The Daily Shot: 19-May-21

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Rates

• Global Developments

• Food for Thought

The United States

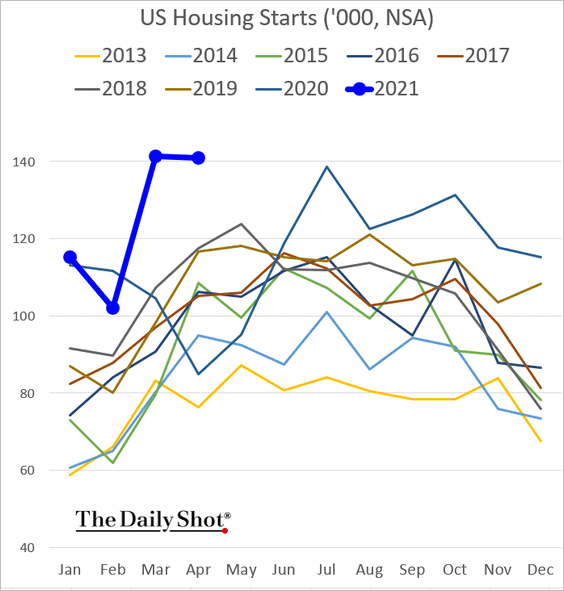

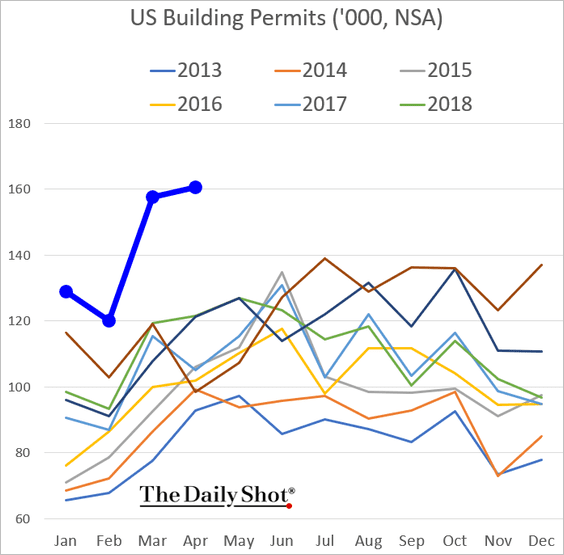

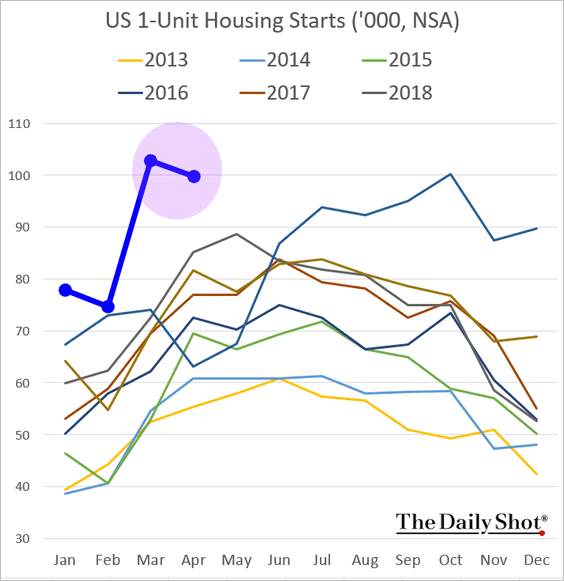

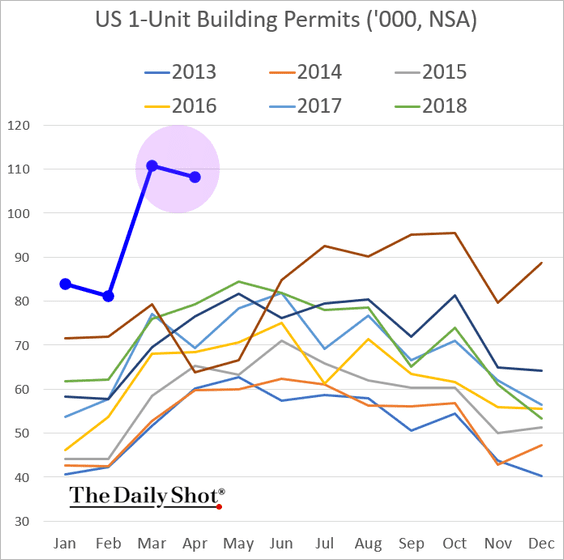

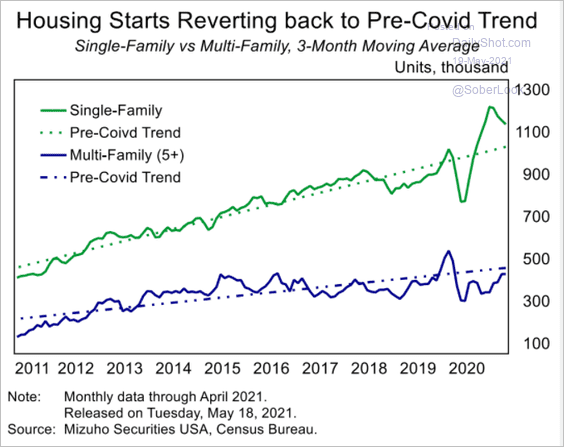

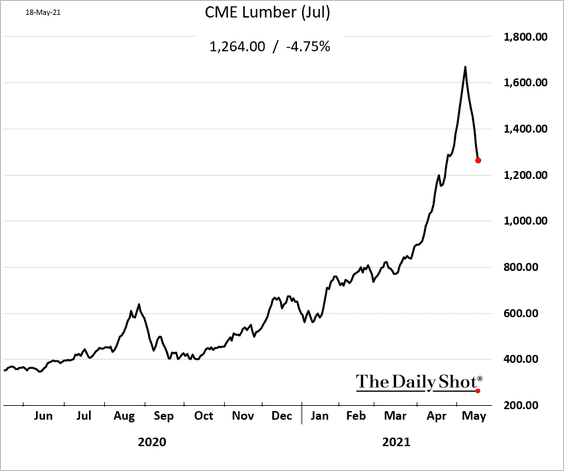

1. Residential construction paused in April amid headwinds from supply/labor bottlenecks and soaring lumber costs.

• Housing starts:

• Permits:

• Single-family construction slowed.

• Single-family starts are returning to their pre-COVID trend.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

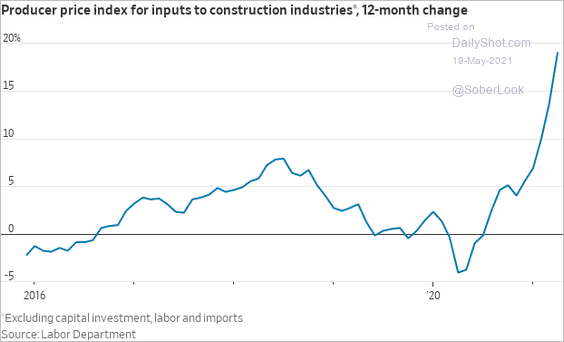

• Construction costs have surged.

Source: @jeffsparshott

Source: @jeffsparshott

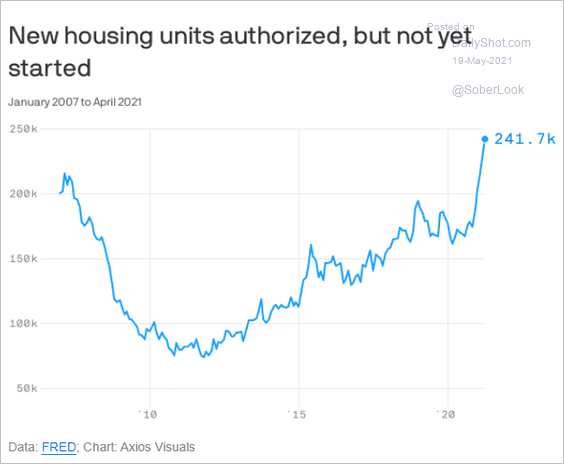

• The backlog of units authorized but not yet started keeps climbing.

Source: @axios Read full article

Source: @axios Read full article

——————–

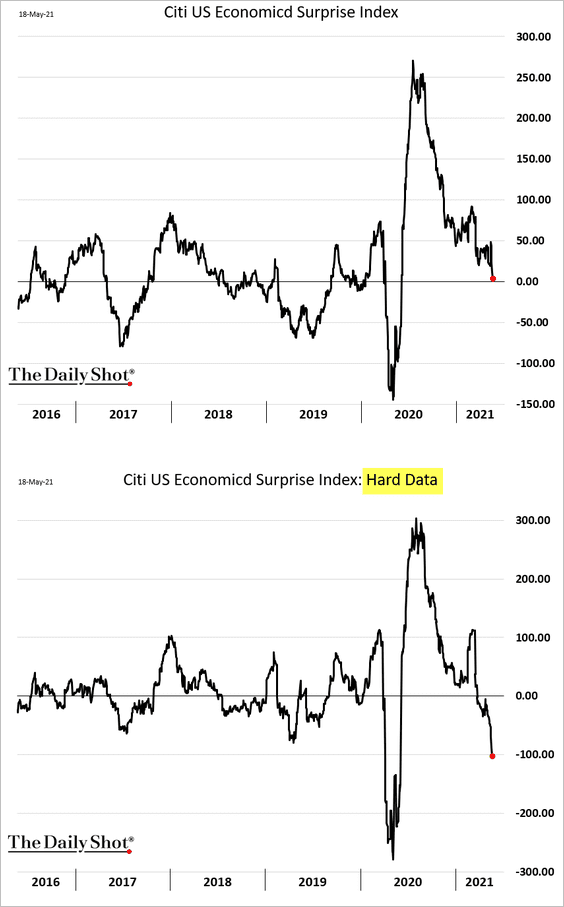

2. The Citi Economic Surprise Index declined further after the disappointing housing starts report.

Source: Citi

Source: Citi

3. Next, we have some updates on the labor market and wage trends.

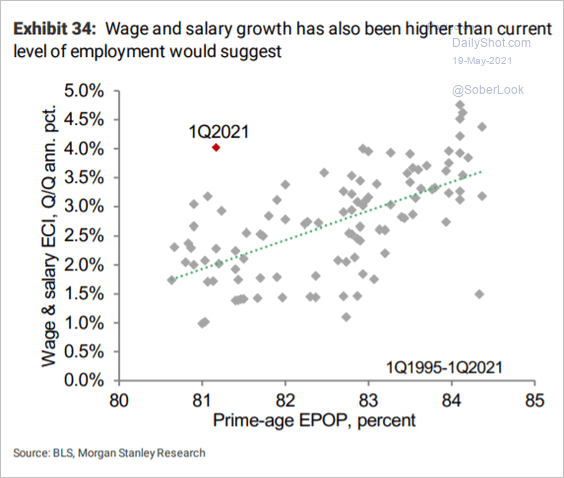

• The first-quarter increase in the Employment Cost Index was too high relative to the prime-age employment-to-population ratio.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

• For now, the Atlanta Fed’s wage tracker isn’t showing any acceleration in wage growth.

![]()

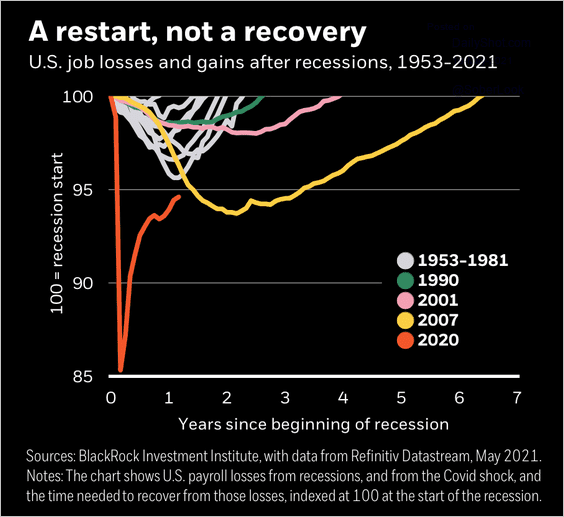

• There is still a long way to go to recoup jobs lost during the pandemic.

Source: BlackRock

Source: BlackRock

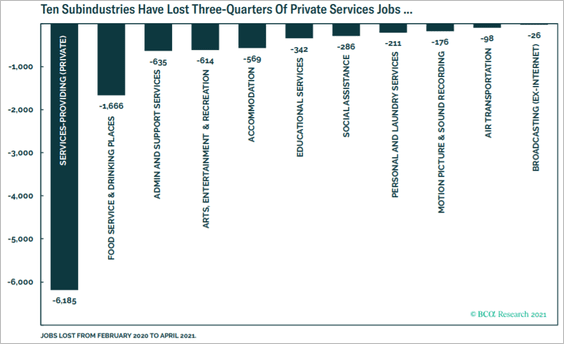

• Here are the service sectors with the highest job losses.

Source: BCA Research

Source: BCA Research

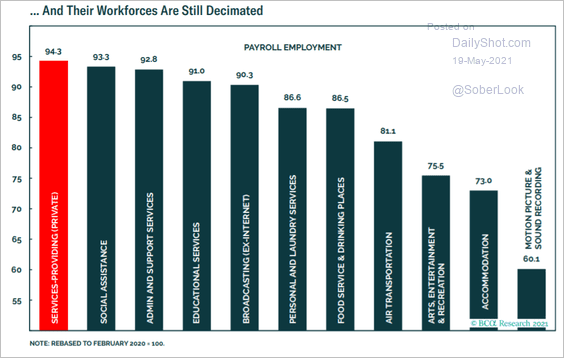

This chart shows where service-sector employment stands relative to pre-COVID levels.

Source: BCA Research

Source: BCA Research

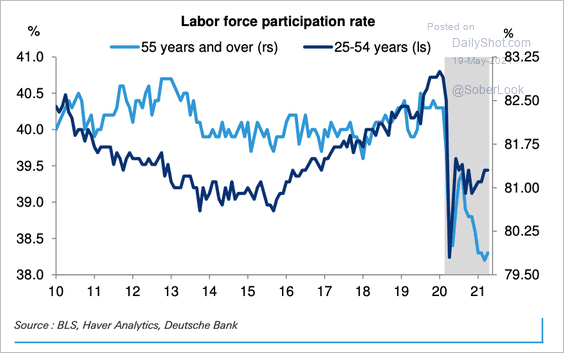

• Labor force participation for older age groups has failed to recover even as the economy reopens.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

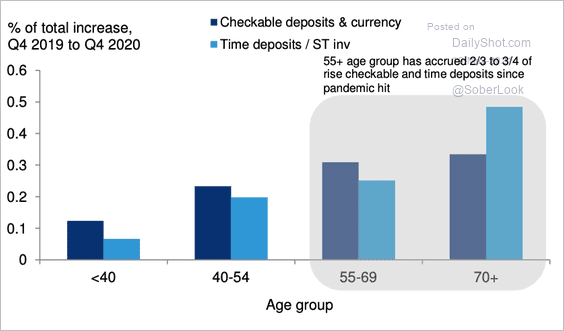

By the way, older age groups account for a majority of the rise in liquid assets over the past year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

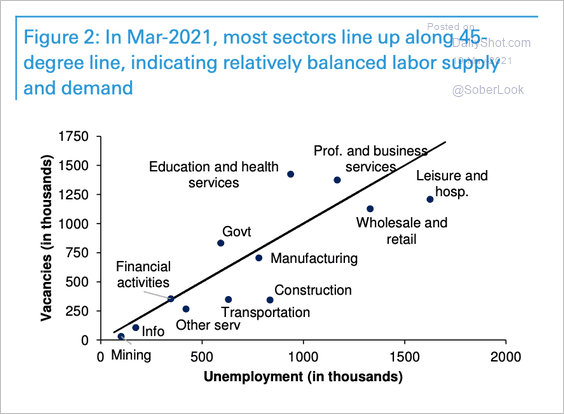

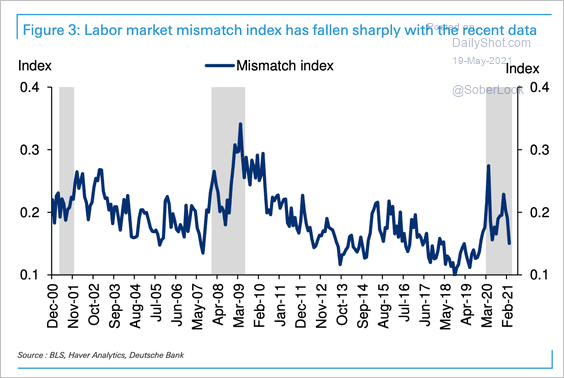

• The gap between unemployment and job openings has closed substantially across sectors over the past few months, according to Deutsche Bank (2 charts).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

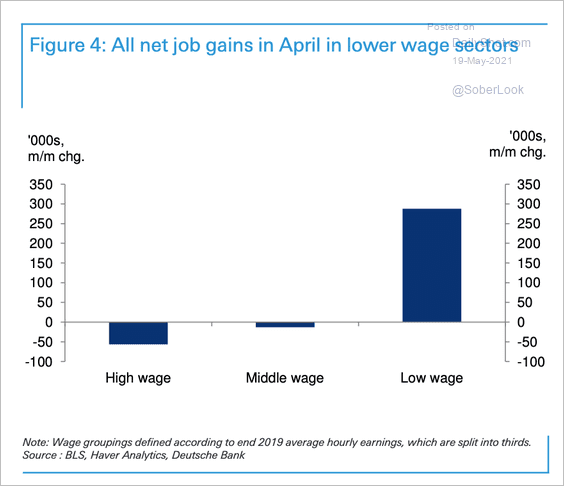

• Job gains in April were driven by low-wage sectors.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

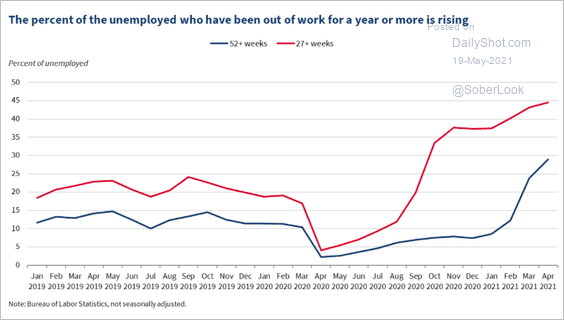

• Long-term unemployment continues to climb.

Source: Council of Economic Advisers Read full article

Source: Council of Economic Advisers Read full article

——————–

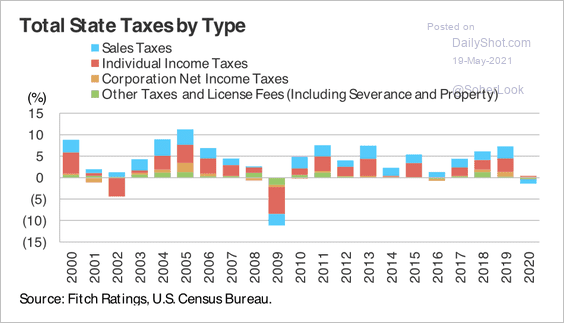

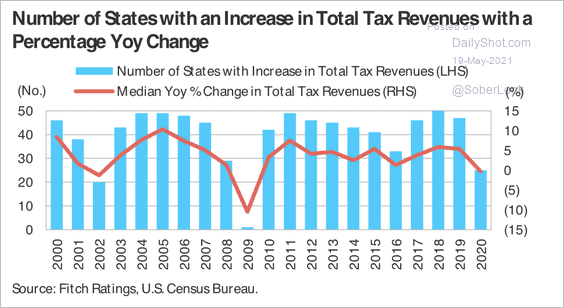

4. State tax revenue took a milder hit last year relative to the financial crisis (2 charts).

Source: Fitch Ratings

Source: Fitch Ratings

Source: Fitch Ratings

Source: Fitch Ratings

Back to Index

The United Kingdom

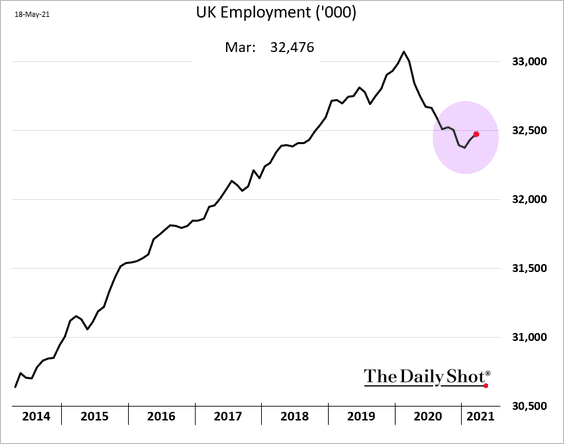

1. UK employment has bottomed.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

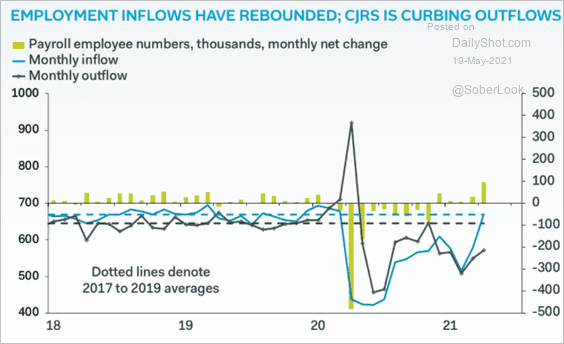

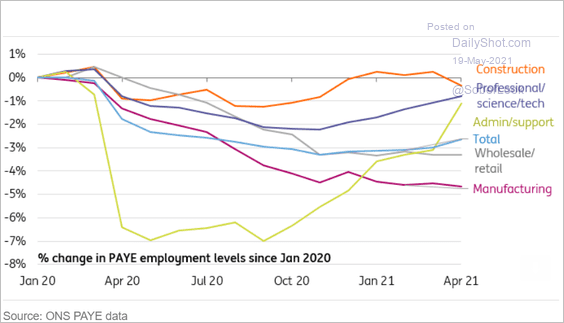

But the recovery remains uneven.

Source: ING

Source: ING

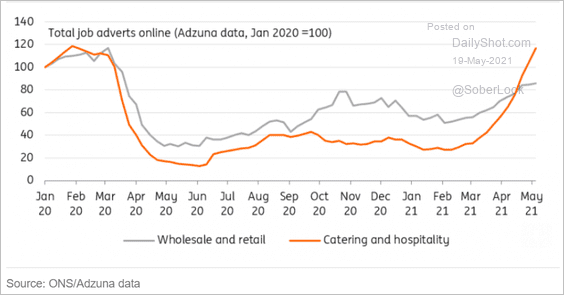

• Catering and hospitality job ads have fully recovered.

Source: ING

Source: ING

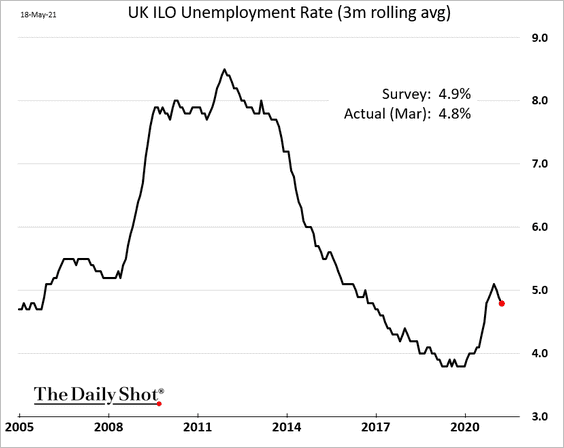

• Here is the unemployment rate.

——————–

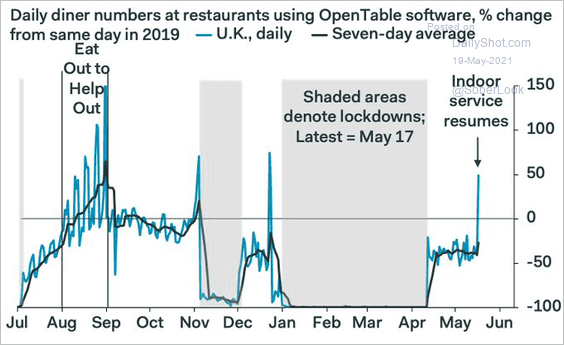

2. Restaurant diner numbers improved sharply.

Source: @samueltombs

Source: @samueltombs

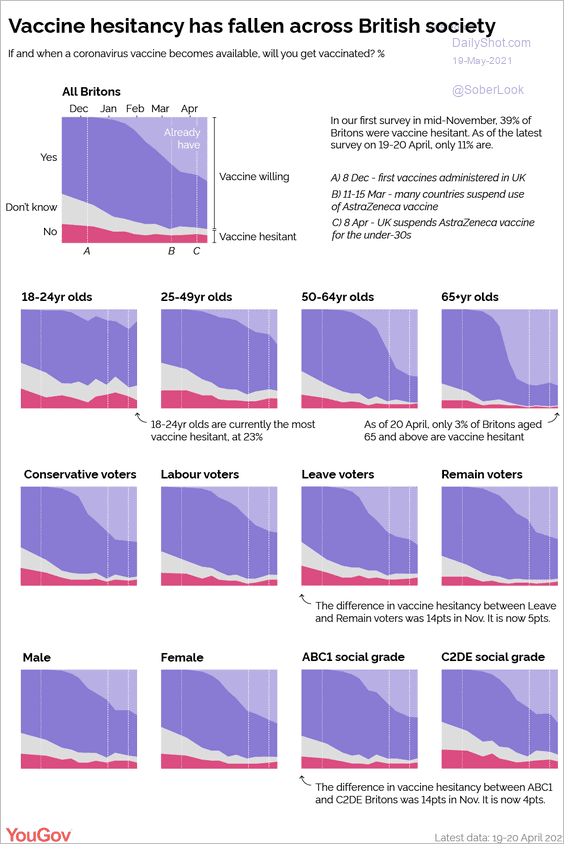

3. Vaccine hesitancy has been declining.

Source: YouGov Read full article

Source: YouGov Read full article

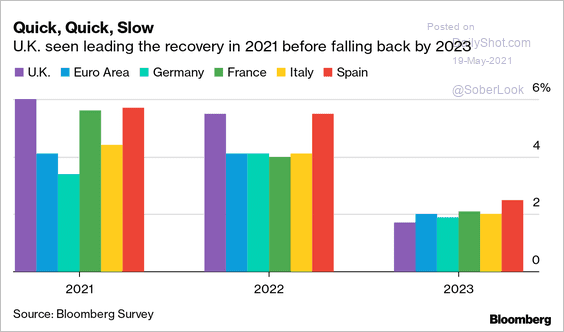

4. Here is a forecast for UK growth vs. the Eurozone.

Source: @markets Read full article

Source: @markets Read full article

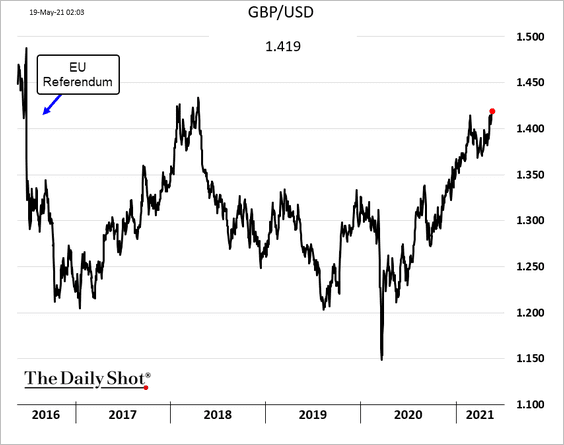

5. The pound continues to climb vs. USD.

Back to Index

The Eurozone

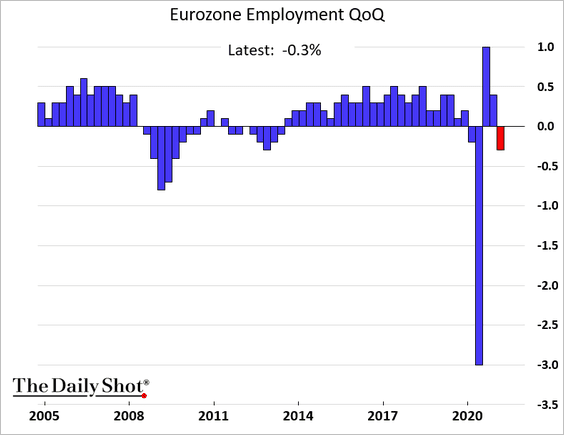

1. Employment declined in the first quarter.

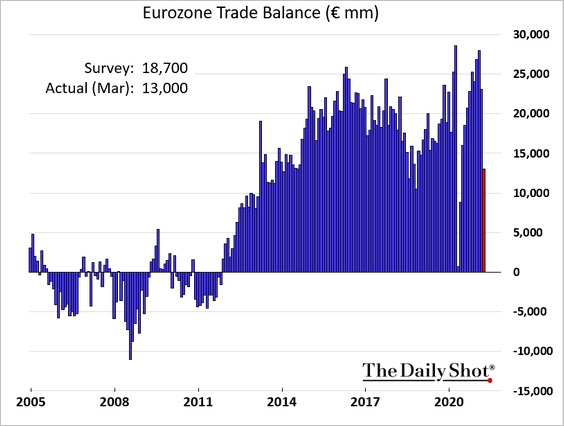

2. The euro-area trade surplus shrunk more than expected in March.

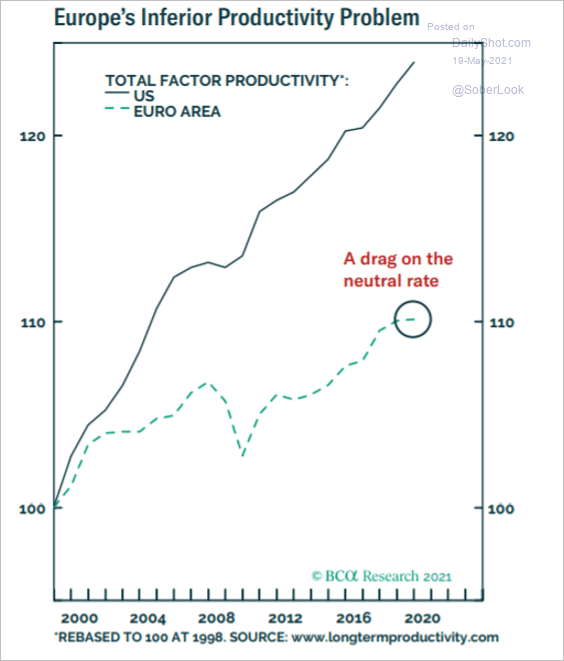

3. Weak productivity gains have been a drag on the neutral rate, limiting the ECB’s room to hike.

Source: BCA Research

Source: BCA Research

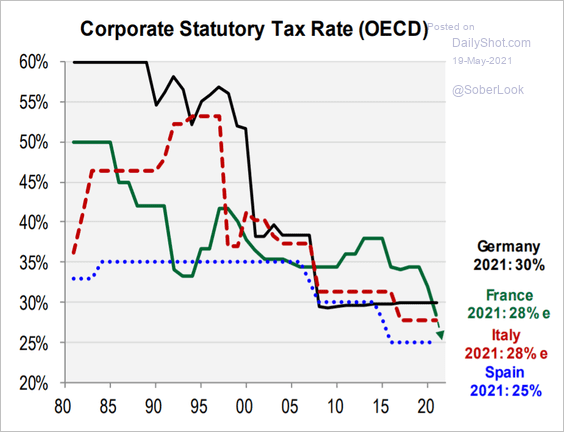

4. Corporate tax rates have been trending lower.

Source: Cornerstone Macro

Source: Cornerstone Macro

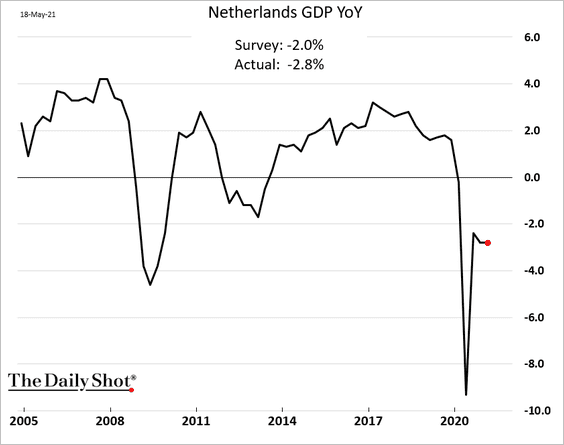

5. The Dutch GDP recovery has slowed.

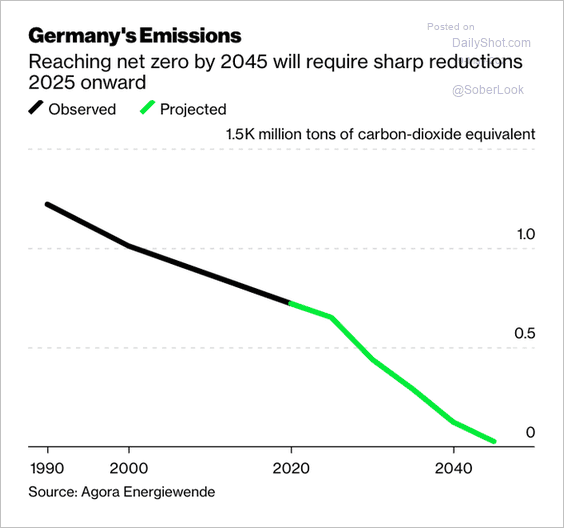

6. This chart shows Germany’s carbon emissions target.

Source: @adam_tooze, @business Read full article

Source: @adam_tooze, @business Read full article

Back to Index

Asia – Pacific

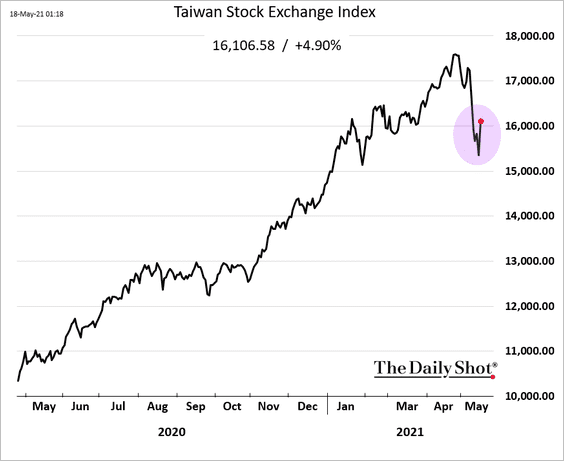

1. Taiwan’s stock market has stabilized.

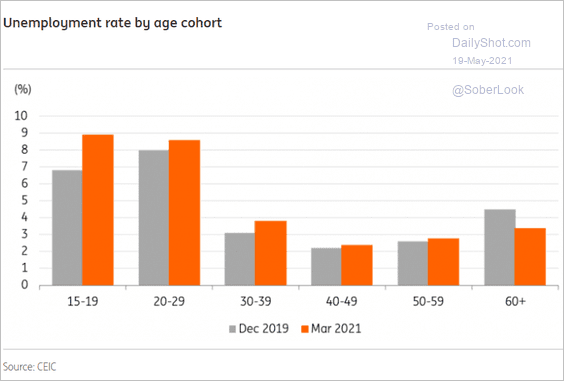

2. Here is South Korea’s unemployment rate by age.

Source: ING

Source: ING

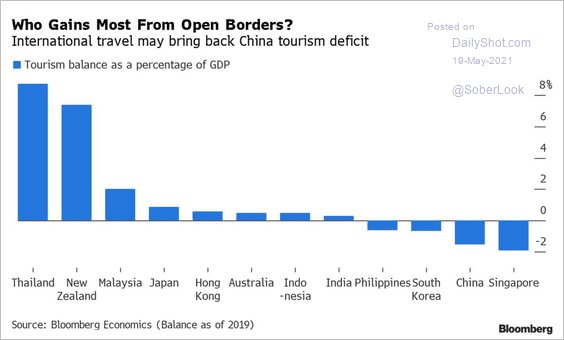

3. This chart shows each country’s tourism trade balance as a share of the GDP.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

China

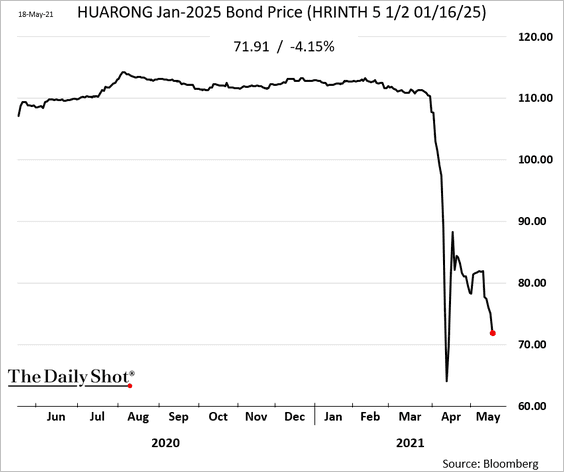

1. Huarong’s bonds remain under pressure amid persistent uncertainty.

Source: The New York Times Read full article

Source: The New York Times Read full article

——————–

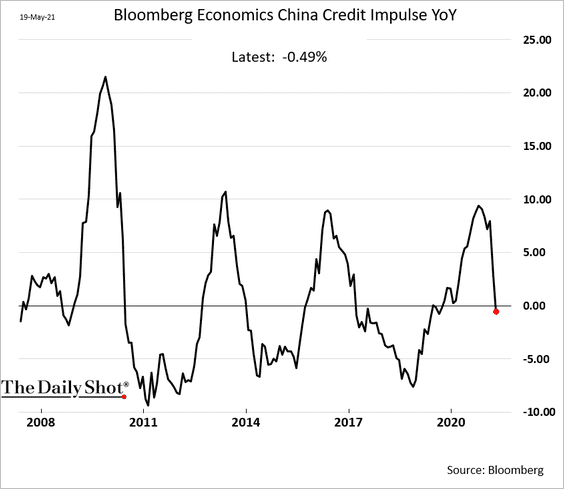

2. China’s credit impulse has weakened, which will be a drag on global commodity markets.

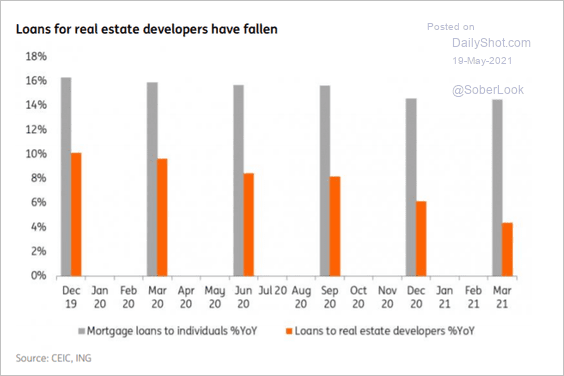

3. Loans to real estate developers have fallen.

Source: ING

Source: ING

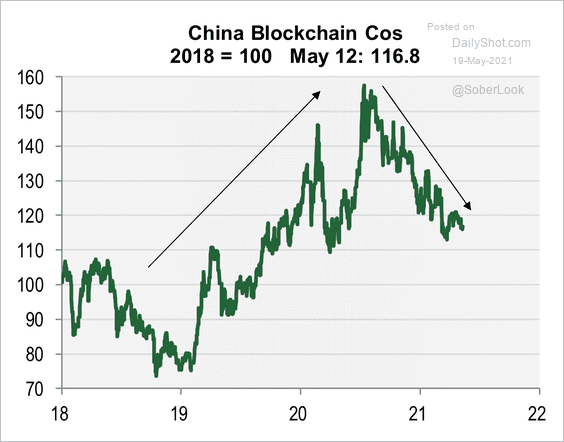

4. Chinese blockchain companies have underperformed over the past year.

Source: Cornerstone Macro

Source: Cornerstone Macro

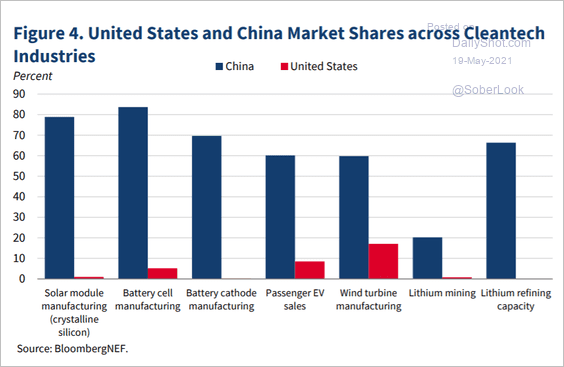

5. China dominates cleantech industries.

Source: Council of Economic Advisers Read full article

Source: Council of Economic Advisers Read full article

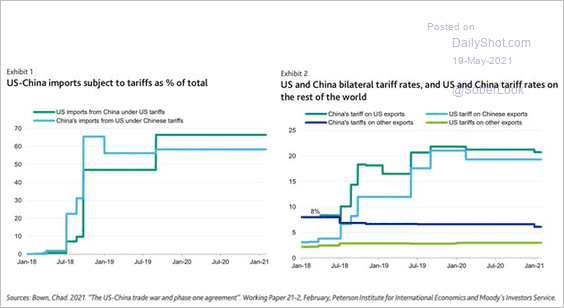

6. Here is a look at the US-China tariffs.

Source: @LizAnnSonders, @PIIE, @MoodysInvSvc

Source: @LizAnnSonders, @PIIE, @MoodysInvSvc

Back to Index

Emerging Markets

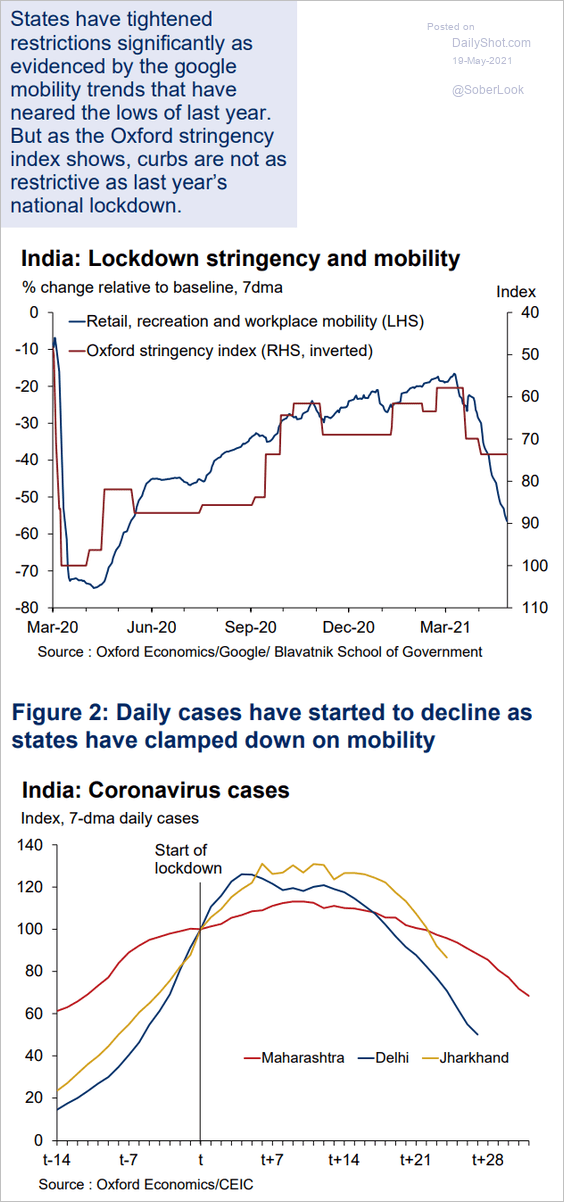

1. India’s COVID cases are moderating amid fresh lockdowns.

Source: Priyanka Kishore, Oxford Economics

Source: Priyanka Kishore, Oxford Economics

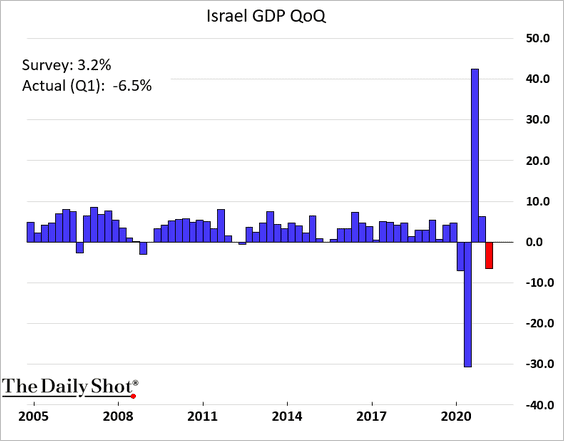

2. Israel’s GDP unexpectedly tumbled in the first quarter.

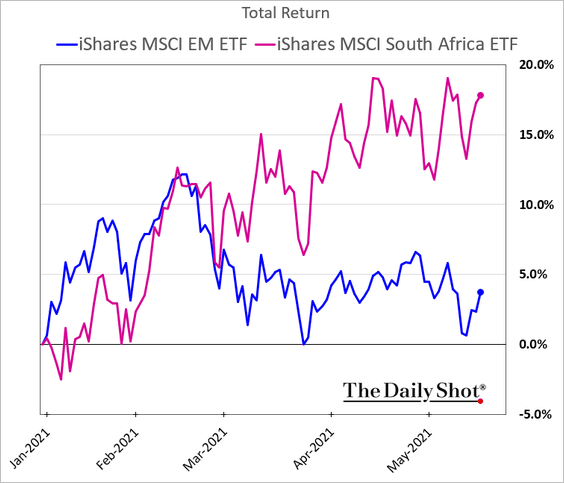

3. South Africa’s shares have been outperforming due to the massive rally in commodities.

h/t @adengat

h/t @adengat

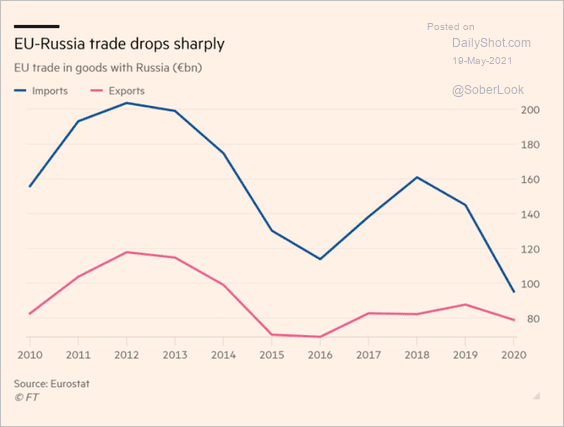

4. This chart shows the EU-Russia trade.

Source: @adam_tooze, @financialtimes, @IEA Read full article

Source: @adam_tooze, @financialtimes, @IEA Read full article

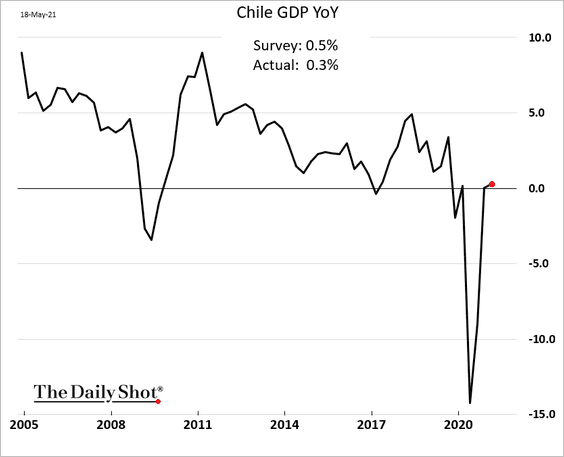

5. Chile is out of recession, but the rebound has lost momentum.

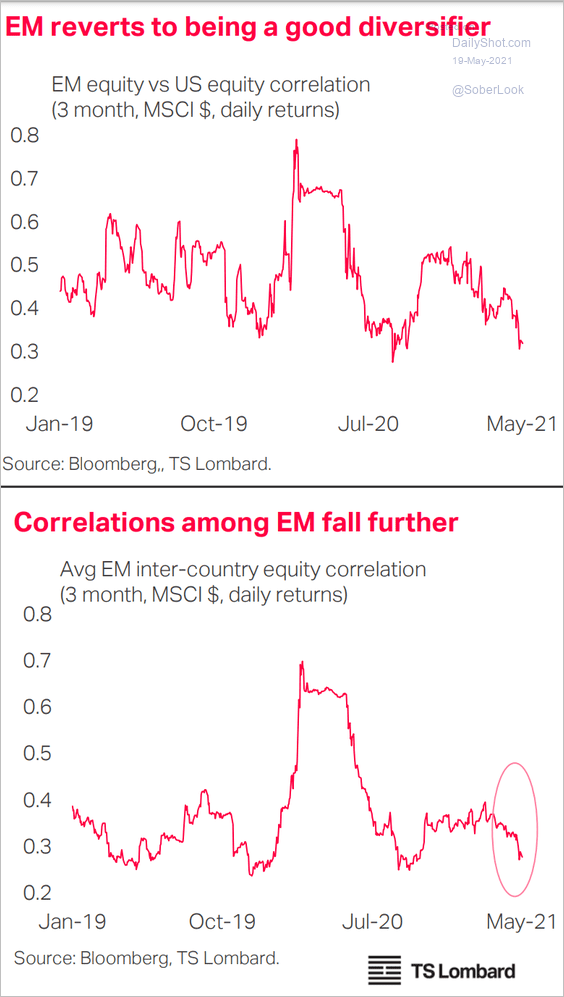

6. EM stock markets are less correlated with the US and among each other.

Source: TS Lombard

Source: TS Lombard

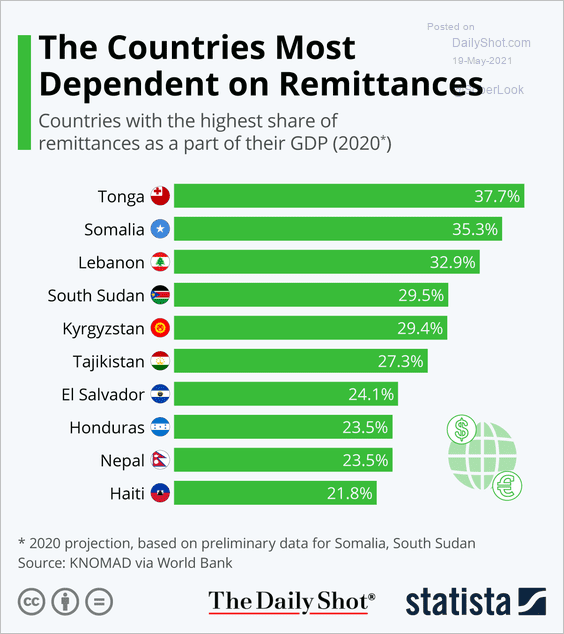

7. Which countries rely most on remittances?

Source: Statista

Source: Statista

Back to Index

Cryptocurrency

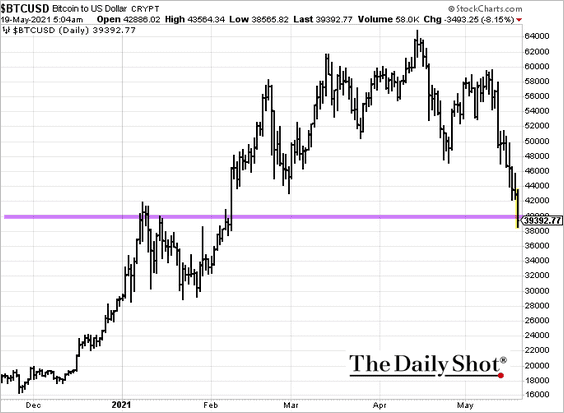

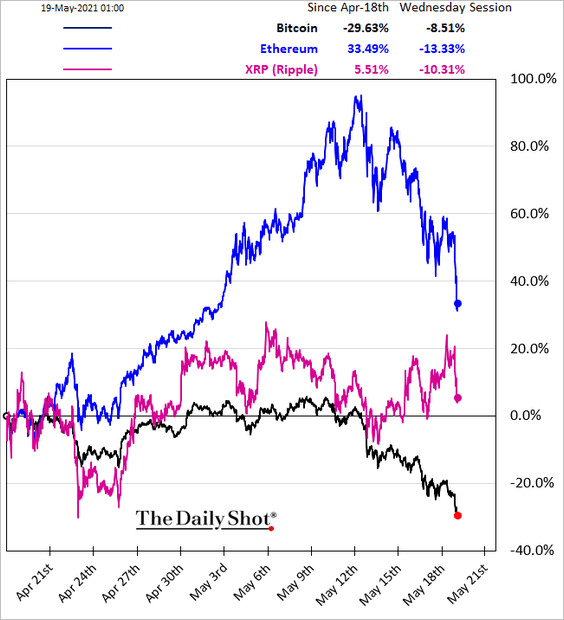

1. Cryptos are under pressure after regulatory action from Beijing.

Source: Mint Read full article

Source: Mint Read full article

• Bitcoin dipped below $40k.

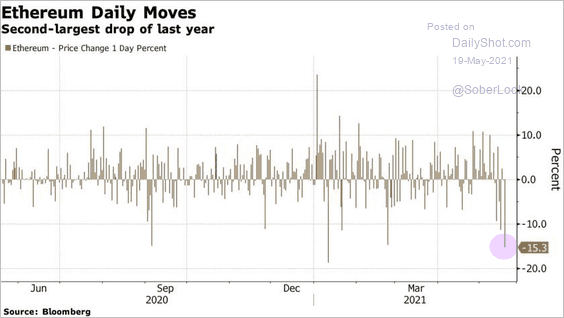

• It was a tough day for Ethereum.

Source: @DiMartinoBooth, @business

Source: @DiMartinoBooth, @business

• Here is the relative performance.

——————–

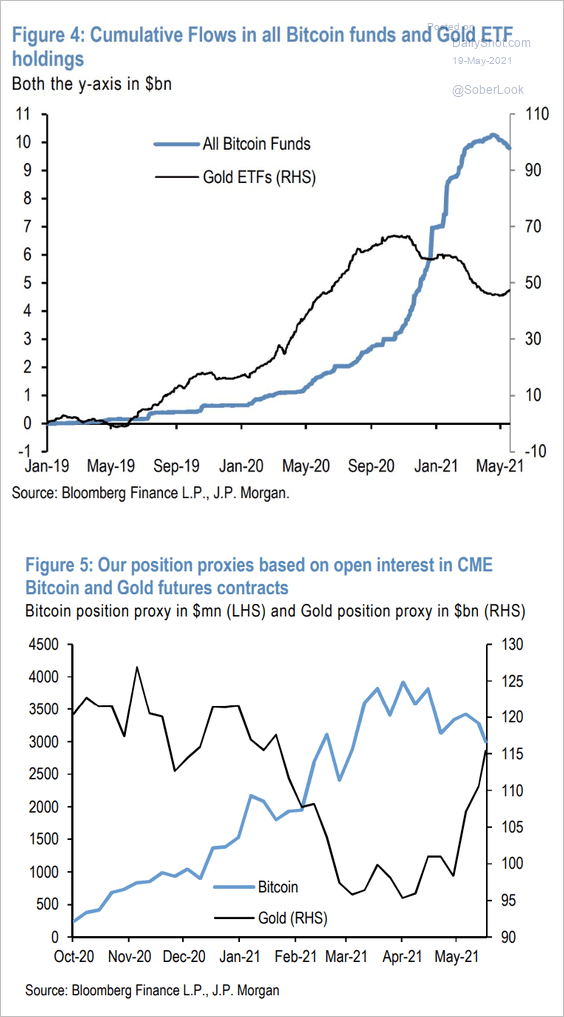

2. The charts below confirm the crypto-gold rotation.

Source: JP Morgan, @SamRo

Source: JP Morgan, @SamRo

Back to Index

Commodities

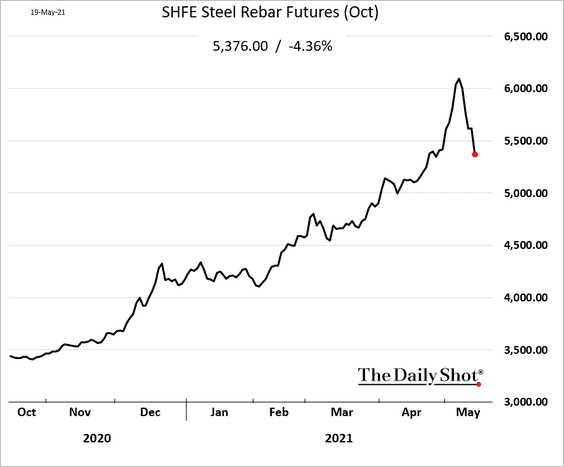

1. China’s steel futures are rolling over.

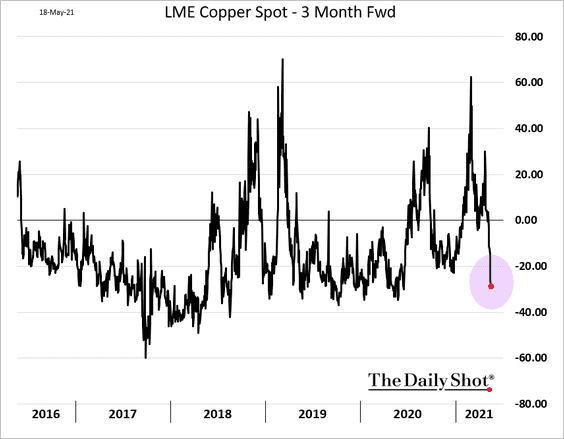

2. Spot copper is now trading at a discount to the three-month forward. It’s an indication of weakening demand pressures (see story).

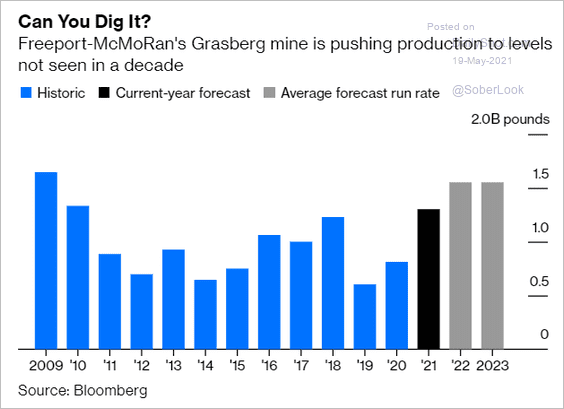

Copper production has been ramping up.

Source: @davidfickling, @bopinion Read full article

Source: @davidfickling, @bopinion Read full article

——————–

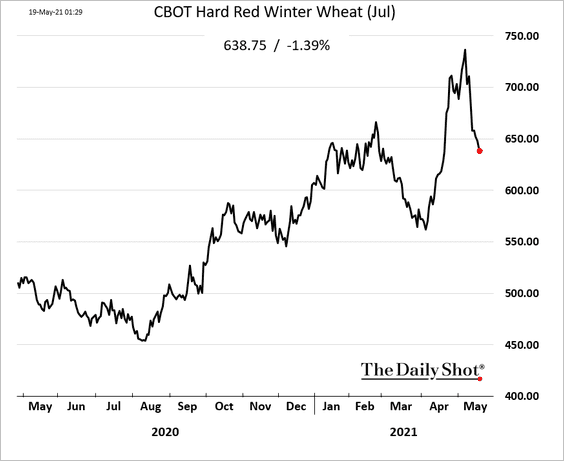

3. US wheat futures are well off the highs.

4. And lumber continues to tumble.

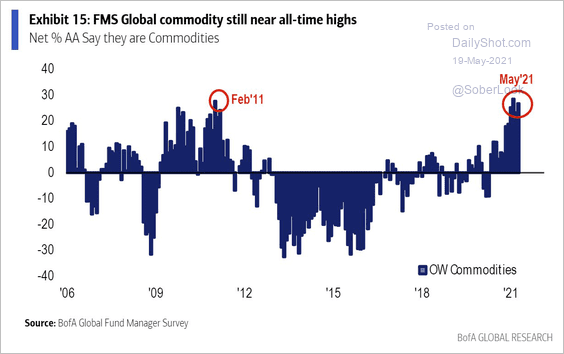

5. Commodity positioning remains stretched.

Source: BofA Global Research; @Callum_Thomas

Source: BofA Global Research; @Callum_Thomas

Back to Index

Energy

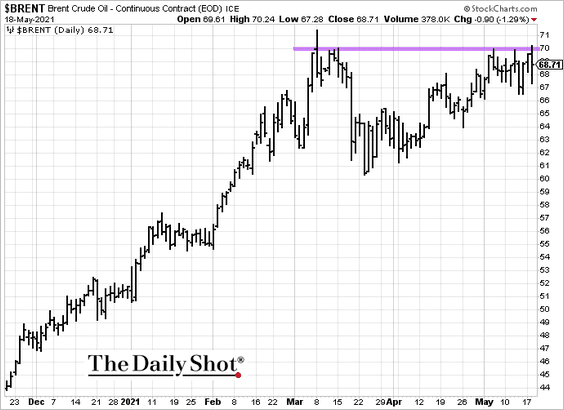

1. Brent crude tested resistance at $70/bbl three times this month.

Source: barchart.com

Source: barchart.com

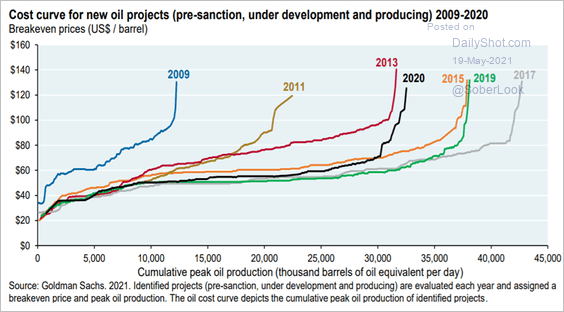

2. Next, we have the cost curves for new oil projects.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

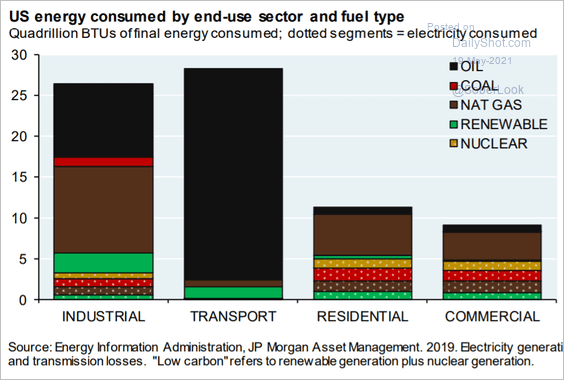

3. This chart shows US energy consumption by end-use and fuel type.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Back to Index

Equities

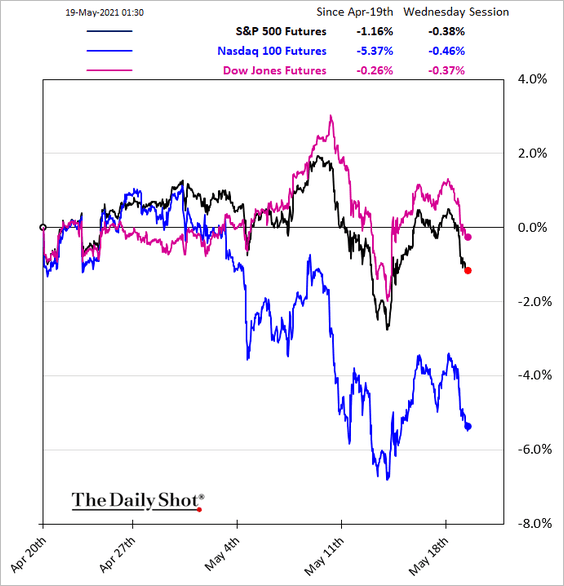

1. The Nasdaq 100 continues to lag.

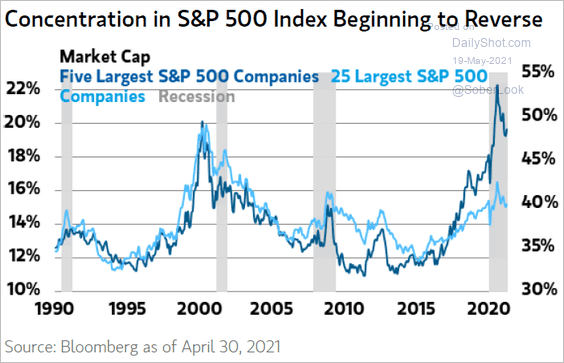

2. Related to the above, the S&P 500 concentration has been moderating.

Source: @ISABELNET_SA, @MorganStanley

Source: @ISABELNET_SA, @MorganStanley

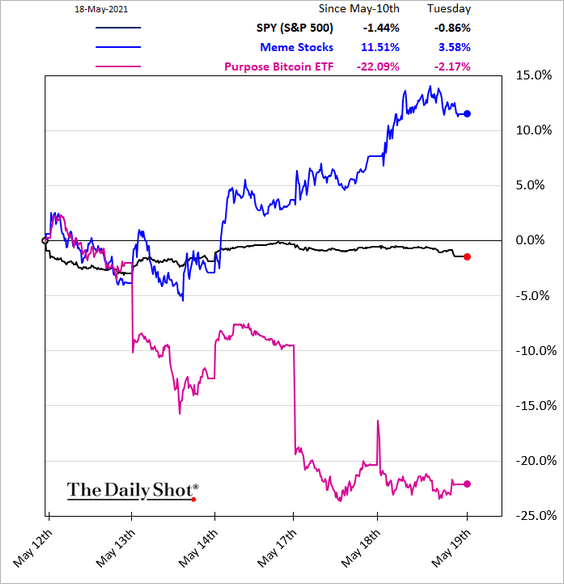

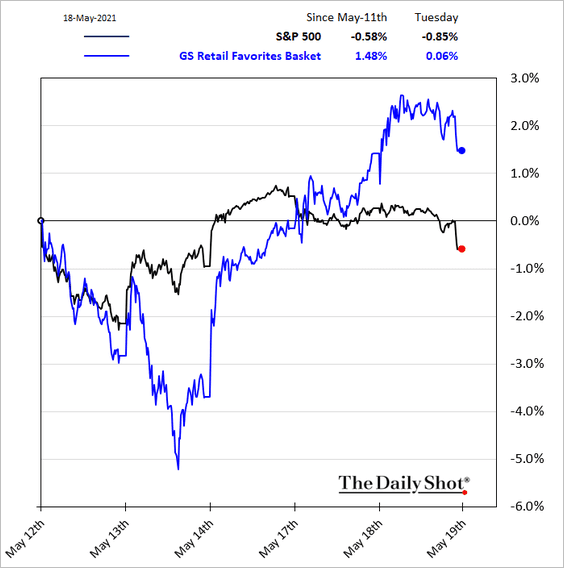

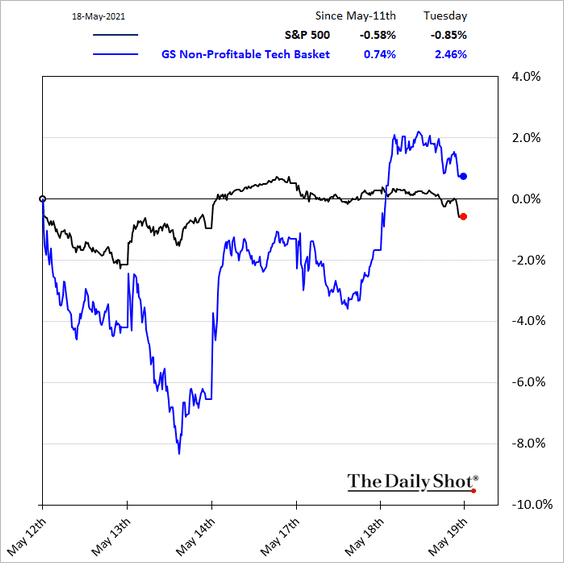

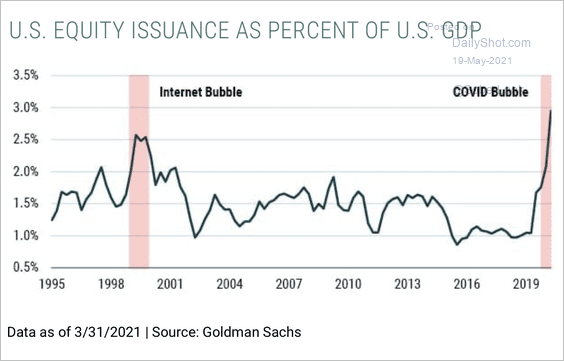

3. We continue to see the rotation out of crypto back into stocks favored by the Reddit crowd.

• Meme stocks vs. bitcoin:

• Retail favorites:

• Non-profitable tech:

• Microcaps:

——————–

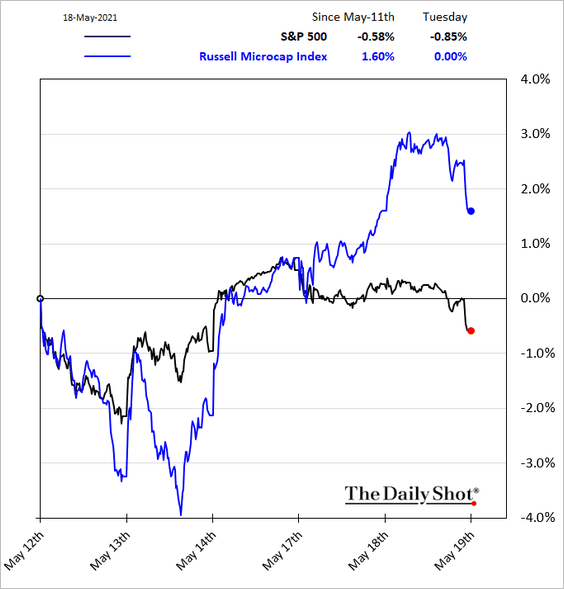

4. This year’s fund inflows have been impressive. Will we see a pullback?

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

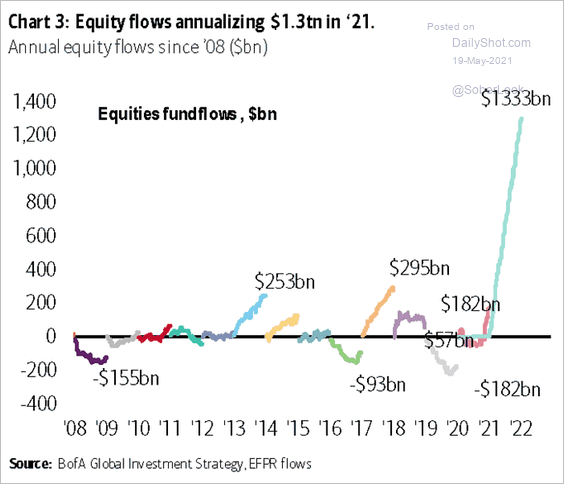

5. This chart shows equity issuance as a percent of US GDP.

Source: @jessefelder Read full article

Source: @jessefelder Read full article

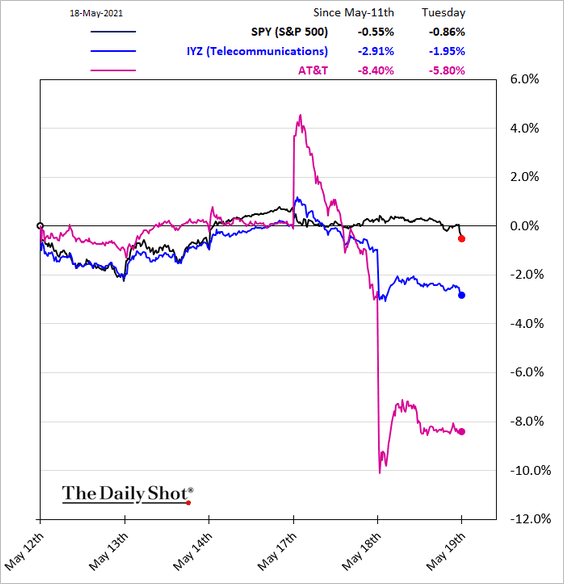

6. Telecoms came under pressure on Tuesday.

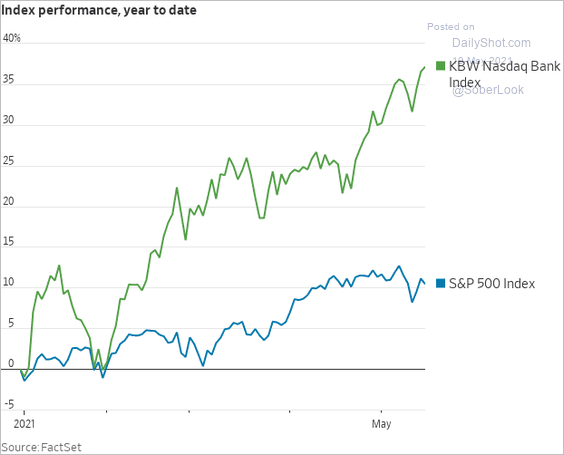

7. It’s been a good few months for bank shares.

Source: @WSJ Read full article

Source: @WSJ Read full article

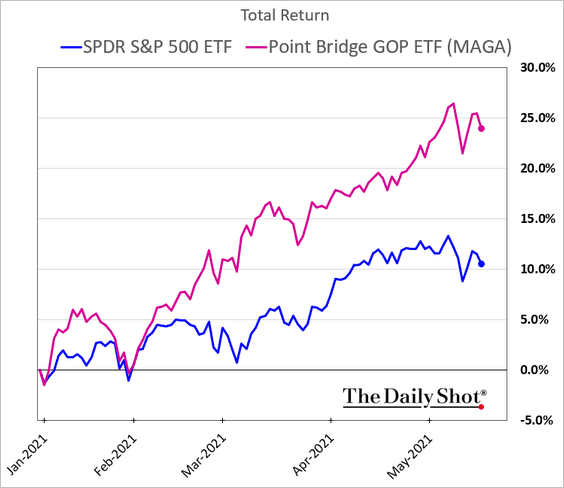

8. The GOP ETF has been outperforming because of higher concentrations of cyclical sectors (see story).

h/t @Tobin_Tweets, @business

h/t @Tobin_Tweets, @business

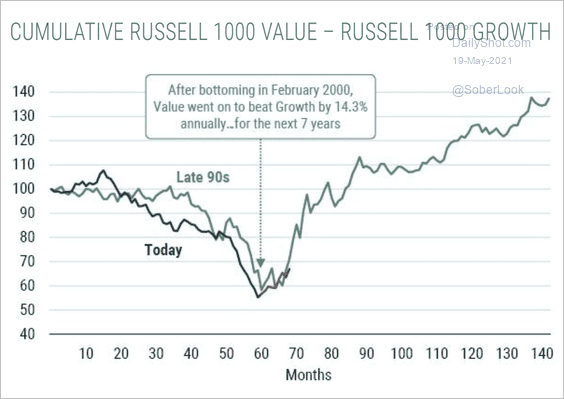

9. Will value continue to outperform growth?

Source: @jessefelder, @verdadcap Read full article

Source: @jessefelder, @verdadcap Read full article

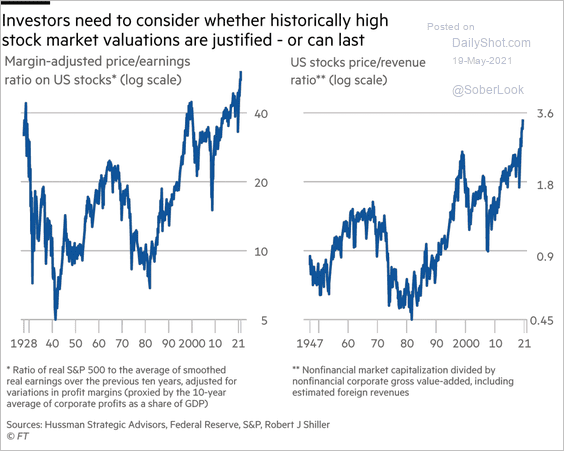

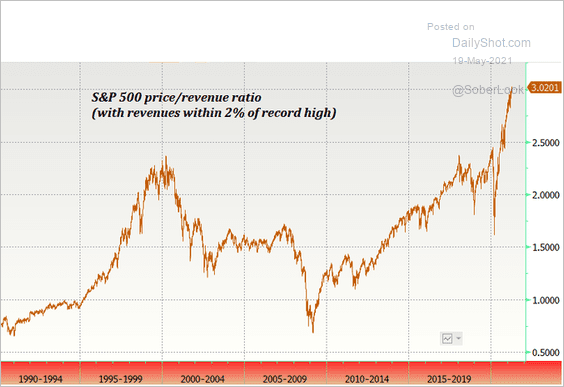

10. Valuations remain a concern (2 charts).

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: @hussmanjp

Source: @hussmanjp

——————–

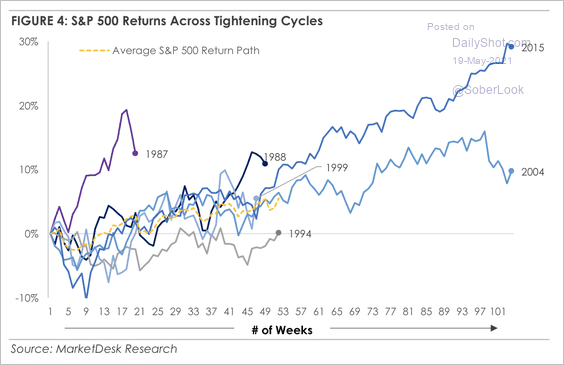

11. Historically, a selloff occurs at the beginning of a tightening cycle but ultimately, equities trade higher.

Source: MarketDesk Research

Source: MarketDesk Research

Back to Index

Alternatives

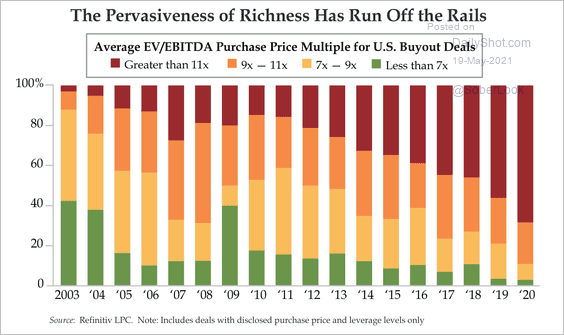

1. Roughly 70% of US buyouts have been priced above 11x EBITDA.

Source: Quill Intelligence

Source: Quill Intelligence

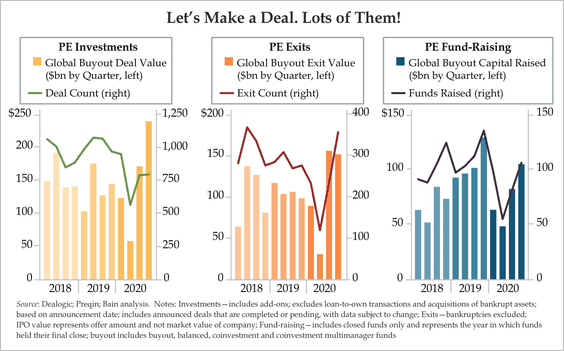

2. Global private equity deal activity came roaring back after the brief pandemic slump.

Source: Quill Intelligence

Source: Quill Intelligence

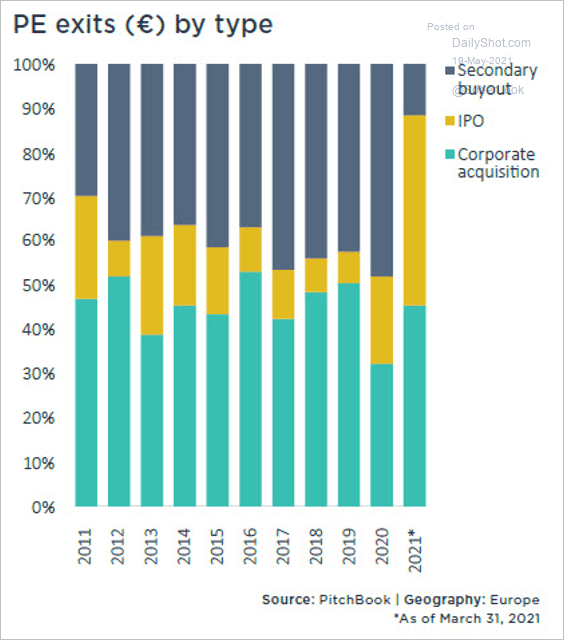

3. IPOs are dramatically surpassing secondary deals in European private equity exits.

Source: PitchBook

Source: PitchBook

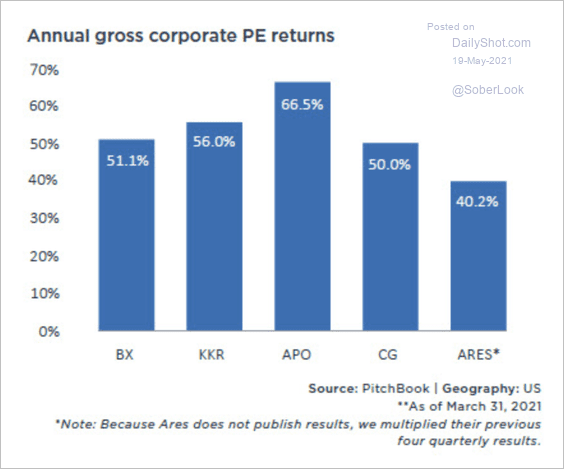

4. Trailing 12-month returns are on the upswing for publicly traded private equity managers.

Source: PitchBook

Source: PitchBook

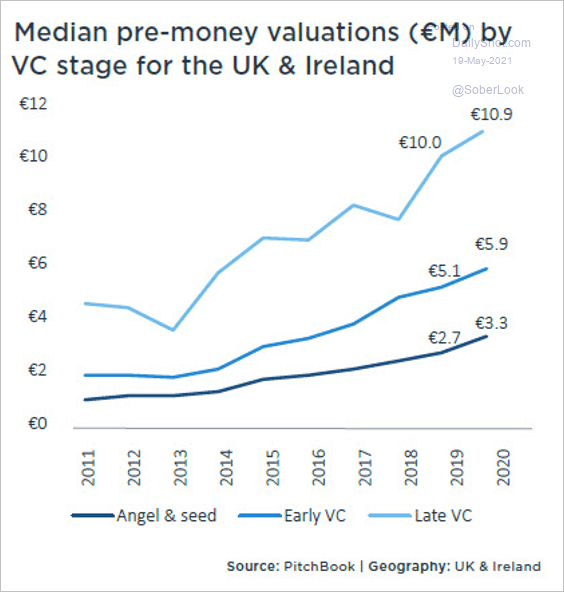

5. Valuations continued to grow across all VC stages in the UK and Ireland despite Brexit uncertainties last year.

Source: PitchBook

Source: PitchBook

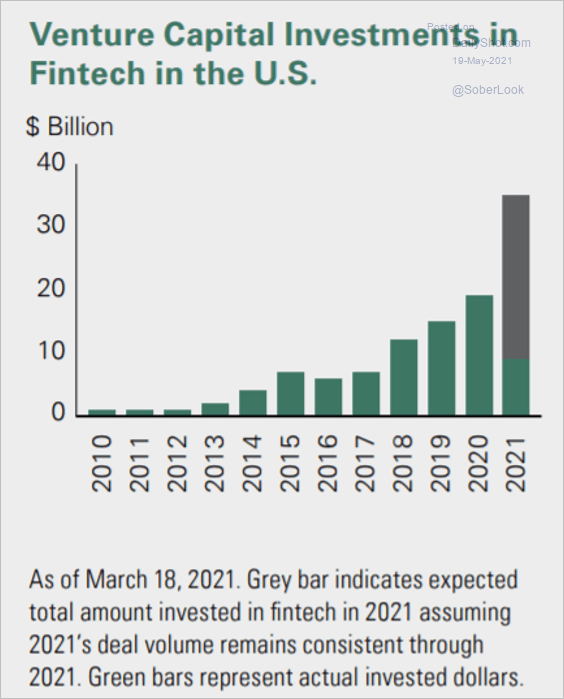

6. Fintech VC deals are popular this year.

Source: https://www.bessemertrust.com/sites/default/files/2021-04/04_01_21_BT_QIP_Future_of_Money_UA_0.pdf Read full article

Source: https://www.bessemertrust.com/sites/default/files/2021-04/04_01_21_BT_QIP_Future_of_Money_UA_0.pdf Read full article

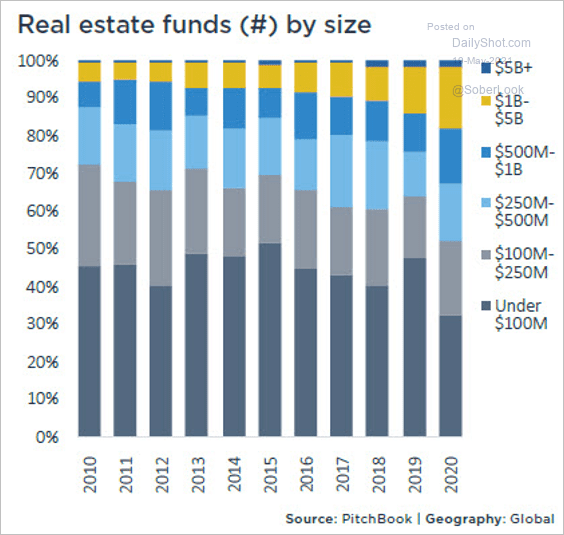

7. The number of global real estate funds under $500 million reached the lowest level since 2004 last year. However, activity for funds between $500 million and $5 billion held relatively steady year-over-year.

Source: PitchBook

Source: PitchBook

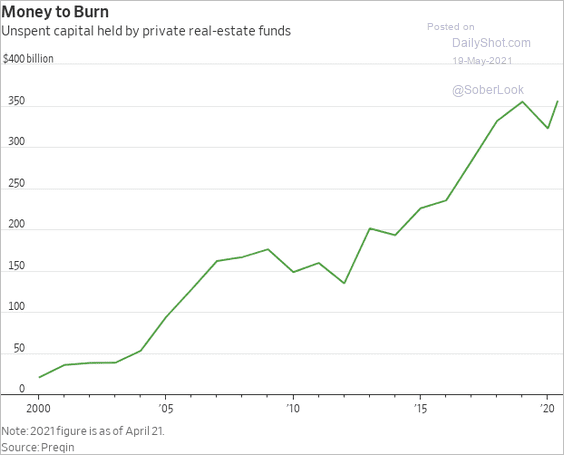

8. There is plenty of available capital in private real-estate funds.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Rates

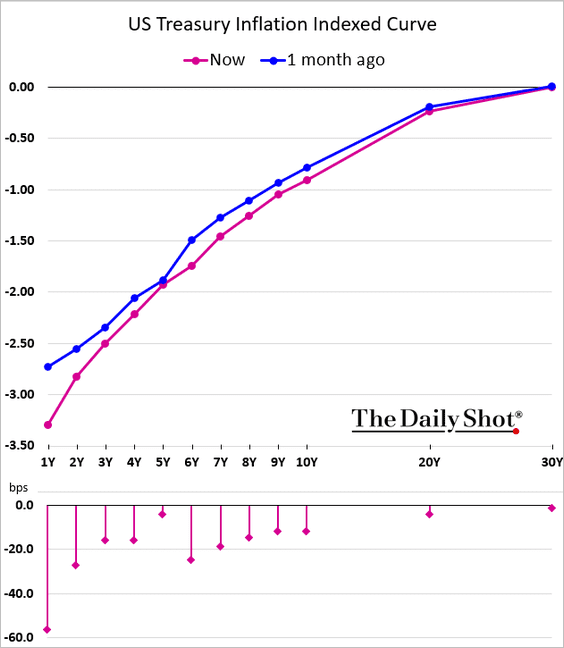

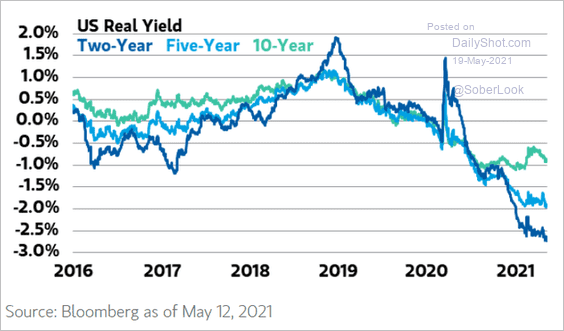

1. The TIPS curve continues to steepen as shorter-maturity real yields move deeper into negative territory (2 charts).

Source: @ISABELNET_SA, @MorganStanley

Source: @ISABELNET_SA, @MorganStanley

——————–

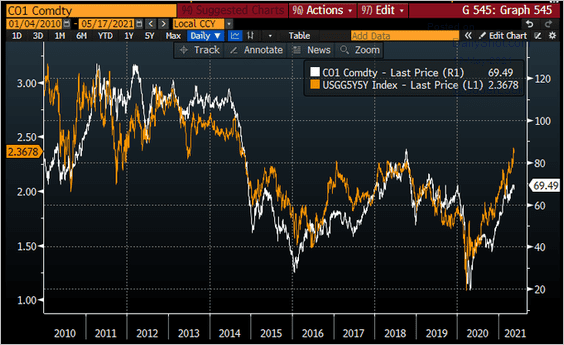

2. Long-term inflation expectations (5yr, 5yr forward) remain correlated with crude oil.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

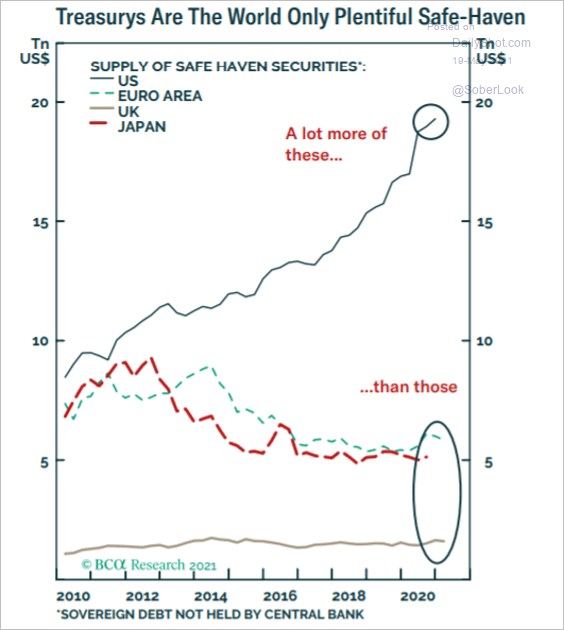

3. Global safe-haven assets are increasingly dominated by Treasuries.

Source: BCA Research

Source: BCA Research

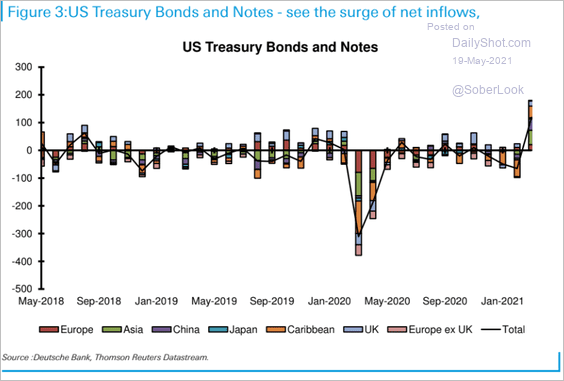

4. Foreigners have been buying Treasury notes and bonds (see definition of TIC).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

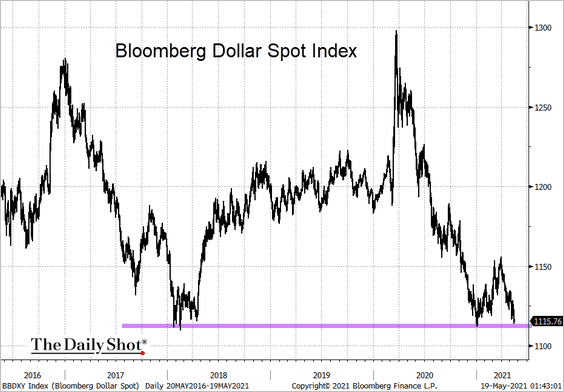

1. The Bloomberg US Dollar Index is at support.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

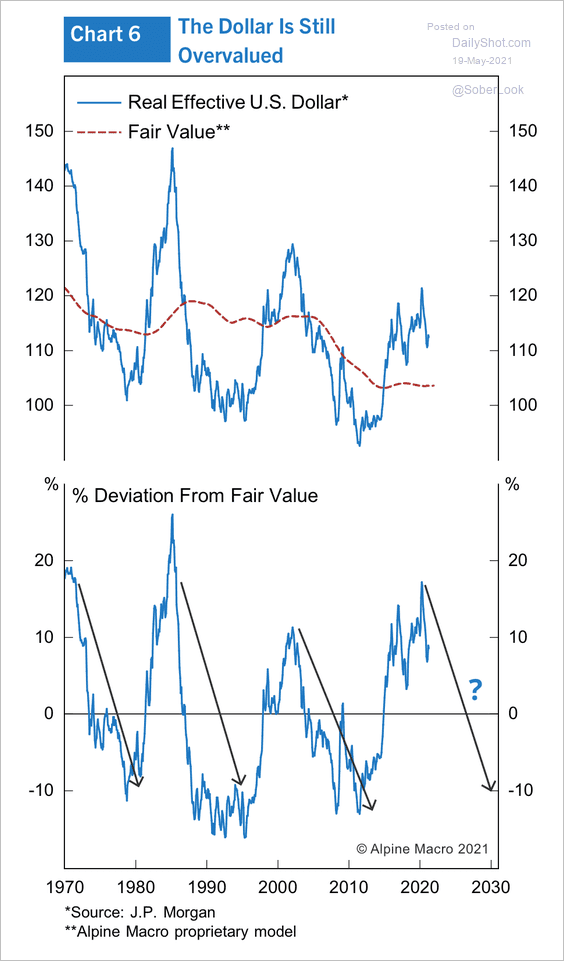

The dollar still appears overvalued despite recent weakness.

Source: Alpine Macro

Source: Alpine Macro

——————–

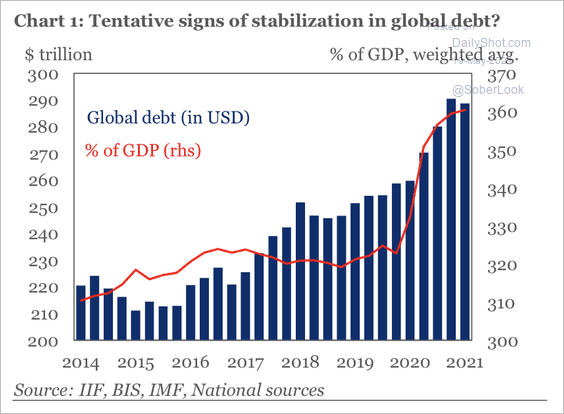

2. Total global debt fell by $1.7 trillion to $289 trillion in Q1, which was the first decline in about two years, according to IIF.

Source: IIF

Source: IIF

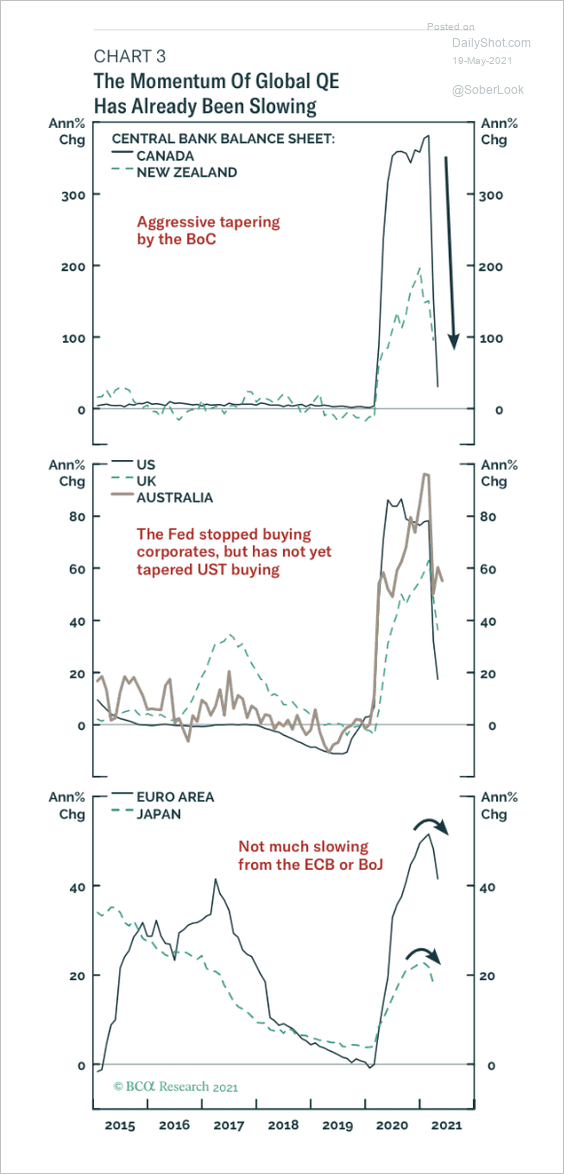

3. The pace of global central bank balance sheet expansion peaked at the start of the year.

Source: BCA Research

Source: BCA Research

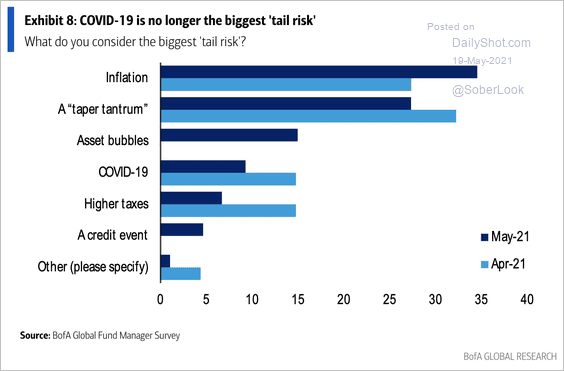

4. What do global fund managers consider the biggest tail risk?

Source: BofA Global Research; @SamRo

Source: BofA Global Research; @SamRo

5. Home price appreciation accelerated last year across OECD economies.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

Back to Index

Food for Thought

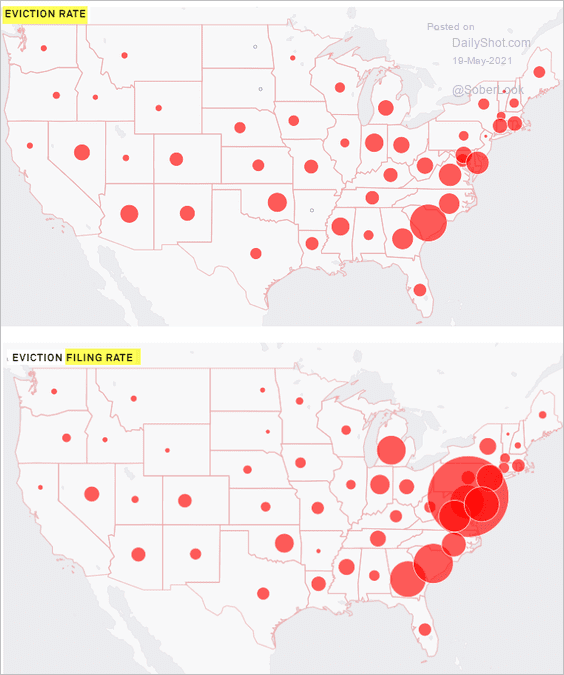

1. Eviction rates and eviction filing rates (the big circle is PA):

Source: Princeton University’s Eviction Lab

Source: Princeton University’s Eviction Lab

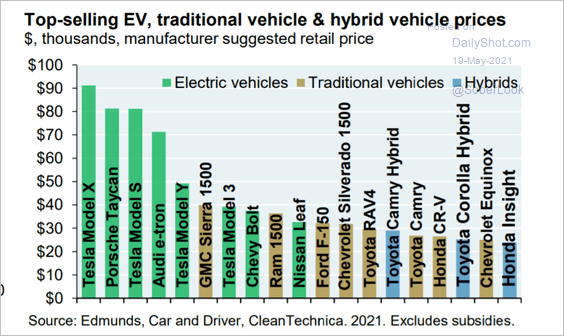

2. EV prices:

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

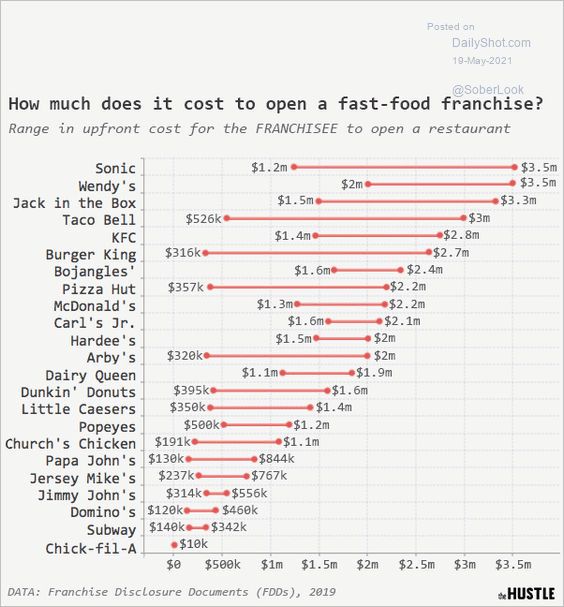

3. Fast food franchise costs:

Source: The Hustle; h/t JJ Read full article

Source: The Hustle; h/t JJ Read full article

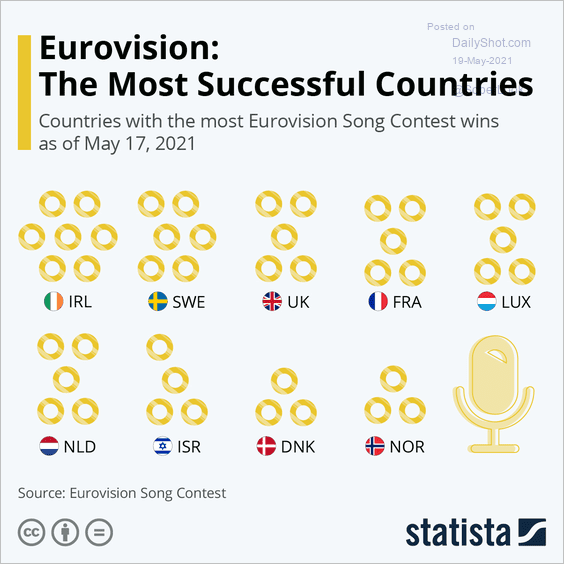

4. The Eurovision Song Contest:

Source: Statista

Source: Statista

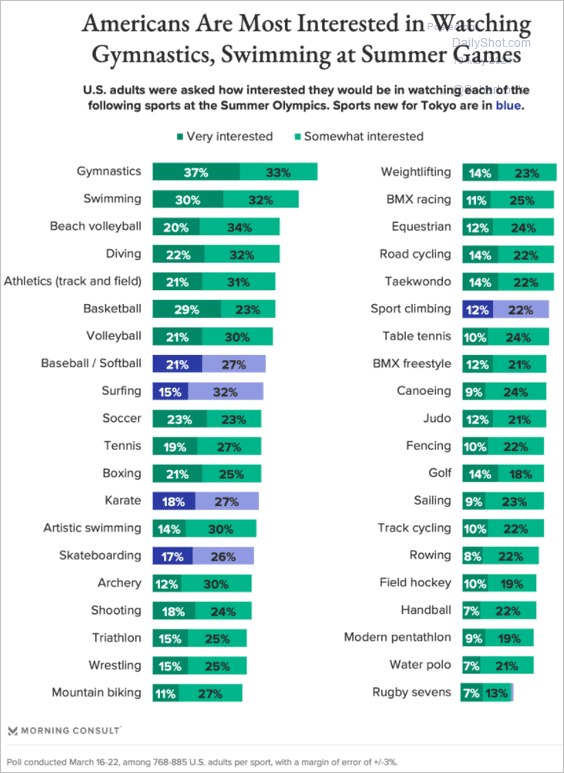

5. Americans’ interest in watching Olympic sports:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

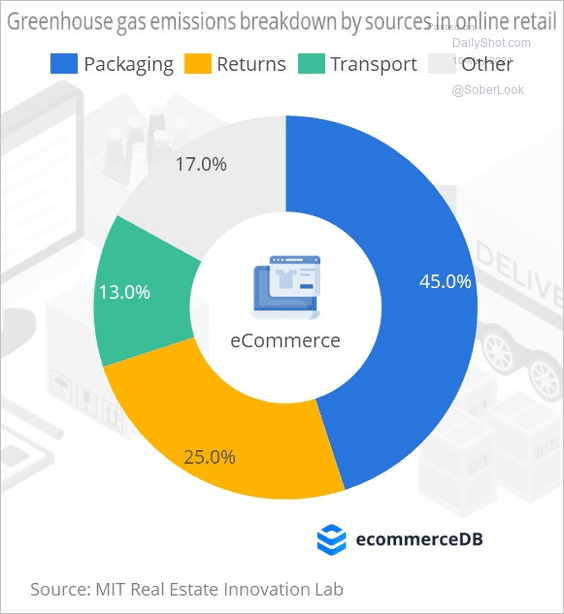

6. Greenhouse gas emissions from online retail:

Source: eCommerce DB Read full article

Source: eCommerce DB Read full article

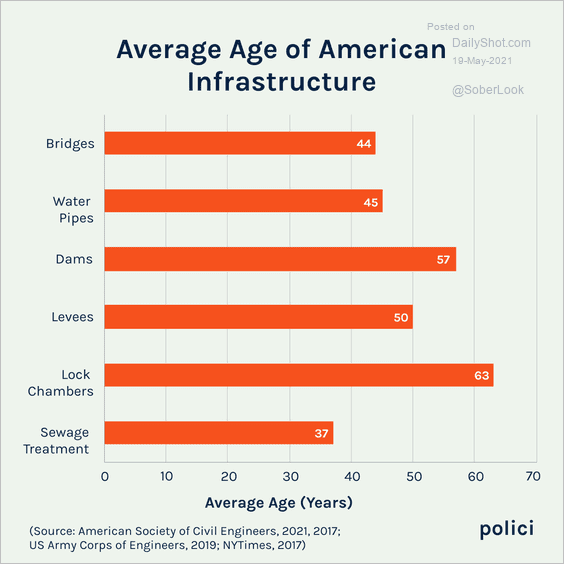

7. Average age of US infrastructure:

Source: polici Read full article

Source: polici Read full article

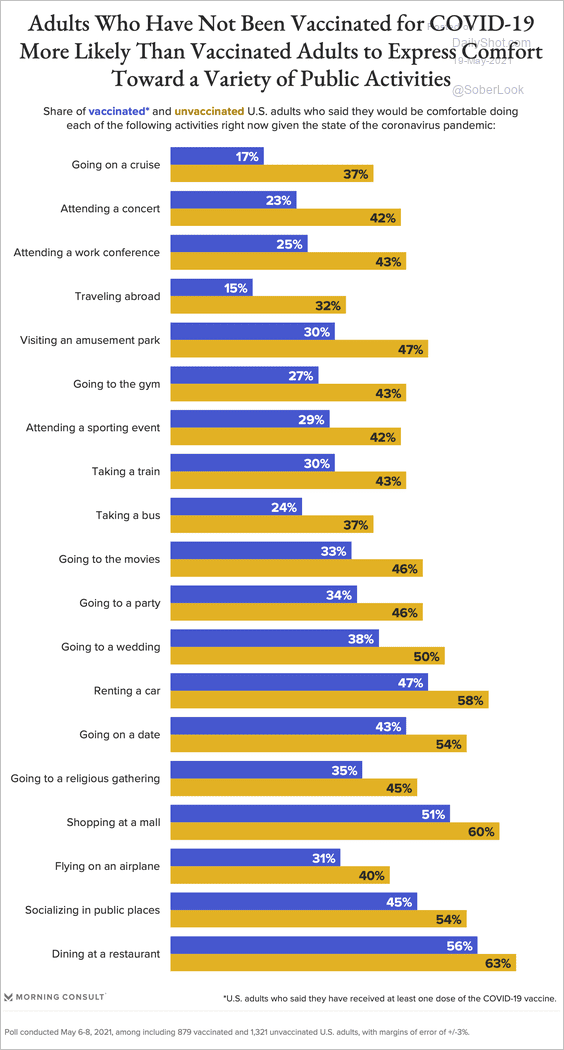

8. Comfort with public activities:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

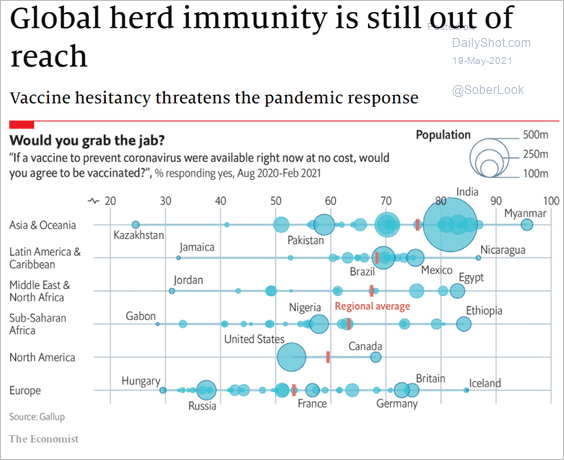

9. Vaccine hesitancy globally:

Source: The Economist Read full article

Source: The Economist Read full article

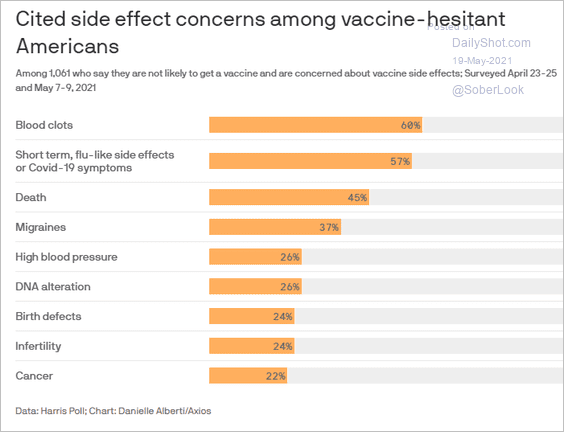

10. Vaccine misinformation:

Source: @axios Read full article

Source: @axios Read full article

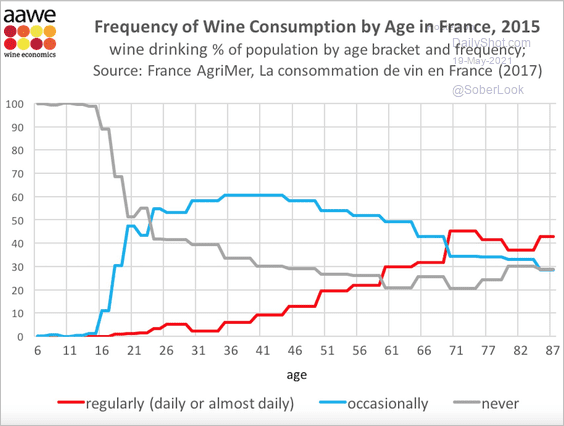

11. Wine consumption by age in France:

Source: @wineecon

Source: @wineecon

——————–

Back to Index