The Daily Shot: 10-Jun-21

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

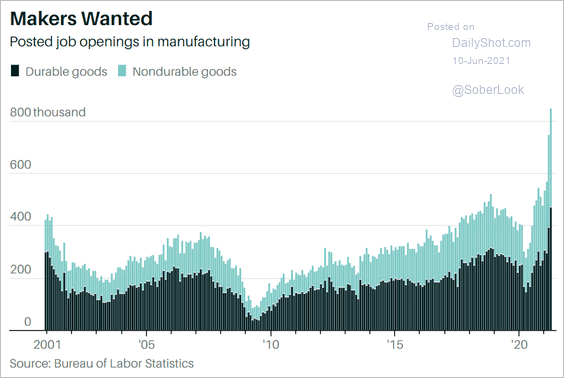

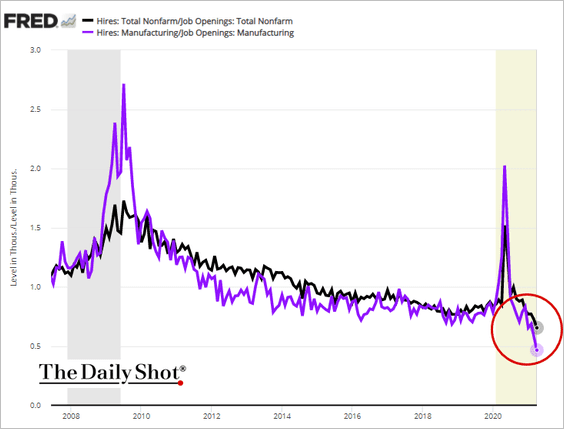

1. Let’s begin with some labor market and wage trends.

• As discussed previously, worker shortages in manufacturing are becoming acute.

Source: Barron’s Read full article

Source: Barron’s Read full article

The hires-to-openings ratio in the sector is lower than the overall US labor force.

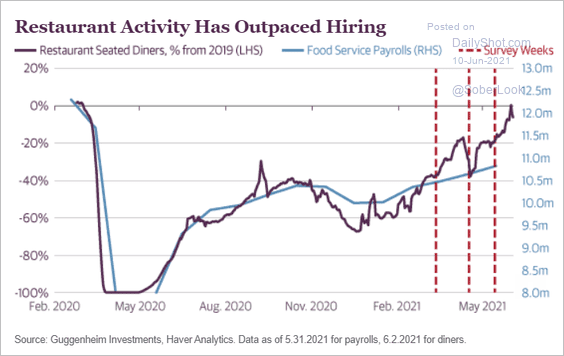

• Restaurants are having trouble hiring as they reopen.

Source: Guggenheim

Source: Guggenheim

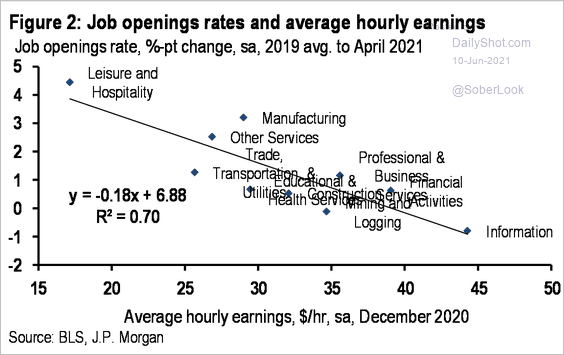

• This scatterplot shows the relationship between changes in job openings and sector wages.

Source: JP Morgan; @bcheungz

Source: JP Morgan; @bcheungz

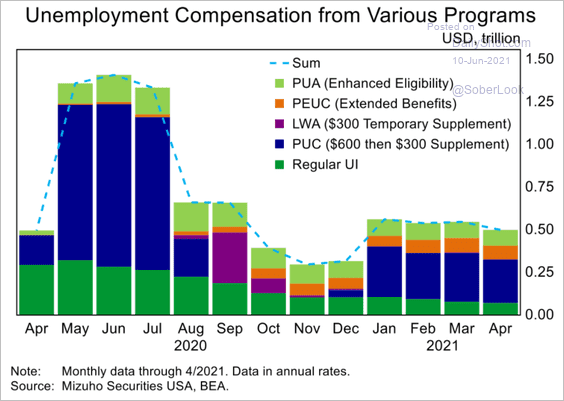

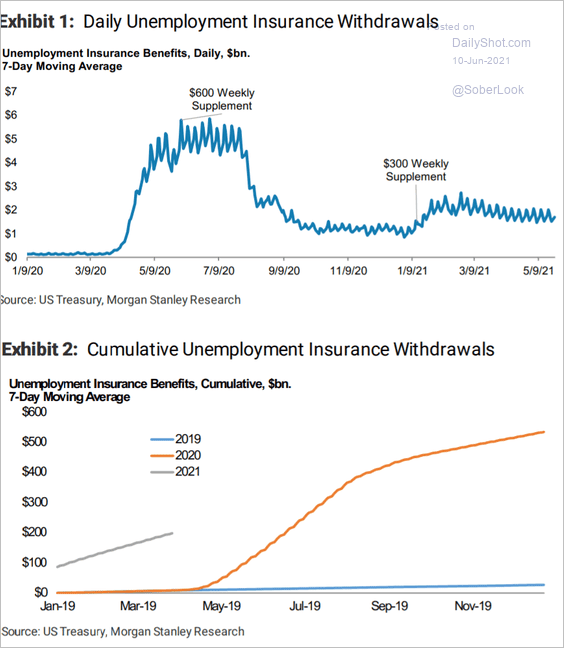

• Here are the dollar amounts drawn from unemployment benefits programs (2 charts).

Source: Mizuho Securities USA

Source: Mizuho Securities USA

Source: Morgan Stanley Research

Source: Morgan Stanley Research

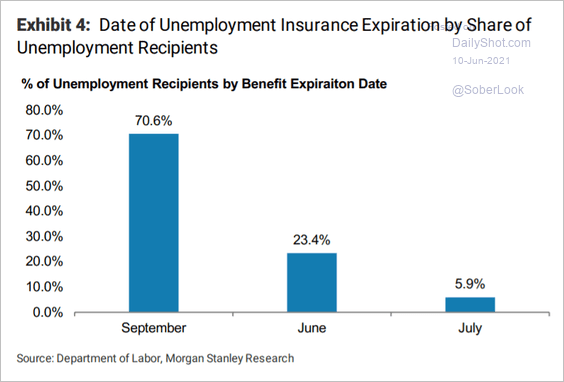

When will the emergency programs expire?

Source: Morgan Stanley Research

Source: Morgan Stanley Research

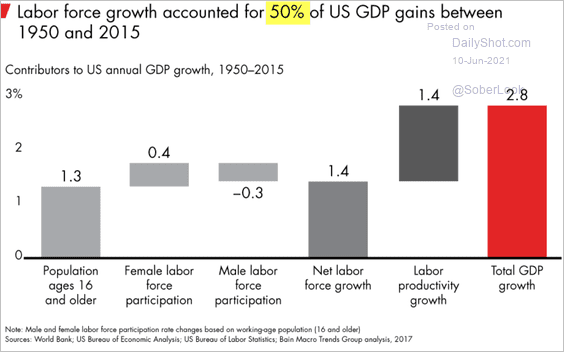

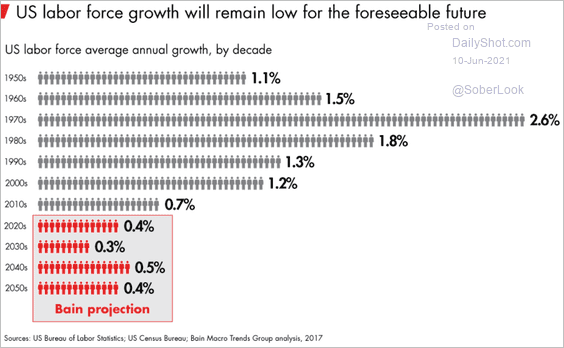

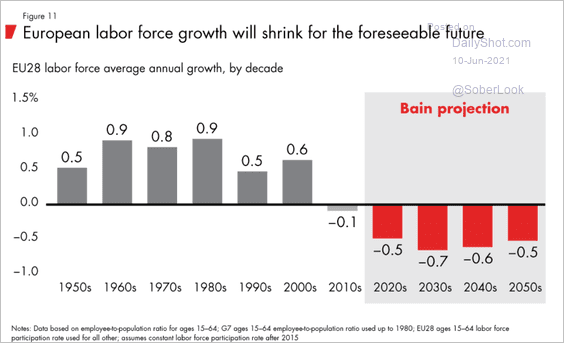

• Labor force growth is vital for economic expansion.

Source: Bain & Company Read full article

Source: Bain & Company Read full article

But it’s expected to remain tepid.

Source: Bain & Company Read full article

Source: Bain & Company Read full article

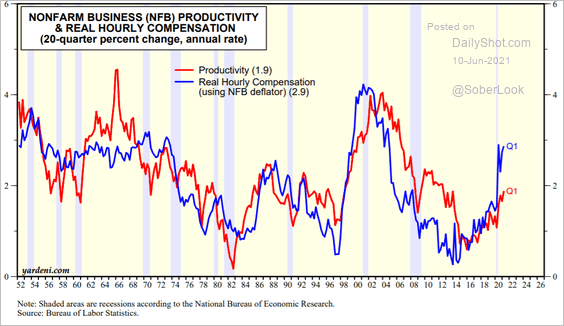

• This chart shows the recent divergence between productivity and wages (these indices were partially distorted by disproportionally large job losses in low-wage sectors).

Source: Yardeni Research

Source: Yardeni Research

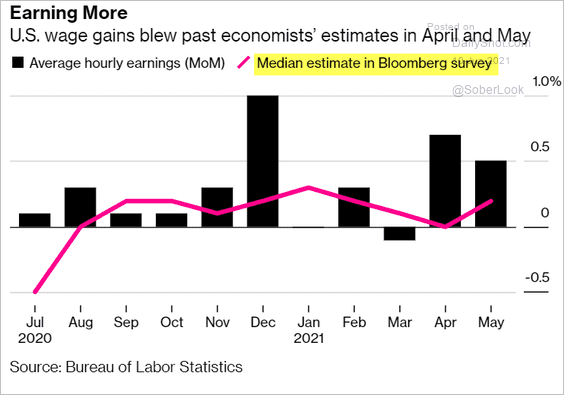

• Wage growth has been surprising to the upside.

Source: @markets Read full article

Source: @markets Read full article

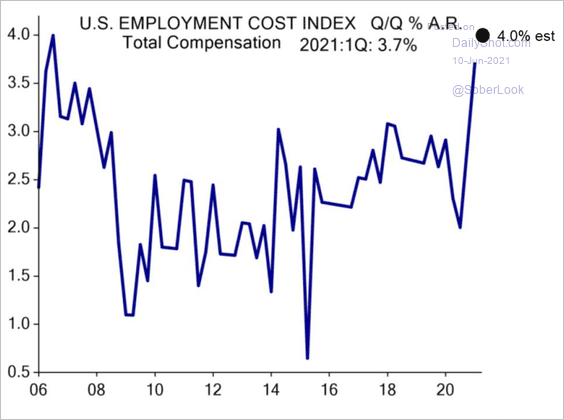

• Evercore ISI expects faster growth in compensation costs in Q2.

Source: Evercore ISI

Source: Evercore ISI

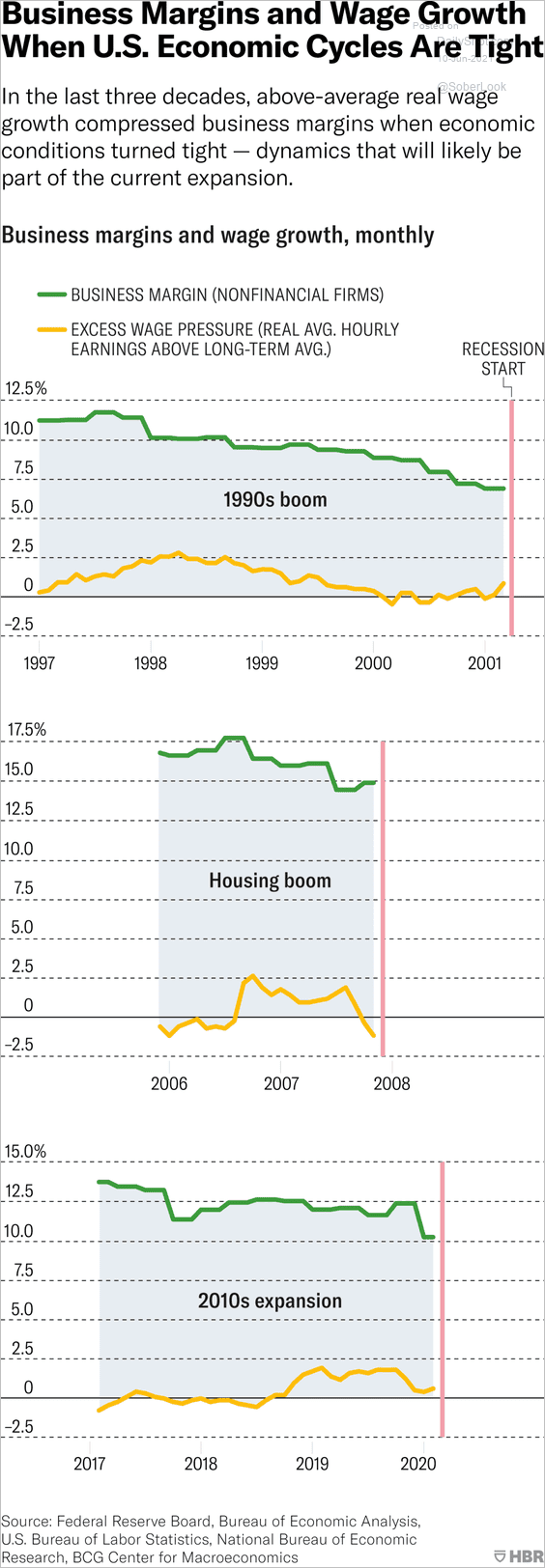

• Above-average wage growth can compress business margins.

Source: HBR Read full article

Source: HBR Read full article

——————–

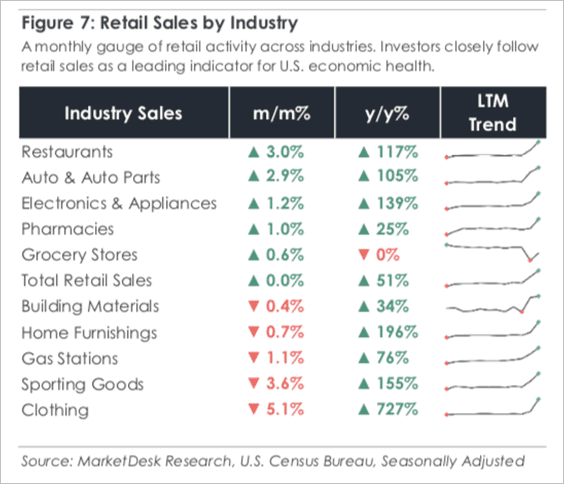

2. Restaurant and auto sales have been leading the surge in retail activity.

Source: MarketDesk Research

Source: MarketDesk Research

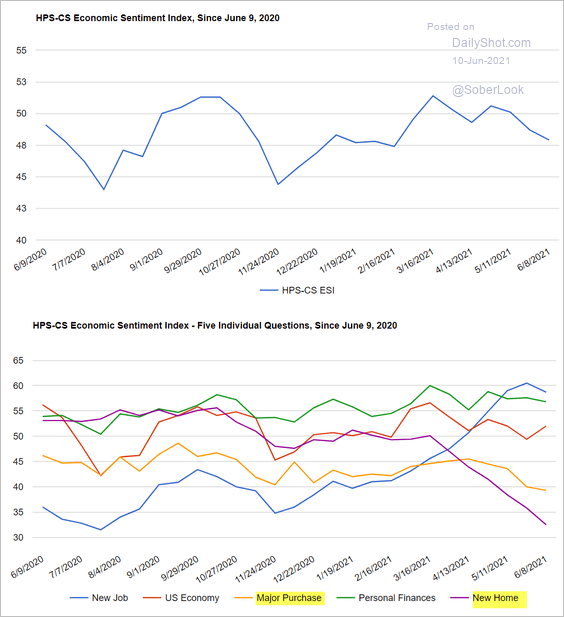

3. Rising prices in consumer durables and rapid home price appreciation are becoming a drag on consumer confidence.

Source: @HPSInsight, @CivicScience

Source: @HPSInsight, @CivicScience

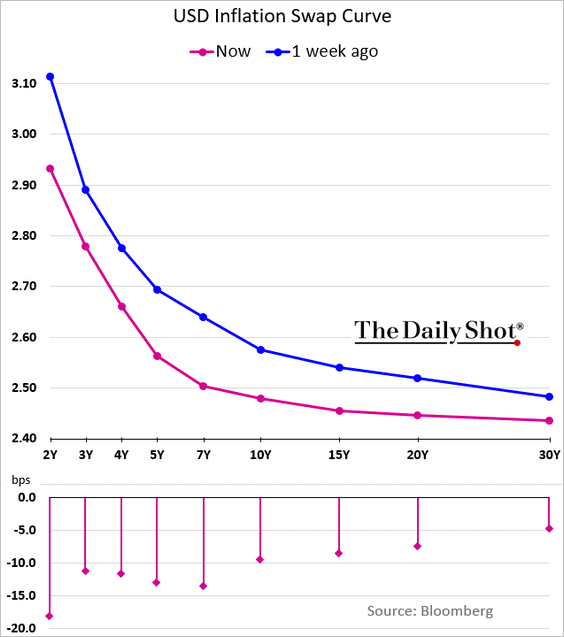

4. The market is buying the Fed’s “transient” inflation narrative. Here is the US inflation swap curve.

Back to Index

The United Kingdom

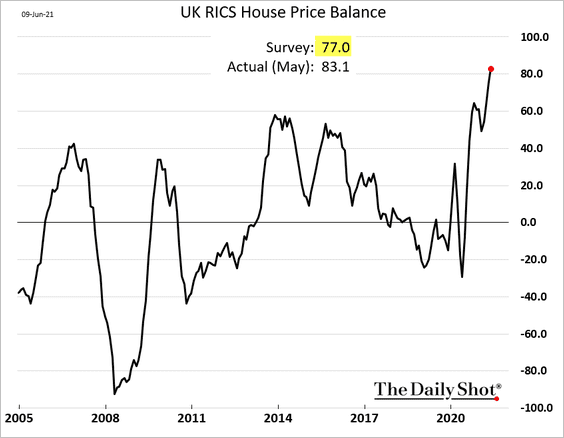

1. Home price appreciation strengthened last month.

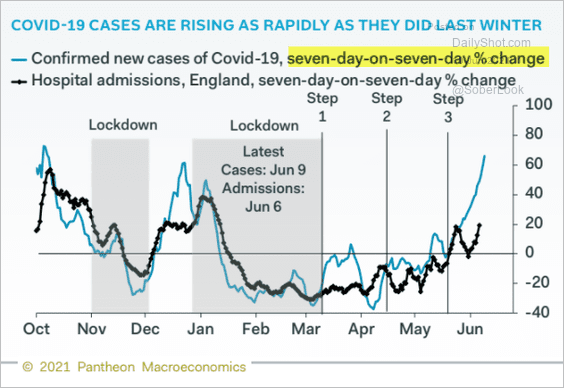

2. The sharp uptick in COVID cases is alarming.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

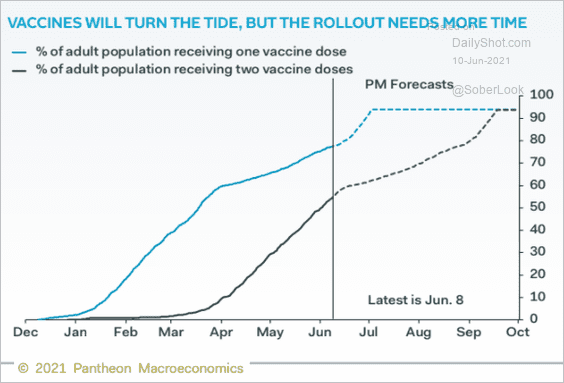

The pace of vaccinations needs to accelerate.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

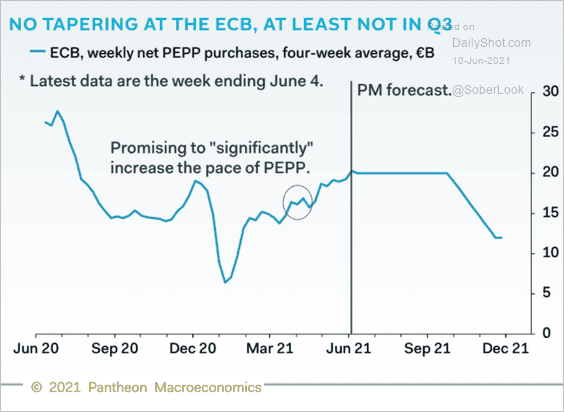

1. Many analysts don’t expect the ECB to begin tapering until Q4 or later.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

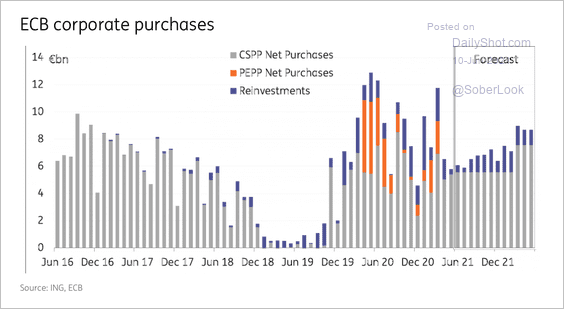

• ING does not expect the ECB to follow the Fed’s lead in selling its corporate bond holdings.

Source: ING

Source: ING

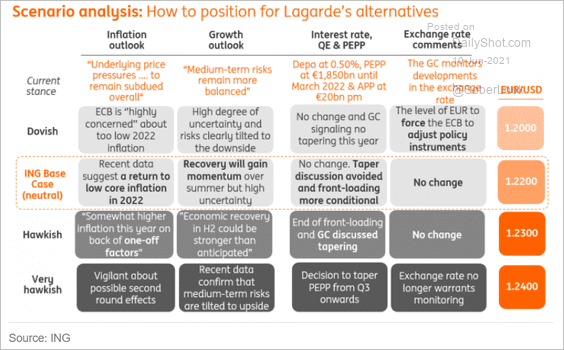

• Here are some scenarios for today’s ECB announcement and a potential impact on the euro.

Source: ING

Source: ING

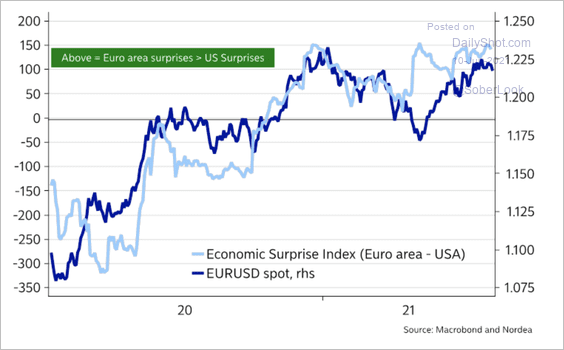

2. Positive economic surprises relative to the US have benefited EUR/USD over the past year.

Source: Nordea Markets

Source: Nordea Markets

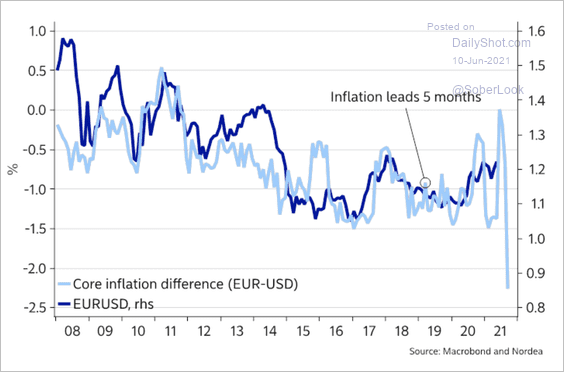

However, a record spread between euro-area and US core-inflation could weigh on EUR/USD.

Source: Nordea Markets

Source: Nordea Markets

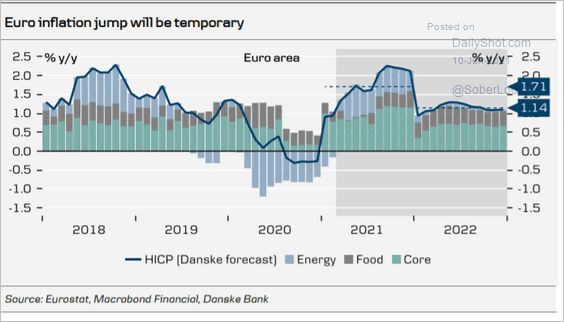

3. Here is a comment from Danske Bank on inflation: “Although the recent recovery in inflation expectations is welcoming news for the ECB, we think the rise in core inflation observed this year will be temporary.”

Source: Danske Bank

Source: Danske Bank

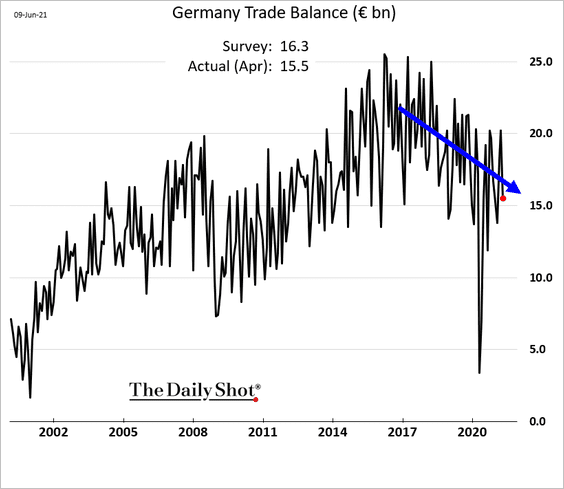

4. Germany’s trade surplus continues to trend lower.

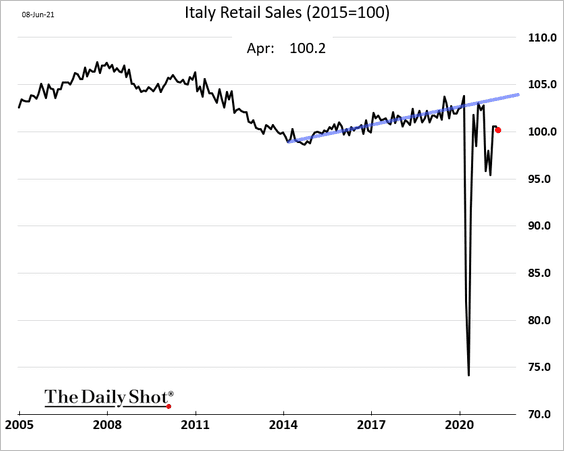

5. Italy’s retail sales remain well below the pre-COVID trend.

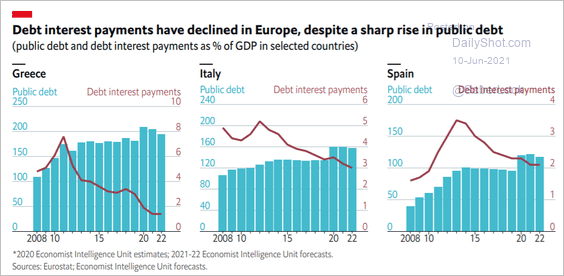

6. Despite sharp increases in debt-to-GDP ratios, governments’ interest payments have been moving lower.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Europe

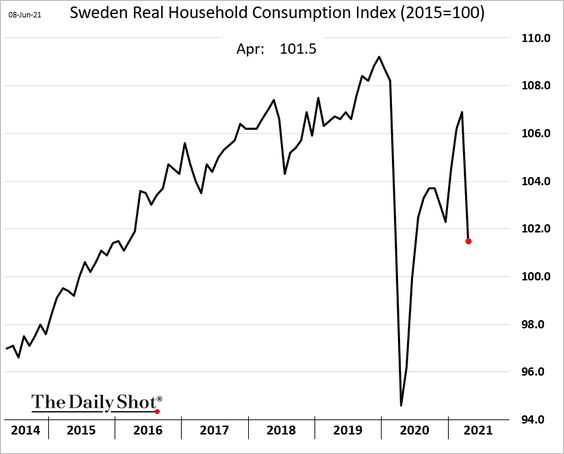

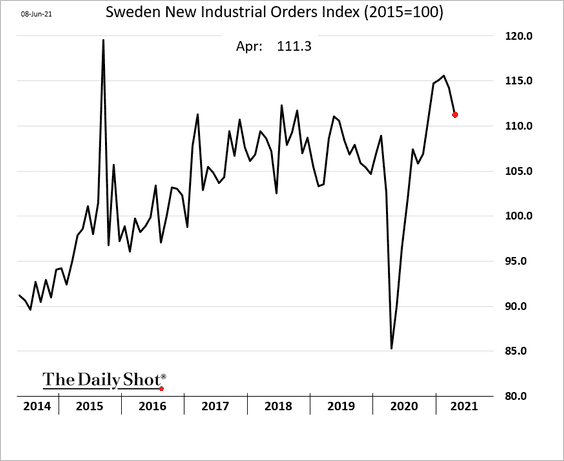

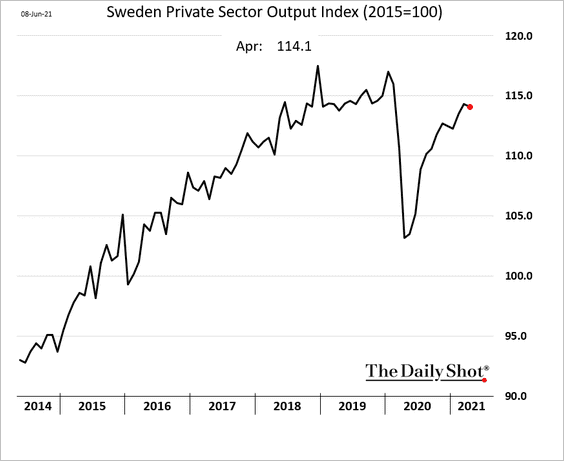

1. Let’s begin with Sweden.

• Household consumption tumbled in April.

• Industrial orders eased.

• Private-sector output is still below pre-COVD levels.

——————–

2. The EU’s labor force growth will remain negative in the decades to come.

Source: Bain & Company Read full article

Source: Bain & Company Read full article

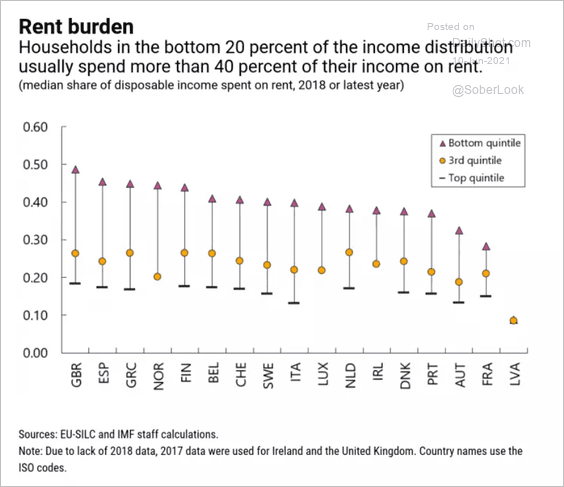

3. This chart shows household rent burdens in select economies.

Source: WEF Read full article

Source: WEF Read full article

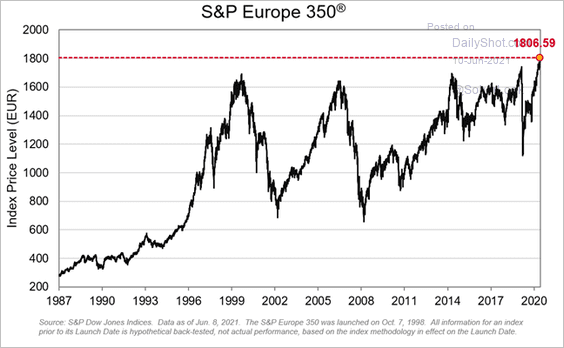

4. European equity markets are hitting record highs.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Japan

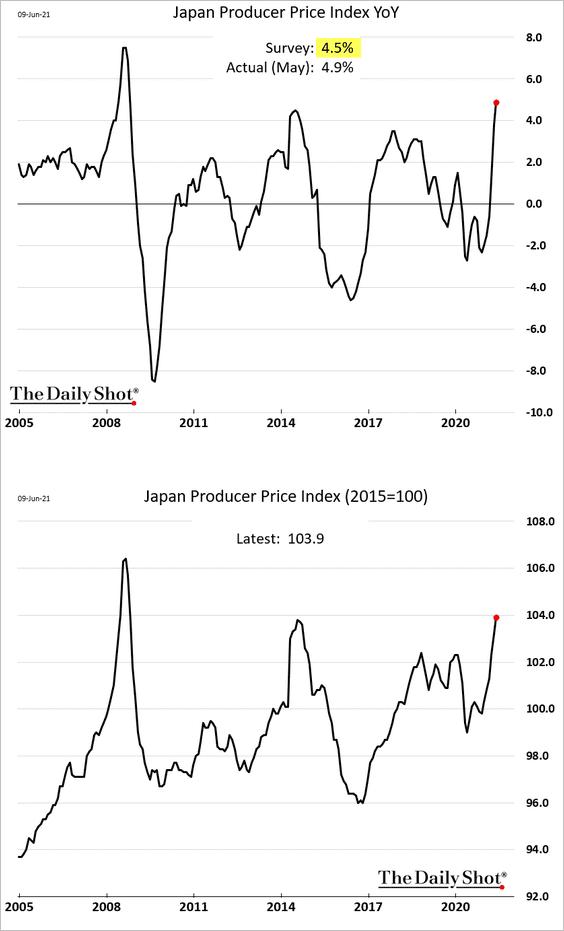

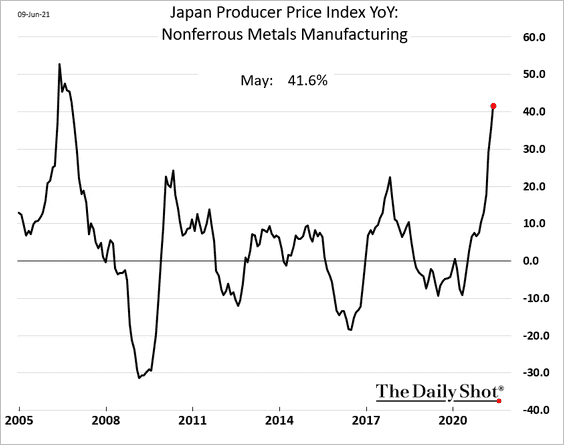

1. Producer price gains surprised to the upside, driven by energy and industrial commodities.

——————–

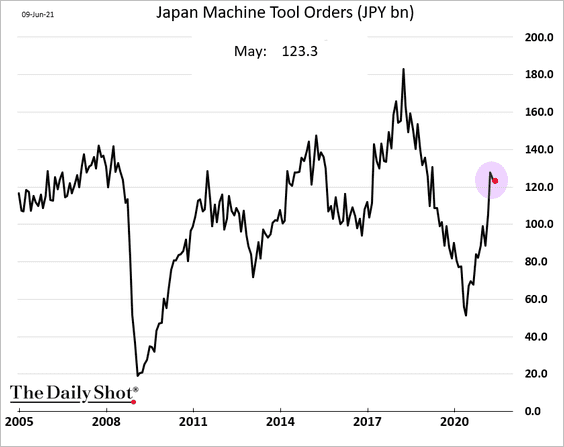

2. Gains in machine tool orders paused in May.

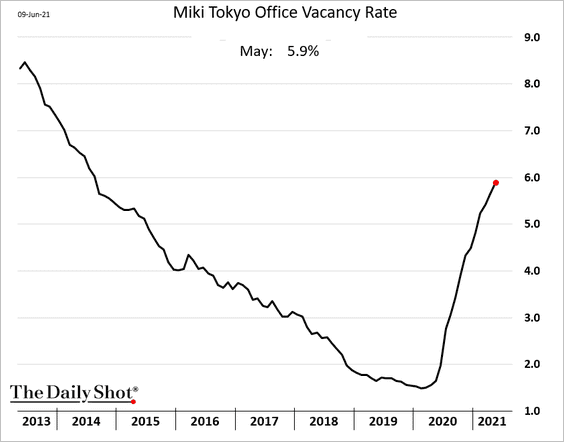

3. Tokyo’s office vacancy rate keeps climbing.

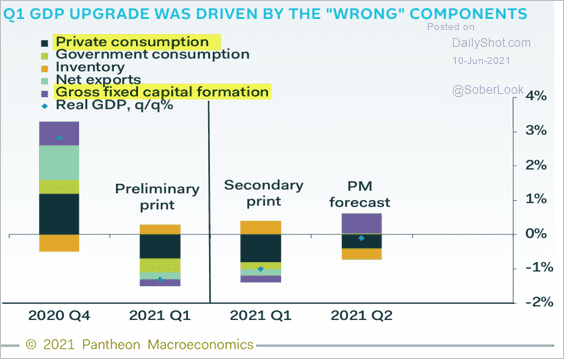

4. Private consumption is expected to be a drag on GDP growth again this quarter.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

China

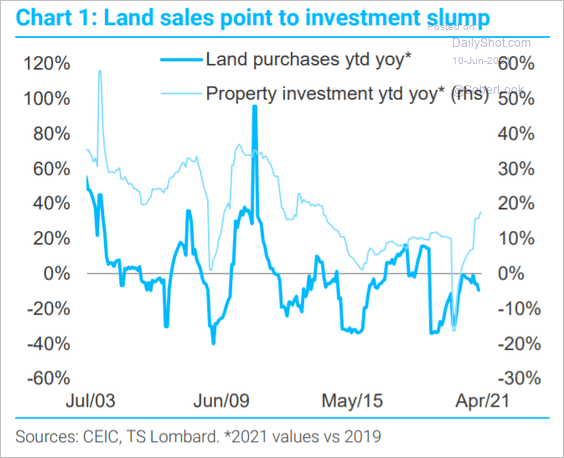

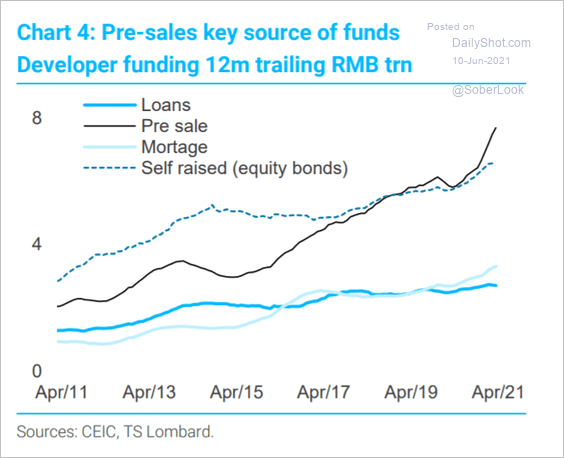

1. Land sales point to real estate investment slump.

Source: TS Lombard

Source: TS Lombard

How do property developers fund themselves?

Source: TS Lombard

Source: TS Lombard

——————–

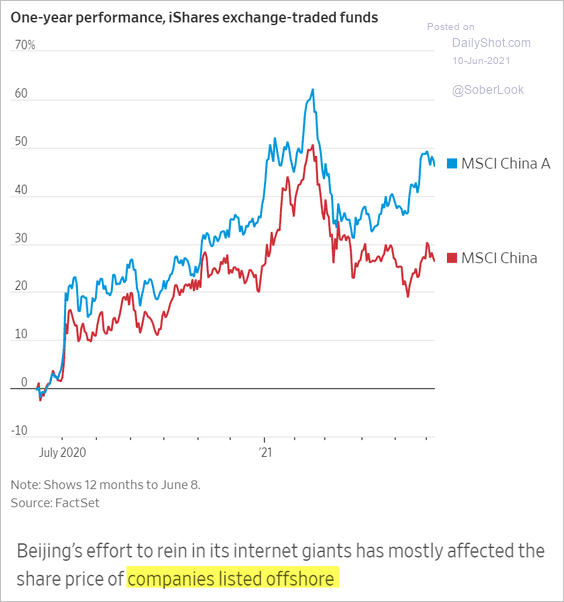

2. Beijing’s crackdown on tech firms had more impact on shares trading in Hong King than in the mainland.

Source: @WSJ Read full article

Source: @WSJ Read full article

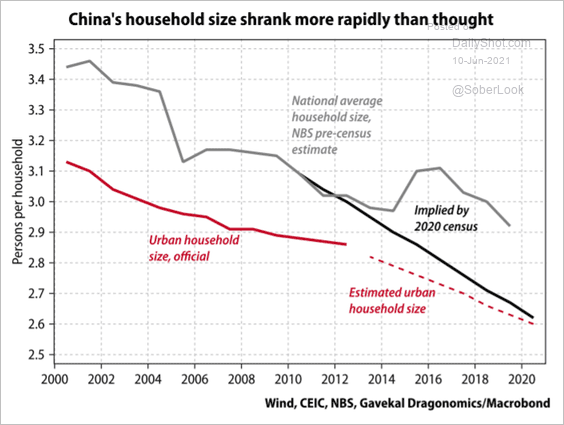

3. According to Gavekal Research, “migration is shrinking the average household size more sharply than previously estimated.”

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

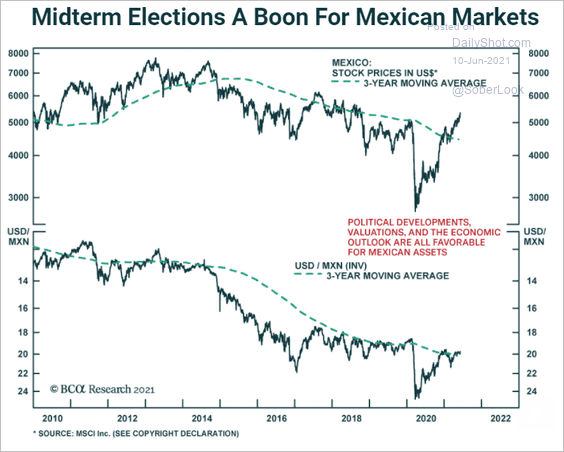

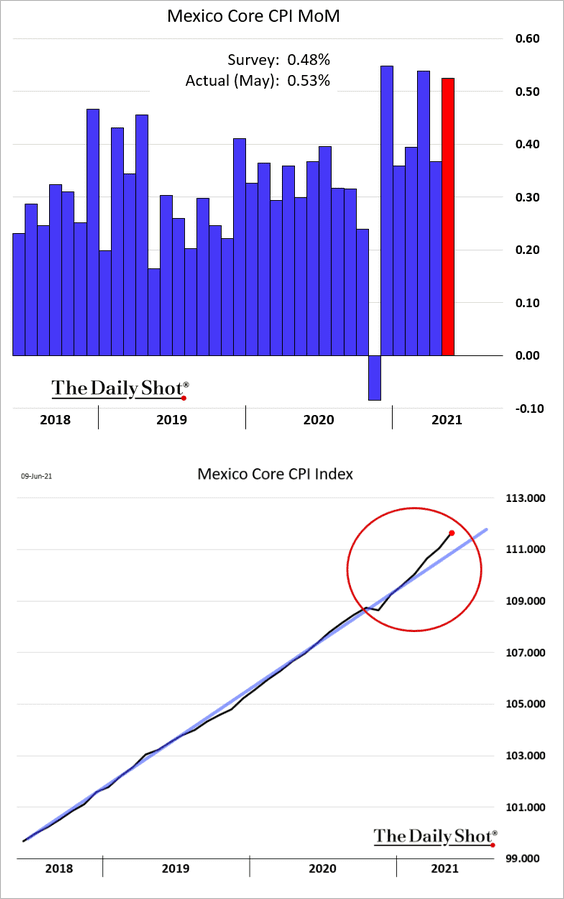

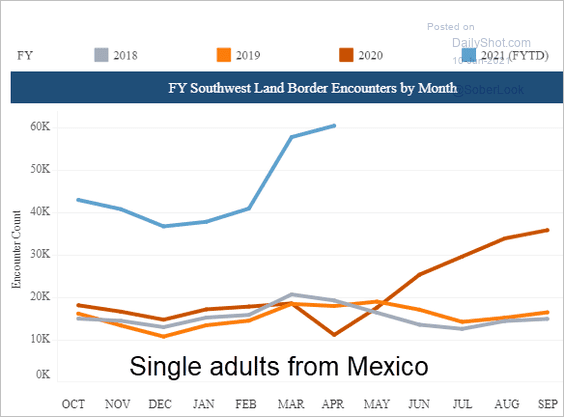

1. Let’s begin with Mexico.

• The markets cheered the ruling leftist coalition failing to secure two-thirds of the seats in the lower house.

Source: BCA Research

Source: BCA Research

• Core inflation surprised to the upside, with price gains now deviating from the pre-COVID trend (2nd chart).

• A sharp increase in single Mexican men apprehended at the US border points to a deterioration in the nation’s labor market.

Source: CBP

Source: CBP

——————–

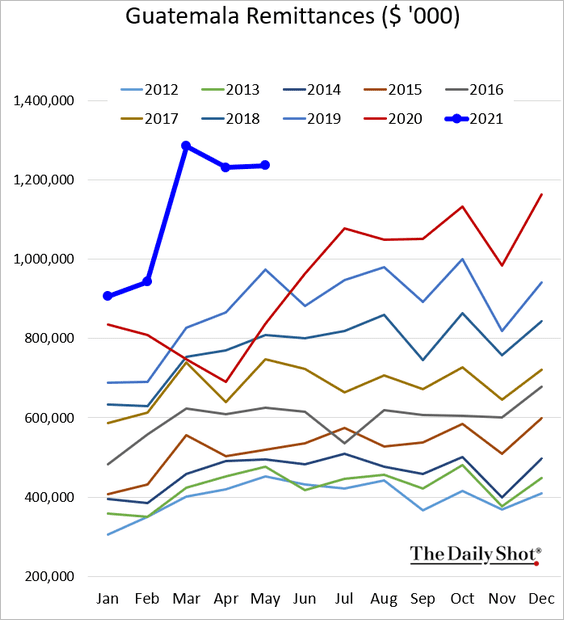

2. Guatemala’s remittances remain at record highs for this time of the year.

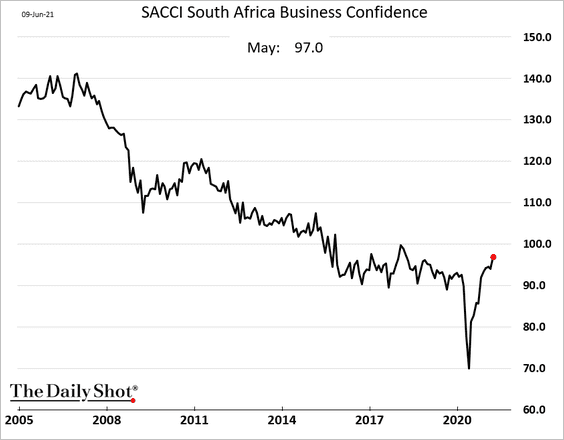

3. South Africa’s business confidence is rebounding.

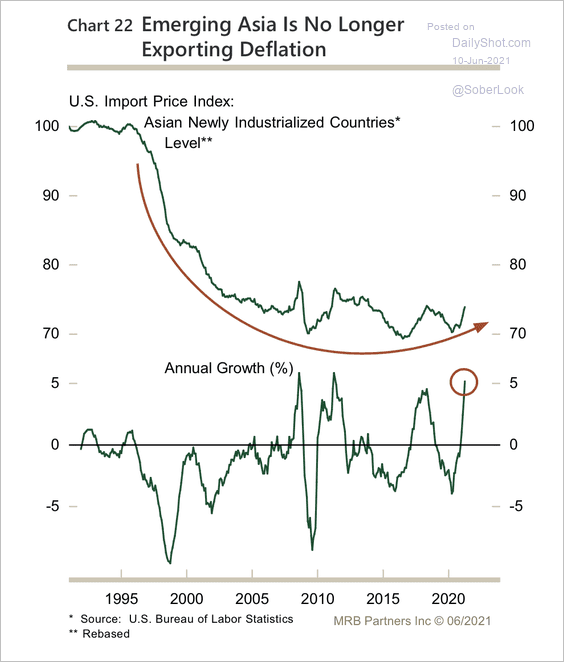

4. EM Asia’s inflation is on the upswing.

Source: MRB Partners

Source: MRB Partners

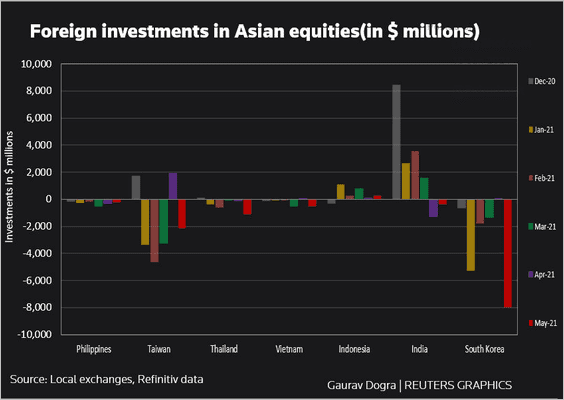

5. Asian equity markets saw outflows in May.

Source: Reuters Read full article

Source: Reuters Read full article

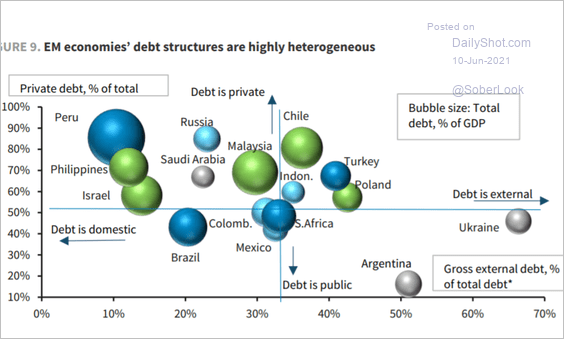

6. This scatterplot shows the relative amounts of public and private debt vs. external/internal debt mix.

Source: Barclays Research

Source: Barclays Research

Back to Index

Commodities

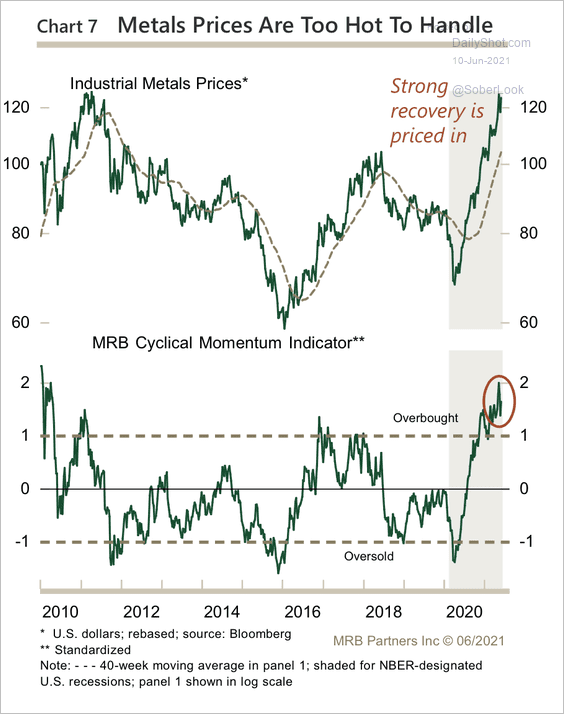

1. Industrial metal prices appear to be overbought.

Source: MRB Partners

Source: MRB Partners

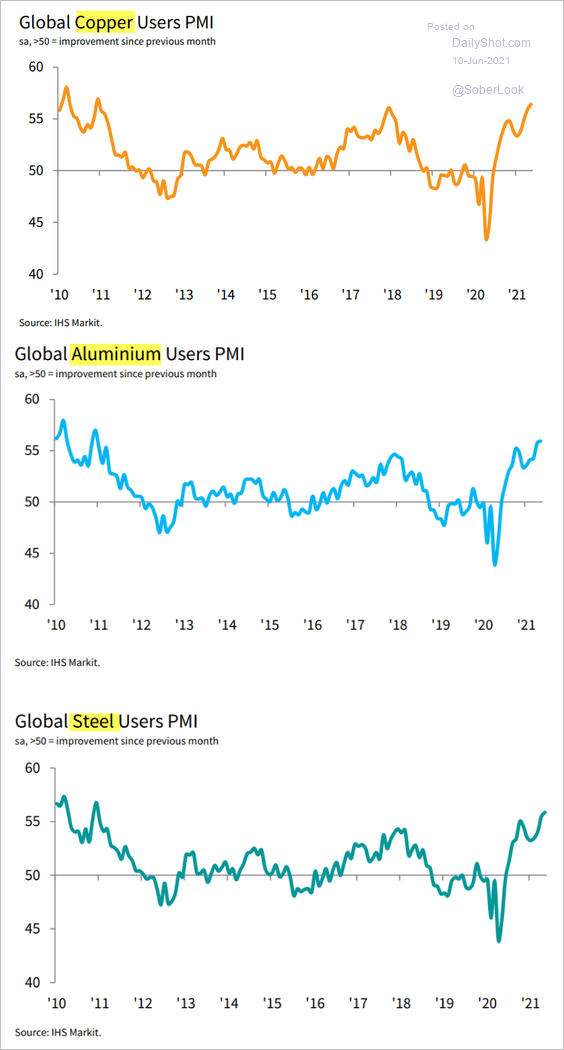

2. Industrial metals users’ business activity accelerated in May.

Source: IHS Markit

Source: IHS Markit

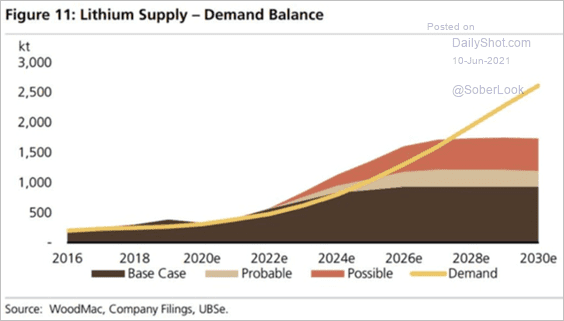

3. This chart illustrates the looming lithium market deficit.

Source: Kitco Read full article

Source: Kitco Read full article

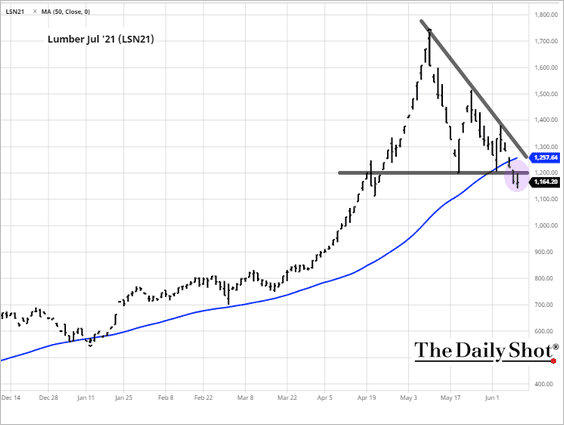

4. Technicals don’t look great for lumber.

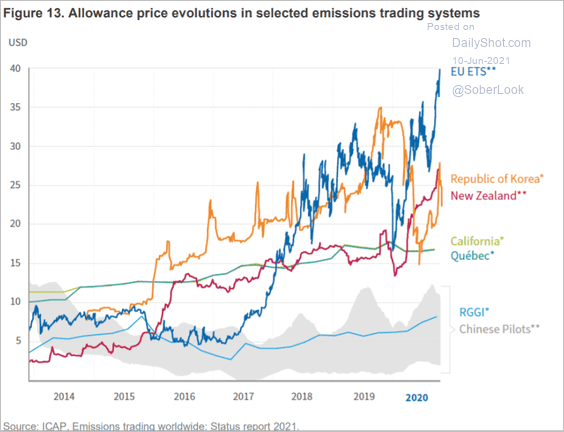

5. Here the price evolution of major emissions allowance markets.

Source: ftserussell.com Read full article

Source: ftserussell.com Read full article

Back to Index

Energy

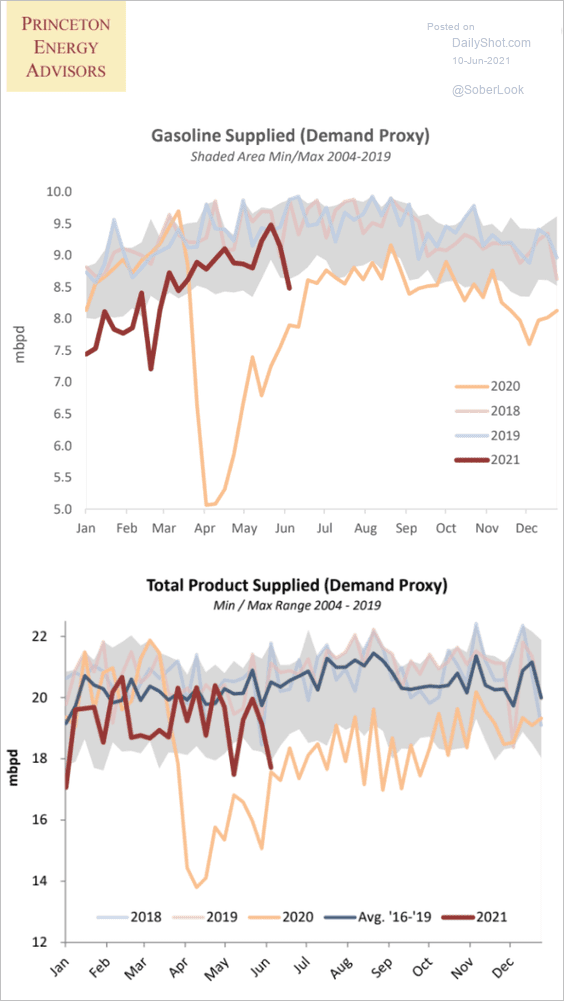

1. US gasoline demand dropped sharply last week, perhaps distorted by the Memorial Day holiday.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

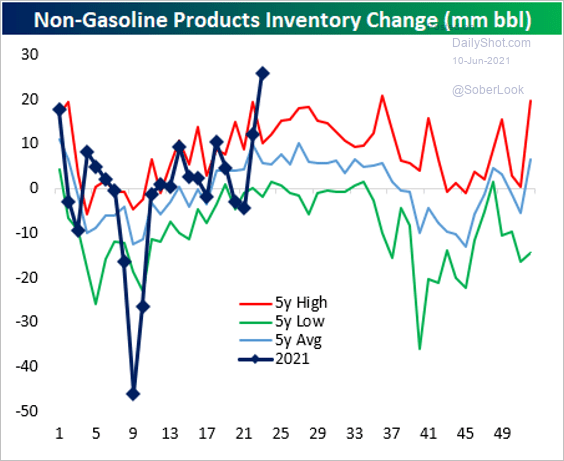

2. Non-gasoline refined products inventories jumped.

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

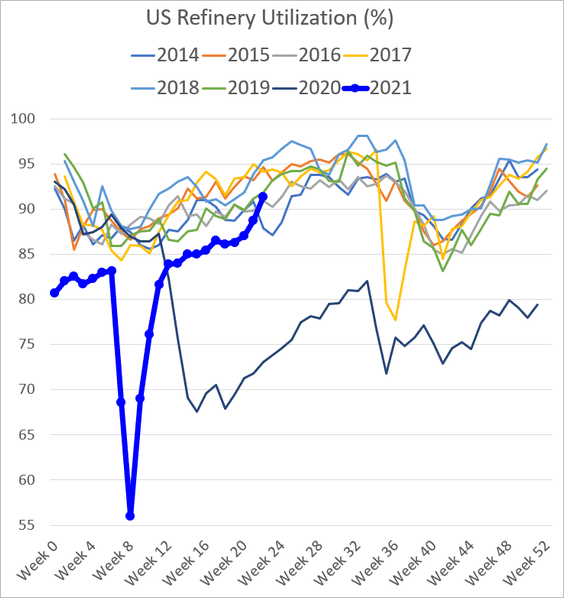

3. Refinery utilization is surging.

——————–

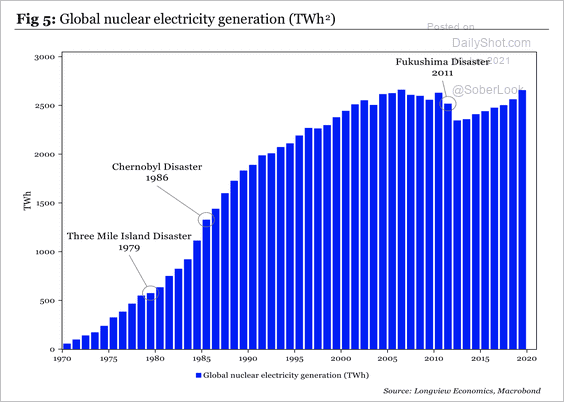

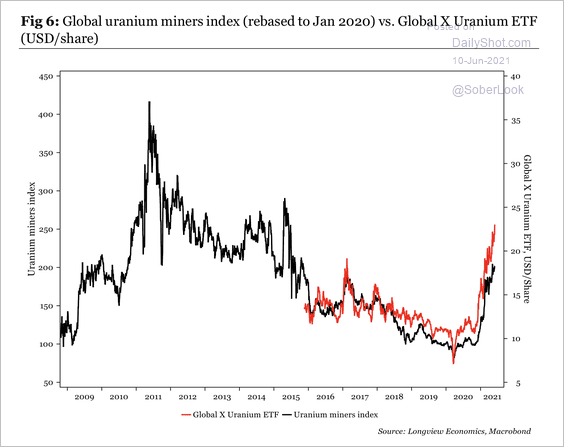

4. Global nuclear electricity generation has been steadily recovering over the past decade.

Source: Longview Economics

Source: Longview Economics

Uranium mining stocks have rallied over the past year.

Source: Longview Economics

Source: Longview Economics

——————–

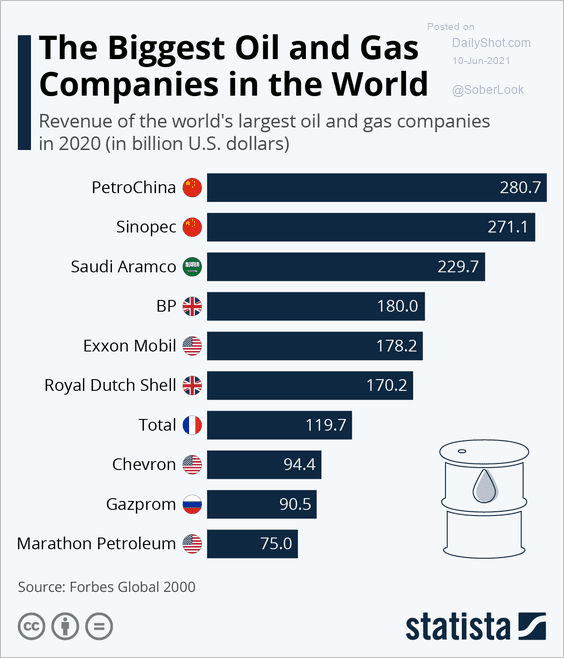

5. Here are the largest global oil & gas companies.

Source: Statista

Source: Statista

Back to Index

Equities

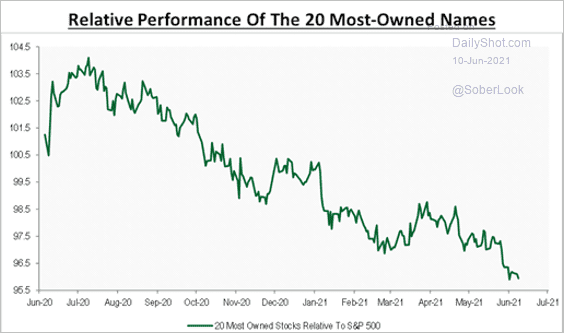

1. Most-owned names in the S&P 500 have consistently underperformed over the past 12 months.

Source: @MichaelKantro

Source: @MichaelKantro

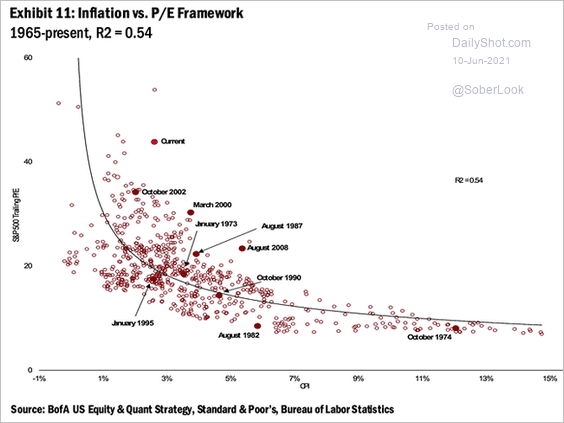

2. Valuation multiples tend to contract when inflation climbs.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

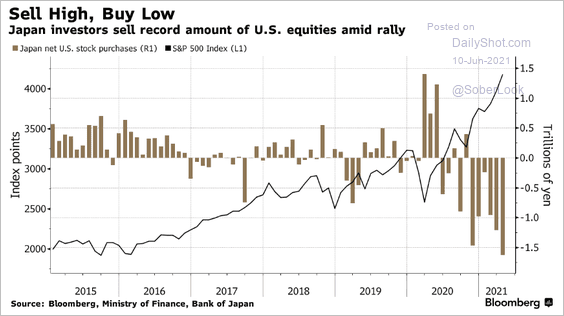

3. Japanese investors have been selling US stocks.

Source: Masaki Kondo Read full article

Source: Masaki Kondo Read full article

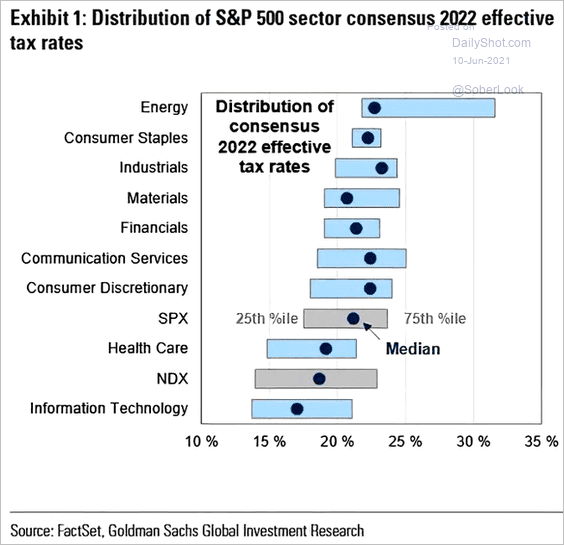

4. The 15% minimum effective tax rate should not impact the market (consensus estimates are higher across the board).

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

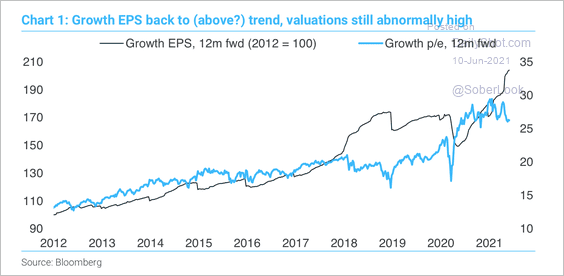

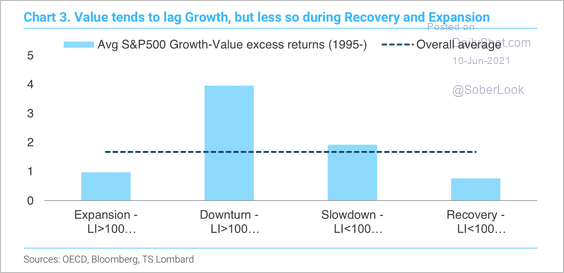

5. Growth stocks have posted strong earnings, although valuations remain high.

Source: TS Lombard

Source: TS Lombard

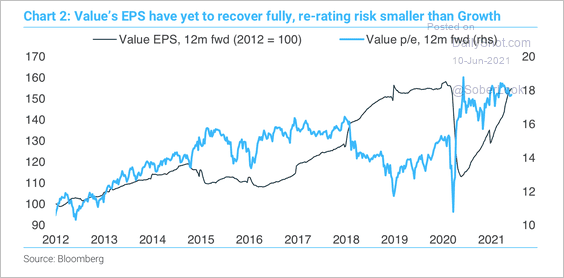

The earnings recovery for value stocks has lagged growth over the past year (2 charts).

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

——————–

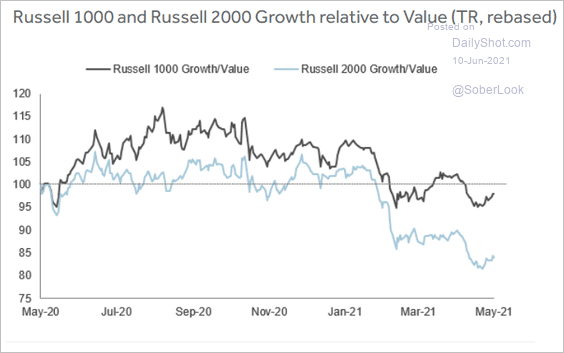

6. The recent underperformance of growth stocks has been more pronounced among small-caps.

Source: FTSE Russell

Source: FTSE Russell

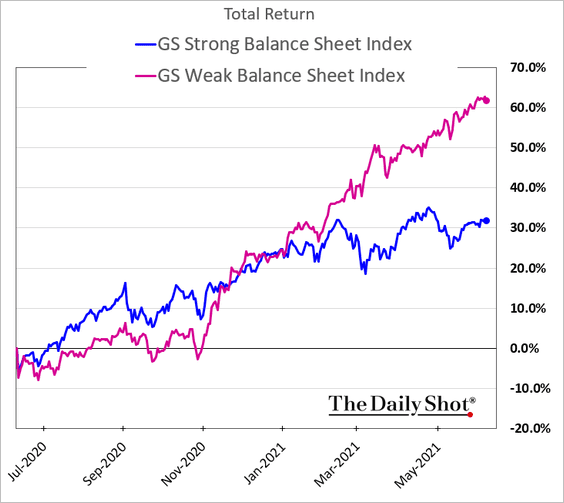

7. Companies with weak balance sheets continue to outperform (reflation bets).

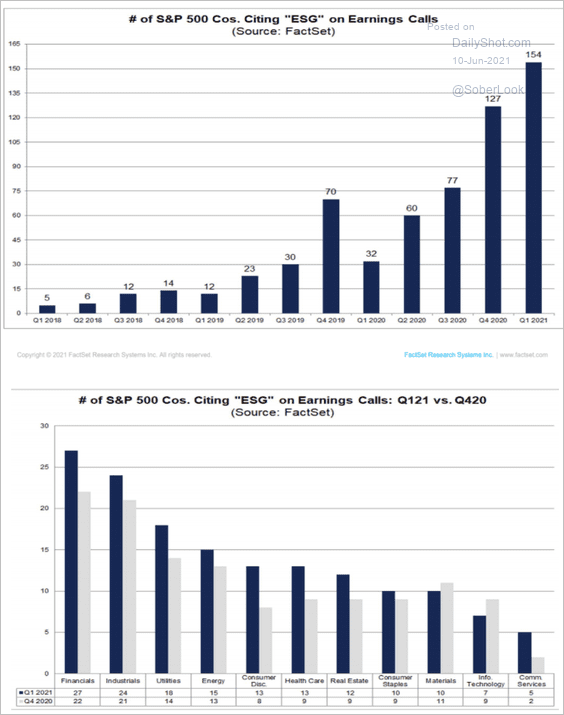

8. Companies are increasingly citing “ESG” on earnings calls.

Source: @FactSet

Source: @FactSet

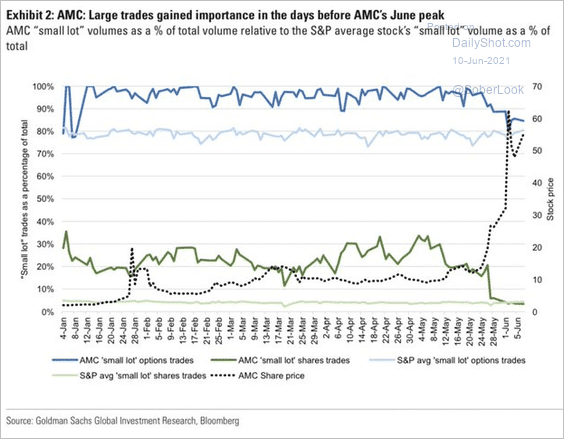

9. According to Goldman, “small-lot trading declines prior to the peak in share price, implying that large traders drive stock price moves prior to and following the peak in the episodes we analyzed.”

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

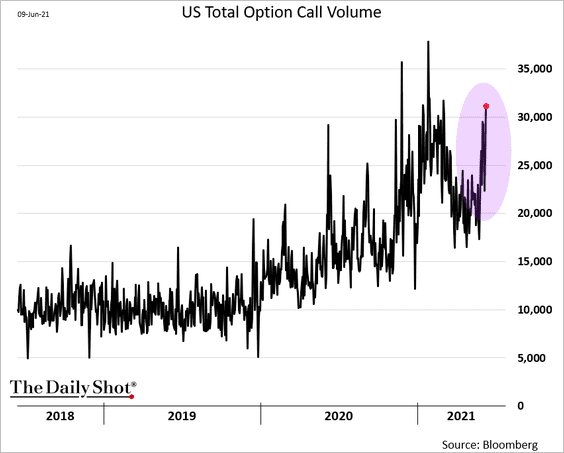

10. Next, we have some updates on the options markets.

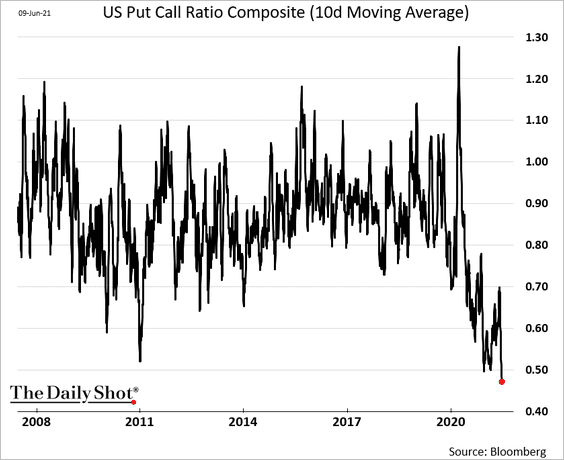

• Demand for call options accelerated in recent days, …

… sending the put-call ratio to extreme lows.

——————–

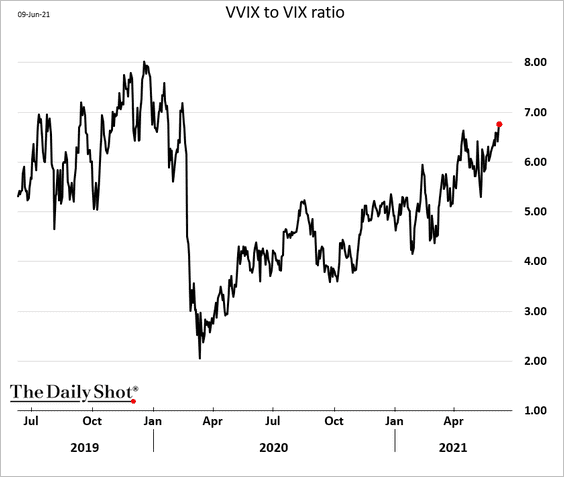

• The VVIX-to-VIX ratio keeps climbing, pointing to strong demand for VIX call options.

Back to Index

Credit

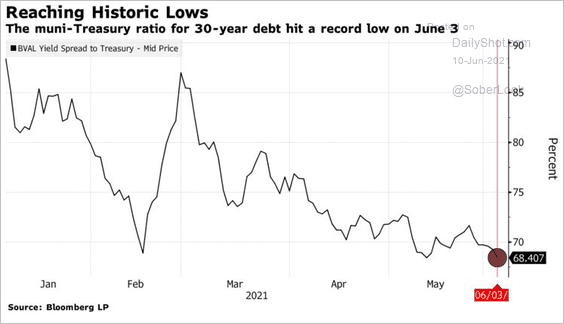

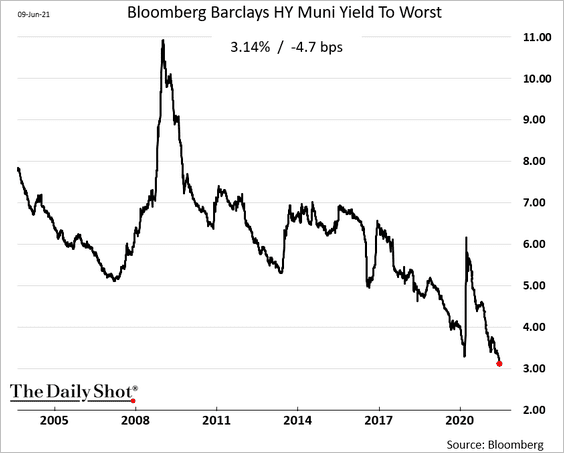

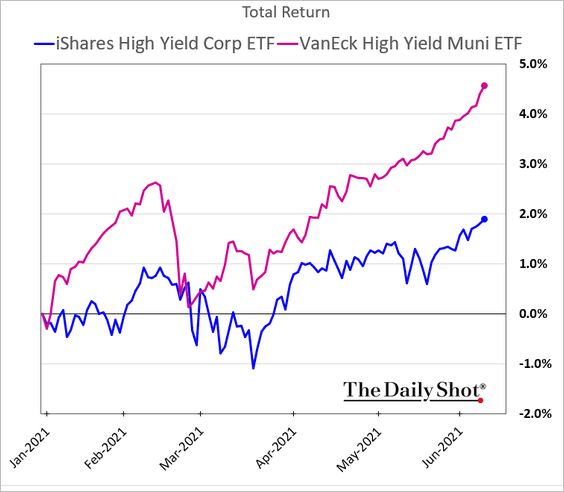

1. Muni markets continue to outperform.

• The muni-Treasury yield ratio:

Source: @markets Read full article

Source: @markets Read full article

• HY muni yield (a new low):

• High-yield munis outperforming high-yield corporates:

——————–

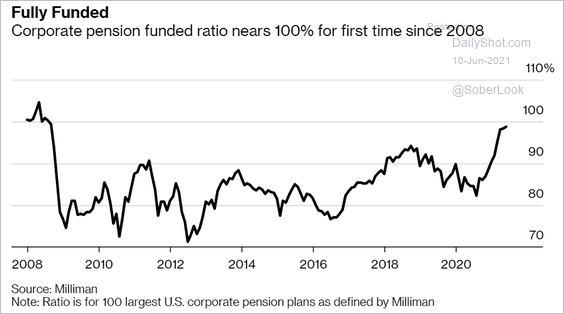

2. Corporate pensions are close to being fully funded. Will they roll out of risky assets into investment-grade debt to lock in their funding levels?

Source: Bloomberg Read full article

Source: Bloomberg Read full article

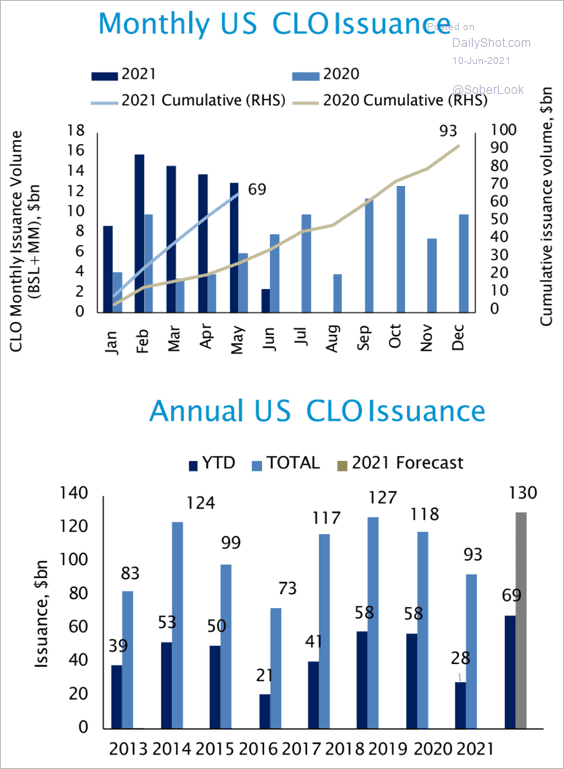

3. US CLO activity remains robust.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Rates

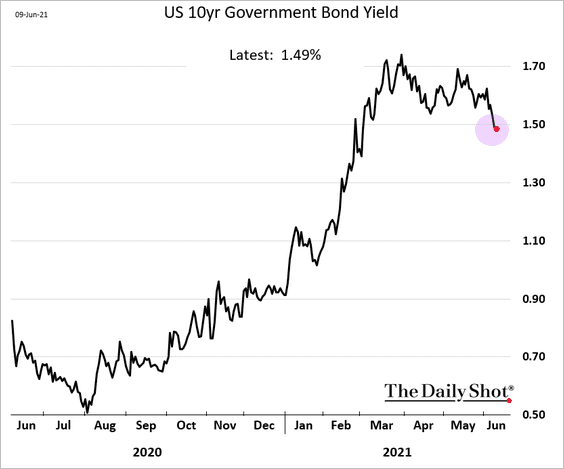

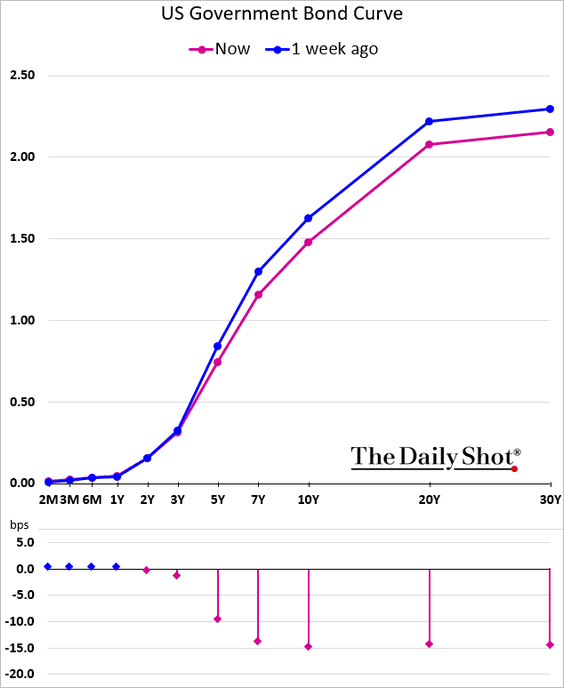

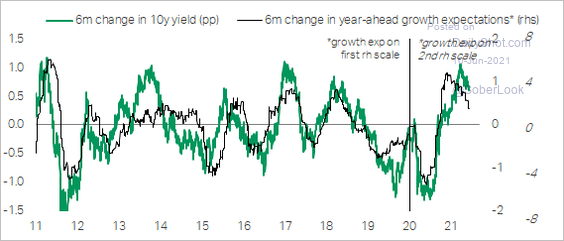

1. The 10yr Treasury yield is below 1.5%, …

… as the Treasury curve flattens.

Is all the “good news” about the US economy priced in?

Source: @oliver_brennan

Source: @oliver_brennan

——————–

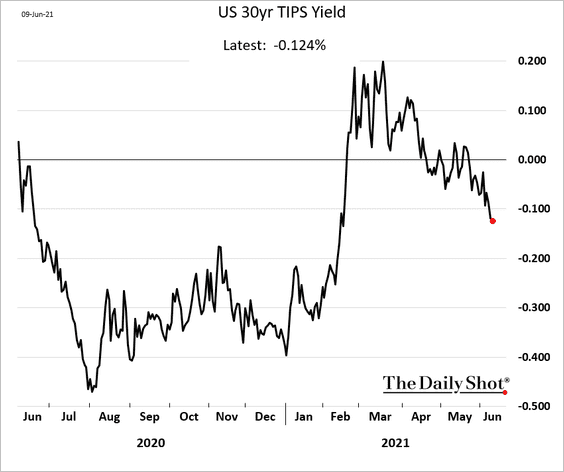

2. Longer-dated real yields continue to move lower.

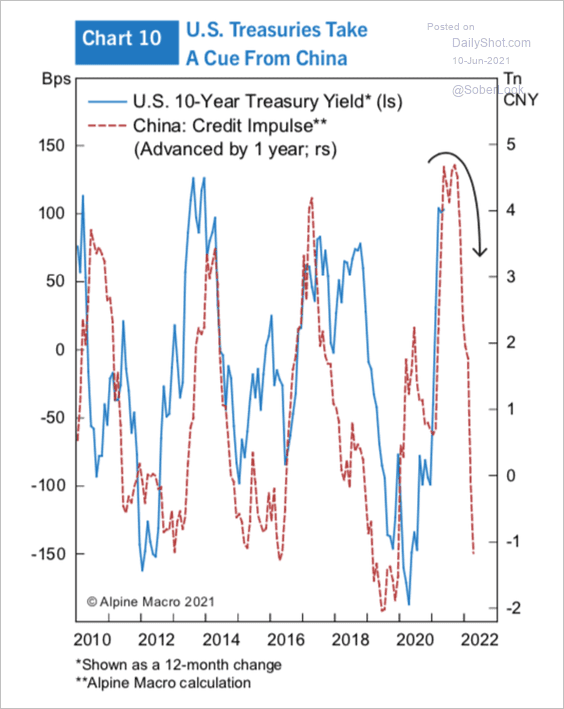

3. The decline in China’s credit impulse points to lower Treasury yields.

Source: Alpine Macro

Source: Alpine Macro

——————–

Food for Thought

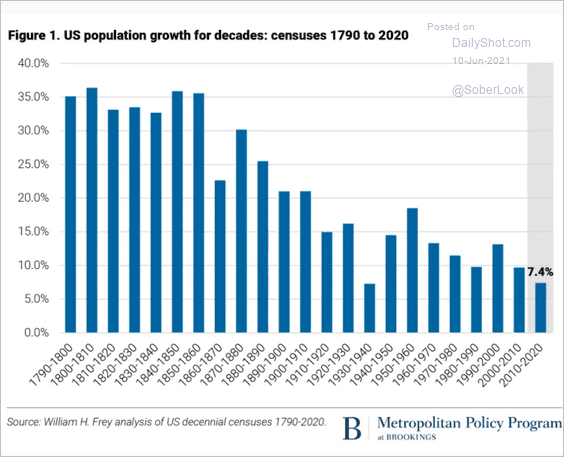

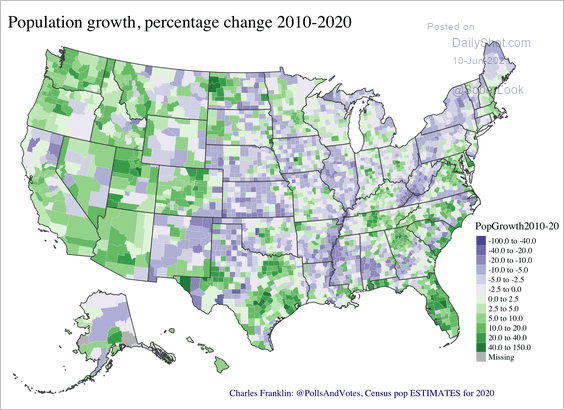

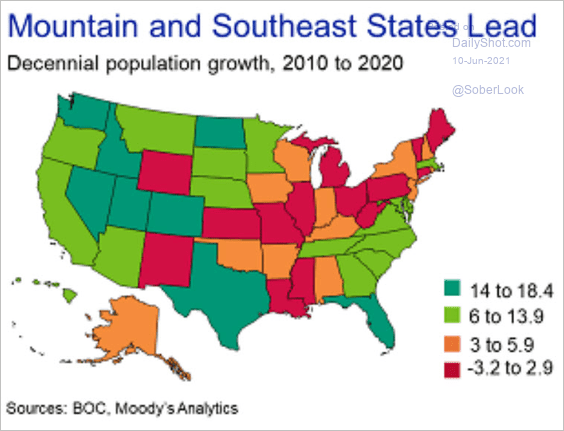

1. US population growth (3 charts):

Source: Brookings

Source: Brookings

Source: @PollsAndVotes Read full article

Source: @PollsAndVotes Read full article

Source: Moody’s Analytics

Source: Moody’s Analytics

——————–

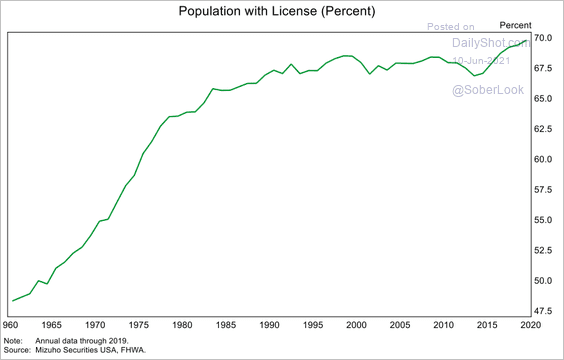

2. US population with a driver’s license:

Source: Mizuho Securities USA

Source: Mizuho Securities USA

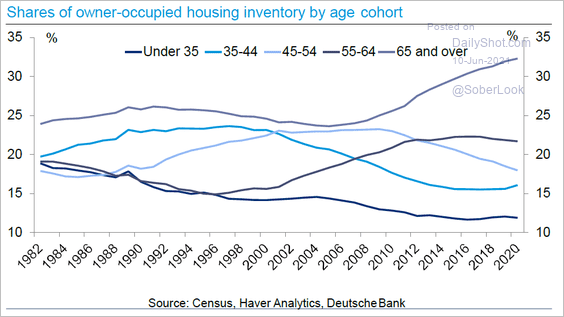

3. Homeownership by age:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

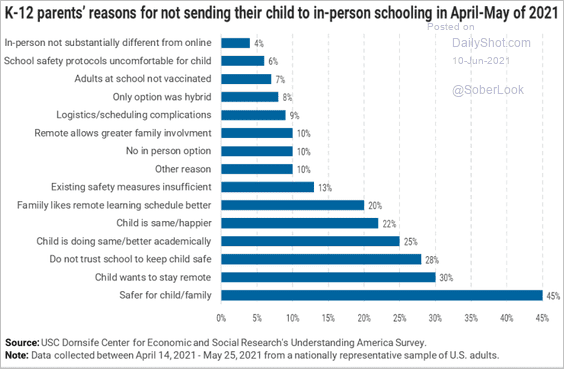

4. Why are some parents sticking with remote learning – even as schools reopen?

Source: The Brookings Institution Read full article

Source: The Brookings Institution Read full article

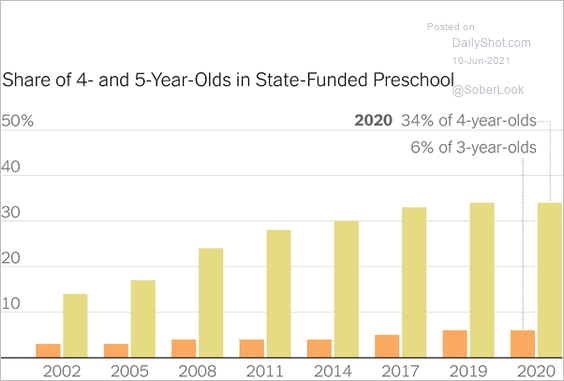

5. State-funded preschool:

Source: The Upshot Read full article

Source: The Upshot Read full article

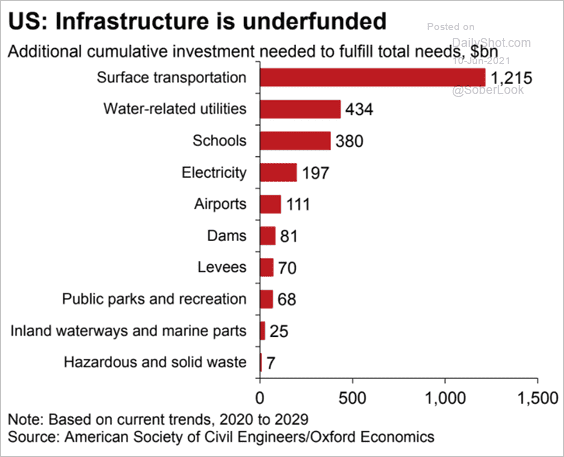

6. Underfunded US infrastructure:

Source: Oxford Economics

Source: Oxford Economics

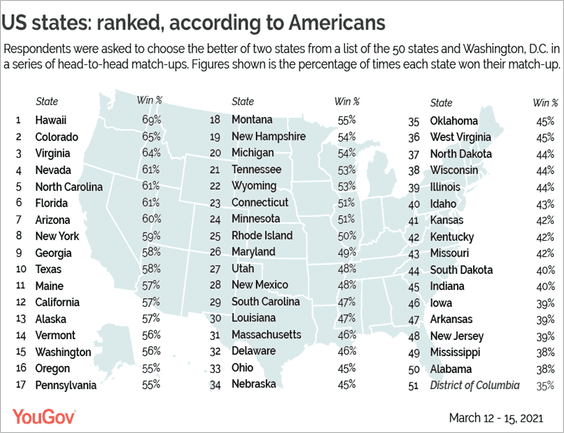

7. US states ranked:

Source: YouGov Read full article

Source: YouGov Read full article

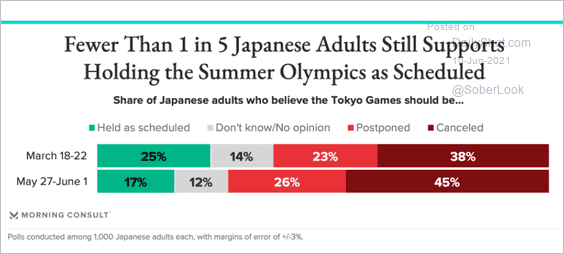

8. Falling support for holding the Summer Olympics in Japan:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

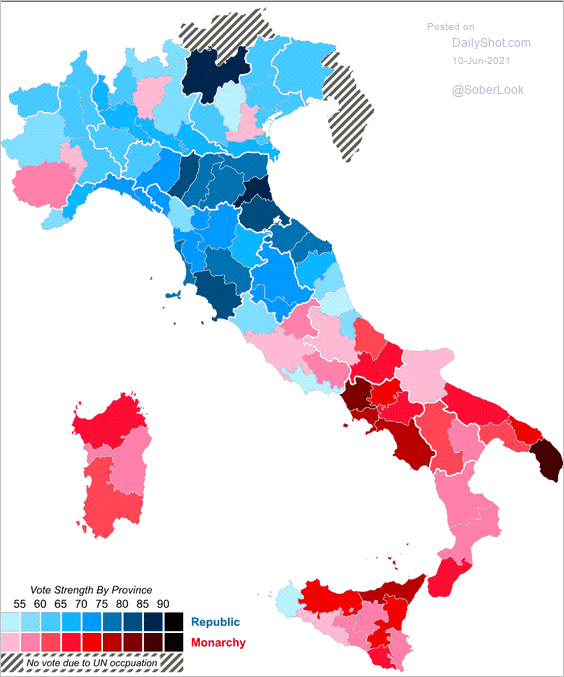

9. The 1946 Italian referendum on becoming a republic vs. a monarchy:

Source: Wikipedia Read full article

Source: Wikipedia Read full article

——————–

Back to Index