The Daily Shot: 25-May-21

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

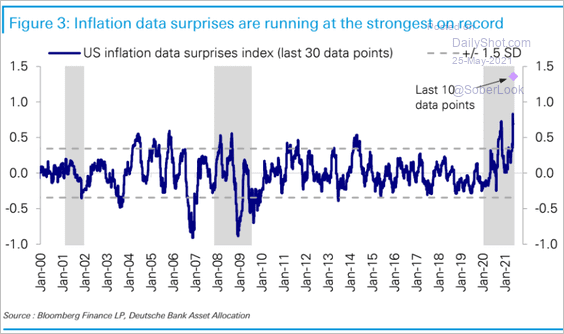

1. Let’s begin with some updates on inflation.

• Inflation data have been surprising to the upside.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

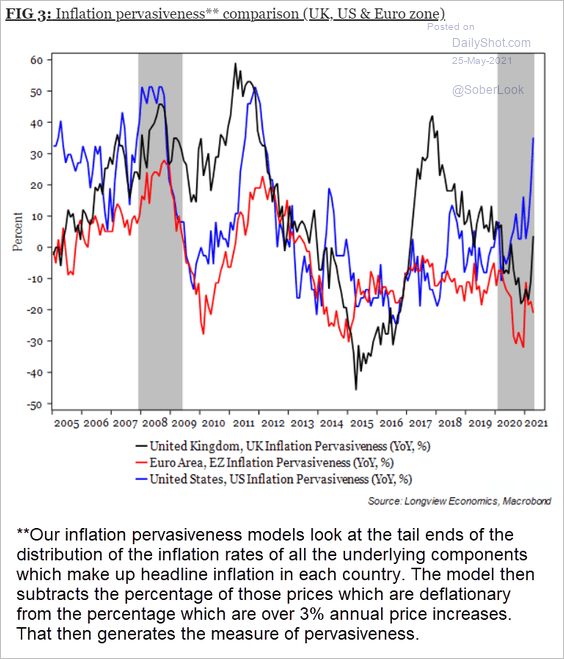

• US inflation pervasiveness (see definition below) has outpaced other countries.

Source: Longview Economics

Source: Longview Economics

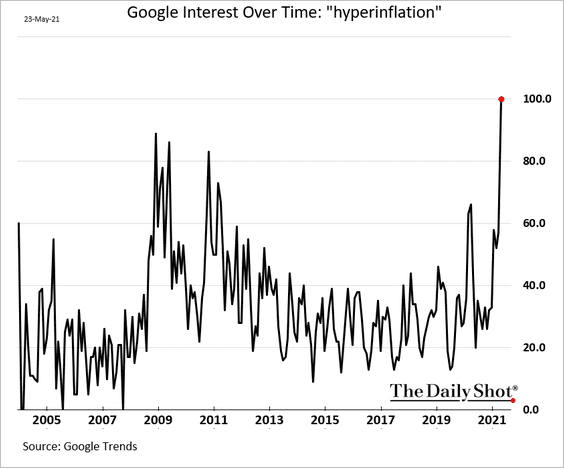

• Google search activity for “hyperinflation” accelerated this year.

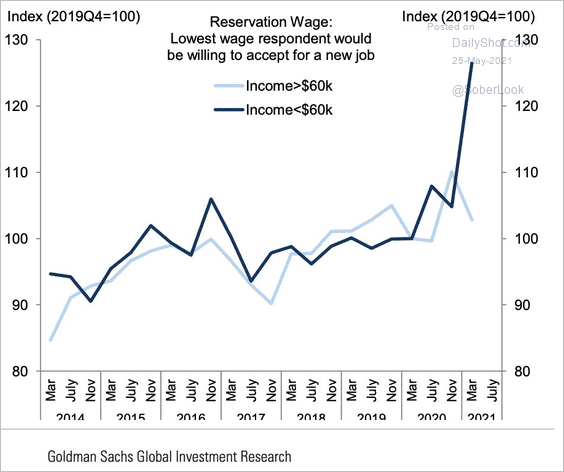

• Lower-paid workers would demand much higher pay to take a new job.

Source: Goldman Sachs, @ercorbeil

Source: Goldman Sachs, @ercorbeil

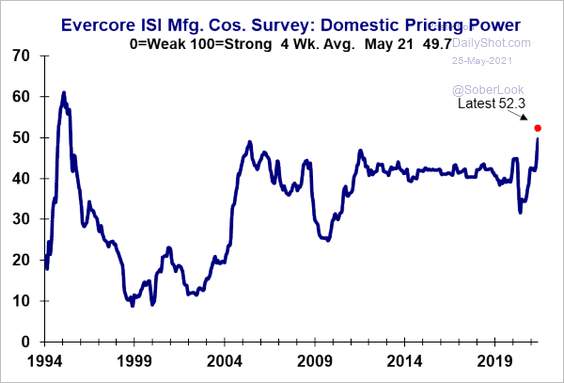

• The Evercore ISI business survey points to growing pricing power for US firms.

Source: Evercore ISI

Source: Evercore ISI

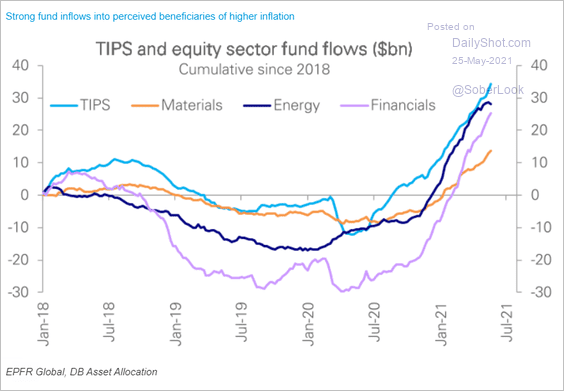

• Fund flows into inflation-sensitive sectors remain robust (TIPS = inflation-linked Treasuries).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

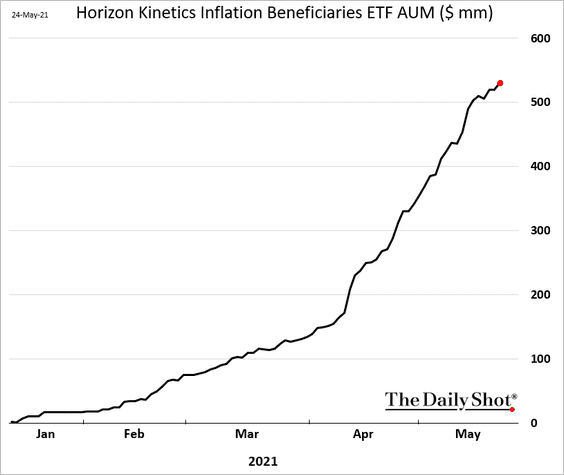

Launched in January, an ETF focused on inflation-sensitive stocks now has over half a billion in assets.

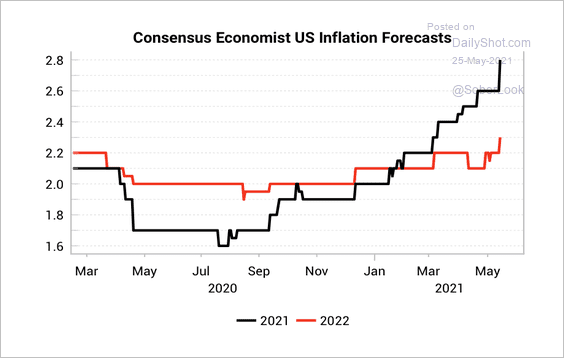

• The consensus inflation projections have barely moved for 2022 CPI compared with the surge in 2021 forecasts. The Fed refers to this trend as “anchored” longer-term inflation expectations.

Source: Variant Perception

Source: Variant Perception

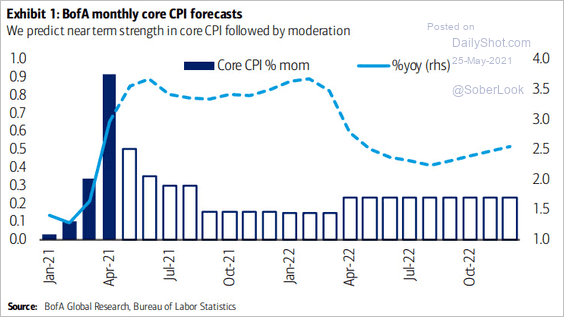

• Here is BofA’s core CPI forecast.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

——————–

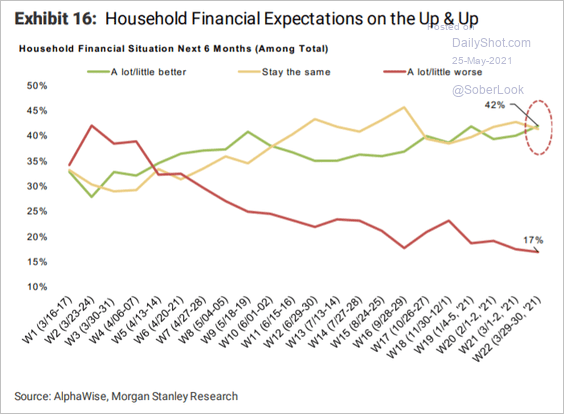

2. Household’s financial expectations are improving, …

Source: Morgan Stanley Research

Source: Morgan Stanley Research

… but consumer confidence is off the 2021 highs.

Source: Morning Consult Read full article

Source: Morning Consult Read full article

——————–

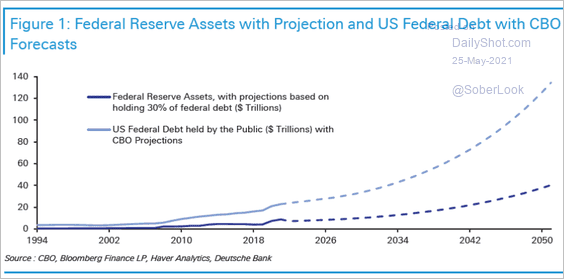

3. Will the Fed be forced to hold a substantial portion of the growing Federal debt (MMT)?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

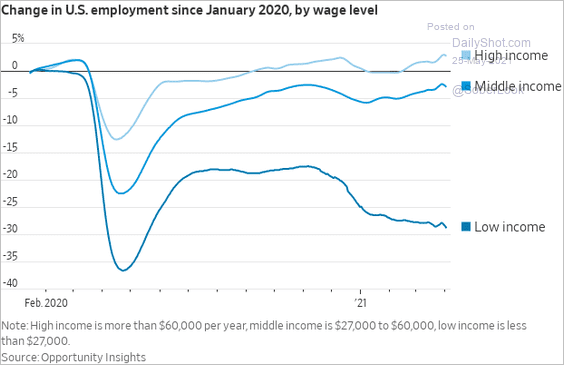

4. Low-income employment recovery has a long way to go (which is why the Fed remains dovish).

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

The United Kingdom

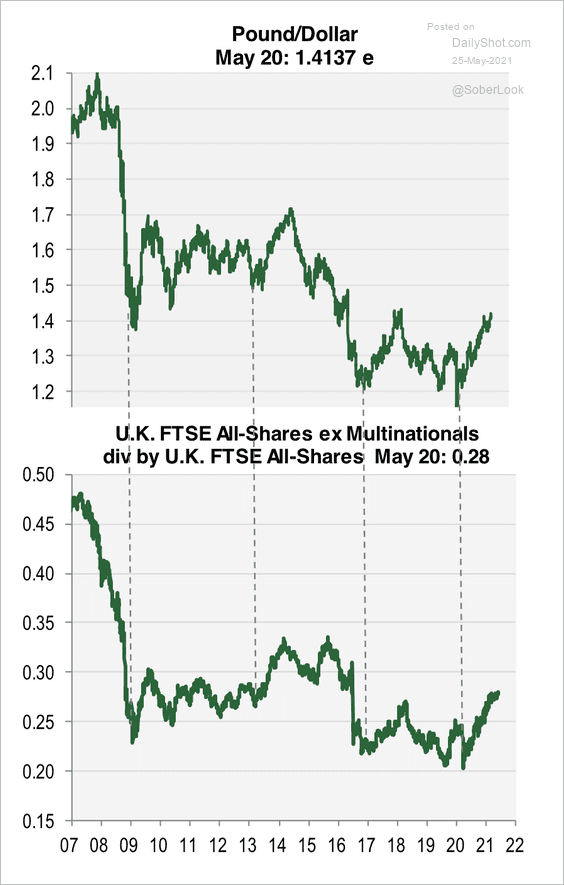

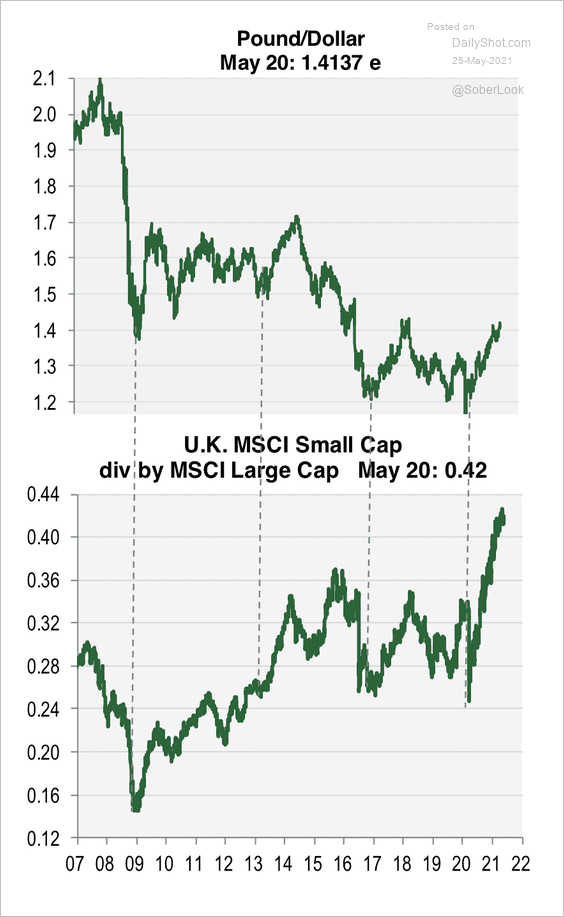

1. A stronger pound is a headwind for UK multinationals and a tailwind for smaller, domestically focused companies (2 charts).

Source: Cornerstone Macro

Source: Cornerstone Macro

Source: Cornerstone Macro

Source: Cornerstone Macro

——————–

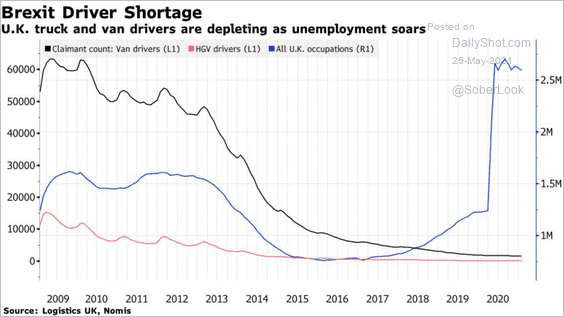

2. Just like the US, the UK is facing a shortage of truck drivers.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

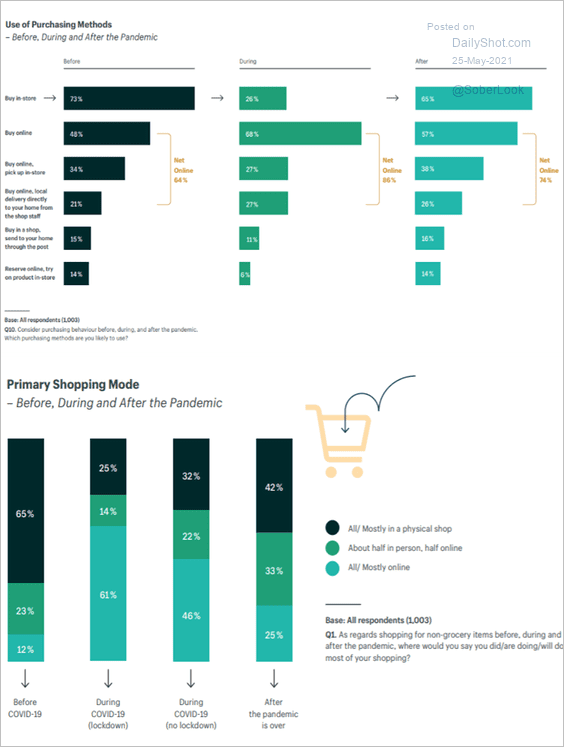

3. Next, we have some data on changes in shopping habits.

Source: Shopify Read full article

Source: Shopify Read full article

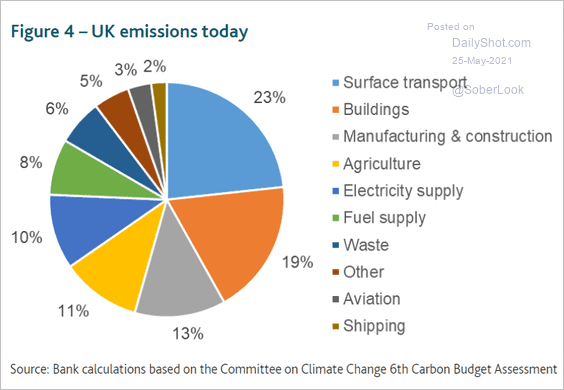

4. What are the sources of carbon emissions in the UK?

Source: BoE Read full article

Source: BoE Read full article

Back to Index

The Eurozone

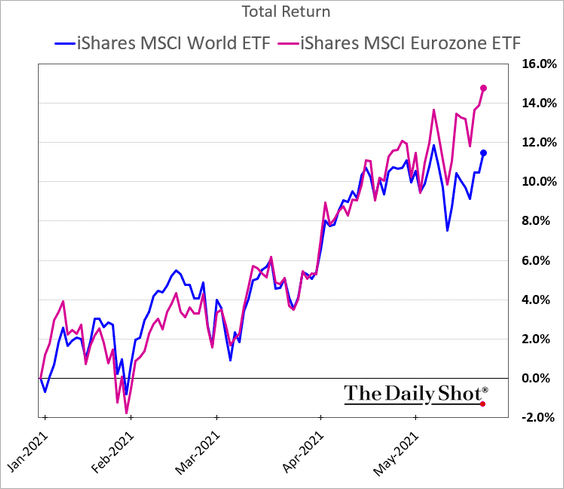

1. Euro-area shares have been outperforming.

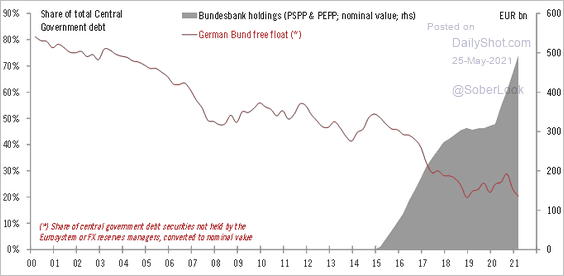

2. Bund free float has fallen to record lows and will likely keep shrinking.

Source: @fwred

Source: @fwred

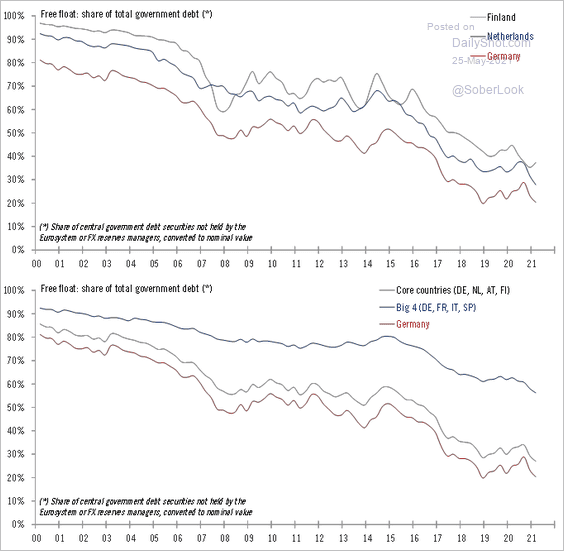

Below are some free-float trends in other Eurozone debt markets.

Source: @fwred

Source: @fwred

——————–

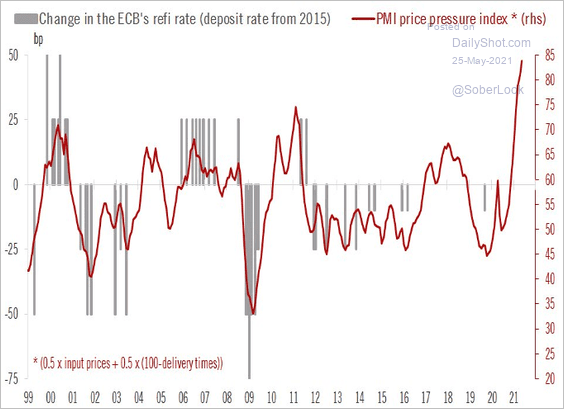

3. The ECB’s current monetary policy is inconsistent with euro-area business-sector price pressures.

Source: @fwred

Source: @fwred

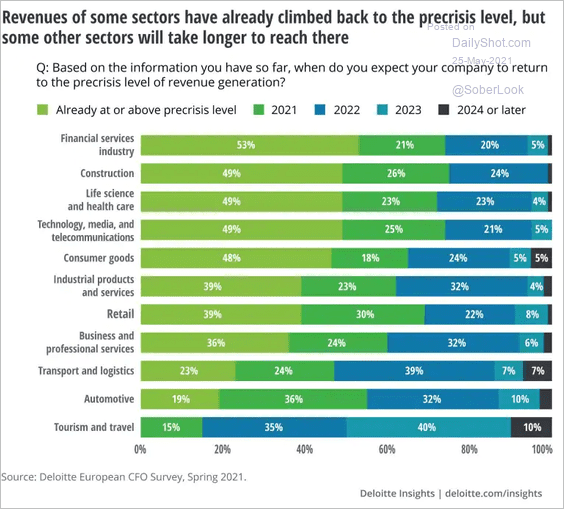

4. Here is a look at revenue recovery by sector.

Source: Deloitte Global Economist Network Read full article

Source: Deloitte Global Economist Network Read full article

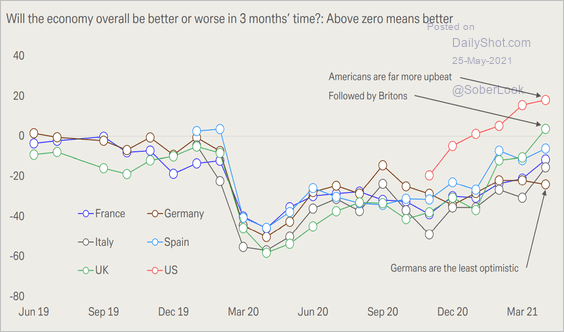

5. Germans are not very optimistic about the economy.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

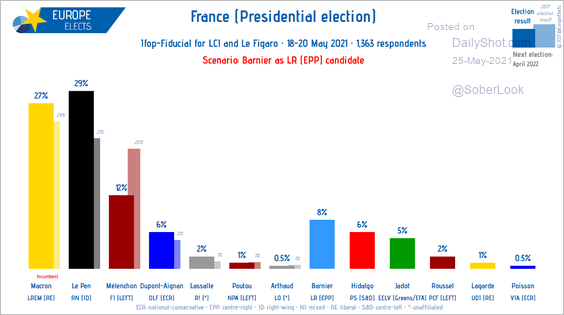

6. Le Pen is polling well – a potential issue for France and the Eurozone.

Source: @EuropeElects

Source: @EuropeElects

Back to Index

Europe

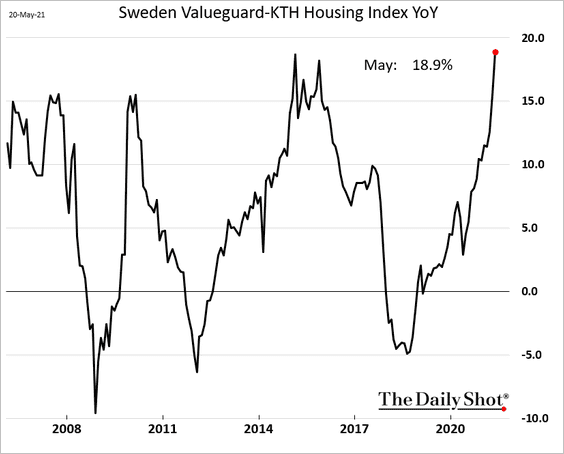

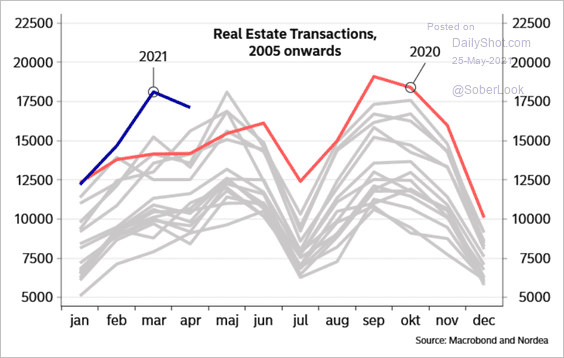

1. Sweden’s housing prices are up 19% from a year ago.

And housing transactions remain at multi-year highs.

Source: Nordea Markets

Source: Nordea Markets

——————–

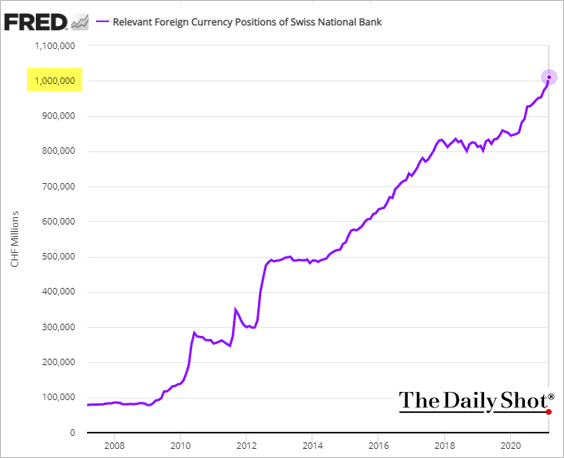

2. The Swiss central bank (SNB) is now holding over CHF 1 trillion worth of foreign currencies.

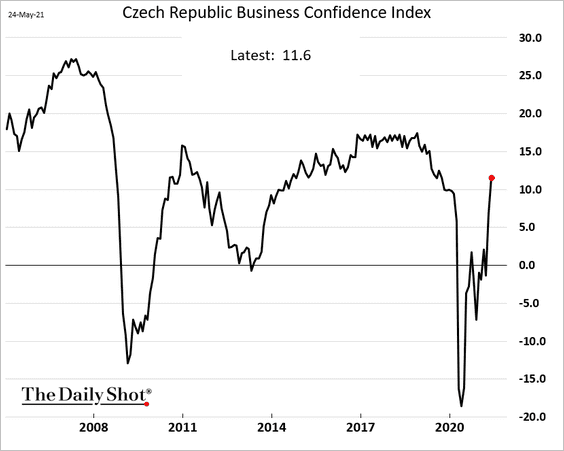

3. Czech business confidence is rebounding.

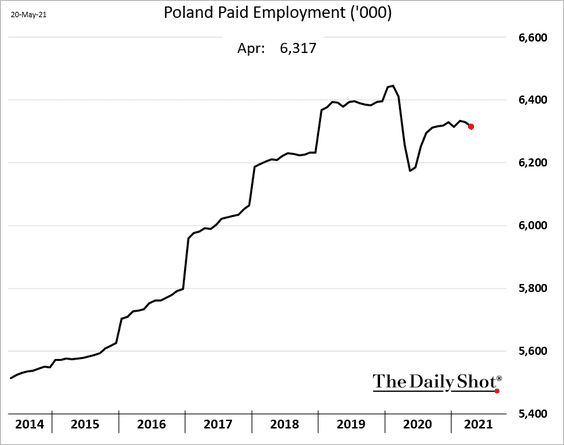

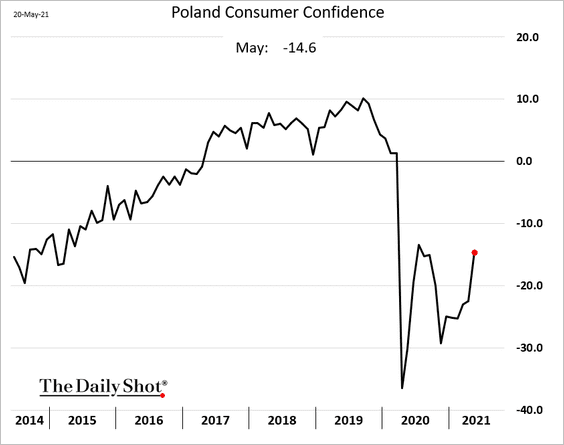

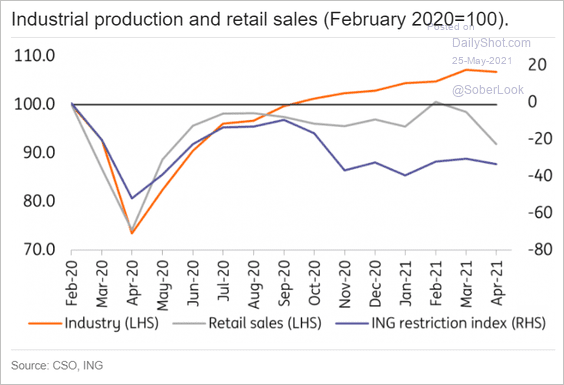

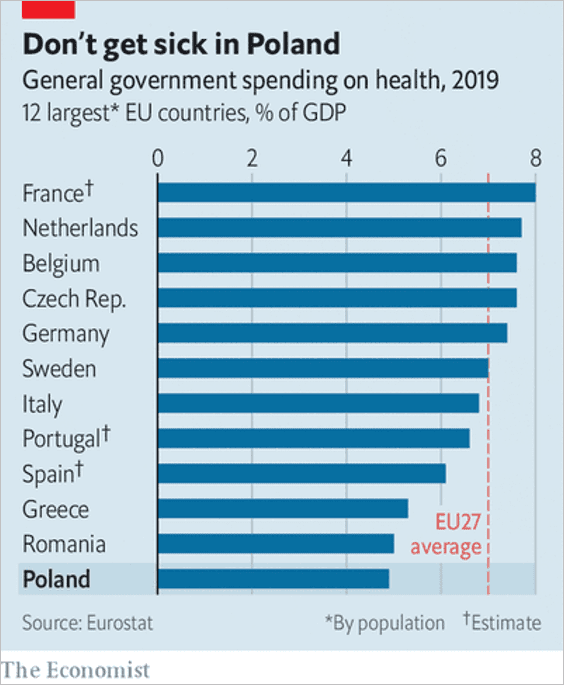

4. Next, we have some updates on Poland.

• Employment recovery will take some time.

• Consumer confidence is up this month but remains depressed.

• Industrial production has rebounded, but retail sales have been soft.

Source: ING

Source: ING

• Time to boost health spending?

Source: The Economist

Source: The Economist

——————–

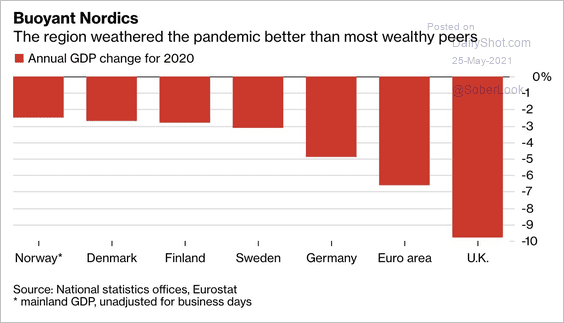

5. Nordic countries’ economies have been relatively resilient.

Source: @AlecStapp

Source: @AlecStapp

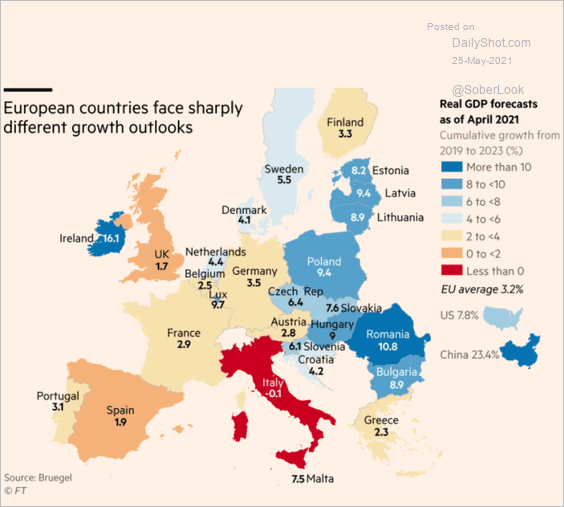

6. European growth outlook is uneven.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

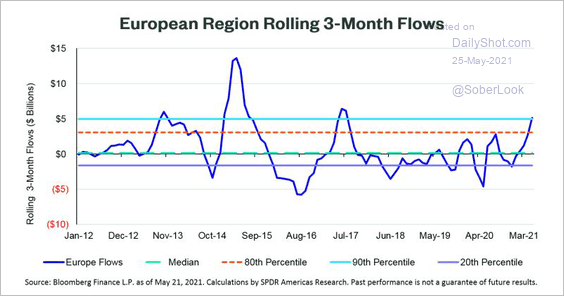

7. Equity inflows have strengthened this year.

Source: Matthew Bartolini

Source: Matthew Bartolini

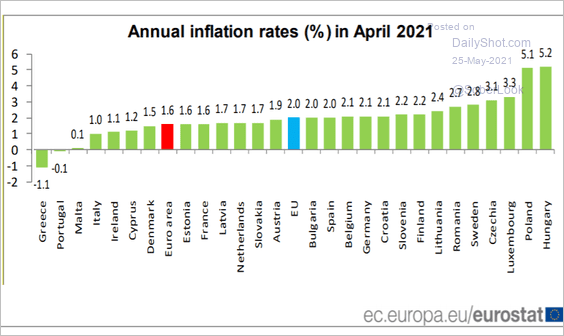

8. Here is a look at inflation rates across the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia – Pacific

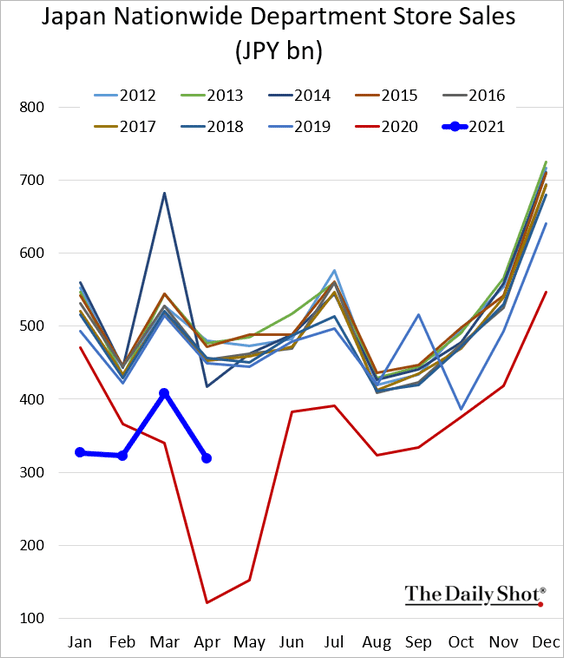

1. Japan’s department store sales remain depressed.

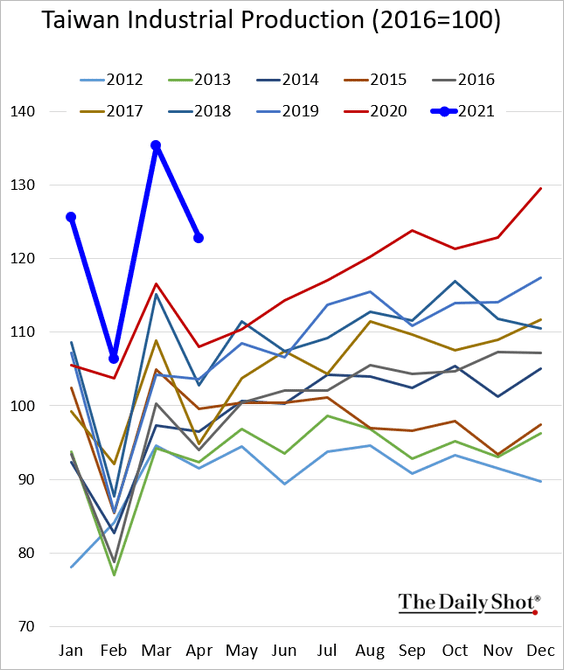

2. Taiwan’s industrial production has been robust, but the April figure was below forecasts.

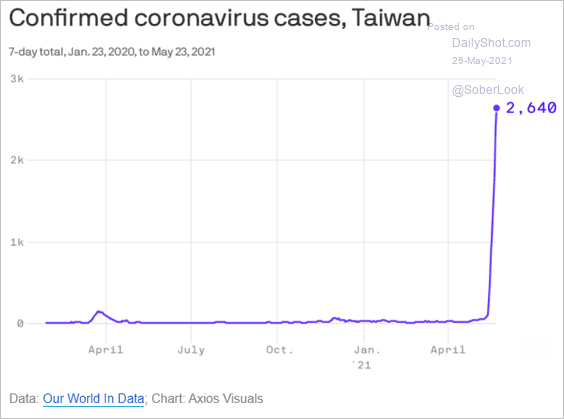

Separately, Taiwan’s COVID cases have accelerated.

Source: @axios Read full article

Source: @axios Read full article

——————–

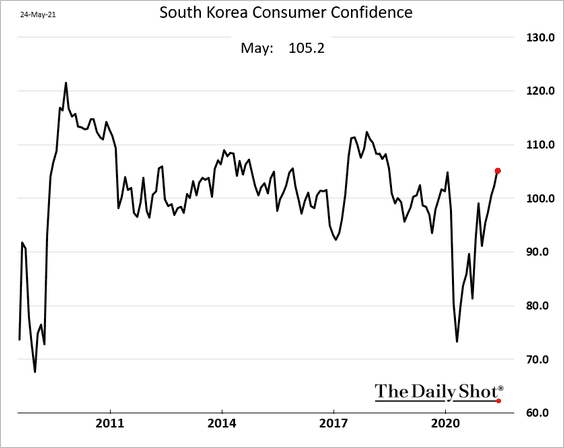

3. South Korea’s consumer confidence continues to recover.

Back to Index

China

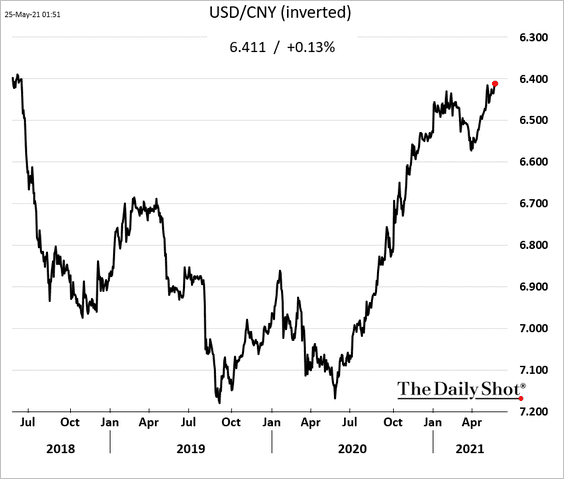

1. The renminbi hit the highest level in nearly three years.

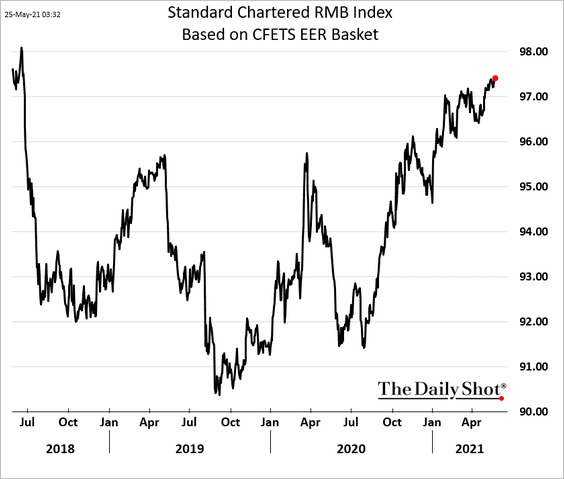

Here is the RMB index relative to a basket of currencies.

——————–

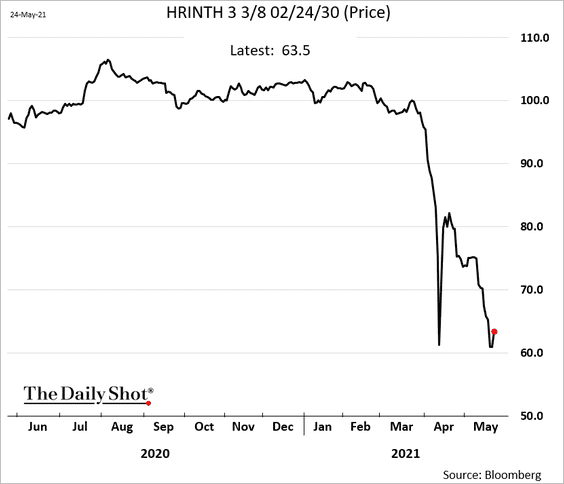

2. Huarong bonds found a bid near the April lows.

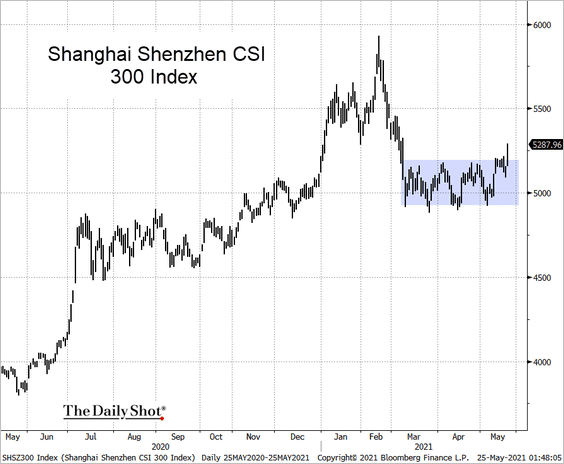

3. The Shanghai Shenzhen CSI 300 Index broke out of its trading range.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

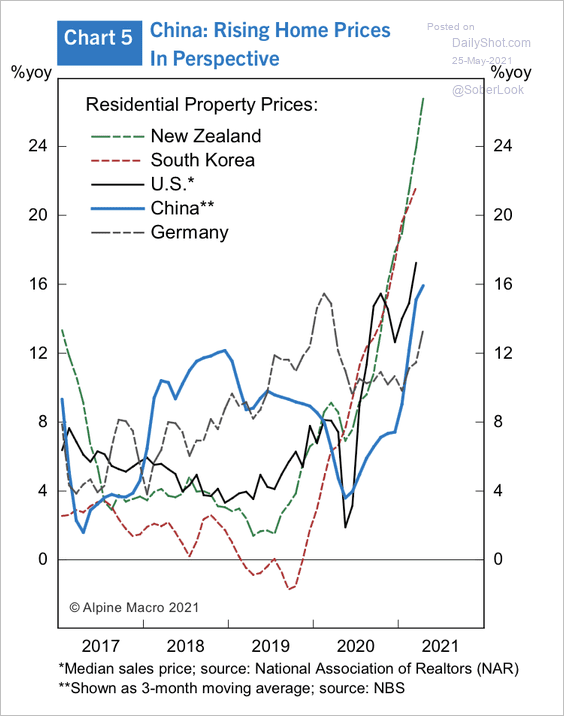

4. Home price acceleration over the past year pales in comparison to other major economies.

Source: Alpine Macro

Source: Alpine Macro

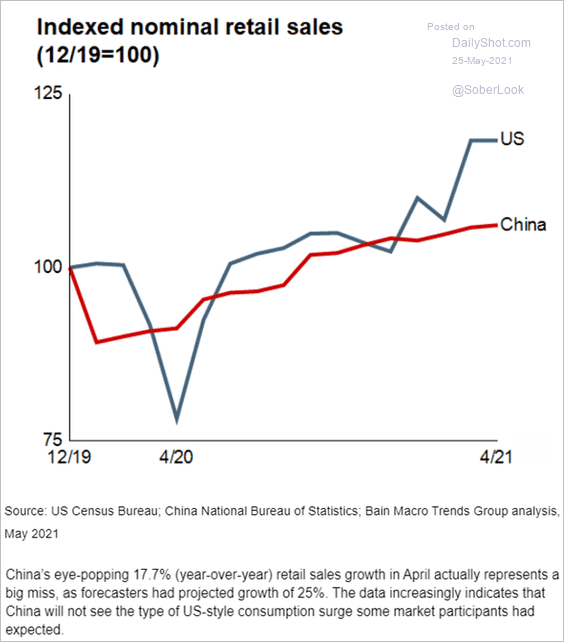

5. The rebound in retail sales hasn’t been as robust as in the US.

Source: Bain & Company

Source: Bain & Company

6. Steel production has been impressive, driven by robust margins.

Source: Credit Suisse, @Scutty

Source: Credit Suisse, @Scutty

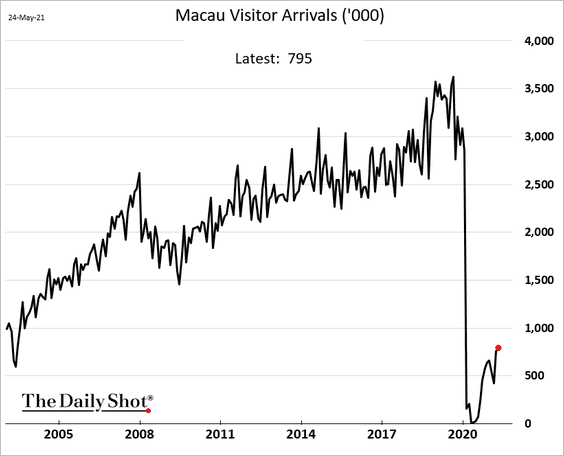

7. Macau visitor numbers remain depressed.

Back to Index

Emerging Markets

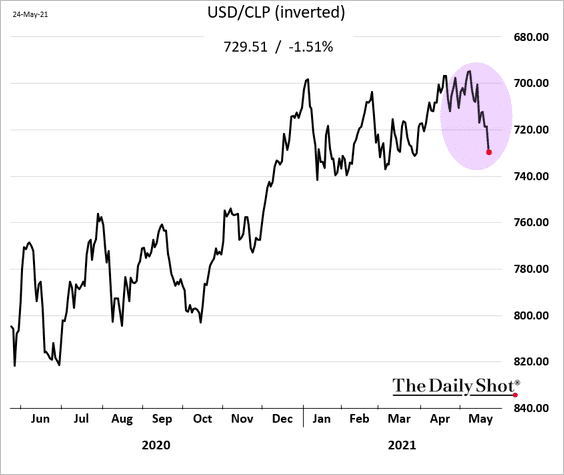

1. The Chilean peso has been under pressure since the elections.

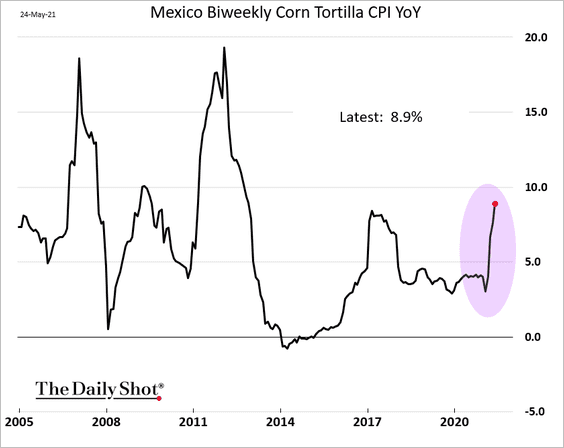

2. Mexico’s core CPI is above Banxico’s target range.

And rapid gains in grain prices have been putting upward pressure on food inflation.

h/t Max de Haldevang

h/t Max de Haldevang

——————–

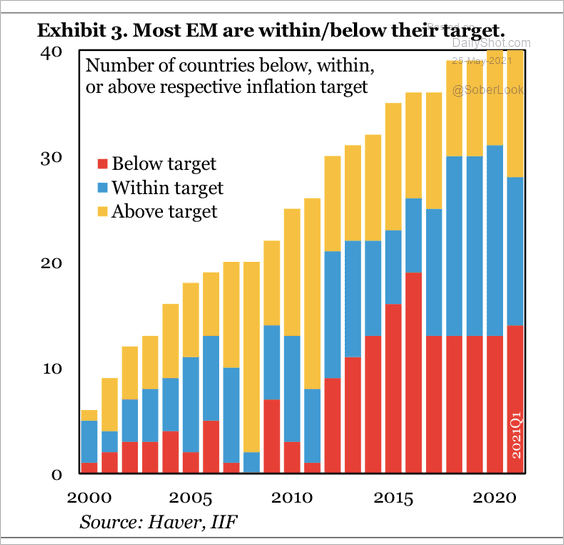

3. Most EM countries are within or below target inflation levels.

Source: IIF

Source: IIF

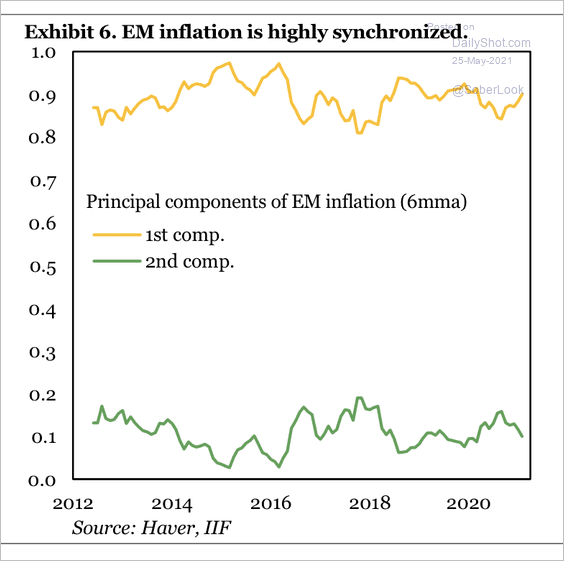

Inflation cycles have been more synchronized in recent years.

Source: IIF

Source: IIF

——————–

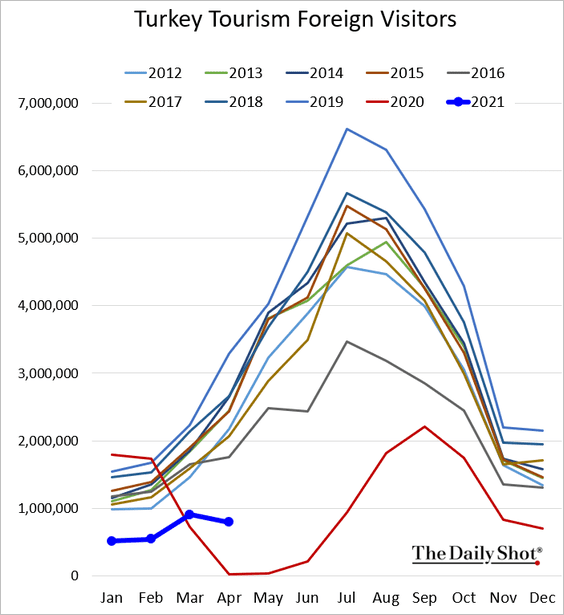

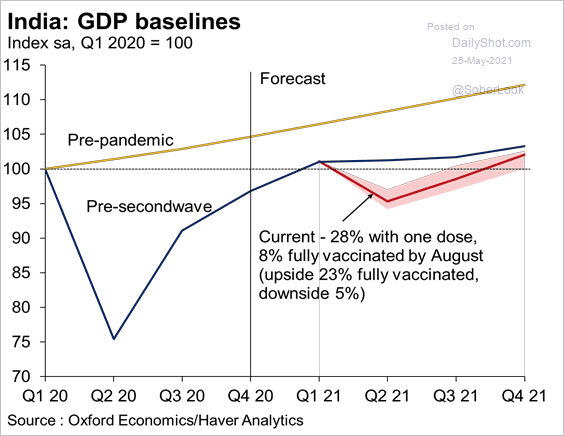

4. Turkey’s tourism recovery has a long way to go.

5. Here is an updated forecast for India’s GDP path from Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

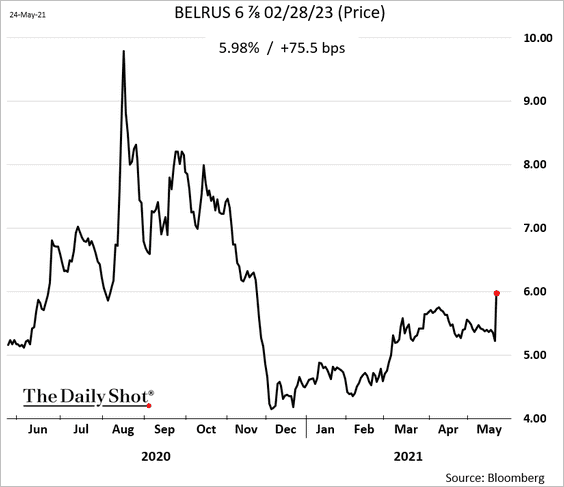

6. The thuggish action by Belarus sent its bond yields higher.

Source: CNN World Read full article

Source: CNN World Read full article

Back to Index

Cryptocurrency

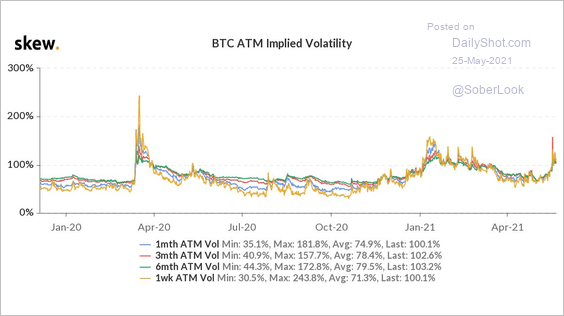

1. Bitcoin at-the-money implied volatility is at the highest level since the January sell-off.

Source: @skewdotcom

Source: @skewdotcom

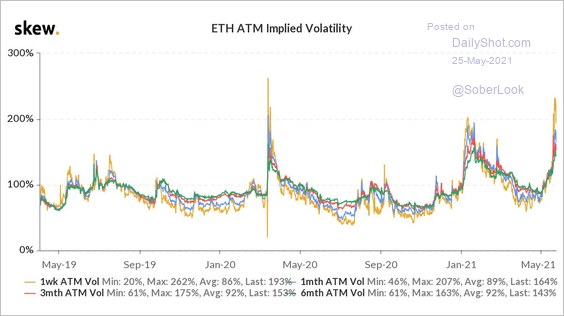

Ether’s at-the-money implied volatility nearly doubled over the past month.

Source: @skewdotcom

Source: @skewdotcom

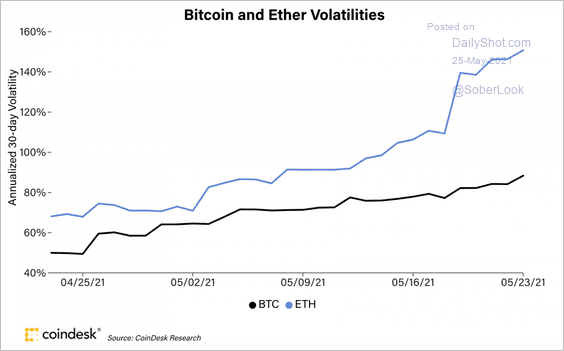

Ether’s annualized volatility is much higher than bitcoin’s.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

——————–

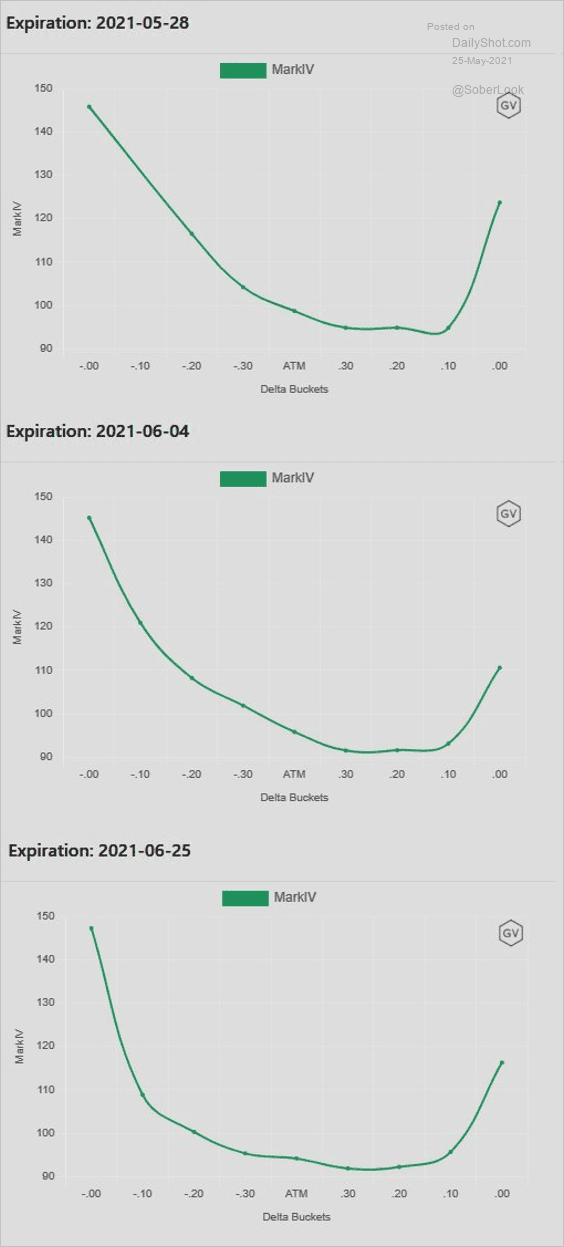

2. Bitcoin’s skew has blown out (premium on downside protection).

Source: @Melt_Dem, @GenesisVol

Source: @Melt_Dem, @GenesisVol

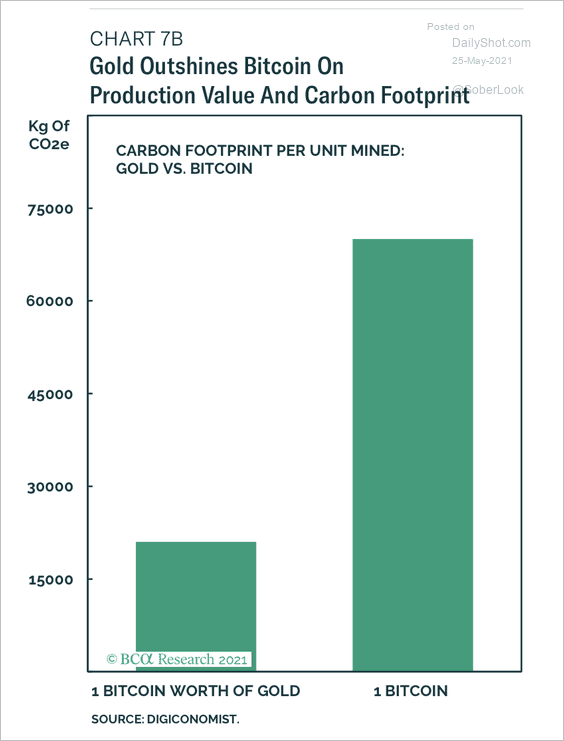

3. On a one-to-one basis, gold has a lower carbon footprint than bitcoin, according to BCA Research.

Source: BCA Research

Source: BCA Research

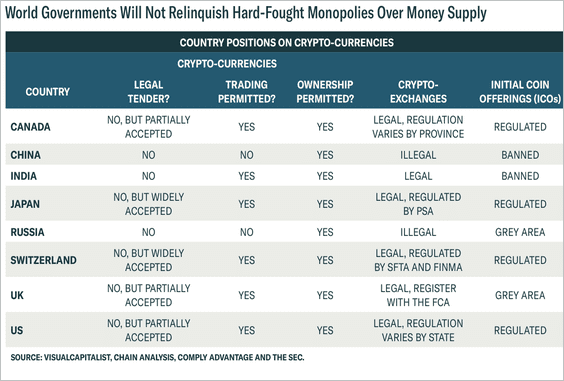

4. Here is a look at different countries’ positions on cryptocurrencies.

Source: BCA Research

Source: BCA Research

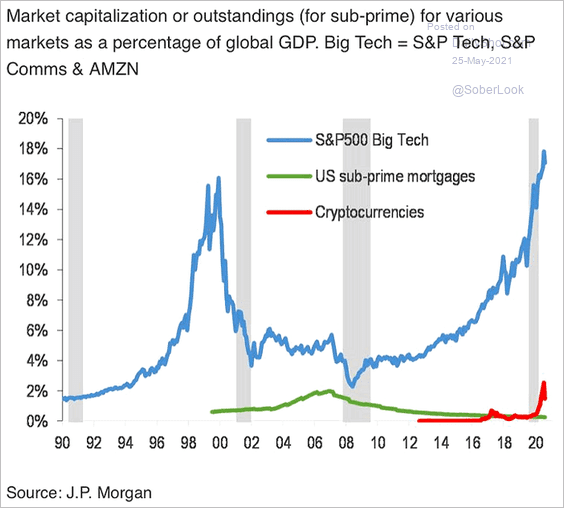

5. The crypto selloff had little impact on other asset classes.

Source: @ISABELNET_SA, @jpmorgan Read full article

Source: @ISABELNET_SA, @jpmorgan Read full article

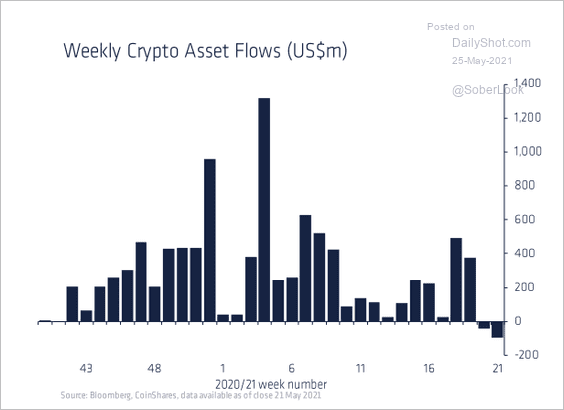

6. Digital asset funds suffered outflows for a second straight week as investor demand waned during the crypto sell-off.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

A European ETN tracking bitcoin has been experiencing outflows since the start of the year.

![]() h/t @ksengal, @business

h/t @ksengal, @business

Back to Index

Equities

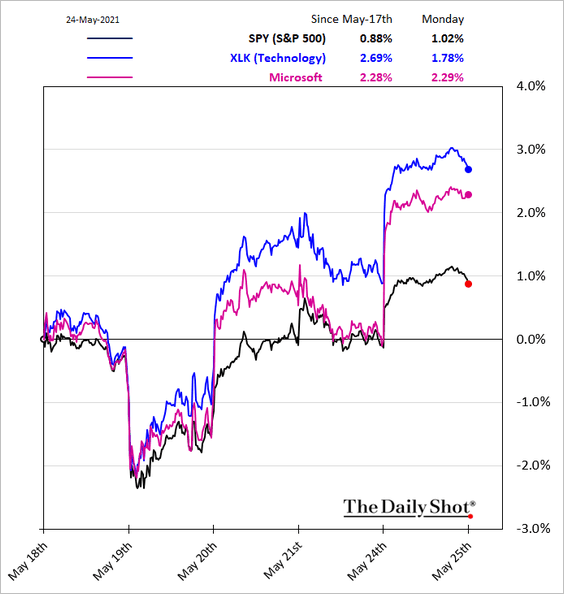

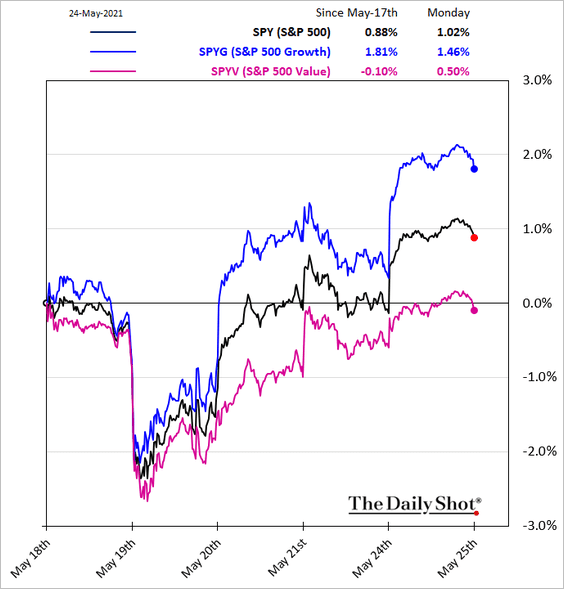

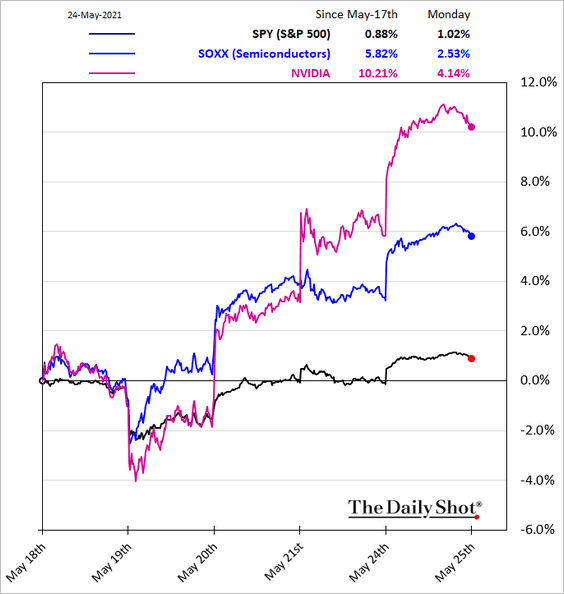

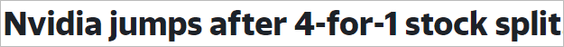

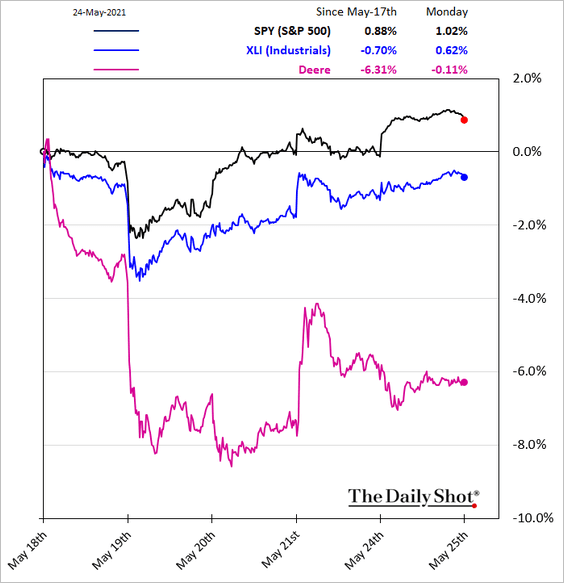

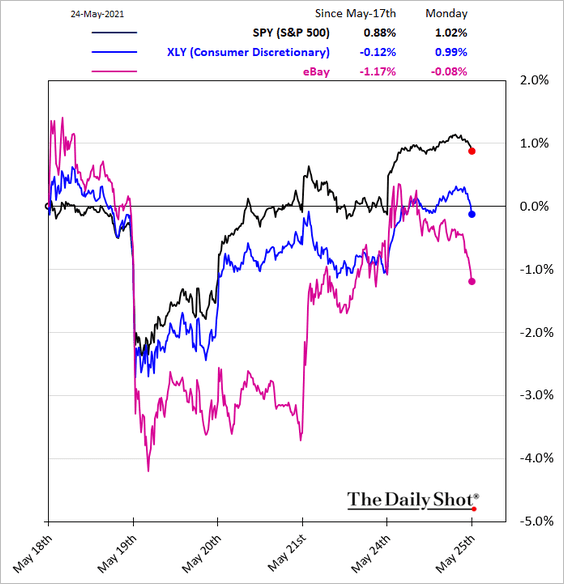

1. Tech shares led the market rebound on Monday, …

… with value stocks lagging growth.

Here are several other sector trends.

• Semiconductors:

Source: Yahoo Finance Read full article

Source: Yahoo Finance Read full article

• Industrials:

• Banks:

• Consumer discretionary:

• Consumer staples:

——————–

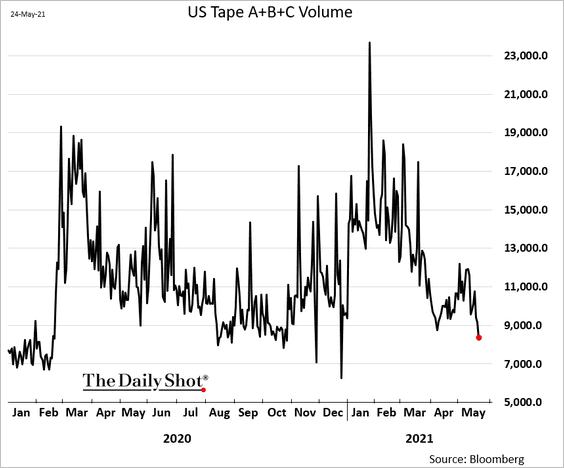

2. The US trading volume hit the lowest level of the year.

h/t @luwangnyc

h/t @luwangnyc

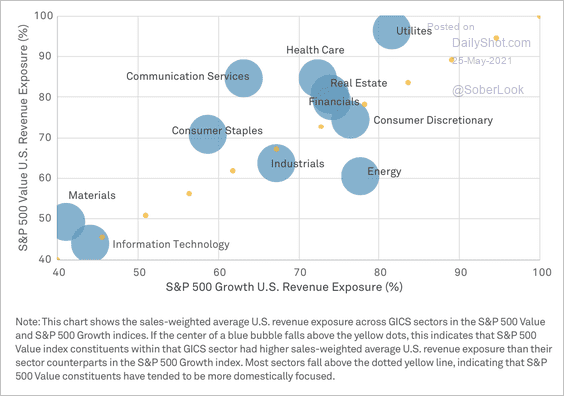

3. S&P 500 value constituents are typically more domestically focused.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

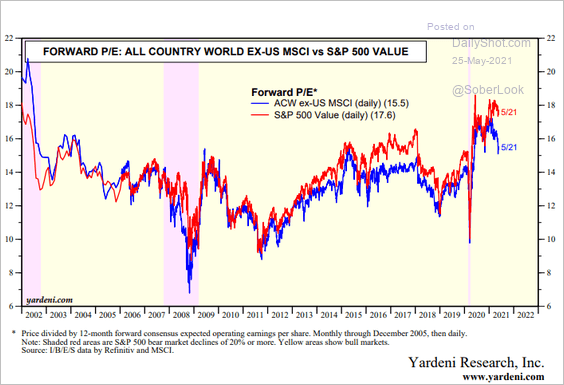

4. US shares are trading at a substantial premium to the rest of the world.

Source: Yardeni Research

Source: Yardeni Research

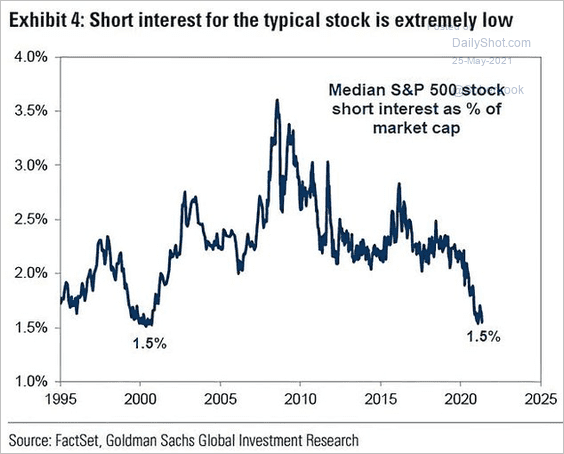

5. Short interest in US stocks remains near a two-decade low, making the market vulnerable to downside gaps.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

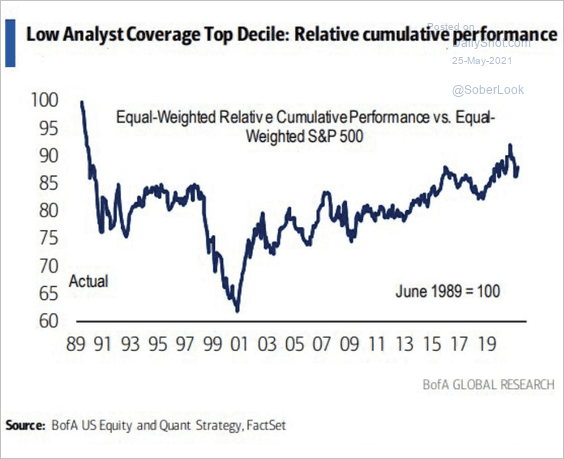

6. Stocks neglected by analysts tend to outperform over the long run.

Source: BofA Global Research, @SamRo, @RBAdvisors Read full article

Source: BofA Global Research, @SamRo, @RBAdvisors Read full article

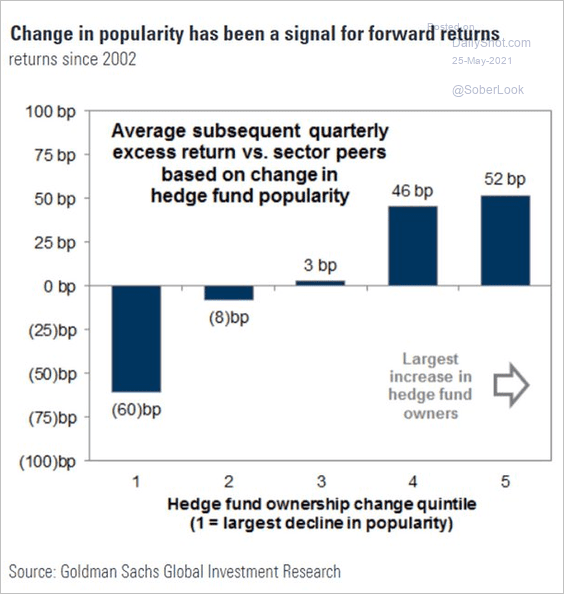

7. An increase in hedge fund ownership of a stock can signal stronger performance ahead.

Source: @LizAnnSonders, @GoldmanSachs

Source: @LizAnnSonders, @GoldmanSachs

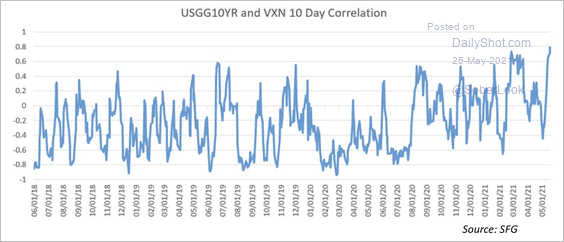

8. The 10-day correlation between Treasury yields and Nasdaq volatility is at the highest level in about three years.

Source: Chris Murphy; Susquehanna Derivative Strategy

Source: Chris Murphy; Susquehanna Derivative Strategy

Back to Index

Credit

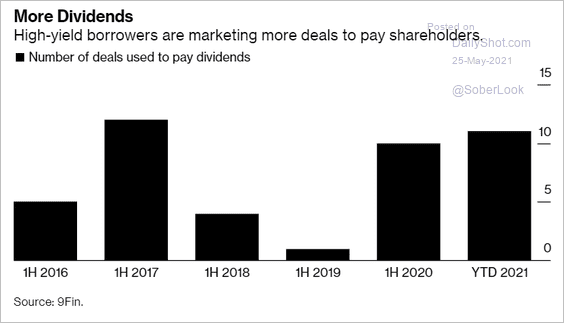

1. With the cost of high-yield debt funding near record lows, dividend recaps are increasingly popular.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

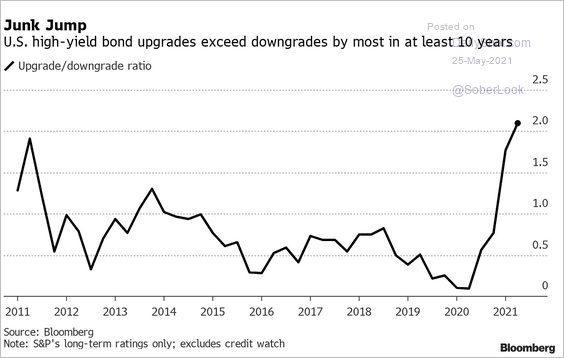

2. Rating agencies have been upgrading US high-yield bonds.

Source: Caleb Mutua, @TheTerminal, Bloomberg Finance L.P. Read full article

Source: Caleb Mutua, @TheTerminal, Bloomberg Finance L.P. Read full article

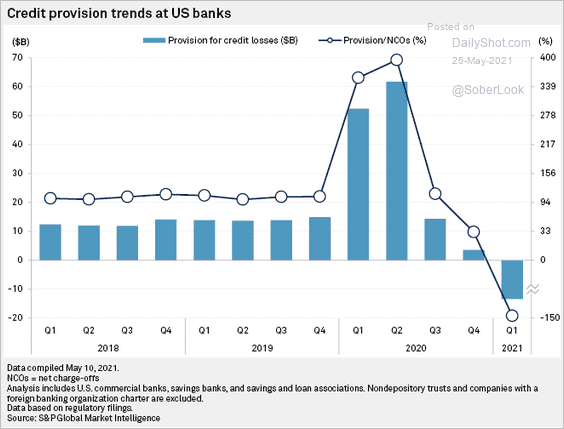

3. Banks have been reversing some credit provisions taken last year.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Global Developments

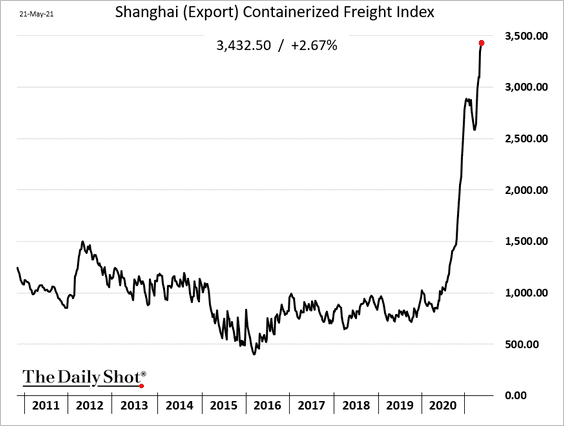

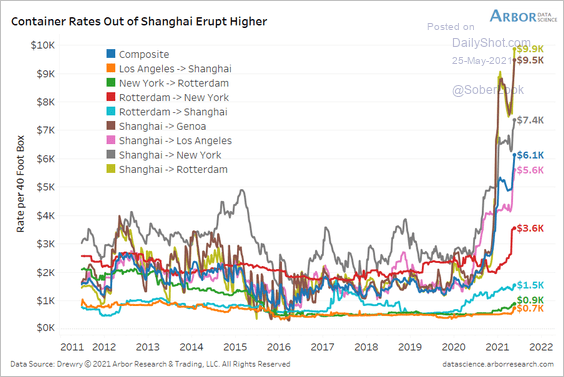

1. Container freight costs continue to surge.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

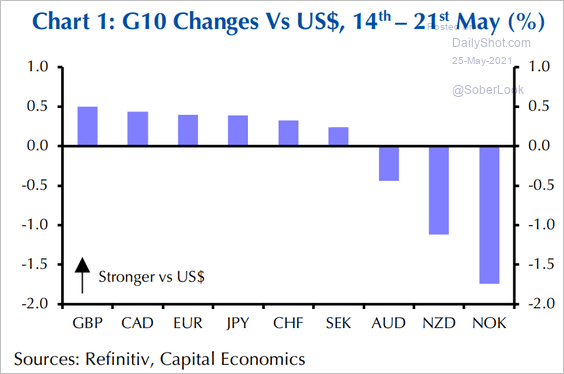

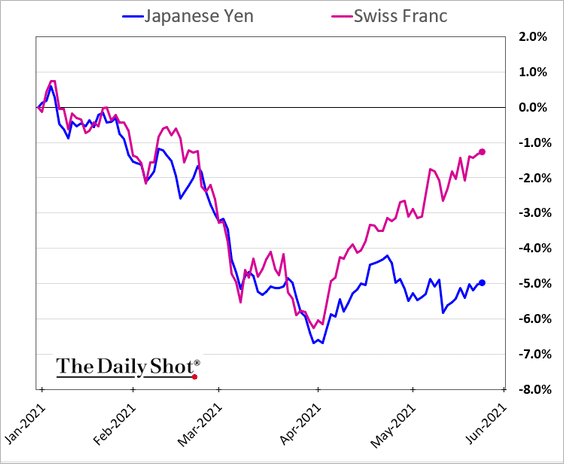

2. Next, we have some updates on currency markets.

• The G10 performance vs. USD:

Source: Capital Economics

Source: Capital Economics

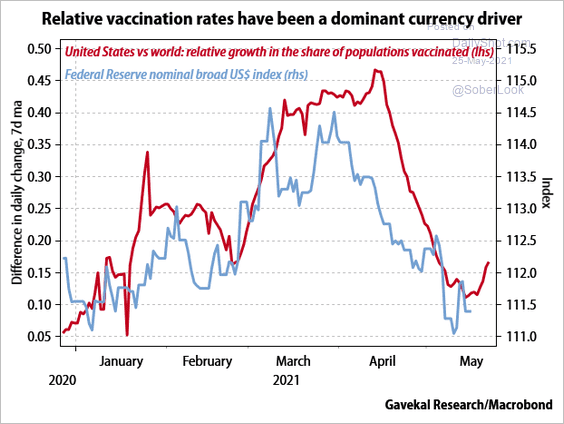

• The dollar vs. the vaccination differential between the US and the rest of the world:

Source: Gavekal Research

Source: Gavekal Research

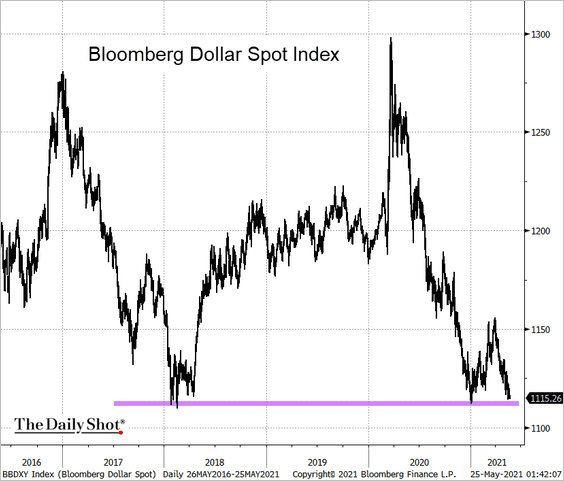

• The Bloomberg US dollar index (at support):

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• The two safe-haven currencies diverging (vs. USD):

——————–

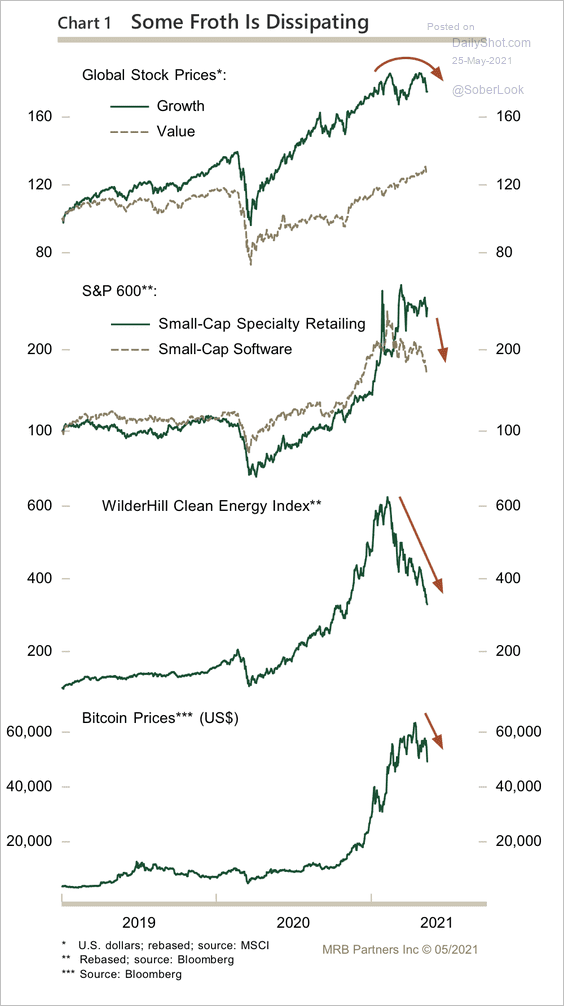

3. Returns in some of the hottest market areas are starting to fade.

Source: MRB Partners

Source: MRB Partners

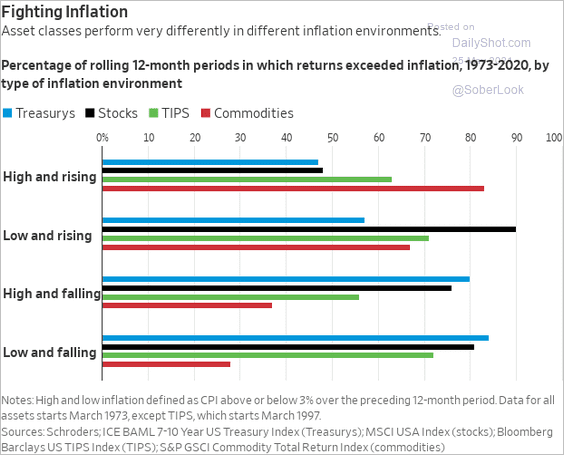

4. How do various asset classes perform in different inflation regimes?

Source: @WSJ Read full article

Source: @WSJ Read full article

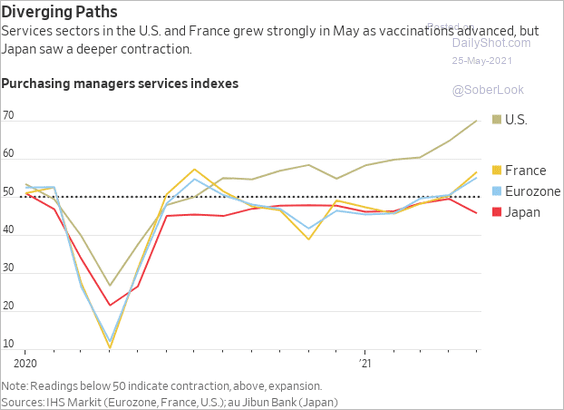

5. This chart shows service-sector PMIs (business activity) for the US, France, and Japan.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Food for Thought

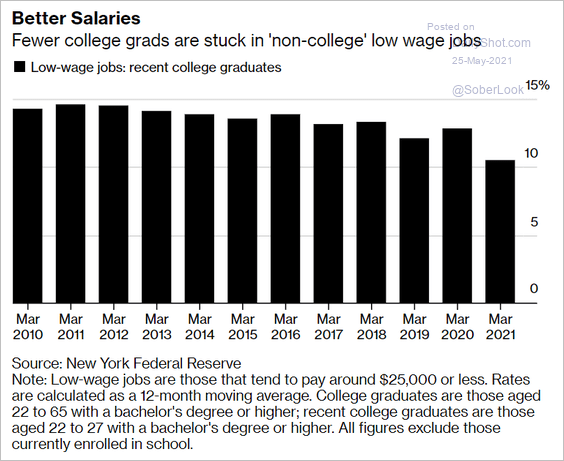

1. College grads in low-wage jobs:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

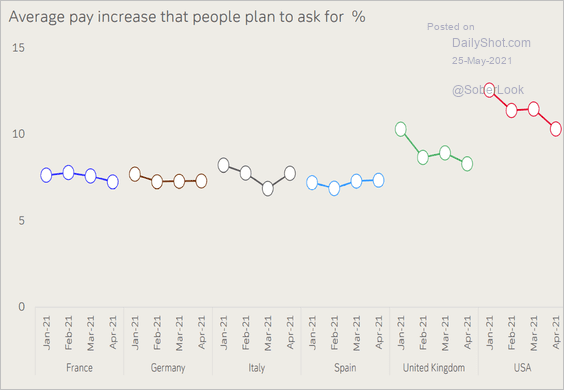

2. Asking for a pay increase:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

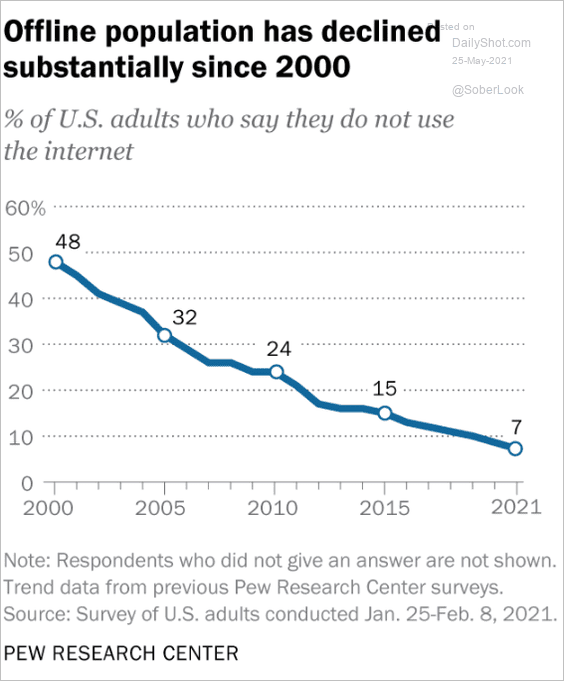

3. US offline population:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

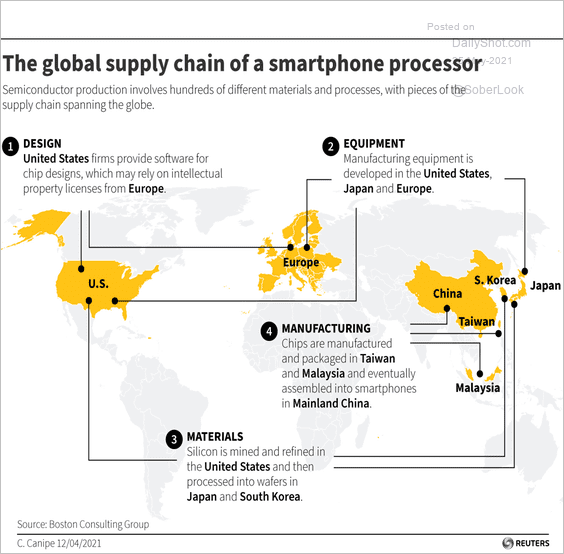

4. The supply chain for a smartphone processor:

Source: Reuters Read full article

Source: Reuters Read full article

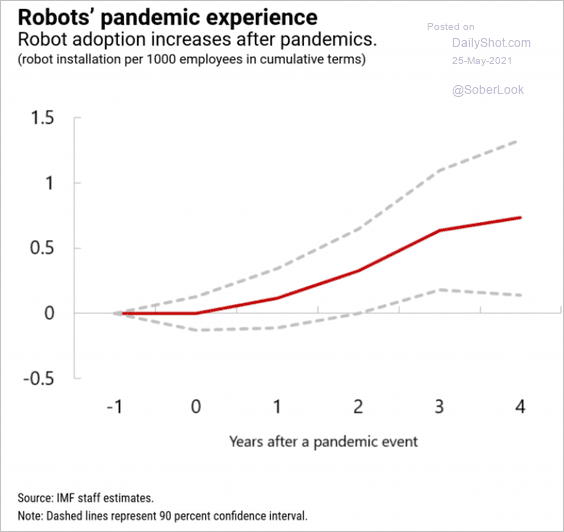

5. Robot adoption after pandemics:

Source: IMF Read full article

Source: IMF Read full article

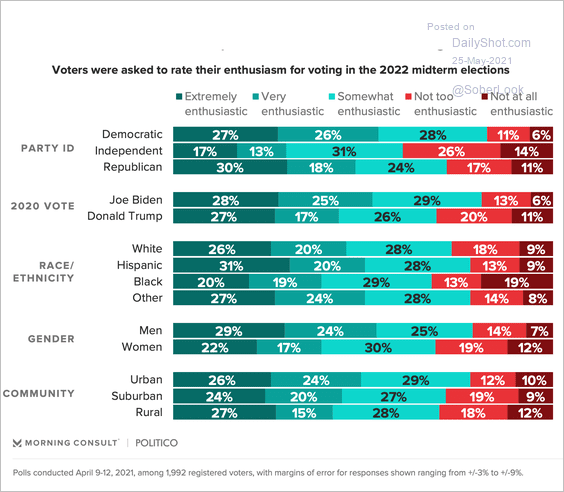

6. US voting enthusiasm for the 2022 midterm elections:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

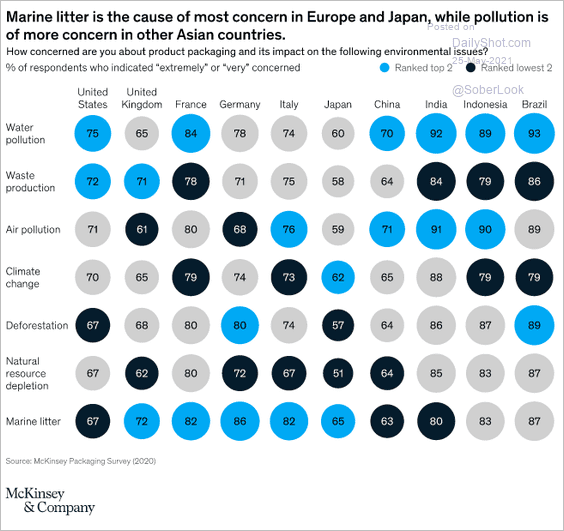

7. Environmental concerns in product packaging:

Source: McKinsey Insights Read full article

Source: McKinsey Insights Read full article

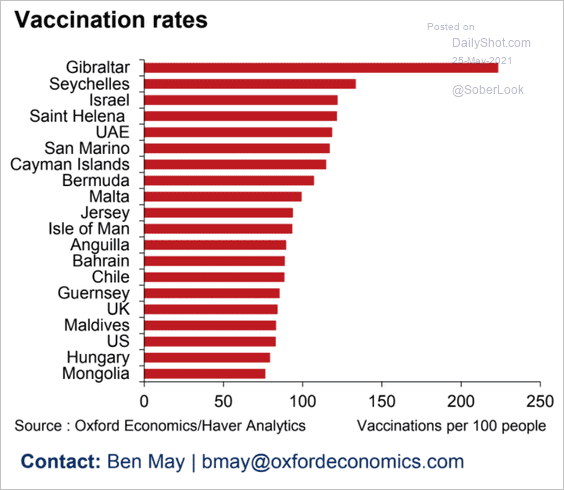

8. Vaccination rates:

Source: Oxford Economics

Source: Oxford Economics

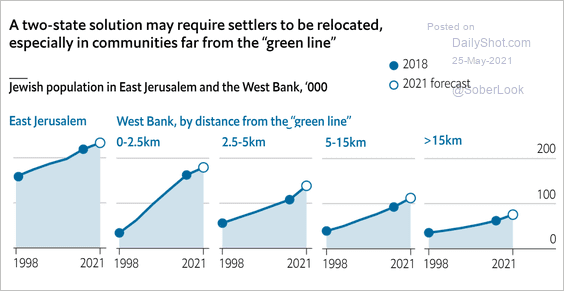

9. Jewish population in East Jerusalem and the West Bank:

Source: The Economist Read full article

Source: The Economist Read full article

10. Fashion trends across the US:

Source: trendd.io, r/dataisbeautiful

Source: trendd.io, r/dataisbeautiful

——————–

Back to Index