The Daily Shot: 26-May-21

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

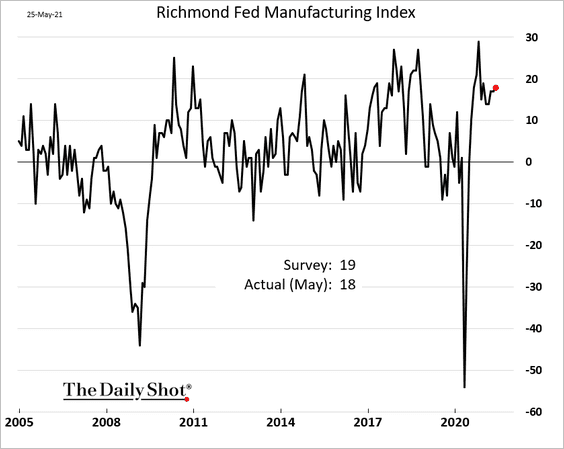

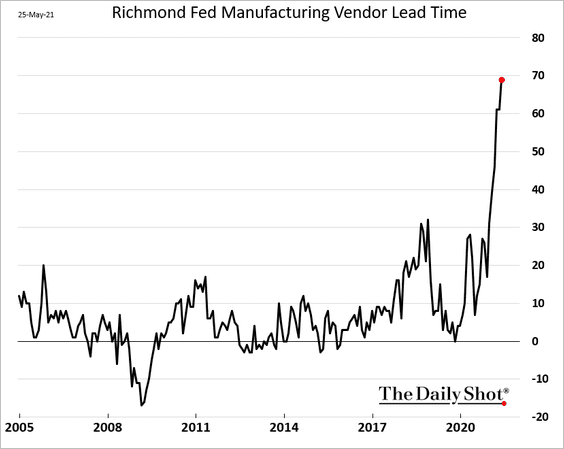

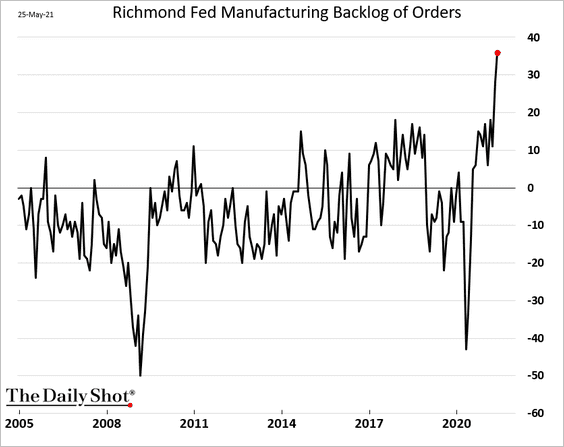

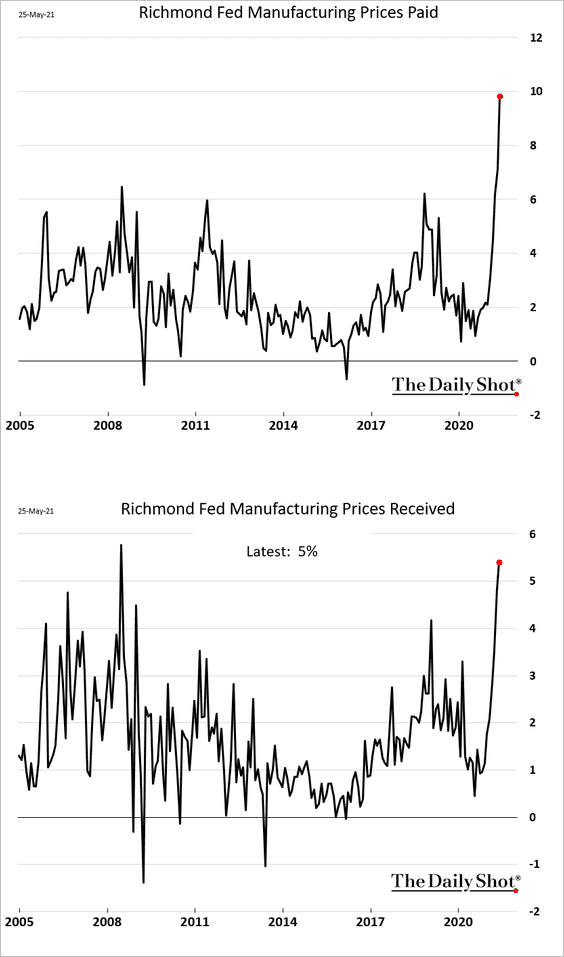

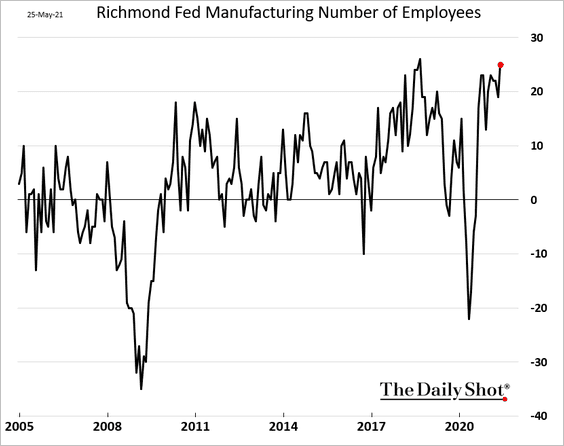

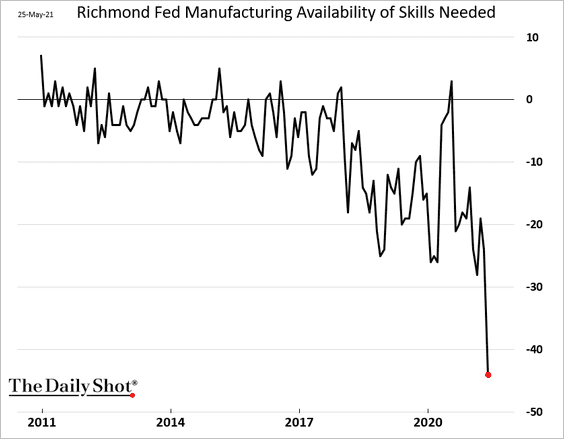

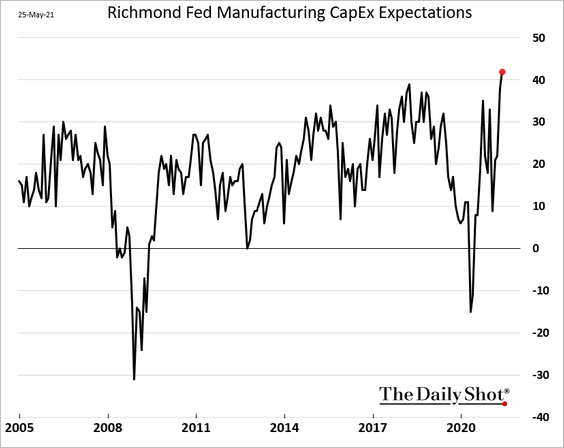

1. Let’s begin with the Richmond Fed’s manufacturing report.

• The headline index is off the highs but remains quite strong.

• As we’ve seen in other regions, supply chain constraints continue to worsen.

– Vendor lead time:

– Backlog of orders:

• Price pressures keep building.

• Manufacturers continue to hire.

But they are struggling with shortages of skilled workers. It’s amusing to hear politicians and the media talk about “bringing back” manufacturing jobs. The jobs are already here. The workers are not.

Manufacturers are boosting investments to make their existing workers more productive.

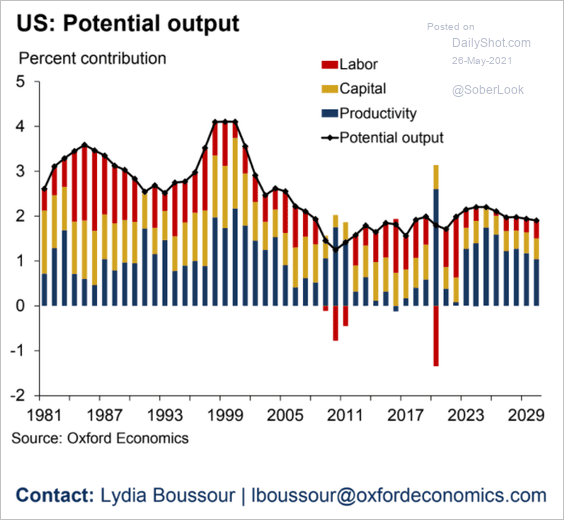

By the way, with the labor force growth increasingly constrained, productivity gains will drive economic expansion in the years to come. That’s why watching CapEx trends is critical.

Source: Oxford Economics

Source: Oxford Economics

——————–

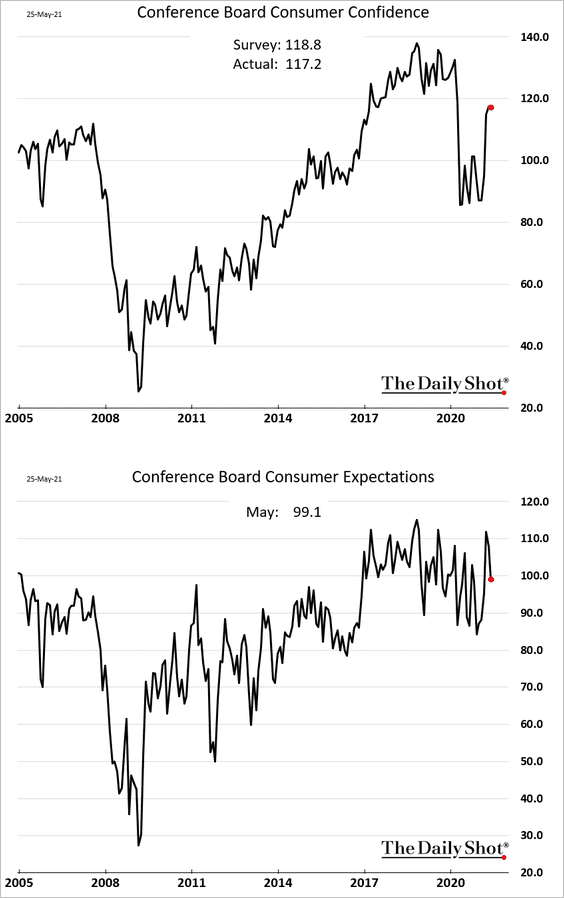

2. The Conference Board’s consumer confidence index was weaker than expected in May.

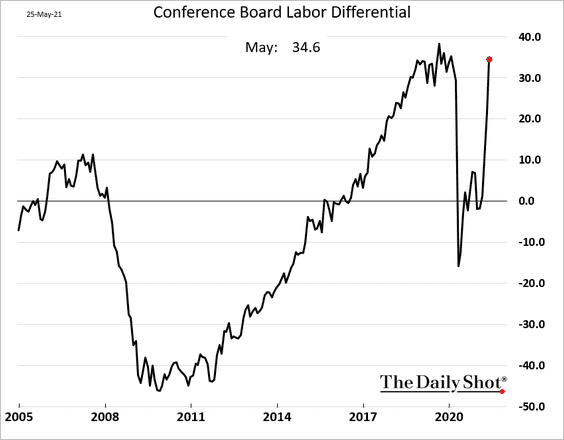

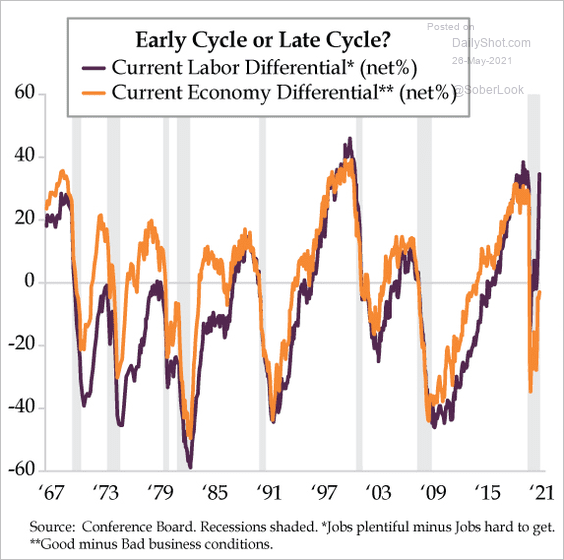

• But the labor differential (“jobs plentiful” – “jobs hard to get”) has fully rebounded, pointing to strengthening demand for labor.

A similar index measuring consumers’ perceptions of business conditions is lagging.

Source: The Daily Feather

Source: The Daily Feather

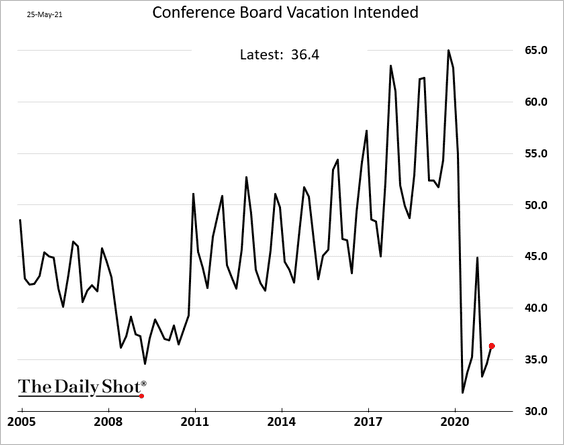

• The Conference Board’s index measuring households’ vacation plans remains depressed.

——————–

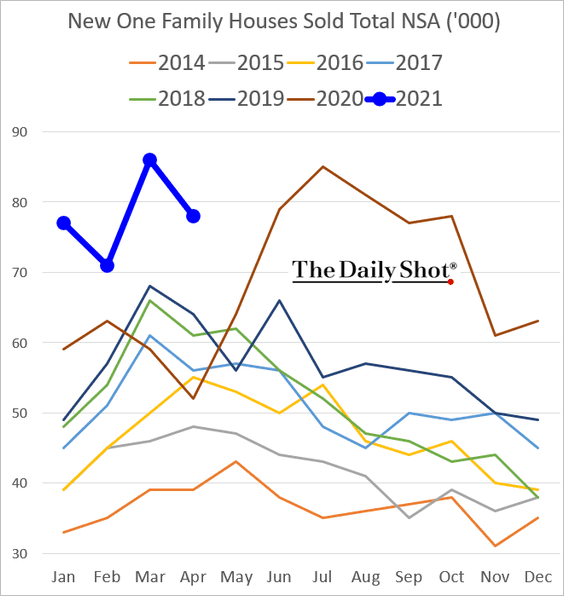

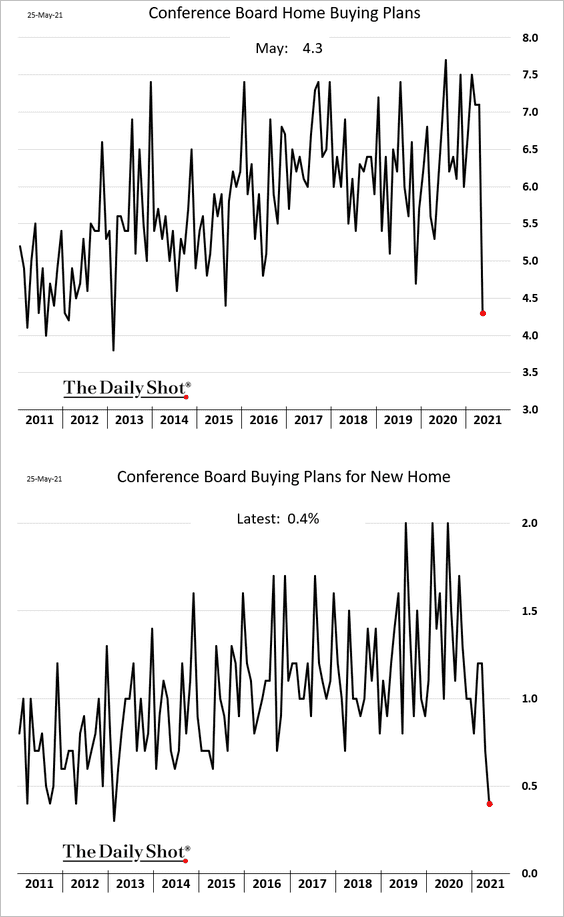

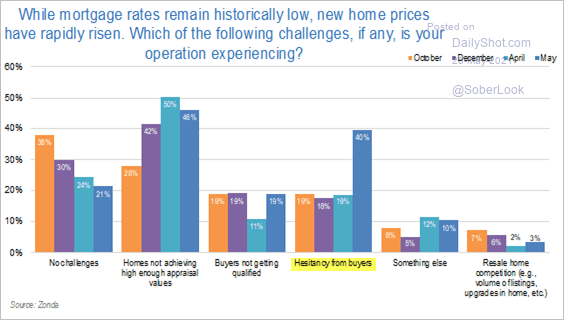

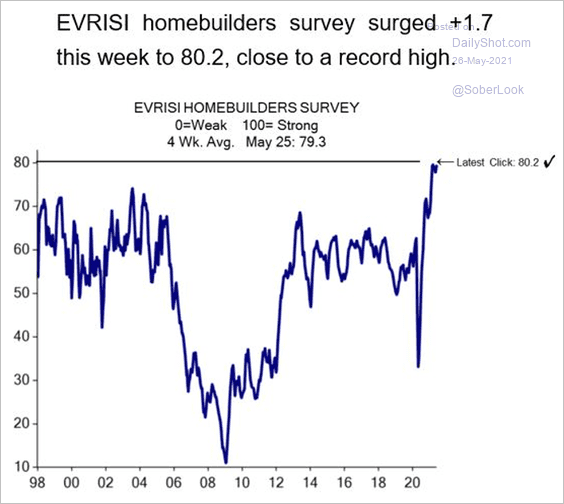

3. Next, we have some updates on the housing market.

• New home sales in April were weaker than market expectations.

• The “home buying plans” index from the Conference Board declined sharply this month.

• Builders increasingly see hesitancy from buyers.

Source: @AliWolfEcon

Source: @AliWolfEcon

• However, here is the Evercore ISI homebuilder survey index.

Source: Evercore ISI

Source: Evercore ISI

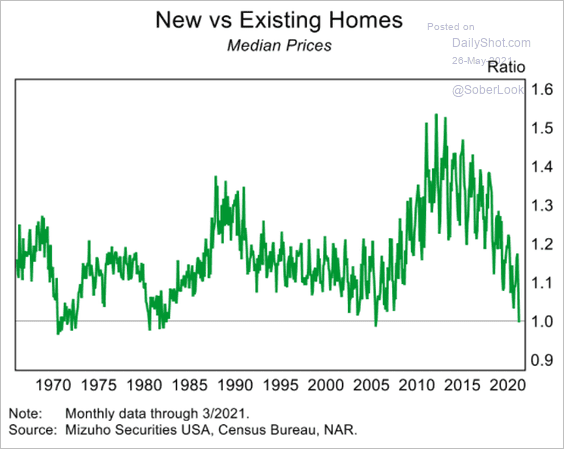

• Median new home prices are now at par with existing homes.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

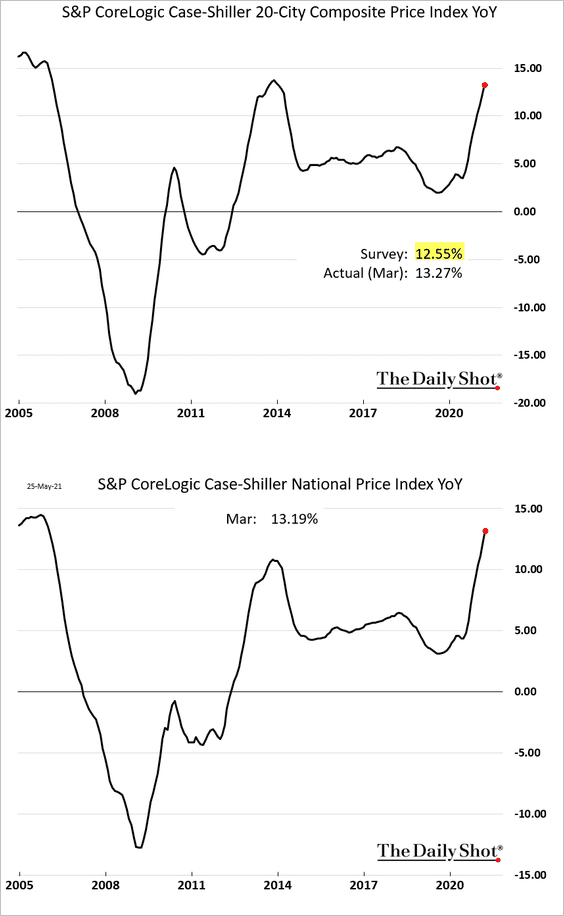

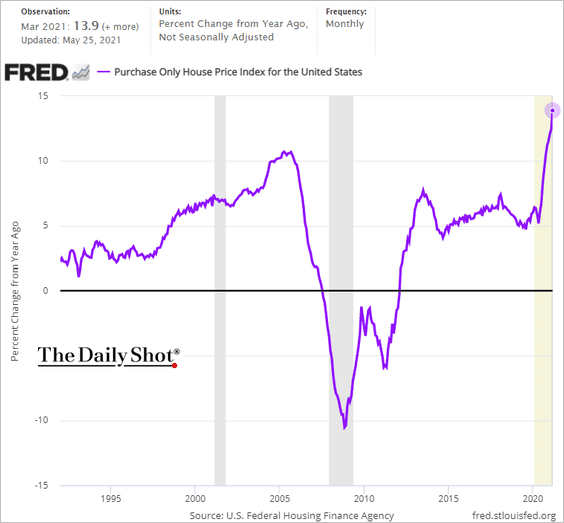

• Home price appreciation accelerated further in March.

Here is a similar index from the FHFA.

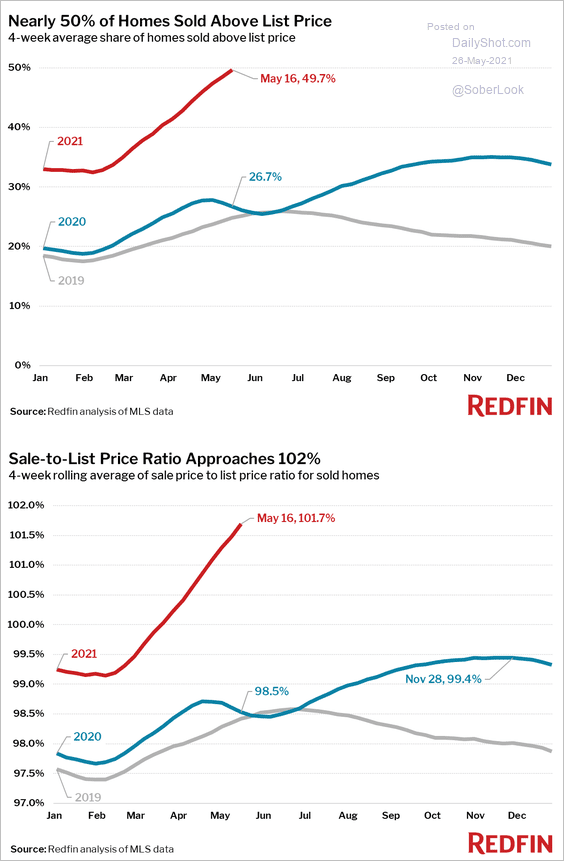

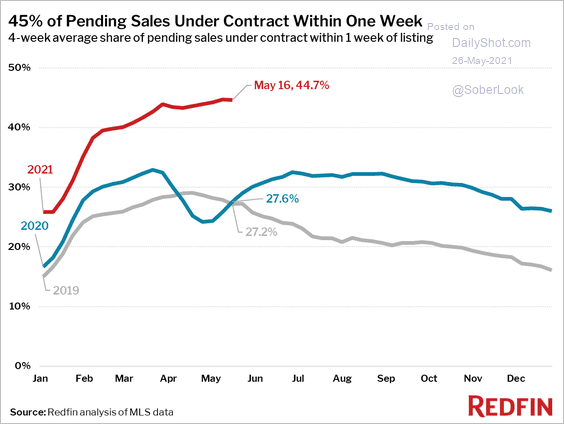

• 50% of homes have been sold above list price.

Source: Redfin

Source: Redfin

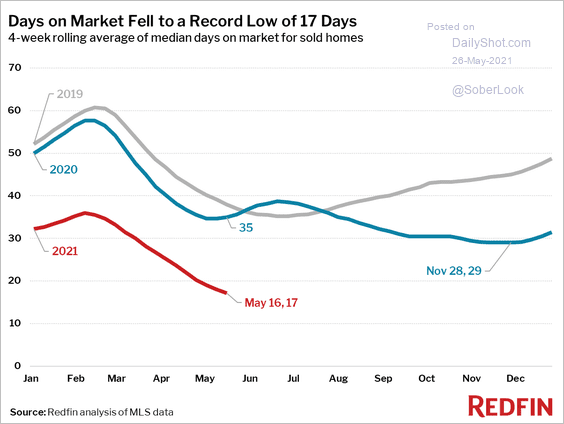

• Homes are selling quickly.

Source: Redfin

Source: Redfin

Source: Redfin

Source: Redfin

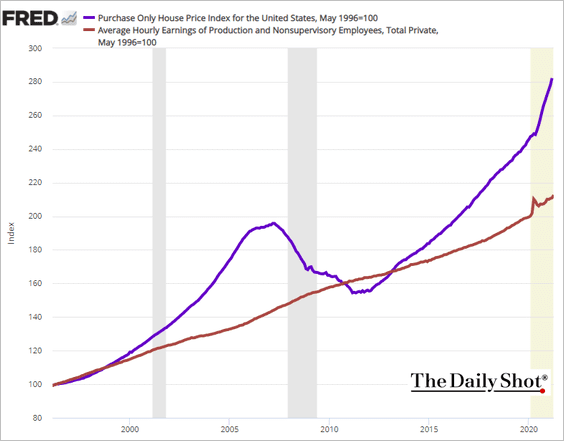

• Home price gains continue to outpace wages.

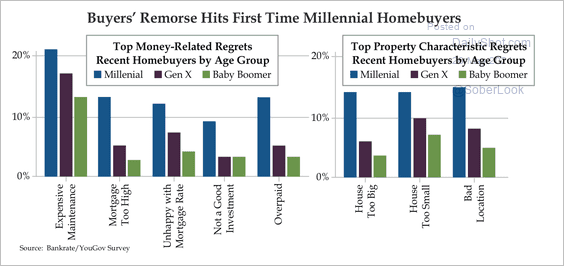

• High housing prices, maintenance costs, and mortgage payments are some factors leading to buyers’ remorse.

Source: Quill Intelligence

Source: Quill Intelligence

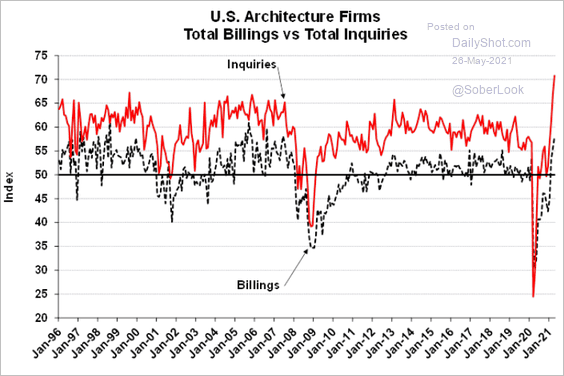

• Artchitectural firms’ billings and inquiries have risen sharply.

Source: Evercore ISI

Source: Evercore ISI

——————–

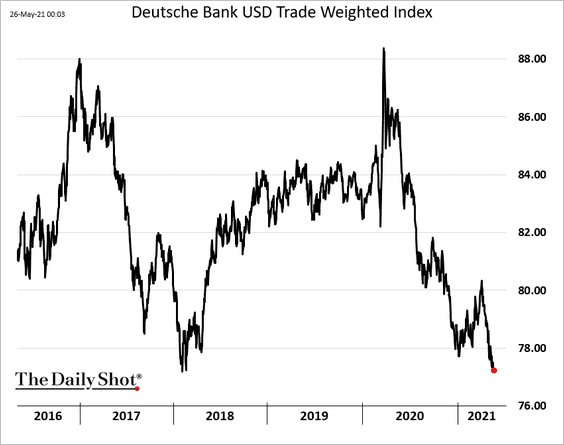

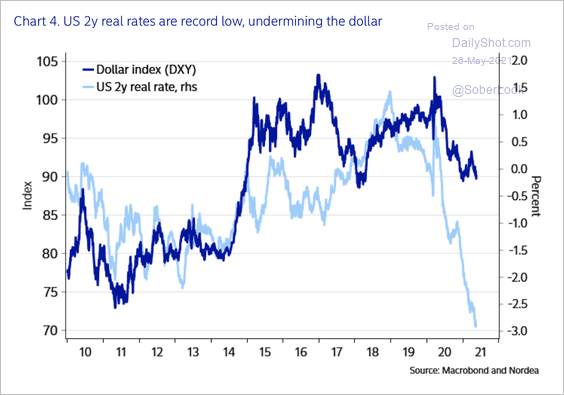

4. The US dollar continues to weaken.

The decline in US real rates suggests further weakness for the dollar.

Source: Nordea Markets

Source: Nordea Markets

——————–

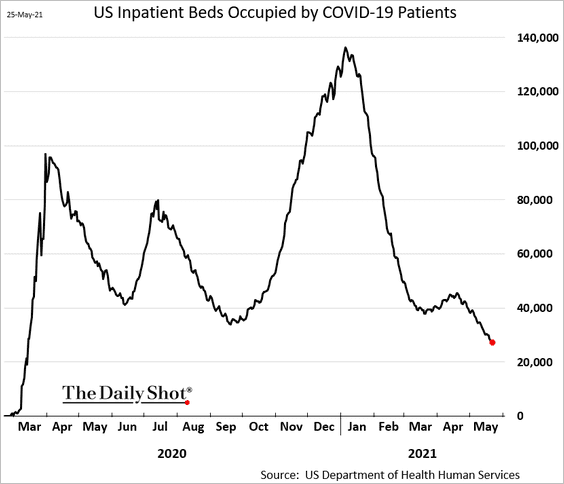

5. COVID-related hospitalizations continue to moderate.

Back to Index

The United Kingdom

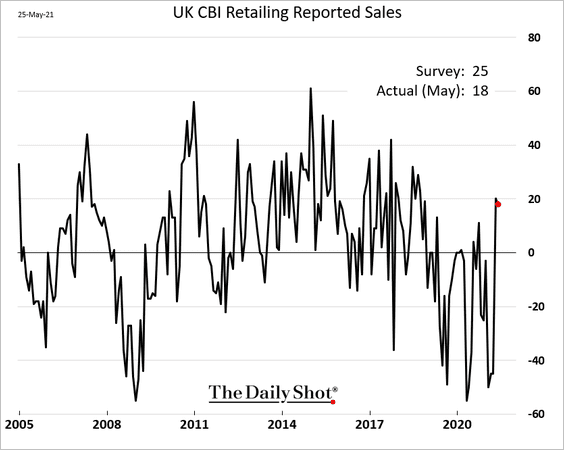

1. The CBI retail sales index was softer than expected, but the recovery will continue.

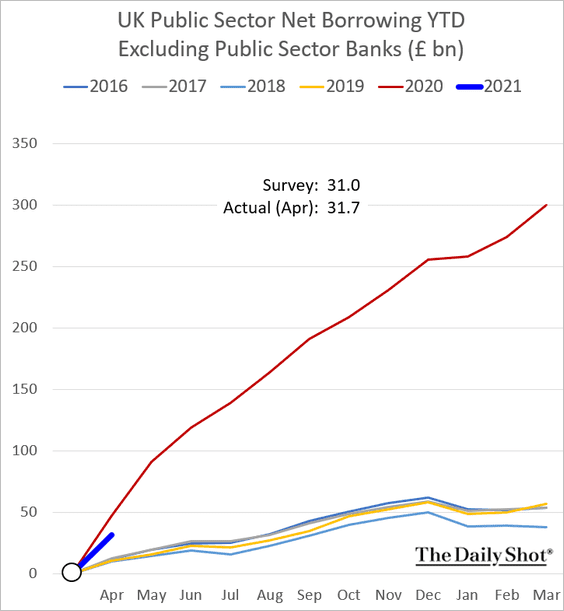

2. Government borrowing in April was roughly in line with forecasts.

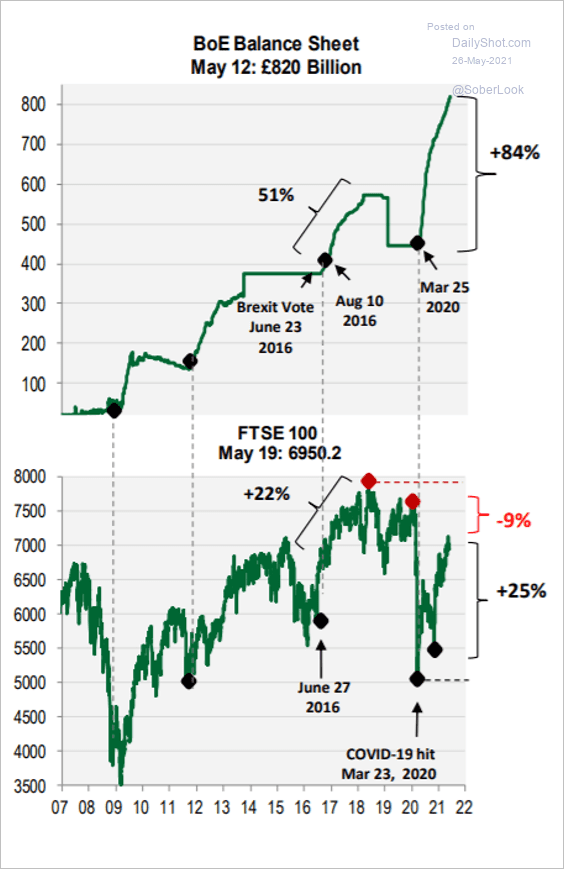

3. The BoE’s balance sheet spike didn’t push the FTSE 100 to a new high this time around.

Source: Cornerstone Macro

Source: Cornerstone Macro

Back to Index

The Eurozone

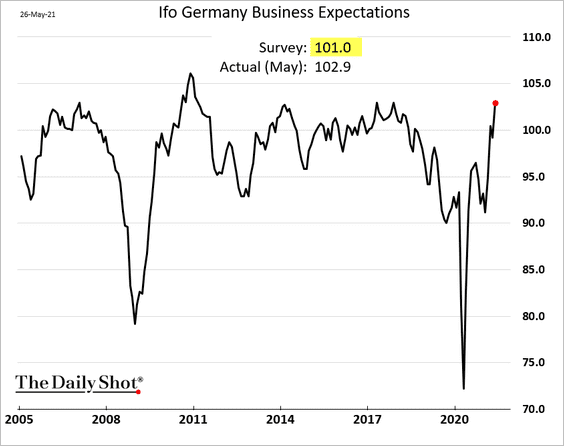

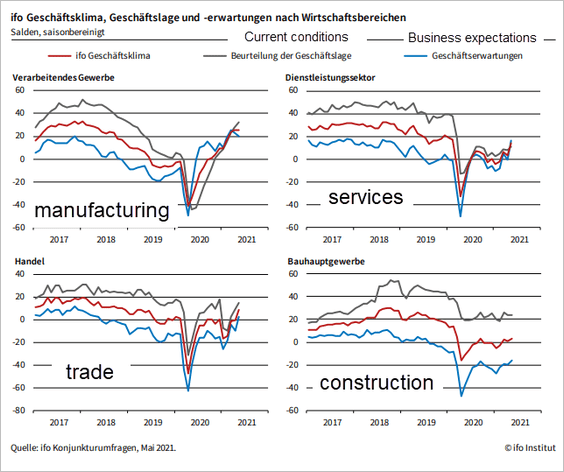

1. Germany’s Ifo index of business expectations rose sharply this month.

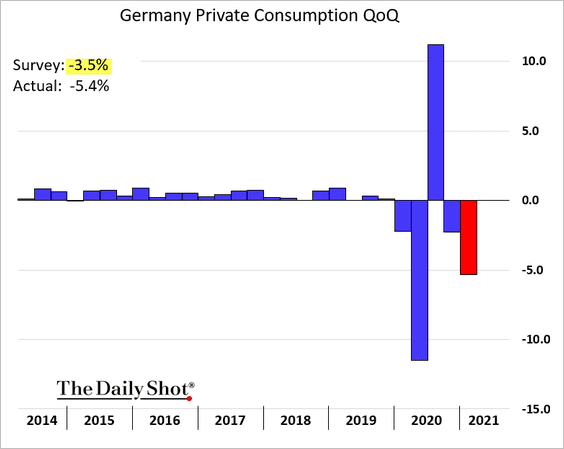

2. Germany’s private consumption tumbled in Q1, but we should see a strong rebound this quarter.

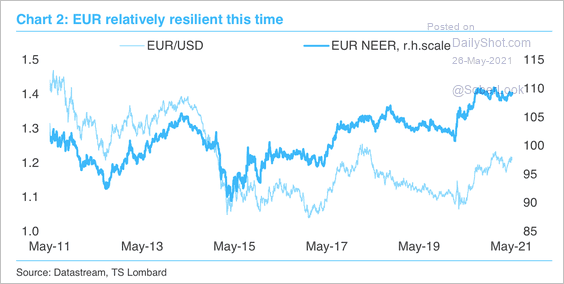

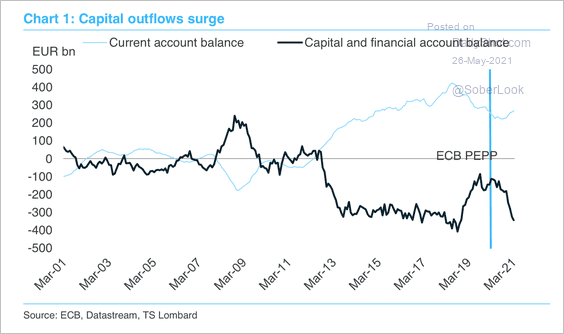

3. The euro has remained resilient despite the surge in capital outflows (2 charts).

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

Back to Index

Asia – Pacific

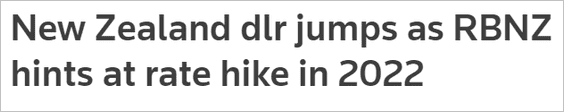

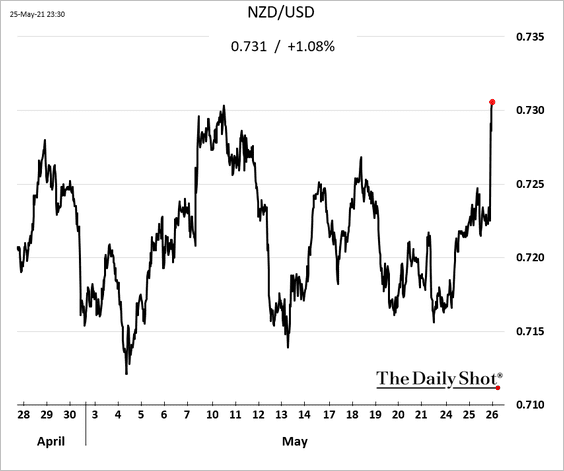

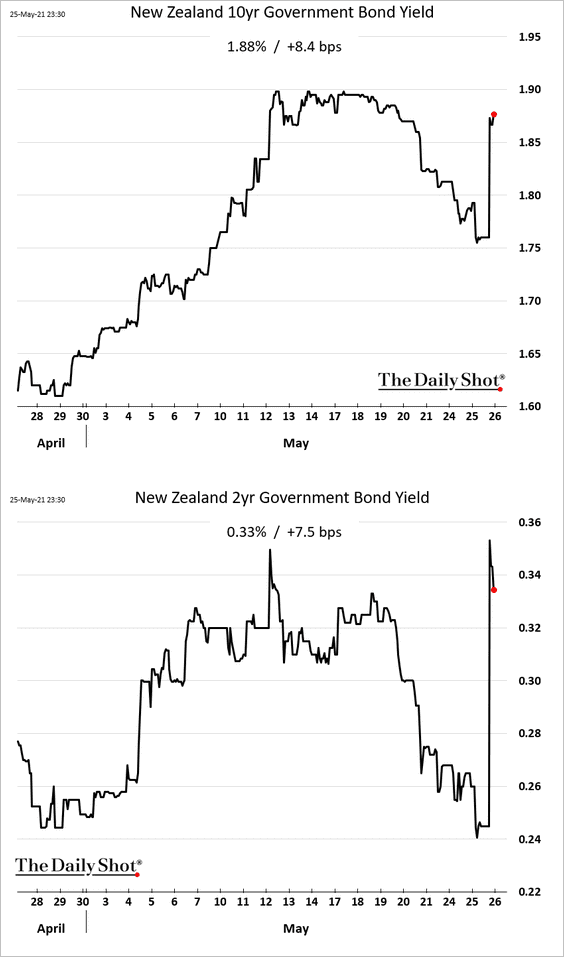

1. The RBNZ struck a hawkish tone.

Source: Reuters Read full article

Source: Reuters Read full article

The Kiwi dollar and bond yields jumped.

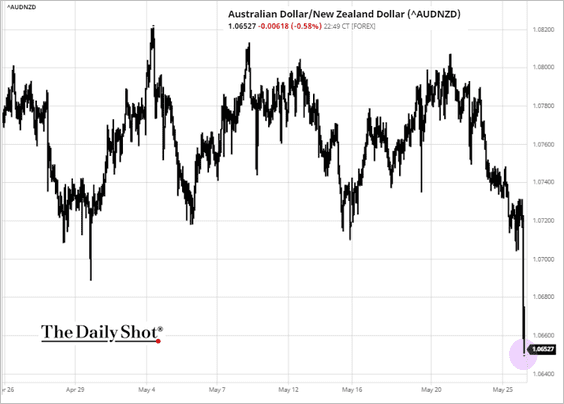

Here is the AUD/NZD cross.

Source: barchart.com

Source: barchart.com

——————–

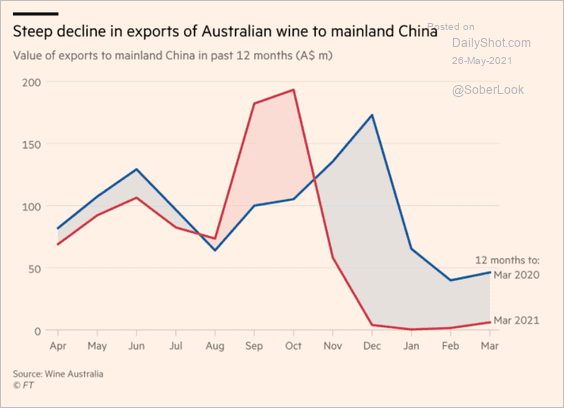

2. China continues to punish Australia for requesting an investigation into the origins of COVID (which the US is demanding now).

Source: @financialtimes Read full article

Source: @financialtimes Read full article

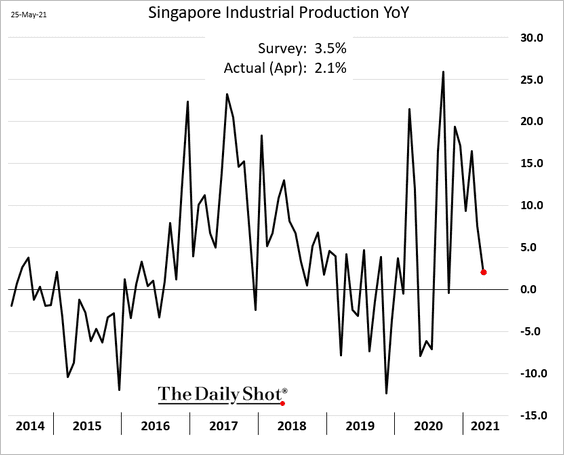

3. Singapore’s industrial production slowed last month.

Back to Index

China

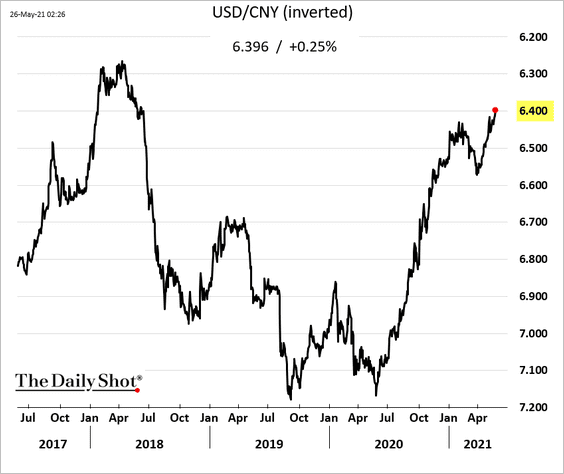

1. The renminbi continues to climb vs. USD.

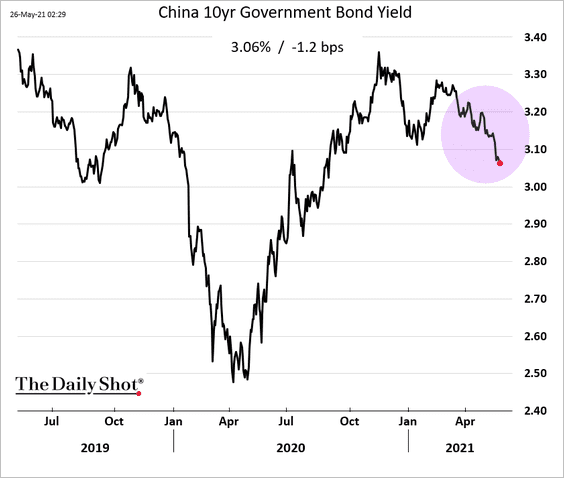

2. Bond yields are drifting lower amid international demand.

3. Foreigners have been buying up Chinese stocks.

Source: John Liu Read full article

Source: John Liu Read full article

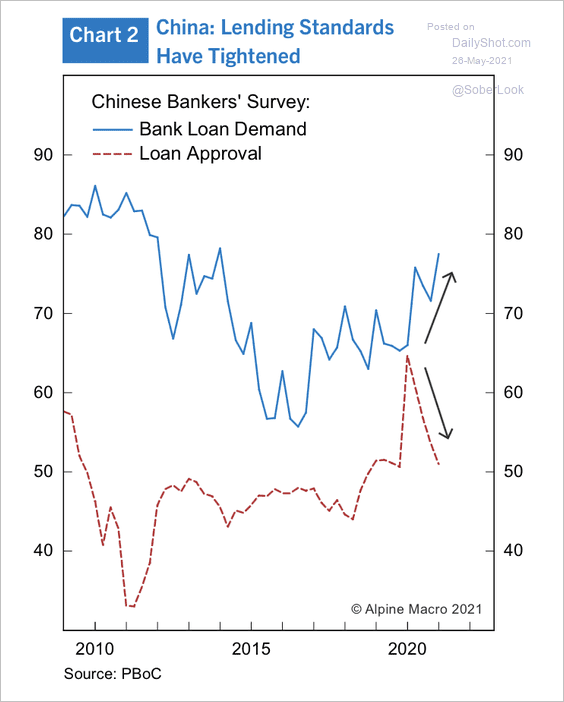

4. Obtaining credit has been difficult over the past year, which can strain economic growth.

Source: Alpine Macro

Source: Alpine Macro

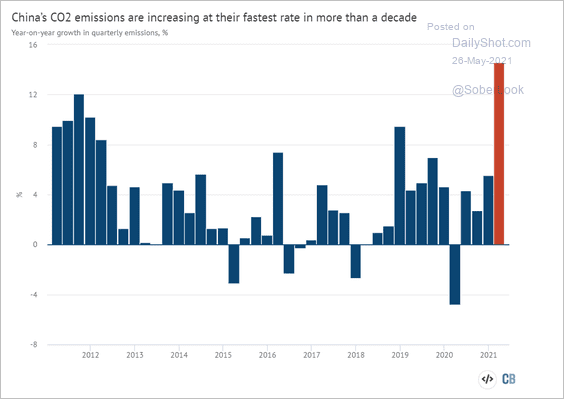

5. CO2 emissions are up sharply.

Source: Carbon Brief Read full article

Source: Carbon Brief Read full article

Back to Index

Emerging Markets

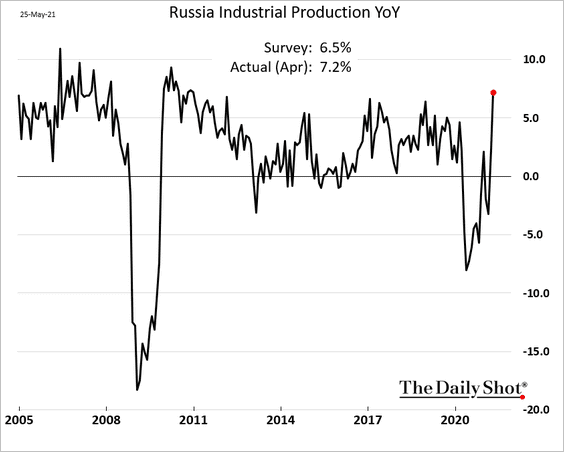

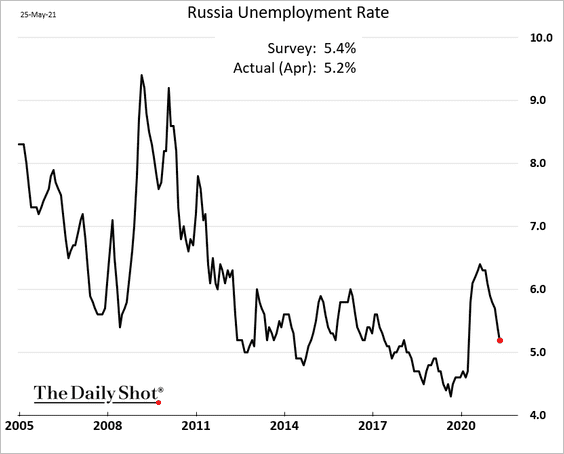

1. Russia’s economy strengthened last month.

• Industrial production (above consensus):

• The unemployment rate:

——————–

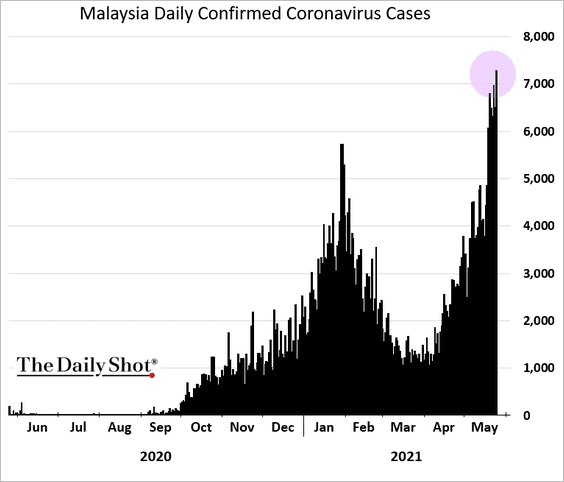

2. Malaysia’s COVID cases continue to climb.

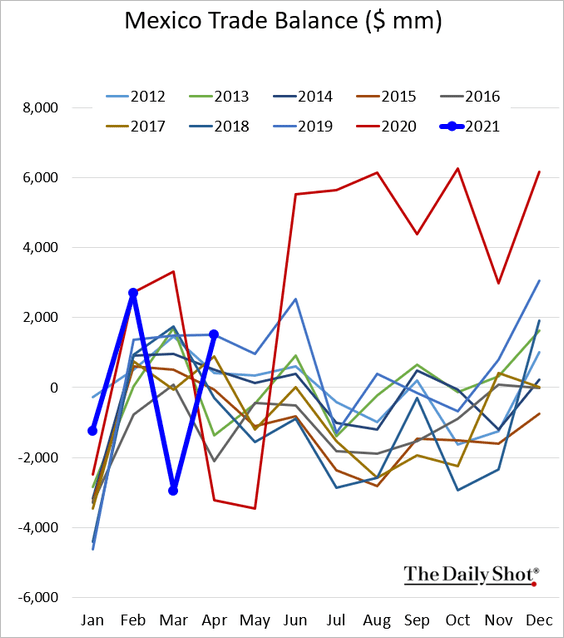

3. Mexico’s trade balance swung back into surplus last month after an unexpected drop in March.

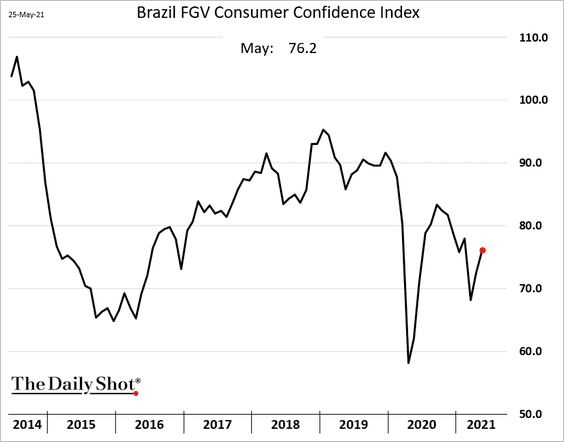

4. Brazil’s consumer confidence improved this month but remains well below pre-COVID levels.

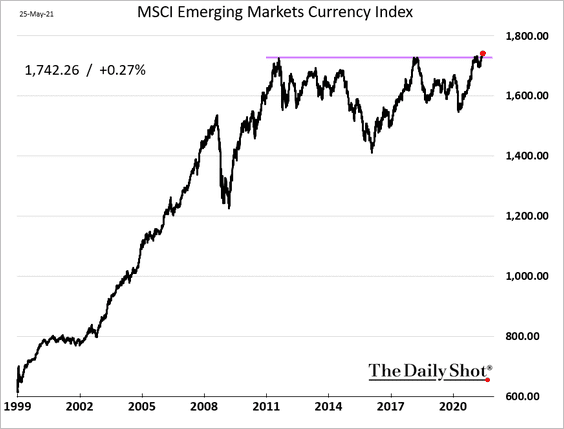

5. The MSCI EM Currency Index hit a record high as the US dollar slumps.

Back to Index

Cryptocurrency

1. Bitcoin is back above $40k. Will we test resistance at $42k?

Source: FTX

Source: FTX

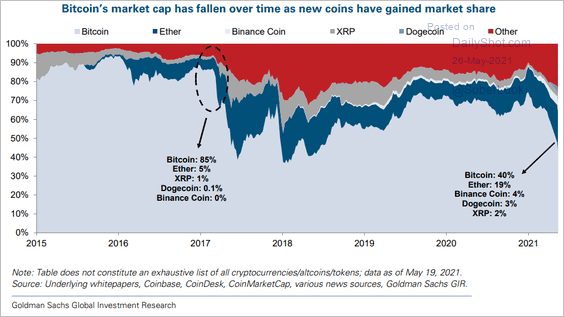

2. Bitcoin has lost market share this year.

Source: Goldman Sachs

Source: Goldman Sachs

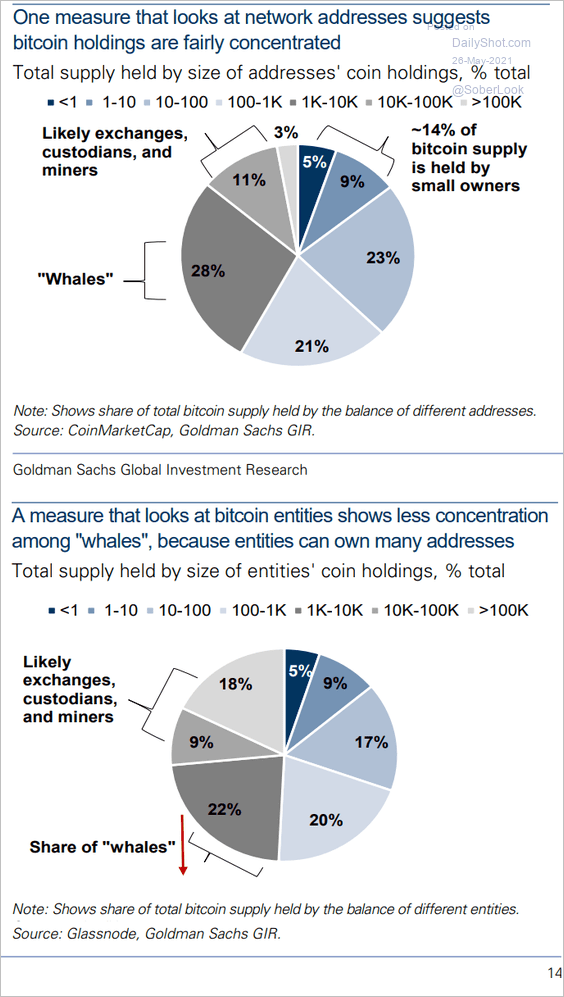

3. How concentrated are bitcoin holdings?

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Commodities

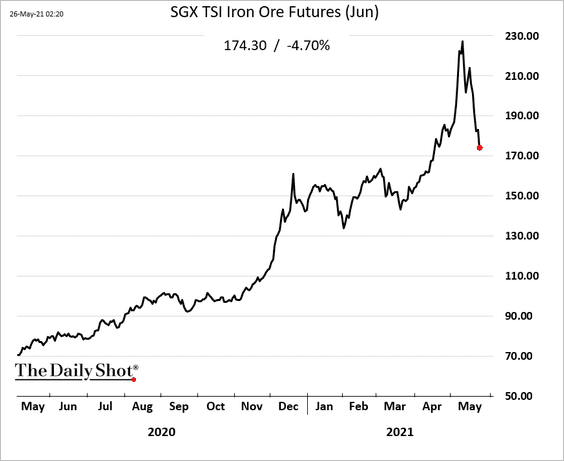

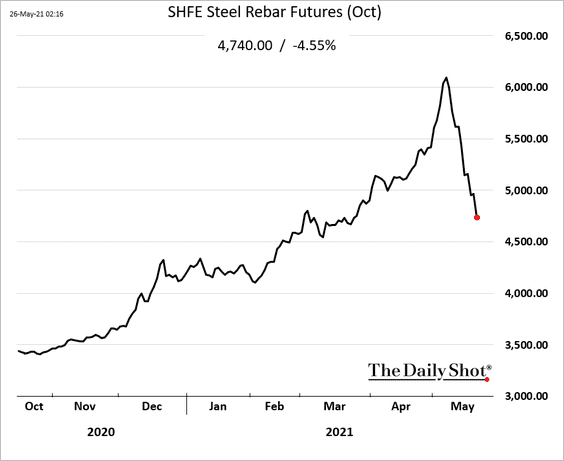

1. Iron ore and steel futures continue to tumble (under pressure from Beijing).

——————–

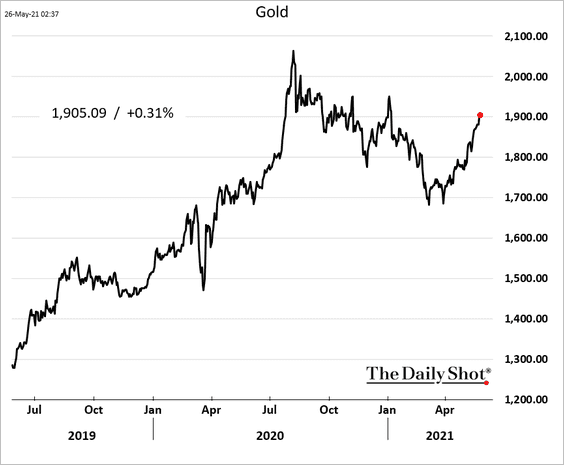

2. Gold is back above $1900/oz.

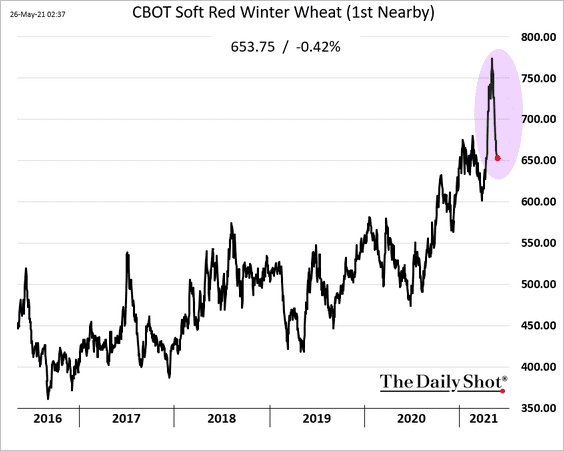

3. US wheat prices slumped in recent days.

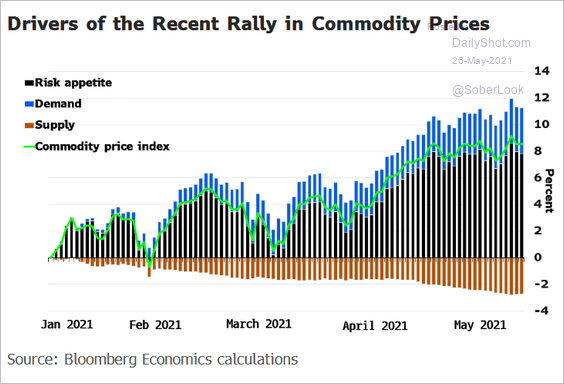

4. Here are the drivers of the recent rally in commodity prices.

Source: @RoyeBjorn Read full article

Source: @RoyeBjorn Read full article

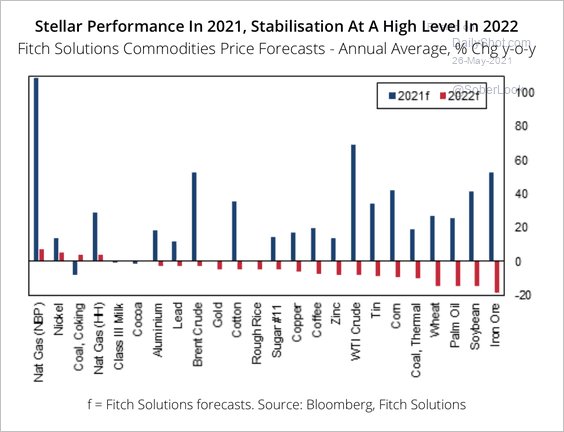

5. Fitch expects the rise in commodity prices to slow next year but remain firmly above trend.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

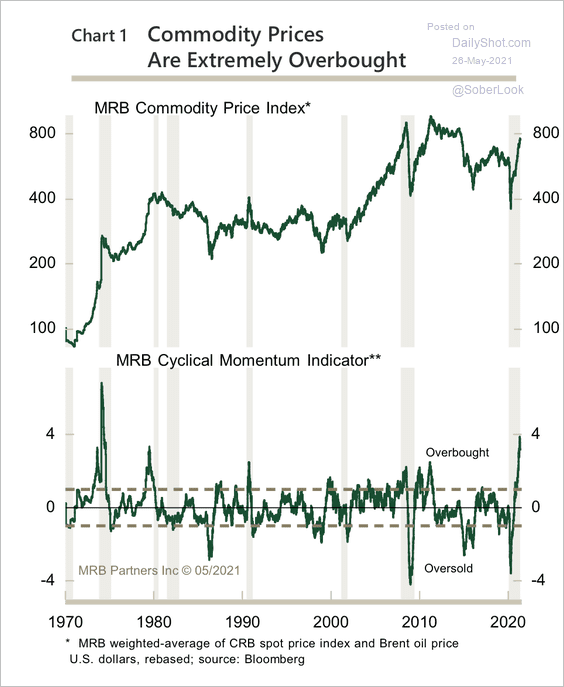

Commodities are the most overbought since the 1970s, according to MRB Partners.

Source: MRB Partners

Source: MRB Partners

——————–

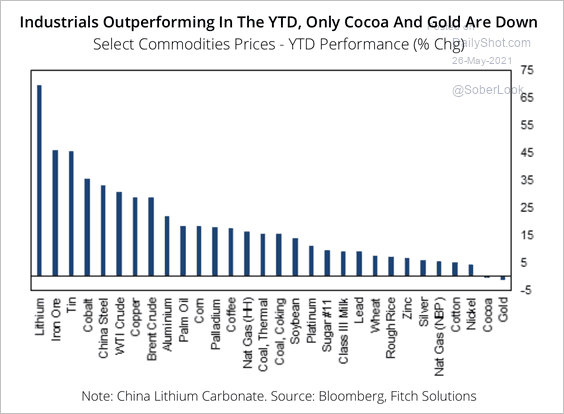

6. Here is a look at year-to-date performance across commodities.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

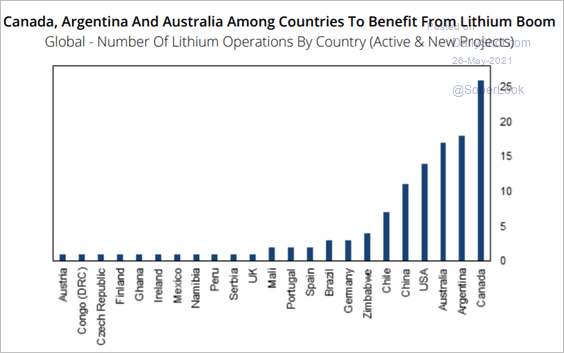

7. Who are the beneficiaries of the lithium boom?

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Back to Index

Equities

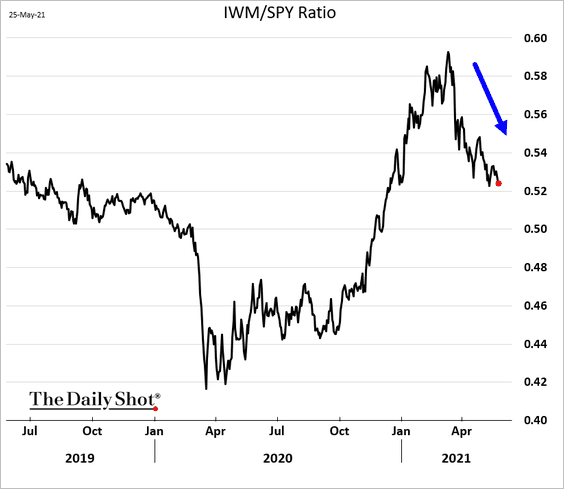

1. Small caps continue to lag the S&P 500.

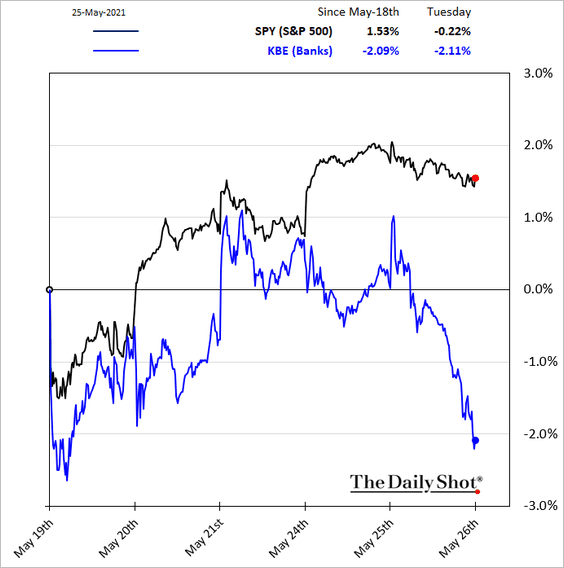

2. Bank shares sold off as Treasury yields declined.

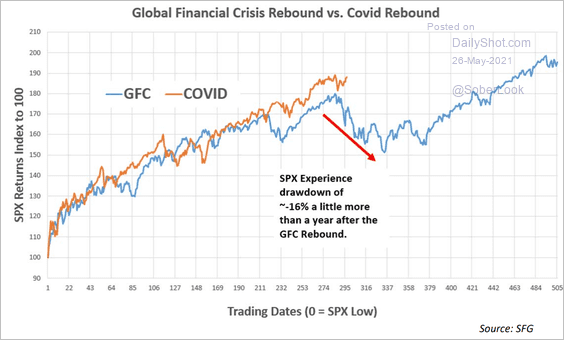

3. Is the rally about to pause?

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

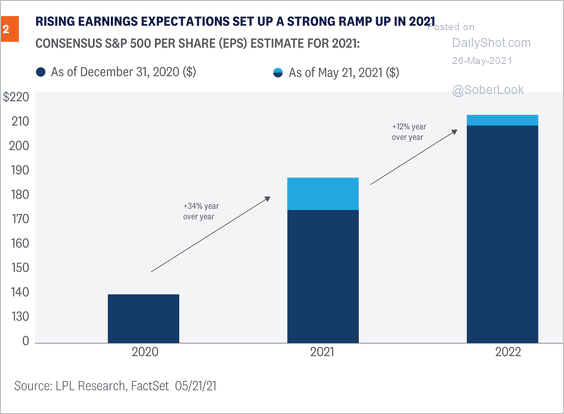

4. This chart shows the changes in earnings forecasts since the start of the year.

Source: LPL Research

Source: LPL Research

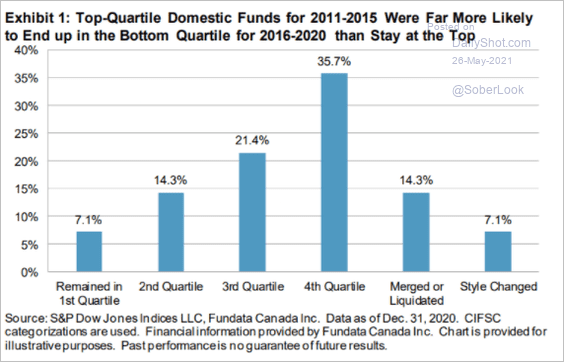

5. Chasing top-performing funds isn’t a good idea.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

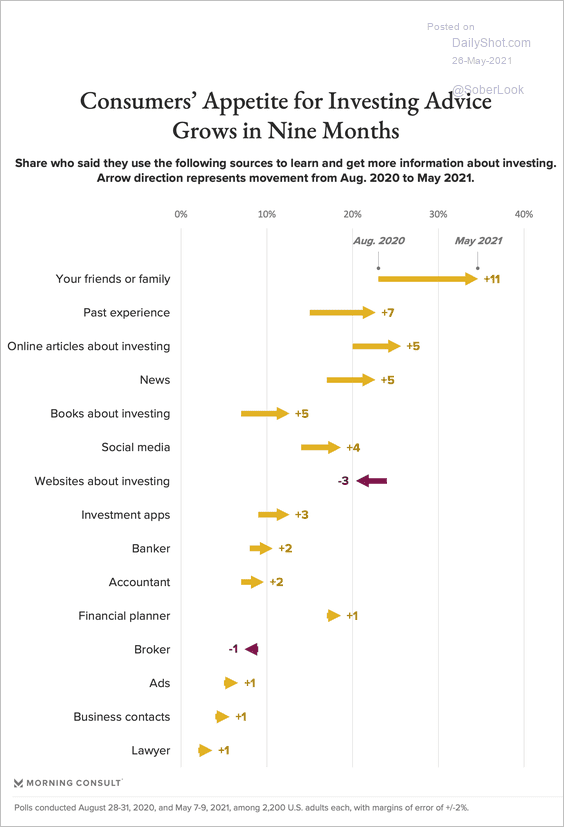

6. Consumers want more investment advice.

Source: Morning Consult Read full article

Source: Morning Consult Read full article

Back to Index

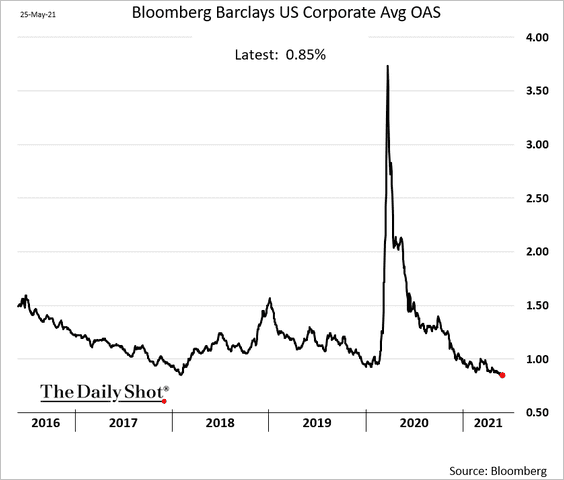

Credit

1. US investment-grade bond spreads keep tightening.

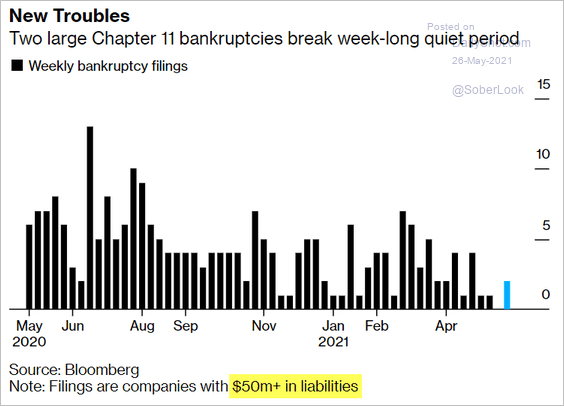

2. Bankruptcies among larger firms have become much less frequent.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Rates

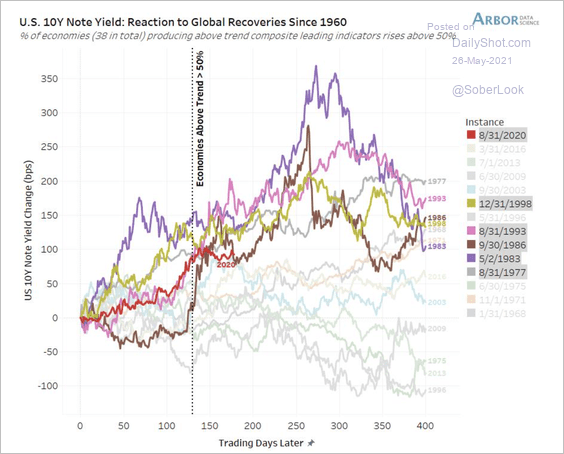

1. The 10-year Treasury yield is tracking past global recoveries.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

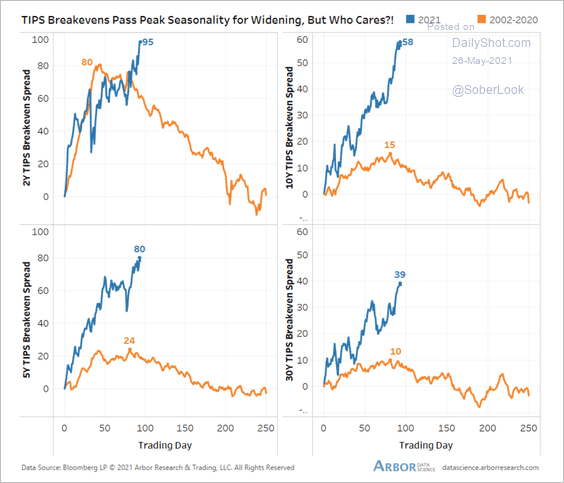

2. TIPS breakeven rates have widened well beyond seasonal peaks.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

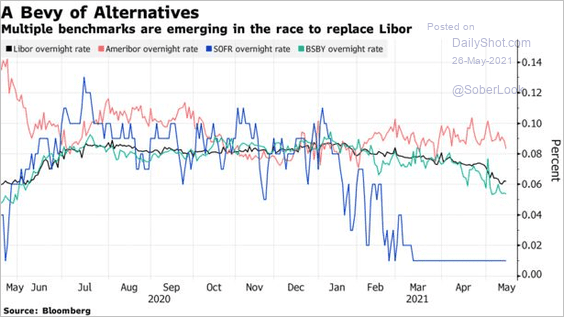

3. The competition for LIBOR replacement heats up, with many market participants preferring “credit-sensitive” rates (that represent banks’ unsecured funding costs).

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Global Developments

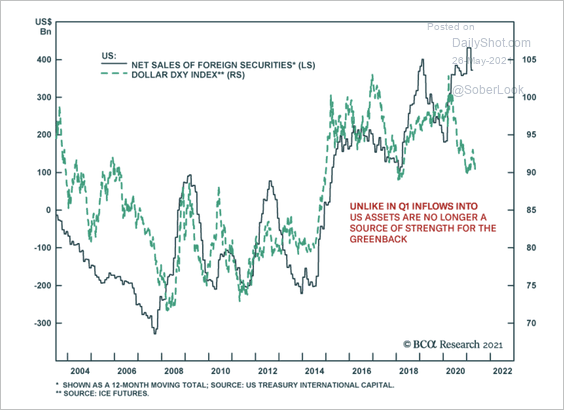

1. Net sales of securities outside of the US are no longer a source of dollar strength.

Source: BCA Research

Source: BCA Research

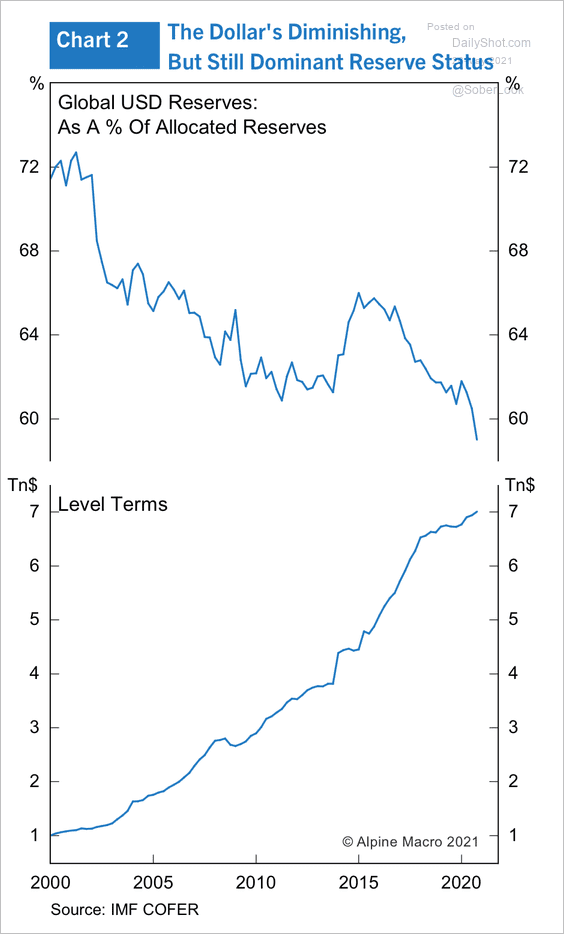

2. Reserve holdings of the dollar have grown slower than other currencies over the past decade.

Source: Alpine Macro

Source: Alpine Macro

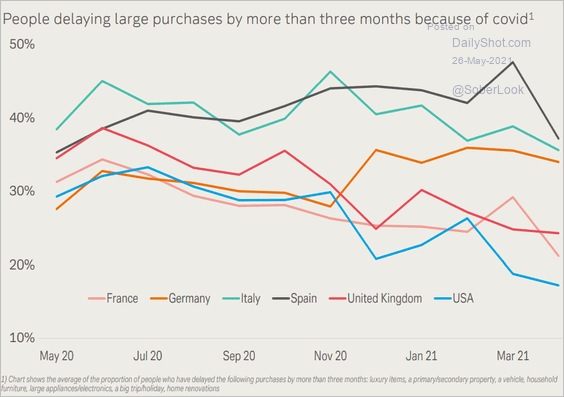

3. Fewer households are delaying large purchases.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

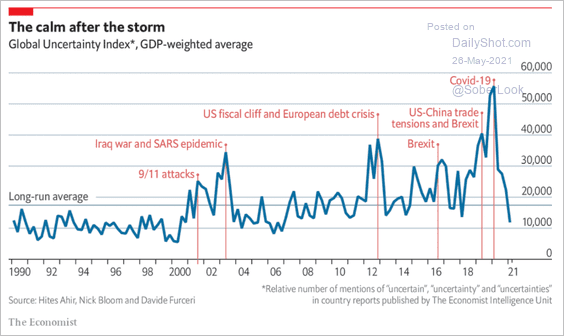

4. The Global Uncertainty Index has collapsed.

Source: The Economist Read full article

Source: The Economist Read full article

——————–

Food for Thought

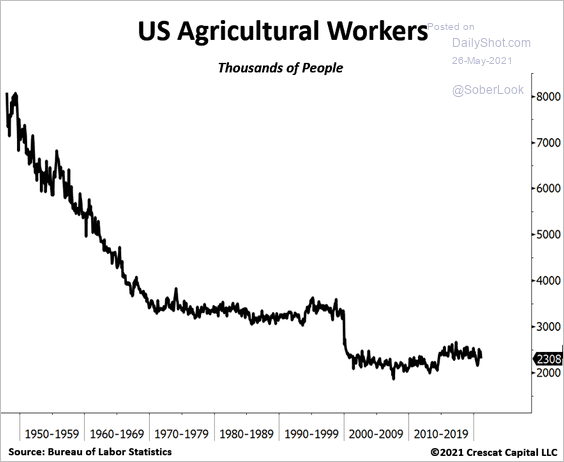

1. US agricultural workers:

Source: @TaviCosta

Source: @TaviCosta

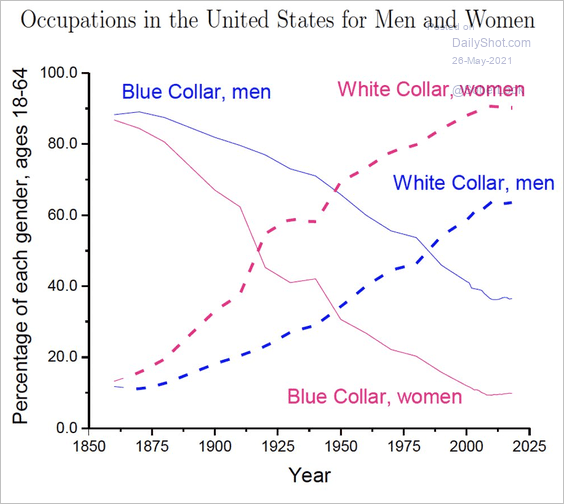

2. The evolution of US workforce composition:

Source: @_alice_evans Read full article

Source: @_alice_evans Read full article

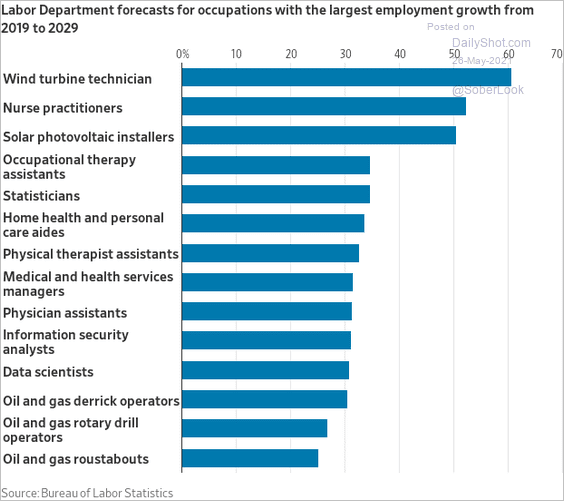

3. US occupations with largest employment growth:

Source: @WSJ Read full article

Source: @WSJ Read full article

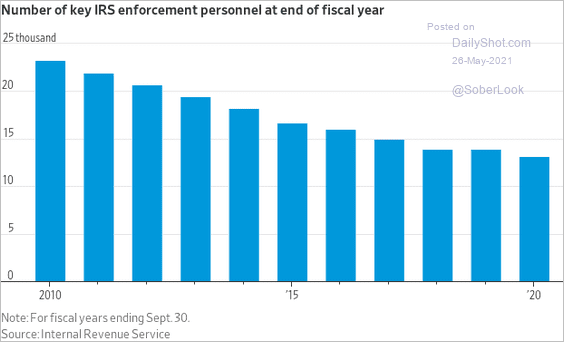

4. IRS enforcement personnel:

Source: @WSJ Read full article

Source: @WSJ Read full article

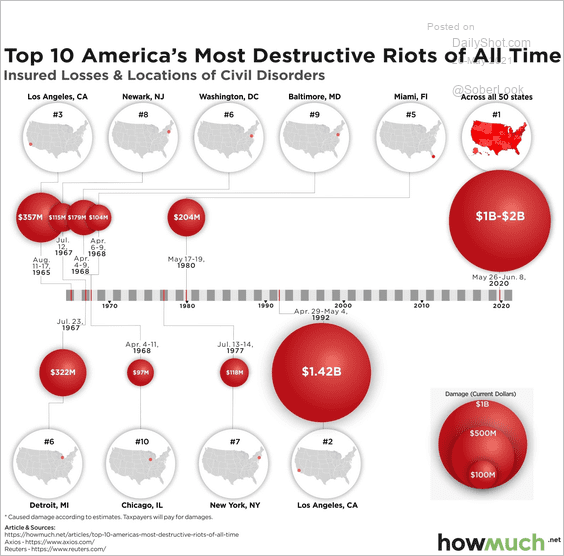

5. Most destructive riots in the US:

Source: @howmuch_net Read full article

Source: @howmuch_net Read full article

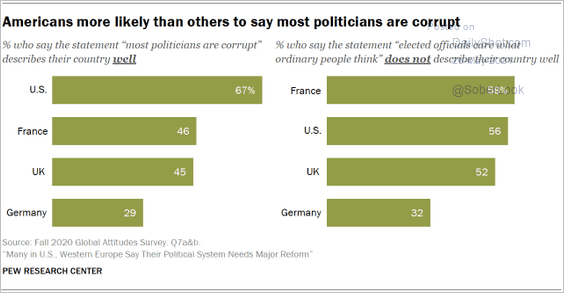

6. Corrupt politicians:

Source: @pewglobal Read full article

Source: @pewglobal Read full article

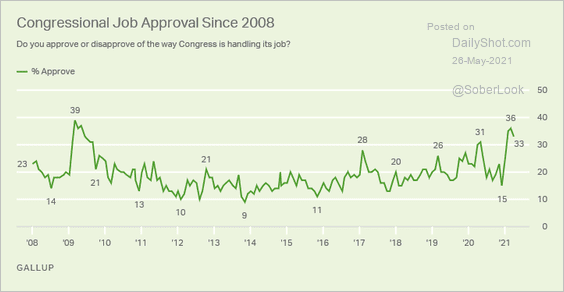

7. Congressional job approval:

Source: Gallup Read full article

Source: Gallup Read full article

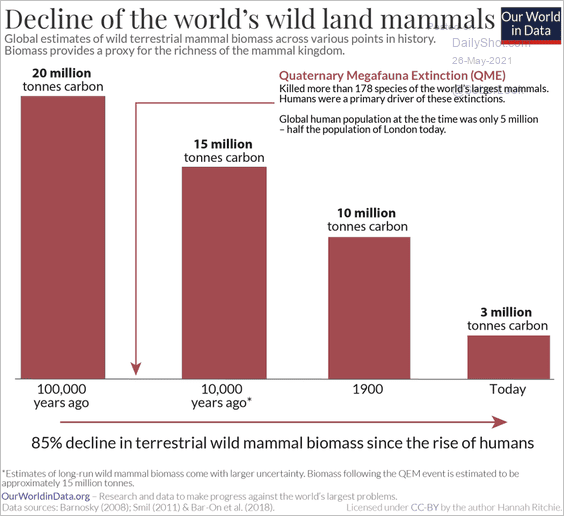

8. The world’s wild land mammals:

Source: @_HannahRitchie, @OurWorldInData Read full article

Source: @_HannahRitchie, @OurWorldInData Read full article

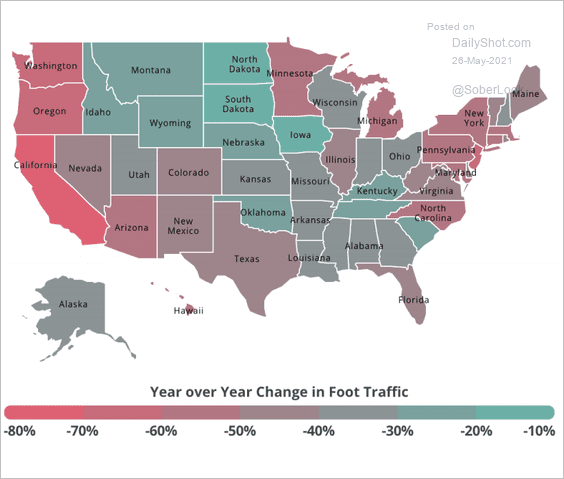

9. Year-over-year changes in gym visits:

Source: Placer Labs Read full article

Source: Placer Labs Read full article

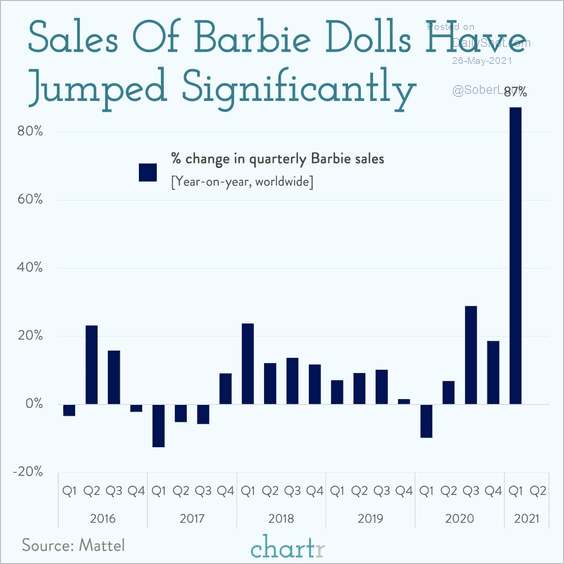

10. Sales of Barbie dolls:

Source: @chartrdaily

Source: @chartrdaily

——————–

As a reminder, the next Daily Shot will be published on June 1st.

Back to Index