The Daily Shot: 24-Jun-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia – Pacific

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

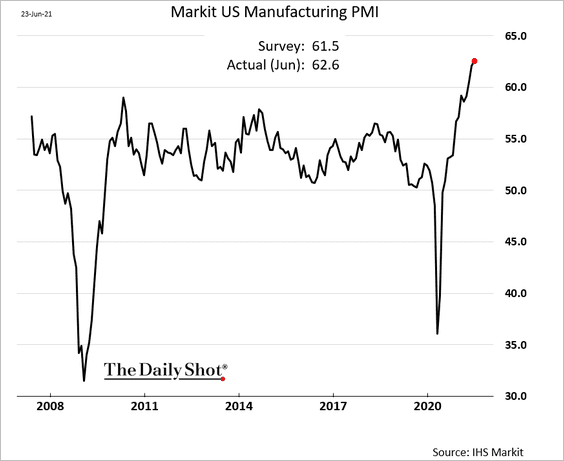

1. The Markit Manufacturing PMI hit a new record, pointing to exceptionally strong growth in US factory activity.

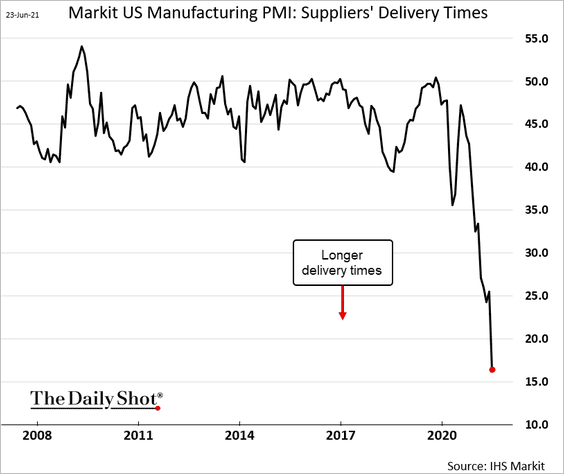

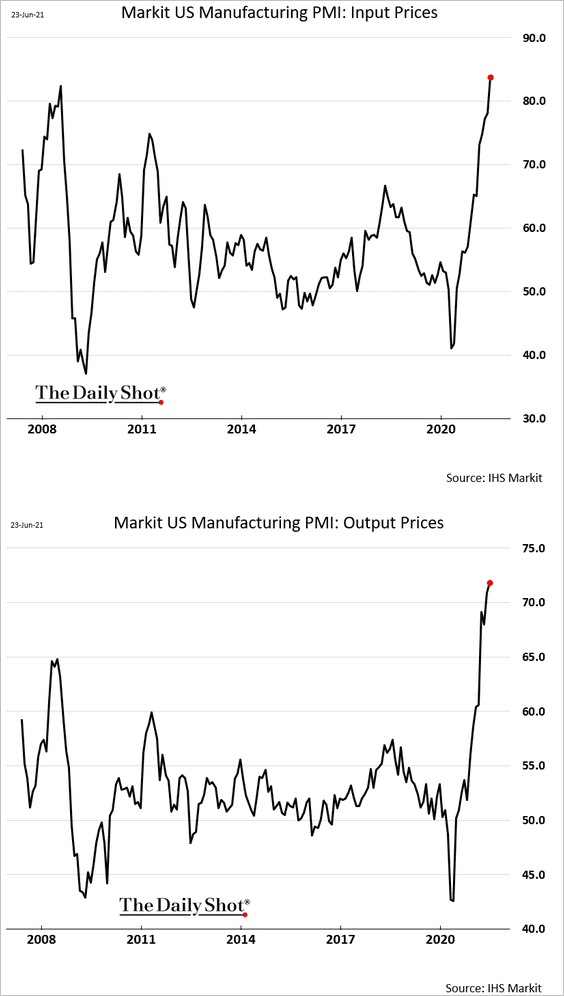

Neither supply chain bottlenecks nor price pressures show signs of abating.

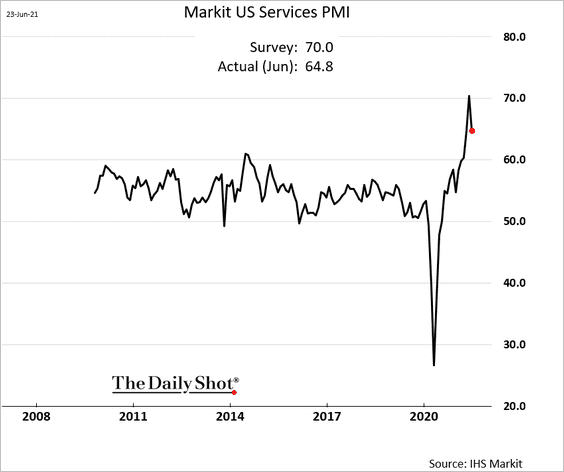

Markit’s service-sector growth index eased from the May peak but remains robust.

——————–

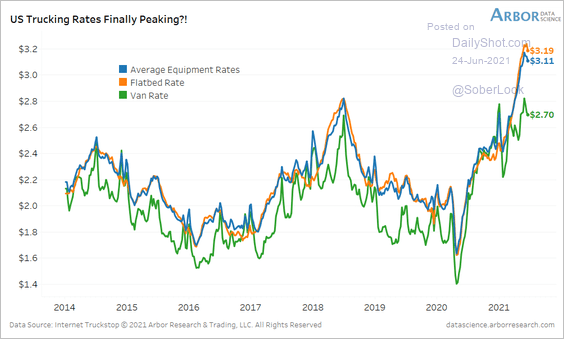

2. Trucking rates appear to be peaking.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

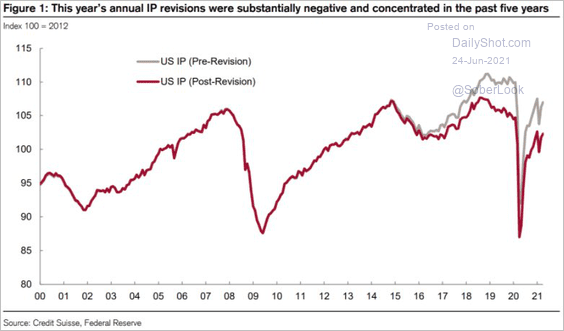

3. The massive revision in the nation’s industrial production index shows that the trade war did more damage to output than previously thought.

Source: @LizAnnSonders, @CreditSuisse

Source: @LizAnnSonders, @CreditSuisse

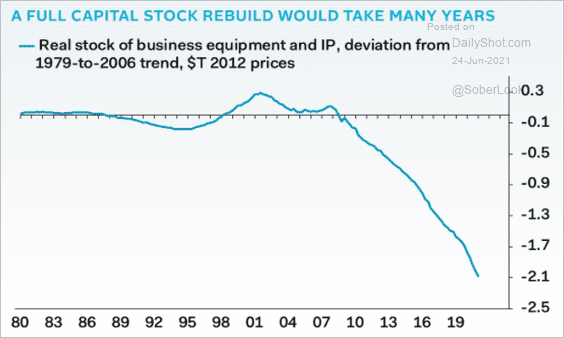

4. After years of underinvestment, …

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

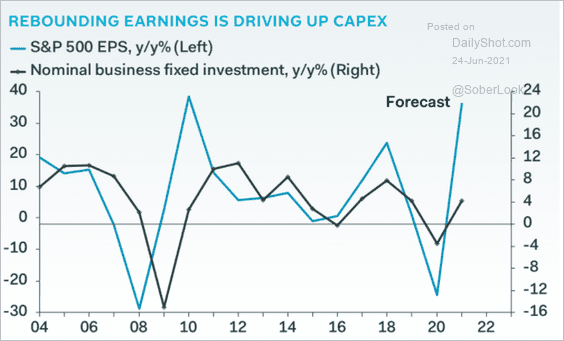

… CapEx is expected to rebound, boosted by strong corporate earnings.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

5. Next, we have some updates on the housing market.

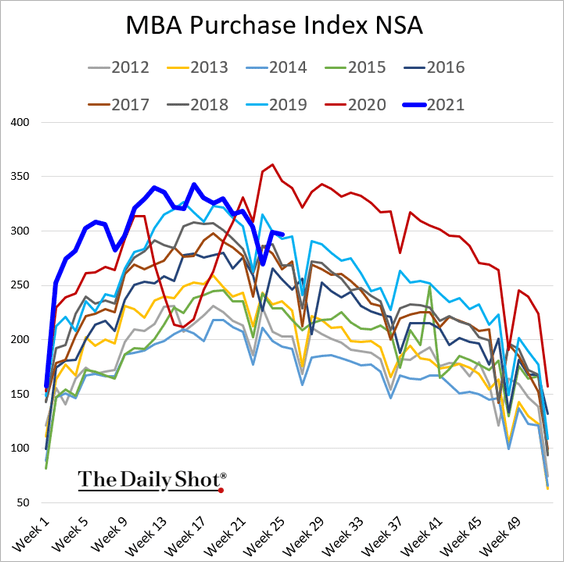

• Loan applications for house purchase are now at 2019 levels, suggesting that the pandemic-driven surge in housing activity is ebbing.

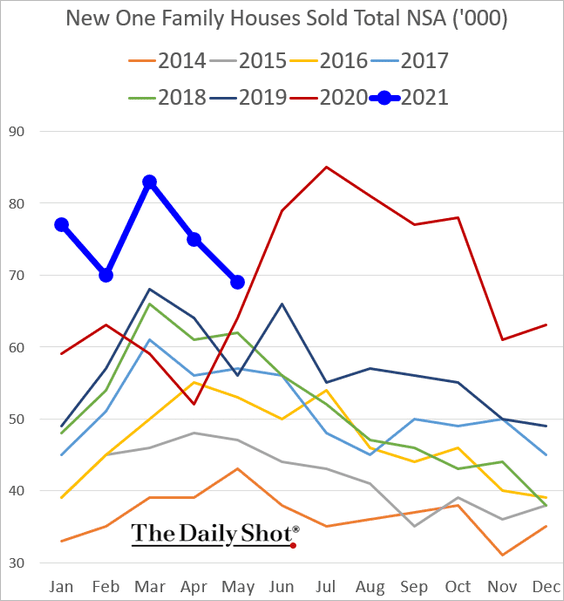

• New home sales remain elevated but are moderating.

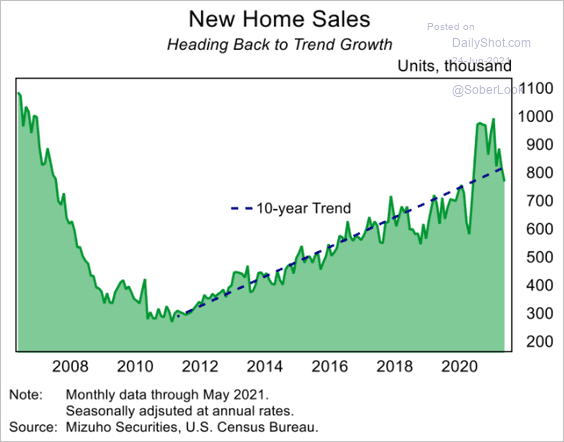

We are back to the pre-COVID trend.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

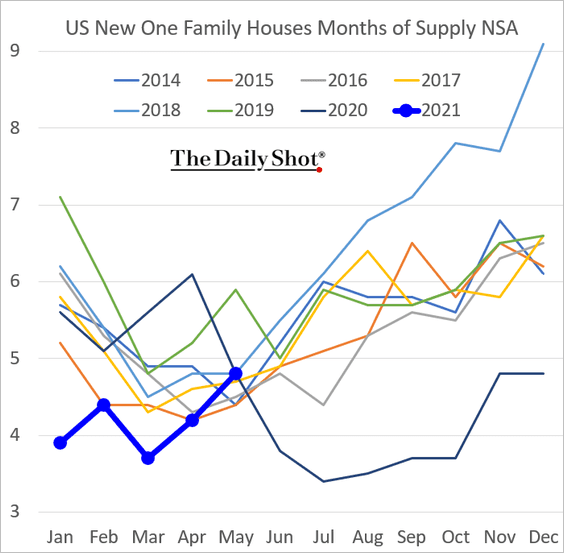

– The inventory of new homes for sale (measured in months of supply) climbed in May.

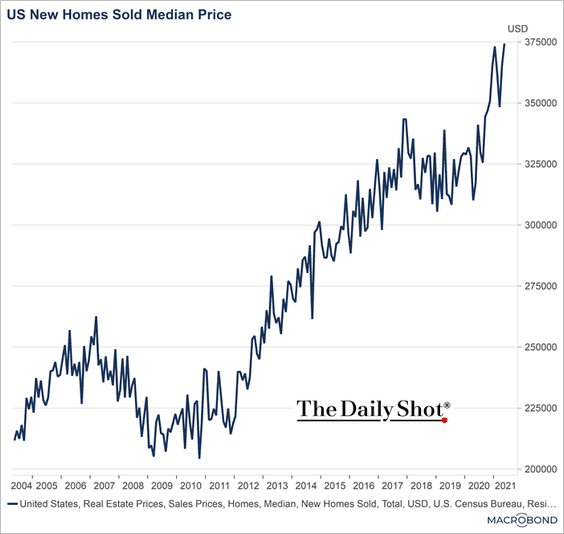

– The median price of new homes sold hit a record high.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

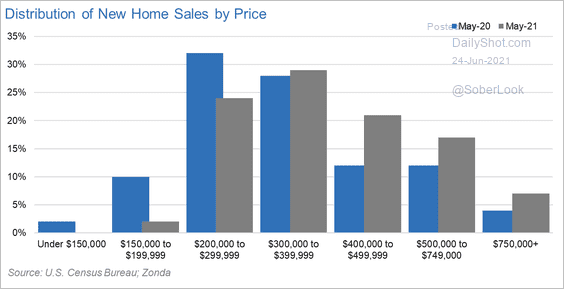

Here is the shift in price categories from May 2020.

Source: @TheStalwart, @AliWolfEcon Read full article

Source: @TheStalwart, @AliWolfEcon Read full article

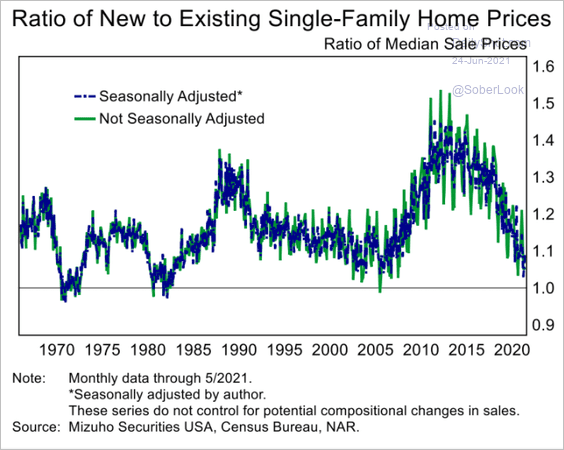

• This chart shows the ratio of new to existing home prices.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

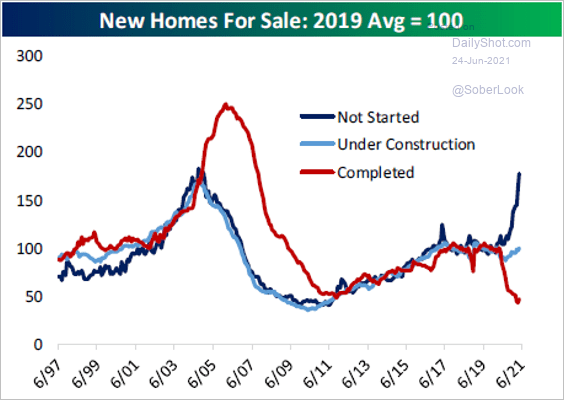

• Construction on many new homes for sale hasn’t started yet, as homebuilders face capacity constraints.

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

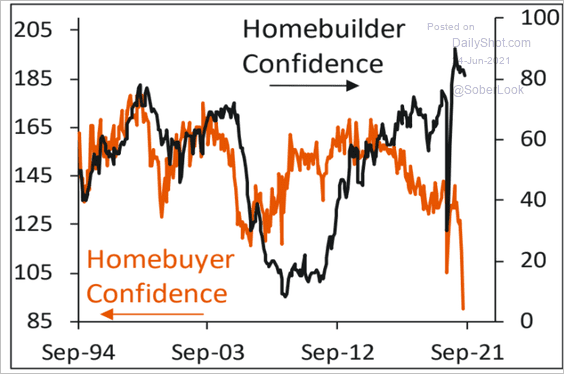

• Homebuilder and homebuyer confidence trends have diverged.

Source: Piper Sandler

Source: Piper Sandler

——————–

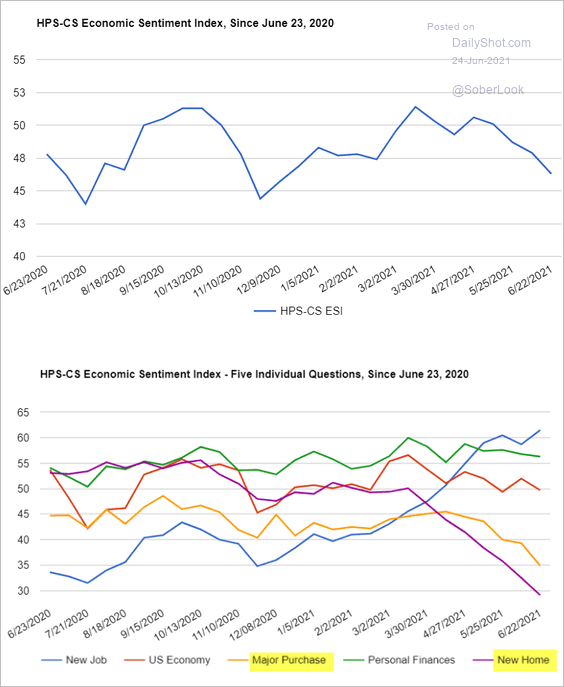

6. Just as we saw in the U. Michigan report, the HP S-CS data show consumers increasingly uneasy with buying a home or making other major purchases. This trend is due to rapid price gains.

Source: @HPS_CS, @HPSInsight, @CivicScience

Source: @HPS_CS, @HPSInsight, @CivicScience

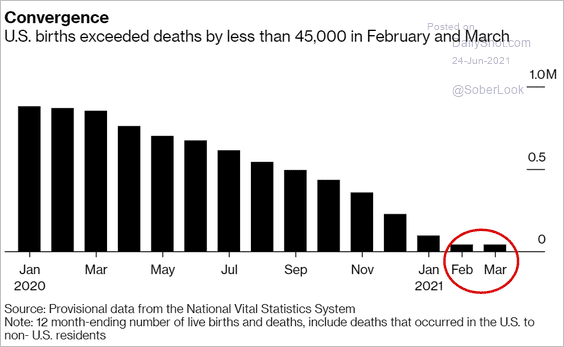

7. US birth rates are collapsing and are now only slightly above death rates. With immigration remaining depressed (chart), the US is “turning Japanese.”

Source: @business Read full article

Source: @business Read full article

Back to Index

Canada

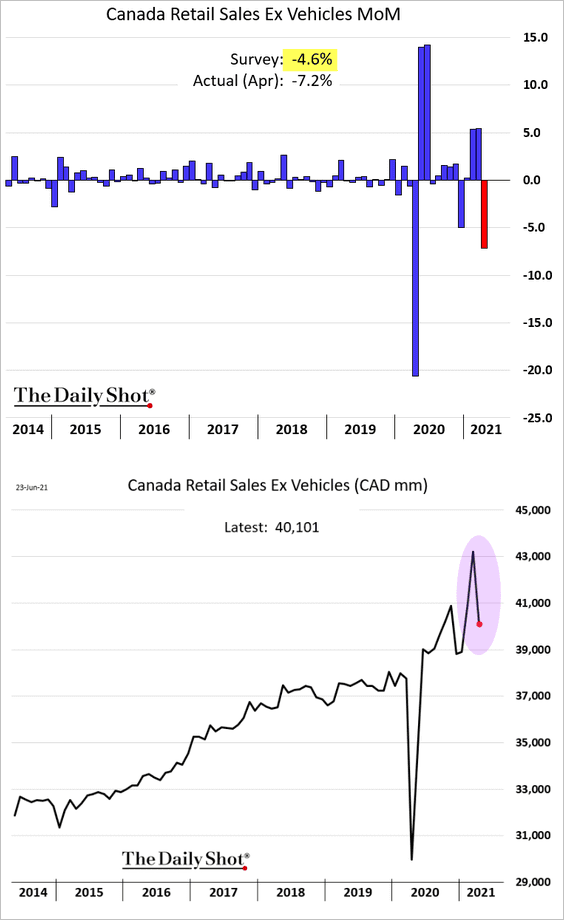

1. Retail sales tumbled in April but were still well above pre-COVID levels.

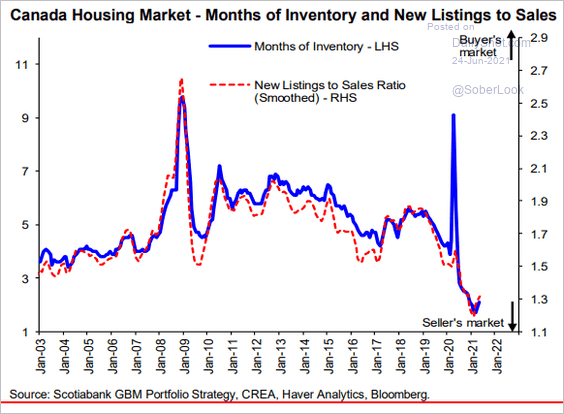

2. Canada’s housing inventory remains exceptionally tight.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

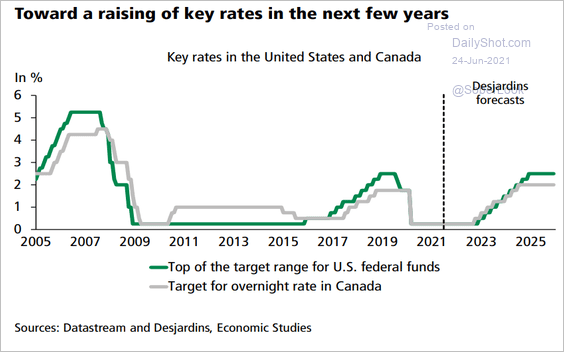

3. According to Desjardins, the BoC will begin hiking rates in tandem with the Fed.

Source: Desjardins

Source: Desjardins

4. Here is the Oxford Economics Recovery Tracker.

![]() Source: Oxford Economics

Source: Oxford Economics

Back to Index

The United Kingdom

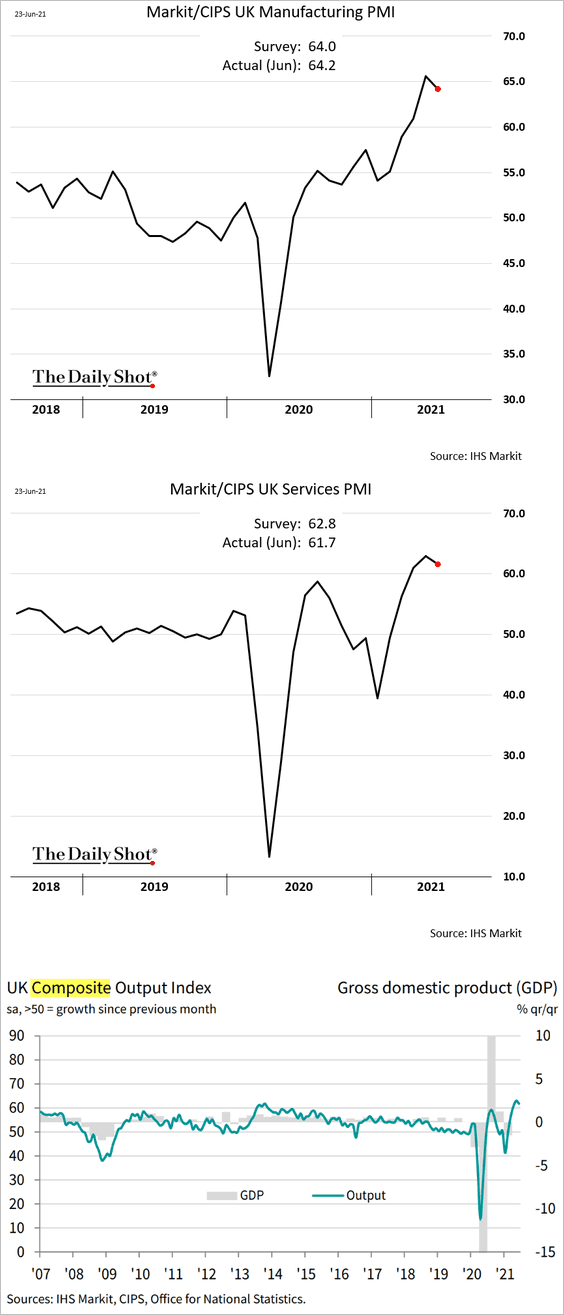

1. June PMI indices were off the highs, but growth remains robust.

Source: IHS Markit

Source: IHS Markit

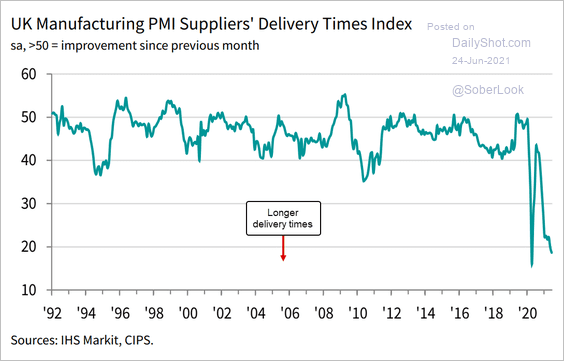

Supplier bottlenecks are becoming more extreme.

Source: IHS Markit

Source: IHS Markit

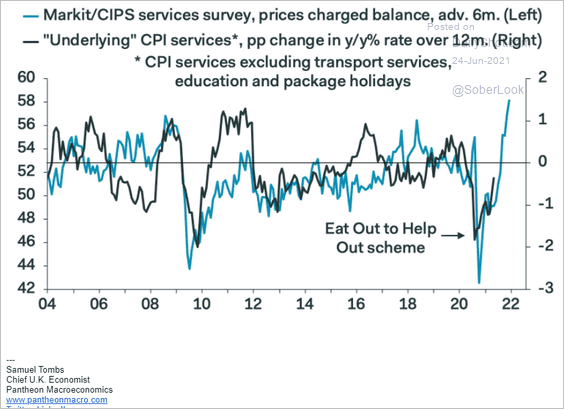

The services PMI price index points to a sharp acceleration in service consumer inflation.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

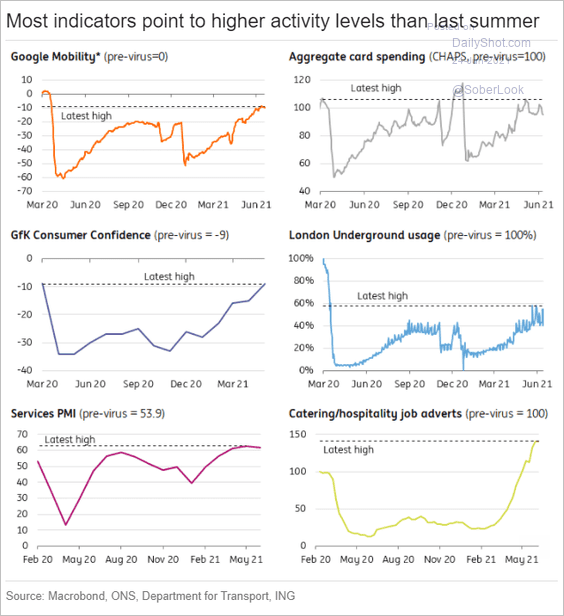

2. High-frequency indicators suggest that activity is close to full recovery.

Source: ING

Source: ING

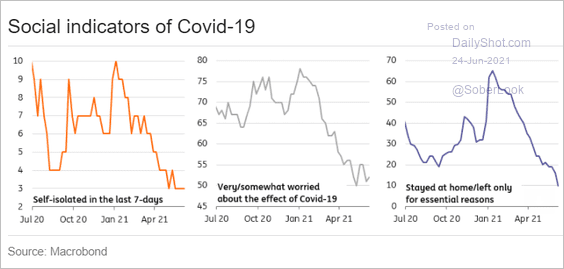

Social distancing indices are trending lower.

Source: ING

Source: ING

——————–

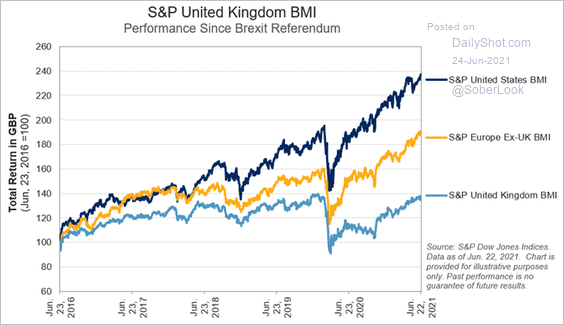

3. UK stocks continue to underperform.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

The Eurozone

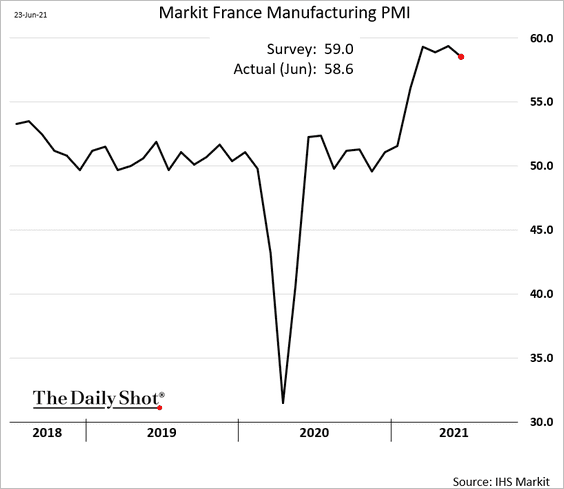

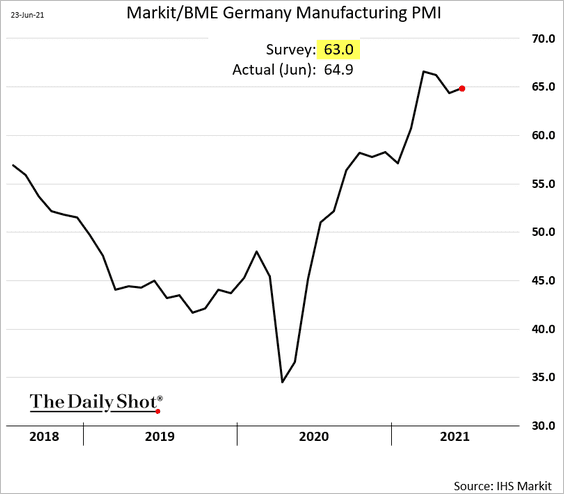

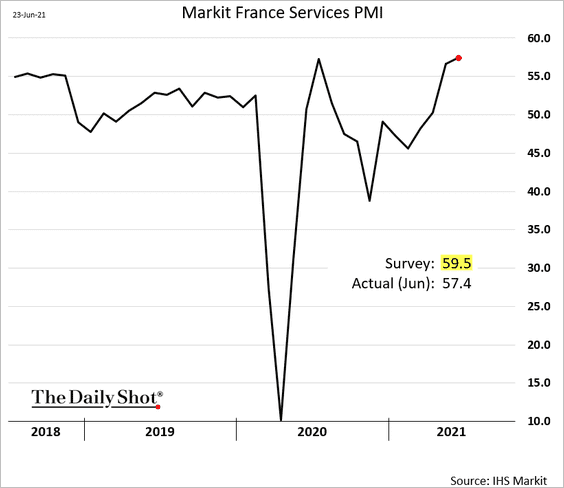

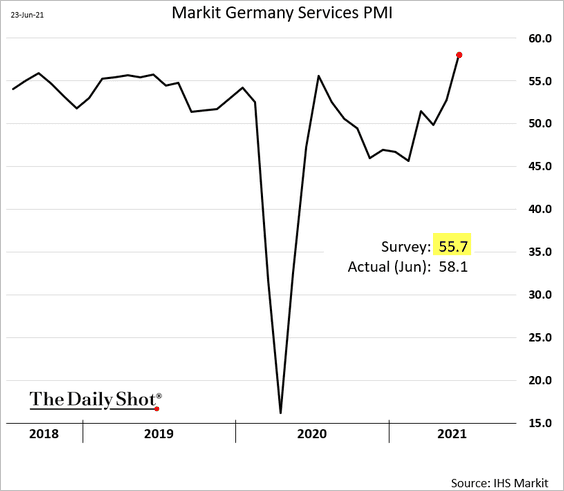

1. The June PMI report shows business activity accelerating.

• Manufacturing:

• Services (sharp gains in Germany):

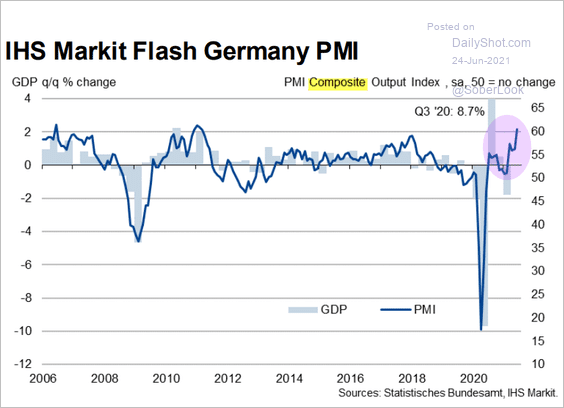

• Germany’s composite PMI:

Source: IHS Markit

Source: IHS Markit

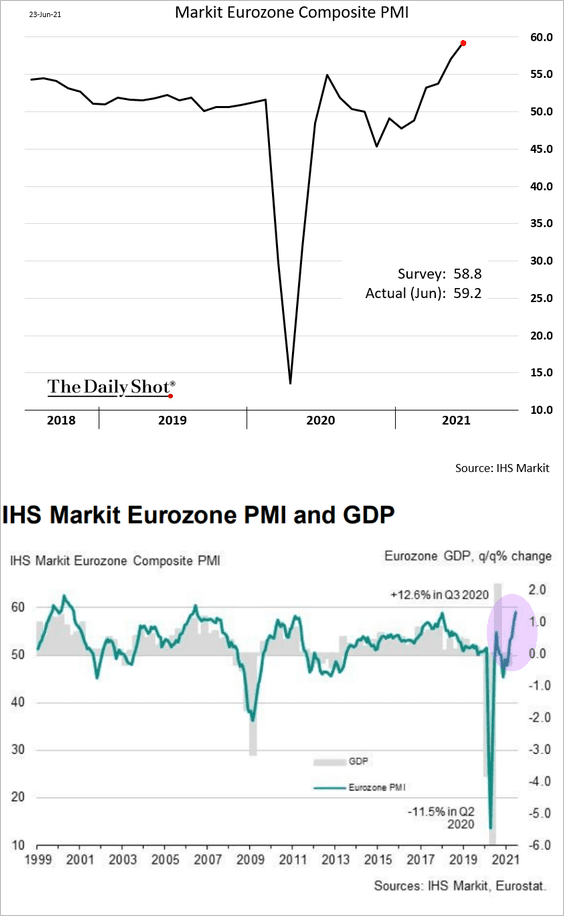

• The Eurozone composite PMI:

Source: IHS Markit

Source: IHS Markit

——————–

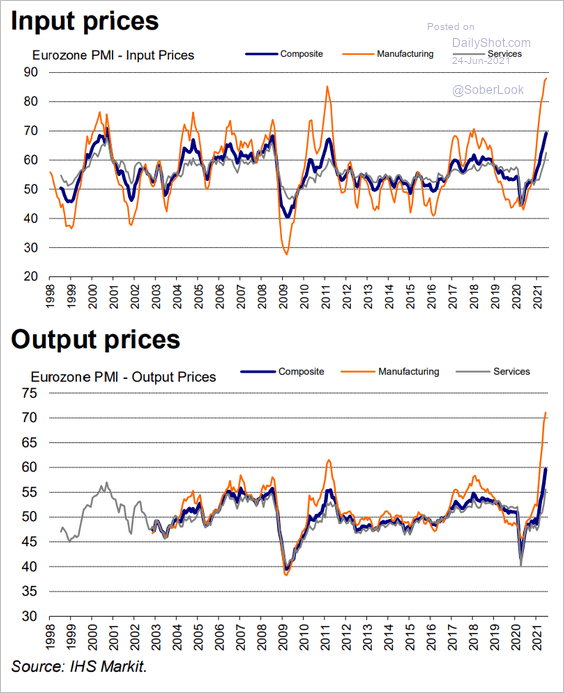

2. Price pressures continue to build.

Source: IHS Markit

Source: IHS Markit

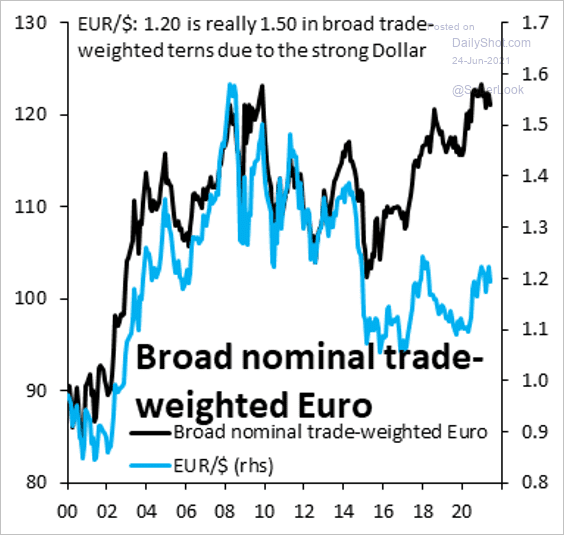

3. The euro is much stronger than the EUR/USD exchange rate suggests. Will the currency strength delay the ECB’s QE taper?

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

Back to Index

Asia – Pacific

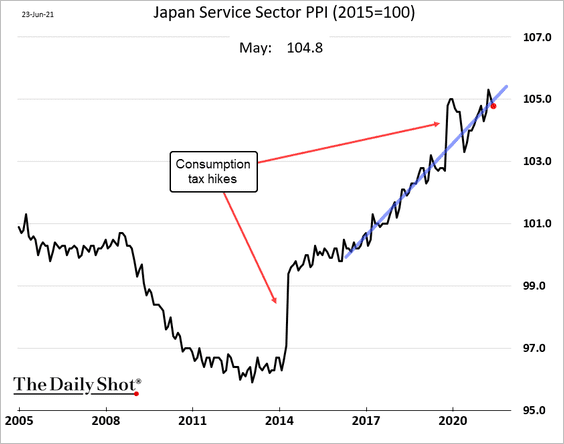

1. Japan’s recent service-sector PPI gains are consistent with the multi-year trend.

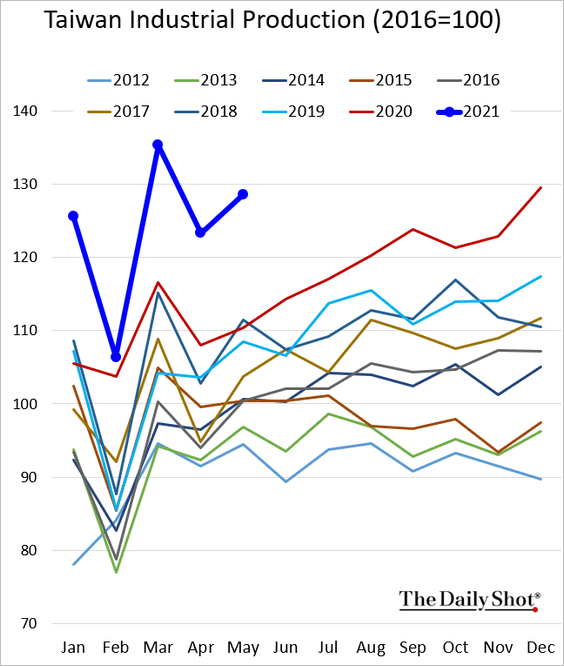

2. Taiwan’s industrial production remains remarkably strong (boosted by export orders).

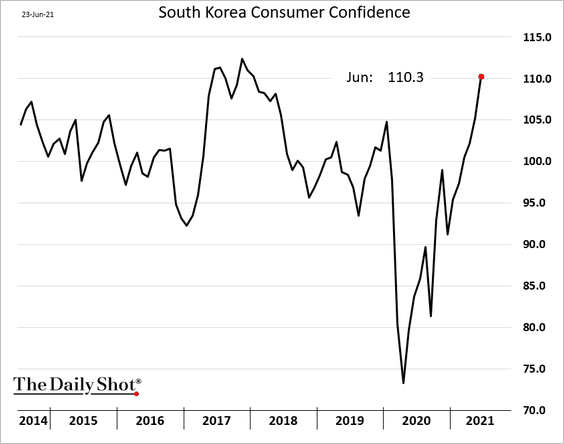

3. South Korea’s consumer confidence is surging.

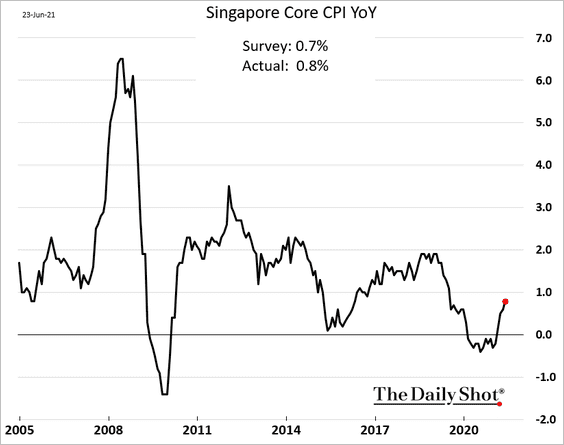

4. Singapore’s consumer inflation is recovering, but the core CPI remains below 1%.

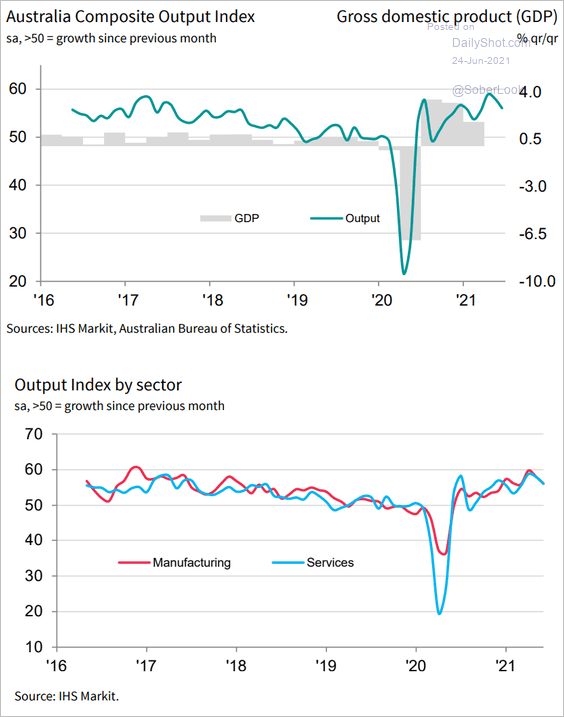

5. Australia’s PMI indicators are off the highs, but expansion continues.

Source: IHS Markit

Source: IHS Markit

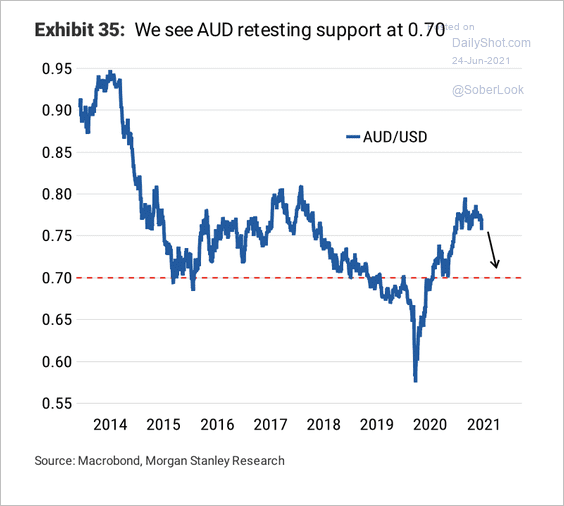

Separately, Morgan Stanley expects AUD/USD to re-test support at 0.70.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Emerging Markets

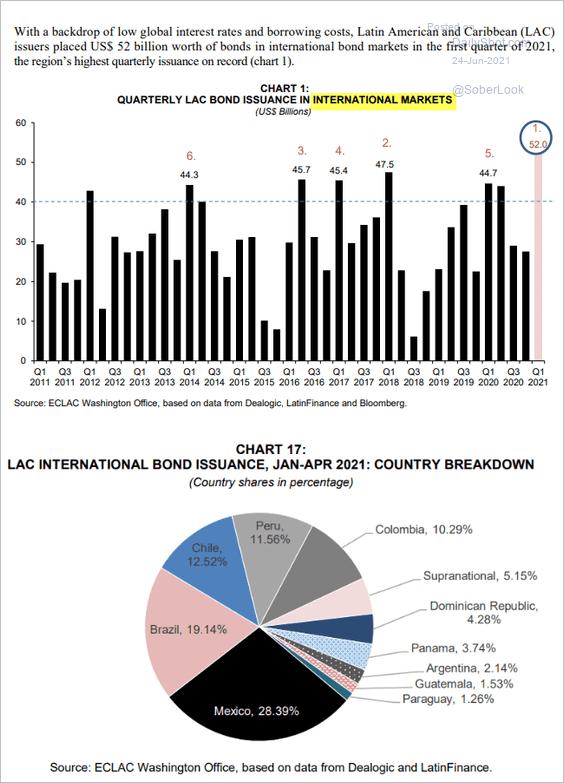

1. Let’s start with some data on LatAm international debt issuance.

Source: ECLAC – United Nations Read full article

Source: ECLAC – United Nations Read full article

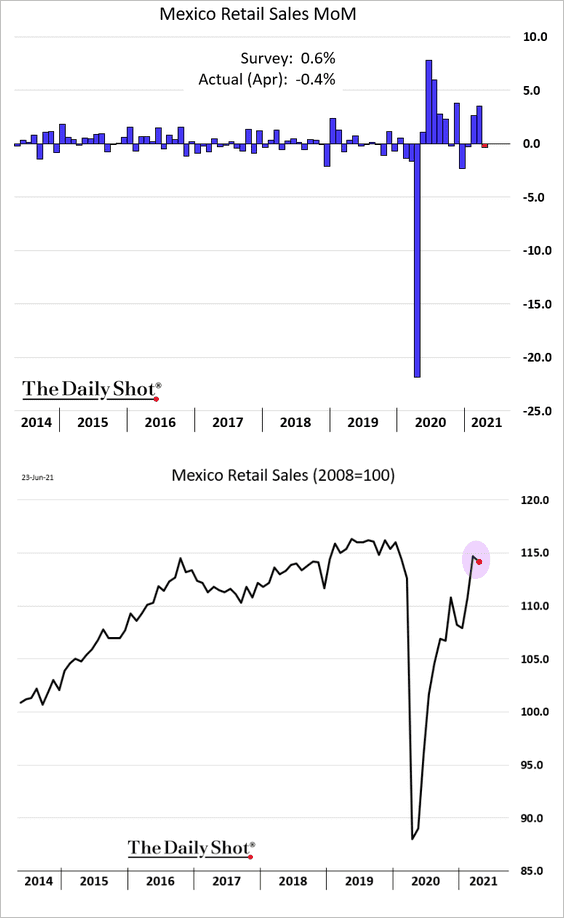

2. Mexican retail sales unexpectedly dipped in April. Note that recent retail sales reports missed market expectations across North America (Mexico, Canada, and the US).

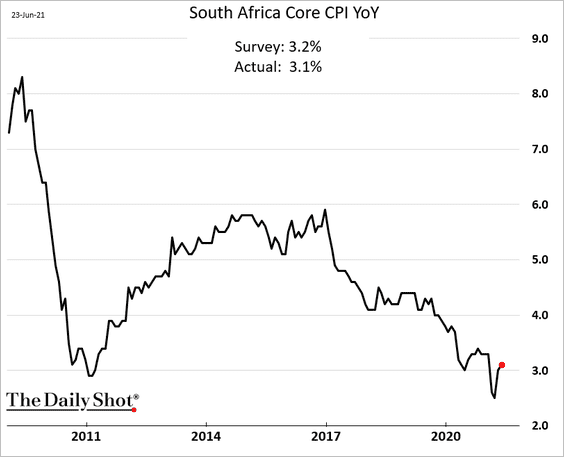

3. South Africa’s inflation remains relatively benign.

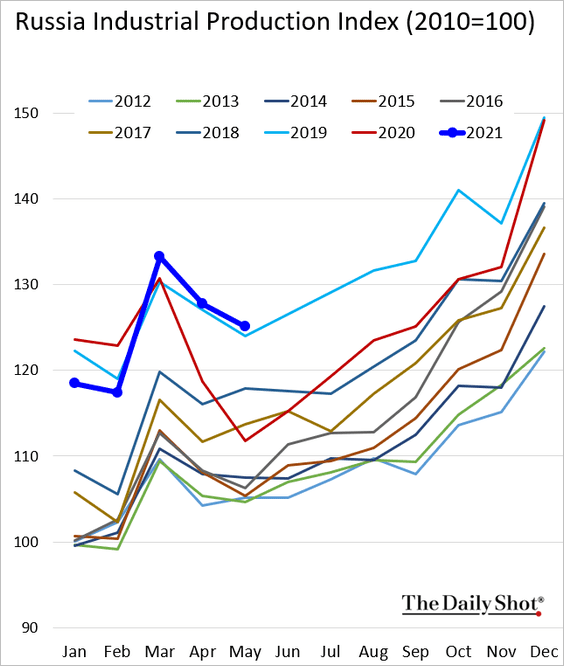

4. Russia’s industrial production is in line with pre-COVID (2019) levels.

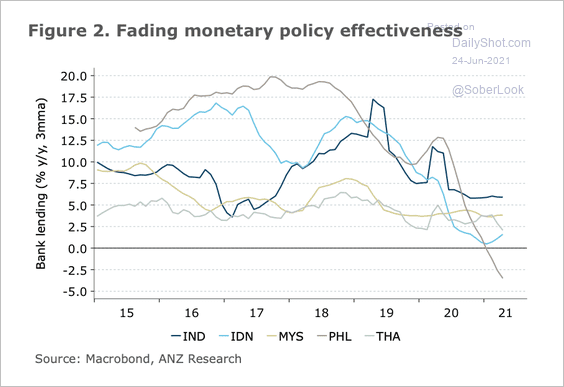

5. Bank lending has weakened in some emerging Asia countries over the past few years.

Source: ANZ Research

Source: ANZ Research

Back to Index

Cryptocurrency

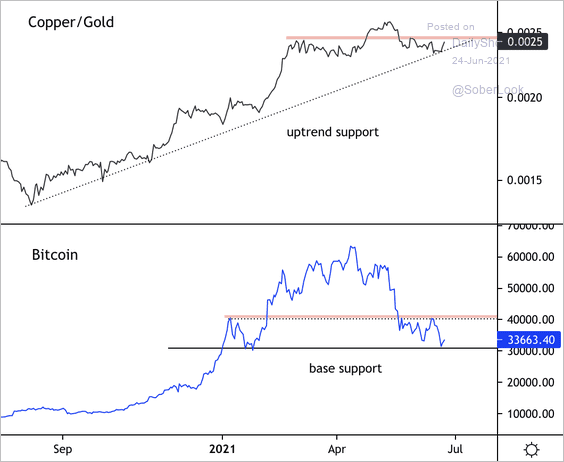

1. Bitcoin’s sell-off coincided with a broader move away from risky assets over the past month, as shown by the decline in the copper/gold ratio. Will support hold?

Source: Dantes Outlook

Source: Dantes Outlook

Also, we’ve got a head-and-shoulders formation in Bitcoin.

Source: @carlquintanilla, @DRWTrading

Source: @carlquintanilla, @DRWTrading

——————–

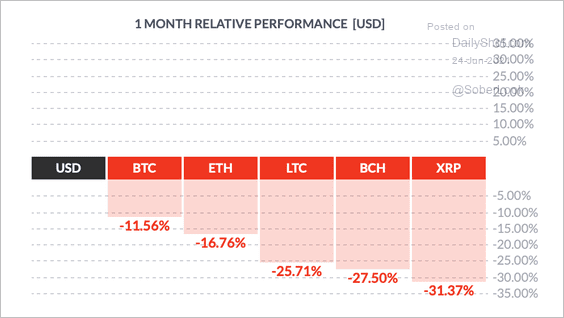

2. Some of the largest cryptocurrencies are still down over the past month.

Source: FinViz

Source: FinViz

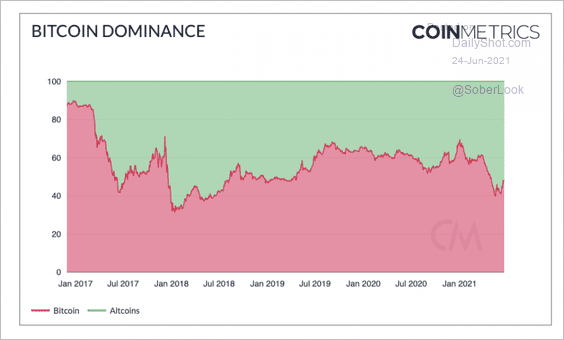

3. Bitcoin has lost market share to altcoins this year.

Source: Coin Metrics

Source: Coin Metrics

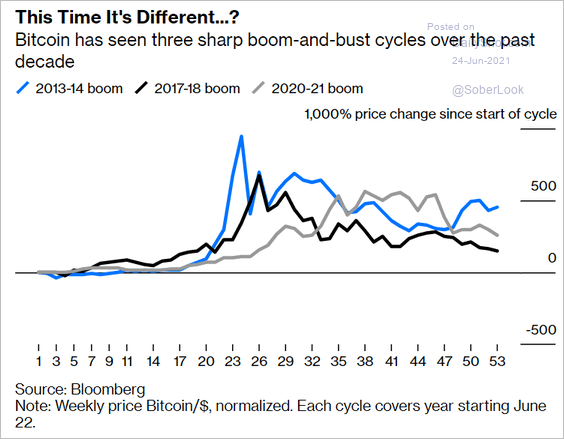

4. Is the latest boom/bust cycle different?

Source: @LionelRALaurent, @bopinion Read full article

Source: @LionelRALaurent, @bopinion Read full article

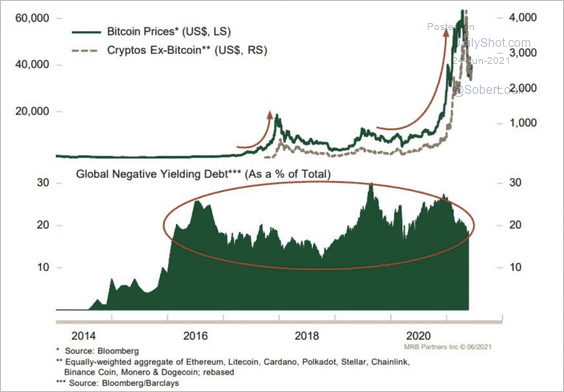

5. The recent decline in the share of global negative-yielding debt could present a headwind for cryptocurrencies.

Source: MRB Partners

Source: MRB Partners

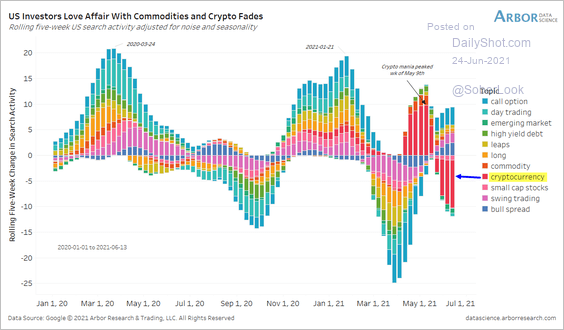

6. Online search activity for crypto declined in recent weeks.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Back to Index

Commodities

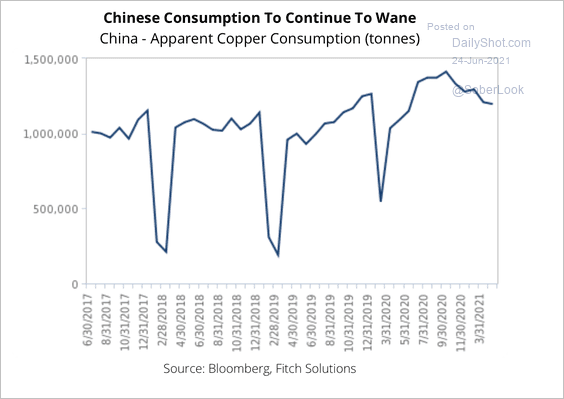

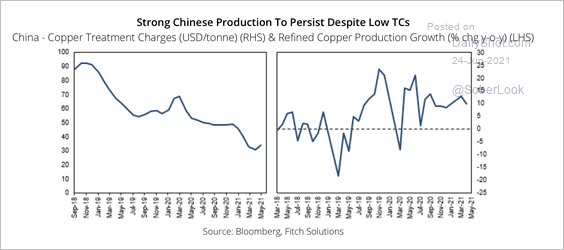

1. Fitch Solutions expects that lower Chinese demand and higher production will pressure copper prices towards the second half of the year (2 charts).

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

——————–

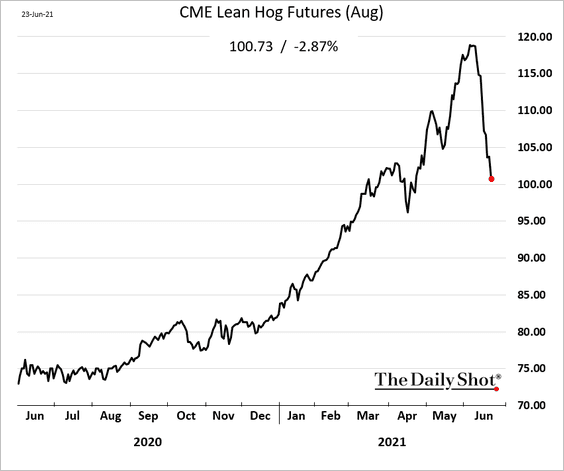

2. Chicago hog futures continue to tumble.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Energy

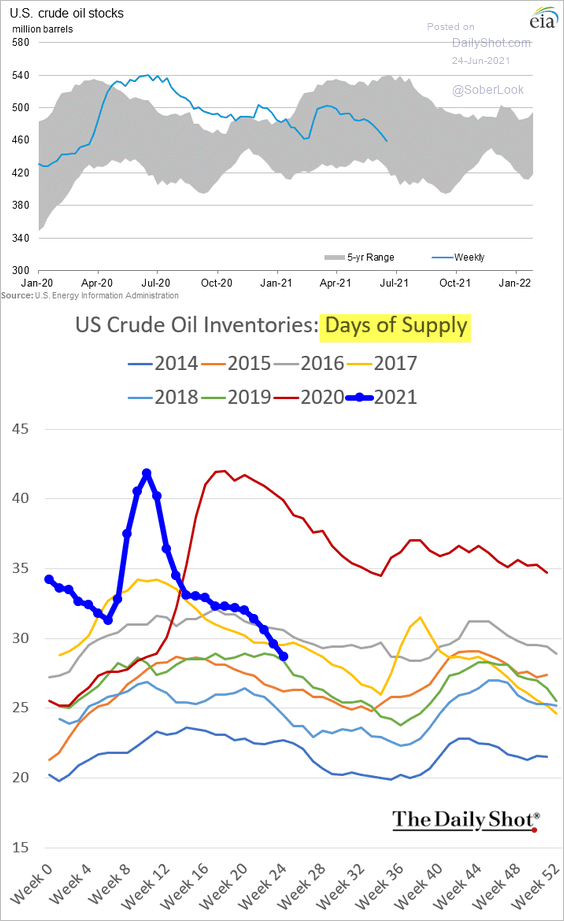

1. US crude oil inventories keep shrinking.

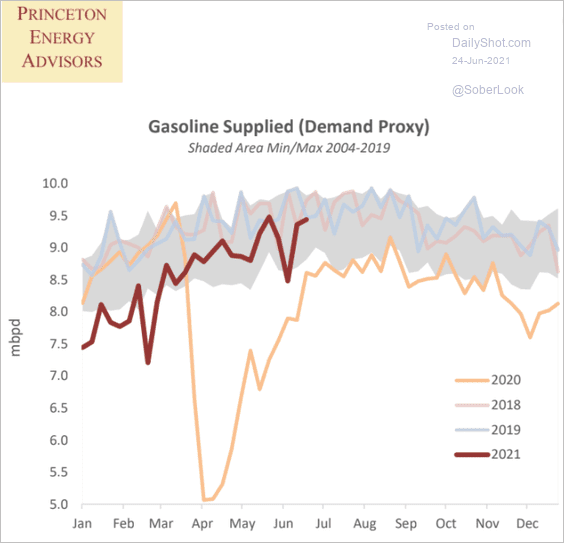

Gasoline demand remains robust (just below 2018/19 levels).

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

——————–

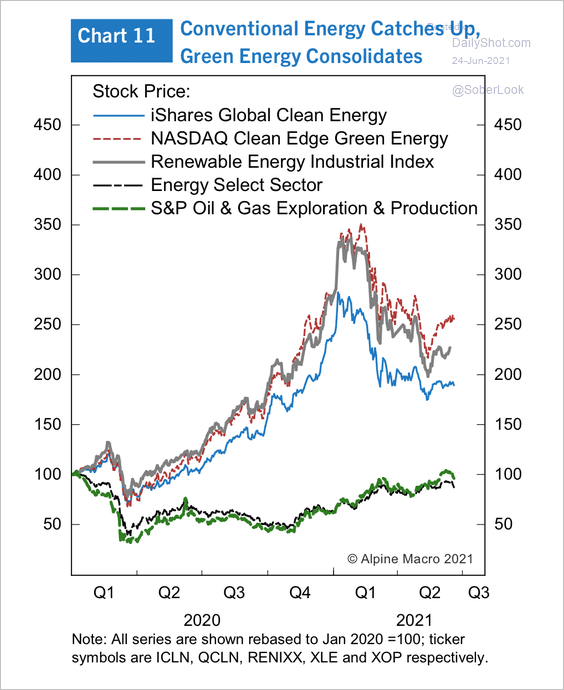

2. Conventional oil and gas shares are recovering as renewable energy stocks consolidate.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Equities

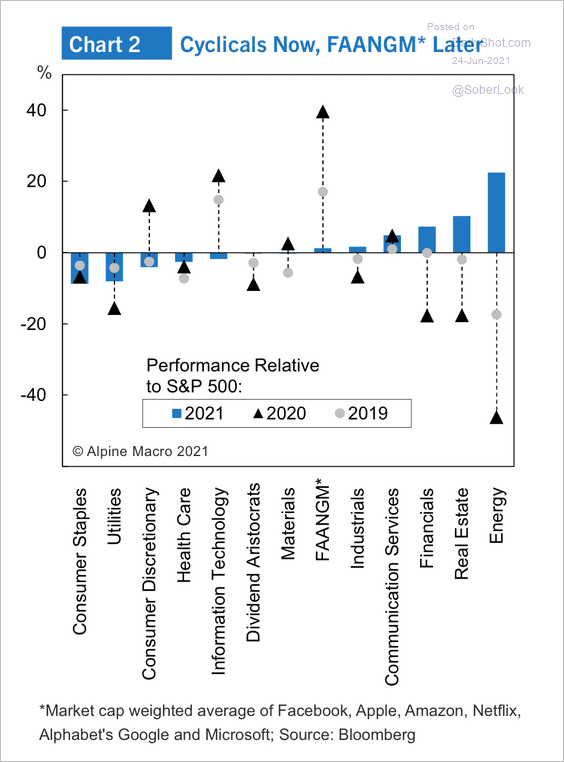

1. This chart shows the performance of key sectors relative to the S&P 500 over the past two years. Cyclicals have benefitted from mean reversion.

Source: Alpine Macro

Source: Alpine Macro

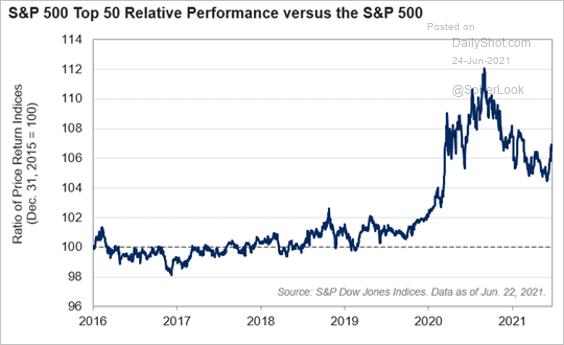

2. The downward trend of the top 50 stocks in the S&P 500 relative to the overall index appears to be over.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

3. Here are the industries targeted by SPACs.

Source: Hyde Capital

Source: Hyde Capital

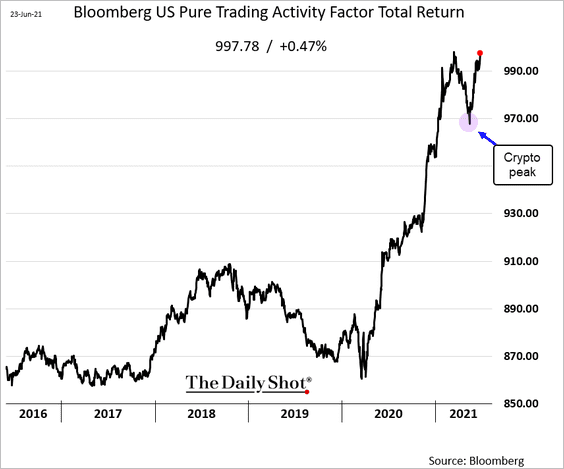

4. Bloomberg’s trading activity factor, which measures stocks’ trading turnover, is nearing record highs. The recent rebound corresponds to the crypto market peak.

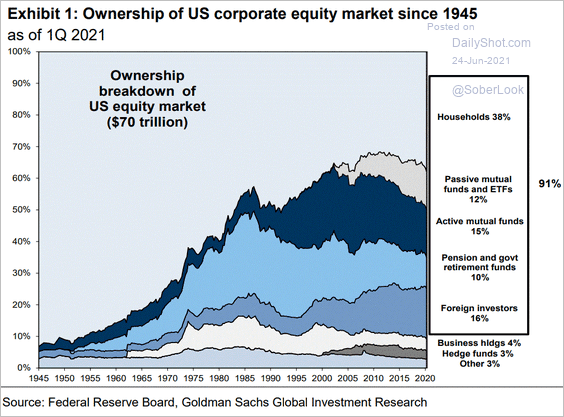

5. Who owns US equities?

Source: Goldman Sachs; Haresh Raju

Source: Goldman Sachs; Haresh Raju

Back to Index

Rates

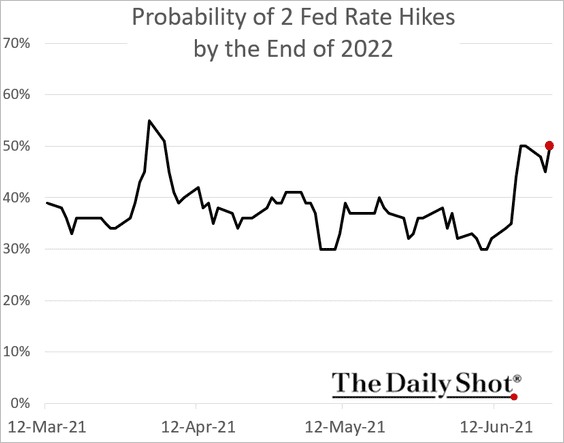

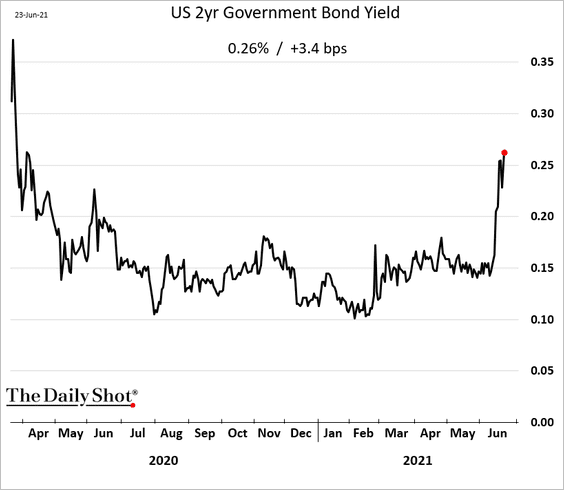

1. While Chair Powell’s comments remain dovish, other Fed officials are talking about rate hikes next year. That would suggest that QE tapering should start later this year to give the central bank a sufficient runway.

Source: @markets Read full article

Source: @markets Read full article

The market has now fully priced in a 2022 liftoff, with a 50% chance of two rate hikes next year.

With more hikes priced in, the 2-year Treasury yield climbed further.

——————–

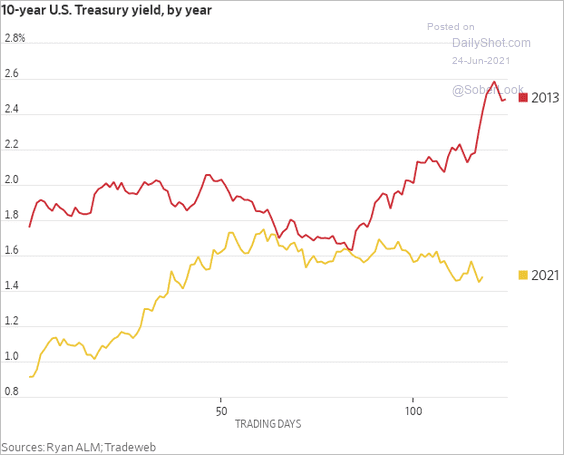

2. The recent movements in the 10yr Treasury yield have been quite different than during taper-tantrum in 2013.

Source: @WSJ Read full article

Source: @WSJ Read full article

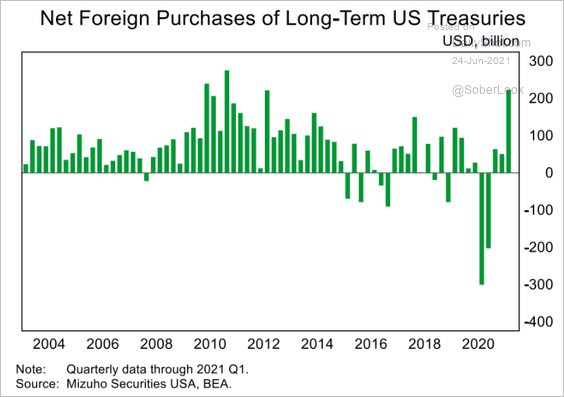

3. Foreigners have been buying Treasuries again.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

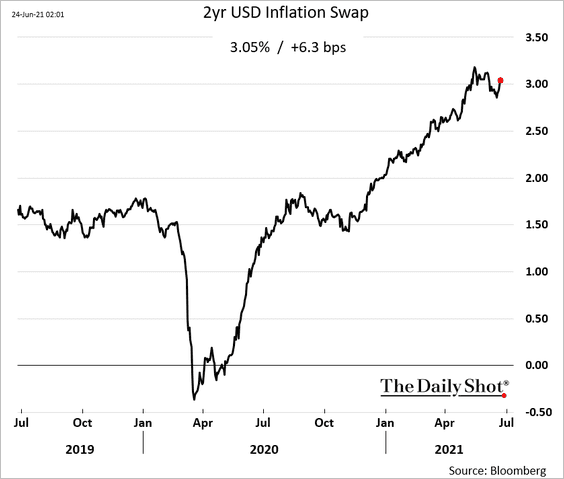

4. The 2-year inflation swap (a measure of inflation expectations) is back above 3%.

Back to Index

Global Developments

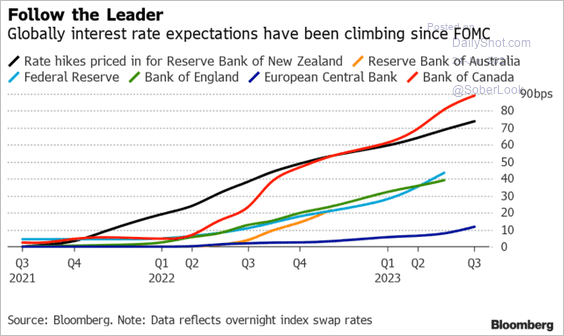

1. Here are the market-implied policy rate trajectories for select economies.

Source: @StephenSpratt Read full article

Source: @StephenSpratt Read full article

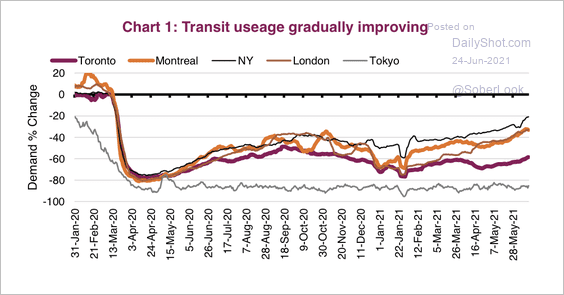

2. Transit usage is gradually improving, although still below pre-pandemic levels.

Source: Market Ethos, Richardson GMP

Source: Market Ethos, Richardson GMP

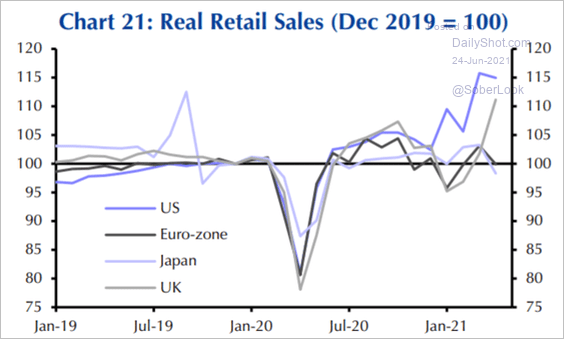

3. The recovery in retail sales has been uneven across advanced economies.

Source: Capital Economics

Source: Capital Economics

——————–

Food for Thought

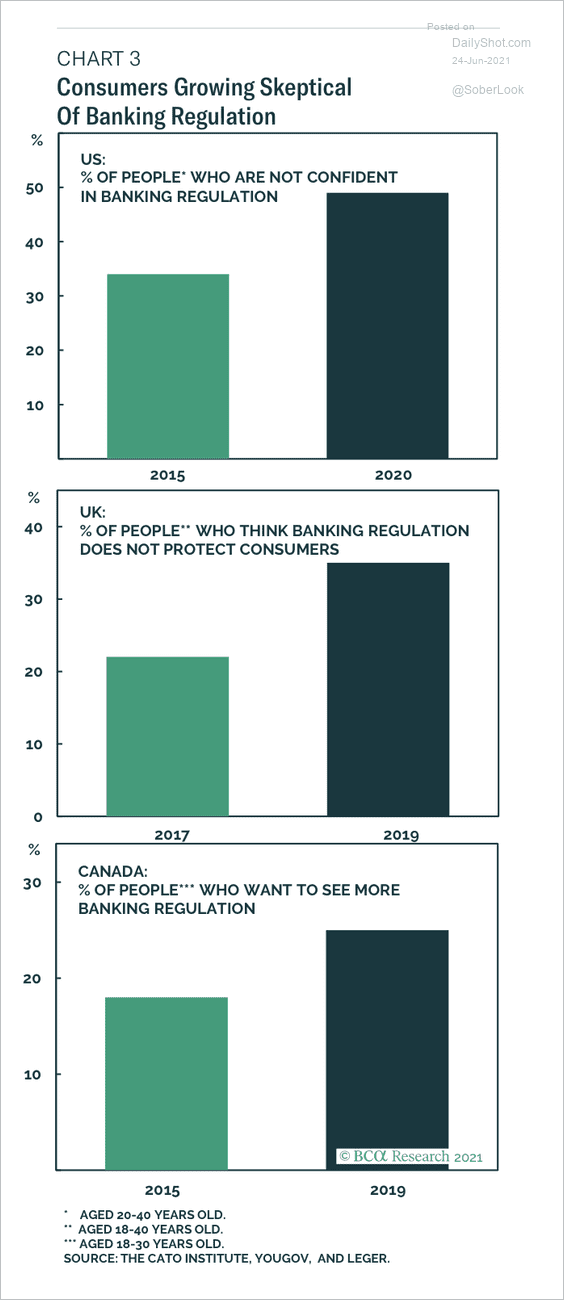

1. Attitudes toward banking regulation:

Source: BCA Research

Source: BCA Research

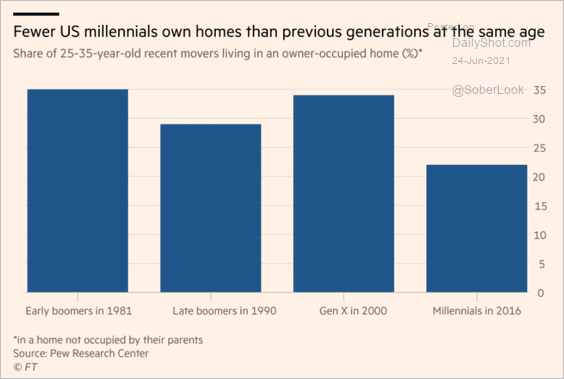

2. Homeownership by generation:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

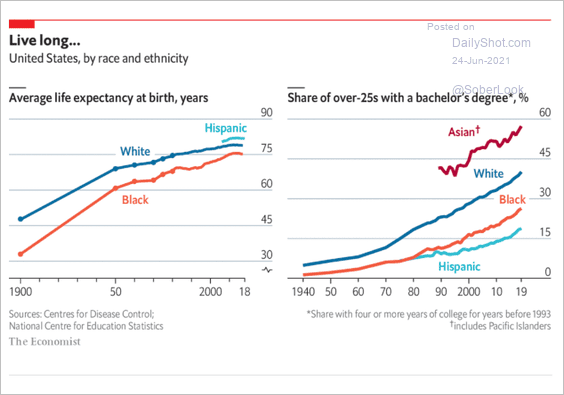

3. US changes in life expectancy and education levels:

Source: The Economist Read full article

Source: The Economist Read full article

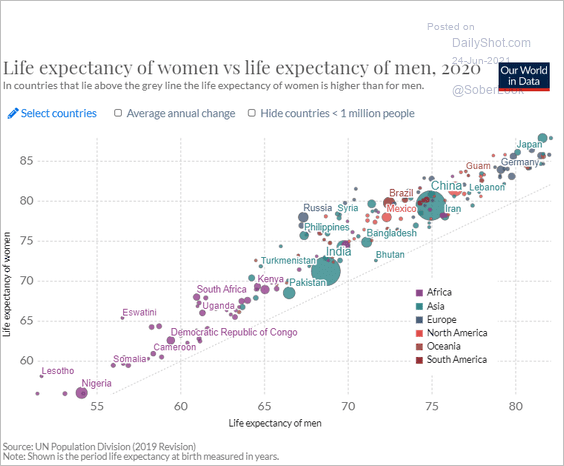

4. Life expectancy of women vs. men:

Source: Our World In Data Read full article

Source: Our World In Data Read full article

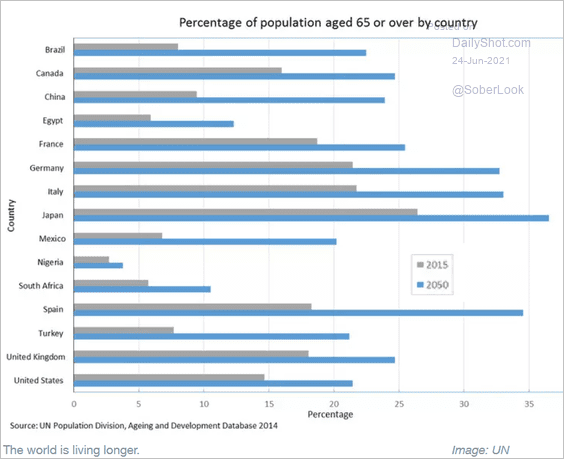

5. Population aged 65 and older by country:

Source: WEF Read full article

Source: WEF Read full article

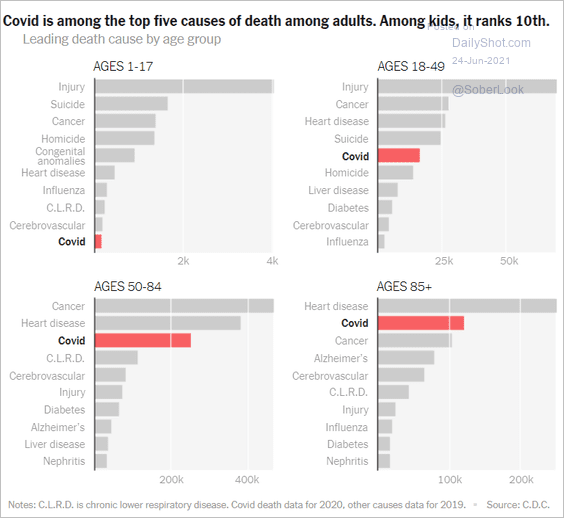

6. COVID deaths by age:

Source: The New York Times Read full article

Source: The New York Times Read full article

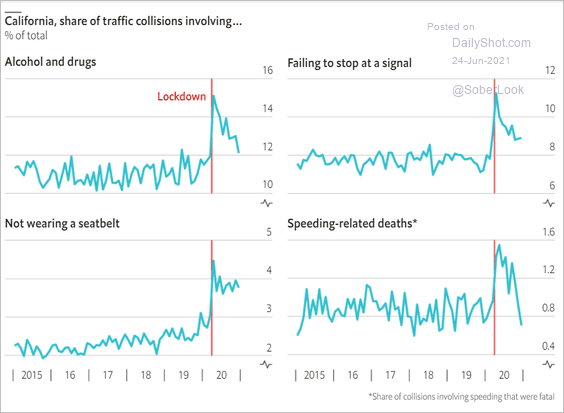

7. Share of traffic collisions in California involving …

Source: The Economist Read full article

Source: The Economist Read full article

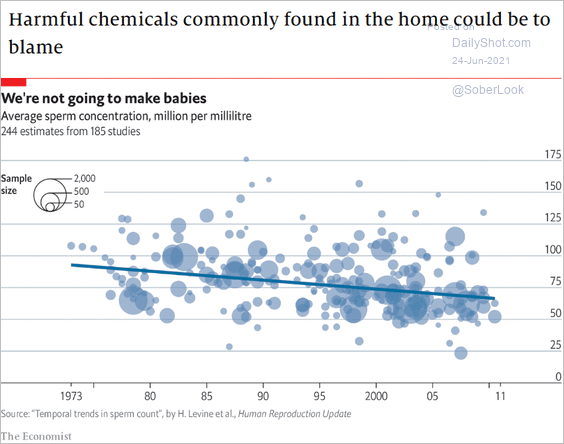

8. Sperm concentration over time:

Source: The Economist Read full article

Source: The Economist Read full article

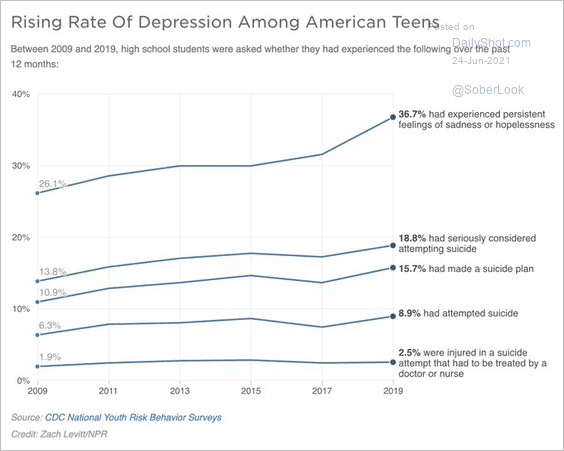

9. Teen depression rates:

Source: @jessefelder, NPR Read full article

Source: @jessefelder, NPR Read full article

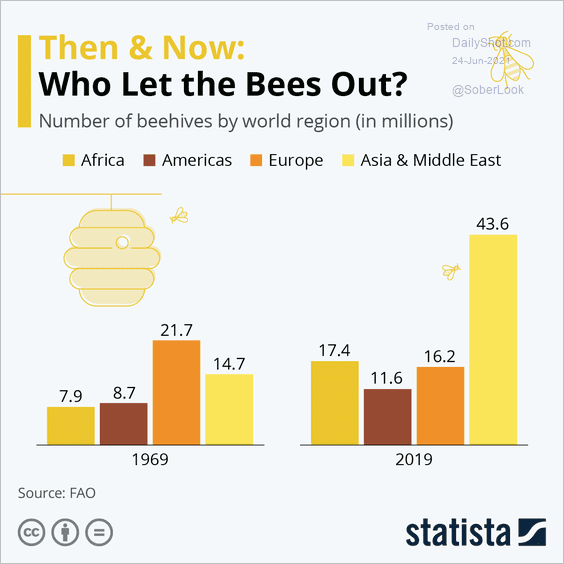

10. The number of beehives by region:

Source: Statista

Source: Statista

——————–

Back to Index