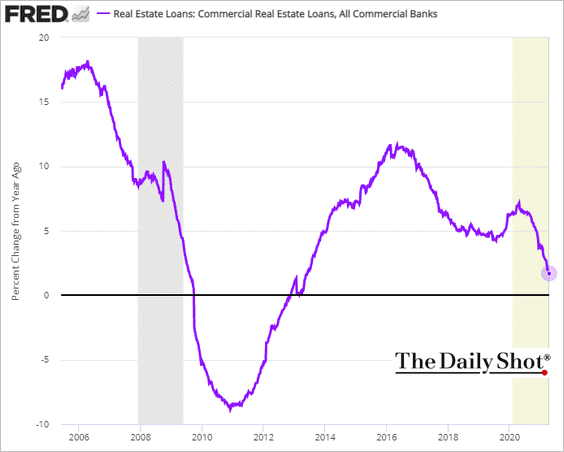

3. US banks have been slowing their commercial real estate credit growth.

Back to Index

Rates

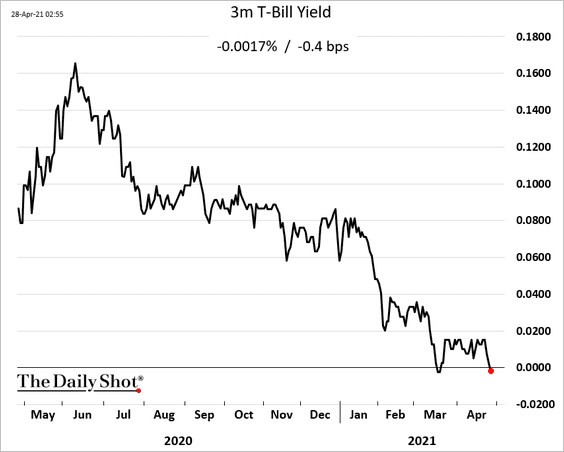

1. The 3-month Treasury bill yield is back in negative territory …

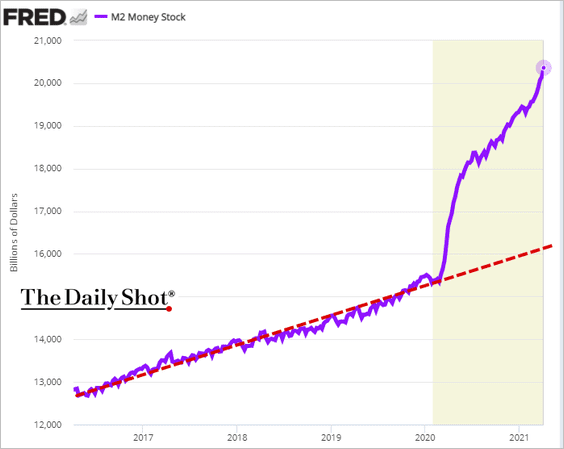

… amid rising liquidity.

——————–

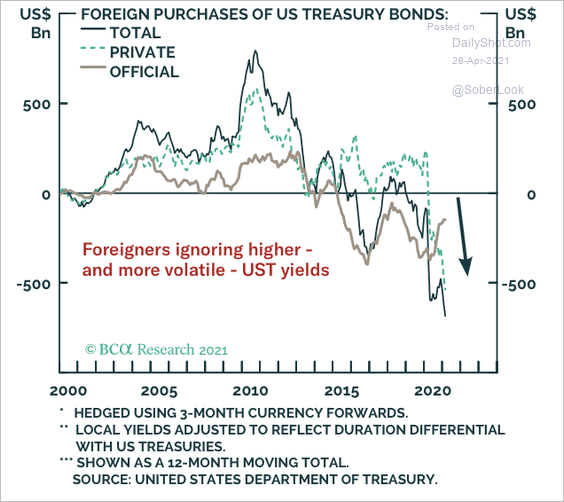

2. Foreign investors remain net sellers of Treasuries.

Source: BCA Research

Source: BCA Research

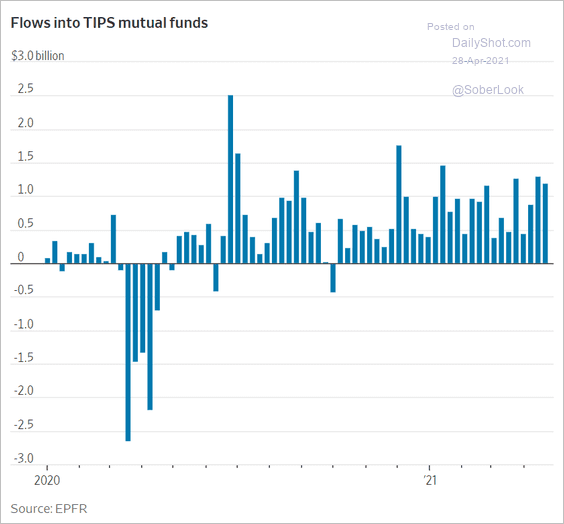

3. Flows into inflation-linked Treasuries remain robust.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Global Developments

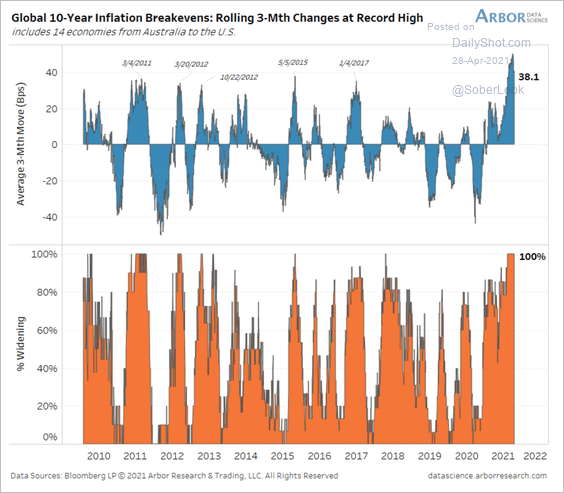

1. 10-year inflation expectations across the world have risen sharply.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

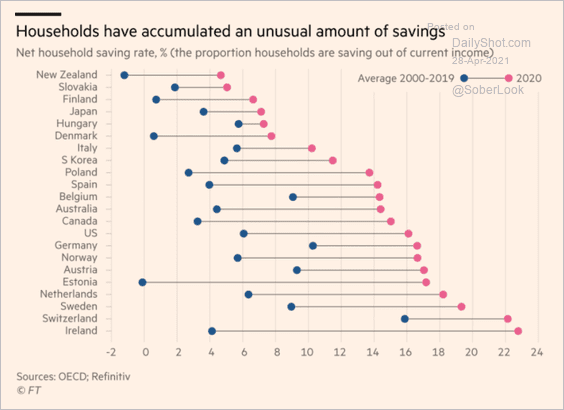

2. Households are sitting on substantial savings.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

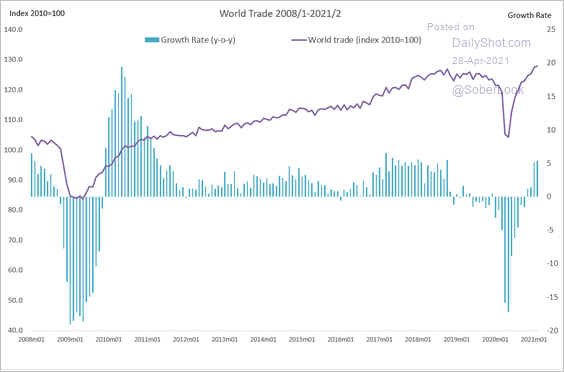

3. Global trade has recovered.

Source: @berthofmanecon Read full article

Source: @berthofmanecon Read full article

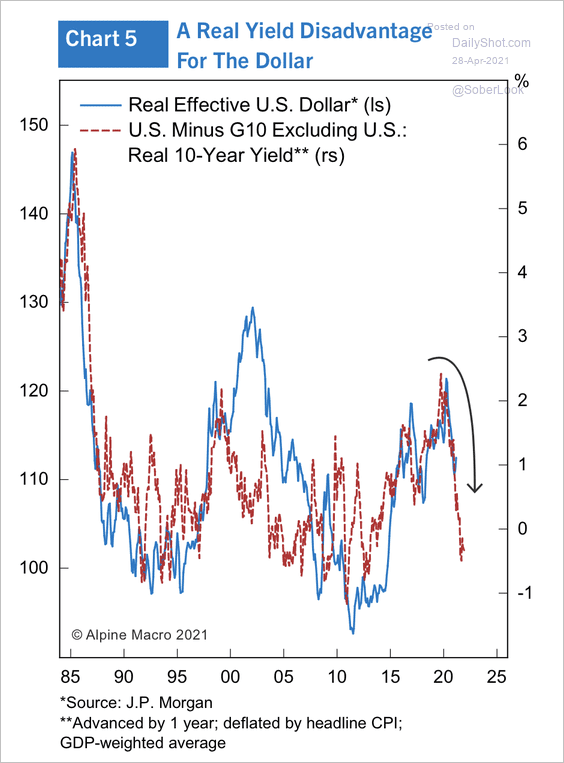

4. Real yield differentials suggest further downside in the dollar.

Source: Alpine Macro

Source: Alpine Macro

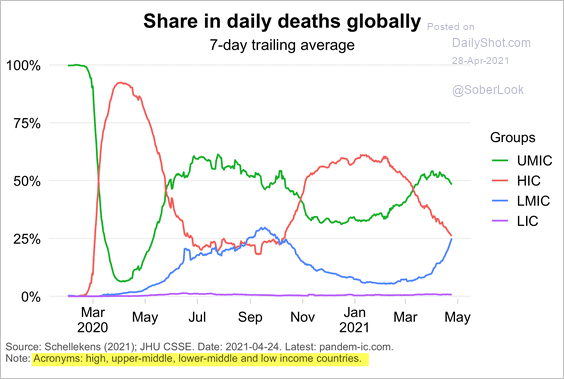

5. This chart shows the share in daily COVID-related deaths by country income group.

Source: World Bank

Source: World Bank

——————–

Back to Index

Food for Thought

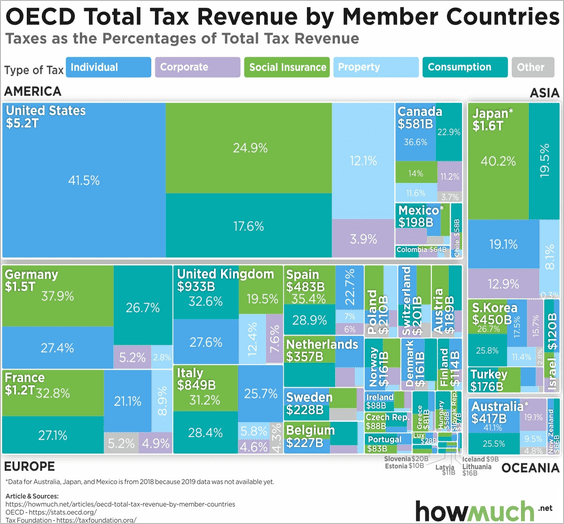

1. OECD total tax revenue:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

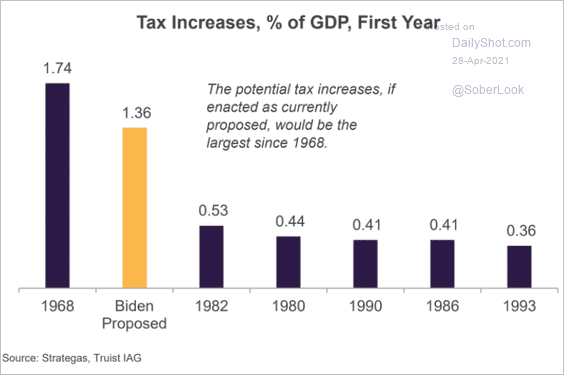

2. US proposed tax increases:

Source: Truist Advisory Services

Source: Truist Advisory Services

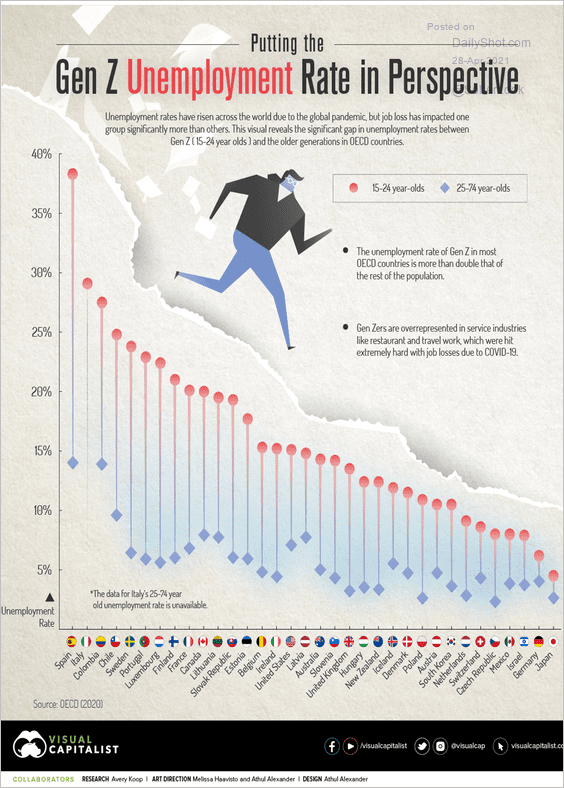

3. Gen-Z unemployment rates:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

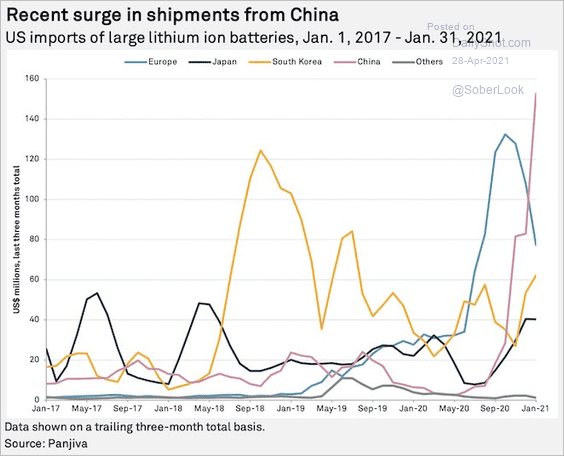

4. US imports of large lithium-ion batteries:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

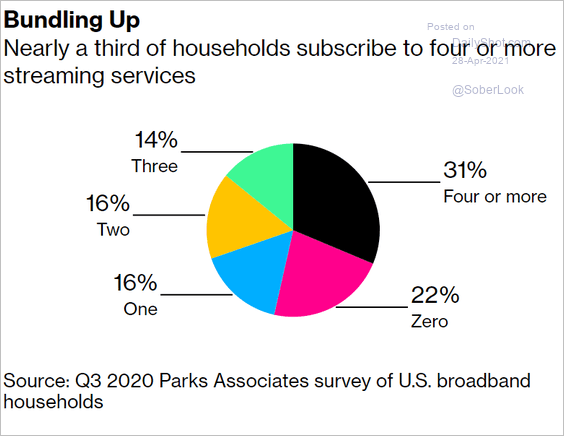

5. Streaming services subscriptions:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

6. Semiconductor manufacturers:

![]() Source: Statista

Source: Statista

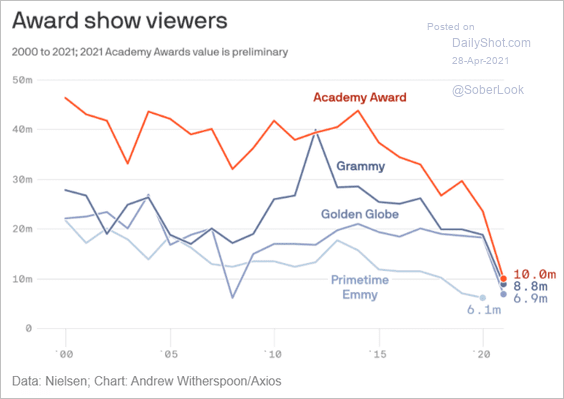

7. Academy Awards viewership:

Source: @axios Read full article

Source: @axios Read full article

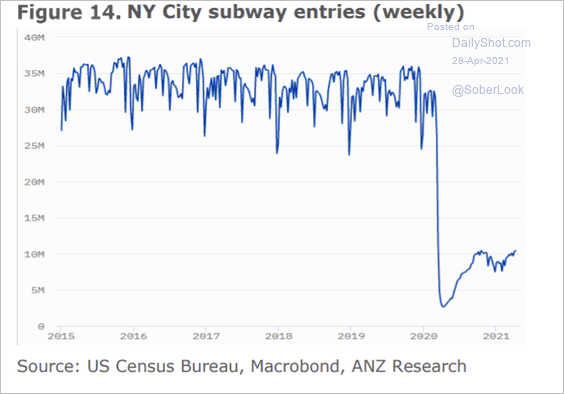

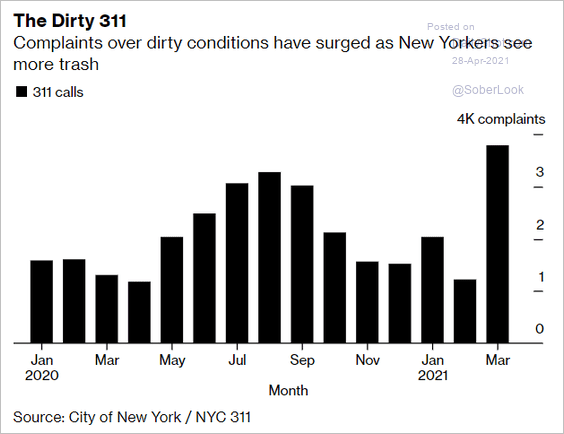

8. NYC subway ridership:

Source: ANZ Research

Source: ANZ Research

• NYC complaints about dirty conditions:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

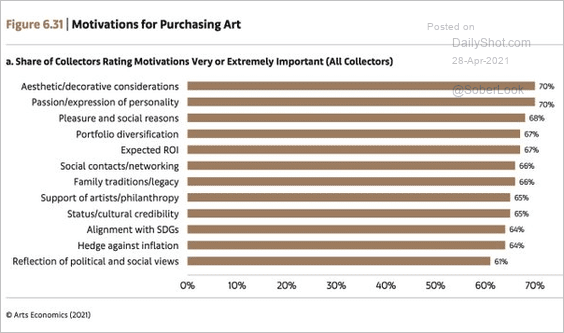

9. Why people buy art?

Source: @SamRo

Source: @SamRo

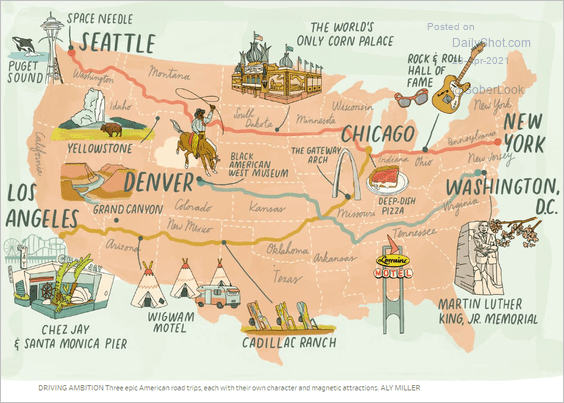

10. Driving across the US:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Back to Index