The Daily Shot: 02-Jun-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

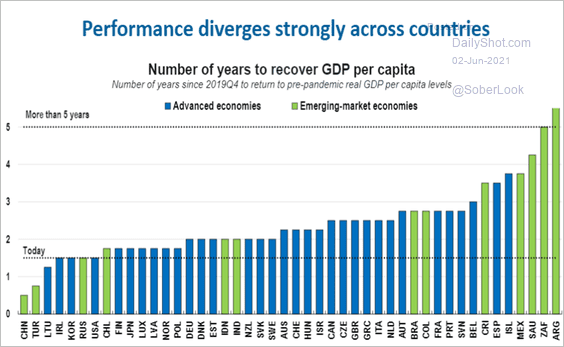

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

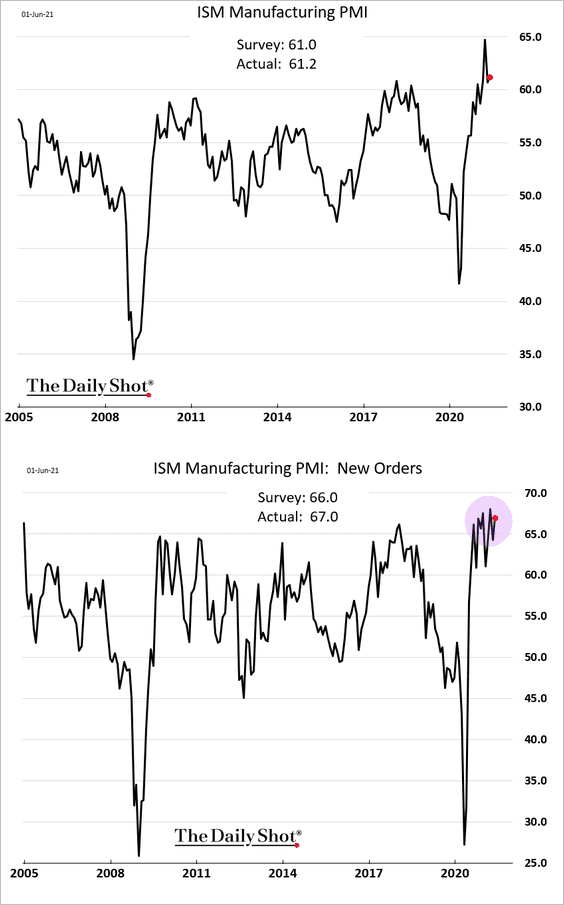

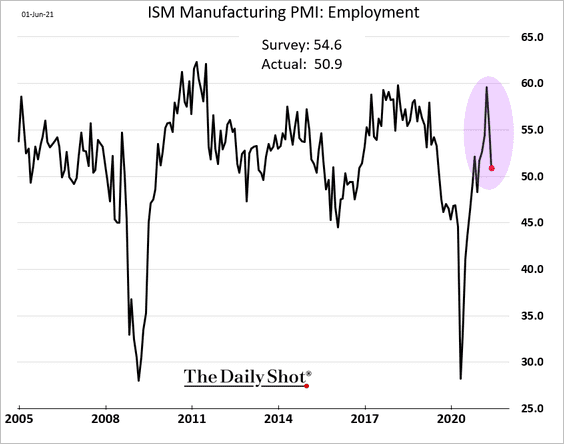

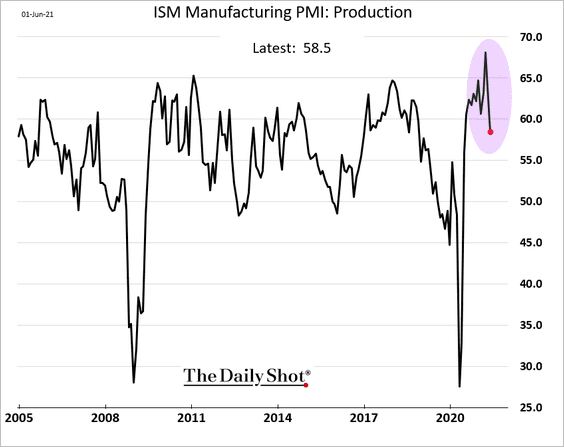

1. The ISM Manufacturing PMI continues to show rapid expansion in US factory activity.

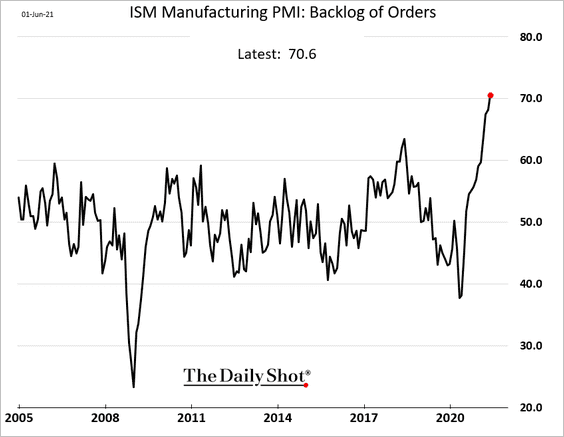

• US manufacturers are struggling to keep up …

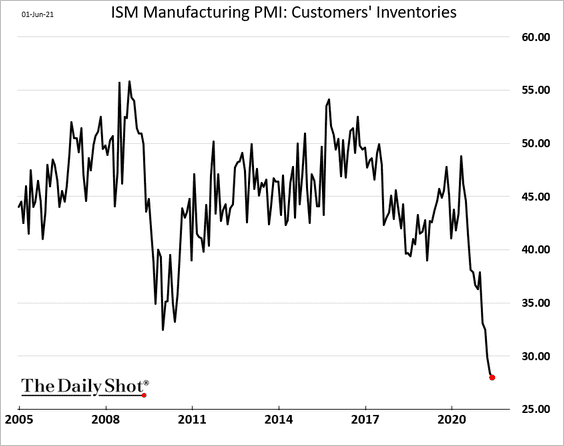

… as customers’ inventories shrink.

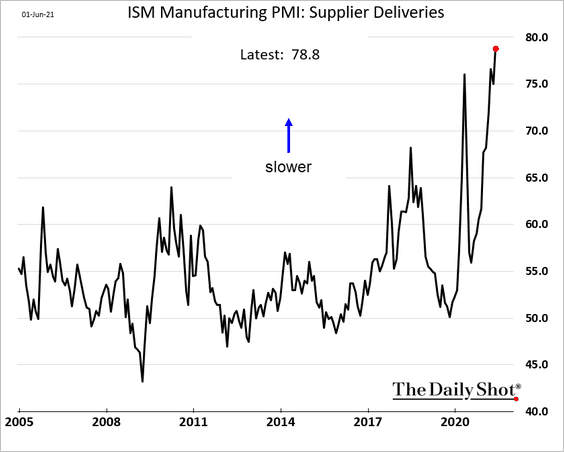

• Factories face two headwinds.

– worsening supply-chain bottlenecks:

– worker shortages (creating a drag on hiring):

Source: MarketWatch Read full article

Source: MarketWatch Read full article

• As a result, production growth has been moderating.

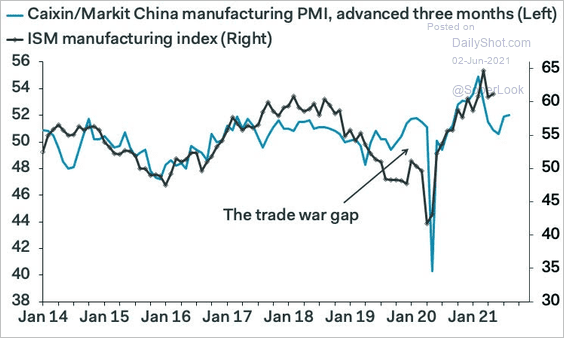

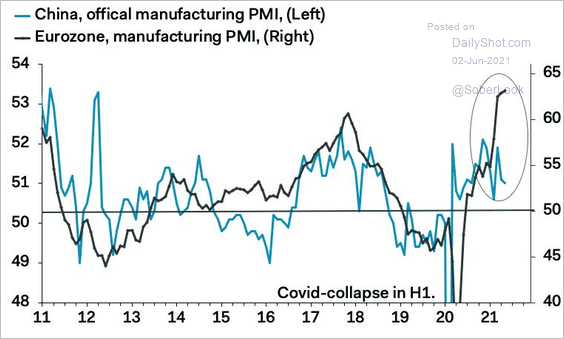

• Subdued manufacturing growth in China points to downside risks for the ISM Manufacturing PMI.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

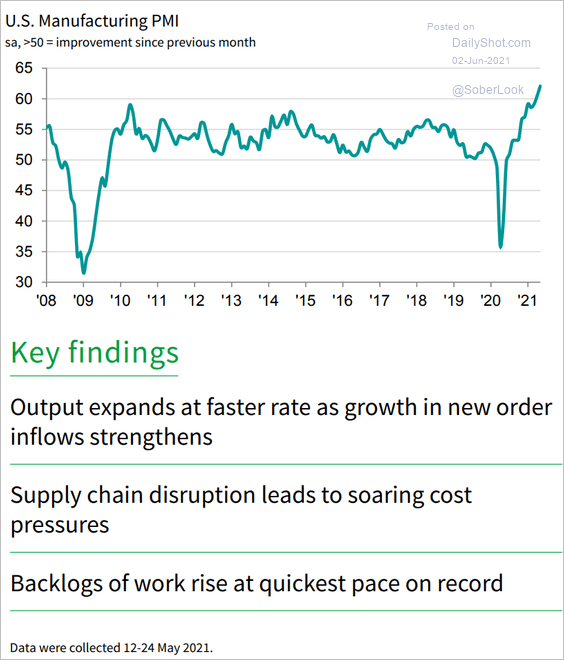

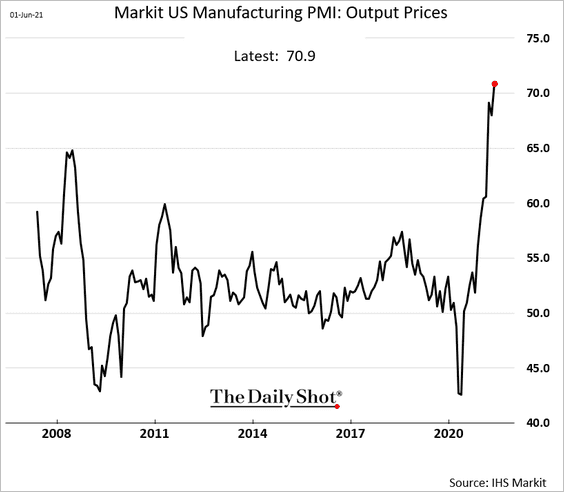

2. A similar manufacturing indicator from IHS Markit also shows tremendous growth, …

Source: IHS Markit

Source: IHS Markit

… with manufacturers rapidly boosting output prices.

——————–

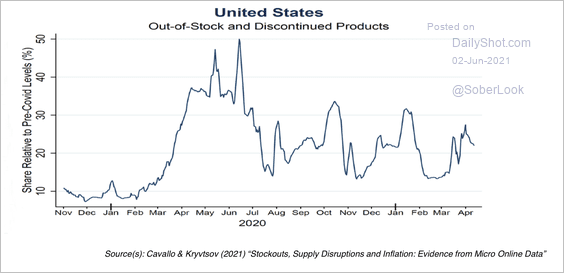

2. Out-of-stock or discontinued items remain about 20% higher than pre-pandemic levels. This is due to many sectors experiencing shortages of materials and labor.

Source: III Capital Management

Source: III Capital Management

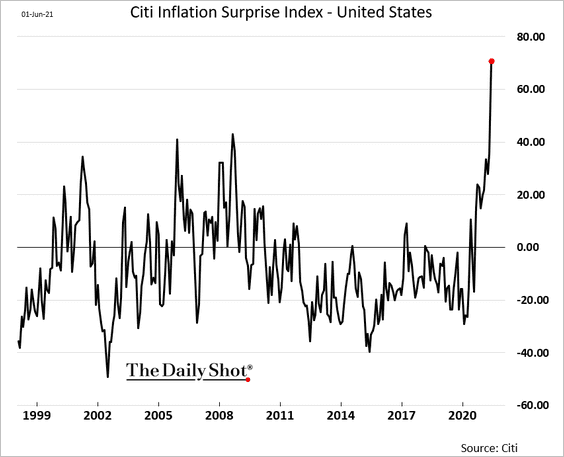

3. Next, we have some updates on inflation.

• Economists were surprised by the intensity of the pandemic recovery price gains. The Citi Inflation Surprise Index hit a record high.

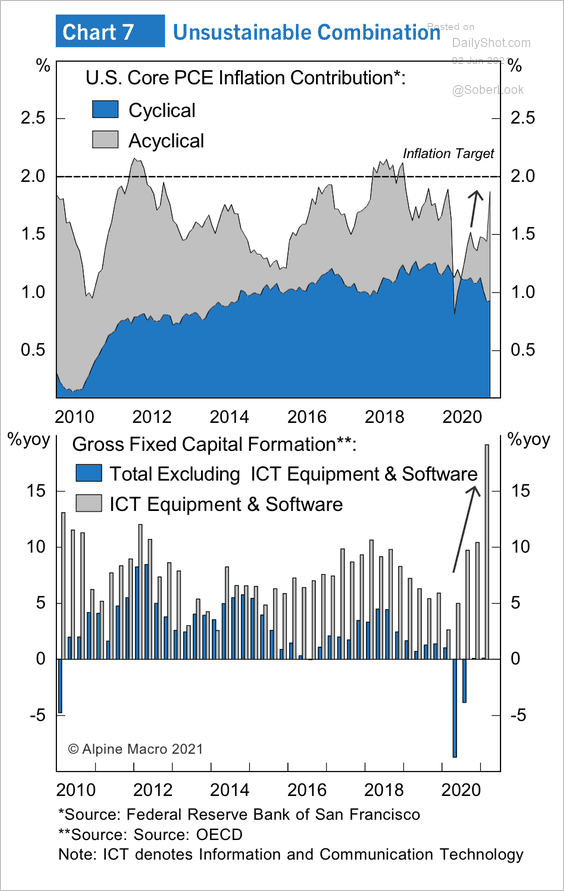

• The component of core PCE inflation that does not correlate with the business cycle is rising sharply.

Source: Alpine Macro

Source: Alpine Macro

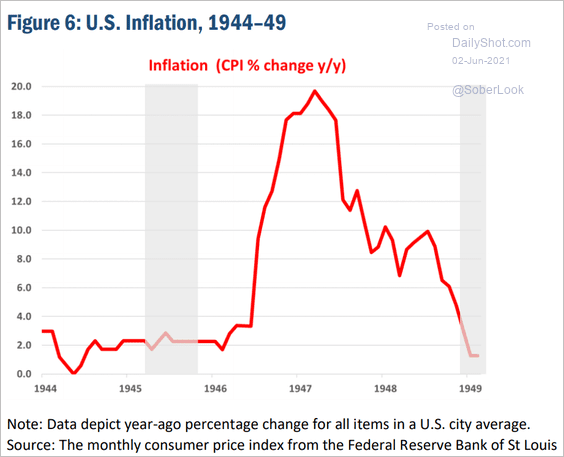

• US inflation spiked after WW-II but subsided within a couple of years. Should we expect a similar pattern in the current cycle?

Source: Atlanta Fed

Source: Atlanta Fed

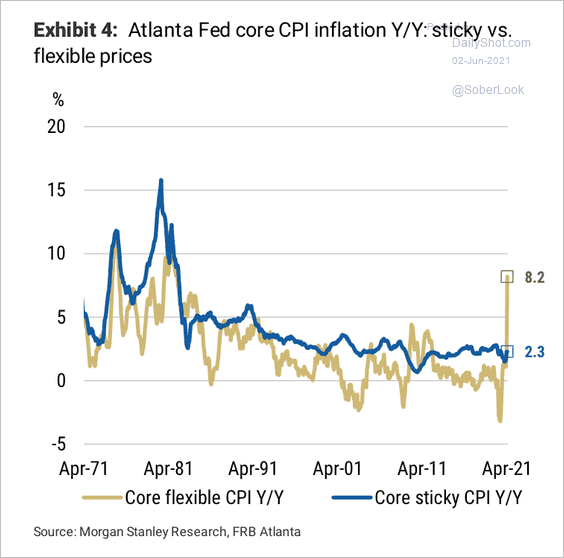

• A majority of inflation gains in the April CPI report came from flexible prices, not sticky prices, which tend to move more slowly.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

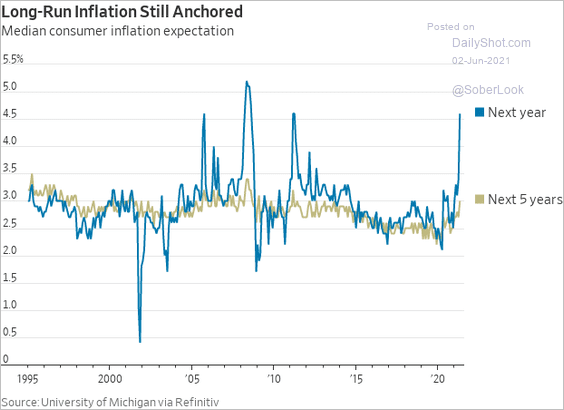

• The Fed has been taking comfort in inflation expectations being “well-anchored.”

– Consumer inflation expectations (short-term vs. long-term):

Source: @WSJ Read full article

Source: @WSJ Read full article

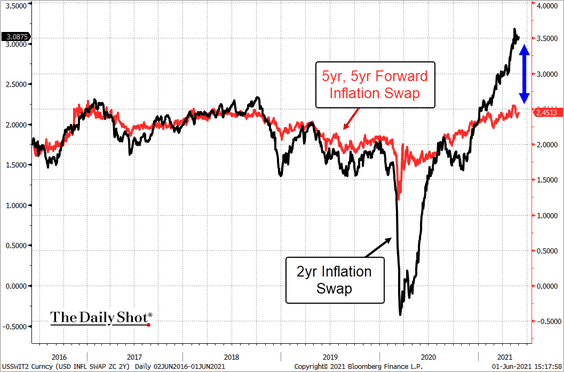

– Market-based inflation expectations (short-term vs. long-term):

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

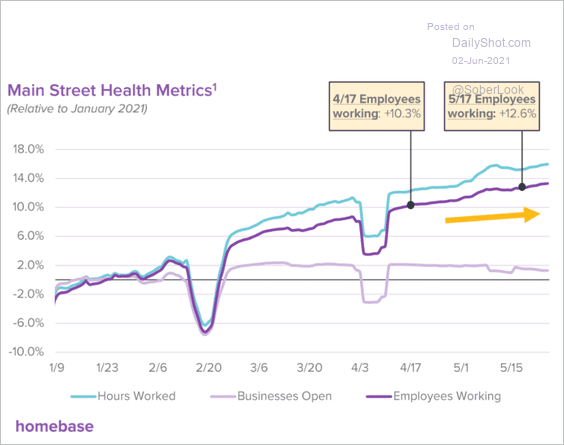

4. Small business data from Homebase point to an ongoing recovery in the labor market.

Source: Homebase

Source: Homebase

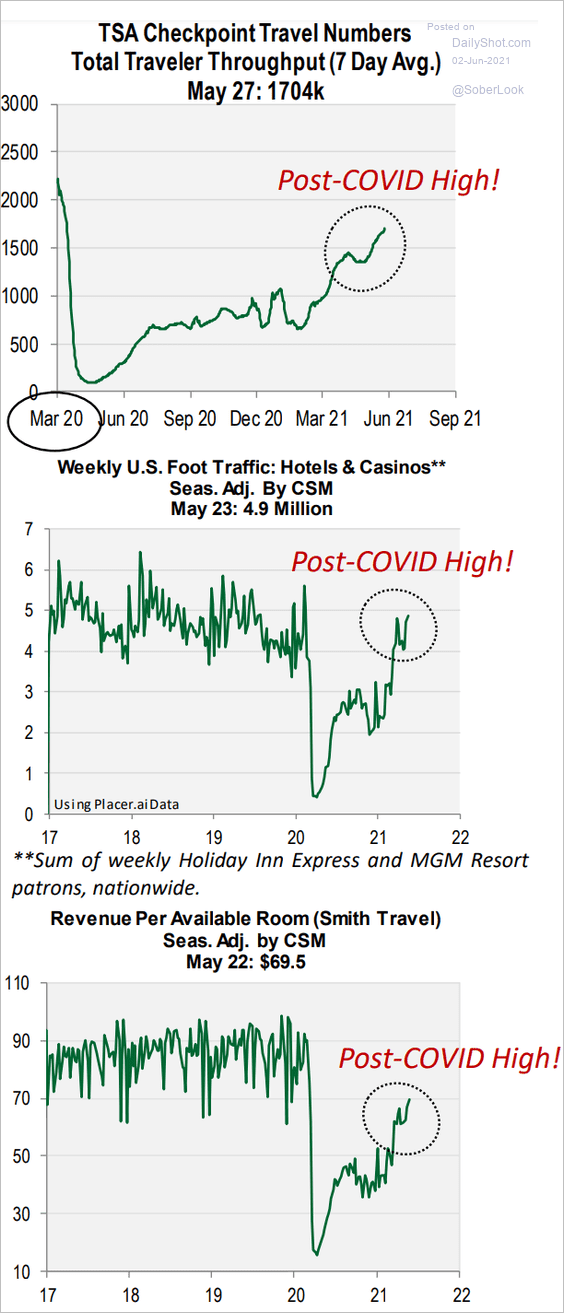

5. High-frequency indicators continue to improve.

Source: Cornerstone Macro

Source: Cornerstone Macro

Back to Index

Canada

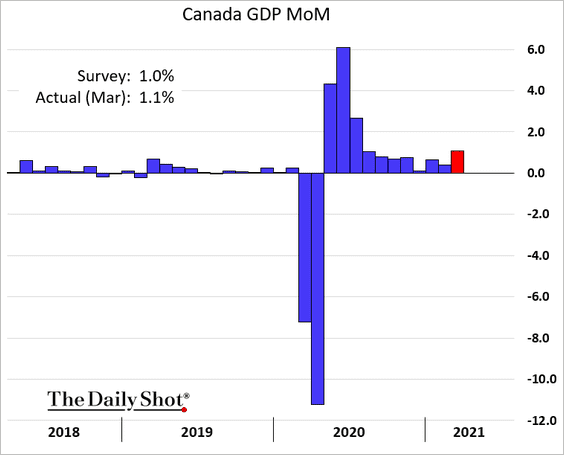

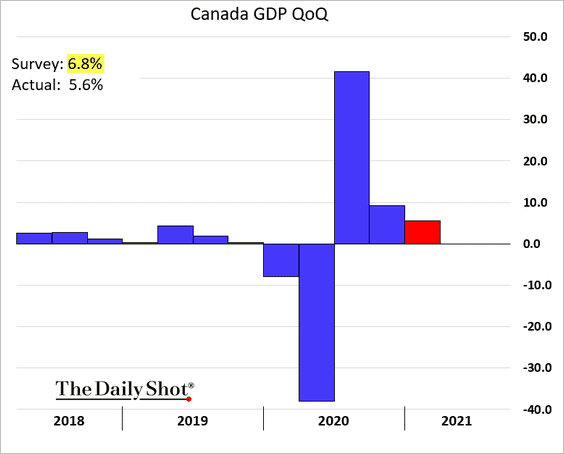

1. Economic activity expanded quickly in March, …

… but the GDP growth for Q1 was disappointing (vs. expectations).

——————–

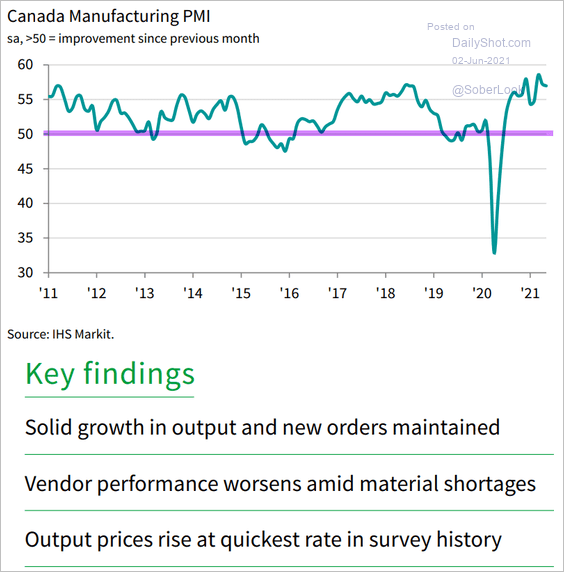

2. Factory activity remains robust, but Canada’s manufacturers face the same issues as US peers.

Source: IHS Markit

Source: IHS Markit

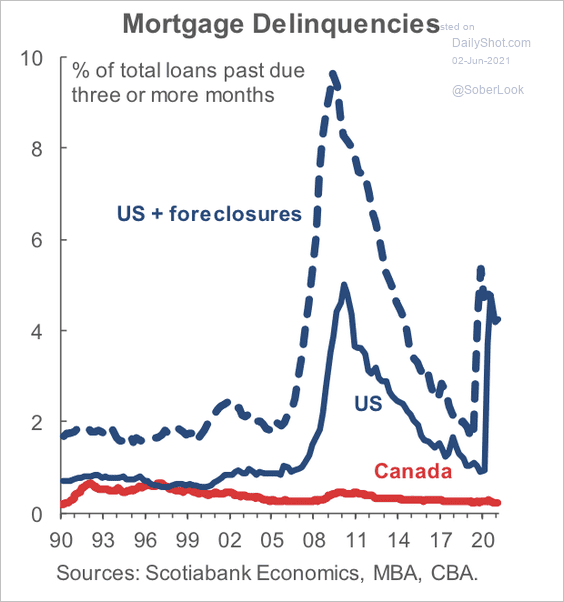

3. Unlike the US, Canada did not experience a spike in mortgage delinquencies during the pandemic.

Source: Scotiabank Economics

Source: Scotiabank Economics

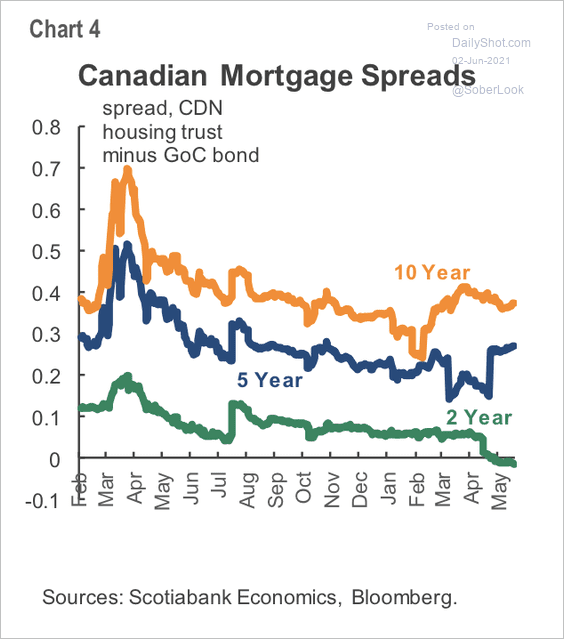

4. Mortgage spreads have been somewhat stable over the past year.

Source: Scotiabank Economics

Source: Scotiabank Economics

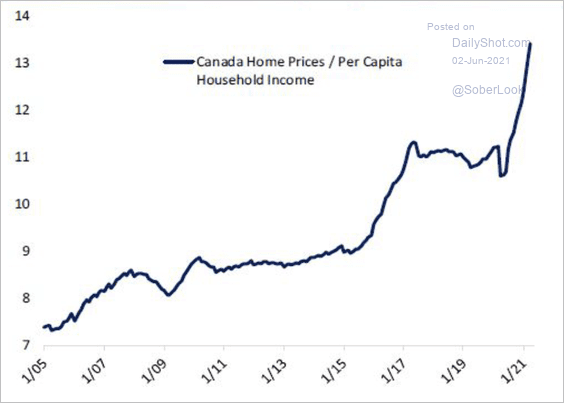

5. Home prices are still exploding relative to incomes.

Source: Bespoke Investments

Source: Bespoke Investments

Back to Index

The United Kingdom

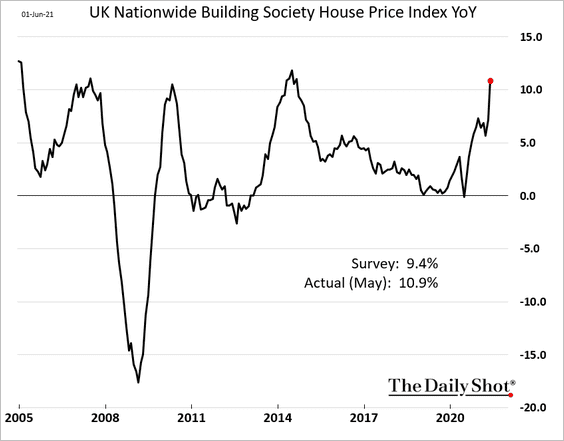

1. Home prices were up over 10% in May (relative to May of 2020).

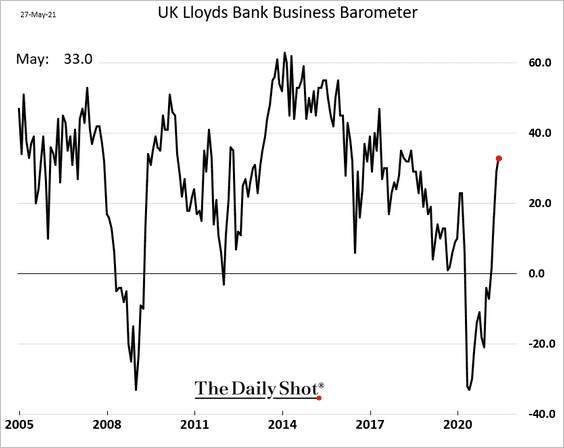

2. Business sentiment continues to rebound and is now well above pre-COVID levels.

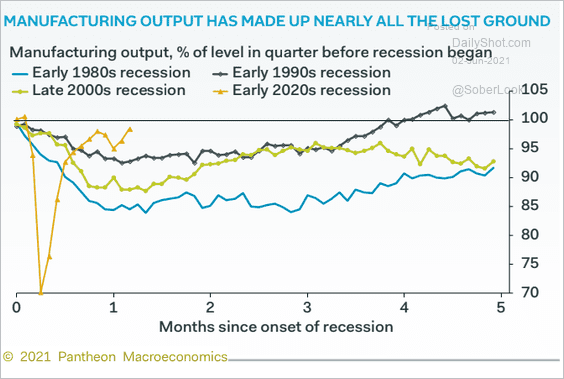

3. Manufacturing output has almost fully recovered.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

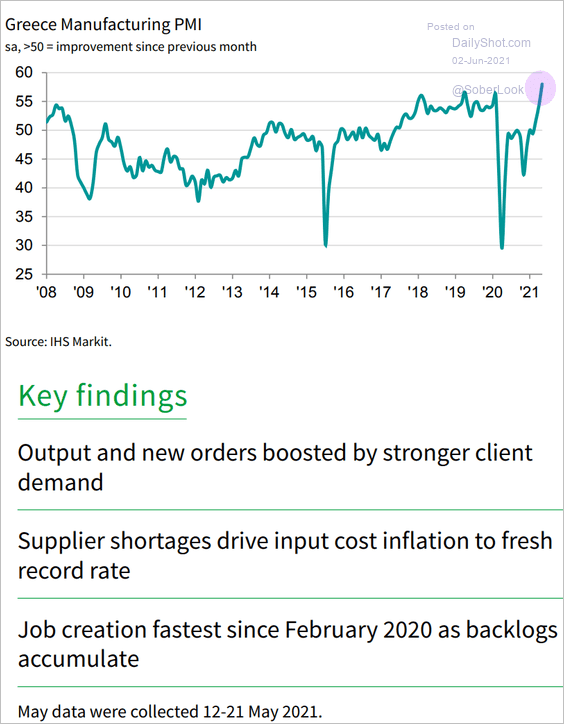

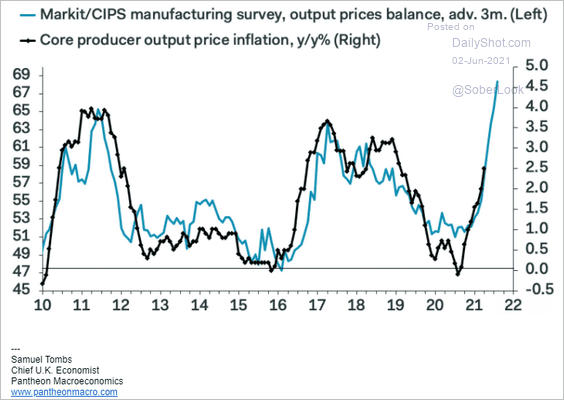

4. Factory activity grew rapidly in May, …

Source: IHS Markit

Source: IHS Markit

… and output price hikes point to a sharp rise in the PPI.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

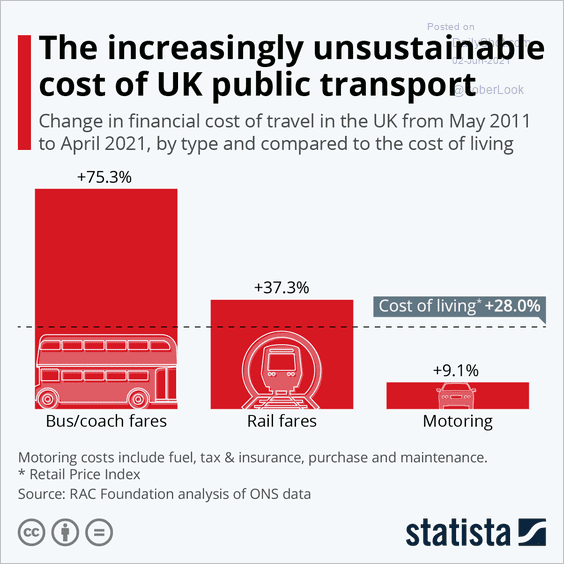

5. Public transportation costs have risen massively over the past decade.

Source: Statista

Source: Statista

Back to Index

The Eurozone

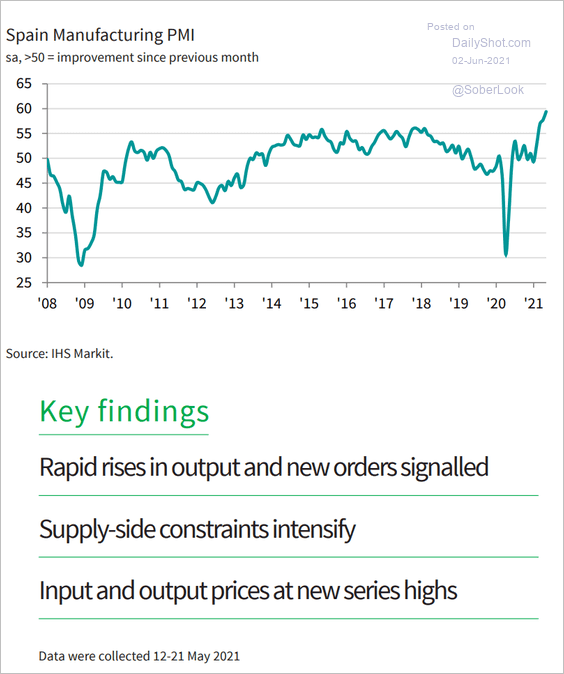

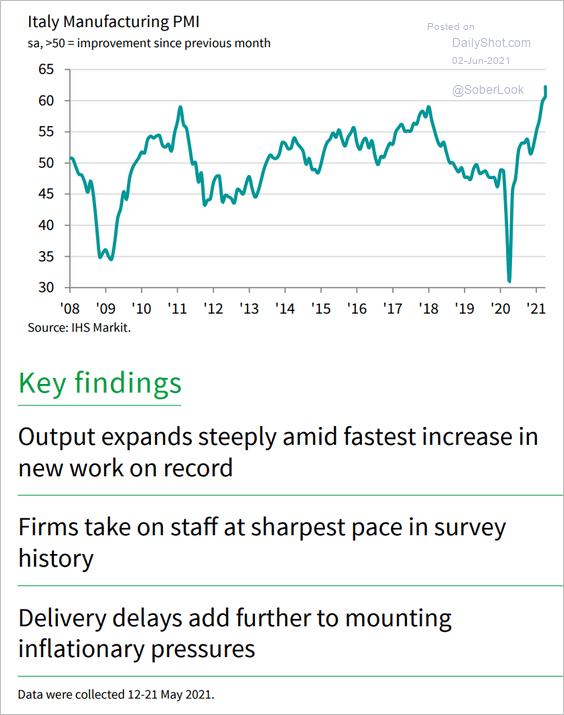

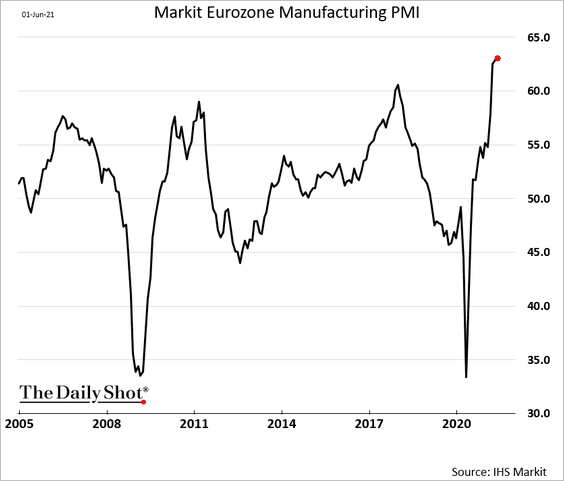

1. Manufacturing growth has been exceptional, but supply-chain bottlenecks have intensified.

• Spain:

Source: IHS Markit

Source: IHS Markit

• Italy:

Source: IHS Markit

Source: IHS Markit

• The Eurozone:

Given slower growth in China, the euro area’s factory activity expansion is about to peak.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

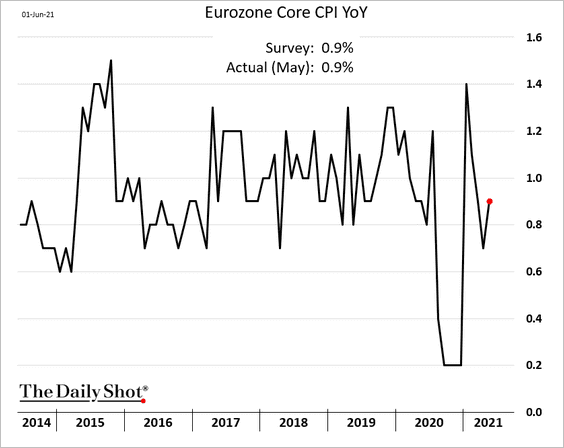

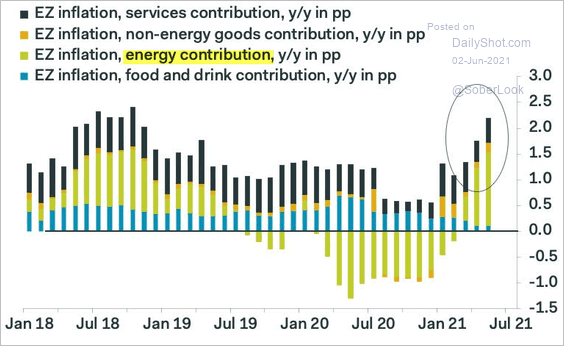

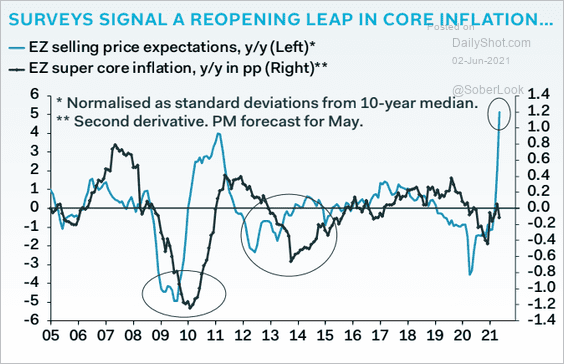

2. The Eurozone’s core CPI is still below 1%.

• Energy drove most of the year-over-year increases in the headline CPI.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Businesses expect sharp gains in output prices, which points to higher consumer inflation ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

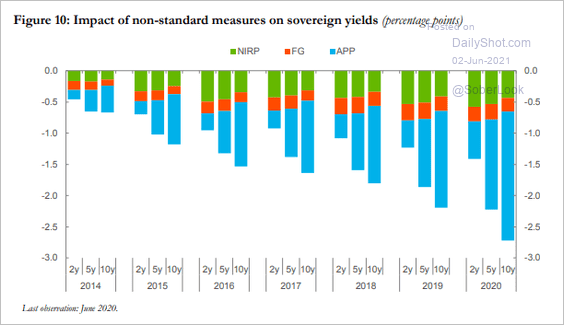

3. The ECB estimates that negative rates, the central bank’s forward guidance, and QE depressed bond yields by more than 250 bps.

Source: @fwred

Source: @fwred

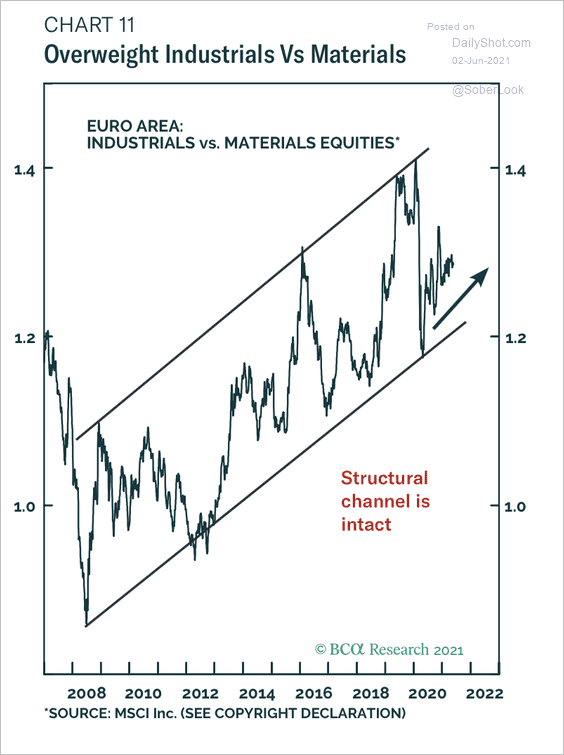

4. European industrial stocks have been outperforming materials since the financial crisis low.

Source: BCA Research

Source: BCA Research

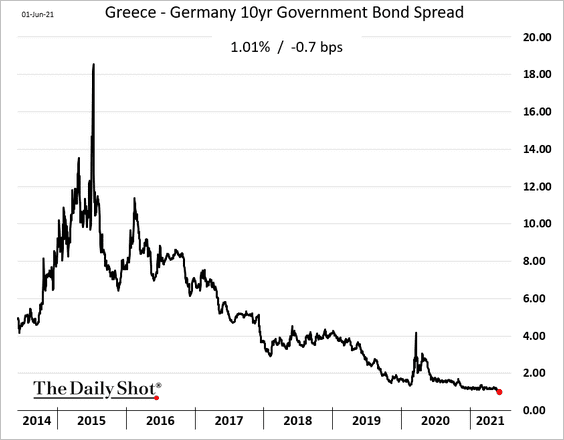

5. Greek bond spreads over Germany hit a record low.

Back to Index

Europe

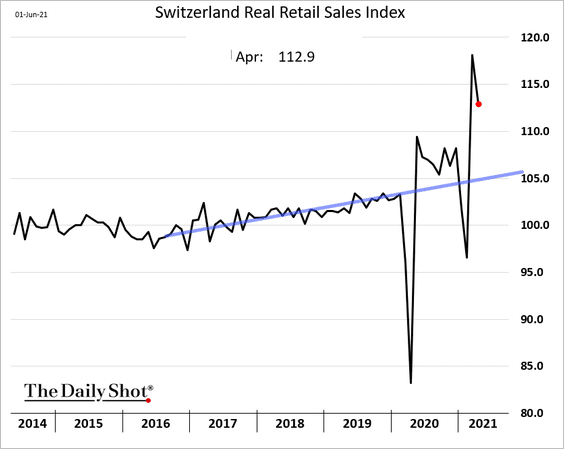

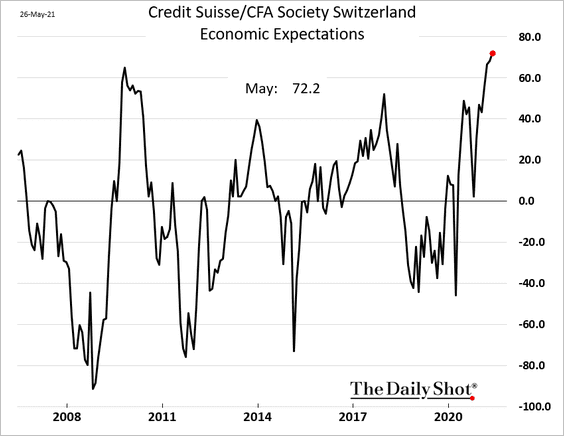

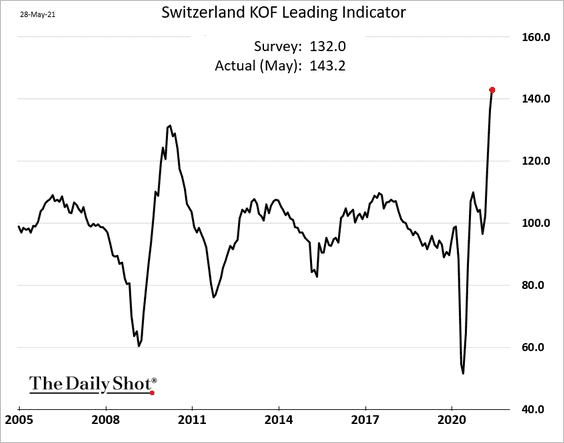

1. The Swiss economy is roaring back.

• Retail sales:

• Economic expectations:

• The leading index:

——————–

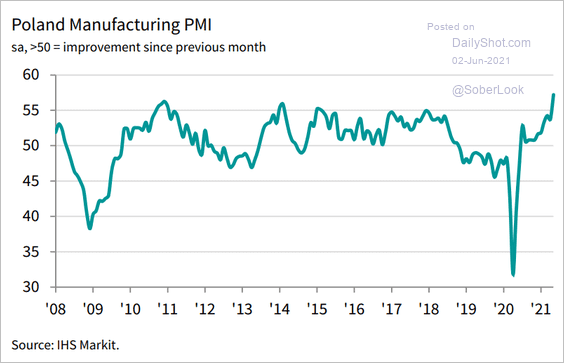

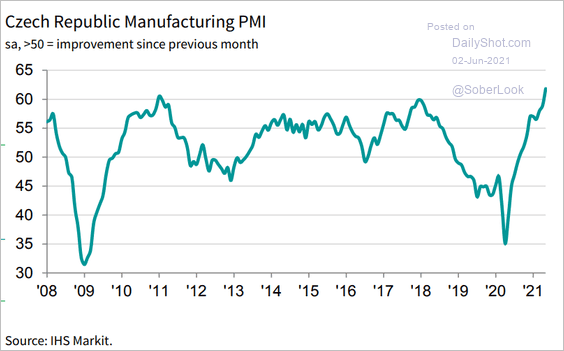

2. Central Europe’s factory activity is surging.

• Poland:

Source: IHS Markit

Source: IHS Markit

• The Czech Republic:

Source: IHS Markit

Source: IHS Markit

——————–

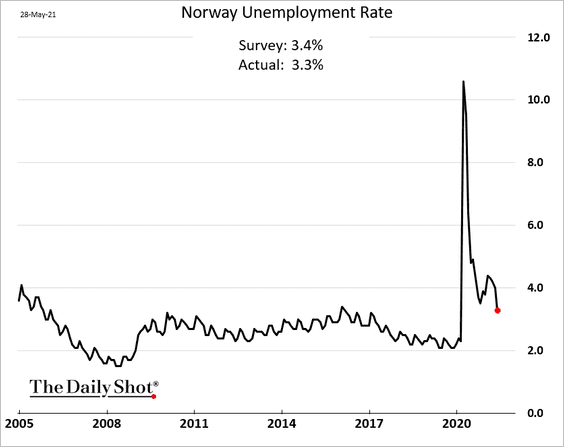

3. Norway’s unemployment rate continues to moderate.

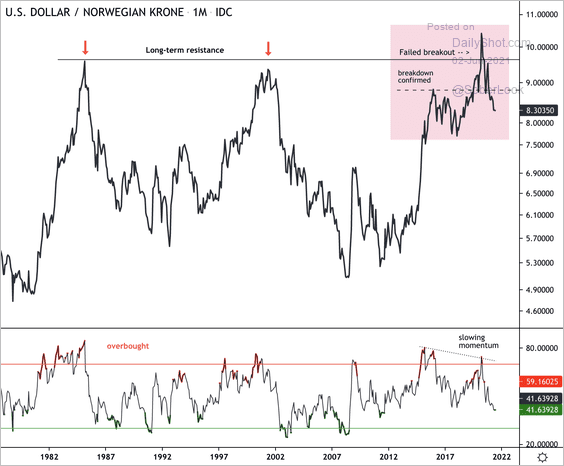

Is USD/NOK set for another down cycle?

Source: Dantes Outlook

Source: Dantes Outlook

——————–

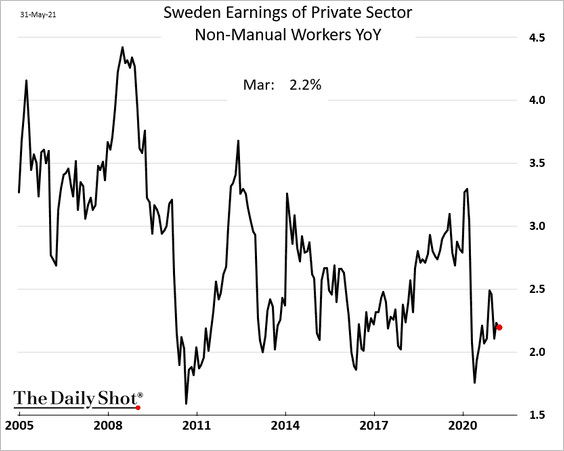

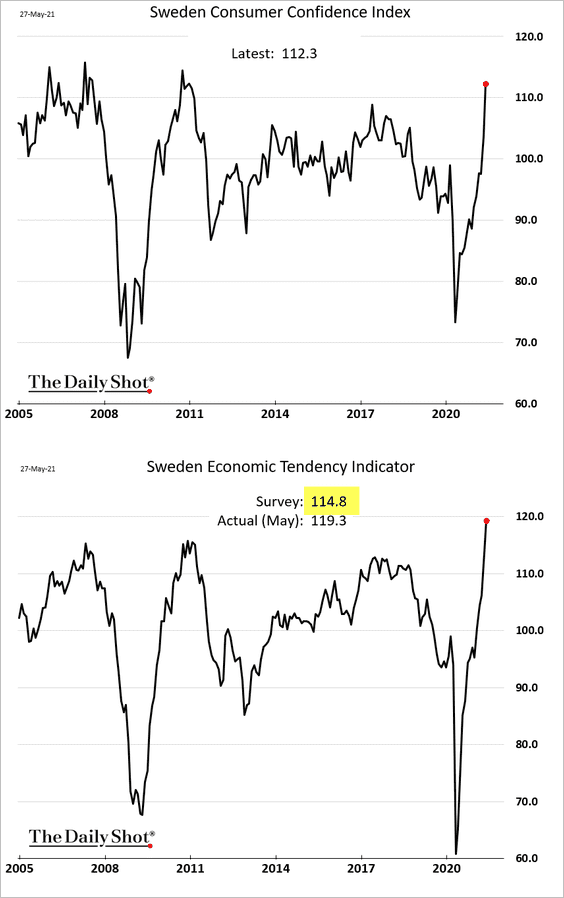

4. Sweden’s wage growth has not rebounded to pre-COVID levels.

But consumer sentiment is soaring.

——————–

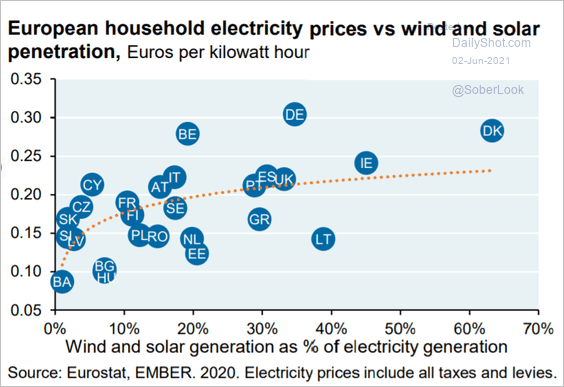

5. This chart shows electricity prices vs. wind and solar penetration.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

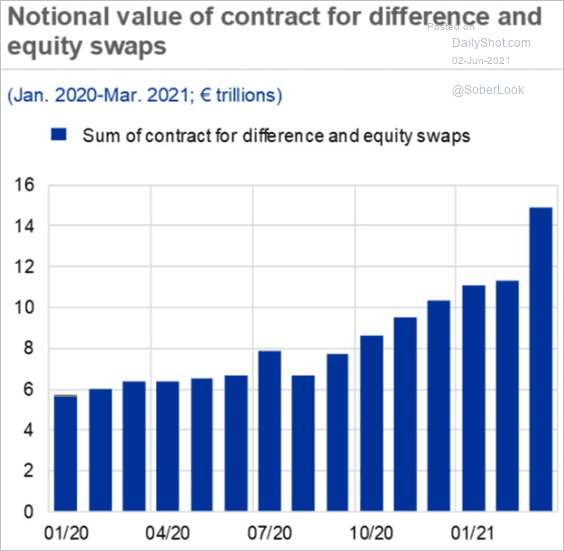

6. Equity derivatives activity (used to leverage equity positions) has been on the rise.

Source: ECB, Bloomberg Read full article

Source: ECB, Bloomberg Read full article

Back to Index

Asia – Pacific

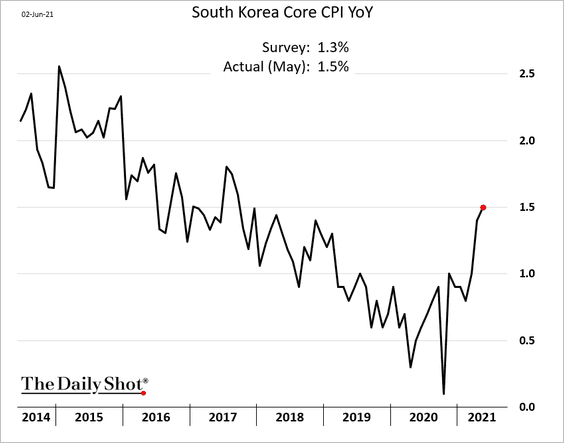

1. South Korea’s inflation was firmer than expected in May.

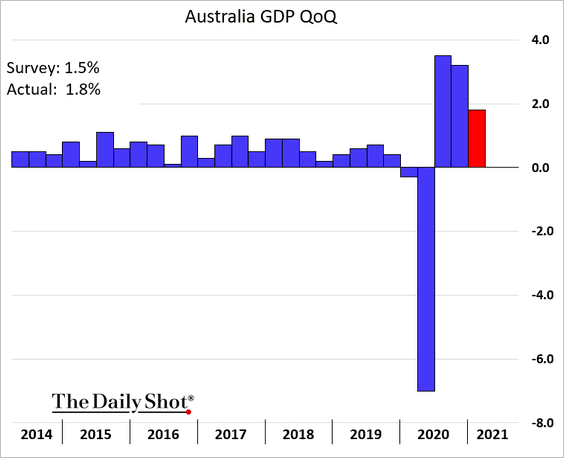

2. Australia’s first-quarter GDP growth exceeded economists’ forecasts.

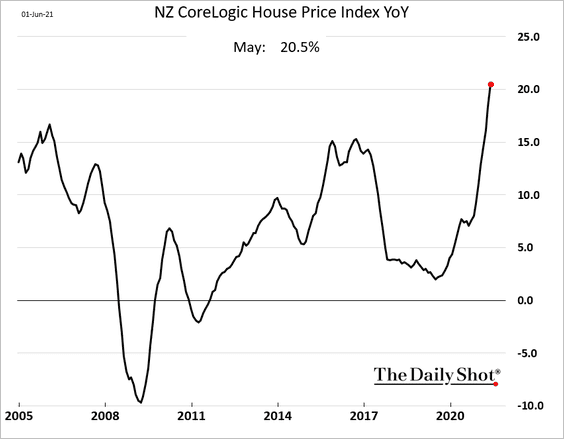

3. New Zealand’s home price appreciation topped 20% in May.

Back to Index

China

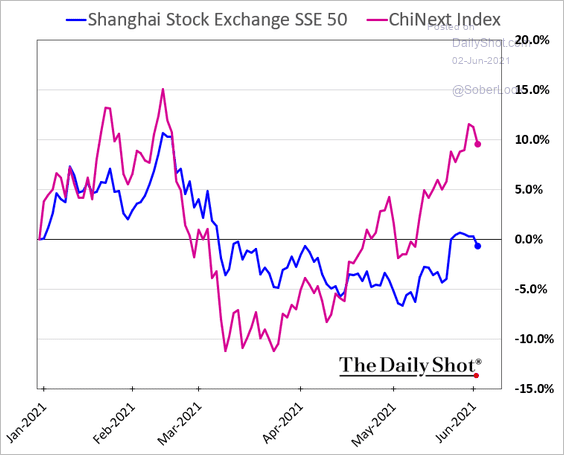

1. Smaller growth stocks (ChiNext) have been outperforming large caps.

h/t John Liu

h/t John Liu

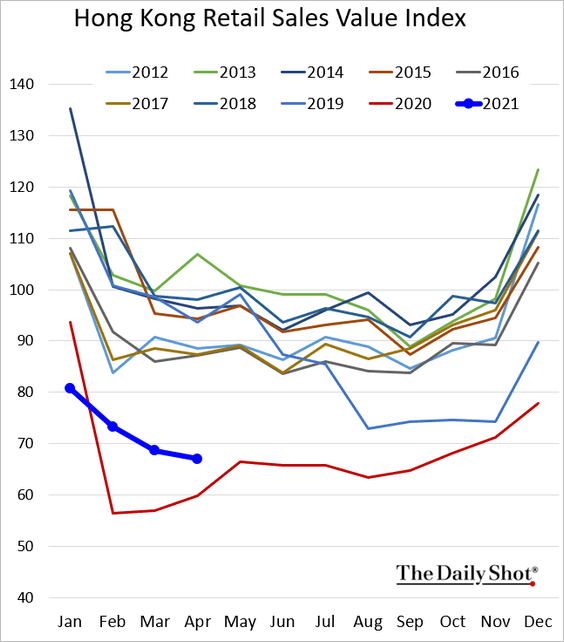

2. Hong Kong’s retail sales remain depressed – well below forecasts.

Back to Index

Emerging Markets

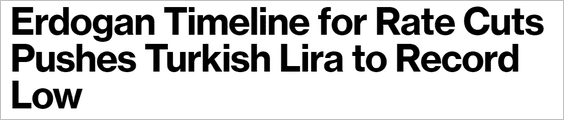

1. The Turkish lira hit a record low.

Source: @markets Read full article

Source: @markets Read full article

Source: barchart.com

Source: barchart.com

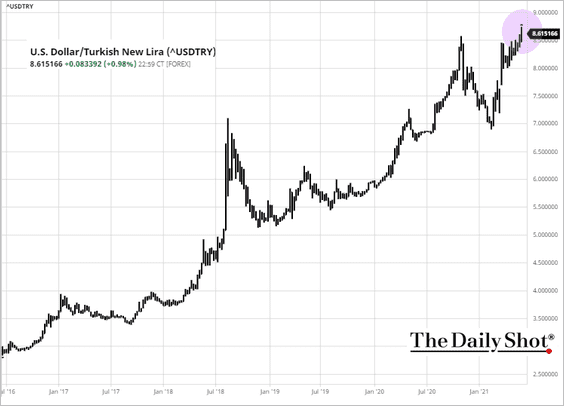

Turkey’s manufacturing activity contracted in May.

——————–

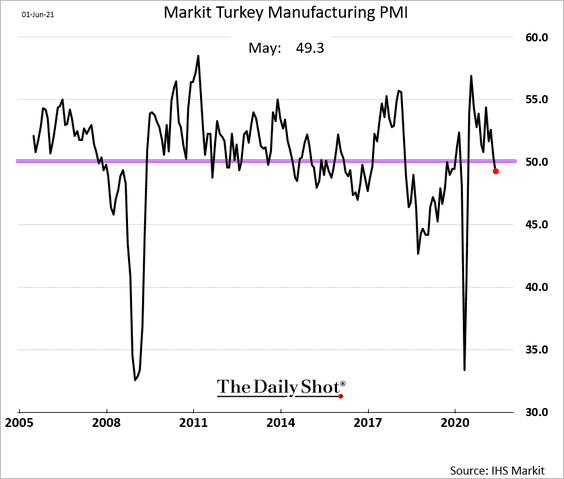

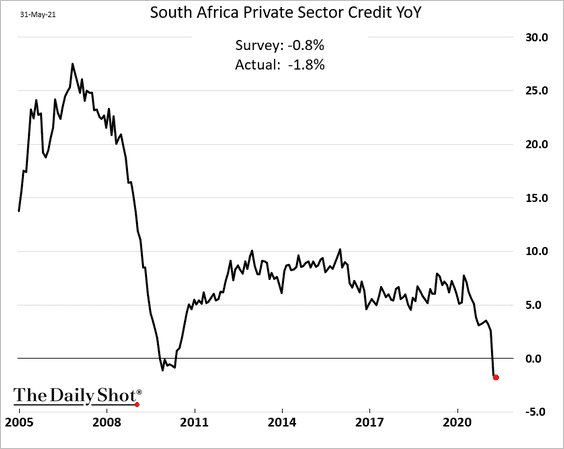

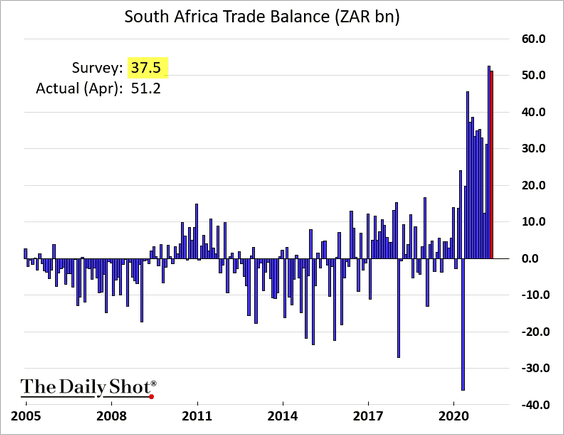

2. Here are some updates on South Africa.

• Manufacturing PMI (stronger than expected):

• Credit growth:

• Trade surplus (well above forecasts):

——————–

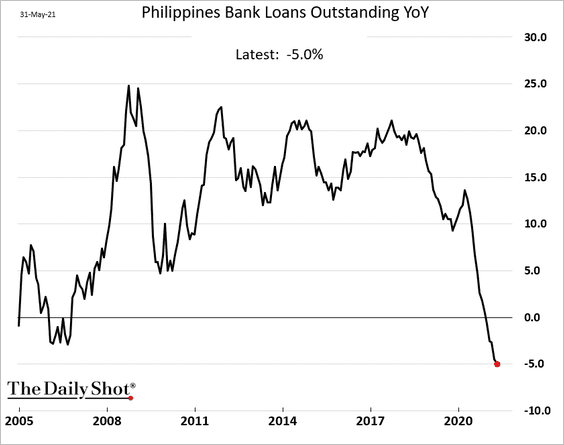

3. Philippine private-sector credit continues to contract.

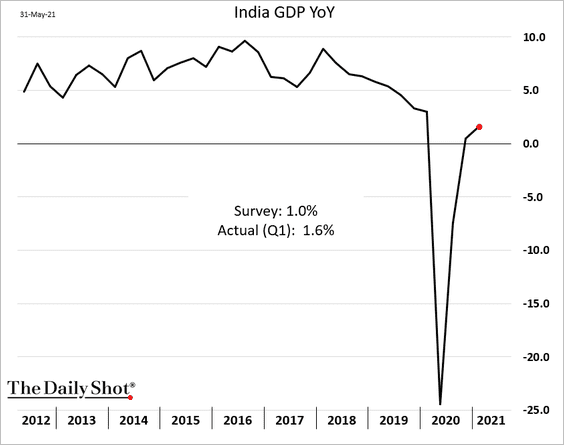

4. India pulled out of recession in Q1.

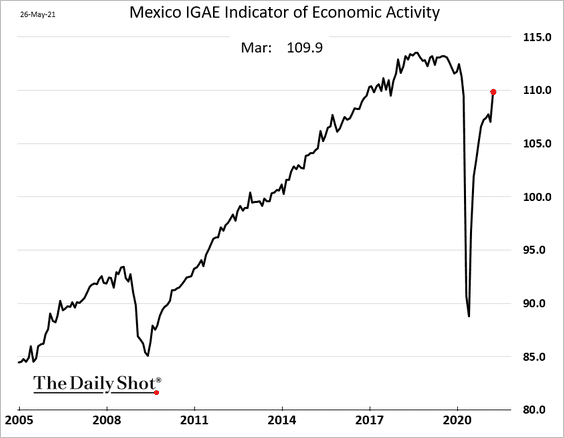

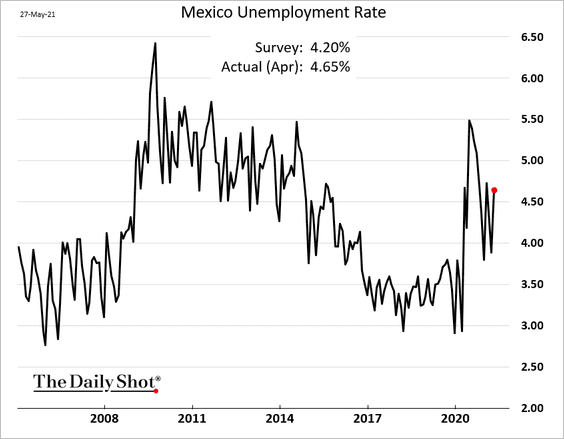

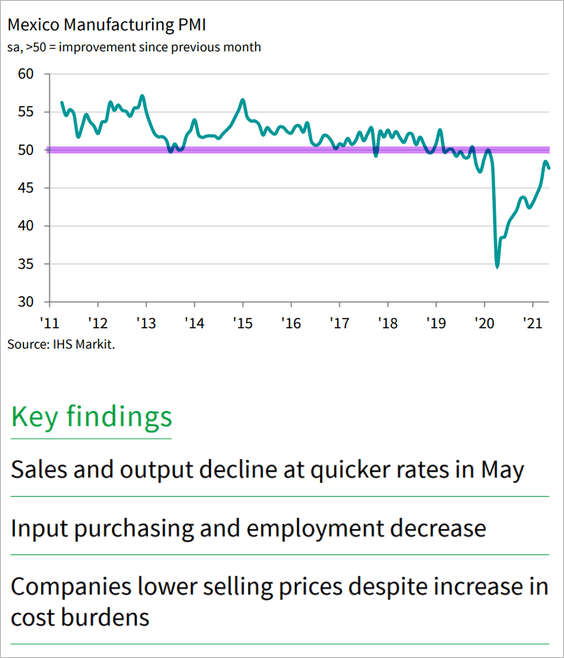

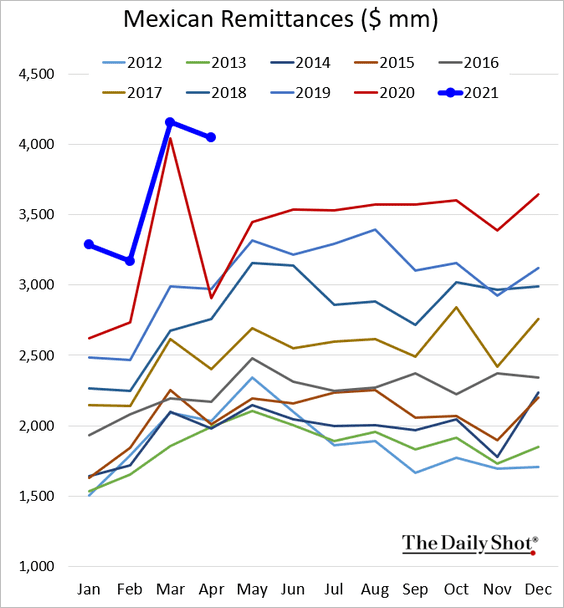

5. Next, we have some updates on Mexico.

• Economic activity (through March):

• The unemployment rate (higher than expected):

• Manufacturing activity (still in contraction territory):

• Remittances (a record high for this time of the year):

——————–

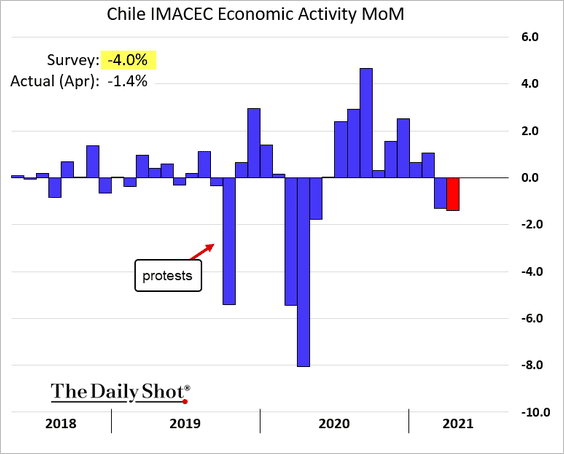

6. Chile’s economic activity contracted less than expected in April.

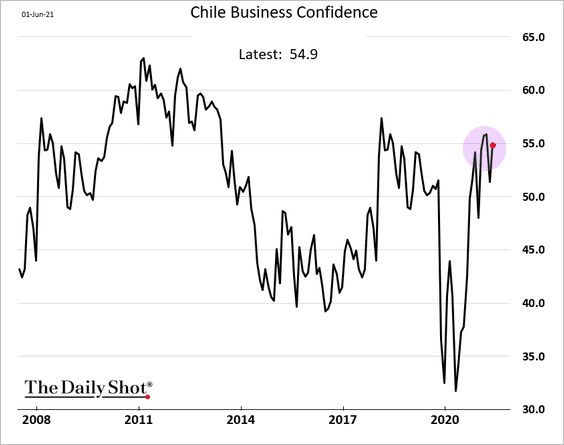

Business confidence remains robust.

——————–

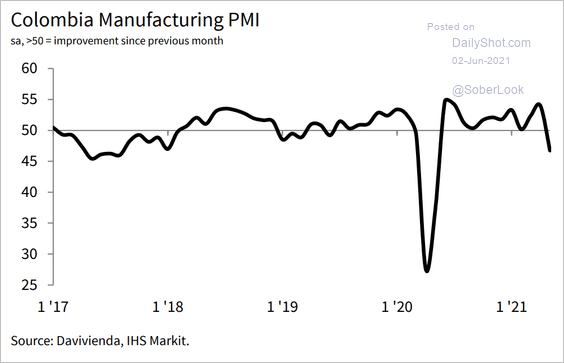

7. Colombia’s manufacturing sector is struggling.

Source: IHS Markit

Source: IHS Markit

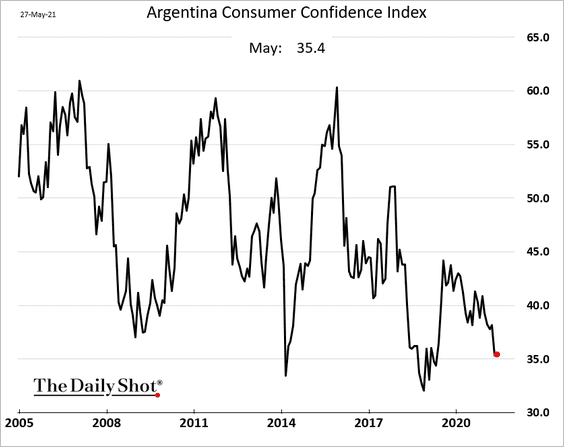

8. Here is Argentina’s consumer confidence.

9. How long will it take to return to pre-COVID GDP per capita levels?

Source: OECD Read full article

Source: OECD Read full article

Back to Index

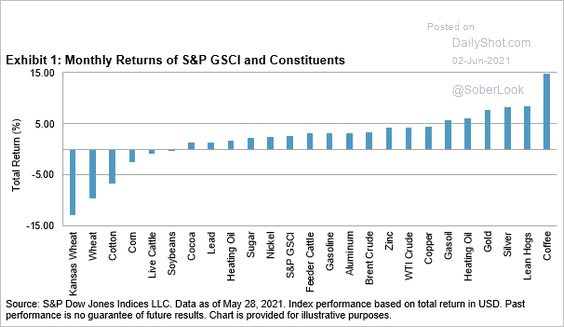

Commodities

Here is the May performance across select commodities.

Source: Fiona Boal, S&P Global Market Intelligence

Source: Fiona Boal, S&P Global Market Intelligence

Back to Index

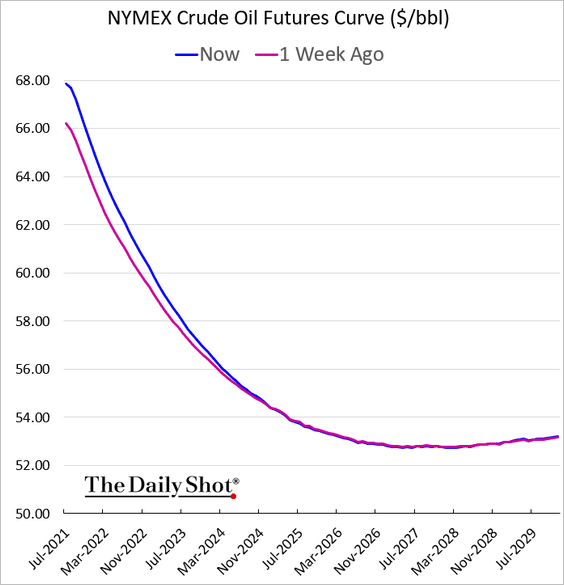

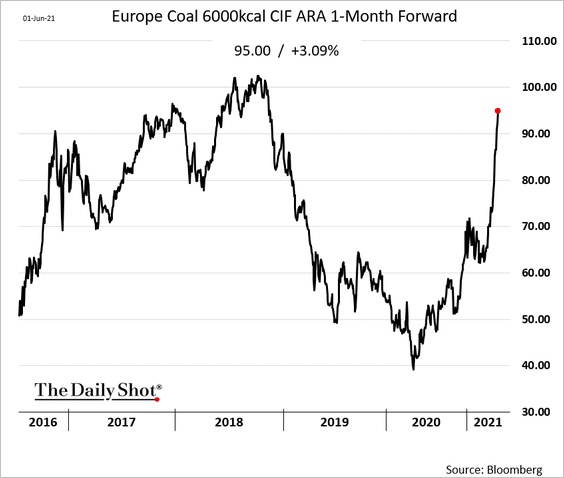

Energy

1. The WTI crude curve backwardation keeps increasing as US inventories tighten.

2. European coal prices have been surging.

Back to Index

Equities

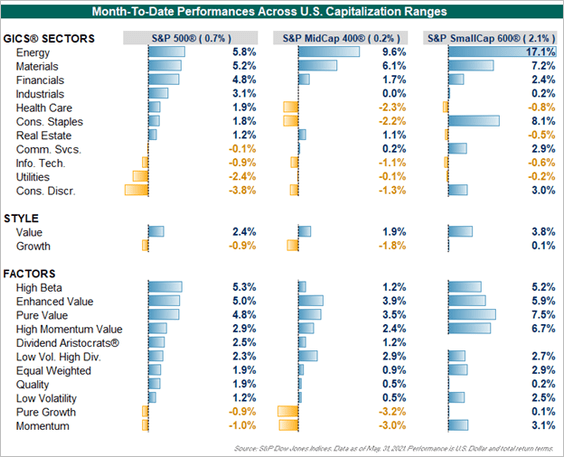

1. Let’s start with the May returns across sectors and factors.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

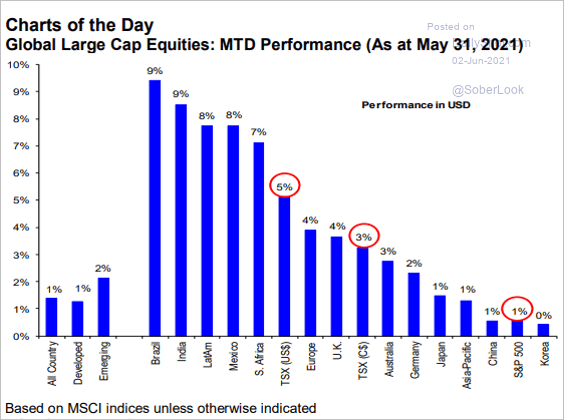

And here is how markets performed globally.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

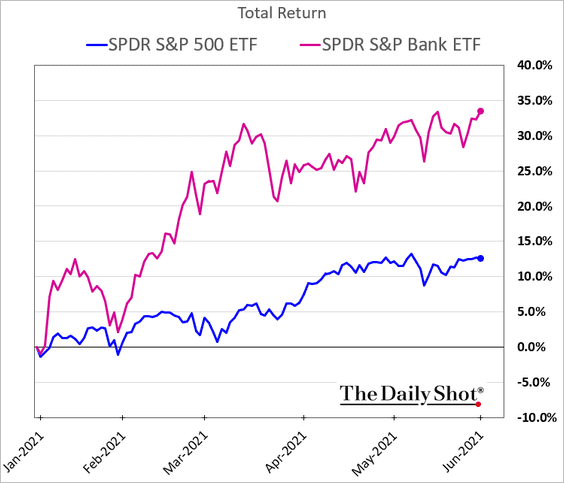

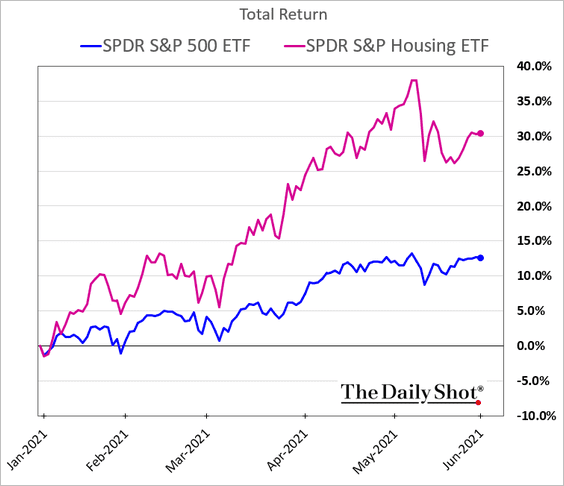

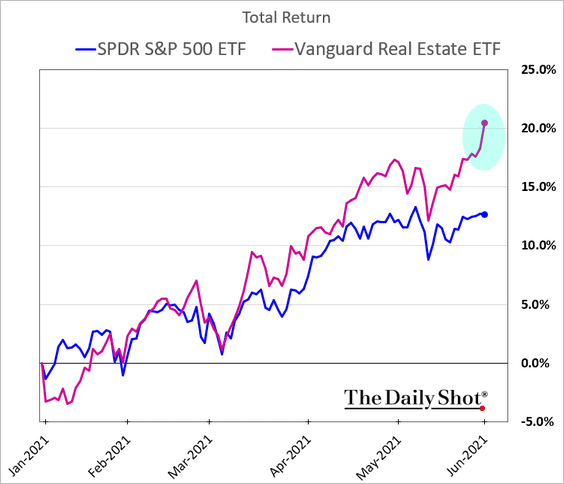

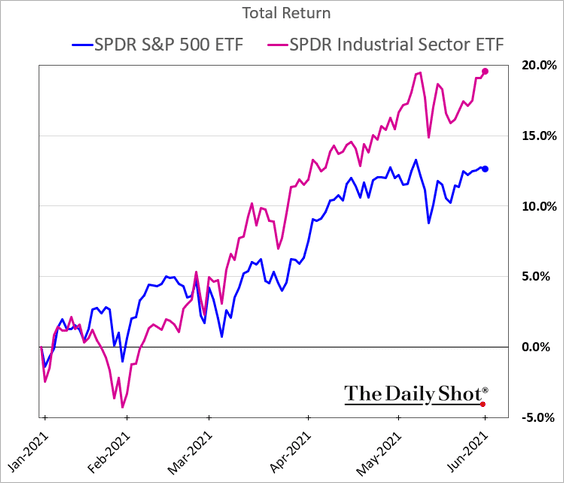

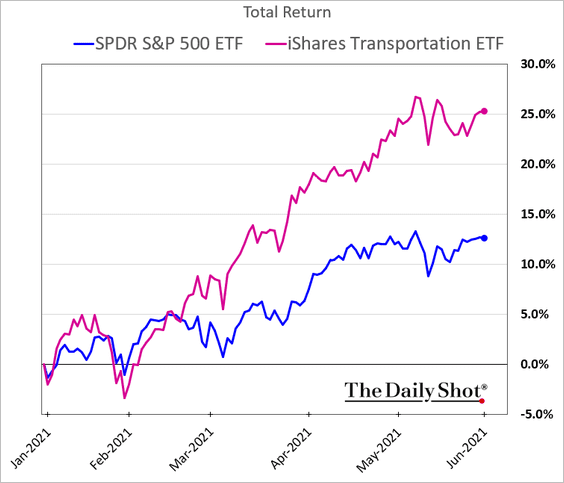

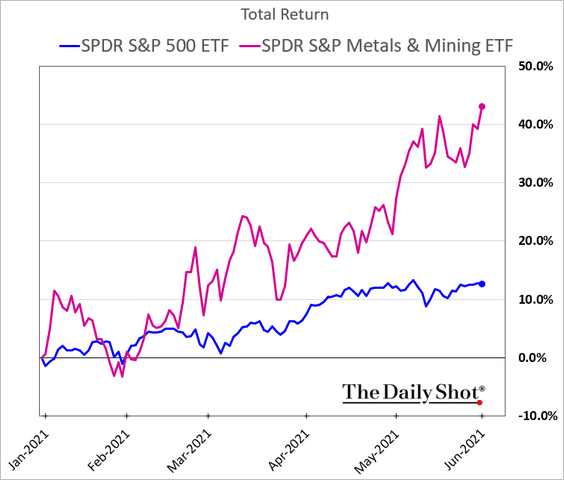

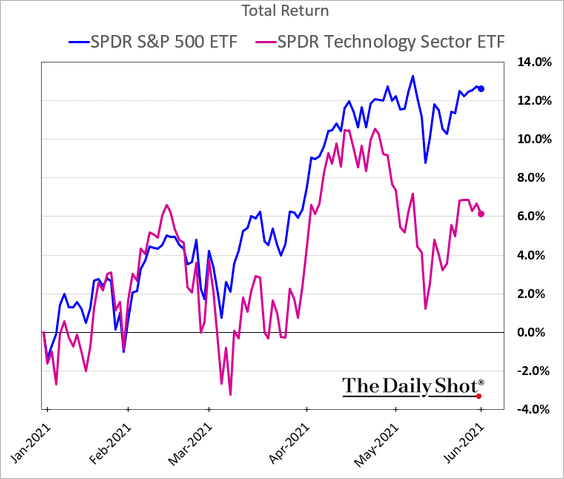

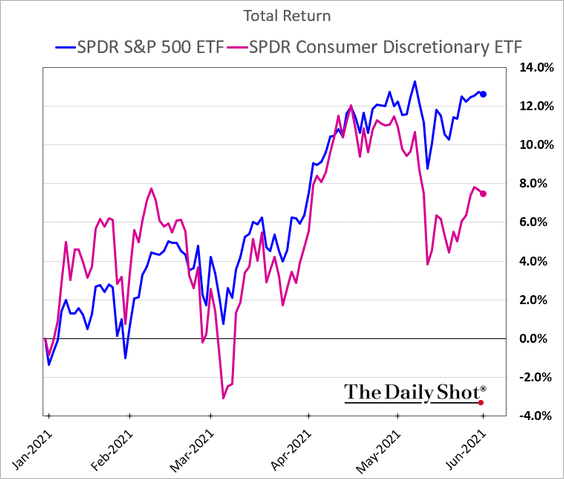

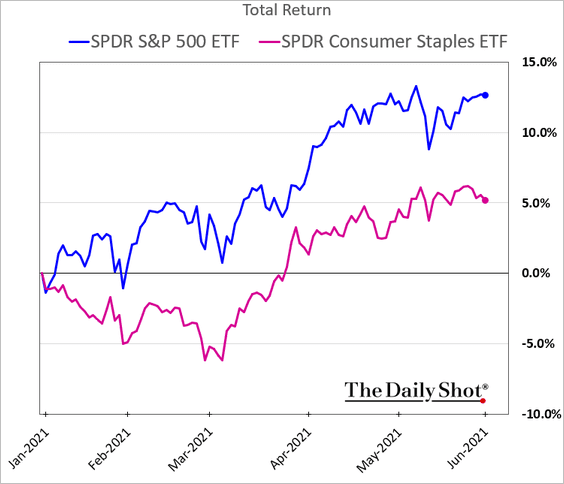

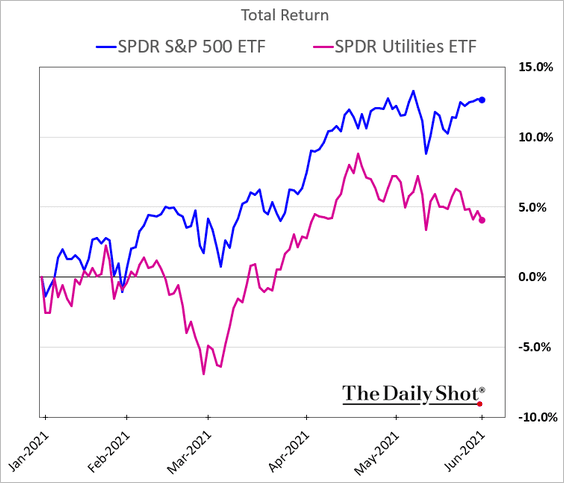

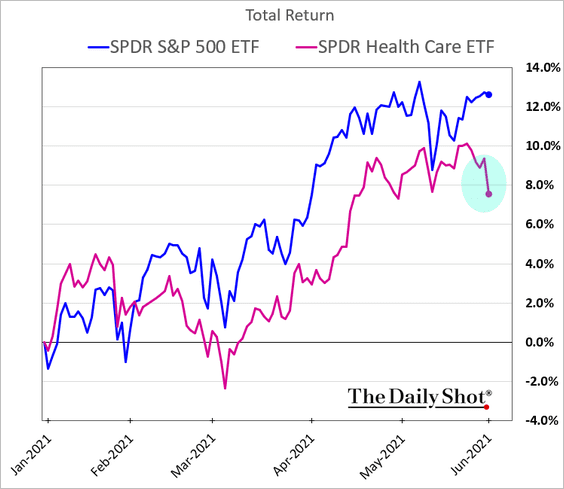

2. Next, let’s take a look at year-to-date sector performance.

• Banks:

• Housing:

• REITs:

• Industrials:

• Transportation:

• Metals & Mining:

• Tech:

• Consumer discretionary:

• Consumer staples:

• Utilities:

• Healthcare:

——————–

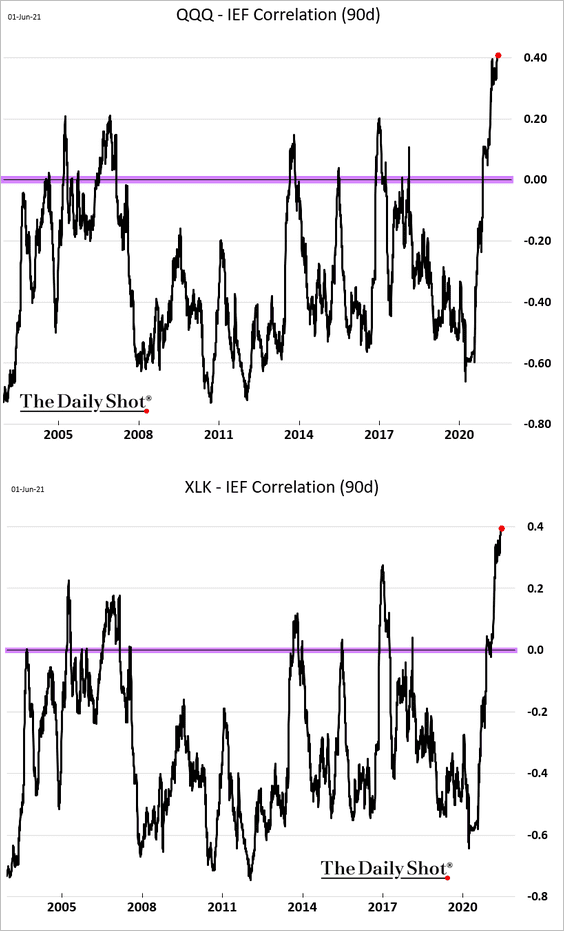

3. Stock-bond correlations remain elevated, especially for growth shares.

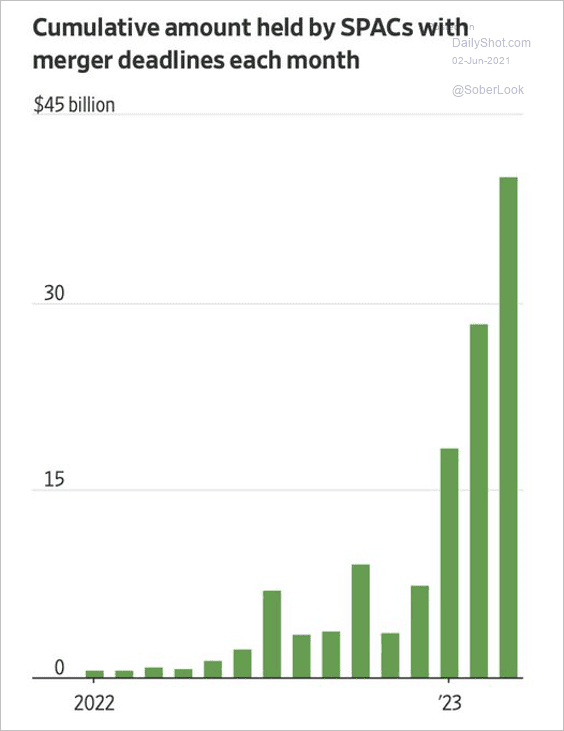

4. Many SPACs will be forced to buy overpriced companies before hitting their deadlines (to return cash to investors).

Source: @jessefelder, @WSJ Read full article

Source: @jessefelder, @WSJ Read full article

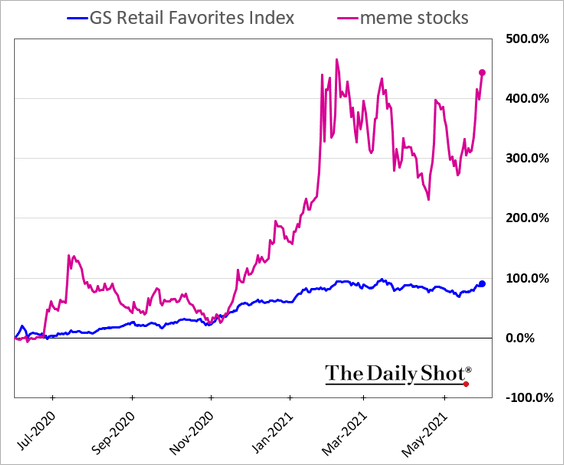

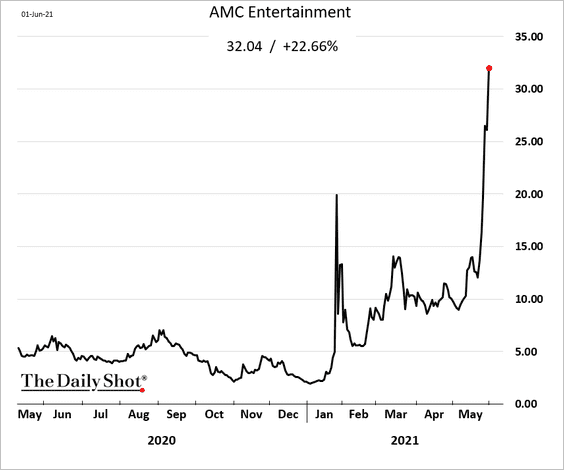

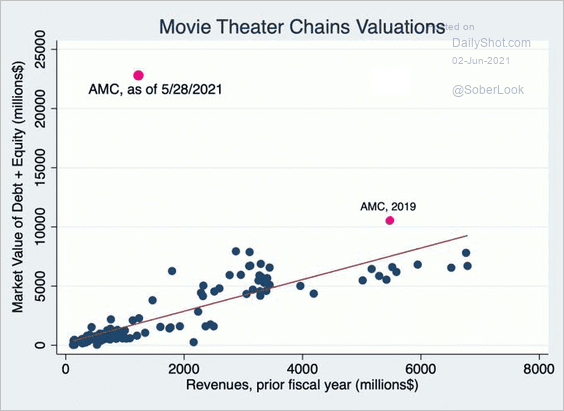

5. There are “retail favorites,” and then there are meme stocks.

Madness …

Source: @jessefelder, The Blindfolded Chimpanzee Read full article

Source: @jessefelder, The Blindfolded Chimpanzee Read full article

Back to Index

Credit

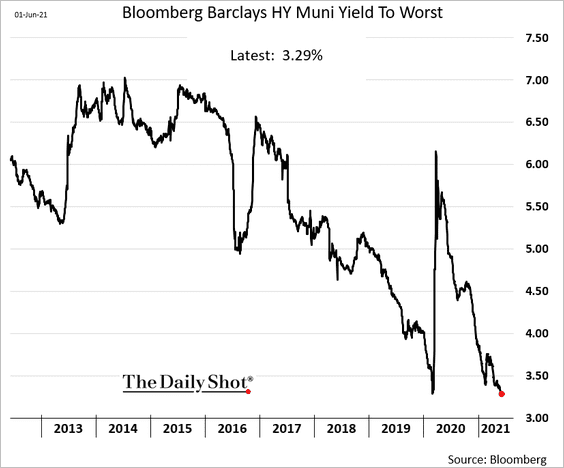

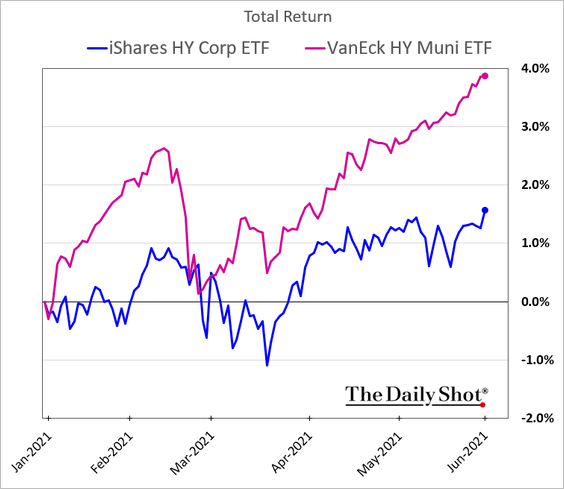

High-yield munis continue to rally, …

… outperforming high-yield corporates.

Back to Index

Rates

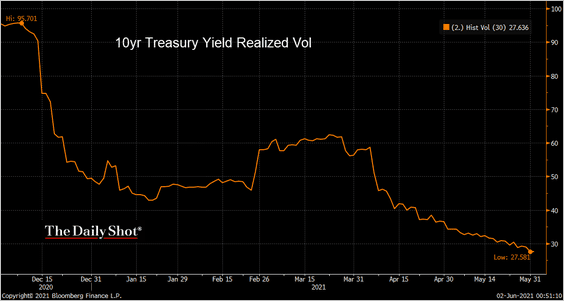

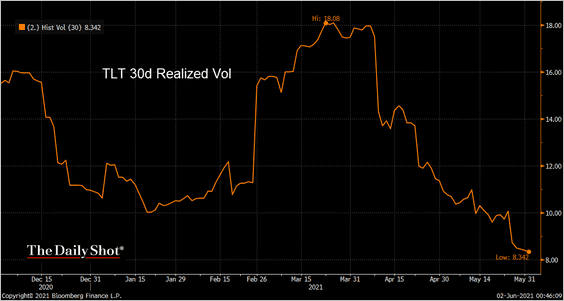

1. Realized volatility has declined in the 10-year Treasury yield and the iShares 20+ year Treasury bond ETF (TLT) since March (2 charts).

Source: @TheTerminal, Bloomberg Finance L.P.; h/t Chris Murphy, Susquehanna Derivative Strategy

Source: @TheTerminal, Bloomberg Finance L.P.; h/t Chris Murphy, Susquehanna Derivative Strategy

Source: @TheTerminal, Bloomberg Finance L.P.; h/t Chris Murphy, Susquehanna Derivative Strategy

Source: @TheTerminal, Bloomberg Finance L.P.; h/t Chris Murphy, Susquehanna Derivative Strategy

——————–

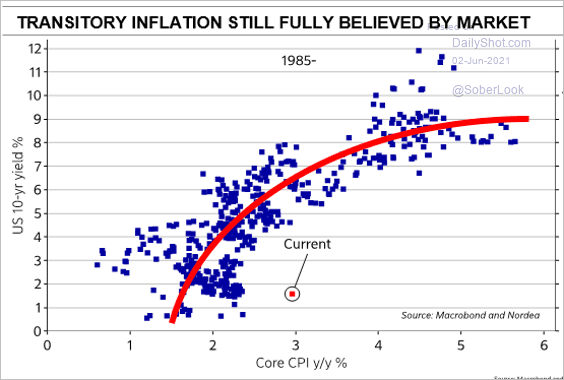

2. Based on current yield levels, the bond market still doesn’t expect high inflation to persist for very long. The Fed’s QE also contributes to lower yields.

Source: @MikaelSarwe

Source: @MikaelSarwe

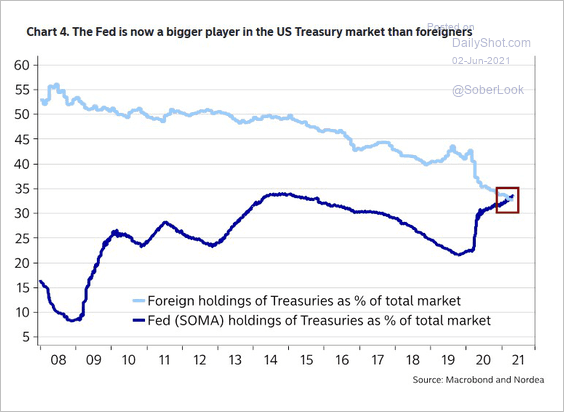

3. The Fed now holds more Treasuries than foreign investors.

Source: Nordea Markets, @jessefelder

Source: Nordea Markets, @jessefelder

——————–

Food for Thought

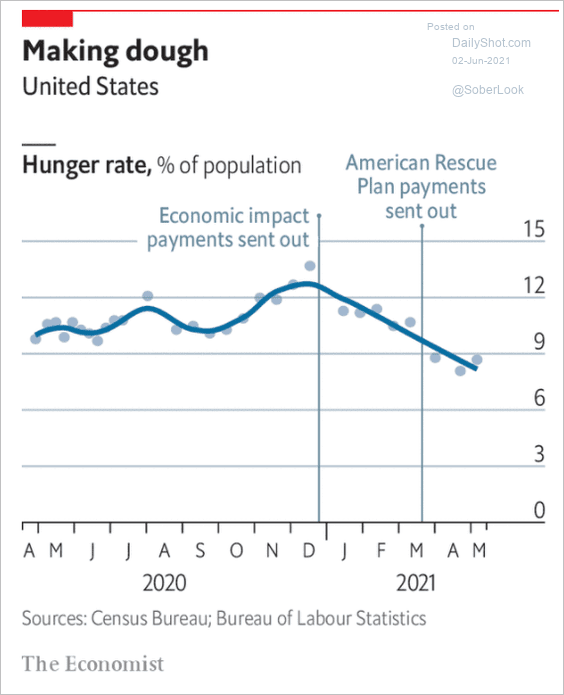

1. Declining hunger rate in the US:

Source: The Economist Read full article

Source: The Economist Read full article

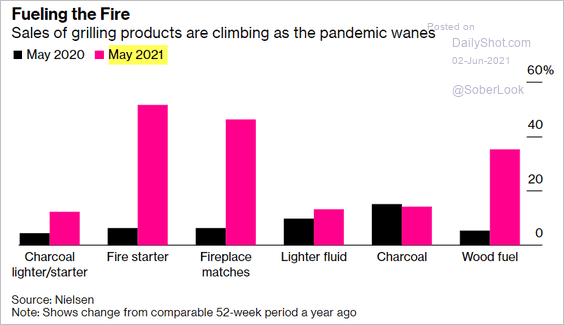

2. Demand for grilling products:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

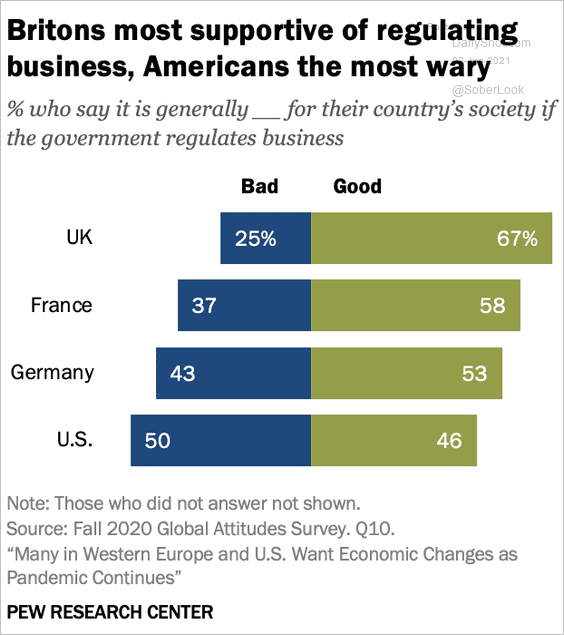

3. Views on business regulation:

Source: Pew Research Center

Source: Pew Research Center

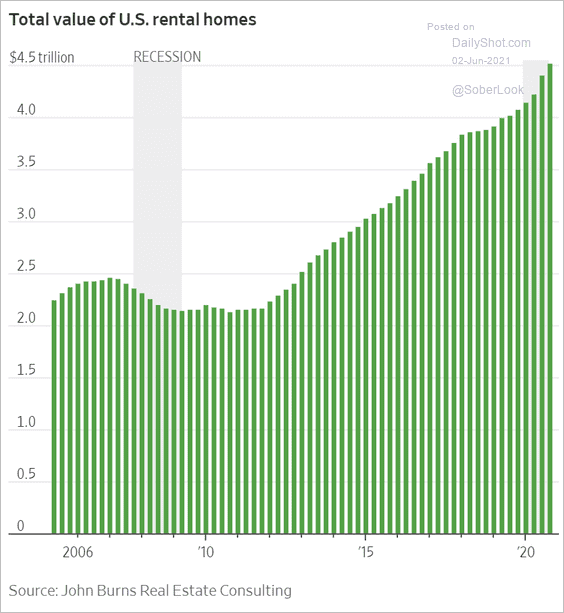

4. The value of US rental homes:

Source: @WSJ Read full article

Source: @WSJ Read full article

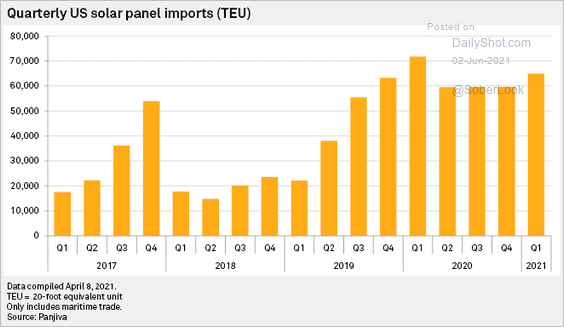

5. US solar panel imports:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

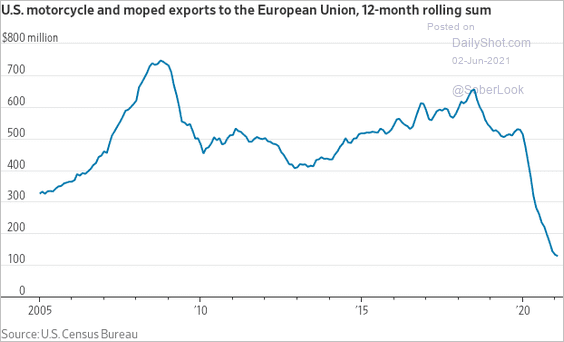

6. US motorcycle exports to the EU:

Source: @jeffsparshott

Source: @jeffsparshott

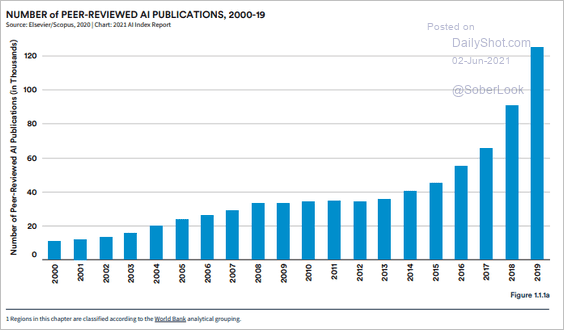

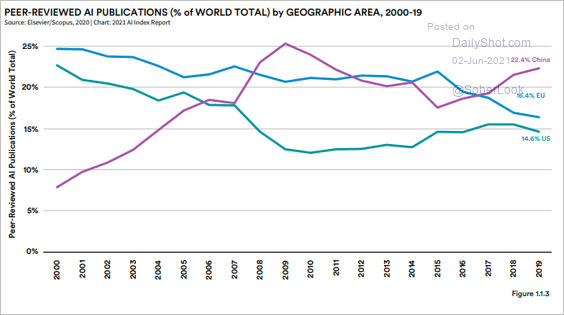

7. AI publications (2 charts):

Source: Artificial Intelligence Index Report 2021

Source: Artificial Intelligence Index Report 2021

Source: Artificial Intelligence Index Report 2021

Source: Artificial Intelligence Index Report 2021

——————–

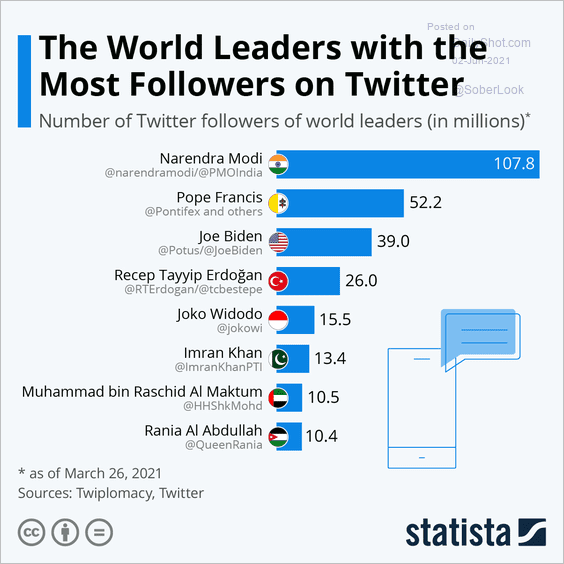

8. World leaders with most Twitter followers:

Source: Statista

Source: Statista

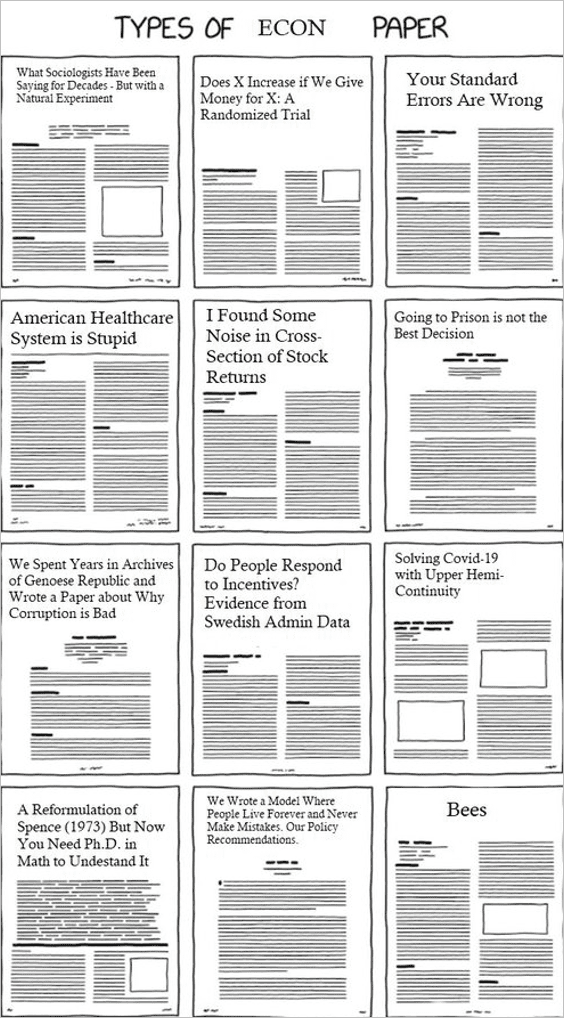

9. Types of economics papers:

Source: @maximananyev

Source: @maximananyev

——————–

Back to Index