The Daily Shot: 14-Jun-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

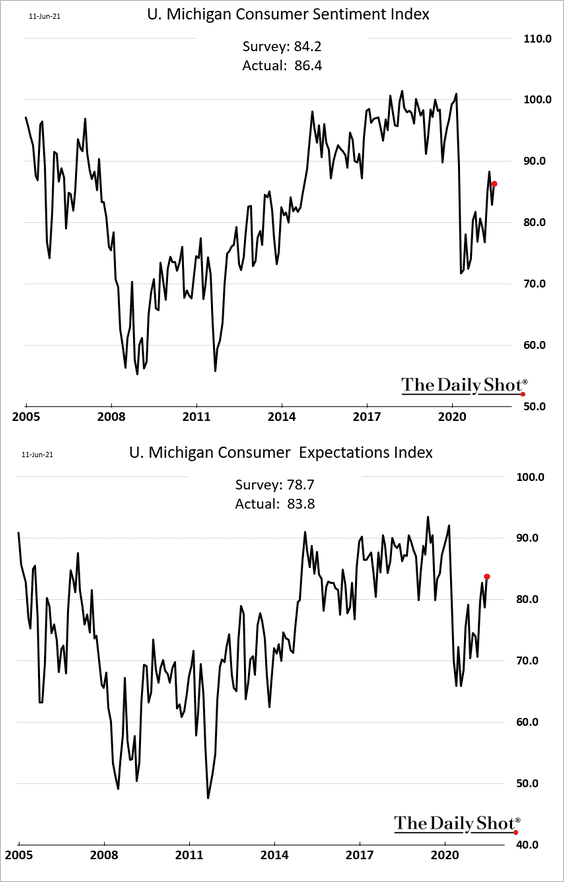

1. The U. Michigan consumer sentiment index strengthened this month.

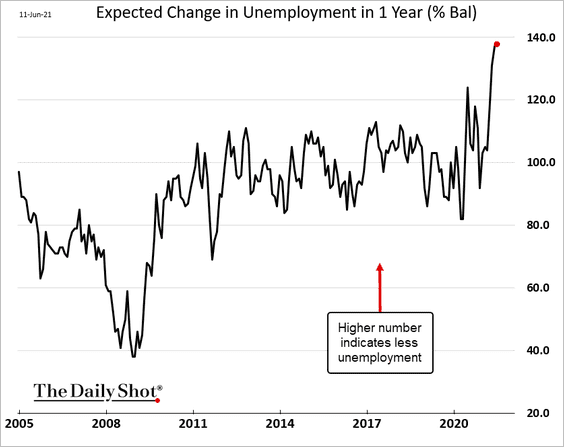

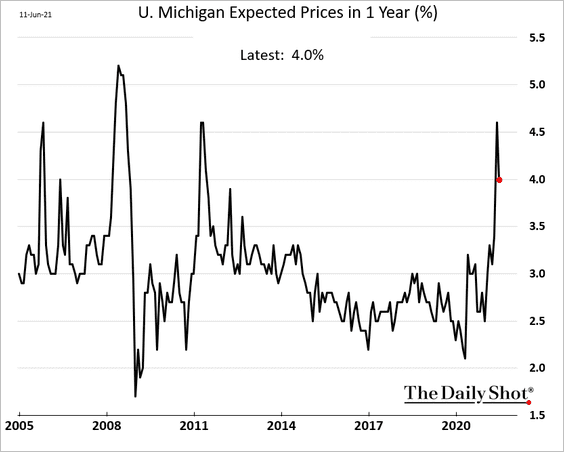

• Americans are increasingly confident in the jobs market.

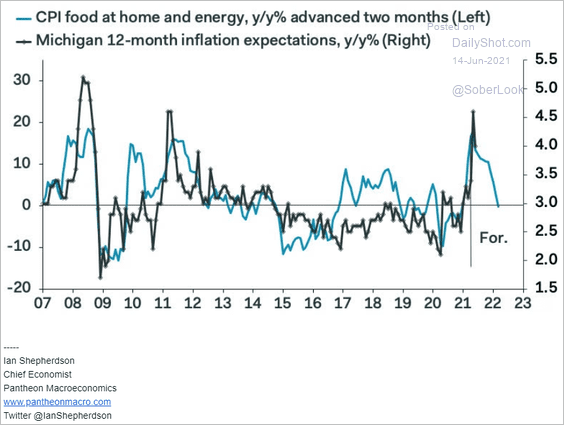

• Inflation expectations pulled back, …

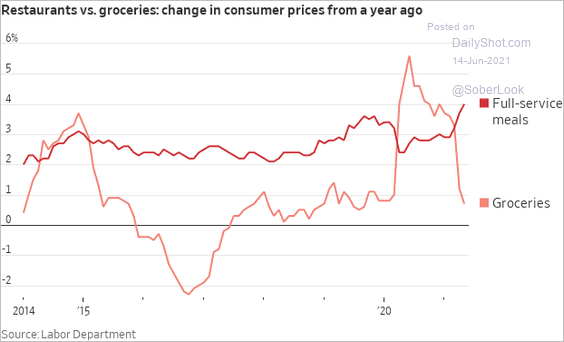

… as the “food at home” CPI component eased (2 charts).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: @jeffsparshott

Source: @jeffsparshott

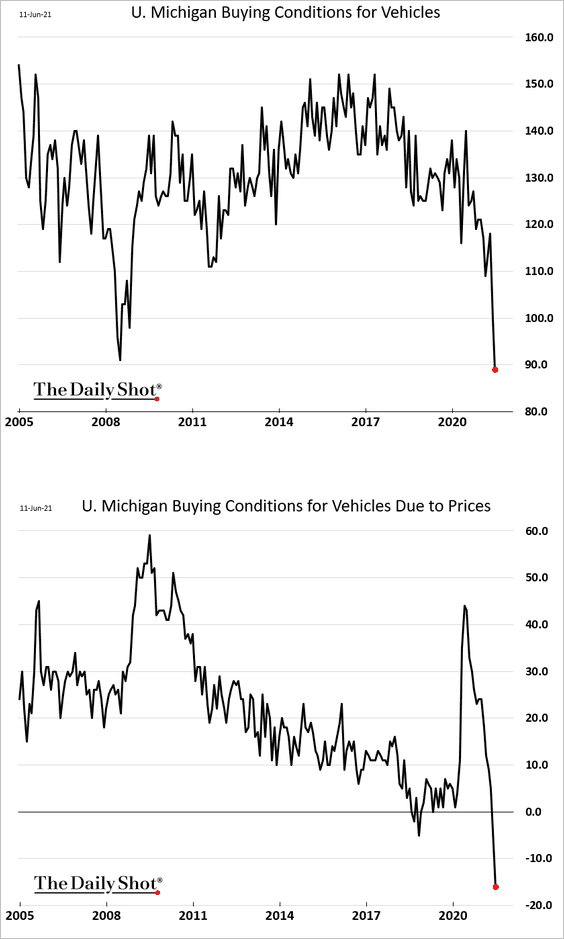

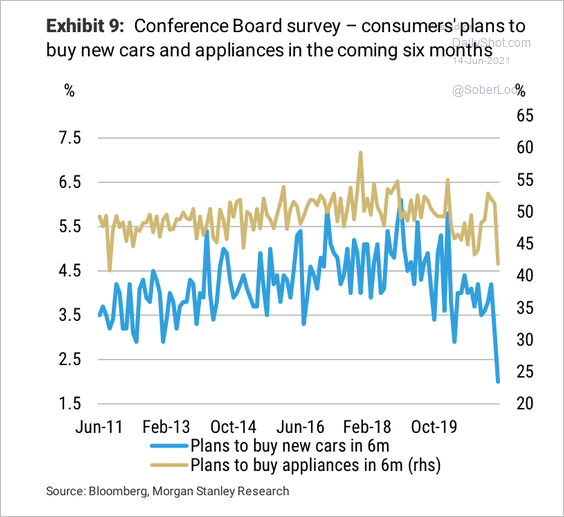

• Buying conditions for vehicles tumbled amid shortages and rapid price increases (see #5 below).

By the way, the May Conference Board’s report also showed consumer unease with purchasing a vehicle.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

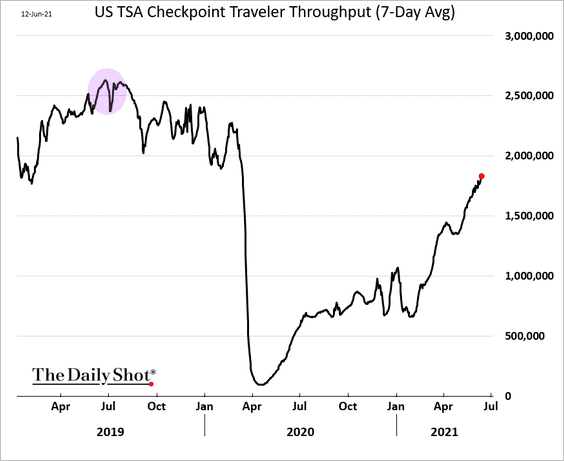

2. High-frequency indicators continue to show improvement.

• Air travel:

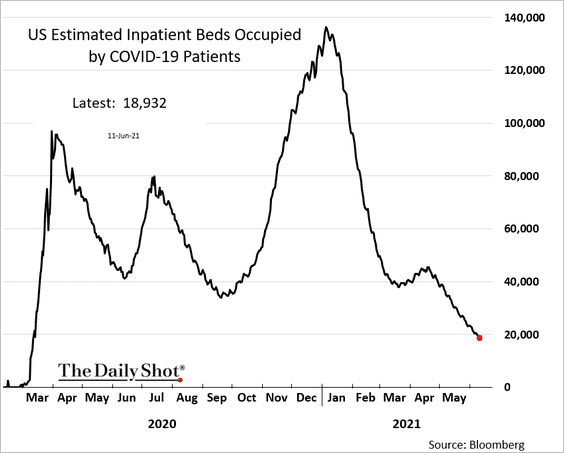

• COVID-related hospitalizations:

——————–

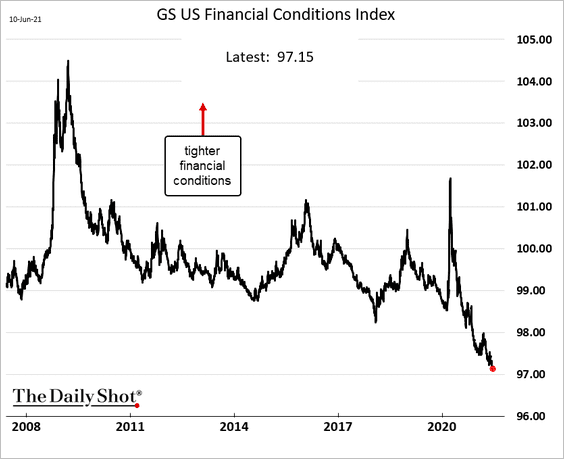

3. Goldman’s US financial conditions index shows an extraordinary level of accommodation.

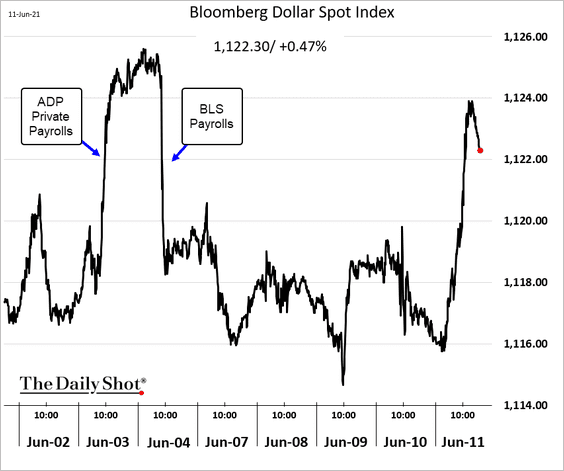

4. The US dollar jumped on Friday as traders lighten up on their bets against the greenback ahead of the FOMC meeting.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

5. Next, we have some updates on inflation.

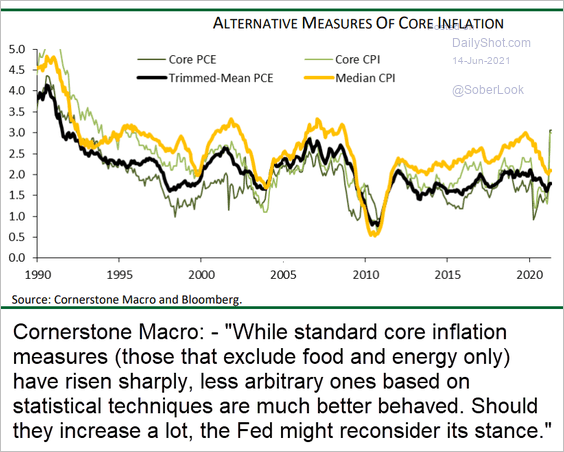

• Alternative measures of core inflation (see comment):

Source: Cornerstone Macro

Source: Cornerstone Macro

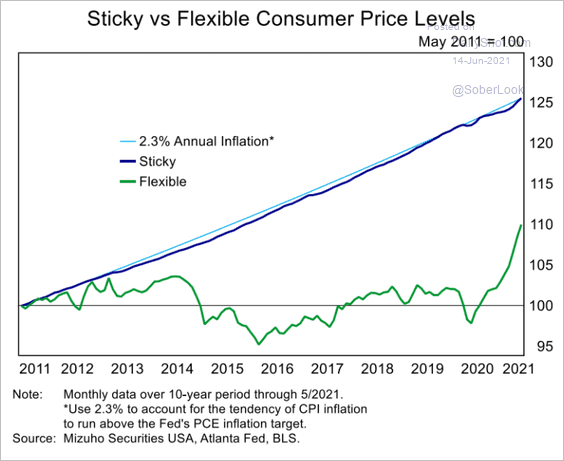

• Sticky vs. flexible CPI:

Source: Mizuho Securities USA

Source: Mizuho Securities USA

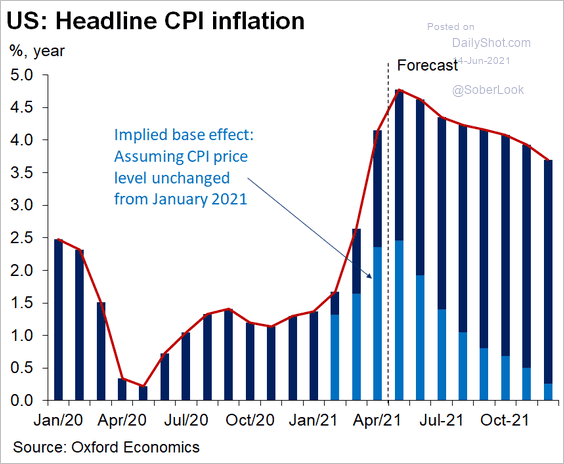

• Base effects and a forecast from Oxford Economics:

Source: @GregDaco

Source: @GregDaco

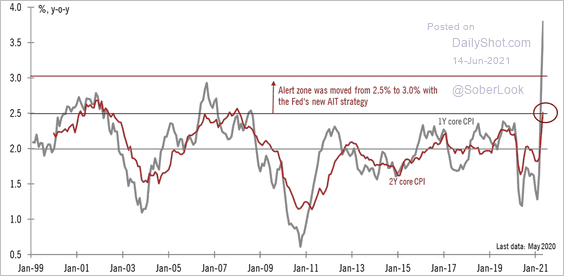

• The 2-year changes in core CPI (annualized) :

Source: @TCosterg

Source: @TCosterg

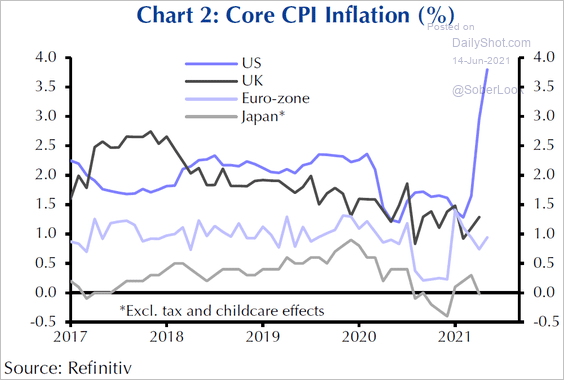

• US core CPI vs. other advanced economies:

Source: Capital Economics

Source: Capital Economics

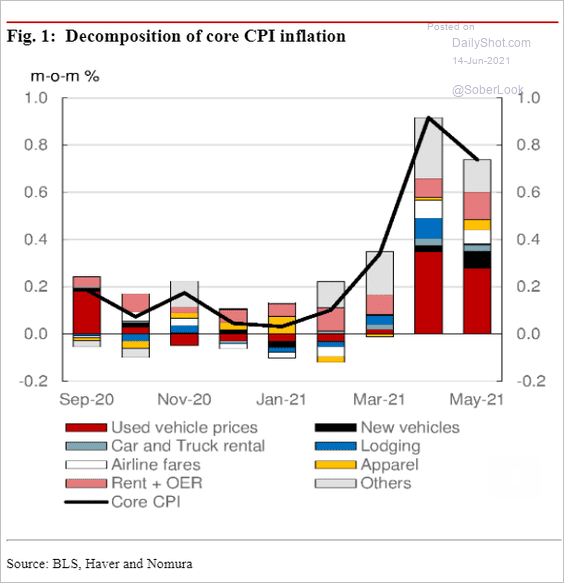

• The decomposition of core CPI (month-over-month):

Source: Nomura Securities

Source: Nomura Securities

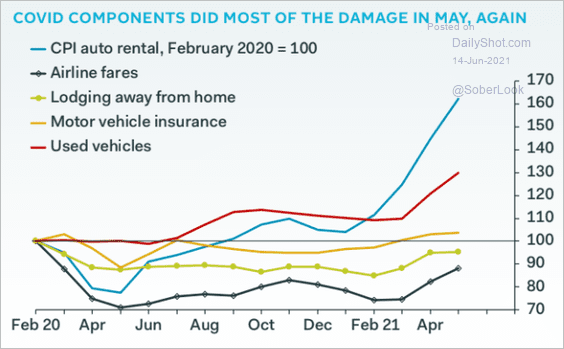

• COVID-related components:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

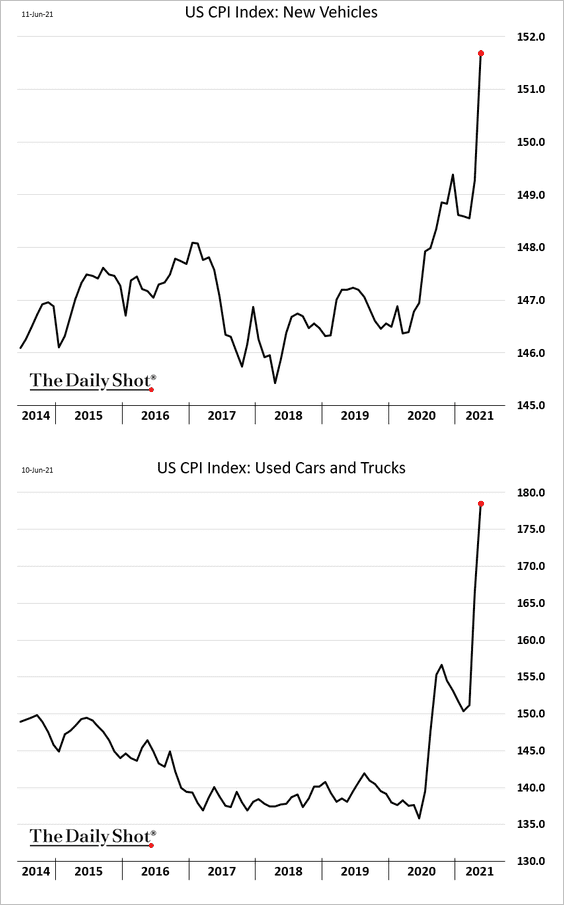

• Vehicle prices (CPI index):

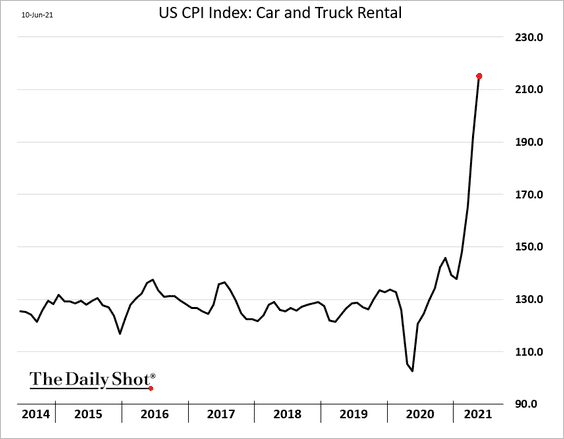

• Car rental (CPI index):

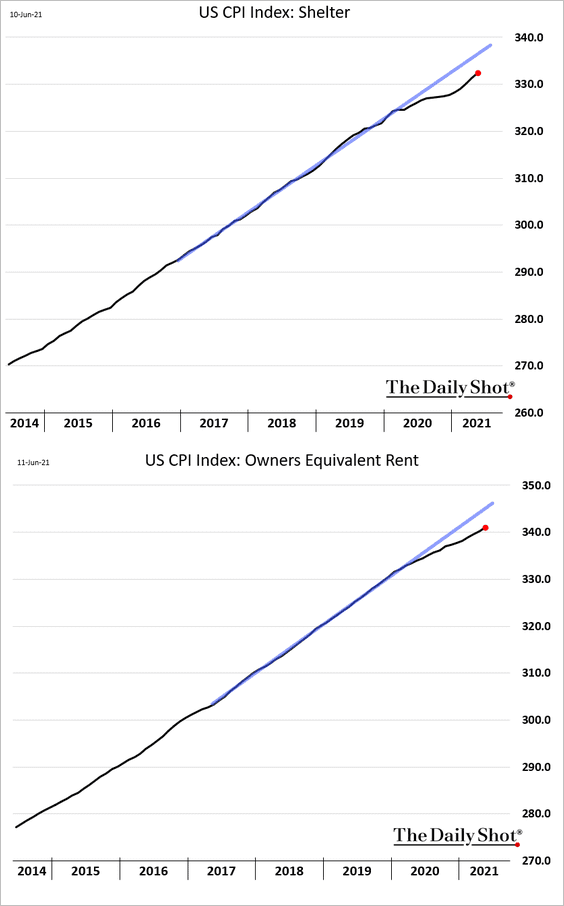

• Shelter (CPI index):

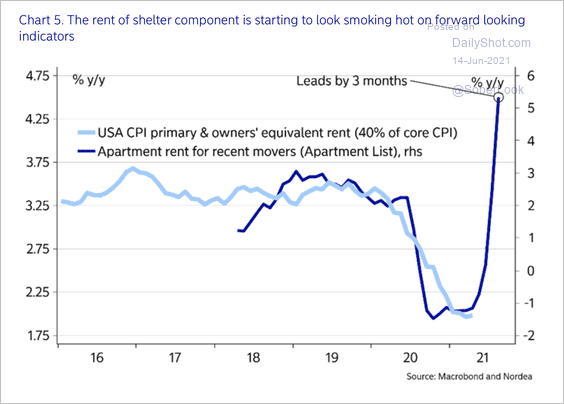

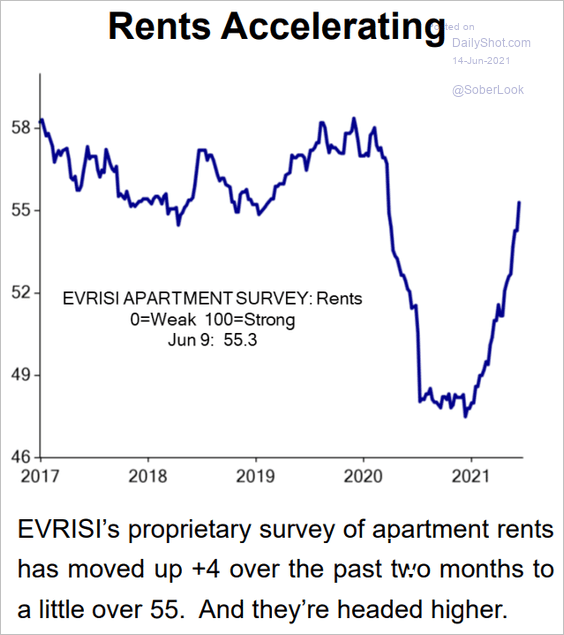

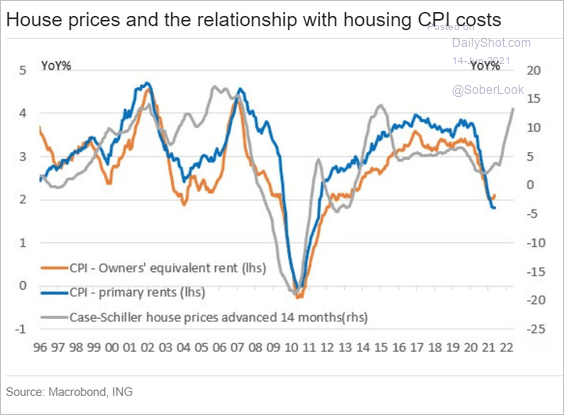

• Gains in shelter inflation ahead (3 charts):

Source: Nordea Markets

Source: Nordea Markets

Source: Evercore ISI

Source: Evercore ISI

Source: ING

Source: ING

Here are a few additional trends:

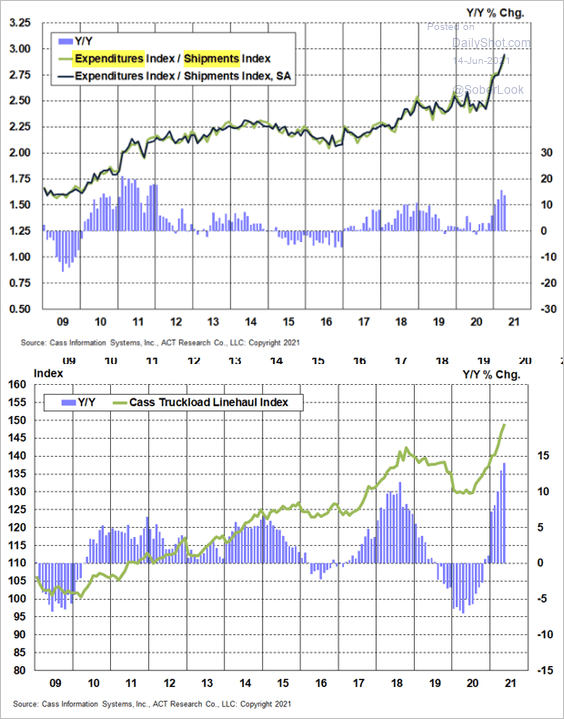

• Freight rates are rising quickly, …

Source: Cass Information Systems

Source: Cass Information Systems

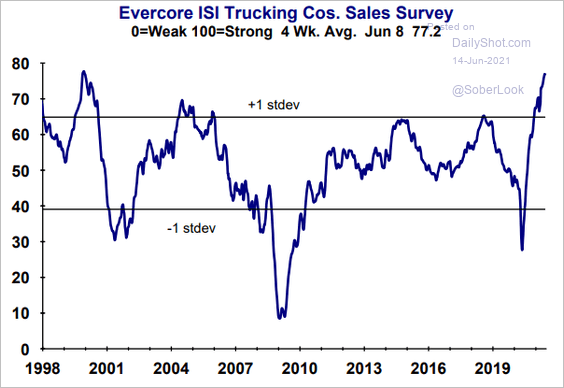

… boosting trucking companies’ sentiment.

Source: Evercore ISI

Source: Evercore ISI

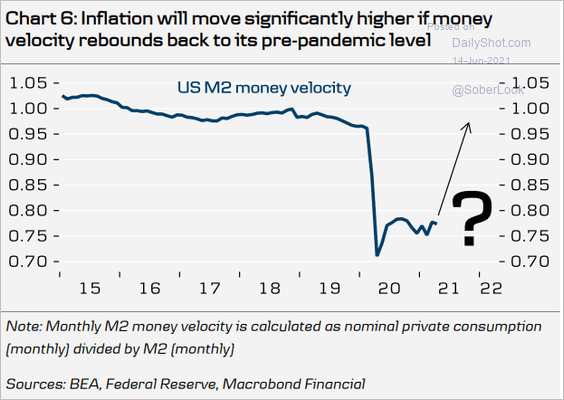

• Will the velocity of money begin to rise, becoming a tailwind for inflation?

Source: Danske Bank

Source: Danske Bank

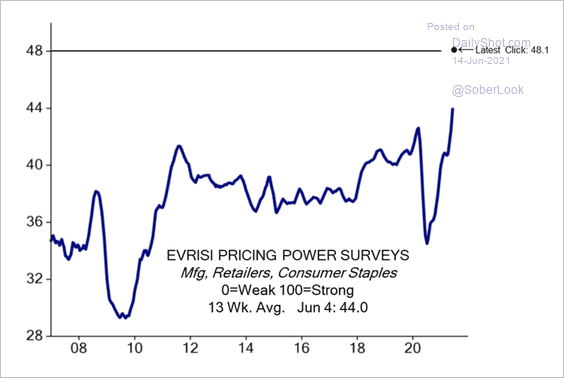

• The Evercore ISI corporate pricing power index hit a new high.

Source: Evercore ISI

Source: Evercore ISI

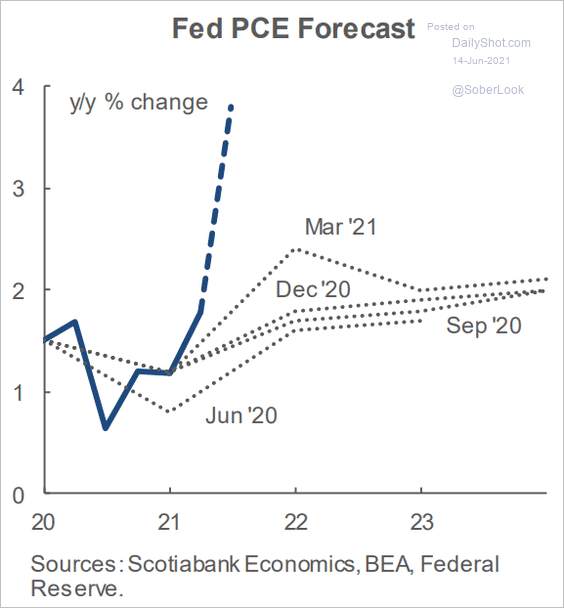

• The FOMC will be boosting its inflation estimates for 2021.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

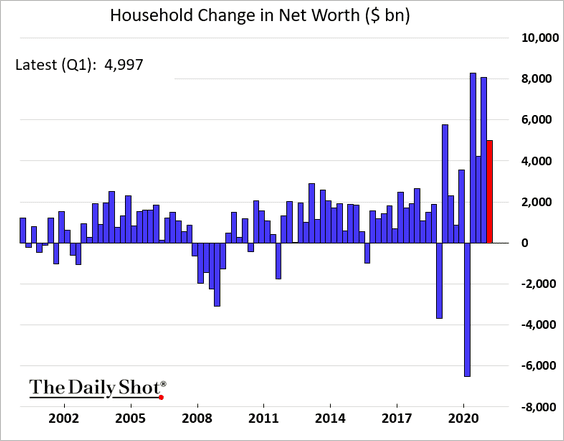

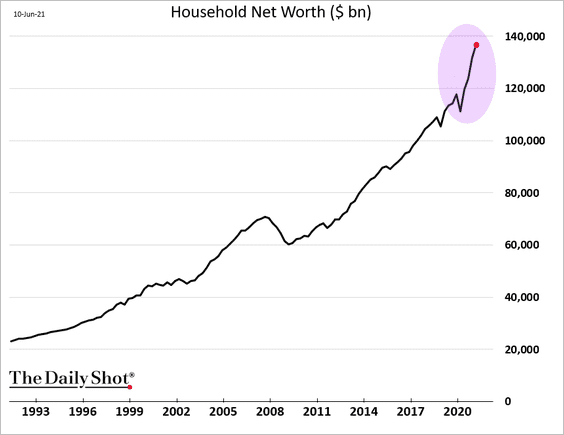

6. Household net worth has been surging.

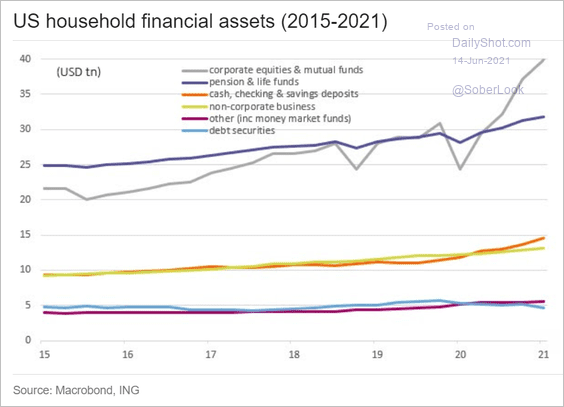

Here are the trends in household financial assets.

Source: ING

Source: ING

Back to Index

Canada

1. Canada’s labor market has outperformed the US.

Source: ING

Source: ING

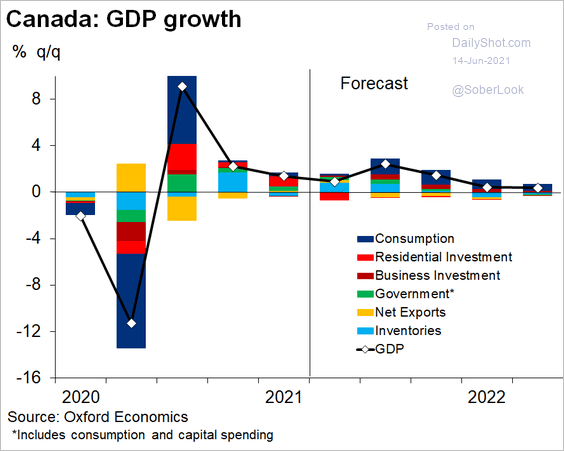

2. Oxford Economics expects strong growth this year.

Source: Tony Stillo, Oxford Economics

Source: Tony Stillo, Oxford Economics

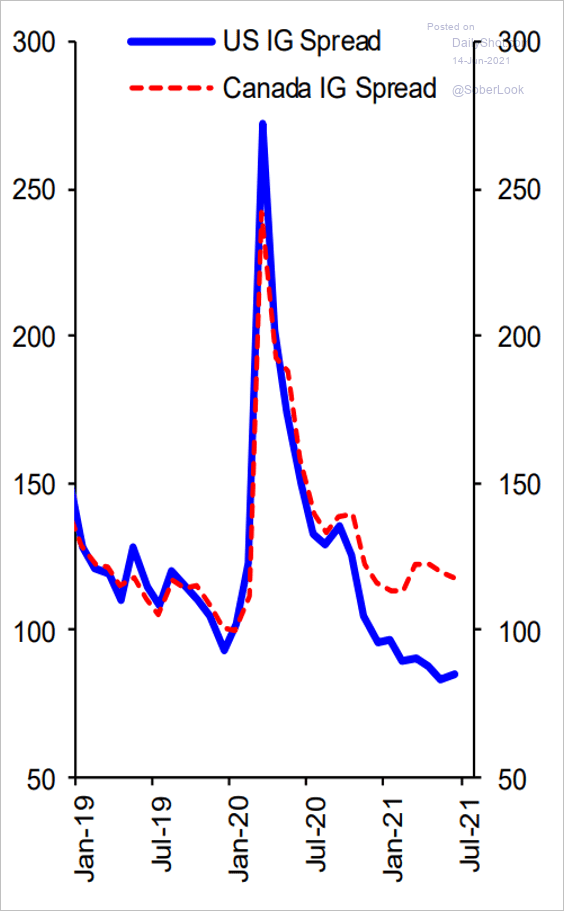

3. Canadian investment-grade bonds have underperformed US peers.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Back to Index

The United Kingdom

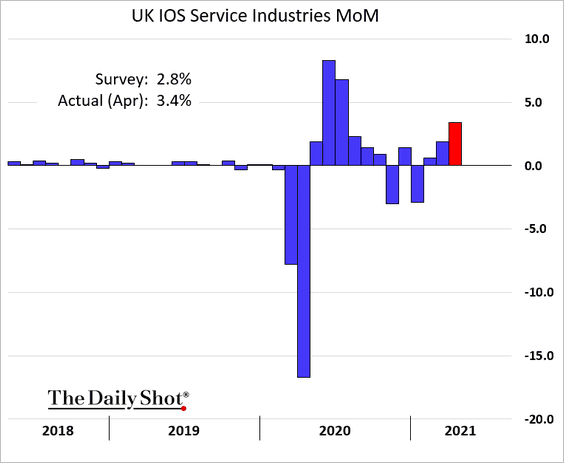

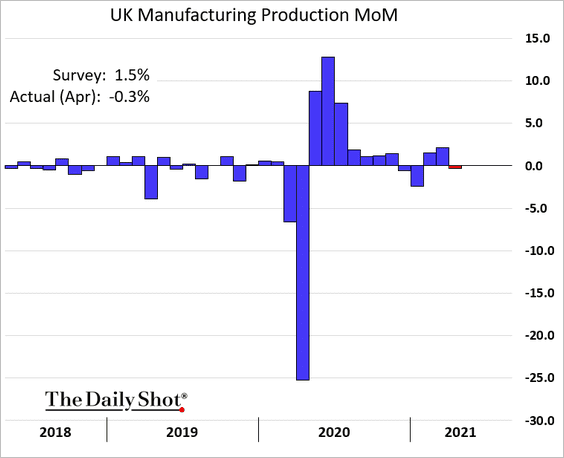

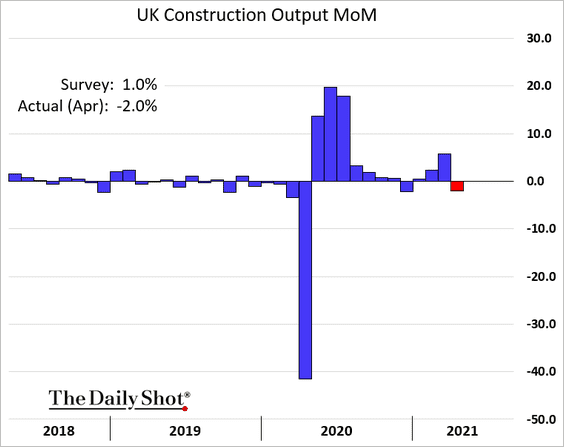

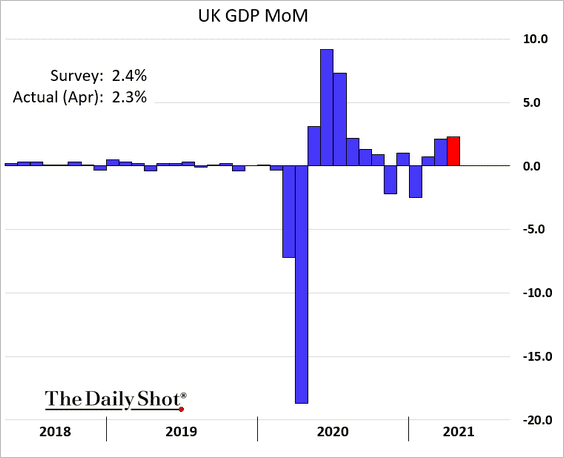

1. Service-sector output was stronger than expected in April.

• But manufacturing and construction output slowed.

• Here is the GDP estimate:

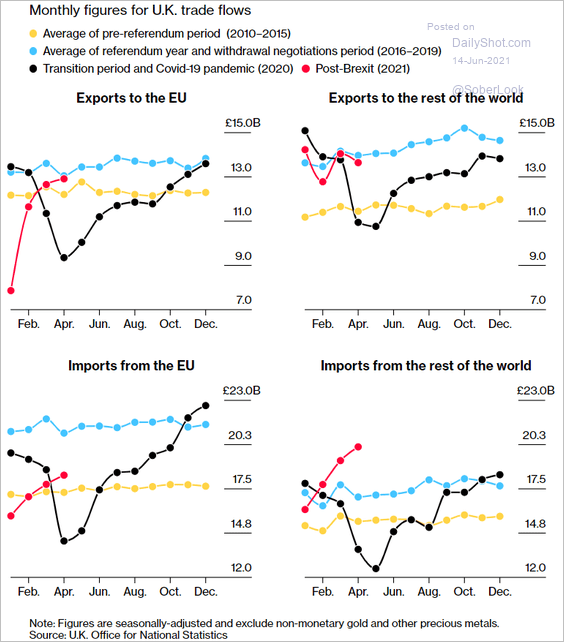

2. Trade with the EU continues to improve:

Source: @lizzzburden, @bbgvisualdata Read full article

Source: @lizzzburden, @bbgvisualdata Read full article

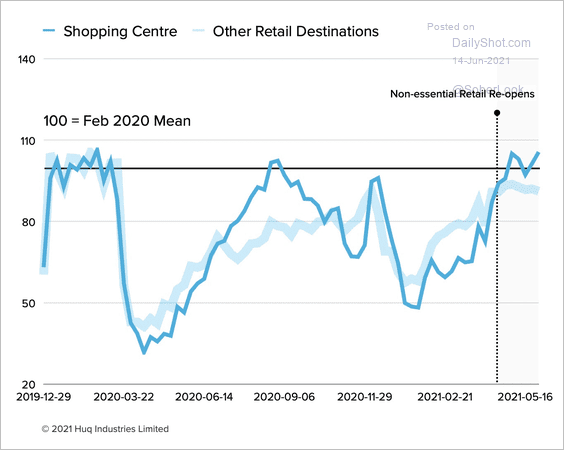

3. Shoppers are returning to malls.

Source: huq Read full article

Source: huq Read full article

Back to Index

The Eurozone

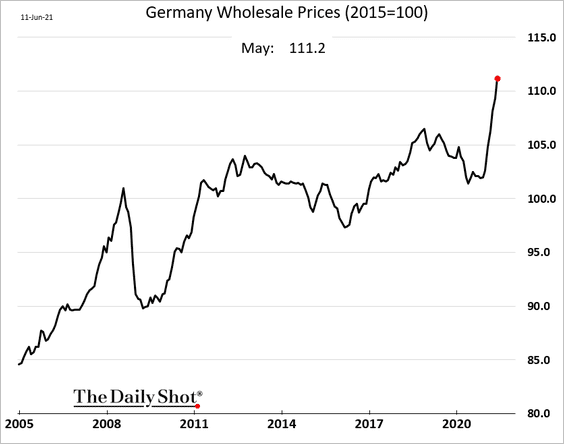

1. German wholesale prices have been surging.

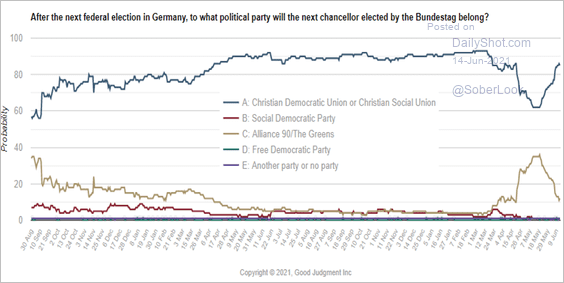

Separately, superforecasters once again expect CDU/CSU to remain in power after the next election.

Source: Good Judgment

Source: Good Judgment

——————–

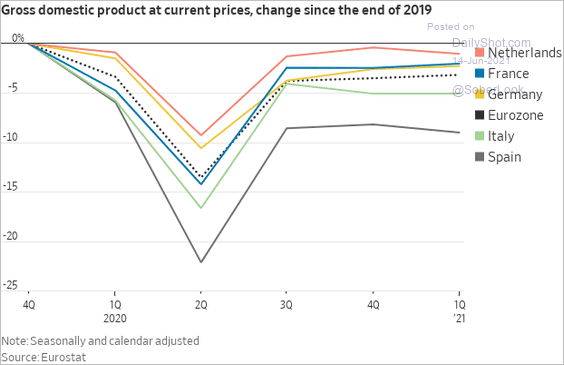

2. We should see a sharp GDP rebound in Q2.

Source: @WSJ Read full article

Source: @WSJ Read full article

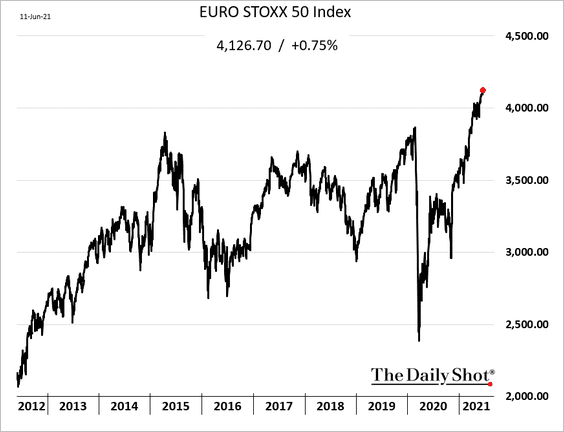

3. The stock market has been surging.

Back to Index

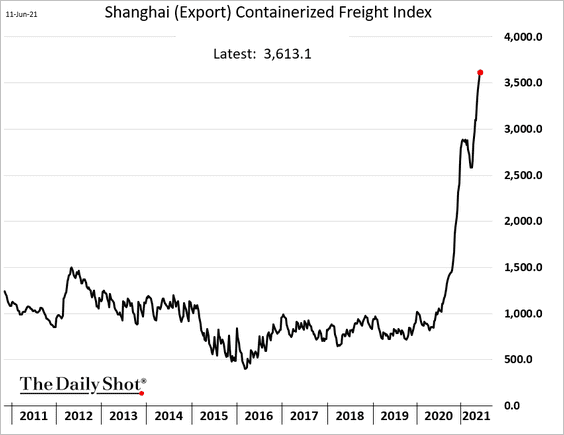

China

1. Export shipping costs continue to climb. At some point, this trend becomes a drag on sales.

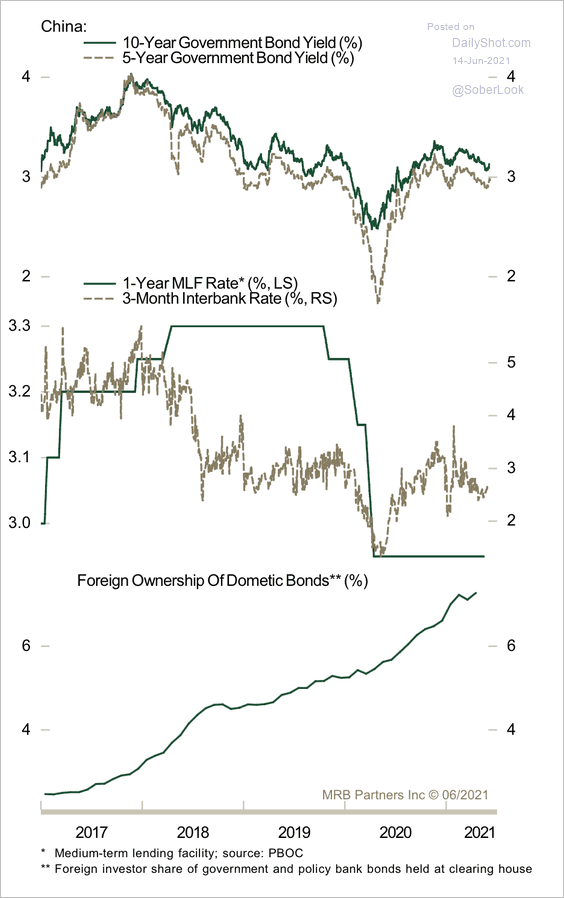

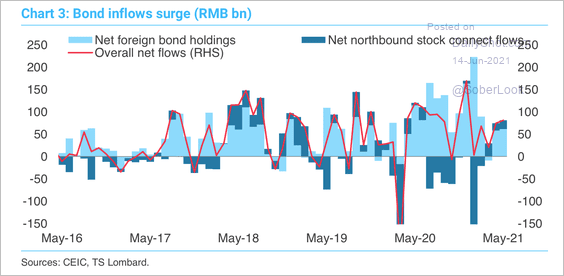

2. Foreign buying of government bonds has capped yields (2 charts).

Source: MRB Partners

Source: MRB Partners

Source: TS Lombard

Source: TS Lombard

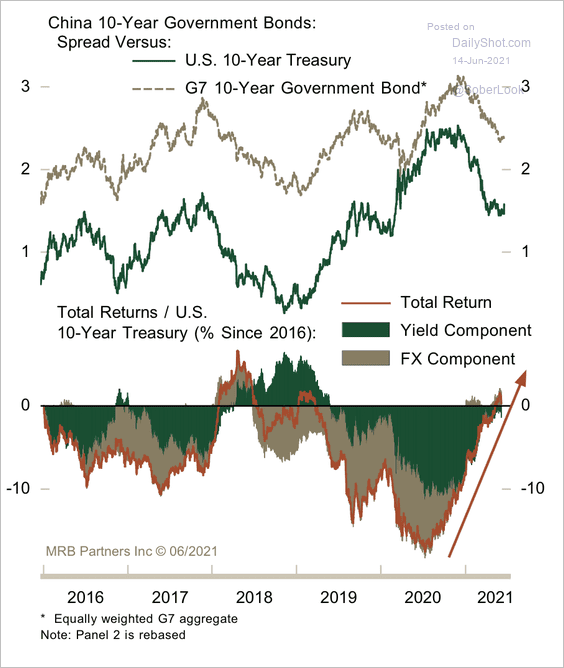

Chinese government bonds have been outperforming Treasuries recently.

Source: MRB Partners

Source: MRB Partners

——————–

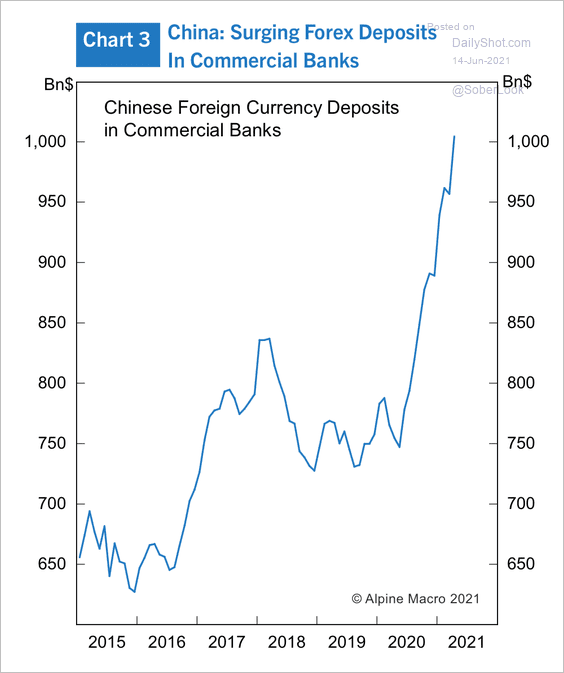

3. Foreign currency deposits in Chinese commercial banks have surged over the past year. By increasing the reserve requirements on foreign exchange deposits, the central bank forces commercial banks to hold forex on their balance sheet, which could ease upward pressure on the renminbi, according to Alpine Macro.

Source: Alpine Macro

Source: Alpine Macro

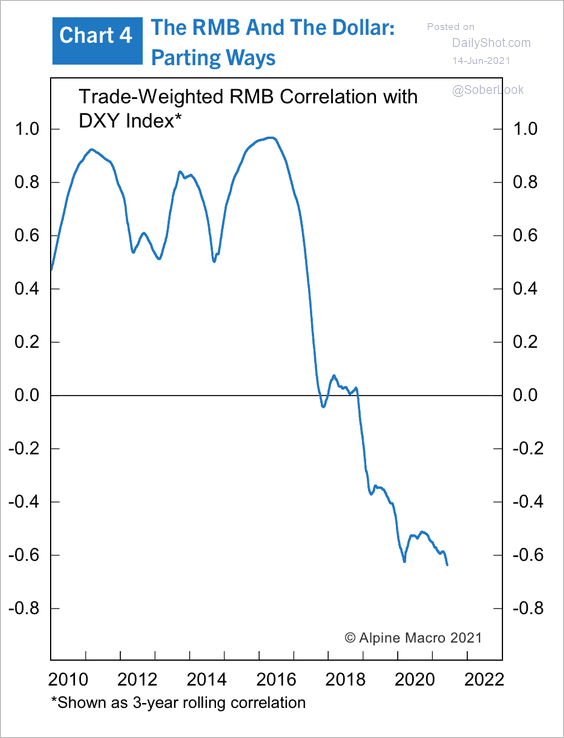

4. The correlation between the trade-weighted renminbi and the dollar has weakened substantially over the past few years.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Emerging Markets

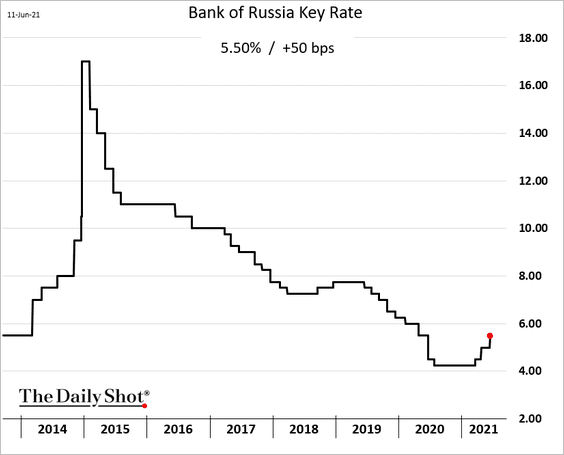

1. Russia’s central bank hiked rates again amid inflationary pressures.

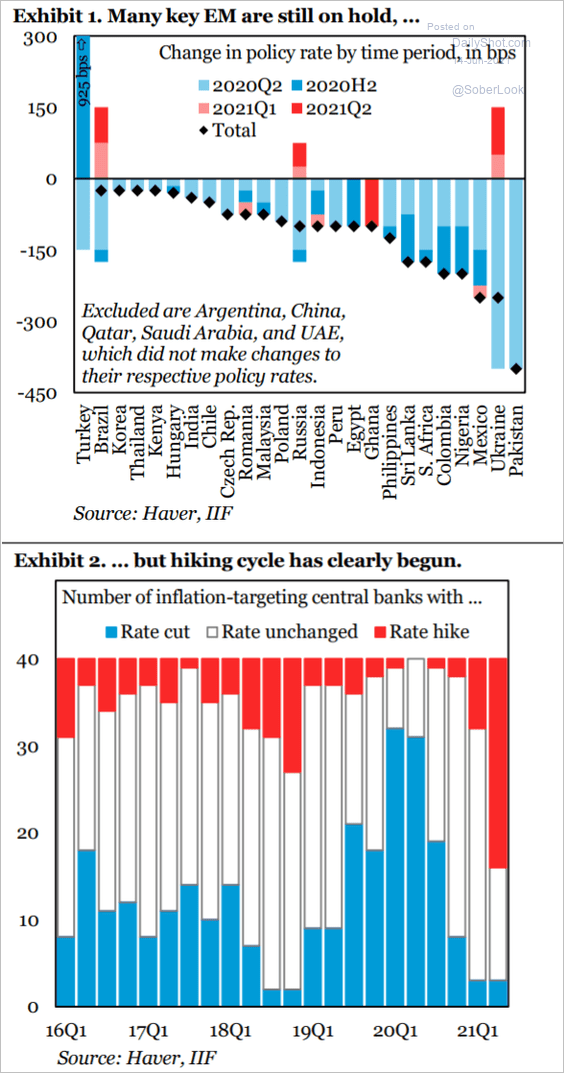

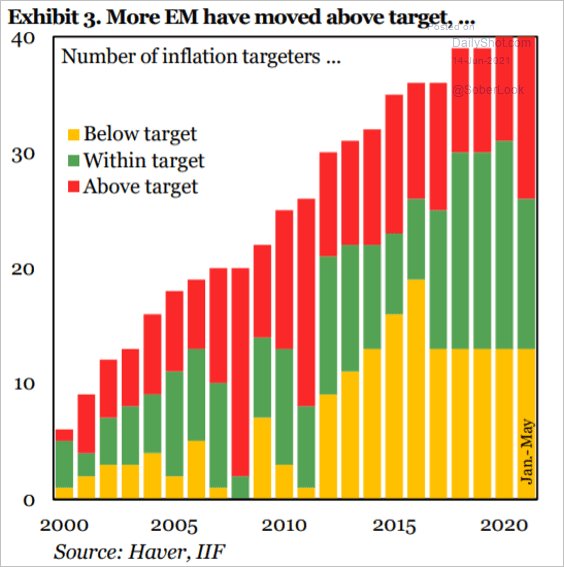

2. Here is the situation with other EM central banks (3 charts).

Source: IIF

Source: IIF

Source: IIF

Source: IIF

——————–

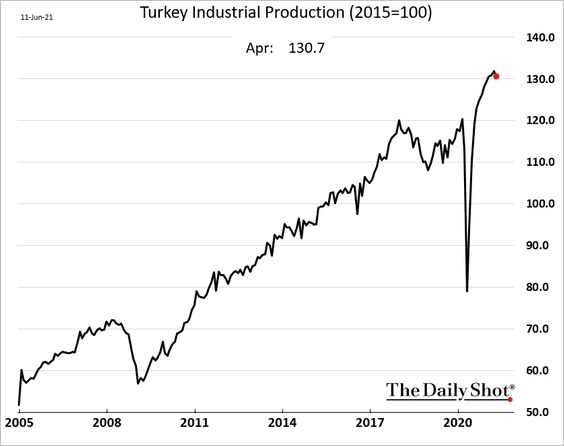

3. Turkey’s industrial output remains robust.

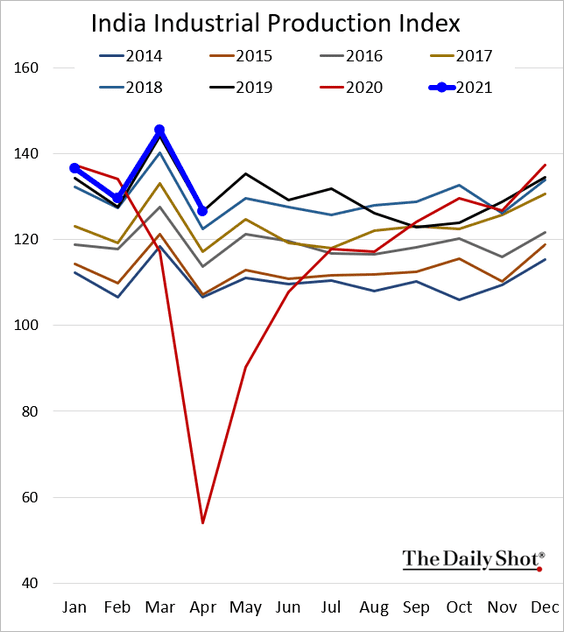

4. India’s industrial production is now in line with 2019 levels.

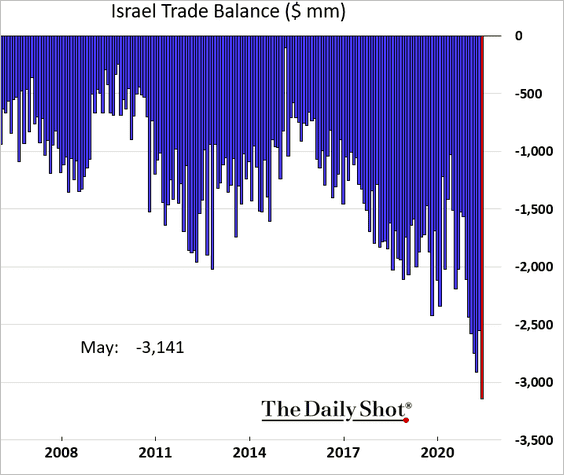

5. Israel’s trade deficit hit another record high.

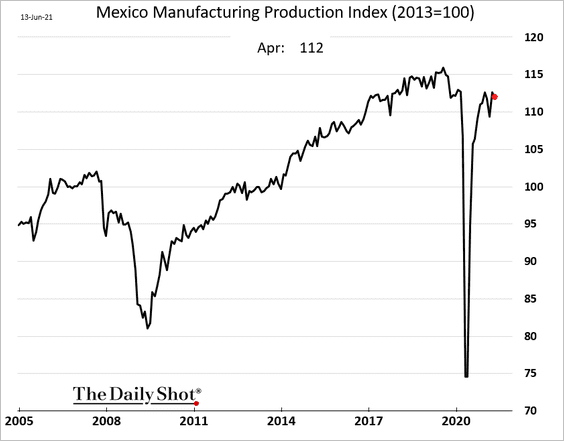

6. Mexico’s manufacturing production pulled back in April.

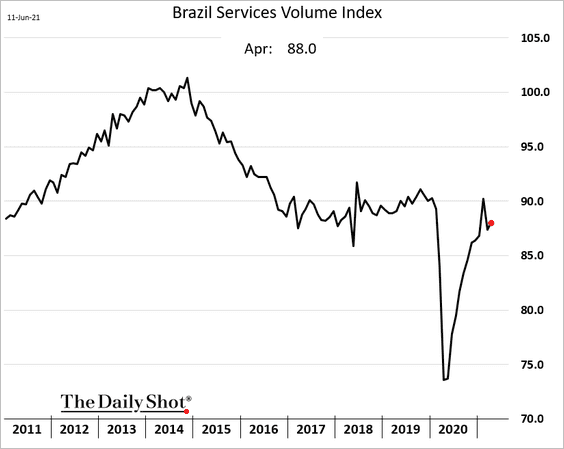

7. Here is Brazil’s service sector output.

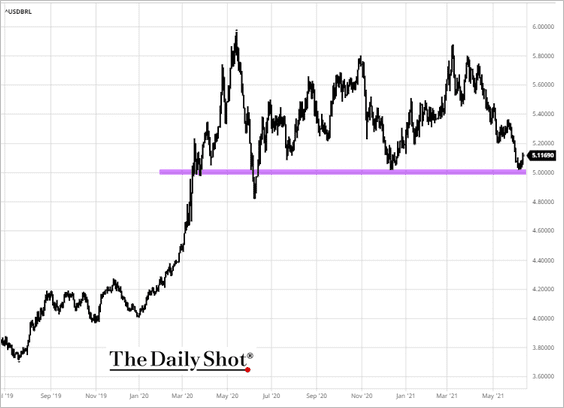

Separately, USD/BRL held support near the 5.0 level.

Source: barchart.com

Source: barchart.com

Back to Index

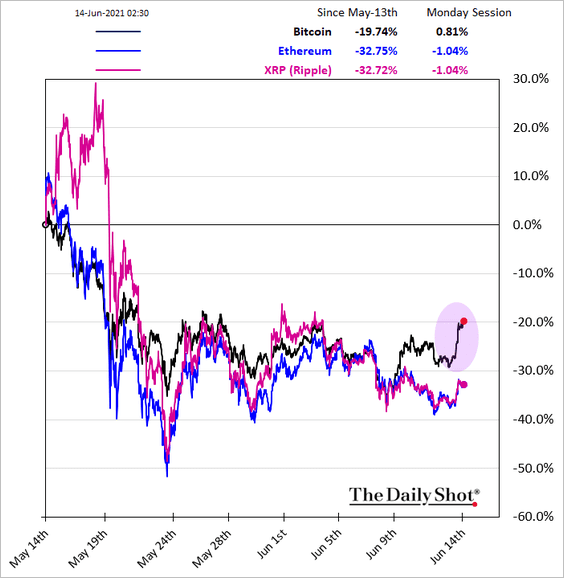

Cryptocurrency

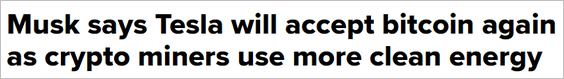

1. Elon isn’t completely giving up on bitcoin, …

Source: CNBC Read full article

Source: CNBC Read full article

… sending the largest crypto higher over the weekend.

——————–

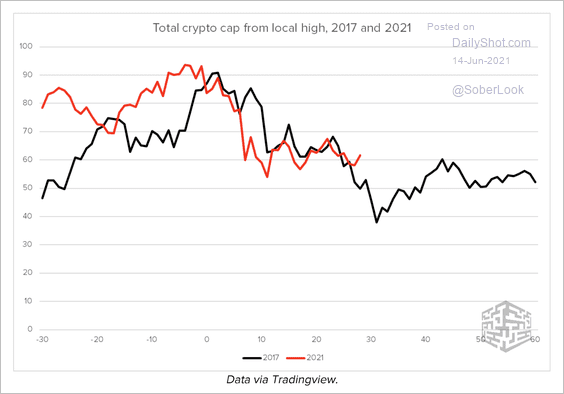

2. The total crypto market cap could soon stabilize based on the 2017 parallel.

Source: Enigma Securities

Source: Enigma Securities

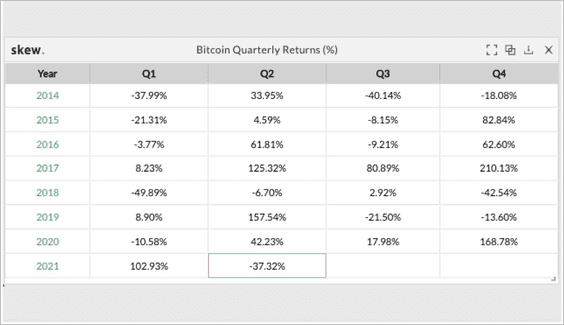

3. Bitcoin is on track for its first down quarter since Q1 2020.

Source: @skewdotcom

Source: @skewdotcom

Back to Index

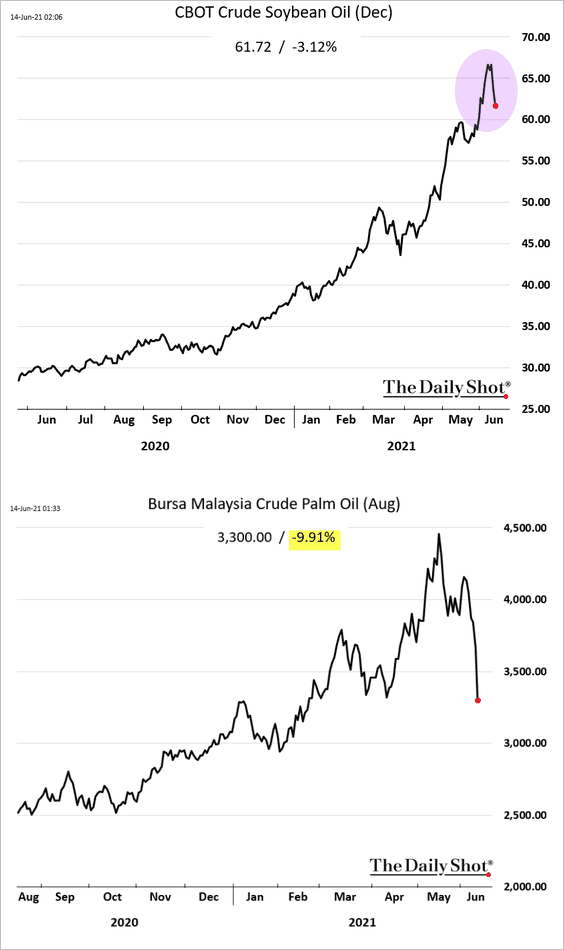

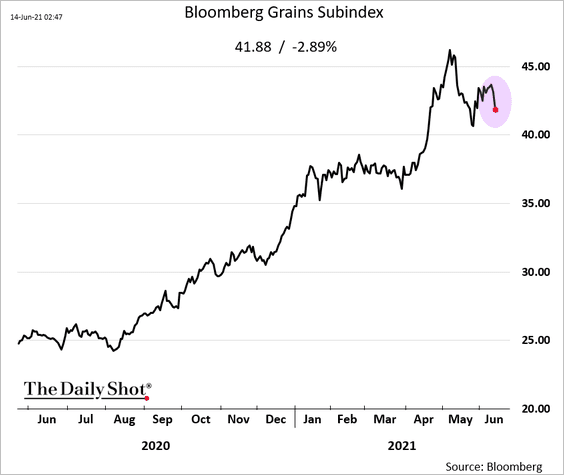

Commodities

1. US soybean oil is rolling over, sending palm oil sharply lower.

2. US grains are lower this morning.

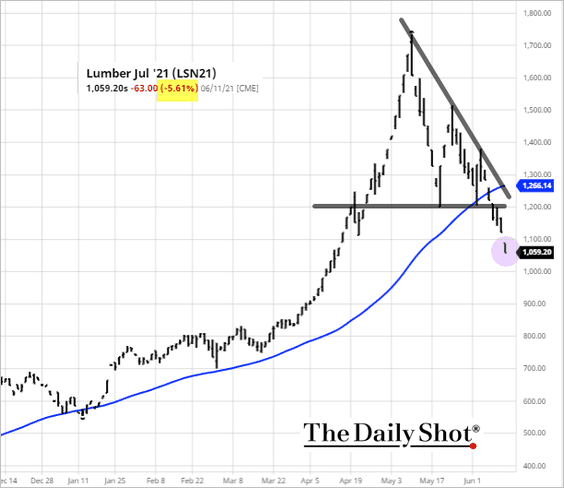

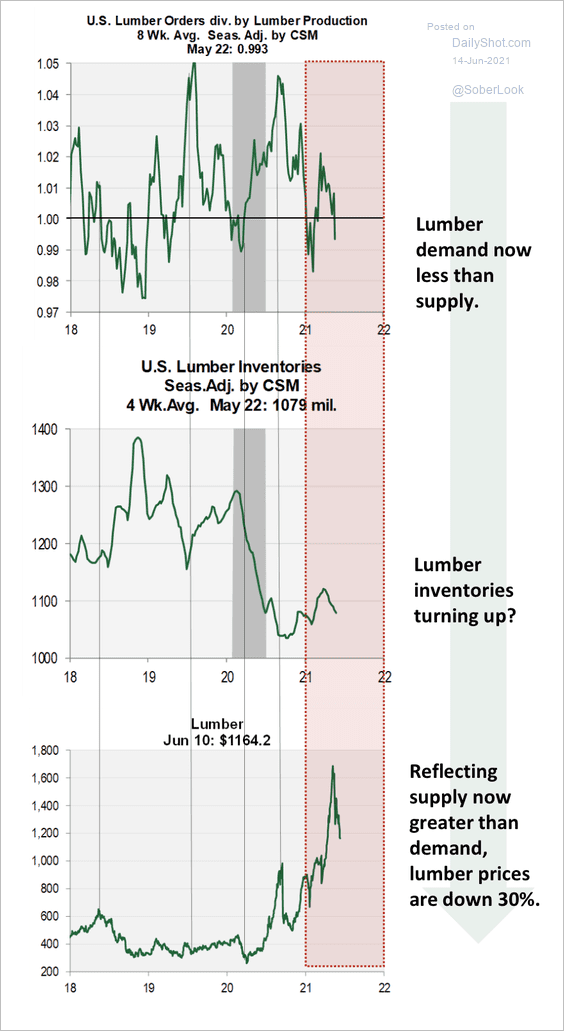

3. Lumber futures are under pressure.

Source: barchart.com

Source: barchart.com

Source: Bloomberg Read full article

Source: Bloomberg Read full article

The drop in lumber prices suggests recent inflation spikes will prove transitory, according to Cornerstone Macro.

Source: Cornerstone Macro

Source: Cornerstone Macro

——————–

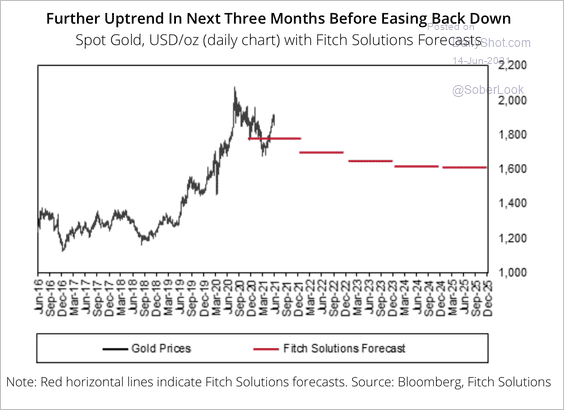

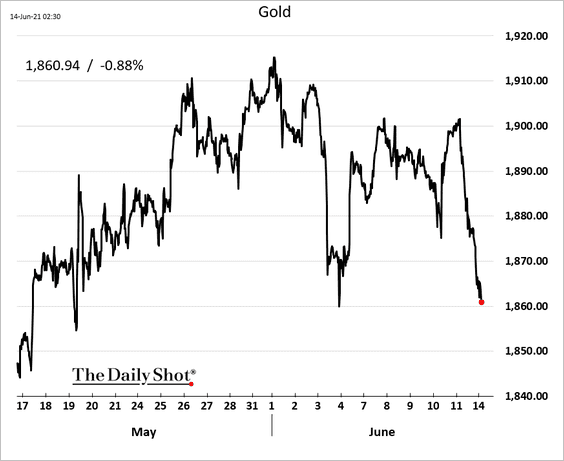

4. Fitch expects near-term upside in gold prices before easing off as inflationary pressures wane.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Gold is softer ahead of the FOMC meeting as the dollar climbs.

——————–

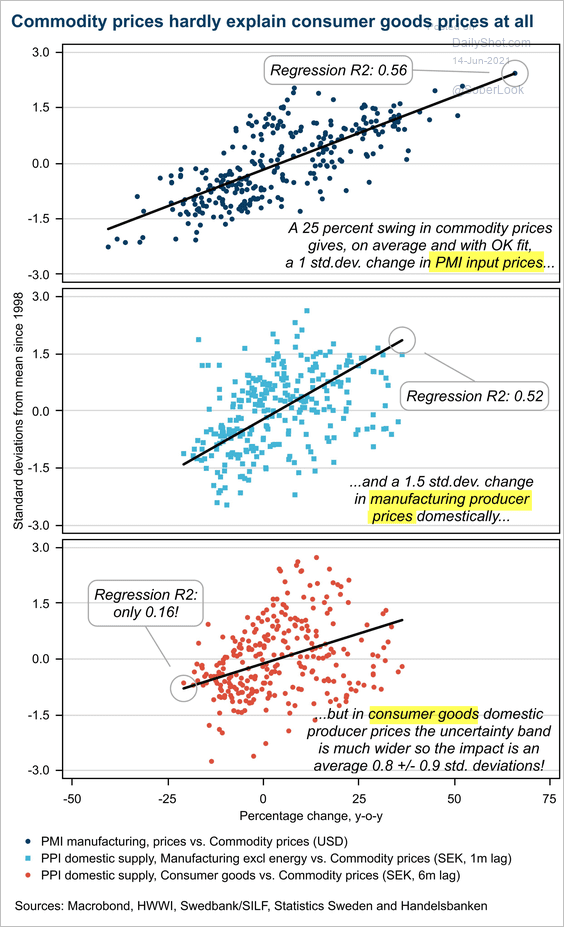

5. Commodities are not very correlated with consumer goods prices.

Source: @Johan_E_Lof

Source: @Johan_E_Lof

Back to Index

Energy

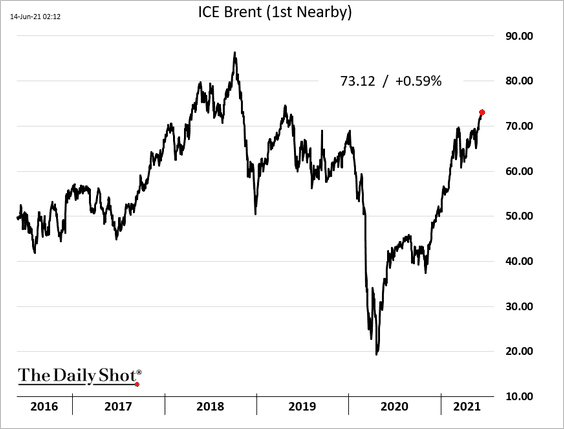

1. Brent is above $73/bbl.

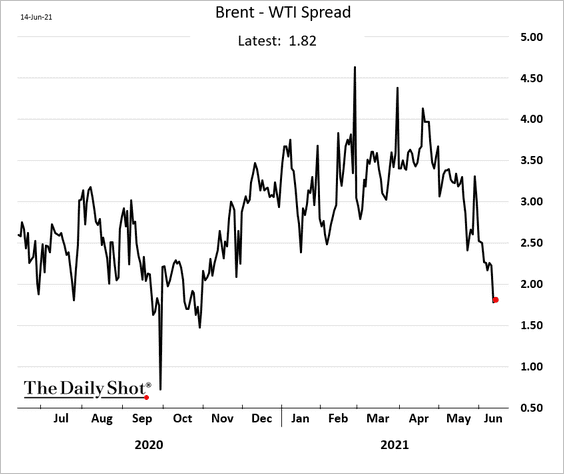

2. The Brent-WTI spread has been tightening as US inventories shrink.

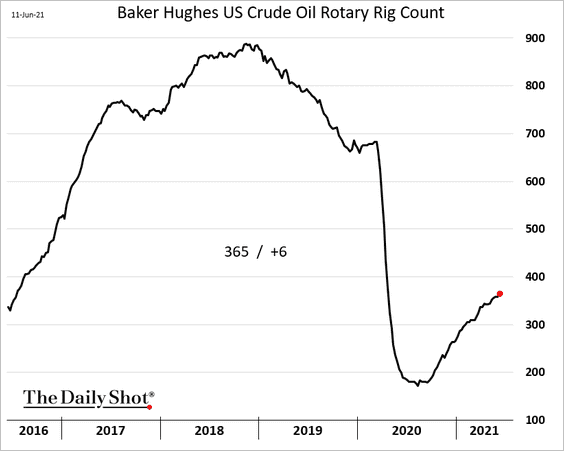

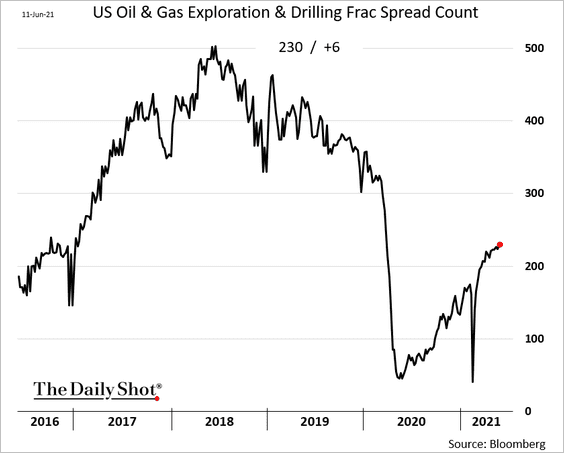

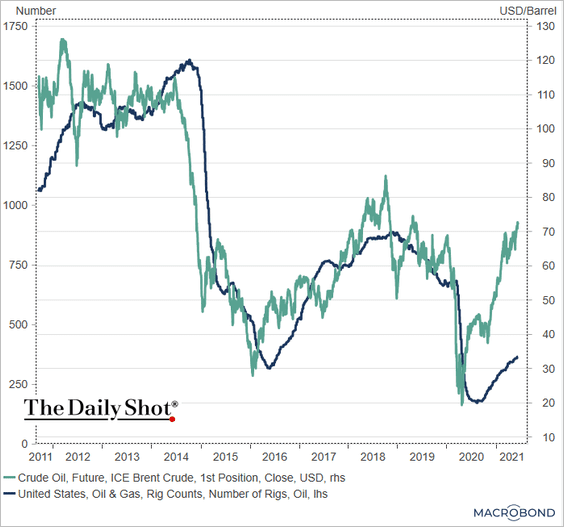

3. The US rig count and frac spread continue to grind higher.

Given the price rebound, we should see the number of rigs rising further.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

——————–

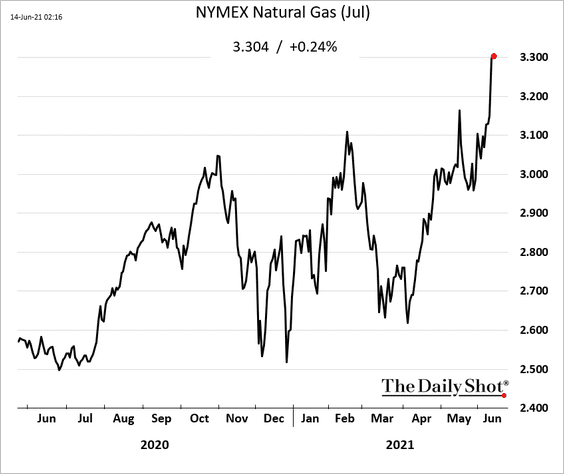

4. US natural gas is above $3.30/MMBtu.

Back to Index

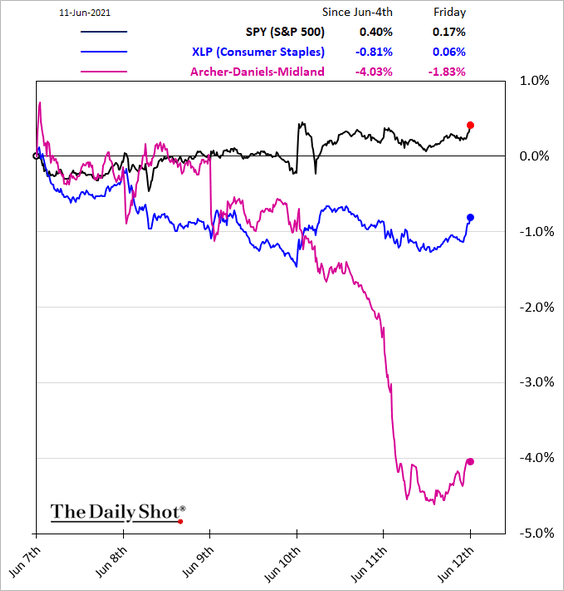

Equities

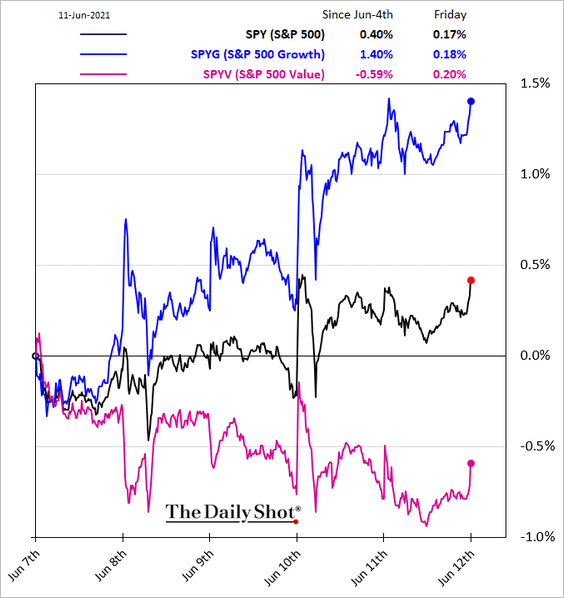

1. Growth outperformed value last week, …

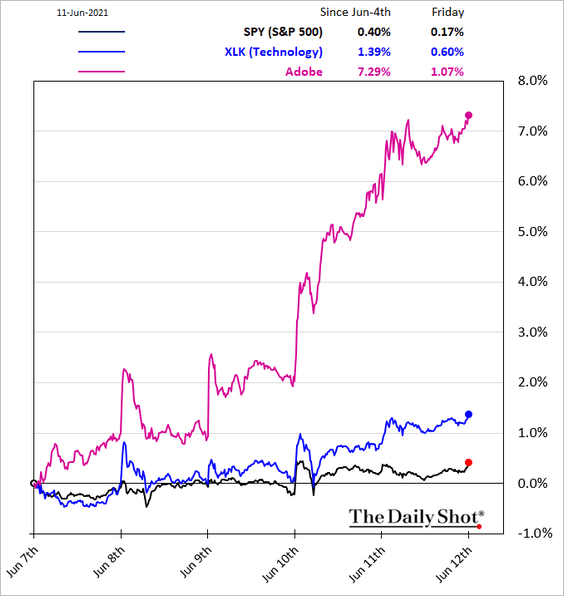

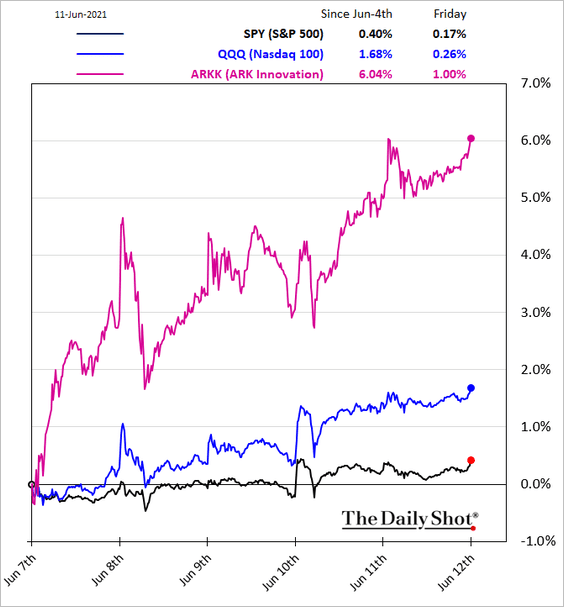

… with tech leading the way.

Speculative tech companies surged.

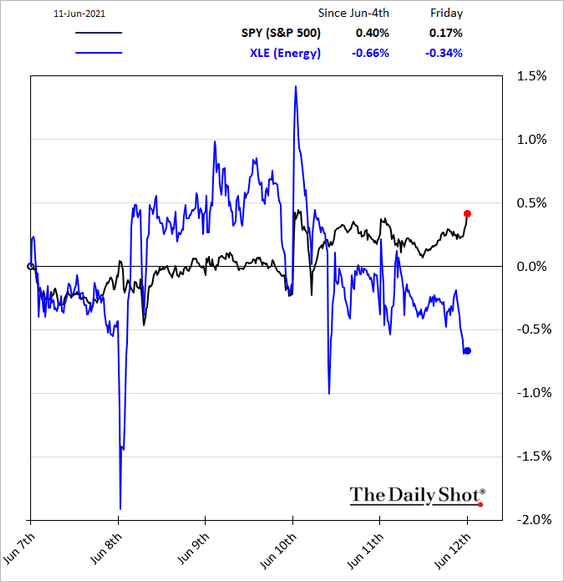

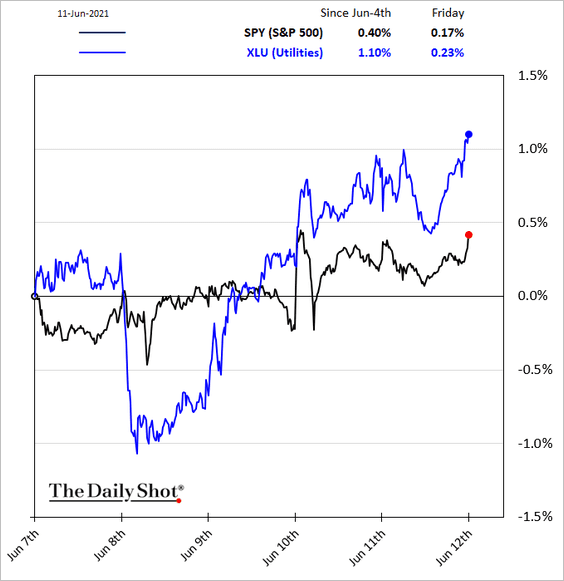

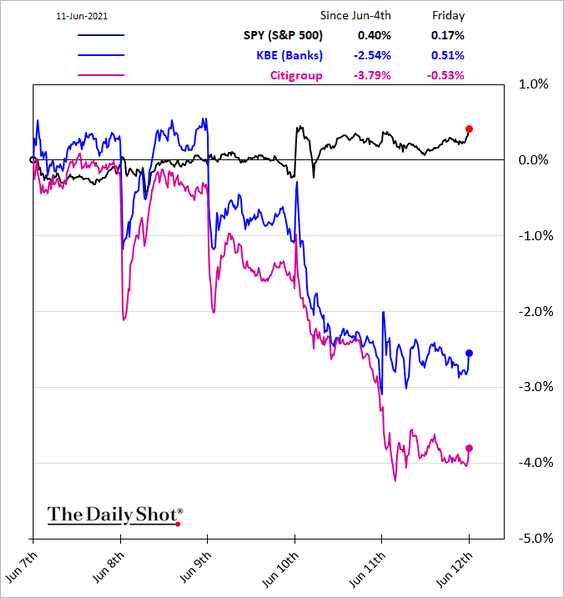

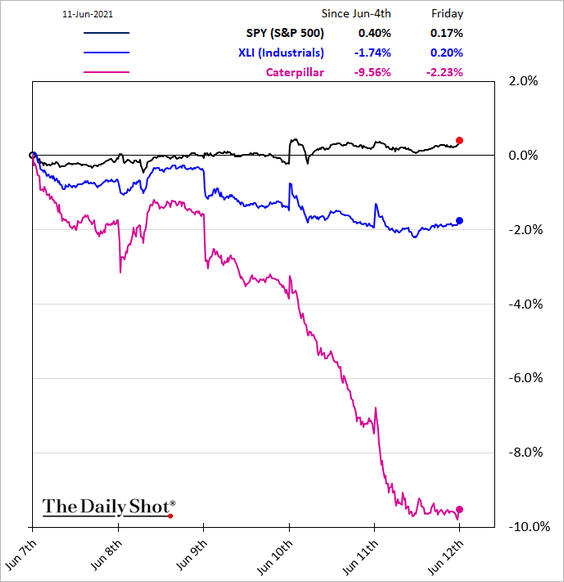

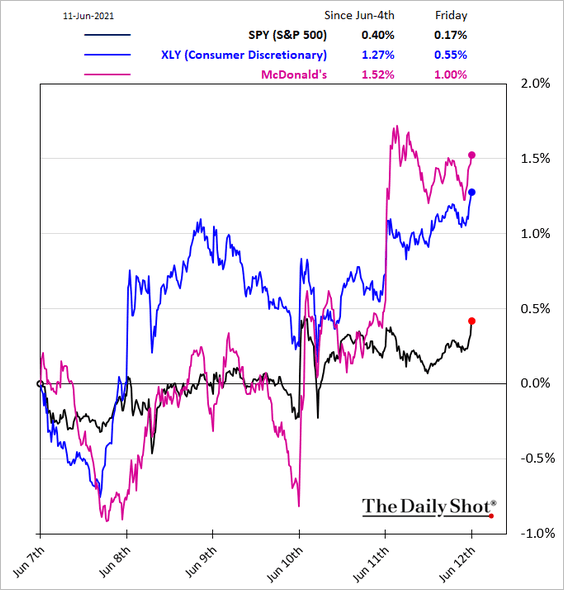

2. Here are a few other sector charts.

• Energy:

• Utilities (boosted by lower Treasury yields):

• Banks (hurt by lower Treasury yields):

• Industrials:

• Consumer discretionary:

• Consumer staples:

——————–

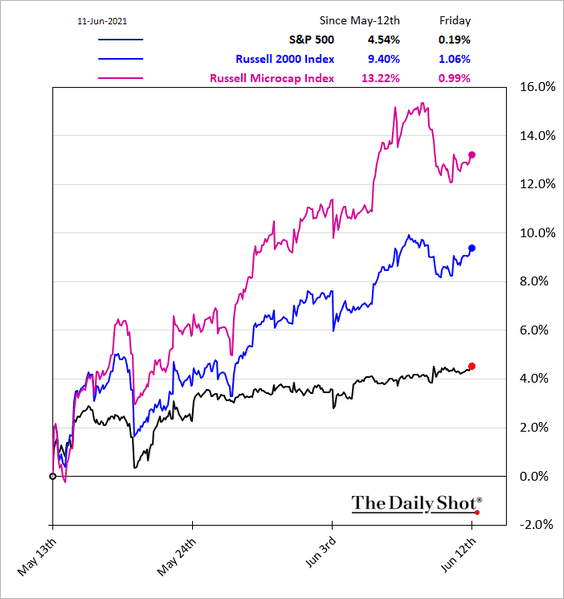

3. Small caps and microcaps continue to outperform (boosted by the Reddit crowd).

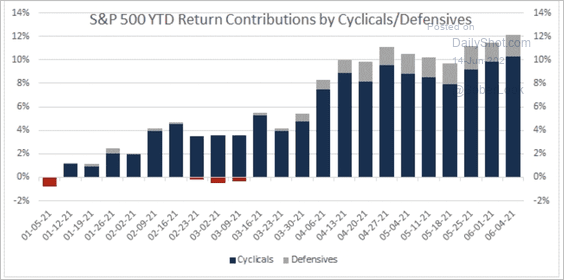

4. Cyclical stocks contributed more than ten percentage points (85%) of the S&P 500’s gains so far this year, according to Evercore ISI.

Source: Evercore ISI

Source: Evercore ISI

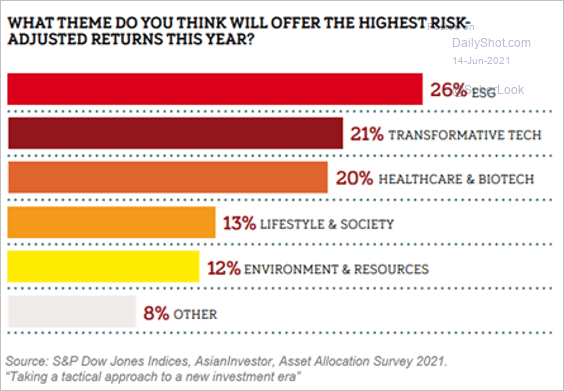

5. Which thematic portfolios will outperform this year on a risk-adjusted basis?

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

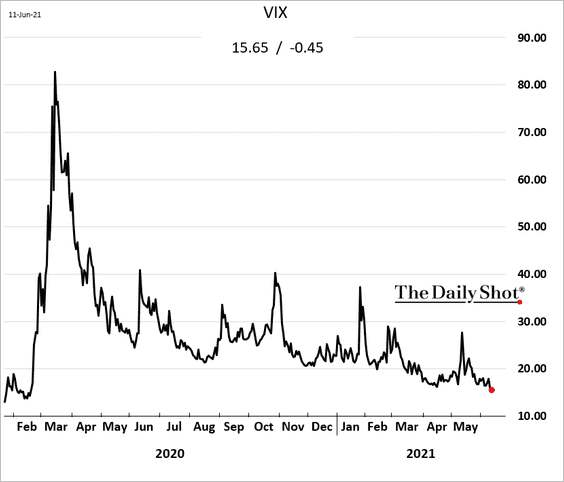

6. VIX has declined to its lowest point since the start of the pandemic (below 16).

Back to Index

Rates

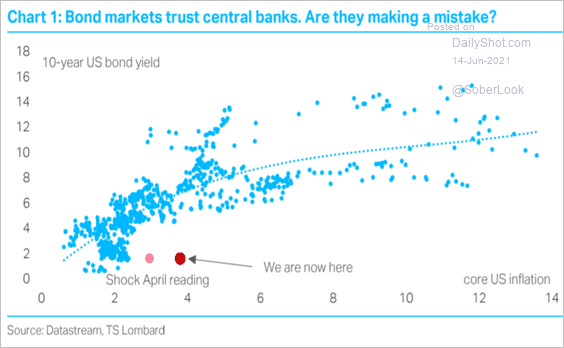

1. Treasury yields have further decoupled from the US core CPI …

Source: TS Lombard

Source: TS Lombard

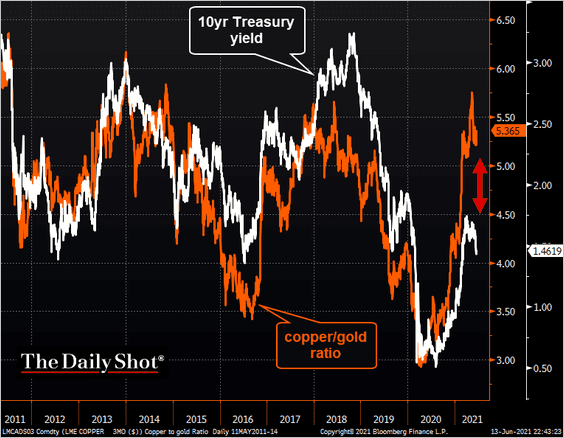

… and from the copper-to-gold ratio.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

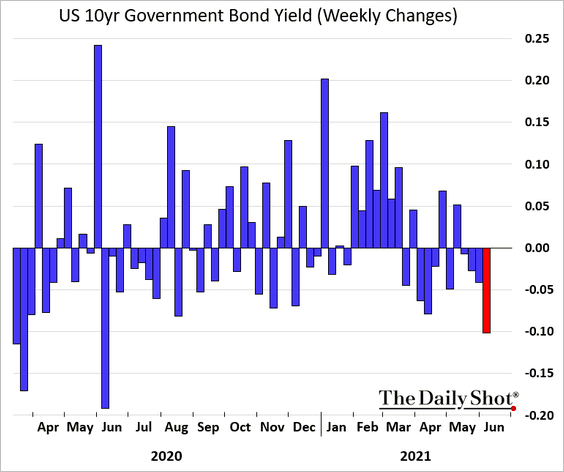

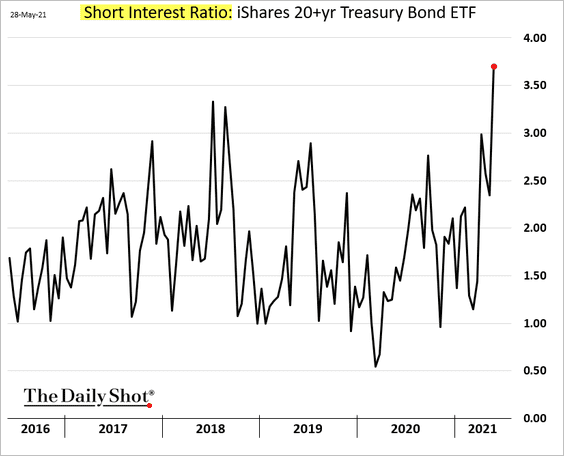

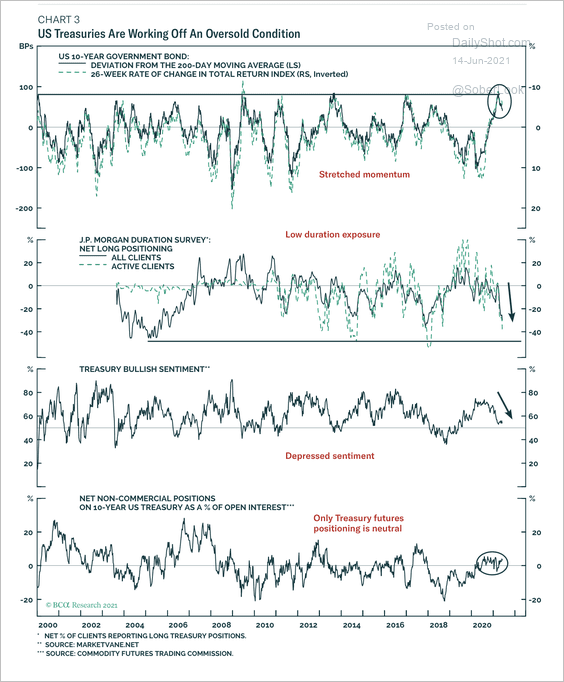

2. Treasury yields saw a substantial decline last week, …

… driven in part by short-covering.

Technicals suggest Treasuries are still oversold.

Source: BCA Research

Source: BCA Research

——————–

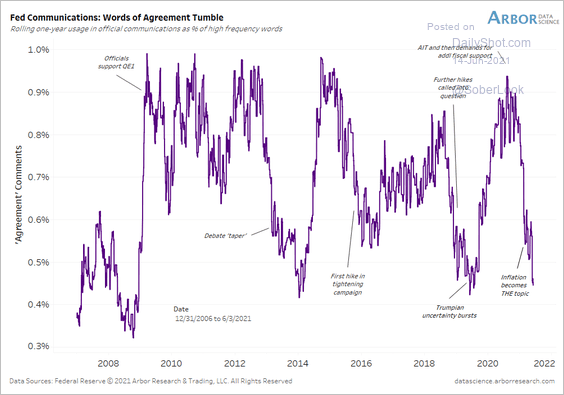

3. Fed officials have been in disagreement this year, which could signal an incoming hawkish shift.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Back to Index

Food for Thought

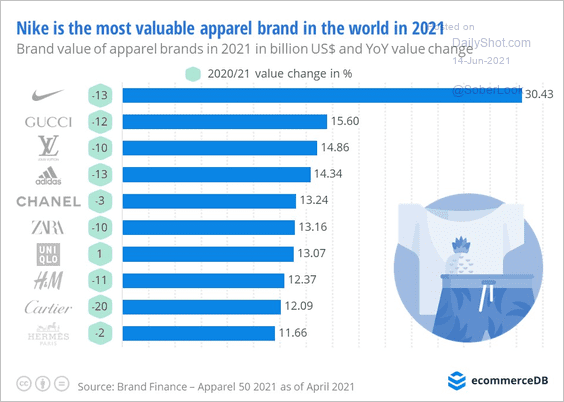

1. Most valuable apparel brands:

Source: eCommerceDB Read full article

Source: eCommerceDB Read full article

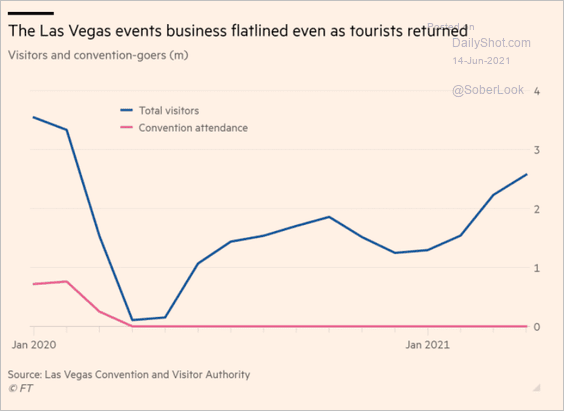

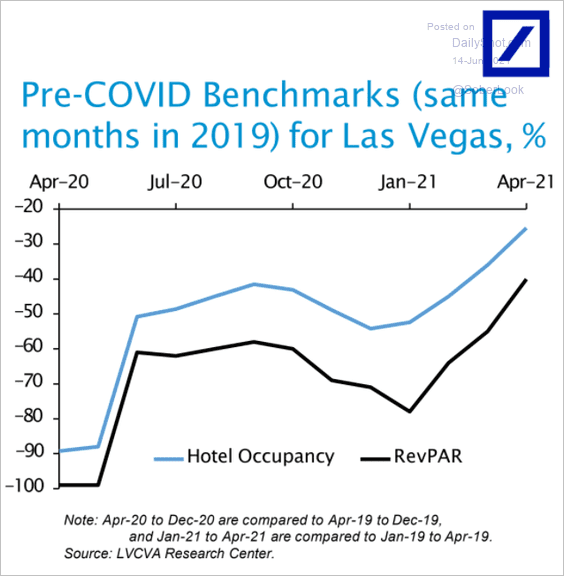

2. Las Vegas business activity (2 charts):

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

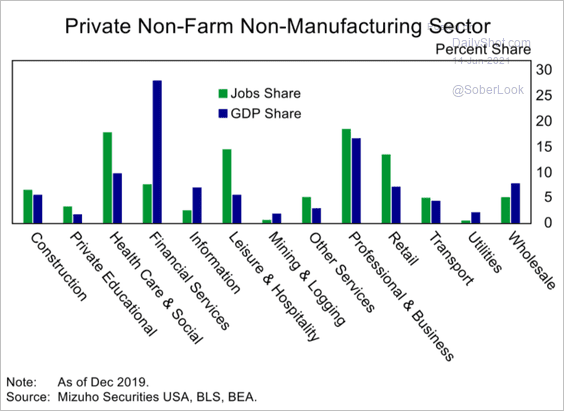

3. US jobs share vs. GDP contribution, by sector:

Source: Mizuho Securities USA

Source: Mizuho Securities USA

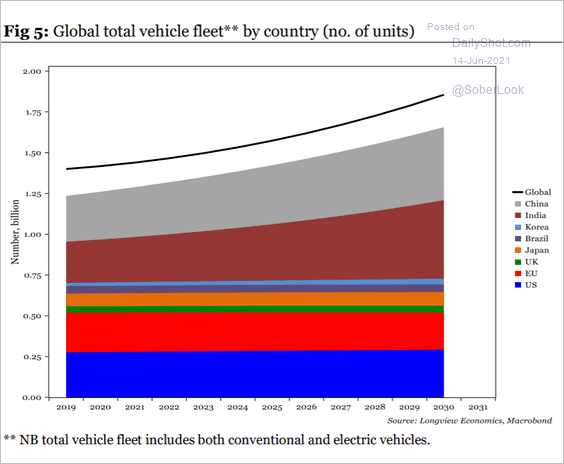

4. Global vehicle fleet:

Source: Longview Economics

Source: Longview Economics

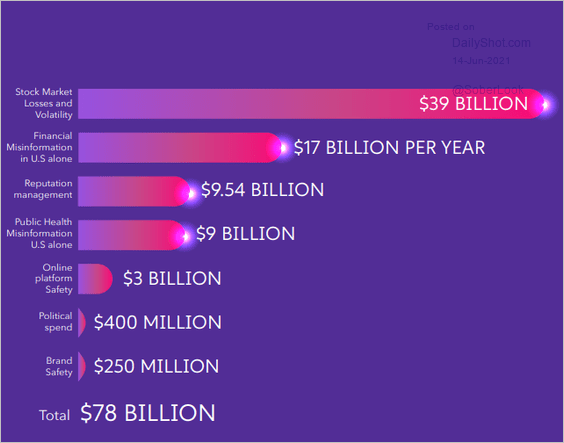

5. The economic cost of fake news:

Source: CHEQ, University of Baltimore Read full article

Source: CHEQ, University of Baltimore Read full article

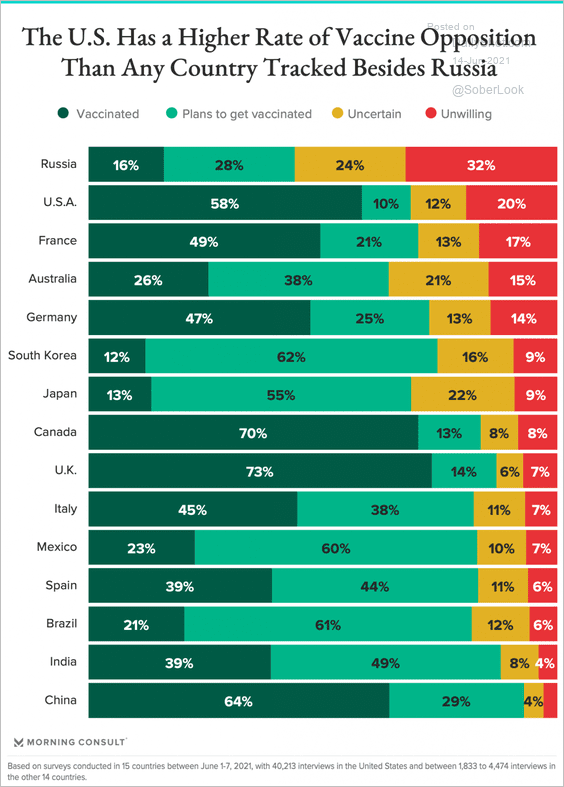

6. Vaccine opposition:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

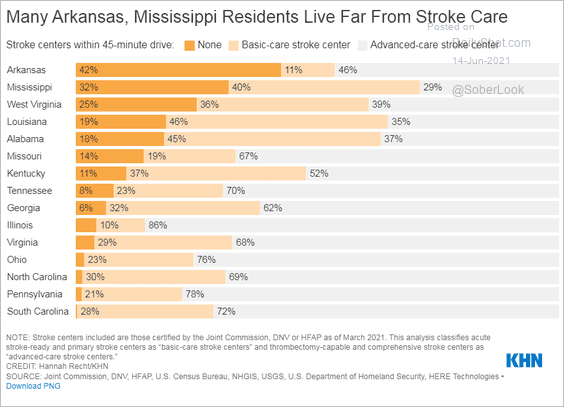

7. Distance from stroke care centers:

Source: KHN Read full article

Source: KHN Read full article

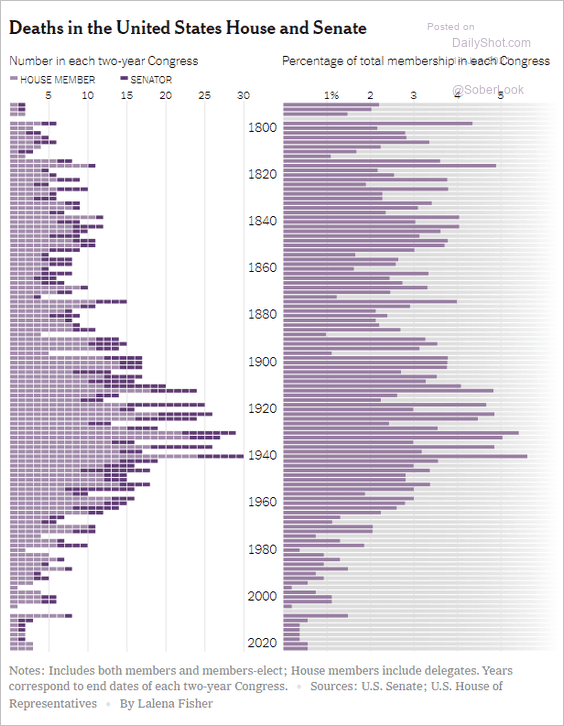

8. Deaths in US Congress:

Source: @IanPrasad Read full article

Source: @IanPrasad Read full article

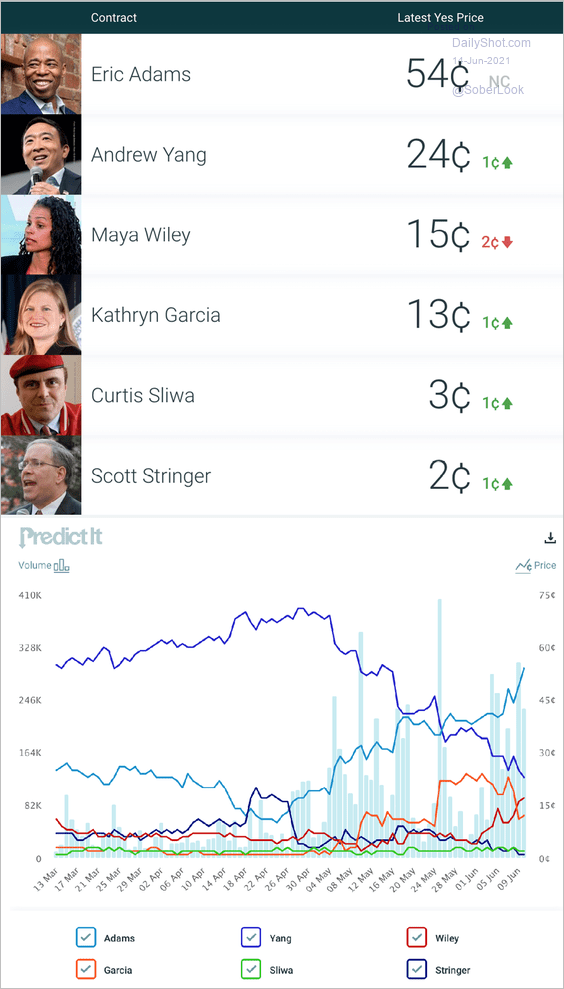

9. Betting market odds for the NYC mayoral elections:

Source: @Predictit

Source: @Predictit

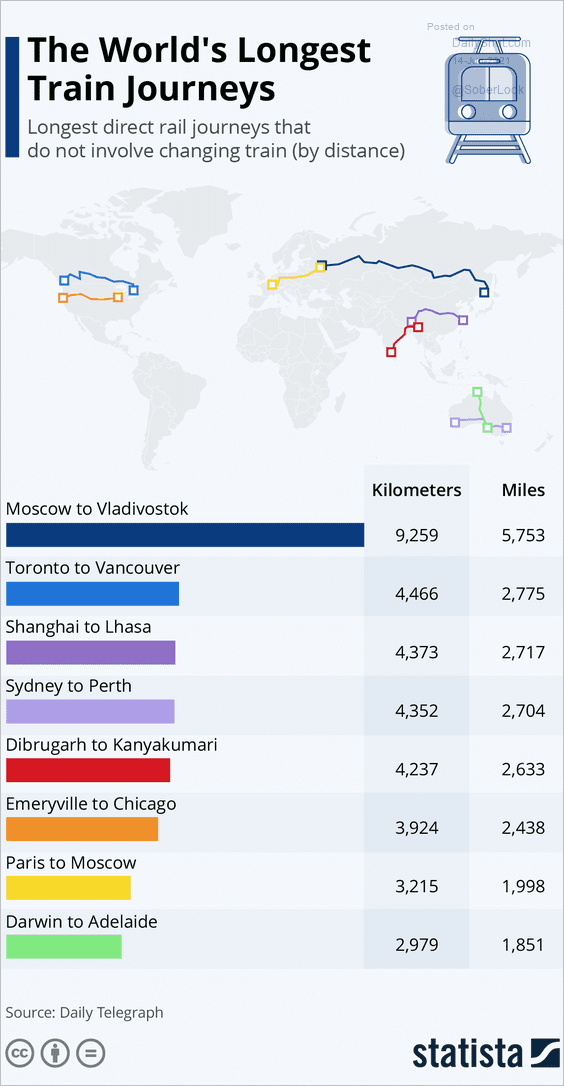

10. Longest train journeys:

Source: Statista

Source: Statista

——————–

Back to Index