The Daily Shot: 03-Jun-21

• Administrative Update

• The United States

• The United Kingdom

• The Eurozone

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

Administrative Update

Please note that clicking on “unsubscribe from The Daily Shot” at the bottom of the letter will not cancel your subscription. It will just remove you from the distribution list, and you will still have access to The Daily Shot online. For information on changing your account status, please go to https://thedailyshot.com/account-management/.

Back to Index

The United States

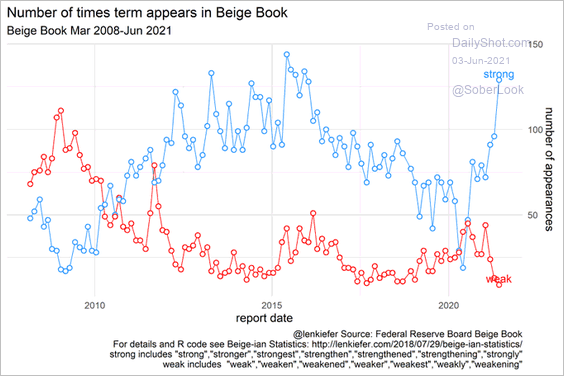

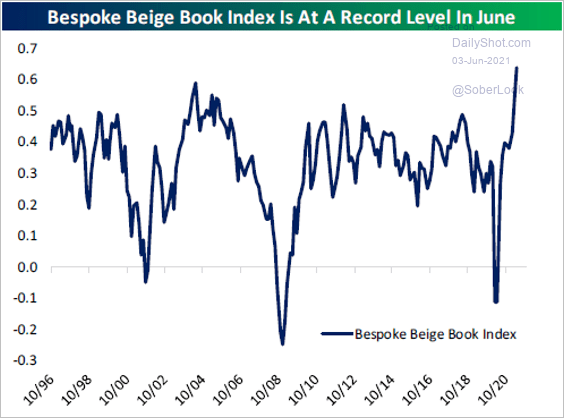

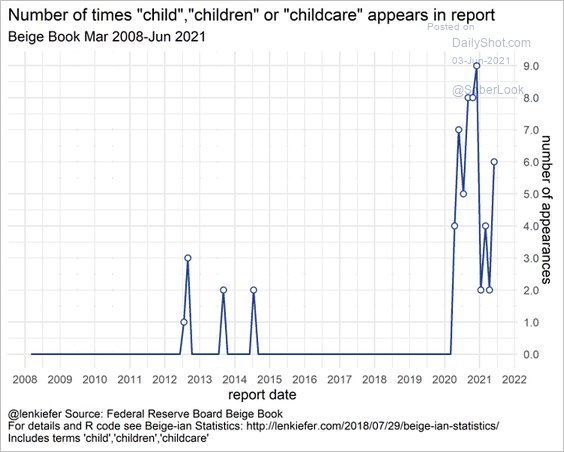

1. The Fed’s Beige Book report shows rapidly improving economic conditions (2 charts).

Source: @lenkiefer

Source: @lenkiefer

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

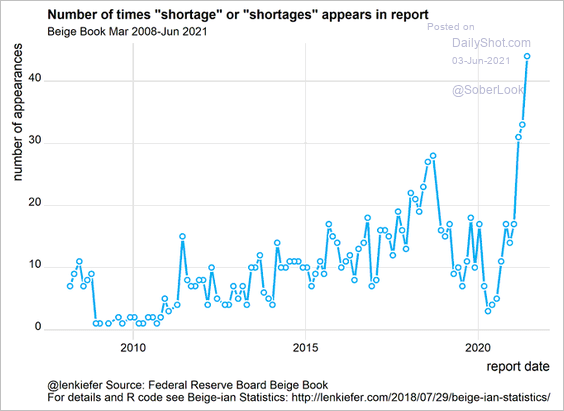

Businesses increasingly face shortages of materials and labor.

Manufacturers reported that widespread shortages of materials and labor along with delivery delays made it difficult to get products to customers. Similar challenges persisted in construction.

Source: @lenkiefer

Source: @lenkiefer

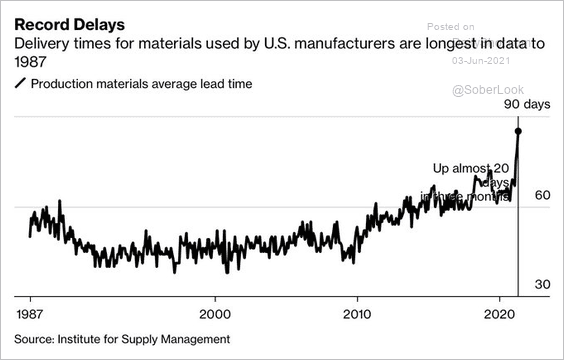

As we saw earlier, this trend is supported by data from ISM and other PMI reports.

Source: @jessefelder Read full article

Source: @jessefelder Read full article

Childcare-related challenges persist.

Source: @lenkiefer

Source: @lenkiefer

——————–

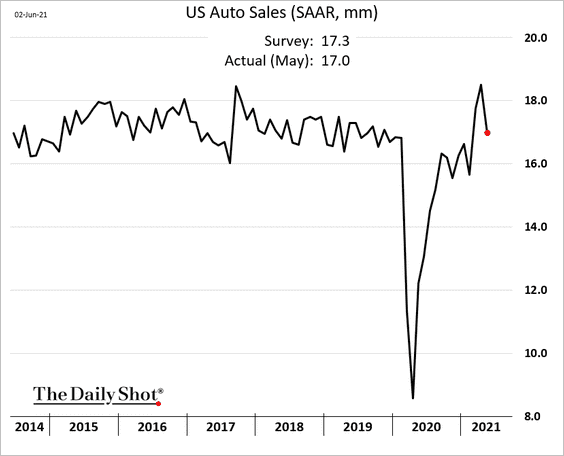

2. US auto sales are off the highs.

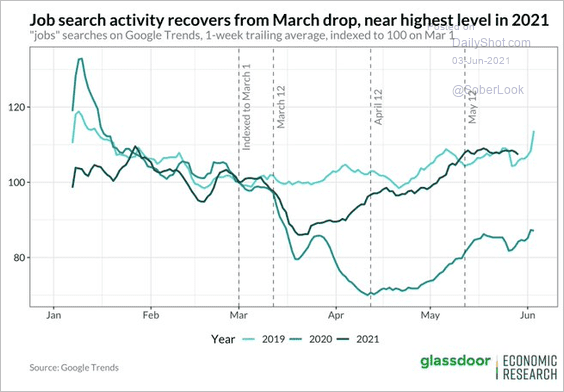

3. Job search activity has recovered.

Source: @DanielBZhao

Source: @DanielBZhao

4. The number of seated diners at US restaurants is back at pre-COVID levels.

Source: @LizAnnSonders, @OpenTable

Source: @LizAnnSonders, @OpenTable

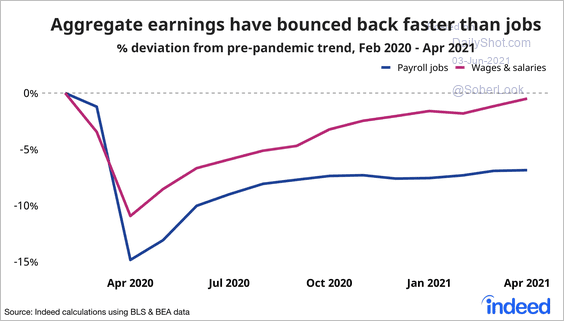

5. Wage costs have been rebounding faster than payrolls.

Source: @nick_bunker

Source: @nick_bunker

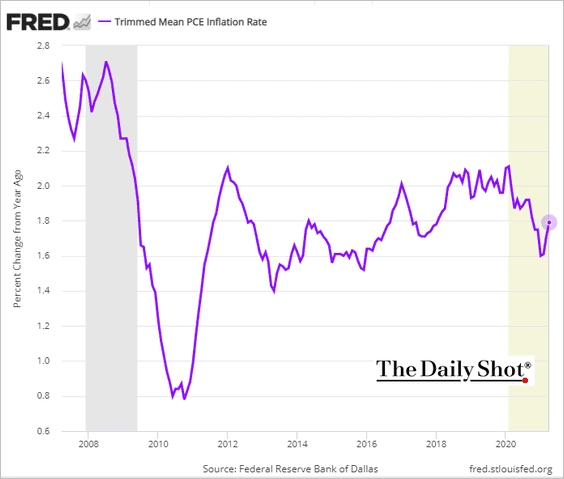

6. The Dallas Fed’s trimmed-mean PCE inflation measure remains subdued. Fed officials tend to track this indicator closely.

7. The US is the only OECD country with a positive post-COVID near-term GDP revision (largely due to the massive stimulus).

Source: @WSJ Read full article

Source: @WSJ Read full article

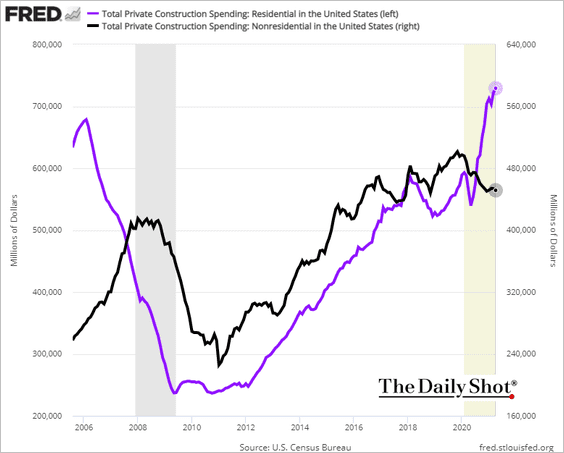

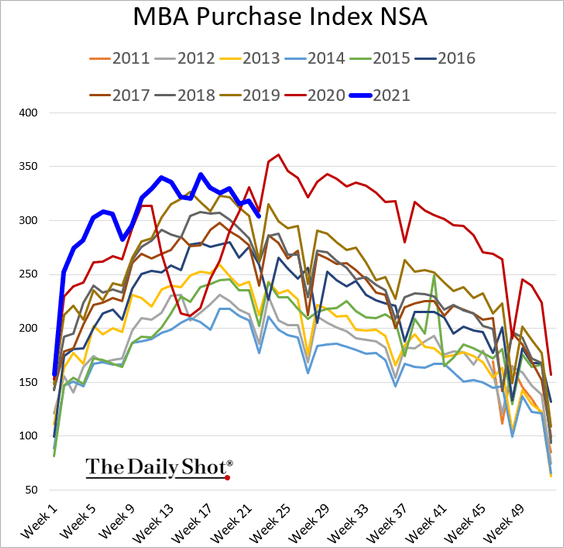

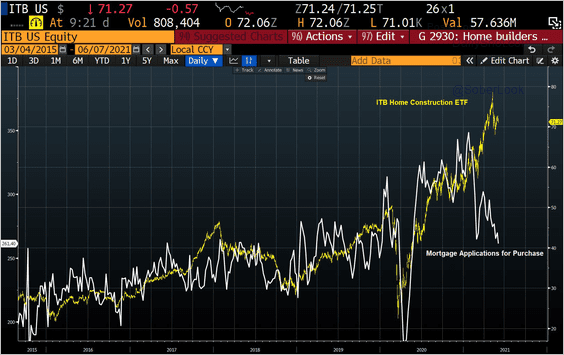

8. Finally, we have some updates on the housing market.

• Residential construction spending continues to trend higher, widening the gap with nonresidential expenditures.

• Mortgage applications to purchase a home have lost momentum.

But housing shares are yet to feel the impact.

Source: @JulianMI2

Source: @JulianMI2

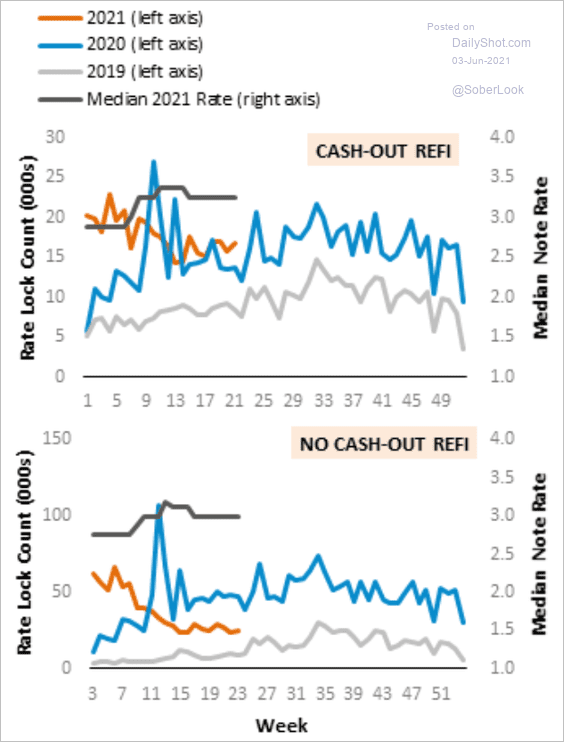

• Refinancing activity has been slowing as well, especially for transactions that don’t involve taking out equity.

Source: AEI Housing Center

Source: AEI Housing Center

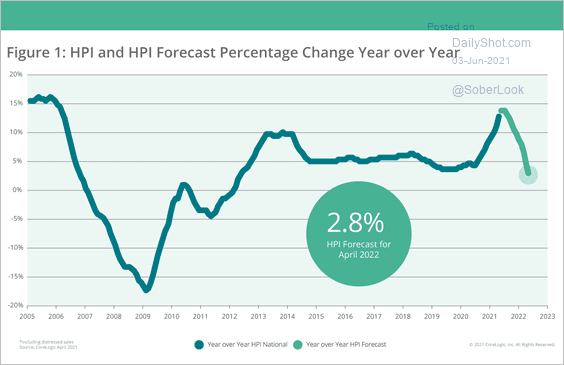

• According to CoreLogic, home price appreciation is peaking.

Source: CoreLogic

Source: CoreLogic

Back to Index

The United Kingdom

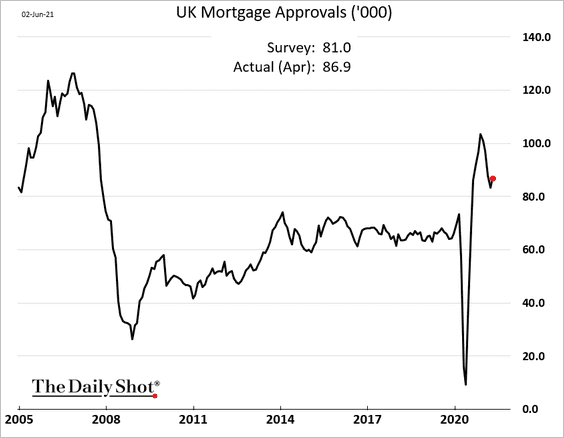

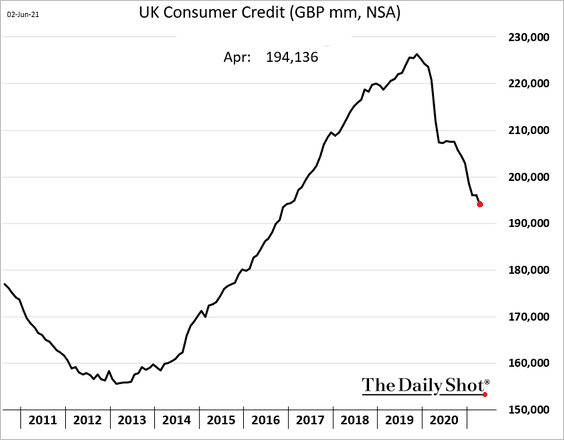

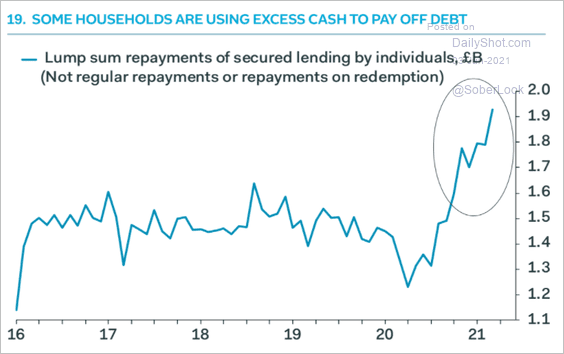

1. April mortgage approvals topped forecasts.

But consumer credit continues to shrink as households remain cautious about debt.

Many are paying off their loans.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

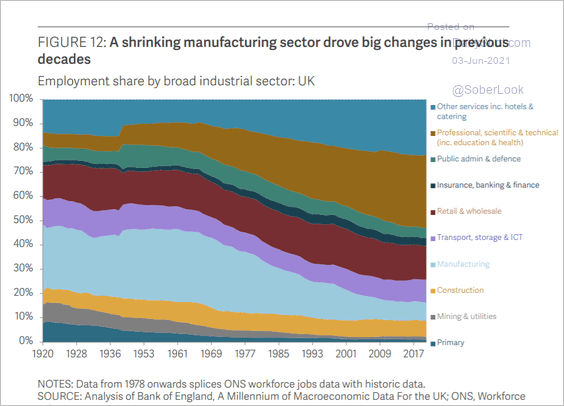

2. This chart shows UK employment distribution by sector since 1920.

Source: The Economy 2030 Inquiry Read full article

Source: The Economy 2030 Inquiry Read full article

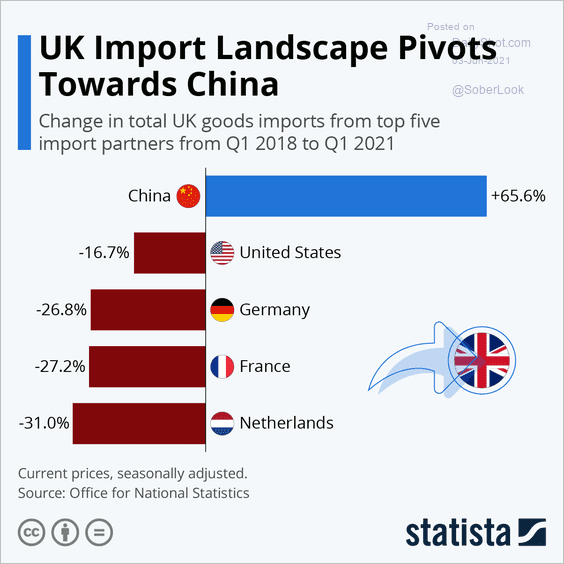

3. UK imports have shifted toward China since 2018.

Source: Statista

Source: Statista

Back to Index

The Eurozone

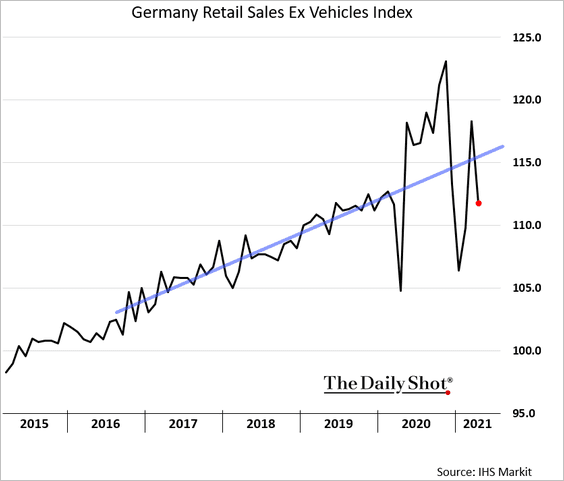

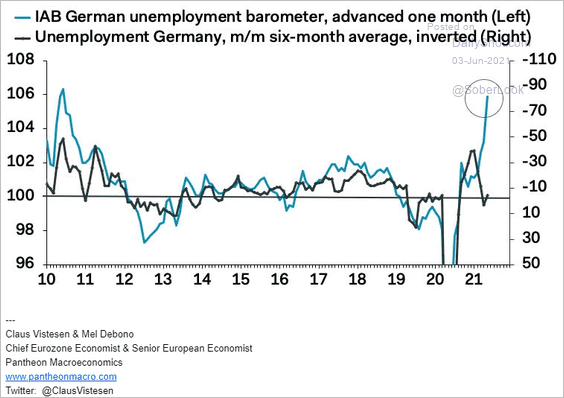

1. German retail sales dropped back below the pre-COVID trend in April.

But the situation should improve as unemployment shrinks further.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

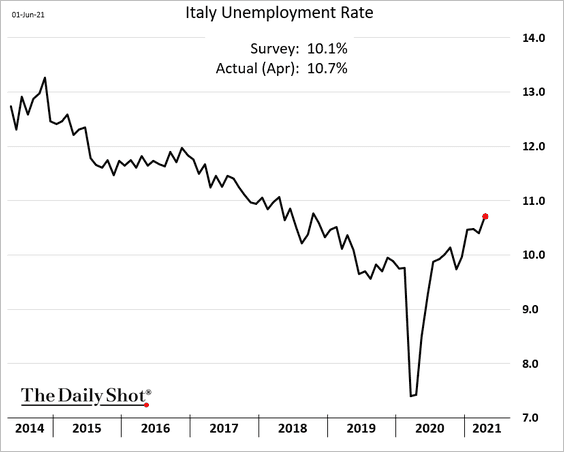

2. Italy’s unemployment rate keeps grinding higher.

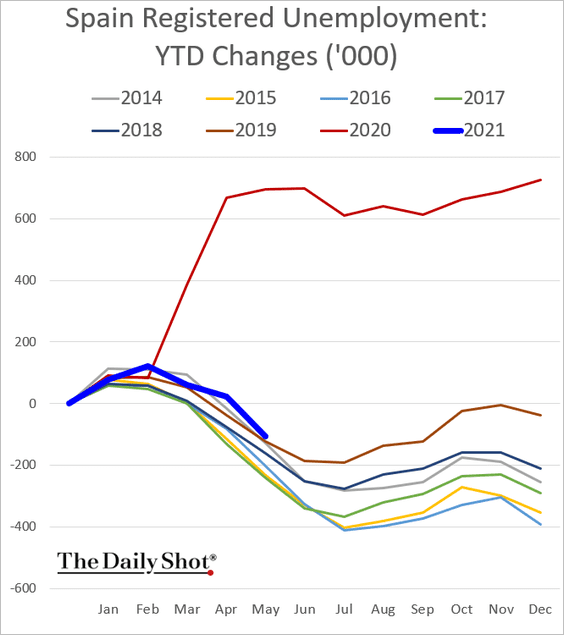

Here are Spain’s year-to-date changes in unemployment (roughly at 2019 levels).

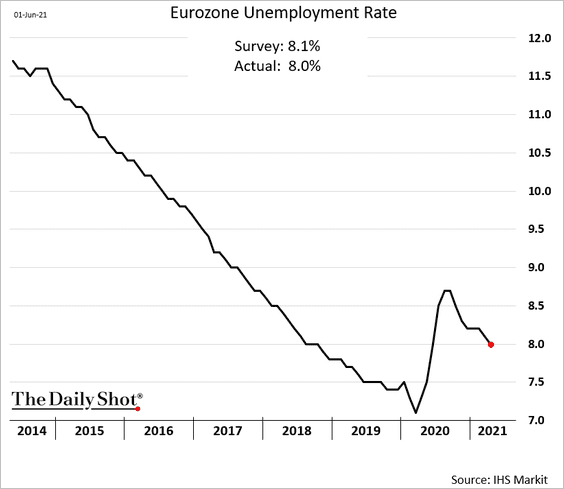

At the Eurozone level, we continue to see improvements in unemployment.

——————–

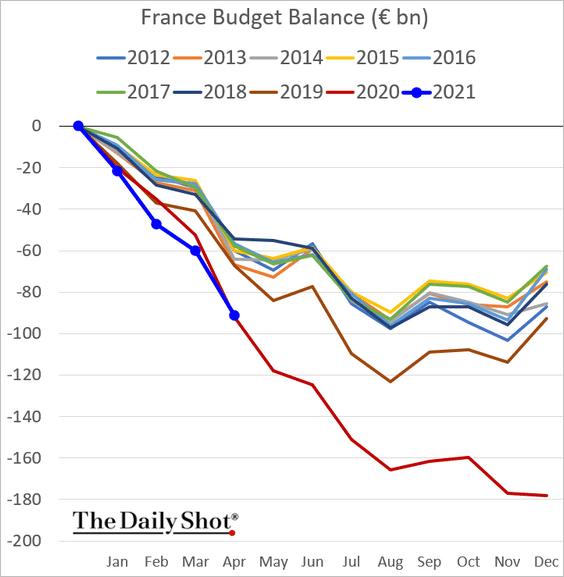

3. French budget deficit is following last year’s path.

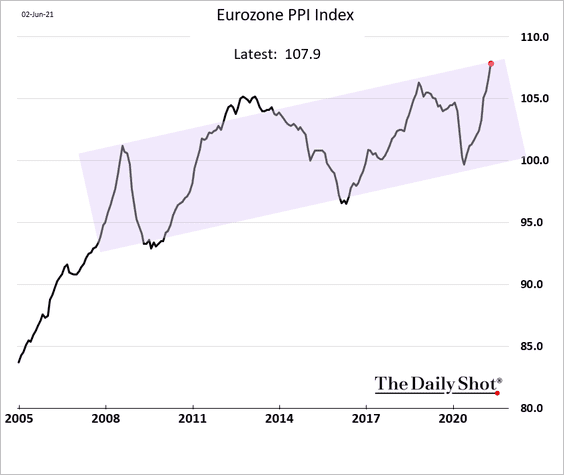

4. The Eurozone’s producer price index is at the upper end of its post-2008 range.

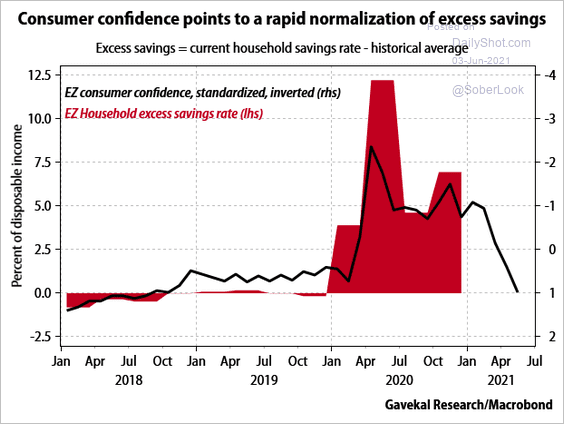

5. Improving consumer confidence points to reduced excess savings ahead.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

China

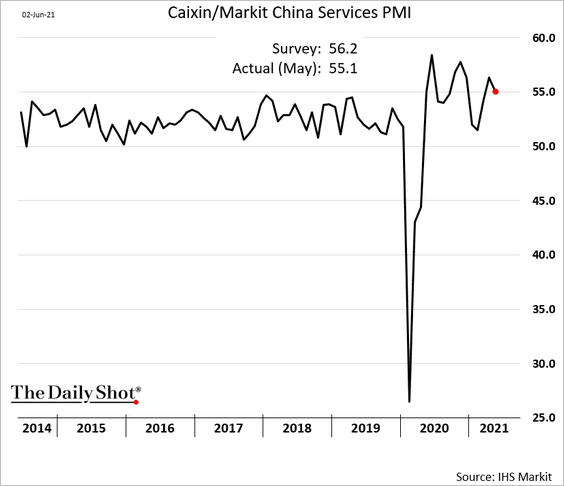

1. The Markit services PMI report was softer than expected, but growth remained stable in May.

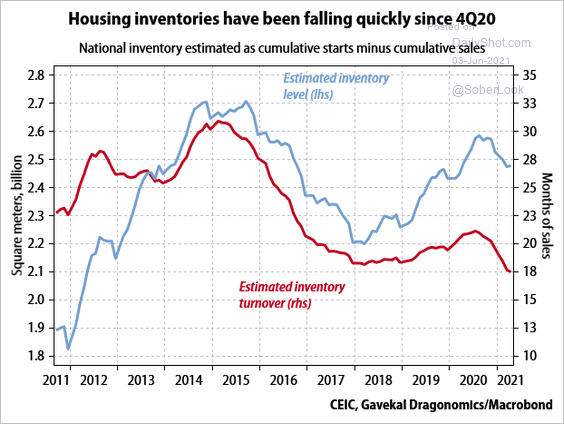

2. Housing inventories have been falling since Q4 of last year.

Source: Gavekal Research

Source: Gavekal Research

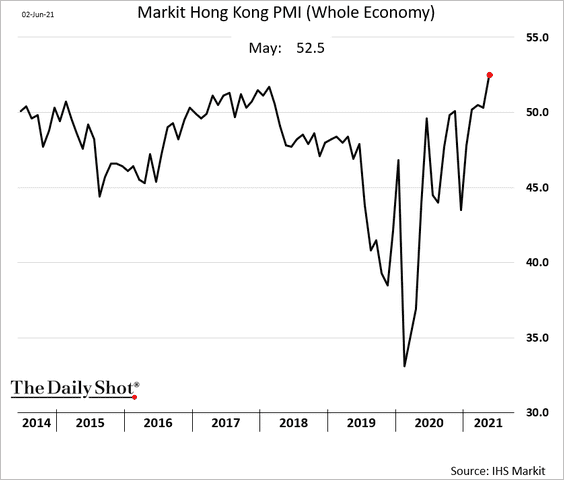

3. Hong Kong’s business activity accelerated further in May.

——————–

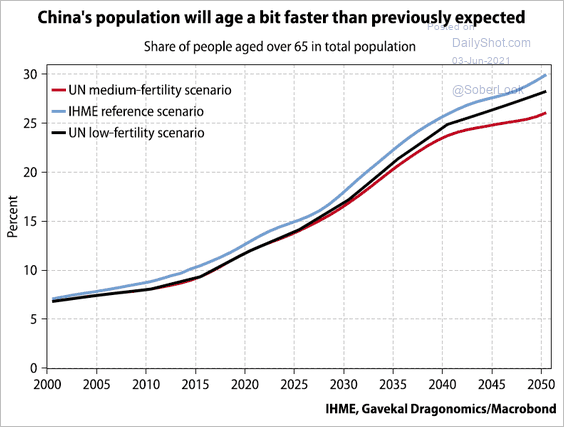

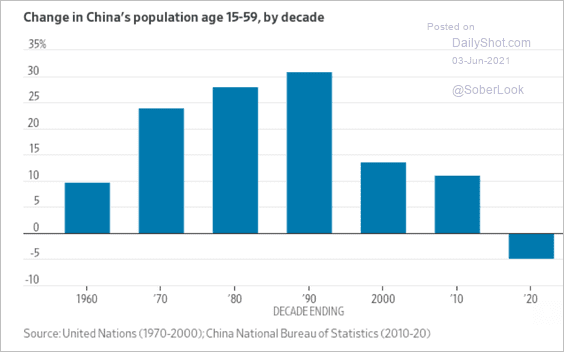

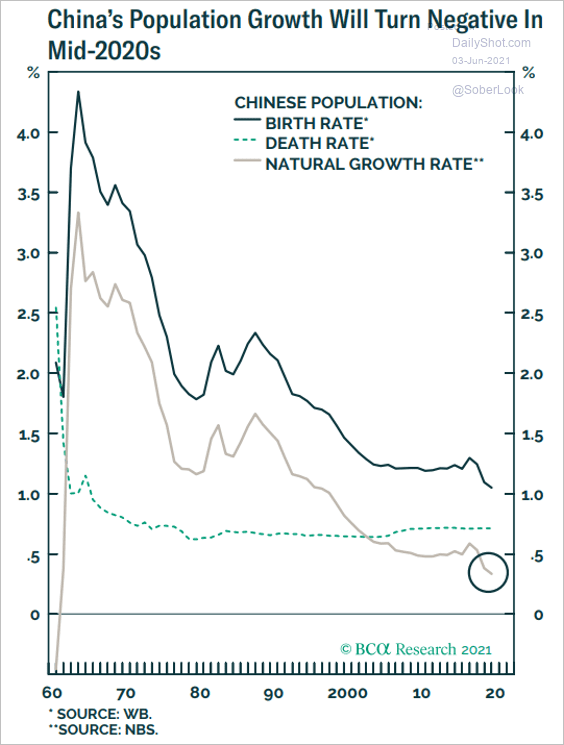

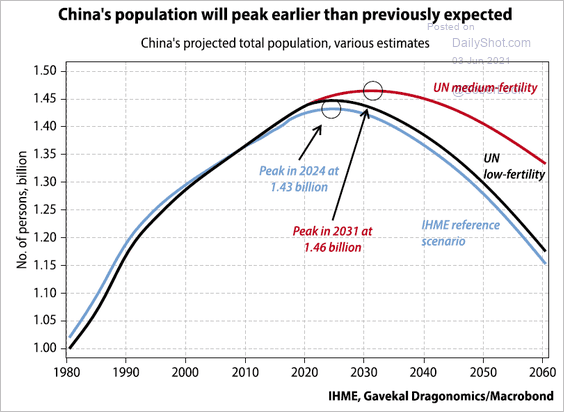

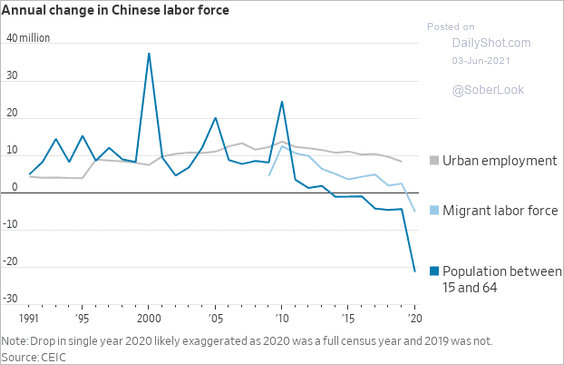

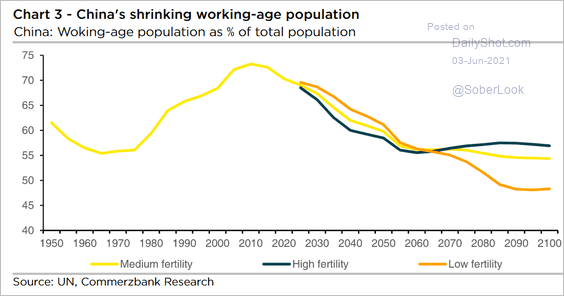

4. Next, we have a number of updates on China’s demographics.

• Aging population:

Source: Gavekal Research

Source: Gavekal Research

• Population changes by decade:

Source: @WSJ Read full article

Source: @WSJ Read full article

• Natural growth rate:

Source: BCA Research

Source: BCA Research

• Total population (about to peak):

Source: Gavekal Research

Source: Gavekal Research

• Working-age population changes:

Source: @WSJ Read full article

Source: @WSJ Read full article

• Working-age population projections:

Source: Commerzbank Research

Source: Commerzbank Research

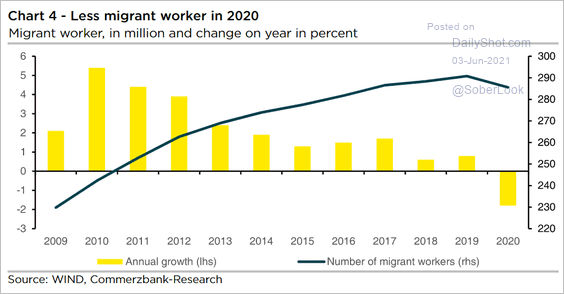

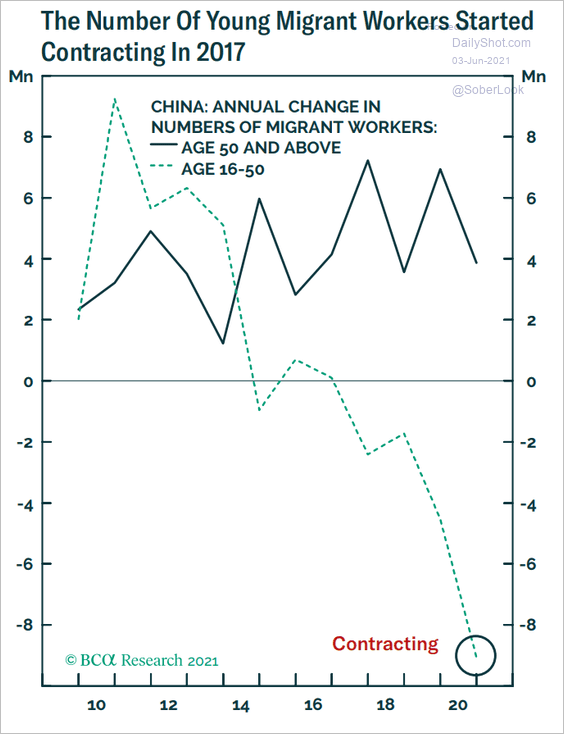

• Migrant workers (2 charts):

Source: Commerzbank Research

Source: Commerzbank Research

Source: BCA Research

Source: BCA Research

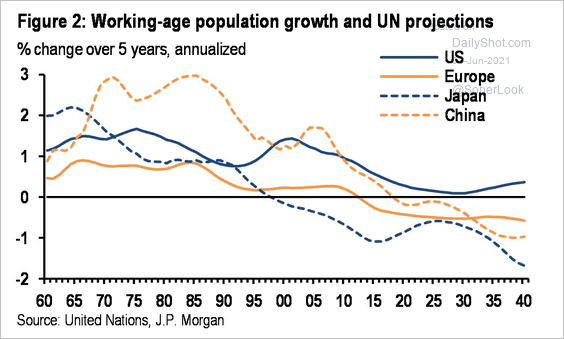

• Working-age population growth vs. other countries:

Source: JP Morgan, @carlquintanilla

Source: JP Morgan, @carlquintanilla

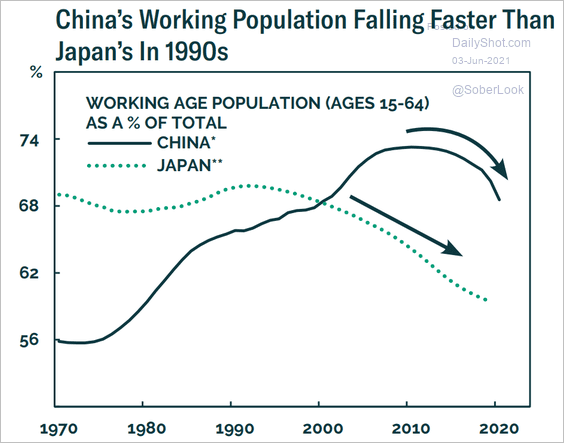

• Working-age population decline vs. Japan in the 1990s:

Source: BCA Research

Source: BCA Research

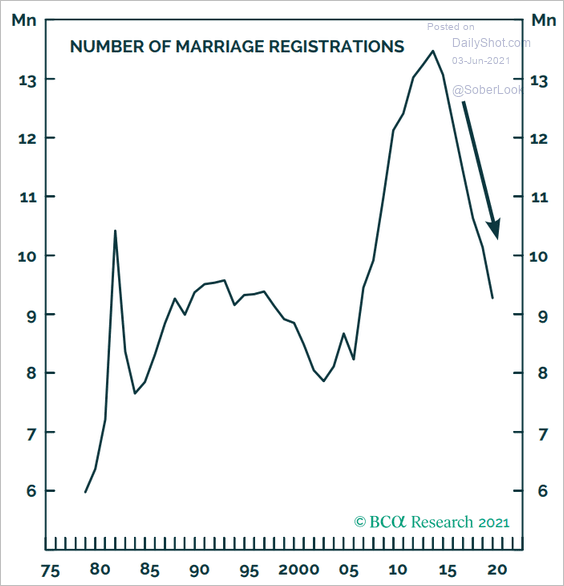

• Marriages:

Source: BCA Research

Source: BCA Research

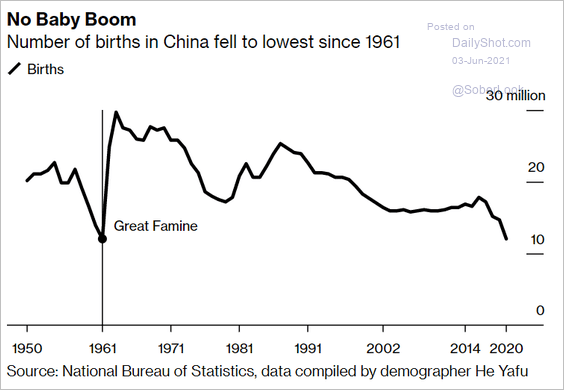

• Number of births:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

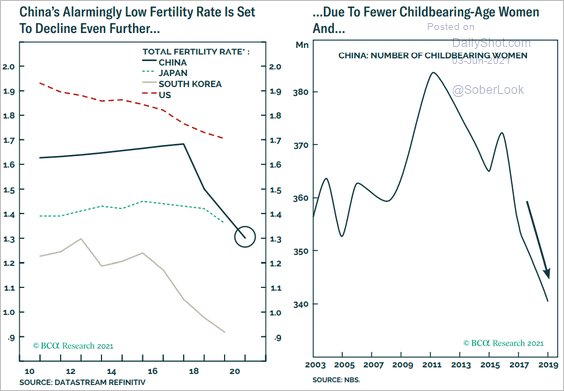

• Fertility rate:

Source: BCA Research

Source: BCA Research

• Beijing’s response to deteriorating demographics:

Source: @WSJ Read full article

Source: @WSJ Read full article

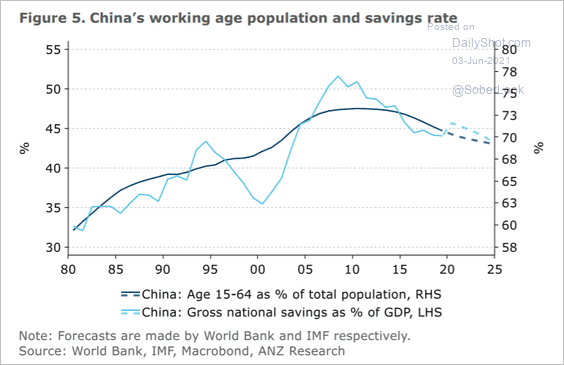

• Working-age population and the savings rate:

Source: ANZ Research

Source: ANZ Research

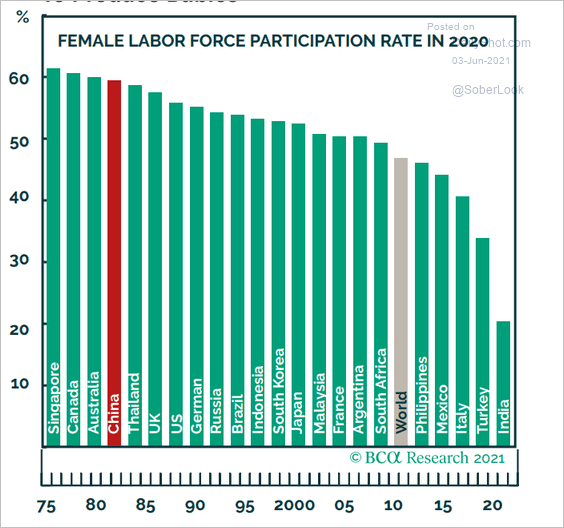

• Female labor force participation:

Source: BCA Research

Source: BCA Research

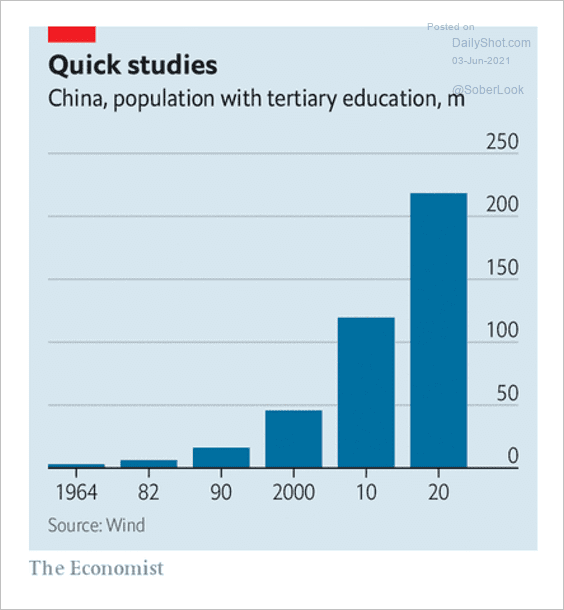

• Population with tertiary education:

Source: @adam_tooze; The Economist Read full article

Source: @adam_tooze; The Economist Read full article

Back to Index

Emerging Markets

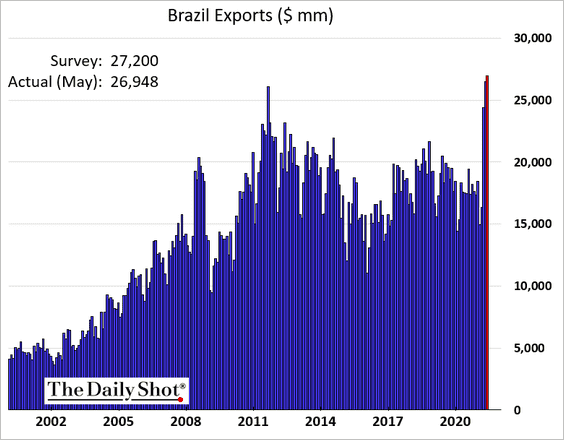

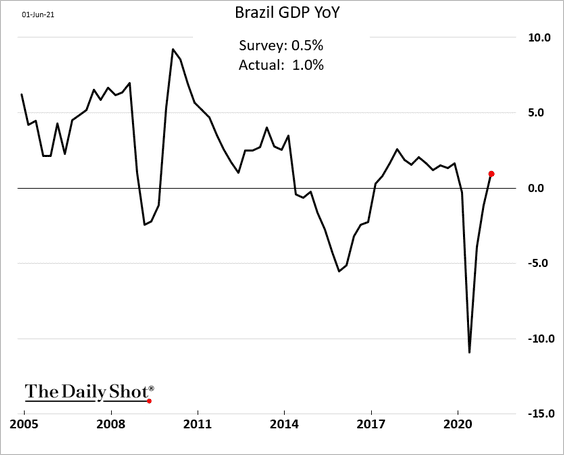

1. Let’s begin with Brazil.

• Exports (record high):

• The GDP rebound (as of Q1):

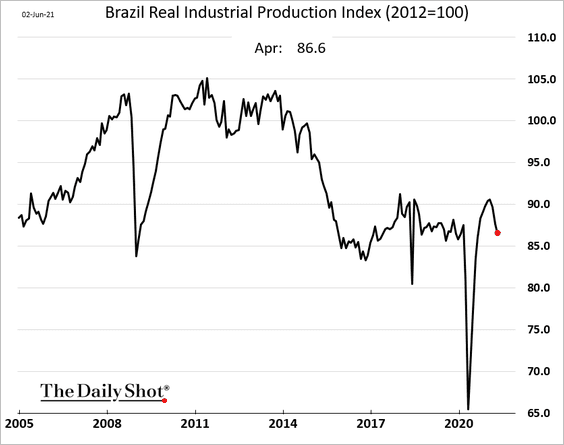

• Industrial production (weaker):

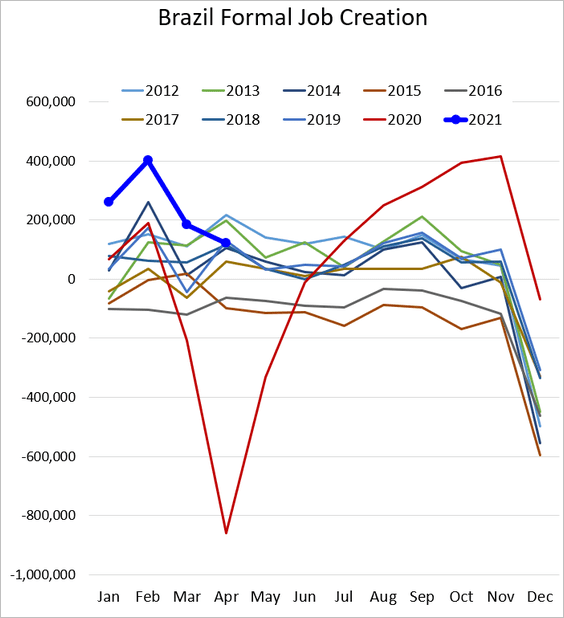

• Forma job creation (weaker):

• USD/BRL (headed toward 5.0):

——————–

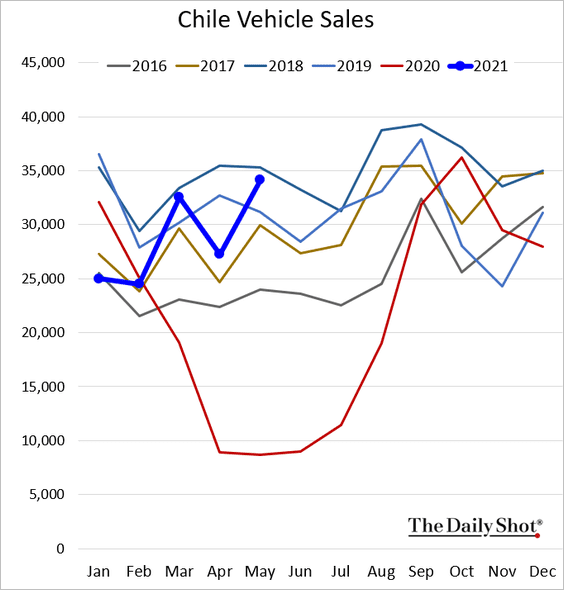

2. Chilean vehicle sales continue to rebound.

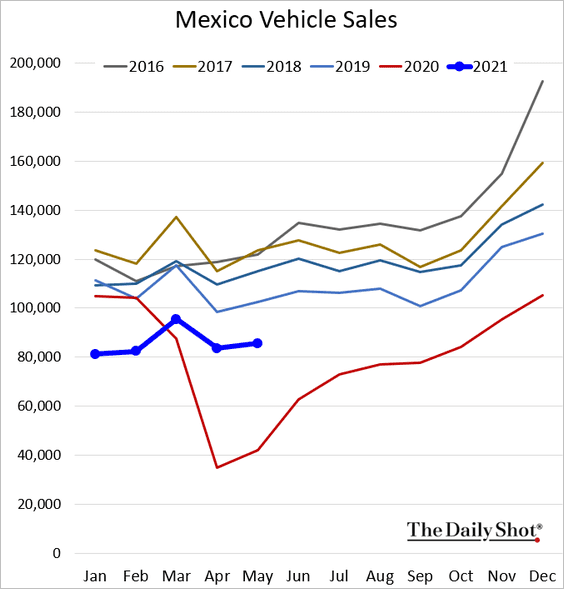

3. Mexican vehicle sales remain depressed.

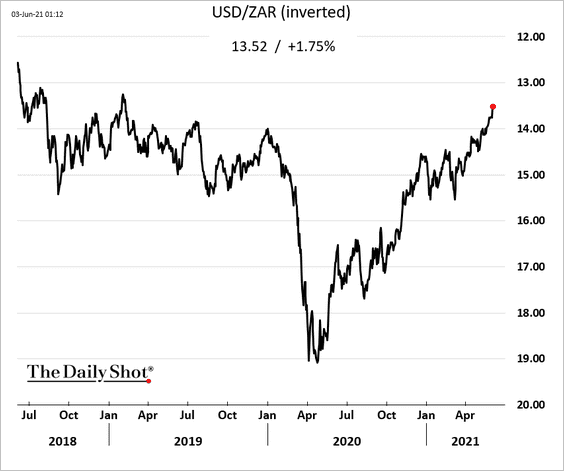

4. The South African rand rally has accelerated.

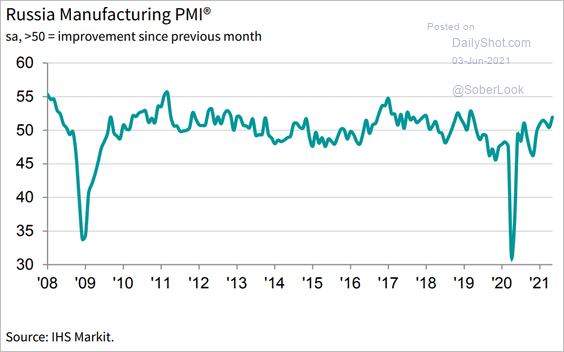

5. Russia’s manufacturing growth strengthened in May.

Source: IHS Markit

Source: IHS Markit

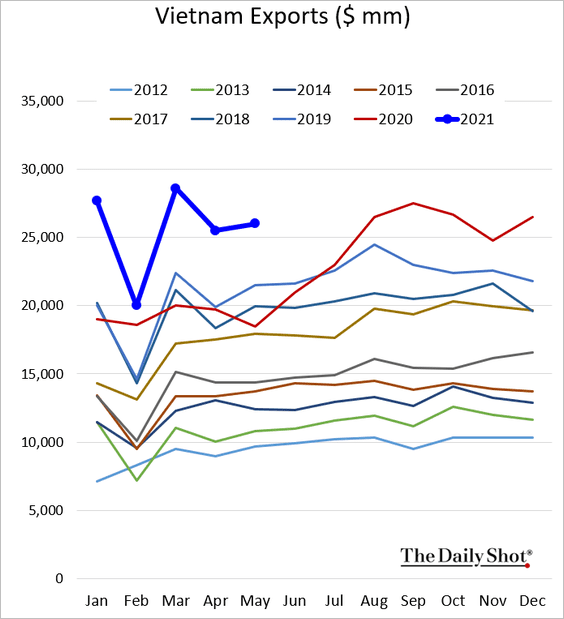

6. Vietnam’s exports remain at record highs for this time of the year.

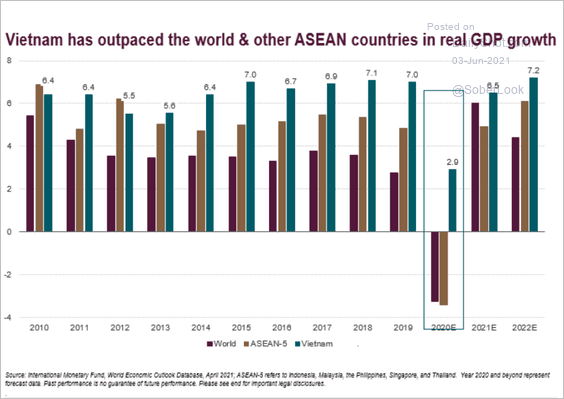

The nation’s economic growth is outpacing other ASEAN economies.

Source: FTSE Russell

Source: FTSE Russell

——————–

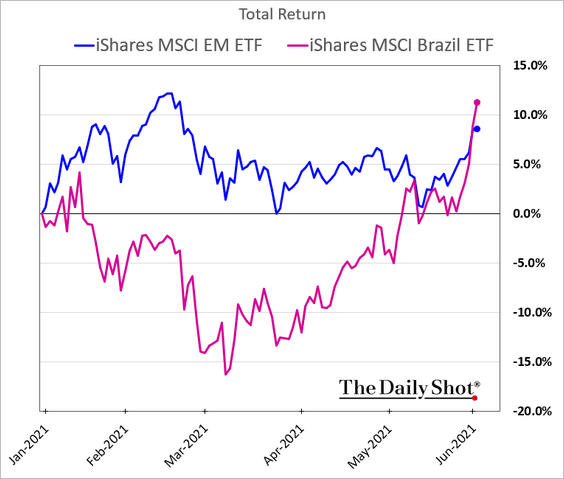

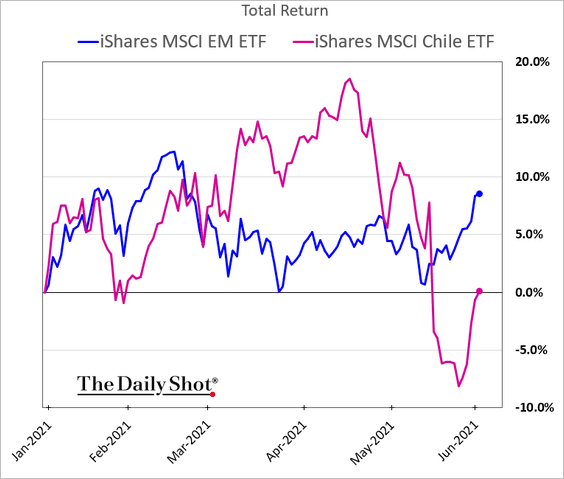

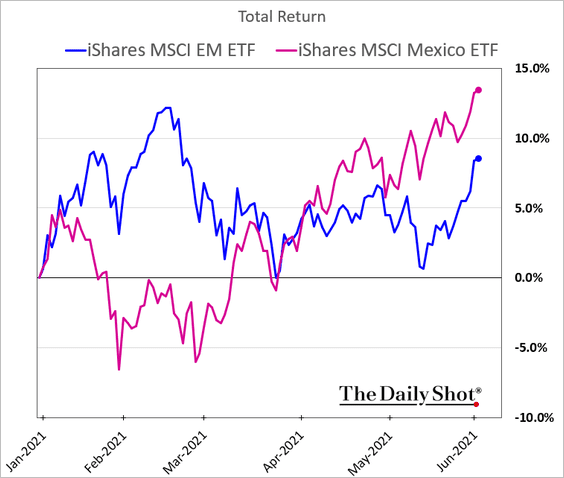

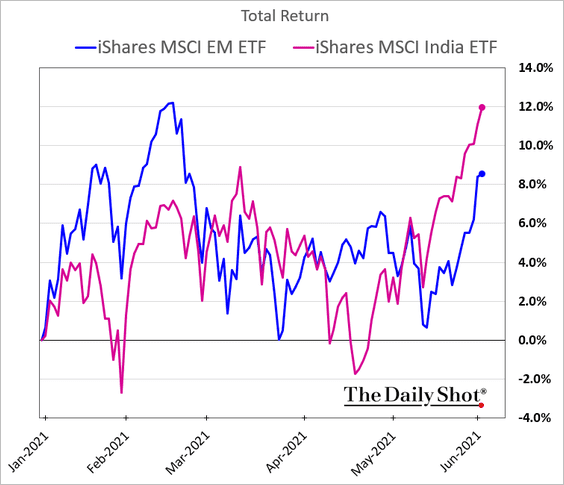

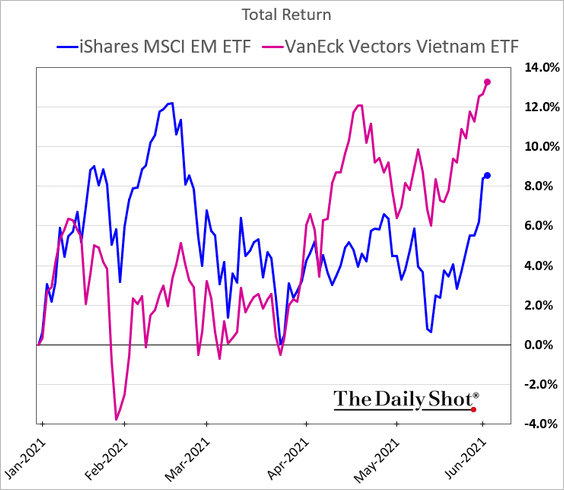

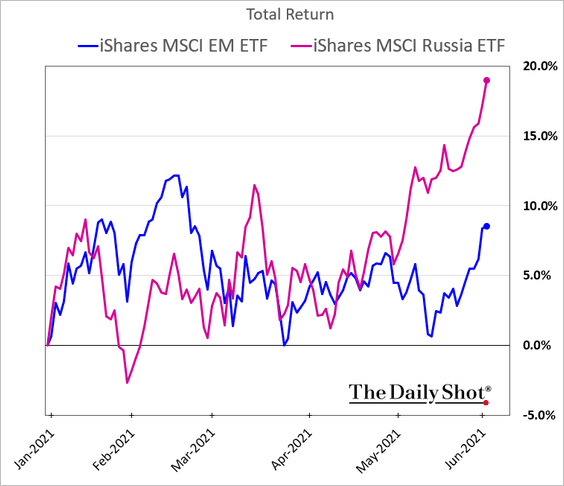

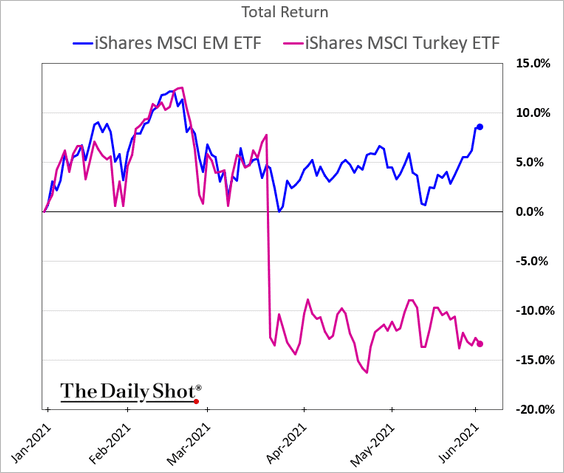

7. Next, we have the year-to-date performance for select equity markets (in US dollar terms).

• Brazil (rapid rebound):

• Chile (off the lows):

• Mexico:

• India:

• Vietnam:

• South Africa:

• Russia:

• Turkey:

Back to Index

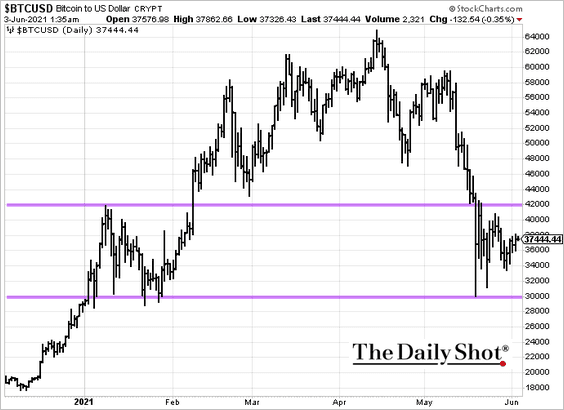

Cryptocurrency

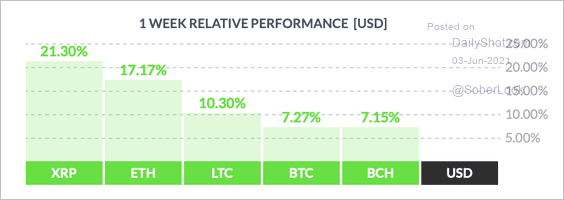

1. Cryptos moved higher this week:

• Bitcoin:

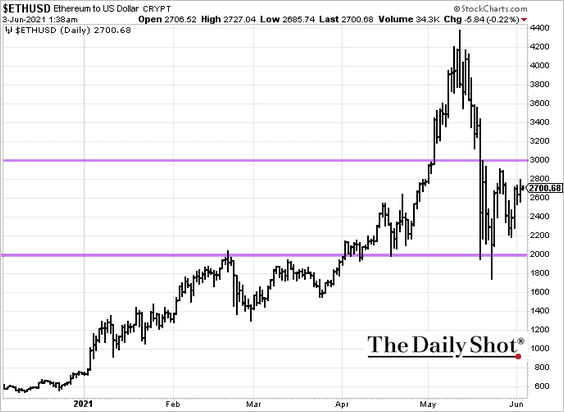

• Ethereum:

XRP and ETH have taken the lead over the past week as the broader crypto selloff stabilizes.

Source: FinViz

Source: FinViz

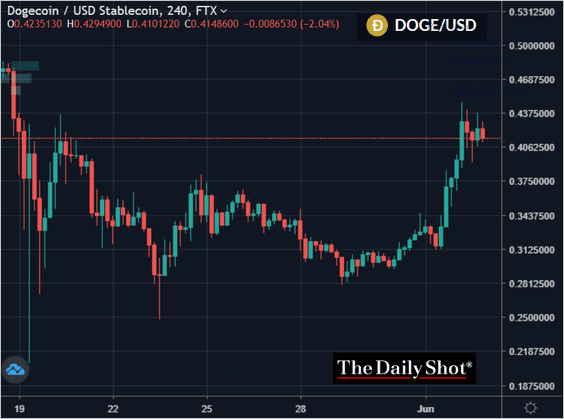

• Dogecoin rose sharply:

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: FTX

Source: FTX

——————–

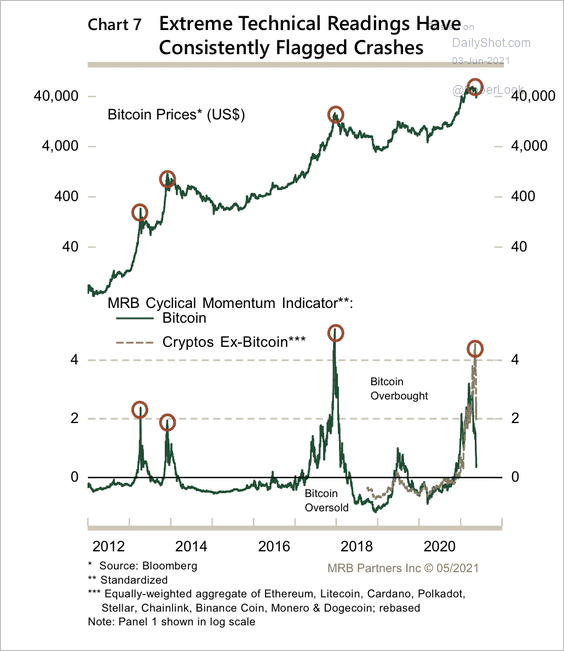

2. Technicals suggest that bitcoin is not yet oversold.

Source: MRB Partners

Source: MRB Partners

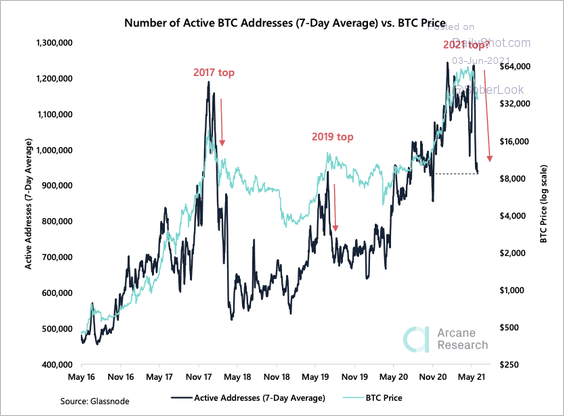

3. Bitcoin’s blockchain activity is declining, which suggests further downside in BTC.

Source: Arcane Research Read full article

Source: Arcane Research Read full article

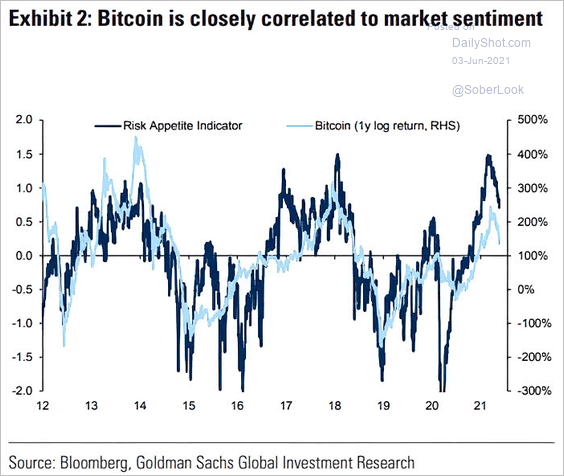

4. Bitcoin is correlated to market sentiment (it’s a risk asset, not a safe-haven asset):

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

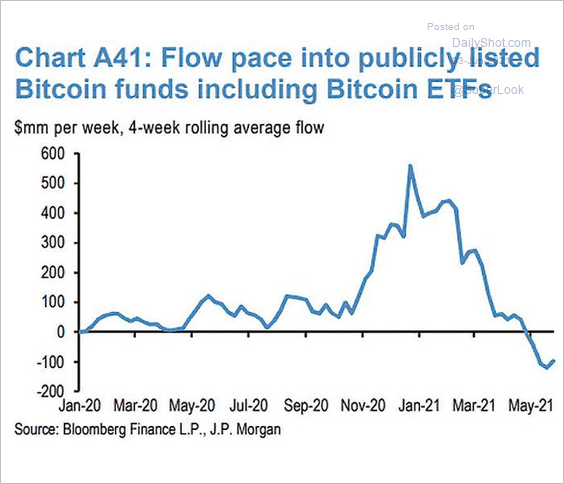

5. Fund flows appear to have bottomed.

Source: @ISABELNET_SA, @jpmorgan

Source: @ISABELNET_SA, @jpmorgan

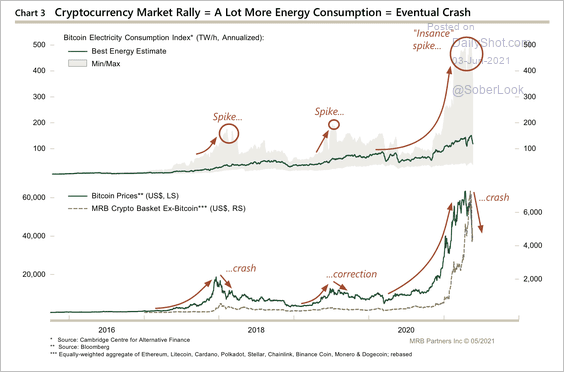

6. Spikes in bitcoin electricity consumption typically coincide with price peaks.

Source: MRB Partners

Source: MRB Partners

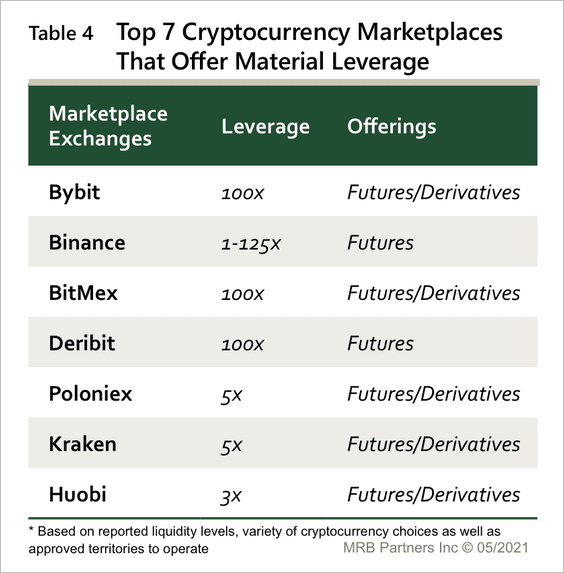

7. Crypto exchanges offer substantial leverage.

Source: MRB Partners

Source: MRB Partners

Back to Index

Energy

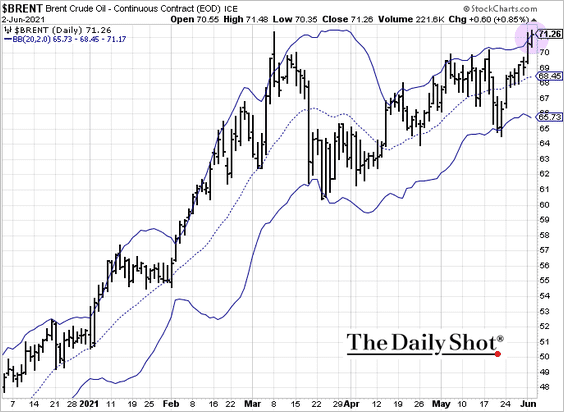

1. Brent broke above $71/bbl and is now above the upper Bollinger Band.

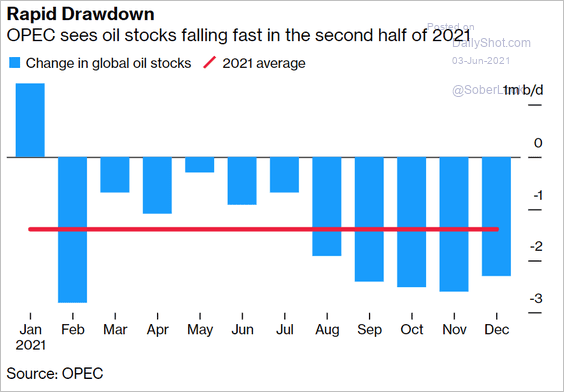

2. Global crude oil inventories will continue to tighten, according to OPEC.

Source: @markets Read full article

Source: @markets Read full article

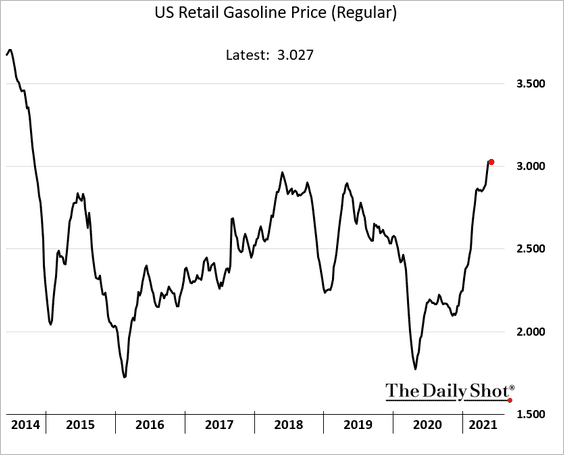

3. US retail gasoline prices are holding above $3.0/gal.

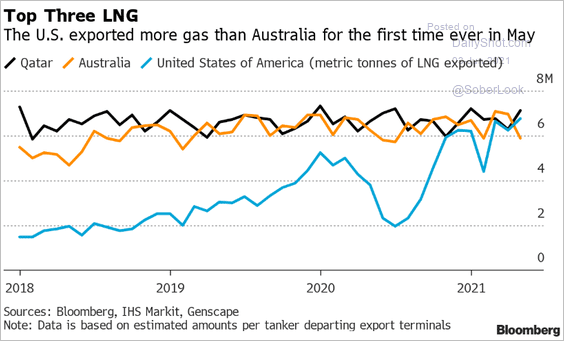

4. US LNG exports have accelerated.

Source: Kevin Varley Read full article

Source: Kevin Varley Read full article

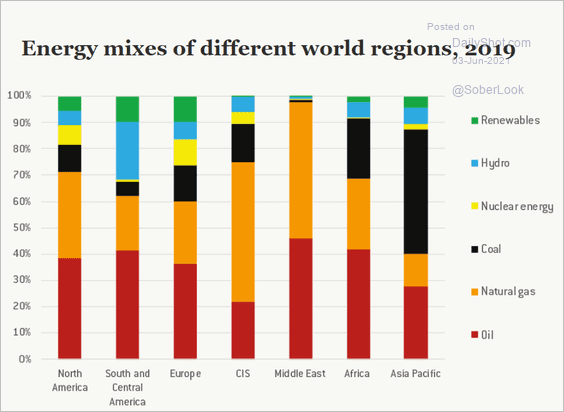

5. This chart shows energy mixes by region.

Source: Bruegel Read full article

Source: Bruegel Read full article

Back to Index

Equities

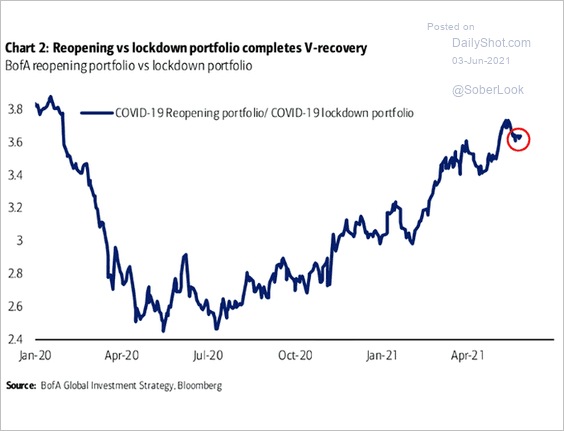

1. Let’s start with the ratio of BofA’s reopening and lockdown portfolios.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

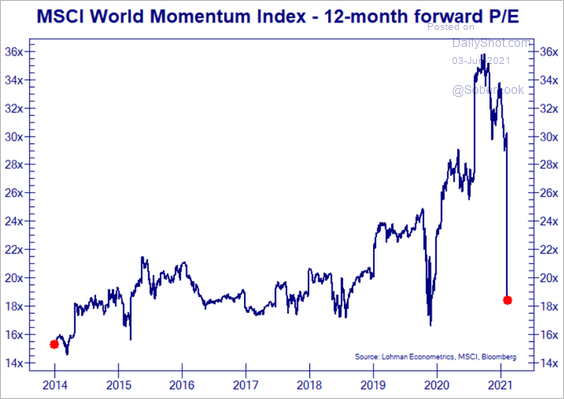

2. The momentum factor rebalancing has been massive, with many value stocks entering the index.

Source: @Not_Jim_Cramer

Source: @Not_Jim_Cramer

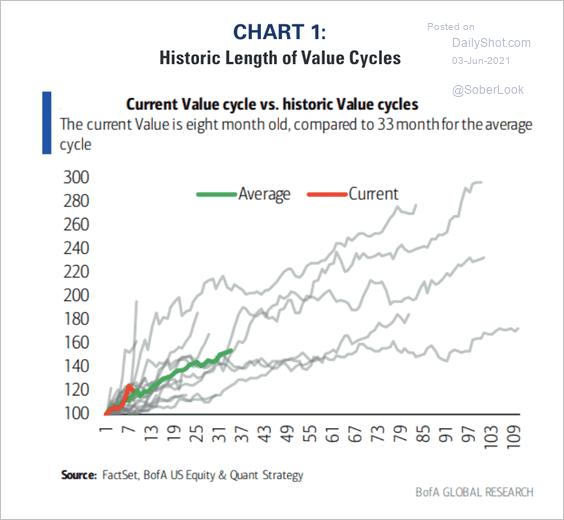

3. The current rotation into value stocks is on track with previous cycles.

Source: BofA Global Research

Source: BofA Global Research

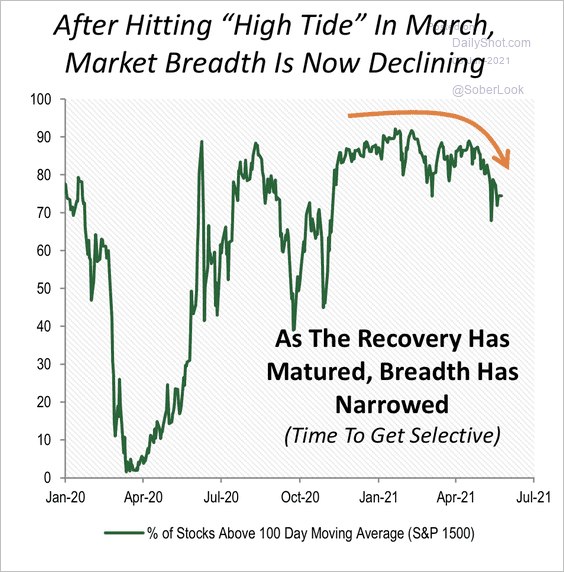

4. The percentage of stocks above the 100-day moving average is starting to wane.

Source: Cornerstone Macro

Source: Cornerstone Macro

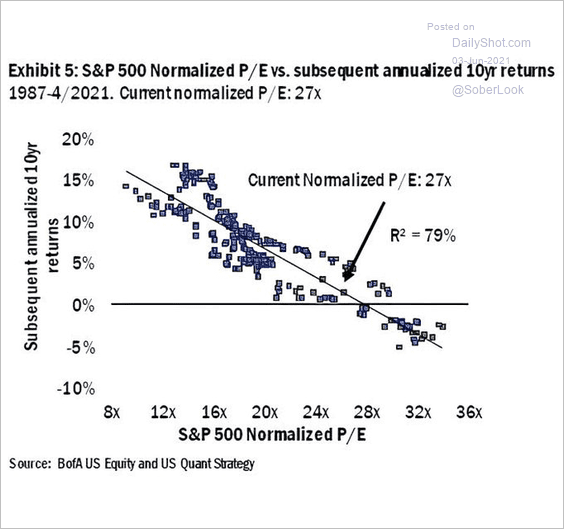

5. Despite its sub-2% yield, the 10yr Treasury could outperform the S&P 500 over the next decade (amid lofty valuations).

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

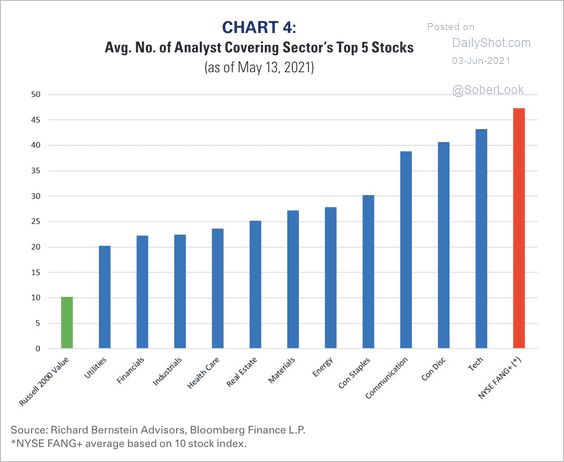

6. The five largest companies in the Russell 2,000 Value Index receive relatively little analyst coverage.

Source: Richard Bernstein Advisors

Source: Richard Bernstein Advisors

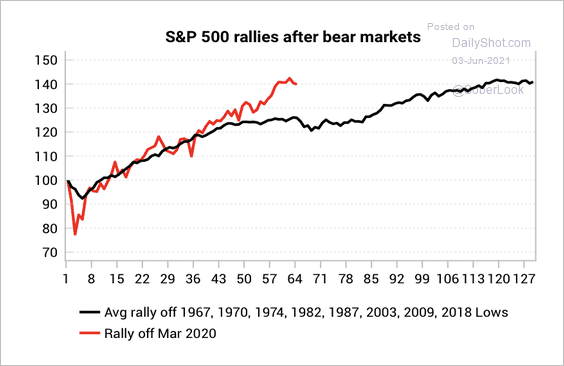

7. The S&P 500 could enter a summer lull similar to historical post-bear market rallies.

Source: Variant Perception

Source: Variant Perception

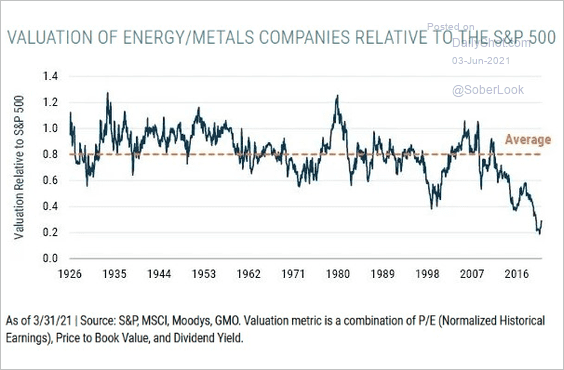

8. Despite inflation concerns, energy and metals companies trade at a substantial discount relative to the S&P 500.

Source: @jessefelder, GMO Read full article

Source: @jessefelder, GMO Read full article

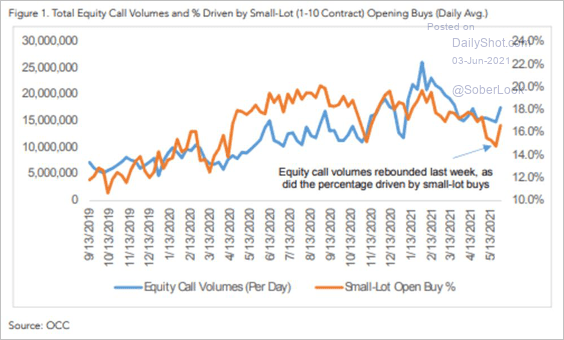

9. Retail options trading is picking up again.

Source: OCC, @markets Read full article

Source: OCC, @markets Read full article

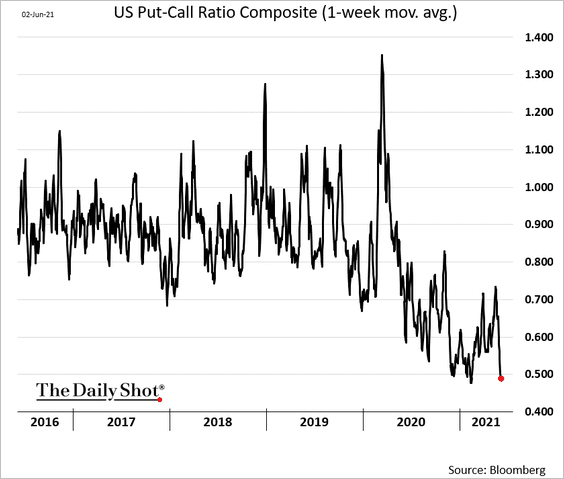

10. The US put-call ratio is nearing multi-year lows.

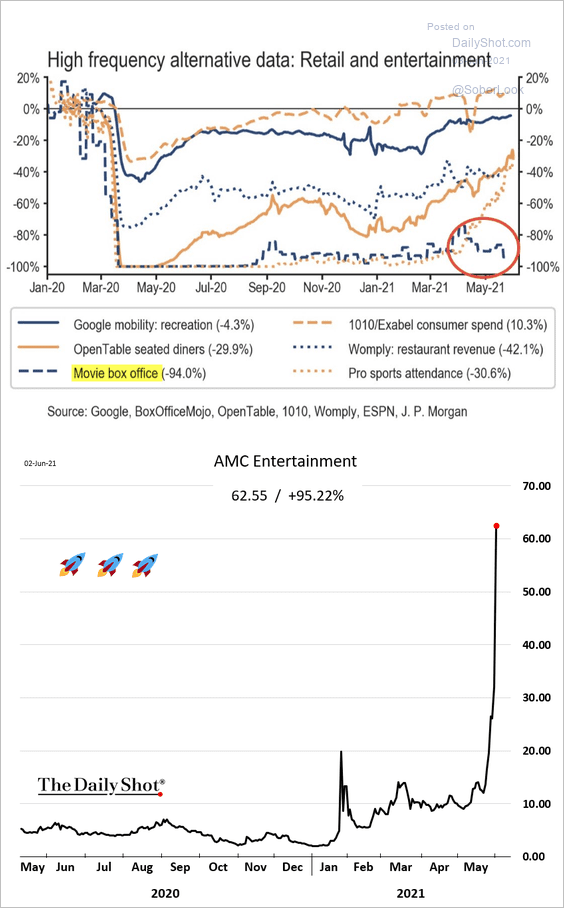

11. Let’s all go to the movies …

Source: JP Morgan, @carlquintanilla

Source: JP Morgan, @carlquintanilla

Back to Index

Credit

The Fed will be selling its corporate bond portfolio. It’s a relatively small amount, but it suggests that the central bank is thinking about trimming back its emergency programs. Will the taper announcement come later this summer?

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Global Developments

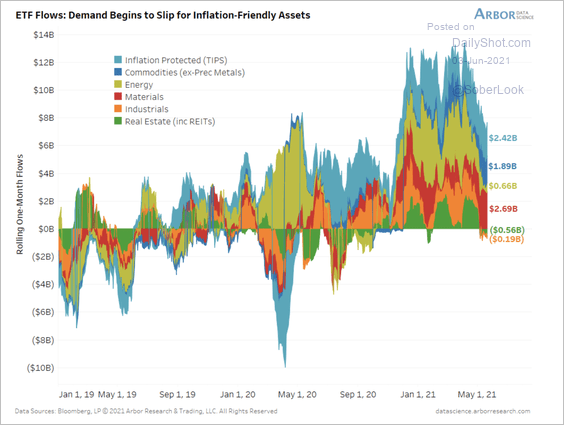

1. Inflation-friendly ETFs have seen decelerating flows over the past month.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

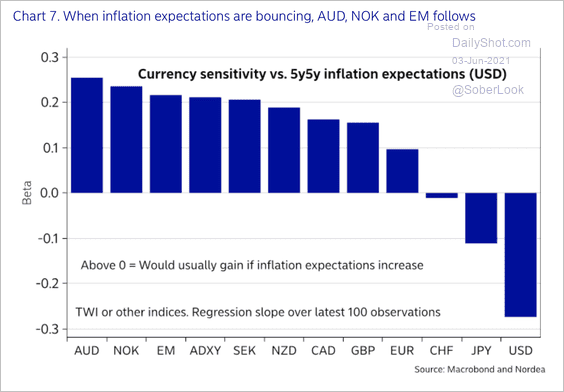

2. The Aussie dollar, Norwegian Krone and EM currencies tend to perform well as inflation expectations rise.

Source: Nordea Markets

Source: Nordea Markets

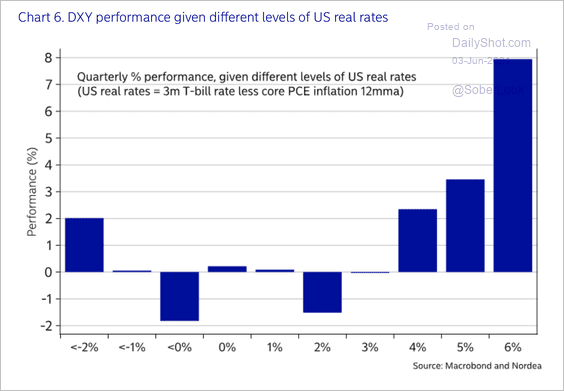

3. The reflationary environment is almost always negative for the dollar.

Source: Nordea Markets

Source: Nordea Markets

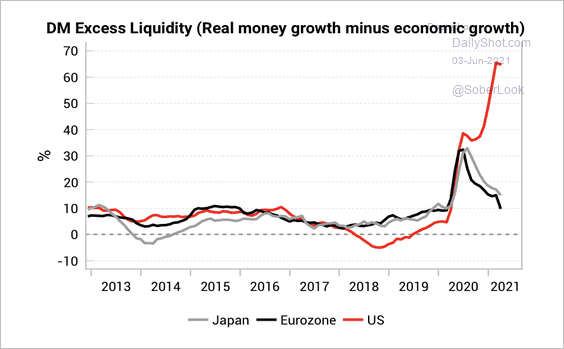

4. US excess liquidity remains much higher than Europe and Japan.

Source: Variant Perception

Source: Variant Perception

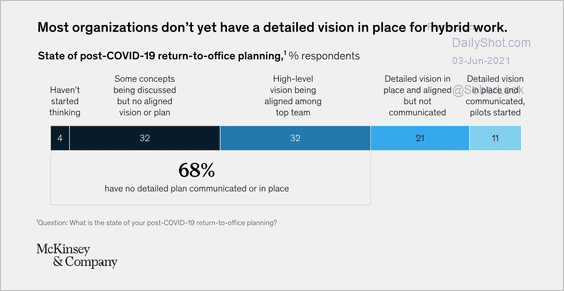

5. Most companies surveyed by McKinsey do not have detailed plans on how to implement a return to the workplace.

Source: McKinsey & Compan

Source: McKinsey & Compan

——————–

Food for Thought

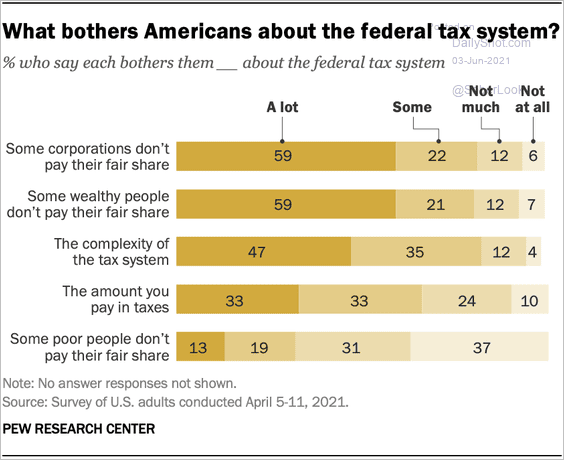

1. What bothers Americans about the federal tax system?

Source: Pew Research Center

Source: Pew Research Center

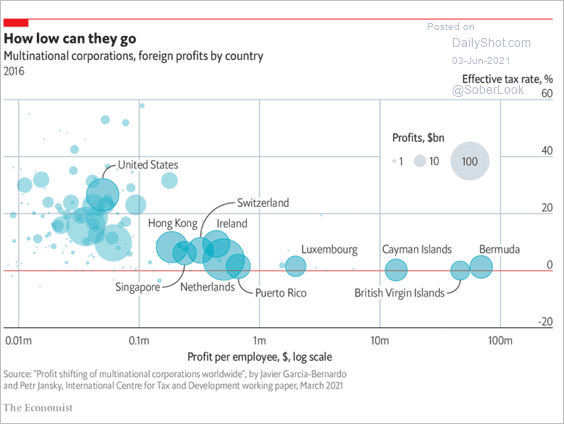

2. Multinationals’ effective tax rates vs. profit per employee:

Source: The Economist Read full article

Source: The Economist Read full article

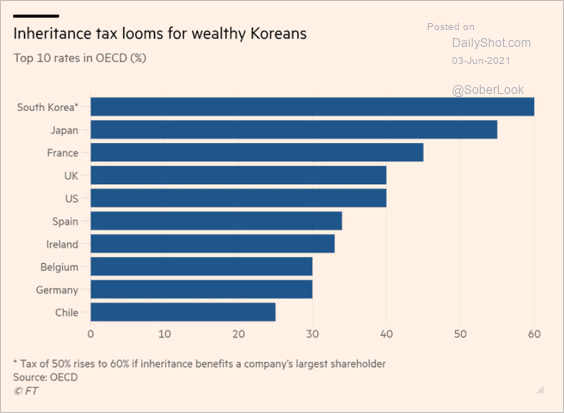

3. Inheritance tax:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

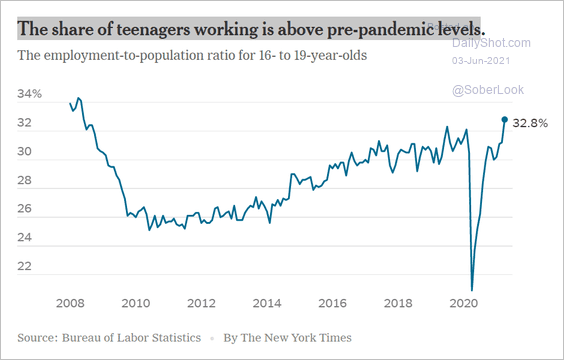

4. Teen employment:

Source: The New York Times Read full article

Source: The New York Times Read full article

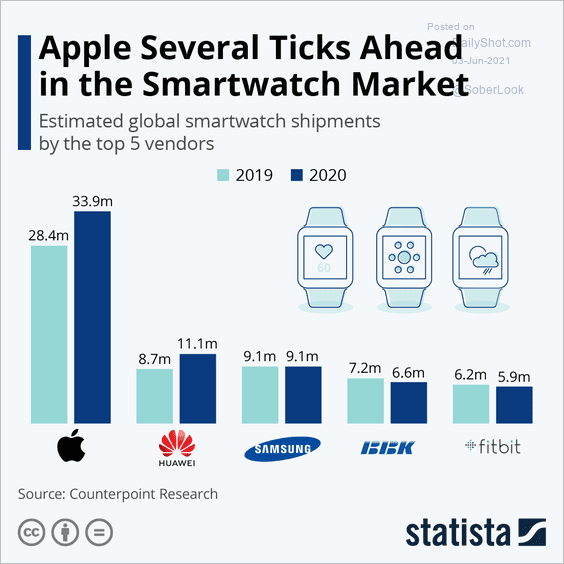

5. The smartwatch market:

Source: @chartrdaily

Source: @chartrdaily

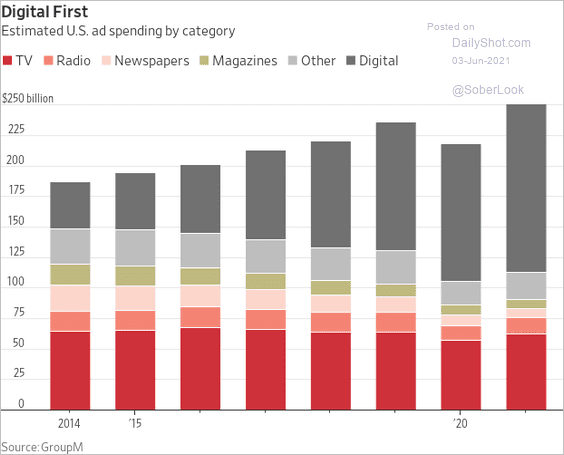

6. Ad spending by category:

Source: @WSJ Read full article

Source: @WSJ Read full article

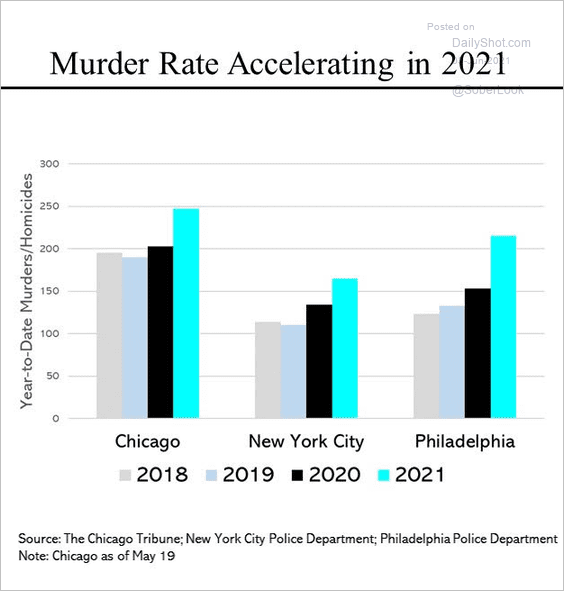

7. Murder rates in select cities:

Source: @SteveRattner

Source: @SteveRattner

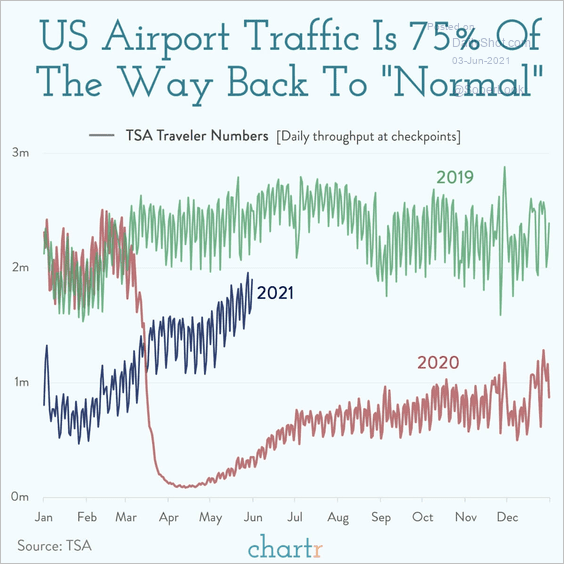

8. US airport traffic:

Source: @chartrdaily Read full article

Source: @chartrdaily Read full article

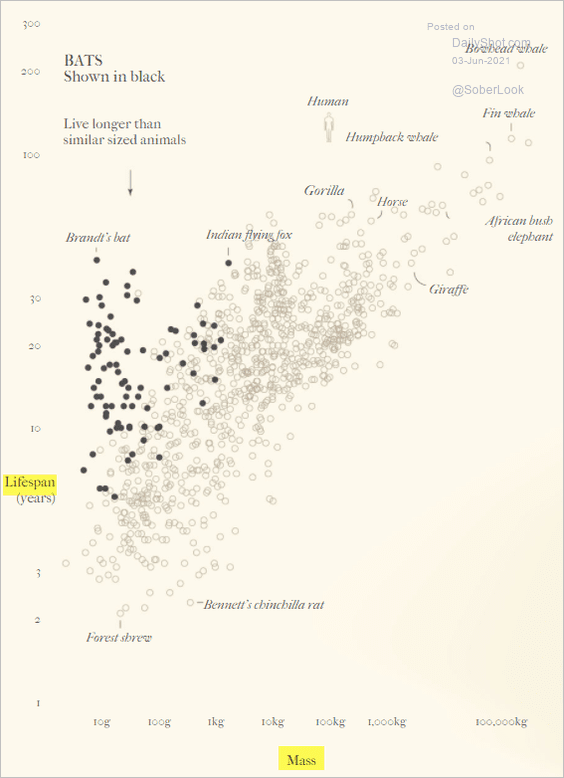

9. Animals’ lifespan vs. mass:

Source: Reuters Read full article

Source: Reuters Read full article

——————–

Back to Index