The Daily Shot: 05-May-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

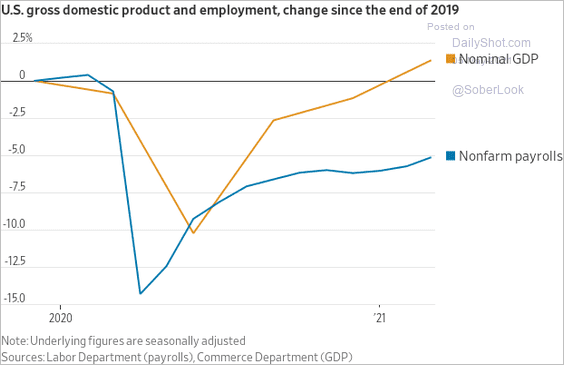

1. Let’s begin with some updates on the labor market.

• The jobs recovery has been lagging the economic rebound.

Source: @WSJ Read full article

Source: @WSJ Read full article

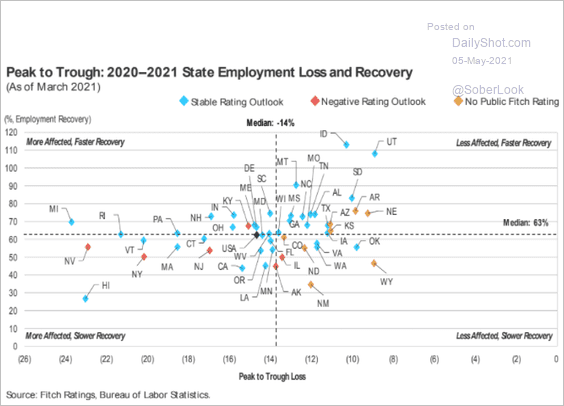

• This scatterplot shows employment recovery vs. peak to trough loss by state.

Source: Fitch Ratings

Source: Fitch Ratings

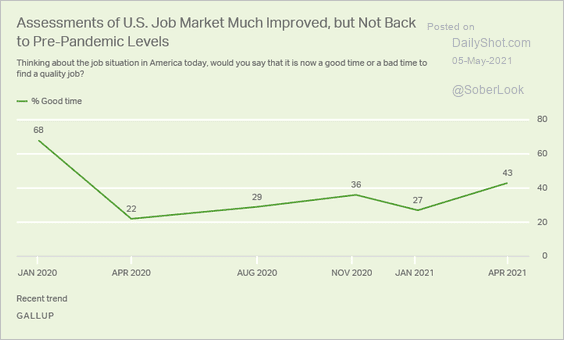

• Job market evaluations improved but are not back to pre-COVID levels.

Source: Gallup Read full article

Source: Gallup Read full article

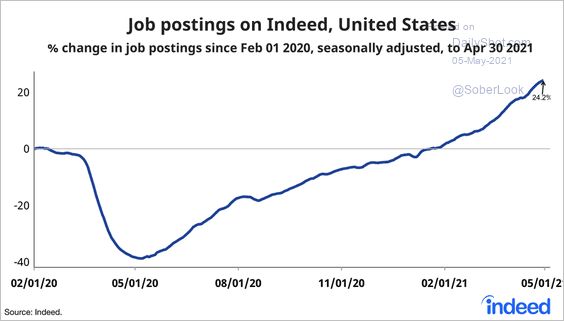

• Job openings on Indeed keep climbing.

Source: @JedKolko, @indeed

Source: @JedKolko, @indeed

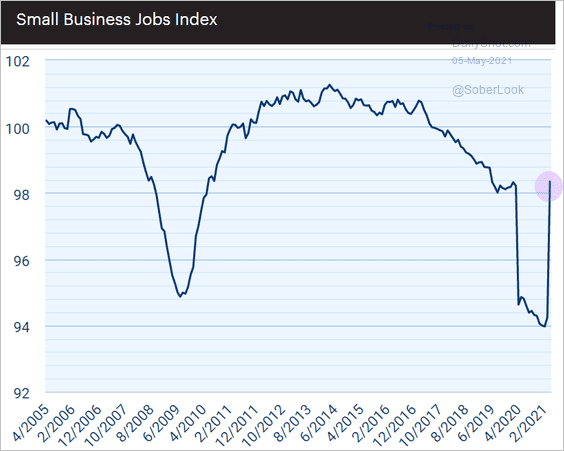

• Small business employment indicators point to substantial improvements.

Source: Paychex/IHS Markit Small Business Employment Watch

Source: Paychex/IHS Markit Small Business Employment Watch

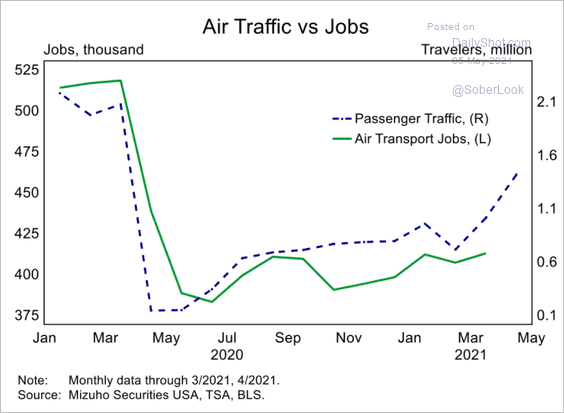

• Air transport jobs are coming back.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

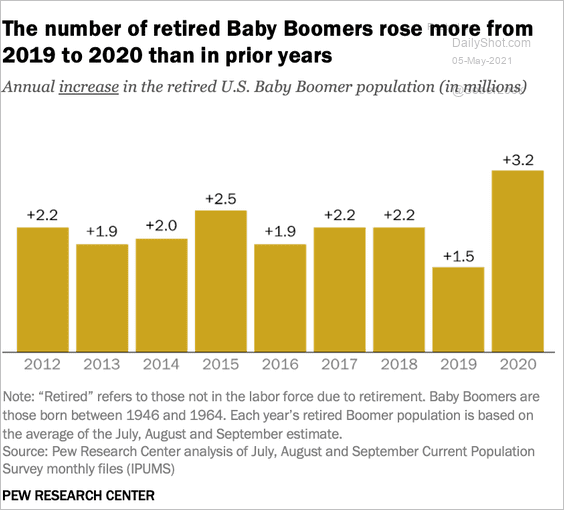

• A jump in Boomer retirements last year may exacerbate labor shortages in some sectors.

Source: Pew Research Center

Source: Pew Research Center

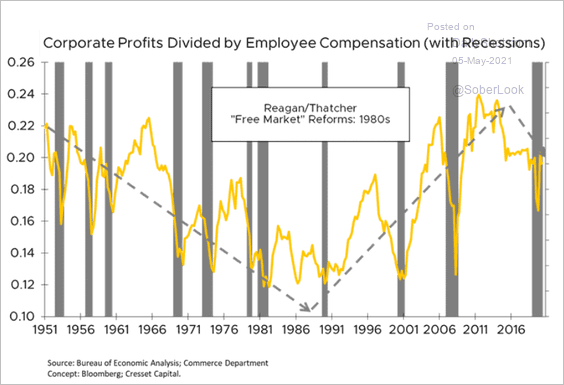

• This chart shows the ratio of corporate profits to employee compensation.

Source: Jack Ablin, Cresset Wealth Advisors

Source: Jack Ablin, Cresset Wealth Advisors

——————–

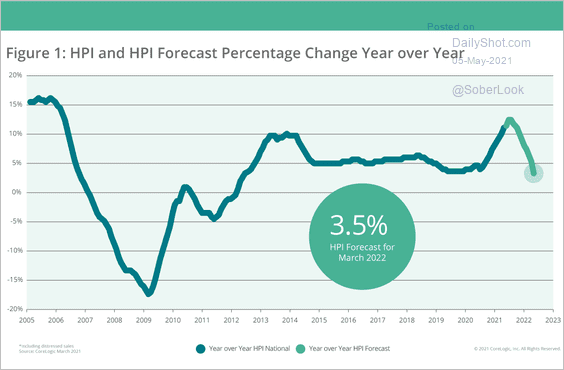

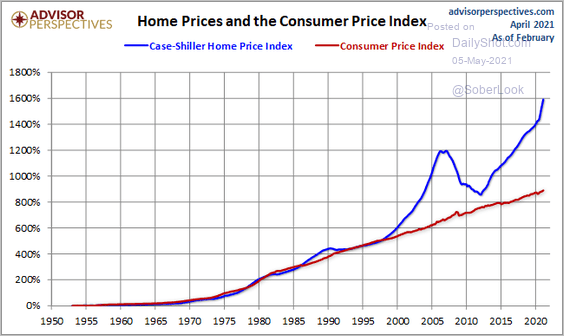

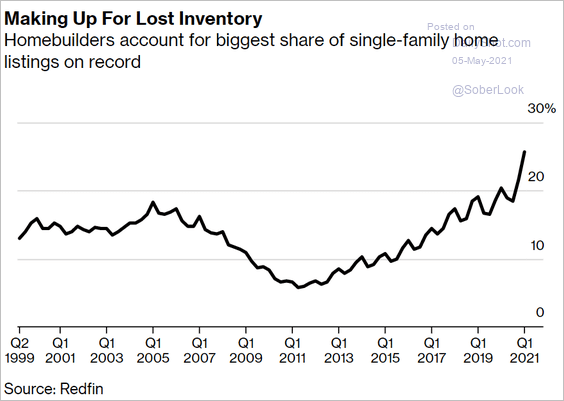

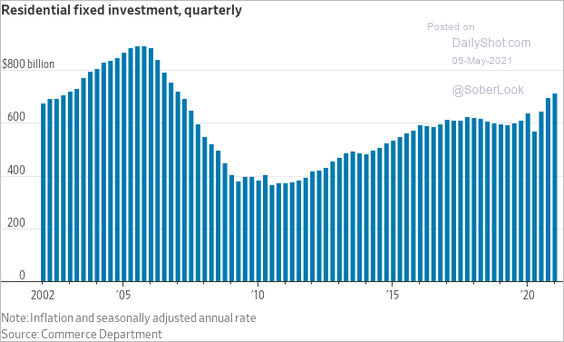

2. Next, let’s take a look at some trends in the housing market.

• Home price appreciation will moderate next year, according to CoreLogic.

Source: CoreLogic

Source: CoreLogic

• Home prices decoupled from the CPI since 2000.

Source: @AdvPerspectives, @MI_Investments

Source: @AdvPerspectives, @MI_Investments

• New homes represent a growing proportion of housing inventory in the market.

Source: @markets Read full article

Source: @markets Read full article

• Residential fixed investment has accelerated (see chart) but is still below the housing peak (reached in 2006).

Source: @WSJ Read full article

Source: @WSJ Read full article

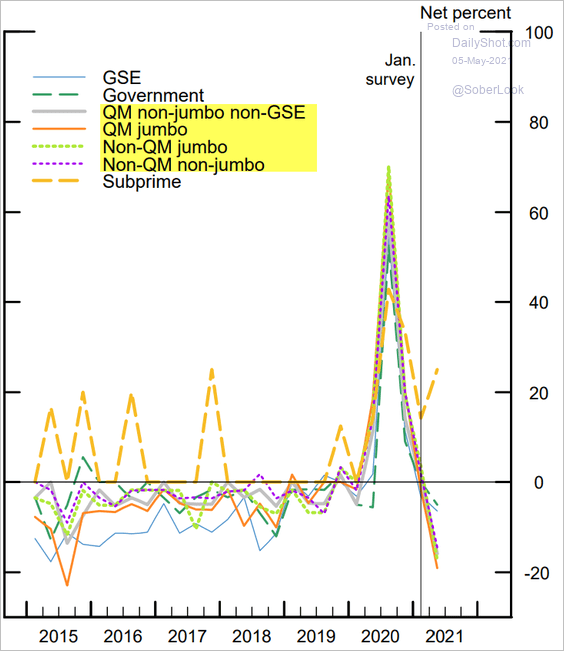

• Banks have been easing lending standards on mortgages, especially nonconforming loans (chart shows the net percent of lenders tightening standards).

Source: Federal Reserve Board

Source: Federal Reserve Board

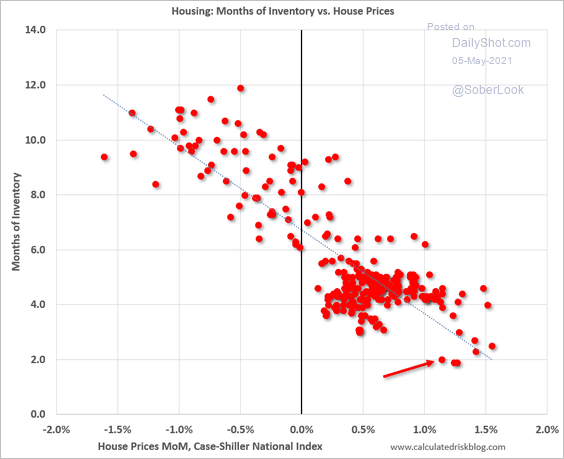

• Tight inventories are highly correlated with faster home price appreciation, …

Source: Calculated Risk Read full article

Source: Calculated Risk Read full article

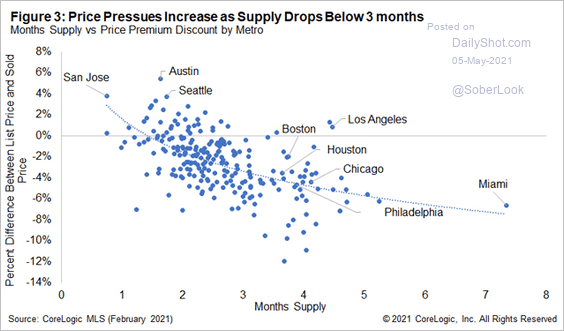

… and smaller differences between list and selling prices.

Source: CoreLogic

Source: CoreLogic

——————–

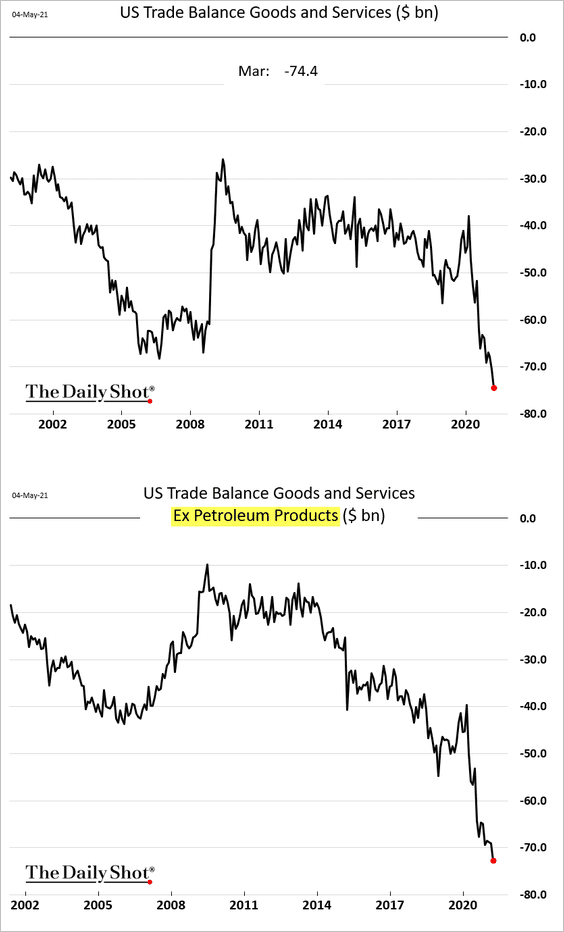

3. The trade deficit hit a record high amid robust import demand.

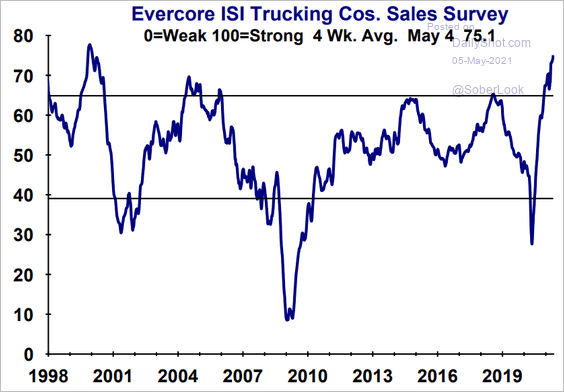

4. The Evercore ISI trucking index hit the highest level in over two decades.

Source: Evercore ISI

Source: Evercore ISI

Back to Index

Canada

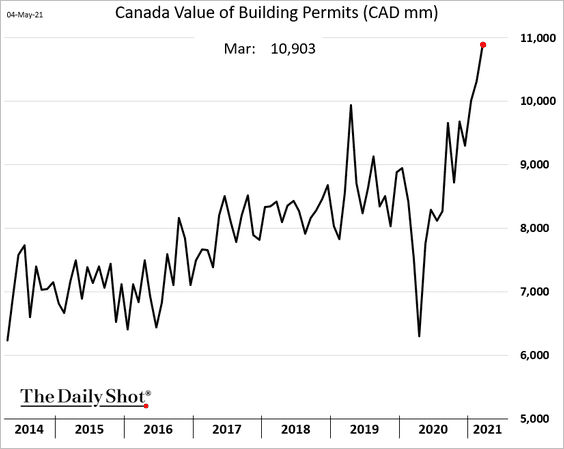

1. Residential construction is booming.

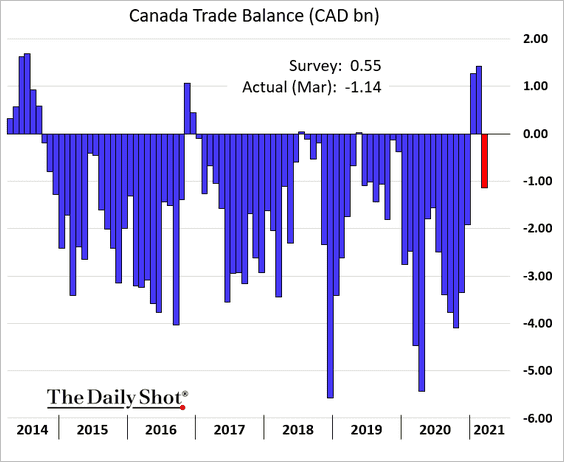

2. The trade balance unexpectedly swung into deficit in March.

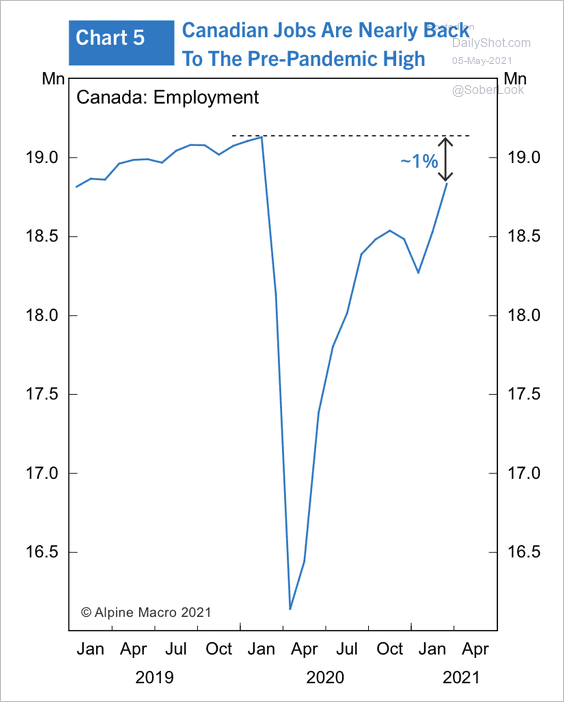

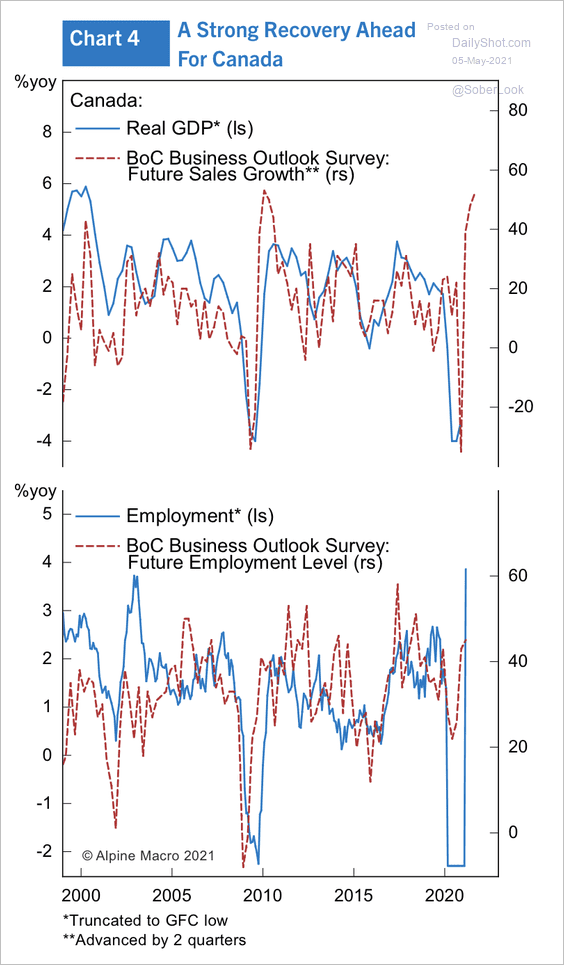

3. The labor market is set to reclaim the pre-pandemic peak well ahead of the US.

Source: Alpine Macro

Source: Alpine Macro

Businesses expect to increase employment as the economy rebounds.

Source: Alpine Macro

Source: Alpine Macro

——————–

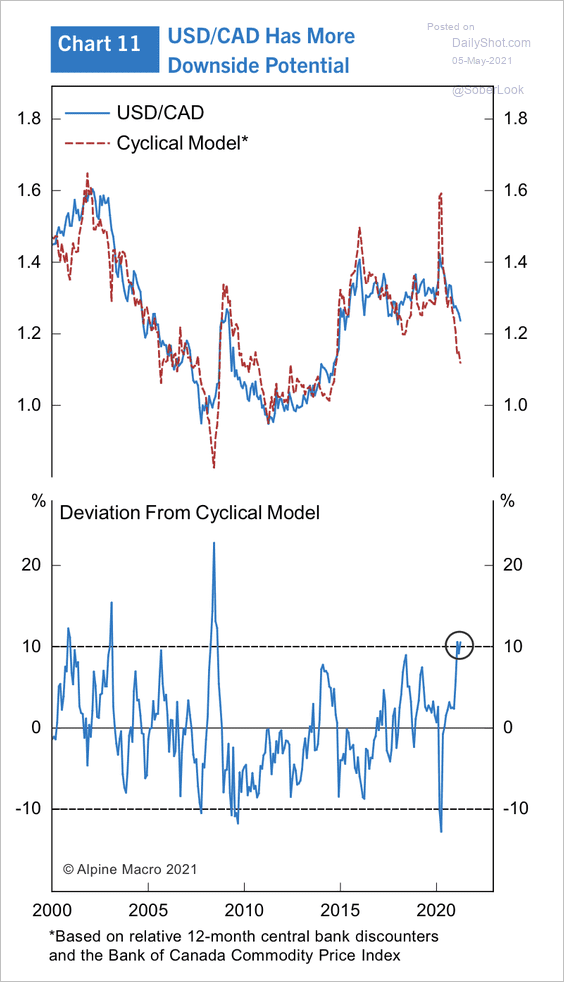

4. Alpine Macro expects USD/CAD to drop another 10%.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

The United Kingdom

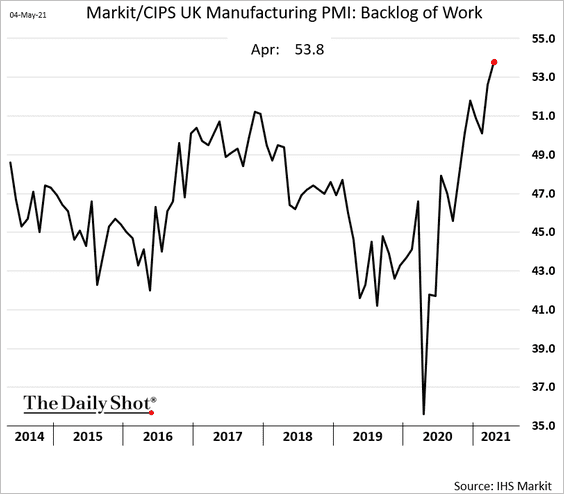

1. UK factories are increasingly facing backlogs.

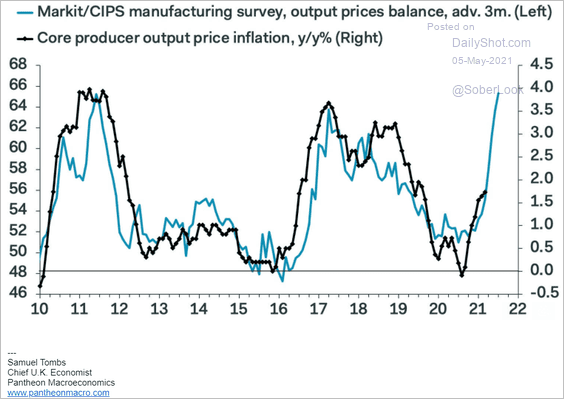

Rapidly rising output prices point to a higher PPI ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

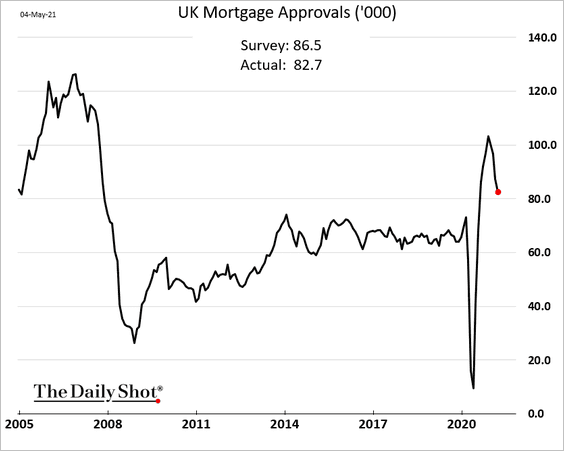

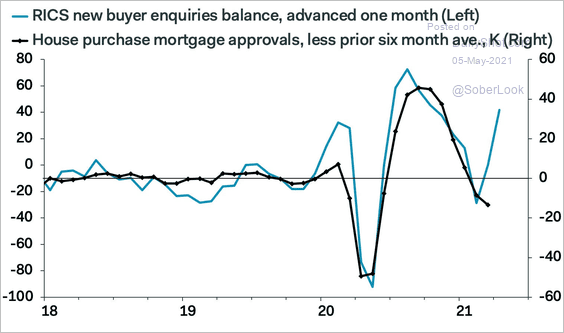

2. Mortgage approvals were lower than expected in March.

But the RICS buyer inquiries data point to a rebound.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

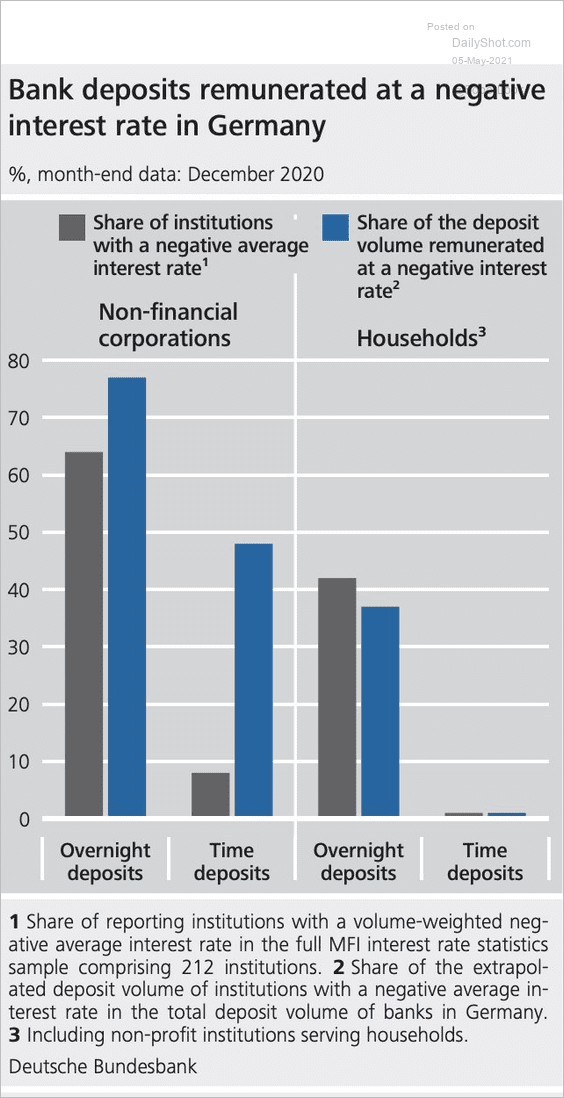

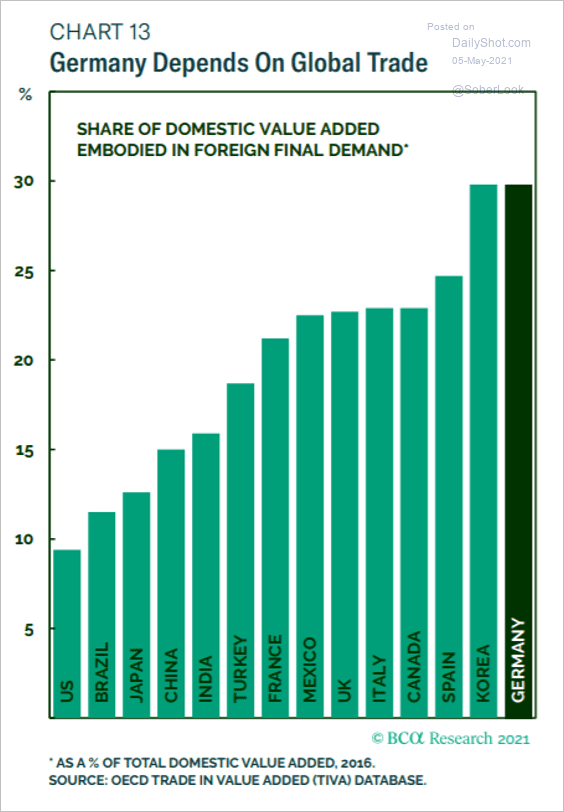

1. Let’s begin with Germany.

• Negative deposit rates:

Source: The Deutsche Bundesbank; @Schuldensuehner

Source: The Deutsche Bundesbank; @Schuldensuehner

• Dependence on foreign trade:

Source: BCA Research

Source: BCA Research

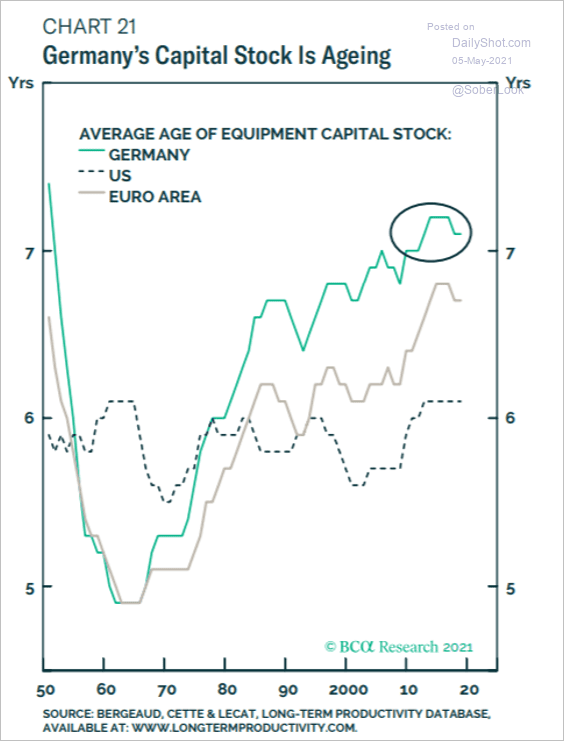

• Aging capital stock (equipment, structures, etc.):

Source: BCA Research

Source: BCA Research

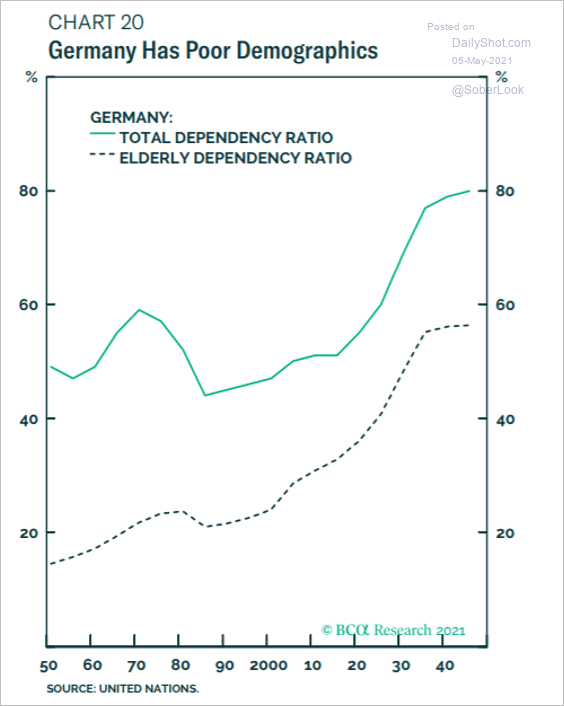

• Dependency ratios:

Source: BCA Research

Source: BCA Research

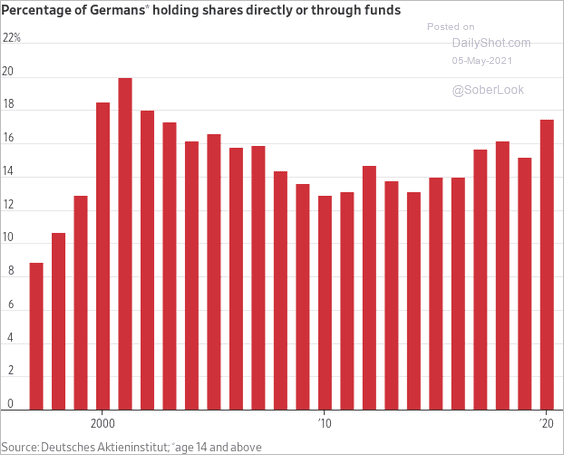

• Households’ equity holdings:

Source: @WSJ Read full article

Source: @WSJ Read full article

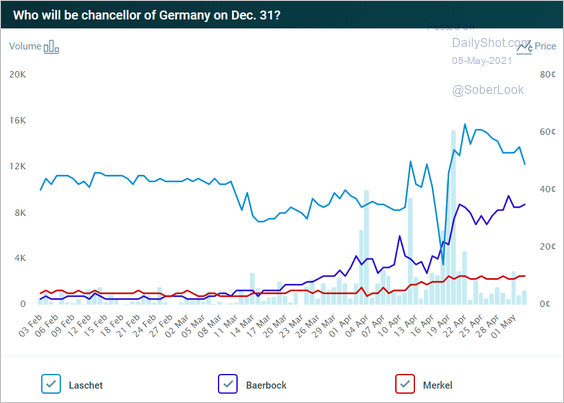

• Election outcome odds in the betting markets:

Source: @PredictIt

Source: @PredictIt

——————–

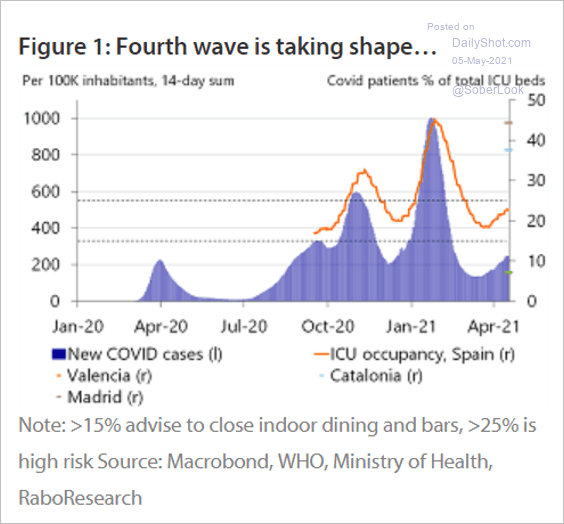

2. Spain is facing another COVID wave.

Source: RaboResearch

Source: RaboResearch

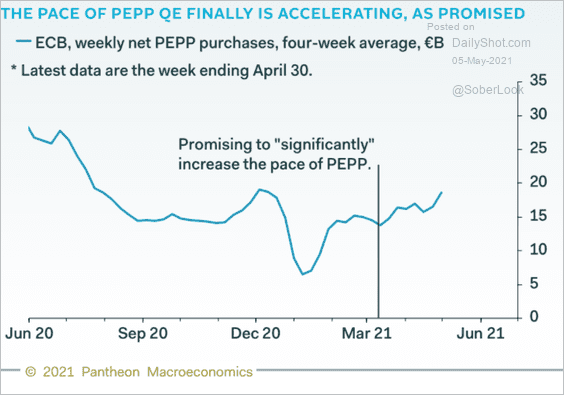

3. The ECB’s net securities purchases have accelerated (as promised).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

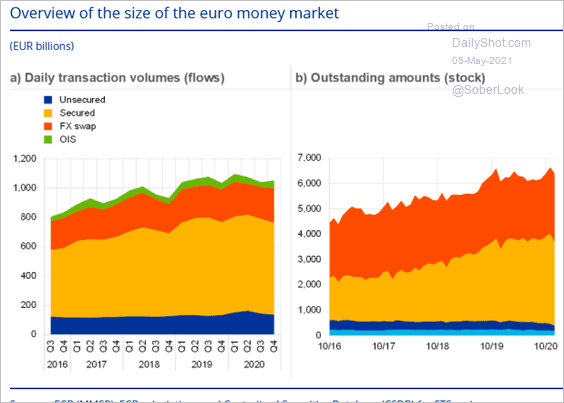

4. Here is a look at the euro-area money markets.

Source: ECB Read full article

Source: ECB Read full article

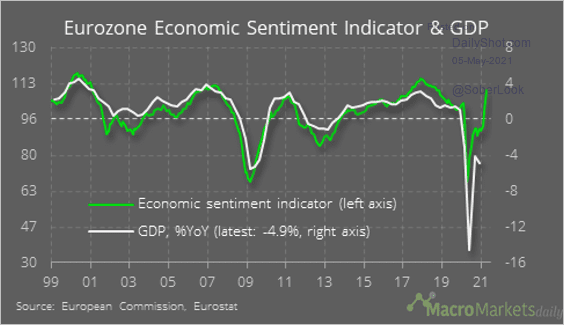

5. Improvements in sentiment point to stronger economic growth ahead.

Source: @macro_daily

Source: @macro_daily

Back to Index

Europe

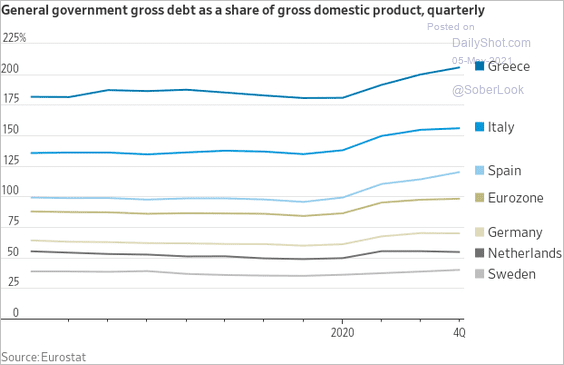

1. Let’s start with some data on government debt/deficit.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: Eurostat Read full article

Source: Eurostat Read full article

——————–

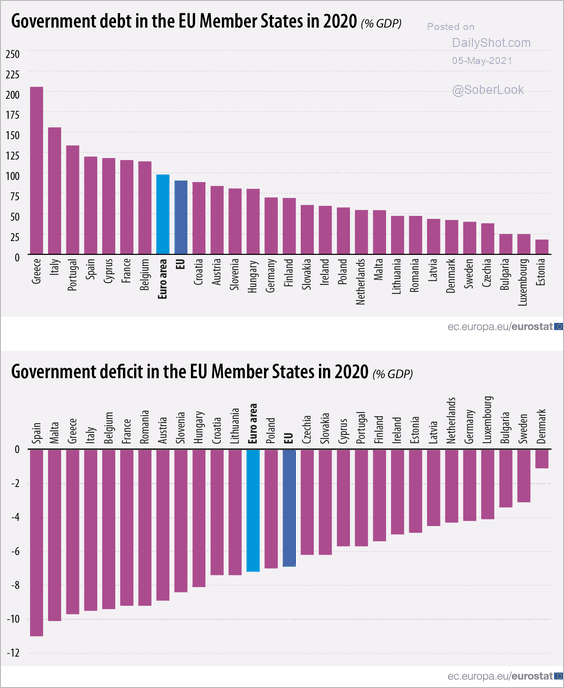

2. How much slack is there in the EU’s labor market?

Source: Eurostat Read full article

Source: Eurostat Read full article

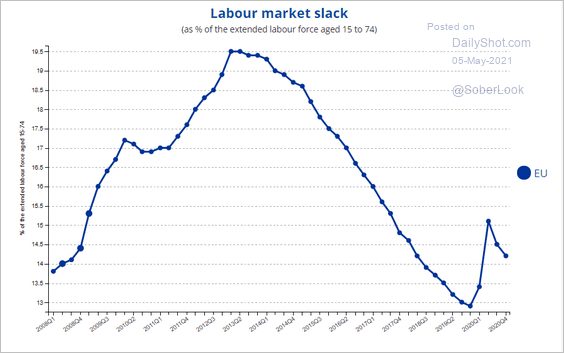

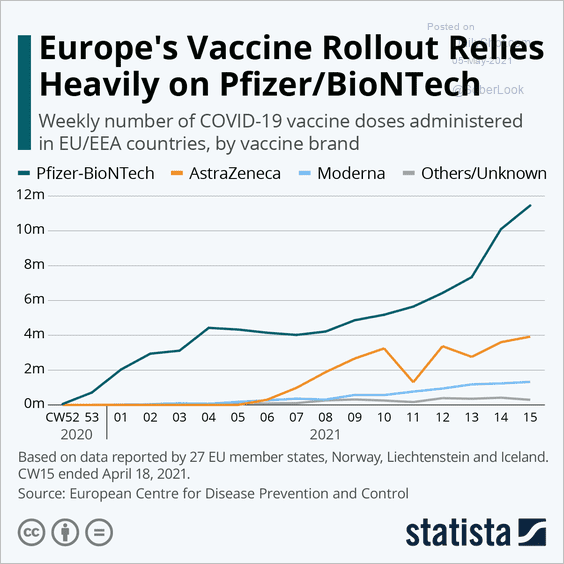

3. Next, we have a couple of charts on the vaccine situation.

• Vaccine brands:

Source: Statista

Source: Statista

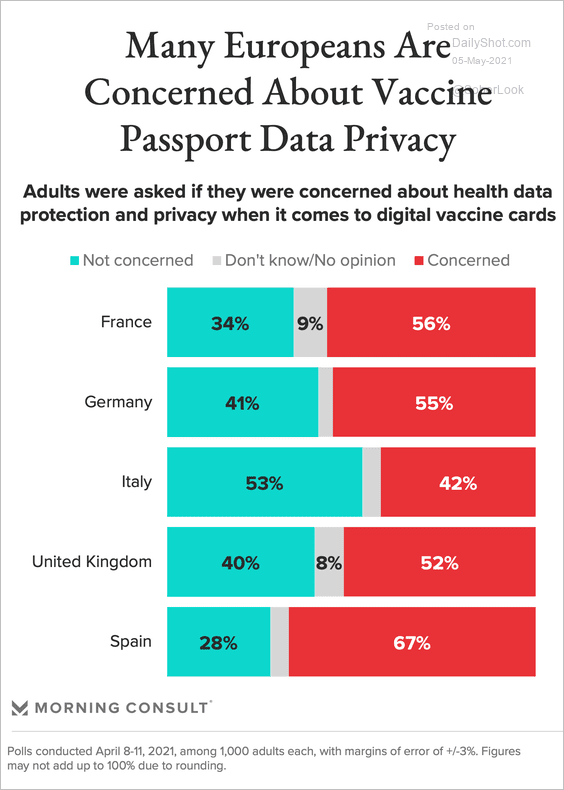

• Concerns about vaccine passport data privacy:

Source: Morning Consult

Source: Morning Consult

——————–

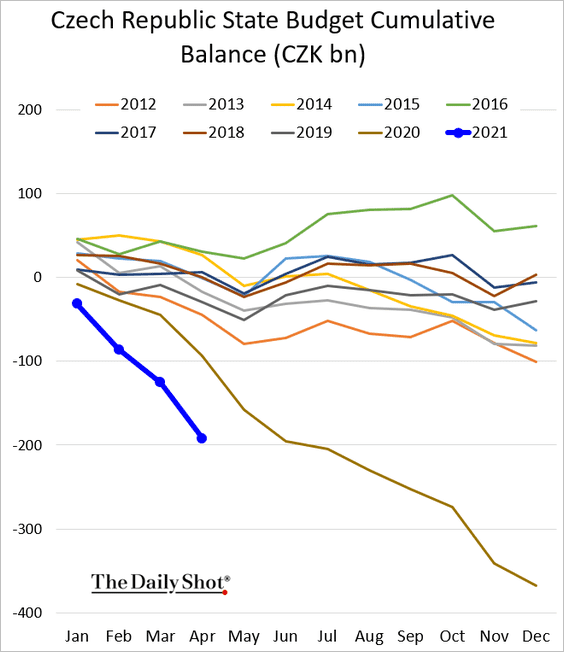

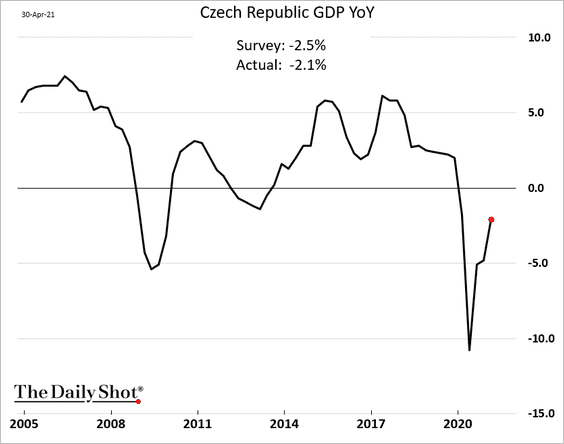

4. Finally, we have a couple of updates on the Czech Republic.

• Budget deficit:

• GDP growth:

Back to Index

Asia – Pacific

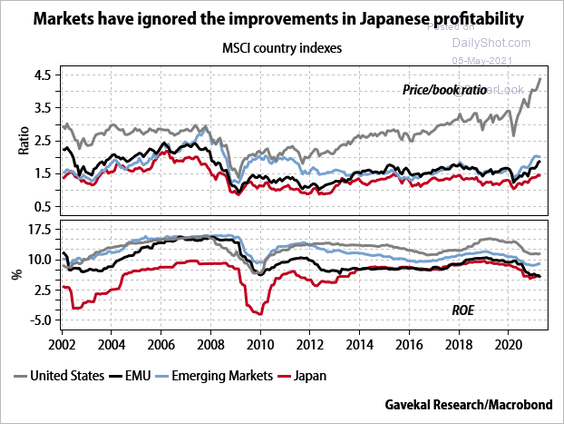

1. Japan’s shares trade at a discount to global peers.

Source: Gavekal Research

Source: Gavekal Research

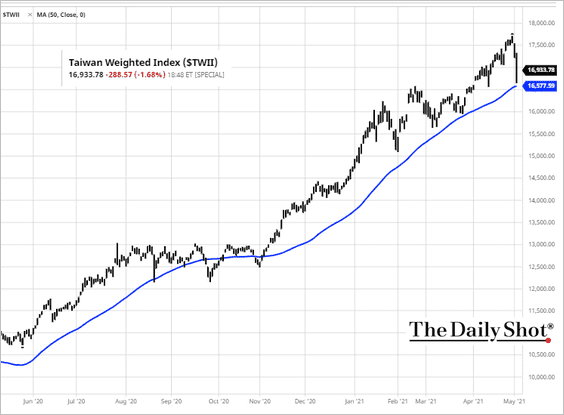

2. Taiwan’s benchmark index held support at the 50-day moving average.

Source: barchart.com

Source: barchart.com

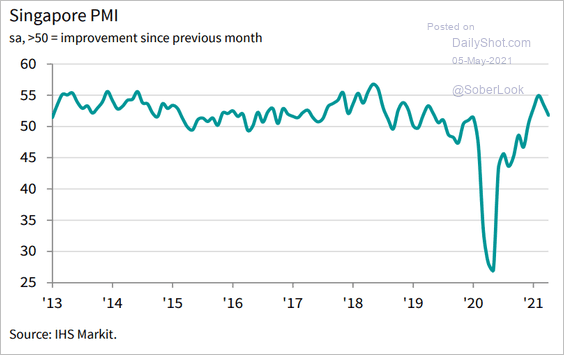

3. Singapore’s business activity growth is moderating.

Source: IHS Markit

Source: IHS Markit

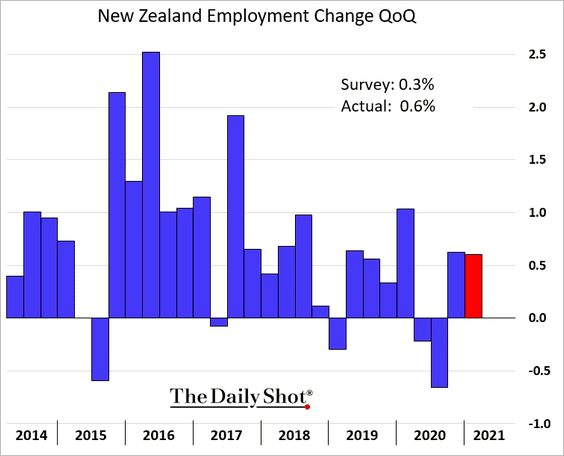

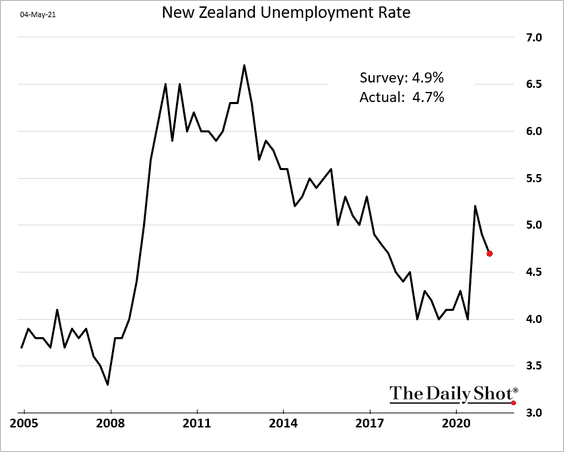

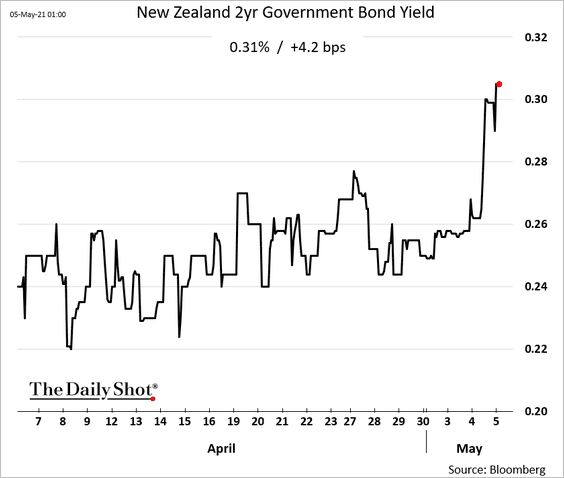

4. New Zealand’s Q1 employment report was stronger than expected.

• Employment gains:

• The unemployment rate:

Bond yields climbed in response.

——————–

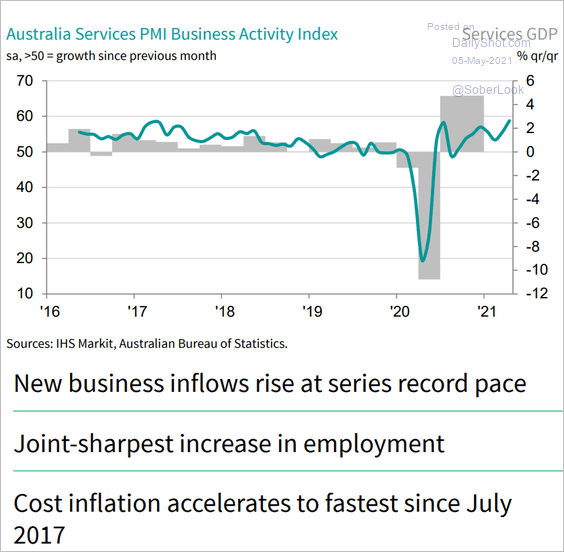

5. Next, we have some updates on Australia.

• The RBA remains dovish despite robust economic growth. The central bank is focused on the labor market recovery (similar to the Fed).

Source: MarketWatch Read full article

Source: MarketWatch Read full article

• Service-sector activity is surging.

Source: IHS Markit

Source: IHS Markit

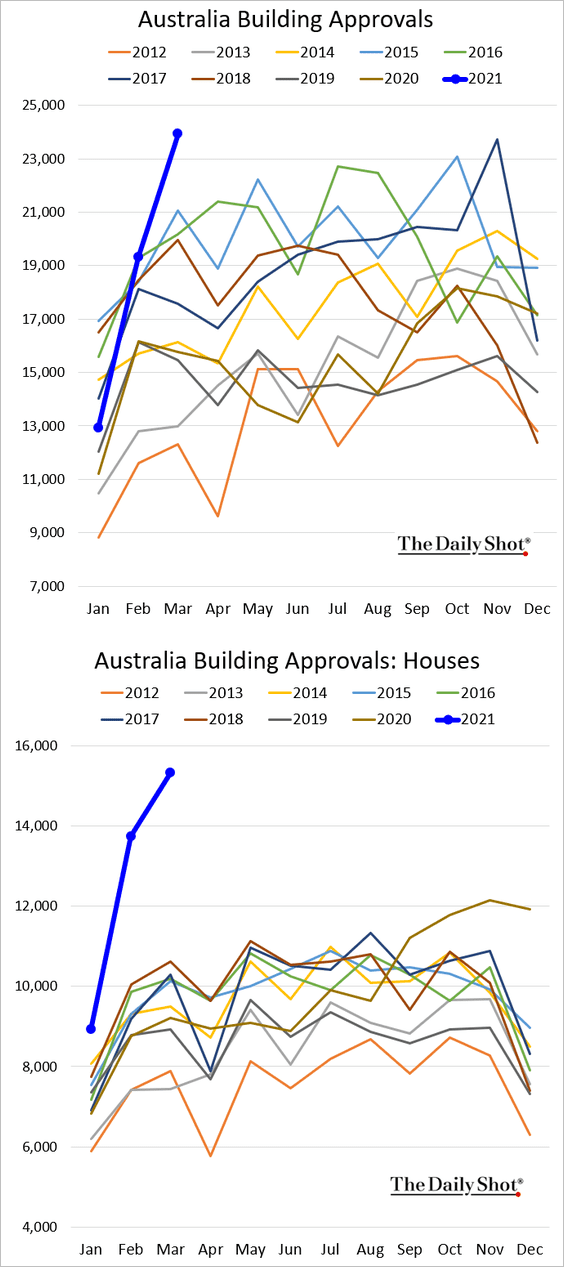

• Residential construction is booming. March saw slower gains in house permits (2nd chart), but apartment construction strengthened.

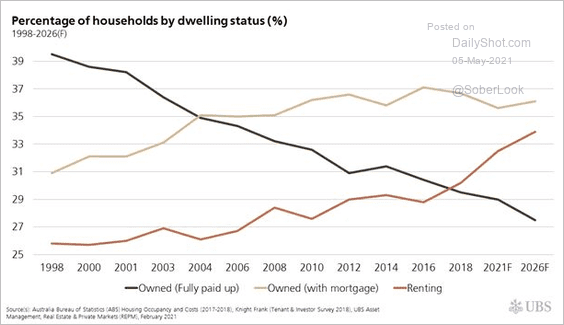

• This chart shows the percentage of Australia’s households by dwelling status.

Source: UBS Asset Management

Source: UBS Asset Management

Back to Index

China

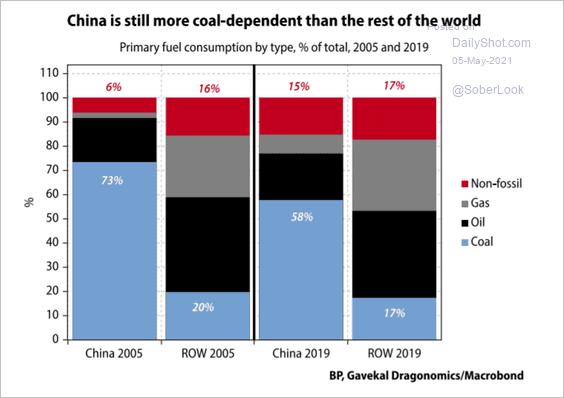

1. China remains dependent on coal.

Source: Gavekal Research

Source: Gavekal Research

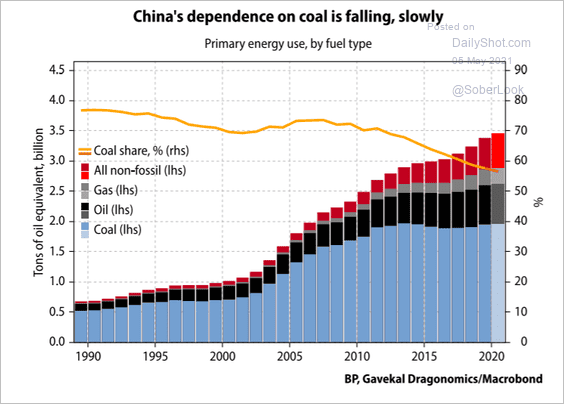

But coal’s share of primary energy use is gradually declining.

Source: Gavekal Research

Source: Gavekal Research

——————–

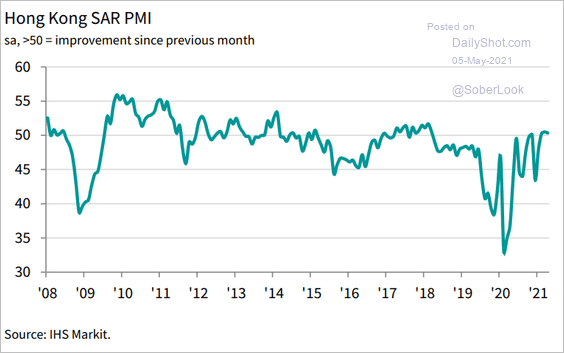

2. Hong Kong’s business sector is finally in growth mode (barely).

Source: IHS Markit

Source: IHS Markit

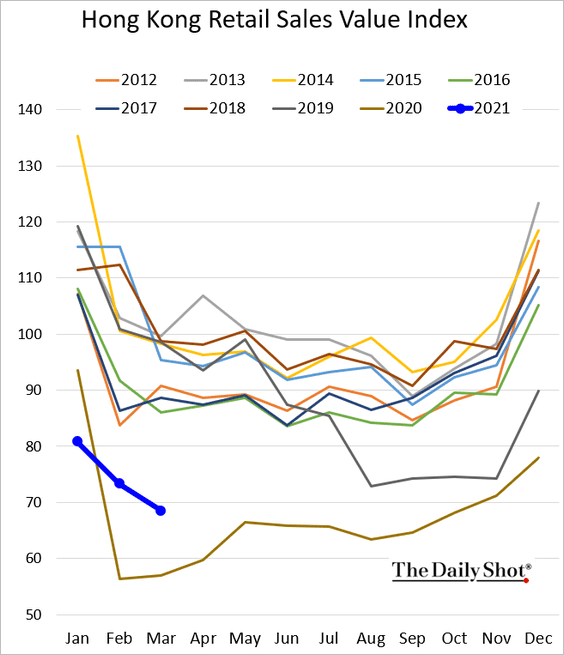

Retail sales remain soft.

Back to Index

Emerging Markets

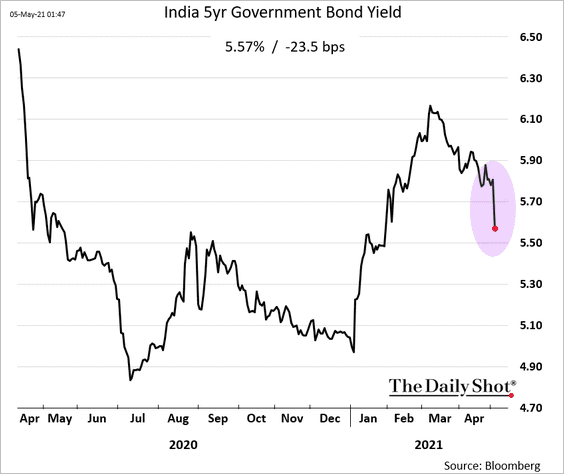

1. The RBI took measures to cushion the COVID crisis impact.

Source: @business Read full article

Source: @business Read full article

Bond yields tumbled.

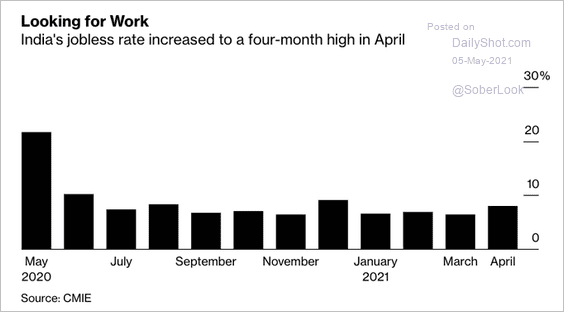

India’s unemployment worsened last month.

Source: @IlyaSpivak, @business Read full article

Source: @IlyaSpivak, @business Read full article

——————–

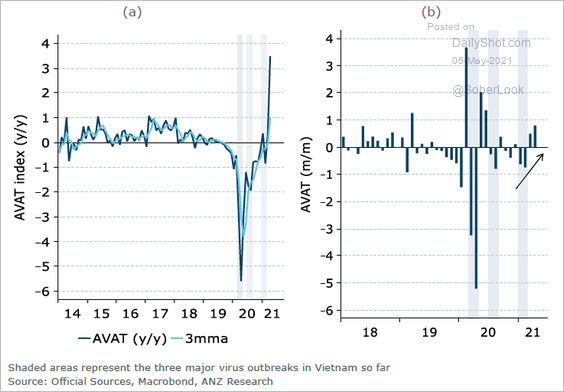

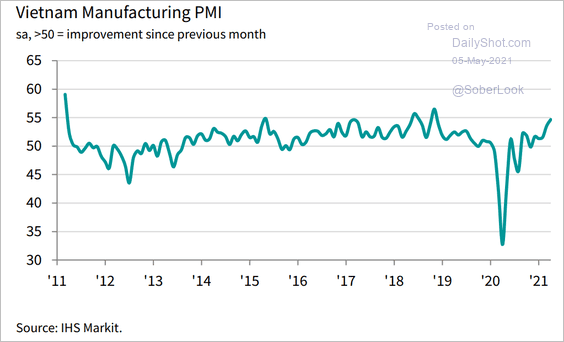

2. Vietnam’s economy is rebounding (2 charts).

Source: ANZ Research

Source: ANZ Research

Source: IHS Markit

Source: IHS Markit

——————–

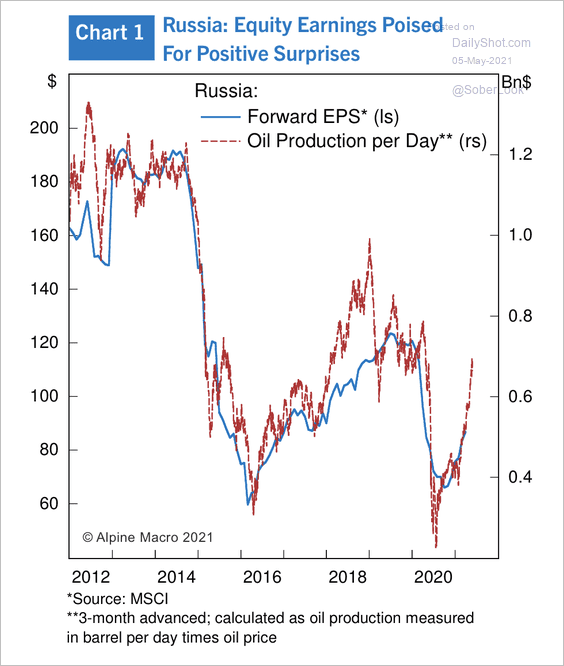

3. The rise in oil production bodes well for Russian stock earnings.

Source: Alpine Macro

Source: Alpine Macro

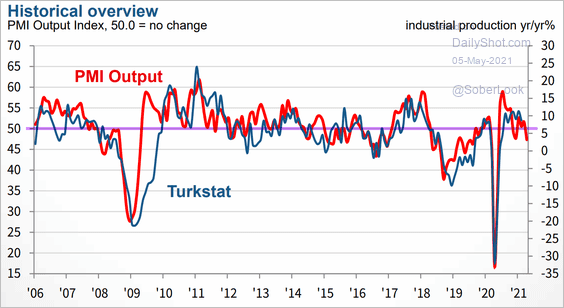

4. Turkey’s manufacturing output shifted into contraction mode last month (PMI < 50).

Source: IHS Markit

Source: IHS Markit

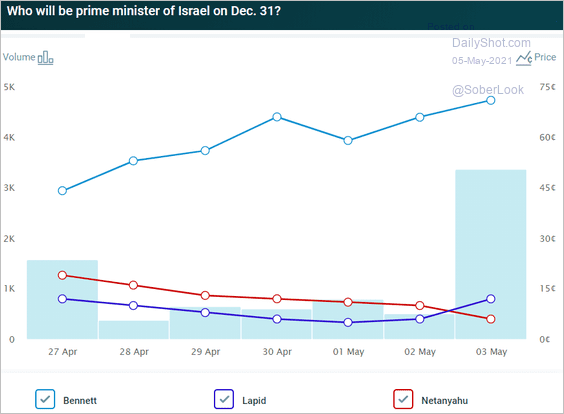

5. The market is betting that Naftali Bennett is the next Prime Minister of Israel.

Source: @PredictIt

Source: @PredictIt

Source: Jpost Read full article

Source: Jpost Read full article

——————–

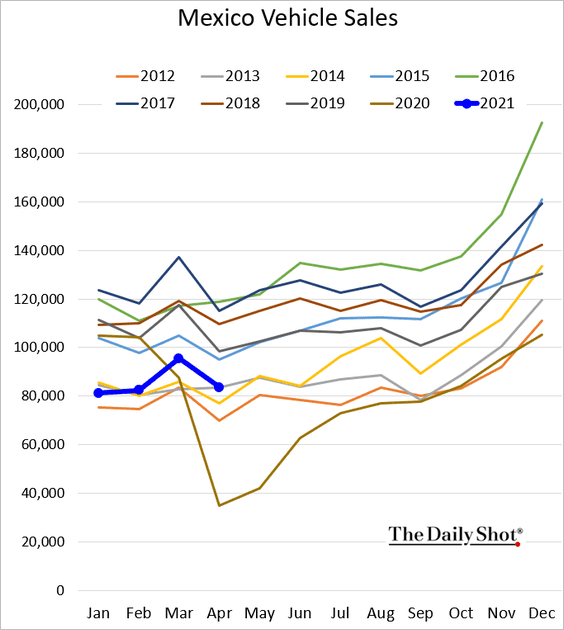

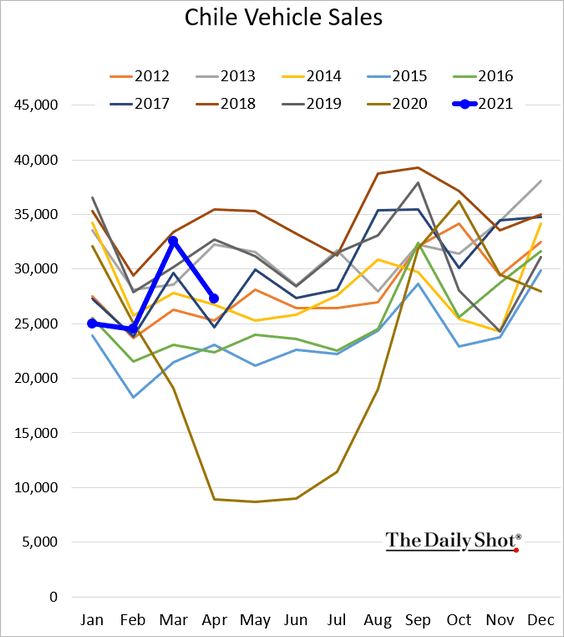

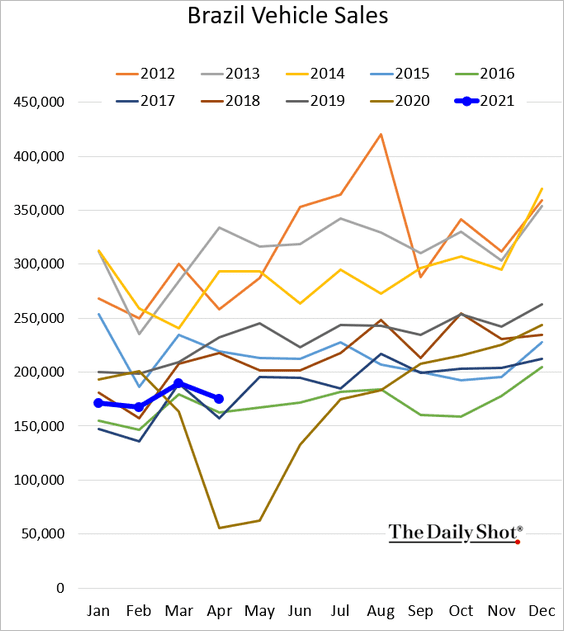

6. Next, let’s take a look at vehicle sales in Latin America.

• Mexico:

• Chile:

• Brazil:

——————–

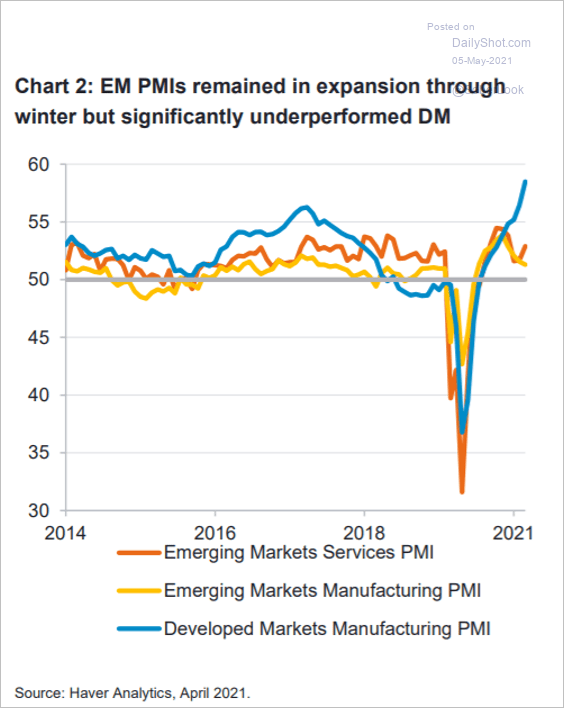

7. EM factory rebound is lagging growth in advanced economies.

Source: Fidelity Investments

Source: Fidelity Investments

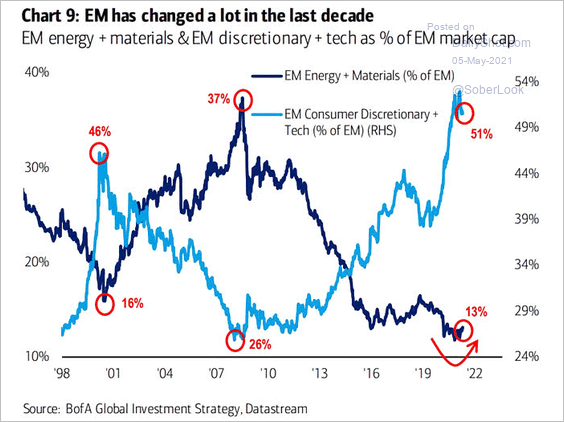

8. EM equity sector dominance appears to be shifting.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

Back to Index

Cryptocurrency

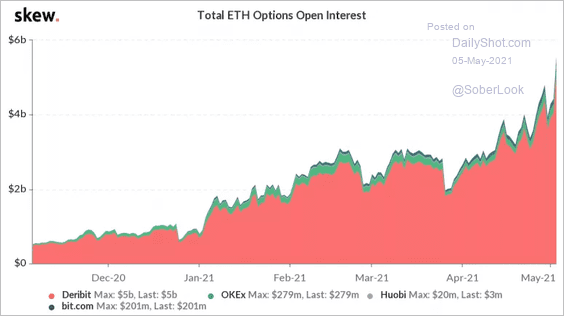

1. Ether’s open interest has risen sharply to record highs above $5 billion.

Source: Skew Read full article

Source: Skew Read full article

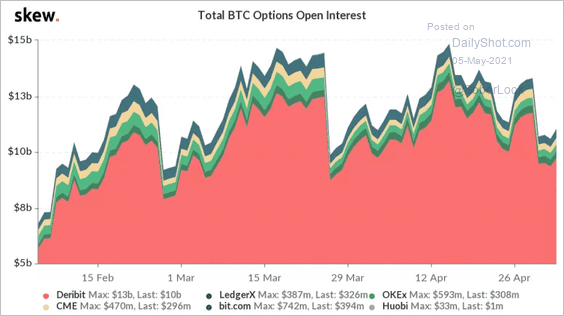

2. Meanwhile, open interest in bitcoin’s options market has been trending lower in recent weeks.

Source: Skew Read full article

Source: Skew Read full article

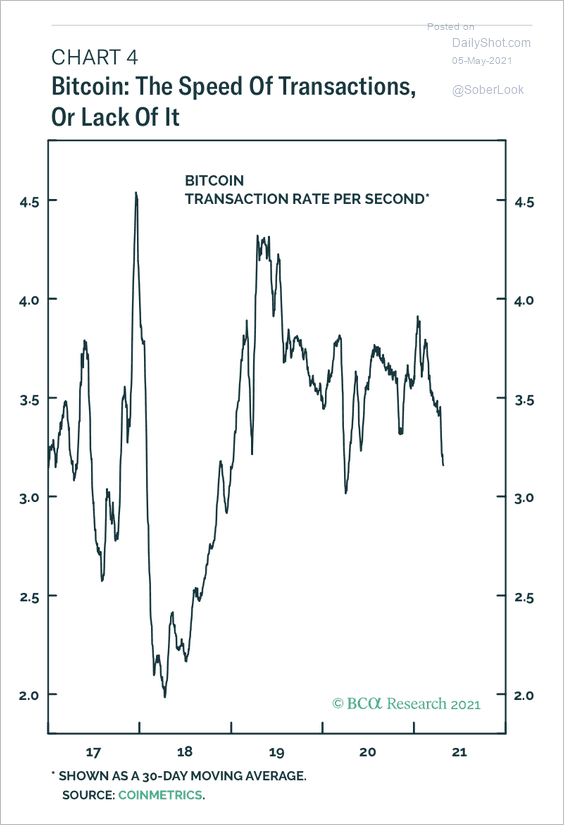

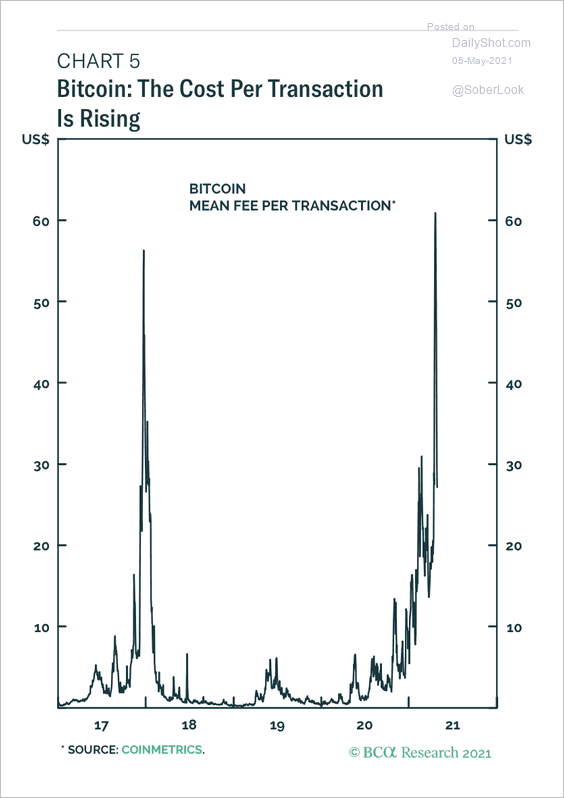

3. Bitcoin’s transaction speed is slowing while costs are rising (2 charts).

Source: BCA Research

Source: BCA Research

Source: BCA Research

Source: BCA Research

——————–

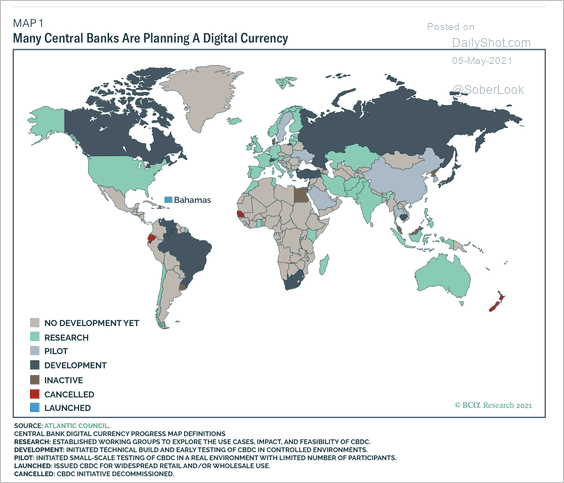

4. Most G10 central banks have outlined their digital currency plans.

Source: BCA Research

Source: BCA Research

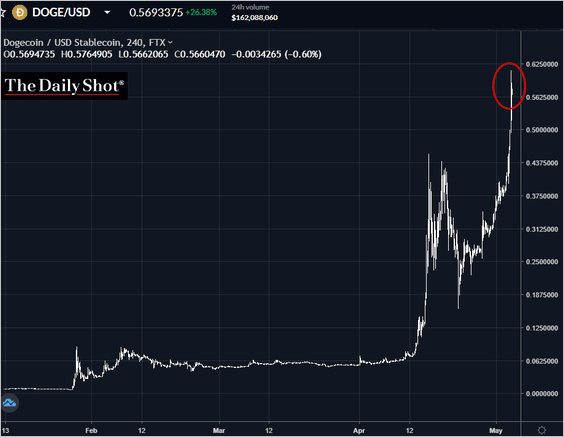

5. Dogecoin hit a record high.

Source: FTX

Source: FTX

Back to Index

Commodities

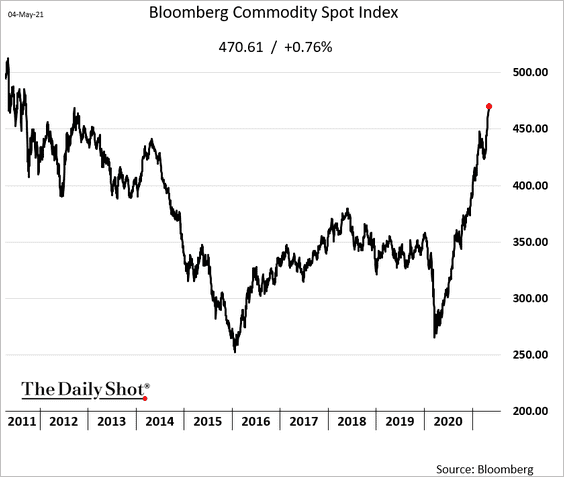

1. Bloomberg’s commodity index is at multi-year highs.

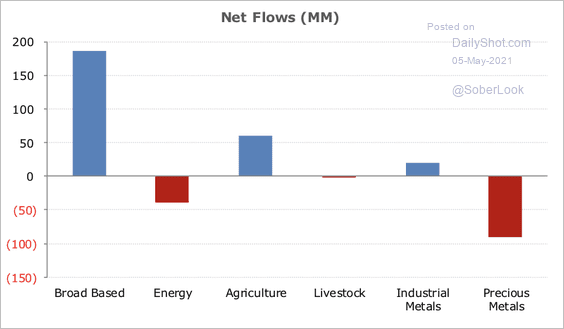

US flows into broad-based commodities and agriculture ETFs increased over the past week while investors positioned away from energy and precious metals.

Source: ANZ Research

Source: ANZ Research

——————–

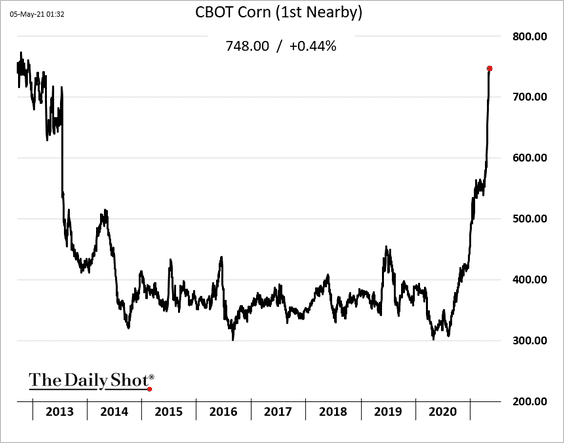

2. US corn futures continue to surge, …

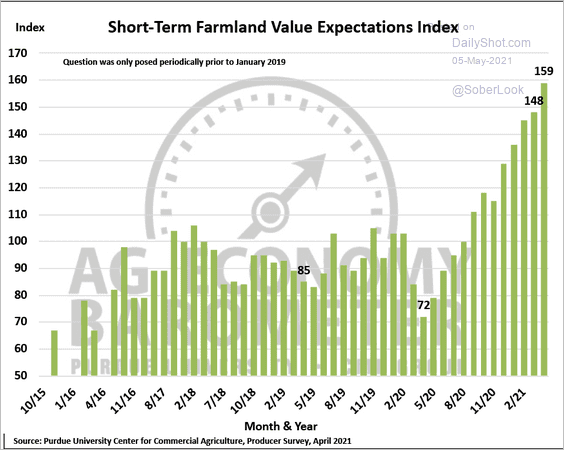

… as grain prices boost farmland values.

Source: Purdue University/CME Group Ag Economy Barometer

Source: Purdue University/CME Group Ag Economy Barometer

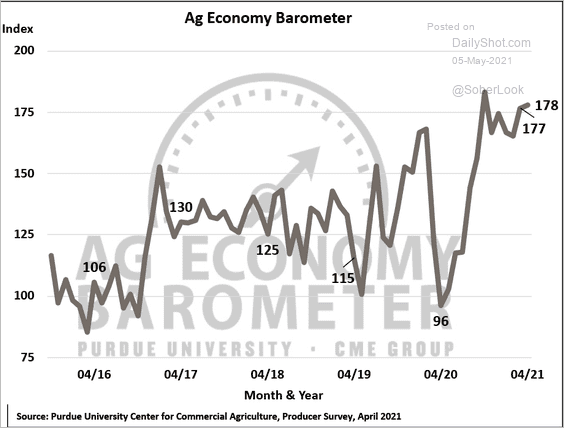

US farmers’ sentiment remains elevated.

Source: Purdue University/CME Group Ag Economy Barometer

Source: Purdue University/CME Group Ag Economy Barometer

——————–

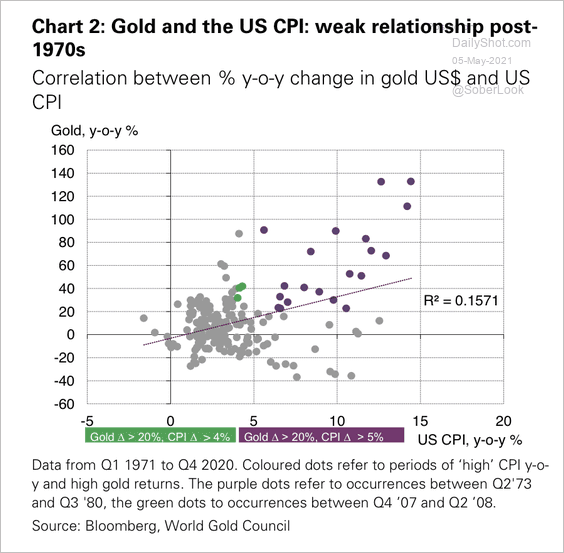

3. There has been a weak relationship between gold and US CPI over the past 50 years.

Source: World Gold Council

Source: World Gold Council

Back to Index

Energy

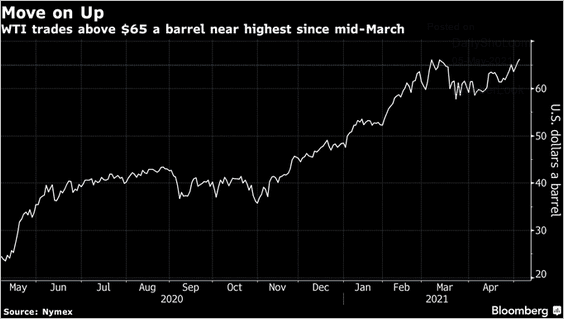

1. WTI futures are above $65/bbl.

Source: @markets Read full article

Source: @markets Read full article

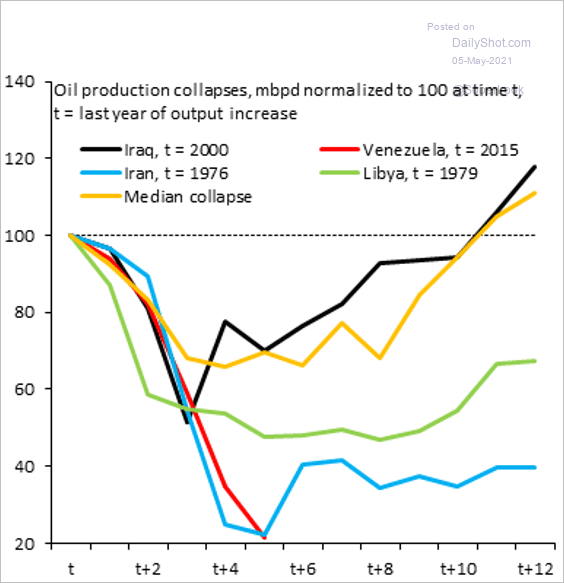

2. Here is a look at oil production collapses.

Source: @SergiLanauIIF

Source: @SergiLanauIIF

Back to Index

Equities

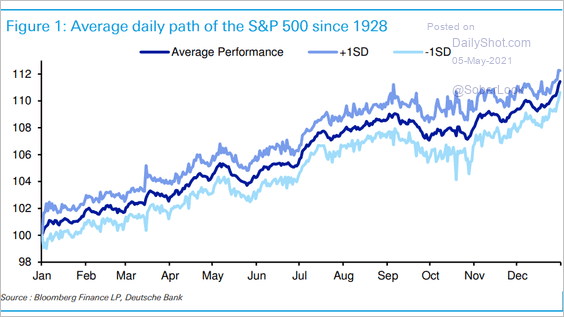

1. Let’s start with the seasonal path for the S&P 500 since 1928.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

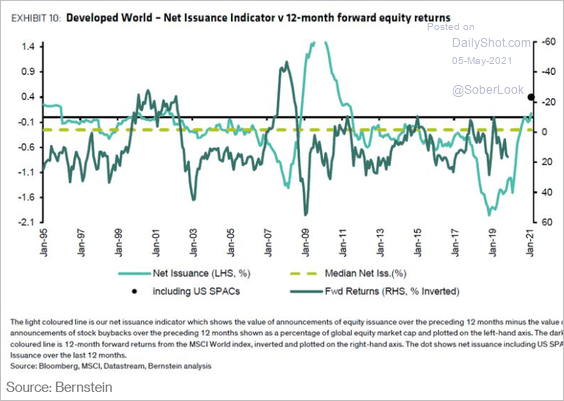

2. Net equity issuance in advanced economies is back in positive territory.

Source: Bernstein, @markets Read full article

Source: Bernstein, @markets Read full article

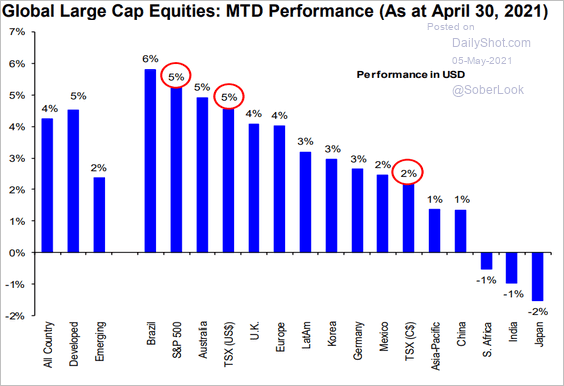

3. Here is a look at stock market performance globally over the past month.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

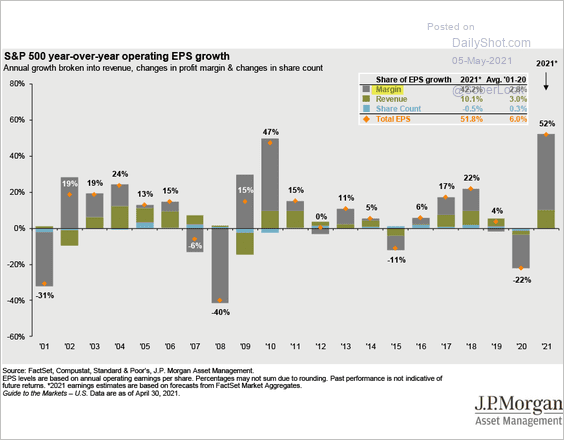

4. Margin improvements have been driving EPS growth this year.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

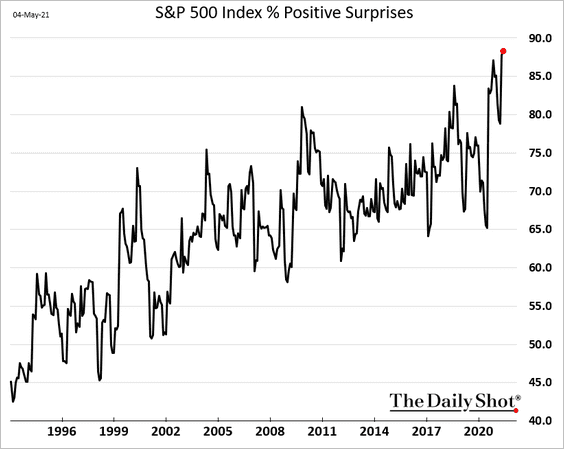

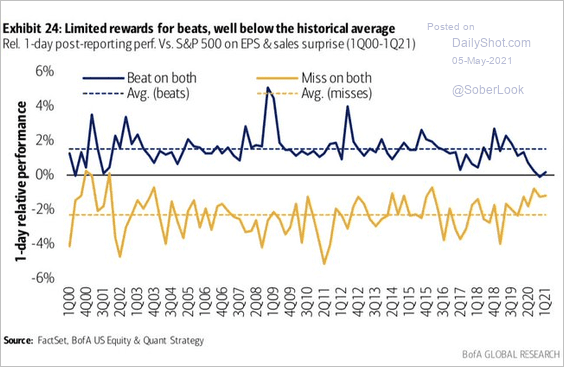

5. Positive earnings surprises are at record highs.

h/t @LizAnnSonders

h/t @LizAnnSonders

But the market hasn’t been rewarding positive surprises lately.

Source: BofA Global Research

Source: BofA Global Research

——————–

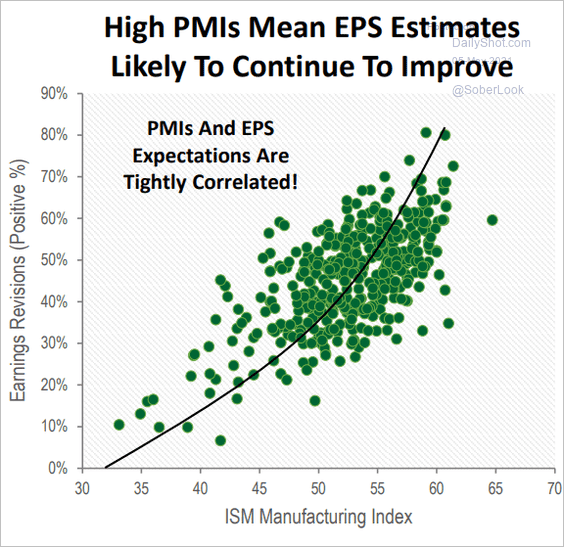

6. Earnings estimates are tightly correlated to the ISM Manufacturing PMI.

Source: Cornerstone Macro

Source: Cornerstone Macro

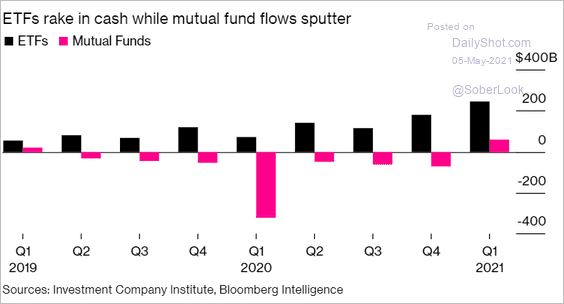

7. ETF assets growth continues to outperform mutual funds. The trend is likely to continue after the looming capital gains tax hike because ETFs give investors more control over realizations than mutual funds.

Source: @wealth Read full article

Source: @wealth Read full article

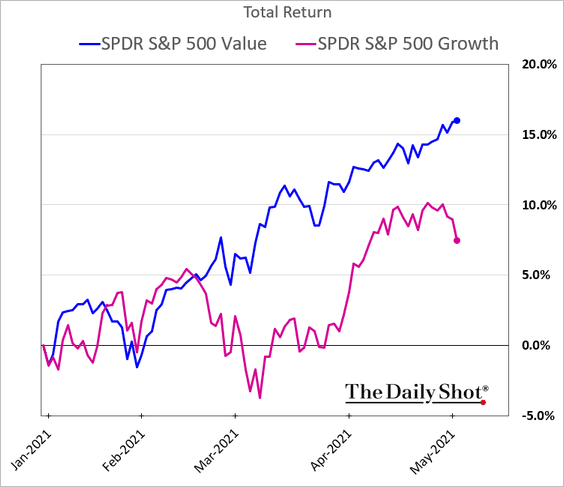

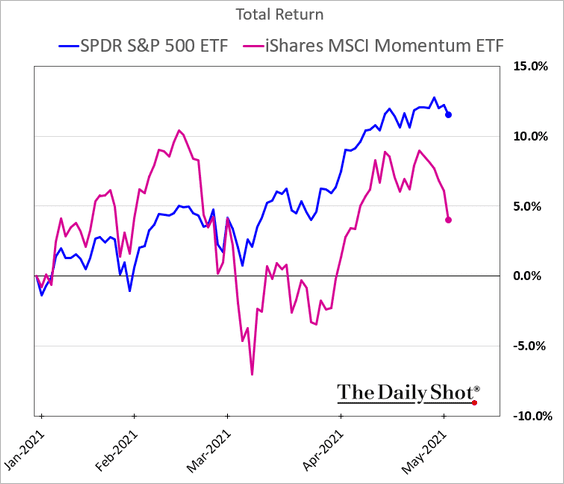

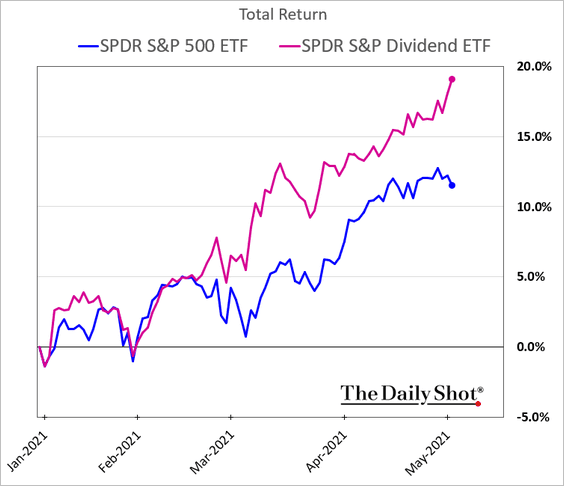

8. Next, we have some equity factor performance trends (year-to-date).

• Value vs. growth:

• Momentum:

• High-dividend shares:

Back to Index

Rates

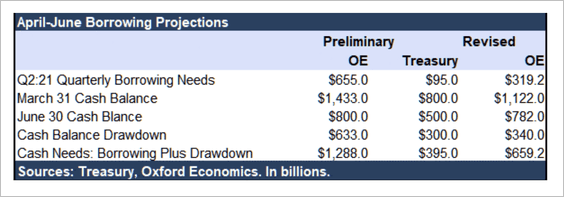

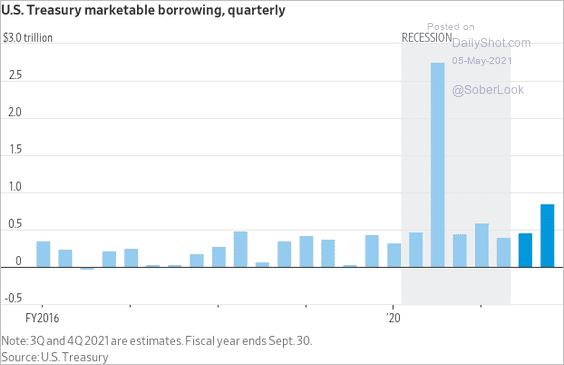

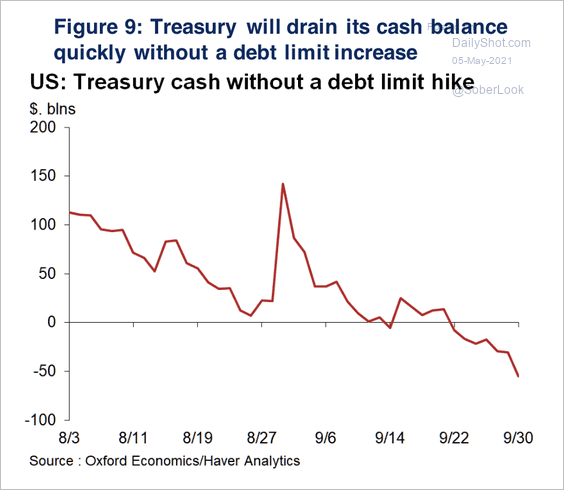

1. Oxford Economics revised its Treasury borrowing projections lower due to stronger-than-expected tax collections.

Source: Oxford Economics

Source: Oxford Economics

Source: @WSJ Read full article

Source: @WSJ Read full article

Oxford Economics expects the Treasury will hit the debt limit in early September and burn through its remaining cash.

Source: Oxford Economics

Source: Oxford Economics

——————–

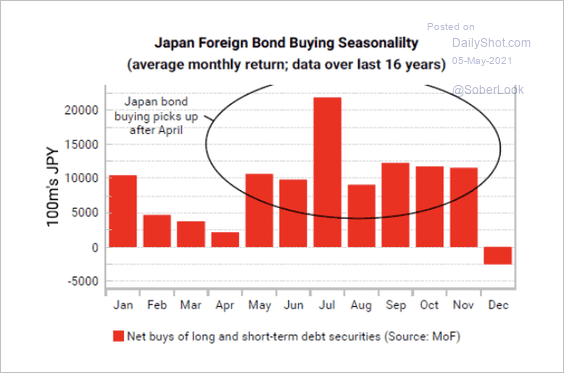

2. Japanese Treasury bond-buying tends to pick up after April.

Source: Variant Perception

Source: Variant Perception

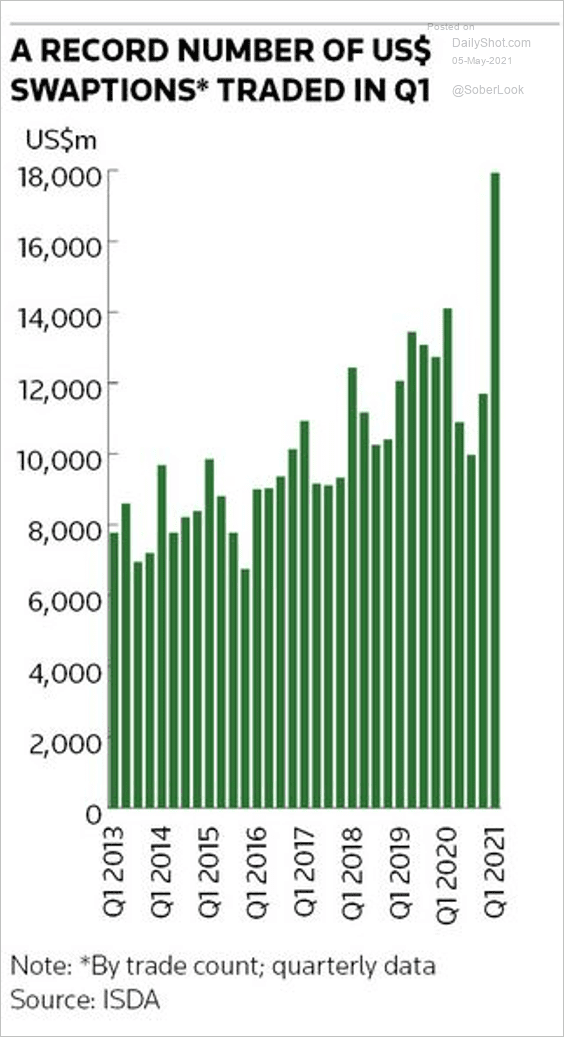

3. Swaption trading soared last quarter amid rising Treasury yields.

Source: IFR Read full article

Source: IFR Read full article

Back to Index

Global Developments

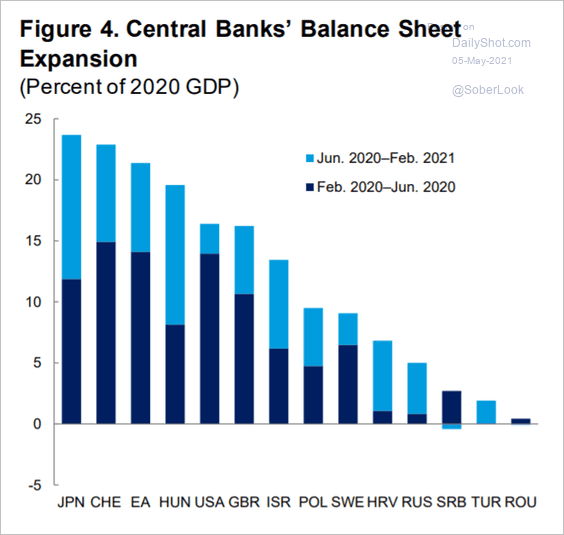

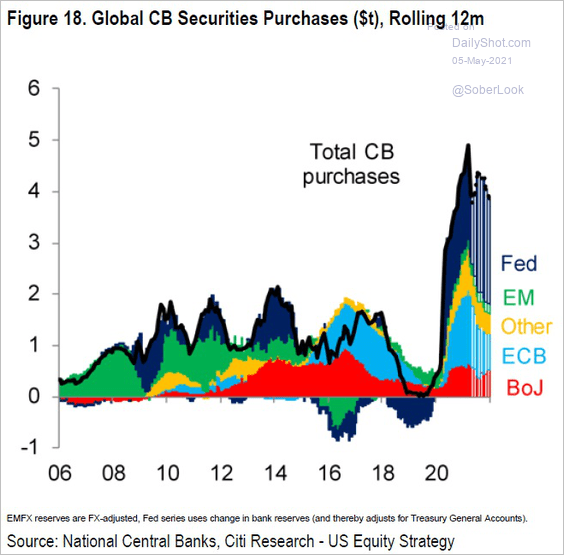

1. Here is a look at central banks’ balance sheet expansion since the start of the pandemic.

Source: IMF Read full article

Source: IMF Read full article

Source: @Scutty

Source: @Scutty

——————–

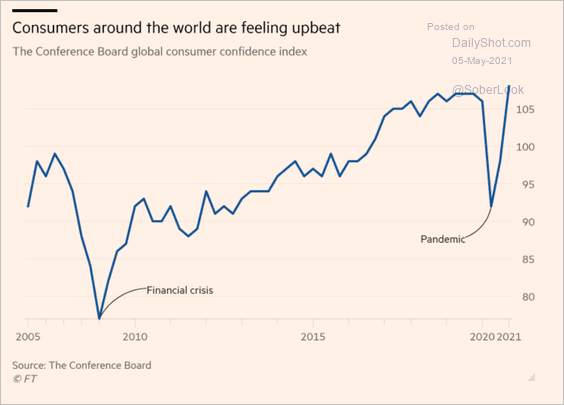

2. Consumer confidence has rebounded.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

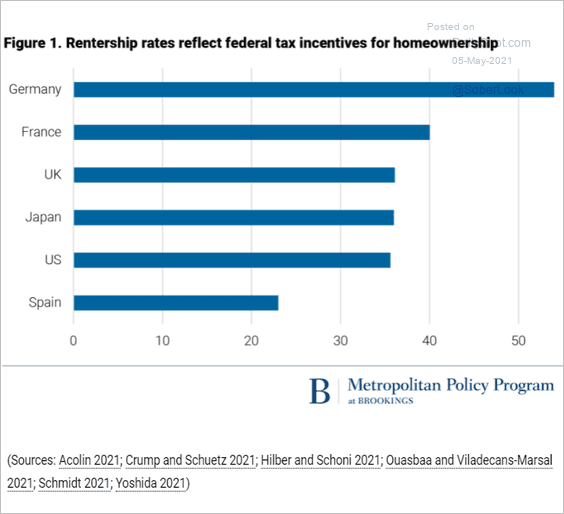

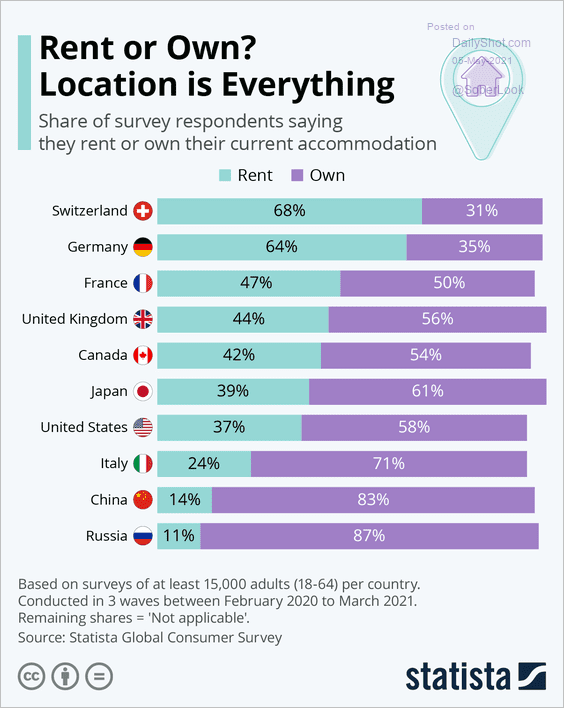

3. Next, we have the rentership rates in select economies.

Source: Brookings Read full article

Source: Brookings Read full article

Source: Statista

Source: Statista

——————–

Food for Thought

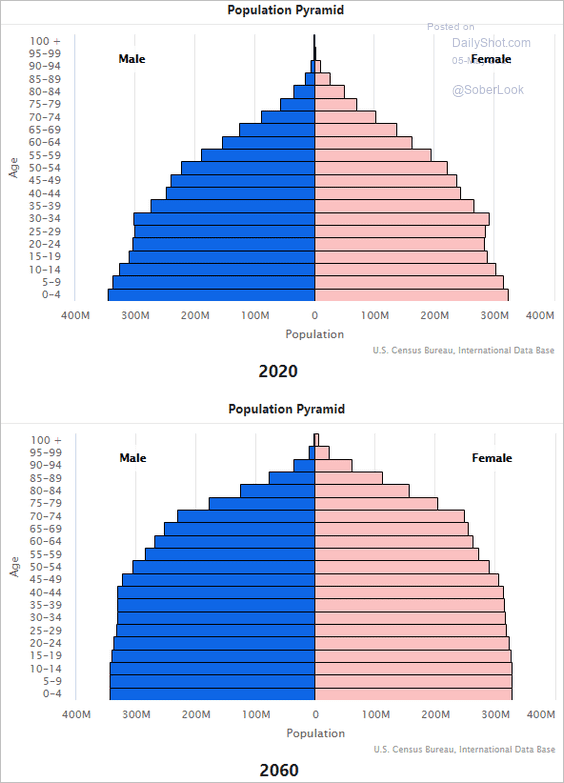

1. US population pyramid projections:

Source: The Census Bureau

Source: The Census Bureau

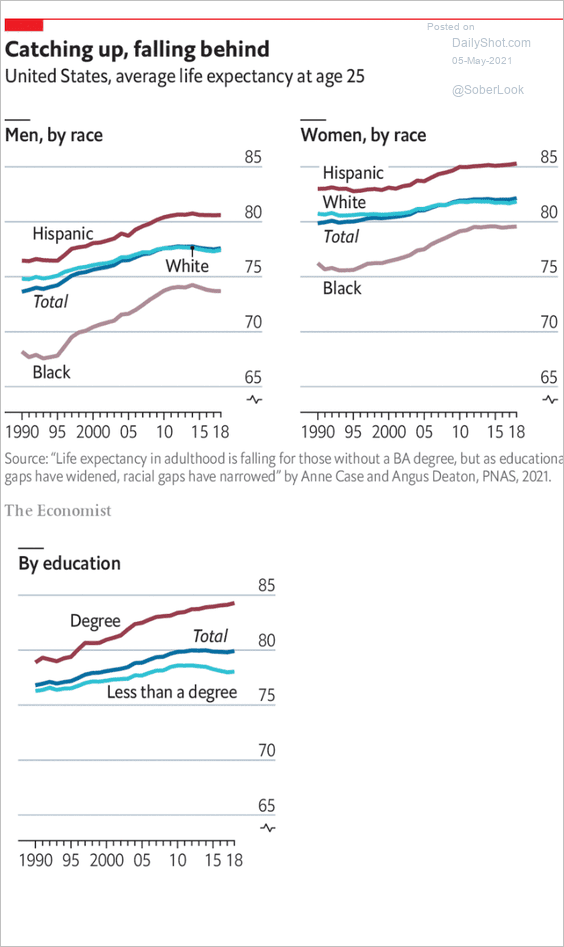

2. US life expectancy:

Source: The Economist Read full article

Source: The Economist Read full article

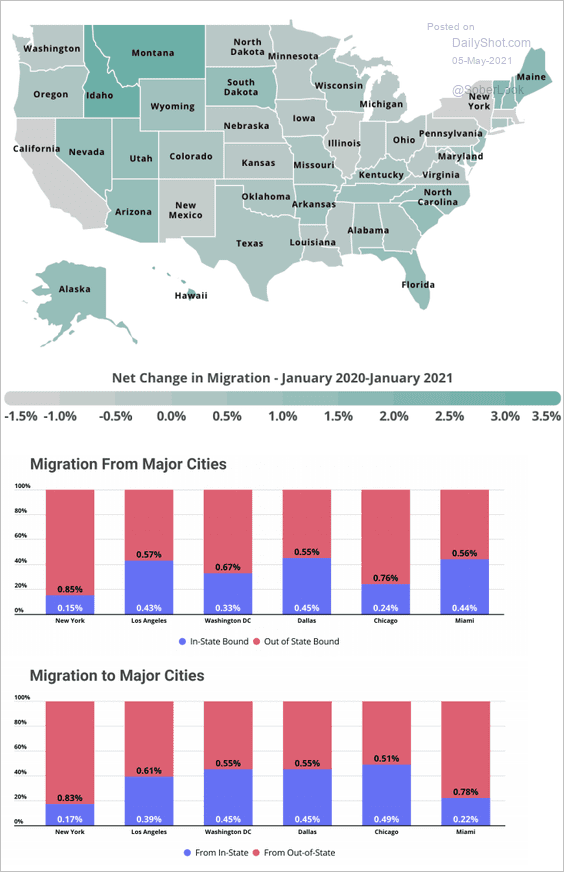

3. Migration within the US:

Source: Placer Labs Read full article

Source: Placer Labs Read full article

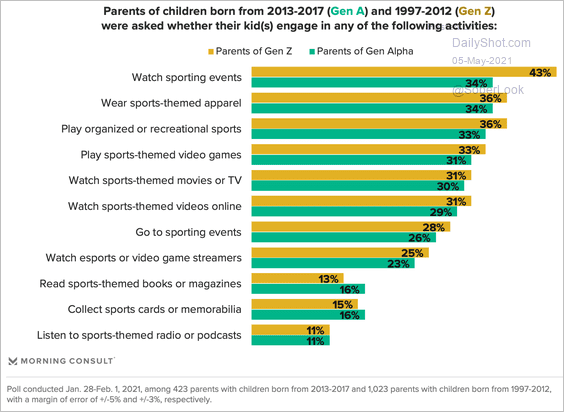

4. Gen-Z vs. Gen Alpha:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

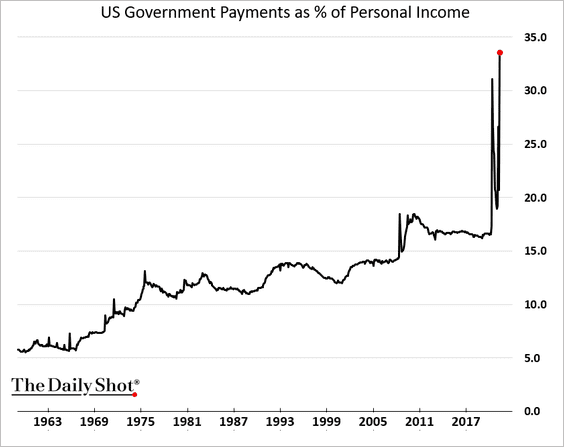

5. US government payments to households as a percent of personal income:

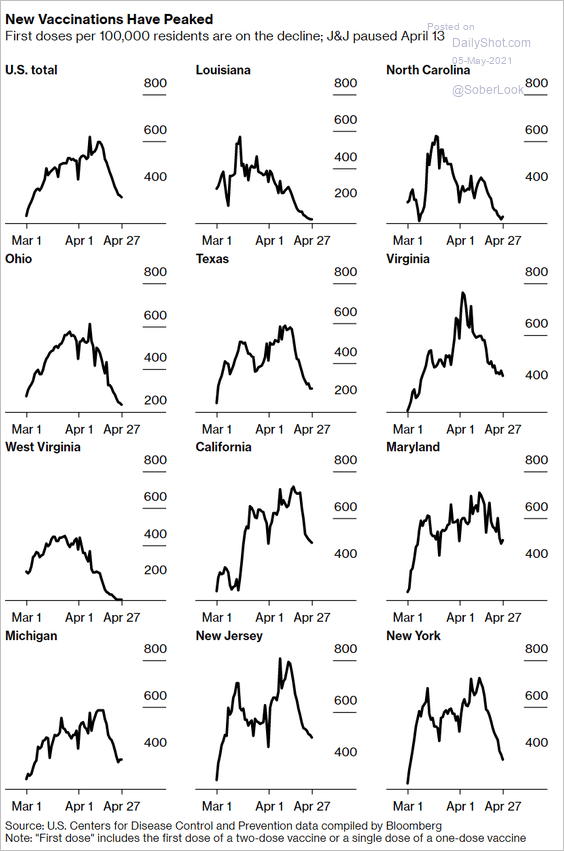

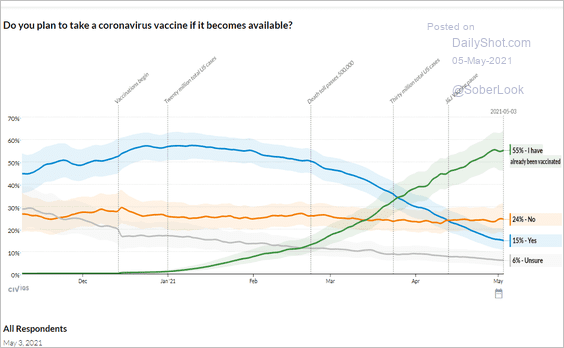

6. US vaccination trends:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Source: Civiqs Read full article

Source: Civiqs Read full article

——————–

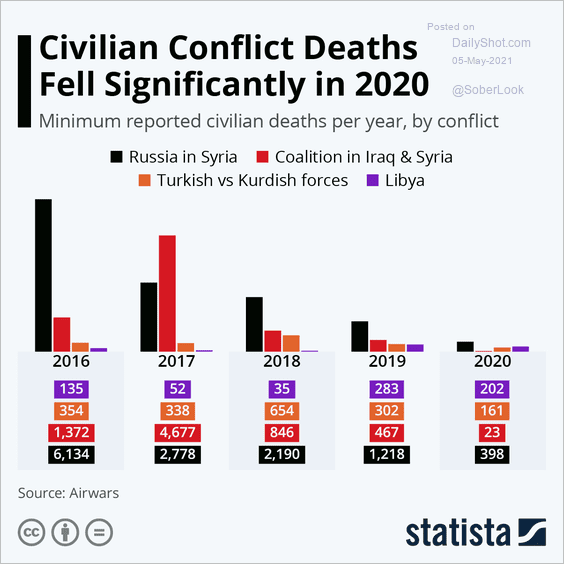

7. Civilian conflict deaths:

Source: Statista

Source: Statista

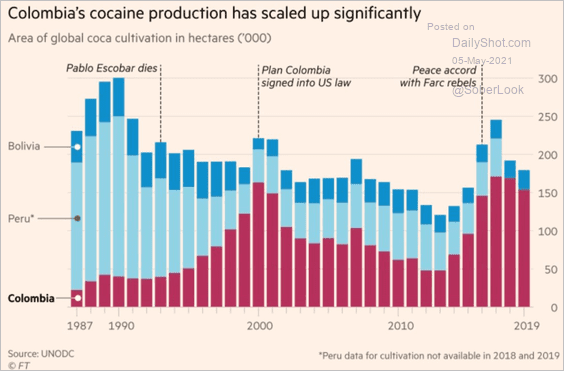

8. Cocaine production by country:

Source: @adam_tooze, @gideon_long Read full article

Source: @adam_tooze, @gideon_long Read full article

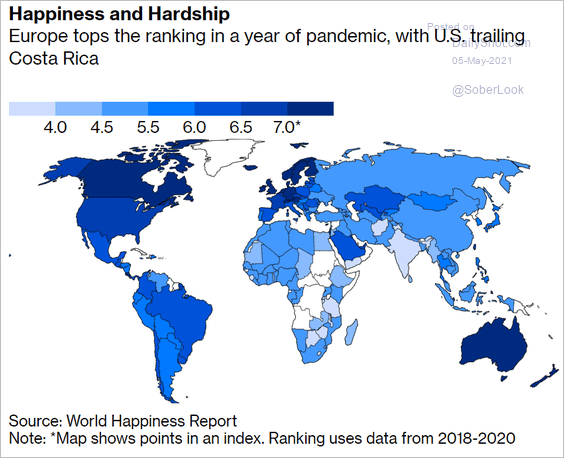

9. The happiness index:

Source: @business Read full article

Source: @business Read full article

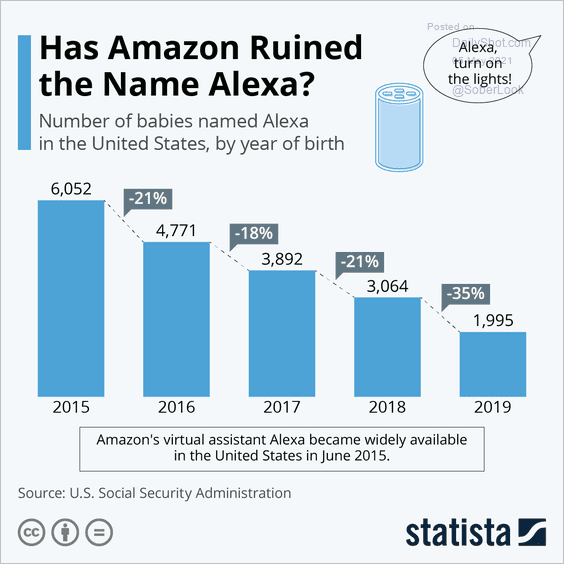

10. The number of babies named Alexa:

Source: Statista

Source: Statista

——————–

Back to Index