The Daily Shot: 11-May-21

• Equities

• Credit

• Rates

• Energy

• Commodities

• Cryptocurrency

• Emerging Markets

• China

• The Eurozone

• The United Kingdom

• Canada

• The United States

• Global Developments

• Food for Thought

Equities

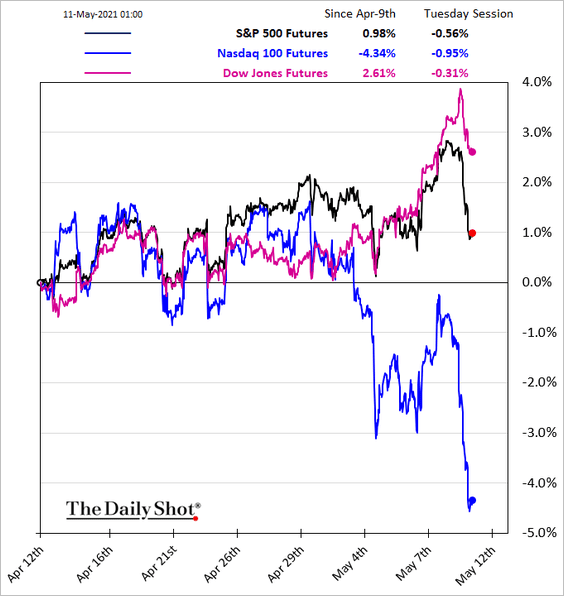

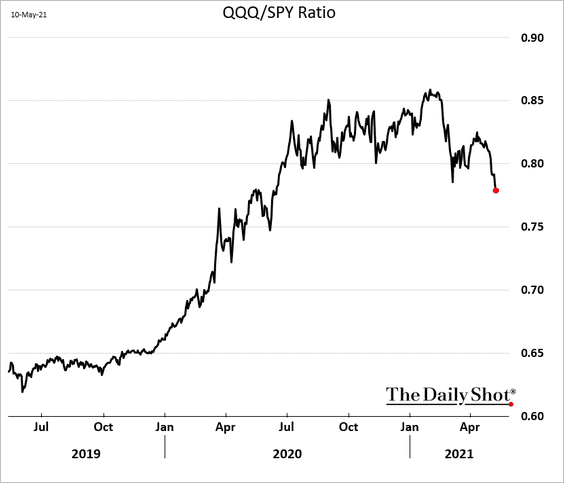

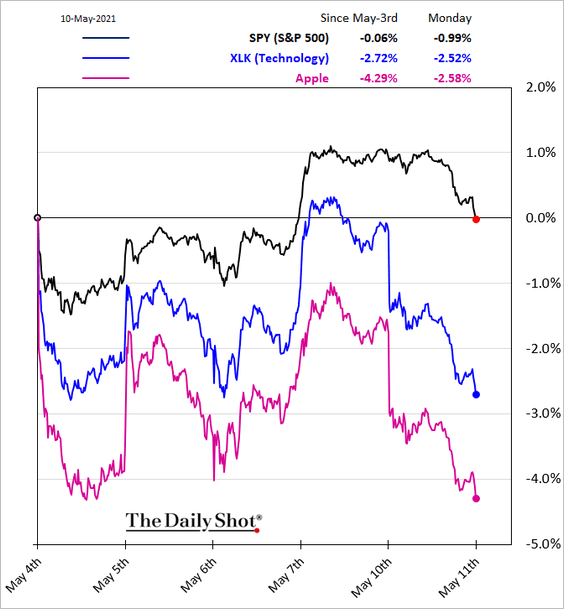

1. Tech stocks have widened their underperformance, with the Nasdaq 100 losing over 4% in the last few days.

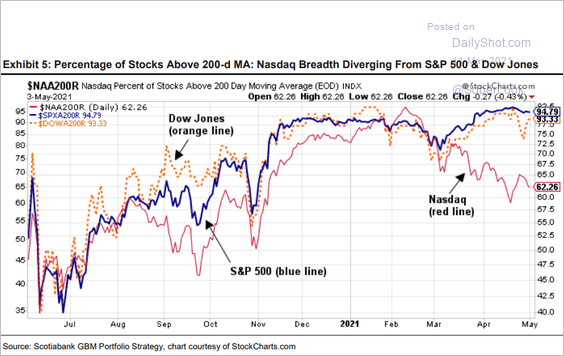

The Nasdaq’s breadth has diverged from the S&P 500 and the Dow.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

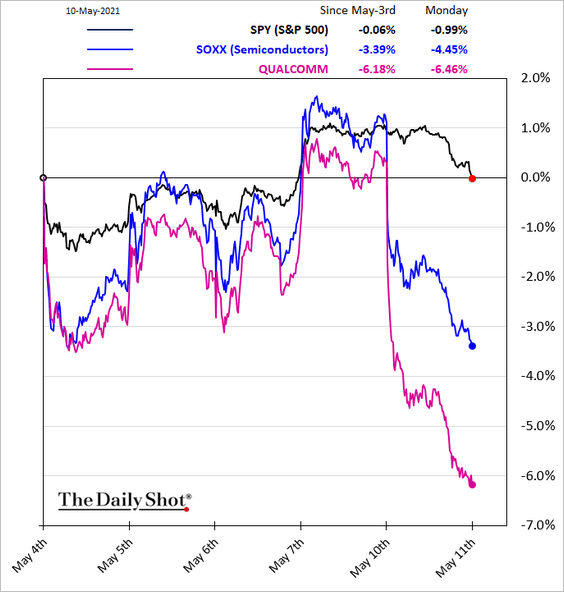

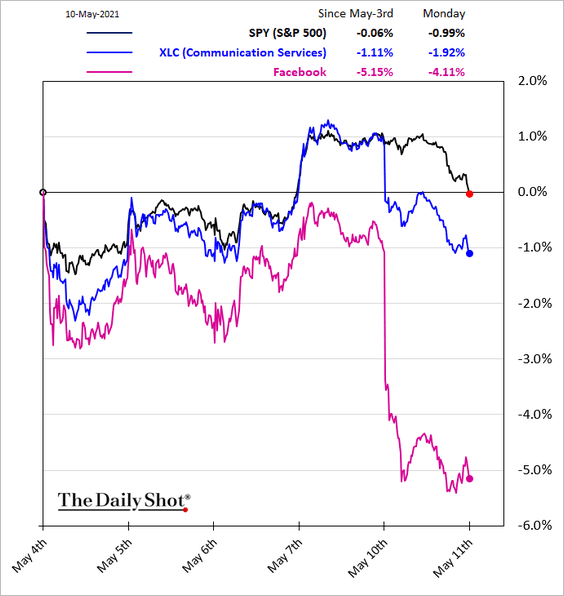

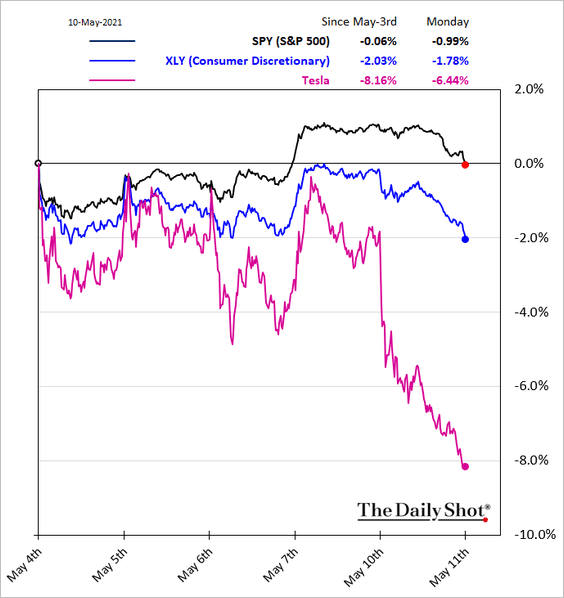

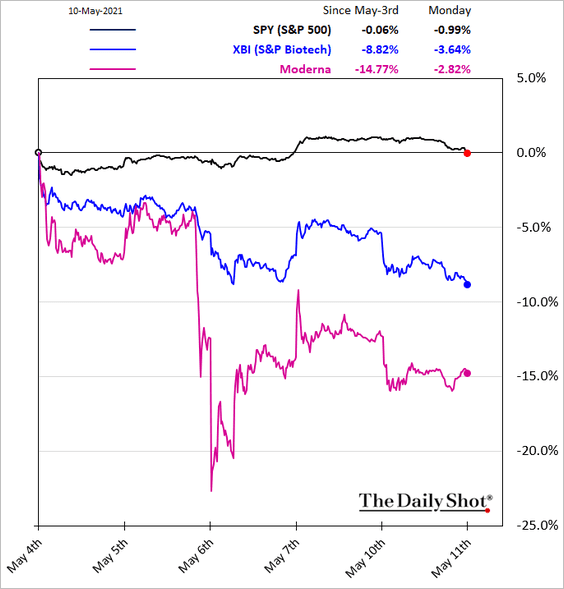

Here are some sector trends over the past five business days.

– Tech and semiconductors:

– Communication Services:

– Consumer Discretionary:

– Biotech:

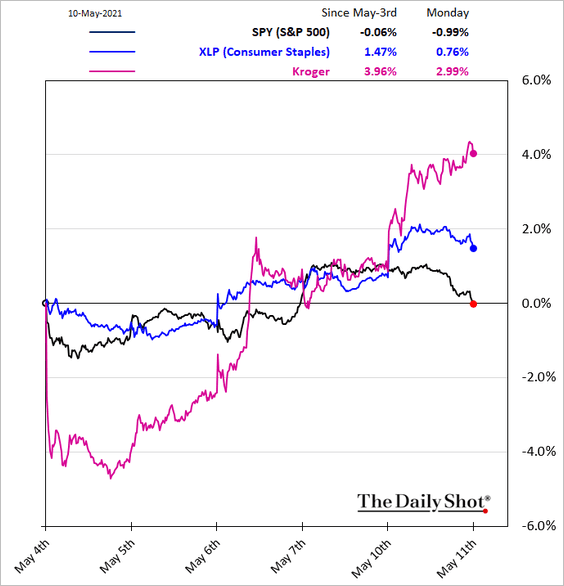

– Consumer Staples:

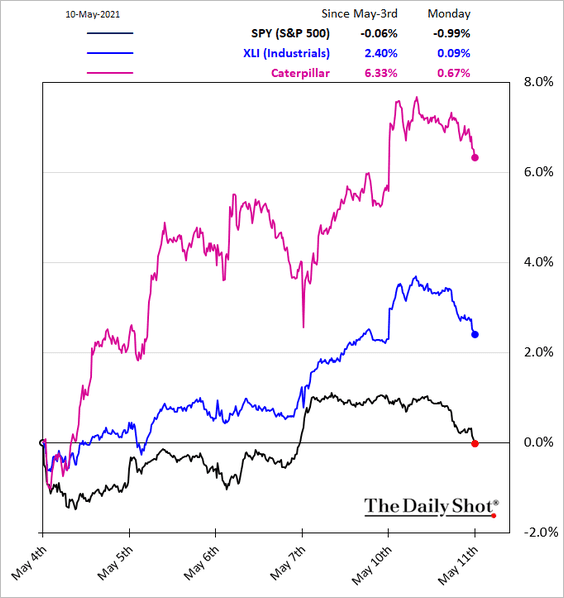

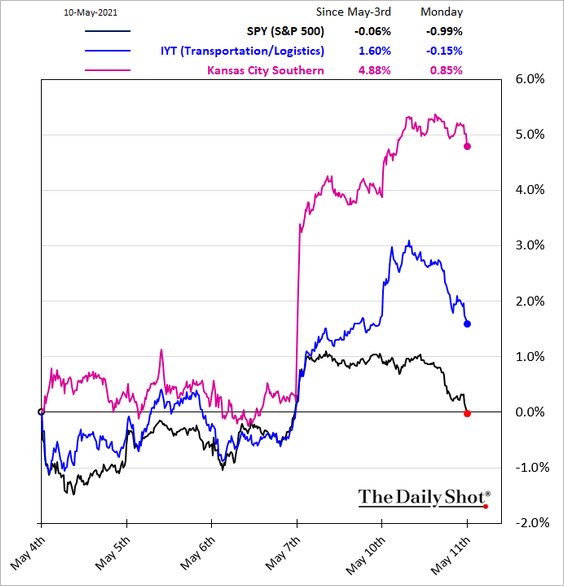

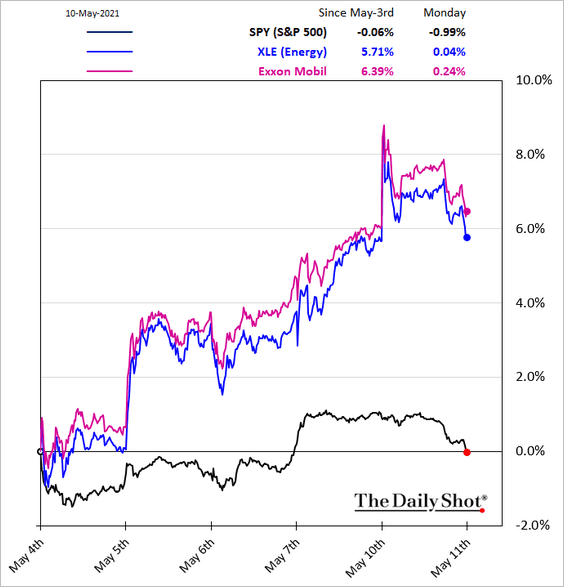

• Reflation bets continue to outperform.

– Industrials:

– Transportation:

– Energy:

——————–

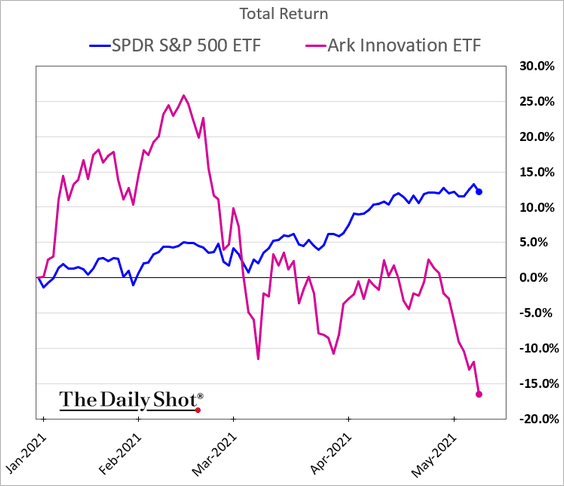

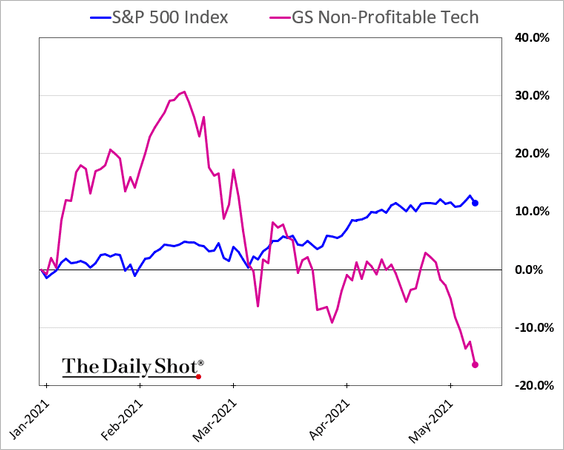

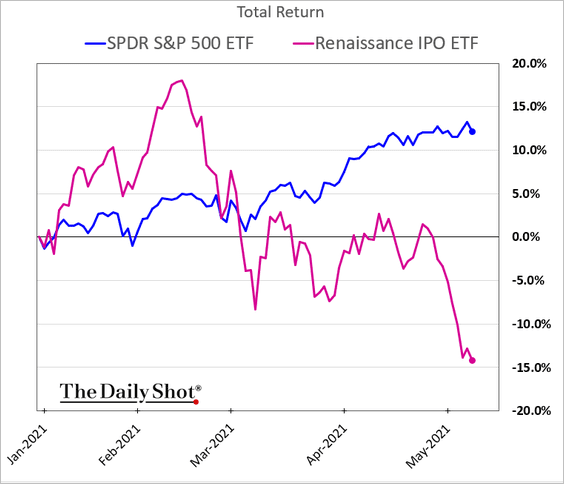

2. Speculative stocks remain under pressure. Below is the year-to-date performance.

• Ark Innovation:

• Nonprofitable tech:

• Post-IPO stocks:

——————–

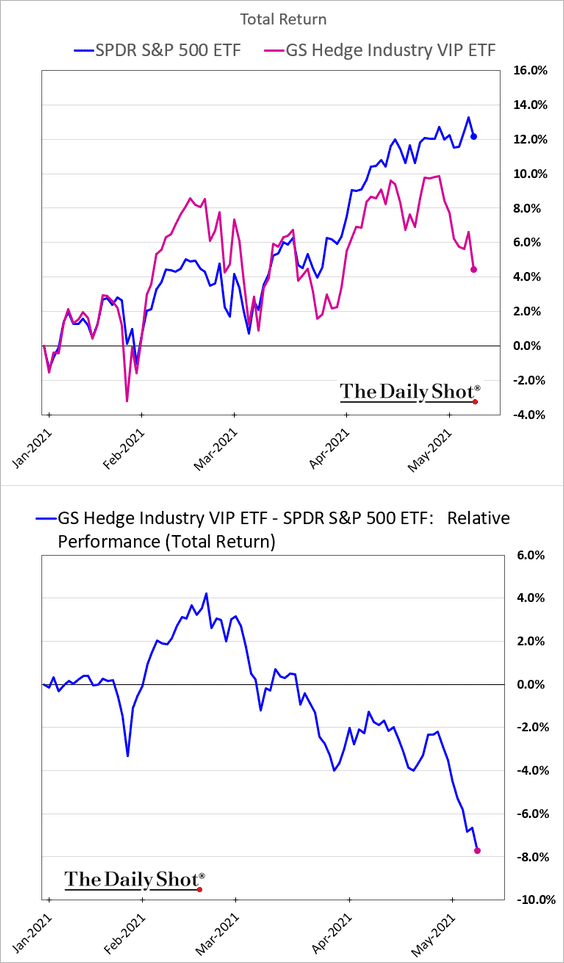

3. Stocks widely held by hedge funds (long positions) are suddenly underperforming. Some market participants suggested that tighter prime brokerage limits (post-Archegos) have contributed to this trend.

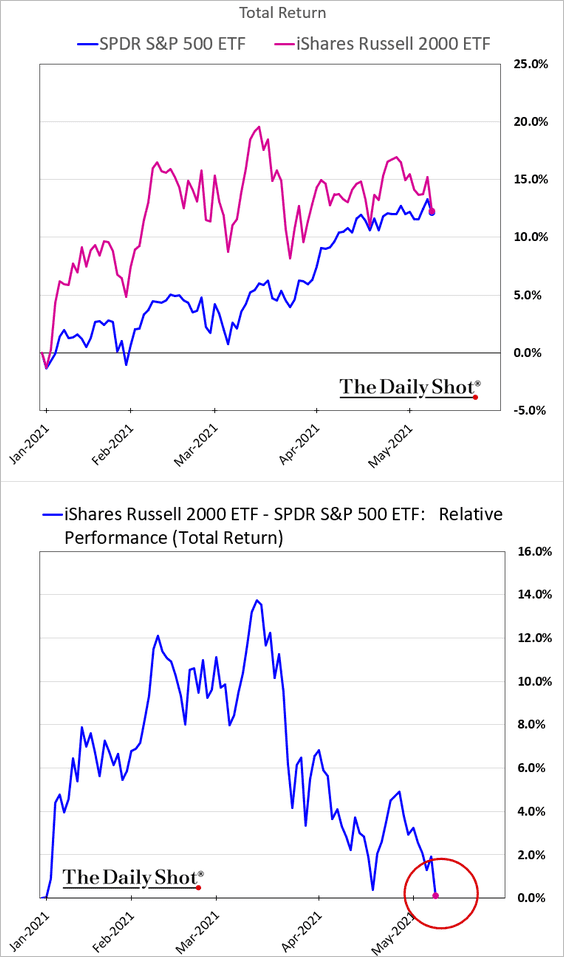

4. Small caps have given up their year-to-date outperformance.

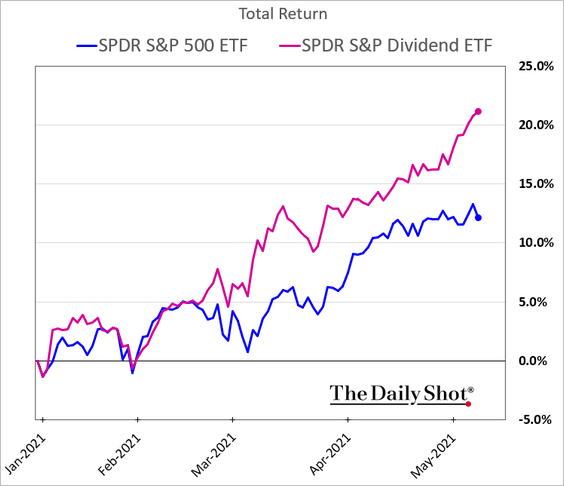

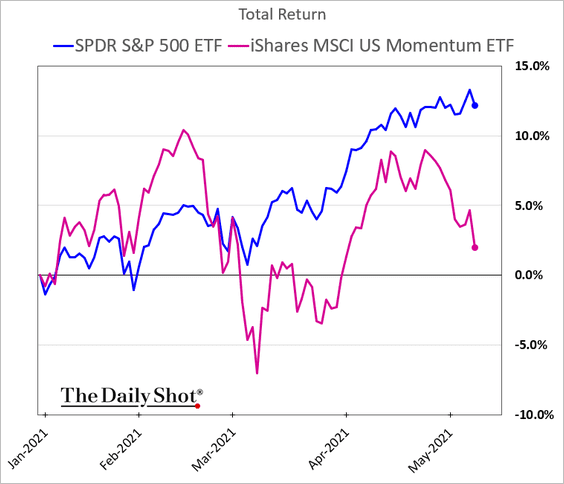

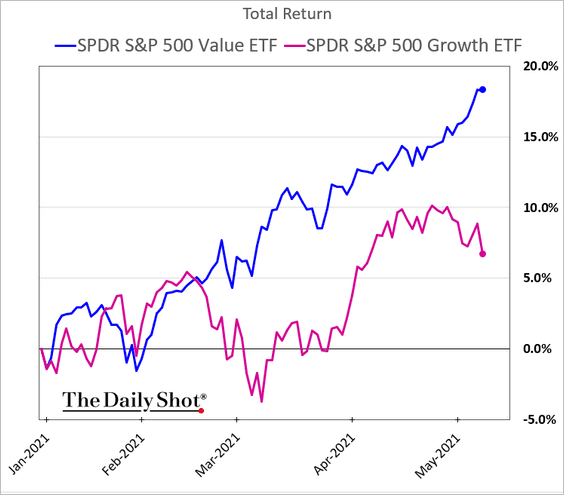

Below are some additional equity factor performance trends (year-to-date).

– High-dividend stocks:

– Momentum:

– Value vs. growth:

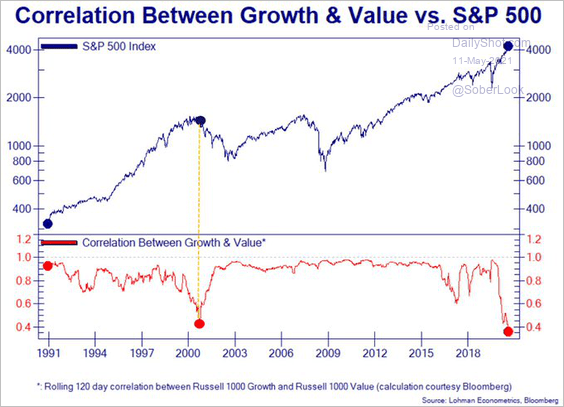

• The correlation between value and growth factors plunged recently. The last time that happened was in the early phase of the dot-com crash.

Source: @Not_Jim_Cramer

Source: @Not_Jim_Cramer

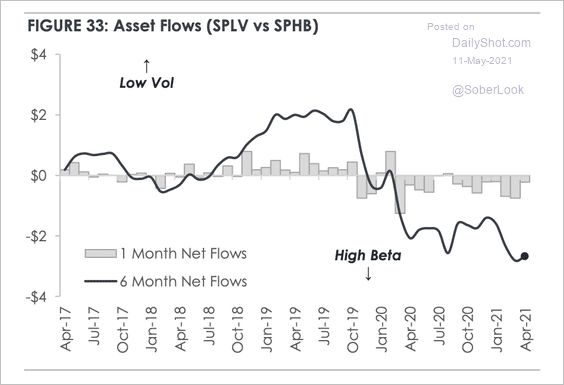

• Net flows continue to favor high beta over low volatility stocks.

Source: MarketDesk Research

Source: MarketDesk Research

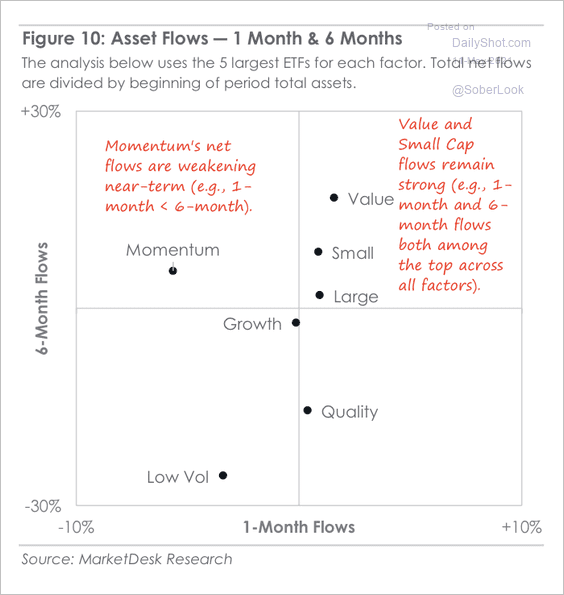

• Flows into momentum ETFs weakened over the past six months.

Source: MarketDesk Research

Source: MarketDesk Research

——————–

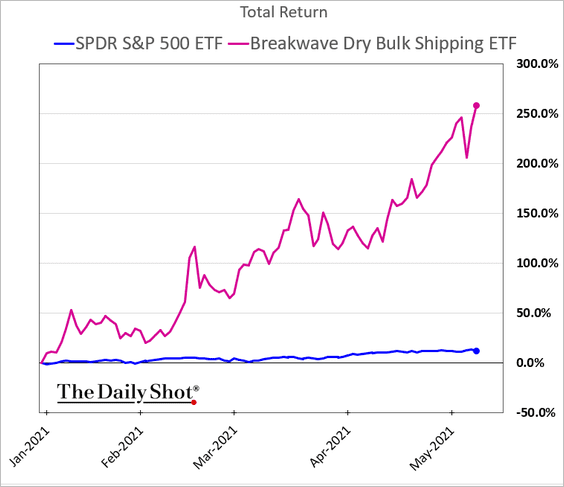

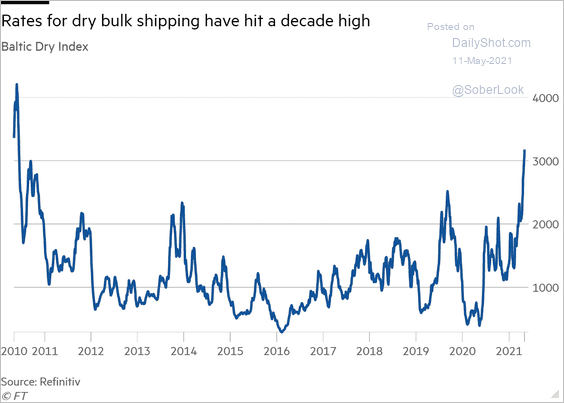

5. Dry-bulk shipping companies’ shares continue to surge.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

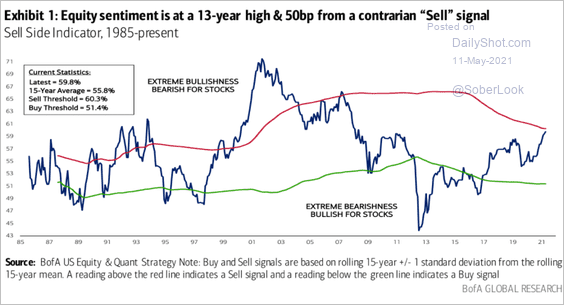

6. BofA’s sentiment index shows the market pushing into “extreme bullishness” territory.

Source: BofA Global Research

Source: BofA Global Research

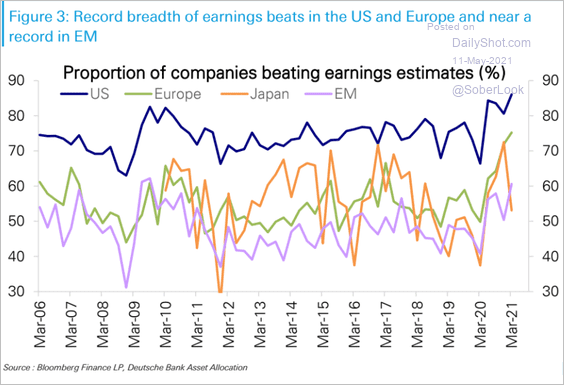

7. US and European market breadth of earnings beats has been near record highs.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

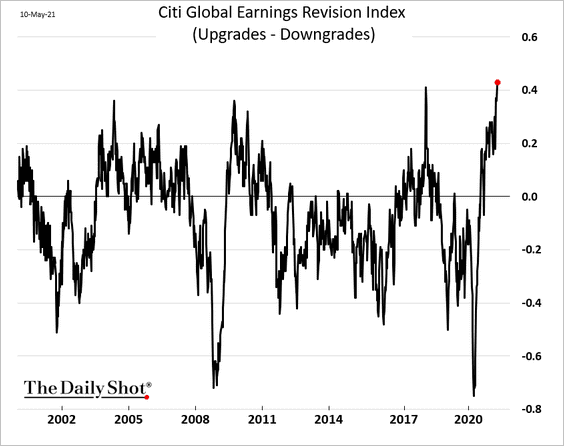

The Citi global earnings revisions index (analysts’ upgrades vs. downgrades) hit a new record.

h/t Cormac Mullen

h/t Cormac Mullen

——————–

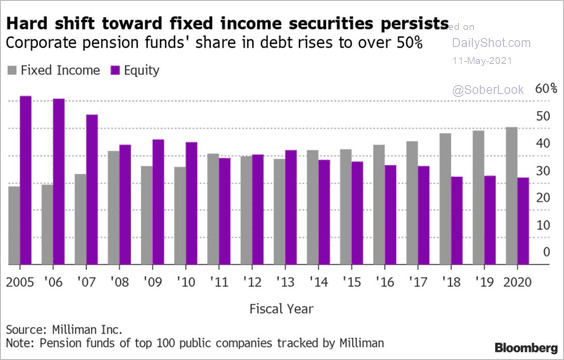

8. Finally, this chart shows corporate pension funds’ debt and equity allocations since 2005.

Source: @BloombergQuint Read full article

Source: @BloombergQuint Read full article

Back to Index

Credit

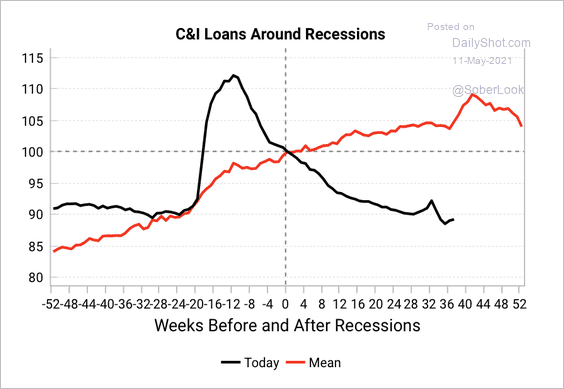

1. US business lending has been weak compared to the post-recession average.

Source: Variant Perception

Source: Variant Perception

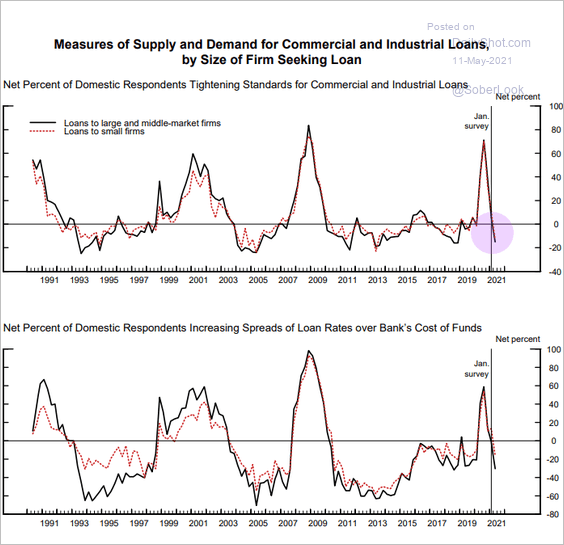

Banks have started easing lending standards for business credit this year.

Source: Federal Reserve Board

Source: Federal Reserve Board

——————–

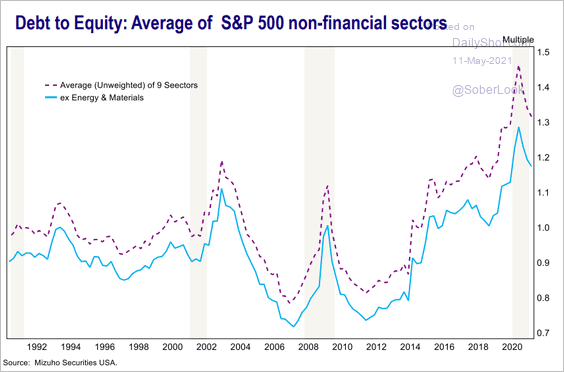

2. S&P 500 corporate leverage is coming off the highs but remains elevated.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

Back to Index

Rates

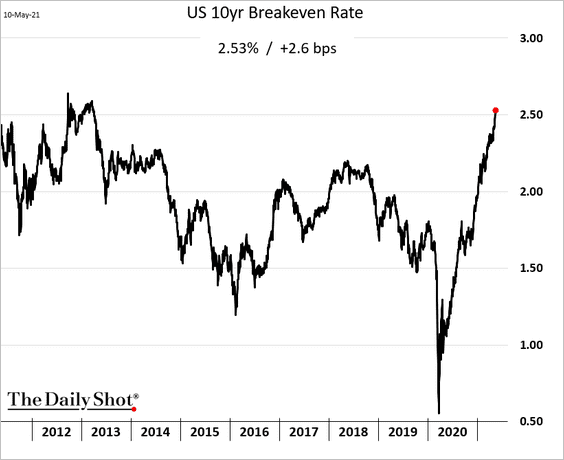

1. Market-based inflation expectations keep grinding higher.

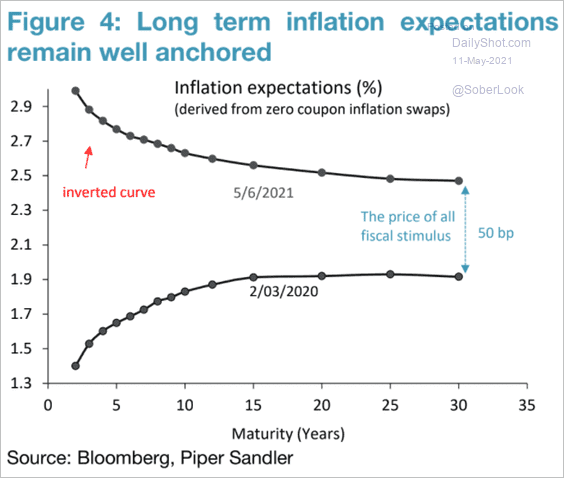

However, the long end of the inflation swap curve remains relatively well anchored. The market expects the Fed to get inflation under control over the long run.

Source: Piper Sandler

Source: Piper Sandler

——————–

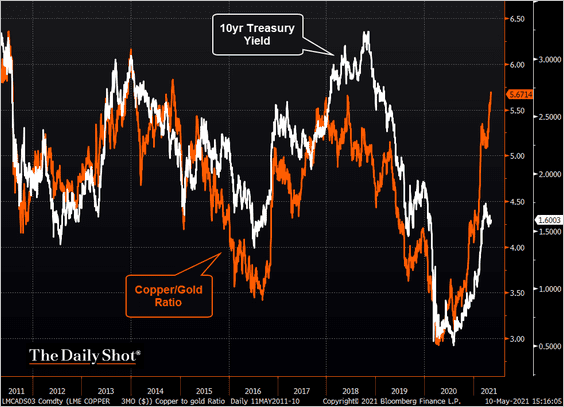

2. The copper-to-gold ratio and Treasury yields generally don’t diverge for very long. Something will have to give.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

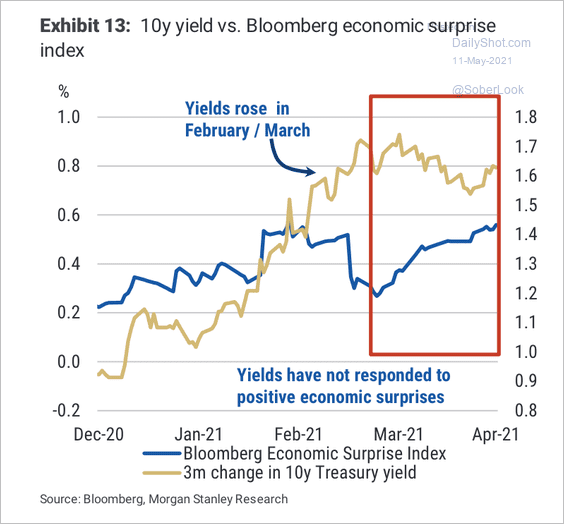

Related to the above, the 10-year Treasury yield has declined over the past month while the Bloomberg economic surprise index continued to rise.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

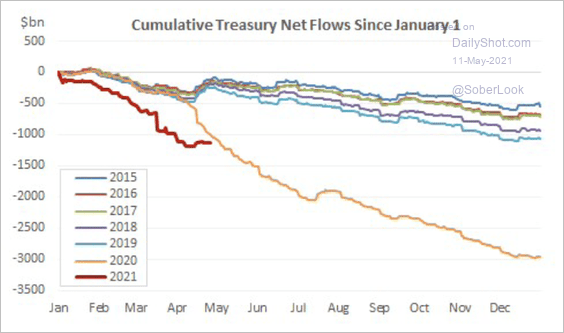

3. Treasury outflows moderated in April.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

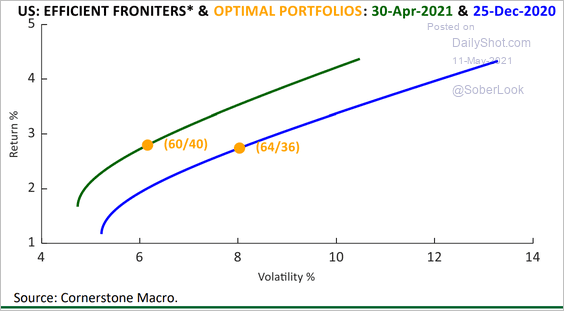

4. Adding Treasuries to an equities portfolio remains an effective hedge (reducing volatility).

Source: Cornerstone Macro

Source: Cornerstone Macro

Back to Index

Energy

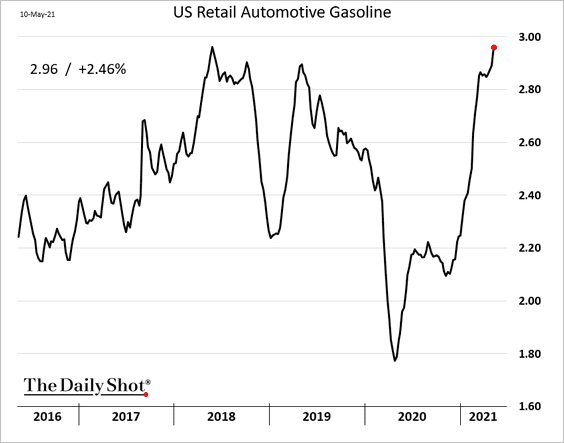

1. US retail gasoline prices ticked higher in response to the Colonial Pipeline situation. But the overall market reaction has been muted.

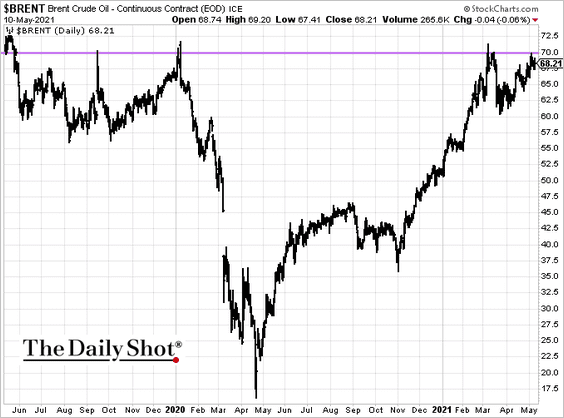

2. Brent is holding resistance at $70/bbl.

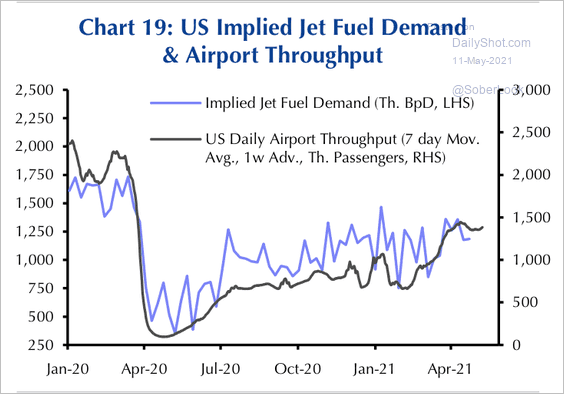

3. Jet fuel demand is increasing as mobility improves.

Source: Capital Economics

Source: Capital Economics

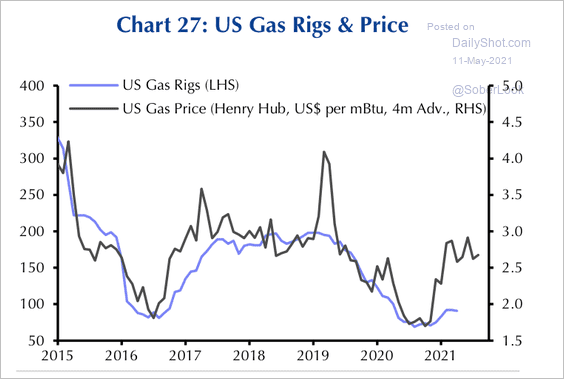

4. Will the number of US gas rigs pick up as natural gas prices recover?

Source: Capital Economics

Source: Capital Economics

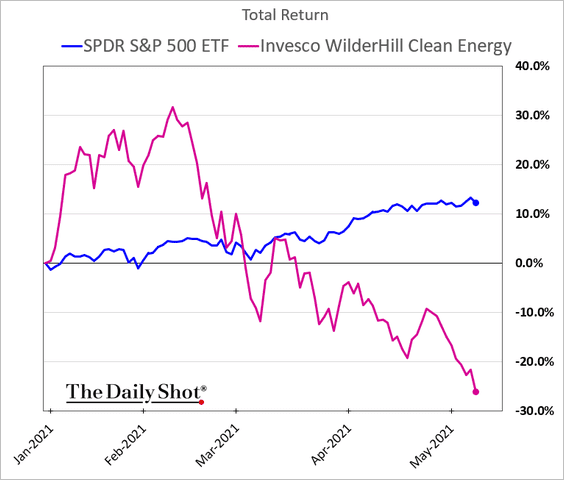

5. Clean energy stocks are down sharply this year.

Back to Index

Commodities

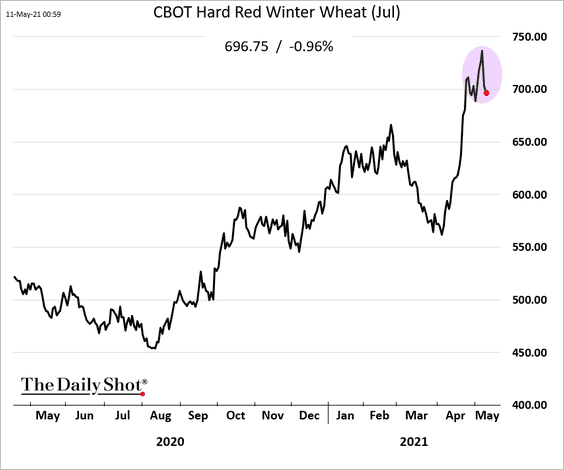

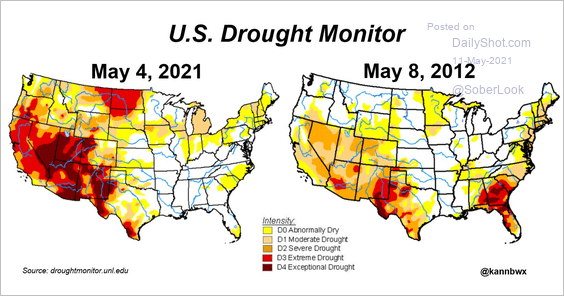

1. US grains are off the highs. Improving weather conditions in parts of the world helped alleviate some of the supply concerns.

US drought conditions have been easing.

Source: @kannbwx

Source: @kannbwx

——————–

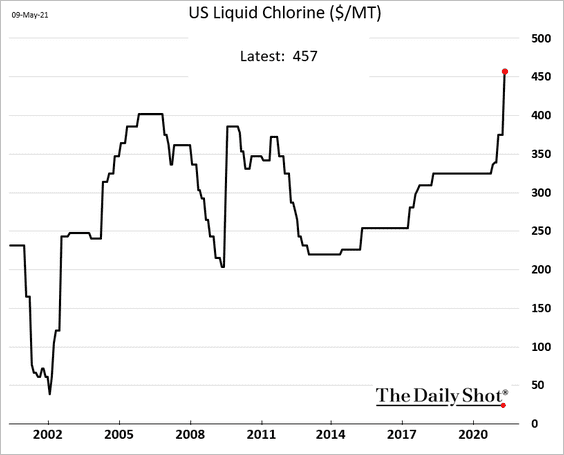

2. Will we see chlorine hoarding this summer?

Source: HowStuffWorks Read full article

Source: HowStuffWorks Read full article

Back to Index

Cryptocurrency

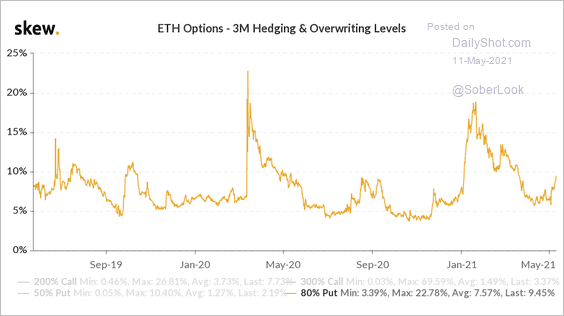

1. The cost of hedging ether for a 20%+ fall over the next three months has only seen a minor increase.

Source: @skewdotcom

Source: @skewdotcom

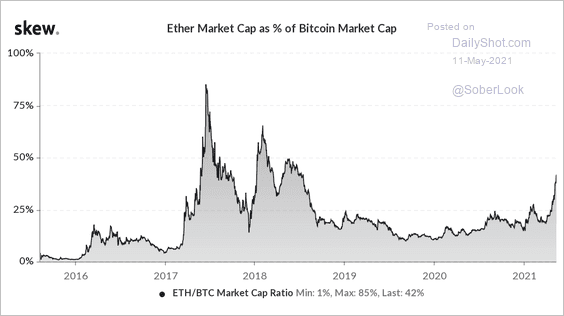

2. Ether’s market cap relative to bitcoin is rapidly approaching 50%.

Source: @skewdotcom

Source: @skewdotcom

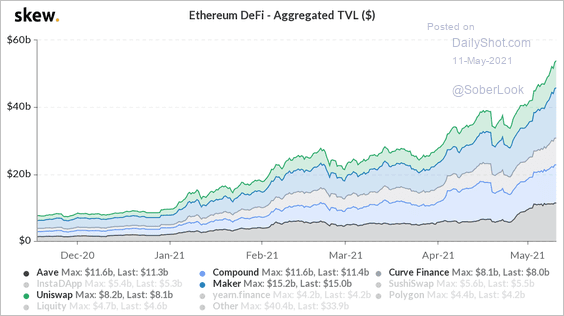

3. The total value locked in decentralized finance (DeFi) protocols running on the Ethereum blockchain is approaching $60 billion.

Source: @skewdotcom

Source: @skewdotcom

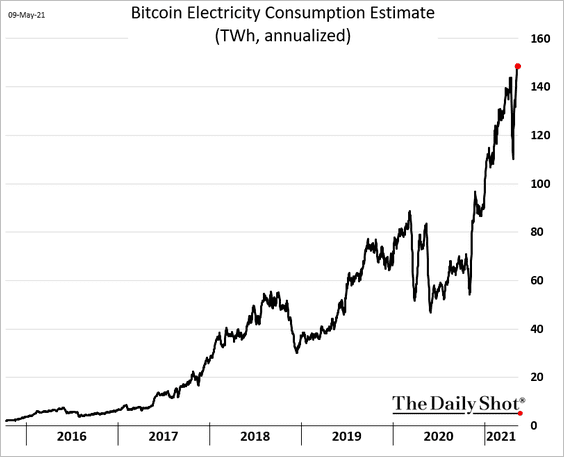

4. Bitcoin mining electricity usage is now estimated to be higher than the power consumption of Sweden and about half of the electricity used in the UK.

Source: CCAF

Source: CCAF

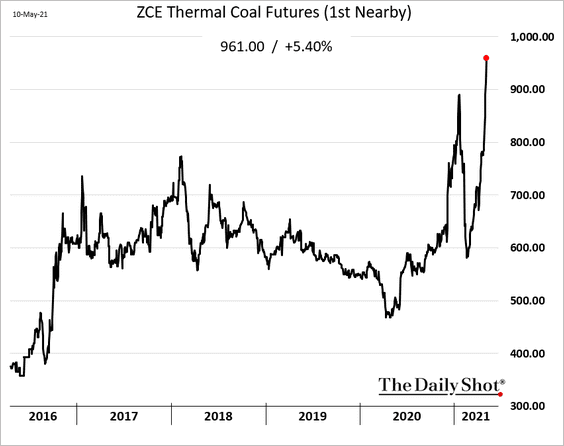

With a substantial portion of bitcoin mining taking place in China, the cryptocurrency’s rapidly rising demand for power contributes to higher thermal coal prices.

Back to Index

Emerging Markets

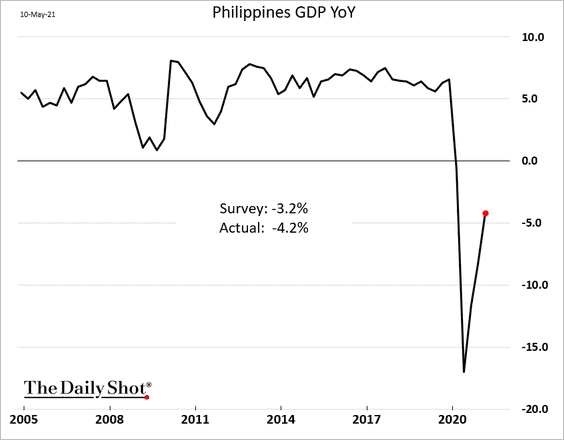

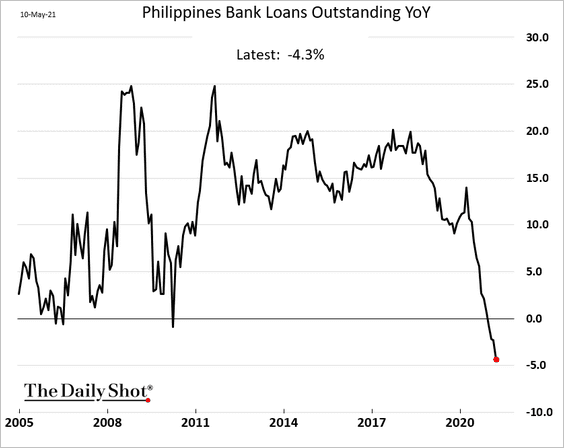

1. The Philippine Q1 GDP growth was weaker than expected.

Credit continues to contract.

——————–

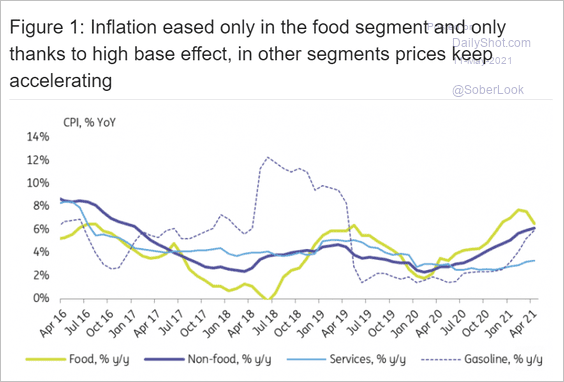

2. Russia’s softer-than-expected inflation print was driven by food items. Price gains in other sectors continue to climb.

Source: ING

Source: ING

3. Below is Citigroup’s EM inflation surprise index.

Source: @markets Read full article

Source: @markets Read full article

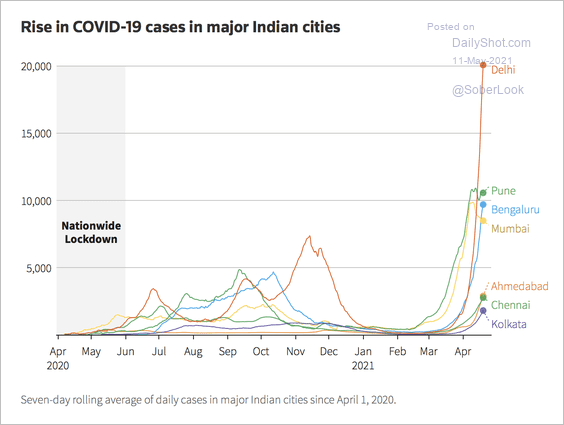

4. Here are the COVID trends across India’s cities.

Source: Reuters Read full article

Source: Reuters Read full article

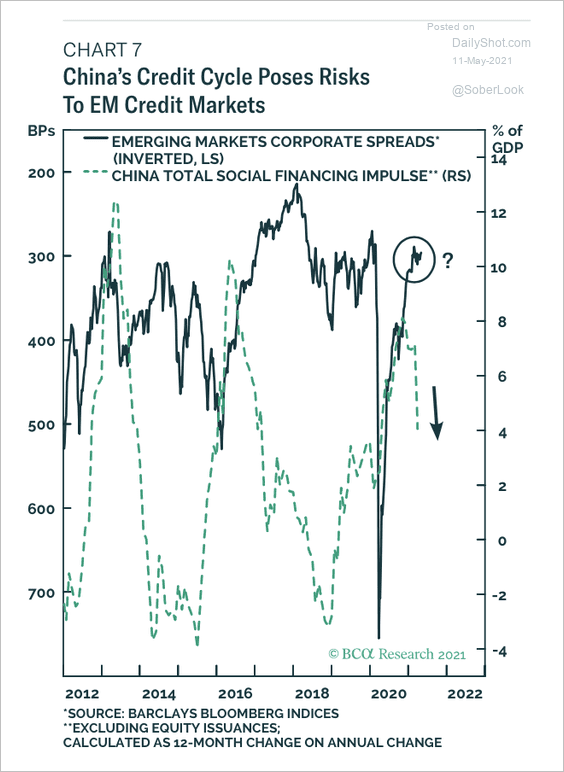

5. The decline in China’s social financing points to widening EM corporate credit spreads.

Source: BCA Research

Source: BCA Research

Back to Index

China

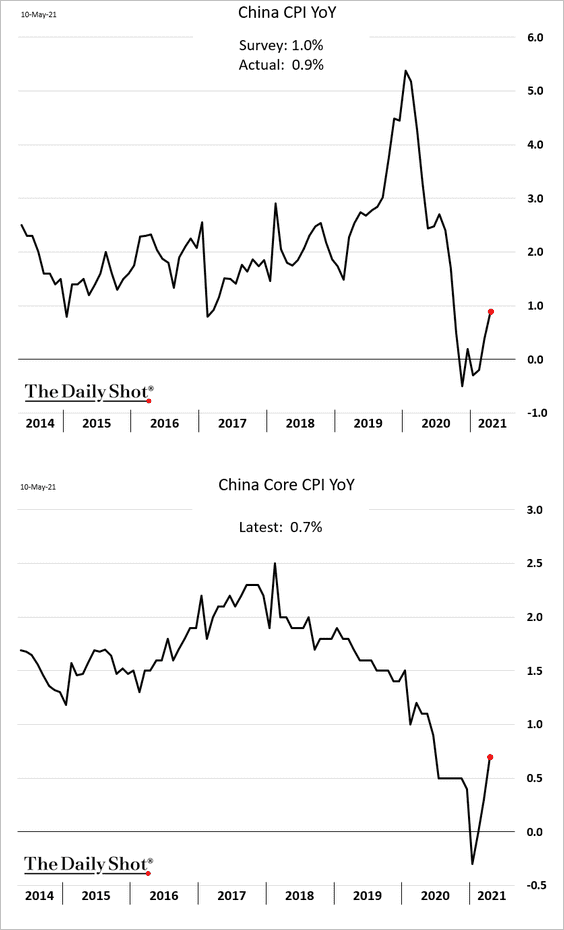

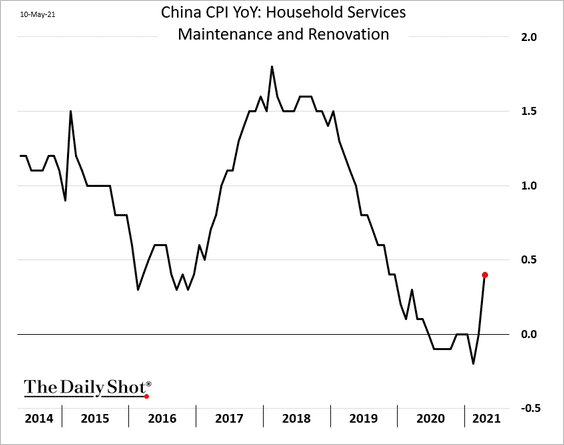

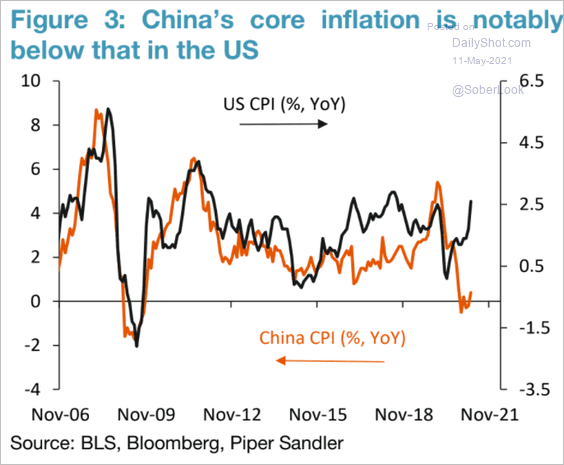

1. Consumer inflation continues to recover.

And there are more gains ahead.

Source: Piper Sandler

Source: Piper Sandler

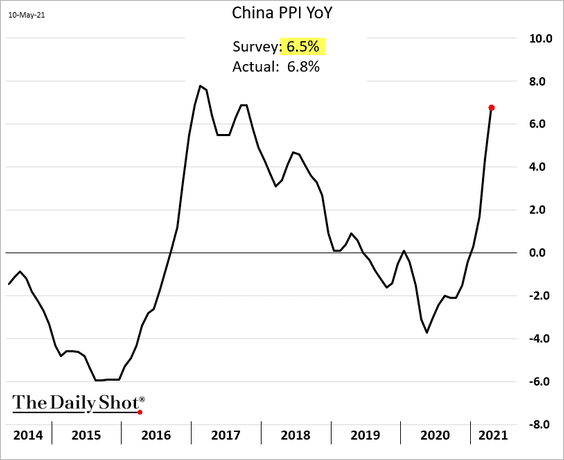

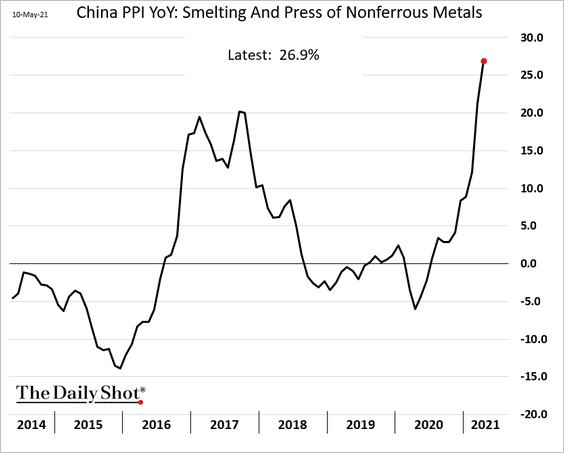

2. The PPI surprised to the upside …

… due to surging industrial commodity prices.

——————–

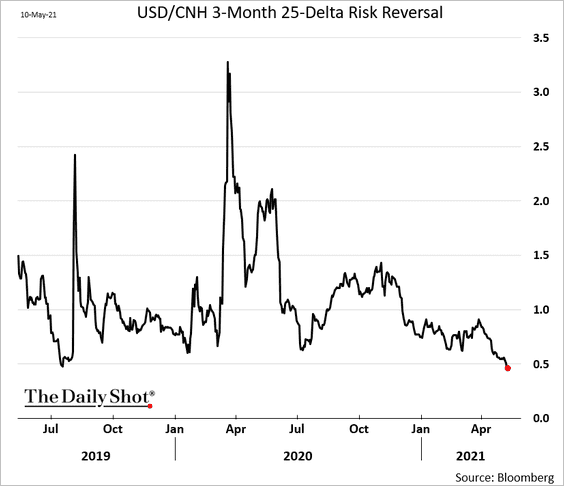

3. Traders remain upbeat on the yuan (negative on the US dollar).

h/t John Liu

h/t John Liu

Back to Index

The Eurozone

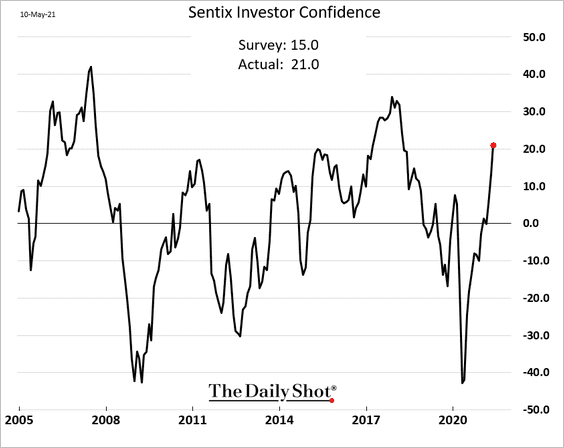

1. The Sentix Investor Confidence index is surging, pointing to further improvements in economic activity.

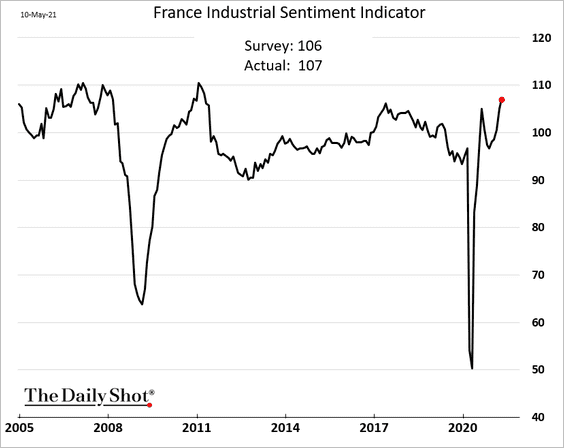

2. French industrial confidence is at the highest level in a decade.

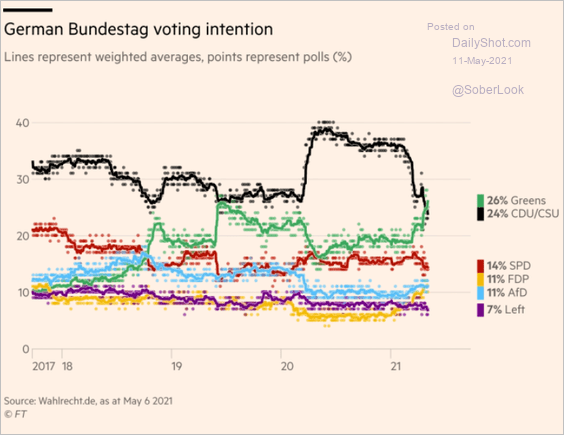

3. Germany’s Greens continue to poll well.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

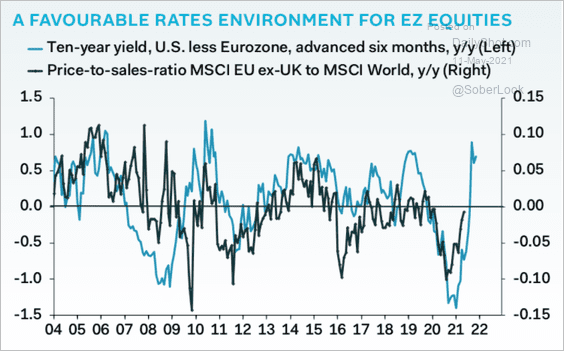

4. The US-Eurozone yield differentials point to further upside for European shares.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The United Kingdom

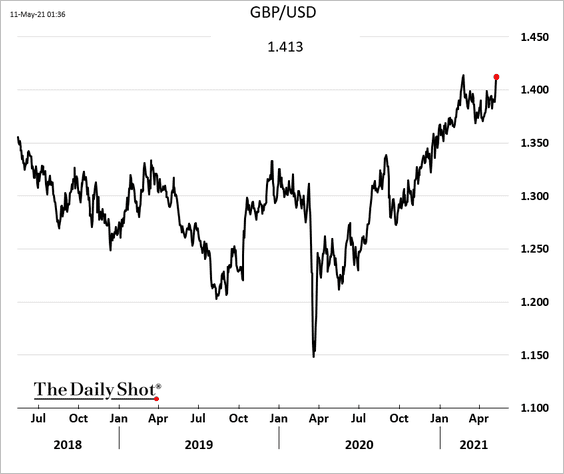

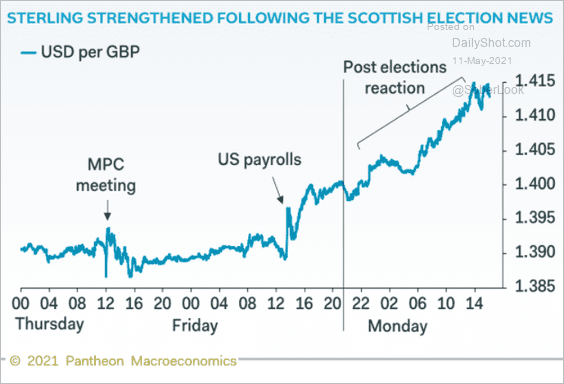

1. The pound is approaching a multi-year high vs. USD.

Traders are not worried about the Scottish election news.

Source: Reuters Read full article

Source: Reuters Read full article

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

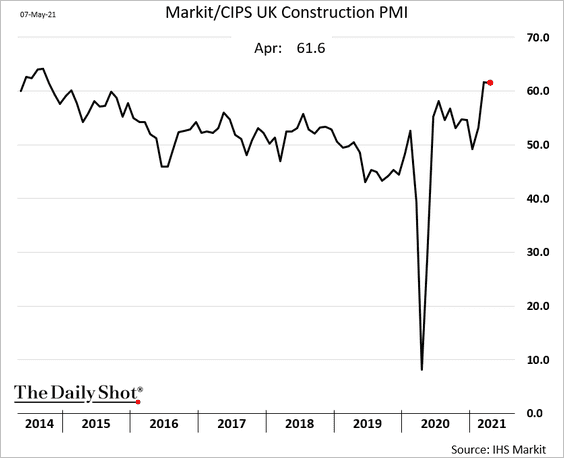

2. Construction activity has been robust.

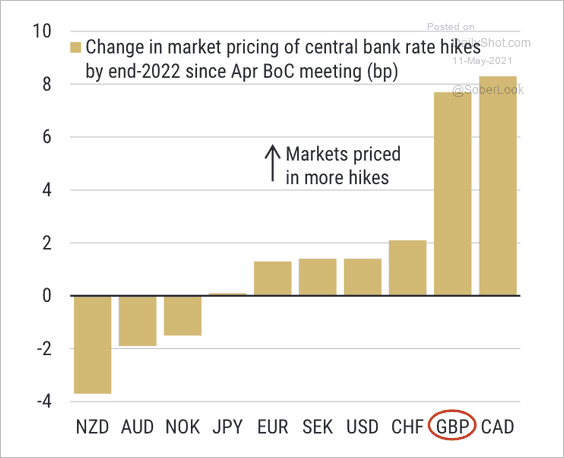

3. Markets expect the BOE will be the next G10 central bank to turn hawkish.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Canada

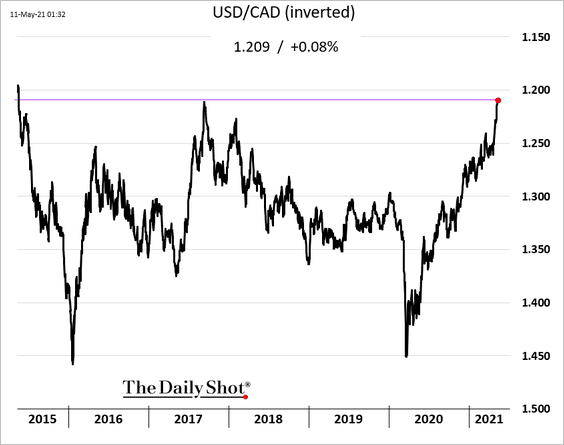

The loonie hit a multi-year high vs. the US dollar.

Back to Index

The United States

1. Let’s begin with housing.

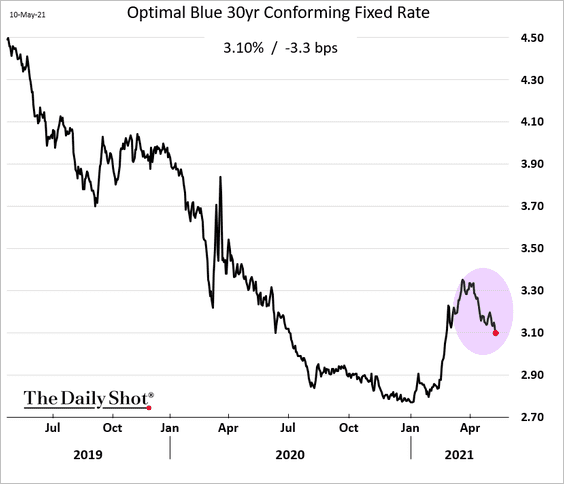

• Mortgage rates continue to drift lower.

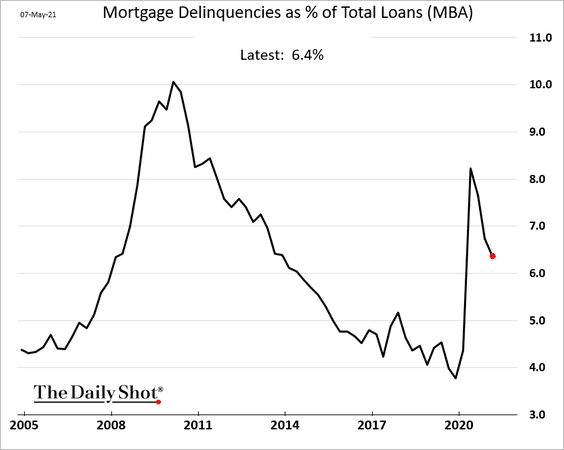

• Mortgage delinquencies are retreating from the recent highs.

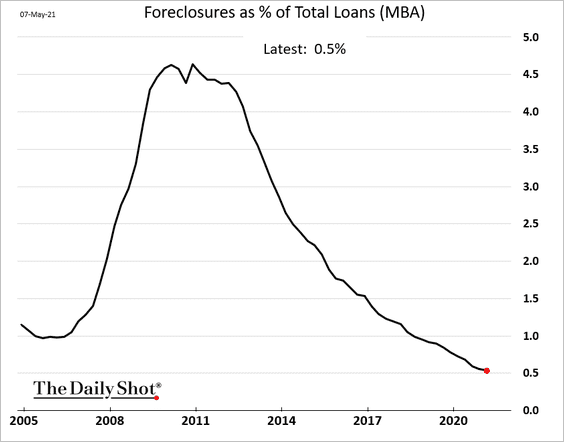

Foreclosures hit a multi-decade low.

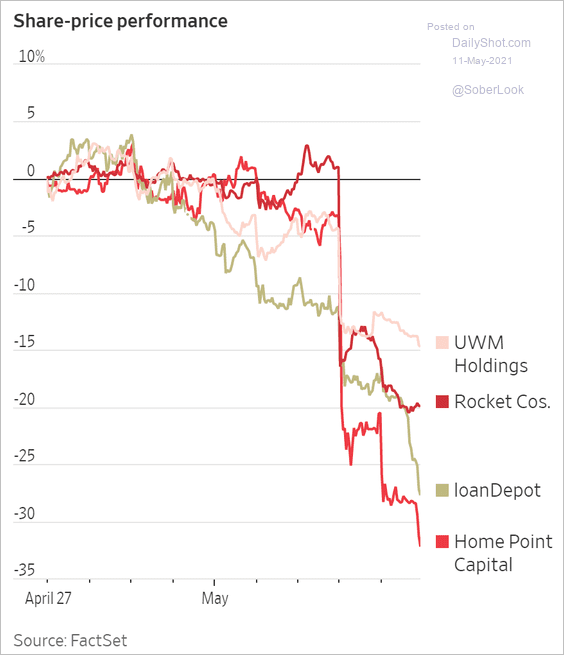

• Non-bank lenders’ share prices suggest that the mortgage boom is over.

Source: @WSJ Read full article

Source: @WSJ Read full article

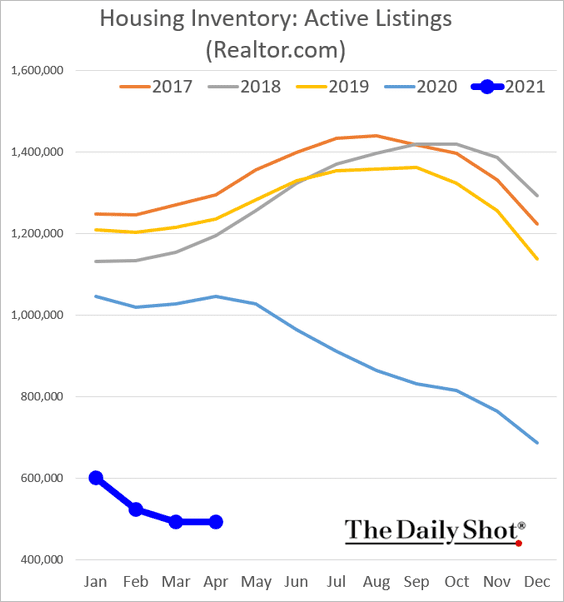

• Housing inventories remain extraordinarily low.

——————–

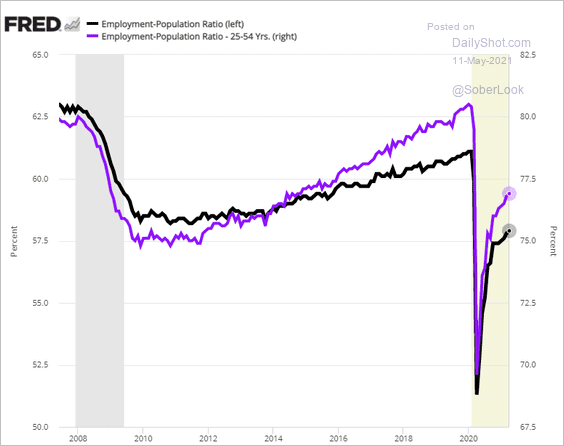

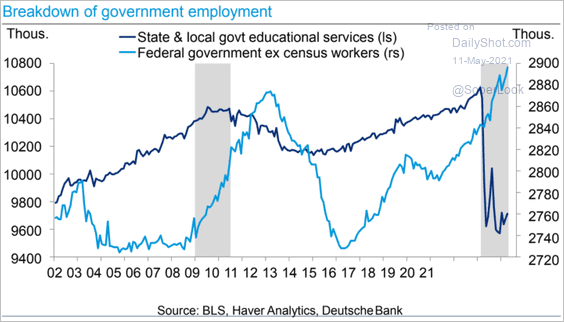

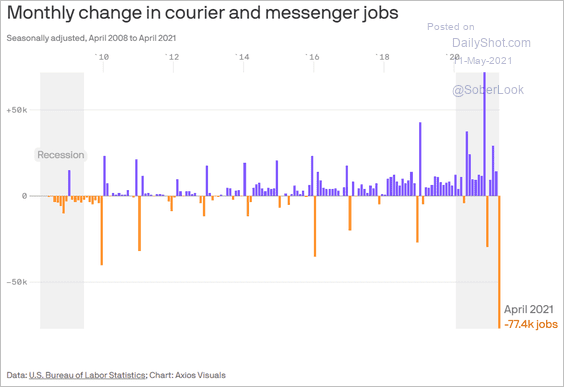

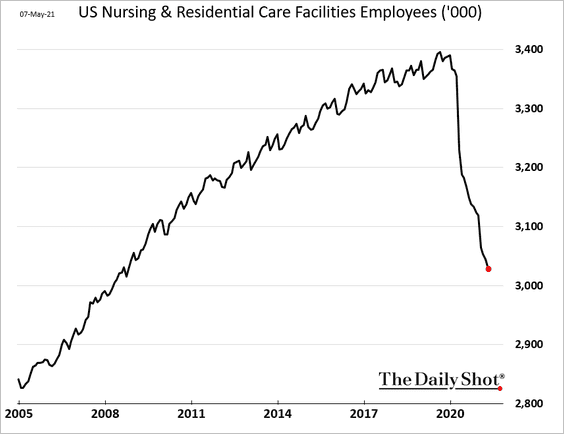

2. Next, we have some updates on the labor market.

• Employment-to-population ratio:

• Government employment:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Delivery industry job losses last month:

Source: @axios Read full article

Source: @axios Read full article

• Nursing home employment:

Further reading

Further reading

——————–

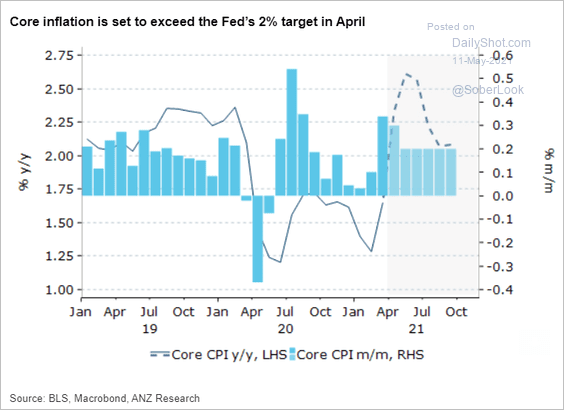

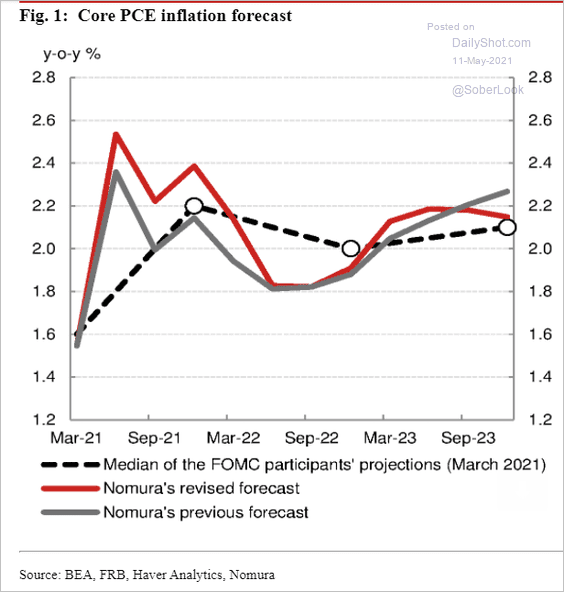

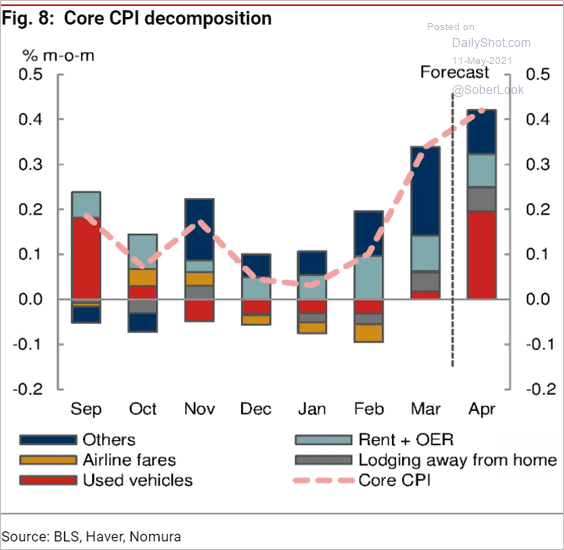

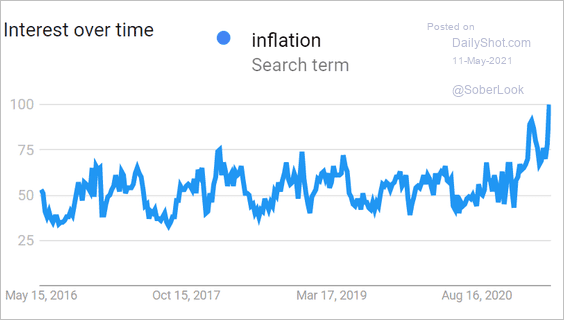

3. Here are some updates on inflation.

• ANZ’s core CPI forecast:

Source: ANZ Research

Source: ANZ Research

• Nomura’s core PCE forecast:

Source: Nomura Securities

Source: Nomura Securities

• Nomura’s estimate for the April core CPI change (month-over-month):

Source: Nomura Securities

Source: Nomura Securities

• Google search activity for “inflation”:

Source: Google Trends

Source: Google Trends

——————–

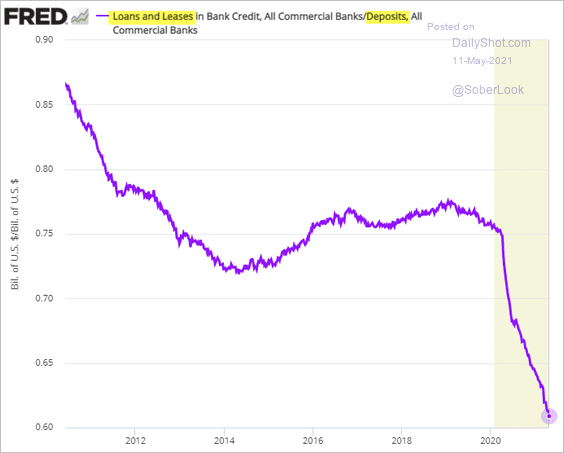

4. US loan-to-deposit ratio hit a new low as the Fed’s securities purchases boost bank deposits.

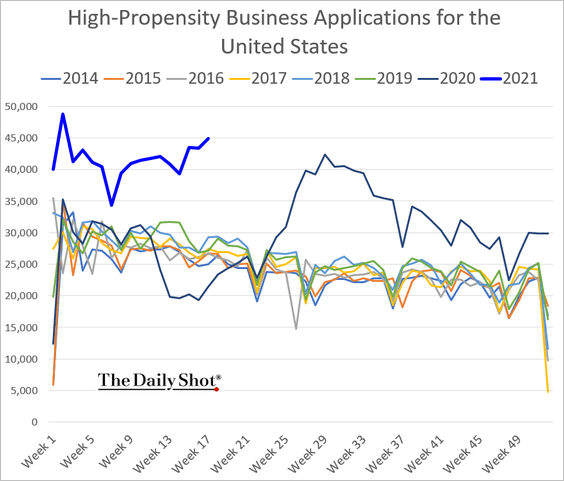

5. Business applications remain highly elevated.

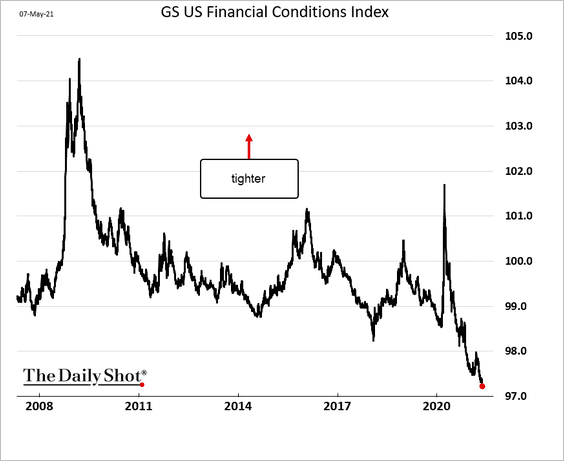

6. US financial conditions have been exceptionally accommodative.

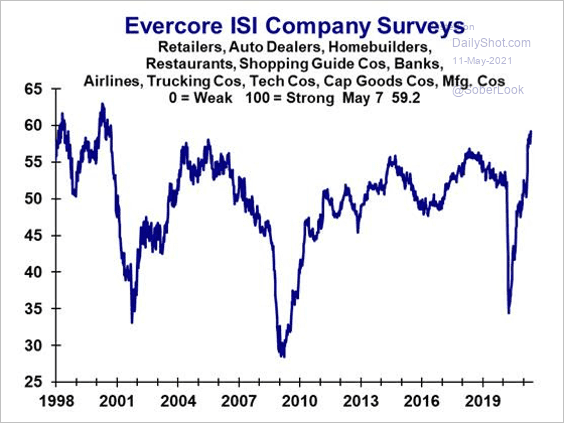

7. US businesses are increasingly upbeat. The Evercore ISI Company Survey hit the highest level since 2000.

Source: Evercore ISI

Source: Evercore ISI

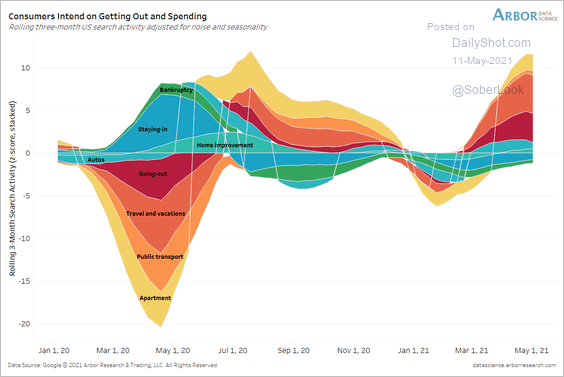

8. US consumers are getting out and spending.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Back to Index

Global Developments

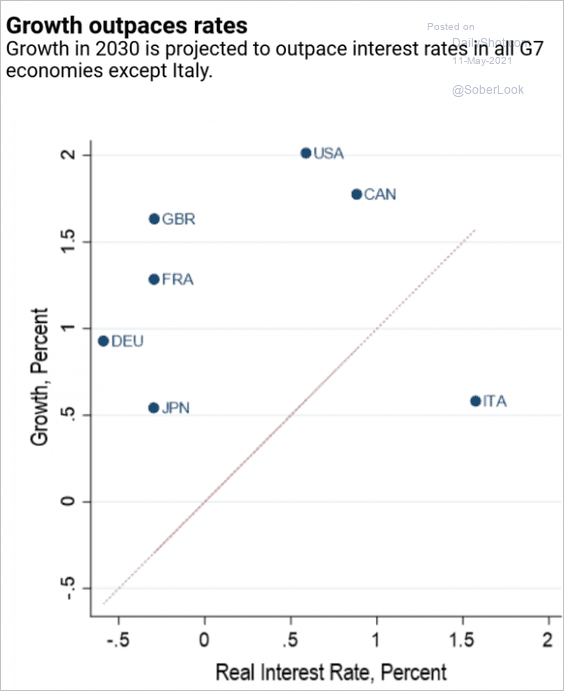

1. This scatterplot shows projected growth vs. interest rates in advanced economies.

Source: IMF Read full article

Source: IMF Read full article

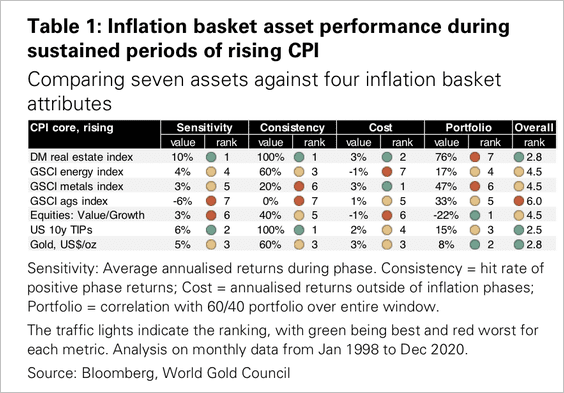

2. Which assets perform best during sustained periods of high inflation?

Source: World Gold Council

Source: World Gold Council

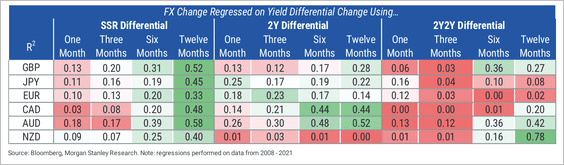

3. Generally, shadow rate differentials do a better job explaining variation in currency movements than nominal rate differentials, according to Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

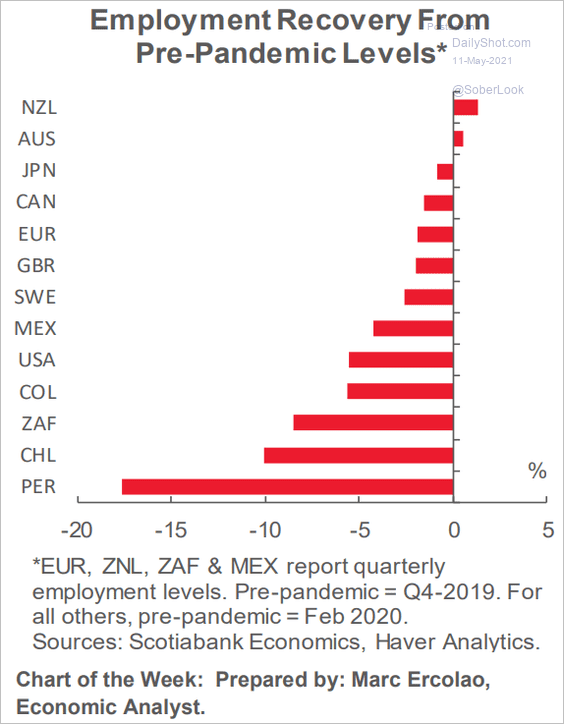

4. Finally, we have the employment recovery from pre-pandemic levels.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

Food for Thought

1. What’s easy and difficult with remote work?

Source: Prudential Financial

Source: Prudential Financial

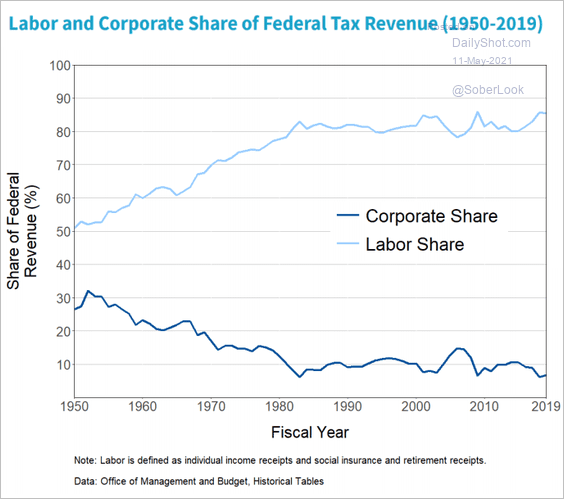

2. Corporate vs. labor share of US federal tax revenue:

Source: The US Treasury Read full article

Source: The US Treasury Read full article

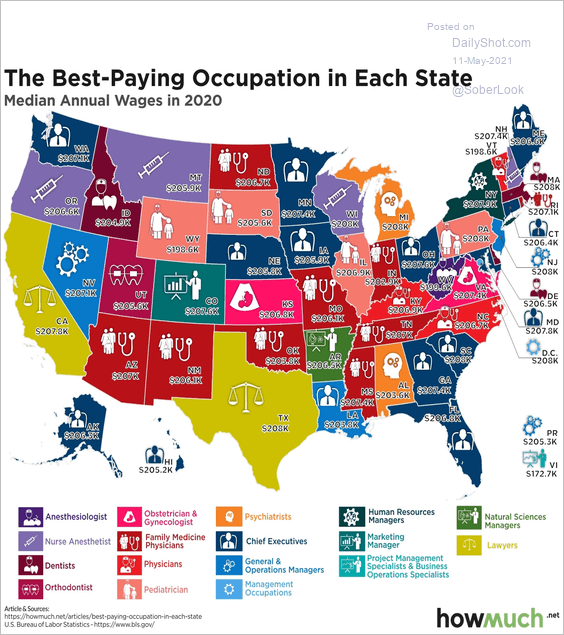

3. Best-paying occupations:

Source: @howmuch_net Read full article

Source: @howmuch_net Read full article

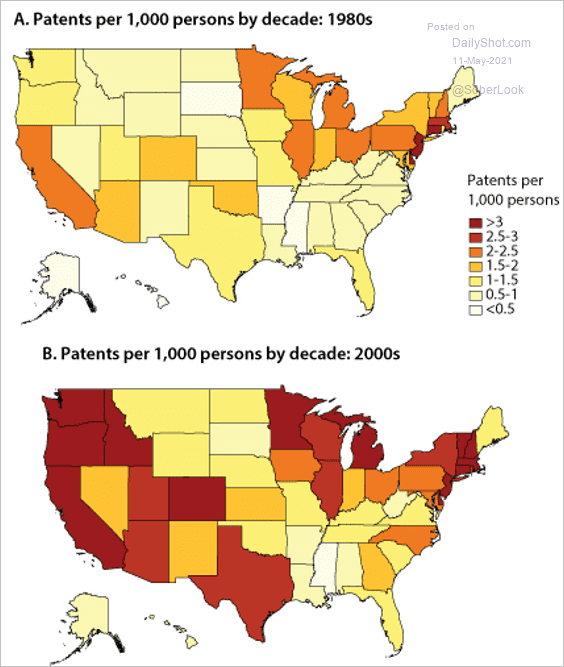

4. Patents per 1,000 persons, by state:

Source: St. Louis Fed Read full article

Source: St. Louis Fed Read full article

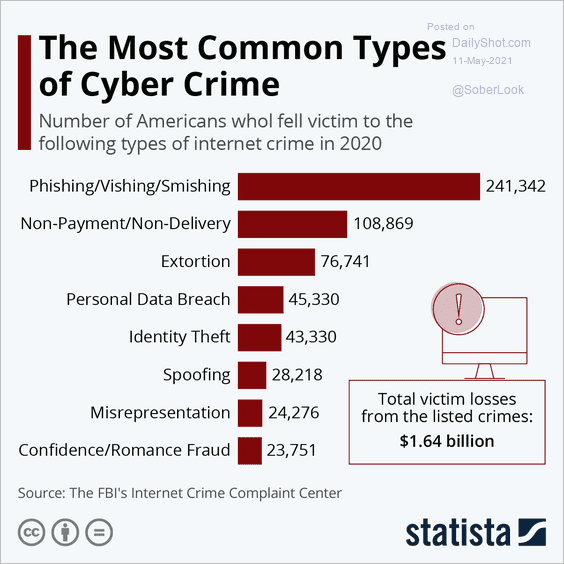

5. Common types of cybercrime:

Source: Statista

Source: Statista

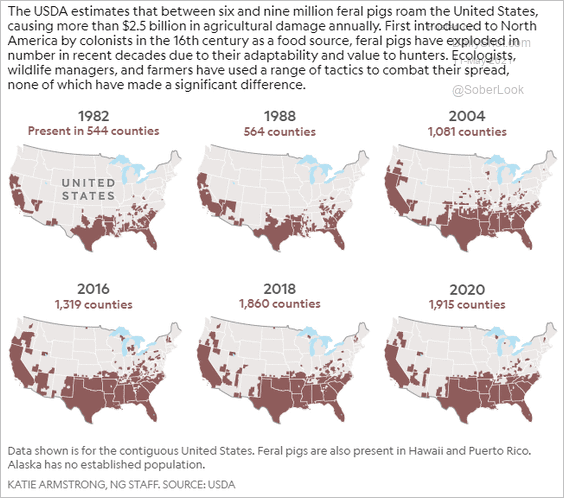

6. The spread of feral pigs across the US:

Source: National Geographic Read full article

Source: National Geographic Read full article

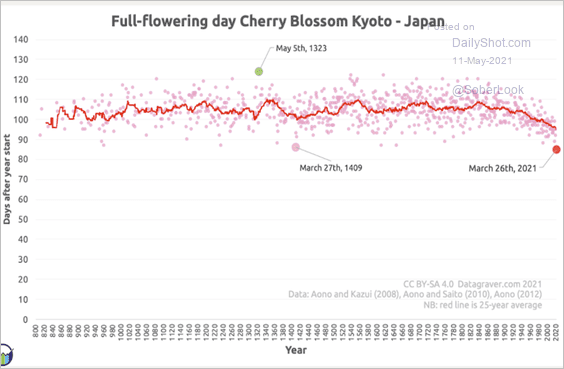

7. Kyoto cherry blossoms start day (each year):

Source: Datagraver.com Read full article

Source: Datagraver.com Read full article

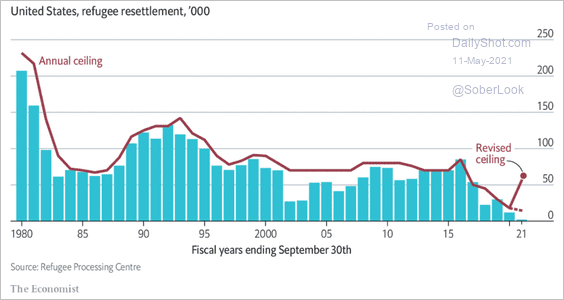

8. US refugee resettlement:

Source: The Economist Read full article

Source: The Economist Read full article

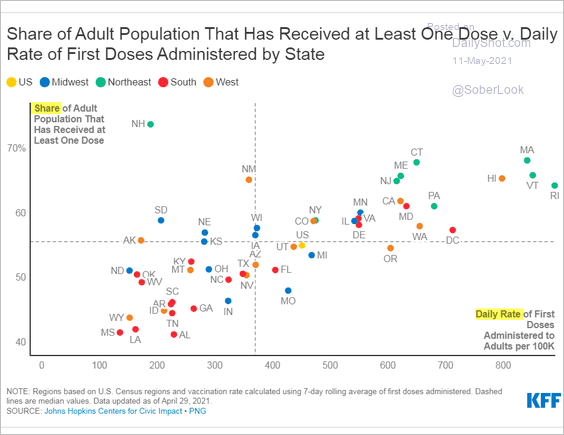

9. Vaccinations by state:

Source: KFF Read full article

Source: KFF Read full article

10. What is the Gulf Stream?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

Back to Index