The Daily Shot: 15-Jun-21

• The United States

• Canada

• Europe

• Asia – Pacific

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

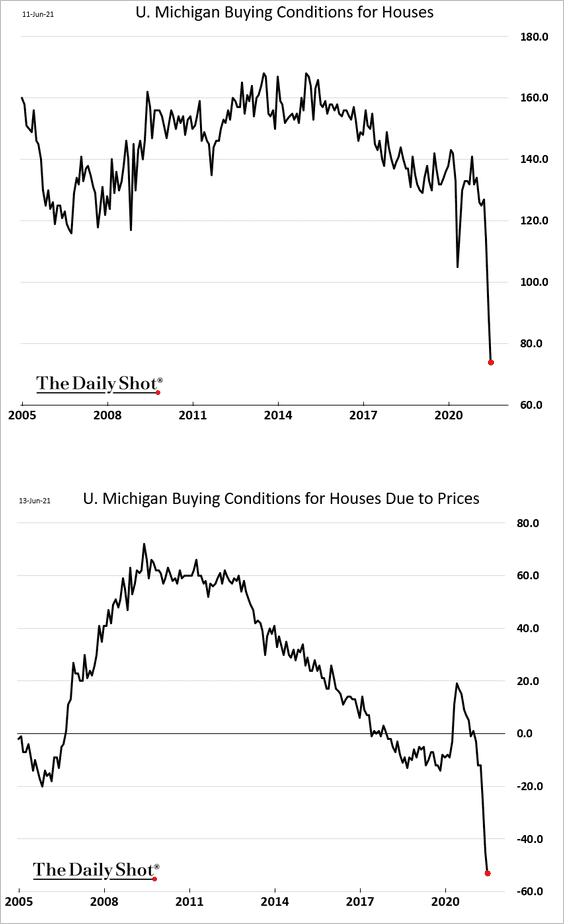

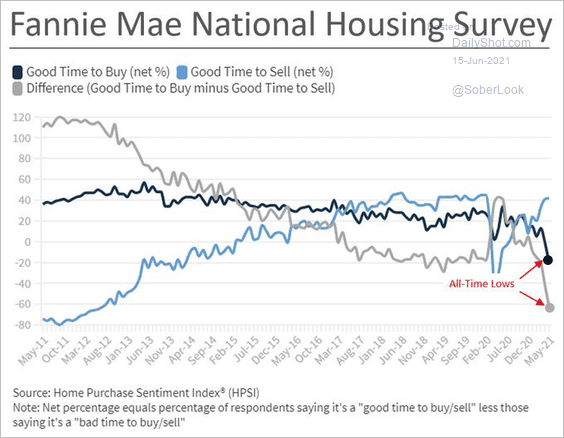

1. Let’s begin with the housing market.

• US consumers now view the buying conditions for houses as worst in years, as prices surge (2 charts).

Source: Fannie Mae, @Not_Jim_Cramer Read full article

Source: Fannie Mae, @Not_Jim_Cramer Read full article

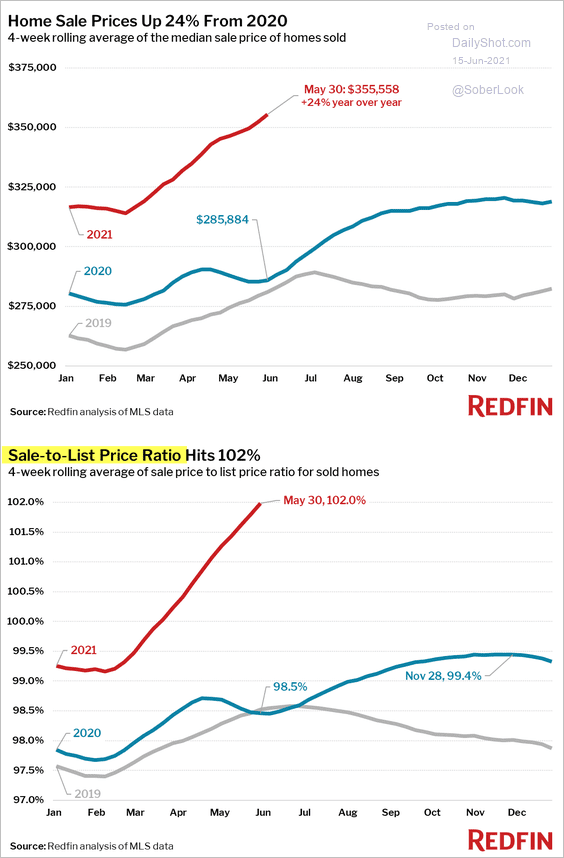

• Home prices continued to climb last month, with a majority of houses selling above list prices.

Source: Redfin

Source: Redfin

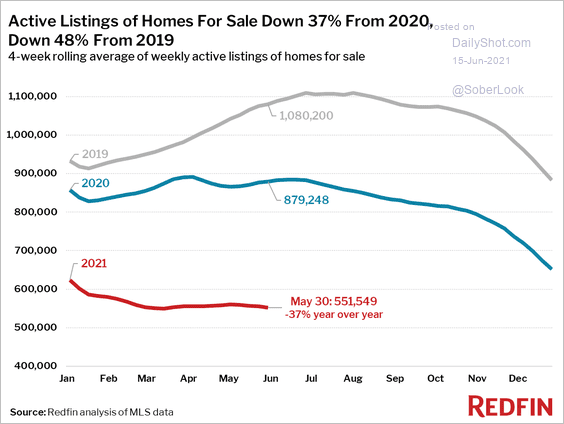

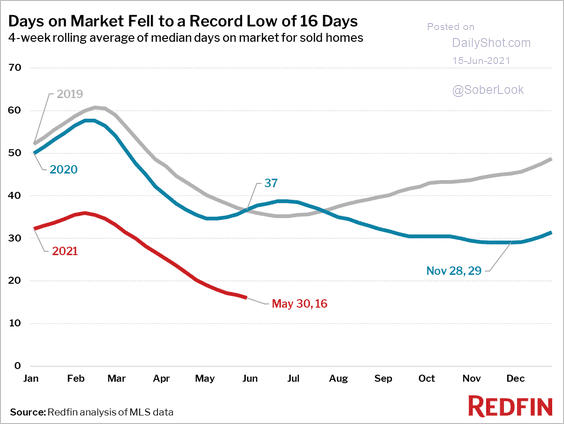

• Inventories remain tight.

Source: Redfin

Source: Redfin

Source: Redfin

Source: Redfin

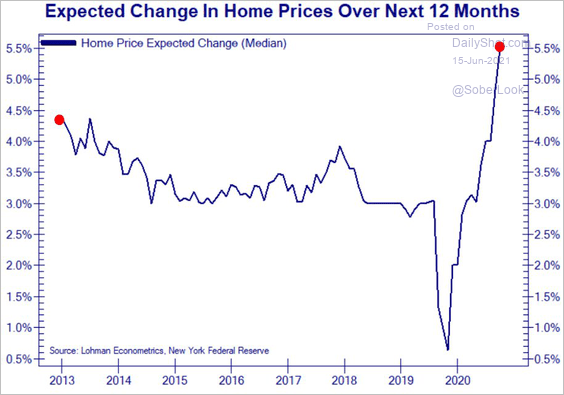

• Americans expect home prices to climb much faster going forward.

Source: @Not_Jim_Cramer

Source: @Not_Jim_Cramer

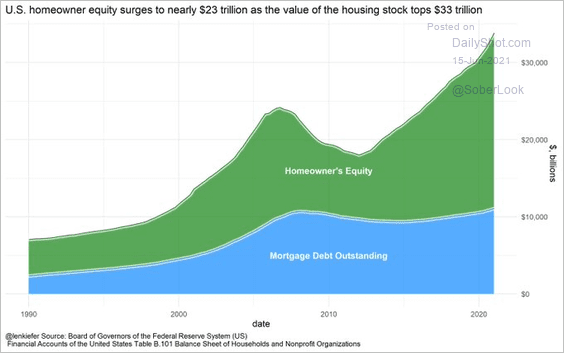

• Home equity is rising rapidly, outpacing debt (the housing market is “deleveraging”).

Source: @lenkiefer

Source: @lenkiefer

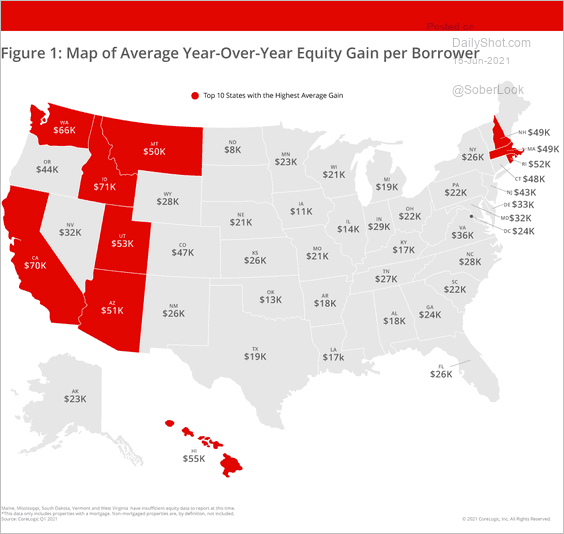

Source: CoreLogic

Source: CoreLogic

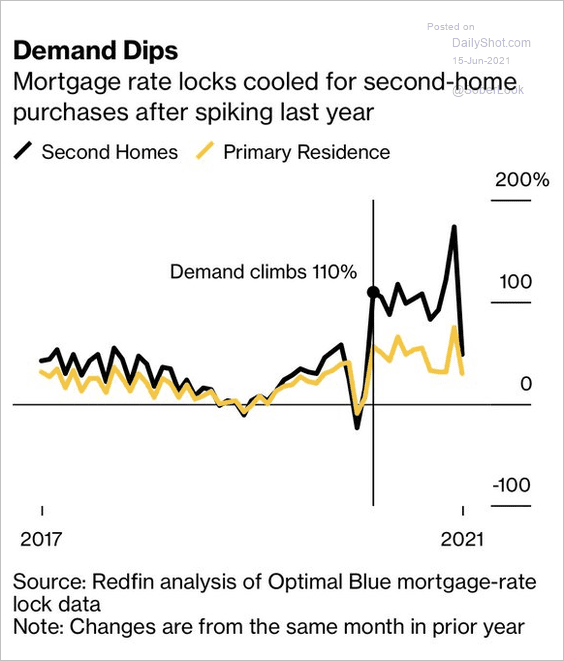

• Mortgage activity suggests that second home purchases moderated in recent months (though still elevated).

Source: @carlquintanilla, @business Read full article

Source: @carlquintanilla, @business Read full article

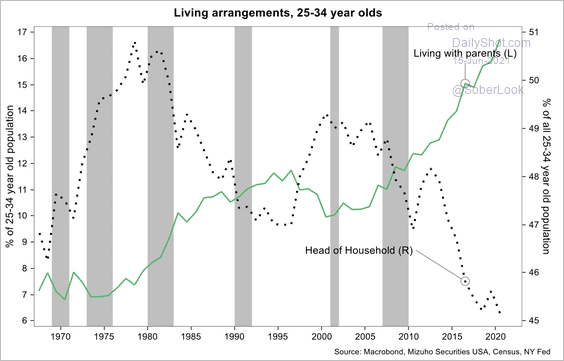

• A growing share of 25-34-year-olds live with their parents. Will we see substantial pent-up demand from first-time homebuyers over the next few years?

Source: Mizuho Securities USA

Source: Mizuho Securities USA

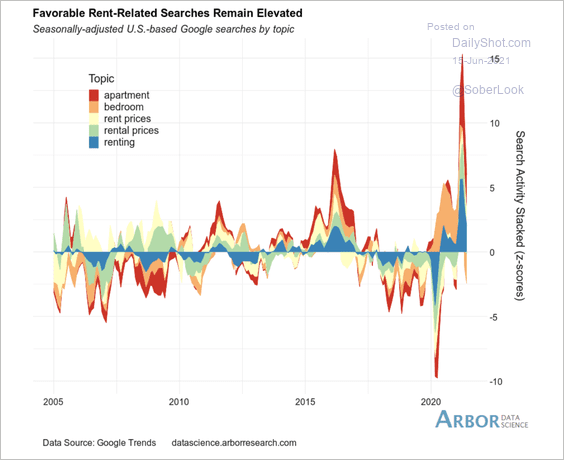

• Google searches for apartments have cooled as rental prices rise from low levels.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

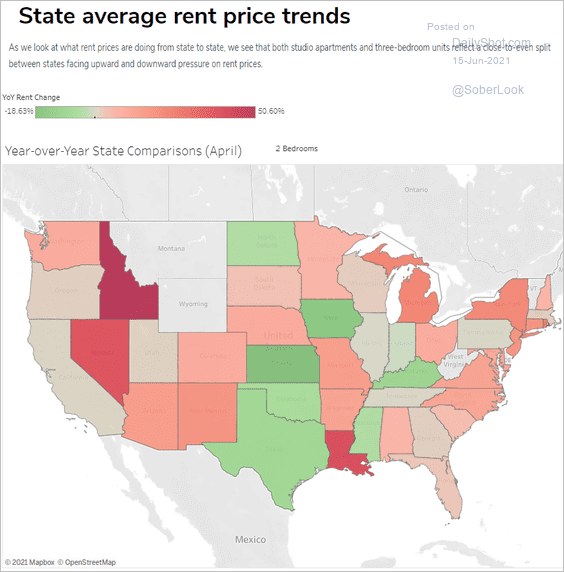

This map shows rent price trends by state.

Source: Apartment Guide Read full article

Source: Apartment Guide Read full article

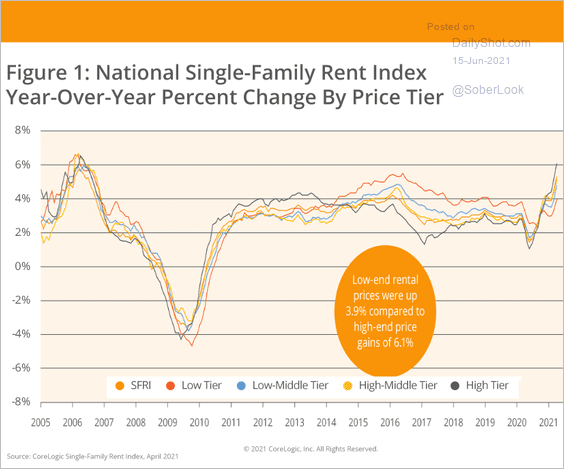

• Increases in rental costs for single-family homes are accelerating, led by high-tier properties.

Source: CoreLogic

Source: CoreLogic

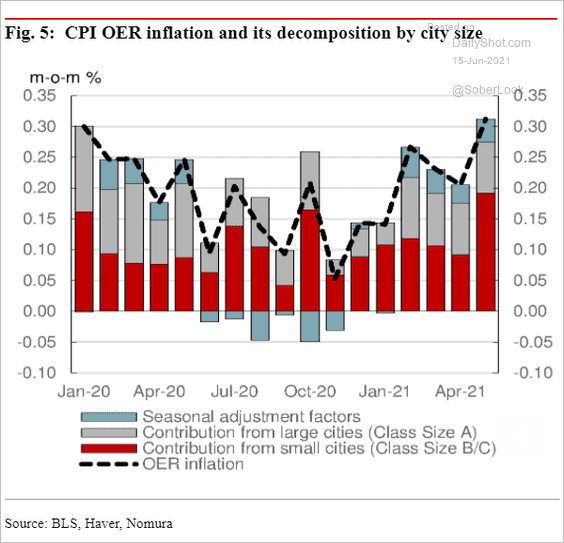

• Gains in owners’ equivalent rent (OER) have been stronger in small cities.

Source: Nomura Securities

Source: Nomura Securities

——————–

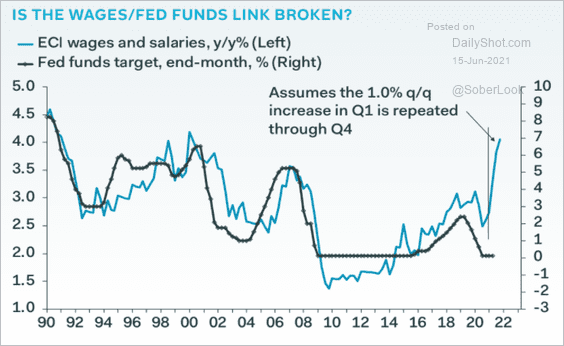

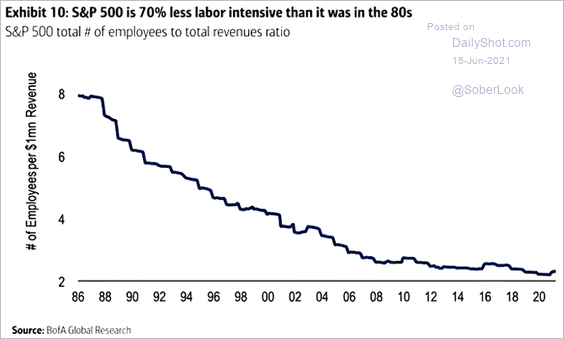

2. Next, we have some updates on wage trends.

• Wages have decoupled from the monetary policy.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• However, the Atalanta Fed’s wage tracker is yet to show an acceleration in pay increases.

![]() Source: @AtlantaFed

Source: @AtlantaFed

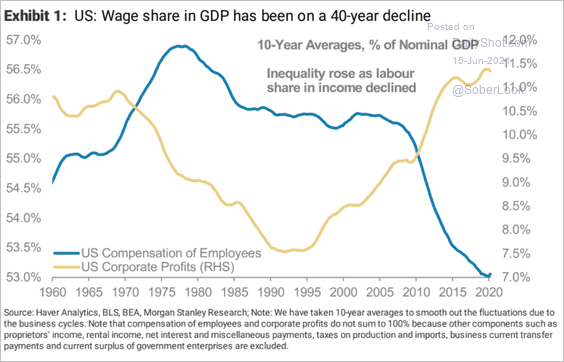

• Has the wage share in GDP finally bottomed?

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Businesses are much less labor-intensive these days.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

——————–

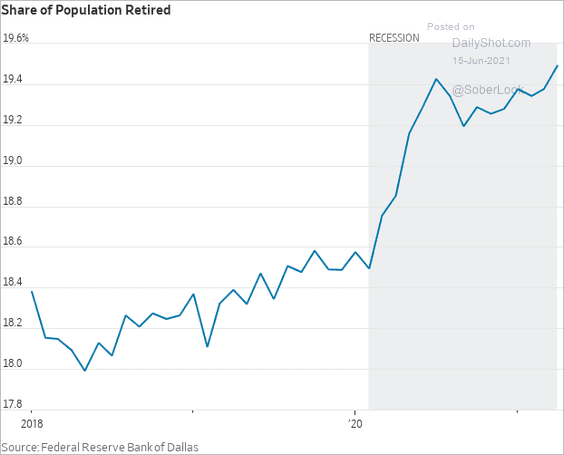

3. With more Americans retiring, …

Source: @WSJ Read full article

Source: @WSJ Read full article

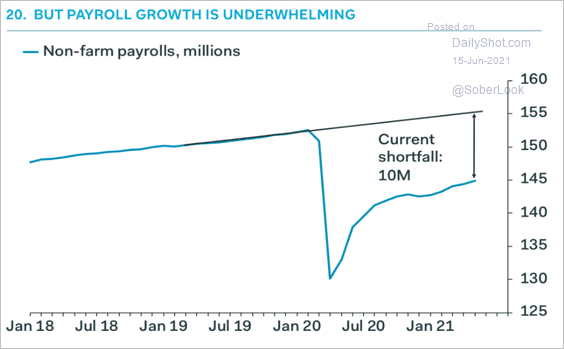

… the Fed may have to rethink its forecasts for “full employment” timing (the gap below may be overstating the labor market weakness).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

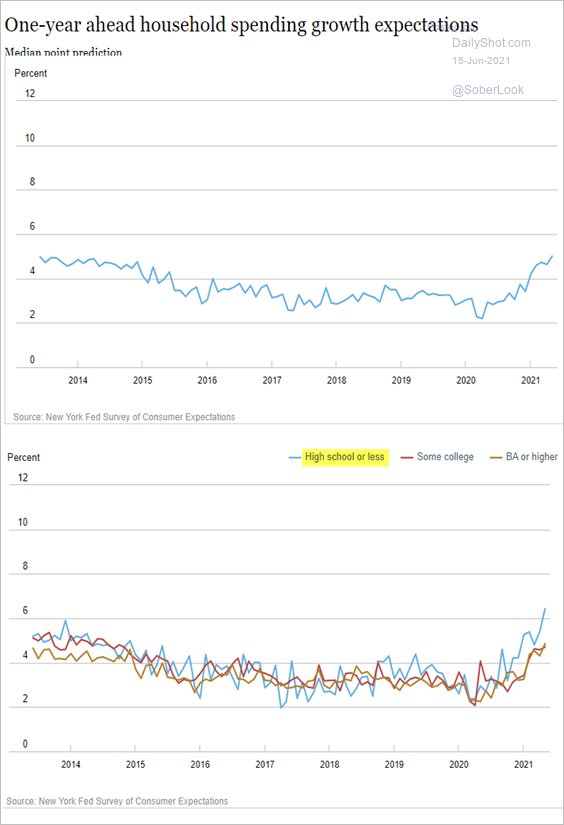

4. US households expect to spend substantially more over the next 12 months.

Source: NY Fed

Source: NY Fed

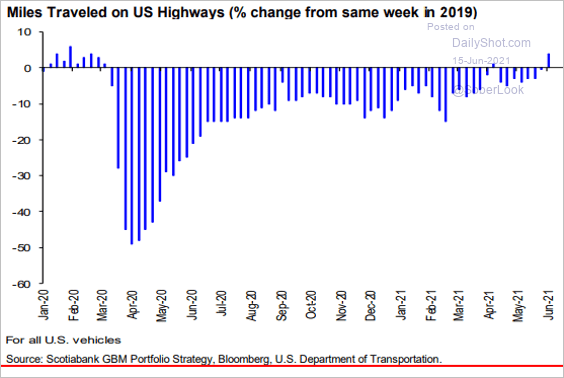

5. Americans are now driving more than they did in 2019.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

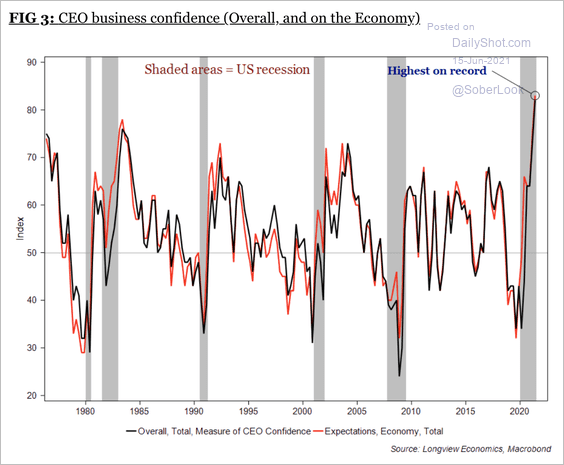

6. CEO business confidence is the highest on record.

Source: Longview Economics

Source: Longview Economics

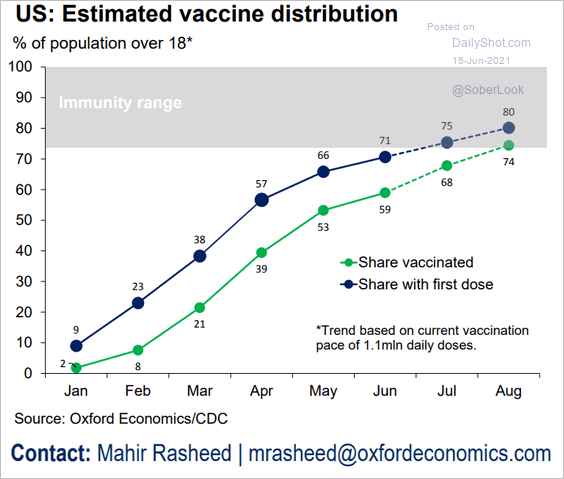

7. The US is nearing herd immunity, …

Source: Oxford Economics

Source: Oxford Economics

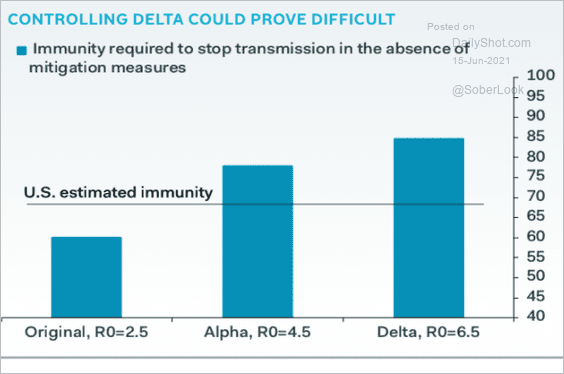

… but new variants pose a risk.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Canada

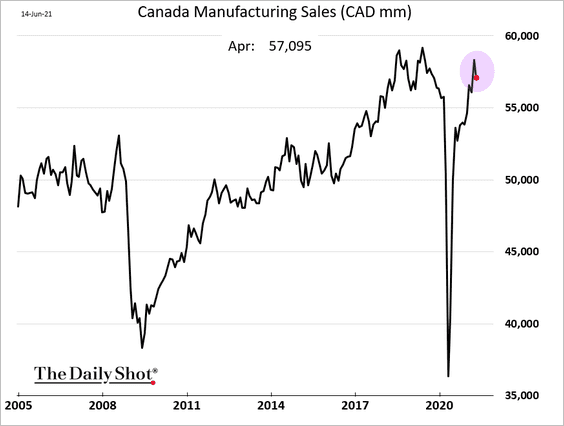

1. Manufacturing sales dipped in April.

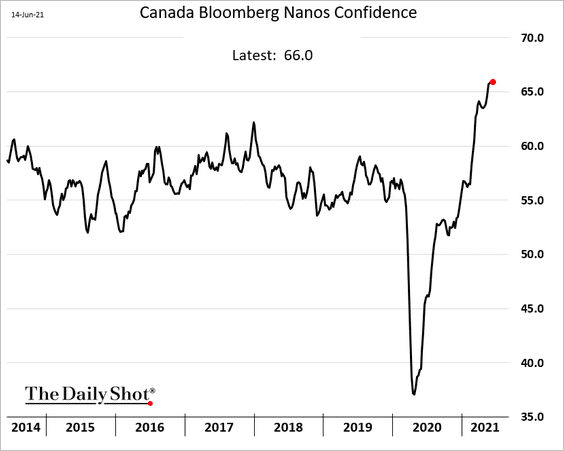

2. Consumer confidence is holding at multi-year highs.

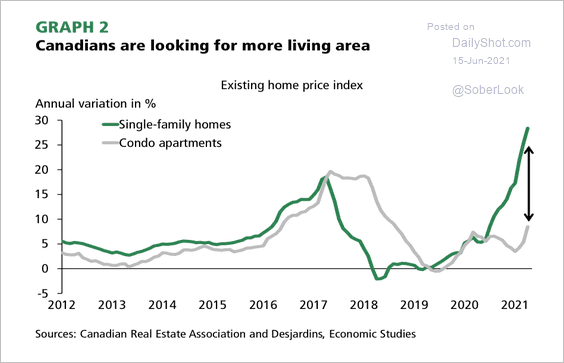

3. Single-family homes have seen stronger price growth than condo apartments over the past year.

Source: Desjardins

Source: Desjardins

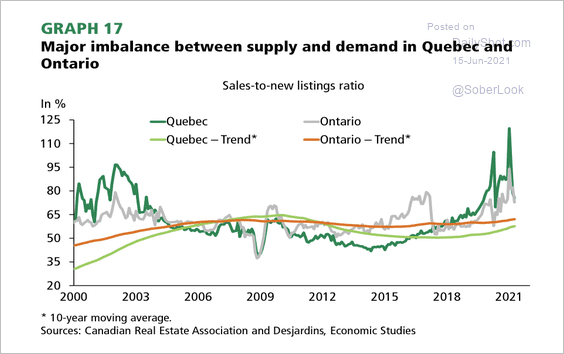

The sales-to-new listings ratio has started to decline in Quebec and Ontario this year.

Source: Desjardins

Source: Desjardins

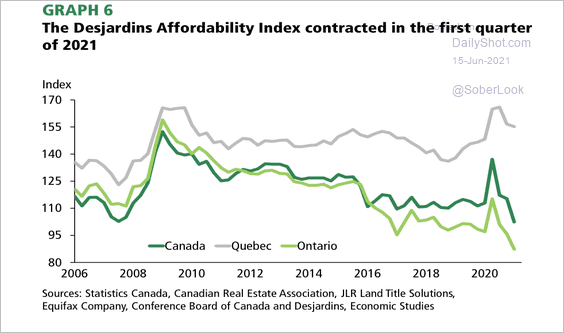

Housing affordability has deteriorated over the past few months as property prices accelerate and interest rates start to rise again.

Source: Desjardins

Source: Desjardins

——————–

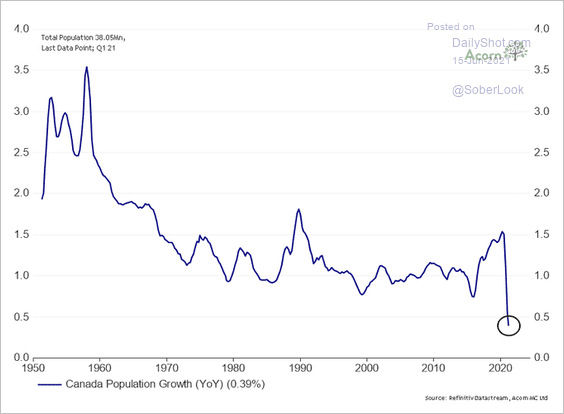

4. Population growth stalled last year.

Source: @RichardDias_CFA

Source: @RichardDias_CFA

Back to Index

Europe

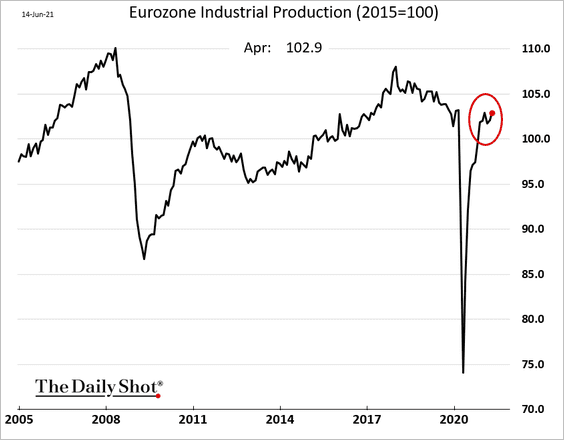

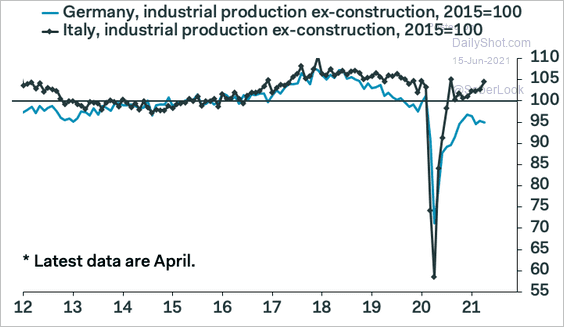

1. Euro-area industrial production climbed in April.

But gains have been uneven.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

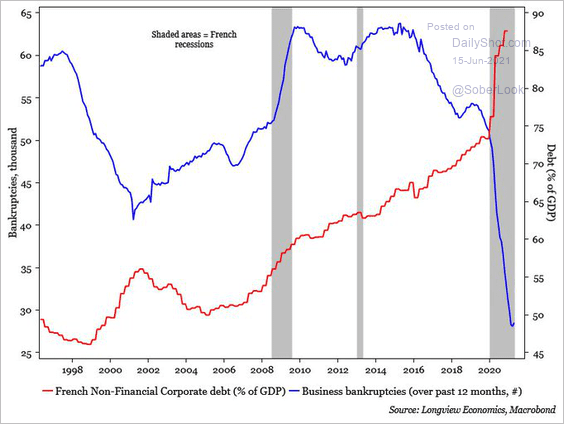

2. French business bankruptcies tumbled since the start of the pandemic (due to state aid), even as debt levels surged.

Source: @MichaelaArouet, @Lvieweconomics

Source: @MichaelaArouet, @Lvieweconomics

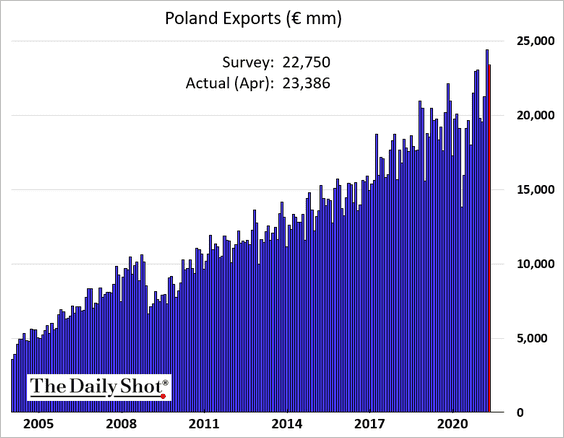

3. Poland’s exports are near record highs.

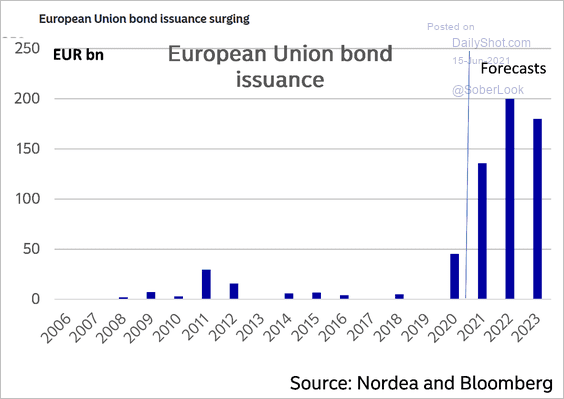

4. The European Union’s debt issuance (separate from individual states’ debt) will peak next year.

Source: Nordea Markets

Source: Nordea Markets

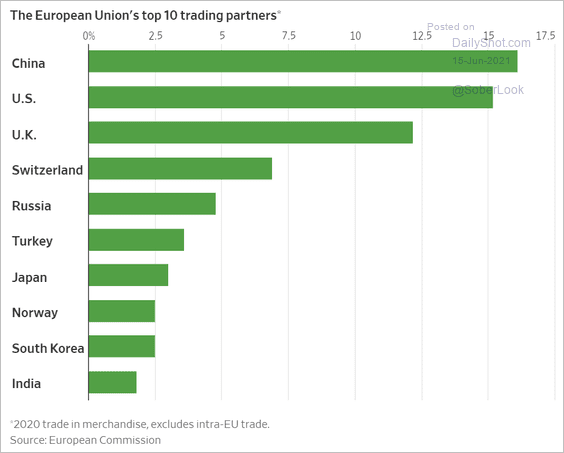

5. China is the EU’s largest trading partner.

Source: @WSJ Read full article

Source: @WSJ Read full article

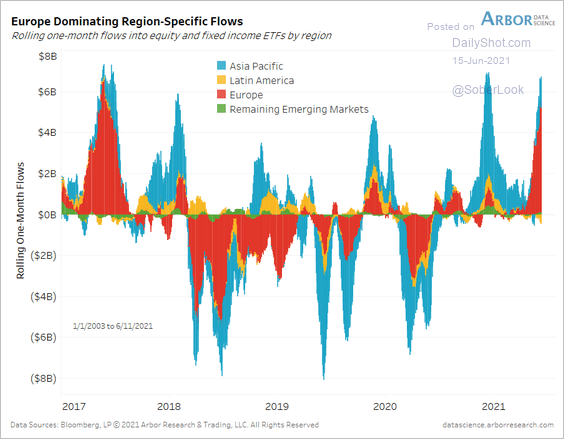

6. Flows into Europe-focused ETFs have accelerated in recent weeks.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Back to Index

Asia – Pacific

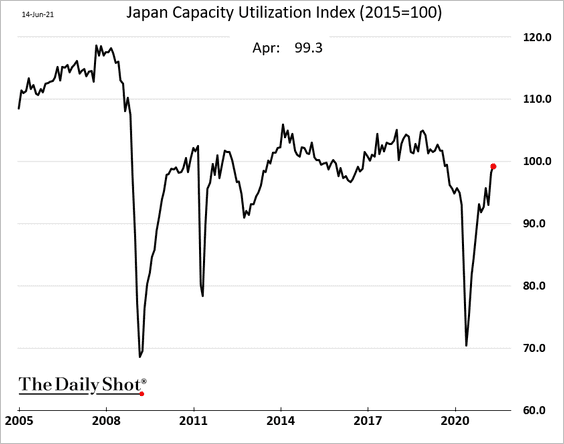

1. Japan’s industrial capacity utilization is above pre-COVID levels.

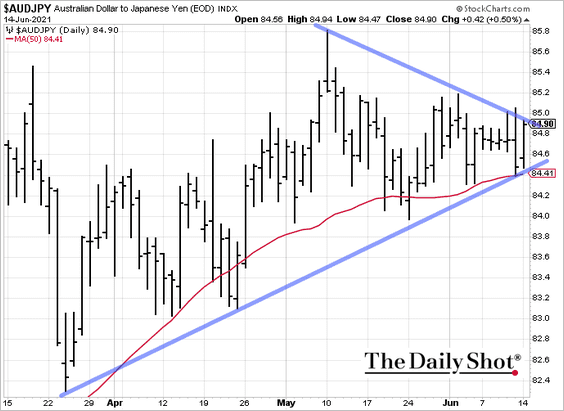

2. Aussie-yen, an indicator of global risk appetite, is in a wedge pattern. Will we see a breakout?

h/t Michael G. Wilson

h/t Michael G. Wilson

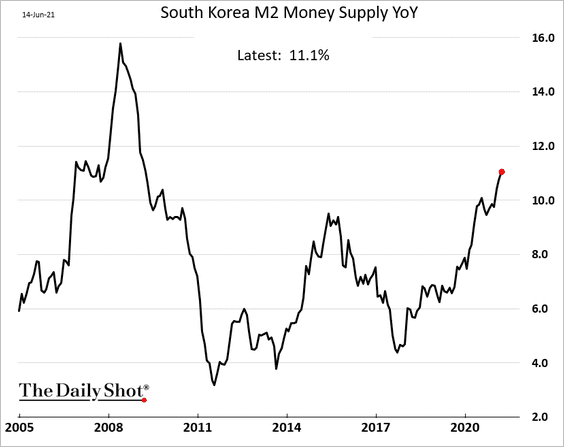

3. South Korea’s broad money supply growth is above 11% for the first time in over a decade.

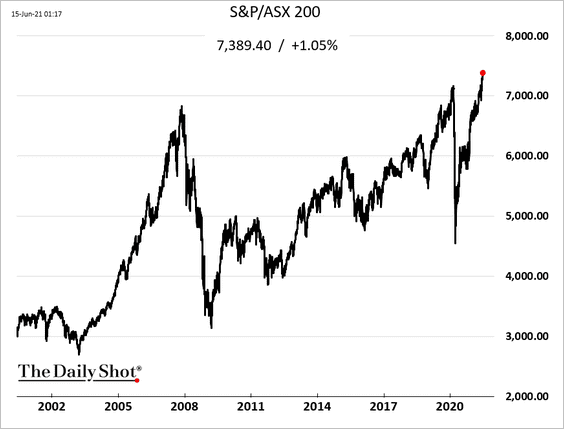

4. Australia’s stock market benchmark hit another record high.

Back to Index

Emerging Markets

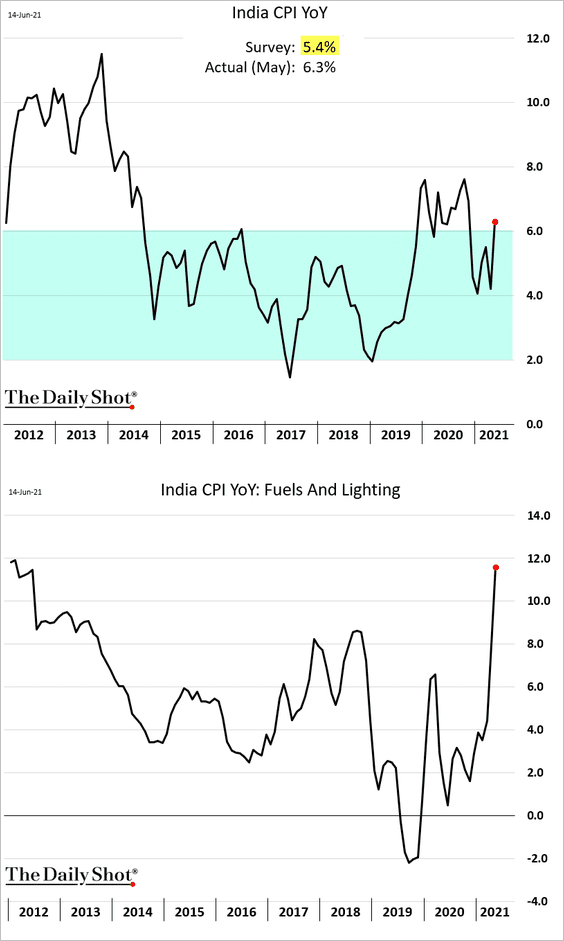

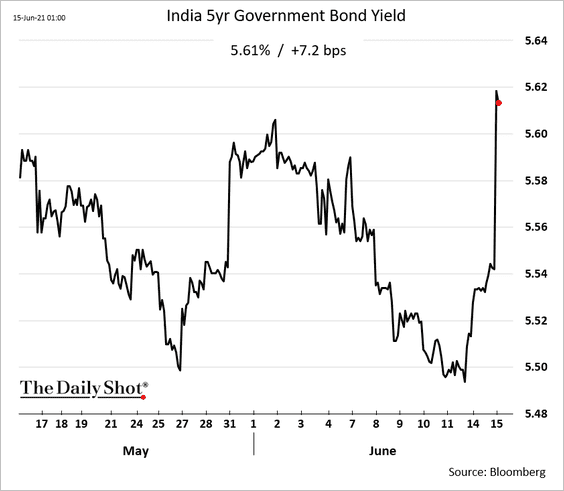

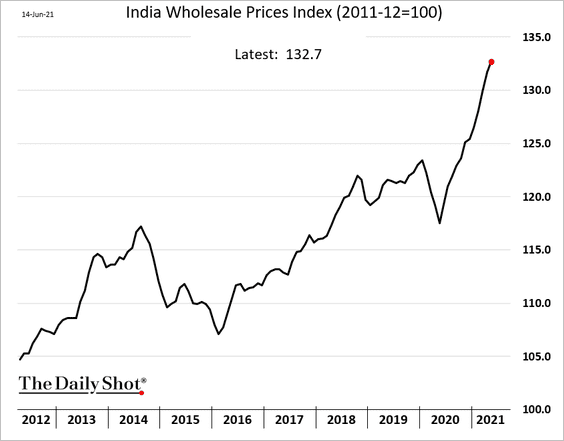

1. India’s inflation surprised to the upside, creating a potential headache for the RBI.

Bond yields jumped in response to the CPI surprise.

Wholesale prices are rising rapidly.

——————–

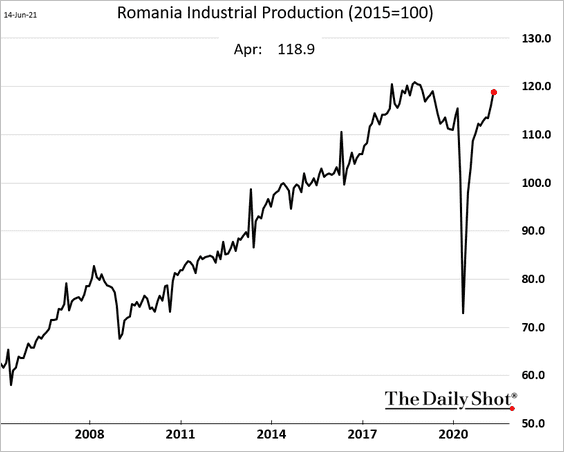

2. Romania’s industrial production is approaching record highs.

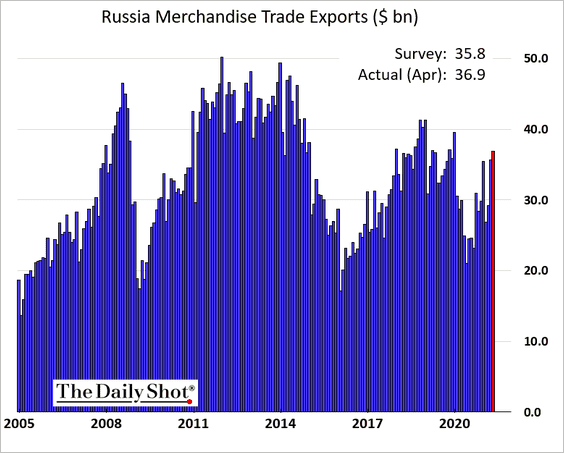

3. Russia’s exports surprised to the upside.

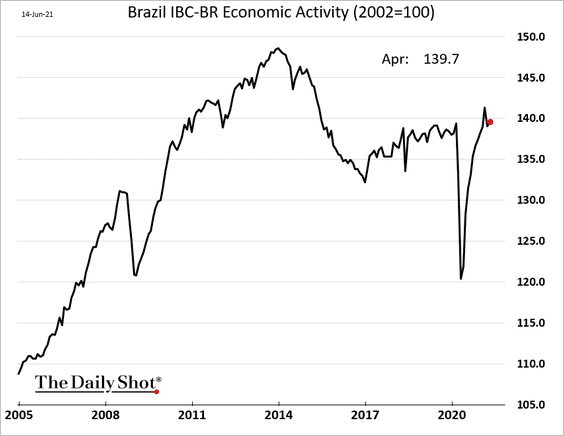

4. Brazil’s April economic activity was disappointing, but it held above pre-COVID levels.

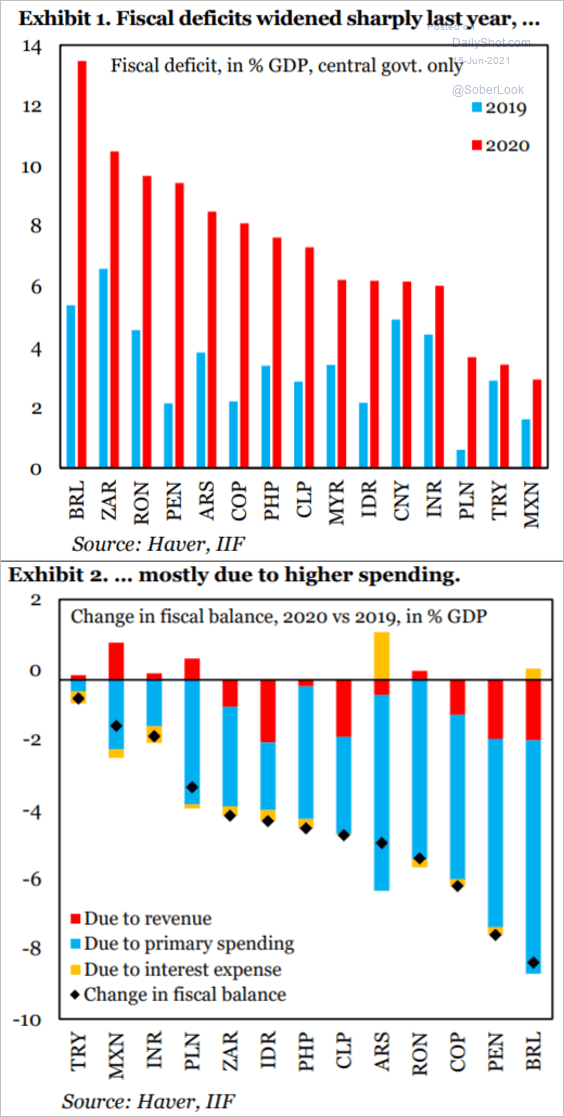

5. Here is a look at fiscal deficits.

Source: IIF

Source: IIF

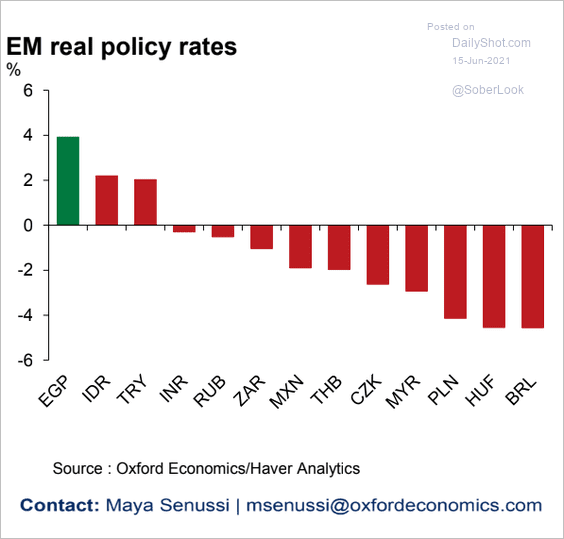

6. Few economies have positive real policy rates (rates set by central banks less inflation).

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Commodities

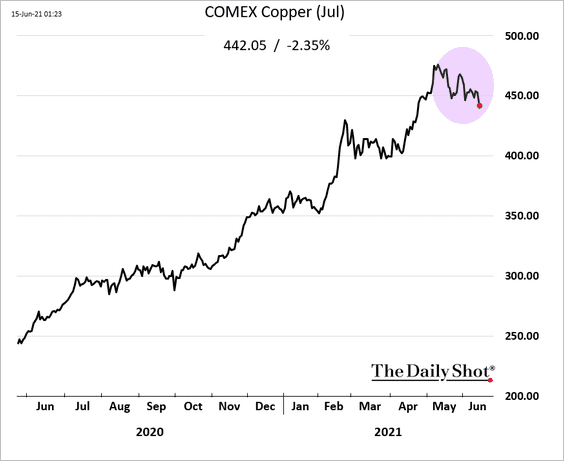

1. The rally in copper is fading.

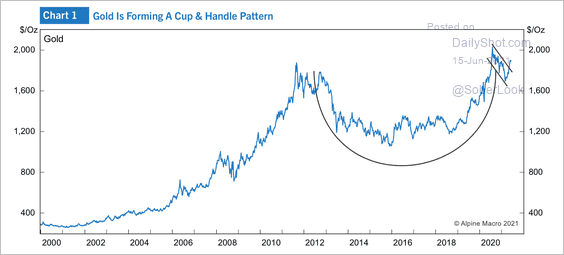

2. Gold has resumed its long-term uptrend, …

Source: Alpine Macro

Source: Alpine Macro

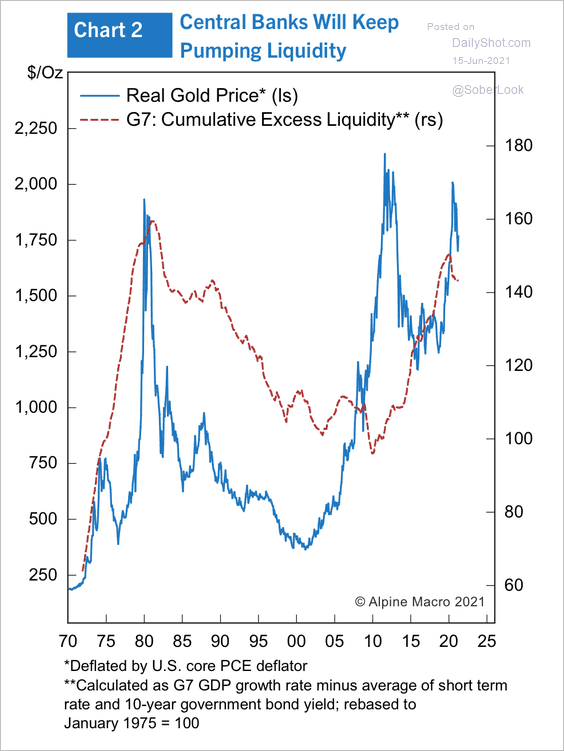

… supported by central bank excess liquidity.

Source: Alpine Macro

Source: Alpine Macro

——————–

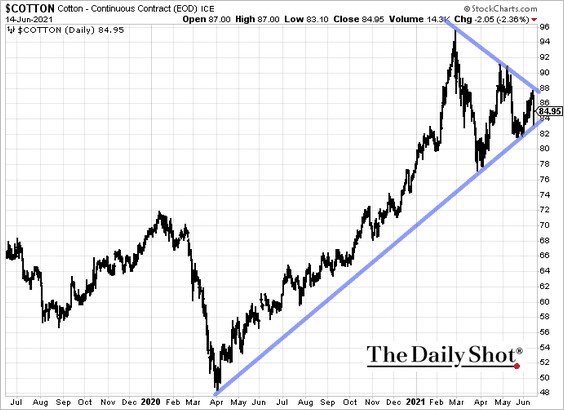

3. US cotton futures are in a wedge pattern.

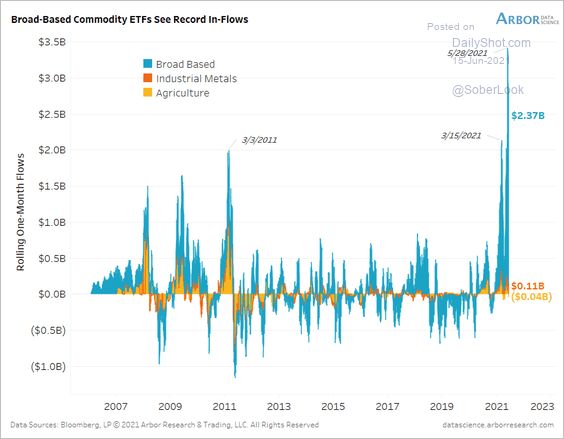

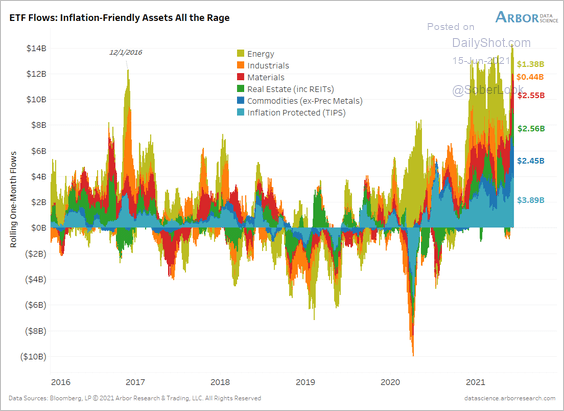

4. Flows into commodity ETFs have been unprecedented.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

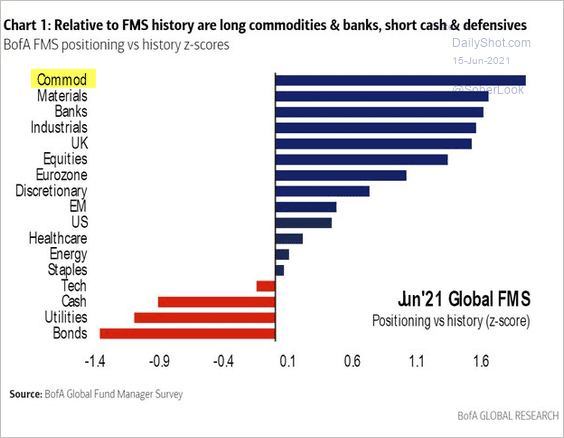

Is commodity positioning becoming stretched?

Source: BofA Global Research; @Callum_Thomas

Source: BofA Global Research; @Callum_Thomas

Back to Index

Energy

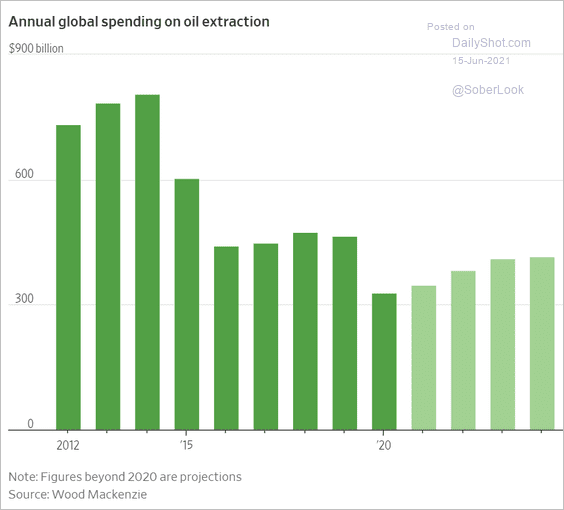

1. Will underinvestment in oil extraction exacerbate the market deficit over the next few years?

Source: @WSJ Read full article

Source: @WSJ Read full article

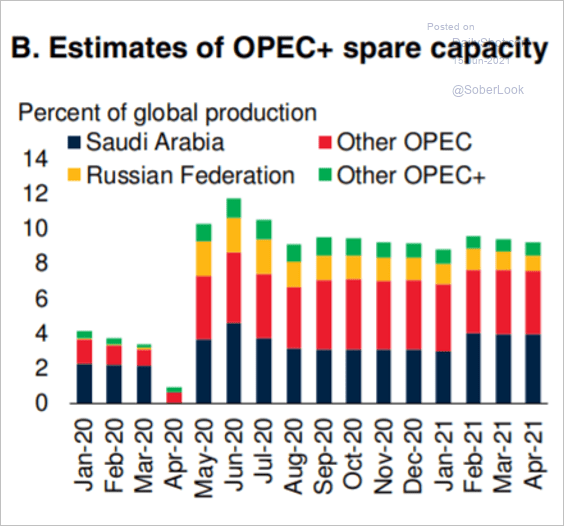

2. This chart shows the OPEC+ spare capacity (“other OPEC+” is mostly Kazakhstan).

Source: World Bank Group

Source: World Bank Group

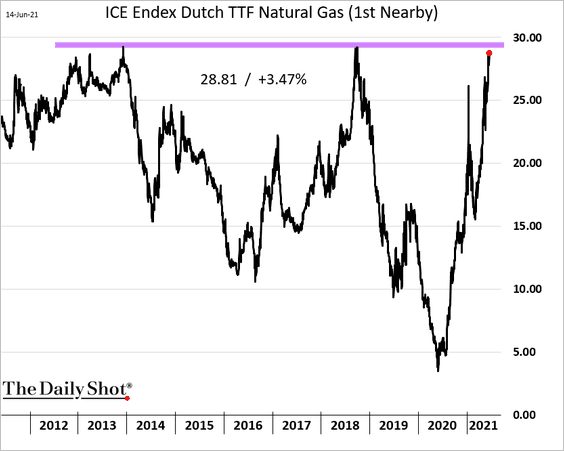

3. European natural gas prices are approaching multi-decade highs.

Back to Index

Equities

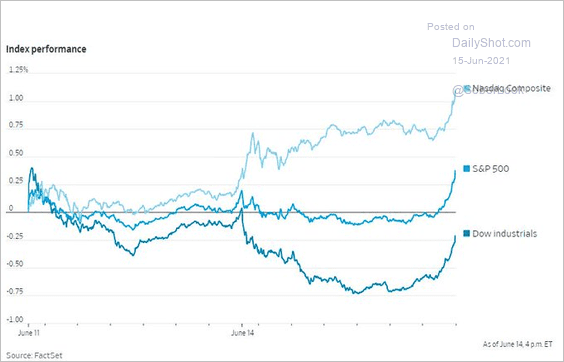

1. US indices hit record highs again as the market rebounded at the end of the day.

Source: @WSJmarkets Read full article

Source: @WSJmarkets Read full article

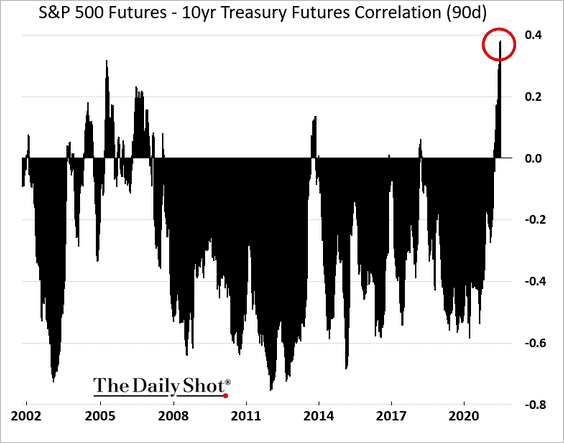

2. Stock-bond correlations remain at multi-year highs.

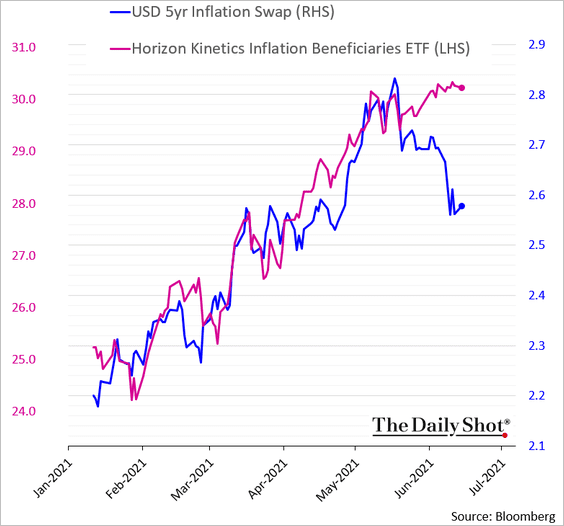

3. Equities and fixed-income markets are sending different signals on inflation, …

h/t Cormac Mullen

h/t Cormac Mullen

… amid massive inflows into inflation-sensitive stocks.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

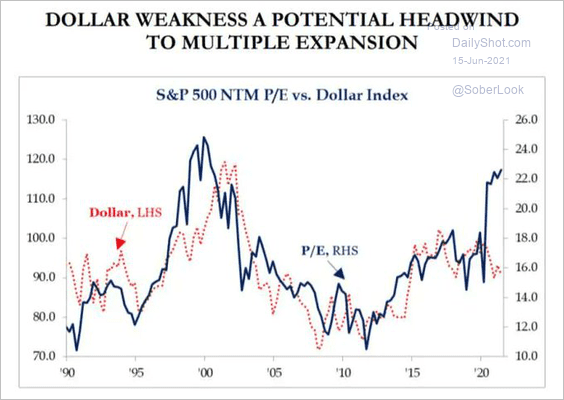

4. A weak US dollar could be a headwind for multiple expansion.

Source: @jessefelder, @financialtimes Read full article

Source: @jessefelder, @financialtimes Read full article

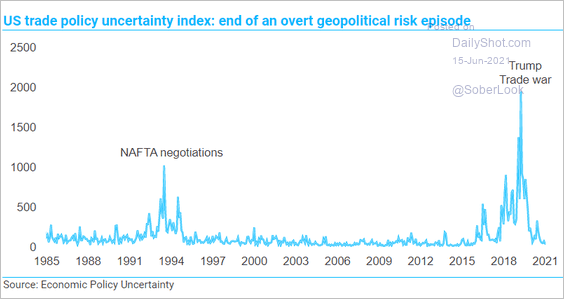

5. Is the market ignoring China-related trade uncertainties?

Source: TS Lombard

Source: TS Lombard

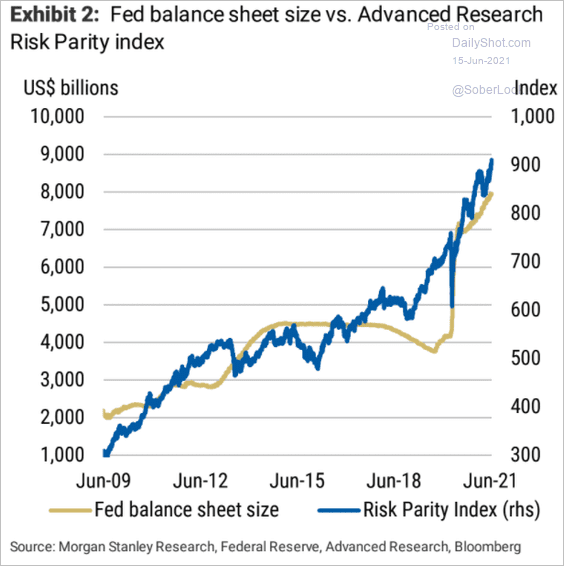

6. Risk parity strategies are outperforming as the Fed holds rates near zero.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

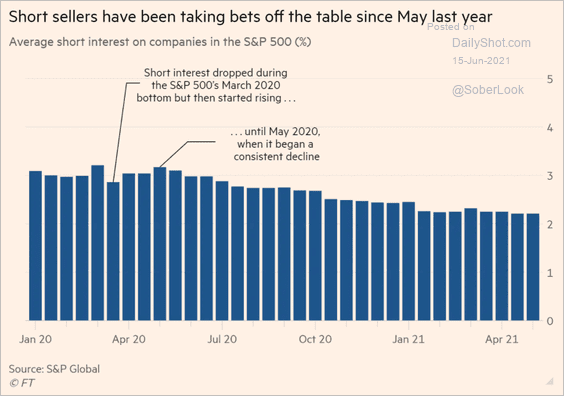

7. US market short interest continues to shrink.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

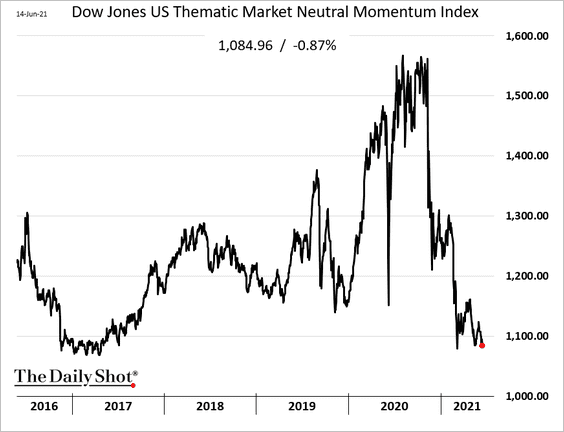

8. The momentum factor got whipsawed as newly-included value stocks underperform.

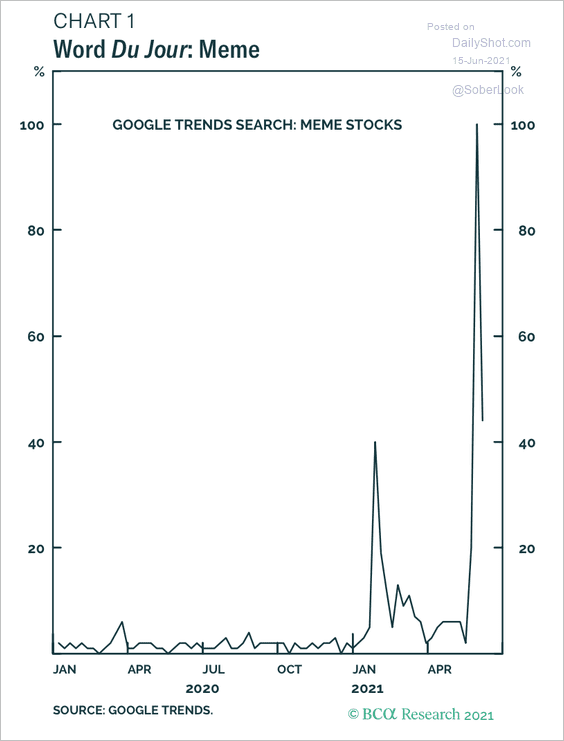

9. Google searches for “meme stocks” are starting to decline from extreme levels last month.

Source: BCA Research

Source: BCA Research

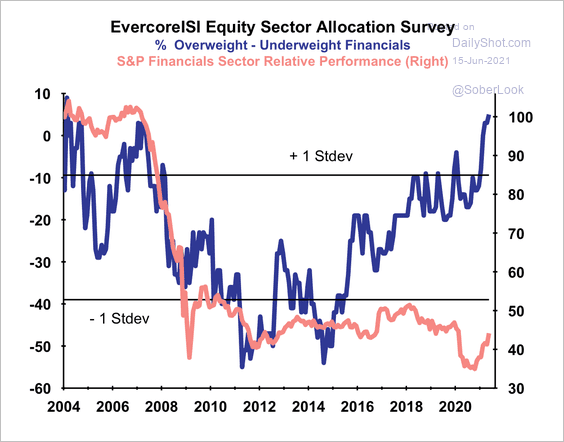

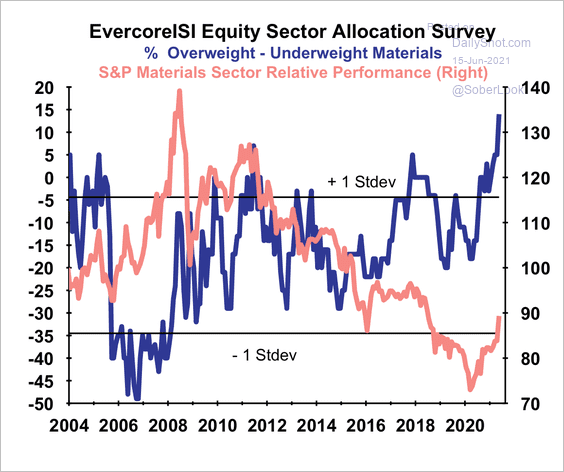

10. A majority of long-only investors surveyed by Evercore ISI have increased their exposure to financial and material stocks relative to the S&P 500 over the past month (2 charts).

Source: Evercore ISI

Source: Evercore ISI

Source: Evercore ISI

Source: Evercore ISI

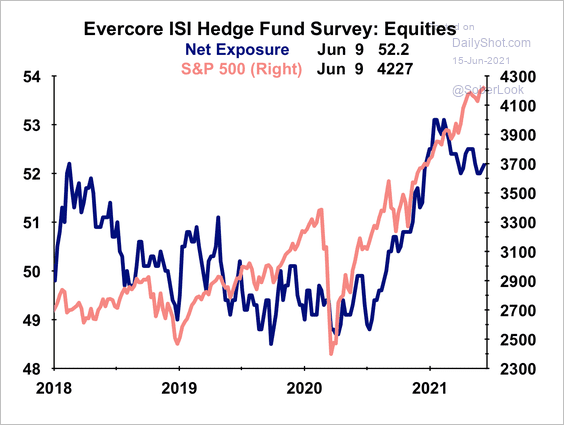

Hedge funds surveyed by Evercore ISI have increased their equity exposure over the past two weeks, albeit still below peak levels from earlier this year.

Source: Evercore ISI

Source: Evercore ISI

Back to Index

Credit

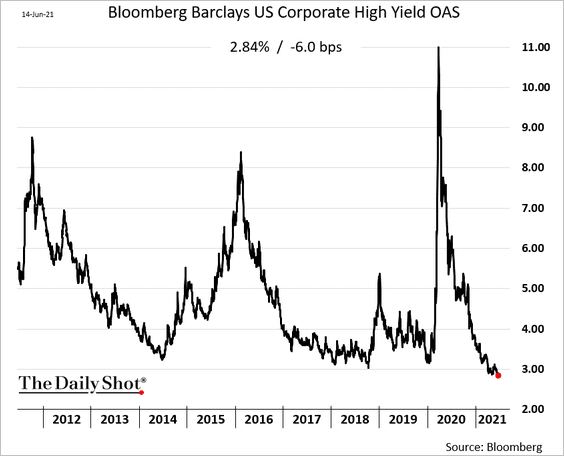

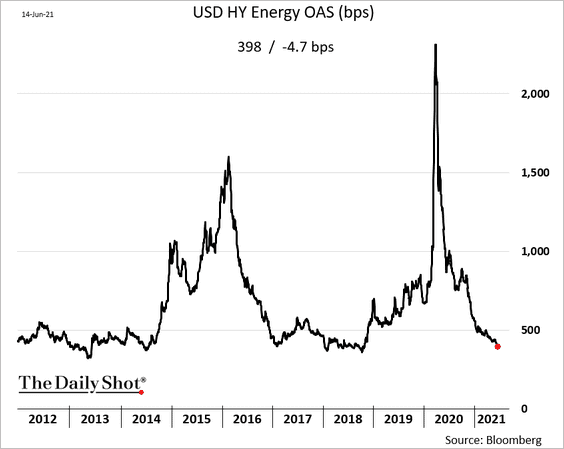

1. Rising oil prices sent US high-yield bond spreads to new lows.

——————–

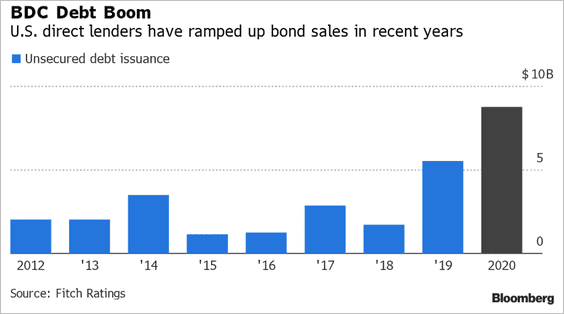

2. BDC debt issuance surged last year.

Source: Olivia Raimonde, Bloomberg Finance L.P. Read full article

Source: Olivia Raimonde, Bloomberg Finance L.P. Read full article

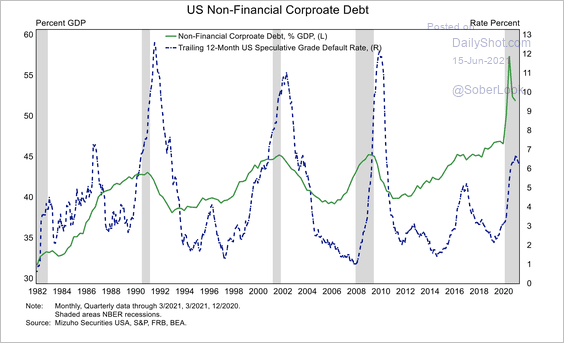

3. Corporate leverage has increased sharply over the past year while defaults are relatively low.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

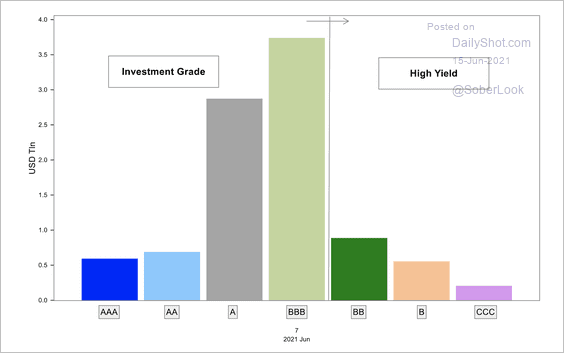

4. Here is a look at the US corporate bond market-cap by rating …

Source: Mizuho Securities USA

Source: Mizuho Securities USA

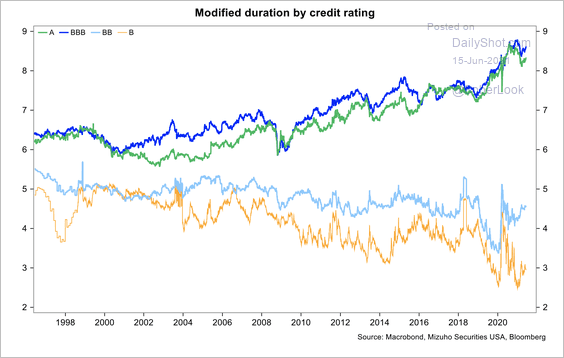

…and duration by rating category.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

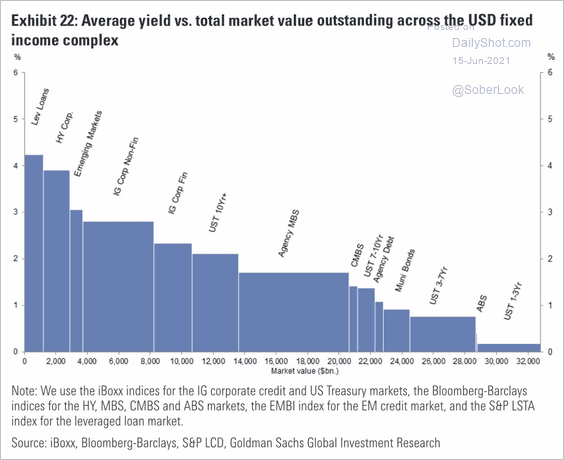

5. Below is an overview of debt yields across the USD fixed-income markets.

Source: Goldman Sachs; h/t James W.

Source: Goldman Sachs; h/t James W.

Back to Index

Rates

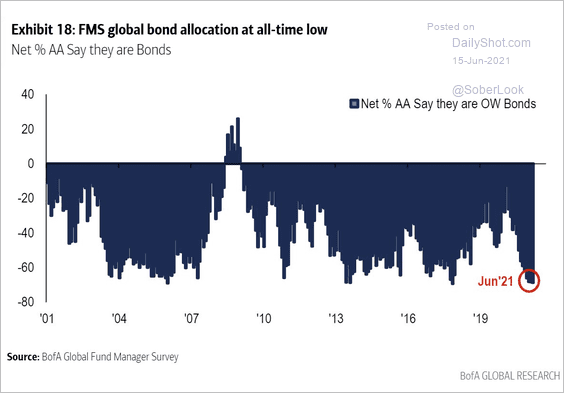

1. Investor bond allocations remain near extreme lows.

• Fund managers:

Source: BofA Global Research; @Callum_Thomas

Source: BofA Global Research; @Callum_Thomas

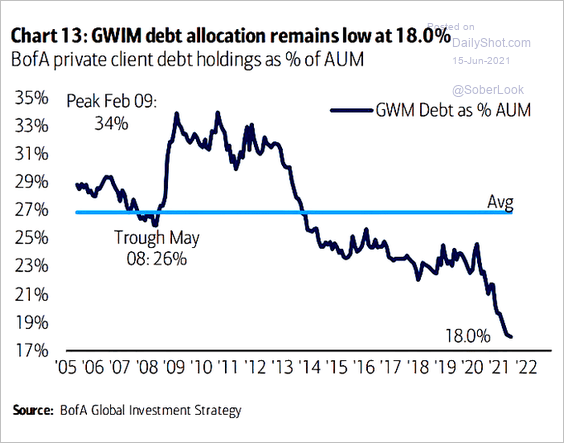

• Merrill Lynch private clients:

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

——————–

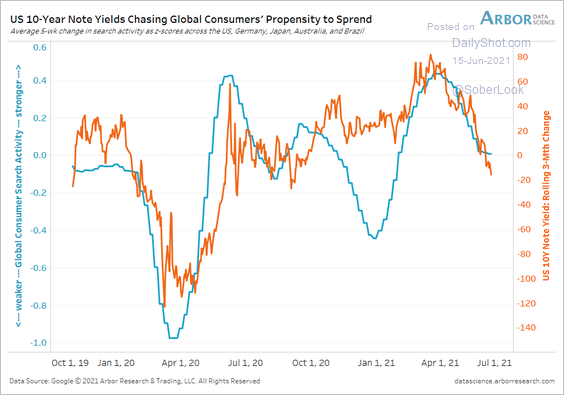

2. Are Treasury yields signaling a peak in global consumer spending?

Source: Arbor Research & Trading

Source: Arbor Research & Trading

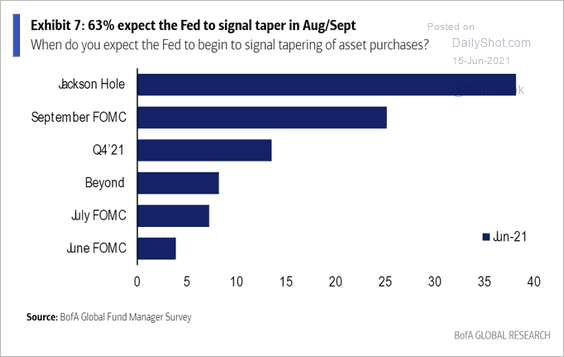

3. When will the Fed announce QE taper?

Source: BofA Global Research; @Callum_Thomas

Source: BofA Global Research; @Callum_Thomas

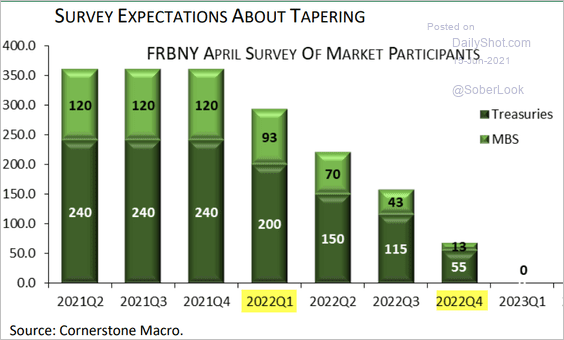

When will the Fed begin tapering?

Source: Cornerstone Macro

Source: Cornerstone Macro

——————–

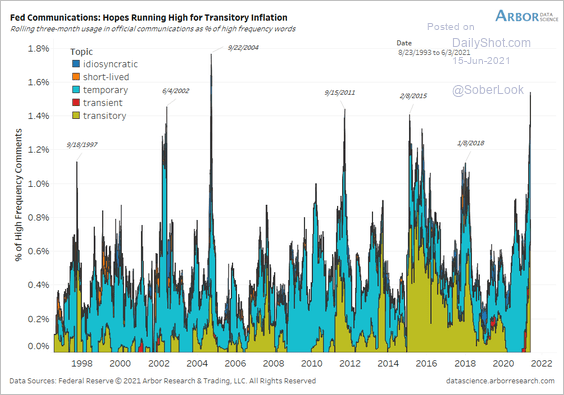

4. Fed officials continue to view inflation as transitory.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

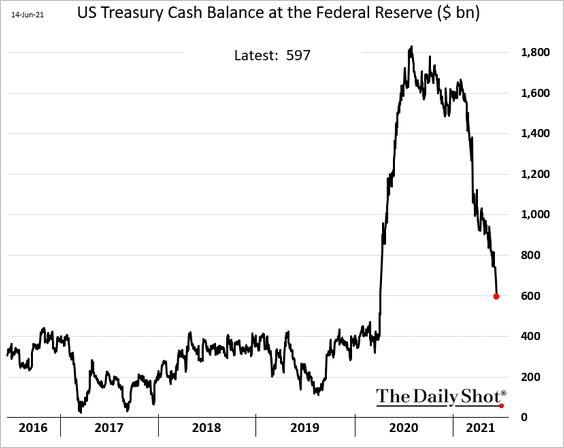

5. The US Treasury continues to rapidly withdraw cash from its account at the Fed.

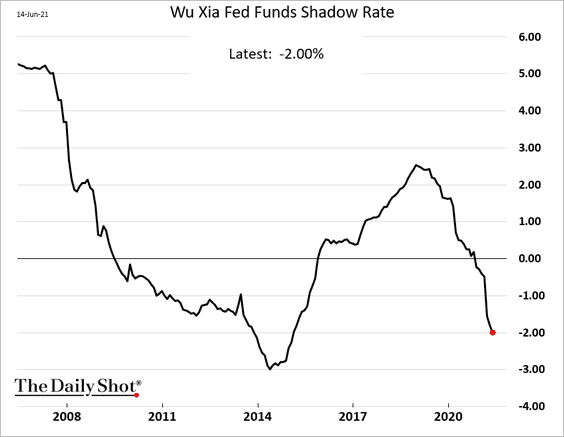

6. The US shadow rate hit the lowest level in years.

Back to Index

Global Developments

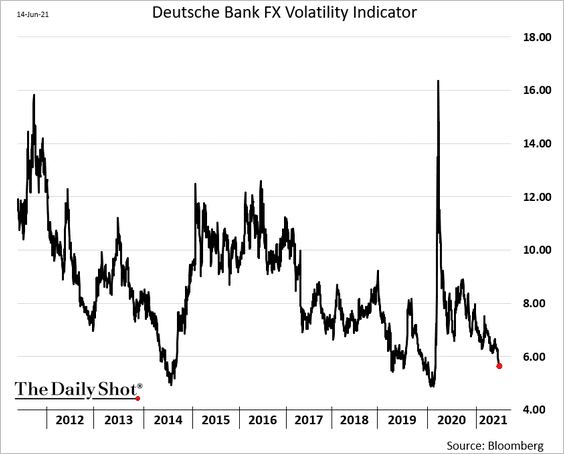

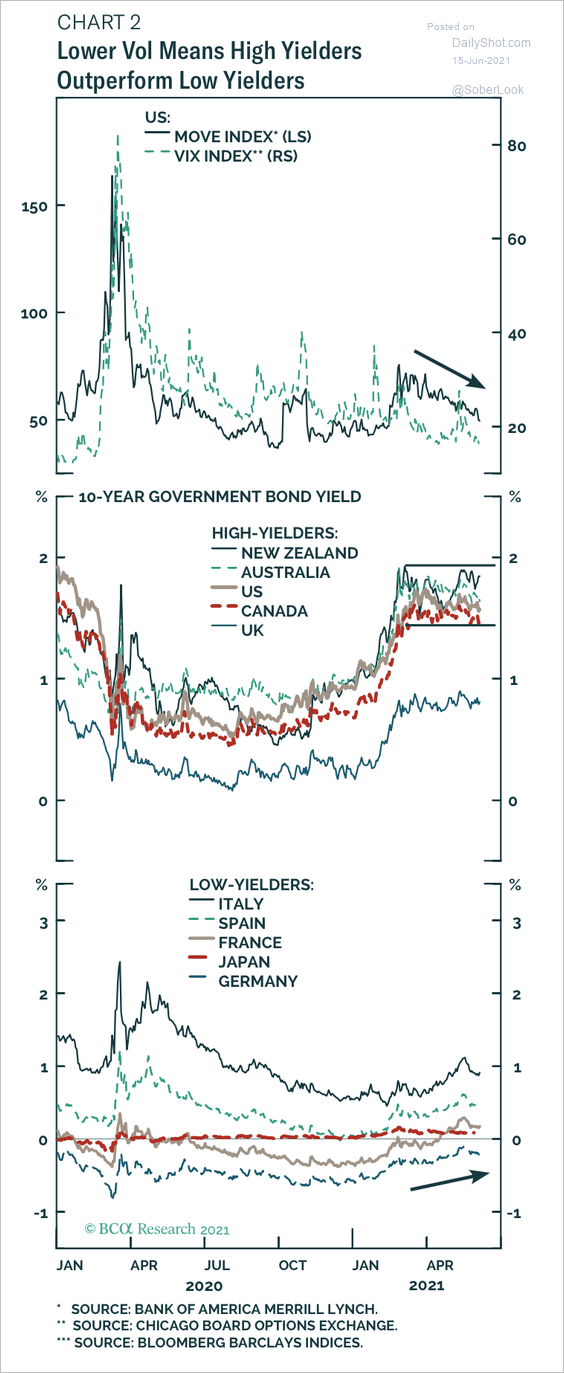

1. Currency markets’ implied volatility continues to decline.

Low volatility in fixed income has benefitted high-yielding government bonds versus low-yielders.

Source: BCA Research

Source: BCA Research

——————–

2. Semiconductor prices are well above trend.

![]() Source: @SnippetFinance, @jpicerno

Source: @SnippetFinance, @jpicerno

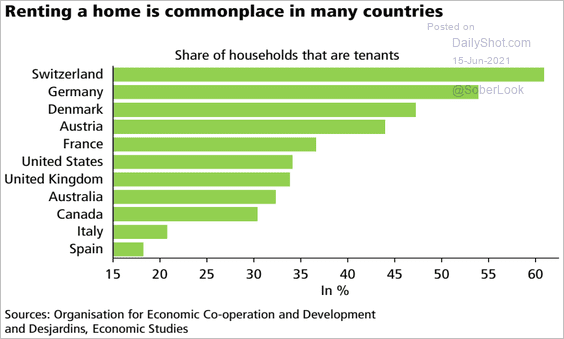

3. Renting a home is common in many countries.

Source: Desjardins

Source: Desjardins

——————–

Food for Thought

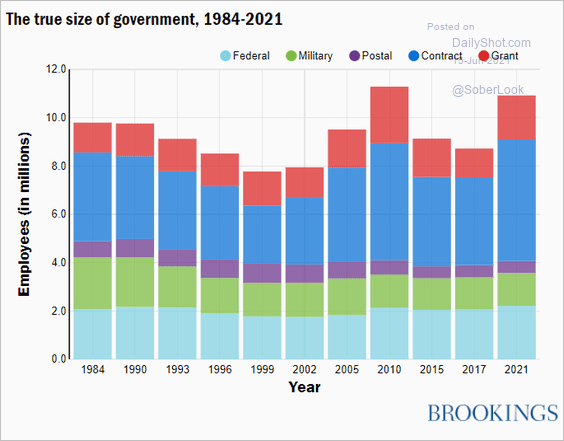

1. US government employment:

Source: Brookings Read full article

Source: Brookings Read full article

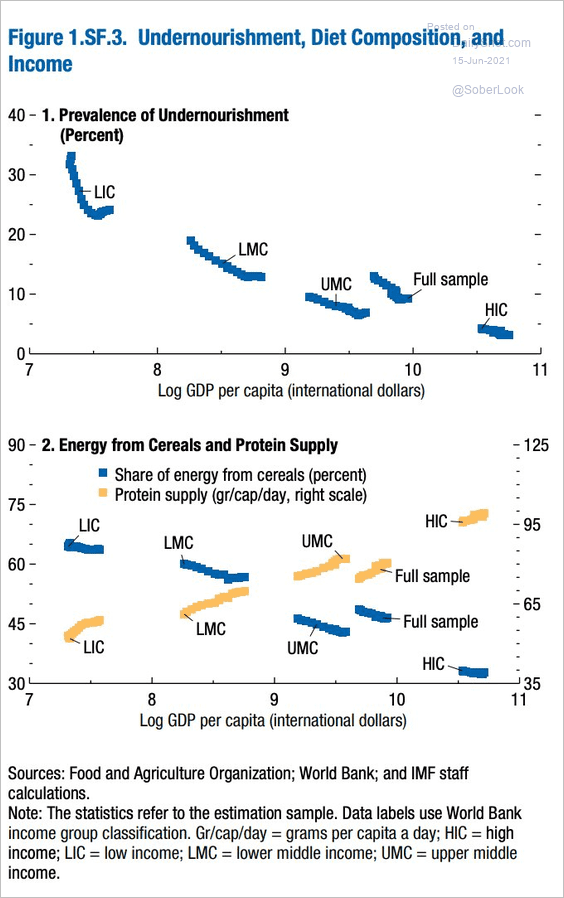

2. Undernourishment, diet composition, and income:

Source: @adam_tooze; IMF WEO April 2021.

Source: @adam_tooze; IMF WEO April 2021.

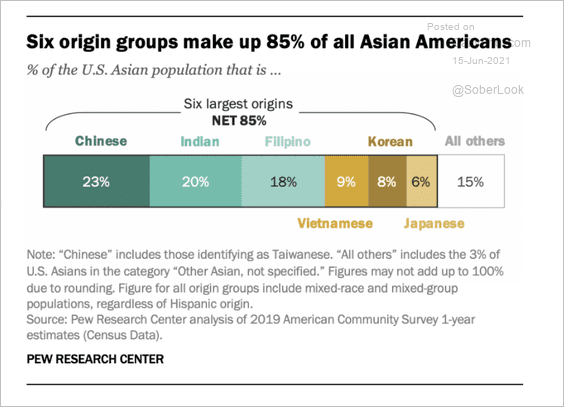

3. Asian-origin groups in the US:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

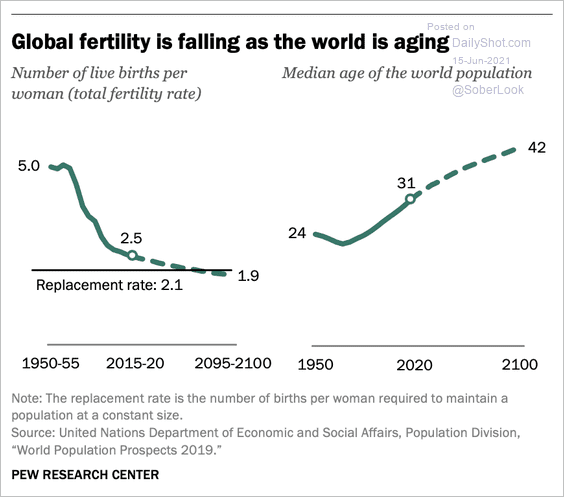

4. Falling fertility and aging populations:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

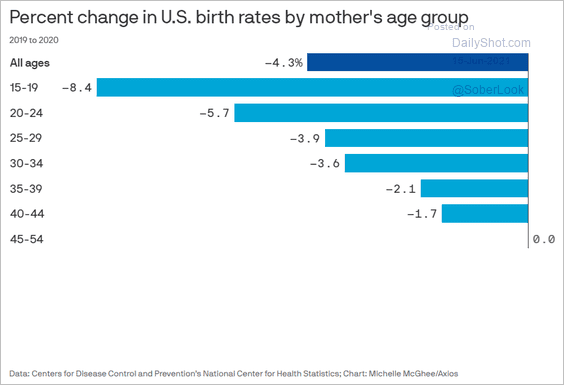

5. Changes in US birth rates by mother’s age:

Source: @axios Read full article

Source: @axios Read full article

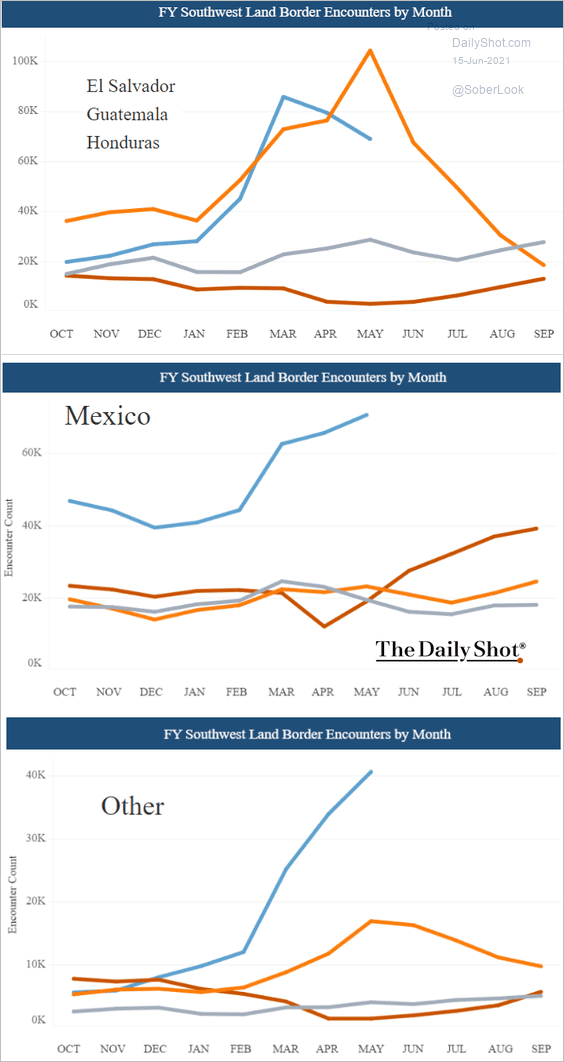

6. US Southwest border apprehensions by country of origin:

Source: CBP

Source: CBP

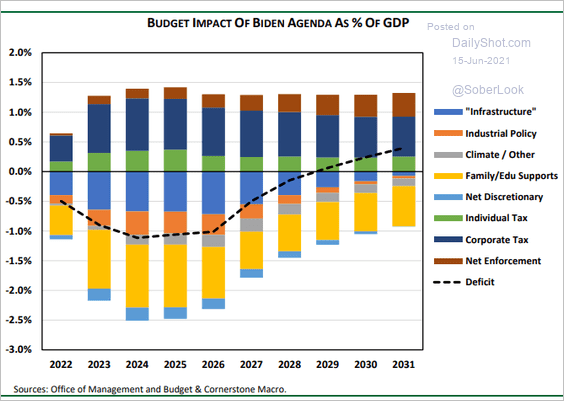

7. Biden agenda’s impact on the federal budget:

Source: Cornerstone Macro

Source: Cornerstone Macro

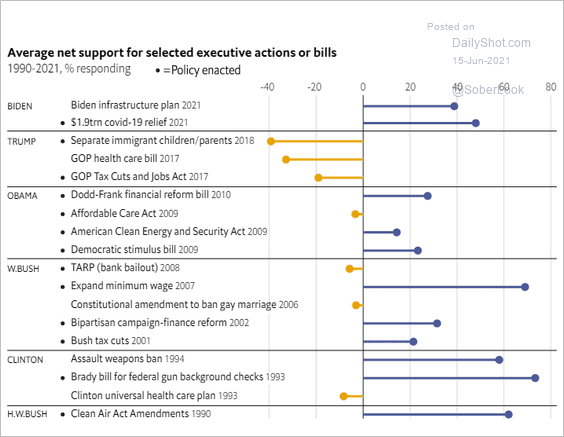

8. Support for executive actions or bills:

Source: The Economist Read full article

Source: The Economist Read full article

9. Monday was Flag Day.

• First national flag of the United States (Grand Union Flag, 1775):

Source: Legends of America Read full article

Source: Legends of America Read full article

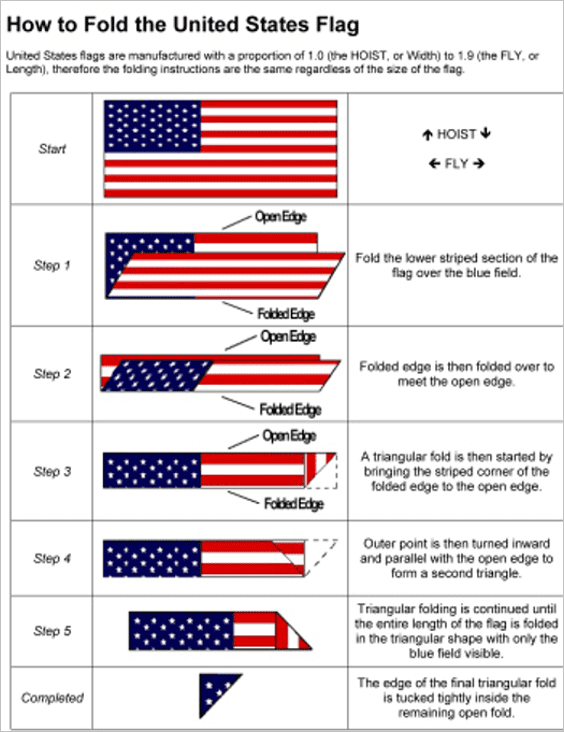

• How to fold the US flag:

Source: EWHS AFJROTC Read full article

Source: EWHS AFJROTC Read full article

——————–

Back to Index