The Daily Shot: 17-May-21

• Administrative Update

• The United States

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

Administrative Update

Please note that The Daily Shot will not be published from May 27th to May 31st.

Back to Index

The United States

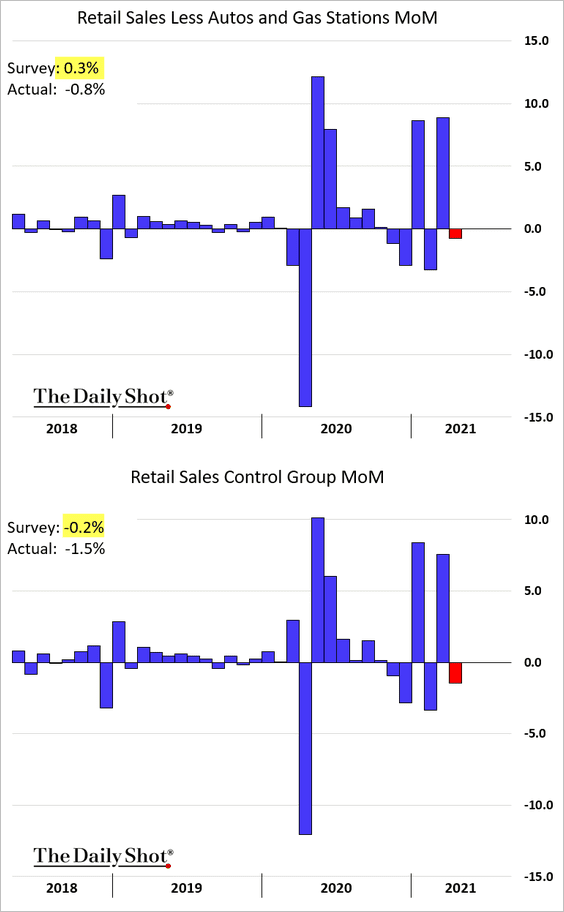

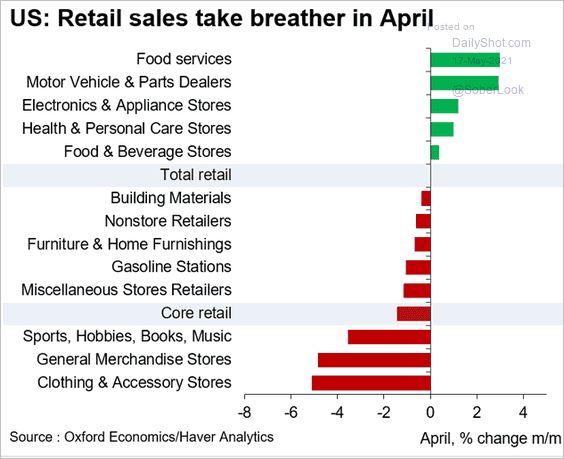

1. After massive stimulus-driven gains in March, last month’s retail sales surprised to the downside. Some analysts have suggested that US consumers are starting to balk at rising prices.

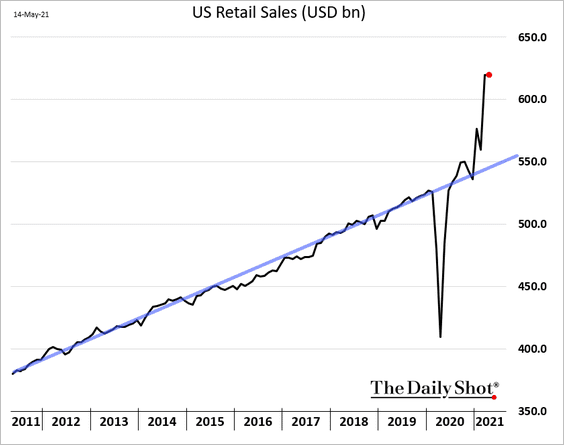

Nonetheless, retail sales are running well above trend.

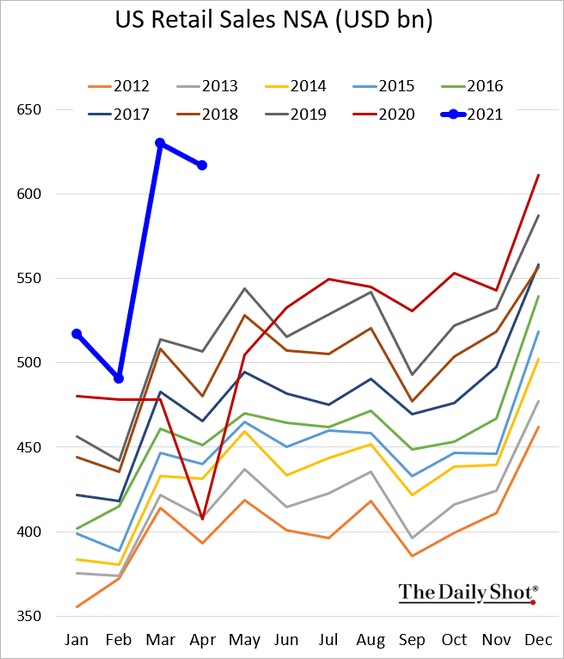

Here is the same index without seasonal adjustments.

Online shopping remains strong, but its share of the overall retail sales has eased.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

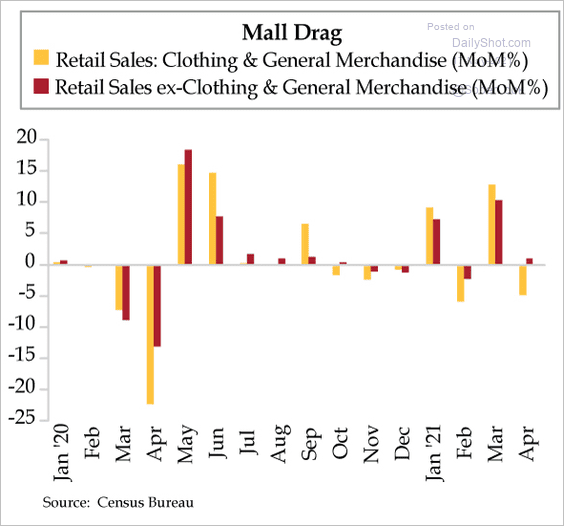

Consumers pulled back on mall shopping.

Source: The Daily Feather

Source: The Daily Feather

Here is the breakdown by sector.

Source: @GregDaco

Source: @GregDaco

——————–

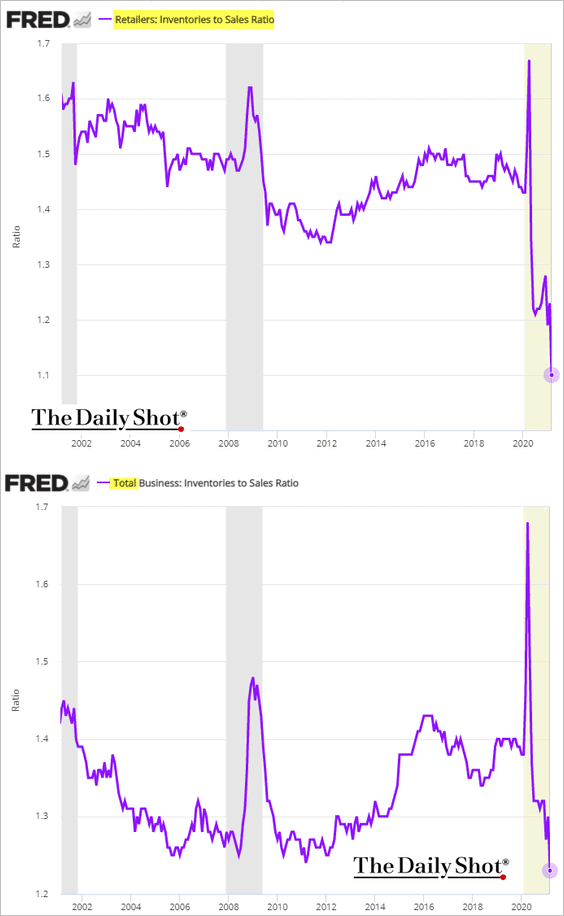

2. Retailers’ inventories-to-sales ratio has cratered.

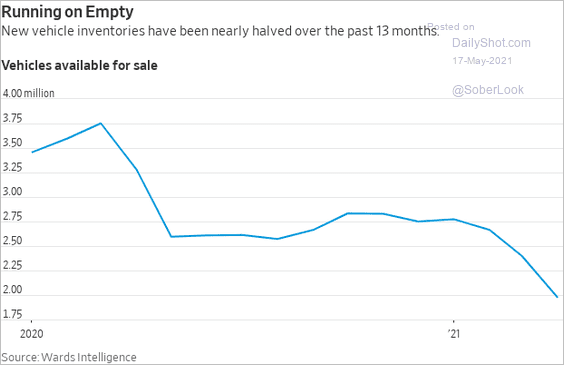

This chart shows new vehicle inventories.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

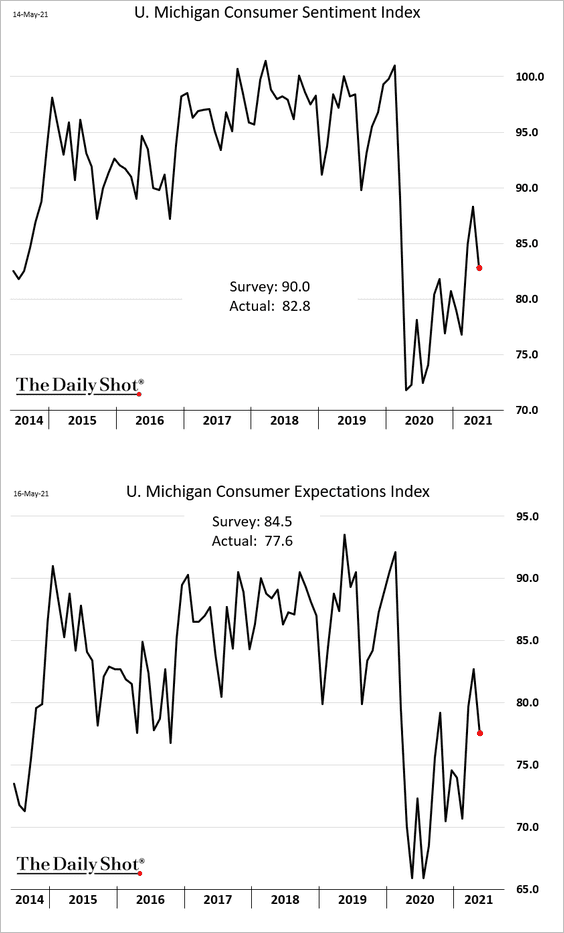

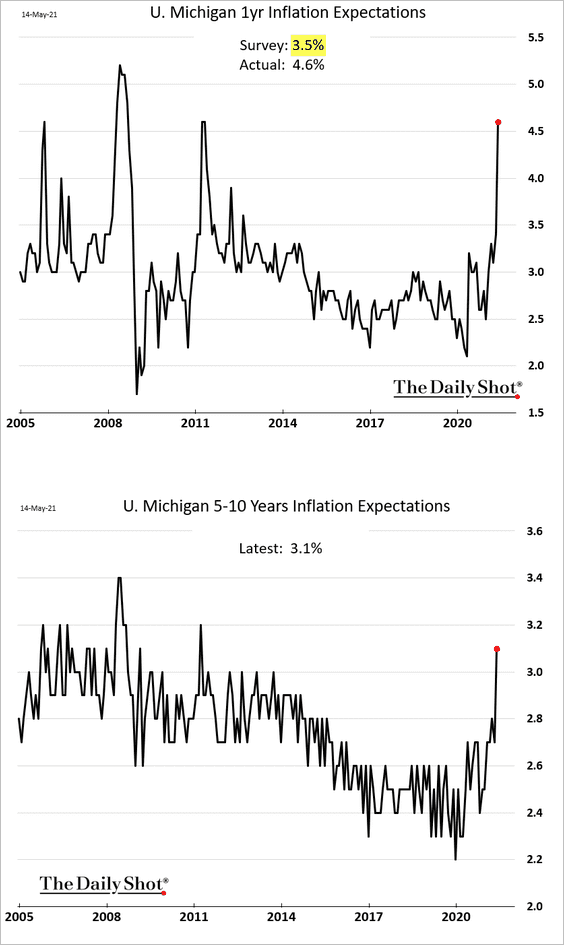

3. The U. Michigan consumer sentiment index slumped in May, coming in well below market consensus. Once again, inflation concerns might be to blame.

Here are the sentiment trends for Republicans and Democrats.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

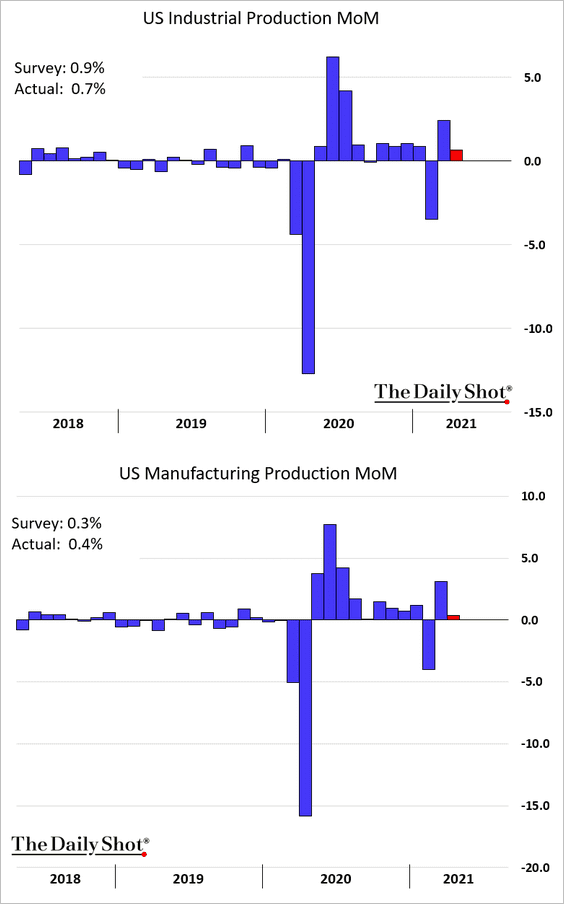

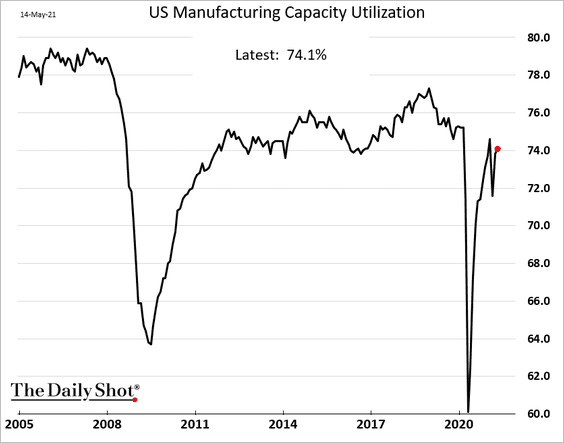

4. Manufacturing output expanded a bit faster than expected, …

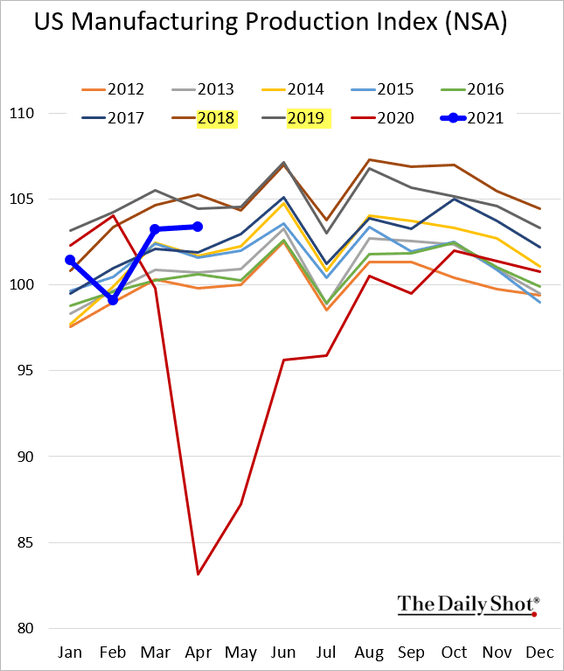

… but is holding below 2018 and 2019 levels for this time of the year.

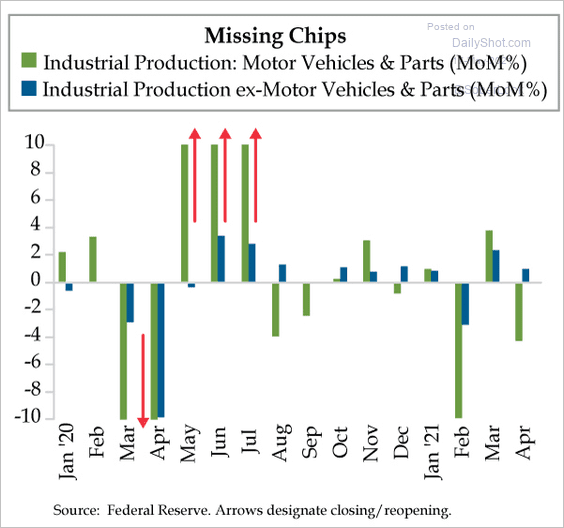

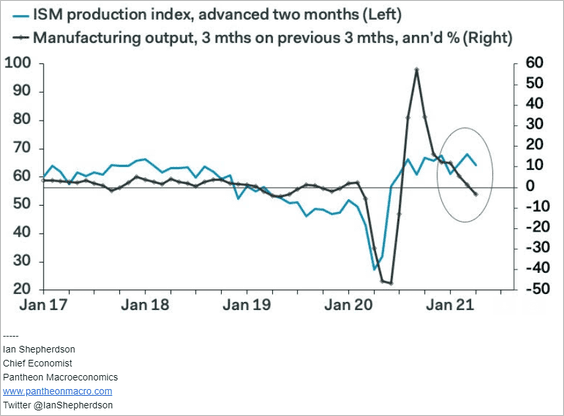

Chip shortages remain a drag (2 charts).

Source: The Daily Feather

Source: The Daily Feather

Factory capacity utilization is not back at pre-COVID levels yet.

——————–

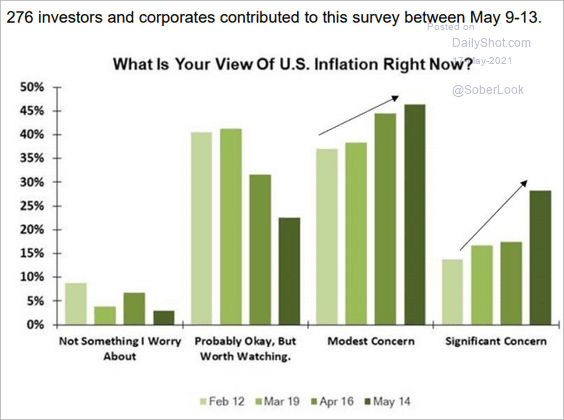

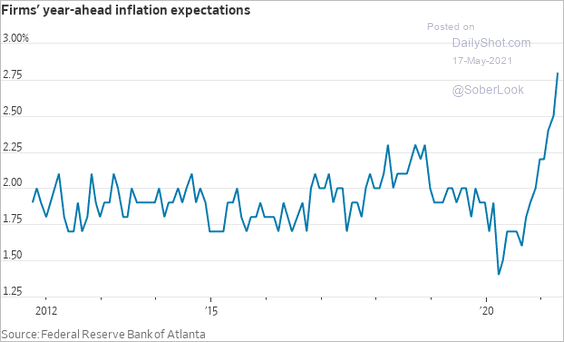

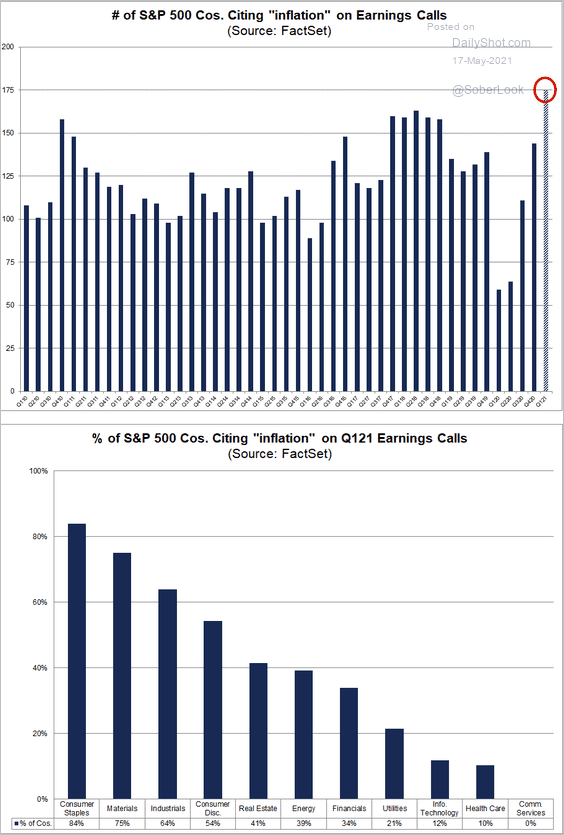

5. Next, we have some updates on inflation.

• Inflation concerns have spread across the economy.

– Consumer inflation expectations:

– Investor concerns:

Source: Evercore ISI

Source: Evercore ISI

– Business inflation expectations:

Source: @jeffsparshott

Source: @jeffsparshott

– S&P 500 companies citing “inflation” on earnings calls:

Source: @FactSet Read full article

Source: @FactSet Read full article

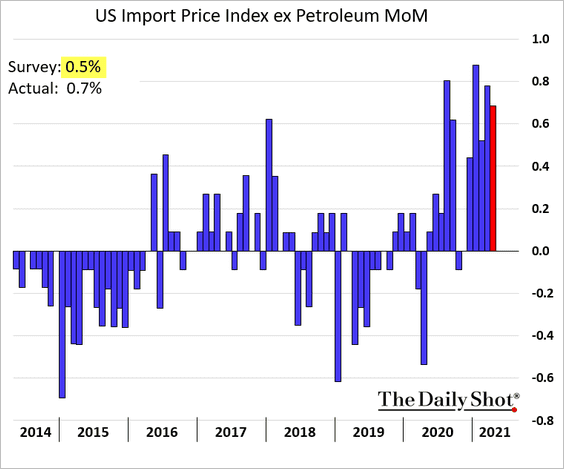

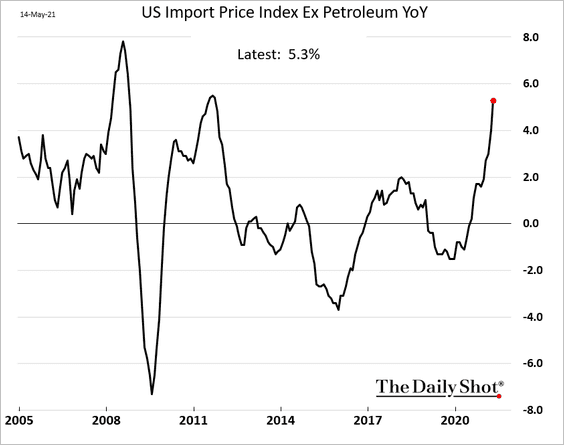

• Import prices increased more than expected last month.

——————–

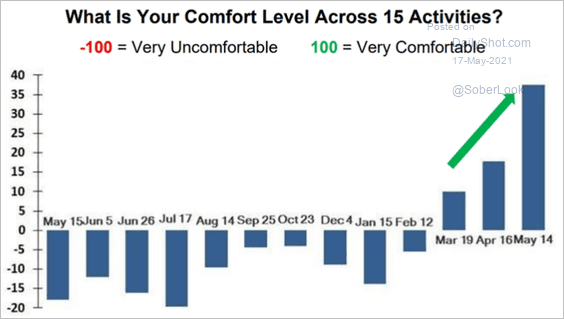

6. Americans are increasingly comfortable with many activities they have avoided since the start of the pandemic.

Source: Evercore ISI

Source: Evercore ISI

Back to Index

Europe

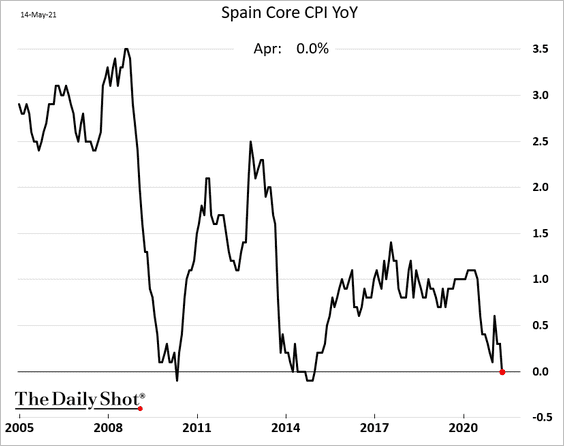

1. Spain’s core CPI is back at zero.

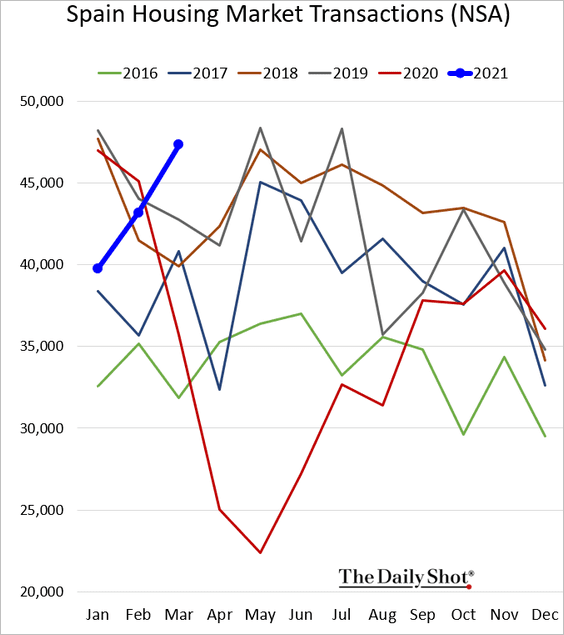

The nation’s housing market is heating up.

——————–

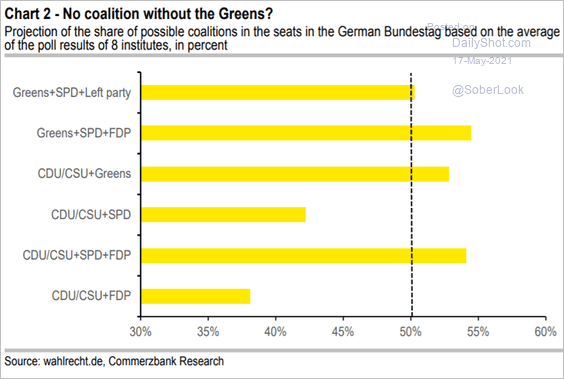

2. Greens are likely to be a part of Germany’s governing coalition.

Source: Commerzbank Research

Source: Commerzbank Research

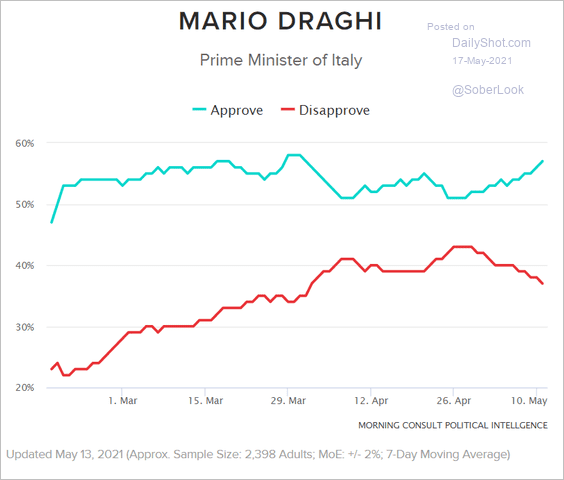

3. Here are Mario Draghi’s approval ratings.

Source: Morning Consult

Source: Morning Consult

——————–

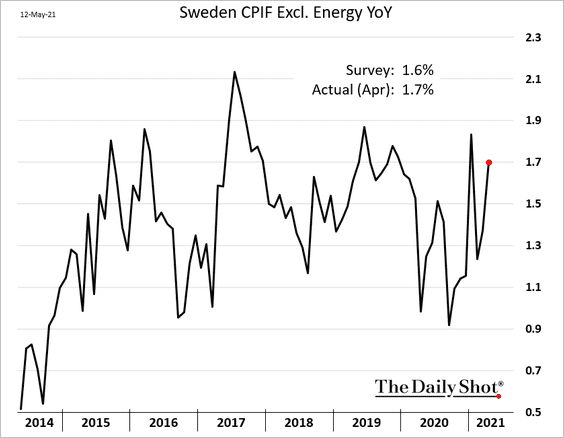

4. Sweden’s inflation was a bit firmer than expected.

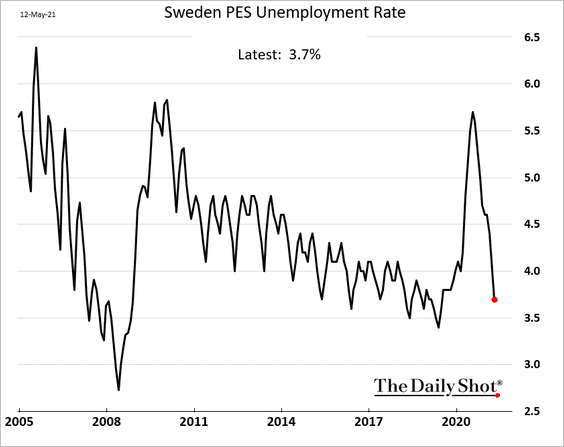

The unemployment rate continues to moderate.

——————–

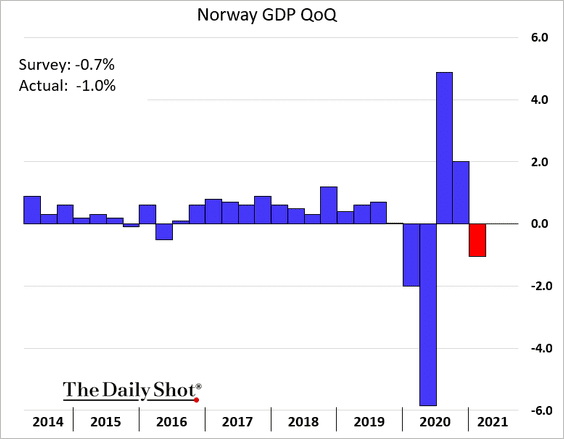

5. Norway’s Q1 GDP growth was a bit disappointing.

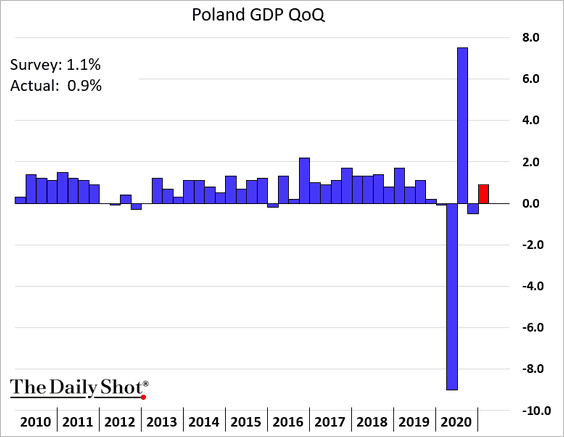

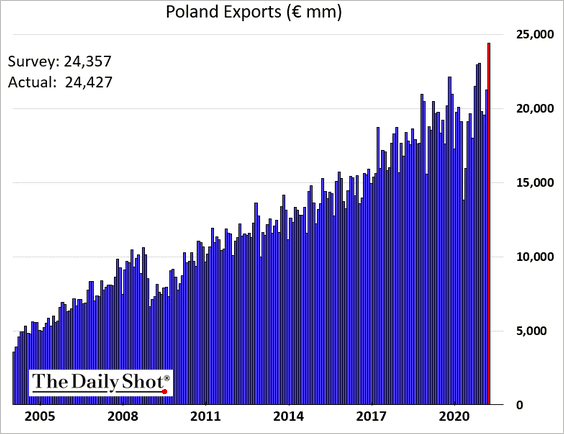

6. Poland’s Q1 GDP was softer than expected.

Polish exports hit a record high, but imports climbed even faster, shrinking the nation’s trade surplus.

——————–

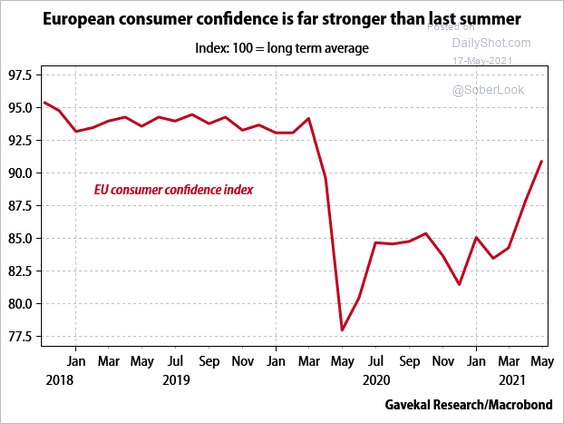

7. EU consumer confidence continues to improve.

Source: Gavekal Research

Source: Gavekal Research

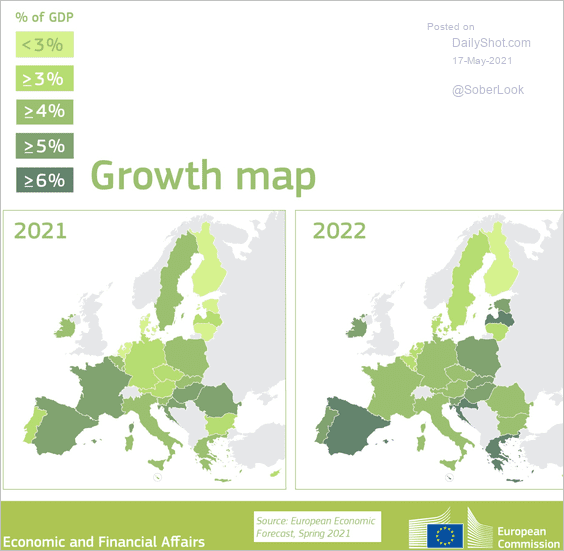

8. Here is the projected growth map.

Source: EC Read full article

Source: EC Read full article

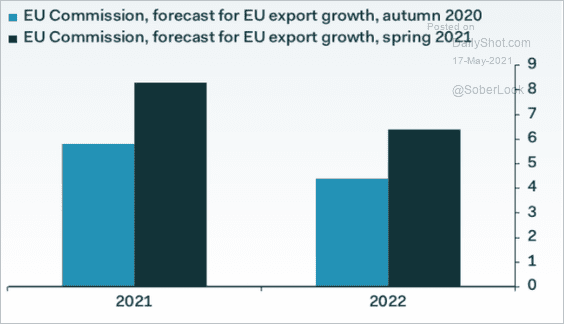

9. Expectations of stronger exports drove the upgrades in growth forecasts (#3 here).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

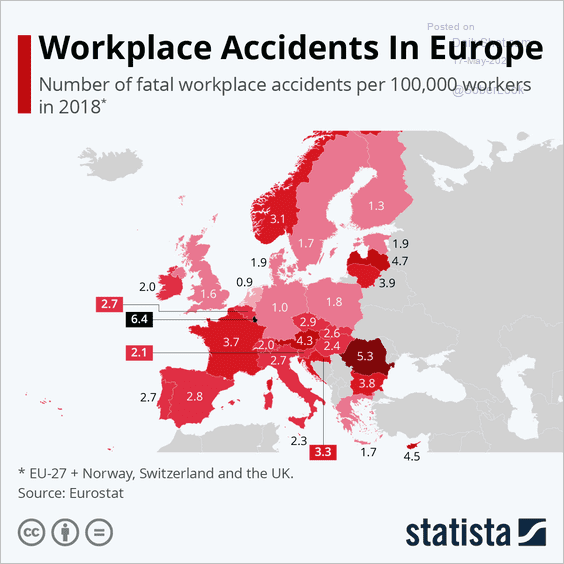

10. Finally, we have a map of workplace accidents across Europe.

Source: Statista

Source: Statista

Back to Index

Asia – Pacific

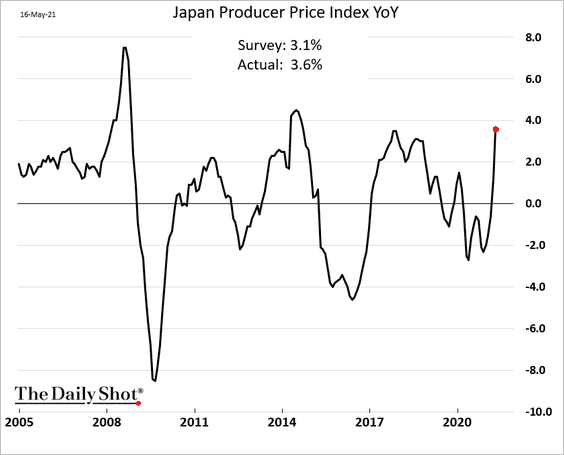

1. Japan’s producer prices rose more than expected, driven by energy and metals.

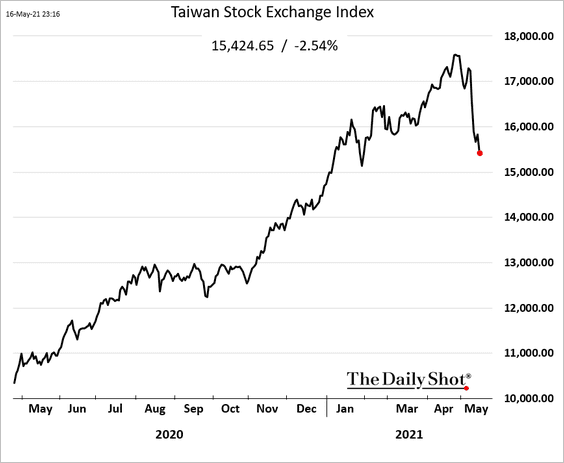

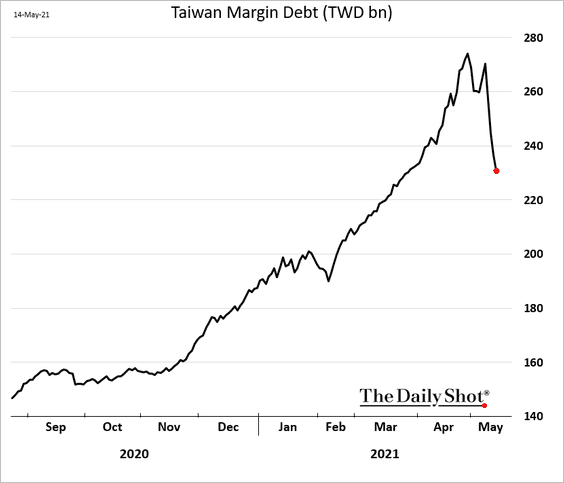

2. Taiwan’s stock market has been tumbling in recent days amid investor deleveraging (2nd chart).

h/t @JeannyYu

h/t @JeannyYu

——————–

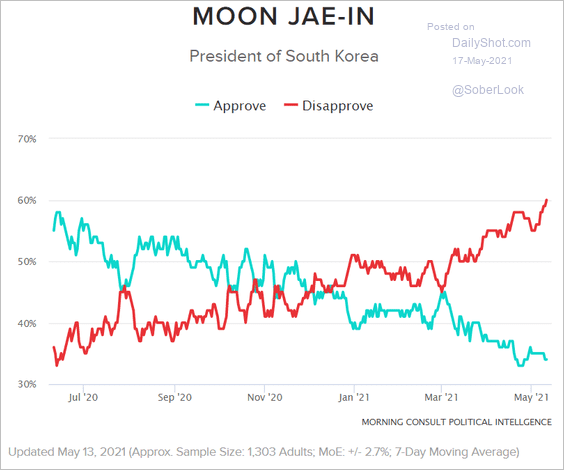

3. This chart shows President Moon’s approval ratings.

Source: Morning Consult

Source: Morning Consult

4. New Zealand’s service activity index hit the highest level in over a decade.

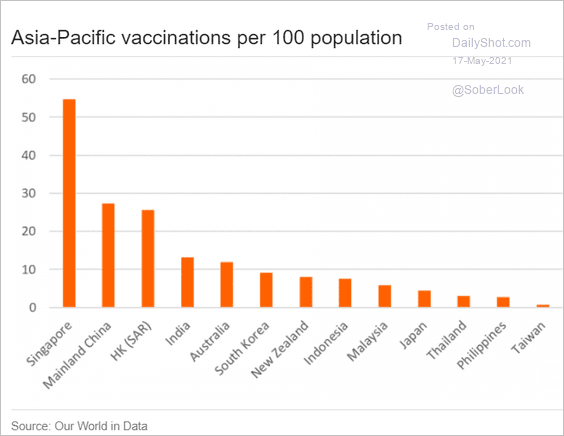

5. Here is the vaccination progress across Asia-Pacific.

Source: ING

Source: ING

Back to Index

China

1. April industrial production was roughly in line with expectations.

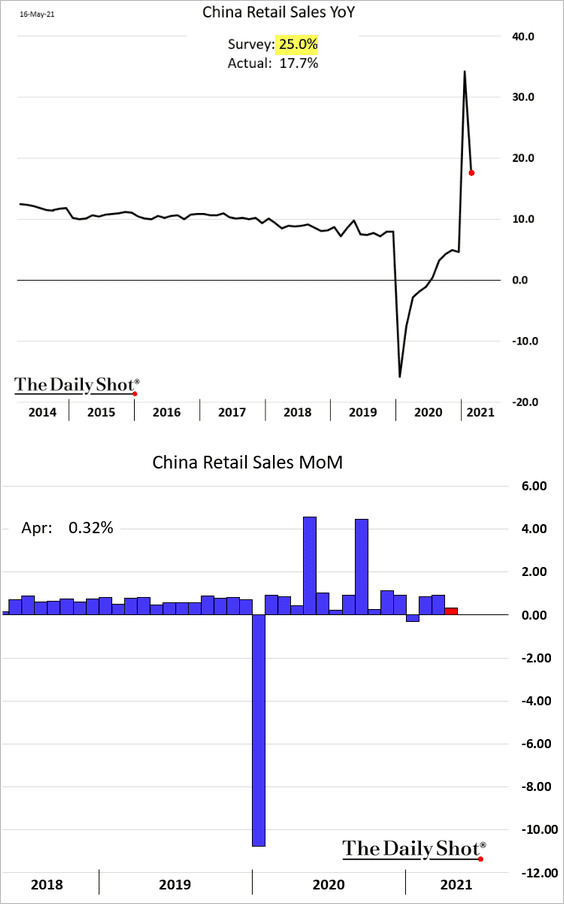

However, retail sales were disappointing. Are higher prices becoming a drag (similar to the US)?

——————–

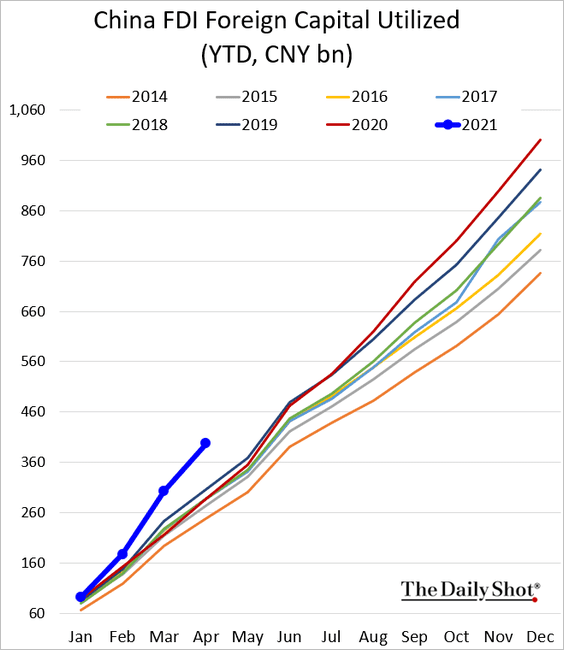

2. Foreign direct investment has been strong this year.

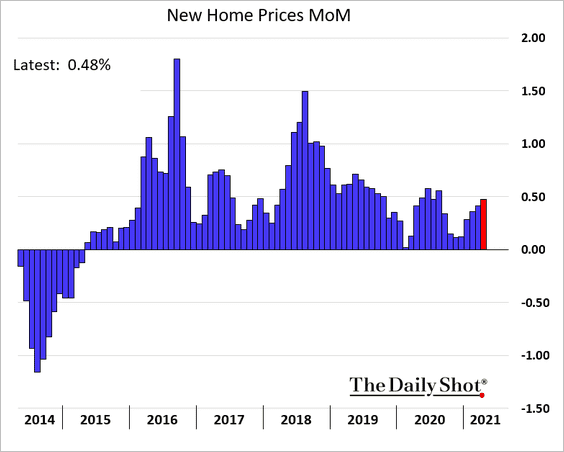

3. Home price appreciation is grinding higher.

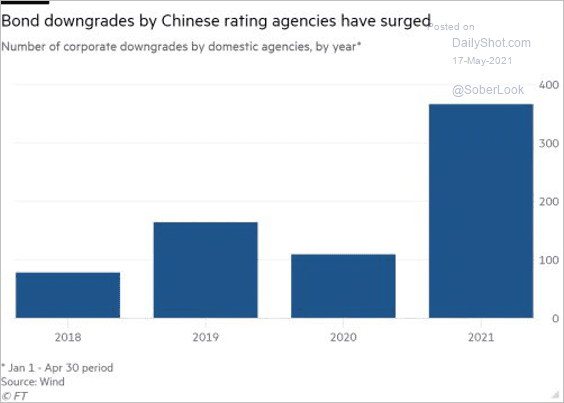

4. Domestic rating companies are starting to do their job, …

Source: @DiMartinoBooth, @financialtimes Read full article

Source: @DiMartinoBooth, @financialtimes Read full article

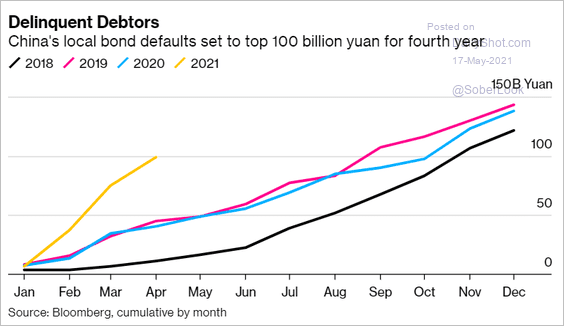

… as local bond defaults soar.

Source: @business Read full article

Source: @business Read full article

——————–

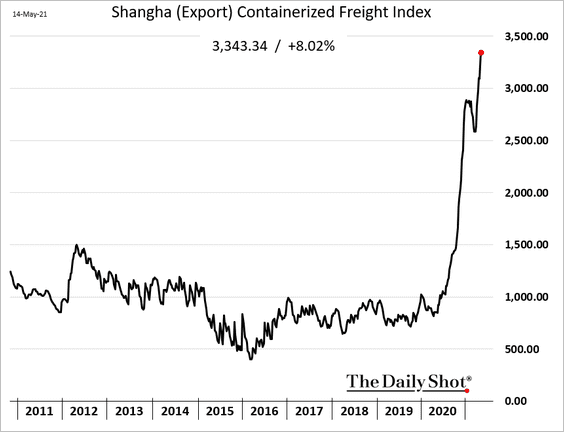

5. Shipping costs continue to surge.

6. Encouraged by Beijing, the number of semiconductor startups jumped last year.

![]() Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Emerging Markets

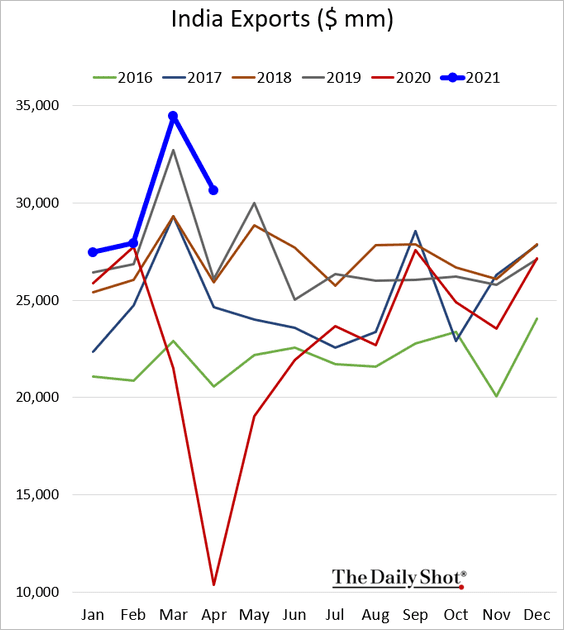

1. Let’s begin with India.

• Exports are running at multi-year highs.

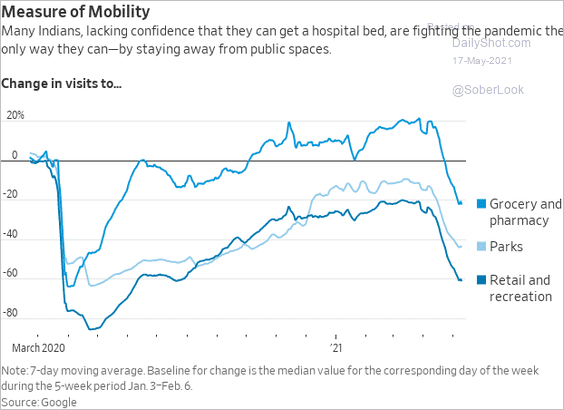

• Mobility has deteriorated.

Source: @WSJ Read full article

Source: @WSJ Read full article

• Modi’s approval ratings took a hit but are still high.

Source: Morning Consult

Source: Morning Consult

——————–

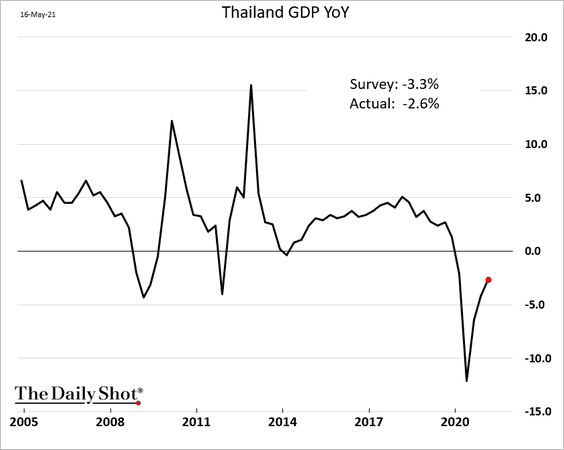

2. The Thai GDP rebound has been stronger than expected but will still take time.

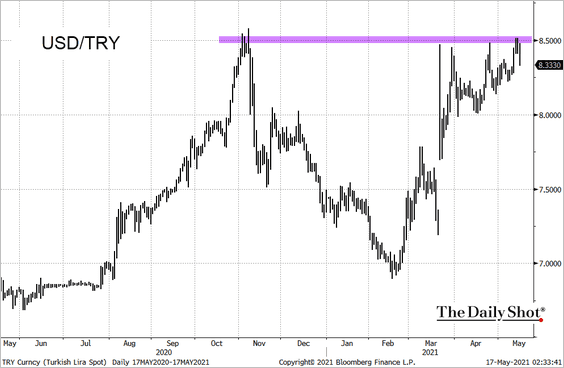

3. USD/TRY held resistance at 8.5 (the lira strengthened).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

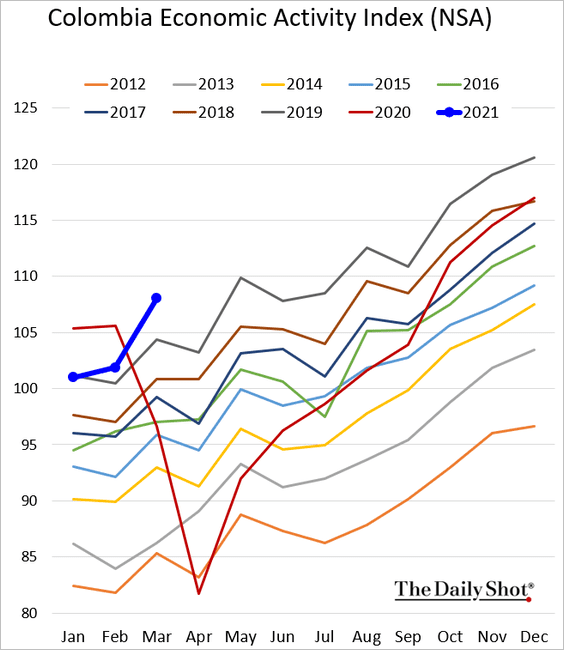

4. Colombia’s Q1 GDP surprised to the upside.

Here is the nation’s economic activity.

——————–

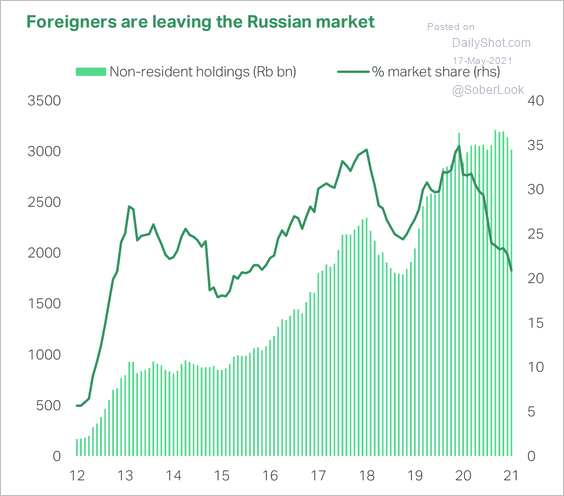

5. Foreign investors are deserting Russian markets.

Source: TS Lombard

Source: TS Lombard

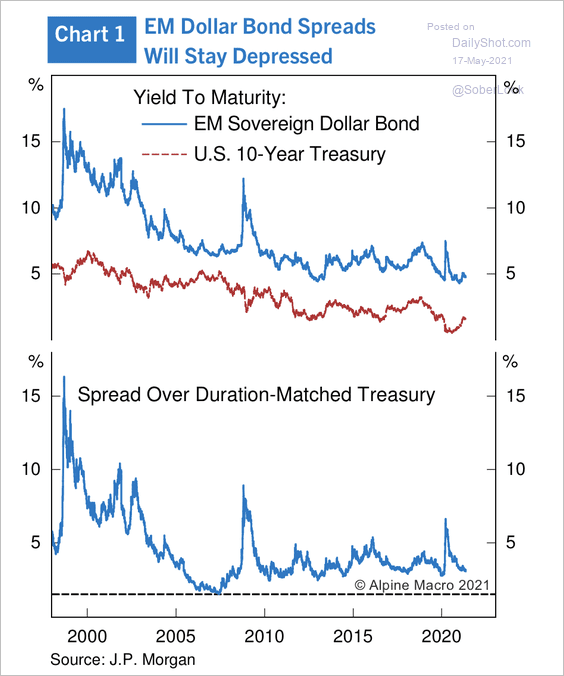

6. Alpine Macro expects EM sovereign dollar spreads to remain tight due to macro improvements and a favorable global liquidity backdrop.

Source: Alpine Macro

Source: Alpine Macro

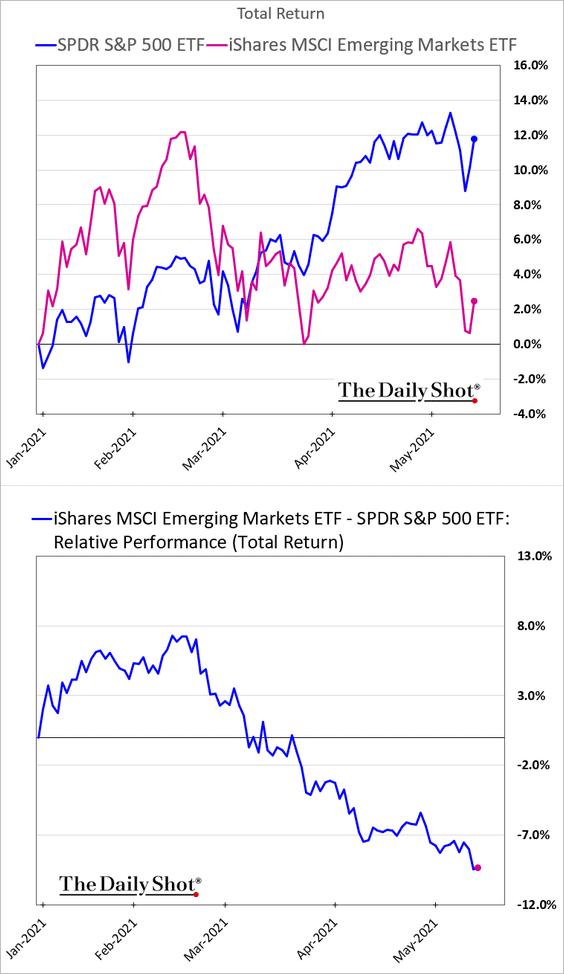

7. EM stocks have underperformed this year (in dollar terms).

h/t @adam_tooze

h/t @adam_tooze

Back to Index

Cryptocurrency

1. Bitcoin is below $45k in response to further comments from Elon.

Source: CNBC Read full article

Source: CNBC Read full article

——————–

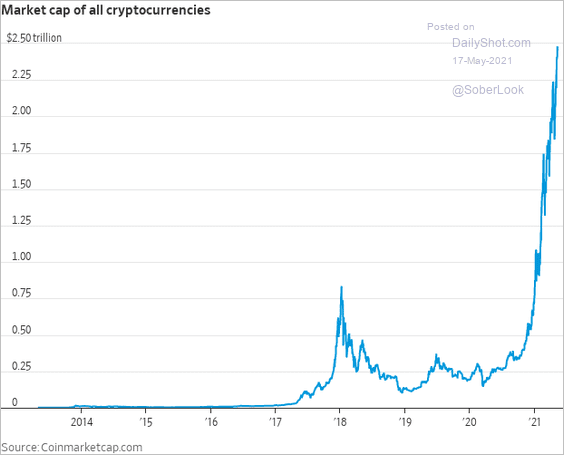

2. Here is the total crypto market cap.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Commodities

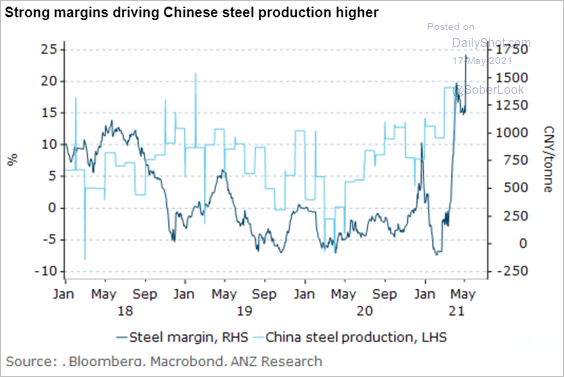

1. China’s steel prices remain under pressure amid attempts to halt the rally by the authorities.

Steel margins have been strong, which boosted output.

Source: ANZ Research

Source: ANZ Research

——————–

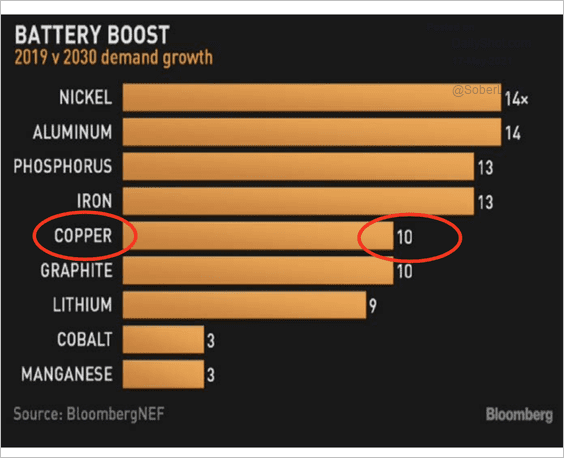

2. Battery demand for some commodities is expected to significantly rise over the next decade.

Source: BloombergNEF, III Capital Management

Source: BloombergNEF, III Capital Management

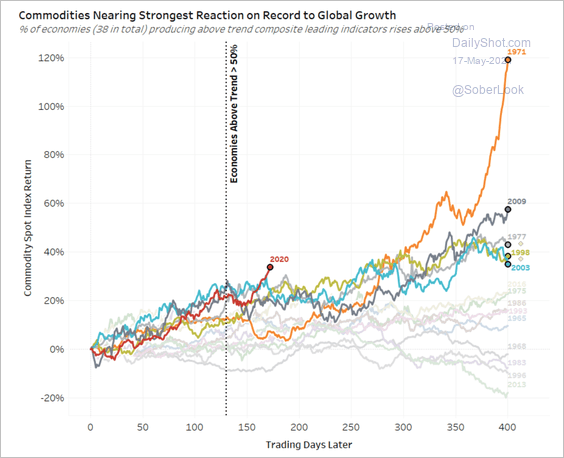

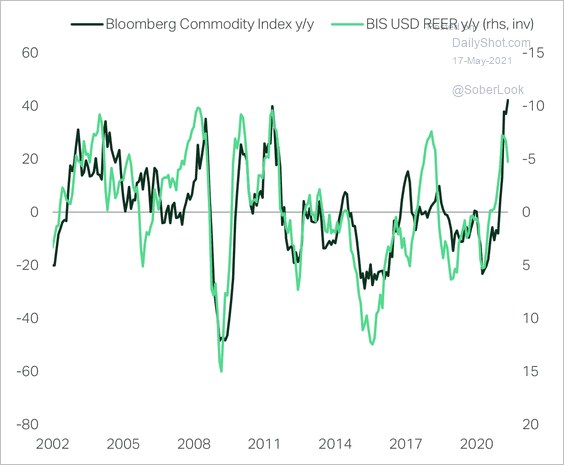

3. Commodities have been reacting strongly to global growth relative to prior years.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

A weaker dollar has been helping to fuel the commodity rise.

Source: TS Lombard

Source: TS Lombard

——————–

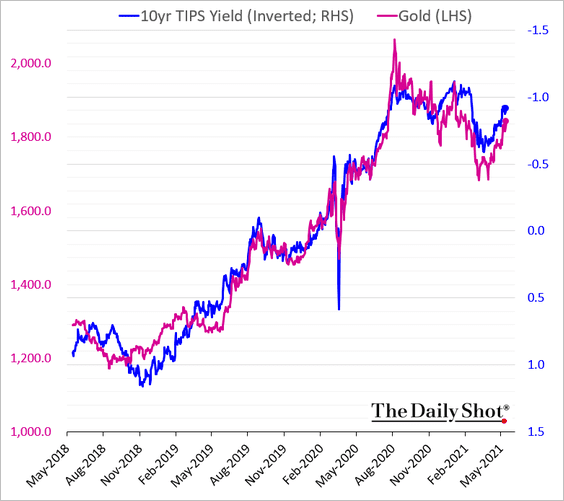

4. Lower real yields in the US have been supporting gold.

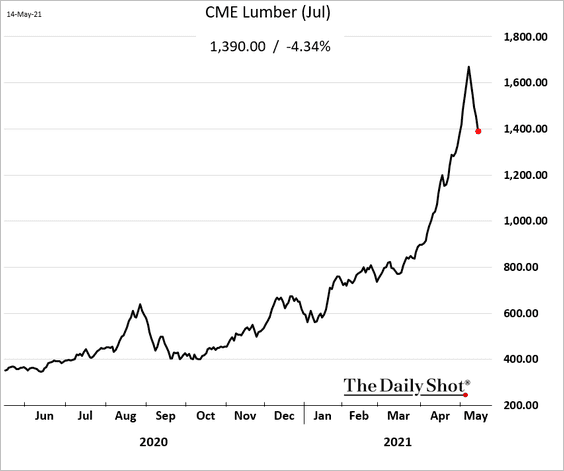

5. The unprecedented rally in US lumber futures appears to be fading.

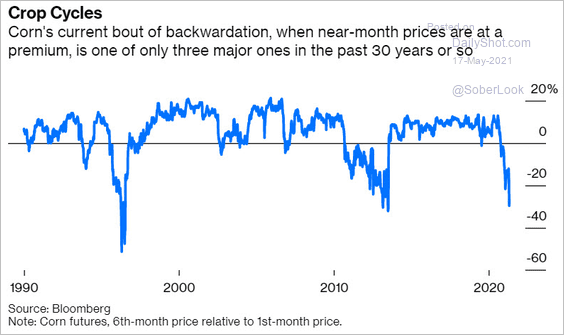

6. The backwardation in US corn futures has been unusual.

Source: @DiMartinoBooth, @bopinion Read full article

Source: @DiMartinoBooth, @bopinion Read full article

Back to Index

Energy

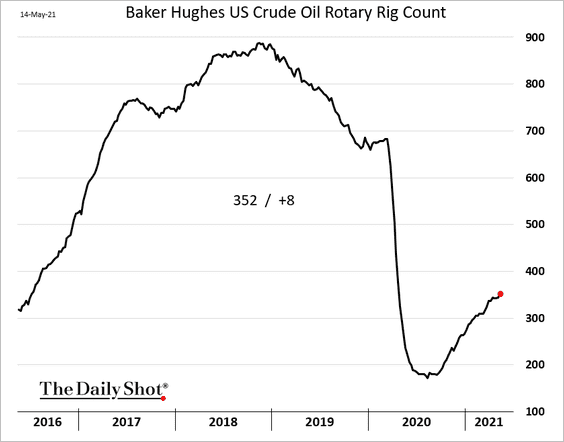

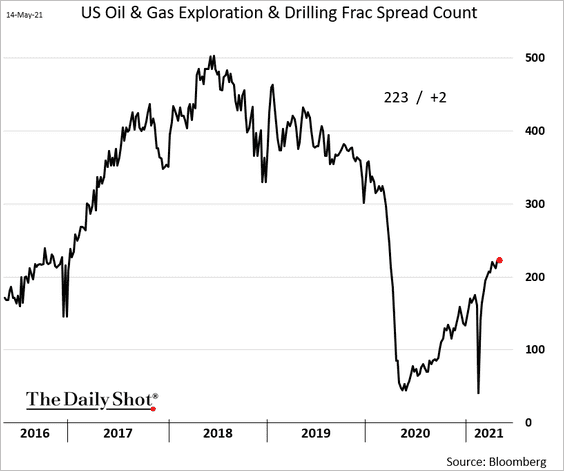

1. US rig count is grinding higher.

And US frac spread showed some improvement as well.

——————–

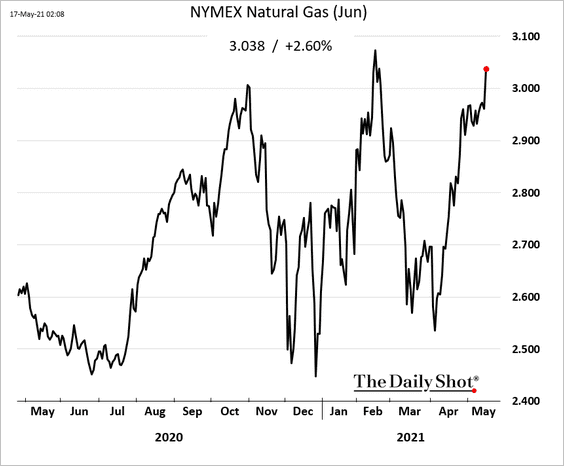

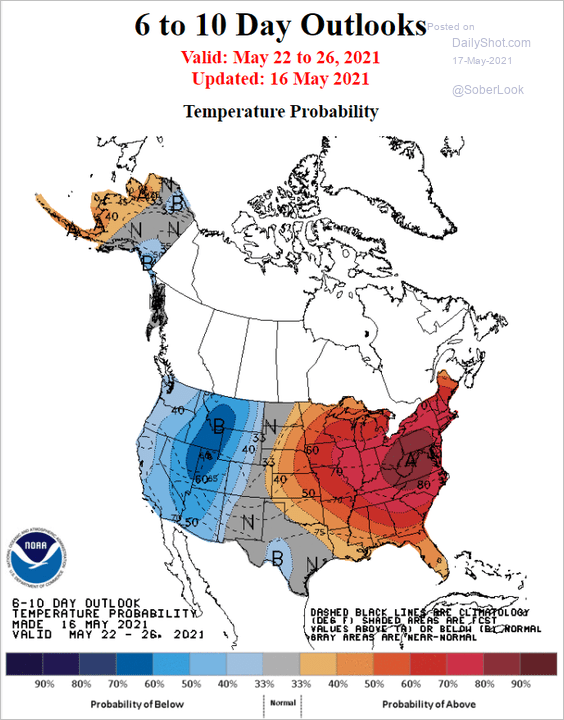

2. June NYMEX natural gas futures are above $3/mmbtu amid forecasts for a heatwave in parts of the country.

Source: NOAA

Source: NOAA

——————–

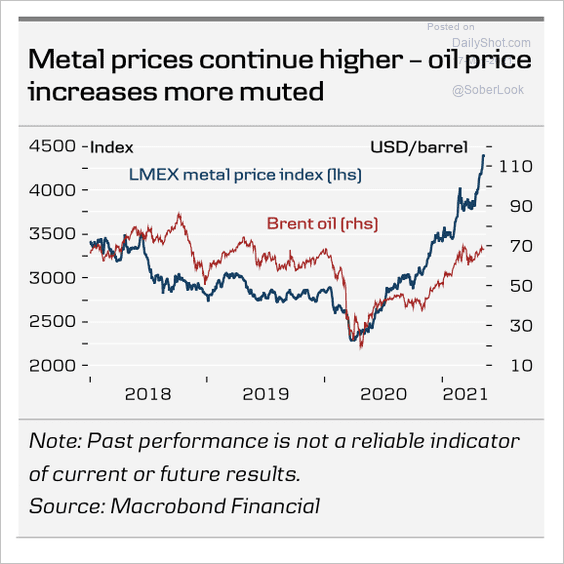

3. Oil prices have lagged the rise in metal prices over the past year.

Source: Danske Bank

Source: Danske Bank

Back to Index

Equities

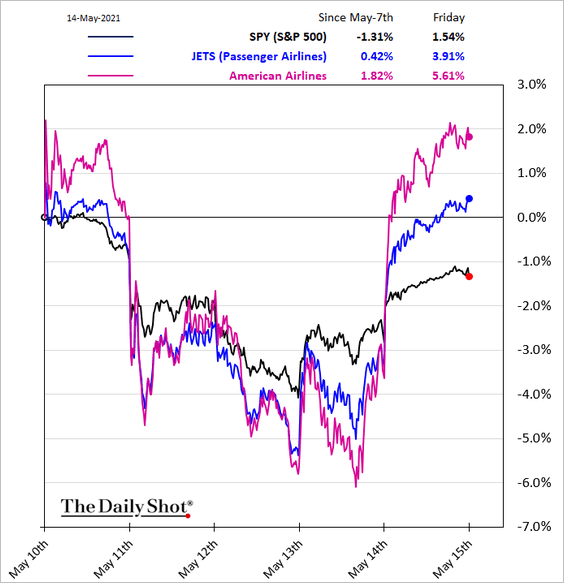

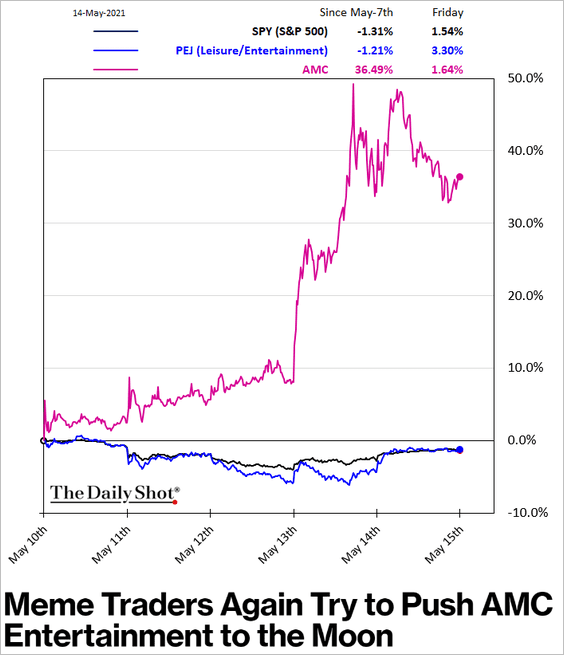

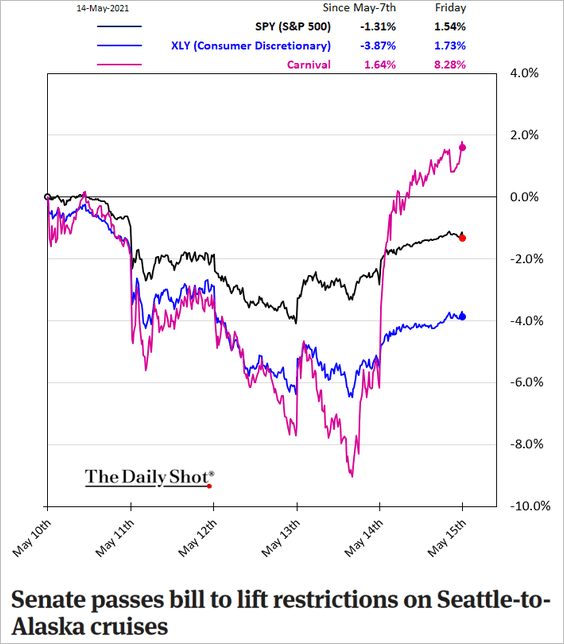

1. The “reopening” trade got a boost last week (3 charts).

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Source: The Seattle Times Read full article

Source: The Seattle Times Read full article

——————–

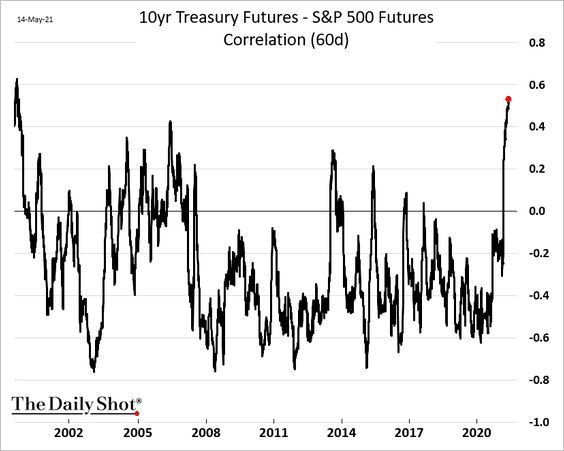

2. The correlation between stocks and bonds has risen sharply in recent weeks.

h/t @justinaknope

h/t @justinaknope

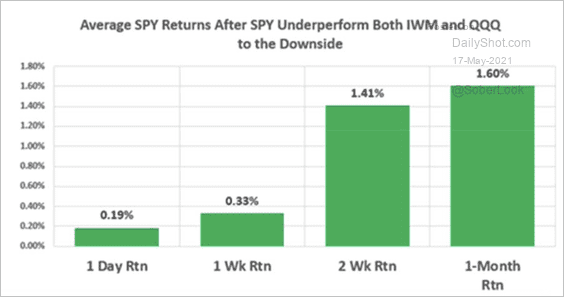

3. Although rare, the S&P 500 tends to perform well after lagging both small-caps and tech stocks.

Source: Susquehanna Derivative Strategy

Source: Susquehanna Derivative Strategy

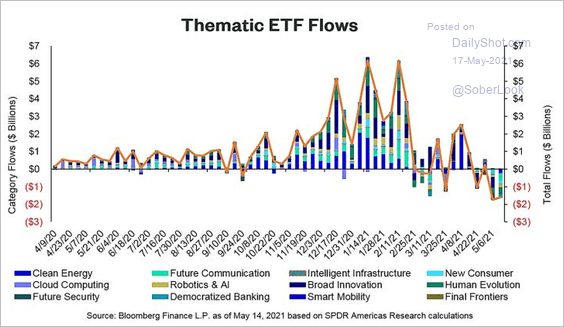

4. Thematic ETFs continue to see outflows.

Source: Matthew Bartolini Read full article

Source: Matthew Bartolini Read full article

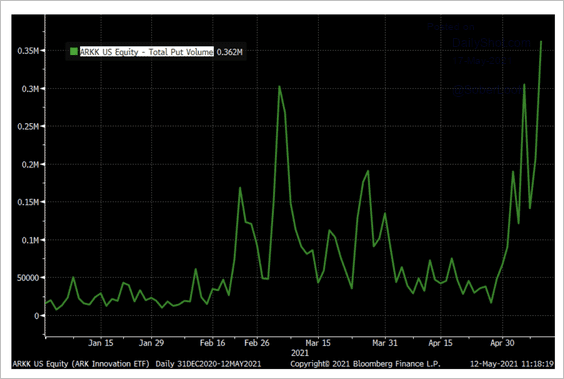

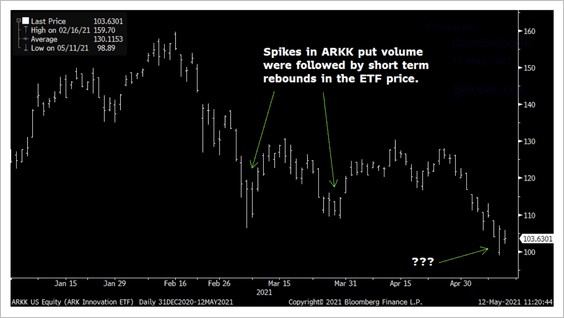

5. Put volume in the ARK Innovation ETF (ARKK) made an all-time high last week, which typically precedes short-term price recoveries (2 charts).

Source: Susquehanna Derivative Strategy

Source: Susquehanna Derivative Strategy

Source: Susquehanna Derivative Strategy

Source: Susquehanna Derivative Strategy

——————–

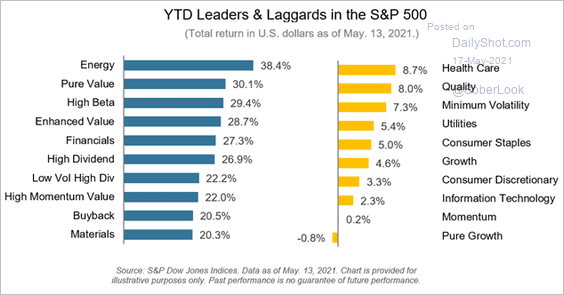

6. This chart shows the year-to-date S&P 500 performance by sector.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

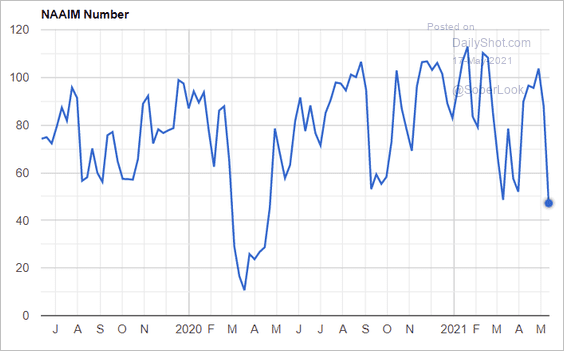

7. Investment managers have pared back their equity exposure.

Source: NAAIM

Source: NAAIM

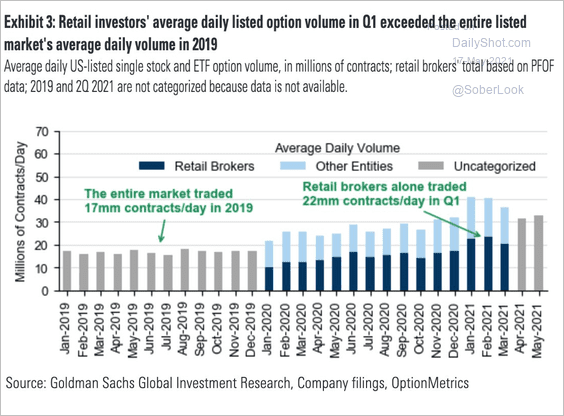

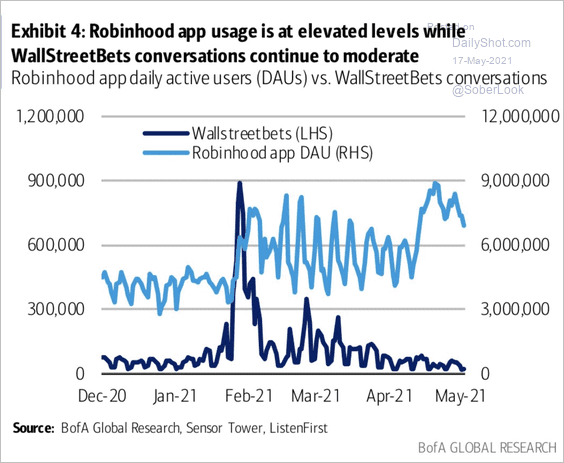

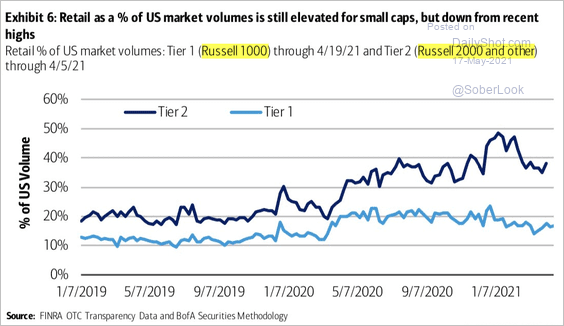

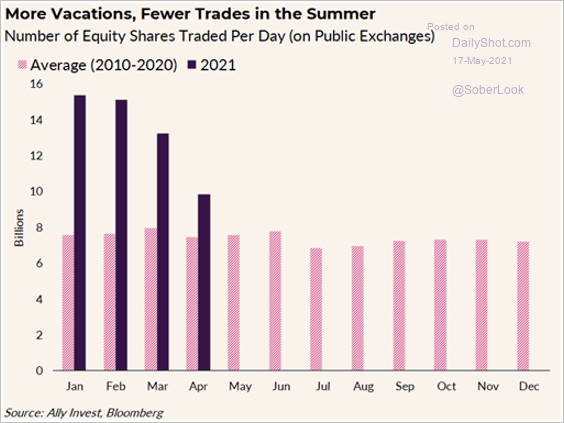

8. Next, we have some updates on retail investor activity.

• Options trading since the start of the pandemic:

Source: Goldman Sachs, @RobinWigg

Source: Goldman Sachs, @RobinWigg

• Robinhood app usage and WallStreetBets (Reddit) activity:

Source: BofA Global Research, @WallStJesus

Source: BofA Global Research, @WallStJesus

• Retail investors as a percentage of large-cap and small-cap trading:

Source: BofA Global Research, @WallStJesus

Source: BofA Global Research, @WallStJesus

• Total shares traded:

Source: Ally Invest

Source: Ally Invest

Back to Index

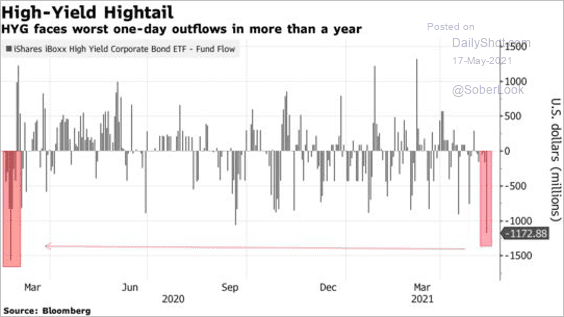

Credit

1. The largest high-yield ETF saw some outflows last week.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

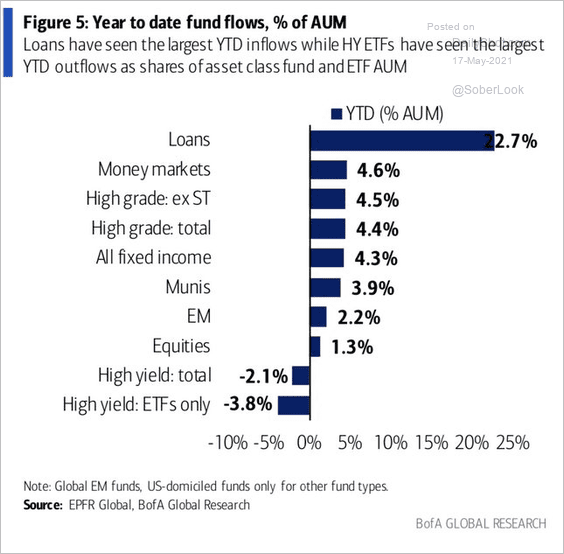

2. This chart shows year-to-date flows across fixed-income categories.

Source: BofA Global Research, @WallStJesus

Source: BofA Global Research, @WallStJesus

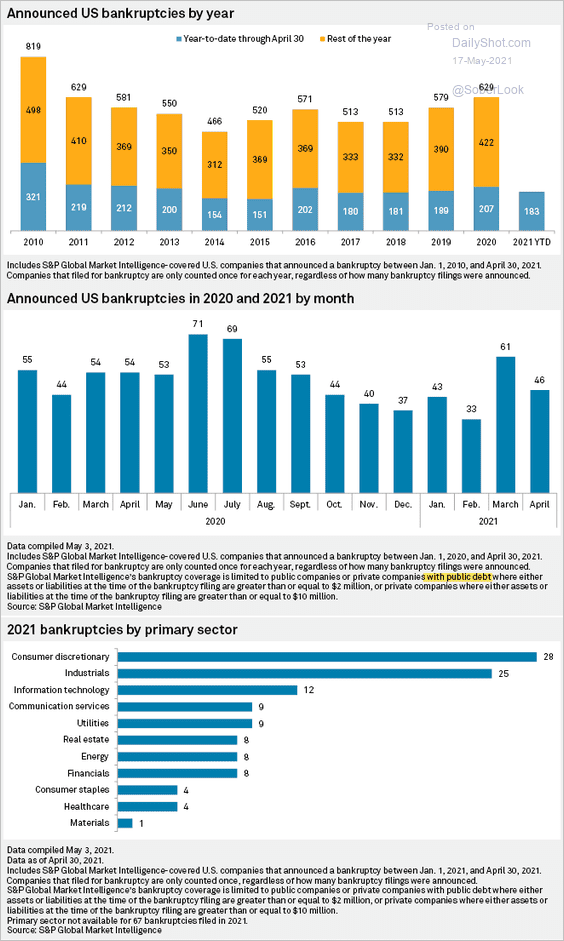

3. Next, we have some data on US bankruptcies for companies with public debt.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Global Developments

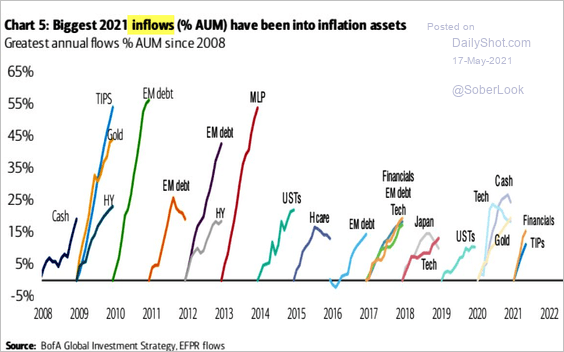

1. The chart below shows asset classes with the highest fund inflows by year.

Source: BofA Global Research, @WallStJesus

Source: BofA Global Research, @WallStJesus

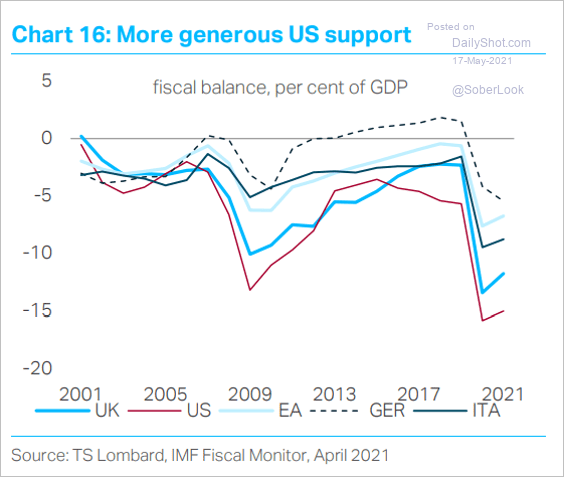

2. The US fiscal support has been more generous than other advanced economies.

Source: TS Lombard

Source: TS Lombard

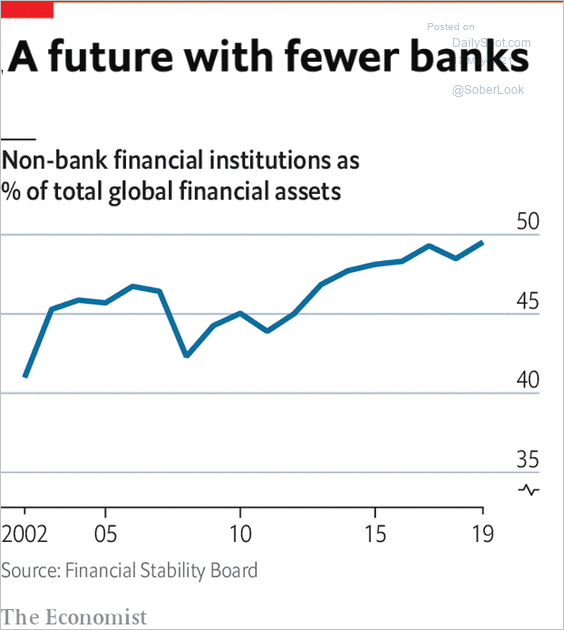

3. Growth in nonbank financial institutions continues.

Source: The Economist Read full article

Source: The Economist Read full article

——————–

Food for Thought

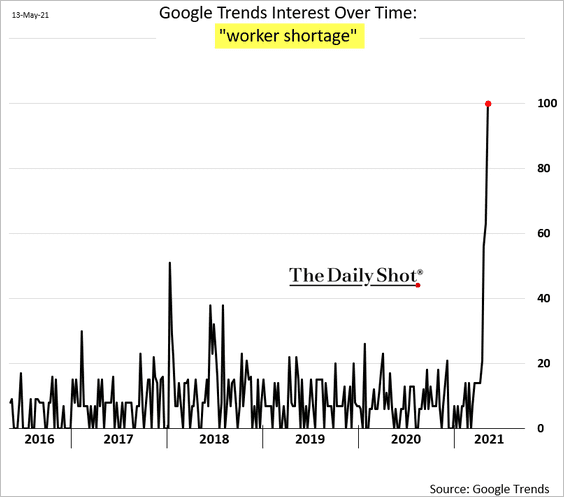

1. Google search activity for “worker shortage”:

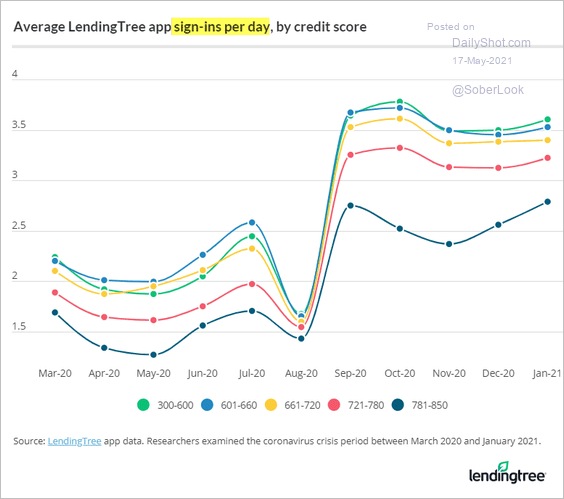

2. Consumers obsessively checking their credit score:

Source: LendingTree Read full article

Source: LendingTree Read full article

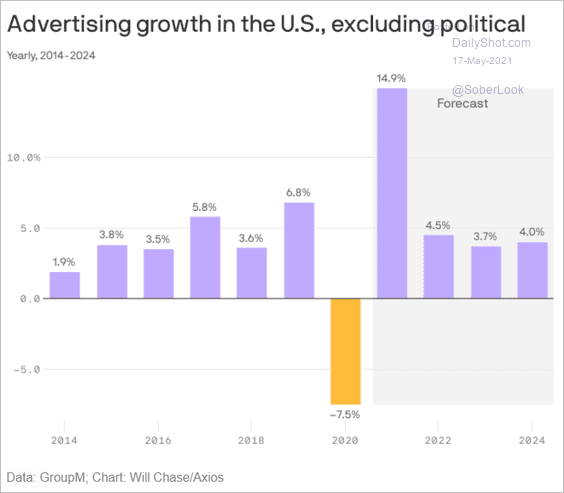

3. Growth in US advertising activity:

Source: @axios Read full article

Source: @axios Read full article

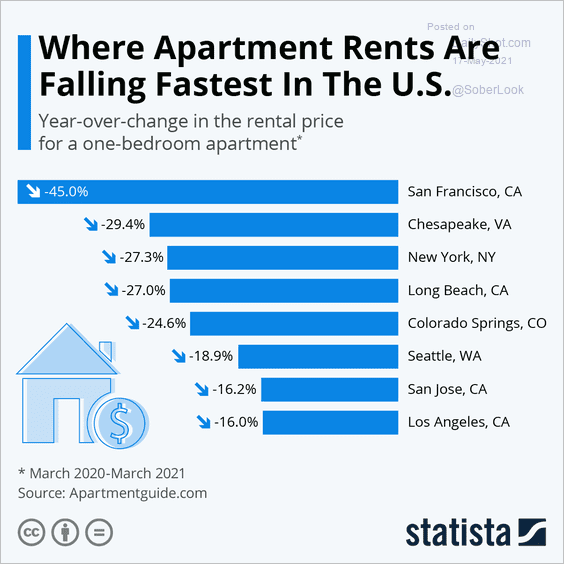

4. Post-COVID declines in apartment rents:

Source: Statista

Source: Statista

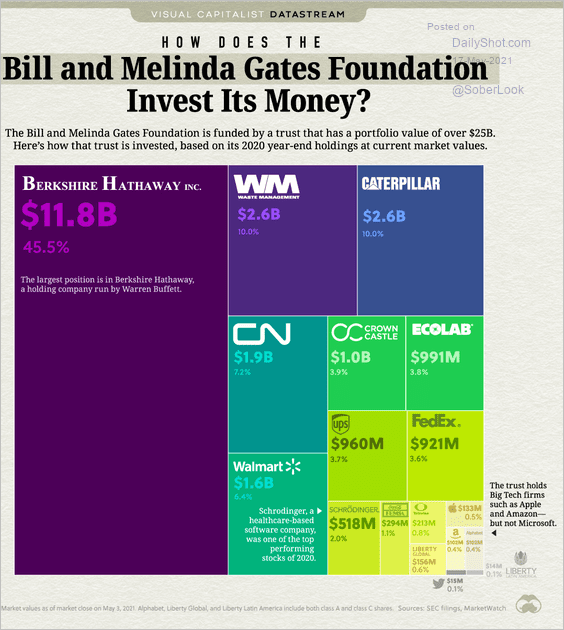

5. The Gates Foundation investments:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

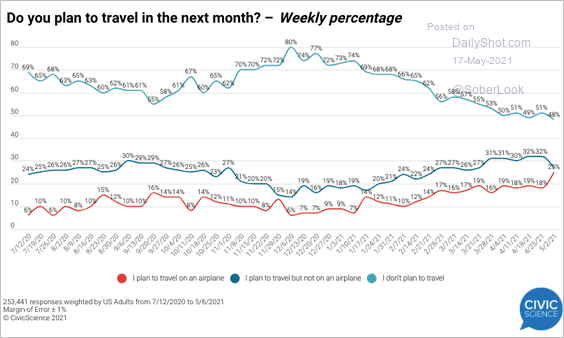

6. Plans to travel in the next month:

Source: CivicScience Read full article

Source: CivicScience Read full article

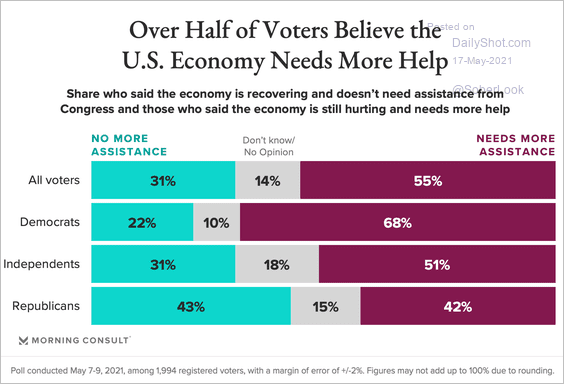

7. More help for the economy:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

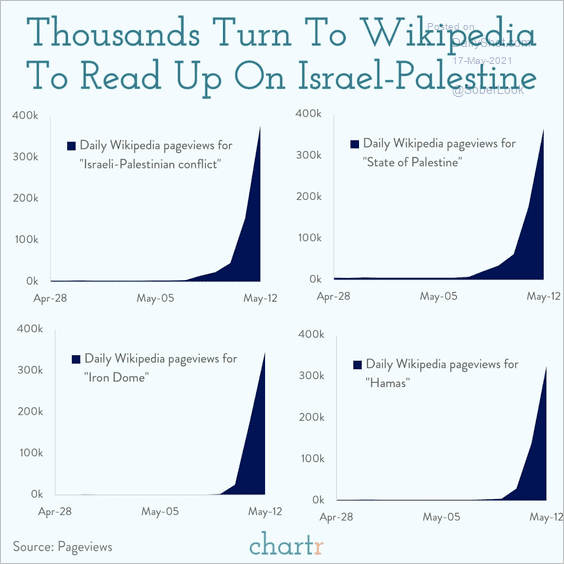

8. Interest in the Israeli-Palestinian conflict:

Source: @chartrdaily Read full article

Source: @chartrdaily Read full article

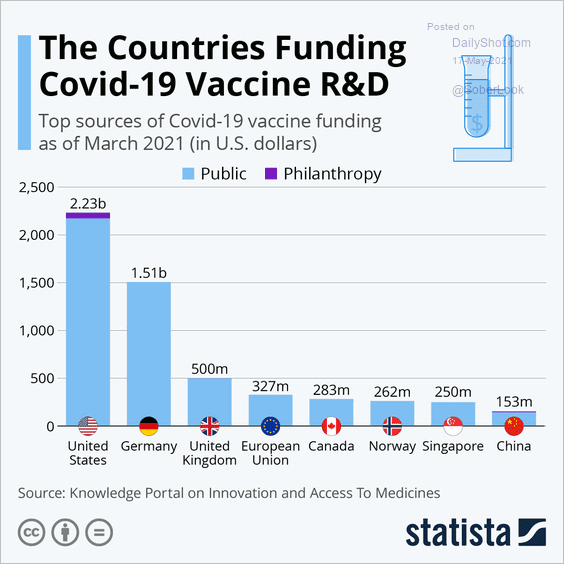

9. Vaccine funding:

Source: Statista

Source: Statista

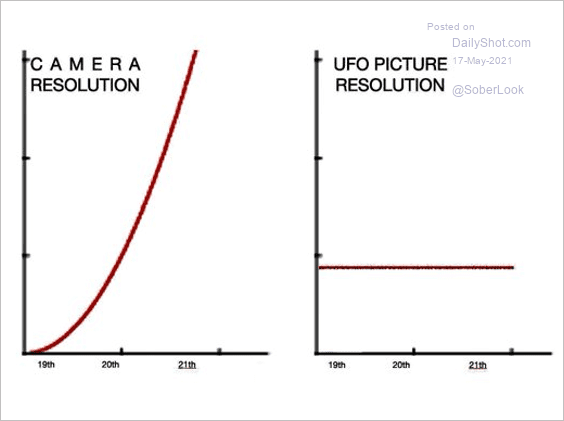

10. UFO picture resolution:

Source: @elonmusk

Source: @elonmusk

——————–

Back to Index