The Daily Shot: 08-Jun-21

• The United States

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

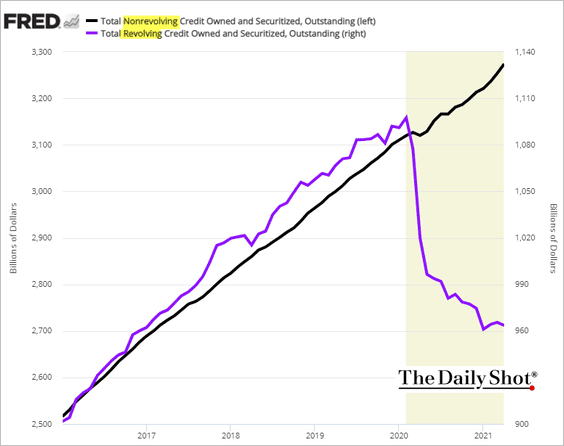

1. Let’s begin with consumer credit.

• Despite increased spending, credit card balances (revolving credit) are not rebounding. On the other hand, auto loans and student debt (nonrevolving credit) continue to grow.

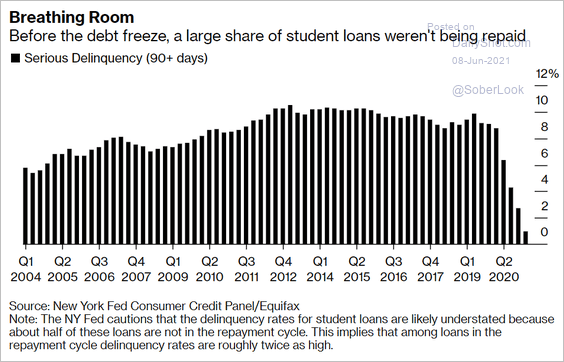

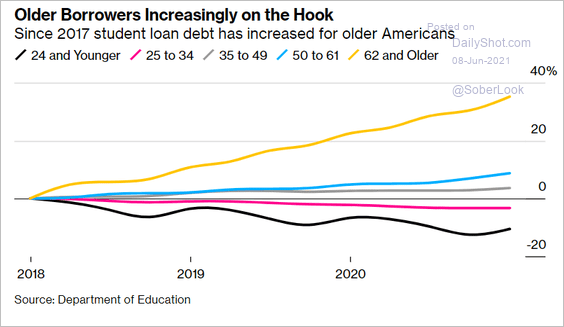

• The moratorium on student debt payments ends in October. Many borrowers have stopped paying and are hoping for debt forgiveness. Absent such a policy change, we are likely to see delinquencies climbing back to pre-COVID highs and perhaps even higher.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

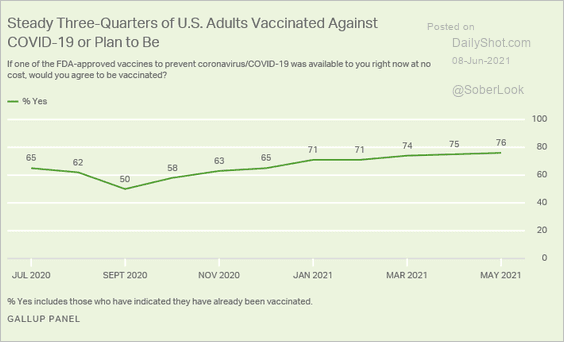

2. Three-quarters of Americans are either vaccinated or plan to be. Much of the remaining quarter is likely to remain unvaccinated.

Source: Gallup Read full article

Source: Gallup Read full article

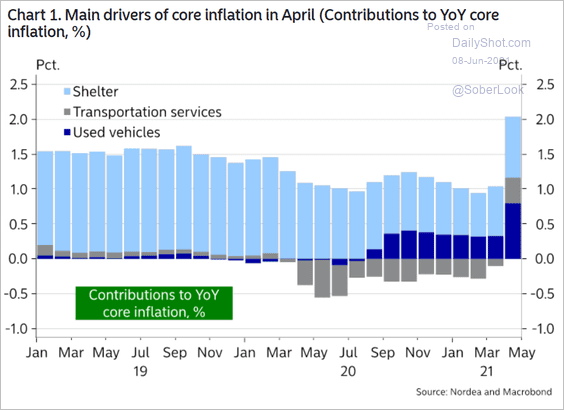

3. Next, we have some updates on inflation.

• Here are the main drivers of core inflation in April (year over year).

Source: Nordea Markets

Source: Nordea Markets

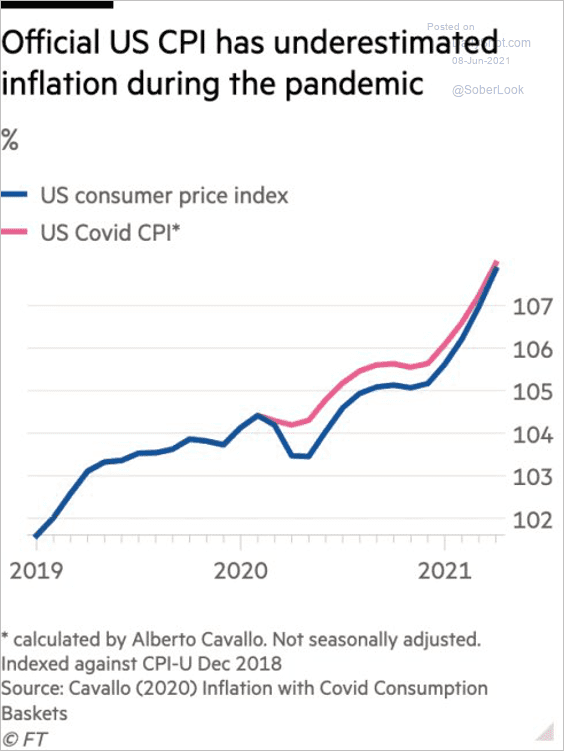

• The official CPI has converged with the “COVID CPI,” which takes into account the changes in spending patterns last year.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

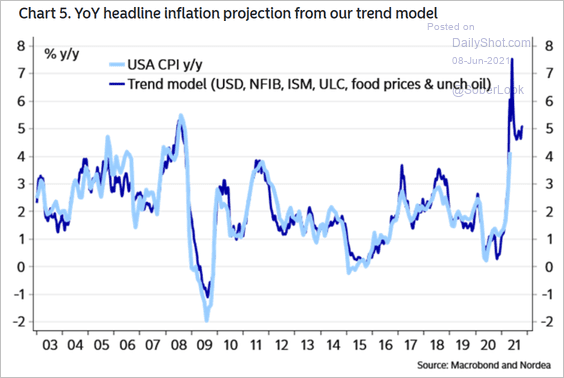

• Will the headline CPI hit 7% (year-over-year)?

Source: Nordea Markets

Source: Nordea Markets

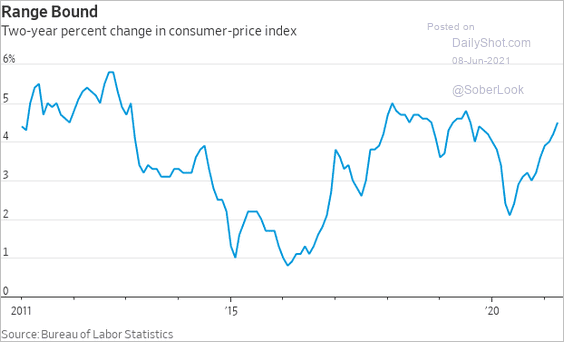

• Inflation does not look extreme when prices are compared to 2019 levels.

Source: @WSJ Read full article

Source: @WSJ Read full article

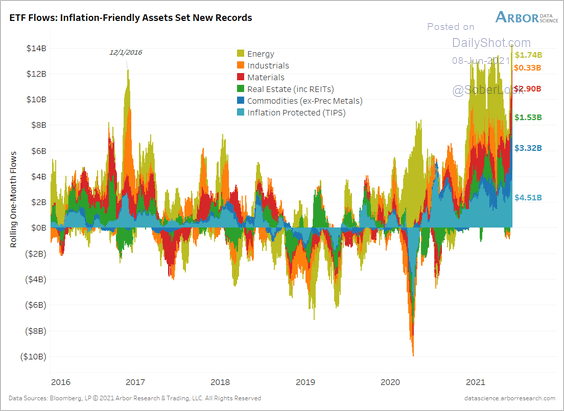

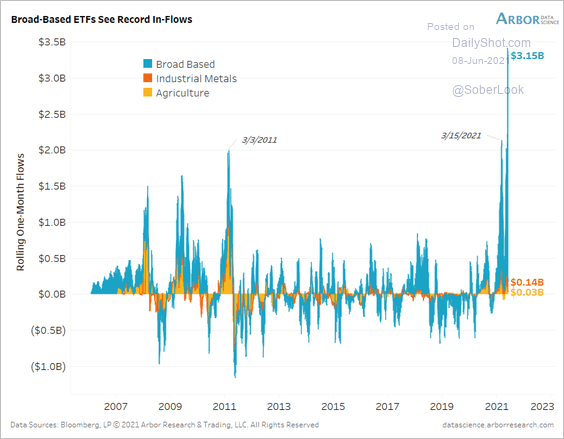

• Fund flows into inflation-friendly assets set a record high.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

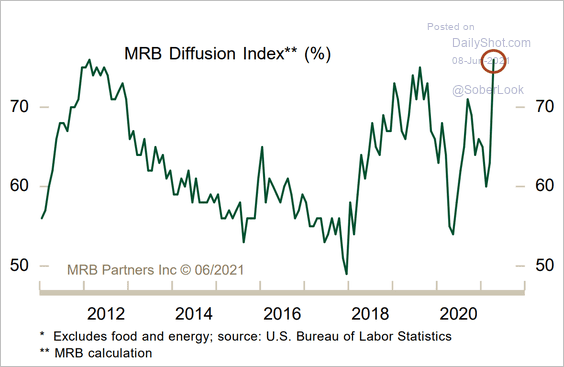

• Most CPI components saw price gains in April.

Source: MRB Partners

Source: MRB Partners

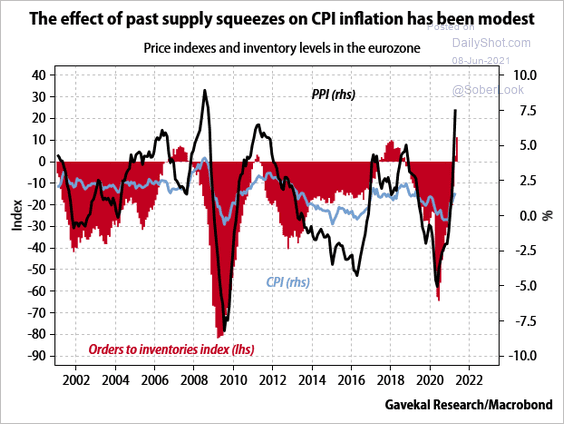

• Past supply squeezes had a limited impact on the CPI.

Source: Gavekal Research

Source: Gavekal Research

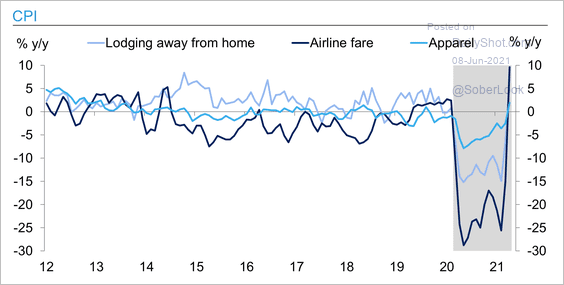

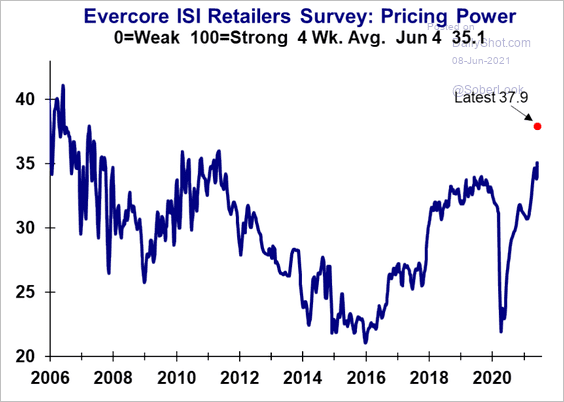

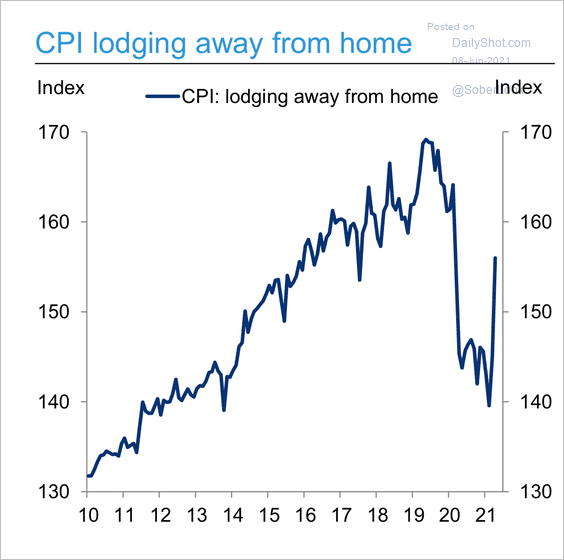

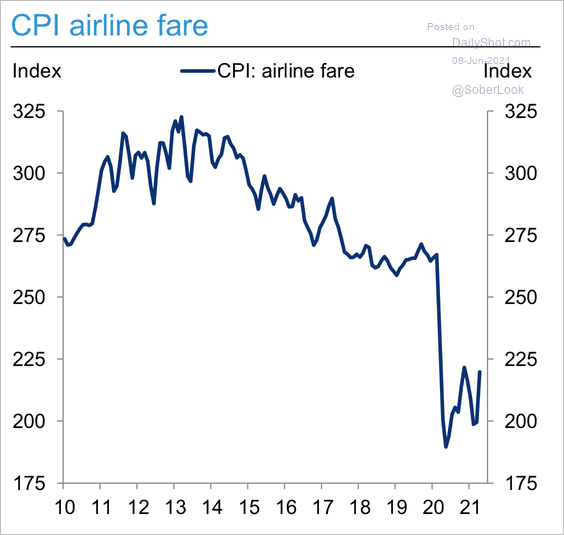

• Sectors at the epicenter of the pandemic shock are finally starting to regain some pricing power (2 charts).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Evercore ISI

Source: Evercore ISI

• Despite the spike in inflation rates in some sectors, prices are still well off pre-pandemic levels (2 charts).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

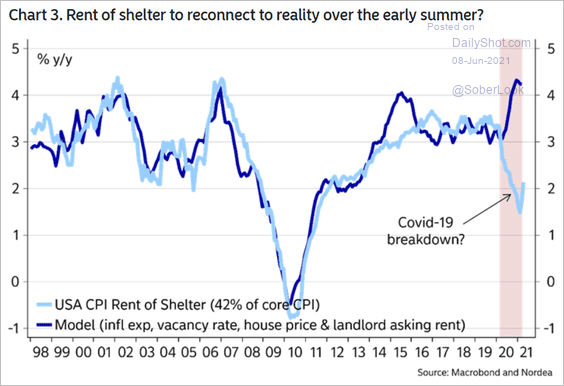

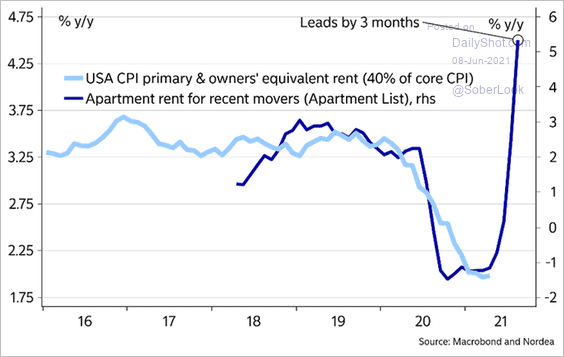

• Leading indicators point to higher rent inflation (2 charts).

Source: Nordea Markets

Source: Nordea Markets

Source: Nordea Markets

Source: Nordea Markets

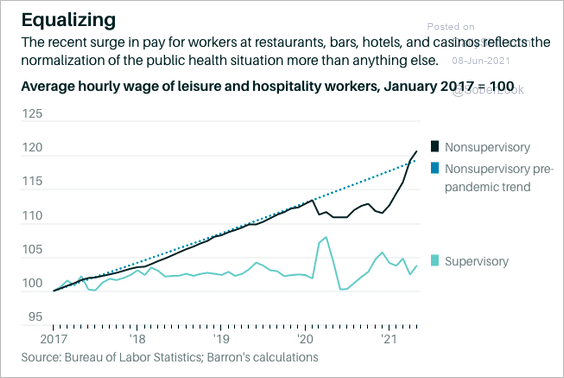

• As we saw yesterday, leisure and hospitality wages are rising quickly. But some of those gains are simply a return to the pre-COVID trend.

Source: @CardiffGarcia, @M_C_Klein Read full article

Source: @CardiffGarcia, @M_C_Klein Read full article

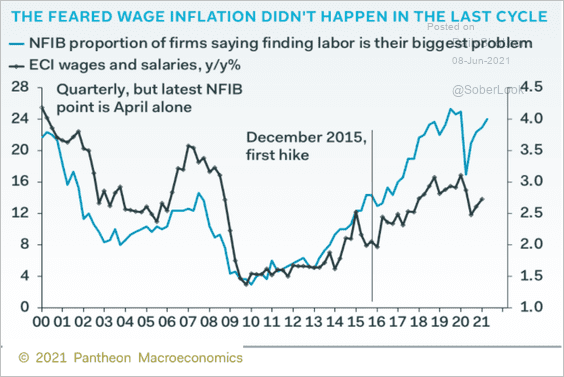

• Wage inflation didn’t accelerate during previous periods of tight labor markets. Is it different this time?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

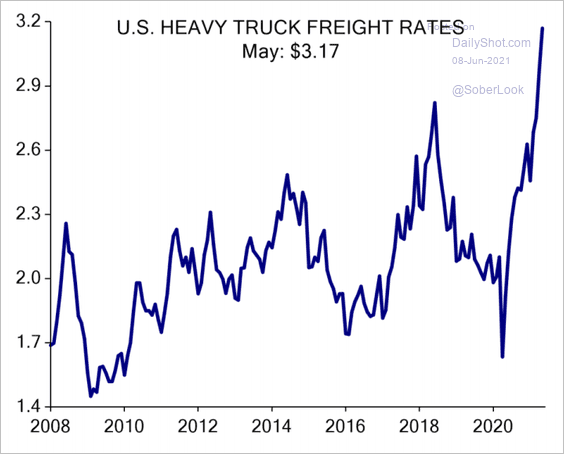

• Truck freight rates have surged.

Source: Evercore ISI

Source: Evercore ISI

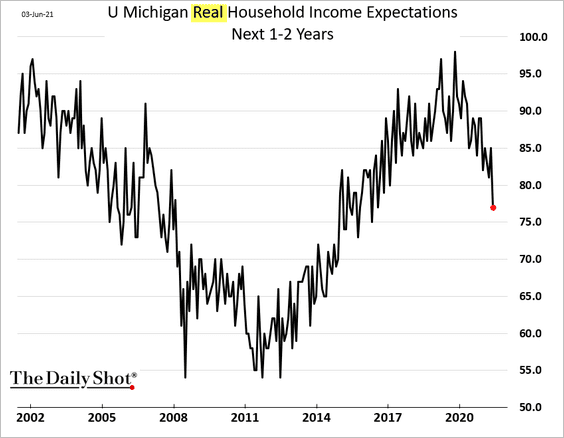

• The U. Michigan real household income expectations have rolled over as inflation expectations climb.

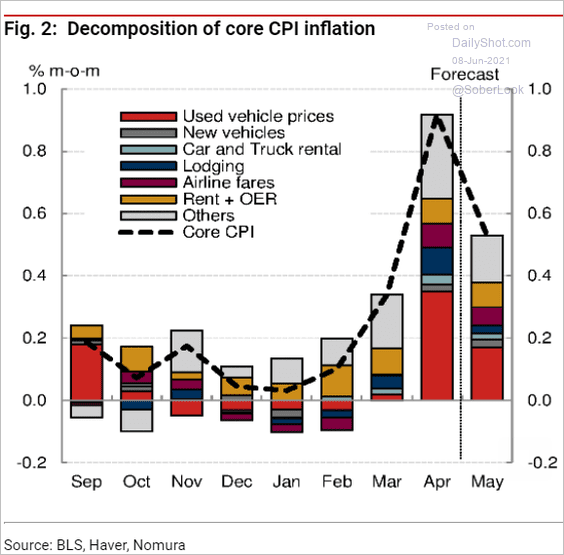

• Nomura expects the May core CPI to moderate from April but remain above trend.

Source: Nomura Securities

Source: Nomura Securities

Back to Index

The Eurozone

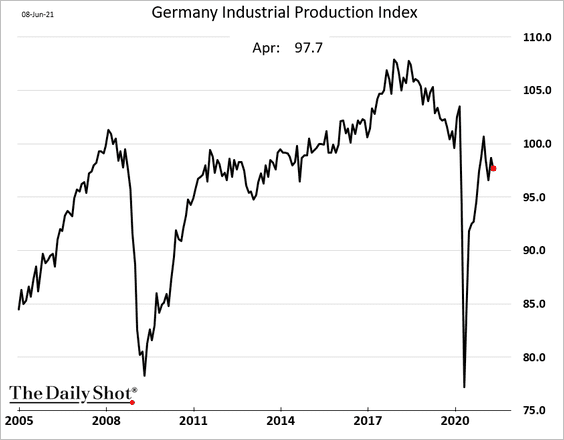

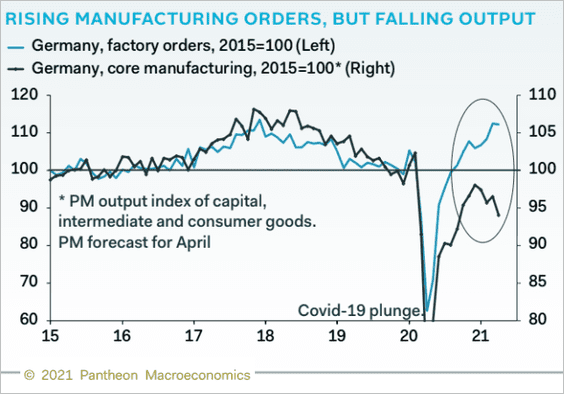

1. German factory orders were near record highs in April.

But industrial output remains depressed.

Supply shortages have become a significant drag on production.

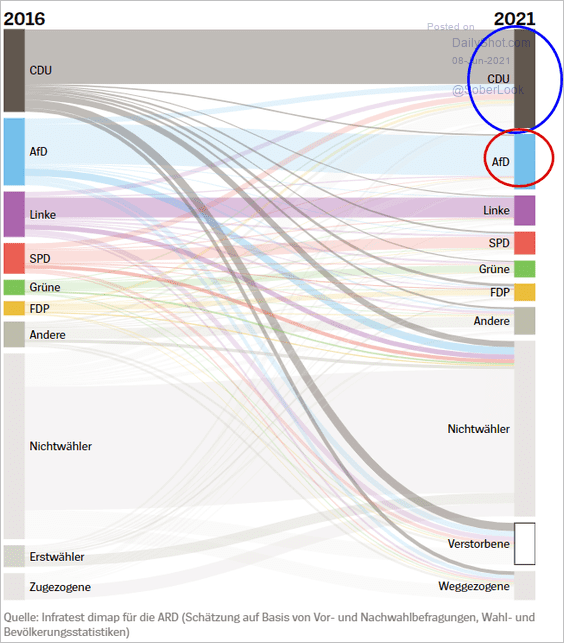

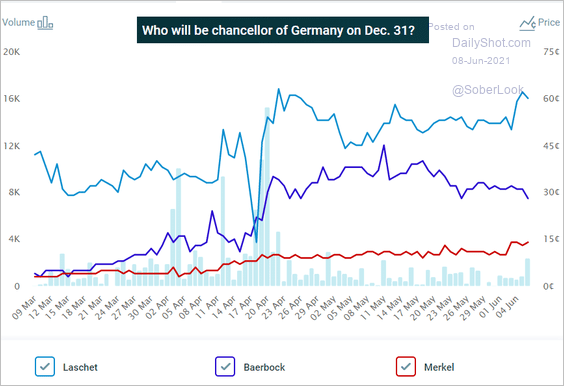

Separately, Angela Merkel’s party performed well in regional elections (East Germany) while the nationalist party (AfD) lost ground.

Source: @adam_tooze Read full article

Source: @adam_tooze Read full article

Here are the betting market odds.

Source: @PredictIt

Source: @PredictIt

——————–

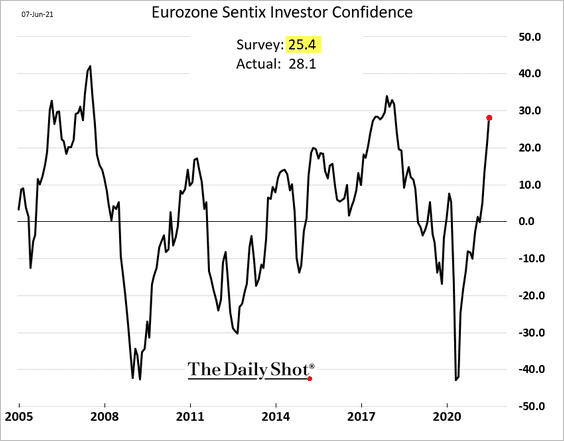

2. Investor confidence is surging.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

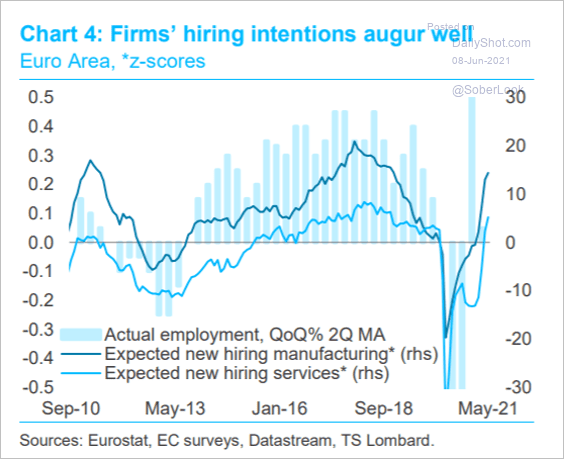

3. Corporate hiring intentions have rebounded.

Source: TS Lombard

Source: TS Lombard

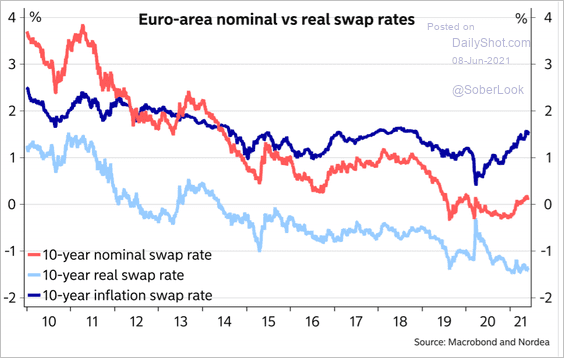

4. Real rates have been trending lower as inflation expectations climb.

Source: Nordea Markets

Source: Nordea Markets

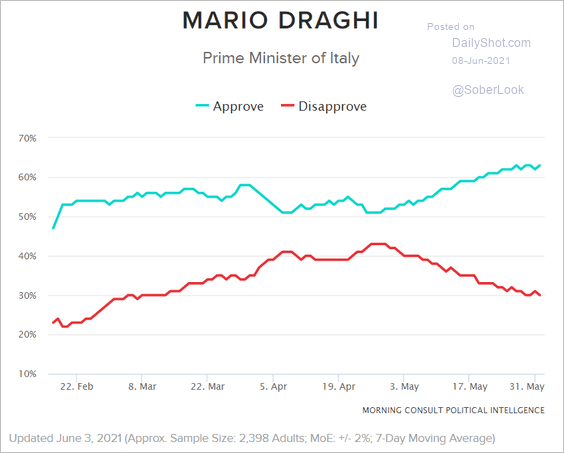

5. Mario Draghi’s approval ratings remain elevated.

Source: Morning Consult

Source: Morning Consult

Back to Index

Europe

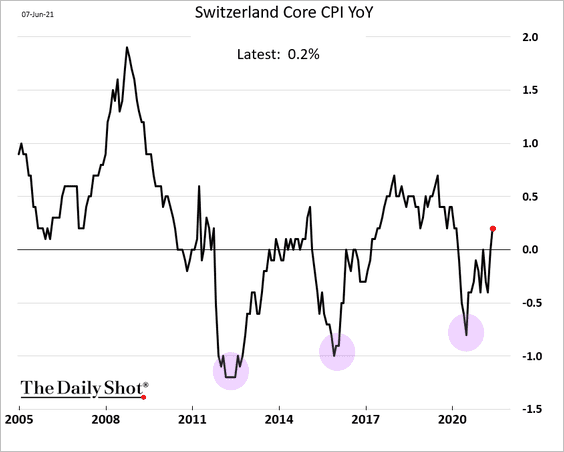

1. Switzerland is finally out of its third deflationary cycle in a decade.

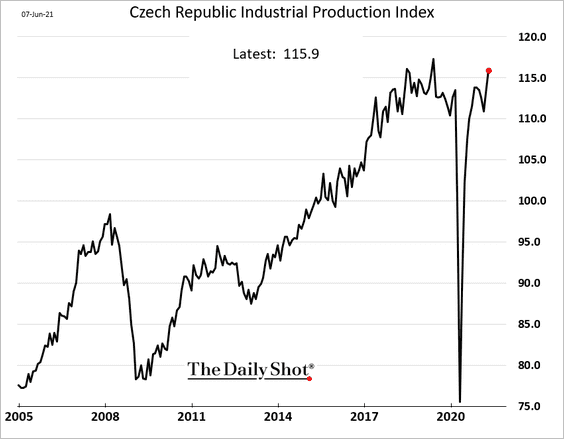

2. Czech industrial production is near record highs.

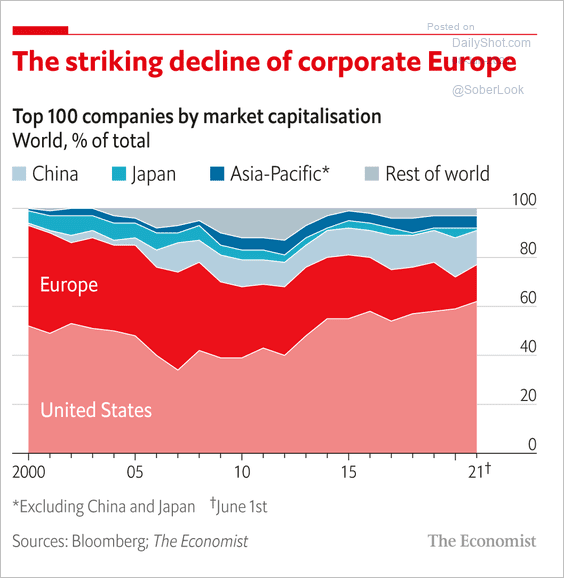

3. Europe’s share of the global equity market cap has been shrinking. Higher concentrations in financials and lower exposure to tech are part of the reason.

Source: @ECONdailycharts Read full article

Source: @ECONdailycharts Read full article

Back to Index

Japan

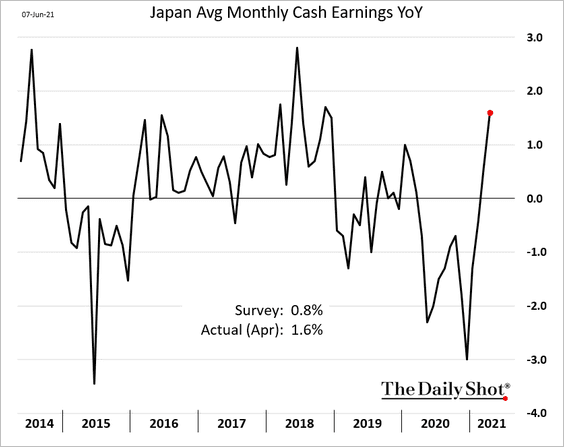

1. Wages rose more than expected in April.

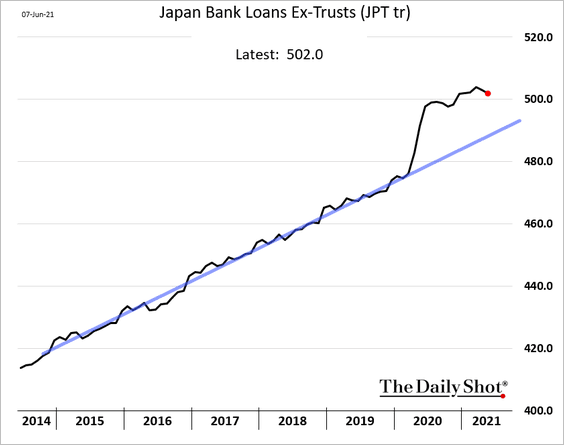

2. Bank loans remain well above trend but appear to have peaked for now.

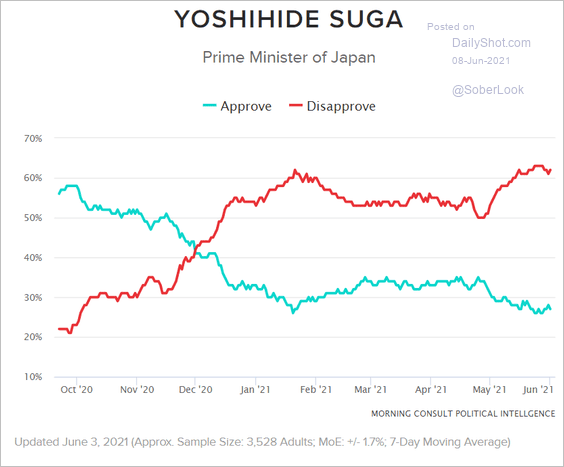

3. Suga’s approval ratings remain low.

Source: Morning Consult

Source: Morning Consult

Back to Index

China

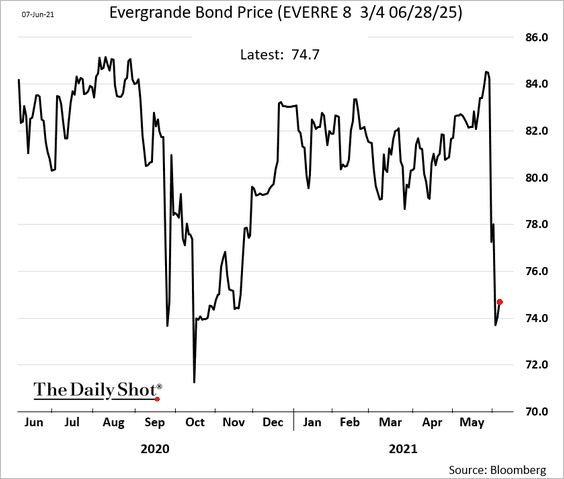

1. Evergrande, China’s most indebted property developer, is trying to calm nervous investors.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

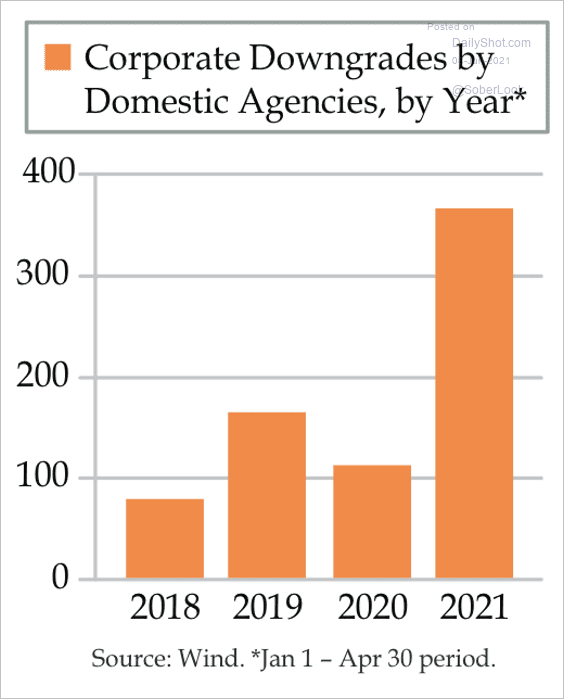

2. Corporate downgrades by domestic agencies spiked this year.

Source: Quill Intelligence

Source: Quill Intelligence

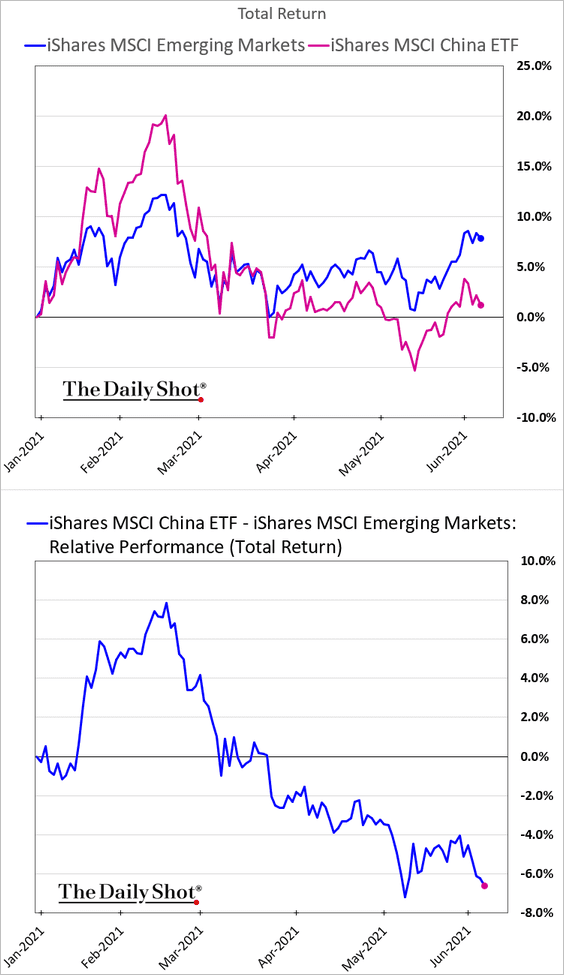

3. The stock market continues to lag EM peers.

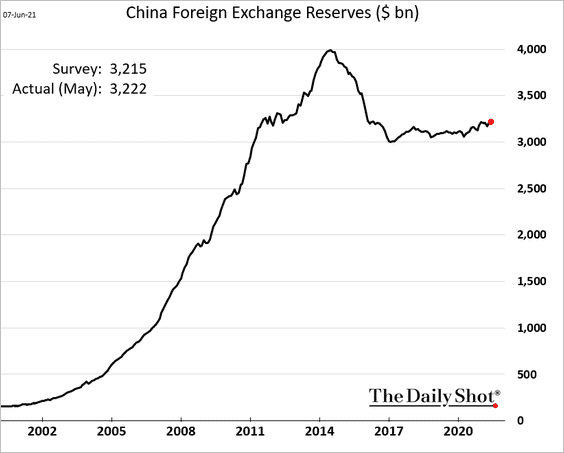

4. China’s F/X reserves are grinding higher.

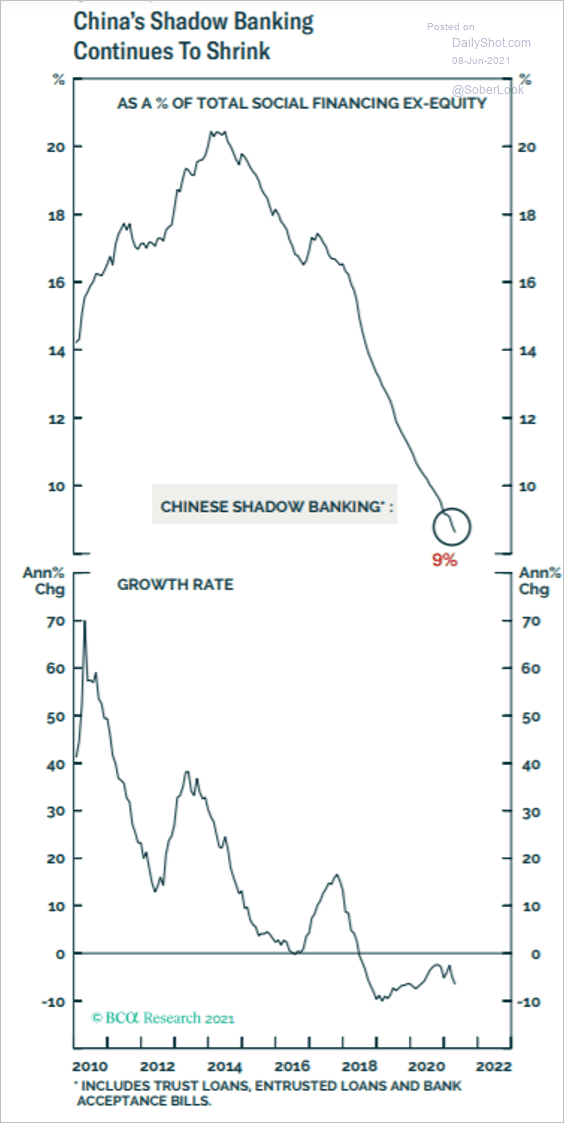

5. Shadow banking balances continue to shrink.

Source: BCA Research

Source: BCA Research

Back to Index

Emerging Markets

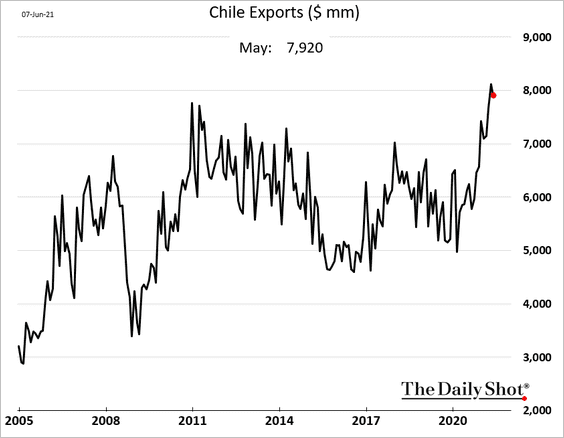

1. Chile’s exports remained near record levels last month, …

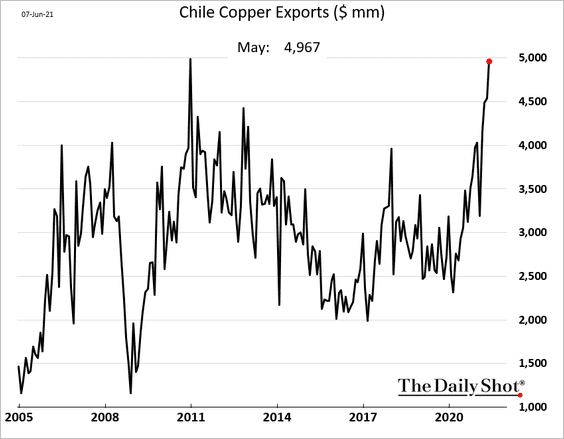

… as copper sales surge.

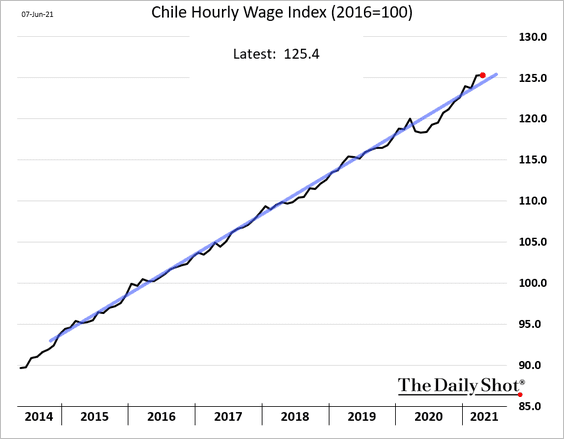

Separately, Chile’s wage growth is now above the pre-COVID trend.

——————–

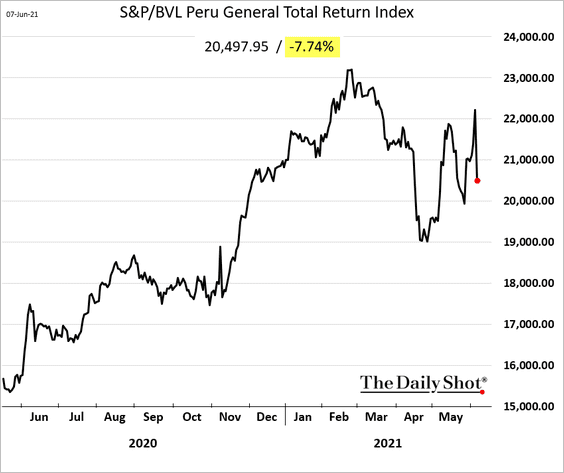

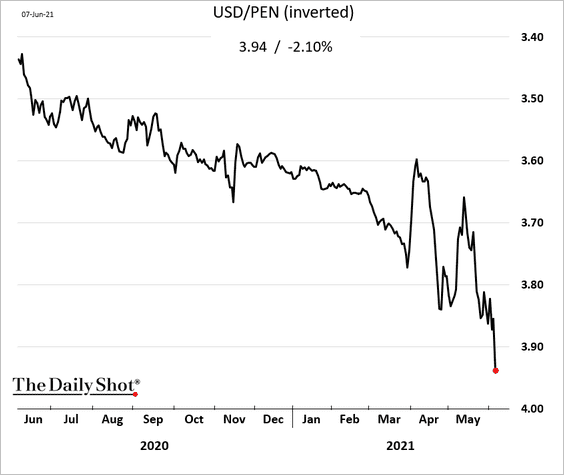

2. Peruvian assets tumbled as Pedro Castillo (the leftist candidate) pulls ahead.

Source: BBC Read full article

Source: BBC Read full article

• Stock market:

• The Peruvian sol:

——————–

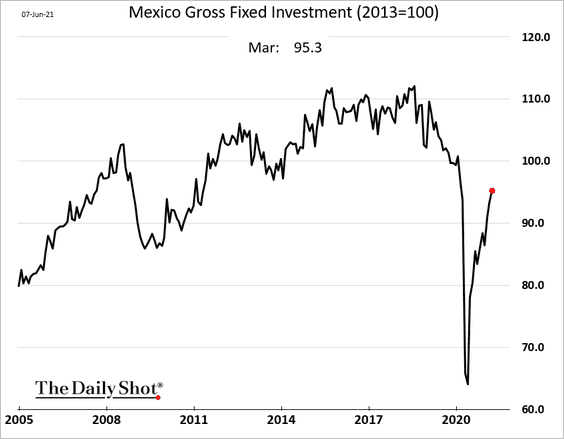

3. Mexico’s fixed investment is rebounding.

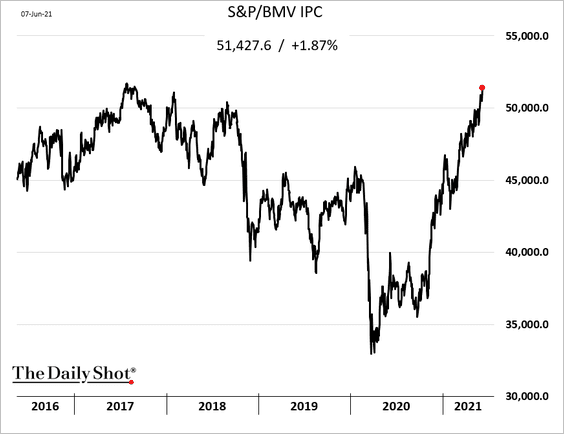

The stock market is at multi-year highs.

——————–

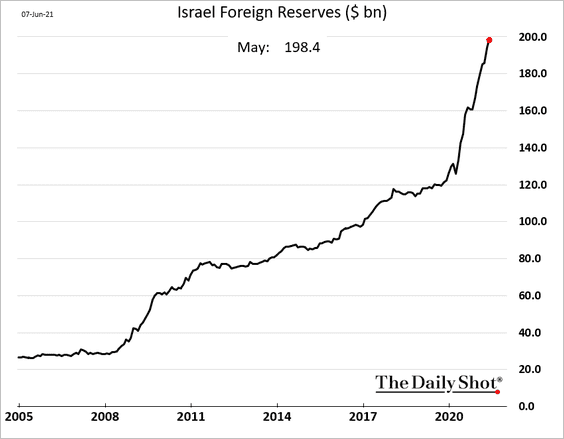

4. Israel’s F/X reserves are approaching $200 bn.

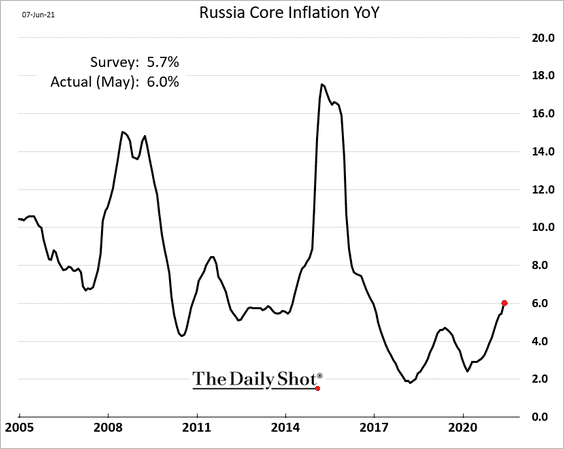

5. Russia’s inflation surprised to the upside.

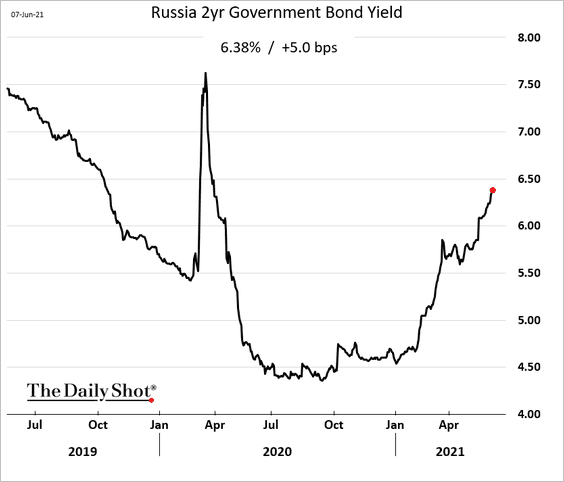

And short-term bond yields keep grinding higher.

——————–

6. The Philippine unemployment rate remains elevated.

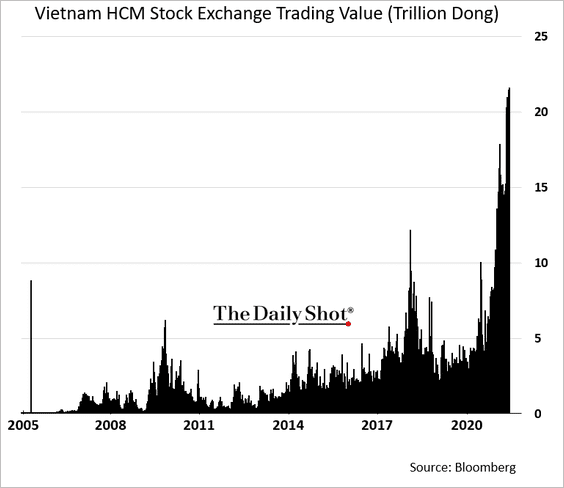

7. Vietnam’s stock trading volume has been hitting record highs.

h/t Nguyen Kieu Giang Read full article

h/t Nguyen Kieu Giang Read full article

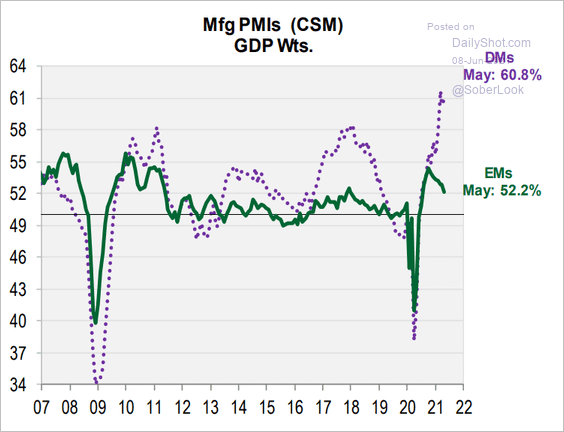

8. EM manufacturing PMIs (business activity) are lagging advanced economies.

Source: Cornerstone Macro

Source: Cornerstone Macro

Back to Index

Cryptocurrency

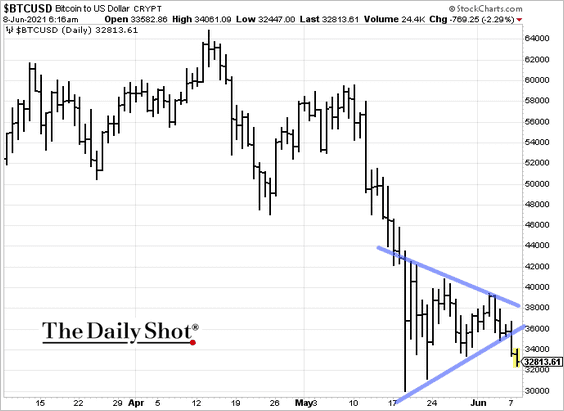

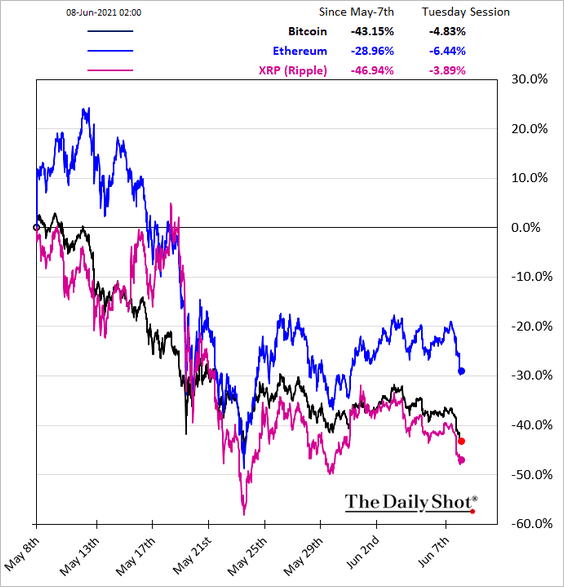

1. Cryptos are under pressure this morning.

——————–

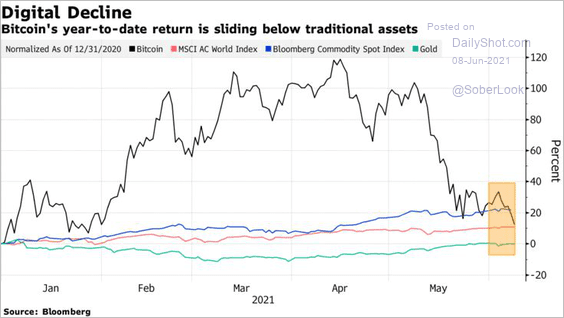

2. Year-to-date, bitcoin is underperforming some traditional assets.

Source: @markets Read full article

Source: @markets Read full article

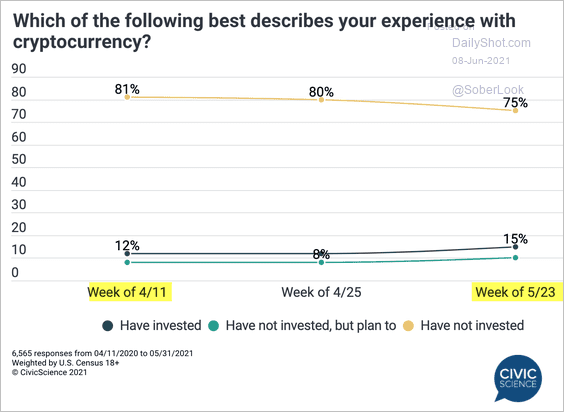

3. Surveys show a substantial jump in retail investors’ interest in cryptos over the past month.

Source: @CivicScience Read full article

Source: @CivicScience Read full article

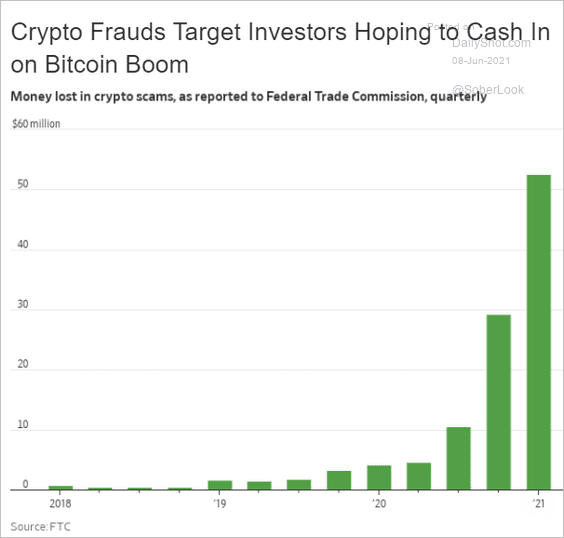

4. Crypto scams have spiked this year.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Commodities

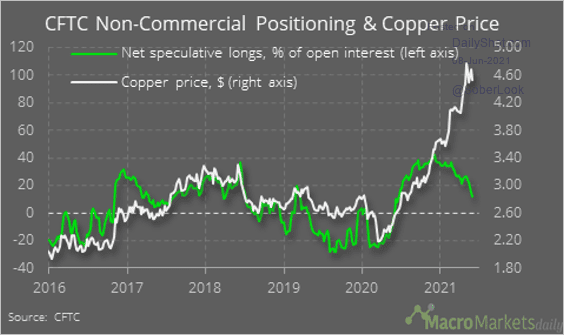

1. Speculative bets on copper have been rolling over.

Source: @macro_daily

Source: @macro_daily

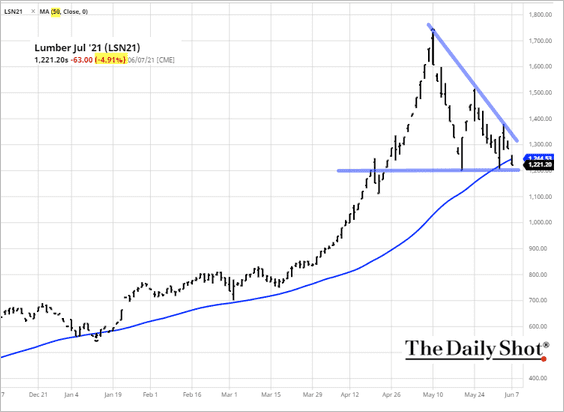

2. US lumber is at support.

Source: barchart.com

Source: barchart.com

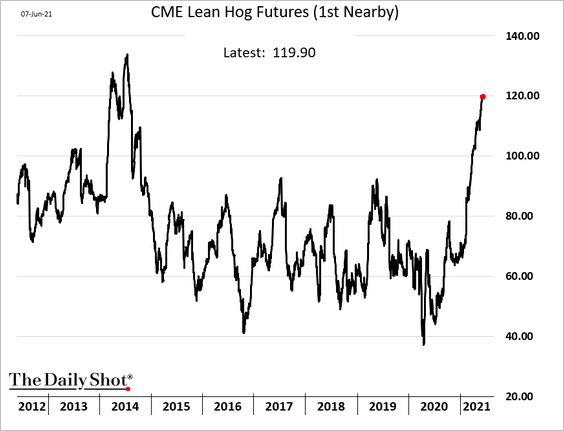

3. Chicago lean hog futures keep moving higher.

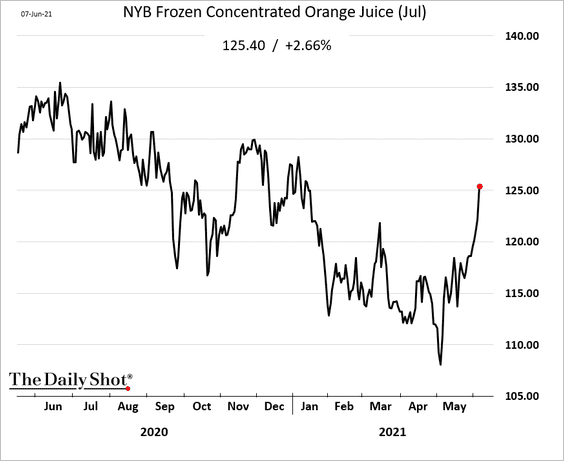

4. Orange juice futures spiked in recent days as we enter the hurricane season.

5. Flows into broad commodity funds are surging.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Back to Index

Energy

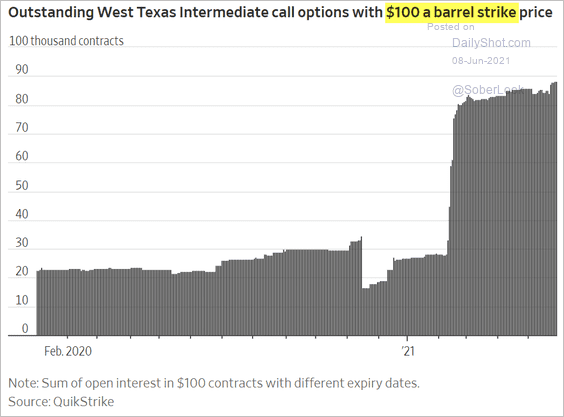

1. Some options traders are betting on $100/bbl oil.

Source: @WSJ Read full article

Source: @WSJ Read full article

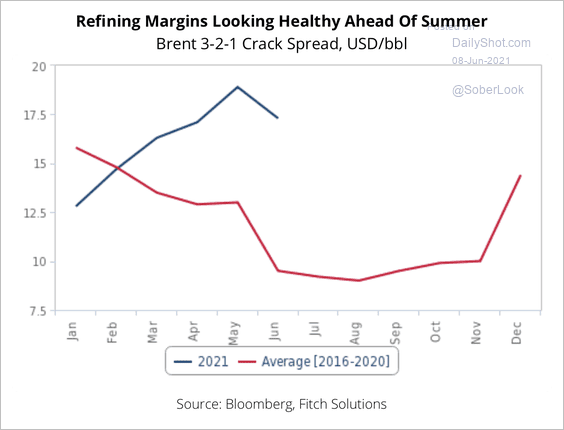

2. Global refining margins are well above seasonal norms despite a slight dip in May.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

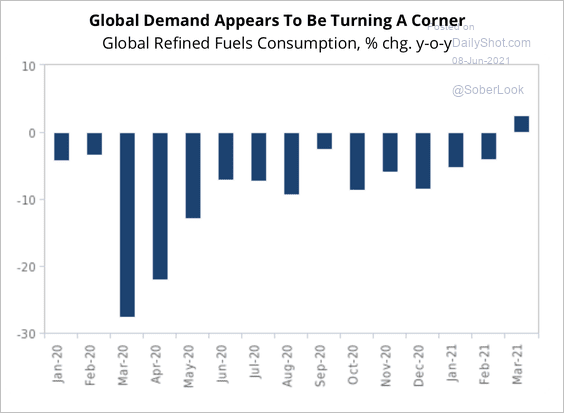

Refined fuels consumption has turned positive year-over-year.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

——————–

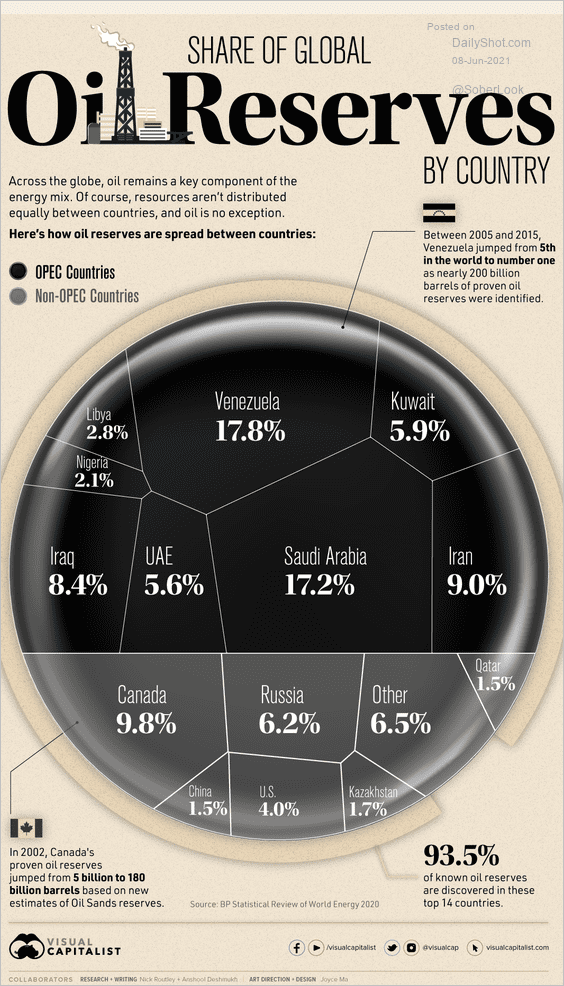

3. Here is an overview of global oil reserves.

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

Back to Index

Equities

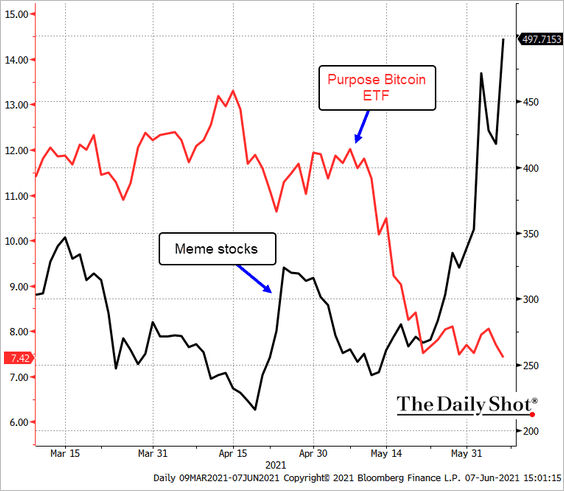

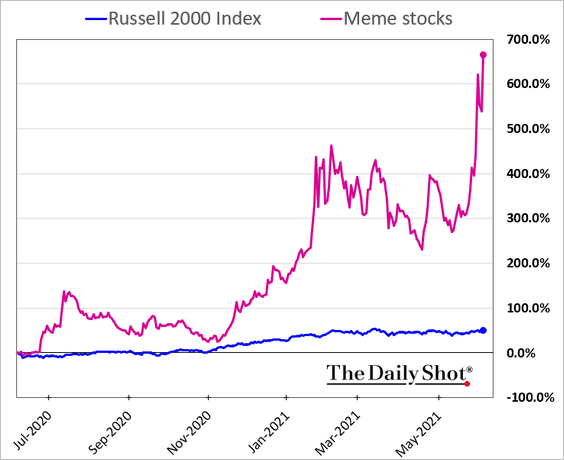

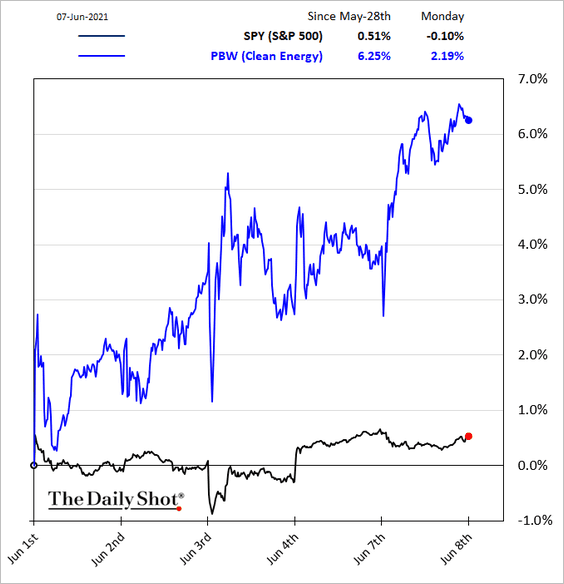

1. The recent crypto weakness is pushing the Reddit crowd back into meme stocks.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Some old favorites, such as clean energy and cannabis stocks, got revisited.

——————–

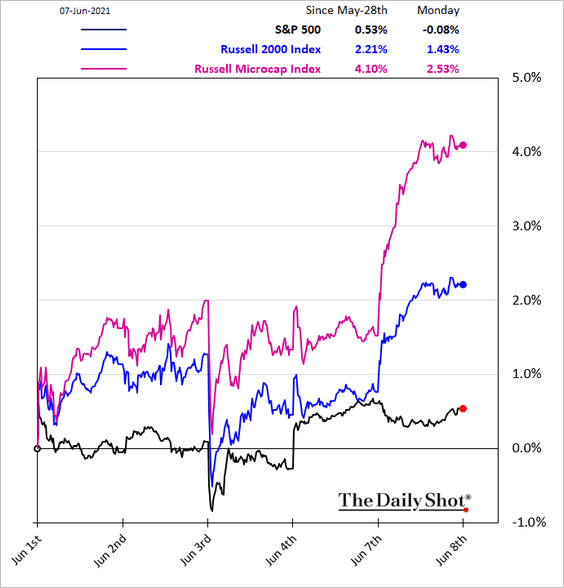

2. In part due to the trend above, small caps and especially microcaps jumped on Monday.

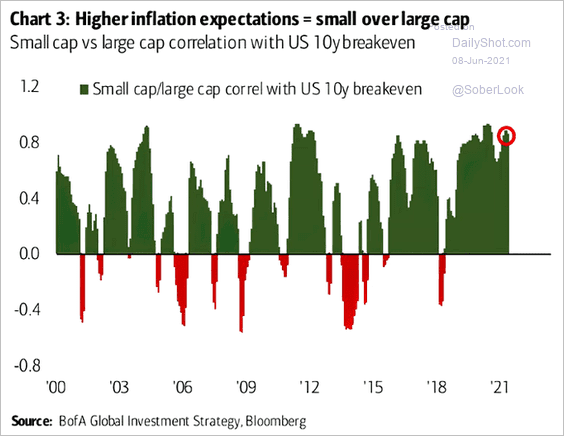

By the way, small-cap relative performance is correlated with inflation expectations.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

——————–

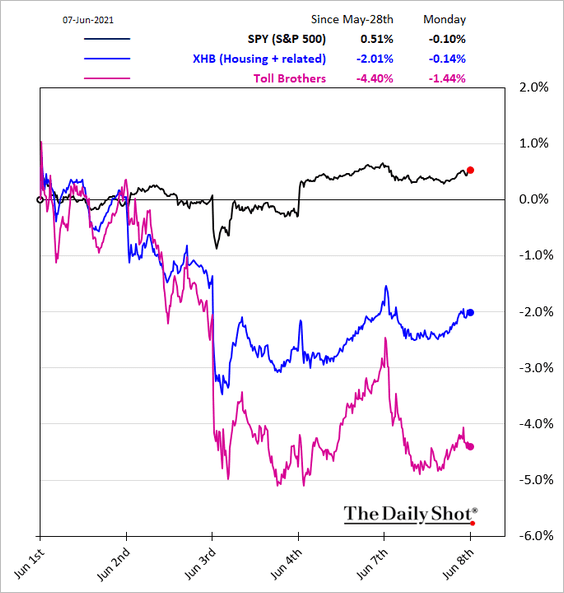

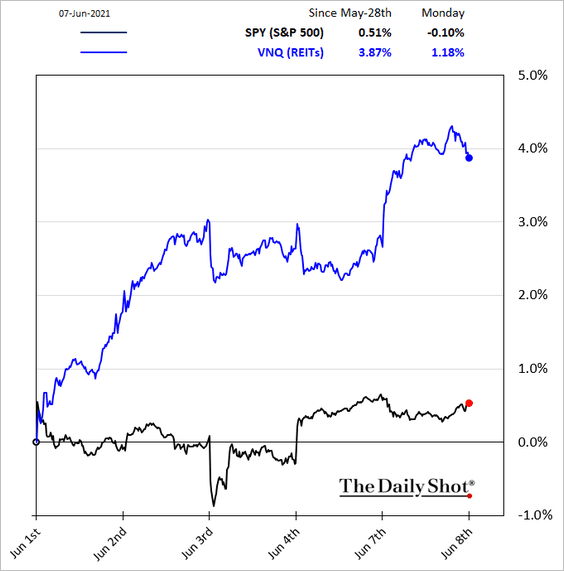

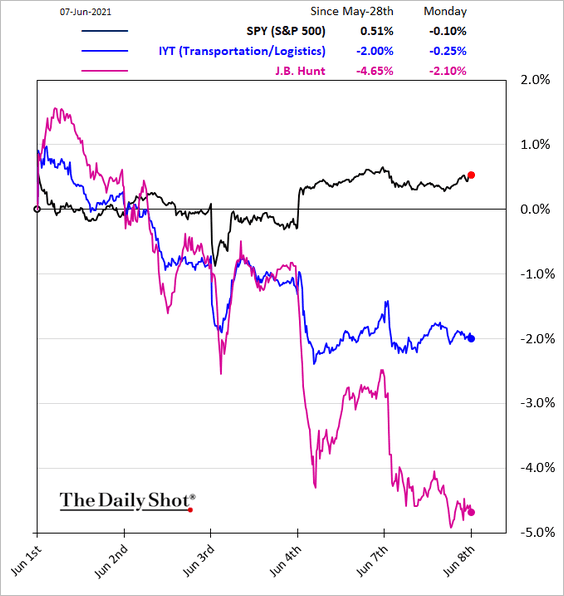

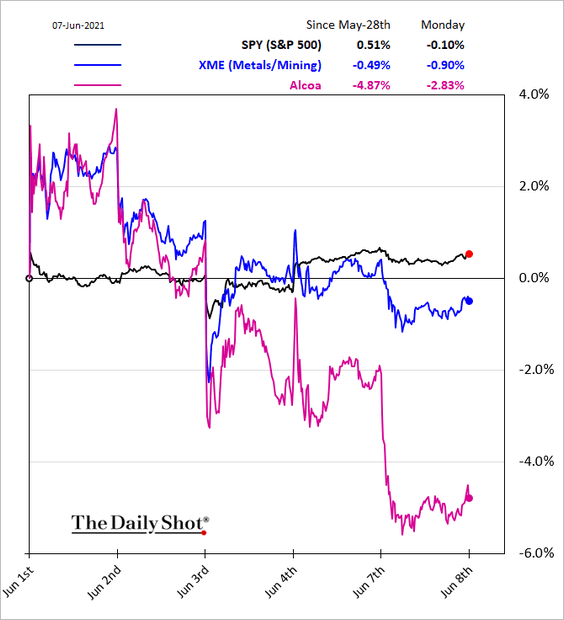

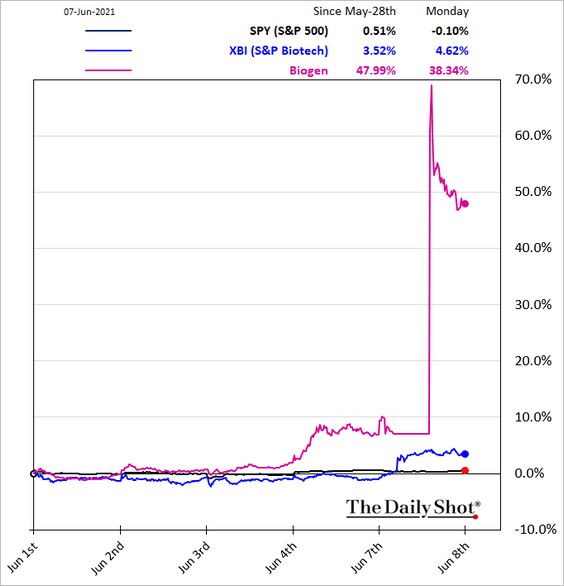

3. Here are some sector updates.

• Housing:

• REITs:

• Transportation:

• Metals & Mining:

• Biotech:

——————–

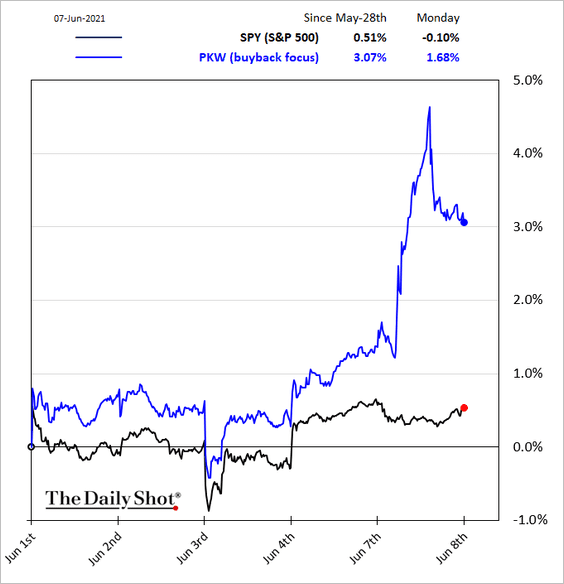

4. Companies known for share buybacks rallied.

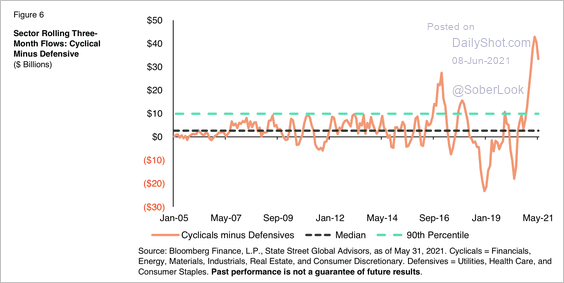

5. Cyclical versus defensive ETF flows are starting to decline from an all-time high.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

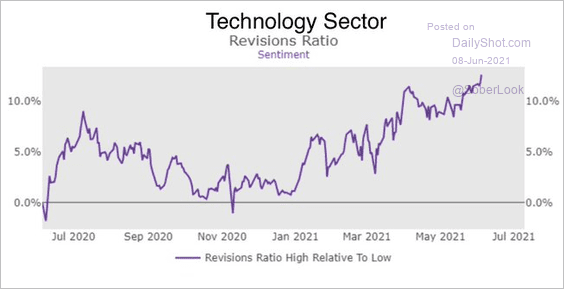

6. Net revisions to tech earnings continue to climb.

Source: @MichaelKantro

Source: @MichaelKantro

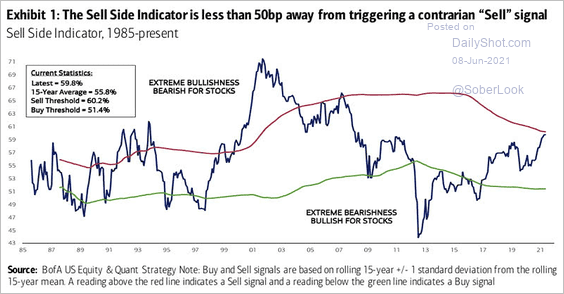

7. BofA’s Sell Side Indicator is approaching “sell signal” levels, …

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

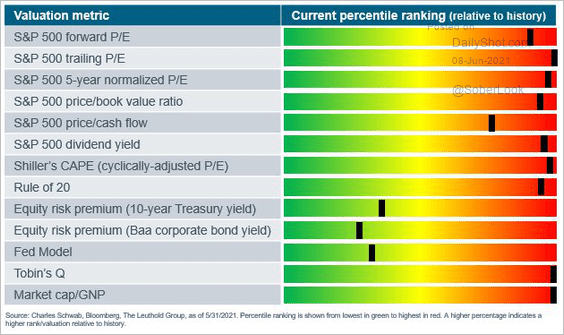

… as valuation metrics remain stretched.

Source: @LizAnnSonders

Source: @LizAnnSonders

——————–

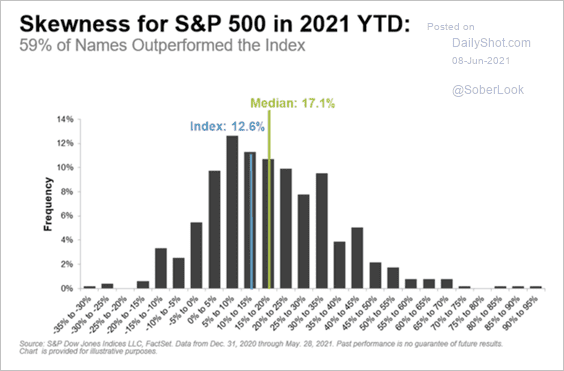

8. 59% of stocks have outperformed the S&P 500 year-to-date.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

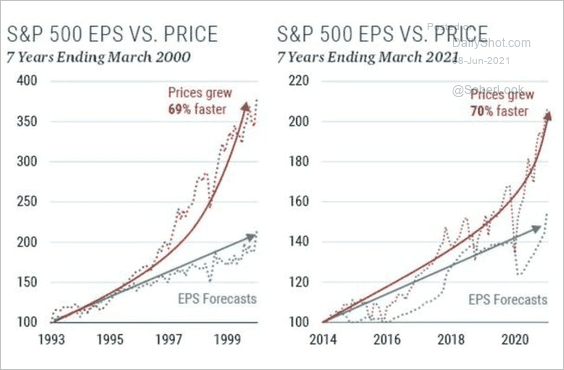

9. The recent divergence between prices and earnings expectations resembles the 1990s.

Source: @jessefelder, GMO Read full article

Source: @jessefelder, GMO Read full article

Back to Index

Alternatives

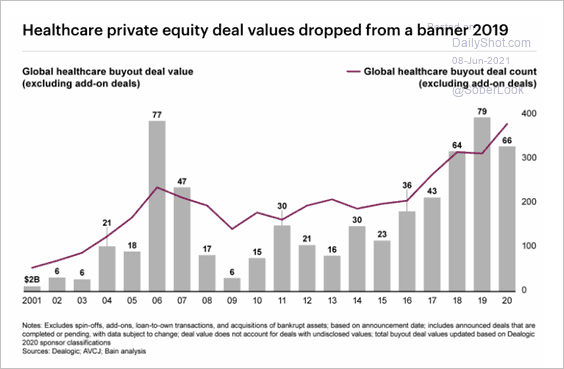

1. Healthcare private equity deals moderated last year following a record-breaking 2019.

Source: Bain & Company

Source: Bain & Company

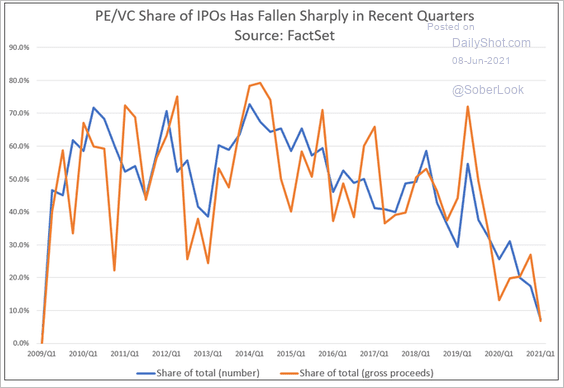

2. As SPACs have dominated the IPO market in recent quarters, the role of PE/VC financing has diminished substantially (here is a video “explaining” the trend).

Source: @FactSet Read full article

Source: @FactSet Read full article

Back to Index

Credit

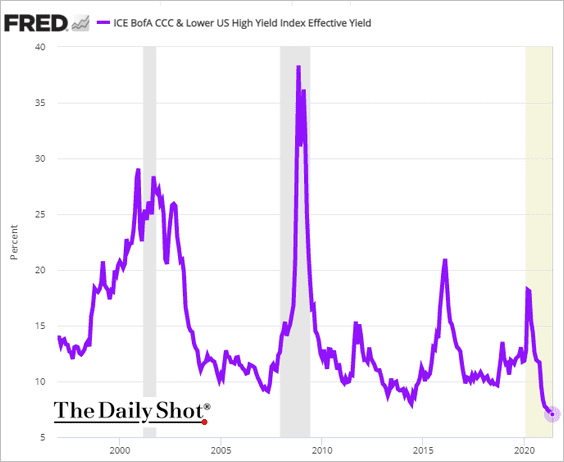

1. US CCC-rated (and lower) bond yields hit a record low.

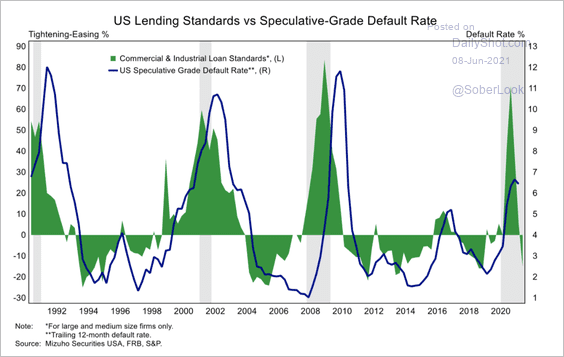

2. This chart shows US speculative-grade default rate vs. lending standards.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

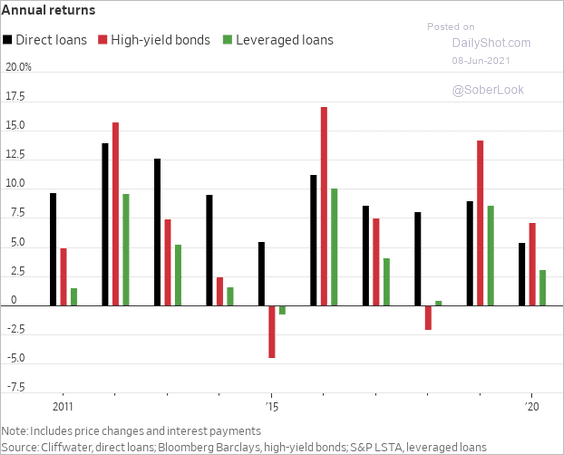

3. Investor demand for direct lending assets remains robust amid relatively strong performance.

Source: @WSJ Read full article

Source: @WSJ Read full article

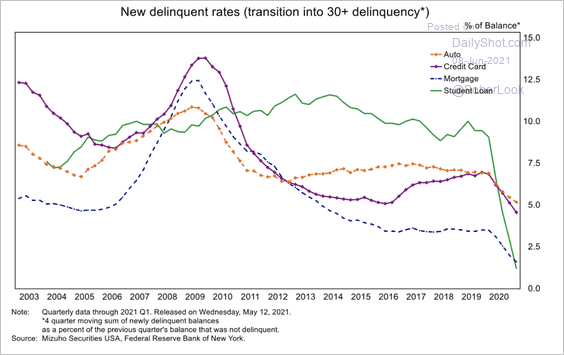

4. Consumer credit delinquencies are approaching 20-year lows across loan types.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

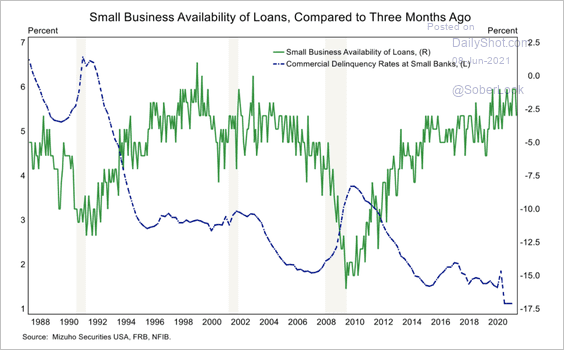

5. Small businesses have greater access to bank funding as delinquency rates experienced by small banks decline.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

Back to Index

Rates

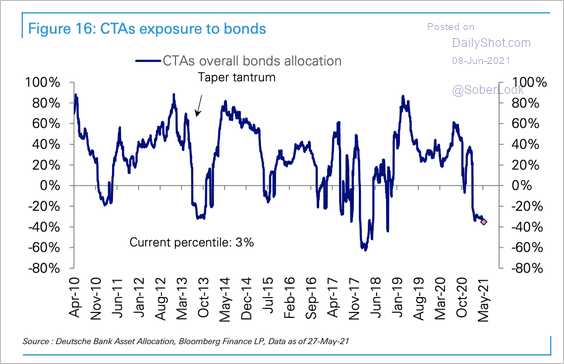

1. CTAs are net-short bonds – similar to the 2013 taper tantrum.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

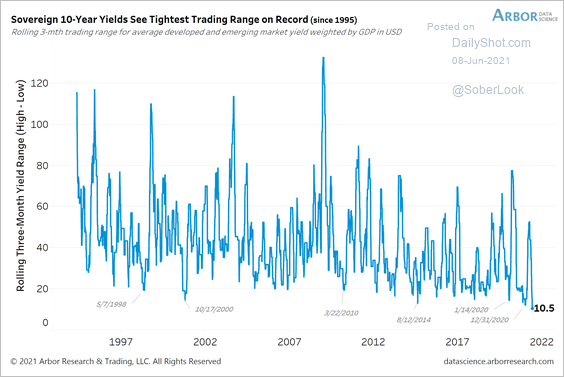

2. Global sovereign yields have been trading in a tight range.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

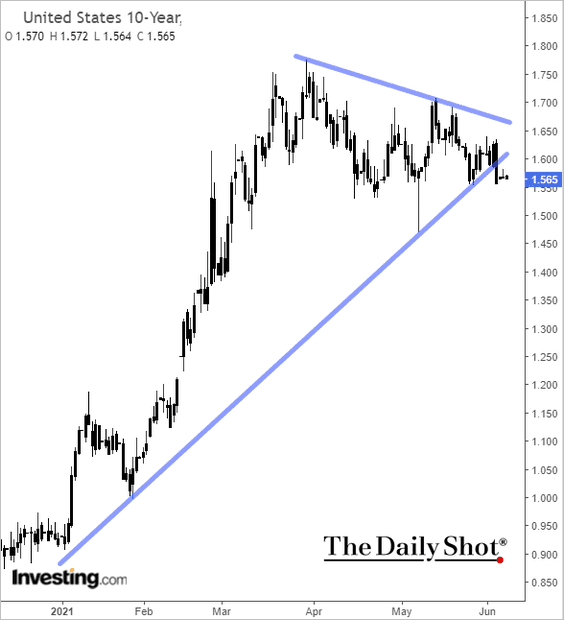

Here is the 10yr Treasury yield.

——————–

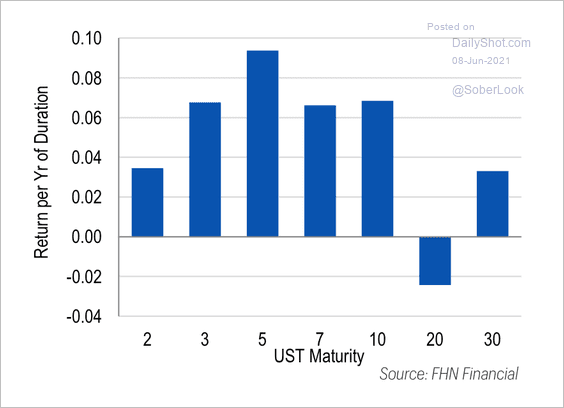

3. Treasury risk-adjusted returns were the highest in the 5-year maturity last month.

Source: FHN Financial

Source: FHN Financial

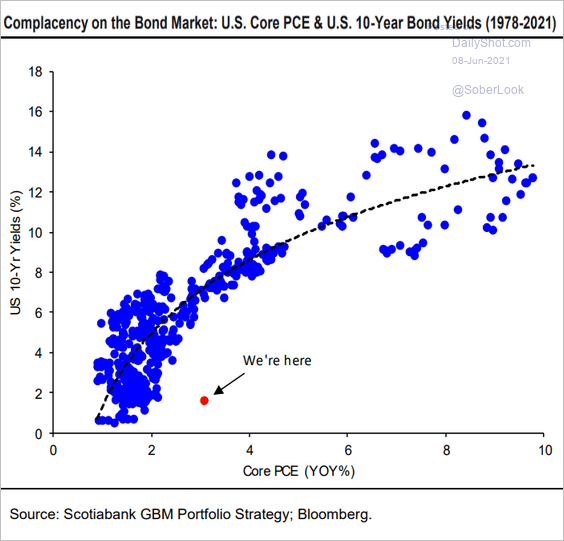

4. Longer-dated Treasury yields are much too low, given the current inflation rate (the market isn’t concerned about elevated inflation persisting).

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

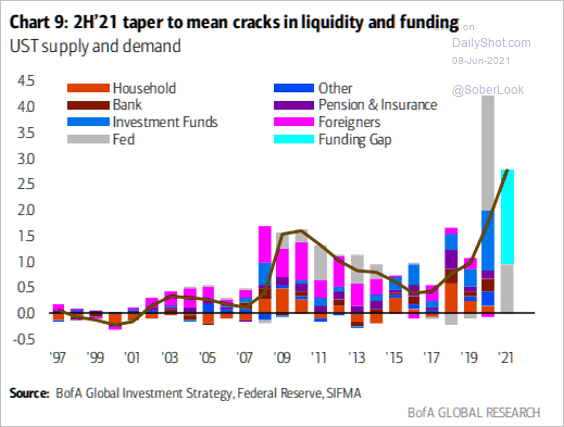

5. The Fed’s taper will create a substantial funding gap for the US Treasury.

Source: BofA Global Research, @themarketear

Source: BofA Global Research, @themarketear

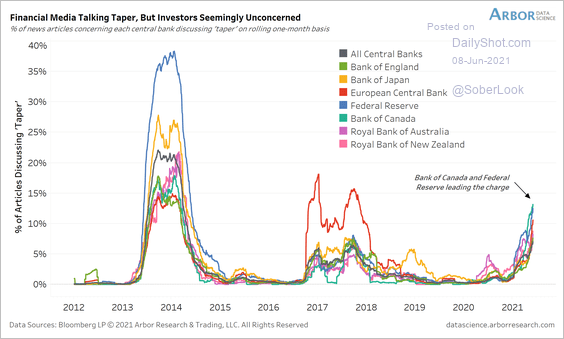

6. The media is increasingly talking about global central banks’ QE taper.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Back to Index

Global Developments

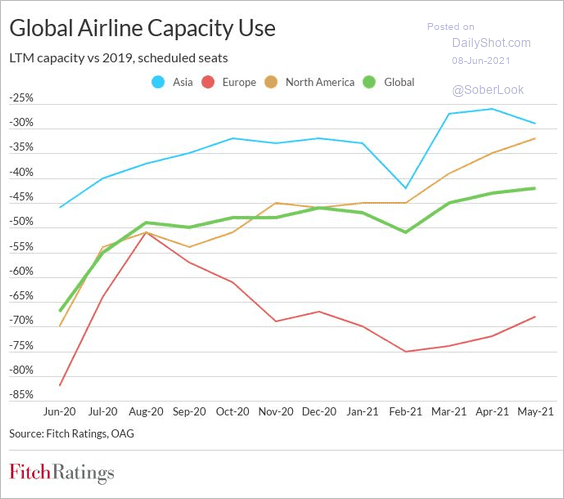

1. Europe lags other regions in airline capacity use.

Source: @FitchRatings Read full article

Source: @FitchRatings Read full article

2. Economists are increasingly paying attention to the global inflation uptick.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Food for Thought

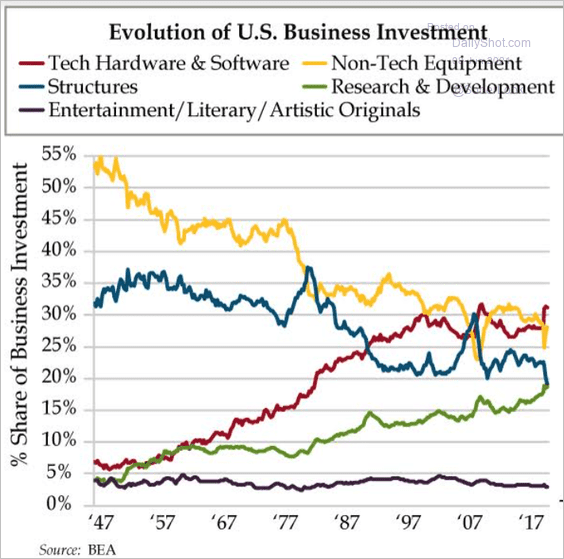

1. Business investment over time:

Source: The Daily Feather

Source: The Daily Feather

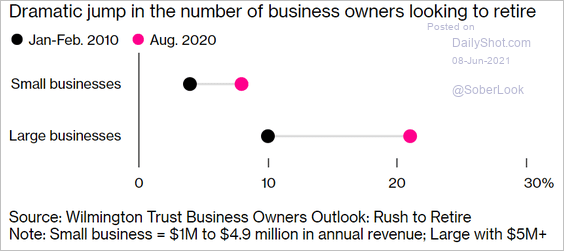

2. Business owners looking to retire:

Source: @wealth Read full article

Source: @wealth Read full article

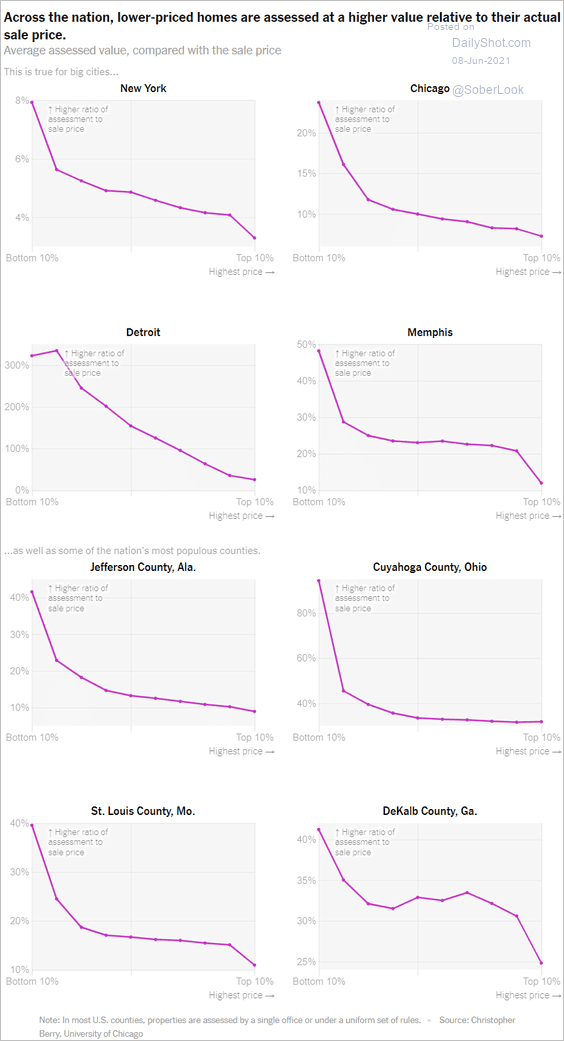

3. Lower-priced homes are assessed at a higher value relative to the actual sales price.

Source: The New York Times Read full article

Source: The New York Times Read full article

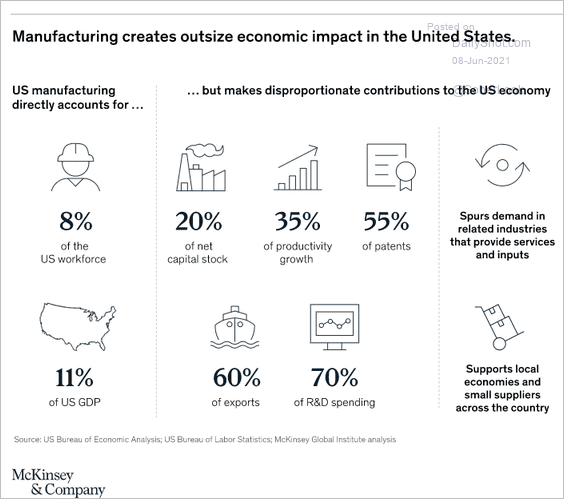

4. The manufacturing sector’s outsize impact:

Source: McKinsey Read full article

Source: McKinsey Read full article

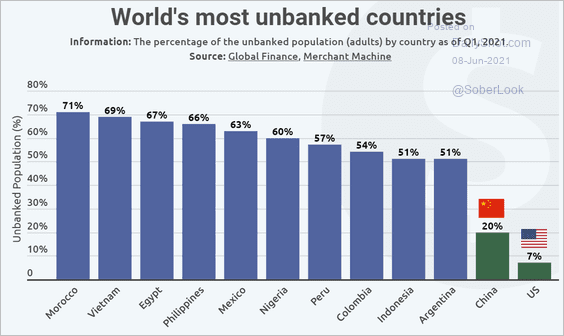

5. Most unbanked countries:

Source: Finbold

Source: Finbold

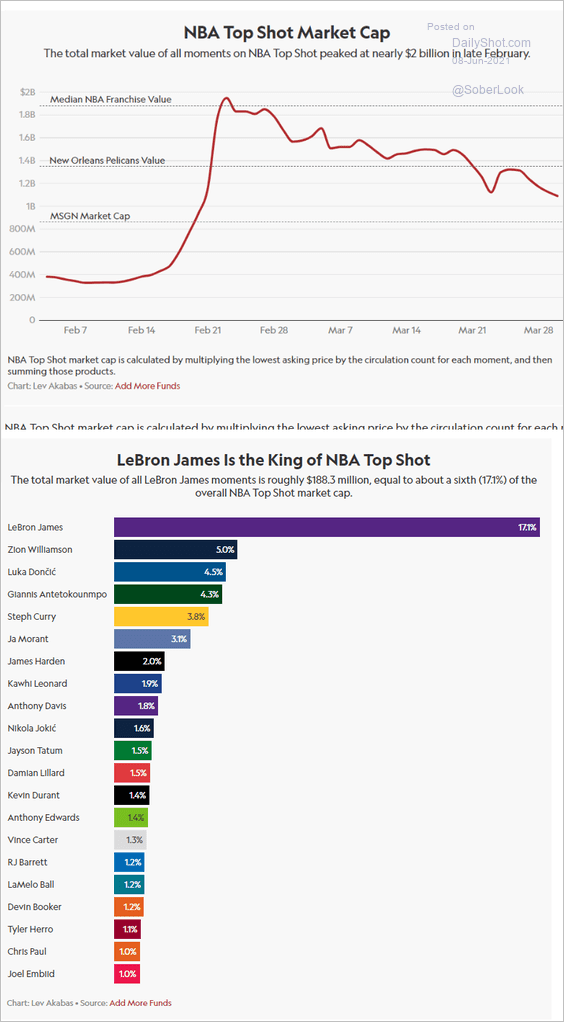

6. The NBA Top Shot market value:

Source: Sportico Read full article

Source: Sportico Read full article

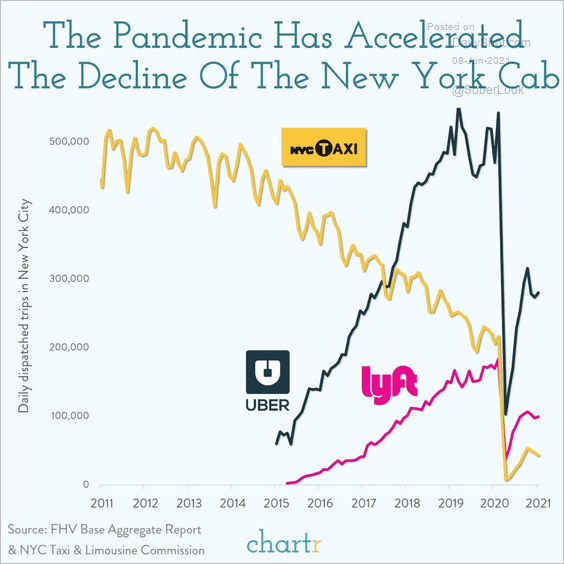

7. The decline of New York City’s yellow cab:

Source: @chartrdaily

Source: @chartrdaily

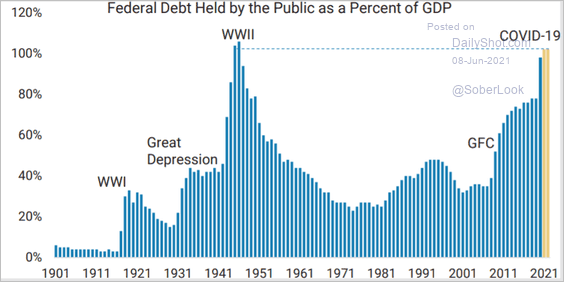

8. Projected US federal debt-to-GDP ratio:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

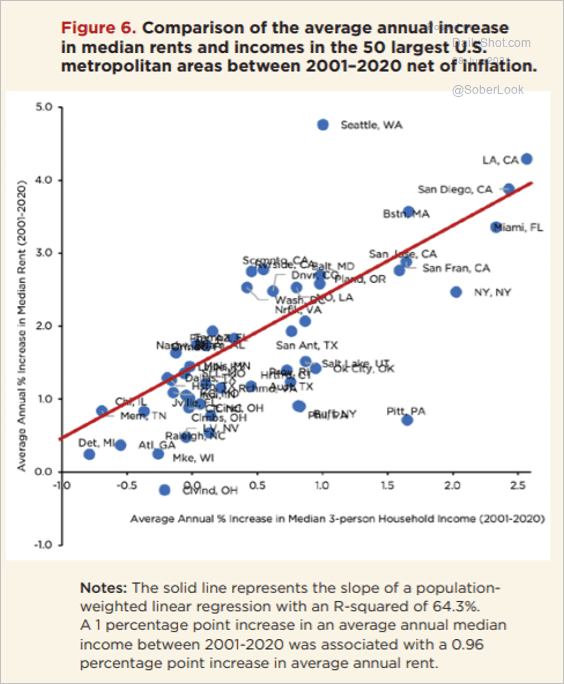

9. US incomes vs. rent:

Source: Mortgage Bankers Association

Source: Mortgage Bankers Association

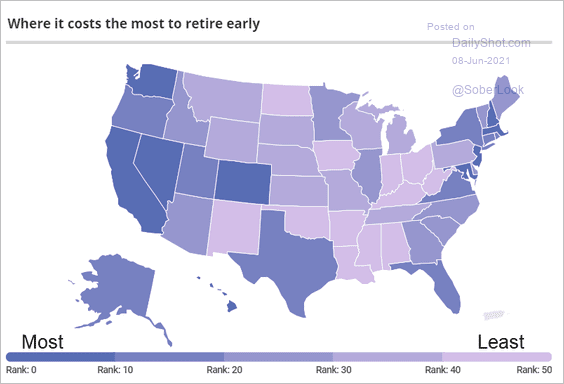

10. Retirement costs:

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

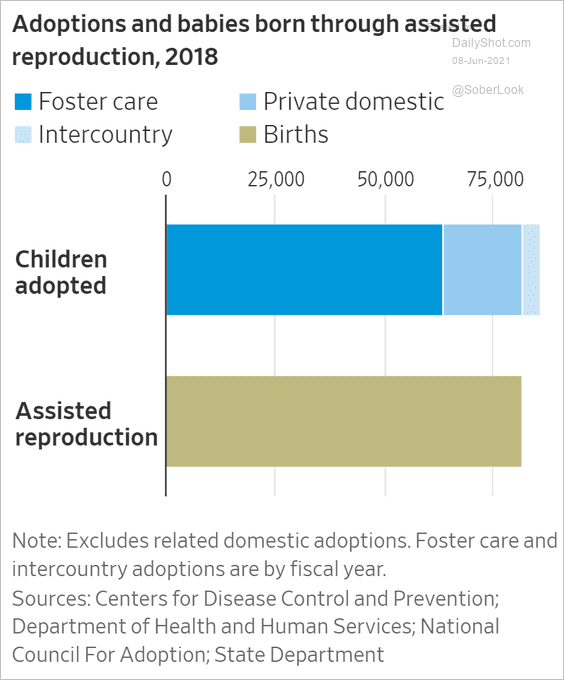

11. Adoptions and assisted reproduction:

Source: @WSJ Read full article

Source: @WSJ Read full article

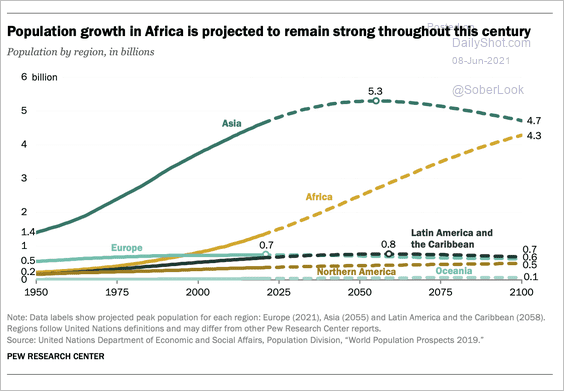

12. Global population projections:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

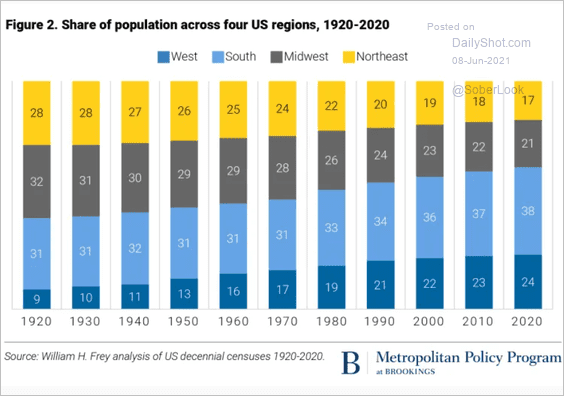

13. Share of the population across US regions:

Source: Brookings

Source: Brookings

14. Growth in student debt by age:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

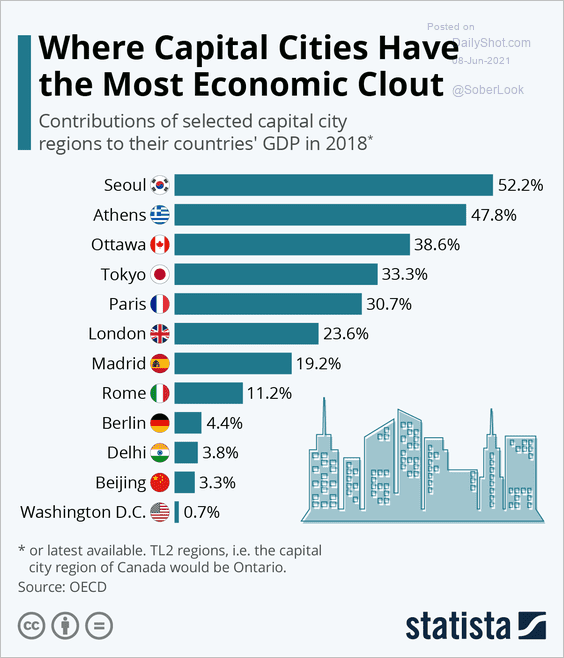

15. Capital cities’ share of countries’ GDP:

Source: Statista

Source: Statista

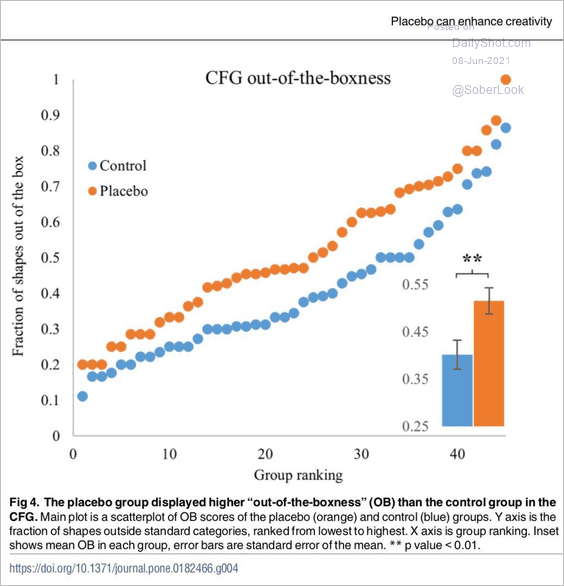

16. Participants in this experiment were asked to smell a substance (cinnamon), and half were randomly told the substance was designed to enhance creativity.

Source: @emollick; Rozenkrantz, Mayo, Ilan, Hart, Noy Read full article

Source: @emollick; Rozenkrantz, Mayo, Ilan, Hart, Noy Read full article

——————–

Back to Index