The Daily Shot: 14-May-21

• The United States

• The Eurozone

• Japan

• Asia – Pacific

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Food for Thought

The United States

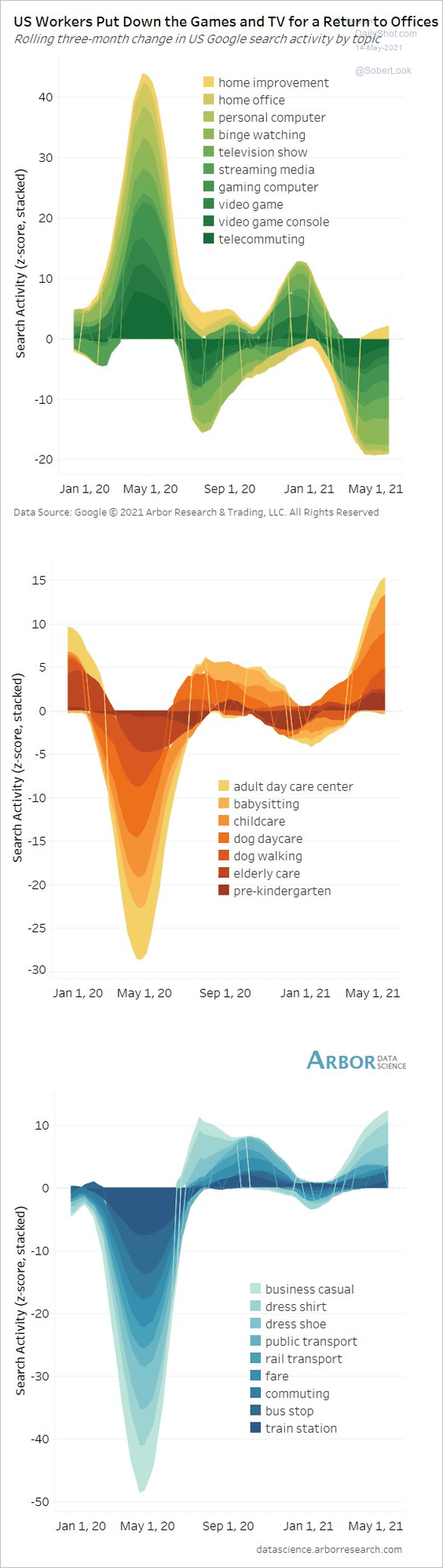

1. Let’s begin with some updates on the labor market.

• Online search activity points to a return to the workplace.

Source: @benbreitholtz

Source: @benbreitholtz

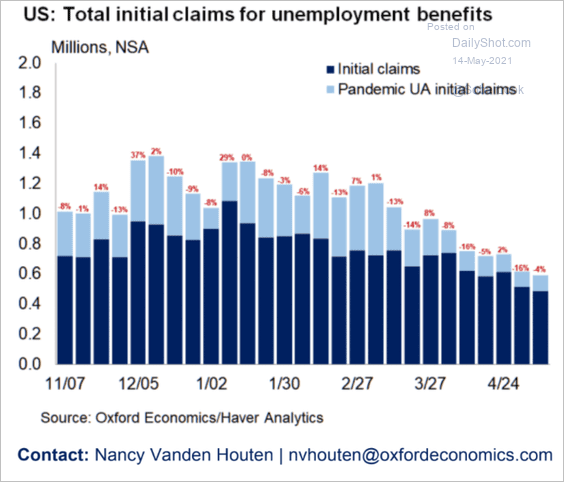

• Jobless claims continue to trend lower.

Source: Oxford Economics

Source: Oxford Economics

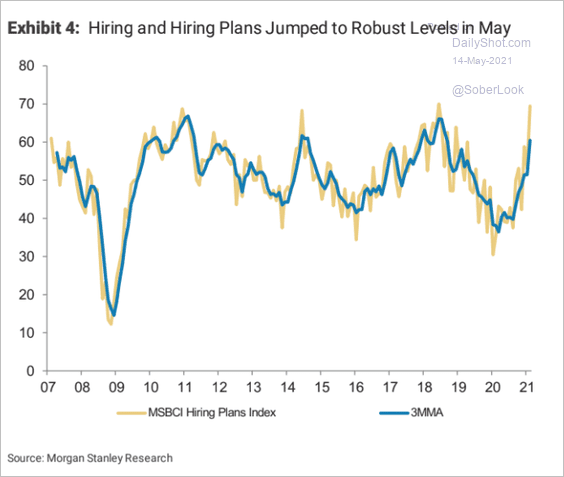

• According to a Morgan Stanley survey, corporate hiring plans keep growing.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

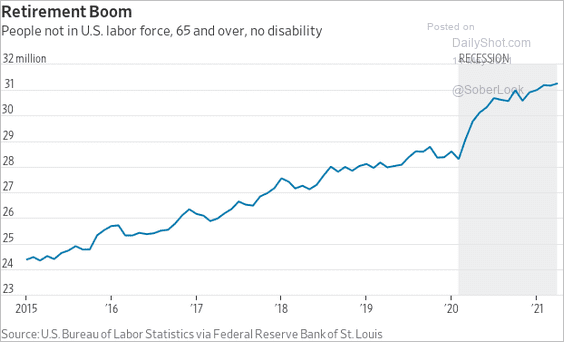

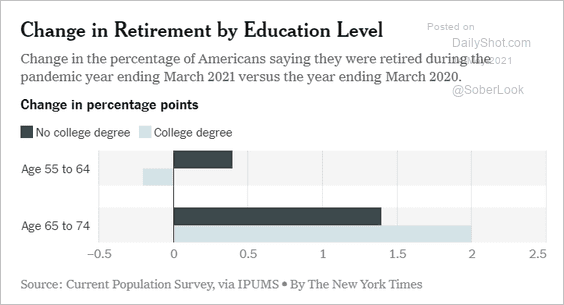

• A substantial number of older Americans retired since the start of the pandemic (2 charts). This is one of several factors contributing to labor shortages.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: The New York Times Read full article

Source: The New York Times Read full article

• Anectodal evidence continues to point to wage hikes.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

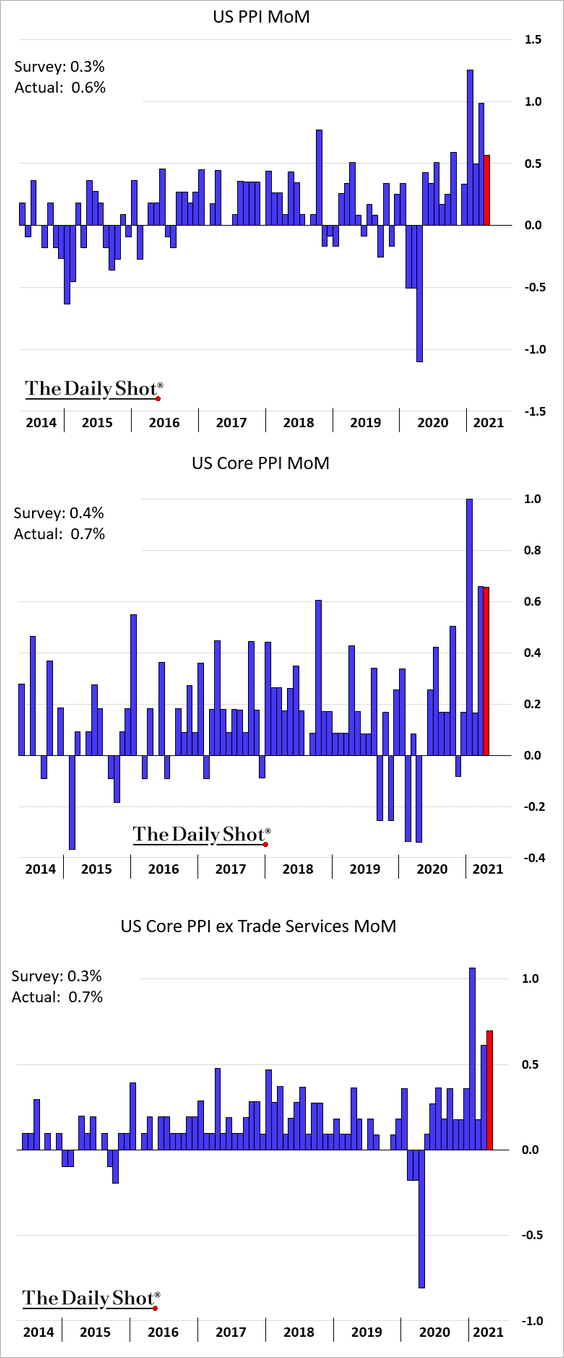

2. Next, let’s continue with inflation trends.

• The April report on producer prices surprised to the upside. The third chart below excludes trade services (business markups), which tend to be volatile.

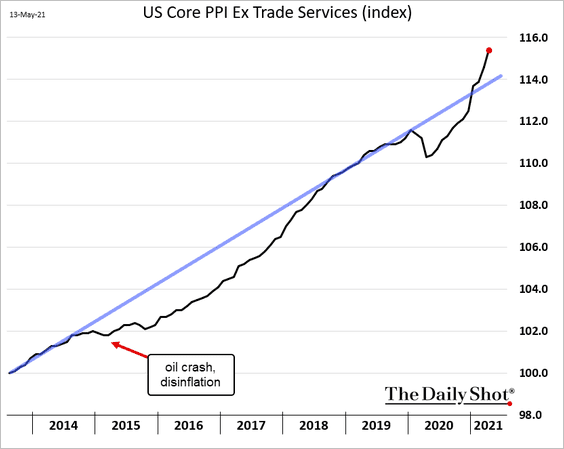

Here is the core PPI index relative to trend.

• On a year-over-year basis, the core PPI is yet to peak, according to Pantheon Macroeconomics.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

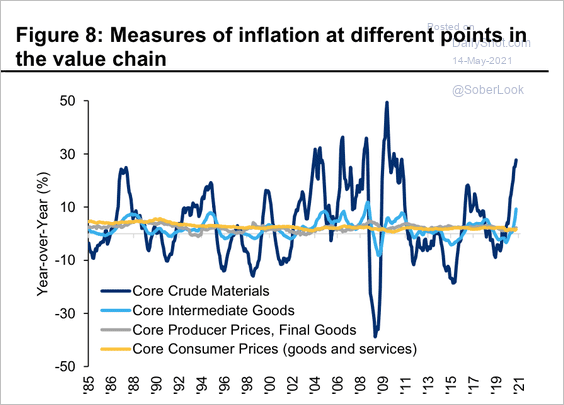

• Materials and goods inflation, which tends to be volatile, is unlikely to persist at high levels, according to Citi Private Bank.

Source: Citi Private Bank

Source: Citi Private Bank

• These charts show contributions to the core CPI. COVID-sensitive sectors and items impacted by chip shortages drove the latest gains (2nd chart).

Source: Nomura Securities

Source: Nomura Securities

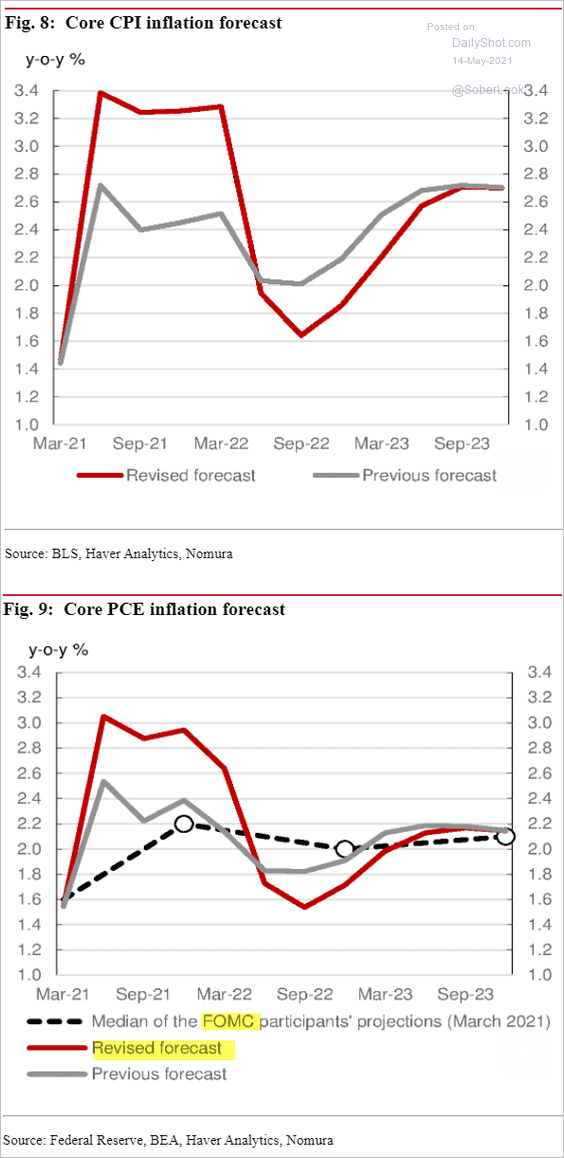

• Nomura expects the core PCE inflation (2nd chart) to overshoot the FOMC’s forecasts this year but undershoot them next year.

Source: Nomura Securities

Source: Nomura Securities

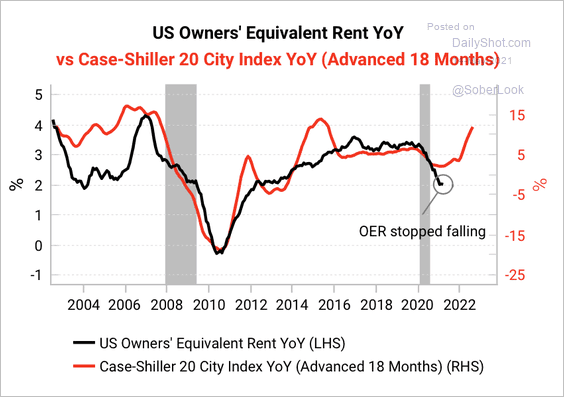

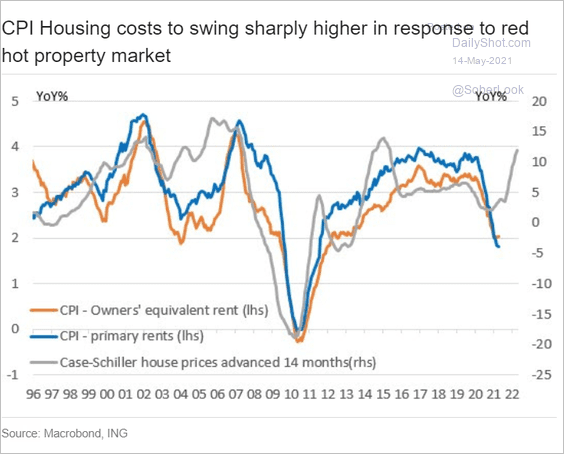

• Owners’ equivalent rent inflation is stabilizing after the pandemic slump and could rise along with housing prices (2 charts).

Source: Variant Perception

Source: Variant Perception

Source: ING

Source: ING

——————–

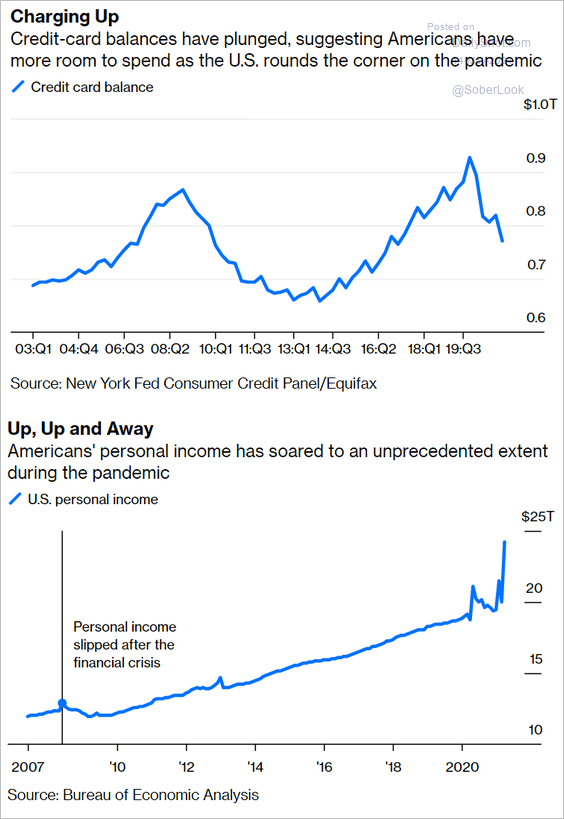

• Elevated consumer spending capacity is expected to be a tailwind for inflation.

Source: @bopinion Read full article

Source: @bopinion Read full article

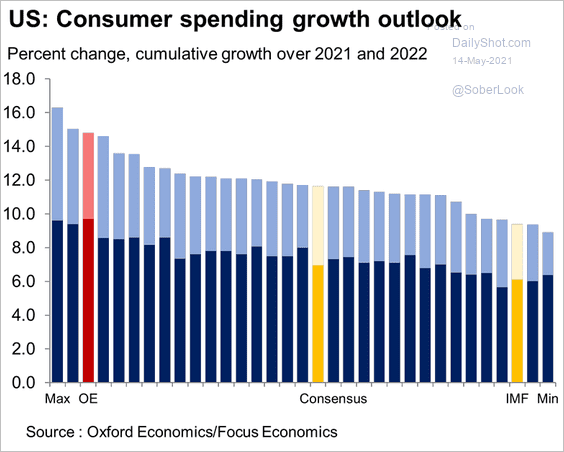

Here is a forecast for consumer spending from Oxford Economics (vs. other predictions).

Source: Oxford Economics

Source: Oxford Economics

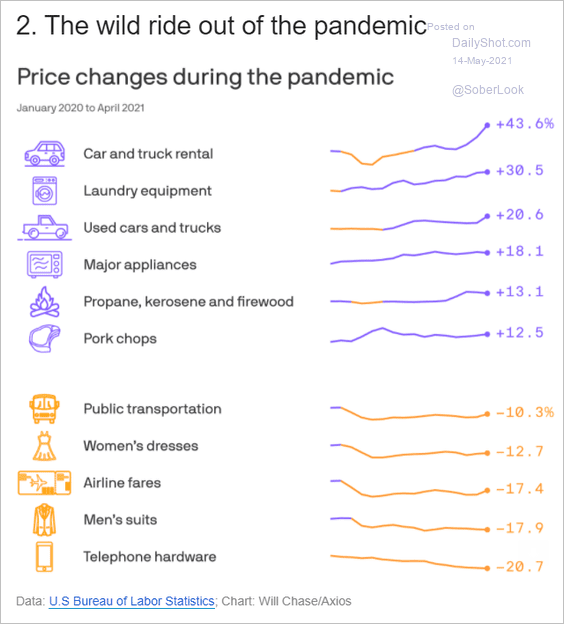

• Below are some price trends relative to pre-pandemic levels.

Source: Felix Salmon, @axios

Source: Felix Salmon, @axios

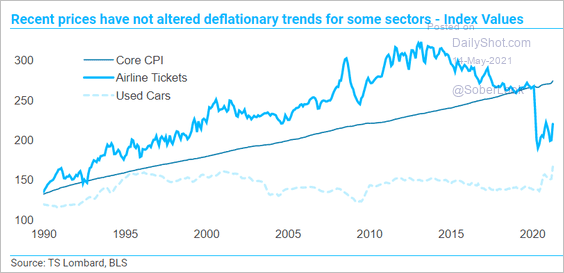

• While airline tickets and used cars saw significant price increases recently, these gains are well below the long-term CPI trend.

Source: TS Lombard

Source: TS Lombard

——————–

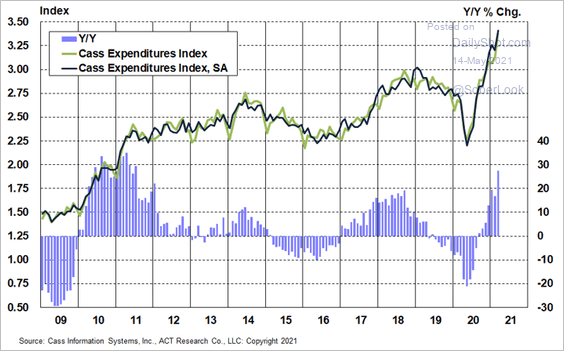

3. Freight expenditures have risen sharply since the pandemic lows.

Source: Cass Information Systems

Source: Cass Information Systems

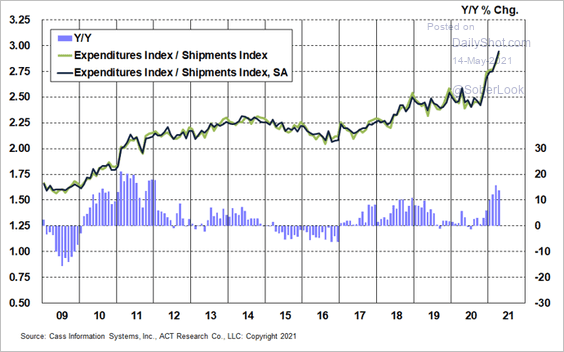

Shipping costs have been surging.

Source: Cass Information Systems

Source: Cass Information Systems

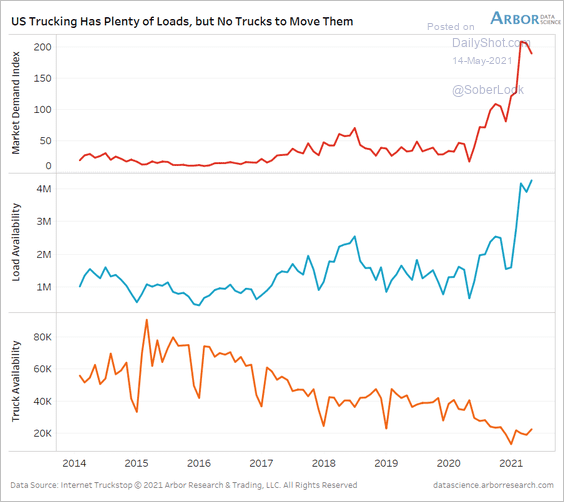

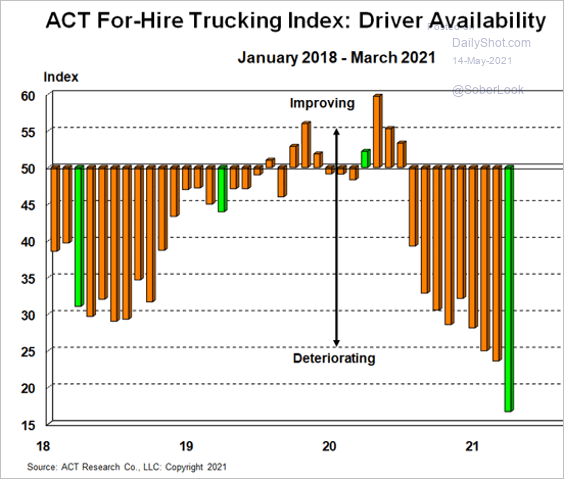

And the shortage of truck drivers is becoming more acute (2 charts).

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Source: Cass Information Systems

Source: Cass Information Systems

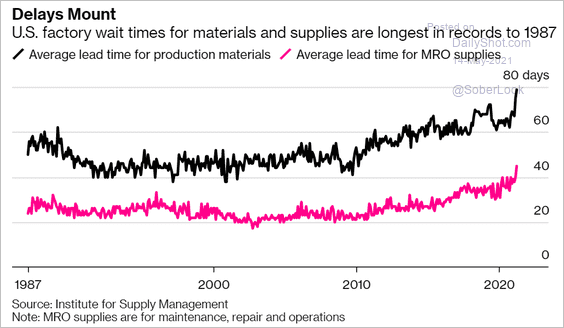

Shipping bottlenecks have been contributing to rising factory wait times.

Source: @markets Read full article

Source: @markets Read full article

——————–

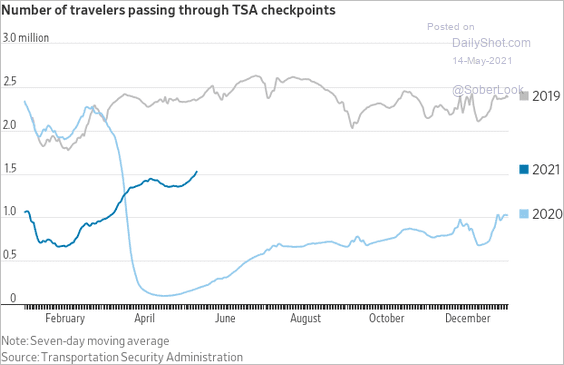

4. Air travel continues to recover.

Source: @WSJ Read full article

Source: @WSJ Read full article

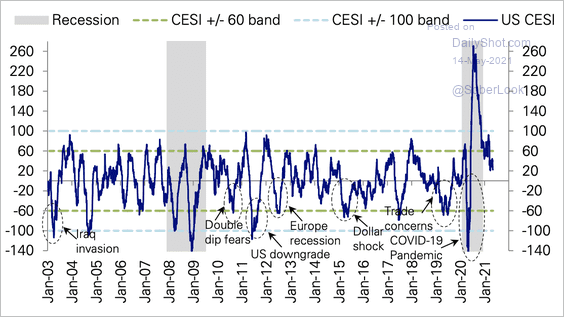

5. Economic data surprises have returned to a normal range after reaching unprecedented highs.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

The Eurozone

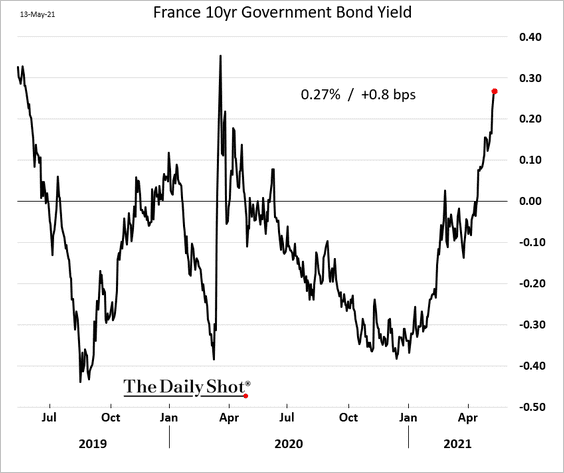

1. Yields continue to climb.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

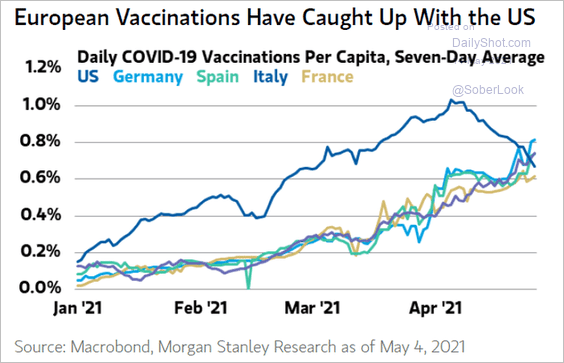

2. The pace of vaccinations has caught up with the US.

Source: @ISABELNET_SA, @MorganStanley

Source: @ISABELNET_SA, @MorganStanley

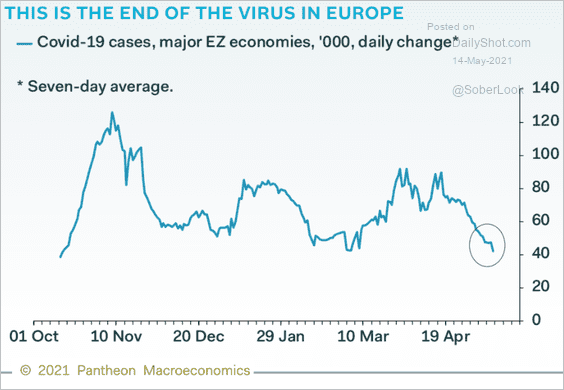

And COVID cases are tumbling.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

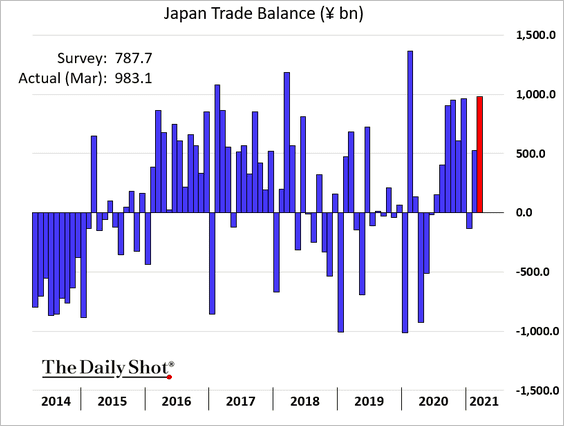

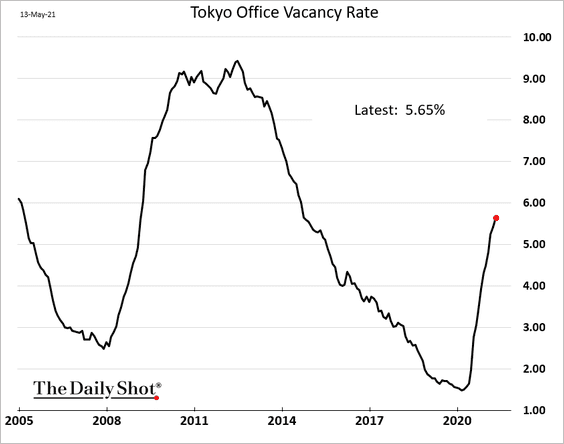

Japan

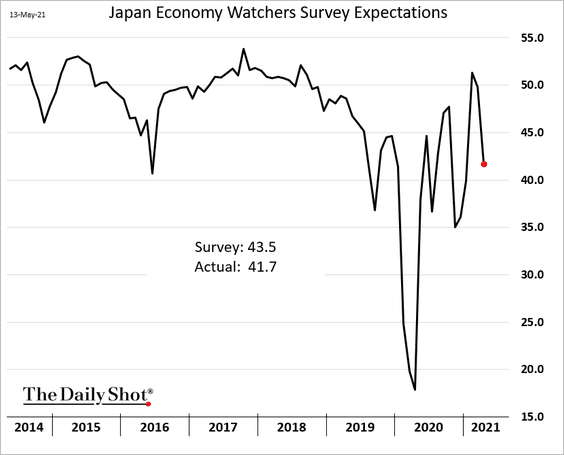

1. The Economy Watchers index declined more than expected.

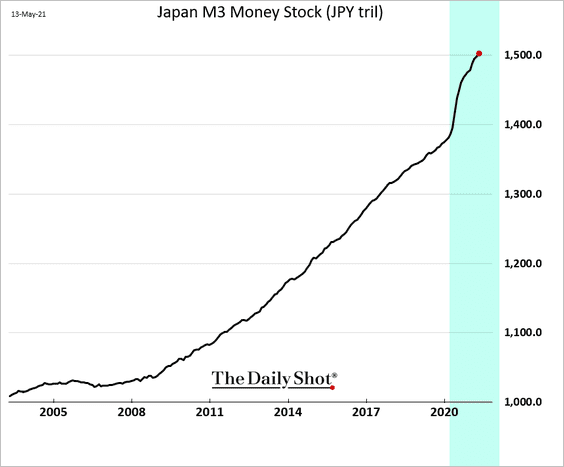

2. The growth in Japan’s broad money supply has been robust since the start of the pandemic.

3. The March trade surplus surprised to the upside.

4. Tokyo office vacancies keep climbing.

Back to Index

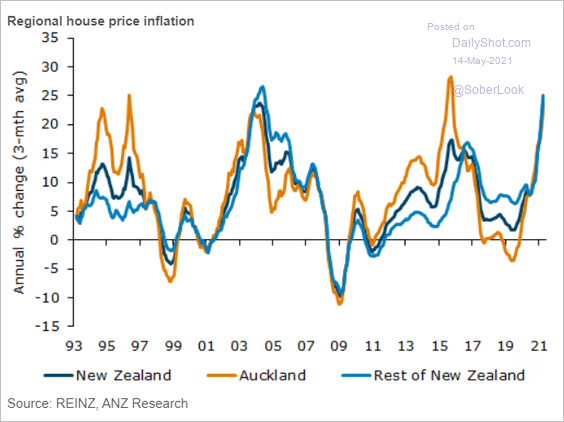

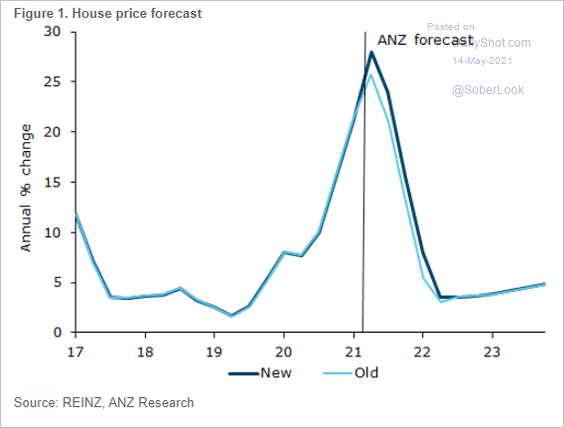

Asia – Pacific

1. Singapore’s stocks tumbled in response to new COVID curbs.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

2. New Zealand’s housing market has been hot.

Source: ANZ Research

Source: ANZ Research

But is home price appreciation about to peak?

Source: ANZ Research

Source: ANZ Research

Back to Index

Emerging Markets

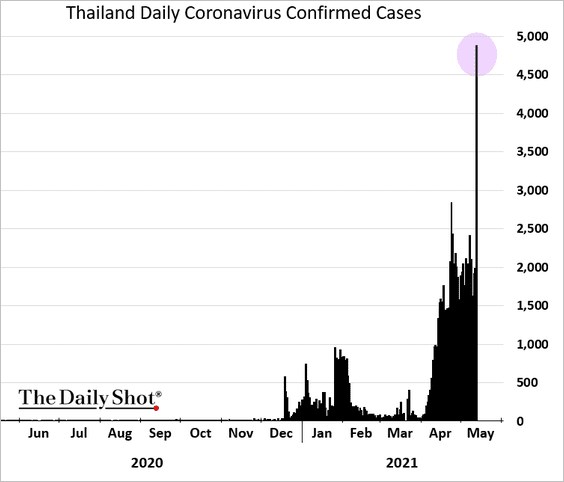

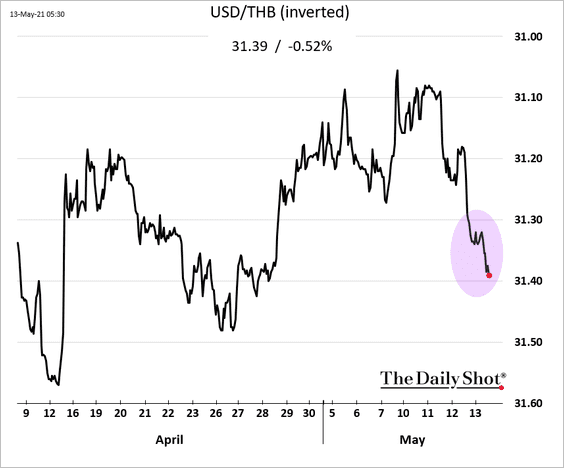

1. COVID cases spiked in Thailand.

The Thai baht is weaker.

——————–

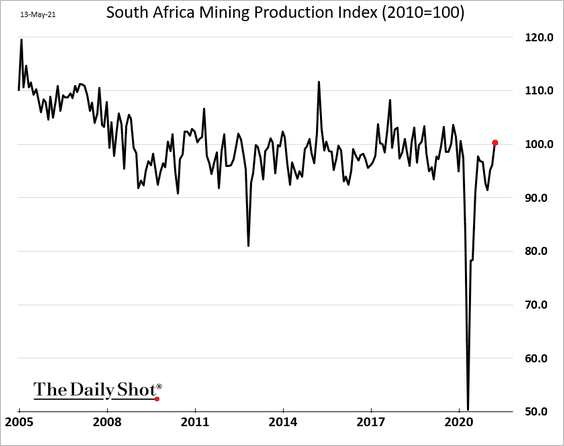

2. South Africa’s mining output has recovered.

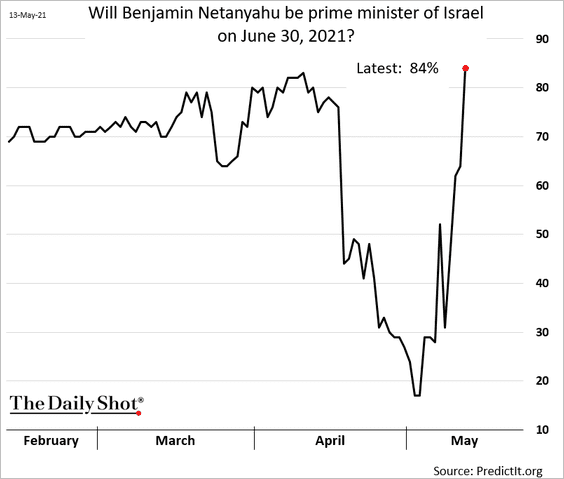

3. Israel’s Benjamin Netanyahu is back on top.

Source: @axios Read full article

Source: @axios Read full article

——————–

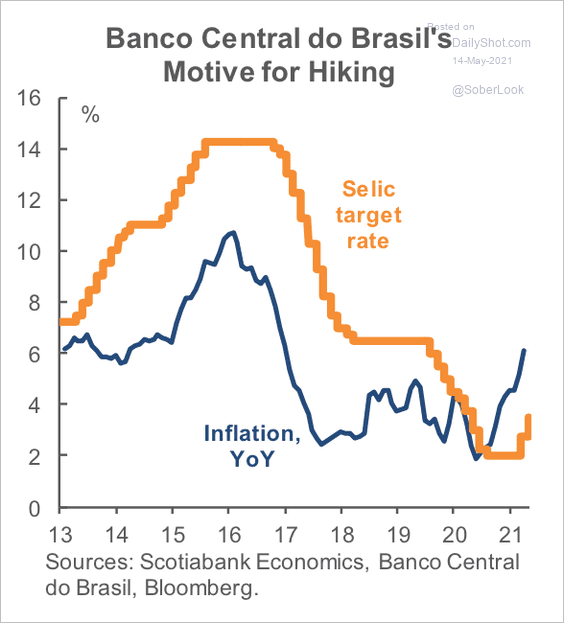

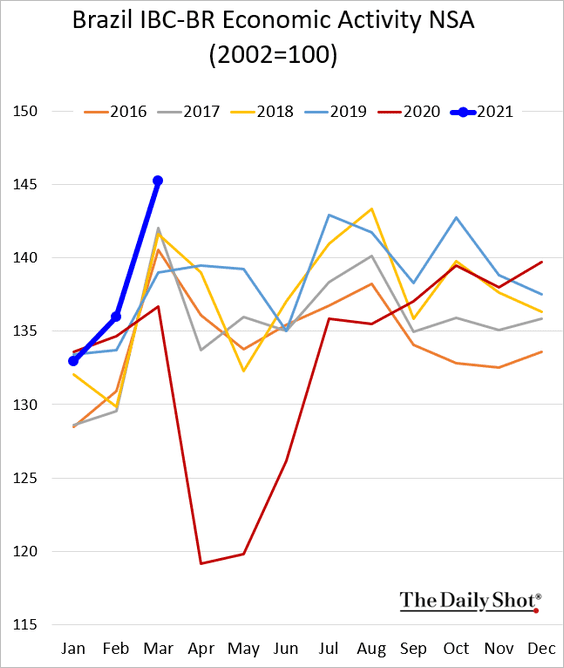

4. Next, we have some updates on Brazil.

• Inflation continues to run above the central bank’s target rate, suggesting further rate hikes to come.

Source: Scotiabank Economics

Source: Scotiabank Economics

• Economic activity strenghened in the first quarter.

——————–

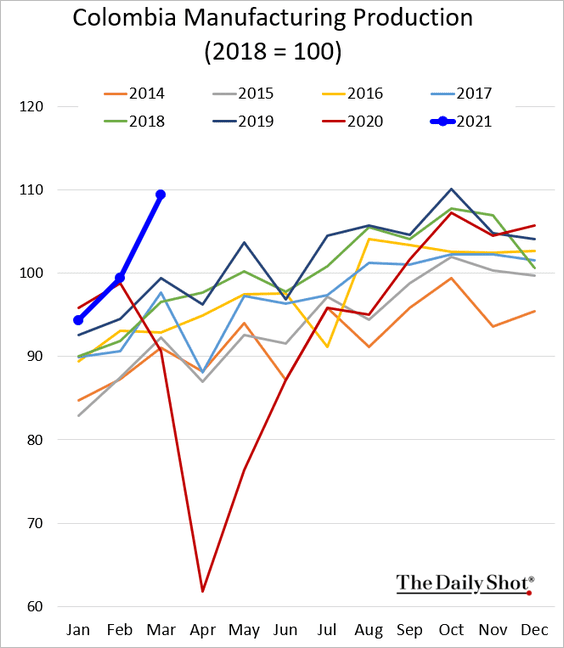

5. Colombia’s factory output surged last quarter.

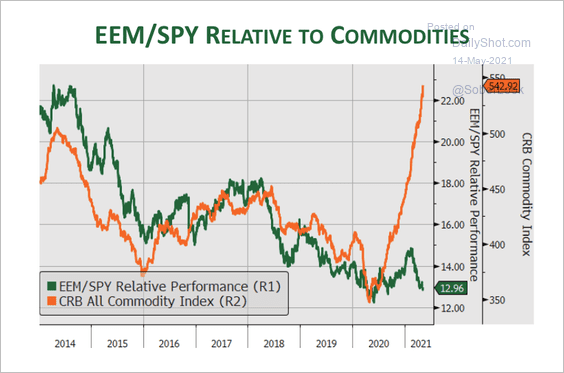

6. Will EM equities start to outperform given the sharp rise in commodity prices?

Source: Cornerstone Macro

Source: Cornerstone Macro

Back to Index

Cryptocurrency

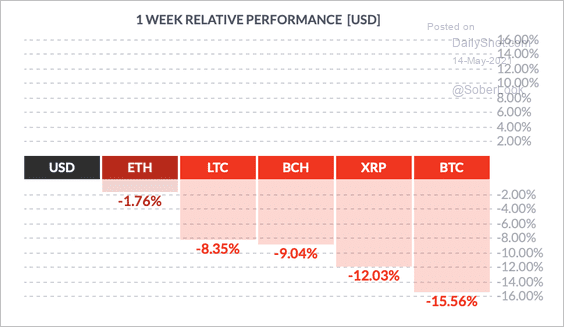

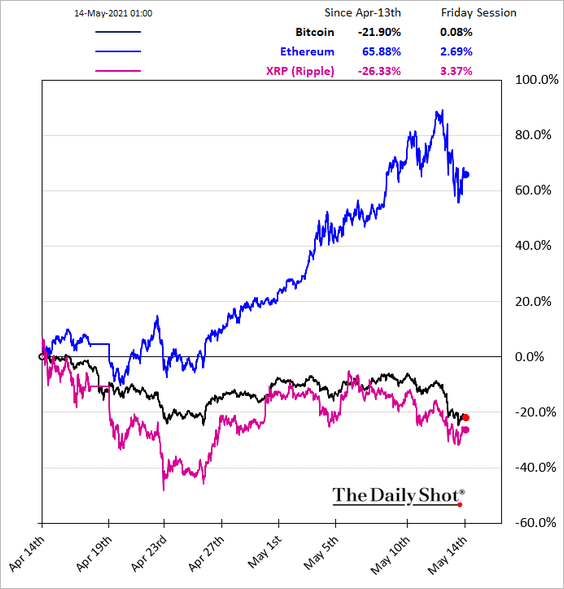

1. It’s been a rough week for cryptocurrencies.

Source: FinViz

Source: FinViz

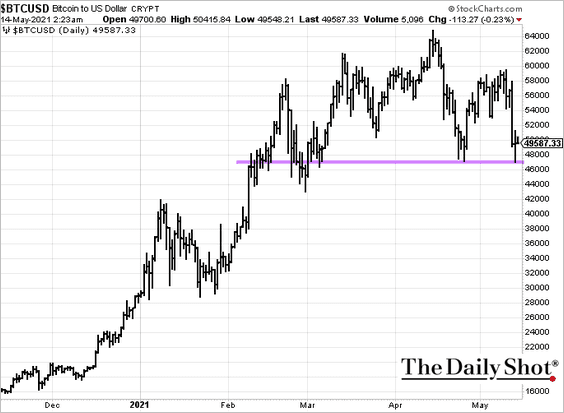

Bitcoin is below $50k, but it held support at $47k.

——————–

2. About 80% of Ethereum derivatives trading is in perpetual swaps.

Source: @skewdotcom

Source: @skewdotcom

3. The cost of insuring against a 20%+ correction in bitcoin over the next three months has spiked.

Source: @skewdotcom

Source: @skewdotcom

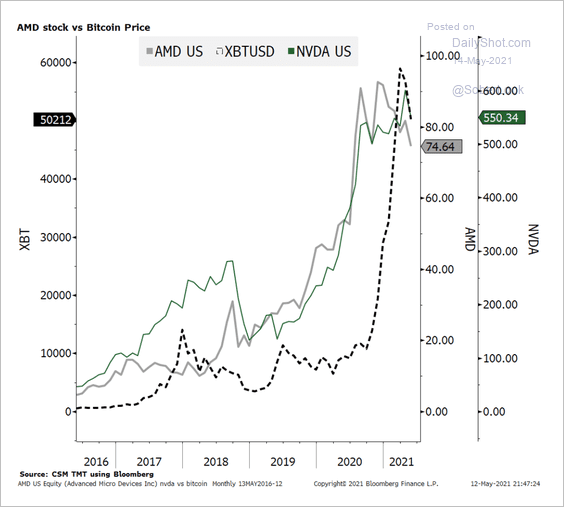

4. Popular semiconductor stocks have traded in lockstep with bitcoin over the past few years.

Source: Victor Cossel; Cornerstone Macro

Source: Victor Cossel; Cornerstone Macro

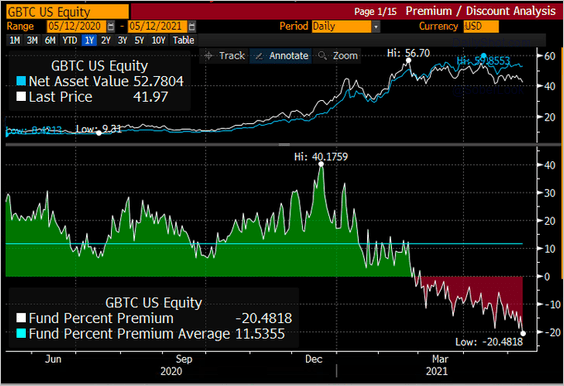

5. Grayscale Bitcoin Trust’s discount to AUM continues to widen.

Source: @EricBalchunas, @JSeyff

Source: @EricBalchunas, @JSeyff

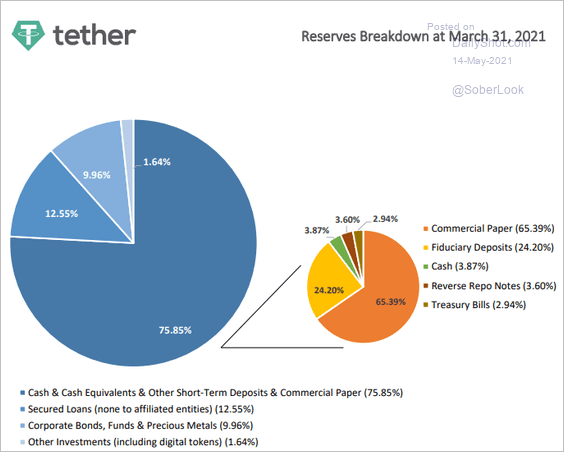

6. This chart shows the asset portfolio backing Tether.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

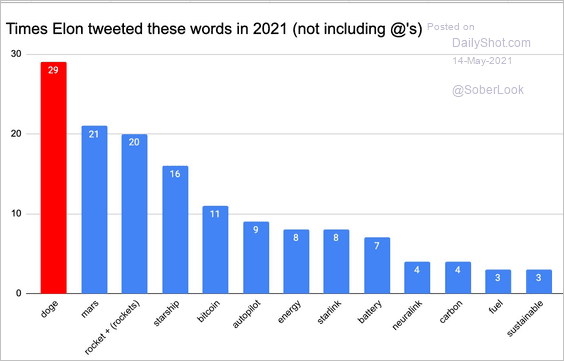

7. And finally, we have our friend Elon’s most frequently used words on Twitter.

Source: @rohunvora

Source: @rohunvora

Back to Index

Commodities

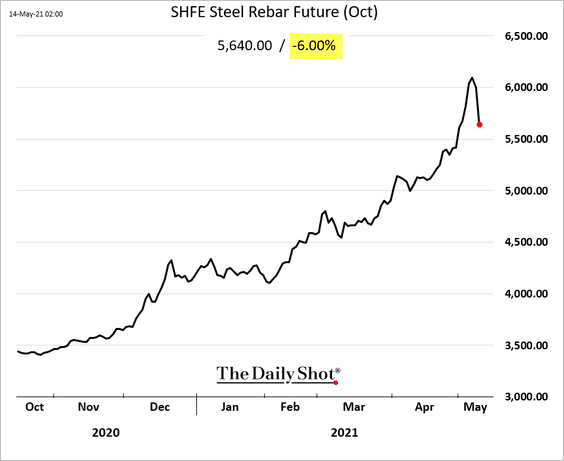

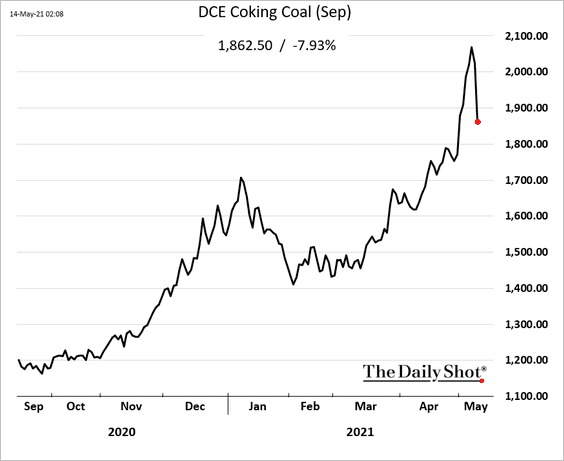

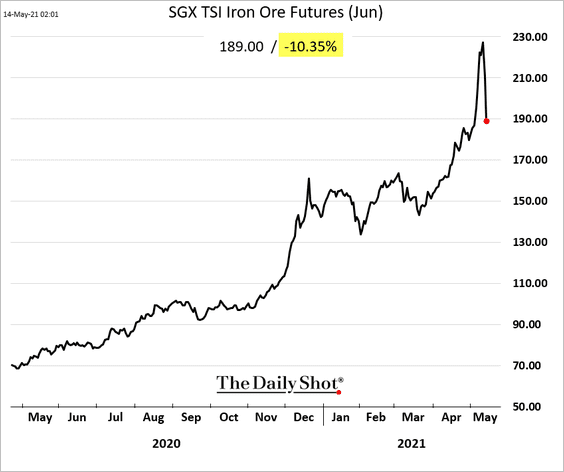

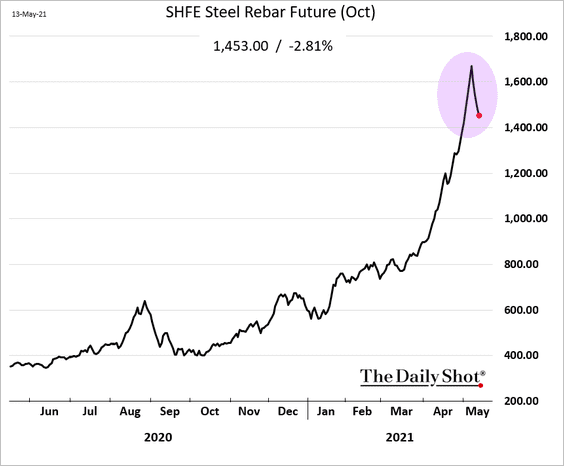

1. Beijing is trying to contain the runaway steel prices. And we are starting to see some results.

• Steel rebar:

• Coking coal:

• Iron ore (massive decline):

——————–

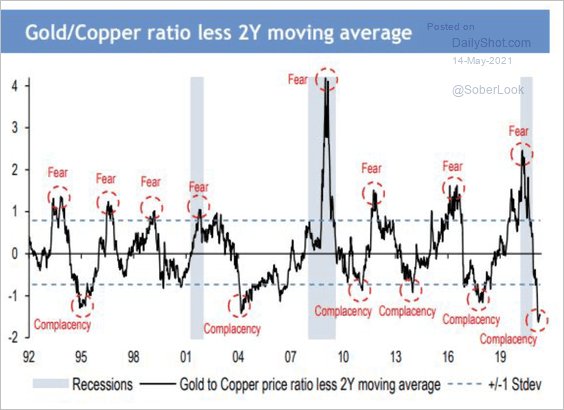

2. The gold/copper ratio is at an extreme low, which suggests investor complacency.

Source: JP Morgan

Source: JP Morgan

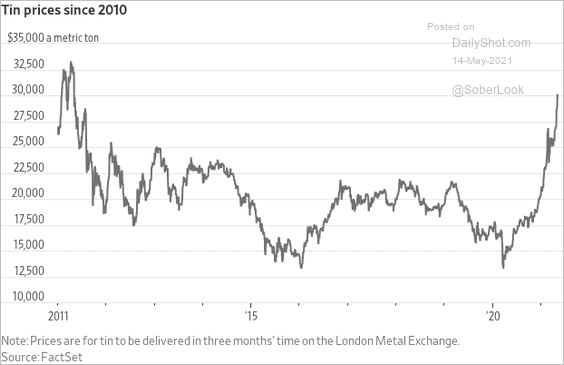

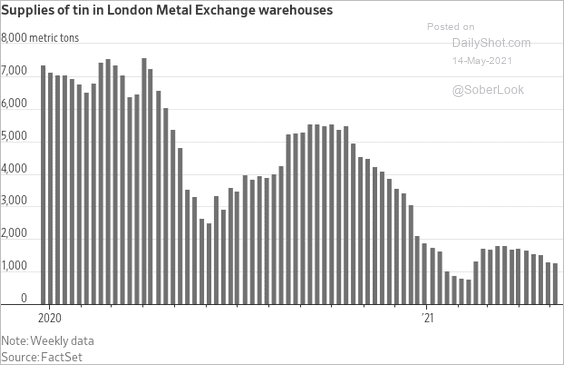

3. Tin prices have been rising as inventories tighten.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

4. US lumber futures are off the highs.

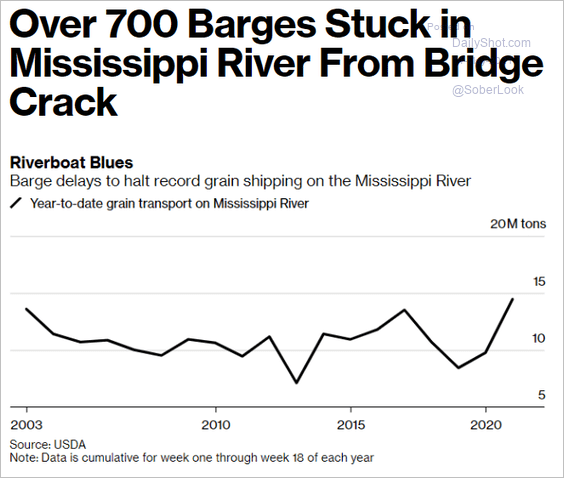

5. US grain shipping is backed up on the Mississippi River.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

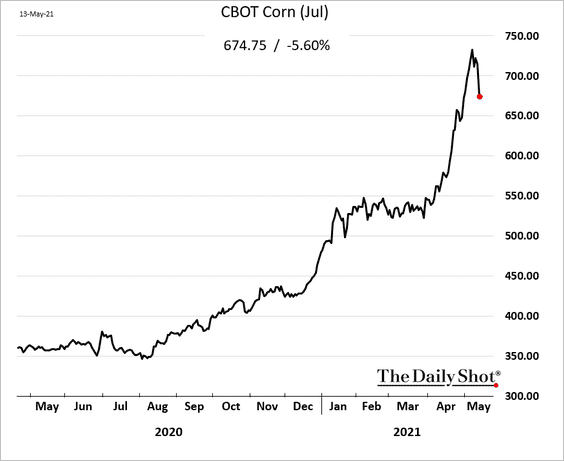

6. US corn and other grains are off the highs.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

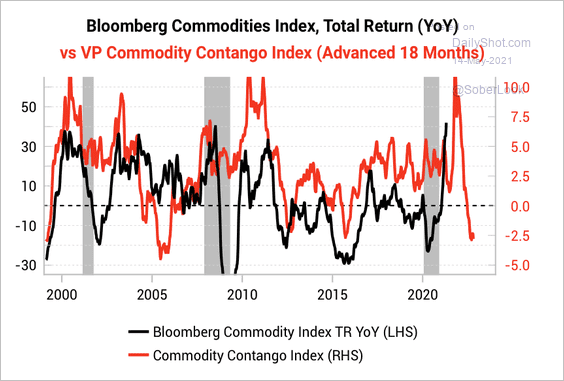

7. Most commodity futures have shifted into backwardation.

Source: Variant Perception

Source: Variant Perception

Back to Index

Energy

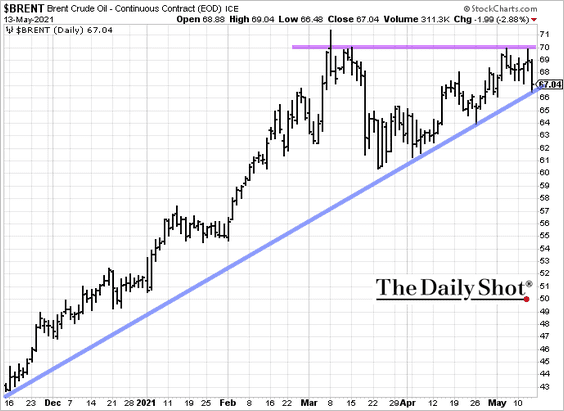

1. Brent futures are consolidating.

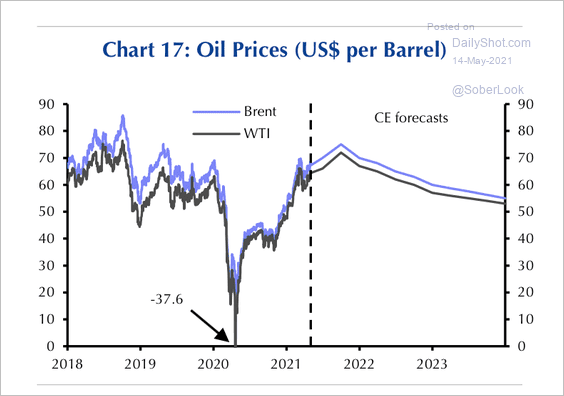

2. Capital Economics expects oil prices to peak this year before falling.

Source: Capital Economics

Source: Capital Economics

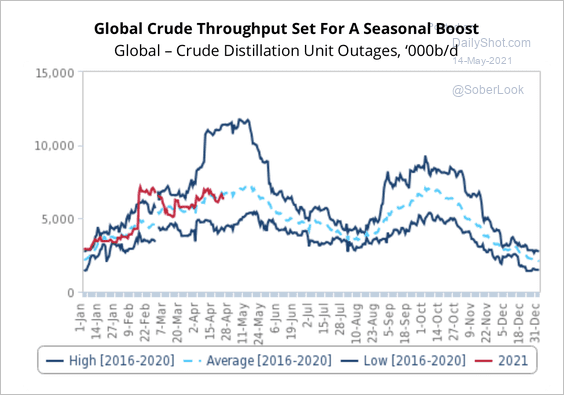

3. Fitch Solutions estimates 2-3 million barrels per day could be added to production over the next few months, significantly increasing global crude oil throughput.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Back to Index

Equities

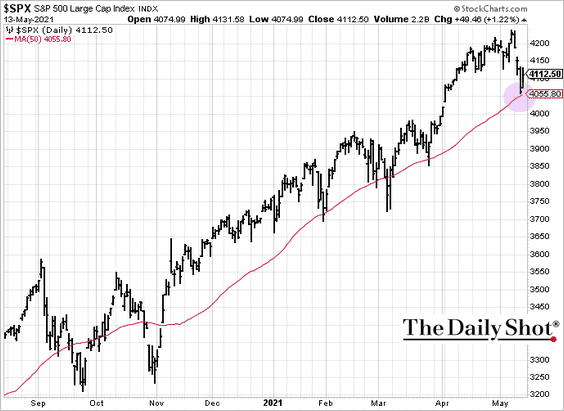

1. The S&P 500 held support at the 50-day moving average.

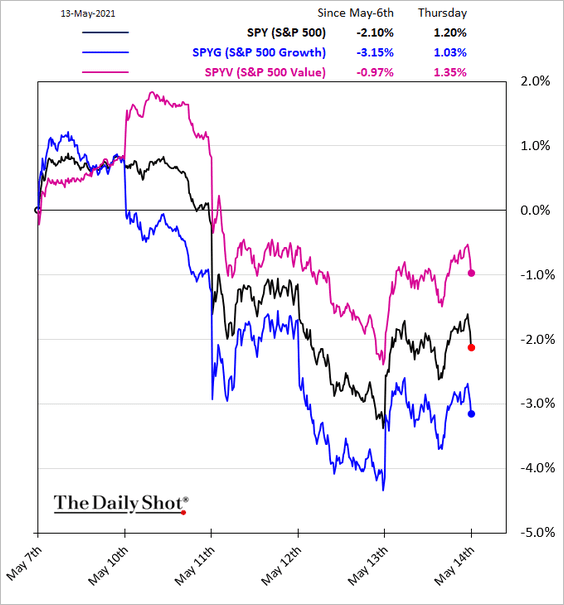

2. Growth stocks continue to underperform.

Source: Yahoo Finance Read full article

Source: Yahoo Finance Read full article

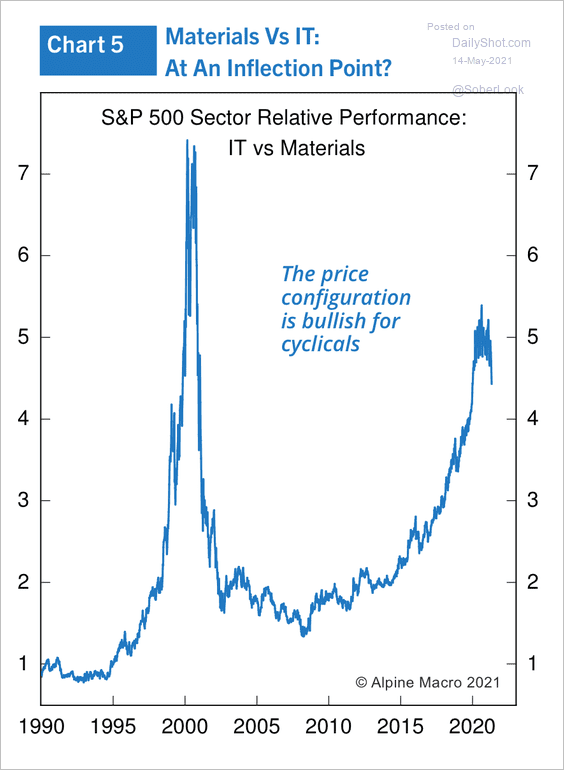

The IT sector started to underperform materials recently after several years of outperformance.

Source: Alpine Macro

Source: Alpine Macro

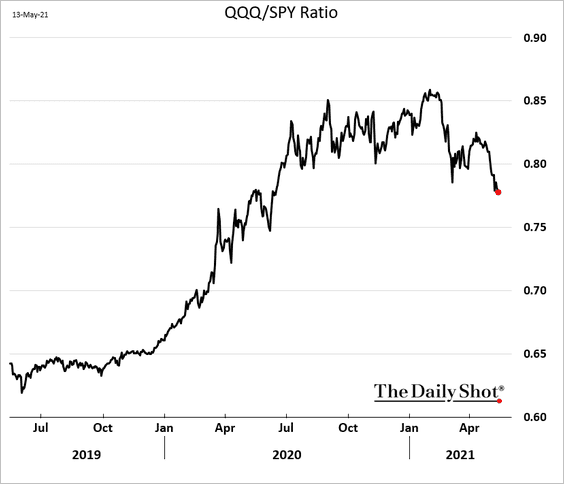

The Nasdaq 100/S&P 500 ratio continues to move lower.

——————–

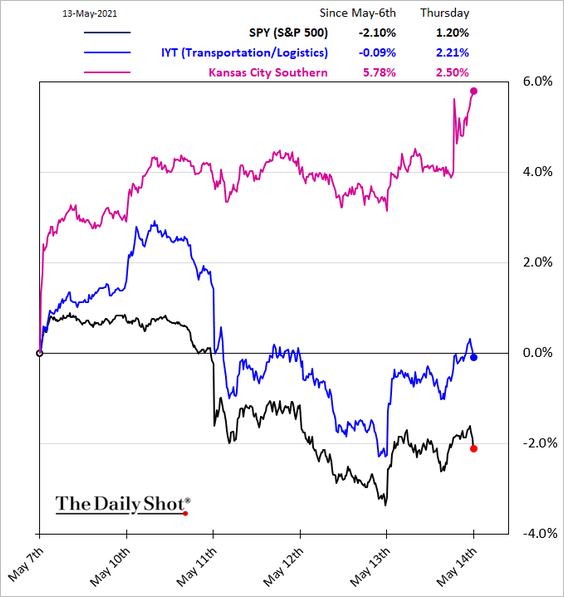

3. Transportation stocks have been outperforming, boosted by Kansas City Southern.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

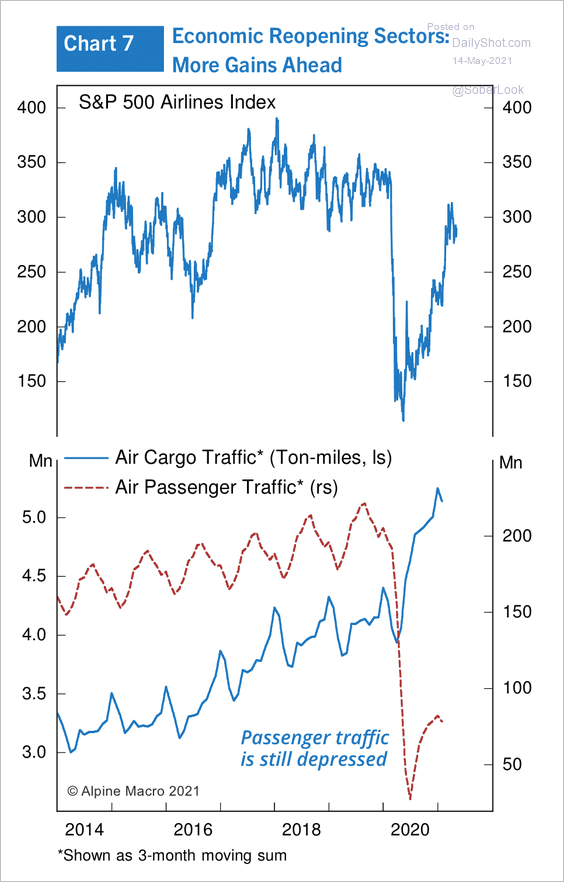

4. Airline stocks are recovering, although passenger traffic remains very low.

Source: Alpine Macro

Source: Alpine Macro

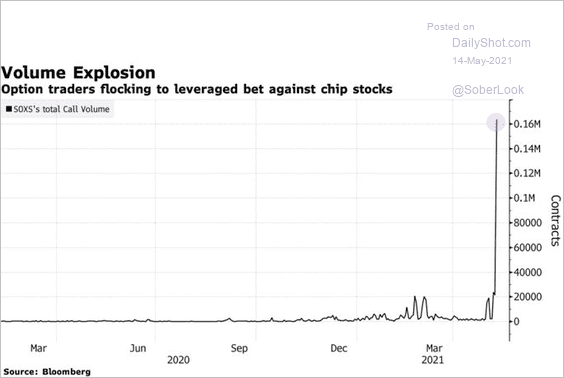

5. Someone is making a big bet against semiconductor stocks.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

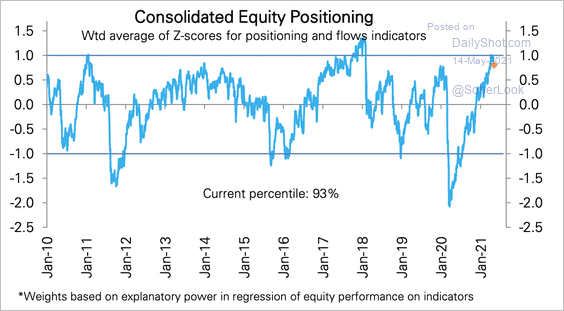

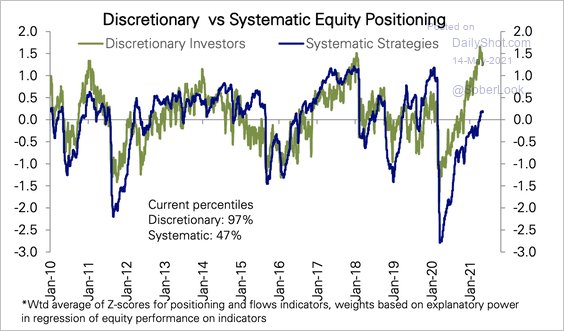

6. Overall equity positioning is starting to decline from peak levels, …

Source: Deutsche Bank Research

Source: Deutsche Bank Research

… mostly driven by discretionary investors. Systematic strategy positioning has stayed well below prior peaks despite the equity rally.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

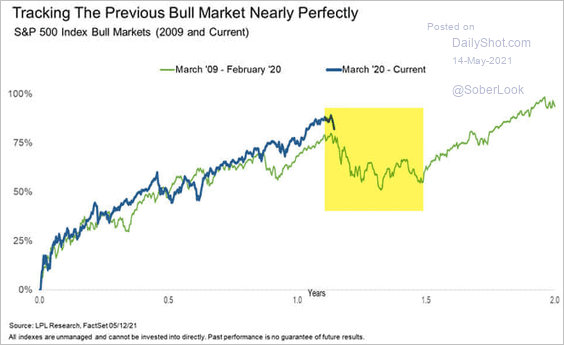

7. Here is the current rally vs. the previous bull market.

Source: @RyanDetrick

Source: @RyanDetrick

——————–

Food for Thought

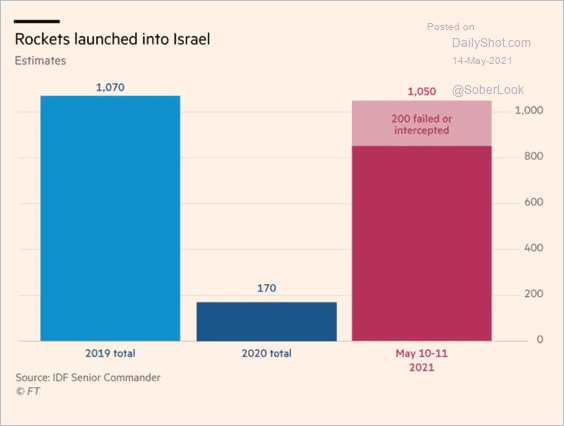

1. Rockets launched into Israel:

Source: @adam_tooze, @financialtimes Read full article

Source: @adam_tooze, @financialtimes Read full article

Source: @AFP, Anas Baba

Source: @AFP, Anas Baba

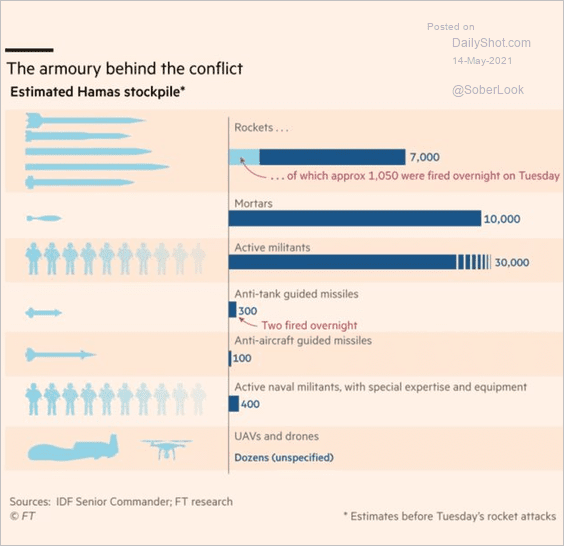

• Estimated Hamas military stockpile:

Source: @adam_tooze, @financialtimes Read full article

Source: @adam_tooze, @financialtimes Read full article

——————–

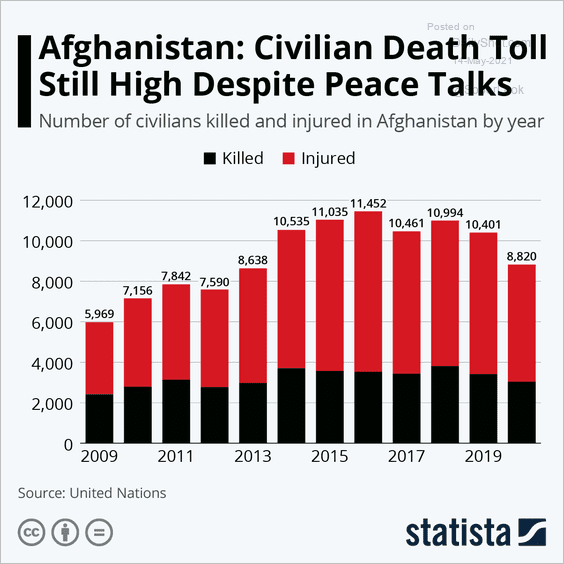

2. Afghan civilian death toll:

Source: Statista

Source: Statista

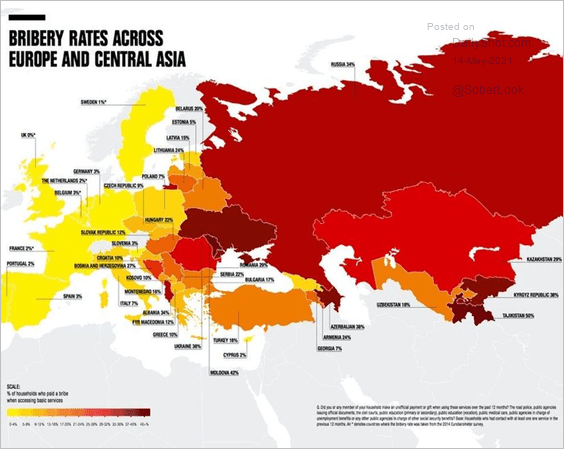

3. Bribery rates across Europe and Central Asia:

Source: @simongerman600, @anticorruption Read full article

Source: @simongerman600, @anticorruption Read full article

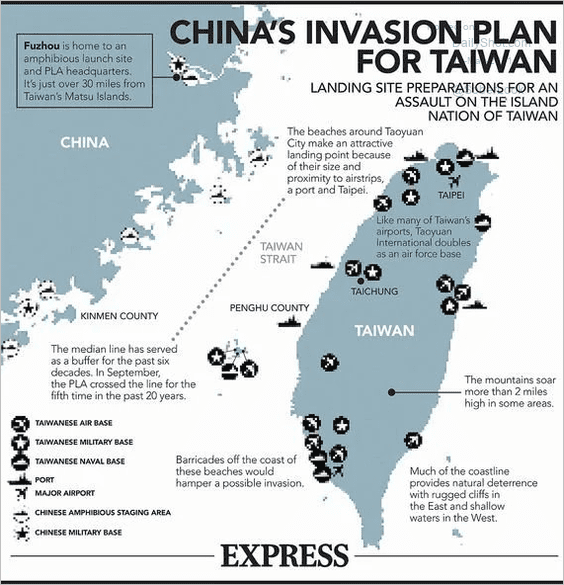

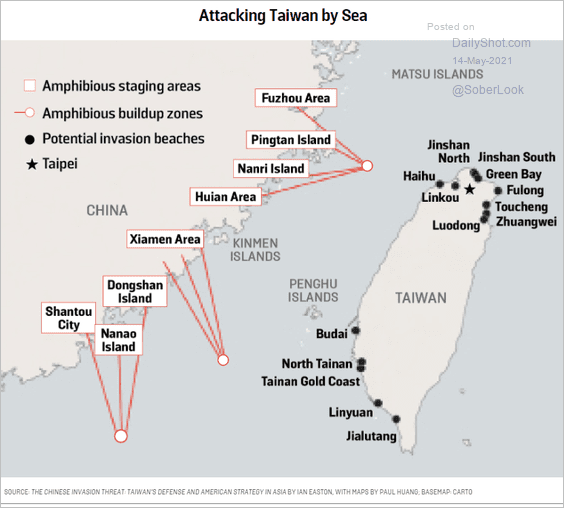

4. China’s invasion plans for Taiwan (2 maps):

Source: Express Read full article

Source: Express Read full article

Source: FP Read full article

Source: FP Read full article

——————–

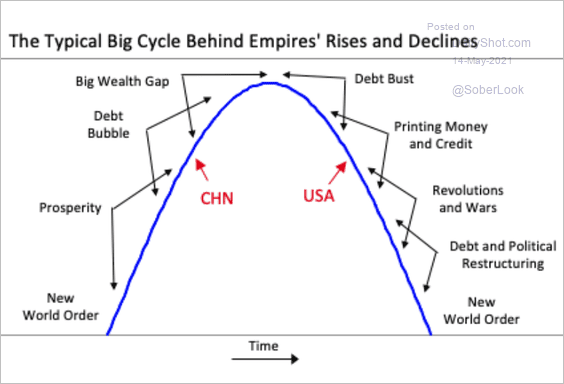

5. Empire cycles:

Source: Ray Dalio Read full article

Source: Ray Dalio Read full article

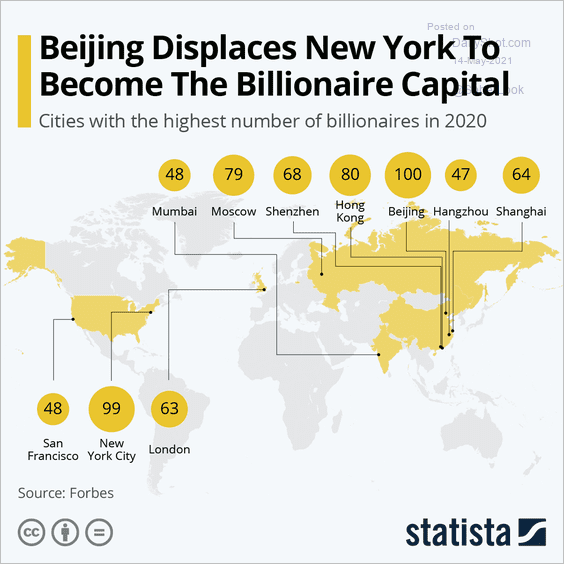

6. Cities with most billionaires:

Source: Statista

Source: Statista

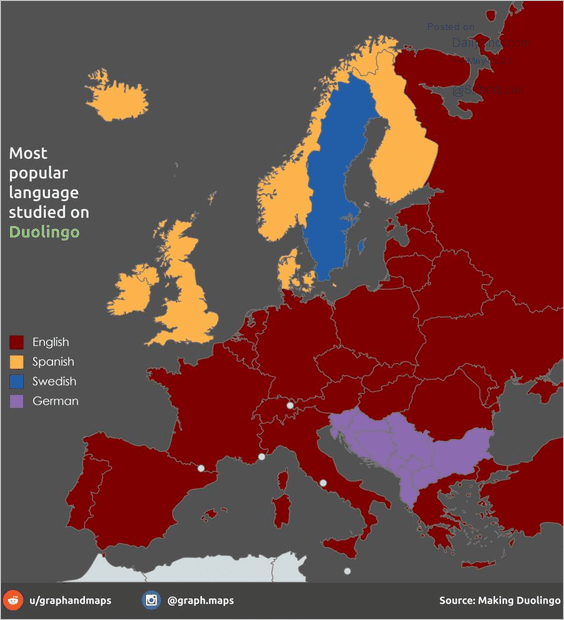

7. Most popular languages studied on Duolingo across Europe:

Source: @simongerman600, @Duolingo Read full article

Source: @simongerman600, @Duolingo Read full article

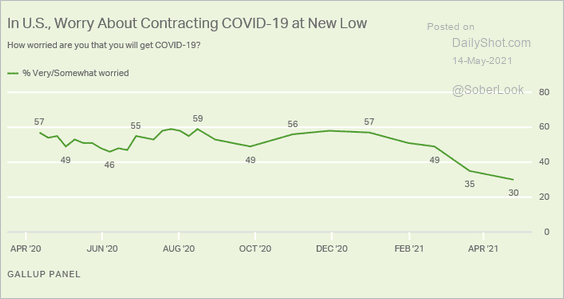

8. US concerns about contracting COVID:

Source: Gallup Read full article

Source: Gallup Read full article

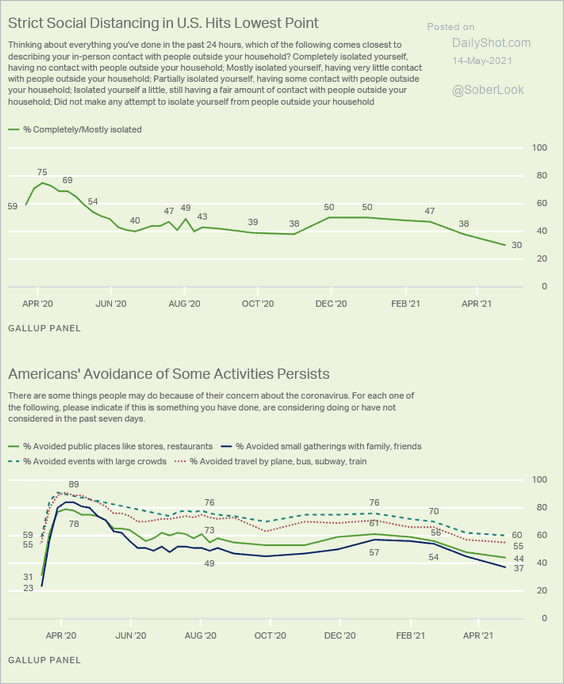

• Social distancing:

Source: Gallup Read full article

Source: Gallup Read full article

——————–

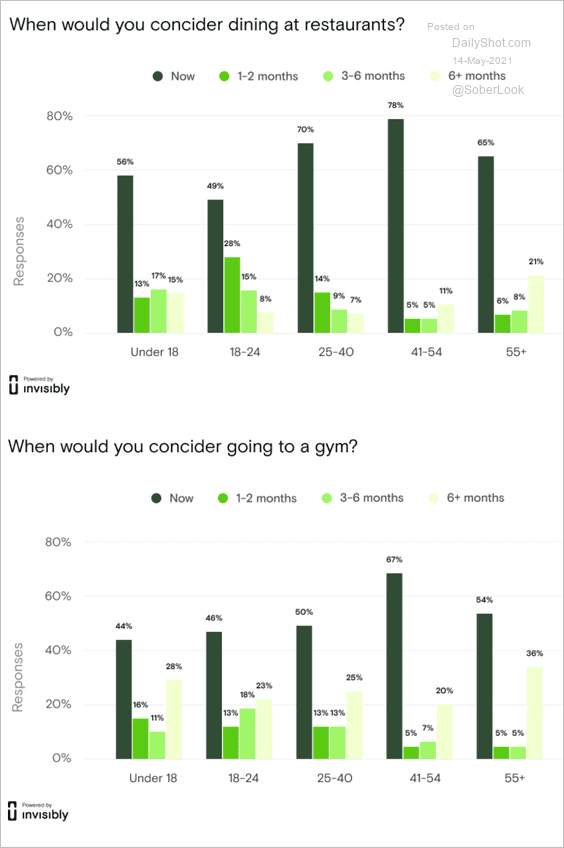

9. Readiness to go out, by age:

Source: Invisibly Read full article

Source: Invisibly Read full article

10. Trying to see the 12 dots at once:

Source: Veselin Jevrosimovic

Source: Veselin Jevrosimovic

——————–

Have a great weekend!

Back to Index