The Daily Shot: 09-Jun-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Aisa – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Rates

• Food for Thought

The United States

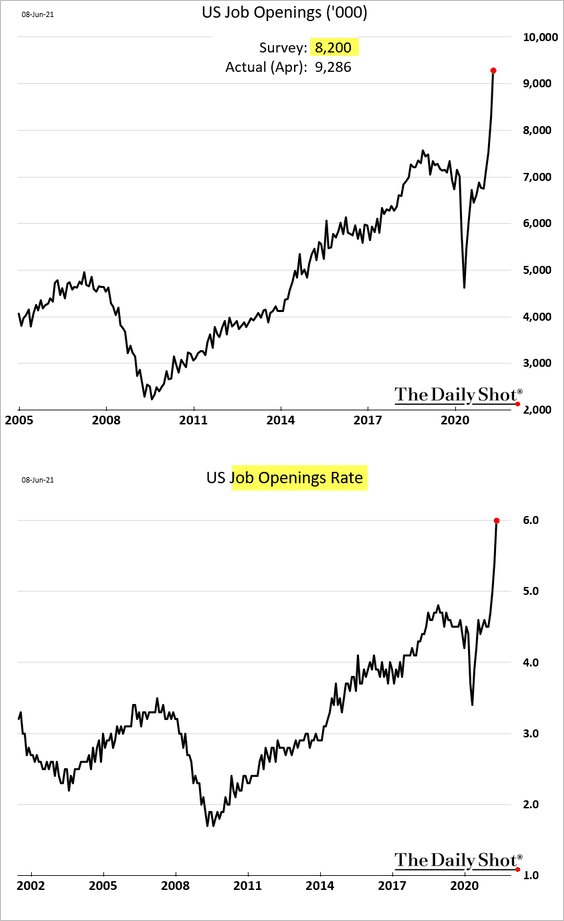

1. The labor market continues to tighten, with the latest job openings indicators hitting record highs (well above consensus forecasts). Note that both the absolute number and the openings rate have been surging.

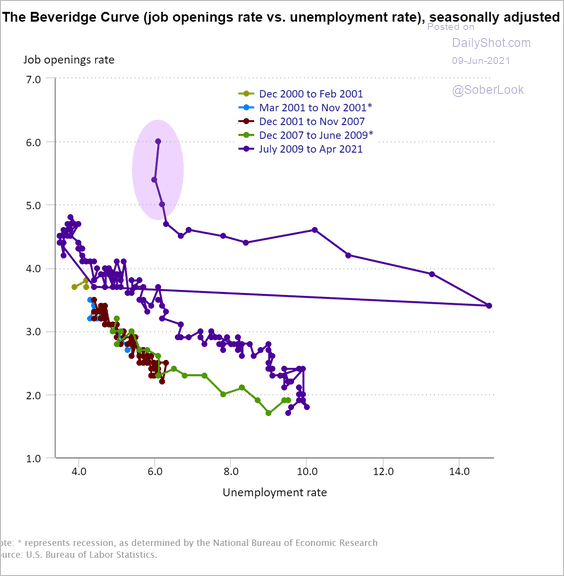

The labor market’s acute supply constraints are clearly visible in the Beveridge curve.

Source: U.S. Bureau of Labor Statistics

Source: U.S. Bureau of Labor Statistics

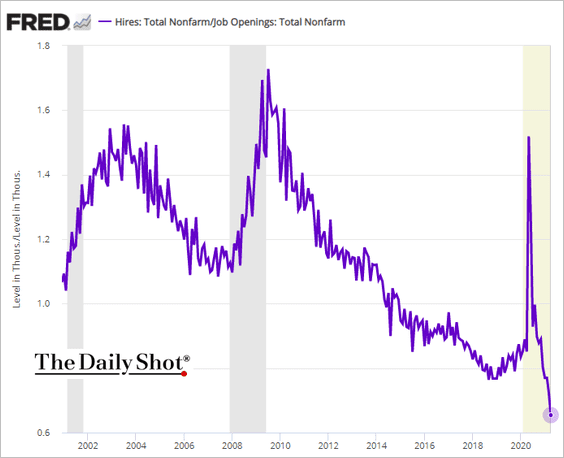

Here is the hires-to-openings ratio.

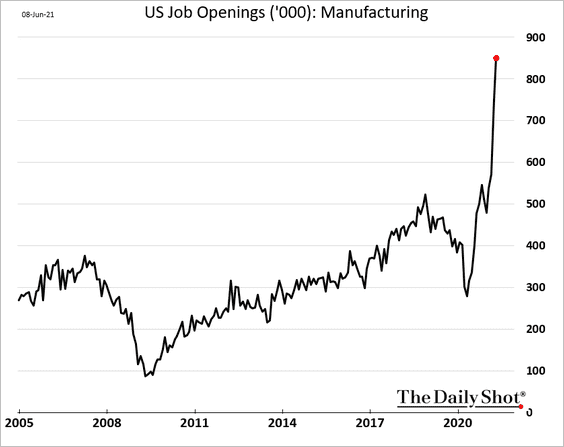

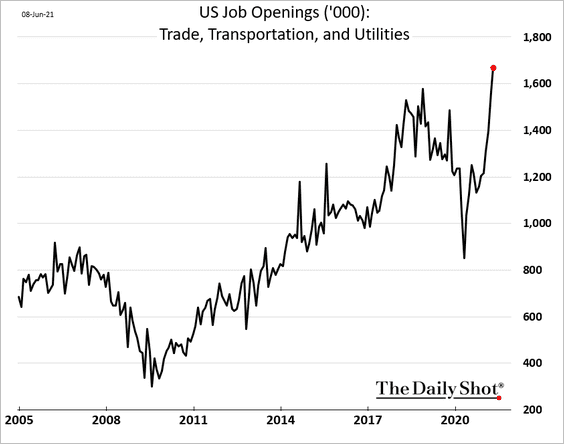

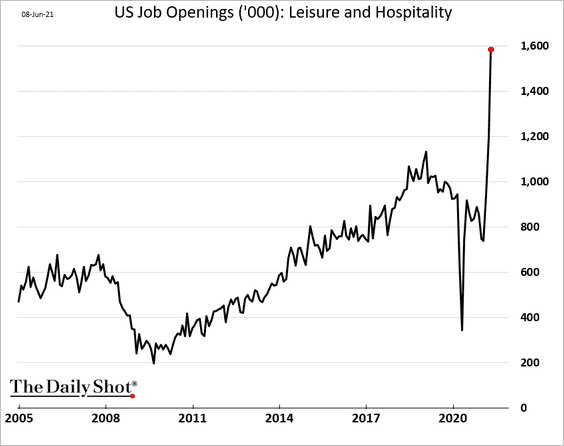

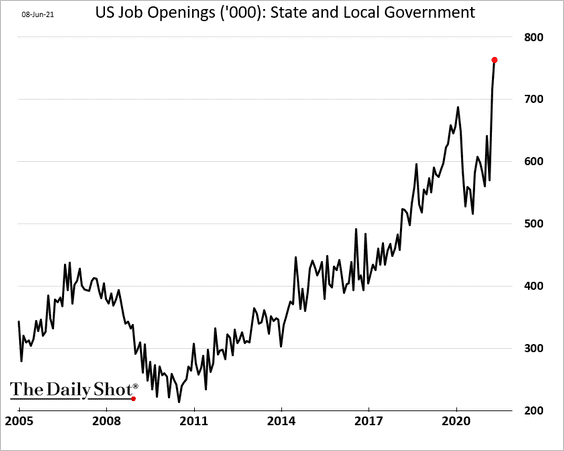

Gains in job openings were quite broad, with many sectors hitting record levels.

– Manufacturing (factory jobs are here; workers are not):

– Trade, Transportation, and Utilities:

– Leisure and hospitality:

– State and local government:

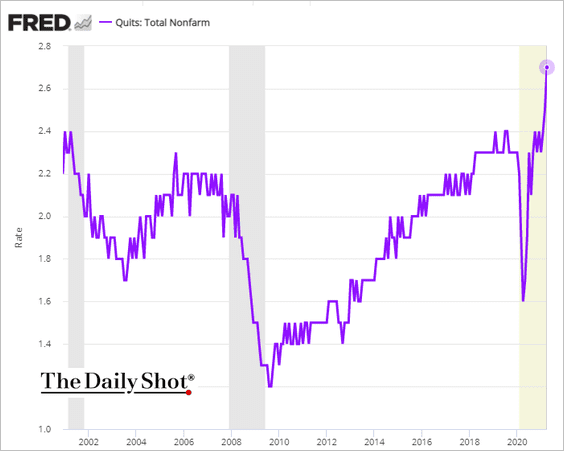

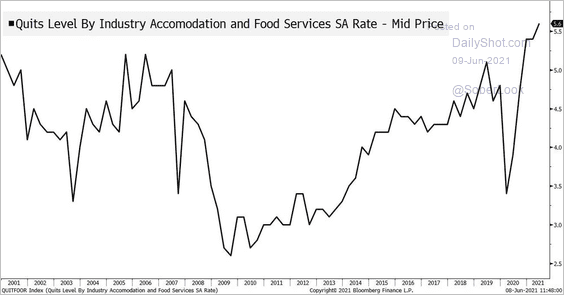

• The rate of voluntary resignations (quits rate) hit a record high, pointing to confidence in the job market and rising competition for workers.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

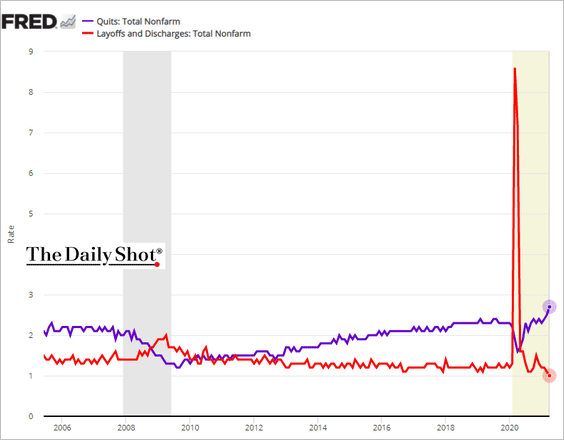

This chart shows the quits rate vs. layoffs.

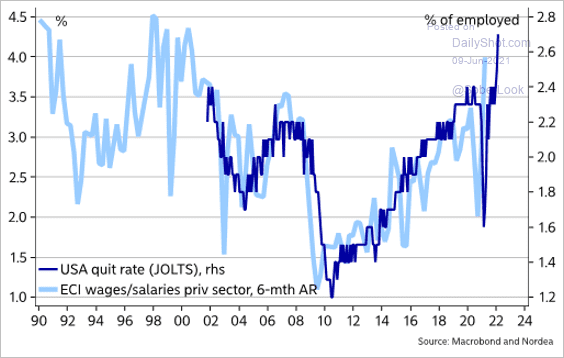

The spike in resignations points to higher wage inflation.

Source: @MikaelSarwe

Source: @MikaelSarwe

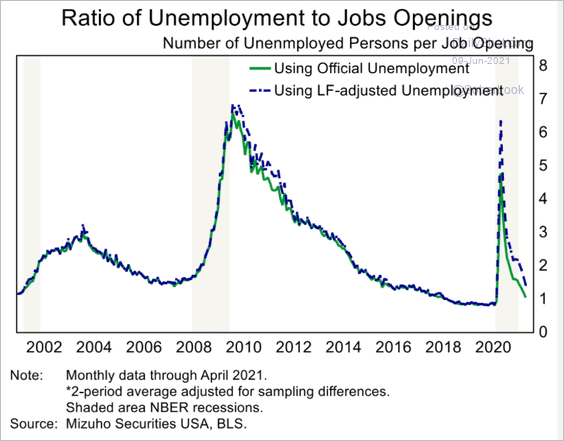

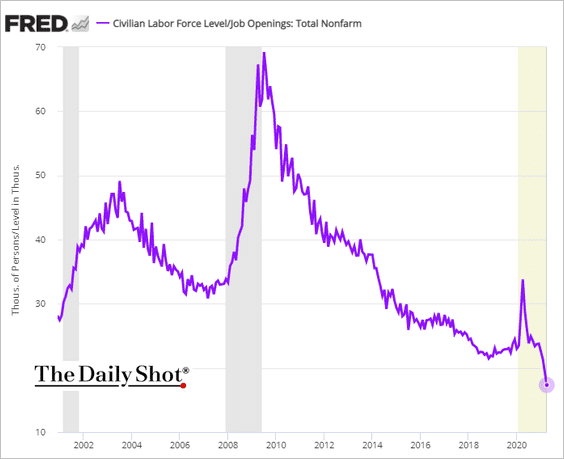

• Here is the unemployment-to-openings ratio.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

And this chart shows the total number of US workers (employed and unemployed) per one job opening.

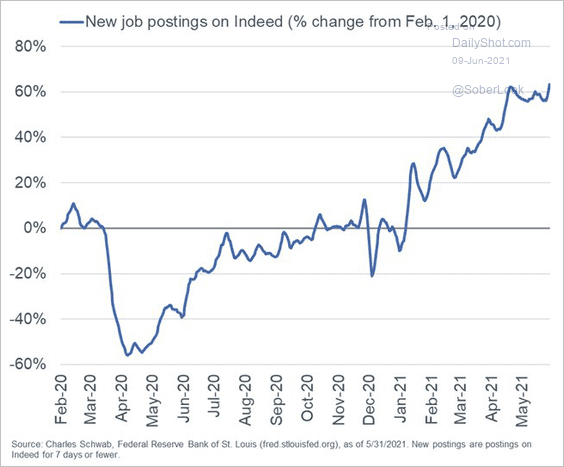

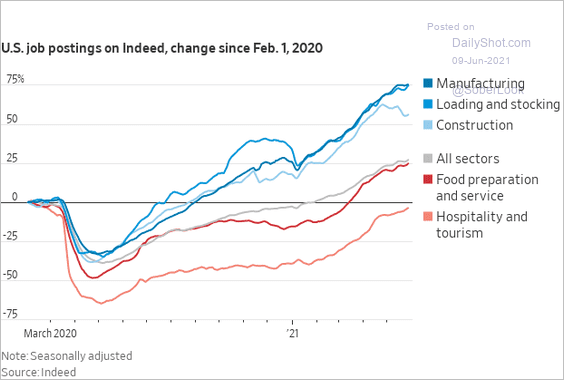

• Job openings posted on Indeed continue to climb.

Source: @LizAnnSonders, @indeed

Source: @LizAnnSonders, @indeed

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

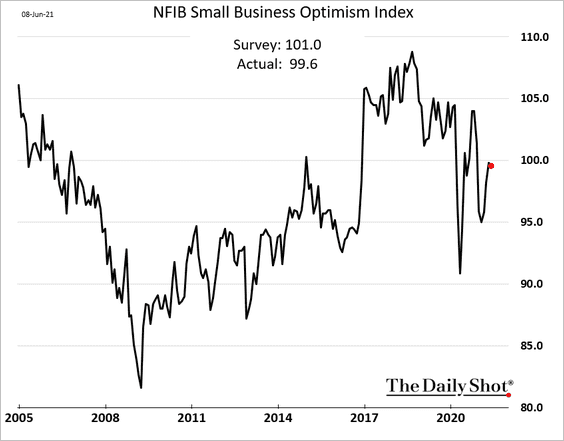

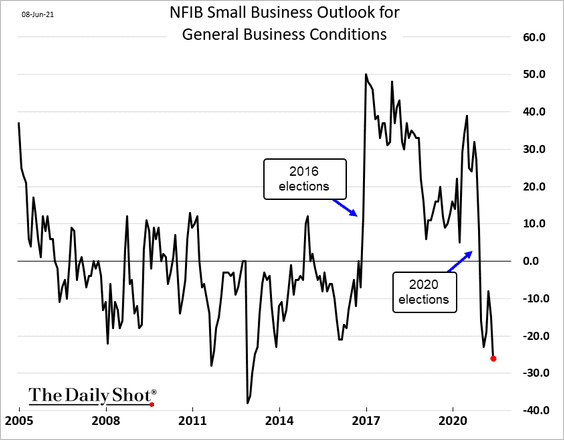

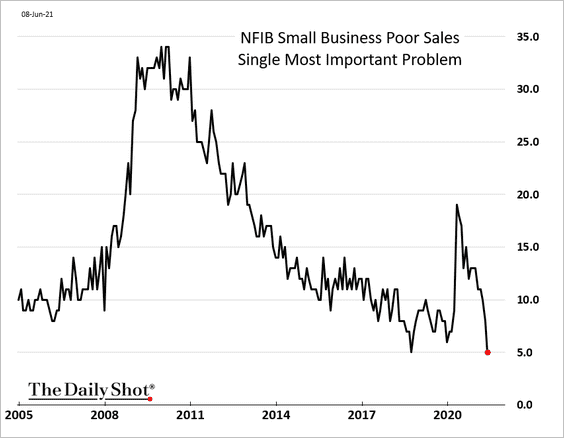

2. The May NFIB Small Business Optimism Index was below expectations.

However, the weakness in the report was primarily due to partisan sentiment.

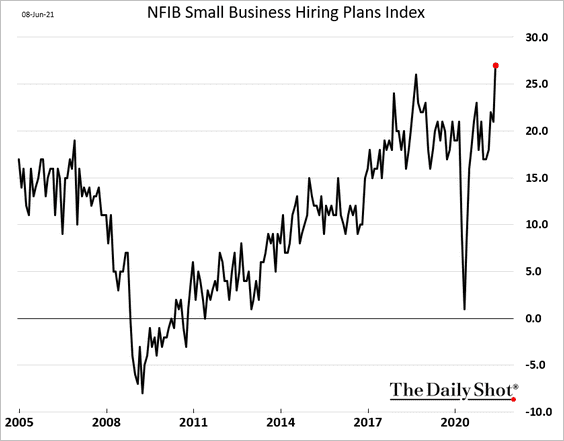

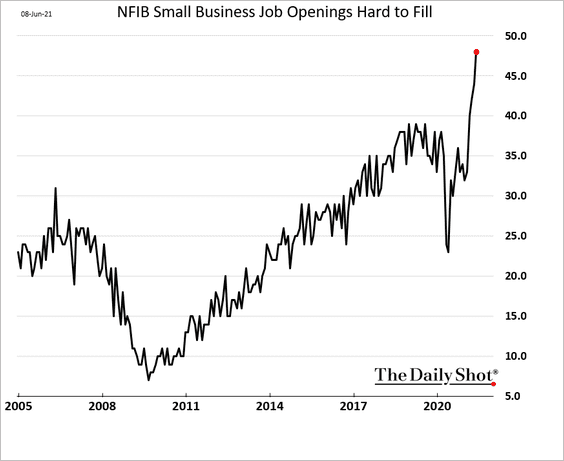

The underlying dynamics of the report were very strong.

– Poor sales as the most important problem:

– Hiring plans:

• Just as with the jobs openings data, the NFIB report points to acute labor shortages.

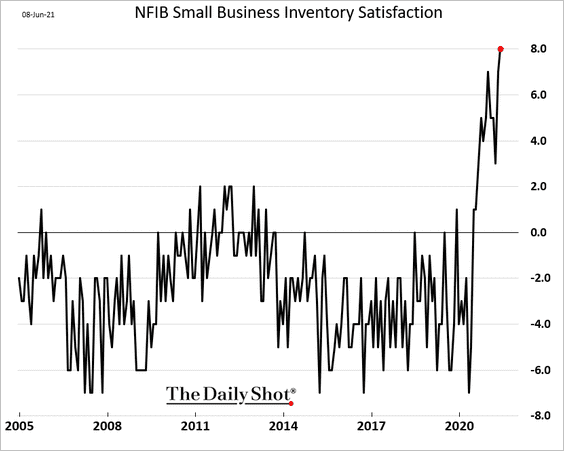

• Inventories are extremely tight due to supply constraints.

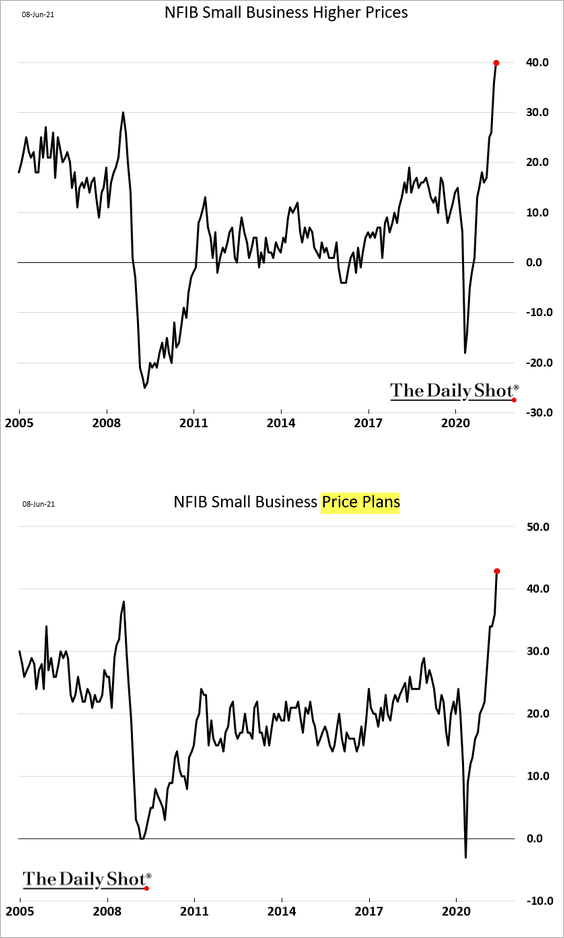

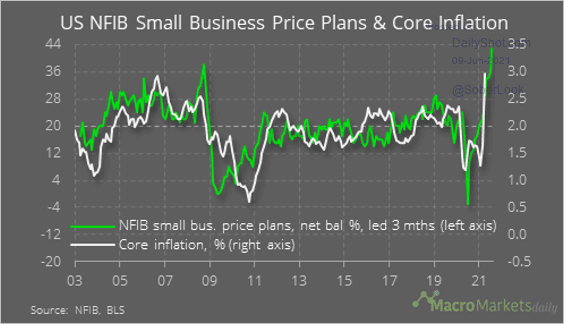

• Businesses now have pricing power. They are raising prices and plan to keep doing so in the months ahead.

This trend points to higher consumer inflation.

Source: @macro_daily

Source: @macro_daily

——————–

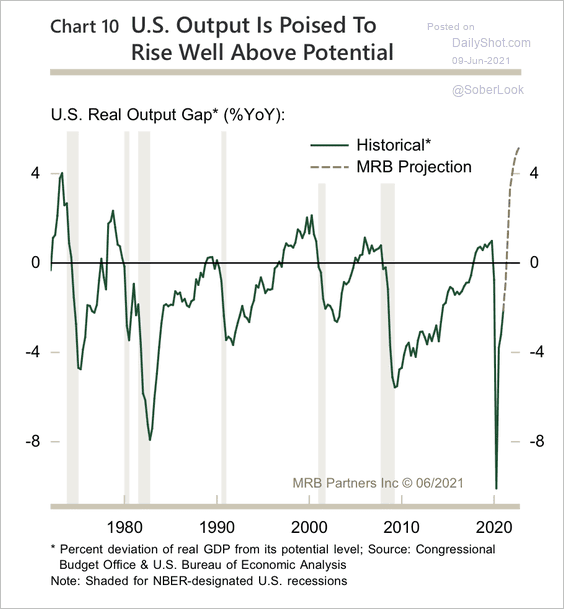

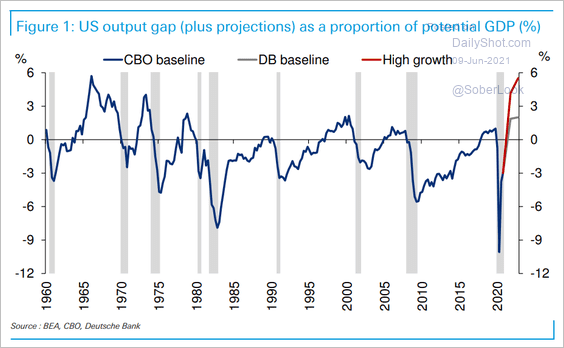

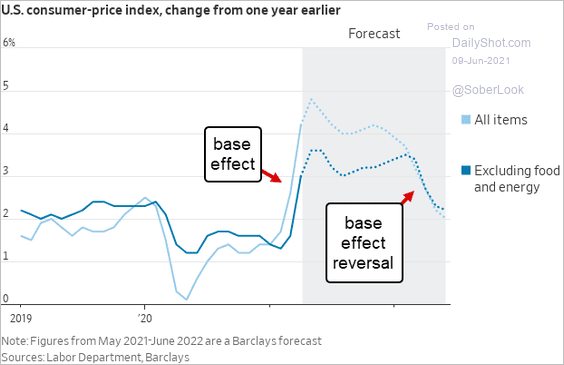

3. Let’s continue with the inflation theme.

• To forecast inflation, one needs a reliable estimate of the output gap. MRB Partners expects the output gap to rise toward 4% next year, which could boost inflation.

Source: MRB Partners

Source: MRB Partners

Here is Deutsche Bank’s forecast.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

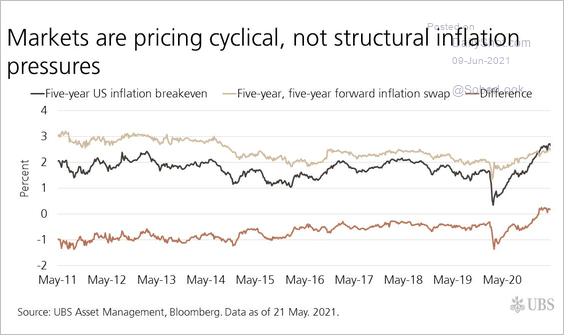

• Markets are pricing cyclical rather than structural inflation pressures.

Source: UBS Asset Management

Source: UBS Asset Management

• Here is the year-over-year CPI forecast from Barclays.

Source: @WSJ Read full article

Source: @WSJ Read full article

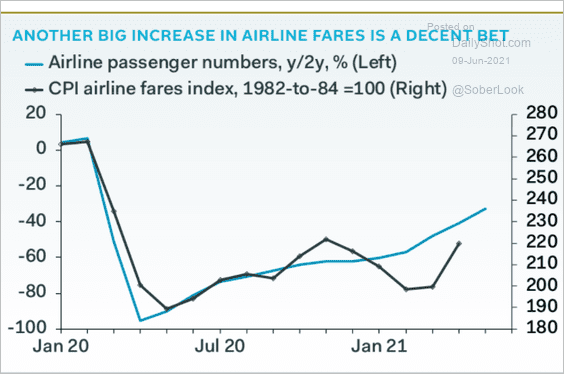

• Airline fares inflation is rebounding.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

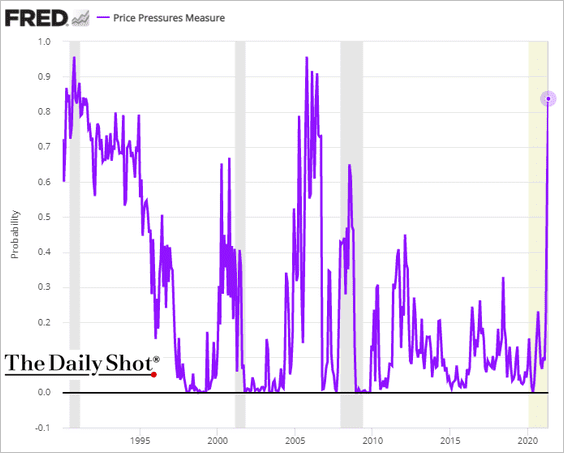

• Below is the St. Louis Fed’s Price Pressures Measure.

This series measures the probability that the expected personal consumption expenditures price index (PCEPI) inflation rate (12-month percent changes) over the next 12 months will exceed 2.5 percent.

——————–

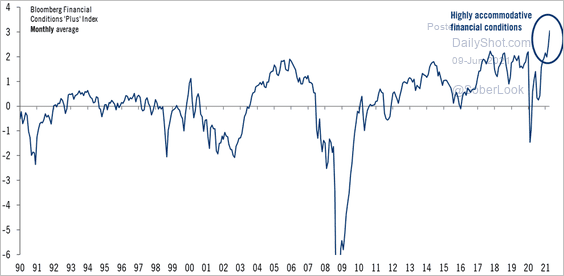

4. US financial conditions are most accommodative in decades (a chart for our friends at the Federal Reserve).

Source: @TCosterg

Source: @TCosterg

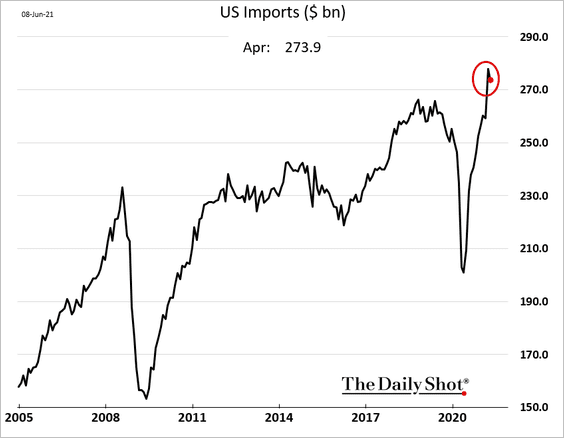

5. US imports came off the highs due to supply disruptions.

Back to Index

Canada

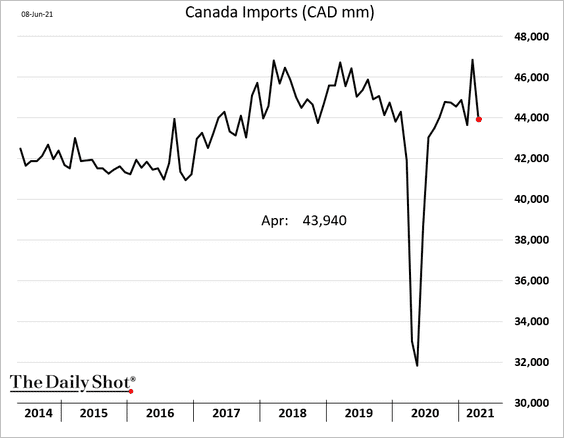

1. Canadian imports fell sharply due to supply disruptions in the auto industry. The trade balance swung into surplus.

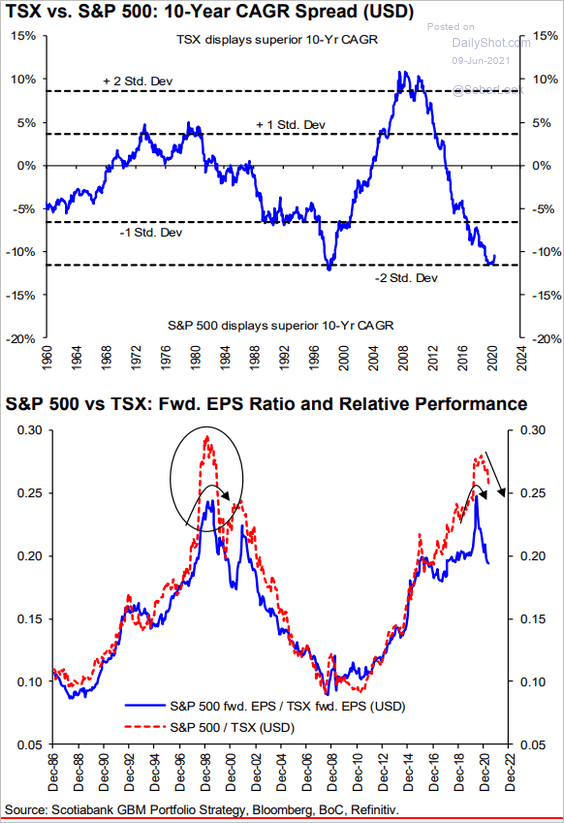

2. Will Canada’s stock market outperform the S&P 500 in the months ahead?

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Back to Index

The United Kingdom

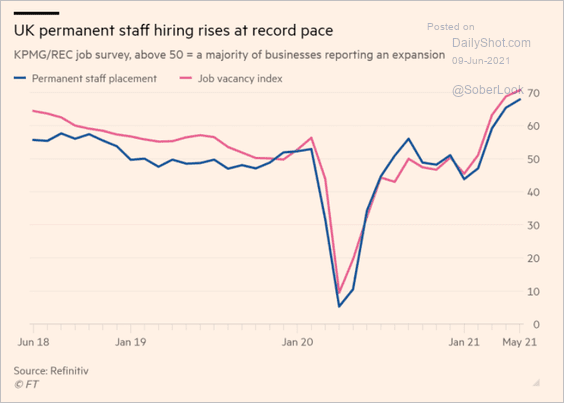

1. Permanent staff hiring has accelerated.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

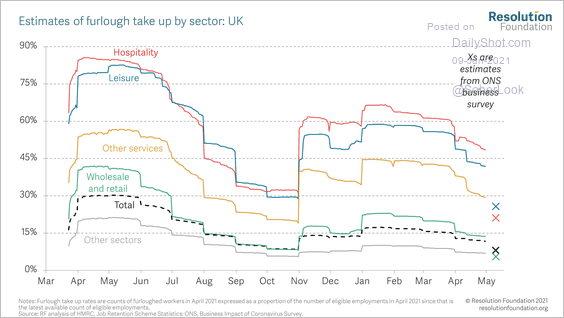

Low-paid workers are now moving off furlough in large numbers.

Source: @resfoundation

Source: @resfoundation

——————–

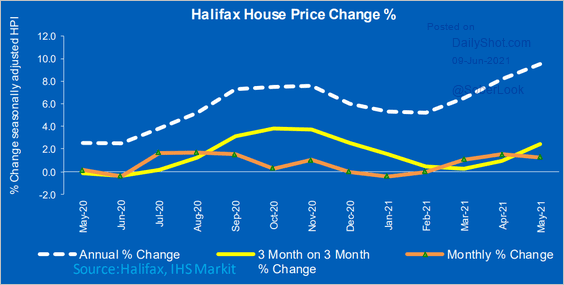

2. Home price appreciation continues to strengthen.

Source: IHS Markit

Source: IHS Markit

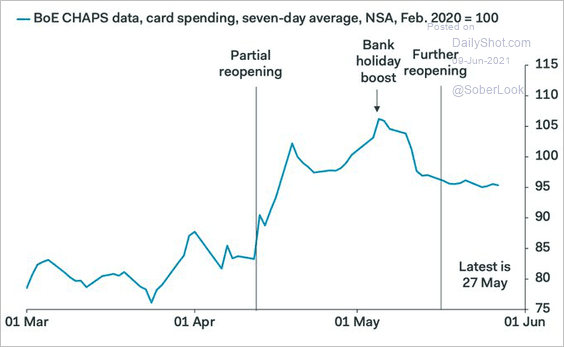

3. Card spending deteriorated last month.

Source: @samueltombs

Source: @samueltombs

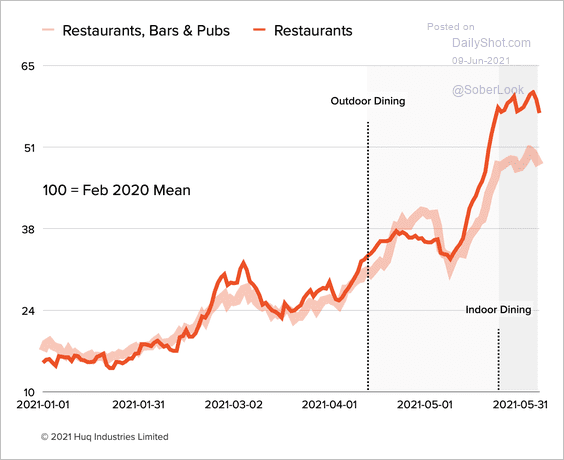

But restaurant/pub activity has been robust.

Source: huq Read full article

Source: huq Read full article

Back to Index

The Eurozone

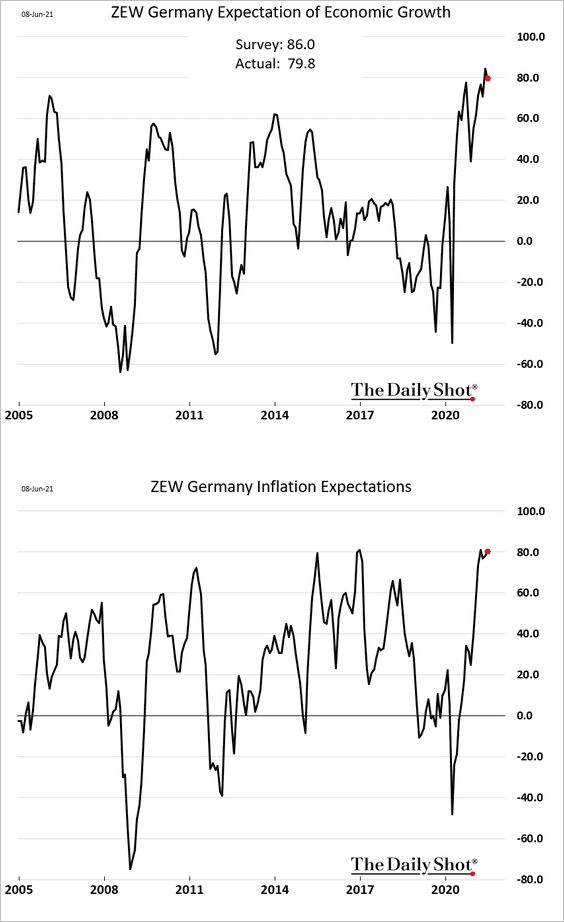

1. Germany’s ZEW economic expectations index is off the highs but still very strong. Inflation expectations remain elevated (2nd chart).

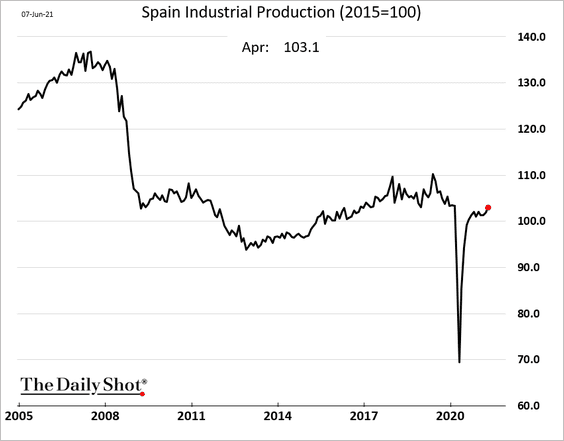

2. Spain’s industrial production is almost at pre-COVID levels.

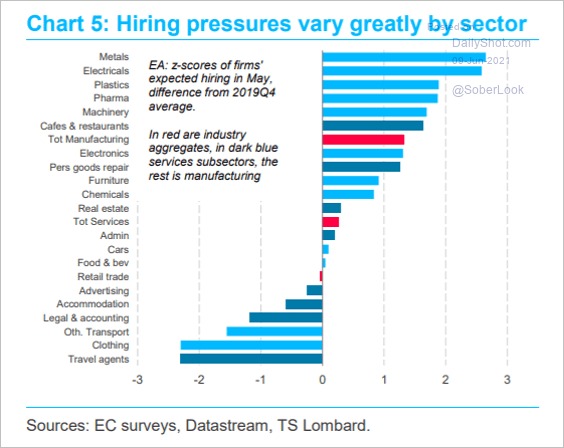

3. This chart shows hiring pressures by sector.

Source: TS Lombard

Source: TS Lombard

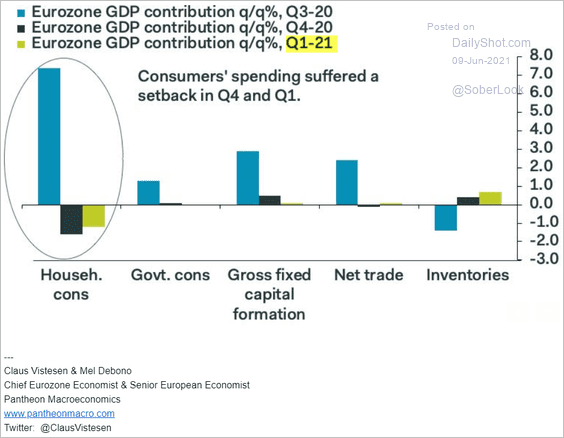

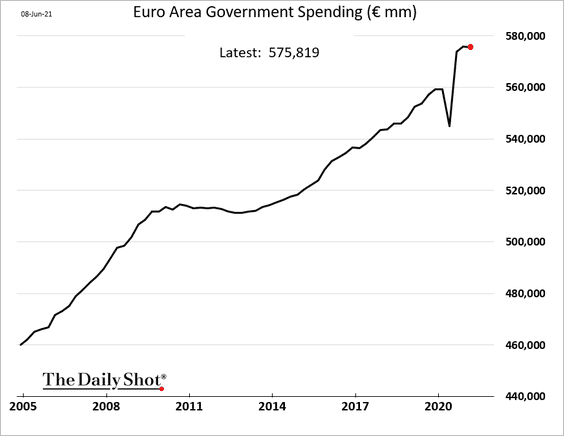

4. Next, we have some trends in the key components of the GDP (through Q1).

• Contributions:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

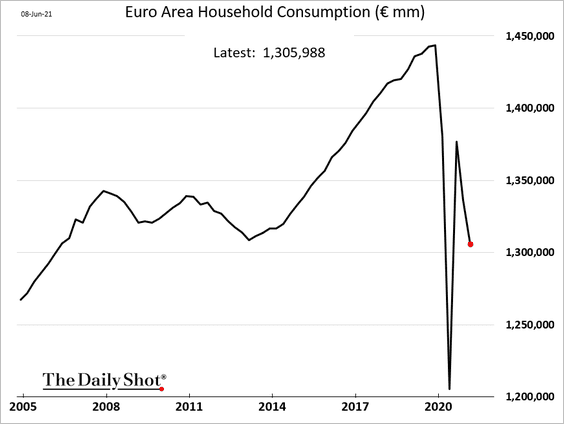

• Household consumption (down in Q4 and Q1):

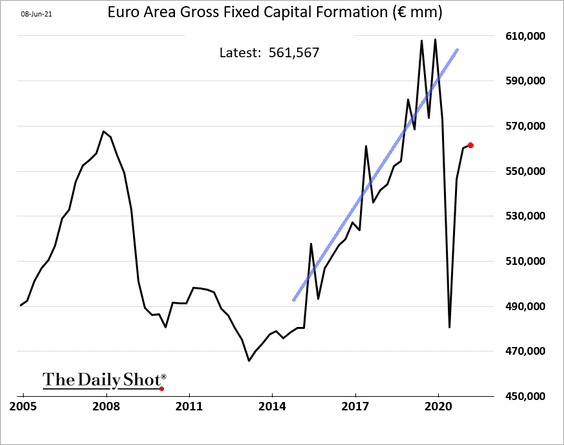

• Business investment:

• Government spending (flat in Q1):

Back to Index

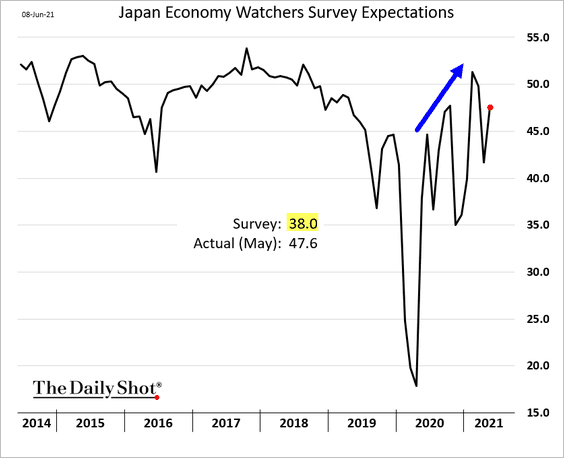

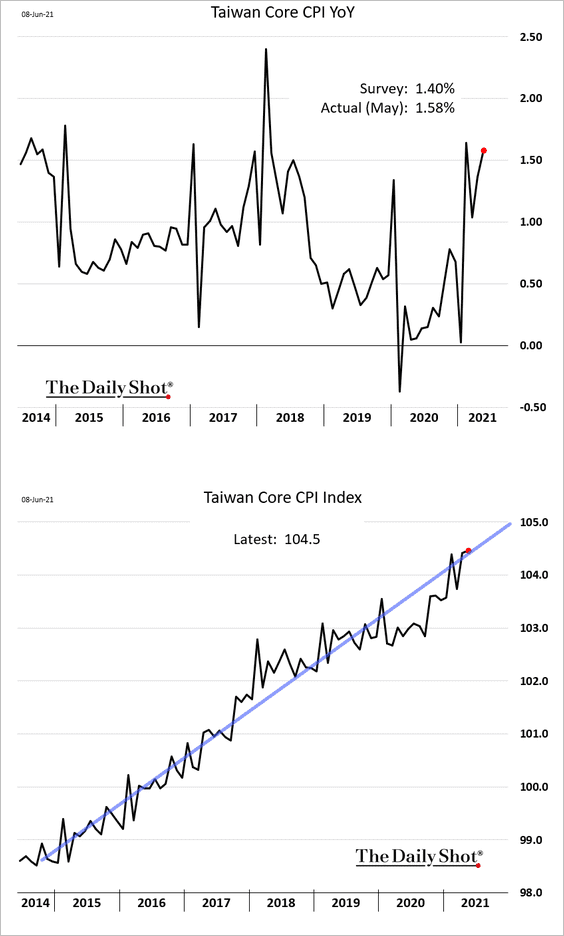

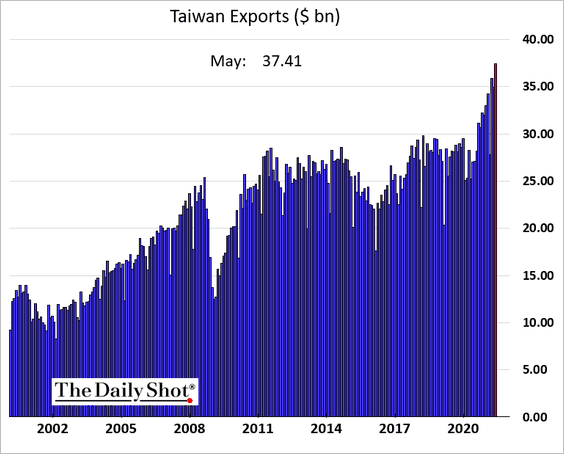

Aisa – Pacific

1. Japan’s Economy Watchers Expectations index is trending higher.

2. Taiwan’s core CPI came in above forecasts.

Tawan’s exports hit a record high.

——————–

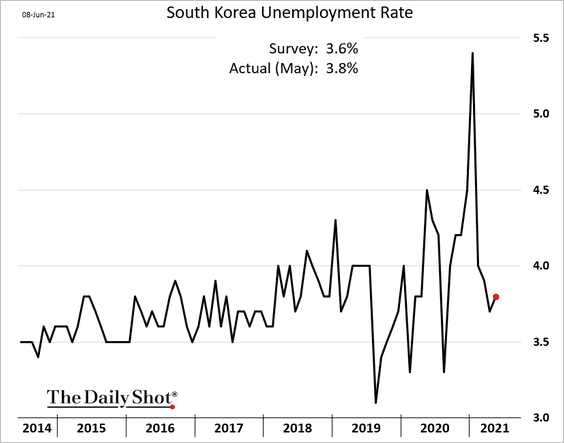

3. South Korea’s May unemployment rate was higher than expected.

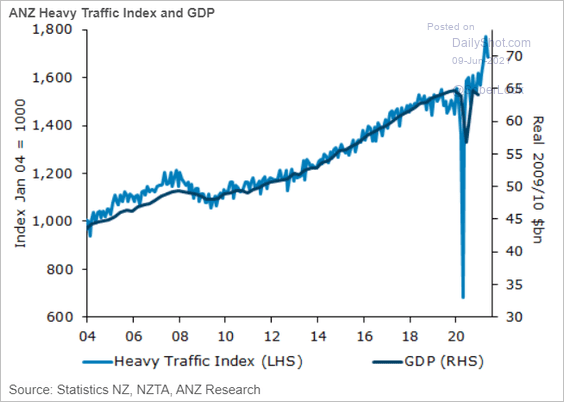

4. New Zealand’s heavy truck traffic points to strong GDP growth.

Source: ANZ Research

Source: ANZ Research

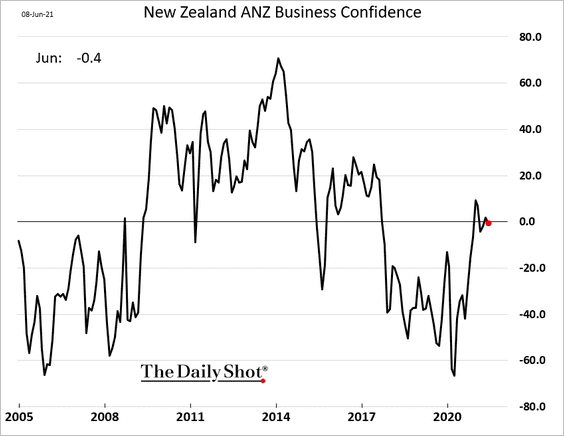

Business confidence has leveled off.

——————–

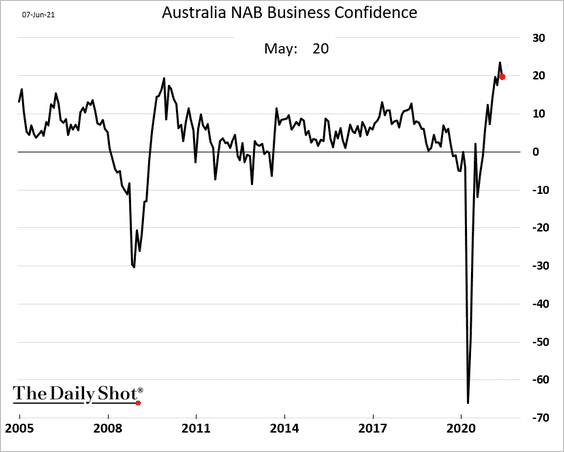

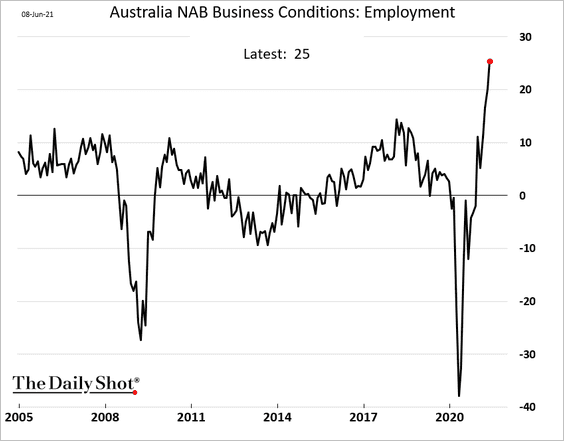

5. Next, we have some updates on Australia.

• Business confidence remains robust.

Hiring has been surging.

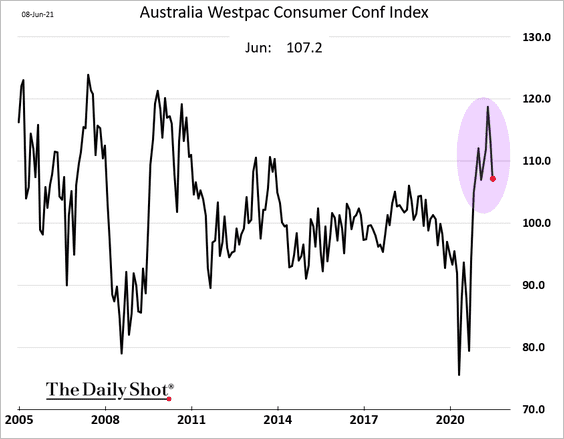

• Consumer confidence dipped this month.

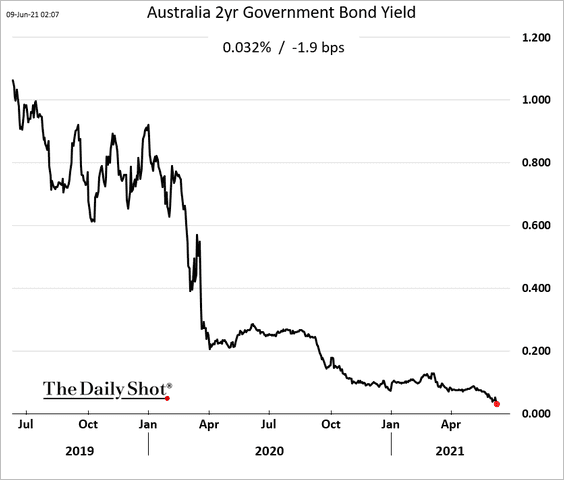

• The 2-year yield hit a record low.

——————–

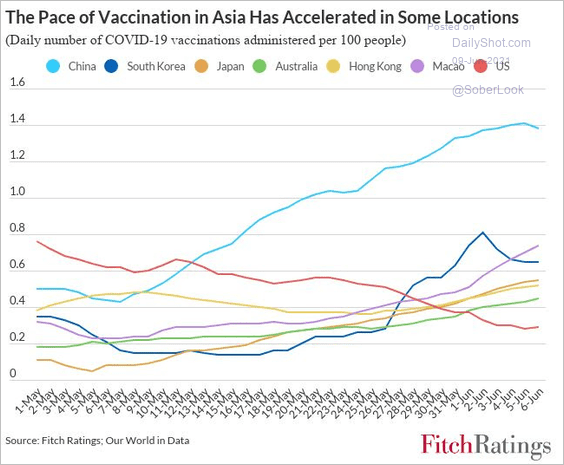

6. This chart shows vaccination trends in select countries.

Source: Fitch Ratings

Source: Fitch Ratings

Back to Index

China

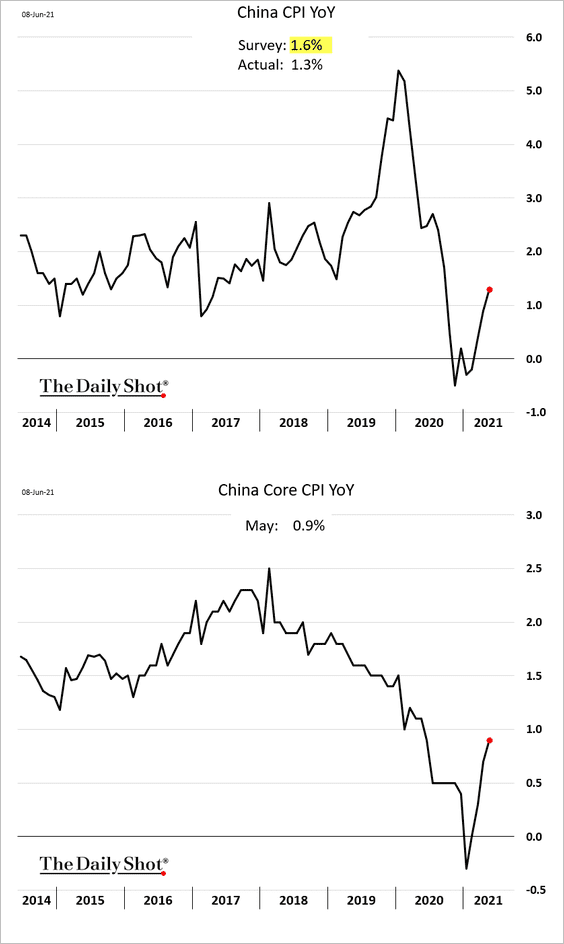

1. The May CPI report surprised to the downside.

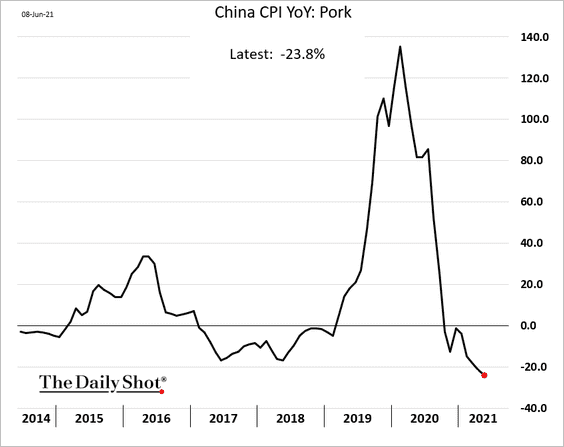

Pork prices have been coming off the highs, putting downward pressure on food inflation.

——————–

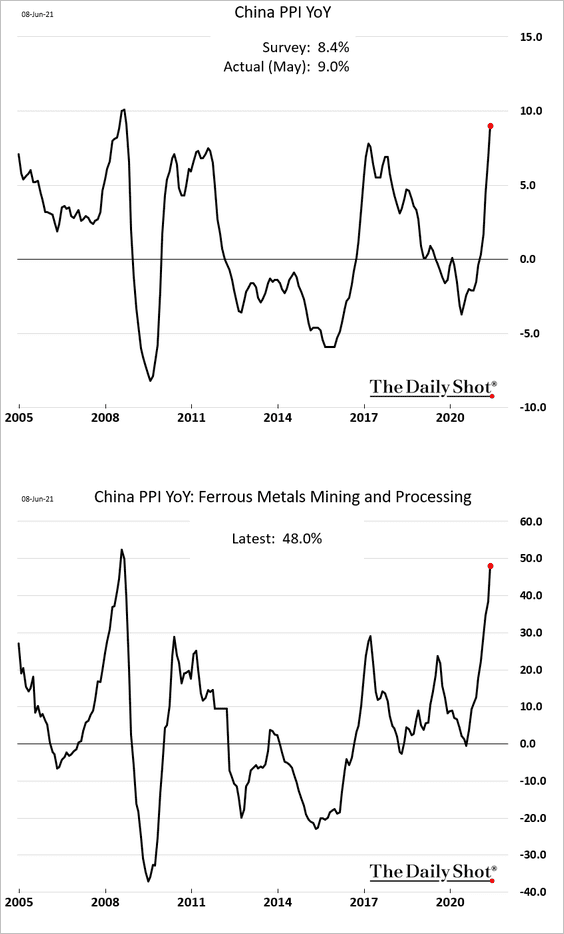

2. On the other hand, producer prices topped forecasts, driven by industrial commodity and energy prices.

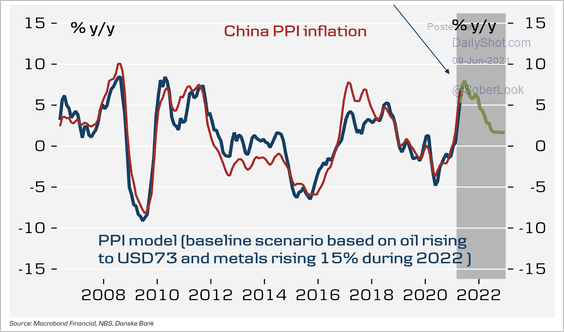

Danske Bank expects PPI to peak over the next two months and then level off into 2022.

Source: Danske Bank

Source: Danske Bank

——————–

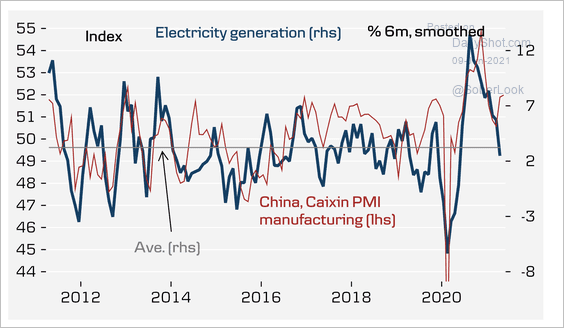

3. The decline in electricity generation points to weaker manufacturing activity.

Source: Danske Bank

Source: Danske Bank

Back to Index

Emerging Markets

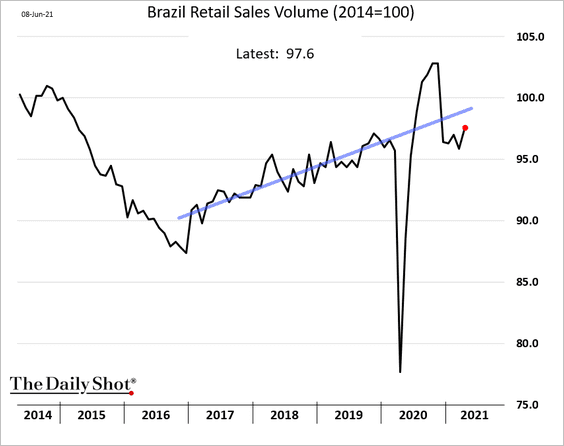

1. Brazil’s retail sales remain below the pre-COVID trend.

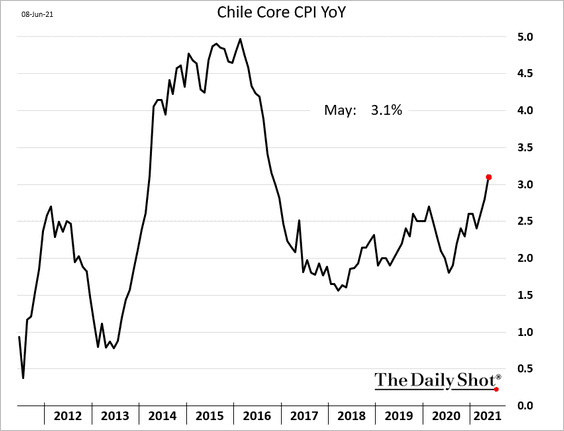

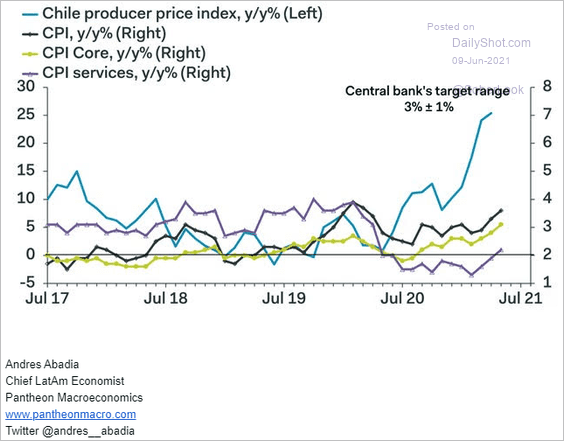

2. Chile’s inflation has been trending higher, with the core CPI now above 3%. The central bank may begin to raise rates soon.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

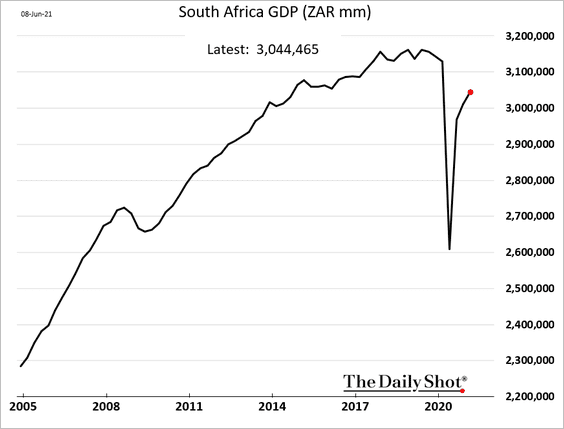

3. South Africa’s GDP is still below pre-COVID levels.

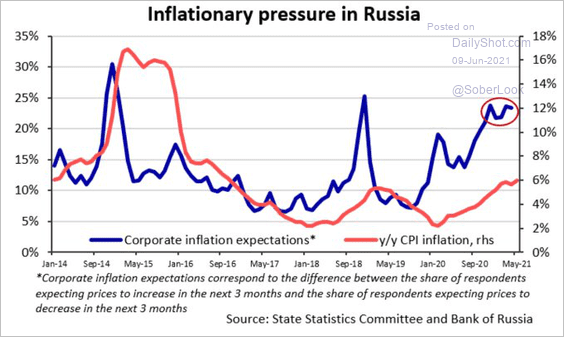

4. Russia is facing some inflationary pressures, with more rate hikes on the way.

Source: @Tatiana_Evd

Source: @Tatiana_Evd

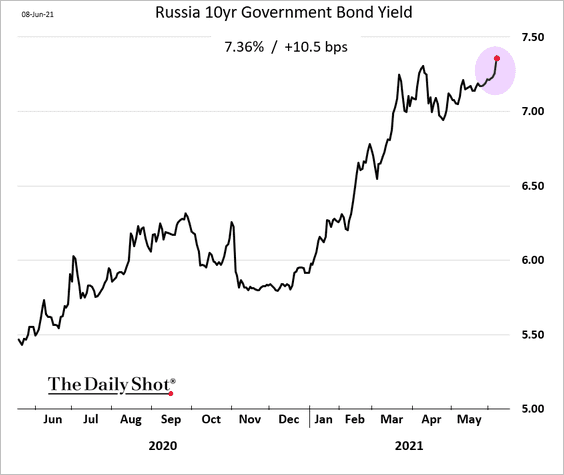

The 10yr bond yield jumped this week.

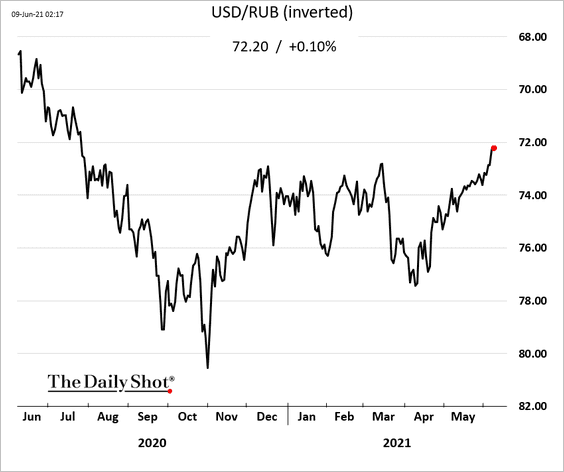

And the ruble continues to climb.

——————–

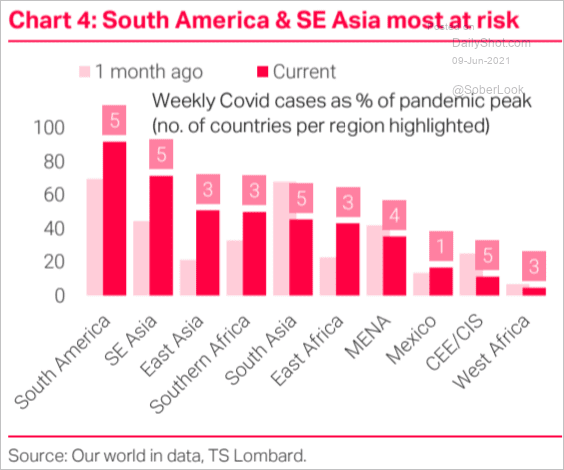

5. Here is the COVID situation across EM economies.

Source: TS Lombard

Source: TS Lombard

Back to Index

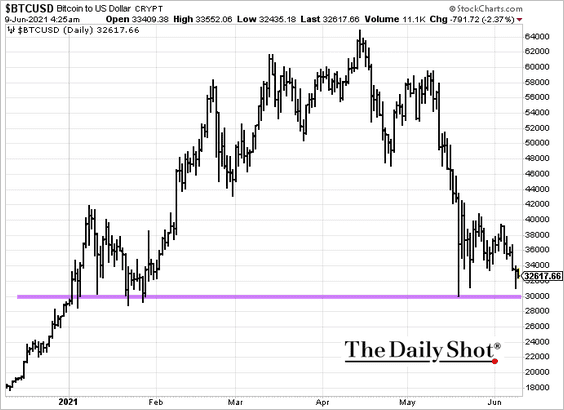

Cryptocurrency

1. Bitcoin is holding support at $30k.

2. The IRS wants to track crypto movements.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

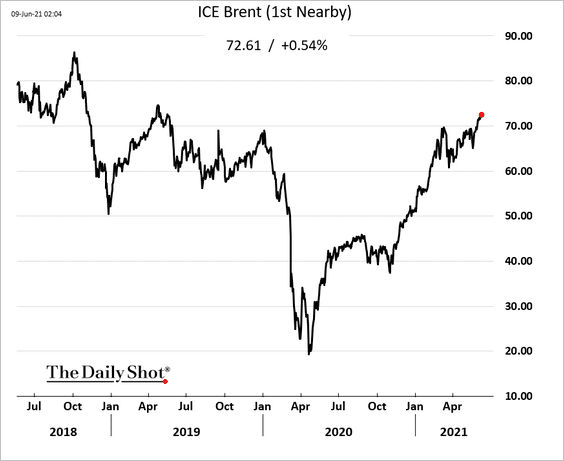

Energy

1. Brent continues to grind higher.

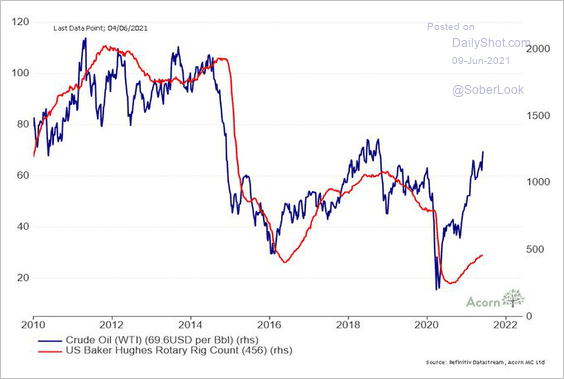

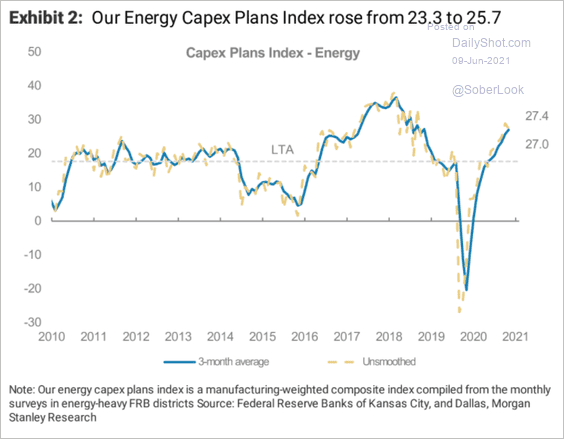

2. Rising prices bode well for energy CapEx (2 charts).

• Rigs vs. prices:

Source: @RichardDias_CFA

Source: @RichardDias_CFA

• Morgan Stanley’s CapEx index:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

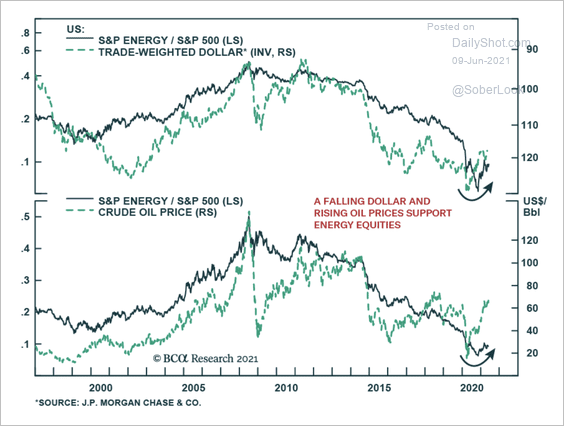

3. A lower dollar and rising oil prices could benefit energy stocks.

Source: BCA Research

Source: BCA Research

Back to Index

Equities

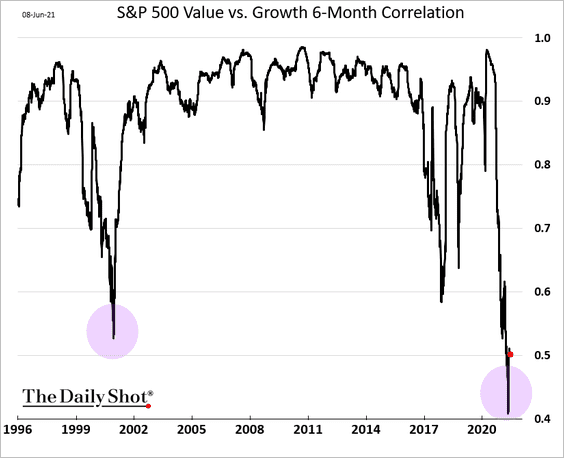

1. Exceptionally low correlation between value and growth points to massive rotation (from growth to value).

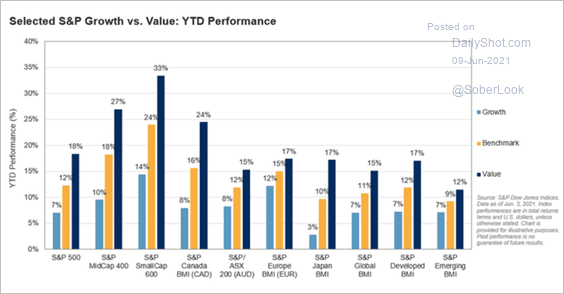

The resurgence of value stocks has been a major trend so far this year, outperforming growth in most regions globally.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

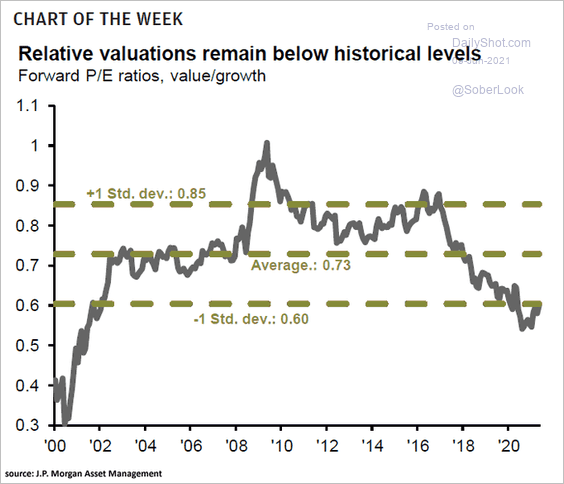

Value stocks’ valuations are still relatively low.

Source: @ISABELNET_SA, @JPMorganAM

Source: @ISABELNET_SA, @JPMorganAM

——————–

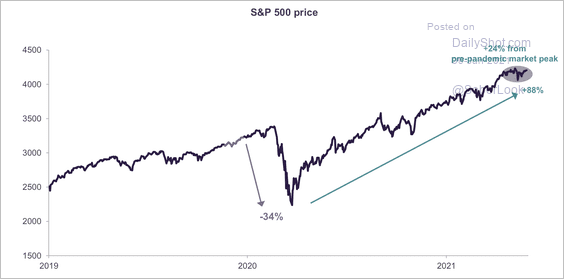

2. The S&P 500 has been consolidating gains following a record rebound off pandemic lows.

Source: Truist Advisory Services

Source: Truist Advisory Services

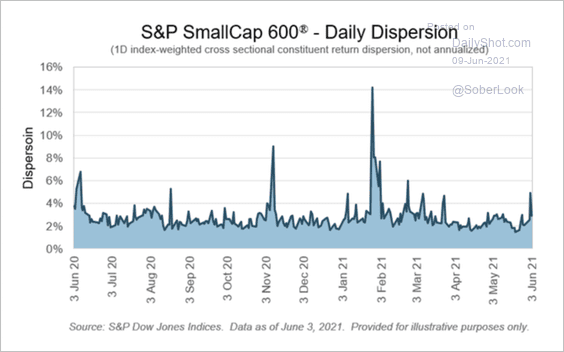

3. The S&P SmallCap 600 Index’s daily return dispersion is rising again, which typically benefits stock pickers.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

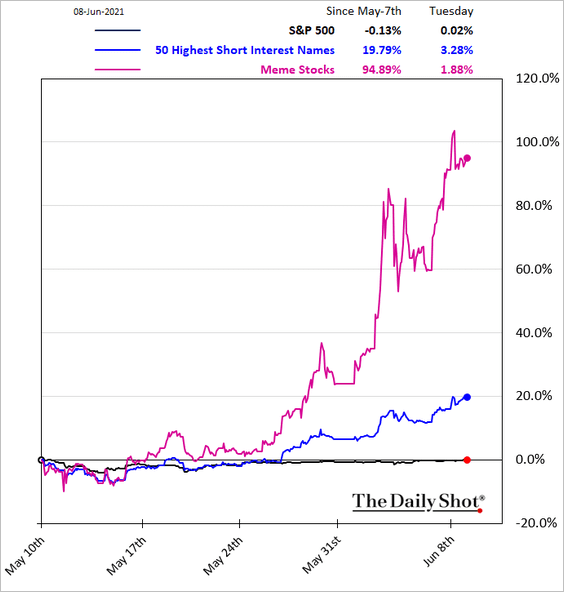

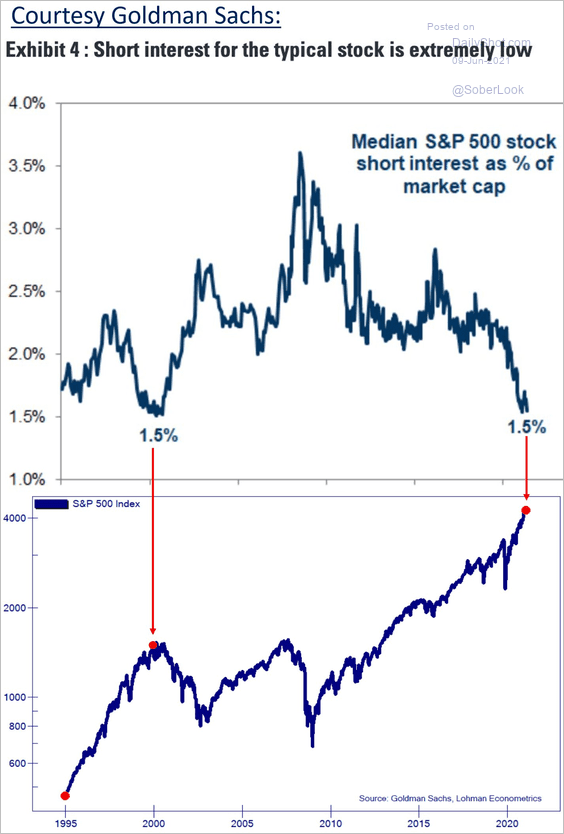

4. Targeted by the Reddit crowd, the most shorted names are up 20% over the past couple of weeks.

5. With institutional traders afraid to short stocks, the market is vulnerable to a downside gap.

Source: Goldman Sachs, @Not_Jim_Cramer

Source: Goldman Sachs, @Not_Jim_Cramer

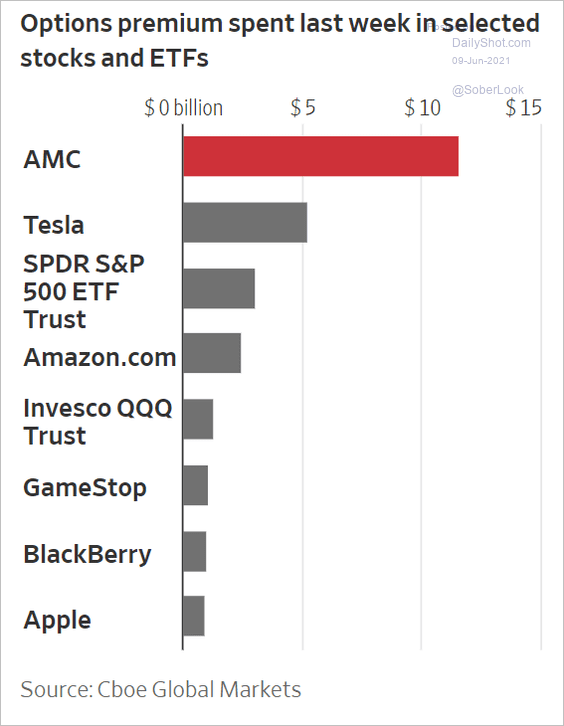

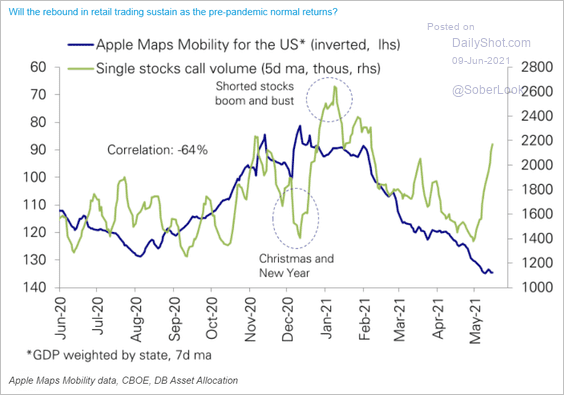

6. Retail investors are deploying options again.

Source: @WSJ Read full article

Source: @WSJ Read full article

Improved mobility (and a partial return to the office) hasn’t stopped individual investors from playing the options game – so far.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

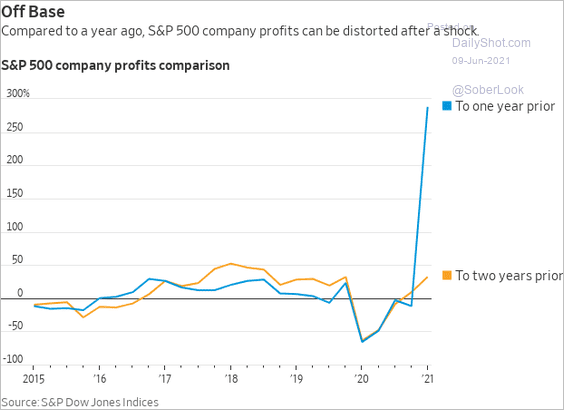

7. Here is an illustration of base effects in the S&P 500 profits.

Source: @WSJ Read full article

Source: @WSJ Read full article

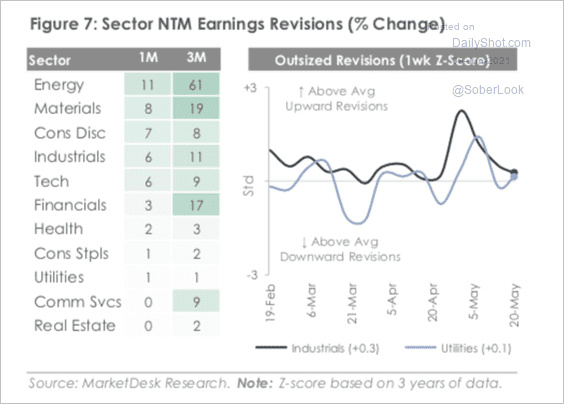

• Earnings revisions have trended higher recently, especially for energy and material stocks.

Source: MarketDesk Research

Source: MarketDesk Research

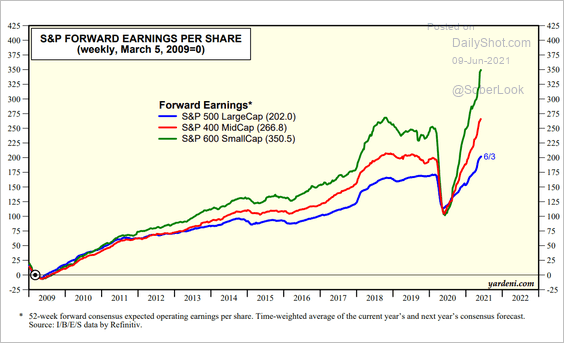

• This chart shows the evolution of forward EPS for large, mid, and small-cap shares.

Source: Yardeni Research

Source: Yardeni Research

——————–

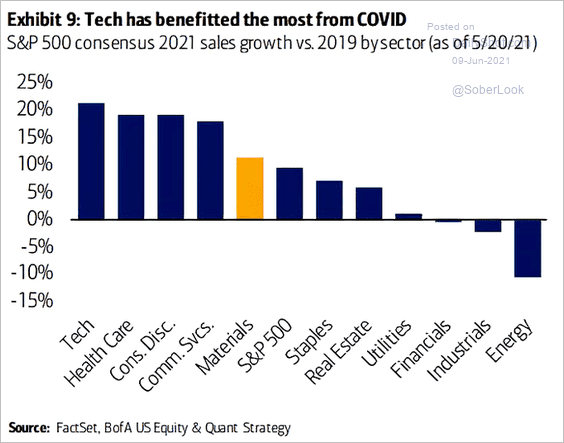

8. Which sectors benefitted the most from COVID?

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

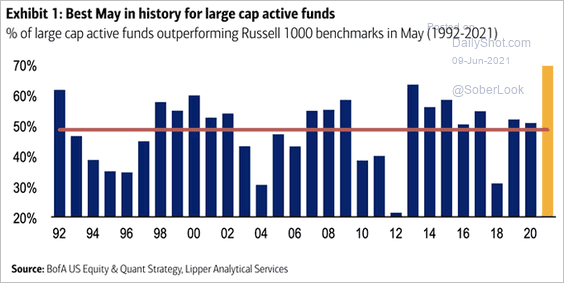

9. Active large-cap funds did well in May.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

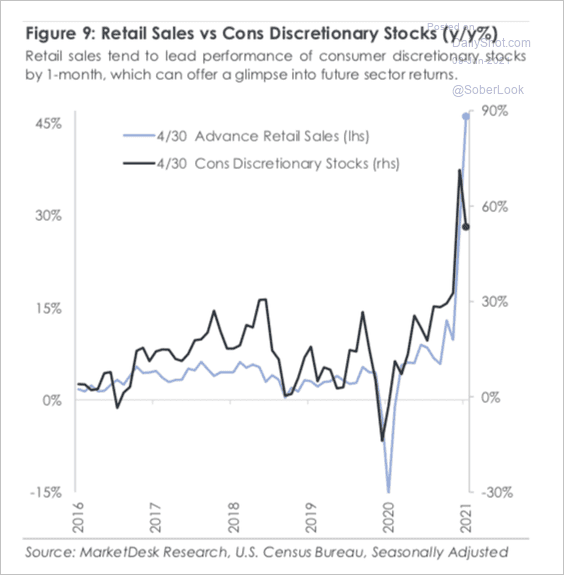

10. The recovery in retail sales points to continued gains in consumer discretionary stocks.

Source: MarketDesk Research

Source: MarketDesk Research

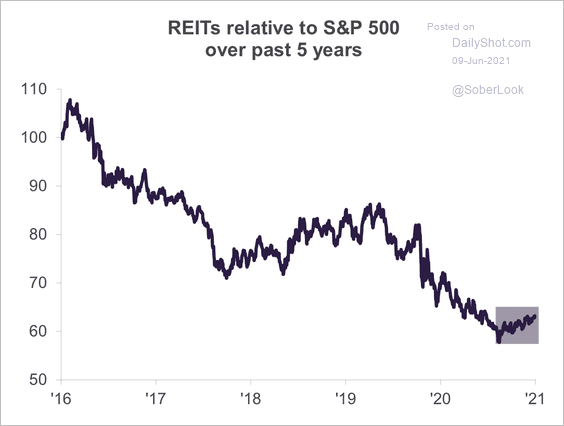

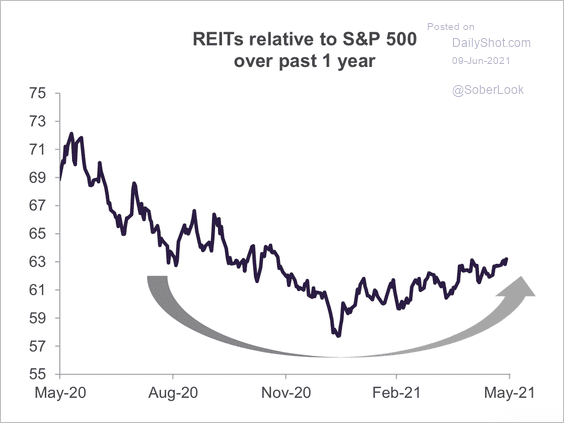

11. REITs have been recovering relative to the S&P 500 after extended underperformance (2 charts).

Source: Truist Advisory Services

Source: Truist Advisory Services

Source: Truist Advisory Services

Source: Truist Advisory Services

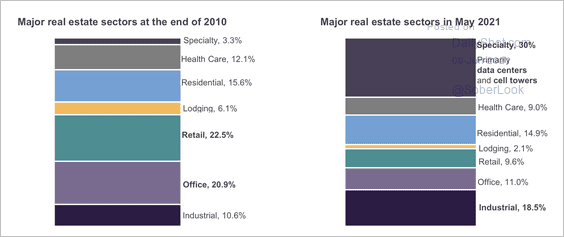

The Morningstar US REITs Index now includes more specialty REITs, primarily in data centers and cell towers.

Source: Truist Advisory Services

Source: Truist Advisory Services

Back to Index

Rates

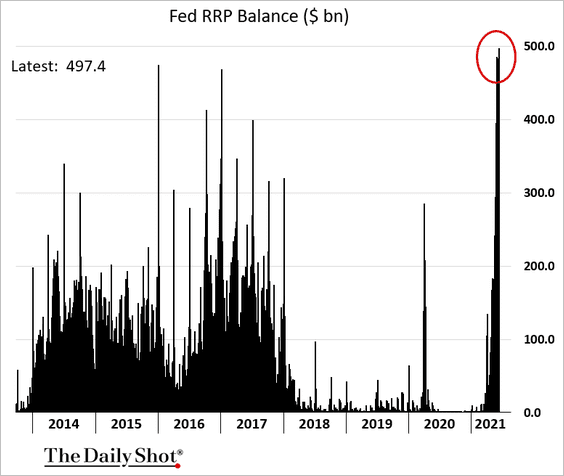

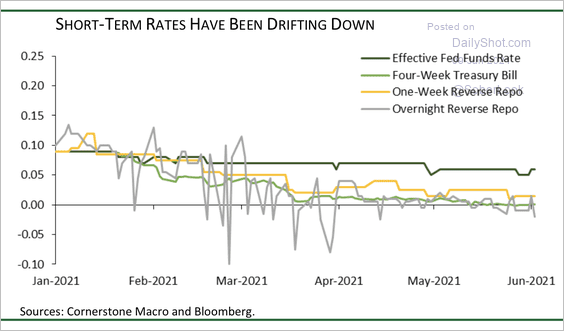

1. The Fed has been able to drain some excess liquidity with the reverse repo program. Banks and money market funds are depositing more cash with the central bank (nearly half a trillion now). This is what’s keeping short-term rates from moving deep into negative territory.

Short-term rates have drifted lower as demand for securities associated with large increases in bank reserves and money fund assets have exceeded supply, according to Cornerstone Macro.

Source: Cornerstone Macro

Source: Cornerstone Macro

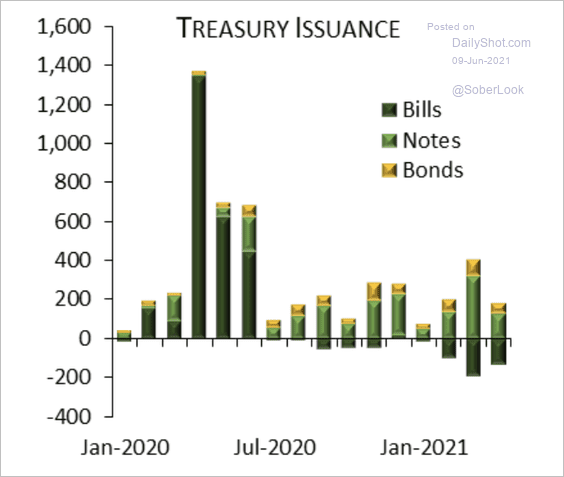

The Treasury’s net issuance of bills has been negative in recent months, putting downward pressure on yields.

Source: Cornerstone Macro

Source: Cornerstone Macro

——————–

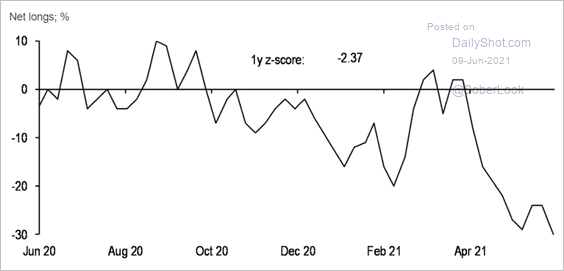

2. JP Morgan’s client survey points to deeper bets against Treasuries. The risk to yields is to the downside.

Source: JP Morgan, @themarketear

Source: JP Morgan, @themarketear

——————–

Food for Thought

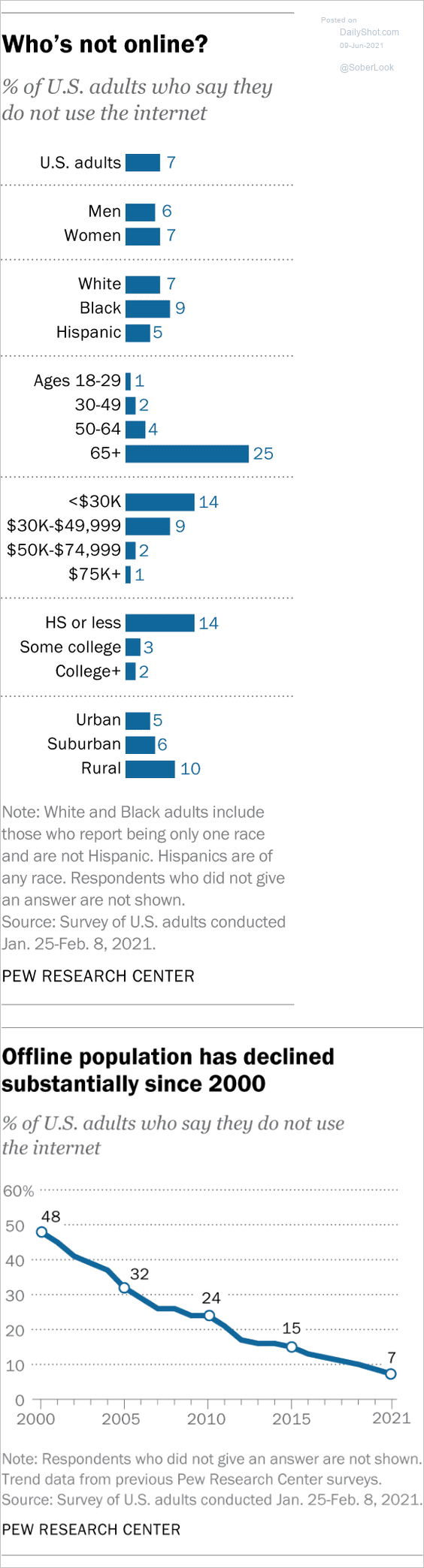

1. Who is not online?

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

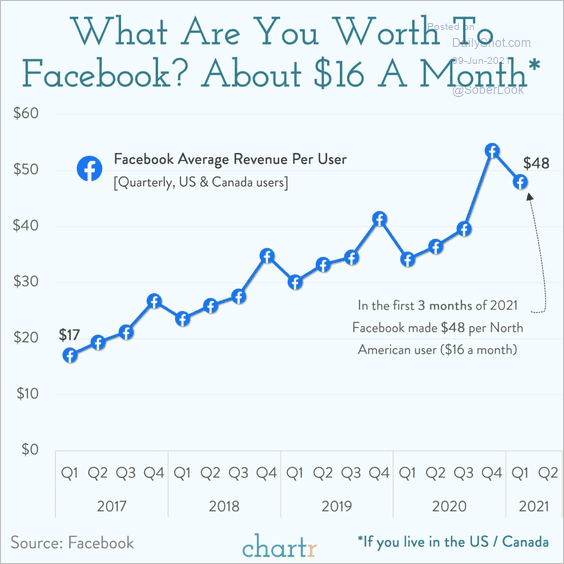

2. What are you worth to Facebook?

Source: @chartrdaily

Source: @chartrdaily

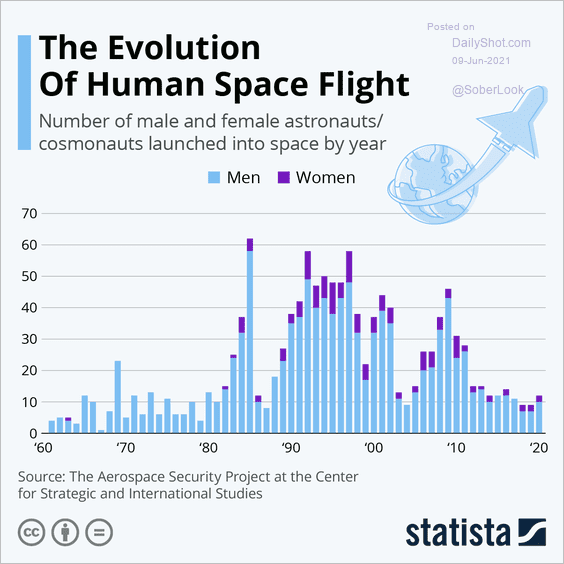

3. The evolution of human space flight:

Source: Statista

Source: Statista

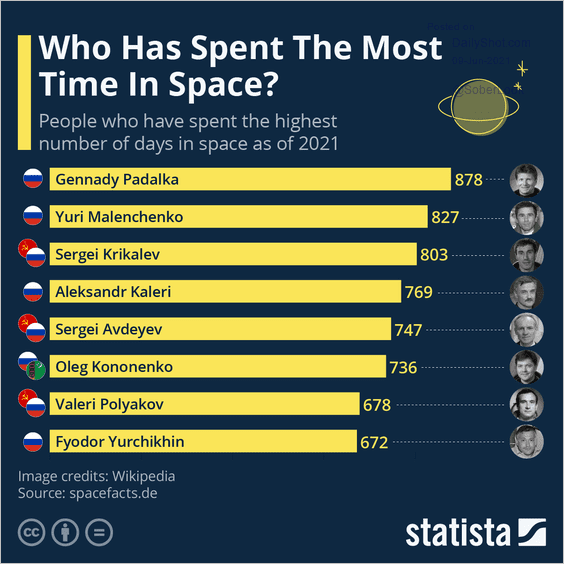

4. Highest number of days in space:

Source: Statista

Source: Statista

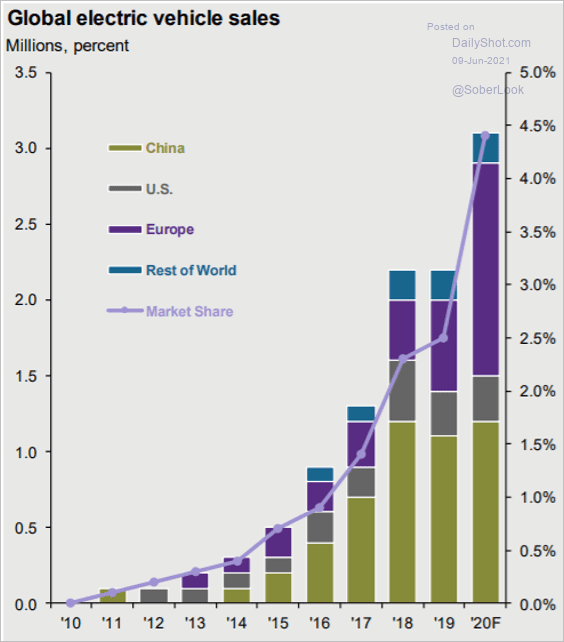

5. Global EV sales:

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

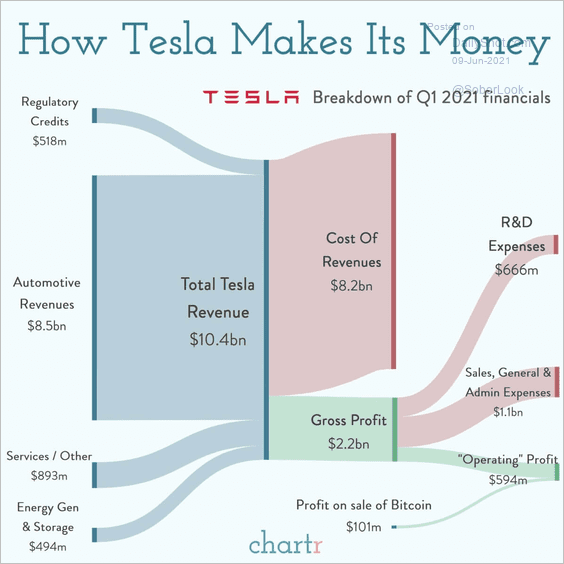

6. How Tesla makes its money:

Source: @chartrdaily

Source: @chartrdaily

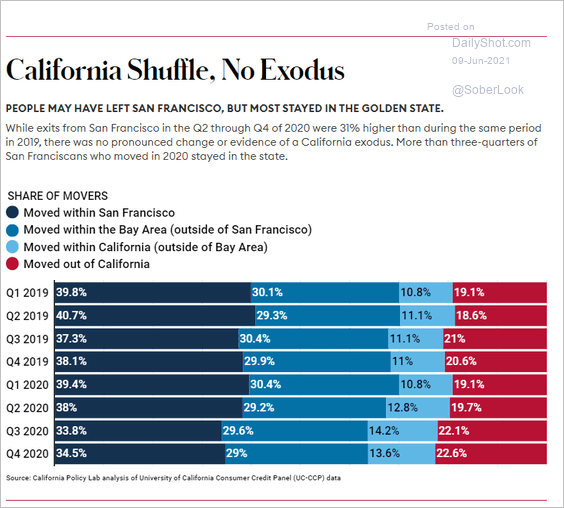

7. Leaving San Francisco:

Source: Forbes Read full article

Source: Forbes Read full article

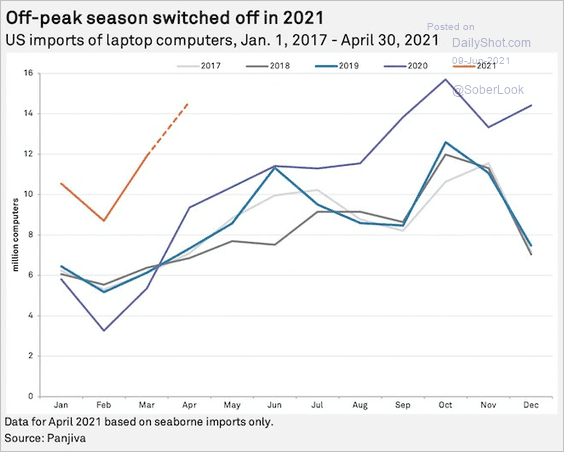

8. US imports of laptop computers:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

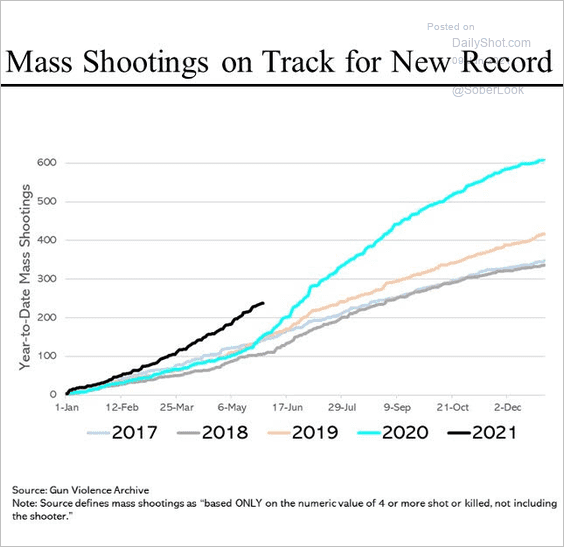

9. US mass shootings:

Source: @SteveRattner

Source: @SteveRattner

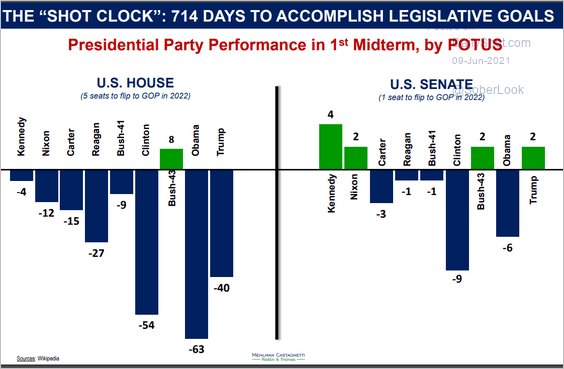

10. President’s party performance in first midterms:

Source: Bruce Mehlman Read full article

Source: Bruce Mehlman Read full article

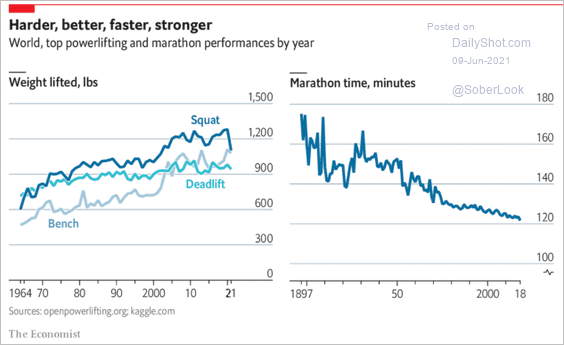

11. Top powerlifting and marathon performances over time:

Source: The Economist Read full article

Source: The Economist Read full article

——————–

Back to Index